Notice of Meeting:

I hereby give notice that an ordinary meeting of the Finance

Committee will be held on:

Date: Monday

18 July 2016

Time: 1.30

pm or at the conclusion of the Economic Development Committee meeting

(whichever is later)

Venue: Edinburgh

Room, Municipal Chambers,

The

Octagon, Dunedin

Sue Bidrose

Finance Committee

PUBLIC AGENDA

|

Chairperson

|

Cr Richard Thomson

|

|

|

Deputy Chairperson

|

Cr Hilary Calvert

|

|

|

Members

|

Cr David Benson-Pope

|

Cr John Bezett

|

|

|

Mayor Dave Cull

|

Cr Doug Hall

|

|

|

Cr Aaron Hawkins

|

Cr Mike Lord

|

|

|

Cr Jinty MacTavish

|

Cr Andrew Noone

|

|

|

Cr Neville Peat

|

Cr Chris Staynes

|

|

|

Cr Lee Vandervis

|

Cr Andrew Whiley

|

|

|

Cr Kate Wilson

|

|

Senior Officer Grant

McKenzie, Group Chief Financial Officer

Governance Support Officer Wendy

Collard

Wendy Collard

Governance Support Officer

Telephone: 03 477 4000

Wendy.Collard@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

Finance Committee

18 July 2016

|

|

ITEM TABLE OF CONTENTS PAGE

1 Public

Forum 4

2 Apologies 4

3 Confirmation

of Agenda 4

4 Declaration

of Interest 4

Part

A Reports (Committee has power to decide these matters)

5 Financial

Result - Period Ended 31 May 2016 5

6 Rating

Adjustment Possibilities for Māori Freehold Land 29

Part

B Reports (Committee has power to recommend only on these

items)

7 Rates

Rebate - Occupational Right Agreements 41

|

Finance Committee

18 July 2016

|

|

1 Public

Forum

At the close of the agenda no

requests for public forum had been received.

2 Apologies

Apologies have been received from Mayor

Dave Cull and Councillors Mike Lord, Chris Staynes and Andrew Whiley.

That the Committee:

Accepts the apologies from Mayor

Dave Cull and Councillors Mike Lord, Chris Staynes and Andrew Whiley.

3 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

4 Declaration

of Interest

There were no new declarations of

interest.

|

Finance Committee

18 July 2016

|

|

Part

A Reports

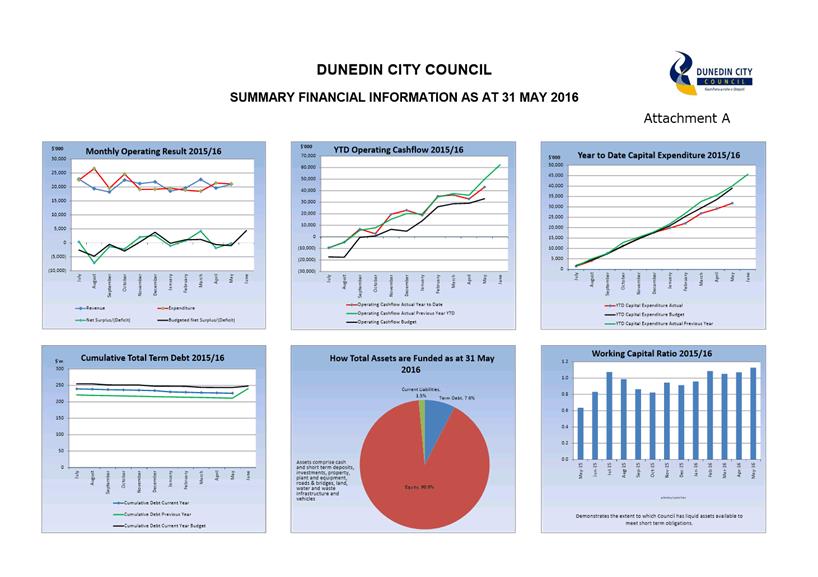

Financial Result - Period Ended 31 May 2016

Department: Finance

EXECUTIVE SUMMARY

1 This

report provides the financial results for the period ended 31 May 2016 and the

financial position as at that date.

|

RECOMMENDATIONS

That the Finance Committee:

a) Notes the

Financial Performance for the period ended 31 May 2016 and the Financial

Position as at 31 May 2016.

|

BACKGROUND

2 This

report provides a commentary of the financial performance of Council for the

period ended 31 May 2016 and the financial position as at that date.

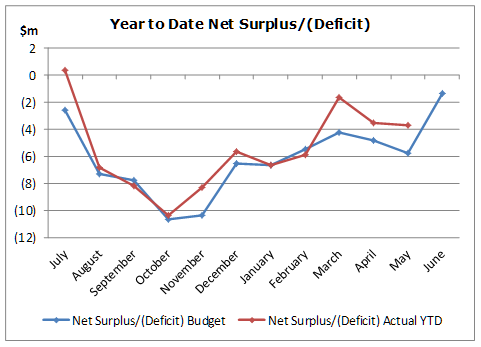

DISCUSSION

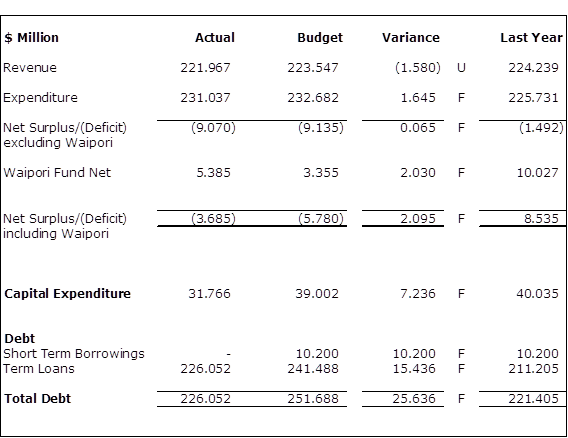

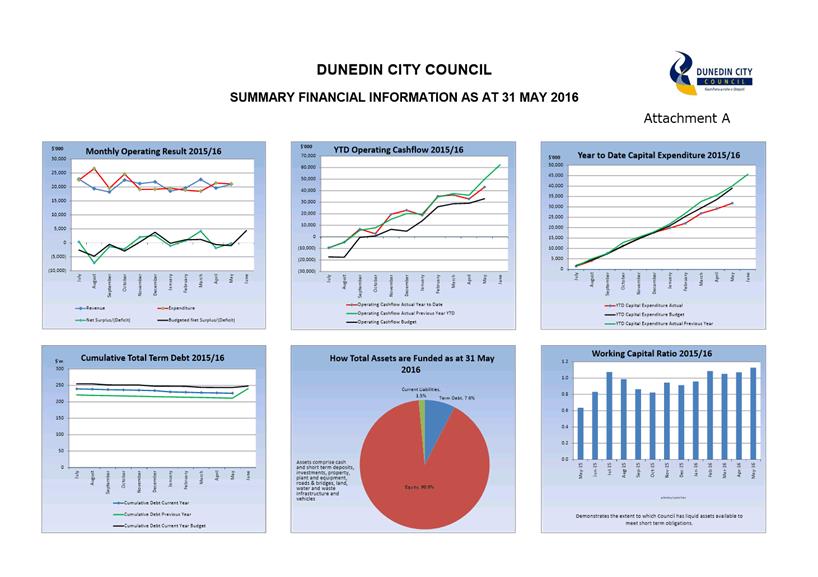

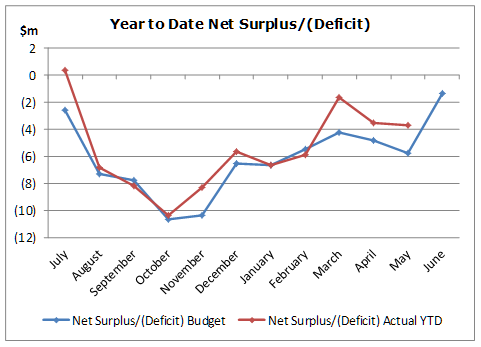

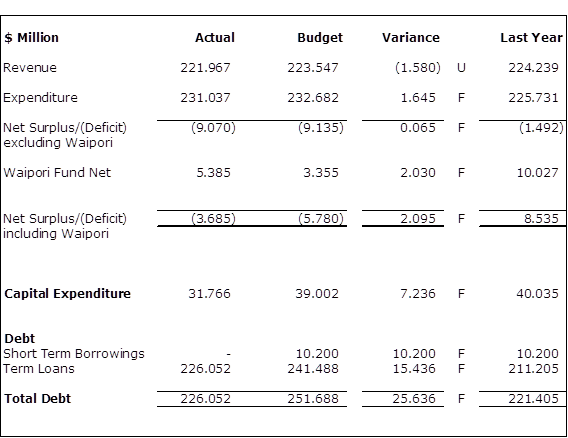

3 The net

deficit (including Waipori) for the eleven months to May was $3.685 million or

$2.095 million better than budget.

4 The

favourable variance against budget was due to the following:

· $2.030k

– Waipori Fund, resulting from fair value gains in investments, partially

offset by losses on the disposal of some international equities.

· $1.055

million – higher than expected other operating revenue. Favourable

variances included: Solid Waste due to additional tonnage through the Green

Island Landfill; Transport where community road safety and corridor access

revenue was greater than budget; Improved property revenue including higher

than expected residential occupancy; an unbudgeted recovery for the service

level agreement with Dunedin City Treasury Ltd; and additional revenue from the

Regional Partner Network contract in Economic Development. These favourable

variances were partially offset by lower parking enforcement revenue, and lower

water sales revenue.

· $644k

– contributions due to the early timing of recoveries from developments

in Mosgiel.

