|

|

Hearings Committee

5 November 2019

|

Part

A Reports

Development Contributions Remission - 21, 25

and 27 Fryatt Street, Dunedin

Department: Planning

EXECUTIVE SUMMARY

1 This

report considers a request to the Dunedin City Council (the Council) for the

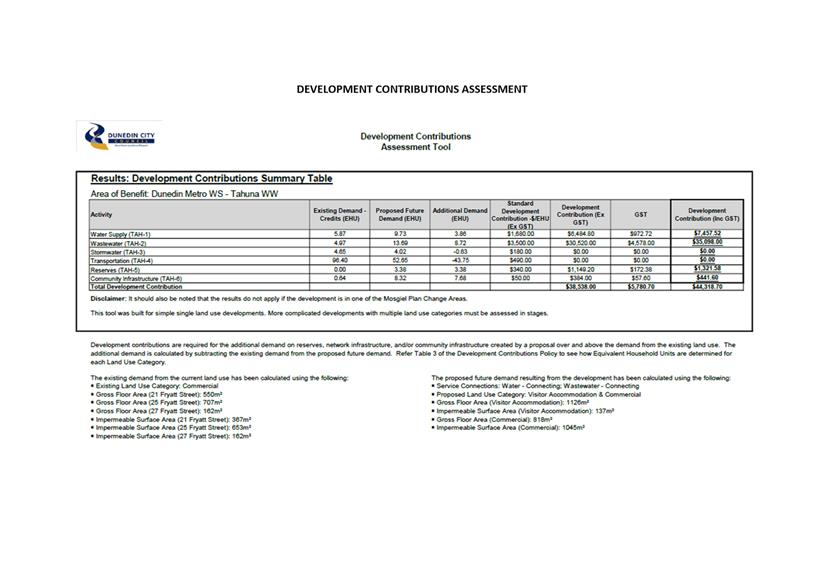

remission of development contributions for the alteration and expansion of an

existing building to accommodate commercial and residential/visitor

accommodation activities at 21, 25 and 27 Fryatt Street, Dunedin.

2 The

application has been considered under the six assessment matters for remissions

in the Development Contributions Policy (the Policy).

3 The

applicant, Loan and Mercantile 2000 Limited, was charged a development

contribution of $38,538.00 (excluding GST).

4 The

Hearings Committee (the Committee) is asked to consider whether a remission should

be granted, and if so to authorise the Financial Controller to remit a

specified maximum amount.

5 The

applicant wishes to be heard by the Committee.

|

RECOMMENDATIONS

That the Committee:

a) Considers

the application for a remission of development contributions levied to Loan

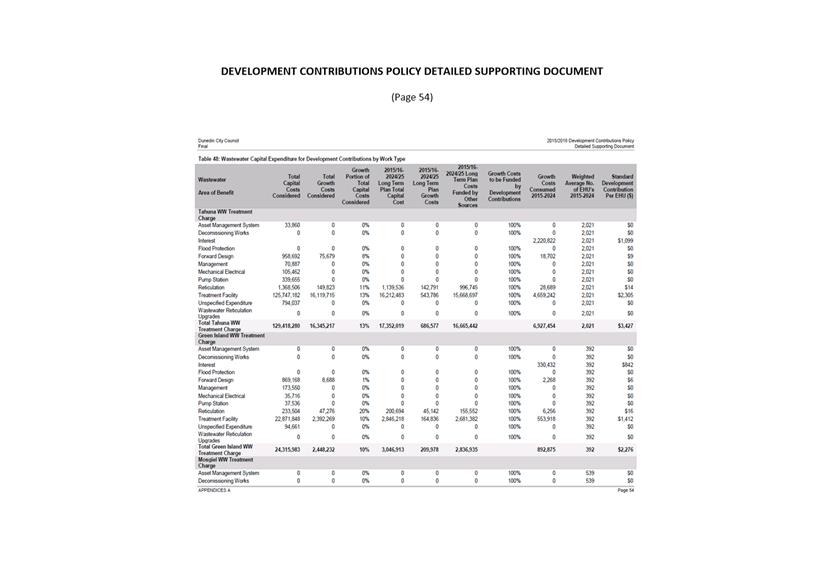

and Mercantile 2000 Limited for the alteration and expansion of an existing

building to accommodate commercial and residential/visitor accommodation

activities at 21, 25 and 27 Fryatt Street, Dunedin.

