|

Economic Development

Committee

12 September 2017

|

|

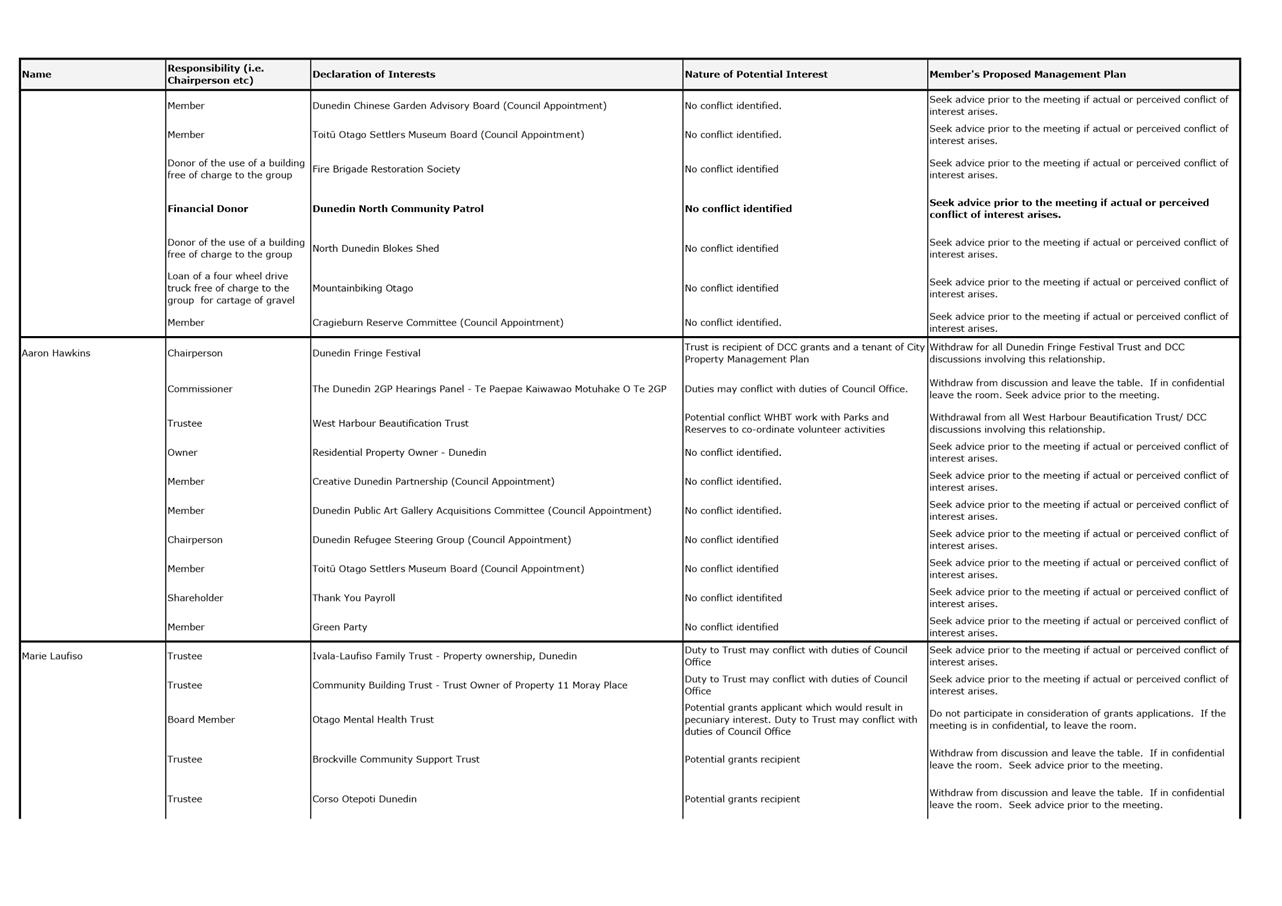

Part

A Reports

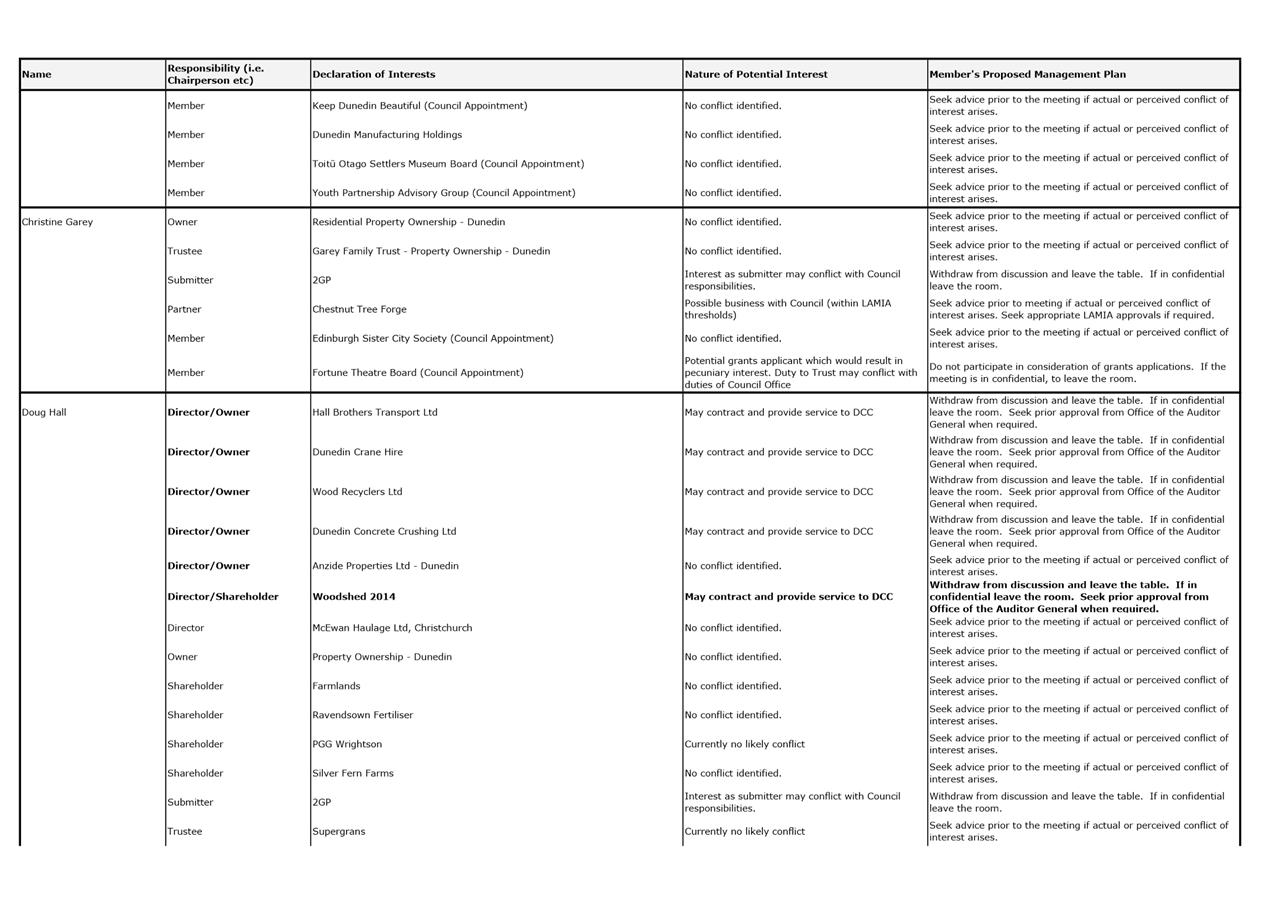

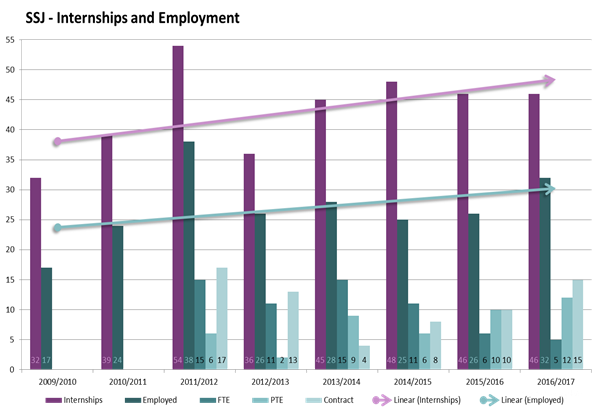

Dunedin Marketing - Autumn/Winter Campaign

2017

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

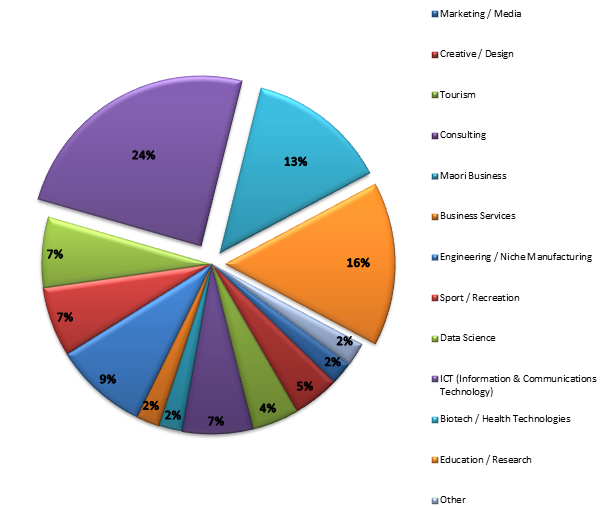

1 The

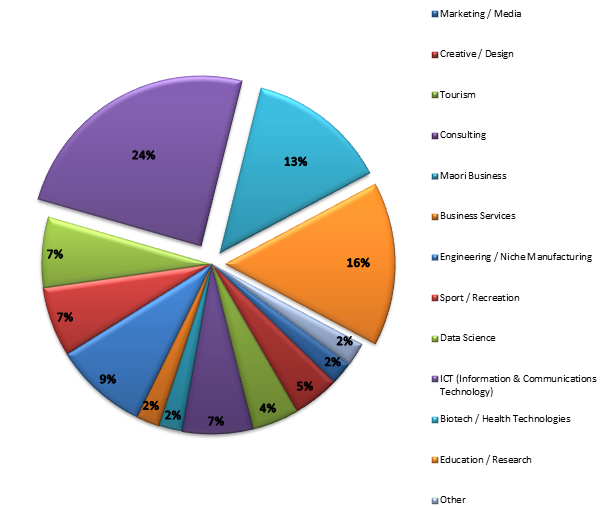

purpose of this report is to update the Committee on the results of the 'Where

