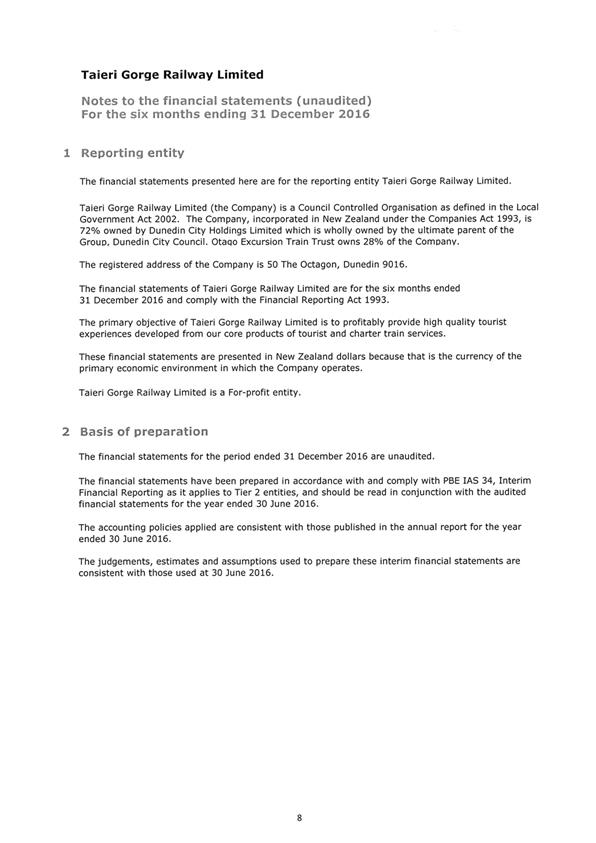

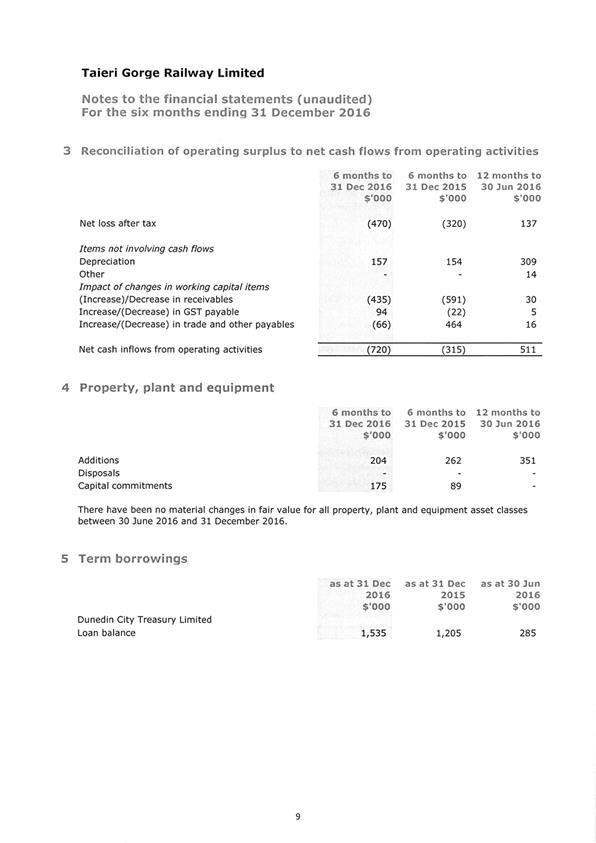

|

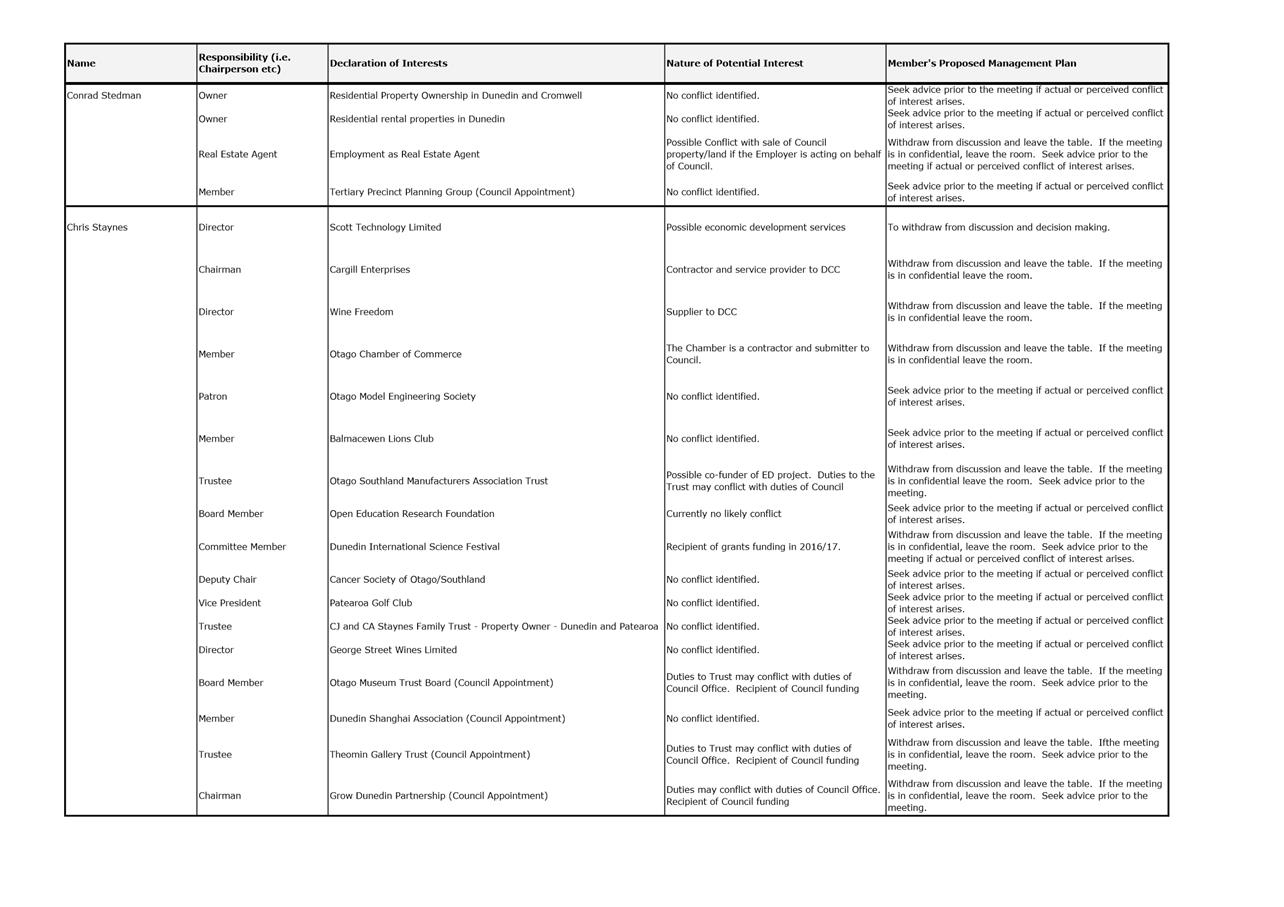

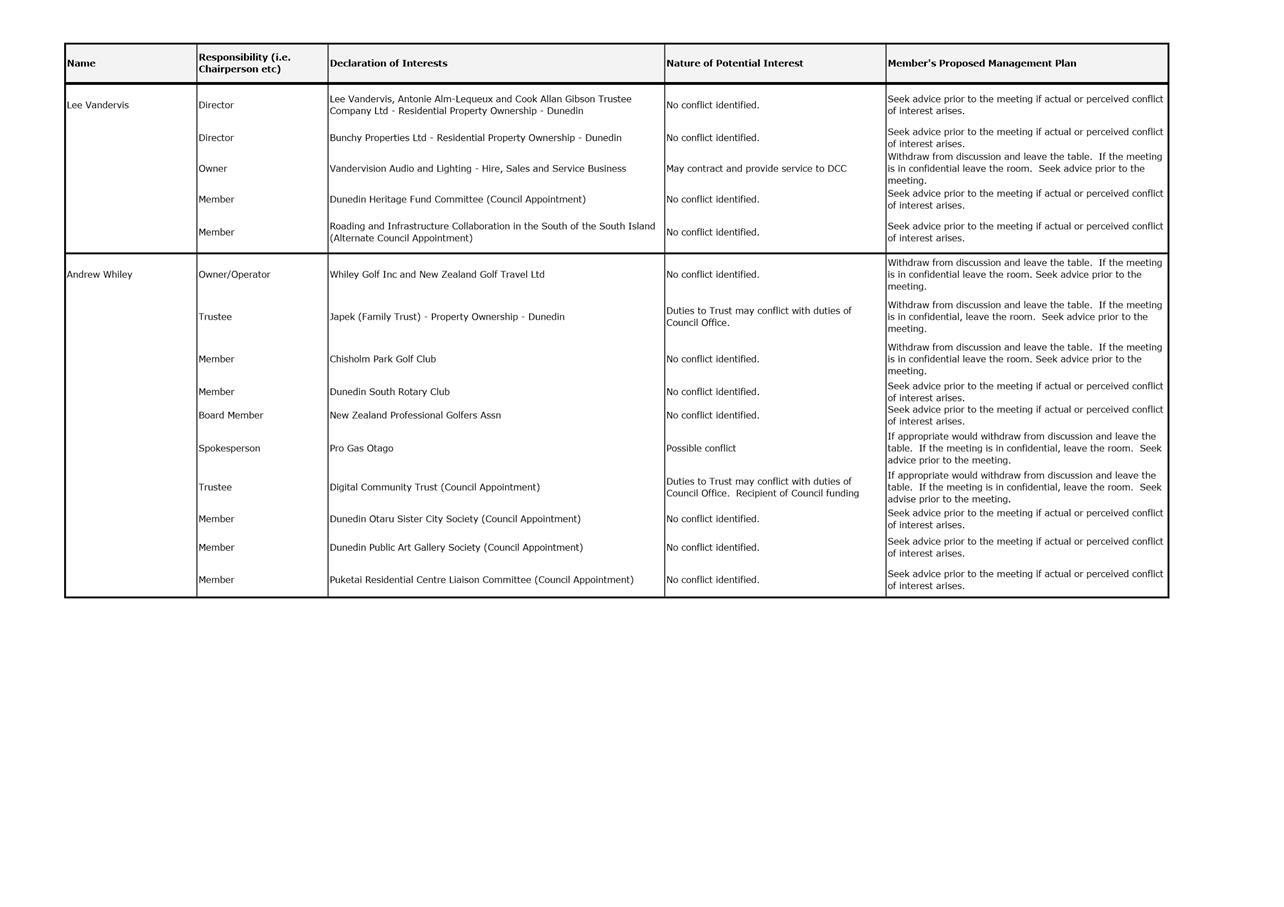

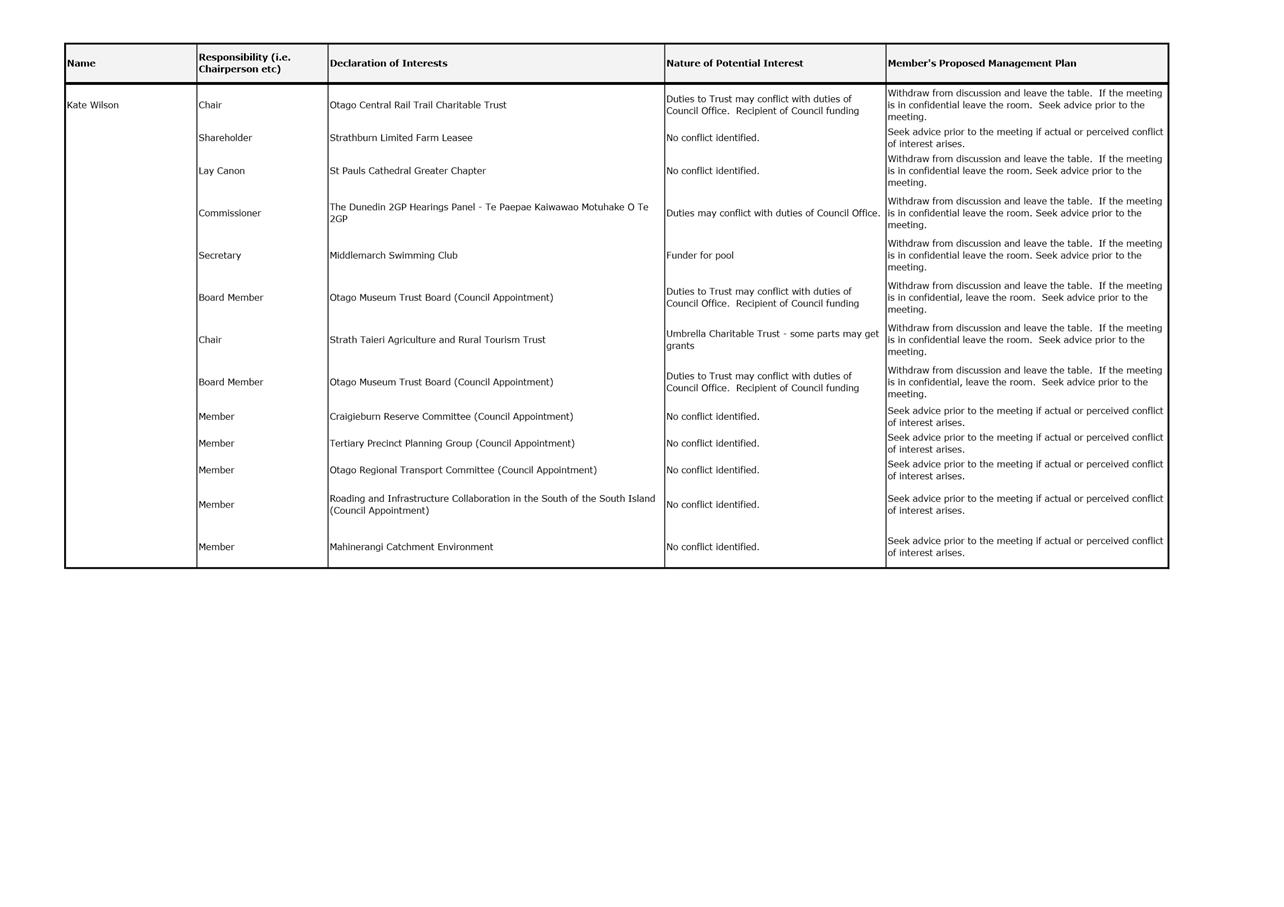

Finance and Council Controlled Organisations

Committee

13 March 2017

|

|

Financial

Review

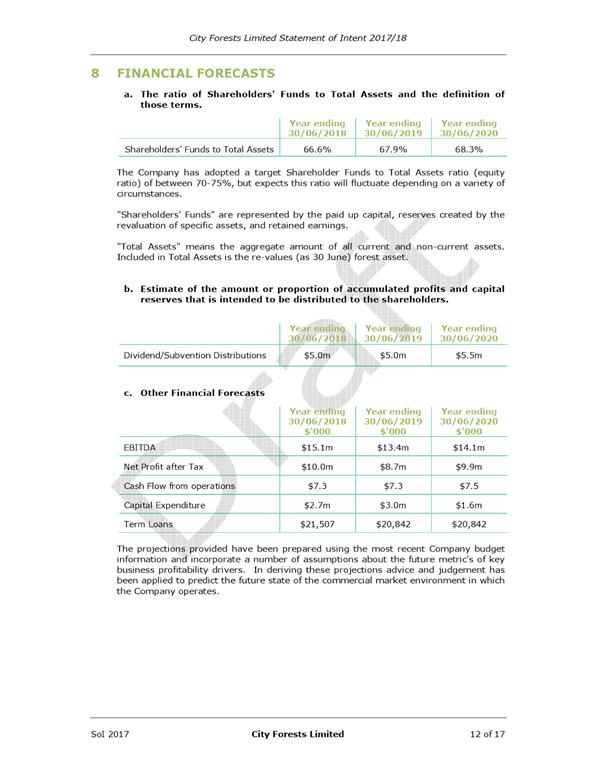

For The Seven months

ended 31 January 2017

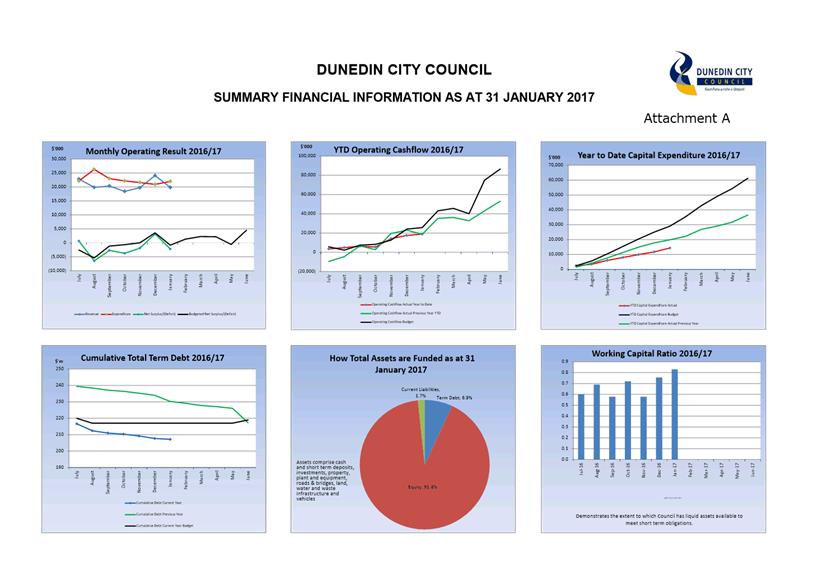

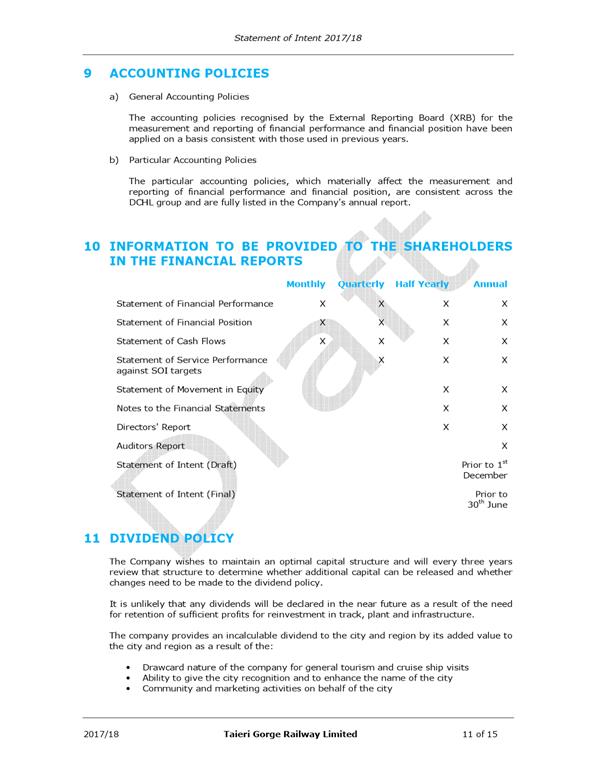

This report provides a detailed commentary on the

Council’s financial results for the period ended 31 January 2017 and the

financial position at that date.

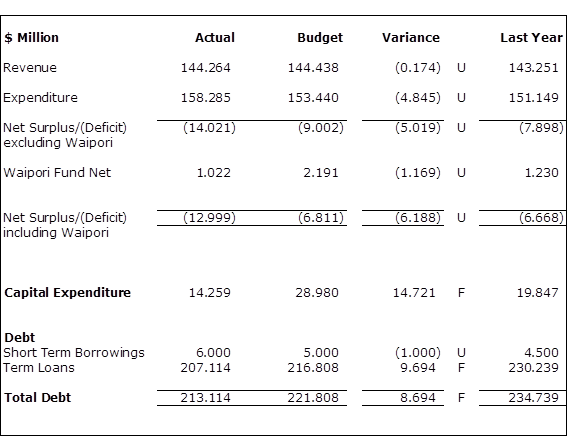

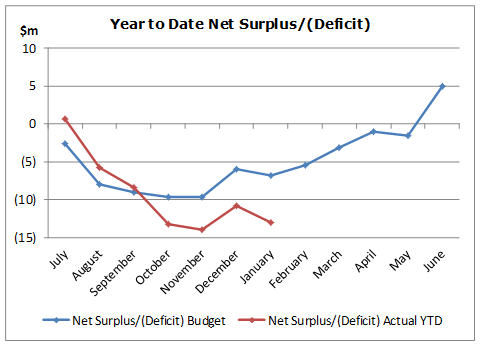

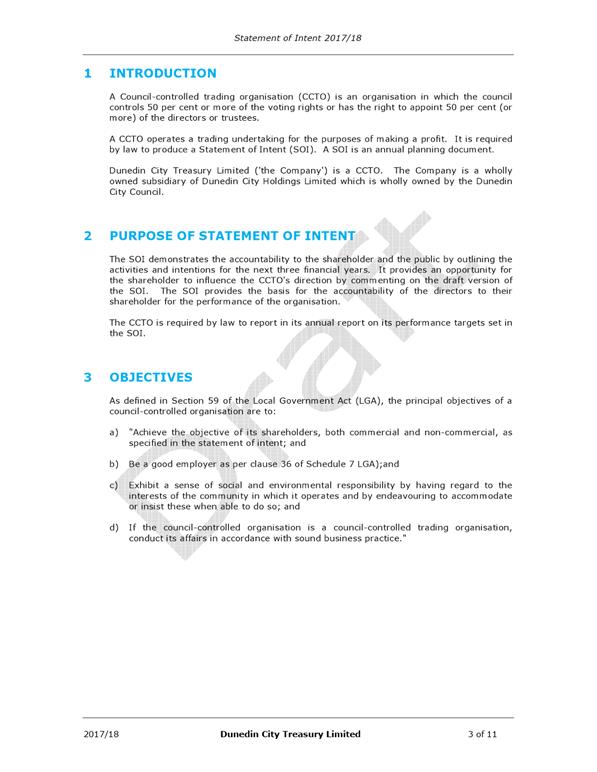

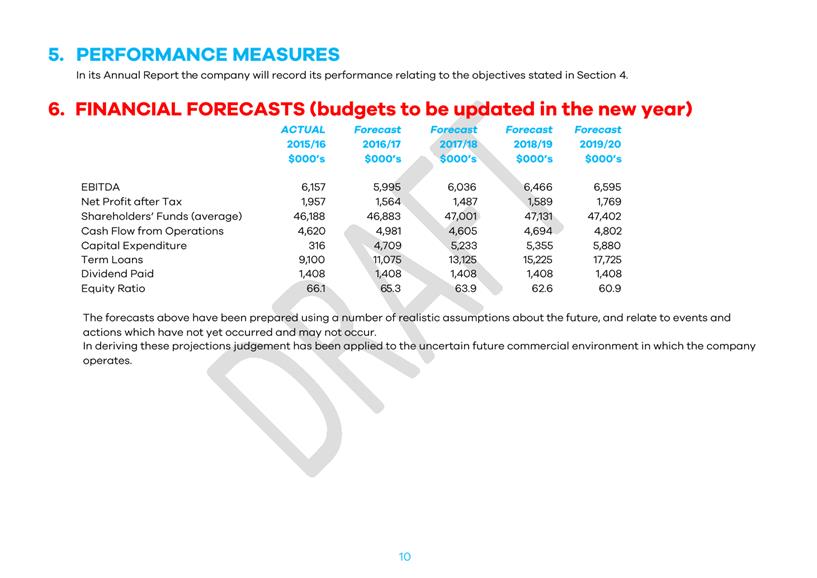

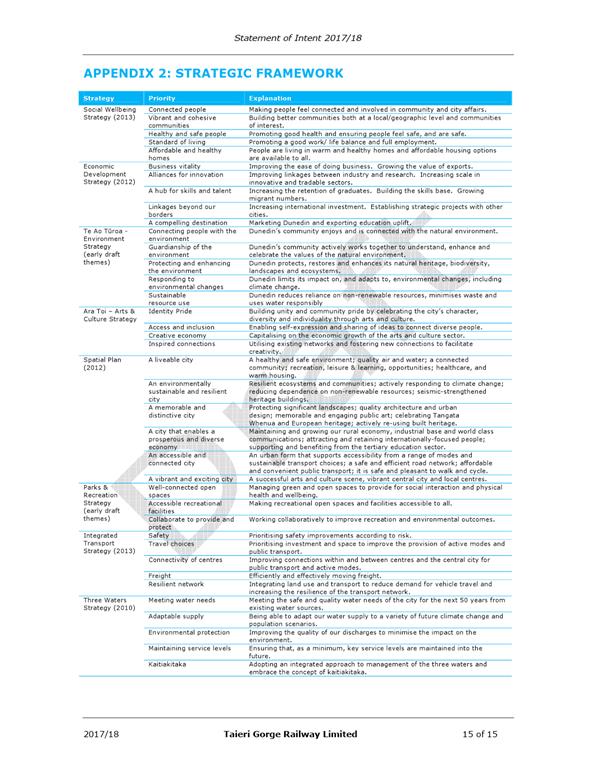

net surplus/(Deficit)

(including waipori)

The net deficit (including

Waipori) for the period to January 2017 was

$12.999 million or $6.188 million unfavourable to budget.

The unfavourable variance

against budget was due to the following:

· $1.977 million - lower than expected grants revenue mainly as a

result of Transport undertaking less subsidised roading work than expected

(both operational and capital).

· $1.897 million – fees and levies expenditure was higher than

expected due to: unbudgeted building assessments including structural and

seismic engineering; early timing of software licence fee costs in BIS;

unbudgeted fees associated to the district plan (2GP); contract review and

audit costs in Parks; resource consent processing and costs associated with

appeals and compliance; and additional Building Services expenditure to assist

with the building consent processing backlog.

· $2.656 million – higher depreciation costs as a result of the

revaluation of Water and Waste assets effective from 1 July 2016.

· $1.169 million – Waipori Fund, resulting from fair value

write-downs a number of investment portfolios.

These unfavourable variances

were partially offset by:

· $1.317 million – higher than expected other operating

revenue. This favourable variance was mainly due to: Three Waters revenue

being $507k up on budget with water sales being higher than expected. Property

revenue was favourable $212k, largely due to better than expected occupancy

rates for housing. Regulatory Services revenue was favourable $167k due to

increased building consent activity and animal control infringement fees.

Parks & Recreation income was also up due to unbudgeted income from the

Waikouaiti forest harvest.

· $547k – materials supplies and services expenditure was less

than expected largely due to BIS expenditure on external contracted

services being less than budgeted and the timing of key projects under

the Grow Dunedin Partnership.

