Notice of Meeting:

I hereby give notice that an ordinary meeting of the Dunedin

City Council will be held on:

Date: Wednesday

30 June 2021

Time: 9.00

am

Venue: Council

Chamber, Municipal Chambers, The Octagon, Dunedin

Sandy Graham

Council

PUBLIC AGENDA

|

Mayor

|

Mayor Aaron Hawkins

|

|

|

Deputy Mayor

|

Cr Christine Garey

|

|

|

Members

|

Cr Sophie Barker

|

Cr David Benson-Pope

|

|

|

Cr Rachel Elder

|

Cr Doug Hall

|

|

|

Cr Carmen Houlahan

|

Cr Marie Laufiso

|

|

|

Cr Mike Lord

|

Cr Jim O'Malley

|

|

|

Cr Jules Radich

|

Cr Chris Staynes

|

|

|

Cr Lee Vandervis

|

Cr Steve Walker

|

|

|

Cr Andrew Whiley

|

|

Senior Officer Sandy

Graham, Chief Executive Officer

Governance Support Officer Lynne

Adamson

Lynne Adamson

Governance Support Officer

Telephone: 03 477 4000

Lynne.Adamson@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

|

Council

30 June 2021

|

ITEM TABLE OF CONTENTS PAGE

1 Opening 4

2 Public

Forum 4

2.1 Red Light 4

3 Apologies 4

4 Confirmation

of Agenda 4

5 Declaration

of Interest 5

6 Confirmation

of Minutes 19

6.1 Ordinary Council

meeting - 10 May 2021 19

6.2 Ordinary Council

meeting - 25 May 2021 20

6.3 Ordinary Council

meeting - 31 May 2021 21

Minutes

of Community Boards

7 Saddle

Hill Community Board - 18 March 2021 22

8 Mosgiel-Taieri

Community Board - 14 April 2021 23

9 Otago

Peninsula Community Board - 15 April 2021 24

10 West

Harbour Community Board - 21 April 2021 25

Reports

11 Actions

From Resolutions of Council Meetings 26

12 Council

Forward Work Programme 31

13 Adoption

of 10 year plan 2021-31 41

