Notice of Meeting:

I hereby give notice that an ordinary meeting of the Finance

and Council Controlled Organisations Committee will be held on:

Date: Tuesday

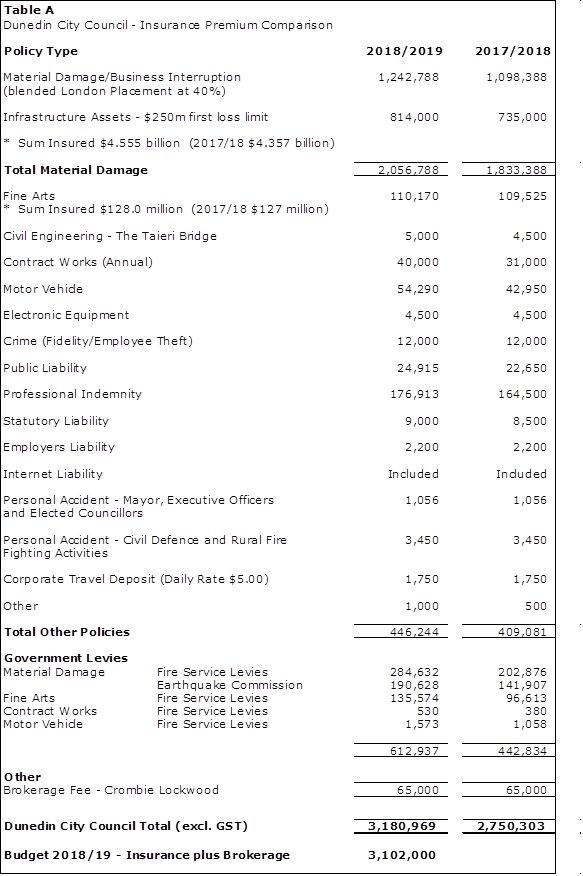

11 September 2018

Time: 1.30

pm (or at the conclusion of the previous meeting, whichever is later)

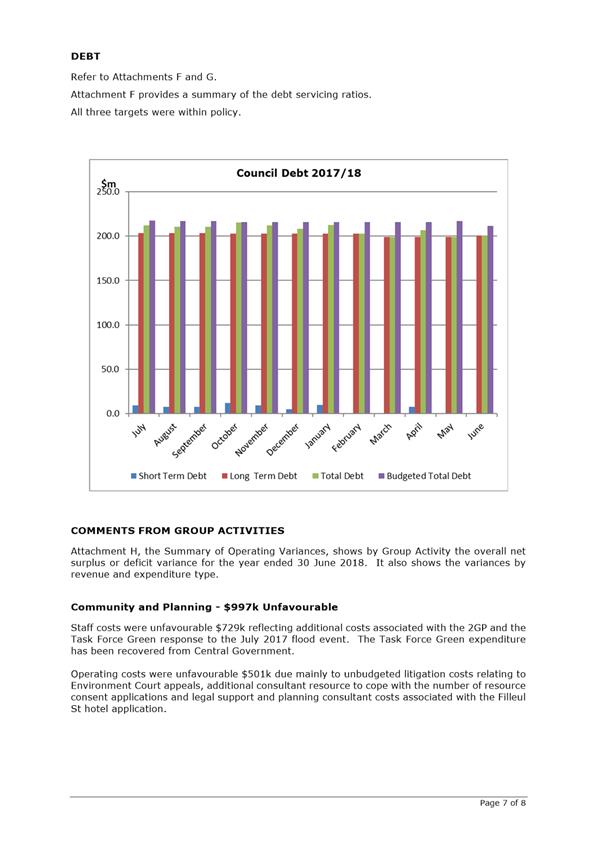

Venue: Edinburgh

Room, Municipal Chambers, The Octagon, Dunedin

Sue Bidrose

Finance and Council Controlled Organisations Committee

PUBLIC AGENDA

|

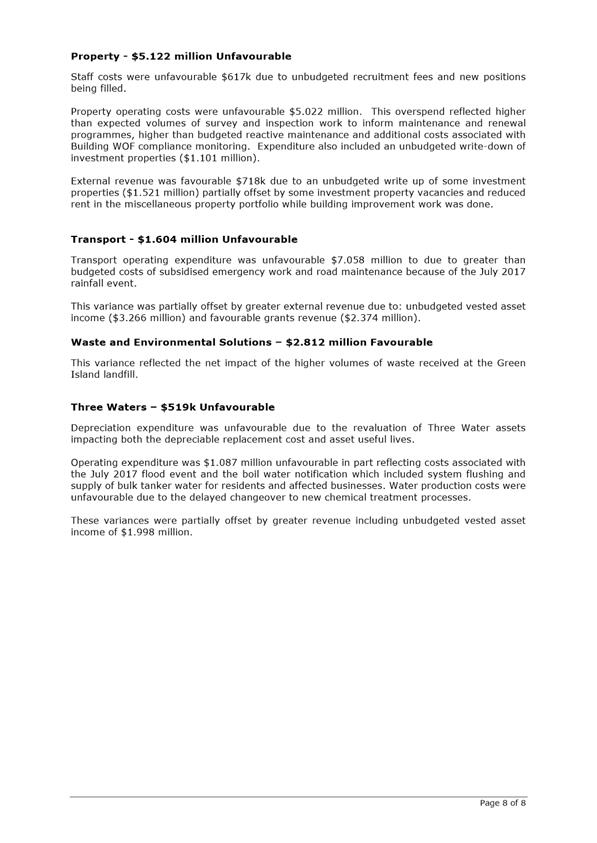

Chairperson

|

Mike Lord

|

|

|

Deputy Chairperson

|

Doug Hall

|

|

|

Members

|

David Benson-Pope

|

Dave Cull

|

|

|

Rachel Elder

|

Christine Garey

|

|

|

Aaron Hawkins

|

Marie Laufiso

|

|

|

Damian Newell

|

Jim O'Malley

|

|

|

Chris Staynes

|

Conrad Stedman

|

|

|

Lee Vandervis

|

Andrew Whiley

|

|

|

Kate Wilson

|

|

Senior Officer Dave

Tombs, General Manager Finance and Commercial

Governance Support Officer Jenny

Lapham

Jenny Lapham

Governance Support Officer

Telephone: 03 477 4000

Jenny.Lapham@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

ITEM TABLE OF CONTENTS PAGE

1 Public

Forum 4

2 Apologies 4

3 Confirmation

of Agenda 4

4 Declaration

of Interest 5

Part

A Reports (Committee has power to decide these matters)

5 Waipori

Fund - Quarter Ending June 2018 15

6 Financial

Result - Year Ended 30 June 2018 22

7 Insurance

Renewal Year Ended 30 June 2019 43

8 Items

for Consideration by the Chair 52

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

1 Public

Forum

At the close of the agenda no

requests for public forum had been received.

2 Apologies

Apologies have been received from Mayor

Dave Cull and Cr Rachel Elder.

That the Committee:

Accepts the apologies from Mayor

Dave Cull and Cr Rachel Elder.