the Wild Things Are' (WTWTA) Autumn/Winter 2017 Campaign Activity between

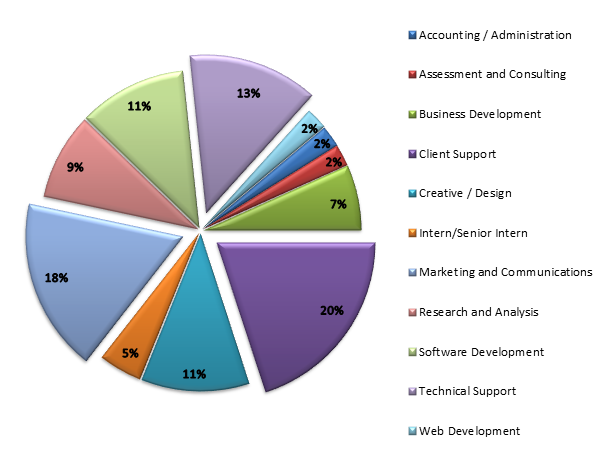

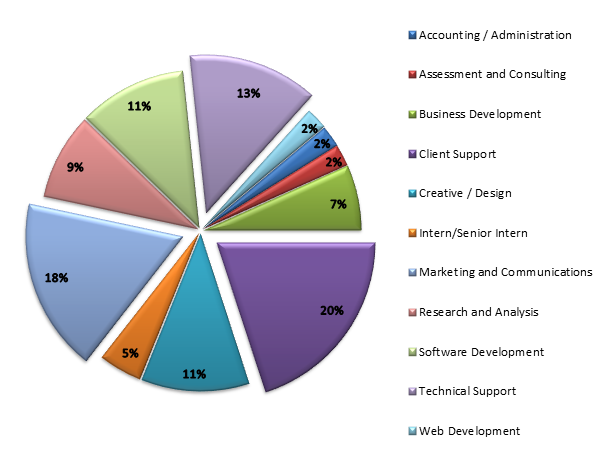

February and June 2017.

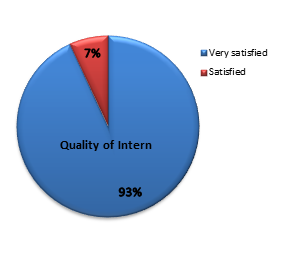

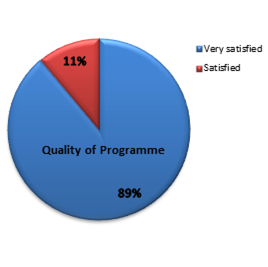

2 The

purpose of the WTWTA campaign was to raise awareness of Dunedin as a compelling

destination. The primary target market focus was Brisbane and surrounding

regions in Australia.

