|

Finance Committee

13 June 2016

|

|

Attachment I

Attachment I

Financial Review

For The

Ten Months ended 30 April 2016

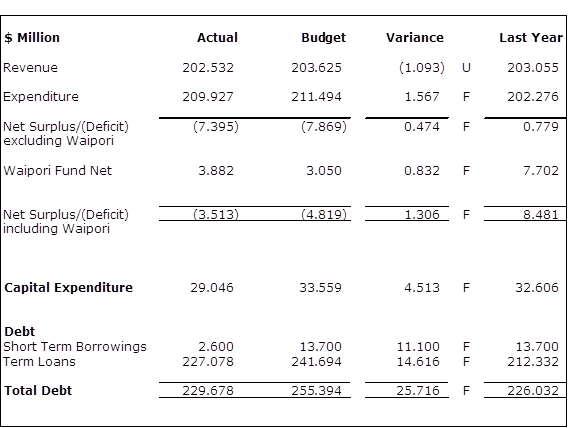

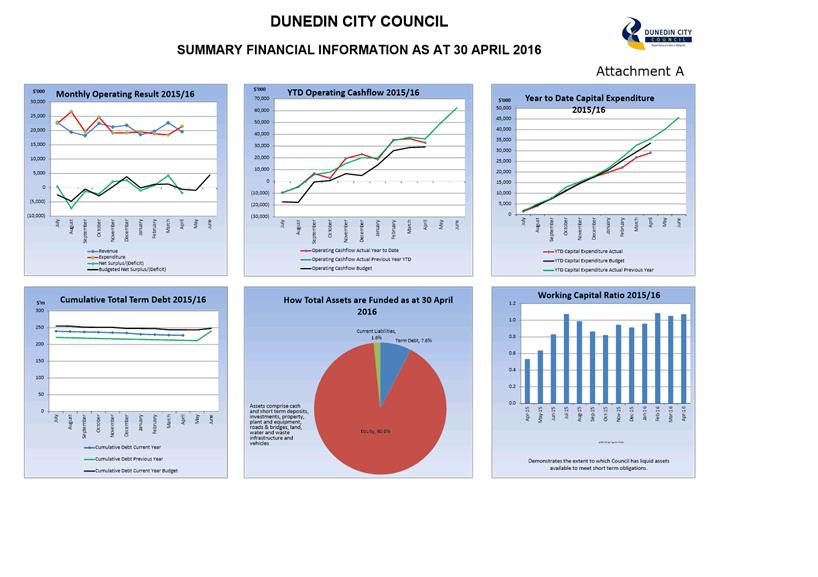

This report provides a commentary on the

Council’s financial results for the ten months ended 30 April 2016 and

the financial position at that date.

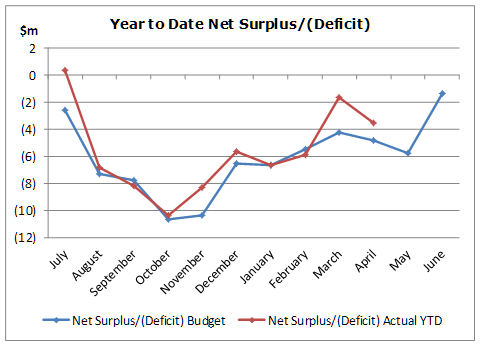

net

surplus/(Deficit) (including waipori)

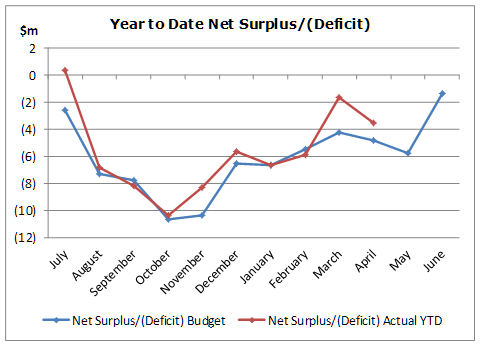

The net deficit

(including Waipori) for the ten months to April was $3.513 million or $1.306

million better than budget.

The favourable

variance against budget was due to the following:

· $1.011

million – higher than expected other operating revenue. Favourable

variances included: Solid Waste due to additional tonnage through the Green

Island Landfill; Transport where community road safety and corridor access

revenue was greater than budget; Improved property revenue including higher

than expected residential occupancy; an unbudgeted recovery for the service

level agreement with Dunedin City Treasury Ltd; and additional revenue from the

Regional Partner Network contract in Economic Development. These favourable

variances were partially offset by lower parking enforcement revenue, and lower

water sales revenue.

· $695k

– contributions due to the early timing of recoveries from developments

in Mosgiel.

· $2.285

million - assets operations and maintenance expenditure was less than

expected largely due to delayed timing related to transport work including

drainage works, traffic services maintenance, sealed paving maintenance and

non-subsidised general maintenance. In addition property maintenance was

running behind budget. These favourable variances were partially offset

by the early timing of sports-field maintenance, unbudgeted expenditure re the

Ocean Beach holding pattern and expenditure on a condition assessment of the

Green Island landfill digester.

· $1.371

million – lower than expected interest costs, primarily due to the lower

than expected loan balances.

· $832k

– Waipori Fund, resulting from fair value gains in investments, partially

offset by losses on the disposal of some international equities.

These

favourable variances were partially offset by:

· $2.457

million - depreciation costs were higher than expected due to the revision of

useful lives for the Council property portfolio as a result of the June 2015

building asset revaluation exercise. The useful lives were adjusted to

reflect the component nature of building assets.

· $2.878

million - lower than expected grants revenue mainly as a result of Transport

undertaking less capital projects than expected.

