Notice of Meeting:

I hereby give notice that an ordinary meeting of the

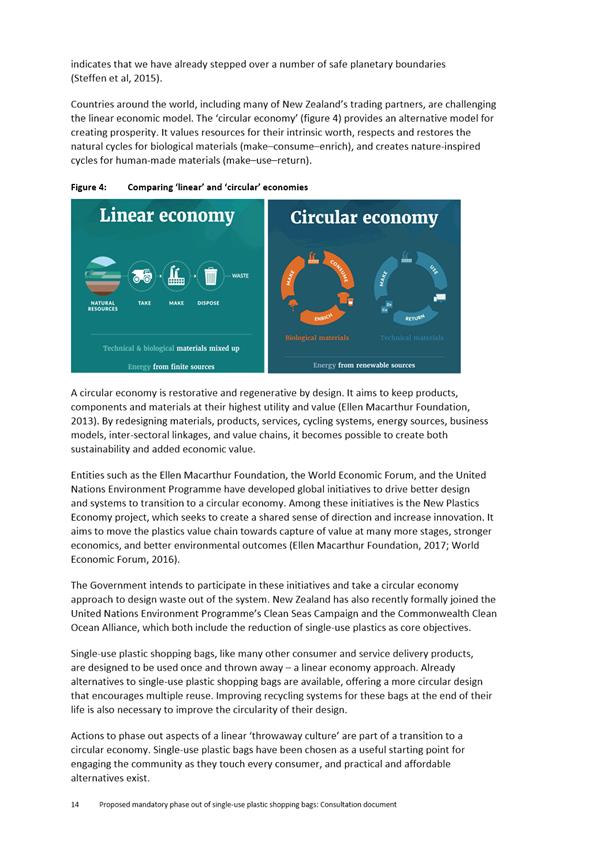

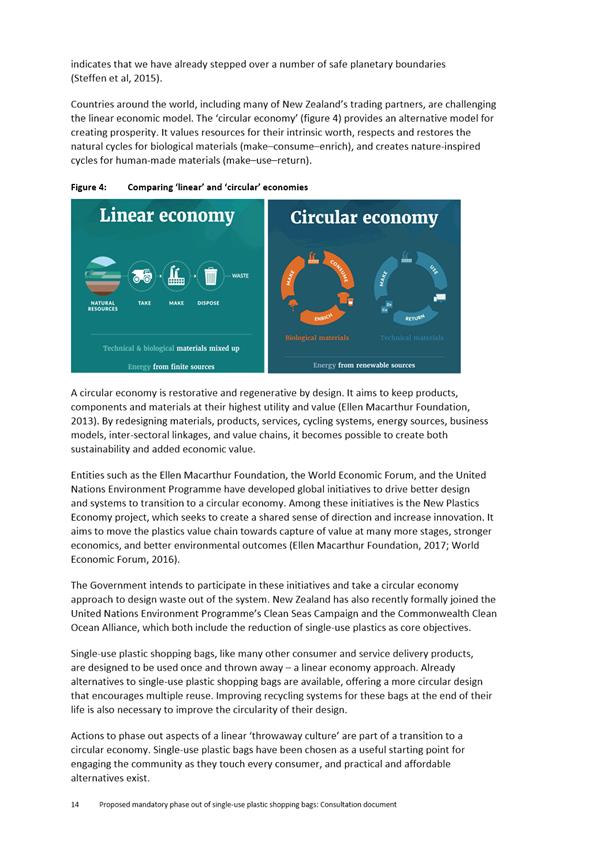

Economic Development Committee will be held on:

Date: Tuesday

11 September 2018

Time: 1.00

pm

Venue: Edinburgh

Room, Municipal Chambers, The Octagon, Dunedin

Sue Bidrose

Economic Development Committee

PUBLIC AGENDA

|

Chairperson

|

Chris Staynes

|

|

|

Deputy Chairperson

|

Christine Garey

|

Andrew Whiley

|

|

Members

|

David Benson-Pope

|

Dave Cull

|

|

|

Rachel Elder

|

Doug Hall

|

|

|

Aaron Hawkins

|

Marie Laufiso

|

|

|

Mike Lord

|

Damian Newell

|

|

|

Jim O'Malley

|

Conrad Stedman

|

|

|

Lee Vandervis

|

Kate Wilson

|

Senior Officer John

Christie, Director Enterprise Dunedin

Governance Support Officer Jenny

Lapham

Jenny Lapham

Governance Support Officer

Telephone: 03 477 4000

Jenny.Lapham@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

Economic Development

Committee

11 September 2018

|

|

ITEM TABLE OF CONTENTS PAGE

1 Public

Forum 4

2 Apologies 4

3 Confirmation

of Agenda 4

4 Declaration

of Interest 5

Part

A Reports (Committee has power to decide these matters)

5 Enterprise

Dunedin July to September 2018 Activity Report 15

6 Enterprise

Dunedin Cruise Update Report 20

7 Film

Dunedin 23

8 Start-Up

Ecosystem 27

9 Submission

on the phase out of single use plastic shopping bags 34

10 Items

for Consideration by the Chair 93

|

Economic Development

Committee

11 September 2018

|

|

1 Public

Forum

At the close of the agenda no

requests for public forum had been received.

2 Apologies

Apologies have been received from Mayor

Dave Cull, Cr Rachel Elder.

That the Committee:

Accepts the apologies from Mayor

Dave Cull, Cr Rachel Elder.

