|

Finance and Council

Controlled Organisations Committee

13 March 2018

|

|

Part

A Reports

Financial Result - Period Ended 31 January

2018

Department: Finance

EXECUTIVE SUMMARY

1 This

report provides the financial results for the period ended 31 January 2018 and

the financial position as at that date.

|

RECOMMENDATIONS

That the Committee:

a) Notes the Financial

Performance for the period ended 31 January 2018 and the Financial Position

as at 31 January 2018.

|

BACKGROUND

2 This

report provides a commentary of:

· the forecast operating result of

Council for the whole of the 2017/18 financial year (Part 3), and

· The performance of Council for the period ended 31 January 2018 and the

financial position as at that date (Parts 4 to 8).

DISCUSSION

3 Commentary

on expected Full Year Budget Overspend

Section 1 to this Report shows that Council

has a budgeted Net Deficit (excluding Waipori) for 2017/18 of $3.587m.

Various events occur throughout each financial year that cause variances

between the actual operating surplus/deficit and the budgeted operating

surplus/deficit. The following events will impact on Council’s Net

Deficit (excluding Waipori) budget of $3.587m for 2017/18 (approximate

figures):

Operating Expenditure – the following

unbudgeted operating expenditure items are expected to be incurred:

· $8.5m

related to work carried out in response to the July 2017 flood event

(additional $4m capital expenditure will also be incurred)

· $5.5m

related to the Property Division focussing on its deferred maintenance program

and a general increase in its service levels

Revenue – the following budgeted

approximate revenue streams will not be received in 2017/18 (largely just a

timing difference as these have been deferred to 2018/19):

· $5m due

to the deferral of capital works, mainly related to LED and cycle ways

· $3m

related to the deferral of NZTA funding in association with the Peninsula

project

These ‘negatives’ are expected

to be partially offset by the following unbudgeted revenue streams that are

expected to arise:

· $9m,

being NZTA funding for work carried out in response to the July 2017 flood

event

· $2m as

the level of waste received to landfill exceeds the budgeted figure as a

privately owned facility is no longer operating

· $1m in

additional Development Contributions, mainly associated with development in

Mosgiel

The nett effect of these matters on the

Operating Result (excluding Waipori) is that:

· Operating

Expenditure will exceed budget by around $14m

· Income

is expected to exceed budget by around $4.2m and

· Operating Result will be around $10m worse than budget

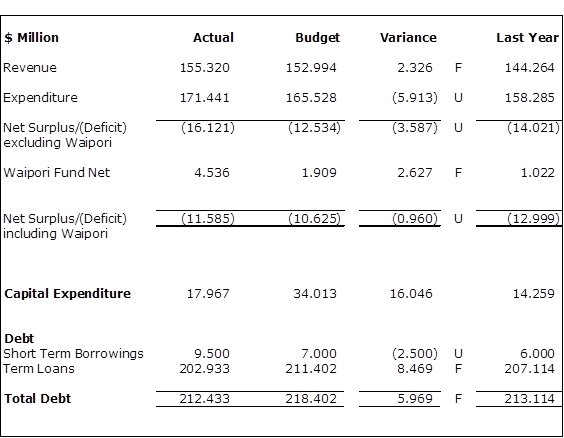

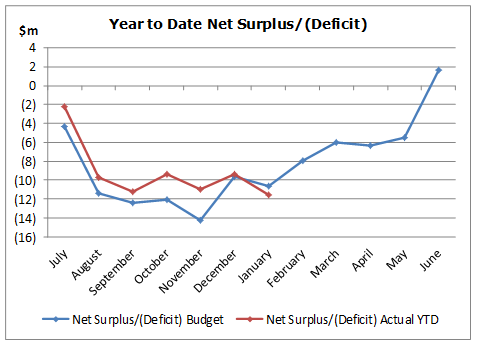

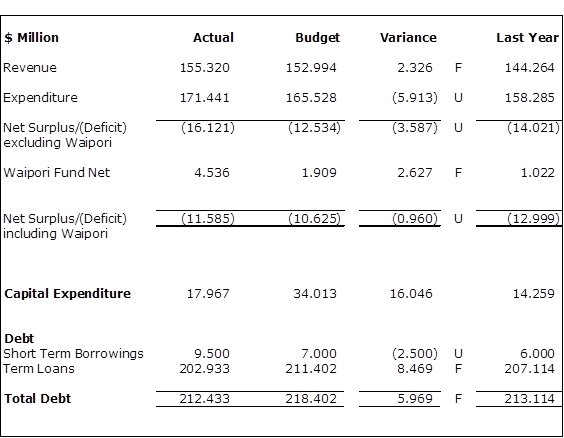

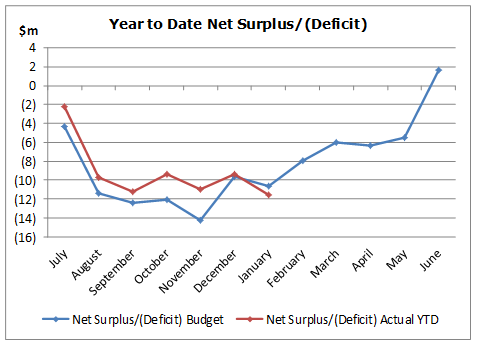

4 Commentary

on Year to Date Result (Table in Section 1)

The unfavourable YTD variance against

budget was due to the following:

· $3.110

million higher than expected asset operations and maintenance expenditure

primarily due to emergency repair work associated with the July 2017 flood

event.