b) Authorises

the Financial Controller to give the applicant a development contribution

remission of a maximum of $38,538.00 (excluding GST), should the Committee

decide to grant the application.

|

BACKGROUND

Purpose

of Development Contributions

6 The

purpose of development contributions is to enable the Council to recover from

those persons undertaking development a fair and equitable portion of the costs

of capital expenditure necessary to service growth over the long term (section

197AA Local Government Act 2002). If development contributions are not

collected then the growth has to be funded from other sources including rates

and/or debt.

7 Under

Clause 12 of the Committee delegations, the Committee has the power “to

consider and determine applications for remission of a development contribution

for an unusual development where the contribution is greater than $5,000 and

less than $50,000”.

Assessment

of Development Contributions for 21, 25 and 27 Fryatt Street

8 The

assessment of development contributions payable in relation to 21, 25 and 27

Fryatt Street was made using the Policy, contained within the Long Term Plan

2015/16 - 2024/25.

9 The

existing buildings, zoned ‘Port 2’ under the operative Dunedin City

District Plan, are held within three titles, and have a combined land area of

approximately 1,483m2. The current buildings are broken-down into the

following:

· 21

Fryatt Street (held in Computer Freehold Register OT288/82), consists of a two

storey (front) and single storey (rear) structure which is rated commercial,

and has a Gross Floor Area (GFA) of 550m2, and Impermeable Surface Area (ISA)

of 367m2. The ground floor of the building has been vacant for approximately 15

years, but the upper floor has been used more recently for an unconsented

residential activity;

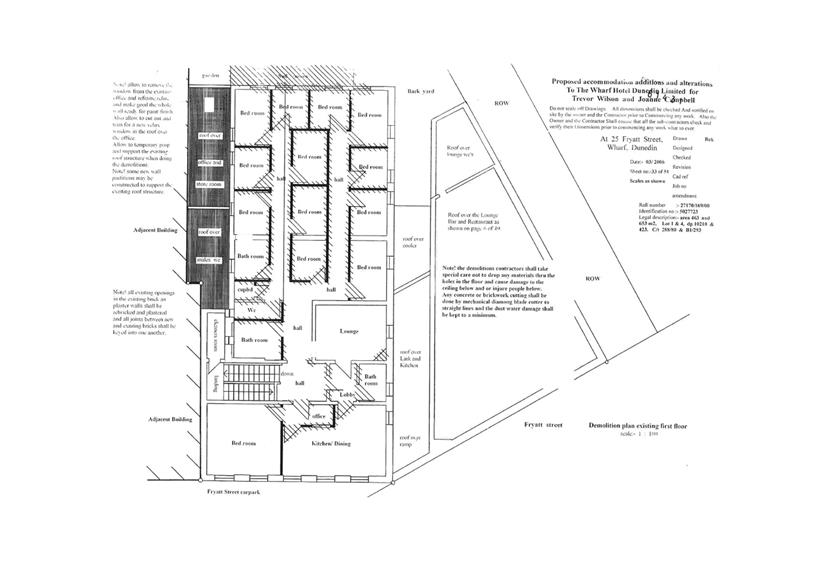

· 25

and 27 Fryatt Street (held in Computer Freehold Registers OT19C/133 and

OTB1/293) consist of a commercial operation, being a bar and restaurant trading

as the ‘The Wharf Hotel’. Number 25 consists of two storey

structure with a GFA of 707m2, and ISA of 653m2. The adjoining building

at number 27, is single level, and contains the restaurant associated with the

business. Both buildings are accessed internally. The building at

number 27 has a GFA of 162m2, and ISA of 162m2.