· $3.000

million - assets operations and maintenance expenditure was less than

expected largely due to savings related to transport work including drainage

works, traffic services maintenance, paving maintenance and non-subsidised

general maintenance. In addition property maintenance was running behind

budget. These favourable variances were partially offset by unbudgeted

expenditure re the Ocean Beach holding pattern and expenditure on a condition

assessment of the Green Island Waste Treatment digester and repairs to the

Mosgiel Waste Treatment clarifiers.

· $1.563

million – lower than expected interest costs, primarily due to the lower

than expected loan balances.

5 These

favourable variances were partially offset by:

· $2.877

million - depreciation costs were higher than expected due to the revision of

useful lives for the Council property portfolio as a result of the June 2015

building asset revaluation exercise. The useful lives were adjusted to

reflect the component nature of building assets.

· $3.463

million - lower than expected grants revenue mainly as a result of Transport

undertaking less capital projects than expected.

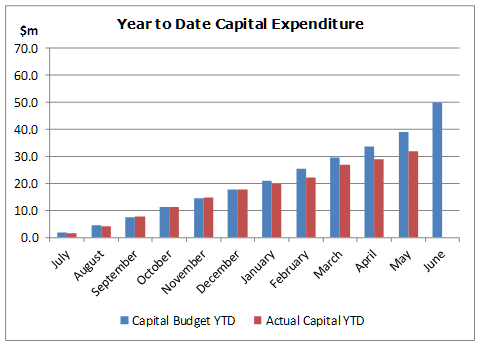

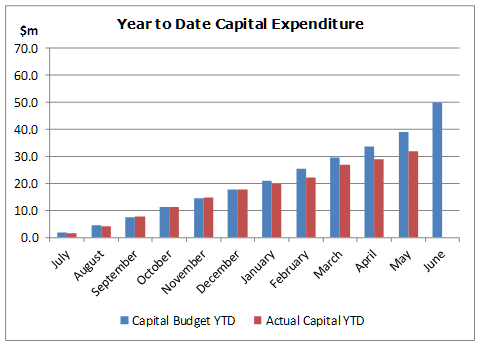

6 Capital

expenditure was less than budget by $7.236 million. Project delays have arisen

across a number of portfolios while project scoping is finalised. These

favourable variances were partially offset by earlier than expected expenditure

on water and waste services projects.

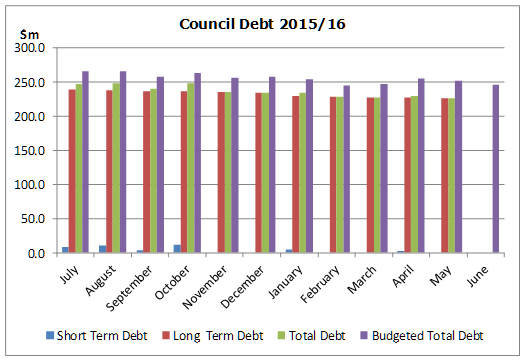

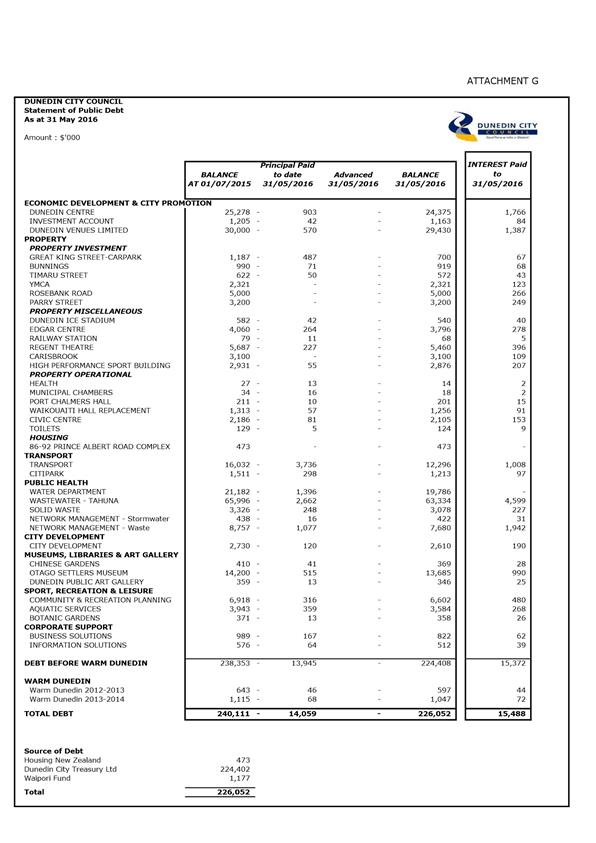

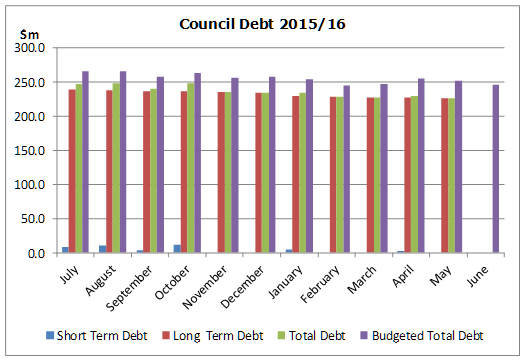

7 Total

Council debt as at 31 May 2016 was $226.052 million or $25.636 million lower

than budget. This variance reflected a better than expected opening

position for the 2015/16 financial year, strong operating cashflow for the year

to date reflecting the lower than expected operating expenditure and funds

received from property disposals (Caledonian Bowling Club, Union Street and the

Emerson's Brewery site).

OPTIONS

8 Not

applicable.

NEXT STEPS

9 Not

applicable.

Signatories

|

Author:

|

Lawrie Warwood - Financial Analyst

Gavin Logie - Financial Controller

|

|

Authoriser:

|

Grant McKenzie - Group Chief Financial Officer

|

Attachments

|

|

Title

|

Page

|

|

a

|

One Page Financial

Summary

|

9

|

|

b

|

Statement of Financial

Performance

|

10

|

|

c

|

Statement of Financial

Position

|

11

|

|

d

|

Statement of Cashflows

|

12

|

|

e

|

Capital Expenditure

Summary by Activity

|

13

|

|

f

|

Borrowing and

Investment Policy

|

14

|

|

g

|

Statement of Public

Debt

|

15

|

|

h

|

Statement of Operating

Variances

|

17

|

|

i

|

Financial Review

|

19

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

The financial expenditure reported in this report relates

to providing local infrastructure, public services and regulatory functions

for the community.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

This report has no direct contribution to the Strategic

Framework, although the financial expenditure reported in this report has

contributed to all of the strategies.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report fulfils the internal financial reporting

requirements for Council.

|

|

Financial

considerations

Not applicable – reporting only.

|

|

Significance

Not applicable – reporting only.

|

|

Engagement –

external

There has been no external engagement.

|

|

Engagement - internal

The report is prepared as a summary for the individual

department financial reports.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

Finance Committee

18 July 2016

|

|

|

Finance Committee

18 July 2016

|

|

|

Finance Committee

18 July 2016

|

|

|

Finance Committee

18 July 2016

|

|

|

Finance Committee

18 July 2016

|

|

|

Finance Committee

18 July 2016

|

|

|

Finance Committee

18 July 2016

|

|

|

Finance Committee

18 July 2016

|

|

|

Finance Committee

18 July 2016

|

|

Attachment I

Attachment I

Financial Review

For The

Eleven Months ended 31 May 2016

This report provides a commentary on the

Council’s financial results for the eleven months ended 31 May 2016 and

the financial position at that date.

net

surplus/(Deficit) (including waipori)

The net deficit (including Waipori) for the

eleven months to May was $3.685 million or

$2.095 million better than budget.

The favourable

variance against budget was due to the following:

· $2.030

million – Waipori Fund, resulting from fair value gains in investments,

partially offset by losses on the disposal of some international equities.

· $1.055

million – higher than expected other operating revenue. Favourable

variances included: Solid Waste due to additional tonnage through the Green

Island Landfill; Transport where community road safety and corridor access

revenue was greater than budget; Improved property revenue including higher

than expected residential occupancy; an unbudgeted recovery for the service

level agreement with Dunedin City Treasury Ltd; and additional revenue from the

Regional Partner Network contract in Economic Development. These favourable

variances were partially offset by lower parking enforcement revenue, and lower

water sales revenue.

· $644k

– contributions due to the early timing of recoveries from developments

in Mosgiel.

· $3.000

million - assets operations and maintenance expenditure was less than

expected largely due to savings related to transport work including drainage

works, traffic services maintenance, paving maintenance and non-subsidised

general maintenance. In addition property maintenance was running behind

budget. These favourable variances were partially offset by unbudgeted

expenditure re the Ocean Beach holding pattern and expenditure on a condition

assessment of the Green Island Waste Treatment digester and repairs to the

Mosgiel Waste Treatment clarifiers.

· $1.563

million – lower than expected interest costs, primarily due to the lower

than expected loan balances.

These

favourable variances were partially offset by:

· $2.877

million - depreciation costs were higher than expected due to the revision of

useful lives for the Council property portfolio as a result of the June 2015

building asset revaluation exercise. The useful lives were adjusted to

reflect the component nature of building assets.

· $3.463

million - lower than expected grants revenue mainly as a result of Transport

undertaking less capital projects than expected.