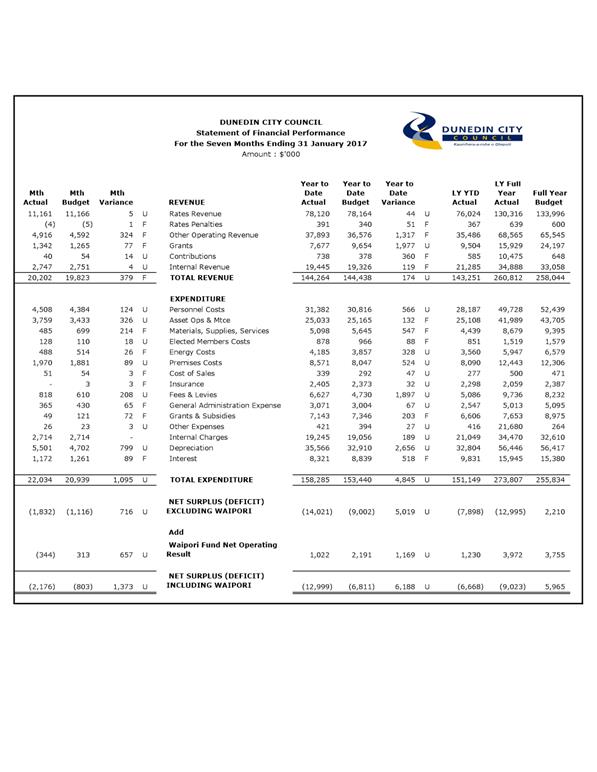

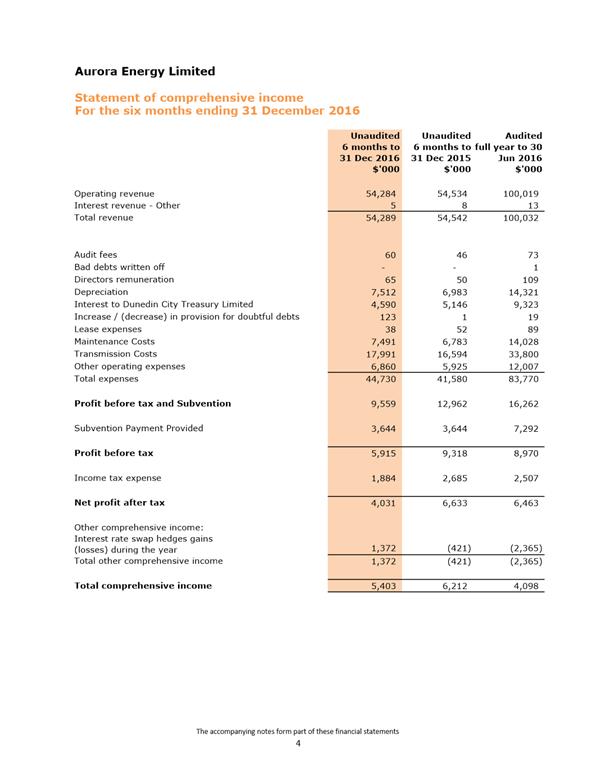

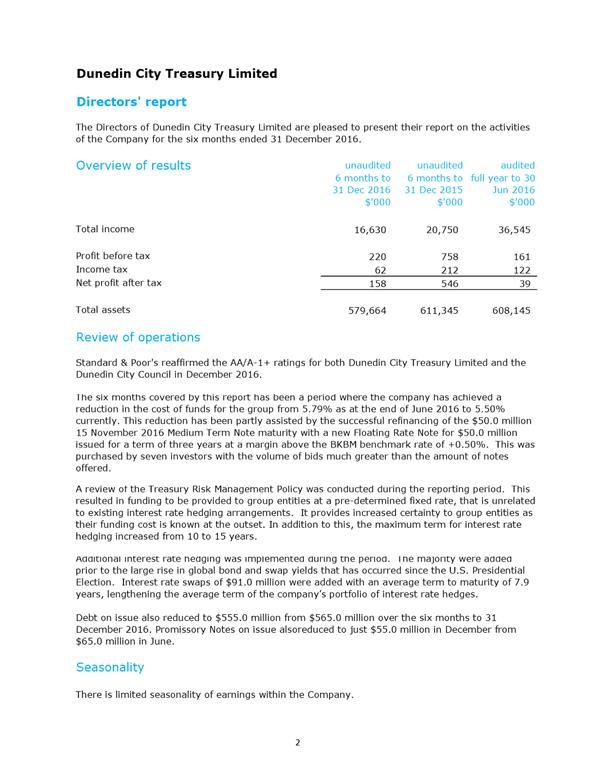

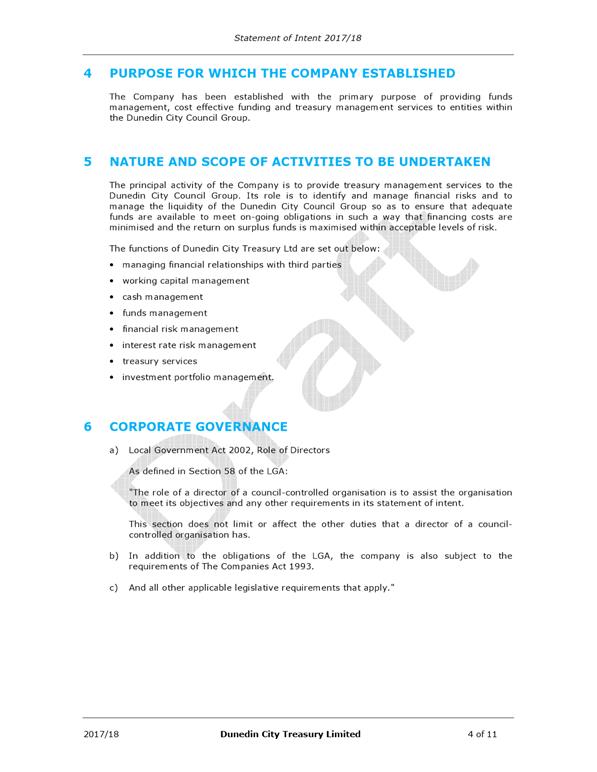

REVENUE

The total revenue for the period was $144.264 million

or $174k less than budget.

The major variances were as follows:

Other Operating Revenue

Actual $37.893 million, Budget $36.576 million,

Favourable variance $1.317 million

Three Waters revenue was favourable $507k primarily due to

higher than expected water sales, in part impacted by the timing of meter

readings, and trade waste and recoverable revenue.

Solid Waste revenue was favourable $305k due to higher than

budgeted income from general landfill fees and refuse bags sales.

Property revenue was favourable $212k mainly due to housing

occupancy rates being greater than budgeted as well as decreased vacancy times

between tenancies.

Parks revenue was favourable $131k due to income from

forestry harvesting at Waikouaiti.

Regulatory Services revenue was favourable $167k in part due

to building consent and inspection fees were greater than budgeted reflecting

increased activity in this area to get consent processing back within statutory

deadlines.

Grants

Actual $7.677 million, Budget $9.654 million,

Unfavourable variance $1.977 million

Transport grants and subsidy revenue was unfavourable by

$2.225 million due to less than expected NZTA funded work (both operating &

capital) taking place year to date.

Expenditure

The total expenditure for the period was

$158.285 million or $4.845 million greater than budget.

The major variances were as follows:

Asset Operations and Maintenance Costs

Actual $25.033 million, Budget $25.165 million,

Favourable variance $132k

Transport costs were favourable $1.145 million due in part

to delayed timing of general maintenance and sealed pavement maintenance while

the new contractor increases their resources to meet contracted obligations.

Environmental maintenance was also favourable and will remain so throughout the

year as Parks and Recreation now undertakes this work.

Solid Waste costs were favourable $221k due to reduced

refuse collection and landfill contract contingency and variable costs.

These favourable variances were partially offset by:

Parks costs were unfavourable $962k due mainly to the

increase in green space maintenance contract costs and the unbudgeted

management contract associated with the University Oval.

Property costs were unfavourable $267k mainly due to

deferred maintenance issues for a number of properties now being addressed.

Aquatic Services were unfavourable $155k due to unbudgeted

interior maintenance costs, including the cost of asbestos removal.

Materials Supplies and Services

Actual $5.098 million, Budget $5.645 million, Favourable

variance $547k

Enterprise Dunedin costs were favourable $416k due to the

delayed timing of a number projects and campaigns.

BIS external support costs were under budget $503k.

Corporate policy expenditure is tracking behind budget $177k

due to unspent funding for climate change and sustainability.

Dunedin 2GP costs were unfavourable $243k, with an

offsetting favourable variance in staff costs relating to this project.

Property costs are unfavourable $234k due to unbudgeted

disposal costs associated with the Union St property at Logan Park, as well as

an unbudgeted increase in the service level agreement payment to DVML for the

management of the Dunedin Centre/Town Hall.

Energy Costs

Actual $4.185 million, Budget $3.857 million,

Unfavourable variance $328k

Transportation energy

costs were unfavourable $102k. This was in part due to the way the costs

for state highway lights and signals are now accounted for. As a result

there was a corresponding favourable variance in Transportation within the

Asset Ops and Maintenance costs.

The remaining variance

was across a number of operating units reflecting higher than expected

consumption – both gas and electricity.

Premises Costs

Actual $8.571 million, Budget $8.047 million,

Unfavourable variance $524k

Property costs were

unfavourable by $577k. This variance included: unbudgeted costs for

properties yet to be sold; additional costs associated with the Municipal Lane

toilet now operating on a 24 hour basis; and higher than expected building

warrant of fitness costs due to the level of remedial work identified by

consultants to bring some buildings up to required standards.

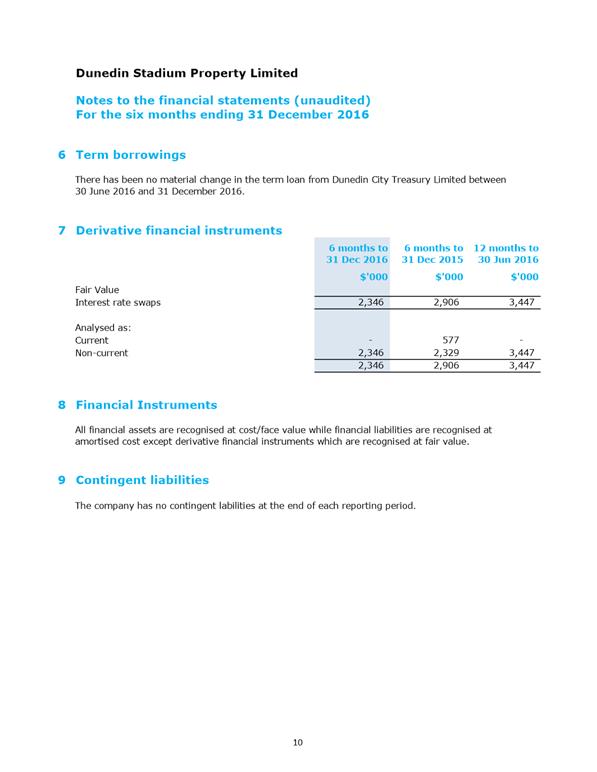

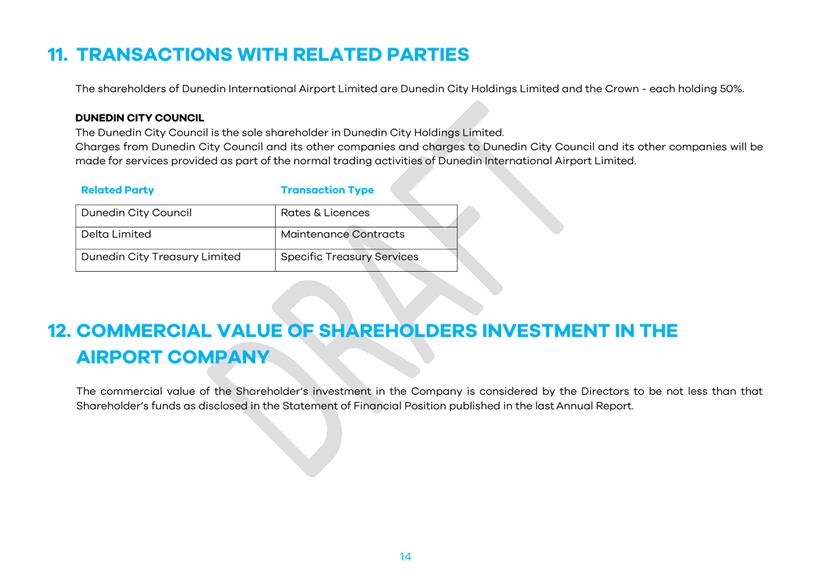

Fees and Levies

Actual $6.627 million, Budget $4.730 million,

Unfavourable variance $1.897 million

BIS costs were

unfavourable $118k due to the early timing of software licence fee expenditure.

Property expenditure was unfavourable $887k. This related to

costs associated with compiling condition and hazard assessments across the

operating building portfolio including in the Civic Centre, Ice Stadium and

Edgar Centre. Some of the work involved structural and seismic

engineering work.

Regulatory Services were

unfavourable $288k mainly due to higher consultancy costs for building consents

work being processed by third parties.

Resource Consents costs

were unfavourable $168k mainly due to unbudgeted litigation costs on a number

of appeals, prosecutions and other compliance matters, as well as planning

costs associated with processing resource consent applications.

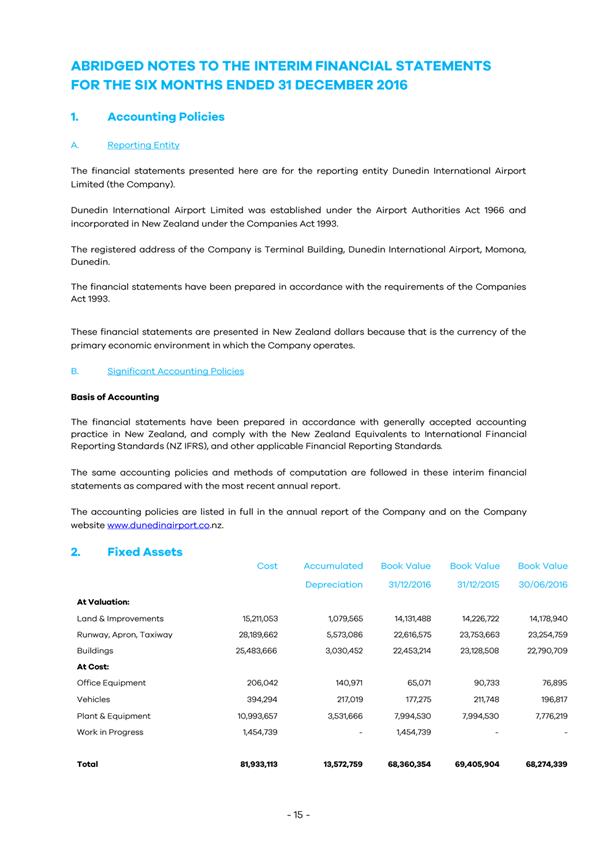

Depreciation

Actual $35.566 million, Budget $32.910 million,

Unfavourable variance $2.656 million

Depreciation was unfavourable $2.656 million, reflecting the

increase in the value of Three Waters infrastructure assets as a result of the

revaluation effective from 1 July 2016.