10 The

development proposed by the applicant alters and expands the existing buildings

at 21 and 25 Fryatt Street, to accommodate commercial and residential/visitor

accommodation (commercial residential) activities, which involves the

following:

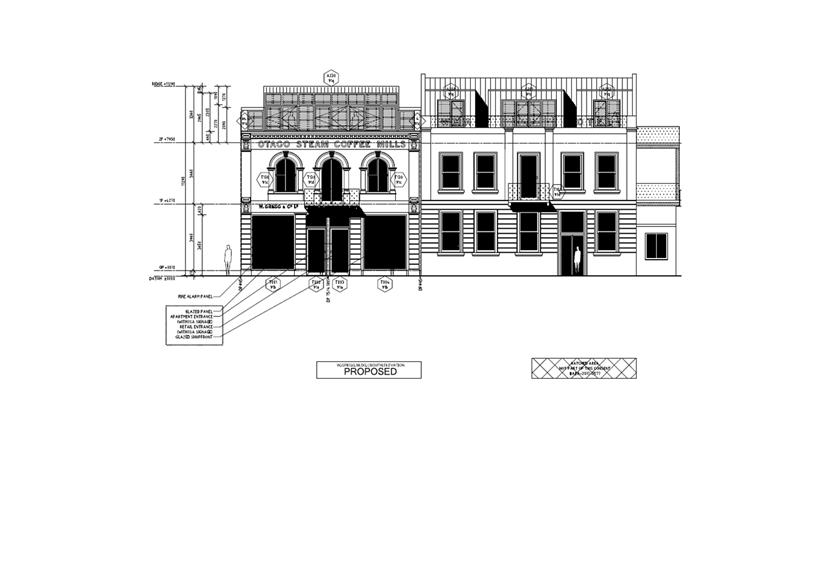

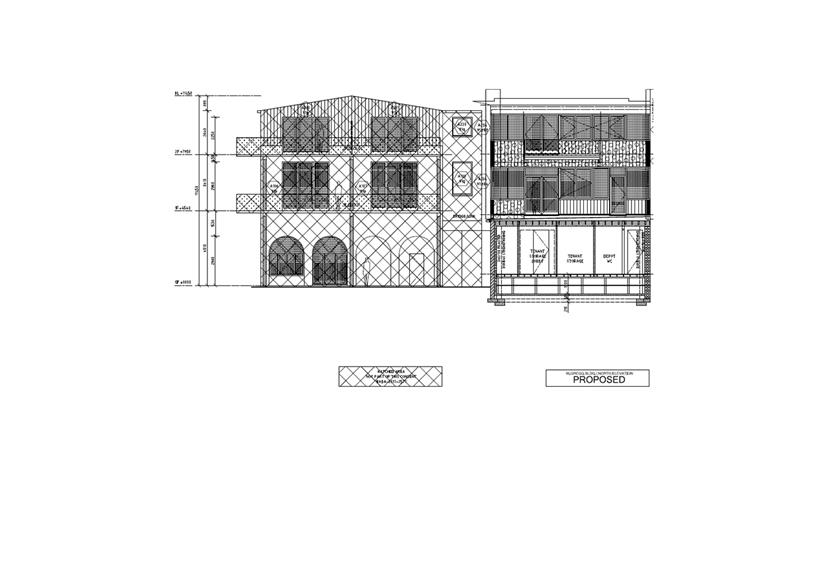

· The

construction of an additional floor level (Second Floor), spanning the two

buildings, with the additional floor having a GFA of 464m2;

· Changing

the use by converting the existing first floor into residential/commercial

residential units;

· On

the ground floor of 21 Fryatt Street, creating a commercial retail and/or

commercial office activity at the front, as well as a lobby to access the above

units.

11 The

ground floor of 25 and 27 Fryatt Street will continue to function as the public

space of the Wharf Hotel.