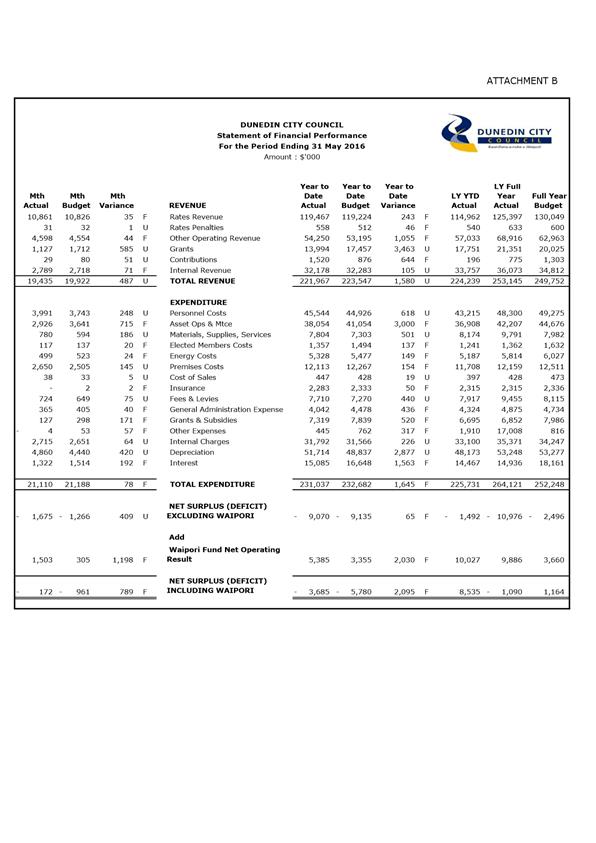

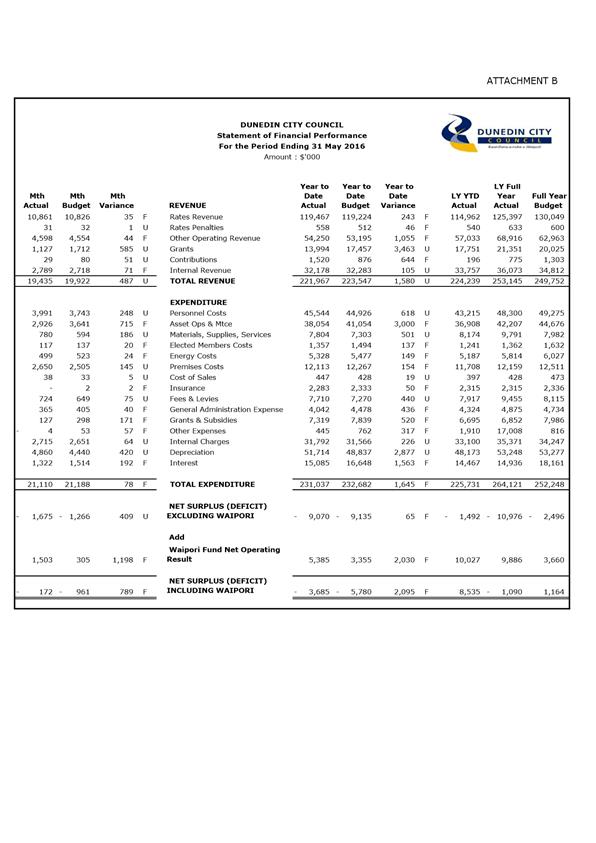

REVENUE

The total revenue for the period was

$221.967 million or $1.580 million less than budget.

The major income variances were as follows:

Other Operating Revenue

Actual $54.250 million, Budget $53.195

million, Favourable variance $1.055 million

Solid Waste revenue was favourable $638k

primarily due to additional tonnage processed through the Green Island

landfill.

Transport revenue was favourable $340k due

to community roading safety receiving an unbudgeted amount of $86k relating to

the cycle way network and safer schools, and corridor access way revenue being

$264k favourable to budget.

Finance revenue was favourable $284k due to the unbudgeted

service level fee recovery from Dunedin City Treasury Ltd ($275k).

Economic Development revenue was favourable

$124k due to receipt of Regional Business Partner Network contract revenue.

Property revenue was favourable

$233k. This primarily related to higher than expected residential revenue

with higher occupancy levels.

These favourable variances were partially

offset by:

Parking Enforcement

revenue was unfavourable $336k with both infringement fees and court fines

recoveries being less than expected. This was in part due to fewer

infringement notices being issued along with a higher number of referrals for

court collection.

Three Waters revenue was unfavourable $349k

due to water consumption being lower than expected.

Grants

Actual $13.994 million, Budget $17.457

million, Unfavourable variance $3.463 million

Transport grants and subsidy revenue was

unfavourable by $3.653 million due to less than expected NZTA funded work

(operating & capital) taking place year to date.

This unfavourable variance was partially

offset by:

$108k favourable variance in Civic due to

donations received related to the June Flood Relief fund.

Events and Community Development grants

were favourable $49k due to an unbudgeted grant from the Ministry of Youth

Development and the timing of Creative New Zealand grants.

Contributions

Actual $1.520 million, Budget $876k,

Favourable variance $644k

Development contribution revenue was

favourable due to the early timing of recoveries from Mosgiel developments.

Expenditure

The total expenditure for the period was

$231.037 million or $1.645 million less than budget.

The major expenditure variances were as

follows:

Personnel Costs

Actual $45.544 million, Budget $44.926

million, Unfavourable variance $618k

The unfavourable variance was due to higher

than expected recruiting costs, increased fringe benefit costs associated with

the private use of Council vehicles, and unbudgeted salary costs funded from

external recoveries.

These unfavourable variances were partially

offset by under-expenditure on staff training ($103k) and a number of position

vacancies across Council.

Asset Operations and Maintenance Costs

Actual $38.054 million, Budget $41.054

million, Favourable variance $3.000 million

Transport costs were favourable $1.536

million largely due to timing differences with the completion of routine

drainage work ($128k), pavement maintenance ($384k), traffic services

maintenance ($419k), cycleway maintenance ($137k) and non-subsidised general

maintenance ($219k). There will be savings in this area at year end.

Property costs were $1.276 million

favourable with planned work on hold while a new operational method of

assessing required maintenance for the housing portfolio is commissioned.

This will result in savings at year end.

BIS costs were $513k favourable due mainly

to delayed outsourcing of non-production environments as part of the

Infrastructure as a Service project.

These favourable variances were partially

offset by:

Parks expenditure was ahead of budget $355k

due mainly to unbudgeted work on the Ocean Beach Holding Pattern ($286k).

Water and Waste Services expenditure was

unfavourable $246k due to higher than expected water network maintenance costs

and plant maintenance costs associated with an unplanned expenditure on the

Green Island Treatment plant thermophillic digester, which is now

complete. There have been a number of other unscheduled maintenance

expenses for emergency repairs, including for example repairs on the clarifiers

at the Mosgiel WWTP.

General Administration Expenses

Actual $4.042 million, Budget $4.478

million, Favourable variance $436k

This favourable variance reflected

savings across a number of departments including promotional costs, travel

expenditure, telecommunications, printing & stationery and sundry

expenditure.

Grants & Subsidies

Actual $7.319 million, Budget $7.839

million, Favourable variance $520k

This favourable variance

resulted from the timing of various community and civic grants across Council

including Heritage Rates Remission grants, GigCity grant and Waste Strategy

grants.

Depreciation

Actual $51.714 million, Budget $48.837

million, Unfavourable variance $2.877 million

Depreciation costs were higher than

expected primarily due to a change in useful life for buildings as a result of

the June 2015 building asset revaluation exercise. The useful lives were

adjusted to reflect the component nature of these assets.

Interest

Actual $15.085 million, Budget $16.648

million, Favourable variance $1.563 million

The favourable variance in interest costs

was primarily due to the lower than expected level of debt.

WAIPORI FUND NET

OPERATING RESULT

Actual

$5.385 million, Budget $3.355 million, Favourable variance $2.030 million

The Waipori Fund net operating

result was favourable for the year to date mainly due to unrealised gains in

investments, partially offset by losses associated with the disposal of some

international equities.

Consistent with the overall

market, gains were recorded in May across most investment types (equities and

property), albeit the gain on international equities was impacted by the

stronger New Zealand dollar.