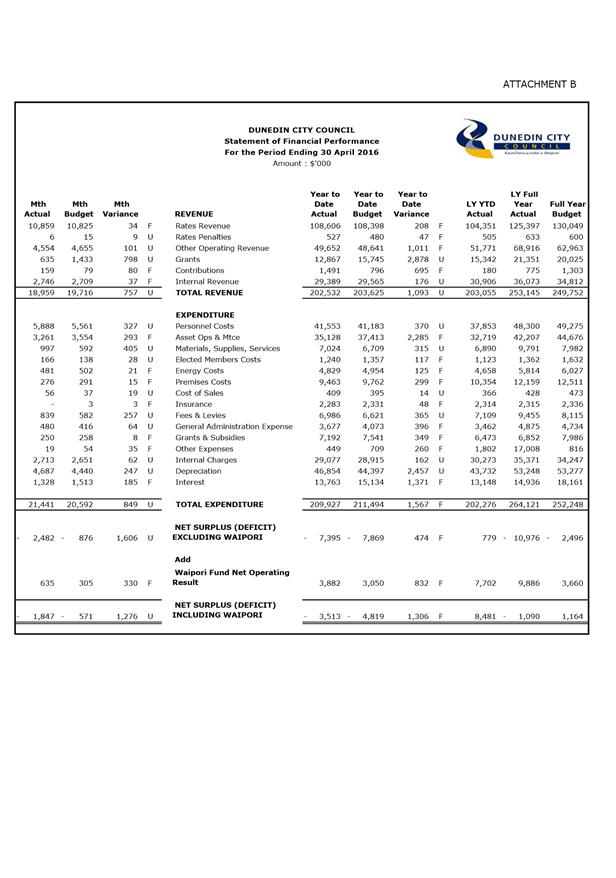

REVENUE

The total revenue for the period was

$202.532 million or $1.093 million less than budget. The major

income variances were as follows:

Other Operating Revenue

Actual $49.652 million, Budget $48.641

million, Favourable variance $1.011 million

Solid Waste revenue was favourable $734k

primarily due to additional tonnage processed through the Green Island

landfill.

Transport revenue was favourable $288k due

to community roading safety receiving an unbudgeted amount of $79k relating to

the cycle way network and safer schools, and corridor access way revenue being

$222k favourable to budget.

Finance revenue was favourable $256k due to the unbudgeted

service level fee recovery from Dunedin City Treasury Ltd ($248k) along with

unbudgeted other recoveries versus budget.

Economic Development revenue was favourable

$147k due to receipt of Regional Business Partner Network contract revenue.

Property revenue was favourable

$176k. This primarily related to higher than expected residential revenue

with higher occupancy levels.

These favourable variances were partially

offset by:

·

Parking Enforcement revenue was unfavourable

$306k with both infringement fees and court fines recoveries being less than

expected. This was in part due to fewer infringement notices being issued

along with a higher number of referrals for court collection.

Three Waters revenue was unfavourable $176k

due to water consumption being lower than expected.

Grants

Actual $12.867 million, Budget $15.745

million, Unfavourable variance $2.878 million

Transport grants and subsidy revenue was

unfavourable by $3.139 million due to less than expected NZTA funded work

(operating & capital) taking place year to date.

This unfavourable variance was partially

offset by:

$108k favourable variance in Civic due to

donations received related to the June Flood Relief fund.

Events and Community Development grants

were favourable $94k due to an unbudgeted grant from the Ministry of Youth

Development and the timing of Creative New Zealand grants.

Contributions

Actual $1.491 million, Budget $796k,

Favourable variance $695k

Development contribution revenue was

favourable due to the early timing of recoveries from Mosgiel developments.

Expenditure

The total expenditure for the period was

$209.927 million or $1.567 million less than budget. The major expenditure

variances were as follows:

Personnel Costs

Actual $41.553 million, Budget $41.183

million, Unfavourable variance $370k

The unfavourable variance was due to higher

than expected recruiting costs, increased fringe benefit costs associated with

the private use of Council vehicles, and unbudgeted salary costs funded from

external recoveries and savings in general operating budgets.

These unfavourable variances were partially

offset by under-expenditure on staff training ($96k) and a number of position

vacancies across Council.

Asset Operations and Maintenance Costs

Actual $35.128 million, Budget $37.413

million, Favourable variance $2.285 million

Transport costs were favourable $1.327

million largely due to timing differences with the completion of routine

drainage work ($139k), pavement maintenance ($185k), traffic services

maintenance ($508k) and non-subsidised general maintenance ($244k). There

is likely to be some savings in this area at year end.

Property costs were $1.193 million

favourable with planned work on hold while a new operational method of

assessing required maintenance for the housing portfolio is commissioned.

This is likely to result in savings at year end.

BIS costs were $345k favourable due mainly

to the timing of Infrastructure as a Service costs.

These favourable variances were partially

offset by:

Parks expenditure was ahead of budget $383k

due to the early timing of sports field maintenance, the timing of building

maintenance work, and unbudgeted work on the Ocean Beach Holding Pattern

($188k).

Water and Waste Services expenditure was

unfavourable $318k due to the early timing of water network maintenance costs

and plant maintenance costs associated with an unplanned expenditure on the

Green Island Treatment plant thermophillic digester, which is now

complete. There have been a number of other unscheduled maintenance

expenses for emergency repairs, including for example repairs on the clarifiers

at the Mosgiel WWTP.

Premises Costs

Actual $9.463 million, Budget $9.762

million, Favourable variance $299k

Costs were favourable across a number of departments, mainly

due to the timing of building warrant of fitness and rate payments.

General Administration Expenses

Actual $3.677 million, Budget $4.073

million, Favourable variance $396k

This favourable variance

reflected savings across a number of departments including promotional costs,

travel expenditure, telecommunications, printing & stationery and sundry

expenditure.

