![]()

Council

MINUTES

Minutes of an ordinary meeting of the Dunedin City Council held in the Council Chamber, Dunedin Public Art Gallery, The Octagon, Dunedin on Tuesday 27 June 2023, commencing at 10.00 am

PRESENT

|

Mayor |

Mayor Jules Radich |

|

|

Deputy Mayor |

Cr Sophie Barker

|

|

|

Members |

Cr Bill Acklin |

Cr David Benson-Pope |

|

|

Cr Christine Garey |

Cr Kevin Gilbert |

|

|

Cr Carmen Houlahan |

Cr Marie Laufiso |

|

|

Cr Cherry Lucas |

Cr Mandy Mayhem |

|

|

Cr Steve Walker |

Cr Brent Weatherall |

|

|

Cr Andrew Whiley |

|

|

IN ATTENDANCE |

Sandy Graham (Chief Executive Officer), Robert West (General Manager Corporate and Quality), Claire Austin (General Manager Customer and Regulatory), Simon Pickford (General Manager Community Services), Simon Drew (General Manager Infrastructure and Development), John Christie (Manager Enterprise Dunedin), Carolyn Allan (Senior Management Accountant), Jeanine Benson (Group Manager Transport), David Ward (Group Manager 3 Waters), Nadia McKenzie (In-House Legal Counsel), Vicki Kestila (Masters Games Manager) and Clare Sullivan (Principal Committee Advisor). |

Governance Support Officer Lynne Adamson

OPENING

Dr Lux Selvanesan and Mrs Nirmala Naryanan opened the meeting with a prayer on behalf of the Hindu Temple Society and the Dunedin Multi-cultural Council.

Dr Selvanesan acknowledged Matua David Ellison and the recent passing of Kristan Mouat, co-principal of Logan Park High School and a valued member of the Dunedin Multi-cultural Council.

Tony Cummings and Hazel Salter spoke on behalf of the Dunedin Citizens Association on the DCC Hospital Campaign and the concerns they had with the proposed changes to the new hospital.

Mr Cummings and Ms Salter responded to questions.

|

Moved (Mayor Jules Radich/Cr Steve Walker): That the Council:

Accepts the apologies from Crs Lee Vandervis and Jim O’Malley.

Motion carried (CNL/2023/139) |

|

|

Moved (Mayor Jules Radich/Cr Sophie Barker): That the Council: Confirms the agenda without addition or alteration.

Motion carried (CNL/2023/140) |

Members were reminded of the need to stand aside from decision-making when a conflict arose between their role as an elected representative and any private or other external interest they might have.

|

|

Moved (Mayor Jules Radich/Cr Cherry Lucas): That the Council:

a) Notes the Elected Members' Interest Register; and b) Confirms the proposed management plan for Elected Members' Interests. c) Notes the proposed management plan for the Executive Leadership Team’s Interests. Motion carried (CNL/2023/141) |

|

|

Moved (Cr David Benson-Pope/Cr Steve Walker): That the Council: a) Confirms the public part of the minutes of the Ordinary Council meeting held on 30 May 2023 as a correct record. Motion carried (CNL/2023/142) |

|

|

Moved (Cr Sophie Barker/Cr Cherry Lucas): That the Council:

a) Confirms the public part of the minutes of the Extraordinary Council meeting held on 06 June 2023 as a correct record. Motion carried (CNL/2023/143) |

|

|

A report from Civic provided an update on the implementations of resolutions made at Council meetings. |

|

|

Moved (Mayor Jules Radich/Cr Steve Walker): That the Council:

a) Notes the Open and Completed Actions from resolutions of Council meetings as attached. Motion carried (CNL/2023/144) |

|

|

A report from Civic provided the updated forward work programme for the 2022-2023 year. |

|

|

The Chief Executive Officer (Sandy Graham) spoke to the report and responded to questions.