3 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

|

Economic Development

Committee

11 September 2018

|

|

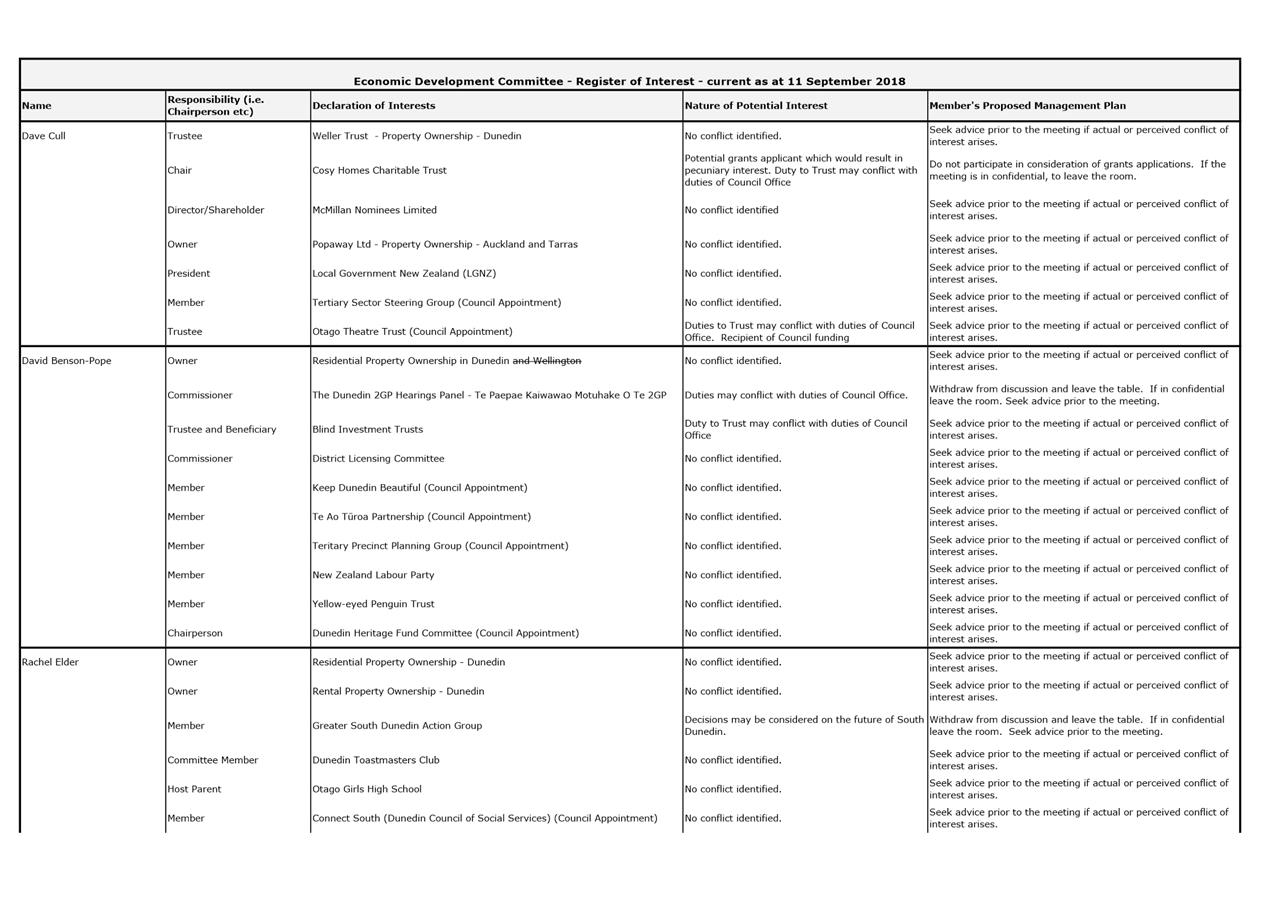

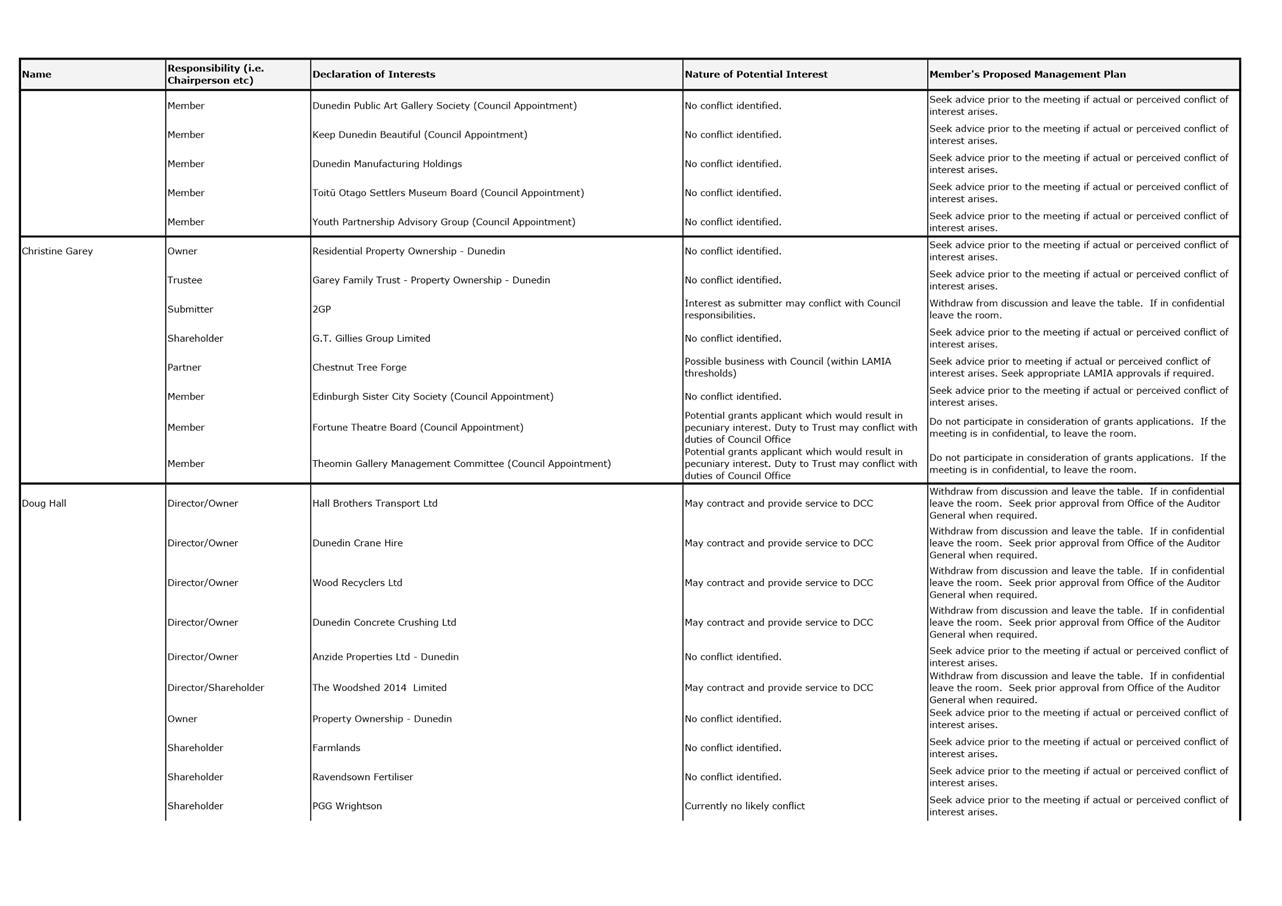

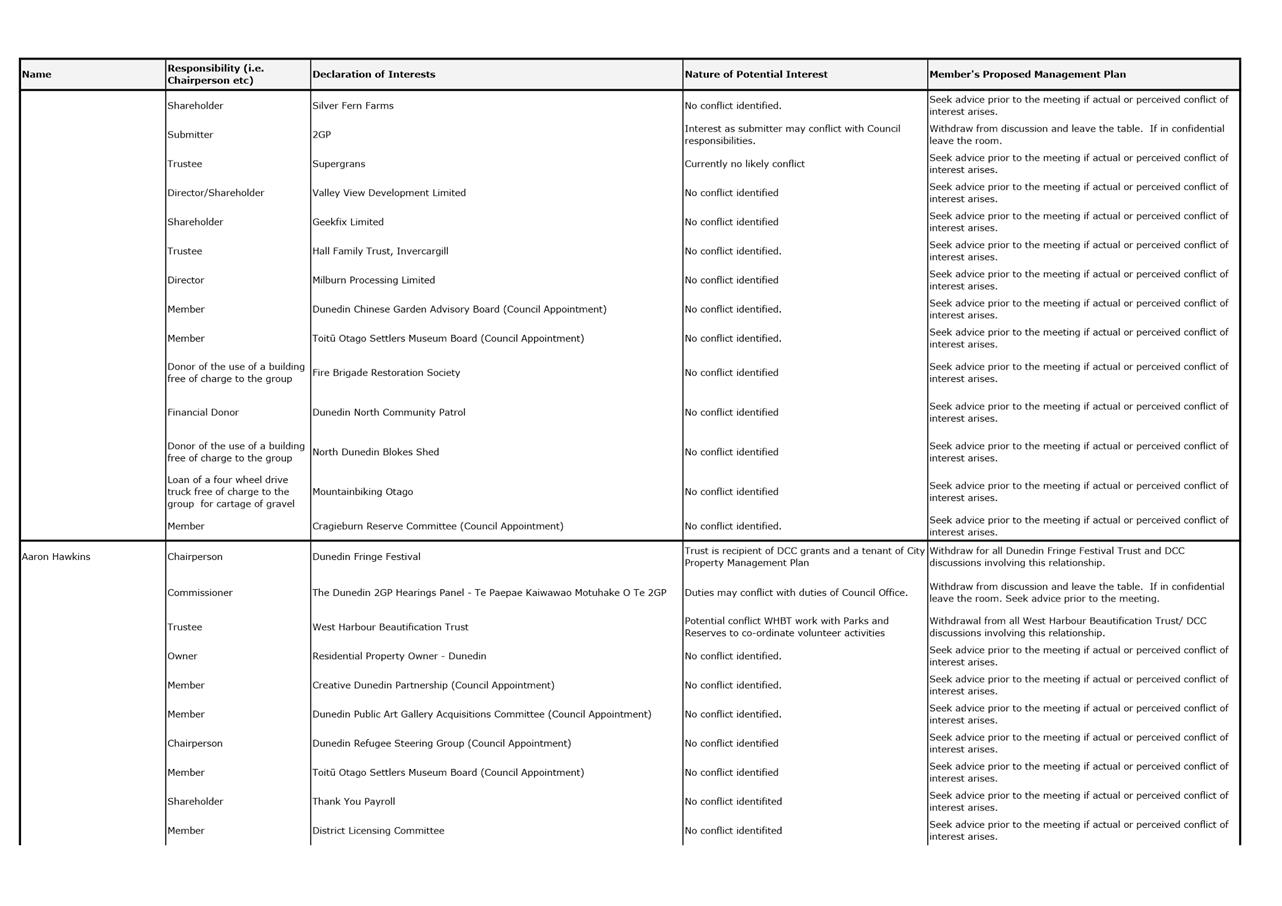

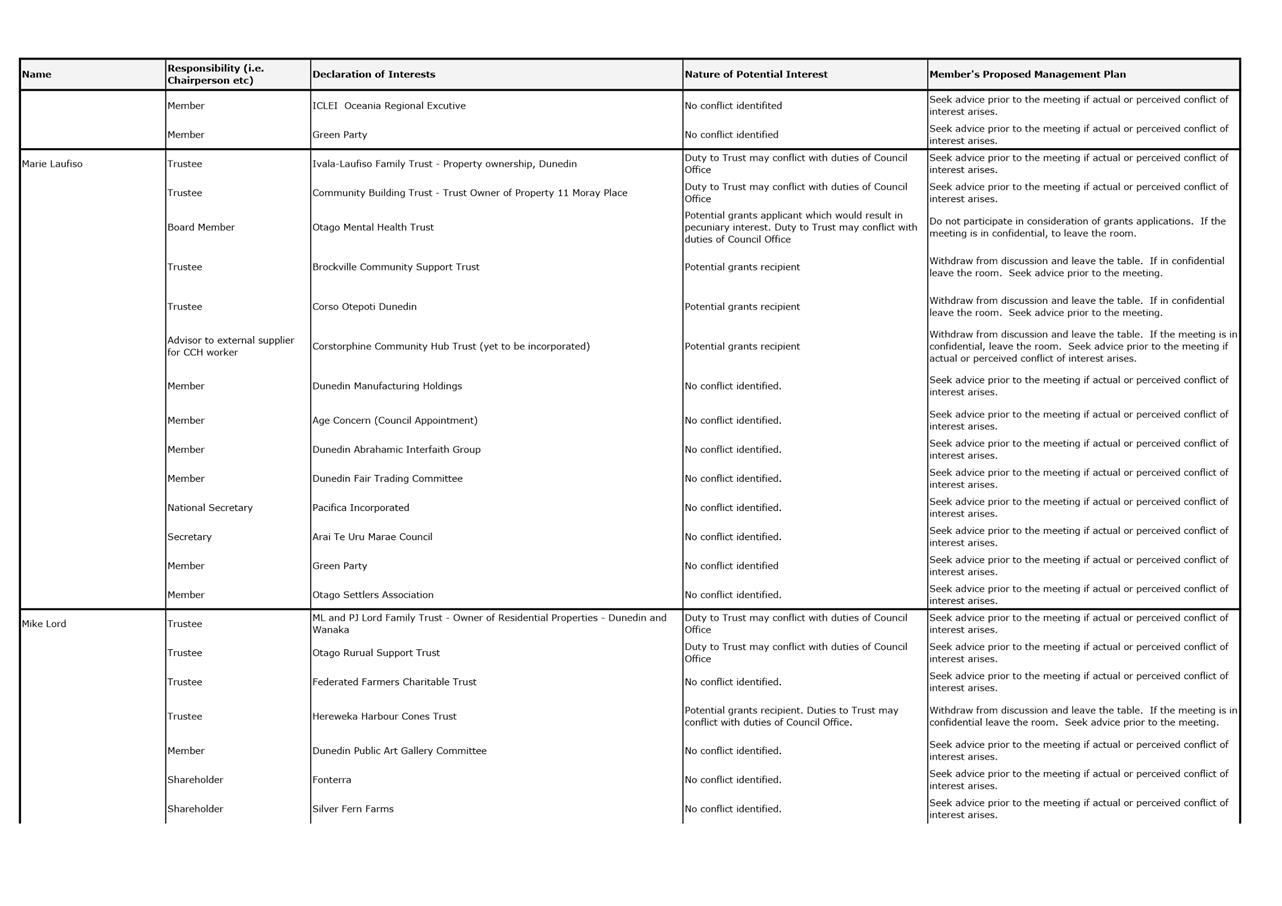

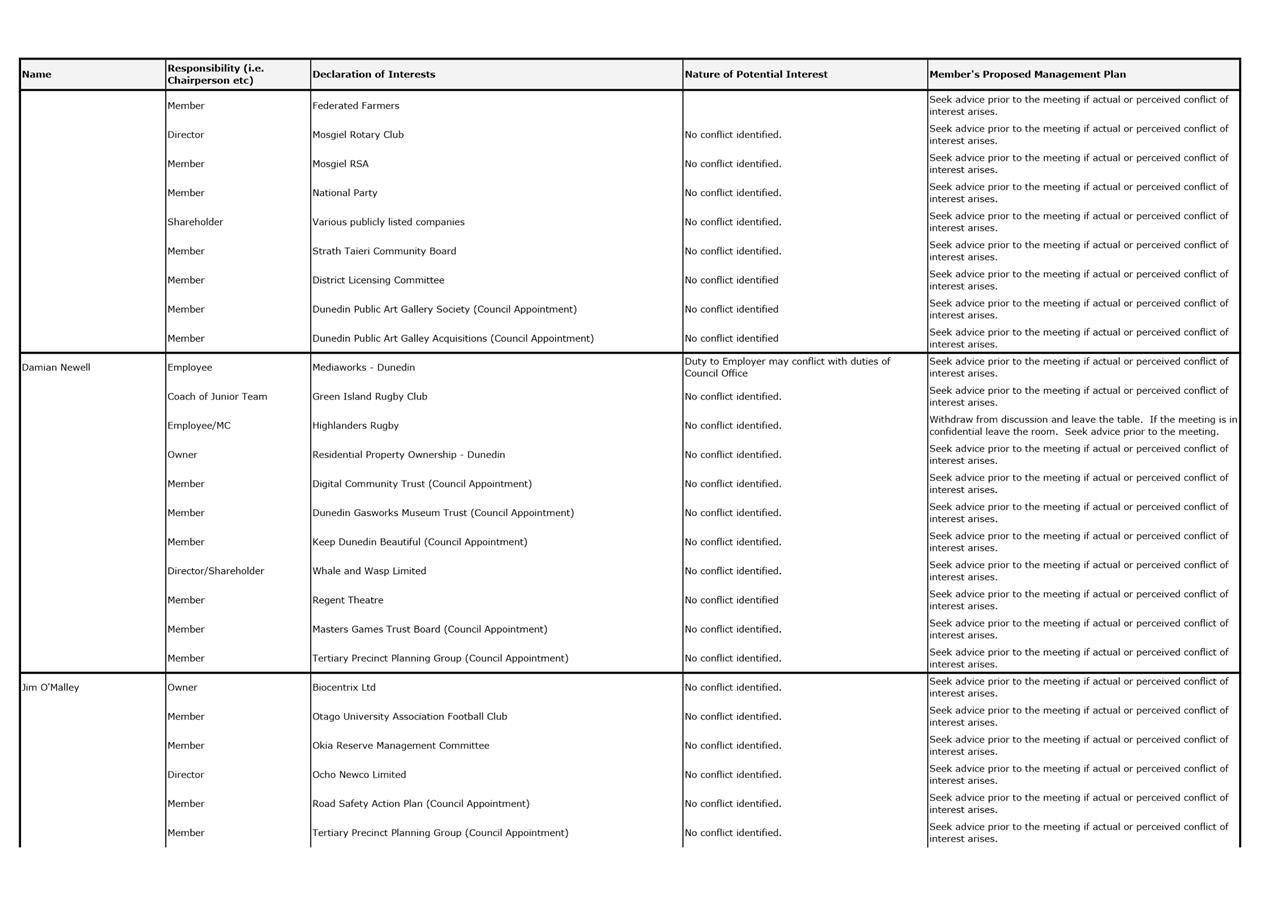

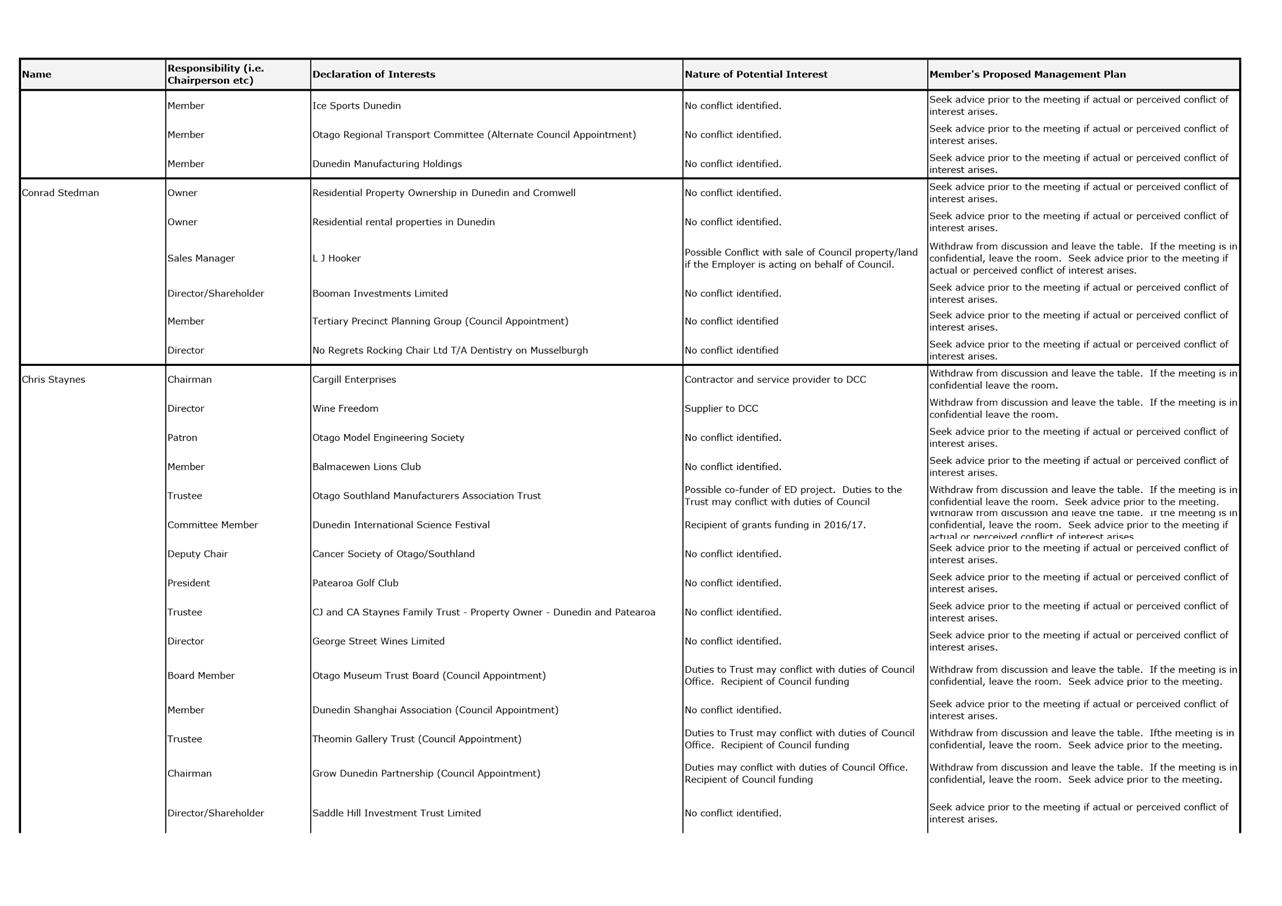

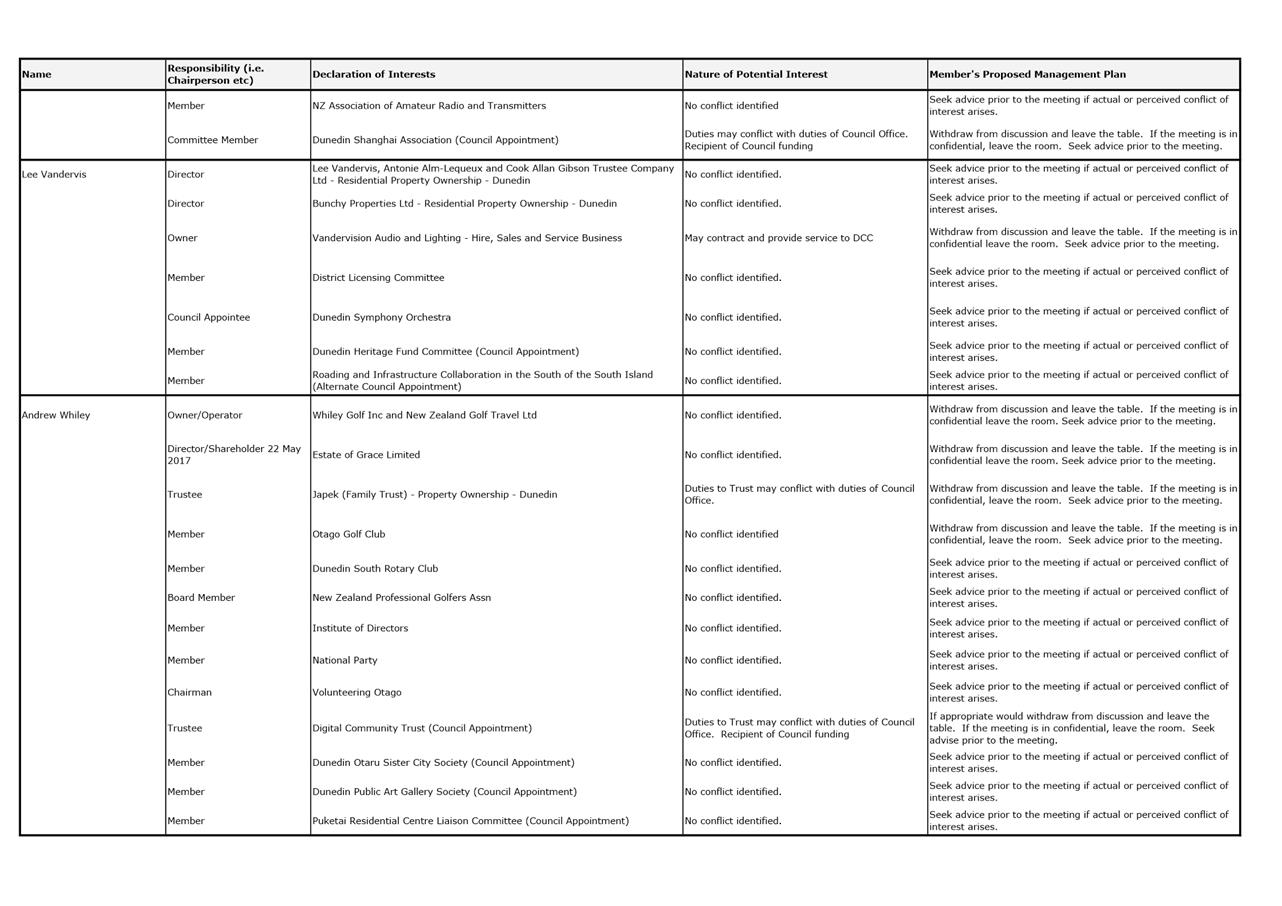

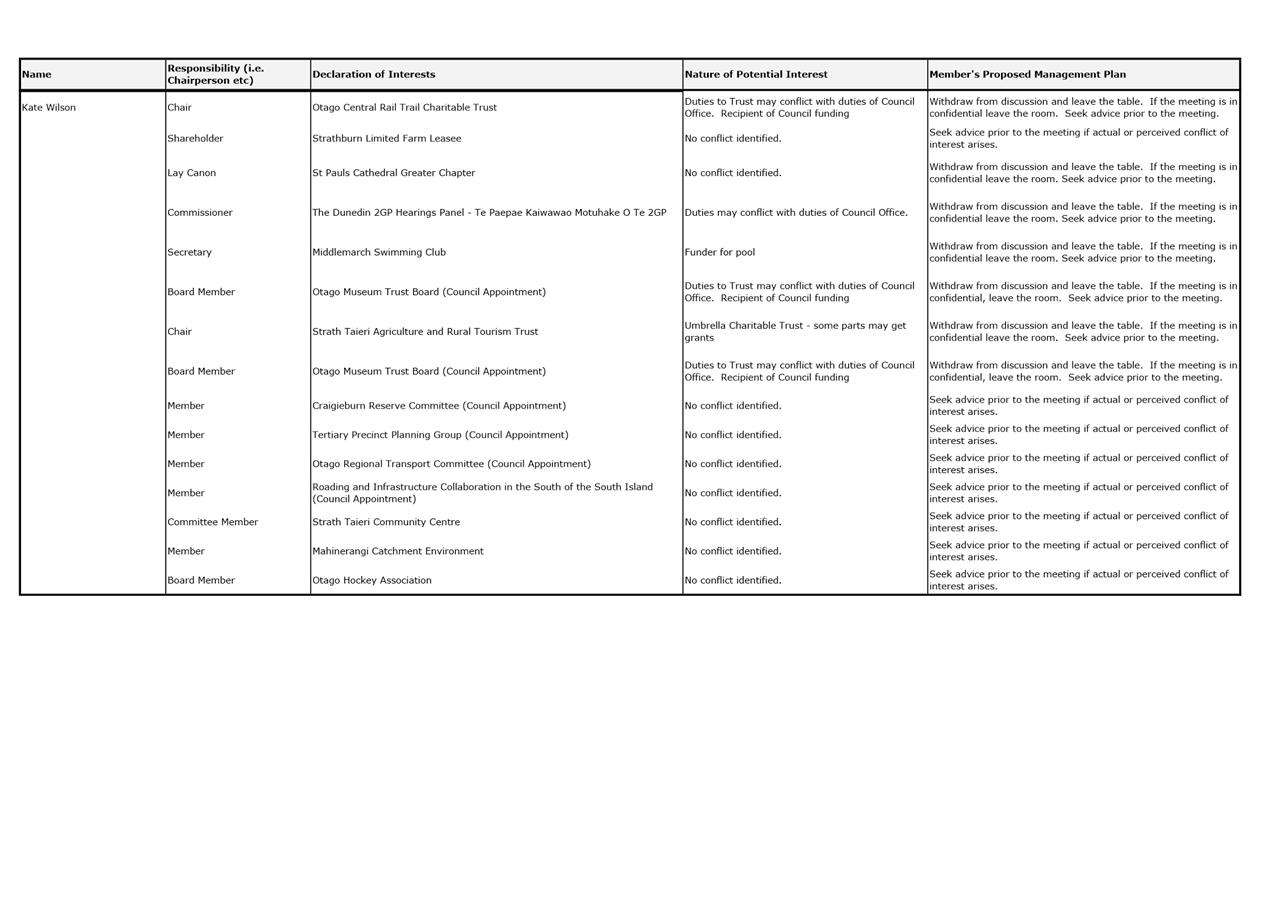

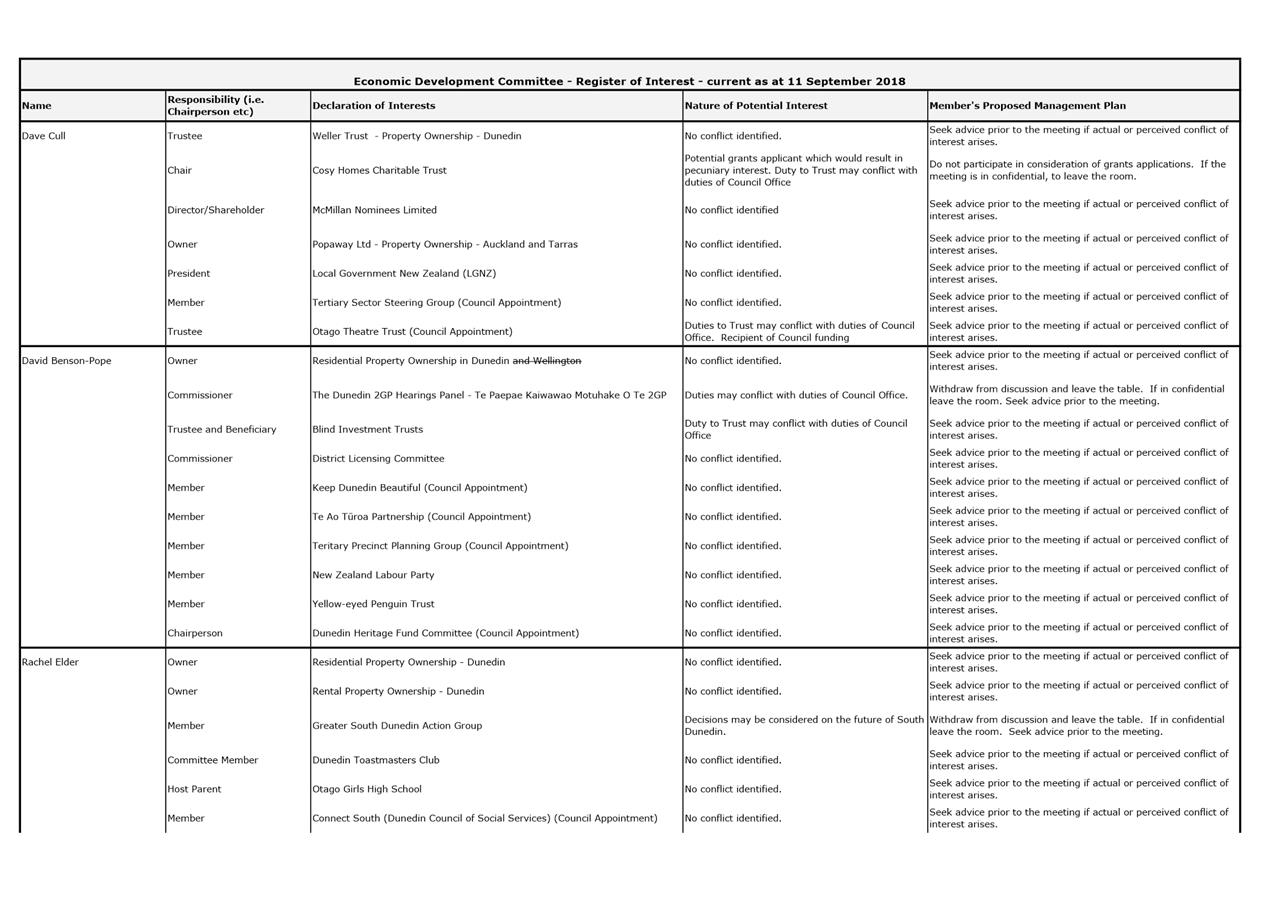

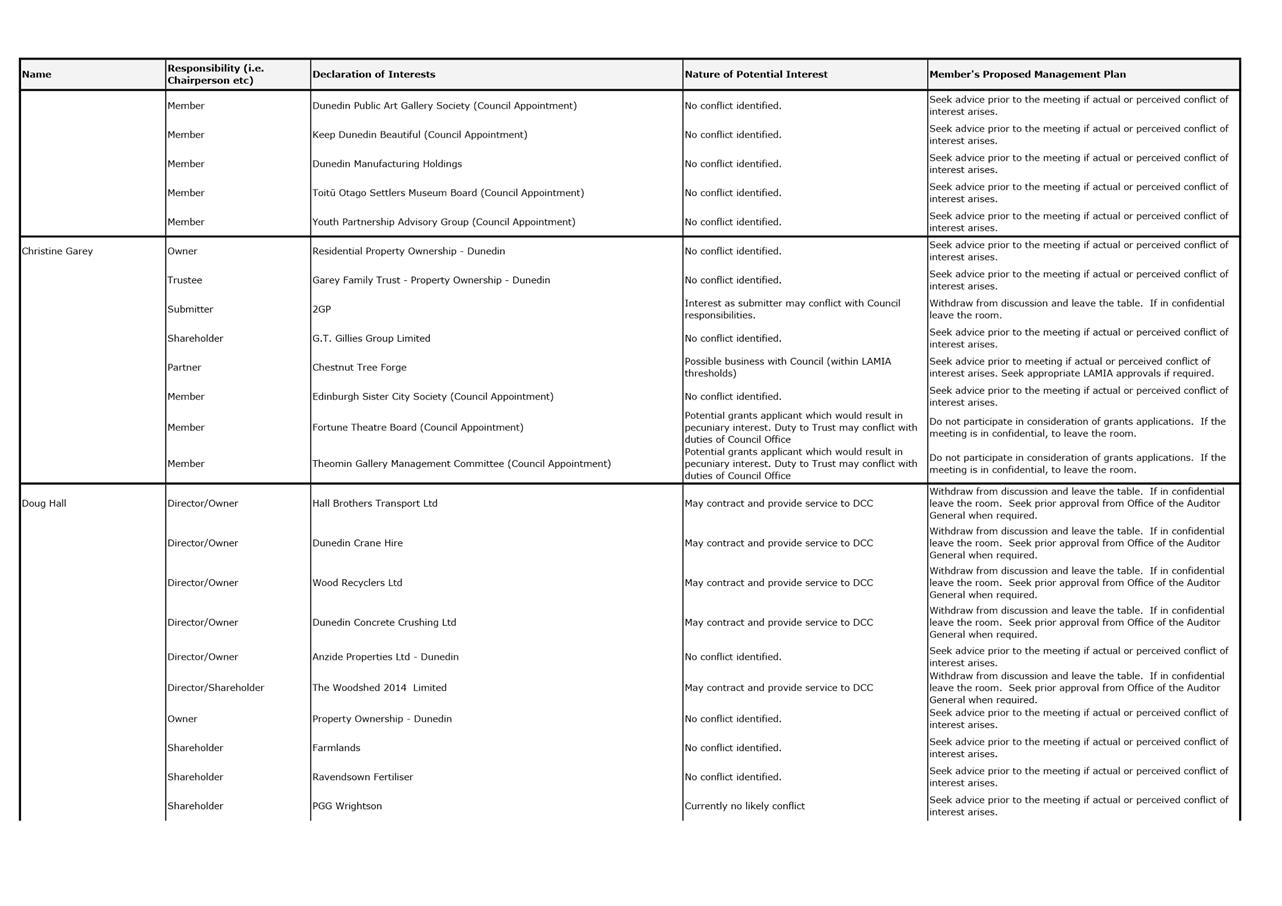

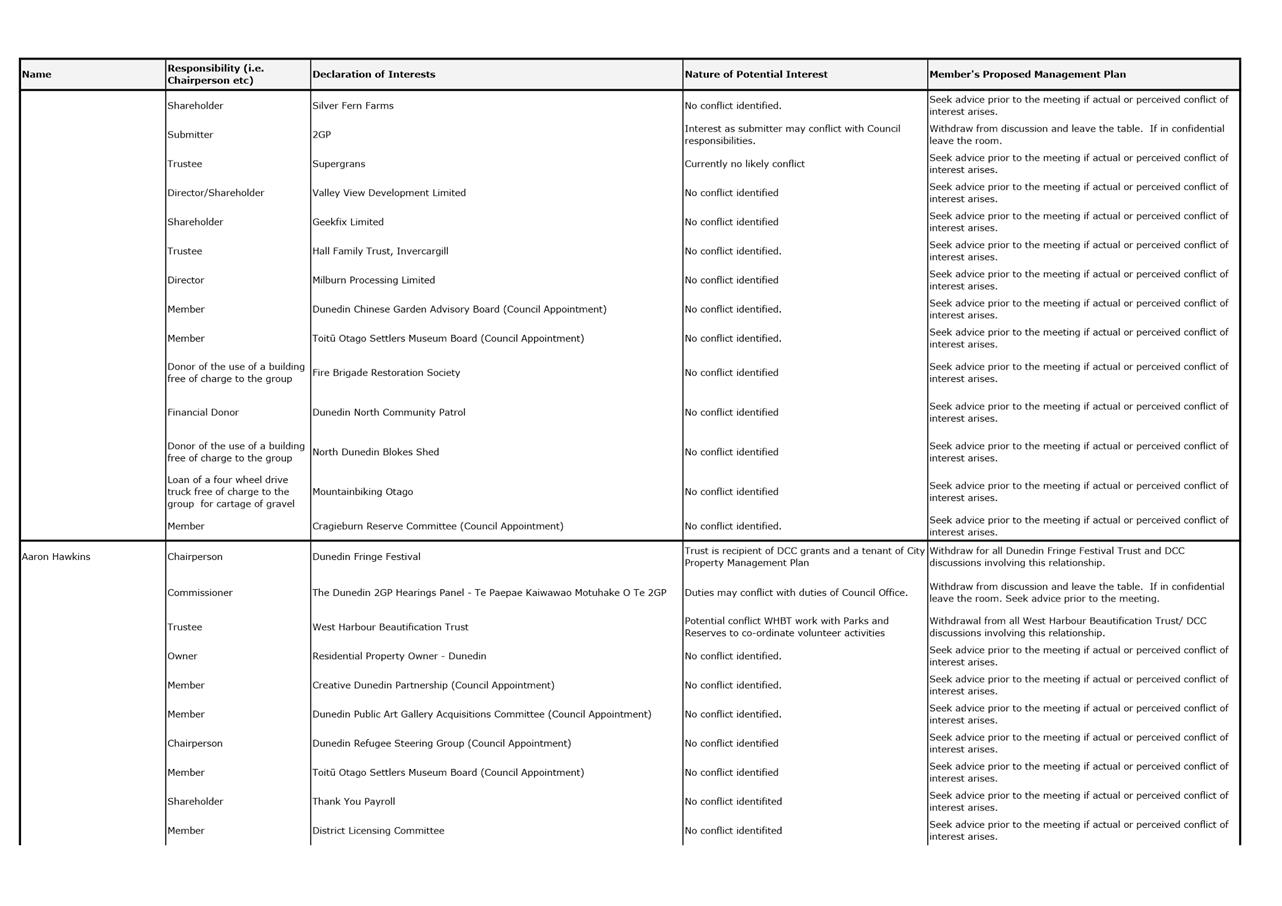

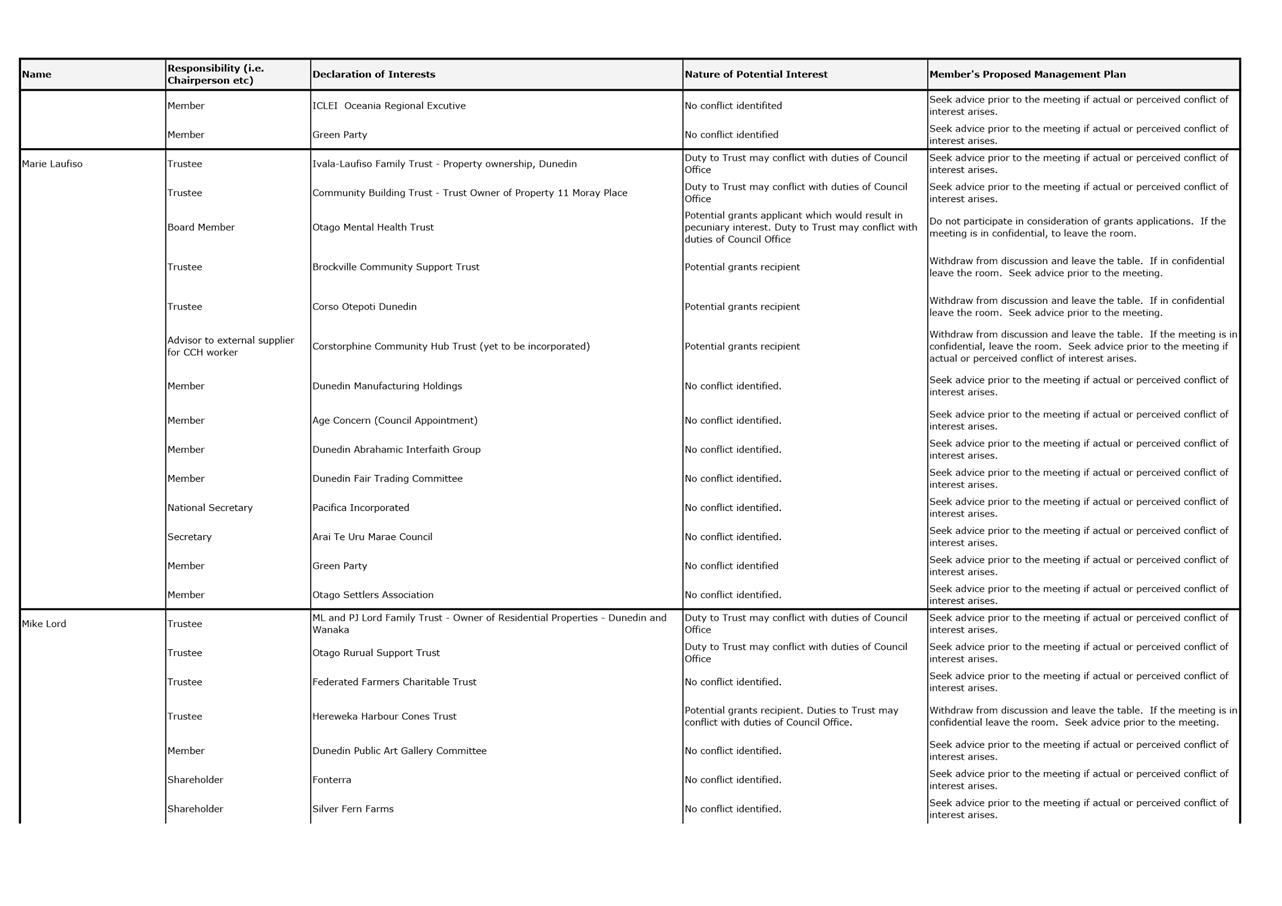

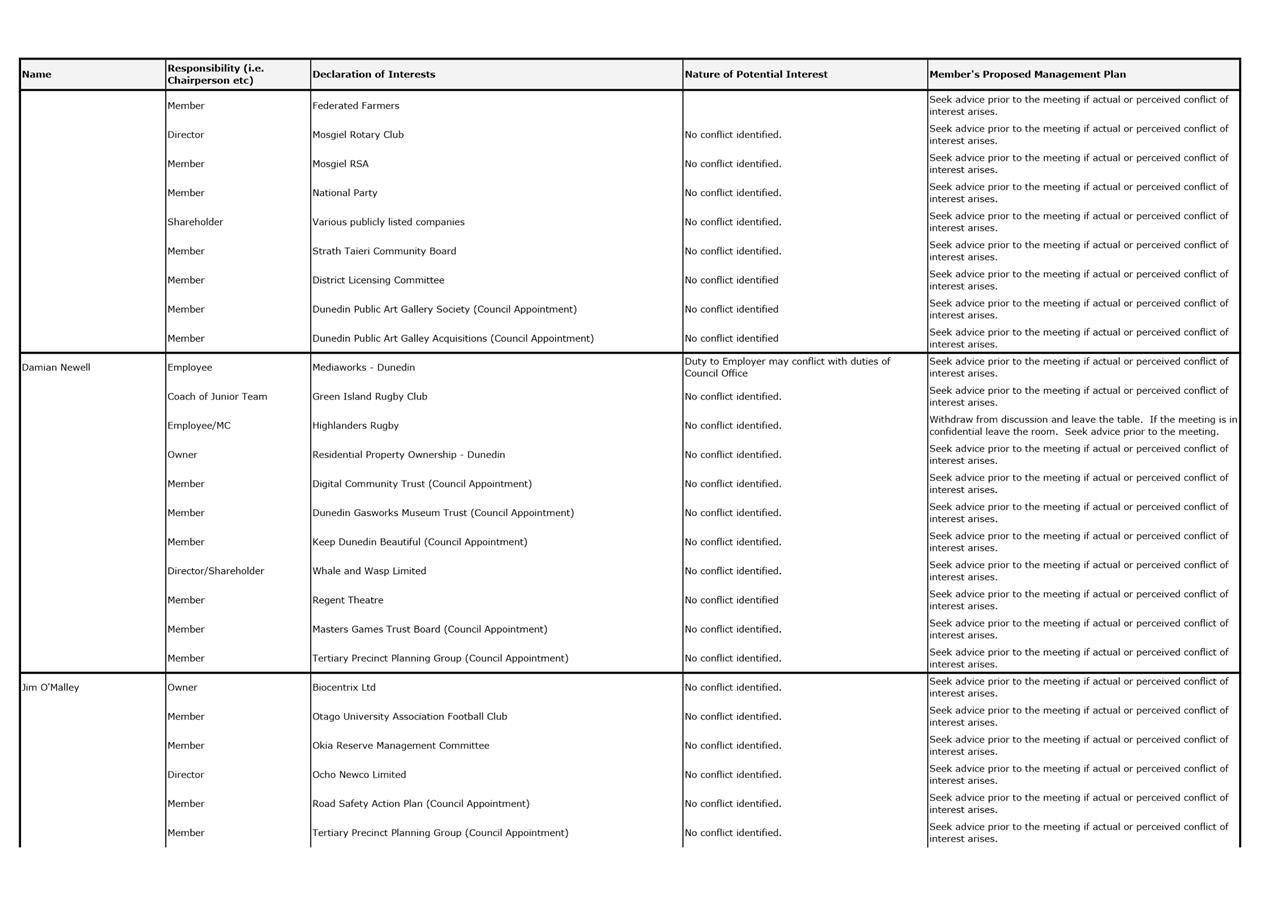

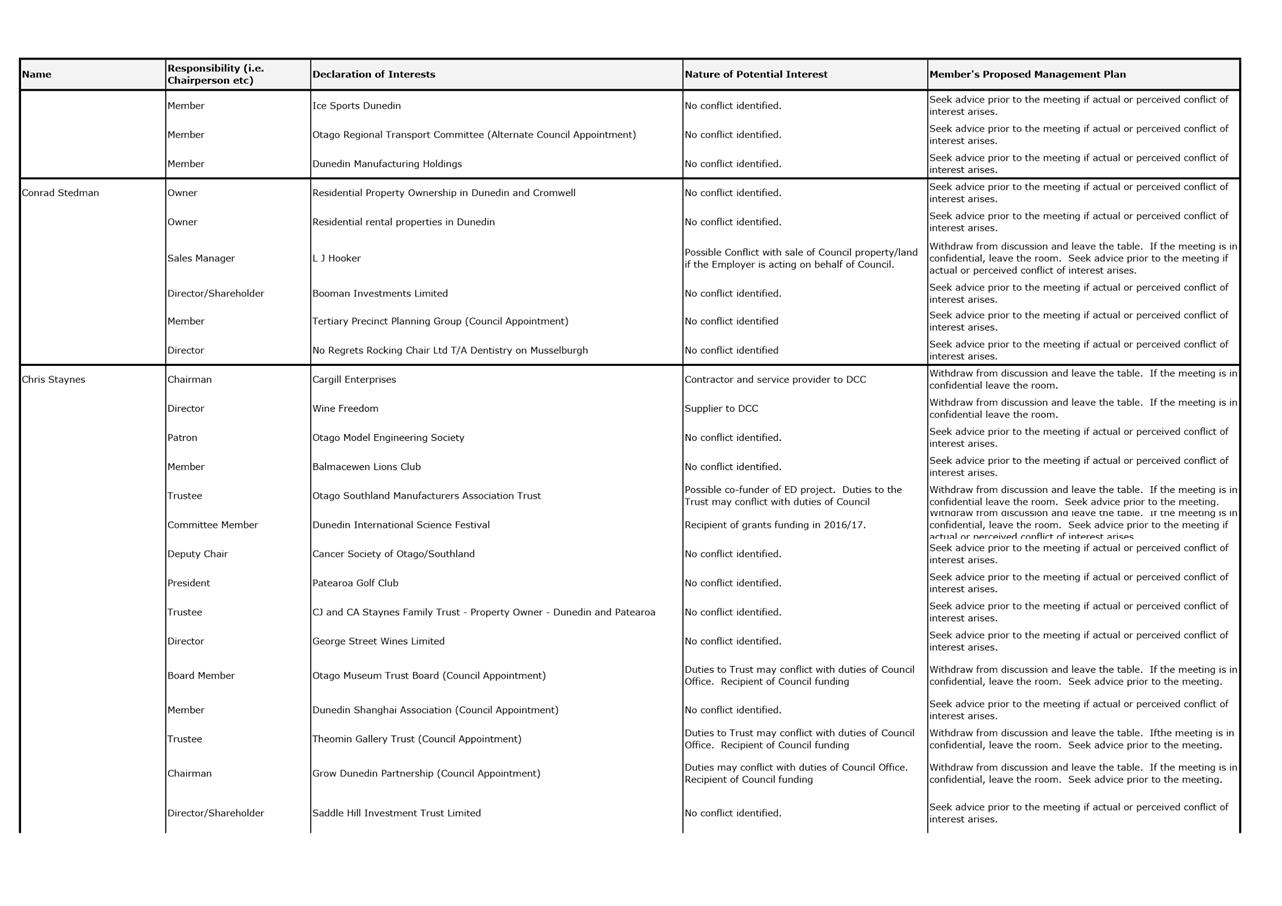

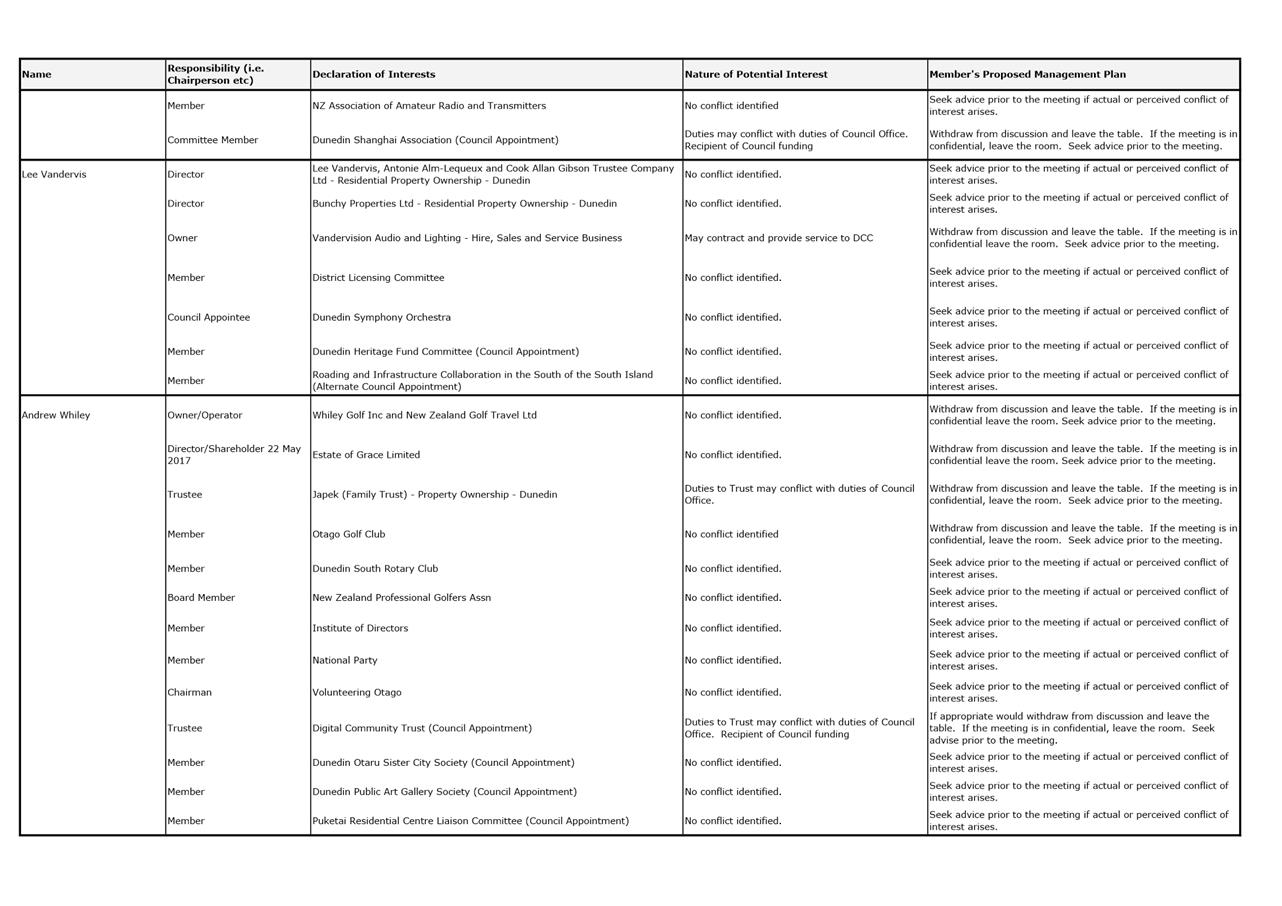

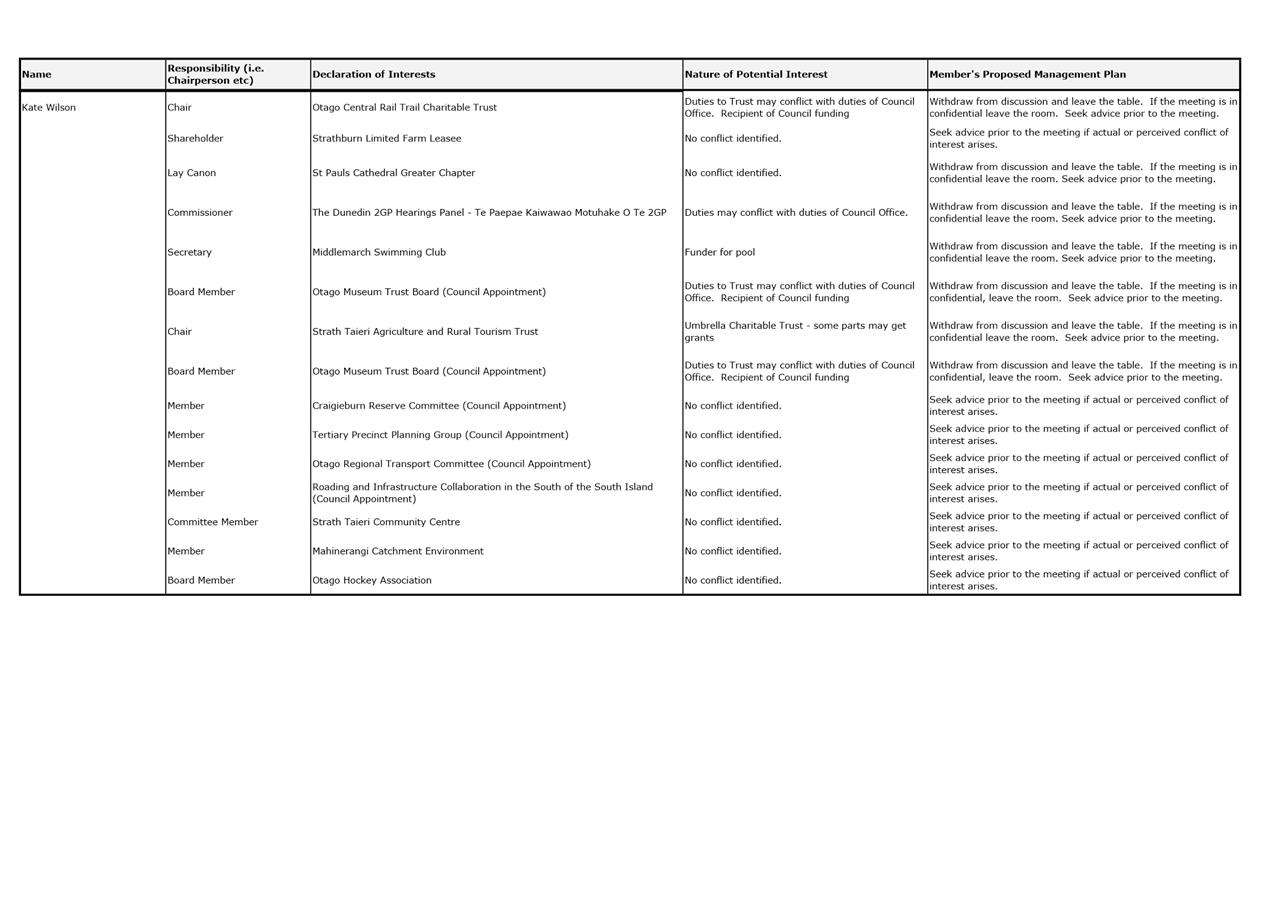

Declaration of Interest

EXECUTIVE SUMMARY

1. Members are reminded of the need

to stand aside from decision-making when a conflict arises between their role

as an elected representative and any private or other external interest they

might have.

2. Elected

members are reminded to update their register of interests as

soon as practicable, including amending the register at this meeting if

necessary.

|

RECOMMENDATIONS

That the Committee:

a) Notes/Amends

if necessary the Elected Members' Interest Register attached as Attachment A;

and

b) Confirms/Amends the proposed management plan for Elected Members' Interests.

|

Attachments

|

|

Title

|

Page

|

|

a

|

Register of Interest

|

7

|

|

Economic Development Committee

11 September 2018

|

|

|

Economic Development Committee

11 September 2018

|

|

|

Economic Development Committee

11 September 2018

|

|

|

Economic Development Committee

11 September 2018

|

|

|

Economic Development Committee

11 September 2018

|

|

|

Economic Development Committee

11 September 2018

|

|

|

