|

Finance Committee

5 September 2016

|

|

Attachment I

Attachment I

Financial Review

For The

Year Ended 30 June 2016

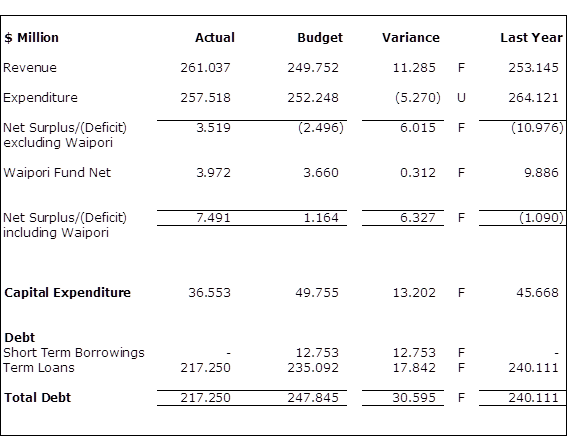

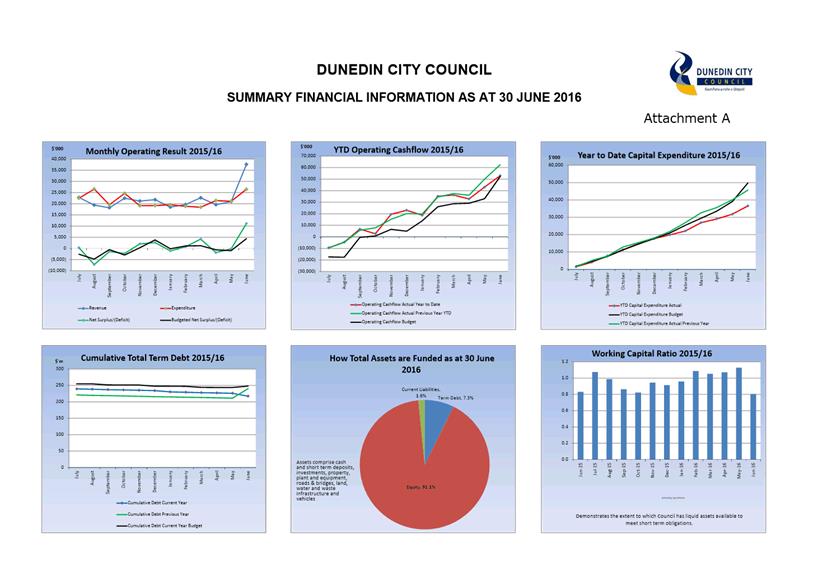

This report provides a commentary on the

Council’s financial results for the year ended

30 June 2016 and the financial position at that date.

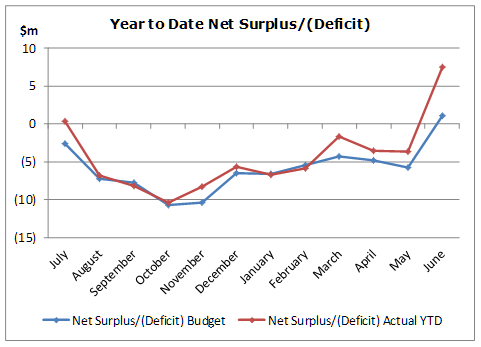

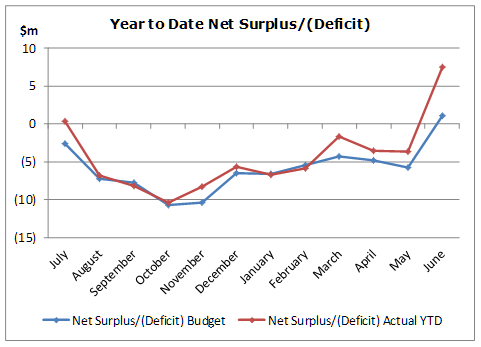

net surplus/(Deficit)

(including waipori)

The net

surplus (including Waipori) for the twelve months to June was $7.491 million or

$6.327 million better than budget.

The favourable

variance against budget was due to the following:

· $5.708

million – higher than expected other operating revenue. Favourable

variances included:

Ø $730k

fair value gains in Investment Properties;

Ø $3.885

million gain on the disposal of property assets (Union Street and Caledonian);

Ø $300k

an unbudgeted recovery for the service level agreement with Dunedin City

Treasury Ltd;

Ø $504k

solid waste due to additional tonnage through the Green Island Landfill;

Ø $323k

Transport where community road safety and corridor access revenue was greater

than budget;

Ø $331k

Improved property revenue including higher than expected residential occupancy;

These favourable variances were partially offset by

lower parking enforcement revenue, and lower water sales revenue.

