Reports

2017/18 Rating Method

Department: Finance

EXECUTIVE SUMMARY

1 The

Council has a Financial Strategy that sets a rate increase limit of 3% unless

there are exceptional circumstances. The draft budget as presented has an

overall increase in rates of 3%. This report will outline how the overall 3%

increase impacts on various properties within the City.

2 The

report also addresses the impact of the 2016 general revaluation and the rating

effect it has on individual properties. Given that it is a revaluation year,

rate changes for 2017/18 year will vary depending on what has happened to the

capital value for individual properties.

3 There are

also changes to the community services targeted rate (increase 1.4%), the

Forsyth Barr Stadium differential (increase of 1.4%) and the Strath Taieri

Commercial differential and these are detailed in the report.

4 The

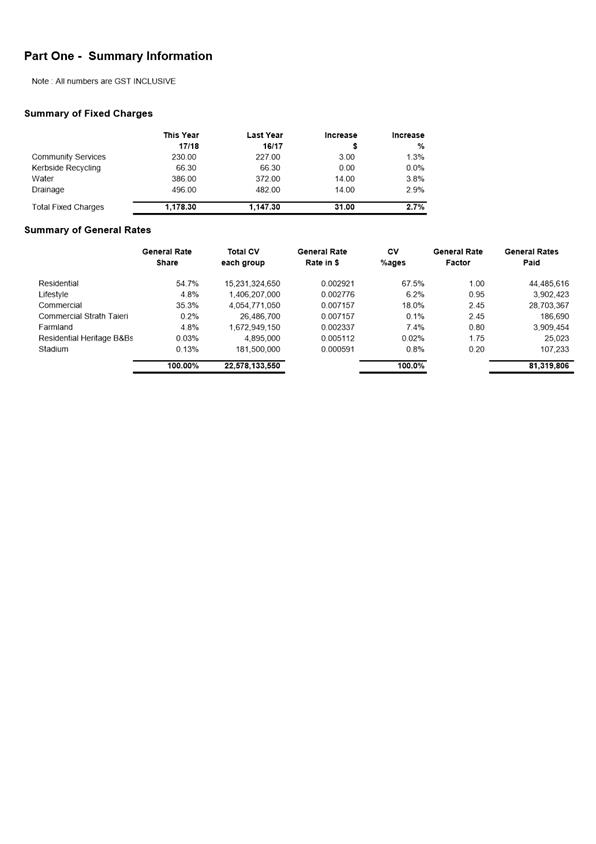

overall effect is a draft budget with a rate increase of 3%.

