Notice of Meeting:

I hereby give notice that an ordinary meeting of the

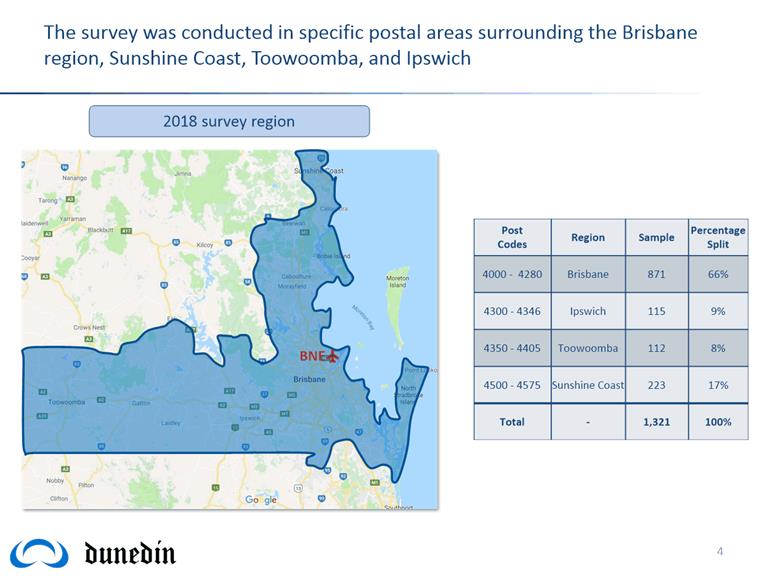

Economic Development Committee will be held on:

