|

Finance and Council

Controlled Organisations Committee

21 May 2019

|

|

Financial Review

For the

period ended 31 March 2019

This report provides a detailed commentary

on the Council’s financial results for the period ended 31 March 2019 and

the financial position at that date.

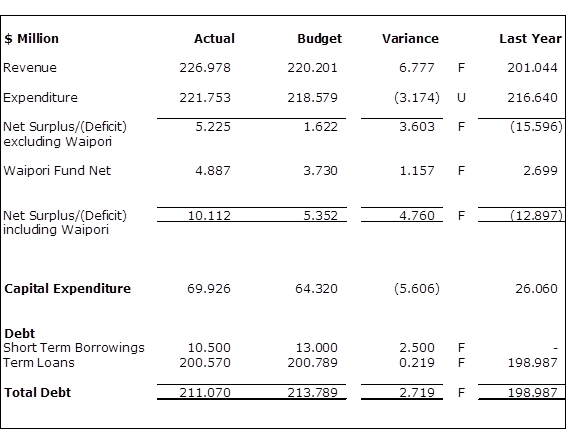

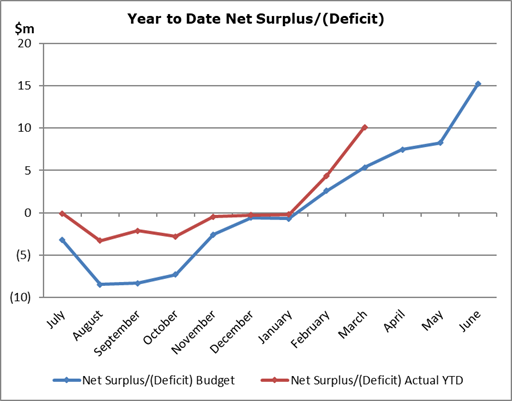

net surplus/(Deficit)

(including waipori)

The net

surplus (including Waipori) for the period ended 31 March 2019 was

$10.112 million or $4.760 million better than budget.

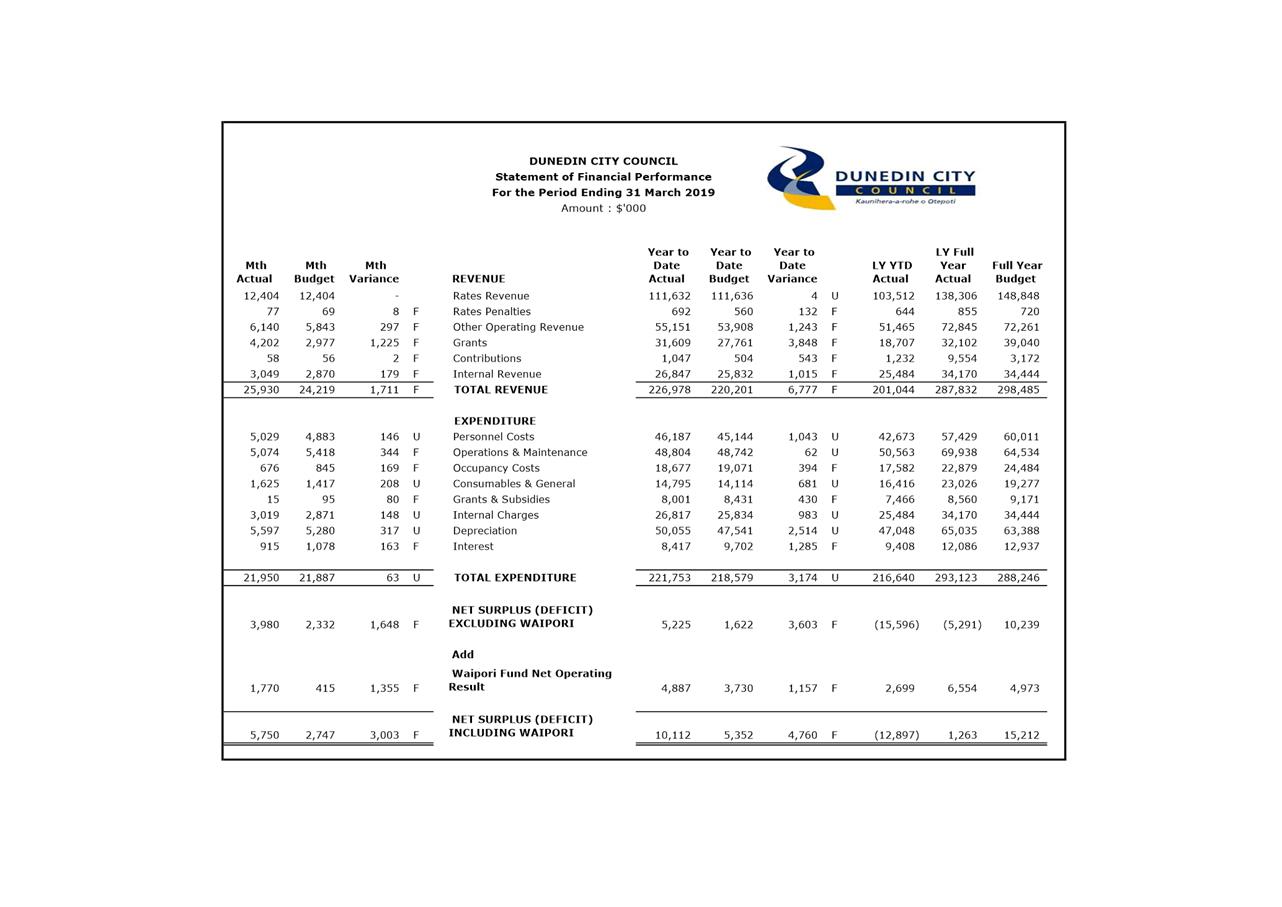

REVENUE

The total revenue for the period was

$226.978 million or $6.777 million greater than budget.