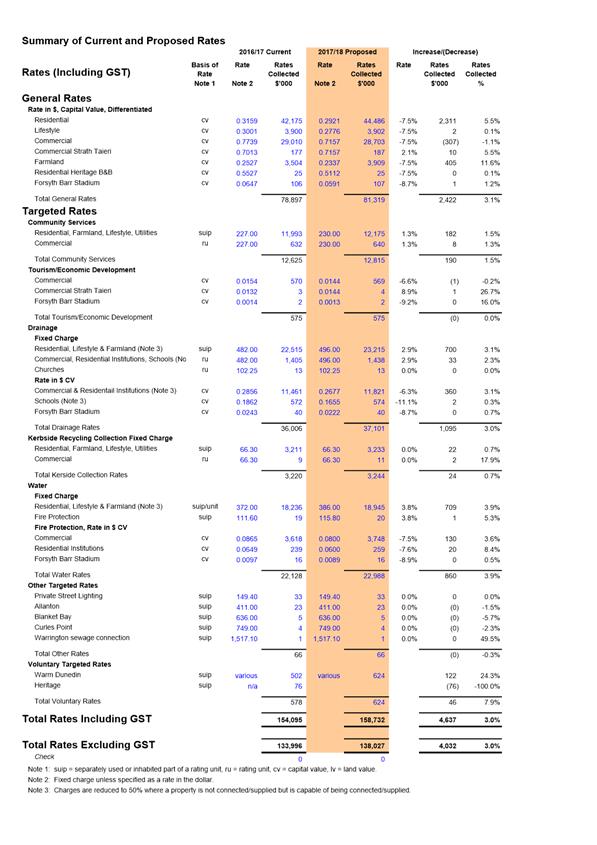

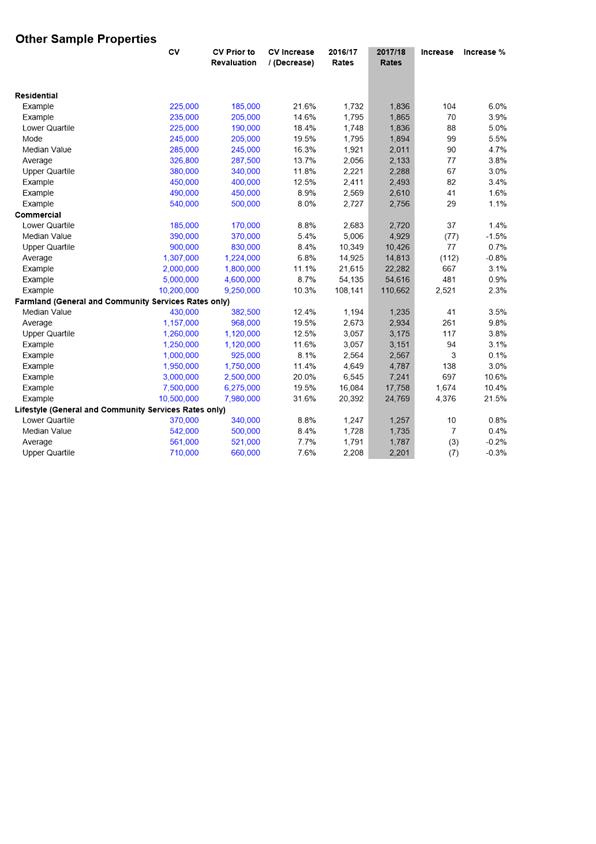

|

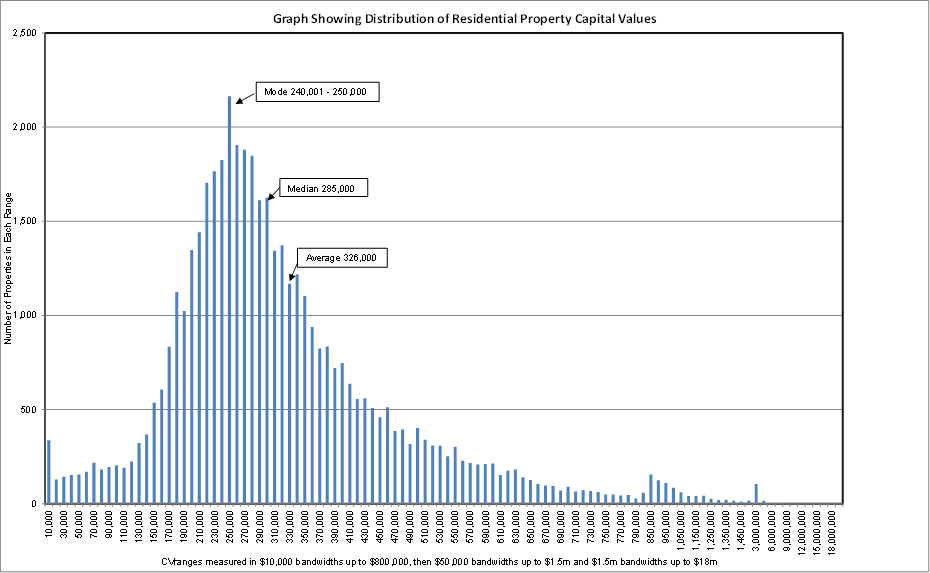

1 RECOMMENDATIONS

That the Council, for the purposes of community engagement:

a) Approves

the general rate differential for the 2017/18 year which incorporates the

final step in the phased increase to the Strath Taieri commercial general

rate differential and Tourism/Economic Development targeted rate.