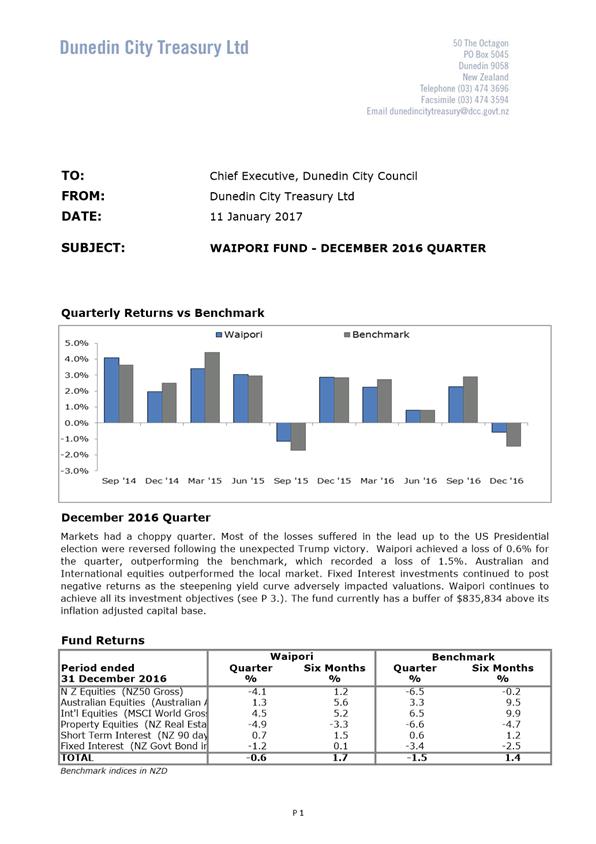

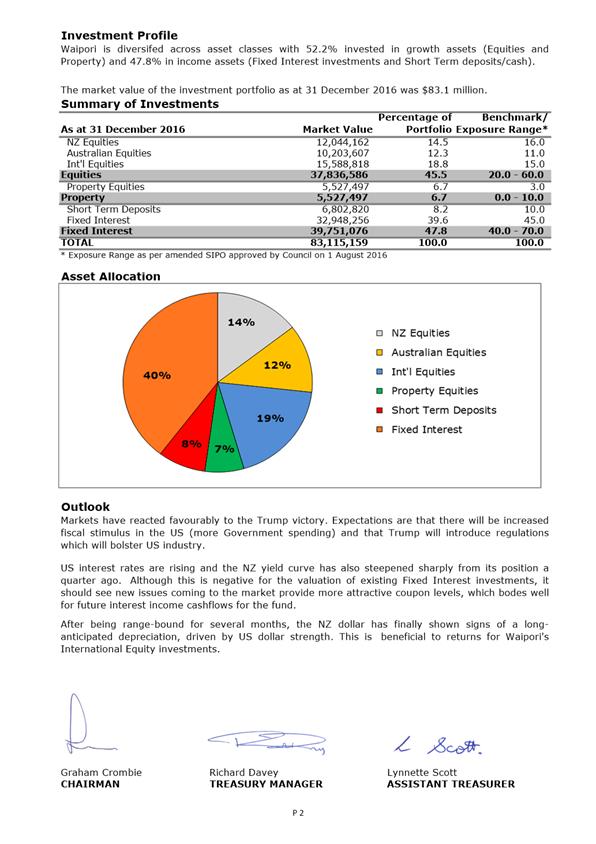

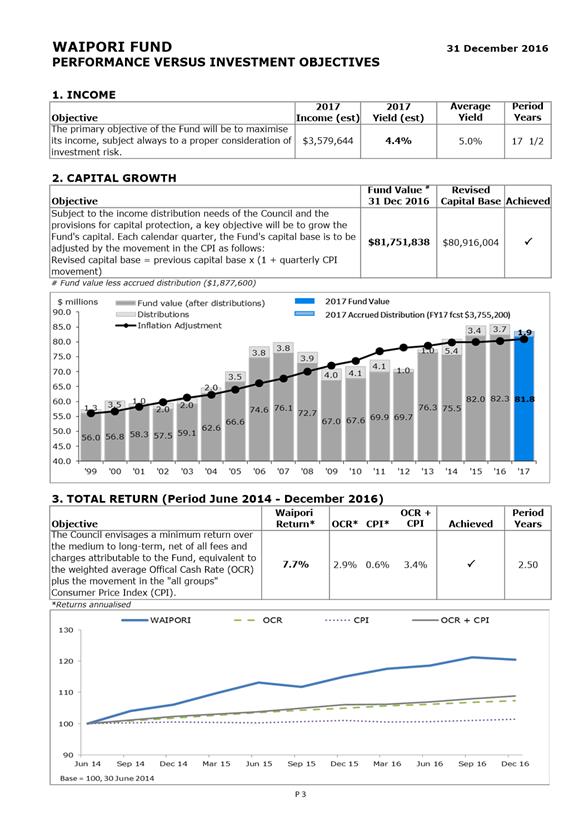

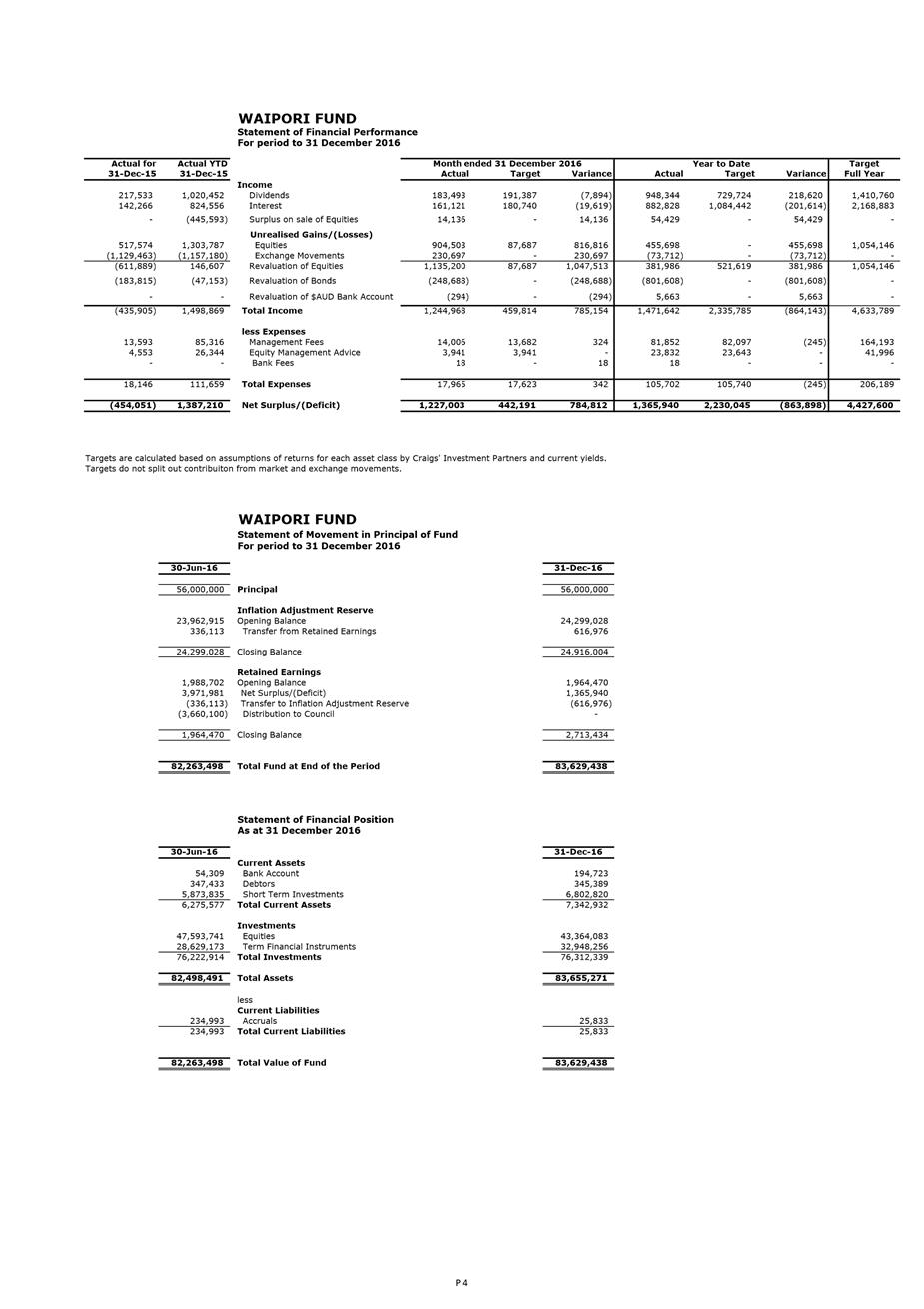

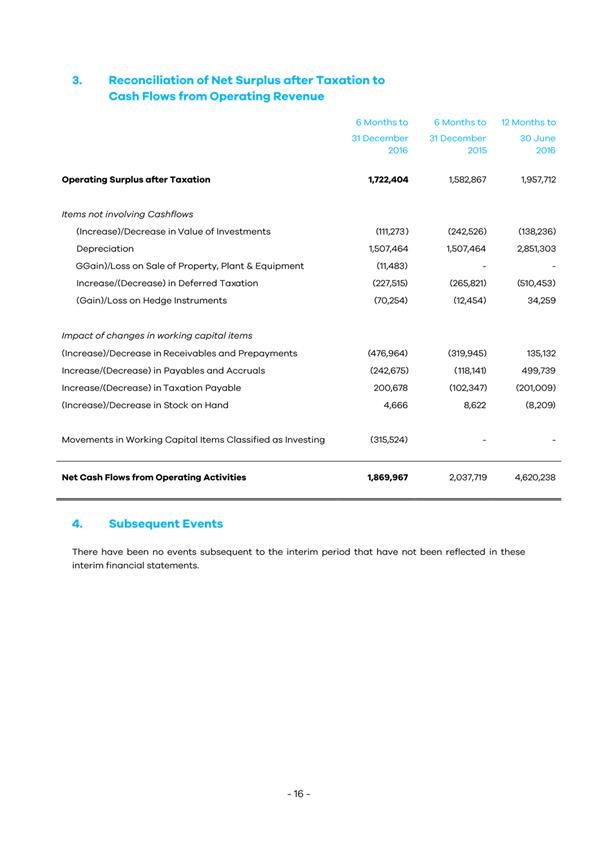

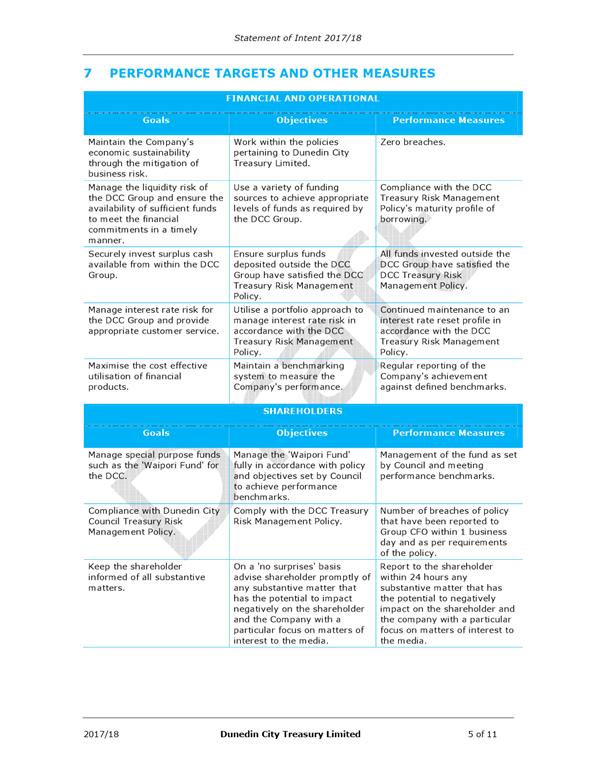

WAIPORI FUND NET OPERATING

RESULT

Actual $1.022 million,

Budget $2.191 million, Unfavourable variance $1.169 million

The Waipori

Fund net operating result was unfavourable for the period mainly due to

unrealised losses across a number of investment portfolios.