3 This

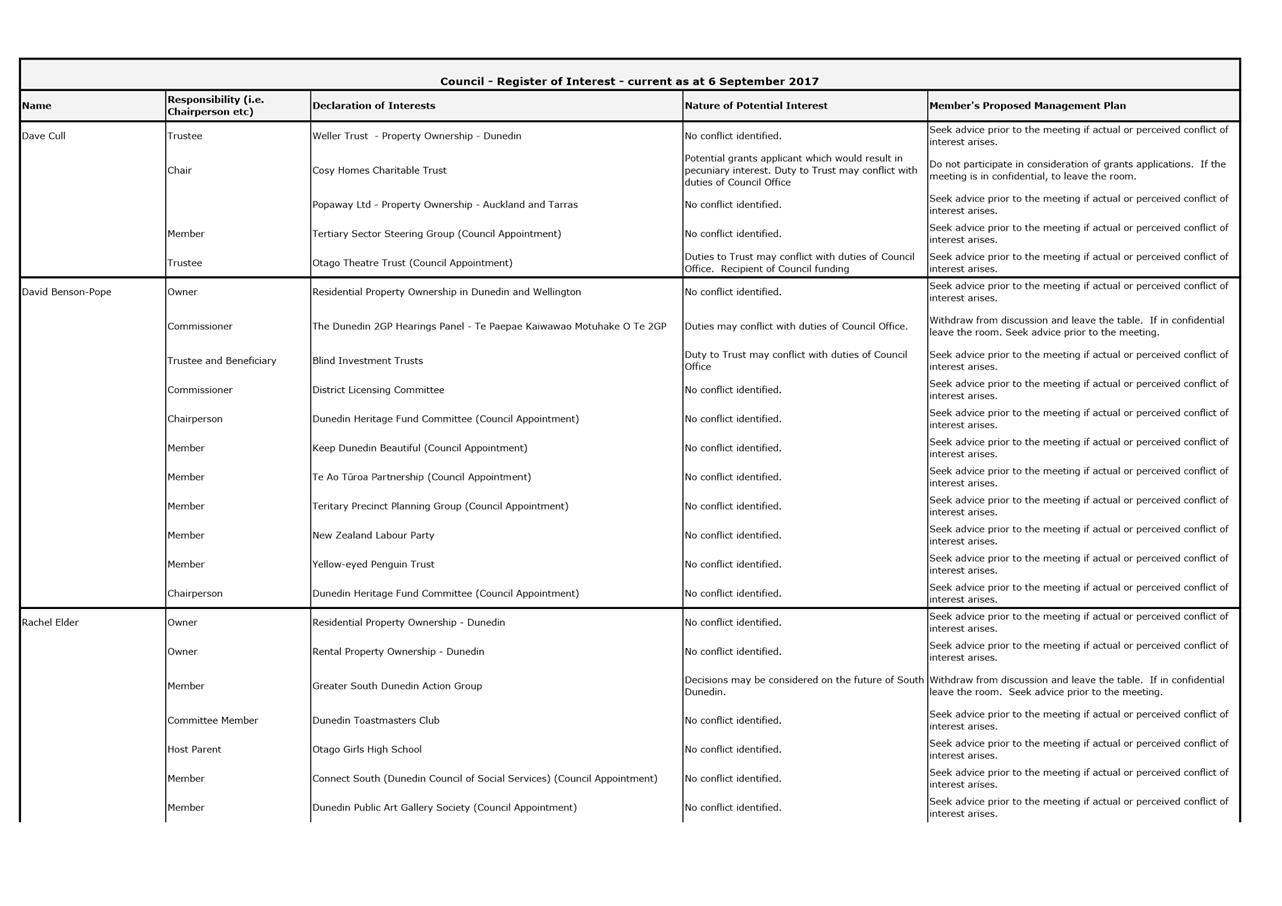

campaign is Year Two of a three year strategy for Australia, continuing to

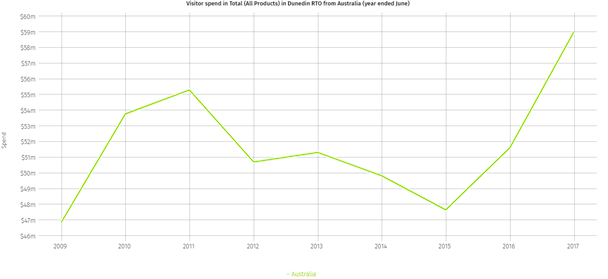

educate the Queensland markets about Dunedin as an accessible and intriguing

destination. The same ‘Wild’ key theme was used in last year's

Australian markets for consistency with slightly different messaging promoting

compelling reasons to visit Dunedin in Autumn & Winter 2017.

4 For

further details refer to Attachment A – WTWTA Campaign Summary Proposal.

|

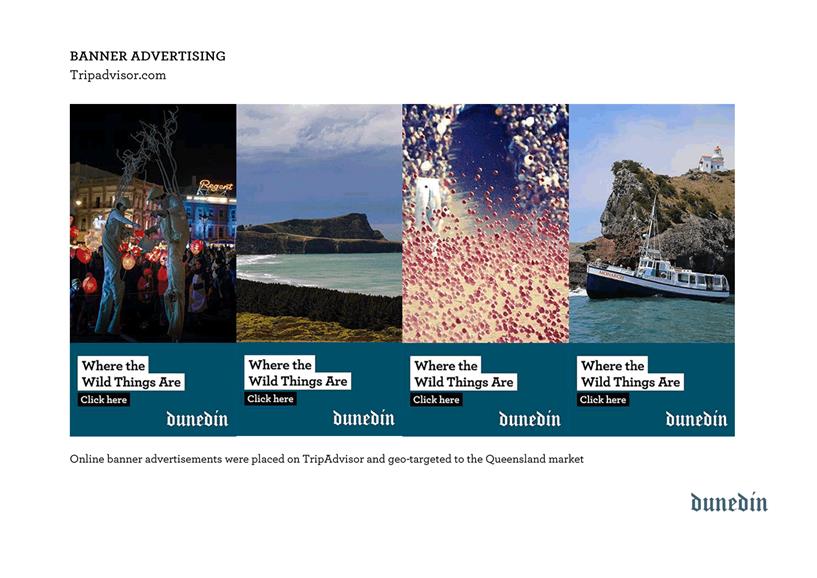

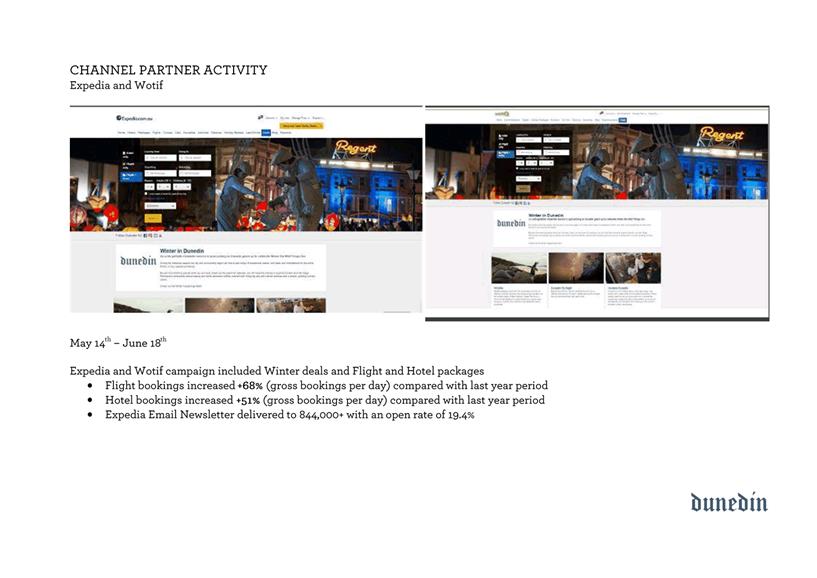

RECOMMENDATIONS

That the Committee:

a) Notes the

Dunedin Marketing Autumn/Winter Campaign 2017 report.

|

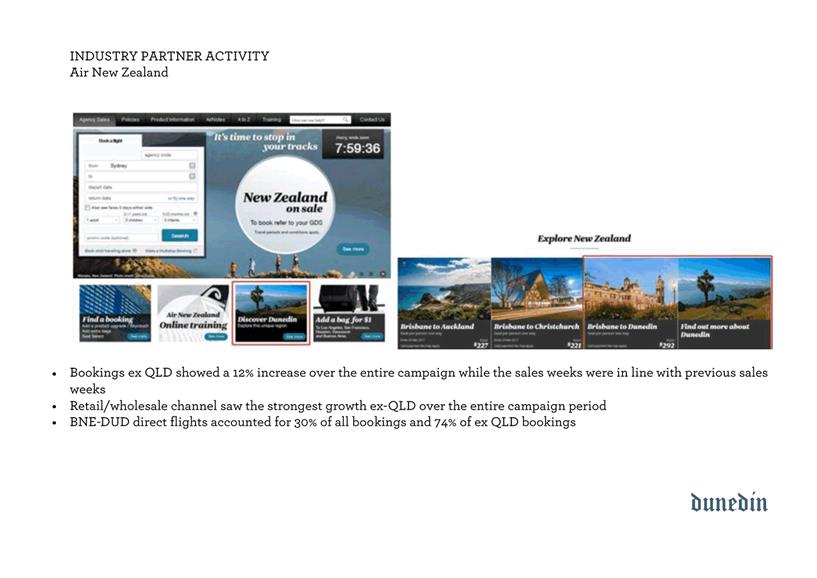

background

5 This

campaign was the last consumer campaign of Enterprise Dunedin’s annual

marketing activity in 2017 financial year from within existing budgets.

