Notice of Meeting:

I hereby give notice that an ordinary meeting of the Finance

and Council Controlled Organisations Committee will be held on:

Date: Tuesday

22 May 2018

Time: 2.00

pm (or at the conclusion of the previous meeting, whichever is later)

Venue: Edinburgh

Room, Municipal Chambers, The Octagon, Dunedin

Sue Bidrose

Finance and Council Controlled Organisations Committee

PUBLIC AGENDA

|

Chairperson

|

Mike Lord

|

|

|

Deputy Chairperson

|

Doug Hall

|

|

|

Members

|

David Benson-Pope

|

Dave Cull

|

|

|

Rachel Elder

|

Christine Garey

|

|

|

Aaron Hawkins

|

Marie Laufiso

|

|

|

Damian Newell

|

Jim O'Malley

|

|

|

Chris Staynes

|

Conrad Stedman

|

|

|

Lee Vandervis

|

Andrew Whiley

|

|

|

Kate Wilson

|

|

Senior Officer Dave

Tombs, General Manager Finance and Commercial

Governance Support Officer Jenny

Lapham

Jenny Lapham

Governance Support Officer

Telephone: 03 477 4000

Jenny.Lapham@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

ITEM TABLE OF CONTENTS PAGE

1 Public

Forum 4

2 Apologies 4

3 Confirmation

of Agenda 4

4 Declaration

of Interest 5

Part

A Reports (Committee has power to decide these matters)

5 Heritage

Rates Relief 2017-18 15

6 Financial

Result - Period Ended 31 March 2018 24

7 Waipori

Fund - Quarter Ending March 2018 48

8 Items

for Consideration by the Chair

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

1 Public

Forum

At the close of the agenda no

requests for public forum had been received.

2 Apologies

At the close of the agenda no

apologies had been received.