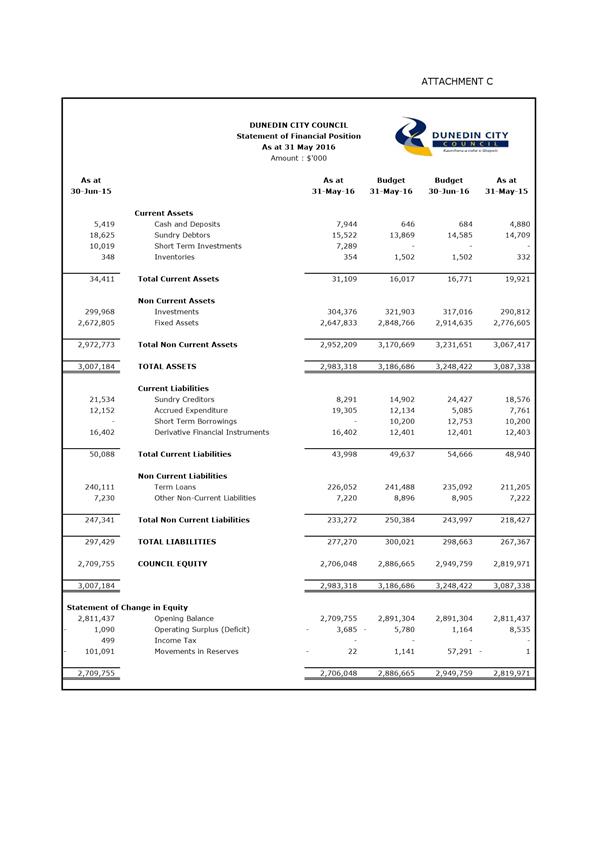

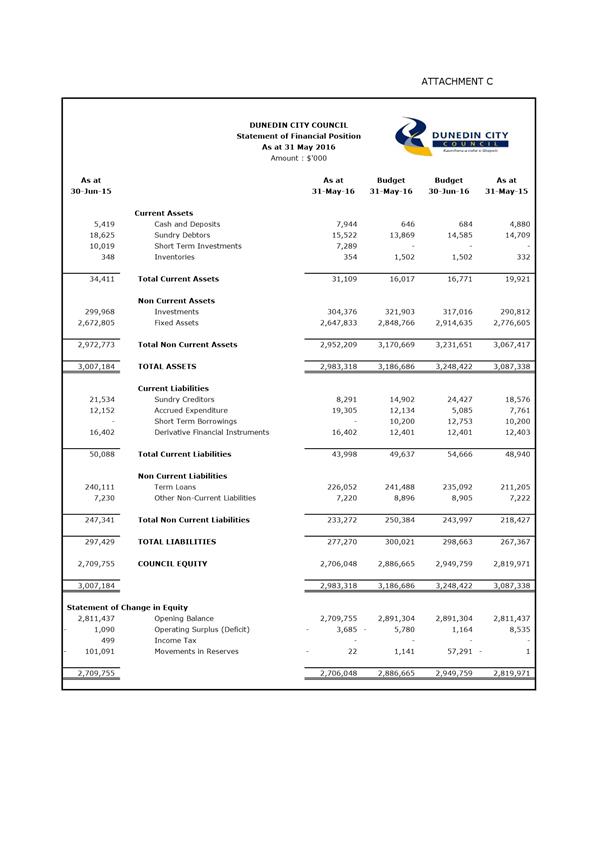

Statement of

Financial Position

A Statement of Financial Position is

provided as Attachment C.

The value of fixed assets was less than

budget as at 31 May 2016, due to lower capital expenditure (2014/15 and

2015/16), a net write down of investment properties 30 June 2015 and a negative

revaluation adjustment processed across building and infrastructural assets

again effective 30 June 2015.

Terms loans were less than budget primarily

due to a lower than expected loan balance at the start of the current financial

year and proceeds from asset disposals being used to pay down debt and savings

in capital expenditure.

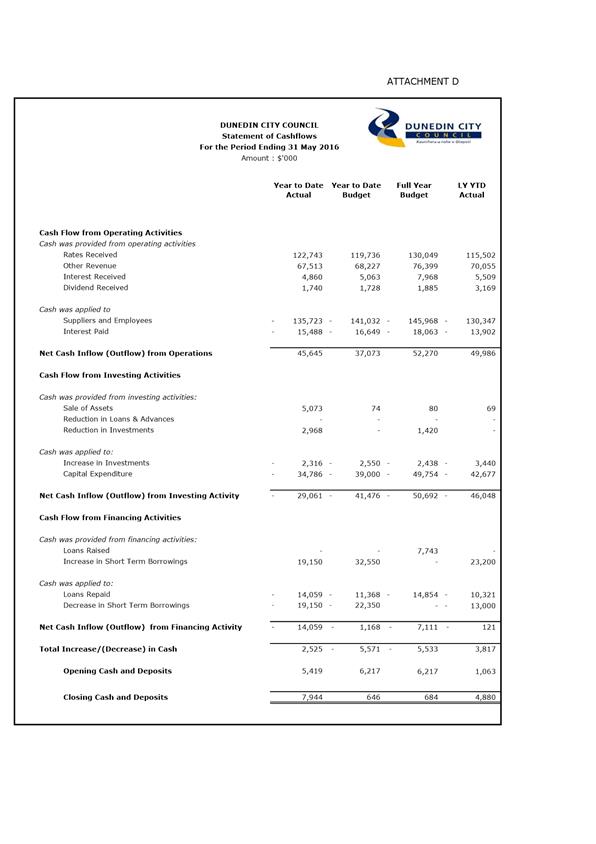

Statement of

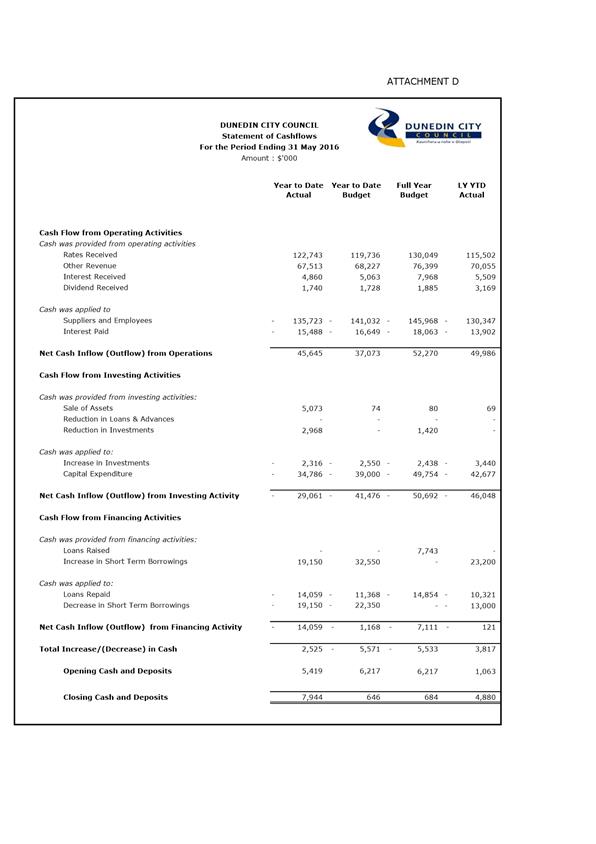

Cashflows

A Statement of Cashflows is provided as

Attachment D.

Net cashflow from operations was better

than expected reflecting the impact of the lower operating expenses (including

interest paid).

Cash outflows from investing were less than

budgeted mainly due to asset sales being greater than anticipated (Caledonian

Bowling Club site, Union St and the Emerson’s Brewery site), a lower

level of capital expenditure and delayed capital contribution payments to

subsidiary companies.

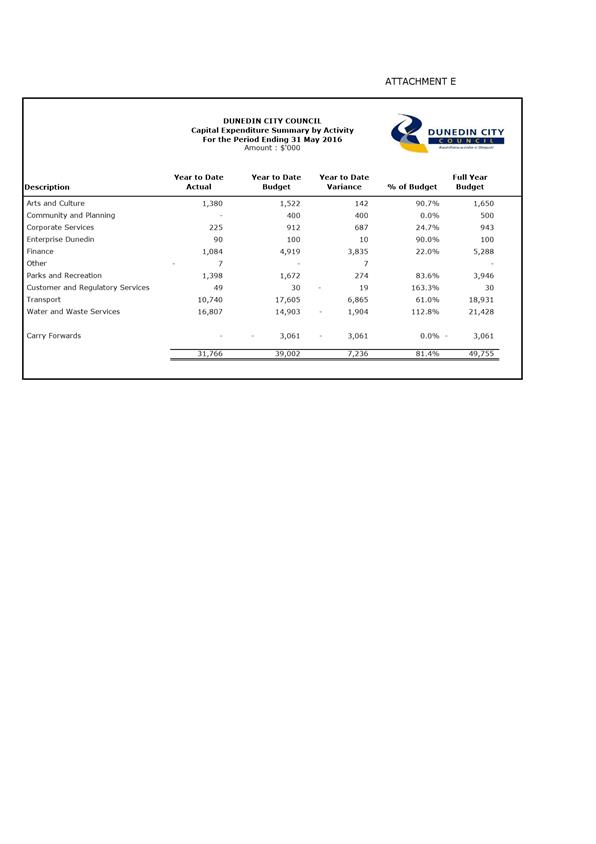

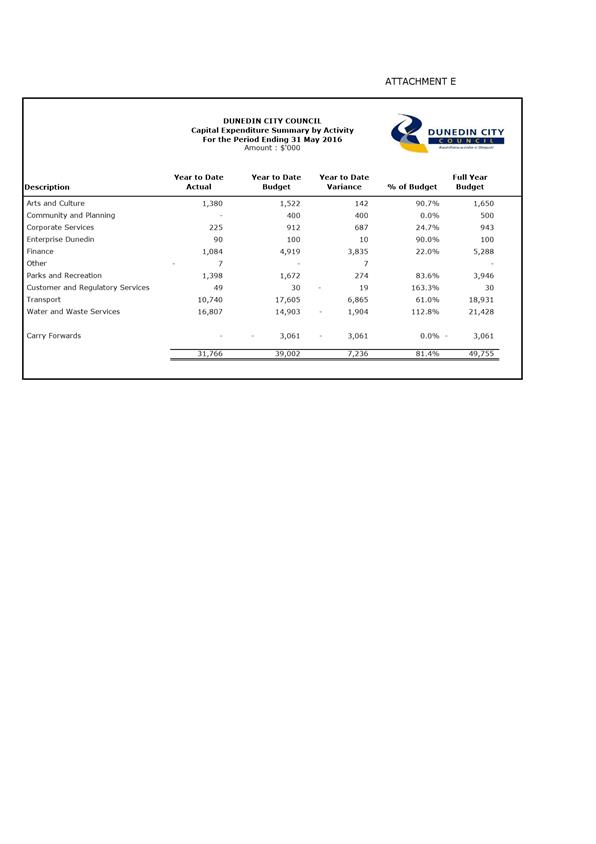

Capital

Expenditure

A summary of the capital expenditure

programme by Activity is provided as Attachment E.

Total capital expenditure for the period to

31 May 2016 was $31.766 million or 81.4% of the year-to-date budget of

$39.002 million. Note that the budget includes allocations of

$3.061 million of carry forwards from 2014/15.

Arts and Culture capital expenditure was $142k favourable

This variance was due to an under-spend on

collection acquisitions across the group and delays in completing the air

conditioning project at the Art Gallery. Library acquisitions are

expected to be on budget at year-end while Art Gallery expenditure is partly

dependant on external funding.

