Notice of Meeting:

I hereby give notice that an ordinary meeting of the Finance

and Council Controlled Organisations Committee will be held on:

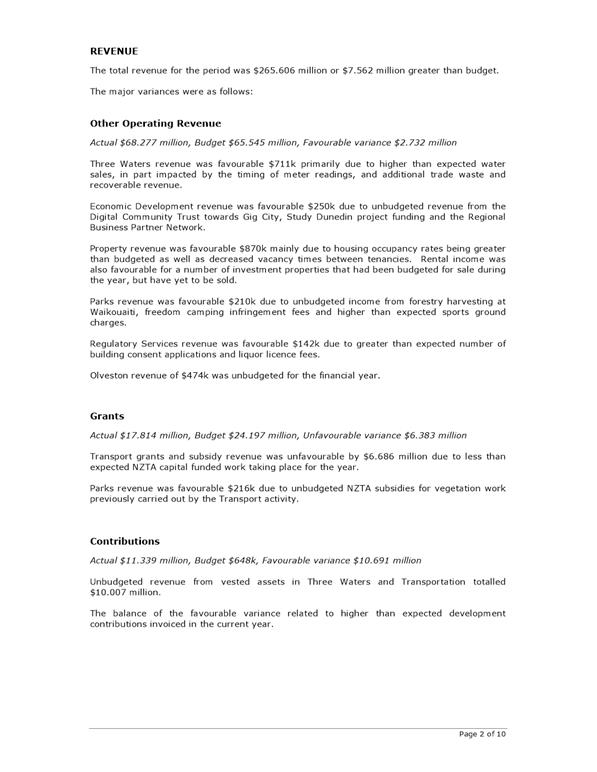

Date: Tuesday

12 September 2017

Time: 2.00

pm (or at the conclusion of the previous meeting, whichever is later)

Venue: Edinburgh

Room, Municipal Chambers, The Octagon, Dunedin

Sue Bidrose

Finance and Council Controlled Organisations Committee

PUBLIC AGENDA

|

Chairperson

|

Cr Mike Lord

|

|

|

Deputy Chairperson

|

Cr Doug Hall

|

|

|

Members

|

Cr David Benson-Pope

|

Mayor Dave Cull

|

|

|

Cr Rachel Elder

|

Cr Christine Garey

|

|

|

Cr Aaron Hawkins

|

Cr Marie Laufiso

|

|

|

Cr Damian Newell

|

Cr Jim O'Malley

|

|

|

Cr Chris Staynes

|

Cr Conrad Stedman

|

|

|

Cr Lee Vandervis

|

Cr Andrew Whiley

|

|

|

Cr Kate Wilson

|

|

Senior Officer Gavin

Logie, Acting Chief Financial Officer

Governance Support Officer Jenny

Lapham

Jenny Lapham

Governance Support Officer

Telephone: 03 477 4000

Jenny.Lapham@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

ITEM TABLE OF CONTENTS PAGE

1 Public

Forum 4

1.1 Public Forum 4

2 Apologies 4

3 Confirmation

of Agenda 4

4 Declaration

of Interest 5

Part

A Reports (Committee has power to decide these matters)

5 Insurance

Renewal Year Ended 30 June 2018 15

6 Financial

Result - Year Ended 30 June 2017 24

7 Special

Consultative Procedure for new RMA fee categories 46

8 Notification

of Agenda Items for Consideration by the Chair

Resolution to Exclude the Public 63

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

1 Public

Forum

1.1 Public Forum

David Ross, wishes to address the meeting concerning the

Waipori Fund and Interest Rates.

2 Apologies

Apologies have been received from Mayor

Dave Cull and Cr Chris Staynes.

That the Committee:

Accepts the apologies from Mayor

Dave Cull and Cr Chris Staynes.

3 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

RECOMMENDATIONS

That the Committee:

Confirms the agenda with

the following alteration:

- In

regard to Standing Order 2.1, Option C be adopted in relation to moving and

seconding and speaking to amendments

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

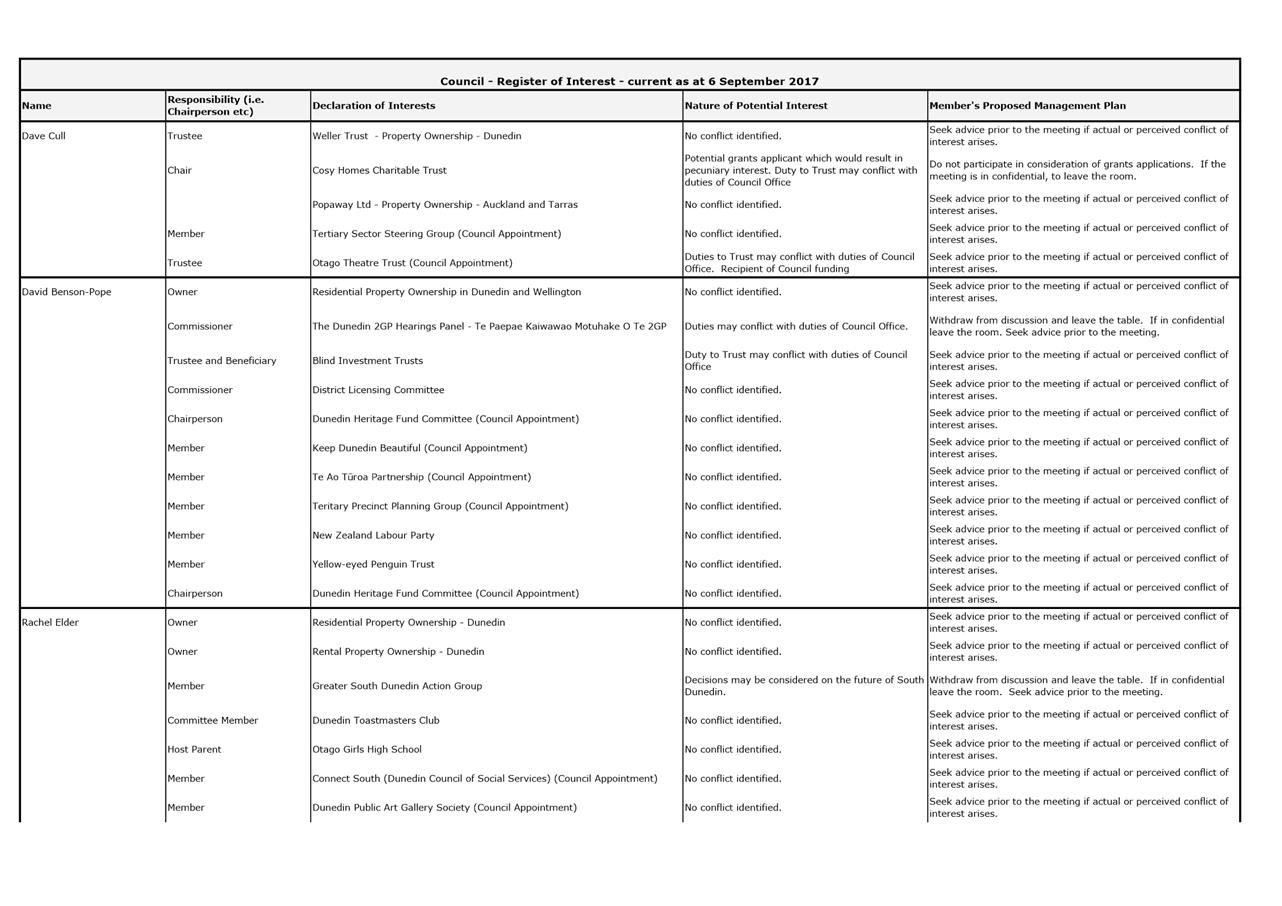

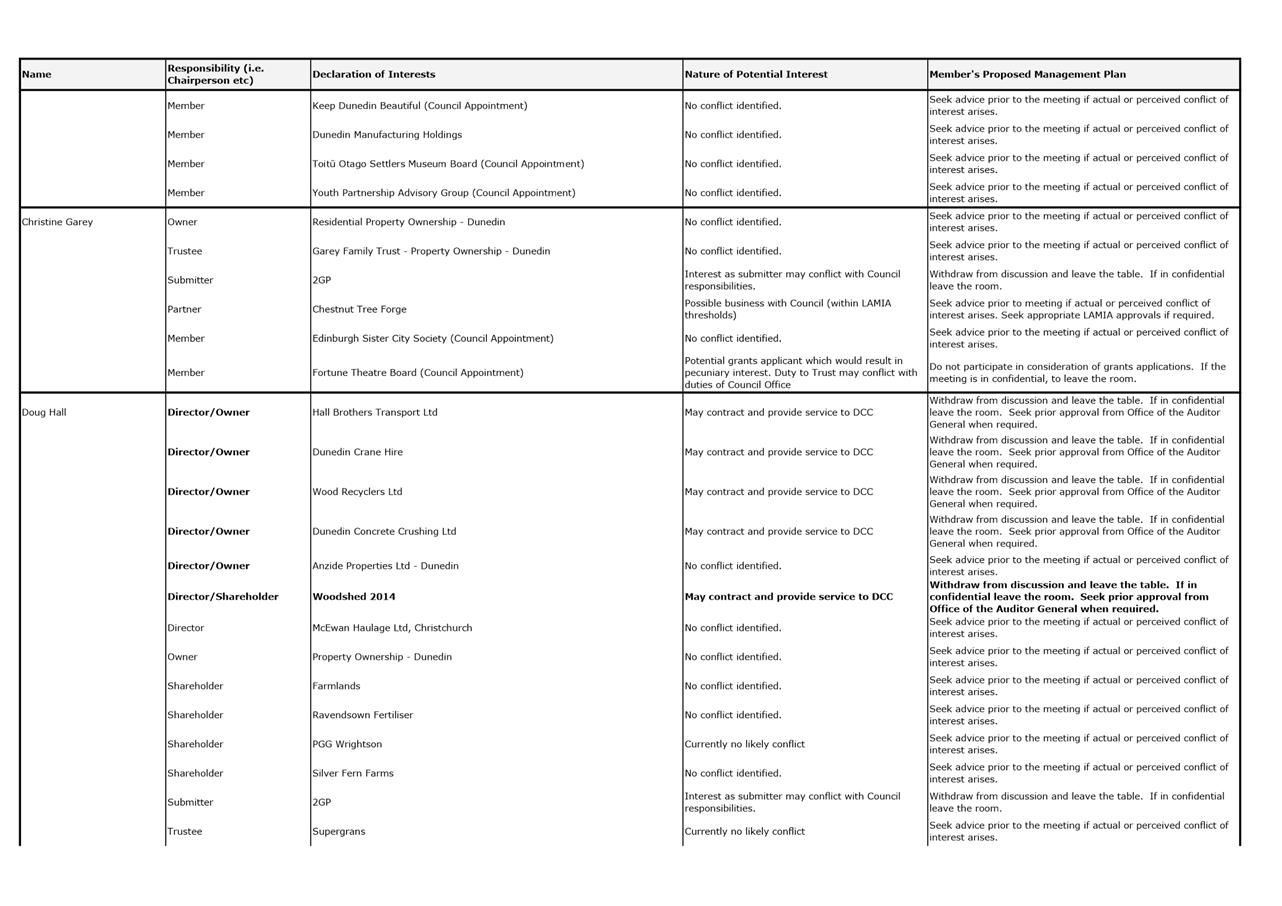

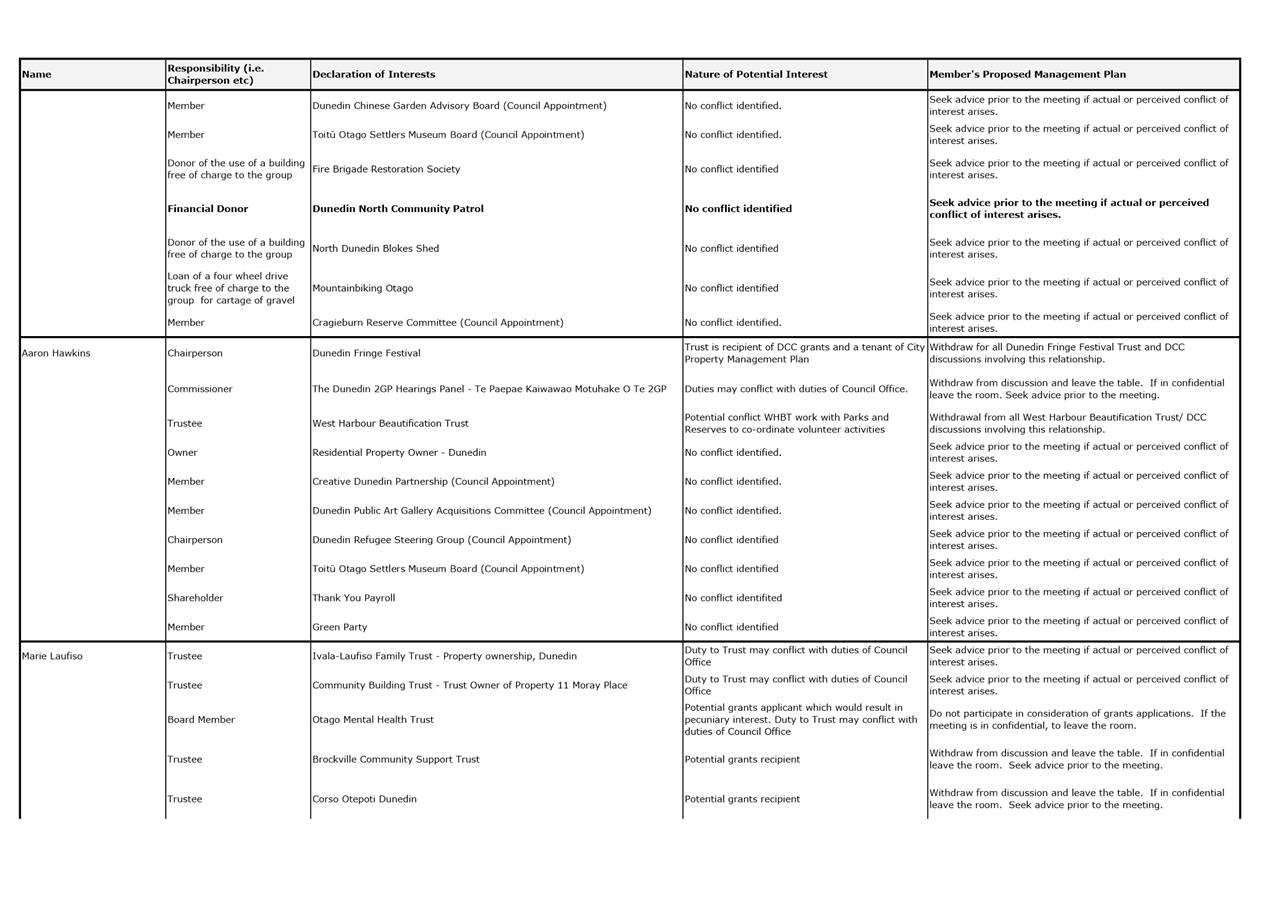

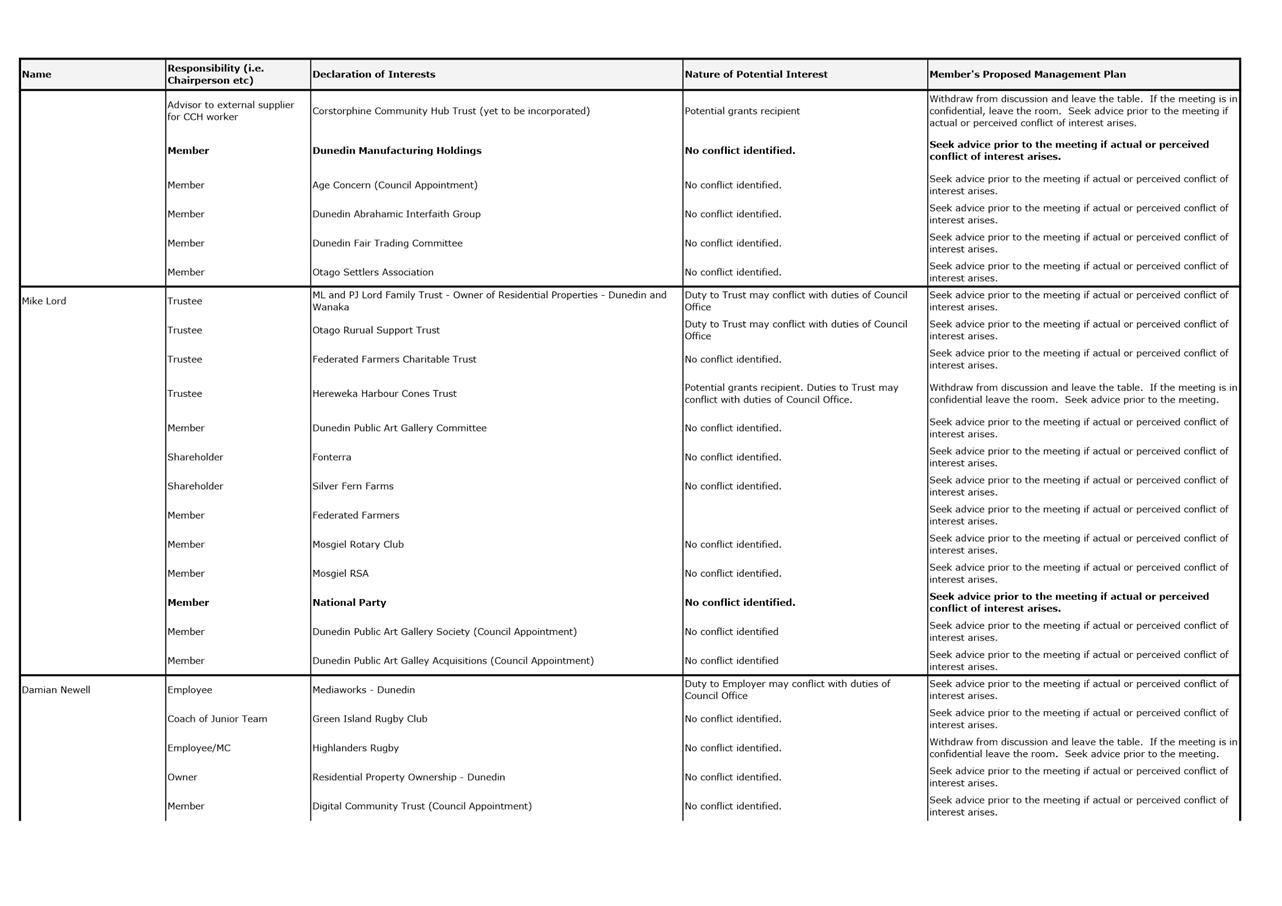

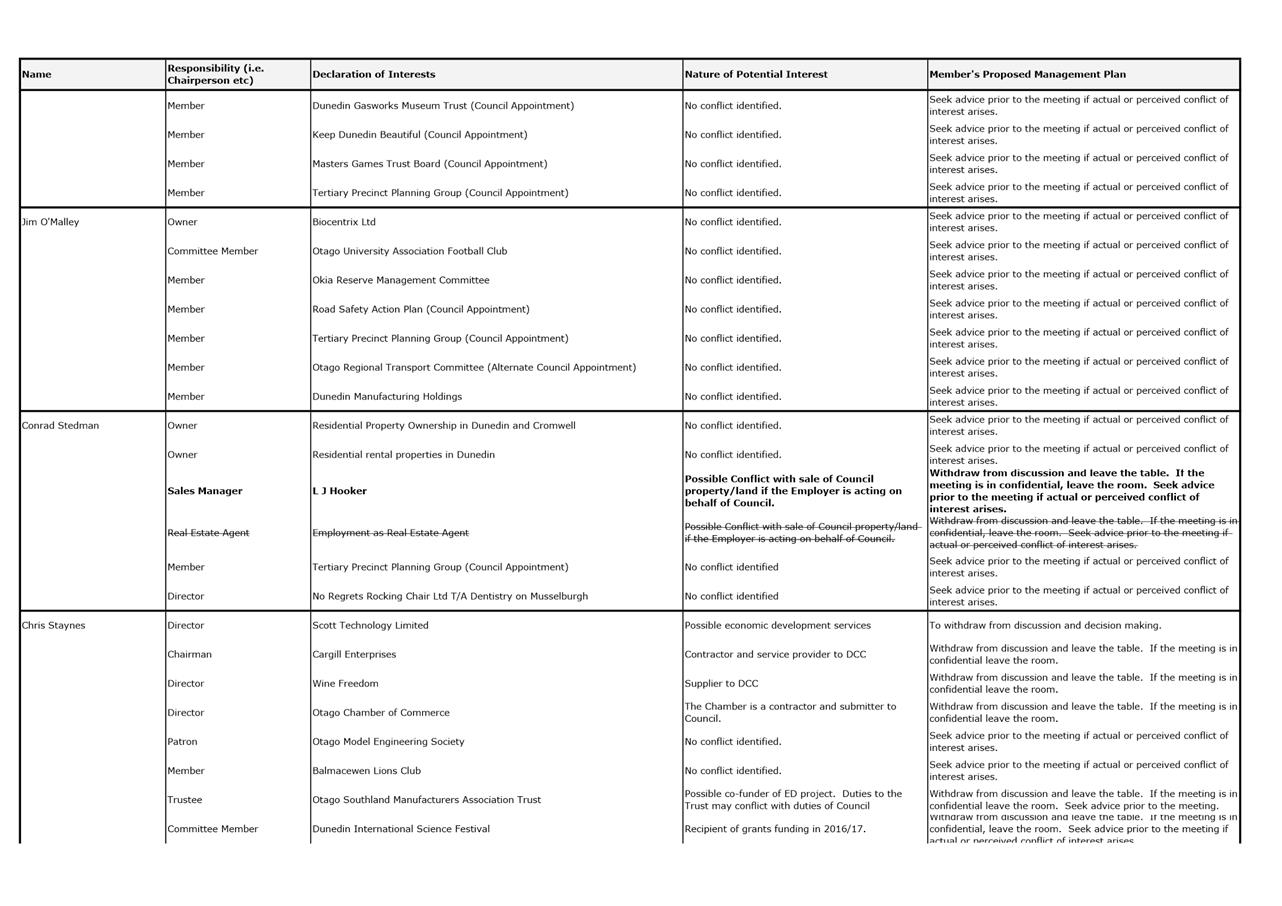

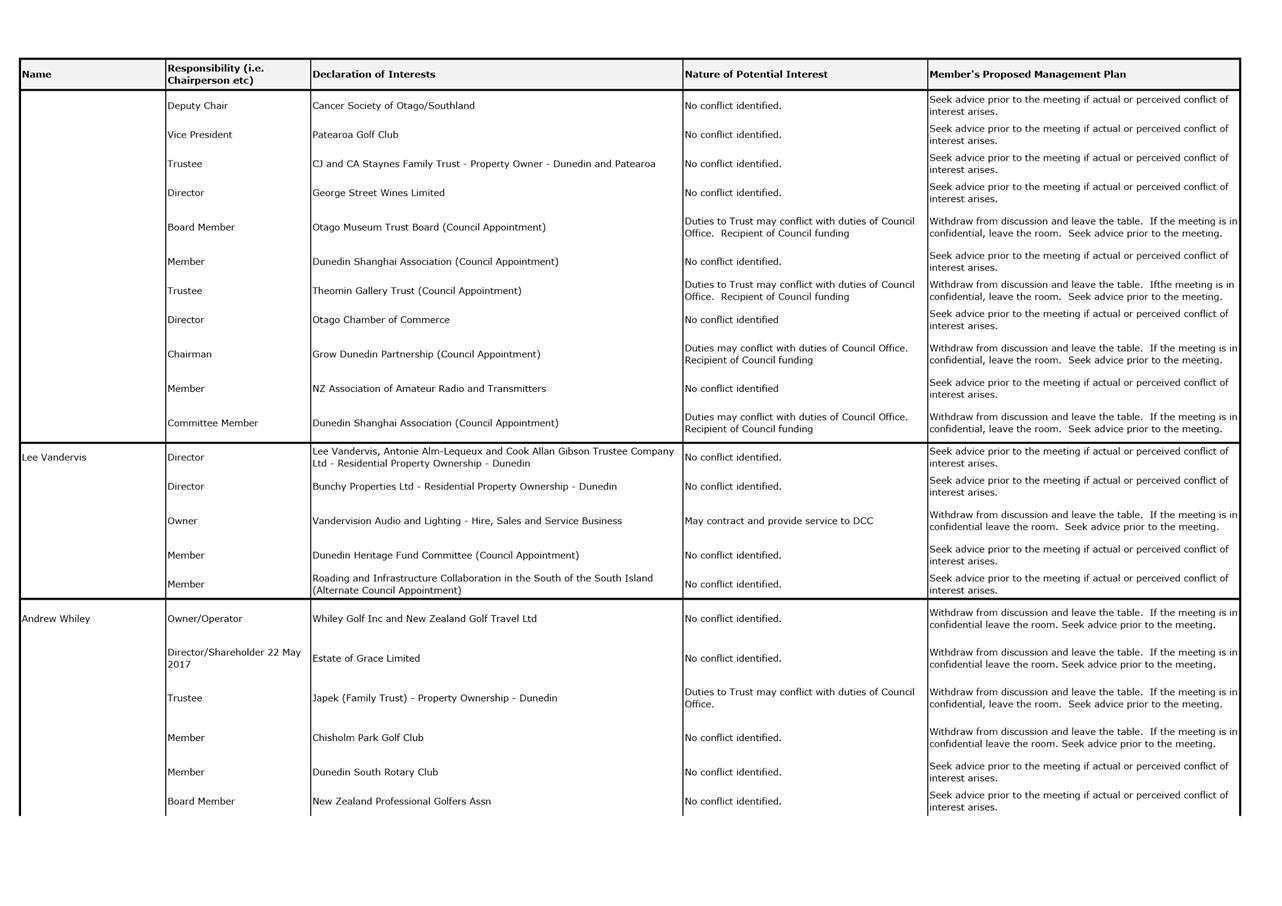

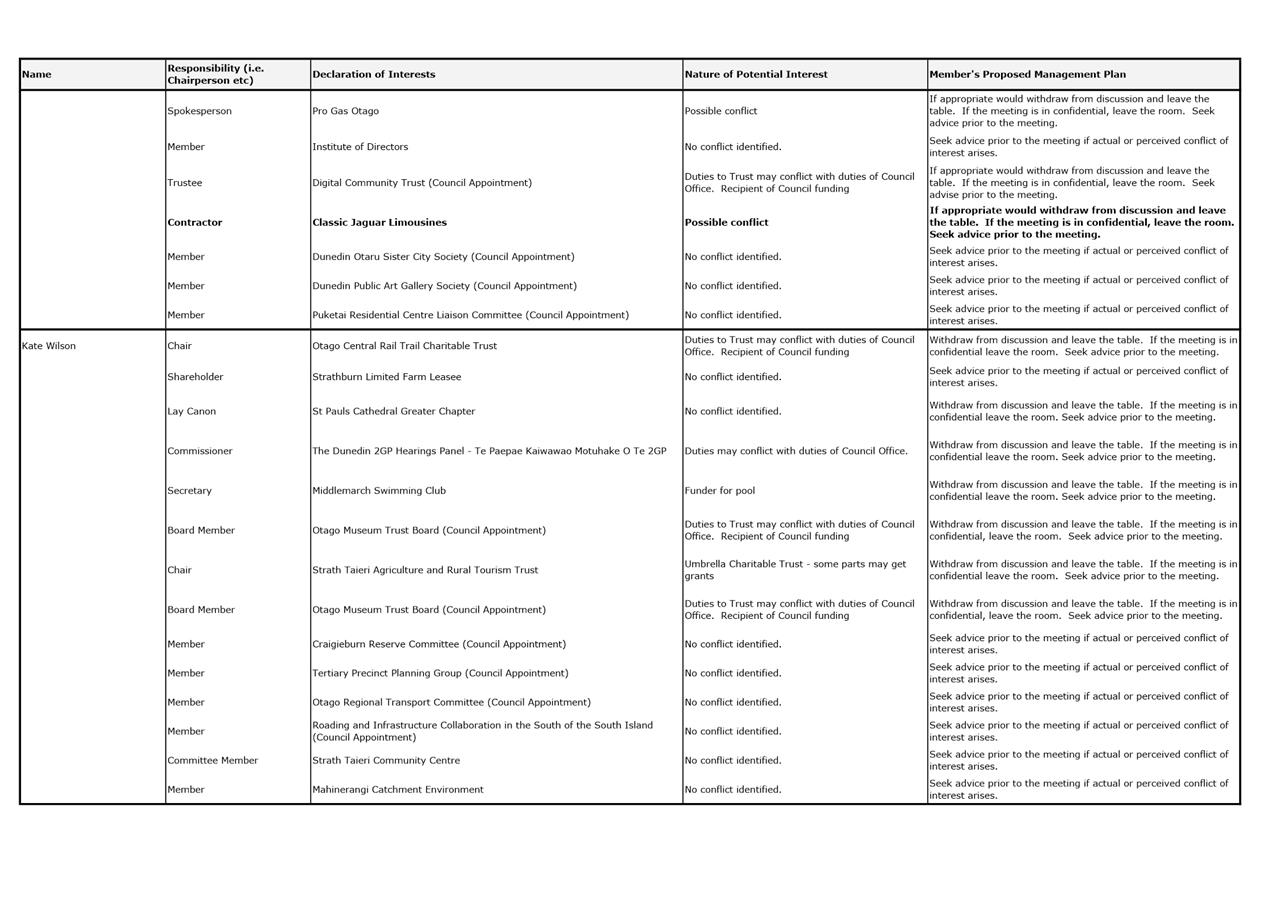

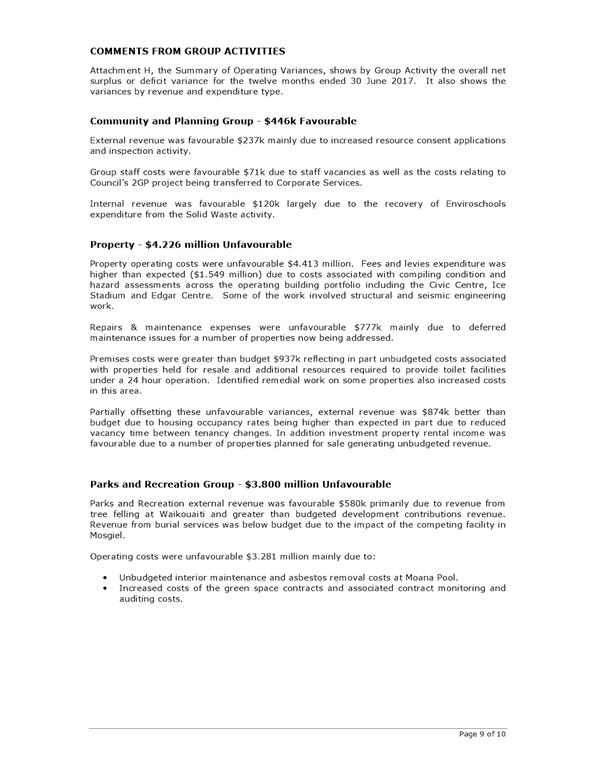