6 This

WTWTA campaign into Australia themed around Wild Dunedin including iconic

aspects of weather, landscapes, events, festivals, food and the city’s

unique wildlife. "Dunedin is a great small city

with a WILD side; WILD life,

people, places, weather, scenery, days, nights, culture, food, events,

entertainment and experiences - an intriguing,

eclectic compelling and surprising wild destination."

7 The

primary purpose of this campaign was to raise Dunedin brand awareness and

position Dunedin as a compelling destination with travellers primarily in the

Brisbane market and surrounding regions.

8 The campaign

was also visible to wider global markets online through Dunedin NZ channels

– website and social media (Facebook and Instagram).

Objectives

9 The

objectives of the campaign included:

a) achieve a good

increase in awareness of Dunedin and visibility of 'brand Dunedin' with the key

primary audiences in Brisbane and surrounding regions via Dunedin NZ digital,

social and Australian media and bookings and referral channels,

b) encourage

shoulder/low season response to market activations through the travel dreaming

and planning phases about Dunedin,

c) increase

Dunedin’s visibility and attractiveness as a destination to visit over

the Autumn and Winter,

d) generate

additional social media and campaign engagement including a Dunedin NZ Facebook

competition,

e) generate

awareness of campaign deals and encouraged bookings and visit Dunedin between

May to August,

f) generate

further awareness of Dunedin as a year round destination with the Australian

travel trade.

Discussion

10 The WTWTA campaign

was a five month multi-channel campaign across digital, social, competition,

video, media and trade platforms.

11 The total campaign

budget was in excess of $680,000 of which Enterprise Dunedin contributed

$275,000 to the campaign. This included direct investment contributions of

$25,000 and in kind campaign partner investment contributions of over $385,000.

12 The campaign brought

together 18 local, national and international industry, trade and media

partners including Enterprise Dunedin.

13 Enterprise

Dunedin supported this campaign on DunedinNZ.com digital channels with

landing pages/event, social media content and electronic direct mail via the

following portfolio channels:

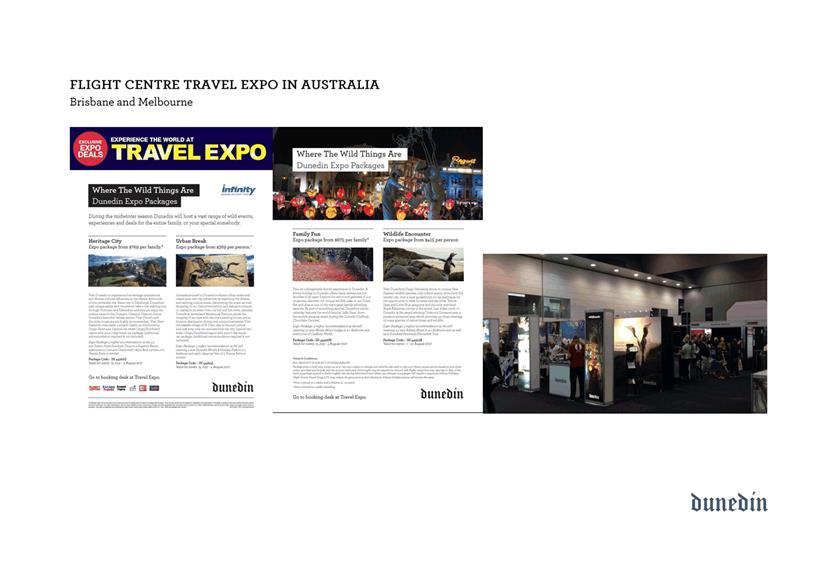

a) Brand/Digital/Consumer – Travel Expo (Feb in BNE & MEL), Facebook

Ads, Autumn Instameet (Instagram), Twitter, & Consumer data base

(Dunedin’s historic social reach 1.3million monthly),

b) PR/Media & Comms – Travel Influencers, Writers & Photo/Videographer Famils

– Brisbane Times & APN, Instameet Influencers (BNE), Key Event Media

– Fashion/Arts,

c) Travel Trade & Industry –Tourism NZ - Wholesaler Event (Mar), Travel

Trade Frontline Training Roadshow (SYD, MEL, BNE, PER),

d) Business Events – Australian Professional Conference Organisers (PCO) Association

Trade Event (BNE), Australian PCO & Media Famil, Tourism NZ - Business

Event Roadshow (SYD, MEL, BNE, CAN), CIM Magazine Ad.

14 Two influential

Australian media partners' travel channels were used to leverage the Dunedin

brand, content and imagery promoting Dunedin as a WILD travel destination. The

campaign ran across print, digital, mobile and social channels including

editorial, advertising, short articles, quiz’s competitions, and deals.

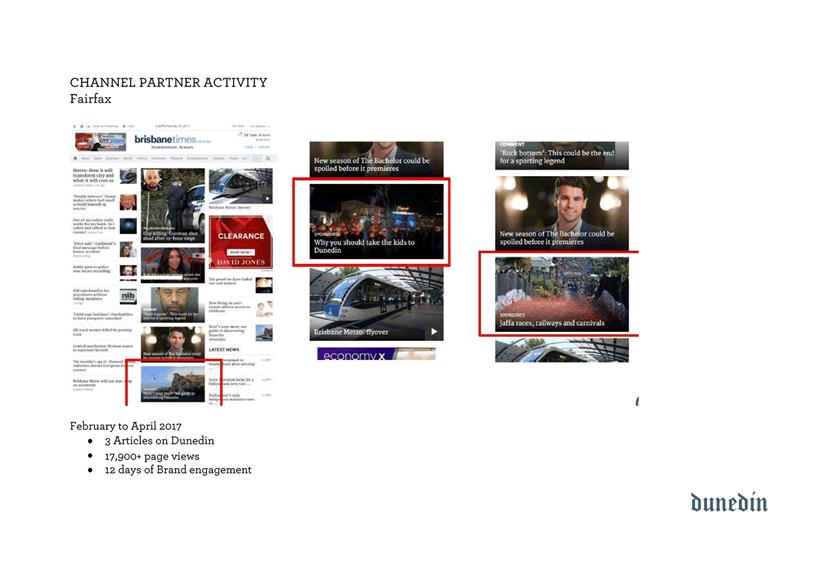

- Fairfax

Media Australia reaches 13 million Australians daily with national and metro

news, business and lifestyle mastheads; including the Brisbane Times, Sydney

Morning Herald and Melbourne Age.

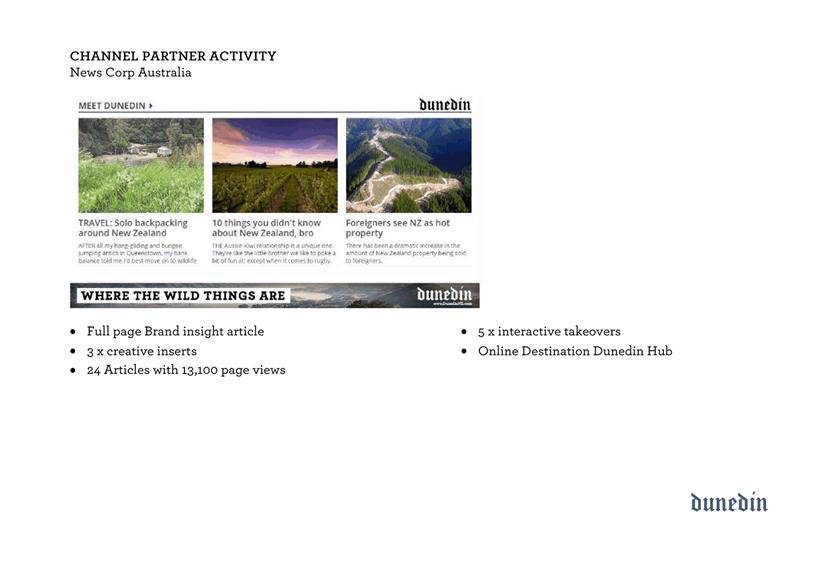

- News

Corp APN Australian Regional Media reaches 2.3 million Australians via multiple

platforms with 12 significant regional mastheads across Queensland and New South

Wales.