Community and Planning Group capital expenditure was $400k favourable

The 2015/16 City Wide Amenity Upgrade has

been delayed until 2016/17.

Corporate Services capital expenditure was $687k favourable

A number of corporate systems upgrades and

other ICT projects were delayed while scoping work is carried out. Some

of these projects are now underway.

Finance capital

expenditure was $3.835 million favourable

A number of building capital projects are

in the investigation and design stages. As such they will not be

completed in the current financial year.

Parking meter and fleet replacement

programmes are also running behind budget ($176k and $88k respectively).

These are expected to be spent by year end.

Transport capital

expenditure was $6.865 million favourable

Cycle Network expenditure was $1.643 million favourable.

Options are being considered around how best to deliver the remaining

works.

Footpath

Resurfacing was $858k favourable. Some of this work is now underway

including footpaths (North, South and Central) and kerb and channelling.

Other

renewal work was favourable with projects at various stages of

development. Some expenditure will carry over to 2016/17.

The Turnbull’s Bay slip repairs were $1.072 million

unfavourable. The contract has reached practical completion stage, although

buttressing is yet to be completed.

Water and Waste Services capital expenditure was $1.904 million unfavourable

The delivery of the capital programme continues to progress well.

The renewals budget is fully committed for the year, and any further tenders

let will have a start date after

1 July 2016.

A budget carry-forward of $2.300 million from the unspent Tahuna

Biosolids project has been signalled to fund the Biosolids project requirements

in 2016/17, along with reallocation to switchboard upgrades and Portobello Road

stormwater screens.

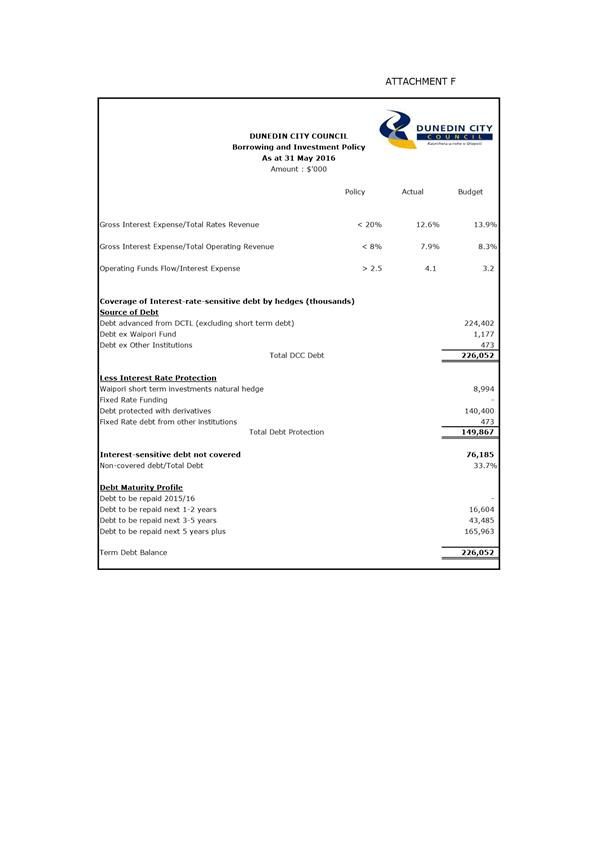

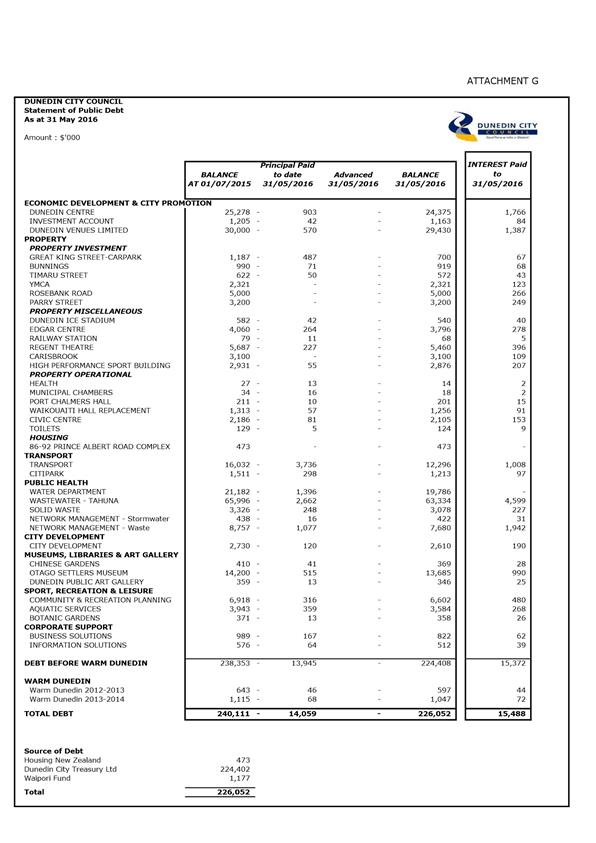

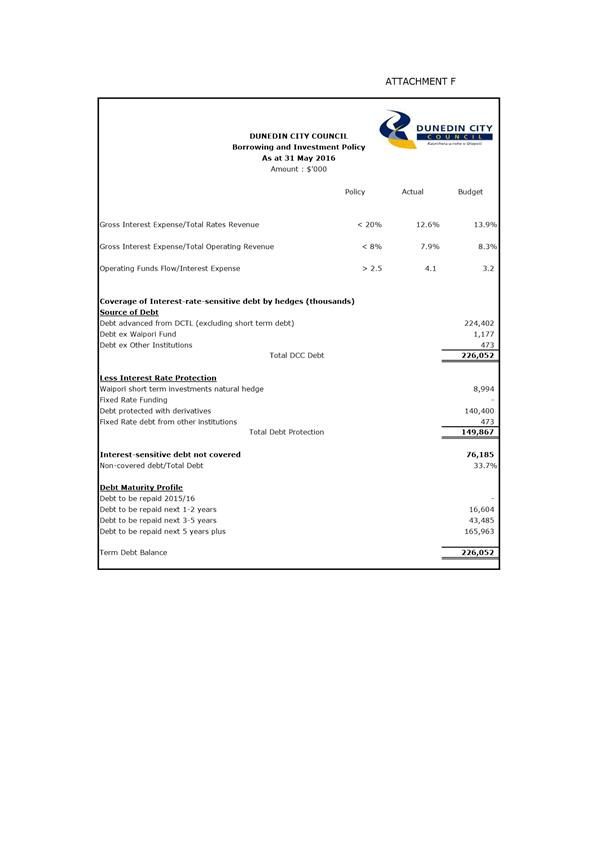

Debt

Refer to Attachments F and G.

Attachment F provides a summary of the debt

servicing ratios for the year to date.

All of the ratios met the specified

targets. These ratios are impacted by the timing of revenue which is not

necessarily spread evenly throughout the year compared with the cost of

servicing debt.

Term debt was below expectations for the

year to date due to no new loans raised in the 2014/15 and 2015/16 financial

years. Asset sales in the current year have also contributed to a

reduction in debt.

Note that both the actual and budget

figures include the $30.0 million transferred from Dunedin Venues Limited

effective 30 June 2015.

Debtors and rates

outstanding

Sundry debtors outstanding as at 31 May

2016 totalled $15.522 million. This included long term debt of $3.568 million,

and debt associated with Warm Dunedin of $2.781

million.

Of the $3.568 million long term debt,

$3.100 million was for debt relating to the sale of Carisbrook. This is due for

repayment July 2016.

Debtors outstanding for more than four

months (excluding long term debt and Warm Dunedin) totalled $460k, compared

with last year’s total of $310k as at 31 May 2015.

Rates arrears relating to prior year rates

totalled $394k. This was higher than the $226k total as at May

2015. Of this total $69k was being recovered under formal arrangements

with Council, while the balance was being actively pursued.