Economic Development Committee

11 September 2018

|

|

|

Economic Development Committee

11 September 2018

|

|

|

Economic Development

Committee

11 September 2018

|

|

Part

A Reports

Enterprise Dunedin July to September 2018

Activity Report

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee on a

selection of Enterprise Dunedin activities during the period July to September

2018.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Enterprise Dunedin 1 July to 30 September 2018 Activity Report.

|

BACKGROUND

2 Enterprise

Dunedin activity is informed by the 2013-2023 Economic Development Strategy

('strategy'). The strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances for

innovation – to improve linkages between industry and research.

c) A hub for

skills and talent – to increase retention of graduates, build the skills

base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A compelling

destination – to increase the value of tourism and events and improve the

understanding of Dunedin’s advantage.

3 The

strategy sets out two economic goals:

a) 10,000 extra

jobs over 10 years (requiring growth of approximately 2% per annum).

b) An average of

10,000 of extra income for each person (requiring GDP per capita to rise about

2.5% per annum).

DISCUSSION

4 Business

Vitality

a) The Otago

Regional Business Partnership (RBP):

· The

RBP is composed of the Otago Chamber of Commerce, Otago Southland Employers

Association and DCC. Funding is provided by New Zealand Trade and Enterprise

and Callaghan Innovation.

· During

the period, the RBP supported 39 new clients through training grants worth

$11,500, and matched 17 mentors to businesses. It achieved a net promoter score

of 70% (an indicator of client satisfaction), exceeding the target of 50%.

· Enterprise

Dunedin is working with five Callaghan Innovation clients who are preparing