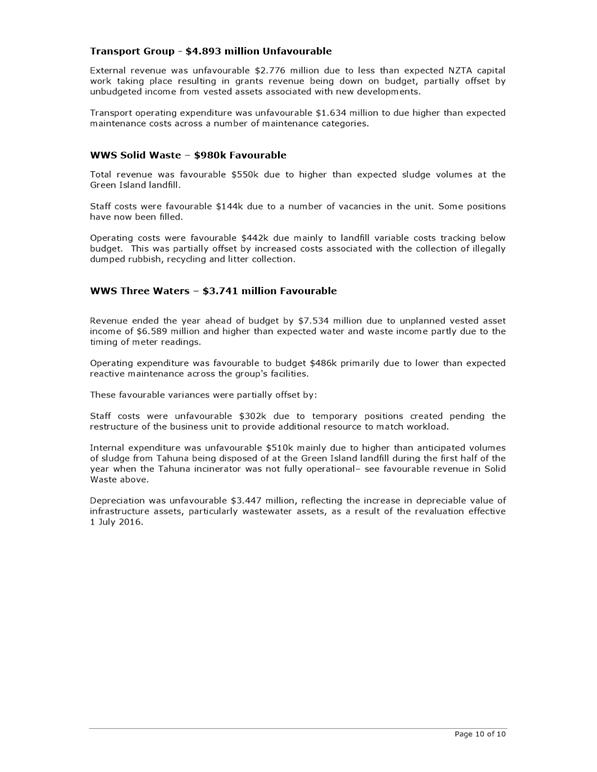

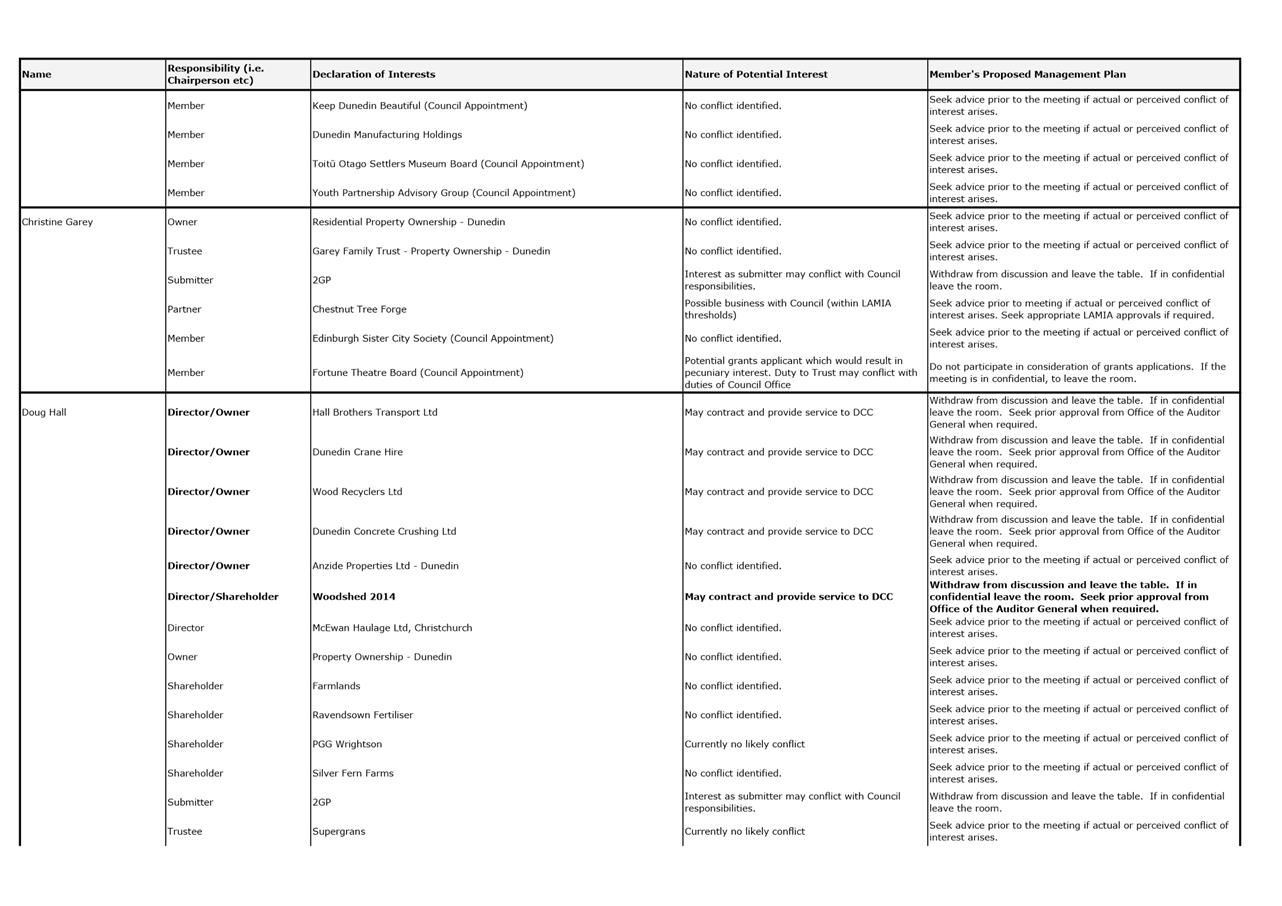

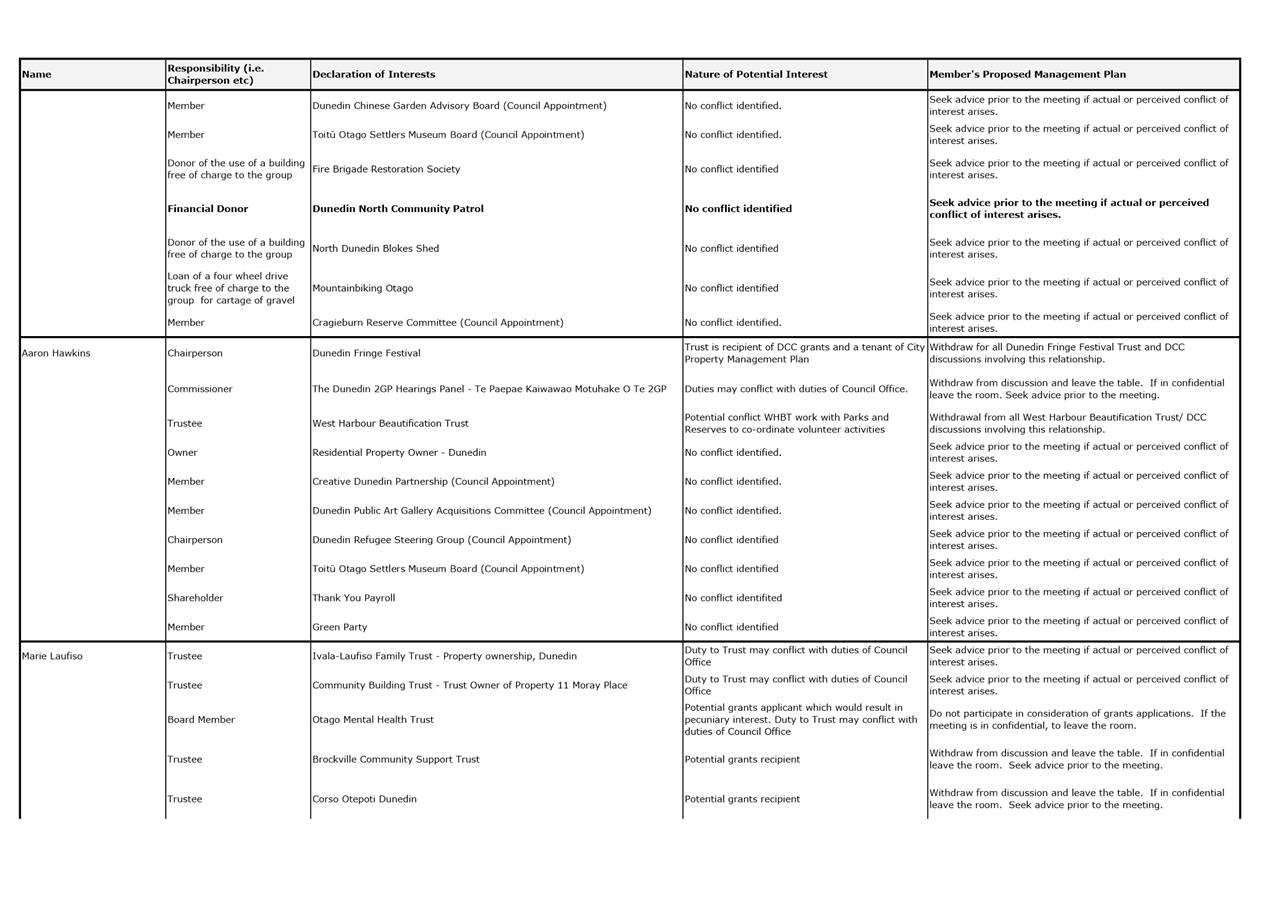

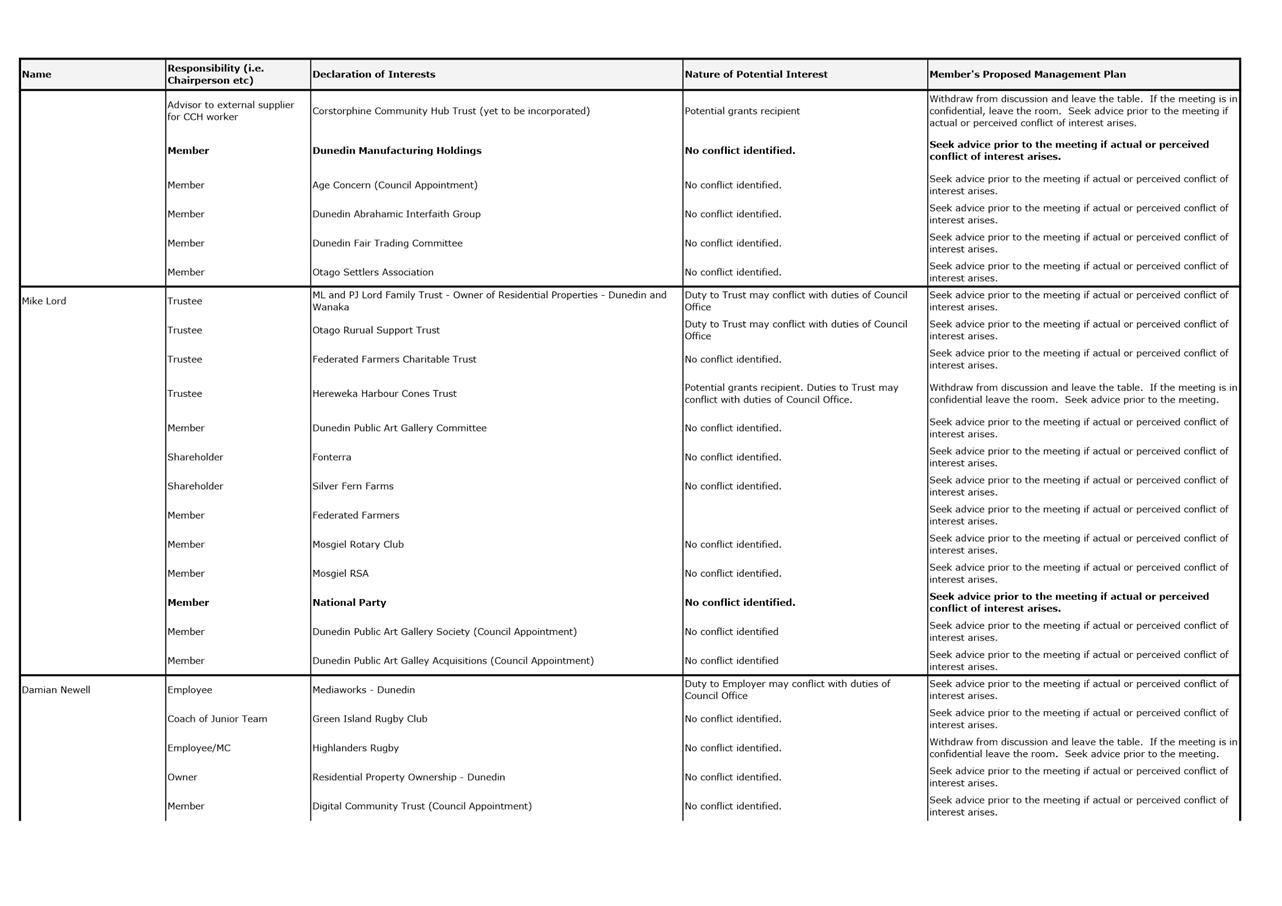

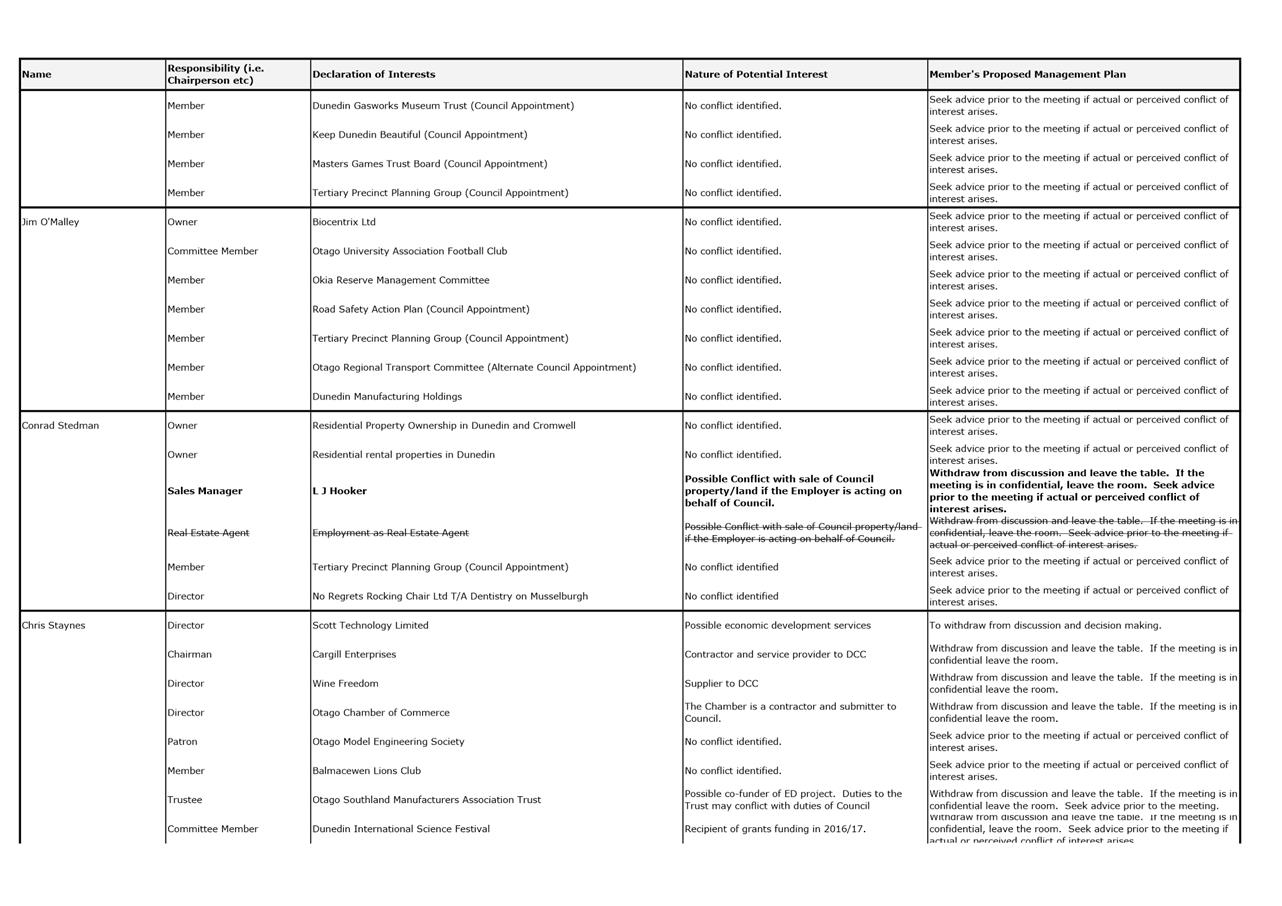

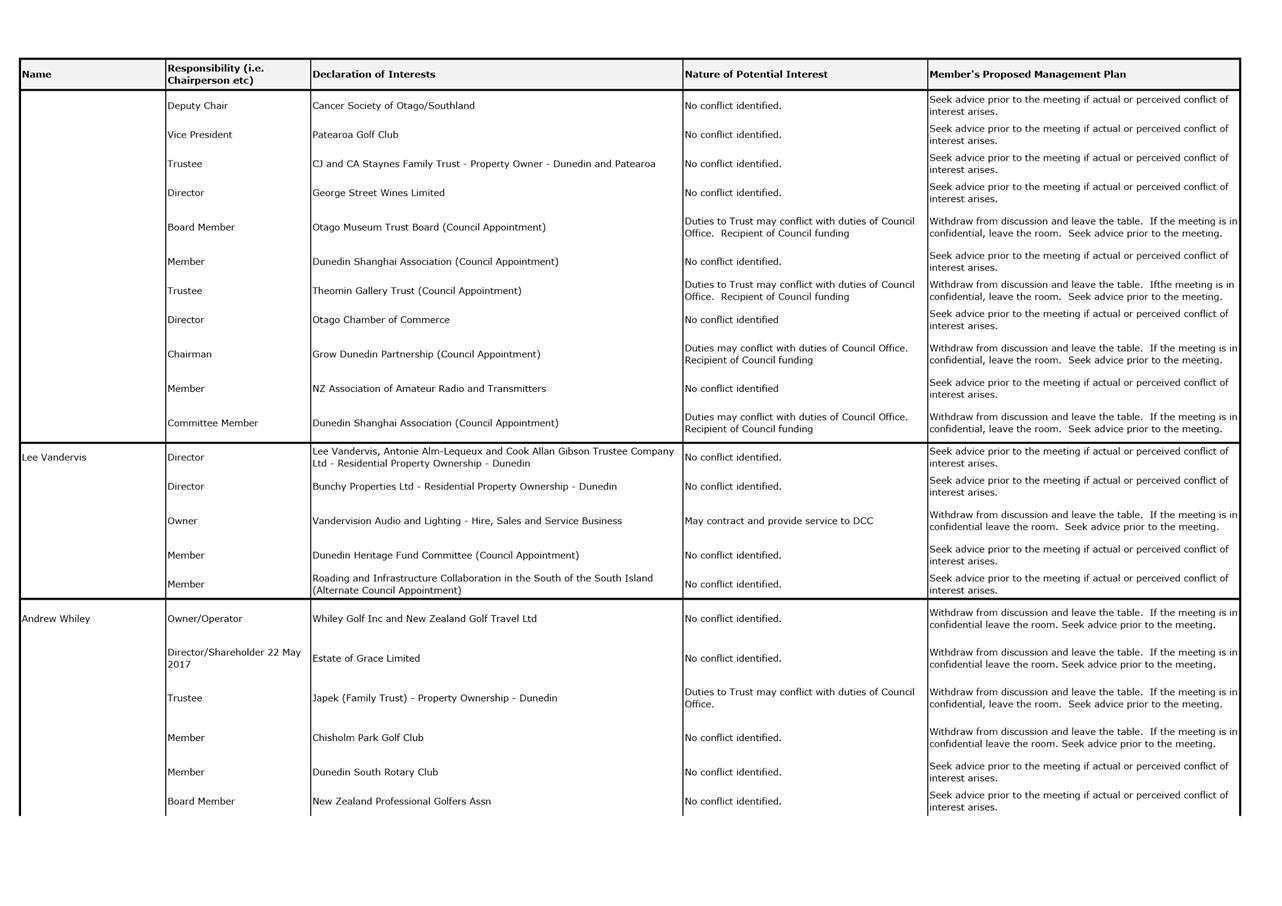

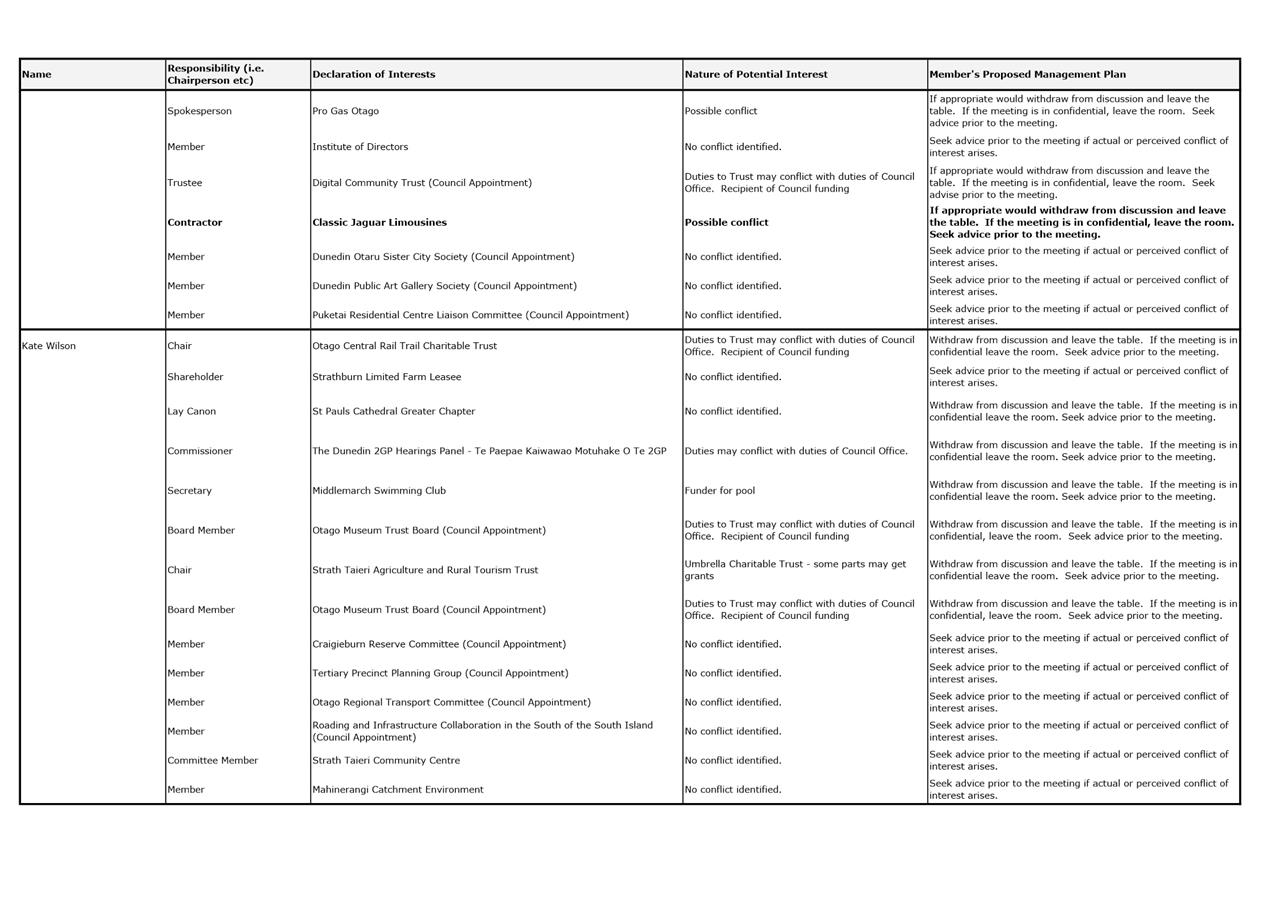

Declaration of Interest

EXECUTIVE SUMMARY

1. Members are reminded of the need

to stand aside from decision-making when a conflict arises between their role

as an elected representative and any private or other external interest they

might have.

