|

|

Economic Development Committee

3 September 2019

|

Part

A Reports

Dunedin City Quarterly Economic Monitor Report

- June 2019

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 Economics

consulting firm, Infometrics has been commissioned to provide quarterly

economic monitoring reports for Enterprise Dunedin.

2 The

purpose of the report is to provide Enterprise Dunedin and the Economic

Development Committee with an update of progress against the 2023-2023 Economic

Development Strategy and overview of the Dunedin economy.

|

RECOMMENDATIONS

That the Committee:

a) Notes the Dunedin

City Quarterly Economic Monitor Report – June 2019

|

BACKGROUND

3 Enterprise

Dunedin activity is informed by the 2013-23 Economic Development Strategy

('strategy'). The strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances

for innovation – to improve linkages between industry and research.

c) A

hub for skills and talent – to increase retention of graduates, build the

skills base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A

compelling destination – to increase the value of tourism and events and

improve the understanding of Dunedin’s advantages.

The Strategy sets out two economic goals:

· 10,000

extra jobs over 10 years (requiring employment growth of approximately 2% per

annum).

· An

average $10,000 extra income for each person (requiring GDP per capita to rise

by 2.5% per annum).

DISCUSSION

4 The

attached report provides the following insights into the Dunedin economy:

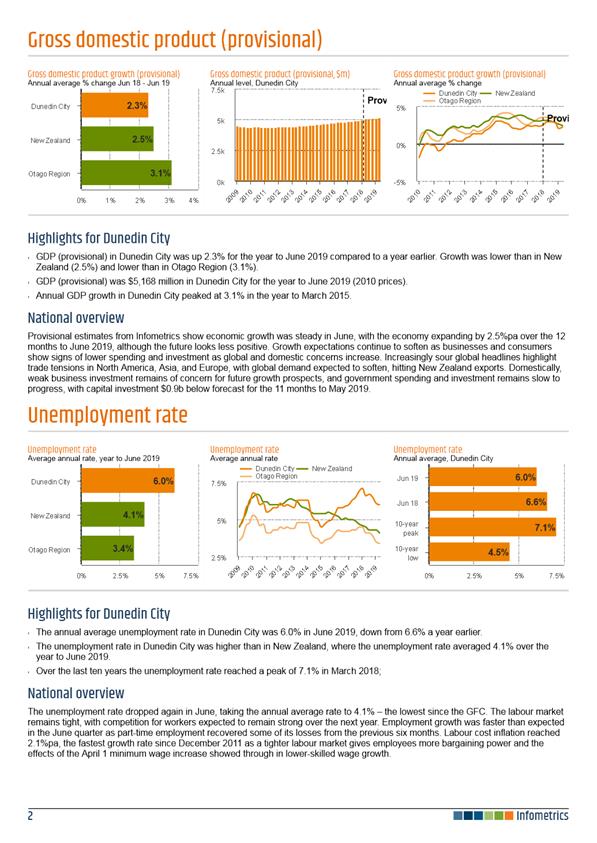

a) Dunedin’s

unemployment rate fell to 6.0% in June 2019, down from 6.6% a year ago.

Although unemployment remains above the national average, recent improvements

suggest that employers are beginning to have the confidence to invest in their

enterprise by taking on new staff.

b) Two major factors appear to be behind the higher rate

of unemployment over the recent years:

· Longstanding hollowing

out in Dunedin’s manufacturing sector has continued. In addition, those

employed who have lost manufacturing-related jobs do not necessarily have

skills that were readily transferable to industries that were gaining jobs,

such as professional services.

1

· A skills mismatch

between job seekers and the types of jobs that were created. With net migration

of 4,300 and employment growth of 3,469 between 2015 and 2018, it’s

plausible that workers moving to Dunedin filled the bulk of new jobs.

2

c) This skills mismatch is something that takes time to

solve as people must retrain or develop new skills. Some of those that have

been unemployed may also be forced to eventually take more elementary positions

in new industries than they had originally hoped for.

d) Despite a recent decline in the unemployment rate, the

number of people gaining access to Jobseeker Support crept up marginally over

the June 2019 year. Government policy remains part of the reason for this

divergence, with less stringent welfare policies increasing the number of

people accessing Jobseeker Support. Encouragingly for Dunedin is that the 0.7%

increase in those seeking Jobseeker Support is significantly less than the 9.6%

national increase.