Grants & Subsidies

Actual $7.192 million, Budget $7.541

million, Favourable variance $349k

This favourable variance

resulted from the timing of various community and civic grants across Council

including Heritage Rates Remission grants, GigCity grant and Waste Strategy

grants.

Depreciation

Actual $46.854 million, Budget $44.397

million, Unfavourable variance $2.457 million

Depreciation costs were higher than

expected primarily due to a change in useful life for buildings as a result of

the June 2015 building asset revaluation exercise. The useful lives were

adjusted to reflect the component nature of these assets.

Interest

Actual $13.763 million, Budget $15.134

million, Favourable variance $1.371 million

The favourable variance in interest costs

was primarily due to the lower than expected level of debt.

WAIPORI FUND NET

OPERATING RESULT

Actual

$3.882 million, Budget $3.050 million, Favourable variance $832k

The Waipori Fund net operating

result was favourable for the period mainly due to unrealised gains in

investments, partially offset by losses associated with the disposal of some

international equities.

Consistent with the overall

market, gains were recorded in April across most investment types (equities and

property), albeit the gain on international equities was impacted by the strong

New Zealand dollar.

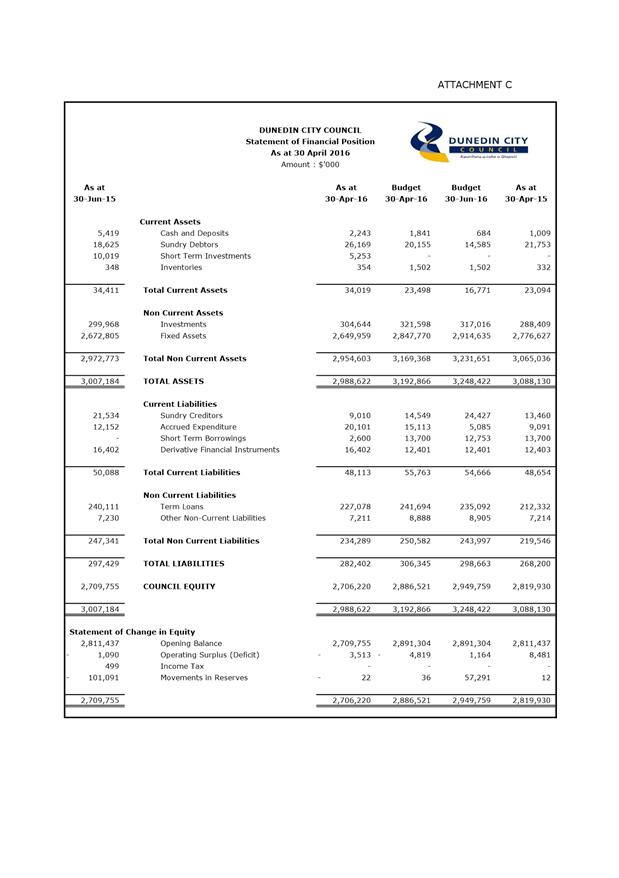

Statement of

Financial Position

A Statement of Financial Position is

provided as Attachment C.

The value of fixed assets was less than

budget as at 30 April 2016, due to lower capital expenditure (2014/15 and

2015/16), a net write down of investment properties 30 June 2015 and a negative

revaluation adjustment processed across building and infrastructural assets

again effective 30 June 2015.

Terms loans were less than budget primarily

due to a lower than expected loan balance at the start of the current financial

year and proceeds from asset disposals being used to pay down debt.

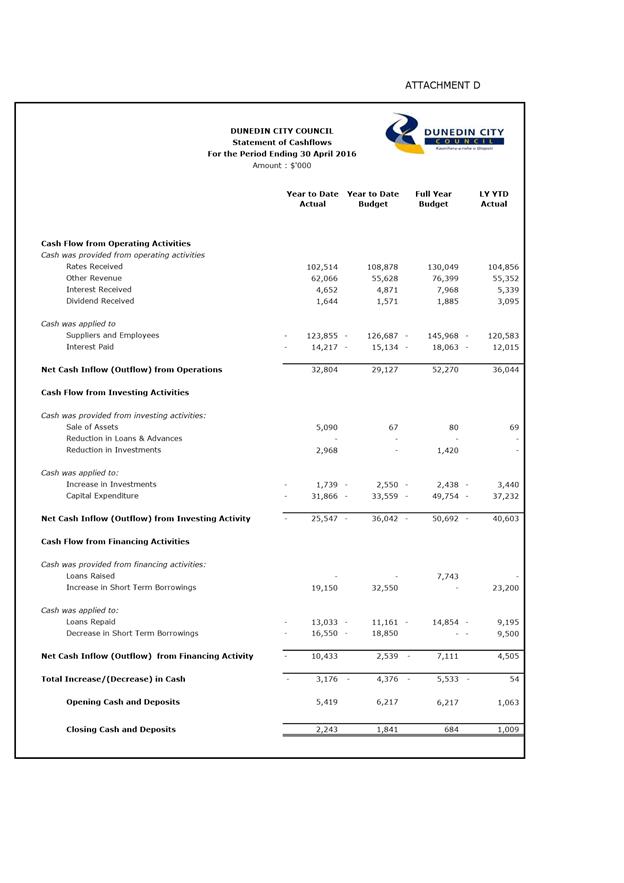

Statement of

Cashflows

A Statement of Cashflows is provided as

Attachment D.

Net cashflow from operations was better

than expected reflecting the impact of the lower operating expenses (including

interest paid).

Cash outflows from investing were less than

budgeted mainly due to asset sales being greater than anticipated (Caledonian

Bowling Club site, Union St and the Emerson’s Brewery site).

