Notice of Meeting:

I hereby give notice that an ordinary meeting of the

Economic Development Committee will be held on:

Date: Tuesday

19 March 2019

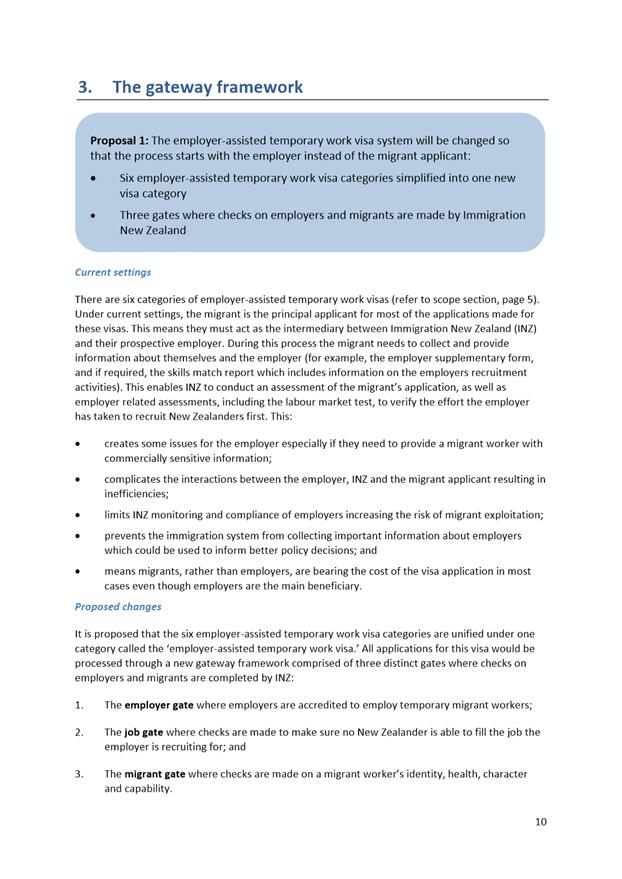

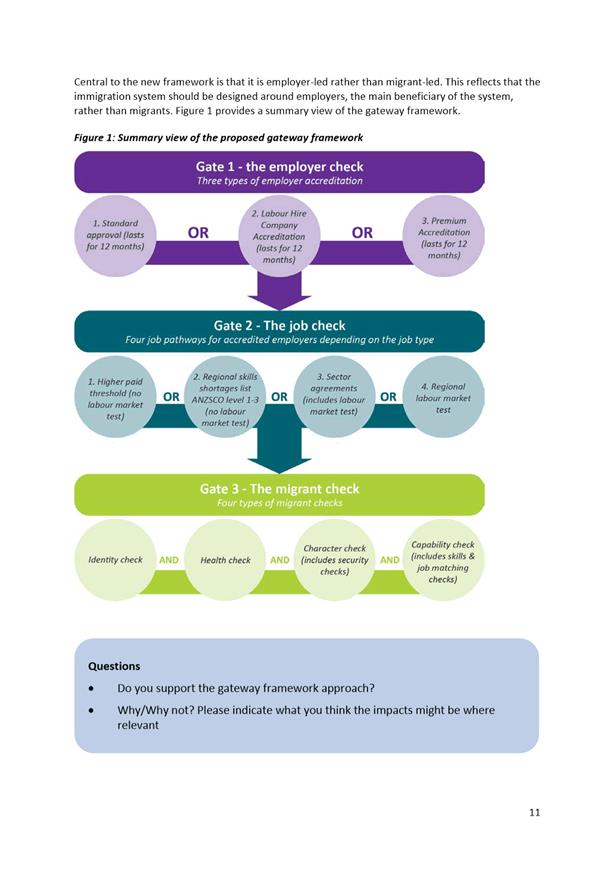

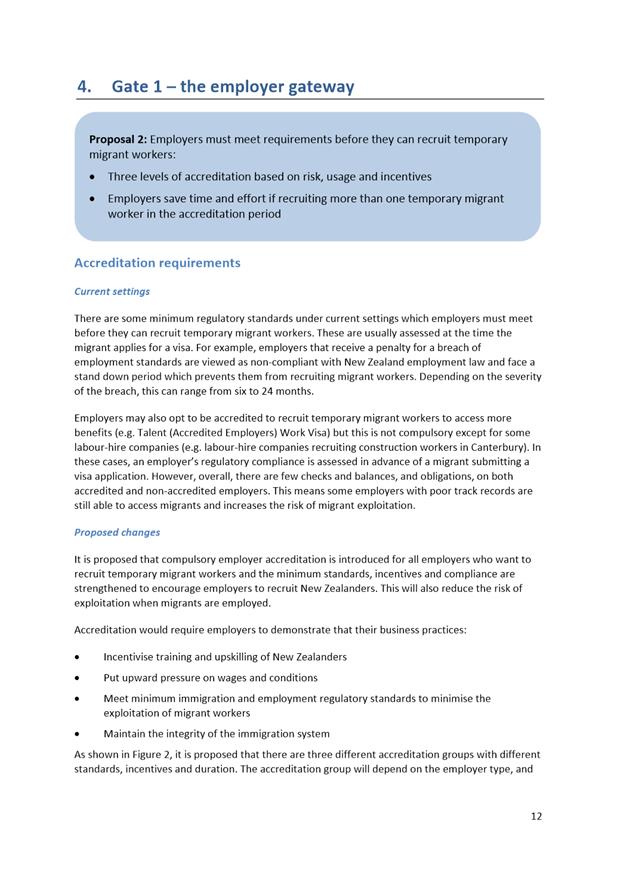

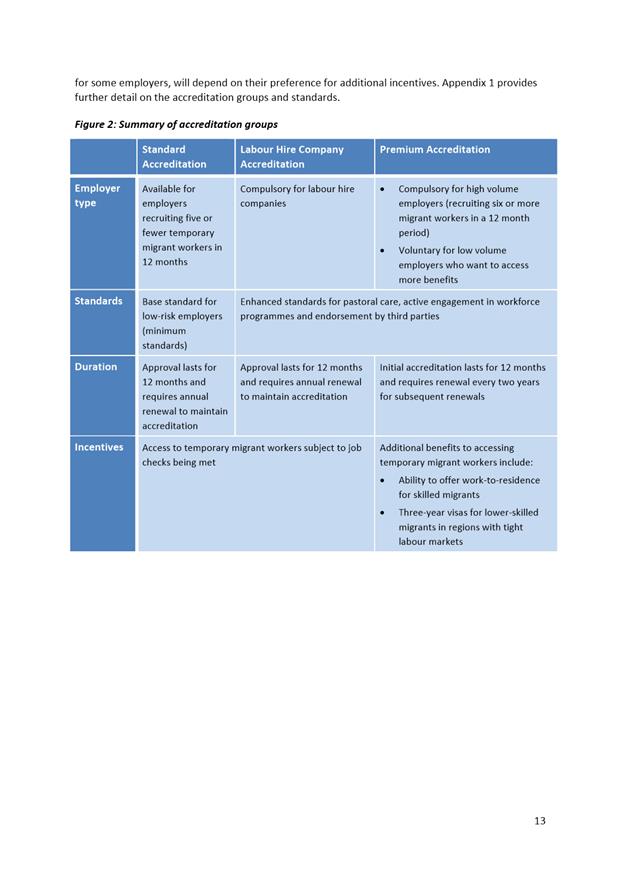

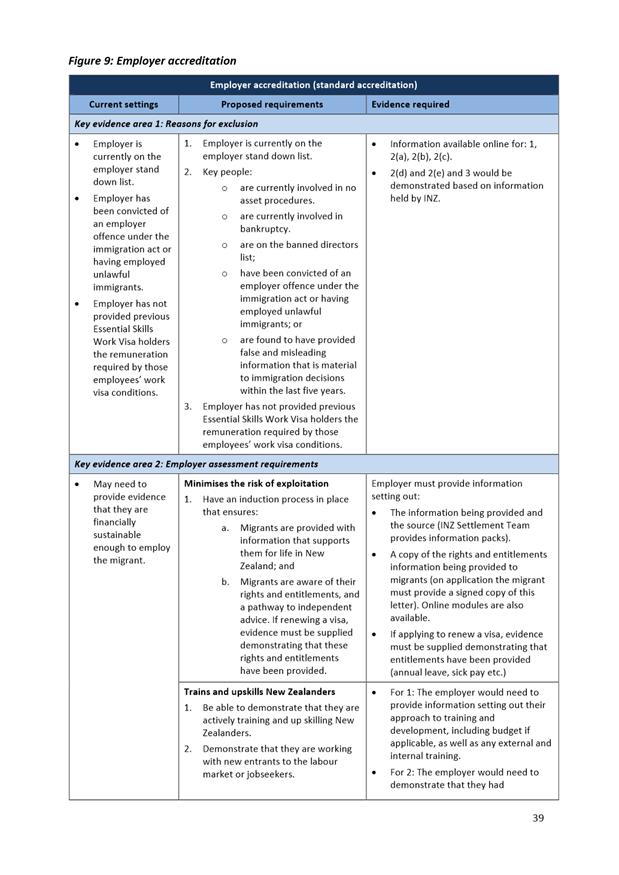

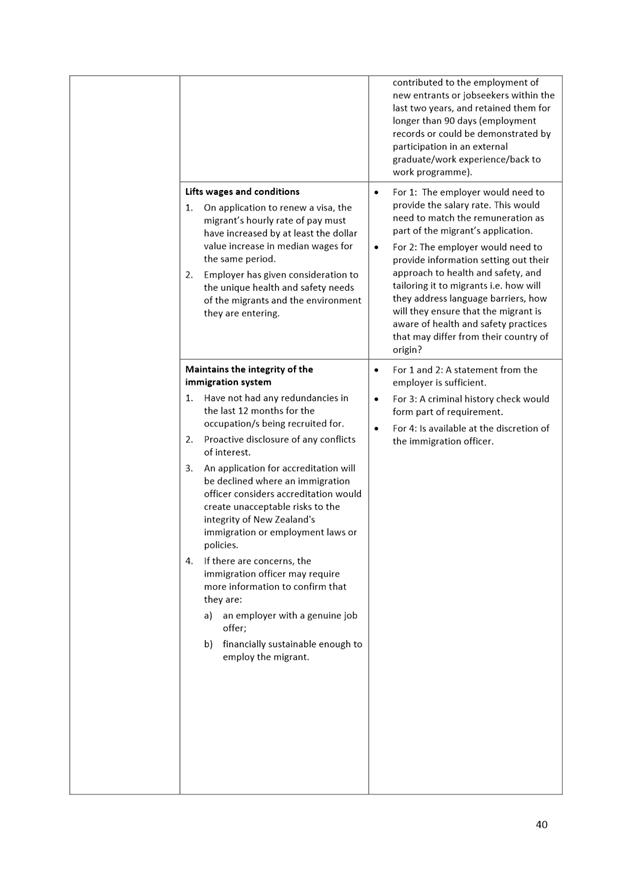

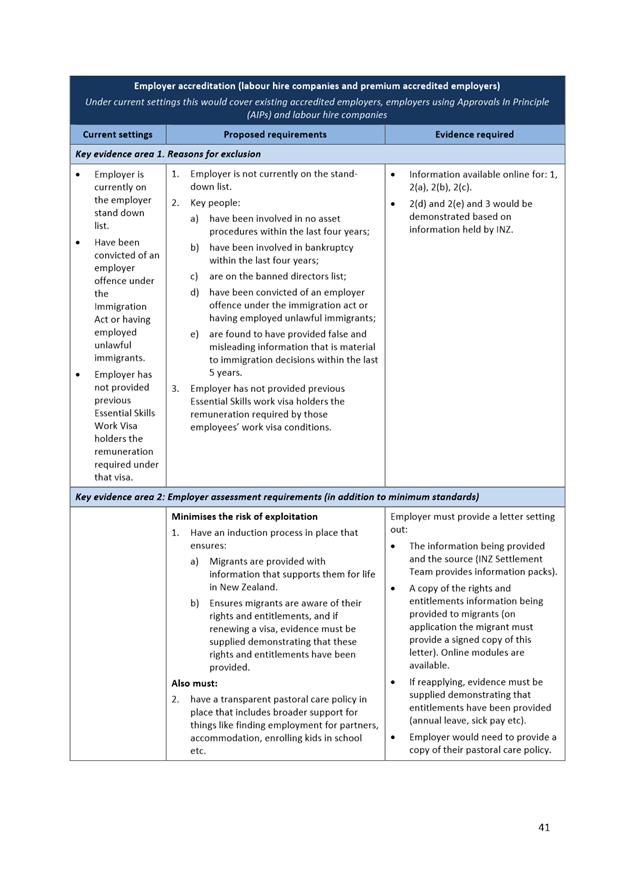

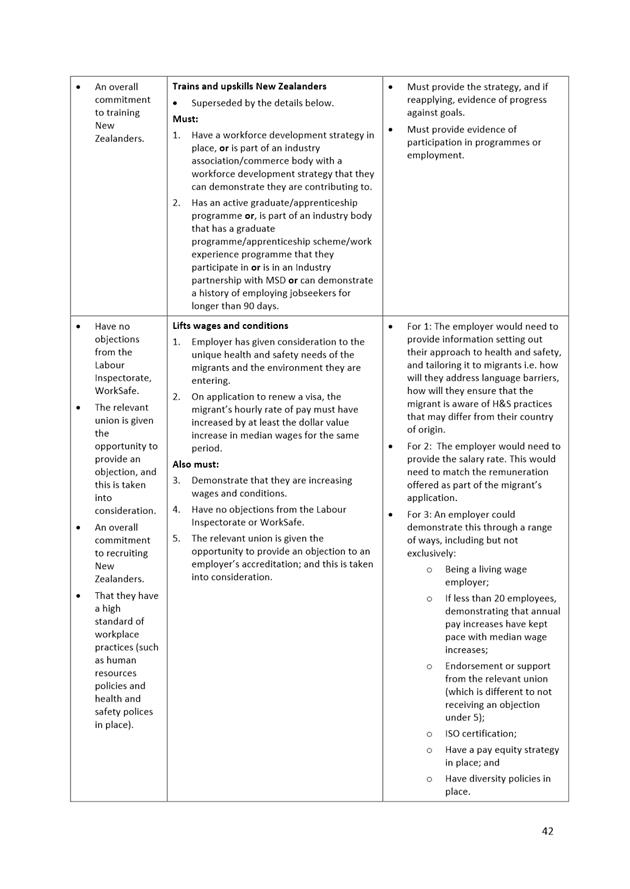

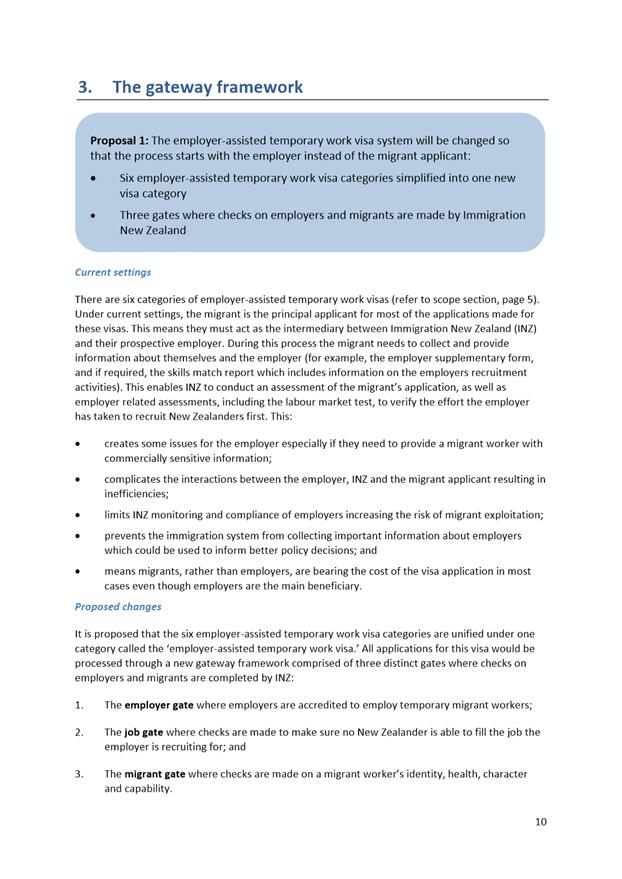

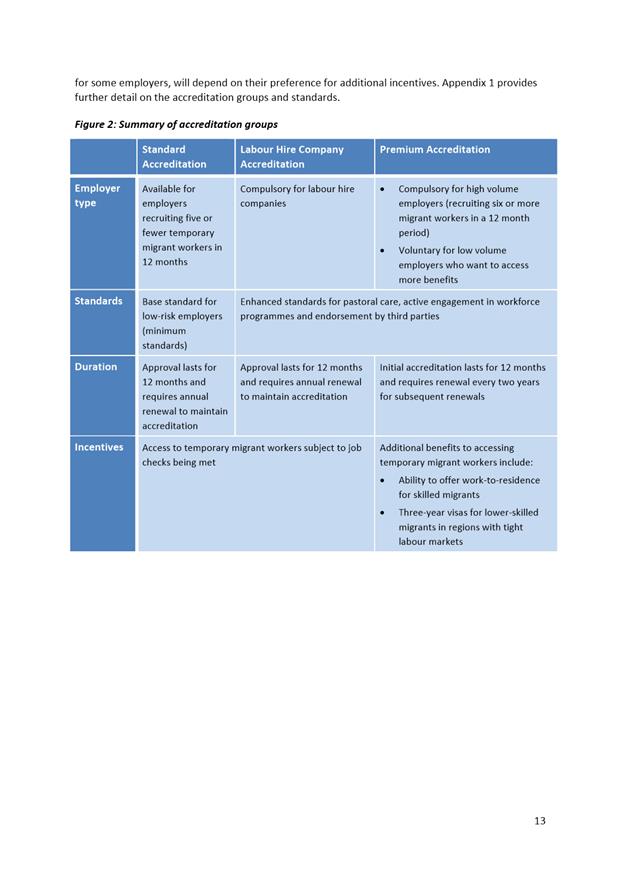

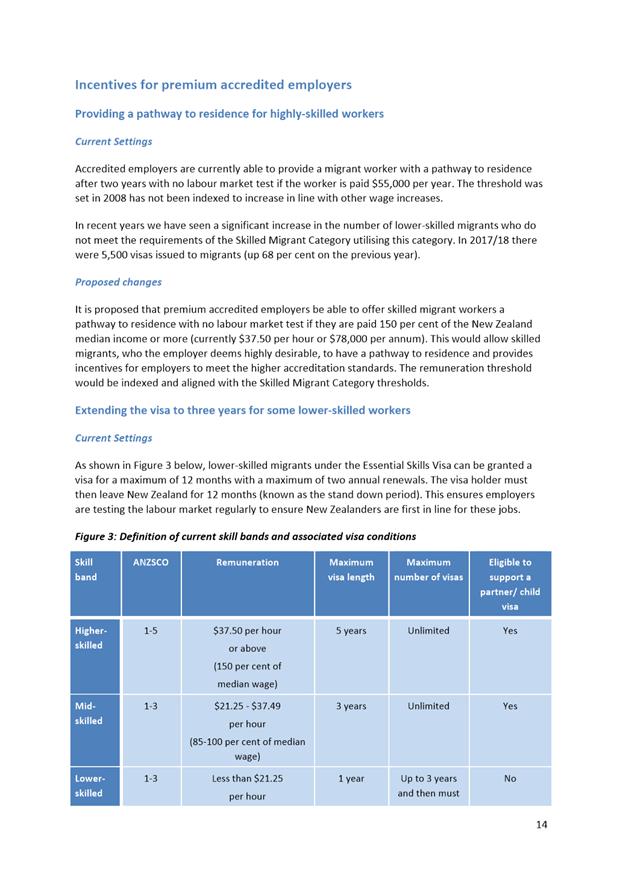

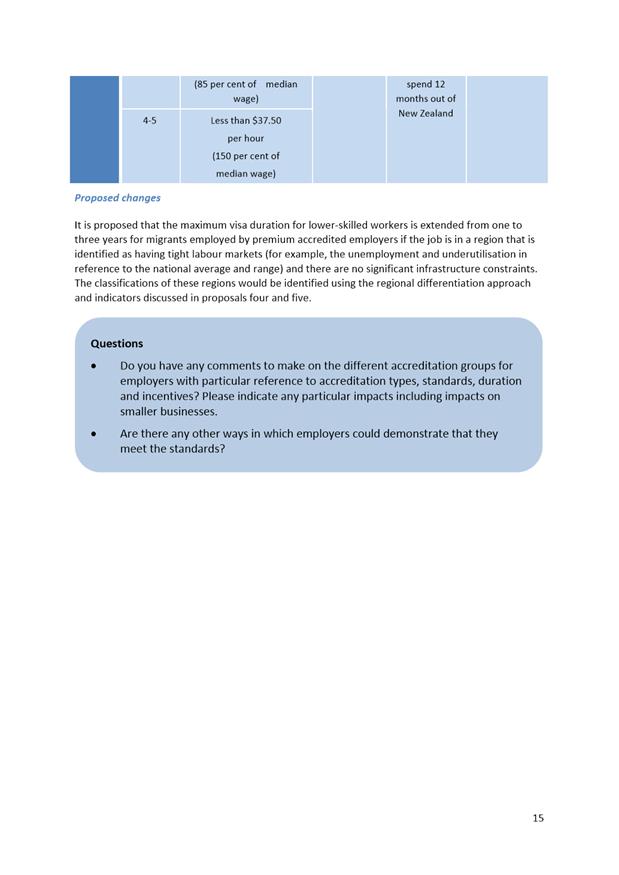

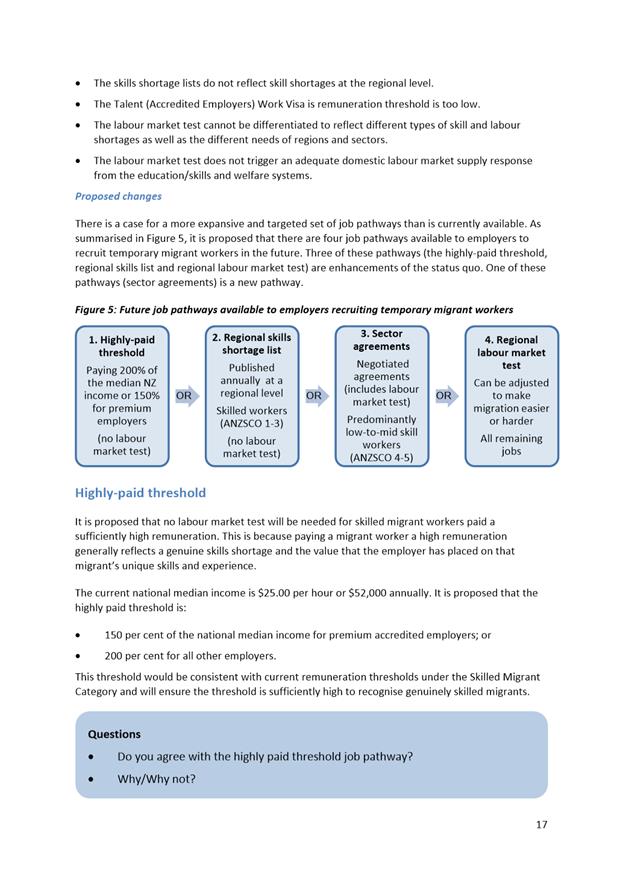

Time: 1.30

pm (or at the conclusion of the previous meeting, whichever is later)

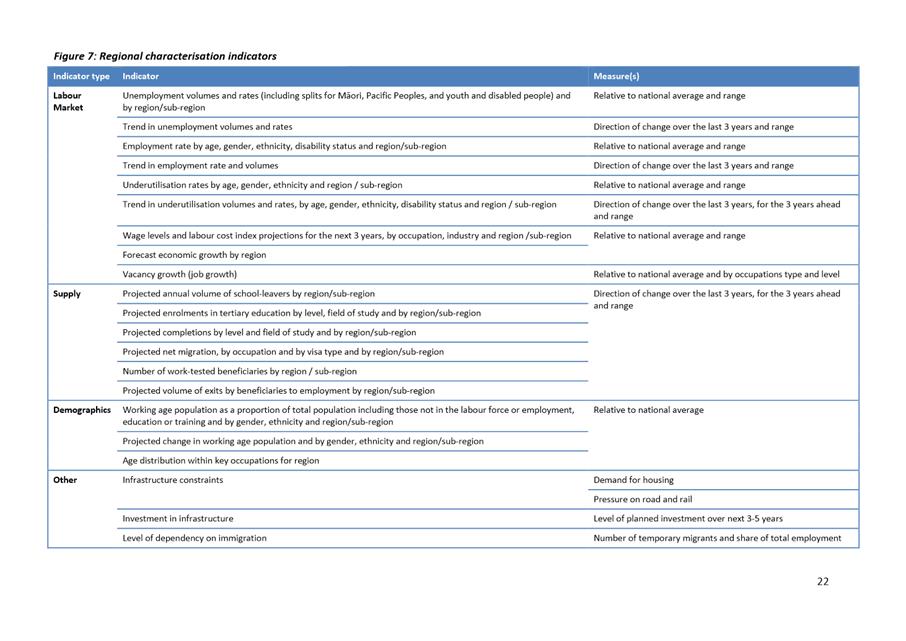

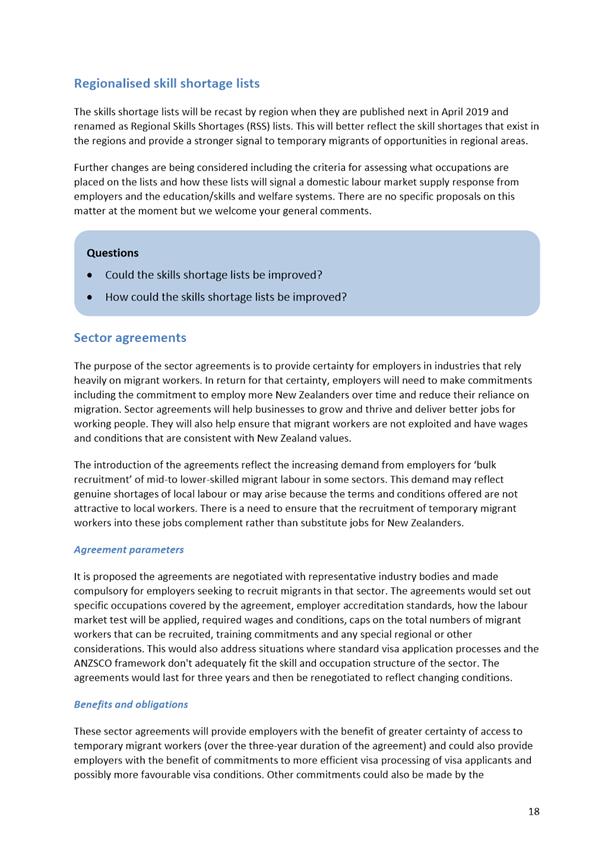

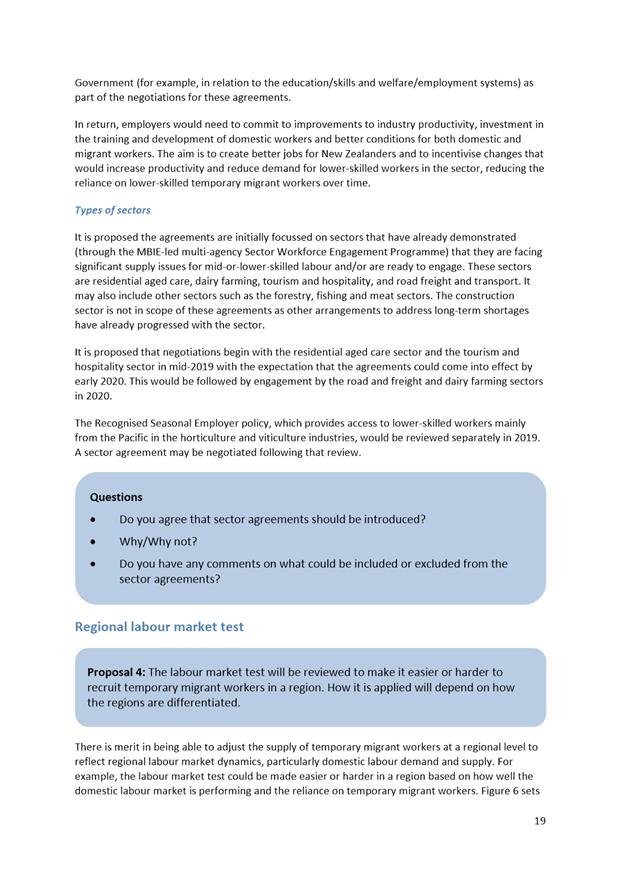

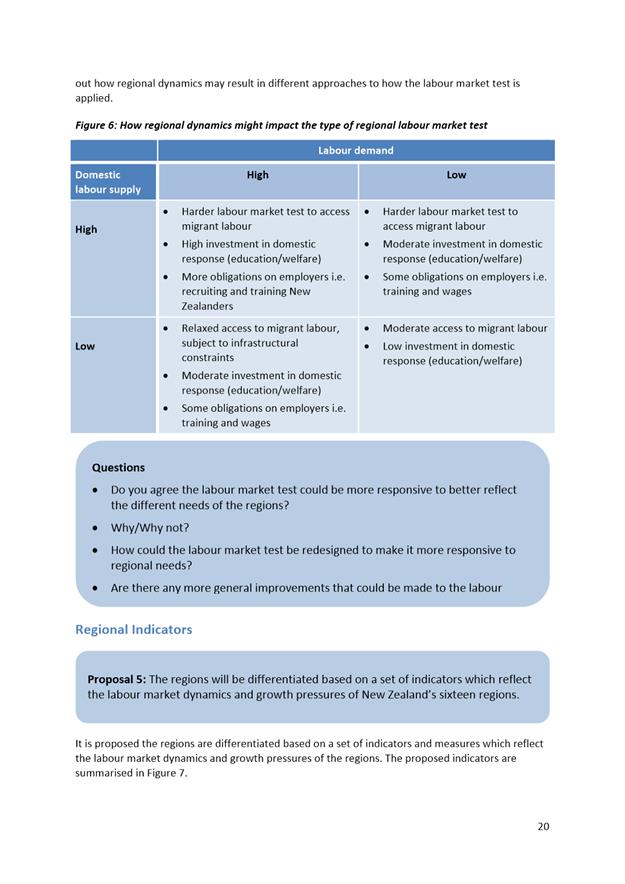

Venue: Edinburgh

Room, Municipal Chambers,

The

Octagon, Dunedin

Sue Bidrose

Economic Development Committee

PUBLIC AGENDA

|

Chairperson

|

Cr Chris Staynes

|

|

|

Deputy Chairperson

|

Cr Christine Garey

|

Andrew Whiley

|

|

Members

|

Cr David Benson-Pope

|

Mayor Dave Cull

|

|

|