3 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

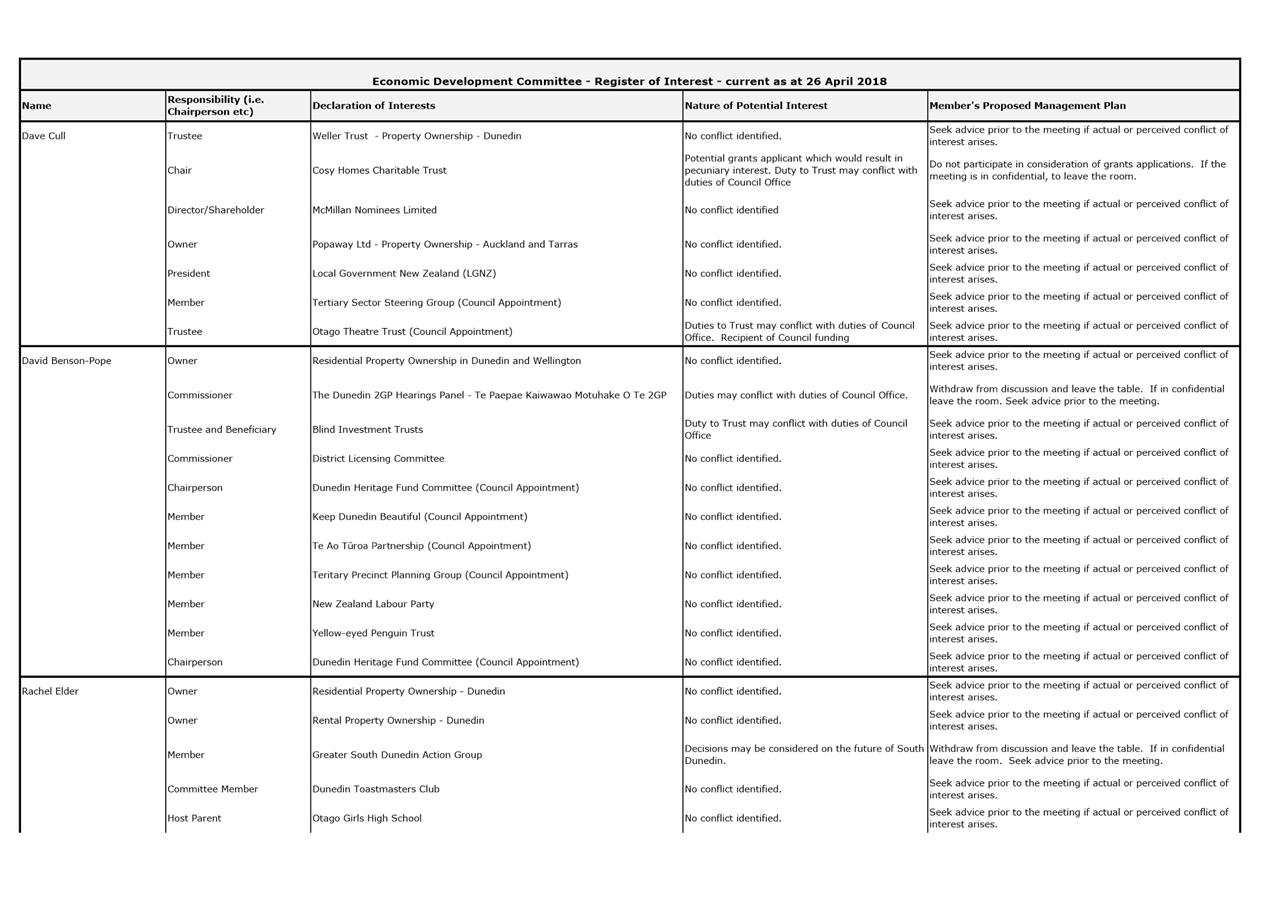

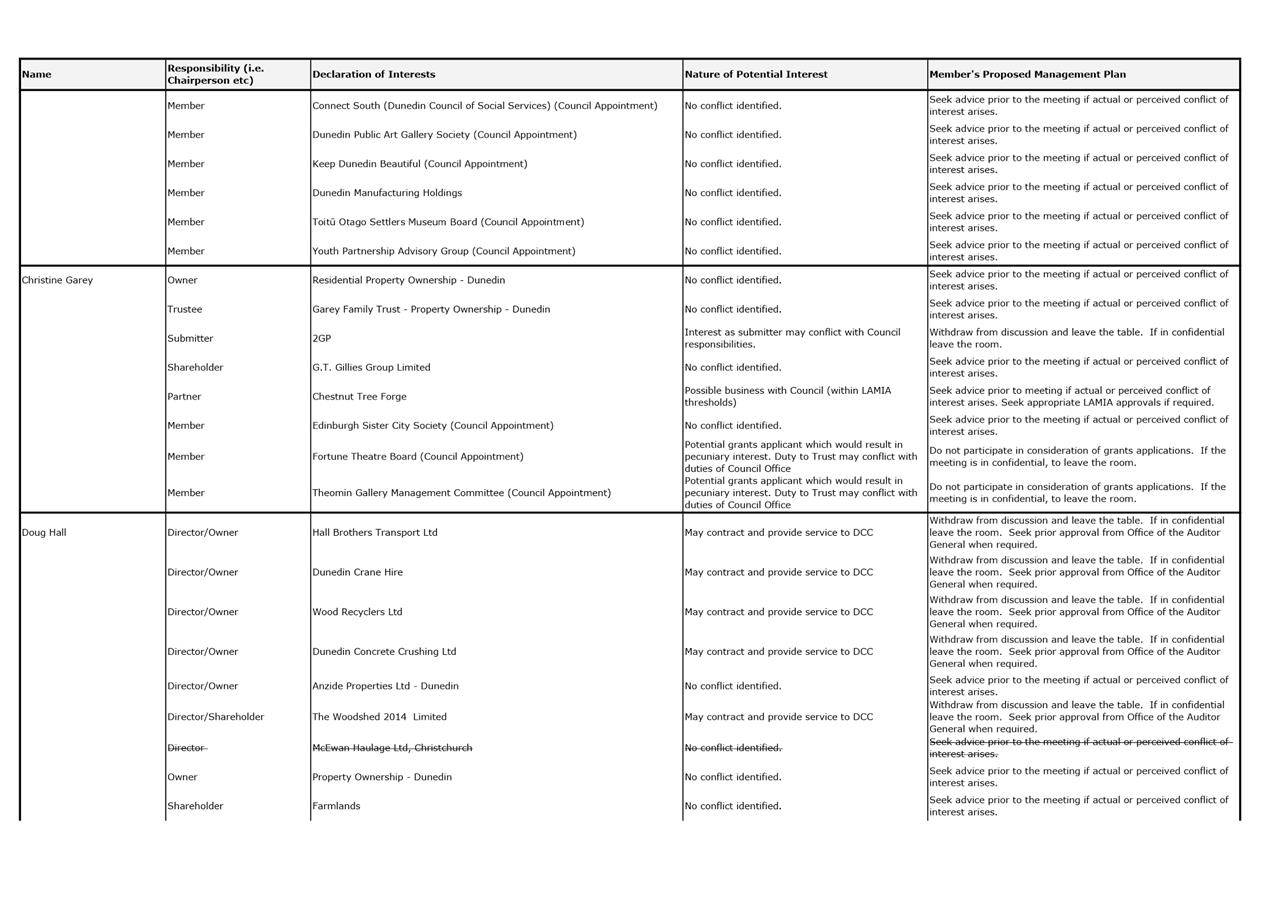

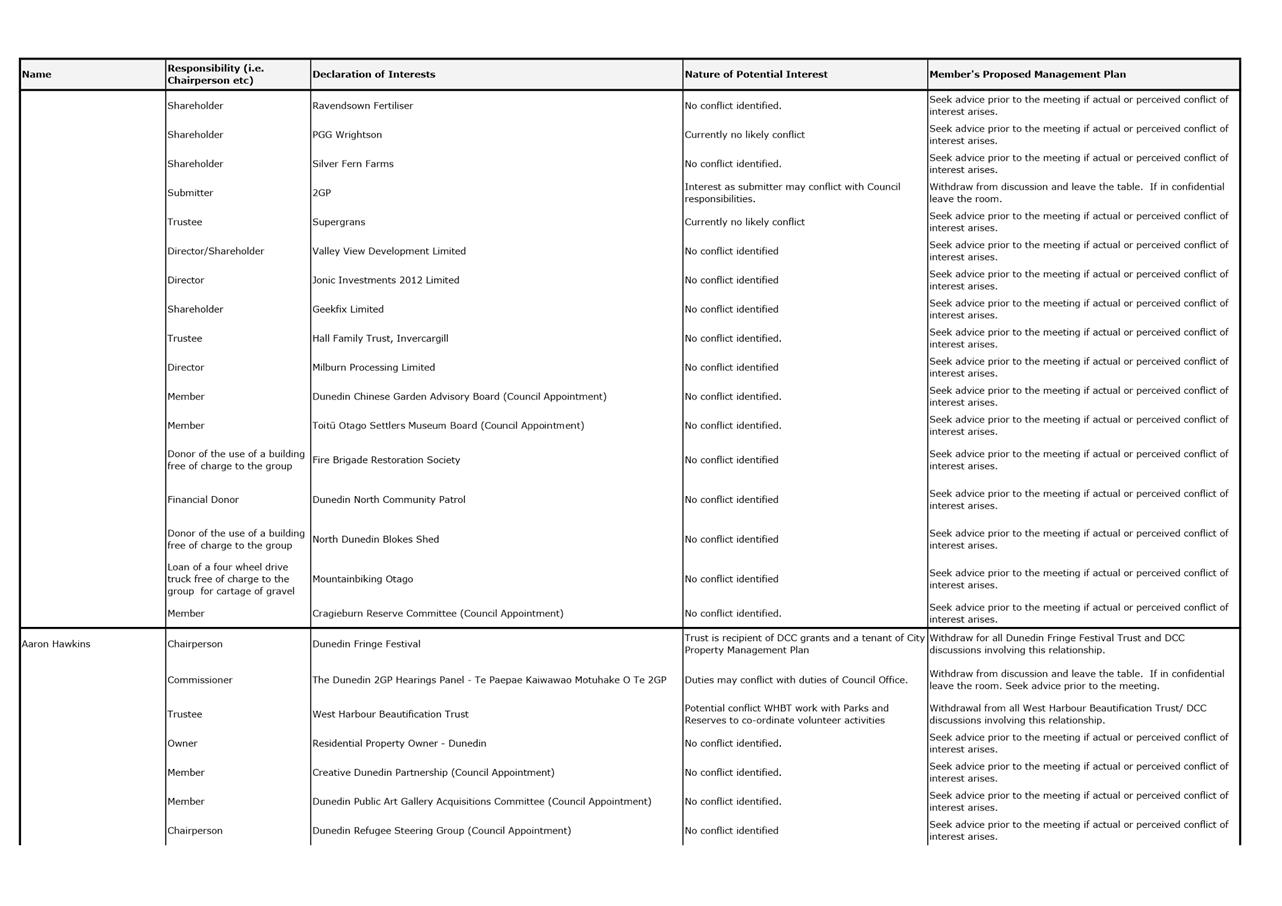

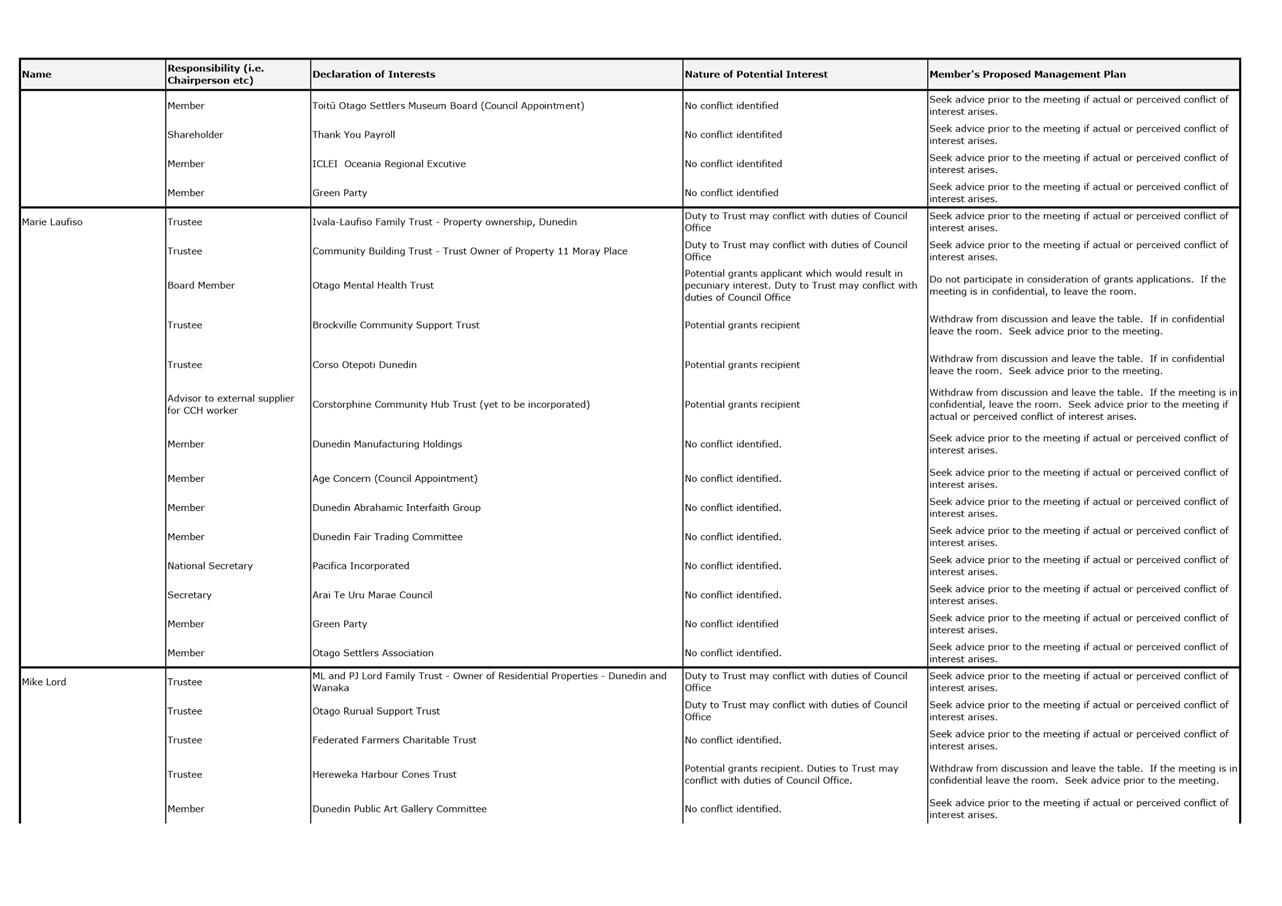

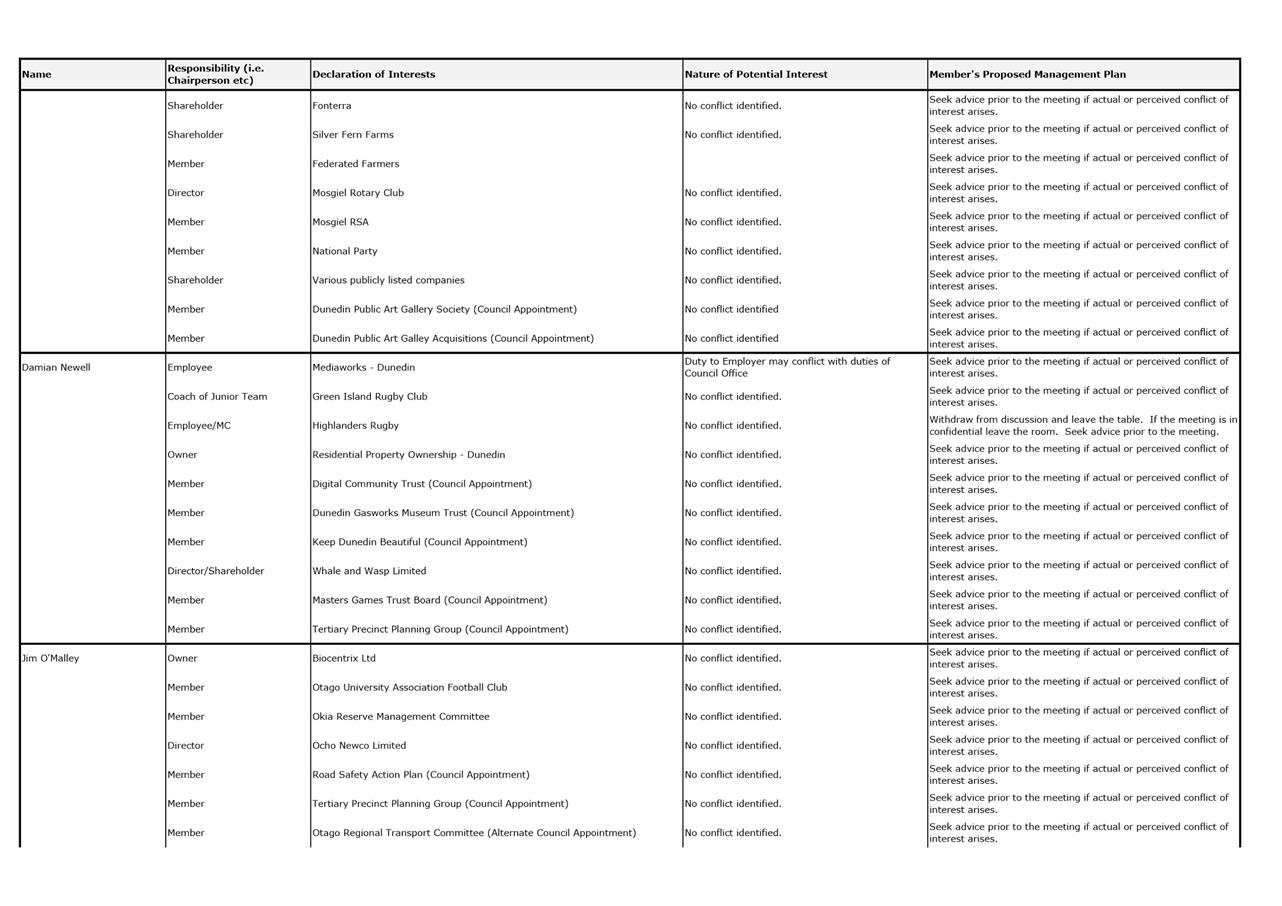

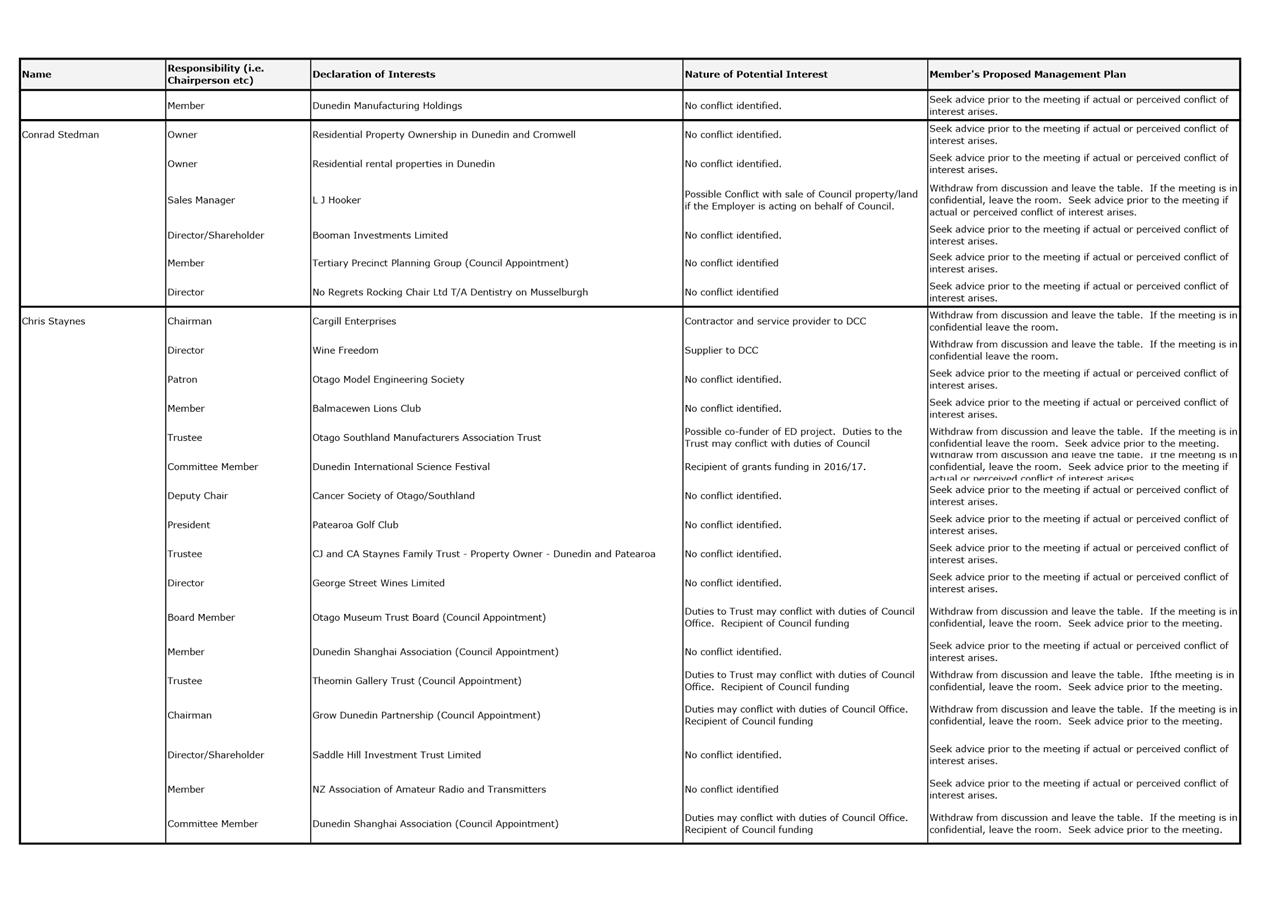

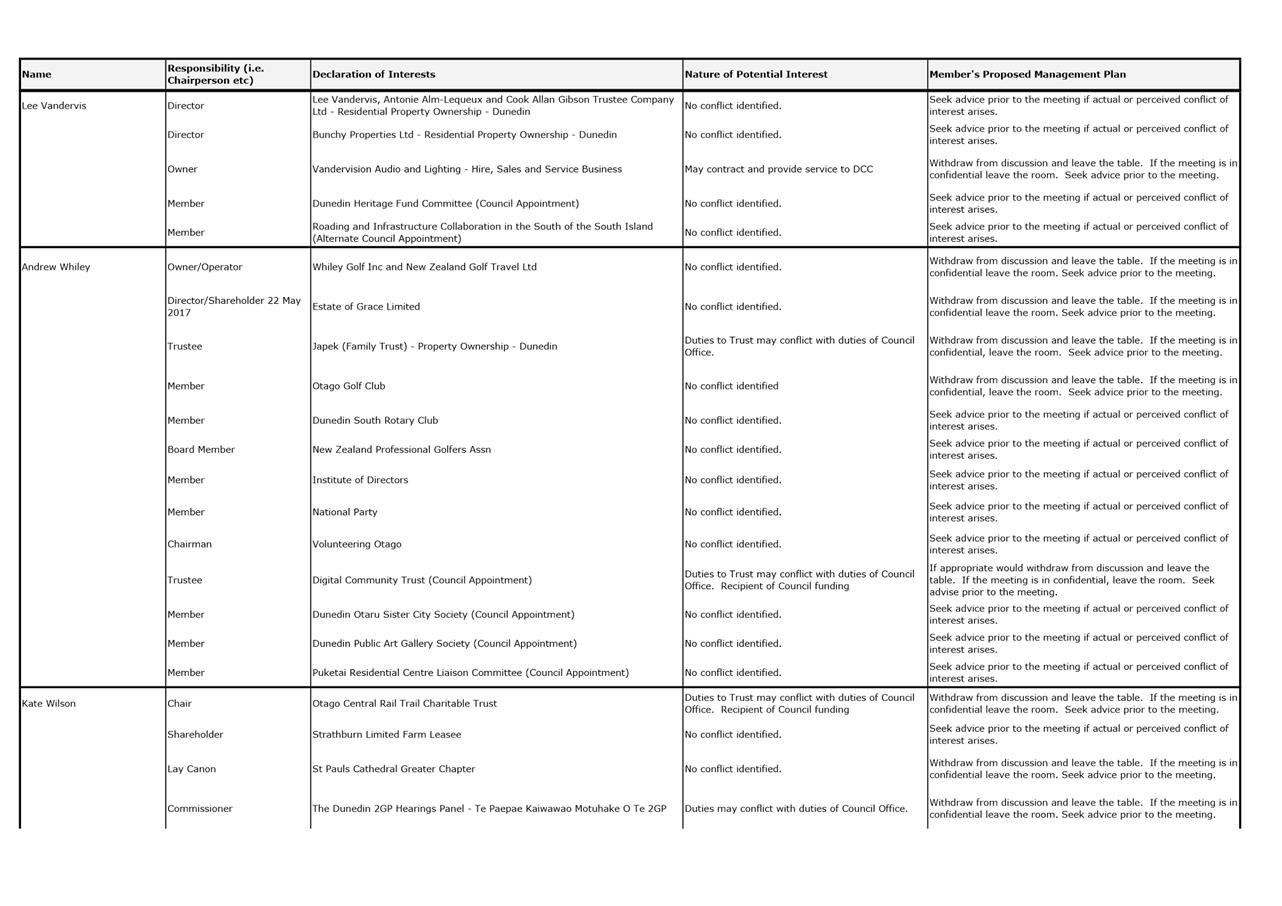

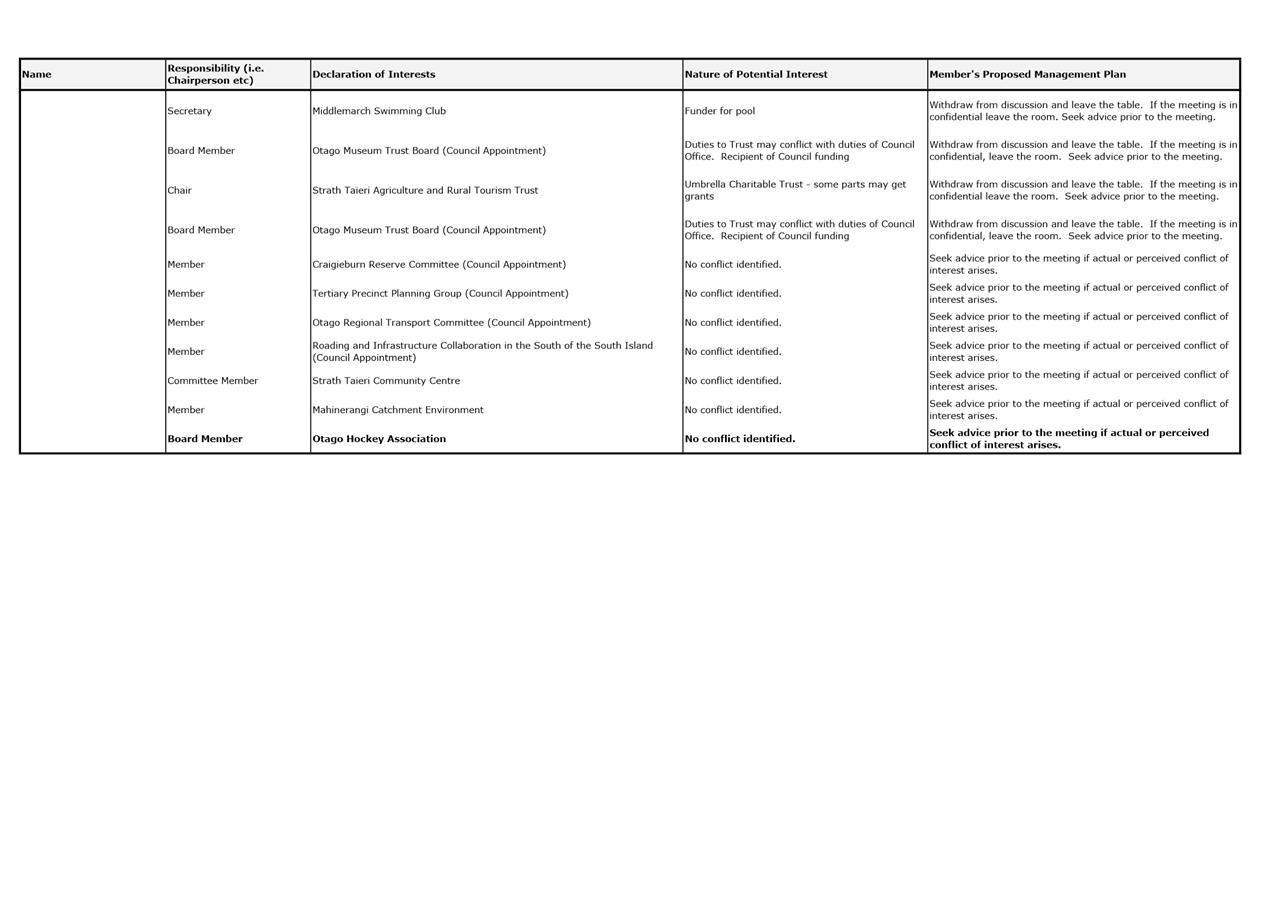

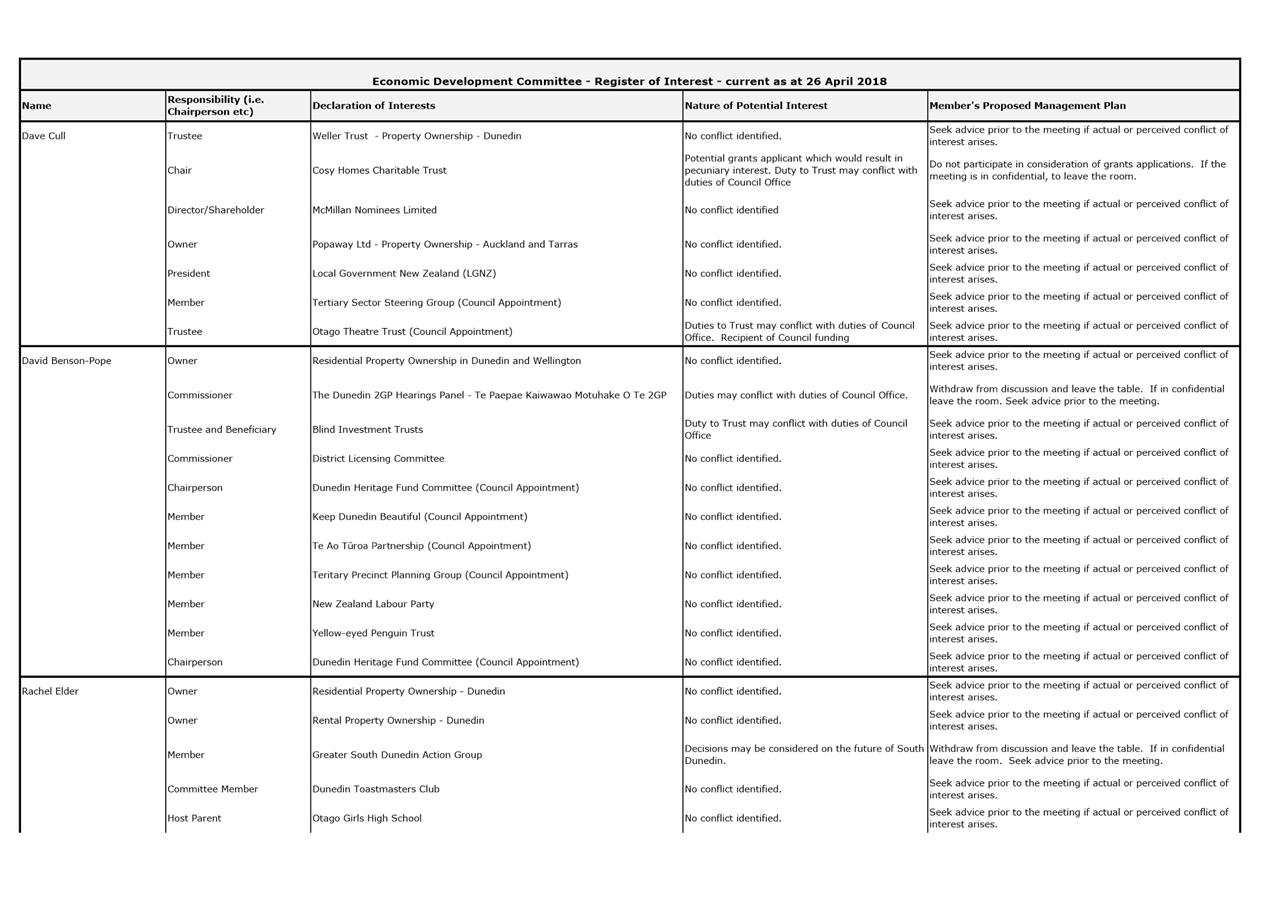

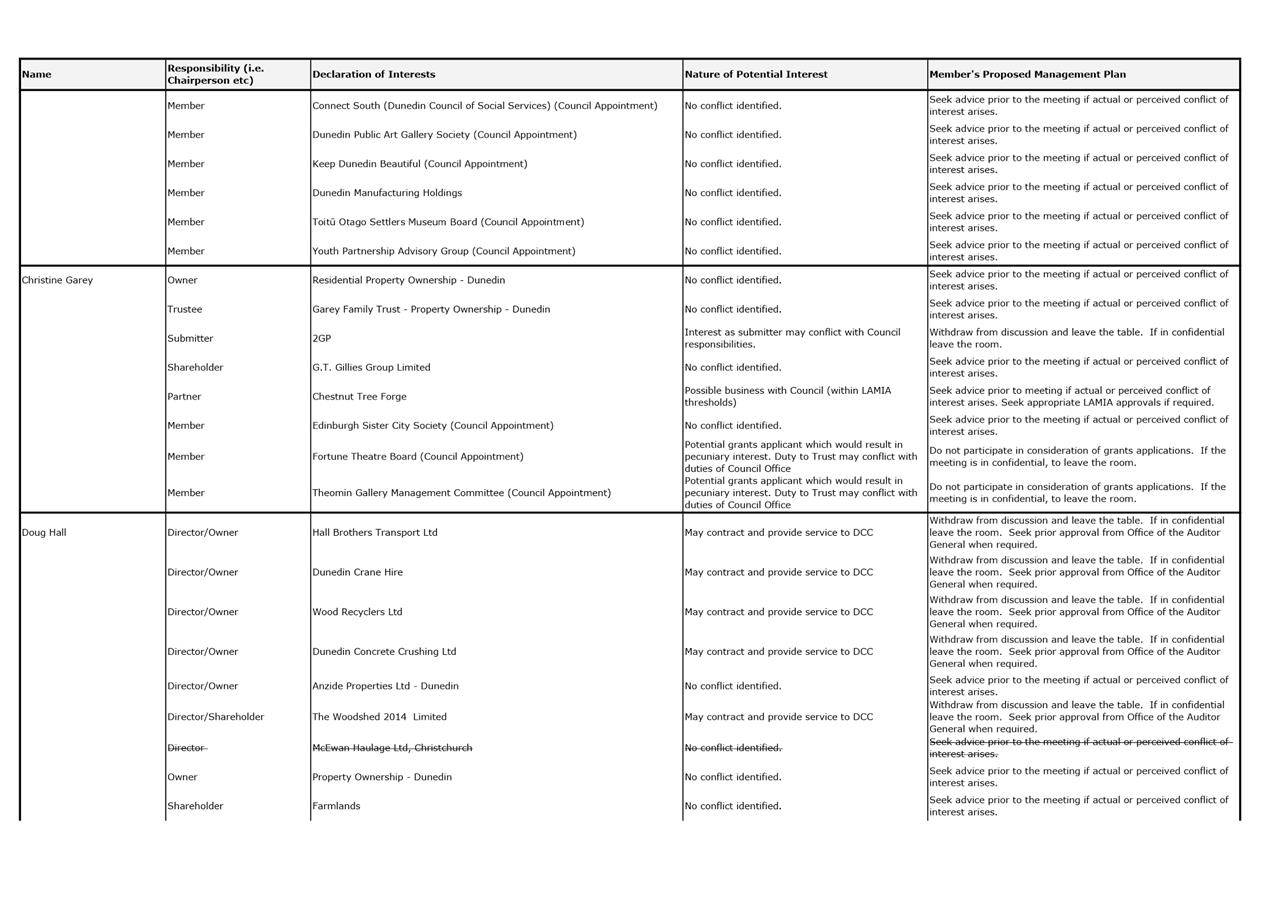

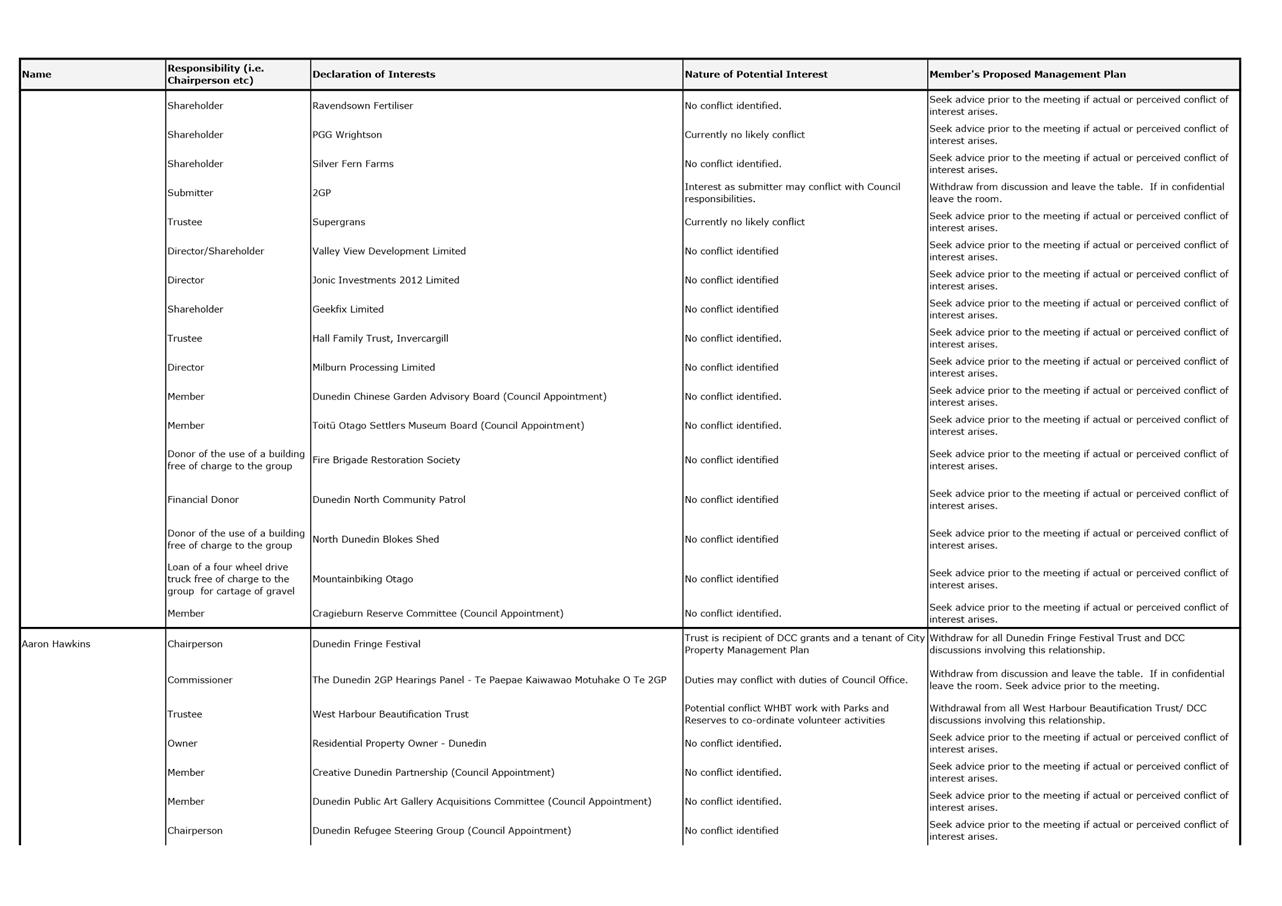

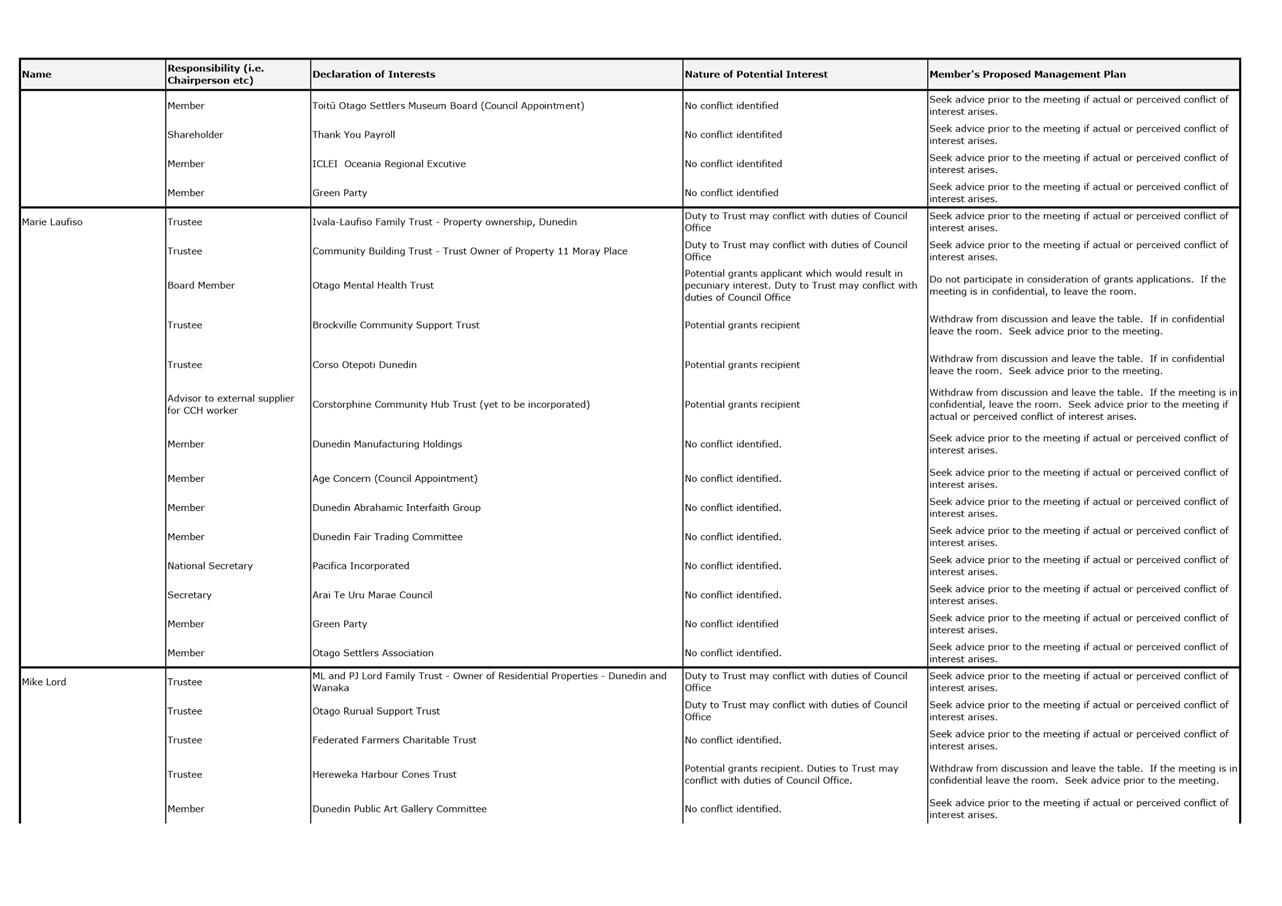

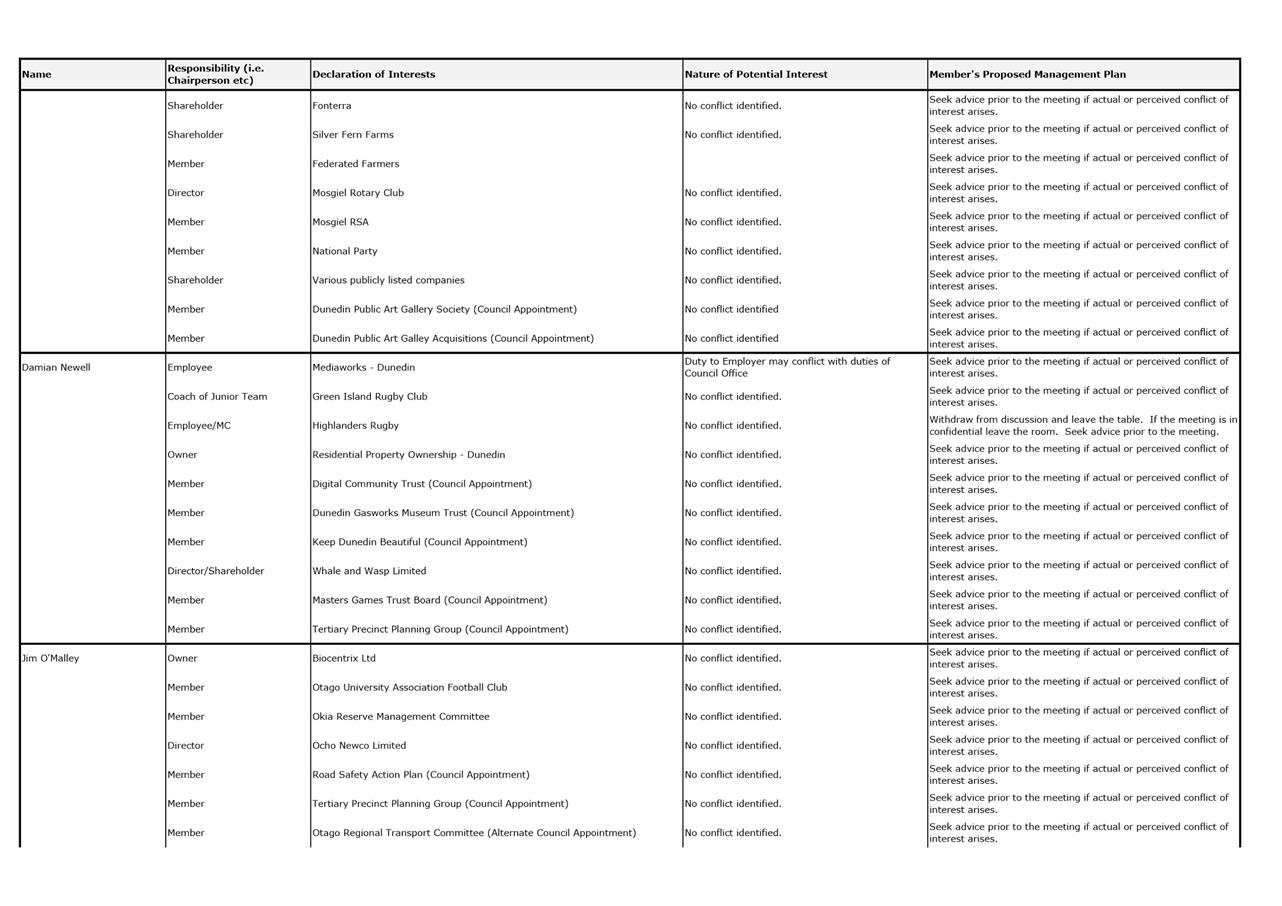

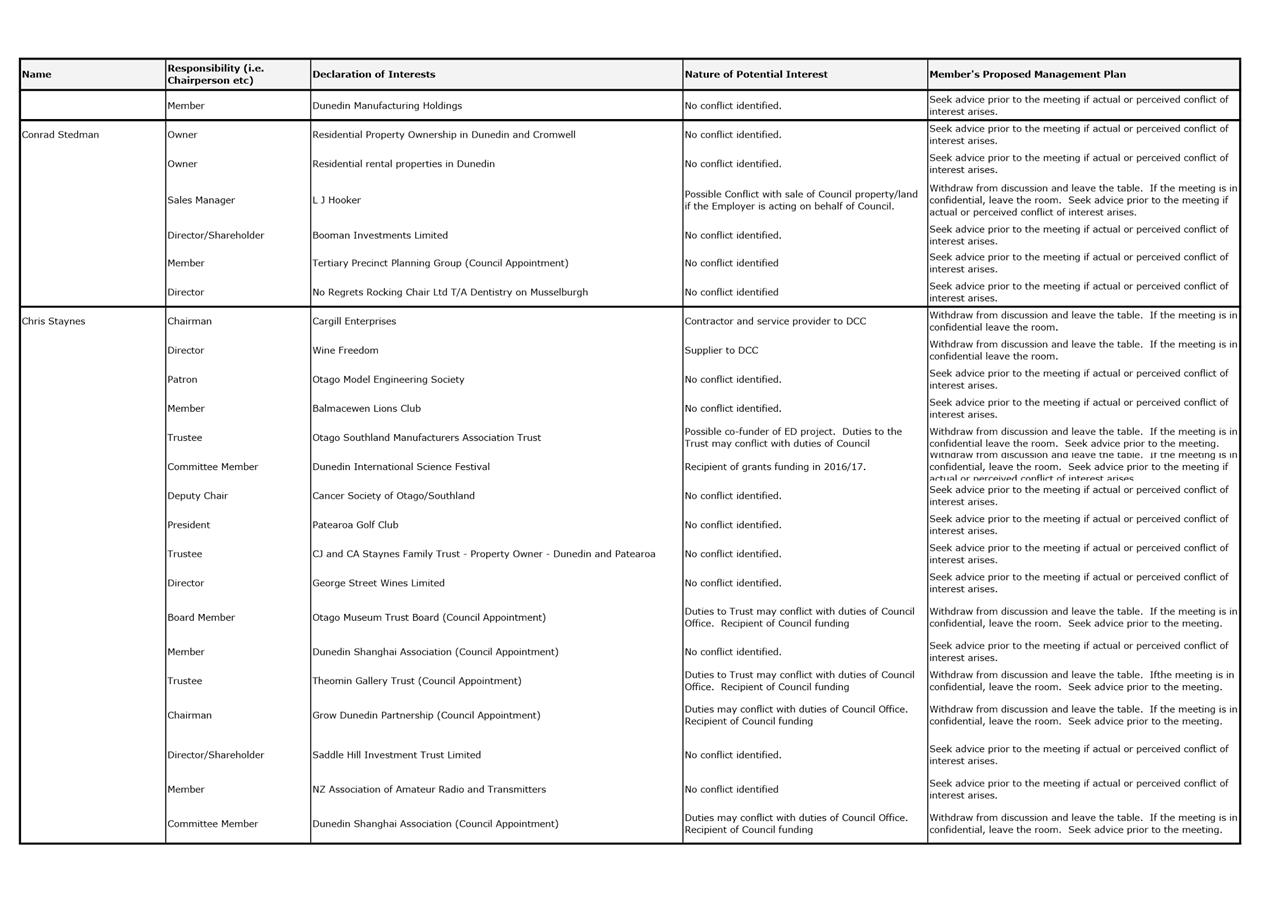

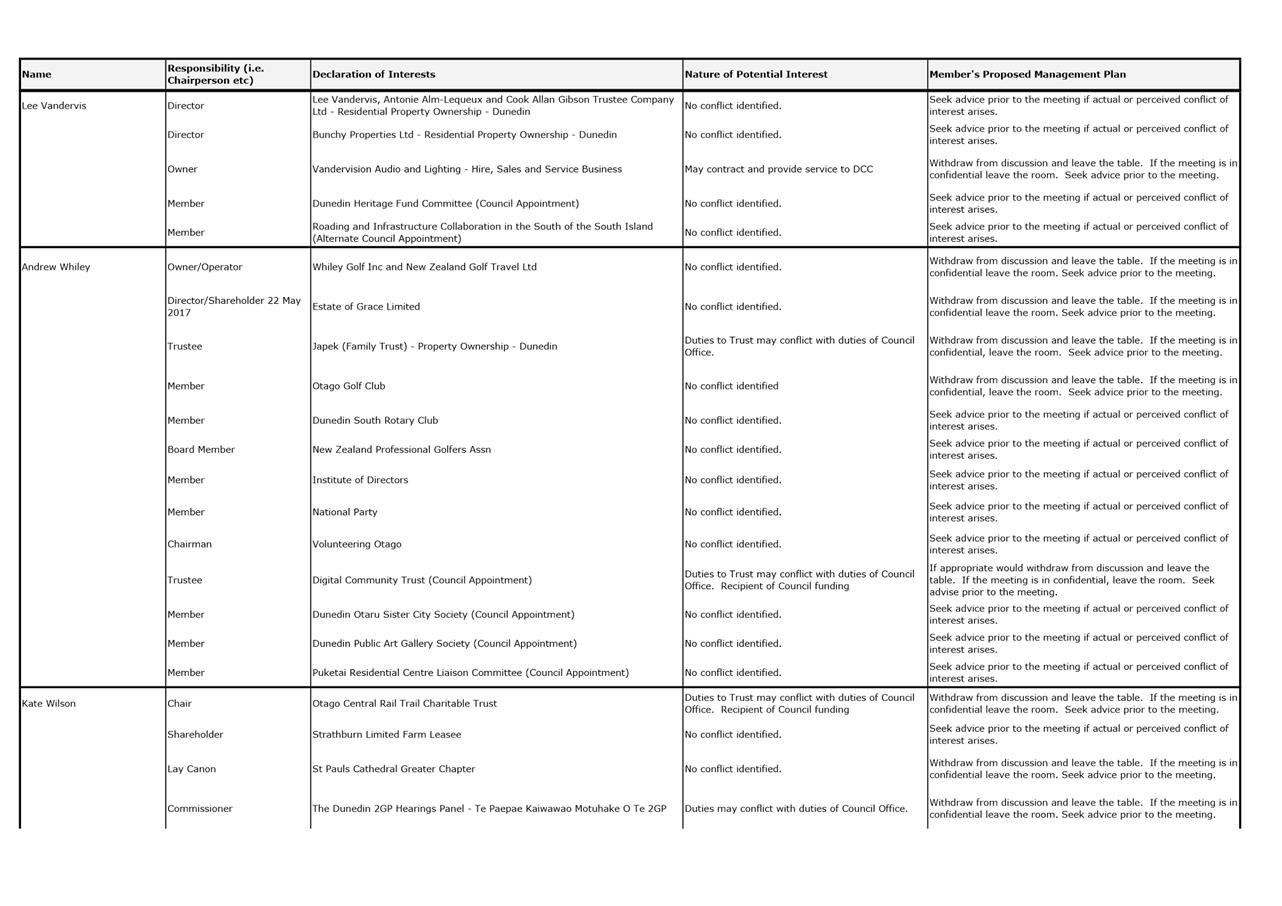

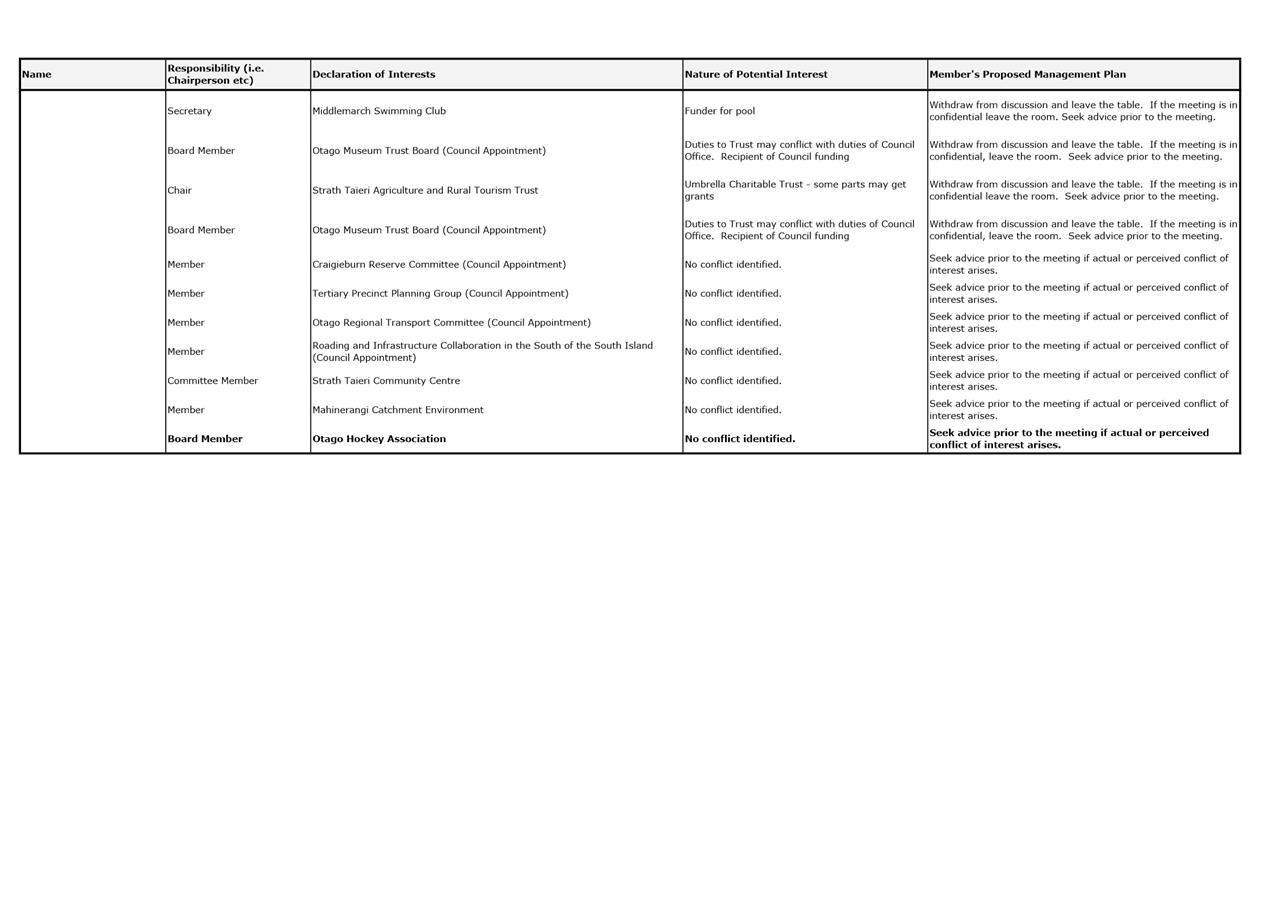

Declaration of Interest

EXECUTIVE SUMMARY

1. Members are reminded of the need

to stand aside from decision-making when a conflict arises between their role

as an elected representative and any private or other external interest they

might have.

2. Elected

members are reminded to update their register of interests as

soon as practicable, including amending the register at this meeting if

necessary.

|

RECOMMENDATIONS

That the Committee:

a) Notes/Amends

if necessary the Elected Members' Interest Register attached as Attachment A;

and

b) Confirms/Amends the proposed management plan for Elected Members' Interests.

|

Attachments

|

|

Title

|

Page

|

|

a

|

Register of Interest

|

7

|

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

Part

A Reports

Heritage Rates Relief 2017-18

Department: Planning

EXECUTIVE SUMMARY

1 This

report provides recommendations on applications for rates relief for six

earthquake strengthening and re-use projects.

2 Four of

the applications meet the purpose of the Contestable Fund for Rates Relief for

Heritage Buildings policy, which offers relief as an incentive for restoration

and upgrade, and recognises the investment in seismic, fire, and other upgrades

on heritage buildings.

3 Two of

the applications meet the purpose of the Contestable Fund for Rates Relief for

the Comprehensive Reuse of Heritage Buildings policy, which offers temporary

relief where investment in heritage buildings result in a substantial increase

in the value of the building.

4 Details

and recommendations for each project are provided.

|

RECOMMENDATIONS

That the Committee:

a) Grants 100%

rates relief (based on the general rate amount of $4,921.61) for two years

for the earthquake strengthening and restoration of 52 Tennyson Street from

the Contestable Fund for Rates Relief for Heritage Buildings.

b) Grants 100%

rates relief (based on the general rate amount of $11,510.02) for one year

for the design and construction of a replica boundary wall and railings for

Dunedin Prison from the Contestable Fund for Rates Relief for Heritage

Buildings.

c) Grants

100% rates relief for three years (based on general rate amount of $5,122.32)

for the earthquake strengthening, fire safety improvements and façade

restoration of 192 Princes Street from the Contestable Fund for Rates Relief

for Heritage Buildings.

d) Grants 100%

rates relief for three years (based on general rate amount of $7,328.98) for

the earthquake strengthening and façade restoration of 50 Dundas

Street from the Contestable Fund for Rates Relief for Heritage Buildings.

e) Grants a

rates freeze for two years upon completion of the conversion of the ground

and first floors of 8 Stafford Street from storage to a start-up hub and

associated uses from the Contestable Fund for Rates Relief for the

Comprehensive Reuse of Heritage Buildings.

f) Grants a

rates freeze for two years upon completion of the conversion of the upper

floors of 77 Stuart Street from offices to a hotel from the Contestable Fund

for Rates Relief for the Comprehensive Reuse of Heritage Buildings.

|

BACKGROUND

5 The

Contestable Fund for Rates Relief for Heritage Buildings policy offers relief

as an incentive for restoration and upgrade, and recognises the investment in

seismic, fire, and other upgrades on heritage buildings.

6 The

Contestable Fund for Rates Relief for the Comprehensive Reuse of Heritage

Buildings policy targets reuse projects in buildings with heritage

