Notice of Meeting:

I hereby give notice that an ordinary meeting of the Dunedin

City Council will be held on:

Date: Monday

23 January 2017

Time: 9.00am

Venue: Edinburgh

Room, Municipal Chambers,

The

Octagon, Dunedin

Sue Bidrose

Council

PUBLIC AGENDA

|

Mayor

|

Mayor Dave Cull

|

|

|

Deputy Mayor

|

Cr Chris Staynes

|

|

|

Members

|

Cr David Benson-Pope

|

Cr Rachel Elder

|

|

|

Cr Christine Garey

|

Cr Doug Hall

|

|

|

Cr Aaron Hawkins

|

Cr Marie Laufiso

|

|

|

Cr Mike Lord

|

Cr Damian Newell

|

|

|

Cr Jim O'Malley

|

Cr Conrad Stedman

|

|

|

Cr Lee Vandervis

|

Cr Andrew Whiley

|

|

|

Cr Kate Wilson

|

|

Senior

Officer Sue

Bidrose, Chief Executive Officer

Governance

Support Officer Pam Jordan

Pam Jordan

Governance Support Officer

Telephone: 03 477 4000

Pam.Jordan@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as Council

policy until adopted.

ITEM TABLE OF CONTENTS PAGE

1 Introduction 4

2 Apologies 4

3 Confirmation

of Agenda 4

4 Declaration

of Interest 5

Reports

5 Draft

2017/18 Annual Plan Budget Material 11

6 Draft

2017/18 Budget - Water and Waste Group 31

7 Emissions

Trading Scheme Liabilities and Proposed Carbon Management Policy 39

8 Draft

2017/18 Budget - Solid Waste 49

9 Update

on the Tertiary Precinct Safety and Accessibility Upgrade 57

10 Draft

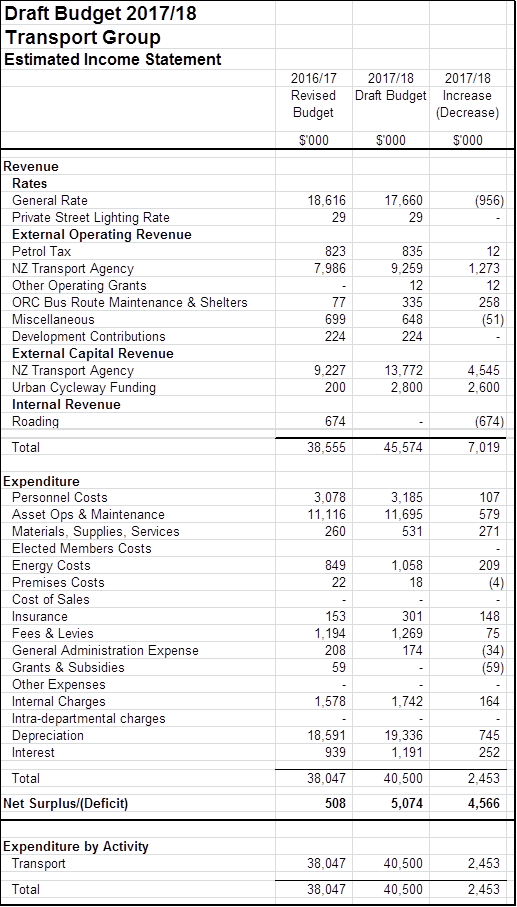

2017/18 Budget - Transport Group 63

11 Draft

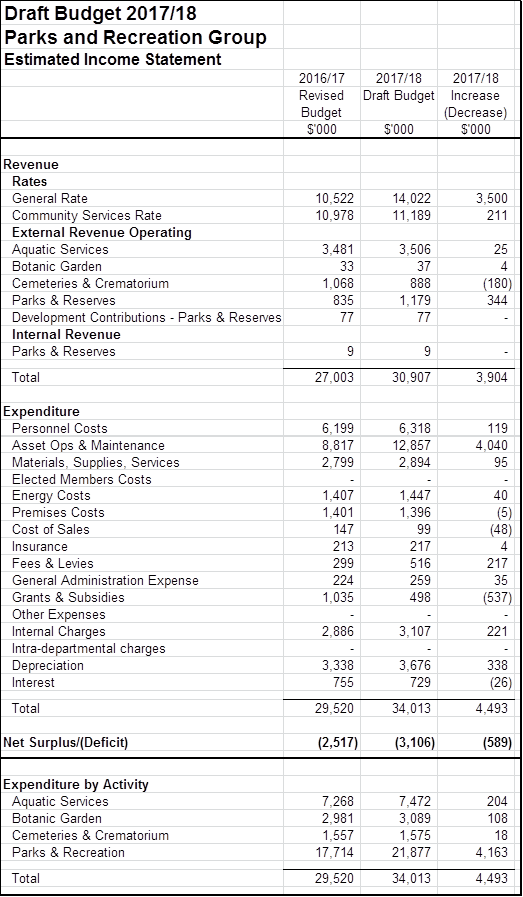

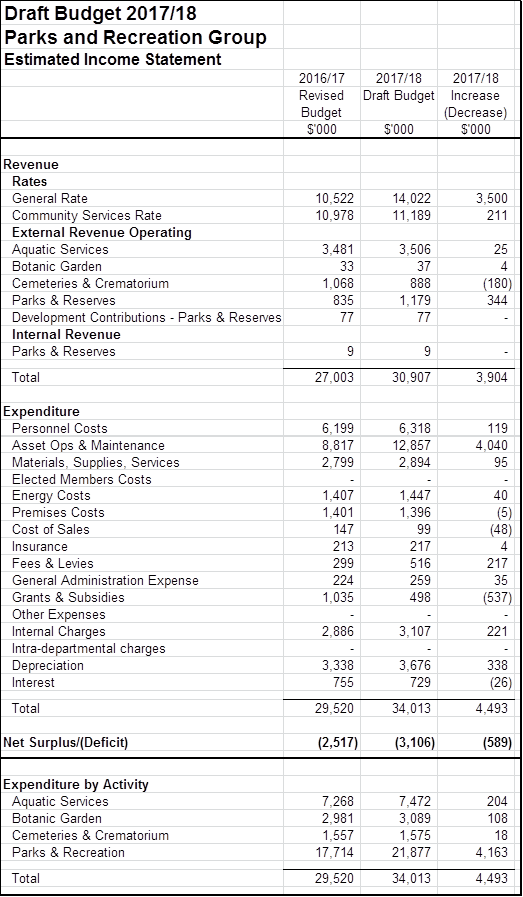