b) Approves

an increase in the community services targeted rate for the

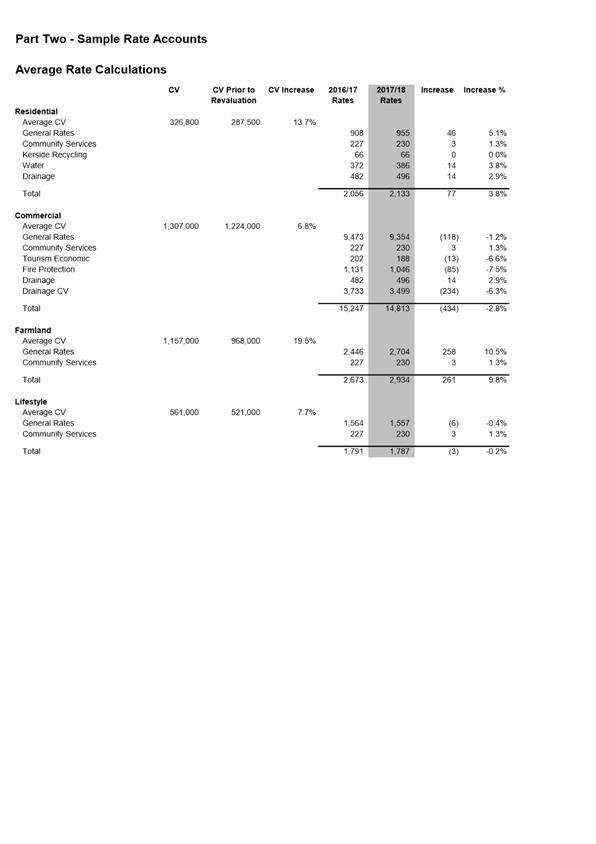

2017/18 year based on the June 2016 Local Government Cost Index (LGCI) of

1.4%, to $230.00 including GST.

c) Approves

an increase in the Forsyth Barr Stadium differentials for the 2017/18

year based on the June 2016 LGCI of 1.4%.

d) Approves

the current rating method for the setting of all other rates for the

2017/18 year

|

BACKGROUND

5 The

purpose of this report is to detail the proposed changes to the rating method

for the 2017/18 year and discuss the impact on individual rate accounts.

6 In

addition, the Council requested further work be undertaken on some rating

issues that were highlighted during the previous Annual Plan and this report

provides an update on those issues. These include issues relating to retirement

villages and Maori freehold land.

7 Please

note that unless specified, all rating figures in this report are GST

inclusive.

Financial Strategy

DISCUSSION

8 The

Council approved a Financial Strategy as part of the 2015/16 - 2014/25 Long

Term Plan process. It included a rate increase limit of 3% per annum

unless there are exceptional circumstances.

9 The draft

budget proposes a 3% increase in line with the financial strategy. This is

achieved by various funding mechanisms within the rates policy which will now

be discussed in more detail.

10 The single biggest

impact is the 2016 general revaluation and the effect this has had on the

rating values.

Community Services Rate

11 When the Council

considered the rating method for the 2015/16 year, it agreed that the community

services targeted rate should be increased annually by the Local Government

Cost Index (LGCI). An allowance for the June 2016 LGCI of 1.4% would

increase this from $227.00 to $230.00 for the 2017/18 year. The community

services rate is a fixed charge on all rateable properties.

General Rate

12 The general rate

impact for the 2017/18 year incorporates changes as a result of the draft

budget increase, the final step in the transition to align the general rate

differential for commercial properties in Strath Taieri, changes in the rating

database (for example, new improvements or new houses) and the 2016 general

revaluation.