3 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

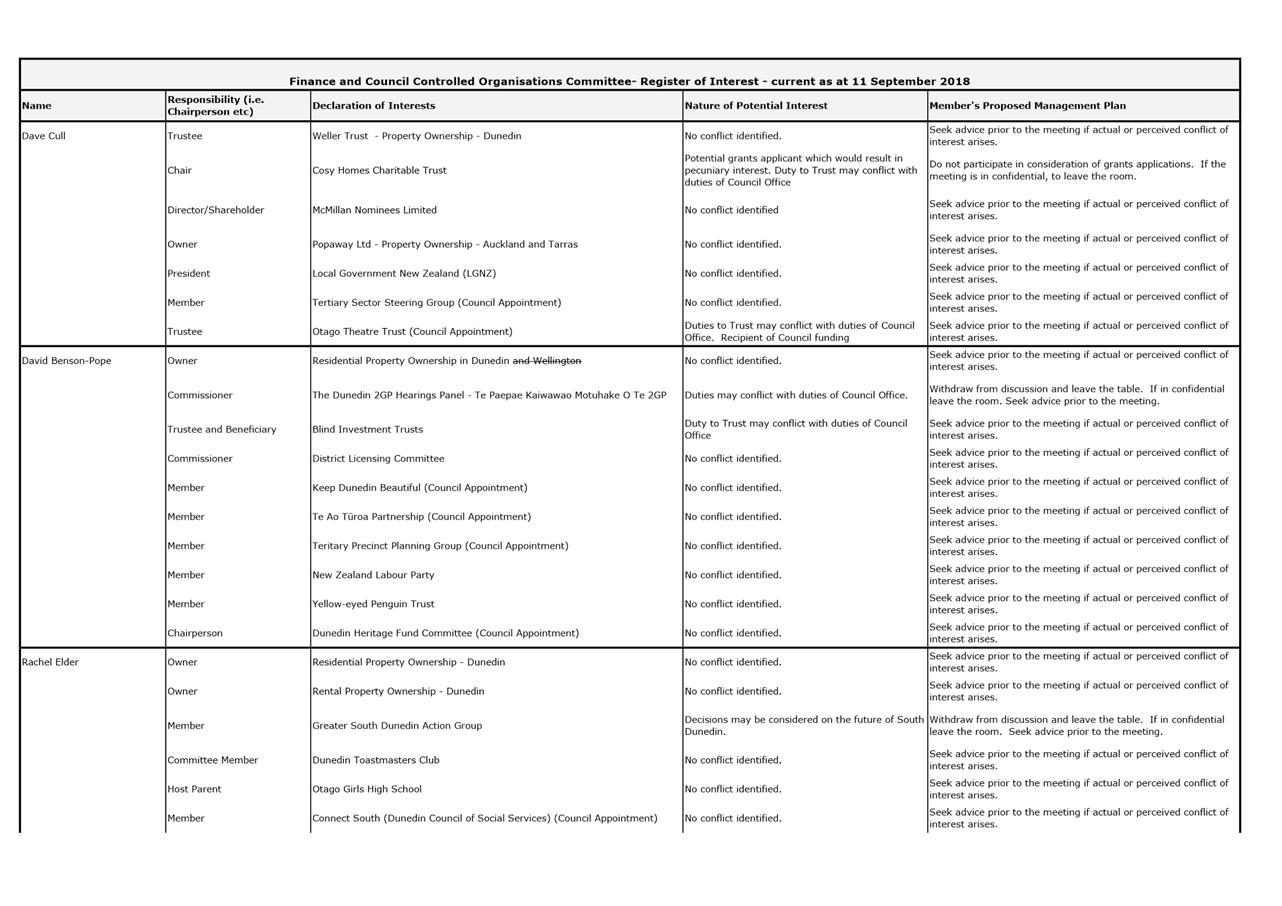

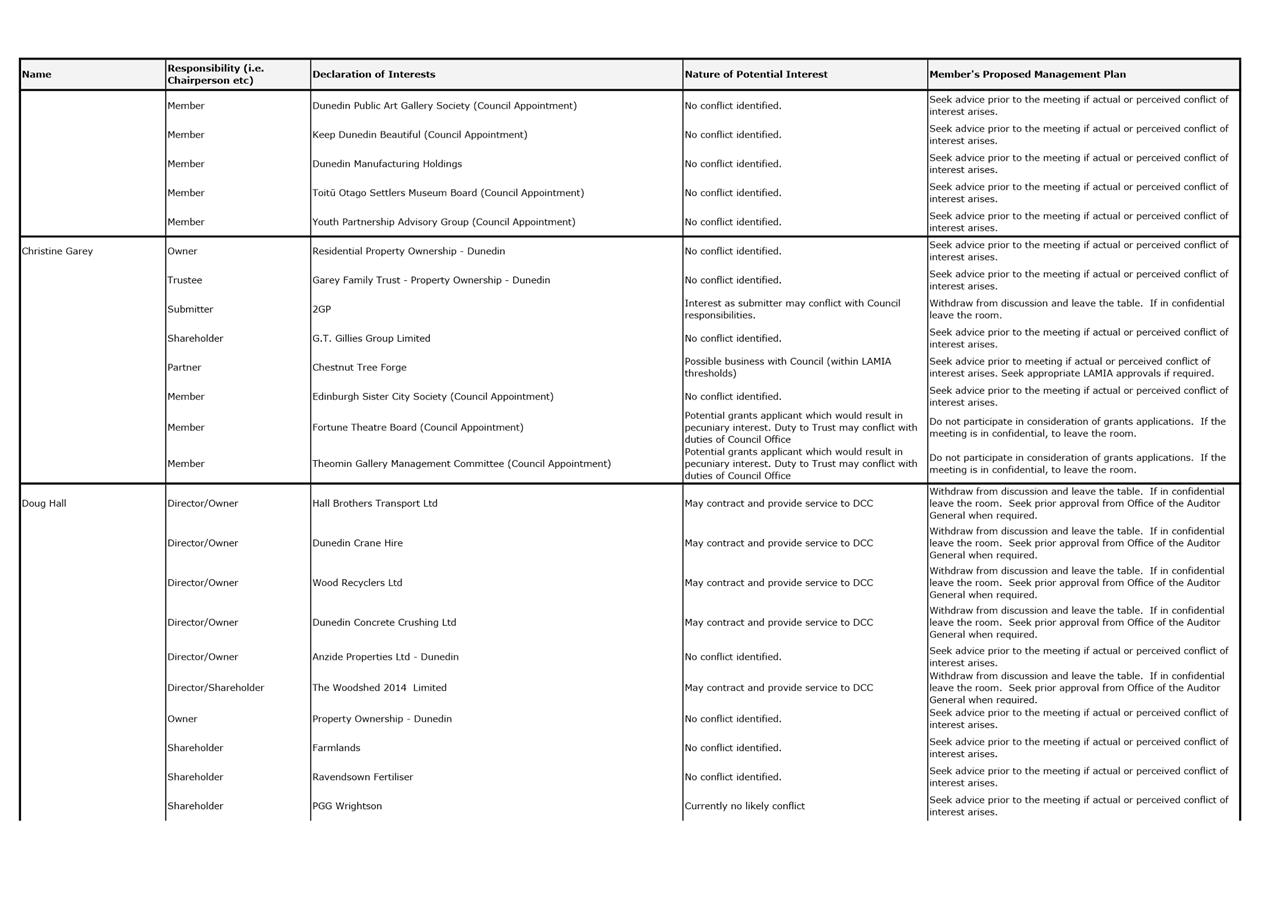

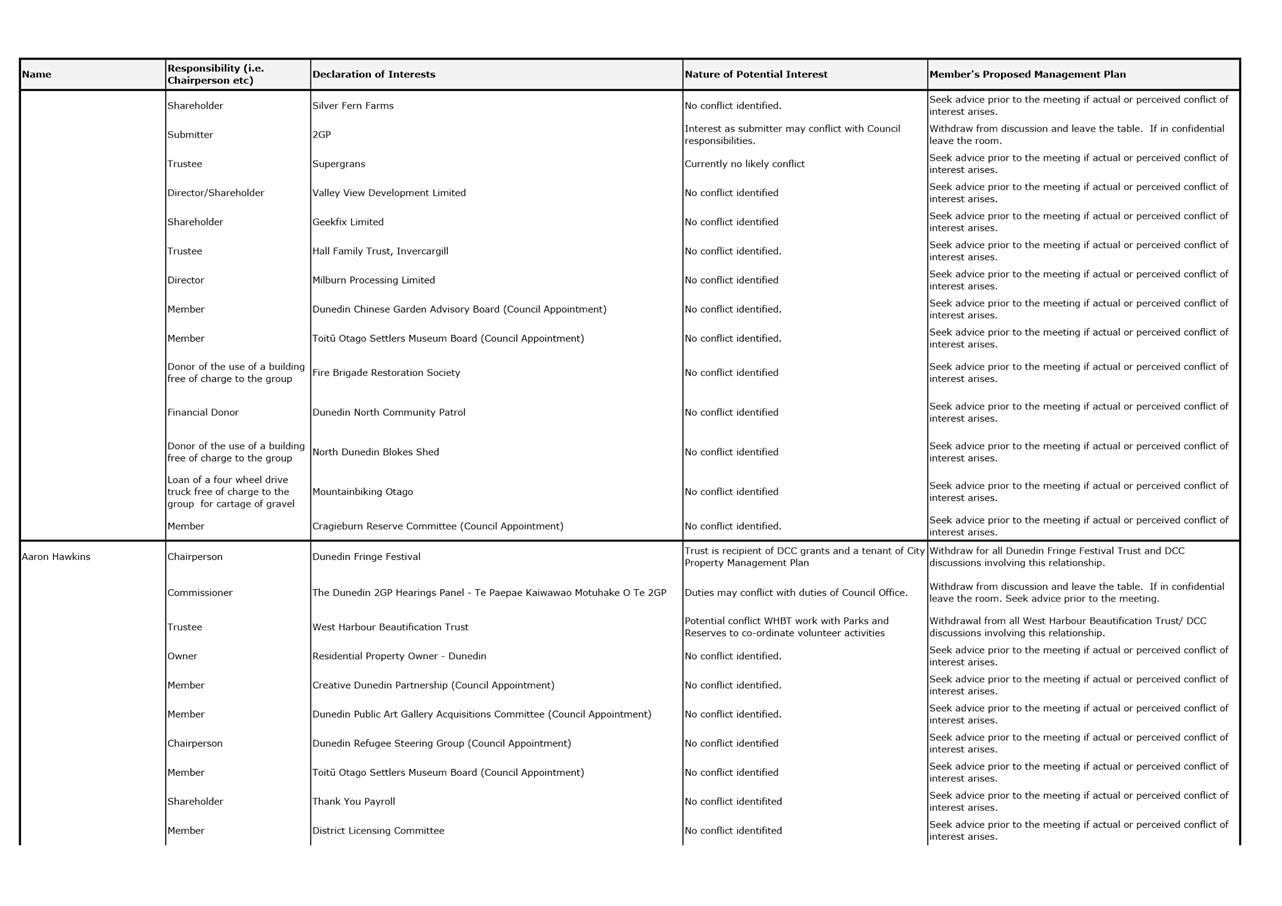

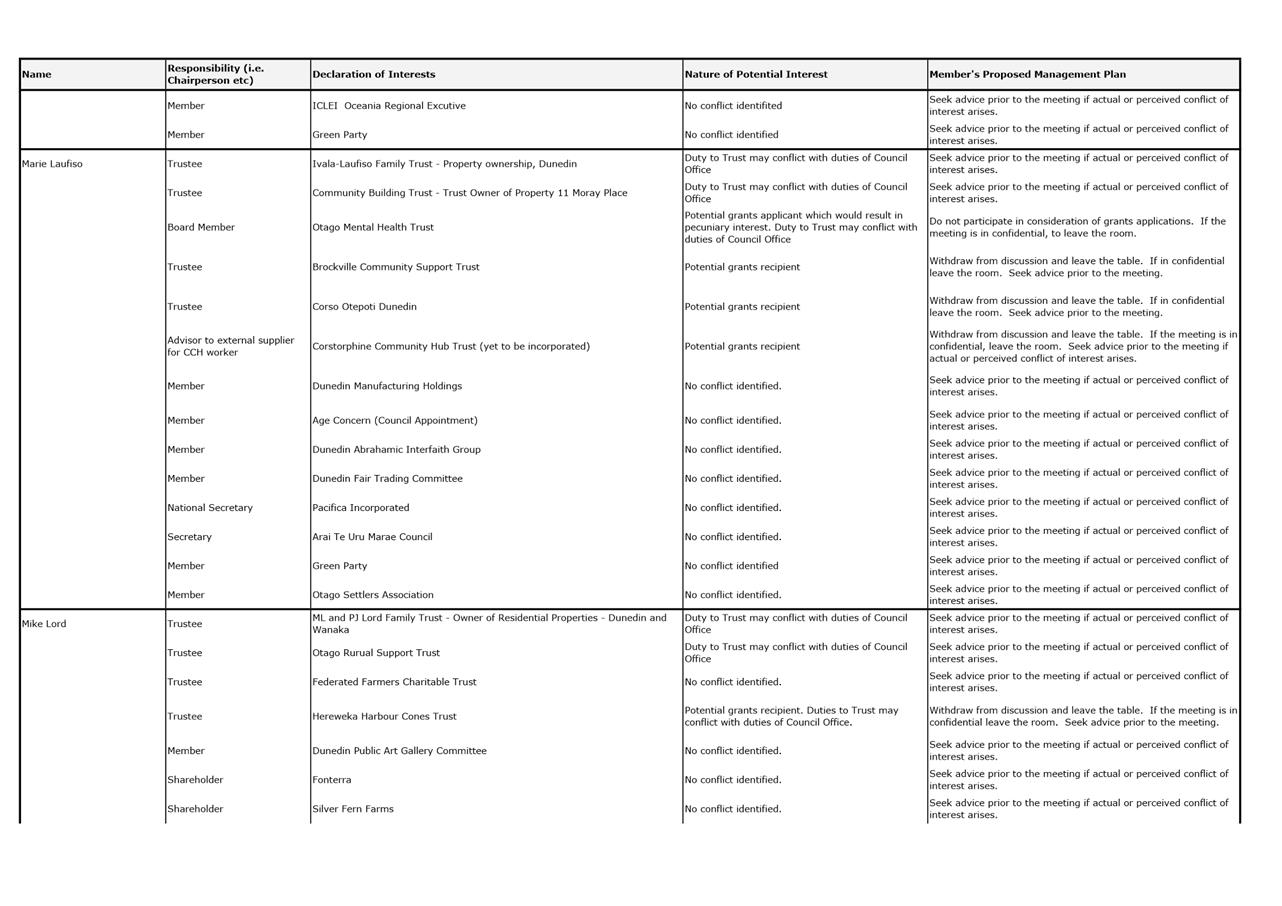

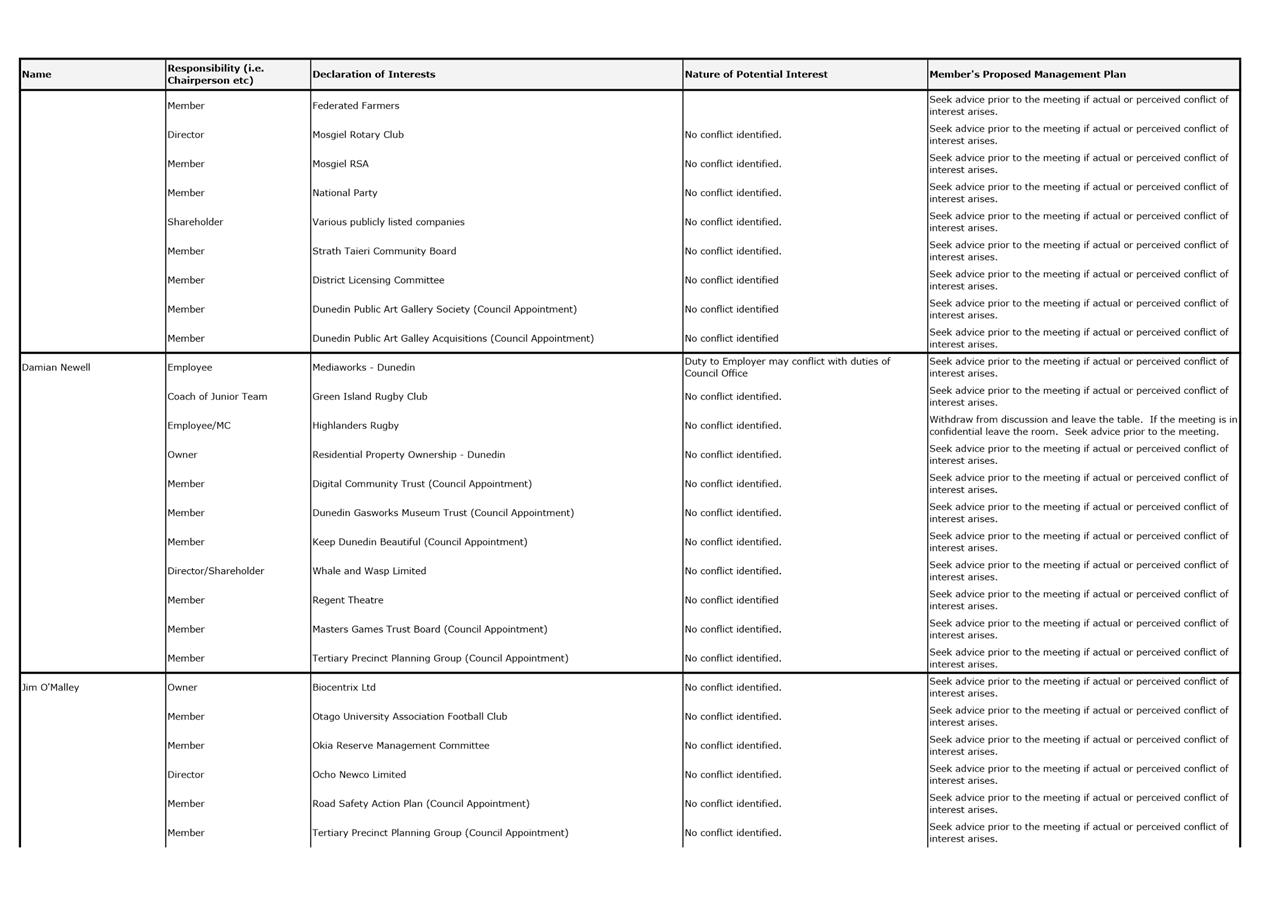

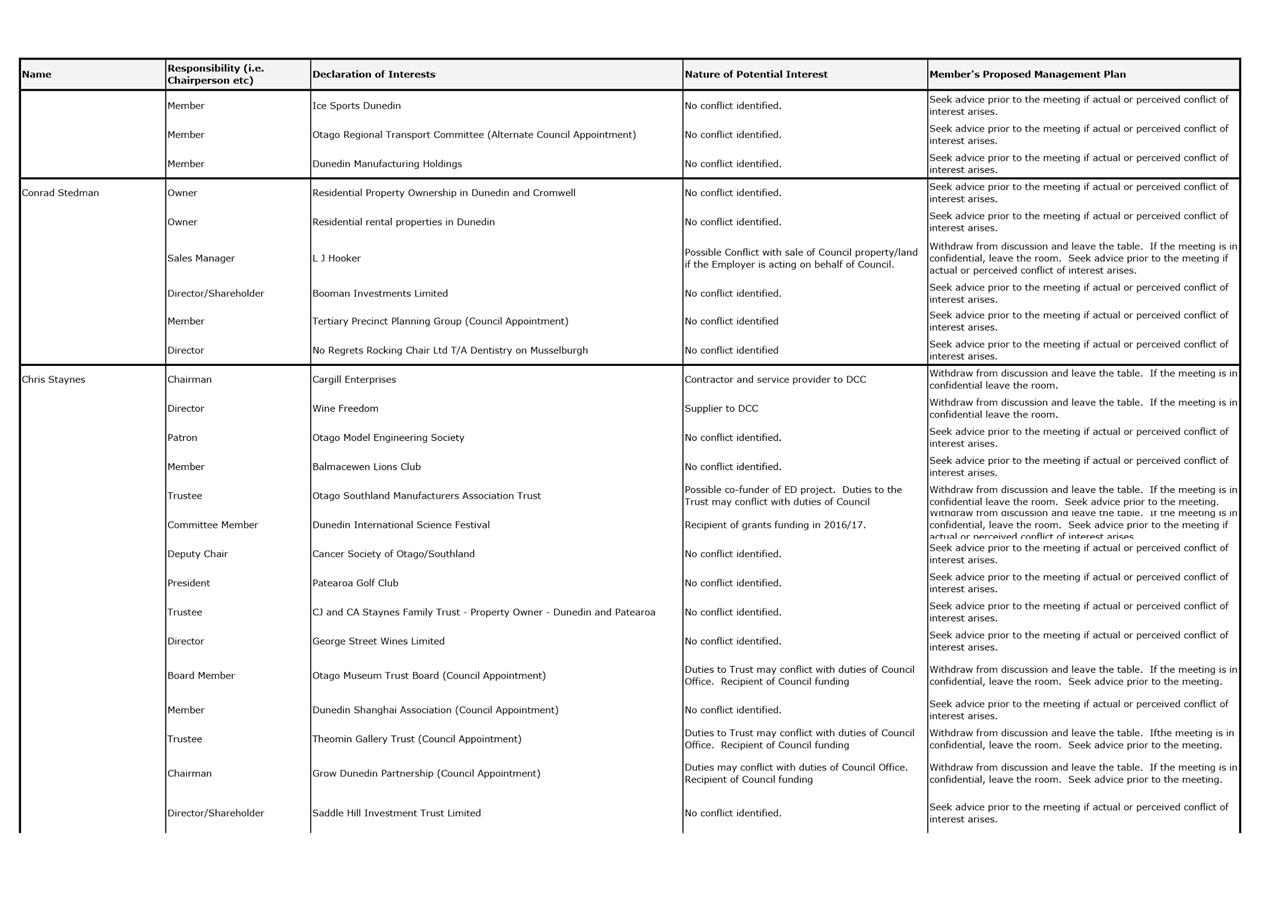

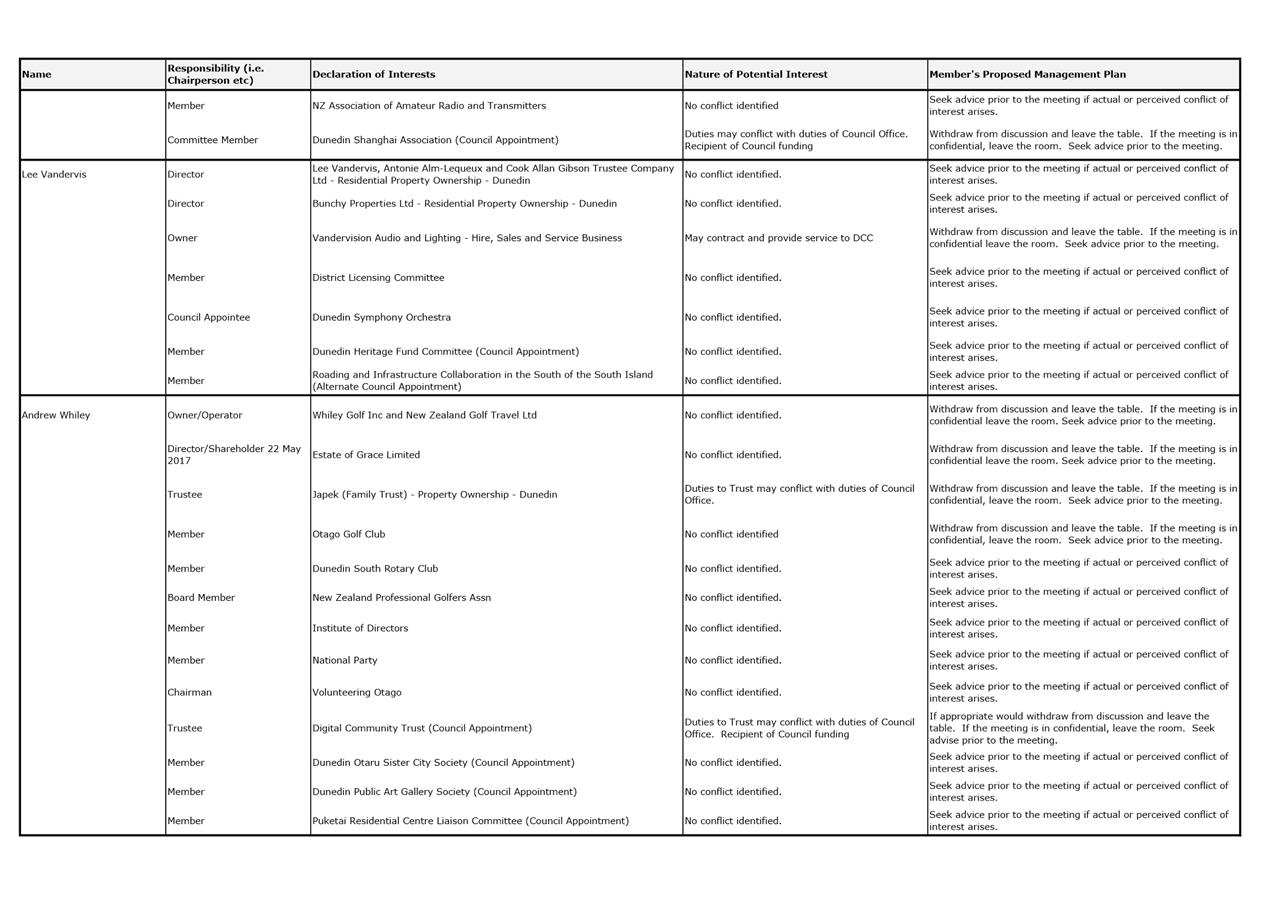

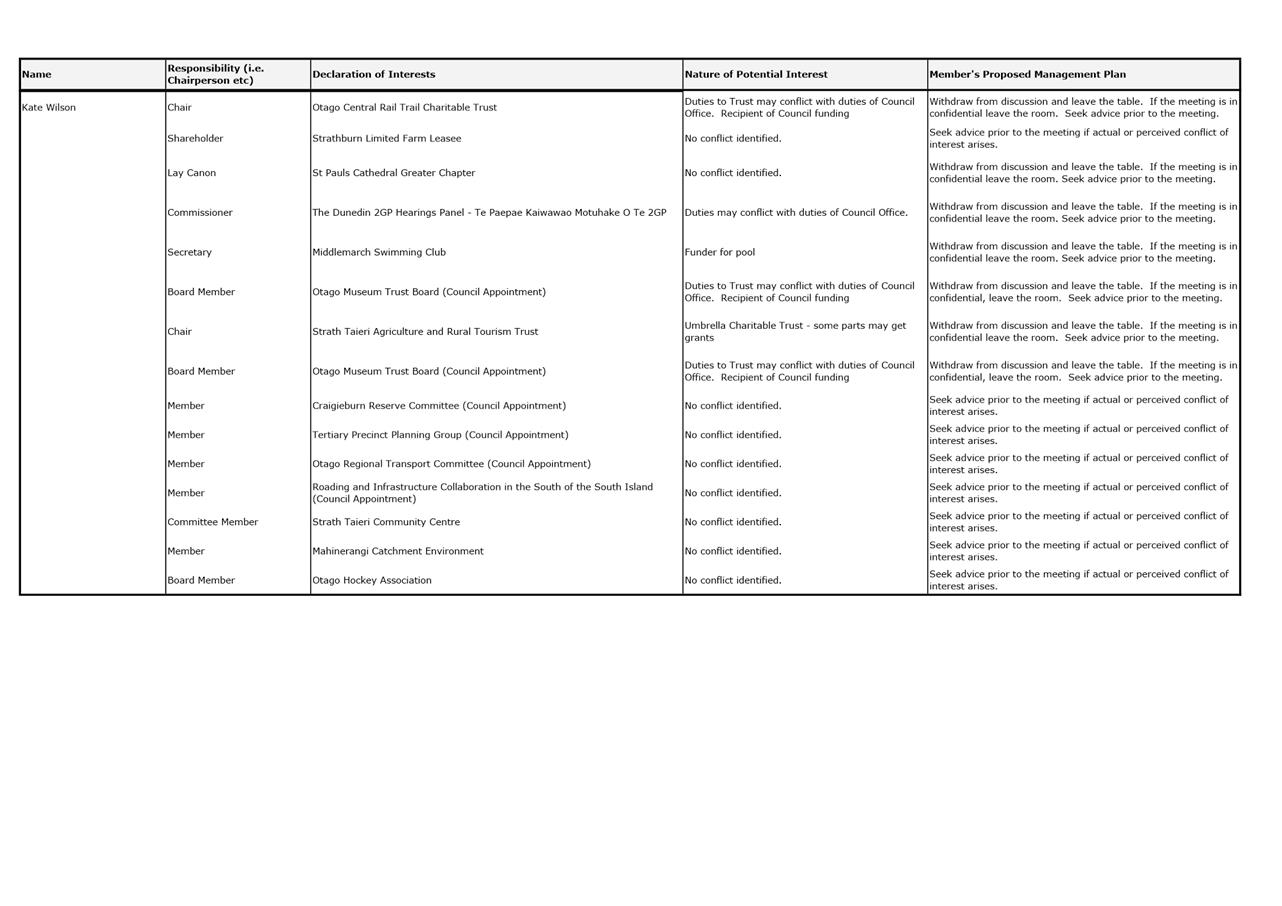

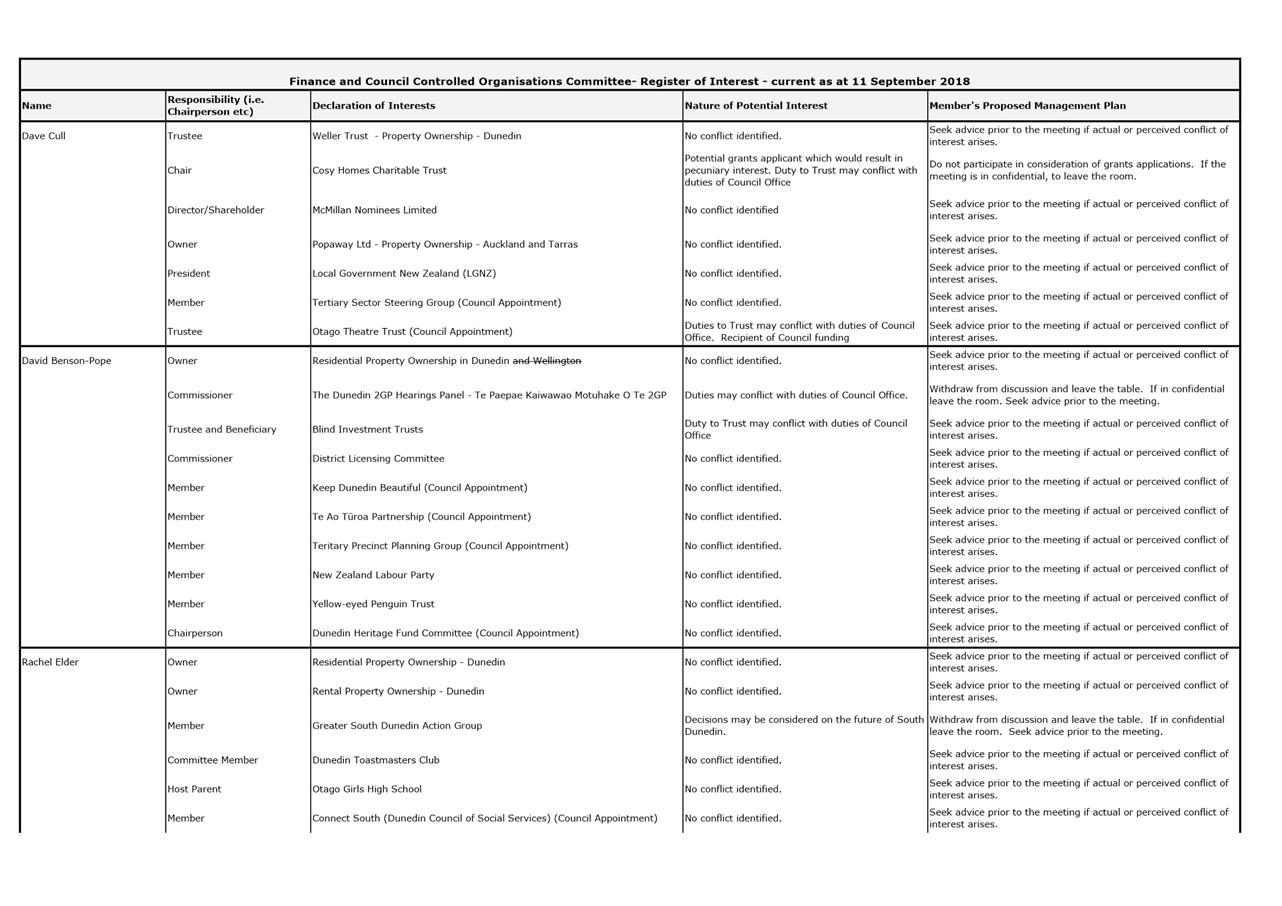

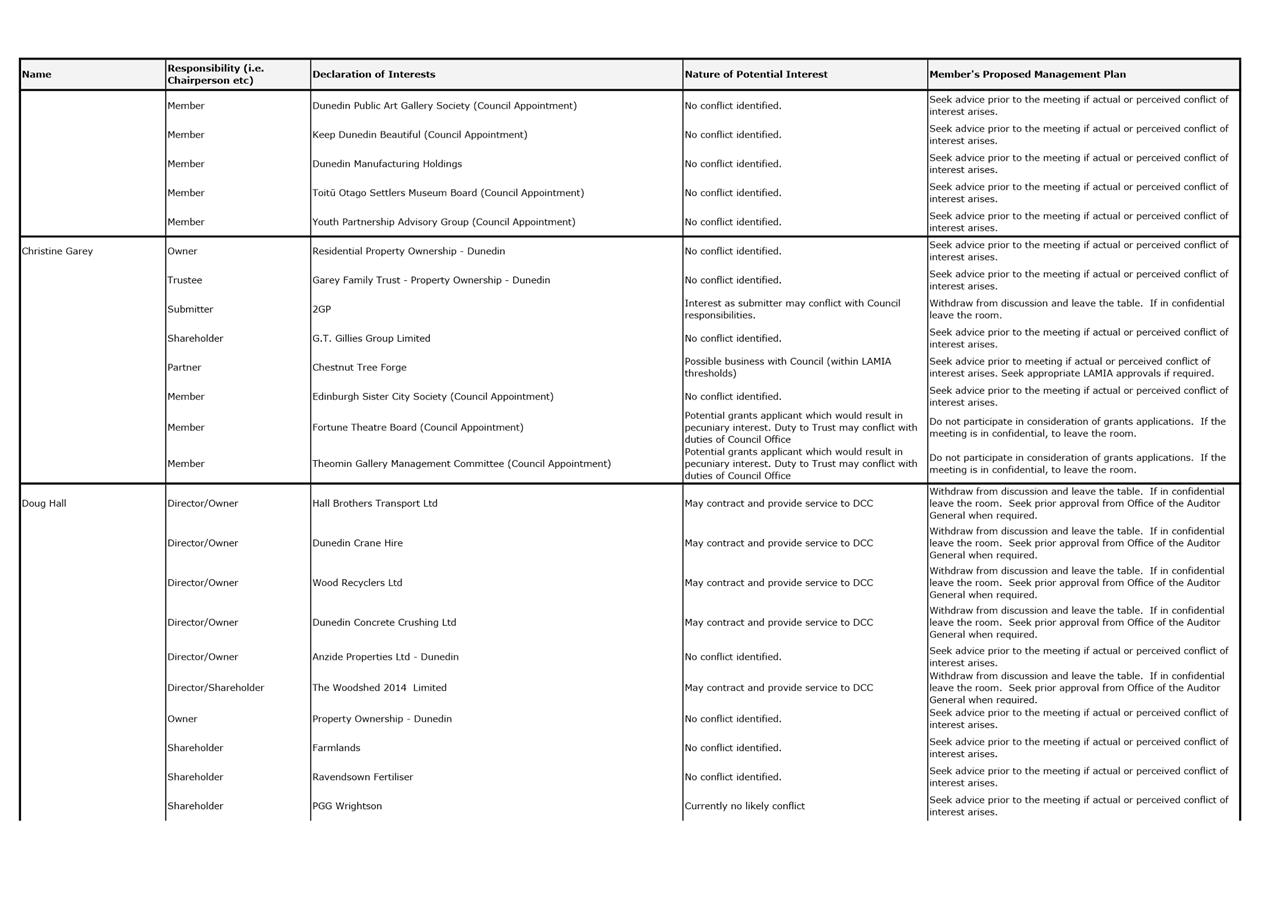