14 Setting

of Rates for the 2021/22 Financial Year 46

15 Māori

Representation 72

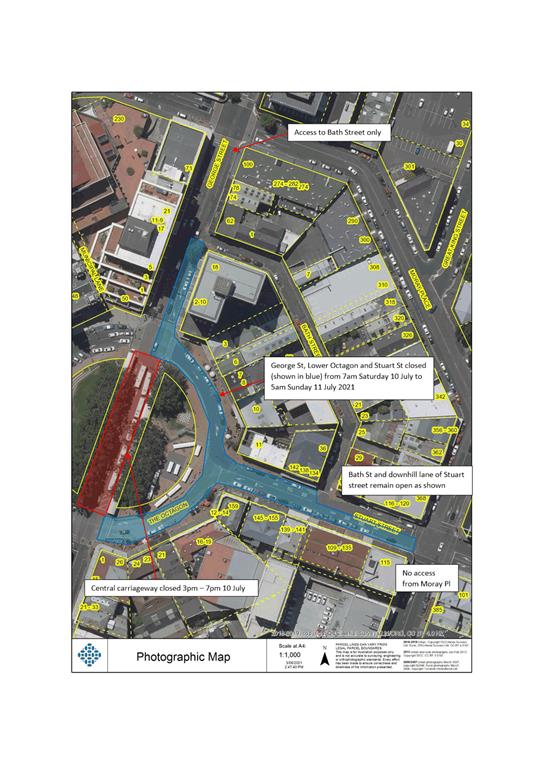

16 Event

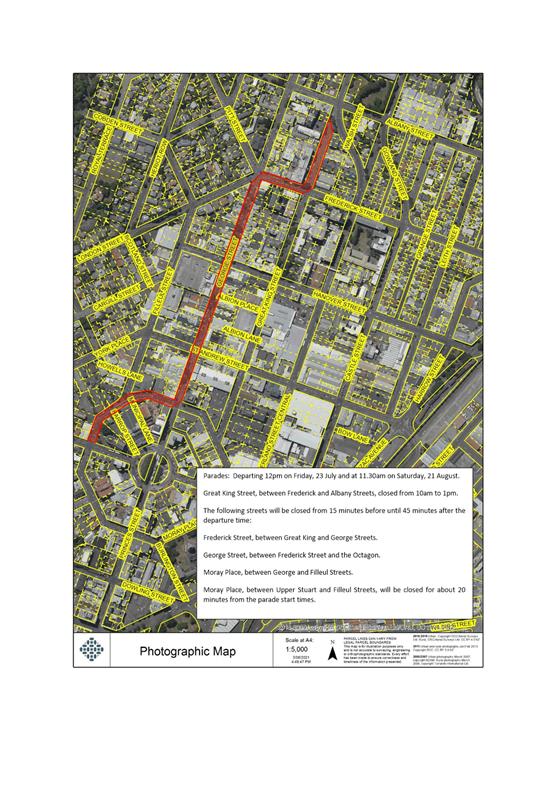

Road Closures 73

17 LGNZ

Annual General Meeting Remits 86

18 Proposed

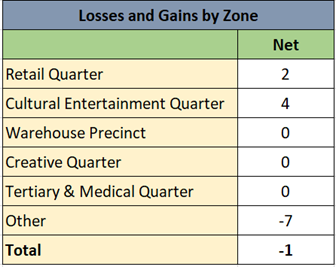

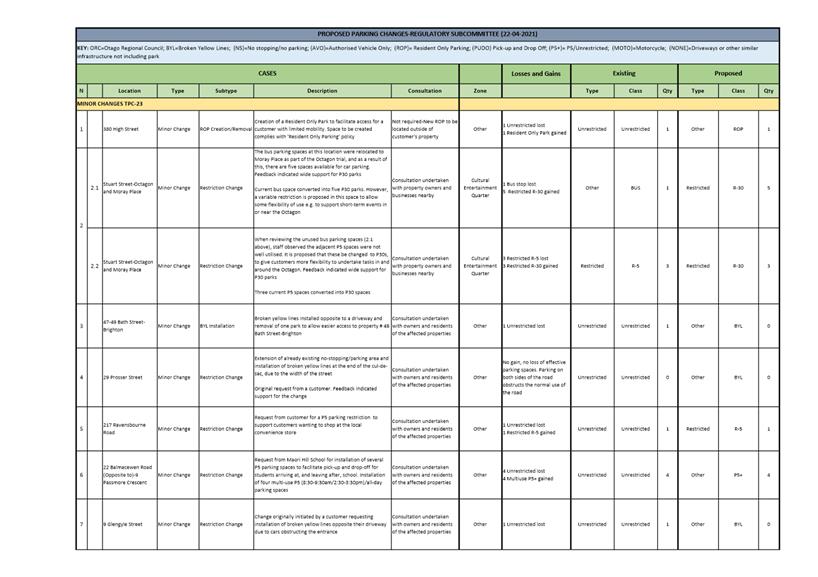

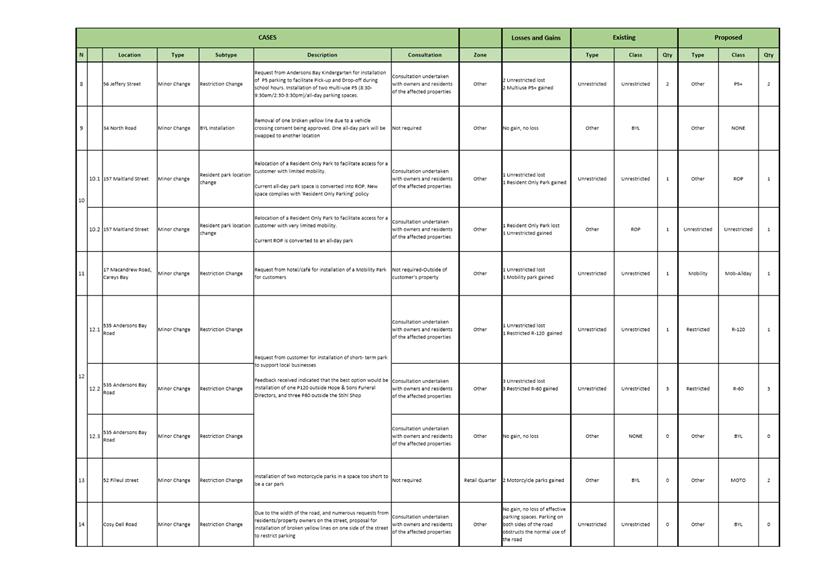

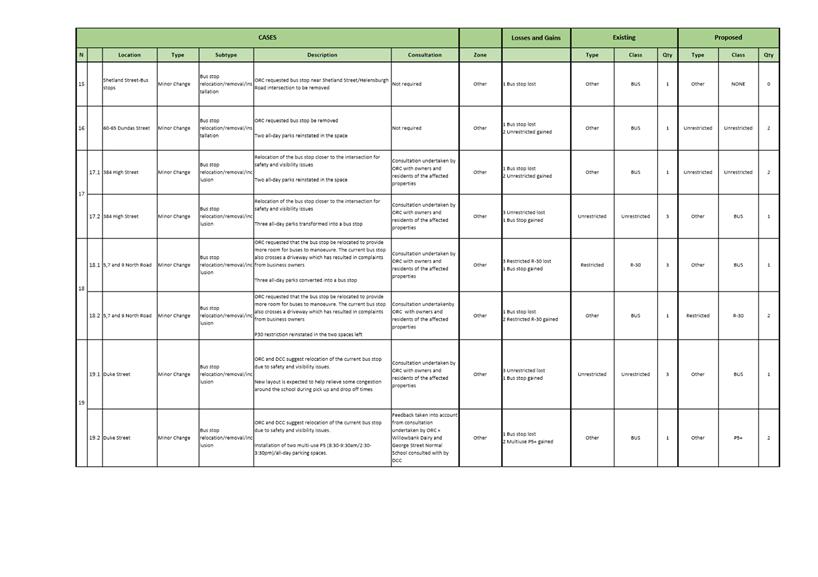

Parking Restriction Changes - June 2021 168

19 Proposed

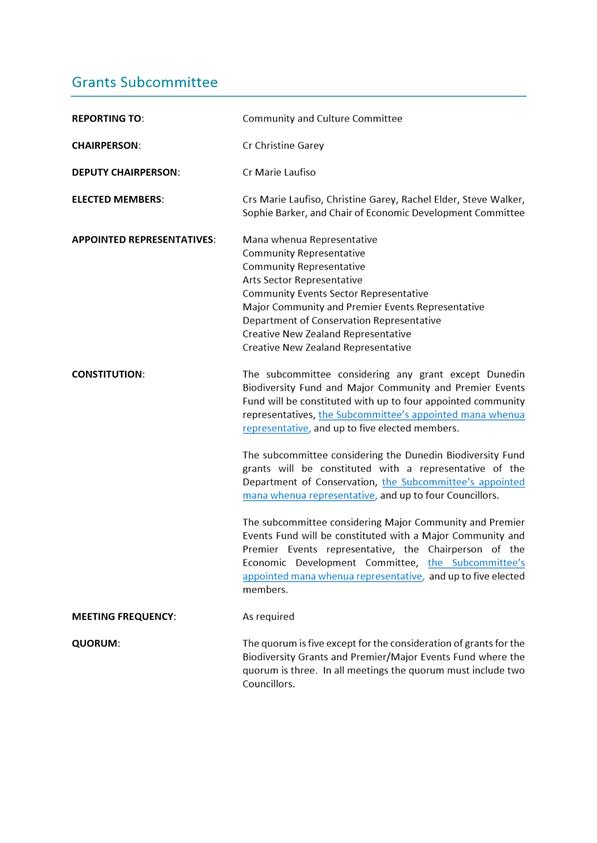

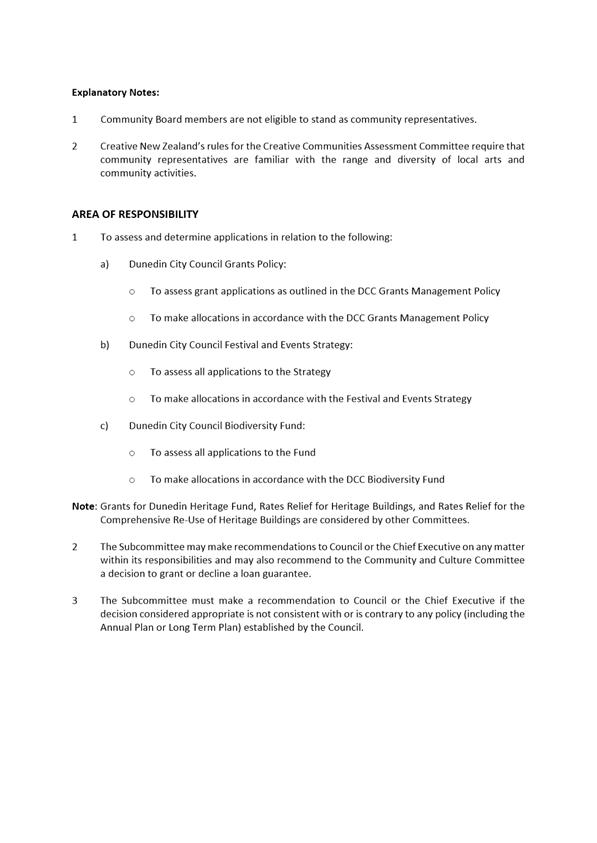

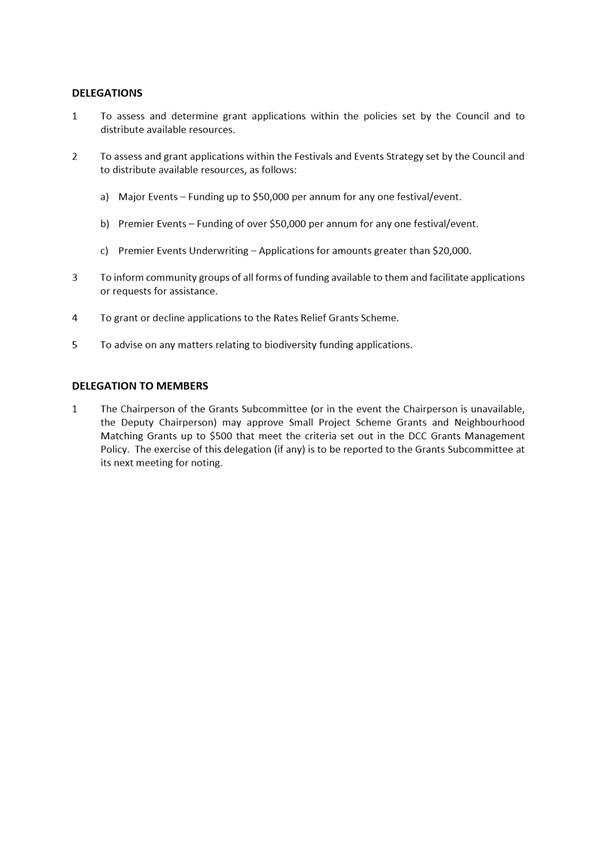

Amendments to DCC Grants Subcommittee Delegations 187

20 Councillor

Appointment to Outside Organisation 192

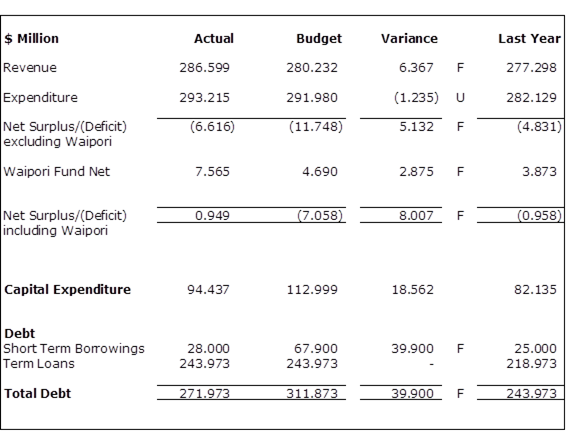

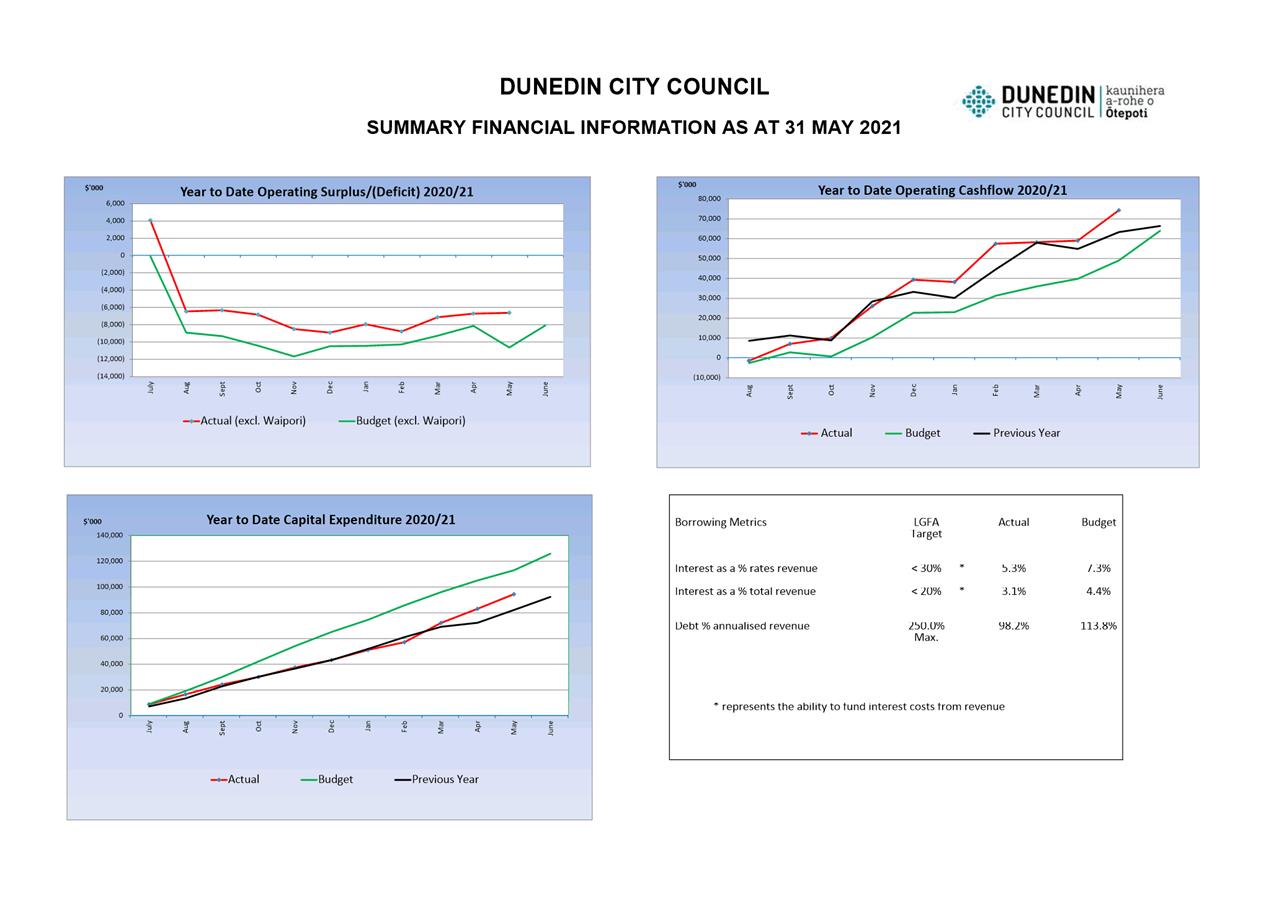

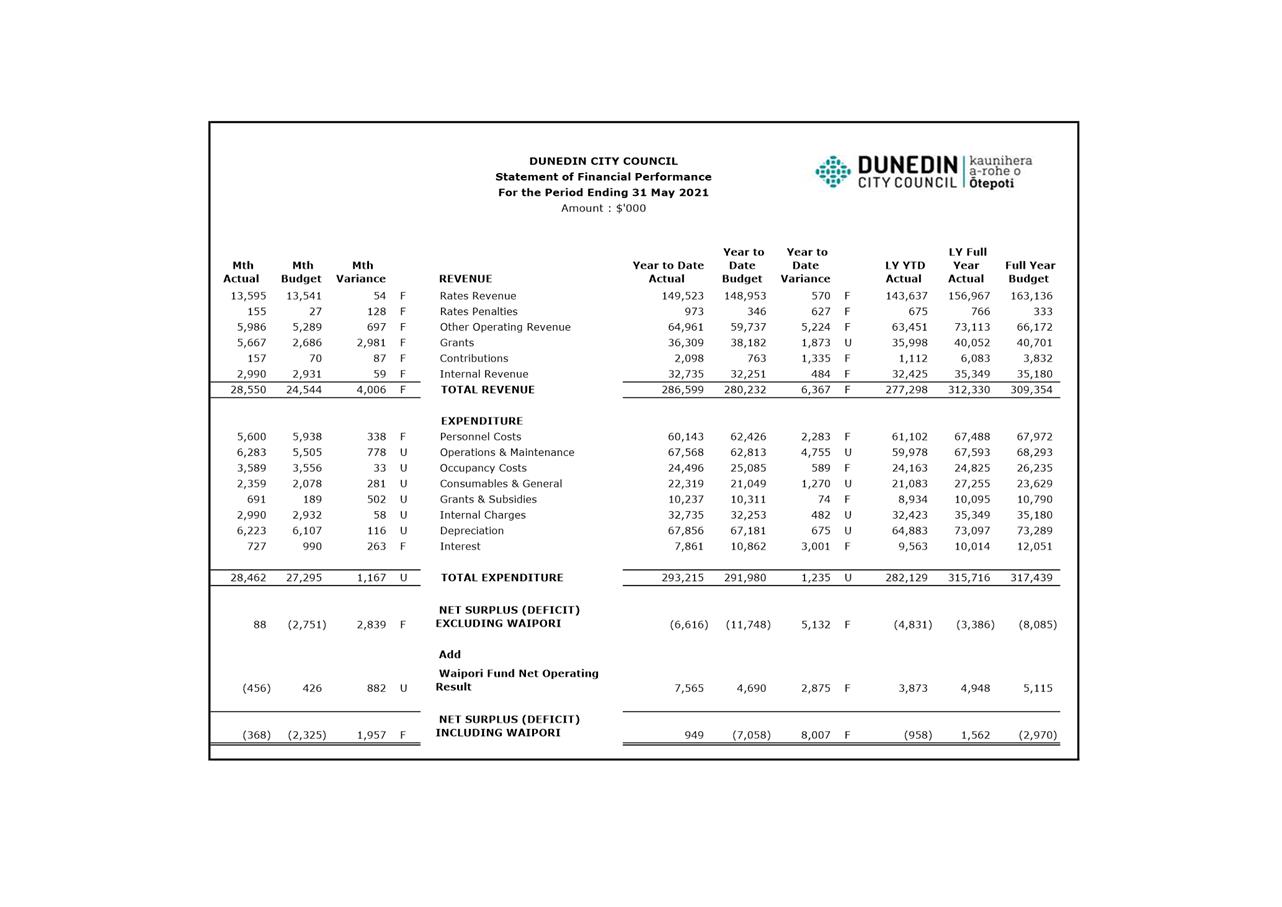

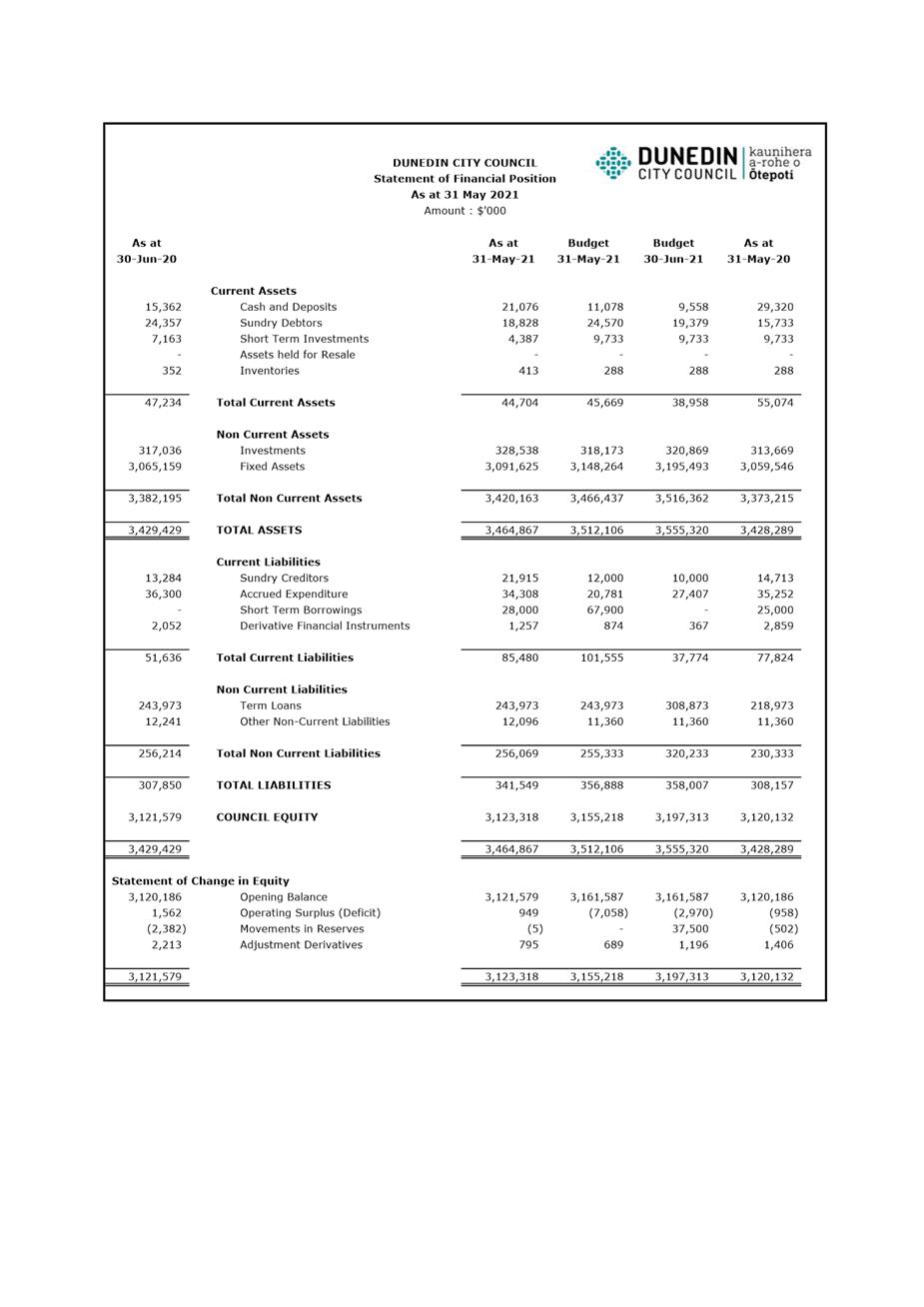

21 Financial

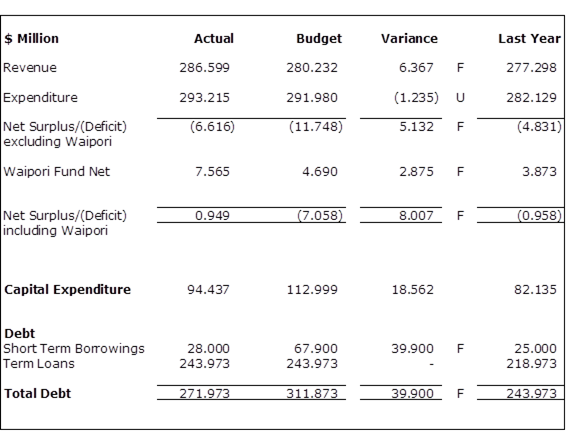

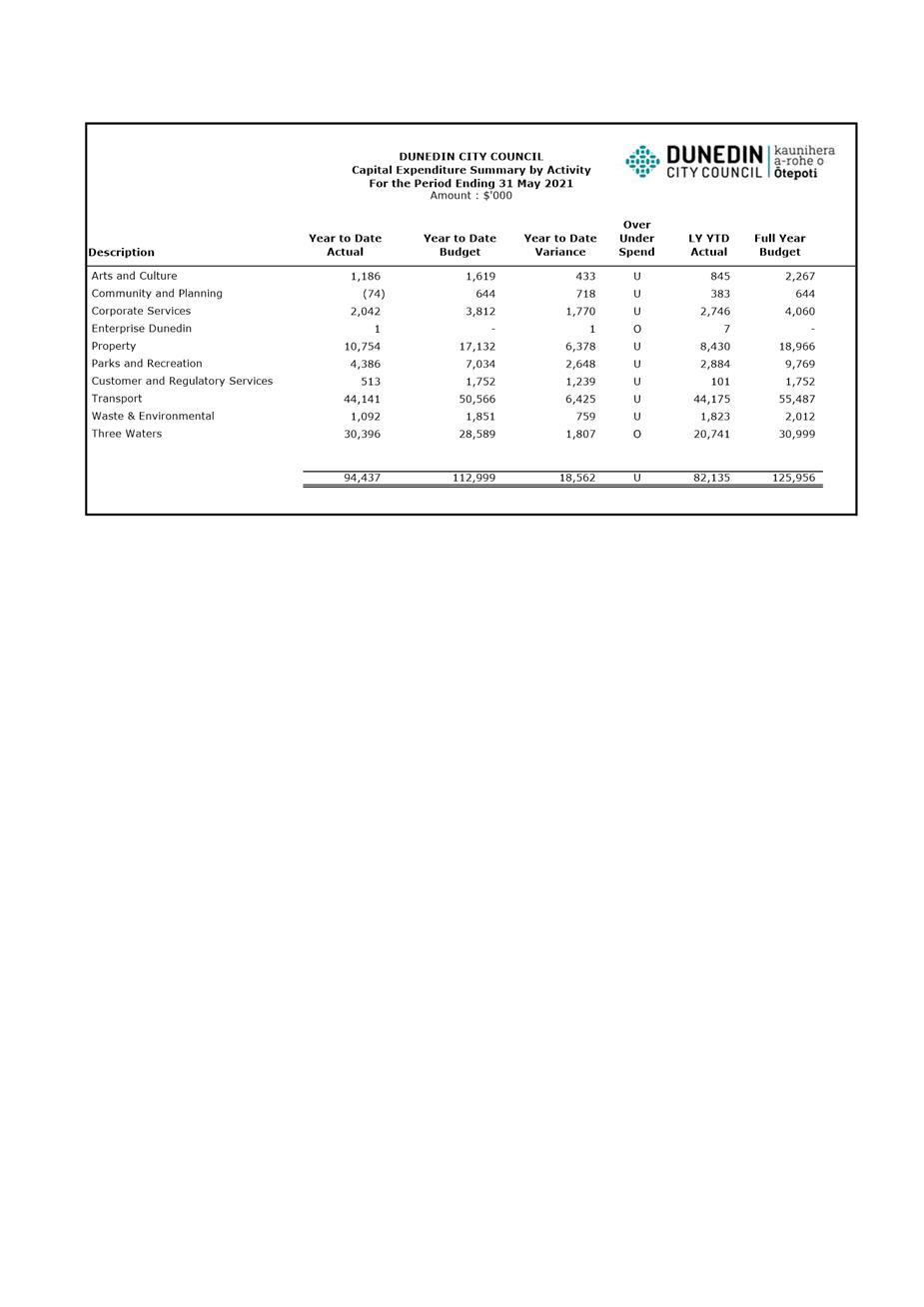

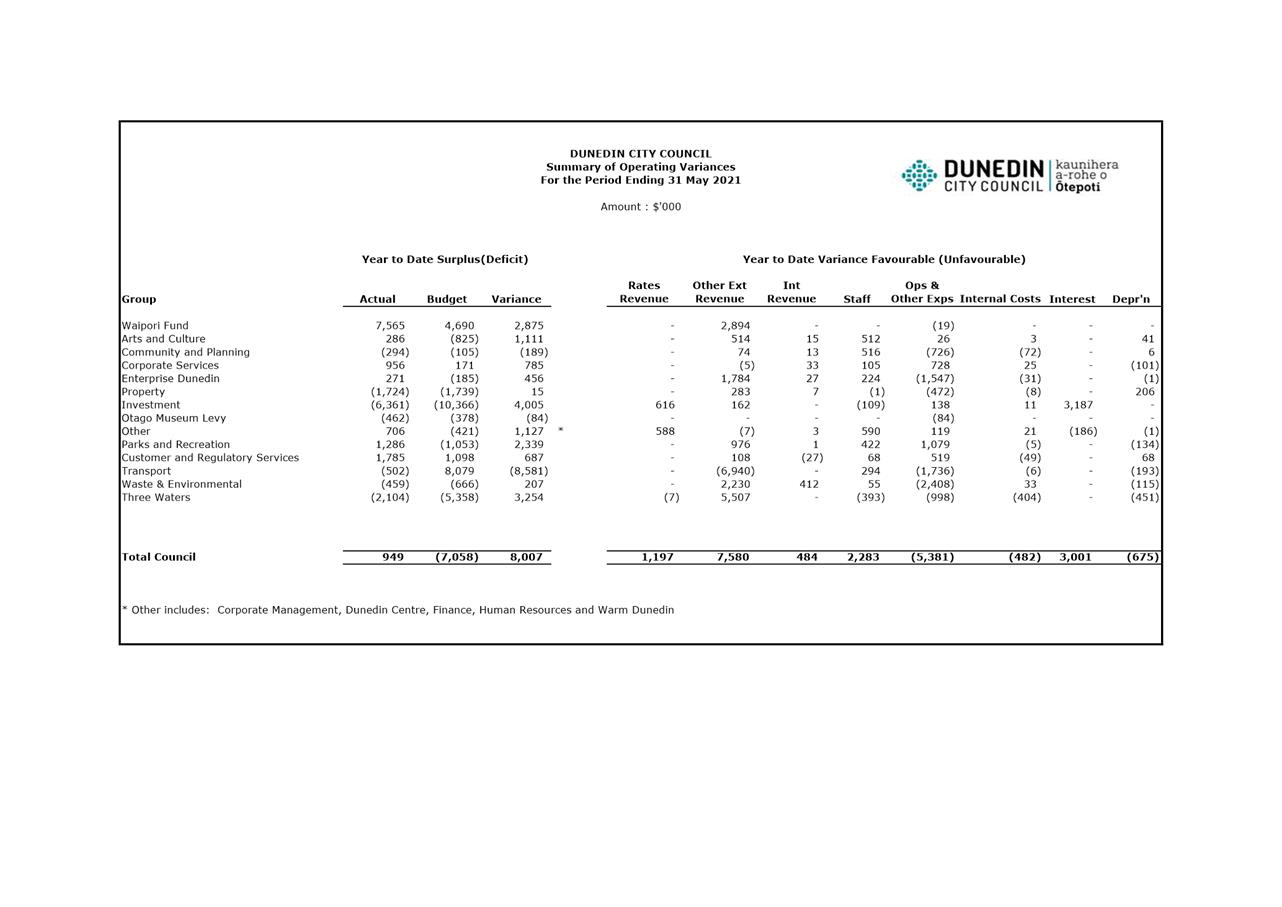

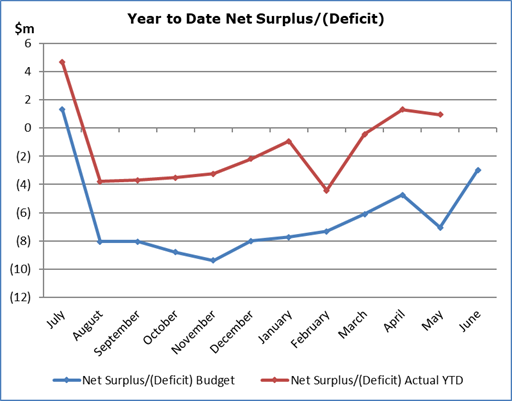

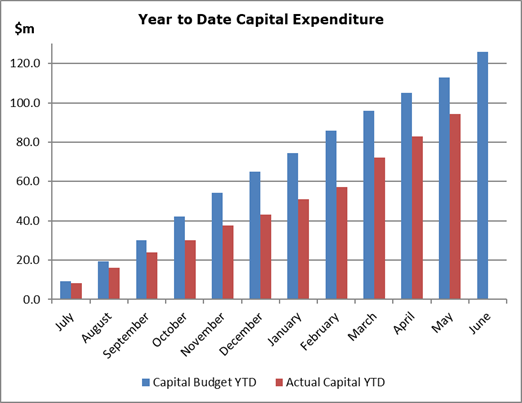

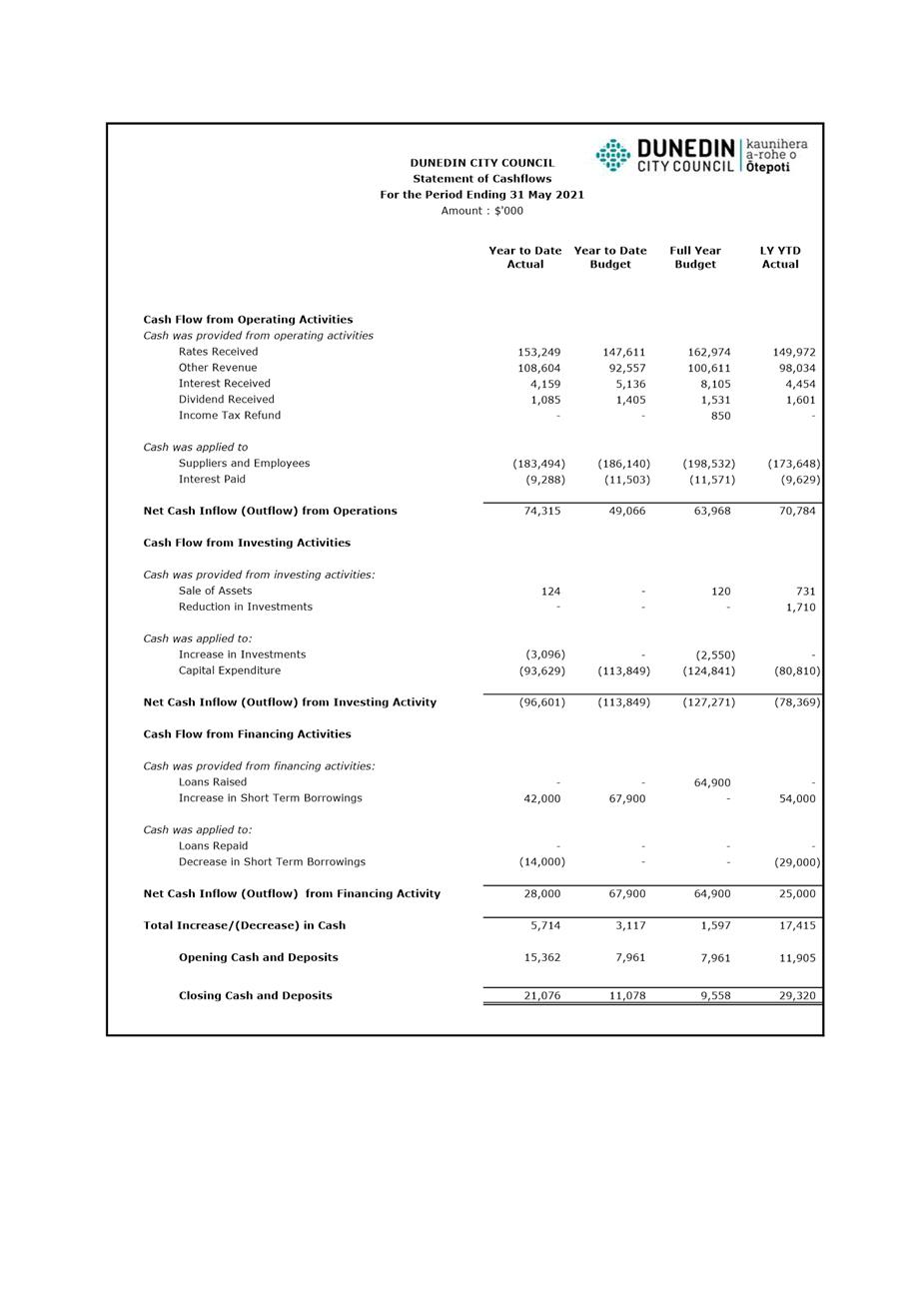

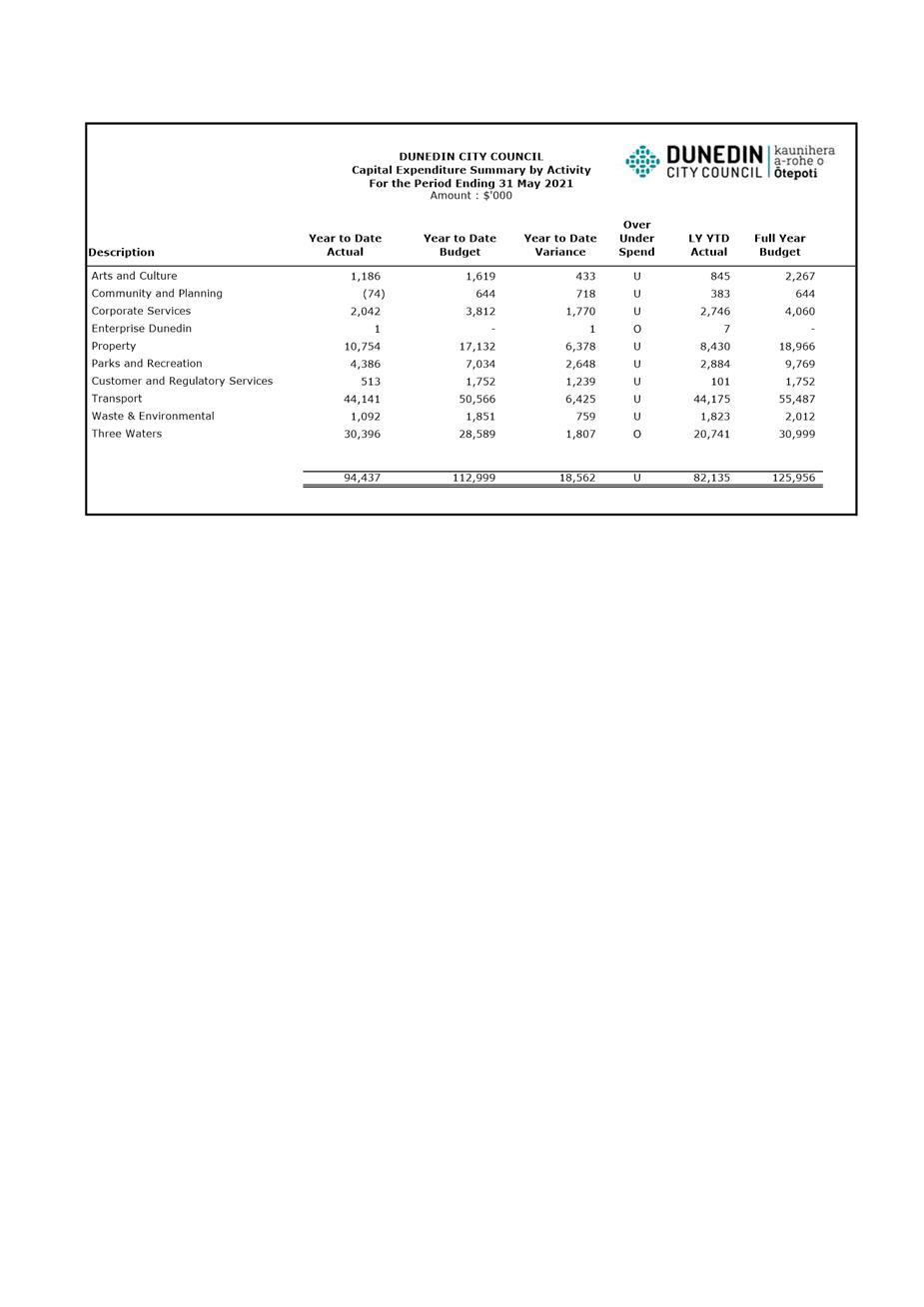

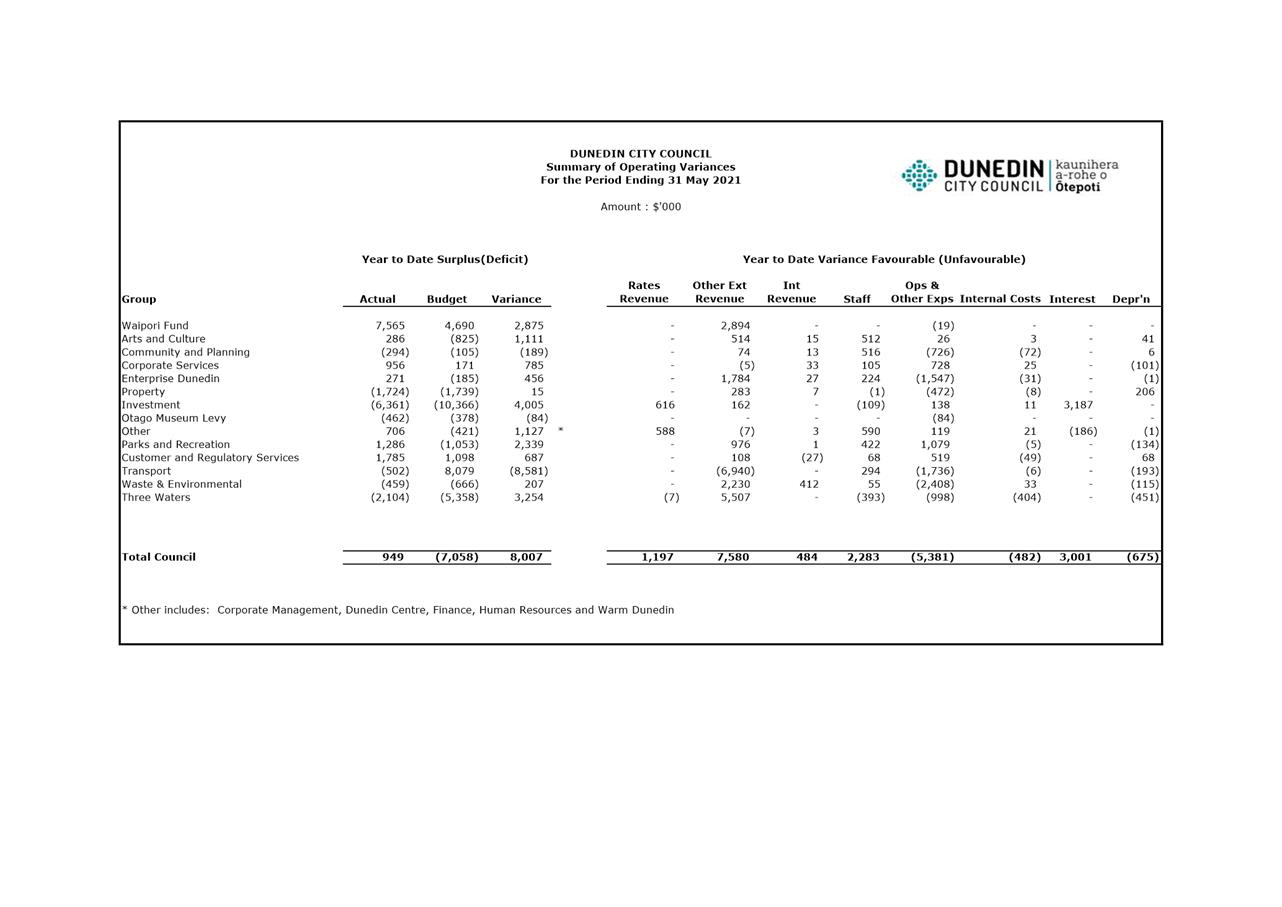

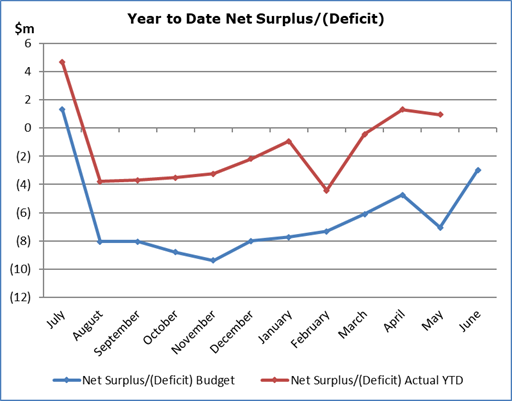

Result - Period Ended 31 May 2021 193

22 Waipori

Fund - Quarter Ending March 2021 210

23 2021/2022

Statements of Intent - Dunedin City Holdings Group Companies 216

24 Dunedin

Railways Limited 217

Resolution to Exclude the Public 220

|

|

Council

30 June 2021

|

1 Opening

Peter Manins will open

the meeting with a prayer on behalf of the Baha’I community.