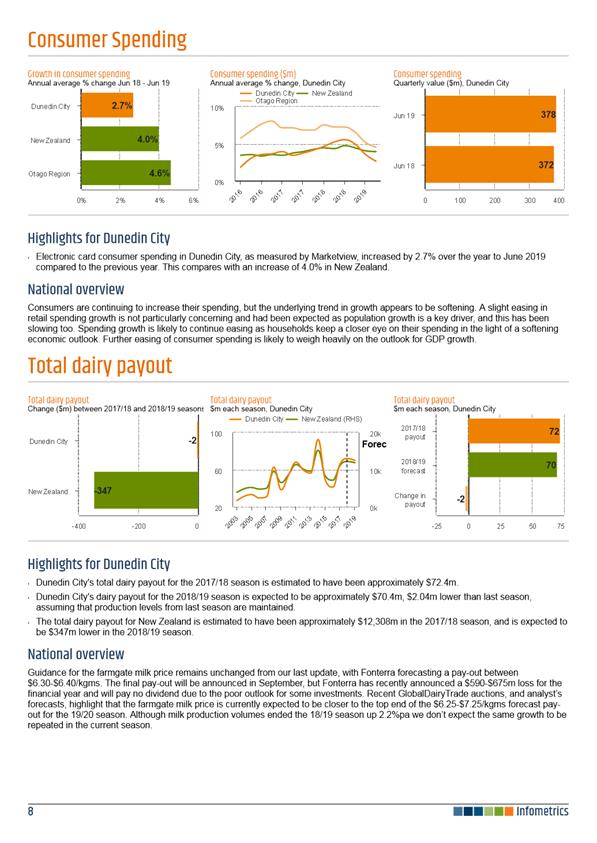

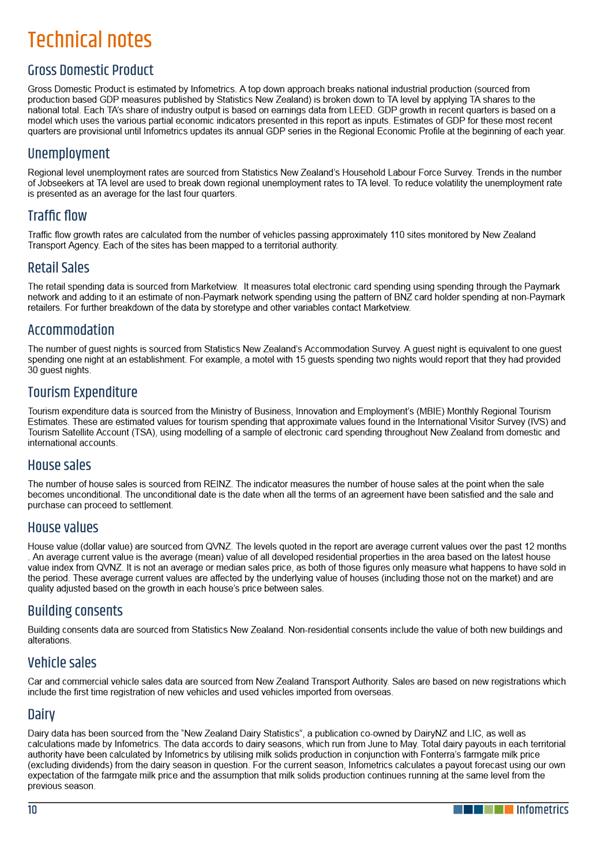

e) Provisional GDP estimates for Dunedin showed growth of

2.3% in the June 2019 year, close to national growth of 2.5%.

f) A 4.2% increase in the number of people enrolled with

local health providers indicates a further acceleration in population growth.

This highlights an ongoing stream of people choosing Dunedin as a place to

live, work, study and do business.