The major variances were as follows:

Other Operating Revenue

Actual $55.151 million, Budget $53.908

million, Favourable variance $1.243 million

Regulatory Services revenue was favourable

$522k, mainly due to increased building services activity.

Waste and Environment Solutions revenue was

favourable $185k due to increased landfill revenue.

Parking Operations revenue was favourable

$160k reflecting increased usage of parking facilities, both on-street and

off-street.

Revenue from cemeteries and crematorium was

favourable $138k primarily due to an increase in the number of cremations.

Transportation revenue was favourable $123k

mainly due to greater than expected corridor accessway revenue.

Grants

Actual $31.609 million, Budget $27.761

million, Favourable variance $3.848 million

Transport grants and subsidy revenue was

favourable $2.934 million primarily due to the higher level of capital project

delivery.

Art Gallery revenue was favourable $170k

due to an unbudgeted equipment grant for racking.

Investment Account revenue was favourable

$600k due to the unbudgeted Waterfront grant from the Provincial Growth Fund.

Expenditure

The total expenditure for the period was

$221.753 million or $3.174 million greater than budget.

The major variances were as follows:

Personnel Costs

Actual $46.187 million, Budget $45.144

million, Unfavourable variance $1.043 million

This unfavourable variance was due to

higher than expected recruitment costs, unbudgeted costs associated with the 2GP

and a budget understatement in Aquatics (remedied for the 2019/20 budget).

Operations and Maintenance Costs

Actual $48.804 million, Budget $48.742

million, Unfavourable variance $62k

Property costs were unfavourable $1.157

million and included increased reactive maintenance in the housing portfolio

along with unbudgeted costs with demolition work and asbestos removal at Thomas

Burns St and Dukes Road.

Parks costs were unfavourable $448k due to

greater than budgeted building maintenance and reserves work to date.

Civic and Admin Services were unfavourable

$149k due to costs associated with the second-generation district plan.

These unfavourable variances were partially

offset by:

BIS costs were favourable $745k with

project management and other contracted services costs being less than

expected.

Transport costs were favourable $542k.

Winter environmental maintenance was minimal due to favourable weather

conditions. The amount of sealed pavement and footpath maintenance work

and subsidised emergency work was less than expected.

Waste and Environmental Solutions costs

were favourable $231k due to the reduced cost of the refuse collection

contract.

Consumables and General Costs

Actual $14.795 million, Budget $14.114

million, Unfavourable variance $681k

Waste

and Environmental Services consultants costs were unfavourable $307k due to

unbudgeted expenditure relating to the Waste Futures project.

Resource

Consents was unfavourable $258k mainly due to the need to use planning

consultants to deal with the number of consent applications.

Regulatory

Services was unfavourable $129k due partly to the cost of offsite processing of

consents and competency assessments.

Grants and Subsidies Costs

Actual $8.001 million, Budget $8.431

million, Favourable variance $430k

The favourable variance was due to delayed

disbursement of some grants including heritage support and waste strategy.

Depreciation

Actual $50.055 million, Budget $47.541

million, Unfavourable variance $2.514 million

This variance was due

to a revaluation of Three Waters and Transportation assets impacting both the

depreciable replacement cost and asset useful lives.

Interest

Actual $8.417 million, Budget 9.702

million, Favourable variance $1.285 million

Interest expenditure was less than budget primarily

due to a favourable floating interest rate applied to the non-fixed interest

borrowing.