12 The

proposal is deemed to create an additional GFA of 464m2. This results in new

Commercial GFA of 818m2, and ISA of 1045m2. In addition, there is a

change of use of the existing first floor to visitor accommodation (which is

deemed to be the appropriate use), with a GFA of 1126m2, and ISA of 137m2.

13 The

development contribution is payable for the additional demand being created by

Loan and Mercantile 2000 Limited over and above the previous land use.

The development contribution was calculated as follows:

|

Water Supply

|

$6,484.80

|

|

Wastewater

|

$30,520.00

|

|

Stormwater

|

$0.00

|

|

Transportation

|

$0.00

|

|

Reserves

|

$1,149.20

|

|

Community Infrastructure

|

$384.00

|

|

Total Development Contribution

excluding GST

|

$38,538.00

|

14 This

amount has not yet been invoiced.

15 The

initial assessment for this development was $30,823.40. This has been increased

to reflect changes in the building layer as per a building consent applied for

on the 10 January 2018. As of today, the development contribution of $38,538.00

is payable for this development.

Remission

Request Summary

16 Loan and Mercantile 2000 Limited has requested a remission of the

development contributions charged to alter and expand an

existing building to accommodate commercial and visitor accommodation

activities on the property at 21, 25 and 27 Fryatt Street, Dunedin.

17 A

full copy of the remission application is attached for the Committee’s

reference. The applicant wishes to be heard in support of the

remission request.