|

|

|

Moved (Mayor Jules Radich/Cr Bill Acklin): That the Council:

a) Notes the updated Council forward work programme as shown in Attachment A. Motion carried (CNL/2023/145) |

|

9 Three Waters Reform Update and Submission on Water Services Entities Amendment Bill |

|

|

|

A report from the Executive Leadership Team and Legal provided an update to Council on Affordable Water Reform (previously called Three Waters Reform); The report summarised the Water Services Entities Amendment Bill and sought a delegation to authorise the Council's Chief Executive Officer, in consultation with the Chair of the Infrastructure Services Committee, to (i) prepare a draft submission to Parliament’s Select Committee on the WSEs Amendment Bill; and (ii) send the finalised submission to the Select Committee. |

|

|

The Chief Executive Officer (Sandy Graham), General Manager Infrastructure and Development (Simon Drew), Group Manager 3 Waters (David Ward) and In-House Legal Counsel (Nadia McKenzie) spoke to the report and responded to questions on the submission process and content. It was noted that the submission would be forwarded to Councillors prior to being submitted. |

|

|

Moved (Mayor Jules Radich/Cr Carmen Houlahan): That the Council:

a) Notes the update on Affordable Water Reform (previously called Three Waters Reform). b) Delegates authority to the Council's Chief Executive Officer, in consultation with the Chair of the Infrastructure Services Committee, to (i) prepare a draft submission to Parliament’s Select Committee on the WSEs Amendment Bill; and (ii) send the finalised submission to the Select Committee. c) Authorises the Chair of Infrastructures Services (or his delegate) to speak to the submission. Motion carried (CNL/2023/147) |

Cr Andrew Whiley left the meeting at 11.58 am and returned at 12.02 pm.

|

|

A report from Events and the Community Development Team presented a Deed of Variation between the Council and Dunedin (New Zealand) Masters Games Trust Board in response to a request from Council to consider matters and ensure the Deed was in line with current legislative requirements. |

|

|

The Chief Executive Officer (Sandy Graham); General Manager Community Services (Simon Pickford); and Masters Games Manager (Vicki Kestila) spoke to the report and responded to questions.

|

|

|

Moved (Cr Sophie Barker/Cr Bill Acklin): That the Council:

a) Notes the proposed Deed of Variation between the Council and the Dunedin (New Zealand) Masters Games Trust Board, which varies the Dunedin (New Zealand) Masters Games Trust. b) Authorises the affixing of Council’s Seal to the Deed of Variation. Motion carried (CNL/2023/148) |

|

11 New Zealand Masters Games Service Level Agreement and Statement of Intent 2023 - 2025 |

|

|

|

A report from Events and Community Development presented the Statement of Intent and Service Level Agreement for the Dunedin (New Zealand) Masters Games Trust for approval. |

|

|

The General Manager Community Services (Simon Pickford); and Masters Games Manager (Vicki Kestila) spoke to the report and responded to questions.

|

|

|

Moved (Cr Bill Acklin/Cr Sophie Barker): That the Council:

a) Approves the 2023 – 2025 Dunedin (New Zealand) Masters Games Trust Statement of Intent. b) Approves the 2023 – 2025 Dunedin (New Zealand) Masters Games Trust Service Level Agreement. Motion carried (CNL/2023/149) |

|

|

A report from Transport sought approval for temporary road closures for the following events: a) Brass Band Marching Competition b) Mana Moana Event c) City Activation FIFA – Octagon d) City Activation All Blacks vs Australia – Octagon e) Special Rigs for Special Kids |

|

|

The General Manager Infrastructure and Development (Simon Drew) spoke to the report and responded to questions.

|

|

|

Moved (Cr Steve Walker/Cr Bill Acklin): That the Council:

a) Resolves to close the roads detailed below (pursuant to Section 319, Section 342, and Schedule 10 clause 11(e) of the Local Government Act 1974): i) Brass Band Marching Competition Date and Times: Friday 7 July 2023, from 12.45pm to 2.30pm.

Roads: · Princes Street, between Moray Place and the Octagon. · Octagon Central Carriageway. · George Street, between Octagon to Moray Place. · Moray Place, between George Street and Filleul Street.

ii) Mana Moana Event Dates and Times: Friday 14, Saturday 15 and Sunday 16 July 2023, from 4.00pm to 9.30pm.