Date: Tuesday

20 November 2018

Time: 1.00

pm

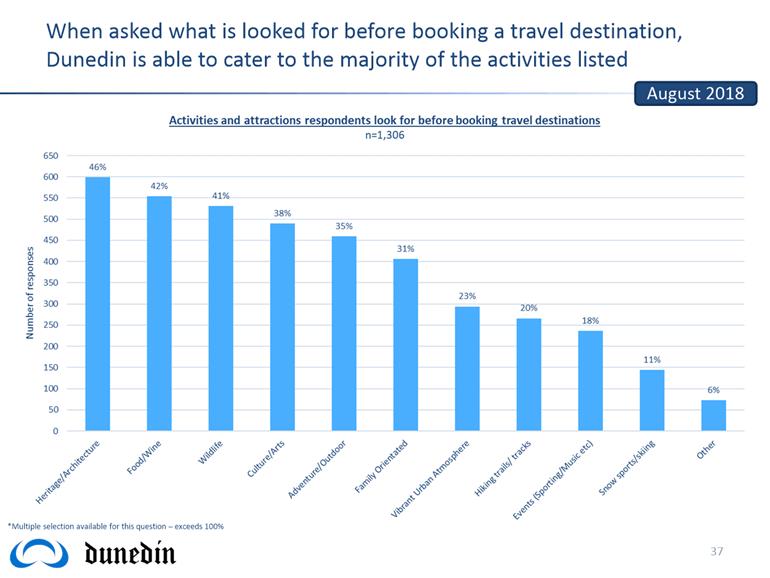

Venue: Edinburgh

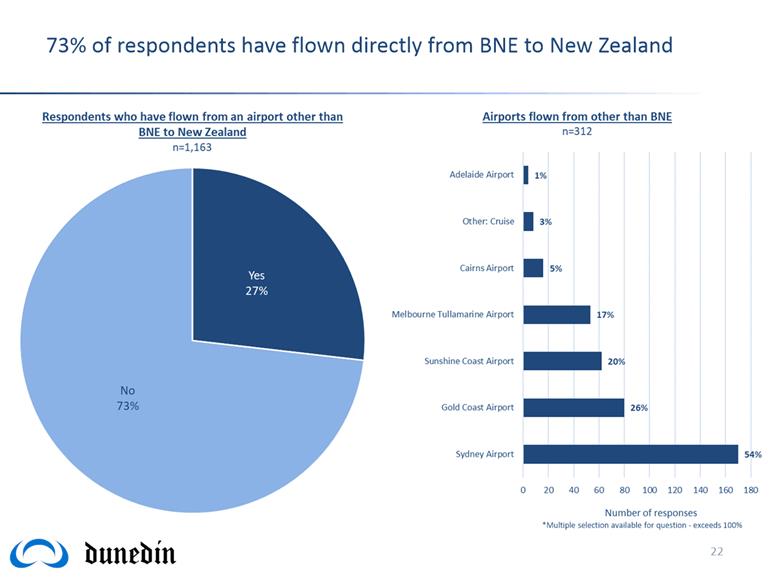

Room, Municipal Chambers, The Octagon, Dunedin

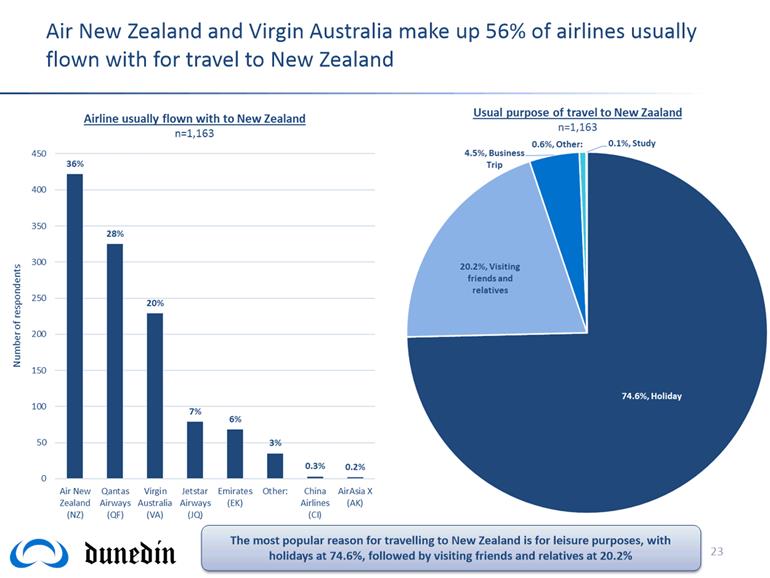

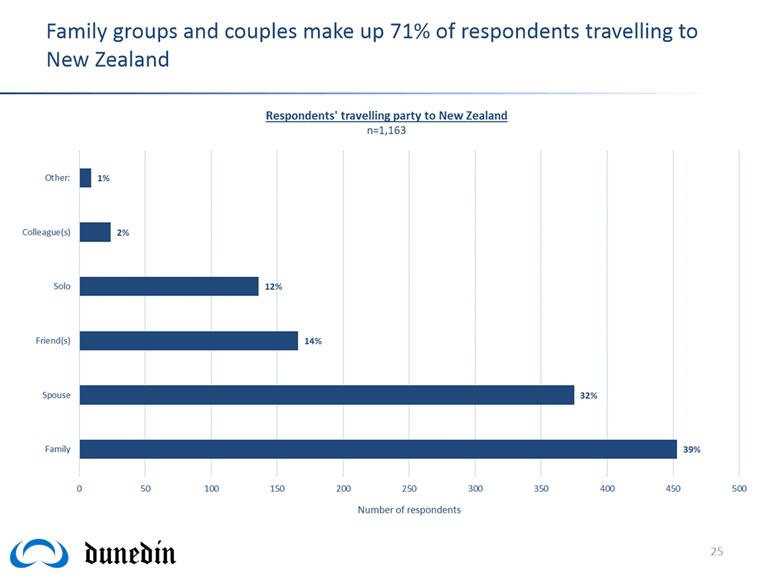

Sue Bidrose

Economic Development Committee

PUBLIC AGENDA

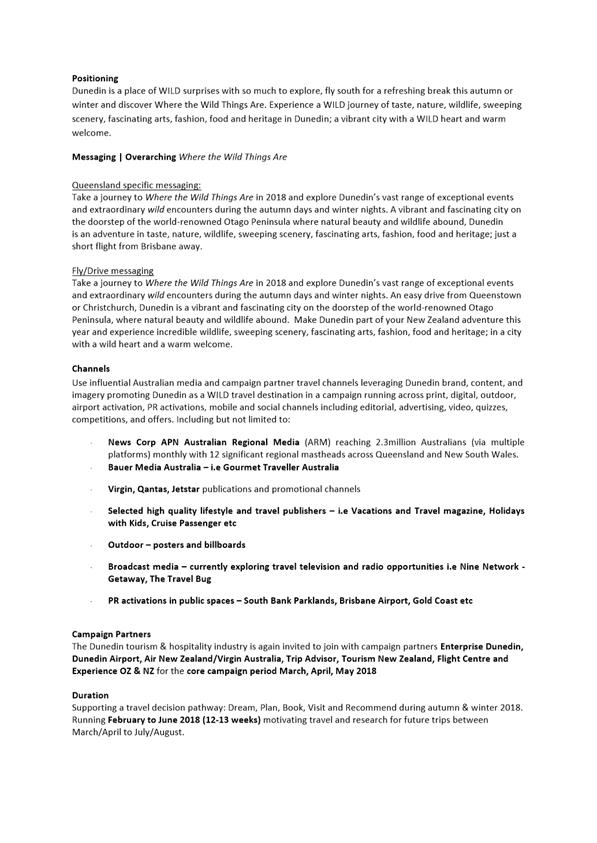

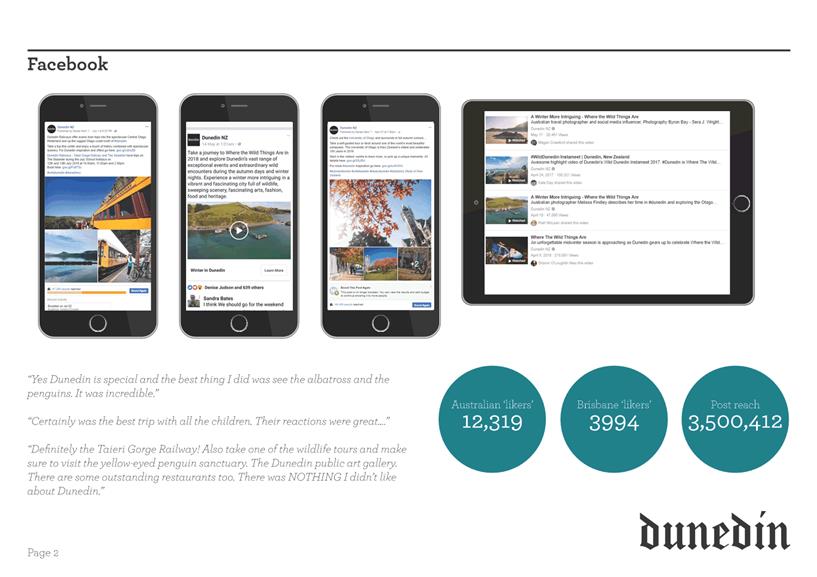

|

Chairperson

|

Cr Chris Staynes

|

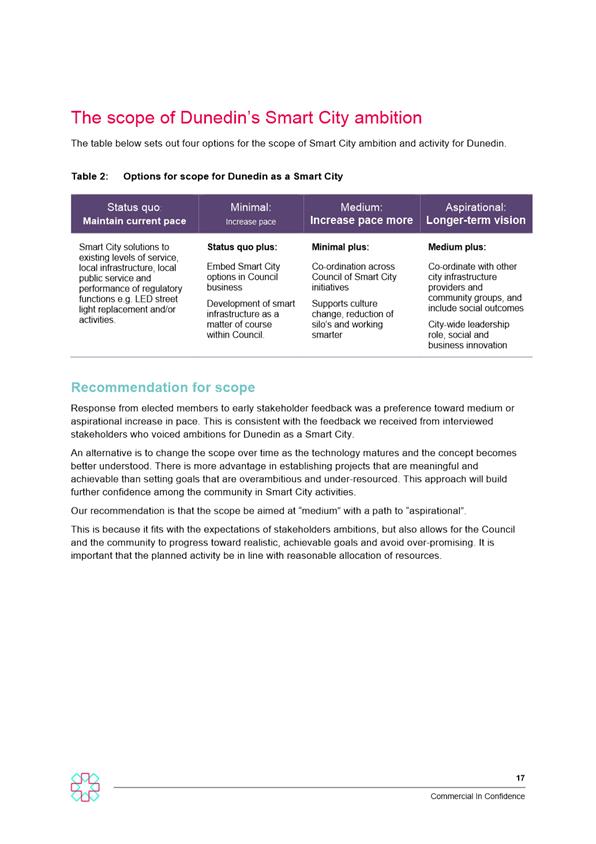

|

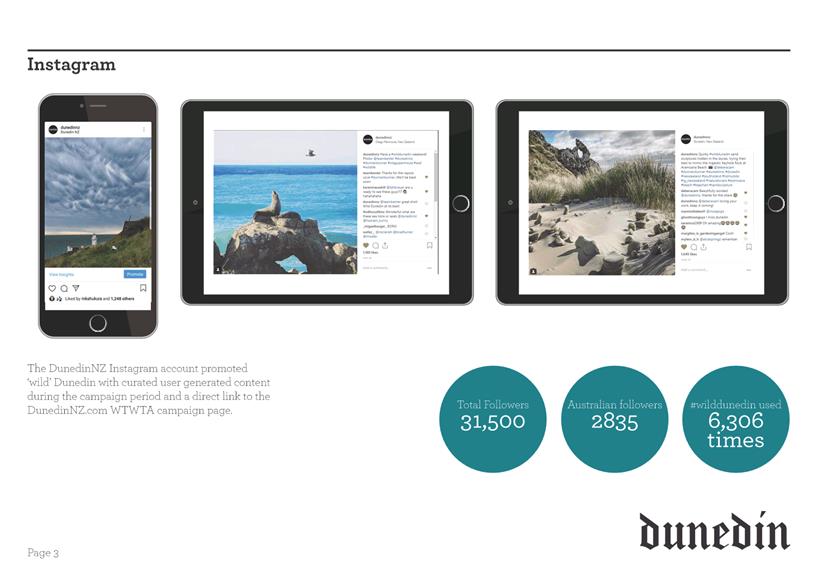

|

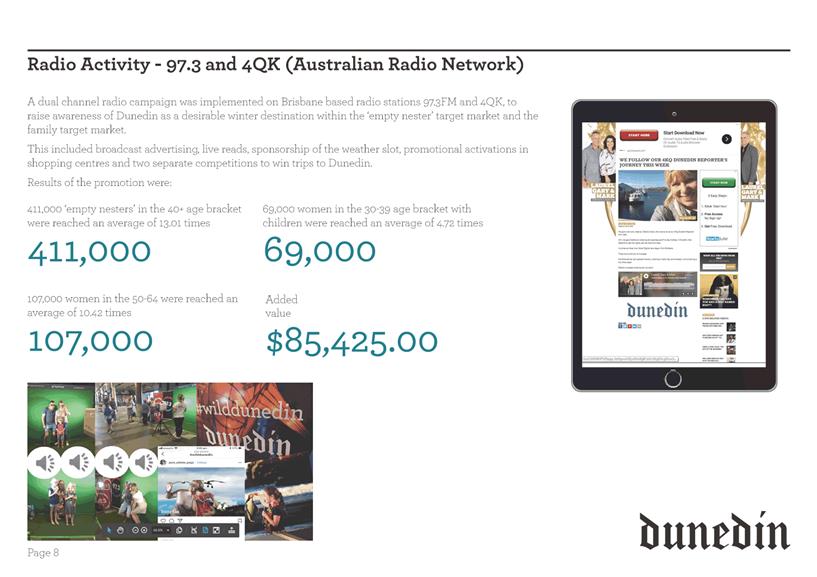

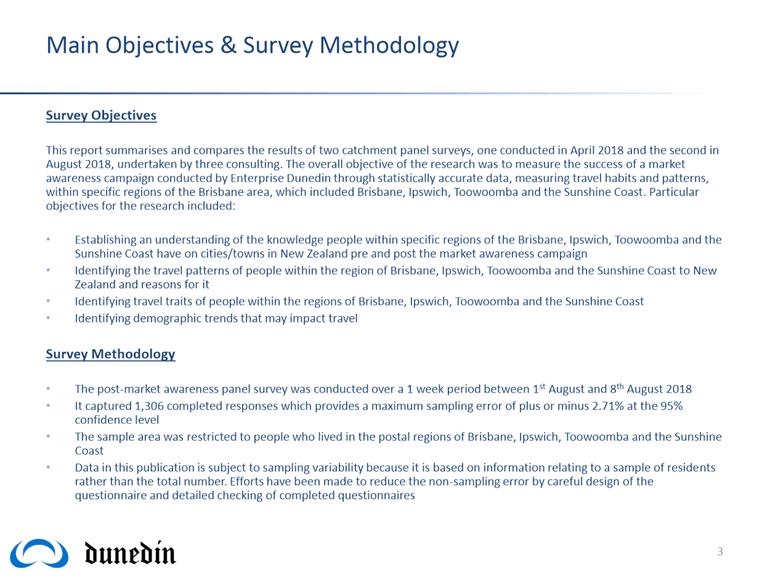

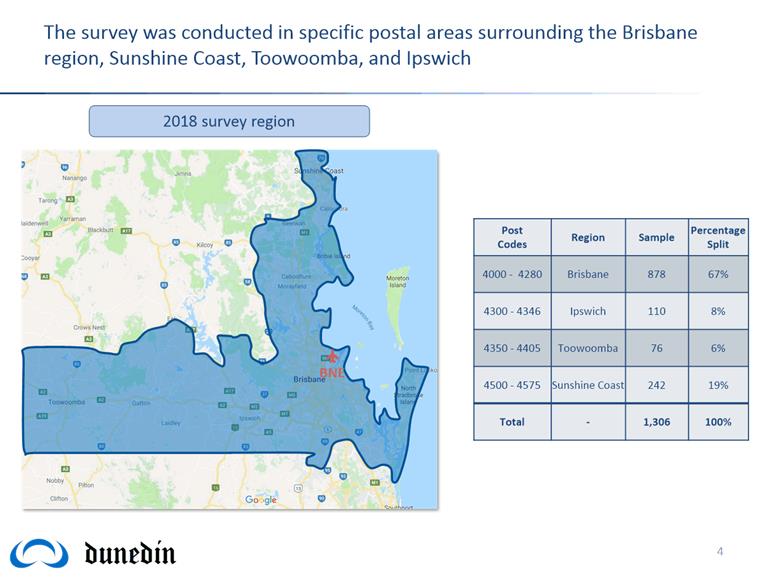

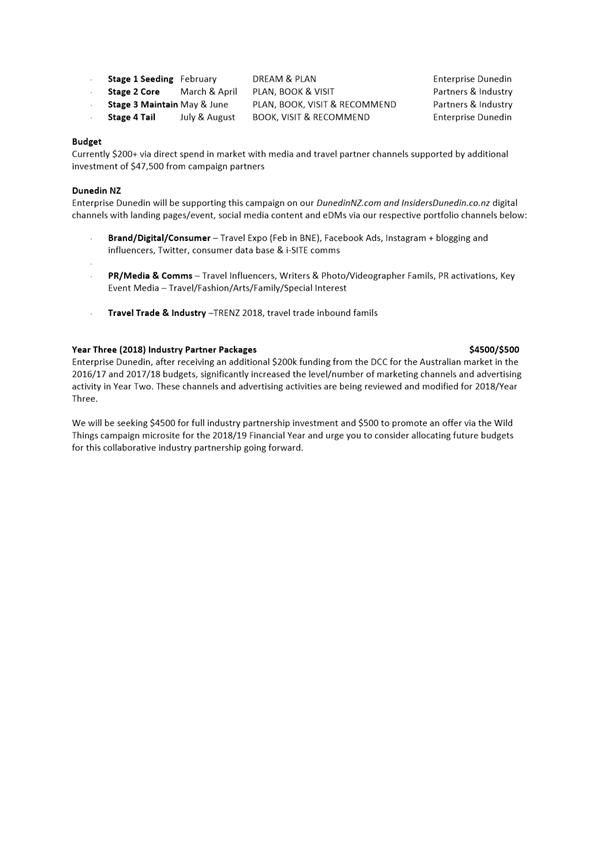

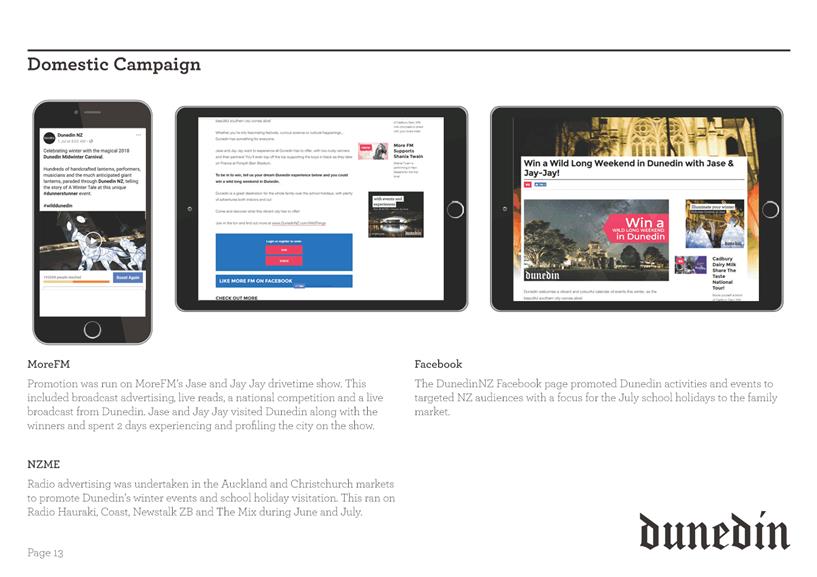

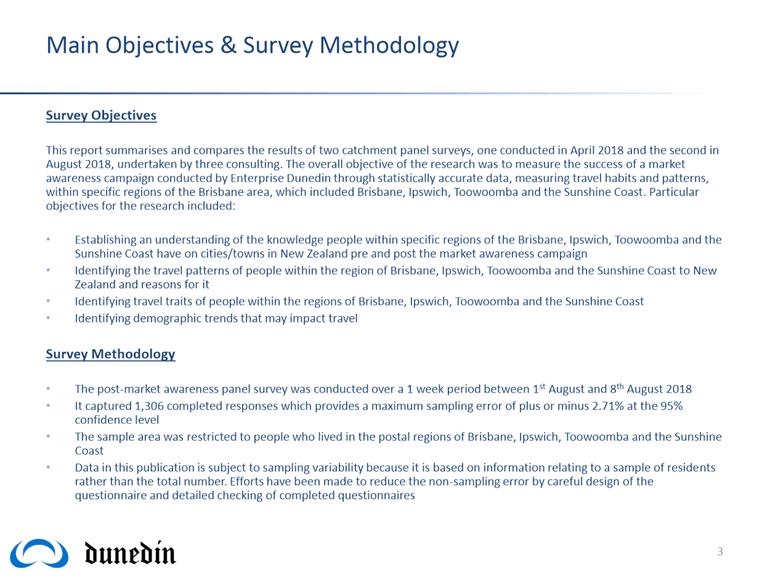

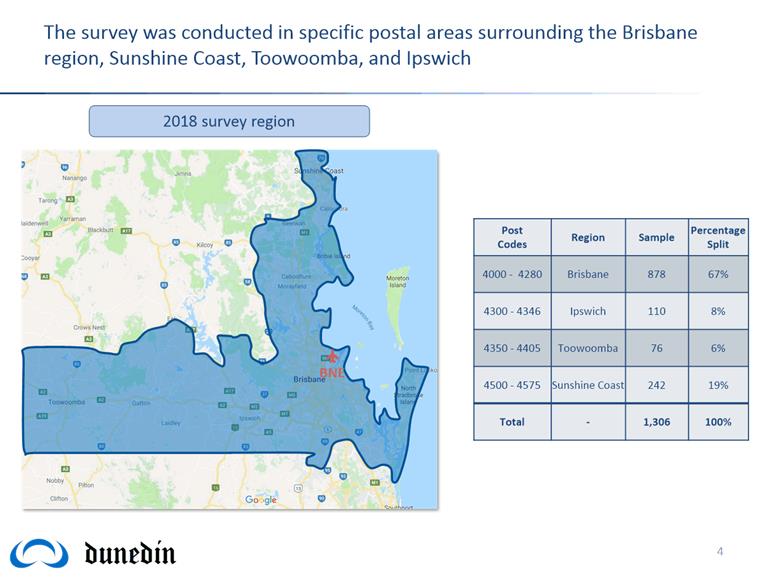

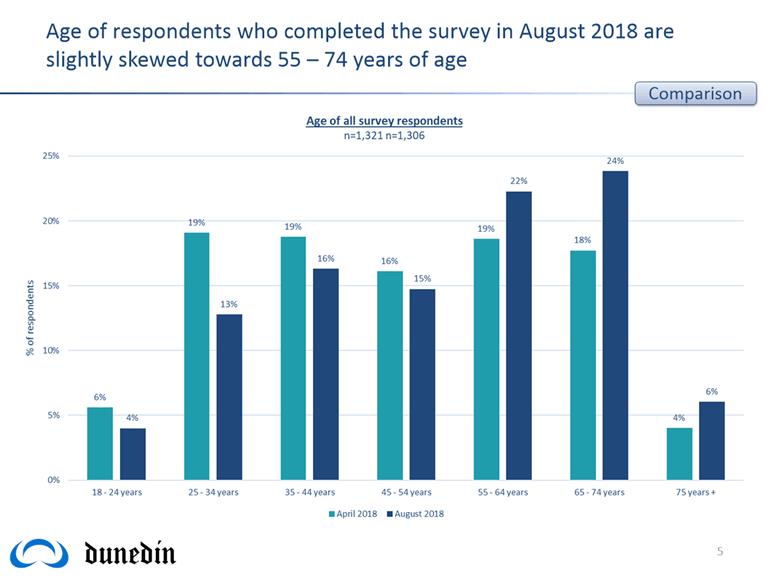

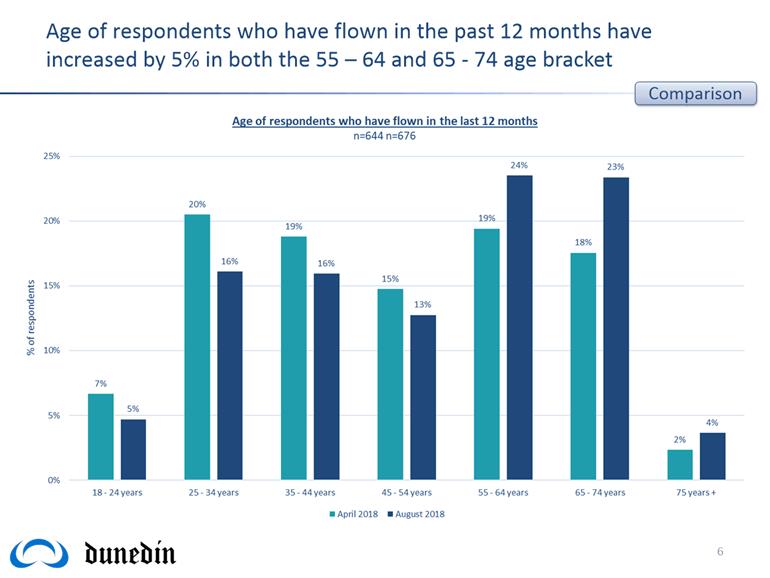

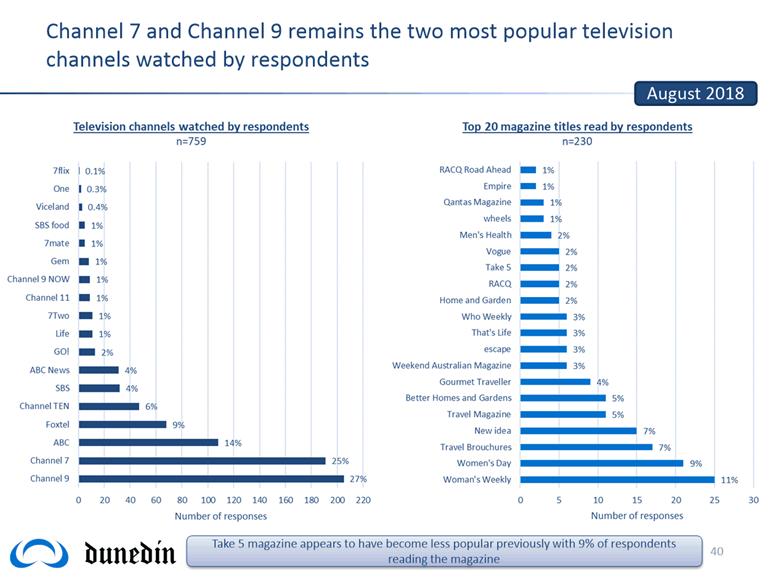

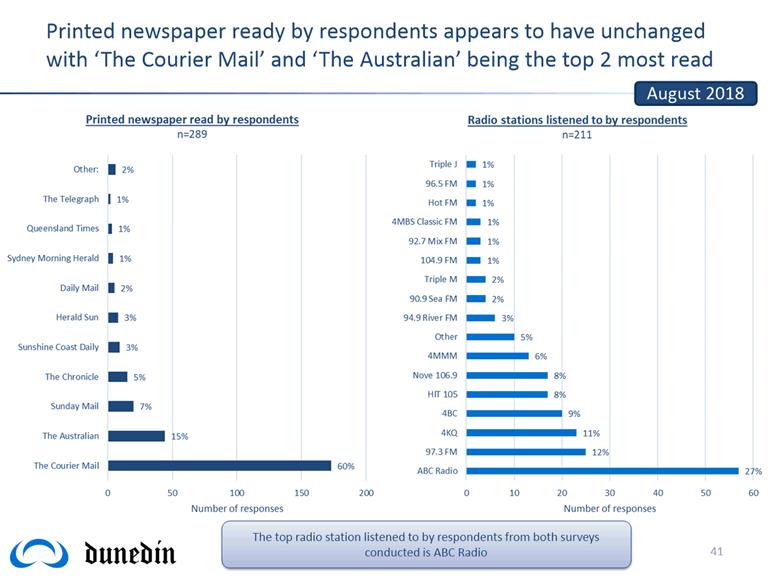

|

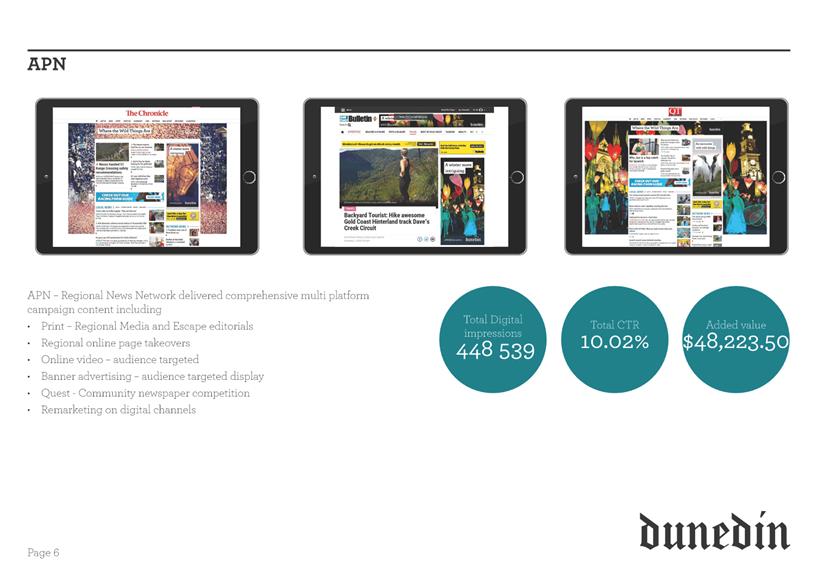

|

|

|

Deputy Chairperson

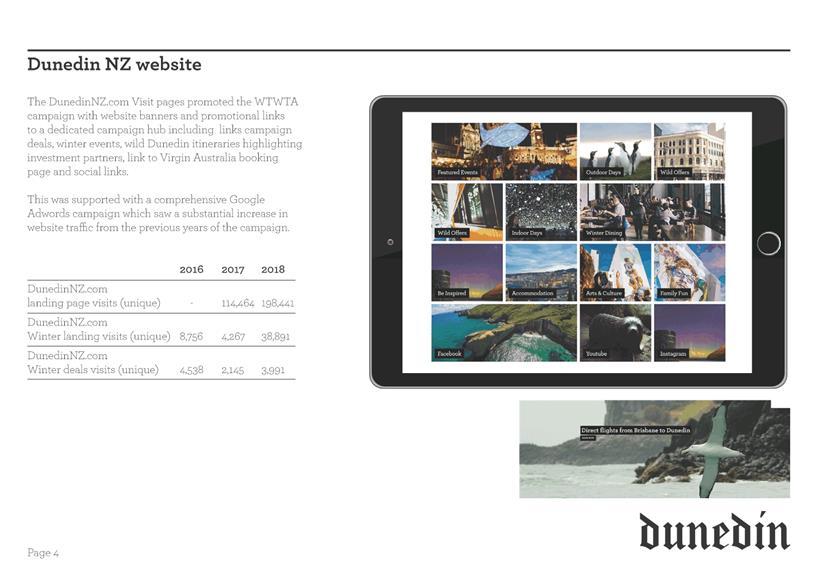

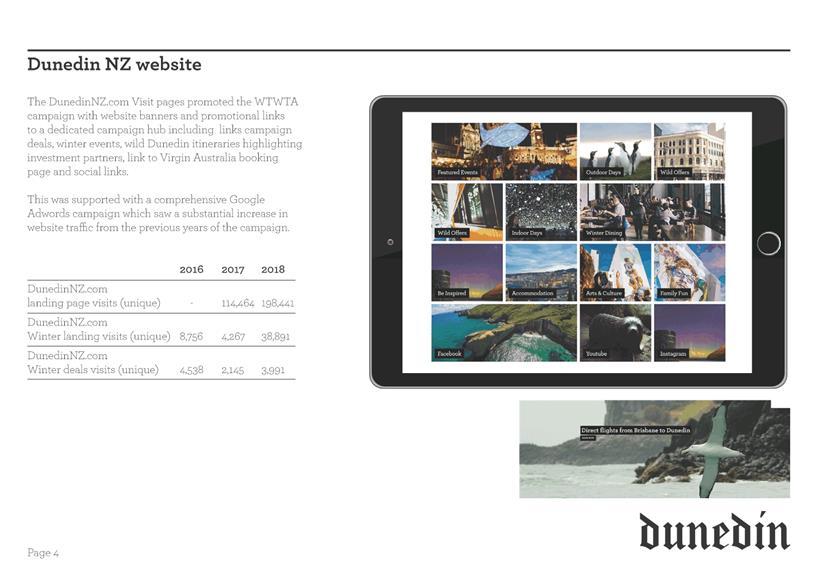

|

Cr Christine Garey

|

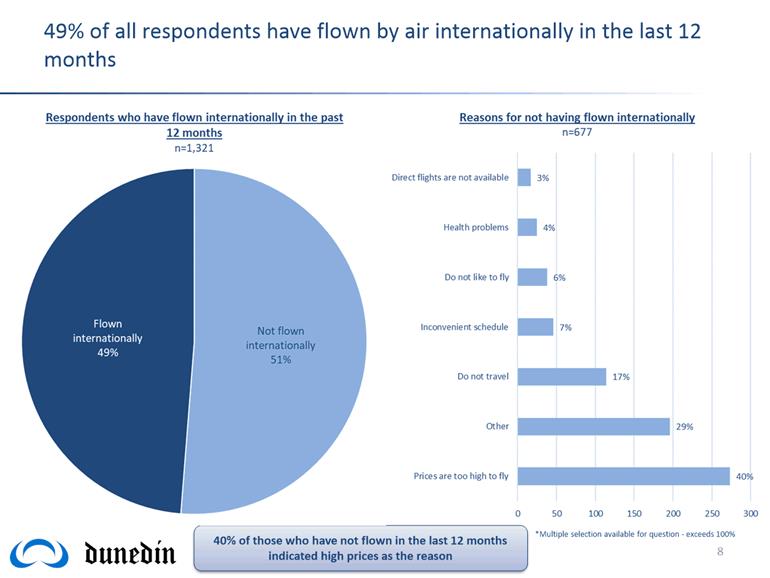

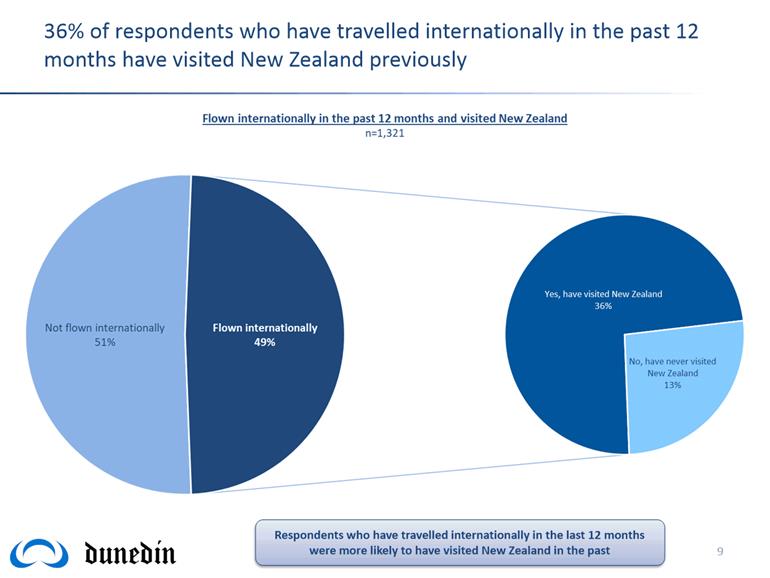

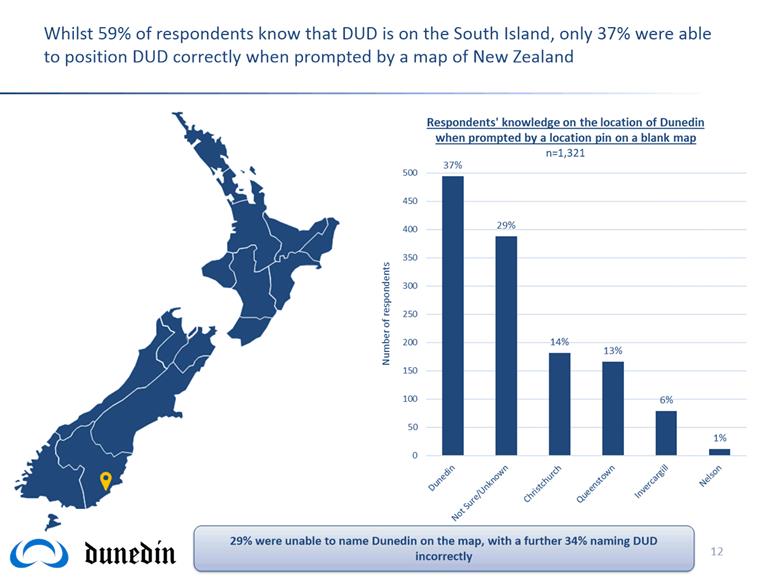

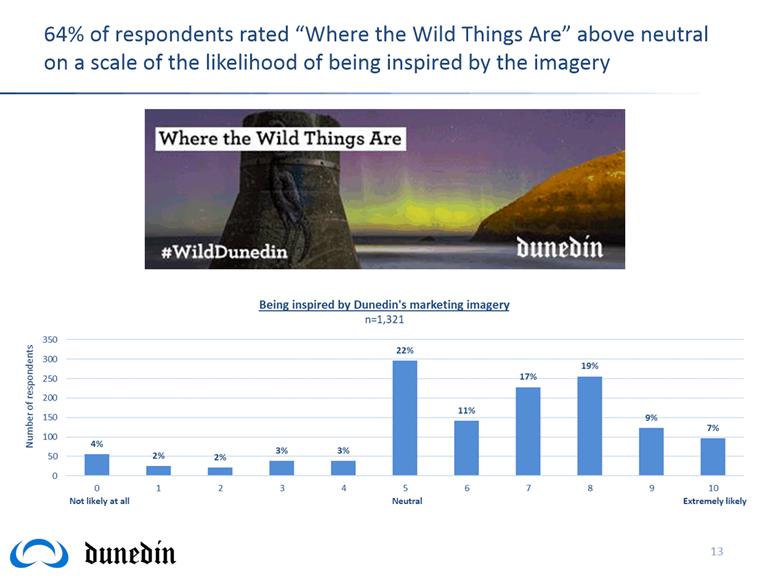

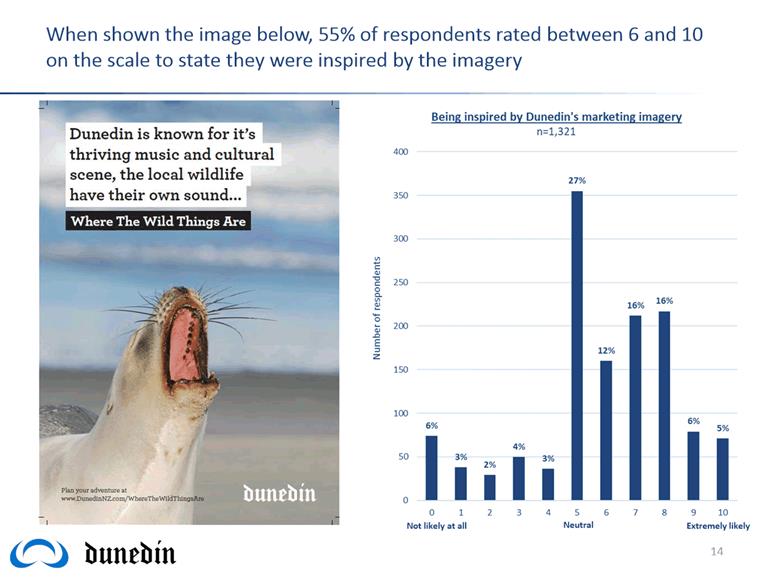

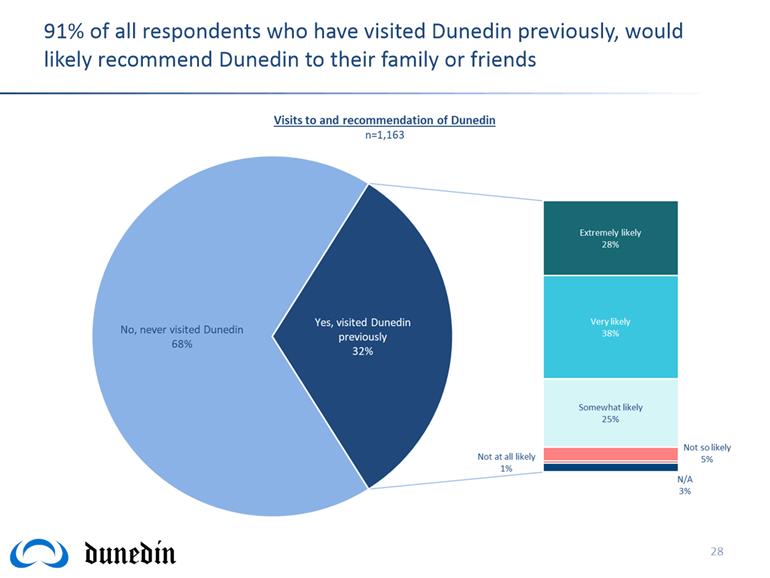

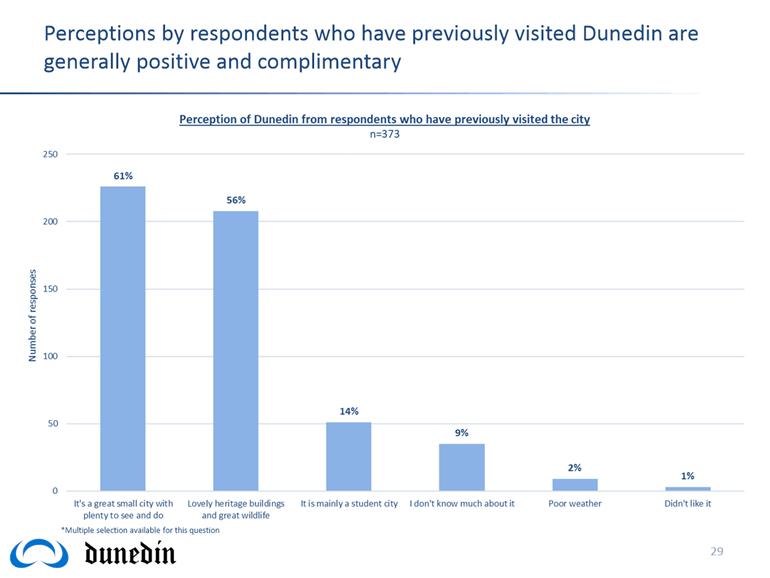

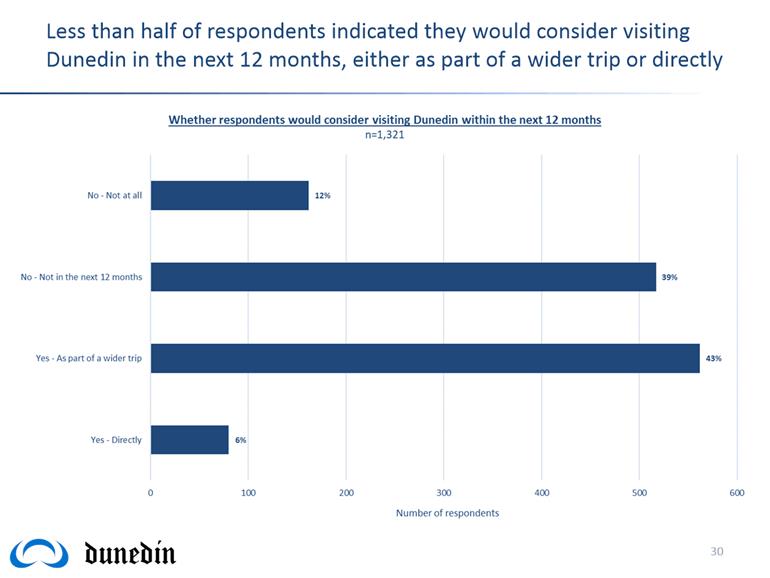

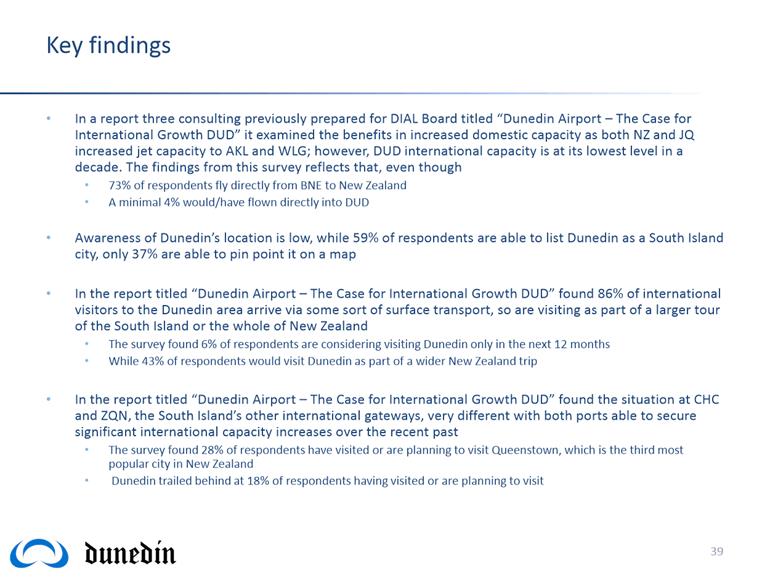

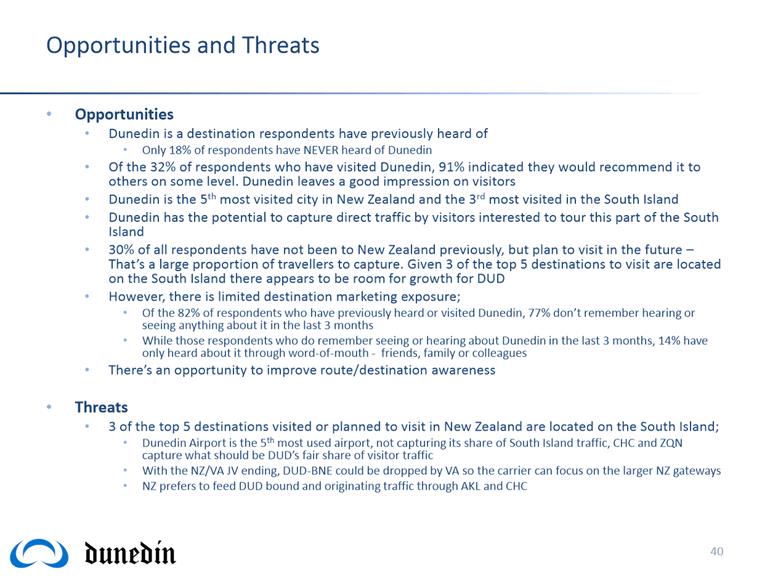

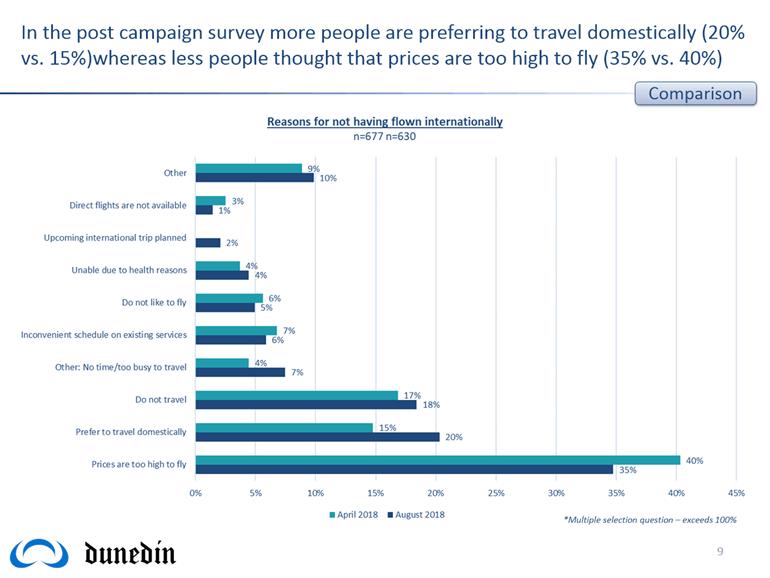