2 Public

Forum

2.1 Red

Light

Anna-Lena Bininda and Corey Allan

wish to address the meeting concerning Red Light Dunedin.

3 Apologies

At the close of the agenda no

apologies had been received.

4 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

|

|

Council

30 June 2021

|

Declaration of Interest

EXECUTIVE SUMMARY

1. Members

are reminded of the need to stand aside from decision-making when a conflict

arises between their role as an elected representative and any private or other

external interest they might have.

2. Elected

members are reminded to update their register of interests as

soon as practicable, including amending the register at this meeting if

necessary.

3. Staff members are

reminded to update their register of interests as soon as practicable.

|

RECOMMENDATIONS

That the Council:

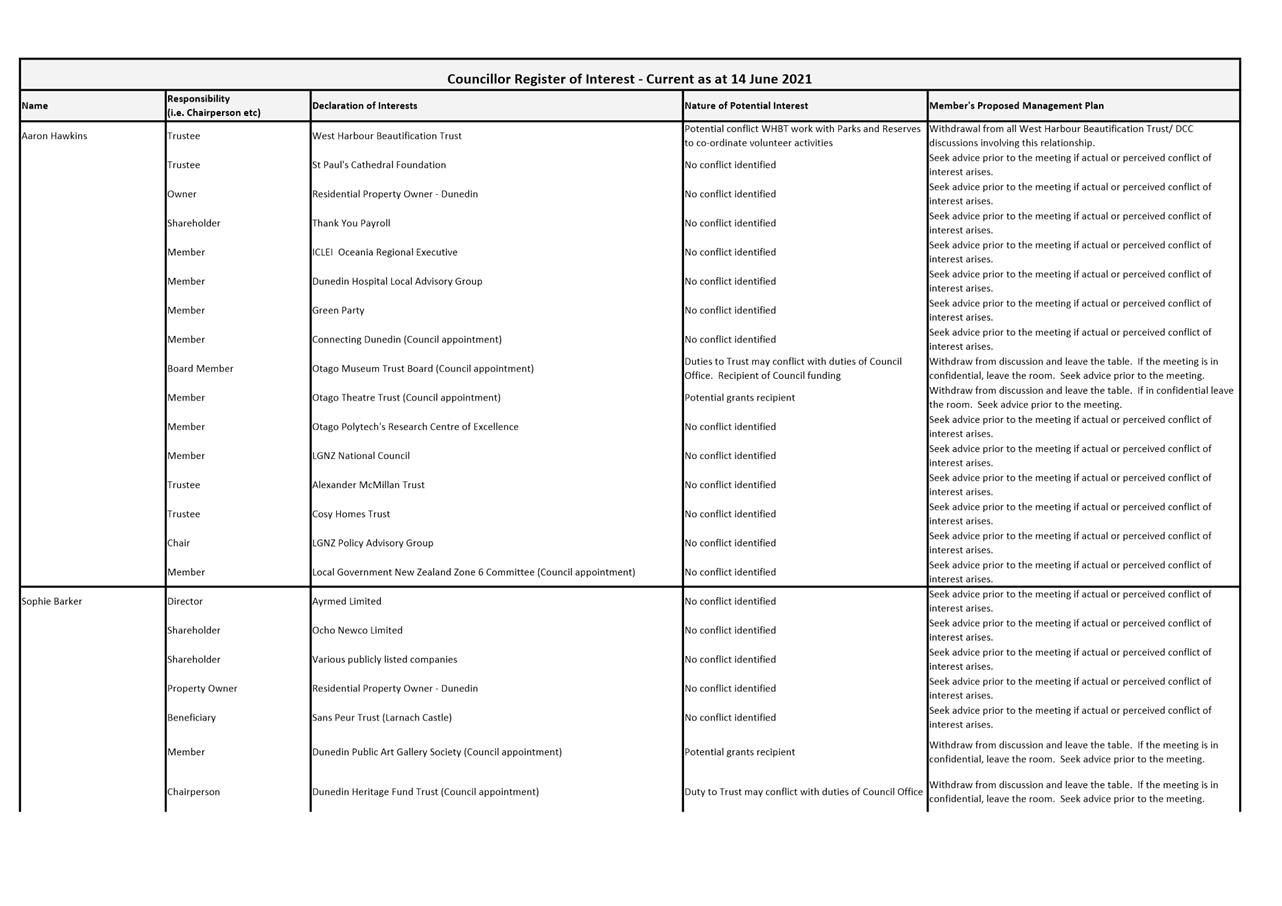

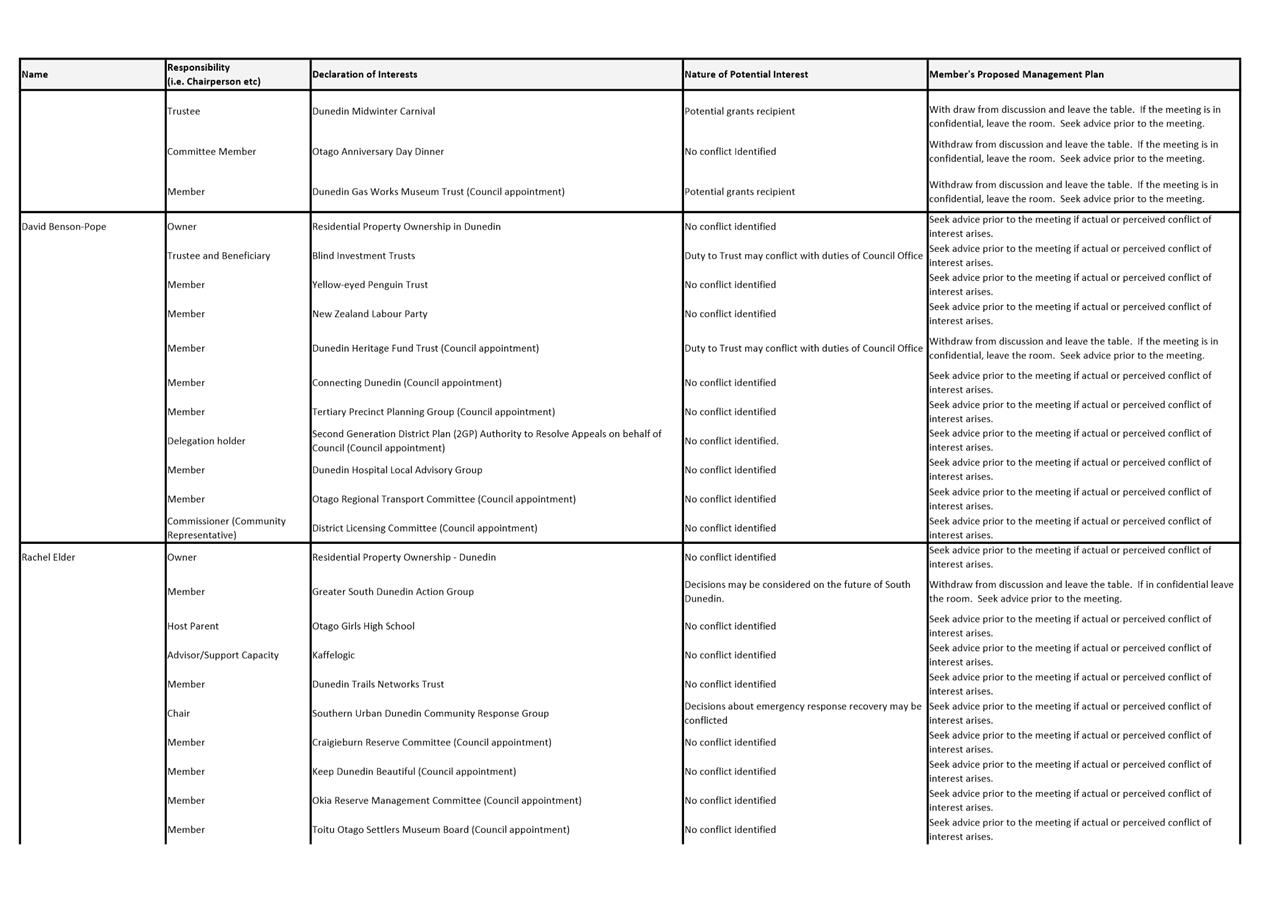

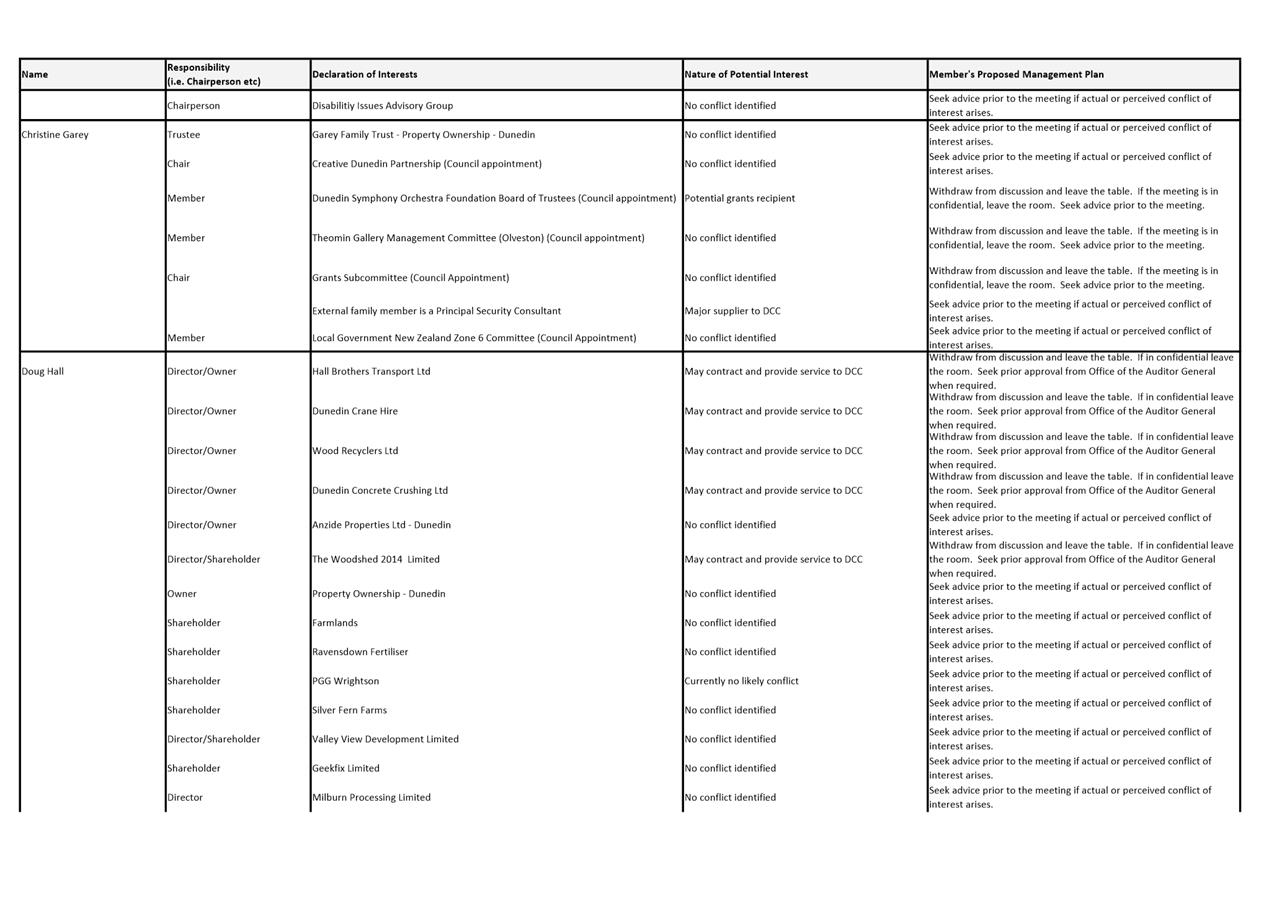

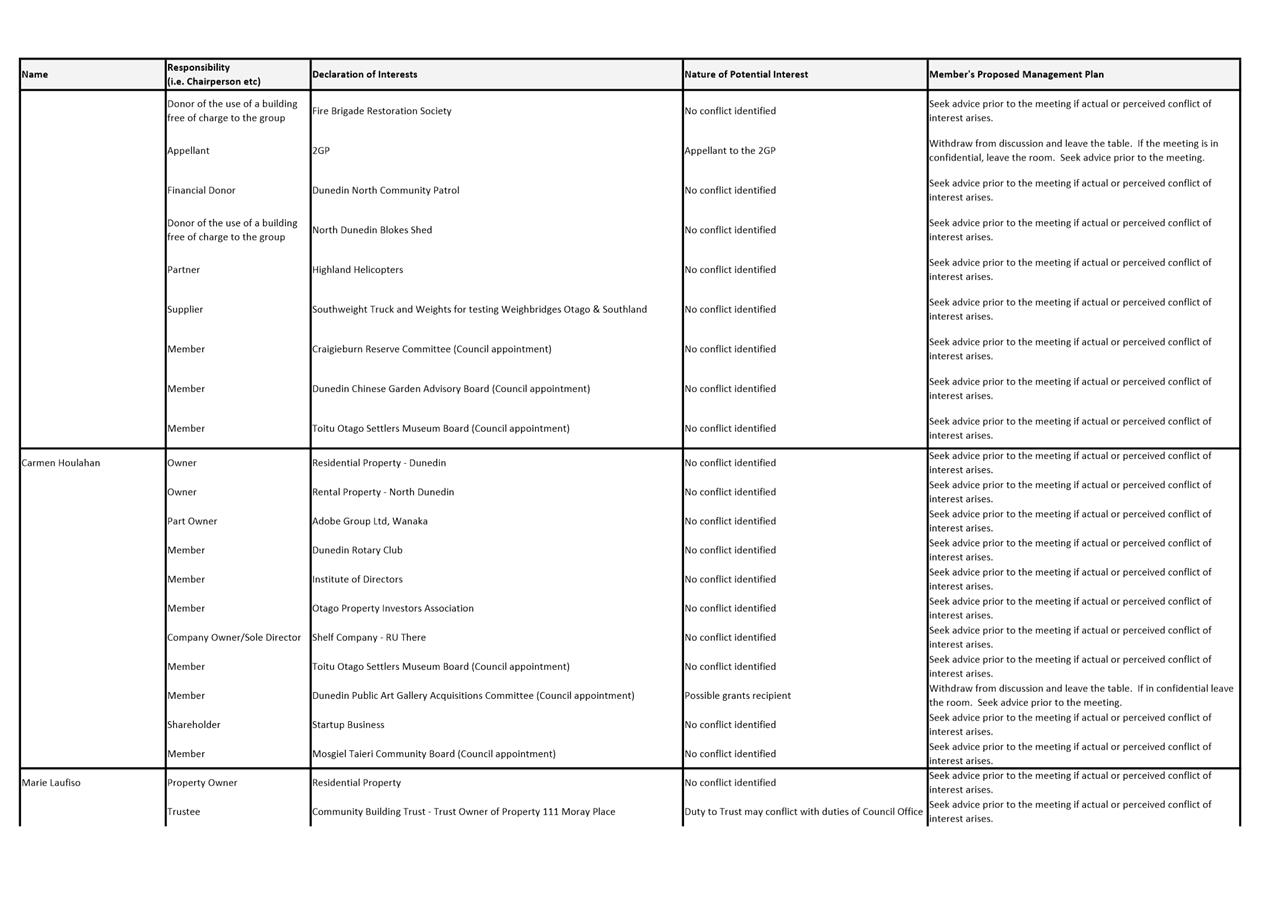

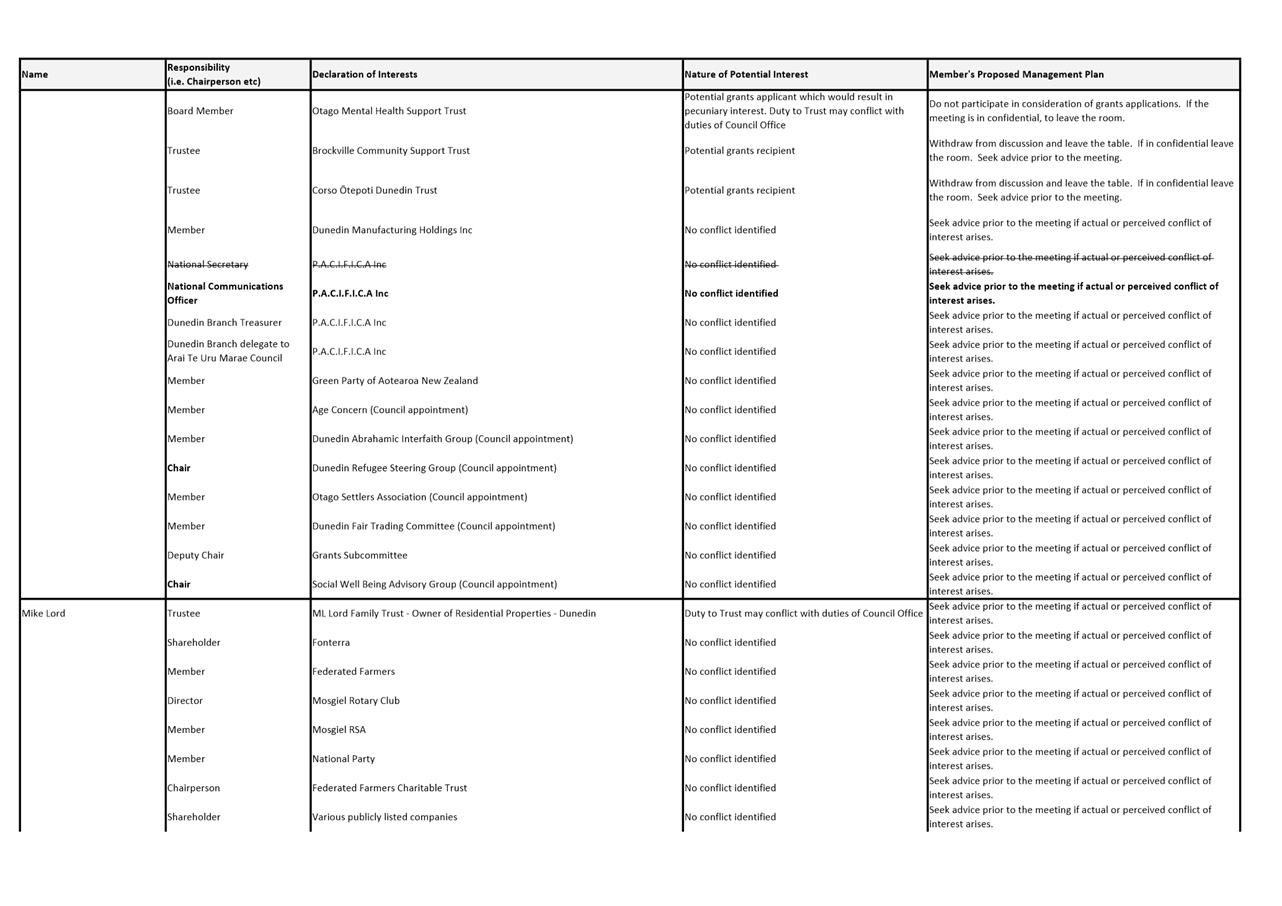

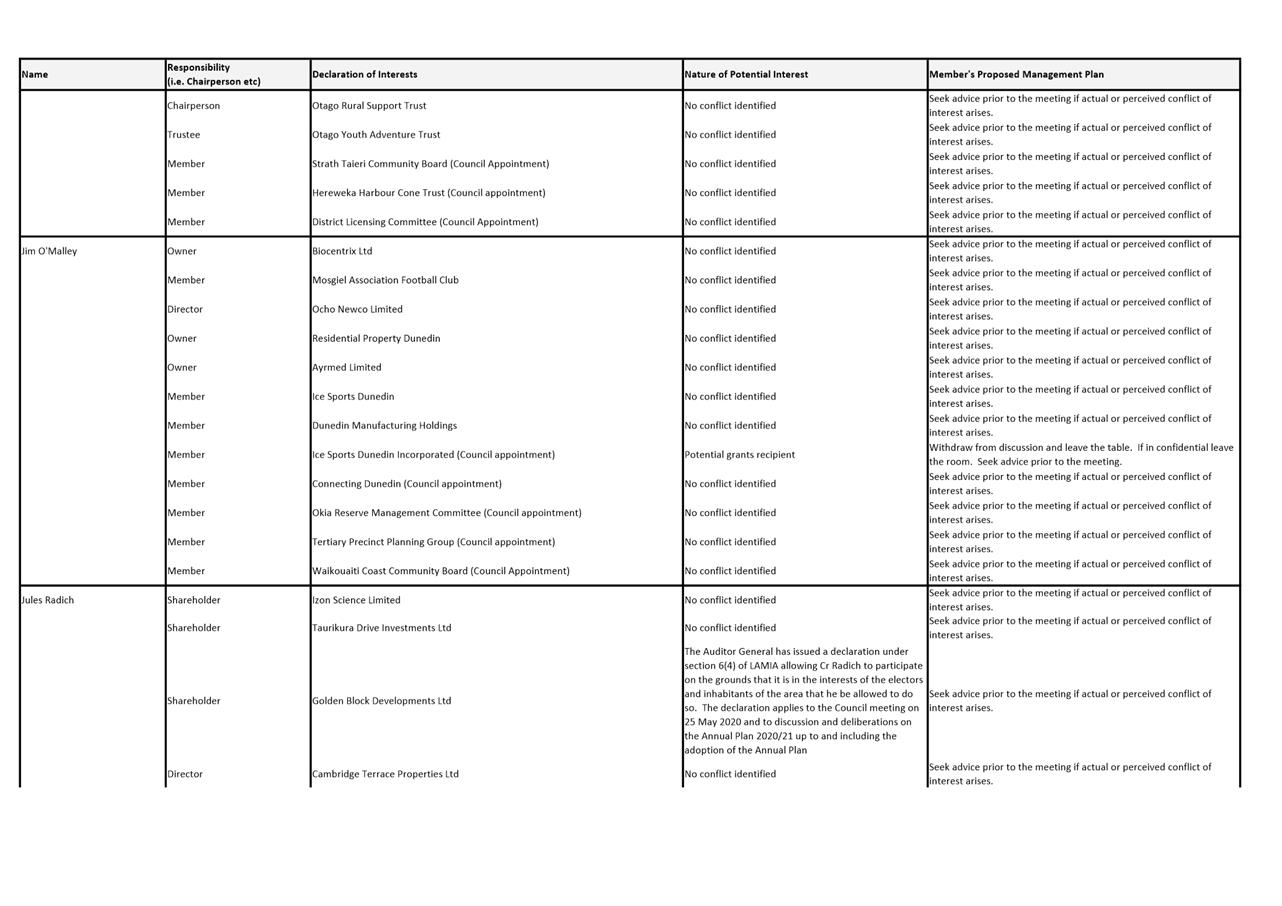

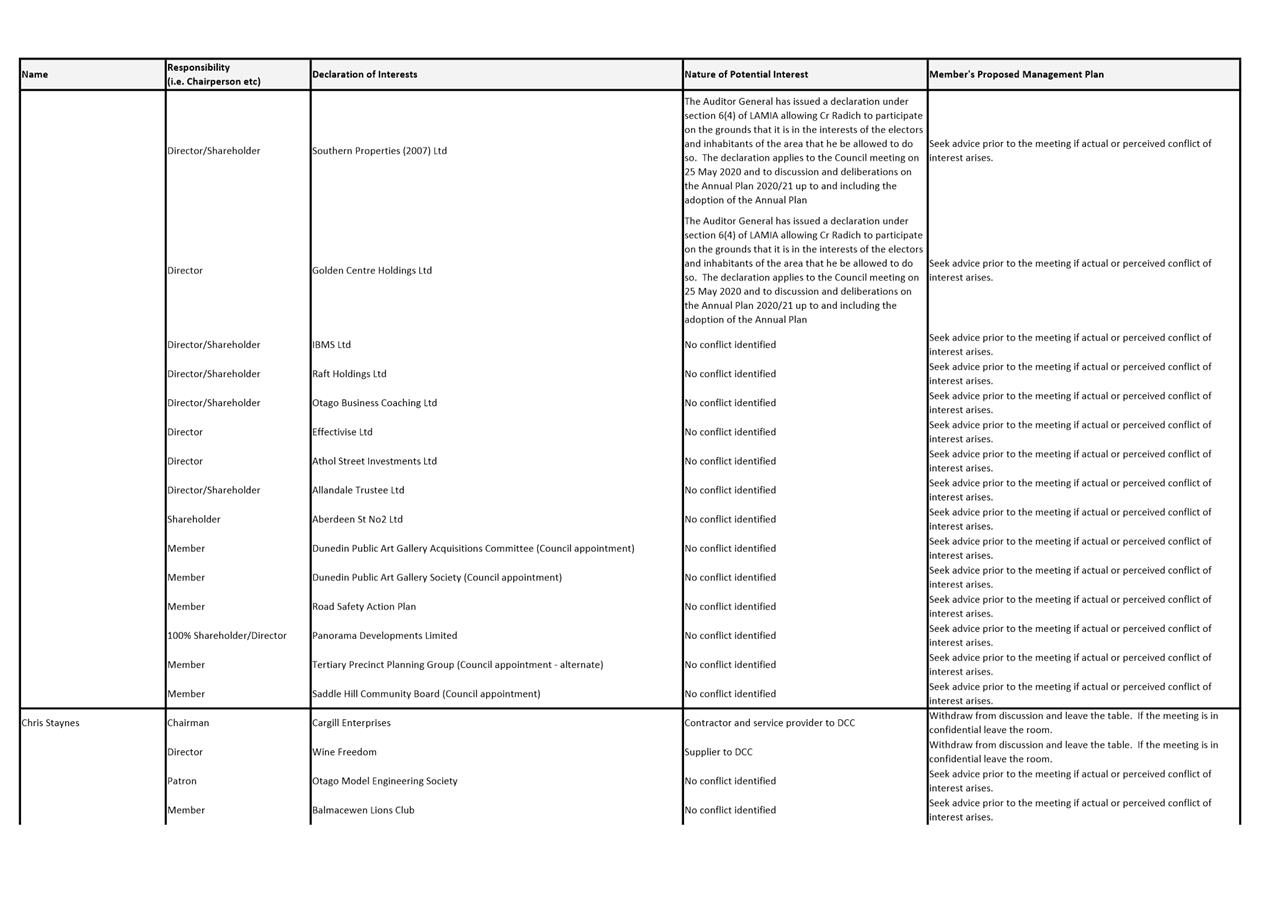

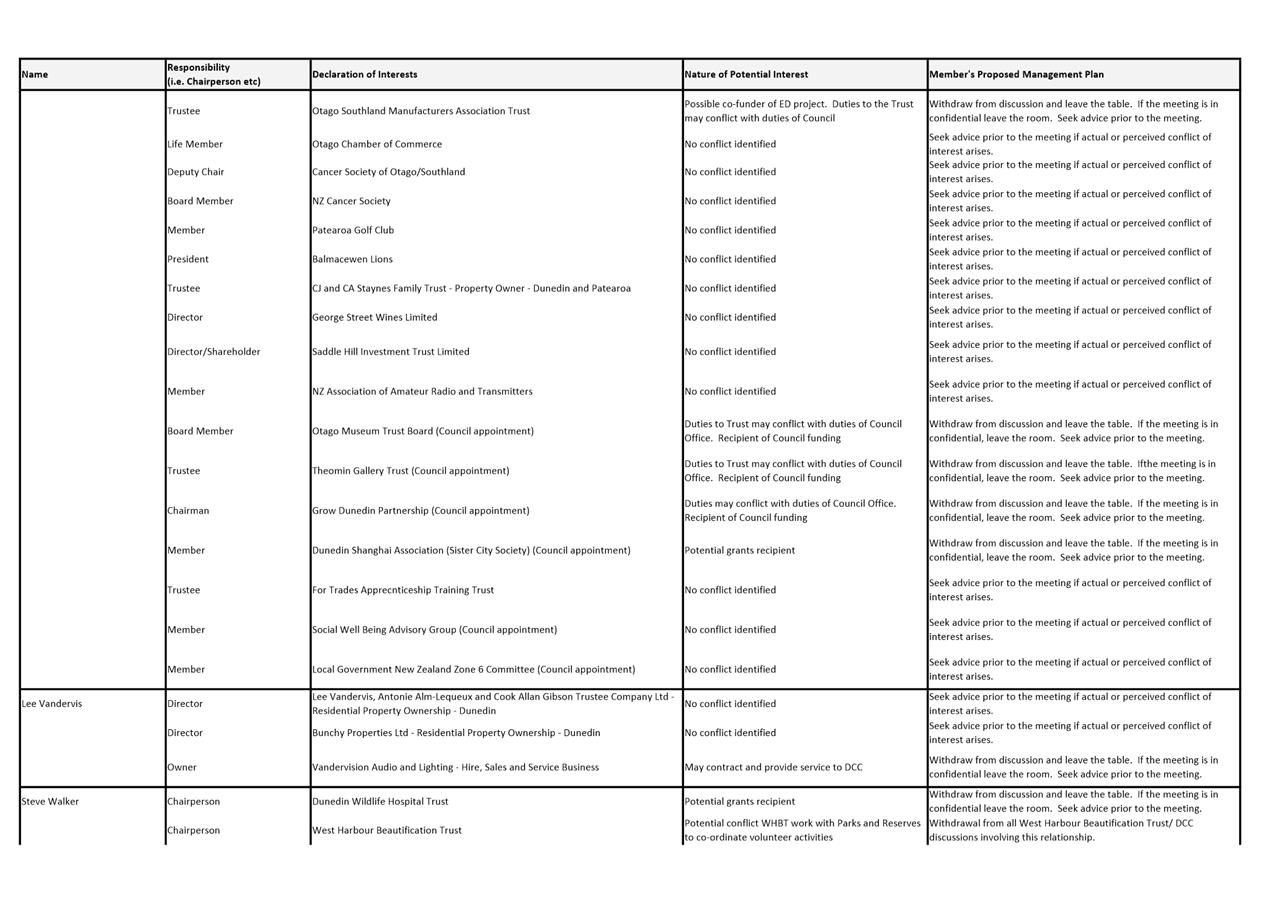

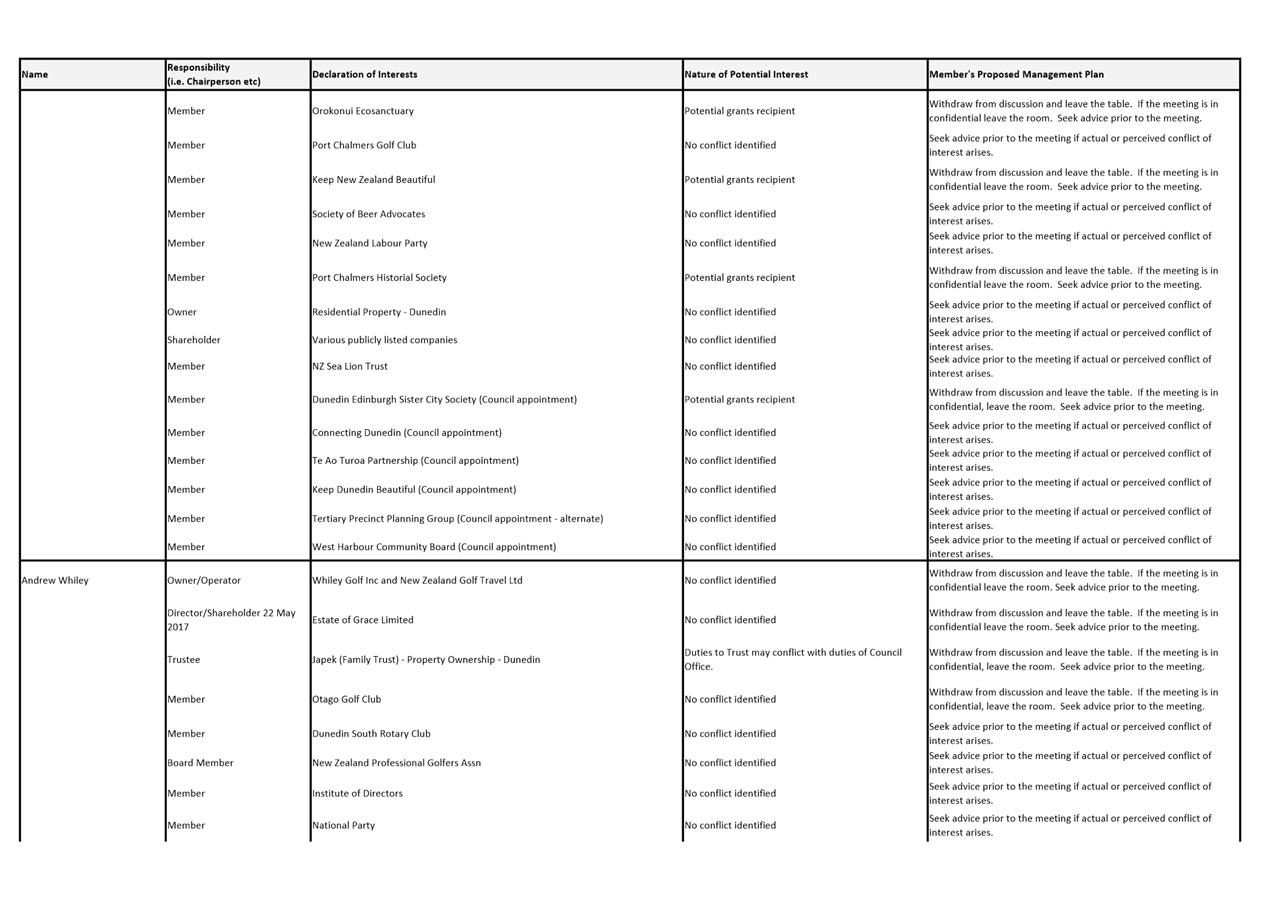

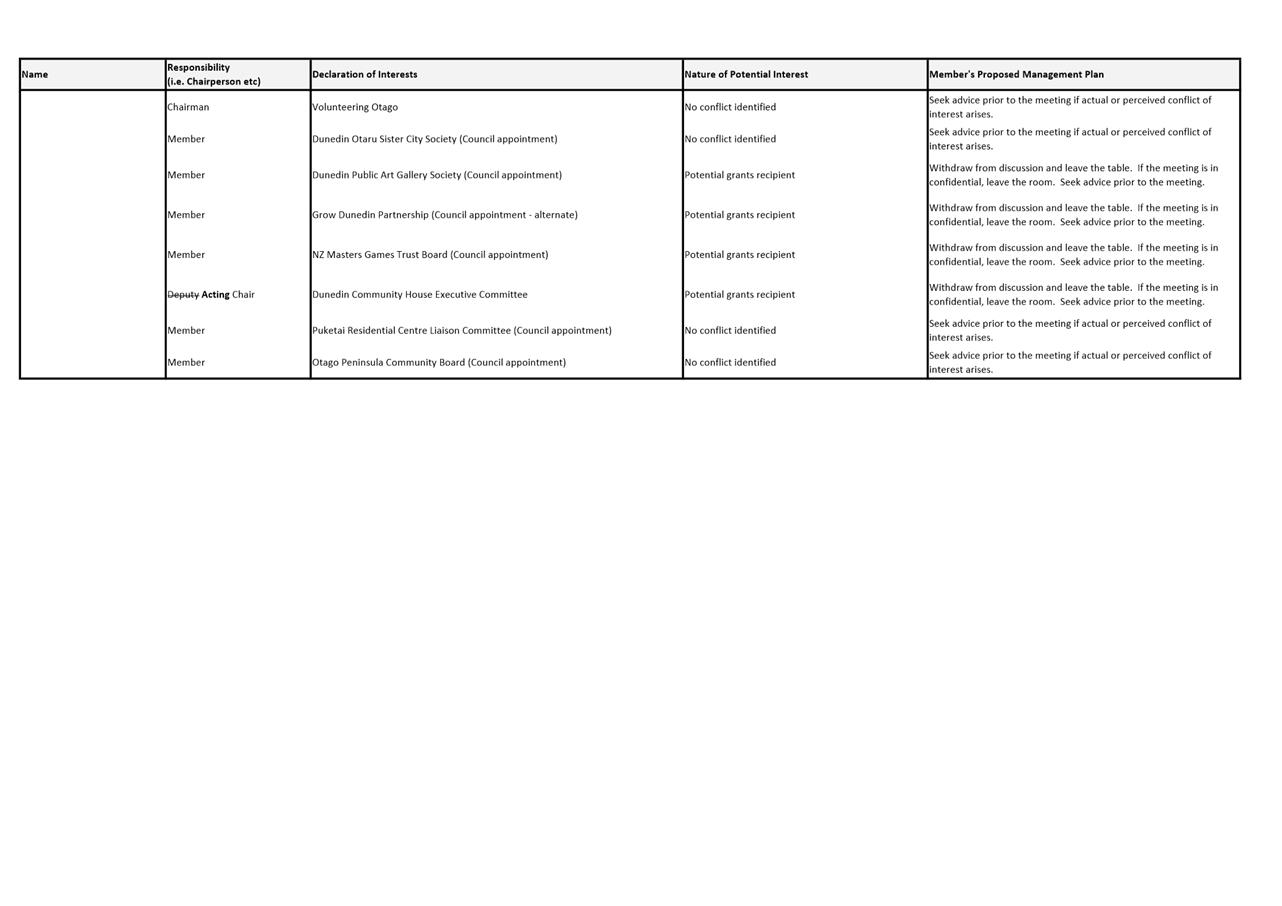

a) Notes/Amends if necessary, the Elected Members'

Interest Register attached as Attachment A; and

b) Confirms/Amends the proposed management plan for

Elected Members' Interests.

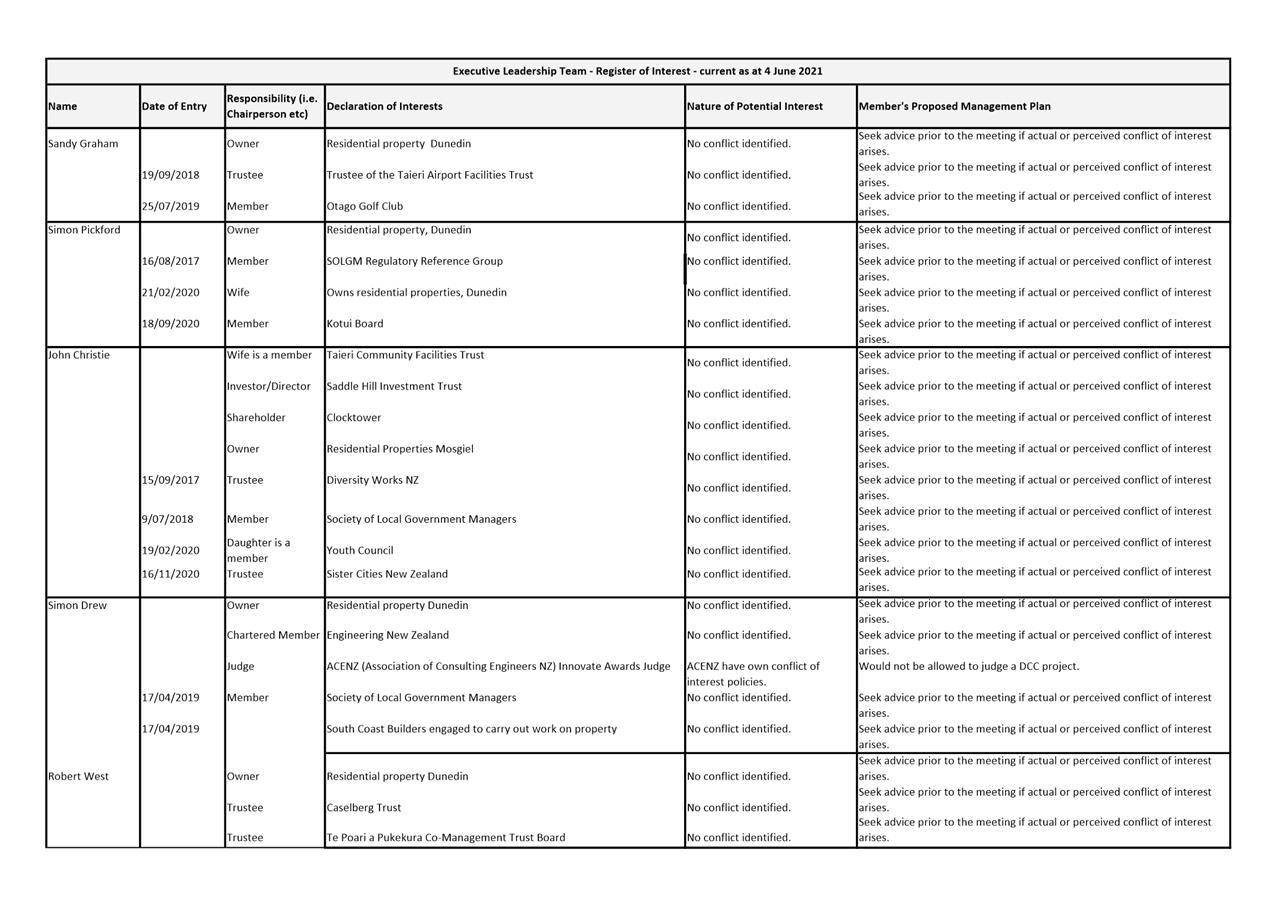

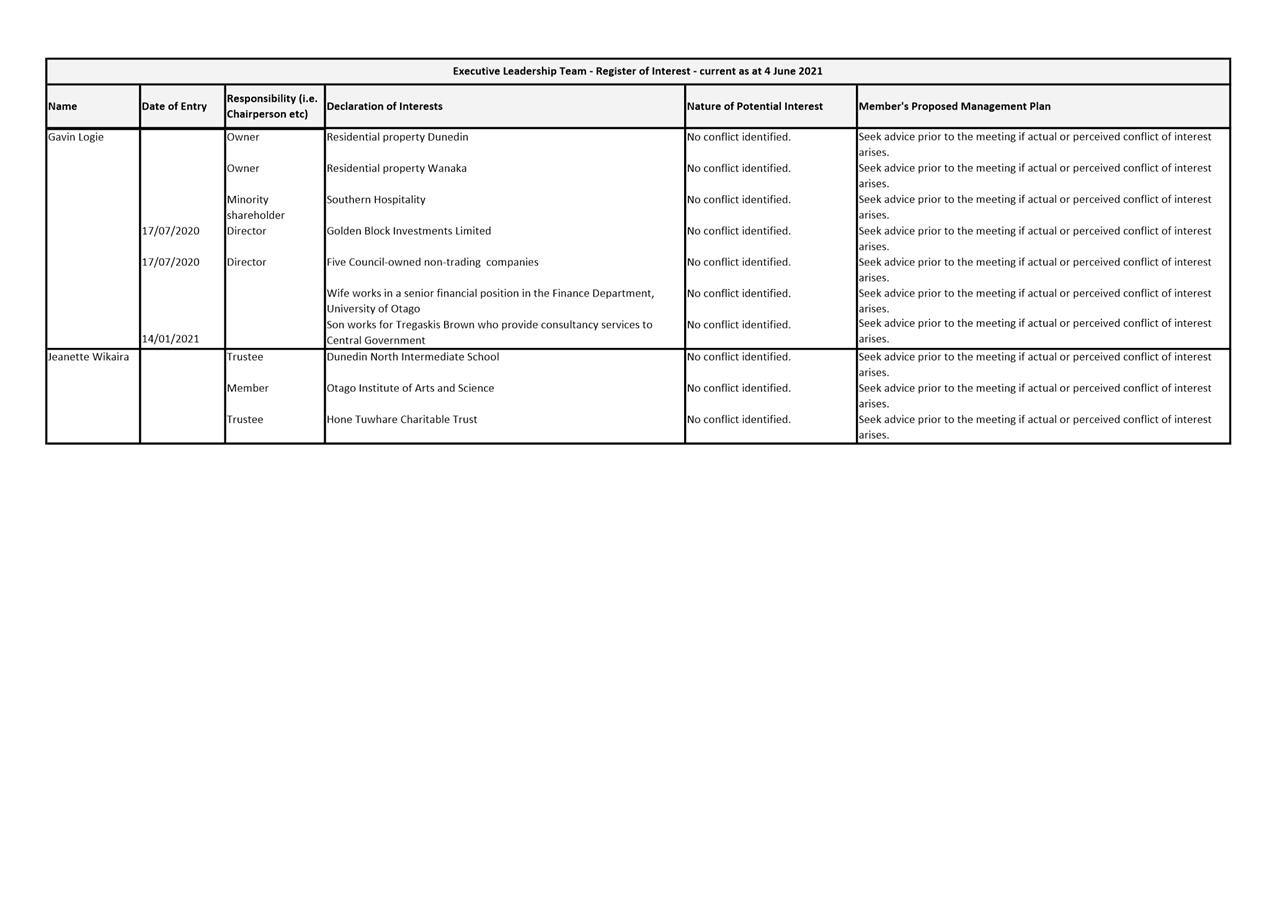

c) Notes the proposed management plan for the Executive

Leadership Team.