13 The final step in a seven

year phase-in to align the general rate differential for commercial properties

in Strath Taieri to the full commercial general rate is taken in the 2017/18

year.

Revaluation Impact

14 The latest

revaluation was effective on 1 July 2016 and forms the basis for rating for the

2017/18 rating year.

15 When property values

change as a result of a revaluation, the largest impact relates to the general

rate. For the 2016/17 year, the general rate represented 51% of the total

rate requirement.

16 Table one below

illustrates the overall change in capital value (CV) by property category for

all properties that pay the general rate.

|

|

Capital Value

CV[1]

2016/17

|

CV2

2017/18

|

CV

Inc/(Dec)

|

% Inc/

(Dec)

|

|

Residential

|

13,353,044,100

|

15,231,324,650

|

1,878,280,550

|

14.1

|

|

Lifestyle

|

1,299,934,400

|

1,406,207,000

|

106,272,600

|

8.2

|

|

Commercial

|

3,788,166,650

|

4,054,771,050

|

266,604,400

|

7.0

|

|

Commercial Strath Taieri

|

25,441,200

|

26,486,700

|

1,045,500

|

4.1

|

|

Farmland

|

1,386,627,400

|

1,672,949,150

|

286,321,750

|

20.6

|

|

Residential Heritage B&Bs

|

4,535,000

|

4,895,000

|

360,000

|

7.9

|

|

Forsyth Barr Stadium

|

163,450,000

|

181,500,000

|

18,050,000

|

11.0

|

|

Total

|

20,021,198,750

|

22,578,133,550

|

2,556,934,800

|

12.8

|

Table 1: Capital

Value by Category

17 Overall, there has

been a 12.8% increase in capital value between June 2016, when rates for the

2016/17 year were set, and now.

18 The impact on the

general rates paid by individual properties depends on whether a properties CV

has changed by more or less than, the overall increase or decrease in CV.

For example, if the CV of a particular property increased by more than the

overall increase, then this property would pay more general rates.

19 In addition to

valuation and budget changes, the total amount of general rates to be collected

is also impacted by the amount of community services rates collected. The

combined increase in general and community services rates as per the draft

budget is 2.8%. The proposed increase in the community services charge

for 2017/18 is 1.4%. This change, combined with any growth in the rating

database has resulted in a 3.1% required increase in general rates.

20 The 3.1% increase in

general rates will not be evenly distributed between the property

categories. These changes are highlighted across various property

categories in Attachment A.

Residential Capital Value Distribution

21 Attachment B

provides a chart showing the distribution of the new residential property

capital values. Each bar on the chart represents the number of properties

within each capital value range. For example, there are 2,164 properties

in the $240,001 to $250,000 band. This is the band with the most

properties in it.

22 In total there are

46,546 residential properties paying general rates, of that, 80% fall within

the $150,001 and $470,000 capital value bands.

23 There are 142 higher

value properties with a capital value of $1.5 million and over. Included

in these properties are 76 blocks of flats, community houses and cribs, 27 rest

homes, halls of residences and boarding houses, 5 large areas of vacant land

and 34 private residences. These properties are noted because their inclusion

impacts on statistical information, for example the average residential

property value.

24 Council policy for rates

on low value properties is that any property with a capital value of $3,500 or

less pays general rates only. The minimum rate is $5.00.

Forsyth Barr Stadium Rates

25 Since the 2013/14

year, the differentiated Forsyth Barr Stadium rates have been inflation

adjusted annually. For the 2017/18 year, it is proposed to increase these rates

by the June 2016 LGCI of 1.4%.

Schedule of Rates

26 Attachment A also

provides details of the individual rates and the amount collected from each

rate.