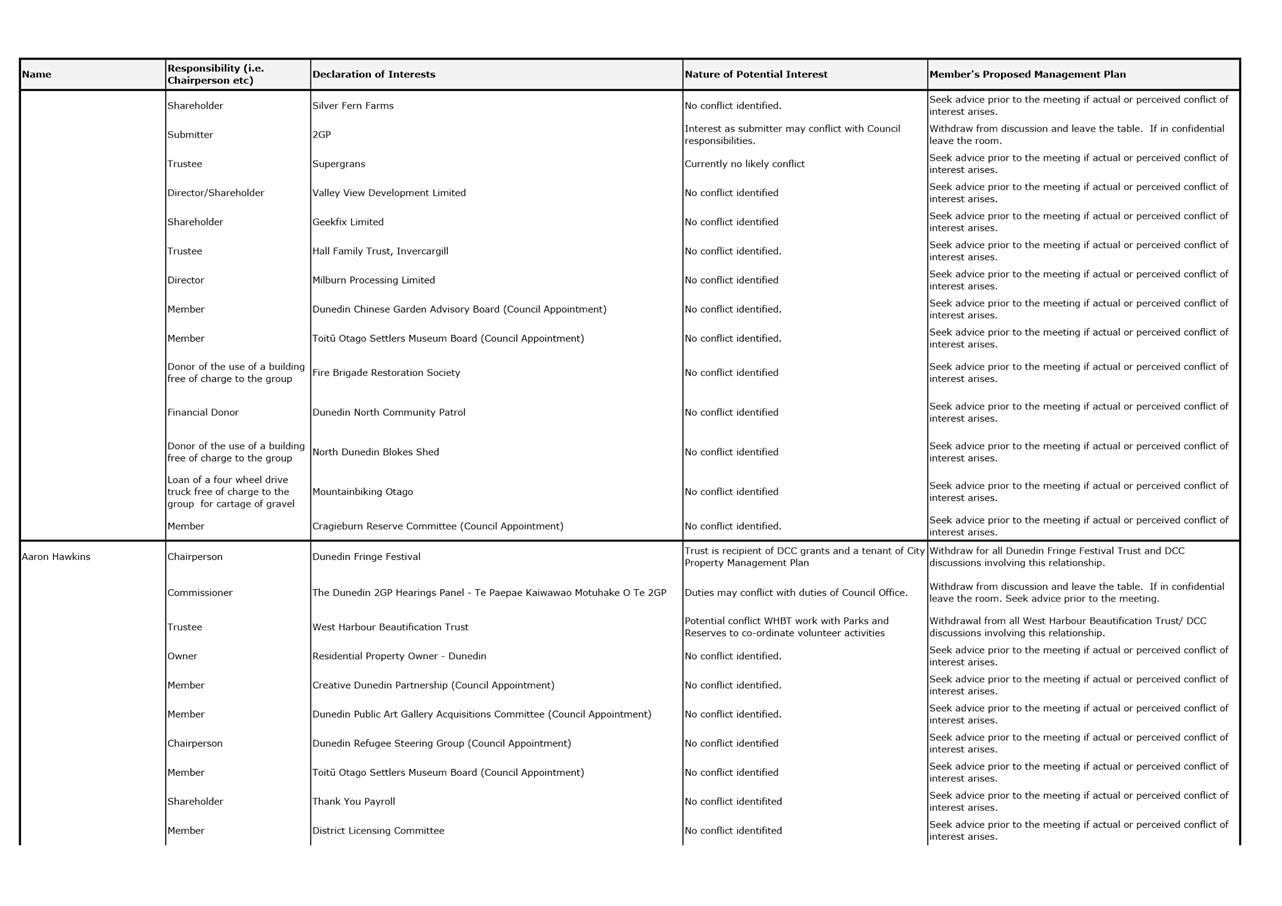

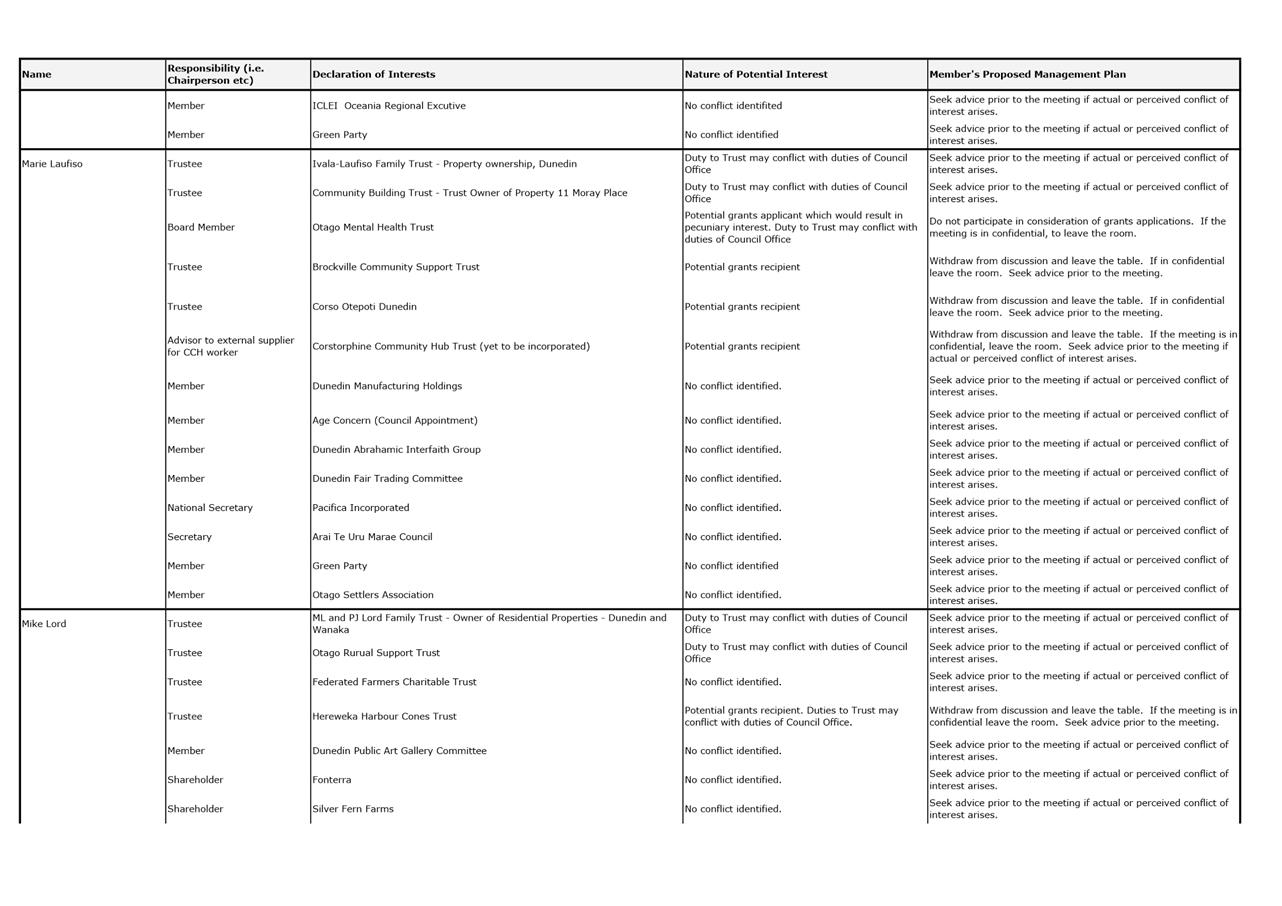

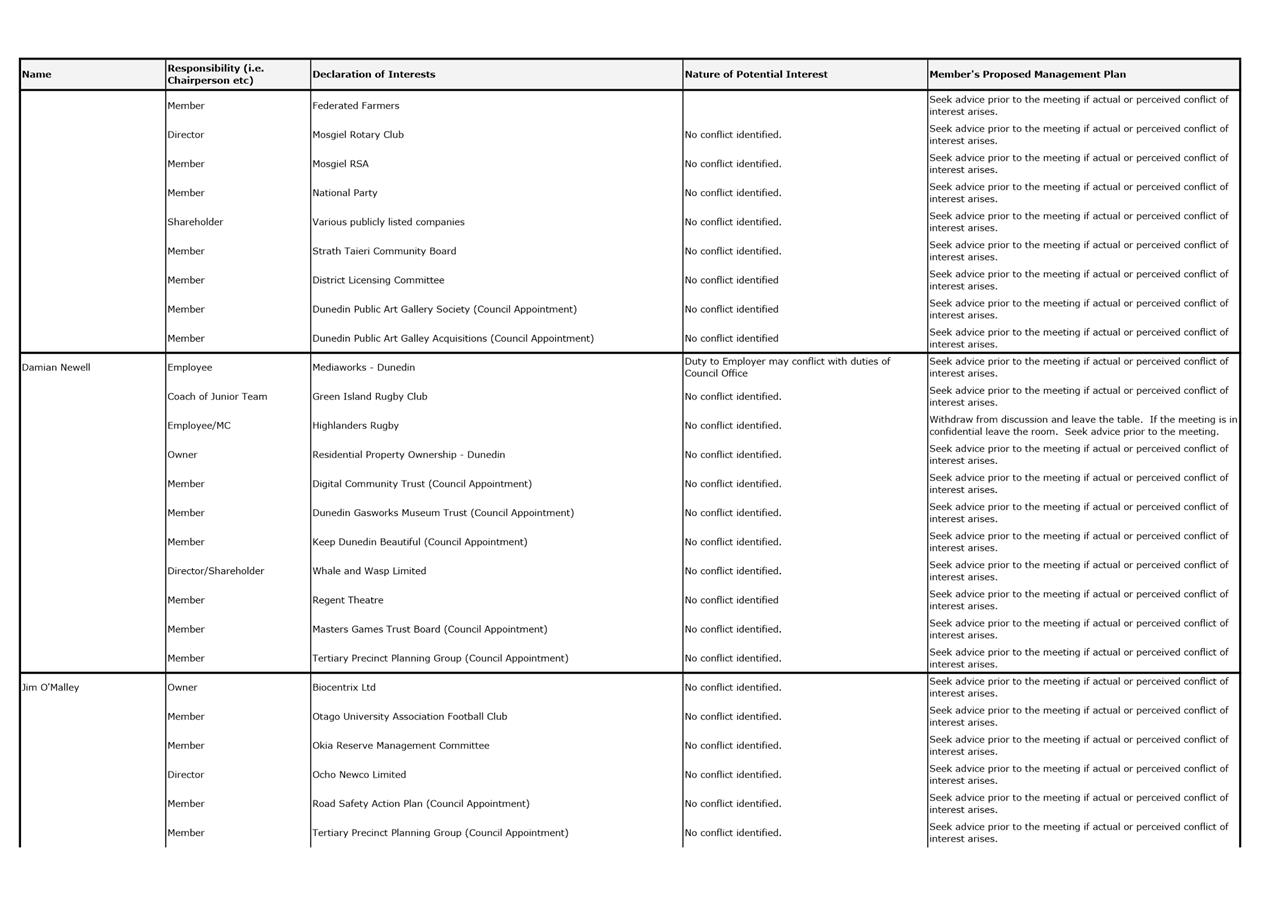

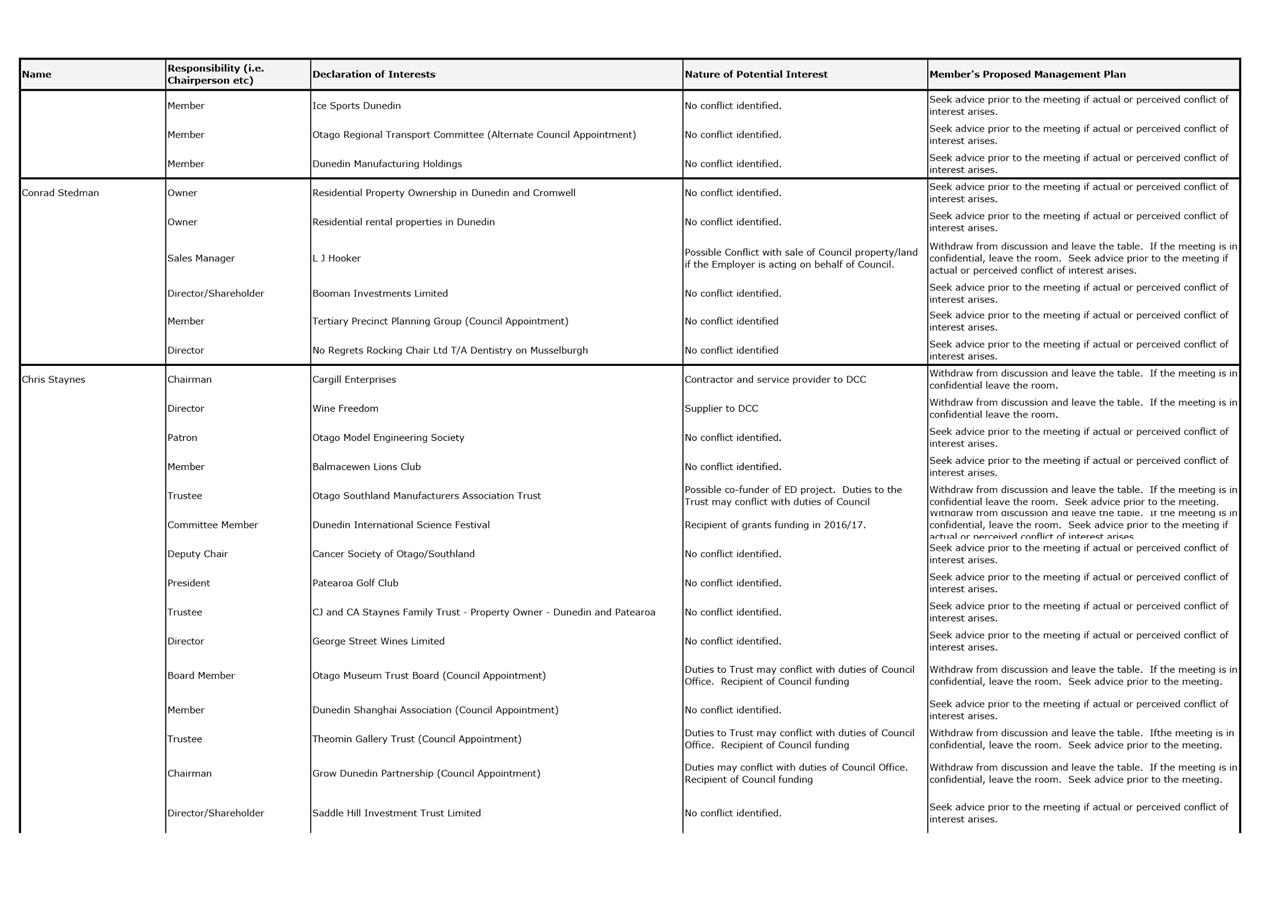

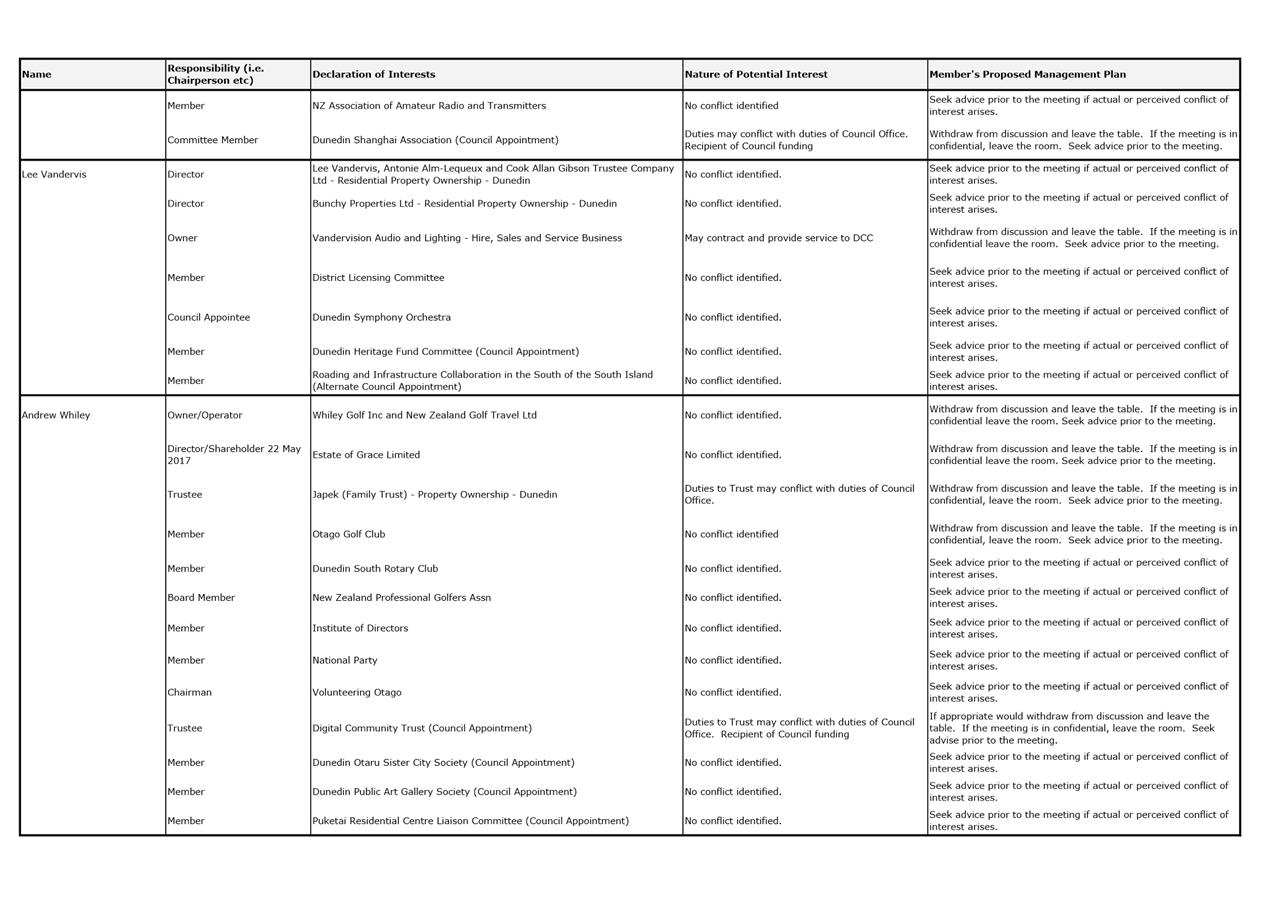

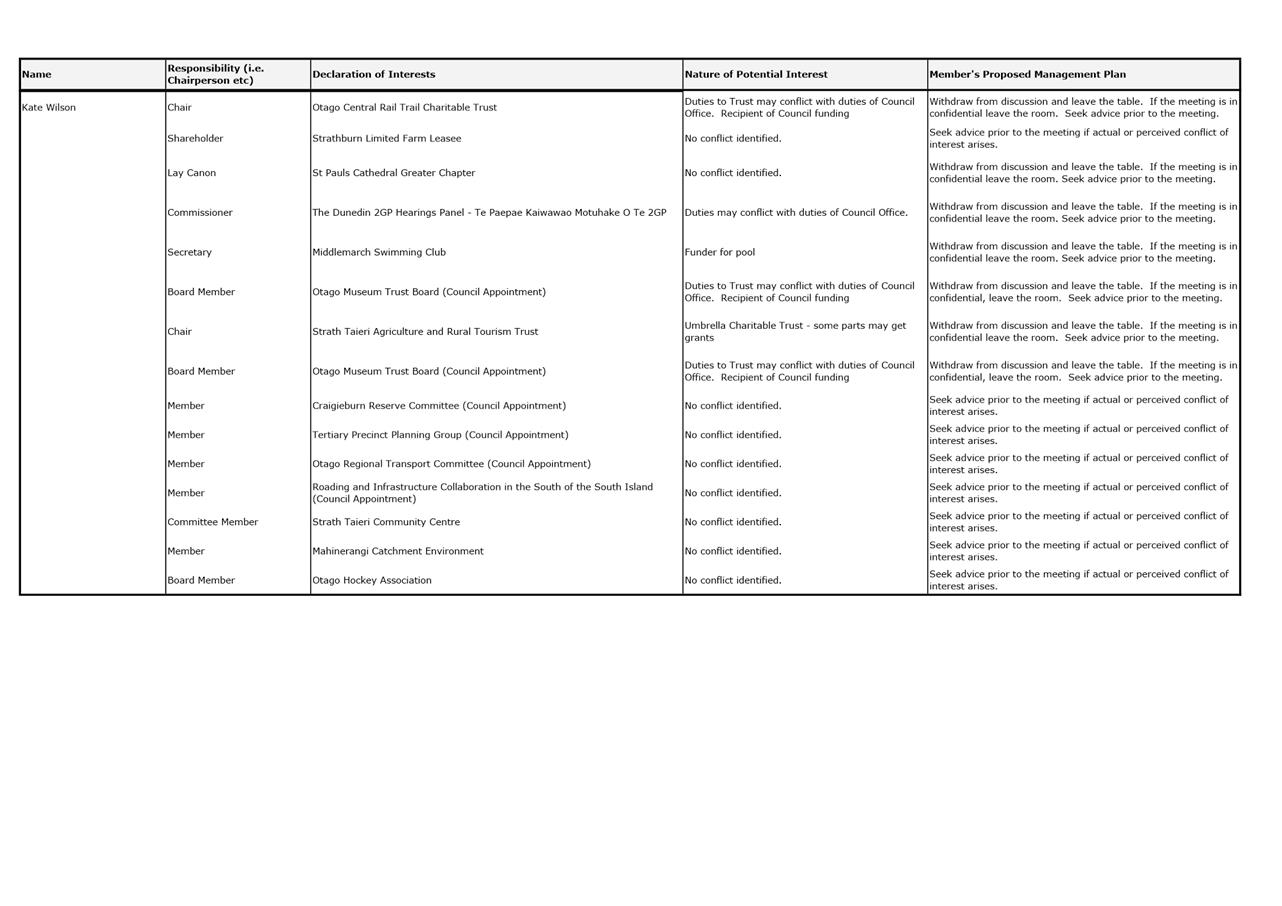

Declaration of Interest

EXECUTIVE SUMMARY

1. Members are reminded of the need

to stand aside from decision-making when a conflict arises between their role

as an elected representative and any private or other external interest they

might have.