2017/18 Budget - Parks and Recreation Group 70

12 Draft

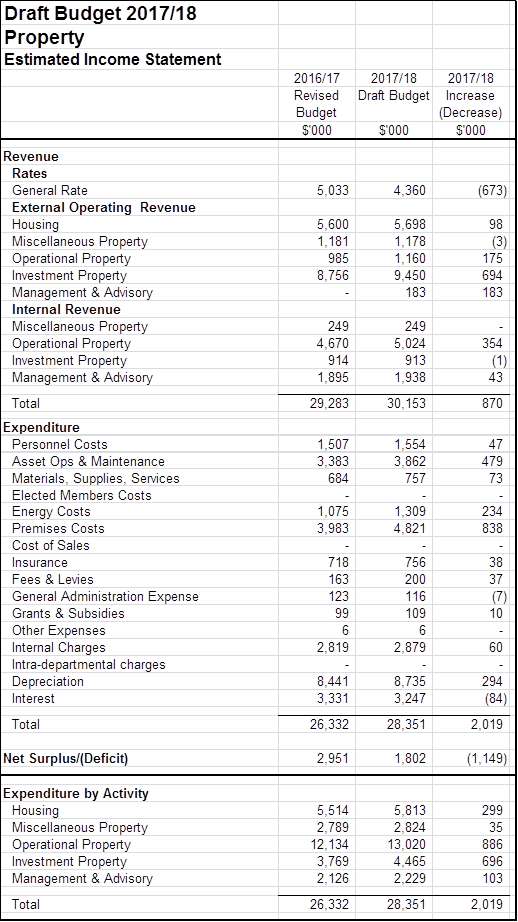

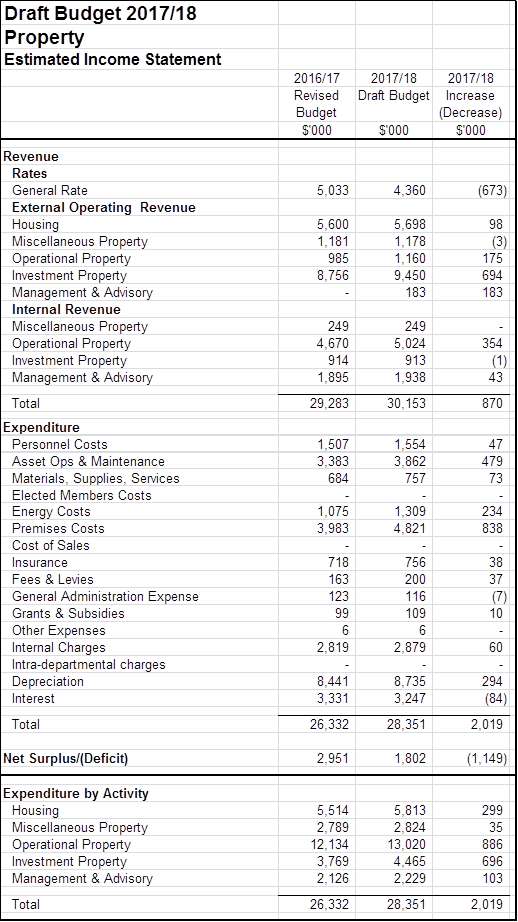

2017/18 Budget - Property 89

13 Draft

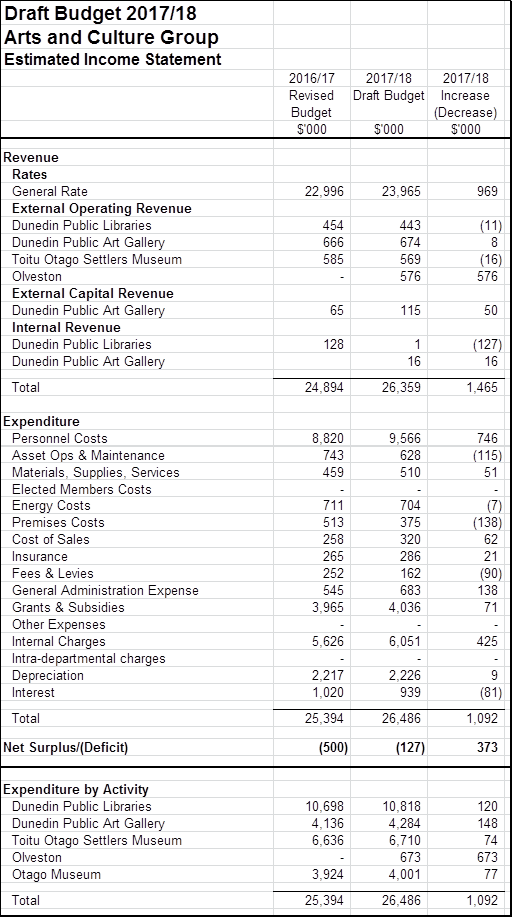

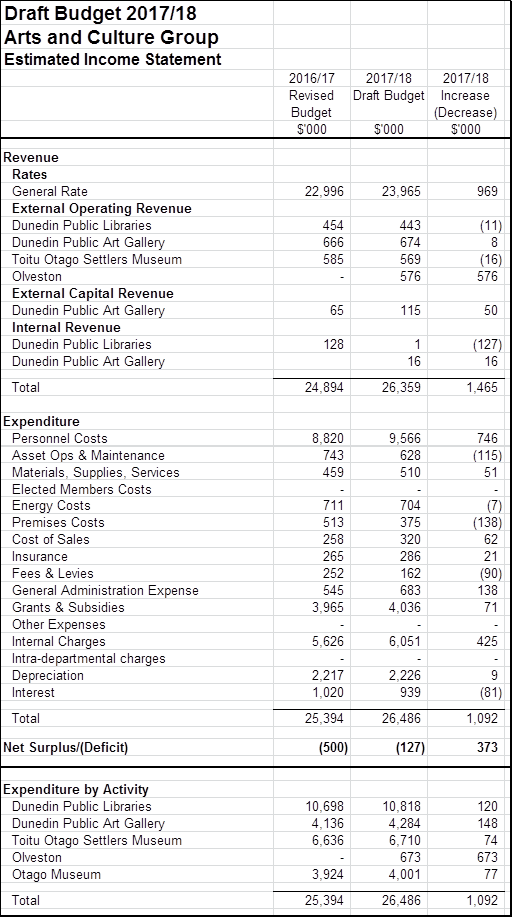

2017/18 Budget - Arts and Culture Group 96

14 Draft

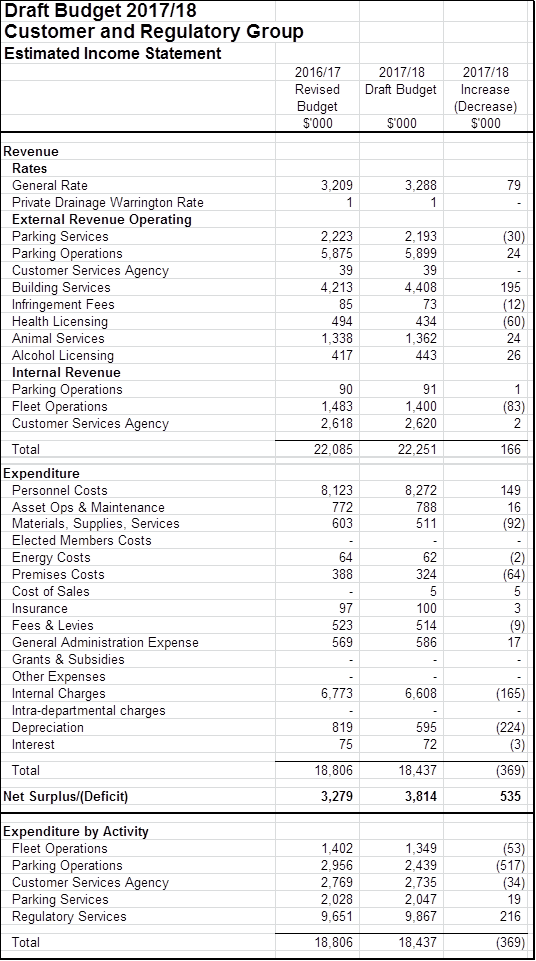

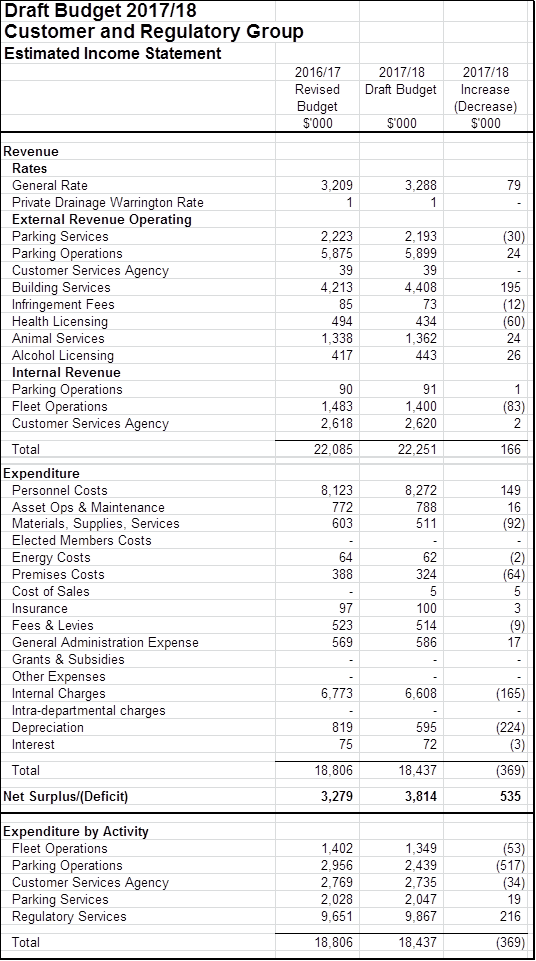

2017/18 Budget - Customer and Regulatory Group 107

15 Te

Ao Tūroa Environment Strategy Funding 137

16 Review

of the Allocation of Funding to Applicants to the Biodiversity Fund 143

17 Draft

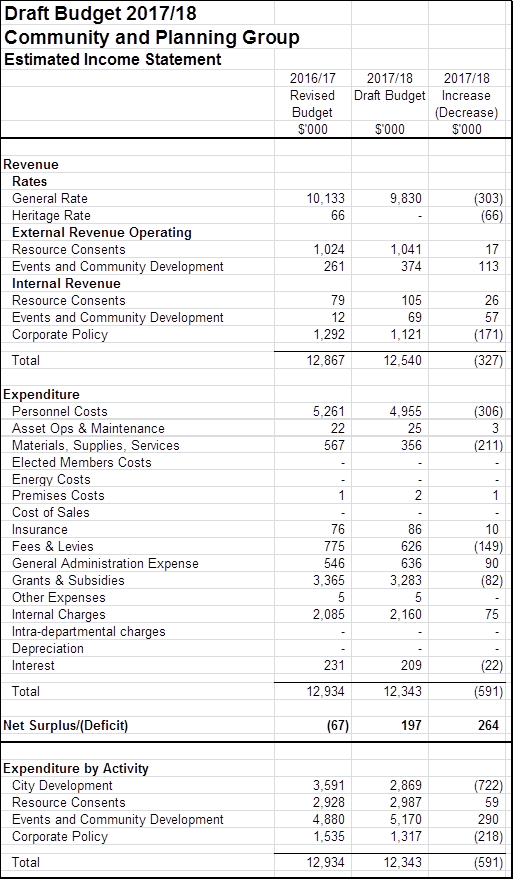

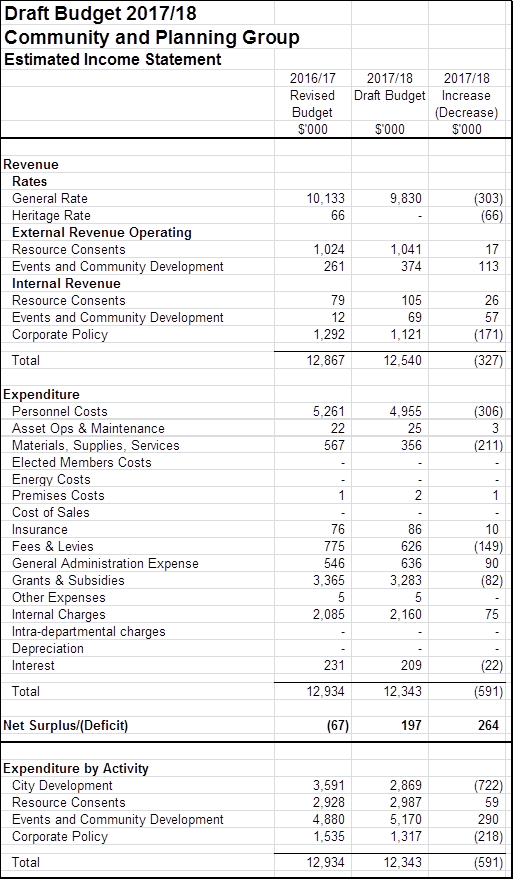

2017/18 Budget - Community and Planning Group 156

18 Draft

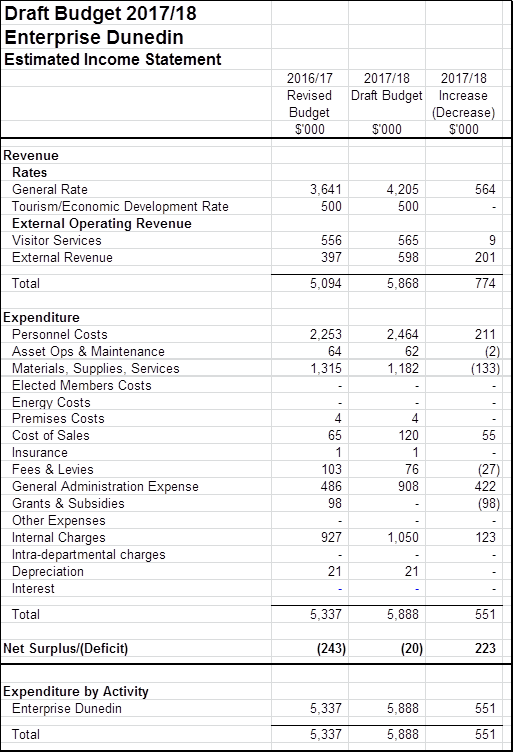

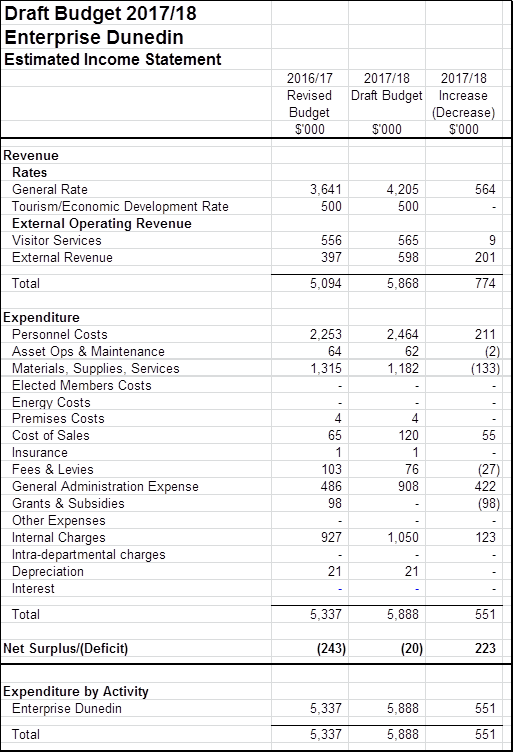

2017/18 Budget - Enterprise Dunedin 168

19 Draft

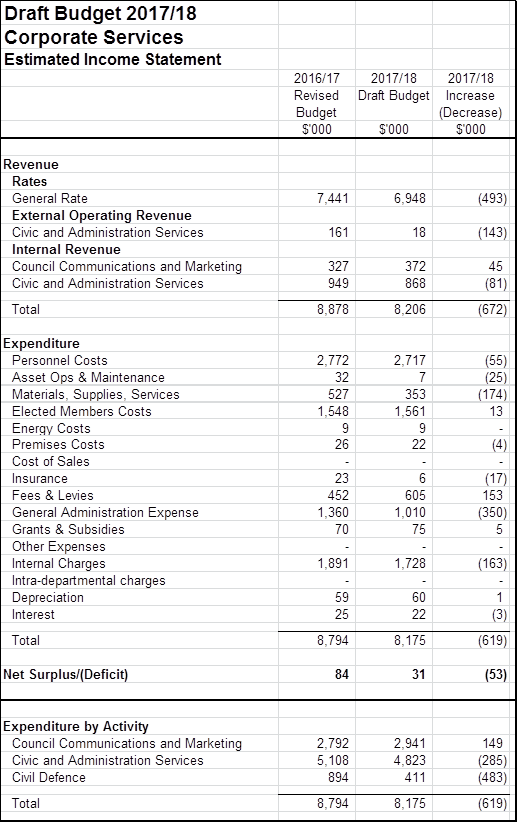

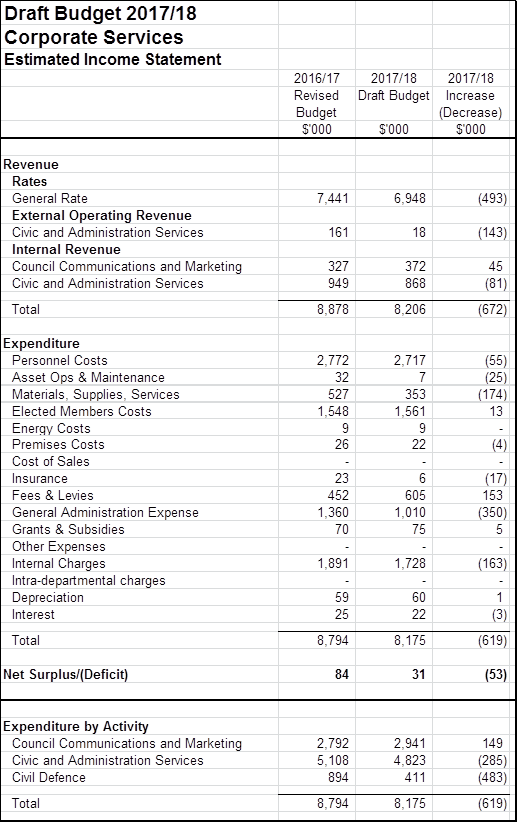

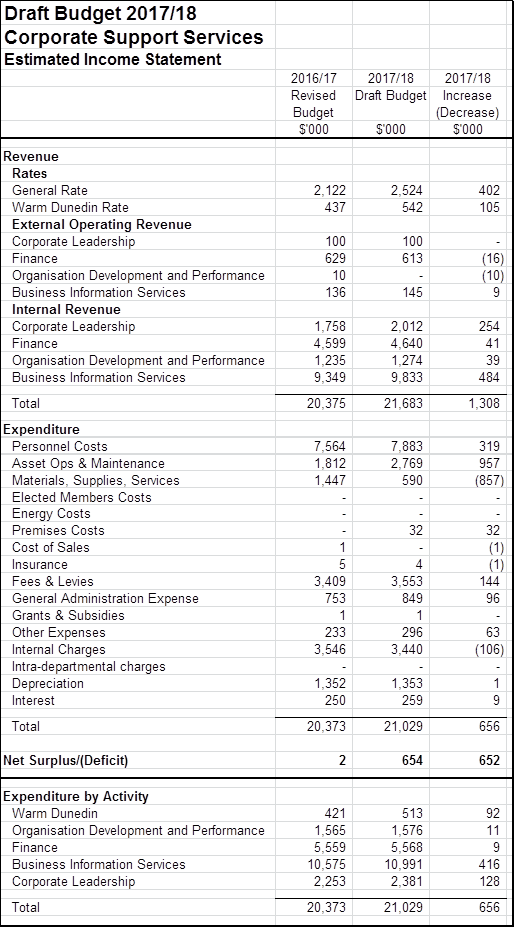

2017/18 Budget - Corporate Services 174

20 Draft

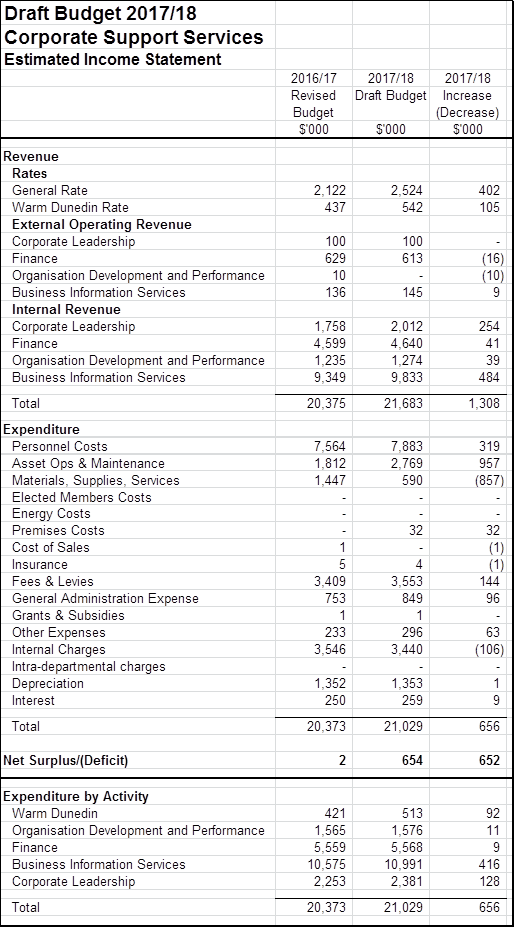

2017/18 Budget - Corporate Support Services 180

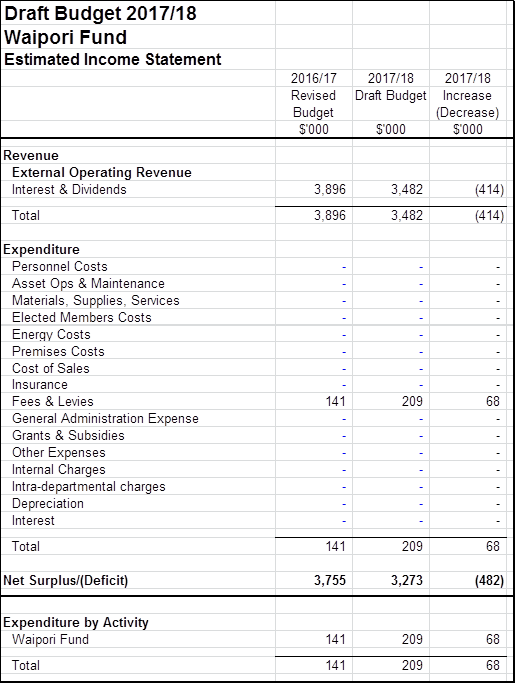

21 Draft

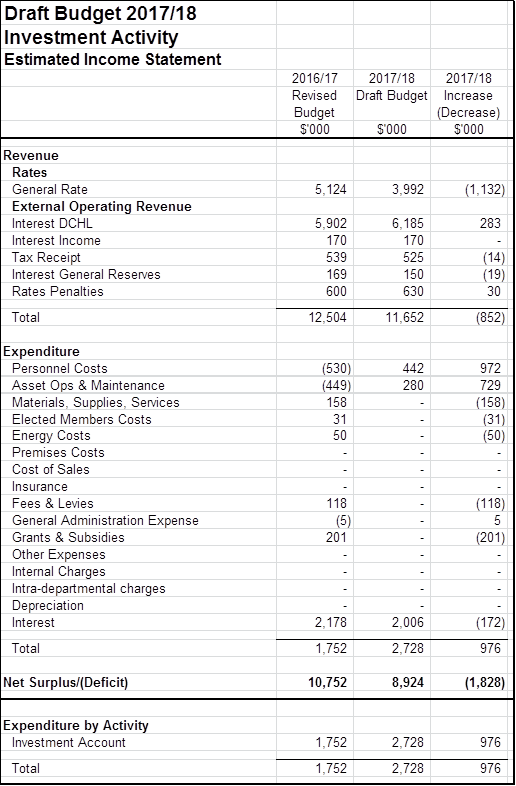

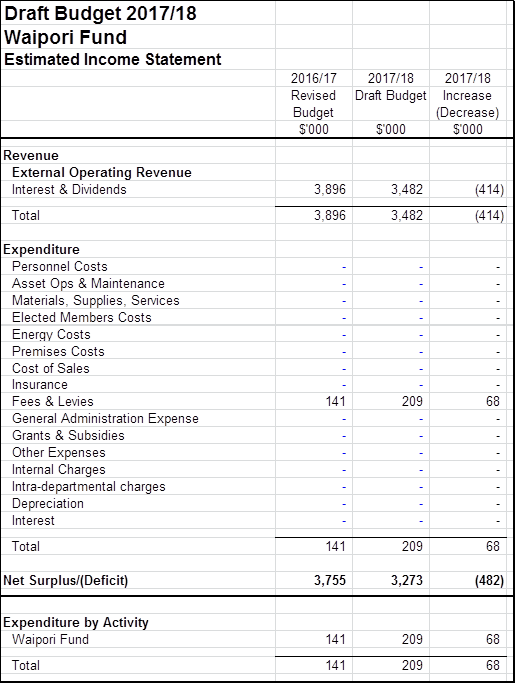

2017/18 Budget - Waipori Fund 186

22 Draft

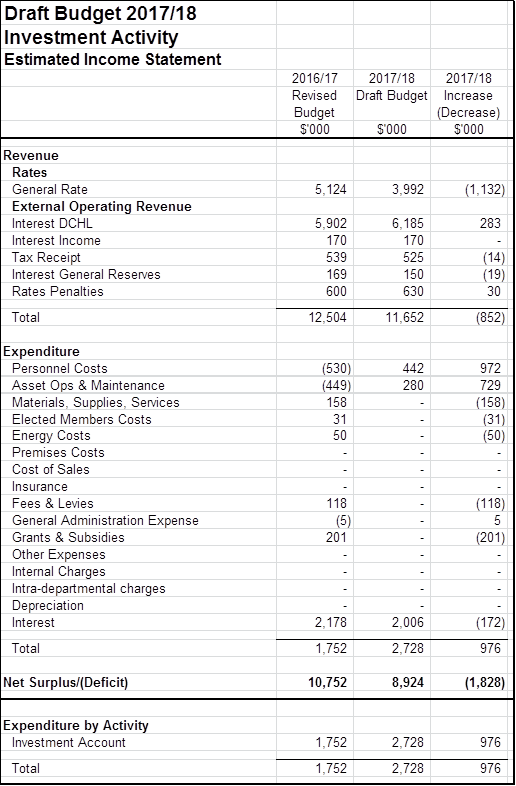

2017/18 Budget - Investment Account 190

1 INTRODUCTION

2 Apologies

At the close of the agenda no apologies had been received.

