Notice of Meeting:

I hereby give notice that an ordinary meeting of the

Economic Development Committee will be held on:

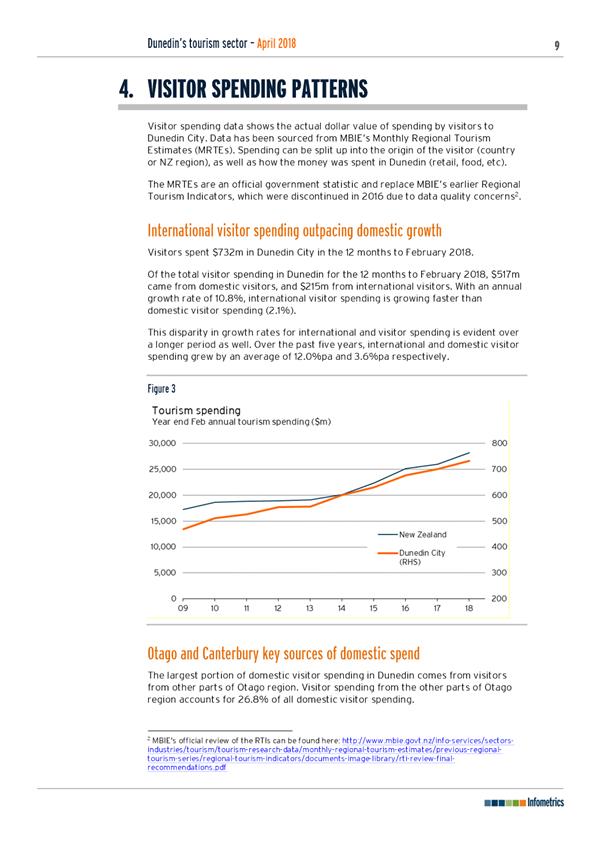

Date: Tuesday

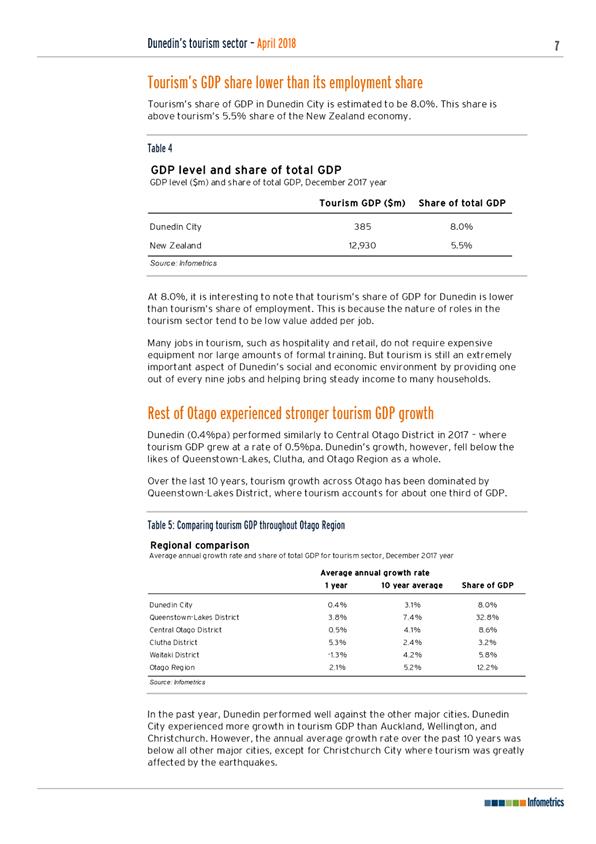

22 May 2018

Time: 1.00

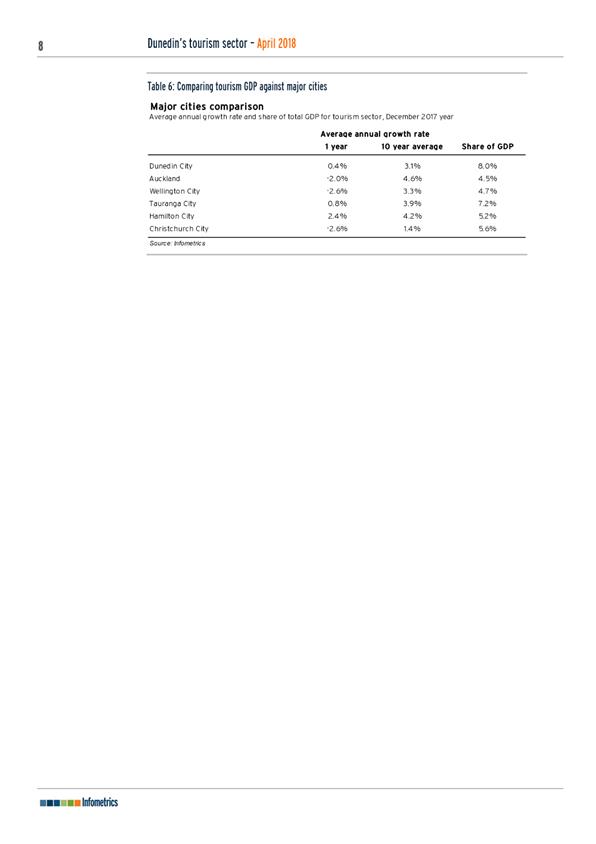

pm

Venue: Edinburgh

Room, Municipal Chambers, The Octagon, Dunedin

Sue Bidrose

Economic Development Committee

PUBLIC AGENDA

|

Chairperson

|

Chris Staynes

|

|

|

Deputy Chairperson

|

Christine Garey

|

Andrew Whiley

|

|

Members

|

David Benson-Pope

|

Dave Cull

|

|

|

Rachel Elder

|

Doug Hall

|

|

|

Aaron Hawkins

|

Marie Laufiso

|

|

|

Mike Lord

|

Damian Newell

|

|

|

Jim O'Malley

|

Conrad Stedman

|

|

|

Lee Vandervis

|

Kate Wilson

|

Senior Officer John

Christie, Director Enterprise Dunedin

Governance Support Officer Jenny

Lapham

Jenny Lapham

Governance Support Officer

Telephone: 03 477 4000

Jenny.Lapham@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

Economic Development

Committee

22 May 2018

|

|

ITEM TABLE OF CONTENTS PAGE

1 Public

Forum 4

1.1 Public Forum - Gareth Evans, Fara

Engineering 4

2 Apologies 4

3 Confirmation

of Agenda 4

4 Declaration

of Interest 5

Part

A Reports (Committee has power to decide these matters)

5 Long-term

perfomance of Dunedin's tourism sector - Infometrics Report 15

6 Infometrics

Quarterly Economic Monitor Report December 2017 44

7 Enterprise

Dunedin Q3 January to March 2018 Activity Report 59

8 Film

Dunedin Development Report 64

9 Items

for Consideration by the Chair

Resolution to Exclude the Public 71

|

Economic Development

Committee

22 May 2018

|

|

1 Public

Forum

1.1 Public Forum - Gareth Evans,

Fara Engineering

Gareth Evans, Chief Executive Officer of Farra Engineer

wishes to address the meeting regarding the Dunedin Engineering Hub.

2 Apologies

At the close of the agenda no

apologies had been received.