2. Elected

members are reminded to update their register of interests as

soon as practicable, including amending the register at this meeting if

necessary.

|

RECOMMENDATIONS

That the Committee:

a) Notes/Amends

if necessary the Elected Members' Interest Register attached as Attachment A;

and

b) Confirms/Amends the proposed management plan for Elected Members' Interests.

|

Attachments

|

|

Title

|

Page

|

|

a

|

Register of Interest

|

7

|

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

Part

A Reports

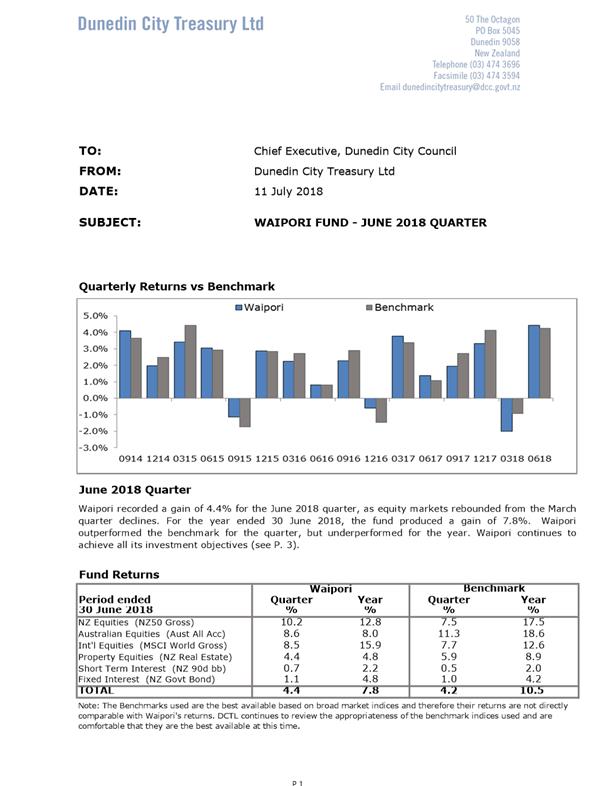

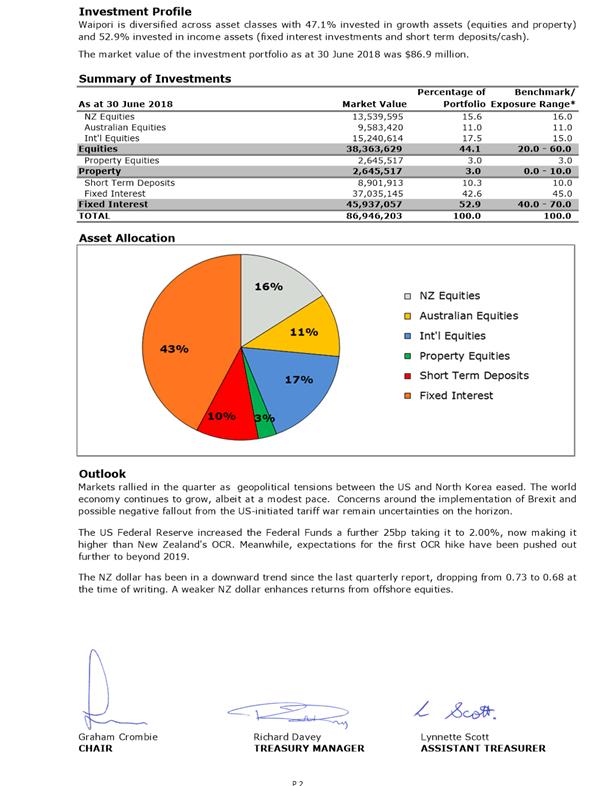

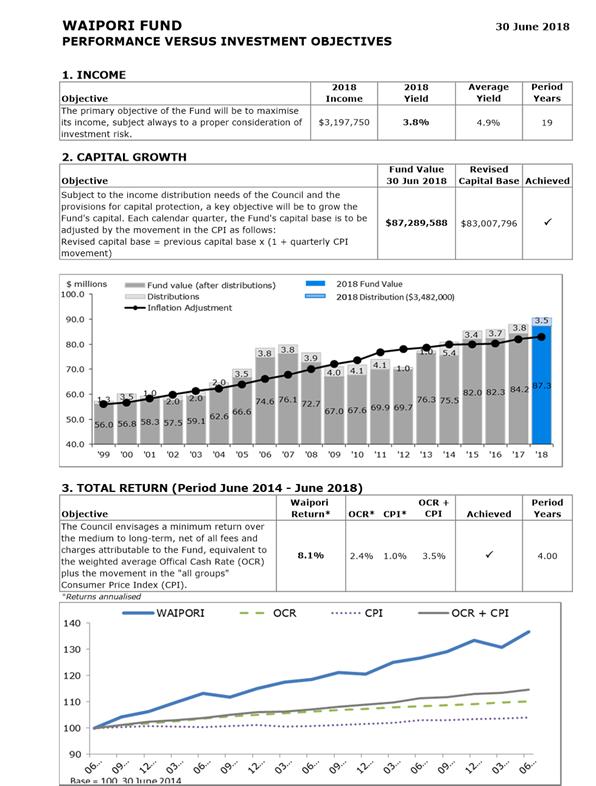

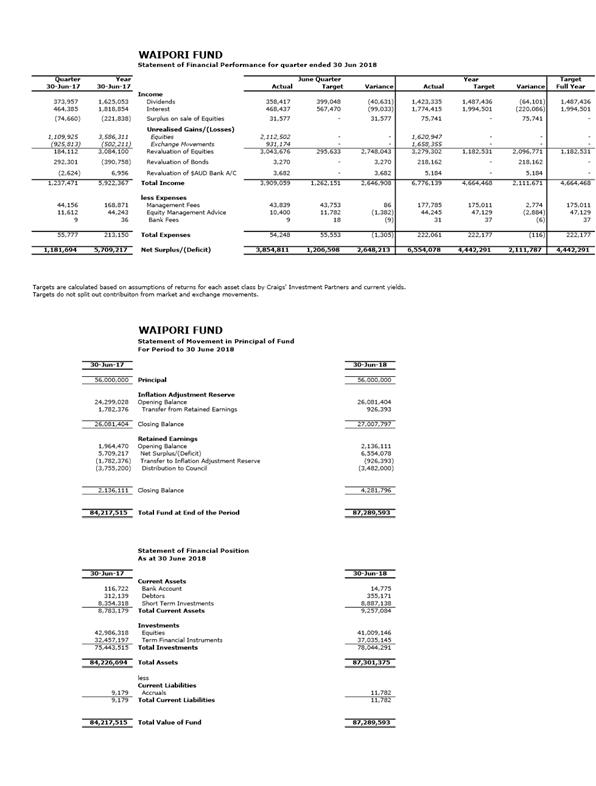

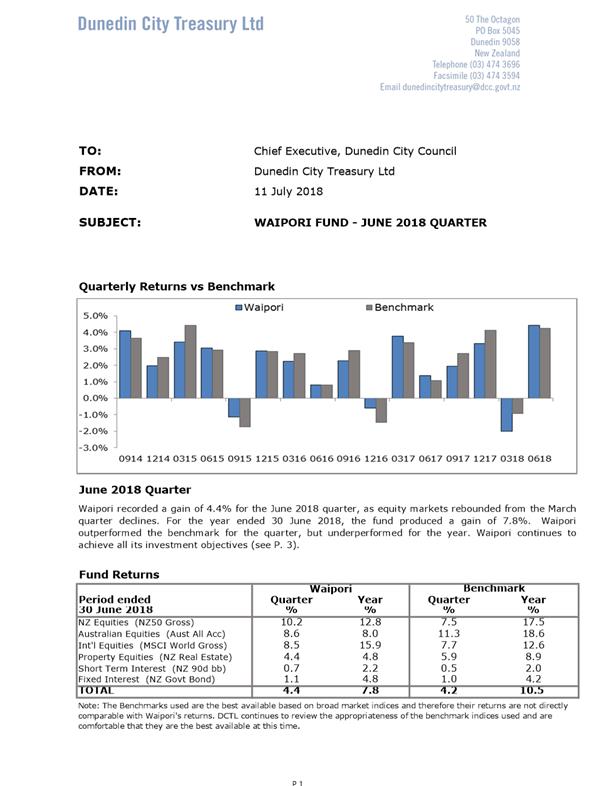

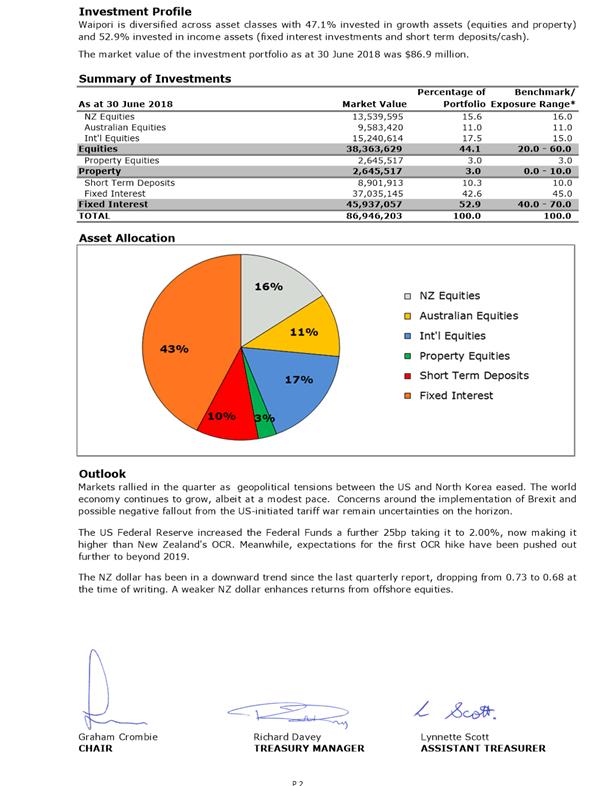

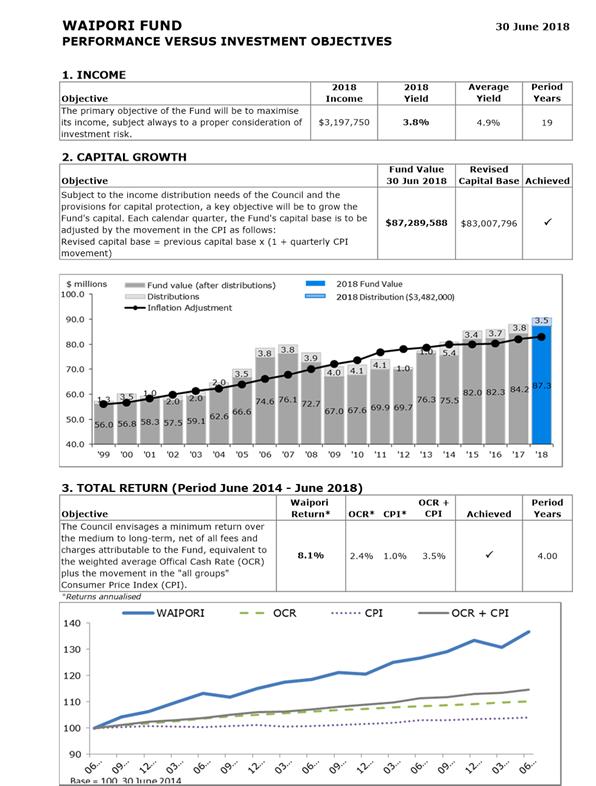

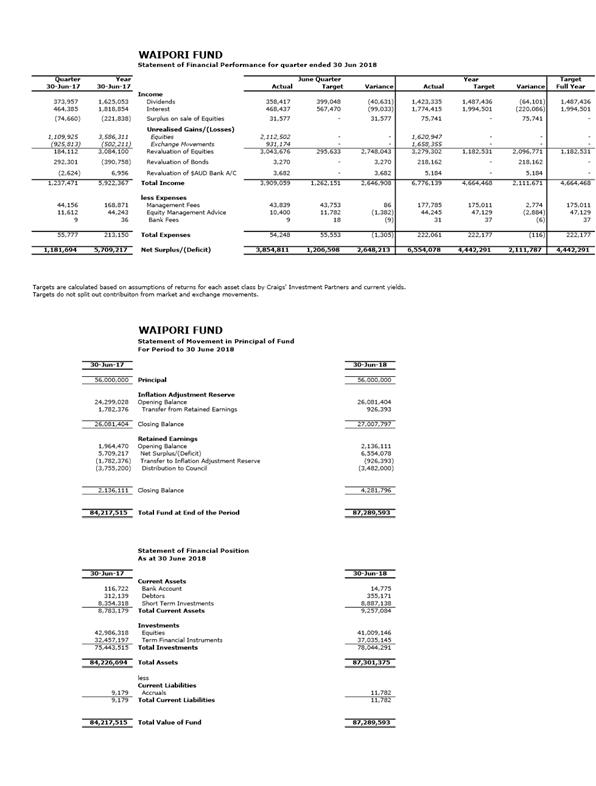

Waipori Fund - Quarter Ending June 2018

Department: Finance

EXECUTIVE SUMMARY

1 The

attached report from Dunedin City Treasury Limited provides information on the

results of the Waipori Fund for the quarter ending 30 June 2018.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

report from Dunedin City Treasury Limited on the Waipori Fund for the quarter

ending 30 June 2018.

|

BACKGROUND

2 Not

applicable.

DISCUSSION

3 Not

applicable.

OPTIONS

4 Not

applicable.

NEXT STEPS

5 Not

applicable.

Signatories

|

Author:

|

Richard Davey - Treasury Manager

|

|

Authoriser:

|

Dave Tombs - General Manager Finance and Commercial

|

Attachments

|

|

Title

|

Page

|

|

a

|

Waipori Fund - June 2018

Quarter

|

18

|

|

SUMMARY OF CONSIDERATIONS

|

|

|

Fit with purpose

of Local Government

This

report relates to providing local infrastructure, public services and

regulatory functions for the community.

|

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

This report has no direct contribution to the Strategic

Framework.

|

|

|

Māori Impact

Statement

There

are no known impacts on tangata whenua.

|

|

|

Sustainability

There

are no known implications for sustainability.

|

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

The

report fulfils the financial reporting requirements for Council.

|

|

|

Financial

considerations

Not

applicable – reporting only.

|

|

|

Significance

Not

applicable – reporting only.

|

|

|

Engagement –

external

This report has been prepared for and approved by the

Board of Dunedin City Treasury Limited.

|

|

|

Engagement -

internal

This report has been prepared for the Board of Dunedin

City Treasury Limited.

|

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

|

Community Boards

There are no known implications for Community Boards.