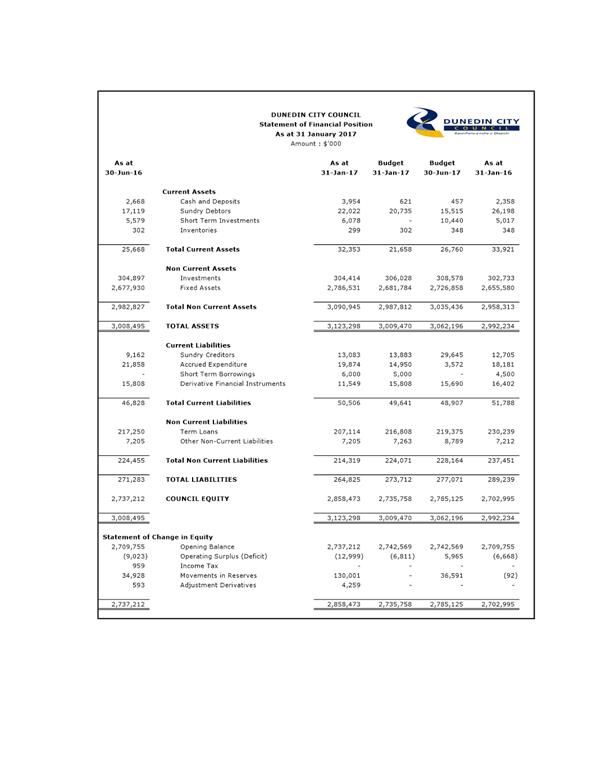

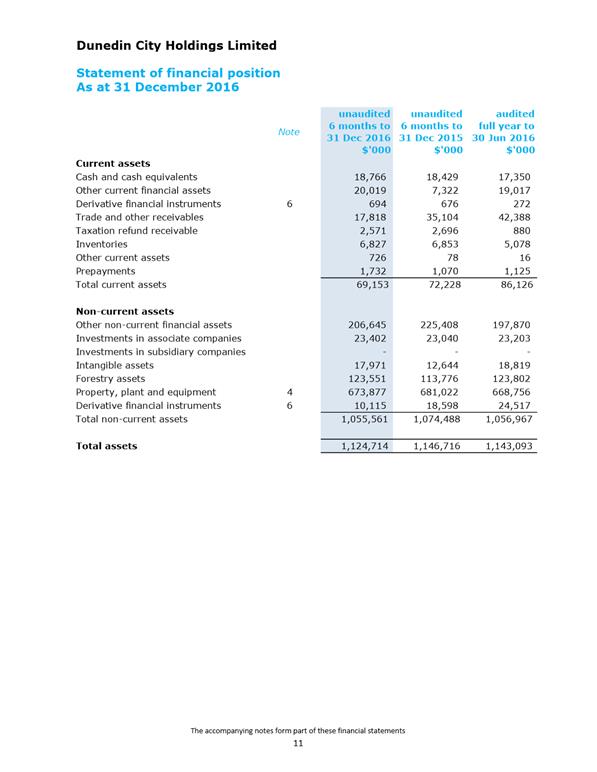

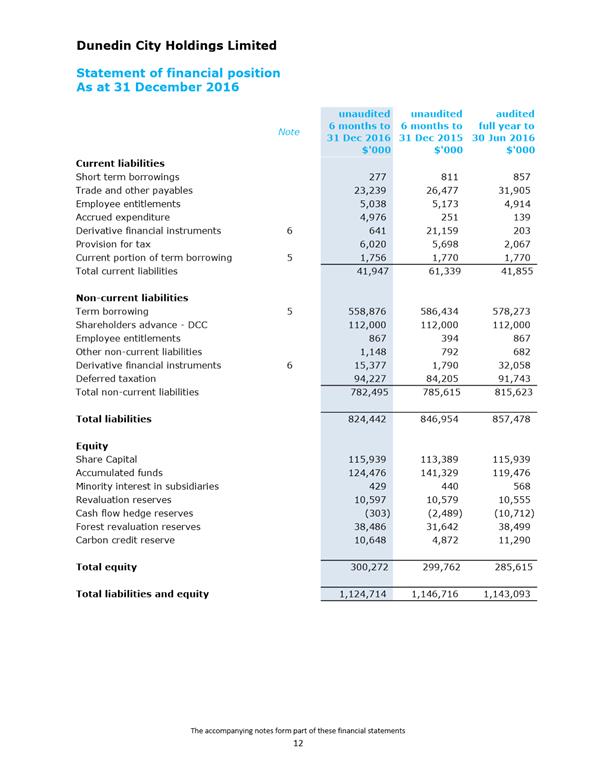

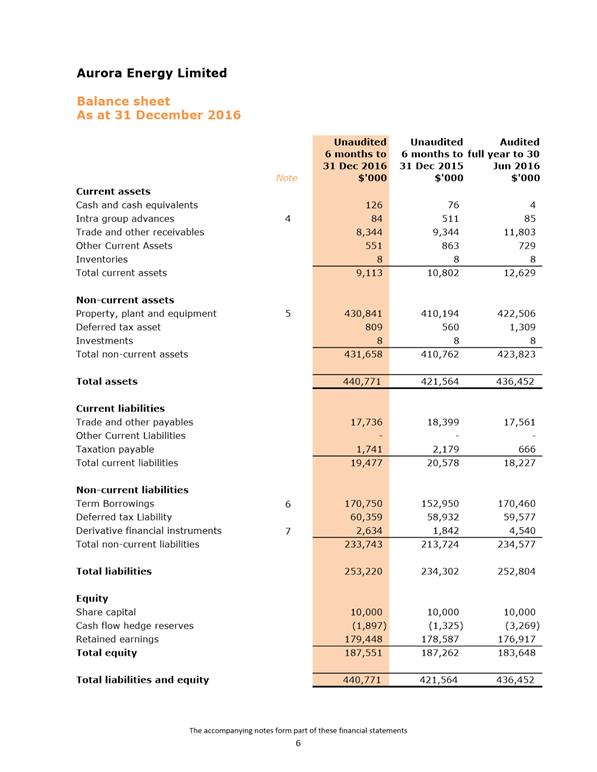

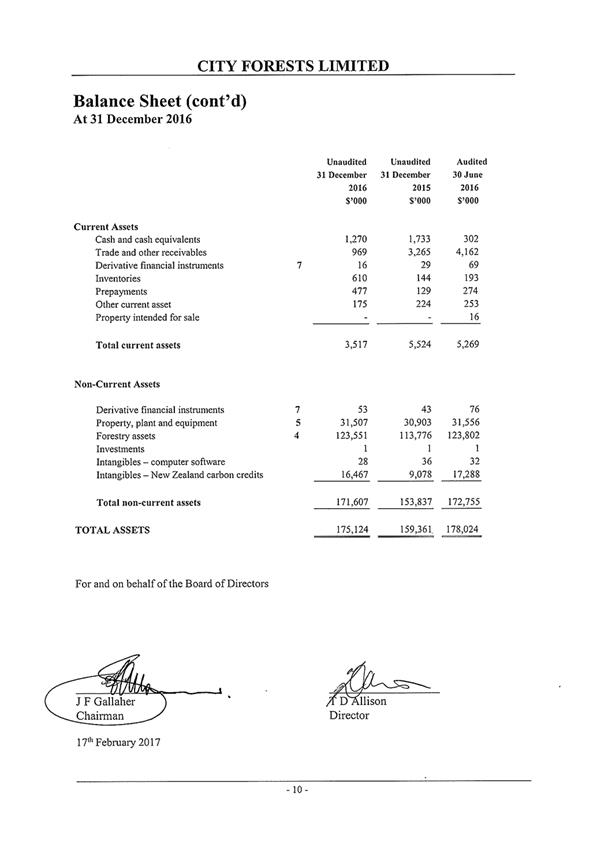

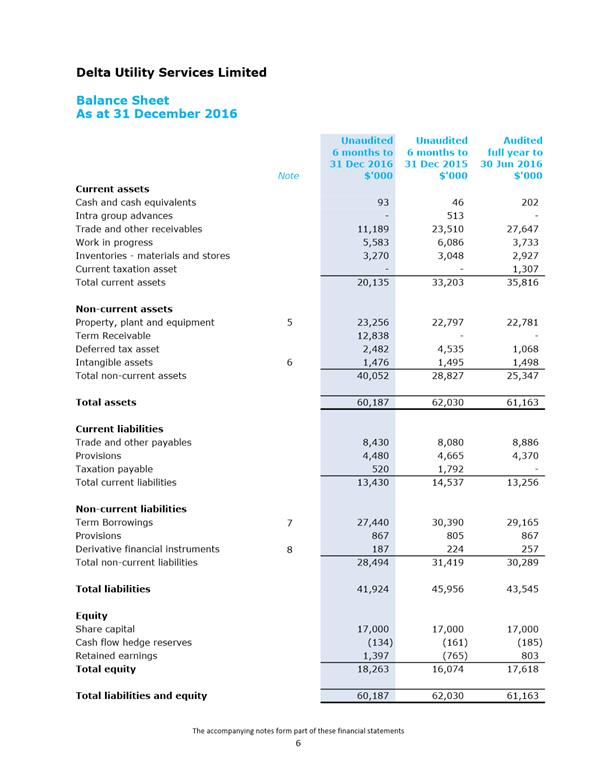

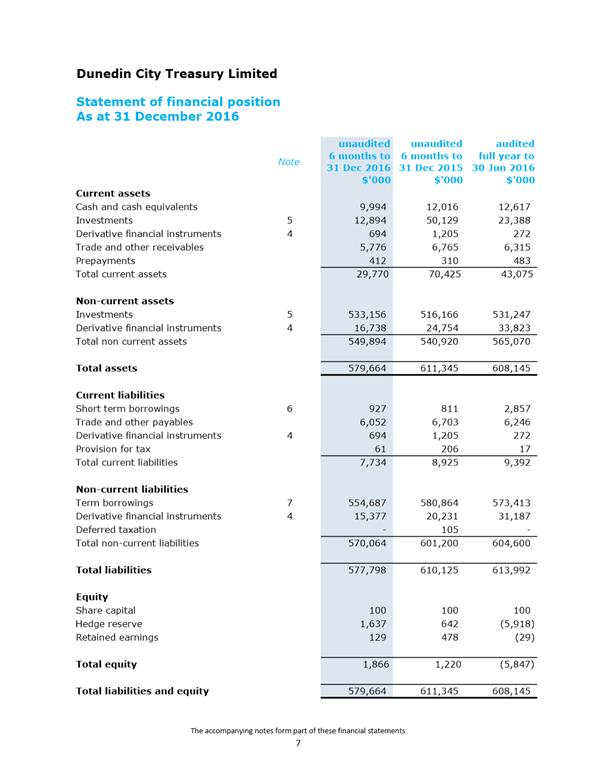

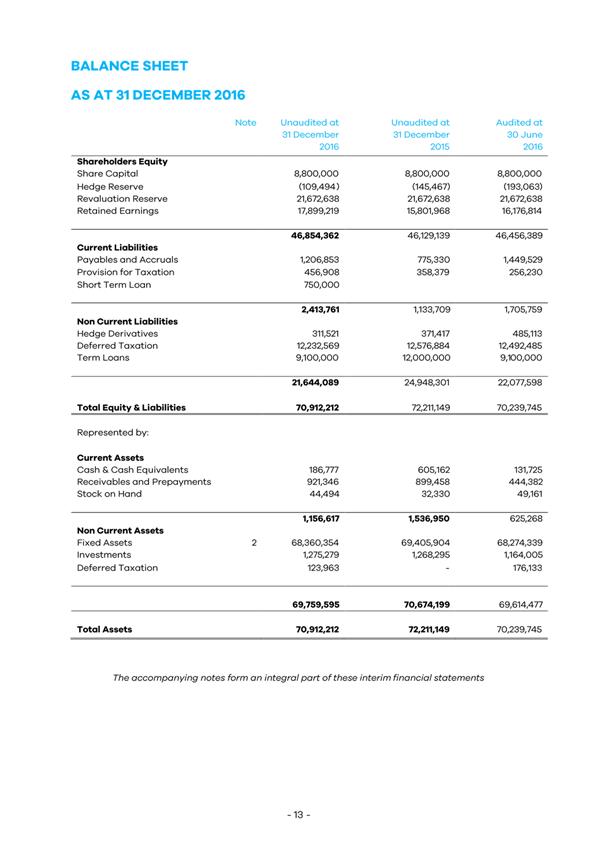

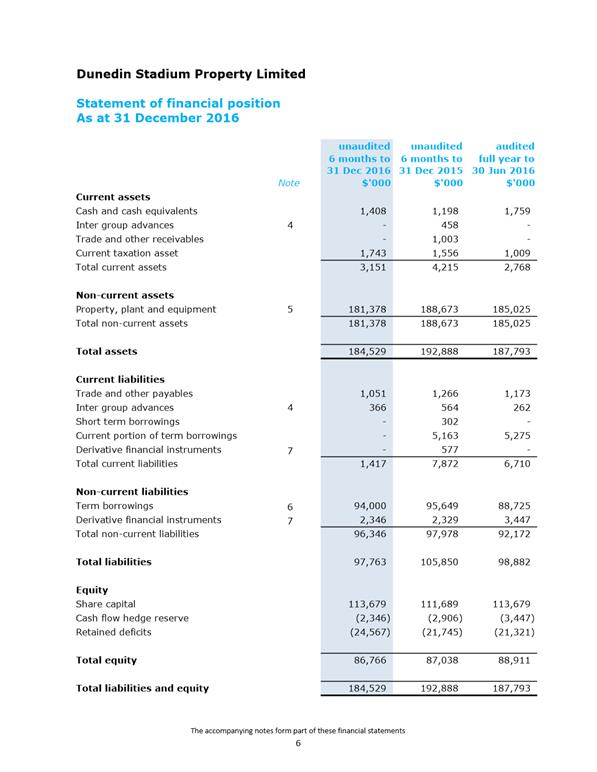

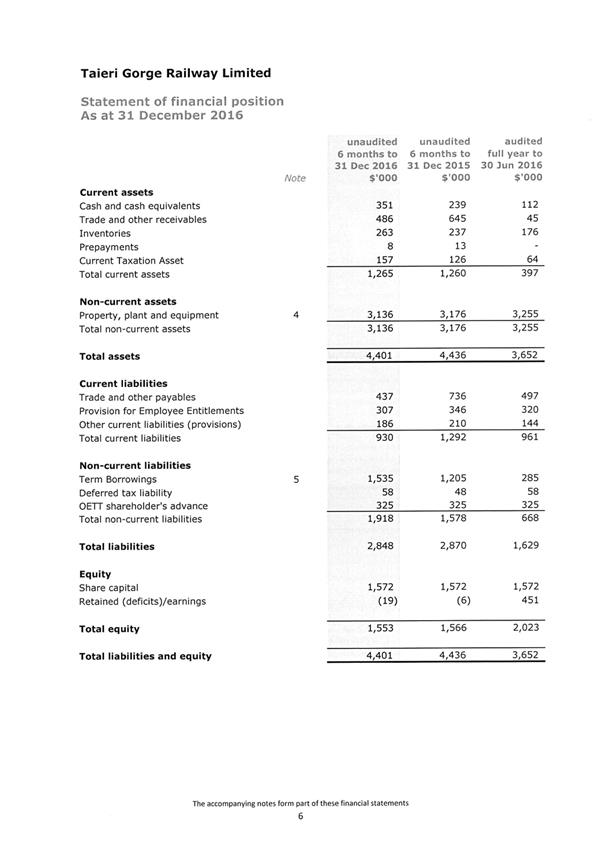

Statement of Financial

Position

A Statement of Financial Position is provided as Attachment

C.

The value of fixed assets was greater than budget as at 31

January 2017, mainly due to a higher than expected revaluation increase applied

to infrastructure assets (in particular Three Waters assets).