· $9.172

million – contributions due to the early timing of recoveries from

developments in Mosgiel as well as unbudgeted vested assets revenue ($8.302

million) in Transportation and Three Waters ($640k).

· $2.687

million - assets operations and maintenance expenditure was less than

expected largely due to delayed timing related to transport work including

drainage works, traffic services maintenance, paving maintenance and

non-subsidised general maintenance. In addition property maintenance was

running behind budget. These favourable variances were partially offset

by expenditure on a condition assessment of the Green Island Waste Treatment

digester and repairs to the Mosgiel Waste Treatment clarifiers.

· $2.216

million – lower than expected interest costs, primarily due to the lower

than expected loan balances.

· $312k

– Waipori Fund, resulting from fair value gains in investments, partially

offset by losses on the disposal of some international equities.

These

favourable variances were partially offset by:

· $3.169

million - depreciation costs were higher than expected due to the revision of

useful lives for the Council property portfolio as a result of the June 2015

building asset revaluation exercise. The useful lives were adjusted to

reflect the component nature of building assets.

· $3.977 million - lower than expected grants revenue mainly as a

result of Transport undertaking less capital projects than expected. The

cancelled University Oval Cricket Light project resulted in budgeted revenue of

$1.2 million not being received. Both of these items are reflected in

savings in capital expenditure.

· $4.575 million – other expenses higher than budgeted primarily

due to fair value losses on Investment Properties ($4.240 million).

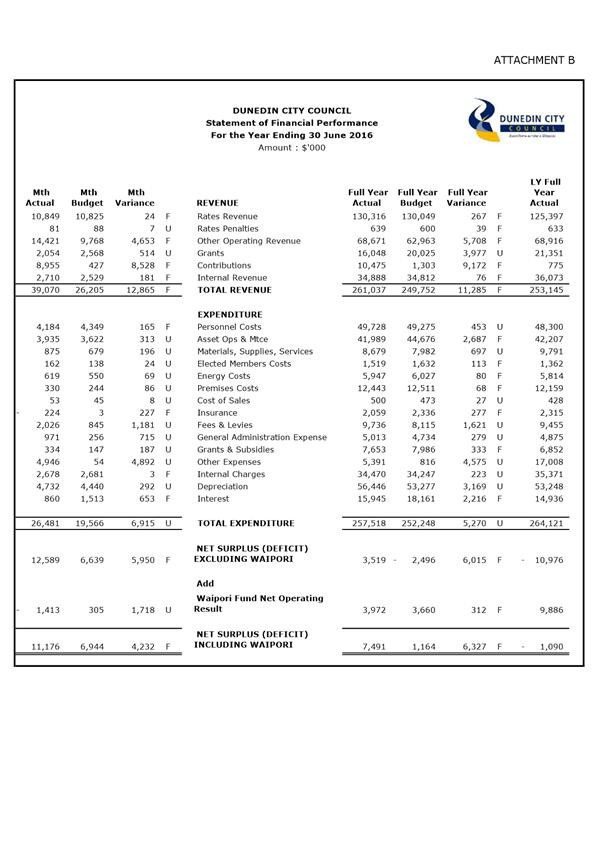

REVENUE

The total revenue for the year was

$261.037 million or $11.285 million greater than budget.

The major income variances were as follows:

Other Operating Revenue

Actual $68.671 million, Budget $62.963

million, Favourable variance $5.708 million

Solid Waste revenue was favourable $504k

primarily due to additional tonnage processed through the Green Island

landfill.

Transport revenue was favourable $323k due

to community roading safety receiving an unbudgeted amount of $95k relating to

the cycle way network and safer schools, and corridor access way revenue being

$238k favourable to budget.

Finance revenue was favourable $312k due to the unbudgeted

service level fee recovery from Dunedin City Treasury Ltd ($300k) along with

unbudgeted other recoveries versus budget.

Economic Development revenue was favourable

$138k due to receipt of Regional Business Partner Network contract revenue.

Parks revenue was favourable $3.903 million

mainly due to the gain realised on the sale of some property related assets.