3 Confirmation

of agenda

Note: Any additions must

be approved by resolution with an explanation as to why they cannot be delayed

until a future meeting.

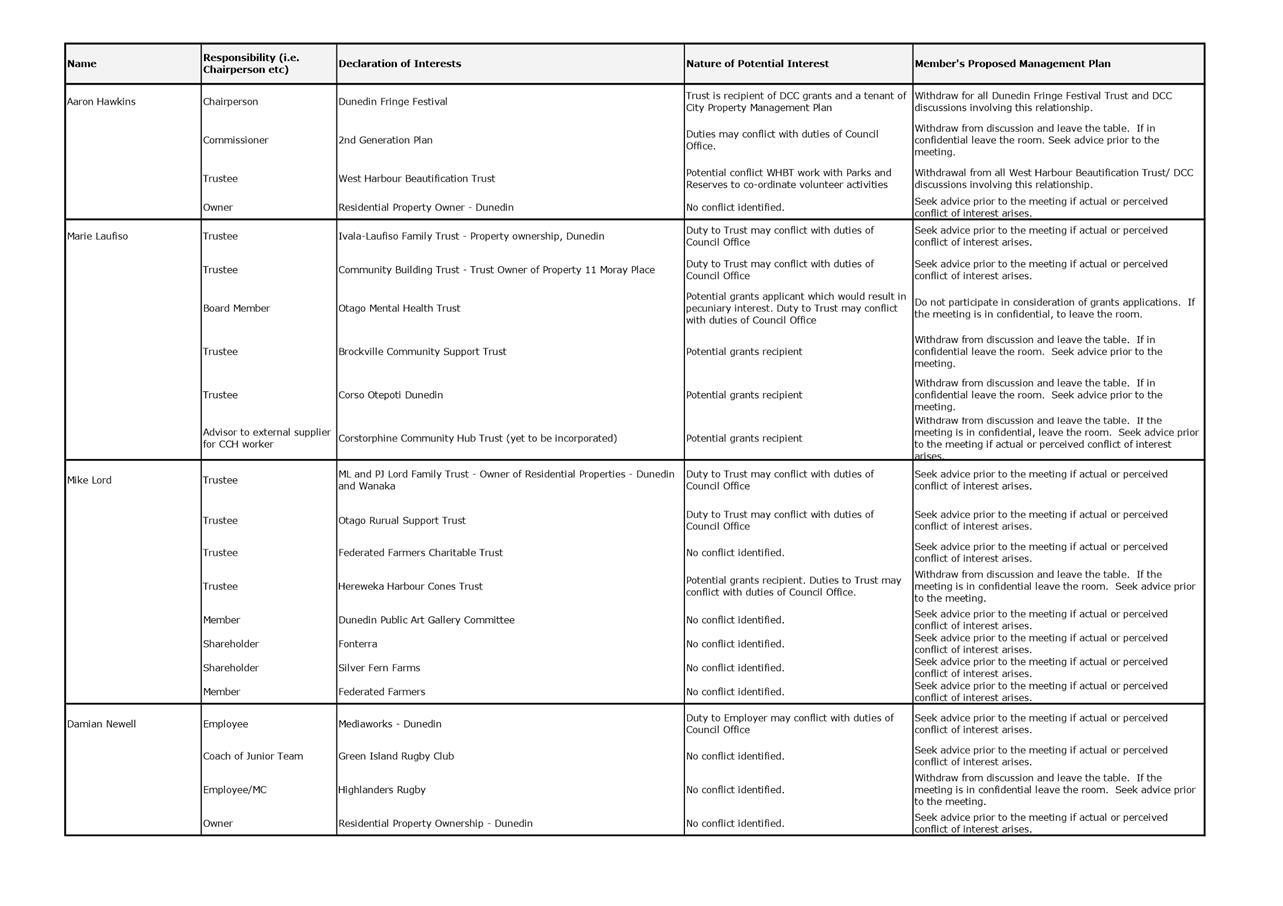

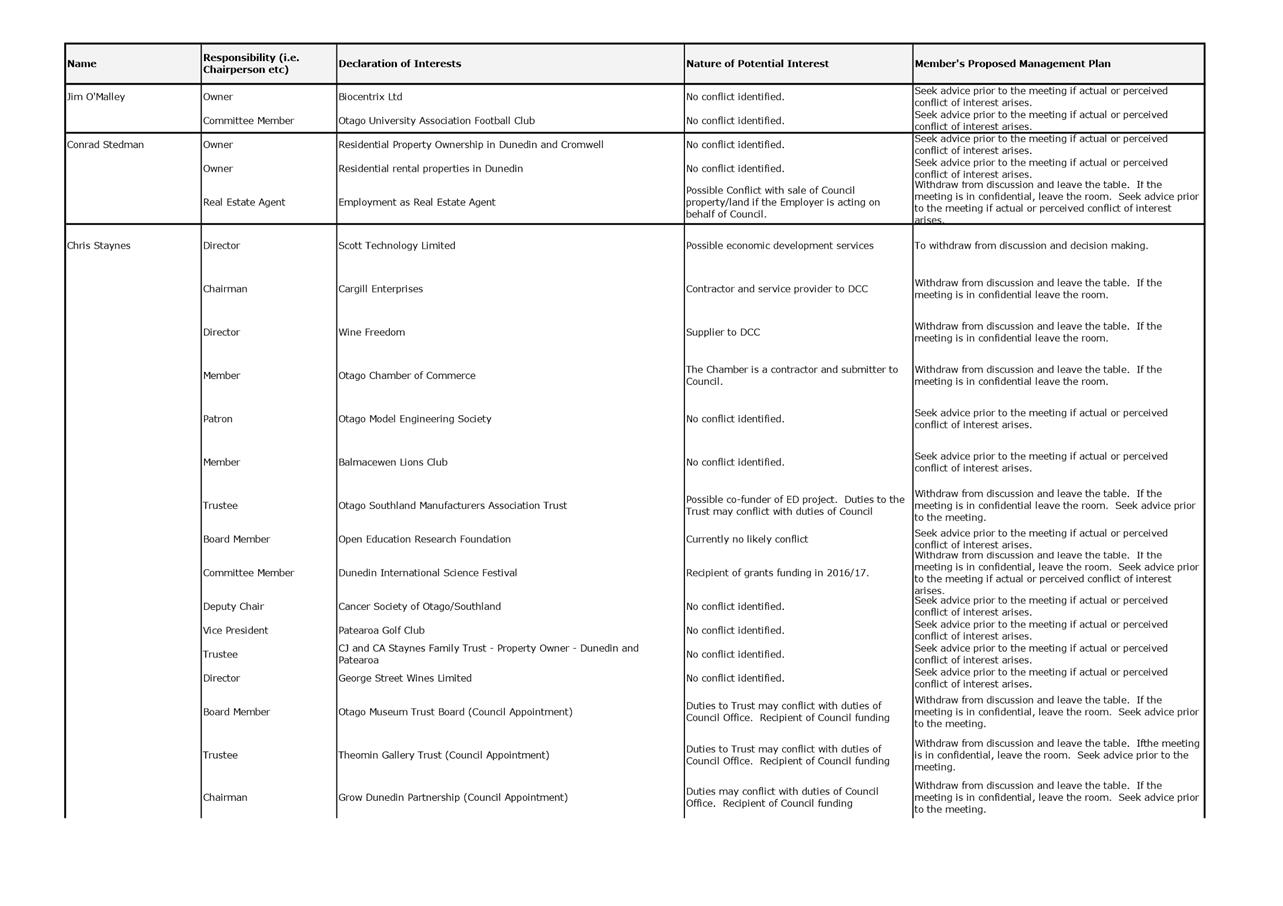

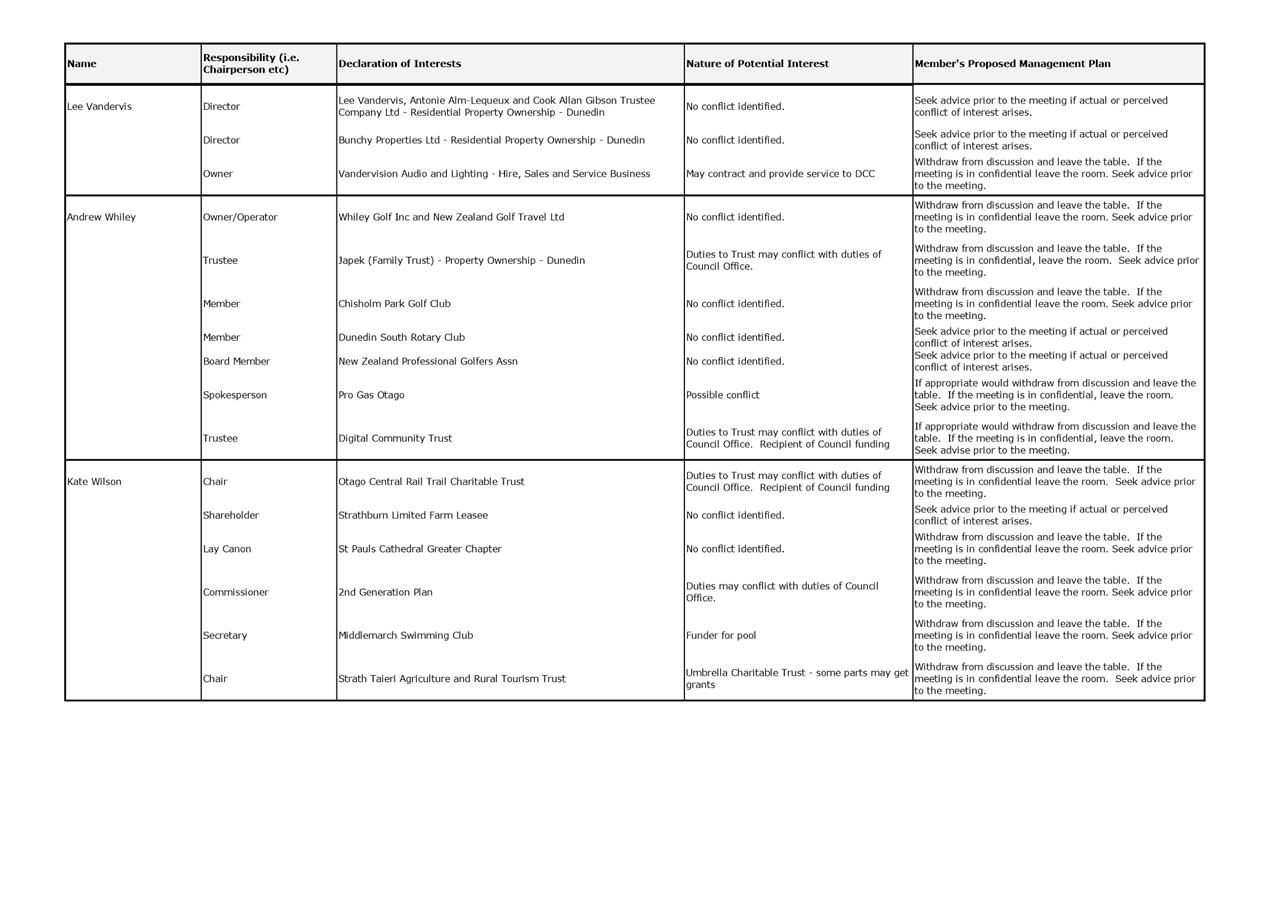

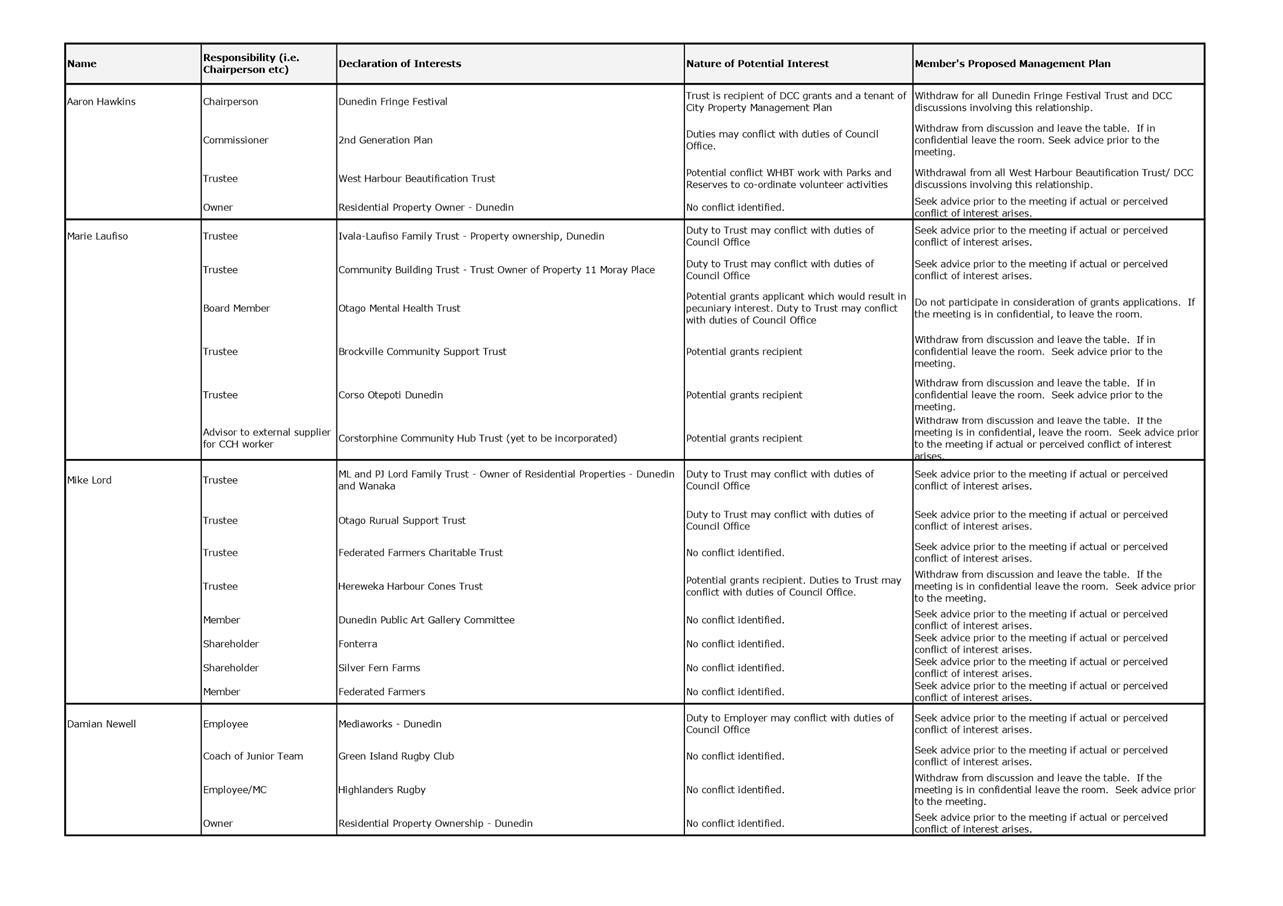

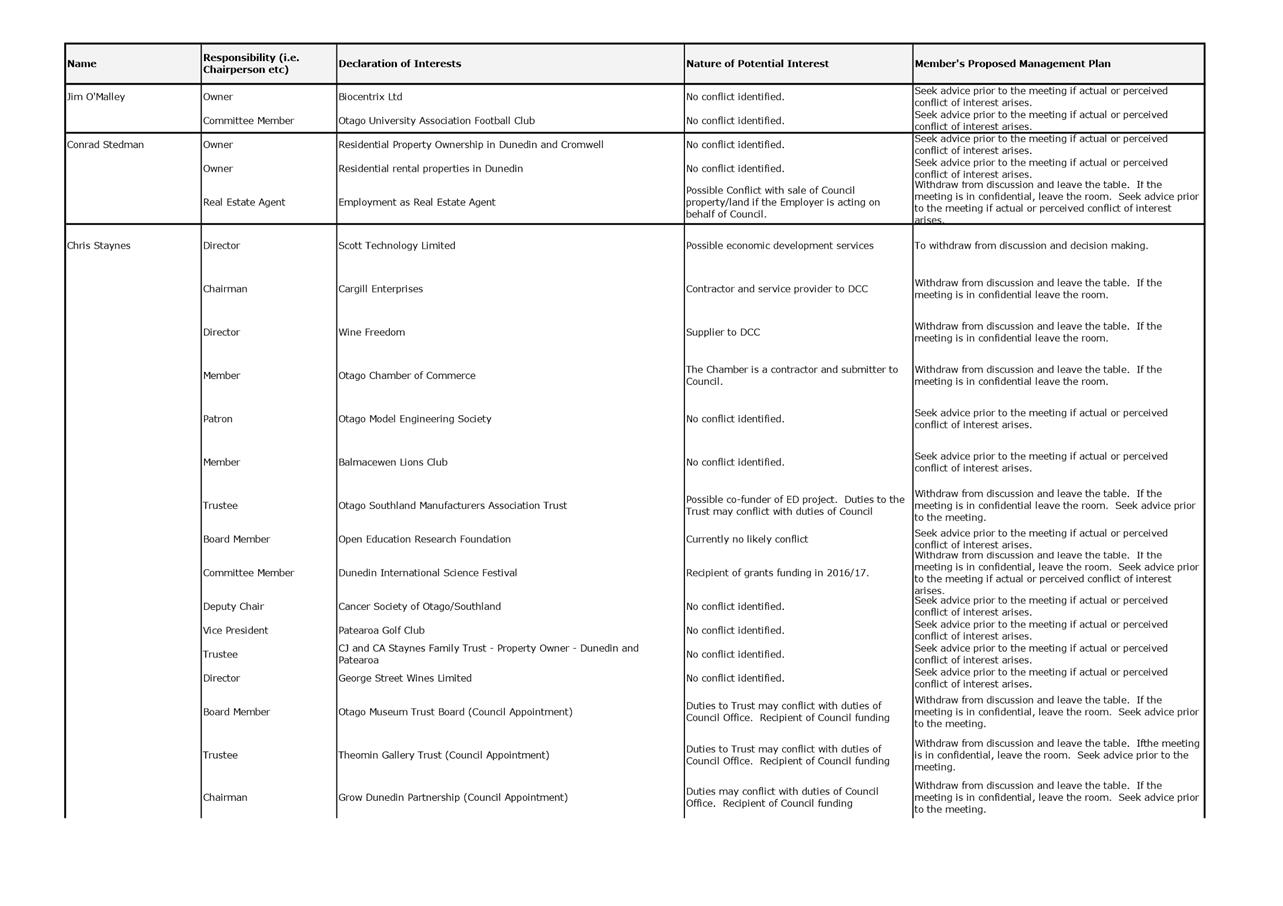

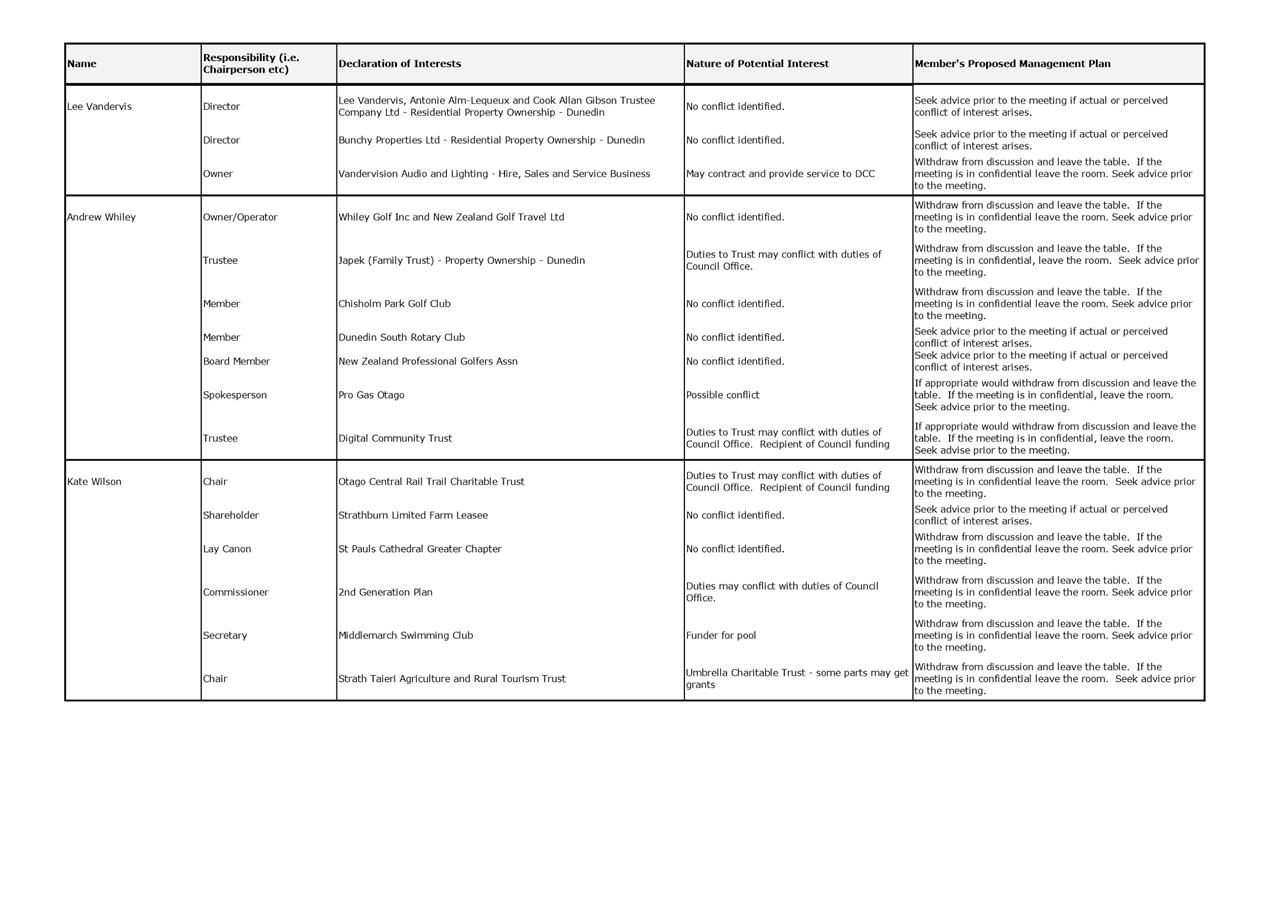

Declaration of Interest

Department: Civic and Legal

EXECUTIVE SUMMARY

1 Members are reminded of the need to recognise and declare interests

and to manage any conflicts between those interests and their role as an

elected representative.

2 Elected

members are reminded to update their register of interests as soon as practicable,

including amending the register at this meeting if necessary.

|

RECOMMENDATIONS

That the Council:

a) Notes/Amends if necessary the Elected Members' Interest Register attached as

Attachment A; and

b) Confirms

the proposed management plan for Elected Members' Interests.

|

Signatories

|

Authoriser:

|

Kristy Rusher - Manager Civic and Legal

|

Attachments

|

|

Title

|

Page

|

|

a

|

Elected Members'

Register of Interests

|

7

|

Reports

Draft 2017/18 Annual Plan Budget Material

Department: Community and Planning and Finance

EXECUTIVE SUMMARY

1 This

report provides commentary on the budget material presented in the agenda for

the 23 January 2017 Annual Plan Council Meeting.

2 Annual

Plans are completed under revised legislation and are exception-only documents

focused on changes from the relevant year in the Long Term Plan. The budgets

for the 2017/18 year have been updated and changes are described in this

report.

3 The draft

budget for 2017/18 includes an overall rate increase of 2.99%. This is in

line with the limit set in the Financial Strategy. Budget updates incorporated

in the draft budget include timing changes to the capital expenditure programme

in Transport and Property in the 2016/17 and 2017/18 years. Maintenance

costs are increased, reflecting increased costs arising from contract renewals

and the need to address maintenance of facilities.

4 The

changes made to budgets are not significant or material meaning a consultation

process is not required. Community engagement will explain why consultation is

not required and indicate what is planned and programmed in the 2017/18 year.

5 In the

third year of an LTP, work on the Annual Plan and development of the next LTP

run concurrently. Staff plan to utilise the engagement process to introduce and

lead into the new LTP.

6 The

engagement process will provide opportunities for the community to provide

feedback on the draft budgets for 2017/18 to the Council.

|

RECOMMENDATIONS

That the Council:

a) Approves

the draft 2017/18 budget as shown/amended in Attachment A.

b) Confirms the

proposed community engagement process for the 2017/18 Annual Plan budget,

allowing work to proceed on development of engagement material and a detailed

engagement plan for subsequent approval by the Council.

|

BACKGROUND

Annual

Plan process

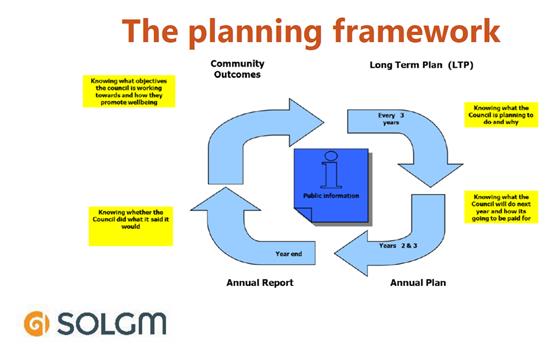

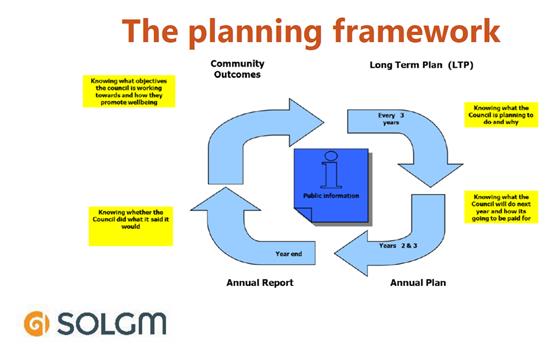

7 The

Annual Plan is a core part of the local government planning and public

accountability framework as shown in the diagram below. Completed in the second

and third years of the three year LTP cycle, an Annual Plan is a

‘slice’ from the LTP and forms the link between the LTP and the

process of setting rates for each year.

8 Amendments

made to Local Government Act 2002 (LGA) in August 2014 changed the nature of

the Annual Plan process. The Annual Plan is now an ‘exceptions

only’ document focused on significant or material changes from year

concerned in the LTP. The revised legislation also repealed the requirement to

undertake a special consultative procedure when consulting on an annual plan,

unless a formal amendment to the LTP is being made.

· If

there are no significant or material changes between the LTP and proposed

annual plan, a Council is not required to consult on their draft budget unless

they choose to do so.

· If

not consulting, a Council is however required to communicate with the community

about the reasons for that decision.

· A

council has to adopt an annual plan each year regardless of whether

consultation is undertaken or not. The plan document will consist of the annual

plan budget and funding impact statement for the year concerned along with

rating base information and descriptions of any changes from the LTP.

9 The

legislative changes removed duplications in consultation processes and reduced

costs by not requiring information in the LTP to be reproduced in the Annual

Plan unless it has changed. The purpose of consulting on Annual Plans is

focused on any significant or material changes.

10 These changes