3 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

|

Economic Development

Committee

22 May 2018

|

|

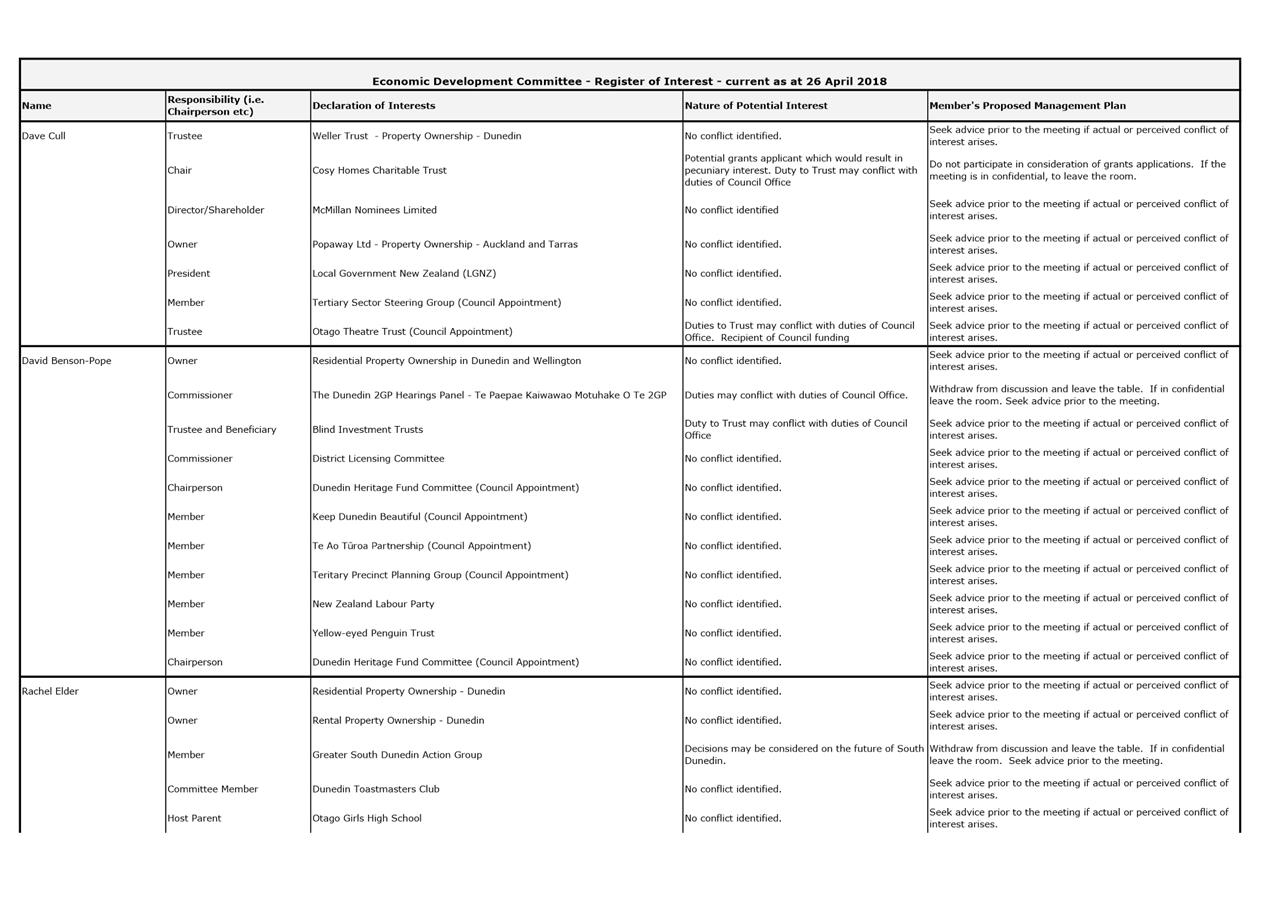

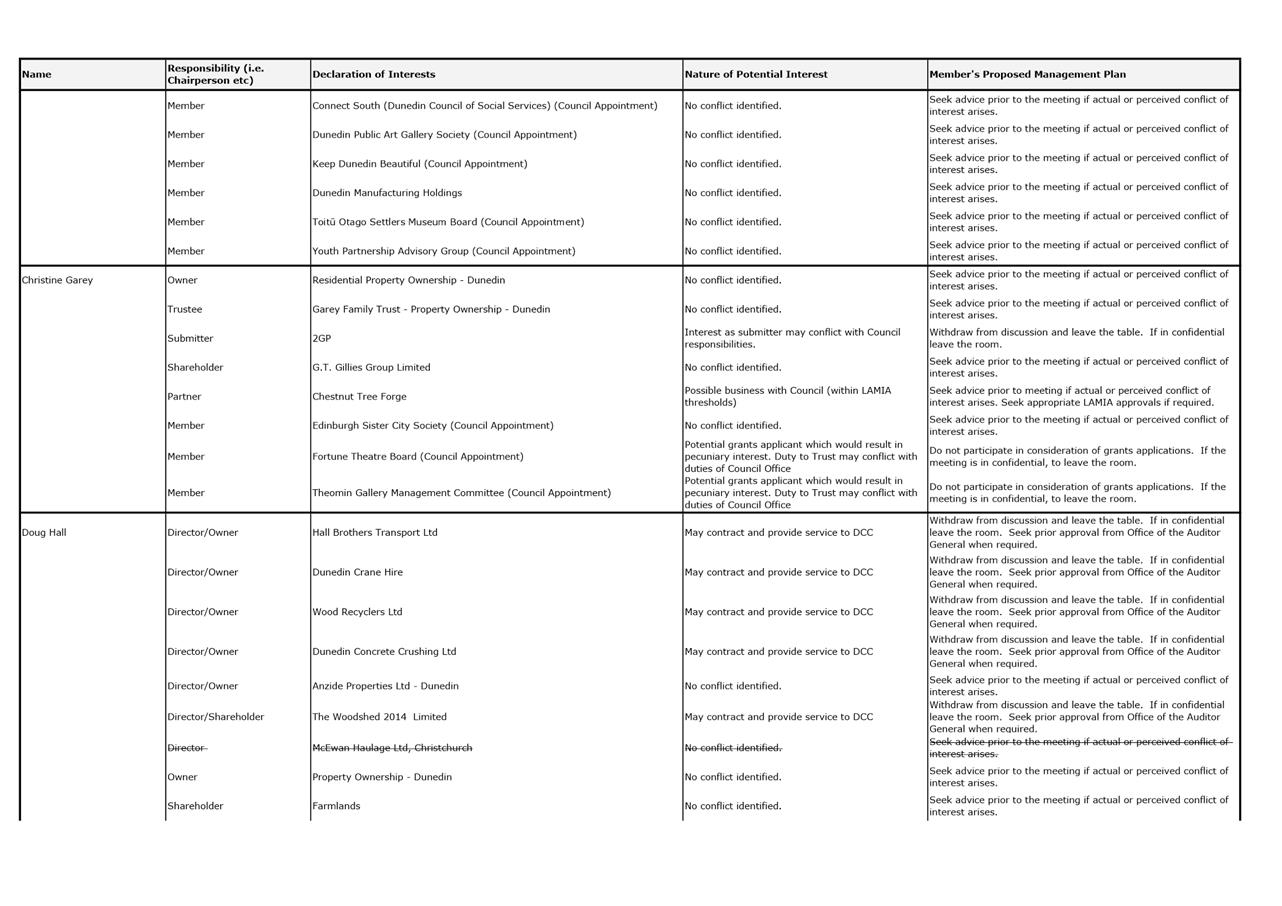

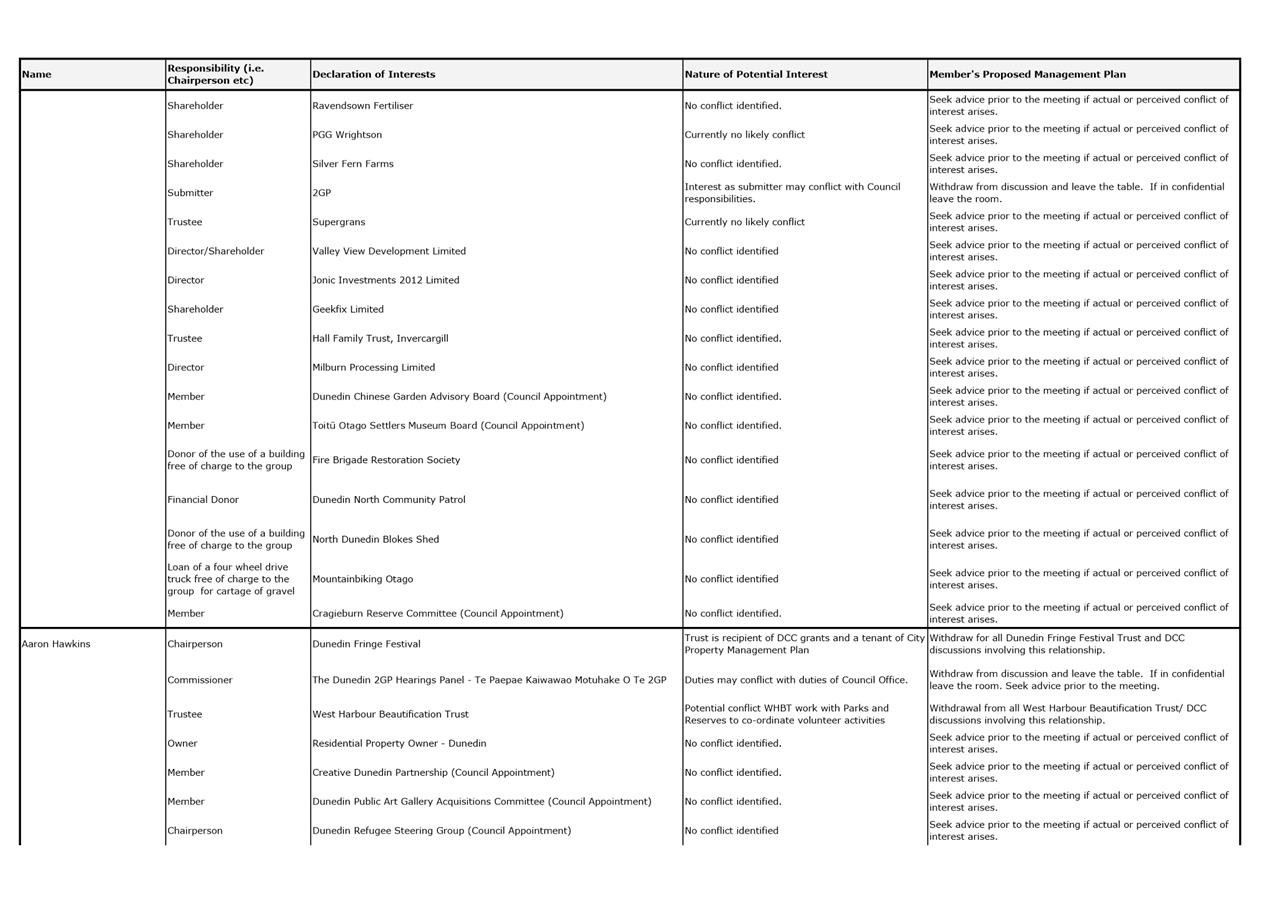

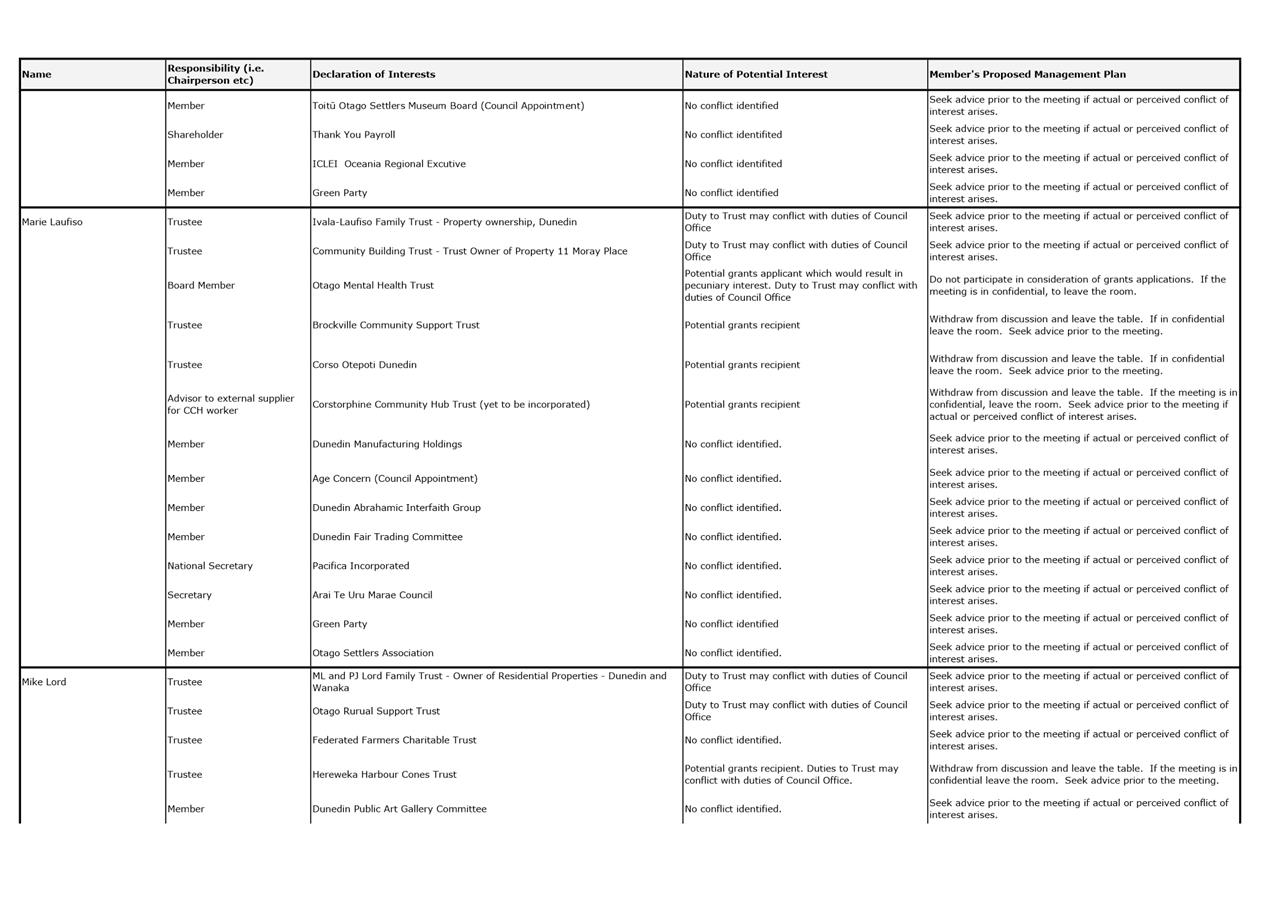

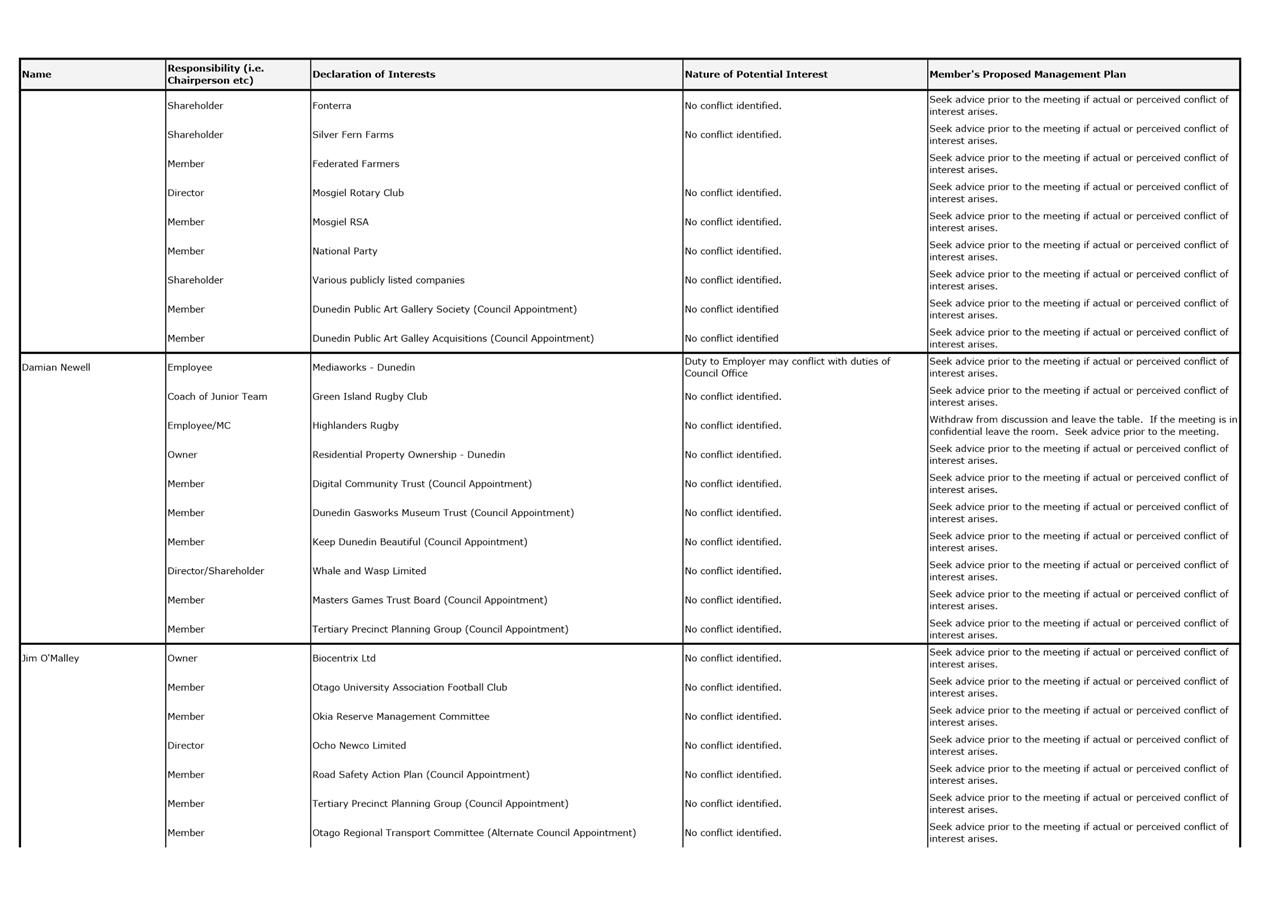

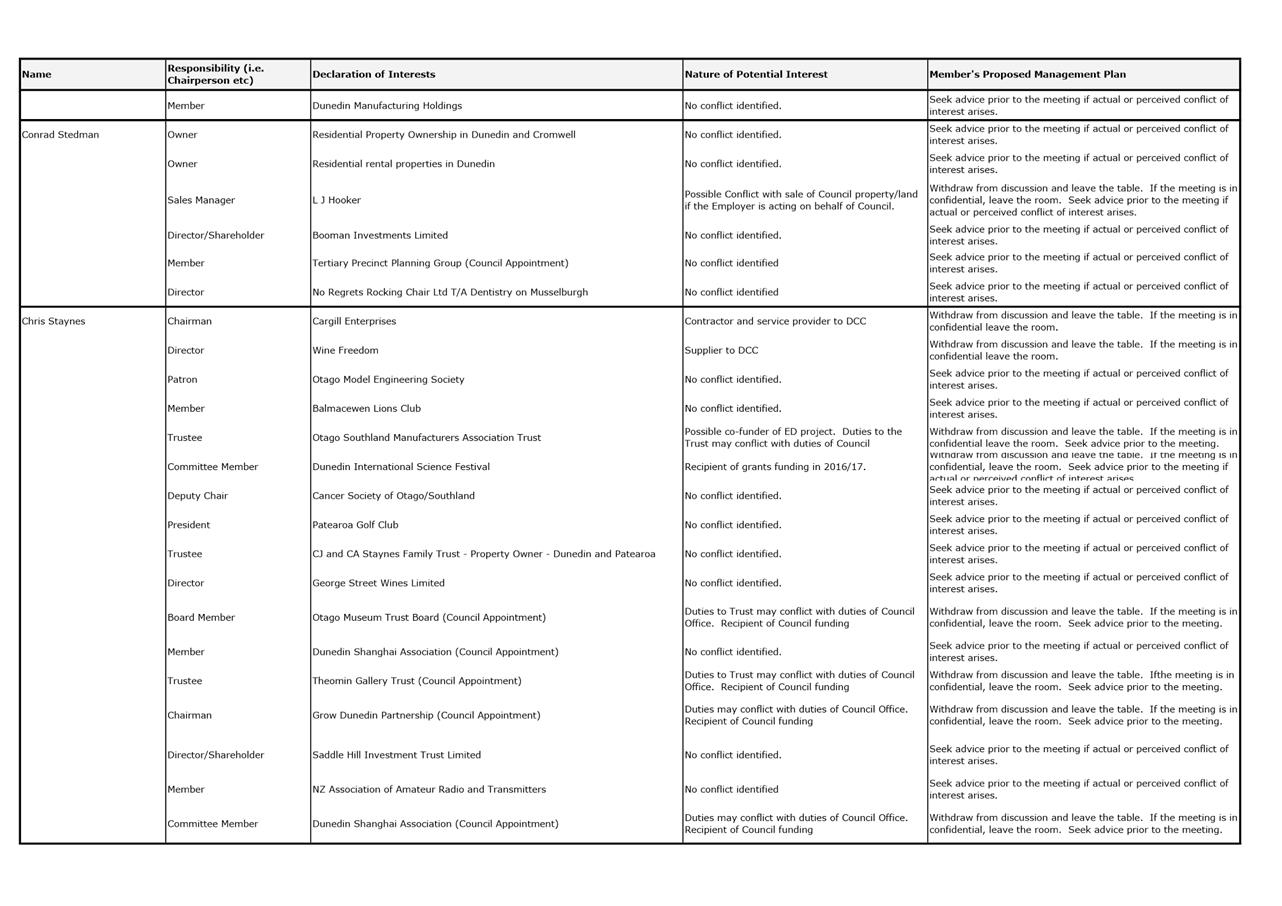

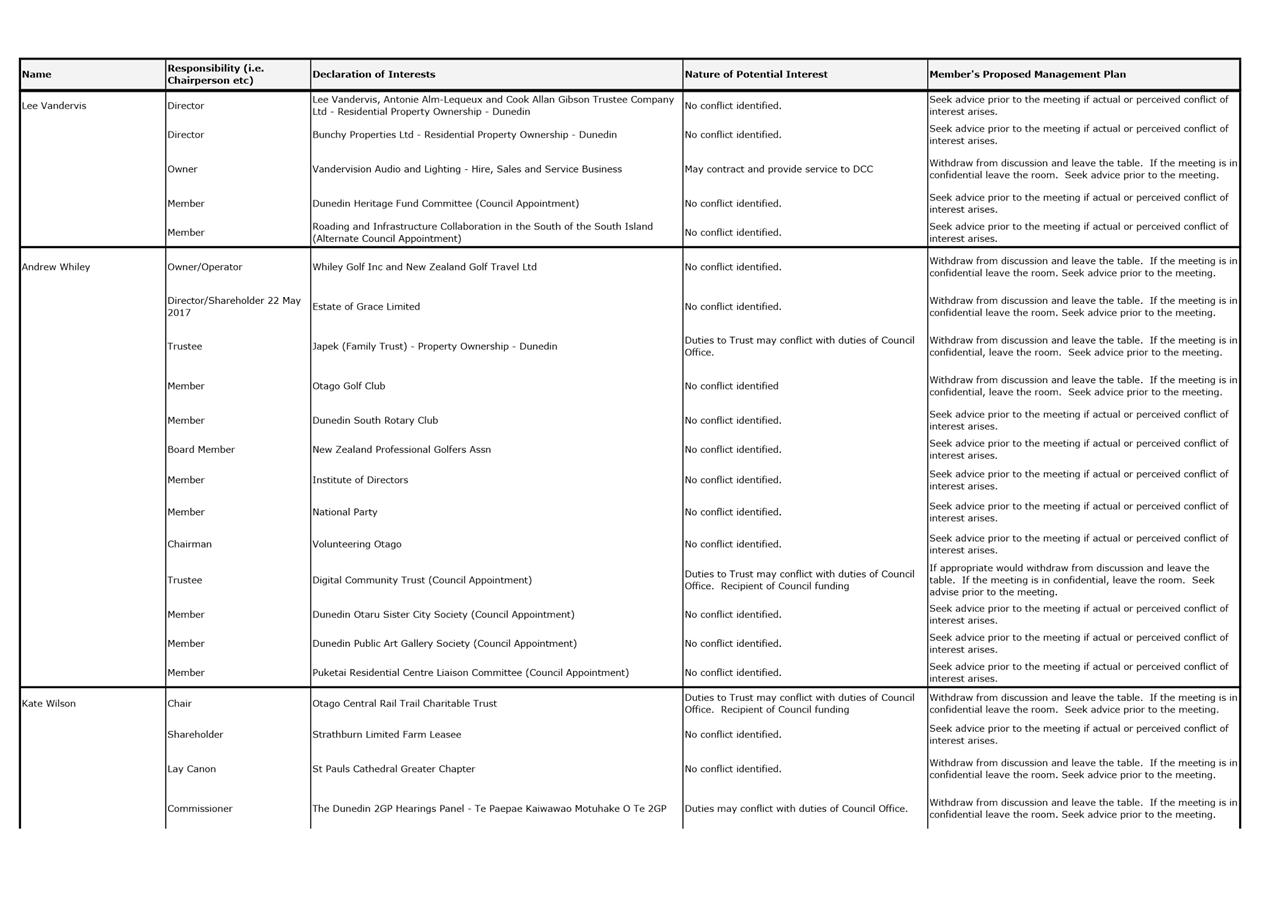

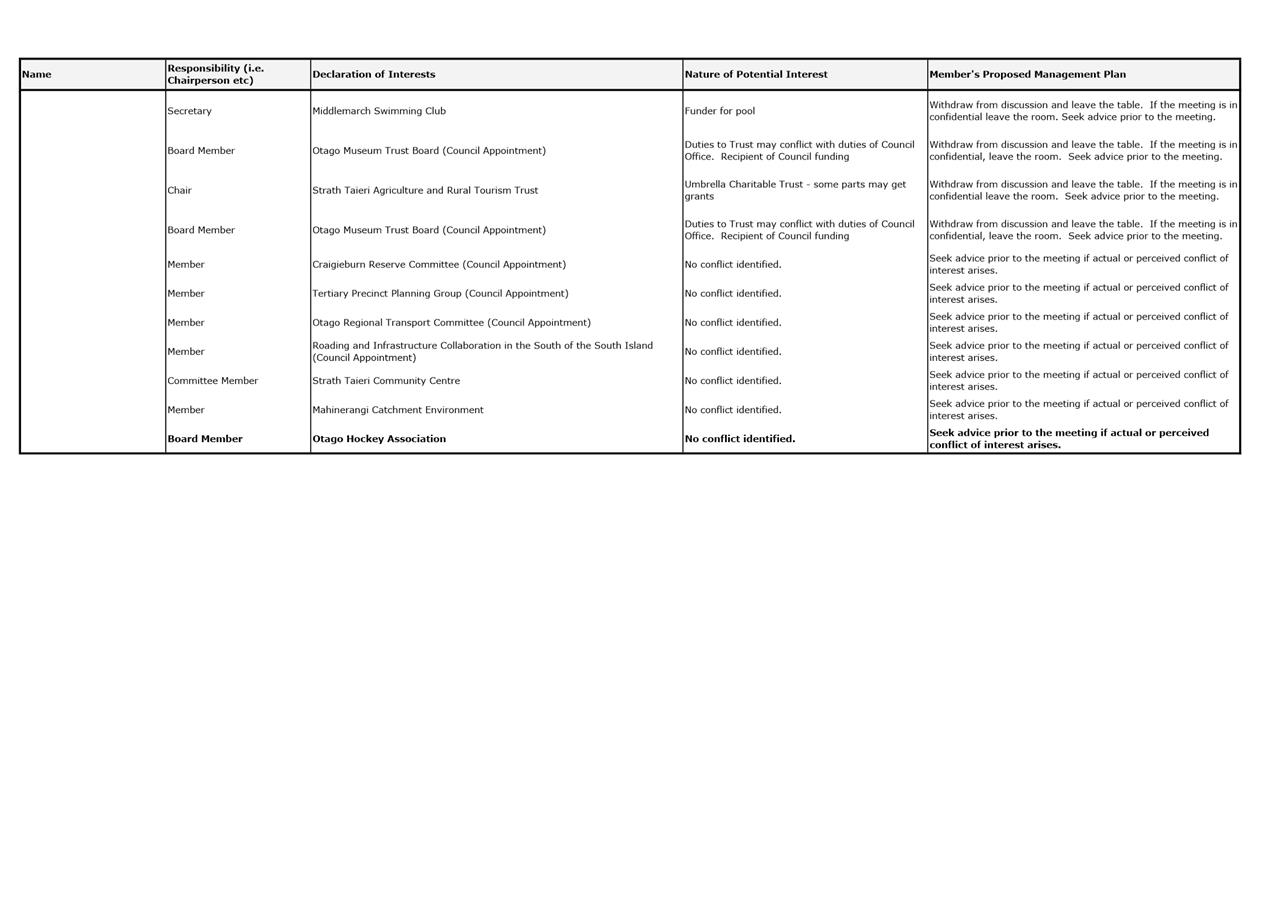

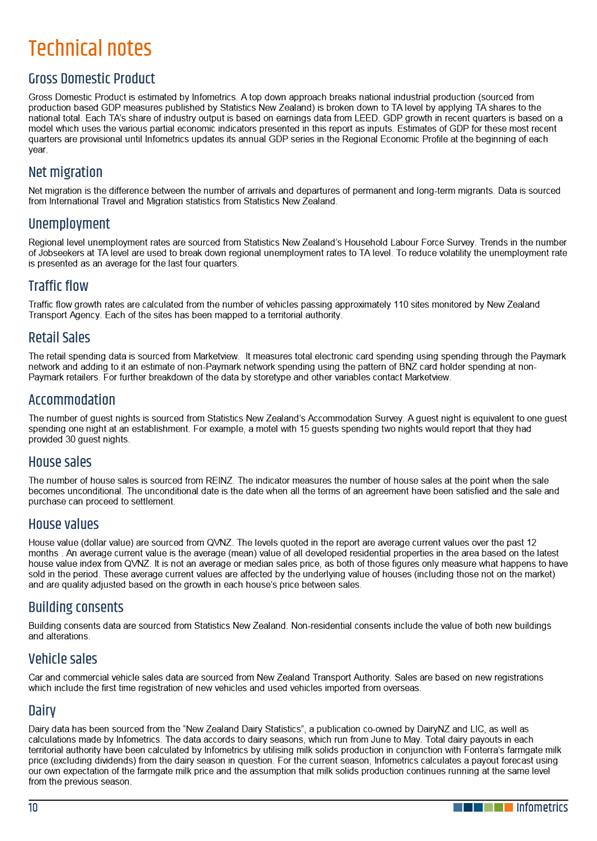

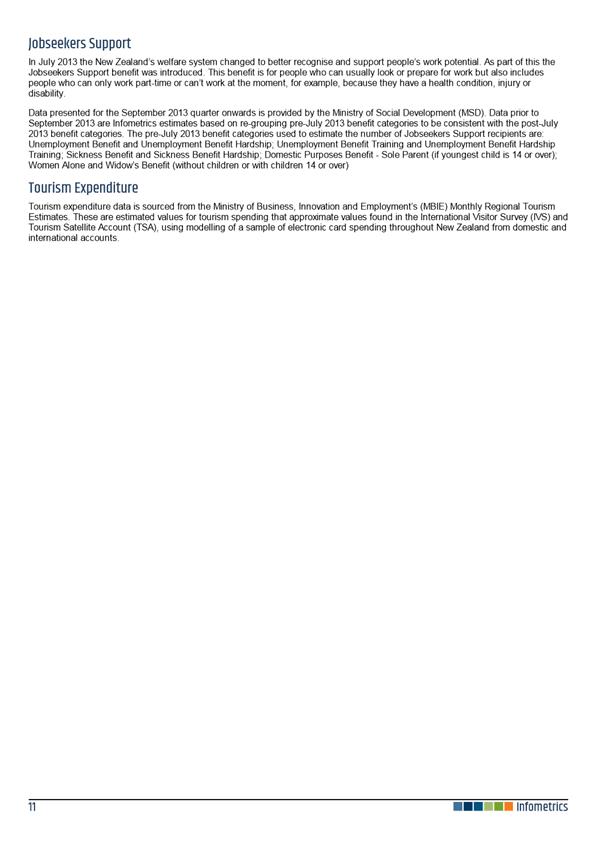

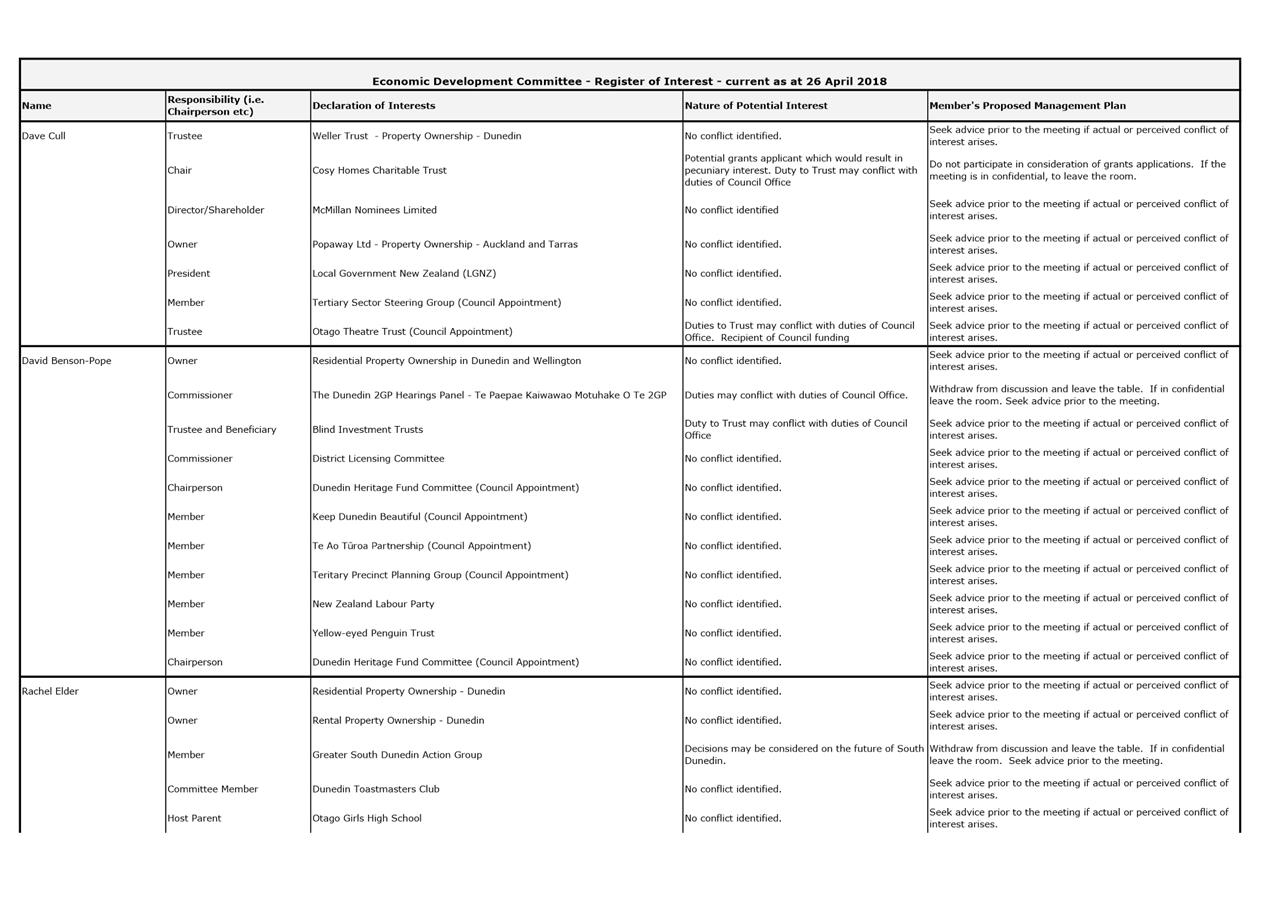

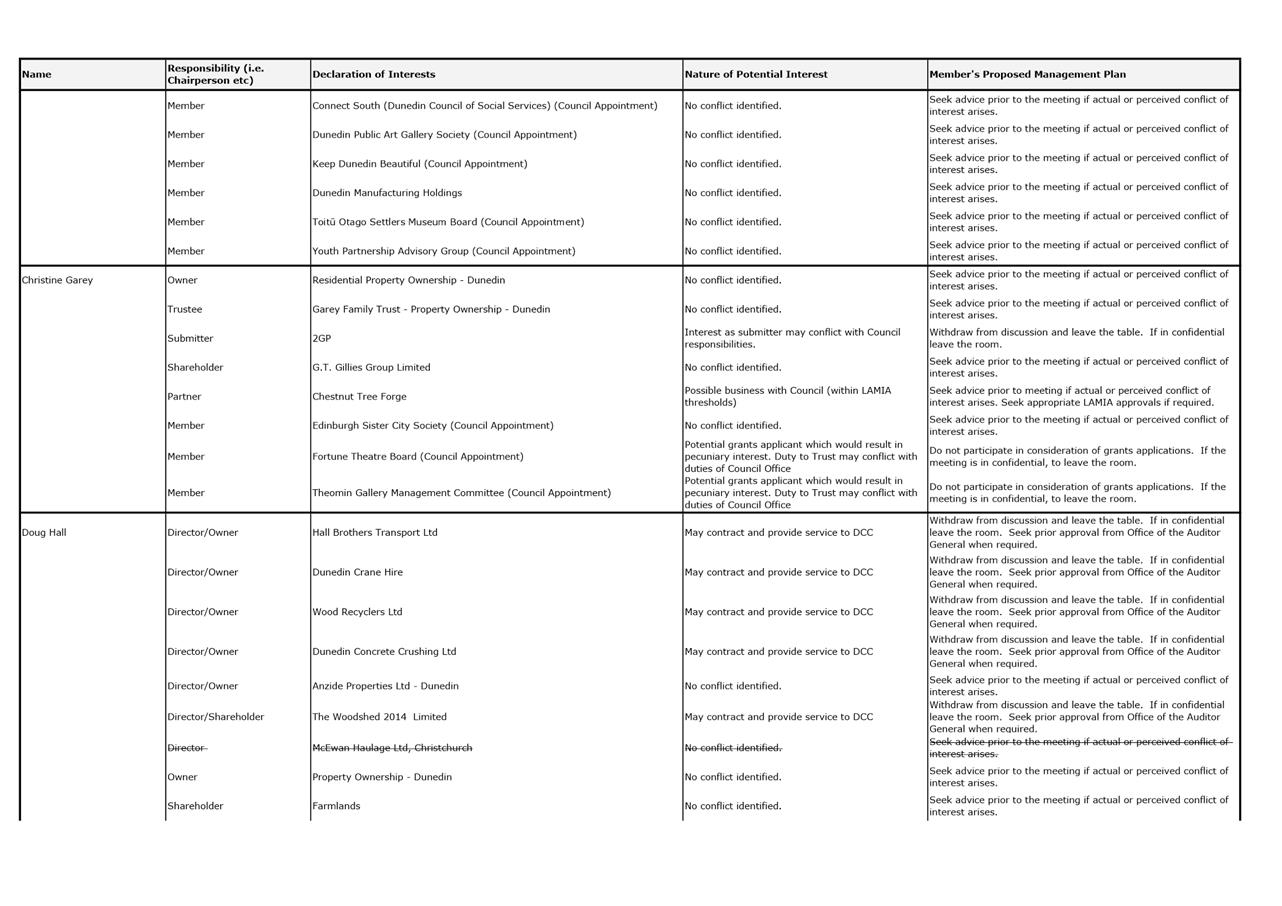

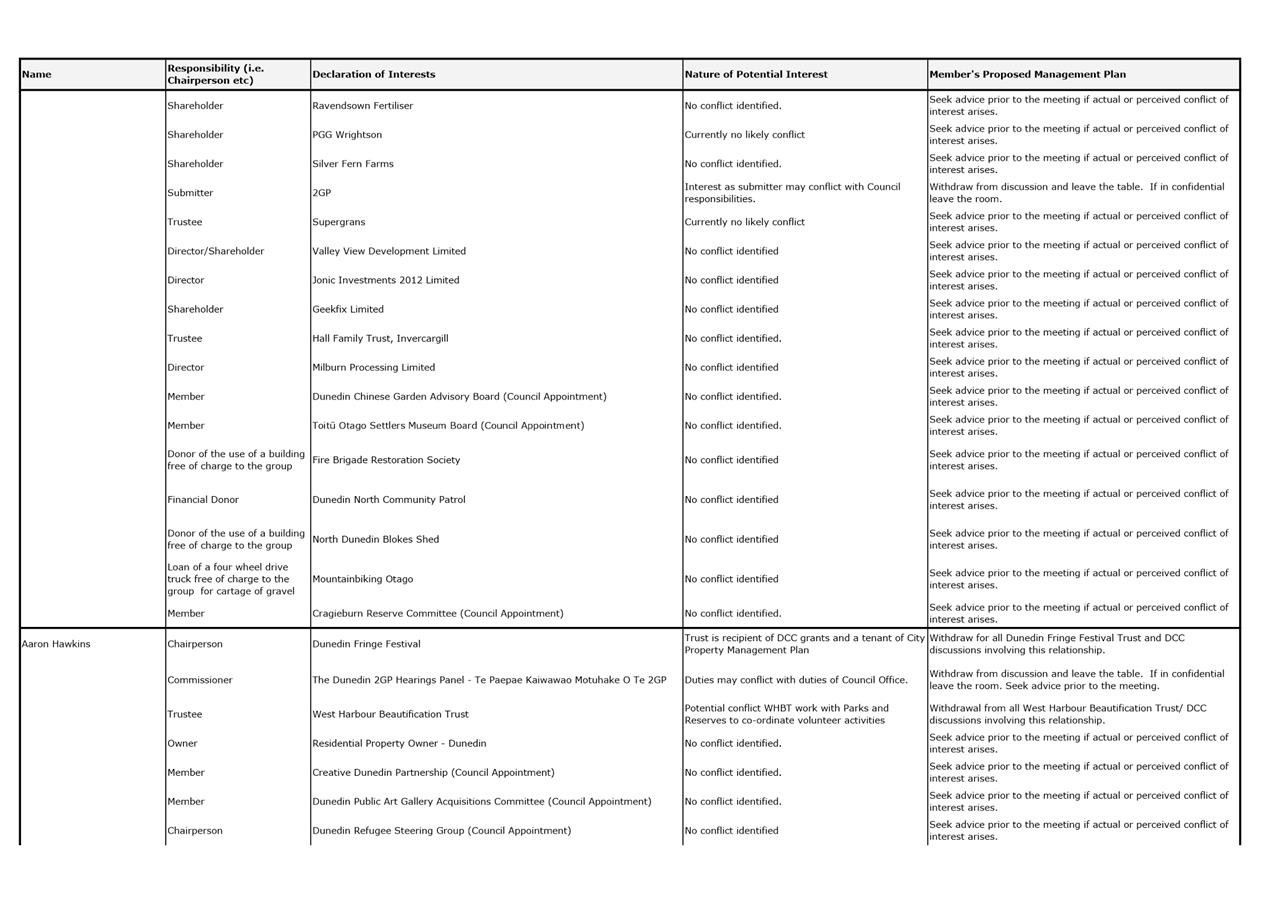

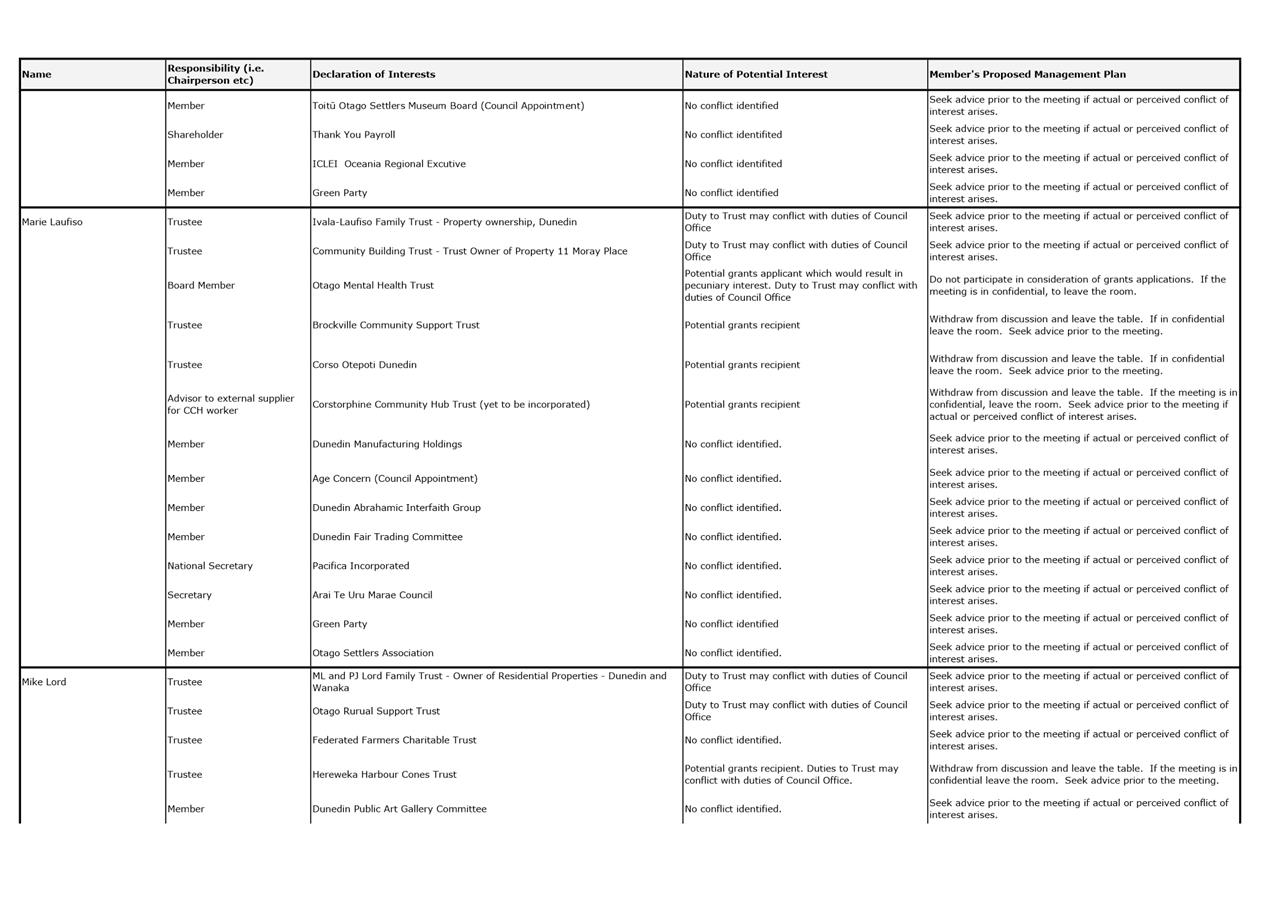

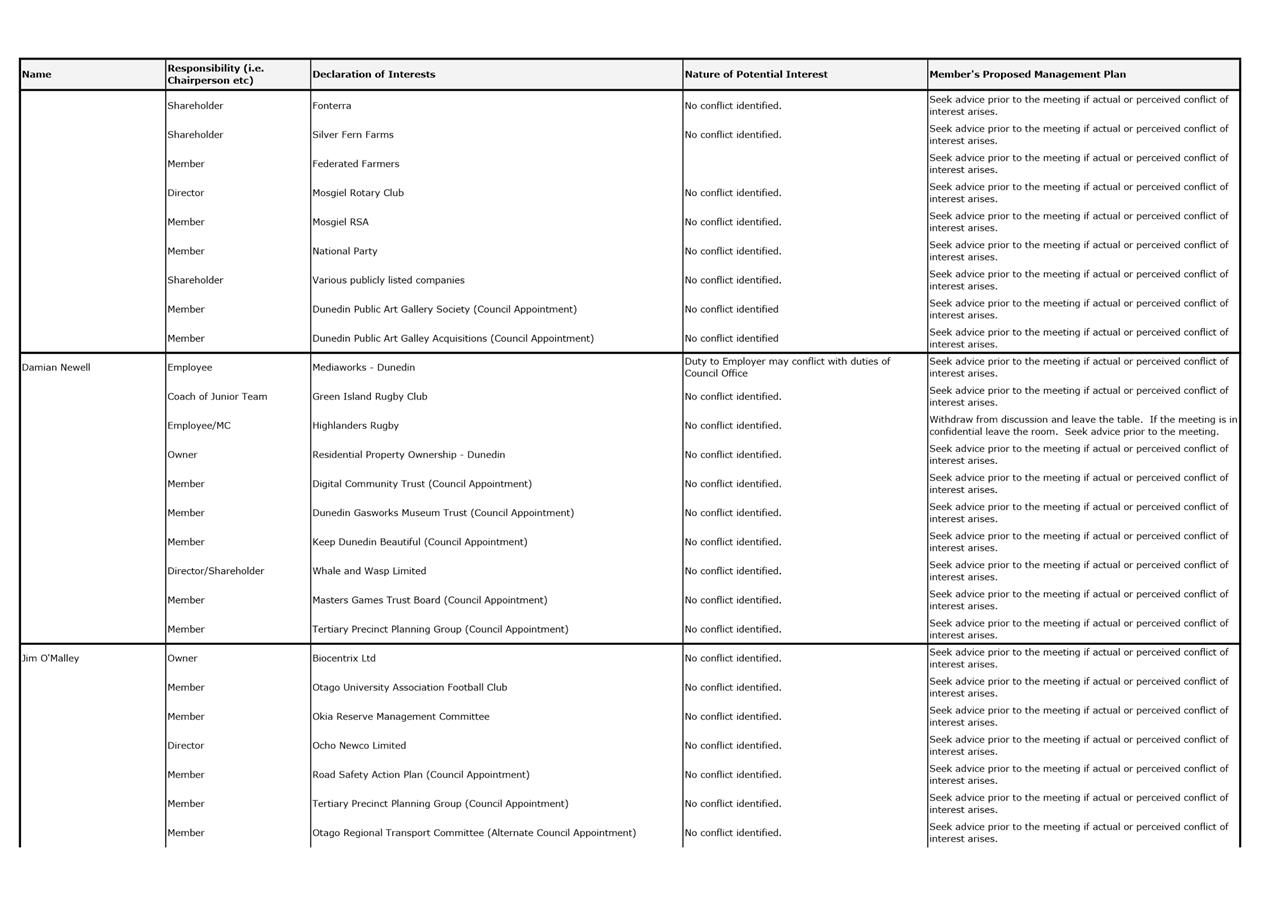

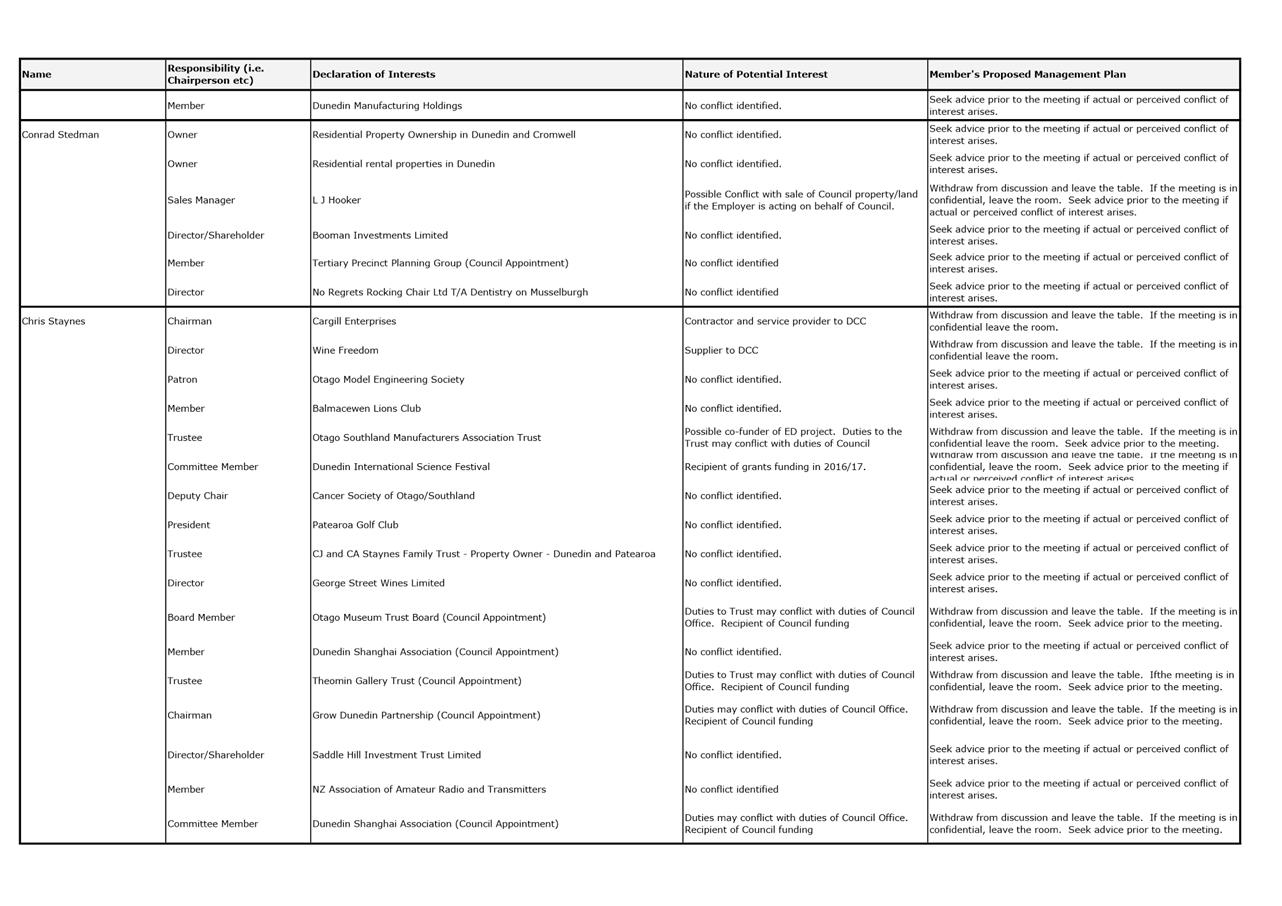

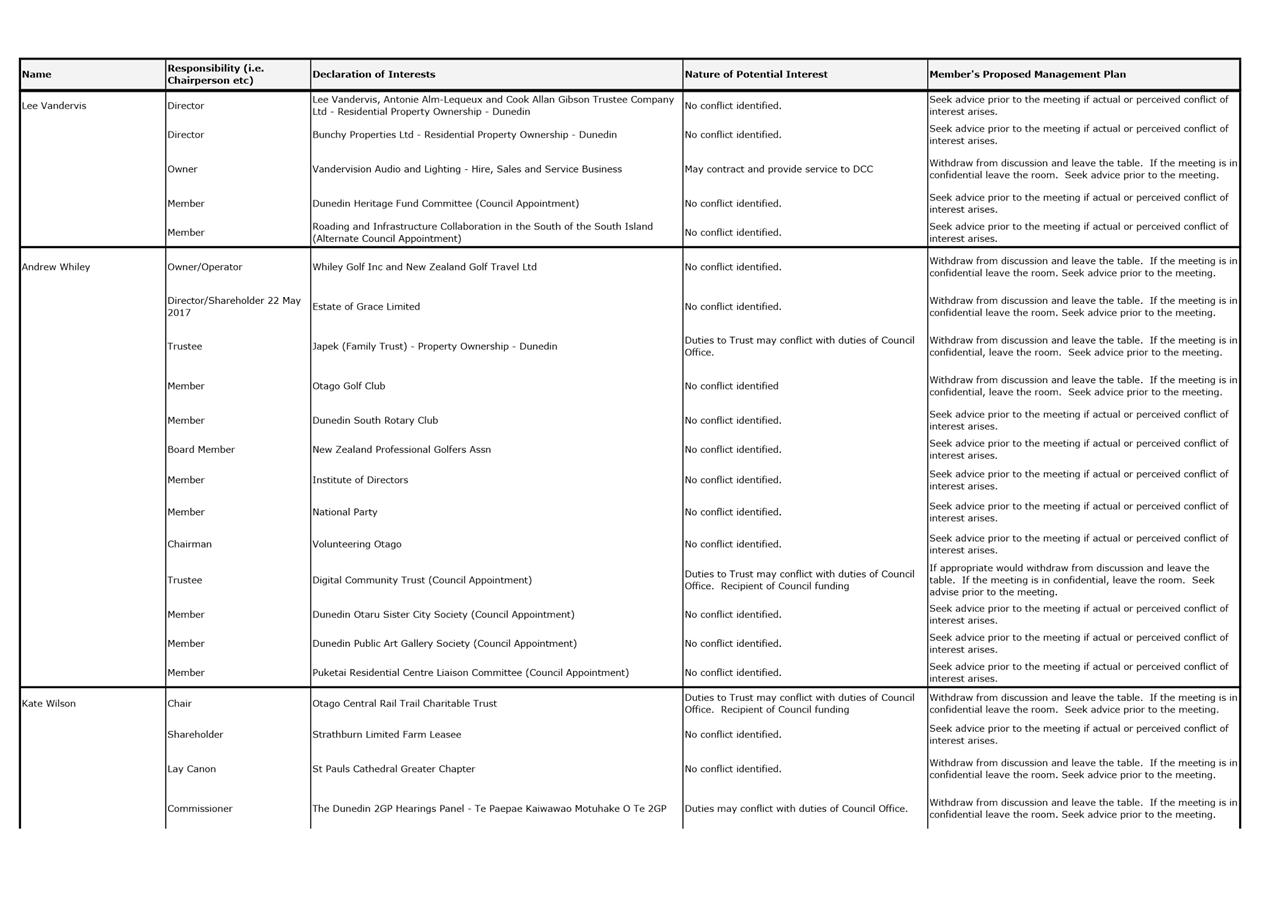

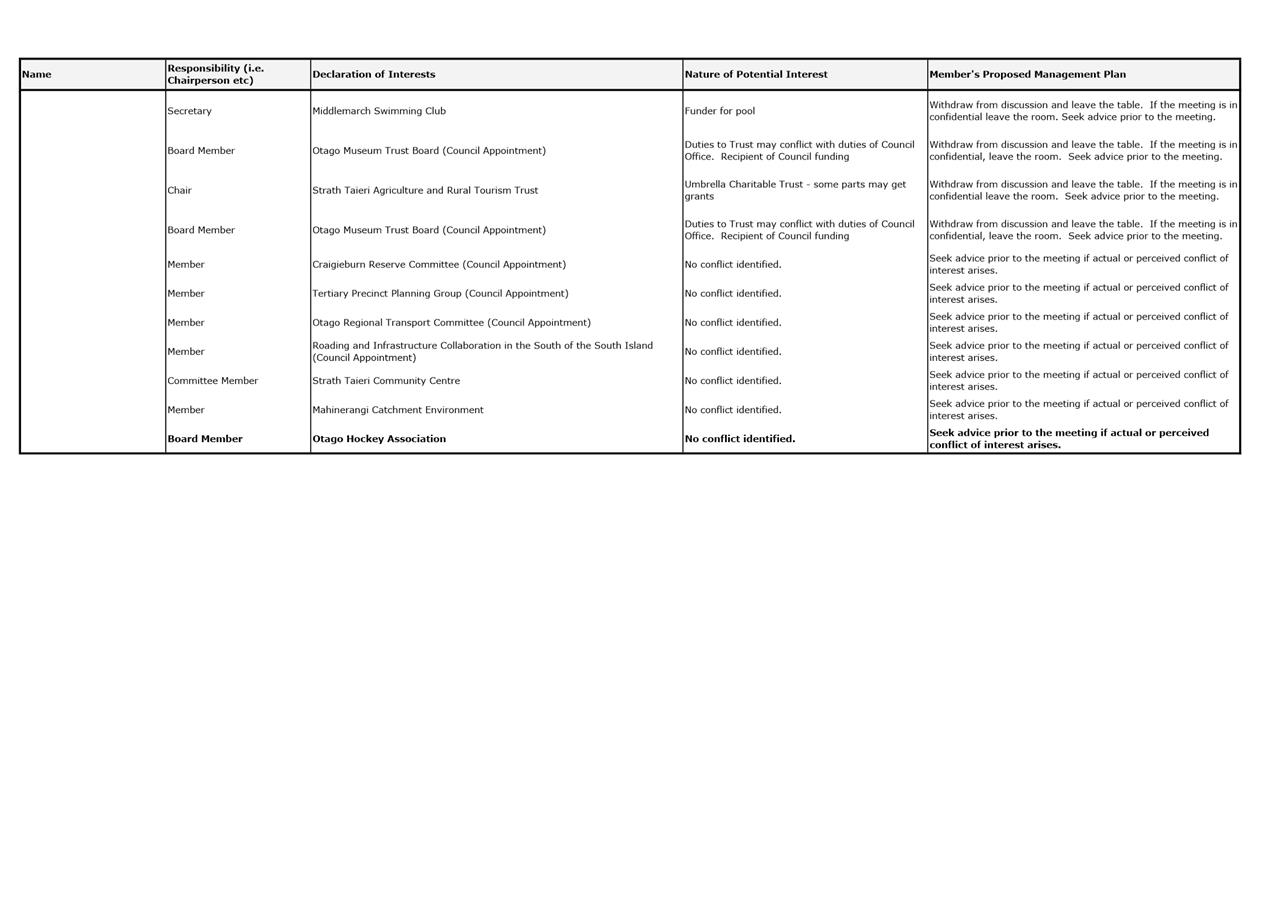