Property revenue was favourable

$882k. This primarily related to fair value gains for Investment

Properties. There was also higher than expected residential revenue with

higher occupancy levels.

These favourable variances were partially

offset by:

·

Parking Enforcement revenue was unfavourable

$347k with both infringement fees and court fines recoveries being less than

expected. This was in part due to fewer infringement notices being issued

along with a higher number of referrals for court collection.

Three Waters revenue was unfavourable $525k

due to water consumption being lower than expected.

Grants

Actual $16.048 million, Budget $20.025

million, Unfavourable variance $3.977 million

Transport grants and subsidy revenue was

unfavourable by $3.006 million due to less than expected NZTA funded work

(operating & capital) taking place year to date.

Parks contributions revenue was

unfavourable $1.197 million. $1.2 million budgeted revenue from Otago

Cricket was not received due to the cancelling of the University Oval Cricket

Light project.

This unfavourable variance was partially

offset by:

$108k favourable variance in Civic due to

donations received related to the June Flood Relief fund.

Contributions

Actual $10.475 million, Budget $1.303 million,

Favourable variance $9.172 million

Unbudgeted

vested assets revenue in Transportation $8.302 million and Three Waters

$640k.

Development contribution revenue was $204k

favourable due to the early timing of recoveries from Mosgiel developments.

Expenditure

The total expenditure for the year was

$257.518 million or $5.270 million greater than budget.

The major expenditure variances were as

follows:

Personnel Costs

Actual $49.728 million, Budget $49.275

million, Unfavourable variance $453k

The unfavourable variance was due to higher

than expected recruiting costs, increased fringe benefit costs associated with

the private use of Council vehicles, and unbudgeted salary costs funded from

external recoveries and savings in general operating budgets.

These unfavourable variances were partially

offset by under-expenditure on staff training ($102k) and a number of position

vacancies across Council.

Asset Operations and Maintenance Costs

Actual $41.989 million, Budget $44.676

million, Favourable variance $2.687 million

Transport costs were favourable $1.617

million largely due to under expenditure in the areas of routine drainage work

($59k), pavement maintenance ($74k), traffic services maintenance ($536k),

cycleway maintenance ($149k) and general maintenance ($934k).

Property costs were $1.015 million

favourable with planned work on hold while a new operational method of

assessing required maintenance for the various property portfolios was

commissioned.

BIS costs were $673k favourable due mainly

to lower than expected Infrastructure as a Service costs.

Fleet Operations costs were favourable

$132k mainly due to fuel and repair costs being less than budgeted.

These favourable variances were partially

offset by:

Parks expenditure was ahead of budget $452k

due mainly to unbudgeted renovations of sports fields, maintenance and event

costs at the University Oval, deferred maintenance costs of coastal structures

and costs associated with contract reviews.

Water and Waste Services expenditure was

unfavourable $255k due to higher than expected water network maintenance costs

and plant maintenance costs associated with an unplanned expenditure on the

Green Island Treatment plant thermophillic digester, which is now

complete. There have been a number of other unscheduled maintenance

expenses for emergency repairs, including for example repairs on the clarifiers

at the Mosgiel WWTP.

Fees and Levies

Actual $9.736 million, Budget $8.115

million, Unfavourable variance $1.621 million

Property costs were unfavourable

$1.001 million, mainly professional fees relating to the development of

deferred maintenance schedules and identification of hazards. There were

also unbudgeted costs associated with the development of the Vanguard

methodology for property maintenance systems.

Regulatory Services costs were

unfavourable $377k due to unbudgeted consultancy costs relating to outsourced

building consent processing and unbudgeted legal costs.

BIS costs were unfavourable

$203k. External consultant expenditure was unfavourable $358k due to

costs relating to the transition to externally out-sourced services. This

was partially offset by reduced Microsoft licencing fees as a result of better

than expected contract negotiations.

Resource Consents costs were

unfavourable $119k mainly due to unbudgeted litigation costs on a number of

appeals, prosecutions and other compliance matters.

Grants & Subsidies

Actual $7.653 million, Budget $7.986

million, Favourable variance $333k

This favourable variance resulted

from an underspend on various community and civic grants across Council

including Heritage Rates Remission grants, GigCity grant and Waste Strategy

grants.

The budgeted underwriting for

the Otago Therapeutic Pool Trust was not called upon ($100k).

Other Expenses

Actual $5.391 million, Budget $816k,

Unfavourable variance $4.575 million

Property costs were unfavourable $4.209

million due to fair value losses on Investment Properties.

