|

Economic Development

Committee

21 November 2017

|

|

Part

A Reports

Business Events Update

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to provide an overview and update on the Business Events

activity undertaken by Enterprise Dunedin.

2 Business

Events contribute to Dunedin’s Economic Strategy theme, “Compelling

Destination” and link into other key themes such as “Business

Vitality”, “Alliances For Innovation”, “Linkages Beyond

our Borders” and “Hub for Skills and Talent”.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Business Events update.

|

BACKGROUND

3 The

Ministry for Business, Innovation and Employment (MBIE) measures business

events activity in New Zealand through the Convention Activity Survey (CAS). A

business events activity is defined as Meetings/Seminars, Incentive Activities,

Conferences/Conventions, Tradeshows/Exhibition and Special Occasion activities.

4 MBIE also

measure the annual economic contribution of multi-day conventions and

conference activity to the New Zealand economy through the Convention Delegate

Survey (CDS)

5 Business

events continue to be a lucrative market for tourism in New Zealand and Dunedin

as delegates stay longer, spend more and travel in off/shoulder seasons. MBIE

released the CDS year ending December 2016 revealing an increase in delegate

spend and length of stay for the period:

· International

delegates spent an average of 6 nights in New Zealand (4.2 nights in the host

region), spending an estimated $334 per night. This is almost double the

average spend per night for all international visitors according to the

International Visitor Survey (IVS).

· Domestic

delegates (New Zealand delegates from outside the event region) spent an

average 3 nights in the event region, spending an estimated $504 per night.

6 Enterprise

Dunedin works in partnership with Tourism New Zealand to bid for international

conferences. Tourism New Zealand received an additional $34m for the period of

2014-17 from MBIE to support this. They manage the Conference Assistance

Programme (CAP); a fund available to national and international associations

and organisations that bid to host international conferences in New

Zealand. This programme provides funding, expertise and support to

develop international conference bids, as well as on-going support when the

bids have been successful.

7 Business

events, particularly international conventions, have a significant flow on

effect for Dunedin through facilitating knowledge exchange and building

international networks, consequently raising the profile of the city and

encouraging growth and investment in key sectors.

8 The role

of Enterprise Dunedin is to generate leads for the city and its key partners.

These leads are predominantly generated from sales and marketing activity in

the domestic and Australian market.

9 The

proposed opening of four new convention centres in Auckland, Wellington,

Christchurch and Queenstown highlights the need to build on the momentum we are

experiencing and look for new opportunities for growth to ensure we remain

sustainable, and continue to grow market share. International conferences offer

the strongest potential for growth.

10 Enterprise Dunedin,

supported by Grow Dunedin Partnership and University of Otago funding, has

continued to fund an FTE for a fixed term period until 30 June 2018, with a

hope to make this role permanent as part of the Long Term Plan. The focus

for this resource continues to be to drive the International Business Events

Plan attracting high yield visitors to Dunedin in winter and shoulder seasons,

increasing overall market share, and highlight the city’s thought

leaders, tertiary institutions and key industry sectors on a global stage.

DISCUSSION

11 In the year ending June

2017 Dunedin continues to hold market share at 3% of business events

experiencing strong growth in a period where six destinations have lost market

share.

12 The city has

experienced a 5.7% increase in the number of events on the previous year to

date which equates to 80 additional events.

13 The number of

delegates attending events has grown by 16.2% to 124,026 and the number of

delegate days associated by 18.4% to 139,142 days - more than double the

national average.

14 Since 01 July 2016

Enterprise Dunedin has generated 28 leads, including 11 formal bids for the

city and its venues and suppliers, with a potential economic impact to the city

of $17,381,175 for the period of 2017-2020 if successful.

15 Enterprise Dunedin,

in conjunction with Tourism New Zealand, hosted a function at the University of

Otago to promote the Conference Assistance Programme and support available when

bidding for international conferences. This was endorsed by the Vice Chancellor

and was attended by approximately 50 academic staff. Additional presentations

have also been made to various divisions with the University.

a) From this

activity four leads were generated, three of which have progressed into formal

bids and one is still in the early stages of research.

b) From previous

international bid activity four international conferences were secured with an

estimated economic value of $4.2m. This includes the World Congress of

Herpetology which will welcome 1000 delegates to the city for six days in

2020.

c) Enterprise

Dunedin has received significant industry partnership from Tourism New Zealand

to fund this activity and the entire bidding process. The value of this

partnership is estimated at $106,000 for the 2016/17 financial period.