15 The campaign’s

primary target market was travellers from Brisbane. The highlighted travel

period for to Dunedin was April 2017 onwards.

Campaign

Partners

16 This is the first

year Enterprise Dunedin has partnered with Australian Media groups - Fairfax

and News Corp APN - Australian Regional Media. Together with global online

partners for travel booking and referral - Expedia, Wotif and TripAdvisor in

Australia.

17 National and

trans-Tasman campaign partners were Air New Zealand and Virgin Australia,

together with the Flight Centre and Infinity Travel.

18 Local campaign

partners included Dunedin Airport, Scenic Hotels (Southern Cross and Dunedin

City), Distinction Hotel, Otago Peninsula Trust (Royal Albatross Colony and

Blue Penguins Pukekura), Larnach Castle, Monarch Wildlife, and Orokonui

Ecosanctuary.

19 There was a total of

18 campaign partners comprising nine trans-Tasman and national and nine local

industry partners providing a combined local direct investment contribution of

$25,000 and wider in kind campaign partner investment contribution of over

$385,000.

20 Combined these

relationships collaborated to assist Enterprise Dunedin delivering a campaign

leading potential Australian travellers through an identified travel decision

pathway: 'Dream, Plan, Book, Visit and Recommend.'

Results

Overall

21 The most robust and

reliable measure of economic value and benefit for Dunedin from this and

associated campaigns is Australian Visitor Spend in Dunedin, this based on the

Ministry of Business Innovation and Employment's (MBIE) Major Regional Tourism

Estimates (MTREs).

Australian Visitor

Spend in Dunedin

|

Year Ended June 2017

|

Dunedin

|

New Zealand

|

|

Australian Visitor Spend

|

$60M

|

13.5% 13.5%

(compared to year ended Jun 16)

|

$ 2845M

|

9.9% 9.9%

(compared to year ended Jun 16)

|

|

Australian Market Share

of total Visitor Spend (New Zealand)

|

26%

|

24.5%

|

|

|

|

|

|

1

2

Source: MBIE Tourism

Dashboard - Visitor Markets – Visitor Spend by Origin* – Dunedin

RTO Region

3

*Major Regional Tourism

Estimates - MRTEs are an estimate of total regional tourism spend including

cash and online spending, and excluding Goods and Services Tax (GST).

4

www.tourismdashboard.mbie.govt.nz

5

22 The graph below

illustrates the increase in visitor spend from Australia in Dunedin for the

last two years 2017/2016 and 2016/2017 during which the WTWTA Campaigns have

been delivered into the Australian market.

6

7

Source: MBIE Tourism

Dashboard - Visitor Markets – Visitor Spend by Origin* – Dunedin

RTO Region

8

*Major Regional Tourism

Estimates - MRTEs are an estimate of total regional tourism spend including

cash and online spending, and excluding Goods and Services Tax (GST).

9

www.tourismdashboard.mbie.govt.nz

10

23 The 2016/2017

increase is 3.6% above the national average growth from the Australian market.

The Year One and Two WTWTA Campaigns have influenced these results.

24 These campaigns

combined together with individual local industry efforts and the wider

partnership work Enterprise Dunedin undertakes with the SOUTH Marketing

Alliance (Christchurch Airport, Tourism New Zealand and other South Island RTOs)

also focussing on increasing Australian traveller visitation to South Island

destinations including Dunedin.

25 For further detailed

results refer to Attachment B – WTWTA Campaign Partner Detailed Results

and Attachment C - WTWTA Campaign Execution Examples.

analysis

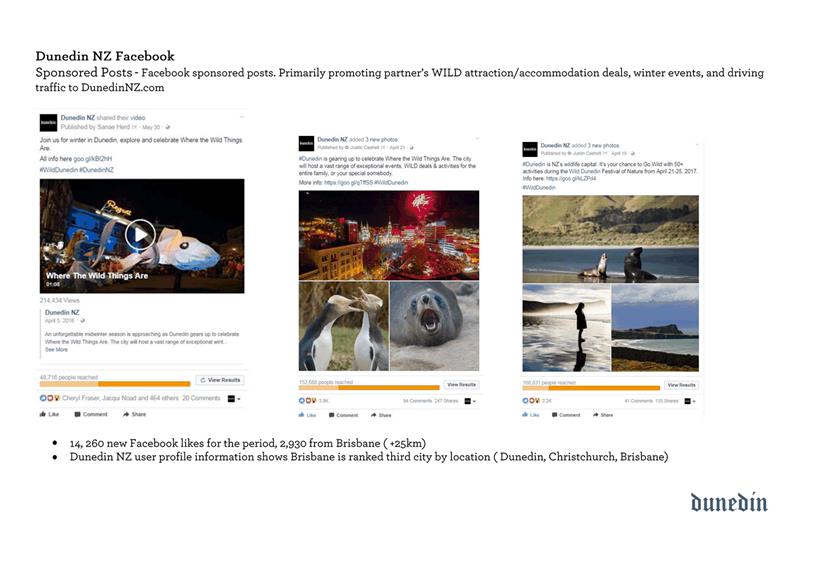

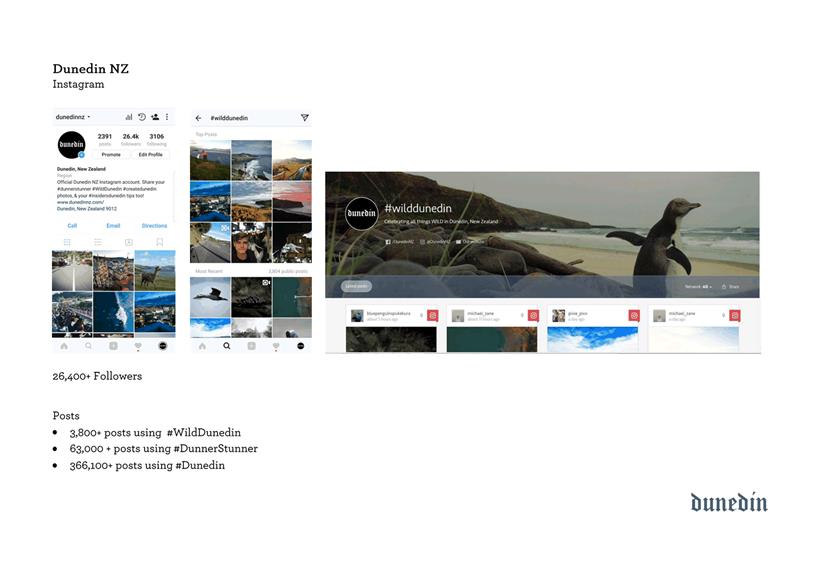

26 There was a

substantial increase in activity and engagement on Dunedin NZ social media

channels. Both Facebook and Instagram saw marked increases contributing to new

followers on new channels.