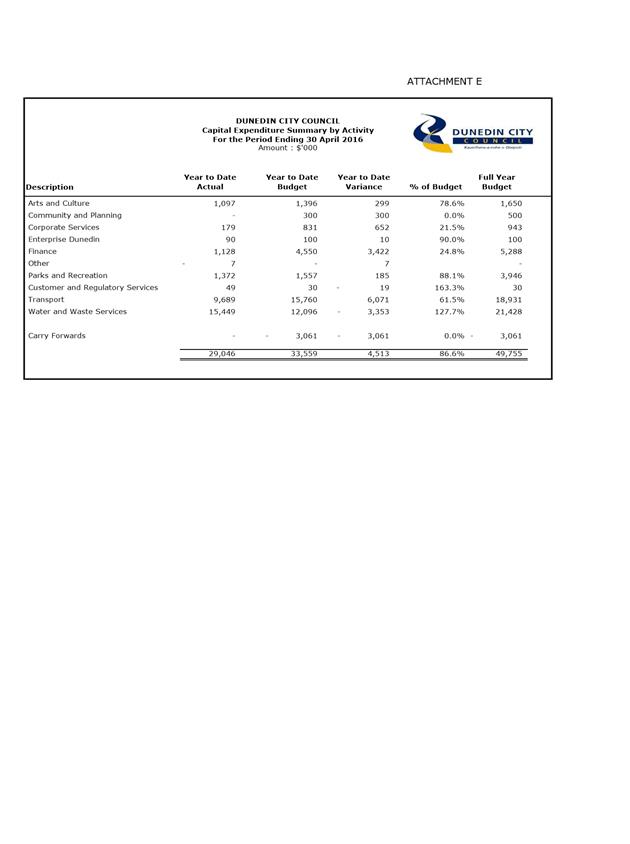

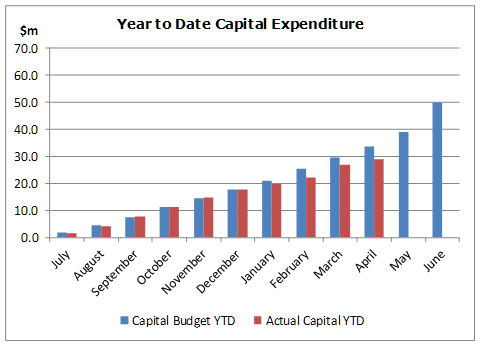

Capital

Expenditure

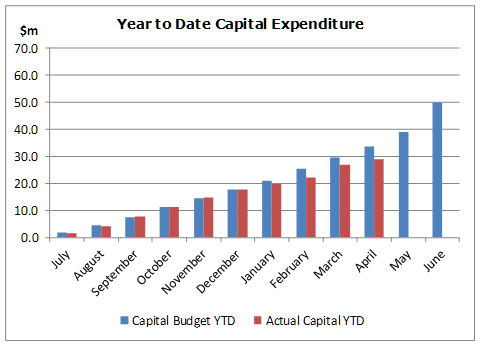

A summary of the capital expenditure

programme by Activity is provided as Attachment E.

Total capital expenditure for the period to

30 April 2016 was $29.046 million or 86.6% of the year-to-date budget of

$33.559 million. Note that the budget includes allocations of

$3.062 million of carry forwards from 2014/15.

Arts and Culture capital expenditure was $299k favourable

This variance was due to an under-spend on

collection acquisitions for both the Art Gallery and Libraries. Library

acquisitions are expected to be on budget at year-end while Art Gallery

expenditure is partly dependant on external funding.

Community and Planning Group capital expenditure was $300k favourable

The 2015/16 City Wide Amenity Upgrade has

been delayed until 2016/17 due to the Jetty Street hearing process.

The tender for Jetty Street upgrade is about

to be released and the main phase of work should commence in September 2016.

Corporate Services capital expenditure was $652k favourable

A number of corporate systems upgrades and

other ICT projects were delayed while scoping work is carried out. Some

of these projects are now underway.

Finance capital

expenditure was $3.422 million favourable

A number of building capital projects are

in the investigation and design stages. As such some will not be

completed in the current financial year.

Parking meter and fleet replacement

programmes are also running behind budget ($176k and $129k respectively). A

tender is in the market for the meter replacement.

Transport capital

expenditure was $6.071 million favourable

Cycle Network expenditure was $1.443 million favourable.

Options are being considered around how best to deliver the remaining

works.

Footpath

Resurfacing was $813k favourable. Footpath contacts (North, South and

Central) and a kerb and channel contract are now underway.

Other

renewal work was $4.887 million favourable with work at various stages of

development and some expenditure likely to carry over to 2016/17.

The Turnbull’s Bay slip repairs were $1.072 million

unfavourable. The contract has reached practical completion stage, although

buttressing is yet to be completed.

Water and Waste Services capital expenditure was $3.353 million unfavourable

The delivery of the capital programme continues to progress well.

The renewals budget is fully committed for the year, and any further tenders

let will have a start date after

1 July 2016.

A budget carry-forward of $2.300 million from the unspent Tahuna Biosolids

project has been signalled to fund the Biosolids project requirements in

2016/17, along with reallocation to switchboard upgrades and Portobello Road

stormwater screens.