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Councillor Register of

Interest

|

7

|

|

⇩b

|

ELT Register of

Interest

|

17

|

|

|

Council

30 June 2021

|

Confirmation

of Minutes

Ordinary Council meeting - 10 May 2021

|

RECOMMENDATIONS

That the Council:

Confirms the public part of the minutes of the

Ordinary Council meeting held on 10 May 2021 as a correct record.

|

Attachments

|

|

Title

|

Page

|

|

⇨a

|

Minutes of Ordinary

Council meeting held on 10 May 2021 (Under Separate Cover 1)

|

|

|

|

Council

30 June 2021

|

Ordinary Council meeting - 25

May 2021

|

RECOMMENDATIONS

That the Council:

Confirms the public part of the minutes of the

Ordinary Council meeting held on 25 May 2021 as a correct record.

|

Attachments

|

|

Title

|

Page

|

|

⇨a

|

Minutes of Ordinary

Council meeting held on 25 May 2021 (Under Separate Cover 1)

|

|

|

|

Council

30 June 2021

|

Ordinary Council meeting - 31

May 2021

|

RECOMMENDATIONS

That the Council:

a) Confirms the public part of the minutes of the

Ordinary Council meeting held on 31 May 2021 as a correct record.

|

Attachments

|

|

Title

|

Page

|

|

⇨a

|

Minutes of Ordinary

Council meeting held on 31 May 2021 (Under Separate Cover 1)

|

|

|

|

Council

30 June 2021

|

Minutes

of Community Boards

Saddle Hill Community Board - 18 March 2021

gg

|

RECOMMENDATIONS

That the Council:

a) Notes the minutes of the Saddle Hill Community Board meeting held on 18 March 2021.

|

Attachments

|

|

Title

|

Page

|

|

⇨a

|

Minutes of Saddle Hill Community

Board held on 18 March 2021 (Under Separate Cover 1)

|

|

|

|

Council

30 June 2021

|

Mosgiel-Taieri Community

Board - 14 April 2021

gg

|

RECOMMENDATIONS

That the Council:

a) Notes the minutes of the Mosgiel-Taieri Community Board meeting held on 14 April

2021

|

Attachments

|

|

Title

|

Page

|

|

⇨a

|

Minutes of

Mosgiel-Taieri Community Board held on 14 April 2021 (Under Separate Cover

1)

|

|

|

|

Council

30 June 2021

|

Otago Peninsula Community

Board - 15 April 2021

gg

|

RECOMMENDATIONS

That the Council:

a) Notes the minutes of the Otago Peninsula Community Board meeting held on 15 April

2021

|

Attachments

|

|

Title

|

Page

|

|

⇨a

|

Minutes of Otago

Peninsula Community Board held on 15 April 2021 (Under Separate Cover 1)

|

|

|

|

Council

30 June 2021

|

West Harbour Community Board

- 21 April 2021

gg

|

RECOMMENDATIONS

That the Council:

a) Notes minutes of the West Harbour Community Board meeting held on 21 April 2021

|

Attachments

|

|

Title

|

Page

|

|

⇨a

|

Minutes of West Harbour

Community Board held on 21 April 2021 (Under Separate Cover 1)

|

|

|

|

Council

30 June 2021

|

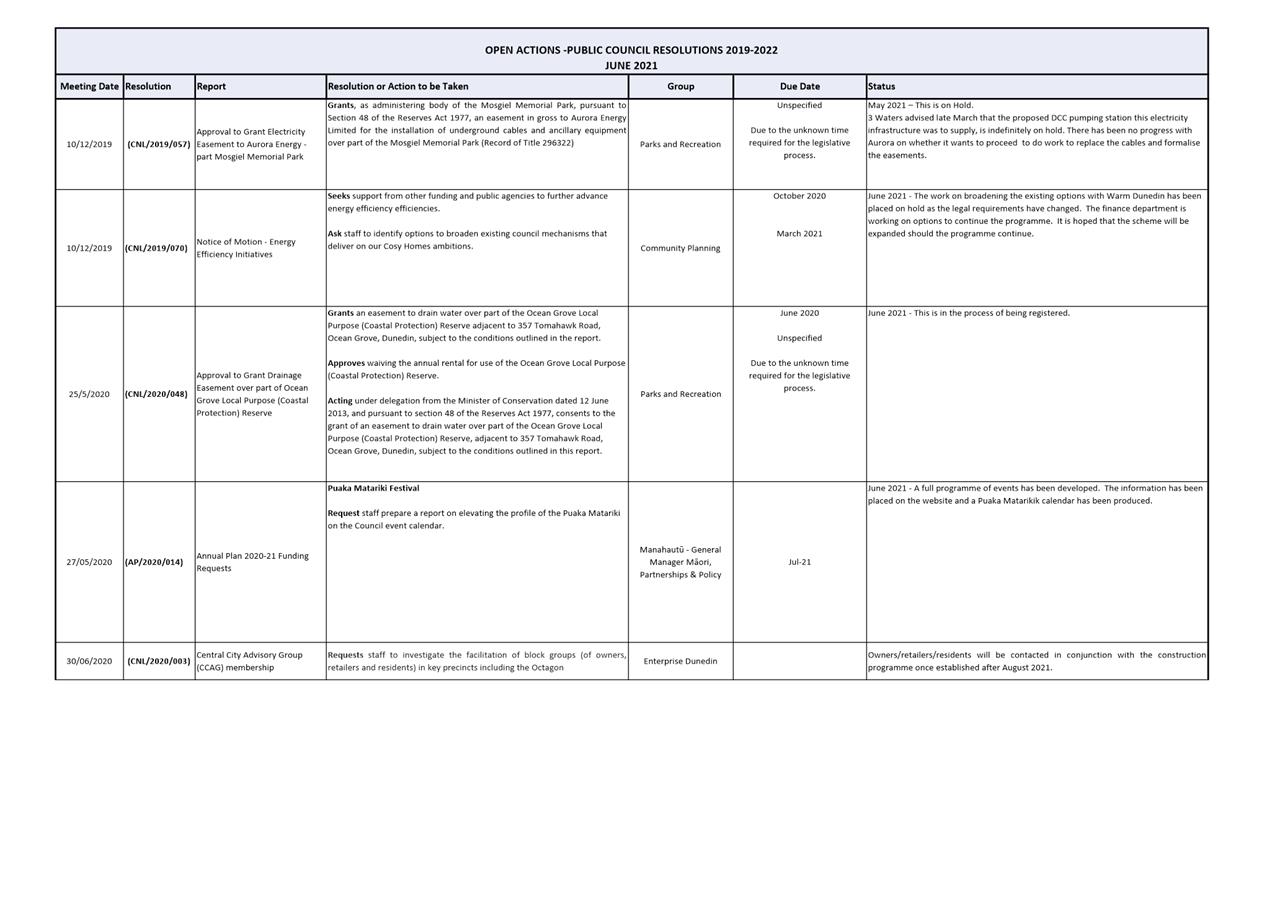

Reports

Actions From Resolutions of Council Meetings

Department: Civic

EXECUTIVE SUMMARY

1 The

purpose of this report is to show progress on implementing resolutions made at

Council meetings.

2 As

this report is an administrative report only, there are no options or Summary

of Considerations.

|

RECOMMENDATIONS

That the Council:

Notes the Open and Completed Actions from resolutions of Council

meetings as attached.

|

discussion

3 This

report also provides an update on resolutions that have been actioned and

completed since the last Council meeting.

NEXT STEPS

4 Updates

will be provided at future Council meetings.

Signatories

|

Author:

|

Lynne Adamson - Governance Support Officer

|

|

Authoriser:

|

Clare Sullivan - Manager Governance

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Open and Completed

Action Lists

|

27

|

|

|

Council

30 June 2021

|

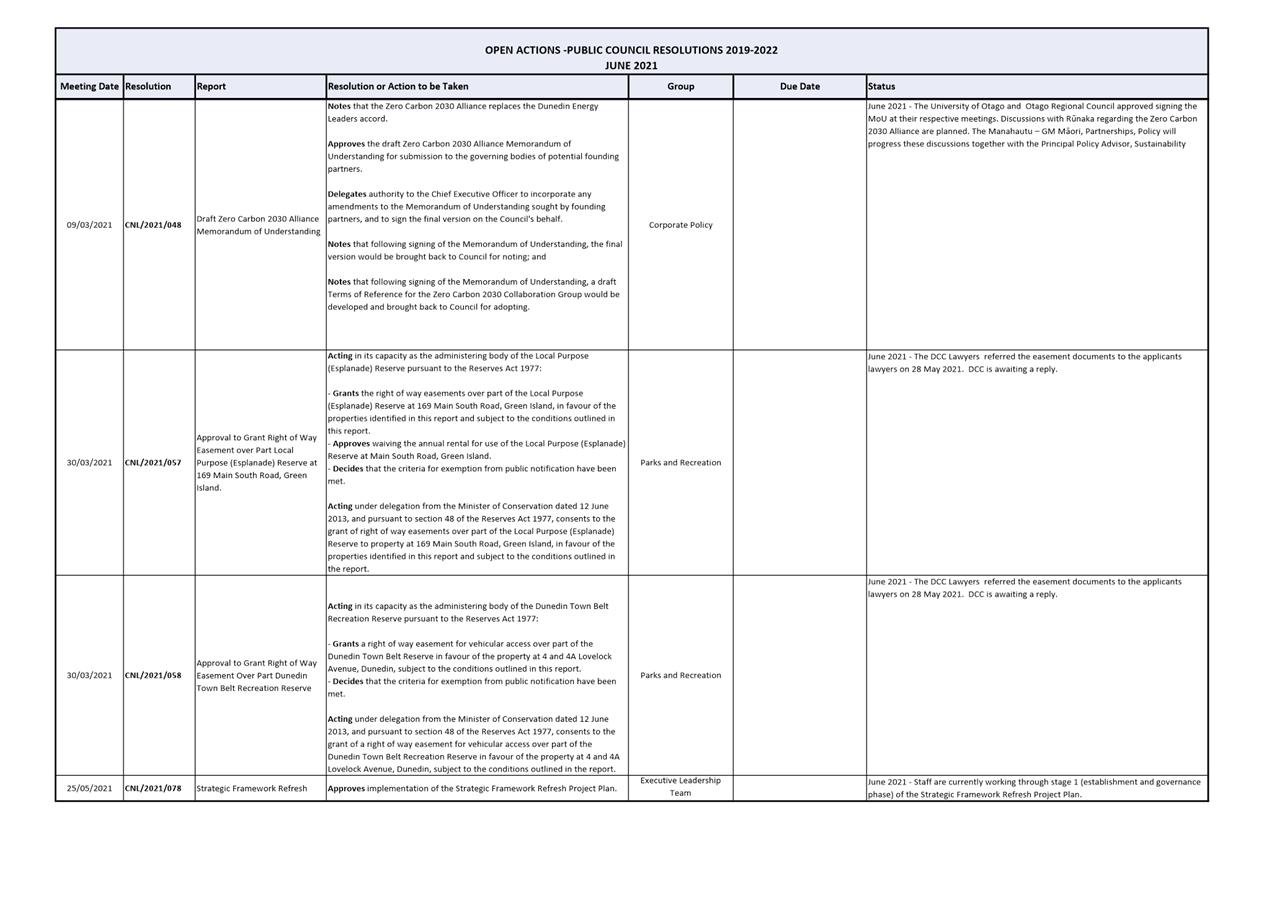

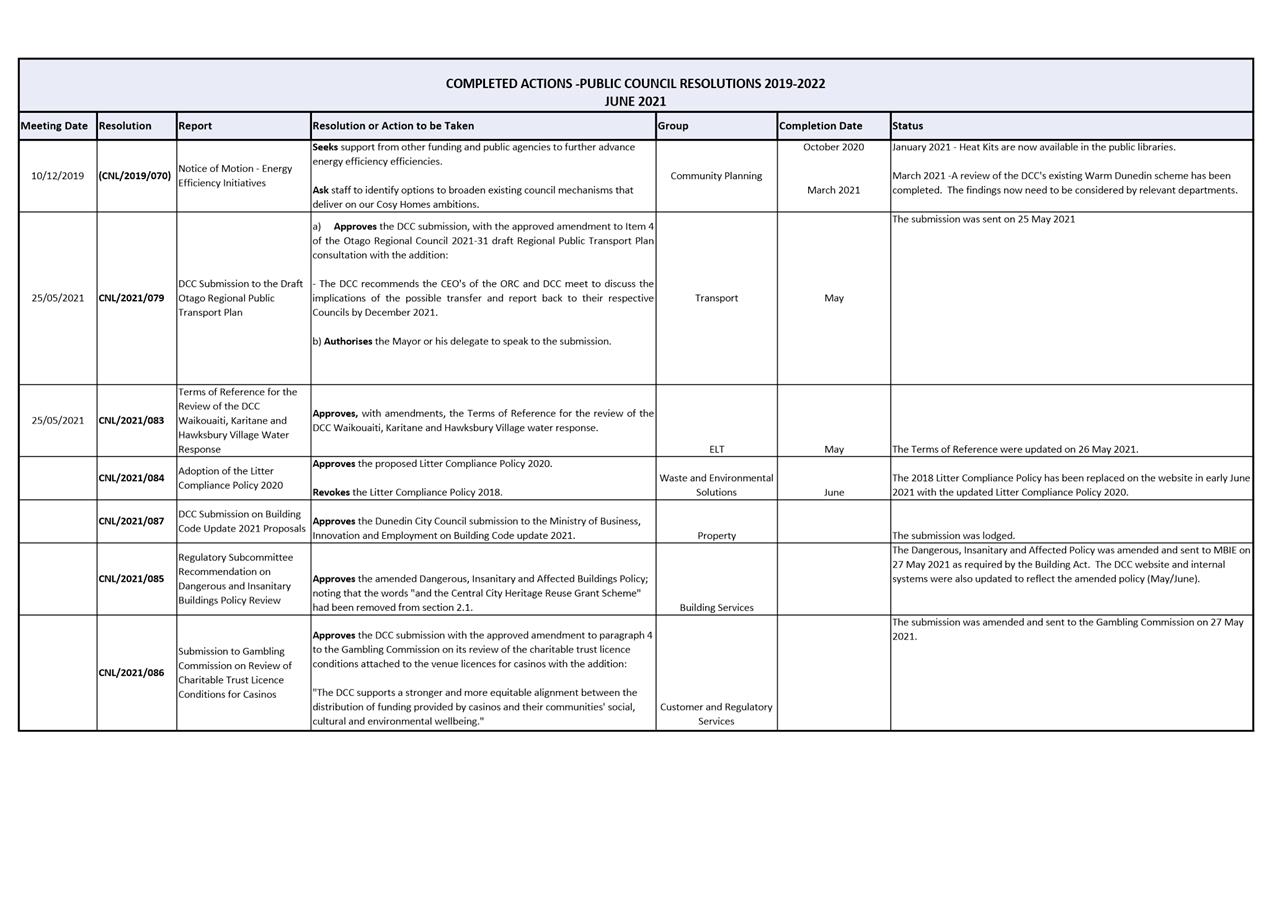

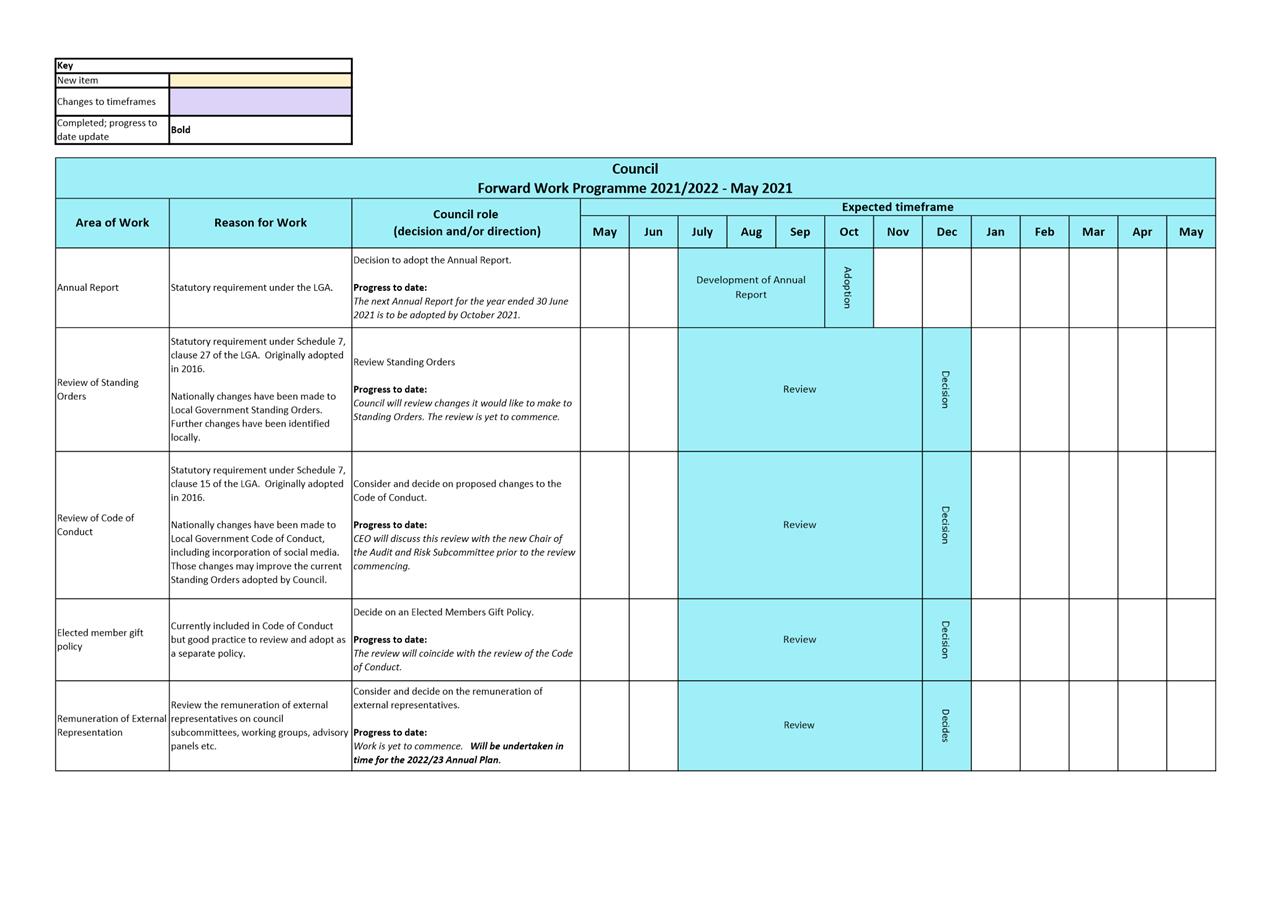

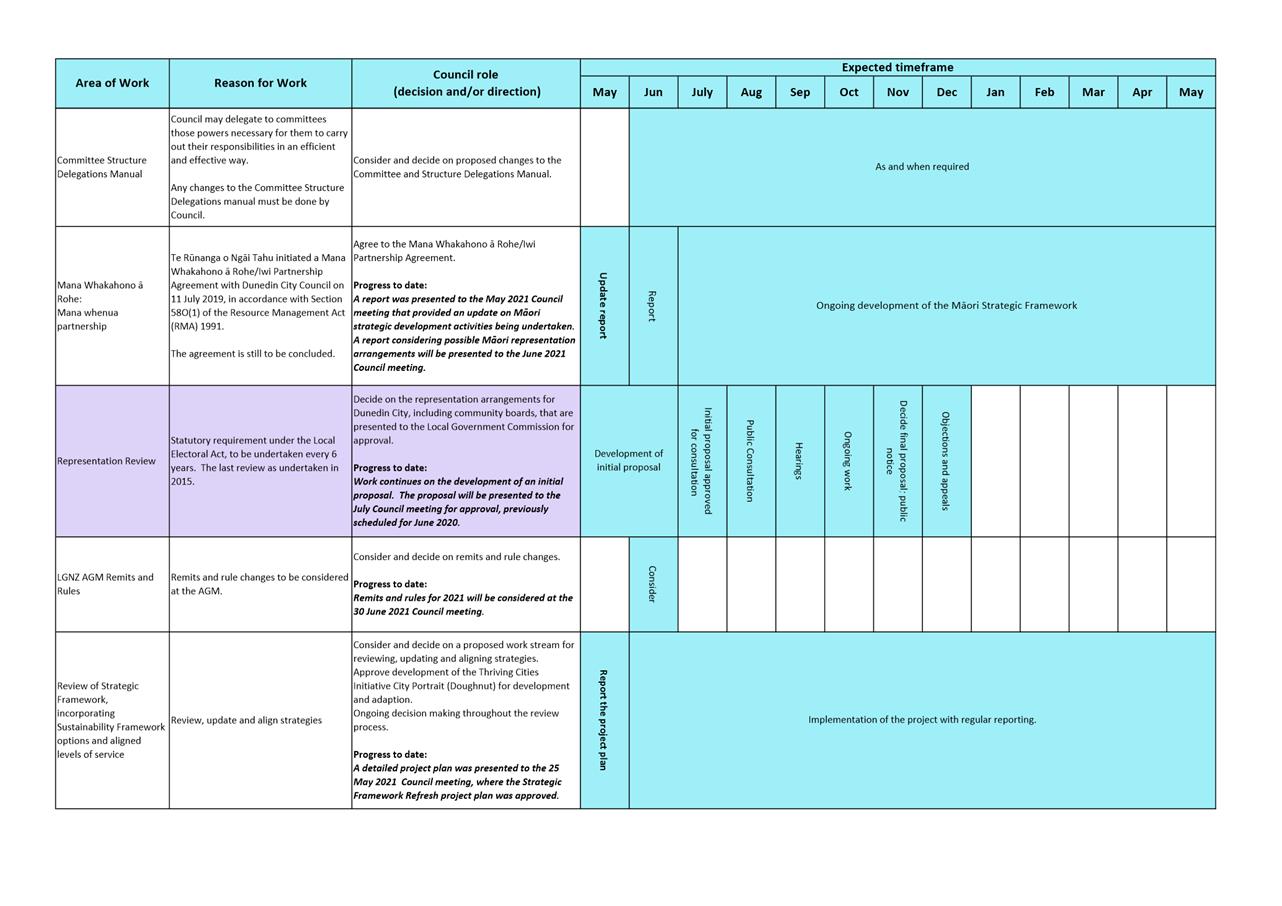

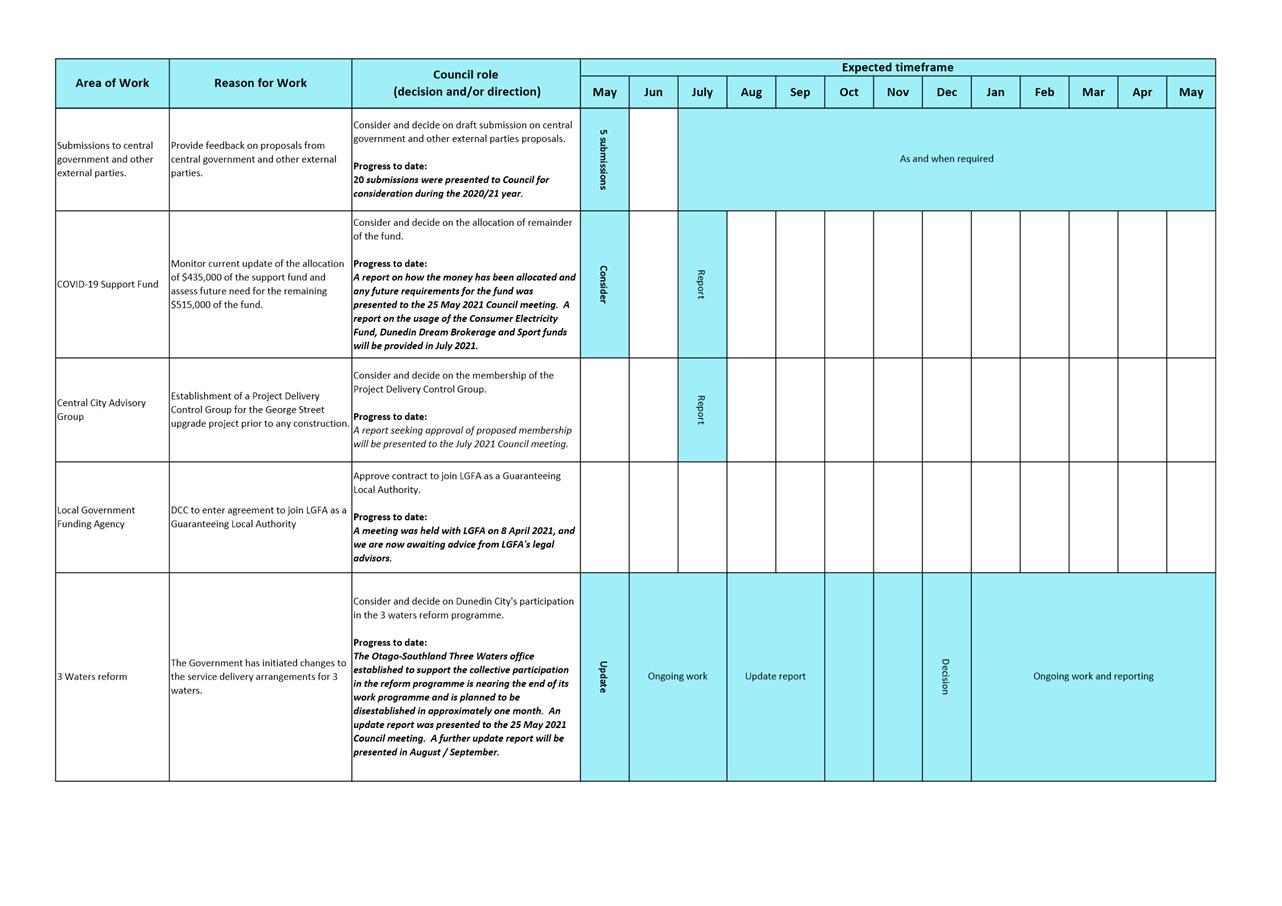

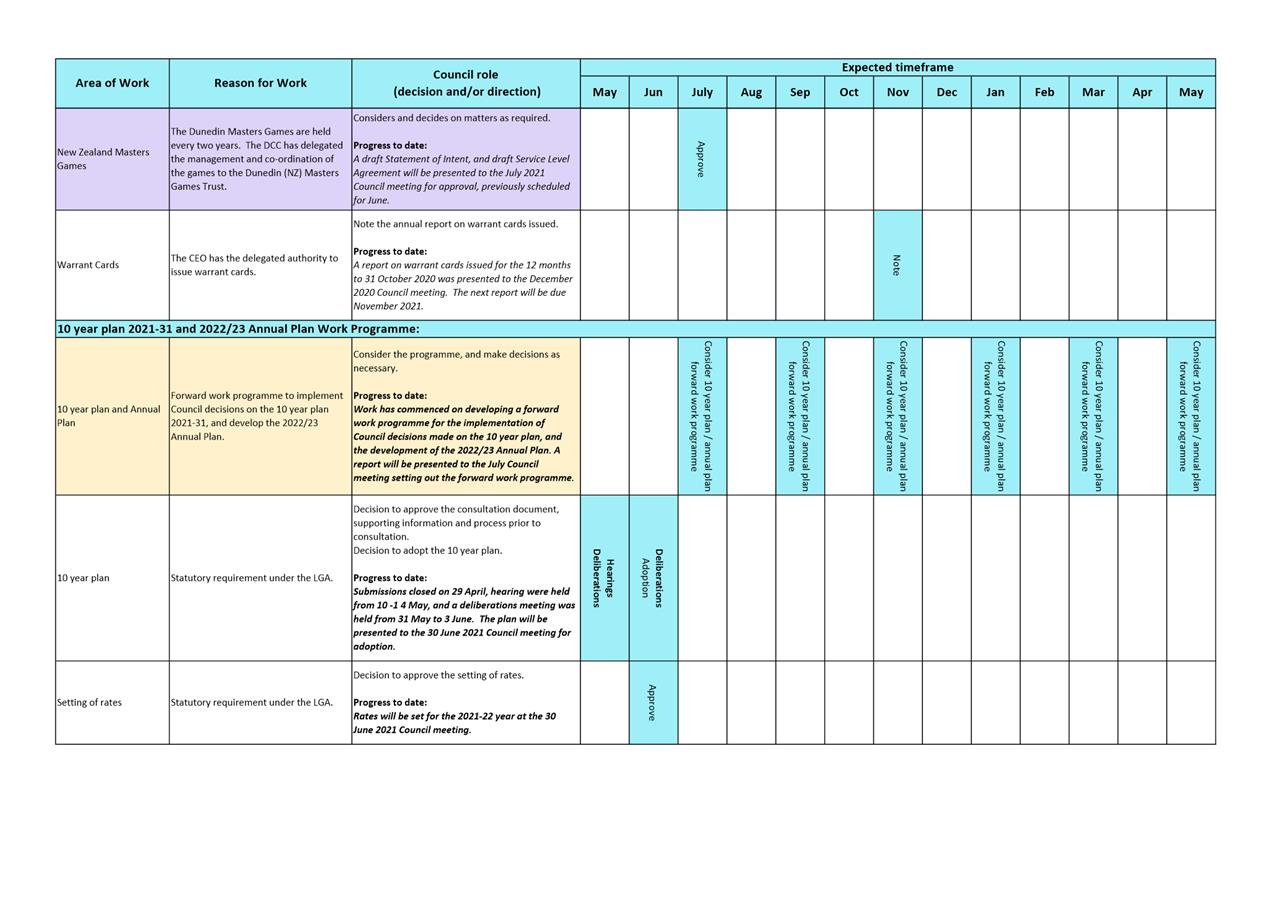

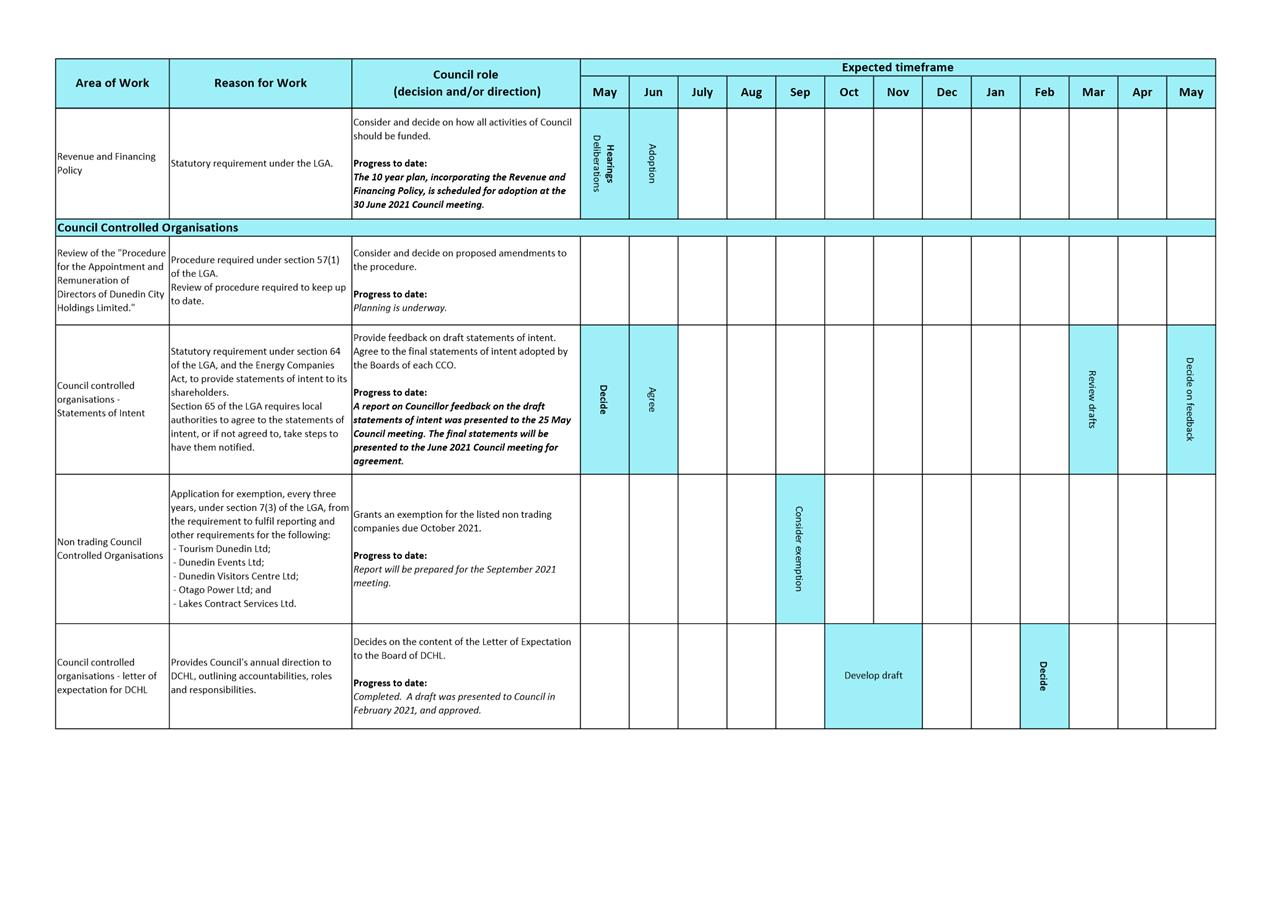

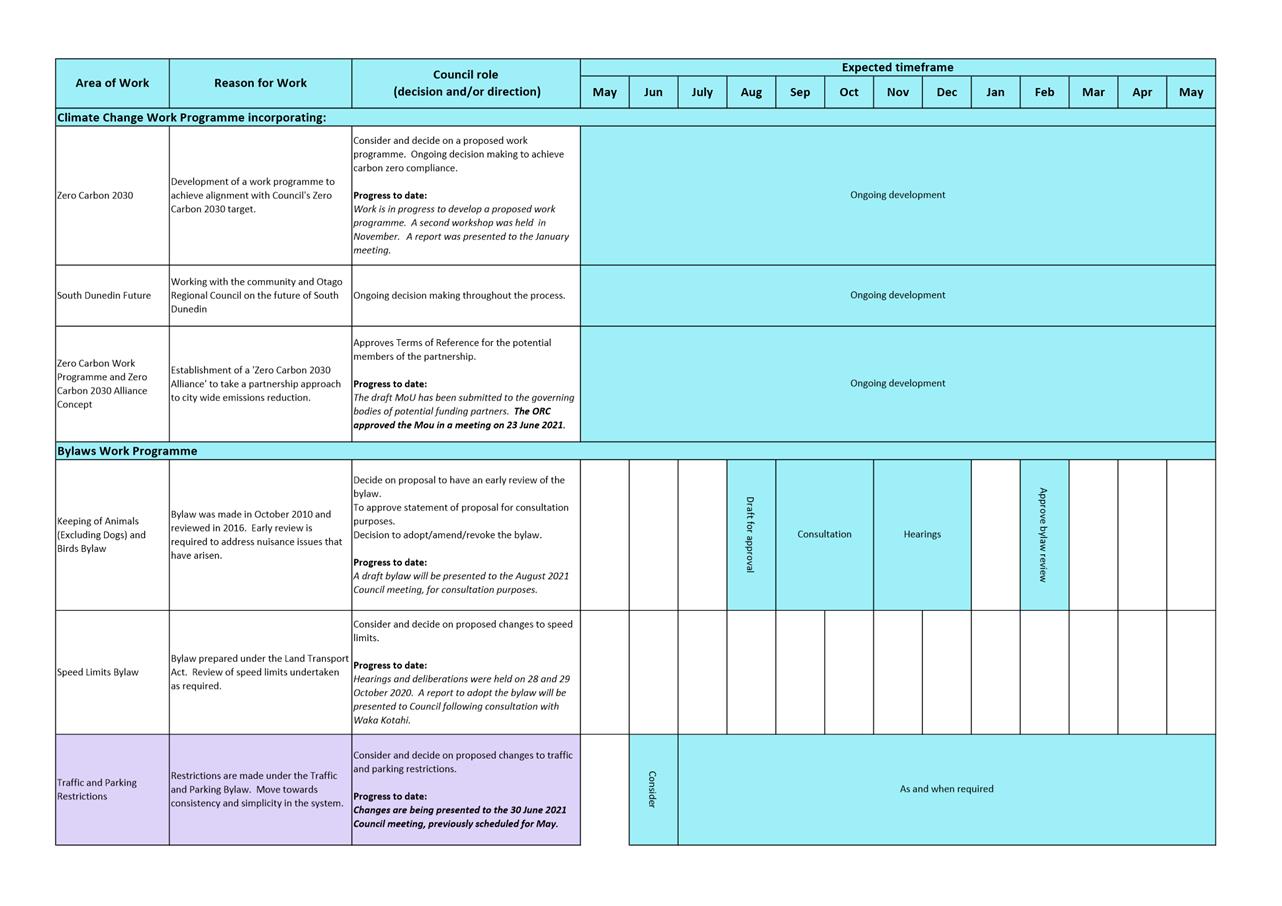

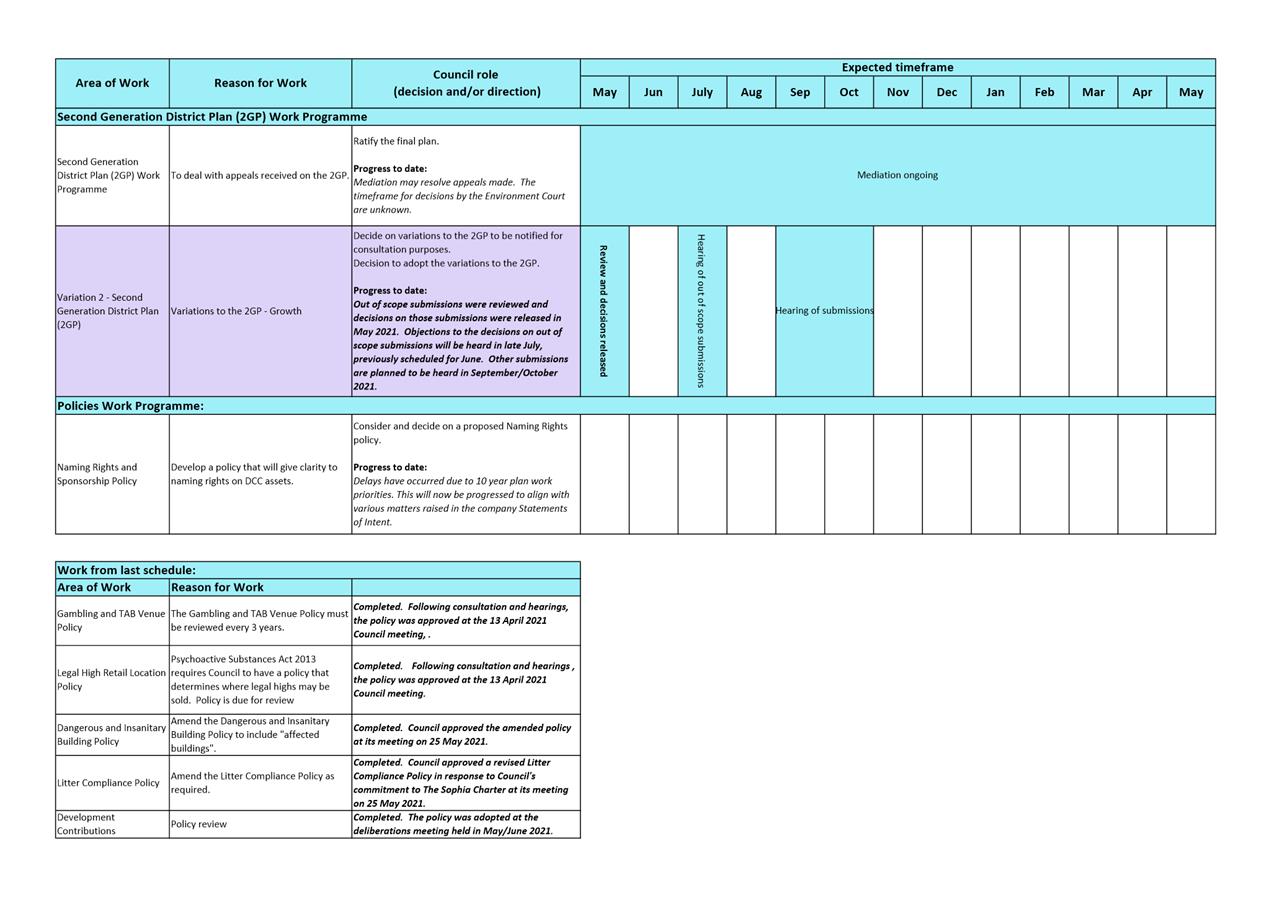

Council Forward Work Programme

Department: Corporate Policy

EXECUTIVE SUMMARY

1 The

purpose of this report is to provide the updated forward work programme for the

2021-2022 year (Attachment A).

2 As

this is an administrative report only, there are no options or Summary of

Considerations.

|

RECOMMENDATIONS

That the Council:

Notes the

updated Council forward work programme as shown in Attachment A.

|

DISCUSSION

3 The

forward work programme is a regular agenda item which shows areas of activity,

progress and expected timeframes for Council decision making across a range of

areas of work.

4 As

an update report, the purple highlight shows changes to timeframes. New

items added to the schedule are highlighted in yellow. Items that have been

completed or updated are shown as bold.

5 The

forward work programme contains items from the action list where the action has

resulted in a report to be presented back to Council. Items have been

closed on the action list and incorporated in the forward work programme.

NEXT STEPS

6 An

updated report will be provided for the next Council meeting.

Signatories

|

Author:

|

Sharon Bodeker - Corporate Planner

|

|

Authoriser:

|

Sandy Graham - Chief Executive Officer

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Forward work programme

- June 2021

|

33

|

|

|

Council

30 June 2021

|

Adoption of 10 year plan 2021-31

Department: Corporate Policy and Finance

EXECUTIVE SUMMARY

1 This

report recommends the adoption of the 10 year plan 2021-31. It describes

changes made to the plan since it was approved for consultation on 9 March

2021.

2 Audit

New Zealand (Audit NZ) is currently auditing the 10 year plan document and will

provide the Council with an ‘Independent Auditor’s report’ on

completion of the audit.

|

RECOMMENDATIONS

That the Council:

a) Adopts the Revenue and Financing Policy for

inclusion in the 10 year plan 2021-31.

b) Approves the 10 year plan 2021-31.

c) Receives the ‘Independent auditor’s

report on the Dunedin City Council’s 2021-31 Long Term Plan’ from

Audit New Zealand.

d) Adopts the 10 year plan 2021-31

e) Authorises the Council’s Chief Executive

Officer to make any minor editorial changes resulting from the final quality

checks that will occur prior to the printing of the 10 year plan 2021-31

document.

f) Authorises the Chief Executive Officer to drawdown

debt up to total debt of $340 million in the 2021/22 year.

|

BACKGROUND

3 The

Local Government Act 2002 (LGA) requires all local authorities to

develop a 10 year plan. Section 93(6) of the LGA provides that the

purpose of the 10 year plan is to describe the Council’s activities;

describe the community outcomes for Dunedin; provide integrated decision-making

and co-ordination of resources; provide a long-term focus for the decisions and

activities of the Council; and provide a basis for accountability of the local

authority to the community.

4 Schedule

10 of the LGA specifies the minimum information and content that must be

included in the 10 year plan including groups of activities (including capital

expenditure, levels of service and funding impact statements); Council

controlled organisations; Financial Strategy; Infrastructure Strategy; Revenue

and Financing Policy; forecast financial statements (including balancing of

budget, rating information and reserve funds); and significant forecasting

assumptions.

5 The

10 year plan must be adopted before the commencement of the first year to which

it relates (1 July 2021), and continues in force until the close of the third

consecutive year to which it relates.

6 At

is meeting on 9 March 2021, Council adopted ‘The Future of Us – 10

year plan consultation document 2021-31” for consultation with the

community. The consultation document explained the Council’s

proposals for the 10 year plan, based on decisions made at the Council meetings

on 14-15 December 2020, 27-29 January 2021, and 23 February 2021.

7 The

community consultation and engagement period ran from 30 March to 29 April

2021. A range of community feedback activities and events were held

during this period.

8 Council

considered the community feedback received and made final decisions on that

feedback at its deliberations meeting on Monday 31 May to Thursday 3 June

2021. Reports presented at the deliberations meeting included a summary

of the feedback received, requests for funding and new amenities/projects, and

information on five specific engagement topics, kerbside collection, Shaping

Future Dunedin Transport, community housing, performing arts venue, and public

toilets.

DISCUSSION

9 The

final 10 year plan document has been developed based on the content of the

consultation document and the supporting documents previously approved by

Council. The document reflects the resolutions made by Council during

deliberations and decision making in May 2021.

10 The

following points should be noted in relation to the financial statements:

· Rates

Revenue remains unchanged,

· Development

contribution revenue has been increased to reflect the increased level of

charges in the policy that was adopted at the 31 May 2021 deliberations

meeting,

· Grants

and subsidies revenue from Waka Kotahi has been reduced to reflect the

reduction of subsidised consultancy spend by the Transport department.