Roads: · Fryatt Street, from Fish Street to Wharf Street. Dates and Times: Wednesday 12 July to Sunday 16 July 2023, all hours.

Roads: · Birch Street carpark.

iii) City Activation FIFA – Octagon Dates and Times: Sunday 30 July and Monday 31 July 2023, from 7.00am to 7.00am.

Roads: · The Lower Octagon, from George Street to Princes Street. · Lower Stuart Street, from The Octagon to Moray Place.

Access will be available to Bath Street and the eastbound lane of Lower Stuart Street from Bath Street to Moray Place. iv) City Activation All Blacks vs Australia – Octagon Dates and Times: Saturday 5 August and Sunday 6 August 2023, from 6.00am to 8.00am.

Roads: · The Lower Octagon, from George Street to Princes Street. · Lower Stuart Street, from The Octagon to Moray Place.

Access will be available to Bath Street and the eastbound lane of Lower Stuart Street from Bath Street to Moray Place. v) Special Rigs for Special Kids Date and Times: Sunday 27 August 2023, from 6.00am to 6.00pm.

Roads: · Midland Street, from Otaki Street to Portsmouth Drive. · Otaki Street, from Midland Street to Teviot Street. · Teviot Street, from Portsmouth Drive to Timaru Street will be temporarily closed for 20 minutes to allow the convoy to leave.

Motion carried (CNL/2023/150) |

Moved (Mayor Jules Radich/Cr Carmen Houlahan)

That the Council:

Adjourns the meeting until 12.45 pm.

Motion carried

The meeting adjourned at 12.13 pm and reconvened at 12.48 pm.

|

13 Dunedin City Holdings Group Companies - Statements of Intent 2023/24 |

|

|

|

A report from Civic noted that the 2023/24 Statements of Intent of Dunedin City Holdings Ltd (DCHL) had been adopted by their respective boards and endorsed by the board of DCHL. The report recommended that Council agreed to the Statements of Intent for DCHL and its Group companies for the 2023/24 year. |

|

|

The Chief Executive Officer (Sandy Graham) advised that Councillors were provided with electronic copies of the Statements of Intent, however, due to an error, members of the public had only been able to view copies from the morning of the meeting. She apologised for the breach of Standing Orders on the availability of the papers.

The General Manager Dunedin City Holdings Ltd (Jemma Adams) spoke to the Statements of Intent and responded to questions.

|

|

|

Moved (Cr Sophie Barker/Cr Andrew Whiley): That the Council:

a) Agrees to the 2023/2024 Statements of Intent of Dunedin City Holdings Ltd and its subsidiary and associate companies. Motion carried (CNL/2023/151) |

|

|

A report from Civic recommended the adoption of the Annual Plan 2023/24 and approval of matters associated with the Annual Plan. |

|

|

The Chief Executive Officer (Sandy Graham), and Senior Management Accountant (Carolyn Allan) spoke to the report and responded to questions.

|

|

|

Moved (Mayor Jules Radich/Cr Cherry Lucas): That the Council:

a) Notes the matters in section 100(2) of the Local Government Act 2002 being: i) the estimated expenses of maintaining the predicted levels of service, capacity and assets set out in the 10 year plan 2021-31; ii) the projected revenue available to fund the estimated expenses; iii) the equitable allocation of responsibility for funding the provision and maintenance of assets and facilities throughout their useful life; and iv) Council’s Revenue and Financing Policy, Treasury Risk Management Policy, and Development Contributions Policy. b) Agrees that, having had regards to the matters in paragraph (a) above, it is financially prudent for Council to set for the 2023/24 financial year, projected operating revenues at a level that will not meet projected operating expenses. c) Notes in accordance with section 80 of the Local Government Act 2002 that: i) The decision to not fully fund the increase in depreciation, including 3 Waters, is inconsistent with Council’s Revenue and Financing Policy; and ii) The inconsistency arises from the revaluation of assets, and the uncertainty of timing of 3 Waters reform; and iii) The Revenue and Financing Policy and the Financial Strategy will be reviewed as part of the development of the 10 year plan 2024-34. d) Adopts the Annual Plan 2023/24. e) Authorises the Chief Executive to make any minor editorial changes resulting from quality checks prior to the final printing of the Annual Plan 2023/24 document. f) Authorises the Chief Executive to drawdown debt up to total debt of $600 million in the 2023/24 year. Motion carried (CNL/2023/152) |

|

|

A report from Finance advised that following adoption of the Annual Plan 2023/24, the Council needed to set the rates as provided for in the Funding Impact Statement for the 2023/24 year. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