2. Elected members

are reminded to update their register of interests as soon as practicable,

including amending the register at this meeting if necessary.

|

RECOMMENDATIONS

That the Committee:

a) Notes/Amends

if necessary the Elected Members' Interest Register attached as Attachment A;

and

b) Confirms/Amends the proposed management plan for Elected Members' Interests.

|

Attachments

|

|

Title

|

Page

|

|

a

|

Interest Register

|

7

|

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

Part

A Reports

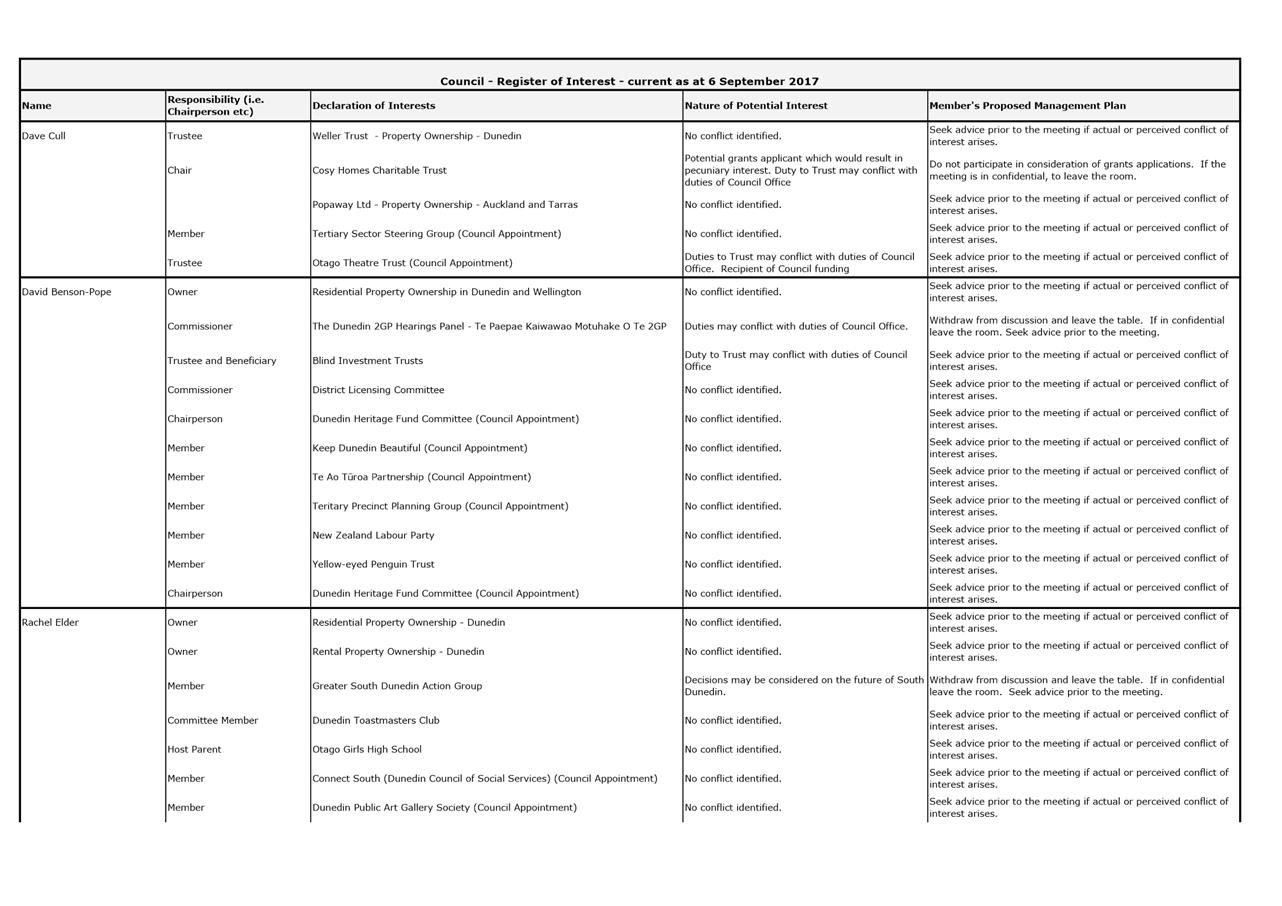

Insurance Renewal Year Ended 30 June 2018

Department: Finance

EXECUTIVE SUMMARY

1 This

report provides a summary of the insurance renewal for the Dunedin City Council

for the year ended 30 June 2018.

2 For the

purposes of this insurance policy renewal, the DCC Group (where referenced)

comprises the Dunedin City Council and any Council Controlled Organisation

and/or subsidiary company more than 50% owned by the Council – including

but not limited to: Dunedin City Holdings Limited; Dunedin City Treasury Limited;

City Forests Limited; Dunedin International Airport Limited; Dunedin Stadium

Property Limited; Dunedin Venues Management Limited; Taieri Gorge Railway

Limited; The Theomin Gallery Management Committee (Olveston); and Dunedin

Transport Limited.

Note: Some CCOs and subsidiaries hold

individual policies and/or have particular policy terms, conditions and limits.

3 This

report details the changes that have been negotiated around policy terms,

conditions, coverage, excesses and premiums applied.

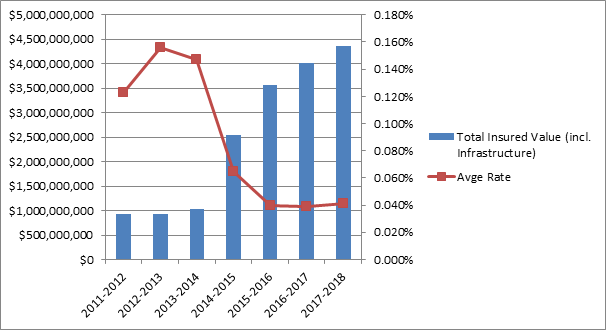

4 The material

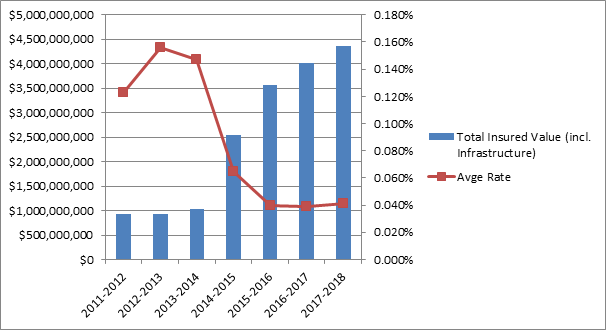

damage premium for 2017/18 have been impacted by a number of factors including:

increase in insured values (8.5%) and tightening of local market pricing and

capacity following recent insurance events (Kaikoura earthquakes and Edgecumbe

flooding). The note 14 graph does however highlight the continued

increase in asset value covered while maintaining a relatively low cost per

dollar insured.

|

RECOMMENDATIONS

That the Council:

a) Notes the

Insurance Renewal Year Ended 30 June 2018.

|

BACKGROUND

5 The

Council historically placed its insurance cover with New Zealand underwriters

only. The risk with this strategy became evident following the

Christchurch earthquakes when capacity in this market became constrained.

6 As part

of the 2014/15 insurance renewal Council was able to place 35% of its core

cover into the international market, which provided significant risk mitigation

in relation to market capacity, but also delivered the opportunity to extend

cover to infrastructure assets as well as creating market tension to ensure

other renewal terms and conditions were favourable.

7 This

strategy has continued in subsequent years with placement into the

international market dropping to 30% as capacity returned to the local market.

8 In the

most part of 2016 insurers were actively competing to protect existing market

share while new entrants were seeking to gain market share. Unfortunately

the November 2016 Kaikoura earthquake (and consequential damage caused

elsewhere including Wellington) has quickly seen the market tighten as insurers

reassess their exposures in the New Zealand region.

DISCUSSION

9 The

initial approach to the market for the 2017/18 financial year was on the basis

of existing local placement set at 70% and international placement set at 30%.

10 Significant capacity

restrictions in the local market resulted in this placement at only providing

60% cover. London was able to fill the 10% gap, but did so on the basis

of a $750.0 million limit any one occurrence or in the aggregate for the natural

disaster cover.

11 What this means is

Council will be self-insured beyond this $750.0m limit for 10% of any claim.

12 Infrastructure cover

is provided on the understanding that Central Government will contribute 60% of

funding towards reinstatement. The limits and excesses noted for this

cover are for the DCC's portion only. Therefore a loss would need to

exceed $5.0 million before the insurers would contribute to any claim i.e.

40% of $5.0m being the current excess of $2.0m.

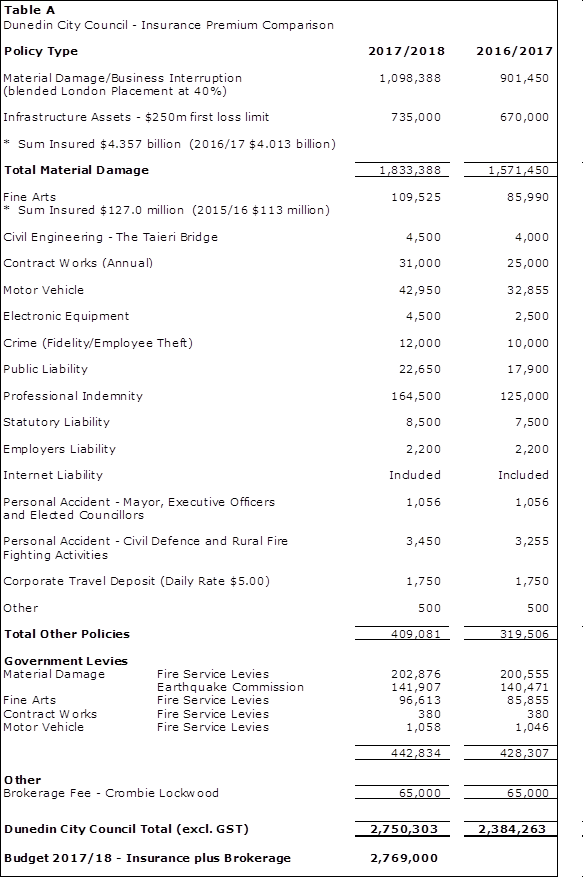

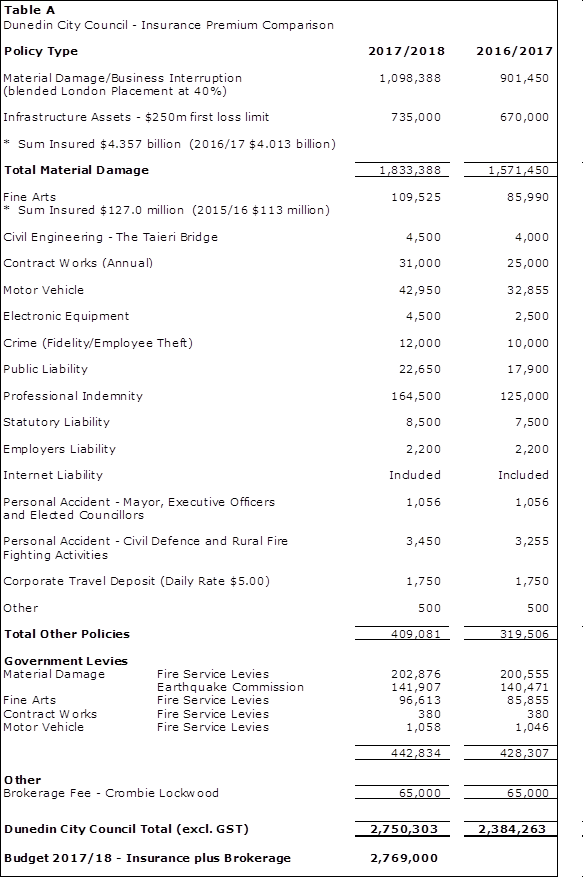

13 Table A provides a comparison

of insurance premiums between 2016/17 and 2017/18. All premiums are quoted

exclusive of GST.

14 The

following graph provides a historically perspective on value insured and the

associated unit premium.

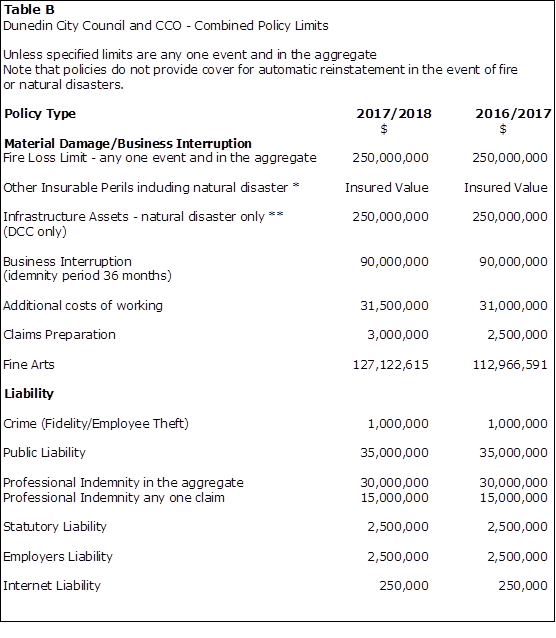

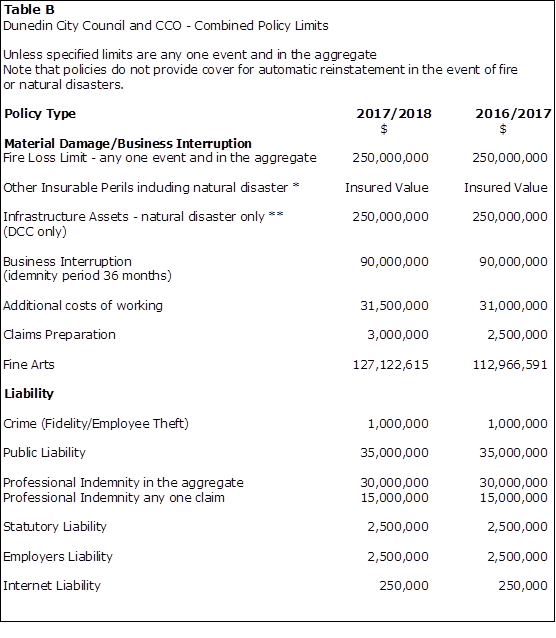

Policy Limits

* This limit applies to 90% of

the assets insured. The remaining 10% is limited to

$750.0 million any one claim or in the aggregate ie: 10% self-insured for

claims in excess of $750.0m.

** Natural Disaster Perils

include earthquake, volcanic eruption, tsunami, geothermal activity,

hydrothermal activity and, in respect of the outfalls only cover extended to

include storm (Force 10). This definition excludes the impact of

floods.