The revenue has also been adjusted down for the maintenance and renewal funding

now confirmed for 2022-2024,

· Other

revenue has been increased to reflect revised depreciation costs for Waste and

Environmental (see comment below) plus income from the additional new housing

units approved by Council during deliberations,

· Other

expenses have been updated to reflect additional operating savings, partially

offset by funding requests approved during deliberations. It should be

noted that the expenditure savings made will come from reduced consultancy and

contracted services spend and therefore not impact levels of services.

These savings will be achieved by a mixture of in-sourcing the work and

prioritising the spend on the appropriate activities,

· Personnel

costs have been adjusted to reflect revised staffing structures, the planned

general wage increase for 2021/22 and an anticipated level of vacancies.

Costs have also been increased to reflect the in-sourcing of the Project

Management function offset by a reduction in the PMO consultancy spend,

· Financial

expenses have reduced due to the planned lower levels of debt. Debt has

been impacted by the additional development contribution revenue, increased

other revenue, interest and operational expenditure savings, partially offset

by the lower level of Waka Kotahi funding,

· Depreciation

has been updated following an internal review of this expenditure line and

includes adjustments primarily for Three Waters (to reflect the anticipated

impact of the most recent accounting valuation) and increases in Waste &

Environmental related to the planned diversion facilities and new landfill.

11 Capital

budgets have been updated to reflect decisions made at the deliberations

meeting, along with a review of timing for the delivery of capital works.

The capital budget has increased by $10.0m over the 10 years to reflect the

additional investment in new community housing.

12 The

final 10 year plan will include an opinion from the Auditor General on the

extent to which the Council has complied with the legislative purpose of a 10

year plan and the quality of the information and assumptions underlying the

forecast information in the plan.

13 Audit

NZ, on behalf of the Auditor General, has reviewed the changes made to the 10

year plan content since the audit of the consultation document and supporting

documents in February / March 2021. An update on the status of the audit

opinion will be given at the meeting.

OPTIONS

14 As

the adoption of the 10 year plan is a legal requirement, there are no options.

NEXT STEPS

15 Once

adopted, the 10 year plan will be subject to final quality checks and graphic

design, and printed for public distribution in hard copy and on the

Council’s website.

16 Information

on the 10 year plan and the outcome of Council decision making will be included

in FYI and in the Star in mid-July 2021.

Signatories

|

Author:

|

Sharon Bodeker - Corporate Planner

Carolyn Allan - Senior Management Accountant

|

|

Authoriser:

|

Gavin Logie - Chief Financial Officer

Sandy Graham - Chief Executive Officer

|

Attachments

|

|

Title

|

Page

|

|

⇨a

|

10 year plan 2021-31

(Under Separate Cover 2)

|

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision enables democratic local

decision making and action by, and on behalf of communities, and promotes the

social, economic, environmental and cultural well-being of communities in the

present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The 10 year plan contributes to all of the objectives and

priorities of the strategic framework as it describes the Council’s

activities, the community outcomes, and provides a long term focus for

decision making and coordination of the Council’s resources, as well as

a basis for community accountability.

|

|

Māori Impact

Statement

There has been engagement with both Mana whenua and taurahere during the consultation process.

|

|

Sustainability

The 10 year plan has considered various aspects of the

Council’s approach to sustainability. Major issues and

implications for sustainability are discussed in the Infrastructure Strategy

and financial resilience is discussed in the Financial Strategy. The

Climate 2030 Rapid Review and DCC Emissions Reduction Opportunities report

addresses a range of other issues.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report adopts the 10 year plan 2021-31.

|

|

Financial

considerations

Financial considerations are included in the 10 year plan

2021-31.

|

|

Significance

The 10 year plan is considered to be of high importance in

terms of the Council’s Significance and Engagement Policy and the

engagement that has been undertaken as part of the 10 year plan process has

reflected this significance.

|

|

Engagement –

external

Extensive community engagement was undertaken on the draft

budgets and content of the 10 year plan.

|

|

Engagement -

internal

Staff from across council have been involved in the

development of the 10 year plan.

|

|

Risks: Legal /

Health and Safety etc.

Any specific risks in the development of the 10 year plan

were considered in the relevant supporting documents. The significant

forecasting assumptions highlight these in detail and the assumptions have

driven the content of the 10 year plan.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

Many projects and items identified in Community Board Plans

have been incorporated in the budgets following engagement with Community

Boards during the development of the plan. The Community Boards have

participated in the consultation process and all have submitted on the plan.

|

|

|

Council

30 June 2021

|

Setting of Rates for the 2021/22 Financial

Year

Department: Finance

EXECUTIVE SUMMARY

1 Following

the adoption of the 10 year plan 2021-31, the Council now needs to set the

rates as provided for in the Funding Impact Statement for the 2021/22 year.

|

RECOMMENDATIONS

That the Council:

a) Sets the following rates under the Local Government (Rating)

Act 2002 on rating units in the district for the financial year commencing 1

July 2021 and ending on 30 June 2022.

1 General

Rate

A general rate set under section 13 of the Local

Government (Rating) Act 2002 made on every rating unit, assessed on a

differential basis as described below:

· A

rate of 0.3091 cents in the dollar (including GST) of capital value on every

rating unit in the "residential" category.

· A

rate of 0.2937 cents in the dollar (including GST) of capital value on every

rating unit in the "lifestyle" category.

· A

rate of 0.7604 cents in the dollar (including GST) of capital value on every

rating unit in the "commercial" category.

· A

rate of 0.5410 cents in the dollar (including GST) of capital value on every

rating unit in the "residential heritage bed and breakfasts"

category.

· A

rate of 0.2473 cents in the dollar (including GST) of capital value on every

rating unit in the "farmland" category.

· A

rate of 0.0621 cents in the dollar (including GST) of capital value on the

“stadium: 10,000+ seat capacity” category.

2 Community

Services Rate

A targeted rate for community services, set under section

16 of the Local Government (Rating) Act 2002, assessed on a differential basis

as follows:

· $102.00

(including GST) per separately used or inhabited part of a rating unit for

all rating units in the "residential, residential heritage bed and

breakfasts, lifestyle and farmland" categories.

· $102.00

(including GST) per rating unit for all rating units in the "commercial

and stadium: 10,000+ seat capacity" categories.

3 Kerbside

Recycling Rate

A targeted rate for kerbside recycling, set under section

16 of the Local Government (Rating) Act 2002, assessed on a differential

basis as follows:

· $106.10

(including GST) per separately used or inhabited part of a rating unit for

rating units in the "residential, residential heritage bed and

breakfasts, lifestyle and farmland" categories.

· $106.10

(including GST) per rating unit for rating units in the

"commercial" category.

4 Drainage

Rates

A targeted rate for drainage, set under section 16 of the

Local Government (Rating) Act 2002, assessed on a differential basis as

follows:

· $618.50

(including GST) per separately used or inhabited part of a rating unit for

all rating units in the "residential, residential heritage bed and

breakfasts, lifestyle and farmland" categories and which are

"connected" to the public sewerage system.

· $309.25

(including GST) per separately used or inhabited part of a rating unit for

all rating units in the "residential, residential heritage bed and

breakfasts, lifestyle and farmland" categories and which are

"serviceable" by the public sewerage system.

· $618.50

(including GST) per rating unit for all rating units in the "commercial,

residential institutions, schools and stadium: 10,000+ seat capacity"

categories and which are "connected" to the public sewerage system.

· $309.25

(including GST) per rating unit for all rating units in the "commercial,

residential institutions and schools" categories and which are

"serviceable" by the public sewerage system.

· $102.25

(including GST) per rating unit for all rating units in the

"church" category and which are "connected" to the public

sewerage system.

Rating units which are not "connected" to the

scheme and which are not "serviceable" will not be liable for this

rate. Drainage is a combined targeted rate for sewage disposal and

stormwater. Sewage disposal makes up 78% of the drainage rate, and

stormwater makes up 22%. Non-rateable land will not be liable for the

stormwater component of the drainage targeted rate. Rates demands for

the drainage targeted rate for non-rateable land will therefore be charged at

78%.

5 Commercial

Drainage Rates – Capital Value

A targeted rate for drainage, set under section 16 of the

Local Government (Rating) Act 2002, assessed on a differential basis as

follows:

· A

rate of 0.2878 cents in the dollar (including GST) of capital value on every

rating unit in the "commercial and residential institution"

category and which are "connected" to the public sewerage system.

· A

rate of 0.1439 cents in the dollar (including GST) of capital value on every

rating unit in the "commercial" category and which are

"serviceable" by the public sewerage system.

· A

rate of 0.2159 cents in the dollar (including GST) of capital value on every

rating unit in the "school" category and which are

"connected" to the public sewerage system.

· A

rate of 0.1079 cents in the dollar (including GST) of capital value on every

rating unit in the "school" category and which are

"serviceable" by the public sewerage system.

· A

rate of 0.0233 cents in the dollar (including GST) of capital value on the

“stadium: 10,000+ seat capacity” category.

This rate shall not apply to properties in Karitane,

Middlemarch, Seacliff, Waikouaiti and Warrington. This rate shall not

apply to churches. Drainage is a combined targeted rate for sewage

disposal and stormwater. Sewage disposal makes up 78% of the drainage

rate, and stormwater makes up 22%. Non-rateable land will not be liable

for the stormwater component of the drainage targeted rate. Rates

demands for the drainage targeted rate for non-rateable land will therefore

be charged at 78%.

6 Water

Rates

A targeted rate for water supply, set under section 16 of

the Local Government (Rating) Act 2002, assessed on a differential basis as

follows:

· $469.00

(including GST) per separately used or inhabited part of any

"connected" rating unit which receives an ordinary supply of water

within the meaning of the Dunedin City Bylaws excepting properties in

Karitane, Merton, Rocklands/Pukerangi, Seacliff, Waitati, Warrington, East

Taieri, West Taieri and North Taieri.

· $234.50

(including GST) per separately used or inhabited part of any

"serviceable" rating unit to which connection is available to

receive an ordinary supply of water within the meaning of the Dunedin City

Bylaws excepting properties in Karitane, Merton, Rocklands/Pukerangi, Seacliff,

Waitati, Warrington, East Taieri, West Taieri and North Taieri.

· $469.00

(including GST) per unit of water being one cubic metre (viz.

1,000 litres) per day supplied at a constant rate of flow during a full

24 hour period to any "connected" rating unit situated in

Karitane, Merton, Seacliff, Waitati, Warrington, West Taieri, East Taieri or

North Taieri.

· $234.50

(including GST) per separately used or inhabited part of any

"serviceable" rating unit situated in Waitati, Warrington, West

Taieri, East Taieri or North Taieri. This rate shall not apply to the

availability of water in Merton, Karitane or Seacliff.

7 Fire

Protection Rates

A targeted rate for the provision of a fire protection

service, set under section 16 of the Local Government (Rating) Act 2002, assessed

on a differential basis as follows:

· A

rate of 0.0826 cents in the dollar (including GST) of capital value on all

rating units in the "commercial" category. This rate shall

not apply to churches.

· A

rate of 0.0620 cents in the dollar (including GST) of capital value on all

rating units in the "residential institutions" category.

· A

rate of 0.0094 cents in the dollar (including GST) of capital value on the

“stadium: 10,000+ seat capacity” category.

· $140.70

(including GST) for each separately used or inhabited part of a rating unit

within the "residential, residential heritage bed and breakfasts,

lifestyle and farmland" category that is not receiving an ordinary

supply of water within the meaning of the Dunedin City Bylaws.

8 Water

Rates – Quantity of Water

A targeted rate for the quantity of water provided to any

rating unit fitted with a water meter, being an extraordinary supply of water

within the meaning of the Dunedin City Bylaws, set under section 19 of the

Local Government (Rating) Act 2002, according to the following scale of

charges (GST inclusive):

|

|

Annual Meter Rental Charge

|

|

20mm nominal diameter

|

$157.01

|

|

25mm nominal diameter

|

$201.57

|

|

30mm nominal diameter

|

$223.85

|

|

40mm nominal diameter

|

$253.56

|

|

50mm nominal diameter

|

$513.48

|

|

80mm nominal diameter

|

$634.42

|

|

100mm nominal diameter

|

$669.43

|

|

150mm nominal diameter

|

$962.24

|

|

300mm nominal diameter

|

$1,248.68

|

|

Hydrant Standpipe

|

$621.69

|

|

Reconnection Fee

|

$437.60

|

|

Special Reading Fee

|

$59.47

|

|

|

Backflow Prevention Charge

|

|

Backflow Preventer

Test Fee

|

$108.44

|

|

Backflow Programme - incomplete application fee

(hourly rate)

|

$43.54

|

|

Rescheduled Backflow

Preventer Test Fee

|

$61.61

|

|

|

Water Charge

|

|

Merton, Hindon and individual farm supplied Bulk

Raw Water Tariff

|

$0.11 per cubic metre

|

|

All other treated water per cubic metre

|

$1.76 per cubic metre

|

|

Disconnection of Water Supply – AWSCI to

excavate

|

$243.69

|

|

Disconnection of Water Supply – DCC

contractor to excavate

|

$954.81

|

Where the supply of a quantity of water is subject

to this Quantity of Water Targeted Rate, the rating unit will not be liable

for any other targeted rate for the supply of the same water.

9 Allanton

Drainage Rate

A targeted rate for the capital contribution towards the

Allanton Wastewater Collection System, set under section 16 of the Local

Government (Rating) Act 2002, of $411.00 (including GST) per rating unit, to

every rating unit paying their contribution towards the scheme as a targeted

rate over 20 years. Liability for the rate is on the basis of the

provision of the service to each rating unit. The Allanton area is

shown in the map below:

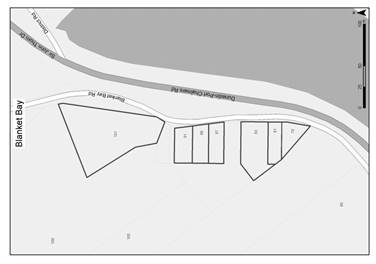

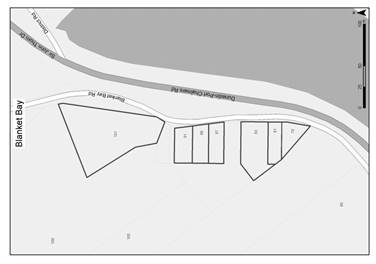

10 Blanket

Bay Drainage Rate

A targeted rate for the capital contribution towards the

Blanket Bay Drainage System, set under section 16 of the Local Government

(Rating) Act 2002, of $636.00 (including GST) per rating unit, to every

rating unit paying their contribution towards the scheme as a targeted rate

over 20 years. Liability for the rate is on the basis of the

provision of the service to each rating unit. The Blanket Bay area is

shown in the map below:

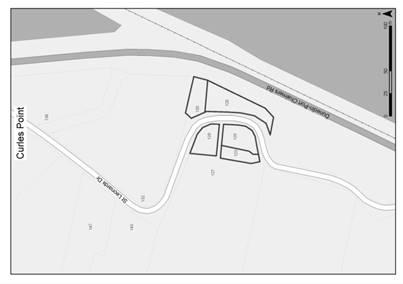

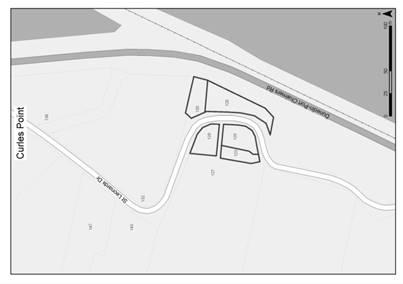

11 Curles

Point Drainage Rate

A targeted rate for the capital contribution towards the

Curles Point Drainage System, set under section 16 of the Local Government

(Rating) Act 2002, of $749.00 (including GST) per rating unit, to every

rating unit paying their contribution towards the scheme as a targeted rate

over 20 years. Liability for the rate is on the basis of the

provision of the service to each rating unit. The Curles Point area is

shown in the map below:

12 Tourism/Economic

Development Rate

A targeted rate for Tourism/Economic Development, set

under section 16 of the Local Government (Rating) Act 2002, assessed on

a differential basis as follows:

· 0.0116

cents in the dollar (including GST) of capital value on every rating unit in

the "commercial" category.

· 0.0013

cents in the dollar (including GST) of capital value on the “stadium:

10,000+ seat capacity” category.

13 Warm

Dunedin Targeted Rate Scheme

A targeted rate for the Warm Dunedin Targeted Rate

Scheme, set under section 16 of the Local Government (Rating) Act 2002, per

rating unit in the Warm Dunedin Targeted Rate Scheme.

The targeted rate scheme provides a way for homeowners to

install insulation and/or clean heating. The targeted rate covers the

cost and an annual interest rate. The interest rates have been and will

be:

Rates commencing 1 July 2013 and 1 July 2014 8%

Rates commencing 1 July 2015 and 1 July 2016 8.3%

Rates commencing 1 July 2017 7.8%

Rates commencing 1 July 2018 7.2%

Rates commencing 1 July 2019 6.8%

Rates commencing 1 July 2020 5.7%

Rates commencing 1 July 2021 4.4%

14 Private

Street Lighting Rate

A targeted rate for the purpose of

recovering the cost of private street lights, set under section 16 of the

Local Government (Rating) Act 2002, assessed on a differential basis as

follows:

· $149.40

(including GST) per private street light divided by the number of separately

used or inhabited parts of a rating unit for all rating units in the

"residential and lifestyle" categories in the private streets as

identified in the schedule below.

· $149.40

(including GST) per private street light divided by the number of rating

units for all rating units in the "commercial" category in the

private streets as identified in the schedule below.