· $2.332

million higher fees & levies costs. This included consultancy costs in

Property covering for vacant positions and a high volume of building survey and

inspection work undertaken to inform maintenance and renewal programmes.

In addition Building Services expenditure is higher than expected to ensure

consenting activity meets the required statutory deadlines. A number of

other departments had higher than expected expenditure associated with the

development of asset renewal plans (eg: Logan Park Precinct, Dunedin Ice

Stadium) and coverage for position vacancies.

· $1.830

million lower than expected grants revenue in Transport due to the delays being

experienced in the capital programme (including cycleways and Peninsula

projects), partially offset by the higher revenue associated with the emergency

repair work discussed above.

· $832k

higher materials, supplies & services expenditure. This included

costs associated with the 2GP, flood relief expenditure and contracted services

to assist in the management of the property portfolio.

5 These

unfavourable YTD variances were partially offset by:

· $3.173

million – higher than expected other operating revenue. This

favourable variance was mainly due to: Waste and Environmental Solutions

revenue was greater than expected with additional tonnage through the Green

Island landfill being the overflow from the closure of the Fairfield Landfill;

and higher than expected building consent activity in Regulatory

Services. Parking operations revenue was also higher than expected with

increased metered activity.

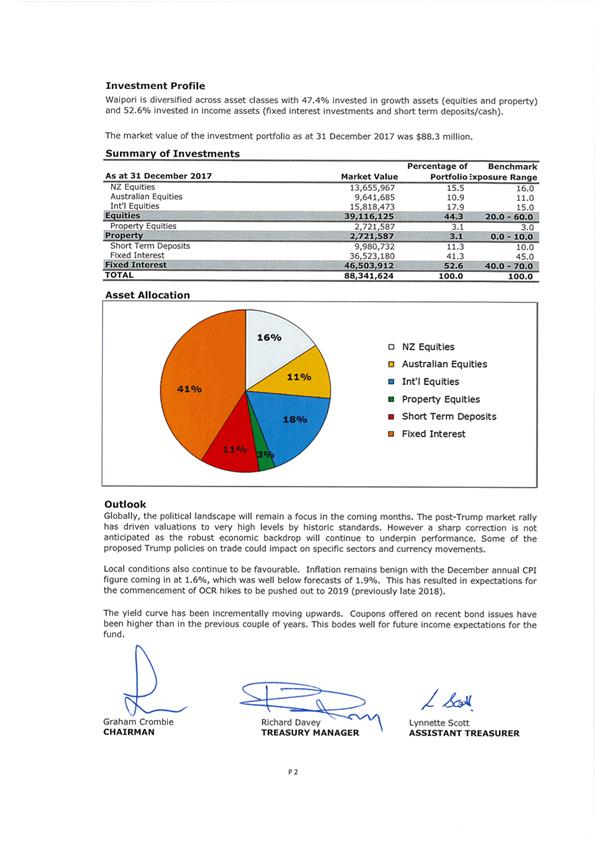

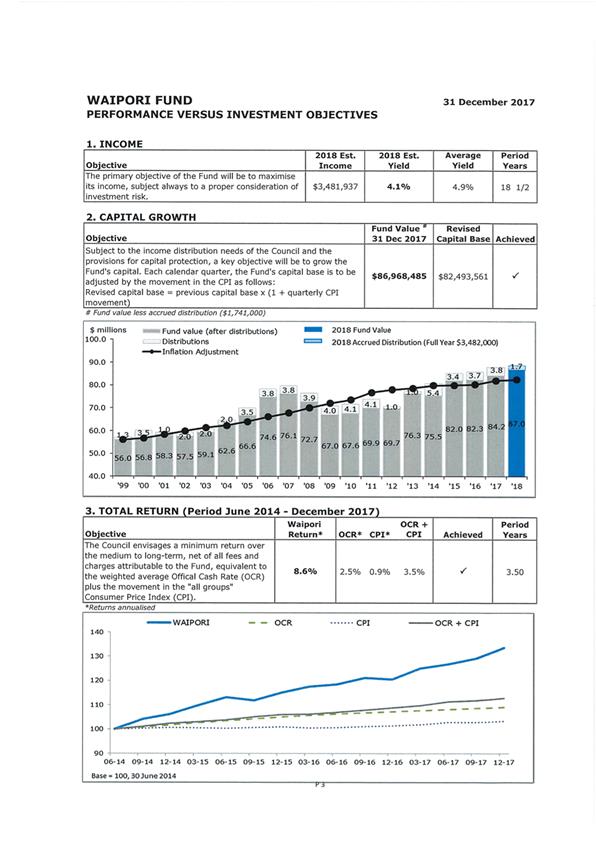

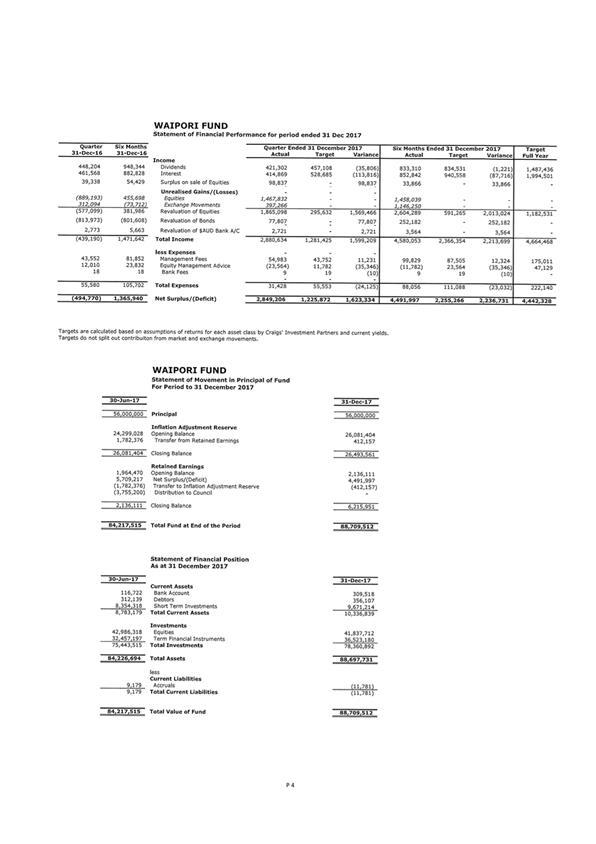

· $2.627

million Waipori Fund resulting from unbudgeted fair value gains across a number

of investment portfolios – in particular international equities driven by

the weaker NZD. This result is prior to the recent deterioration in world

equity markets.

· $795k

– Grants expenditure was lower than budgeted due to the delayed timing of

grant payments including the grant associated with the development on the new

hockey turf in South Dunedin ($510k).

· $797k

– favourable interest expenditure driven by the lower debt level and

favourable floating interest rate.

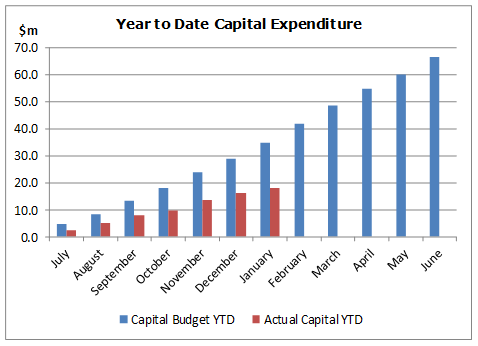

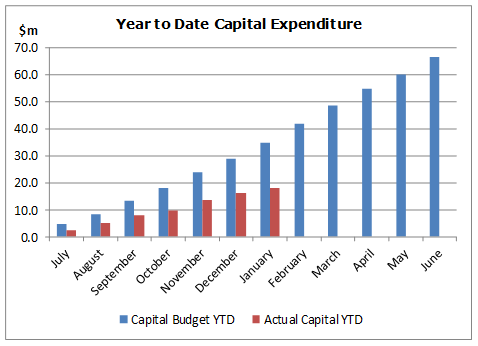

6 YTD

Capital expenditure was less than budget by $16.046 million. Project delays

have arisen across a number of portfolios while project scoping and design is

finalised.

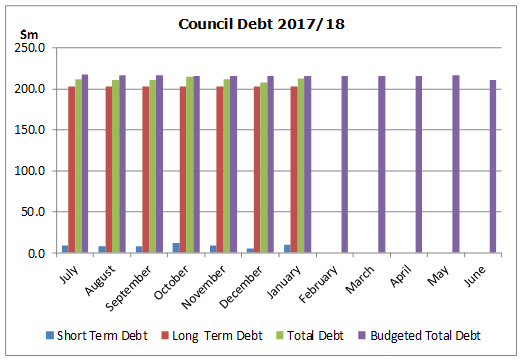

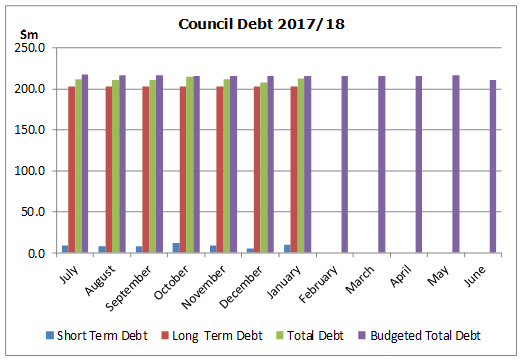

7 Total

Council debt as at 31 January 2018 was $212.433 million or $5.969 million lower

than budget. This variance reflected delayed expenditure on capital

projects. Note that the $9.500 million short term debt was repaid early

February.

OPTIONS

8 Not

applicable.

NEXT STEPS

9 Not

applicable.