Cr Rachel Elder

|

Cr Doug Hall

|

|

|

Cr Aaron Hawkins

|

Cr Marie Laufiso

|

|

|

Cr Mike Lord

|

Cr Damian Newell

|

|

|

Cr Jim O'Malley

|

Cr Conrad Stedman

|

|

|

Cr Lee Vandervis

|

Cr Kate Wilson

|

Senior Officer John

Christie, Director Enterprise Dunedin

Governance Support Officer Wendy

Collard

Wendy Collard

Governance Support Officer

Telephone: 03 477 4000

Wendy.collard@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

Economic Development

Committee

19 March 2019

|

|

ITEM TABLE OF CONTENTS PAGE

1 Public

Forum 4

2 Apologies 4

3 Confirmation

of Agenda 4

4 Declaration

of Interest 5

Part

A Reports (Committee has power to decide these matters)

5 TRENZ

2018 Update Report 15

6 Enterprise

Dunedin October to December 2018 Activity Report 20

7 DCC

submission: a new approach to employer-assisted work visas and regional

workforce planning 29

8 Items

for Consideration by the Chair 86

Resolution to Exclude the Public 87

|

Economic Development

Committee

19 March 2019

|

|

1 Public

Forum

At the close of the agenda no

requests for public forum had been received.

2 Apologies

An apology has been received from

Mayor Dave Cull.

That the Committee:

Accepts the apology from

Mayor Dave Cull.