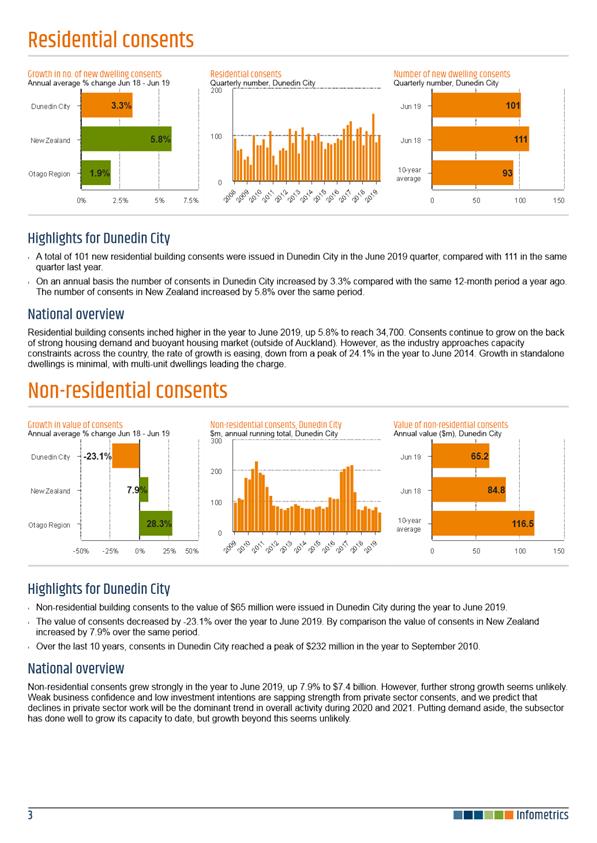

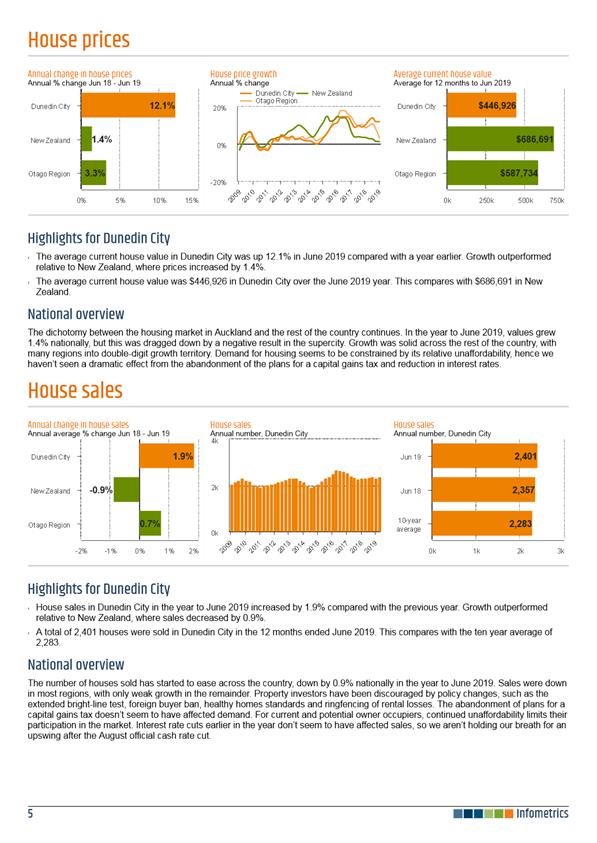

g) Population growth has put upward pressure on house

prices and sales. Homebuilding has pushed higher in response to this demand,

although challenges remain accessing construction staff given building activity

remains high across the region.

h) Dunedin is likely to be insulated from economic

uncertainly, by large scale infrastructure investment that will shortly get

underway. For instance, the government has allocated $1.4bn to the Dunedin

hospital rebuild, with more than 1,000 workers expected to work on the project.

i) Tourism spending grew moderately. Visitor spending

growth was 2.0% over the June 2019 year, just behind the national increase of

3.2%.

j) Despite more visitor spending, commercial guest nights

eased 3.5%, pulled down by international guest nights. A similar pattern to

international guest nights has been experienced nationally, as international

visitor arrivals growth slows and private accommodation platforms, such as

Airbnb, continue to expand. Statistics NZ recently estimated private

accommodation accounted for 18% of guest nights nationally.

5 The monitoring report for

year ending June 2019 is provided as Attachment A for the Economic Development

Committee.

OPTIONS

6 There

are no options.

