|

Economic Development Committee

21 May 2019

|

|

Part

A Reports

Enterprise Dunedin Activity Report

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee on a

selection of Enterprise Dunedin activities to April 2019.

|

RECOMMENDATIONS

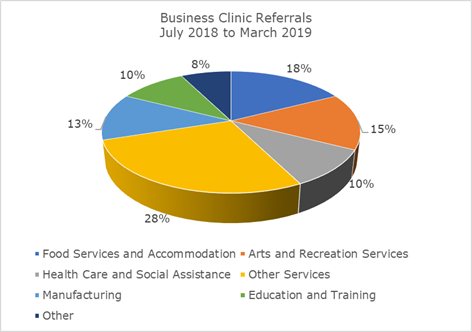

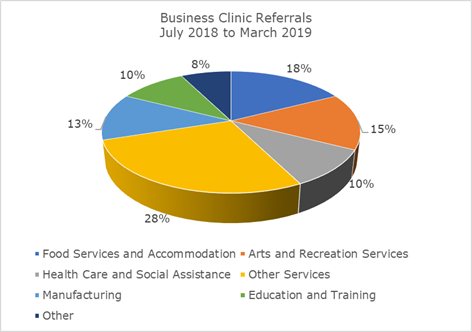

That the Committee:

a) Notes the

Enterprise Dunedin Activity Report.

|

BACKGROUND

2 Enterprise

Dunedin activity is informed by the 2013-2023 Economic Development Strategy

(strategy). The strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances for