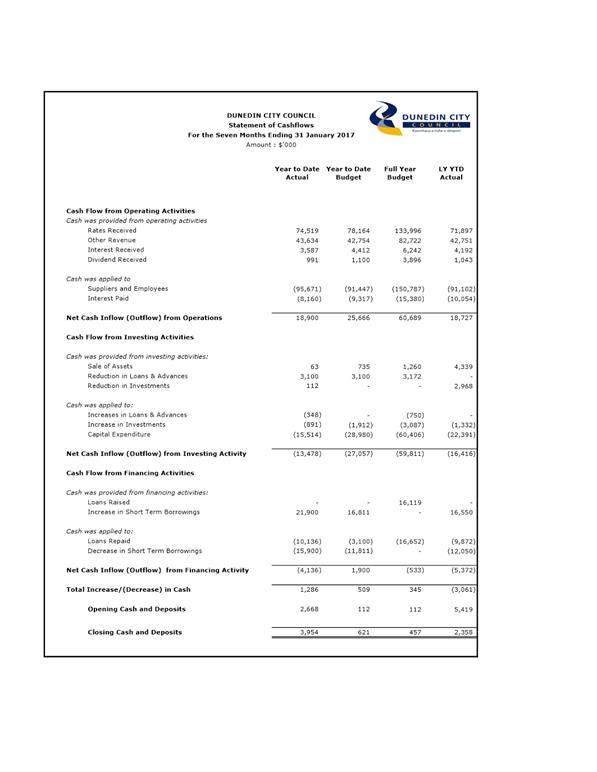

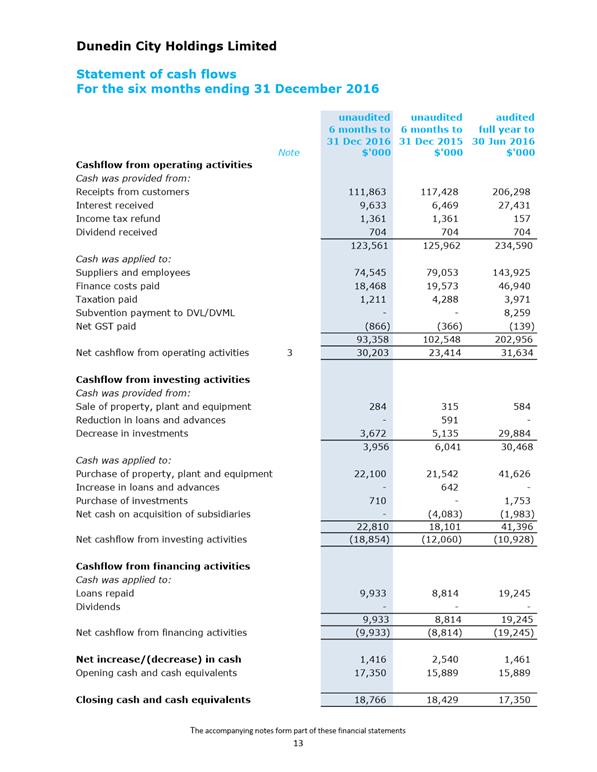

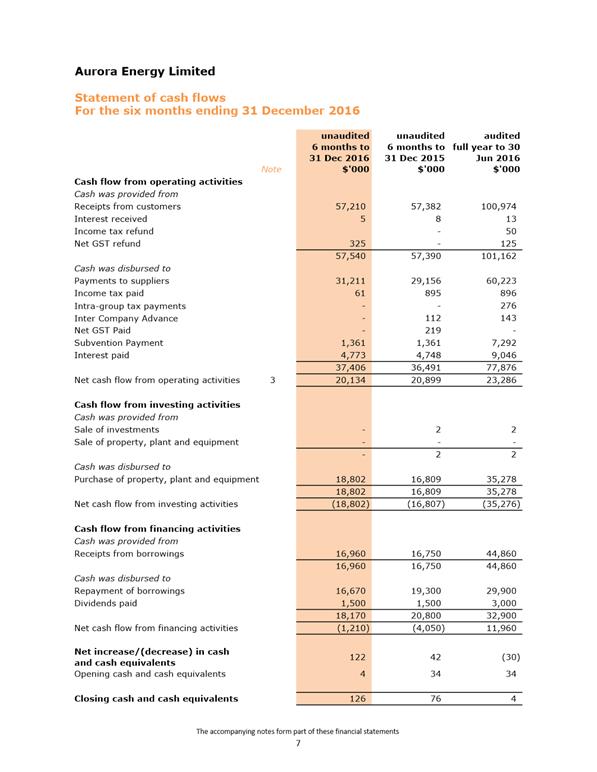

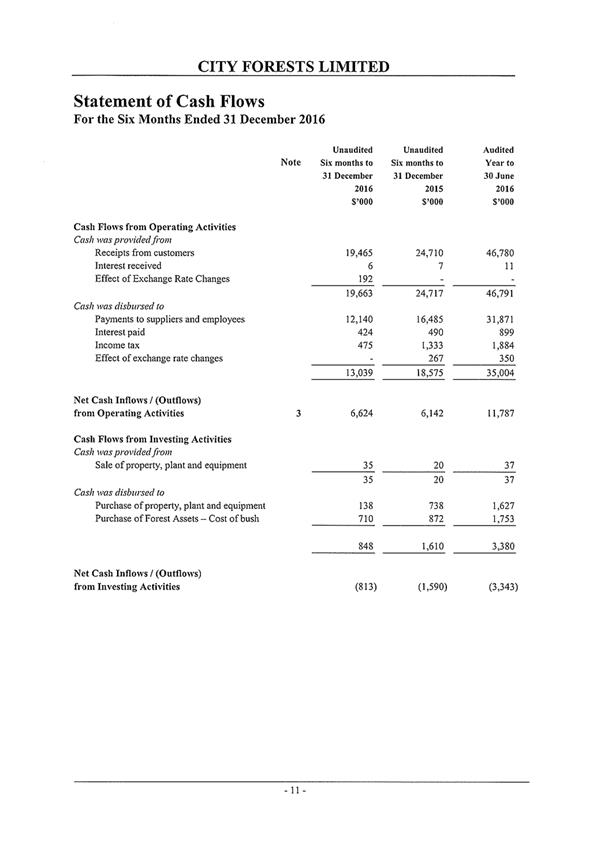

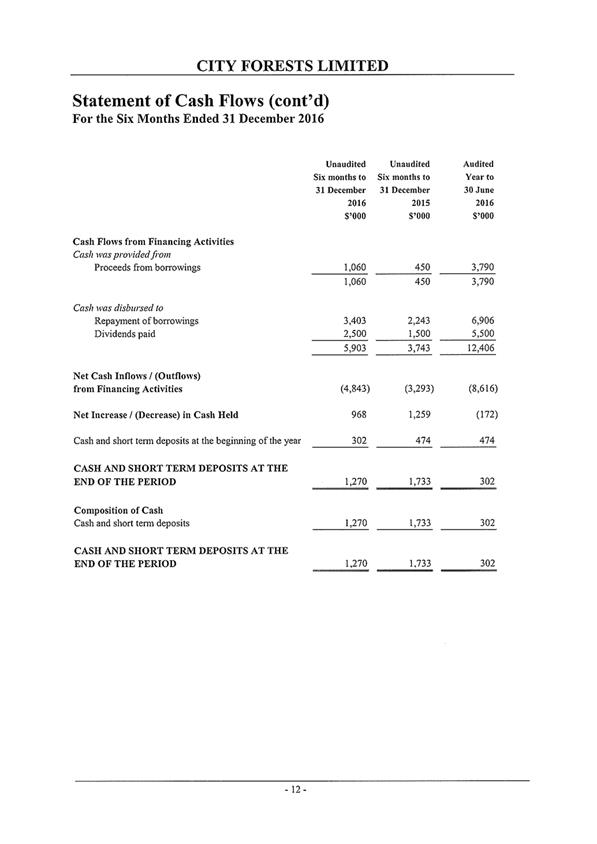

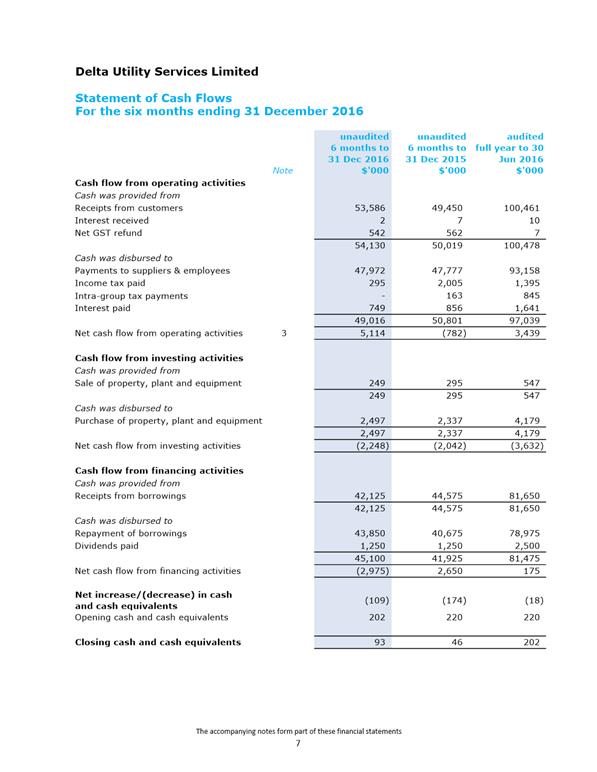

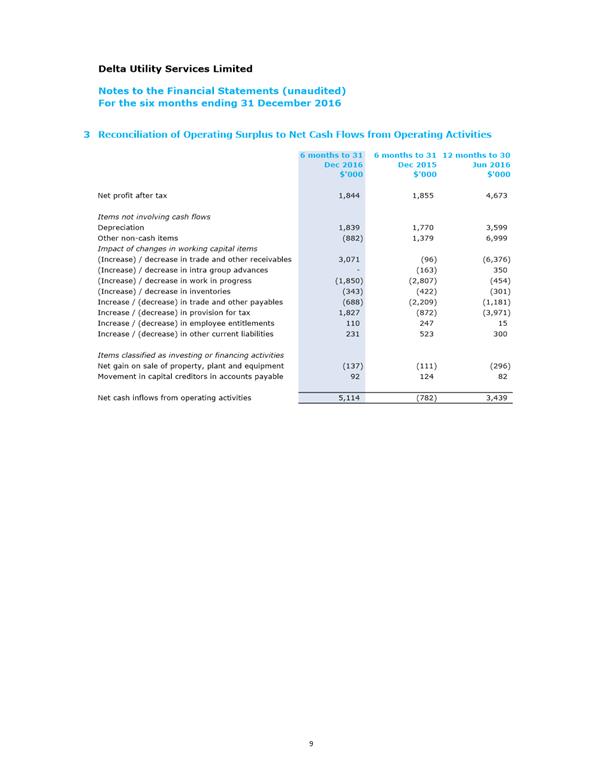

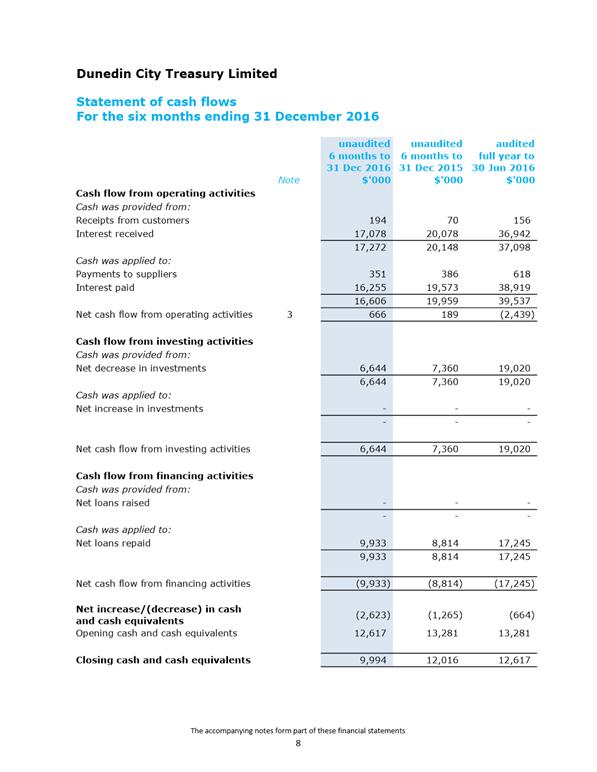

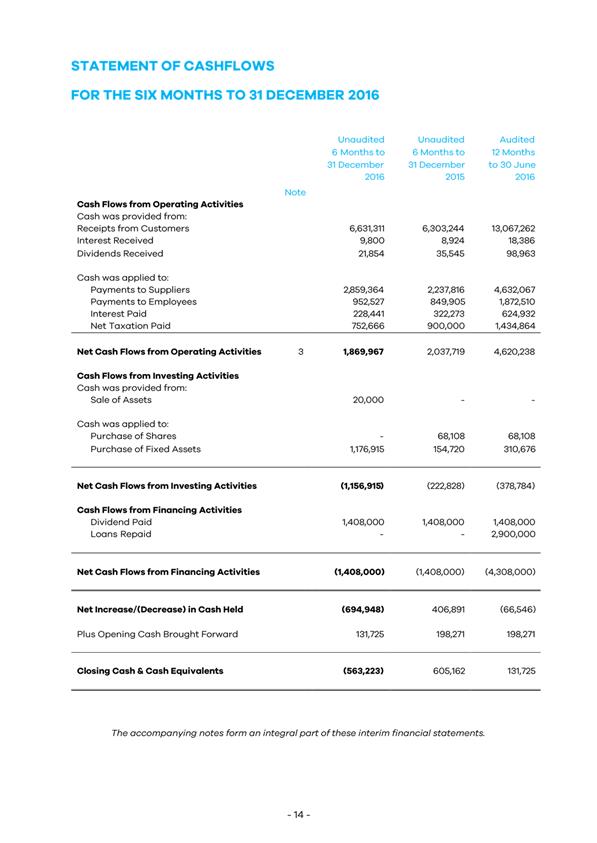

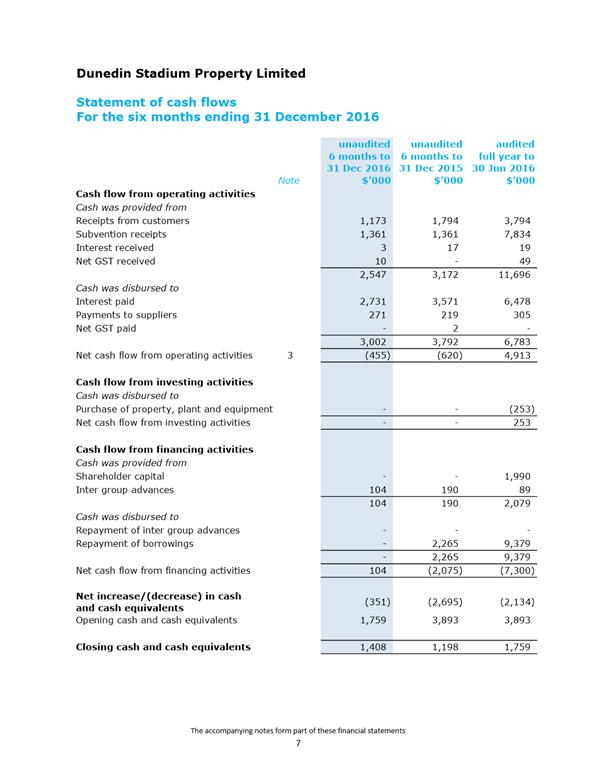

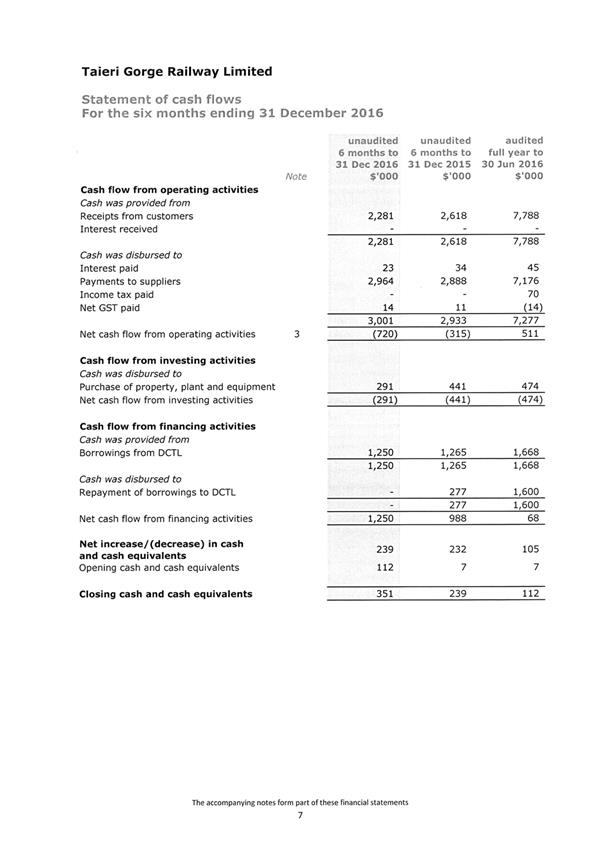

Statement of Cashflows

A Statement of Cashflows is provided as Attachment D.