Signatories

|

Author:

|

Suz Jenkins - Finance and Office Manager

Benje Patterson - Business Analysis Contractor

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Dunedin City Quarterly

Monitor Report - June 2019

|

21

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose of Local Government

This report

relates to providing a public service and it is considered good-quality and

cost-effective.

|

|

Fit with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development

Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport

Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation

Strategy

|

☐

|

☐

|

☒

|

|

Other strategic

projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible

for the delivery of the 2013-2023 Economic Development Strategy.

|

|

Māori Impact Statement

There are no known impacts

for tangata whenua.

|

|

Sustainability

There are no known impacts

for sustainability.

|

|

LTP/Annual Plan / Financial Strategy /Infrastructure

Strategy

Enterprise Dunedin

activities and delivery on the 2023-2023 Economic Development Strategy are

included in the 2018-28 Long Term Plan.

|

|

Financial considerations

There are no financial

considerations.

|

|

Significance

This report is considered

low significance under the Significance Engagement Policy.

|

|

Engagement – external

Infometrics Ltd were

engaged to provide the report.

|

|

Engagement - internal

No internal engagement has

been undertaken.

|

|

Risks: Legal / Health and Safety etc.

There are no identified

risks.

|

|

Conflict of Interest

There are no conflicts of

interest.

|

|

Community Boards

There are no known

implications for Community Boards.

|

|

|

Economic Development Committee

3 September 2019

|

Enterprise Dunedin Activity Report - August 2019

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee on a

selection of Enterprise Dunedin activities.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Enterprise Dunedin Activity Report – August 2019.

|

BACKGROUND

2 Enterprise

Dunedin activity is informed by the 2013-2023 Economic Development Strategy

(strategy). The strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances

for innovation – to improve linkages between industry and research.

c) A

hub for skills and talent – to increase retention of graduates, build the

skills base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A

compelling destination – to increase the value of tourism and events and

improve the understanding of Dunedin's advantages.

3 The

strategy sets out two economic goals:

a) 10,000

extra jobs over 10 years (requiring growth of approximately 2% per annum).

b) An

average of 10,000 of extra income for each person (requiring GDP per capita to

rise 2.5% per annum).

DISCUSSION

Major Projects and Key Focus Areas

Project

China

4 Qingdao

delegation to Dunedin

A

Vice Mayoral level delegation led by the Vice President of Committee visited

Dunedin in July.

5 Shanghai

Staff Exchange ‑ Shang Bin

a) An

official from the Shanghai Foreign Affairs Office joined Enterprise Dunedin on

5 August for an eight-week staff exchange, as part of an agreement with

Shanghai agreed in 2013. The official, Shang Bin will gain a better

understanding of Dunedin and the cooperation occurring between Dunedin and

Shanghai in various fields.

b) She

will also meet with external parties who have projects or alliances with

Shanghai, including the University of Otago, Otago Polytechnic, Chamber of

Commerce, Chinese Garden and the New Zealand–China Non-Communicable

Diseases Research Collaboration Centre (NCD CRCC).

6 Signing

of Education Commission Agreement

a) The

education commission agreement between the Shanghai Education Commission and

Enterprise Dunedin was re-signed in Shanghai by Dunedin City CEO, Dr Sue

Bidrose, and the Shanghai Education Commission Deputy Director General, Mr. Li

Yongzhi.

b) The

Shanghai Education Commission acknowledged the activities of the Dunedin

Mayoral Scholarship and assisting Shanghai university students in gaining work

experience in their areas of study/professional interest while in Dunedin.

7 Mayoral

led delegation for opening of film festival

a) Mayor

Cull, Shanghai NZ Consul General, Andrew Robinson, and Director of the Film

Department of Shanghai Film Bureau, Peng Qizhi opened the NZ film festival in

Shanghai in July. Four Dunedin films were included in the festival which also

attracted 150 guests for the opening.

Enterprise

Dunedin Activity Outcomes

8 Enterprise

Dunedin’s activities are focused around the Economic Development Strategy

themes. The following section provides highlights of some of the key activities

and outcomes that have occurred within each theme during the past few months.

Business Vitality

9 The

Otago Regional Business Partnership (RBP) final update for the 2018/19 year

a) The

Otago RBP is funded to deliver business capability support, mentors and research

grants by New Zealand Trade and Enterprise (NZTE) and Callaghan Innovation. For

the year ending June 2019, all KPI’s were met apart from Business Mentors

which achieved 82% of the KPI.

b) At

the completion of the 2018/19 financial year the Otago RBP issued 285 clients

with approximately $215,000 in training grants and matched 94 mentors to

businesses.

c) Over

this reporting period five Callaghan Innovation clients were successful with

research and development project grants totalling more than $100,000. This

supported projects totalling $300,000 approximately in value. One Student

Career grant was successful with a value of $35,000. Three research and

development project applications, each more than $1 million were underway at

the conclusion of the financial year (one of these has since been approved).