reinforce the LTP’s position as the principal planning document in the

Local Government planning framework.

11 Work on the

development of the 2018-2028 LTP started in September 2016. An LTP takes a

minimum of eighteen months to develop and consult on the required material

which means this work overlaps with the completion of the 2017/18 Annual Plan.

Format of budget material

12 This year, for the

first time, the material for discussion at the January Annual Plan Council

Meeting is being distributed in an electronic format. Print copies can be made

available upon request in the week immediately prior to the meeting.

13 Budget information

for Council activities is presented in group reports within the agenda for the

meeting rather than in a separate folder. The report groupings used for budget

information are the same as those used for financial reporting and are slightly

different from those used in the 2015/16 – 2024/25 Long Term Plan (LTP).

14 The agenda is

ordered to allow reports with implications for group budgets to be considered

immediately before the group budget report concerned.

15 All budget material

is draft.

16 Budget material and

commentary relates to Dunedin City Council activity only. Financial information

for the wider Council group of companies is not required as part of the Annual

Plan or LTP.

17 The Draft budget is

attached to this report as well as the detailed capital expenditure programme.

Consideration of strategic fit, significance and

materiality

18 All decisions made

at the January Annual Plan Council meeting need to be considered in terms of

fit with the purpose of local government, the Council’s strategic

framework and level of significance or materiality of the decision. The

Council’s Significance and Engagement Policy guides this consideration.

The staff assessment of these matters is outlined in the ‘summary of

considerations’ section of each of the reports.

DISCUSSION

19 This report

supplements the budget material contained in group reports providing a

commentary on the draft budgets for the 2017/18 Annual Plan.

Budget overview

20 The Financial

Strategy sets an annual rate increase limit of 3% unless there are exceptional

circumstances. The proposed budget for 2017/18 delivers an annual rate increase

of 2.99%.

21 The draft budget was

developed by staff over a three month period from September to November 2016

guided by budget parameters to deliver an overall budget increase of 3% or

lower.

22 The budget process

highlighted several matters that impacted our ability to reach the 3% rate

increase limit set in the Financial Strategy and required attention.

These issues will be addressed further in the next LTP 2018-2028. These include

capacity to deliver capital expenditure, maintenance costs, and rates affordability.

Capacity to deliver capital

expenditure

23 The timing of the

capital programme included in the LTP in Transport and Property has been

re-phased in the 2016/17 and 2017/18 years to more accurately reflect the

capacity to deliver some projects.

24 Work on some

projects has been reprogrammed to reflect how much progress can realistically

be achieved each month, factoring in changes such as new health and safety

requirements introduced since the projects were originally planned or

reflecting updated resource procurement and contractor availability/tendering

timelines.

Maintenance Costs

25 Over the past two

years there has been a review of, and increased community interest in, the

management of maintenance contracts and backlogs of deferred maintenance and

renewals.

· The

draft budget continues to address the backlog of water and waste renewals

identified as an issue in the infrastructure strategy in the LTP.

· Service

reviews and scheduled contract renewals highlighted the importance of contract

monitoring and supervision in delivering promised levels of service to the

community.

26 These issues have

been acknowledged and resolved. There are visible results from contracts being

more closely supervised and monitored. For example, the central activity

area (CAA) is cleaner and attended to more regularly. Contractors are

more visible in the city, especially the mud tank cleaning truck and street

sweepers. This has come at a cost with contractors seeking higher prices in

contract renewals.

27 Service reviews have

highlighted deferred building maintenance in activities such as Parks and

Recreation and Property.

28 The net result of

this is an increase in maintenance costs.

29 While this is not

seen as significant in terms of this Annual Plan, it does mean that there will

potentially be some hard decisions in the next LTP regarding levels of service

and affordability.

Affordability

30 Dunedin City Council

rates are in the lower quartile when compared with other Councils in NZ.