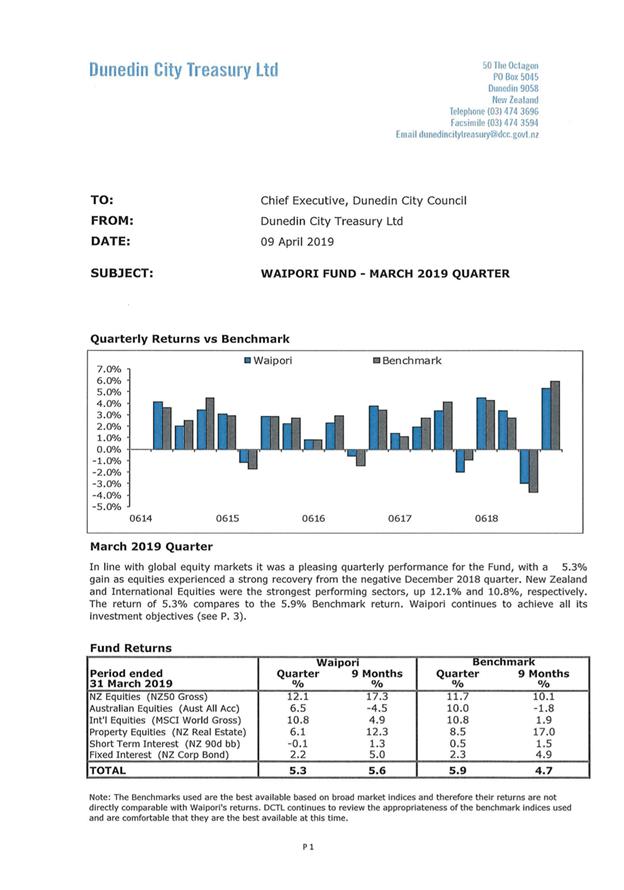

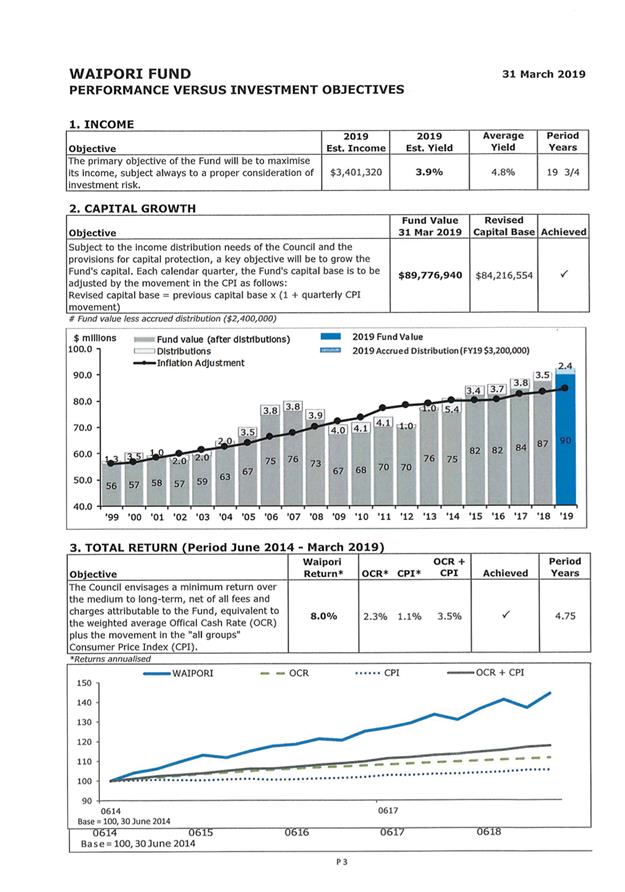

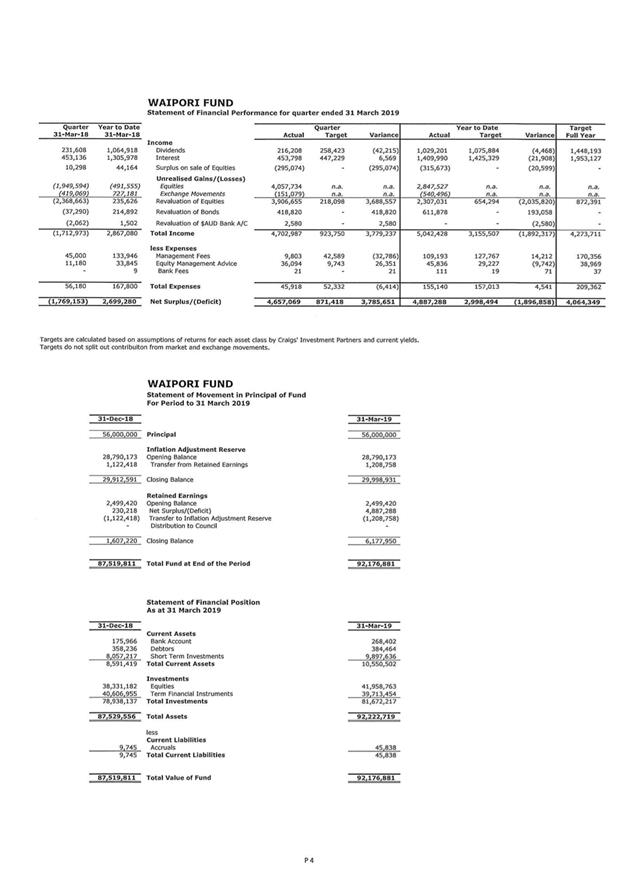

WAIPORI FUND NET

OPERATING RESULT

Actual

$4.887 million, Budget $3.730 million, Favourable variance $1.157 million

The year to date Waipori was reflective of

current market conditions which saw a positive market movement during March in

both New Zealand and international equity markets.