significance, where the investment in the building will result in a substantial

increase in the value of the building.

7 The

policies assesses building projects against the following criteria:

· Contribution

to heritage protection: The Council will consider whether, and to what extent,

the work being undertaken contributes positively to the protection of heritage

values and long-term retention of the building.

· Level

of investment: The Council will consider the level of financial investment in

the building. The Council recognises that some of the most important heritage

building projects will not necessarily provide the greatest economic

returns. However, there will often be tangible and intangible benefits.

· Expediting

the use of heritage buildings: The Council will consider whether, and to what

extent, the continued and on-going use and retention of the building will be

facilitated by the granting of relief.

· Integration

with other Council policies and strategies: The Council will consider the

extent to which proposed works are consistent with the Dunedin District Plan

and the Dunedin Spatial Plan. Preference will be given to projects that

are consistent with the objectives and policies of the District Plan and

Spatial Plan. The Council will look favourably on projects that align

with other Council strategies such as the Economic Development Strategy and

Arts and Culture Strategy. In order to increase the potential for

area-wide regeneration, the Council may target specific geographic areas of the

city on an annual basis in conjunction with this scheme and other targeted

incentives. The Council will view projects in areas of the city where

there is substantial private investment in re-use positively.

· Public

benefit: The Council recognises that the community benefit from the upgrade and

improvement of heritage buildings, in terms of improved amenity, public safety

and longer term economic and rating benefits. Projects with high public

visibility and continued public access/use will be viewed positively.

8 The

budget for the Contestable Fund for Rates Relief for Heritage Buildings in

2017/18 is $70,000. Previously committed allocations equal

$5,194.54. This year’s applications will total $27,982.93. If

the recommendations are accepted and approved, the total spend of the Contestable

Fund for Rates Relief for Heritage Buildings will be $33,177.47.

9 The

budget of the Contestable Fund for Rates Relief for the Comprehensive Reuse of

Heritage Buildings is $100,000. Previously committed allocations equal

$61,957.65. There are currently four outstanding projects that have not been

completed and therefore have not had their rates recalculated based on their

new values. It is highly likely that two of these projects will be

completed within the next twelve months and will draw upon their allocations in

the new financial year.

10 Both contestable

funds will no longer be open for new applications from 2018/19 onwards, as all

the funding for the heritage grants schemes will be subsumed into a larger

Dunedin Heritage Fund.

DISCUSSION

11 The following

applications have been made to the Contestable Fund. Where heritage buildings

have previously received financial support from the Contestable Funds, the

Dunedin Heritage Fund, or the Central City Heritage Reuse Grants Scheme, the

amounts have been noted.

Hulmes Court, 52

Tennyson Street

12 Hulmes Court is an

ornately detailed early villa dating from the 1860s and is a rare survivor of

Dunedin’s original wooden construction. It is currently used as a

Bed and Breakfast. It is a scheduled heritage building on the District

Plan and is a Category 2 Historic Place on the New Zealand Heritage List.

The property has been recently awarded a grant of $20,000 from the Dunedin

Heritage Fund towards the cost of earthquake strengthening the chimneys and

restoring the slate roof.

13 The applicant seeks

rates relief towards the costs of these works as well as for repairs to the

walls, including replacing timber cladding where necessary and repainting of

the villa while the scaffolding is in place for the works to the roof.

14 The assessment

against the policies is as follows:

· Contribution

to heritage protection: the work proposed will keep the building watertight and