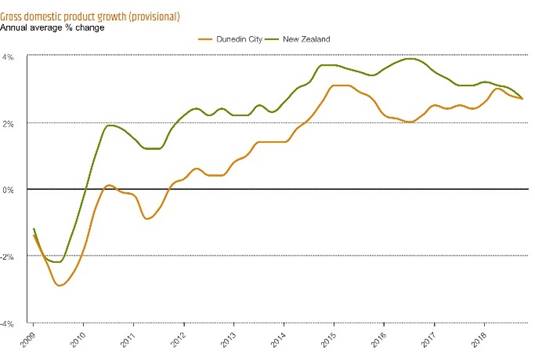

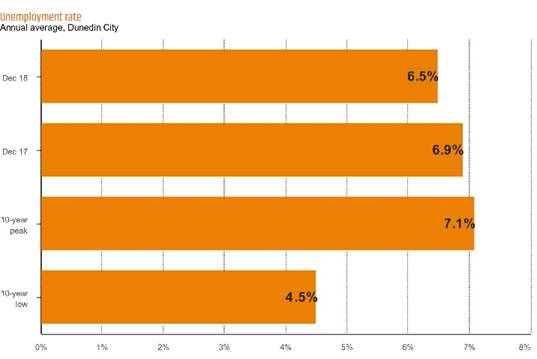

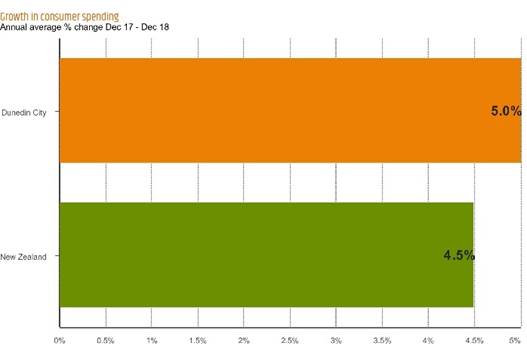

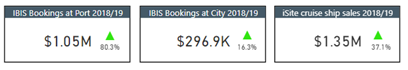

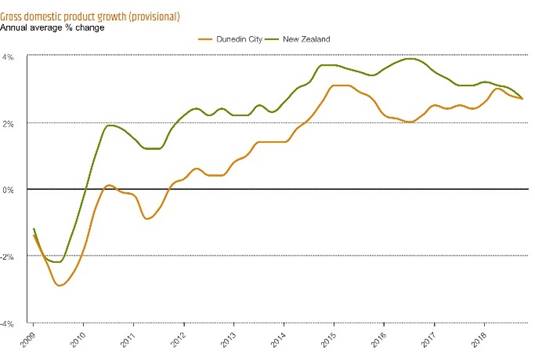

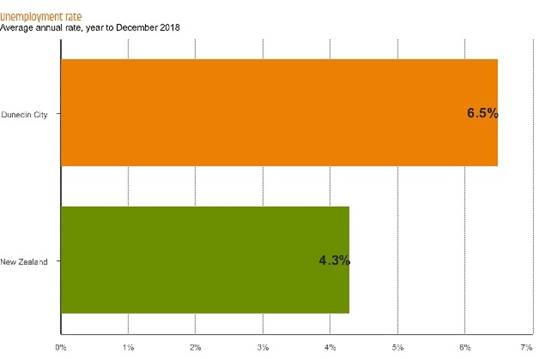

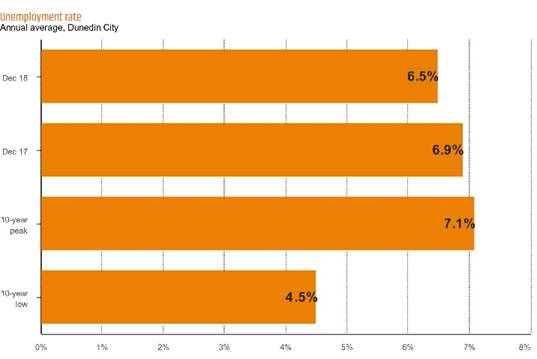

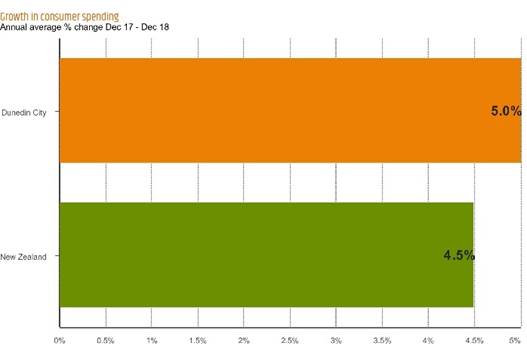

innovation – to improve linkages between industry and research.

c) A hub for

skills and talent – to increase retention of graduates, build the skills

base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A compelling

destination – to increase the value of tourism and events and improve the

understanding of Dunedin's advantage.

3 The

strategy sets out two economic goals:

a) 10,000 extra

jobs over 10 years (requiring growth of approximately 2% per annum).

b) An average of

10,000 of extra income for each person (requiring GDP per capita to rise 2.5%

per annum).

DISCUSSION

Major Projects and Key Focus Areas

Enterprise Dunedin Review –

Implementing Recommendations

4 The

Enterprise Dunedin review report was released in February. Many of the key

recommendations have been implemented or are in progress. In particular:

· Recruitment

of a City Marketing Manager – the process for recruitment began in March

and interviews with shortlisted candidates were undertaken on 13 May 2019.

· A

Visit Dunedin stakeholder group has been created to improve engagement with the

Tourism Sector, discuss opportunities and share insights. The 14 members

include the Motel Association, Hotel General Managers, Dunedin Host, DVML,

Dunedin Airport, Otago Chamber of Commerce (i.e. Chamber, retail and tourism

representatives), Ara Toi, Economic Development Committee Chairs.

· Martin

Jenkins has been engaged to review Grow Dunedin Partnership governance. A

revised structure, for Chair, meeting schedule, membership and function will be

given to each of the six Grow Dunedin stakeholders (Council, Otago Chamber of

Commerce, Otago Employer Association, University of Otago, Otago Polytechnic

and Ngāi Tahu) to take back to their respective governance boards for

approval.

· Sharing

insights and information – the DunedinNZ Insights online research and

statistics webpage went live in March.

Centre of Digital Excellence

5 On 30

April, Council approved the application to the Provincial Growth Fund (PGF) for

the development of the Centre of Digital Excellence (CODE) to be in Dunedin.

The application is supported by a business case prepared in collaboration with

the New Zealand Game Developers Association (NZGDA), local and international

gaming companies, the University of Otago, Otago Polytechnic, local secondary

schools, Ministry of Business Innovation and Employment (MBIE) and other

stakeholders.