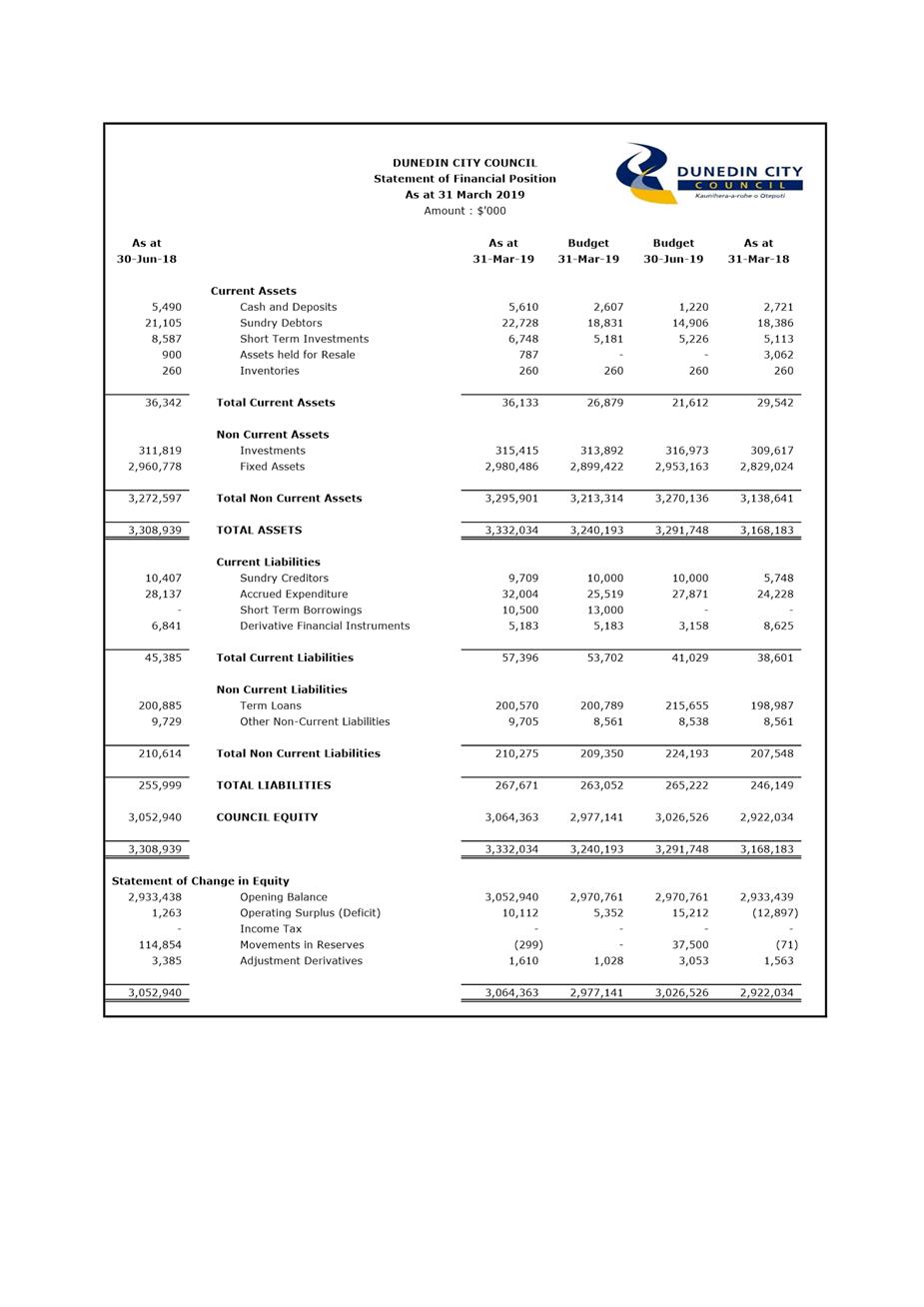

Statement of

Financial Position

A Statement of Financial Position is

provided as Attachment C.

Short term investments of $6.748 million

relate to the Waipori Fund.