3 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

|

Economic Development

Committee

19 March 2019

|

|

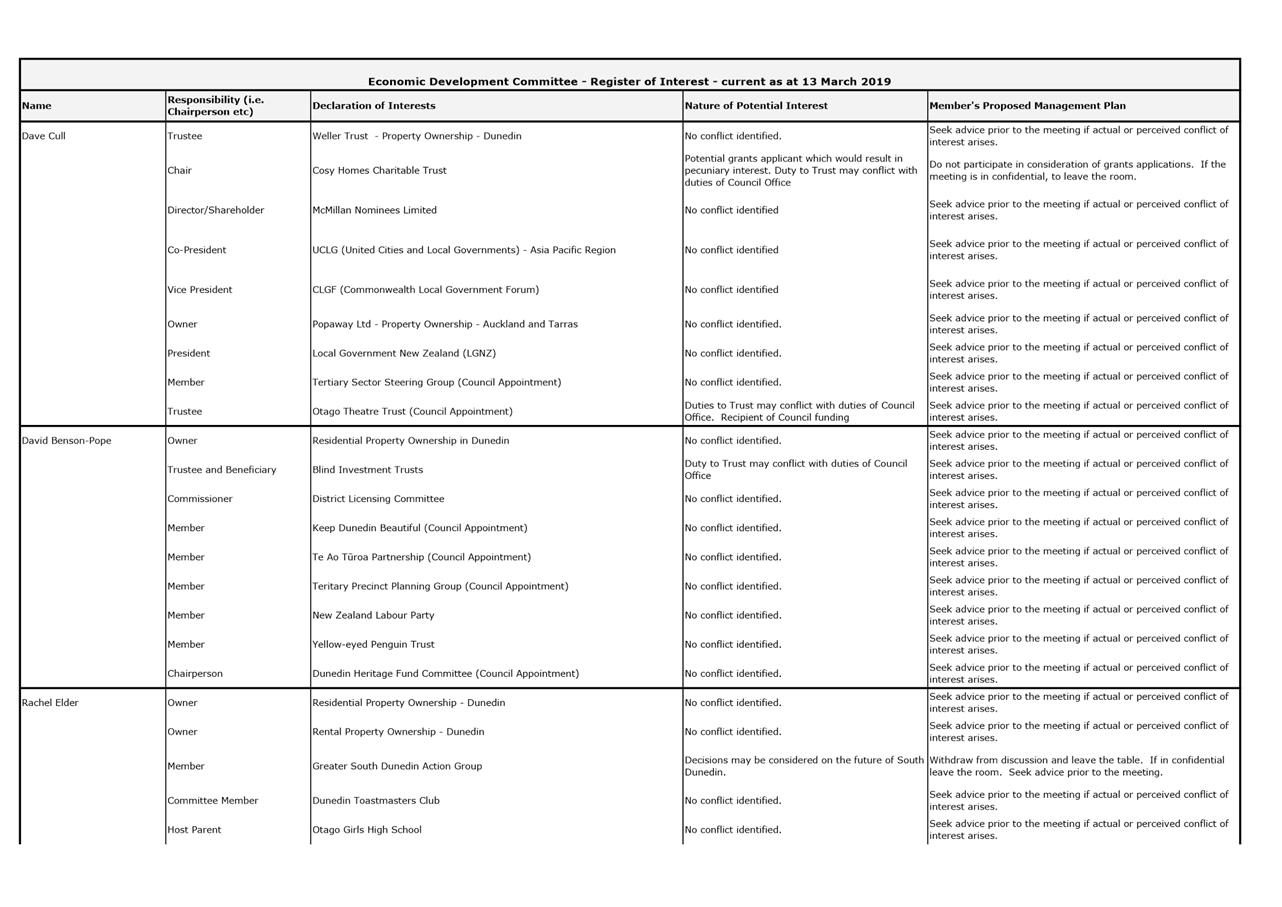

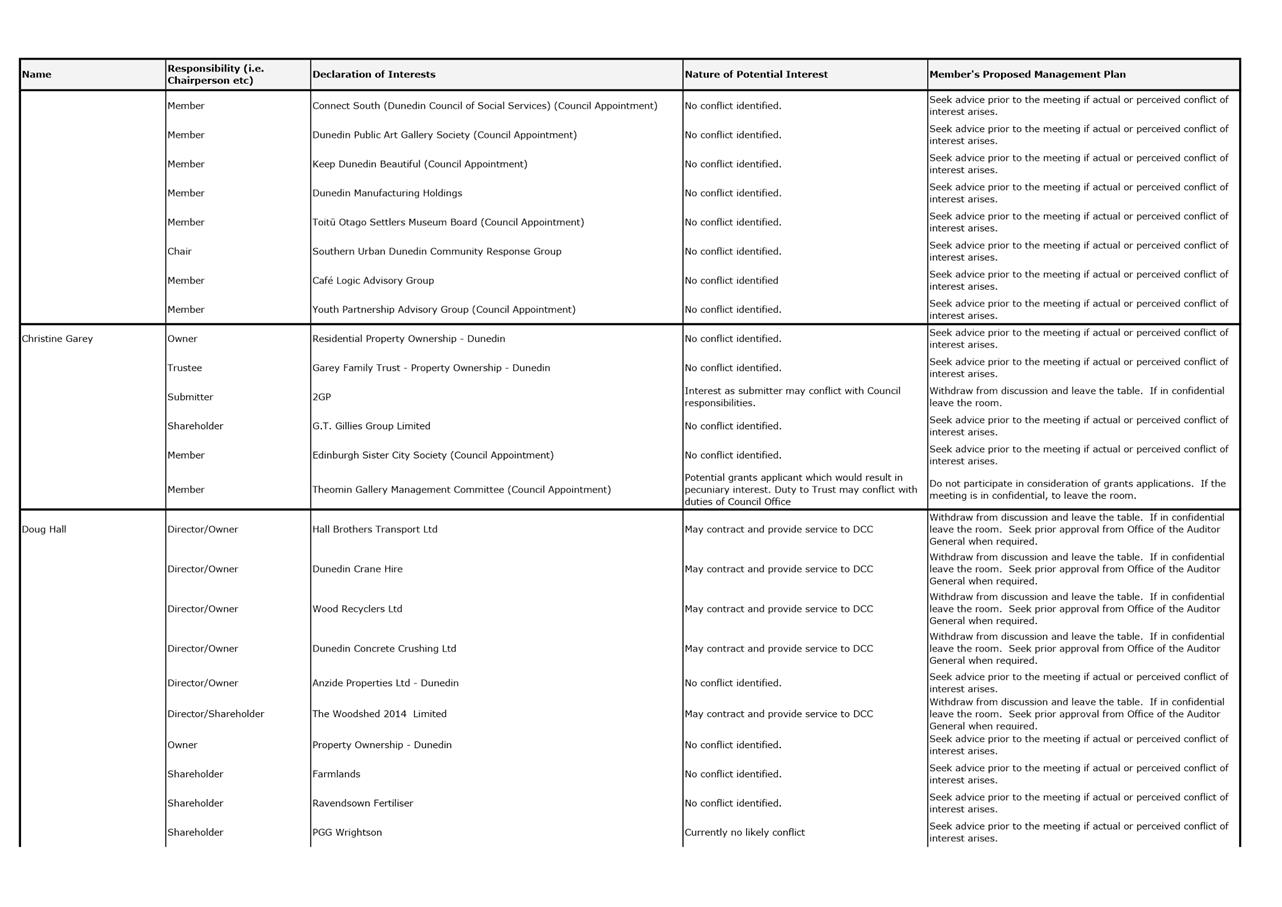

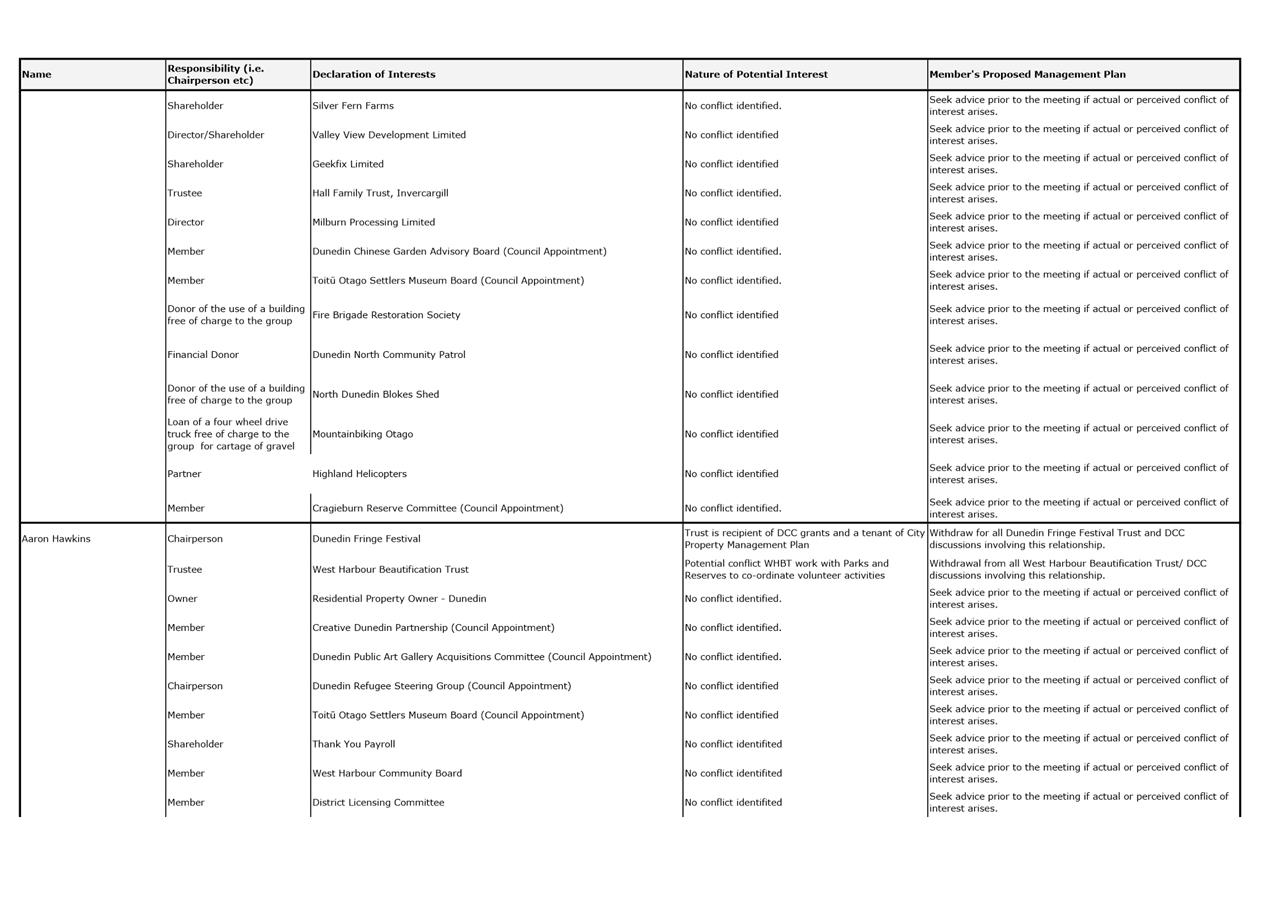

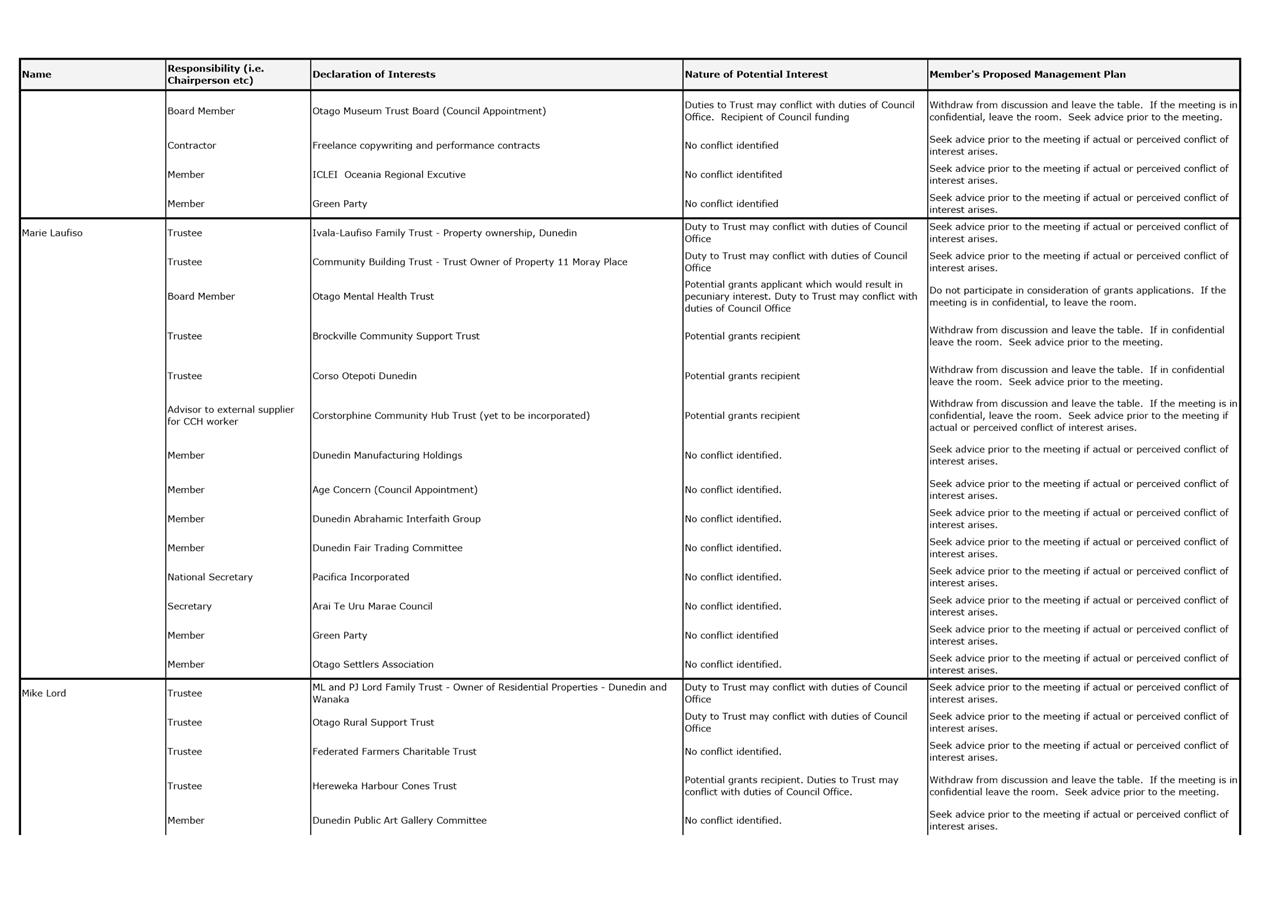

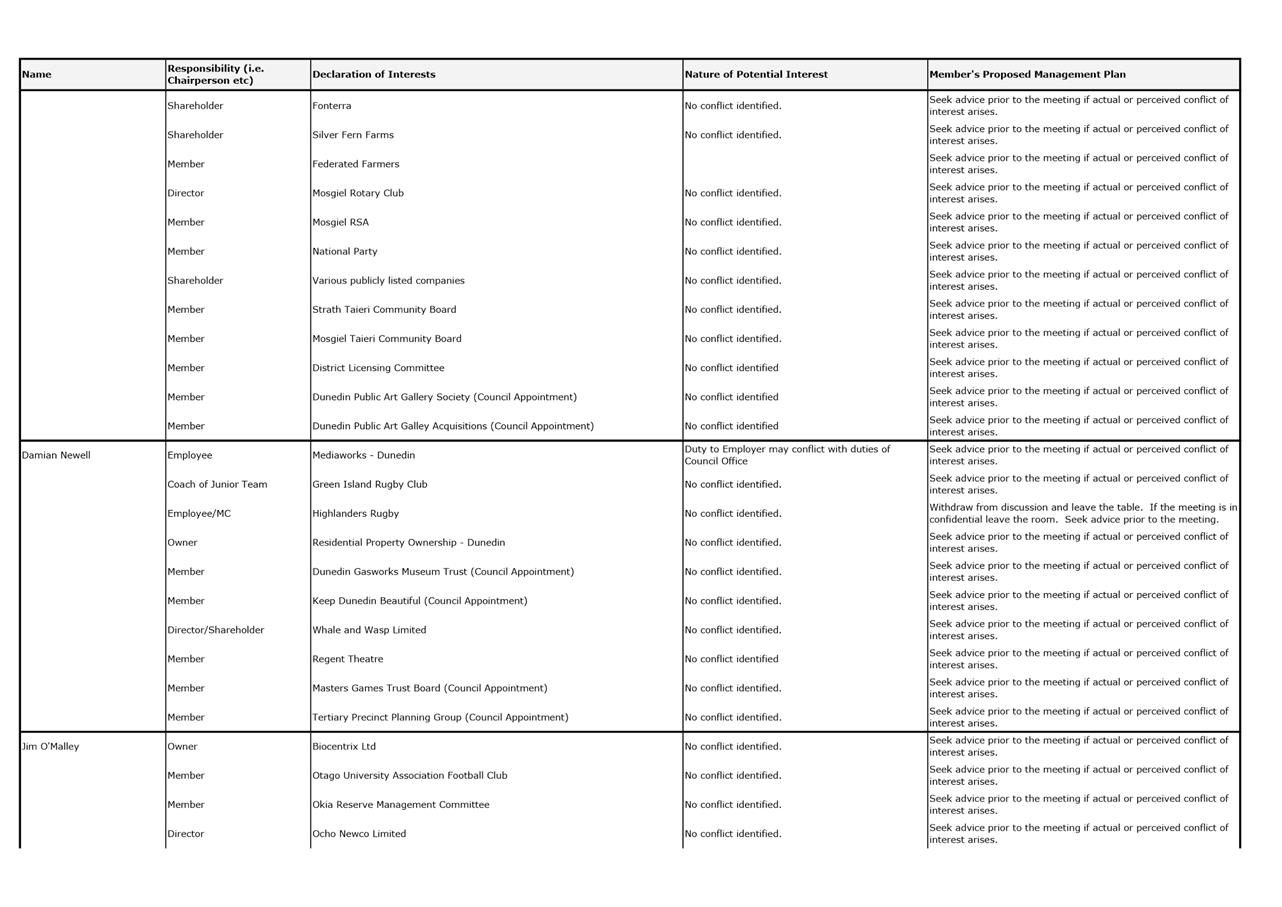

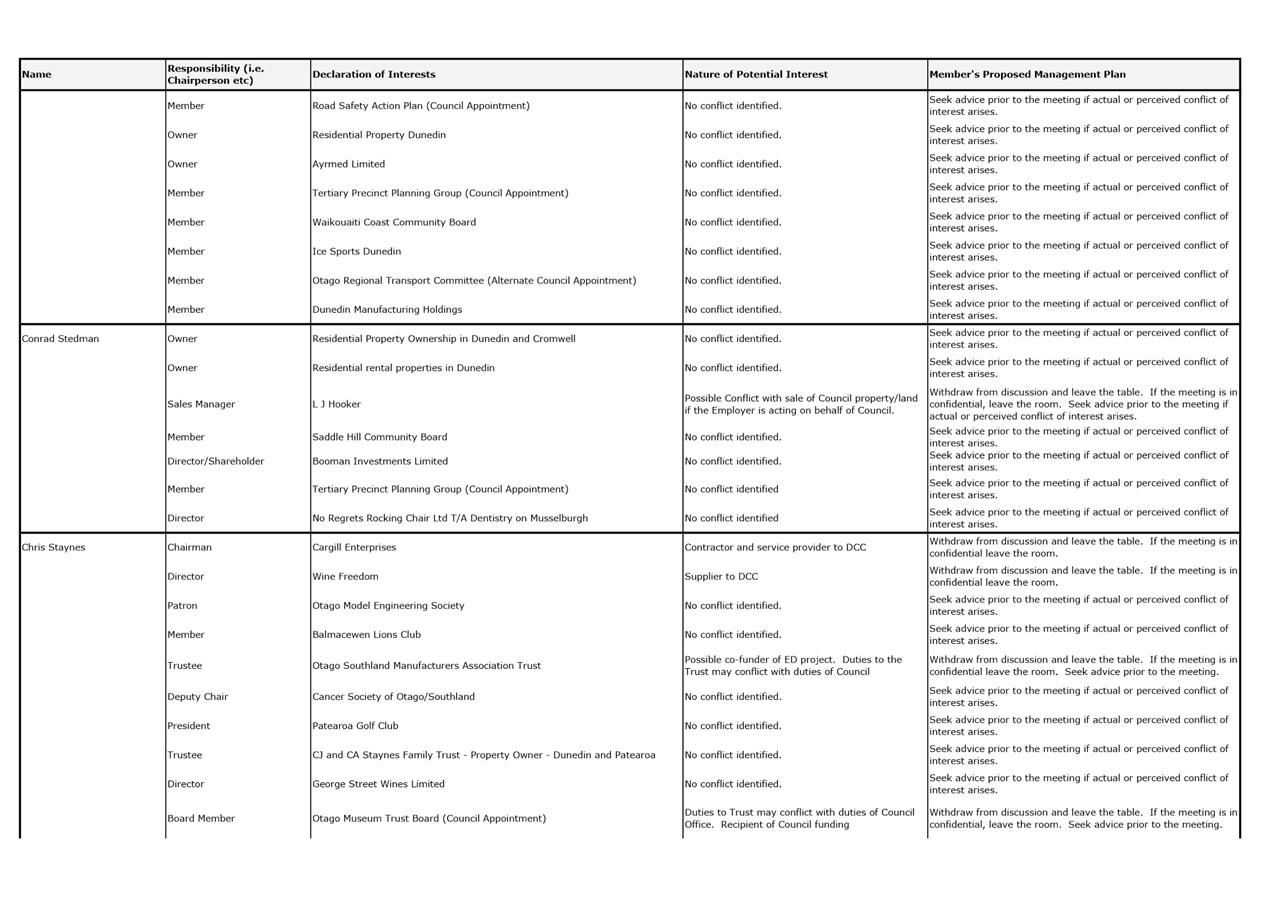

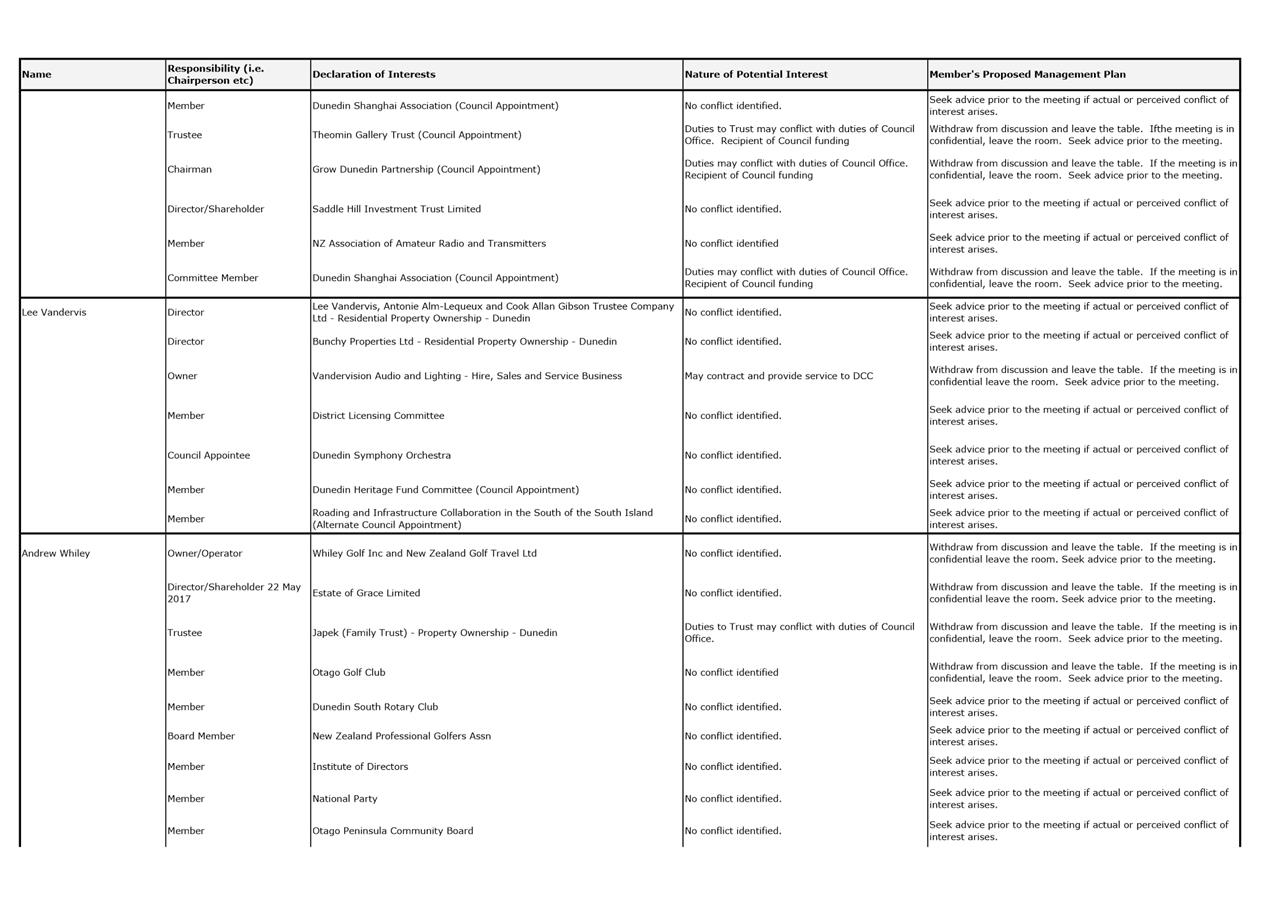

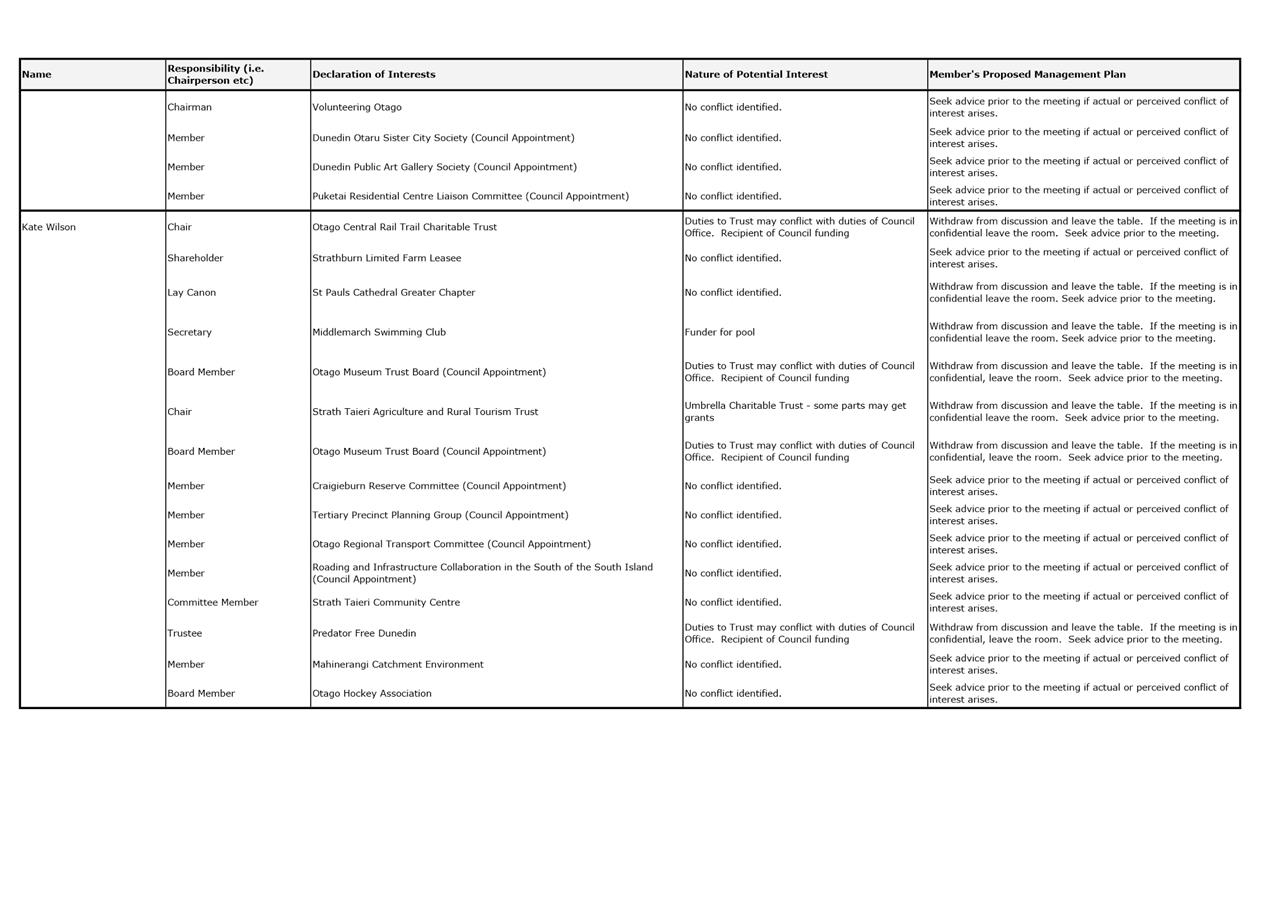

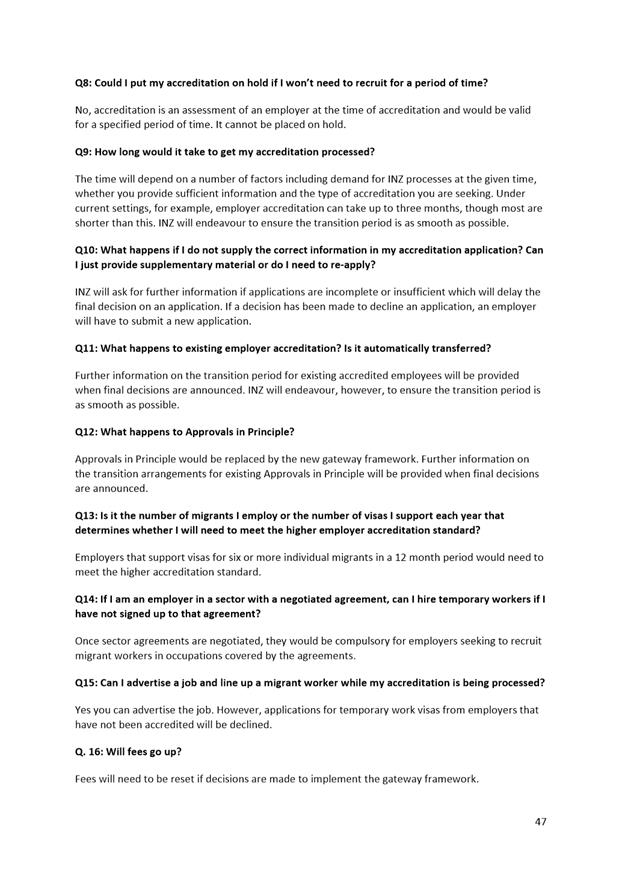

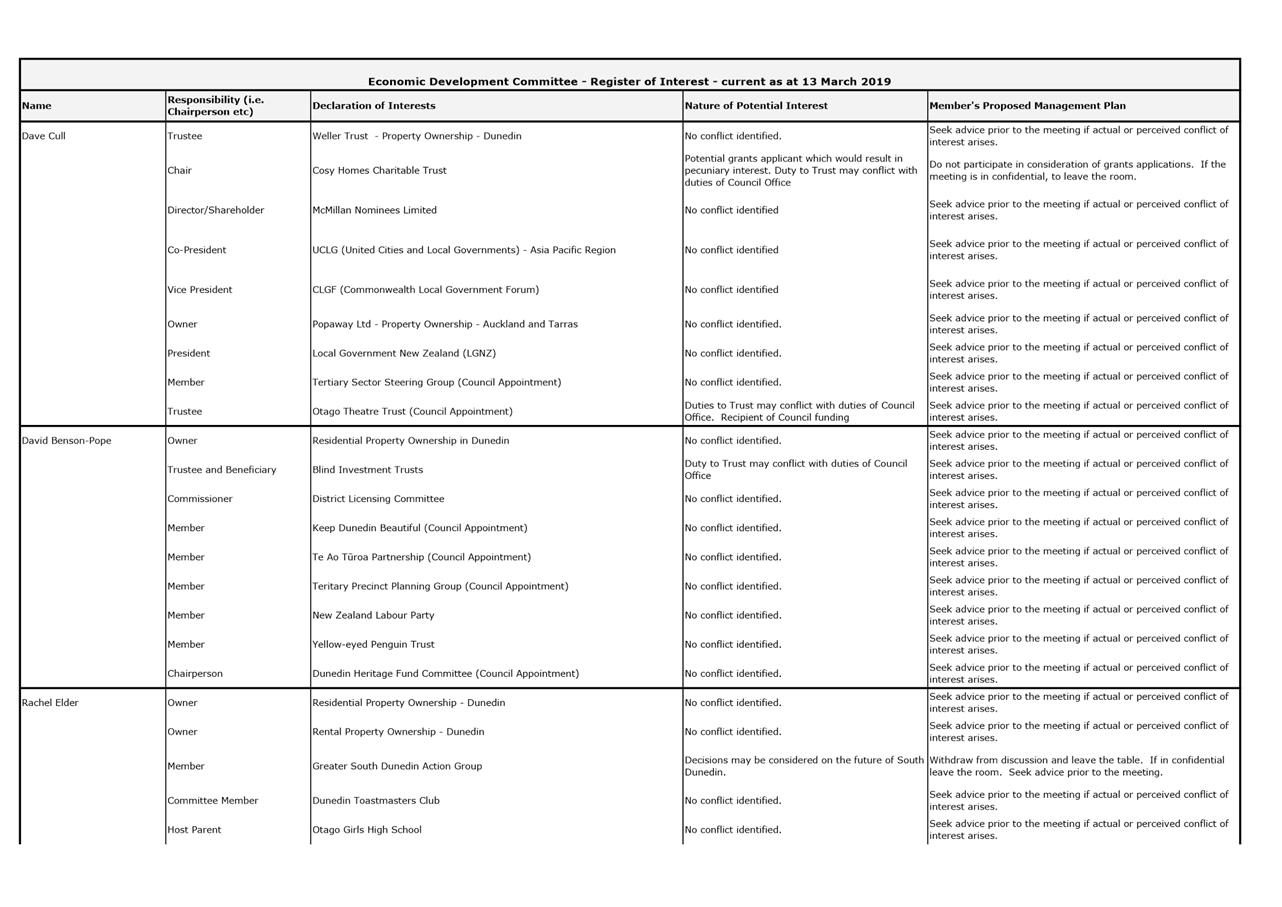

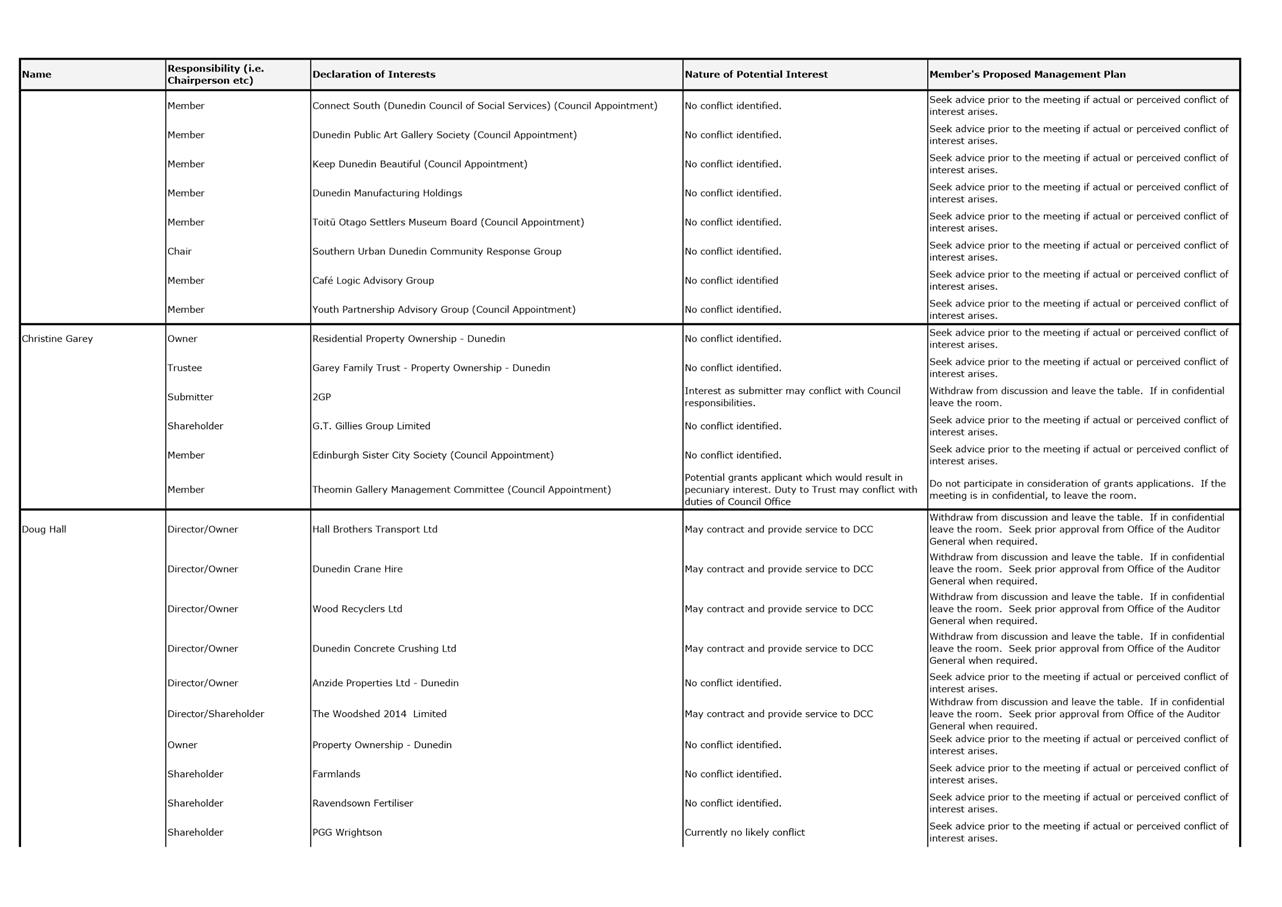

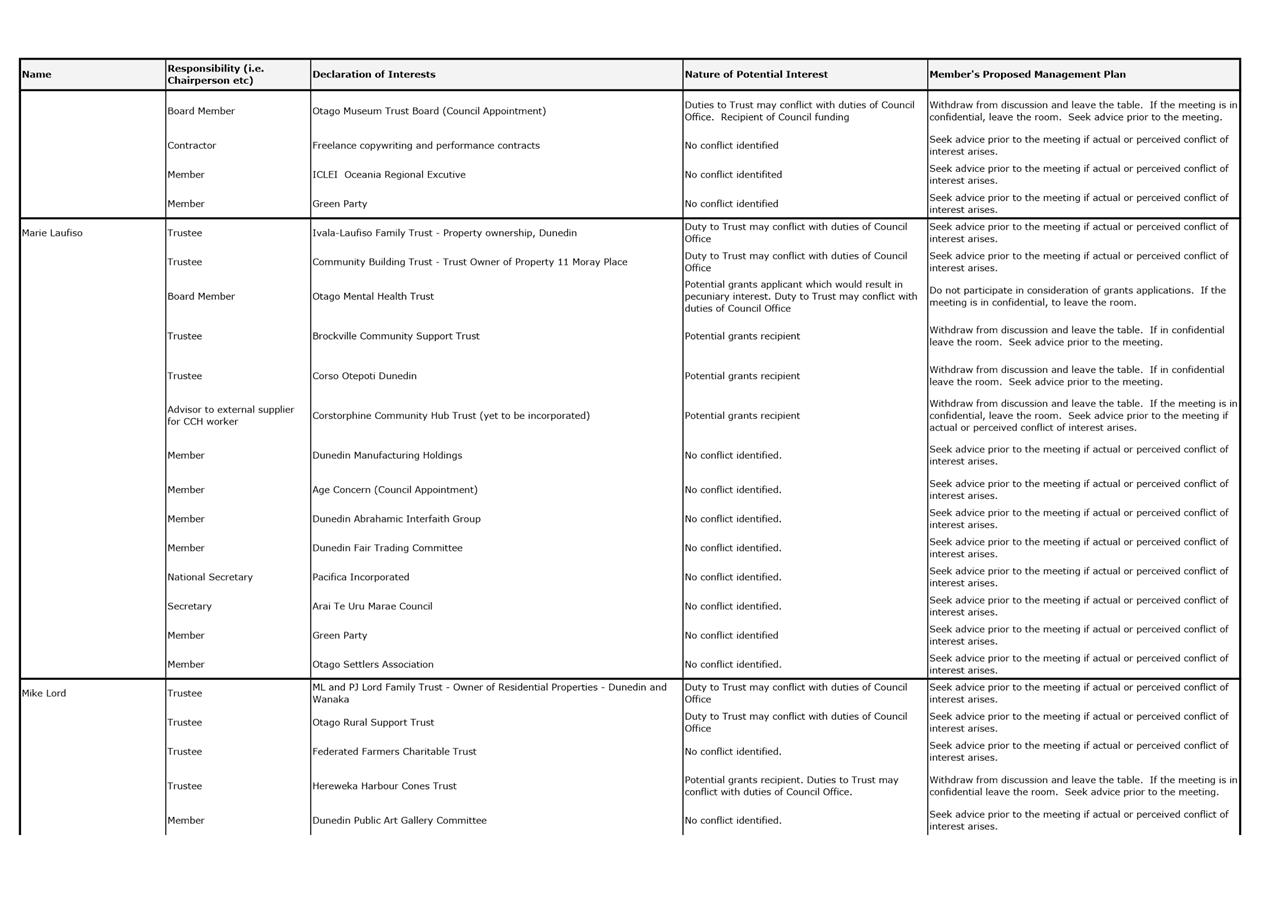

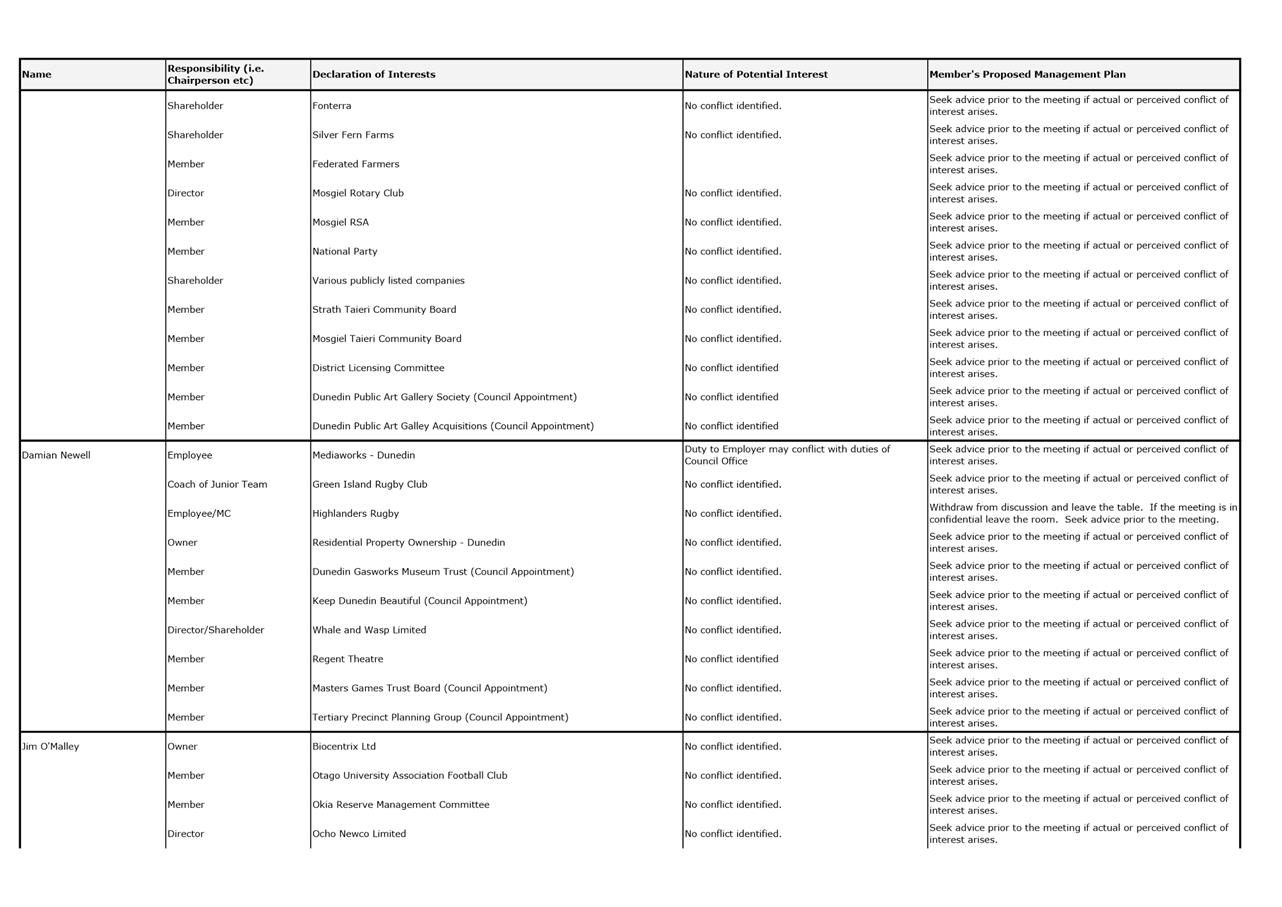

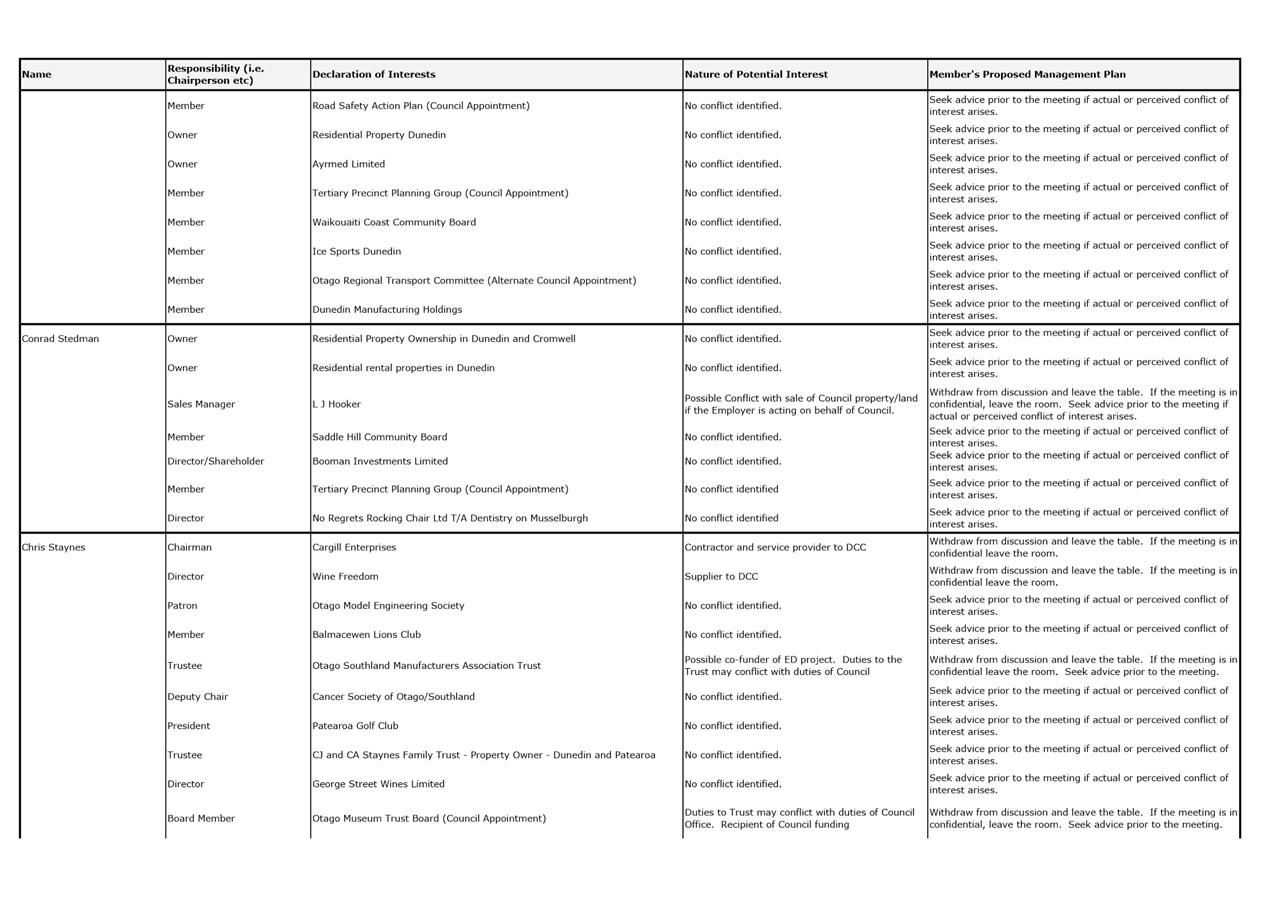

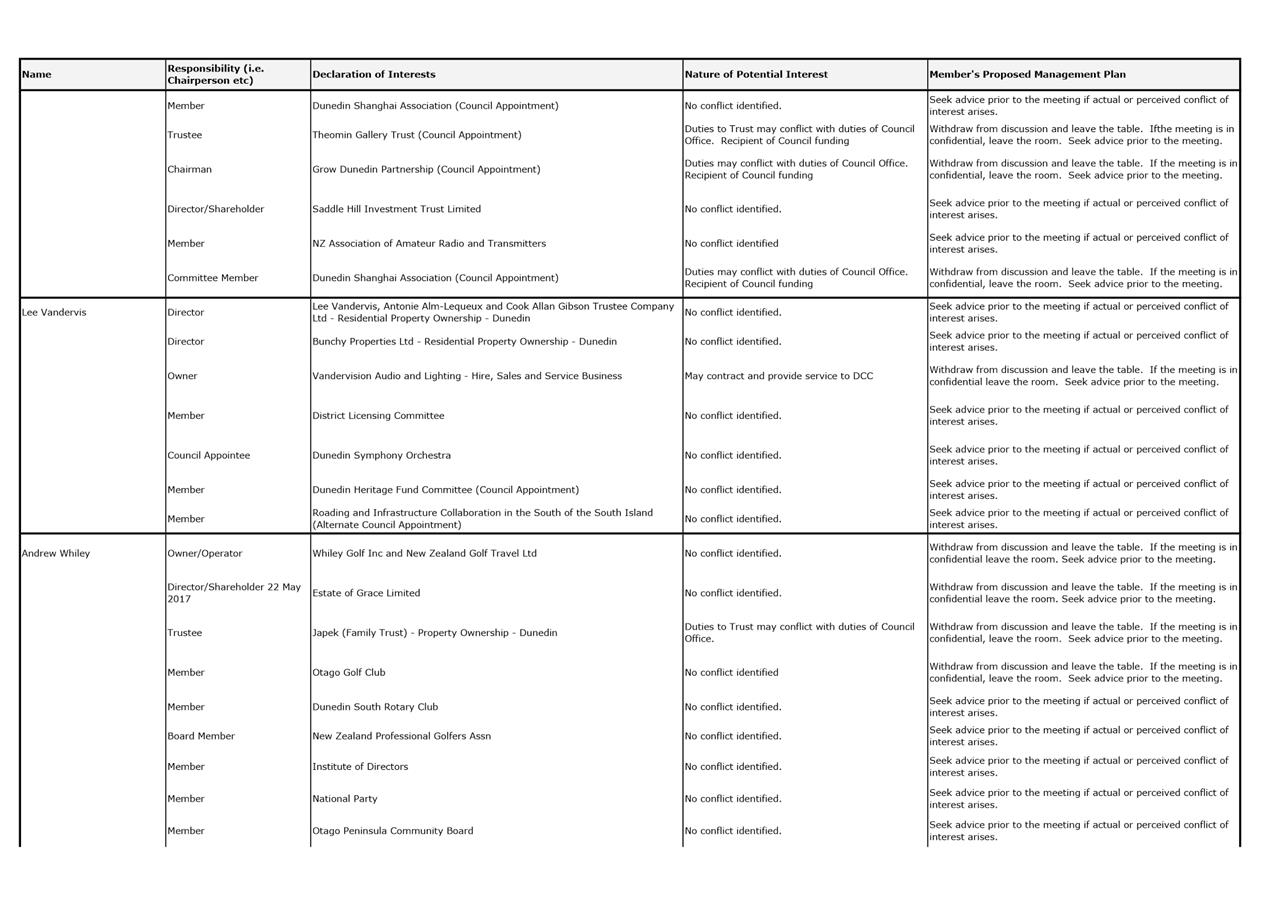

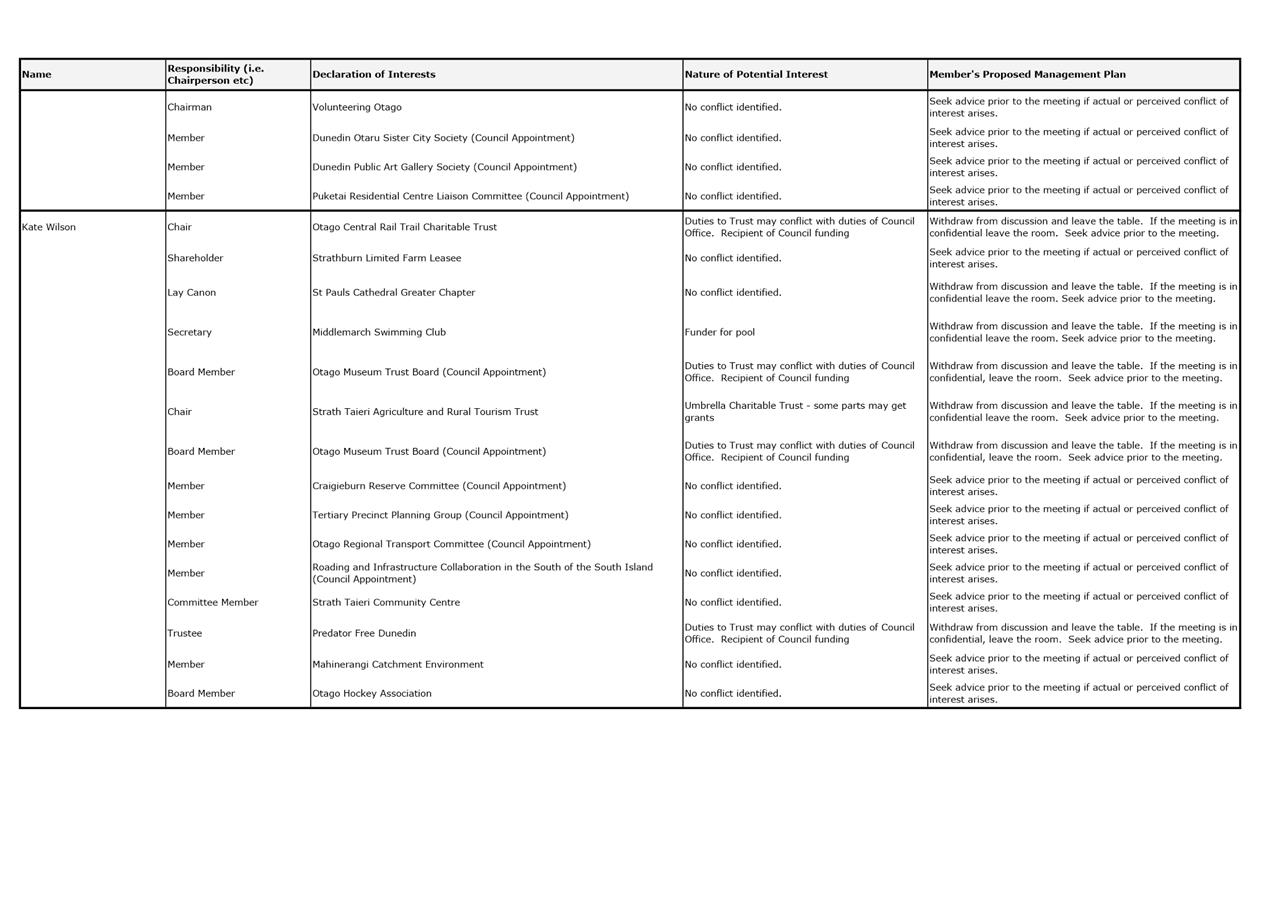

Declaration of Interest

EXECUTIVE SUMMARY

1.

Members are reminded of the need to stand aside from decision-making

when a conflict arises between their role as an elected representative and any

private or other external interest they might have.

2. Elected members

are reminded to update their register of interests as soon as practicable,

including amending the register at this meeting if necessary.

|

RECOMMENDATIONS

That the Committee:

a) Notes/Amends

if necessary the Elected Members' Interest Register attached as Attachment A;

and

b) Confirms/Amends the proposed management plan for Elected Members' Interests.

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Elected Members'

Register of Interest

|

7

|

|

Economic Development

Committee

19 March 2019

|

|

|

Economic Development

Committee

19 March 2019

|

|

Part

A Reports

TRENZ 2018 Update Report

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to provide an update on the Dunedin hosted TRENZ 2018

event survey results and outcomes.

2 Enterprise

Dunedin in partnership with Tourism Waitaki, Venture Southland and Dunedin

Airport, hosted TRENZ 2018 in Dunedin from 7 to 10 May 2018.

3 The TRENZ

2018 event showcased the region to international travel trade buyers, sellers

from around New Zealand, and media delegates via the welcome and closing

ceremonies and planned activity days.

4 1,257

delegates were hosted over the four-day event, and post-event survey results

estimated that buyer, seller and media delegates stayed a total of 5,361 nights

in Dunedin while attending TRENZ 2018.

5 The

economic impact study conducted for TRENZ 2018 estimated $10.3 million in

additional forward booking revenues for Dunedin, Waitaki and Southland, from

travel trade over and above business that had previously been placed with the