6 CODE is

expected to grow the video game development industry in Dunedin through:

· supporting

local leadership, education, research and innovation and international

connections, while also fostering talent, diversity and inclusion;

· working

with the Dunedin start-up ecosystem to enable them to scale up and build

capability;

· focusing

on points of difference for Dunedin - particularly in relation to health,

education and research strengths;

· showcasing

game development and its application across multiple sectors.

7 The

application has been made to Government with a decision likely to be made by

the end of June.

Otago Regional Economic

Development Framework

8 Enterprise

Dunedin continued working with economic development agencies across Otago on a

draft Otago Regional Economic Development (ORED) framework. The framework,

which is supported by Otago Mayors and Chief Executives, is intended to promote

effective collaboration between Otago councils, Ngāi Tahu and local

Runaka, and regional and national stakeholders, so that economic development

projects and initiatives that can provide multi-district benefits can be

identified and progressed.

9 The draft

framework is expected to be presented to Otago Mayors in late June.

Energy

10 The District Energy

System is continuing work to evaluate the feasibility of a new district energy

system for central Dunedin. The working group (DCC, University of Otago,

Southern DHB, Ministry of Health) has engaged Stantec to develop an indicative

business case. The objective is to develop a short-list of potential system

options, including fuel/energy source, reticulation system specifications, and

overall system size and scalability. Work on the business case began in March,

and the final report is expected in July.

11 The 2017/18 Dunedin

Energy Study is the fourth annual study on Dunedin’s total energy use and

associated greenhouse gas emissions. This has been completed by the Centre for

Sustainability at the University of Otago. Results showed a 5% increase

in energy use and 6% increase in greenhouse gas emissions over the previous year.

The study also revealed that Dunedin is number one nationally in per capita

electric vehicle ownership, which was highlighted in local and national press,

including One News, Otago Daily Times, and Stuff.

12 Enterprise Dunedin

continues to work with ChargeNet and Aurora to progress installation of an EV

fast charger on Water St, as approved by Council on 26 March 2019. ChargeNet is

currently working on a site plan with an installation date yet to be confirmed.

Enterprise

Dunedin Activity Outcomes

13 Enterprise

Dunedin’s activities are focused around the Economic Development Strategy

themes. The following section provides highlights of some of the key activities

and outcomes that have occurred within each activity theme during the past few

months.

Business Vitality

Business Relations

14 Attracting

investment into the city and fostering job growth are a core part of the

Enterprise Dunedin work programme. Key projects from this quarter include:

· Work

with the developers of a 380-unit Grange Lifecare retirement village in

Mosgiel, which was granted resource consent in March. Construction will take

place in stages over ten years and create between 20-50 subcontractor jobs.

Once completed, it will employ up to 80 rest home staff. This is a good example

of cross-Council cooperation, with Enterprise Dunedin working with DCC City

Planning and Water and Waste Group staff to come to a workable outcome with the

developer on a long-term project with good employment potential.

· Continuing

efforts with another developer seeking to build a 13,500 m2

factory, which could lead to the creation of around 80 jobs. Enterprise Dunedin

is assisting with working through required regulatory processes.

Business Clinic

15 There were 40

referrals to the Enterprise Dunedin business clinics during the July 2018 to

April 2019 period. The range and proportion of participating industries is

outlined below:

16 Recent

successes from engagement with the business clinic service include:

· a

high-end music repair business confirming its relocation from Sydney to

Dunedin;

· an

enterprise that specialises in motion capture suits for game developers and

filmmakers relocating from Auckland to Dunedin.

Alliances for Innovation

Film Dunedin

17 Film permits issued

for the period April 2018 to March 2019 were slightly up, with 39 permits

issued compared to 37 for the previous year.

18 Of note is that the

total number of location shoot days increased, due to productions having a

longer average duration – for example, during the March 2019 quarter

there were 50 screen shoot days, up from 18.6 during the March 2018 quarter.

19 An analysis of the

origin of the productions over the past year shows that 41% were Dunedin

productions, 28% were other New Zealand productions and 31% were international

productions.

20 International

productions are typically of a much larger scale than New Zealand productions

with each employing three to four times the number of crew, on average,

compared to a typical New Zealand production.