The Senior Management Accountant (Carolyn Allan) spoke to the report and responded to questions.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Moved (Cr David Benson-Pope/Cr Andrew Whiley): That the Council: a) Sets the following rates under the Local Government (Rating) Act 2002 on rating units in the district for the financial year commencing 1 July 2023 and ending on 30 June 2024. 1 General Rate A general rate set under section 13 of the Local Government (Rating) Act 2002 made on every rating unit, assessed on a differential basis as described below: · A rate of 0.2566 cents in the dollar (including GST) of capital value on every rating unit in the "residential" category. · A rate of 0.2438 cents in the dollar (including GST) of capital value on every rating unit in the "lifestyle" category. · A rate of 0.6338 cents in the dollar (including GST) of capital value on every rating unit in the "commercial" category. · A rate of 0.4490 cents in the dollar (including GST) of capital value on every rating unit in the "residential heritage bed and breakfasts" category. · A rate of 0.2053 cents in the dollar (including GST) of capital value on every rating unit in the "farmland" category. · A rate of 0.0508 cents in the dollar (including GST) of capital value on the “stadium: 10,000+ seat capacity” category. 2 Community Services Rate A targeted rate for community services, set under section 16 of the Local Government (Rating) Act 2002, assessed on a differential basis as follows: · $111.50 (including GST) per separately used or inhabited part of a rating unit for all rating units in the "residential, residential heritage bed and breakfasts, lifestyle and farmland" categories. · $111.50 (including GST) per rating unit for all rating units in the "commercial and stadium: 10,000+ seat capacity" categories. 3 Kerbside Recycling Rate A targeted rate for kerbside recycling, set under section 16 of the Local Government (Rating) Act 2002, assessed on a differential basis as follows: · $106.10 (including GST) per separately used or inhabited part of a rating unit for rating units in the "residential, residential heritage bed and breakfasts, lifestyle and farmland" categories. · $106.10 (including GST) per rating unit for rating units in the "commercial" category. 4 Drainage Rates A targeted rate for drainage, set under section 16 of the Local Government (Rating) Act 2002, assessed on a differential basis as follows: · $683.00 (including GST) per separately used or inhabited part of a rating unit for all rating units in the "residential, residential heritage bed and breakfasts, lifestyle and farmland" categories and which are "connected" to the public sewerage system. · $341.50 (including GST) per separately used or inhabited part of a rating unit for all rating units in the "residential, residential heritage bed and breakfasts, lifestyle and farmland" categories and which are "serviceable" by the public sewerage system. · $683.00 (including GST) per rating unit for all rating units in the "commercial, residential institutions, schools and stadium: 10,000+ seat capacity" categories and which are "connected" to the public sewerage system. · $341.50 (including GST) per rating unit for all rating units in the "commercial, residential institutions and schools" categories and which are "serviceable" by the public sewerage system. · $102.25 (including GST) per rating unit for all rating units in the "church" category and which are "connected" to the public sewerage system. Rating units which are not "connected" to the scheme and which are not "serviceable" will not be liable for this rate. Drainage is a combined targeted rate for sewage disposal and stormwater. Sewage disposal makes up 78% of the drainage rate, and stormwater makes up 22%. Non-rateable land will not be liable for the stormwater component of the drainage targeted rate. Rates demands for the drainage targeted rate for non-rateable land will therefore be charged at 78%. 