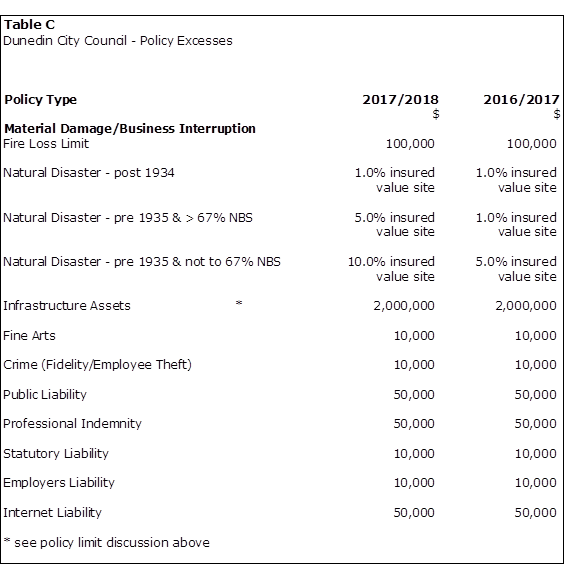

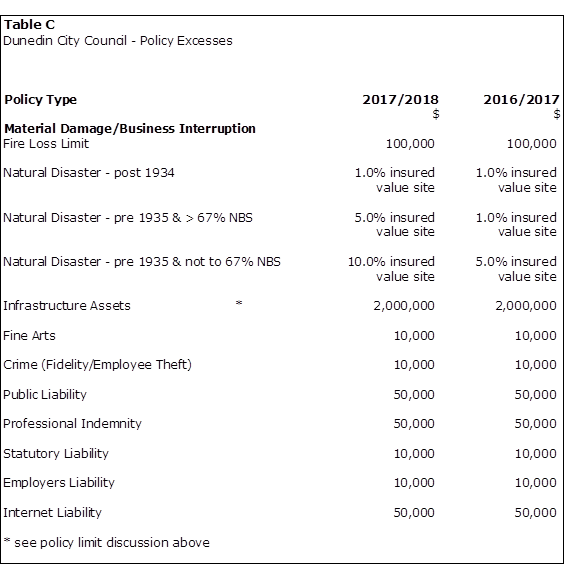

Policy Excesses

Uninsured Risks/Emerging Insurance Trends.

15 It is acknowledged

that with any insurance cover the Council will accept a degree of uninsured

risk, whether it be reflected as higher excesses, policy limits and/or

uninsured assets. In terms of particular risks associated with the

current programme the following should be noted:

· Policies

do not provide cover for automatic reinstatement of the sum insured in the

event of fire or Natural Disaster losses. If a significant loss occurs

additional insurance cover may need to be purchased.

· While

Asset Schedules have been extensively reviewed and updated, any assets excluded

from the schedules will not be covered, and those incorrectly valued may not be

adequately covered.

· Liability

Policy limits will need to be continually reviewed in light of claims history,

emerging trends and because these policy limits are held as group limits.

· Emerging

trends that remain under consideration include an extension of current policy

coverage for more robust Cyber Risk protection, as well as risks posed by

terrorism, climate change, contagious disease, pollution and weather tight home

claims.

· An

increasing recognition of the extent of asbestos risks and the potential costs

of identification/ maintenance/ removal activities may necessitate further Policy

reviews.

· The

Material Damage - Fire First Loss limit of $250m needs to be sufficient to

provide cover for fire following any cause including Natural Disaster losses

(it incorporates all assets insured by the Group). In order to test this limit,

a review exercise was completed in October 2014. It is recommend that a similar

review exercise is completed to ensure the existing first loss limit remains

adequate based on adjusted values since 2014.

· Infrastructure

asset coverage can be extended to include a sub limit of $25.0m for damage

caused by flood (defined as 'the covering of normally dry land by water that

has escaped or been released from the normal confines of a lake, river, creek

and other natural watercourses, a reservoir, canal or dam) and storm (defined

as winds, rain or snow) perils for an additional premium of $430k per annum.

· Government

Levies – fire service and earthquake commission levies are subject to

change outside the control of Council. Notably, there has been an amalgamation

of the urban and rural fire services into one organisation (Fire and Emergency

New Zealand). The funding structure for this new organisation is in transition,

however it is believed that levies will be charged on commercial property based

on the sum insured (previously fire first loss limit $250.0m). The initial

impact of this change will see an increase in fire service levies (FSL) of some

40%, with the move to sum insured planned for 2019.

Options

16 Not applicable.

Next Steps

17 The DCC Group

Insurance Policy is subject to an annual review and renewal.

18 Additional and

ongoing Policy review, monitoring and negotiation activities will be undertaken

by Council staff and representatives of the Crombie Lockwood Insurance

Programme Service Team to ensure adequate coverage remains in place for the DCC

and DCC Group Companies.

Signatories

|

Author:

|

Gavin Logie - Acting Chief Financial Officer

|

|

Authoriser:

|

Sue Bidrose - Chief Executive Officer

|

Attachments

There are no attachments

for this report.

|

SUMMARY OF

CONSIDERATIONS

|

|

Fit

with purpose of Local Government

The financial expenditure

detailed in this report relates to providing local infrastructure, public

services and regulatory functions for the community.

|

|

Fit

with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

This report has no direct contribution to the Strategic

Framework, however the financial expenditure noted in this report is

reflected within the Financial Strategy and the Insurance Policy contributes

to the effective and ongoing realisation of all DCC strategies.

|

|

Māori

Impact Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no implications for sustainability.

|

|

LTP/Annual

Plan/Financial Strategy

The planned insurance programme is as noted in the LTP.

|

|

Financial

considerations

The budget for insurance cover plus brokerage 2017/18 is

$2.769 million. The current quoted premium falls just below this

budget. Note that the final premium may differ slightly due to changes

in the declared insurance values.

|

|

Significance

Not applicable – reporting only.

|

|

Engagement

- external

·

The insurance programme has been developed in conjunction with

our insurance brokers and key staff from Council and CCOs. The Acting

Chief Financial Officer and Aurora Chief Financial Officer presented to local

insurers in Auckland on the programme for 2017/18.

|

|

Engagement

– internal

The insurance programme has been developed in conjunction

with DCC insurance brokers and key staff from Council and CCOs.

|

|

Risks:

Legal/Health and Safety etc.

This report identifies a small number of risks that remain

untreated or are emerging as factors that require further review.

|

|

Conflict

of Interest

There are no identified

conflicts of interest.

|

|

Community

Boards

There are no known implications for Community

Boards.

|

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

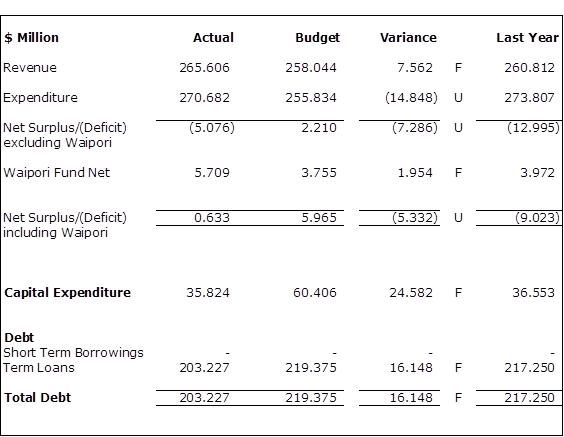

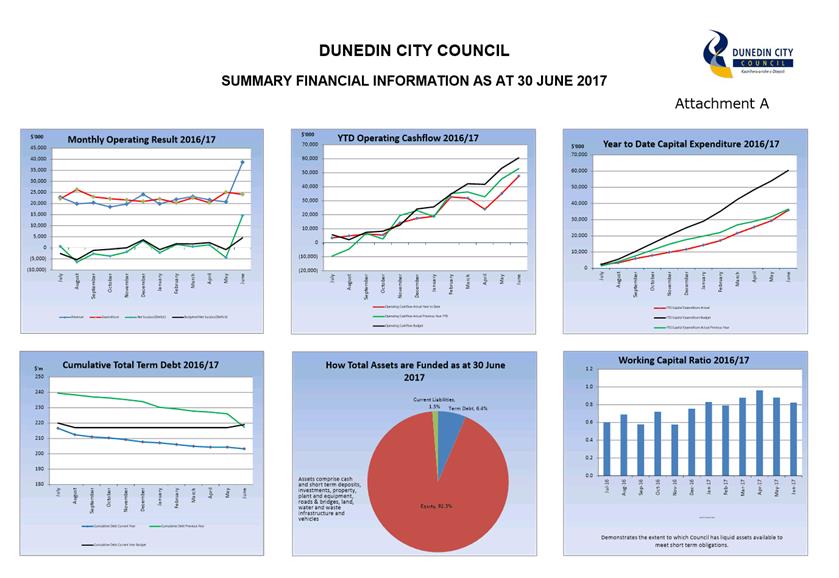

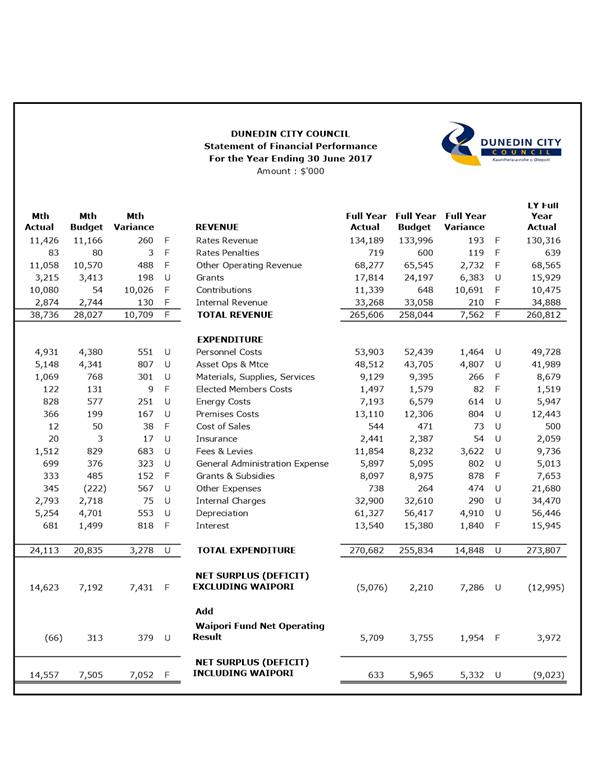

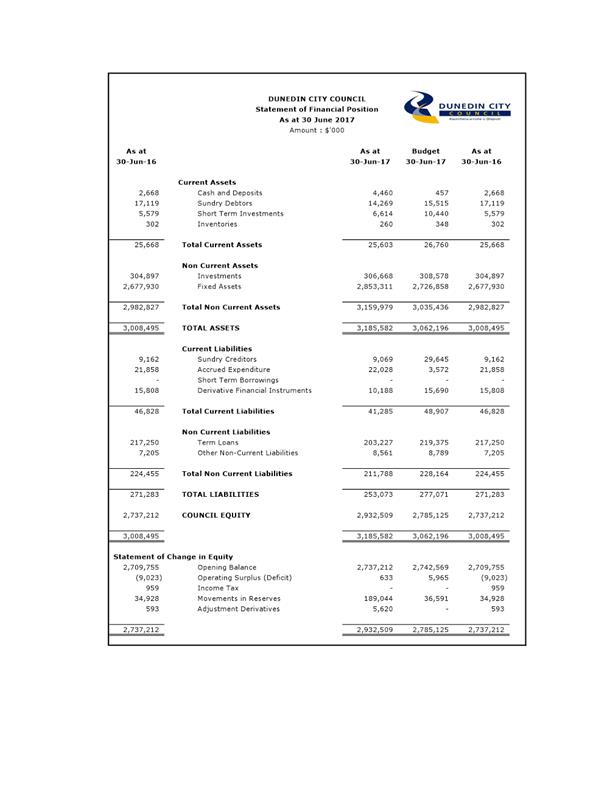

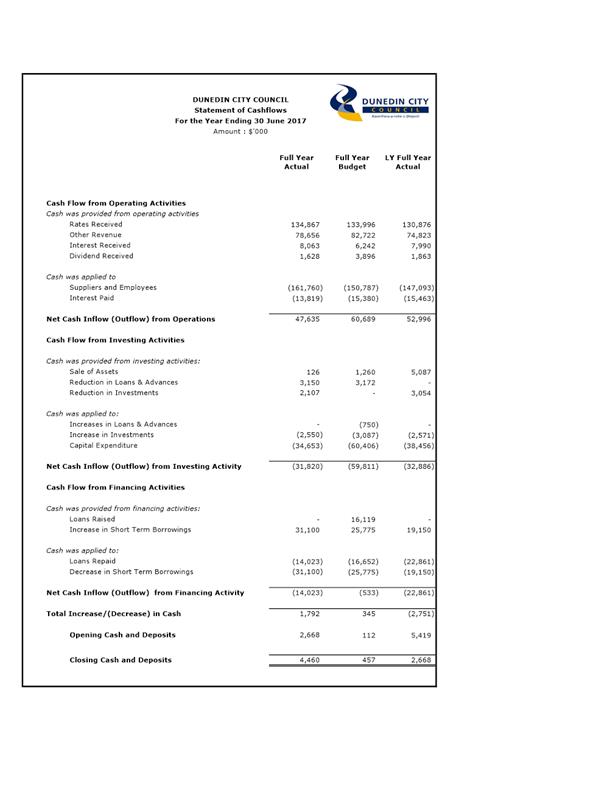

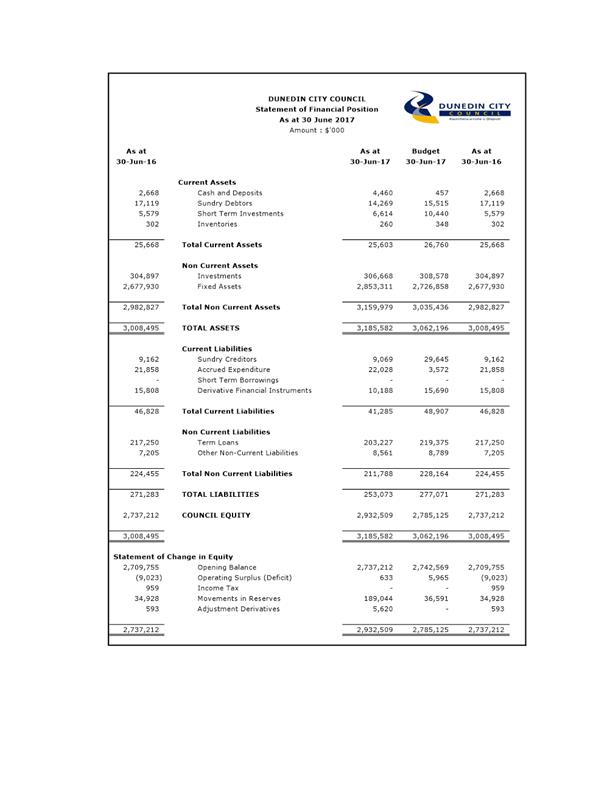

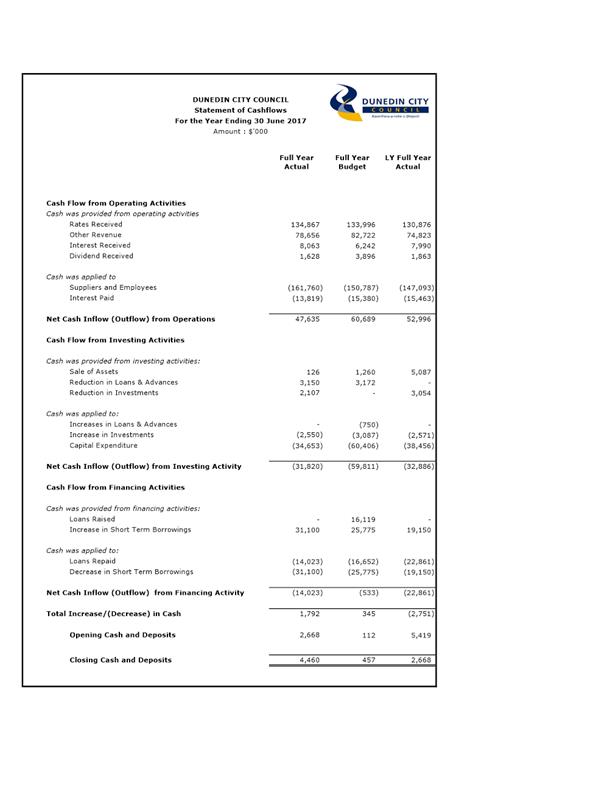

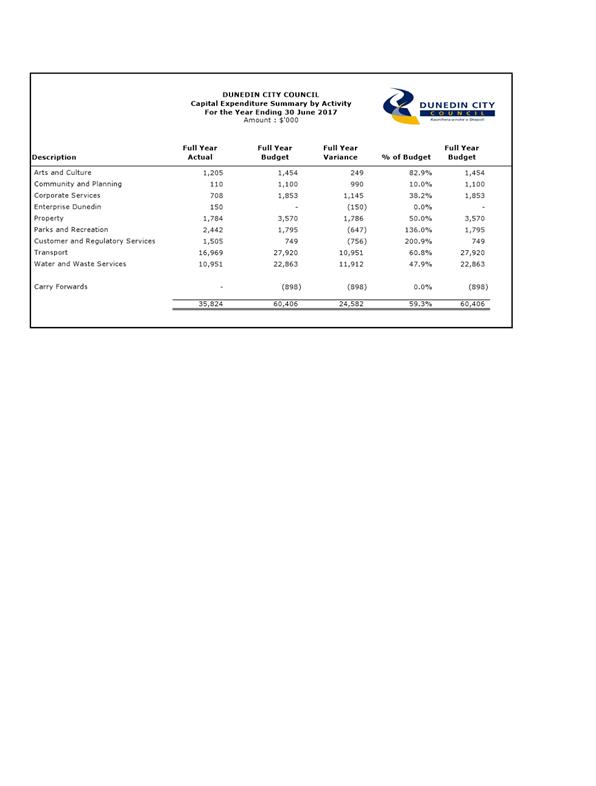

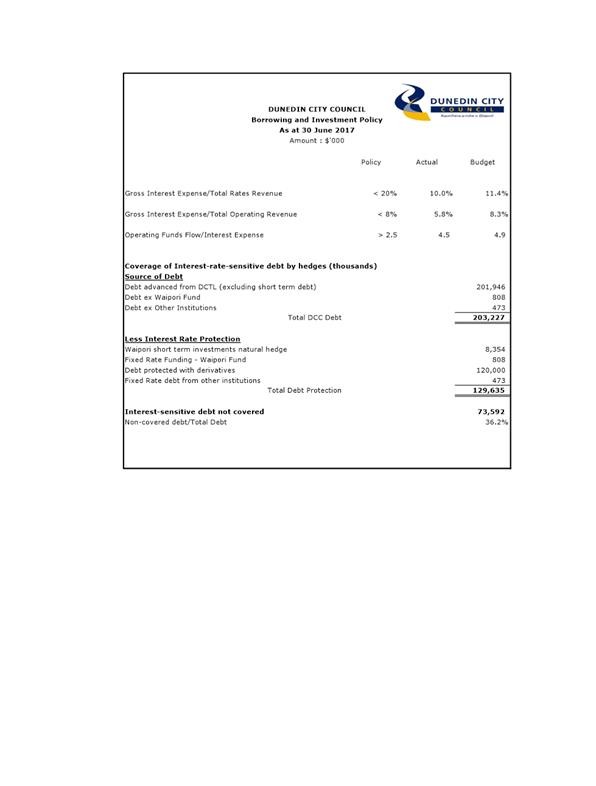

Financial Result - Year Ended 30 June 2017

Department: Finance

EXECUTIVE SUMMARY

1 This

report provides the financial results for the year ended 30 June 2017 and the financial

position as at that date.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Financial Performance for the year ended 30 June 2017 and the Financial

Position as at 30 June 2017.

b) Notes that

the year end result is subject to external audit by Audit New Zealand.

|

BACKGROUND

2 This

report provides a commentary of the financial performance of Council for the year ended 30 June 2017 and the financial

position as at that date.