Table - Film characteristics by production origin

(March 2019 year)

|

Production Origin

|

Proportion of

Permits

|

Average Shoot

Days Per Permit

|

Average Crew

Per Permit

|

|

Dunedin

|

41%

|

3.3

|

4.1

|

|

Rest of New Zealand

|

28%

|

1.2

|

5.1

|

|

International

|

31%

|

2.3

|

17.5

|

|

Total

|

100%

|

2.4

|

8.5

|

A Hub for Skills and Talent

Start-up Dunedin

21 Startup Dunedin has

expanded its engagement. Event attendees totalled 1,125 over the March 2019

year, up 36% from a year earlier.

22 Individual

programmes are performing close to capacity. For example, there were

72 entries in the Challenger series, of which 20 pitches were reviewed and

three were selected for incubation. All three incubatees are going well.

23 More Startups are

generating real income. During the March 2019 year, 58% of Startups had paying

customers, up from 41% the previous year.

A Compelling Destination

Visitor Statistics

a) Bed

Nights

i) Commercial guest nights have risen just 0.1% over the

February 2019 year.

ii) A similar pattern has been experienced nationally, as

visitor arrivals growth slows and private accommodation platforms, such as

Airbnb, continue to expand. Guest nights in Dunedin in February 2018 had also

spiked due to one-offs such as the Masters Games and Robbie Williams concert.

iii) However, occupancy in Dunedin remains high.

Dunedin’s commercial accommodation occupancy rate across all types of

accommodation was 57% over the past 12 months, compared to 46% nationally.

Dunedin’s motel occupancy rate was 71% compared to 62% nationally.

b) International Trade

i) Trade travel work involves various activities to

promote and support bookings via trade travel channels to overseas travellers.

Supporting trade travel is also a key priority in Tourism New Zealand’s

strategic plans.

ii) During the year to March 2019, 1,024 travel agents

participated in training by Enterprise Dunedin staff on Dunedin’s tourism

offering; this number is similar to the previous year’s activity.

Enterprise Dunedin also hosted 52 agents on Famils in the local area.

iii) All efforts in trade support, training and famils

undertaken, were focused on agents from, or marketing in, Dunedin’s most

productive visitor markets, of Australia, China, UK/Europe, USA and South-East

Asia.

c) Business Events (Conferences)

i) Although business events in Dunedin for the 12-month

period to December 2018 decreased slightly, from 1,571 (in 2017) to 1,468, they

were generally larger events that extended over more days. Therefore, delegate

days in Dunedin still rose, as evident from the table below. A larger number of

delegate days helps support guest nights in Dunedin.

Table - Delegate days and average event duration

|

December Year

|

Delegate Days

|

Average Event Duration (Days)

|

|

2017

|

25,705

|

1.6

|

|

2018

|

36,538

|

2.3

|

ii) Enterprise Dunedin’s prospecting for business

events has expanded over the past year. During the 12 months to March 2019,

Enterprise Dunedin put in bids, followed up leads and assisted with 54

prospective business events, up from 30 the previous year.

iii) There is typically a long lead time from initial

engagement on a prospective business event until a final decision is made. Of

the 54 prospective conference events engaged with over the past 12 months

(covering the period 2020-2026), four were unsuccessful, 40 are still in

progress, and 10 conferences were successful.

d) PR and Promotions

i) There were 11 media famils hosted during the period

from January to March 2019. Media representatives were from New Zealand,

Australia, China, Japan, Hong Kong, Canada, and Argentina.

ii) In March 2019, Enterprise Dunedin organised a 15-page

New Zealand Herald supplement dedicated to Dunedin, which featured several

articles focusing on the life, work and visit themes. The main intention of the

supplement was to showcase the future job opportunities and lifestyle of the

city, but also raise awareness of Dunedin as a compelling domestic destination

to visit. The supplement was distributed to 75,000 New Zealand Herald

subscribers in the urban Auckland area.

e) i-SITE Visitor Centre

i) The 2018/2019 cruise season has been a record season.

An analysis of scheduled services shows 352,148 total passengers (including

crew), up from 254,750 in the 2017/18 season (October to April) - an increase

of over 38%. Total passenger numbers have almost doubled since the 2014/15

season when they totalled 189,349.

ii) Dunedin’s cruise industry has not only grown in

volume terms but is also attracting higher value visitors. An analysis of

Statistics New Zealand cruise expenditure statistics shows that the average

earnings per cruise visitor to Dunedin has risen from $134 (ex GST) in 2014/15

to $193 in 2017/18.