region.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

TRENZ 2018 Update Report

|

BACKGROUND

6 Tourism

in New Zealand is a $39.1 billion industry. It contributed $778 million to

Dunedin’s economy to the year ending January 2019 (Source: MBIE’s

Monthly Regional Tourism Estimates).

7 TRENZ is

the largest annual tourism event in New Zealand and is managed by Tourism

Industry Aotearoa (TIA). It is a national ‘business to business’

event where New Zealand travel sellers connect, interact and do business with a

target audience of key travel trade buyers and international media from 29

markets.

8 The 2018

event was held in Dunedin for the first time at The Edgar Centre from 7 to 10

May 2018.

9 Enterprise

Dunedin partnered with its International Marketing Alliance partners, Tourism

Waitaki and Venture Southland along with Dunedin Airport to host TRENZ 2018.

10 Event costs included

a TRENZ ‘Host City’ fee plus city activation costs of $57,000. The

costs were covered from Enterprise Dunedin’s budget, together with joint

venture partner investment from Tourism Waitaki, Venture Southland and Dunedin

Airport. The delivery of the event was supported by an in-kind contribution of

$32,952. Key industry partners were:

· Tourism

Industry Aotearoa (TIA)

· Tourism

Waitaki

· Venture

Southland

· Dunedin

Airport

· Hotel

Partners including Scenic Hotels Group and Distinction Hotels

· The

Edgar Centre

· Dunedin

Venues and Restaurant Associates

11 The 2018 TRENZ event

hosted 373 international travel buyers.

12 The value of the

event is reflected in the research commissioned by TIA. The evaluation

methodology had three elements:

· 210

on-site ‘mood of the delegates’ micro-surveys conducted by student

volunteers;

· 47

qualitative 15-minute interviews with Buyer, Seller, Media Trade and Sponsor

delegates conducted during the appointment schedules;

· A

post event online survey of all Buyer, Seller and Media delegates to formally

evaluate the event, measure its financial impact, and explore opportunities for

developing the event in the future. 583 delegates completed the survey,

representing a 46% response rate.

DISCUSSION

13 TRENZ 2018 was one

of the largest business events the city has hosted in the last ten years and

strengthens Dunedin’s messaging as a premier business events destination.

14 During the TRENZ

event 1,475 delegates were hosted over the four days.

15 Survey respondents

reported staying a total of 2,235 nights in Dunedin, with buyers staying an