applications to support their research and development.

b) Energy Plan:

· Yoogo

Share spoke to the Council and other Dunedin organisations about its electric

vehicle (EV) sharing service. Enterprise Dunedin is working to support

Yoogo’s application for funding to the Energy Efficiency and Conservation

Authority’s Low Emissions Vehicle Contestable Fund to bring EV sharing to

Dunedin.

· Discussions

are ongoing with the Ministry of Health, Southern DHB, and University of Otago,

about further study of the potential for a new District Energy System for

Dunedin. An MOU is being negotiated for co-funding the business case for this

project.

5 A Hub for

Skills and Talent

a) Sexy Summer

Jobs (SSJ):

· In the

2017/2018 season, the Sexy Summer Jobs Business Internship Programme placed 48

interns into 30 businesses. Twenty-four interns gained employment (50%) and 15

of the roles post internship were new positions (62%). Business satisfaction is

high - 89% of businesses involved are satisfied or very satisfied with the

programme.

· Facilitating

relationships and opportunities for businesses and students to meet, is key to

the SSJ programme’s success. The SSJ speed interview event will be held

19 September at the Otago Polytechnic. This event is hosted by Enterprise

Dunedin, the University of Otago, Otago Polytechnic, and Firebrand, and enables

businesses to meet students and retain talented people in the city.

6 A

Compelling Destination:

a) International

Travel Trade:

· Enterprise

Dunedin, in partnership with Air New Zealand, hosted 20 inbound tour operators,

showcasing city attractions and helping build their knowledge of Dunedin.

b) Business

Events:

· Business

events staff will be exhibiting at the Convene South trade exhibition in

Christchurch this month, in partnership with Dunedin Venues and Otago Museum.