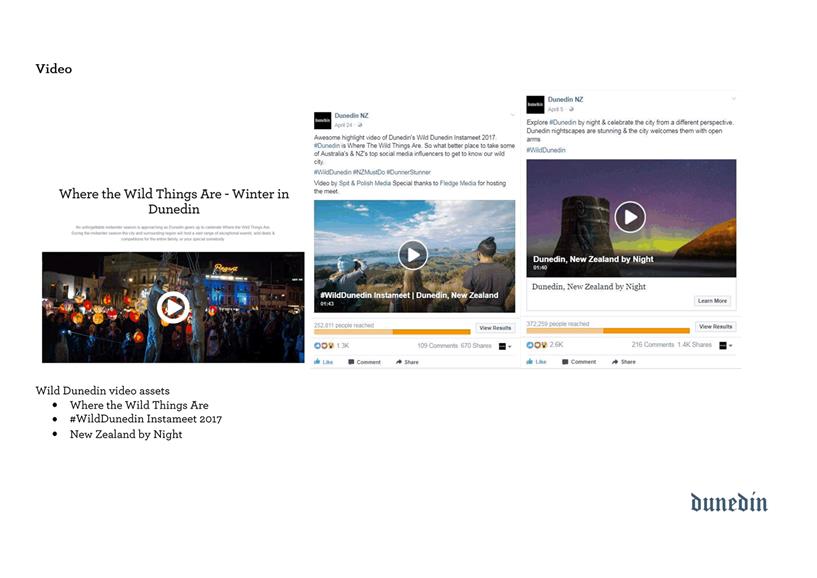

27 The Dunedin NZ

Facebook competition again drew significant attention, adding almost 5000

contacts to Enterprise Dunedin’s consumer database from Brisbane.

28 Responses to Dunedin

video posts during the campaign period were also significant with over 430,000

views via Facebook.

29 In addition the

campaign resulted in a significant number of Dunedin banner advertising views

and ad click engagements on Fairfax and News Corp APN media websites with

Dunedin pages on TripAdvisor, Expedia and Wotif sites linked to DunedinNZ.com.

Significantly this also included consumers posting and sharing Dunedin

articles, images and video on their own social media feeds.

30 Evidence of

decreases in the number of Dunedin website visits and the flow on to WTWTA

Campaign and deal pages reflects a global consumer trend of increased

engagement with social media and looking to make planning and booking decisions

on these platforms as opposed to clicking further down to websites.

31 This decrease is

likely also reflective of increased Dunedin content on partner media, booking

and referral sites including the Dunedin Hub and Discover Destination Dunedin

feature pages and the Dunedin pages on both Expedia and TripAdvisor

websites.

32 Enterprise Dunedin's

consumer database has increased by 4,970+ competition entry emails from

Brisbane who have opted into the consumer newsletter to whom remarketing

(email) of future campaigns can be undertaken.

33 Travel-minded

consumers who either, watched Dunedin videos, or interacted with Dunedin Facebook

ads are able to be retargeted (online advertising) via Facebook with future

Dunedin messaging and campaigns. (Both of the

above digital marketing activities comply with NZ Privacy laws).

34 Evidence shows

‘Dunedin Fare Sale’ bookings increased markedly during campaign

activity with Air New Zealand (Virgin Air) recording a 12% increase in bookings

from Australia to Dunedin over the campaign compared to the previous

‘Dunedin Fare Sale’ period. This included significant Travel Trade

activity with travel wholesalers and retailers' indicating this is remains a

preferred method of booking travel to New Zealand.

35 Brisbane-Dunedin

direct flights accounted for 30% of all bookings and 74% of Queensland

bookings. Brisbane-Dunedin direct flight bookings and load factors saw little

change compared to the same period last year with some months showing a slight

decrease in booking activity indicating a significant number of Australian

consumers also travel to Dunedin via Auckland, Christchurch and possibly

Queenstown Airports.

36 Australian Visitor

spend measures indicate more than 13% increase in visitor spend in to year end

June 2017 on the same period last year. This is 3.6% above national average

growth in Australian Visitor spend for New Zealand.

conclusion

37 As evidenced by the

above results and commentary the WTWTA Campaign 2017 can be summarised as

follows:

a) achieved

a good increase in awareness, visibility with the key primary Brisbane and

surrounding regions via Dunedin NZ digital, social and Australian media and

bookings and referral channels.

b) encouraged

shoulder/low season markets with Australian consumers responding to market

activations evidenced by competition entries and high levels of social media

engagement and increased views of the WTWTA video.

c) increased

Dunedin’s visibility and attractiveness as a destination to visit over

the Autumn and Winter as evidenced by digital engagement Australian Media and

Online Booking partner sites; however this may have also contributed to a

decrease in the Dunedin NZ website visits and WTWTA Campaign and deal pages.

d) generated

additional social media and campaign engagement including a Dunedin NZ Facebook

competition resulting significant market responses above media, booking and

referral partner campaign benchmarks.

e) generated

awareness of campaign deals and encouraged bookings to travel to Dunedin

between May to August, are evidenced by:

- the

News Corp post campaign survey results the increase in planning and bookings

activity as a result of the campaign,

- and

via Air NZ (Virgin Air) Dunedin Fare sale bookings from Queensland and Brisbane

supported by growth from New South Wales and Victoria,

- this

combined with the increases in planning and bookings engagement and activity on

Expedia and TripAdvisor channels,

- the

Dunedin NZ WTWTA Campaign deals produced results for a limited number of

industry partners who created WTWTA Campaign deals measured and shared their

results,

- the

above results are detailed in Attachment B - WTWTA Campaign Partner Detailed

Results.

f) generated

further awareness of Dunedin as a year round destination with the Australian

travel trade is evidenced in the uptake of the Air New Zealand sale bookings

via travel wholesalers and retailers.

38 A summary report for

the ‘Where the Wild Things Are’ Autumn/Winter Campaign 2017 with

examples of WTWTA Campaign PR media, trade, digital and social media activity,

and banner advertising are in Attachment C – WTWTA Campaign Execution

Examples.

next steps

39 Enterprise Dunedin

plan use similar channels to market to the east coast of Australia next winter.

40 More emphasis on

advertising and offers will be placed on social media and booking channel

partners as opposed to driving traffic to the Dunedin NZ website deal page in

response to a shift in consumer online booking trends.

41 Enterprise Dunedin

will continue to build on ‘Dunedin brand’ momentum increasing the

profile of the city in collaborative seasonal campaigns across key target

markets.

42 There is an appetite

from local industry partners for additional focus on NZ Domestic Campaigns with

a lower investment entry point and involving a print component.

43 Lessons learnt have

also informed activity in the upcoming ‘Dunedin Events - Stay Longer

Explore and Do More' campaign promoting travel to Dunedin in the late September

to early December shoulder season.

Signatories

|

Author:

|

Ryan Craig - Destination Dunedin Manager

Kyla Anderson - Business Analyst, Enterprise Dunedin

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

a

|

WTWTA Campaign Summary

Proposal

|

23

|

|

b

|

WTWTA Campaign Partner

Detailed Results

|

25

|

|

c

|

WTWTA Campaign Execution

Examples

|

30

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing a public service and is

considered good-quality and cost-effective use of budget to promote the

Dunedin brand, marketing Dunedin collaboratively with private sector

partnership and added financial contribution.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

This activity in this report contributed to the Economic

Development theme ‘Compelling Destination’ and associated action

‘Marketing Dunedin’. It also contributed to the Arts and Culture,

Events and Festivals, Parks and Recreation strategies by promoting activity

under these thereby also contributing to the Social Wellbeing Strategy.

|

|

Māori Impact

Statement

Ngai Tahu is one of the six partners who are responsible

for governing and delivering the Economic Development Strategy.

|

|

Sustainability

The activity in this report aids in building sustainability

of air connectivity to Australia providing economic, social and environmental

benefits to the city.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no implications from the activity in this

report.

|

|

Financial considerations

There are no financial implications. All activity in this

report was within budget of $275,000. The activity drew external financial

contributions of $25,000 and in kind contributions of $385,000.

|

|

Significance

This report is considered of low significance in terms of

the Council’s Significance and Engagement Policy.

|

|

Engagement –

external

There has been external engagement with local, national

and international industry, trade and media partners around activity within

this report.

|

|

Engagement - internal

There has been engagement with DCC Events and Festivals,

Marketing and Communication, Web Team and the Dunedin iSite around activity

within this report.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

Economic Development Committee

12 September 2017

|

|

Sexy Summer Jobs

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee on the

results of the Sexy Summer Jobs Programme (SSJ) for the 2016/17 season.