5 Commercial Drainage Rates – Capital Value A targeted rate for drainage, set under section 16 of the Local Government (Rating) Act 2002, assessed on a differential basis as follows: · A rate of 0.2354 cents in the dollar (including GST) of capital value on every rating unit in the "commercial and residential institution" category and which are "connected" to the public sewerage system. · A rate of 0.1177 cents in the dollar (including GST) of capital value on every rating unit in the "commercial" category and which are "serviceable" by the public sewerage system. · A rate of 0.1766 cents in the dollar (including GST) of capital value on every rating unit in the "school" category and which are "connected" to the public sewerage system. · A rate of 0.0883 cents in the dollar (including GST) of capital value on every rating unit in the "school" category and which are "serviceable" by the public sewerage system. · A rate of 0.0190 cents in the dollar (including GST) of capital value on the “stadium: 10,000+ seat capacity” category. This rate shall not apply to properties in Karitane, Middlemarch, Seacliff, Waikouaiti and Warrington. This rate shall not apply to churches. Drainage is a combined targeted rate for sewage disposal and stormwater. Sewage disposal makes up 78% of the drainage rate, and stormwater makes up 22%. Non-rateable land will not be liable for the stormwater component of the drainage targeted rate. Rates demands for the drainage targeted rate for non-rateable land will therefore be charged at 78%. 6 Water Rates A targeted rate for water supply, set under section 16 of the Local Government (Rating) Act 2002, assessed on a differential basis as follows: · $517.00 (including GST) per separately used or inhabited part of any "connected" rating unit which receives an ordinary supply of water within the meaning of the Dunedin City Bylaws excepting properties in Karitane, Merton, Rocklands/Pukerangi, Seacliff, Waitati, Warrington, East Taieri, West Taieri and North Taieri. · $258.50 (including GST) per separately used or inhabited part of any "serviceable" rating unit to which connection is available to receive an ordinary supply of water within the meaning of the Dunedin City Bylaws excepting properties in Karitane, Merton, Rocklands/Pukerangi, Seacliff, Waitati, Warrington, East Taieri, West Taieri and North Taieri. · $517.00 (including GST) per unit of water being one cubic metre (viz. 1,000 litres) per day supplied at a constant rate of flow during a full 24 hour period to any "connected" rating unit situated in Karitane, Merton, Seacliff, Waitati, Warrington, West Taieri, East Taieri or North Taieri. · $258.50 (including GST) per separately used or inhabited part of any "serviceable" rating unit situated in Waitati, Warrington, West Taieri, East Taieri or North Taieri. This rate shall not apply to the availability of water in Merton, Karitane or Seacliff. 7 Fire Protection Rates A targeted rate for the provision of a fire protection service, set under section 16 of the Local Government (Rating) Act 2002, assessed on a differential basis as follows: · A rate of 0.0670 cents in the dollar (including GST) of capital value on all rating units in the "commercial" category. This rate shall not apply to churches. · A rate of 0.0503 cents in the dollar (including GST) of capital value on all rating units in the "residential institutions" category. · A rate of 0.0077 cents in the dollar (including GST) of capital value on the “stadium: 10,000+ seat capacity” category. · $155.10 (including GST) for each separately used or inhabited part of a rating unit within the "residential, residential heritage bed and breakfasts, lifestyle and farmland" category that is not receiving an ordinary supply of water within the meaning of the Dunedin City Bylaws. 8 Water Rates – Quantity of Water A targeted rate for the quantity of water provided to any rating unit fitted with a water meter, being an extraordinary supply of water within the meaning of the Dunedin City Bylaws, set under section 19 of the Local Government (Rating) Act 2002, according to the following scale of charges (GST inclusive):