31 There is an

opportunity cost relating to lower rates. Pressure has been put on our ability

to deliver services at the levels promised while balancing periods of

challenging budgetary issues and financial constraint. As a result,

deferred property and asset maintenance issues have started to emerge.

32 There is no

‘wiggle room’ left in the budget. If we want to add anything new to

our work programmes, we will need to reduce spend elsewhere. There is always a

tension in balancing affordability with community expectations.

33 The Financial

Strategy sets a limit of 3% on rates increases; a higher rates increase would

be inconsistent with this parameter.

34 The remainder of

this report outlines the key budgetary changes.

Draft Operating Budget

35 The draft operating

budget is attached (Attachment A). Explanations are provided below for all

variances in excess of $1.000m.

Revenue

Rates

36 Overall rates

revenue has increased by $3.992m, which is 2.99% higher than 2016/17. The

main drivers of this increase are increases in maintenance and staff costs and

the continued step-up in renewals expenditure in the Water and Waste group.

Fees and Charges

37 Fees and charges

have been increased by 3% in most cases. The exceptions are activities where

fees are set by statute, are linked to reviews of strategies, policies or

by-laws or where increases would be a disincentive to utilisation/compliance.

38 Landfill fees in the

Solid Waste activity have been increased by more than 3% in response to

increasing Emission Trading Scheme (ETS) costs. Categories of waste attracting

ETS costs have had user fees increased by an additional 8.5% on top of the 3%

overall increase.

External Operating Revenue

39 The draft budgets

show an increase in external operating revenue of $5.117m. The main

drivers are additional New Zealand Transport Agency (NZTA) subsidy, Landfill

revenue and property rental and recoveries.

External Capital Revenue

40 The draft budgets

show an increase in external capital revenue of $7.195m. This relates to the

capital expenditure programme and includes additional revenue for Transport

projects from NZTA and the central government funded Urban Cycle Fund.

Expenditure

Staff Costs

41 The draft budgets

show an increase in staff costs of $2.614m. This increase incorporates a 2% increase

across all staff salaries and an allowance for incremental steps. The

main changes over and above this are described in the table below.

a) City

Development – additional resources were included in the 2016/17

budget to assist with the Second Generation District Plan and Central City

Plan. These positions have been removed in the 2017/18 budget.

b) Civil

Defence – the staff budget for Civil Defence has been removed due to

the establishment of a new Civil Defence and Emergency Management model.

c) Council

Communications and Marketing – an additional staff member has been

included in this area to provide communications resource to the infrastructure

group.

d) Customer

and Regulatory Services – an additional staff member has been

included in this area following restructuring within Building Services.

e) Enterprise

Dunedin – an additional staff member is included in this area

resulting from restructuring within Enterprise Dunedin.

f) Investment

Account – additional resources have been included in the budget

pending activity reviews. The ramping up of expenditure on infrastructure needs

to follow an initial investment in asset management, contract management and

project management resources.

g) Civic Leadership

and Administration – provision has been made for an additional

in-house lawyer.

h) Olveston

– the draft budget incorporates all costs for Olveston, including the

staff costs.

i) Solid

Waste – the draft budget incorporates a City Custodian and an Education

and Promotions Officer.

j) Transport -

one additional staff member has been included in the Network Development team

for corridor access work.

Asset operations and maintenance / materials, supplies

and services

42 The draft budget

shows an increase in asset operations and maintenance costs of $7.794m and a

decrease in materials, supplies and services costs of $1.240m. The net

increase of $6.554m incorporates the following changes:

· Parks

and Recreation - Parks and Recreation have renewed contracts to maintain

Dunedin’s parks and reserves, cemeteries and trees. The new

contracts have resulted in an increase in cost. In addition, building

maintenance budgets have been increased due to the need to address deferred

maintenance on Parks and Recreation assets, in particular recreation facilities

such as gyms, toilets and changing rooms.

· Transport

- Roading maintenance costs have increased due to new maintenance contract

prices. Street cleaning costs in the central business district have also

increased in order to maintain required service levels. An increase is included

for new bus shelters, funded by the ORC.

Premises Costs

43 A rate increase of

3% has been included in the budget assumption for rates expenditure on Council

owned buildings and utilities. However, any further impact resulting from the

revaluation of properties may need to be addressed when further rates modelling

work is completed in time for the January 2017 budget meeting.

Internal Charges

44 Internal charges

have increased by $1.046m. The main increases are from Business

Information Services (BIS) due to increased expenditure needs and in Water and

Waste as a result of increased landfill fees for sludge disposal.

Depreciation

45 Depreciation expense

has increased by $5.626m. This is due to increases in infrastructure

asset valuations completed at 1 July 2016.

Second Generation District Plan

(2GP)

46 The Second

Generation District Plan (2GP), which sets the rules for development within the

city is nearing completion. When the 2GP project enters the appeals phase in

mid-2017, legal expenses are likely to be incurred. It is however

difficult to quantify and budget for these costs. When incurred, the Executive

Leadership Team will manage these costs within the overall Council budget.

Capital Expenditure

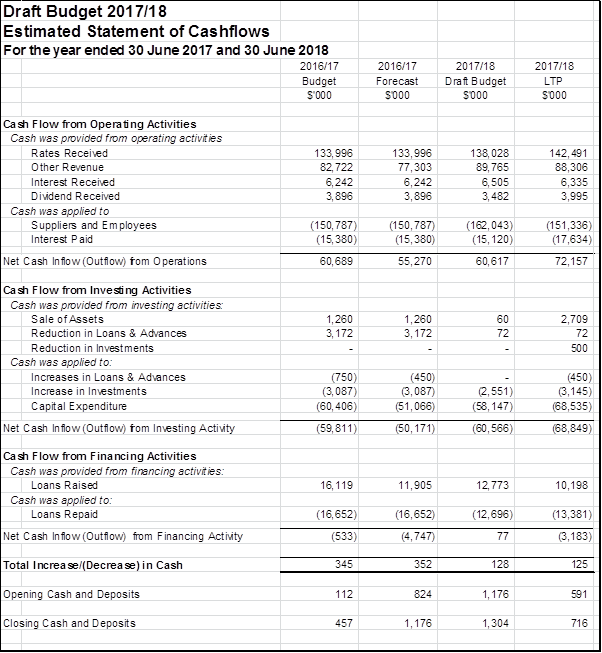

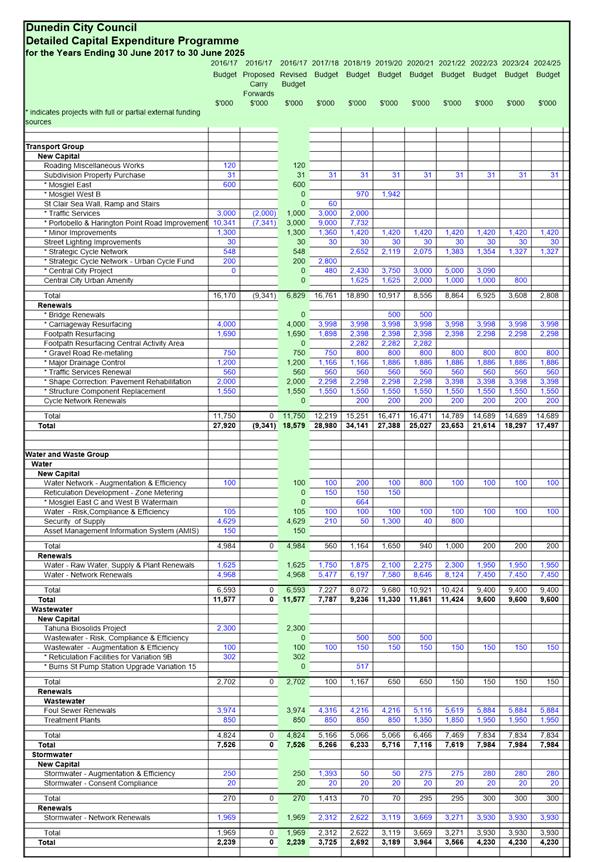

47 The total capital

expenditure programme included in draft budget is $58.147m for the 2017/18

year. This compares with $68.535m in the 2017/18 year of the LTP.

48 For the 2016/17

year, actual capital expenditure is forecast to be less than 2016/17 Annual

Plan budget.

49 The reviewed timing

has been incorporated in the Transport and Property areas. Details of the

changes are included in the relevant group reports.

50 The capital

expenditure programme will be reviewed in its entirety as part of the

development of the next LTP. Issues relating to capacity, resourcing,

affordability, ability to spend, deferred maintenance and renewals will be

addressed within the constraints of financial strategy.

Comparison with Long Term Plan 2015/16

51 The 2017/18 budget

is the third year of the Long Term Plan 2015/16 (LTP). Due to the nature of

forecasts, a number of assumptions have changed since the LTP was developed.

52 The 2017/18 forecast

included in the LTP has been compared to this draft budget. A number of

the differences follow on from and are consistent with the changes made to the

2016/17 Annual Plan budget.

53 Rates revenue is

less than forecast in the 2017/18 year of the LTP. The draft 2017/18

budget increases rates within the 3% limit set in the Financial Strategy.

The LTP forecast 5%.

54 External revenue is

higher than forecast in the 2017/18 year of the LTP. This is mainly due

to the additional revenue now forecast for the Green Island Landfill.

55 Operational costs

are higher than forecast in the 2017/18 year of the LTP. The staff costs

reflect additional resources and revised activity structures. The

additional operational costs also reflect the increase in maintenance costs.

56 Loan interest is

lower than forecast in the 2017/18 year of the LTP and is consistent with the

changes made in the 2016/17 Annual Plan. It reflects reduced debt levels

and reduced interest rate assumption.

57 Depreciation is

higher than forecast in the 2017/18 year of the LTP due to the increase in valuation

for infrastructure assets.

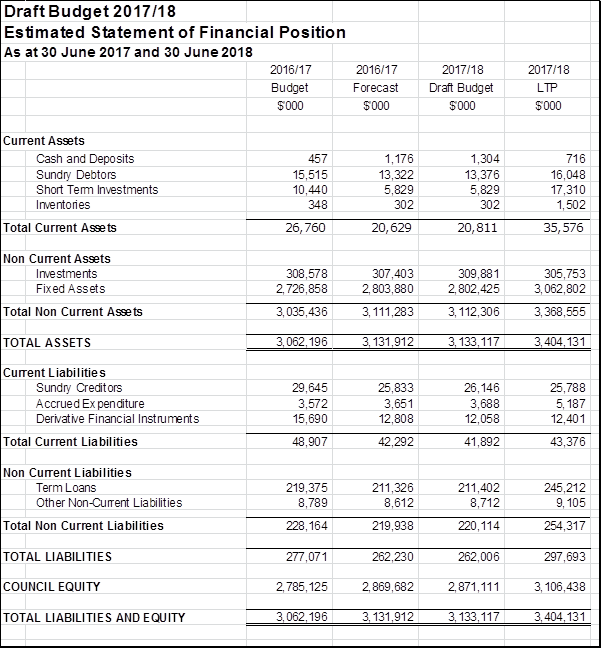

58 The Balance Sheet

has been updated to reflect the 2015/16 Annual Report results, carry forwards

and revaluation for 1 July 2016.

59 Term loans are less

than forecast in the LTP which is also consistent with the changes made in the

2016/17 Annual Plan. This is due to proceeds from property sales,

additional cash being applied to debt reduction and changes in timing of the

capital expenditure programme.

Community engagement on draft

budgets

60 Amendments to the

LGA in 2014 mean local authorities are no longer required to consult on the

Annual Plan if the plan “does not include significant or material

differences from the content of the long term plan for the financial year to

which the proposed annual plan relates”.

61 The updates made to

the budgets for the 2017/18 year are not currently viewed as significant or

material.

62 It is proposed to

still carry out a community engagement process in April 2017 to inform key

stakeholders and the wider community on the content of the draft 2017/18

budgets and to provide opportunities for feedback. This engagement process will

also introduce and lead in to the LTP 2018-2028.

63 The focus of the

community engagement will be on:

· Describing

any differences in draft budgets for 2017/18, including reasons for the

differences and why they are not considered significant or material;

· Reminding

the community about the activities and projects that were included in the

LTP for the 2017/18 year and continue to be included in the draft budget; and

· Foreshadowing

the LTP 2018-2028 process and opportunities for community involvement.

64 Opportunities for

community feedback on the draft budgets will be confirmed in a subsequent

report. The proposed community engagement activities will include:

· Information

sent to every Dunedin household;

· Councillor

face-to-face sessions open to all of the community;

· Social

media through Facebook and Twitter;

· Networking

with communities through Community Boards and other stakeholder groups; and

· Web

information and feedback process (as well as hard copy).

65 All of the community

feedback and an analysis of the feedback will be provided to the Council for

its consideration prior to adopting the Annual Plan 2017/18. The feedback

will also be used in the development of the LTP 2018-2028.

OPTIONS

66 Not

applicable.

NEXT STEPS

67 Following

confirmation of the proposed approach to community engagement by the Council,

staff will develop an engagement document and a detailed engagement plan. This

will be brought back to the Council for an initial review in late February 2017

and for final approval in March 2017.

68 Following the

community engagement process, the community feedback will be provided to the

Council in May 2017 to allow the Council to consider the community’s

views on the draft budgets prior to adopting the 2017/18 Annual Plan in June

2017.

69 A budget update will

be provided in May 2017 which will update the forecast for the 2016/17

year. This will take into account progress on the capital expenditure

programme.

70 If you have

questions about the budget materials please email them to Vivienne Harvey

Personal Assistant to the Chief Executive Officer. Responses will be provided

to all Councillors no later than Friday 20 January 2017.

Signatories

|

Author:

|

Jane Nevill - Corporate Planner

Carolyn Allan - Senior Management Accountant

|

|

Authoriser:

|

Sue Bidrose - Chief Executive Officer

|

Attachments

|

|

Title

|

Page

|

|

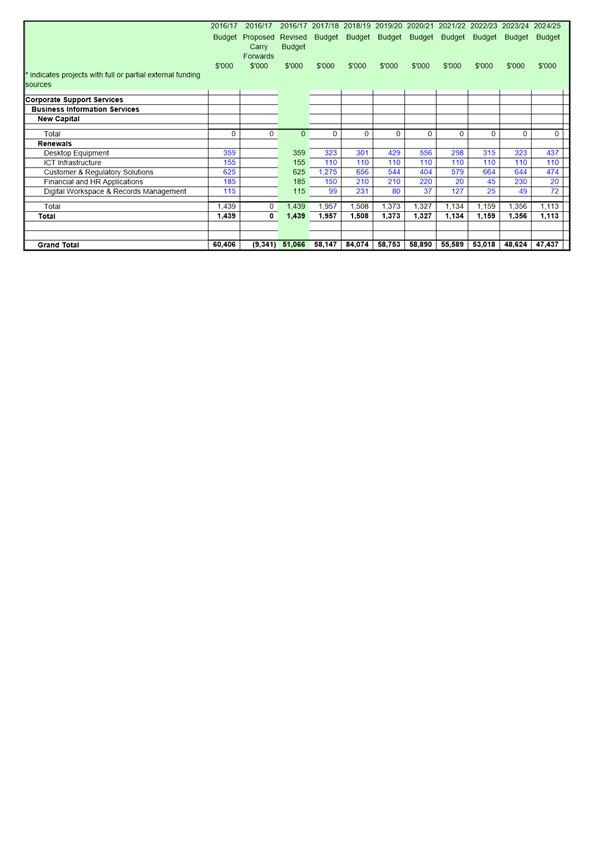

a

|

Draft Budget 2017/18

|

22

|

|

b

|

Capital Expenditure

Programme

|

25

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report enables democratic local decision making and

action by, and on behalf of communities; and meets the current and future

needs of the Dunedin communities for good quality local infrastructure,

public services and regulatory function in a way that is most cost effective

for households and businesses.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The Annual Plan is part of the Council’s strategic

framework. Forecast budgets, projects and activities associated with the

implementation of the other strategies are included in the Long Term Plan and

reviewed in each Annual Plan Year.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua. Engagement

processes for the 2017/18 Annual Plan will need to ensure that there is

opportunity for Māori to contribute.