improve its seismic performance while limiting its impact on the villa’s

architectural and historic significance.

· Level

of investment: the property is in good condition and has been successfully used

as a heritage B&B for some time. As well as being a notable heritage

building in the city centre, its current role supports heritage tourism in

Dunedin.

· Expediting

the use of heritage buildings: use as a B&B minuses the degree of

subdivision and attendant harm to the building’s interior that would be

likely to occur were the building be converted into apartments, offices or

flats. Granting rates relief will allow the continued use of the building

as a heritage B&B during a period of construction work.

· Integration

with other Council policies and strategies: the proposed works are consistent

with the District Plan and the Spatial Plan. The use of the building as visitor

accommodation also accords with the Economic Development Strategy.

· Public

Benefit: the proposed works are visible from the street and will improve the

appearance of the building and public safety.

15 It is recommended

that 100% rates relief is granted for two years, based on the current general

rate amount of $4,921.61.

Dunedin Prison,

Castle Street

16 Dunedin Prison was

constructed between 1895 and 1897 in a Queen Anne Style. It is a

scheduled heritage building and is located within the Anzac Square/Railway

Station Heritage Precinct in the District Plan. It is a Category 1

Historic Place on the New Zealand Heritage List. The Dunedin Prison

Charitable Trust has been awarded grants totalling $65,000 from the Dunedin

Heritage Fund in recent years and has previously been awarded rates relief

between 2014 and 2017.

17 The applicant is

seeking rates relief for the cost of restoring the previously demolished

boundary walls and railings facing Castle Street.

18 The assessment

against the policies is as follows:

· Contribution

to heritage protection: while the works proposed will not directly support the

restoration of the historic building, they will greatly improve the appearance

of the building from Castle Street and Anzac Square when viewed from the

Railway Station and Toitū Otago Settlers Museum in particular.

· Level

of investment: The Dunedin Prison Charitable Trust has taken on a substantial

challenge in the form of a large heritage building that can no longer be used

for its intended purpose. They have already successfully restored the

roof and façade of the Administration Block and have started to find

tenants to use parts of the historic complex.

· Expediting

the use of heritage buildings: improving the appearance of the Prison through

restoring the lost boundary wall and railings may help secure additional

tenants for the heritage building, which will support its further restoration

and its long-term future.

· Integration

with other Council policies and strategies: the proposed works are consistent

with the District Plan and the Spatial Plan.

· Public

Benefit: the new boundary wall will contribute to the heritage character of

Anzac Square and further increase its appeal for visitors.

19 It is recommended

that 100% rates relief is granted for one year, based on the current general

rate amount of $11,510.02.

Eldon Chambers, 192

Princes Street

20 The building at 192

Princes Street was originally constructed in 1866 to a design by R.A. Lawson,

but was substantially remodelled to an Art Deco design by Clere, Clere &

Hill in 1939 for Boots the Chemist. The building was later occupied by

the New Canton Restaurant until 2013. The building is located within the North

Princes Street/Moray Place/Exchange Townscape Precinct in the District Plan and

is identified as a Character Contributing Building in the Second Generation

District Plan. The property has recently been awarded a grant of $10,000

from the Dunedin Heritage Fund and a grant of $30,000 from the Central City

Heritage Reuse Grants Scheme for the restoration of the building’s Art

Deco façade and the earthquake strengthening of the building.

21 The applicant is

seeking rates relief for the cost of restoring the façade, the

earthquake strengthening and the fire safety upgrade of the building.