Table - Total cruise spending in Dunedin and average

daily spend

|

June Years

|

2015

|

2016

|

2017

|

2018

|

|

Total Spend ($000's)

|

$25,368

|

$29,761

|

$34,795

|

$49,080

|

|

Average Daily Spend/Visitor (ex GST)

|

$133.97

|

$143.95

|

$150.33

|

$192.66

|

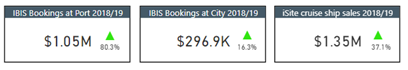

iii) The table below shows the split between cruise sales from

the Port satellite and the city office, as reported via IBIS (the i-SITE

booking engine). These sales are for tour, transport and activity bookings.

f) Study Dunedin

i) International students contributed $197 m to

Dunedin’s economy during the 2017/18 year.

ii) The following table breaks down this value added into

different parts of the international education sector in Dunedin.

Table - International sector breakdown, 2017/18

|

Type

|

Number of Students

|

Value Added

($m)

|

|

University

|

2,977

|

115

|

|

Private Training Establishment

|

736

|

28

|

|

Schools

|

637

|

29

|

|

Institutes of Technology and Polytechnics

|

517

|

24

|

|

English Language School

|

37

|

1

|

|

Total

|

4,904

|

197

|

iii) An indicative understanding of more recent trends in

international student numbers can be gleaned from visa data for Otago. The data

shows that the number of valid student visas in Otago in February 2019 was

3,967 – down slightly on the 4,055 valid visas a year ago, but well up on

the 3,592 valid visas in February 2017.

iv) To put the Otago result in context, international

students in Dunedin represented 76% of the total number of international

students in Otago during 2017/18.

DUNEDIN’S CURRENT ECONOMIC PERFORMANCE

24 Infometrics

Quarterly Economic Monitor for the December 2018 quarter was released on 28

February 2019; the full report is available at: https://ecoprofile.infometrics.co.nz/Dunedin+City/QuarterlyEconomicMonitor.

25 An Enterprise

Dunedin media release responding to the report can be found at: https://www.dunedinnz.com/business/enterprise-dunedin/news-stories/business-news/quarterly-economic-monitor-points-to-healthy-tourism-growth

26 Highlights include:

· The

economy expanded by 2.7% over the December 2018 year, consistent with the

national economy. This growth follows a revised 2.4% per annum expansion in

2017.

· Traffic

flows in Dunedin are rising at a similar level, up 2.3% in 2018.

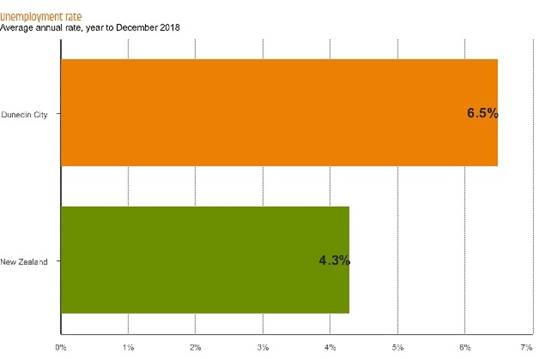

· Dunedin’s

unemployment rate averaged 6.5% in 2018, compared to 6.9% in 2017.

· Strong

job prospects are encouraging people to relocate to Dunedin to live. Given the

ongoing delays in the release of Census data and the removal of airport

departure cards, Infometrics has recently begun using enrolments at primary

health providers as a timely proxy for population growth. The data shows that

health enrolments in Dunedin City grew 1.9% across 2018.

· Growth

in consumer spending climbed 5.0% in 2018, following 4.2% growth the previous

year, and continue to remain above the national average.

· Data

from Marketview shows that purchases on electronic cards climbed 5.0% in 2018,

following 4.2% growth the previous year.

· More

recent data made available since the Infometrics report shows that visitor

spending in Dunedin for the year to February 2019 year increased 4.9% to

$774 m, with international visitor spending rising 7.5% and domestic

visitor spending rising 4.2%. A key factor pushing up international visitor

spending in Dunedin has been the cruise industry.

1

OPTIONS

27 As this is a report

for noting, there are no options.

NEXT STEPS

28 Feedback on the

activity report will be incorporated in future updates.