|

|

|

|

|

|

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

|

Finance and Council Controlled Organisations

Committee

11 September 2018

|

|

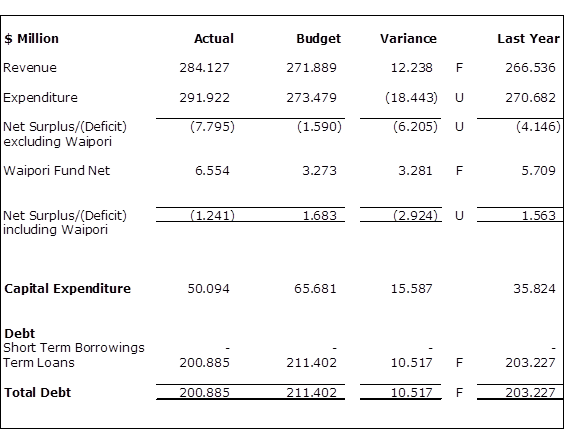

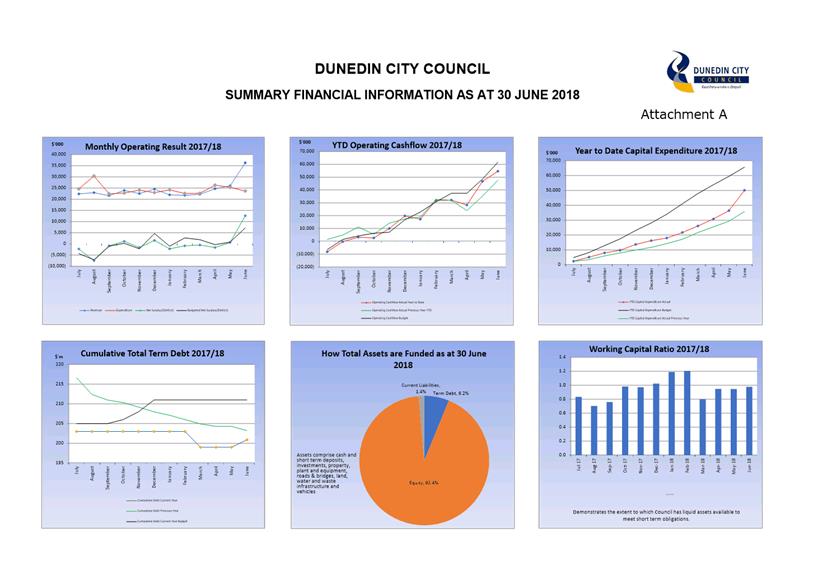

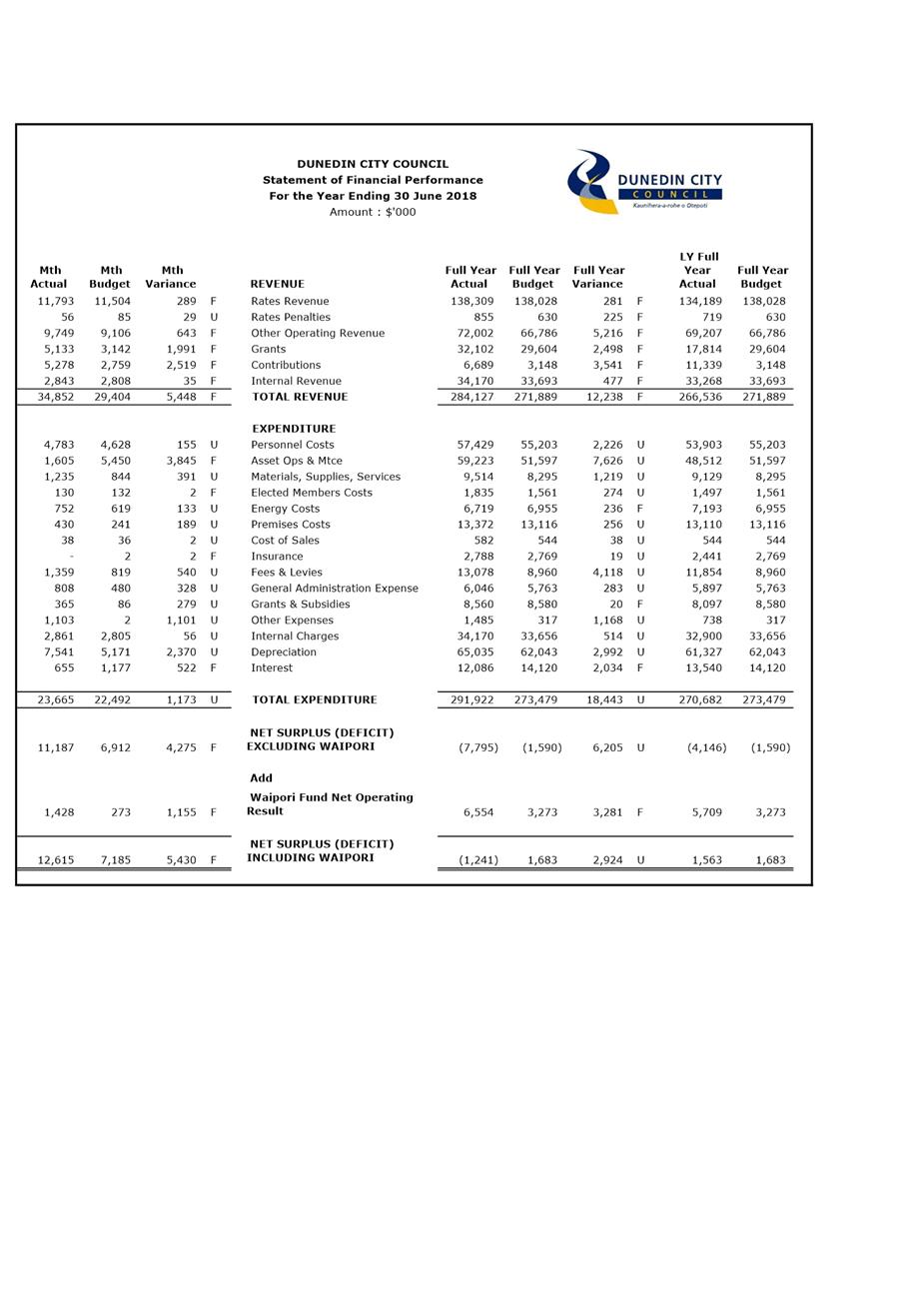

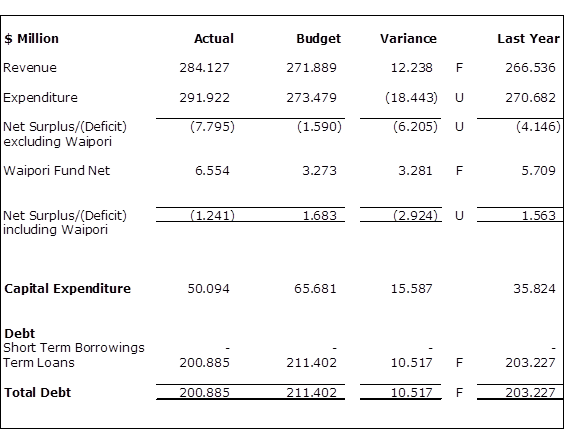

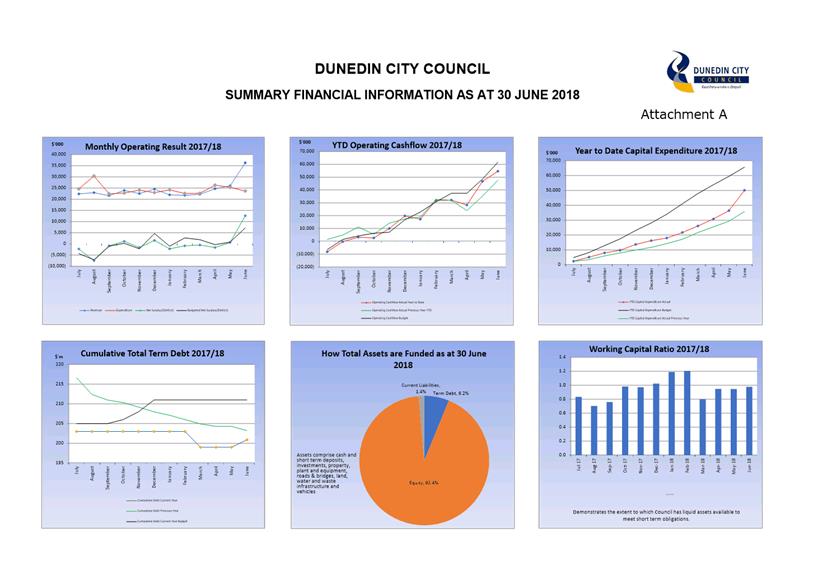

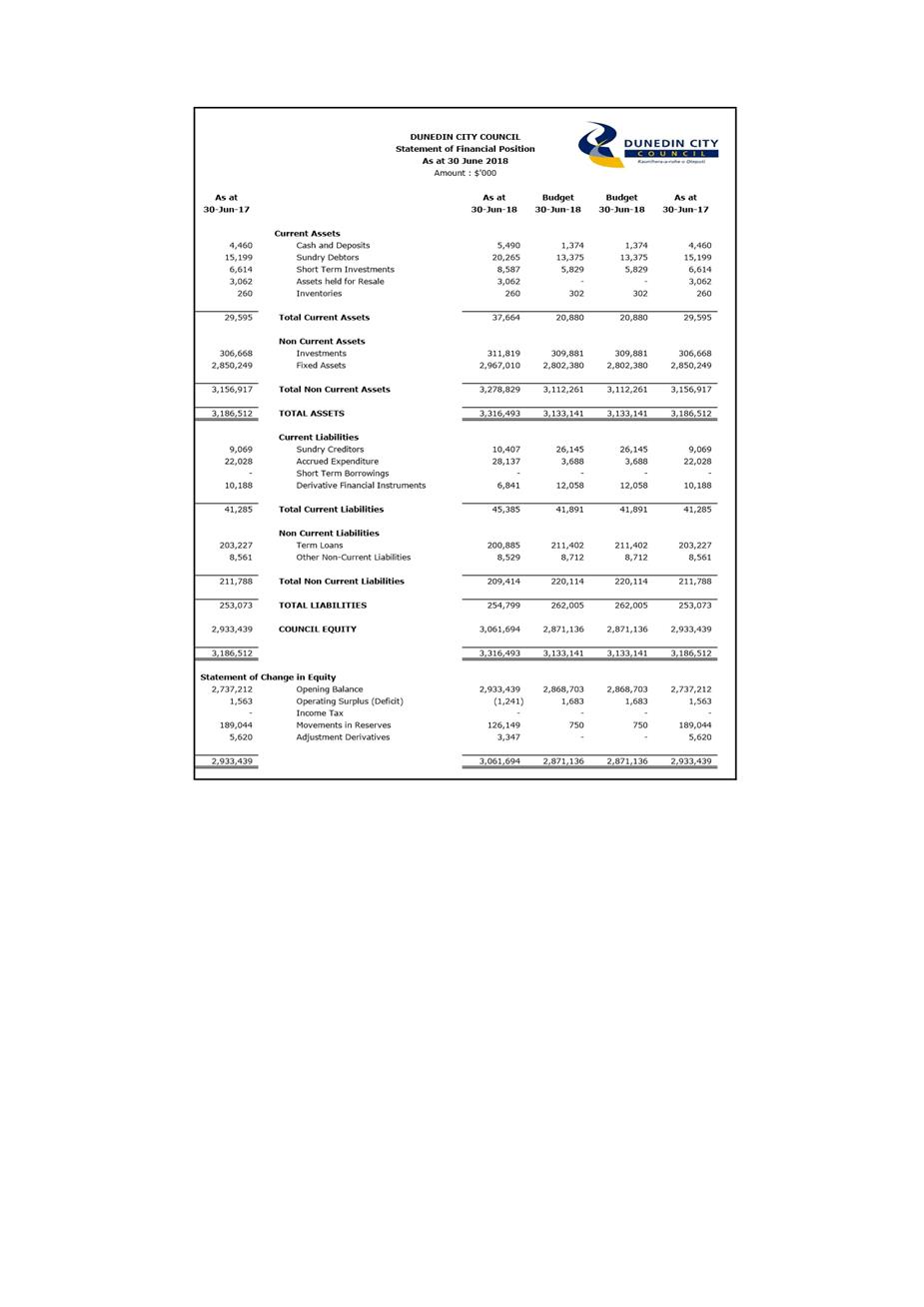

Financial Result - Year Ended 30 June 2018

Department: Finance

EXECUTIVE SUMMARY

1 This

report provides the financial results for the year ended 30 June 2018 and the

financial position as at that date.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Financial Performance for the year ended 30 June 2018 and the Financial

Position as at 30 June 2018.

b) Notes that

the year end result is subject to final adjustments and external audit by

Audit New Zealand.

|

BACKGROUND

2 This

report provides a commentary of the financial performance of Council for the

year ended 30 June 2018 and the financial position as at that date.

DISCUSSION

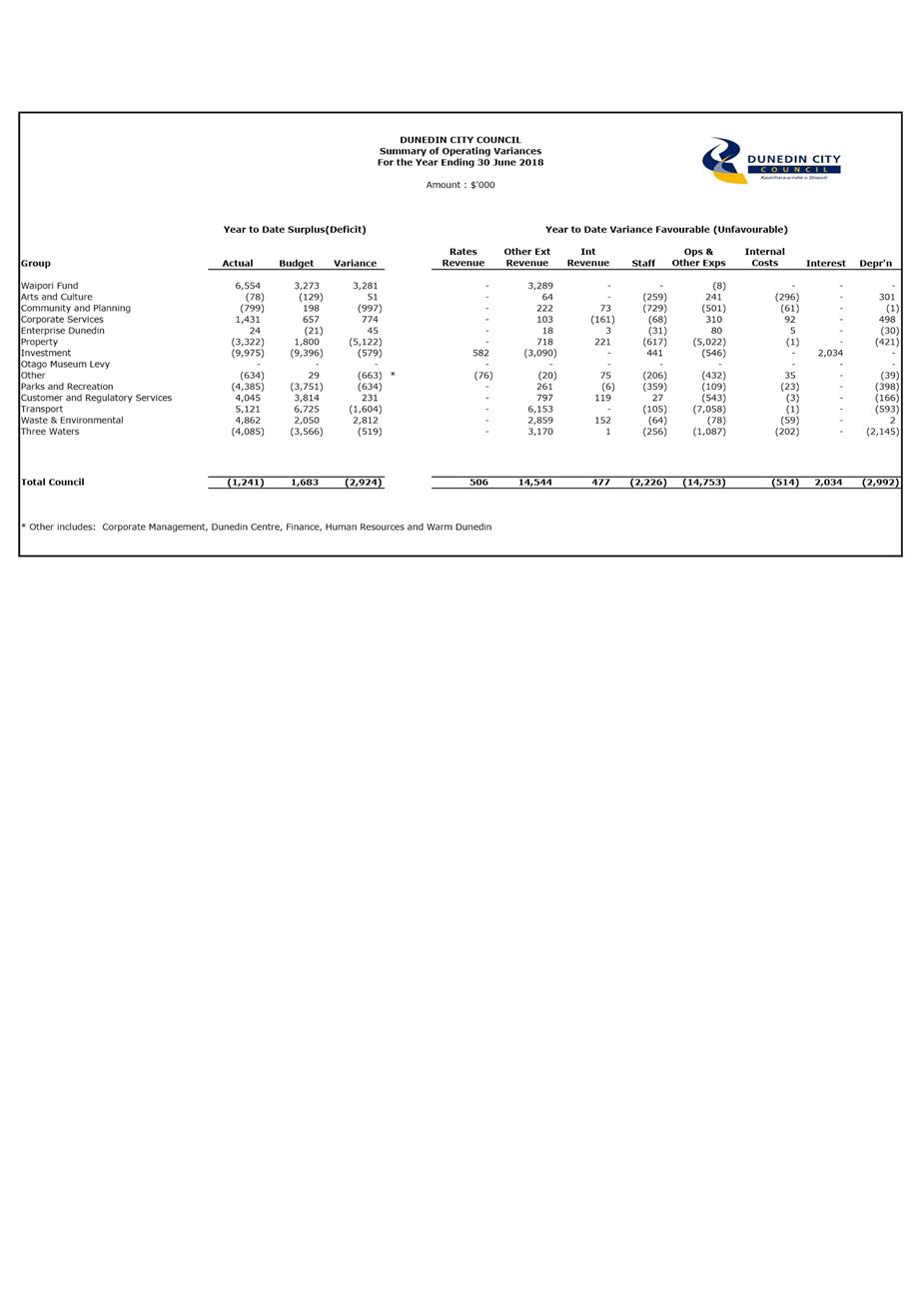

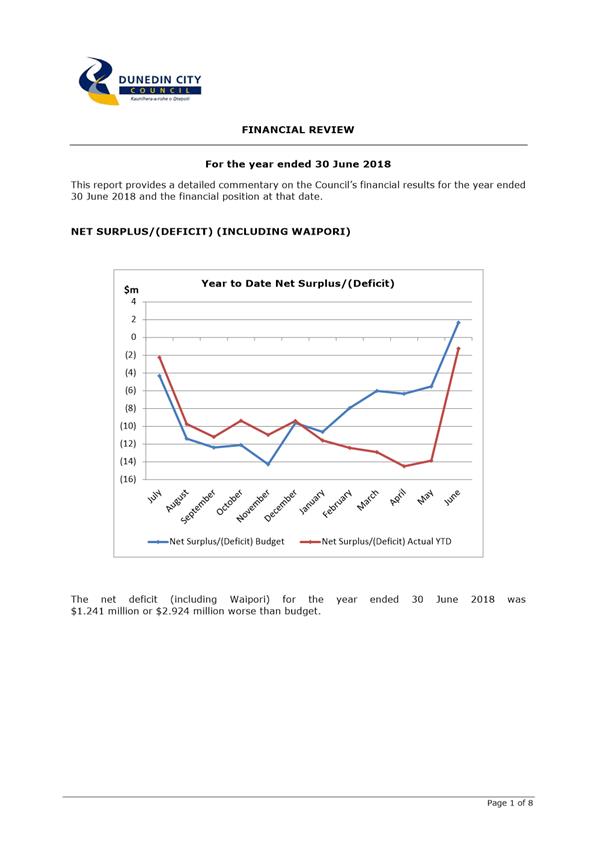

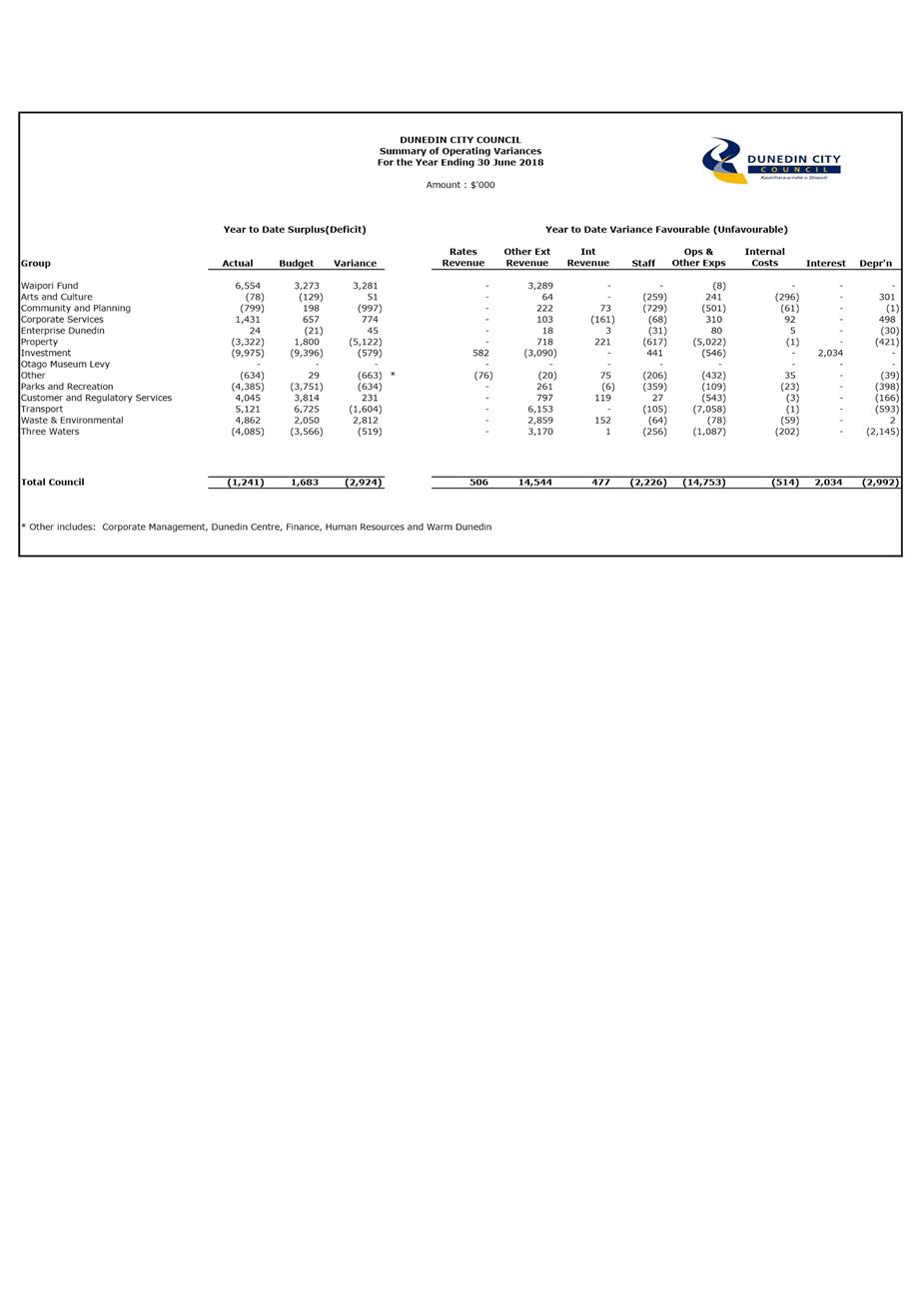

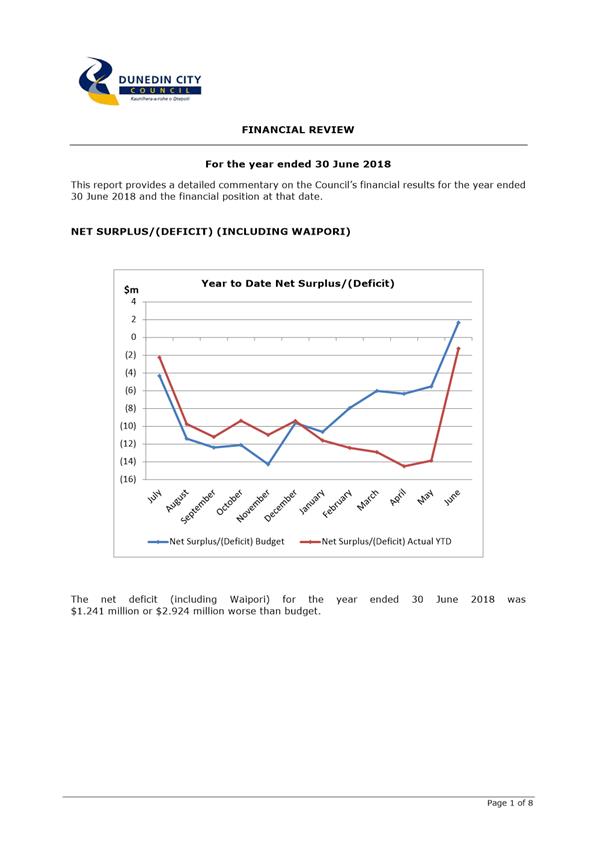

3 Section

1 to this Report shows that Council has a full year Net Deficit (excluding

Waipori) of $7.8m which was $6.2m worse than the budgeted deficit figure of

$1.6m. Various events occur throughout each financial year that cause

variances between the actual operating surplus/deficit and the budgeted

operating surplus/deficit.

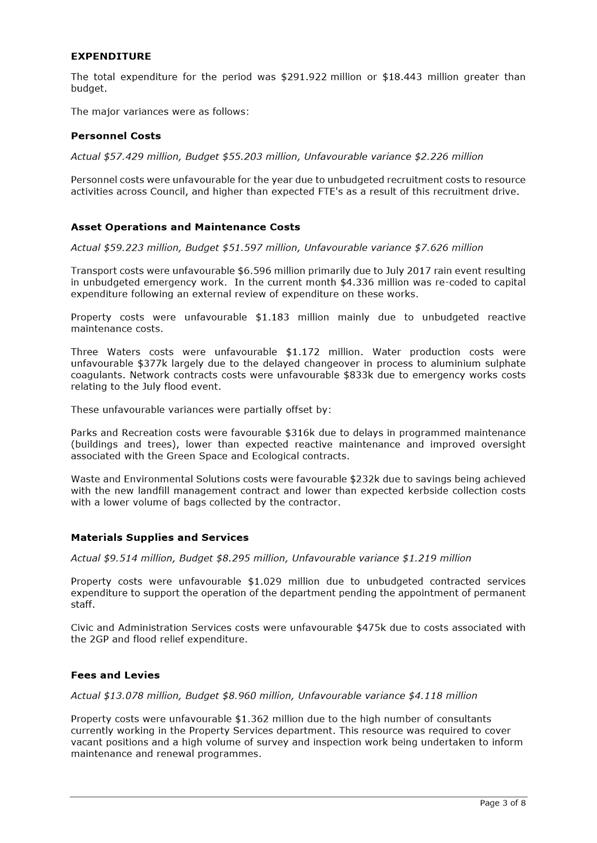

4 Commentary

on the full year result (Table in Section 1)

The unfavourable variance against budget

was due to the following:

· $7.626

million higher than expected asset operations and maintenance expenditure

primarily due to emergency repair work associated with the July 2017 flood

event, and maintenance costs across the Property portfolio.

· $4.118

million higher fees & levies costs. This included costs associated with a

number of initiatives across Council including: asset surveys, asset

inspections, development of asset management plans, system & process

reviews and assistance with Council-wide procurement activities. In

addition Building Services expenditure is higher than expected to ensure

consenting activity meets the required statutory deadlines.