Overall Impact

27 The following table

shows the overall rate income (including GST) by property category for 2016/17

and 2017/18.

|

Category

|

2016/17

($’000)

|

2017/18

($’000)

|

$ change

($’000)

|

% change

|

|

Residential

|

98,056

|

102,158

|

4,102

|

4%

|

|

Lifestyle

|

4,953

|

4,980

|

27

|

1%

|

|

Commercial

|

46,774

|

46,885

|

111

|

0%

|

|

Farmland

|

4,312

|

4,709

|

397

|

9%

|

|

Total

|

154,095

|

158,732

|

4,637

|

3%

|

28 When considering the

impact on individual properties, the relative impact of the 2016 general

property revaluation needs to be considered. The change in capital values

across the city varies by property, by suburb and by category of

property. This means that the rating effect is distributed differently

depending on what has happened to the CV.

29 The table below

shows, for the average value property in each category, the total estimated

rates for 2017/18. The examples include general rates and the community

services rate for all properties. Targeted rates are included for

residential and commercial properties only.

|

Including GST

|

CV

|

Total Rates

2017/18

|

|

Residential

|

326,800

|

2,133

|

|

Lifestyle

|

561,000

|

1,787

|

|

Commercial

|

1,307,000

|

14,813

|

|

Farmland

|

1,157,000

|

2,934

|

30 The attachments

provide further information on scenarios but broadly show that there is no

standard percentage increase because of the variations in capital value

changes.

31 The sample property

rate impacts incorporate:

· The

forecast rate increase of 3%.

· The

final step in the transition to increase the general rate and the Economic

Development/Tourism targeted rate for commercial properties in Strath Taieri to

commercial rates.

· An

increase of $3.00 in the Community Services

rate.

· An

increase of 1.4% in the differentiated rates paid by the Forsyth Barr Stadium.

· An

assumption around CV change.

Rate Maximum

32 Under the Local

Government (Rating) Act 2002, certain rates must not exceed 30% of total rates

revenue. This includes the use of a uniform annual general charge and any

targeted rates that are set on a uniform basis excluding targeted rates set

solely for water supply or sewage disposal. In the rates models provided,

these rates represent 25% of total rates revenue.

Rate Rebate

33 When considering the

affordability of rates on low income households, it is worth noting that, for

the 2015/16 year, around 3,190 residential properties received a government

funded rates rebate. The average rebate was $547; the maximum rebate

available was $610.

Rating Adjustment Possibilities

34 As a result of

submissions made during consultation on the draft 2016/17 budget, the Council

requested further information on rating adjustment possibilities for retirement

village licence to occupy houses and Māori Freehold land. Reports on

these two issues were provided to the Finance Committee on 18 July 2016.

An update on progress since then is provided below.

35 In addition, a

report was requested which considers rating policies for residential properties

being used for short term commercial rental and/or multiple studio rooms.

Rates Rebate (Retirement Village Residents) Amendment

Bill

36 The Bill addresses

an anomaly in the Rates Rebate Act 1973, and extends coverage of the scheme to

those residences of retirement villages who have occupation right agreements

and pay rates either directly or indirectly.

37 The Finance

Committee requested that staff petition Central Government to expedite the

Rates Rebate (Retirement Village Residents) Amendment Bill. This has been

actioned.

38 The Rates Rebate

(Retirement Village Residents) Amendment Bill received a first reading on 9

November 2016 and was referred to the Local Government and Environment Select

Committee for submissions. Public submissions have been invited; the

submission period closes on Tuesday 31 January 2017.

Rates Remission Policy - Māori Freehold Land

39 The Finance

Committee requested that a revised policy be developed for the remission of

rates on Māori freehold land. Council staff are in the process of

developing a draft policy to be considered and consulted on as part of the

2018/19 – 2026/27 Long Term Plan process.

Rating Method Review

40 A scoping report

will be provided to the Finance Committee on rating policies for residential

properties being used for short term commercial rental and/or multiple studio

rooms with a view to addressing any proposed changes during the 2018/19 –

2027/28 Long Term Plan process.

OPTIONS

41 No options are

provided as this report and the draft budget are giving effect to the Financial

Strategy and previous decisions of the Council.