Declaration of Interest

EXECUTIVE SUMMARY

1. Members are reminded of the need

to stand aside from decision-making when a conflict arises between their role

as an elected representative and any private or other external interest they

might have.

2. Elected

members are reminded to update their register of interests as

soon as practicable, including amending the register at this meeting if

necessary.

|

RECOMMENDATIONS

That the Committee:

a) Notes/Amends

if necessary the Elected Members' Interest Register attached as Attachment A;

and

b) Confirms/Amends the proposed management plan for Elected Members' Interests.

|

Attachments

|

|

Title

|

Page

|

|

a

|

Register of Interest

|

7

|

|

Economic Development

Committee

22 May 2018

|

|

|

Economic Development Committee

22 May 2018

|

|

|

Economic Development Committee

22 May 2018

|

|

|

Economic Development Committee

22 May 2018

|

|

|

Economic Development Committee

22 May 2018

|

|

|

Economic Development Committee

22 May 2018

|

|

|

Economic Development Committee

22 May 2018

|

|

|

Economic Development Committee

22 May 2018

|

|

|

Economic Development

Committee

22 May 2018

|

|

Part

A Reports

Long-term perfomance of Dunedin's tourism

sector - Infometrics Report

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

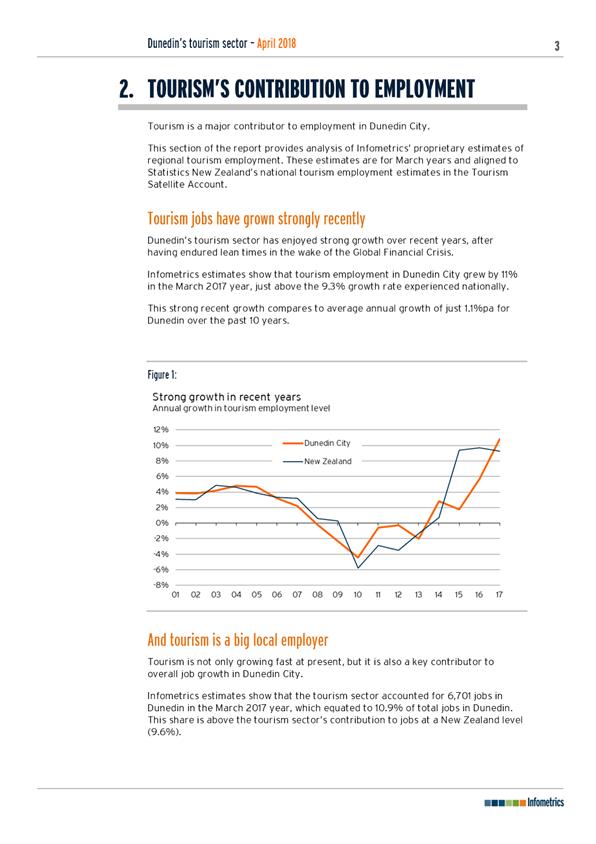

1 Infometrics

was commissioned to provide a long-term view of performance in Dunedin’s

tourism sector for Enterprise Dunedin.

2 The

purpose of this report is to present the report from Infometrics to the

Economic Development Committee and highlight areas of progress made in the

delivery of the compelling destination’s theme in the Economic

Development Strategy.