average of 4.5 nights, sellers 4.3 nights and media 3.9 nights. Together with

delegate numbers, and adjusting for the proportion of delegates living in

Dunedin, it was estimated that buyer, seller and media delegates stayed a total

of 5,361 nights in Dunedin while attending TRENZ 2018.

16 An increased

percentage (on previous years) of both buyers and seller delegates participated

in at least one Dunedin tourism activity during the highly successful

‘Activity Afternoon’. 46% of buyer respondents, anticipate

increasing their itinerary content in the Dunedin, Waitaki and Southland

region.

17 An economic impact

study conducted post event for TRENZ 2018 found that Buyers estimated a likely

increase of additional business from itinerary content in to the regions of

Dunedin, Waitaki and Southland of $10.3 million over the course of a year.

18 TRENZ 2018 generated

226 media articles, with an estimated advertising value of $1.56 million,

including a piece exclusively on Dunedin in CNN traveller which had an

estimated advertising value of $687,000.

OPTIONS

19 As this is a report for noting, there

are no options.

NEXT STEPS

20 Continue to work in

partnership with our regional partners Tourism Waitaki and Venture Southland

with a suggested ‘Lower South Island’ regional marketing approach

to strengthen the regions attraction as a compelling destination.

21 Leverage off the success

of the TRENZ 2018 event and continue to showcase Dunedin and neighbouring

regions to help grow the visitor numbers, GDP and Dunedin’s economy.

22 Explore

opportunities to showcase Dunedin through global media coverage and contacts

made as a result of hosting TRENZ 2018.

23 Work with Tourism

Industry Aotearoa to investigate the opportunity for the region to host TRENZ

again.

Signatories

|

Author:

|

Suz Jenkins - Finance and Office Manager

Gil Abercrombie - Travel Trade Sales and Marketing

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This activity relates to providing a public service and it

is consider good quality and cost-effective by growing the Dunedin economy by

continuing to promote the city as a compelling destination.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

Hosting TRENZ 2018 in Dunedin provided the city the

opportunity for strategic alignment across multiple themes within the

Economic Development Strategy of Compelling Destination and Linkages Beyond

our Borders.

|

|

Māori Impact

Statement

Kai Tahu are one of the six partners in the Economic

Development Strategy. Connections were made between local Iwi and Tourism