Depreciation

Actual $56.446 million, Budget $53.277

million, Unfavourable variance $3.169 million

Depreciation costs were higher than

expected primarily due to a change in useful life for buildings as a result of

the June 2015 building asset revaluation exercise. The useful lives were

adjusted to reflect the component nature of these assets.

Interest

Actual $15.945 million, Budget $18.161

million, Favourable variance $2.216 million

The favourable variance in interest costs

was primarily due to the lower than expected level of debt.

WAIPORI FUND NET

OPERATING RESULT

Actual

$3.972 million, Budget $3.660 million, Favourable variance $312k

The Waipori Fund net operating

result was favourable for the year mainly due to unrealised gains in property

investments and New Zealand equities, partially offset by losses associated

with the disposal of some international equities.

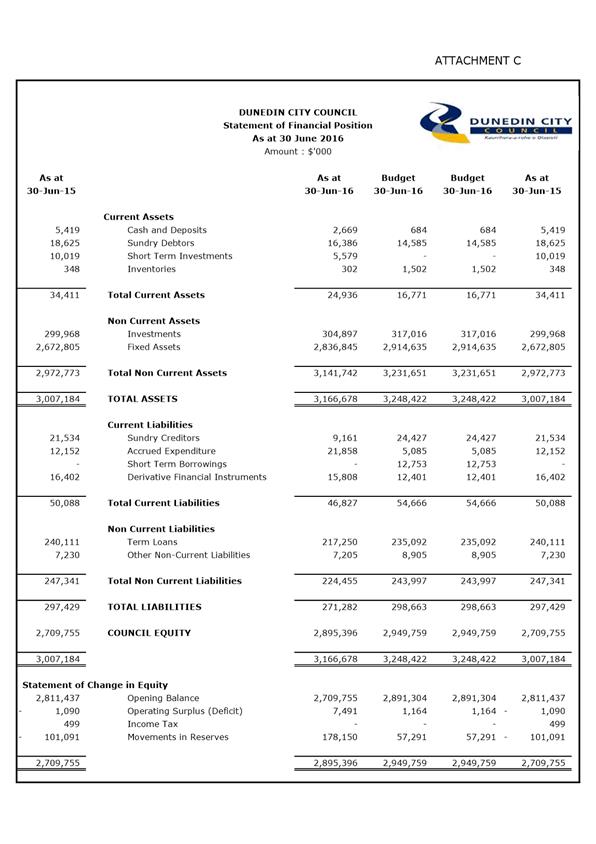

Statement of

Financial Position

A Statement of Financial Position is

provided as Attachment C.

The value of fixed assets was less than

budget as at 30 June 2016, due to lower capital expenditure (2014/15 and

2015/16), a net write down of investment properties (2014/15 and 2015/16) and a

negative revaluation adjustment processed across building and infrastructural

assets again effective 30 June 2015.

Terms loans were less than budget primarily

due to a lower than expected loan balance at the start of the current financial

year, delayed capital expenditure 2015/16 and proceeds from asset disposals

being used to pay down debt.

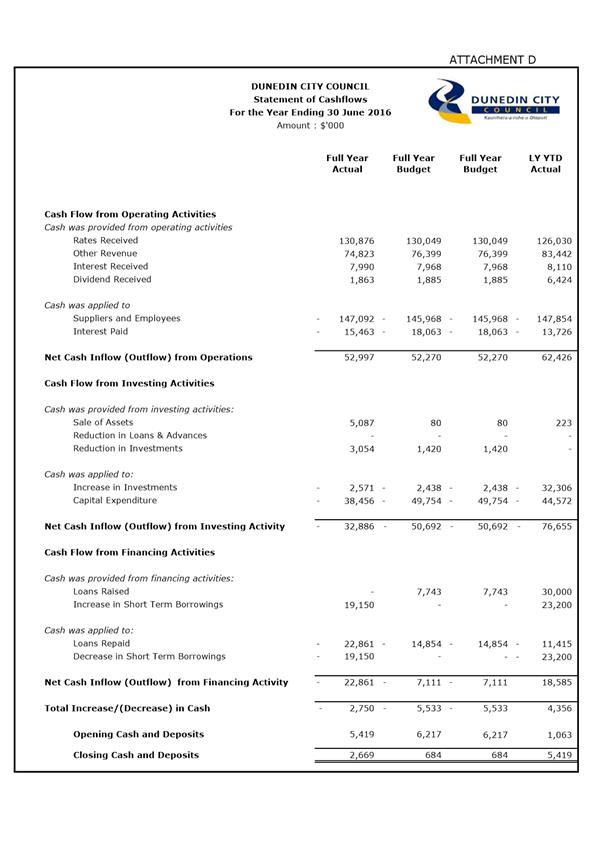

Statement of

Cashflows

A Statement of Cashflows is provided as

Attachment D.