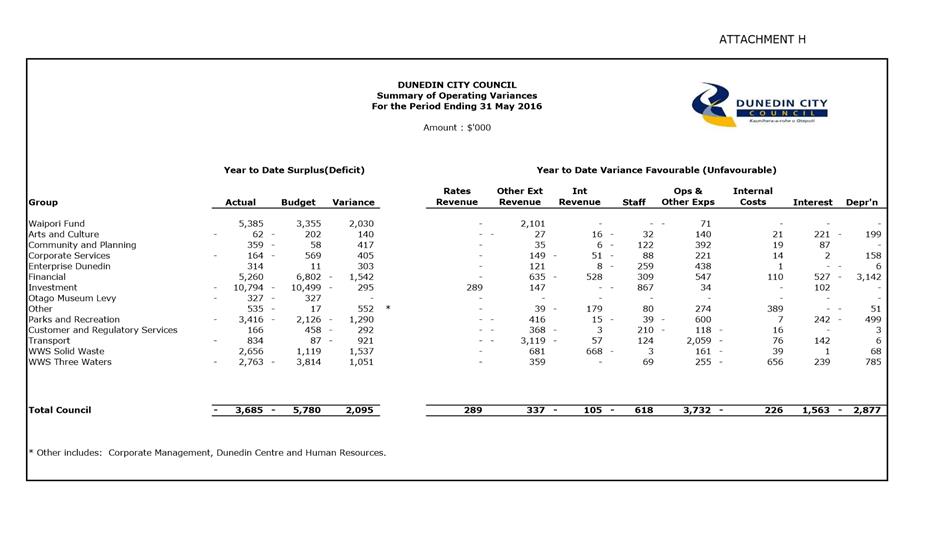

Comments from

group activities

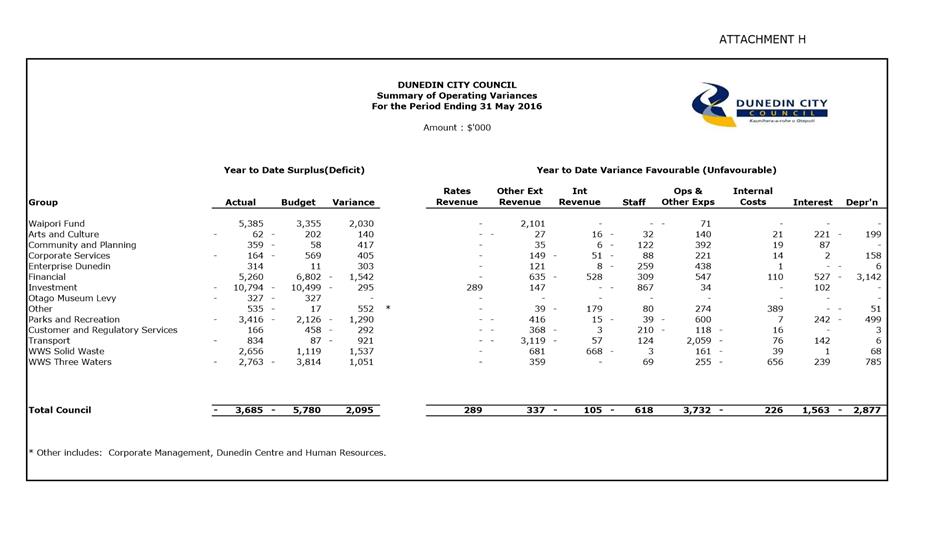

Attachment H, the Summary of Operating

Variances, shows, by Group Activity, the overall net surplus or deficit

variance for the period ended 31 May 2016. It also shows the variances by

revenue and expenditure type.

Community and Planning Group - $417k

Favourable

The

favourable variance was mainly due to the delayed timing of the payment of

Community, Arts, Civic and Events grants that will be paid in June.

Corporate Services Group - $405k Favourable

This favourable variance was due to

underspends across the group including 2 GP Hearing Costs and Council wide

advertising expenditure.

Enterprise Dunedin Group - $303k Favourable

This

favourable variance related primarily to delayed project based expenditure

(including Export Education Uplift), and the timing of Regional Partner Network

expenditure.

Finance Group - $1.542 million Unfavourable

Depreciation was unfavourable $3.142

million due to the change in useful lives of Council building assets resulting

from the June 2015 asset revaluation.

External revenue was $635k favourable

primarily due to an unbudgeted recovery for the service level agreement with

Dunedin City Treasury Limited, and higher than expected residential property

revenue with good occupancy.

Operating costs were favourable $547k due

mainly to planned property expenditure on hold while a new operational method

of assessing required maintenance for the housing portfolio is commissioned.

Parks and Recreation Group – $1.290

million Unfavourable

Operating expenditure was unfavourable

$600k due to deferred building maintenance and expenditure on the Ocean Beach

holding pattern project, for which there was no budget. Energy costs at

the crematorium and new propagation facility at the Botanic Garden were also

slightly greater than budgeted.

External revenue was unfavourable $416k due

to lower than expected revenue across a number of areas - development

contributions (budget overstatement), and burial revenue (move to cremations).

Customer and Regulatory Services Group

– $292k Unfavourable

The unfavourable operating variance was

primarily due to lower than expected revenue across a number of operating units

- Building inspection fees due to lower recoverable activity and parking

infringement fees and court fine recoveries due to fewer infringement notices

being issued along with a higher number of referrals for court collection.

Transport Group - $921k Unfavourable

External revenue was unfavourable $3.119

million mainly due to less than expected NZTA capital and operating work taking

place resulting in grants revenue being down on budget. The unfavourable

variance was partially offset by unbudgeted road safety revenue and an increase

in revenue from corridor access ways.

Operating expenditure was favourable $2.059

million primarily due to delayed timing of traffic services maintenance,

drainage works, pavement maintenance and non-subsidised general maintenance.

Personnel costs were favourable $124k due

to a number of vacancies in the group.

WWS Solid Waste – $1.537 million

Favourable

Landfill revenues were favourable due to

the combination of increased waste tonnages from out of the district, and

higher than expected sludge volumes.

WWS Three Waters – $1.051 million

Favourable

Revenue was $359k favourable, largely due

to unbudgeted development contribution revenue, partially offset by a shortfall

in water sales and trade waste revenue.

Total

expenditure was favourable primarily due to savings in depreciation costs.

|

Finance Committee

18 July 2016

|

|

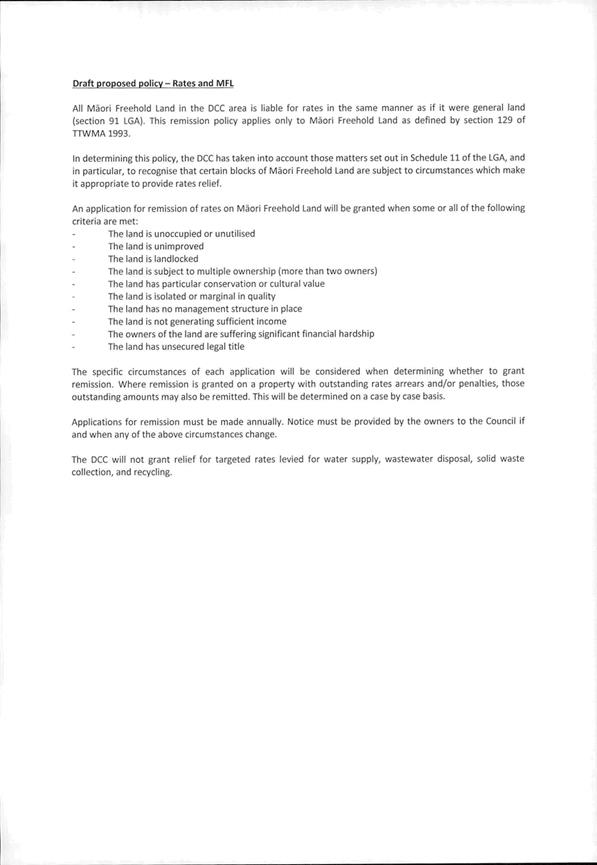

Rating Adjustment Possibilities for Māori

Freehold Land

Department: Finance

EXECUTIVE SUMMARY

1 This

report discusses rating adjustment possibilities for Māori freehold land.

2 Councillors

have requested a report on this topic following a submission from Ngāi

Tahu Māori Law Centre, requesting changes be made to the Council’s

current remission of rates policy for Māori freehold land.

3 A revised

policy could be developed in consultation with key stakeholders and feedback

from the Finance Committee.

|

RECOMMENDATIONS

That the Committee:

Decides

whether or not to develop a revised

policy for the remission of rates on Māori freehold land.

|

BACKGROUND

4 The

Council received a submission from the Ngāi Tahu Māori Law Centre as

part of the 2016/17 Annual Plan consultation requesting a change to the rating

policy regarding the remission of rates for Māori Freehold Land. As

a result of this and other submissions, the Council moved the following

resolution:

"Moved (Cr Richard

Thomson/Cr Hilary Calvert):

That the Finance Committee seeks reports for its meeting

on 18 July 2016 on:

· Rating adjustment possibilities for:

· retirement village licence to occupy houses;

· Maori freehold land

· Consideration of rating policies for residential

properties being used for short term commercial rental and/or

multiple studio rooms.

Motion carried (AP/2016/017)"

5 This

report discusses rating adjustment possibilities for Māori freehold land.

Māori

Freehold Land

6 Māori

freehold land is defined in the Local Government (Rating) Act 2002 (LGRA) as “land

whose beneficial ownership has been determined by the Māori Land Court by

freehold order”. There must be an order in the Māori land court records that

confers the status of Māori freehold land upon

the particular block of land.

7 The factors that make Māori freehold land “different”

relate to its different tenure arrangements, the restrictions on alienability,

and the fact much of it cannot be put to economic use.

8 As a

general rule, Māori freehold land is liable for rates as if it were

general land. There are, however, certain unique requirements for the

assessment and enforcement of rates on Māori freehold land, and a requirement

to have a policy on the remission and postponement of rates on Maori freehold

land.

9 The two

major differences in the enforcement provisions between Māori freehold

land and general land are:

· Māori

freehold land cannot be sold for unpaid rates

· Unpaid

rates generally have to be recovered through the charging order process in the

Māori Land Court system. There is a minimum timeframe and minimum

amount of rates required to access this process.

10 Each local authority

must have a policy covering remission and postponement of rates on Māori

freehold land.

Remission

and Postponement of Rates

11 The Council’s

existing policy, as stated in the 2015/16-2024/25 Long Term Plan for remission

of rates for Māori freehold land is that there is no specific policy;

however other Council rates remission policies may apply. The same policy is in

place for the postponement of rates for Māori freehold land.

12 Provided that the

Council can demonstrate it has considered the objectives and criteria of

schedule 11 of the Local Government Act 2002 (LGA), a policy of no remissions

and postponements is in accordance with both the letter and spirit of the

legislation.

13 The objectives to be

considered are:

· Supporting

the use of the land by the owners for traditional purposes

· Recognising

and supporting the relationship of Māori

and their culture and traditions with their ancestral lands

· Avoiding further

alienation of Māori freehold land

· Facilitating any wish of

the owners to develop the land further for economic use

· Recognising and taking

account of the presence of waahi tapu that may affect the use of the land for

other purposes

· Recognising and taking

account of the importance of the land in providing economic use

· Recognising and taking

account of the importance of the land in providing economic and infrastructure

support for marae and associated papakainga housing (whether on the land or

elsewhere)

· Recognising and taking

account of the importance of the land for community goals relating to

· The

preservation of the natural character of the coastal environment

· The

protection of outstanding natural features

· The

protection of significant indigenous vegetation and significant habitats of

indigenous fauna

· Recognising

the level of community services provided to the land and its occupiers, and

· Recognising

matters relating to the physical accessibility of the land.