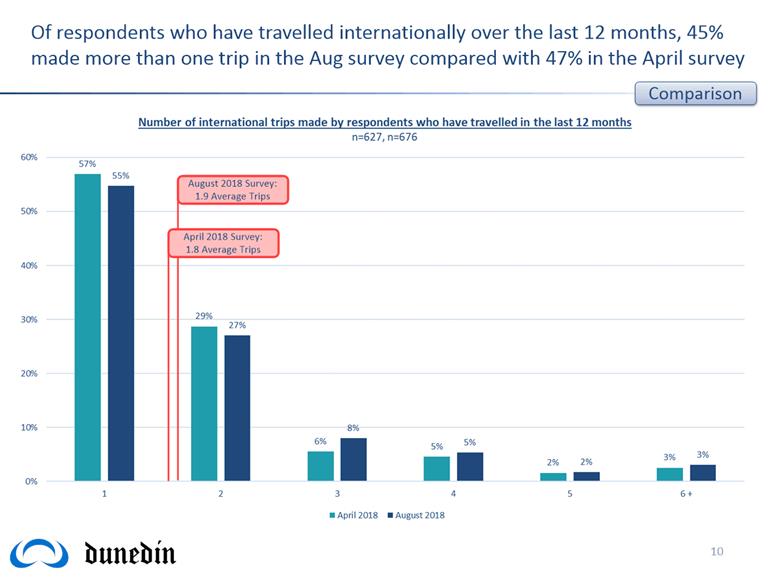

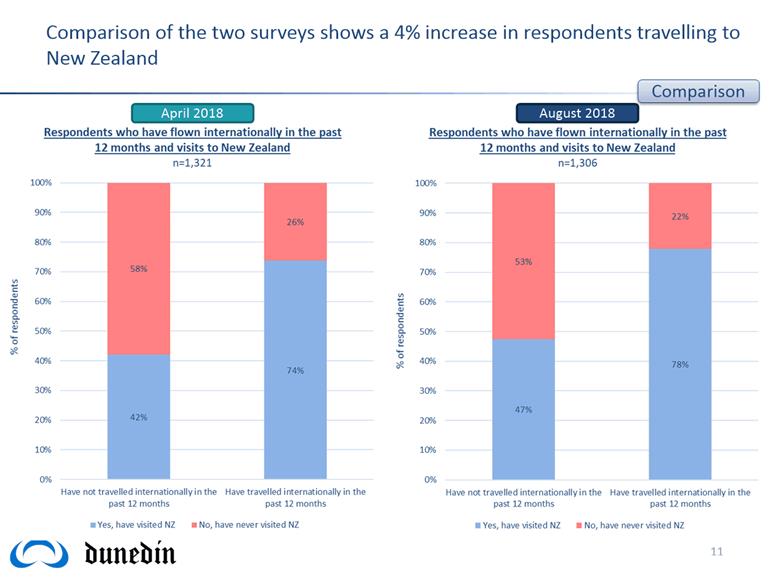

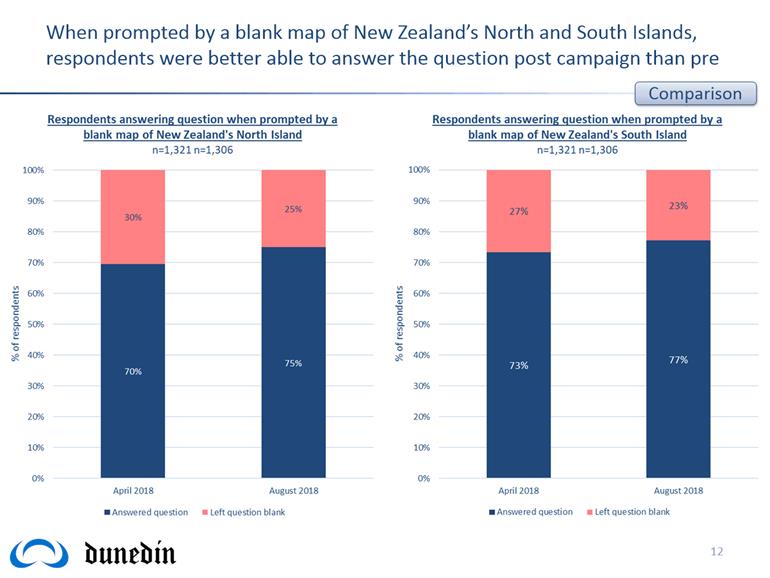

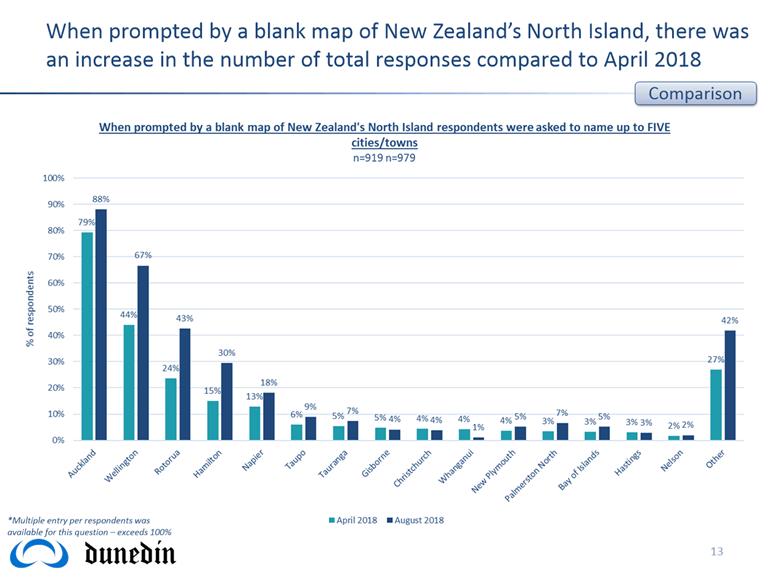

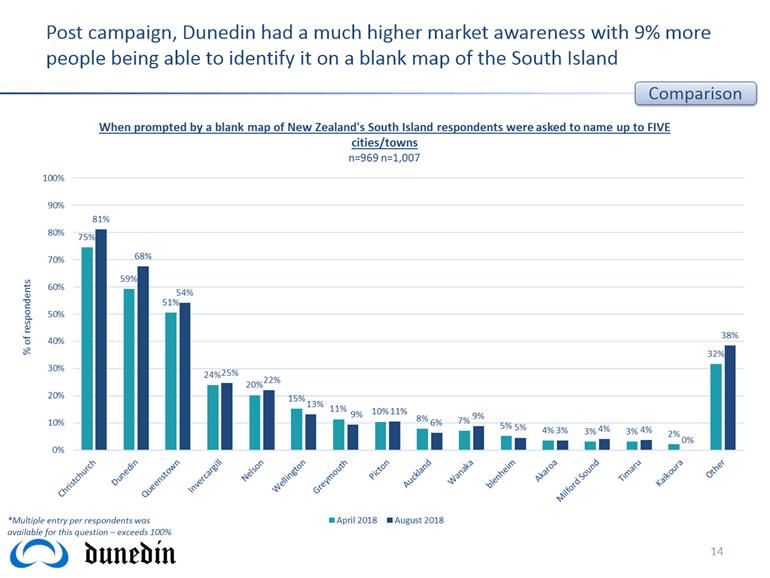

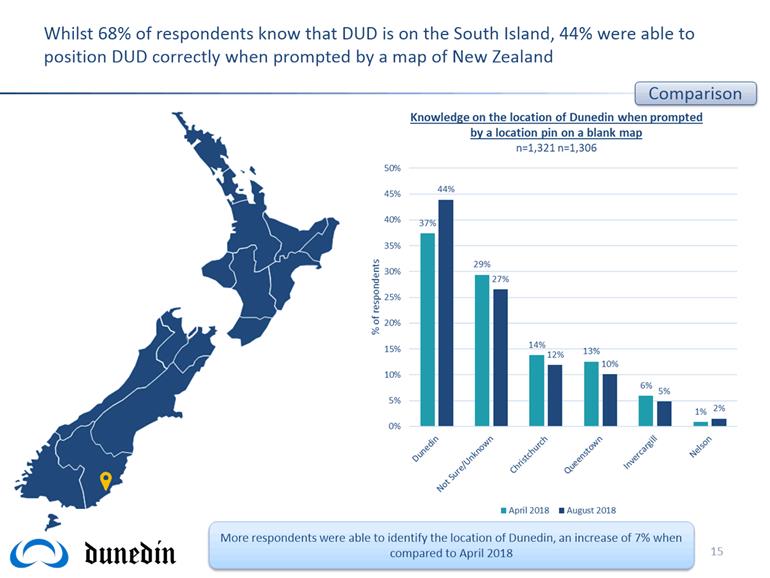

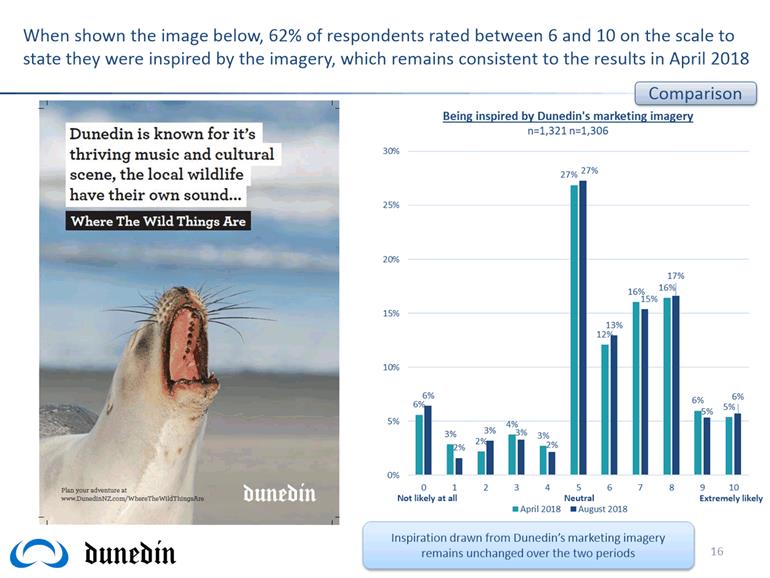

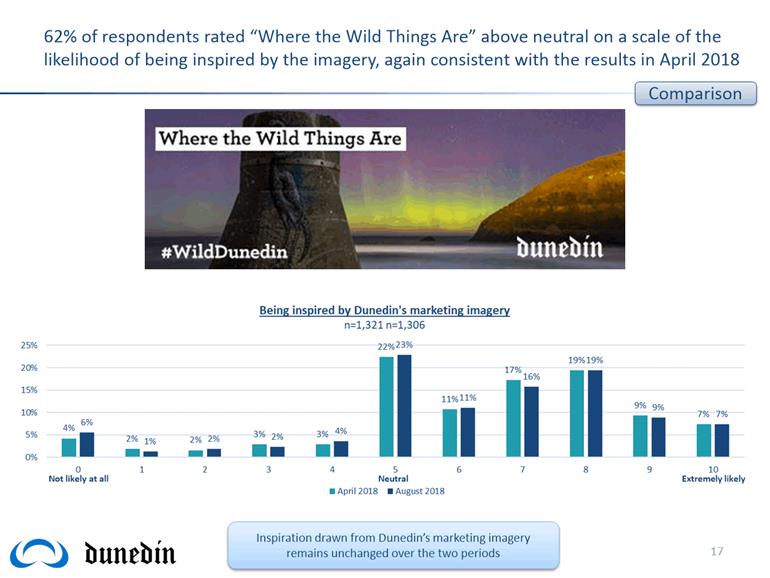

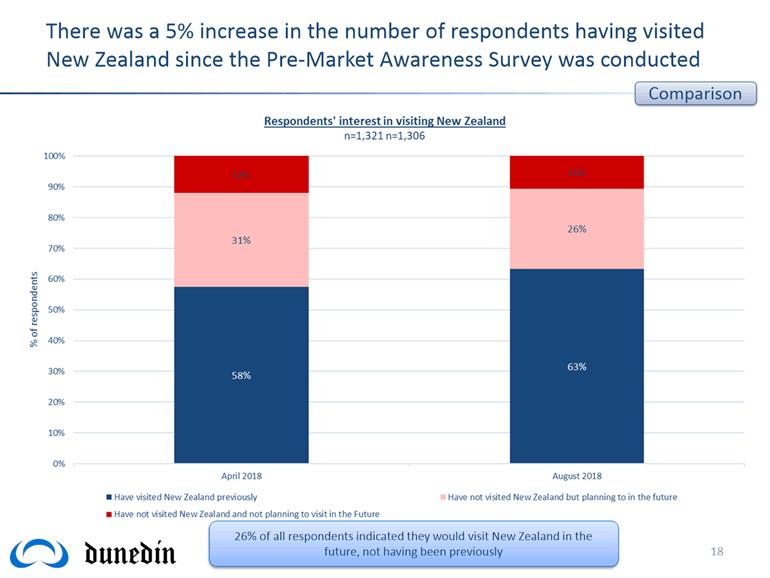

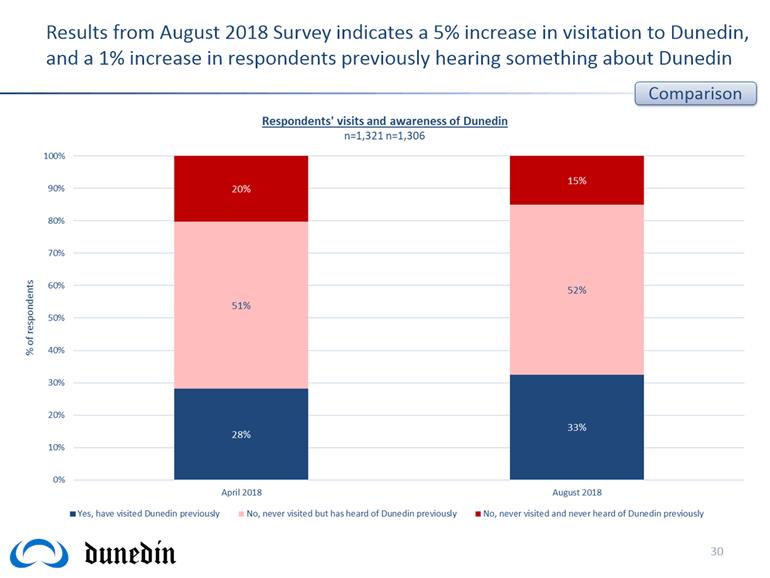

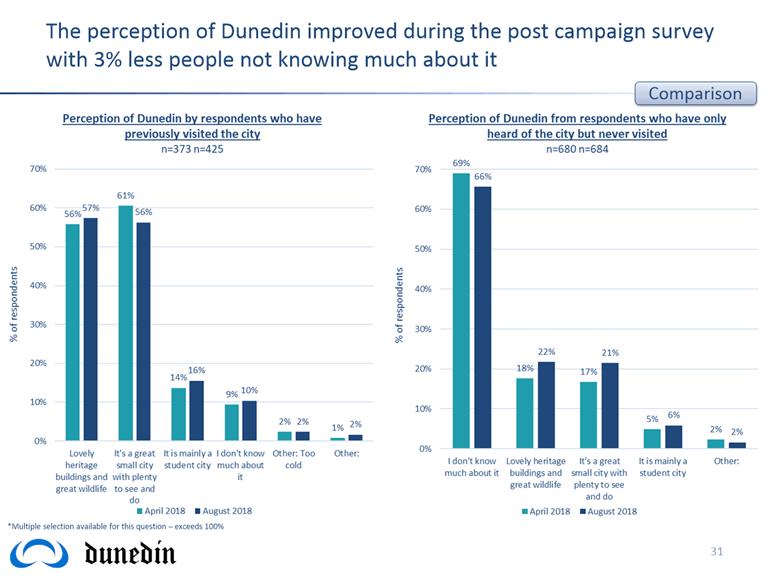

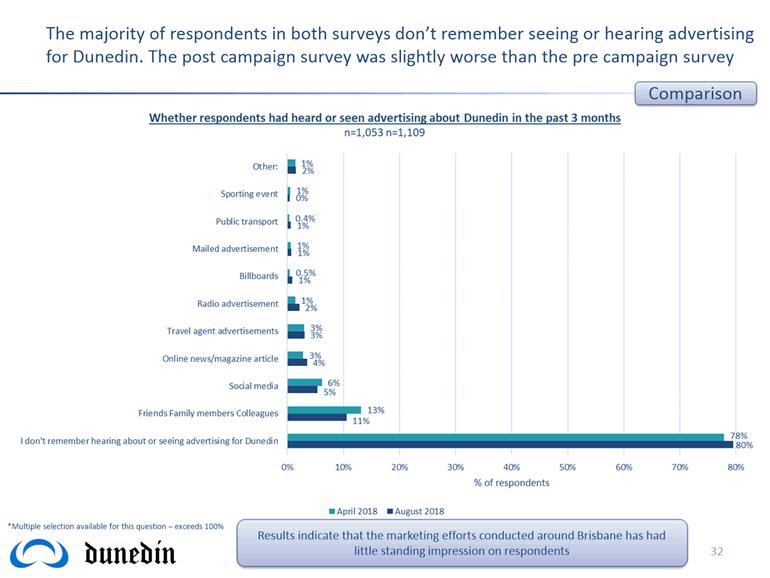

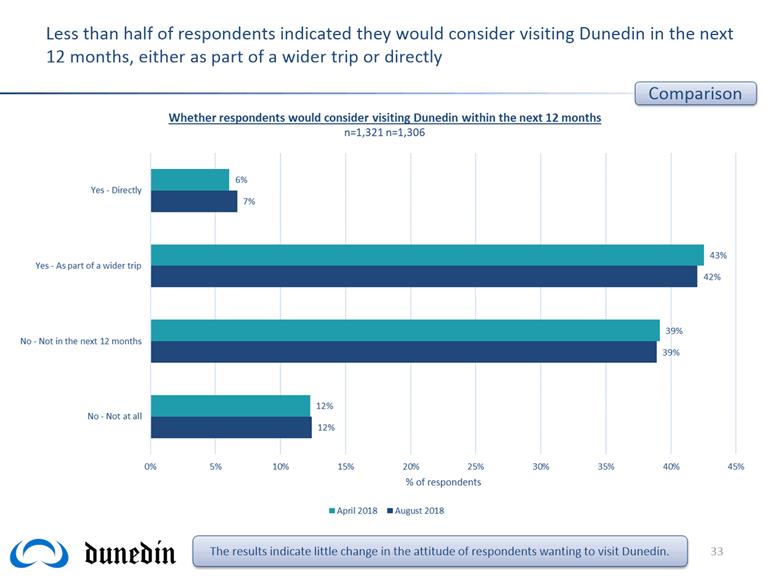

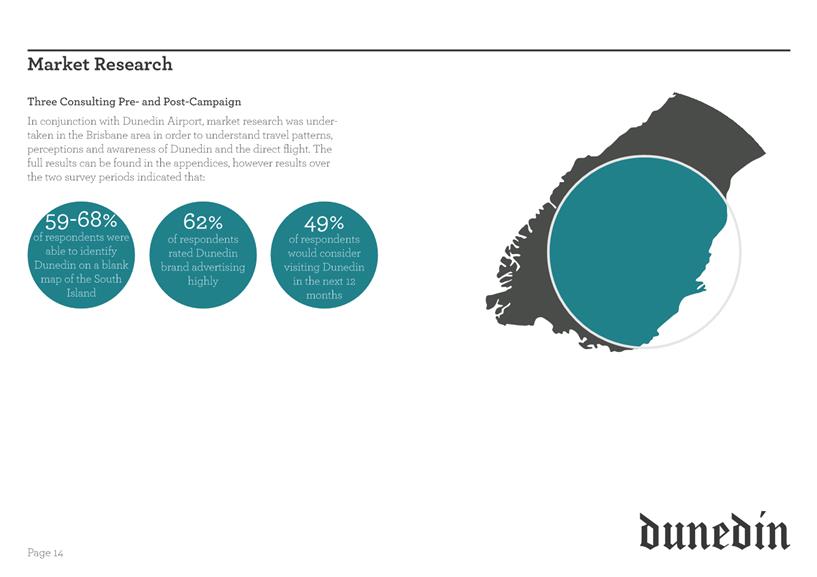

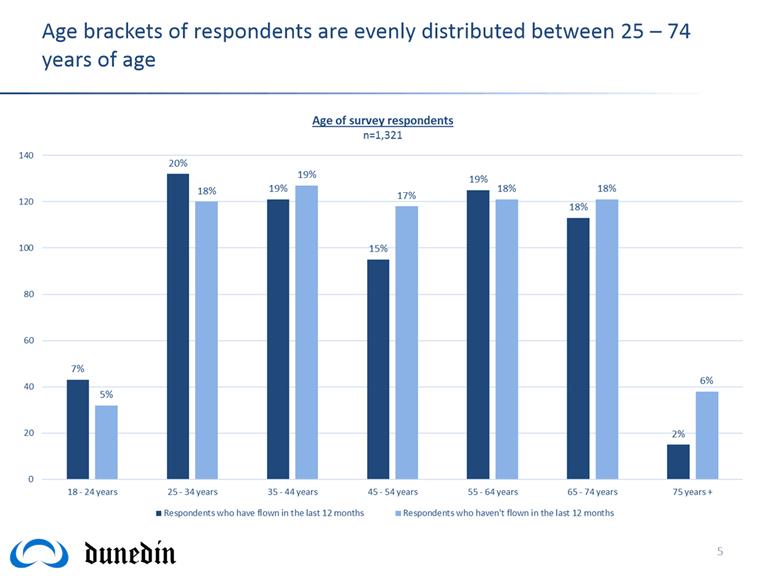

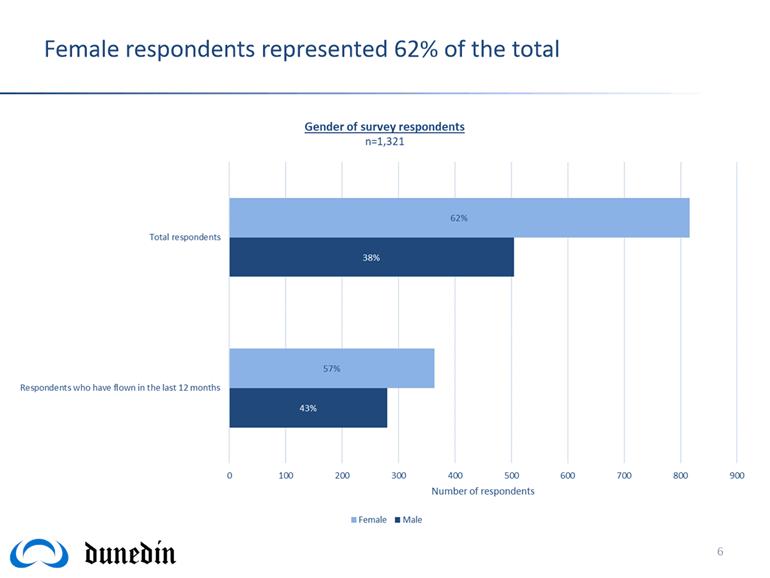

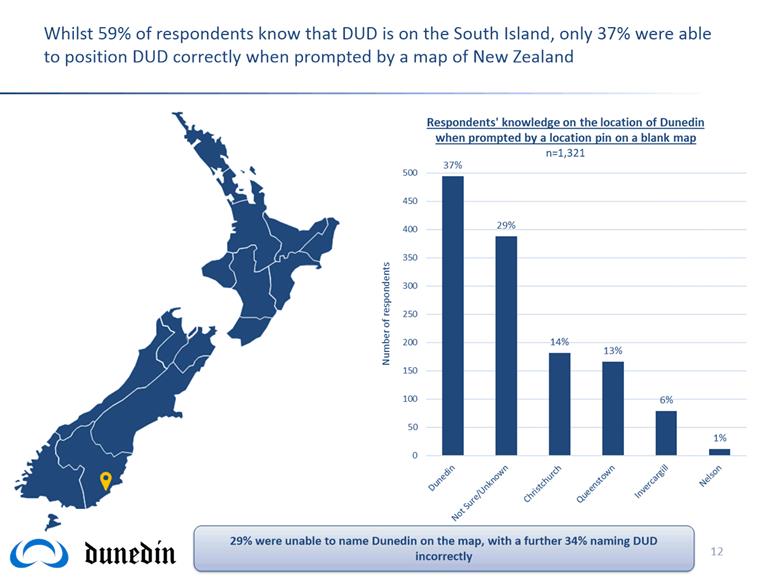

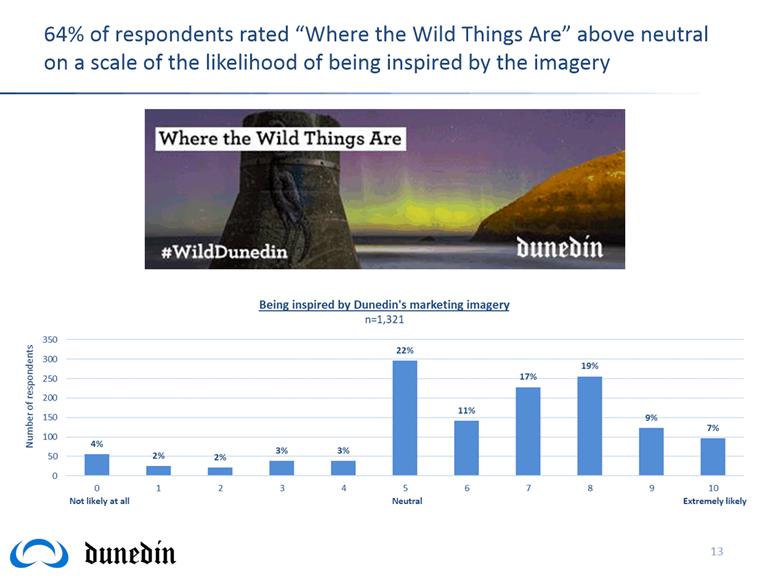

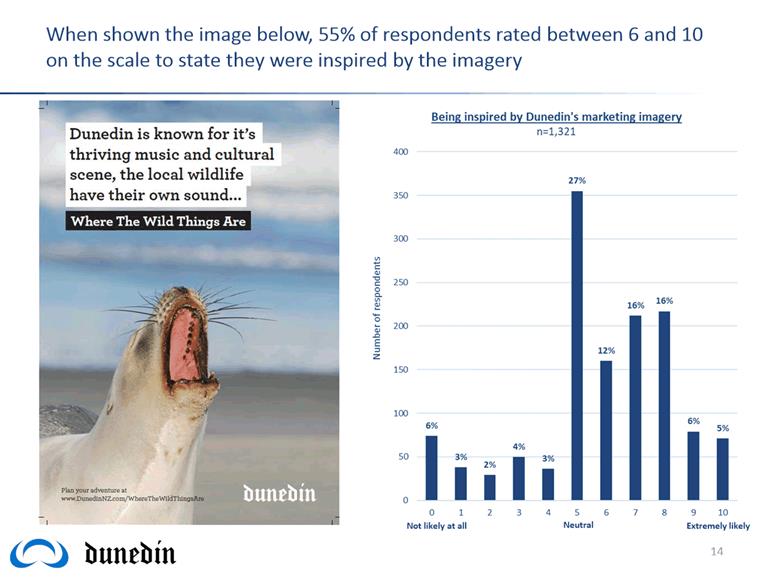

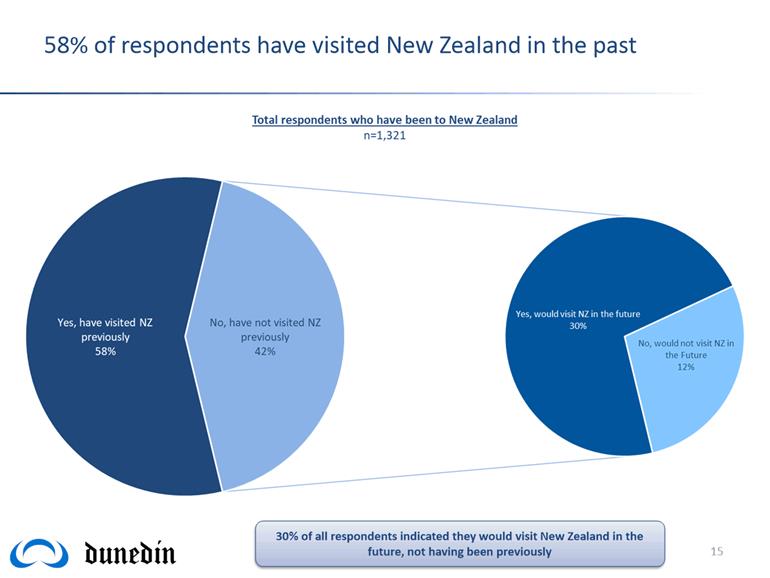

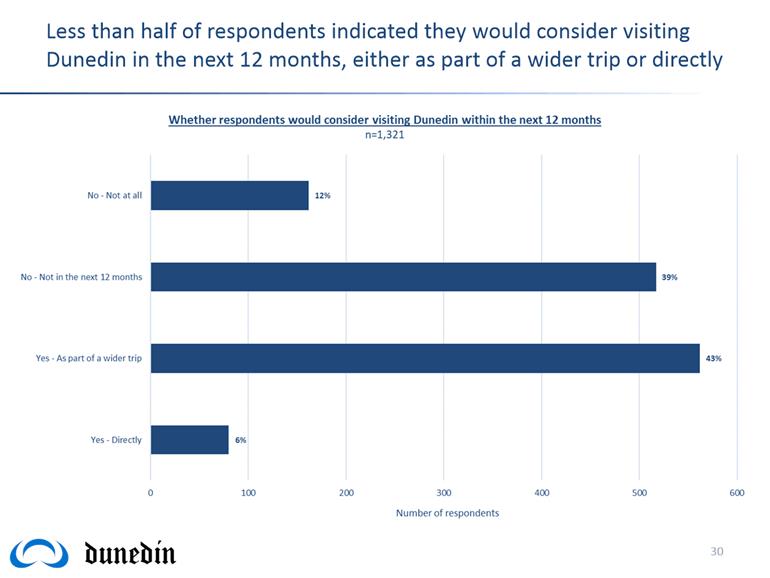

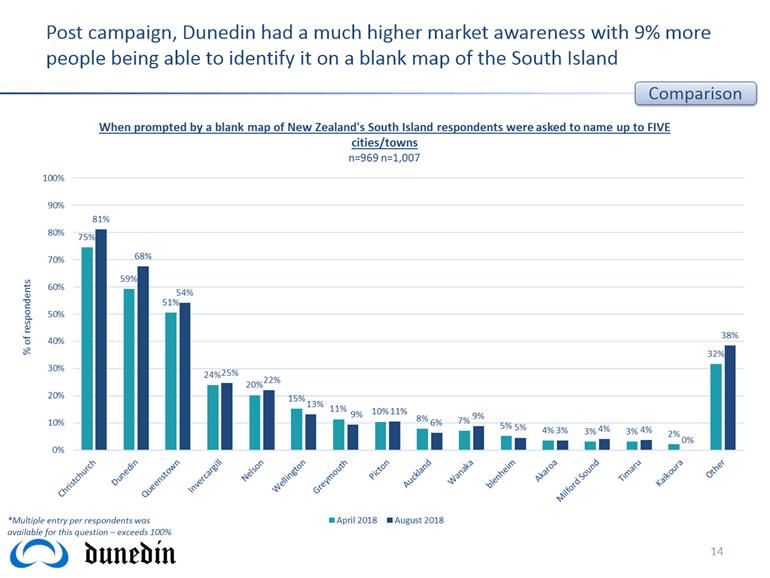

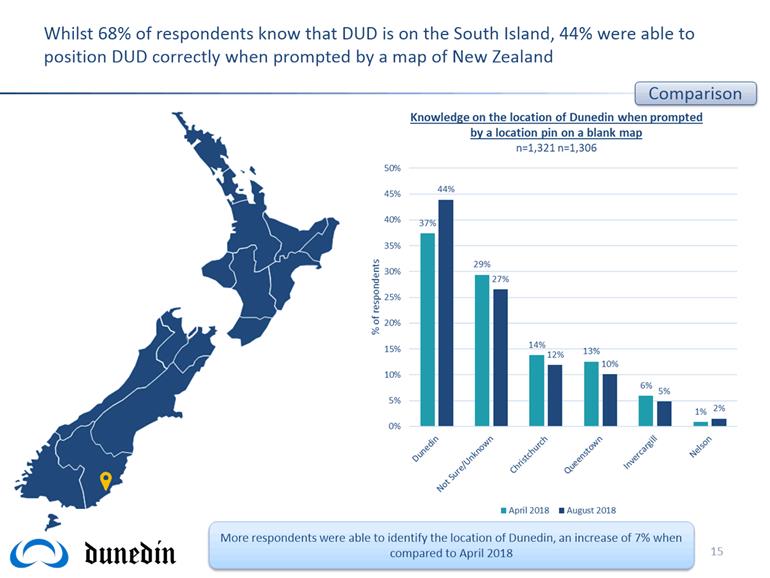

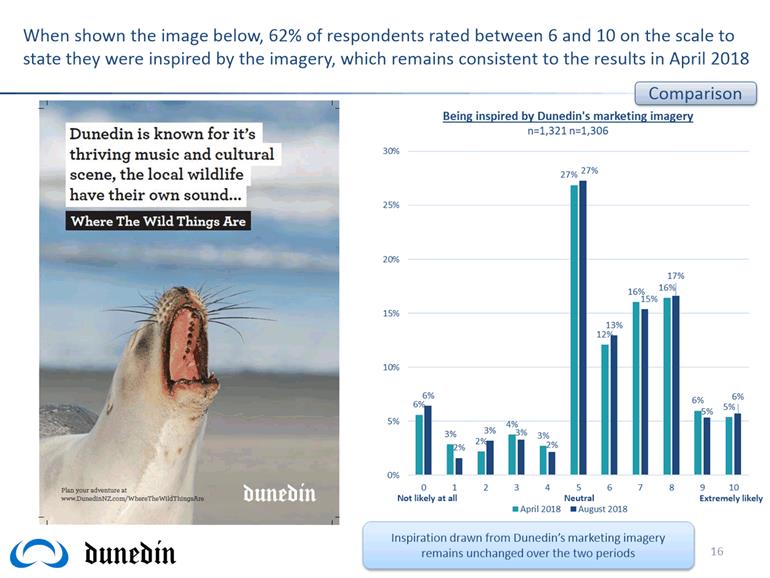

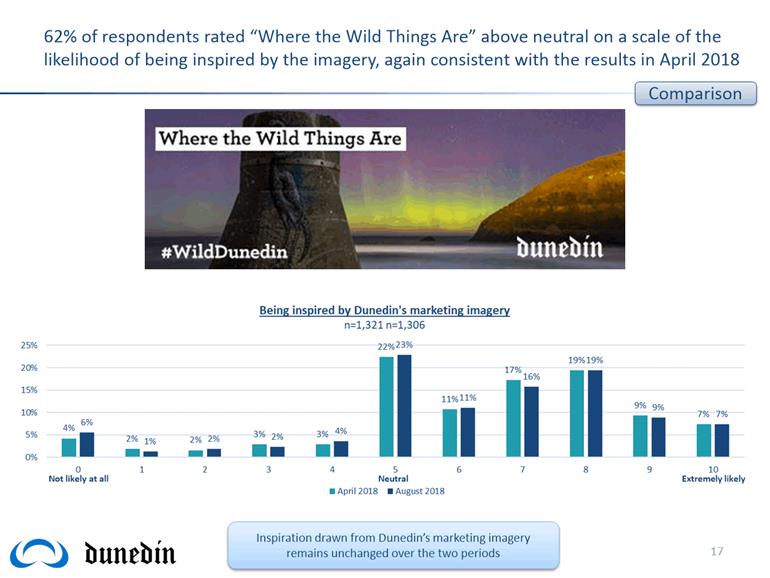

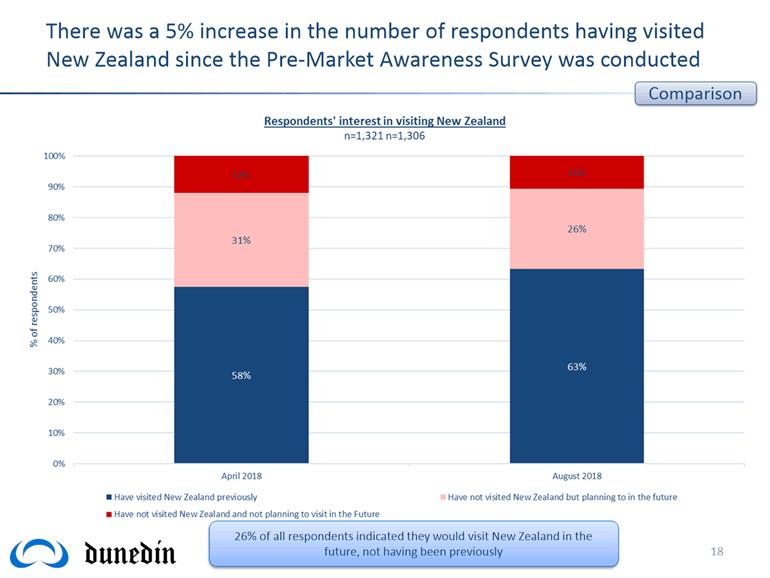

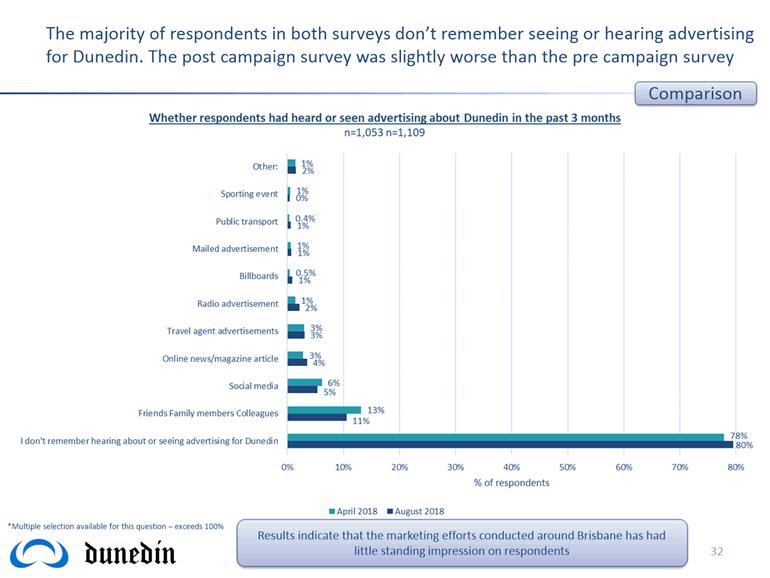

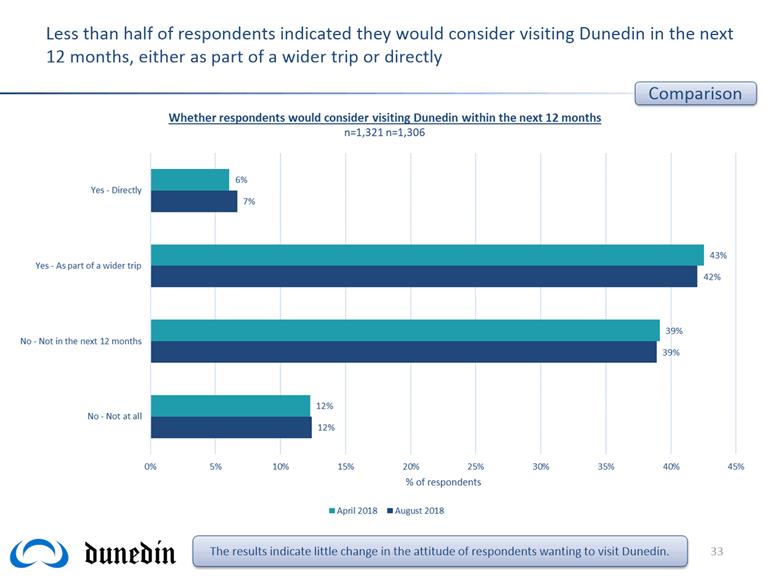

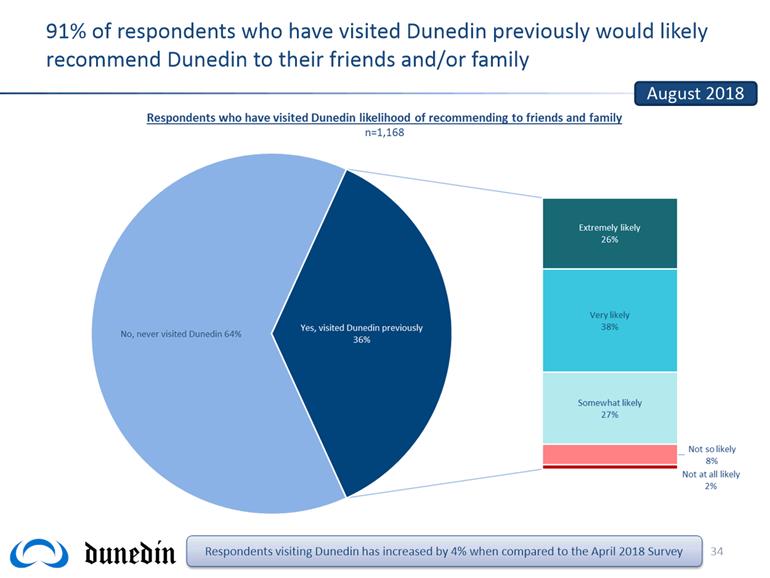

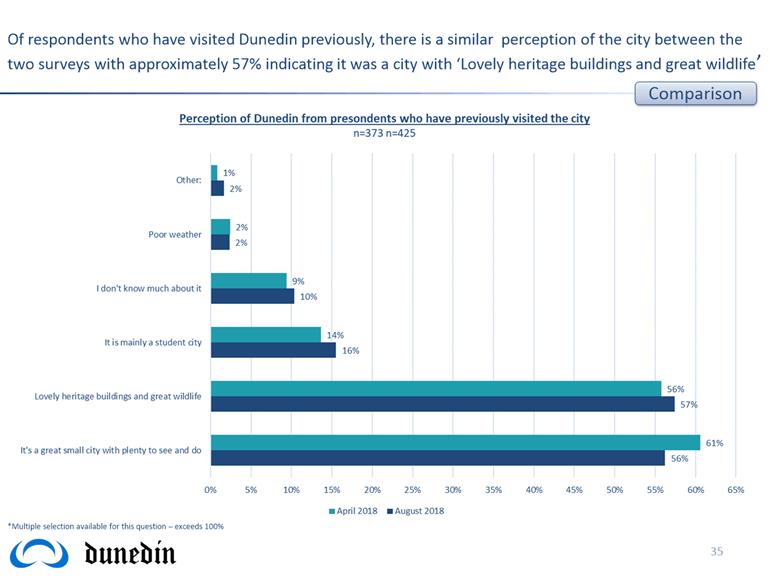

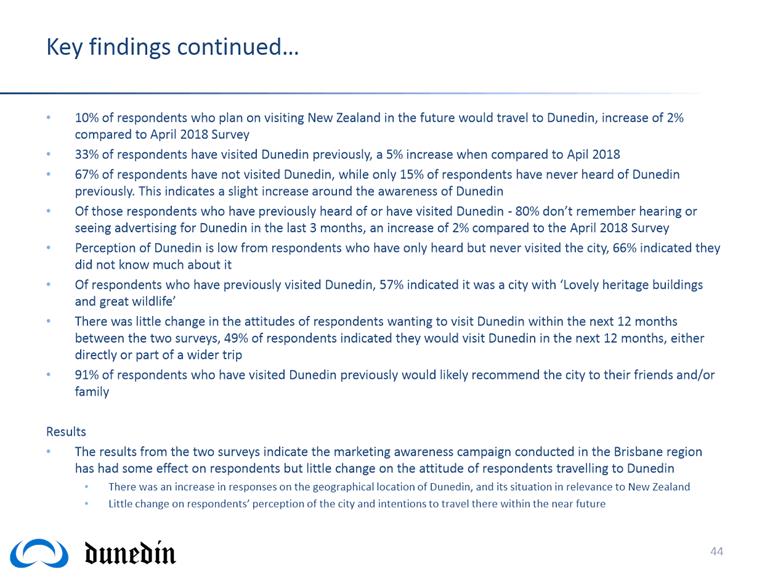

Cr Andrew Whiley

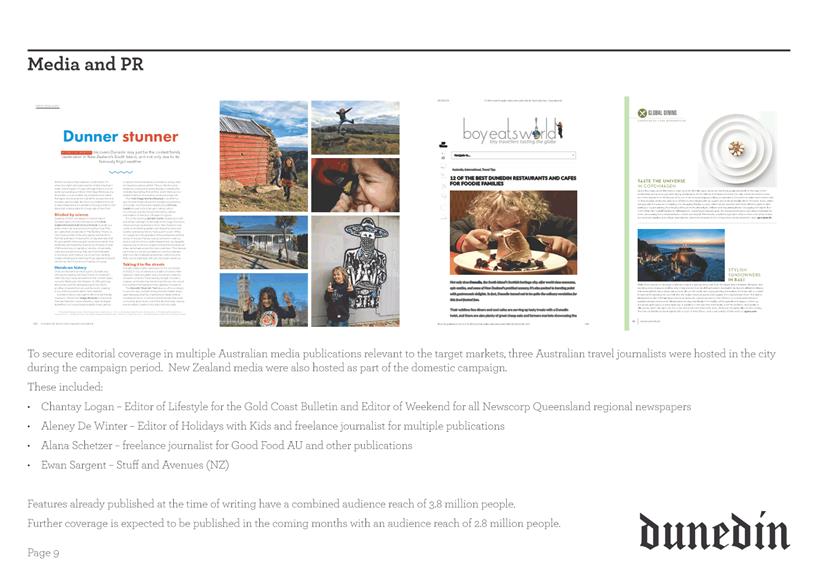

|

|

|

|

|

|

Members

|

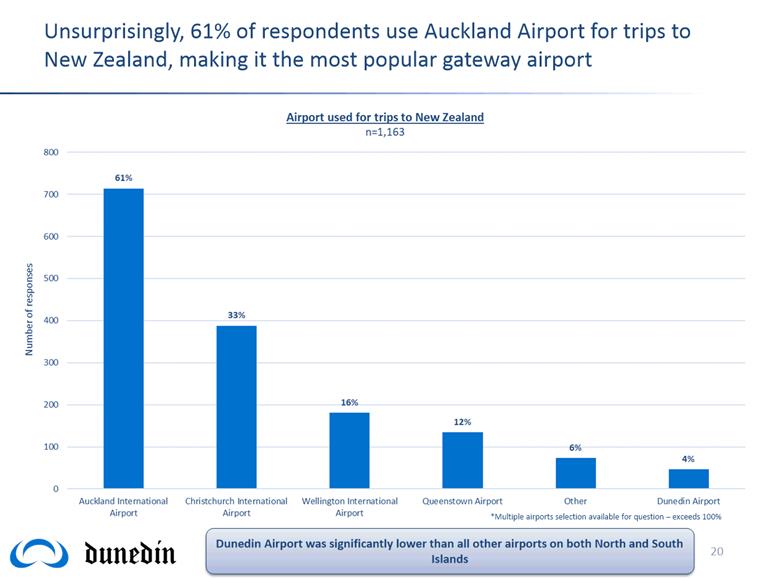

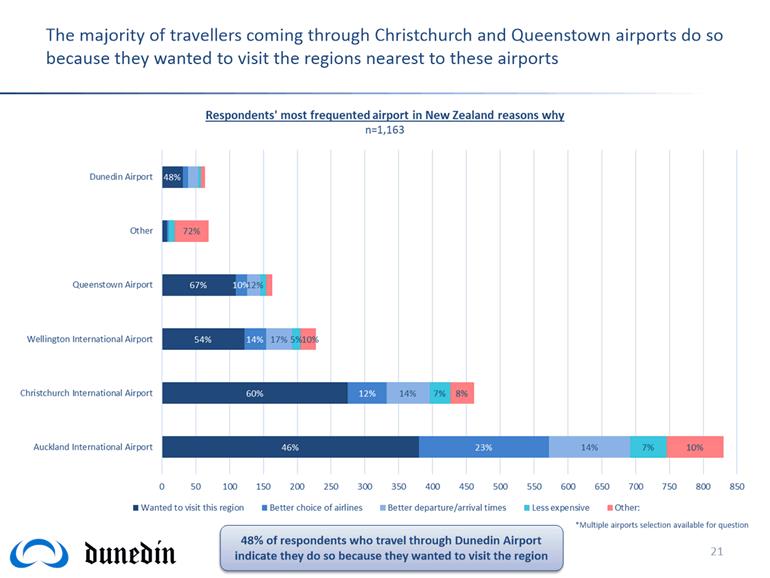

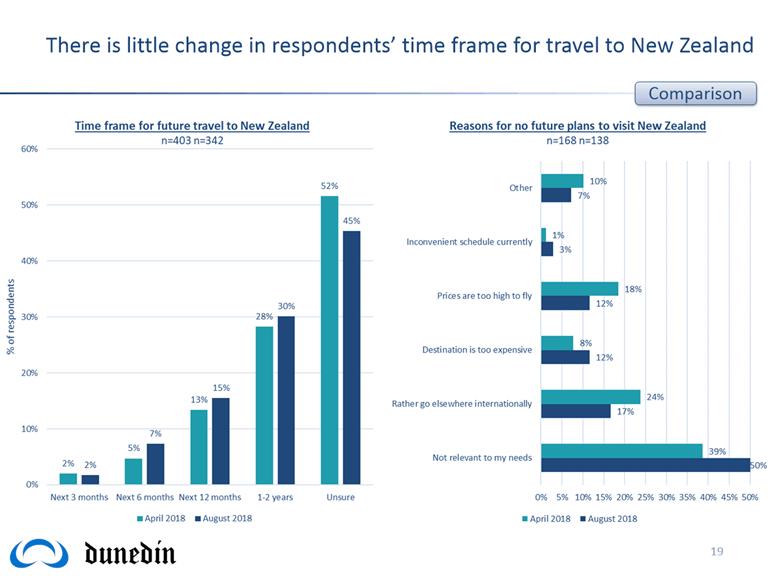

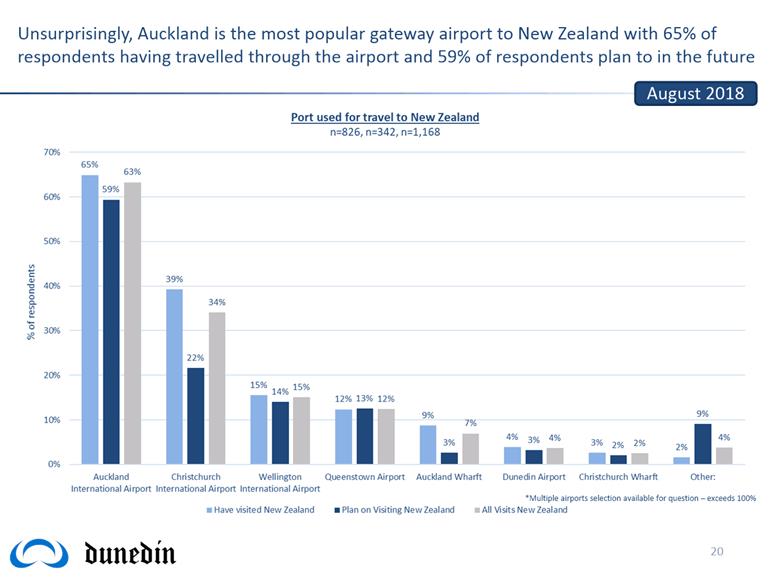

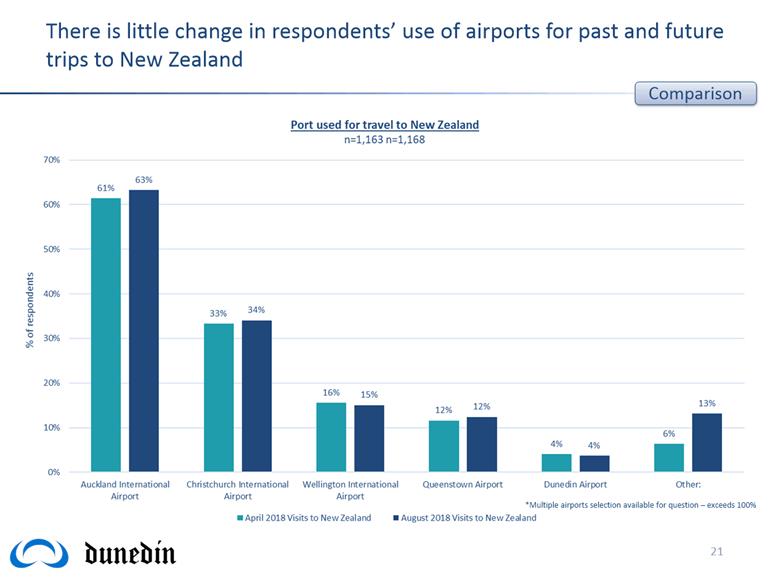

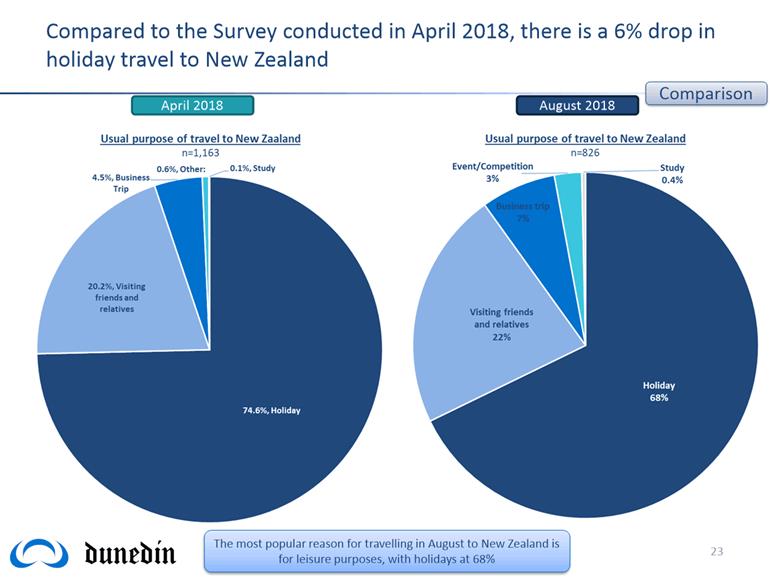