DISCUSSION

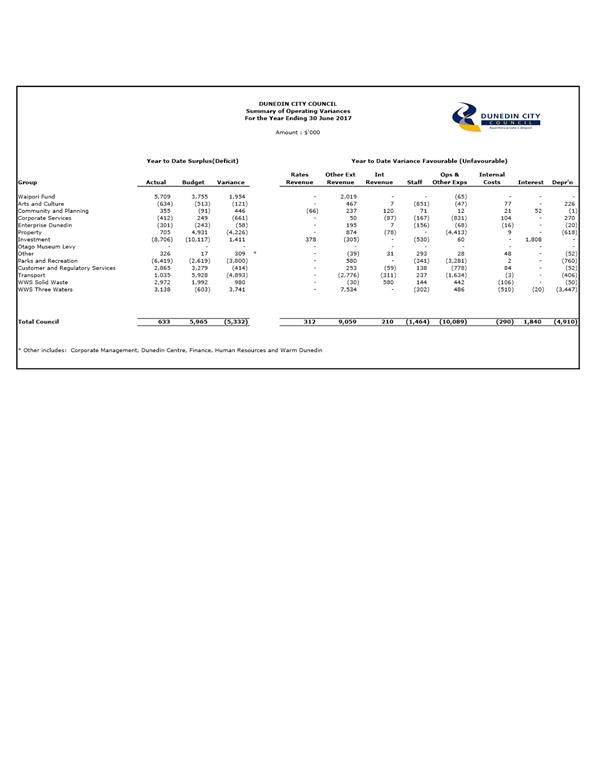

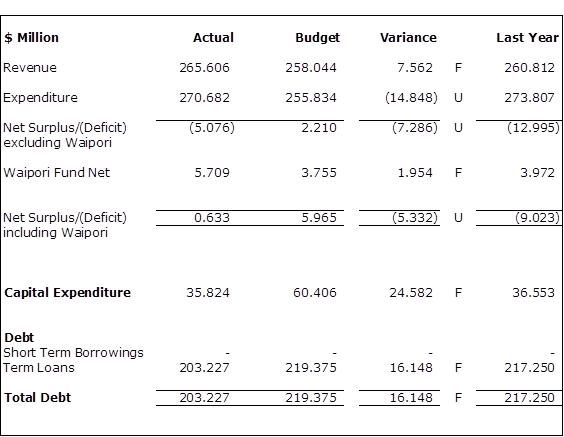

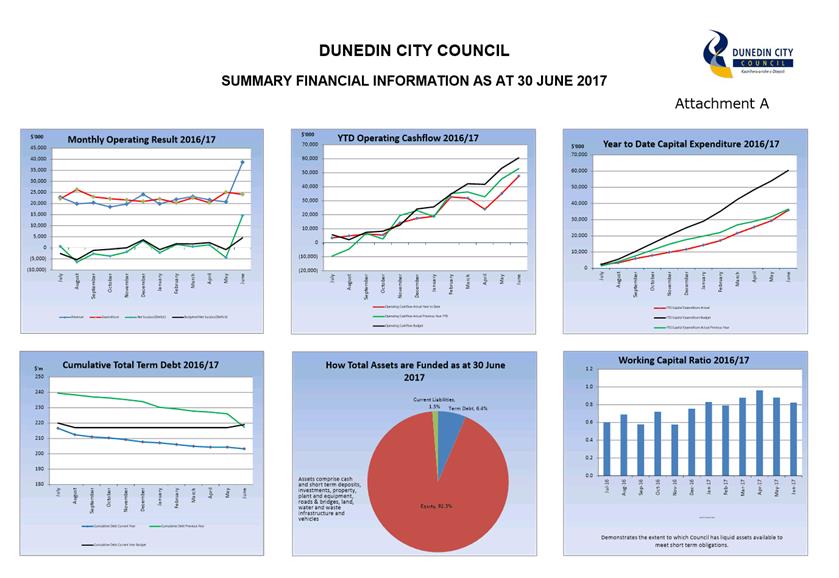

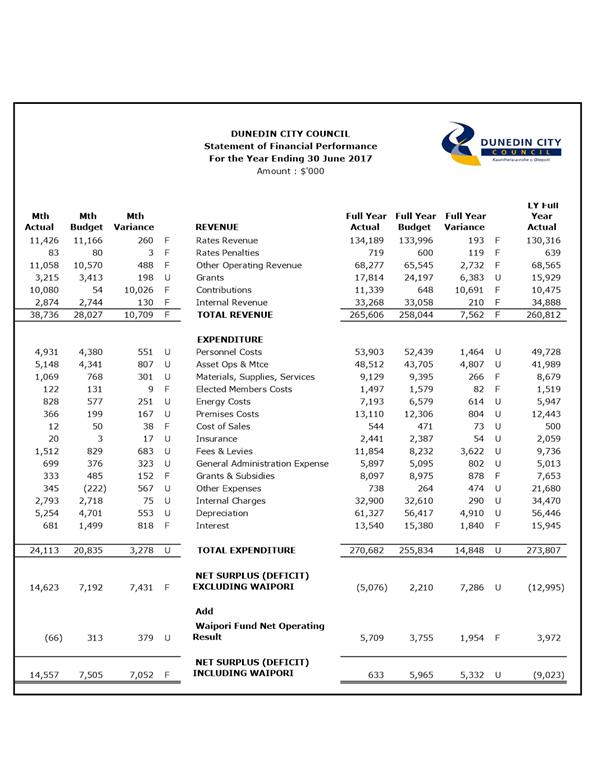

3 The

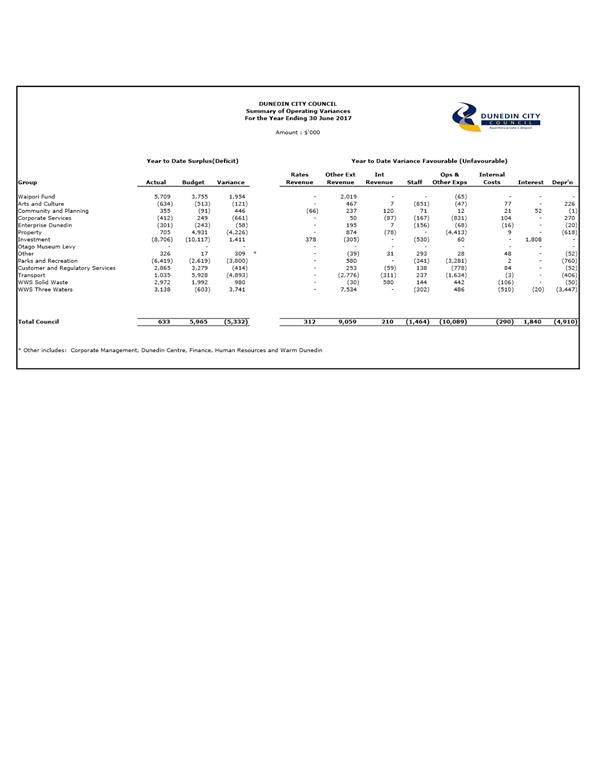

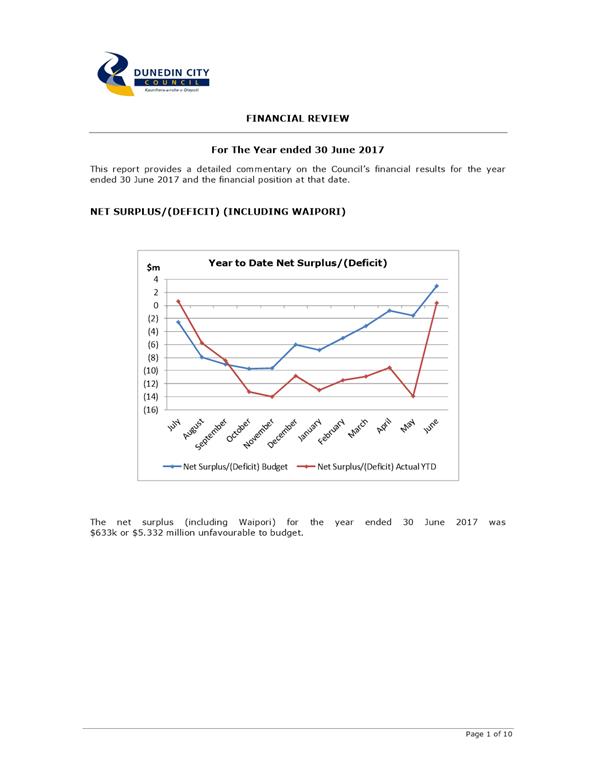

net surplus (including Waipori) for the year was $633k or $5.332 million

unfavourable to budget.

4 The

unfavourable variance against budget was due to the following:

· $6.383

million - lower than expected grants revenue mainly as a result of Transport

undertaking less subsidised capital expenditure than expected (Peninsula &

LED lighting).

· $1.464

million – higher personnel costs including: Olveston expenditure not

budgeted ($469k); and project resourcing where budget is included elsewhere

($445k).

· $4.807

million – higher asset ops and maintenance costs. Parks was

unfavourable $2.677 million mainly due to the increase in green space

maintenance contract costs and higher than budgeted Ocean Beach expenditure;

BIS included $716k costs reclassified from Materials Supplies & Services;

Property $526k due to deferred maintenance issues for a number of properties

now being addressed; and Transport $582k with higher than expected expenditure

across a number of maintenance categories.

· $3.622

million – higher than expected fees and levies expenditure. This

included: Property $1.549 million being costs associated with unbudgeted

building assessments including structural and seismic engineering; Transport

$801k being costs associated with consultants engaged to backfill for vacant

positions; Regulatory $504k being additional resourcing for building consent

operations to ensure statutory deadlines are met; Resource consents $419k with

additional consent processing costs, and costs associated with appeals and compliance;

and $296k unbudgeted fees associated with the district plan (2GP).

· $4.910

million – higher depreciation costs as a result of the revaluation of

Water and Waste assets effective from 1 July 2016.

5 These

unfavourable variances were partially offset by:

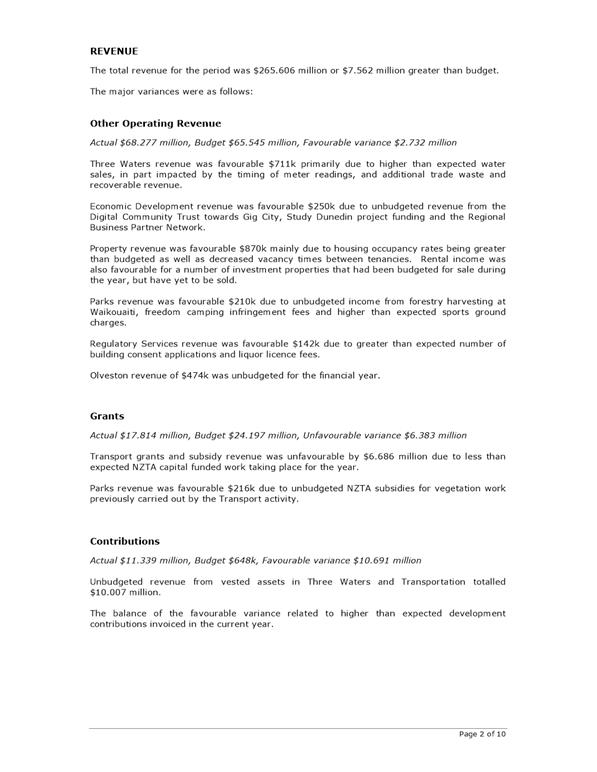

· $2.732

million – higher than expected other operating revenue. This

favourable variance was mainly due to: Three Waters revenue being $711k up on

budget with water sales, trade waste charges and recoverable revenue being

higher than expected. Property revenue was favourable $870k, largely due to

better than expected occupancy rates for housing. Parks & Recreation income

was also up due to unbudgeted income from the Waikouaiti forest harvest.

Olveston revenue of $474k was not budgeted in the current year.

· $10.691

million – favourable contributions income due primarily to unbudgeted

vested assets in Transport ($3.418 million) and Three Waters ($6.589 million).

· $1.840

million – favourable interest expense due to the lower debt level and the

floating interest rate being less than budget.

· $1.954

million – Waipori Fund, resulting from fair value gains across a number

of investment portfolios. There favourable result was partially driven by

the impact of a weaker NZD on international equity holdings.

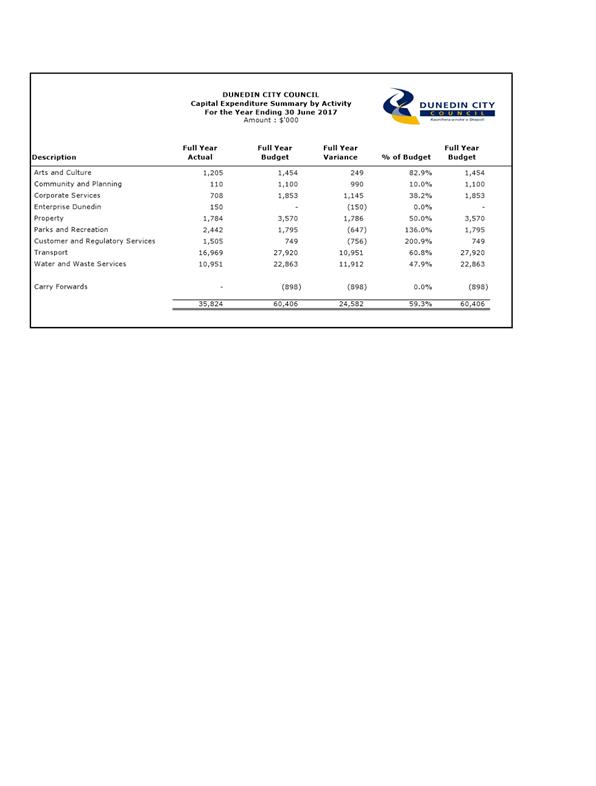

6 Capital

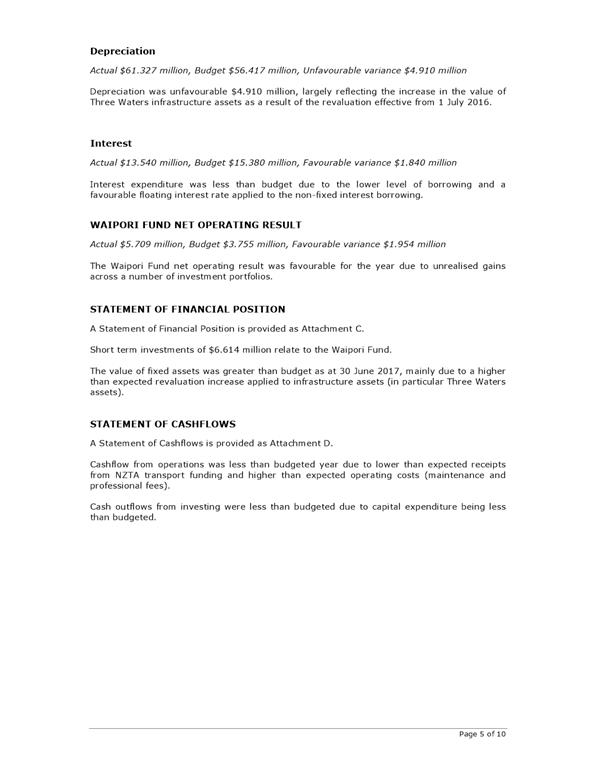

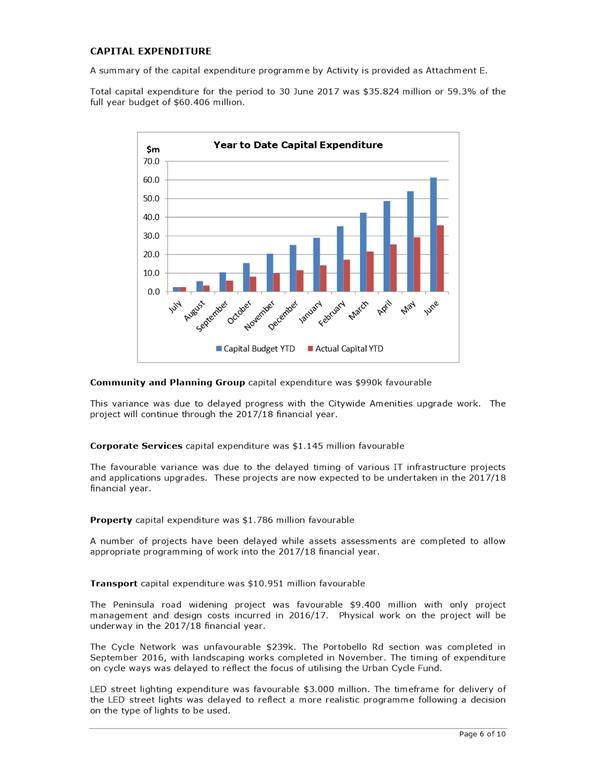

expenditure was less than budget by $24.582 million. Project delays have arisen

across a number of portfolios while project scoping and design is finalised.