Signatories

|

Author:

|

Lawrie Warwood - Financial Analyst

Gavin Logie - Financial Controller

|

|

Authoriser:

|

Dave Tombs - General Manager Finance and Commercial

|

Attachments

|

|

Title

|

Page

|

|

a

|

Summary Financial

Information

|

20

|

|

b

|

Statement of Financial

Performance

|

21

|

|

c

|

Statement of Financial

Position

|

22

|

|

d

|

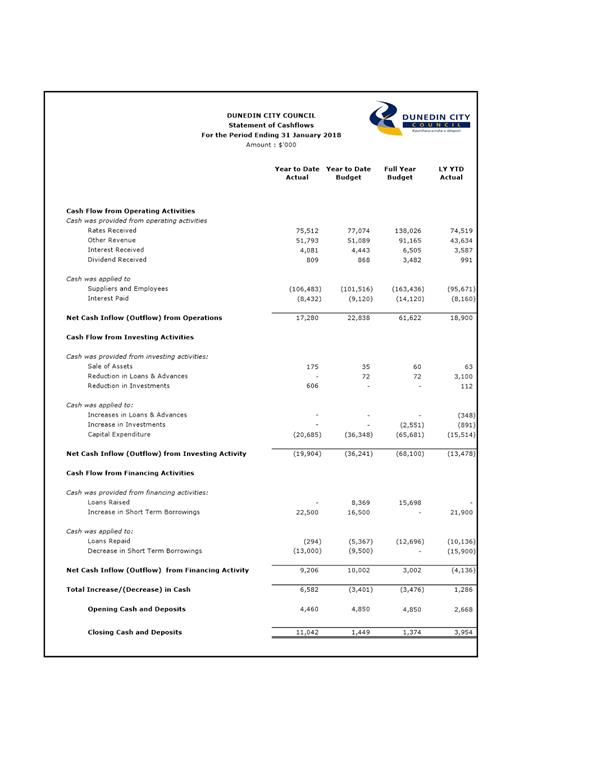

Statement of Cashflows

|

23

|

|

e

|

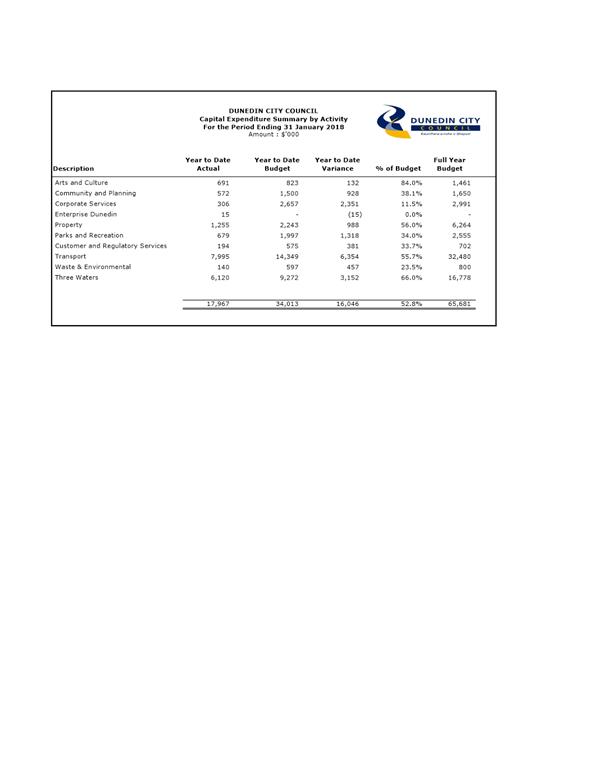

Capital Expenditure

Summary

|

24

|

|

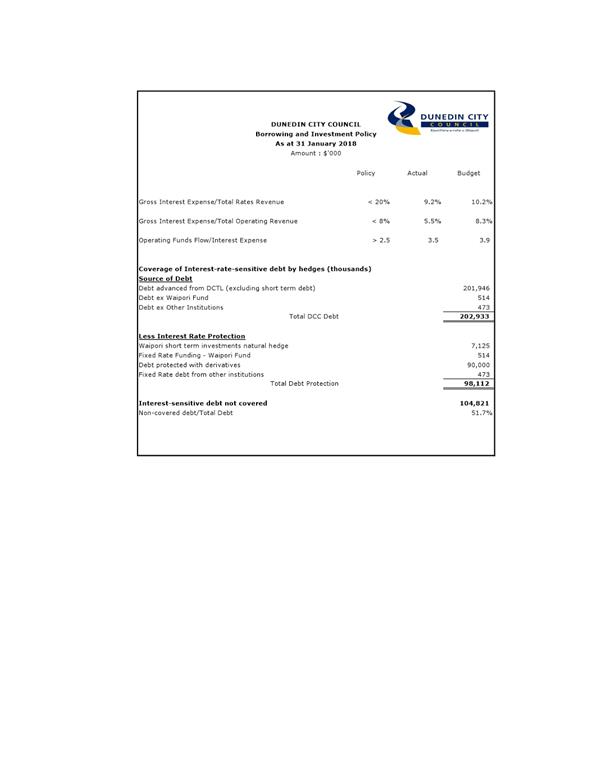

f

|

Borrowing and

Investment Policy

|

25

|

|

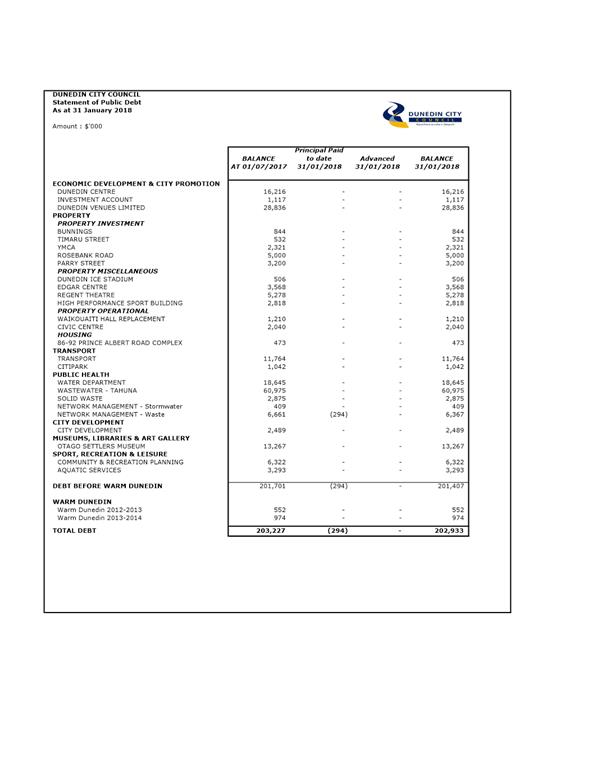

g

|

Statement of Public

Debt

|

26

|

|

h

|

Summary of Operating

Variances

|

27

|

|

i

|

Financial Review

|

28

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

The financial expenditure reported in this report relates

to providing local infrastructure, public services and regulatory functions

for the community.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

This report has no direct contribution to the Strategic

Framework, although the financial expenditure reported in this report has