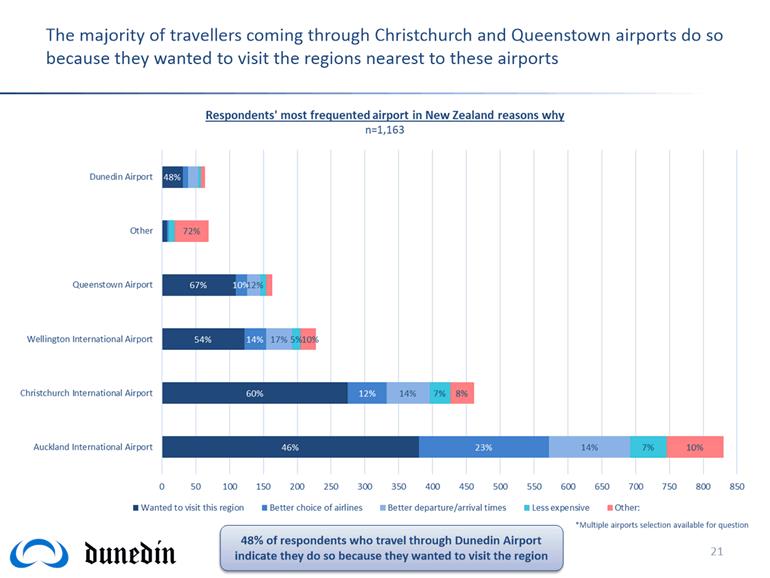

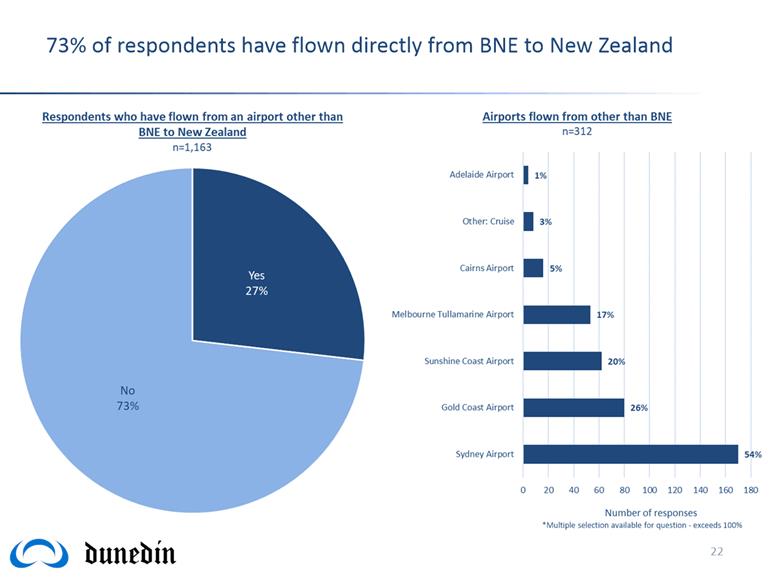

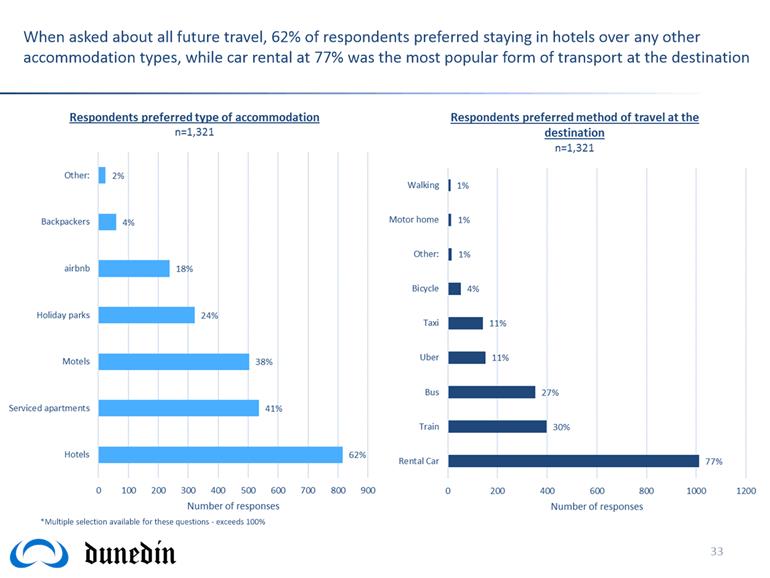

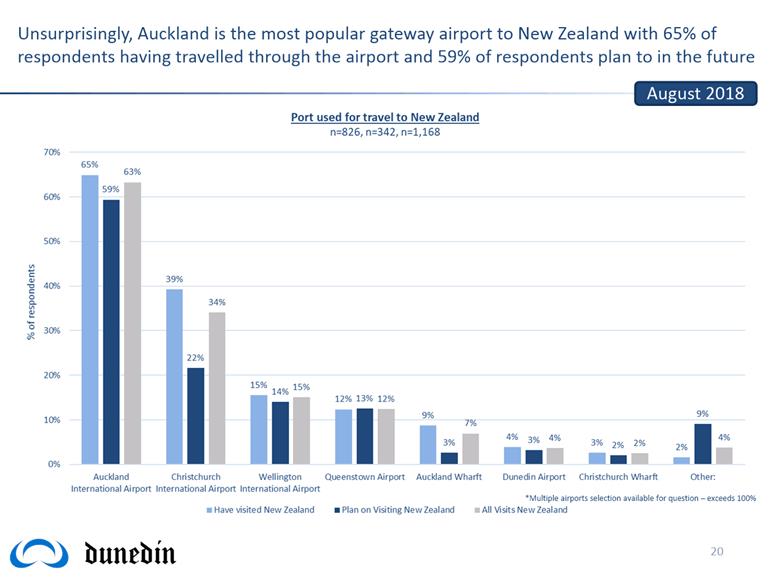

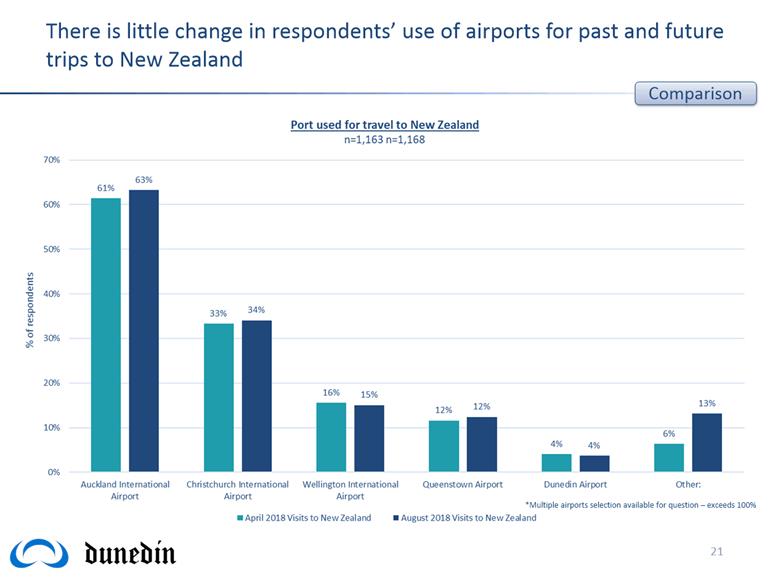

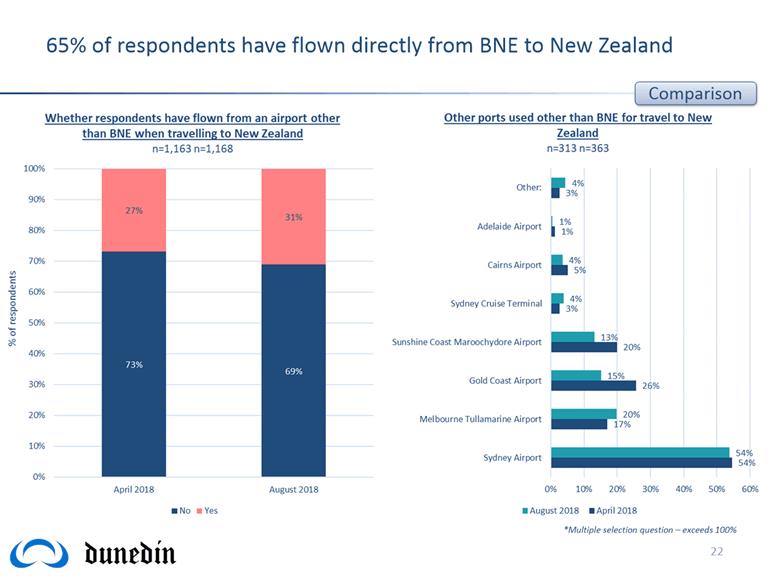

Cr David Benson-Pope

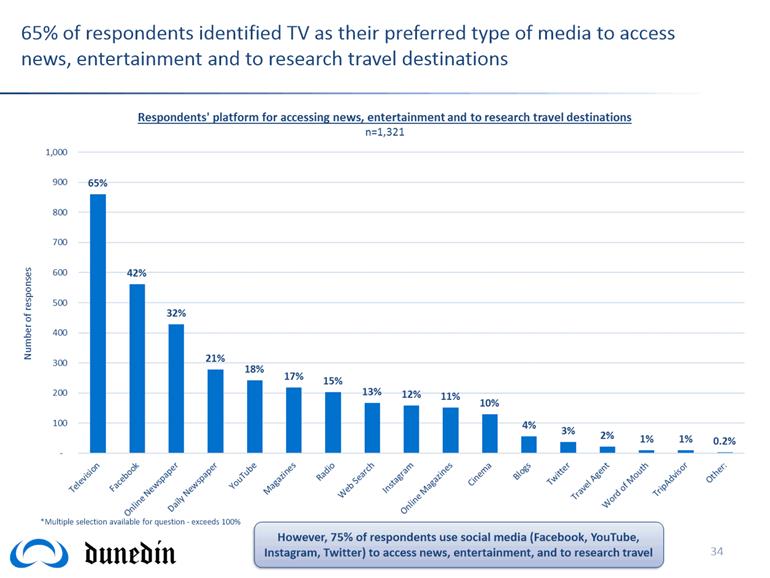

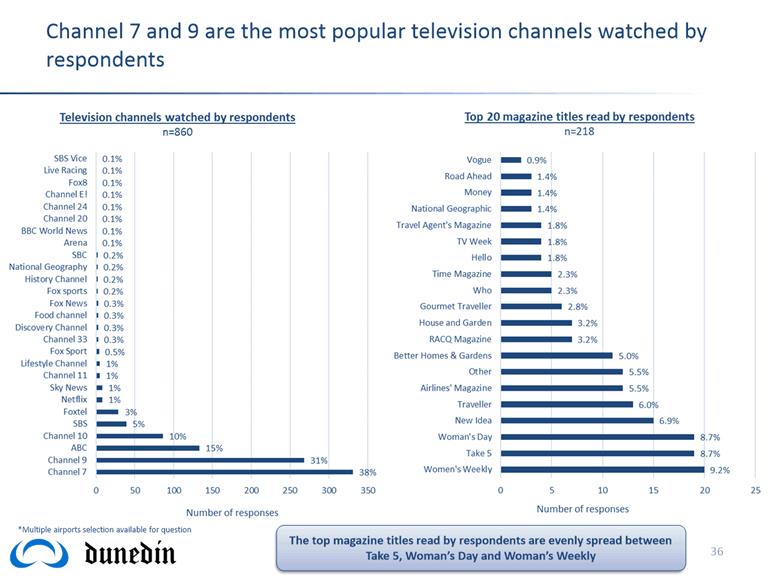

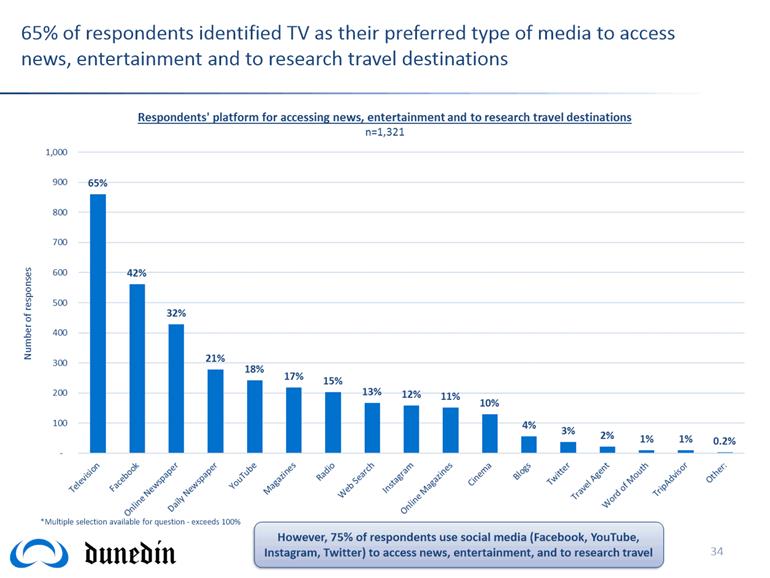

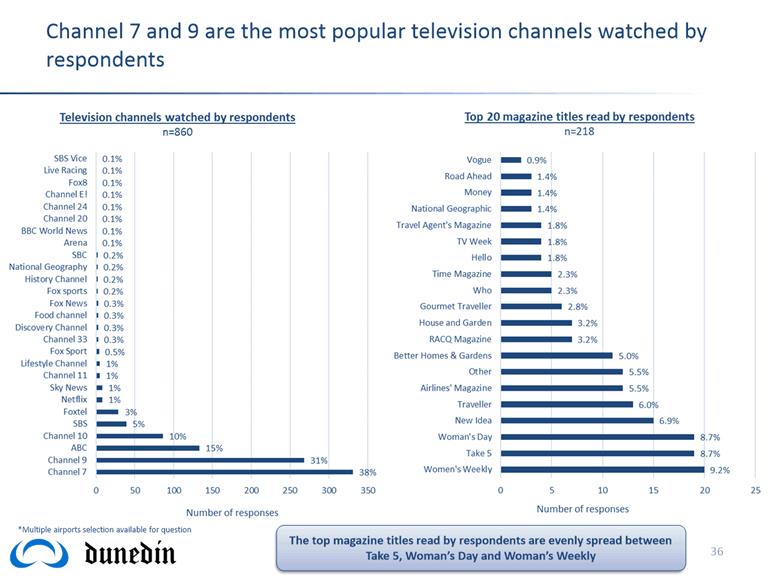

|

Mayor Dave Cull

|

|

|

Cr Rachel Elder

|

Cr Doug Hall

|

|

|

Cr Aaron Hawkins

|

Cr Marie Laufiso

|

|

|

Cr Mike Lord

|

Cr Damian Newell

|

|

|

Cr Jim O'Malley

|

Cr Conrad Stedman

|

|

|

Cr Lee Vandervis

|

Cr Kate Wilson

|

Senior Officer John

Christie, Director Enterprise Dunedin

Governance Support Officer Jenny

Lapham

Jenny Lapham

Governance Support Officer

Telephone: 03 477 4000

Jenny.Lapham@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

Economic Development

Committee

20 November 2018

|

|

ITEM TABLE OF CONTENTS PAGE

1 Public

Forum 4

2 Apologies 4

3 Confirmation

of Agenda 4

4 Declaration

of Interest 5

Part

A Reports (Committee has power to decide these matters)

5 Enterprise

Dunedin July to September 2018 Activity Report 15

6 Dunedin

Marketing - Autumn/Winter Campaign 2018 20

7 GigCity/Smart

City 131

8 Items

for Consideration by the Chair 183

Resolution to Exclude the Public 184

|

Economic Development

Committee

20 November 2018

|

|

1 Public

Forum

At the close of the agenda no

requests for public forum had been received.

2 Apologies

At the close of the agenda no

apologies had been received.