|

1-10

|

Achilles Avenue

|

9

|

Glengarry Court

|

|

1

|

Alton Avenue

|

10

|

Glengarry Court

|

|

2

|

Alton Avenue

|

11

|

Glengarry Court

|

|

2A

|

Alton Avenue

|

12

|

Glengarry Court

|

|

3

|

Alton Avenue

|

13

|

Glengarry Court

|

|

4

|

Alton Avenue

|

14

|

Glengarry Court

|

|

5

|

Alton Avenue

|

15

|

Glengarry Court

|

|

6

|

Alton Avenue

|

16

|

Glengarry Court

|

|

7

|

Alton Avenue

|

17

|

Glengarry Court

|

|

8

|

Alton Avenue

|

18

|

Glengarry Court

|

|

9

|

Alton Avenue

|

19

|

Glengarry Court

|

|

7

|

Angle Avenue

|

20

|

Glengarry Court

|

|

9

|

Angle Avenue

|

21

|

Glengarry Court

|

|

11

|

Angle Avenue

|

22

|

Glengarry Court

|

|

20

|

Angle Avenue

|

23

|

Glengarry Court

|

|

22

|

Angle Avenue

|

24

|

Glengarry Court

|

|

24

|

Angle Avenue

|

48

|

Glenross Street

|

|

43

|

Arawa Street

|

50

|

Glenross Street

|

|

47

|

Arawa Street

|

54

|

Glenross Street

|

|

17

|

Awa Toru Drive

|

56

|

Glenross Street

|

|

19

|

Awa Toru Drive

|

58

|

Glenross Street

|

|

21

|

Awa Toru Drive

|

60

|

Glenross Street

|

|

23

|

Awa Toru Drive

|

110

|

Glenross Street

|

|

25

|

Awa Toru Drive

|

114

|

Glenross Street

|

|

27

|

Awa Toru Drive

|

116

|

Glenross Street

|

|

29

|

Awa Toru Drive

|

230

|

Gordon Road

|

|

31

|

Awa Toru Drive

|

229

|

Gordon Road

|

|

33

|

Awa Toru Drive

|

34

|

Grandview Crescent

|

|

35

|

Awa Toru Drive

|

10

|

Halsey Street

|

|

37

|

Awa Toru Drive

|

1

|

Hampton Grove, Mosgiel

|

|

39

|

Awa Toru Drive

|

2

|

Hampton Grove, Mosgiel

|

|

41

|

Awa Toru Drive

|

3

|

Hampton Grove, Mosgiel

|

|

43

|

Awa Toru Drive

|

4

|

Hampton Grove, Mosgiel

|

|

45

|

Awa Toru Drive

|

5

|

Hampton Grove, Mosgiel

|

|

47

|

Awa Toru Drive

|

6

|

Hampton Grove, Mosgiel

|

|

49

|

Awa Toru Drive

|

7

|

Hampton Grove, Mosgiel

|

|

60A

|

Balmacewen Road

|

8

|

Hampton Grove, Mosgiel

|

|

60B

|

Balmacewen Road

|

9

|

Hampton Grove, Mosgiel

|

|

62

|

Balmacewen Road

|

10

|

Hampton Grove, Mosgiel

|

|

64

|

Balmacewen Road

|

11

|

Hampton Grove, Mosgiel

|

|

1

|

Balmoral Avenue

|

12

|

Hampton Grove, Mosgiel

|

|

2

|

Balmoral Avenue

|

14

|

Hampton Grove, Mosgiel

|

|

3

|

Balmoral Avenue

|

15

|

Hampton Grove, Mosgiel

|

|

4

|

Balmoral Avenue

|

16

|

Hampton Grove, Mosgiel

|

|

5

|

Balmoral Avenue

|

17

|

Hampton Grove, Mosgiel

|

|

6

|

Balmoral Avenue

|

18

|

Hampton Grove, Mosgiel

|

|

7

|

Balmoral Avenue

|

19

|

Hampton Grove, Mosgiel

|

|

8

|

Balmoral Avenue

|

20

|

Hampton Grove, Mosgiel

|

|

9

|

Balmoral Avenue

|

21

|

Hampton Grove, Mosgiel

|

|

10

|

Balmoral Avenue

|

22

|

Hampton Grove, Mosgiel

|

|

11

|

Balmoral Avenue

|

23

|

Hampton Grove, Mosgiel

|

|

12

|

Balmoral Avenue

|

24

|

Hampton Grove, Mosgiel

|

|

16

|

Balmoral Avenue

|

25

|

Hampton Grove, Mosgiel

|

|

17

|

Balmoral Avenue

|

26

|

Hampton Grove, Mosgiel

|

|

19

|

Barclay Street

|

4

|

Harold Street

|

|

211

|

Bay View Road

|

12

|

Harold Street

|

|

211A

|

Bay View Road

|

70a

|

Hazel Avenue

|

|

211B

|

Bay View Road

|

70

|

Hazel Avenue

|

|

1

|

Beaufort Street

|

72

|

Hazel Avenue

|

|

3

|

Beaufort Street

|

215a

|

Helensburgh Road

|

|

119

|

Belford Street

|

217a

|

Helensburgh Road

|

|

12

|

Bell Crescent

|

217b

|

Helensburgh Road

|

|

14

|

Bell Crescent

|

219

|

Helensburgh Road

|

|

24

|

Bell Crescent

|

219a

|

Helensburgh Road

|

|

26

|

Bell Crescent

|

219b

|

Helensburgh Road

|

|

7

|

Bishop Verdon Close

|

221

|

Helensburgh Road

|

|

9

|

Bishop Verdon Close

|

223

|

Helensburgh Road

|

|

10

|

Bishop Verdon Close

|

49

|

Highcliff Road

|

|

11

|

Bishop Verdon Close

|

49A

|

Highcliff Road

|

|

12

|

Bishop Verdon Close

|

51

|

Highcliff Road

|

|

8

|

Bonnington Street

|

57

|

Highcliff Road

|

|

8a

|

Bonnington Street

|

295

|

Highcliff Road

|

|

10

|

Bonnington Street

|

297

|

Highcliff Road

|

|

20K

|

Brighton Road

|

313

|

Highcliff Road

|

|

20J

|

Brighton Road

|

315a

|

Highcliff Road

|

|

20H

|

Brighton Road

|

315b

|

Highcliff Road

|

|

20G

|

Brighton Road

|

317

|

Highcliff Road

|

|

20F

|

Brighton Road

|

16

|

Highgate

|

|

20E

|

Brighton Road

|

18

|

Highgate

|

|

20D

|

Brighton Road

|

20

|

Highgate

|

|

20C

|

Brighton Road

|

34a

|

Highgate

|

|

20B

|

Brighton Road

|

34

|

Highgate

|

|

20A

|

Brighton Road

|

216

|

Highgate

|

|

20

|

Brighton Road

|

218

|

Highgate

|

|

34

|

Burgess Street

|

144A

|

Highgate

|

|

36

|

Burgess Street

|

144B

|

Highgate

|

|

38

|

Burgess Street

|

146

|

Highgate

|

|

40

|

Burgess Street

|

146A

|

Highgate

|

|

42

|

Burgess Street

|

148

|

Highgate

|

|

44

|

Burgess Street

|

9

|

Kilgour Street

|

|

46

|

Burgess Street

|

11

|

Kilgour Street

|

|

48

|

Burgess Street

|

15

|

Kilgour Street

|

|

50

|

Burgess Street

|

20

|

Kinvig Street

|

|

181

|

Burt Street

|

22

|

Kinvig Street

|

|

183

|

Burt Street

|

2

|

Koremata Street

|

|

185

|

Burt Street

|

4

|

Koremata Street

|

|

7

|

Bush Road, Mosgiel

|

12

|

Koremata Street

|

|

80

|

Caldwell Street

|

3

|

Lawson Street

|

|

82

|

Caldwell Street

|

4

|

Leithton Close

|

|

1

|

Campbell Lane

|

6

|

Leithton Close

|

|

4

|

Campbell Lane

|

9

|

Leithton Close

|

|

5

|

Campbell Lane

|

10

|

Leithton Close

|

|

6

|

Campbell Lane

|

11

|

Leithton Close

|

|

7

|

Campbell Lane

|

14

|

Leithton Close

|

|

8

|

Campbell Lane

|

15

|

Leithton Close

|

|

9

|

Campbell Lane

|

18

|

Leithton Close

|

|

10

|

Campbell Lane

|

19

|

Leithton Close

|

|

11

|

Campbell Lane

|

21

|

Leithton Close

|

|

12

|

Campbell Lane

|

22

|

Leithton Close

|

|

13

|

Campbell Lane

|

23

|

Leithton Close

|

|

14

|

Campbell Lane

|

26

|

Leithton Close

|

|

15

|

Campbell Lane

|

27

|

Leithton Close

|

|

30

|

Cardigan Street, North East Valley

|

28

|

Leithton Close

|

|

32

|

Cardigan Street, North East Valley

|

29

|

Leithton Close

|

|

34

|

Cardigan Street, North East Valley

|

32

|

Leithton Close

|

|

36

|

Cardigan Street, North East Valley

|

33

|

Leithton Close

|

|

22

|

Centennial Avenue, Fairfield

|

36

|

Leithton Close

|

|

24

|

Centennial Avenue, Fairfield

|

5

|

Leven Street

|

|

26

|

Centennial Avenue, Fairfield

|

2

|

Leyton Terrace

|

|

28

|

Centennial Avenue, Fairfield

|

21-67

|

Lock Street

|

|

150

|

Chapman Street

|

23a

|

London Street

|

|

150A

|

Chapman Street

|

25

|

London Street

|

|

152

|

Chapman Street

|

1-25

|

London Street

|

|

12

|

Clearwater Street

|

2-25

|

London Street

|

|

14

|

Clearwater Street

|

3-25

|

London Street

|

|

16

|

Clearwater Street

|

8

|

Lynwood Avenue

|

|

18

|

Clearwater Street

|

10

|

Lynwood Avenue

|

|

20

|

Clearwater Street

|

12c

|

Lynwood Avenue

|

|

22

|

Clearwater Street

|

12b

|

Lynwood Avenue

|

|

24

|

Clearwater Street

|

12a

|

Lynwood Avenue

|

|

26

|

Clearwater Street

|

12

|

Lynwood Avenue

|

|

28

|

Clearwater Street

|

14

|

Lynwood Avenue

|

|

30

|

Clearwater Street

|

3

|

McAllister Lane, Mosgiel

|

|

32

|

Clearwater Street

|

5

|

McAllister Lane, Mosgiel

|

|

34

|

Clearwater Street

|

7

|

McAllister Lane, Mosgiel

|

|

36

|

Clearwater Street

|

9

|

McAllister Lane, Mosgiel

|

|

22

|

Cole Street

|

11

|

McAllister Lane, Mosgiel

|

|

11

|

Corstorphine Road

|

13

|

McAllister Lane, Mosgiel

|

|

11A

|

Corstorphine Road

|

15

|

McAllister Lane, Mosgiel

|

|

13

|

Corstorphine Road

|

17

|

McAllister Lane, Mosgiel

|

|

15

|

Corstorphine Road

|

19

|

McAllister Lane, Mosgiel

|

|

17

|

Corstorphine Road

|

210

|

Main South Road, Green Island

|

|

21

|

Corstorphine Road

|

1

|

Mallard Place, Mosgiel

|

|

23

|

Corstorphine Road

|

2

|

Mallard Place, Mosgiel

|

|

25

|

Corstorphine Road

|

3

|

Mallard Place, Mosgiel

|

|

11

|

Craighall Crescent

|

4

|

Mallard Place, Mosgiel

|

|

15

|

Craighall Crescent

|

5

|

Mallard Place, Mosgiel

|

|

1

|

Dalkeith Road, Port Chalmers

|

6

|

Mallard Place, Mosgiel

|

|

2

|

Dalkeith Road, Port Chalmers

|

7

|

Mallard Place, Mosgiel

|

|

4

|

Dalkeith Road, Port Chalmers

|

8

|

Mallard Place, Mosgiel

|

|

6

|

Dalkeith Road, Port Chalmers

|

9

|

Mallard Place, Mosgiel

|

|

8

|

Dalkeith Road, Port Chalmers

|

10

|

Mallard Place, Mosgiel

|

|

10

|

Dalkeith Road, Port Chalmers

|

11

|

Mallard Place, Mosgiel

|

|

12

|

Dalkeith Road, Port Chalmers

|

12

|

Mallard Place, Mosgiel

|

|

21

|

Davies Street

|

13

|

Mallard Place, Mosgiel

|

|

22

|

Davies Street

|

14

|

Mallard Place, Mosgiel

|

|

1

|

Devon Place

|

15

|

Mallard Place, Mosgiel

|

|

2

|

Devon Place

|

11

|

Malvern Street

|

|

3

|

Devon Place

|

15

|

Malvern Street

|

|

4

|

Devon Place

|

17a

|

Malvern Street

|

|

5

|

Devon Place

|

30

|

Marne Street

|

|

6

|

Devon Place

|

32

|

Marne Street

|

|

7

|

Devon Place

|

42

|

Marne Street

|

|

9

|

Devon Place

|

44

|

Marne Street

|

|

10

|

Devon Place

|

46

|

Marne Street

|

|

11

|

Devon Place

|

48

|

Marne Street

|

|

12

|

Devon Place

|

50

|

Marne Street

|

|

13

|

Devon Place

|

2

|

Meldrum Street

|

|

14

|

Devon Place

|

10

|

Meldrum Street

|

|

15

|

Devon Place

|

33

|

Melville Street

|

|

16

|

Devon Place

|

14

|

Middleton Road

|

|

17

|

Devon Place

|

16

|

Middleton Road

|

|

18

|

Devon Place

|

18

|

Middleton Road

|

|

19

|

Devon Place

|

20

|

Middleton Road

|

|

20

|

Devon Place

|

22

|

Middleton Road

|

|

139b

|

Doon Street

|

24

|

Middleton Road

|

|

139a

|

Doon Street

|

26

|

Middleton Road

|

|

139

|

Doon Street

|

28

|

Middleton Road

|

|

141

|

Doon Street

|

30

|

Middleton Road

|

|

143

|

Doon Street

|

37

|

Middleton Road

|

|

145

|

Doon Street

|

37a

|

Middleton Road

|

|

149

|

Doon Street

|

39

|

Middleton Road

|

|

151

|

Doon Street

|

43

|

Middleton Road

|

|

5

|

Dorset Street

|

47a

|

Middleton Road

|

|

7

|

Dorset Street

|

19

|

Montague Street

|

|

10

|

Dorset Street

|

21

|

Montague Street

|

|

11

|

Dorset Street

|

23

|

Montague Street

|

|

12

|

Dorset Street

|

29

|

Moray Place

|

|

14

|

Dorset Street

|

415

|

Moray Place

|

|

16

|

Dorset Street

|

72

|

Newington Avenue

|

|

18

|

Dorset Street

|

37

|

Norwood Street

|

|

20

|

Dorset Street

|

41

|

Norwood Street

|

|

21

|

Dorset Street

|

39

|

Pacific Street

|

|

17

|

Duckworth Street

|

1

|

Pembrey Street

|

|

19

|

Duckworth Street

|

2

|

Pembrey Street

|

|

21

|

Duckworth Street

|

3

|

Pembrey Street

|

|

35

|

Duckworth Street

|

4

|

Pembrey Street

|

|

37

|

Duckworth Street

|

5

|

Pembrey Street

|

|

39

|

Duckworth Street

|

6

|

Pembrey Street

|

|

39a

|

Duckworth Street

|

7

|

Pembrey Street

|

|

41

|

Duckworth Street

|

8

|

Pembrey Street

|

|

47

|

Duckworth Street

|

10

|

Pembrey Street

|

|

49

|

Duckworth Street

|

11

|

Pembrey Street

|

|

53

|

Duckworth Street

|

264

|

Pine Hill Road

|

|

|

Dunedin Airport

|

264A

|

Pine Hill Road

|

|

1–31

|

Eastbourne Street

|

266A

|

Pine Hill Road

|

|

2–31

|

Eastbourne Street

|

266B

|

Pine Hill Road

|

|

3–31

|

Eastbourne Street

|

268A

|

Pine Hill Road

|

|

4–31

|

Eastbourne Street

|

268B

|

Pine Hill Road

|

|

5–31

|

Eastbourne Street

|

270

|

Pine Hill Road

|

|

6–31

|

Eastbourne Street

|

272

|

Pine Hill Road

|

|

7–31

|

Eastbourne Street

|

274

|

Pine Hill Road

|

|

8–31

|

Eastbourne Street

|

278A

|

Pine Hill Road

|

|

9–31

|

Eastbourne Street

|

278B

|

Pine Hill Road

|

|

10–31

|

Eastbourne Street

|

390

|

Pine Hill Road

|

|

11–31

|

Eastbourne Street

|

409

|

Pine Hill Road

|

|

12–31

|

Eastbourne Street

|

411

|

Pine Hill Road

|

|

13–31

|

Eastbourne Street

|

5

|

Pinfold Place, Mosgiel

|

|

14–31

|

Eastbourne Street

|

6

|

Pinfold Place, Mosgiel

|

|

15–31

|

Eastbourne Street

|

8

|

Pinfold Place, Mosgiel

|

|

16–31

|

Eastbourne Street

|

9

|

Pinfold Place, Mosgiel

|

|

17–31

|

Eastbourne Street

|

10

|

Pinfold Place, Mosgiel

|

|

18–31

|

Eastbourne Street

|

11

|

Pinfold Place, Mosgiel

|

|

19–31

|

Eastbourne Street

|

12

|

Pinfold Place, Mosgiel

|

|

20–31

|

Eastbourne Street

|

13

|

Pinfold Place, Mosgiel

|

|

21–31

|

Eastbourne Street

|

14

|

Pinfold Place, Mosgiel

|

|

22–31

|

Eastbourne Street

|

15

|

Pinfold Place, Mosgiel

|

|

23–31

|

Eastbourne Street

|

19

|

Queen Street

|

|

24–31

|

Eastbourne Street

|

19A

|

Queen Street

|

|

25–31

|

Eastbourne Street

|

223

|

Ravensbourne Road

|

|

26–31

|

Eastbourne Street

|

87

|

Riselaw Road

|

|

27–31

|

Eastbourne Street

|

89

|

Riselaw Road

|

|

28–31

|

Eastbourne Street

|

89A

|

Riselaw Road

|

|

29–31

|

Eastbourne Street

|

91

|

Riselaw Road

|

|

30–31

|

Eastbourne Street

|

91A

|

Riselaw Road

|

|

31–31

|

Eastbourne Street

|

93

|

Riselaw Road

|

|

32–31

|

Eastbourne Street

|

93A

|

Riselaw Road

|

|

33–31

|

Eastbourne Street

|

21

|

Rosebery Street

|

|

34–31

|

Eastbourne Street

|

16

|

Selkirk Street

|

|

35–31

|

Eastbourne Street

|

11

|

Shand Street, Green Island

|

|

36–31

|

Eastbourne Street

|

14

|

Sheen Street

|

|

37–31

|

Eastbourne Street

|

6

|

Silver Springs Boulevard, Mosgiel

|

|

38–31

|

Eastbourne Street

|

8

|

Silver Springs Boulevard, Mosgiel

|

|

39–31

|

Eastbourne Street

|

10

|

Silver Springs Boulevard, Mosgiel

|

|

40–31

|

Eastbourne Street

|

12

|

Silver Springs Boulevard, Mosgiel

|

|

41–31

|

Eastbourne Street

|

14

|

Silver Springs Boulevard, Mosgiel

|

|

42–31

|

Eastbourne Street

|

16

|

Silver Springs Boulevard, Mosgiel

|

|

43–31

|

Eastbourne Street

|

20

|

Silver Springs Boulevard, Mosgiel

|

|

46–31

|

Eastbourne Street

|

22

|

Silver Springs Boulevard, Mosgiel

|

|

47–31

|

Eastbourne Street

|

24

|

Silver Springs Boulevard, Mosgiel

|

|

50–31

|

Eastbourne Street

|

26

|

Silver Springs Boulevard, Mosgiel

|

|

51–31

|

Eastbourne Street

|

28

|

Silver Springs Boulevard, Mosgiel

|

|

8

|

Echovale Avenue

|

1-27

|

St Albans Street

|

|

10

|

Echovale Avenue

|

2-27

|

St Albans Street

|

|

12

|

Echovale Avenue

|

3-27

|

St Albans Street

|

|

2

|

Elbe Street

|

4-27

|

St Albans Street

|

|

202

|

Elgin Road

|

5-27

|

St Albans Street

|

|

204

|

Elgin Road

|

6-27

|

St Albans Street

|

|

206

|

Elgin Road

|

7-27

|

St Albans Street

|

|

208

|

Elgin Road

|

8-27

|

St Albans Street

|

|

1

|

Eton Drive

|

9-27

|

St Albans Street

|

|

4

|

Eton Drive

|

10-27

|

St Albans Street

|

|

5

|

Eton Drive

|

11-27

|

St Albans Street

|

|

6

|

Eton Drive

|

12-27

|

St Albans Street

|

|

7

|

Eton Drive

|

13-27

|

St Albans Street

|

|

8

|

Eton Drive

|

4

|

Stanley Square

|

|

9

|

Eton Drive

|

5

|

Stanley Square

|

|

10

|

Eton Drive

|

6

|

Stanley Square

|

|

11

|

Eton Drive

|

7

|

Stanley Square

|

|

12

|

Eton Drive

|

8

|

Stanley Square

|

|

13

|

Eton Drive

|

9

|

Stanley Square

|

|

14

|

Eton Drive

|

10

|

Stanley Square

|

|

15

|

Eton Drive

|

11

|

Stanley Square

|

|

16

|

Eton Drive

|

12

|

Stanley Square

|

|

17

|

Eton Drive

|

365

|

Stuart Street

|

|

18

|

Eton Drive

|

367

|

Stuart Street

|

|

19

|

Eton Drive

|

367A

|

Stuart Street

|

|

20

|

Eton Drive

|

55

|

Sunbury Street

|

|

2

|

Everton Road

|

57

|

Sunbury Street

|

|

3

|

Everton Road

|

59

|

Sunbury Street

|

|

4

|

Everton Road

|

59A

|

Sunbury Street

|

|

64

|

Every Street

|

67

|

Tahuna Road

|

|

66

|

Every Street

|

67A

|

Tahuna Road

|

|

68

|

Every Street

|

67B

|

Tahuna Road

|

|

70

|

Every Street

|

69

|

Tahuna Road

|

|

76

|

Every Street

|

69A

|

Tahuna Road

|

|

7

|

Fern Road, Ravensbourne

|

69B

|

Tahuna Road

|

|

9

|

Fern Road, Ravensbourne

|

69C

|

Tahuna Road

|

|

11

|

Fern Road, Ravensbourne

|

1

|

Taupo Lane

|

|

13

|

Fern Road, Ravensbourne

|

2

|

Taupo Street

|

|

15

|

Fern Road, Ravensbourne

|

1

|

Thomas Square

|

|

17

|

Fern Road, Ravensbourne

|

2

|

Thomas Square

|

|

19

|

Fern Road, Ravensbourne

|

3

|

Thomas Square

|

|

21

|

Fern Road, Ravensbourne

|

4

|

Thomas Square

|

|

19

|

Ferntree Drive

|

5

|

Thomas Square

|

|

21

|

Ferntree Drive

|

6

|

Thomas Square

|

|

23

|

Ferntree Drive

|

7

|

Thomas Square

|

|

25

|

Ferntree Drive

|

8

|

Thomas Square

|

|

43

|

Forfar Street

|

9

|

Thomas Square

|

|

45

|

Forfar Street

|

4A

|

Totara Street, Ravensbourne

|

|

47

|

Forfar Street

|

44

|

Turnbull Street

|

|

47a

|

Forfar Street

|

46

|

Turnbull Street

|

|

49

|

Forfar Street

|

85A

|

Victoria Road

|

|

51

|

Forfar Street

|

85B

|

Victoria Road

|

|

53

|

Forfar Street

|

85C

|

Victoria Road

|

|

53a

|

Forfar Street

|

85D

|

Victoria Road

|

|

1–80

|

Formby Street

|

85G

|

Victoria Road

|

|

5–80

|

Formby Street

|

85H

|

Victoria Road

|

|

6–80

|

Formby Street

|

85I

|

Victoria Road

|

|

7–80

|

Formby Street

|

85J

|

Victoria Road

|

|

8–80

|

Formby Street

|

85K

|

Victoria Road

|

|

10–80

|

Formby Street

|

85L

|

Victoria Road

|

|

14–80

|

Formby Street

|

85M

|

Victoria Road

|

|

15–80

|

Formby Street

|

85N

|

Victoria Road

|

|

16–80

|

Formby Street

|

85O

|

Victoria Road

|

|

17–80

|

Formby Street

|

85P

|

Victoria Road

|

|

18–80

|

Formby Street

|

85Q

|

Victoria Road

|

|

19–80

|

Formby Street

|

85R

|

Victoria Road

|

|

20–80

|

Formby Street

|

146

|

Victoria Road

|

|

239

|

Fryatt Street

|

44

|

Waimea Avenue

|

|

248

|

George Street

|

46

|

Waimea Avenue

|

|

559

|

George Street

|

48

|

Waimea Avenue

|

|

150A

|

Gladstone Road North

|

50

|

Waimea Avenue

|

|

150B

|

Gladstone Road North

|

58/60

|

Waimea Avenue

|

|

150C

|

Gladstone Road North

|

62/64

|

Waimea Avenue

|

|

150D

|

Gladstone Road North

|

16

|

Warwick Street

|

|

150E

|

Gladstone Road North

|

18

|

Warwick Street

|

|

152B

|

Gladstone Road North

|

23

|

Warwick Street

|

|

152C

|

Gladstone Road North

|

1

|

Wenlock Square

|

|

152D

|

Gladstone Road North

|

2

|

Wenlock Square

|

|

152E

|

Gladstone Road North

|

3

|

Wenlock Square

|

|

154A

|

Gladstone Road North

|

4

|

Wenlock Square

|

|

214

|

Gladstone Road North

|

5

|

Wenlock Square

|

|

216

|

Gladstone Road North

|

6

|

Wenlock Square

|

|

218

|

Gladstone Road North

|

7

|

Wenlock Square

|

|

220

|

Gladstone Road North

|

8

|

Wenlock Square

|

|

222

|

Gladstone Road North

|

9

|

Wenlock Square

|

|

224

|

Gladstone Road North

|

10

|

Wenlock Square

|

|

226

|

Gladstone Road North

|

11

|

Wenlock Square

|

|

228

|

Gladstone Road North

|

12

|

Wenlock Square

|

|

230

|

Gladstone Road North

|

14

|

Wenlock Square

|

|

232

|

Gladstone Road North

|

15

|

Wenlock Square

|

|

234

|

Gladstone Road North

|

17

|

Wenlock Square

|

|

39

|

Glenbrook Drive, Mosgiel

|

18

|

Wenlock Square

|

|

41

|

Glenbrook Drive, Mosgiel

|

19

|

Wenlock Square

|

|

45

|

Glenbrook Drive, Mosgiel

|

20

|

Wenlock Square

|

|

47

|

Glenbrook Drive, Mosgiel

|

21

|

Wenlock Square

|

|

49

|

Glenbrook Drive, Mosgiel

|

19

|

Woodside Terrace

|

|

51

|

Glenbrook Drive, Mosgiel

|

20

|

Woodside Terrace

|

|

57

|

Glenbrook Drive, Mosgiel

|

22

|

Woodside Terrace

|

|

1

|

Glenfinnan Place

|

23

|

Woodside Terrace

|

|

3

|

Glenfinnan Place

|

24

|

Woodside Terrace

|

|

4

|

Glenfinnan Place

|

25

|

Woodside Terrace

|

|

4A

|

Glenfinnan Place

|

25a

|

Woodside Terrace

|

|

5

|

Glenfinnan Place

|

26

|

Woodside Terrace

|

|

6

|

Glenfinnan Place

|

27

|

Woodside Terrace

|

|

7

|

Glenfinnan Place

|

29

|

Woodside Terrace

|

|

8A

|

Glenfinnan Place

|

|

|

|

8B

|

Glenfinnan Place

|

|

|

|

9A

|

Glenfinnan Place

|

|

|

|

9B

|

Glenfinnan Place

|

|

|

|

10A

|

Glenfinnan Place

|

|

|

|

10B

|

Glenfinnan Place

|

|

|

|

1

|

Glengarry Court

|

|

|

|

2

|

Glengarry Court

|

|

|

|

3

|

Glengarry Court

|

|

|

|

4

|

Glengarry Court

|

|

|

|

5

|

Glengarry Court

|

|

|

|

6

|

Glengarry Court

|

|

|

|

7

|

Glengarry Court

|

|

|

|

8

|

Glengarry Court

|

|

|

|

|

|

|

|

|

|

|

|

|

Differential Matters and Categories

b) Adopts the following differential categories for the