22 Contribution to

heritage protection: the works proposed will ensure that the building will

perform to at least 67% of modern standards in the event of an earthquake and

meet modern fire standards, ensuring its long-term use. The associated

restoration of the Art Deco façade will also improve the appearance of

the building and of this section of Princes Street which contains a large

concentration of high-quality heritage buildings.

23 The assessment

against the policies is as follows:

· Level

of investment: the applicant has already commissioned detailed seismic

assessment and design work for the earthquake strengthening and associated

upgrades of the building.

· Expediting

the use of heritage buildings: the applicant has a tenant in place for the ground

floor café. Strengthening the building will enable the

applicant’s planned uses for the upper floor and basement level. It

is also likely to increase footfall and interest in Rattray Street and the

northern section of Princes Street where there has been a gradual decline in

economic activity and building maintenance.

· Integration

with other Council policies and strategies: the proposed works are consistent

with the District Plan and the Spatial Plan.

· Public

Benefit: the proposal will improve public safety on Princes Street and improve

the appearance of the local area. It also has the potential to contribute

to the regeneration of Rattray Street and Prices Street area.

24 It is recommended

that 100% rates relief is granted for three years, based on the current general

rate amount of $5,122.32.

Former Methodist

Church, 50 Dundas Street

25 50 Dundas Street is

a former Methodist Church and Sunday School Hall dating from 1879. It is

a scheduled heritage building in the North Dunedin Residential Townscape

Precinct in the District Plan. It is a Category 2 Historic Place on the New

Zealand Heritage List. The church was most recently used as a shop while the

hall’s ground floor is the home of Dunedin Folk Club and its upper floors

are used for student accommodation. An application to the Dunedin

Heritage Fund towards the costs of earthquake strengthening and façade

restoration is currently under consideration.

26 The applicant seeks

rates relief towards the costs of earthquake strengthening and façade

restoration.

27 The assessment

against the policies is as follows:

· Contribution

to heritage protection: the proposed earthquake strengthening and façade

restoration will positively contribute to the protection of the

building’s heritage values and support its long-term use.

· Level

of investment: the applicant has carried out repairs and maintenance to the

building and has commissioned detailed seismic assessment and design.

· Expediting

the use of heritage buildings: the proposed works will support the on-going use

of the building and help attract and retain tenants.

· Integration

with other Council policies and strategies: the proposed works are consistent

with the District Plan and the Spatial Plan and will also support the aims of

Ara Toi Arts and Cultural Strategy by maintaining a performance venue.

· Public

benefit: the proposal will improve public safety and improve the appearance of

the building. It will help also support a performance venue.

28 It is recommended

that 100% rates relief is granted for three years, based on the current general

rate amount of $7,328.98.

Former Ross &

Glendining Building, 8 Stafford Street

29 8 Stafford Street is

a former warehouse, dating in parts from 1866 and extended and altered in 1874

and 1919. It is currently being converted into a start-up and tech

business hub. It is a scheduled heritage building in the North Princes

Street/Moray Place/Exchange Townscape Precinct in the District Plan. The

property has previously received $20,000 from the Dunedin Heritage Fund and

$10,000 from the Central City Heritage Reuse Grants Scheme. Between 2014 and

2017 the property was granted rates relief for three years from the Contestable

Fund for Rates Relief for Heritage Buildings.

30 The applicant is

seeking rates relief towards the costs of the next stage of the conversion

project for the basement, ground and first floors. This comprises

earthquake strengthening and fire upgrades, window frame repair and other

associated works to convert the current storage space to shared office

facilities.

31 The assessment

against the policies is as follows:

· Contribution

to heritage protection: : the works proposed will ensure that the building will

perform to modern standards in the event of an earthquake and meet modern fire

standards, ensuring its long-term use. The appropriate repair of the

extensive glazing will contribute to the building’s performance and its

appearance and accords with the building’s heritage values.

· Level

of investment: the total cost of the conversion of the building to a start-up

and tech business hub has been estimated by the applicant to be approximately

$4 million.

· Expediting

the use of heritage buildings: the granting of a rates freeze will support the

substantial increase in floor space while maintaining the heritage values of

the building.

· Integration

with other Council policies and strategies: the proposed works are consistent

with the District Plan and the Spatial Plan. The use of the building as a

start-up space also accords with the Economic Development Strategy.

· Public

benefit: the proposed use will improve public safety further and improve the

appearance of the building.

32 It is recommended

that a rates freeze is granted for two years.

77 Stuart Street

33 77 Stuart Street is

located on the corner of Crawford Street and Stuart Street and dates from

around 1910. A cycle store occupies the ground floor while its vacant

upper floors were previously leased to the Department of Conservation. It

is a scheduled heritage building and is located within the Lower Stuart Street

Heritage Precinct. It is a Category 2 Historic Place on the New Zealand

Heritage List. It has recently been awarded $5,000 from the Dunedin

Heritage Fund towards the renovation of the windows to the upper storeys as

part of the current conversion to short-stay apartments.

34 The applicant is

seeking rates relief from the Contestable Fund for Rates Relief for the

Comprehensive Reuse of Heritage Buildings for the conversion of the building.

35 The assessment

against the policies is as follows:

· Contribution

to heritage protection: the works proposed primarily impact upon elements of

the building that have been altered by previous office fit-outs. The

appropriate repair of the stained glass windows will contribute to the

building’s performance and its appearance and accords with the

building’s heritage values.

· Level

of investment: the total cost of the conversion of the building to apartments

has been estimated by the applicant to be approximately $4 million.

· Expediting

the use of heritage buildings: a rates freeze will support the establishment of

a new long-term use for the upper floors which will increase pedestrian traffic

on lower Stuart Street.

· Integration

with other Council policies and strategies: the proposed works are consistent

with the District Plan and the Spatial Plan. The use of the building as

visitor accommodation also accords with the Economic Development Strategy.

· Public

benefit: the proposed use will improve public safety further and improve the

appearance of the building.

36 It is recommended

that a rates freeze is granted for two years.

OPTIONS

37 The Committee could

choose to amend any of the recommended amounts provided in the report.

NEXT STEPS

38 Following the

Committee decisions related to the above projects, owners will be notified of

the rates relief amounts available.

Signatories

|

Author:

|

Dan Windwood – Heritage Planner

|

|

Authoriser:

|

Anna Johnson – City Development Manager

Nicola Pinfold – Group Manager Community and

Planning

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing a public service and it

is considered good-quality and cost-effective.

The report supports creating a safer city while retaining

its heritage buildings that contribute to Dunedin’s identity and

attract tourists.

The funding levels contribute towards the public benefit

while at the same ensuring that private gain is paid for by the building

owners, providing value for money to ratepayers.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The report supports the commercial reuse of heritage

buildings in accordance with the aims of the Spatial Plan and the Economic Development

Strategy as well as the Arts and Culture Strategy. It also accords with

the Heritage Strategy.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

The report supports the reuse of existing buildings and positively

contributes to the economic, social and environment sustainability of

Dunedin.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no implications.

|

|

Financial

considerations

Both Contestable Funds are budgeted for. The recommended

grants are within the funds’ limits.

|

|

Significance

This decision is considered to be of low significance in

terms of the Council’s Significance and Engagement Policy.

|

|

Engagement –

external

No external engagement has occurred.

|

|

Engagement - internal

No internal engagement has occurred.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no implications for Community Boards.

|

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

Financial Result - Period Ended 31 March 2018

Department: Finance

EXECUTIVE SUMMARY

1 This

report provides the financial results for the period ended 31 March 2018 and

the financial position as at that date.

|

RECOMMENDATIONS

That the Committee:

a) Notes the Financial

Performance for the period ended 31 March 2018 and the Financial Position as

at 31 March 2018.

|

BACKGROUND

2 This

report provides a commentary of:

· the forecast operating result of

Council for the whole of the 2017/18 financial year (Part 3), and

· The performance of Council for the period ended 31 March 2018 and the financial

position as at that date (Parts 4 to 7).

DISCUSSION

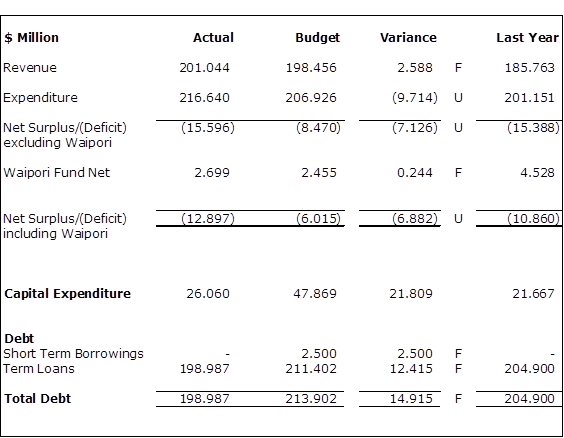

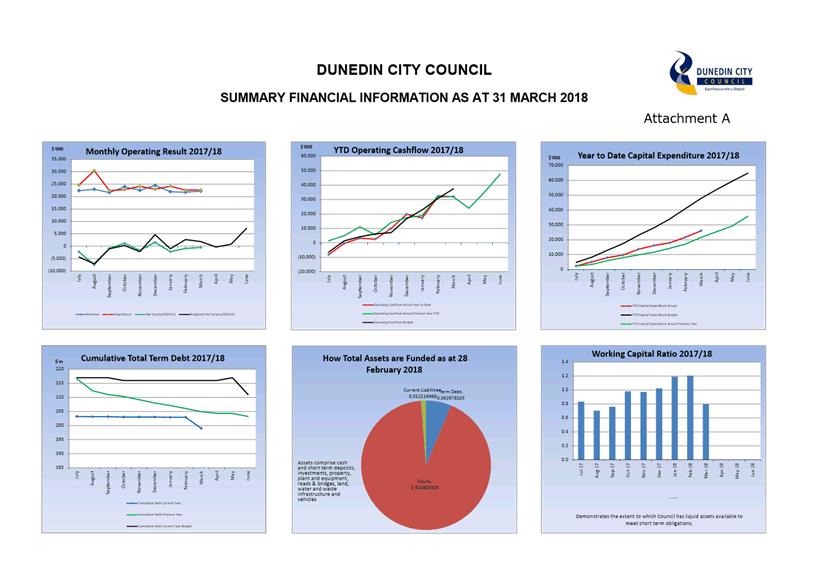

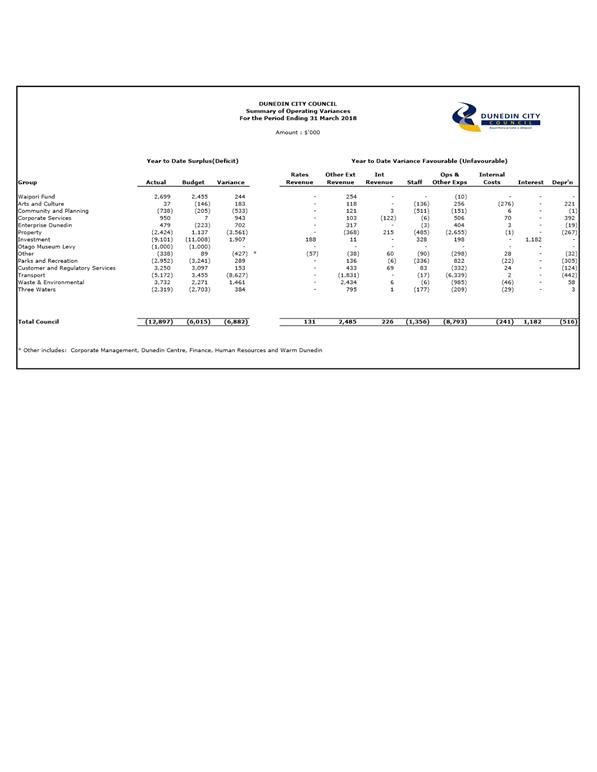

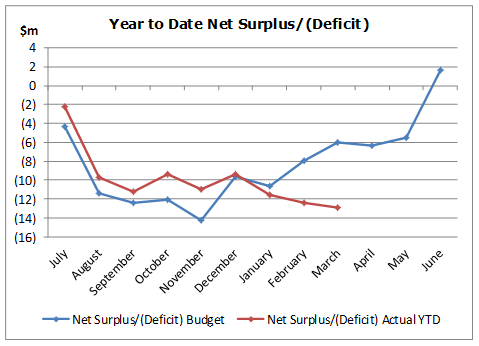

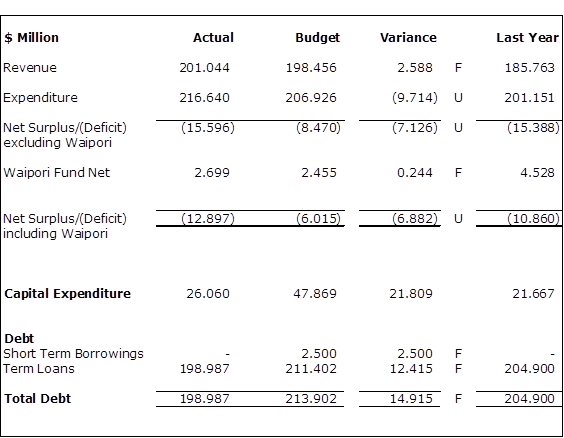

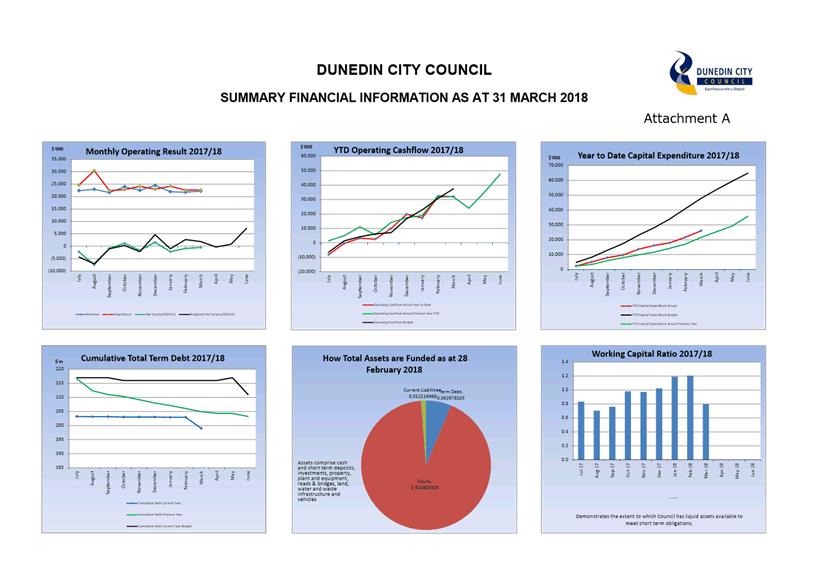

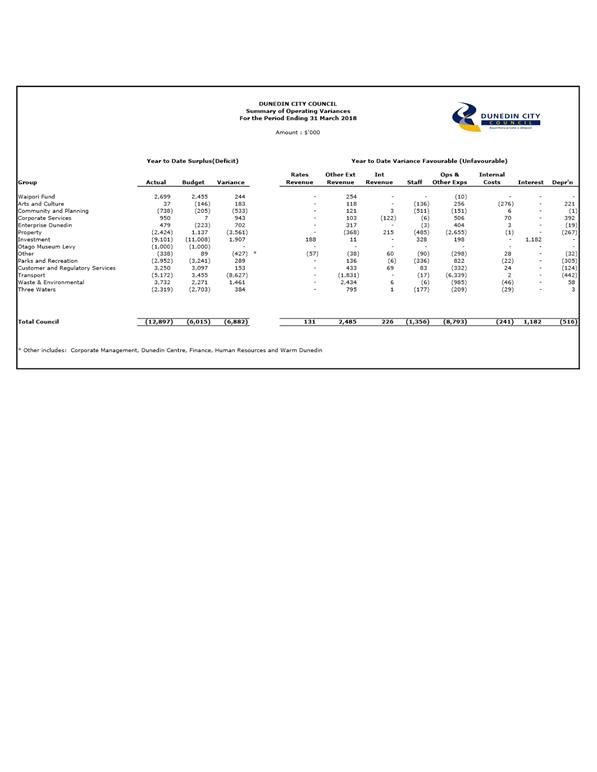

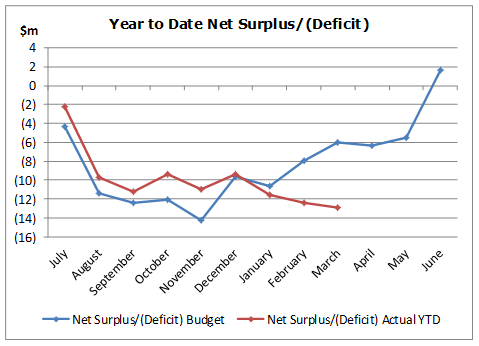

3 Commentary

on expected Full Year Budget Overspend

Section 1 to this Report shows that Council

has a YTD Net Deficit (excluding Waipori) of $15.6m which is $7.1m worse than

the budgeted deficit figure of $8.5m. Various events occur throughout

each financial year that cause variances between the actual operating

surplus/deficit and the budgeted operating surplus/deficit. The following

events will impact on Council’s budgeted Net Deficit (excluding Waipori)

for 2017/18 (approximate figures):

Operating Expenditure – the following

unbudgeted operating expenditure items are expected to be incurred:

· $9.5m

related to work carried out in response to the July 2017 flood event

(additional $4m capital expenditure will also be incurred)

· $4.5m

related to the Property Division focussing on its deferred maintenance program

and a general increase in its service levels

· $1.5m

related to the extra activity conducted by council due to a privately owned

facility no longer operating (offset by extra revenue – see below)

Revenue – the following budgeted

approximate revenue streams will not be received in 2017/18 (largely just a

timing difference as these have been deferred to 2018/19):

· $5m due

to the deferral of capital works, mainly related to LED and cycle ways

· $3m due

to the deferral of NZTA funding related to the Peninsula project

These ‘negatives’ are expected

to be partially offset by the following unbudgeted revenue streams that are

expected to arise:

· $9m,

being NZTA funding for work carried out in response to the July 2017 flood

event

· $2m as

the level of waste received to landfill exceeds the budgeted figure as a

privately owned facility is no longer operating

· $1m in

additional Development Contributions, mainly associated with development in

Mosgiel

The nett effect of these matters on the

Operating Result (excluding Waipori) is that:

· Operating

Expenditure will exceed budget by around $15m

· Income

is expected to exceed budget by around $4m and

· Operating Result will be around $11m worse than budget

1

4 Commentary

on Year to Date Result (Table in Section 1)

The unfavourable YTD variance against

budget was due to the following:

· $5.823

million higher than expected asset operations and maintenance expenditure

primarily due to emergency repair work associated with the July 2017 flood

event.