NEXT STEPS

42 If adopted the

proposed rating method will be included in the supporting documentation that

accompanies the draft 2017/18 budget.

43 While the Council is

engaging with the community on the draft 2017/18 budget, rate account

information is available on the DCC website that shows the proposed rating

impact by individual rate account.

Signatories

|

Author:

|

Carolyn Allan - Senior Management Accountant

|

|

Authoriser:

|

Gavin Logie - Acting Chief Financial Officer

|

Attachments

|

|

Title

|

Page

|

|

a

|

Summary of Current and

Proposed Rates

|

11

|

|

b

|

Distribution of

Residential Property Capital Values

|

12

|

|

c

|

Summary Information

|

13

|

|

d

|

Rates Model

|

14

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision relates to providing a regulatory function

and it is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

This decision fits with the strategic framework because it

provides the necessary rates funding to implement the activities included in

the draft 2017/18 Annual Plan.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

The proposed rating method will be set out with the draft

2017/18 budget material during the community engagement period.

|

|

Financial

considerations

The proposed rating method will be set out with the draft

2017/18 budget material during the community engagement period.

|

|

Significance

This decision is considered low in terms of the

Council’s Significance and Engagement Policy.

|

|

Engagement –

external

The proposed rating method will be set out with the draft

2017/18 budget material during the community engagement period.

|

|

Engagement -

internal

Internal engagement has occurred with staff in the

relevant departments.

|

|

Risks: Legal /

Health and Safety etc.

Legal risks were considered.

|

|

Conflict of

Interest

There are no conflicts of interest identified.

|

|

Community Boards

There are no known implications for Community Boards.

|

Notices of Motion

Department: Office of the Chief Executive

EXECUTIVE SUMMARY

1 Two

Notices of Motion have been received by the Chief Executive Officer. The

Mayor (as the Chairperson of Council) has directed the Chief Executive Officer

not to accept the Notices of Motion for the Annual Plan Council meeting on

23/24 January 2017 as they are not matters related to the Annual Plan (Standing

Order 26.2(b)).

2 With the

agreement of both movers, the Notices of Motion will be referred to the Council

meeting on 21 February 2017 and considered there.

|

RECOMMENDATIONS

That the Council:

a) Notes that

two Notices of Motion have been received and will be considered at the

Council meeting on 21 February 2017.

|

DISCUSSION

3 Section

26 of Standing Orders provides a mechanism for receiving and dealing with

Notices of Motion. Two Notices of Motion have been received by the Chief

Executive Officer for the Council meeting on 23/24 January 2017 that meet the

requirements of Standing Orders.

4 The first

Notice of Motion was received from Councillor Benson-Pope (seconded by

Councillor Hawkins) and relates to the hospital redevelopment and the location

of that redevelopment on or near the current site.

5 The

second Notice of Motion was received from Councillor Hawkins (seconded by

Councillor Laufiso) and relates to the living wage and how Council and its

companies and contractors remunerate their staff.

6 The Mayor

has directed that the Chief Executive Officer refuse the Notices of Motion as

they are not related to Annual Plan matters which are the subject of the

Council meeting on 23/24 January 2017. He has, with the agreement of the

movers, referred them both to the February Council meeting.

7 The Mayor

asked that Councillors were advised of this.

8 The

Notices of Motion will be provided to all Councillors with the agenda papers

for the February meeting along with any relevant staff advice.

OPTIONS

9 There are

no options as this is a noting report relating to an administrative

matter. A Summary of Considerations has not been prepared as this is an

administrative report.

NEXT STEPS

10 The Notices of

Motion will be circulated to all Councillors as part of the agenda for the

Council meeting on 21 February 2017.

Signatories

|

Author:

|

Sandy Graham - General Manager Strategy and Governance

|

|

Authoriser:

|

Sue Bidrose - Chief Executive Officer

|

Attachments

There are no attachments for

this report.