18 The remission request is summarised as follows:

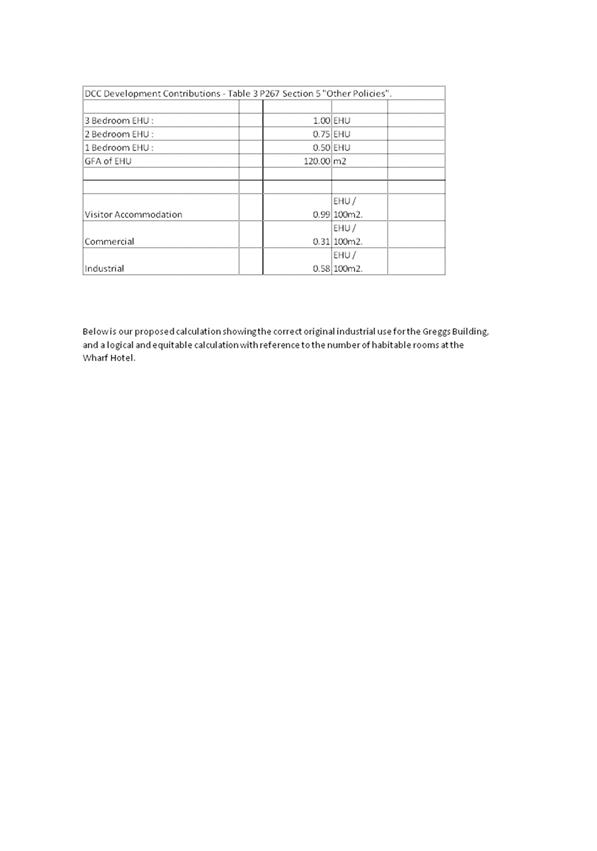

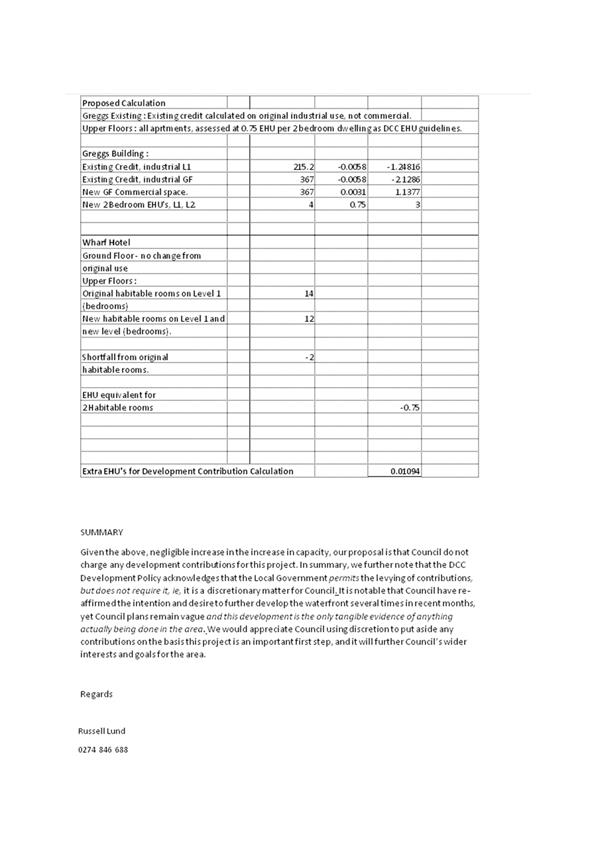

· The development contribution assessment calculation is flawed;

· The proposal should have been assessed as residential type

accommodation, rather than a more intensive visitor accommodation when

calculating the development contributions;

· The capital expenditure outlined in the Policy’s ‘Detailed

Supporting Document’ for wastewater appears to be incorrect;

· Development contributions should not be charged, as this proposal

creates no increase or only a negligible increase in the demand on the

Council’s network (in particular for wastewater), when compared to a

historical industrial use, and prior consents, and rates paid for the site;

· Council should exercise its discretion and not charge development

contributions for this project because of the positive benefits it brings to

the waterfront area and the city.

19 The

applicant wishes to be heard in support of the remission request.

DISCUSSION

20 The

Policy states that six assessment matters are to be considered when considering

a request for remission:

· The

Development Contributions Policy;

· The

DCC's Funding and Financial Policy;

· The

extent to which the value and nature of works proposed by the applicant reduces

the need for works proposed by the DCC in its capital works programme;

· The

level of existing development on the site. Where multiple existing and

pre-existing uses can be established the DCC may have regard to the most

intensive use(s) and the extent of time that has elapsed since those

pre-existing uses existed;

· Development

contributions paid and/or works undertaken and/or land set aside as a result

of:

· Development

Contributions

· Agreements

with the DCC

· Financial

Contributions under the Resource Management Act, and;

· Any

other matters the DCC considers relevant.

21 Each

of these is considered below.

The

Development Contributions Policy

22 The

remission argues that the Policy is flawed, and that the demands generated by

this proposal are in fact nil or negligible. The request also states the new

units better align with a residential unit of use, rather than a more intensive

visitor accommodation.

23 To

assist in determining the proposed land use of the development, the resource

consent decision states:

· ‘The

applicant seeks consent for a mix of residential and commercial residential

activities in the ten upstairs apartments’

24 Under

the Policy, the definition of a residential unit is as follows:

· ‘A residential unit is defined as a residential activity which

consists of a single self-contained household unit, whether of one or more

persons, and includes accessory buildings and a family flat. For the purposes

of this definition, residential activity means the use of land and buildings by

a residential unit for the purpose of permanent living accommodation and

includes emergency housing, refuge centres, halfway houses and papakaika

housing if these are in the form of residential units’

25 Furthermore,

the definition of a visitor accommodation under the Policy is as follows:

· ‘Land or buildings used for the accommodation of people and

which are or can be let on a commercial tariff, including boarding houses for

six guests or more, and home stays for six (6) guests or more. This

category includes backpacker accommodation, motels, hotels, tourist lodges,

holiday flats, tourist cabins, camp grounds, motor inns, and accessory

buildings or ancillary activities on the same site. Boarding houses for

less than six guests and home stays for less than six guests will be treated as

residential’

26 The

Planner in the Resource Consents Department who processed the resource consent

assessed the proposal as a commercial and/or visitor accommodation (commercial

residential) use. No conditions were imposed on the consent to limit the

use of the new units to each activity. Therefore, the units may be fully

occupied as a visitor accommodation.