2

· $3.017

million higher fees & levies costs. This included consultancy costs in

Property covering for vacant positions and a high volume of building survey and

inspection work undertaken to inform maintenance and renewal programmes.

In addition Building Services expenditure is higher than expected to ensure

consenting activity meets the required statutory deadlines. A number of

other departments had higher than expected expenditure associated with the

development of asset renewal plans (eg: Logan Park Precinct, Dunedin Ice

Stadium), system & process reviews and coverage for position vacancies

including procurement activities.

3

· $2.116

million lower than expected grants revenue in Transport due to the delays being

experienced in the capital programme (including cycleways and Peninsula

projects), partially offset by the higher revenue associated with the emergency

repair work discussed above.

4

· $1.356

million higher than expected staffing costs due to unbudgeted recruitment costs

to resource activities across Council, higher than expected FTE's as a result

of this recruitment drive and higher than budgeted training costs.

5

· $707k

higher materials, supplies & services expenditure. This included

costs associated with the 2GP, flood relief expenditure and contracted services

to assist in the management of the property portfolio.

6

5 These

unfavourable YTD variances were partially offset by:

· $3.433

million – higher than expected Other Operating Revenue. This

favourable variance was mainly due to: Waste and Environmental Solutions

revenue was greater than expected with additional tonnage through the Green

Island landfill being the overflow from the closure of the Fairfield Landfill,

higher than expected building consent activity in Regulatory Services and

Parking revenue being higher than expected due to increased metered activity.

· $1.182

million – favourable interest expenditure driven by the lower debt level

and favourable floating interest rate.

7

· $914k

higher than expected development contributions particularly in relation to

developments in Mosgiel.

8

· $644k

– Grants expenditure was lower than budget due to the delayed timing of

grant payments including the grant associated with the development on the new

hockey turf in South Dunedin ($510k).

9

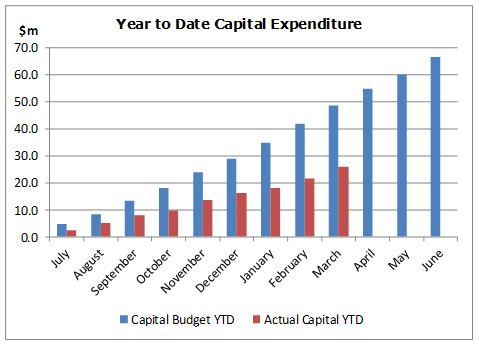

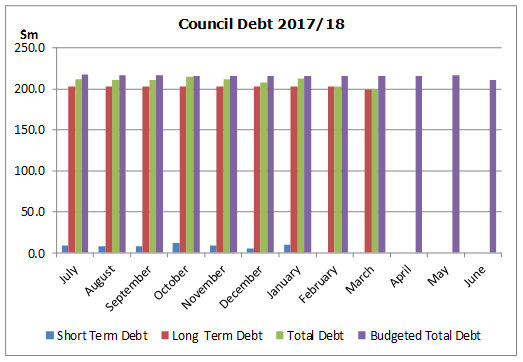

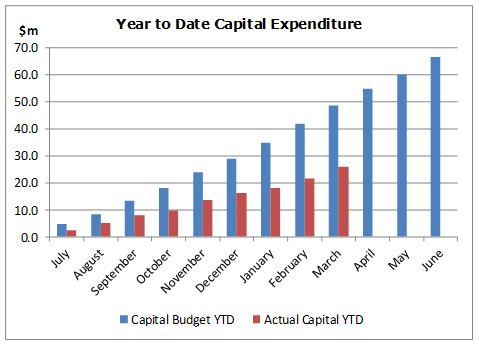

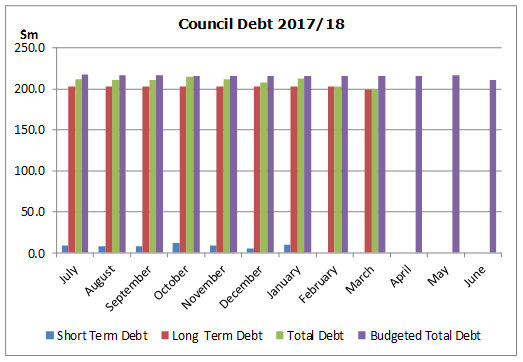

6 YTD

Capital expenditure was less than budget by $26.060 million. Project delays

have arisen across a number of portfolios while project scoping and design is

finalised.

7 Total

Council debt as at 31 March 2018 was $198.987 million or $14.915 million lower

than budget. This variance reflected delayed expenditure on capital

projects, partially offset by the higher level of operating expenditure

discussed above.

OPTIONS

8 Not

applicable.

NEXT STEPS

9 Not

applicable.

Signatories

|

Author:

|

Gavin Logie - Financial Controller

Lawrie Warwood - Financial Analyst

|

|

Authoriser:

|

Dave Tombs - General Manager Finance and Commercial

|

Attachments

|

|

Title

|

Page

|

|

a

|

Financial Graphs

|

29

|

|

b

|

Statement of Financial

Performance

|

30

|

|

c

|

Statement of Financial

Position

|

31

|

|

d

|

Statement of Cashflows

|

32

|

|

e

|

Capital Expenditure

Summary

|

33

|

|

f

|

Borrowing &

Investment Policy

|

34

|

|

g

|

Statement of Public

Debt

|

35

|

|

h

|

Summary of Operating

Variances

|

36

|

|

i

|

Financial Review

|

37

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

The financial expenditure reported in this report relates

to providing local infrastructure, public services and regulatory functions

for the community.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

This report has no direct contribution to the Strategic

Framework, although the financial expenditure reported in this report has

contributed to all of the strategies.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report fulfils the internal financial reporting

requirements for Council.

|

|

Financial

considerations

Not applicable – reporting only.

|

|

Significance

Not applicable – reporting only.

|

|

Engagement –

external

There has been no external engagement.

|

|

Engagement -

internal

The report is prepared as a summary for the individual

department financial reports.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|

|

Finance and Council Controlled Organisations

Committee

22 May 2018

|

|

|

Finance and Council Controlled Organisations

Committee

22 May 2018

|

|

|

Finance and Council Controlled Organisations

Committee

22 May 2018

|

|

|

Finance and Council Controlled Organisations

Committee

22 May 2018

|

|

|

Finance and Council Controlled Organisations

Committee

22 May 2018

|

|

|

Finance and Council Controlled Organisations

Committee

22 May 2018

|

|

|

Finance and Council Controlled Organisations

Committee

22 May 2018

|

|

|

Finance and Council Controlled Organisations

Committee

22 May 2018

|

|

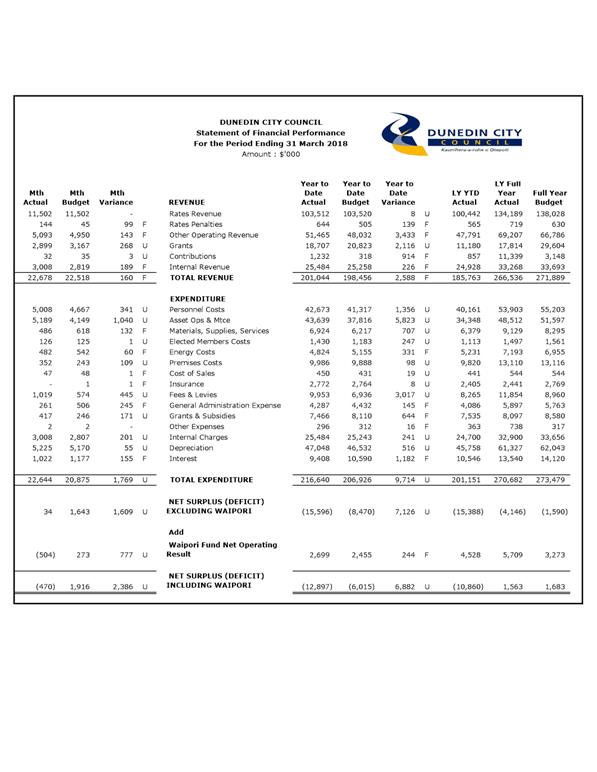

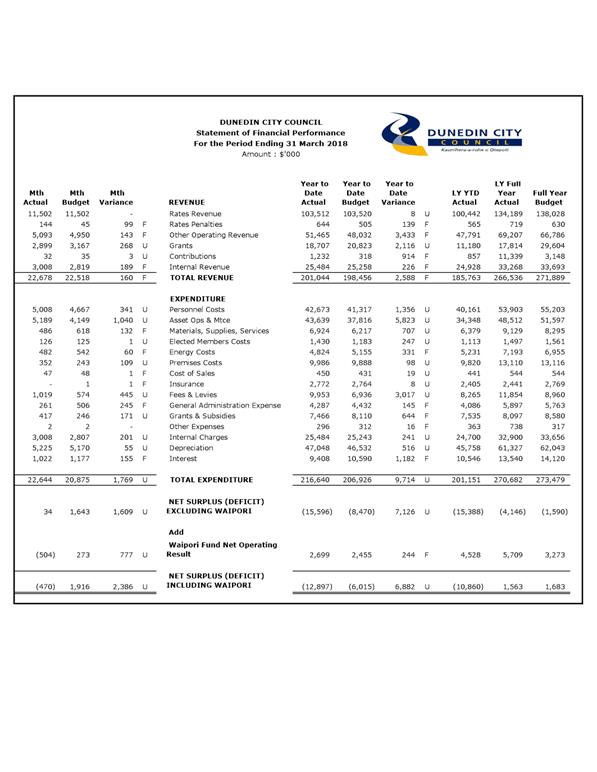

Financial Review

For The

Period ended 31 March 2018

This report provides a detailed commentary

on the Council’s financial results for the period ended 31 March 2018 and

the financial position at that date.

net

surplus/(Deficit) (including waipori)

The net

deficit (including Waipori) for the period ended 31 March 2018 was

$12.897 million or $6.882 million worse than budget.

REVENUE

The total revenue for the period was

$201.044 million or $2.588 million greater than budget.

The major variances were as follows:

Other Operating Revenue

Actual $51.465 million, Budget $48.032

million, Favourable variance $3.433 million

Waste and Environmental Solutions revenue

was favourable $2.434 million due mainly to the level of waste received to

landfill being greater than expected.

Three Waters revenue was $374k favourable.

Water consumption charges and Trade Waste charges were favourable $215k due to

the timing of the closure of the Cadbury factory. External recoveries

were favourable $147k due to unbudgeted recoveries relating to a capital

project.

Parking Operations revenue was favourable

$383k reflecting increased usage for on-street and off-street car parks and car

park buildings.

Economic Development revenue was favourable

$366k due to timing of Regional Business Partnership revenue and Work Ready

Coordinator funding. This variance is expected to disappear by year-end.

Regulatory Services revenue was favourable

$146k due to greater than expected number of building consent applications.

Alcohol licencing and dog registration revenue was also ahead of target.

Civic and Administration revenue was

favourable $95k due to unbudgeted revenue relating to an Otago Regional Council

by-election in their Dunstan constituency. This was partly offset by unbudgeted

expenditure.

These favourable variances were partially

offset by:

Property revenue was unfavourable $373k due

to some vacancies in Investment properties and reduced rent in the

miscellaneous property portfolio while building improvement work was done.

Aquatic Services revenue was unfavourable

$184k. Unfavourable winter weather conditions impacted on revenue for

Moana. In addition gym revenue was less than budget, partly due to

promotions being run by other gyms. Changes to the Learn to Swim programme also

contributed to the reduced revenue.

Grants

Actual $18.707 million, Budget $20.823

million, Unfavourable variance $2.116 million

Transport grants and subsidy revenue was

unfavourable by $2.254 million. The delayed timing of capital projects

(Peninsula and Cycleways) resulted in an unfavourable variance in capital

subsidy revenue ($5.990 million), partly offset by greater than budgeted

operating subsidies ($3.755 million) largely due to expenditure in response to

the July 2017 flooding event.

Contributions

Actual $1.232 million, Budget $318k,

Favourable variance $914k

This variance related to higher than

expected development contributions invoiced in the current year, primarily

related to developments in Mosgiel.

Expenditure

The total expenditure for the period was

$216.640 million or $9.714 million greater than budget.

The major variances were as follows:

Personnel Costs

Actual $42.673 million, Budget $41.317

million, Unfavourable variance $1.356 million

Personnel costs were unfavourable year to

date due mainly to budgets in Property and Aquatic Services not covering

current staff levels.

Asset Operations and Maintenance Costs

Actual $43.639 million, Budget $37.816

million, Unfavourable variance $5.823 million

Transport costs were unfavourable $6.017

million primarily due to July 2017 rain event resulting in unbudgeted emergency

work.

Waste and Environmental Solutions costs were unfavourable

$799k. ETS costs were unfavourable reflecting the additional landfill

activity discussed above. This unfavourable variance was partially offset

by savings being achieved with the new contract and lower than expected kerbside

collection costs with a lower volume of bags collected by the contractor.

Property costs were unfavourable $654k

mainly due to unbudgeted reactive maintenance costs.

Parks costs were favourable $885k due to

delays in programmed maintenance (buildings and trees), lower than expected

reactive maintenance and improved oversight associated with the Green Space and

Ecological contracts and lower than expected Ocean Beach holding pattern costs.

Materials Supplies and Services

Actual $6.924 million, Budget $6.217

million, Unfavourable variance $707k

Property costs were unfavourable $743k due

to unbudgeted contracted services expenditure to support the operation of the

department pending the appointment of permanent staff.

Civic and Administration Services costs were

unfavourable $331k due to costs associated with the 2GP and flood relief

expenditure.

Fees and Levies

Actual $9.953 million, Budget $6.936

million, Unfavourable variance $3.017 million

Property

costs were unfavourable $1.017 million due to the high number of

consultants currently working in the Property Services department. This

variance will increase through the financial year as a result of both

consultants covering vacant positions and a high volume of survey and

inspection work being undertaken to inform maintenance and renewal programmes.

Transport

costs were unfavourable $619 k due to consultant’s costs for health and

safety and other audits, and professional services scoping costs for City

Cluster Schools safety work.

Recreation

Planning costs were unfavourable $491k due to consultant costs relating to the

Logan Park Precinct Plan and recreation planner secondment costs.

Waste

and Environmental Solutions costs were unfavourable $317k due to Ministry

levies being greater than budget due to the higher volumes of waste received at

the Green Island landfill.

Regulatory

Services costs were unfavourable $274k due mainly to higher consultancy costs

for building consents work being processed by third parties.

Resource

Consents costs were unfavourable $195k due to unbudgeted litigation costs and

planning costs associated with processing resource consent applications.

Three

Waters costs were unfavourable $302k due to consultant support for procurement

advisory and system reviews.

Corporate

Management costs were unfavourable $144k due mainly to procurement consultancy

advice.

Grants and Subsidies

Actual $7.466 million, Budget $8.110

million, Favourable variance $644k

Recreation Planning costs were favourable

$619k primarily due to the budgeted grant for the Kings hockey turf not yet

being required due to project delays.

Interest

Actual $9.408 million, Budget $10.590

million, Favourable variance $1.182 million

Interest expenditure was less than budget

due to the lower level of borrowing and a favourable floating interest rate

applied to the non-fixed interest borrowing.