Four Getting Started Grants were also approved totalling $20,000.

d) From

2019/20 the Otago Chamber of Commerce will administer the RBP across the Otago

region. All partners felt administration of the programme would be easier

with a single entity delivering. The Otago Chamber of Commerce was

awarded the Otago RBP contract with support from the DCC and the Otago

Southland Employers Association.

10 Energy

a) The

District Energy System Group is continuing work to evaluate the feasibility of

a new district energy system for central Dunedin. The working group (DCC,

University of Otago, Southern DHB, Ministry of Health) engaged Stantec to

develop an indicative business case including a short-list of potential system

options, comprising fuel/energy source, reticulation system specifications, and

overall system size and scalability. The draft findings were presented by

Stantec to the Local Advisory Hospital Group in July. The final report from

Stantec is due by the end of August.

b) Enterprise

Dunedin continues to work with ChargeNet and Aurora to progress installation of

an electric vehicle (EV) fast charger on Water Street, as approved by Council

on 26 March 2019. The site license agreement has been prepared and is being

reviewed by ChargeNet. The installation date is yet to be confirmed.

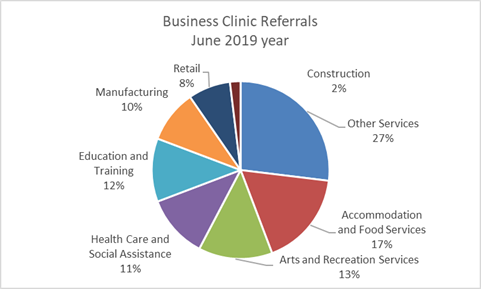

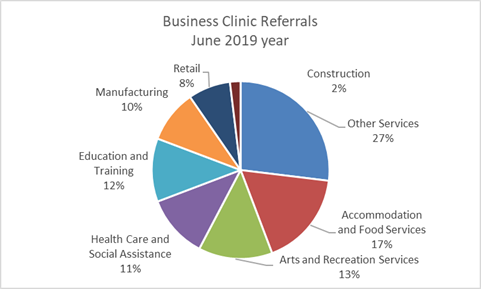

11 Business

clinics

a) There

were 52 referrals to the Enterprise Dunedin business clinics in the year ending

June 2019 year.

b) The

industries that took part in business clinics over the June 2019 year are

summarised in the chart below. A diversified range of industries were

represented in the business clinic service.

Alliances for Innovation

12 Film

Dunedin

a) Film

Dunedin responded to 74 screen enquires about filming in Dunedin to the end of

June 2019. This compares to 41 enquiries in the 2018 year.

b) There

were 46 film permits issued over the 12 months to June 2019, compared to 43 the

previous year.

c) Permit

data indicates an additional 12,048 bed nights were generated by film in

Dunedin in 2018/19 compared with 7,429 the previous year. Permits are only

issued for shoot days on public land. Total bed nights are therefore

considerably more than the actual permitted activity. Blumhouse film Black Xmas

for example, generated 3,000 bed nights but only filmed once on public land and

so only 80 bed nights are included in the figures above.

d) The

total number of location shoot days increased at a faster rate than permits

issued, rising from 57.1 in the June 2018 year to 102 in the June 2019 year.

This increase was driven by productions having a longer average duration.

e) Total

crew numbers working on productions reached 506 in the June 2019 year, with 368

of these employed on international productions, 66 on local Dunedin

productions, and 72 on productions from elsewhere in New Zealand.

f) International

productions are typically of a much larger scale than New Zealand productions.

In the June 2019 year, there were 24.5 crew on average per international

permit. By comparison Dunedin productions had an average of 3.7 crew, while

other New Zealand productions had an average of 5.5 crew.