3 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

|

Economic Development

Committee

20 November 2018

|

|

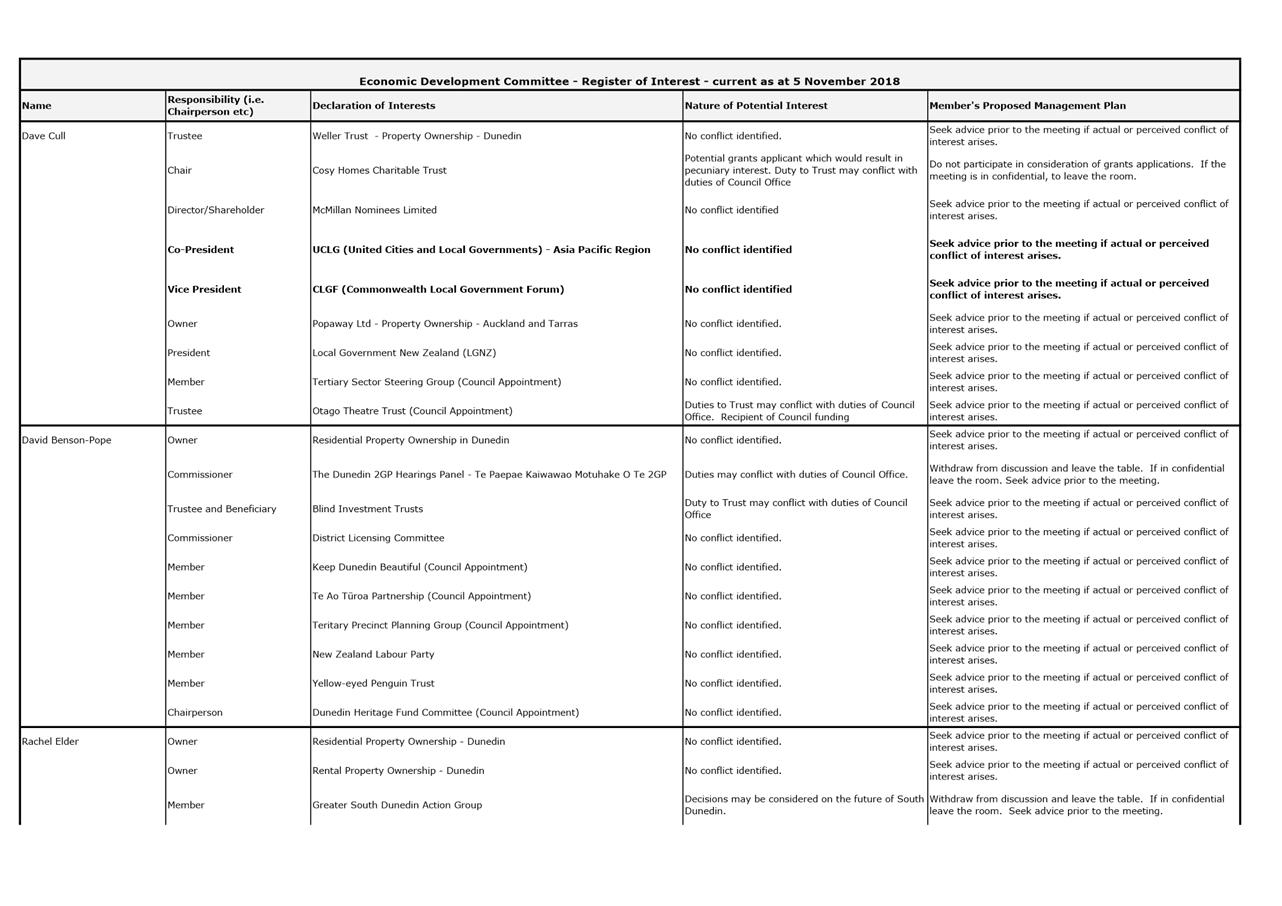

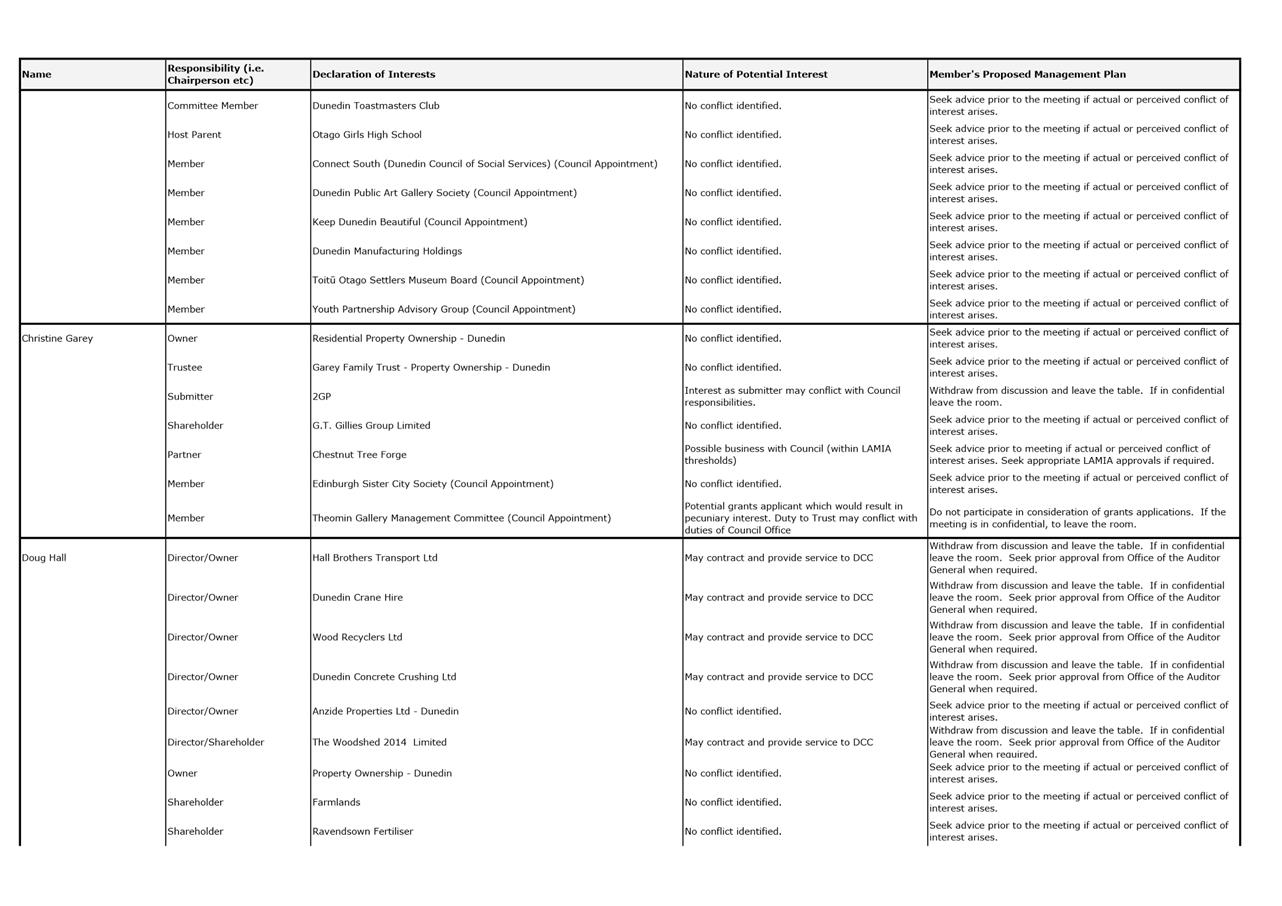

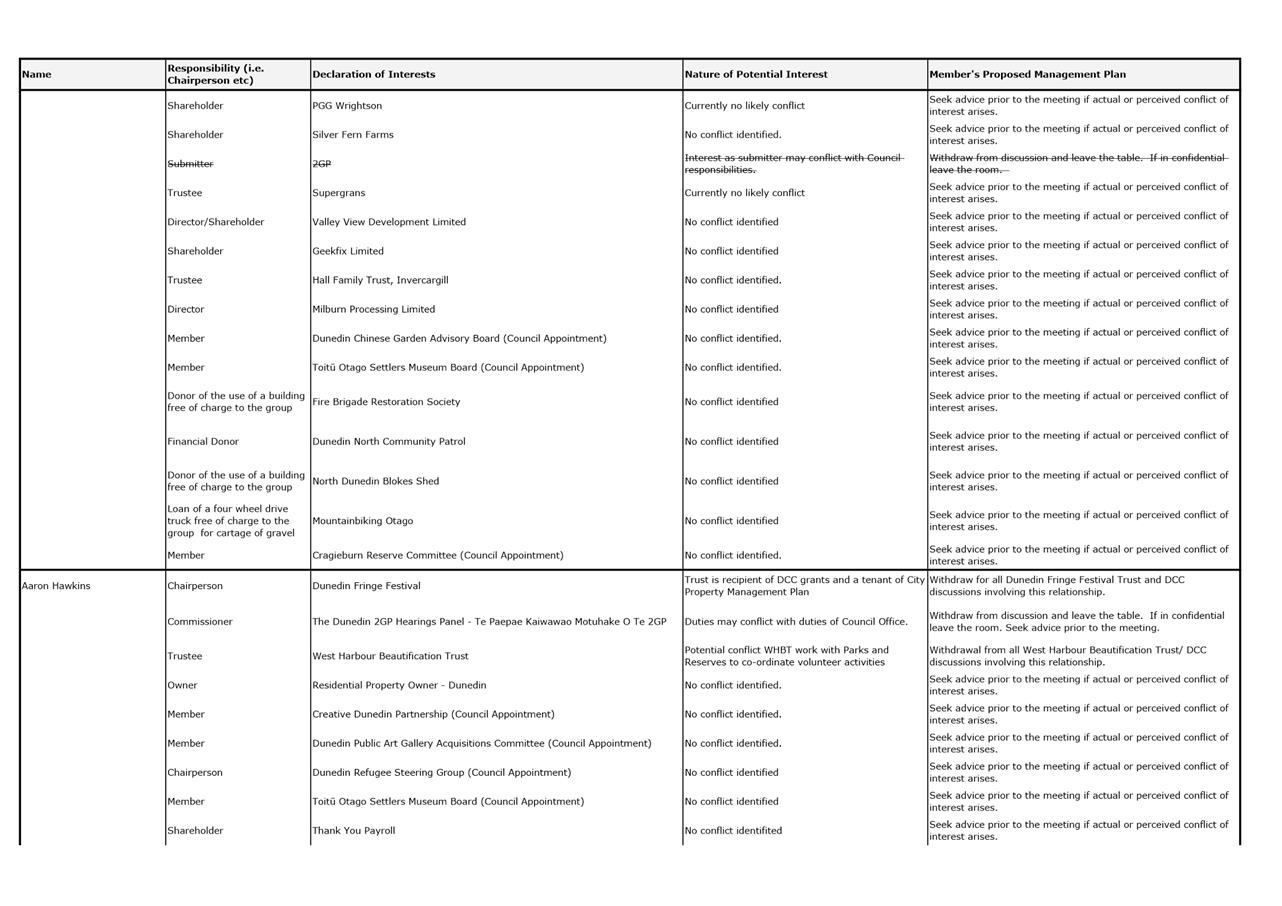

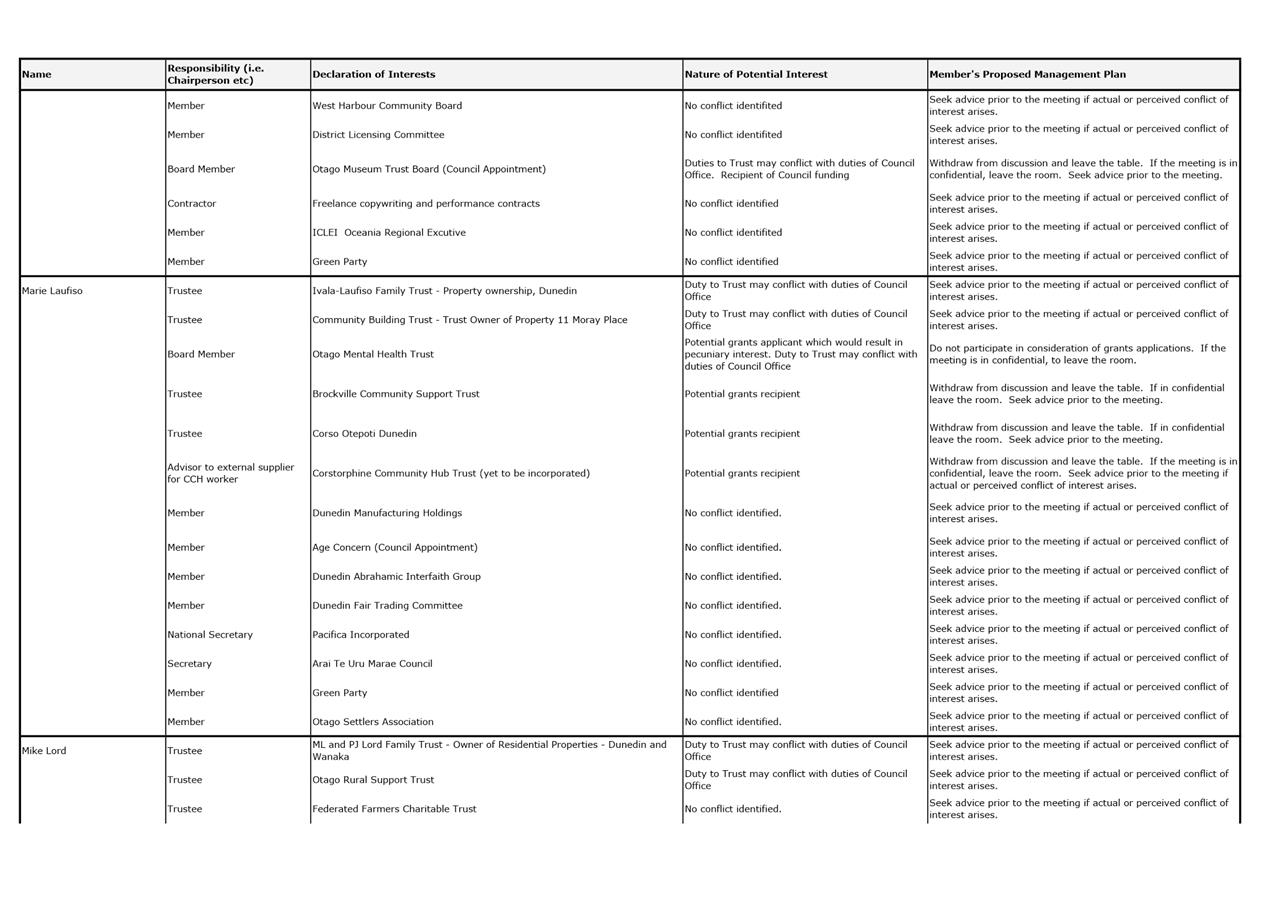

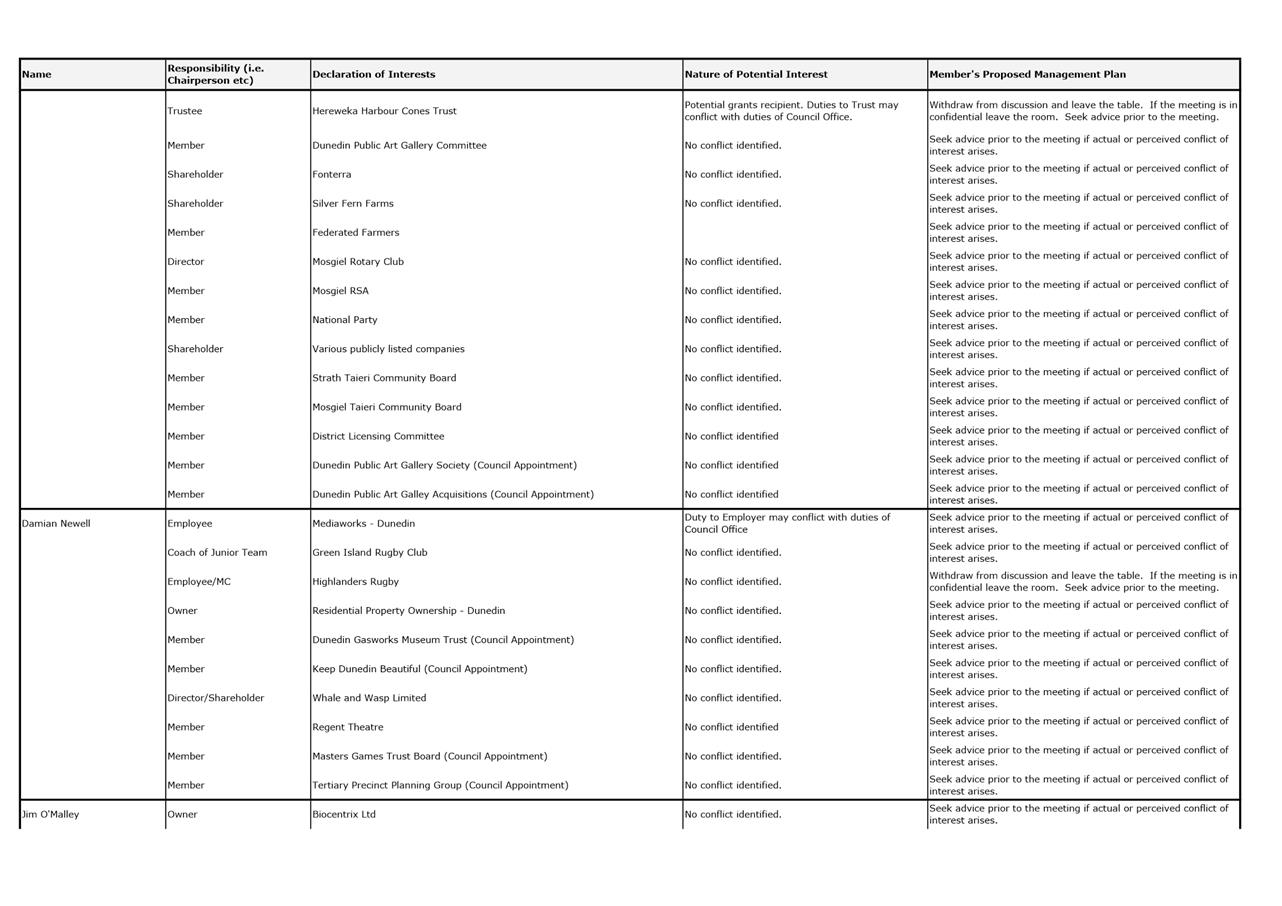

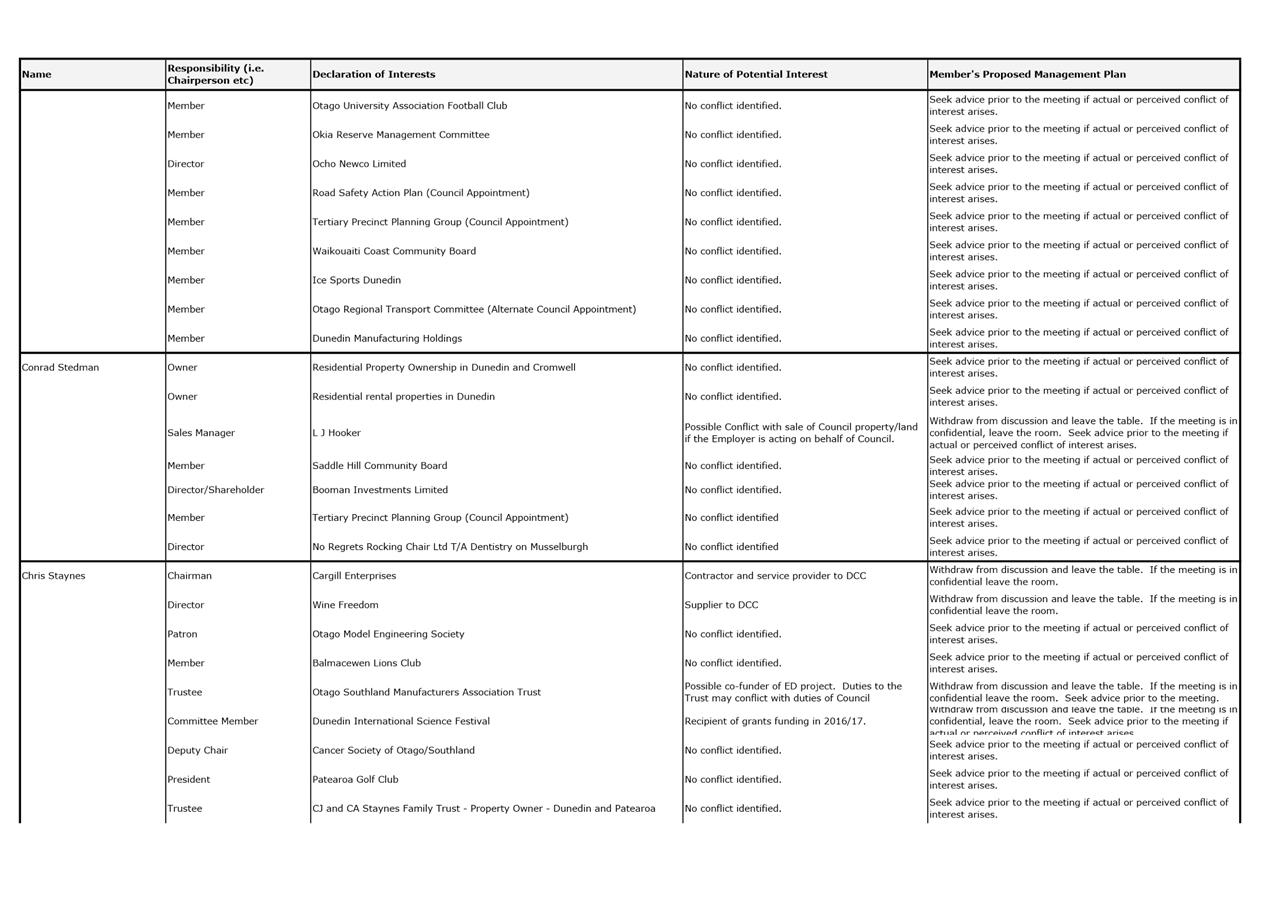

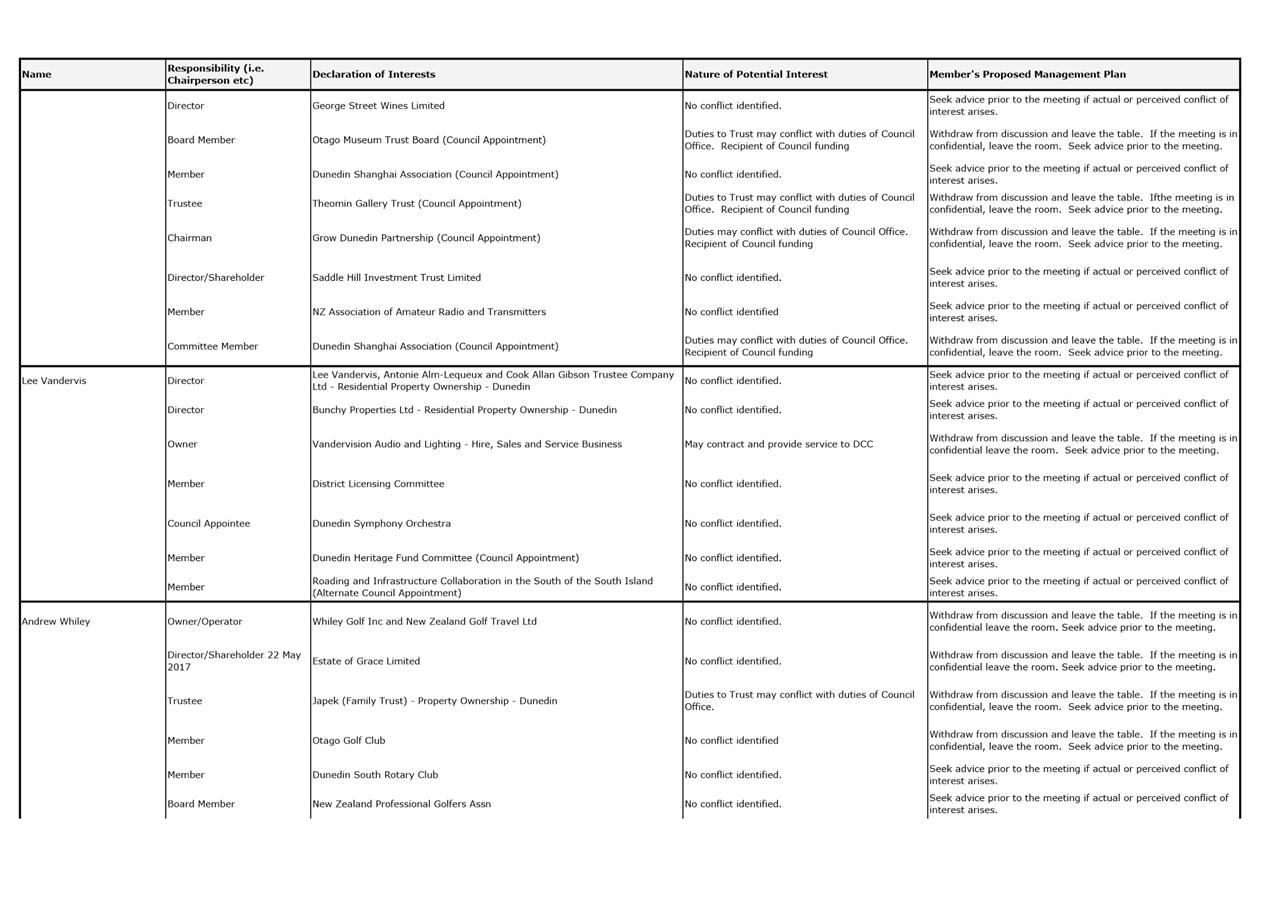

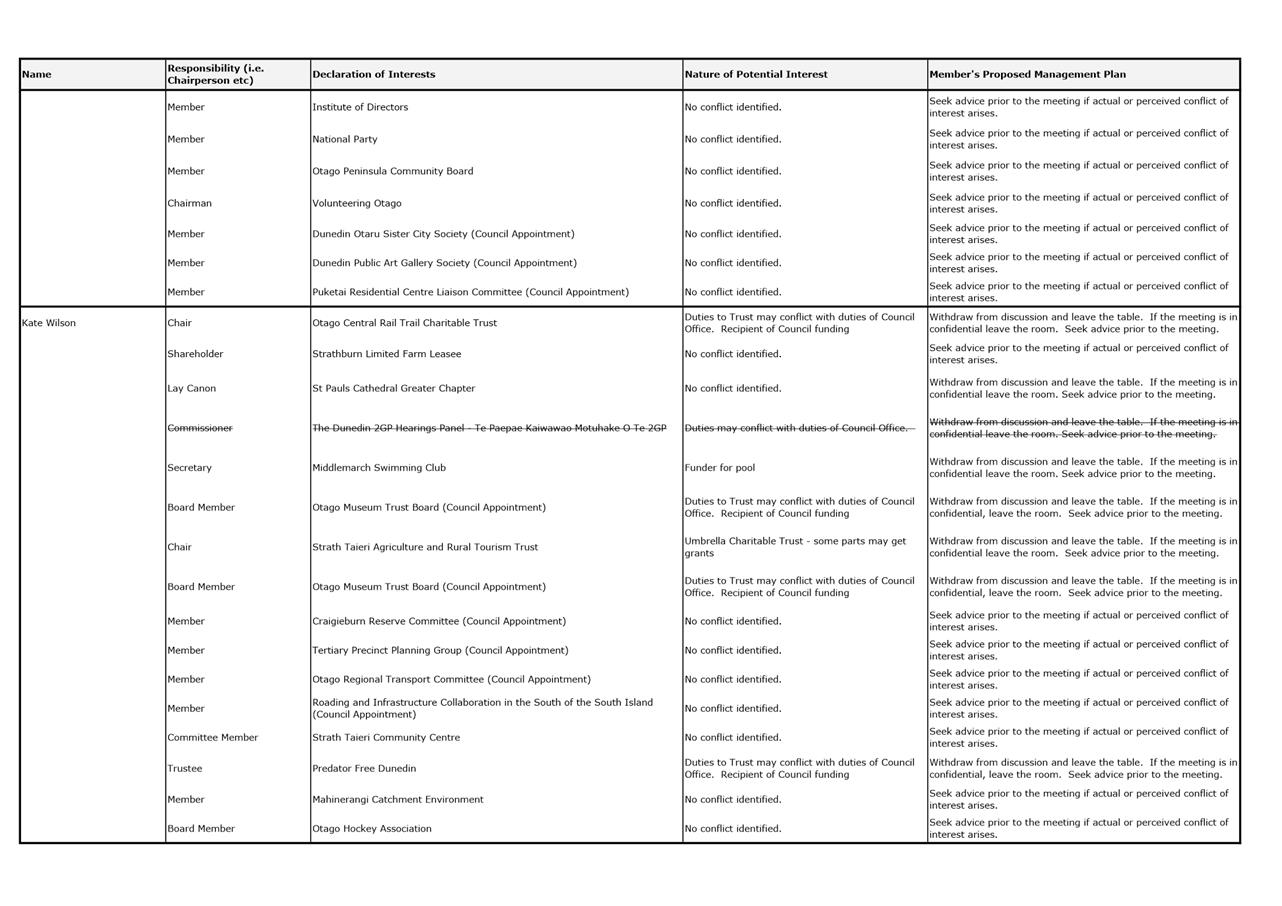

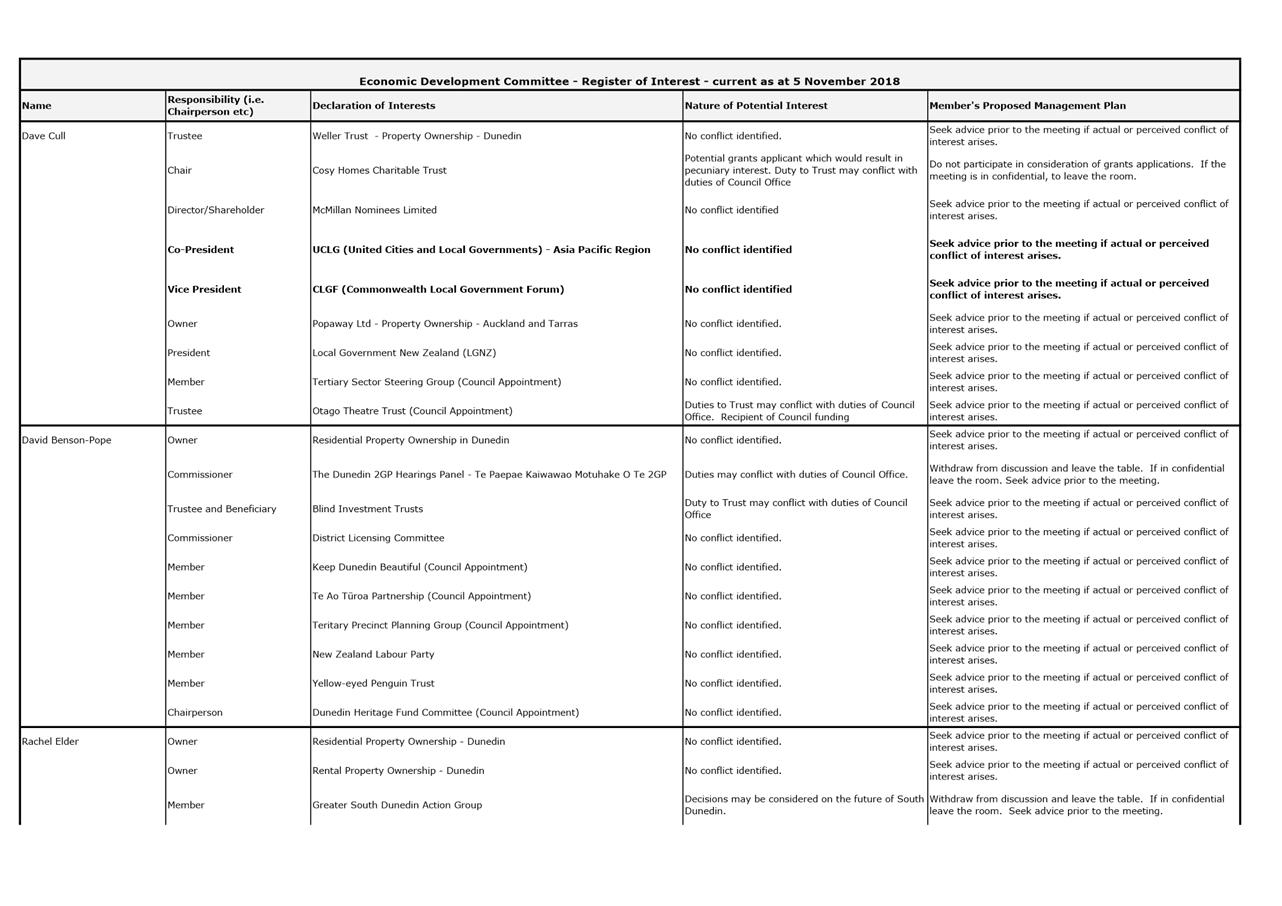

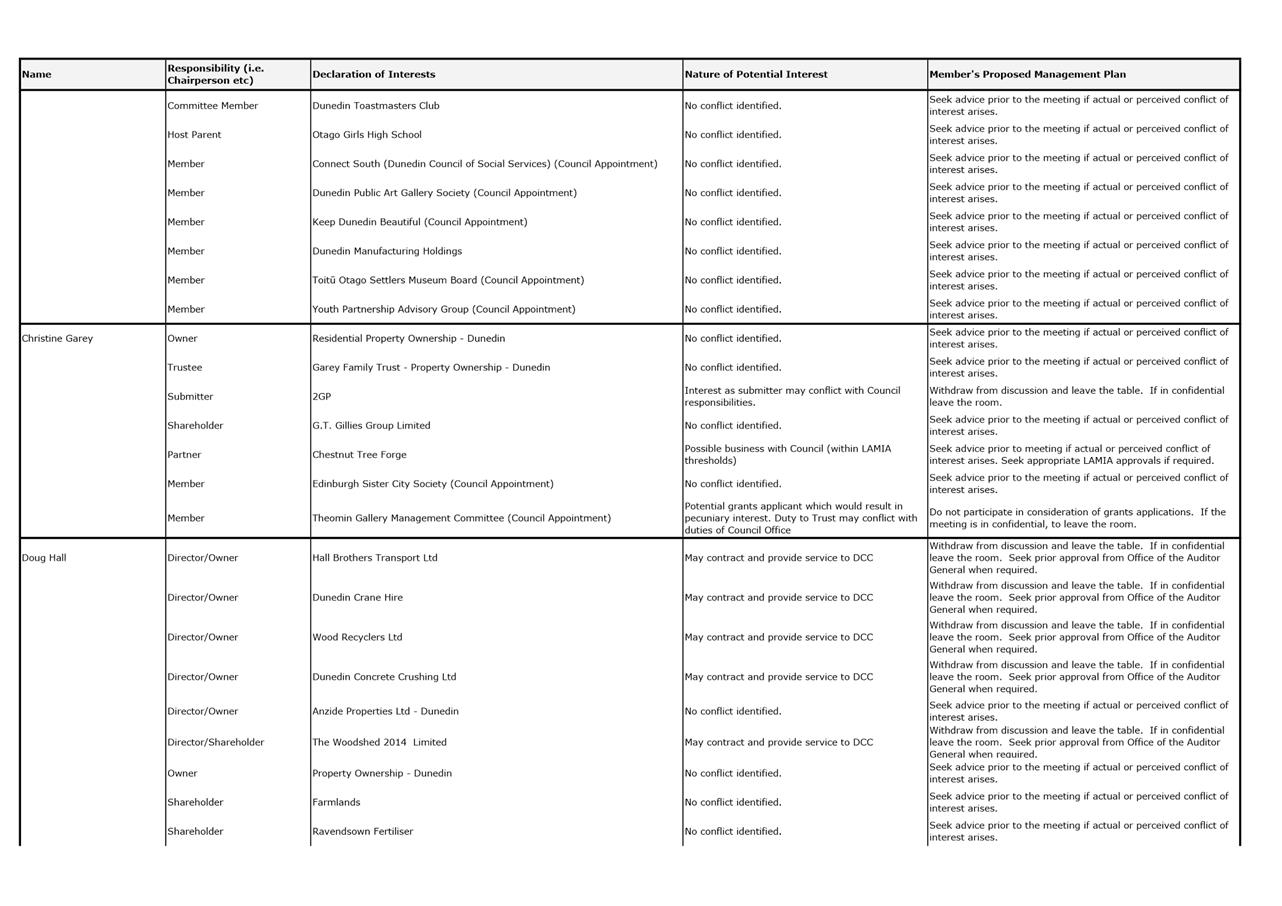

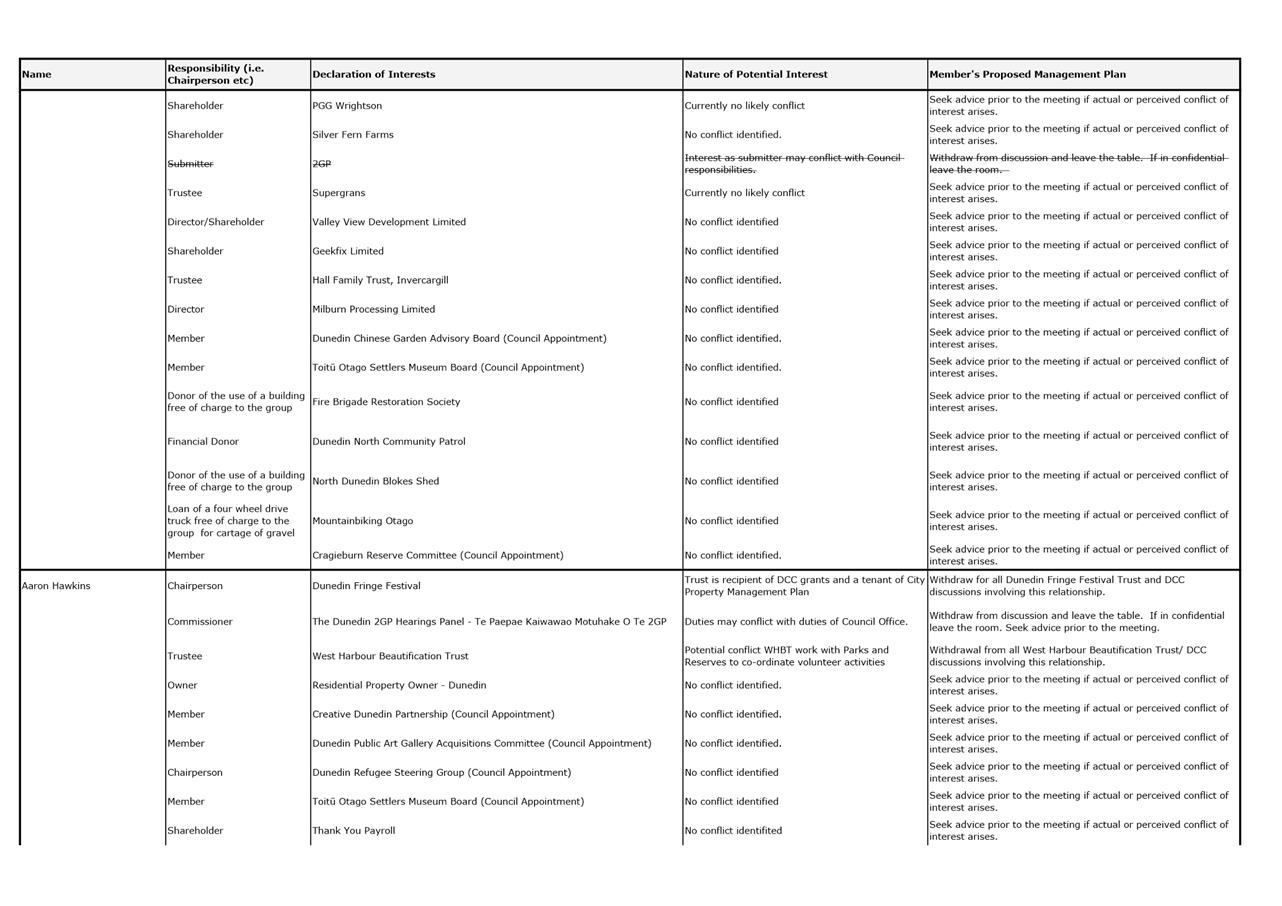

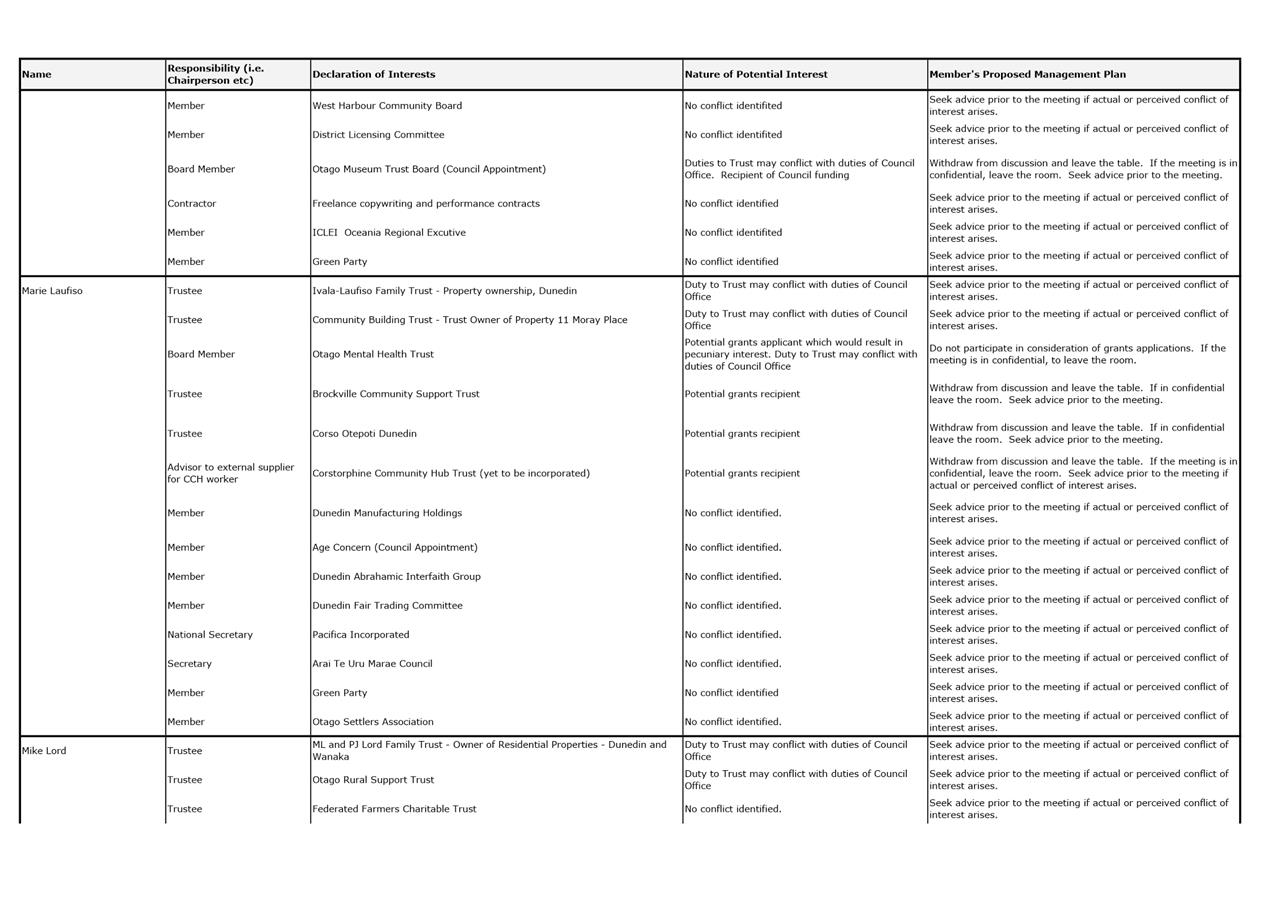

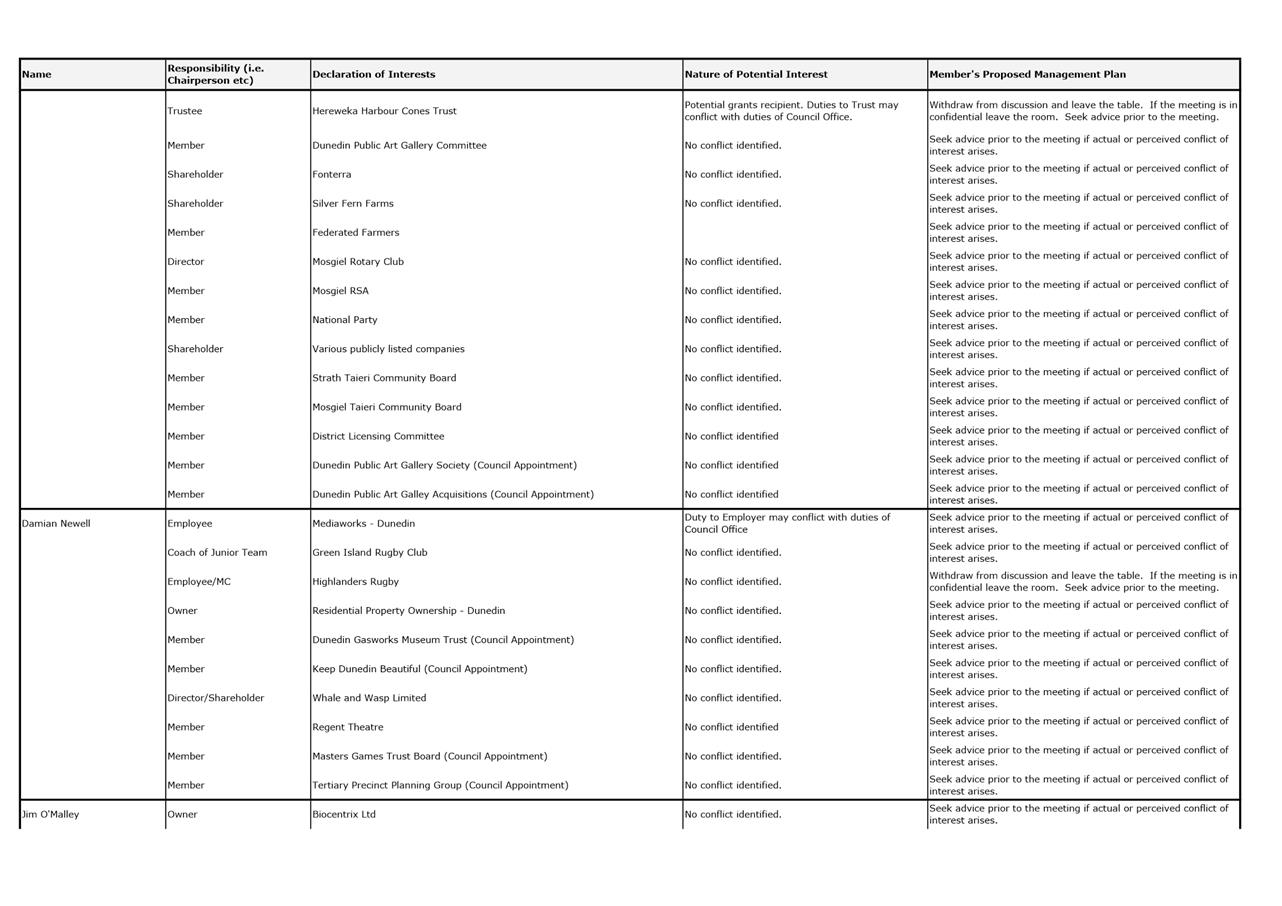

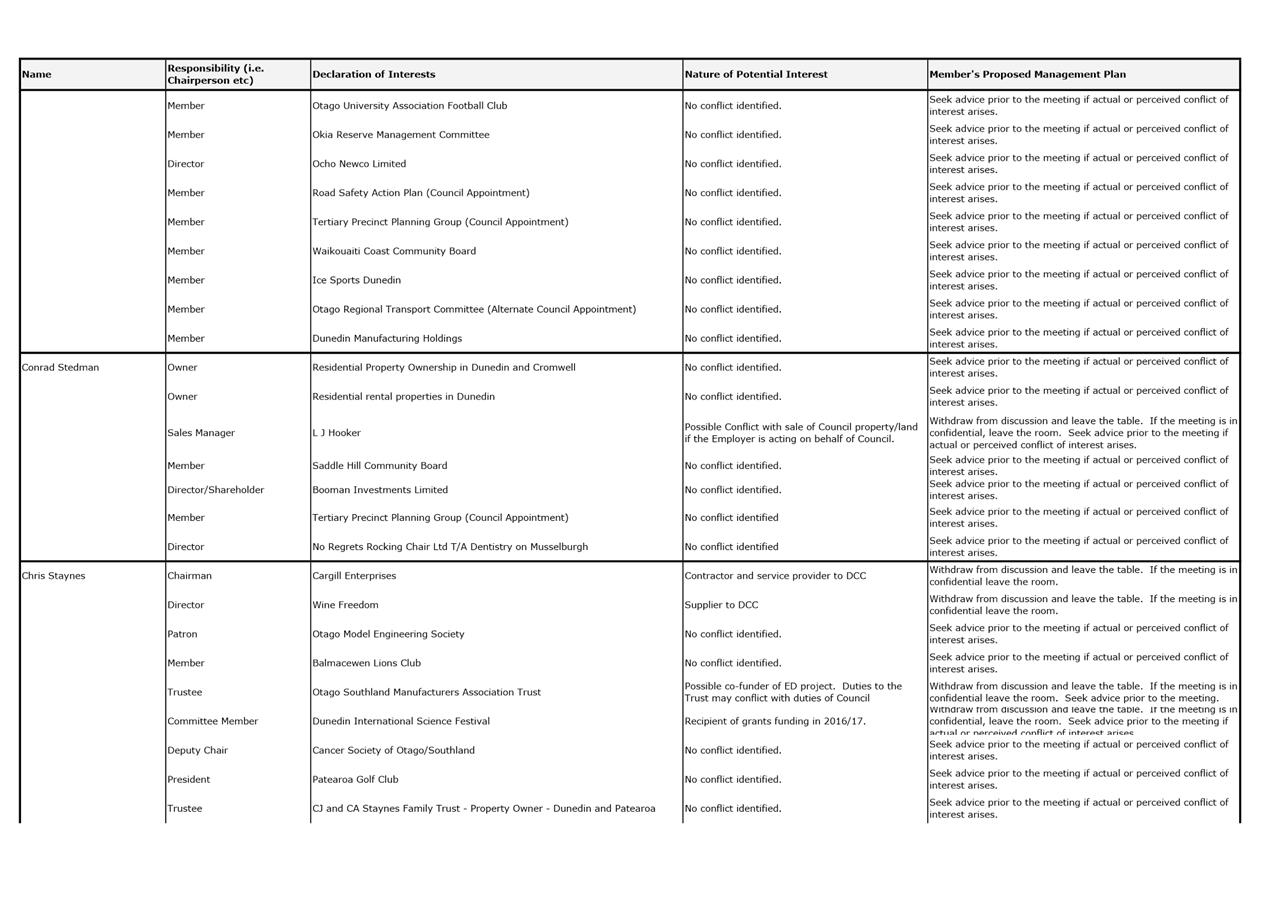

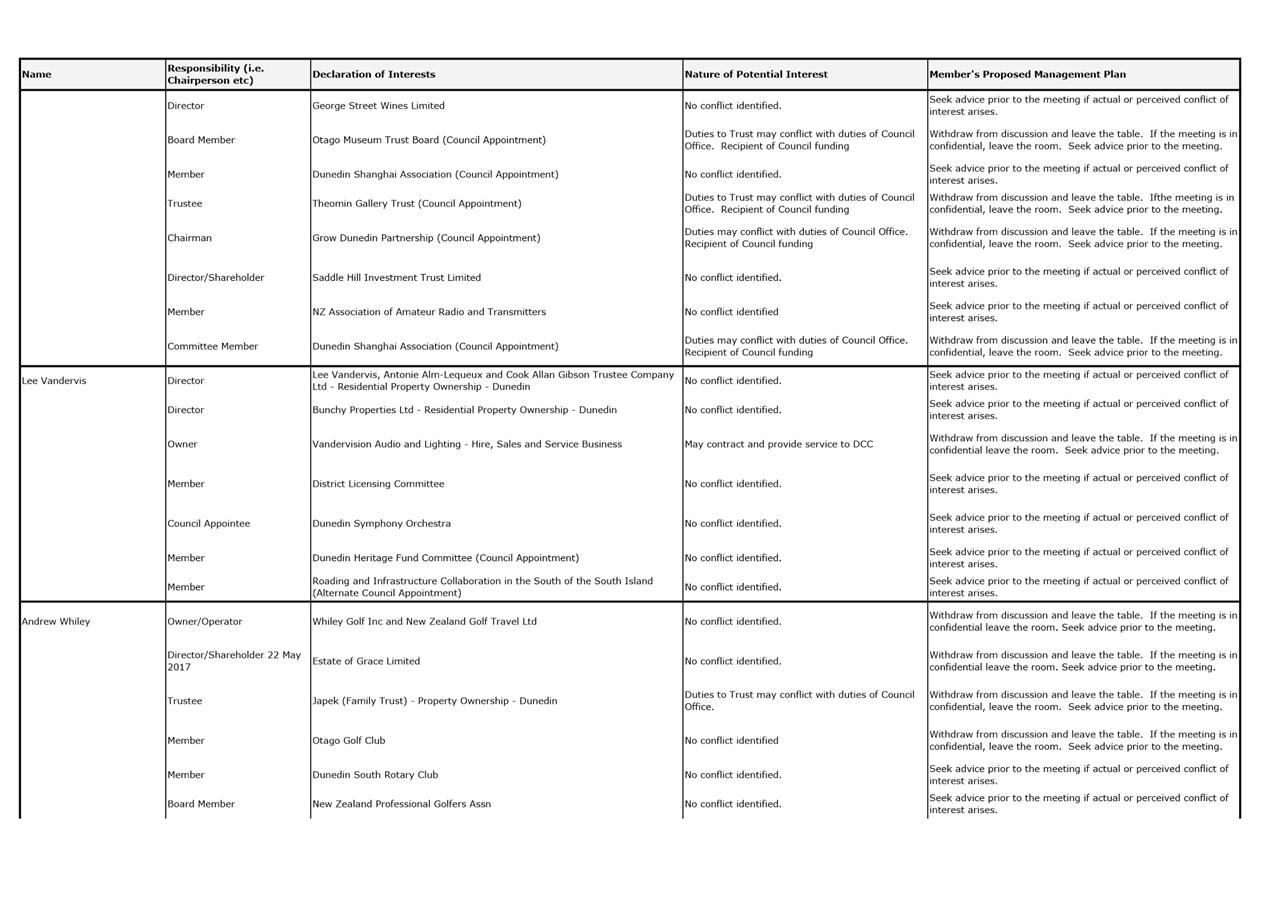

Declaration of Interest

EXECUTIVE SUMMARY

1. Members are reminded of the need

to stand aside from decision-making when a conflict arises between their role

as an elected representative and any private or other external interest they

might have.

2. Elected members

are reminded to update their register of interests as soon as practicable,

including amending the register at this meeting if necessary.

|

RECOMMENDATIONS

That the Committee:

a) Notes/Amends

if necessary the Elected Members' Interest Register attached as Attachment A;

and

b) Confirms/Amends the proposed management plan for Elected Members' Interests.

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Register of Interest

|

7

|

|

Economic Development

Committee

20 November 2018

|

|

|

Economic Development Committee

20 November 2018

|

|

Part

A Reports

Enterprise Dunedin July to September 2018 Activity

Report

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee on a

selection of Enterprise Dunedin activities during the period July to September

2018.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Enterprise Dunedin 1 July to 30 September 2018 Activity Report.

|

BACKGROUND

2 Enterprise

Dunedin activity is informed by the 2013-2023 Economic Development Strategy

('strategy'). The strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances for

innovation – to improve linkages between industry and research.

c) A hub for

skills and talent – to increase retention of graduates, build the skills

base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A compelling

destination – to increase the value of tourism and events and improve the

understanding of Dunedin’s advantage.

3 The

strategy sets out two economic goals:

a) 10,000 extra

jobs over 10 years (requiring growth of approximately 2% per annum).

b) An average of

10,000 of extra income for each person (requiring GDP per capita to rise about

2.5% per annum).

DISCUSSION

4 Business

Vitality

a) The Otago

Regional Business Partnership (RBP):

· The

RBP is composed of the Otago Chamber of Commerce, Otago Southland Employers

Association and Dunedin City Council. The RBP is funded to deliver business

capability support, mentors and research grants by New Zealand Trade and

Enterprise (NZTE) and Callaghan Innovation.

· During

the period, the RBP issued 82 clients $56,374 NZTE in training grants and

matched 21 mentors to businesses.

· Eight

Callaghan Innovation clients were supported during the period with research and

development applications, and five Callaghan Innovation student experience

grants (supporting local companies employ students over the summer) were also

approved.

b) Business

Clinic

· Enterprise

Dunedin business advisors supported 21 clients through business clinics during

the period.

5 Alliances

for innovation

a) Energy

· The

Dunedin City Council, Ministry of Health, Southern DHB, and University of Otago

are continuing negotiations to develop a memorandum of understanding (MOU) for

the development of a District Energy Scheme business case.

· Currently,

three of the four parties have agreed to the terms of the MOU. Final

approval of the MOU is expected in early November 2018 with an estimated

completion date for the business case by April 2019.

b) Film Dunedin

· Film

Dunedin completed a survey of available screen crew and skills in Dunedin. This

will be used in developing a skills database for producers and projects.

· Film

Dunedin received 13 enquiries during the period which resulted in seven permits

being issued.

6 A

Compelling Destination:

a) International

Trade

· Activity

for this period included:

o Tourism Waitaki, on behalf of

Enterprise Dunedin and the regional international marketing alliance (IMA),

undertook in-market agent training roadshows promoting Otago to Australia,

South East Asia and the USA.

o Enterprise Dunedin hosted a

group of 11 Indonesian agents with Tourism New Zealand during the period.

o Enterprise Dunedin in

partnership with Air New Zealand hosted a group of 20 Auckland based inbound

operator agents on a three-day famil tour of Dunedin.

b) Business

Events:

· Activity

for this period included:

o Enterprise Dunedin was awarded

an international bid for the World Leisure Congress 2022 with an approximate

value of $1.7m for the city.

o Six conference leads between

2019-2024 are currently being developed including the Infrastructure NZ

Conference which is expected to attract 800 delegates.

c) Marketing

Campaign and Activity:

· Activity

for this period included:

o Enterprise Dunedin appointed

Australian-based PR agency Seven Communications to raise the profile of Dunedin

in the Australian market (initial term November to June 2019, costing $20,000)

This will be reviewed in June 2019.

o Enterprise Dunedin hosted five

Tourism New Zealand International Media Programme (IMP) visits in the city

during the period. The groups included influencers from the United

States, Australia, Japan and the Philippines.

o Enterprise Dunedin developed a

collaboration with Tourism Central Otago and Tourism Waitaki for international

inbound media visits to showcase the region.

o The new Spring campaign

‘Hidden Dunedin’ between August and early November aimed to promote

additional direct flights with Air New Zealand. The campaign highlighted the

hidden gems in Dunedin, urban adventures and outdoor exploring. A competition

promoting the Dunedin Beer Festival attracted 6,000 entrants from Auckland and

was promoted through the Air New Zealand Facebook page.

o A promotion is underway with

The Breeze radio station to encourage residents to engage with the Dunedin

brand. The promotion includes a competition and prizes.

d) Study Dunedin:

· A

Mayoral Welcome for over 250 students and staff from Dunedin high schools was

held in August. The event included a Mihi Whakatau led by He Waka Kotuia and

international students had an opportunity to learn about activities and

services they could use in the city when not studying. The next scheduled event

will be in March 2019.

· The

latest Education New Zealand (ENZ) figures indicate:

o 4861 international students

were enrolled in Dunedin in 2017, a 6% (533) increase on 2016.

o The Otago region grew by 7%,

second only to Waikato which grew by 8%.

o Top five countries for

enrolments in Dunedin were China, USA, Malaysia, India, and Germany.

o Largest sector percentage

increase from the 2016 results was Otago Polytechnic (14%), closely followed by

high schools (13%).

· Twelve

Thai Principals and two Ministry of Education staff visited Dunedin for four

days in September. The visit aimed to develop partnerships with Dunedin

schools that could lead to student and staff collaboration and exchanges in the