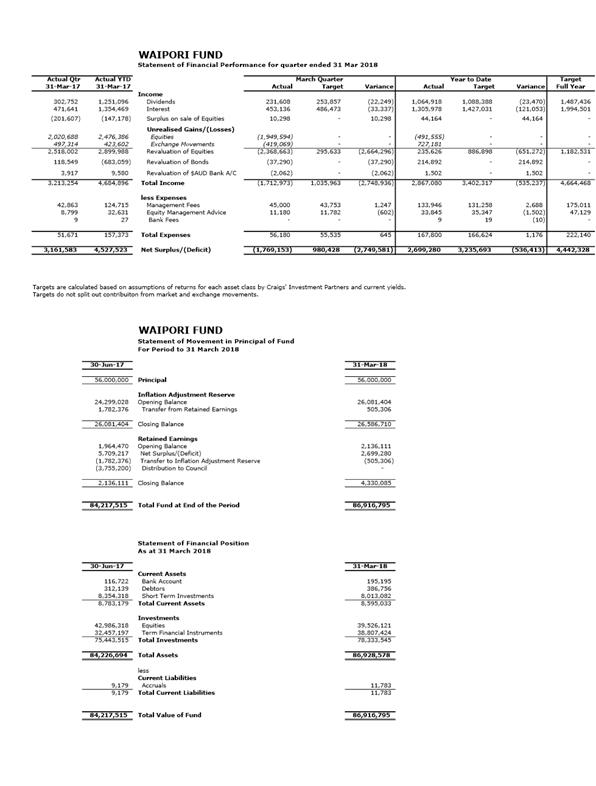

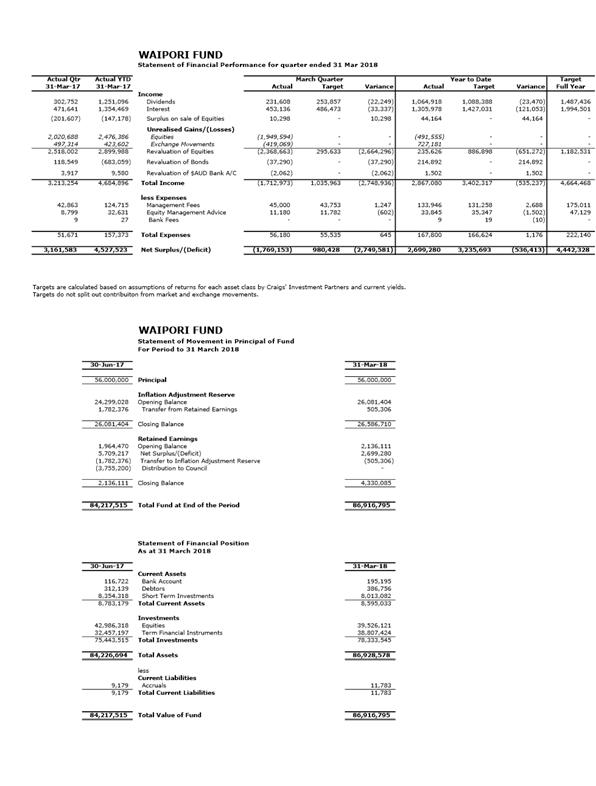

WAIPORI FUND NET

OPERATING RESULT

Actual

$2.699 million, Budget $2.455 million, Favourable variance $244k

The Waipori Fund net operating result was

favourable for the year due to unrealised gains across a number of investment

portfolios. In particular international equities have been favourably

impacted by the weaker NZD. The current month has however seen a

decline in the equities markets both domestically and international.

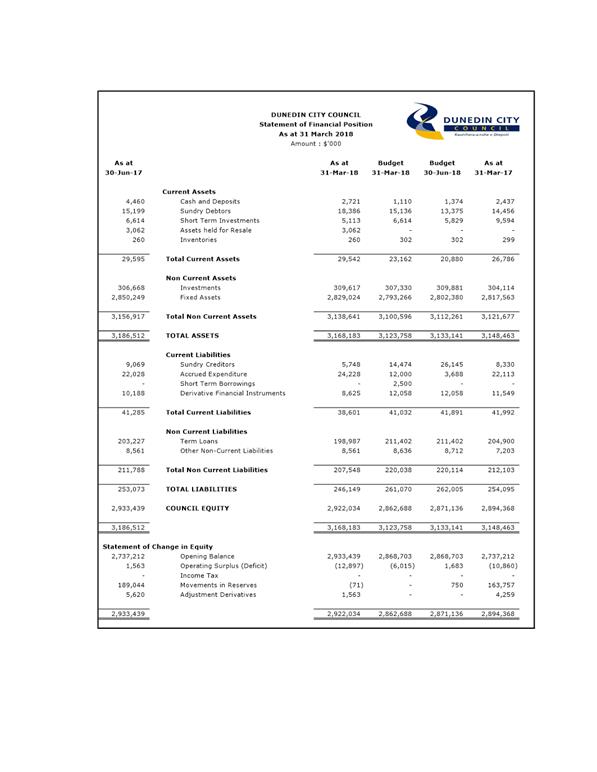

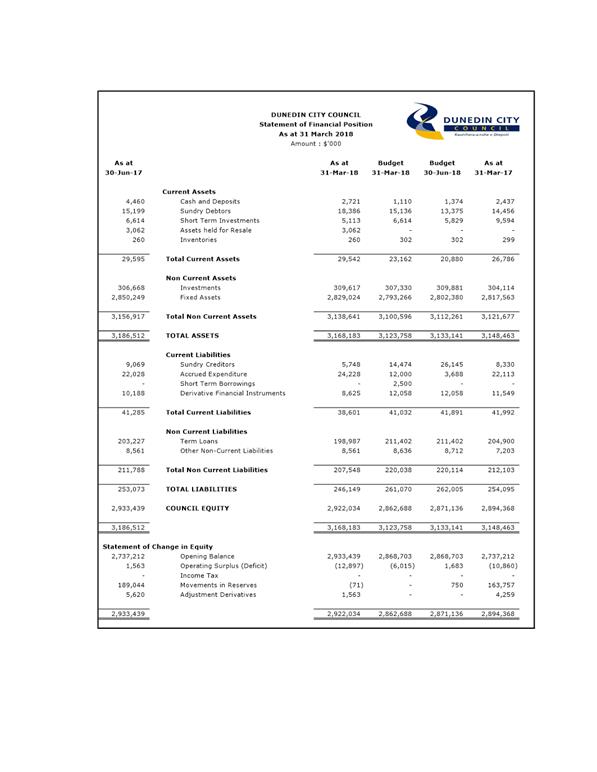

Statement of

Financial Position

A Statement of Financial Position is

provided as Attachment C.

Short term investments of $5.113 million

relate to the Waipori Fund.

Statement of

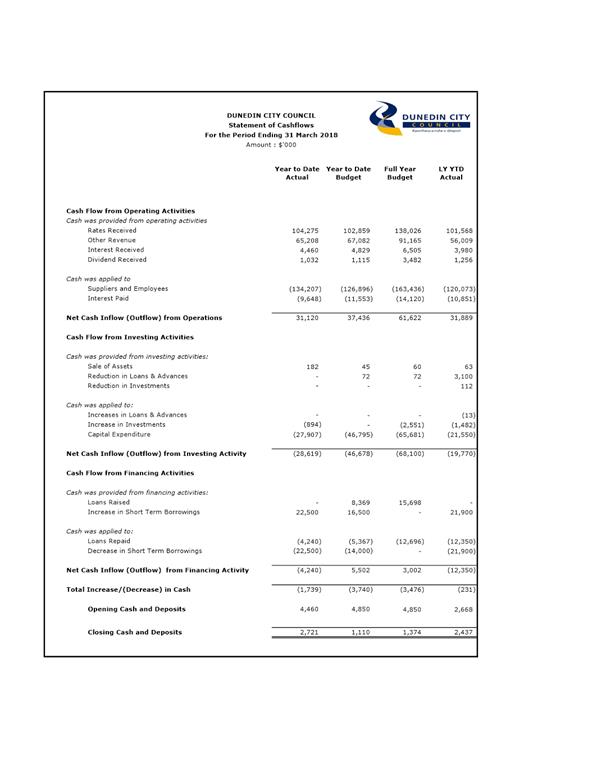

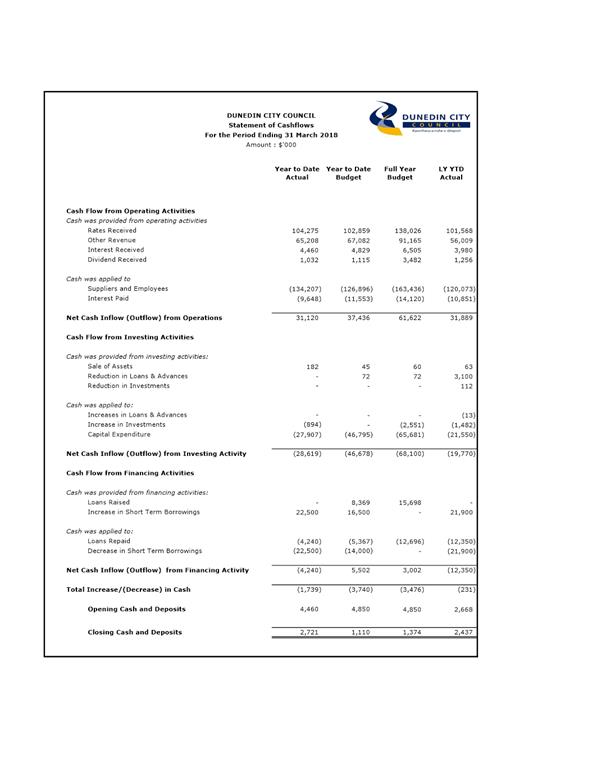

Cashflows

A Statement of Cashflows is provided as

Attachment D.

Cash outflows from investing activities

were less than budgeted due to the delayed capital expenditure discussed below.

Capital

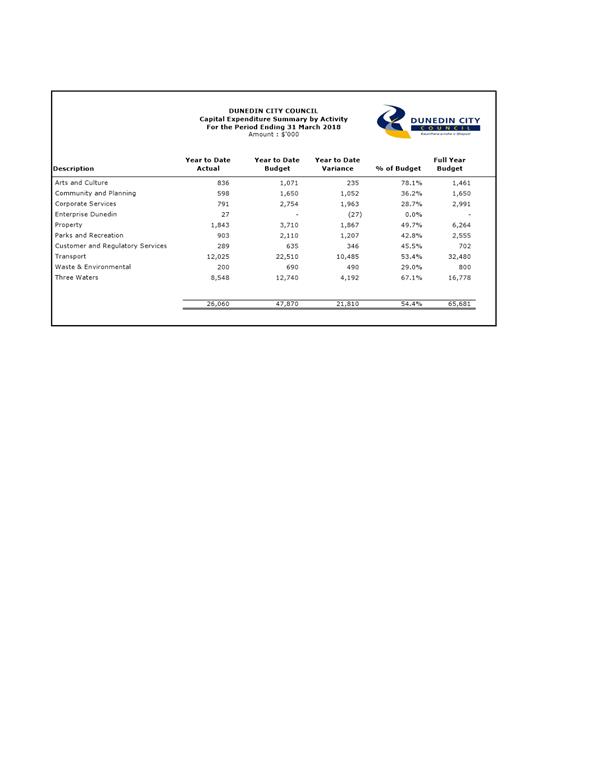

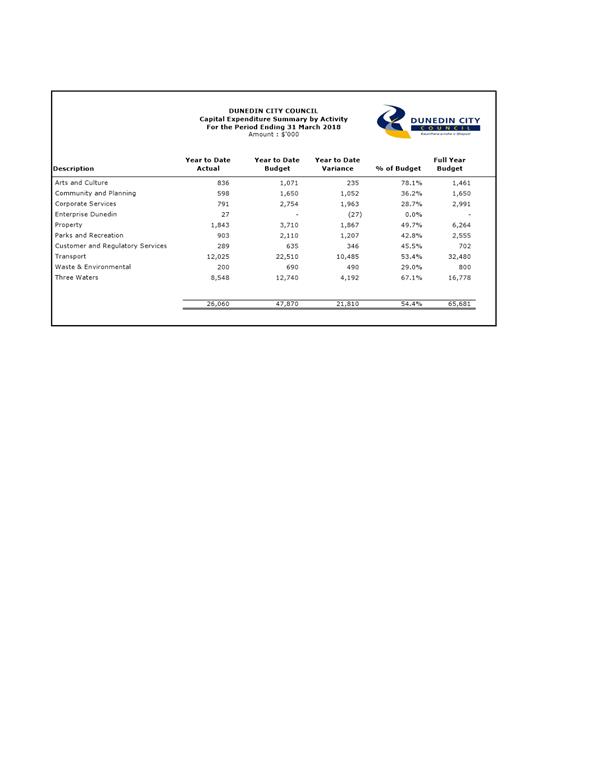

Expenditure

A summary of the capital expenditure

programme by Activity is provided as Attachment E.

Total capital expenditure for the period to

31 March 2018 was $26.060 million or 39.7% of the full year budget of

$65.681 million.

Community

and Planning Group capital expenditure was $1.052

million underspent

This variance was due to delayed progress

with the Citywide Amenities upgrade work. The project will continue into

the 2018/19 financial year.

Corporate Services capital expenditure was $1.963 million underspent

This variance was due to delayed timing of

the Electronic Document and Records Management system replacement

project.

Property capital

expenditure was $1.867 million underspent

Project prioritisation and final scoping

continues to be a focus within the Property group prior to the commencement of

any significant works.

The South Dunedin Complex project was under

budget $800k. The project is in the planning stage with physical work

expected to commence in 2019/20.

Housing upgrades were under budget $542k. Building

consents are being sought for bathroom upgrades, with work expected to occur

this financial year.

Other projects at the scoping stage

include utility upgrades at the Gas Works Museum and skylight replacements at

the Edgar Centre.

Parks and Recreation capital expenditure was $1.207 million underspent

A number of projects have been delayed

while assets assessments are completed to allow appropriate programming of

work.

Tenders for Playground improvements work

have been awarded with work to start in April.

Contracts for changing room refurbishment

at Mosgiel and the Caledonian Gym have been awarded with a start date to be

confirmed. The Chingford Stable re-roofing project is at the tender negotiation

stage.

The Mosgiel East (Highland Park) reserve

development project is nearing completion.

There has been no expenditure to date on

the Logan Park Artificial Turf project ($1 million favourable). This

budget is unlikely to be spent this financial year with construction not

expected to commence until October 2018.

Customer and Regulatory capital expenditure was $346k underspent

The budget for parking meter upgrades (FY

$300k) will not be required for 2017/18 due to all meters being upgraded

in the 2016/17 financial year in order to comply with new credit card

protocols.

Transport capital

expenditure was $10.485 million underspent

The Peninsula road widening project was

under budget by $6.344 million. There has been a delay in commencing the

physical works with full year expenditure likely to be in the order of $2.000

million (full year budget of $10.800 million).

Cycleway expenditure is tracking behind

budget $2.569 million with full year budget of $6.000 million likely to carry

over to the 2018/19 financial year.

Renewals capital was under budget by $3.083

million due to timing. Contracts have been recently awarded for

carriageway resurfacing, kerb and channelling and footpath resurfacing.

These under spends were partially offset

by:

Minor safety improvements were over budget

$1.798 million and included the Highcliff Road and South Dunedin safety works.

The year to date expenditure also included

unbudgeted slip repairs resulting from the July 2017 rain event totalling

$566k.

Three Waters

capital expenditure was $4.192 million underspent

General

network renewals were tracking behind budget, partially offset by on-going

expenditure on the Ross Creek Dam project, Waikouaiti water renewals and the

treatment site switchboard replacement programme.