Net cashflow from operations was better

than expected reflecting the impact of the lower operating expenses (including

interest paid).

Cash outflows from investing were less than

budgeted mainly due to asset sales being greater than anticipated (Caledonian

Bowling Club site, Union St and Anzac Avenue - Emerson’s Brewery site),

and capital expenditure being less than budgeted.

Cash outflows from financing were greater

than budgeted mainly due to no new term debt being raised, and the repayment of

existing term debt being greater than anticipated.

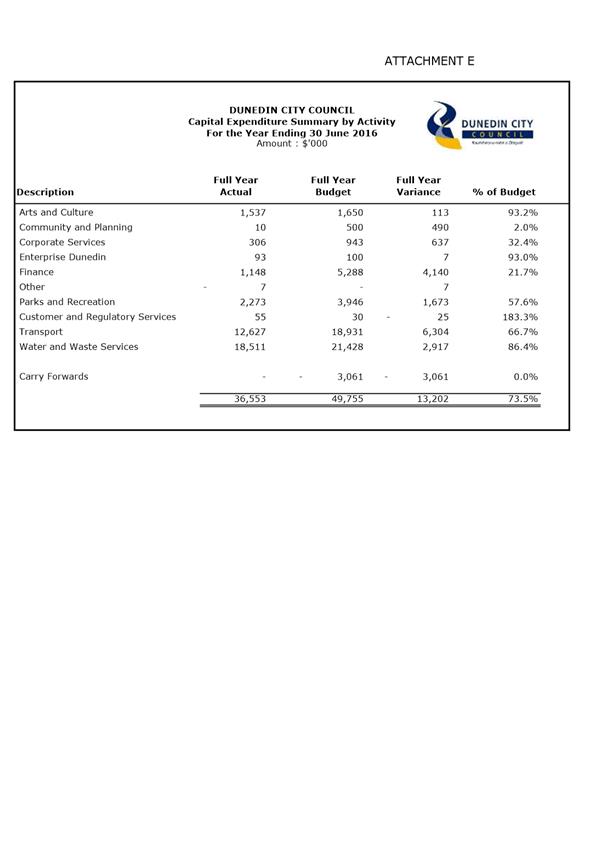

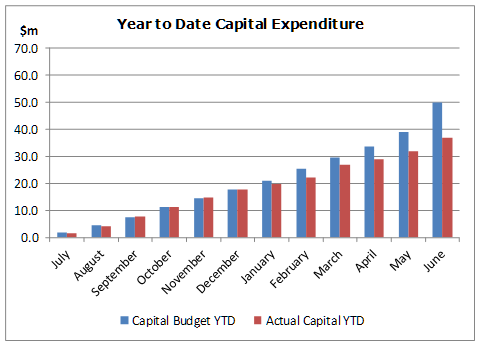

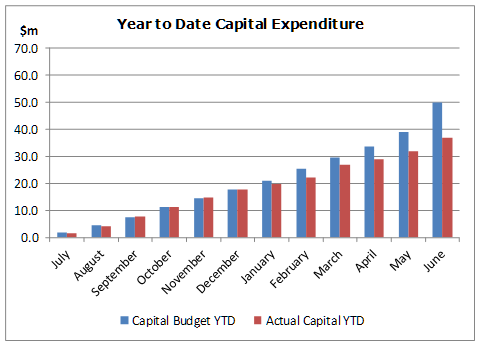

Capital

Expenditure

A summary of the capital expenditure

programme by Activity is provided as Attachment E.

Total capital expenditure for the year to

30 June 2016 was $36.553 million or 74% of the full year budget of $49.755

million. Note that the budget includes allocations of

$3.061 million of carry forwards from 2014/15.

Arts and Culture capital expenditure was $113k favourable

This variance was due to an under-spend on

collection acquisitions for the Art Gallery and delayed completion of their

facility environment upgrade.

Community and Planning Group capital expenditure was $490k favourable

The 2015/16 City Wide Amenity Upgrade has

been delayed until 2016/17 due to the Jetty Street hearing process.