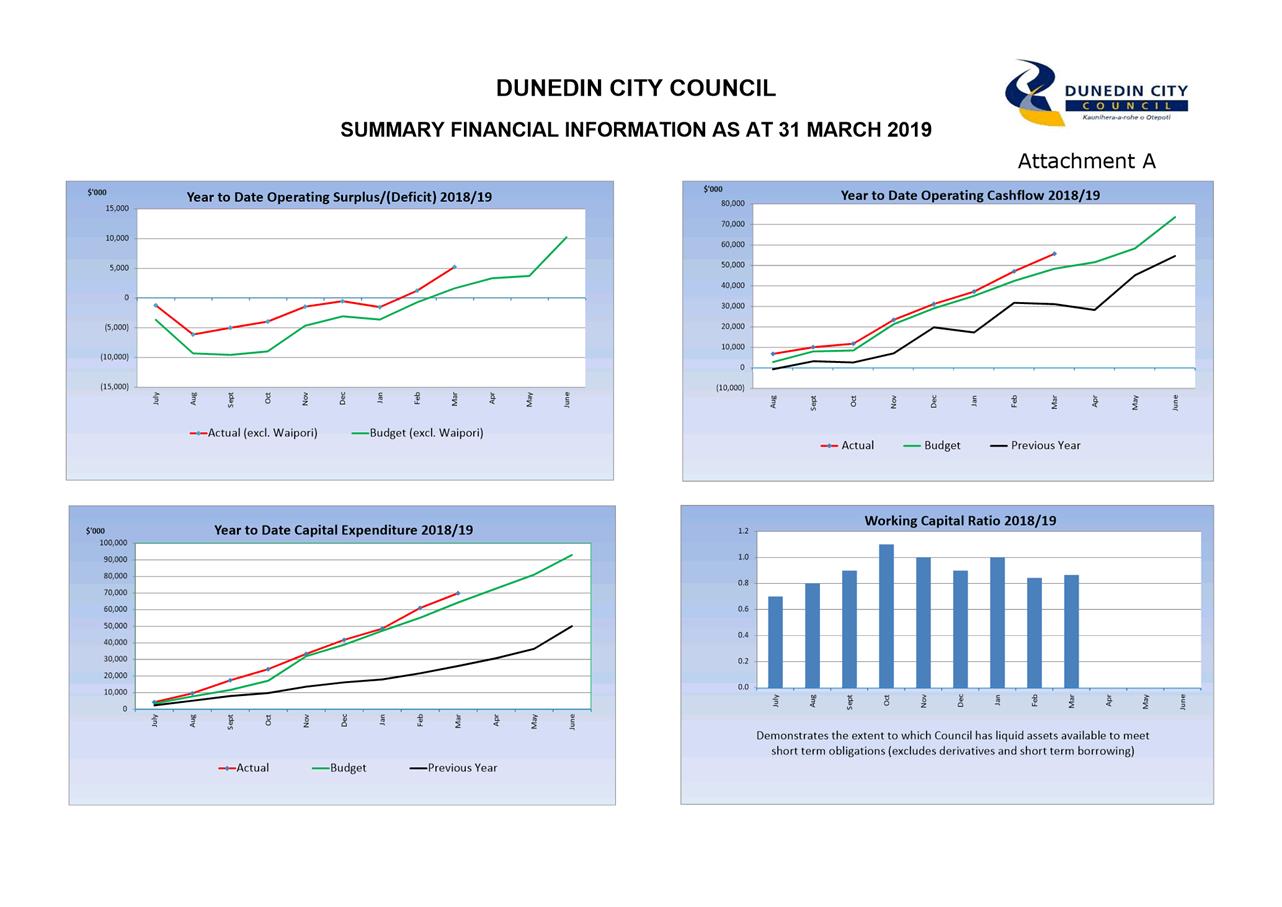

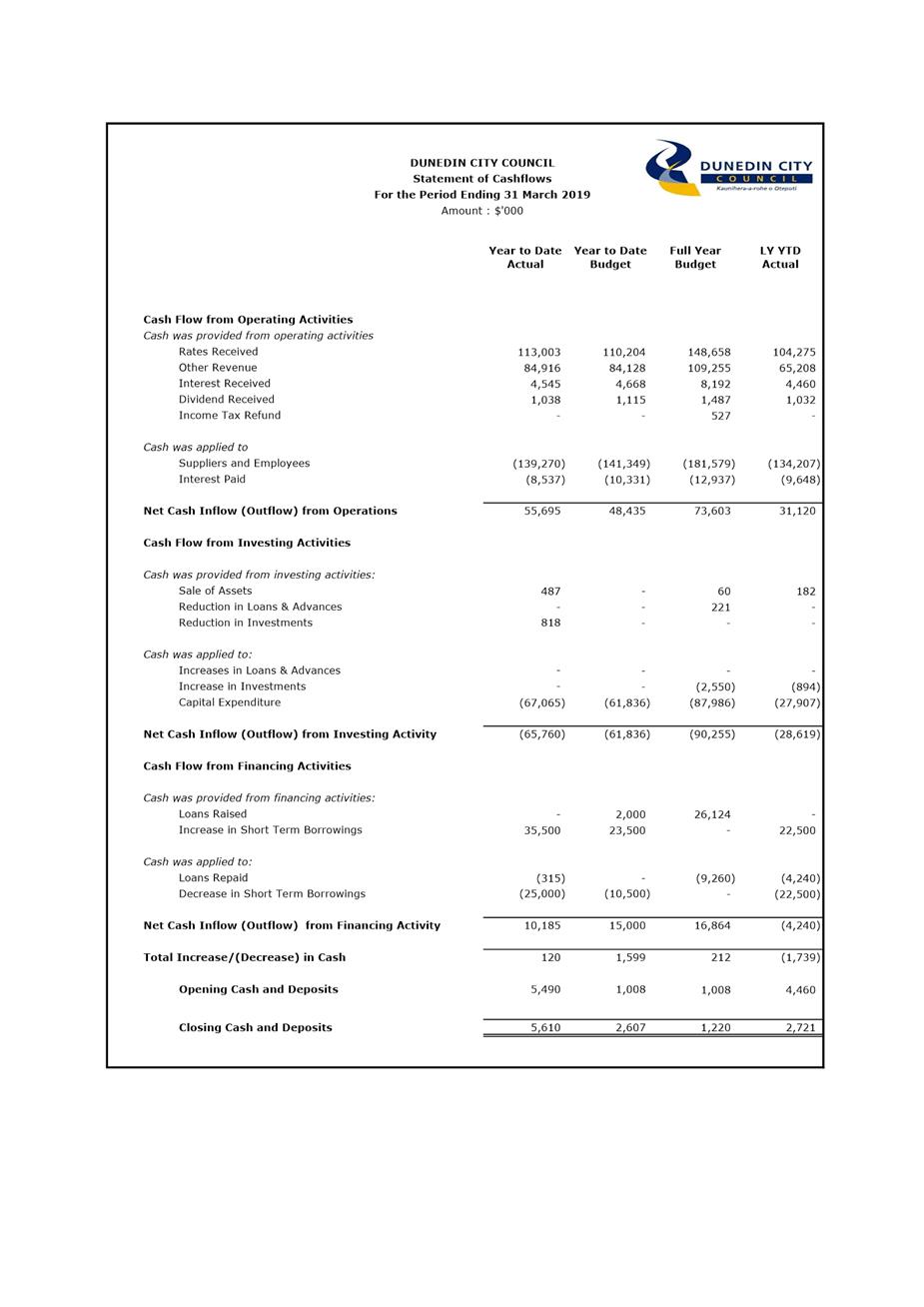

Statement of

Cashflows

A Statement of Cashflows is provided as

Attachment D.

Net cash inflow from operating activities

was favourable to budget due to the lower interest expenditure and favourable

timing related to some revenue lines.