27 Where

a resource consent does not limit the use of an activity, the expectation is

that the Council will levy the maximum possible use of a development, which

recognises the peak demand on infrastructure of a proposal (in this case, particularly

in relation to wastewater). Therefore, the proposal was assessed as a visitor

accommodation activity when calculating the development contributions.

28 The

Policy is based on averages for typical developments throughout the city.

Development contributions pay off growth-related debt (previously incurred by

the Council for capital works to service this site or the wider area

generally), or pay for growth related capital works now or in the future (for

this site or for the wider catchment). Even if no specific works are required

to service a particular site, this does not mean that the levying of

development contributions is inappropriate.

29 In

this case, the potential additional demand is being created with the change in

use from commercial to visitor accommodation and with the additional GFA to be

constructed. The following table compares the additional Equivalent

Household Units (EHUs) when using visitor accommodation compared to ten

two-bedroom residential units:

|

|

Visitor

accommodation

|

10 x residential units (2 habitable

rooms)

|

|

Water Supply

|

2.92 EHUs

|

4.23 EHUs

|

|

Wastewater

|

7.04 EHUs

|

5.24 EHUs

|

|

Stormwater

|

0.00 EHU

|

6.87 EHUs

|

|

Transportation

|

0.00 EHU

|

0.00 EHU

|

|

Reserves

|

2.82 EHUs

|

7.50 EHUs

|

|

Community Infrastructure

|

6.38 EHUs

|

7.21 EHUs

|

30 If

the proposal was to be assessed as creating ten residential apartments (each

with two habitable rooms), then the development contribution required to pay

would be $29,593.50 (excluding GST), compared to the $38,538.00 (excluding GST)

currently levied.

31 The Policy is based on theoretical demand because it is not

practicable to calculate the actual demand of every single development.

The Policy does provide for unusual developments to be individually assessed,

but only where the development creates a significantly different demand on

infrastructure. In principle, the remission process could be used in a

similar way to reduce the development contributions based on the known actual

demand of a development. However, the Committee would need to be

satisfied that the actual demand was going to be less.

32 It is considered that the assessment of the proposed land use has

been correctly made in accordance with the Policy in place at the time of the

application.

33 The

remission request suggested that there were errors within the

‘Development Contributions Policy Detailed Supporting Document’

(DCPDSD), particularly in relation to the ‘Capital Expenditure’

table for wastewater. These tables outline the growth related projects, which

are then used to generate the development contributions levies. While they are

not erroneous, it is acknowledged that the clarity of these tables could be

improved.

34 As referred to earlier,

development contributions pay off growth-related debt (previously incurred by

the Council for capital works to service this site or the wider area

generally), or pay for growth related capital works now or in the future (for

this site or for the wider catchment). It is the writer’s understanding

that in the case of the Tahuna Wastewater Plant a lot of headworks upgrades

have already been completed. Development contributions are currently collected

in some degree, to pay for work that was budgeted and spent under previous Long

Term Plans.

35 Development contributions include debt funding/interest

considerations in addition to capital costs and capital expenditure. Large

infrastructure assets (such as the Tahuna) can be funded over 20-40 years;

these can incur significant interest costs over the funding lifetime.

36 It

is considered that there are no errors in the DCPDSD in relation to wastewater,

and hence there is not a justification for the remission of development

contributions for this reason. If the Committee requires a more in-depth

analysis of the DCPDSD and how it relates to this site, then it may wish to

seek external advice on this matter.

37 There are no known changes to the capital projects being funded by

development contributions that could change the amount payable.

Consideration will need to be given as to whether the granting of a remission

in this case would undermine the integrity of the Policy.

The Council’s

Funding and Financial Policy

38 The

role of development contributions in the Council’s financial strategy is

to fund the growth portion of capital projects. Should a remission of

development contributions be granted for this development then the Council will

require funding from rates or other sources for any shortfall in development

contributions.

Contribution

to Capital

39 The

applicant has not proposed any capital works as part of this development that

would replace the Council’s own capital works.