3 Key

highlights include:

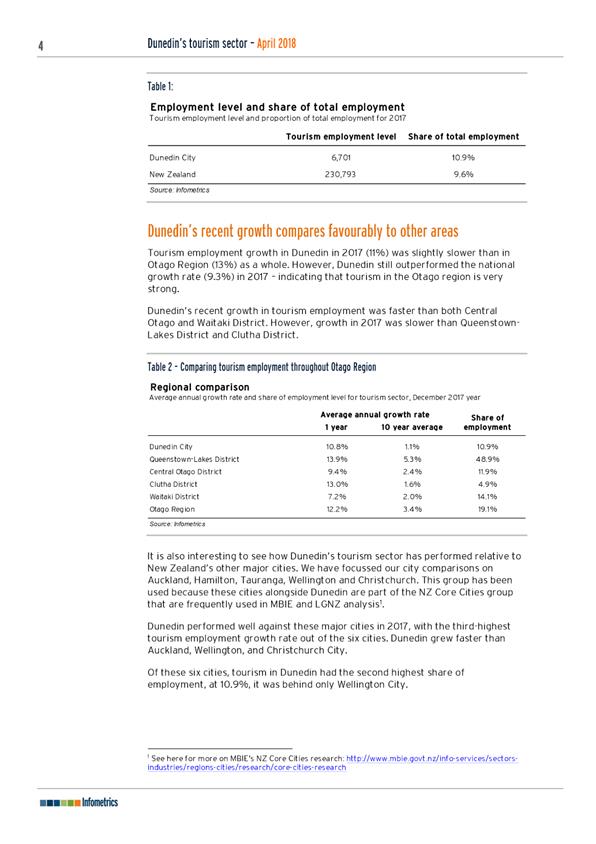

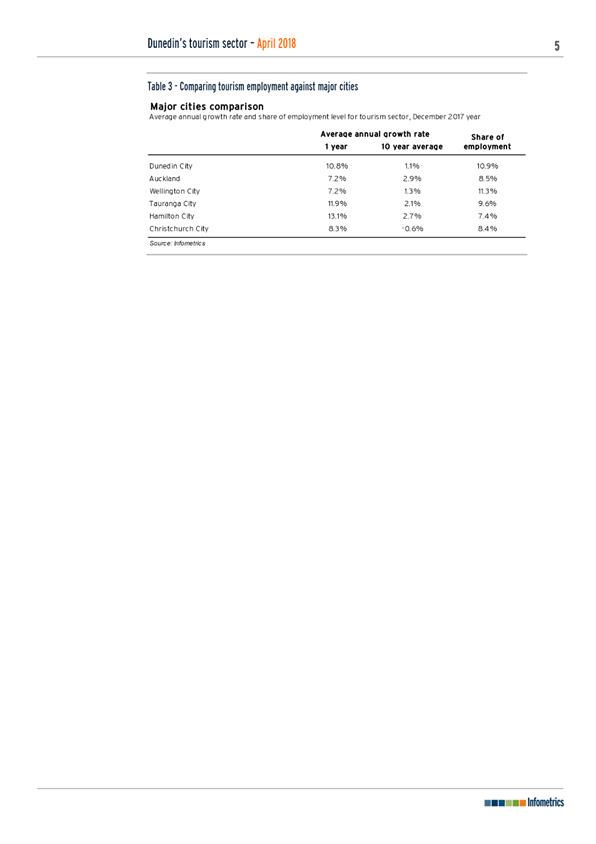

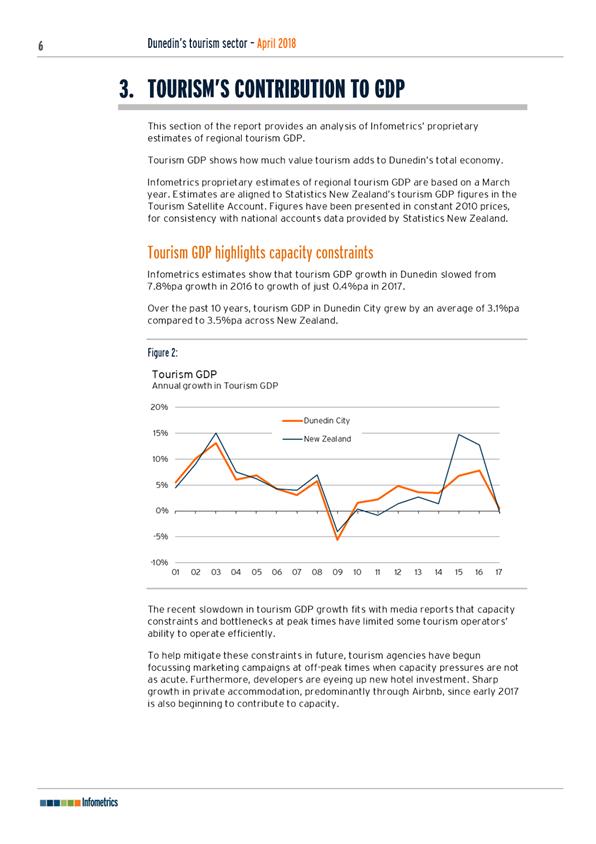

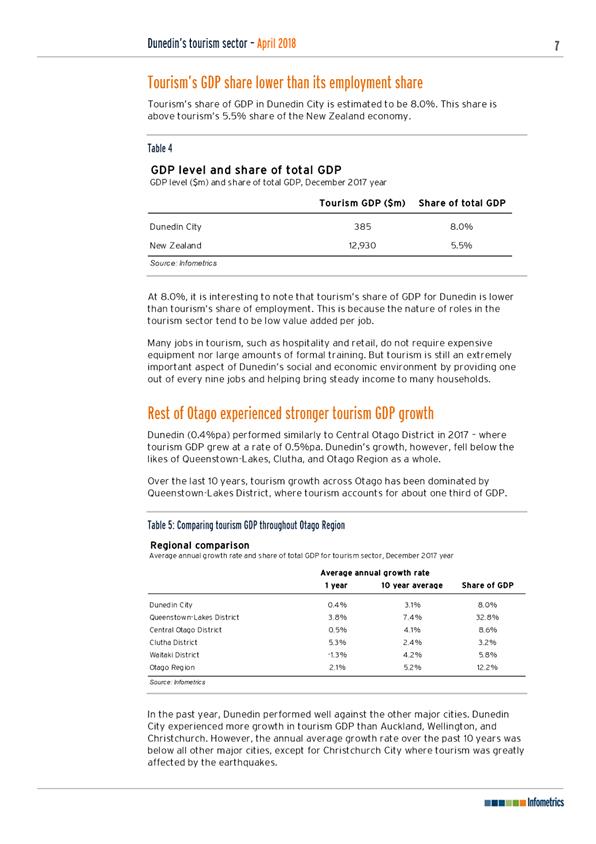

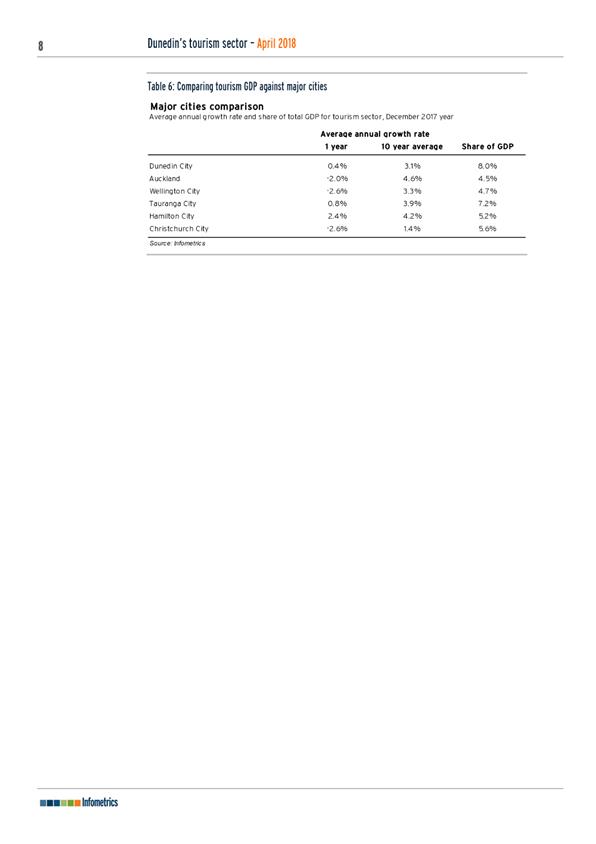

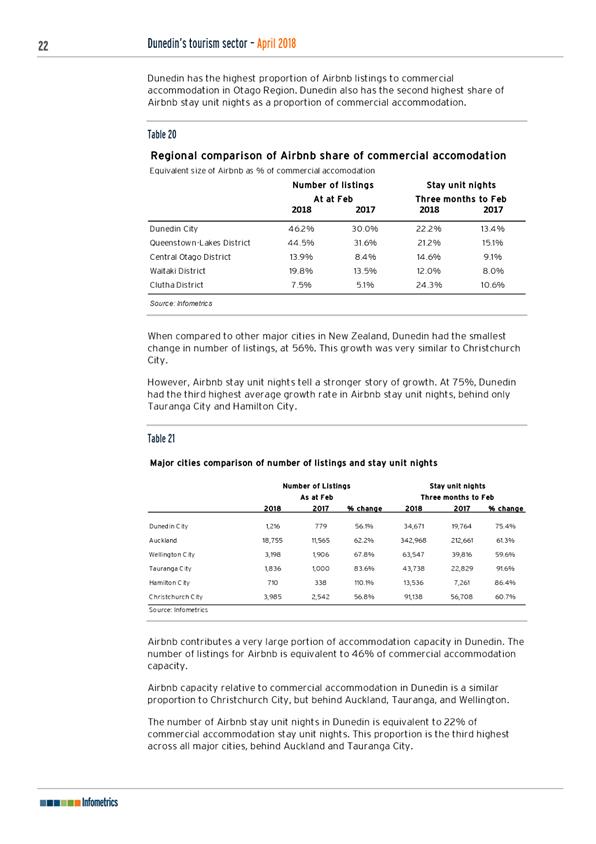

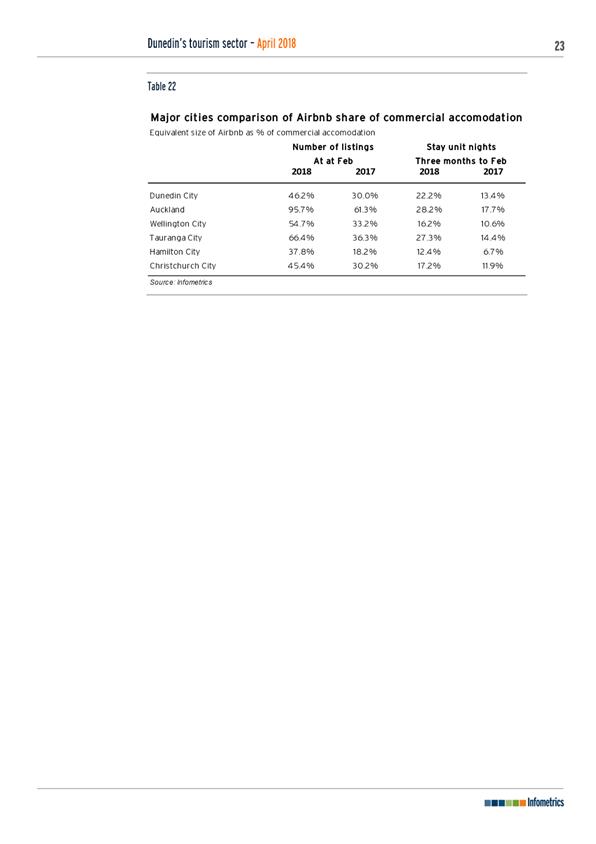

a) In Dunedin tourism accounts for 8% of Dunedin’s

total GDP. This is above the national tourism contribution to GDP which

is 5.5%

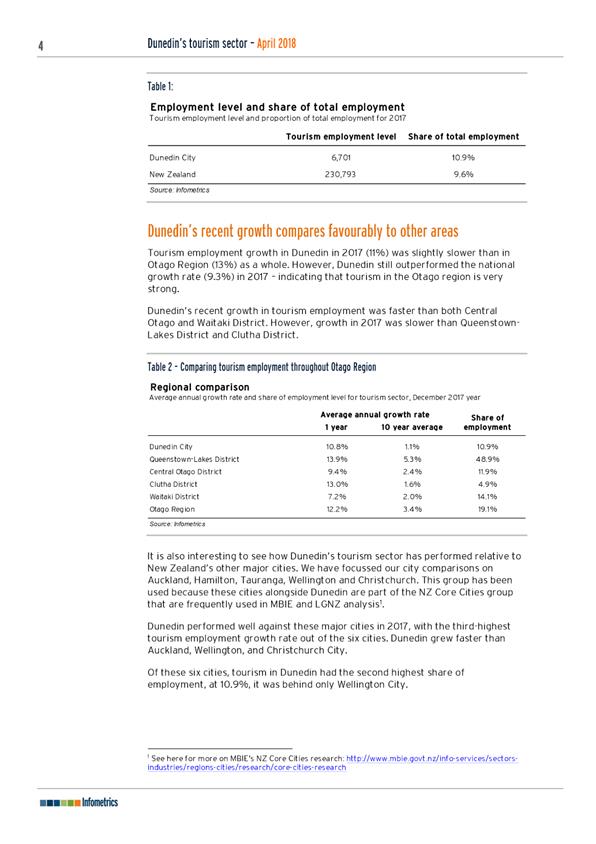

b) Growth in tourism employment in Dunedin was 11%

surpassing the national growth tourism employment of 9.6% during 2017

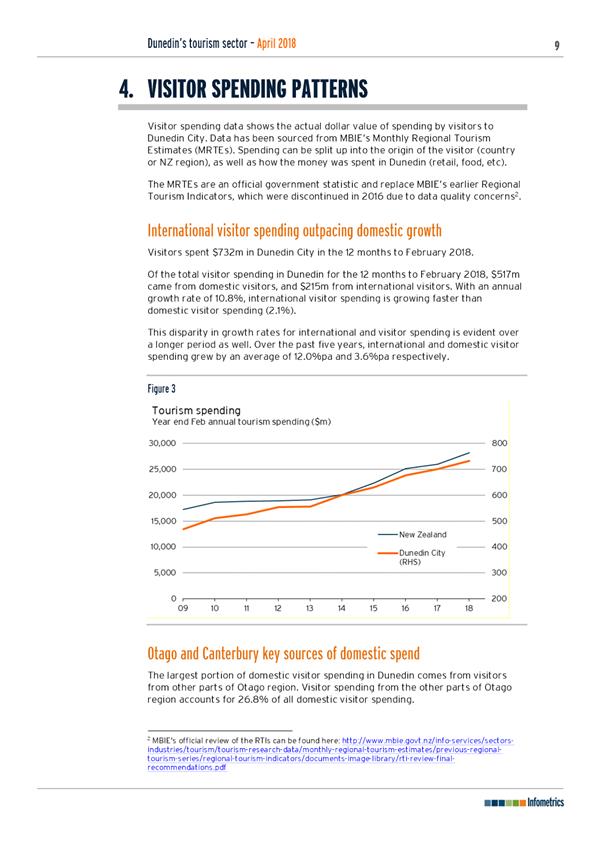

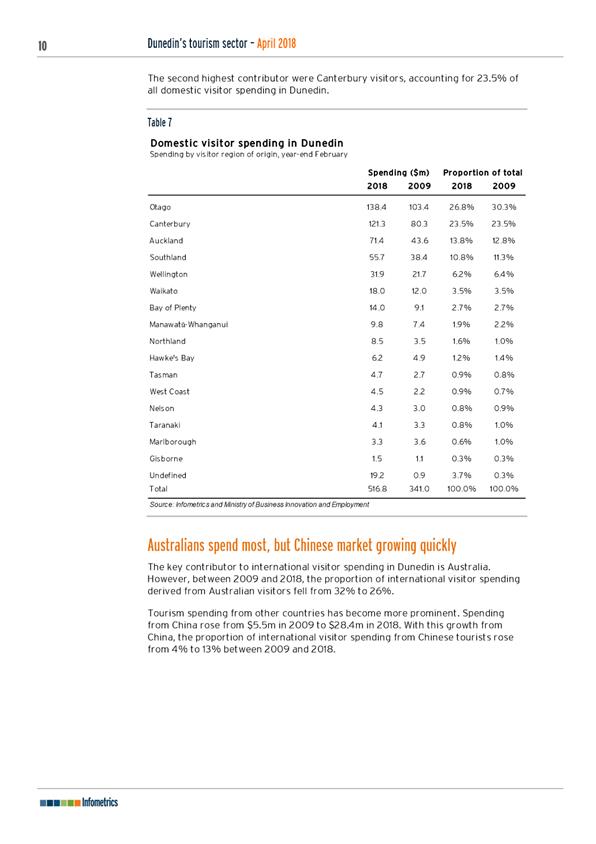

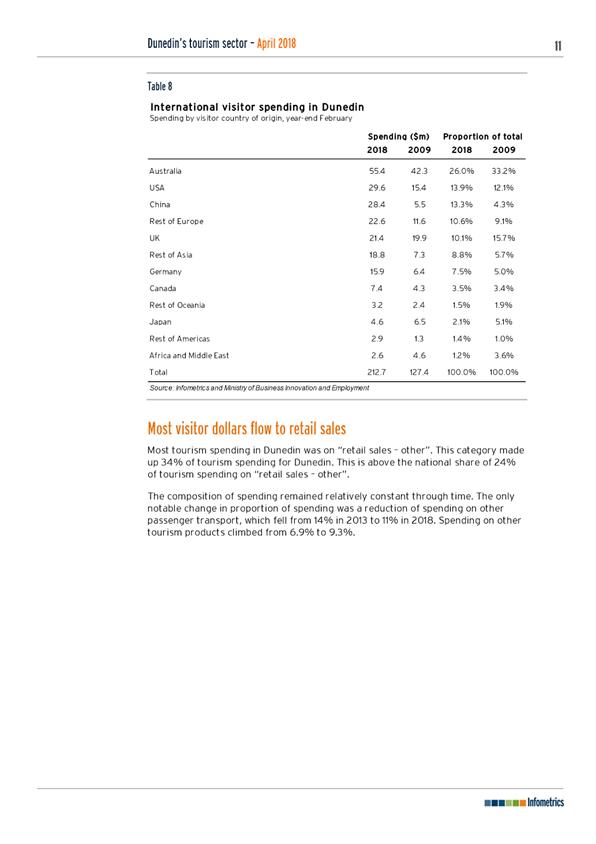

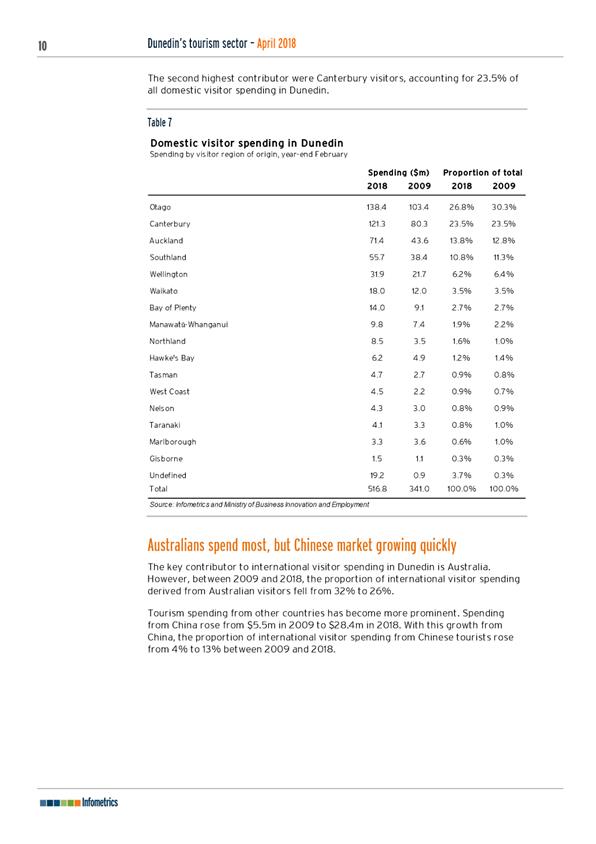

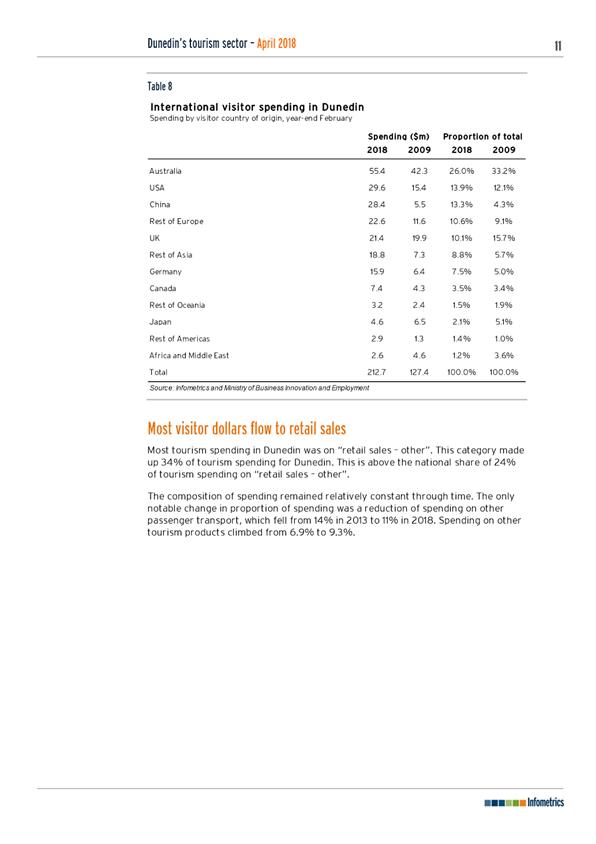

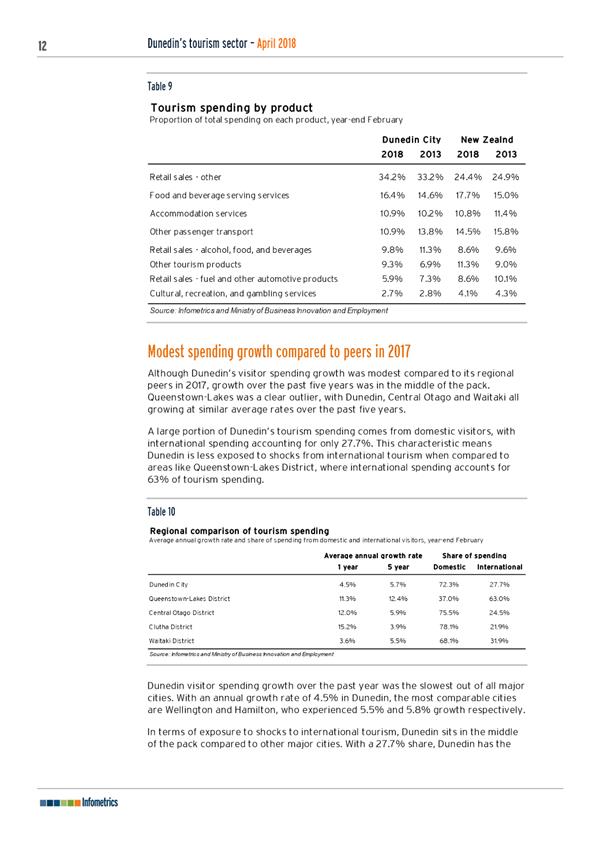

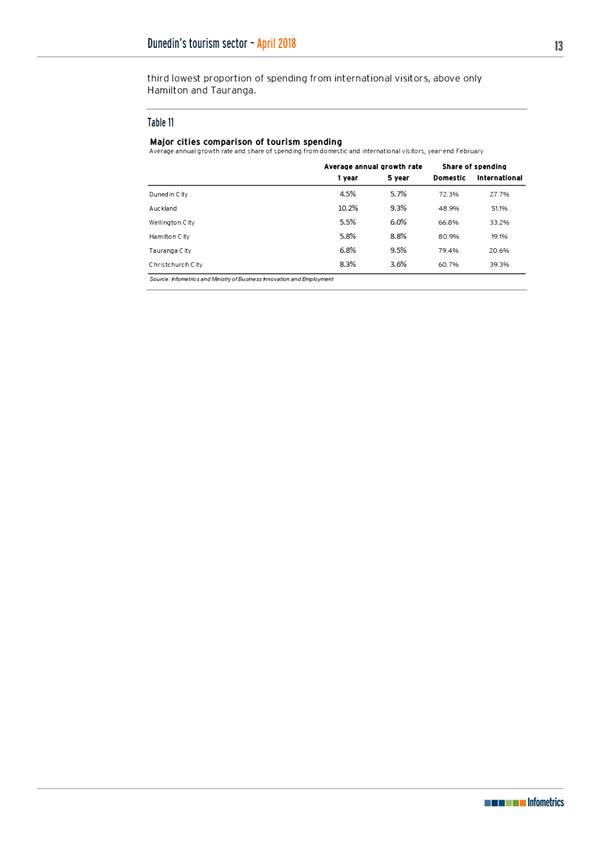

c) Visitor spend in Dunedin in the 12 months to February

2018 was $732m with 72% of this from domestic visitors

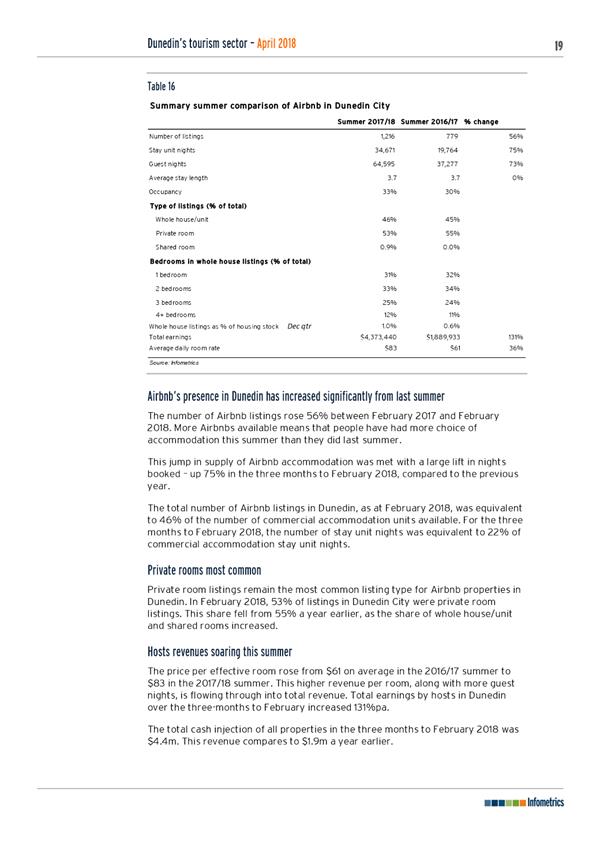

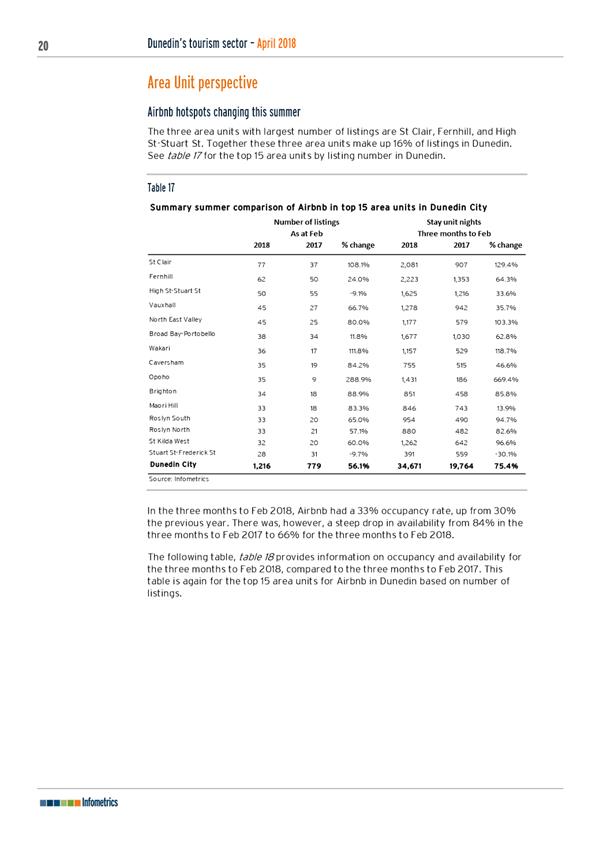

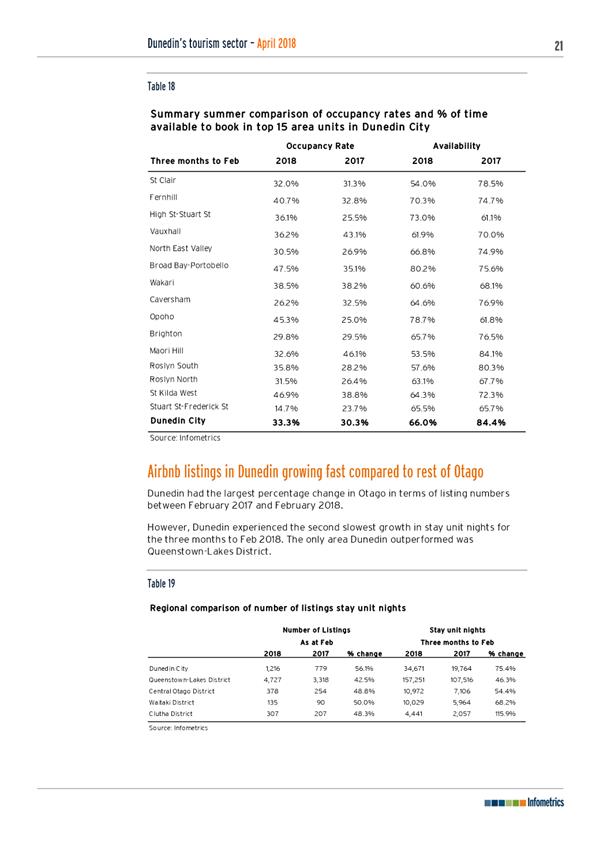

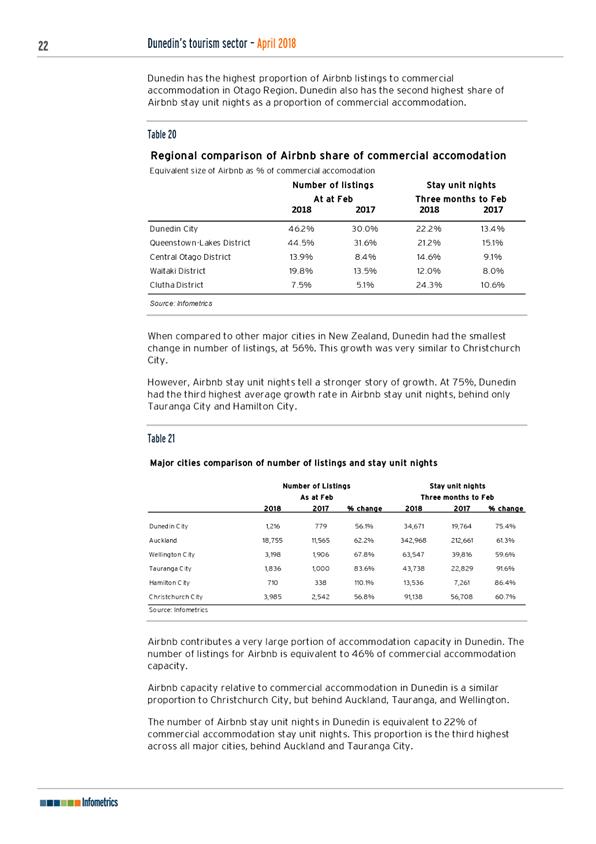

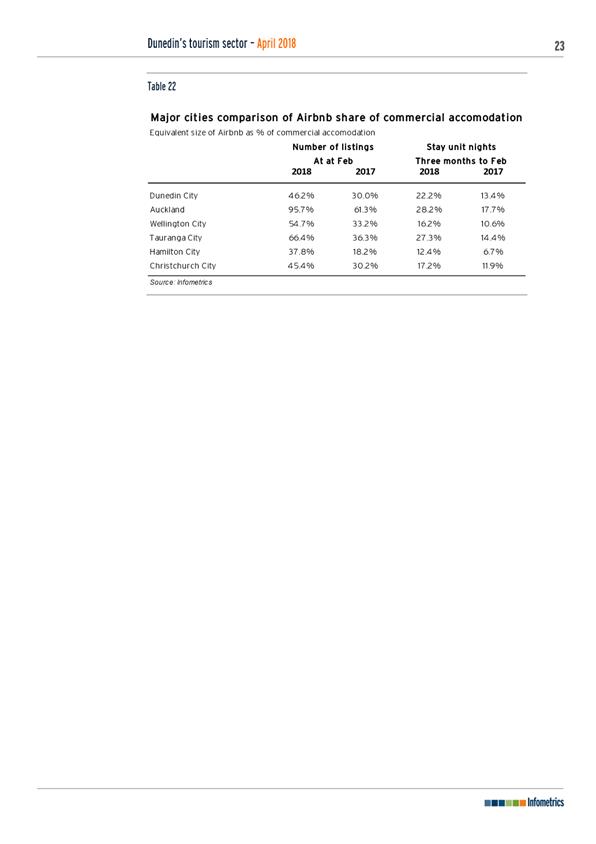

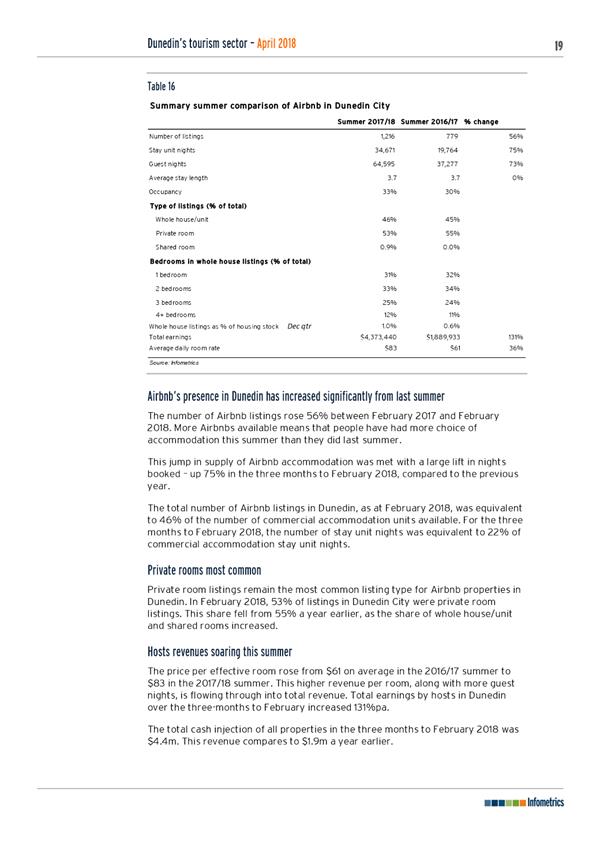

d) Airbnb accommodation grew 75% in stay nights in

Dunedin and is equivalent to 22% of commercial accommodation stay unit nights

e) Capacity for Airbnb accommodation in Dunedin as at

February 2018 is equivalent to 46% of commercial accommodation

4 The

report is provided as Attachment A for the information of the Economic

Development Committee.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

report from Infometrics, “The long-term performance of Dunedin’s

tourism sector” dated April 2018.

|

BACKGROUND

5 Enterprise

Dunedin activity is informed by the 2013-23 Economic Development Strategy

('strategy'). The strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances for

innovation – to improve linkages between industry and research.

c) A hub for

skills and talent – to increase retention of graduates, build the skills

base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A compelling

destination – to increase the value of tourism and events and improve the

understanding of Dunedin’s advantage.

Signatories

|

Author:

|

Kyla Anderson - Business Analyst, Enterprise Dunedin

Suz Jenkins - Finance and Office Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

a

|

The long-term

performance of Dunedin's tourism sector

|

18

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report enables democratic local decision making and

action by, and on behalf of communities.