Corporate Services capital expenditure was $637k favourable

A number of corporate systems upgrades and

other ICT projects were delayed while scoping work is carried out.

Finance capital

expenditure was $4.140 million favourable

A number of building capital projects are

in the investigation and design stages. As such some were not completed

in the current financial year.

Parking meter expenditure was $92k

favourable with some procurement delayed until the 2016/17 financial year.

Fleet replacement capital was close to

budget.

Parks and Recreation capital expenditure was $1.673 million favourable

New capital expenditure was favourable

$2.186 million due to the planned $2.200 million University Oval Cricket Light

project not proceeding.

This was partially offset by unbudgeted

expenditure on the Ocean Beach Erosion structures totalling $660k.

Transport capital

expenditure was $6.304 million favourable

Cycle Network expenditure was $1.579 million favourable. Corrective

work on Portobello Road will be completed in the new financial year.

Footpath

Resurfacing was $488k favourable. Footpath contracts (North and South)

were delivered to a reduced programme. The kerb and channel contract was

completed close to budget.

Carriageway

resurfacing was $944k favourable due to a reduced re-metaling programme and

favourable pricing on a slightly reduced reseal programme.

Other

renewal work was $1.394 million favourable with work at various stages of

development.

The Turnbull’s Bay slip repairs were $1.171 million

unfavourable. The contract has reached practical completion stage, although

buttressing is yet to be completed.

Water and Waste Services capital expenditure was $2.917 million favourable

Water production capital was under budget

$1.811 million. This was due to delays obtaining consent for the Ross Creek

Reservoir project.

Waste treatment capital expenditure was

under budget by $5.620 million due to delays with the biosolids project and

central drainage expenditure.

Network management capital was over budget

by $5.236 million. This was largely attributable to an increase of

planned network renewals which included the Andersons Bay Yellow Zone renewals,

Bradford/Mulberry renewals, the Kaikorai Valley Renewal Programme - Phases 1

& 2, and the University service renewals work. The purchase of 240

Portobello Road also represented a significant expenditure of $1.139 million.