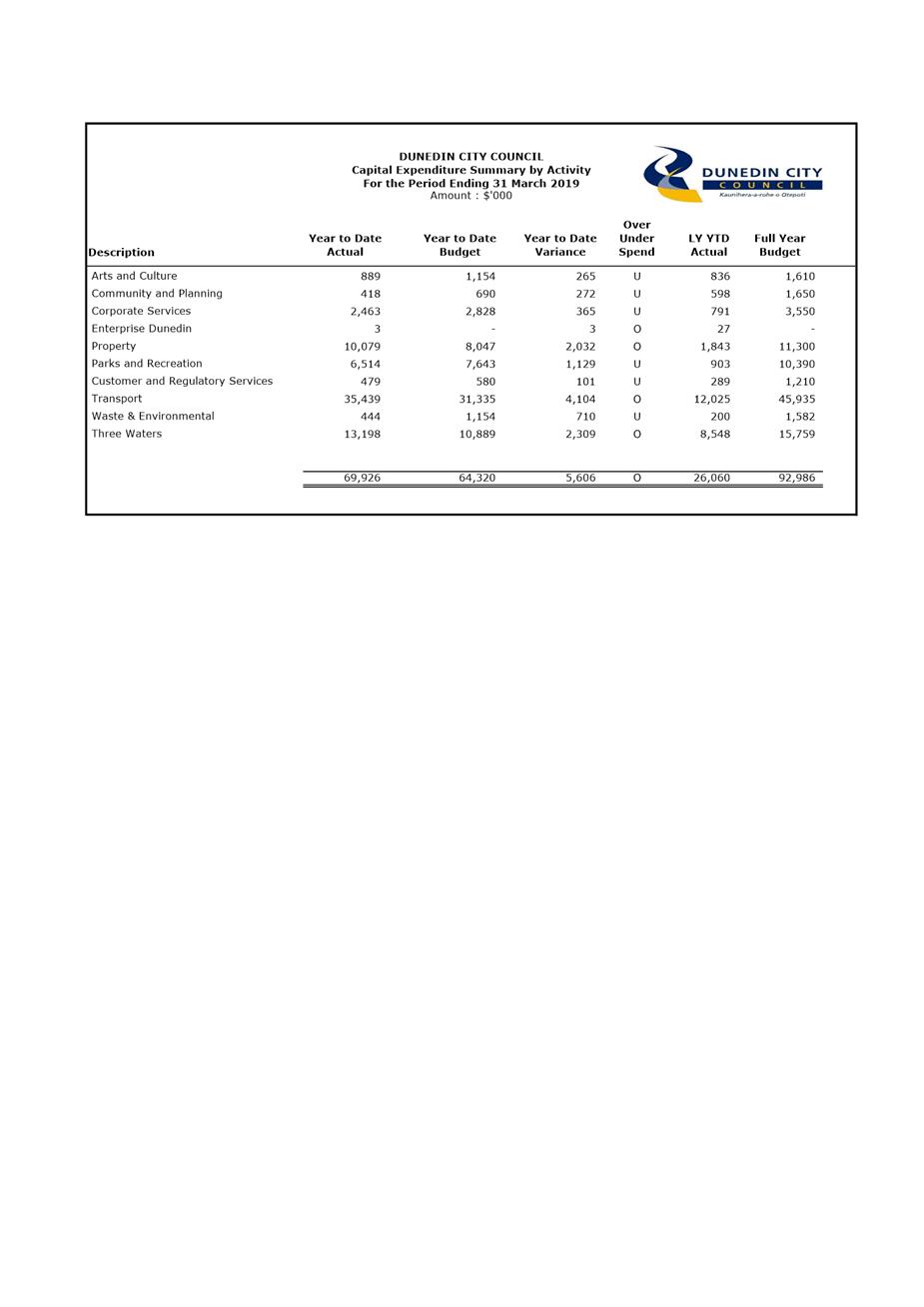

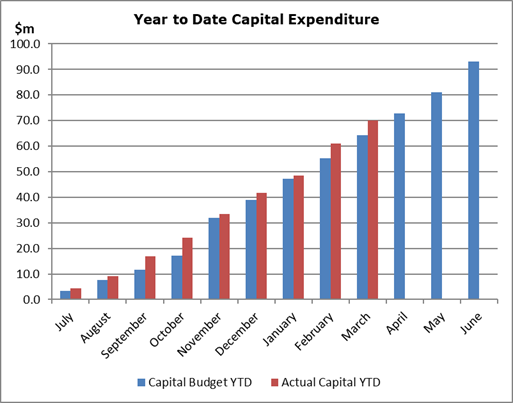

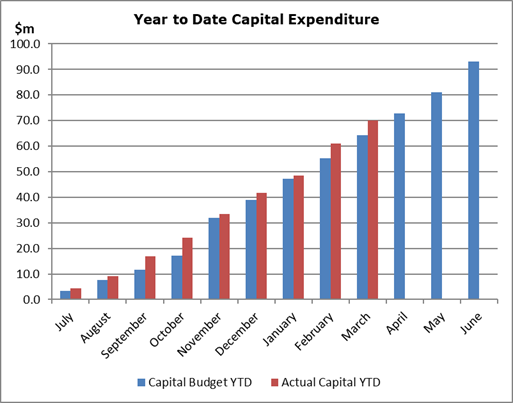

Capital

Expenditure

A summary of the capital expenditure

programme by Activity is provided as Attachment E.

Total capital expenditure for the period to

31 March 2019 was $69.926 million or 75% of the amended full year budget of

$92.986 million.

Corporate Services capital expenditure was $365k underspent

The underspend was primarily driven by

lower than expected expenditure related to the implementation of the new

Electronic Document and Records Management system.

Parks capital

expenditure was $1.129 million underspent

Aquatic Services capital was underspent

$673k due to the delayed timing of works at Moana Pool while detailed scoping

is completed.

General Parks renewals capital was

underspent by $510k due mainly to little expenditure to date required for

second beach slip restoration work. The Logan Park Artificial Turf project was

on budget.

Property capital

expenditure was $2.032 million overspent

The overspend to date was due to the

purchase of the South Dunedin Community Complex site during the month for $4.7

million.

Some property upgrade projects are in the

final stages of design and consenting, including the Mosgiel Library re-roof

and the 54 Moray Place compliance upgrade. The Edgar Centre structural

strengthening work has commenced. Work on the Central Library roof is well

progressed.

Design work for the School St housing

project is almost complete, with site demolition expected to begin in April.

Transport capital

expenditure was $4.104 million overspent

The primary driver for this over spend

related to expenditure on the peninsula widening project, with anticipated

early delivery of sections of the programme.

The overspend has been partly offset by

delays in a number of projects including LED lighting and permanent

reinstatement costs relating to the July 2017 rain event.

Three Waters

capital expenditure was $2.309 million overspent

The overspend was primarily driven by costs

associated with the completion of the Ross Creek Reservoir Refurbishment project.

There was also some unbudgeted emergency works including wastewater pipe

renewals on Brighton road.