14 The Council must

consider:

· The

desirability and importance of the above objectives

· Whether,

and to what extent, the attainment of any of these objectives could be

prejudicially affected if there is no remission of rates or postponement of the

requirement to pay rates on Māori freehold land

· Whether,

and to what extent, the attainment of any of these objectives is likely to be

facilitated by the remission of rates or postponement of the requirement to pay

rates on Māori freehold land, and

· The

extent to which different criteria and conditions for rates relief may

contribute to different objectives.

DISCUSSION

Ngāi

Tahu Māori Law Centre Submission

15 The submission by

the Ngai Tahu Māori Law Centre (attached) suggests that while the current

policy is compliant with the LGA, the lack of a specific remission policy is

having a detrimental effect on the potential rates the Council could be

collecting from Māori Freehold land, and that the rates currently being

charged are hindering the development and utilisation of some of the land.

16 They stressed that

they are not requesting a blanket remission of rates on all Māori freehold

land as some of this land is developed, being used and therefore should be

responsible for the payment of rates, but rather that remissions be applied, on

a case-by-case basis for land blocks where funds cannot be generated to pay

rates from working the land itself, and that meet specific criteria.

17 The submission

stated that listing Māori land as ‘abandoned’ is highly

insensitive, and does not show adequate respect or consideration to the nature

of Māori freehold land.

Dunedin

City Council Māori Freehold Land

18 Historically, the

assessment and enforcement of rates on Māori freehold land has not been an

issue for this Council.

19 Dunedin City does

not have a significant amount of Māori freehold land. There are

currently more than 55,000 rateable properties in the Dunedin City

Council’s rating area.

20 The Council

doesn’t have a list of properties classified as Māori freehold land.

However a search of the legal description in the property database for

any reference to ‘Māori Land’ (ML) identified 261 properties.

Reference in the legal description to ML means the property was originally

surveyed as Māori land. It does not mean that it is still Māori land

because it could have been passed into private ownership. Without a title

search on the 261 properties we cannot be certain how many are Māori

land and/or how many are Māori freehold land.

21 The properties

identified with ML in the legal description are summarised in the table

below. The table shows Māori land, non-rateable Māori land,

Māori land considered ‘abandoned’ for rating purposes and

‘low value’ Māori land.

|

|

Number

of Properties

|

Rates

2015/16

|

Capital

Value

|

|

Māori Land

|

193

|

306,647

|

70,494,600

|

|

Māori Land -

Non-rateable

|

36

|

0

|

18,176,450

|

|

Māori Land -

‘Abandoned’

|

31

|

16,900

|

2,844,300

|

|

Māori Land - Low Value

|

1

|

7

|

2,950

|

|

Total

|

261

|

323,555

|

91,518,300

|

Non-rateable

Māori Land

22 Schedule 1 of the

LGRA defines certain Māori land as non-rateable. This land includes

land that:

· Is

Māori customary land

· Is

used for a Marae or meeting place

· Has

a meeting house erected

· Is

non rateable by virtue of an order of the Council by the Governor General

This land is non-rateable for all rates except those rates

set solely for water supply, sewage disposal or waste collection.

Abandoned Land

23 Where ownership of

any land is not certain and the land appears to be unoccupied, or

“abandoned”, the annual rates are written off. This is the

case with all properties that the Council considers

“abandoned”. There are approximately 118 abandoned properties

in Dunedin city where rates of approximately $27,000 are written off each year

because the ownership is not certain and the properties are not occupied.

In the 2015/16 year, 31 of these properties were Māori land.

24 “Abandoned

land” is any rating unit on which rates have not been paid for three

years or more, and where the ratepayer:

· Is

unknown, or

· Cannot

be found after due inquiry and has no known agent, or

· Is

deceased and has no known agent, or

· Has

given notice that they have abandoned the land or intend to abandon the land.

25 Local authorities

can sell abandoned land. They cannot sell abandoned Māori freehold land.

26 While the treatment

of Māori land properties as abandoned, in most cases, is appropriate and

practical, an instance has been highlighted to the Council where it was not an

appropriate solution and, as the submission from the Ngāi Tahu Māori

Law Centre highlighted, a different remission policy could be more appropriate.

Low Value Rates

27 Rates classified as

‘low value’ are written off where the amount of rates levied is

less than the cost of debt collection. There are approximately 60 low value

properties in Dunedin city where rates of approximately $350 are written off

each year because the cost of collection of the rates exceeds the debt. In the

2015/16 year, 1 of these properties was Māori land.

Other

Remission Policies

28 In addition to the

remission and postponement policies on Māori freehold land, the Council

has the following policies:

· Remission

of rates for extreme financial hardship

· Postponement

of rates for extreme financial hardship

· Remission

of penalties

· Remission

for certain targeted rates on farmland

· Remission

for certain targeted rates on farmland and commercial land used by the same

ratepayer as a single entity

· Remission

of rates on land voluntarily protected for conservation purposes

· Remission

of rates following a natural calamity.

Consultation

29 Consultation on any

change to the remission policy on Maori freehold land will be undertaken with

key stakeholders. This will include local iwi via the Maori Participation

Working Party, Kāi Tahu ki Otago Limited and the Ngāi Tahu Māori

Law Centre.

30 A draft policy could

be developed with feedback from these stakeholders and the Finance

Committee. A draft policy could then be presented to the incoming Council

later in the year for their consideration and then formally approved for

consultation during the January 2017 Annual Plan Council meeting.

31 A draft policy could

be consulted on concurrently with the 2017/18 Annual Plan consultation.

OPTIONS

Option

One

32 The Council could

develop and implement a comprehensive policy allowing for the remission of

rates for Māori Freehold land, on a case-by-case basis, under appropriate

circumstances.

Advantages

· A

specific policy allowing for remission of rates owing could create scope for

some Māori freehold land owners to develop or utilise the land in

question, meaning it could eventually become usable and able to pay rates.

· Clear

policy and criteria would help remove any doubt on what could be remitted.

· Remission

of rates could end the need for land to be classed as ‘abandoned,’

when rates are unable to be paid – which is of cultural significance for

Māori freehold land owners.

Disadvantages

· Additional

administration – application for remission will require annual

consideration on a case by case basis.

Option

Two – Status Quo

33 Maintain the current

policy regarding remission of rates on Māori Freehold land, which is that

there is no specific policy; however other Council rates remission policies may

apply.

Advantages

· Administrative

requirements are unchanged.

Disadvantages

· The

current policy is not specific enough to help meet the needs of some Māori

freehold land owners.

NEXT STEPS

34 If the Finance

Committee agree to develop a revised policy on the remission of rates on

Māori freehold land in consultation with key stakeholders, a draft policy

could be developed and provided to the new Council to consider later in the

year.

Signatories

|

Author:

|

Carolyn Allan - Senior Management Accountant

|

|

Authoriser:

|

Grant McKenzie - Group Chief Financial Officer

|

Attachments

|

|

Title

|

Page

|

|

a

|

Submission from the

Ngai Tahu Māori Law Centre during consultation on the 2016/17 draft

Annual Plan

|

36

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision/report/proposal enables democratic local

decision making and action by, and on behalf of communities by considering a

different approach to unpaid rates on Māori freehold land.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Aspects of a draft policy may touch on the strategies

selected including the Revenue and Financing Policies.

|

|

Māori Impact

Statement

Consultation will be undertaken with key stakeholders

including local iwi via the Maori Participation Working Party, Kāi Tahu

ki Otago Limited and the Ngāi Tahu Māori Law Centre.

|

|

Sustainability

There are no implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

If a revised policy is developed it could be consulted on

concurrently with the 2017/18 Annual Plan.

|

|

Financial

considerations

There are no financial impacts at this stage.

|

|

Significance

The significance of this decision is low.

|

|

Engagement –

external

There has been no external engagement at this stage.

|

|

Engagement -

internal

Advice and information has been sought relevant

departments.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified legal or health and safety risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known impacts for Community Boards at this

stage.

|

|

Finance Committee

18 July 2016

|

|

|

Finance Committee

18 July 2016

|

|

Part

B Reports

Rates Rebate - Occupational Right Agreements

Department: Finance

EXECUTIVE SUMMARY

1 The

Council has requested a report on the provision of a rates rebate for residents

of retirement villages whose property ownership is governed by an

"Occupational Right Agreement (ORA)" or "Licence to Occupy

Agreement (LTO)".

2 The

report identifies the potential pool of residents who may seek to apply for

this rebate based on a survey of the affected retirement villages, along with

estimated costings of the proposal.

3 A private

members bill related to this topic has been developed and is awaiting its first

reading in parliament.

|

1 RECOMMENDATIONS

That the Committee:

a) Notes the

Rates Rebate – Occupational Right Agreements Report and that an update

on the Private Members Bill will be provided to the incoming Council.

|

BACKGROUND

4 The

Council received submissions from retirement villages, local members of

parliament, Grey Power Otago and individual retirement village residents as

part of the 2016/17 Annual Plan consultation. The submitters requested a

change to the Rates Remission Policy for residents of retirement villages who

would qualify for the central government rates rebate scheme, except they

occupy their property under an Occupation Right Agreement. As a result of

this and other submissions, the Council requested that reports be prepared for

the 18 July 2016 Finance Committee as per the following resolution:

"Moved (Cr Richard

Thomson/Cr Hilary Calvert):

That the Finance Committee seeks reports for its meeting

on 18 July 2016 on:

a) Rating

adjustment possibilities for:

· retirement village licence to occupy houses;

· Maori freehold land

b) Consideration

of rating policies for residential properties being used for short term

commercial rental and/or multiple studio rooms.