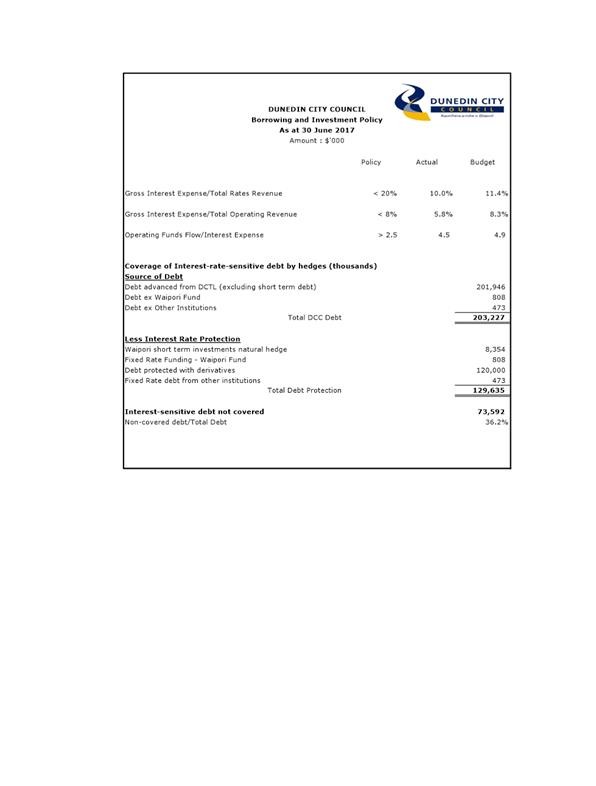

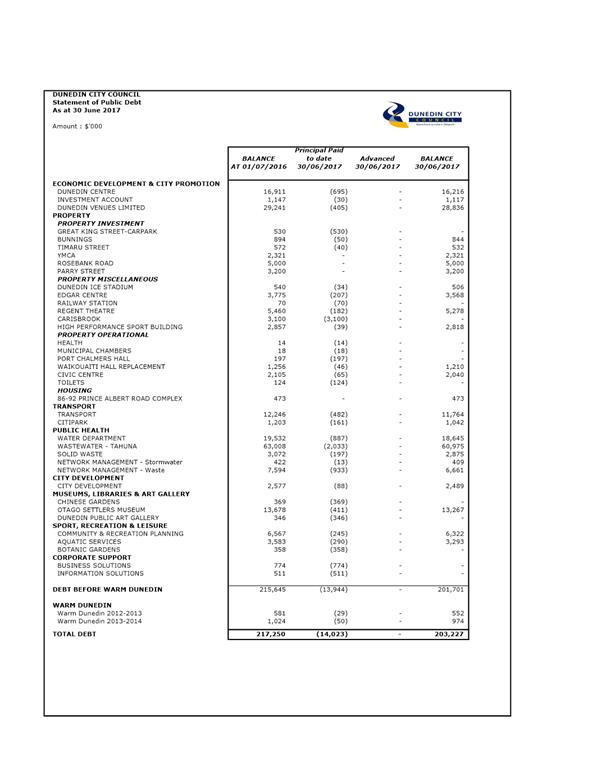

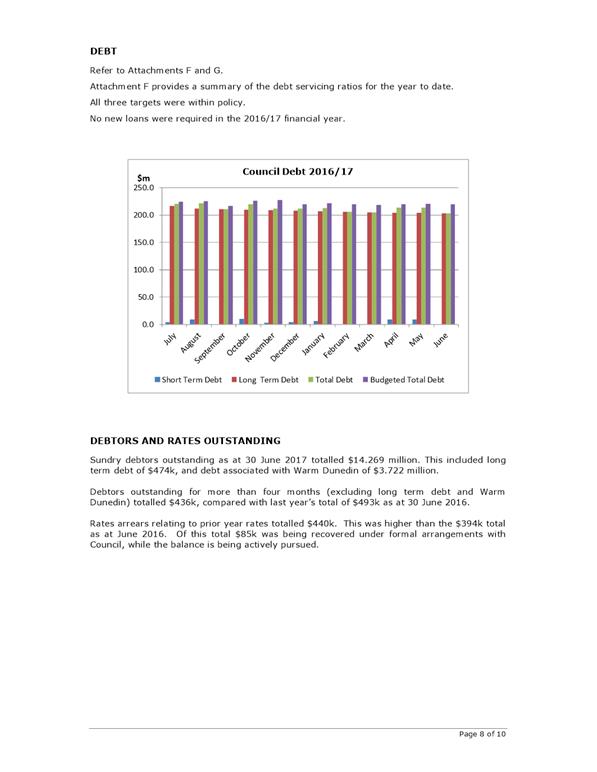

7 Total

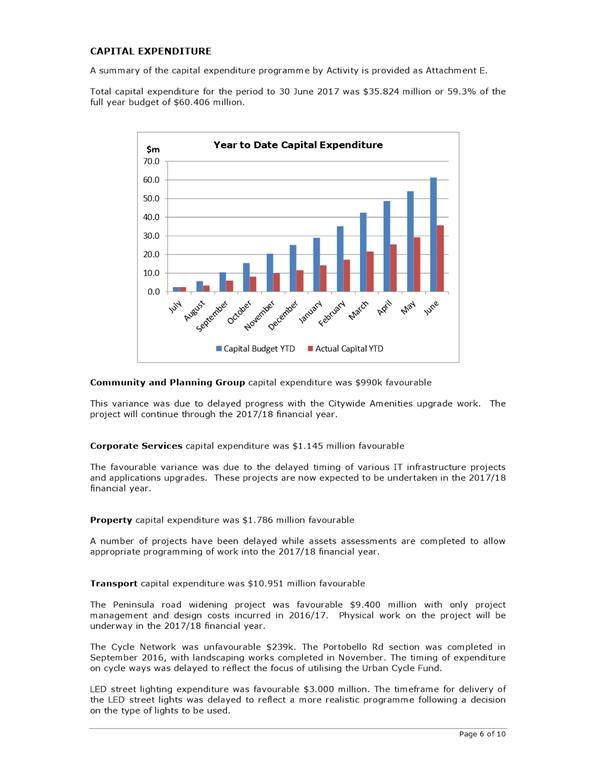

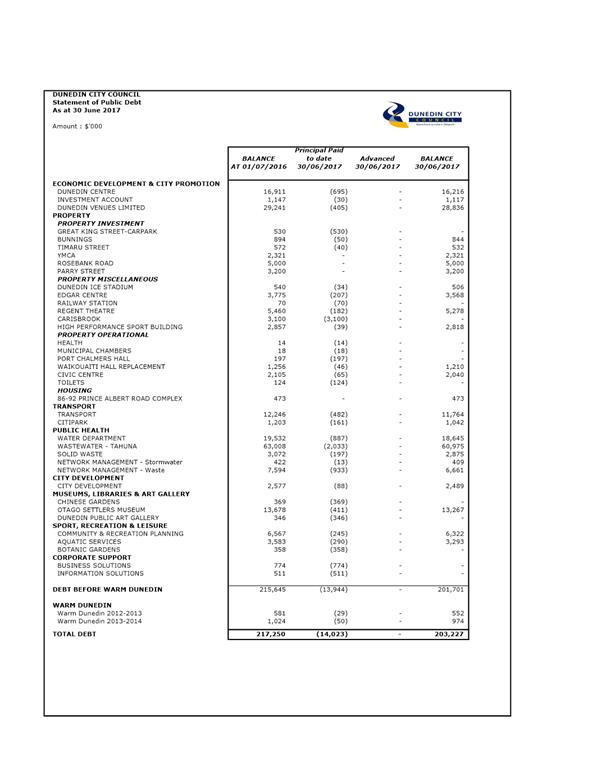

Council debt as at 30 June 2017 was $203.227 million or $16.148 million lower

than budget. This variance reflected early debt repayment resulting

primarily from the lower than expected expenditure on capital projects.

OPTIONS

8 Not

applicable.

NEXT STEPS

9 Not

applicable.

Signatories

|

Author:

|

Lawrie Warwood - Financial Analyst

|

|

Authoriser:

|

Gavin Logie - Acting Chief Financial Officer

|

Attachments

|

|

Title

|

Page

|

|

a

|

Summary Financial

Information

|

28

|

|

b

|

Statement of Financial

Performance

|

29

|

|

c

|

Statement of Financial

Position

|

30

|

|

d

|

Statement of Cashflows

|

31

|

|

e

|

Capital Expenditure

Summary

|

32

|

|

f

|

Borrowing and

Investment Policy

|

33

|

|

g

|

Statement of Public

Debt

|

34

|

|

h

|

Summary of Operating

Variances

|

35

|

|

i

|

Financial Review

|

36

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

The financial expenditure reported in this report relates

to providing local infrastructure, public services and regulatory functions

for the community.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

This report has no direct contribution to the Strategic

Framework, although the financial expenditure reported in this report has

contributed to all of the strategies.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report fulfils the internal financial reporting

requirements for Council.

|

|

Financial

considerations

Not applicable – reporting only.

|

|

Significance

Not applicable – reporting only.

|

|

Engagement –

external

There has been no external engagement.

|

|

Engagement -

internal

The report is prepared as a summary for the individual

department financial reports.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

|

Finance and Council Controlled Organisations

Committee

12 September 2017

|

|

|

Finance and Council Controlled Organisations

Committee

12 September 2017

|

|

|

Finance and Council Controlled Organisations

Committee

12 September 2017

|

|

|

Finance and Council Controlled Organisations

Committee

12 September 2017

|

|

|

Finance and Council Controlled Organisations

Committee

12 September 2017

|

|

|

Finance and Council Controlled Organisations

Committee

12 September 2017

|

|

|

Finance and Council Controlled Organisations

Committee

12 September 2017

|

|

|

Finance and Council Controlled Organisations

Committee

12 September 2017

|

|

|

Finance and Council Controlled Organisations

Committee

12 September 2017

|

|

Special Consultative Procedure for new RMA fee

categories

Department: Community and Planning

EXECUTIVE SUMMARY

1 This

report provides detail on the need to undertake a special consultative

procedure to add three new fee categories to the schedule of fees for Resource

Management Act (RMA) processes.

2 The

report seeks approval to undertake the special consultative procedure.

|

RECOMMENDATIONS

That the Committee:

a) Undertakes

a special consultative procedure to add to the fee schedule for planning

applications.

b) Appoints three

members of the Hearing Committee to hear submissions.

|

BACKGROUND

3 The

Resource Legislation Amendment Act 2017 (RLA) made a range of changes to the

RMA. The bulk of the changes to the RMA take effect from 18 October 2017.

4 The

amendments to the RMA require a range of changes to Council processes. Nearly

all are operational changes that do not require an approval from Council. One

change requiring Council approval is the addition of three new fees to the RMA

schedule of fees. Section 36(3) of the RMA requires a special consultative

procedure to add the new fees.

DISCUSSION

5 There are

a number of changes to the RMA that take effect on 18 October 2017. This report

considers three specific changes. They are:

· New

section “87BA Boundary activities approved by neighbours on infringed

boundaries are permitted activities.” This section established a new

class of permitted activity, where when in a residential zone a side yard or

height plane breach is permitted, if the affected neighbour provides affected

party approval. A person can make an application to the Council.

· New

section “87BB Activities meeting certain requirements are permitted

activities.” This section provides the discretion for a consent authority

to make marginal or temporary breaches a permitted activity.

· New

sub-section 36(1)(af) where a person making an objection under section

357A(1)(f) or (g) requests a hearings commissioner. The cost of using a

hearings commissioner can be recovered.

6 The new

boundary activity and the new temporary activities require a system to process

each application. The RMA allows for the reasonable cost incurred in processing

each application to be recovered. The current DCC fee schedule does not provide

for ss 87BA and 87BB. A fee needs to be added to the schedule for each process.

To establish a fee s36(3) of the RMA requires the use of a special consultative

procedure.

7 The

current DCC fee schedule includes deposits for a range of RMA applications and

processes. It is proposed to add a deposit (fee) for ss 87BA and 87BB

applications. The deposit will be $300. This will provide for two hours of

planner time. If the cost exceeds the deposit the additional cost can be

invoiced for, which is the current practice for other applications. It is

uncertain how many s87BA applications may be received each year. It is

envisaged that it may be in the vicinity of fifty, which is estimated to result

in at least $7,000 in fees during the remainder of the 2017/18 financial year.

8 A new fee

category is also required where a person requests a hearings commissioner to

decide an objection under s357A. This is a new process so the potential costs

are not clear. Because hearings commissioners are independent professionals the

cost to Council will likely be greater than that of a councillor who is an

accredited commissioner. A deposit of $800 is considered appropriate. If the

cost exceeds the deposit the additional cost can be invoiced for, which is the

current practice for other applications. If no fee is specified there is a risk

that a person requests a hearings commissioner and the Council has to cover the

cost.

9 The

addition of three fee categories to the RMA fee schedule is a minor change.

However, section 36(3) of the RMA does require the use of a special

consultative procedure. The documents required to undertake the special

consultative procedure are attached.

OPTIONS

Option

One – Recommended Option

10 To undertake a

special consultative procedure process to add three new RMA fee categories.

Advantages

· A

fee avoids the need to use rate payer funding to pay for the process.

· The

Council will be able to recover from the applicant the costs it is entitled to

recover (estimated to be at least $7,000).

· Alignment

with existing process. The Council already recovers costs for a range of other

RMA application processes.

Disadvantages

· The

time and associated cost of the special consultative procedure.

Option

Two – Status Quo

11 Do not establish new

fee categories.

Advantages

· Avoids

the time and associated cost of the special consultative procedure.

Disadvantages

· The

estimated cost of at least $7,000 for the new processes will be paid from

ratepayer funding in the 2017/18 financial year.

· The

cost of undertaking the process is estimated to be less than the revenue that

will provided through fees for processing applications.

NEXT STEPS

12 If the Committee

supports the recommended use of a special consultative procedure to provide for

the new fee categories, the special consultative procedure will start by public

notification for submissions in September.

Signatories

|

Author:

|

Alan Worthington - Resource Consents Manager

|

|

Authoriser:

|

Nicola Pinfold - Group Manager Community and Planning

Sandy Graham - General Manager Strategy and Governance

|

Attachments

|

|

Title

|

Page

|

|

a

|

Special consultative

procedure documents

|

50

|

|

SUMMARY OF CONSIDERATIONS

|

|

|

Fit with purpose

of Local Government

This proposal relates to providing a regulatory function

and it is considered good-quality and cost-effective.

|

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

Changing the fees makes a limited contribution insofar as

they are concerned with the implementation of the District Plan, which the

primary tool to give effect to the Spatial Plan.

|

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

|

Sustainability

There are no known impacts for sustainability.

|

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no implications for the LTP.

|

|

|

Financial

considerations

If the new fee categories are not added there will be at

least $7,000 in additional cost to the ratepayer in the 2017/18 financial

year. This is considered to be less than the cost of the staff time to

undertaken the special consultative procedure.

|

|

|

Significance

This decision is considered low in terms of the

Council’s Significance and Engagement Policy.

|

|

|

Engagement –

external

There has been no external engagement.

|

|

|

Engagement -

internal

There have been discussions with Corporate Policy staff.

|

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

|

Conflict of

Interest

There is no identified conflict of interest.

|

|

|

Community Boards

There are no specific implications for Community Boards.

|

|

|

|

|

|

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

Proposed changes to City Planning Fee Schedule

There are five documents

for the special consultative procedure. They are:

1. DCC

website page

2. Statement

of proposal

3. Public

notice

4. Submission

form

5. 2017/18

DCC City Planning Fees and Charges with new fees added.

Consultation – RMA Fees and Charges (WEB

‘COVER PAGE’)

a)

b) Introduction

c)

d) Recent

amendments to the Resource Management Act 1991 have created additional

activities which require associated charges. The proposed additional fees listed

below are deposits, with the total cost of processing the applications

determined following at the end of the process. It is proposed that the

existing staff hourly rates specified in the schedule of fees and charges are

used to calculate the fees, except for the hearing commissioners who are

independent of Council and charge independently.

e)

f) The

new fees are:

· Boundary

activities – deposit of $300

· Marginal

or temporary activities – deposit of $300

· Hearing

Commissioner – deposit of $800.

g)

h)

i) Submissions

j)

k) Written

submissions may be made until Friday 13 October 2017.

l)

m) Those who make a

written submission may also make an oral submission at a hearing. A hearing is

scheduled for 31 October 2017 at the Council Chambers in Dunedin. Please

indicate on your submission form if you wish to speak to your submission.