2 The Sexy

Summer Jobs programme has commenced for the 2017/18 season.

3 The

programme supports city economic development and will be considered as part of

future discussions in the 2018-2028 Long Term Plan.

|

RECOMMENDATIONS

That the Economic Development Committee:

a) Notes

the results of the 2016/17 season for the Sexy Summer Jobs Programme.

|

BACKGROUND

4 The

internship programme was established in 2009 by the ICT business sector,

tertiary providers and the DCC to meet significant industry skills shortages.

5 The

objective of the Sexy Summer Jobs Programme is to meet business needs, create

high value jobs, retain skills and talent in the city and contribute to the

economic growth of Dunedin.

6 Businesses

utilise the programme to reduce the commercial risk in taking on an untried

person. It provides the opportunity for market and product development, which

might not otherwise be executed.

7 Under

Dunedin's Economic Development Strategy, the programme aligns to the following

themes which include growing capability and real advantages in ICT, education,

biotechnology, the creative sector and niche manufacturing:

· Hub

for Skills and Talent – attracting and retaining talent in the city

· Business

Vitality – supporting the capability building of export facing businesses

· Alliances

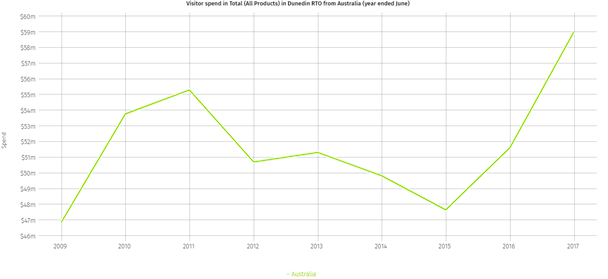

for Innovation – assisting businesses in building scale in export facing

businesses

8 The

following graph reports the number of internships who participated since the

commencement of the Sexy Summer Job programme in 2009; the permanent employment

gained and the upward trend in engagement. From the 2011/12 period, additional

data was captured showing a breakdown of the type of employment gained.

(Source:2016/17 SSJ Business Engagement Survey)

9 The table

below shows results for the 2016/17 Sexy Summer Jobs programme. Of the total

internships in 2016/17, 69% of the interns gained permanent employment and 68%

of those were for newly created positions.

|

KPI

|

Measure

2016/17

|

Result

2016/17

|

|

Total

number of funded internships (50 @ $1,000)

|

50

|

46

|

|

Interns

employed post-internship

|

25

|

32

|

|

Post

internship - New positions created

|

19

|

22

|

|

Business

needs met by high quality of intern

|

80%

|

93%

|

(Source: 2016/17 SSJ Business Engagement Survey)

DISCUSSION

10 Since 2009, 93

businesses across a wide range of sectors have been involved with the

programme: 318 internships resulting in 216 positions with seven new businesses

involved in the 2016/17 season.

11 The programme is

dominated by the “demand” and “need” created from

businesses for student talent.

12 While the programme

started with an ICT focus, it now attracts a wide range of sectors. Technology

and its application is a strong feature of the programme. The programme has now

expanded and is accessed by businesses (including SMEs) from 13 sectors to grow

capabilities and stimulate employment.

13 The following graph

shows the business sectors participating in 2016/17, the top three business

sectors are ICT, Education/Research and BioTech/Health Technologies.

(Source:

2016/17 SSJ Business Engagement Survey)

14 Intern evaluation

reports revealed that the top three benefits of completing a Sexy Summer Job

internship are building relationships with business people and industry

experts, working with experienced teams and adding value to a business.

15 The following graph

shows internship roles for 2016/17, the most common were Client Support,

Marketing and Communications and Technical Support.

(Source: 2016/17 SSJ Business Engagement Survey)

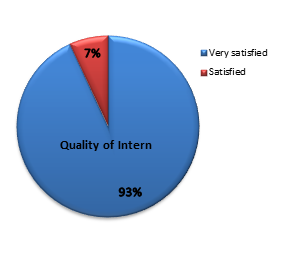

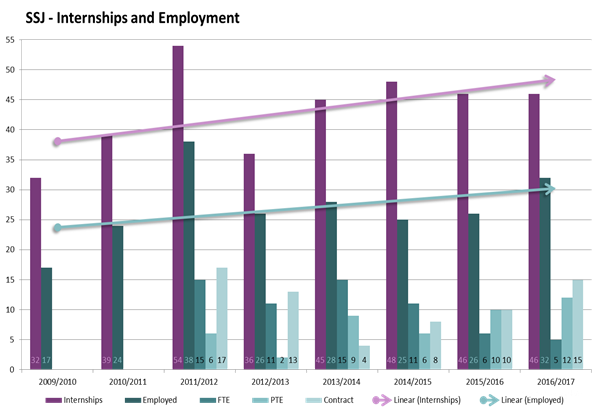

16 The following graphs

show that of the 45 businesses that participated, all reported high levels of

satisfaction with the quality of interns for 2016/17 (93% are very satisfied)

and the quality of the programme (89% are very satisfied).

(Source: 2016/17 SSJ Business Engagement Survey)

oPTIONS

17 No options.

NEXT STEPS

18 The Sexy Summer Jobs

programme has commenced for the 2017/18 season.

19 The programme

supports city economic development and will be considered as part of future

discussions in the 2018-2028 Long Term Plan.

Signatories

|

Author:

|

Kyla Anderson - Business Analyst, Enterprise Dunedin

Chanel O'Brien - Business Development Advisor Skills and

Entrepreneurship

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report enables democratic local decision making and

action by, and on behalf of communities.

This report relates to providing a public service and it

is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

The Sexy Summer Jobs Programme contributes to the Economic

Development Strategy in supporting Dunedin as a hub for skills and talent.

|

|

Māori Impact

Statement

Ngāi Tahu is a key stakeholder engaged with

Dunedin’s Economic Development Strategy.

|

|

Sustainability

The programme supports businesses and economic

sustainability by stimulating job creation, retaining talent and skills in

the city, to link top quality students to local businesses to build

capability, and grow export ready businesses.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no implications.

|

|

Financial

considerations

A budget of $50,000 was provided for the 2016/2017

financial year to issue 48 grants at $1000 per intern. It enabled start-ups

to cover some of the costs of taking on an intern.

|

|

Significance

This activity has been assessed as low in terms of the

Council’s Significance and Engagement Policy.

|

|

Engagement –

external

External parties such as Otago Polytechnic, the University

of Otago and Dunedin businesses are supportive of the programme.

|

|

Engagement -

internal

There has been no internal engagement.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There is no identified conflict of interest.

|

|

Community Boards

There are no implications for Community Boards.

|

|

Economic Development

Committee

12 September 2017

|

|

Dunedin Cruise Ship Season 2017/18

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 This

report is to update Council on Dunedin’s 2016/17 cruise ship

season. The report outlines the importance of the Dunedin cruise market

and how the visitor experience is managed.

2 This is

particularly important in light of the predicted increase of cruise visitors by

30% in the 2018/19 cruise season.

3 The

cruise sector contributes to the “Compelling Destination” theme of

Dunedin’s Economic Development Strategy and contributes over $34 million

GDP to the city’s economy annually.