Table - Film characteristics by

production origin (June 2019 year)

|

Production Origin

|

Proportion of

Permits

|

Average Shoot

Days Per Permit

|

Average Crew

Per Permit

|

|

Dunedin

|

39%

|

3.2

|

3.7

|

|

Rest of New Zealand

|

28%

|

1.1

|

5.5

|

|

International

|

33%

|

2.0

|

24.5

|

|

|

100%

|

2.2

|

11.0

|

A Hub for Skills and

Talent

13 JobDUN

- Business Internship programme

a) Enterprise

Dunedin facilitates the business internship programme – JobDUN

(previously known as Sexy Summer Jobs). The objective of the JobDUN programme

is to meet business needs, create high value jobs, retain skills and talent in

the city and contribute to the economic growth of Dunedin. Businesses utilise

the programme to reduce the commercial risk in taking on an untried person. It

provides the opportunity for market and product development, which might not

otherwise be executed.

b) The

programme allocates funding for 50 intern placements.

c) The

2019/20 programme kicked off in August with promotion to students and

engagement with businesses. Responses so far include:

i) 11

businesses have applied for interns and one of those is a new business

ii) 30

interns have registered interest, 20 placements are still available

iii) The

range of roles is diverse, including marketing, production engineer, software

developers/engineers, web design, graphic design, publicity, electronics,

business development, media, community events

d) Work

is underway in partnership with the University of Otago and Otago Polytechnic,

on the business/intern speed interviews event on 18 September, with several

businesses already registered to attend.

A Compelling Destination

14 Visitor

Statistics

a) Commercial

guest nights fell 3.5% over the June 2019 year. This reduction was concentrated

on the international market, with domestic guest nights still expanding.

b) A

similar pattern to guest nights has been experienced nationally, as

international visitor arrivals growth slows and private accommodation

platforms, such as Airbnb, continue to expand. These private accommodation

platforms are not captured by official accommodation statistics.

c) To

overcome shortcomings in monitoring guest nights, the Ministry of Business,

Innovation and Employment has recently put out a Request for Proposal for an

improved accommodation supply and demand dataset. The new dataset will provide

insight on both the commercial and private accommodation guest nights to a

territorial authority level. The new system is expected to go live in the New

Year, while the existing commercial accommodation monitor will cease following

the release of September data.

d) Occupancy

rates in Dunedin hotels have eased from 71.3% to 68.6% in the June 2019 year

compared to the previous year, according to data from Tourism Industry

Aotearoa. This trend is similar to what was experienced nationally.

Nevertheless, average hotel room rates in Dunedin still increased over the past

year, rising from $149 to $155.

e) Data

collected by Dunedin City Council’s Parks and Recreation team shows the

number of vehicles freedom camping at five monitored locations over the 6

months to 31 May 2019 totalled 13,632. This was up 21% compared to the same

period the previous year.

f) Visitor

spending in Dunedin rose 2.0% over the June 2019 year, just behind the 3.2%pa

growth recorded nationally.

g) Spending

growth was strongest for international visitors to Dunedin, rising 6.0% over

the June 2019 year, compared to 4.6%pa growth nationally. This result has been

strengthened by a record cruise season.

h) Domestic

visitor spending in Dunedin climbed just 0.3% over the June 2019 year, compared

to 2.3%pa growth nationally. Slower growth can be partly attributable to the

biannual hosting of the New Zealand Masters Games and three Ed Sheeran concerts

that inflated the 2018 result.

15 Business

Events (Conferences)

a) Enterprise

Dunedin hosted three clients throughout July for conferences in the shoulder

season of 2020 and 2021. These have a combined estimated value to the

city $772K.

b) Enterprise

Dunedin assisted the Dunedin City Council transport team in securing the 2020

2Walk and CYCLE conference, with an estimated value of $351k for the

city. The event date is yet to be confirmed.

16 Consumer

Marketing – New Zealand and Australia

a) The

domestic winter campaign “Winter Imaginarium” leveraged off winter

events and experiences to encourage visitation to Dunedin over the winter

months with the primary target being the 3.5-hour drive market.

· Using

DunedinNZ social channels and Google Adwords, campaign consumers were directed

to the Winter pages on DunedinNZ.

· Operators

were encouraged to submit deals for this campaign, with 3,495 unique views on

the ‘deals’ webpage.

· A

collaboration with Dunedin Airport focused on the Wellington market in

promoting the James Cameron exhibition ‘Exploring the Deep’ at

Otago Museum. A mirror campaign was run with WREDA on The Breeze Dunedin at the

same time as Enterprise Dunedin’s collaboration in ‘The

Breeze’ in Wellington. This radio and online marketing activity included

the ‘Winter Imaginarium’ video and a competition for a weekend

for two in Dunedin. The entrants who agreed to be included on the Enterprise

Dunedin database will be used for future remarketing.

b) The

DunedinNZ social pages Facebook and Instagram audiences are increasing with

Facebook showing a 3.5% growth and Instagram a 26.8% increase from the last

financial year. Total audience sizes for these channels are Facebook 89,000 and

Instagram 35,500.