Industry Aotearoa to coordinate their involvement in the opening ceremony.

|

|

Sustainability

A key aim of hosting TRENZ is to grow awareness of the

hosting region (Dunedin, Waitaki and Southland) and increasing visitor

numbers. An increase in visitor numbers may have an impact on the

region’s eco-tourism system and environment.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no known implications.

|

|

Financial

considerations

If the city and region were to bid to host TRENZ in the

future there would be financial considerations including City Host fee and

related activation costs.

|

|

Significance

This is considered low significance under the significance

and engagement policy

|

|

Engagement –

external

Enterprise Dunedin in collaboration with Tourism Industry

Aotearoa, engaged with local industry partners including Dunedin Airport,

regional partners Tourism Waitaki and Venture Southland, and the wider

Dunedin tourism industry to host TRENZ 2018. A “TRENZ city activation

group” chaired by the Director of Enterprise Dunedin was established

for this event.

|

|

Engagement -

internal

Enterprise Dunedin was supported by the wider Dunedin City

Council for the delivery of TRENZ 2018 in Dunedin.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

Conflict of

Interest

There is no conflict of interest.

|

|

Community Boards

When relevant, Enterprise Dunedin engaged with Community

Boards as part of hosting TRENZ.

|

|

Economic Development

Committee

19 March 2019

|

|

Enterprise Dunedin October to December 2018

Activity Report

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee on a

selection of Enterprise Dunedin activities during the period October to December

2018.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Enterprise Dunedin 1 October to 31 December 2018 Activity Report.

|

BACKGROUND

2 Enterprise

Dunedin activity is informed by the 2013-2023 Economic Development Strategy

(strategy). The strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances for

innovation – to improve linkages between industry and research.

c) A hub for

skills and talent – to increase retention of graduates, build the skills

base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A compelling

destination – to increase the value of tourism and events and improve the

understanding of Dunedin's advantage.

3 The

strategy sets out two economic goals:

a) 10,000 extra

jobs over 10 years (requiring growth of approximately 2% per annum).

b) An average of

10,000 of extra income for each person (requiring GDP per capita to rise 2.5% per

annum).