Net cashflow from operations was less than budget primarily

due to the timing of rate receipts.

Cash outflows from investing were less than budgeted mainly

due to capital expenditure being less than budgeted.

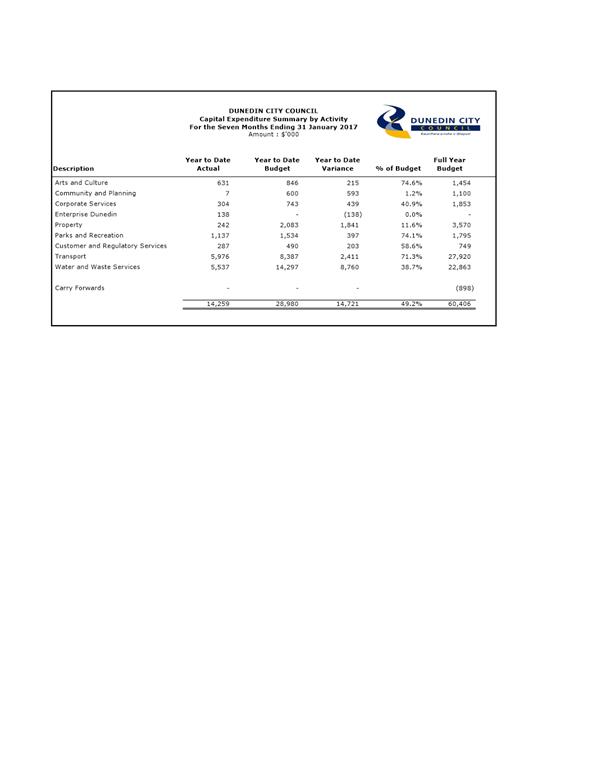

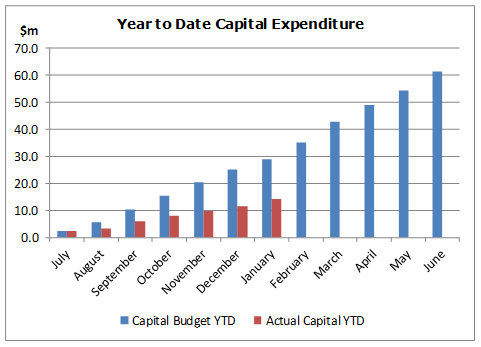

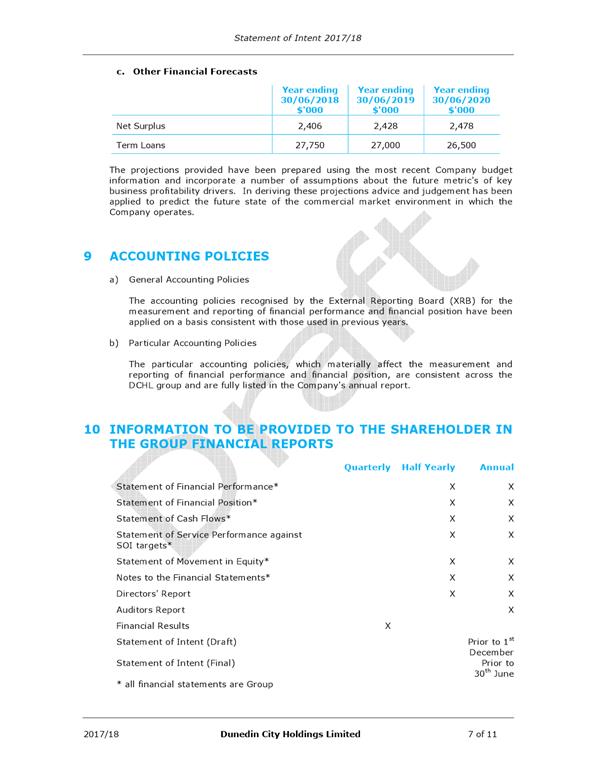

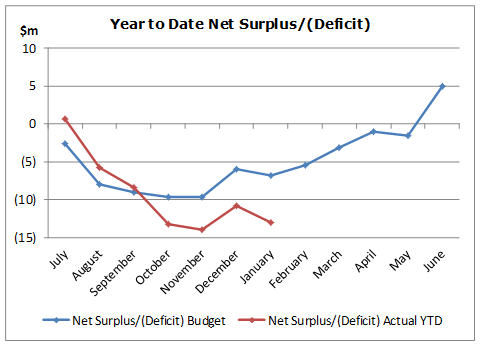

Capital Expenditure

A summary of the capital expenditure programme by Activity

is provided as Attachment E.

Total capital expenditure for the period to 31 January 2017

was $14.259 million or 49.2% of the year to date budget of $28.980

million.

Community and Planning

Group capital expenditure was $593k favourable

This variance was due to delayed progress with the Citywide

Amenities upgrade work.

Property capital expenditure was $1.841 million

favourable

Procurement plans and tender approvals are being prepared

for a number of Property capital projects.

The Ice Stadium upgrade project was underway with the

completion expected in March 2017.

Parks and Recreation capital expenditure was $397k

favourable

The likelihood of the $400k budget for the Mosgiel Aquatic

Centre ($200k YTD) to be spent this financial year is uncertain. Other

Aquatic upgrades are also still to be completed.

Transport capital expenditure was $2.411 million

favourable

A number of renewal projects were late in starting

(carriageway, footpath resurfacing, kerb & channel and gravel road

re-metalling) pending finalisation of contractual details. Most work is

now well underway with completion scheduled on or before 30 June.

Minor Safety improvements were favourable $348k. The

Safety team programme is going to tender, with an estimated value is $1.481

million.

Structure

component replacement capital was favourable $747k. Seawall renewals are

favourable $389k. The programme is being prepared by consultants, but

physical works will be deferred until the 2017/18 financial year.

Retaining wall renewals favourable variance of $197k was due to delayed

timing. This budget is expected to be over spent by year-end. Bridge

Structure expenditure was favourable $160k with the Sutton Mt Ross Rd Bridge

strengthening estimated to cost $550k, and an additional $500k for other

bridges anticipated

The

Peninsula road widening project was favourable $723k with only project

management and design costs expected to be incurred in 2016/17 with the

year-end variance expected to be favourable $8.840 million.

Slip repairs

works were unfavourable $636k due to unbudgeted permanent reinstatement works

related to June 2015 weather event.

The Cycle Network was unfavourable

$506k. The Portobello Rd section was completed in September 2016, with

landscaping works completed in November. Full year expenditure is expected to

be unfavourable $131k.

Water and Waste Services capital expenditure was

$8.760 million favourable

This favourable variance was due to some projects awaiting

necessary approvals including completion of design and consenting components.

Key projects underway include:

· Ross

Creek Reservoir reinforcement where work has commenced with contract awarded to

Downers at below engineers estimate.

· Highcliff/Every/Jeffrey

St works are now well advanced by the contractor.

· Waste

water treatment switchboard replacement at Mosgiel is nearing completion and

Green Island work is currently out for tender.

· Portobello

Storm-water Screen was fully operational and a tender is out for the final

controls section of this project.

Significant strategic reviews on

stormwater assets, and options for flooding issues complimented by overall

condition assessments and modelling of networks, have progressed and were in

consultation with ORC to ensure cross council collaboration.