· Convene

South showcases the best of the South Island’s business event offerings

to professional conference organisers, business events and incentive planners,

as well as a wide range of business event professionals from around New

Zealand. Located in Christchurch, Convene South puts exhibitors face-to-face

with a highly qualified and targeted audience.

· This

is an opportunity to highlight Dunedin as a leading business events destination

within the domestic market. Every buyer at the trade show is interested in the

South Island product, so exhibitors have a chance to make valuable business

connections. This is also a valuable opportunity to network with industry

colleagues and grow current relationships within the business events industry.

c) Marketing

Campaign & Activity:

· Enterprise

Dunedin ran domestic marketing activities to support Year 3 of the “Where

the Wild Things Are” campaign. This included print, digital, radio

and social media advertising and sponsored content. This campaign aim was to

educate the Queensland market with spill-over into wider Australia, about

Dunedin as an accessible and intriguing destination

· The

same ‘Wild’ key theme is used in the both the New Zealand &

Australian markets for consistency with slightly differentiated messaging

giving compelling reasons to visit Dunedin in autumn and winter 2018.

· The

Australian component of the “Where the Wild Things Are” campaign

was wrapped up, with a final media famil hosted in the city during the

International Science Festival, resulting in five blog posts and additional

coverage in print. A full report will be presented at the November EDC meeting.

· The

Hidden Dunedin spring campaign targeting Auckland launched in August with bus

back and online advertising.

· Enterprise

Dunedin supported iD Fashion at New Zealand Fashion Week, hosting Tourism New

Zealand PR advisors and media.

d) Study Dunedin:

· Study

Dunedin in conjunction with Education New Zealand hosted a Vietnamese travel

blogger, photographer and travel agent in July, with a presentation being

live-streamed from the New Zealand Embassy in Vietnam. They will be producing a

video of their visit that we can use on the DunedinNZ.com website and social

media platforms. The Vietnamese market is growing in Dunedin - 46

Vietnamese students were enrolled in 2017, up 15% on the previous year.

· Four

students and a teacher from Dunedin attended the Shanghai Youth Camp in July.

The students experienced cultural classes, toured Shanghai and showcased

Dunedin’s culture to 120 young people from Shanghai’s sister

cities. Students paid their own return airfares but expenses in Shanghai were

paid by the Shanghai Education Commission. Enterprise Dunedin sponsored

the teacher’s participation. This year was the 10th anniversary of the

camp.

· In

July Education New Zealand confirmed its 2018/19 funding for continuation of

the Work Ready Programme for international students. In partnership with

Otago Polytechnic and the University of Otago, the programme will continue to

run existing services and develop new areas, such as Edubits

(microcredentials). Over 350 students participate in the programme every year

and, to date, over 50 students have gained employment in New Zealand.

· In

August the city welcomed 12 students from six university partners in Shanghai.

Their two-week stay included a homestay experience,

business English classes, campus tours, and cultural and tourism activities. They

also completed work experience with Dunedin companies and institutions aligned

to their study. This is the fifth year of this programme, which is run in

partnership with Otago Polytechnic and the University of Otago.

e) i-SITE Visitor

Centre:

· i-SITE

staff have been preparing for the coming summer and cruise season, updating

their product knowledge, and recruiting for seasonal staff.

· June

was quieter this year, a trend noted by all Lower South Island i-SITEs at their

regional meeting. Trading during July and August was similar to the same time

last year.

NEXT STEPS

8 Feedback

on the activity report will be incorporated in future updates.

Signatories

|

Author:

|

Suz Jenkins - Finance and Office Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing a public service and it

is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the delivery of the

2013-23 Economic Development Strategy. Enterprise Dunedin activities

also contribute to other Council strategies in particular the Arts and

Culture Strategy.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Enterprise Dunedin activities and the 2013-23 Economic

Development Strategy are included in the 2018-28 Long Term Plan.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This decision is considered low significance under the

Significance Engagement Policy.

|

|

Engagement –

external

As an update report, no internal engagement has been undertaken.

|

|

Engagement -

internal

As an update report no external engagement has been

undertaken.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no identified risks.

|

|

Community Boards

There are no implications for Community Boards.

|

|

Economic Development

Committee

11 September 2018

|

|

Enterprise Dunedin Cruise Update Report

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 This

report presents the results of the 2017/18 Cruise season and forecasts for the

2018/19 season (due to start 1 October 2018).

2 In

2017/18, Dunedin received 89 cruise visits over 69 days, carrying 179,564

passengers. Cruise ship spending for Dunedin rose 41.1% in the 2017/18 season,

increasing from $34.8m to $49.1m. This was well ahead of the national

average increase of 18.3%.

3 The

city is now preparing for 120 ship visits over 90 days with an estimated

251,680 passengers in the upcoming 2018/19 season.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Enterprise Dunedin Cruise Update Report.

|

DISCUSSION

4 The

cruise ship season runs from October to mid-April.

5 Approximately

two-thirds of all cruise ships to New Zealand visit Dunedin.

6 Cruise

ship visitor numbers continue to grow both in Dunedin and nationally. However,

some forecasts suggest that the cruise ship market will plateau over the next 2

years.

2017/18 Cruise Ship Season

Results

7 Cruise

ship spending for Dunedin rose 41.1%, from $34.8m to $49.1m in the 2017/18

season, well ahead of the national average of +18.3%.

8 Dunedin

received 89 cruise visits over 69 days carrying 179,564 passengers in 2017/18.

9 The

largest cruise visitor sector is Australia at 44% of passengers, followed by

the Americas at 25% (this includes Canada), and Europe and New Zealand both at

13%. While the biggest growth by percentage in cruise visitors was from Asia

with an increase of 47%, this is in fact the smallest regional sector

representing only 4% of all cruise passengers.

10 The largest growth

in visitor age bracket by actual numbers was the 40-60 years. The median age

was 64 years.

11 Good weather during

the 2017/18 season resulted in only two weather related cancellations, both on

30 January due to dense fog at Taiaroa Heads. Both vessels sat off the

Heads until after midday waiting for the fog to lift before finally deciding to

sail onto the next port.

12 The last cruise ship

visit for the season was also cancelled due to mechanical issues with the ship.

2018/19 Cruise Ship Season

Forecast

13 The 2018/19 season

is set to start on 1 October 2018 and run through to 12 April 2019.

14 The schedule

includes 120 ships visiting over 90 days with capacity for 251,680

passengers. This represents an increase of 31 ships and 72,116 passengers

over the previous season.

15 This schedule

includes 16 significant days where passenger numbers visiting the city will be

over 4,000. On the double-ship days of 18 October, 8 December, 26 December, and

25 January passenger numbers will exceed 6,000.

16 On 1 October we

welcome a new ship to New Zealand waters, the Majestic Princess, which can

carry 3,560 passengers and 1,346 crew. She will make 14 visits to Dunedin

during the season.

17 Ovation of the Seas,

the largest ship on the circuit with 4,180 passenger capacity, is scheduled to

make 10 visits to Dunedin.

18 In preparation for

this increase, an expanded Cruise Action Group has been planning and preparing

for the known busy days. This includes addressing parking issues for extra

shuttles and tour buses both in the city and Port Chalmers. The aim is to keep

our cruise destination rating high by ensuring visitors experience the best of

Dunedin, while maximising the economic benefits this market brings and being

mindful of impacts on local residents.

OPTIONS

19 As this report is

for noting, there are no options.

NEXT STEPS

Not applicable.

Signatories

|

Author:

|

Louise van de Vlierd - Team Leader Visitor Centre

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing a public service and it

is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

|

|

Māori Impact

Statement

No known impacts for tangata whenua.

|

|

Sustainability

Cruise visitor growth has been strong, but is forecast to

plateau over the coming three years.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

No implications.

|

|

Financial

considerations

No financial implications.

|

|

Significance

This report is considered of low significance in terms of

the Council’s Significance and Engagement Policy.

|

|

Engagement –

external

Engaged with Port Otago and Cruise Association New Zealand

for forecast numbers as well as Stats NZ for the official New Zealand and

Dunedin spend figures.

|

|

Engagement –

internal

Engaged with i-SITE Visitor Centre staff.

|

|

Risks: Legal /

Health and Safety etc.

Not applicable/no identified risks.

|

|

Conflict of

Interest

No conflict of interest.

|

|

Community Boards

This report may be shared with the Port Chalmers Community

Board, as it is the community most impacted by cruise ship visits.

|

|

Economic Development

Committee

11 September 2018

|

|

Film Dunedin

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 This

report is to seek Economic Development Committee approval for a Grow Dunedin

Partnership recommended funding decision.

2 On 8 June

2018, the Grow Dunedin Partnership resolved to allocate $100,000 from an agreed

and existing 2018/19 operating budget of $362,634 to film activities.

3 The

purpose of this funding is to maintain existing film activity and over time

increase levels of service and resourcing from the current 0.25 full time

equivalent (FTE) Film Dunedin Coordinator role to 1.0 FTE.

|

RECOMMENDATIONS

That the Committee:

a) Approves $100,000

from existing 2018/19 Grow Dunedin Partnership operating budgets for Film Dunedin

activity.

|

BACKGROUND

4 Enterprise

Dunedin has identified the development of the film sector as a priority for

2018/19. Film activity supports the 2013-23 Economic Development Strategy (EDS)

and economic goals of:

a) 10,000 extra jobs over ten years

(requiring employment growth of approximately 2% per annum);

b) An average of $10,000 extra

income for each person (requiring GDP per capita to rise by about 2.5% per

annum).

5 Film

contributes to the EDS themes of Business Vitality, Alliances for Innovation, a

Hub for Skills and Talent, Linkages Beyond Our Borders and Compelling

Destination. It also supports the Ara Toi Otepoti – Our Creative Future

Strategy themes of Identity Pride and Creative Economy.

6 Enterprise Dunedin has a dual role in film as

a:

a) Regulator

through the administration of an efficient film permit process;

b) Business

enabler including identification of locations, contractors and accommodation,

community engagement, relationship building, support for training and

vocational pathways.

DISCUSSION

7 On 8 June

2018, the Grow Dunedin Partnership resolved:

a) To allocate

$100,000 (including staffing) from existing 2018/19 operating budgets for film

development.

Moved

(Thomson/Campbell):

8 This

funding will result in an increased level of service from the current 0.25 FTE

allocated to film activity to 0.5 FTE in quarter 1 (2018/19). Current

resourcing will again increase to a 1 FTE in quarter 2 (2018/19).

9 The

increased level of service will deliver a range of additional outcomes beyond

business as usual activity (such as production attraction, business support and

regulatory functions) in 2018/19.

a)

Shanghai Film Festival

10 Enterprise Dunedin

will take a festival of New Zealand films to Shanghai later in the year. The

programme (agreed with the New Zealand Film Commission) is weighted to content

that showcase stories, talent and locations from Dunedin and Otago.

Representatives from the Dunedin film and screen sector will also be invited to

attend the launch of the film festival and business meetings.

b)

Dunedin Shanghai Screen Writers

Exchange

11 The Dunedin Shanghai

Screen Writers exchange will be launched in October 2018. This project is a

result of the memorandum of understanding signed by Enterprise Dunedin and the

Shanghai Art Film Federation and offers a two-month exchange for writers to

develop research, relationships and content for future film and television

productions.

12 The Screen Writers

exchange is part funded by New Zealand Film Commission and is supported by New

Zealand Screenwriters Guild, local businesses and institutions.

c)

Industry Development

13 Research to identify

crew skills and capacity in the city has been completed. This supports

development of a crew database and informs vocational pathways, professional development

and training activity. The database will also enable further engagement with

producers and scouts regarding crew available in the city.

OPTIONS Option One – Approve $100,000 for 2018/19

film activity (preferred option)

14 Option one is the

preferred option. Under this option the EDC would approve $100,000 from

existing 2018/19 Grow Dunedin Partnership operating budgets to support film

activity.

Advantages

· Option

one is supported by Grow Dunedin Partnership;

· Film

activities are resourced during the 2018/19 financial year;

d)

Disadvantages

· $100,000

less for other 2018/19 Grow Dunedin Partnership activities.

Option

Two – Approve smaller or no investment for 2018/19 film activity

15 Under this option

the EDC would approve a smaller investment (i.e. less than $100,000) for

2018/19 from existing 2018/19 Grow Dunedin Partnership operating budgets for

film activity.

Advantages

· $100,000

for other 2018/19 Grow Dunedin Partnership activities.

Disadvantages

· Reduced

level of service and support for film activities.

NEXT STEPS

16 Subject to agreement

by the Economic Development Committee, existing levels of service for film will

be maintained and increased during 2018/19. Updates on the film festival and

business delegation, screenwriters exchange and industry development will be

provided in future Enterprise Dunedin activity reports.

Signatories

|

Author:

|

Fraser Liggett - Economic Development Programme Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing a public service and it

is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

This report describes activity and planning that directly

supports all five themes within the Economic Development Strategy, the

Creative Economy and Creative Pride themes in the Arts and Culture

Strategy.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

Support for film sector contributes to economic growth and

sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

The decision will maintain and increase levels of service

for 2018/19 film activity.

|

|

Financial

considerations

The recommended option has been prioritised in existing

and agreed Grow Dunedin Partnership 2018/19 operating budgets.

|

|

Significance

This decision is considered low in terms of the

Council’s Significance and Engagement Policy.

|

|

Engagement –

external

The Grow Dunedin Partnership has been engaged on this

decision.

|

|

Engagement -

internal

The Ara Toi Group Manager has been engaged on the report.

|

|

Risks: Legal /

Health and Safety etc.

There are no known legal or health and safety issues.

|

|

Conflict of

Interest

There are no identified conflicts of interest.

|

|

Community Boards

There are no implications for Community Boards.

|

|

Economic Development

Committee

11 September 2018

|

|

Start-Up Ecosystem

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to seek Economic Development Committee (EDC) approval

for a Grow Dunedin Partnership recommended funding decision.

2 On 12

July 2018, Grow Dunedin Partners resolved to allocate $150,000, from an agreed

and existing 2018/19 operating budget of $362,634 to support the development of

the start-up ecosystem.

3 The

proposed 2018/19 investment will be matched by $50,000 funding from CreativeHQ/

Callaghan Innovation for the Challenger business incubator programme.

|

RECOMMENDATIONS

That the Committee:

a) Approves $150,000

for measures to support the start-up ecosystem from existing 2018/19 Grow

Dunedin Partnership operating budgets;

b) Notes this

investment will attract $50,000 from Callaghan Innovation for the delivery of

business incubator services during 2018/19.

|

BACKGROUND

4 A

start-up ecosystem is formed in a physical location by people, businesses (in

their various stages of growth) and organisations who wish to support and scale

new start-up companies.

5 The

ecosystem is typically led by entrepreneurs and often includes economic

development agencies, universities, polytechnics, co-working spaces,

professional services and existing and established businesses.

6 Over the

last 18 months Enterprise Dunedin has worked with the Grow Dunedin Partnership,

the Start Up Dunedin Trust and local businesses including co-working spaces

such as Innov8HQ and Petridish to identify measures to support the development

of the ‘Dunedin start-up ecosystem’.

7 This work

has been identified as a key priority for Enterprise Dunedin given the role the

ecosystem plays in supporting the economic goals of the 2013-23 Economic

Development Strategy (EDS):

a) 10,000 extra

jobs over ten years (requiring employment growth of approximately 2% per

annum);

b) An average of

$10,000 extra income for each person (requiring gross domestic product per

capita to rise by about 2.5% per annum).

8 The

development of the start-up ecosystem contributes to all themes of the EDS:

a) Business

Vitality;

b) Alliances for

Innovation;

c) A Hub for

Skills and Talent;

d) Linkages

Beyond Our Borders;

e) Compelling

Destination.

9 During

this period, Enterprise Dunedin and the Grow Dunedin Partners have developed a

greater understanding of the local ecosystem and how it can be supported by:

a) Connections, collaboration and alignment of resources;

b) Improved visibility of activities;

c) Building confidence in the start-up ecosystem;

d) Celebrating business hero stories;

e) Improved performance measurement;

f) Removing barriers to business start-ups;

g) Strengthening support for investors and influencers.

10 This has resulted

in:

a) Grow Dunedin

Partners investing $68,000 in start-up activities during 2017/18;

b) Enterprise

Dunedin entering a memorandum of understanding with Creative HQ (a Wellington

based business support service) funded by Callaghan Innovation for the delivery

of business ‘incubator’ services in Dunedin.

The Dunedin incubator received $25,000 from Callaghan

Innovation during 2017/18 and has been developed by the Start-Up Dunedin Trust

under the brand Challenger Series with businesses such as Gallaway Cook

Allan and Deloitte;

c) Stronger

communication and engagement with the Start-Up Dunedin Trust, the wider

ecosystem, city partners including the Otago Business School and Otago

Polytechnic.

11 The start-up

ecosystem has shown signs of growth and activity over the last 18 months. For

example, the inaugural Challenger Series, launched in June 2018, attracted

71 start-ups in less than two weeks, with 20 being shortlisted and 3 entering

the Challenger Series.

12 The Challenger

Series has highlighted the growing number of quality start-up within the

city as well as willingness of the ecosystem (co-working spaces, city partners,

private sector and Start Up Dunedin Trust) to collaborate on projects.