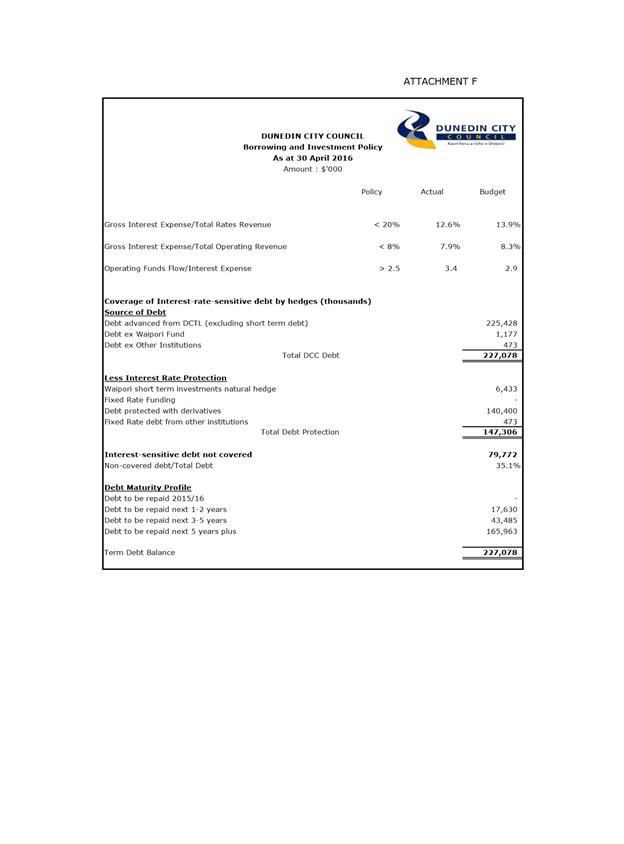

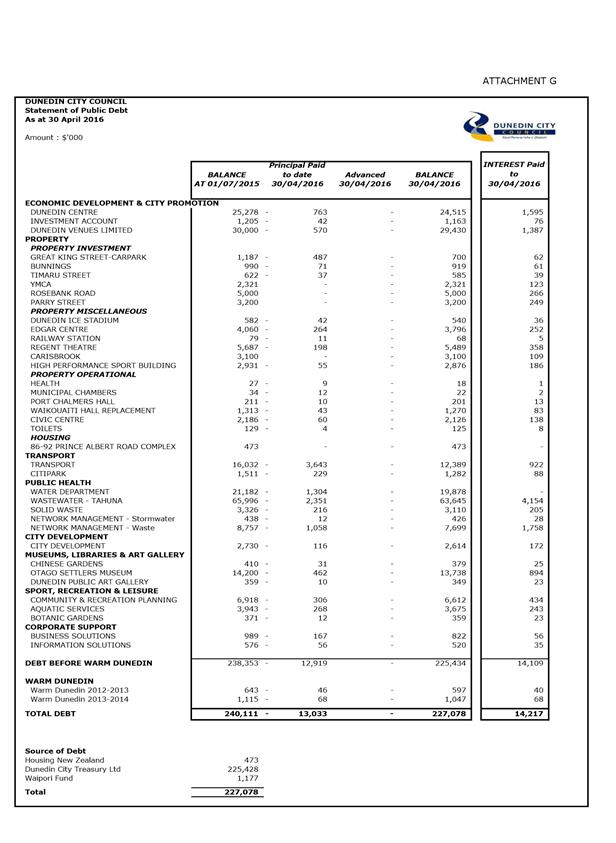

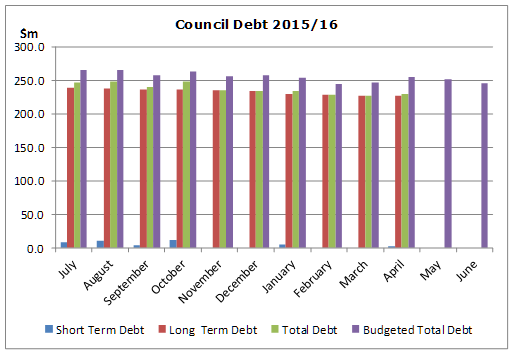

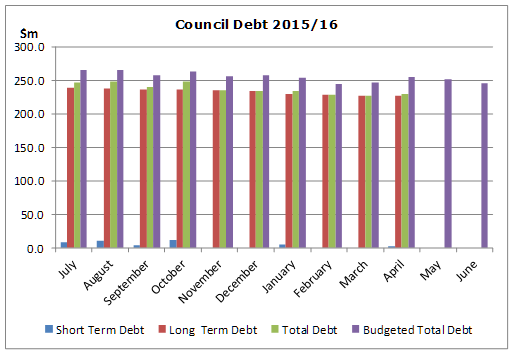

Debt

Refer to Attachments F and G.

Attachment F provides a summary of the debt

servicing ratios for the year to date.

All of the ratios met the specified

targets. These ratios are impacted by the timing of revenue which is not

necessarily spread evenly throughout the year compared with the cost of

servicing debt.

Term debt was below expectations for the

year to date due to no new loans raised in the 2014/15 financial year.

Asset sales in the current year have also contributed to a reduction in

debt.

Note that both the actual and budget

figures include the $30.0 million transferred from Dunedin Venues Limited

effective 30 June 2015.

Debtors and rates

outstanding

Sundry debtors outstanding as at 30 April

2016 totalled $26.169 million. This included long term debt of $3.568 million,

and debt associated with Warm Dunedin of $2.585 million.

Of the $3.568 million long term debt,

$3.100 million was for debt relating to the sale of Carisbrook. This is due for

repayment July 2016.

Debtors outstanding for more than four

months (excluding long term debt and Warm Dunedin) totalled $499k, compared

with last year’s total of $274k as at 30 April 2015.

Rates arrears relating to prior year rates

totalled $426k. This was higher than the $246k total as at April

2015. Of this total $76k was being recovered under formal arrangements

with Council, while the balance was being actively pursued.