Demand

Prior to Development

40 A

remission could be considered if the Policy did not adequately recognise the

previous land uses on the site in terms of demand. The applicant has

raised this as part of their remission request, stating that the proposed

activity will have a much lower demand on the Council’s infrastructure,

when compared to the previous use, and consents. More specifically, it

was argued that the first floor of the existing ‘Wharf Hotel’

should be given credits for visitor accommodation, with 21 Fryatt Street being

treated as industrial to recognise its use a factory and processing facility

for ‘Gregg’s Coffee Club’.

41 In

regards to whether the existing ‘Wharf Hotel’ at 25 Fryatt Street,

should receive credits for the resource consent applied for in 2006 to

establish commercial residential units on the first floor, the resource consent

decision states:

· The

2006 building consent was to give effect to resource consent RMA-2006-0441 (now

renumbered RMA-2006-370226) which gave planning permission for the alterations

of the hotel within a heritage precinct and for new signage. The alterations

were to provide 14 commercial residential bedrooms with en-suites and a

self-contained manager’s flat. The consent had a lapse period of 26 July

2011. The lapse period of the consent was extended by LUC-2006-370226/A on 26

August 2011 for a further five years, resulting in a new lapse period of 26

July 2016. However, a site visit to the hotel has determined that the work has

not been completed, and the consent is considered to have lapsed.

42 Furthermore,

the consent mentions that:

· There

is no current authorisation for 15 commercial residential rooms at this address

despite the applicant’s view. Likewise, there is no indication in Council

records that the apartment with four bedrooms in the building of 21 Fryatt

Street was lawfully established, and it has, in any case, been vacant for over

12 months, rendering any existing use rights that might have applied negated.

43 The

resource consent clearly states that resource consent LUC-2006-370226 has

lapsed and hence there is no valid resource consent to which visitor

accommodation credits could be applied.

44 It

is acknowledged that the ‘Wharf Hotel’ once existed as a visitor

accommodation on the first floor, however, it is understood that this activity

ceased many years ago, and in particular, prior to 1 July 2014, when the

revised Policy first became operative. However, the Committee could consider

and give weight to this, and rates paid in the past for that use, if it so

wishes.

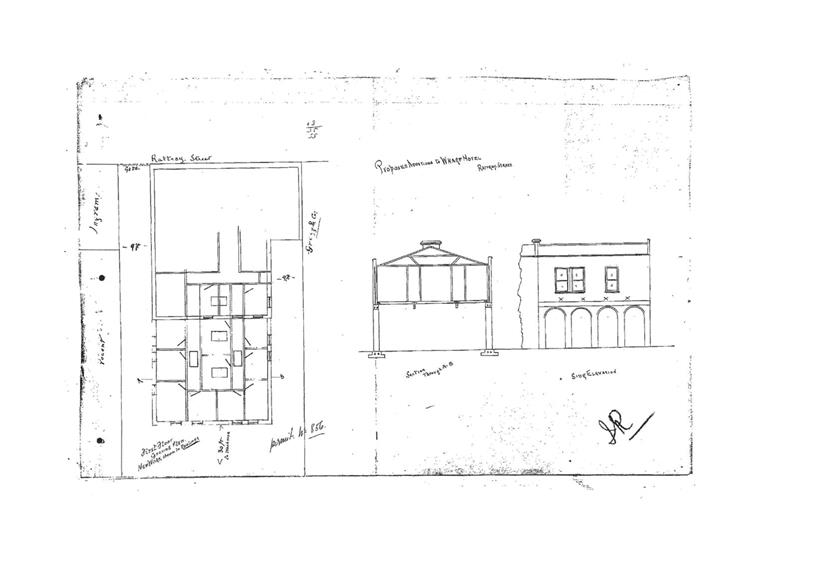

45 The

application refers to the historic use of 21 Fryatt Street being an industrial

activity, operating as a factory and processing facility for

‘Greg’s Coffee Club’. This activity is understood to have

ceased operation in 1925, where the factory moved to its current location on

Forth Street, and well before 1 July 2014, when the revised Policy first became

operative.