13 Table one,

summarises the outcomes achieved by the Start Up Dunedin Trust over the last 12

months:

Table one:

summary of activity

|

Objective

|

Activity

2018

|

Outcome

|

|

Enable

connections, better collaboration and alignment of resources

|

Incubation

Services/Creative HQ - Challenger Series

|

71 start-ups

applied

20

shortlisted

3 start-up

applicants in full incubation programme

|

|

Improve

visibility

|

Community

Events

Start

Up Dunedin Trust hosted events

|

86

events (60 community and 26 Start Up Dunedin Trust hosted events)

|

|

Celebrate

hero stories

|

|

Improve

performance measures

|

Number

of start-up paired with mentors

|

12

start-ups

|

|

Remove

barriers

|

Start-Up

Weekend

|

60 participants

|

|

Strengthen

capability

|

Co.Starters (a programme designed to support early stage

start-ups)

|

40

graduates

|

14 On

8 June 2018, the Grow Dunedin Partnership resolved:

a) Up to $150,000

be assigned for start-up ecosystem development; noting that support funding

will be sought from other sources.

Moved

(Thomson/Campbell).

15 On 12 July 2018, the

Grow Dunedin Partnership subsequently resolved to:

a) Receive the

Start Up Dunedin Trust update and presentation on 2017/18 activity.

b) Note the decision

to prioritise $150,000 from 2018/19 operating budgets for investment in the

start-up ecosystem on 8 June 2018.

c) Note the

proposed split for this investment:

i. $100,000 allocated to

the Start Up Dunedin Trust for the delivery of 2018/19 start-up business

support;

ii. $50,000 for additional

measures to be determined by Enterprise Dunedin, Grow Dunedin Partnership and

the start-up ecosystem.

d) Note this

investment will leverage:

iii. $50,000 from CreativeHQ and

Callaghan Innovation for business incubation services delivered by the Start-Up

Dunedin Trust;

iv. $44,000 from Enterprise

Dunedin for the 2018/19 delivery of Audacious;

v. $40,000 from the University of

Otago for the 2018/19 delivery of Audacious;

vi. $20,000 from the Otago

Polytechnic for the 2018/19 delivery of Audacious.

e) Agree to set

aside $150,000 in 2019/20 operating budgets to ensure surety of investment in

the start-up ecosystem contingent on advice (including the development of the

Centre of Digital Excellence) from Enterprise Dunedin.

f) Note

that resolution needs to be approved under delegation by the Economic

Development Committee on 11 September 2018.

Moved (Gallaher/Staynes).

16 This decision was

also considered in the context of the development of the Centre of Digital

Excellence (CODE) which is currently being developed through a business case.

CODE provides a further opportunity to match future 2019/20 GDP investment

against additional government and private sector support and investment in the

start-up ecosystem.

17 Given this, the Grow

Dunedin Partnership also resolved to set aside $150,000 2019/20 operating

budgets to further support start-up activities contingent on the presentation

of additional advice from Enterprise Dunedin.

DISCUSSION

18 This investment will

support the delivery of the following three workstreams and activities during

2018/19:

Start-Up Support:

a) Raising the

profile and improving the attractiveness of the ecosystem locally, nationally

and internationally;

b) Introducing

investors to Dunedin;

c) Supporting

start-ups through ongoing delivery of the Co-Starters programme;

d) Delivery of

other priorities in the Start Up Dunedin Trust’s 2018/2019 ecosystem

strategy.

CreativeHQ – ‘Challenger

Series’ 2019:

a) Continued

rollout of Challenger Series in conjunction with the private sector and

Callaghan Innovation/CreativeHQ.

Start Up Pilots:

a) Development of additional

pilot activities to address barriers, need or opportunities identified in the

start-up ecosystem.

OPTIONS

Option

One – Approve $150,000 investment in the start-up ecosystem (preferred

option)

19 Option one is the

preferred option. Under this option the EDC would approve $150,000 for 2018/19

from existing Grow Dunedin Partnership budgets to support the start-up

ecosystem.

Advantages

· Option

one is supported by the Grow Dunedin Partnership and has been developed in

conjunction with the start-up ecosystem, local businesses and city partners

over the last 18 months;

· Start

Up Dunedin Trust activities, delivery and outcomes are resourced during the

2018/19 financial year;

· Further

opportunities are created for additional measures to support the start-up

ecosystem;

· Match

funding for CreativeHQ services and 2019 Challenger Series is continued

during 2018/19.

Disadvantages

· $150,000

less for other 2018/19 GDP activities.

Option

Two – Approve smaller investment or no investment in the start-up

ecosystem

20 Under this option

the EDC would approve a smaller investment (i.e. less than $150,000) for

2018/19 from existing Grow Dunedin Partnership budgets to support the start-up

ecosystem.

Advantages

· $150,000

for other 2018/19 Grow Dunedin Partnership activities.

Disadvantages

· Reduced

investment options were considered, but not preferred by the Grow Dunedin

Partnership;

· Reduction

in services and support to the start-up ecosystem during a period of growth;

· Potentially

loss of match funding from CreativeHQ and Callaghan Innovation for Challenger

Series.

NEXT STEPS

21 Subject to EDC

agreement, Enterprise Dunedin will update the existing service level agreement

with the Start Up Dunedin Trust for 2018/19 business support, delivery of the

2018/19 Challenger Series (supported through CreativeHQ funding).

22 Enterprise Dunedin

will also work with Grow Dunedin Partnership to invite proposals for additional

measures to support the start-up ecosystem before quarter two 2018/19.

23 The

proposed investment in the 2018/19 start-up ecosystem will be considered in the

context of the development of the Centre of Digital Excellence (CODE).

Signatories

|

Author:

|

Chanel O'Brien - Business Development Advisor Skills and

Entrepreneurship

|

|

Authoriser:

|

Fraser Liggett - Economic Development Programme Manager

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision relates to providing a public service and it

is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The preferred option within this report supports the

educational, business support and talent attraction goals of the Centre of

Digital Excellence (CODE) and computer gaming sector. Creative

businesses (such as film and digital content) are represented in the start-up

ecosystem. As a result, the proposed option and measures also supports the

theme of Creative Economy under the Arts and Culture Strategy.

|

|

Māori Impact

Statement

Ngai Tahu are represented on the GDP and therefore have

had the opportunity to contribute to decision making on 2018/19 investment in

the start-up ecosystem.

|

|

Sustainability

Ongoing business development and support for the start-up

ecosystem has been identified as one priority by GDP and Enterprise Dunedin

to meet the economic goals in the 2013-23 Economic Development Strategy.

|

|

LTP/Annual Plan / Financial

Strategy /Infrastructure Strategy

There are no implications for the LTP, Annual Plan,

Financial Strategy and Infrastructure Strategy.

|

|

Financial

considerations

The total cost of the recommended option is $200,000 and

comes from existing budgets and external revenue. This figure includes

$150,000 from 2018/19 GDP existing operating budgets for measures to support

the start-up ecosystem and $50,000 external revenue from CreativeHQ/Callaghan

Innovation for the 2018/19 Challenger Series.

|

|

Significance

This decision is considered low in terms of the

Council’s Significance and Engagement Policy

|

|

Engagement –

external

The following organisations have been engaged regarding

the recommendations in this report, the Grow Dunedin Partnership (including: Dunedin

City Council, Otago Chamber of Commerce Incorporated, Otago Southland

Employers Association, University of Otago, Otago Polytechnic, Ngai Tahu,

Anna Campbell, AbacusBio, John Gallaher, Forsyth Barr), the Otago Business

School, Start-Up Dunedin Trust and wider start-up ecosystem via workshops in

2017 and including co-working spaces, Petridish and Innov8HQ, Silver Fern

Farms, Codelingo, NomosOne, TracPlus and CreativeHQ

|

|

Engagement -

internal

There has been no internal engagement.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks. The Dunedin City Council

procurement team have been involved in the development of contracts and

service level agreements with CreativeHQ and Start-Up Dunedin Trust. These

will be managed by Enterprise Dunedin and outcomes reported back to GDP and

EDC Committee.

|

|

Conflict of

Interest

There is no conflict of interests.

|

|

Community Boards

There are no implications for Community Boards.