Signatories

|

Author:

|

Suz Jenkins - Finance and Office Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing a public service and it

is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the delivery of the

2013-23 Economic Development Strategy.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known implications for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Enterprise Dunedin activities and the 2013-23 Economic

Development Strategy are included in the 2018-28 Long Term Plan.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This decision is considered low significance under the

Significance Engagement Policy.

|

|

Engagement –

external

As an update report, no external engagement has been

undertaken.

|

|

Engagement -

internal

As an update report, no internal engagement has been

undertaken.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

Economic Development

Committee

21 May 2019

|

|

Startup Ecosystem

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 This

report seeks Economic Development Committee (EDC) approval for a Grow Dunedin

Partnership (GDP) funding decision in line with GDP’s approvals and delegation.

2 On 28

March 2019, GDP resolved to allocate $150,000, from a proposed 2019/20

operating budget of $360,000 included in the 10 -Year Plan to the Startup

Dunedin Trust (SUDT) to support the development of the startup ecosystem.

3 This

investment builds on 2018//2019 activities and will further develop Dunedin

startup businesses.

|

That the Committee:

a) Approves $150,000

funding to the Startup Dunedin Trust for the 2019/20 financial year from

proposed 2019/20 Grow Dunedin Partnership operating budgets.

b) Notes this

investment will attract $25,000 of funding from Callaghan Innovation for

continuation of the Challenger Series.

|

BACKGROUND

4 A startup

ecosystem is formed in a physical location by people, businesses (in their

various stages of growth) and organisations who wish to support and scale new

startup companies.

5 The

ecosystem is typically led by entrepreneurs and often includes economic

development agencies, universities, polytechnics, co-working spaces,

professional services and existing and established businesses.

6 Development

of the startup ecosystem has been identified as a key priority by GDP and

Enterprise Dunedin given the role it plays in supporting the goals of the

2013-23 Economic Development Strategy (EDS):

a) 10,000 extra

jobs over ten years (requiring employment growth of approximately 2% per

annum);

b) an average of

$10,000 extra income for each person (requiring gross domestic product per

capita to rise by about 2.5% per annum).

7 The

development of the startup ecosystem contributes to all themes of the EDS:

a) Business

Vitality;

b) Alliances for

Innovation;

c) A Hub for

Skills and Talent;

d) Linkages

Beyond Our Borders;

e) Compelling

Destination.

8 On 11

September 2018 the EDC

Moved (Cr Andrew Whiley/Cr Christine Garey):

a) approved

$150,000 for measures to support the startup ecosystem from existing 2018/19

Grow Dunedin Partnership operating budgets;

b) noted this

investment will attract $50,000 from Callaghan Innovation for the delivery of

business incubator services during 2018/19.

Motion

carried (ED/2018/033)

DISCUSSION

2019/2020 Investment in the

Startup Dunedin Trust (SUDT)

9 Table one

summarises a selection of activity undertaken, and outcomes achieved by the

SUDT in the 2018/19 year to date:

Table One: Summary of SUDT

activity 2018/2019

|

Objective

|

Activity

|

Outcome

|

|

Enable connections, better

collaboration and alignment of resource

|

Incubation Services

CreativeHQ Challenger Series

|

· 72

startups registered with three global growth companies going through

incubation

|

|

|

Audacious

|

· 1000

email database sign ups in March 2019, up from 175 sign ups in March 2018.

· 50

registrations (15 at the same time in 2018), a 233% increase in registrations

on the same time as 2018

|

|

Co.Starters

|

· Two

cohorts, 24 startups

|

|

Startup Weekend

|

· 63

individuals, nine teams. The top three teams are continuing with their ideas

|

|

Improve visibility

|

Startup Dunedin Trust hosted

events

|

· 116

events including FoundX in December 2018 showcasing 10 startups

|

|

Improve performance measures

|

Number of startups paired

with mentors

|

· 61

startups connected with mentors, support or advice

|

|

· 82

expressions of interest to mentor startups one-on-one

|

|

Startups with paying

customers

|

· 58%

compared to 41% in the 12 months from March 2018

|

The 2018/19 Dunedin

Ecosystem Support Fund (DES)

10 GDP agreed to set

aside $50,000 (which formed the DES fund) for additional measures to support

the wider startup ecosystem. An independent panel subsequently identified the

following two projects for support:

a) Konaki

Māngai

An internship programme developed by Innov8HQ aimed at

supporting students and youth into startups;

b) Rising Tide

A community-driven grant scheme designed to help launch

early stage businesses and create better founders.