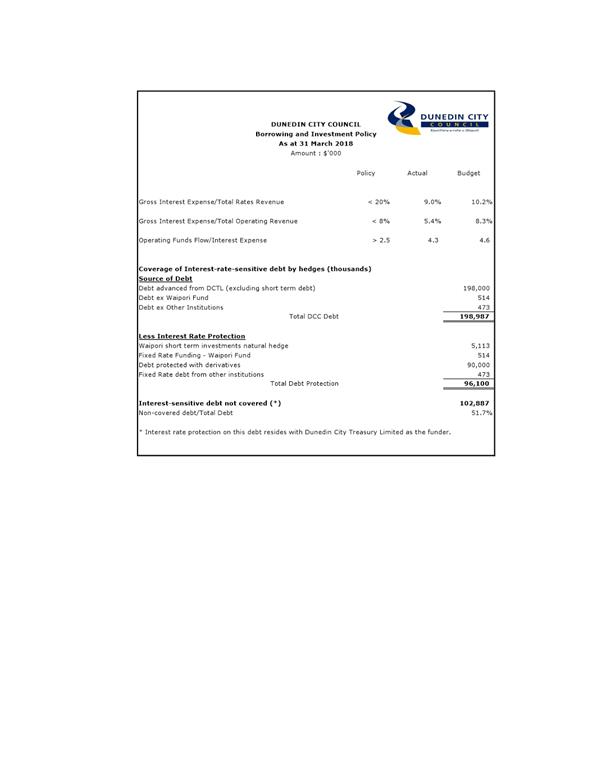

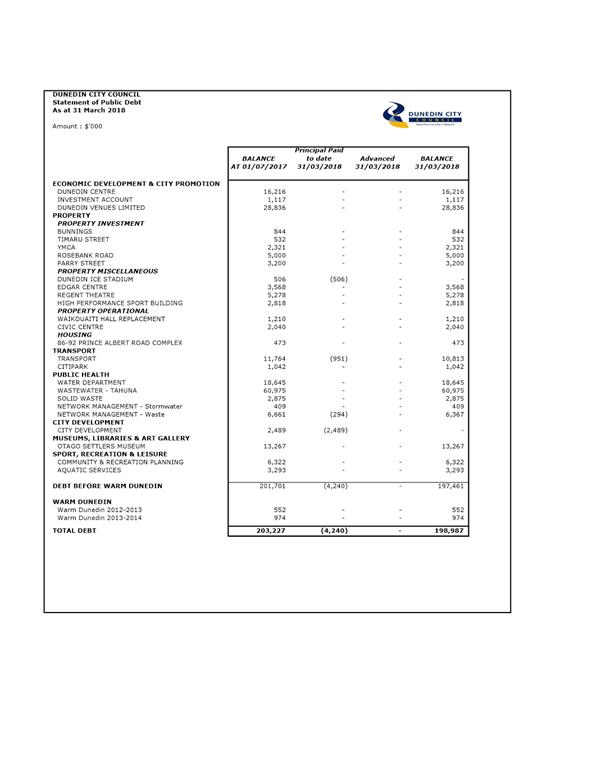

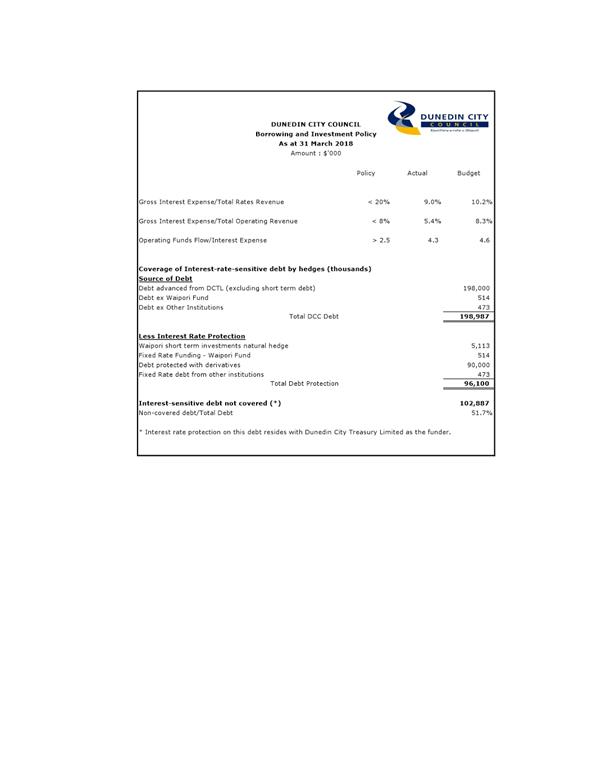

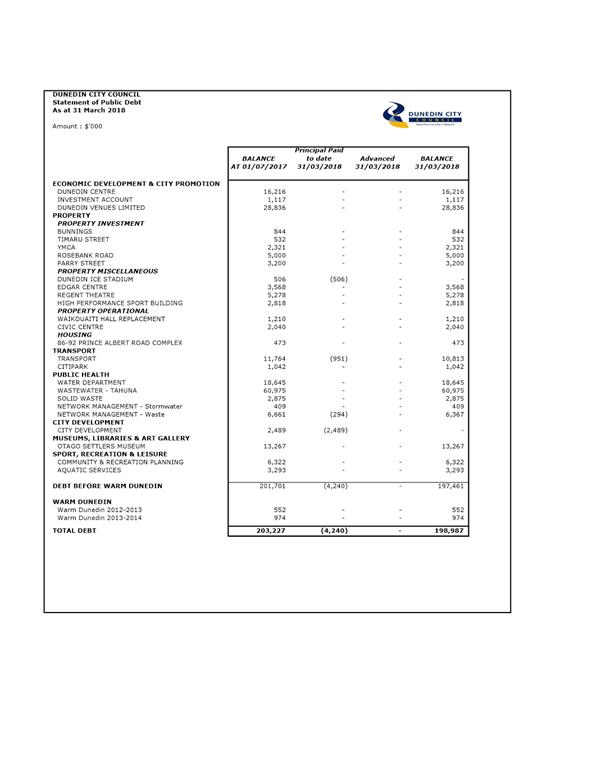

Debt

Refer to

Attachments F and G.

Attachment F

provides a summary of the debt servicing ratios for the year to date.

All three

targets were within policy.

No new loans

were required year to date.

Comments from

group activities

Attachment H, the Summary of Operating

Variances, shows by Group Activity the overall net surplus or deficit variance

for the eight months ended 31 March 2018. It also shows the variances by

revenue and expenditure type.

Community and Planning - $533k Unfavourable

Staff costs were unfavourable $511k

reflecting additional costs associated with the 2GP and the Task Force Green

response to the July 2017 flood event. The Task Force Green expenditure

has been recovered from Central Government.

Operating costs were unfavourable $151k due

mainly to unbudgeted litigation costs relating to Environment Court appeals,

additional consultant resource to cope with the number of resource consent

applications and legal support and planning consultant costs associated with

the Filleul St hotel application.

Enterprise Dunedin - $702k Favourable

External revenue was favourable $317k due

to the timing of budgeted revenue from Regional Business Partners and Education

New Zealand. This variance is expected to disappear by year-end. There was also

some unbudgeted revenue relating to the Business Events activity.

Operating expenditure was favourable $404k due largely to the

delayed timing of various marketing and project activities.

Property - $3.561 million Unfavourable

External revenue was unfavourable $368k due

to some vacancies in Investment properties and reduced rent in the

miscellaneous property portfolio while building improvement work was done.

Staff costs were unfavourable $485k due to

unbudgeted recruitment fees and new positions being filled.

Property operating costs were unfavourable

$2.655 million. Fees and levies expenditure was unfavourable

$1.017 million due to the high number of consultants currently working in the

Property Services department. This variance will increase through the financial

year as a result of both consultants covering positions yet to be filled and a

high volume of survey and inspection work being undertaken to inform

maintenance and renewal programmes.

Repairs & maintenance expenses were

unfavourable $1.397 million mainly due to unbudgeted reactive works and

contractor costs across the Property portfolios and unbudgeted

costs around tenancy changeovers, largely in the Housing portfolio.

Premises costs were greater than budget

$258k largely due to the costs associated with Building WOF compliance

monitoring.

Investment Account – $1.907 million

Favourable

Interest costs were favourable $1.182

million due to the lower level of borrowing and a favourable floating interest

rate applied to the non-fixed interest borrowing.

Parks & Recreation - $289k Favourable

Parks and Recreation operating expenditure

was favourable ($822k) due to delays in programmed maintenance (buildings and

trees), lower than expected reactive maintenance and improved oversight

associated with the Green Space and Ecological contracts. In addition

grants expenditure was lower than budget primarily due to the Kings Hockey Turf

ground still to be paid out.

These favourable variances were partially

offset by additional staff costs in Aquatics relating to increased overtime and

rosters required to resource unplanned illness and leave.

Transport - $8.627 million Unfavourable

External revenue was unfavourable $1.831

million. Capital subsidies were $5.990 million less than budget due to delays

in capital projects (Peninsula widening, LED lighting upgrade and the central

city cycling projects). Operating subsidies were higher than expected due

to increased operating expenditure, including costs incurred in response to the

July 2017 flood event.

Transport operating expenditure was

unfavourable $6.339 million to due to greater than budgeted costs of subsidised

emergency work and road maintenance as a result of the July 2017 rainfall

event.

Waste and Environmental Solutions –

$1.461 million Favourable

This variance reflects the net impact of

the higher volumes of waste received at the Green Island landfill to date.

Three Waters – $384k Favourable

External revenue was favourable $795k due

mainly to greater than budgeted external recoveries and development

contribution revenue. Water consumption charges and Trade Waste charges were

favourable $215k due to the timing of the closure of the Cadbury factory.

External recoveries were favourable $147k due to unbudgeted recoveries relating

to a capital project.

Operating expenditure was $209k

unfavourable in part reflecting costs associated with the July 2017 flood event

and the boil water notification which included system flushing and supply of

bulk tanker water for residents and affected businesses.

|

Finance and Council Controlled Organisations

Committee

22 May 2018

|

|

Waipori Fund - Quarter Ending March 2018

Department: Finance

EXECUTIVE SUMMARY

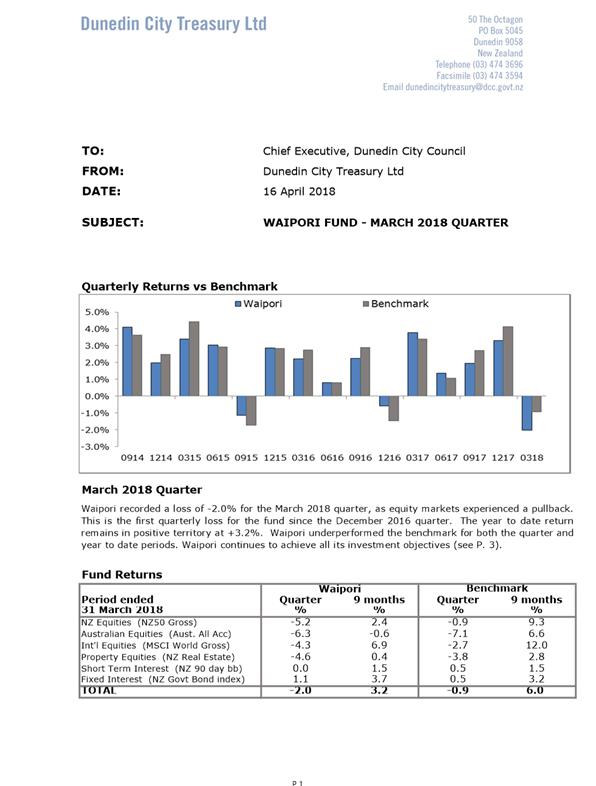

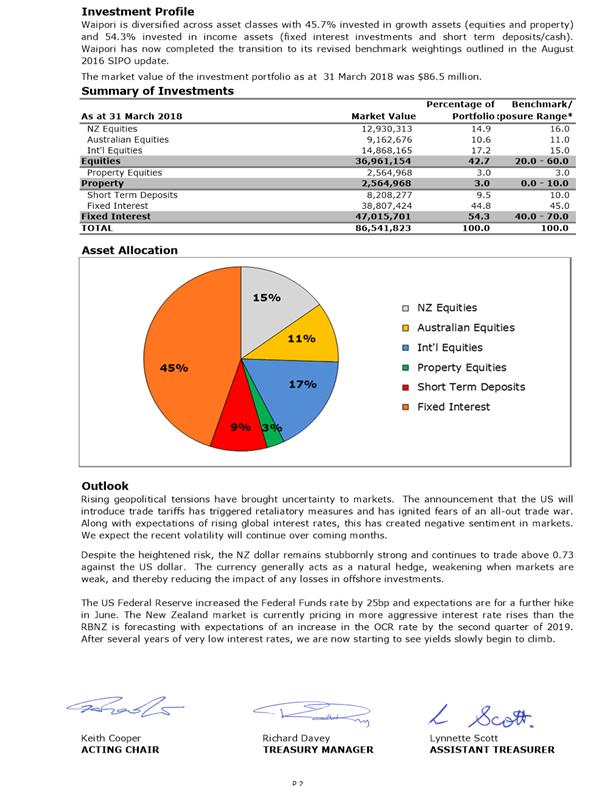

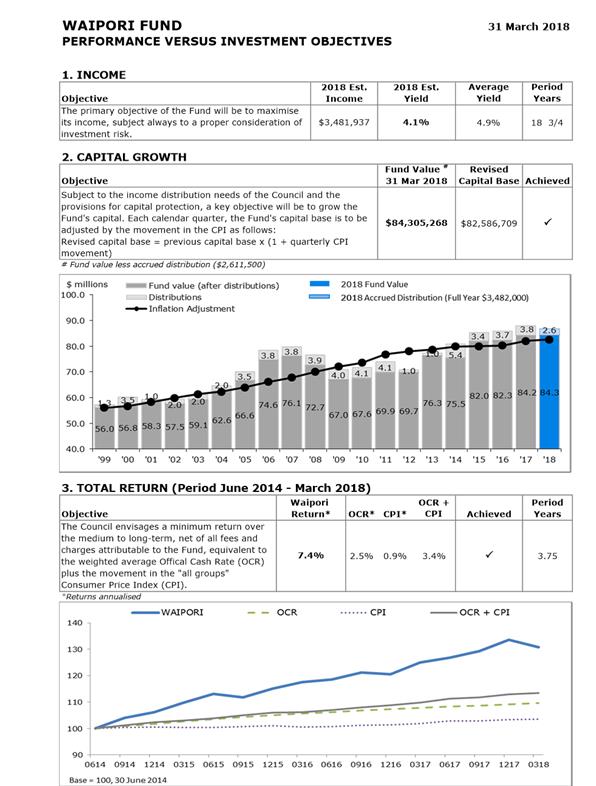

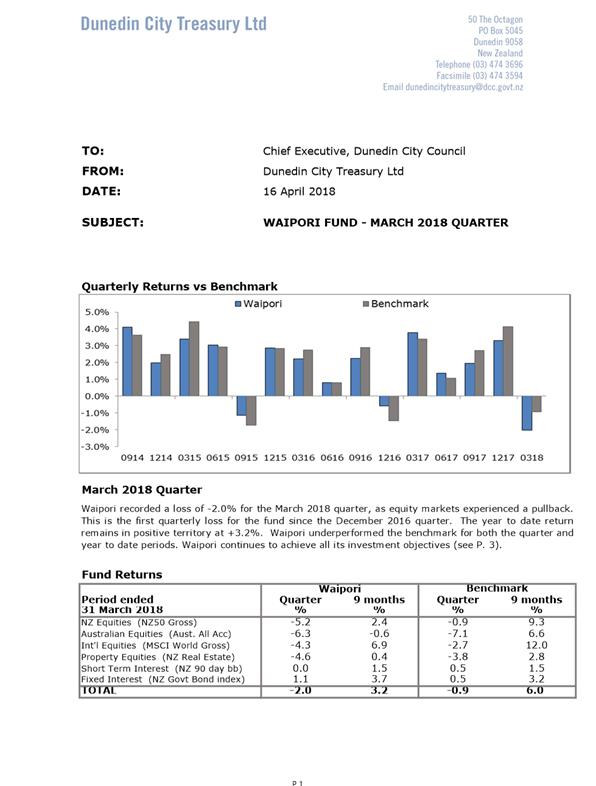

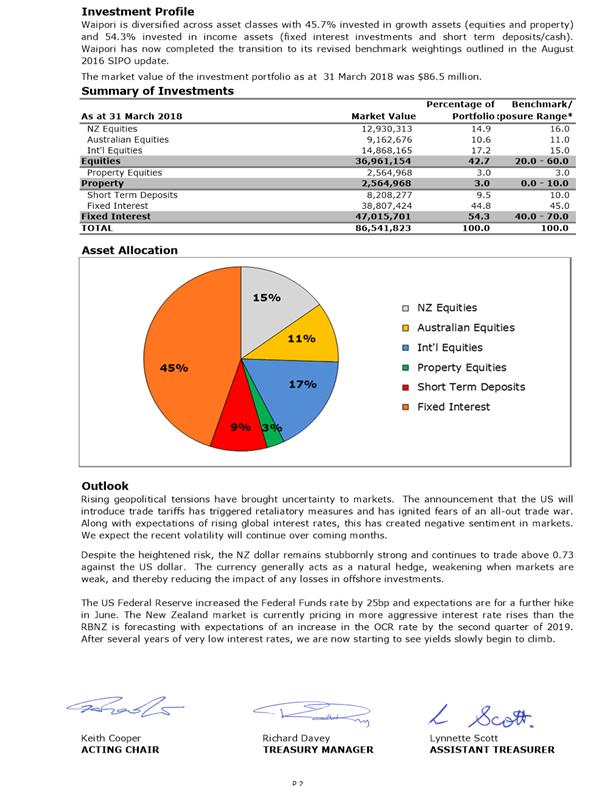

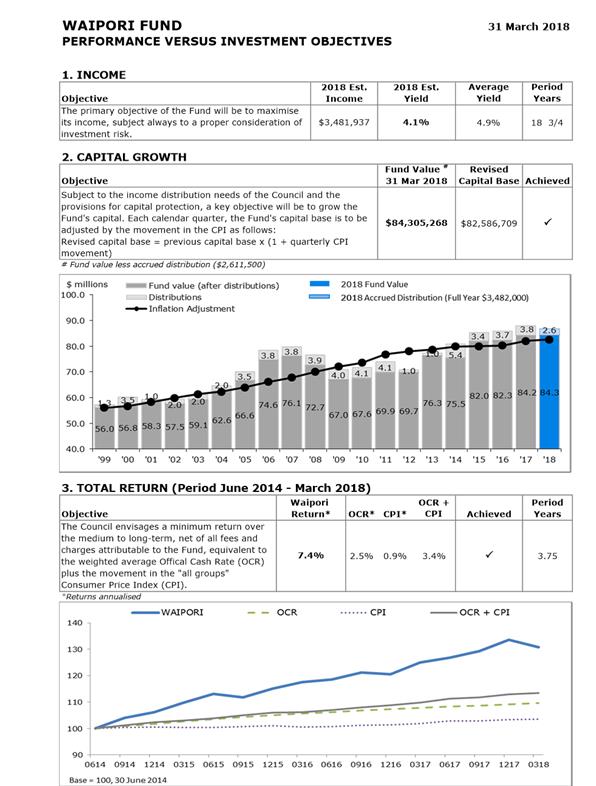

1 The

attached report from Dunedin City Treasury Limited provides information on the

results of the Waipori Fund for the quarter ending 31 March 2018.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

report from Dunedin City Treasury Limited on the Waipori Fund for the quarter

ending 31 March 2018.

|

BACKGROUND

2 Not

applicable.

DISCUSSION

3 Not

applicable.

OPTIONS

4 Not

applicable.

NEXT STEPS

5 Not

applicable.

Signatories

|

Author:

|

Richard Davey - Treasury Manager

|

|

Authoriser:

|

Dave Tombs - General Manager Finance and Commercial

|

Attachments

|

|

Title

|

Page

|

|

a

|

Waipori Fund - March

2018 Quarter

|

50

|

|

SUMMARY OF CONSIDERATIONS

|

|

|

Fit with purpose

of Local Government

This

report relates to providing local infrastructure, public services and

regulatory functions for the community.

|

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

This report has no direct contribution to the Strategic

Framework.

|

|

|

Māori Impact

Statement

There

are no known impacts on tangata whenua.

|

|

|

Sustainability

There

are no known implications for sustainability.

|

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

The

report fulfils the financial reporting requirements for Council.

|

|

|

Financial

considerations

Not

applicable – reporting only.

|

|

|

Significance

Not

applicable – reporting only.

|

|

|

Engagement –

external

This report has been prepared for and approved by the

Board of Dunedin City Treasury Limited.

|

|

|

Engagement -

internal

This report has been prepared for the Board of Dunedin

City Treasury Limited.

|

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

|

Community Boards

There are no known implications for Community Boards.

|

|

|

|

|

|

|

Finance and Council

Controlled Organisations Committee

22 May 2018

|

|