|

|

Sustainability

The LTP contains content regarding the Council’s

approach to sustainability. Major issues and implications for sustainability

are discussed in the 30 year infrastructure strategy and financial resilience

is discussed in the Financial Strategy. This is reflected in the

consideration of content in each Annual Plan.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report notes the requirements for an Exceptions-Only

Annual Plan. Accordingly this report indicates changes to LTP and Annual Plan

budgets for the 2017/18 year.

|

|

Financial

considerations

The financial considerations are noted in the report.

|

|

Significance

The Council’s budgets for 2017/18 have been updated

and compared with the forecast for the 2017/18 year in the LTP. There are no

significant or material changes to 2017/18 budgets.

|

|

Engagement –

external

The organisations involved in developing the budgets for

2017/18 are identified in the relevant reports.

|

|

Engagement -

internal

The Executive Leadership Team, Finance staff, Policy staff

and the Group and Activity Managers have been involved in developing the

budgets and related financial information.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

Conflict of

Interest

There are no known conflicts of interests.

|

|

Community Boards

This material may be of interest to Community Boards.

|

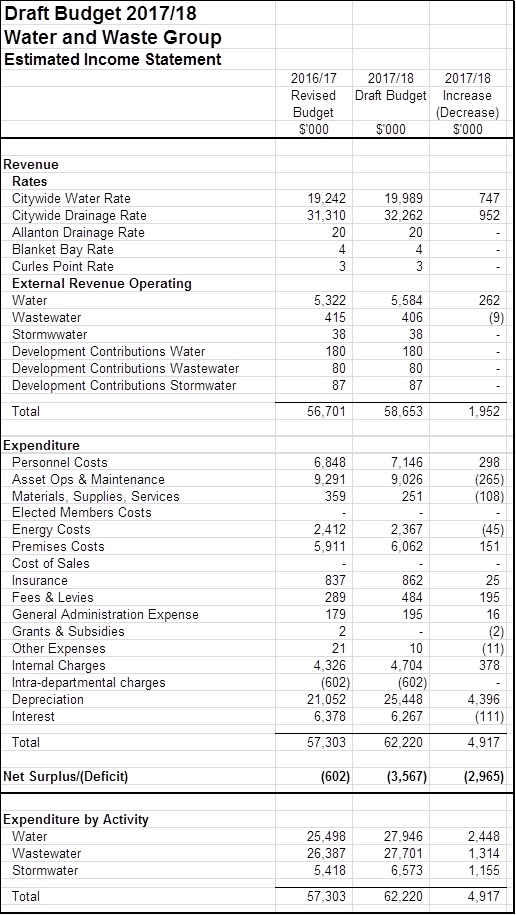

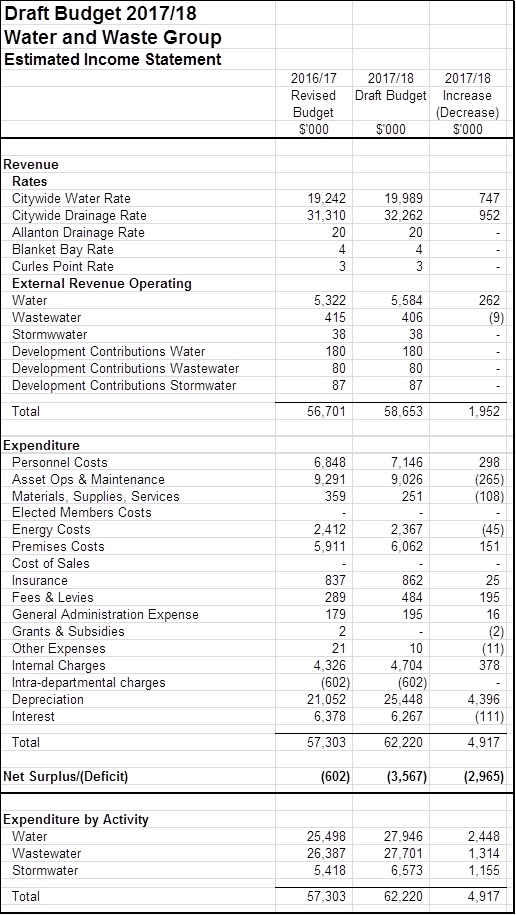

Draft 2017/18 Budget - Water and Waste Group

Department: Community and Planning and Finance

EXECUTIVE SUMMARY

1 This

report provides the draft 2017/18 budget for the Water and Waste

Group. The Water and Waste Group includes the following activities:

· Water

· Wastewater

· Stormwater

|

RECOMMENDATIONS

That the Council:

a) Approves, for

the purposes of community engagement, the draft 2017/18 budget

relating to Water and Waste as shown/amended in Attachment A.

b) Approves,

for the purposes of community engagement, the 2017/18 fees and

charges for the Water and Wastewater activities as shown/amended in

Attachment B.

|

operating budgets

Revenue

Rates

2 The draft

budgets incorporate an overall increase in rates of $1.699 million to fund the

scheduled step-up in renewals expenditure and increases in staff and

operational costs.

External revenue

3 External

revenue has increased by $253k due to an increase in water meter charges and an

increase in lease and licence to occupy revenue, for example, Swampy Summit.

Expenditure

Staff costs

4 Staff

costs have increased by $298k. This increase incorporates an additional staff member

to read water meters, previously contracted out, as well as provision for

salary increases.

Asset operations and

maintenance costs

5 Asset

operations and maintenance costs have reduced by $265k due to savings in

chemical costs.

Materials, supplies and services

6 The

budget for materials, supplies and services has reduced by $108k. The

main reason for this is the removal of the water meter reading contract costs

which has been offset by an increase in staff costs.

Premises costs

7 Premises

costs have increased by $151k, due mainly to increased rates expenditure.

Fees and levies

8 The

budget for fees and levies has increased by $195k. This includes an

allowance for engineering consultancy support to develop a preliminary South

Dunedin flood mitigation plan, condition assessment of critical rising mains,

support for ongoing system improvements and the provision of legal work that

cannot be accommodated within the in-house legal team.

Internal Charges

9 Internal

charges have increased by $378k. The main increases relate to sludge

disposal costs, which have increased in line with the expected increase in

landfill charges, and an increase in Fleet Operations charges due for an

additional vehicle for a meter reader.

Depreciation

10 Depreciation has

increased by $4.396 million due to an increase in the valuation of water and

wastewater assets.

Interest

11 The budget for

interest has reduced by $111k.

capital expenditure Budget

12 There is no change

to the capital expenditure programme.

Fees and charges

13 Fees and charges for

activities in Water and Waste have been increased by 3%. A copy of the

group fees schedule is attached.

Service performance measures

14 There are no changes

proposed to the measures and targets showing in the Long Term Plan 2015/16-2024/25

for Water and Waste in the 2017/18 year.

related reports

15 There are no related

reports for Water and Waste.

Signatories

|

Author:

|

Jane Nevill - Corporate Planner

Carolyn Allan - Senior Management Accountant

|

|

Authoriser:

|

Laura McElhone - Group Manager Water and Waste

|

Attachments

|

|

Title

|

Page

|

|

a

|

Draft Budget 2017/18 -

Water and Waste Group

|

35

|

|

b

|

Fees and Charges -

Water and Waste Group

|

36

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report enables democratic local decision making and

action by, and on behalf of communities; and meets the current and future

needs of the Dunedin communities for good quality local infrastructure in a

way that is most cost effective for households and businesses.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☐

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☐

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☐

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The activities of Water and Waste primarily contribute to

the objectives and priorities of the above strategies.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

The report indicates changes to the LTP and Annual Plan

budgets.

|

|

Financial

considerations

The financial considerations are detailed in the report.

|

|

Significance and

materiality

There are no significant or material changes to the draft

2017/18 budgets for Water and Waste.

|

|

Engagement –

external

There has been no external engagement in developing the

budgets for Water and Waste.

|

|

Engagement -

internal

The Executive Leadership Team, Finance staff, Policy staff

and the managers of Water and Waste have been involved in developing the

budgets and related financial information.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

Conflict of

Interest

There are no known conflict of interests.

|

|

Community Boards

This material may be of interest to Community Boards.

|

Proposed

Fees and Charges 2017/18

Fees

include GST unless otherwise stated.

|

|

2015/16

|

2016/17

|

2017/18

|

|

$

|

$

|

$

|

|

Wastewater

|

|

Network Contributions for a Sewer

Connection

|

|

Where there has been no prior contribution to the existing

network there will be a standard Network Contribution fee for all of the

Dunedin City Council areas

|

5,000.00

|

5,000.00

|

5,150.00

|

|

Wastewater - Trade Waste Charges

|

|

The new charging model moves from three sets of unit rates

for Trade Waste charging (one for each wastewater treatment plant catchment)

to a single set of citywide unit rates. The new model introduces application

fees based on customer category type.

|

|

City Wide Unit Rates

|

|

Volume per cubic metre

|

0.07

|

0.08

|

0.08

|

|

BOD5 per kg

|

0.07

|

0.08

|

0.08

|

|

NFR/TSS per kg

|

0.17

|

0.19

|

0.19

|

|

Compliance Monitoring, Re-Inspection and

Consent Breaches

|

|

Staff per hour

|

105.00

|

108.15

|

111.00

|

|

Laboratory

|

Variable Cost

|

Variable Cost

|

Variable Cost

|

|

Mileage per km

|

|

|

|

|

Tankered Waste Charges per tonne

|

21.00

|

21.63

|

22.00

|

|

Consent Application Fee Category A

|

969.00

|

998.07

|

1028.00

|

|

Consent Application Fee Category B

|

321.00

|

330.63

|

340.00

|

|

Annual Fee

|

161.00

|

165.83

|

171.00

|

|

|

2015/16

|

2016/17

|

2017/18

|

|

$

|

$

|

$

|

|

Water

|

|

Installation of New Services

|

|

Charges for the installation of new services are

determined on a case-by-case basis and are provided as a fixed price quote to

applicants. Alternatively, customers can elect to undertake this work

themselves at their own risk by engaging a Council Approved Water Supply

Connection Installer. That installer will do all work apart from making the

connection to the live water main, which will be undertaken by Council staff.

A fee for making the connection will be charged.

|

|

Network Contributions

|

|

Where there has been no prior contribution to the existing

network there will be a standard Network Contribution fee for all of the

Dunedin City Council areas

|

5,000.00

|

5,000.00

|

5,000.00

|

|

New 20mm diameter domestic water connection

|

Quoted

|

Quoted

|

Quoted

|

|

Commercial or extraordinary water connection

|

Quoted

|

Quoted

|

Quoted

|

|

Disconnection of water supply

|

207.00

|

207.00

|

213.00

|

|

Annual supply charge (meter rental)

|

|

20mm nominal diameter

|

140.00

|

144.00

|

148.00

|

|

25mm nominal diameter

|

179.00

|

184.00

|

190.00

|

|

30mm nominal diameter

|

199.00

|

205.00

|

211.00

|

|

40mm nominal diameter

|

225.00

|

232.00

|

239.00

|

|

50mm nominal diameter

|

456.00

|

470.00

|

484.00

|

|

80mm nominal diameter

|

564.00

|

581.00

|

598.00

|

|

100mm nominal diameter

|

595.00

|

613.00

|

631.00

|

|

150mm nominal diameter

|

855.00

|

881.00

|

907.00

|

|

300mm nominal diameter

|

1,110.00

|

1,143.00

|

1,177.00

|

|

Hydrant Standpipe

|

552.00

|

569.00

|

586.00

|

|

Re-connection Fee - Includes the removal of water

restrictors installed due to non-compliance of the water bylaw

|

371.00

|

371.00

|

382.00

|

|

Special Reading Fee

|

50.00

|

50.00

|

52.00

|

|

Backflow Prevention Programme

|

|

Backflow Preventer Test Fee

|

88.00

|

91.00

|

94.00

|

|

Rescheduled Backflow Preventer Test Fee

|

52.00

|

53.00

|

54.00

|

|

Backflow programme - Incomplete Application Fees (hourly

rate)

|

39.00

|

39.00

|

39.00

|

|

Central Water Scheme Tariff for water

sold by meter

|

|

Treated water per cubic metre

|

1.43

|

1.47

|

1.56

|

|

Bulk Raw Water Tariff to: Merton, Hindon, and individual

farm supplies (per cubic metre)

|

0.11

|

0.11

|

0.11

|

|

Rural Water Schemes have differing

capital and connection charges—please contact the Water and Waste

Services Department for further information.

|

Emissions Trading Scheme Liabilities and

Proposed Carbon Management Policy

Department: Community and Planning and Strategy and Governance

EXECUTIVE SUMMARY

1 Changes

to the New Zealand Emissions Trading Scheme (ETS) will double the quantity of

carbon credits (‘NZUs’) the Council needs to meet it ETS landfill

liabilities (from around 25,000 to more than 50,000 NZUs) by 1 January

2019.

2 This

impact of this is further exacerbated by changes to the cost of credits.

In anticipation of the changes, the market price of NZUs’ increased from

around $7 in mid-2015 to $13.50 in April 2016. NZUs are now trading at around

$18.50 per NZU. An NZU price cap of $25 remains in place under the

ETS.

3 This

report responds to a Council resolution – from May 2016 when the Council

considered a report on the (then) anticipated phase-out of the transitional

treatment (one-for-one central Government subsidy) for landfill emission

liabilities under the ETS – requesting options to reduce the

Council’s ETS liability.

4 Options

include: further recovery of costs through landfill charges; reducing the

quantity of emissions to which the ETS directly applies; minimising the

per-unit cost of NZUs through prudent purchasing and surrendering decisions;

avoiding deforestation (and subsequent ETS liabilities) of Council-owned forest

land; and evaluating opportunities to cost-effectively create NZUs through

Council activities, business opportunities and strategic carbon management

practices.

5 A DCC

Carbon Management Policy is proposed for adoption, which would govern the

management and minimisation of the Council’s carbon

liabilities.

|

RECOMMENDATIONS

That the Council:

a) Adopts the

Carbon Management Policy attached to this report.

|

Background

6 The New

Zealand Emissions Trading Scheme (ETS) was established by the Climate Change

Response (Emissions Trading) Amendment Act 2008, as the foundation for the

country's principal greenhouse gas emissions trading scheme.

7 The DCC

has a specific liability under the ETS as a landfill operator. The DCC

must purchase or create enough NZUs to offset (the carbon equivalent of)

methane emissions from its solid waste facilities and surrender these to the

ETS administrator in May of each year to avoid statutory penalties.

8 Since

2009 ETS participants from the liquid fossil fuels, industrial processing,

stationary energy and waste sectors have been allowed to surrender one NZU for

every two tonnes of emissions (i.e. a 50% surrender obligation).

9 On 26 May

2016 the Government announced this one-for-two transitional measure would be

phased out. From 1 January 2017 the surrender obligation will rise to

67%, then to 83% from 1 January 2018, and to 100% by 1 January 2019.

10 The Council also has

contingent ETS liabilities as a result of its direct ownership of forest land,

for which the Council previously received allocated NZUs from the

Government. These direct holdings are in addition to forest land owned

and managed by City Forests Limited (CFL), for which it also received allocated

NZUs. If the Council or CFL were to deforest this land, it may be liable

for the purchase, offsetting or creation of the corresponding number of

NZUs.

11 Finally, the Council

faces increased indirect costs arising from the ETS (e.g. through its purchase of

energy).

12 In May

2016 the Council resolved:

“(Mayor Dave Cull/Cr Chris Staynes)

That the Council:

Requests a report back from staff identifying options for

reducing Emissions Trading Scheme liability, no later than December 2016.

Motion carried (AP/2016/027)”

Discussion

13 A range of options

to reduce the Council’s landfill ETS liabilities exist.

Landfill user charges

14 A first option is to

recover ETS costs through user charges. The purpose of the ETS is to

encourage reductions in emissions, rather than the purchase of NZUs.