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

STATEMENT OF PROPOSAL (Link on cover page)

Resource Management Act – Fees

and Charges

n)

o)

Reasons for the proposal

p)

q) Recent amendments to the Resource

Management Act 1991 have created additional activities which require associated charges. These include:

· Boundary activities – Council

must exempt ‘boundary activities’ from needing a resource consent

if neighbour approval is provided (s87BA RMA)

· Marginal/temporary breaches –

Council may exempt ‘marginal or temporary’ activities from needing

resource consent

(s87BB RMA)

· Hearing Commissioners – a person making an

objection under s357AB RMA can request a hearing commissioner.

r) These changes come into effect on 18 October 2017, and in order for Council to charge for their processing, fees need to be set. The fees are required

to cover the reasonable costs of processing the applications.

s) The proposed fees are a deposit,

with the total cost of processing the application determined at the end of the process.

It is proposed

that the existing hourly rates specified

in the schedule of fees and charges are used

for boundary activities and marginal/temporary breaches. The full

commissioner costs will be recovered at their charge out rate.

t) As these are new activities a deposit structure

is considered appropriate to ensure that the fair costs associated with processing the

application are paid, which are:

· Boundary activities –

deposit of $300

· Marginal or temporary

activities –

deposit of $300

· Hearing Commissioner - $800.

u)

Legislation

v)

w) The fees are made in accordance with section 36 of the Resource Management Act 1991.

Submissions

Written submissions may be made until Friday

13 October 2017.

x) Those who make a written submission may also make an oral submission. Oral hearings are scheduled for 31 October 2017 at the Council Chambers

in Dunedin. Please indicate on your

submission form if

you wish to speak to your

submission.

y)

Further information

z)

aa)

Further information, including a submission form, is available from the following locations:

· City Planning Enquiries, Ground Floor, Civic Centre,

50 The Octagon, Dunedin

· The Dunedin Central Public Library

· The Mosgiel Service Centre

· Online at http://www.dunedin.govt.nz/rma

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

Public Notice

(Link on Cover page)

Resource Management Act – Fees

and Charges (Public notice)

Recent

amendments to the Resource Management Act 1991 have created additional

activities which require associated charges. These include:

· Boundary activities – Council

must exempt ‘boundary activities’ from needing a resource consent

if neighbour approval is provided (s87BA RMA)

· Marginal/temporary breaches –

Council may exempt ‘marginal or temporary’ activities from needing

resource consent

(s87BB RMA).

· Hearing Commissioners – a person making an

objection under s357AB RMA can request a hearing commissioner.

bb) The proposed fees are a deposit,

with the total cost of processing the application determined at the end of the process.

It is proposed

that the existing hourly rates specified

in the schedule of fees and charges are used

for boundary activities and marginal/temporary breaches. The full

commissioner costs will be recovered at their charge out rate.

· Boundary activities –

deposit of $300

· Marginal or temporary

activities –

deposit of $300

· Hearing Commissioner - $800.

Submissions

Written

submissions may be made until Friday 13 October 2017.

Those

who make a written submission may also make an oral submission at a hearing.

The hearing is scheduled for 31 October 2017 at the Council Chambers in

Dunedin. Please indicate on your submission form if you wish to speak to your

submission. The adoption of the proposed fee changes will occur at the meeting

after hearing submissions.

Further information

Further

information, including a submission form, is available from the following

locations:

• City

Planning Enquiries, Ground Floor, Civic Centre, 50 The Octagon, Dunedin

• The

Dunedin Central Public Library

• The

Mosgiel Service Centre

• Online at

http://www.dunedin.govt.nz/rma.

Sue

Bidrose

Chief

Executive Officer

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

Submission Form (Link On Cover page)

|

SUBMISSION FORM

|

|

Submission concerning fees and charges for

boundary activities and marginal or temporary non-compliances - Resource

Management Act 1991

To: Dunedin City Council, PO Box 5045, Moray Place,

Dunedin 9058

|

|

|

|

I/We wish to lodge a

submission on the proposed fees and charges (Please read privacy statement):

|

|

Your Full Name:______________________________________________________________

|

|

Address for Service (Postal

Address):____________________________________________

|

|

___________________________________________________________________

|

|

Telephone:____________________________

Email Address:_________________________

|

|

□ I require a NZ sign language interpreter to be

present

□ I would like my contact details to be withheld

I Agree/Disagree

with the proposed changes

I Do/Do Not wish

to be heard in support of this submission at a hearing

|

|

Please use the back of this form or

attach other pages as required

|

|

The reasons for my

submission are:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature of submitter:___________________________________ Date:_____________

(or person

authorised to sign on behalf of submitter)

|

|

|

|

Notes to Submitter:

Closing Date: The closing date for

serving submissions on the Dunedin City Council is Friday 13 October 2017

at 5pm.

Electronic Submissions: A

signature is not required if you make your submission by electronic

means. Submissions can be made online at http://www.dunedin.govt.nz/rma

or sent by email to resconsent.submission@dcc.govt.nz.

Privacy: Please note that submissions are public. Your name,

contact details and submission will be included in papers that are available

to the media and the public, including publication on the Council website.

You may request your contact details be withheld. Your submission will

only be used for the purpose of the fees and charges consultation process.

|

Fee Schedule (Link On Cover Page)

Fee

schedule for 2017/18 showing the additions highlighted in yellow (objections

change repeated in land use and subdivision sections).

|

City Planning

|

|

Section 36(1) of the Resource

Management Act 1991 enables the Council to charge a fixed deposit. Section

36(3) allows for additional fees to recover actual and reasonable costs in

cases where the fixed deposit is inadequate. Application costs that exceed

the deposit will be subject to additional charges at the rates and

disbursements set out in the following schedules. For those applications that

attract a fixed deposit, a receipt will be issued at the time of payment. A

GST invoice will be issued at the completion of processing.

|

|

Fees for Land

Use Planning Activities

|

|

Non-Notified

Land Use Consents

|

|

Category A

|

No

charge

|

|

Category B (deposit)

|

500.00

|

|

Category C (deposit)

|

820.00

|

|

Category D (deposit)

|

1,350.00

|

|

Notified Land

Use Consents

|

|

Publicly Notified Land Use

Consents (deposit)

|

8,000.00

|

|

Limited Notified Land Use

Consents (deposit)

|

5,000.00

|

|

Related Land

Use Consents

|

|

Extension of time for land use

consents. (Section 125(1)(b)) (deposit)

|

650.00

|

|

Change or cancellation of

conditions of land use consents (Section 127(1)(b)) (deposit)

|

700.00

|

|

Objections to decisions of land

use consents (Section 357) and fees (Section 357B)

|

No

charge

|

|

Objections to decisions of land

use consents when a hearings commissioner is requested(Section

357AB)(deposit)

|

800.00

|

|

Certificates of compliance

(Section 139) (deposit)

|

800.00

|

|

Outline plan of works (Section

176A) (deposit)

|

1,100.00

|

|

Existing use certificate

(Section 139A) (deposit)

|

850.00

|

|

Boundary activity consent

(section 87BA) (deposit)

|

300.00

|

|

Marginal or temporary activity

consent (section 87BB) (deposit)

|

300.00

|

|

If the application is complex or

significant, or specialist advice is needed, a higher deposit may be required

before proceeding. Fees will be discussed with the applicant in advance.

|

|

Categories of

Fees for Non-Notified Land Use Consents

|

|

Category A:

|

|

Schedule 25.3 trees

|

|

Temporary signs for one-off

not-for-profit cultural events (determination by Resource Consent department)

|

|

Murals

|

|

Replacing roof on buildings that

are located in a townscape or heritage precinct, or on a scheduled building

|

|

Painting of buildings that are

located in the townscape or heritage precincts, or a scheduled building

|

|

Modifying windows above verandah

height of buildings located in a townscape or heritage precinct, or a

scheduled building, or replacing a door on a scheduled building

|

|

Consents required for activities

under Rule 16.6 (Interim Rule for Areas of Significant Conservation Value)

|

|

Except for Schedule 25.3 trees,

Category A provides only for non-notified applications

|

|

Category B:

|

|

Dwelling alterations and

accessory buildings in a residential zone only breaching side/rear yard

and/or height plane angle where written approval of adjoining neighbour(s) is

provided on lodgement

|

|

Category C:

|

|

Rural or rural-residential zone

accessory buildings, and Residential zone accessory buildings including

carports and garages (except as covered by Categories B or D)

|

|

Dwelling alterations including

decks and pergolas resulting in minor breach of bulk and location performance

standard where density of residential activity complies (except as covered by

Category B)

|

|

New dwellings where density of

residential activity complies (except as covered by Category D)

|

|

Signs except for permanent

hoardings

|

|

Category D:

|

|

Retaining walls and/or

earthworks

|

|

Structures, which includes new

dwellings and accessory buildings located in a Landscape Management Area or

an Urban Landscape Conservation Area

|

|

New dwellings and dwelling

alterations not covered by Categories A to C

|

|

New buildings in a

townscape/heritage precinct

|

|

Alteration to buildings located

in a townscape/heritage precinct or to scheduled buildings not covered by

Category A

|

|

Community support activities

|

|

Permanent hoarding signs

|

|

National Environmental Standard

(Soil)

|

|

All non-notified resource

consent applications not provided for by other categories will be charged at

the Category D rate (deposit and actual cost above the deposit)

|

|

Fees for

Subdivision Activities

|

|

Non-Notified Subdivision

Consents (deposit)

|

1,850.00

|

|

Notified

Subdivision Consents

|

|

Publicly Notified Subdivision

Consents (deposit)

|

8,000.00

|

|

Limited Notified Subdivision

Consents (deposit)

|

4,500.00

|

|

Related

Subdivision Consent Matters

|

|

Section 226 application

including certification (deposit)

|

700.00

|

|

Sealing, certification fee for

survey plans (except 224(c)) (per certificate) (deposit)

|

460.00

|

|

Compliance with subdivision

consent conditions (Section 224(c)) (deposit)

|

460.00

|

|

Combined 223 and 224(c)

application (deposit)

|

600.00

|

|

Objections to decisions of

subdivision consents (Section 357) and fees (Section 357B)

|

No

charge

|

|

Objections to decisions of

subdivision consents when a hearings commissioner is requested (Section

357AB) (deposit)

|

800.00

|

|

Extension of time for

subdivision consents (Section 125(1)(b)) (deposit)

|

700.00

|

|

Change or cancellation of

conditions of subdivision consents (Section 127(1) (deposit))

|

1,150.00

|

|

s240 Covenants (deposit)

|

500.00

|

|

s241 Amalgamation of Allotments

(deposit)

|

300.00

|

|

Preparation of consent notices,

certificates, bonds, partial or full release/discharge of bonds, revocation

of easements (fixed fee, but any legal fees recovered at cost)

|

250.00

|

|

Certified copy of Council

Resolution (fixed fee)

|

190.00

|

|

Section 221 application

(deposit)

|

1,000.00

|

|

Section 243 application

(deposit)

|

400.00

|

|

If the application is complex or

significant, or specialist advice is needed, a higher deposit may be required

before proceeding. Fees will be discussed with the applicant in advance.

|

|

Engineering, geotechnical,

contamination and any other technical input will be an additional fee that

recovers actual cost.

|

|

Payment of

Final Fee for Subdivision Applications

|

|

The final fee should be paid

promptly after being sent an invoice. If there are any outstanding interim

invoices they will be required to be paid before the Section 224 Certificate

will be released.

|

|

Planning

– Other Legislation

|

|

Planning certificates for the sale

of liquor (deposit)

|

240.00

|

|

Cancellation of building line

restriction (Section 327A Local Government Act 1974) (deposit)

|

240.00

|

|

Right of way (Section 348 Local

Government Act 1974) (includes processing of application and sealing)

(deposit)

|

600.00

|

|

Overseas Investment Commission

Certificate (deposit)

|

290.00

|

|

Designations/Heritage

Orders/Plan Changes

|

|

For Designations/Heritage

Orders/Plan Changes (privately initiated) following payment of the relevant

deposit, the Council may, at its discretion, invoice for the additional

charges at cost on a monthly basis and may stop work on the application until

such time as the relevant invoice has been paid.

|

|

Plan changes (privately

initiated) (deposit and additional charges at cost)

|

20,000.00

|

|

Heritage order applications

(deposit and additional charges at cost)

|

2,000.00

|

|

Notice of requirement for

designations (Section 168 & Section 181(2)) (deposit and additional charges

at cost)

|

6,500.00

|

|

Minor modifications (Section 181

(3)) (deposit and additional charges at cost)

|

560.00

|

|

Uplifting designations

|

No

charge

|

|

Purchase of District Plan

(available online only, for free)

|

-

|

|

Additional Fees

and Charges

|

|

Processing of notified land use

and subdivision applications and any additional charges applying to any other

planning application listed above will be charged at the following rates:

|

|

Processing

Costs

|

|

Principal Advisor/Team

Leader/Specialist input (senior level) from another council department (per

hour)

|

165.00

|

|

Senior Planner and specialist

input (junior/intermediate level) from another Council department (per hour)

|

165.00

|

|

Planners (per hour)

|

149.00

|

|

Graduate Planners or Monitoring

officer (per hour)

|

117.00

|

|

Development contributions

officer (per hour)

|

117.00

|

|

Compliance Officer (per hour)

|

110.00

|

|

Administrative Officers (per

hour)

|

92.00

|

|

External consultants

|

At

Cost

|

|

Reports commissioned by the

Council

|

At

Cost

|

|

Disbursements

|

|

Postage

|

At

Cost

|

|

Photocopying (per A4 copy)

|

At

Cost

|

|

Public notices

|

At

Cost

|

|

Site signs

|

At

Cost

|

|

Site inspections

|

At

Cost

|

|

Vehicle usage (calculated on

time basis (per min))

|

0.26

|

|

Refund or Cost

Recovery Threshold

|

|

There is a $25 threshold either

side of the final cost whereby if the amount to be refunded or recovered is

less than $25 it will be absorbed to cover the processing cost.

|

|

Hearing Costs

|

|

For all applications involving

elected members attendance at hearings for commercial applicants (GST

registered only)

|

|

Hearing up to 3 hours (fixed

fee)

|

780.00

|

|

Hearings over 3 hours (per day)

|

1,560.00

|

|

Staff attendance at hearings

– cost of staff attending hearing (charged at hourly rates above). For

resource consents, only the processing planner will be charged.

|

|

Request to Use

Commissioner

|

|

1. The

applicant requesting a commissioner in accordance with Section 100A will be

charged at the actual cost of the commissioner, even if submitters also make

the same request. If submitters request a commissioner, and the applicant

does not, then the submitters must pay for the additional costs associated

with the commissioner, with the costs being equally shared between the

submitters requesting it.

|

|

2. Plan changes

or Notice of Requirements which require the use of a commissioner will be

charged at the actual cost of the commissioner.

|

|

Pre-hearing

Meetings

|

|

Staff attendance at hearings

– cost of staff attending hearing (charged at hourly rates above). For

resource consents, only the processing planner will be charged.

|

|

Consent

Monitoring

|

|

Resource Consent monitoring fees

(fixed fee)

|

170.00

|

|

(Each

inspection)

|

|

State of the Environment

monitoring fee (fixed fee)

|

111.00

|

|

Monitoring of activities subject

to requirements of the HSNO Act (fixed fee)

|

125.00

|

|

Fees set by the

Resource Management (Infringement Offences) Regulations 1999 adopted in

2000/01

|

|

Contravention of Section 9

(restrictions of use of land)

|

300.00

|

|

Contravention of an abatement notice

(other than a notice under Section 322(1)(c))

|

750.00

|

|

Contravention of an excessive

noise notice direction under Section 327

|

500.00

|

|

Contravention of Section 22

(failure to provide certain information to an Enforcement Officer)

|

300.00

|

|

Terms of payment: Payment of

additional fees are due within 20 working days of the invoice date or 20th of

the month, whichever is the latest.

|

|

Site

Contamination Search

|

|

Information search to meet

requirement (method) of section 6(2) of the Resource Management (National

Environmental Standard for Assessing and Managing Contaminants in Soil to

Protect Human Health) Regulations 2011

|

|

Residential and rural (fixed fee

per site)

|

155.00

|

|

Commercial and Industrial (fixed

fee per site)

|

300.00

|

|

Development

Contributions

|

|

The Local Government Act

provides for full cost recovery. Application costs that exceed the deposit

will be subject to additional charges at the rates and disbursements set out

in this schedule. For those applications that attract a fixed deposit, a

receipt will be issued at the time of payment. A GST invoice will be issued

at the completion of processing.

|

|

Remissions, unusual developments

and deferral of payment (deposit)

|

410.00

|

|

Objections (Full cost recovery

for commissioners, council staff and other support) (deposit)

|

410.00

|

|

Commissioners are selected and

appointed independently of Council and their full costs will be recovered.

|

|

|

|

|

Finance and Council

Controlled Organisations Committee

12 September 2017

|

|

Resolution to Exclude the

Public

That the Finance and

Council Controlled Organisations Committee:

Pursuant to the provisions of the

Local Government Official Information and Meetings Act 1987, exclude the public

from the following part of the proceedings of this meeting namely:

|

General subject of the matter to be considered

|

Reasons

for passing this resolution in relation to each matter

|

Ground(s) under

section 48(1) for the passing of this resolution

|

Reason for

Confidentiality

|

|

C1

Property Sale

|

S7(2)(i)

The

withholding of the information is necessary to enable the local authority to

carry on, without prejudice or disadvantage, negotiations (including

commercial and industrial negotiations).

|

S48(1)(a)

The public conduct of

the part of the meeting would be likely to result in the disclosure of

information for which good reason for withholding exists under section 7.

|

This report is

confidential to protect Council's position in respect of the negotiations for

a proposed property sale..

|

This resolution is made in

reliance on Section 48(1)(a) of the Local Government Official Information and

Meetings Act 1987, and the particular interest or interests protected by

Section 6 or Section 7 of that Act, or Section 6 or Section 7 or Section 9 of

the Official Information Act 1982, as the case may require, which would be

prejudiced by the holding of the whole or the relevant part of the proceedings

of the meeting in public are as shown above after each item.