contributed to all of the strategies.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report fulfils the internal financial reporting

requirements for Council.

|

|

Financial

considerations

Not applicable – reporting only.

|

|

Significance

Not applicable – reporting only.

|

|

Engagement –

external

There has been no external engagement.

|

|

Engagement -

internal

The report is prepared as a summary for the individual department

financial reports.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

Finance and Council Controlled Organisations

Committee

13 March 2018

|

|

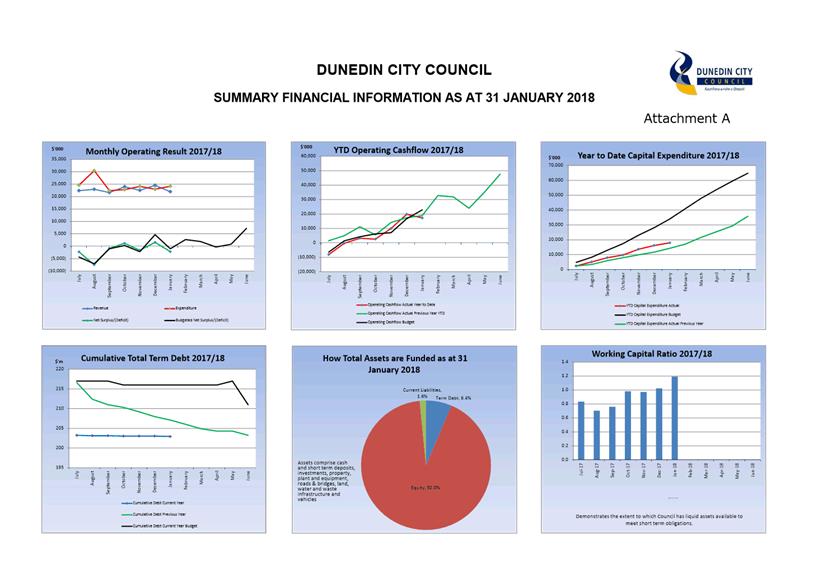

Financial Review

For The

Period ended 31 January 2018

This report provides a detailed commentary

on the Council’s financial results for the period ended 31 January 2018

and the financial position at that date.

net

surplus/(Deficit) (including waipori)

The net

deficit (including Waipori) for the period ended 31 January 2018 was

$11.585 million or $960k worse than budget.

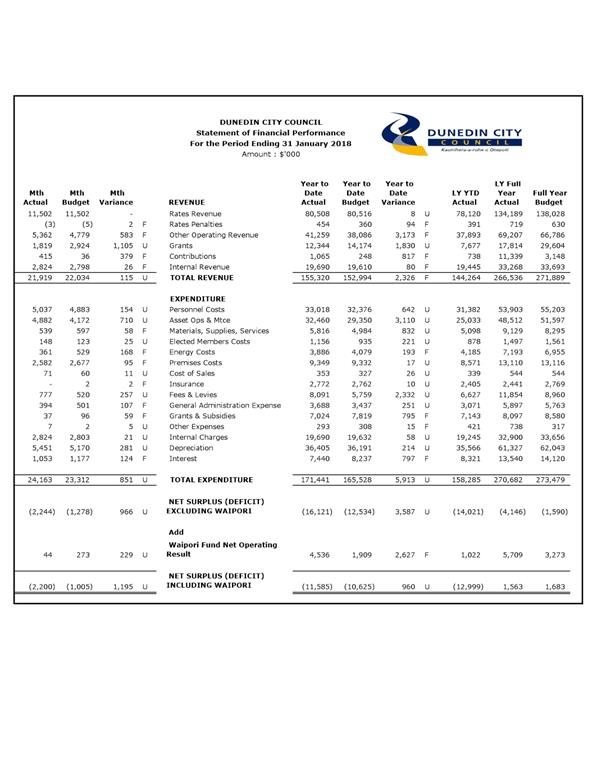

REVENUE

The total revenue for the period was

$155.320 million or $2.326 million greater than budget.