DISCUSSION

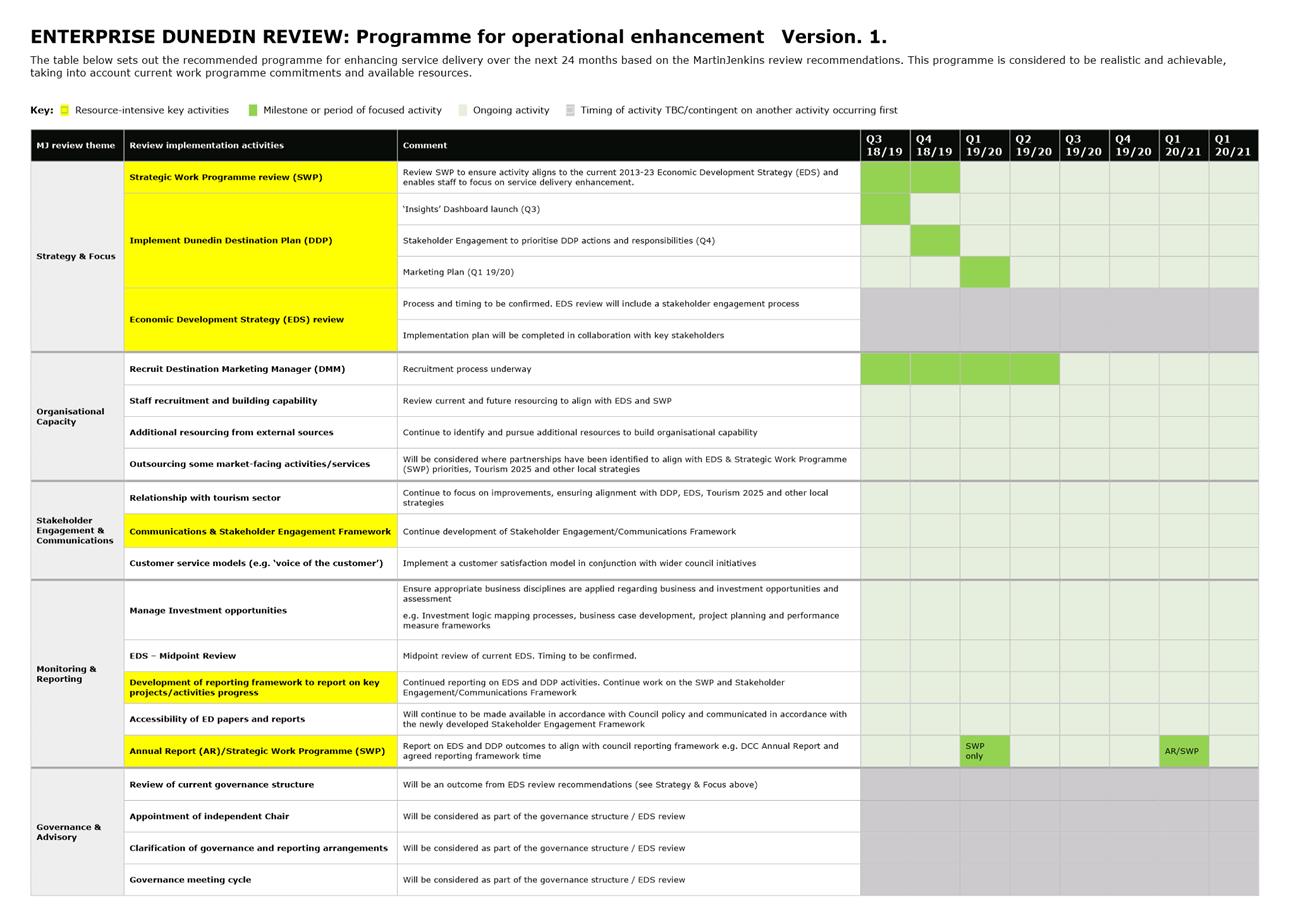

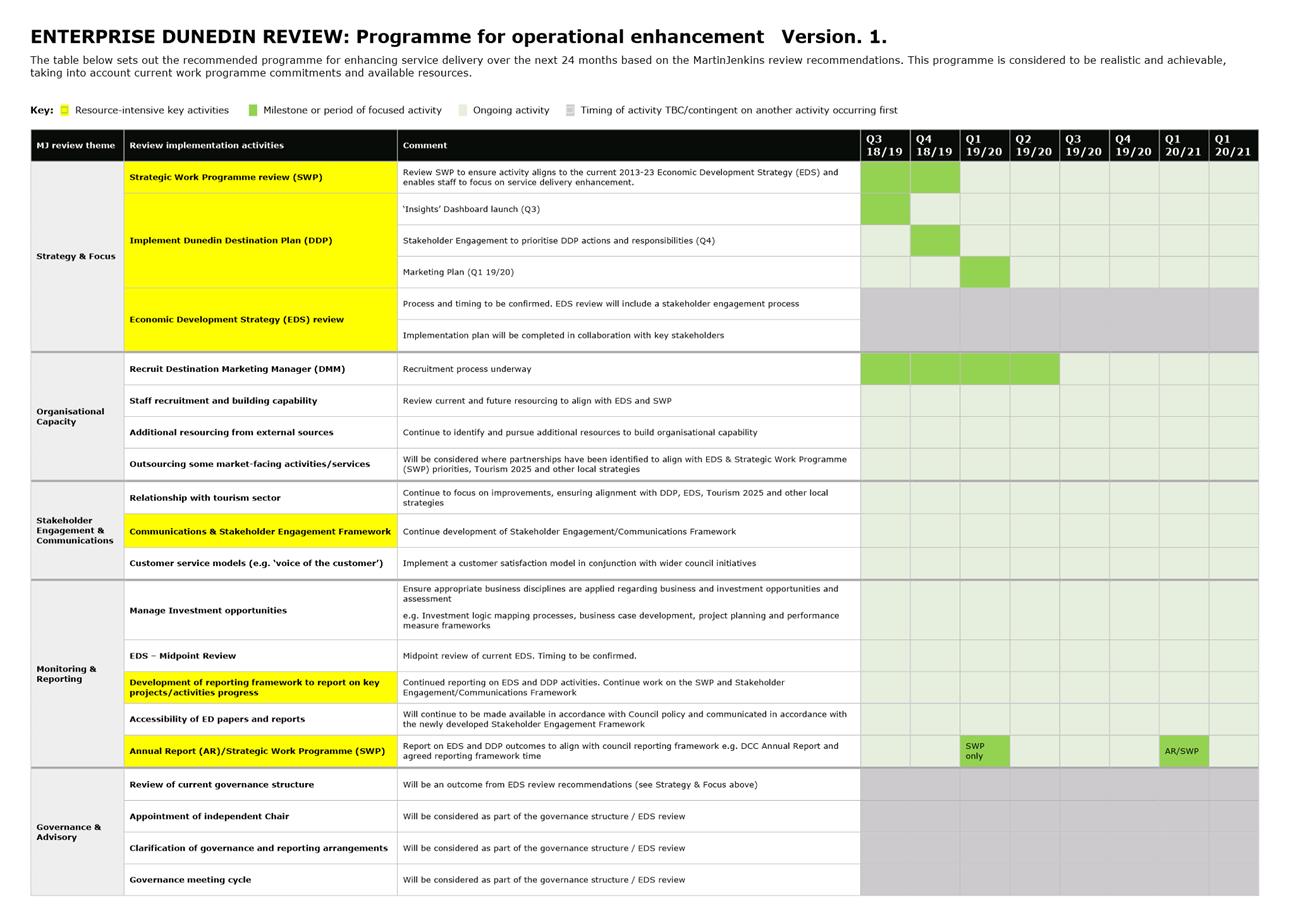

Enterprise

Dunedin Review Update

4 Following

the Martin Jenkins review of Enterprise Dunedin programme of work is underway

to give effect to the recommendations (attachment A). A summary of initial

actions are as follows:

Strategy and Focus

5 Enterprise

Dunedin is reviewing its Strategic Work Programme (SWP) priorities for the

upcoming year and will update Councillors at the May Economic Development

Committee meeting.

Organisational

Capacity

6 The

recruitment of the City Marketing Manager role is underway. There is engagement

with representatives from Dunedin Host, The Otago Chamber of Commerce

(including tourism committee) and Study Dunedin Advisory Group throughout the

recruitment of this role.

Stakeholder

Engagement and Communications

7 Enterprise

Dunedin is enhancing its customer relationship management system to enable

integration with the DCC customer satisfaction monitor. This will enable

Enterprise Dunedin to benchmark and improve customer experience as part of DCC

customer experience monitoring programme.

8 Meetings

with stakeholders have been scheduled to discuss actions that are being taken

to implement the recommendations from the Martin Jenkins report.

Monitoring and

Reporting

9 Work

continues to identify and prepare applications to national and local partners

for investment, including the Centre of Digital Excellence and Otago Regional

Economic Development activity.

10 To align with its

Strategic Work Programme, Enterprise Dunedin has contracted business analyst

support (for an initial period of six months) to provide economic analysis and

further develop the reporting framework including key performance indicators.

Governance and

Advisory

11 A Grow Dunedin

Partner Governance workshop was held on 7 March to discuss the recommendations

in the review relating to current governance of the partnership. A report

outlining options for improvement will be brought back to Council.

2018

Annual Economic Profile Report

12 Dunedin's annual

Economic Profile report to March 2018 was released in January 2019; the full

report is available on the DunedinNZ.com website

https://www.dunedinnz.com/business/toolkit-and-resources/research-and-statistic.

13 Key highlights

include:

a) GDP in Dunedin

City measured $5 billion in the year to March 2018, up 2.6% from a year

earlier. New Zealand's GDP increased by 3.2% over the same period.

b) Dunedin City

accounted for 2.1% of national GDP in 2018.

c) Total

employment in the year to March 2018 was up 2.7% from a year earlier.

Employment in New Zealand increased by 3% over the same period. From March 2013

to March 2018 there has been a net increase of 4,721 jobs in Dunedin.

d) Dunedin City's

population was 130,700 in 2018, up 1.5% from a year earlier. New

Zealand's total population grew by 1.9%.

e) A region's

population can grow through natural growth (births less deaths) and net

migration (arrivals less departures). Dunedin City's population increased

by 1,900 people in the year to June 2018. This increase was made up of

net migration 1,700 and natural increase of 200.

Business Vitality

14 The Otago

Regional Business Partnership (RBP)

a) The RBP is

composed of the Otago Chamber of Commerce, Otago Southland Employers

Association and DCC. The RBP is funded to deliver business capability support,

mentors and research grants by New Zealand Trade and Enterprise (NZTE) and

Callaghan Innovation.

b) Year to date

the RBP issued 124 clients $121,000 in training grants and matched 26 mentors

to businesses.

c) Over this

reporting period three Callaghan Innovation clients were successful with

research and development project grants totalling $80,000. This supported

projects totalling $202,000 in value. One client was successful with a

Student Career grant with a value of $35,000.

d) From the five

student Experience Grants reported in the last quarter report, one company has

since employed both their interns on a full-time basis.

Business Clinic

15 Enterprise Dunedin

business advisors supported 32 clients through business clinics during the

period. Enquiries included new food businesses, property maintenance,

transition housing, and new tourism projects such as glamping and destination

mini-golf. Clients were introduced to other advisors in council where needed

for planning and consent enquiries. They were also offered resources and access

information and support from a range of external agencies and programmes for

business advice.

Alliances for

innovation

Energy

16 Following the

establishment of the MOU between DCC, Ministry of Health, Southern DHB, and

University of Otago, a working group has been formed with DCC as the lead. The

procurement process began in December using the DCC's Long-Term Technical and

Engineering Support Services Panel for the completion of the business case. A

preferred provider has been identified and negotiations are underway to

finalise the agreement. Estimated completion date for the business case is May

2019.

17 Two new ChargeNet

chargers (commercial provider of electric vehicle fast charging stations) were

installed at University of Otago and New World Mosgiel.

18 ChargeNet and Aurora

are exploring opportunities to install additional EV fast charging

infrastructure in Dunedin.

Film Dunedin

19 Work has been

completed on a dedicated Screen section on the DunedinNZ website to profile

Dunedin's screen capability and to support screen businesses and activity in

the city.

20 Film Dunedin

received 15 enquiries during the period which resulted in seven permits being

issued. This generated 532 bed nights for the city (14 shoot days with 38

visiting crew).

Image - Shooting Air New Zealand Safety Video at St Clair

Beach

21 The inaugural

Shanghai Dunedin Screen Writers Exchange went smoothly and was productive.

Dunedin writer, David Hay spent six weeks through December and January in

Shanghai, attending industry meetings and writing. He is now looking for a

Producer and funding to shoot his feature length black Dunedin comedy in 2020.

Image – David Hay meeting with Shanghai Writers

Association

Otago Regional Economic Development (ORED)activity.

22 Enterprise Dunedin

continued to work with other economic development units across Otago on the

development of the ORED framework. This work which was supported by the Otago

Mayoral Forum, has been funded through the Provincial Growth Fund (PGF) and is

intended to support future collaboration between Otago Councils on common

economic development issues.

23 Over the period

economic development managers have continued to identify draft themes or areas

of common interest as well as a framework to support the decision makers on

prioritisation of potential activities. The draft themes were tested with a

broad range of range of business and community stakeholders across Otago such

as the Otago Chamber of Commerce, Silver Fern Farms and Otago Mayoral Forum

during this period. A draft framework is expected to be prepared by June 2019

and will be brought back to Otago Councils before adoption.

Centre of Digital Excellence (CODE)

24 The business case

for CODE was further developed during October and December. This remains a

resource intensive activity for Enterprise Dunedin supported by the Grow

Dunedin Partnership.

25 Design workshops

were held with industry (including Rocketwerkz and Runaway Play), the

University of Otago, Otago Polytechnic, secondary school representatives,

Ministry of Business Innovation and Employment (MBIE), and Education New

Zealand during the period. This work informed advice to the CODE steering group

(again composed of tertiaries, industry and agencies such as the Southern

District Health Board) on the potential scope and solutions for CODE.

26 Further links with

gaming industry in Edinburgh, Dundee and China were also established during the

period. These relationships which included connections with Abertay University

in Dundee and Capital Enterprise London are intended to support the global

export potential of the computer gaming sector, as well as gain access to

potential investors and industry talent. The business case will be further

developed during the next period with a proposed submission to the Provincial

Growth Fund (PGF) by the end of March 2019.

A Compelling

Destination

Dunedin Destination Plan

27 In March the

Insights and Key Visitor Statistics dashboards were launched on DunedinNZ.com.

This work led by Enterprise Dunedin, represents a collaboration from key

sectors across the city.

International Trade

28 Sales/product

training calls were made to 25 inbound operators, wholesalers and coach tour

operators based in Brisbane, Sydney and Melbourne.

29 During an Auckland

based sales visits, met with 28 inbound operators, wholesalers and coach tour

operators to update them on Dunedin tourism product development.

30 Two product managers

from Genting Cruise Lines were hosted during a visit to plan Shore Excursions

for their first NZ cruise in the 2019/2020 season.

31 Enterprise Dunedin

and ChristchurchNZ presented a webinar, which was organised by Tourism New

Zealand to over 80 UK/Europe travel agents.

Business Events

32 Enterprise Dunedin

was successful in winning two conferences for the city, with an approximate

value of $720,000, including an international bid with the Australian and New

Zealand Student Association.

33 Seventeen (17)

conference leads between 2019-2026 are currently being developed including four

International events which are expected to attract over 2500 visitors to the

city.

PR and Promotions

34 Enterprise Dunedin

hosted three domestic media visits and one international media visit, including

Going Down Under Magazine (Netherlands), Newshub Travel and two freelance

journalists who write for numerous national and international publications.

35 Seven Communications

(Australian-based PR Agency) continue to develop story angles and media

outreach activities for the Australian market.

36 Enterprise Dunedin

hosted three Tourism New Zealand International Media Programme visits from

Australian, Japanese and Chinese media outlets in the city.

i-SITE Visitor Centre

37 November and

December were good trading months with record days on 8 December, 3 and 9

January.

38 There has been a

noticeable return of free independent travellers (FIT) wanting our assistance

with bookings, with more of these visitors spending two to three days in

Dunedin.

OPTIONS

39 Not applicable.

NEXT STEPS

40 Feedback on the

activity report will be incorporated in future updates.