|

|

Economic Development

Committee

11 September 2018

|

|

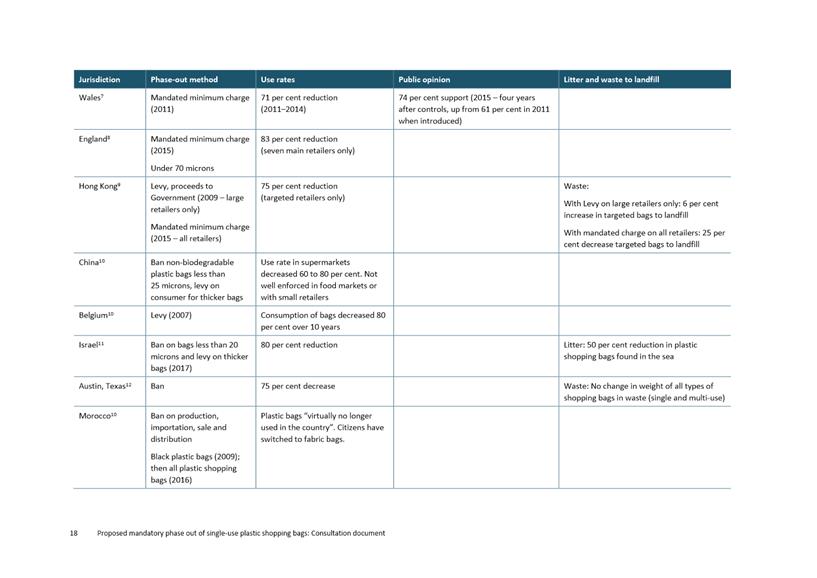

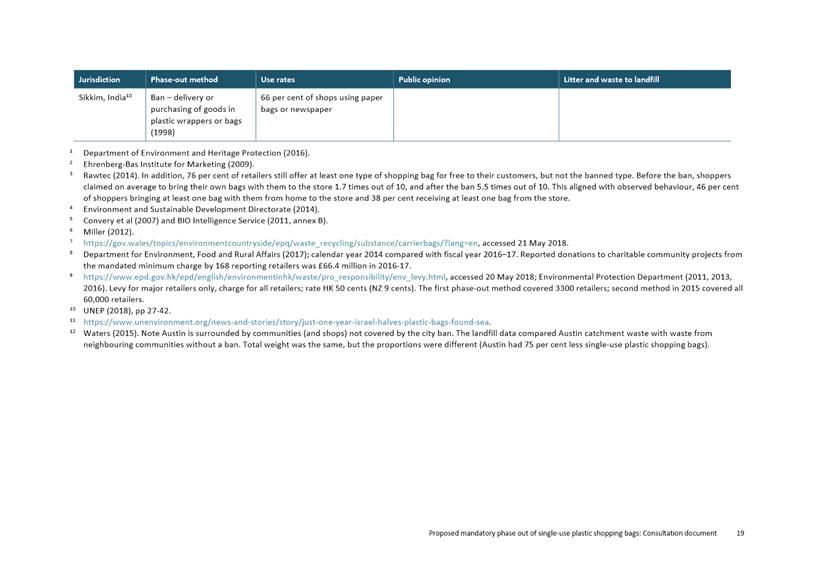

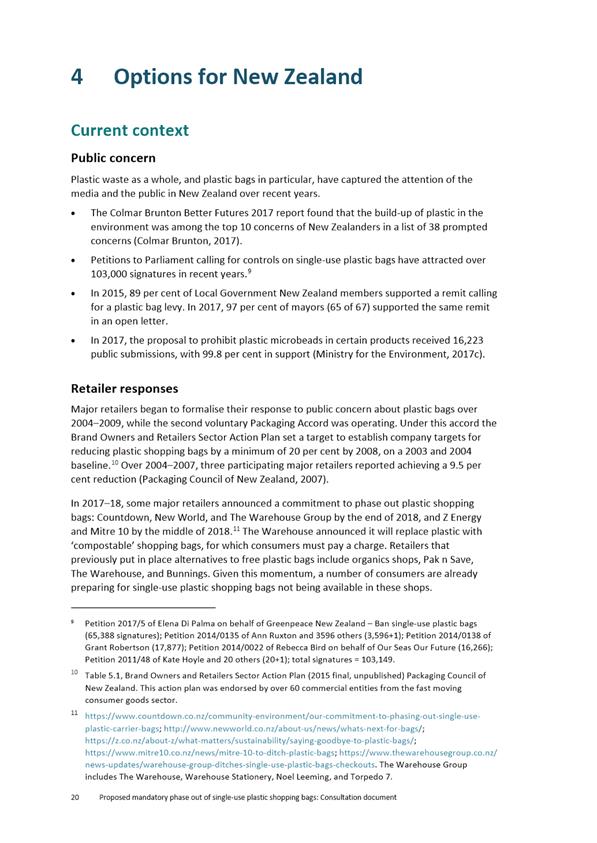

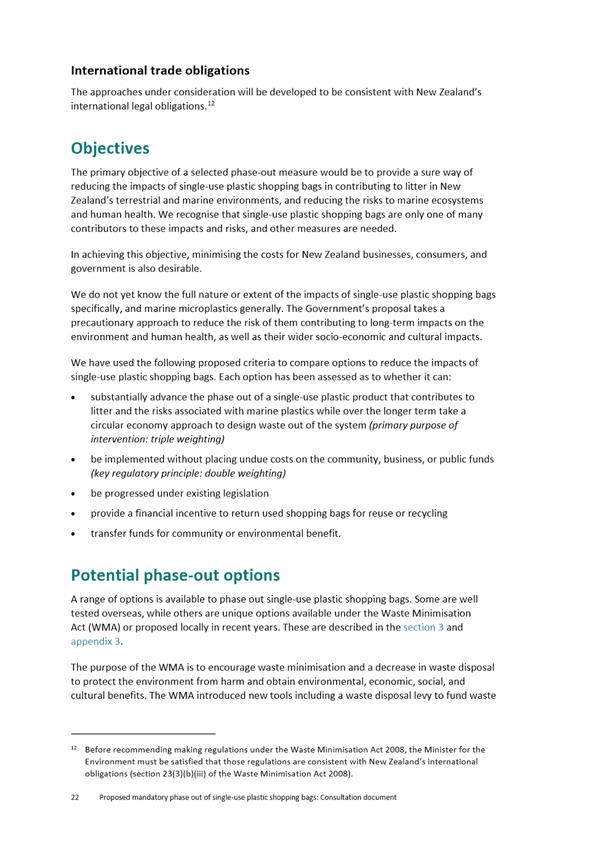

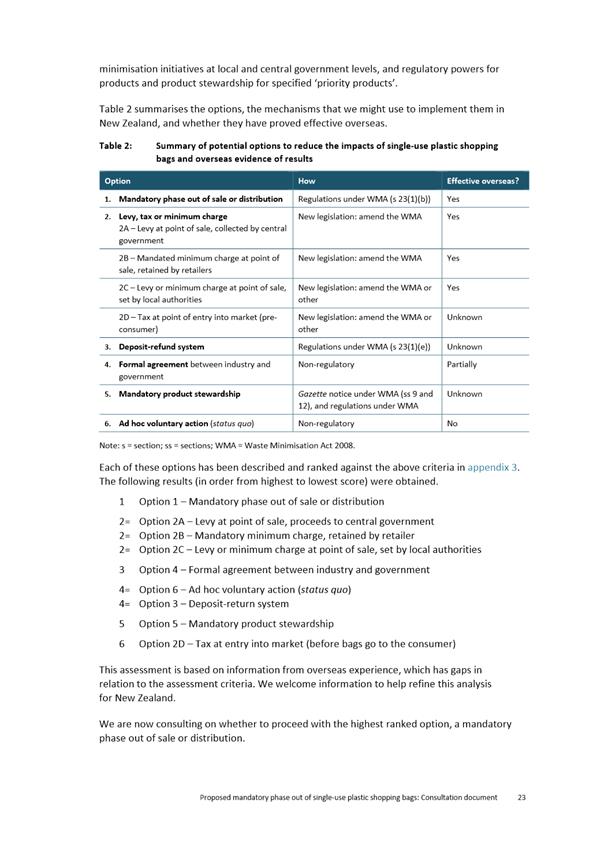

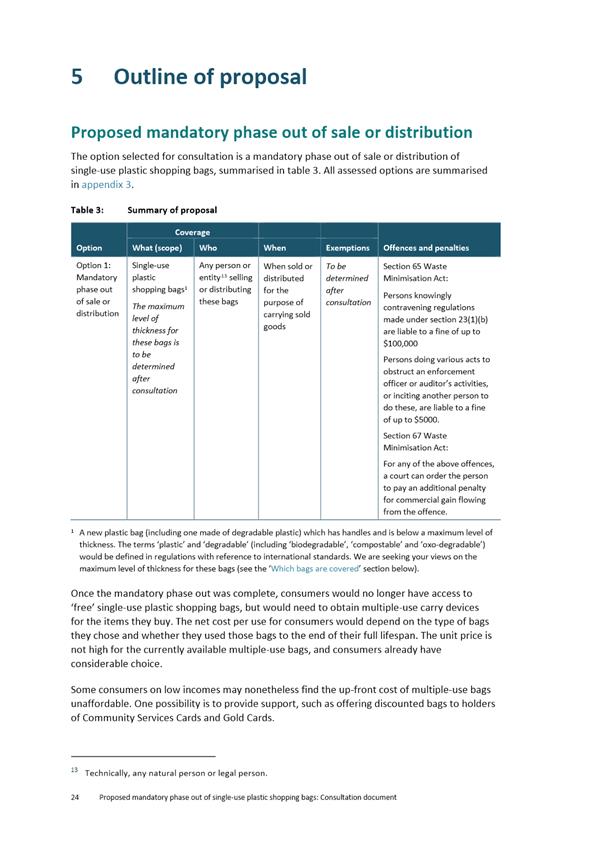

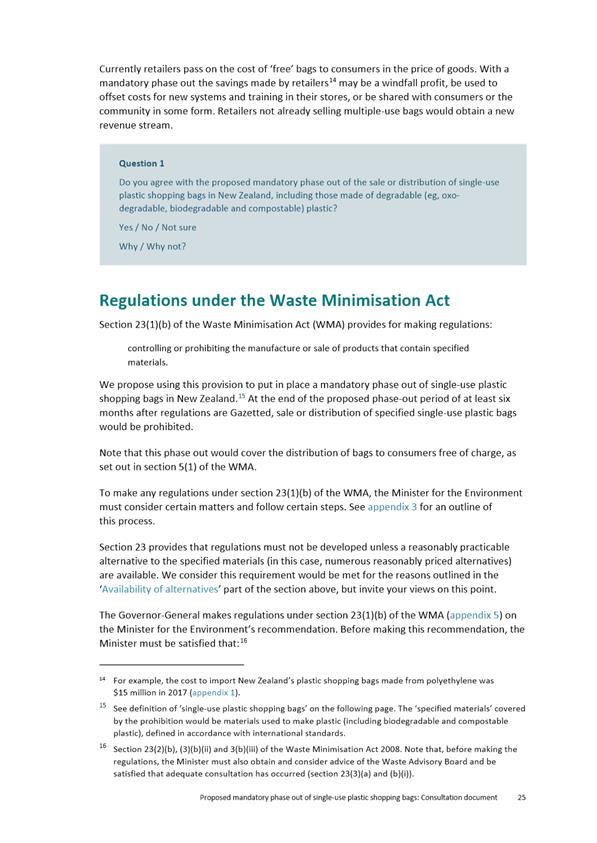

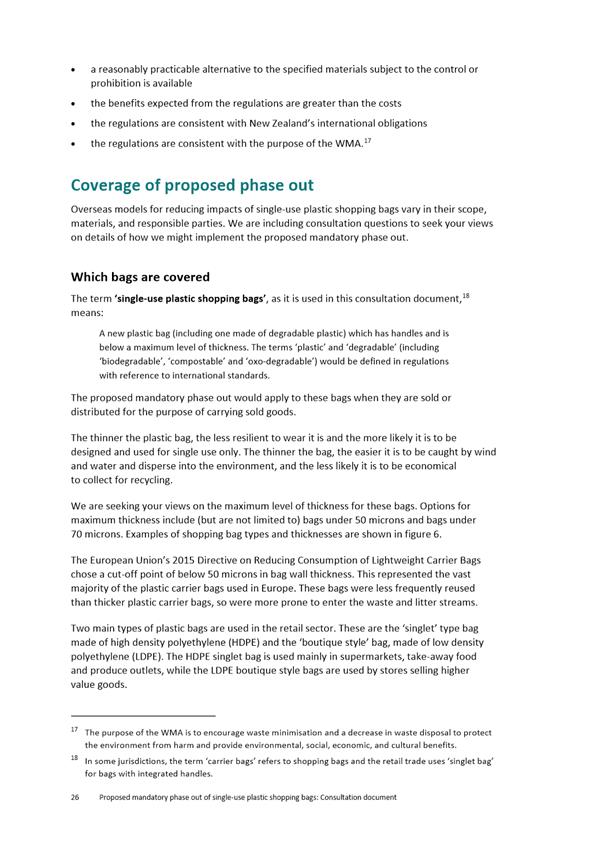

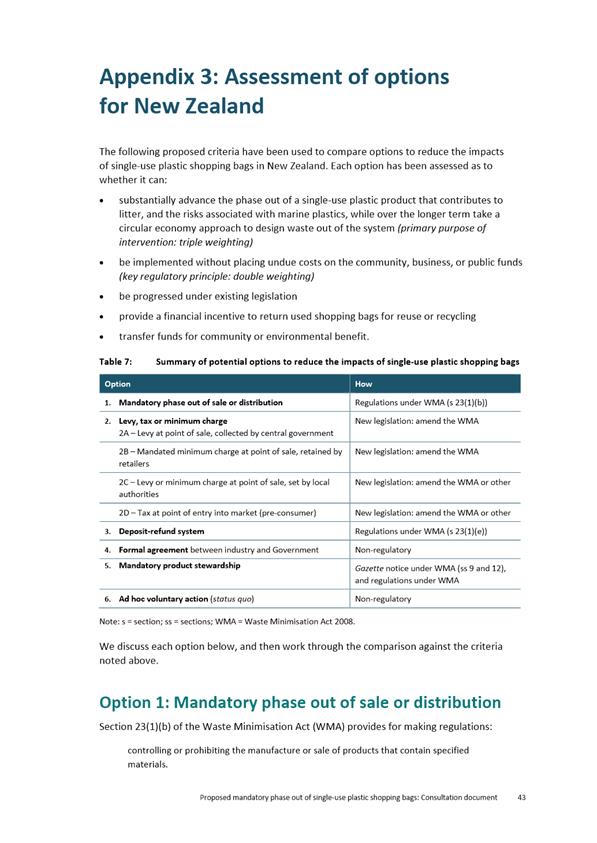

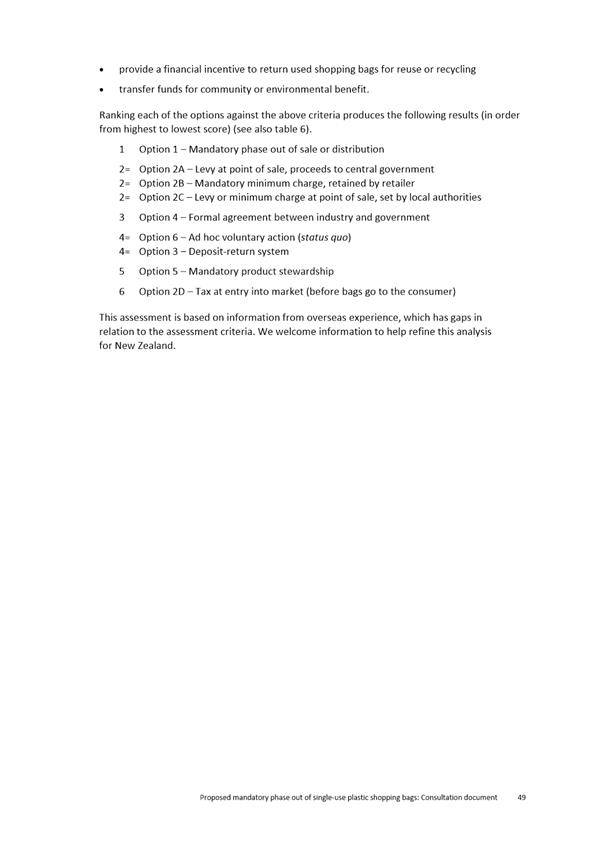

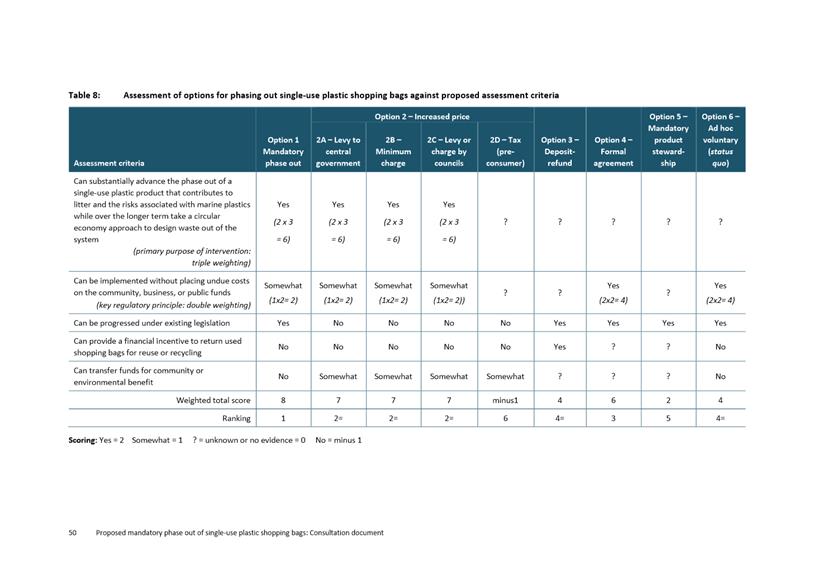

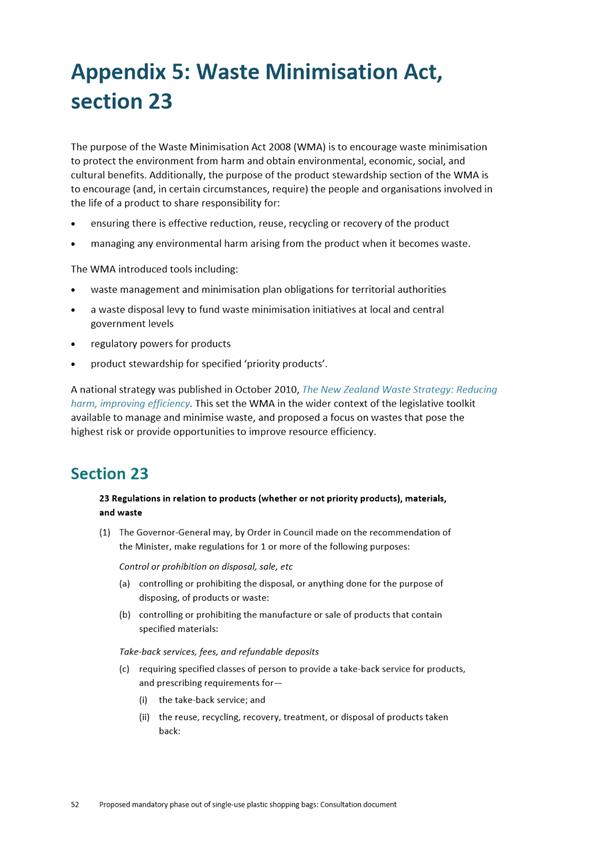

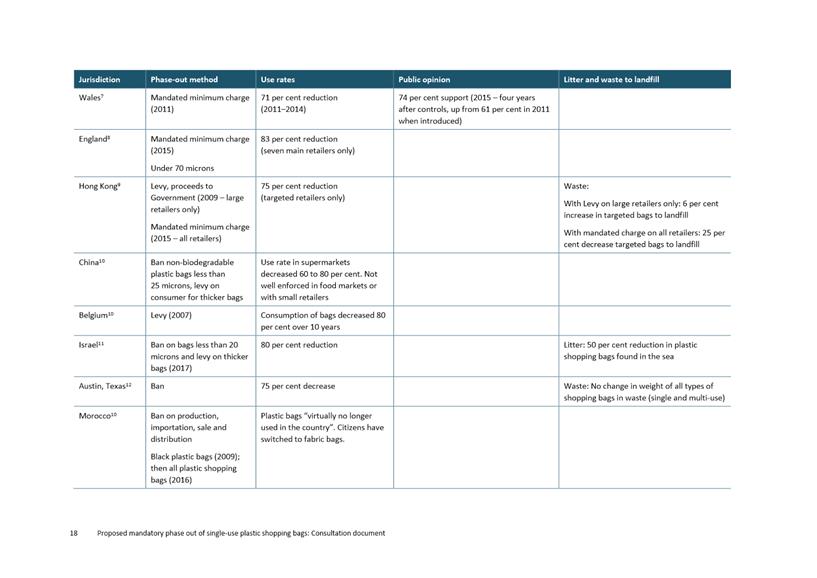

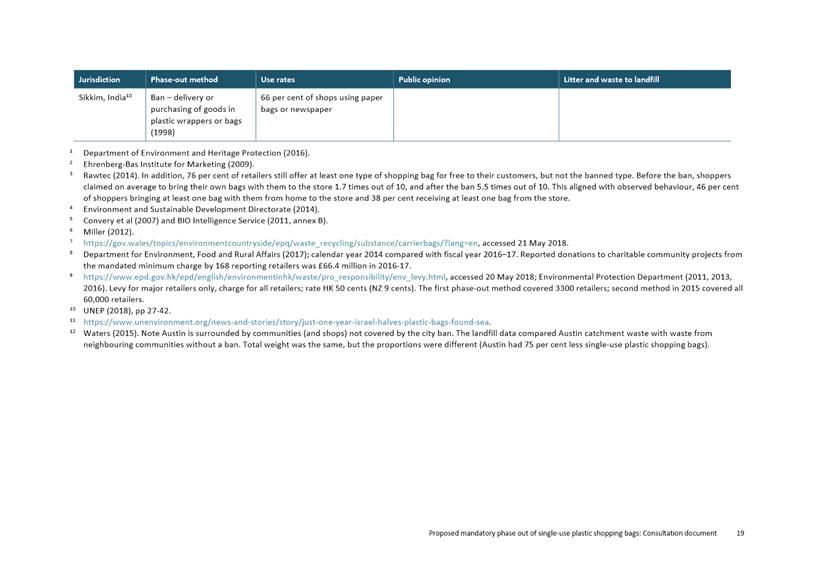

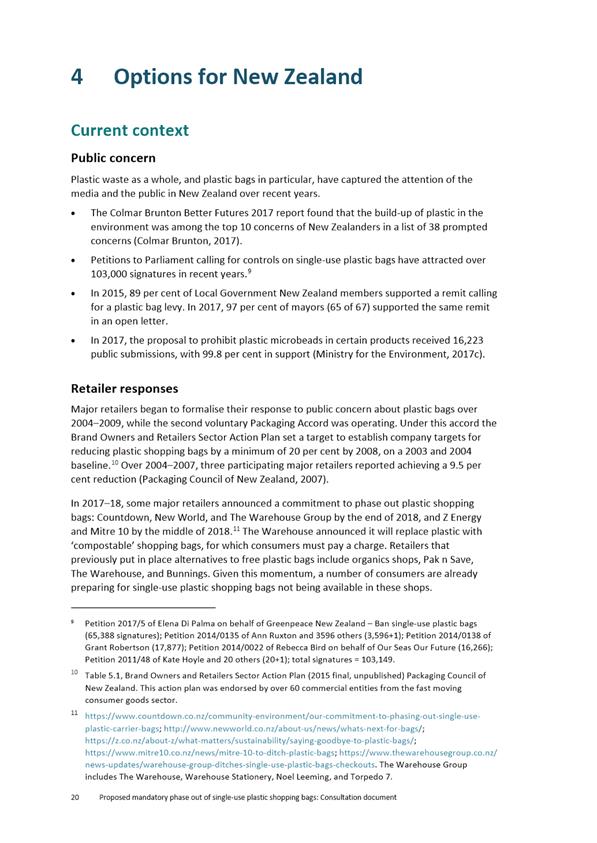

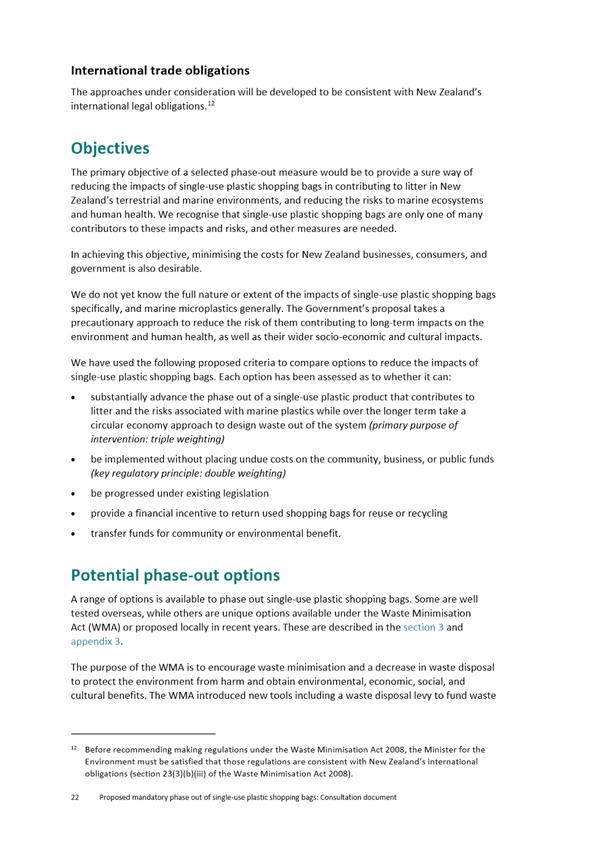

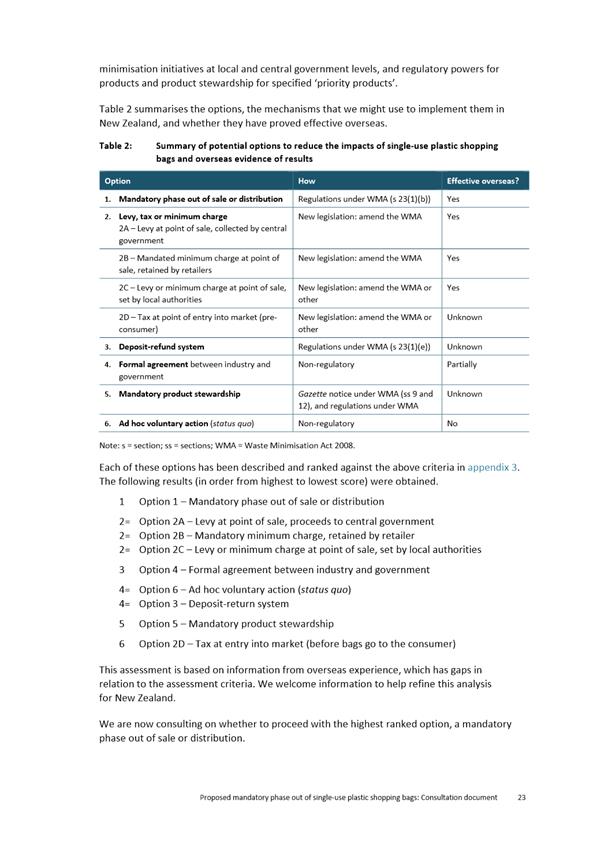

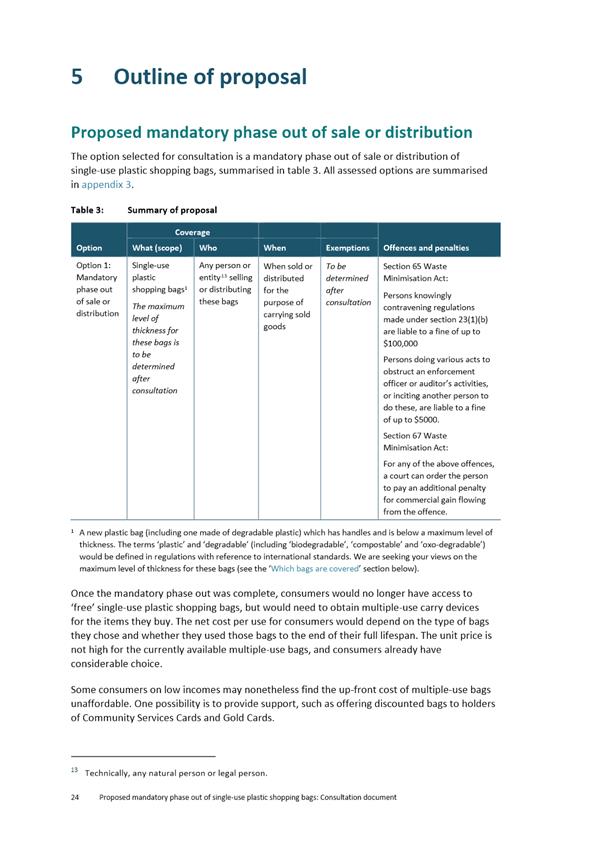

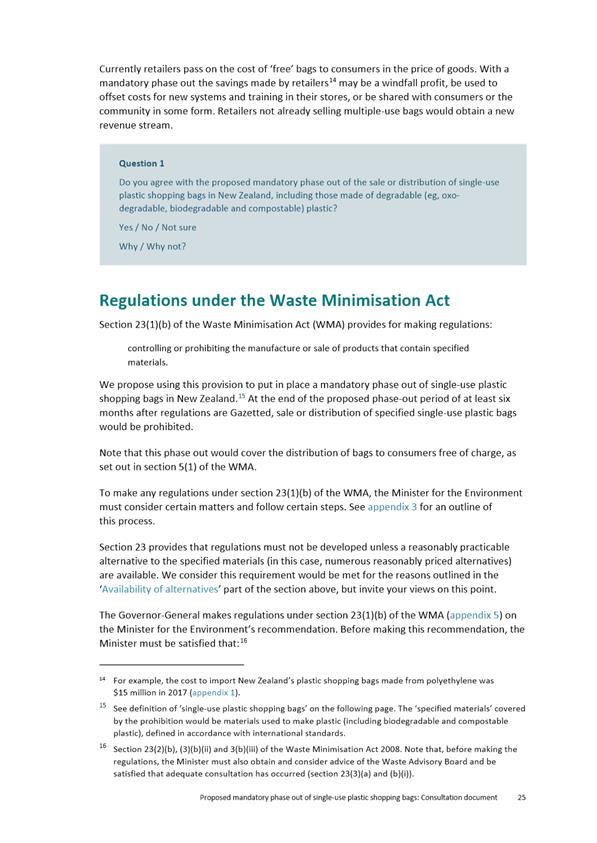

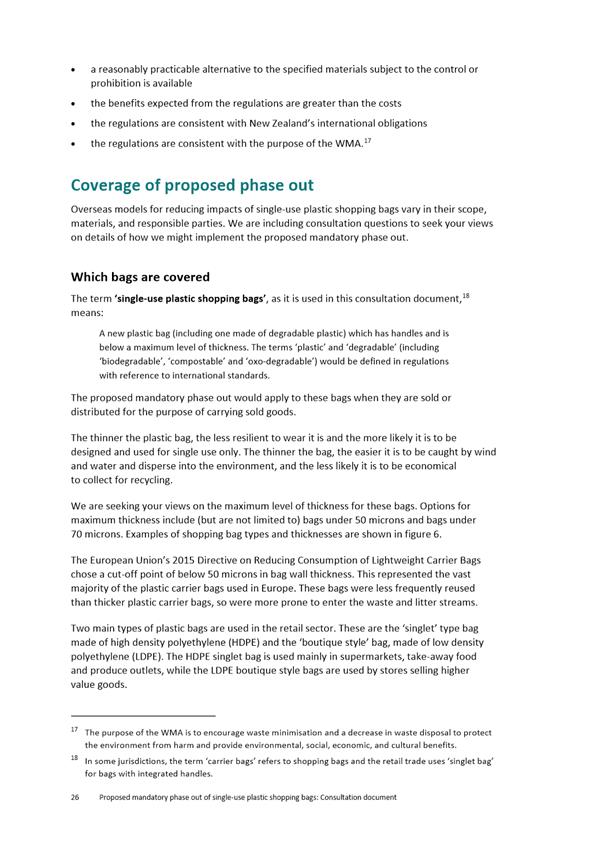

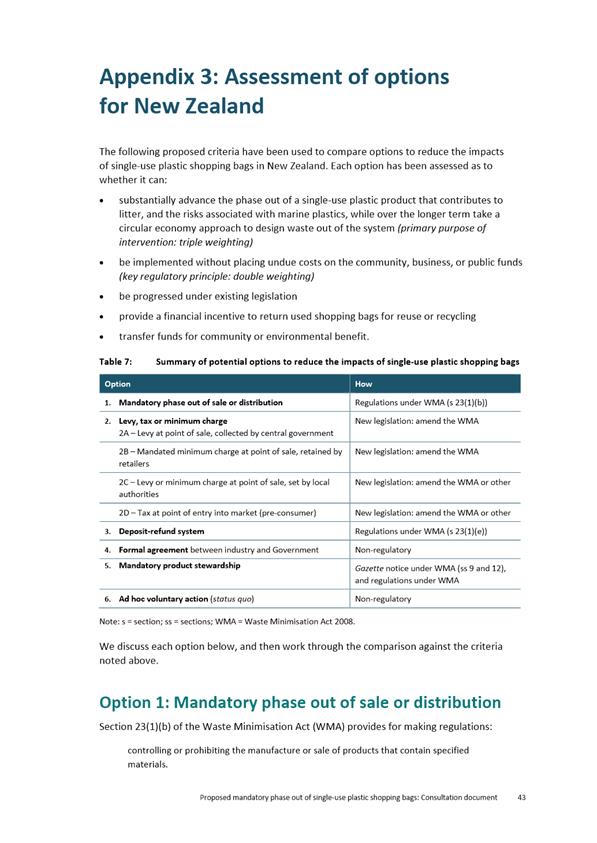

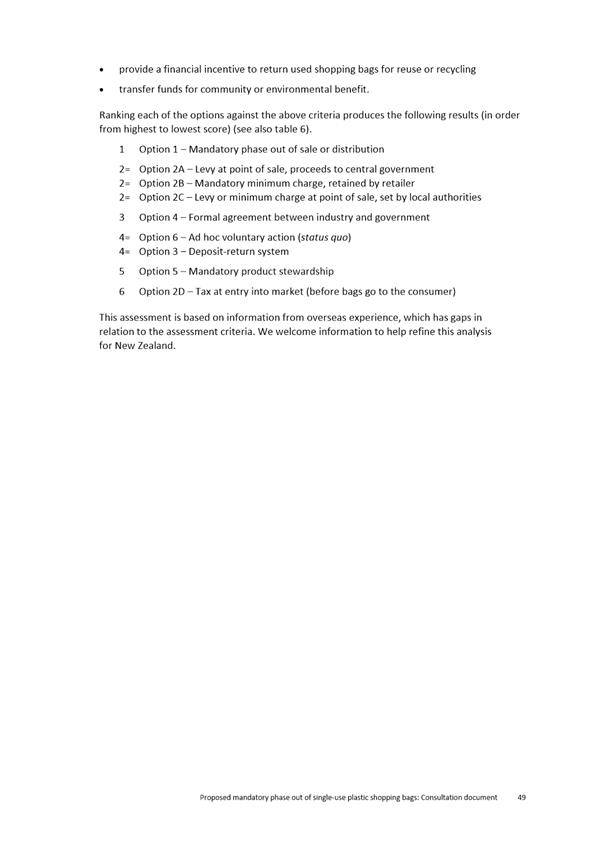

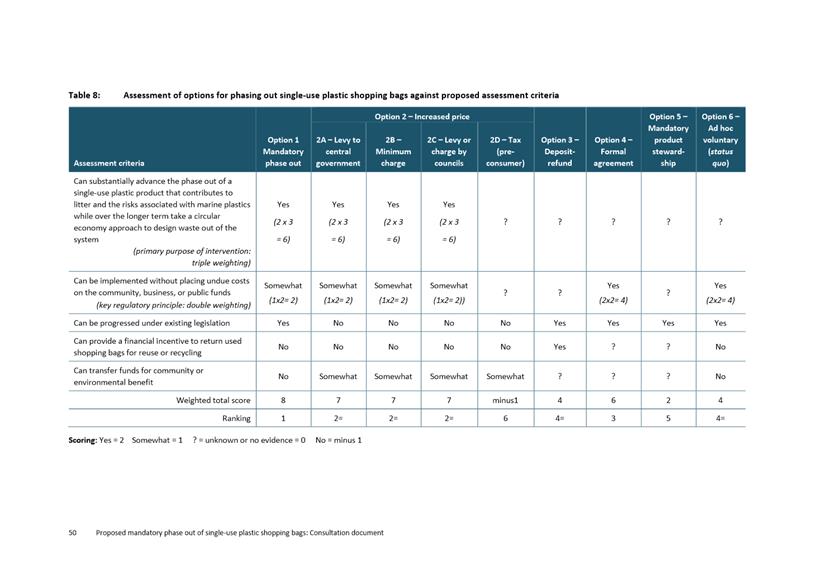

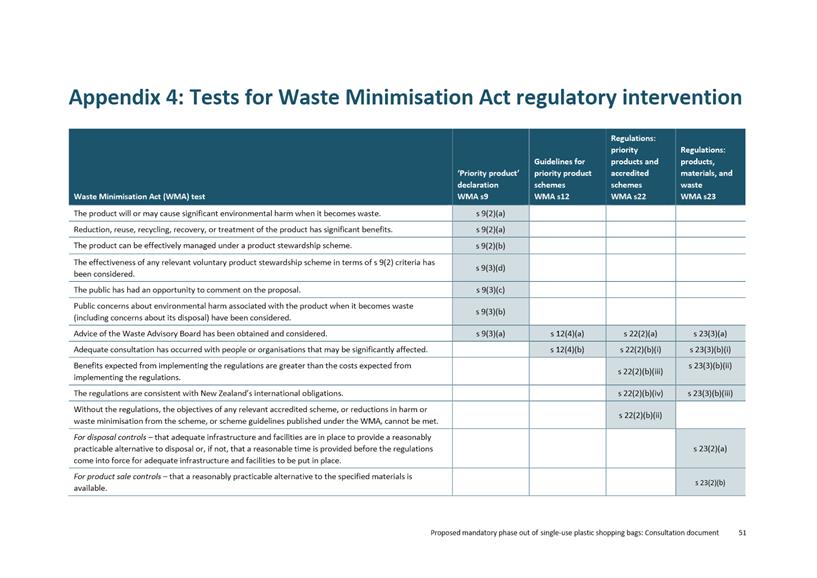

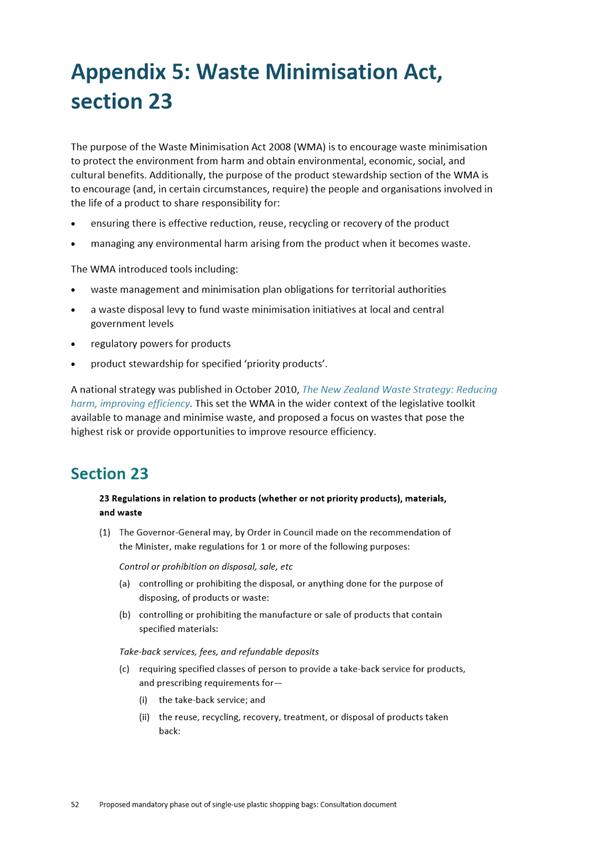

Submission on the phase out of single use

plastic shopping bags

Department: Waste and Environmental Solutions

EXECUTIVE SUMMARY

1 This

report provides a draft Dunedin City Council (DCC) submission (Attachment A) to

the Ministry for the Environment’s Discussion Document (Attachment B) on

the proposed phase out of single use plastic shopping bags. Submissions are due

5pm, Friday 14 September 2018.

2 The

Government is considering phasing out single-use plastic shopping bags in New

Zealand as one of many steps to reduce the negative environmental impacts of

plastic. At the same time, the Government will work toward a longer-term goal

of taking a ‘circular economy’ approach to waste – designing

for less waste and cycling resources, like plastics, back into the economy.

3 There

are 10 proposed options and the attached draft submission supports option 1,

the mandatory phase out of sale or distribution of single use plastic shopping

bags.

4 The

DCC submission notes the first option aligns with the DCC’s support for