11 Both projects are

still currently in delivery and the outcomes will be reported to the EDC at the

end of the 2018/19 financial year.

12 On 28 March 2019,

GDP resolved to allocate $150,000, from a proposed 2019/20 operating budget of

$360,000 to the SUDT to support the development of the startup ecosystem.

13 This investment will

support the delivery of the following workstreams and activities during

2019/20:

a) startup

support, incubation services and a second Challenger Series;

b) continued

delivery of the Audacious programme;

c) ongoing

delivery of Co.Starters;

d) community

events in conjunction with Dunedin co-working spaces;

e) promotion and

marketing of hero stories;

f) further

partnering with government agencies and local and regional investors.

OPTIONS

Option One–Approve $150,000 investment in the Startup Dunedin Trust (preferred

option).

14 EDC approves

$150,000 from proposed 2019/2020 operating budgets to support the startup

ecosystem.

Advantages

· Option

one is supported by GDP and has been developed in conjunction with the SUDT,

the wider ecosystem, local businesses and partners;

· SUDT

activities, delivery and outcomes are resourced during the 2019/2020 financial

year;

· Provides

a platform to build on additional work streams such as the Centre for Digital

Excellence (CODE) and support the development of talent and startups to grow

Dunedin’s technology and creative sectors.

Disadvantages

· $150,000

less for other 2019/2020 GDP activities.

Option

Two–Approve a smaller investment or no investment in the Startup Dunedin

Trust

15 EDC approves a

smaller or no investment (i.e. less than $150,000) for 2019/2020 from proposed

GDP budgets to support the SUDT and the continued development of the startup

ecosystem.

Advantages

· $150,000

for other 2019/2020 GDP activities.

Disadvantages

· Fewer

services and support for the startup ecosystem during a period of increased

momentum and growth;

· Uncertainly

for SUDT, staff and existing programmes;

· Inability

to attract additional match funding from agencies such as CreativeHQ for

incubation services such as a second Challenger series.

NEXT STEPS

16 If funding is

approved, Enterprise Dunedin will update the existing service level agreement

with the SUDT for 2019/2020. Outcomes will be reported back to EDC through

quarterly reports.

Signatories

|

Author:

|

Chanel O'Brien - Business Development Advisor Skills and

Entrepreneurship

|

|

Authoriser:

|

Fraser Liggett - Economic Development Programme Manager

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision relates to providing a public service and it

is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

The preferred option in the report supports the goals of

the Dunedin Economic Development Strategy under the themes Alliances for

Innovation and Hub for Skills and Talent. Creative businesses are represented

in the startup ecosystem. The proposed option and measures also support the

theme of Creative Economy under the Arts and Culture Strategy.

|

|

Māori Impact

Statement

Ngai Tahu are represented on GDP and have an opportunity

to contribute to decision making on the 2019/2020 activities of the SUDT and

the startup ecosystem.

|

|

Sustainability

Ongoing business development and support for the startup

ecosystem has been identified as one priority by GDP and Enterprise Dunedin

to meet the economic goals in the 2013-23 Economic Development Strategy.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no implications for the LTP, Annual Plan,

Financial Strategy and Infrastructure Strategy.

|

|

Financial

considerations

The total cost of the recommended option is $150,000 from

proposed 2019/20 Annual Plan budgets

|

|

Significance

This decision is considered low in terms of the

Council’s Significance and Engagement Policy.

|

|

Engagement –

external

The following organisations have been engaged regarding

the recommendations in this report, the Grow Dunedin Partnership (including:

Dunedin City Council, Otago Chamber of Commerce Incorporated, Otago Southland

Employers Association, University of Otago, Otago Polytechnic, Ngai Tahu,

John Gallaher, Forsyth Barr), the Otago Business School, Startup Dunedin

Trust and wider startup ecosystem.

|

|

Engagement -

internal

There has been no internal engagement.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There is no conflict of interests.

|

|

Community Boards

There are no implications for Community Boards.

|