Signatories

|

Author:

|

Suz Jenkins - Finance and Office Manager

Des Adamson - Business Relationship Manager

Fraser Liggett - Economic Development Programme Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Enhancing Service

Delivery Programme

|

27

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing a public service and it

is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the delivery of the

2013-23 Economic Development Strategy.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Enterprise Dunedin activities and the 2013-23 Economic

Development Strategy are included in the 2018-28 Long Term Plan.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This decision is considered low significance under the

Significance Engagement Policy.

|

|

Engagement –

external

As an update report, no external engagement has been

undertaken.

|

|

Engagement -

internal

As an update report, no internal engagement has been

undertaken.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

Economic Development

Committee

19 March 2019

|

|

|

Economic Development Committee

19 March 2019

|

|

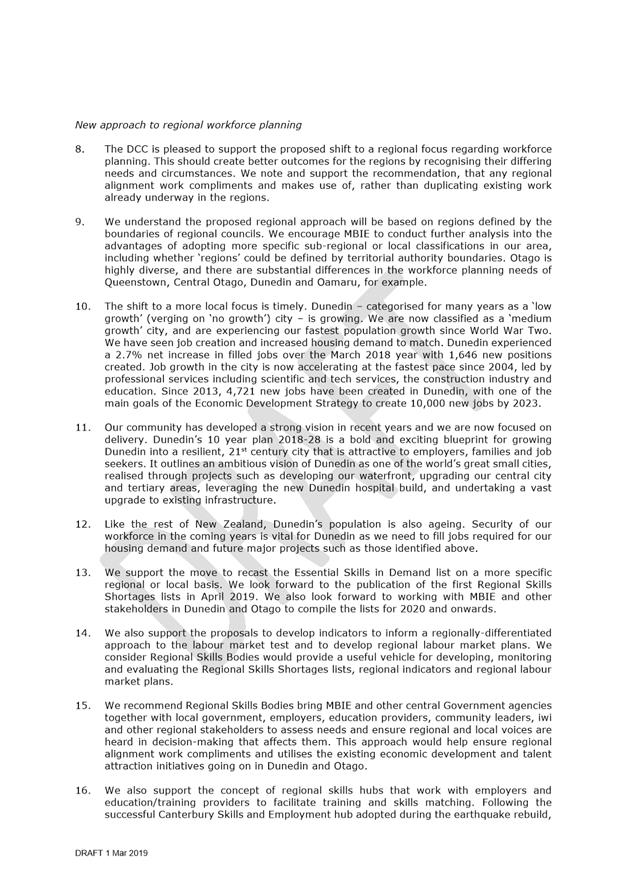

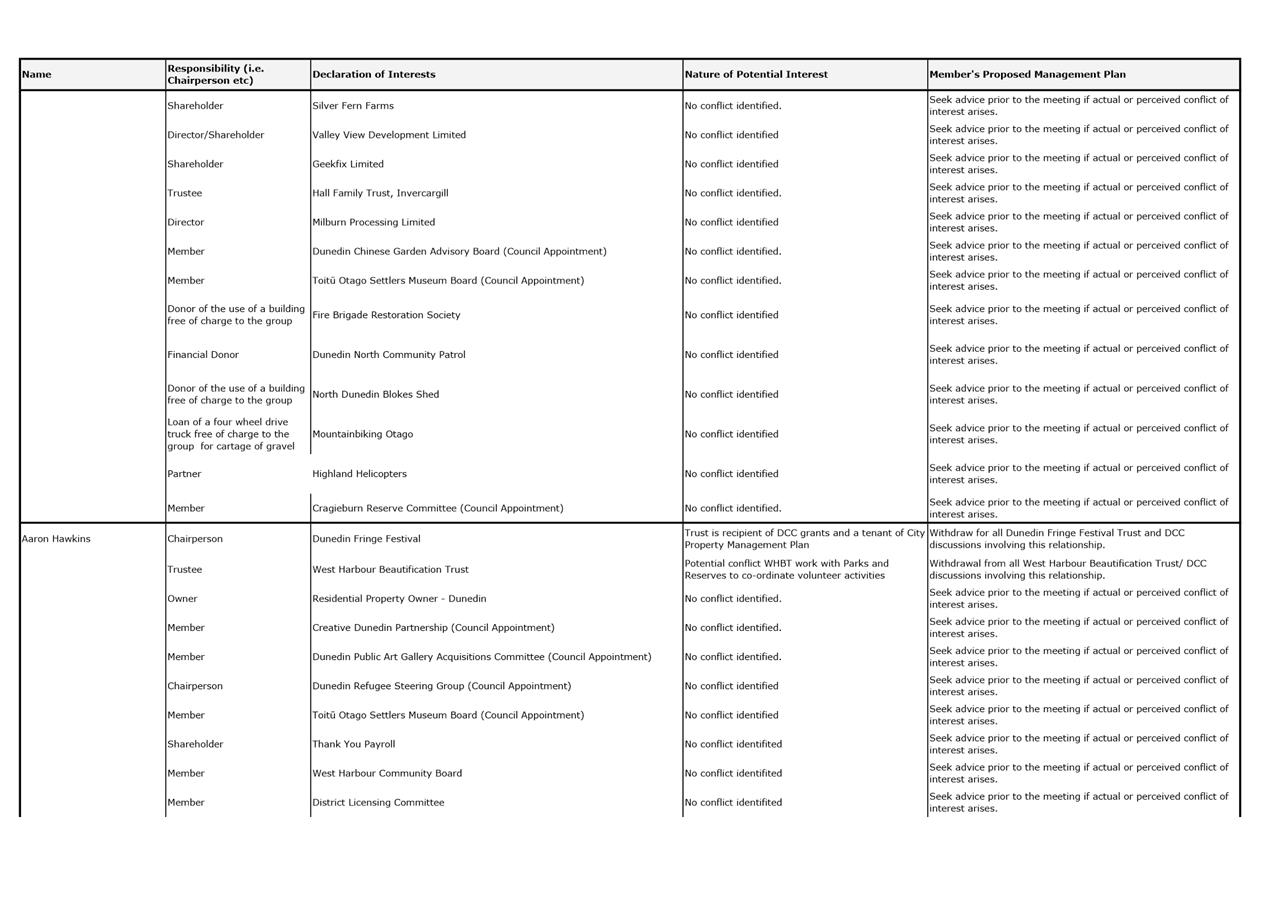

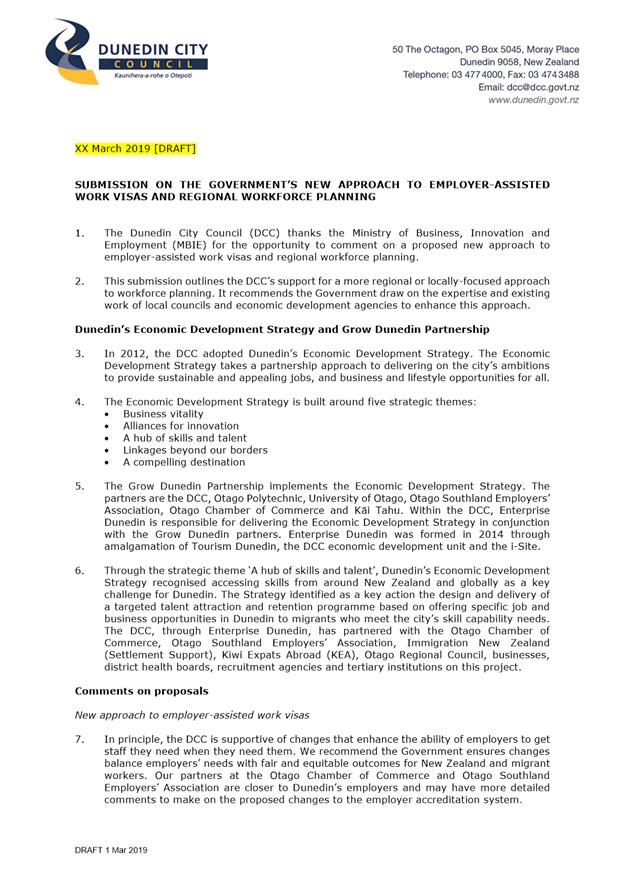

DCC submission: a new approach to

employer-assisted work visas and regional workforce planning

Department: Corporate Policy

EXECUTIVE SUMMARY

1 This

report seeks approval of a Dunedin City Council (DCC) submission to the

Ministry of Business, Innovation and Employment (MBIE) on a new approach to

employer-assisted work visas and regional workforce planning (Attachment A).

2 The draft

DCC submission outlines economic development, talent attraction and workforce

planning initiatives already underway in Dunedin and Otago, upcoming projects

and trends likely to have significant impacts on Dunedin’s workforce

needs, and provides general comments and recommendations on the proposed

documents.

3 The

recommendations in the draft DCC submission aim to enhance workforce planning

outcomes for Dunedin and the wider Otago region.

|

RECOMMENDATIONS

That the Committee:

a) Approves a

DCC submission to the Ministry of Business, Innovation and Employment on a

new approach to employer-assisted work visas and regional workforce planning.

|

BACKGROUND

4 MBIE’s

proposals are set out in ‘A new approach to regional workforce planning:

Consultation discussion paper, December 2018’ (Attachment B). The

deadline for a DCC submission on the proposals is 5pm, 21 March 2019.

5 MBIE

proposes to combine six employer-assisted work visa categories into one

category: the ‘employer-assisted temporary work visa’. Immigration

New Zealand will assess applications for the proposed new employer-assisted

temporary work visa through a framework of three ‘gates’, which is

designed to be employer-led. The three gates are:

a) Gate 1: the

employer gate, where employers are accredited to employ temporary migrant

workers;

b) Gate 2: the

job gate, where checks are made to make sure no New Zealander can fill the job

the employer is recruiting for; and

c) Gate 3: the

migrant gate, where checks are made on a migrant worker’s identity,

health, character and capability.

6 On 28

February 2019 staff from Enterprise Dunedin and Corporate Policy attended a

meeting in Dunedin, where officials from MBIE explained the proposals and

answered questions. Representatives from the Otago Chamber of Commerce, Otago

Southland Employers’ Association and the Southern District Health Board

also attended.

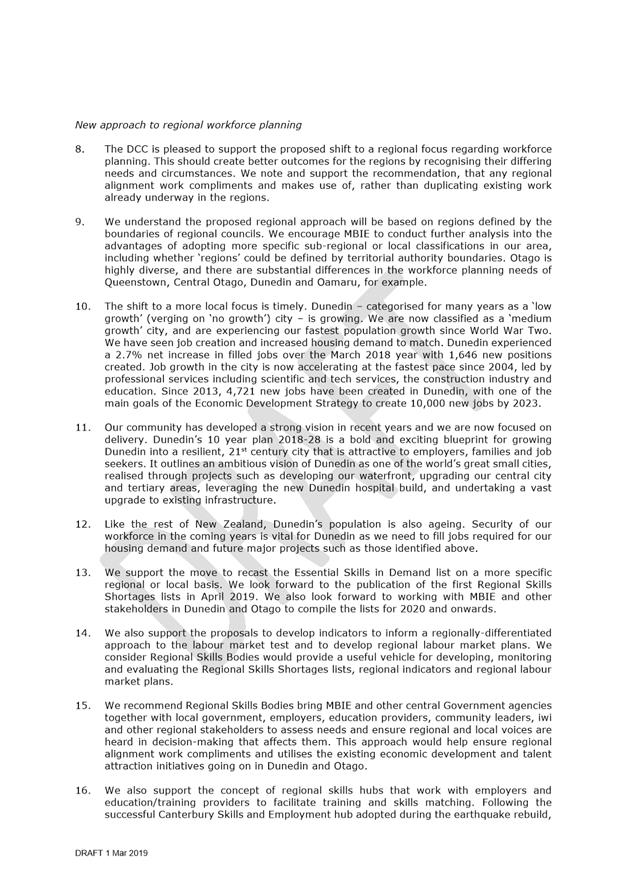

DISCUSSION

7 The draft

DCC submission focuses on aspects of Gate 2, which will see the introduction of

a more region-focused approach to workforce planning. The proposed new approach

includes:

a) Recasting the

Essential Skills in Demand list on a regional basis (the first Regional Skills

Shortages lists are due for publication in April 2019 and will be reviewed

annually);

b) Development of

indicators to inform a regionally-differentiated approach to the labour market

test;

c) Development of

regional labour market plans;

d) Introduction

of Regional Skills Bodies and, in some areas, regional skills and jobs hubs.

8 MBIE’s

discussion document suggests local government and local economic development

agencies could play a role in implementing the proposed regional approach to

workforce planning.

9 The draft

DCC submission outlines economic development, talent attraction and workforce

planning initiatives already underway in Dunedin and Otago, and upcoming

projects and trends likely to have significant impacts on Dunedin’s

workforce needs. It makes recommendations and suggestions about how a more

region-focused approach to workforce planning could be designed to best serve

the needs of Dunedin and the wider Otago region, and indicates the DCC’s

desire to work with MBIE and other stakeholders to deliver regional workforce

planning measures that create beneficial outcomes for Dunedin and Otago.

OPTIONS

Option

One (Recommended Option) – Submit on the proposed new approach to

employer-assisted work visas and regional workforce planning

10 Approve the draft

submission on the proposed new approach to employer-assisted work visas and

regional workforce planning be submitted, along, with any suggested amendments,

to MBIE.

Advantages

· Highlights

issues that could benefit from further consideration as the Government

continues to progress reform of its approach to employer-assisted work visas

and regional workforce planning.

· Highlights

economic development, talent attraction and workforce planning initiatives

already underway in Dunedin and Otago, and upcoming projects and trends likely

to have significant impacts on Dunedin’s workforce needs.

· Highlights

the DCC’s desire to work with MBIE and other stakeholders to deliver

regional workforce planning measures that create beneficial outcomes for

Dunedin and Otago.

Disadvantages

· There

are no identified disadvantages for this option.

Option

Two – Do not submit on the proposed new approach to employer-assisted

work visas and regional workforce planning

11 Do not approve the

draft submission.

Advantages

· There

are no identified advantages for this option.

Disadvantages

· Missed

opportunity to highlight issues that could benefit from further consideration

as the Government continues to progress reform of its approach to

employer-assisted work visas and regional workforce planning.

· Missed

opportunity to highlight economic development, talent attraction and workforce

planning initiatives already underway in Dunedin and Otago, and upcoming

projects and trends likely to have significant impacts on Dunedin’s

workforce needs.

· Missed

opportunity to highlight the DCC’s desire to work with MBIE and other

stakeholders to deliver regional workforce planning measures that create

beneficial outcomes for Dunedin and Otago.

NEXT STEPS

12 If the Committee

approves the submission it will be sent to MBIE for consideration.

Signatories

|

Author:

|

Scott Campbell - Policy Advisor

|

|

Authoriser:

|

Maria Ioannou - Corporate Policy Manager

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Draft DCC submission: a

new approach to employer-assisted work visas and regional workforce planning

|

34

|

|

⇩b

|

A new approach to

employer-assisted work visas and regional workforce planning: Consultation

discussion paper, December 2018

|

37

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

DCC involvement in regional workforce planning supports

providing local infrastructure in ways that are good-quality and

cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

The draft DCC submission supports the strategic theme

‘a hub of skills and talent’ in Dunedin’s Economic

Development Strategy. It also supports Dunedin’s Social Wellbeing

strategy, which identifies working with Economic Development Strategy

partners to develop migrant retention strategies as a main action under the

Manaakitanga implementation pathway.

|

|

Māori Impact

Statement

There are no known specific impacts for tangata whenua

resulting from a decision to approve a DCC submission.

|

|

Sustainability

The draft DCC submission supports measures to ensure the

sustainability of Dunedin’s workforce, particularly for large projects

such as the development of the new Dunedin hospital.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no known impacts for current levels of service

and/or performance measures resulting from a decision to approve the draft

DCC submission.

|

|

Financial

considerations

There are no known financial implications resulting from a

decision to approve the draft DCC submission.

|

|

Significance

This decision has been assessed under the Council’s

Significance and Engagement Policy as being of low significance.

|

|

Engagement –

external

DCC staff met with officials from MBIE, and

representatives from the Otago Chamber of Commerce, Otago Southland

Employers’ Association and the Southern District Health Board on 28

February 2019.

|

|

Engagement -

internal

Staff from Enterprise Dunedin, Corporate Policy and Human

Resources developed this submission.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

Conflict of

Interest

There are no known conflicts of interest

|

|

Community Boards

The proposed new approach to employer-assisted work visas

and regional workforce planning and a DCC submission on the proposals may be

of interest to Community Boards.

|

|

Economic Development

Committee

19 March 2019

|

|

|

Economic Development Committee

19 March 2019

|

|

|

Economic Development Committee

19 March 2019

|

|

Items for Consideration by the Chair

|

Economic Development

Committee

19 March 2019

|

|

Resolution to Exclude the

Public

That the Economic

Development Committee:

Pursuant to the provisions of the

Local Government Official Information and Meetings Act 1987, exclude the public

from the following part of the proceedings of this meeting namely:

|

General subject of the matter to be considered

|

Reasons

for passing this resolution in relation to each matter

|

Ground(s) under

section 48(1) for the passing of this resolution

|

Reason for

Confidentiality

|

|

C1

Tunnel Beach Tourism Infrastructure Fund (TIF) Application

|

S7(2)(h)

The

withholding of the information is necessary to enable the local authority to

carry out, without prejudice or disadvantage, commercial activities.

S7(2)(i)

The

withholding of the information is necessary to enable the local authority to

carry on, without prejudice or disadvantage, negotiations (including

commercial and industrial negotiations).

|

S48(1)(a)

The public conduct of

the part of the meeting would be likely to result in the disclosure of

information for which good reason for withholding exists under section 7.

|

The Department of

Conservation is currently negotiating for a property required for the

project. Until those negotiations are complete, the information needs

to remain non-public..

|

This resolution is made in reliance

on Section 48(1)(a) of the Local Government Official Information and Meetings

Act 1987, and the particular interest or interests protected by Section 6 or

Section 7 of that Act, or Section 6 or Section 7 or Section 9 of the Official

Information Act 1982, as the case may require, which would be prejudiced by the

holding of the whole or the relevant part of the proceedings of the meeting in

public are as shown above after each item.