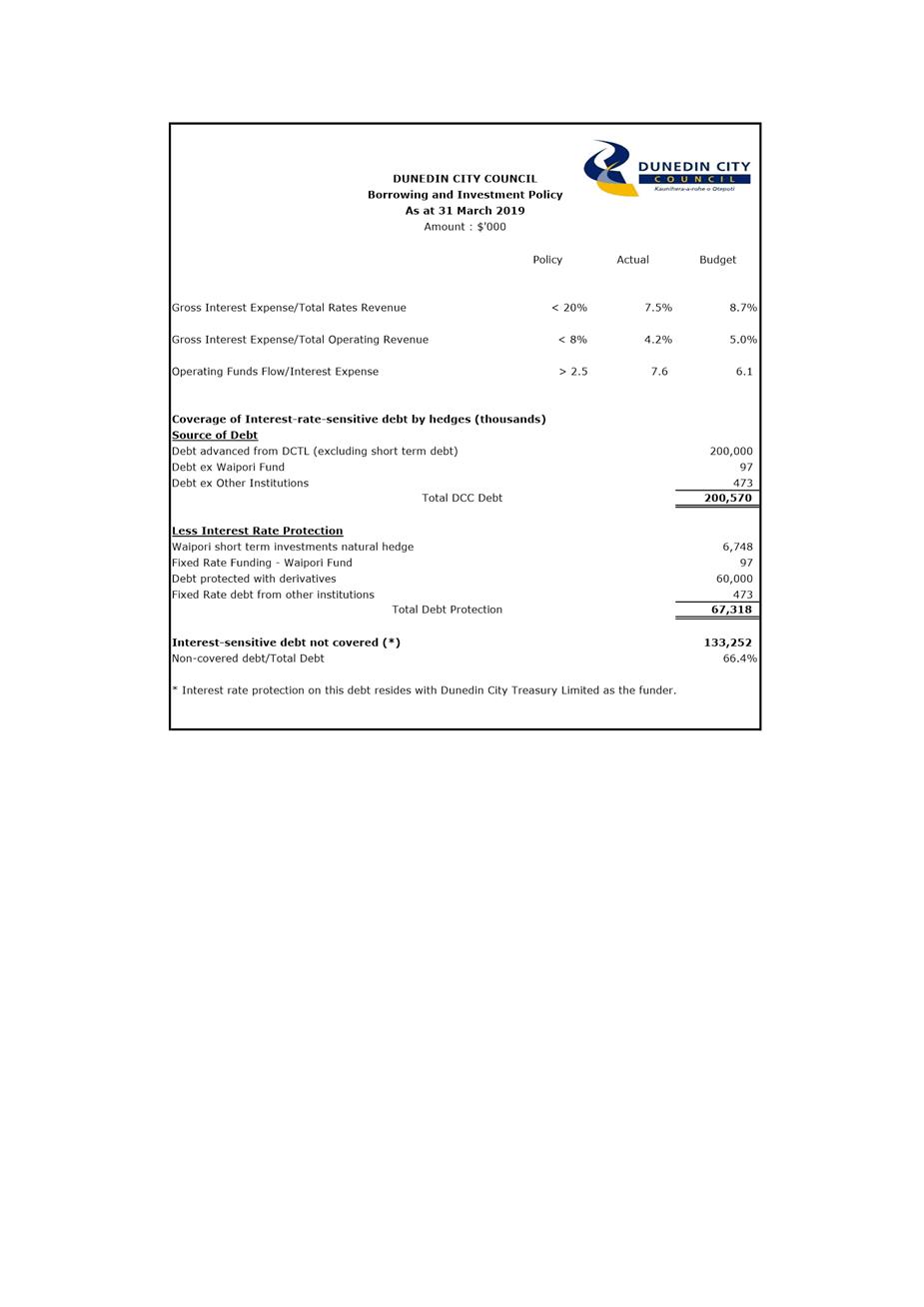

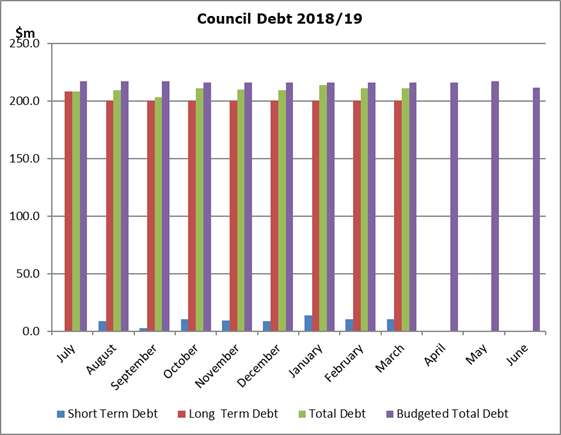

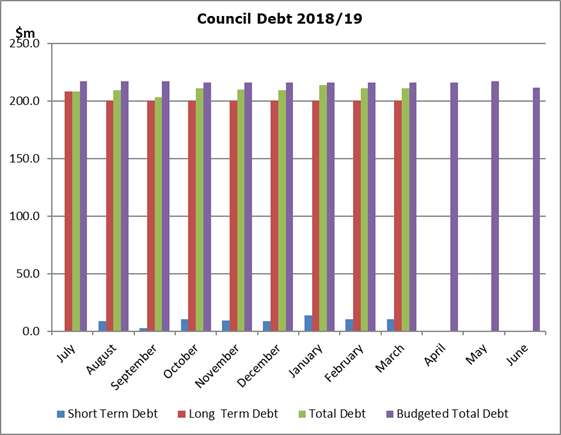

Debt

Refer to

Attachments F and G.

Attachment F

provides a summary of the debt servicing ratios.

All three

targets were within policy.