future.

e) i-SITE Visitor

Centre:

· A

focus for this period has been preparing for the coming ‘High’

season and ‘Cruise’ season with an estimated 120 Cruise ship

visits.

· Recruitment

of seasonal full-time and variable hours staff was completed to cover the high

demand period. These staff include previous seasonal staff and new recruits,

with staged start dates from late September to mid-October.

NEXT STEPS

8 Feedback

on the activity report will be incorporated in future updates.

Signatories

|

Author:

|

Suz Jenkins - Finance and Office Manager

Fraser Liggett - Economic Development Programme Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing a public service and it

is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

.

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the delivery of the

2013-23 Economic Development Strategy. Enterprise Dunedin activities

also contribute to other Council strategies in particular the Arts and

Culture Strategy.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Enterprise Dunedin activities and the 2013-23 Economic

Development Strategy are included in the 2018-28 Long Term Plan.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This decision is considered low significance under the

Significance Engagement Policy.

|

|

Engagement –

external

As an update report, no internal engagement has been

undertaken.

|

|

Engagement -

internal

As an update report no external engagement has been

undertaken.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no identified risks.

|

|

Community Boards

There are no implications for Community Boards.

|

|

Economic Development

Committee

20 November 2018

|

|

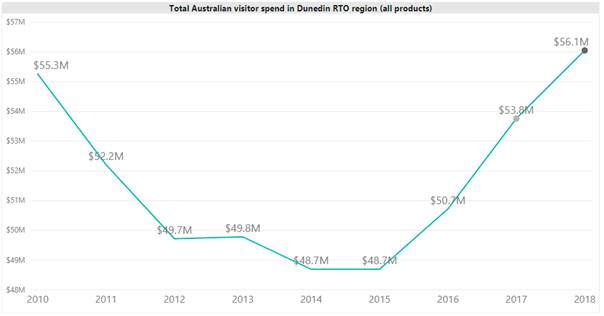

Dunedin Marketing - Autumn/Winter Campaign

2018

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

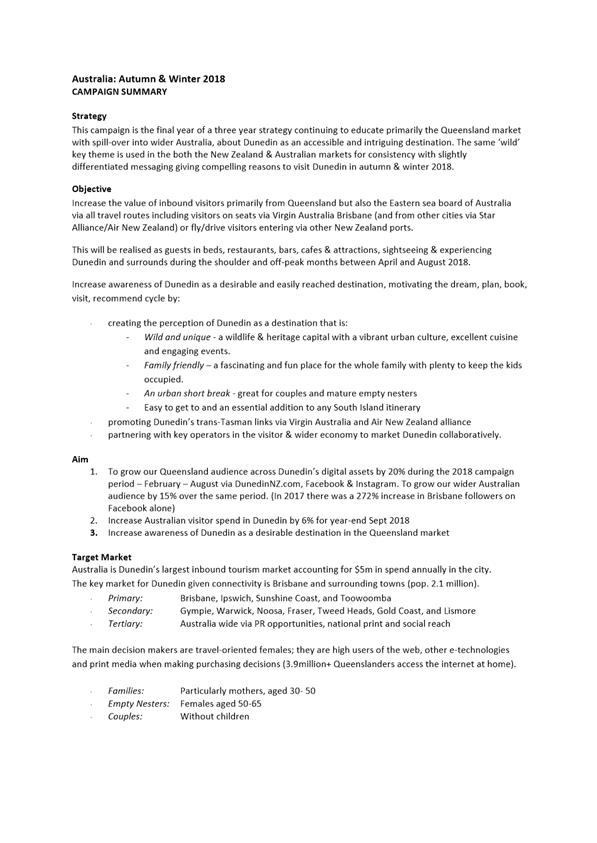

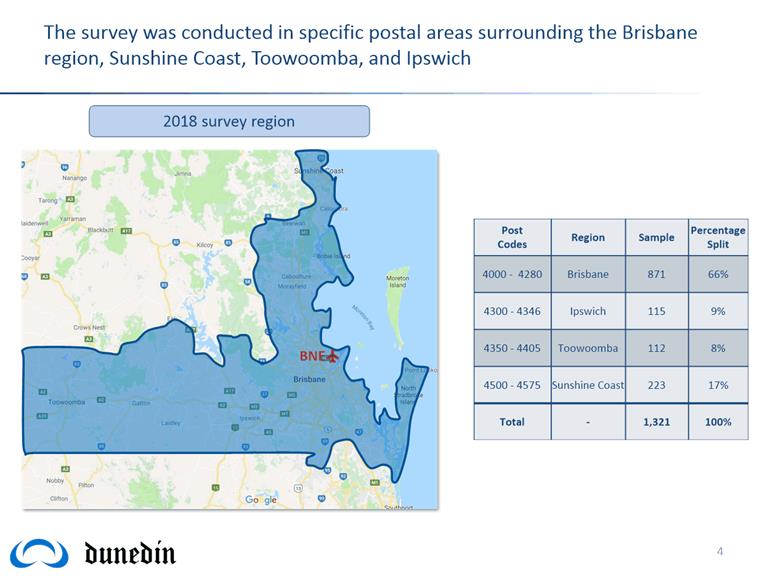

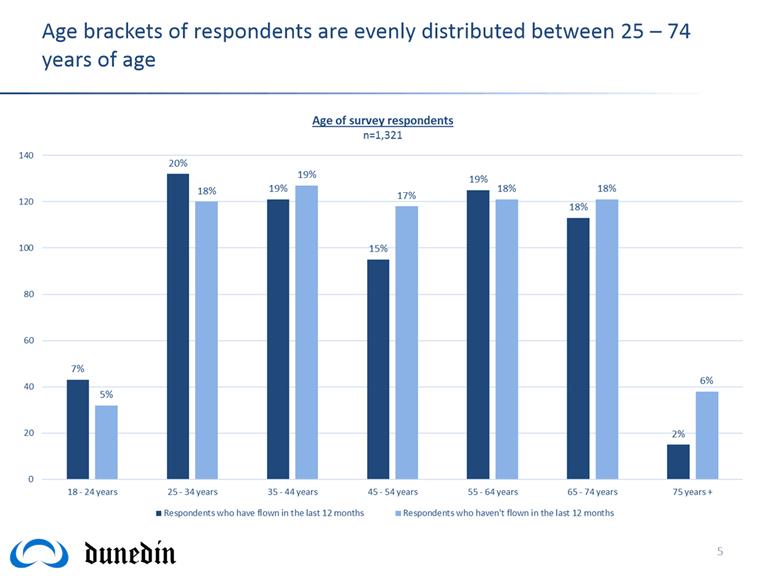

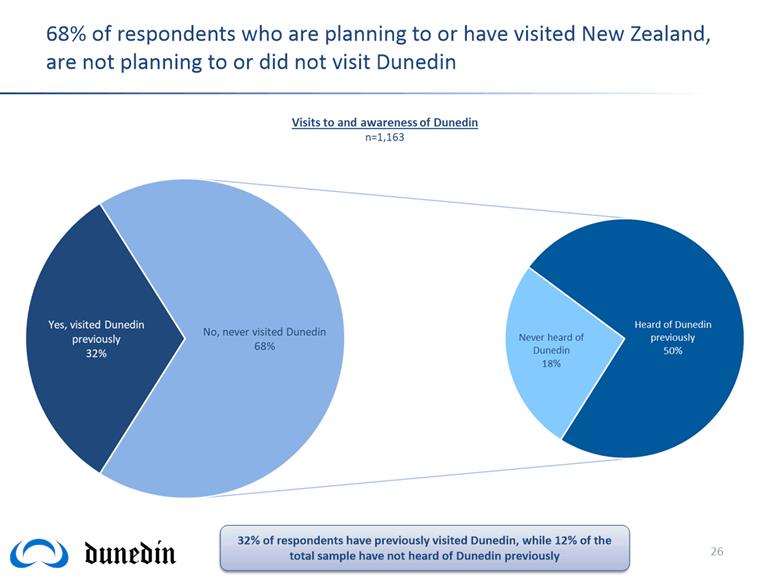

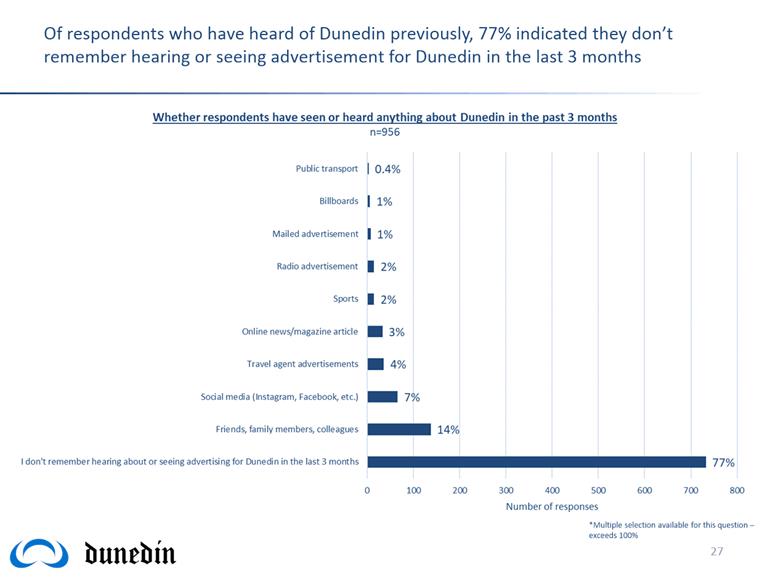

1 The

purpose of this report is to update the Committee on the results of the 'Where

the Wild Things Are' (WTWTA) autumn/winter 2018 campaign activity between

February and August 2018.

2 The

purpose of the campaign was to raise awareness of Dunedin as a compelling

year-round destination and encourage travel in the winter and autumn periods.

The primary target market focus was Brisbane and surrounding regions in Eastern

Australia. The second phase of the campaign which was rolled out during June

and July, included the New Zealand domestic market, targeting Auckland and the

lower South Island.

3 This

campaign is in its final year of a three-year marketing strategy for Australia,

promoting Dunedin to the Queensland and wider Australia market as an accessible

and intriguing destination. The same ‘wild’ key theme has been used

for three consecutive years of the campaign for consistency and reinforcement

of the ‘wild’ Dunedin message.

4 In year

three there has been additional and more diverse use of marketing channels

promoting compelling reasons to visit Dunedin in autumn and winter 2018.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Dunedin Marketing Autumn/Winter Campaign 2018 report.

|

background

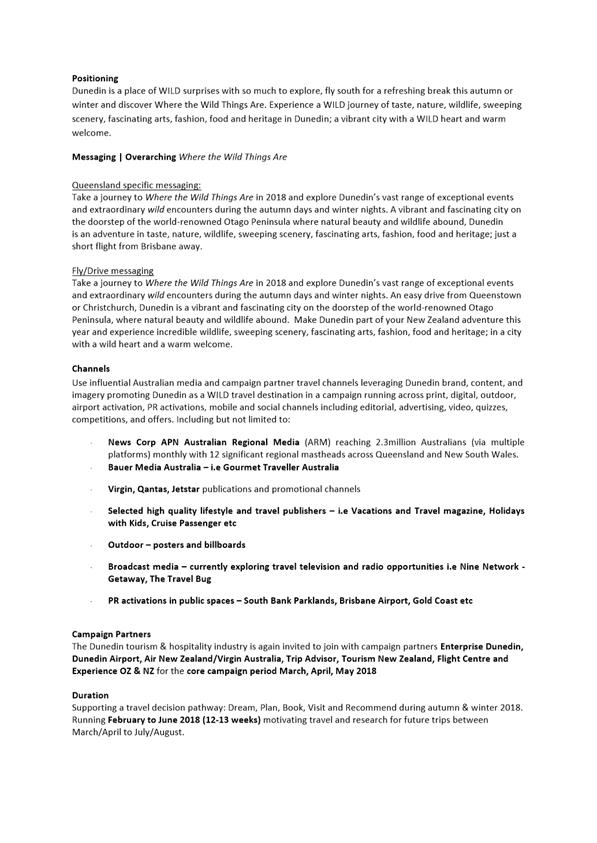

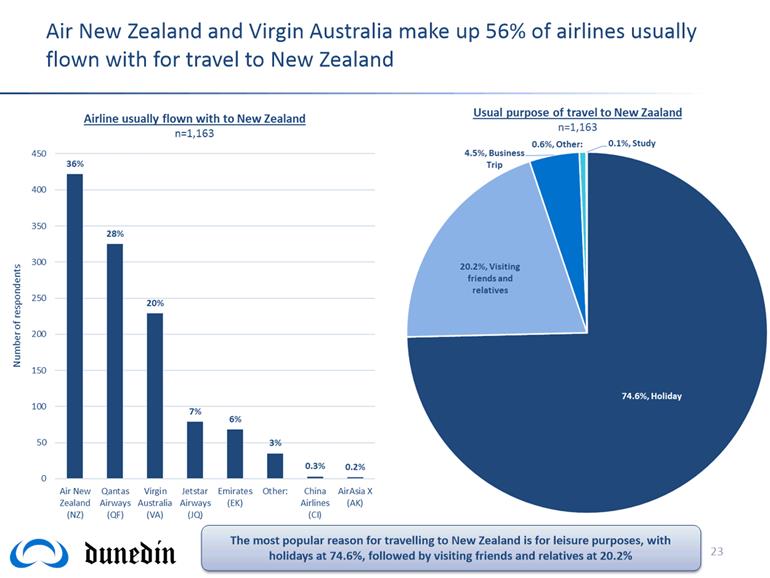

5 Australia

is Dunedin’s largest international visitor market by spend. For the year

ending September 2018, this was 25.2% of total international spend in Dunedin.

6 The 2018

activity is year three, of a three-year consumer marketing campaign in the

Australian market.

7 The

campaign promoted Dunedin as a ‘wild and unique’ destination

highlighting the city’s wildlife and heritage attractions, vibrant urban

culture, excellent cuisine and engaging events.

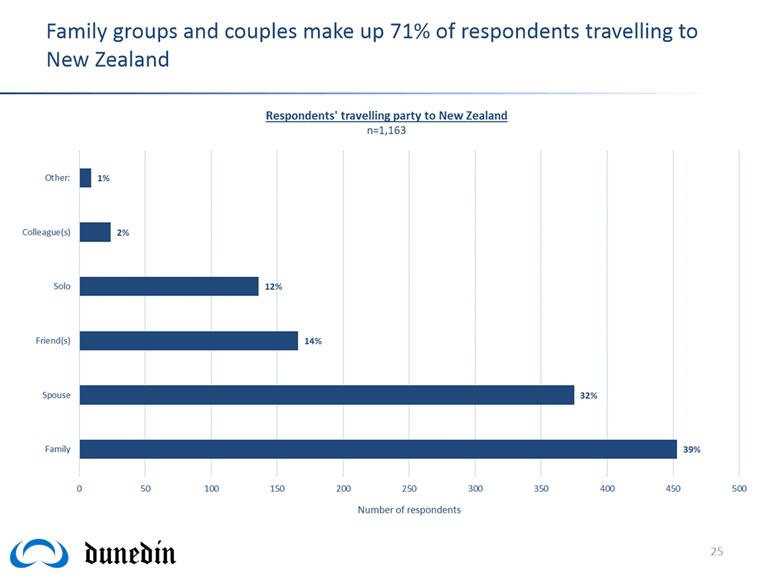

8 The

campaign focused mainly on Queensland as the source of Dunedin’s only

existing direct international flight.

9 Target

market segments included families with school age children, professional

couples without children and older couples.

10 For further details

refer to Attachment A –WTWTA 2018 - Campaign Proposal.

OBJECTIVES

11 The objectives of

the campaign included:

a) increasing

awareness of Dunedin as a desirable and easily reached travel destination

through a diverse spread of marketing channels, referrals and partnerships;

b) encouraging

shoulder/low season visitation and bookings in Dunedin between April and

August;

c) achieving a 6%

increase in Australian visitor spend for year-end September 2018;

d) generating

additional social media and campaign engagement and grow our Queensland

audience across Dunedin’s digital assets by 20% and wider Australian audience

by 15% over the campaign period;

e) generating

awareness of campaign partner products and special deals; and

f) generating

greater awareness of Dunedin as a year-round destination with the Australian

travel trade.

Discussion

12 The 2018 campaign

was a seven-month multi-channel campaign across digital channels, social media,

radio, consumer activations, video, media partners and trade platforms.

13 The total 2018

campaign budget was $496,720 of which Enterprise Dunedin contributed $245,893.

The balance was made up of direct investment contributions and in-kind partner

and supplier contributions.

Campaign Partners

14 The campaign brought

together over 29 local, national and international industry, trade and media

partners including Enterprise Dunedin.

15 National

and trans-Tasman campaign partners were Air New Zealand and Virgin Australia

supported by Dunedin Airport, together with Infinity Travel.

16 Dunedin operator

investment partners from 2017 reinvested in the 2018 campaign and included:

Dunedin Airport, Scenic Hotels (Southern Cross and Dunedin City), Distinction

Hotel, Otago Peninsula Trust (Royal Albatross Colony and Blue Penguins

Pukekura), Larnach Castle, Monarch Wildlife.

17 New investment

partners for the 2018 campaign included Emersons Brewery, NZ International

Science Festival, University of Otago and Olveston Historic Home.

18 Each stage of the

campaign was implemented to lead potential Australian travellers through an

identified travel decision pathway: 'Dream, plan, book, visit and recommend.'

Campaign Channels and Activity

19 Enterprise

Dunedin supported this campaign via the following paid or in-kind activity:

a) Owned Brand/Digital/Consumer

· DunedinNZ.com including dedicated campaign

hub, website banners and visit home page promotional pointers.

· Google Adwords search engine advertising.

· Facebook and Instagram sponsored posts,

adverts and video.

· YouTube campaign video.

· Newsletters to consumer database.

· Exhibition stand at the Flight Centre

consumer travel expo in Brisbane (Feb).

· Two-phase market research in the Brisbane

market in conjunction with Dunedin Airport.

· TripAdvisor Premium Destination

Partnership.

b) PR/Media

· Integrated online/offline campaign with

Newscorp Queensland (APN).

· Cinema advertising with Val Morgan.

· Print and online advertising with

lifestyle, travel and inflight publications.

· Outdoor billboard advertising.

· Travel journalist hosting and features.

· Promotional partnership with Experience OZ

and New Zealand.

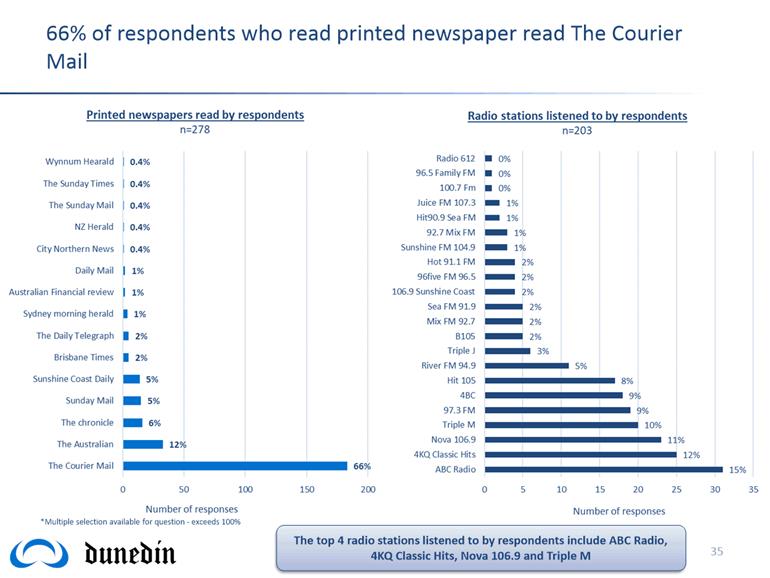

· Radio campaigns on 97.3, 4KQ, Hit 105,

MoreFM and NZME

· Promotional activity with New Zealand media

partners.