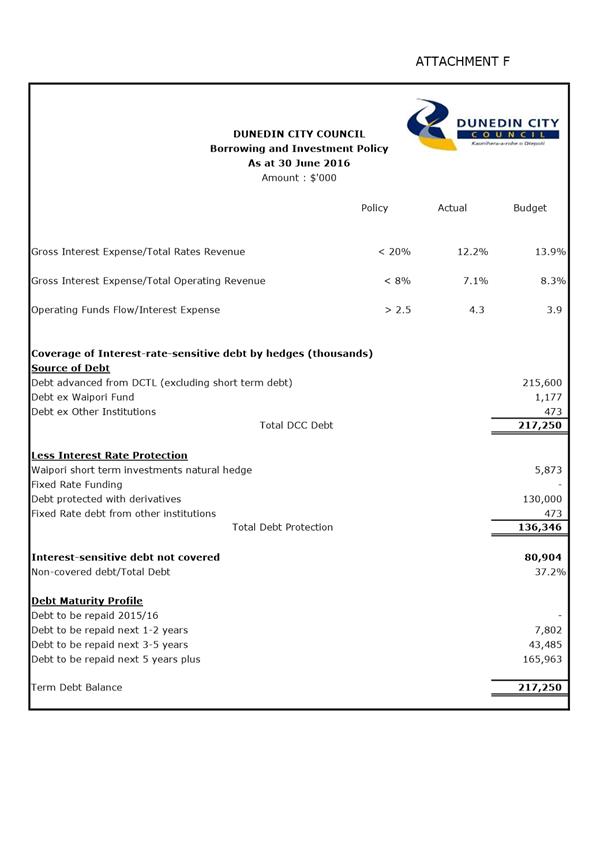

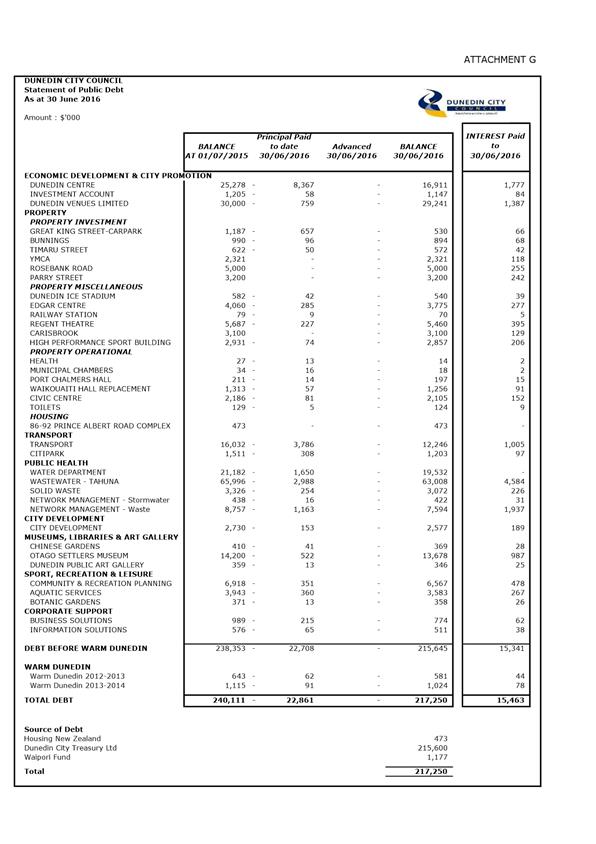

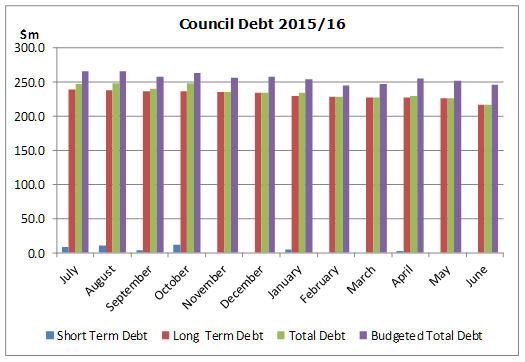

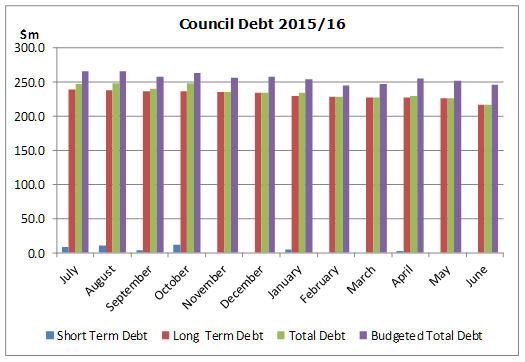

Debt

Refer to Attachments F and G.

Attachment F provides a summary of the debt

servicing ratios for the year to date.

All of the ratios exceeded the specified

targets.

Term debt was below expectations for the

year due to no new loans raised in the 2014/15 and 2015/16 financial

years. Asset sales in the current year have also contributed to a

reduction in debt.

Note that both the actual and budget

figures include the $30.0 million transferred from Dunedin Venues Limited

effective 30 June 2015.

Debtors and rates

outstanding

Sundry debtors outstanding as at 30 June

2016 totalled $16.196 million. This included long term debt of $3.568 million,

and debt associated with Warm Dunedin of $3.273

million.

Of the $3.568 million long term debt,

$3.100 million was for debt relating to the sale of Carisbrook. This was repaid

in July 2016.

Debtors outstanding for more than four

months (excluding long term debt and Warm Dunedin) totalled $493k, compared

with last year’s total of $329k as at 30 June 2015.

Rates arrears relating to prior year rates

totalled $305k. This was higher than the $198k total as at June

2015. Of this total $51k was being recovered under formal arrangements

with Council, while the balance was being actively pursued.