The major variances were as follows:

Other Operating Revenue

Actual $41.259 million, Budget $38.086

million, Favourable variance $3.173 million

Waste and Environmental Solutions revenue

was favourable $2.112 million due mainly to the level of waste received to

landfill being greater than expected.

Parking Operations revenue was favourable

$282k reflecting increased usage for on-street and off-street car parks and car

park buildings.

Enterprise Dunedin revenue was favourable

$270k due to timing of Regional Business Partnership revenue and Work Ready

Coordinator funding.

Regulatory Services revenue was favourable

$191k due to greater than expected number of building consent applications.

Alcohol licencing and dog registration revenue was also ahead of target.

Civic and Administration revenue was

favourable $96k due to unbudgeted revenue relating to an Otago Regional Council

by-election in their Dunstan constituency. This was partly offset by unbudgeted

expenditure.

These favourable variances were partially

offset by:

Property revenue was unfavourable $341k due

to some vacancies in the investment portfolio and reduced rent in some

miscellaneous property while building improvement work was carried out.

Aquatic Services revenue was unfavourable

$91k. Unfavourable winter weather conditions impacted on revenue for

Moana. In addition gym revenue was less than budget, partly due to promotions

being run by other gyms.

Grants

Actual $12.344 million, Budget $14.174

million, Unfavourable variance $1.830 million

Transport grants and subsidy revenue was

unfavourable by $1.835 million. The timing of capital projects resulted

in an unfavourable variance in capital subsidy revenue

($3.692 million), partly offset by greater than budgeted operating subsidies

due to expenditure in response to the July 2017 flooding event.

Contributions

Actual $1.065 million, Budget $248k,

Favourable variance $817k

This variance related to higher than

expected development contributions invoiced in the current year.

Expenditure

The total expenditure for the period was

$171.441 million or $5.913 million greater than budget.

The major variances were as follows:

Personnel Costs

Actual $33.018 million, Budget $32.376

million, Unfavourable variance $642k

Personnel costs were unfavourable year to

date due to higher than budgeted recruitment costs to secure resourcing in a

number of departments, along with higher than expected training costs in

particular leadership development.

Asset Operations and Maintenance Costs

Actual $32.460 million, Budget $29.350

million, Unfavourable variance $3.110 million

Transportation costs were unfavourable $3.502 million primarily due

to July's rain event resulting in unbudgeted emergency work.

Property costs were unfavourable $609k

mainly due to unbudgeted reactive maintenance cost in the Housing portfolio.

Waste and Environmental Solutions costs were unfavourable

$192k. ETS costs were higher than budget reflecting the additional income

activity discussed above.

These unfavourable variances were partially

offset by:

Parks and Recreation expenditure was

favourable ($858k) due to delays in programmed maintenance (buildings &

trees), lower than expected reactive maintenance and improved oversight

associated with the Green Space and Ecological contracts.

Materials Supplies and Services

Actual $5.816 million, Budget $4.984

million, Unfavourable variance $832k

Property costs were unfavourable $647k due

to unbudgeted contracted services expenditure to support the operation of the

department pending appointment of permanent staff.

Civic and Administration Services costs

were unfavourable $292k due to costs associated with the 2GP and flood relief

expenditure.

Fees and Levies

Actual $8.091 million, Budget $5.759

million, Unfavourable variance $2.332 million

Recreation

Planning costs were unfavourable $429k due to consultant costs relating to the

Logan Park Precinct Plan and recreation planner secondment costs.

Property

costs were unfavourable $851k due to the high number of consultants

currently working in the Property Services department. This variance will

increase through the financial year as a result of both consultants covering

vacant positions and a high volume of survey and inspection work being

undertaken to inform maintenance and renewal programmes.

Regulatory

Services costs were unfavourable $251k due mainly to higher consultancy costs

for building consents work being processed by third parties.

Resource

Consents costs were unfavourable $158k due to unbudgeted litigation costs and

planning costs associated with processing resource consent applications.

Transportation

costs were unfavourable $566k due to consultant’s costs for health and

safety and other audits, and professional services scoping costs for City

Cluster Schools safety work.

Three

Waters costs were unfavourable $147k due to consultant support for procurement

activity and system reviews.

Grants and Subsidies

Actual $7.024 million, Budget $7.819

million, Favourable variance $795k

Recreation Planning costs were favourable

$649k primarily due to the budgeted $520k grant for the Kings hockey turf not

yet being required due to project delays.

City Development costs were favourable

$165k due to the timing of Heritage Support grants.

Interest

Actual $7.440 million, Budget $8.237

million, Favourable variance $797k

Interest expenditure was less than budget

due to the lower level of borrowing and a favourable floating interest rate

applied to the non-fixed interest borrowing.