This report relates to providing local insights and it is

considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the delivery of the

Economic Strategy contribute to a number of strategies and plans.

|

|

Māori Impact Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no implications for sustainability

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no implications for LTP.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This report is considered low significance under the

Significance and Engagement Policy.

|

|

Engagement –

external

External engagement to produce the report.

|

|

Engagement -

internal

No internal engagement has been undertaken.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no conflicts of interest.

|

|

Community Boards

There are no implications from report for Community

Boards.

|

|

Economic Development

Committee

22 May 2018

|

|

|

Economic Development Committee

22 May 2018

|

|

Infometrics Quarterly Economic Monitor Report

December 2017

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

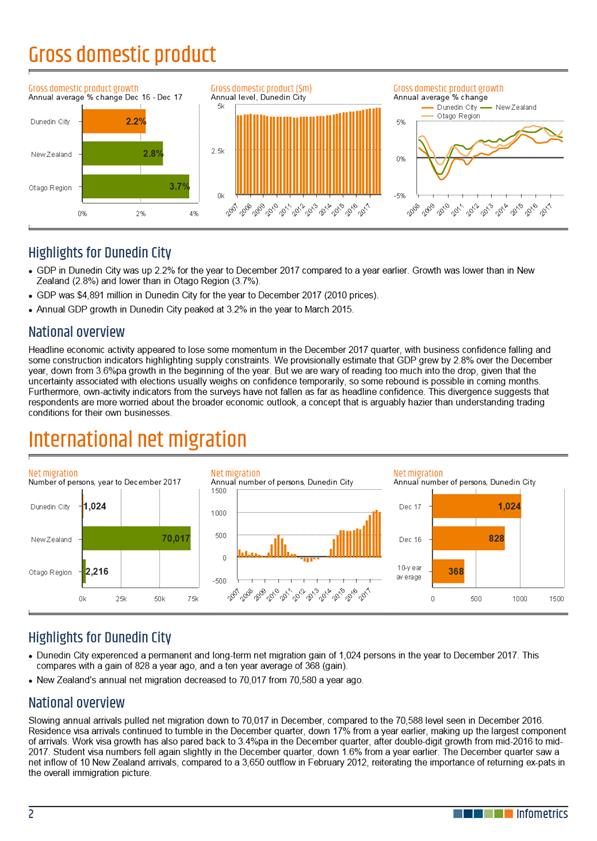

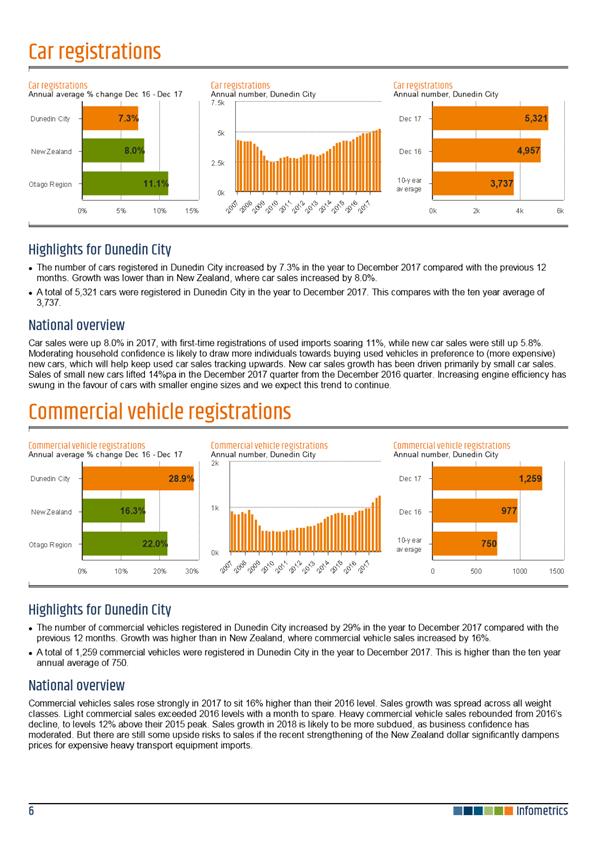

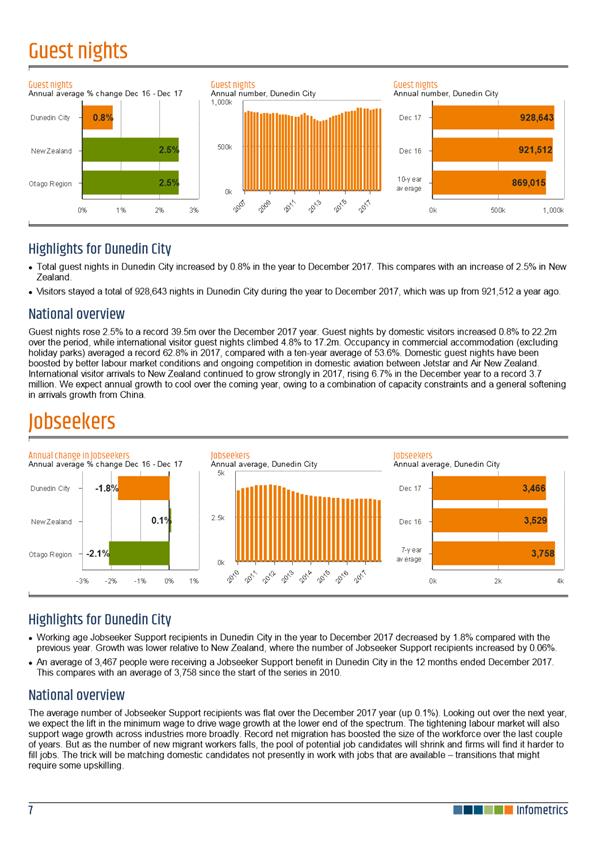

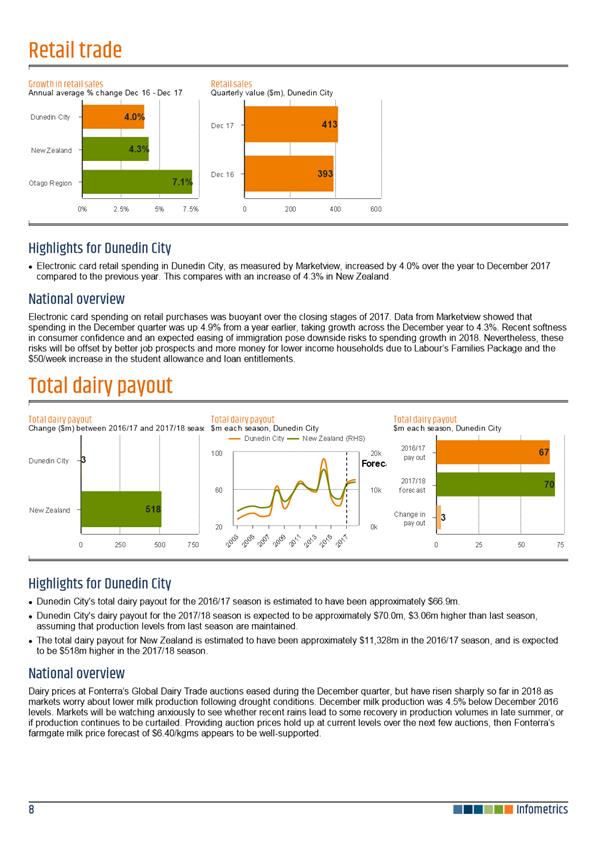

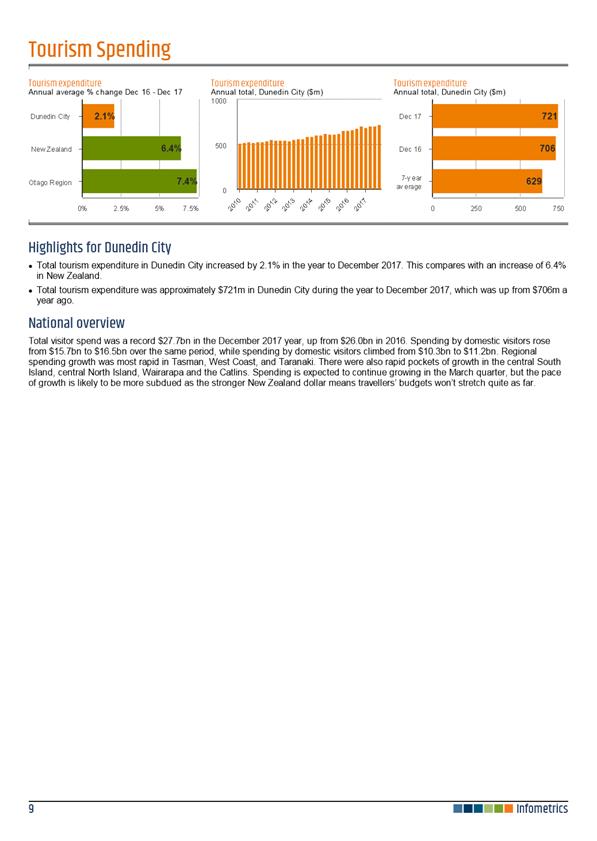

1 Infometrics

has been commissioned to provide quarterly economic monitoring reports for

Enterprise Dunedin.

2 The

purpose of the monitoring report is to provide Enterprise Dunedin and the

Economic Development Committee with an update of progress on the delivery of

the Economic Development Strategy key outcomes.

3 Key

insights include:

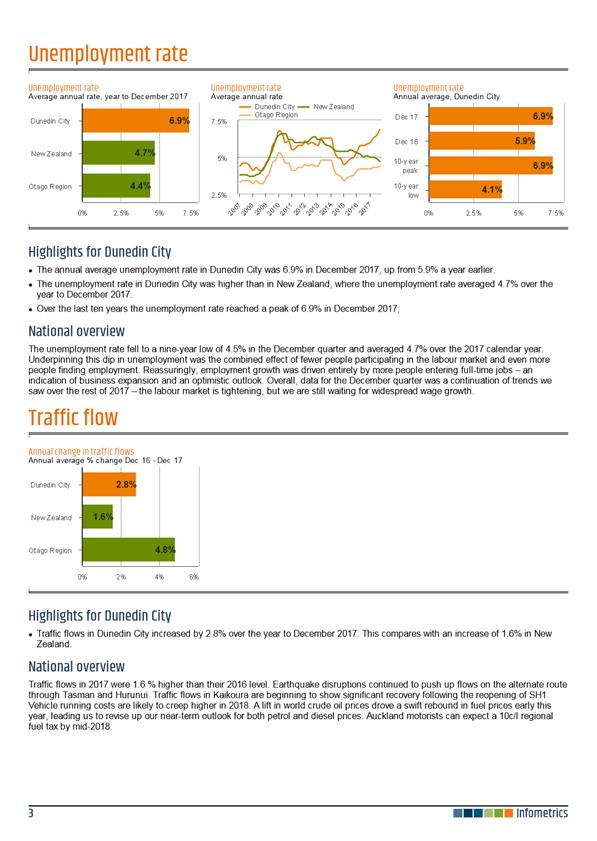

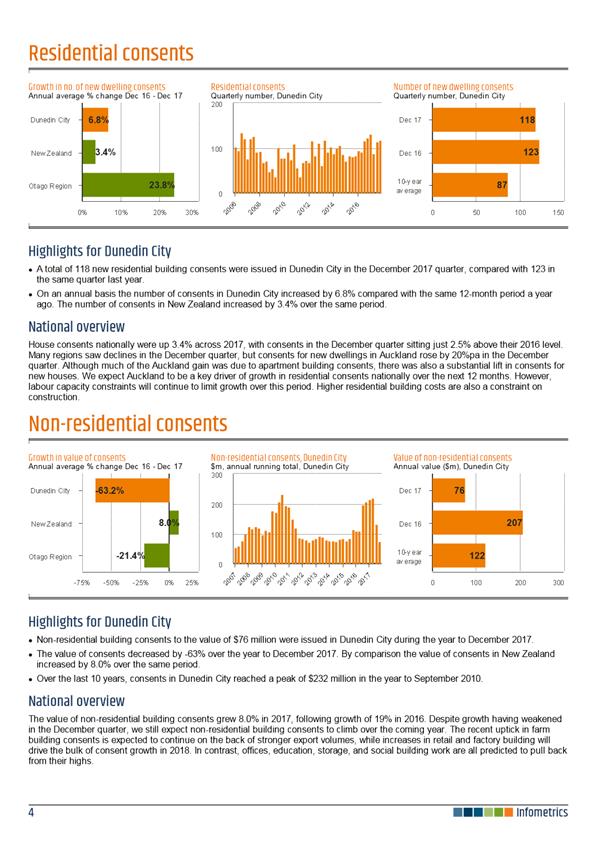

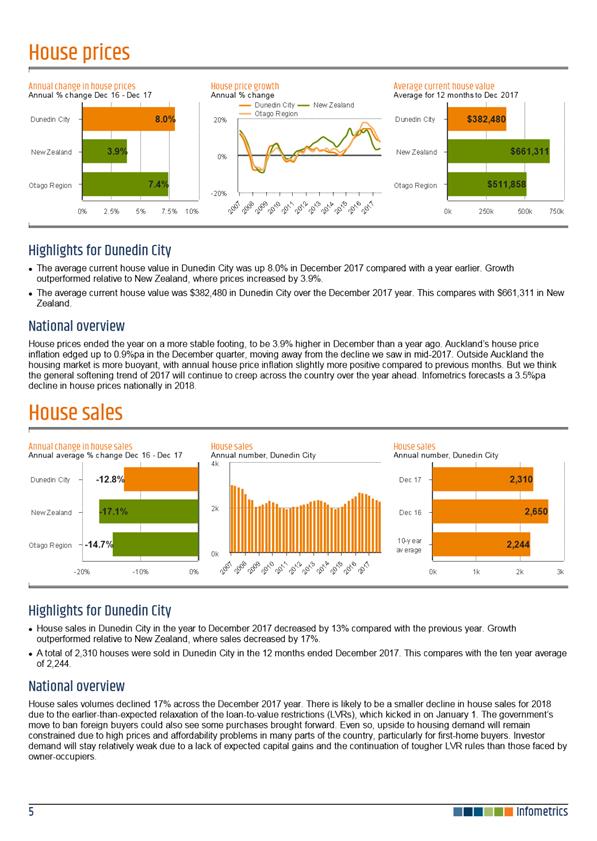

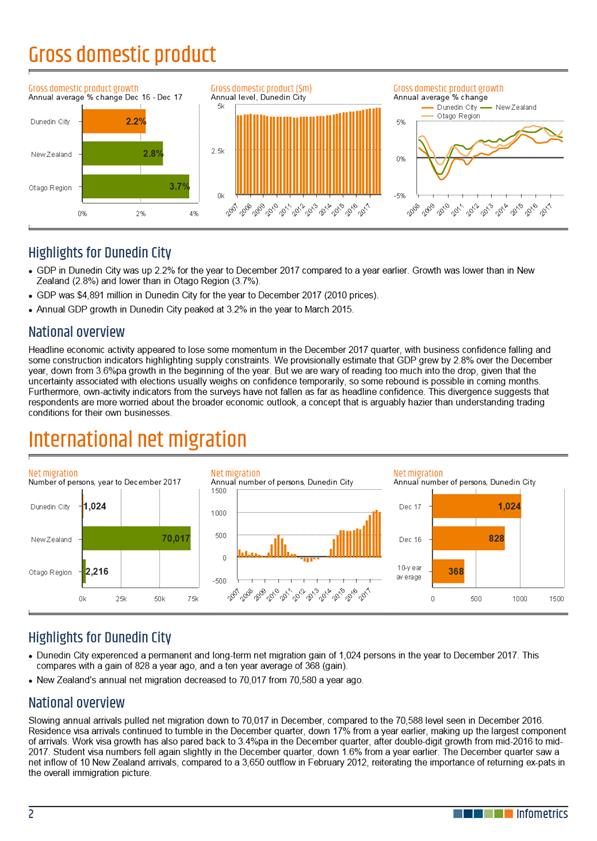

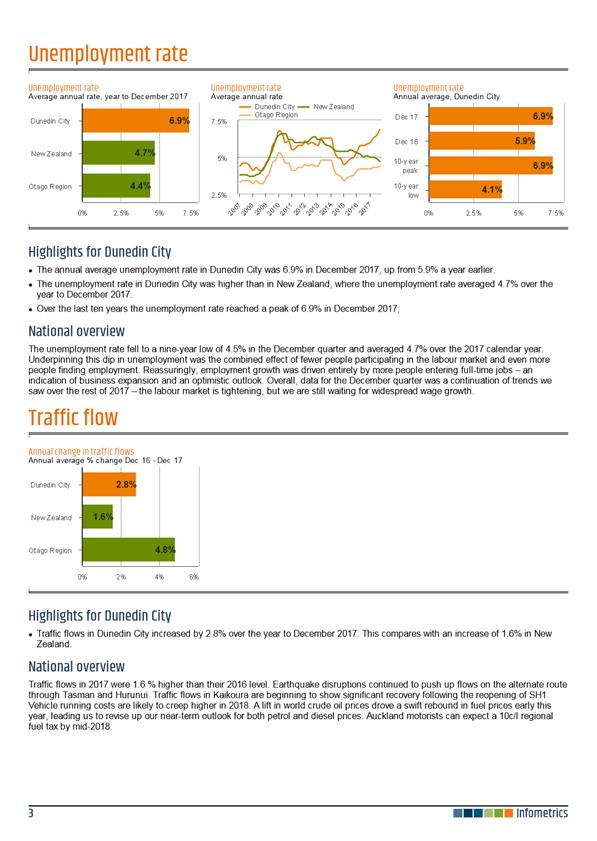

a) GDP increased on average 2% annually in the previous 3

years and isa tracking favourably for a fourth year, this does not include

impacts from the Cadbury factory closure

b) Jobseekers have decreased 1.8% for the 123 months

ending December 2017 compared to the previous period; contributors were rising

employment and population

4 The

monitoring report for year ending December 2017 is provided as Attachment A for

the information of the Economic Development Committee.

1

|

RECOMMENDATIONS

That the Committee:

a) Notes the

report from Infometrics, “Quarterly Economic Monitor” dated

December 2017.

|

BACKGROUND

5 Enterprise

Dunedin activity is informed by the 2013-23 Economic Development Strategy

('strategy'). The strategy is underpinned by five themes:

a) Business vitality

– to improve the ease of doing business.

b) Alliances for

innovation – to improve linkages between industry and research.

c) A hub for

skills and talent – to increase retention of graduates, build the skills

base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A compelling

destination – to increase the value of tourism and events and improve the

understanding of Dunedin’s advantage.

Signatories

|

Author:

|

Kyla Anderson - Business Analyst, Enterprise Dunedin

Suz Jenkins - Finance and Office Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

a

|

Dunedin City Quarterly

Economic Monitor Report

|

48

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report enables democratic local decision making and

action by, and on behalf of communities.

This report relates to providing local insights and it is

considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the delivery of the

Economic Strategy contribute to a number of strategies and plans.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no implications for sustainability

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no implications for LTP.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This report is considered low significance under the

Significance and Engagement Policy.

|

|

Engagement –

external

External engagement to produce the report.

|

|

Engagement - internal

No internal engagement has been undertaken

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no conflicts of interest.

|

|

Community Boards

There are no implications from the for Community Boards.

|

|

Economic Development

Committee

22 May 2018

|

|

|

Economic Development Committee

22 May 2018

|

|

Enterprise Dunedin Q3 January to March 2018

Activity Report

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee on

Enterprise Dunedin activities during Quarter Three 2017/18.

|

a) RECOMMENDATIONS

That the Committee:

Notes

the Enterprise Dunedin Quarter

Three January to March 2018 Activity Report.

|

BACKGROUND

2 Enterprise

Dunedin activity is informed by the 2013-23 Economic Development Strategy

('strategy'). The strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances for

innovation – to improve linkages between industry and research.

c) A hub for

skills and talent – to increase retention of graduates, build the skills

base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A compelling

destination – to increase the value of tourism and events and improve the

understanding of Dunedin’s advantage.

3 The

strategy sets out two economic goals:

a) 10,000 extra

jobs over 10 years (requiring growth of approximately 2% per annum).

b) An average of

10,000 of extra income for each person (requiring GDP per capita to rise about

2.5% per annum).

DISCUSSION

4 Public

relations, marketing activities, and campaigns:

a) International

Travel Trade:

· In

March Enterprise Dunedin facilitated training for 60 South East Asian tour

operators and 100 Australian travel agents across two Tourism New Zealand

events. Enterprise Dunedin promoted the city to 120 national tour operators at

the Regional Tourism New Zealand event in April.

b) Ed Sheeran

Easter weekend:

· Along

with our city partners and other units of Council, Enterprise Dunedin supported

the three Ed Sheeran concerts over Easter. An Ed Sheeran microsite was created

on DunedinNZ.com which attracted more than 11,000 visitors. Of these visitors,

28% engaged with the ‘What’s on in the city’ pages on the

site.

· Significant

publicity was generated by the Ed Sheeran mural. Visitors shared their photos

on their social media channels and Ed Sheeran shared his own mural selfie with

his 21 million followers on Instagram.