Comments from

group activities

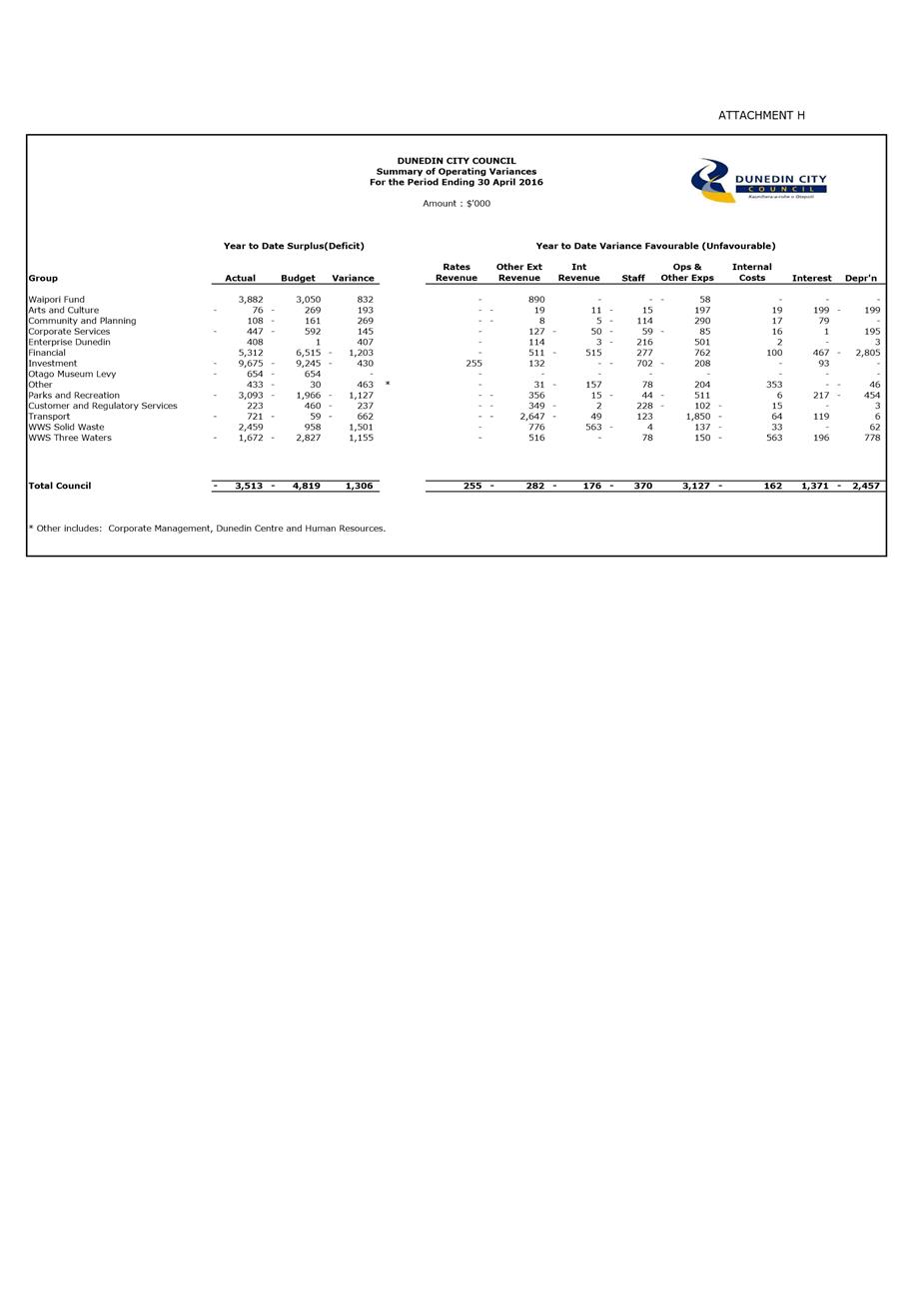

Attachment H, the Summary of Operating

Variances, shows, by Group Activity, the overall net surplus or deficit

variance for the period ended 30 April 2016. It also shows the variances

by revenue and expenditure type.

Community and Planning Group - $269k

Favourable

The

favourable expenditure variance was mainly due to delayed timing of some

community grant payments, Ara Toi expenditure and the Home Insulation service

level agreement payment.

Enterprise Dunedin Group - $407k Favourable

This

favourable variance related primarily to delayed project based expenditure

(including Export Education Uplift), and the timing of Regional Partner Network

expenditure.

Finance Group - $1.203 million Unfavourable

Depreciation was unfavourable $2.805

million due to the change in useful lives of Council building assets resulting

from the June 2015 asset revaluation.

External revenue was $511k favourable

primarily due to an unbudgeted recovery for the service level agreement with

Dunedin City Treasury Limited, and higher than expected residential property

revenue with good occupancy.

Operating costs were favourable $762k due

mainly to planned property expenditure on hold while a new operational method

of assessing required maintenance for the housing portfolio is commissioned.

Parks and Recreation Group – $1.127

million Unfavourable

Operating expenditure was unfavourable

$511k due to the early timing of some sports field work, deferred building

maintenance, and expenditure on the Ocean Beach holding pattern project, for

which there was no budget. Energy costs at the crematorium and new

propagation facility at the Botanic Garden were also slightly greater than

budgeted.

External revenue was unfavourable $356k due

to lower than expected revenue across a number of areas - development

contributions (budget timing), Moana Pool (memberships), and burial revenue

(move to cremations).

Customer and Regulatory Services Group

– $237k Unfavourable

The unfavourable operating variance was

primarily due to lower than expected revenue across a number of operating units

- Building inspection fees due to lower recoverable activity and parking

infringement fees and court fine recoveries due to fewer infringement notices

being issued along with a higher number of referrals for court collection.

Transport Group - $662k Unfavourable

External revenue was unfavourable $2.647

million mainly due to less than expected NZTA capital and operating work taking

place resulting in grants revenue being down on budget. The unfavourable

variance was partially offset by unbudgeted road safety revenue and an increase

in revenue from corridor access ways.