20 The largest

component of the campaign was run in conjunction with Newscorp

Australia’s Queensland platforms, targeting the Brisbane metropolitan

area and surrounding population. The campaign ran across print, digital,

mobile, video and social channels including advertising, competitions and

interactive activities.

Results

2018

Results

21 The most robust and

reliable measure of economic value and benefit for Dunedin from this and

associated campaigns is Australian visitor spend in Dunedin, based on the

Ministry of Business Innovation and Employment's (MBIE) Major Regional Tourism

Estimates (MTREs).

Australian Visitor

Spend in Dunedin

|

Year Ended September 2018

|

Dunedin

|

New Zealand

|

|

Australian Visitor Spend

|

$56.1M

|

7.21% 7.21%

(compared to year ended September 2017)

|

$ 2693M

|

5.25% 5.25%

(compared to year ended September 2017)

|

|

Australian Market Share

of Total International Visitor Spend (New Zealand)

|

25.2%

|

22.9%

|

|

|

|

|

|

Source: MBIE Tourism

Dashboard - Visitor Markets – Visitor Spend by Origin* – Dunedin

RTO Region

*Major

Regional Tourism Estimates - MRTEs are an estimate of total regional tourism

spend including cash and online spending, and excluding Goods and Services Tax

(GST).

www.tourismdashboard.mbie.govt.nz

22 Direct

flights from Brisbane to Dunedin showed an average increase of 4% for the

months March through August, peaking at an increase of 11% in July and August.

23 DunedinNZ’s

social media channels secured 8% increase in ‘likes’ with a total

of 12,319 from wider Australian and a campaign post reach of 3,500,412.

24 The introduction of

Google search engine advertising boosted engagement with the DunedinNZ website.

The campaign landing page showed an 811% increase in unique page views and the

winter deals page secured an 86% increase, as compared to the 2017 campaign

period.

25 The DunedinNZ

database grew by 1,484 Australian consumer contacts, offering an opportunity

for remarketing.

26 A total of 70

destination packages were sold direct to consumers at the World Travel Expo in

Brisbane, a 31% increase from the 2017 expo. Air New Zealand and Virgin

Australia also had a Brisbane to Dunedin fare special at the show.

27 Results from the

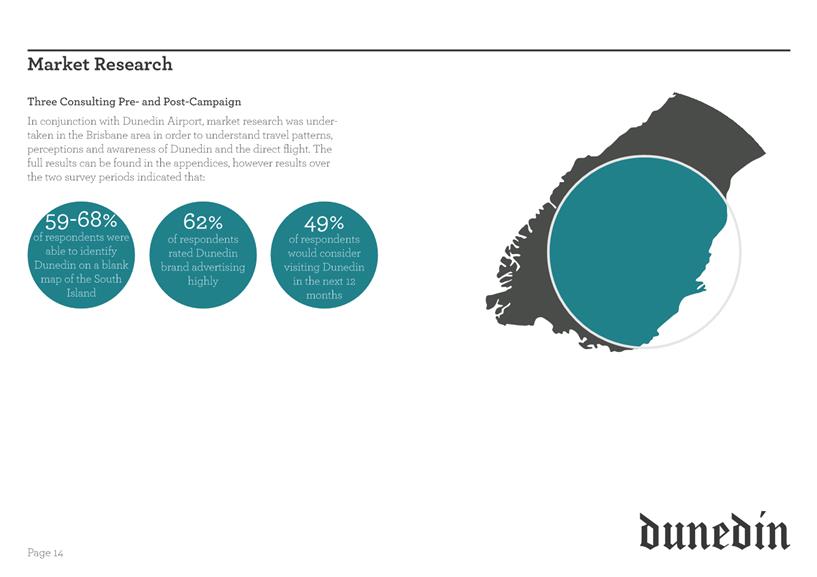

post-campaign market research included a 9% increase in awareness of

Dunedin’s location, with 62% rating WTWTA campaign creatives as

inspiring. At least 49% of respondents would consider visiting Dunedin in the

next 12 months.

28 Media coverage

reached an overall audience of 3.8 million people. Further coverage is expected

to be published in the coming months with an audience reach of 2.8 million

people.

29 Local visitor

industry partners received a total of 4,447 referrals from DunedinNZ.com

throughout the duration of the campaign.

30 Responses to video

posts during the campaign period were also significant with 212,476 views on

the DunedinNZ Facebook and YouTube and a further 107,187 views via Newscorp

channel Unruly.

31 The campaign

resulted in a significant number of Dunedin banner advertising views and ad

click engagements. Total online impressions across multiple partners was

448,539 (APN), 100,452 (Experience Oz and New Zealand), 93,750 (Gourmet

Traveller), 404,300 (WebJet, Virgin Australia).

32 For further detailed

results refer to Attachment A –WTWTA 2018 Campaign Proposal, Attachment B

- WTWTA 2018 Channel & Partner Results, and

Attachment C – Brisbane Market Research.

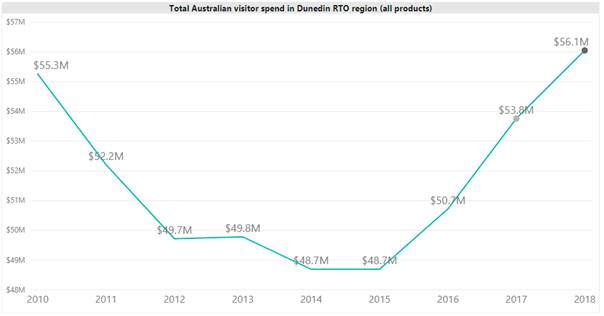

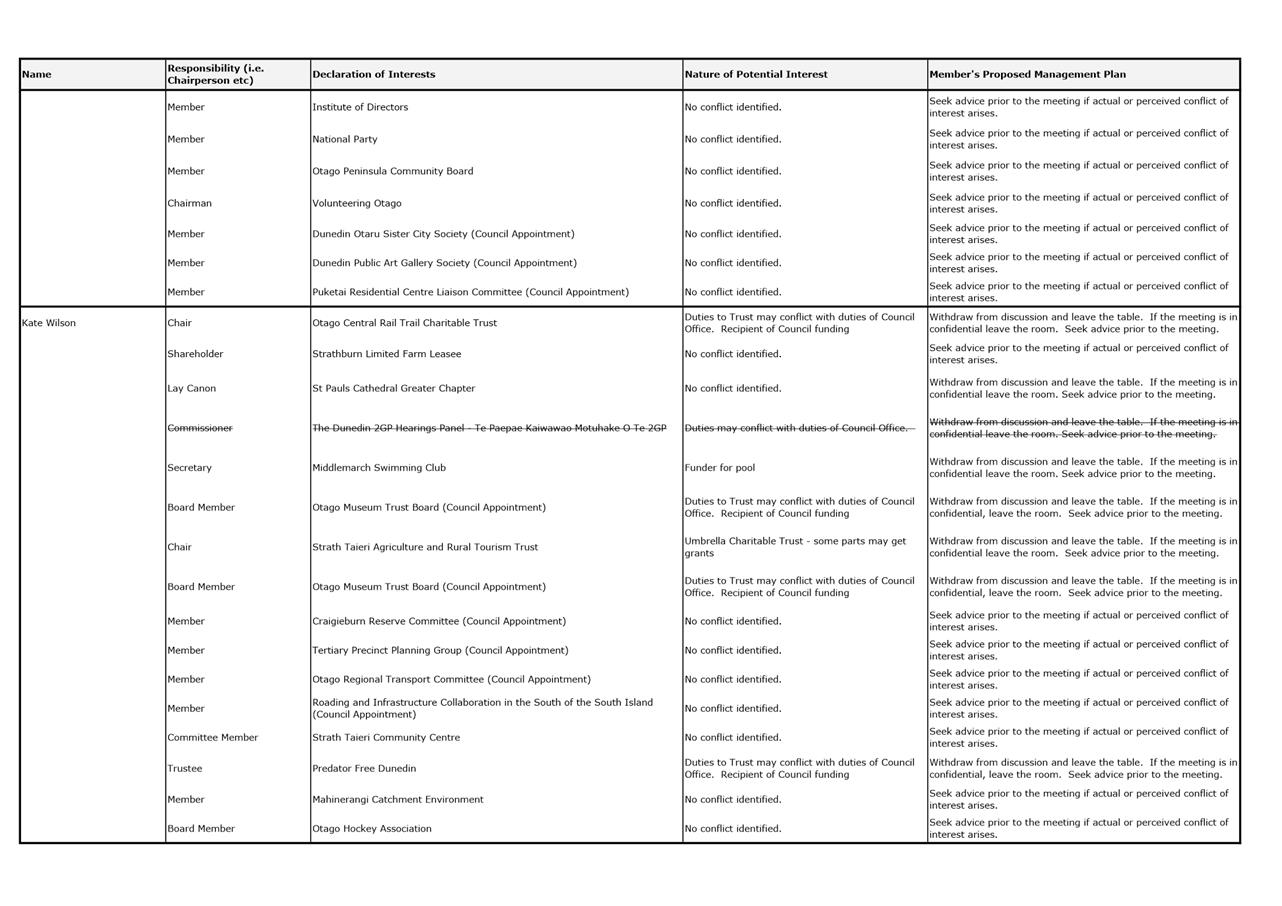

Australian

visitor spend – 2010 to 2018

33 The graph below

illustrates the visitor spend from Australian visitors in Dunedin since 2010.

Source: MBIE Tourism

Dashboard - Visitor Markets – Visitor Spend by Origin* – Dunedin

RTO Region

*Major

Regional Tourism Estimates - MRTEs are an estimate of total regional tourism

spend including cash and online spending, and excluding Goods and Services Tax

(GST).

www.tourismdashboard.mbie.govt.nz

ANALYSIS AND CONCLUSION

34 The increasing

Australian spend in Dunedin over the last three years has been influenced by

campaign activity and increasing awareness of the city as an attractive visitor

destination.

35 For the size of the

market, the campaign budget was utilised as effectively as possible to reach

the target audience across multiple touch points. An increased budget for

future campaigns would ensure further cut-through and the ability to extend the

geographic target market.

36 Market research

indicated the majority of Australian travellers visit Dunedin as part of a

wider South Island journey, with Christchurch and Queenstown airports being the

main ports of direct entry.

37 The research also

indicated that television was the most influential channel driving travel

inspiration. This should be considered for future campaigns, should budget

allow.

38 Campaign objectives

were further bolstered by the individual marketing activity of the local

tourism industry including Dunedin Airport and broader initiatives such as

SOUTH Marketing Alliance (Christchurch Airport, Tourism New Zealand and other

South Island RTOs), the TRENZ travel trade event in Dunedin and Tourism New

Zealand International Media Programme visits.

39 The performance of

Facebook content and competitions were affected by a change in algorithm which

resulted in a reduction in followers and organic reach. The impact of

this was minimised due to the robust spread of alternative marketing channels

employed during the campaign and both the DunedinNZ website and Instagram

achieved above target results.

40 A summary report for

the ‘Where the Wild Things Are’ autumn/winter campaign 2018 with

examples of WTWTA campaign PR, media, trade, digital and social media activity,

and banner advertising are in Attachment B – WTWTA 2018 Channel &

Partner Results.

next steps

41 Based on identified

travel patterns, visitor spend data by region and findings from market

research, Enterprise Dunedin plans to adopt a year-round approach targeting the

wider East Coast of Australia.

42 An Australian-based

PR agency will be utilised to leverage in-market messaging and further raise

awareness of Dunedin to encourage inclusion in direct visits or as part of a

wider South Island journey.

43 Two concentrated

consumer marketing campaigns will be rolled out in the market per year.

Signatories

|

Author:

|

Sanae Herd - Consumer and Brand Marketing Advisor

Sarah Bramhall - Public Relations and Promotions Advisor

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

WTWTA 2018 Campaign

Proposal

|

28

|

|

⇩b

|

WTWTA 2018 Campaign

Channel & Partner Results

|

31

|

|

⇩c

|

Brisbane Market

Research

|

45

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing a public service and is

considered good-quality and cost-effective use of budget to promote the

Dunedin brand, marketing Dunedin collaboratively with private sector

partnership and added financial contribution.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

This activity in this report contributed to the Economic

Development theme ‘Compelling Destination’ and associated action

‘Marketing Dunedin’. It also contributed to the Arts and Culture,

Events and Festivals, Parks and Recreation strategies by promoting activity

under these thereby also contributing to the Social Wellbeing Strategy.

|

|

Māori Impact

Statement

Ngai Tahu is one of the six partners who are responsible

for governing and delivering the Economic Development Strategy.

|

|

Sustainability

The activity in this report contributed to the

sustainability of air connectivity to and from Australia and the economic

sustainability of the visitor industry.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no implications from the activity in this

report.

|

|

Financial

considerations

There are no financial implications.

|

|

Significance

This report is considered of low significance in terms of

the Council’s Significance and Engagement Policy.

|

|

Engagement –

external

There has been external engagement with local, national

and international industry, trade and media partners around activity within

this report.

|

|

Engagement -

internal

There has been engagement with DCC Events and Festivals,

Marketing and Communication, Web Team and the Dunedin iSite around activity

within this report.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

Economic Development

Committee

20 November 2018

|

|

|

Economic Development Committee

20 November 2018

|

|

|

Economic Development Committee

20 November 2018

|

|

|

Economic Development Committee

20 November 2018

|

|

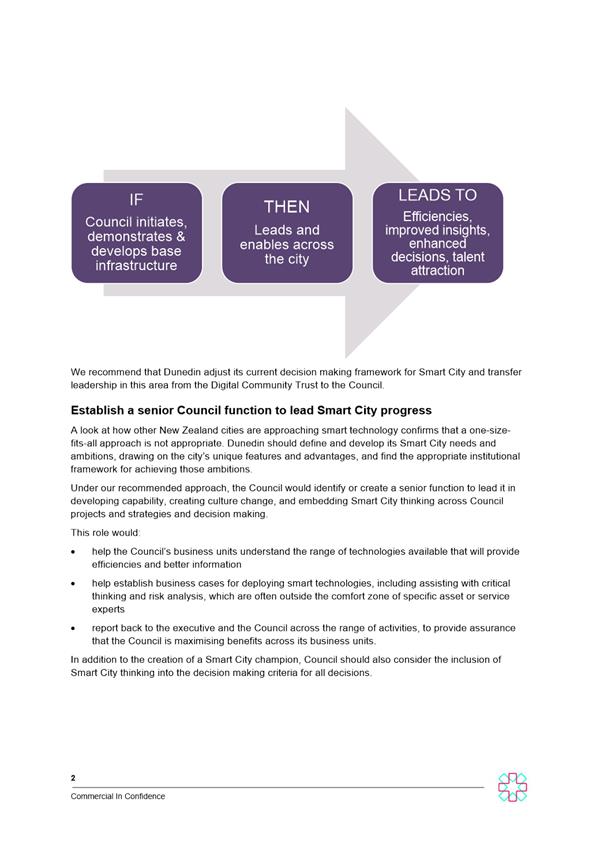

GigCity/Smart City

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

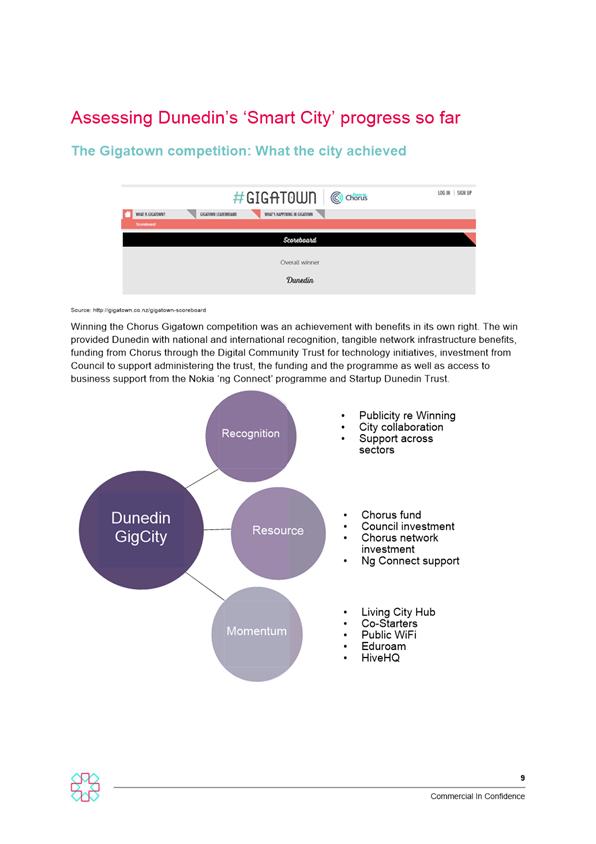

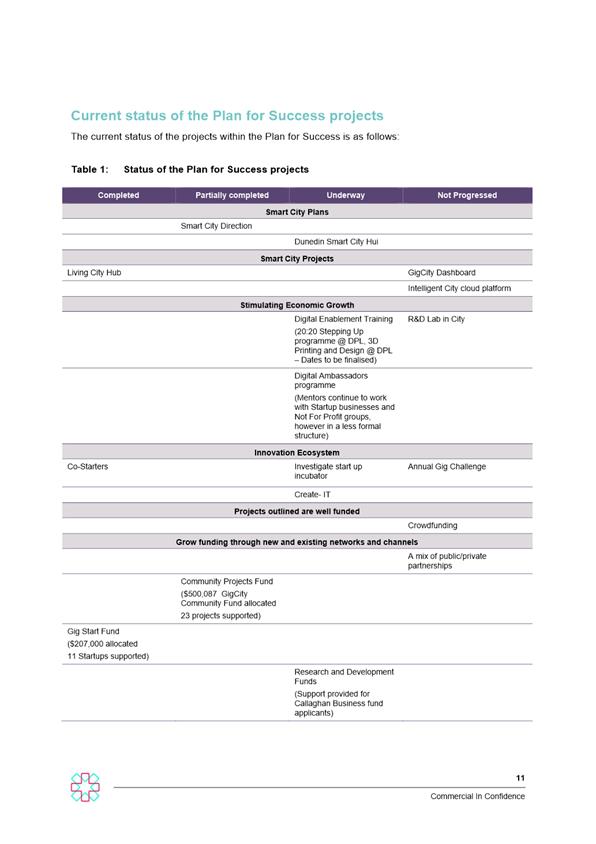

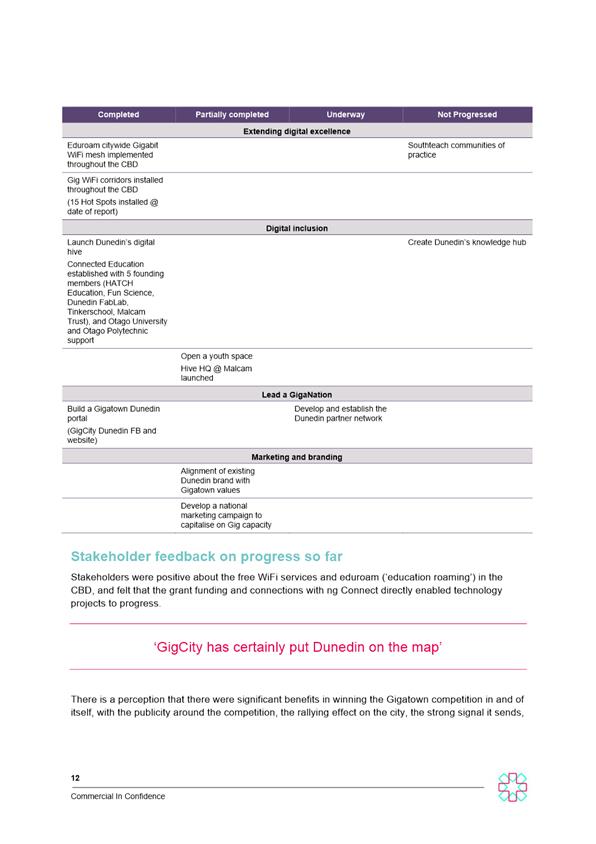

1. The purpose of

this report is to update the Economic Development Committee (EDC) on GigCity

(Gigatown) activities between 2015 and 2018.

2. Over the past

three years, Council and the Digital Community Trust (DCT) have delivered a range

of activities to leverage the benefits of Ultra-Fast Broadband (UFB) and

gigabit internet speed in the city.

3. With the end

of the official Chorus Gigatown rollout and competition benefits period, the

DCT resolved to disestablish in September 2018.

4. This report

reviews activities undertaken by Council and the DCT over the last three years,

as well as potential future options and direction identified by consultants

MartinJenkins (Martin, Jenkins & Associates Limited).

|

RECOMMENDATIONS

That the Committee:

a) Notes the

GigCity/Smart City report.

b) Receives

MartinJenkins Direction Setting for Dunedin as a 21st Century

Smart City report.

c) Notes its

appreciation to the Digital Community Trust (DCT).

|

BACKGROUND

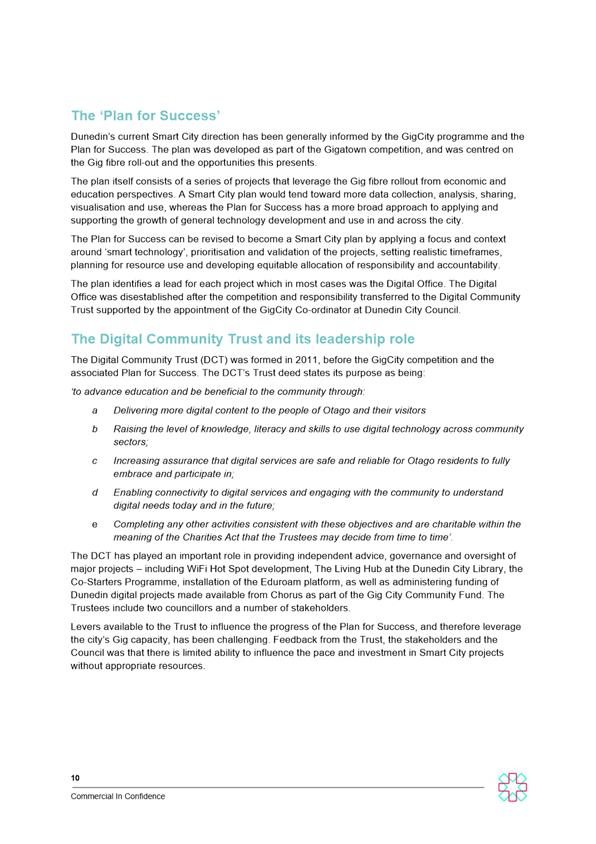

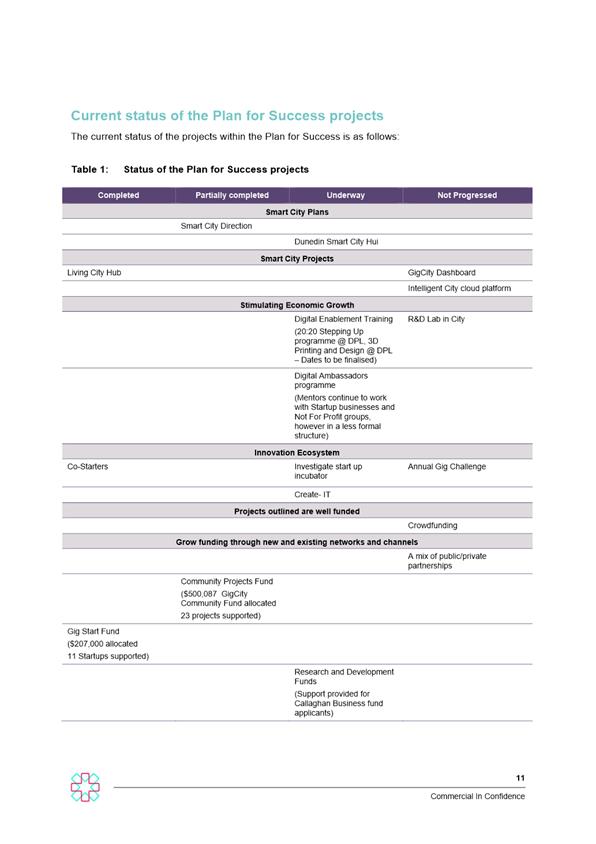

5. Dunedin was

announced as the winner of the Chorus, Gigatown competition in November 2014.

This success was the result of a thirteen-month campaign led by the community,

businesses and the Digital Office (a not-for-profit entity created to deliver

the Dunedin Digital Strategy 2010 - 2013).

6. The

city’s application to the Gigatown competition was informed by the

‘Plan for Success’ which aimed to maximise ultra-fast broadband

(UFB) opportunities.

7. The Plan for

Success included 28 potential initiatives ranging from business support,

community development and innovation and was overseen by the DCT which included

representatives from:

a) Dunedin City Council;

b) Forsyth Barr;

c) Deloitte;

d) Anderson Lloyd;

e) University of Otago;

f) Otago Polytechnic;

g) Southern District Health

Board;

h) Ngāi Tahu;

i) Secondary school

representatives.

8. Through

GigCity, $2.5m has been invested in a broad range of initiatives during the

2015-2018 competition period as follows:

a) Economic: including support

for start-up businesses, delivery of the ‘Co.Starters’ programme,

Nokia ng-Connect programme and subsidised gigabit connections;

b) Social: including the

development of the Gig Community Fund, support for the rollout of wi-fi hot

spots and the GigCity Living Hub in the Dunedin Public Library.

9. GigCity

contributes to all themes of the 2013-23 Economic Development Strategy:

a) Business vitality;

b) Alliances for innovation;

c) A hub for skills and talent;

d) Linkages beyond our borders;

e) A compelling destination.

Discussion

2015-18 Economic Initiatives:

10. Through the Gigatown

competition win, Dunedin residents and businesses have received subsidised

gig-speed internet connectivity which will continue until June 2019. Chorus

estimate that this has resulted in an $8.96m saving to consumers to 30 June

2018 and will be potentially upwards of $15m by June 2019.

11. The $200,000 Gig Start

Fund aimed to grow Dunedin’s local start-up companies and business

ecosystem. The fund was supported by Chorus & Nokia (formerly Alcatel

Lucent) and was delivered locally by the Start Up Dunedin Trust.

12. Through the Gig Start

Fund, 11 local start-up companies received funding for projects that used

gigabit technology, as shown in Table 1:

Table 1: Gig Start Fund

recipients

|

Organisation

|

Description

|

Grant

Awarded

|

|

Bison

Group

|

Logistic

sector cloud-based data management system.

|

$20,000.00

|

|

Photo

Toolbox Ltd

|

Professional

photography sector cloud based digital assets management system.

|

$20,000.00

|

|

Blue

Twist

|

Cloud

based system for the medical sector.

|

$20,000.00

|

|

Adventure

Media Works

|

Online

service simplifying administration for professional photographers.

|

$20,000.00

|

|

Learning

with a Difference

|

Animated

learning programme to help children with dyslexia.

|

$15,000.00

|

|

Responsibility

|

App

and support programme to manage onsite health & safety and hazard

identification.

|

$12,000.00

|

|

Petri

Dish

|

Shared

office space for tech and creative media start-ups, small business and

individuals.

|

$20,000.00

|

|

Such

Crowd

|

Crowd

sourcing platform allowing event demand testing for event planners.

|

$20,000.00

|

|

Codelingo

|

Automated,

project specific code review.

|

$20,000.00

|

|

Swiftlet

|

Cloud

platform for IOT sensor.

|

$20,000.00

|

|

CoDrivr

|

Virtual

reality driving simulator.

|

$20,000.00

|

|

TOTAL

|

|

$207,000.00

|

13. The Start-Up Dunedin

Trust also delivered ‘Co.Starters’ (a business support programme

based out of Chattanooga, USA) which

supported 82 early stage start-up businesses between 2015-2018. In

October 2017 Dunedin hosted the Co.Starters Summit which attracted 20 grass-roots

programme facilitators from Australia and New Zealand.

14. Dunedin business, Tussock

Innovation, was supported through Nokia’s ng Connect programme

which aims to connect innovative companies globally. As a result, Tussock

Innovation showcased their sensor technology at the World Mobile Congress in

Barcelona and the San Francisco Mobile World Congress Americas in 2017.

2015-18

Social Initiatives:

15. Through the Gig Community

Fund, $500,086 was provided to 23 organisations to support education, digital

enablement and youth engagement. As shown in table 2, the projects covered a

variety of organisations using technology as a creative and innovative tool

taking digital experiences beyond consumer entertainment:

Table 2: Gig City Community

Fund Recipients

|

Organisation

|

Description

|

Grant Awarded

|

|

Home of St Barnabas Trust

|

Drive Time Project- Meals on

Wheels Management App

|

$20,000.00

|

|

Letting Space (Wellington

Independent Arts Trust)

|

Urban Dream Brokerage

– digital creative commissions

|

$6,000.00

|

|

Gasworks NZ

|

Gasworks NZ – Digital

citizenship education

|

$20,000.00

|

|

Malcam Charitable Trust

|

Mozilla Hive – Digital

Citizenship education

|

$22,000.00

|

|

Logan Park High School &

Frederic Dichtel, Dr Romain Garby and Dr Alice Harang

|

Te Kaiwhakamāori

– English to Te Reo Translation website

|

$20,000.00

|

|

NZ Python User Group

Incorporated

|

Mine-edin (Minecraft) Pycon

Conference coding workshops

|

$9,020.00

|

|

Otago Polytechnic

|

Digitally Savvy Dunedin

– identification of digital training needs for the workforce

|

$20,000.00

|

|

Methodist Mission Southern

|

Virtual Reality Education

– programmes for high needs learners

|

$25,576.00

|

|

Malcam Charitable Trust

|

Hive Dunedin – Digital

citizenship education

|

$20,000.00

|

|

Letting Space (Wellington

Independent Arts Trust)

|

Urban Dream Brokerage

– digital creative commissions

|

$20,000.00

|

|

Landscape Connections Trust

|

Halo Project –

Digitally enhanced pest management plan

|

$20,000.00

|

|

Circulation Community

Incorporated Society

|

Digital Dunedin Fab Lab

– 3D printing and design

|

$20,190.00

|

|

Otago University

|

Future Convergence –

He Kohinga Pao – Digitally accessible Maori music culture

|

$25,300.00

|

|

Fortune Theatre Trust

|

Fortune Theatre – Back

Page Pass – behind the scenes glimpse of theatre production

|

$20,000.00

|

|

Hills Radio Trust/Otago Access

Radio (OARFM)

|

OARFM Digital Content

Platform for Mobile Devices

|

$20,000.00

|

|

Football South

|

FIFA 17 e-Sports Tournament

|

$20,000.00

|

|

Anglian Family Care Centre

|

Primary Community Data

Project – linking vaccination programmes and the needy

|

$22,000.00

|

|

Valley Community Workspace

Inc.

|

Business Skill Programme

Funding

|

$3,000.000

|

|

ChatBus Trust

|

Fundraising Website and

Mobile Counselling Platform

|

$12,000.00

|

|

Connected Education Trust

|

Hive Dunedin – A

connected education platform for schools

|

$90,000.00

|

|

Ahi Pepe MothNet –

Whakamahara

|

Ahi Pepe MothNet – Led

by Landcare Research. Moth identification and education.

|

$20,000.00

|

|

Presbyterian Support Otago

|

The Elders Gateway –

information platform for older residents of Dunedin

|

$13,000.00

|

|

NZ Marine Studies Centre

|

Fishy Webcam –

bringing the underwater world of Dunedin Harbour to a screen near you.

|

$32,000.00

|

|

TOTAL

|

|

$500,086.00

|

16. In addition, 15 Wi-Fi

hotspots were constructed across the following locations to enable internet

access to residents, visitors, and students:

|

· The

Octagon

|

· Toitu

Early Settlers Museum

|

· Dunedin

Public Library

|

|

· The

Exchange

|

· Dunedin

Public Art Gallery

|

· Mosgiel

Public Library

|

|

· Chinese

Gardens

|

· St

Clair

|

· Port

Chalmers Public Library

|

|

· The

Railway Station

|

· Museum

Reserve

|

· South

Dunedin Hub

|

|

· Botanic

Garden

|

· Macandrew

Bay

|

· Wall

Street Mall

|

17. The Wi-Fi hotspots

provided the infrastructure for Eduroam, a free secure global wireless

network for participating tertiary institutions, launched in late 2017.

18. The GigCity Living Hub

(The Hub) was launched in the Dunedin Public Library at the end of 2016.

Several events have been hosted at The Hub since its launch including:

a) Techweek 2017 – Centre for Space Science public talk;

b) Govt Hack 2017;

c) Electric Vehicle Week 2017 Series;

d) Otago Polytechnic multiscreen art installation;

e) Otago Polytechnic Film Students Short Film launch;

f) 2018 New Zealand Music Week activities;

g) Dunedin Waterfront development video.