· $2.992

million higher than expected depreciation expense following a revaluation of

Three Waters assets including an increase in depreciable replacement cost

(reflecting current market pricing) and a revision of useful lives.

· $2.226

million higher than expected personnel costs due to

unbudgeted recruitment costs to resource activities across Council, and higher

than expected FTE's as a result of this recruitment drive.

· $1.219

million higher materials, supplies & services expenditure. This

included costs associated with the 2GP, flood relief expenditure and contracted

services to assist in the management of the property portfolio.

· $1.168

million higher other expenses primarily driven by a write-down on some

investment properties of $1.101 million as at 30 June.

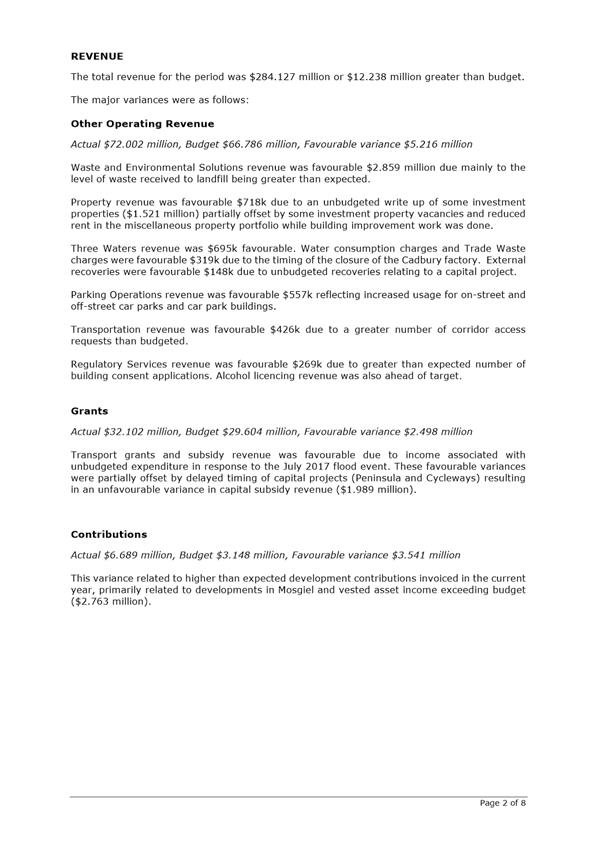

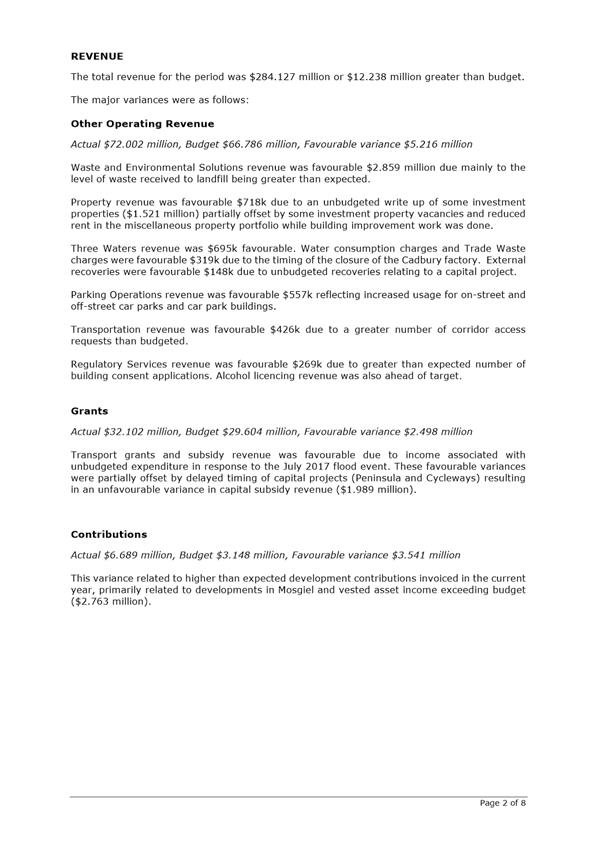

5 These

unfavourable variances were partially offset by:

· $5.216

million – higher than expected Other Operating Revenue. This

favourable variance was mainly due to: Waste and Environmental Solutions

revenue was greater than expected with additional tonnage through the Green

Island landfill being the overflow from the closure of the Fairfield Landfill,

higher than expected building consent activity in Regulatory Services and

Parking revenue being higher than expected due to increased metered

activity. The variance also included the unbudgeted impact of a positive

revaluation of some of Council’s investment properties.

· $2.034

million – favourable interest expenditure driven by the lower debt level

and favourable floating interest rate.

· $3.541

million higher than contribution revenue including development contributions

and higher than expected income from vested assets.

1

· $2.498

million higher than expected grants revenue in Transport due to the emergency

work discussed above, partially offset by lower capital subsidies due to delays

being experienced in the capital programme (including cycleways and Peninsula

projects).

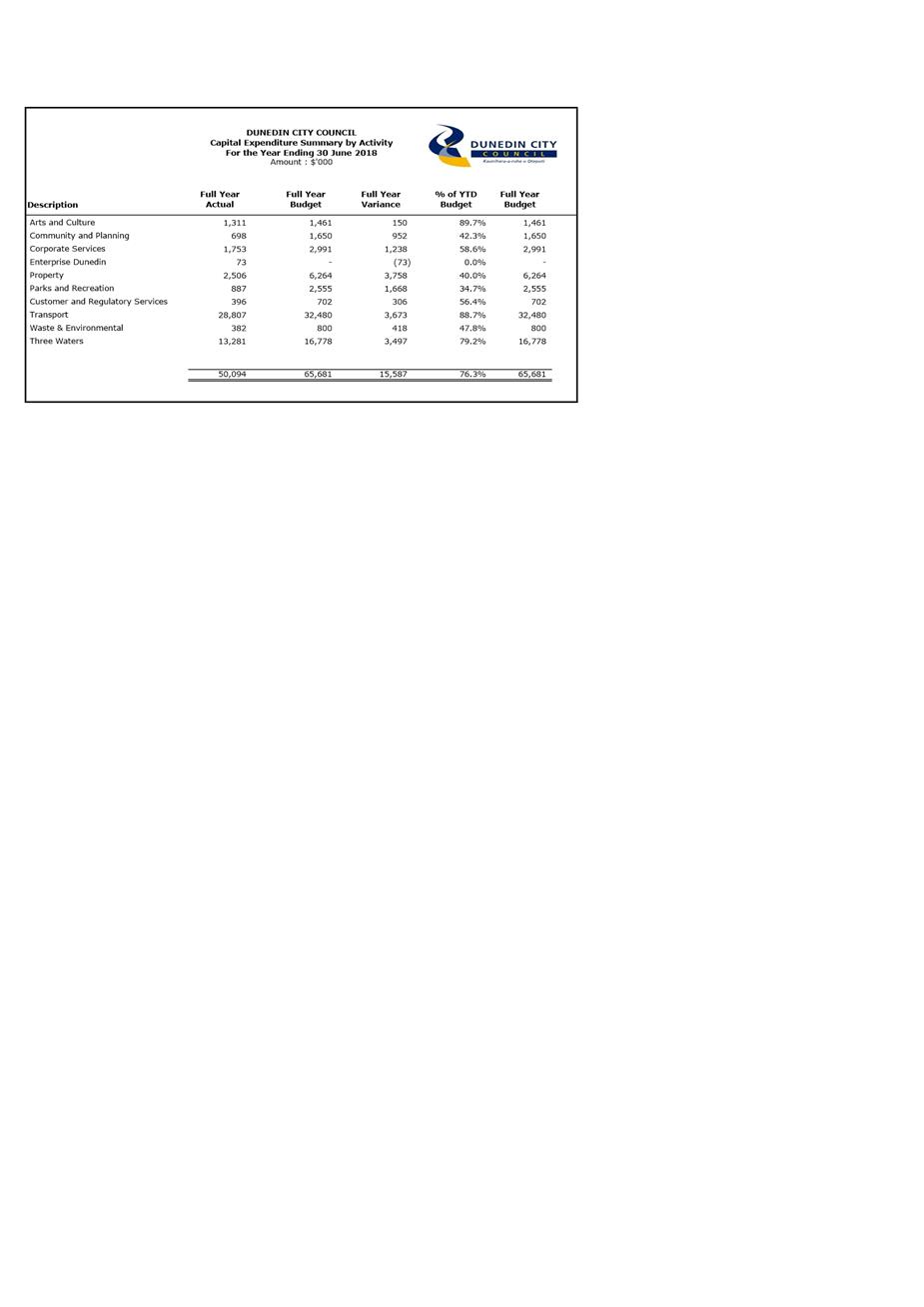

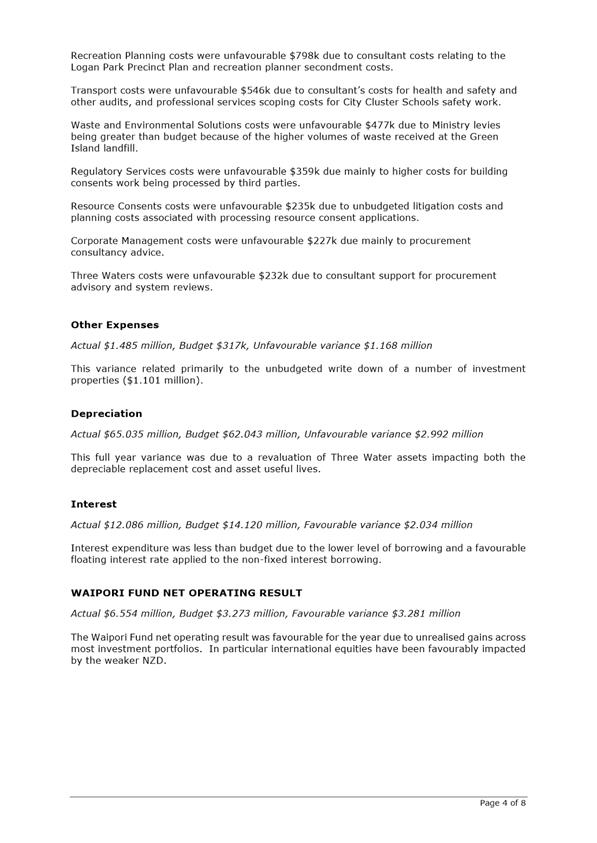

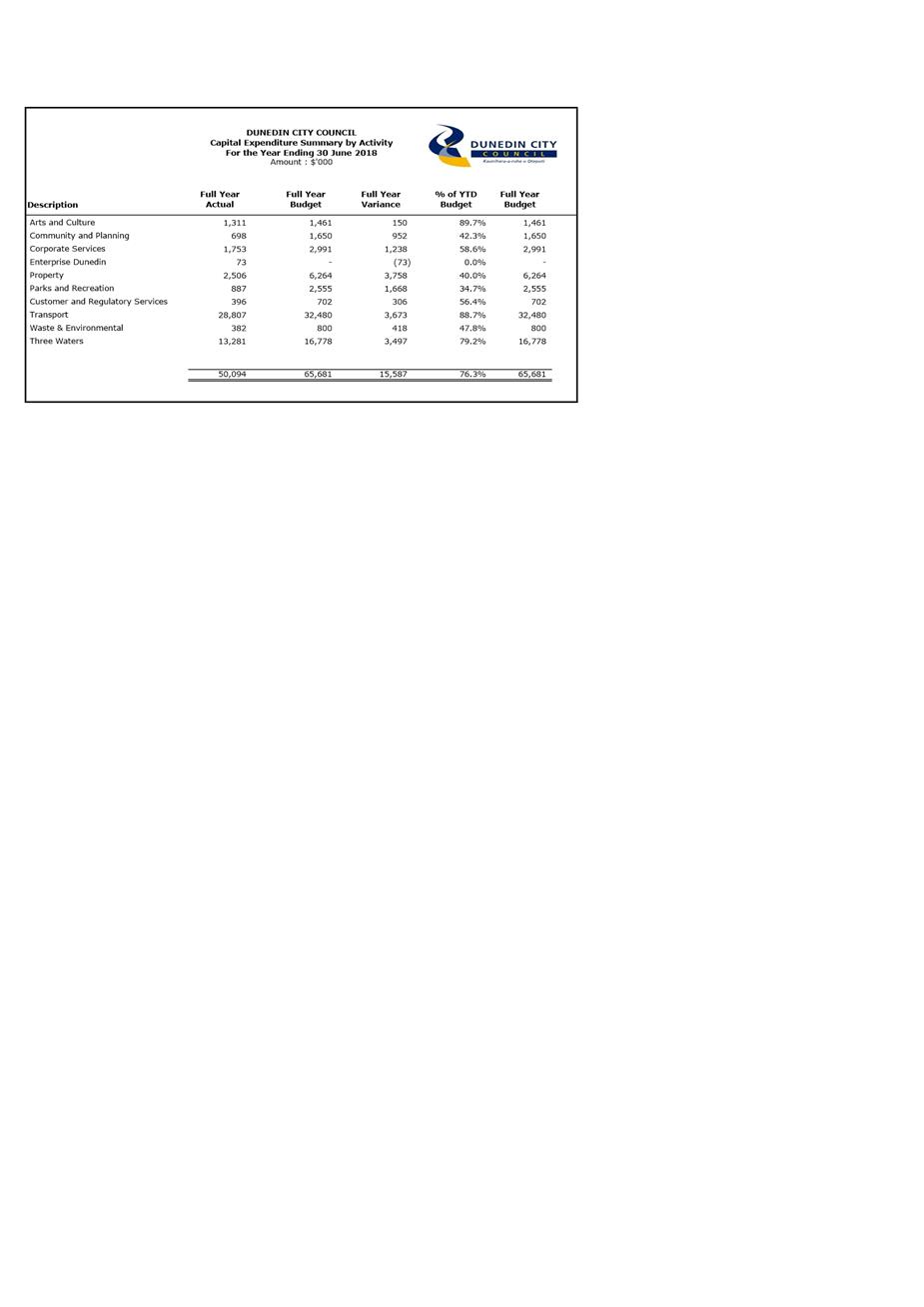

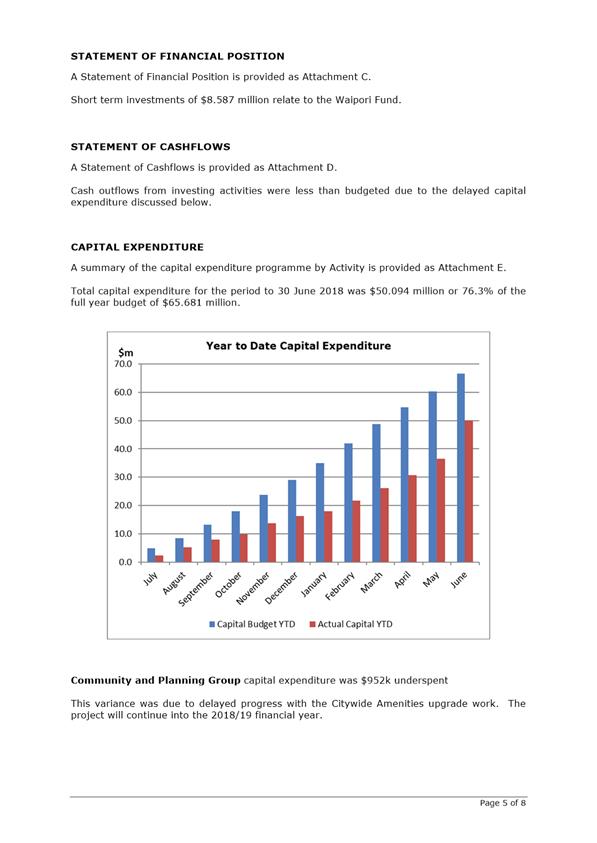

6 Full

year capital expenditure was less than budget by $15.587 million. Project

delays have arisen across a number of portfolios while project scoping and

design is finalised. The full year spend has been impacted by $5.7

million unbudgeted expenditure related to transport reinstatement work

following the July 2017 flood event.