Where the supply of a quantity of water is subject to this Quantity of Water Targeted Rate, the rating unit will not be liable for any other targeted rate for the supply of the same water. 9 Allanton Drainage Rate A targeted rate for the capital contribution towards the Allanton Wastewater Collection System, set under section 16 of the Local Government (Rating) Act 2002, of $411.00 (including GST) per rating unit, to every rating unit paying their contribution towards the scheme as a targeted rate over 20 years. Liability for the rate is on the basis of the provision of the service to each rating unit. The Allanton area is shown in the map below:

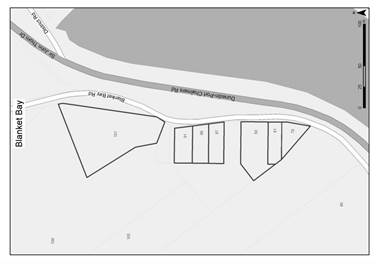

10 Blanket Bay Drainage Rate A targeted rate for the capital contribution towards the Blanket Bay Drainage System, set under section 16 of the Local Government (Rating) Act 2002, of $636.00 (including GST) per rating unit, to every rating unit paying their contribution towards the scheme as a targeted rate over 20 years. Liability for the rate is on the basis of the provision of the service to each rating unit. The Blanket Bay area is shown in the map below:

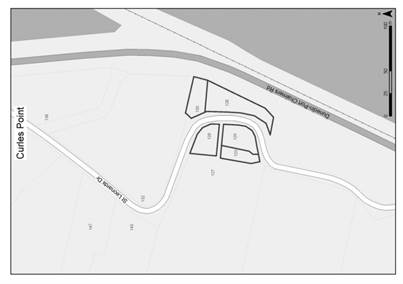

11 Curles Point Drainage Rate A targeted rate for the capital contribution towards the Curles Point Drainage System, set under section 16 of the Local Government (Rating) Act 2002, of $749.00 (including GST) per rating unit, to every rating unit paying their contribution towards the scheme as a targeted rate over 20 years. Liability for the rate is on the basis of the provision of the service to each rating unit. The Curles Point area is shown in the map below:

12 Tourism/Economic Development Rate A targeted rate for Tourism/Economic Development, set under section 16 of the Local Government (Rating) Act 2002, assessed on a differential basis as follows: · 0.0087 cents in the dollar (including GST) of capital value on every rating unit in the "commercial" category. · 0.0011 cents in the dollar (including GST) of capital value on the “stadium: 10,000+ seat capacity” category. 13 Warm Dunedin Targeted Rate Scheme A targeted rate for the Warm Dunedin Targeted Rate Scheme, set under section 16 of the Local Government (Rating) Act 2002, per rating unit in the Warm Dunedin Targeted Rate Scheme. The targeted rate scheme provides a way for homeowners to install insulation and/or clean heating. The targeted rate covers the cost and an annual interest rate. The interest rates have been and will be: Rates commencing 1 July 2013 and 1 July 2014 8% Rates commencing 1 July 2015 and 1 July 2016 8.3% Rates commencing 1 July 2017 7.8% Rates commencing 1 July 2018 7.2% Rates commencing 1 July 2019 6.8% Rates commencing 1 July 2020 5.7% Rates commencing 1 July 2021 4.4% 14 Private Street Lighting Rate A targeted rate for the purpose of recovering the cost of private street lights, set under section 16 of the Local Government (Rating) Act 2002, assessed on a differential basis as follows: · $156.80 (including GST) per private street light divided by the number of separately used or inhabited parts of a rating unit for all rating units in the "residential and lifestyle" categories in the private streets as identified in the schedule below. · $156.80 (including GST) per private street light divided by the number of rating units for all rating units in the "commercial" category in the private streets as identified in the schedule below.