local grass root initiatives and petitions calling for the ban of single use

plastic shopping bags.

|

RECOMMENDATIONS

That the Committee:

a) Approves

the draft submission.

|

Signatories

|

Author:

|

Chris Henderson - Group Manager Waste and Environmental

Solutions

|

|

Authoriser:

|

Leanne Mash - General Manager Infrastructure and Networks

(Acting)

|

Attachments

|

|

Title

|

Page

|

|

a

|

Draft Submission

|

36

|

|

b

|

Discussion Document:

Phase out of single use plastic bags

|

37

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision/report/proposal enables democratic local

decision making and action by, and on behalf of communities.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

This submission relates to the DCC’s Waste

Minimisation and Management Plan.

|

|

Māori Impact

Statement

There are no known local impacts for tangata whenua.

|

|

Sustainability

Supporting the Government’s actions in terms of

waste minimisation and a circular economy are aligned with the DCC’s

ambitions around zero carbon and sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no known implications for the 10 Year Plan or

Annual Plan.

|

|

Financial

considerations

There are no direct financial implications of this

submission.

|

|

Significance

This submission is considered to be of low significance in

terms of the Council’s Significance and Engagement Policy.

|

|

Engagement –

external

There has been no external engagement.

|

|

Engagement -

internal

This submission has been developed by Waste and

Environmental Solutions and Corporate Policy.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no specific implications for Community Boards.

|

|

Economic Development

Committee

11 September 2018

|

|

|

Economic Development Committee

11 September 2018

|

|

|

Economic Development

Committee

11 September 2018

|

|

|

Economic Development

Committee

11 September 2018

|

|

|

Economic Development Committee

11 September 2018

|

|

|

Economic Development

Committee

11 September 2018

|

|

|

Economic Development

Committee

11 September 2018

|

|

Items for Consideration by the Chair