Comments from

group activities

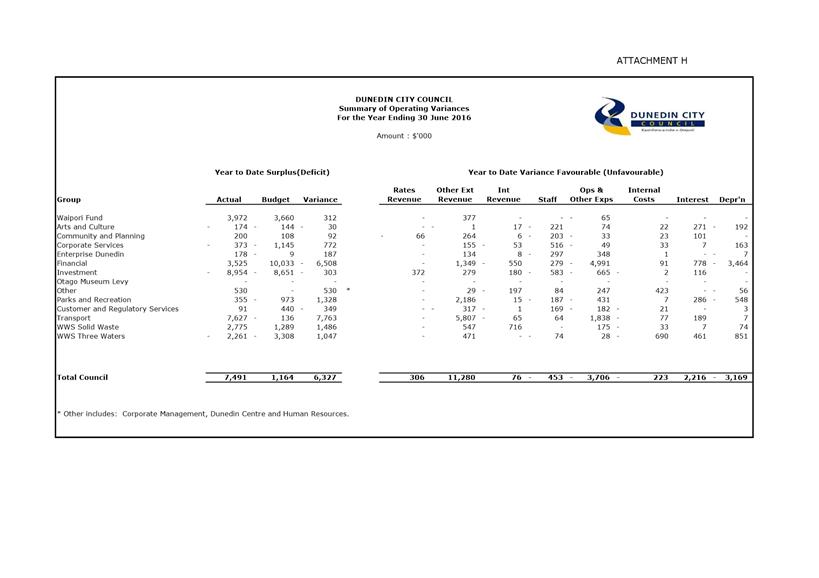

Attachment H, the Summary of Operating

Variances, shows, by Group Activity, the overall net surplus or deficit

variance for the year ended 30 June 2016. It also shows the variances by

revenue and expenditure type.

Corporate Services Group - $772k Favourable

Staff costs were favourable $516k with the

budgeted cost associated with the ICT transition changes being booked in the

2014/15 financial year.

Depreciation was $163k favourable for the

group reflecting the lower than expected capital expenditure for the year.

Enterprise Dunedin Group - $187k Favourable

This favourable variance related primarily

to due to receipt of unbudgeted Regional Business Partner Network contract

revenue.

Finance Group - $6.508 million Unfavourable

Depreciation was unfavourable $3.464

million due to the change in useful lives of Council building assets resulting

from the June 2015 asset revaluation.

Operating expenses were unfavourable $4.991

million mainly due to fair value losses on Investment Properties and

expenditure on developing deferred maintenance schedules and performing

building assessment. These unfavourable variances were partially offset

by delayed maintenance expenditure while this assessment work has been

completed.

Group revenue was favourable $1.349

million. This primarily related to fair value gains on Investment

Properties, higher than expected residential revenue due to higher occupancy

levels and an unbudgeted $300k recovery for the service level agreement with

Dunedin City Treasury Limited.

Parks and Recreation Group – $1.343

million Favourable

External revenue was favourable $2.186

million mainly due to the profit realised on the sale of some Parks property

assets totalling $3.885 million. This was partially offset by an

unfavourable grants revenue variance of $1.197 million due to the cancelling of

the University Oval Lighting project. Development contributions revenue

was also unfavourable $353k.

Operating expenditure was unfavourable

$431k due to unbudgeted Sportsfield renovations and deferred maintenance on

buildings and other structures. Energy costs at the crematorium and new

propagation facility at the Botanic Garden were also slightly greater than

budgeted.

Customer and Regulatory Services Group

– $349k Unfavourable

The unfavourable operating variance was

primarily due to lower than expected revenue across a number of operating units

- Building inspection fees were down due to lower recoverable activity and

parking infringement fees and court fine recoveries due to fewer infringement

notices being issued along with a higher number of referrals for court

collection.

Operating costs were

unfavourable $182k due to unbudgeted consultancy costs relating to outsourced

building consent processing and unbudgeted legal costs.

Staff costs were favourable $187k due to a

number of vacancies across the group and training budgets not utilised.

Transport Group - $7.763 million Favourable

External revenue was favourable $5.807

million due to unbudgeted vested asset income partially offset by less than

expected NZTA capital and operating work taking place resulting in grants

revenue being down on budget. In addition there was some unbudgeted road safety

revenue and an increase in revenue from corridor access ways.

Operating expenditure was favourable $1.838

million primarily due to delayed timing of traffic services maintenance,

drainage works, pavement maintenance and general maintenance.

WWS Solid Waste – $1.486 million

Favourable

Landfill revenues were favourable due to

the combination of increased waste tonnages from out of the district, and

higher than expected sludge volumes.

WWS Three Waters – $1.047 million

Favourable

Revenue was $471k favourable, largely due

to unbudgeted development contribution and vested assets revenue, partially

offset by a shortfall in water sales and trade waste revenue.

Total

expenditure was favourable $576k primarily due to savings in interest and

depreciation costs. Offsetting these variances, internal expenditure was

unfavourable $690k due to higher than anticipated sludge disposal costs during

the Tahuna incinerator refurbishment project, and unfavourable asset

maintenance costs $193k due to higher than anticipated reactive workloads both

on the water network as well as urgent repairs to the Green Island digester and

the Mosgiel Wastewater Treatment Plant clarifiers.