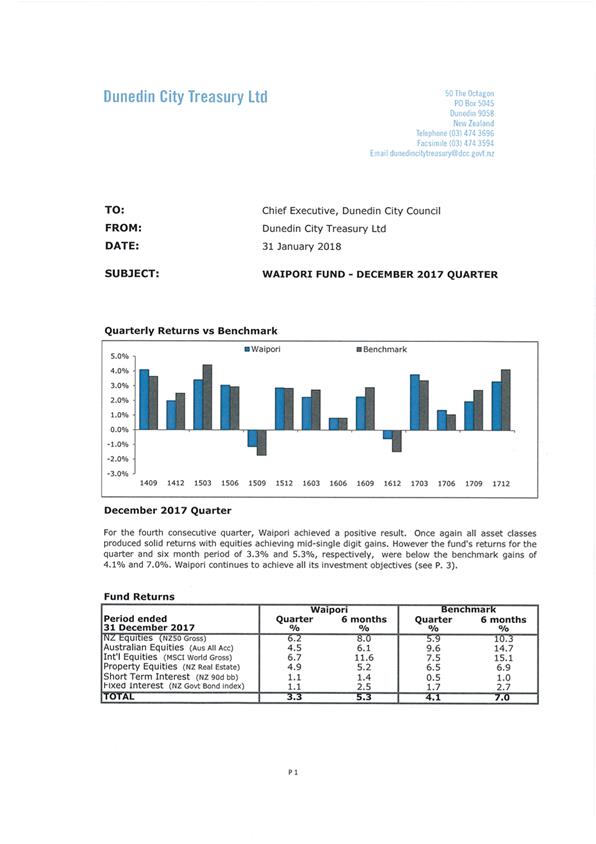

WAIPORI FUND NET

OPERATING RESULT

Actual

$4.536 million, Budget $1.909 million, Favourable variance $2.627 million

The Waipori Fund net operating

result was favourable for the year due to unrealised gains across a number of

investment portfolios. In particular international equities have been

favourably impacted by the weaker NZD.

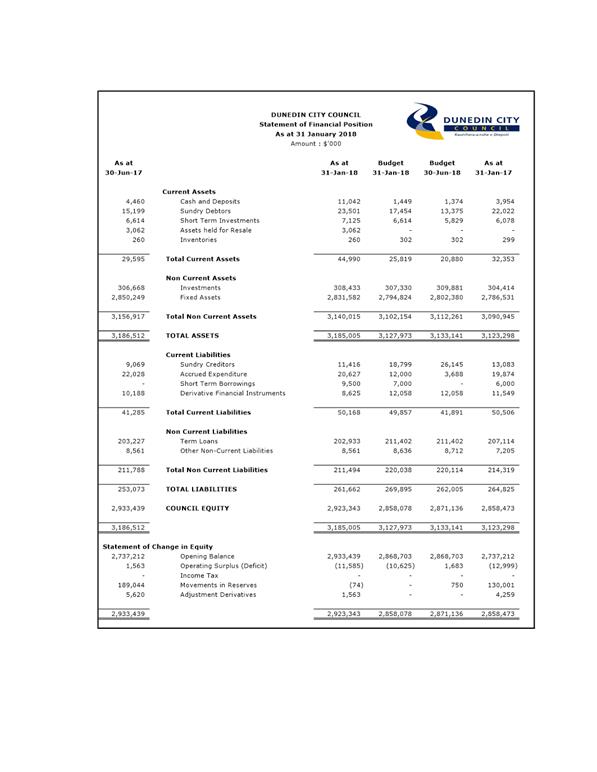

Statement of

Financial Position

A Statement of Financial Position is

provided as Attachment C.

Short term investments of $7.125 million

relate to the Waipori Fund.

The value of fixed assets was greater than

budget as at 31 January 2018, mainly due to a higher than expected revaluation

increase applied to infrastructure assets (in particular Three Waters assets).

Statement of

Cashflows

A Statement of Cashflows is provided as

Attachment D.

Cashflow from operations was less than

budgeted year due to higher than expected operating costs (maintenance and

professional fees).

Cash outflows from investing were less than

budgeted due to capital expenditure being less than budgeted.

Capital

Expenditure

A summary of the capital expenditure

programme by Activity is provided as Attachment E.

Total capital expenditure for the period to

31 January 2018 was $17.967 million or 27.4% of the full year budget of

$65.681 million.

Community

and Planning Group capital expenditure was $928k

underspent

This variance was due to delayed progress

with the Citywide Amenities upgrade work. The project will continue

through the 2017/18 financial year.

Corporate Services capital expenditure was $2.351 million underspent

This variance was due to delayed timing of

the Electronic Document and Records Management system replacement

project. The RFP process is complete with a preferred vendor appointed.

Property capital

expenditure was $988k underspent

Project prioritisation and final scoping

continues to be a focus within the Property group prior to the commencement of

any significant works.

Investment property upgrades were underspent

$212k. Work to date includes 37 Treffers Road roof and yard

reconstruction as well as for 9 Heriot Drive’s sprinkler upgrade.

Completion is expected first quarter 2018.

Parks and Recreation capital expenditure was $1.318 million underspent

A number of projects have been delayed

while assets assessments are completed to allow appropriate programming of

work.

Tenders for Playground improvements work

have closed and are currently being evaluated.