Accordingly, NZU pricing should be reflected in landfill charges as far as

possible, to encourage waste minimisation by landfill users (but not so high as

to encourage illegal dumping, which creates other costs). In the context

of the current 2016/17 Annual Plan, the Council increased the budget for the

Solid Waste activity to reflect the increase NZU prices from $7 in mid-2015 to

$13.50 in May 2016, and increased relevant landfill user charges to recover

these costs.

15 Since then the

Government has confirmed the phase-out of transitional treatment of landfill

ETS liabilities, and the NZU market price has further increased to around

$18.50. The Council is yet to reflect the costs of increased NZU quantities

required as a result of the ETS changes, or the latest market prices, in

budgets or user charges.

16 The cost of the ETS

changes based on indicative annual landfill emissions of around 50,000 tonnes

is tabulated below over the phase-out period at the current budgeted price

($13.50), current market price ($18.50) and the ETS cap ($25.00):

|

DATE

|

01/01/2016

|

01/01/2017

|

01/01/2018

|

01/01/2019

|

|

PRICE

NZUs

|

25,000

|

33,500

|

41,500

|

50,000

|

|

Budget ($13.50)

|

$337,500

|

$452,250

|

$560,250

|

$675,000

|

|

Market ($18.50)

|

$462,500

|

$619,750

|

$767,750

|

$925,000

|

|

ETS Cap ($25.00)

|

$625,000

|

$837,500

|

$1,037,500

|

$1,250,000

|

17 Options for

recovering actual costs will be addressed separately in the context of the

Solid Waste activity budget for 2017/18.

Landfill liability reductions

18 A second option is

to reduce the quantity of landfill emissions to which the ETS directly

applies. Several potentially cost-effective actions previously reported

to the Council (e.g. application for a Unique Emissions Factor, waste

minimisation) are either being implemented or remain under consideration and

development.

Prudent purchase and surrender of NZUs

19 A third option is to

minimise the per-unit cost of NZUs through prudent NZU purchasing and

surrendering decisions. This report recommends the adoption of a proposed

Carbon Management Policy (the Policy), as presented in Attachment A, to more

clearly govern NZU purchases, sales and reporting, aligned to the Dunedin

City Council Treasury Risk Management Policy (Commodities).

Preservation and creation of NZUs

20 A fourth option is

to consider opportunities to preserve or create NZUs (e.g. enhanced forestry

management practices or additional tree planting on Council land). This

will involve a degree of strategic innovation as well as risk, as the costs of

preservation or creation must remain below the market value of NZUs for the

activity to remain cost-effective. The proposed Policy (Attachment A)

requires staff to identify and consider such opportunities within current and

proposed business activities.

Indirect ETS cost reductions

21 The Council may also

mitigate future indirect costs of the ETS (e.g. embedded in energy costs or

project delivery) by reducing the Council’s carbon emissions

generally. Again, the proposed Policy requires staff to identify and

consider such opportunities.

22 The proposed Policy

also aligns and addresses the Council’s other carbon management

initiatives, objectives and obligations, including those outlined in the DCC

Emissions Management and Reduction Plan, its participation in the Compact of

Mayors, and its participation in the city-wide Energy Plan.

Options

Option

One – Adopt the proposed Carbon Management Policy (Recommended Option)

23 It is

recommended the Council adopt the proposed Carbon Management Policy.

Advantages

· Provides

a policy framework for governing the management and minimisation of the

Council’s ETS liabilities.

Disadvantages

· May

not meet all of the Council’s expectations.

Option

Two – Adopt a revised Carbon Management Policy

24 The

Council may wish to revise the proposed Carbon Management Policy.

Advantages

· May

better meet the Council’s preferences for a Carbon Management Policy.

Disadvantages

· None

known.

Option

Three – Do not adopt a Carbon Management Policy (Status Quo)

25 The

Council may decline to adopt the proposed Carbon Management Policy.

Advantages

· None

known.

Disadvantages

· The

Council’s expectations for governing the management and minimisation of

the Council’s ETS liabilities may be unclear.

· The

Council is exposed to heightened risk of (ETS) statutory non-compliance, and

potential financial, reputational and business sector damage.

Next Steps

26 If approved, the

Carbon Management Policy will be implemented by management, including the

development of associated operational guidelines, roles and responsibilities,

and reporting/ monitoring and assurance mechanisms.

Signatories

|

Author:

|

Bill Frewen - Senior Policy Analyst

Andrew Slater - Risk and Internal Audit Manager

|

|

Authoriser:

|

Maria Ioannou - Corporate Policy Manager

Sandy Graham - General Manager Strategy and Governance

|

Attachments

|

|

Title

|

Page

|

|

a

|

Proposed Carbon

Management Policy

|

45

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This proposal enables democratic local decision making and

action by, and on behalf of communities, and to providing local

infrastructure and it is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

This proposal provides a policy framework for governing

the management and minimisation of the Council’s ETS liabilities. The

ETS is a national mechanism for participating in international climate change

mitigation.

|

|

Māori Impact

Statement

This proposal has no known impacts for tangata whenua.

|

|

Sustainability

This proposal provides a policy framework for governing

the management and minimisation of the Council’s ETS liabilities. The

ETS is a national mechanism for participating in international climate change

mitigation.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This proposal provides a policy framework for governing

the management and minimisation of the Council’s ETS liabilities, which

have direct costs to ratepayers and/or landfill users, and implications for

the management of landfill, forest and other assets.

|

|

Financial

considerations

The direct financial impacts of the ETS will be addressed

separately in the context of the Solid Waste activity budget for 2017/18.

|

|

Significance

The significance of this proposal is assessed as medium,

as it involves the management of considerable risks or costs either to ratepayers

and/or landfill users (or both).

|

|

Engagement –

external

This proposal has not been subject to external

consultation as the Council’s ETS liabilities are established by

law. However, the public engagement during the development of Te Ao

Tūroa – The Natural World: Dunedin’s Environment Strategy

demonstrated strong public support for reducing city carbon emissions.

|

|

Engagement -

internal

This proposal has been endorsed by all Groups expected to

participate in the management and minimisation of the Council’s ETS

liabilities.

|

|

Risks: Legal /

Health and Safety etc.

This proposal provides a policy framework for governing

the management and minimisation of the Council’s ETS liabilities.

Non-compliance with ETS requirements could expose the council to potential

liabilities and costs greater than the costs of ETS compliance.

|

|

Conflict of

Interest

There is no known conflict of interest associated with

this proposal.

|

|

Community Boards

There are no known impacts for Community Boards associated

with this proposal.

|

POLICY REGISTER

|

Department responsible:

|

|

|

Policy number:

|

|

|

Policy version:

|

|

|

Review date:

|

|

|

Contribution to

strategic framework - specific priorities:

|

|

DCC Carbon Management POLICY

Category Finance

Type Policy

Approved by Council

Date Policy Took Effect xxx

Last Approved Revision N/A

Sponsor Group

Chief Financial Officer

Responsible Officer Group

Chief Financial Officer

Review Date xxx

1 INTRODUCTION

1.1 The

Dunedin City Council (DCC) Carbon Management Policy (‘this Policy’)

reflects the following statutory and strategic instruments articulating the

Council’s carbon emission obligations and commitments.

1.2 NZ Emissions Trading Scheme

1.2.1 The New

Zealand Emissions Trading Scheme (ETS) is the New Zealand Government’s

principal policy response to climate change. The ETS was established by

the Climate Change Response (Emissions Trading) Amendment Act 2008 in order to:

“… provide for the implementation, operation, and administration of

a greenhouse gas emissions trading scheme in New Zealand that supports and

encourages global efforts to reduce the emission of greenhouse gases.”

1.2.2 The ETS

currently includes the NZ forestry, energy, industrial process and waste

management sectors. Participants in the ETS are required to purchase and/or

'surrender' approved carbon credit units in exchange for equivalent tonnes of

carbon emitted or released into the environment.

1.3 Dunedin City Strategic

Framework

1.3.1 The DCC

has adopted a framework of eight key strategies, including Te Ao Tūroa:

The Natural World, which establishes a commitment to reducing city carbon

emissions. As part of this commitment in 2015 the DCC became a

signatory to the Compact of Mayors which involves reporting, planning and

action towards reducing city carbon emissions.

1.3.2 Within

Dunedin’s Economic Development Strategy, the Energy Plan is a Council-led

city-wide initiative with amongst other goals, a goal of reducing city carbon

emissions.

1.3.3 The

internal DCC Emissions Management and Reduction Plan seeks to minimise the

Council's direct carbon emissions.

1.4 This

Policy also reflects the Council-wide commitment to sustainability and the

principles of kaitiakitaka.

2 Policy

PURPOSE

2.1 This

Policy serves as a public commitment by the DCC to identify, manage and

minimise carbon emissions.

2.2 This

Policy seeks to ensure DCC continues to meet its statutory obligations with

regard to carbon emissions and carbon credit trading activities, including in

particular those responsibilities defined by the ETS.

2.3 This

Policy also informs the effective management of all risks associated with DCC

trading activities on the New Zealand and international carbon market,

including fluctuations in emission unit prices and future liability exposure.

2.4 This

Policy provides a clear set of guidelines by which the DCC shall manage its

carbon management practices and associated business opportunities.

2.5 This

Policy should be read in conjunction with the DCC Treasury Risk Management

Policy (Commodities).

3 ORGANISATIONAL

SCOPE

3.1 This Policy applies to:

3.1.1 All

employees of the DCC, including temporary employees and contractors;

3.1.2 Any

person who is involved in the operation of the DCC, including elected members,

volunteers and those people with honorary or unpaid staff status;

3.1.3 Every business, service or activity of the DCC.

4 DEFINITIONS

4.1 'Carbon

Credit': Generic term for any carbon emissions trading unit representing

one tonne of carbon dioxide equivalent (tCO²e). ETS-approved carbon

credits include New Zealand issued units (NZUs) and Assigned Amount Units

(NZAAUs). Carbon Credits may be purchased, sold, traded and/or offset against

other carbon emitting activities on the carbon market as a means to manage an

organisation's carbon footprint.

4.2 'Carbon

Market': A system of carbon emissions trading that allows participants to

buy and sell carbon credits and thereby manage their carbon footprints, targets

and statutory responsibilities.

4.3 'Carbon

Footprint': A formal measure of total CO2 emissions, calculated within a

specific time period, organisation activity/ies or geographic boundary.

5 Carbon

Management PRinciples

5.1 The DCC shall at all times:

5.1.1 Consider

the impact of current and proposed business activities upon the DCC’s and

the city's carbon footprint, as well as associated statutory obligations and

carbon emission reduction targets.

5.1.2 Identify

and preference those business opportunities that seek to minimise or reduce

carbon emissions through operational efficiencies, energy and environmental

sustainability, and increased carbon offsetting and sequestration potential.

5.1.3 Consider

and prioritise energy and carbon-efficient alternatives when planning capital

expenditure projects, including in particular those pertaining to DCC Property,

Transport, Parks and Recreation, and Three Waters activities.

5.1.4 Identify,

assess and monitor the carbon emission profiles and activities of external DCC

contractors and other business partners engaged in project or service delivery.

6 Carbon

Management Responsibilities

6.1 The

DCC shall ensure appropriate delegated staff resourcing, responsibility and

processes for responsible carbon management practices across all relevant

business activities.

6.2 All

DCC business units / teams shall ensure continued compliance with all

applicable carbon emissions statutory obligations including the ETS, as well as

DCC carbon management and emissions reduction initiatives, policies and

procedures, staff responsibilities and delegations, financial practices and

business activities.

6.3 Processes

for the effective management and quantification of carbon emissions and

ensuring protection against future liabilities (including those arising from

business activities such as changes in land usage and deforestation, external

market fluctuations and natural disasters) shall be established and maintained

by Business Units/ teams, in collaboration with the DCC Finance Department and

in accordance with the guidelines noted in this Policy.

6.4 All

carbon credit transactions, including carbon market registration, credit

purchases and sale/ transfers shall be undertaken with due probity and

diligence by appropriately authorised staff and through accredited carbon

market agents only.

6.5 Anticipated

future liability and carbon credit risk exposure shall be established by

relevant DCC departments in consultation with the DCC Finance Department, and

reviewed no less than annually.

6.6 At

a minimum, the DCC Finance Department shall maintain sufficient carbon credits

to cover anticipated statutory obligations (including the NZ ETS) and future

liability arising from DCC business activities, or alternatively allocate

sufficient budget to purchase equivalent carbon credits on the carbon market.

6.7 Any

decision to trade carbon credits, and/or offset liability shall reflect

appropriate due diligence, be subject to appropriate DCC delegated approval

processes, and consider all associated impacts including dividend and tax

consequences.

6.8 Under

no circumstances should DCC carbon credits be used for financial speculation.

The DCC may take steps to realise value from carbon credits only if:

6.8.1 The

transaction would result in a net benefit to the DCC, and;

6.8.2 Realising

value from transactions will not compromise the DCC’s ability to meet its

emissions targets, obligations and liabilities.

7 Reporting

7.1 Comprehensive

carbon records shall be maintained by all relevant DCC departments that detail

at a minimum business activity carbon emissions, carbon credit liabilities (ETS

and other) and (current/ proposed) changes arising from business activities,

carbon credit transactions (sale, purchase, surrender, offset) and emission

reduction or management targets.

7.2 Carbon

records will be monitored by the DCC Executive Leadership Team and the

Financial Controller as required to ensure compliance with this Policy, an

appropriate level of liability and risk management, and compliance with DCC

carbon targets and obligations.

7.3 This Policy shall be subject to

on-going review and updates as required to address changes in New Zealand and

international carbon credit and emissions legislation and statutory

obligations, and ensure alignment with DCC strategic objectives.

8 RELEVANT

DOCUMENTS

8.1 Te Ao Tūroa: The

Natural World – Dunedin’s Environment Strategy

8.2 Dunedin’s

Economic Development Strategy and Energy Plan 1.0

8.3 DCC Emissions

Management and Reduction Plan

8.4 DCC Treasury Risk

Management Policy (Commodities)