Operating expenditure was favourable $1.850

million primarily due to delayed timing of traffic services maintenance,

drainage works, sealed pavement maintenance and non-subsidised general

maintenance.

Personnel costs were favourable $123k due

to a number of vacancies in the group.

WWS Solid Waste – $1.501 million

Favourable

Landfill revenues were favourable due to

the combination of increased waste tonnages from out of the district, and

higher than expected sludge volumes.

WWS Three Waters – $1.155 million

Favourable

Revenue was $516k favourable, largely due

to unbudgeted development contribution revenue, partially offset by a shortfall

in water sales and trade waste revenue.

Total

expenditure was favourable $639k primarily due to savings in depreciation

costs.

|

Finance Committee

13 June 2016

|

|

Submission to the Government

Administration Select Committee on the Healthy Homes Guarantee Bill (No 2)

Department: Community and Planning

EXECUTIVE SUMMARY

1 This

report accompanies a draft submission from the Dunedin City Council (DCC) to

the Government Administration Select Committee on the Healthy Homes Guarantee

Bill (No 2).

2 The

report provides background to the Bill and a summary of the Council’s

response for the Select Committee’s consideration.

|

RECOMMENDATIONS

That the Committee:

a) Approves the

attached submission to the Government Administration Select Committee on the

Healthy Homes Guarantee Bill (No 2).

|

BACKGROUND

3 Recent

Government amendments to the Residential Tenancies Amendment Act 2016

(‘the Act’) require landlords to fit all rental properties with

insulation and smoke alarms by 1 July 2019.

3 The

Leader of the Opposition’s Healthy Homes Guarantee Bill (No 2)

(‘the Bill’) proposes amendments to the Residential Tenancies Act

1987 with the purpose of ensuring every rental home in New Zealand meets

minimum standards of heating and insulation.

4 The

Bill goes further than the Act in that it adds heating as a requirement for

rental properties, and requires that rental properties’ heating and

insulation meets minimum standards of adequacy for: methods of heating; methods

of insulation; ventilation; drainage; draft-stopping; and minimum indoor

temperatures.

5 The Act allows landlords a maximum period of three years to

comply. The Bill would require the standards to

be published within six months and apply to all lease agreements entered

thereafter. Where no new lease is entered, landlords would have up to five years to comply with the standards.

6 Both the Act and the Bill provide exemptions where compliance is

impracticable (e.g. no access to install under-floor insulation).

Enforcement of both the Act and the Bill would be undertaken through current

residential tenancy enforcement mechanisms.

DISCUSSION

7 During development of the DCC’s Social

Wellbeing Strategy the condition of the city’s housing was identified as

the number one social issue in Dunedin. As a result, one of the three

priorities of the strategy is ‘Better Homes’, recognising that

living in cold, damp housing is detrimental to many households, especially

those with high social needs.

8 The

DCC has been involved in a number of housing-related issues as part of delivery

on the Social Wellbeing Strategy priority, including:

· co-funding

the installation of insulation for the past 10 years for low-income residents

in partnership with other organisations;

· providing

access to the Warm Dunedin Targeted Rate programme for both insulation and

heating;

· upgrading

its Community Housing rental properties;

· being a

partner and funder of the Cosy Home Charitable Trust; and

· taking

part in a Rental Housing Warrant of Fitness (‘Rental WOF’) study

led by the University of Otago.

9 Neither

the Act nor the Bill includes the safety and security features recommended in

the University of Otago’s Housing and Health Research Programme’s

Rental Warrant of Fitness (WOF).[1] Associated research indicates that the median cost for upgrading

rental homes to the Rental WOF standard is around $8,000 although generally the

specific heating and insulation costs are much less.

10 The

attached draft submission supports the Bill but proposes that the Rental WOF

should be the end goal to ensure that everyone living in rental accommodation

has a safe, healthy and warm home.

11 The

draft submission also raises concerns about enforcement, as the onus is

currently placed on tenants to take their landlords to the Tenancy Tribunal

should landlords fail to comply with the new standards. The Rental WOF

addresses this issue by requiring landlords to seek an independent assessment

or inspection before their properties can be tenanted.

12 In

addition, the draft submission proposes:

a) the

maximum time for compliance be brought forward from five to three years, to

more quickly deliver health benefits for tenants while giving landlords and the

insulation and heating industry sufficient time to achieve

compliance.

b) the

Ministry of Building, Innovation and Employment (MBIE) is adequately resourced

for the task of setting the minimum standards.

c) that

the minimum standard for insulation required for all rental properties be set

at the current NZ Building Code as for new builds.

OPTIONS

Option One – Recommended Option

13 The

DCC submits on the Healthy Home Guarantee Bill (No 2), either with or without

amendments to the attached draft submission.

Advantages

· The submission supports proposed legislation that will contribute to

the DCC’s Social Wellbeing priority of ‘Better Homes’ for

Dunedin residents.

Disadvantages

· There are no known disadvantages.

Option Two – Status Quo

14 The

DCC does not submit on the Healthy Homes Guarantee Bill (No 2).

Advantages

· There are no known advantages.

Disadvantages

· Opportunity to support proposed legislation that will

contribute to the Social Wellbeing Strategy’s priority of ‘Better

Homes’ for Dunedin residents is lost.

NEXT STEPS

15 Subject

to the Economic Development Committee’s recommendation, the submission

will be forwarded to the Government Administration Select Committee by 23 June

2016. The submission will be retrospectively approved by the Council on

the 27 June 2016.