Other projects for changing room

refurbishment at Mosgiel and the Caledonian Gym as well as the Botanic Garden

glasshouse renewal have been approved and will be tendered soon.

The Mosgiel East (Highland Park) reserve

development project is nearing completion.

There has been no expenditure to date on

the Logan Park Artificial Turf project ($1 million favourable). This

budget is unlikely to be spent this financial year with construction not

expected to commence until October 2018.

Customer and Regulatory capital expenditure was $381k underspent

The budget for parking meter upgrades (FY

$300k) will not be required for 2017/18 due to all meters being upgraded in the

2016/17 financial year in order to comply with new credit card protocols.

Transport capital

expenditure was $6.354 million underspent

The Peninsula road widening project was

under budget by $3.168 million. There has been a delay in commencing the

physical works with full year expenditure likely to be in the order of $2.000

million (full year budget $10.800 million).

Renewals capital was under budget by $3.424

million due to timing. Contracts have been recently awarded for

carriageway resurfacing, kerb and channelling and footpath resurfacing.

These under spends were partially offset

by:

Minor safety improvements were over budget

$1.274 million and included the Highcliff Road and South Dunedin safety works.

The year to date expenditure also included

unbudgeted slip repairs resulting from the July 2017 rain event totalling

$565k.

Water and Waste Services capital expenditure was $3.152 million underspent

General

network renewals were tracking behind budget, partially offset by on-going

expenditure on the Ross Creek Dam project and the treatment site switchboard

replacement programme.

Debt

Refer to

Attachments F and G.

Attachment F

provides a summary of the debt servicing ratios for the year to date.

All three

targets were within policy.

No new loans

were required year to date.

Debtors and rates

outstanding

Sundry debtors outstanding as at 31 January

2018 totalled $23.501 million. This included long term debt of $435k, and debt

associated with Warm Dunedin of $3.244

million.

Debtors outstanding for more than four

months (excluding long term debt and Warm Dunedin) totalled $641k, compared

with last year’s total of $616k as at 31 January 2017.

Rates arrears relating to prior year rates

totalled $976k. This was higher than the $648k total as at January

2017. Of this total $92k was being recovered under formal arrangements

with Council, while the balance is being actively pursued.

Comments from

group activities

Attachment H, the Summary of Operating

Variances, shows by Group Activity the overall net surplus or deficit variance

for the seven months ended 31 January 2018. It also shows the variances

by revenue and expenditure type.

Enterprise Dunedin Group - $581k Favourable

External revenue was favourable $270k due to

the timing of budgeted revenue from Regional Business Partners and Education

New Zealand. There was also some unbudgeted revenue relating to the Business

Events activity.

Operating expenditure was favourable $304k

due largely to the delayed timing of various marketing and project activities.

Property - $3.327 million Unfavourable

Staff costs were unfavourable $351k due to

unbudgeted recruitment fees, and new positions being filled.

Property operating costs were unfavourable

$2.443 million. Fees and levies expenditure was unfavourable $851k

due to the high number of consultants currently working in the Property

Services department. This variance will increase through the financial year as

a result of both consultants covering positions yet to be filled and a high

volume of survey and inspection work being undertaken to inform maintenance and

renewal programmes.

Repairs & maintenance expenses were

unfavourable $1.256 million mainly due to unbudgeted reactive works and

contractor costs across the Property portfolios.

Premises costs were greater than budget

$295k largely due to the costs associated with Building WOF compliance

monitoring.

Investment Account – $1.337 million

Favourable

Interest costs were favourable $797k due to

the lower level of borrowing and a favourable floating interest rate applied to

the non-fixed interest borrowing.

Parks & Recreation Group - $439k

Favourable

Parks and Recreation operating expenditure

was favourable ($850k) due to delays in programmed maintenance (buildings &

trees), lower than expected reactive maintenance and improved oversight

associated with the Green Space and Ecological contracts. In addition

grants expenditure was lower than budget primarily due to the Kings Hockey Turf

ground still to be paid out.

This favourable variance was partially

offset by Aquatics revenue falling behind budget due to the impact of poor

weather, and increased competition effecting gym revenue. In addition

Aquatics personnel costs exceeded budget due to increased overtime and

rostering required to resource for unplanned illness and leave.

Transport Group - $5.627 million

Unfavourable

External revenue was unfavourable $1.462

million. Capital subsidies were $1.879 million less than budget due to delays

in capital projects (Peninsula widening, LED lighting upgrade and the central

city cycling projects). Operating subsidies were higher than expected due

to increased operating expenditure, including costs incurred in response to the

July 2017 flood event.

Transport operating expenditure was

unfavourable $3.856 million to due to greater than budgeted costs of subsidised

emergency work and road maintenance as a result of the

July 2017 rainfall event.

Waste and Environmental Solutions –

$2.057 million Favourable

Total revenue was favourable $2.112 million

due to due to an increase in waste to landfill.

WWS Three Waters – $404k Favourable

External revenue was favourable $669k due

mainly to an unbudgeted external recovery and higher than expected development

contribution revenue.

Operating expenditure was $266k

unfavourable in part reflecting costs associated with the July 2017 flood event

and the boil water notification which included system flushing and supply of

bulk tanker water for residents and affected businesses.