· As

part of Enterprise Dunedin’s trans-Tasman campaign, radio and social

media competitions were run in Brisbane in lead up to the Ed Sheeran weekend.

The focus was to promote the direct Brisbane-Dunedin flights to the Australian

market.

c) Media

coverage:

· During

the quarter, Enterprise Dunedin has generated articles in key national

magazines such as Kia Ora, Next, Good, Juno, and the New Zealand Herald. The

estimated media value of this national coverage is $40,000.

· Dunedin

featured in the Mindfood Style magazine as part of the trans-Tasman

“Where the Wild Things Are” campaign. This publication has a total

circulation of 306,000 and produced an estimated advertising value of $267,950.

Separately, Dunedin also featured in other Queensland publications with a total

circulation of 550,000.

· Enterprise

Dunedin continued to work with University of Otago and Tourism New Zealand to

attract international conferences. One bid in progress is to host the World

Leisure Congress in 2022 which could attract up to 1600 delegates with an

estimated economic value of $2.8m.

5 i-SITE

Visitor Centre:

a) Visitor

numbers to the i-Site in January were down compared to January last year.

This was attributable to the fine weather in January which meant domestic

visitors and locals stayed outdoors rather than visiting the i-SITE for

activity ideas and bookings.

b) Conversely, in

February, the city was extremely busy and revenue was up 27% on the prior year.

This was due to several events, high international visitor numbers and the

start of the university year. While visitor numbers were up in March, revenue

was down for the month. This can be attributed to Easter concert bookings being

made, up to nine months before visitors arrived.

6 Business

activities:

a) The Otago

Regional Business Partnership (RBP):

· The

RBP partnership is composed of the Otago Chamber of Commerce, Otago Southland

Employers Association and Dunedin City Council. During the quarter the

partnership secured $78,000 worth of Callaghan Innovation grants for research

and development projects. In the year to date, the partnership has issued

approximately $200,000 from New Zealand Trade and Enterprise (NZTE) to support

Otago businesses in areas such as marketing, finance and strategy.

· The

Otago RBP achieved a net promoter score (an indicator of client satisfaction)

of 75%, exceeding the target of 50%. This is a positive indicator of the work

of the RBP advisors and growing business capability in the city and across the

Otago region.

b) GigCity:

· GigCity

announced the sixth and final round of its Community Fund. The New Zealand

Marine Studies Centre received $32,000 for its Fishy Webcam project. This will

gauge the changing environment of Dunedin’s marine life. Live streaming

will show people the diversity of Dunedin’s underwater world.

Presbyterian Support received $13,000 for its Elder Gateway project (an app

providing information for older Dunedin residents).

· A

total of $500,086 has been awarded by Chorus through the GigCity Community

Fund, as part of the Gigatown competition win.

c) GigCity free

wifi usage:

· Active

users grew from 51,000 to 59,000 between January and March. This is a 246%

increase against active users, compared to the same time last year. Cruise ship

visitors, returning students, and Ed Sheeran concert goers contributed to this

growth.

· Sessions

(user interactions on a website) reached over 1 million in February and 1.25

million in March. January was down on December (903,000), due to the summer

holidays.

d) Sexy Summer

Jobs (SSJ):

· The

aim of this programme is to meet business needs, create high value jobs, keep

skills and talent in the city, and contribute to the economic growth.

Businesses use the programme to reduce the commercial risk in taking on an

untried person. It provides the opportunity for market and product development.

The programme has placed 46 interns in 2017/18 and businesses have employed 18

people. It has assisted in the creation of 13 new roles.

e) Techweek 19-27

May

· Enterprise

Dunedin has continued to work with industry and city partners including the

SIGNAL ICT graduate school on Techweek 2018 (a national initiative led by the

New Zealand Technology Industry Association).

f) Over forty

industry and tertiary events are planned in Dunedin which will:

· Allow

the community to experience new technology

· Showcase

our local innovation talent to a local, national and international audiences

· Facilitate

discussions on how tech can be used for positive transformation

g) Study Dunedin:

· Study

Dunedin’s first ‘Have a Go Sports Day’ attracted 300

international students. This event was delivered in conjunction with Dunedin

secondary schools and the tertiary institutions with the aim of supporting

international students link to local clubs and the Dunedin community.

· A

bespoke Study Dunedin directory was produced to support six Dunedin high

schools attending the Hausch Fairs in Germany and Austria. German student

numbers in Dunedin have increased by 15% between 2015 and 2016. The 2017

figures are not yet available but will be reported back to the Committee.

· Study

Dunedin increased its profile and engaged with students at the Otago

Polytechnic and University of Otago international orientation events. Over 70

students connected with the DunedinNZ newsletter.

· Study

Dunedin was invited as a regional agency to attend the SIEBA Agent Event in

Auckland in March. SIEBA is the Schools of International Education Business

Association and is the body for schools supporting international students in

the education sector. They are funded by schools who become members and

by Education New Zealand. The event provided an opportunity to promote study

opportunities in Dunedin secondary schools’ to over 20 agents from a

range of countries.

h) Good Food:

· The

EDC adopted the Good Food Dunedin Charter at the 13 March meeting. The Charter

aims to raise the profile of food resilience issues and assist in the delivery

of the Good Food Dunedin Action Plan.

NEXT STEPS

7 Feedback

on the activity report will be incorporated in future updates.

Signatories

|

Author:

|

Andrea Crawford - Enterprise Dunedin Communications

Advisor

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision relates to

providing local public services and is considered good quality and cost

effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the delivery of the

Economic Strategy contribute to a number of strategies and plans.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Enterprise Dunedin activities and the 2013-23 Economic

Development Strategy are included in the 2015-25 Long Term Plan.

|

|

Financial considerations

There are no financial considerations

|

|

Significance

This decision is considered low significance under the

Significance and Engagement Policy.

|

|

Engagement –

external

As an update report, no external engagement has been

undertaken.

|

|

Engagement -

internal

As an update report, no internal engagement has been

undertaken.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no conflicts of interest.

|

|

Community Boards

There are no implications for Community Boards.

|

|

Economic Development

Committee

22 May 2018

|

|

Film Dunedin Development Report

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The purpose of this report is to update the Economic Development

Committee on the development of film activities and signal proposed plans for

future development.

2 Over the

last two years Enterprise Dunedin has prioritised the development of the film

and digital sector. This work has focused on process and systems, business

support, projects, communications, engagement and relationships.

3 This

activity has resulted in increased film projects in the city and a growing

industry perception of Dunedin as a film friendly city.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Film Dunedin Development Report and proposed approach to sector development.

|

BACKGROUND

4 Film

activity contributes to the 2013-23 Economic Development Strategy themes of

Business Vitality, Alliances for Innovation, a Hub for Skills and Talent,

Linkages Beyond Our Borders and Compelling Destination. It also contributes to

the Ara Toi Otepoti – Our Creative Future Strategy themes of Identity

Pride and Creative Economy.

5 Enterprise Dunedin has a dual role in film:

a) The first as a regulator through the administration of an efficient

film permit process;

b) The second as a business enabler including identification of

locations, contractors and accommodation, community engagement, relationship

building, support for training and vocational pathways.

6 Enquiries to the Enterprise Dunedin, Film Office have increased from

22 in 2016/17 to 54 in 2017/18 (Year to Date). This includes potential

projects, film permits, locations advice and professional meetings with

visiting crew and producers. Across the region, the spend on film production

rose 67% in 2017 from $25m to $34m (refer Stats NZ).

7 Dunedin

is home to Natural History New Zealand (NHNZ) and Animation Research Limited

(ARL). Both companies produce world class content for major media companies and

have international offices.

8 The

companies, Igtimi with Yachtbot, Social Butterfly with Responsibility and

Runaway Play have emerged from NHNZ and ARL. This has further grown the sector

and generated project-based work for independent film makers, composers,

technicians and editors.

9 The

relationship between the film, screen and technology sectors is substantial.

For instance, the New Zealand Film Commission (NZFC) now funds development for

screen (not just film) augmented reality, virtual reality and games.

10 Over the last ten

years, a range of new Dunedin businesses have emerged in the tech and screen

sector such as Tarn Group, Education Perfect, Rocketwerkz and Peekavu.

11 The

city has seen increased interest from production companies and experienced crew

wanting to relocate to the city. Producers are considering permanent or

short-term projects in the city. Existing screen production companies are

developing new facilities and programmes.

DISCUSSION

12 In

March 2016, Enterprise Dunedin commissioned a report to identify opportunities

in the film sector. The report 'Film Dunedin, Implementation Plan' identified

four recommendations:

a) Strengthen

Council processes to ensure a film friendly city;

b) Build

film industry relationships and alliances;

c) Develop

the sector through business support and projects;

d) Promote

the sector through communications and web presence.

13 In

July 2016, the Grow Dunedin Partnership (GDP) agreed to fund $30,000 to support

the development of film activities and delivery of the ‘Film Dunedin

Implementation Plan’ through:

a) A

dedicated 0.25 full time equivalent (FTE) film role (effectively increasing the

Ara Toi Project Coordinator from a 0.5 to 0.75 FTE);

b) Funding

for Film Otago Southland (FOS), a shared service between six Councils’ in

the lower South Island aimed at coordinating film activity, attraction and

investment.

14 GDP

agreed to further fund this activity in 2017/18.

Existing Direction

and Outcomes

15 The

following table sets out progress against the recommendations set out the Film

Dunedin, Implementation Plan and the outcomes which have been achieved.

Table One: 2016-2018 Activity and

Outcomes.

|

Recommendation

|

Activity

|

Outcome

|

|

Film-Friendly city

|

· Improved

permit process, including development of online forms and interdepartmental

and agency collaboration

|

· Growing

recognition as a film friendly city and ease of business by industry

· Compliance

and regulation addressed efficiently and effectively

|

|

Relationships

|

· Relationships

with:

- Screen businesses and education

providers

- Scouts and producers

- Aukaha and Department of

Conservation

- Community Boards

- Short Film Otago

- Film Otago Southland (FOS)

- Regional Film Offices of NZ (RFONZ)

- NZ Film Commission (NZFC)

- Shanghai Media Group (SMG) and Shanghai

Art Film Federation (SAFF)

|

· Increased

business interest and visibility of Dunedin as a film destination

· Advice

and support from FOS

· Access

to international enquiries through RFONZ/NZFC

· Development

of a screen writer exchange and annual festival with SAFF

|

|

Business support and

projects.

|

· Film

Office support for projects (76 enquiries from July 2016 to present)

· Development

of vocational pathways with education and business

· Support

for Wilbur King in the Ring, Radio Dunedin, Chills Documentary,

Milk and Bring it Home video makers

· 2017

China Film Festival

· Shanghai

Dunedin Screen Writers Exchange

|

· Education

and employment opportunities for students

· Wilbur

achieves critical acclaim and awards

· Milk

filmed with all Dunedin crew and international cast

· Chills

finance completed for feature length documentary

· Lloyds

TSB commercial – 1100 bed nights

· 2017

China Film Festival – MOU with SAFF, national media coverage

· Co-production

opportunities via Shanghai and Beijing Cloud

· Screen

writers exchange to create international co-production opportunities

|

|

Communications

|

· National

and international features on China Film Festival

· Regular

ODT coverage of film projects

· Community

Board engagement

|

· Visibility

over the film industry and Dunedin as a destination

· Ease

of business for incoming projects

|

16 In addition

to the above outcomes three production companies (with extensive track records

in film and television production) have been attracted to the city in the last

six months.

17 Their

decision to move to the city is the result of increased film activity, quality

of life, screen locations, skills and talent and gig speed capability. These

businesses have complemented existing companies such as ARL, NHNZ and numerous

small enterprises and represent opportunities for further economic activity.

Industry Feedback about

Dunedin – Opportunities and Looking Forward

18 Over the last six

months existing and new businesses, NZFC, visiting producers and crew have

identified opportunities to further develop film activity in the city.

19 Table two summarises

this feedback and potential areas to support the sector.

Table Two: Industry

Feedback and Opportunities.

|

|

Feedback and Observations

|

Opportunities

|

|

Existing Business

|

· Investing

in new facilities

· Developing

new projects

· Attracting

new skills to Dunedin

|

· Continue

film support processes

· Introductions

· Support

media and PR

|

|

· NHNZ

wins New York Film Festival gold medal for ‘Big Pacific’

· New

owners and new co-productions

|

|

· Employing

more staff

· Developing

new facilities

|

|

· Revising

film and television training

|

|

Producers

· Notable

Pictures (Chills)

· Phil

Turner – Scout (Wanted 2, Lloyds commercial)

· Daz

Caulton – Scout

(Singapore

Airlines commercial)

· Stefan

Roesch – Producer (Milk)

|

· Increasing

appreciation and recognition of city’s film friendly approach

· Engaged

and supportive community

· Ease

of working in a compact city with great locations

· Dunedin

has available crew

NB. All repeat visitors to city

|

· Maintain

and develop business friendly approach

· Increase

visibility of opportunities and projects.

· Advocacy

|

|

Industry and Investors

· New

Zealand Film Commission CEO, Television and Film producers and investors.

|

Strengths:

· Dunedin

positioned to:

- meet global demand for new and

diverse stories and locations

- develop pathways to education

training and industry

· Strong

locations

· Great

quality of life

· Great

business culture, ease of business and red-carpet approaches

· GigCity

infrastructure

Opportunities:

· Transport

connections

· Lack

of resident skilled crew - particularly management

· Capacity

to accommodate crew numbers sometimes restricted

· Gaps

in locations library for quality images

· Communications

to promote Dunedin opportunities internationally

· Facility

to attract TV and larger film productions

|

· Support/enable

content development through:

- Screen writers exchange

- Ngai Tahu to bring forward southern

Maori stories

· Development

of pathways for screen industry

· Local

business support - measures such as the FOS crew database

· Further

development of the image library

· Marketing

|

Opportunities for

Growth

20 This feedback

confirms Dunedin already has many elements of a screen industry, including

high-end post production facilities such NHNZ and ARL and skilled editors

linked by ultrafast broadband. Further elements are already planned, for

instance, a motion capture studio and green screen at Petridish for film,

television and game development.

21 Enterprise

Dunedin will continue to build on the recommendations

in the ‘Film Dunedin Implementation Plan’ including:

· strengthening

Council processes to ensure a film friendly city;

· developing

film industry relationships and alliances (locally, nationally and

internationally);

· developing

the sector through business support (including an audit of film assets,

capacity and capability in the city) and projects;

· explore

opportunities for promotion, communications and attraction.

OPTIONS

22 As this is a noting

report there are no options.

NEXT STEPS

23 Enterprise Dunedin

will continue to enable film development as per the recommendations of the

existing ‘Film Dunedin Implementation Plan’. This will include:

a) Red carpet

support for projects through liaison, locations advice and access and community

engagement;

b) Planning and

advocacy to minimise risks such as accommodation and competing use of locations

or facilities;

c) Business

development advice, and matching screen sector workforce needs with training

and education providers;

d) Coordination

with industry, agencies such as NZFC, RFONZ, FOS and partners in China.

Signatories

|

Author:

|

Antony Deaker - Ara Toi Projects Coordinator

|

|

Authoriser:

|

Fraser Liggett - Economic Development Programme Manager

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

a

|

Confidential Attachment

for Film Dunedin Development Report (Under Separate Cover)(Confidential)

|

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing a public service and it

is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

This report describes activity and planning that directly

supports all five themes within the Economic Development Strategy, the

Creative Economy and Creative Pride themes in the Arts and Culture

Strategy. Film contributes to sense of pride and social well-being as

Dunedin landscapes, stories and culture are reflected on screen.

|

|

Māori Impact

Statement

Engagement with Mana Whenua is managed by the Film

Dunedin office where permit applications engage with wahi tapu and applicants

are introduced to runaka offices and or Aukaha staff as required.

|

|

Sustainability

The report describes plans to improve economic

sustainability of screen sector businesses, and activity that will improve

the social well-being of the city.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

The draft Ten Year Plan operating budgets includes

provision for film activities based on existing levels of service.

|

|

Financial

considerations

As a report for noting, there are no financial

implications.

|

|

Significance

As a report for noting this decision is considered low in

terms of the Council’s Significance and Engagement Policy.

|

|

Engagement –

external

The Film Dunedin office has engaged with local businesses,

education providers, independent creatives, regional and national film

industry organisations. This includes NZFC, FOS, Screen Auckland, Screen

Wellington, Screen BOP, Venture Taranaki and Screen Canterbury.

|

|

Engagement -

internal

The Film Dunedin office has engaged internally with

Transport, Property, Parks and Recreation, Marketing and Comms, Arts and

Culture and Enterprise Dunedin. This has largely been focussed on regulatory

process in the issuing of film permits, film enquiries and potential

projects.

|

|

Risks: Legal /

Health and Safety etc.

There are no known legal or health and safety issues.

However, applicants for film permits are required to supply evidence such as

Public Liability Insurance cover and Health and Safety policies.

|

|

Conflict of

Interest

There are no identified conflicts of interest.

|

|

Community Boards

The Dunedin Film office works with Community Board chairs

to ensure notice of significant projects and seek advice on locations.

A briefing on film activity was provided to all Community Boards during the

April round of meetings.

|

|

Economic Development

Committee

22 May 2018

|

|

Resolution to Exclude the

Public

That the Economic

Development Committee:

Pursuant to the provisions of the

Local Government Official Information and Meetings Act 1987, exclude the public

from the following part of the proceedings of this meeting namely:

|

General subject of the matter to be considered

|

Reasons

for passing this resolution in relation to each matter

|

Ground(s) under

section 48(1) for the passing of this resolution

|

Reason for

Confidentiality

|

|

C1

District Energy Feasibility Study

|

S7(2)(h)

The

withholding of the information is necessary to enable the local authority to

carry out, without prejudice or disadvantage, commercial activities.

|

S48(1)(a)

The public conduct of

the part of the meeting would be likely to result in the disclosure of

information for which good reason for withholding exists under section 7.

|

|

|

C2

Provincial Growth Fund Update

|

S7(2)(h)

The

withholding of the information is necessary to enable the local authority to

carry out, without prejudice or disadvantage, commercial activities.

|

S48(1)(a)

The public conduct of

the part of the meeting would be likely to result in the disclosure of

information for which good reason for withholding exists under section 7.

|

|

This resolution is made in

reliance on Section 48(1)(a) of the Local Government Official Information and

Meetings Act 1987, and the particular interest or interests protected by

Section 6 or Section 7 of that Act, or Section 6 or Section 7 or Section 9 of

the Official Information Act 1982, as the case may require, which would be

prejudiced by the holding of the whole or the relevant part of the proceedings

of the meeting in public are as shown above after each item.