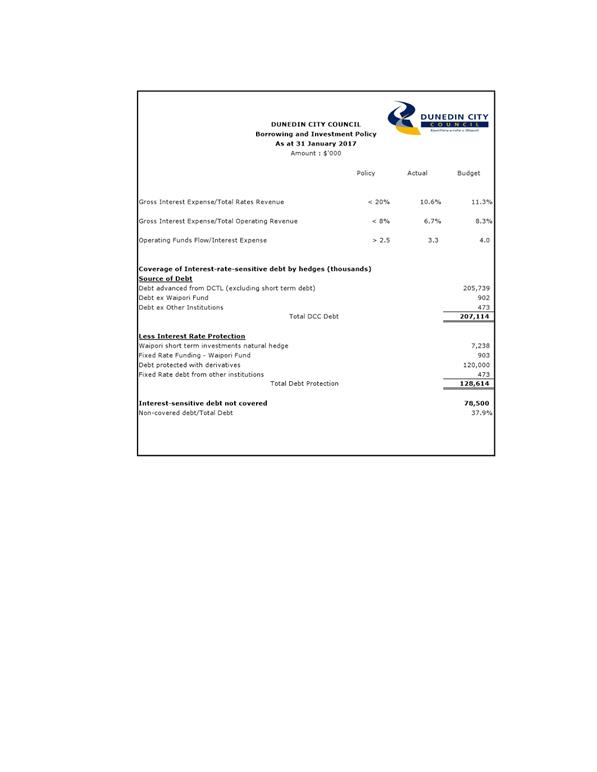

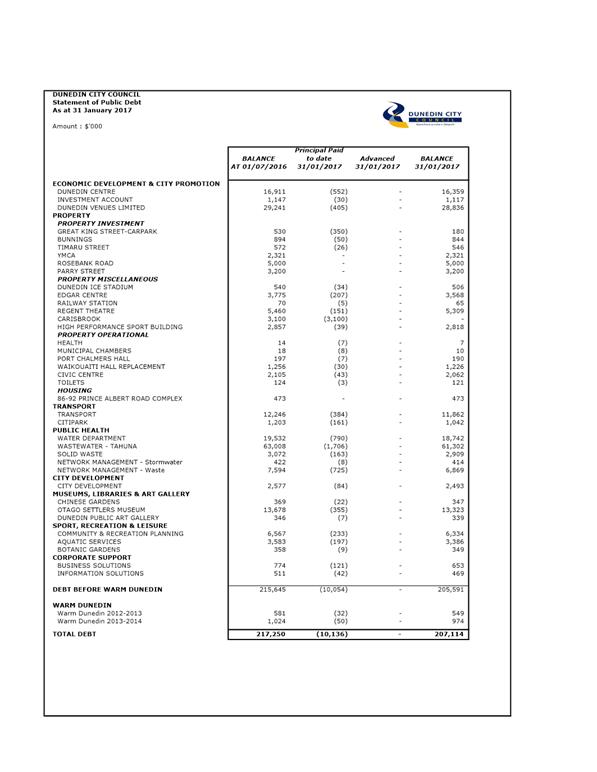

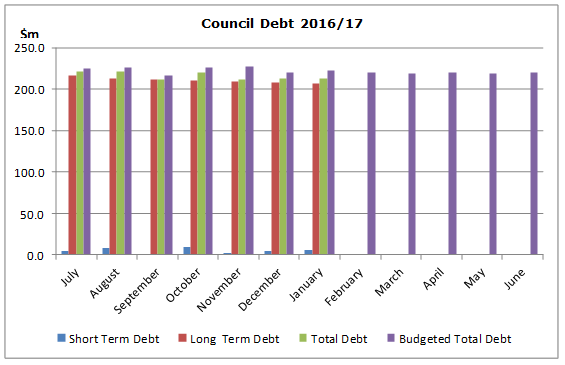

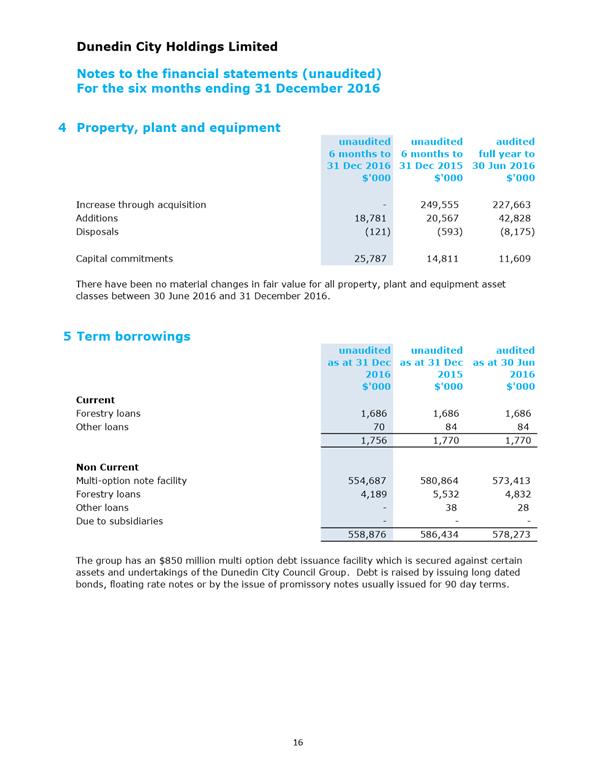

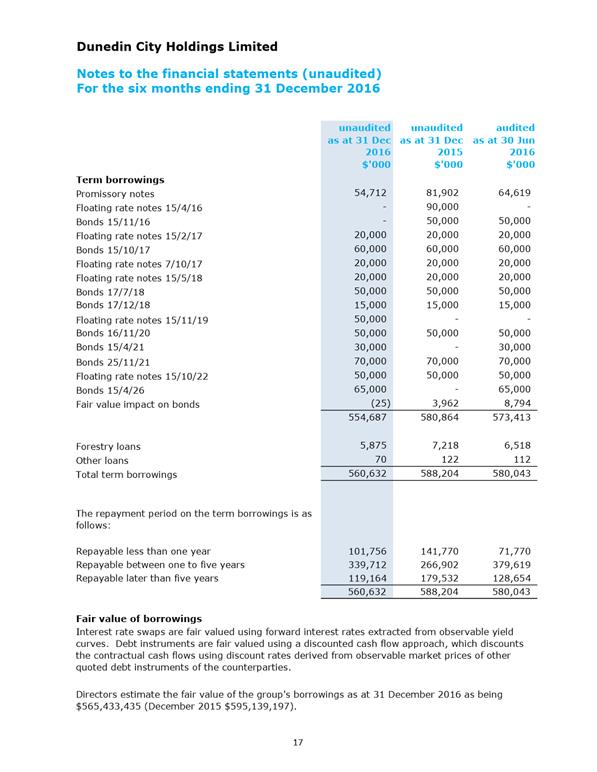

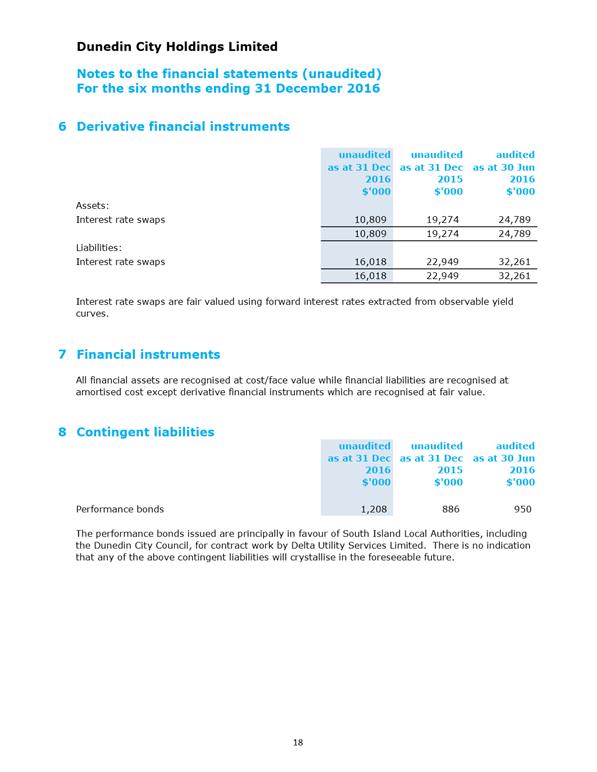

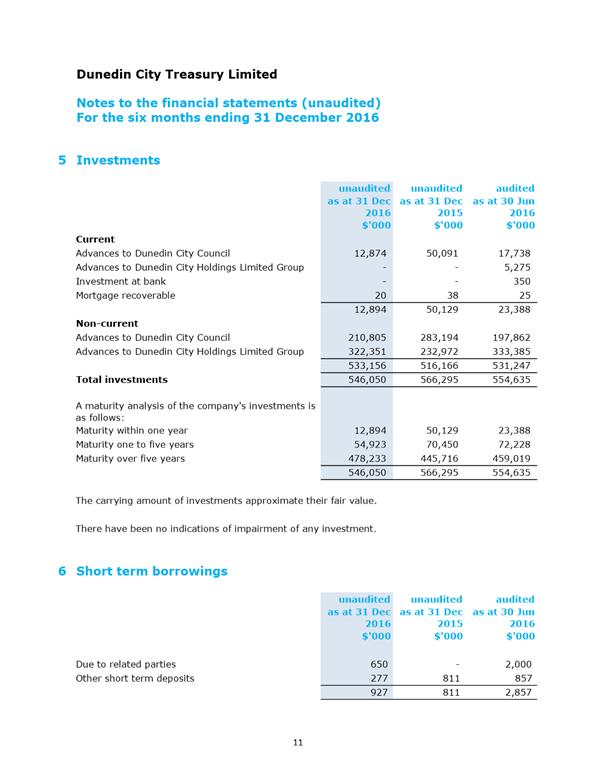

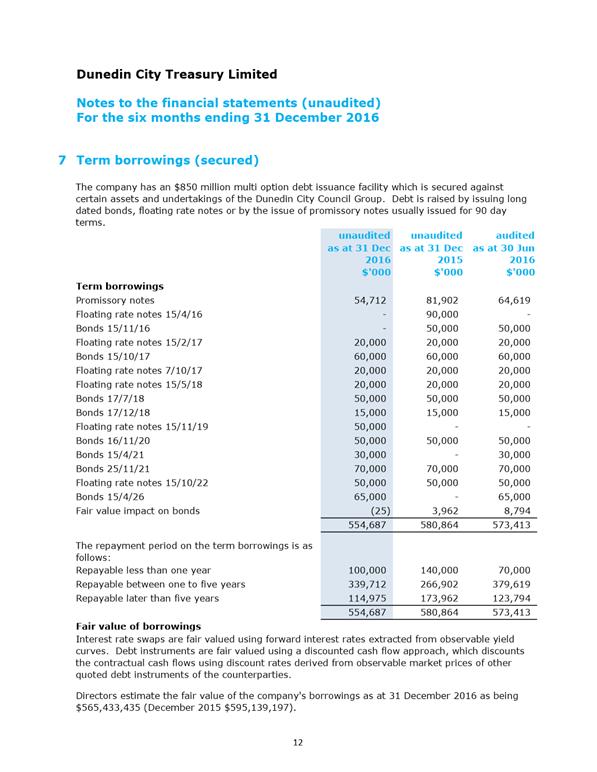

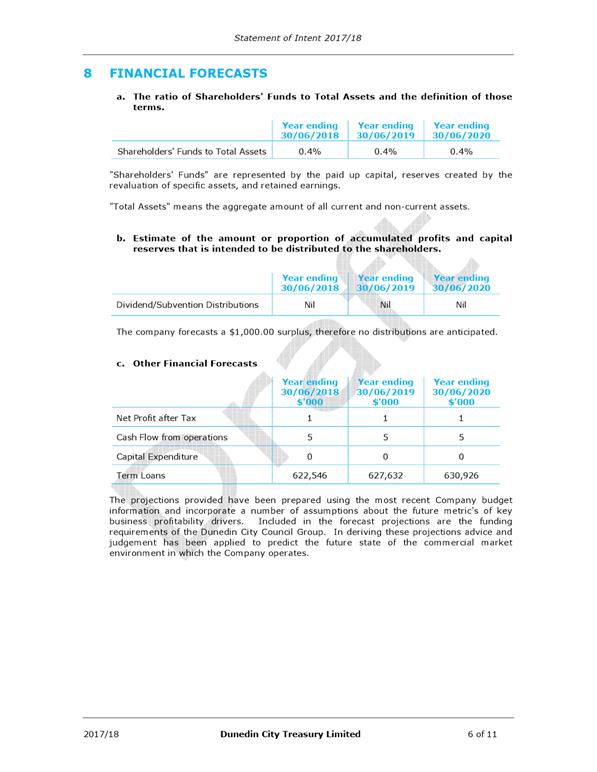

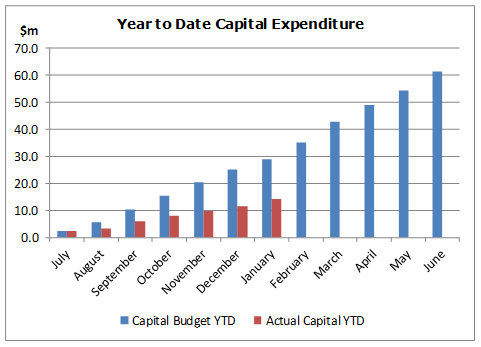

Debt

Refer to Attachments F and

G.

Attachment F provides a summary

of the debt servicing ratios for the year to date.

All three targets are within

policy.

It is anticipated that no new

loans will be required in the 2016/17 financial year.

Debtors and rates outstanding

Sundry debtors outstanding as at 31 January 2017 totalled

$22.022 million. This included long term debt of $459k, and debt associated

with Warm Dunedin of $2.790 million.

Debtors outstanding for more than four months (excluding

long term debt and Warm Dunedin) totalled $396k, compared with last

year’s total of $502k as at 31 January 2016.

Rates arrears relating to prior year rates totalled

$648k. This was higher than the $597k total as at January 2016. Of

this total $114k was being recovered under formal arrangements with Council,

while the balance was being actively pursued.

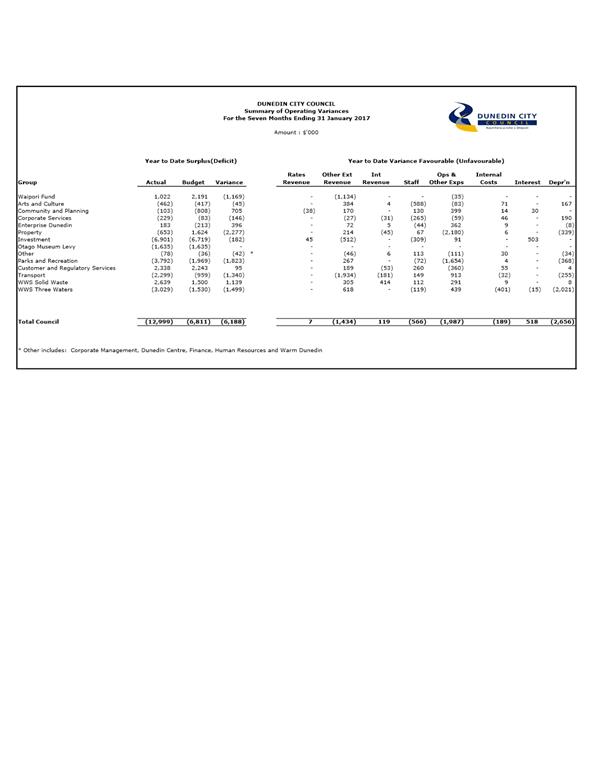

Comments from group

activities

Attachment H, the Summary of Operating Variances, shows, by

Group Activity, the overall net surplus or deficit variance for the seven

months ended 31 January 2017. It also shows the variances by revenue and

expenditure type.

Community and Planning Group - $705k Favourable

Group staff costs were favourable $130k due to staff

vacancies as well as the costs relating to Council’s 2GP project being

transferred to Corporate Services.

Overall operating expenses were also favourable $399k due to

the transfer of 2GP costs, and delayed timing of some project & grants

expenditure including costs associated with the Section17A review project.

Enterprise Dunedin Group - $396k Favourable

This favourable variance

related to the timing of key projects under the Grow Dunedin Partnership.

These projects include Project China, Study Dunedin, Film Development and Sexy

Summer Jobs.

Property - $2.277 million Unfavourable

Property operating costs were unfavourable $2.180 million.

Fees and levies expenditure was higher than expected ($887k) due to costs

associated with compiling condition and hazard assessments across the operating

building portfolio including the Civic Centre, Ice Stadium and Edgar

Centre. Some of the work involved structural and seismic engineering

work.

Repairs & maintenance expenses were unfavourable $267k

mainly due to deferred maintenance issues for a number of properties now being

addressed.

Premises costs were greater than budget $577k reflecting in

part unbudgeted costs associated with properties held for resale and additional

resources required to provide toilet facilities under a 24 hour

operation. Identified remedial work on some properties has also increased

costs in this area.

Partially offsetting these unfavourable variances, external

revenue was $214k better than budget due to housing occupancy rates being

higher than expected, as well as reduced vacancy time between tenancy changes.

Parks and Recreation Group - $1.823 million

Unfavourable

Parks and Recreation external revenue was favourable $267k

primarily due to revenue from tree felling at Waikouaiti and greater than

budgeted development contributions revenue. Revenue from burial services

continued to be below budget and was unfavourable $98k.

Operating costs were unfavourable $1.654 million mainly due

to:

· Unbudgeted

interior maintenance and asbestos removal costs at Moana Pool.

· Increased

costs of green space contracts and associated contract review and auditing

costs.

· Ocean

Beach holding pattern costs.

· Unbudgeted

costs associated with the new contract to manage the University Oval.

Transport Group - $1.340 million Unfavourable

External revenue was unfavourable $1.934 million due to less

than expected NZTA capital and operating work taking place resulting in grants

revenue being down on budget. In addition revenue from corridor access ways was

less than budgeted.

Operating expenditure was favourable $913k primarily due to

favourable expenditure (including some NZTA subsidised work) in the new

maintenance contract while the contractor increases their resources to meet

contracted obligations.

WWS Solid Waste – $1.139 million Favourable

Landfill internal revenue was favourable due to higher than

expected sludge and general waste volumes. Refuse bag sales were also

favourable.

Staff costs were favourable $112k due to a number of

vacancies in the unit that will be filled in the coming months.

Operating costs were favourable $291k due mainly to reduced

refuse collection costs, including rural skip days. Landfill contract

contingency and variable costs are tracking below budget. This has been

partially offset by increased costs associated with the collection of illegally

dumped rubbish, recycling and litter collection.

WWS Three Waters – $1.499 million Unfavourable

Staff costs were unfavourable $119k due to temporary

positions that have been created pending the restructure of the business unit

to provide additional resource to match workload.

Internal expenditure was

unfavourable $401k due to higher than anticipated volumes of sludge from Tahuna

being disposed of at the Green Island landfill during the first half of the

year when the Tahuna incinerator was not fully operational– see

favourable revenue in Solid Waste above.

Depreciation was unfavourable $2.021 million, reflecting the

increase in depreciable value of infrastructure assets, particularly wastewater

assets, as a result of the revaluation effective

1 July 2016.

These unfavourable variances were partially offset by

favourable revenue $618k primarily due to higher than expected water sales in

part impacted by the timing of meter readings.