OPTIONS

16 There are no options

as this is an update report.

NEXT STEPS

17 Dunedin will

continue to build on the market share growth experienced by creating

opportunities in line with the International Business Events Plan. Dunedin

needs to ensure we remain sustainable as competition starts to increase in the

coming years through four proposed new Convention Centres.

18 International

conferences have strong potential for growth – both in value (attracting

high yield visitors in winter/shoulder seasons) and the global profile of

Dunedin and that of our tertiary institutions.

19 Enterprise

Dunedin will continue to work with Tourism New Zealand to

develop a business events ‘Advocates’ programme. This will identify and engage thought leaders in their

field as potential or current, destination champions for business events in

Dunedin.

Signatories

|

Author:

|

Bree Jones - Business Tourism Events Advisor

Kyla Anderson - Business Analyst, Enterprise Dunedin

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This activity relates to providing a public service and it

is considered good-quality and

cost-effective by growing the Dunedin economy by continuing to promote the

city as a compelling destination.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☐

|

|

Spatial Plan

|

☐

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The business events visitor is a key component of the

visitor industry, which contributes to Dunedin Economic Development

Strategy’s theme, a compelling destination, as also outlined in the

Dunedin Visitor Strategy (DVS) 2008-2015.

|

|

Māori Impact

Statement

Ngai Tahu has a representative on the Grow Dunedin

Partnership governance group which has overall governance responsibility for

Dunedin’s Economic Development Strategy.

|

|

Sustainability

These activities promote a sustainable economy as it attracts

delegates to the city in traditionally off-peak and shoulder seasons. These

are high yield visitors that spend more and stay longer than an international

leisure visitor.

These activities potentially contribute to the long-term

economic benefits of the city by increasing the visitor industry’s GDP

and employment.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no known implications.

|

|

Financial

considerations

There are no known financial implications.

|

|

Significance

It is considered to low significance and is consistent

with the Economic Development Strategy’s goals.

|

|

Engagement –

external

These activities are being delivered with the relevant

city partners.

|

|

Engagement -

internal

There is no internal engagement required.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for the Community Boards.

|

|

Economic Development Committee

21 November 2017

|

|

Enterprise Dunedin Q1 2017/18 Activity Report

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 This is

the first activity report prepared by Enterprise Dunedin for the Economic

Development Committee (EDC).

2 The

purpose of this report is to update the EDC on several Enterprise Dunedin

activities during Quarter 1 2017/18.

3 Activity

not included in this update will be addressed in future reports to either EDC

or other committees. For instance, recent updates have been provided to EDC on

Project China and Good Food Dunedin. An update on Enterprise Dunedin Ara Toi

activity was reported through the Community and Culture Committee on 17 October

2017.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Enterprise Dunedin Quarter 1 2017/18 Activity Report.

|

BACKGROUND

4 Enterprise

Dunedin activity is informed by the 2013-23 Economic Development Strategy (or 'strategy').

The strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances for

innovation – to improve linkages between industry and research.

c) A hub for

skills and talent – to increase retention of graduates, build the skills

base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A compelling

destination – to increase the value of tourism and events and improve the

understanding of Dunedin’s advantage.

5 The

strategy sets out two economic goals:

a) 10,000 extra

jobs over 10 years (requiring growth of approximately 2% per annum).

b) An average of

10,000 of extra income for each person (requiring GDP per capita to rise about

2.5% per annum).

DISCUSSION

6 The

latest economic information produced by Infometrics to the year ending 30 June

2017 indicates:

a) Growth in

employment of 1% (and 1.5% for the period until 30 June 2016).

b) Growth of GDP

per capita of 1.4% per annum.

7 The

activity report is composed of two parts:

a) Update on the

development of a planning and reporting framework.

b) Details on

Enterprise Dunedin activities undertaken between 1 July and 30 September 2017.

Enterprise Dunedin Planning and

Reporting Framework

8 Enterprise

Dunedin has been developing a planning and reporting framework since February.

This work will inform more structured reporting (and planning) to the EDC, the

Grow Dunedin Partners (GDP) and community in the future.