Signatories

|

Author:

|

Paul Coffey - Community Advisor

|

|

Authoriser:

|

Nicola Pinfold - Group Manager Community

and Planning

|

Attachments

|

|

Title

|

Page

|

|

a

|

Submission

on the Healthy Homes Guarantee Bill (No 2)

|

5

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit

with purpose of Local Government

The attached submission relates to

providing local infrastructure and a public service and is considered good-quality

and cost-effective.

|

|

Fit

with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The attached submission supports proposed

standards that will contribute to the Social Wellbeing’s priority of

‘Better Homes’. It also supports the objectives of the

city’s Energy Plan and Environment Strategy by supporting legislation

that will contribute to increased energy efficiency. There are also

links between housing quality and the Economic Development Strategy.

Dunedin’s poor quality housing is a factor deterring some people from seeking

employment in Dunedin. The impacts of sick leave relating to poor quality

housing in terms of education and employment are also clearly identified.

|

|

Māori

Impact Statement

There are no specific impacts for tangata

whenua.

|

|

Sustainability

The proposed legislation supports

sustainability principles by contributing to better health and energy

consumption outcomes.

|

|

LTP/Annual

Plan / Financial Strategy /Infrastructure Strategy

There are no LTP or Annual Plan

implications.

|

|

Financial

considerations

There are no financial implications for

the DCC’s social housing budget as the improvements proposed in the

Healthy Homes Guarantee Bill (No 2) can be met within existing budgets.

|

|

Significance

This report has been assessed under the

Council's Significance and Engagement Policy as being of low significance.

|

|

Engagement

– external

There has been no external engagement.

|

|

Engagement

- internal

Staff from Corporate Policy, Events and

Community Development, and Property were consulted in the preparation this

report and attached submission. Staff are happy with the submission's

content.

|

|

Risks:

Legal / Health and Safety etc.

There are no known risks.

|

|

Conflict

of Interest

There are no known conflicts of interest.

|

|

Community

Boards

There are no implications for Community

Boards.

|

|

Finance Committee

13 June 2016

|

|

30 May 2016

To the Government Administration Select Committee

|

Parliament

Buildings

|

|

Private

Bag 18041

|

|

Wellington

6160

|

|

|

SUBMISSION ON THE HEALTHY HOMES GUARANTEE BILL (NO 2)

This submission is from the Dunedin City Council.

Background

1. The

Dunedin City Council is responsible for meeting the current and future needs of

communities for good quality local infrastructure, local public service and

performance of regulatory functions in a way that is most cost effective for

households and businesses, under the Local Government Act 2002.

2. In

2013 the Dunedin City Council released the Social Wellbeing Strategy 2013-2023.

During its development, the condition of the city’s housing was

identified as the number one social issue facing the city. As a result, one of

the three priorities of the Strategy is ‘Better Homes’. This

priority recognises that living in cold, damp housing is detrimental to many

households, especially those with high social needs.

3. The

Dunedin City Council has been involved in a number of housing-related issues

due to its importance to the Social Wellbeing Strategy, including:

· by

co-funding the installation of insulation for the past 10 years for low-income

residents in partnership with other organisations, including the Energy

Efficiency Conservation Authority (EECA);

· by

providing access to the Warm Dunedin Targeted Rate programme for both

insulation and heating;

· as

a partner and funder of the Cosy Home Charitable Trust, the aim of which is

that all homes in Dunedin are warm and cosy by 2025;

· as

one of the partners taking part in a Rental Housing Warrant of Fitness

(‘Rental WOF’) study led by the University of Otago.[2]

4. The

Dunedin City Council is also a significant landlord in the city providing

approximately 950 bedsits and smaller numbers of one and two bedroom

accommodation, mostly to older people. All units have been retrofitted to

EECA standards for ceiling insulation, and under-floor insulation where

possible to install.

5. The

Dunedin City Council is engaged with one Community Housing Provider, Just

Housing, to assist the provision of transitional housing. One new housing

development is planned comprising one and two bedroom homes for social housing.

Recommendations

6. The

Dunedin City Council is pleased to support the Healthy Homes Guarantee Bill (No

2), recognising that the proposals go further than the Residential Tenancies

Amendment Act 2016 to provide people living in rented properties with warm and

healthy accommodation.

7. The

Dunedin City Council can advise that its social housing provision is fiscally

neutral and the improvements proposed in the Bill can be met from existing

operating budgets.

8. However

the Dunedin City Council notes the safety and security elements of the Rental

WOF are absent from the Bill, and proposes that a Rental WOF should be the end

goal to ensure that people renting their homes have warm, healthy and safe

accommodation. The University of Otago Rental WOF research indicates that

the median cost for upgrading rental homes to the Rental WOF standard is around

$8,000, although generally the specific heating and insulation costs are much

less. As research on the cost benefit of Rental WOF shows, savings in

health spending, energy consumption, and a reduction in hazards far outweigh

the costs to individual landlords.

9. The

Dunedin City Council recommends that the maximum period for compliance under

the Bill be brought forward from five years to three years. This will

more quickly deliver health benefits for tenants, while giving landlords and

the insulation and heating industry sufficient time to achieve compliance.

10. The

Dunedin City Council also notes that the Healthy Homes Guarantee Bill (No 2)

and the Residential Tenancies Amendment Act 2016 ultimately leave enforcement

up to tenants via the Tenancy Tribunal. The Dunedin City Council recommends

that the Select Committee consider how best to enforce compliance that does not

put tenancies at risk, such as independent assessment as proposed under the

Rental WOF.

11. The

Dunedin City Council recommends that the Ministry of Building, Innovation and

Employment (MBIE) be adequately resourced for the task of setting the minimum

standards under the Bill.

12. That the

minimum standard for insulation required for all rental properties be set at

the current NZ Building Code as for new builds.

For further information please contact Paul Coffey,

Community Advisor at paul.coffey@dcc.govt.nz

or on 03 474 3847 or 027 321 0100.

Yours sincerely

Dave Cull

Mayor of Dunedin