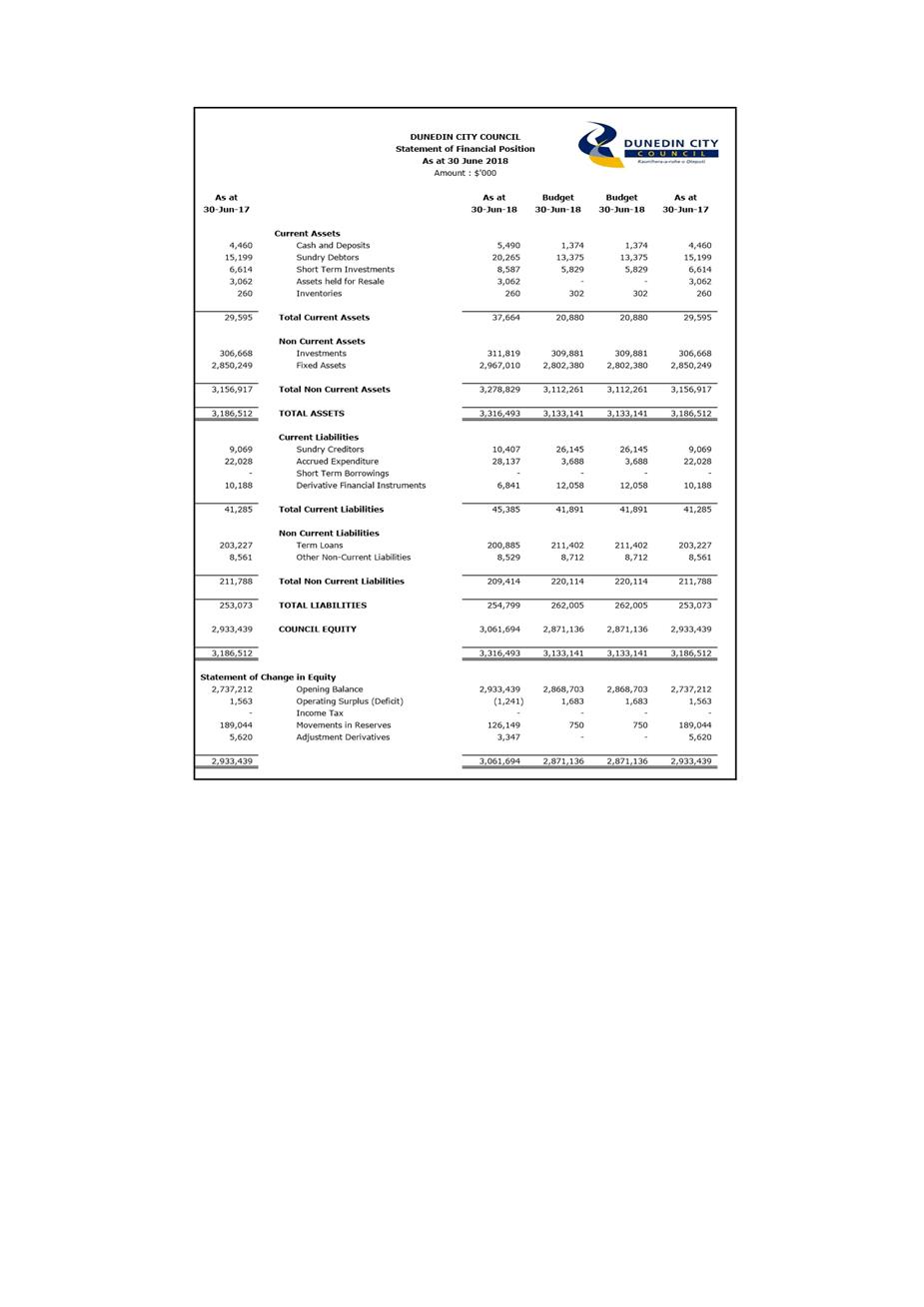

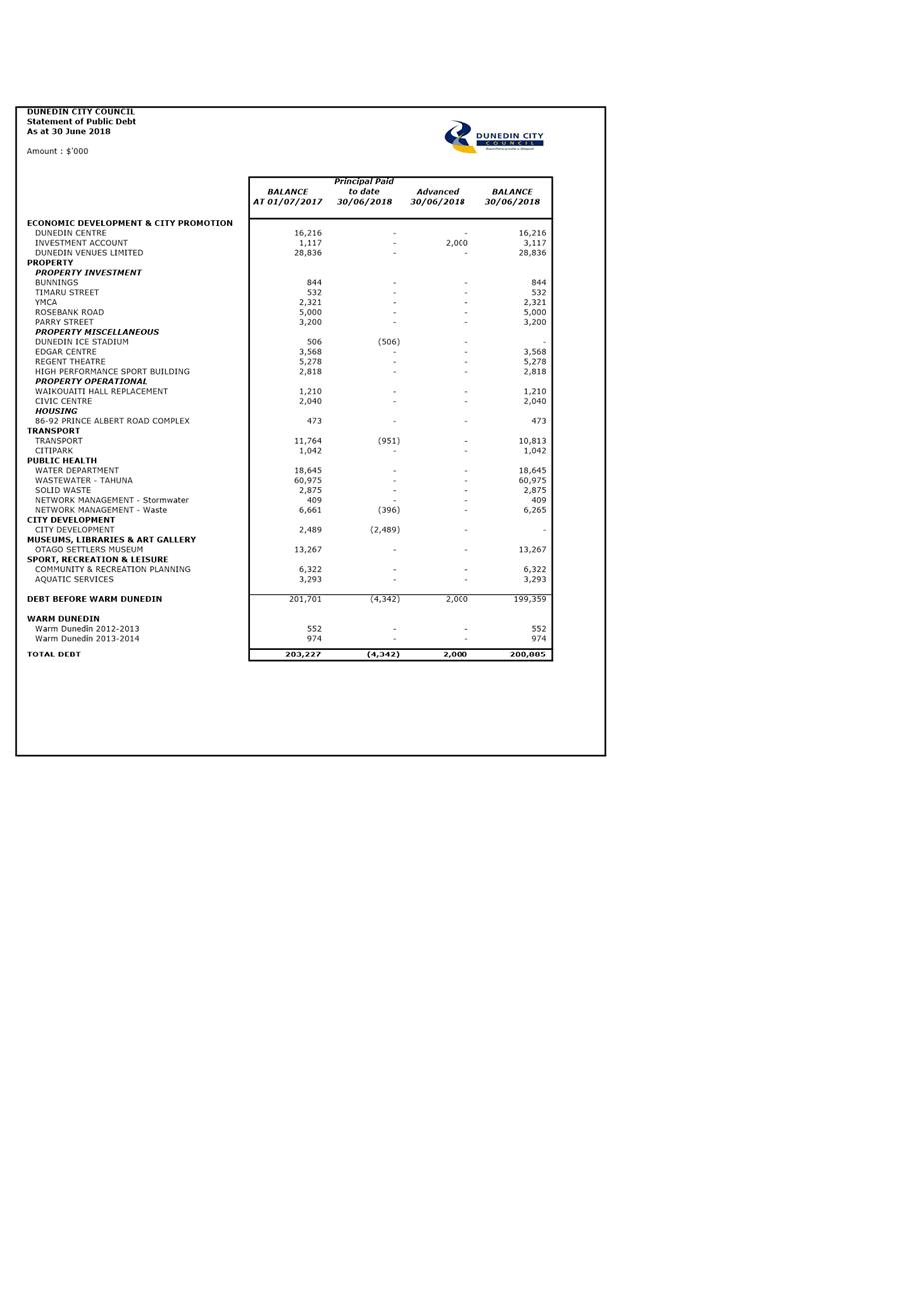

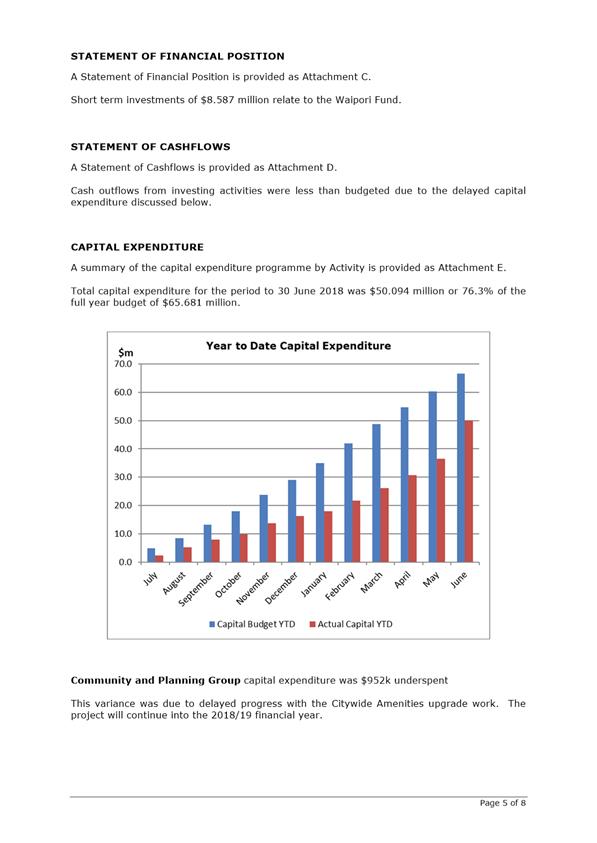

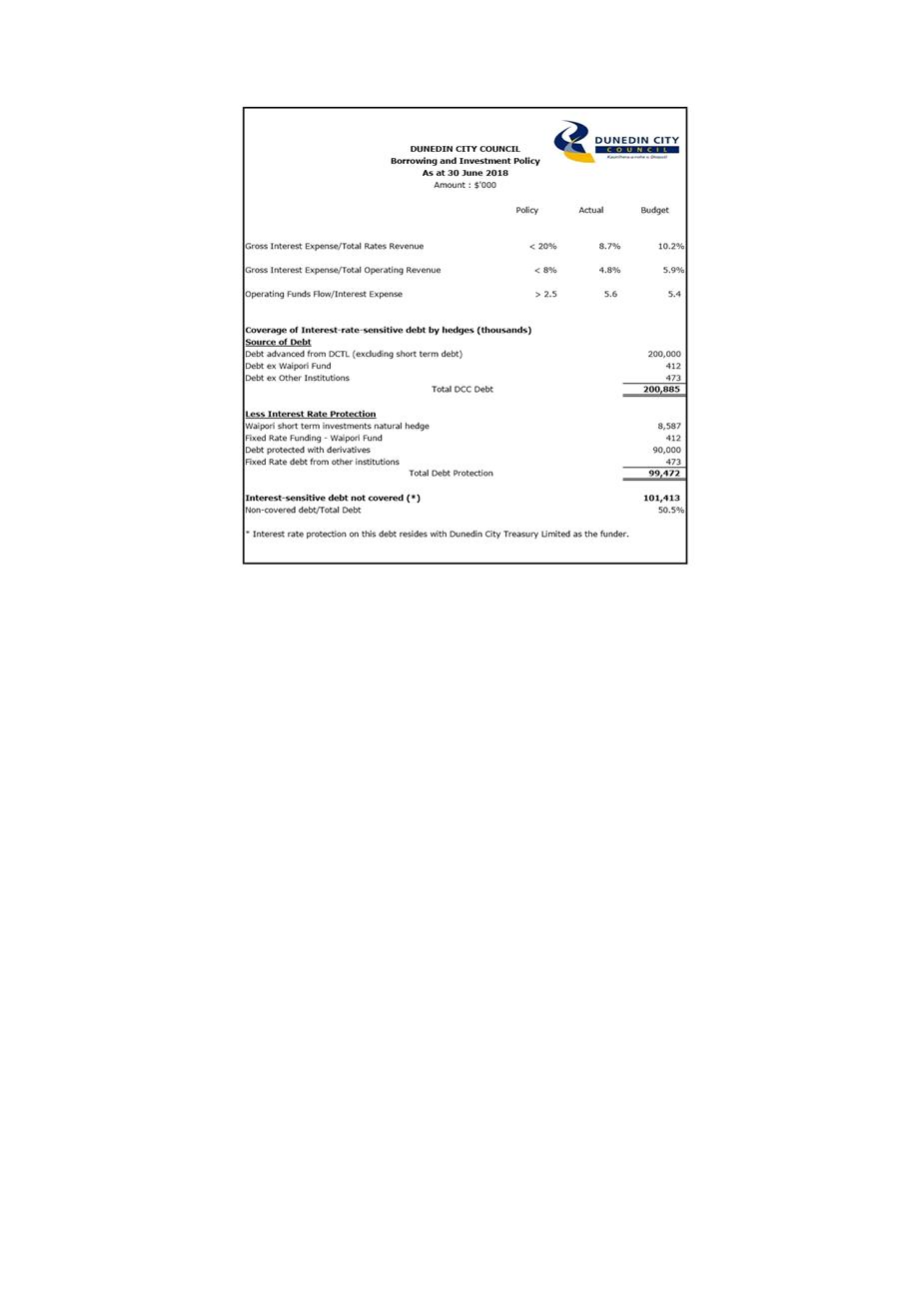

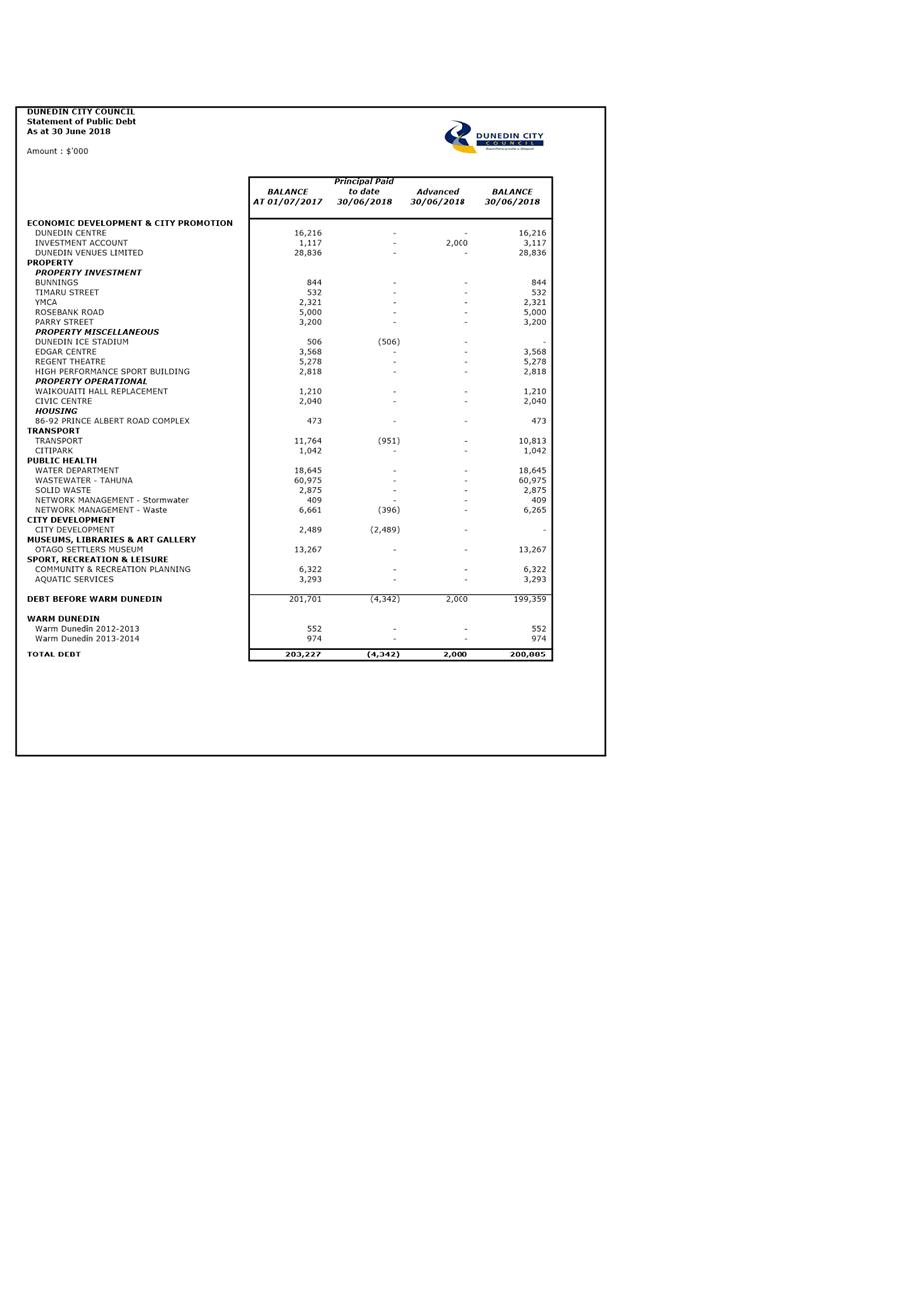

7 Total

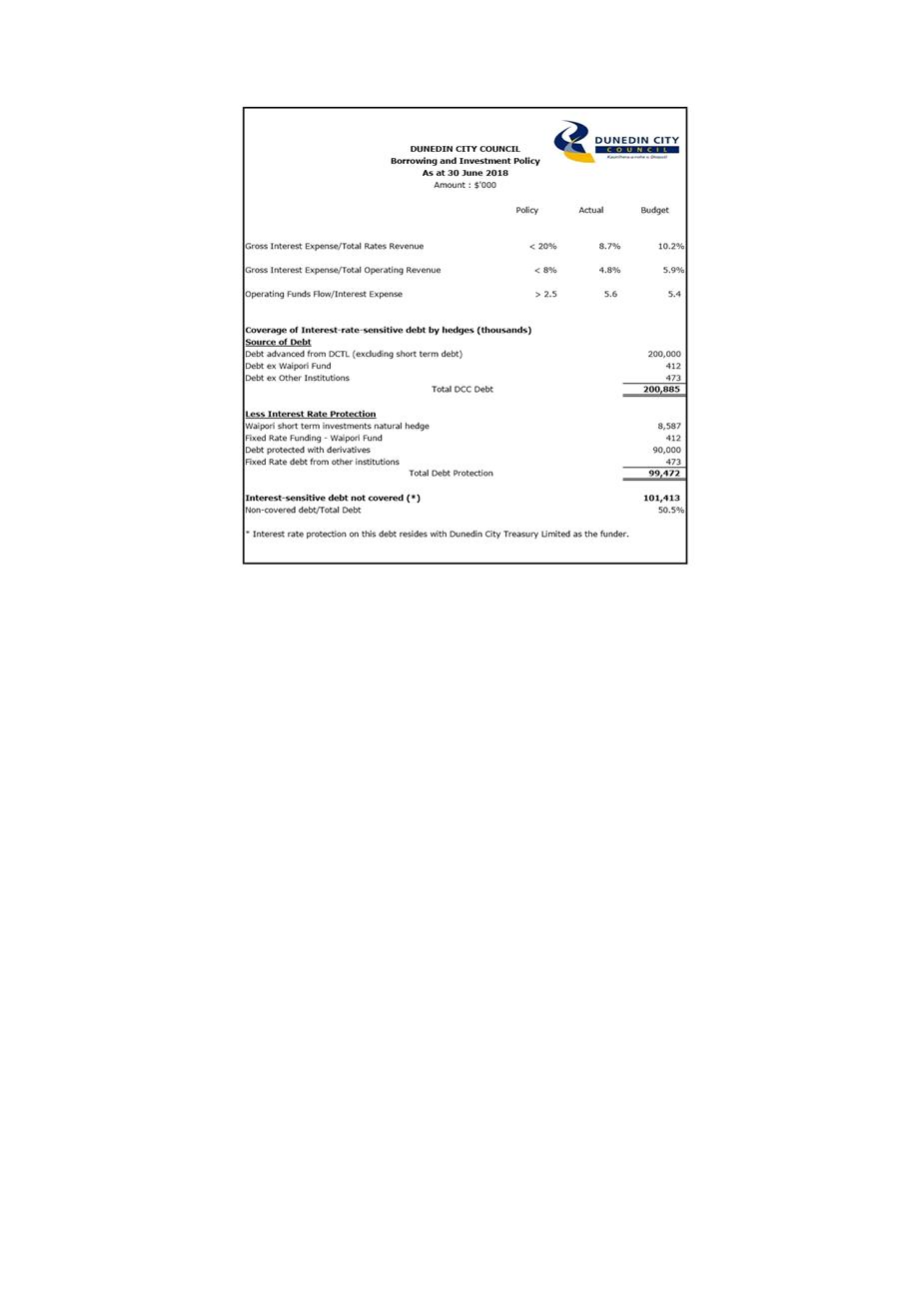

Council debt as at 30 June 2018 was $200.885 million or $10.517 million lower

than budget. This variance reflected delayed expenditure on capital

projects, partially offset by the higher level of operating expenditure

discussed above.

OPTIONS

8 Not

applicable.

NEXT STEPS

9 Not

applicable.

Signatories

|

Author:

|

Gavin Logie - Financial Controller

Lawrie Warwood - Financial Analyst

|

|

Authoriser:

|

Dave Tombs - General Manager Finance and Commercial

|

Attachments

|

|

Title

|

Page

|

|

a

|

Summary Financial

Information

|

26

|

|

b

|

Statement of Financial

Performance

|

27

|

|

c

|

Statement of Financial

Position

|

28

|

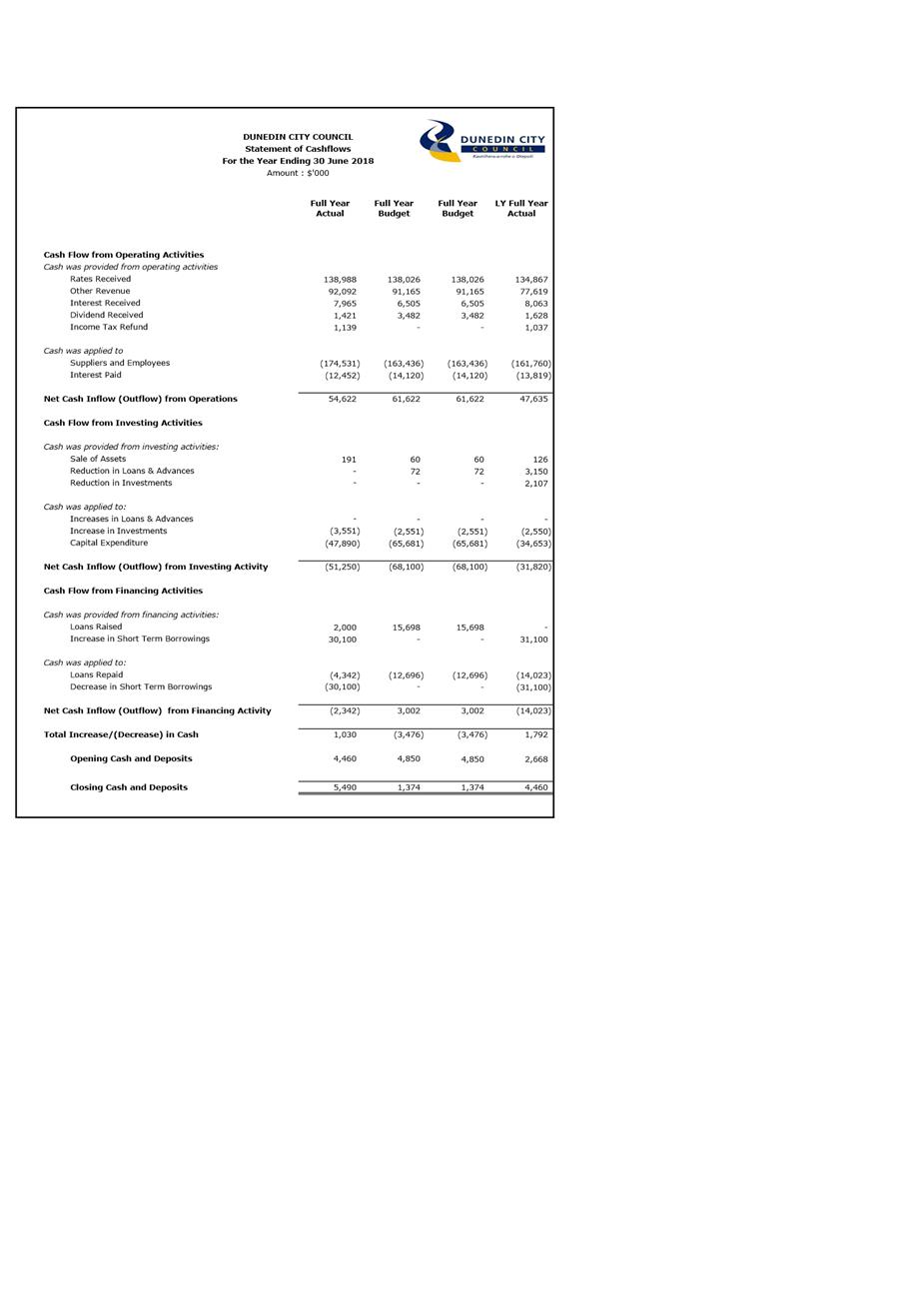

|

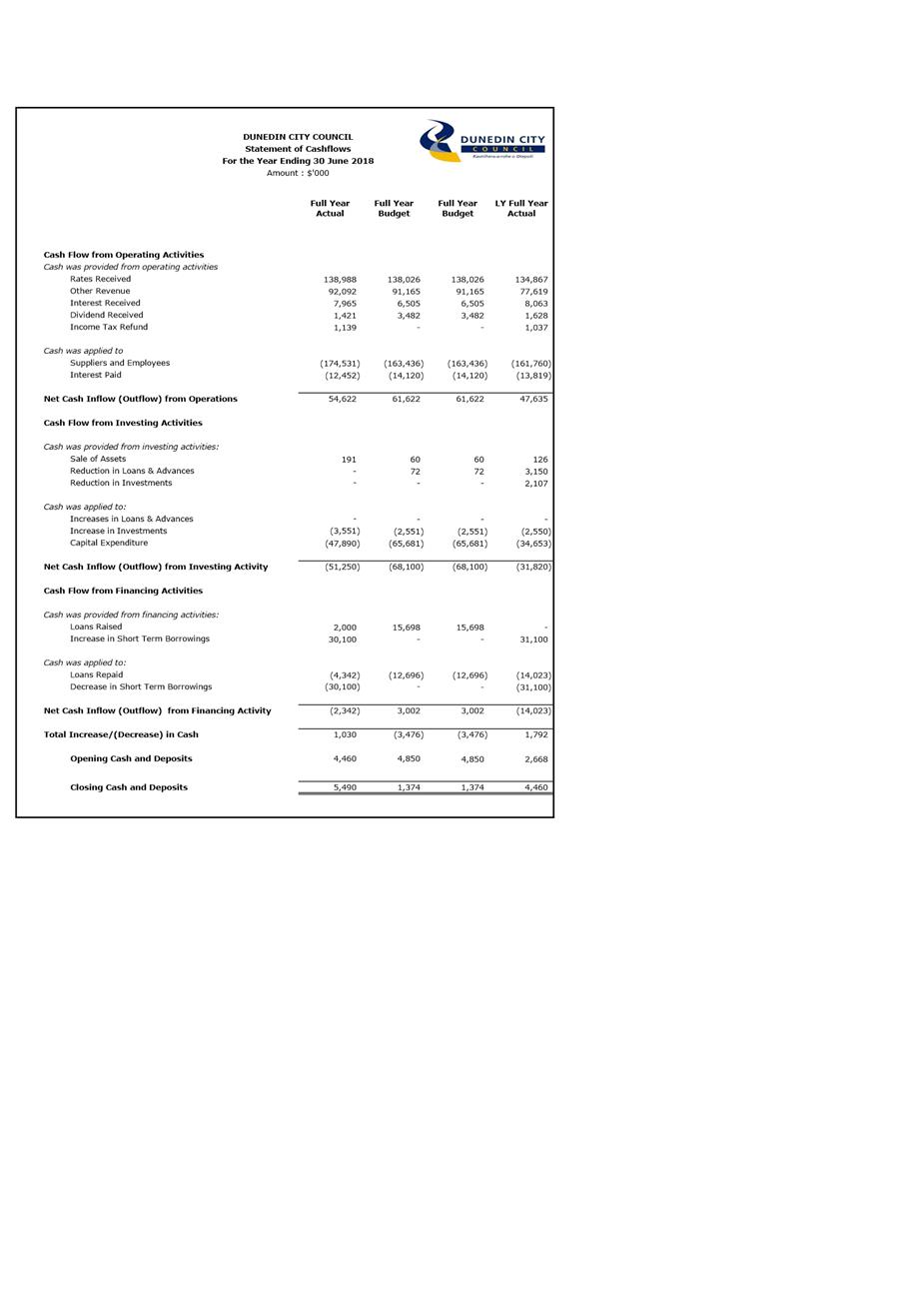

d

|

Statement of Cashflows

|

29

|

|

e

|

Capital Expenditure

Summary

|

30

|

|

f

|

Borrowing &

Investment Policy

|

31

|

|

g

|

Statement of Public

Debt

|

32

|

|

h

|

Operating Variance

Summary

|

33

|

|

i

|

Financial Review

|

35

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

The financial expenditure reported in this report relates

to providing local infrastructure, public services and regulatory functions

for the community.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

This report has no direct contribution to the Strategic

Framework, although the financial expenditure reported in this report has

contributed to all of the strategies.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report fulfils the internal financial reporting

requirements for Council.