9 This

framework has drawn on a range of good practice from New Zealand and Australia

including:

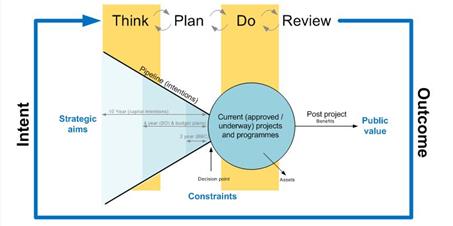

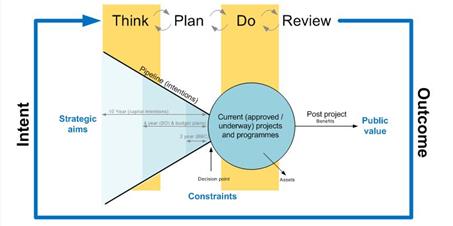

a) The integrated

planning and reporting model below:

b) Reporting

tools such as results based accountability (RBA) – a practical technique

for organisations to evaluate the results of their programmes.

c) Economic

analysis developed by experts such as Infometrics.

10 Future Enterprise

Dunedin Activity Reports will apply the new framework.

Enterprise Dunedin

activities undertaken from 1 July – 30 September 2017

11 The draft Dunedin

Destination Plan:

a) Hearings

on the draft Dunedin Destination Plan were held on 4 and 5 September 2017.

Issues raised by submitters were considered and the draft Dunedin Destination

Plan will be presented to Council for adoption in the New Year.

12 Public Relations,

Marketing Activities, Campaigns and TRENZ:

a) In September,

Enterprise Dunedin hosted Japanese media arranged through Tourism New

Zealand’s International Media Programme (IMP). The visits achieved the

following outcomes:

i) A

Dunedin feature in Brutus (one of the most popular life style

publications in Japan) with circulation of 91,000 resulting in an estimated

advertising value of $214,344.

ii) Promotion of the

Taieri Gorge Rail journey and Dunedin’s craft beer sector via the Asahi

Digital and Travel website and associated online posts resulting in an

estimated advertising value of $260,838.

b) Campaigns:

i) Extend

your Stay:

The Extend your Stay campaign was launched in

mid-September and will run until the end of December. The campaign centres on

significant concerts, events and attractions occurring in Dunedin and

encouraging visitors to stay longer and explore more of the city.

c) TRENZ 2018:

i) Dunedin

will host TRENZ, New Zealand’s biggest business to business travel and

trade event from 7-10 May 2018.

ii) The event is

delivered by Tourism Industry Aotearoa (TIA) on behalf of the industry and is

expected to attract 1500 delegates.

iii) In preparation,

Enterprise Dunedin has established a TRENZ city activation group consisting of

key representative organisations and individuals to ensure the city maximises

the hosting opportunities.

iv) This group will be

focussed on airport welcomes, hosting opportunities, training and development

and will engage with key sectors such as local retailers, transport operators,

tourism operators and the hospitality sectors.

13 i-SITE Visitor

Centre:

a) Preparations

have commenced for the 2017/18 cruise season with an expected 90 ships visiting

the city – an increase from 76 last year.

b) Queries

regarding accommodation for the Ed Sheeran concert in March/April 2018 have

continued. The i-SITE is working to reassure fans outside of Dunedin regarding

accommodation and respond to requests and bookings in relation to other major

upcoming events.

14 Business

activities including:

a) The Otago

Regional Business Partnership (RBP):

i) The

Regional Business Partnership (RBP) includes Dunedin City Council, the Otago

Chamber of Commerce and Otago Southland Employers Association. During the

period, the Otago RBP supported 89 new clients (43% based in Dunedin) through

training grants worth $71,000 and access to business mentors.

ii) The RBP

achieved a net promoter score (and indicator of client satisfaction) of 73%

exceeding the national average of 61% and target of 50%.

iii) The Enterprise

Dunedin Growth Advisor supported the development of a $200,000 research project

which was approved by Callaghan Innovation.

iv) Quarter 1 activity

generally exceeded the forecast performance targets (set by the funders, New

Zealand Trade and Enterprise and Callaghan Innovation) and is a positive

indicator of business capability and growth in the city and across the region.