17 International

Trade

In August Enterprise Dunedin organised a two-day event in

Auckland providing an opportunity for 29 export-ready operators from Dunedin,

Waitaki, Clutha, Central Otago, Southland and Fiordland to meet with 110

inbound tour operators operating in international markets. This was the largest

contingent of Dunedin operators, together with our neighbouring regions to

attend this bi annual event, which provides an excellent showcase of the

diverse tourism products available in our regions.

18 PR

and Promotions

a) For

the year ending June 2019, Enterprise Dunedin hosted 89 people on media famils,

an increase from 79 people the previous year. Of those hosted 46 came to

Dunedin via Tourism New Zealand’s international media programme, while 43

were organised directly through Enterprise Dunedin.

b) Since

the last EDC update, there were four media famils

· Metro

magazine

· Dish

online – readership of 30,000

· New

Zealand Geographic – readership of 337,000 and

· The

Guardian Australia – unique audience of 5.4million

c) Three

Dunedin travel features have recently been published in the Australian market

i) The

Guardian Australia – unique audience of 5.4 million

ii) Courier

Mail (Q Weekend, Brisbane) – readership of 388,000

iii) Nine

Honey Travel – unique audience of 3.5 million.

19 i-SITE

Visitor Centre

a) Statistics

New Zealand have confirmed that the 2018/19 cruise season was a record. Total

passengers (including crew) were 335,441, up from 254,750 in 2017/18.

b) Total

cruise ship expenditure, covering both vessel and visitor spending, was $60.2

million in 2018/19, up from $48.0 million the previous season. Spending by

cruise ships and their visitors were the key contributor to total visitor

spending growth in Dunedin, which climbed $15 million to $771 million.

c) Spending

growth over the past year was driven by a larger volume of passengers, rather

than each passenger spending more. Spending per passenger in 2018/19 was

$179.60, down from $236.48 per passenger in 2017/18.

20 Study

Dunedin

a) The

Work Ready Programme for International Student held another successful semester

networking and speed Interview event in July. The event was supported by

Dunedin employers, recruitment agencies and staff from Otago Polytechnic and

the University of Otago. 75 students and four partners of students

attended many of the sessions and the Otago MBA programme has asked for

specific sessions for its international student cohort this year.

b) Study

Dunedin hosted three Student Focus Group sessions in July and August. All

sectors of study were represented by the 18 students who attended to ensure

that the student voice is reflected in future marketing and student experience

event planning.

c) Dunedin

welcomed the 5th cohort of Shanghai Mayoral Scholarship students in

July. Twelve students from six Shanghai universities attended Business

English Classes, completed work experience in Dunedin businesses, explored the

city cultural institutions and spent time on the Otago peninsula. Many of

the students talked about Dunedin and the experience being life-changing at the

farewell.

NEXT STEPS

21 Feedback

on Enterprise Dunedin activity will be incorporated into future updates.

Signatories

|

Author:

|

Louise van de Vlierd - Team Leader Visitor Centre

Fraser Liggett - Economic Development Programme Manager

Malcolm Anderson - City Marketing Manager

Des Adamson - Business Relationship Manager

Suz Jenkins - Finance and Office Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose of Local Government

This report

promotes the economic well-being of communities in the present and for the

future.

|

|

Fit with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development

Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport

Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation

Strategy

|

☐

|

☐

|

☒

|

|

Other strategic

projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is

responsible for the delivery of the 2013-2023 Economic Development Strategy.

|

|

Māori Impact Statement

There are no known impacts

for tangata whenua.

|

|

Sustainability

There are no known impacts

for sustainability.

|

|

LTP/Annual Plan / Financial Strategy /Infrastructure

Strategy

Enterprise Dunedin

activities and the 2013-2023 Economic Development Strategy are included in

the 2018-28 Long Term Plan.

|

|

Financial considerations

There are no financial

considerations.

|

|

Significance

This decision is considered

low significance under the Significance Engagement Policy.

|

|

Engagement – external

As an update report, no

external engagement has been undertaken.

|

|

Engagement - internal

As an update report, no

internal engagement has been undertaken.

|

|

Risks: Legal / Health and Safety etc.

There are no identified

risks.

|

|

Conflict of Interest

There are no known

conflicts of interest.

|

|

Community Boards

There are no known

implications for Community Boards.

|