|

|

Financial

considerations

Not applicable – reporting only.

|

|

Significance

Not applicable – reporting only.

|

|

Engagement –

external

There has been no external engagement.

|

|

Engagement -

internal

The report is prepared as a summary for the individual department

financial reports.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

|

Finance and Council Controlled Organisations

Committee

11 September 2018

|

|

|

Finance and Council Controlled Organisations

Committee

11 September 2018

|

|

|

Finance and Council Controlled Organisations

Committee

11 September 2018

|

|

|

Finance and Council Controlled Organisations

Committee

11 September 2018

|

|

|

Finance and Council Controlled Organisations

Committee

11 September 2018

|

|

|

Finance and Council Controlled Organisations

Committee

11 September 2018

|

|

|

Finance and Council Controlled Organisations

Committee

11 September 2018

|

|

|

Finance and Council Controlled Organisations

Committee

11 September 2018

|

|

|

Finance and Council Controlled Organisations

Committee

11 September 2018

|

|

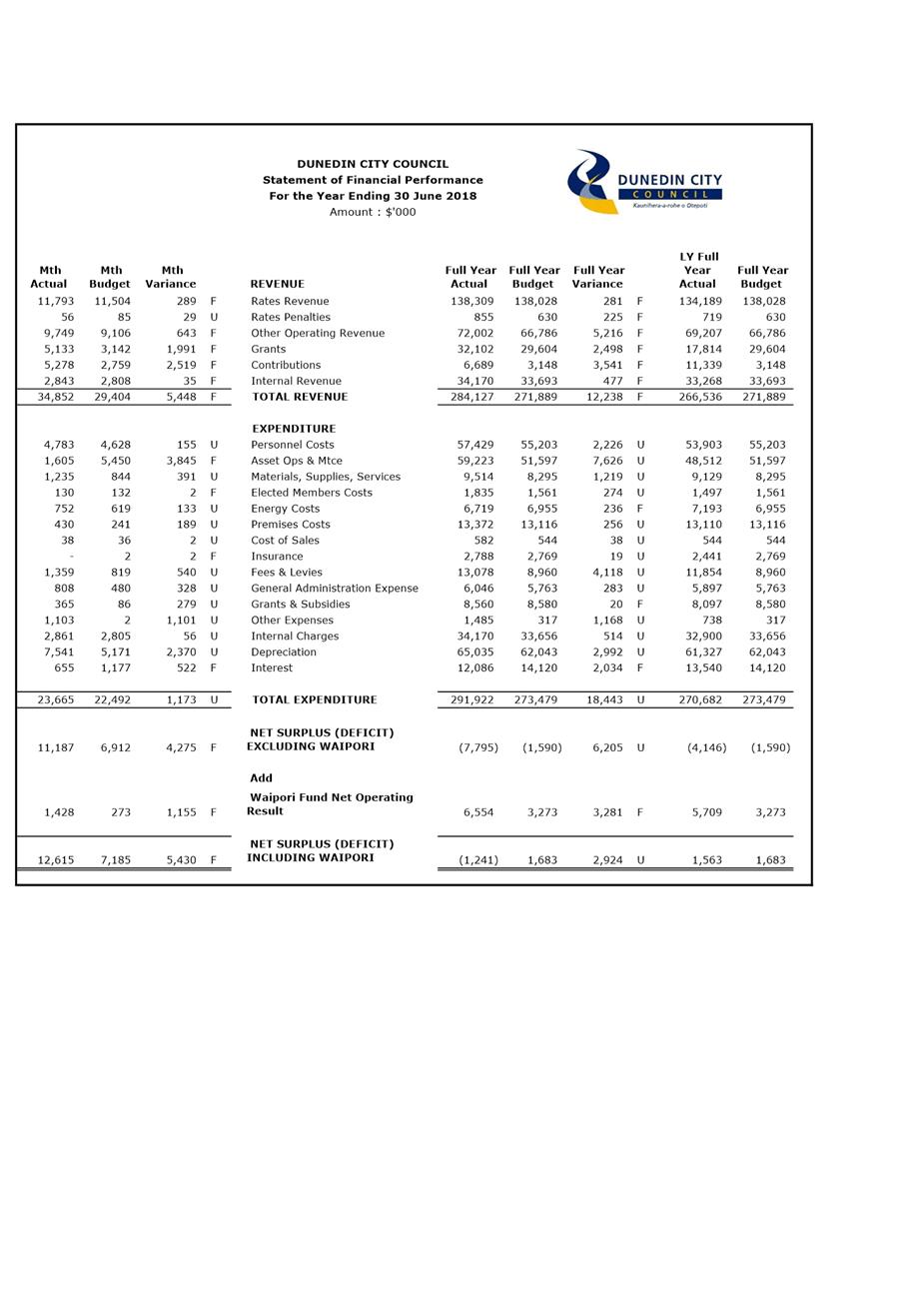

Insurance Renewal Year Ended 30 June 2019

Department: Finance

EXECUTIVE SUMMARY

1 This

report provides a summary of the insurance renewal for the Dunedin City Council

for the year ended 30 June 2019.

2 For the

purposes of this insurance policy renewal, the DCC Group (where referenced)

comprises the Dunedin City Council and any Council Controlled Organisation

and/or subsidiary company more than 50% owned by the Council – including

but not limited to: Dunedin City Holdings Limited; Dunedin City Treasury Limited;

City Forests Limited; Dunedin International Airport Limited; Dunedin Stadium

Property Limited; Dunedin Venues Management Limited; Dunedin Railways Limited;

The Theomin Gallery Management Committee (Olveston); and Dunedin Transport

Limited.

Note: Some CCOs and subsidiaries hold

individual policies and/or have particular policy terms, conditions and limits.

3 This

report details the changes that have been negotiated around policy terms,

conditions, coverage, excesses and premiums applied.

4 The

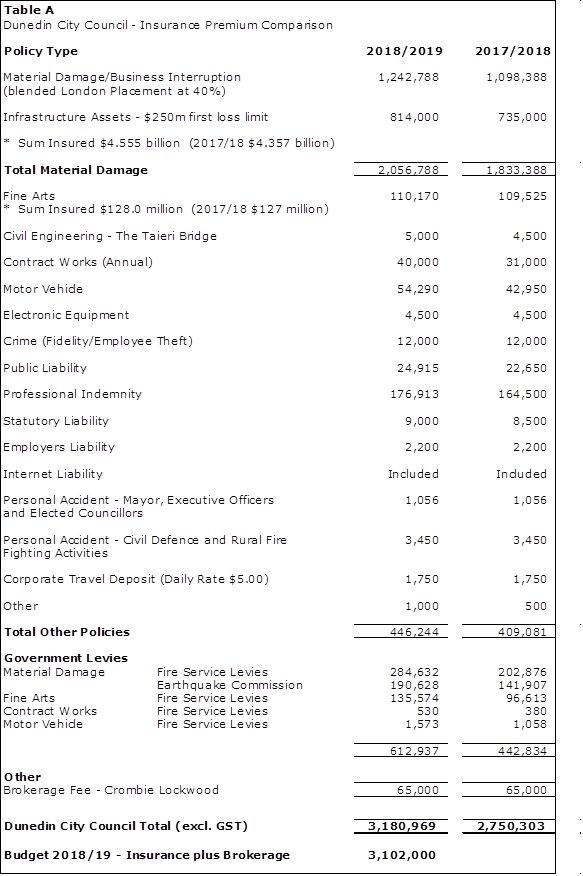

material damage premium for 2018/19 have been impacted by a number of factors

including: increase in insured values (4.5%) and tightening of market pricing

and capacity following recent insurance events (Kaikoura earthquakes and

Edgecumbe flooding). The note 14 graph does however highlight the

continued increase in asset value covered while maintaining a relatively low

cost per dollar insured.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Insurance Renewal Year Ended 30 June 2019.

|

BACKGROUND

5 The

Council historically placed its insurance cover with New Zealand underwriters

only. The risk with this strategy became evident following the

Christchurch earthquakes when capacity in this market became constrained.

6 As part

of the 2014/15 insurance renewal Council was able to place 35% of its core

cover into the international market, which provided significant risk mitigation

in relation to market capacity, but also delivered the opportunity to extend

cover to infrastructure assets as well as creating market tension to ensure

other renewal terms and conditions were favourable.

7 In the

most part of 2016 insurers were actively competing to protect existing market

share while new entrants were seeking to gain market share. Unfortunately

the November 2016 Kaikoura earthquake (and consequential damage caused

elsewhere including Wellington) has quickly seen the market tighten as insurers

reassess their exposures in the New Zealand region.

DISCUSSION

8 The

current insurance market is driven by continued pressure on capacity for

natural disaster cover and the limited availability of infrastructure cover.

9 The

approach to the market for the 2018/19 financial year was to secure the

conditions of the current programme, while minimising the level of premium increase.

10 The placement

achieved is consistent with 2017/18 as follows - local placement set at 60% and

international placement set at 40%. The international placement is split:

30% full cover and 10% on the basis of a $750.0 million limit any one occurrence

or in the aggregate for the natural disaster cover.

11 What this means is

Council will continue to be self-insured beyond this $750.0m limit for 10% of

any claim.

12 Infrastructure cover

is provided on the understanding that Central Government will contribute 60% of

funding towards reinstatement. The limits and excesses noted for this

cover are for the DCC's portion only. Therefore a loss would need to

exceed $5.0 million before the insurers would contribute to any claim i.e.

40% of $5.0m being the current excess of $2.0m.

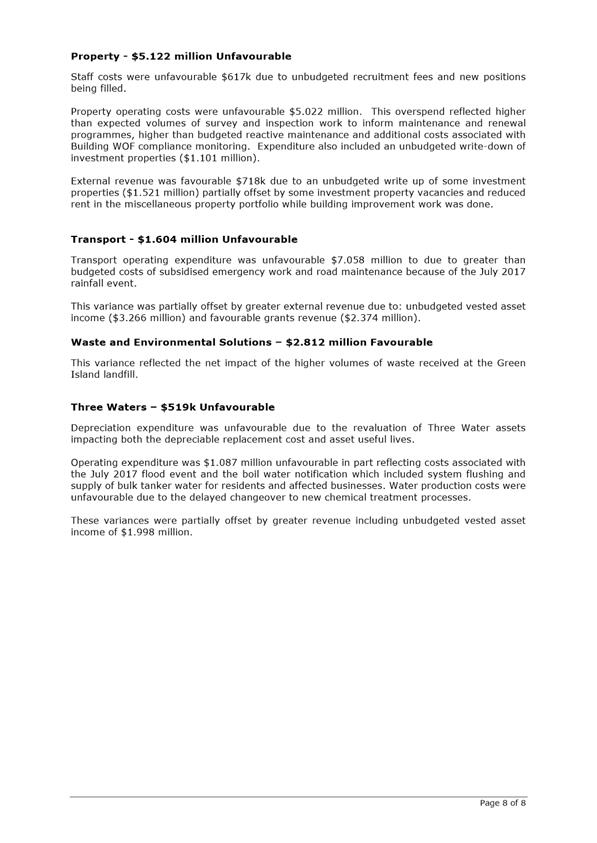

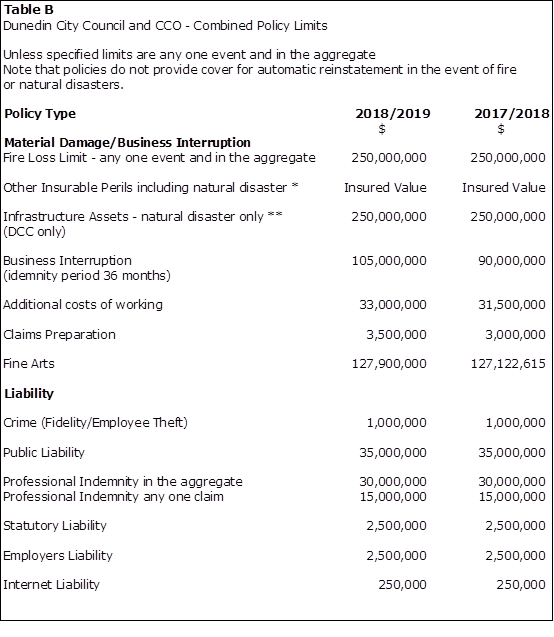

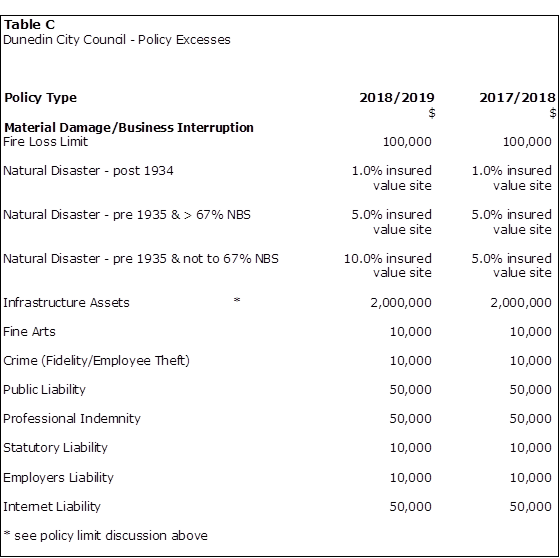

13 Table A provides a

comparison of insurance premiums between 2017/18 and 2018/19. All figures are

quoted exclusive of GST.

14 The

following graph provides a historically perspective on value insured and the

associated unit premium.

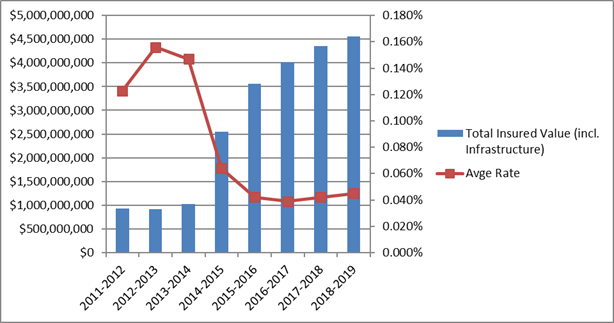

Policy Limits

* This limit applies to 90% of

the assets insured. The remaining 10% is limited to

$750.0 million any one claim or in the aggregate ie: 10% self-insured for

claims in excess of $750.0m.

** Natural Disaster Perils

include earthquake, volcanic eruption, tsunami, geothermal activity,

hydrothermal activity and, in respect of the outfalls only cover extended to

include storm (Force 10). This definition excludes the impact of

floods.

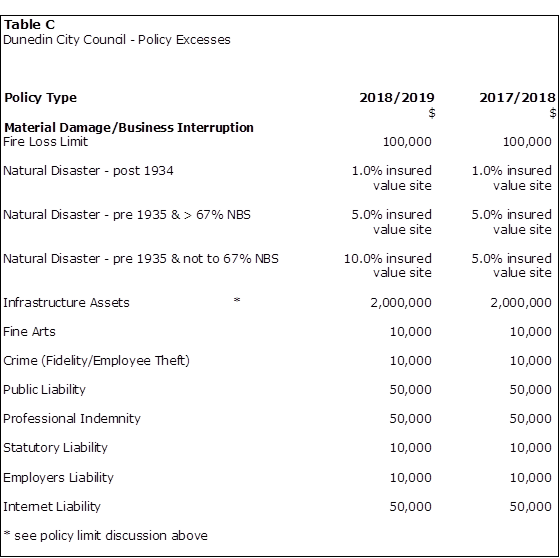

Policy Excesses

Uninsured Risks/Emerging Insurance Trends.

15 It is acknowledged

that with any insurance cover the Council will accept a degree of uninsured

risk, whether it be reflected as higher excesses, policy limits and/or

uninsured assets. In terms of particular risks associated with the current

programme the following should be noted:

· Policies

do not provide cover for automatic reinstatement of the sum insured in the

event of fire or Natural Disaster losses. If a significant loss occurs

additional insurance cover may need to be purchased.

· While

Asset Schedules have been extensively reviewed and updated, any assets excluded

from the schedules will not be covered, and those incorrectly valued may not be

adequately covered.

· Liability

Policy limits will need to be continually reviewed in light of claims history,

emerging trends and because these policy limits are held as group limits.

· Emerging

trends that remain under consideration include an extension of current policy

coverage for more robust Cyber Risk protection, as well as risks posed by

terrorism, climate change, contagious disease, pollution and weather tight home

claims.

· An

increasing recognition of the extent of asbestos risks and the potential costs

of identification/ maintenance/ removal activities may necessitate further Policy

reviews.

· The

Material Damage - Fire First Loss limit of $250m needs to be sufficient to

provide cover for fire following any cause including Natural Disaster losses

(it incorporates all assets insured by the Group). While this limit is still

considered sufficient, it will continue to be reviewed annually.

· Government

Levies – fire service and earthquake commission levies are subject to

change outside the control of Council. Notably, there has been an amalgamation

of the urban and rural fire services into one organisation (Fire and Emergency

New Zealand). The funding structure for this new organisation has impacted

these levies for the 2018/19 financial year with a 40% increase over 2017/18.

Options

16 Not applicable.

Next Steps

17 The DCC Group Insurance

cover is subject to an annual review and renewal.

18 Additional and

ongoing Policy review, monitoring and negotiation activities will be undertaken

by Council staff and representatives of the Crombie Lockwood Insurance

Programme Service Team to ensure adequate coverage remains in place for the DCC

and DCC Group Companies.

Signatories

|

Author:

|

Gavin Logie - Financial Controller

|

|

Authoriser:

|

Dave Tombs - General Manager Finance and Commercial

|

Attachments

There are no attachments

for this report.

|

SUMMARY OF

CONSIDERATIONS

|

|

Fit

with purpose of Local Government

The financial expenditure

detailed in this report relates to providing local infrastructure, public

services and regulatory functions for the community.

|

|

Fit

with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

This report has no direct contribution to the Strategic

Framework, however the financial expenditure noted in this report is

reflected within the Financial Strategy and the Insurance Policy contributes

to the effective and ongoing realisation of all DCC strategies.

|

|

Māori

Impact Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no implications for sustainability.

|

|

LTP/Annual

Plan/Financial Strategy

The planned insurance programme is as noted in the LTP.

|

|

Financial

considerations

The budget for insurance cover plus brokerage 2018/19 is

$3.102 million. The quoted premium exceeds this budget by $79k

reflecting the tightening insurance market.

|

|

Significance

Not applicable – reporting only.

|

|

Engagement

- external

·

The insurance programme has been developed in conjunction with

our insurance brokers and key staff from Council and CCOs.

|

|

Engagement

– internal

The insurance programme has been developed in conjunction

with DCC insurance brokers and key staff from Council and CCOs.

|

|

Risks:

Legal/Health and Safety etc.

This report identifies a small number of risks that remain

untreated or are emerging as factors that require further review.

|

|

Conflict

of Interest

There are no identified

conflicts of interest.

|

|

Community

Boards

There are no known implications for

Community Boards.

|

|

Finance and Council

Controlled Organisations Committee

11 September 2018

|

|

Items for Consideration by the Chair