4 Dunedin’s

Cruise Action Group continue to meet and review the action points.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Dunedin Cruise Ship Season 2017/18 report.

|

BACKGROUND

New Zealand

Cruise Industry

5 The

cruise sector is an important, visible and growing part of the visitor economy

and key to our compelling destination theme. The joint partnership approach

with Port Otago and the visitor industry is pivotal to enabling the visitor

experience to be delivered. Council facilitates the collaborative approach and

leads destination management, ensuring the marketing promise is

delivered. Cruise contributes to Dunedin’s economic development,

city vitality and reputation as one of the world’s great small cities.

6 The

cruise sector contributed a record $447 million to New Zealand’s economy

in the 2016-17 season and that figure is forecast to grow to $514 million in

2017-18 season. The 2016-17 cruise season for New Zealand saw 235,900

passengers on 42 separate ships which made 138 voyages and spent 747 days at

ports around the country. Australians made up the majority of cruise passengers

(48%), followed by North Americans (21%), Europeans (13%) and New Zealanders

(10%).

|

Region

|

Total Value Add ($m)2016/17

|

Forecast Value Add ($m)2017/18

|

|

Otago

|

$34

|

$38

|

|

New

Zealand

|

$490

|

$514

|

Dunedin

Cruise Industry

7 Dunedin

is fortunate to be a coastal destination and well positioned for cruise ships

who include Fiordland in their itinerary as Port Chalmers is a night’s

cruise away. Cruise provides key GDP to the city’s visitor sector with an

estimated $34 million GDP (Source. Cruise NZ

2017) being injected into the city’s economy.

8 During

the 2016/17 season Dunedin welcomed 76 ship visits carrying 144,450 passengers.

9 Cruise

destination delivery is facilitated in Dunedin by the Cruise Action Group,

whose members are representatives from Dunedin City Council, Dunedin Host,

Otago Chamber of Commerce, Port Otago, and the University of Otago. The

group oversees the delivery of the Dunedin Cruise Action Plan 2014-2018.

10 The Cruise Action

Plan’s vision is “To be the premier cruise destination in New

Zealand, where passengers and crew want to disembark, and after a memorable

experience, they want to return”.

11 There are three key

performance indicators for this:

a) To increase the number of

passengers disembarking in Dunedin.

b) To achieve a passenger

satisfaction rating of 90% or more (as measured by the annual Cruise New

Zealand survey).

c) To increase the average daily

spend per passenger.

12 Key statistics:

a) Of those passengers who visit

Dunedin, at least 90% will disembark (Source: Thyne, Henry, Lloyd 2009).

It should be noted that research in other markets suggests that up to 40% of

passengers do not disembark when a ship is in port. The rate of

disembarkation in Dunedin appears to be higher, possibly because it is either

the first or last port of call for New Zealand.

b) Dunedin currently receives

approximately 61% of all cruise ship

passengers who visit New Zealand. (Source: Cruise New Zealand 2017).

c) Cruise contributed 30% of the

Dunedin i-SITE turnover. The i-SITE is charged by the DCC to be 50%

self-funded.

DISCUSSION

Dunedin

cruise ship passenger experience

13 Cruise New Zealand

advises that cruise passengers base their satisfaction on factors including

iconic destination attractions, genuine experiences, New Zealand made products,

easiness of access to retail opportunities, welcoming acknowledgement,

atmosphere, value for money, friendliness and shelter from the elements.

These are all factors to consider when making decisions about their Dunedin experience.

The Cruise Action Plan has addressed many of these factors however visitor

amenities and experiences can always be improved.

14 Key areas the Cruise

Action Plan addresses:

a) Developing a collective

approach to the cruise industry

b) Developing and co-ordinate

transportation and infrastructure

c) Being passenger and crew

focused

d) Providing a memorable quality

experience

e) Optimising passenger and crew

expenditure

f) Information provision and

promotion

g) Research and advocacy for

future needs

h) Public Health and Safety

notification

15 In the last 7 years,

significant improvements have been made to the Dunedin cruise visitor

experience. Key initiatives include:

a) Formation of a Cruise Action

Group committed to the delivery of Cruise Action Plan.

b) Implementation of the Cruise

Action Plan with achievements around operator, retail, stakeholder support,

communication, shuttle parking, visitor information and experience.

c) Communicative stakeholder

approach and partnerships to deliver the Cruise Action Plan.

d) Dedicated staff time for

cruise destination management and specialised operator support.

e) Research with University of

Otago Marketing Department around cruise experience.

f) Port Otago’s

significant investment in a dedicated area where visitors are welcomed by

i-SITE staff and volunteers, where they can book activities and tours for the

day and meet their pre booked private tour operators and have access to free

Wi-Fi.

g) A dedicated cruise shuttle

stop in the Octagon centre carriageway.

16 For 2016/17, the key

improvement was Port Otago building a multi-purpose cruise terminal/warehouse.

This facility meant that for the first time passengers had a totally dry

facility, out of the wind where i-SITE staff and volunteers could greet them

with information and assistance on how they could spend their day in Dunedin.

Staff also directed passengers to their waiting pre booked local tours within

the space. Free Wi-Fi was provided to waiting passengers in the lounge area.

OPTIONS

17 As this report is

for information purposes only there are no options.

NEXT STEPS

18 In 2017/18 Dunedin

is set to welcome 26 ships on 91 visits bringing an estimated 183,648

passengers in the coming season. Forty nine of these visits are by ships with

passenger capacity of over 2,000, with seven scheduled visits by `Ovation of

the Seas’ which has a capacity of over 4,000.

19 The forecasts for

2018/19 cruise season at this stage show Dunedin is expecting the largest

growth for the season at an estimated 30% increase. This will impact on

staffing requirements on these days and plans are being developed in

preparation.

Signatories

|

Author:

|

Kyla Anderson - Business Analyst, Enterprise Dunedin

Louise van de Vlierd - Team Leader Visitor Centre

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report enables democratic local decision making and

action by, and on behalf of communities.

This report relates to providing local infrastructure and

it is considered good-quality and cost-effective.

This report relates to providing a public service and it

is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

The cruise sector contributes to the Compelling

Destination theme in the Economic Development Strategy. It is an important

generator of GDP, job creation and awareness of Dunedin as one of the

world’s great small cities.

|

|

Māori Impact

Statement

Ngāi Tahu is a key stakeholder engaged with

Dunedin’s Economic Development Strategy with representation on the

Growing Dunedin Partnership group. Ngāi Tahu cultural heritage is

acknowledged as an important aspect of the Compelling Destination theme and

visitor experience.

|

|

Sustainability

Cruise management contributes to growing Dunedin’s

economy in a sustainable beneficial manner.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no implications for currently

agreed budgets and plans.

|

|

Financial

considerations

There are no implications for currently

agreed budgets and plans.

|

|

Significance

This report is considered of low significance in terms of

the Council’s Significance and Engagement Policy.

At approximately 5% of Dunedin’s visitor economy and

an estimated $34 million GDP cruise is a significant contributor to the

city’s wellbeing and is managed accordingly.

|

|

Engagement –

external

The Cruise Action Group works with a variety of council

departments who all contribute positively to visitor management.

|

|

Engagement -

internal

The Cruise Action Group is representative

of major cruise stakeholders and works with a wide range of city and national

stakeholders including NZ Transportation Agency, Department of Conservation,

Cruise New Zealand, Tourism New Zealand and Otago Regional Council.

|

|

Risks: Legal /

Health and Safety etc.

Not applicable to this noted report

|

|

Conflict of

Interest

Not applicable to this noted report

|

|

Community Boards

Chalmers Community Board are important stakeholders around

Port Chalmers, Port Chalmers Volunteers and SH88 speed limits.

|