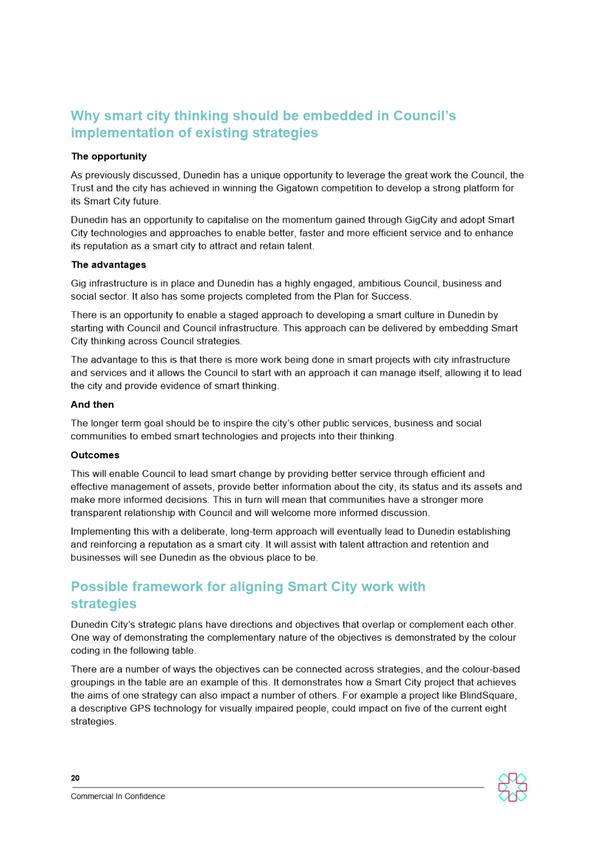

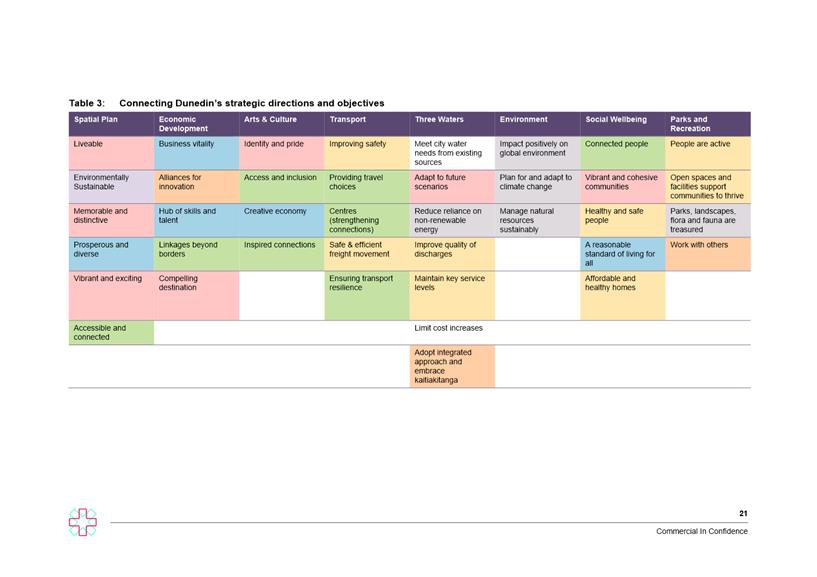

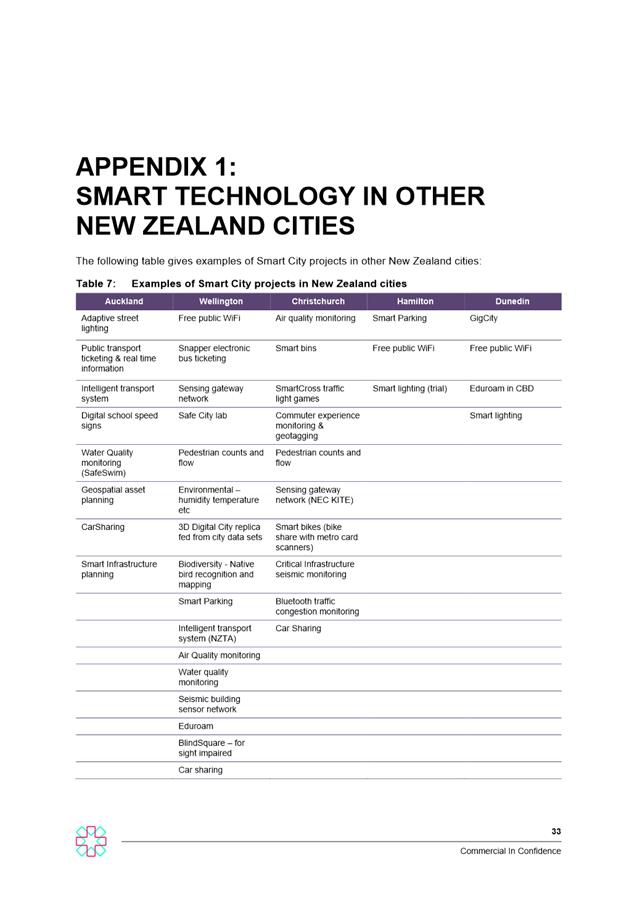

Image One: GigCity Living

Hub Usage: Ev Week 2017 & General Use

19. As part of the

competition, the DCT oversaw a dedicated communications and marketing plan to:

a) Maintain and increase awareness of Gig City community initiatives, local

business ‘hero stories’ and outcomes;

b) Promote Dunedin as a digital leader, showcasing and promoting economic

development opportunities.

20. Because of this marketing

and promotion, 170 news items were generated between April 2015 and August

2018, generating an estimated $1.3m earned media value (EVA).

21. A notable highlight was

the Australian Broadcasting Corporation (ABC) 4 Corners Story in October 2017,

which compared Dunedin and New Zealand’s UFB programme with

Australia’s National Broadband Network (NBN). The ABC programme resulted

in visits to Dunedin from:

a) The

Mayor, Councillor and Chief Executive from the City of Greater Bendigo;

b) Tasmanian

telecommunication company Launtel (Launceston Telecommunication).

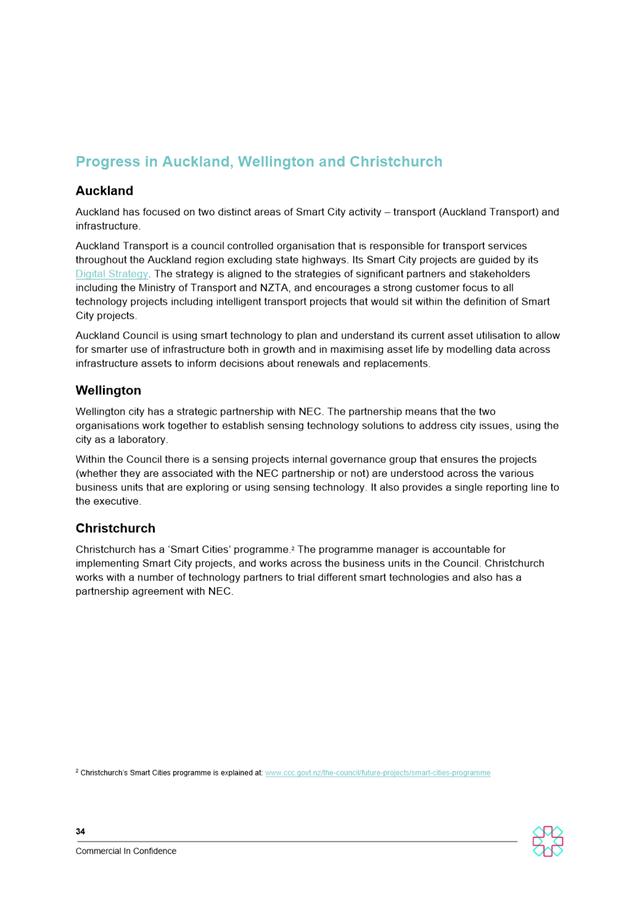

THE MARTINJENKINS REPORT

22. In August 2017, the DCT

appointed MartinJenkins consultants to undertake a high-level review of the

activities delivered under GigCity and to provide direction for future

activity. The MartinJenkins report noted:

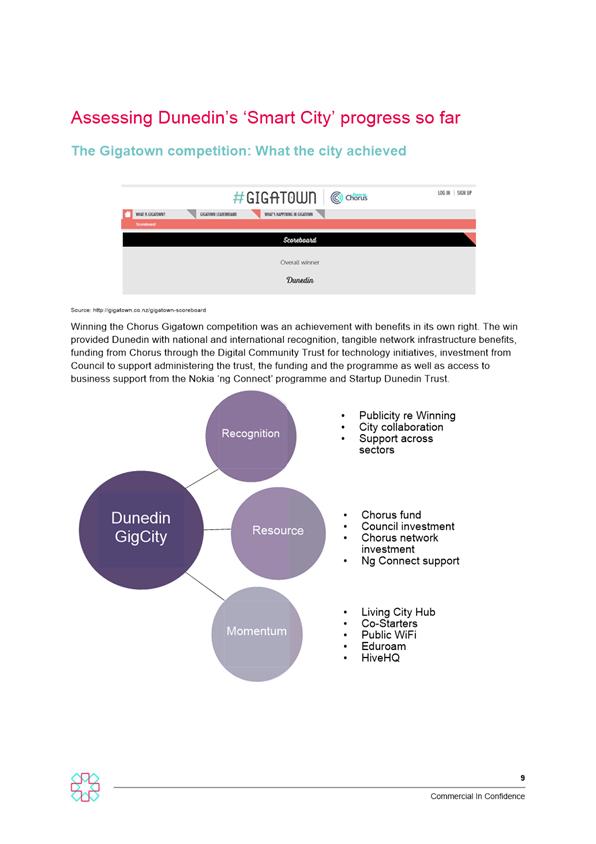

a) There

were significant benefits in winning the Gigatown competition in and of itself,

with the publicity around the competition, the rallying effect on the city, and

the signals it sent;

i. That Dunedin is a good place to do

business in, and that business can be done between Dunedin and anywhere in the

world;

ii. The infrastructure itself is viewed

as being of high standard with a lot of opportunities to leverage, and is also

perceived to have had a very positive effect around the Vogel St area;

b. In some cases, there was a

perception by stakeholders, that more could have been done to take advantage of

opportunities set out in the plan;

c. There was a general view by

stakeholders that while progress was slower than expected, expectations were

probably too high to start with.

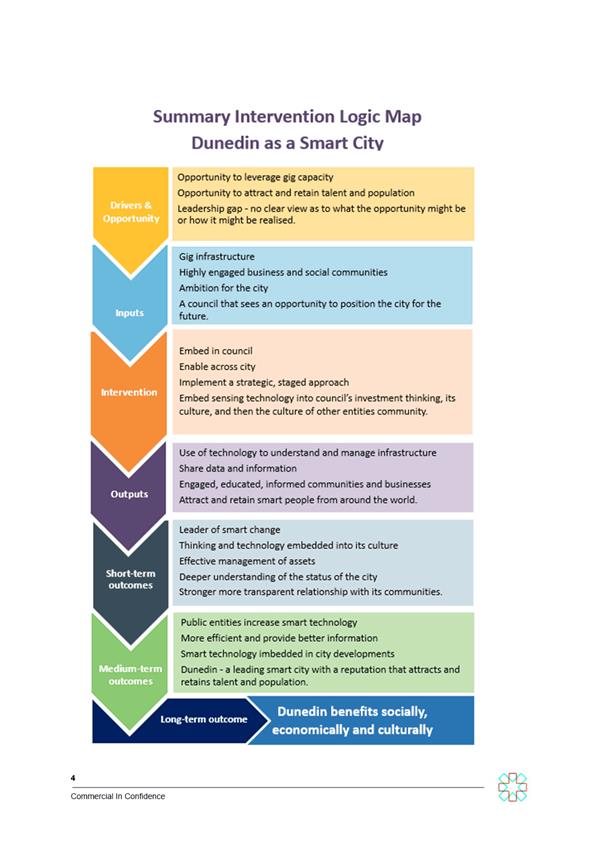

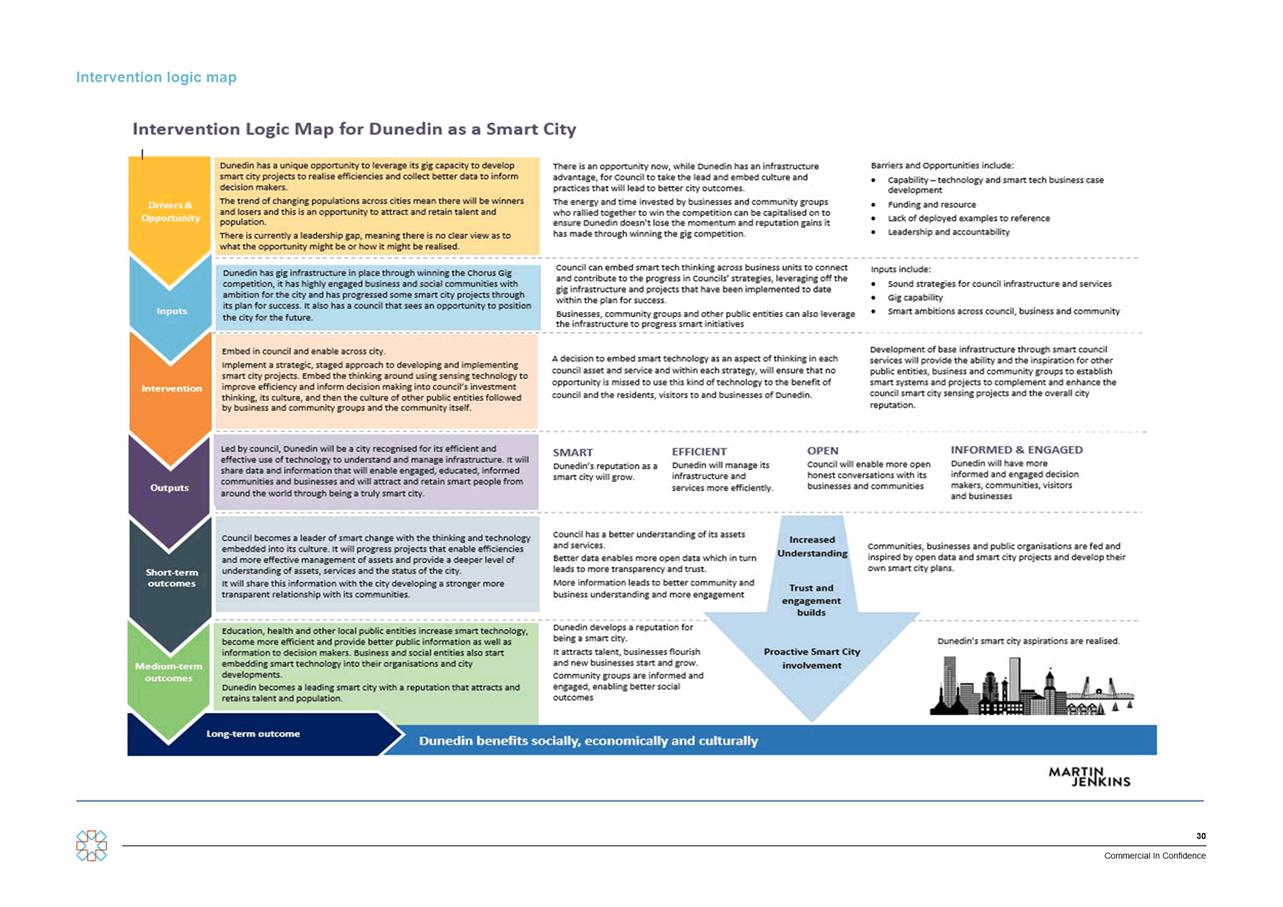

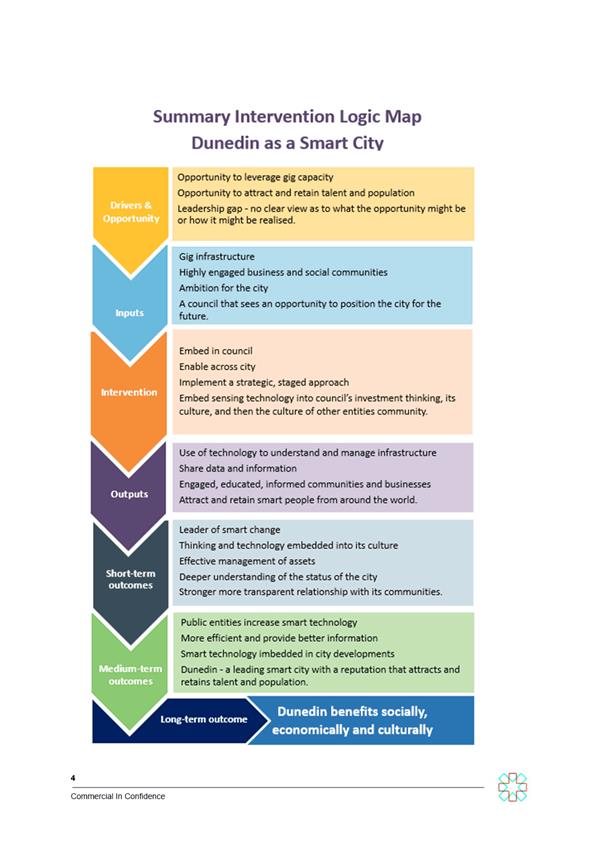

23. MartinJenkins

also considered options to build on the outcomes achieved through GigCity and

opportunities to continue progress towards the concept of a ‘Smart

City’, defined as:

A city which uses

technology to inform, engage and connect with people, and to manage the

city’s assets in the most efficient way possible, with the aim of

providing better experiences for the city’s residents, visitors and

businesses.

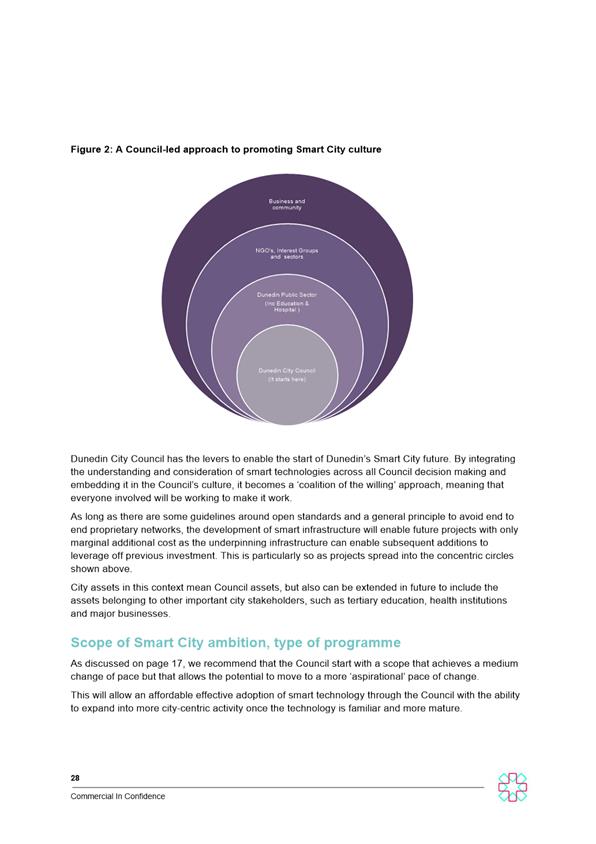

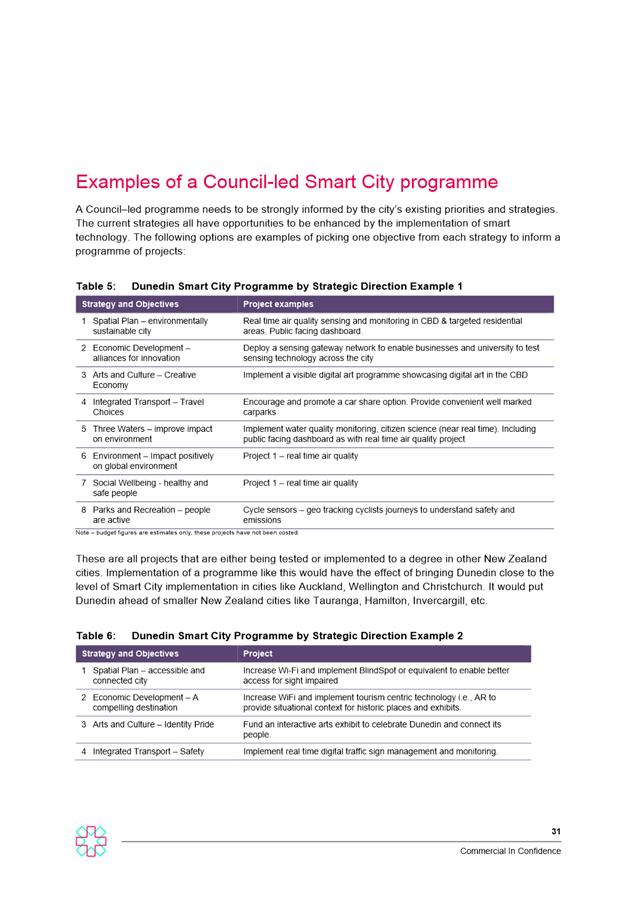

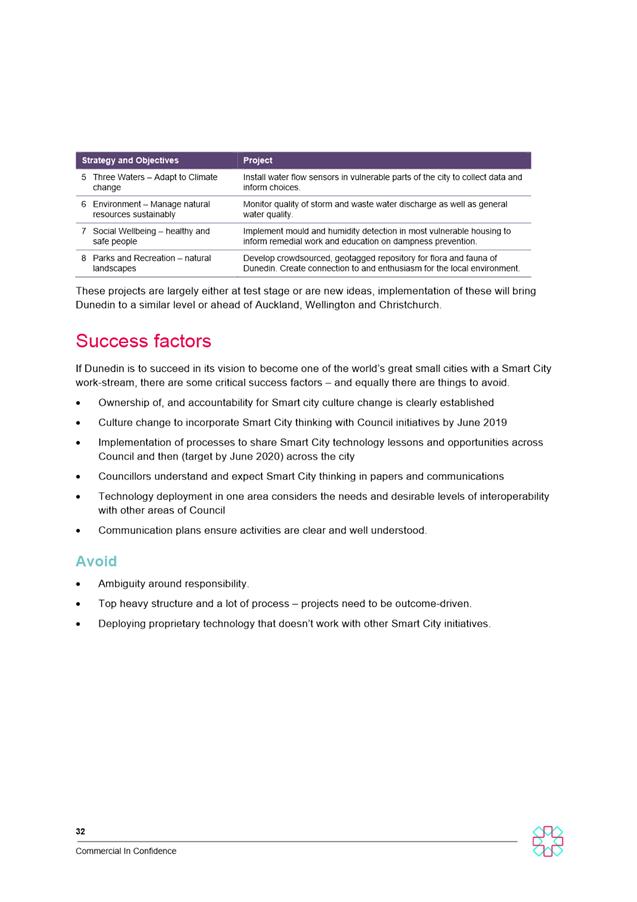

24. The MartinJenkins report

recognised Council’s progress and investment in Smart City systems - e.g.

LED lights - and recommended:

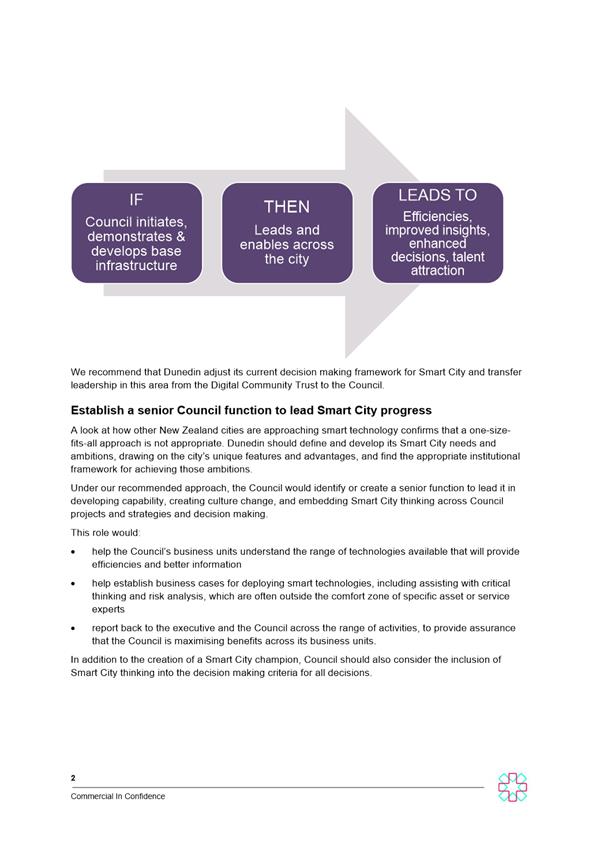

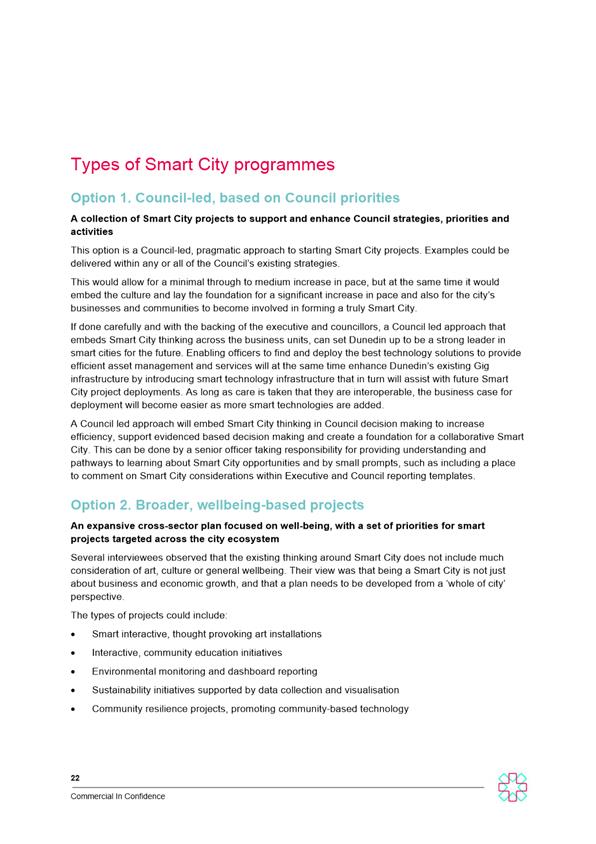

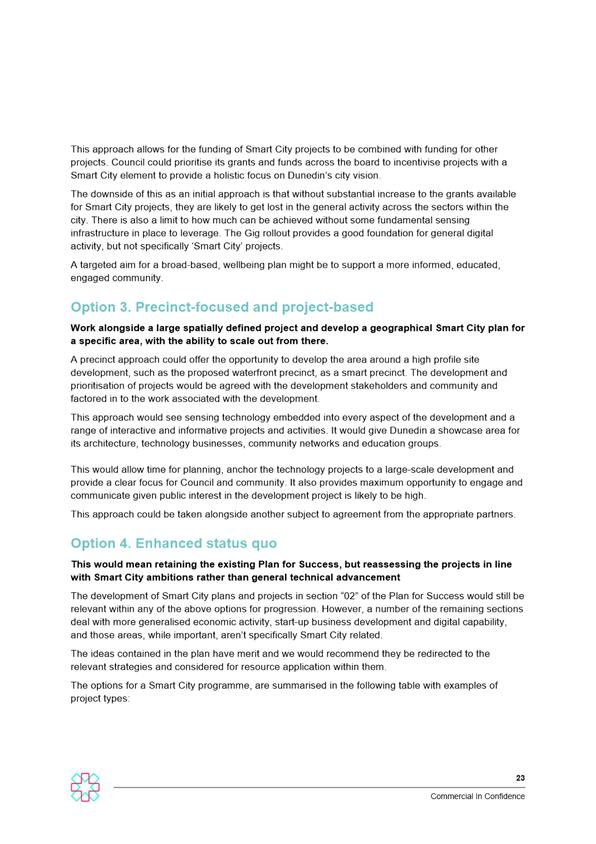

a) The adoption of a Council-led

approach based on real needs and priorities;

b) Embedding smart technology

across Council strategies;

c) Adopting an incremental

approach which builds confidence through the application of mature and stable

technologies;

d) Establishing a senior function

to lead Smart City across Council.

Taking the Lessons Forward

MartinJenkins Report

25. The DCT received the

MartinJenkins report and recommendations in March 2018. Since this time Smart

City thinking has been considered by the DCC leadership forum.

26. On 16 May 2018, Council

resolved to set aside $100,000 for the development of Smart City activities as

part of the 2018-28 Ten Year Plan deliberations:

That the Council:

a) Provides an additional $100,000 in the operational Economic

Development budget in 2018/19 for new work around the future of Dunedin as a

Smart City.

Moved (Cr Andrew Whiley/Cr Christine Garey)

27. The intention of the

2018/19 funding is to build on the MartinJenkins recommendations by identifying

a pilot project(s) which can be used to demonstrate how a Smart City

‘proof of concept’ and thinking could be championed and

appropriately embedded through the DCC Senior Leadership Team (SLT) and Council

strategies.

28. Development of the pilot

is being progressed by Enterprise Dunedin, Business Information Services and a

subset of SLT activity managers.

Investment in the start-up

ecosystem

29. Over the last 18 months

the Grow Dunedin Partners (GDP), Start Up Dunedin and private sector have

considered options to support the start-up business ecosystem. The DCT has also

been engaged during this period, which subsequently resulted in EDC investing

$150,000 into the start-up ecosystem on 11 September 2018.

30. This investment will

continue to build on the aims, objectives and outcomes of the GigStart Fund by:

a) Continuing delivery of

measures to support, connect and resource start-up businesses through

programmes such as Co.Starters;

b) Promoting Dunedin's start-up

ecosystem - e.g. showcasing successful start-up businesses;

c) Improving measurements

around the start-up ecosystem’s performance in the city.

Centre of Digital Excellence

(CODE)

31. The development of the

Centre of Digital Excellence (CODE) in Dunedin, through which the Government

aims to create a $1bn computer gaming sector over ten years, has also provided

an opportunity to progress GigCity economic and social outcomes. Building on

the Plan for Success, GigStart and Gig Community Fund, CODE provides the

opportunity to:

a) Support development of

computer gaming and ‘gamification’ sector in the city. Gamification

is the application of computer gaming technology in areas such as health and

education;

b) Support work being

undertaken in the entrepreneurial start-up and creative businesses;

c) Promote Dunedin’s

credentials as a global tech-savvy and smart city.

OPTIONS

32. There are no

options as this is a report for noting.

NEXT STEPS

33. Enterprise Dunedin will

work with the SLT regarding implementation of the findings from the

MartinJenkins report. This activity will involve identification, investment and

delivery of Smart City pilot projects with SLT during 2018/19.

34. Further regular updates

will be provided to the EDC on the development of the start-up ecosystem, CODE

and 2018/19 proof of concept pilots.

Signatories

|

Author:

|

Fraser Liggett - Economic Development Programme Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

MartinJenkins Report

March 2018; Direction Setting for Dunedin as a 21st Century Smart City

|

141

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing a public service and it

is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☒

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The recommendations in the MartinJenkins smart city report

contribute to all strategies within Council’s strategic framework.

|

|

Māori Impact

Statement

No known impact for tangata whenua

|

|

Sustainability

Smart City development potentially contributes to Social

Wellbeing, Infrastructure and Economic benefits for the city through

delivering of information for better decision making and driving effective

cost efficiency in Council activities.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

On 16 May 2018 Council resolved to provide $100,000 for

2018/19 for smart city activity in the LTP.

|

|

Financial

considerations

On 16 May 2018 Council resolved to provide $100,000 for

2018/19 or Smart City activity in the LTP.

|

|

Significance

This decision is considered medium in terms of the Council’s

Significance and Engagement Policy.

|

|

Engagement –

external

The Digital Community Trust including Dunedin City

Councillors, Forsyth Barr, Deloitte, Anderson Lloyd, University of Otago,

Otago Polytechnic, Southern District Health Board, Ngāi Tahu and

secondary school representatives were engaged and supportive of the

recommendations in the MartinJenkins report and proposed direction post

GigCIty.

|

|

Engagement –

internal

ELT and business innovation services have been engaged on

the MartinJenkins report. In addition, initial thinking and Smart City

opportunities were discussed with the DCC leadership forum in March 2018.

Discussions have been undertaken with the Chief Information Officer and SLT

activity managers regarding the development of a smart city pilot during

2018/19.

|

|

Risks: Legal /

Health and Safety etc.

No Risks have been identified.

|

|

Conflict of

Interest

There are no conflict of interest.

|

|

Community Boards

There are no implications for Community Boards.

|

|

Economic Development

Committee

20 November 2018

|

|

|

Economic Development Committee

20 November 2018

|

|

Items for Consideration by the Chair

|

Economic Development Committee

20 November 2018

|

|

Resolution to Exclude the

Public

That the Economic

Development Committee:

Pursuant to the provisions of the

Local Government Official Information and Meetings Act 1987, exclude the public

from the following part of the proceedings of this meeting namely:

|

General subject of the matter to be considered

|

Reasons

for passing this resolution in relation to each matter

|

Ground(s) under

section 48(1) for the passing of this resolution

|

Reason for

Confidentiality

|

|

C1

Centre of Digital Excellence (CODE) Update

|

S7(2)(h)

The

withholding of the information is necessary to enable the local authority to

carry out, without prejudice or disadvantage, commercial activities.

|

S48(1)(a)

The public conduct of

the part of the meeting would be likely to result in the disclosure of

information for which good reason for withholding exists under section 7.

|

|

This resolution is made in

reliance on Section 48(1)(a) of the Local Government Official Information and

Meetings Act 1987, and the particular interest or interests protected by

Section 6 or Section 7 of that Act, or Section 6 or Section 7 or Section 9 of

the Official Information Act 1982, as the case may require, which would be

prejudiced by the holding of the whole or the relevant part of the proceedings

of the meeting in public are as shown above after each item.