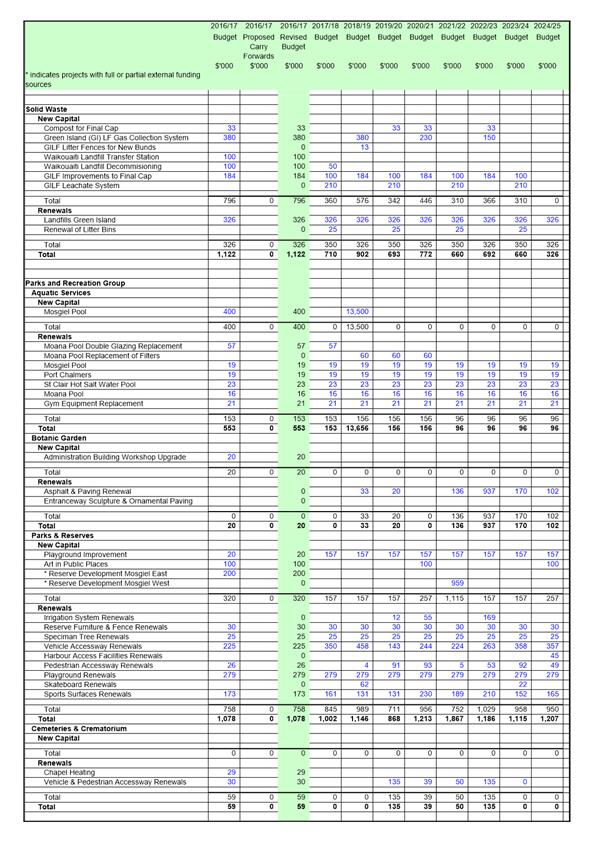

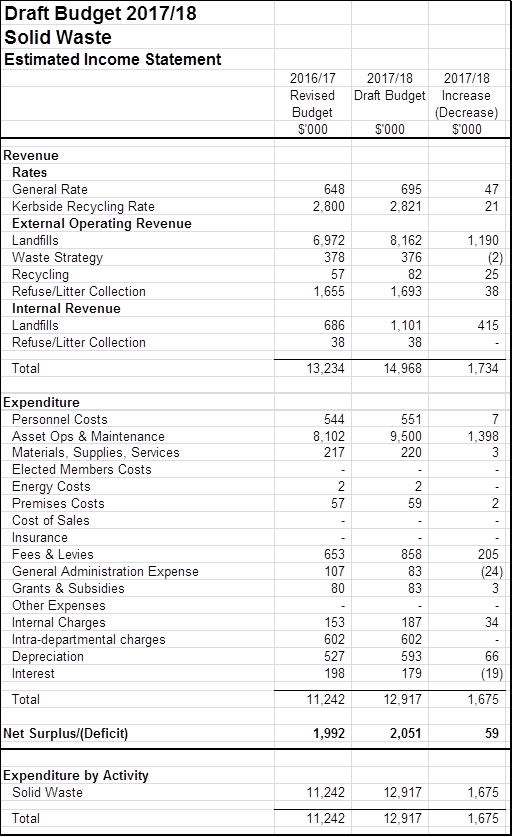

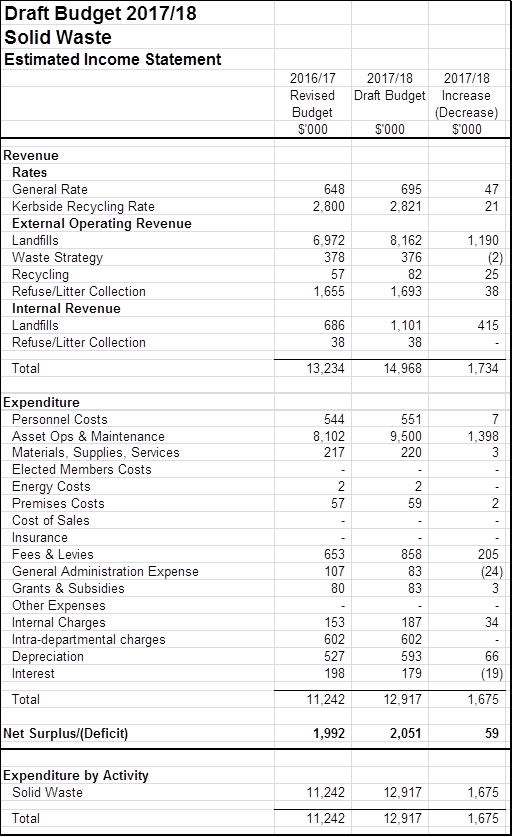

Draft 2017/18 Budget - Solid Waste

Department: Community and Planning and Finance

EXECUTIVE SUMMARY

1 This

report provides the draft 2017/18 budget for Solid Waste.

|

RECOMMENDATIONS

That the Council:

a) Approves, for

the purposes of community engagement, the draft 2017/18 budget

relating to Solid Waste as shown/amended in Attachment A.

b) Approves, for

the purposes of community engagement, the 2017/18 fees and charges for

Solid Waste as shown/amended in Attachment B.

|

operating budgets

Revenue

External revenue

2 External

revenue has increased by $1.251 million due to increased emissions trading

scheme (ETS) costs needing to be recovered as well as an increase in volumes of

waste to the landfill.

Internal revenue

3 Internal

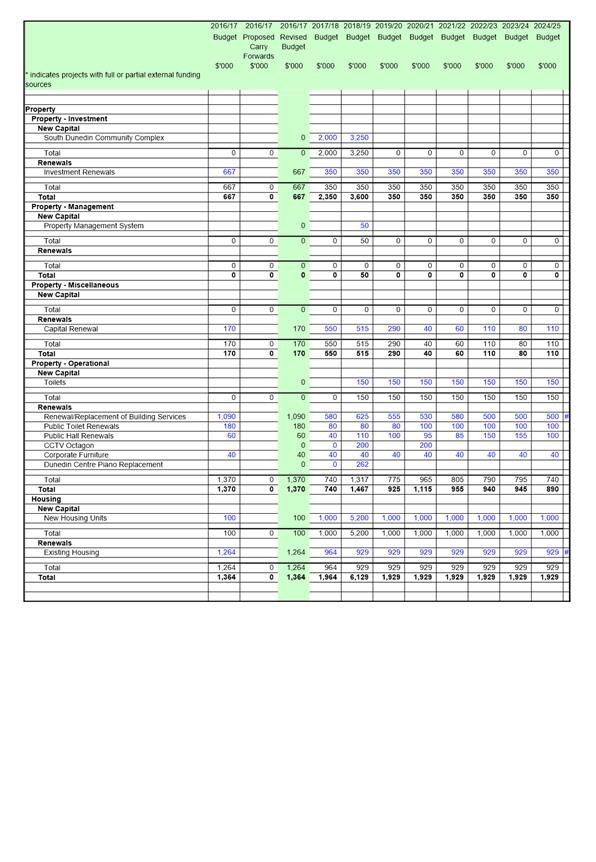

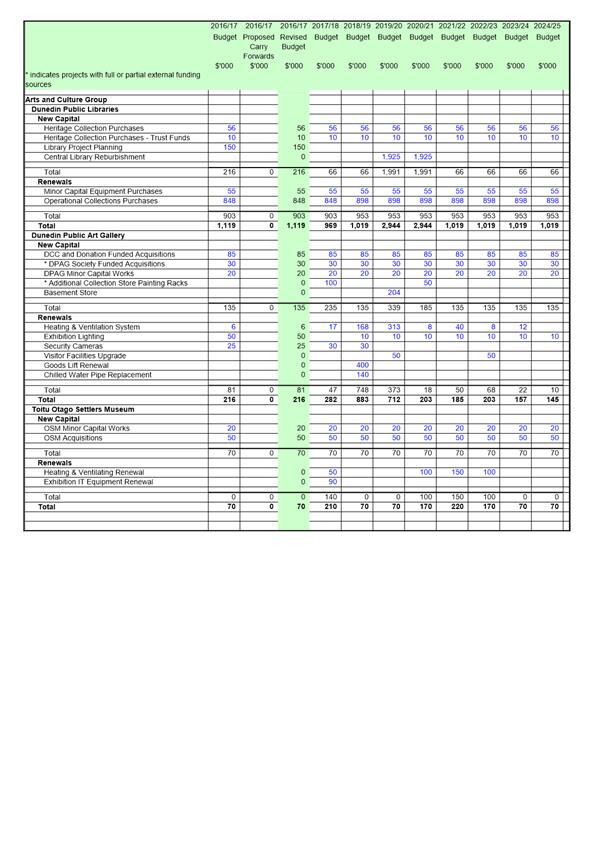

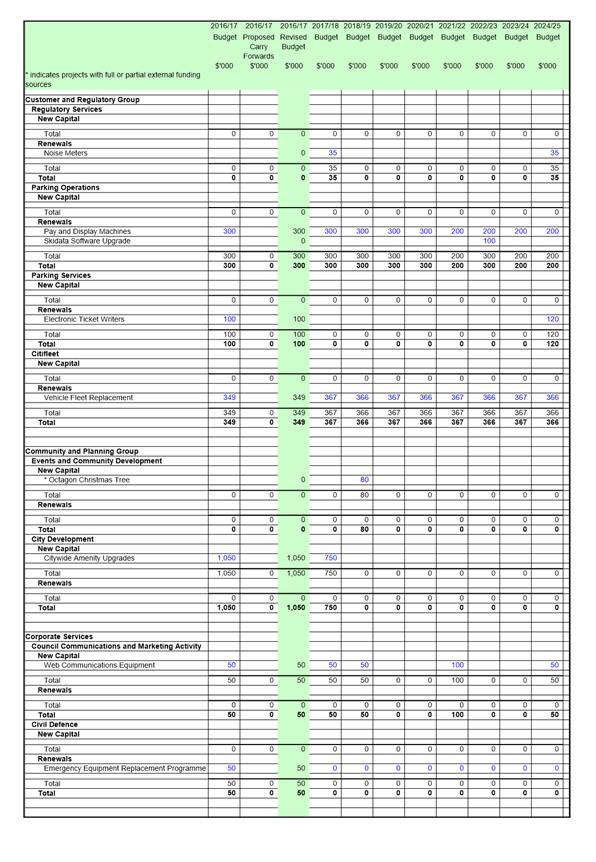

revenue has increased by $415k due to higher landfill disposal revenue from the

Water and Waste Group for the disposal of sludge. The increase is driven

by the increase of prices at the landfill.

Expenditure

Asset operations and maintenance

costs

4 Asset

operations and maintenance costs have increased by $1.398 million.

Landfill contract costs have increased by $772k due to increased volumes of

waste and an inflationary adjustment. ETS costs have increased by $509k based

on anticipated market price ($25 per tonne) and anticipated waste volumes.

Fees and levies

5 Fees and

levies have increased by $205k. This provides funding for ongoing work on

planning for the future of the landfill operation. It also provides

additional funding for the waste disposal levy paid to the Ministry for the

Environment, which is based on waste volume.

Net

Surplus/(Deficit)

6 The

annual contribution to rates from Solid Waste has increased by $353k due to

additional revenue and reduced capital expenditure requirements for the 2017/18

year.

capital expenditure Budget

7 No change

to the capital expenditure programme.

fees and charges

8 Fees and

charges for Solid Waste have been reviewed and adjusted to reflect increases to

ETS costs and more clearly differentiate the fee groups where ETS is applicable.

9 Fees have

increased by 3% in line with budget parameters and by a further 8.5% for fees

where ETS costs apply. A copy of the fees schedule is attached; fees

where ETS costs do not apply are shown in bold blue font. Some fees are

unchanged from 2016/17 or slightly reduced as a result of a review, for example

fees for 100% vegetation loads. A copy of the fees schedule is attached.

Service performance measures

10 There are no changes

proposed to the measures and targets showing in the Long Term Plan

2015/16-2024/25 for Solid Waste in the 2017/18 year.

related reports

11 There is a related

report for Solid Waste: “Emissions trading scheme liabilities and

proposed carbon management policy”.

Signatories

|

Author:

|

Jane Nevill - Corporate Planner

Carolyn Allan - Senior Management Accountant

|

|

Authoriser:

|

Laura McElhone - Group Manager Water and Waste

|

Attachments

|

|

Title

|

Page

|

|

a

|

Draft Budget 2017/18 -

Solid Waste

|

52

|

|

b

|

Fees and Charges -

Solid Waste

|

53

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report enables democratic local decision making and

action by, and on behalf of communities; and meets the current and future

needs of the Dunedin communities for good quality local infrastructure and

public services in a way that is most cost effective for households and

businesses.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☐

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☐

|

|

Spatial Plan

|

☐

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☐

|

The activities of Solid Waste primarily contribute to the

objectives and priorities of the above strategies.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

The report indicates changes to the LTP and Annual Plan

budgets.

|

|

Financial considerations

The financial considerations are detailed in the report.

|

|

Significance and

materiality

There are no significant or material changes to the draft

2017/18 budgets for Solid Waste.

|

|

Engagement –

external

There has been no external engagement in developing the

budgets for Solid Waste.

|

|

Engagement -

internal

The Executive Leadership Team, Finance staff, Policy staff

and the managers of Solid Waste have been involved in developing the budgets

and related financial information.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

Conflict of

Interest

There are no known conflict of interests.

|

|

Community Boards

This material may be of interest to Community Boards.

|

Proposed

Fees and Charges 2017/18

Bold blue font

indicates 3% fees increase.

Black font

indicates fees where ETS costs apply. These are increased by 3% plus a

further 8.5%.

Fees

include GST unless otherwise stated.

|

|

2016/17

$

|

2017/18

$

3% Council incr

8.5% ETS

|

|

Waste Management - Solid Waste Landfill

Charges

|

|

Landfill Charges – For all DCC

landfills and transfer stations

|

|

Small Vehicle Charges

|

|

Non-DCC Refuse bag – per bag, (max size 80 litres)

|

3.00

|

3.50

|

|

Multiple bags will be charged at $3 each.

The maximum charge would be the appropriate vehicle rate.

|

|

Car – small load

|

14.00

|

16.00

|

|

Car – large load

|

32.00

|

36.00

|

|

Wool pack per pack or part pack

|

14.00

|

16.00

|

|

Wheelie Bin per bin or part bin

|

14.00

|

16.00

|

|

Station wagon – small load

|

23.00

|

26.00

|

|

Station wagons – large load

|

51.00

|

57.00

|

|

Cars and single axle trailers, vans and utes – small

load

|

34.00

|

38.00

|

|

Cars and single axle trailers, vans and utes – large

load

|

64.00

|

72.00

|

|

Clay Cover (clay)

|

10.00

|

10.00

|

|

Note: Clay cover charges are subject to

seasonal variation in line with day light saving time i.e. is taken free of

charge during the warmer months. Cover is not accepted at Middlemarch

Transfer Station

|

|

Cleanfill

|

19.00

|

21.00

|

|

Note: Cleanfill is not accepted at

Middlemarch Transfer Station

|

|

Demolition

|

31.00

|

32.00

|

|

Note: Demolition Waste is not accepted at Middlemarch

Transfer Station

|

|

Car tyres – each

|

5.00

|

5.00

|

|

Vehicle bodies

|

82.00

|

84.00

|

|

Vegetation

|

|

Note: Mixed loads of vegetation and

general waste must be clearly separable for composting and landfill

disposal

|

|

Car – small load (mixed load)

|

10.00

|

10.00

|

|

Car – small load 100% veg

|

|

9.00

|

|

Car – large load (mixed load)

|

23.00

|

24.00

|

|

Car - large load 100% veg

|

|

23.00

|

|

Wool pack 100% veg

|

10.00

|

9.00

|

|

Wheelie Bin per bin 100% veg

|

10.00

|

9.00

|

|

Station wagon – small (mixed load)

|

14.00

|

14.00

|

|

Station wagon – small 100% veg

|

|

13.00

|

|

Station wagon – large load (mixed load)

|

35.00

|

36.00

|

|

Station wagon – large load 100% veg

|

|

34.00

|

|

Car with single axle trailer, van or ute (small mixed

load)

|

21.00

|

22.00

|

|

Car with single axle trailer, van and ute 100% veg (small

load)

|

|

21.00

|

|

Car and single axle trailer, van and ute – (large

mixed load)

|

44.00

|

45.00

|

|

Car and single axle trailer, van and ute 100% veg

|

|

42.00

|

|

Large Vehicle Charges

|

|

|

|

Charges by weight at the Green Island

Landfill (Weighbridge ) per tonne

|

|

General solid waste per tonne

|

153.00

|

171.00

|

|

minimum charge

|

74.00

|

86.00

|

|

Green Waste per tonne (100% vegetation)

|

88.00

|

91.00

|

|

minimum charge

|

44.00

|

46.00

|

|

Clean fill per tonne (dry)

|

15.00

|

15.00

|

|

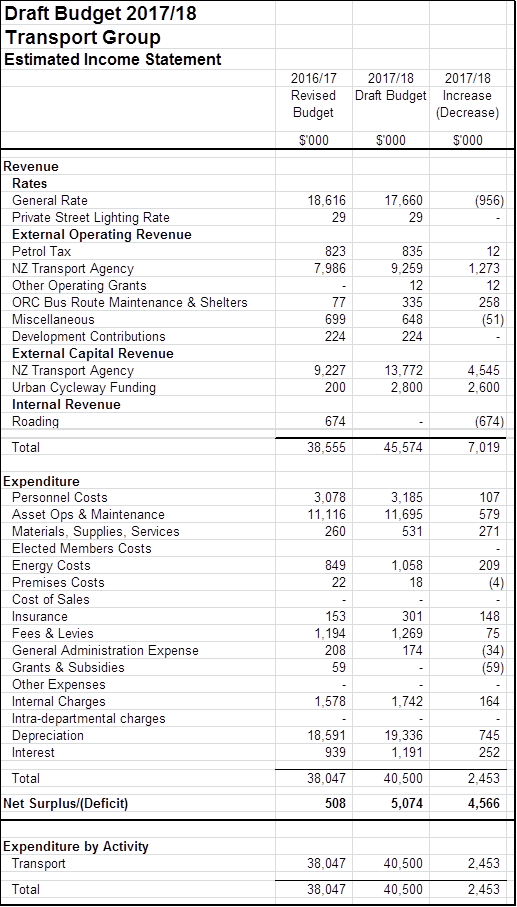

minimum charge