Motion carried (AP/2016/017)"

5 This

report discusses rating adjustment possibilities for retirement village licence

to occupy houses.

Rates

Rebate Scheme

6 The

central government offers a rates rebate scheme to low income households.

The scheme is administered by the Department of Internal Affairs (DIA) which

offers a maximum rebate of $610 for the 2015/16 and 2016/17 rating years.

7 Applications

to the scheme are administered by Council, with the rebate assistance coming in

the form of a deduction on the rates bill. This rebate or deduction is

then reimbursed to Council by the DIA.

8 The

rebate scheme is only available where the resident is the owner or lessee of

the rating unit i.e. the resident must be directly liable for the payment of

local authority rates and hence the residents name must appear on the rate

account. Other low income households that have tenancy agreements or a

right to occupy the property but are not the identified ratepayer are excluded

from the scheme. This is the case even if the occupants are responsible

for paying the rates through the terms of their occupancy agreement.

9 This is a

particular issue for retirement villages where the property ownership is held

under an occupational rights or licence to occupy agreement. Residents

under these arrangements cannot access the rebate scheme as they would if

ownership was via full title to the property.

10 The long term

solution to this issue would be to redefine ‘ratepayer’ in the

legislation. In the interim a number of Councils including Auckland City,

Thames Coromandel District, New Plymouth District and Kapiti District have

implemented rebate schemes for retirement villages operating under the

occupancy right arrangements, with the available rebate being a direct cost to

Council.

11 A private members

bill addressing this issue has been developed and is awaiting first reading in

parliament. The general policy statement from this bill outlines the key

issue as shown below:

a) “The

rates rebate scheme was introduced in 1973 to allow ratepayers of residential

properties who are on low incomes to receive a rebate on their rates.

This was before the expansion of retirement villages and occupation right

agreements (ORAs). Residents of retirement villages with ORAs pay rates

but, in most circumstances, pay indirectly (i.e. to the retirement village

owner) rather than directly to the local authority. Under the Rates

Rebate Act 1973, these residents are not entitled to a rates rebate. It

is this anomaly that this Bill addresses.”

b) “Some

local authorities have changed their rating practice so that individual

residents with ORAs are billed directly for their rates. In these

instances, the residents are entitled to apply for a rates rebate. This

amendment would ensure that, regardless of the billing practice of the local

authority, residents are recognised as paying rates, and are therefore entitled

to apply for a rates rebate.”

12 Clause 4 of the

Rates Rebate (Retirement Village Residents) Amendment Bill proposes

replacing the definition of ‘ratepayer’ with one that

recognises as ratepayers not only those persons defined as ratepayers under the

Local Government (Rating) Act 2002, but also those residents of retirement

villages who pay rates, directly or indirectly, in connection with their

occupation right agreements.

DISCUSSION

13 A survey was

conducted of retirement villages within Dunedin City. Five villages were

identified and contact was made to obtain the number of dwellings, type of

dwellings and the property rights for each dwelling.

14 The survey was

conducted by resident Diane Carnie and her assistance has been greatly

appreciated.

15 The following table

summarises the number of dwellings in each of the property categories, i.e. the

number of townhouses, apartments, unit titled and ORAs.

|

Retirement Village

|

Townhouses

|

Apartments

|

Unit

Titled

|

ORAs

|

|

Brooklands

|

135

|

|

49

|

86

|

|

Chatsford

|

187

|

81

|

96

|

172

|

|

Frances Hodgkins

|

|

74

|

48

|

26

|

|

Summerset

|

61

|

40

|

|

101

|

|

Yvette Williams

|

|

32

|

|

32

|

|

Total

|

383

|

227

|

193

|

417

|

16 The following table

provides an analysis of the potential direct cost to Council if they were to

adopt and hence fund a rebate scheme for ORA or LTO residents.

|

Retirement Village

|

ORAs

#

|

Rates

Rebate Maximum

$

|

Rates

Rebate Likely Scenario

$

|

|

Brooklands

|

86

|

52,460

|

18,361

|

|

Chatsford

|

172

|

104,920

|

36,722

|

|

Frances Hodgkins

|

26

|

15,860

|

5,551

|

|

Summerset

|

101

|

61,610

|

21,564

|

|

Yvette Williams

|

32

|

19,520

|

6,832

|

|

Total

|

417

|

$254,370

|

$89,030

|

|

Cost to Council (excl GST)

|

|

$221,191

|

$77,417

|

|

Full Rebate (2015/16)

|

|

$610

|

$610

|

|

Percentage Eligible

|

|

100%

|

35%

|

17 The table shows the

maximum rebate if all 417 ORA dwellings received the full $610 rebate.

This is an unlikely scenario due to the other rates rebate scheme

restrictions. The table also shows a more likely scenario based on an

assumption that 35% of the 410 dwellings would be eligible for the rates rebate.

The cost of this scenario is $77,417.

18 Note that there

would also be an additional administrative cost to introduce a Council funded

rates rebate scheme. While it is difficult to estimate, if we assumed 1

hour per rebate and an hourly rate of $40 this would equate to a cost of

between $6k and $17k.

19 The actual cost

would be dependent on the level of applications to the scheme and whether or

not the processing commitment can be met with current levels of

resourcing. The Council currently engages temporary staffing to deal with

the applications made to the DIA funded rebate programme.

Development

of a new Remission Policy

20 Option one below

discusses the development of a new remission policy specifically for the

provision of rates rebates for retirement village ORA or LTO residents.

21 To be eligible for

the remission the following criteria would need to be meet:

a) Be a resident

of an approved retirement village (i.e. the five identified above) under an

occupational right or licence to occupy agreement

b) Reside in a

unit or apartment that is identified by the Dunedin City Council as a

separately used or inhabited part of the retirement village to which separate

rate charges are applied

c) Have resided

on the property at the beginning of the rating year (1 July)

d) Be an

individual, rather than an organisation or trust

e) Only one

application per unit or apartment would be accepted.

22 In terms of the

conditions for granting the rebate this would be in line with the criteria used

by the DIA including reference to the rates applicable to the property, the

applicants gross household earnings, and the rebate thresholds set by the DIA.

23 The rebate would be

made on the consolidated rate account for the retirement village, who would

then have the responsibility to pass back to the resident concerned – in

line with the current process used for these villages.

Financial

Implications

24 The budget estimate

for the implementation of the likely scenario shown in paragraph 15 is

$77,417. These costs, along with any administration costs are unbudgeted.

25 If the Council

approved a new remission policy for this purpose, in the 2016/17 year this

expenditure would need to be funded from savings elsewhere and/or reprioritised

budgets. A specific budget would need to be provided for in the draft

2017/18 budget.

Consultation

26 A new remission

policy can be developed at any time. Consultation does not require a

special consultative procedure, however it does require consultation with

affected parties where access to the relevant information is provided along

with the opportunity to present their views to the Council. Consultation could

be initiated via direct correspondence with the retirement villages and other

interested parties.

OPTIONS

Option

One

27 Develop a new rates

remission policy to include a rates rebate/remission for retirement village

residents where property ownership is through an occupancy right or licence to

occupy agreement. In this option the rebate would be offered in line with

the current criteria used for the DIA funded rebate programme.

Advantages

· Provides

a temporary solution to the anomaly in the legislation that prevents this form

of property ownership accessing the current low income rates rebate scheme.

Disadvantages

· There

would be a direct cost to Council in implementing the rebate.

Option

Two – Status Quo

28 In this option the

Council would not introduce a Council funded rebate scheme for the affected

residents of retirement villages but would revisit the options when the outcome

of the private members bill is known.

Advantages

· There

would be no additional cost to Council.

Disadvantages

· The

legislative anomaly that prevents this form of property ownership accessing the

current low income rates rebate scheme would remain. This anomaly would not be

addressed in this option, until/unless legislative change occurs.

NEXT STEPS

29 An update on the

private members bill will be provided to the incoming Council.

30 The recommended

option is to wait until the outcome of the private members bill is known.

An update would then be provided to the Finance Committee for

consideration.

Signatories

|

Author:

|

Carolyn Allan - Senior Management Accountant

Gavin Logie - Financial Controller

|

|

Authoriser:

|

Grant McKenzie - Group Chief Financial Officer

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

The proposal to offer a rates rebate/remission to

residents in retirement villages relates to providing a public service and it

is considered good-quality and cost-effective. Adoption of option one

would seek to address an anomaly in the current rating legislation related to

the ownership model used by retirement villages and how that impacts access

to the current government funded rebate scheme.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

l☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

A rates rebate/remission to residents in retirement

villages would have relevance to the Revenue and Financing Policies and the

Social Wellbeing Strategy.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

If a rebate scheme is adopted there will be an on-going

annual cost to Council until the legislation is updated to recognise the use

of occupational right agreements for retirement villages.

|

|

Financial

considerations

If a rebate scheme is adopted there will be an on-going

annual cost to Council until the legislation is updated to recognise the use

of occupational rights agreements for retirement villages.

|

|

Significance

The significance of this decision is low.

|

|

Engagement –

external

In preparing this report, Council through a third party

has contacted retirement villages where the property right of residents is

covered by an occupational right or licence to occupy agreement.

In addition submissions were made through the 2016/17

annual plan consultation process. Submitters included: Retirement

Villages, local MPs, Grey Power Otago and individual retirement village

residents.

|

|

Engagement -

internal

There has been no internal engagement on this matter.

|

|

Risks: Legal /

Health and Safety etc.

There are no known legal and/or health and safety risks.

|

|

Conflict of

Interest

There are no identified conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|