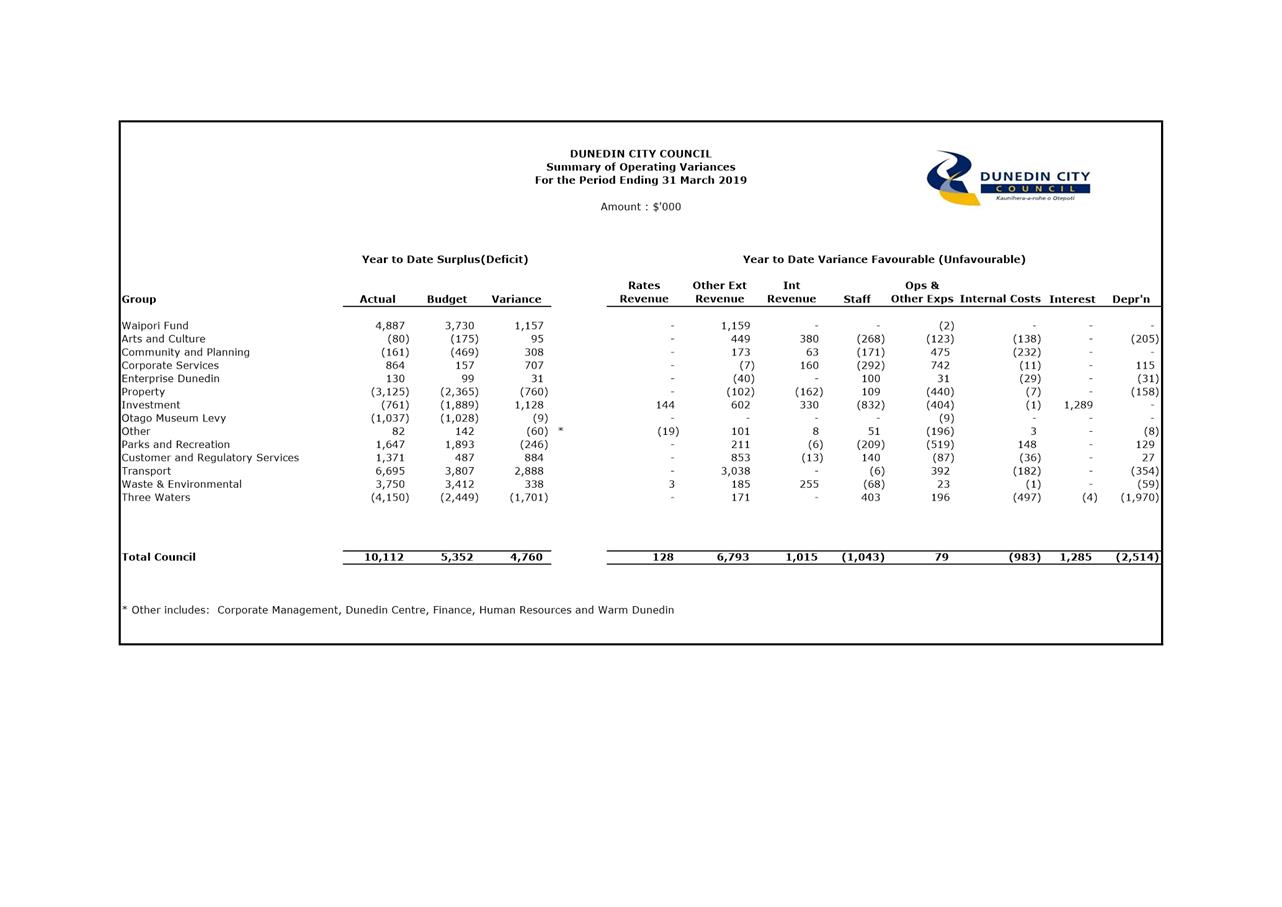

Comments from

group activities

Attachment H, the Summary of Operating

Variances, shows by Group Activity the overall net surplus or deficit variance

for the period ended 31 March 2019. It also shows the variances by

revenue and expenditure type.

Community and Planning - $308k Favourable

Operating costs were favourable $475k in

part due to delayed disbursement of grants including City service and Heritage.

Corporate Services - $707k Favourable

BIS operating costs were favourable $949k

due to the delayed timing of project management/contracted services costs.

Property - $760k Unfavourable

Operating costs were unfavourable $440k,

due to higher than expected levels of housing maintenance, unplanned repairs to

some operational buildings and some unbudgeted projects including the

demolition of buildings at three sites.

Revenue was unfavourable to budget due to

vacancies across the portfolio in part to allow for the redevelopment of

properties including School Street Housing complex and 54 Moray Place.

These unfavourable variances were partially

offset by lower staff costs ($109k) as vacancies were still in the process of

being filled.

Parks and Recreation - $246k Unfavourable

Parks operating costs were unfavourable

$499k mainly due to an increased focus on building maintenance, seismic and

asset condition assessments and unscheduled reserve works.

This unfavourable variance was partially

offset by higher revenue including: increased number of cremations, favourable

participation in the new inhouse swim school and additional revenue including

development contributions.

Customer and Regulatory - $884k Favourable

External revenue was favourable $853 with

increased activity across a number of operational areas – in particular

parking operations and building services.

Transport - $2.888 million Favourable

Transport operating revenue was greater

than budget ($3.038 million) due to NZTA funding for capital projects including

the Green Island roundabouts, urban cycleways, peninsula road widening and

flood response work.

Transport operating expenditure was favourable

$392k due to winter environmental maintenance being minimal due to favourable

weather conditions and the amount of sealed pavement and footpath maintenance

work being less than expected.

Three Waters - $1.701 million Unfavourable

This unfavourable variance was primarily

due to higher than budgeted depreciation resulting from the revaluation of

Three Water assets impacting on both the depreciable replacement cost and asset

useful lives.

This unfavourable variance was partially

offset by savings in personnel costs due to vacancies in the Planning activity,

and higher than budgeted development contributions.