b) Support for

the start-up ecosystem:

i) Enterprise

Dunedin has continued to review the business start-up ecosystem. This process

has brought together a range of companies, co-working spaces and other

stakeholders to identify problems, benefits and options to support business start-ups.

ii) Funded and

supported by GDP, the intention is to encourage new ventures, develop

entrepreneurship and successful scalable businesses.

c) GigCity/Smart

City activities including Techweek18:

i) The

fifth round of the GigCity Community Fund received seventeen applications in

August. While outside Quarter 1, $147,000 funding for projects aimed at

education and health were subsequently announced on 15 October.

ii) In August,

the Digital Community Trust (DCT) appointed Martin Jenkins to review GigCity

activity to date and present options on future technology and smart city

activity. Enterprise Dunedin intends to present early options later in

December.

iii) Enterprise

Dunedin worked with the Australian Broadcasting Commission (ABC) Four

Corners programme on a comparison of the rollout of ultra-fast broadband

(UFB) in Dunedin with Australia. This was a positive story about Dunedin and

businesses and can be accessed via the link to the ABC website: http://www.abc.net.au/4corners/whats-wrong-with-the-nbn/9077900

iv) Work is continuing

with the SIGNAL ICT graduate school, University of Otago and Otago Polytechnic

on the development of events for Techweek 2018. The aim of Techweek is to

inspire, connect and build capability through a nationwide festival of

innovation in conjunction with businesses and institutions.

d) Sexy Summer

Jobs (SSJ):

i) The

annual Sexy Summer Jobs (SSJ) programme, aimed at meeting business need through

student internships has commenced for 2017/18. The speed interview event was

held on 20 September which has so far resulted in attracting 32 businesses (12

of which are new to the programme).

ii) Early indications

are that the business participating in the programme will again come from the

tech, education/research and biotech/health technology sectors.

15 Study Dunedin:

a) An agent event

promoting international study in Dunedin was held in Auckland during August.

The event focused on the Japan study market and brought together ten Dunedin

high schools, the University of Otago (including Foundation Studies programmes)

and Otago Polytechnic with 39 agents. Two agents were invited to visit Dunedin

at the end of September.

b) Study Dunedin

attended an Education New Zealand (ENZ) Student Fair and Agent Seminar event in

Bangkok in August. Sixteen agent meetings were held and Study Dunedin engaged

with over 40 individuals during the Fair.

c) The Study

Dunedin sections of the DunedinNZ.com have been refreshed. The website, which

is designed to market the city to prospective international students, has been

updated to include 360° video segments with real students talking about

their Dunedin study experiences.

d) A dedicated

Dunedin agent networking event was held for 11 agents who have existing

relationships with Dunedin institutions.

e) An industry

survey was conducted in June/July to gauge the cohort’s needs from Study

Dunedin going forward. The results of the survey and workshops will inform

new plans and KPI’s for the remainder of the 2017/18 and going forward.

16 Energy:

a) A new Energy

Planning Co-ordinator was appointed in September. The initial focus has been on

the preparation of a feasibility study to consider the expansion of the

district energy scheme in Dunedin’s CBD using biomass power. This report

is expected to be completed in the New Year.

OPTIONS

17 As an update report,

there are no options.

NEXT STEPS

18 Feedback on the

activity report will be incorporated in future updates.

19 The following areas

will be progressed during Quarter 2:

a) Continued

development of the planning and reporting framework which will report on a

broader range of Enterprise Dunedin activity including film, Good Food Dunedin

and Ara Toi.

b) The draft

Dunedin Destination Marketing Plan.

c) Ongoing

development of measures and activities to support the start-up ecosystem.

Signatories

|

Author:

|

Fraser Liggett - Economic Development Programme Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision relates to

providing local public services and is considered good quality and cost

effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin activities contribute to a number of

strategies and plans, including Council’s Energy Plan.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Enterprise Dunedin activities and the 2013-23 Economic

Development Strategy are included in the 2015-25 Long Term Plan.

|

|

Financial considerations

There are no financial considerations.

|

|

Significance

This decision is considered low significance under the

Significance and Engagement Policy.

|

|

Engagement –

external

As an update report, no external engagement has been

undertaken

|

|

Engagement -

internal

As an update report, no internal engagement has been

undertaken.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no conflicts of interest.

|

|

Community Boards

There are no implications for Community Boards.

|