Differential Matters and Categories b) Adopts the following differential categories for the 2023/24 financial year. The differential categories are determined in accordance with the Council's land use codes. The Council's land use codes are based on the land use codes set under the Rating Valuation Rules 2008 and are set out in Attachment A. In addition, the Council has established categories for residential institutions, residential heritage bed and breakfasts, the stadium: 10,000+ seat capacity, churches, and schools. 1 Differentials Based on Land Use The Council uses this matter to: · Differentiate the General rate. · Differentiate the Community Services rate. · Differentiate the Kerbside Recycling rate. · Differentiate the Private Street Lighting rate. · Differentiate the Tourism/Economic Development rate. · Differentiate the Fire Protection rate. The differential categories based on land use are: · Residential – includes all rating units used for residential purposes including single residential, multi-unit residential, multi-use residential, residential special accommodation, residential communal residence dependant on other use, residential bach/cribs, residential carparking and residential vacant land. · Lifestyle – includes all rating units with Council's land use codes 2, 20, 21, 22 and 29. · Commercial – includes all rating units with land uses not otherwise categorised as Residential, Residential Heritage Bed and Breakfasts, Lifestyle, Farmland or Stadium: 10,000+ seat capacity. · Farmland - includes all rating units used solely or principally for agricultural or horticultural or pastoral purposes. · Residential Heritage Bed and Breakfasts – includes all rating units meeting the following description: · Bed and breakfast establishments; and · Classified as commercial for rating purposes due to the number of bedrooms (greater than four); and · Either: · the majority of the establishment is at least 80 years old, or · the establishment has Heritage New Zealand Pouhere Taonga Registration, or · the establishment is a Dunedin City Council Protected Heritage Building as identified in the District Plan; and · The bed and breakfast owner lives at the facility. · Stadium: 10,000+ seat capacity – this includes land at 130 Anzac Avenue, Dunedin, Assessment 4026695, Valuation reference 27190-01403. 2 Differentials Based on Land Use and Provision or Availability of Service The Council uses these matters to differentiate the drainage rate and the commercial drainage rate. The differential categories based on land use are: · Residential – includes all rating units used for residential purposes including single residential, multi-unit residential, multi-use residential, residential special accommodation, residential communal residence dependant on other use, residential bach/cribs, residential carparking and residential vacant land. · Lifestyle - includes all rating units with Council's land use codes 2, 20, 21, 22 and 29. · Farmland - includes all rating units used solely or principally for agricultural or horticultural or pastoral purposes. · Commercial – includes all rating units with land uses not otherwise categorised as Residential, Residential Heritage Bed and Breakfasts, Lifestyle, Farmland, Residential Institutions, Stadium: 10,000+ seat capacity, Churches or Schools. · Stadium: 10,000+ seat capacity – this includes land at 130 Anzac Avenue, Dunedin, Assessment 4026695, Valuation reference 27190-01403. · Residential Heritage Bed and Breakfasts – includes all rating units meeting the following description: · Bed and breakfast establishments; and · Classified as commercial for rating purposes due to the number of bedrooms (greater than four); and · Either: · the majority of the establishment is at least 80 years old or · the establishment has Heritage New Zealand Pouhere Taonga Registration or · the establishment is a Dunedin City Council Protected Heritage Building as identified in the District Plan; and · The bed and breakfast owner lives at the facility. · Residential Institutions - includes only rating units with the Council's land use codes 95 and 96. · Churches – includes all rating units used for places of religious worship. · Schools - includes only rating units used for schools that do not operate for profit. The differential categories based on provision or availability of service are: · Connected – any rating unit that is connected to a public sewerage drain. · Serviceable – any rating unit that is not connected to a public sewerage drain but is capable of being connected to the sewerage system (being a property situated within 30 metres of a public drain). 3 Differentials Based on Provision or Availability of Service The Council uses this matter to differentiate the water rates. The differential categories based on provision or availability of service are: · Connected – any rating unit that is supplied by the water supply system. · Serviceable – any rating unit that is not supplied but is capable of being supplied by the water supply system (being a rating unit situated within 100 metres of the nearest water supply). Minimum Rates c) Approves that where the total amount of rates payable in respect of any rating unit is less than $5.00 including GST, the rates payable in respect of the rating unit shall be such amount as the Council determines but not exceeding $5.00 including GST. Low Value Rating Units d) Approves that rating units with a capital value of $8,500 or less will only be charged the general rate. Land Use Codes e) Approves that the land use codes attached to this report are adopted as the Council's land use codes for the purpose of the rating method. Separately Used or Inhabited Part of a Rating Unit f) Adopts the following definition of a separately used or inhabited part of a rating unit: "A separately used or inhabited part of a rating unit includes any portion inhabited or used by the owner/a person other than the owner, and who has the right to use or inhabit that portion by virtue of a tenancy, lease, licence, or other agreement. This definition includes separately used parts, whether or not actually occupied at any particular time, which are provided by the owner for rental (or other form of occupation) on an occasional or long term basis by someone other than the owner. For the purpose of this definition, vacant land and vacant premises offered or intended for use or habitation by a person other than the owner and usually used as such are defined as 'used'. For the avoidance of doubt, a rating unit that has a single use or occupation is treated as having one separately used or inhabited part." Lump Sum Contributions g) Approves that no lump sum contributions will be sought for any targeted rate. Rating by Instalments h) Approves the following schedule of rates to be collected by the Council, payable by four instalments. The City is divided into four areas based on Valuation Roll Numbers, as set out below:

Area 4 comprises ratepayers with multiple assessments who pay on a schedule. Due Dates for Payment of Rates i) Approves the due dates for all rates with the exception of water rates, which are charged based on water meter consumption, will be payable in four instalments due on the dates below:

Water meter invoices are sent separately from other rates. Where water rates are charged based on metered consumption using a meter other than a Smart Water Meter, invoices are sent on a quarterly or monthly basis and the due date for payment shall be on the 20th of the month following the date of the invoice as set out in the table below:

Where water rates are charged based on consumption calculated using a Smart Water Meter, invoices will be sent out on a monthly basis, with the due date being on the 20th of the month. Penalties j) Resolves to charge the following penalties on unpaid rates: 1 A charge of 10% of the unpaid rates instalment will be added to the amount of any instalment remaining unpaid the day after the instalment due date set out above. 2 Where a ratepayer has not paid the first instalment by the due date of that instalment, and has paid the total rates and charges in respect of the rating unit for the 2023/24 rating year by the due date of the second instalment, the 10% additional charge for the first instalment shall be remitted. 3 For amounts levied in any previous financial year and which remain unpaid on 1 October 2023, 10% of that sum shall be charged, including additional charges (if any). 4 For amounts levied in any previous financial year and which remain unpaid on 1 April 2024, 10% of that sum shall be charged, including additional charges (if any). Assessing and Recovering Rates k) Approves that the Chief Executive Officer, Chief Financial Officer and Rates and Revenue Team Leader be authorised to take all necessary steps to assess and recover the above rates.

Motion carried (CNL/2023/153) |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Cr Steve Walker left the meeting at 1.28 pm

|

|

In accordance with Standing Order 26.1 a Notice of Motion was received from Cr David Benson-Pope. |

|

|

Under Standing Order 26.4, an alteration of the Notice of Motion was moved (Cr David Benson-Pope That the Council:

Amends the Notice of Motion by including the following amendment:

“Supports the Open Letter from the Tertiary Education Union to Government and the Tertiary Education Commission.”

Motion carried (CNL/2023/154) with the unanimous agreement of the Council

|

|

|

Moved (Cr David Benson-Pope/Cr Carmen Houlahan): That the Council: a) Recognises the vital and critical role the University of Otago plays in the wider wellbeing of Dunedin City. b) Offers its support in lobbying for greater government funding of New Zealand’s first University. c) Directs the CEO to determine what, if any, assistance the City may be able to provide to the University. d) Formally supports the Open Letter from the Tertiary Education Union to Government and the Tertiary Education Commission. Motion carried (CNL/2023/155) |

Cr Steve Walker returned to the meeting at 2.04 pm.

|

Moved (Mayor Jules Radich/Cr Sophie Barker): That the Council:

Pursuant to the provisions of the Local Government Official Information and Meetings Act 1987, exclude the public from the following part of the proceedings of this meeting namely:

This resolution is made in reliance on Section 48(1)(a) of the Local Government Official Information and Meetings Act 1987, and the particular interest or interests protected by Section 6 or Section 7 of that Act, or Section 6 or Section 7 or Section 9 of the Official Information Act 1982, as the case may require, which would be prejudiced by the holding of the whole or the relevant part of the proceedings of the meeting in public are as shown above after each item. That Ms Jemma Adams (General Manager, DCHL) be permitted to attend the meeting to speak to Item C5 – Dunedin City Holdings Group Director Appointments and Re-Appointments to provide assistance in relation to the matters to be discussed.” That the meeting adjourn to enable the members of the public and media to leave.

Motion carried (CNL/2023/156) |

The meeting moved into confidential at 2.05 pm and concluded at 4.32 pm.

..............................................

MAYOR