46 More

recent uses of the building have been commercial in nature, being a car parts

business, offices and storage. However, the building is currently vacant.

47 Whilst the subject site has a prior history as an industrial

activity, the more recent activities are commercial in nature.

48 The site at 21 Fryatt Street has a current rating classification of

Commercial, and land use description of ‘Commercial:

Offices’. This is deemed appropriate for carrying out a development

contributions assessment under the Policy. However, the Committee could, through this remission process,

consider and give weight to the historical industrial land uses and rates paid

by those uses if it thought it was relevant.

Previous

Historical Contributions

49 Historical

contributions on a site potentially could be used to offset a current

development contribution assessment.

50 No

historical contributions on this site have been identified. Rates paid in

the past are not considered relevant to this matter.

Other

Matters

51 This

criteria is broad and allows the Committee to consider any other matters

relevant to the development and/or remission application.

52 It

is a catchall and can be used to consider "other matters" raised by

the applicant, evidence, submissions and staff reports and/or comments.

This could include items not previously considered under the other criteria

above.

53 It

should be noted that any decision under this criteria (or any of the other

criteria for that matter) must not be arbitrary and needs to be justified.

54 The

applicant’s remission application raised a matter which could be

considered under this assessment criteria relating to economic development.

55 The

applicant’s remission application included discussion about the Councils

intention to redevelop the waterfront area, and that this proposal is the ‘only

tangible evidence of anything actually being done in the area’.

56 The

sole purpose of the Policy is to recover from those undertaking development a

fair, equitable, and proportionate portion of the costs of capital expenditure

necessary to service growth, rather than being a tool for promoting and

encouraging economic development

OPTIONS

57 The

Committee has three options. They could decline the remission request, grant a

partial remission or grant a full remission. The advantages and

disadvantages of each option are outlined in the body of this report.

58 The

Committee now needs to decide which option it prefers.

NEXT STEPS

59 The

decision of the Hearing Committee will be communicated to the applicant, and

staff will act upon the decision made.

Signatories

|

Author:

|

Galina Usoltseva - Development Contributions Officer

|

|

Authoriser:

|

Alan Worthington - Resource Consents Manager

Nicola Pinfold - Group Manager Community and Planning

Gavin Logie - Financial Controller

|

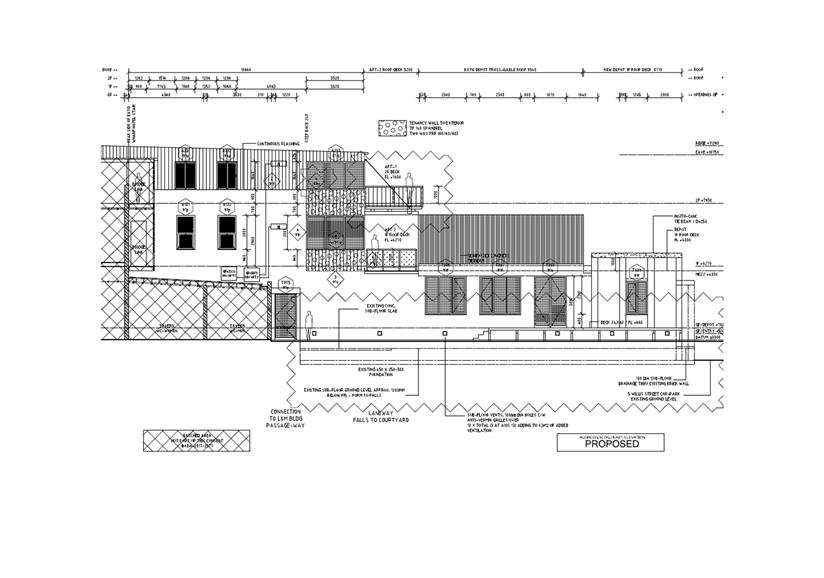

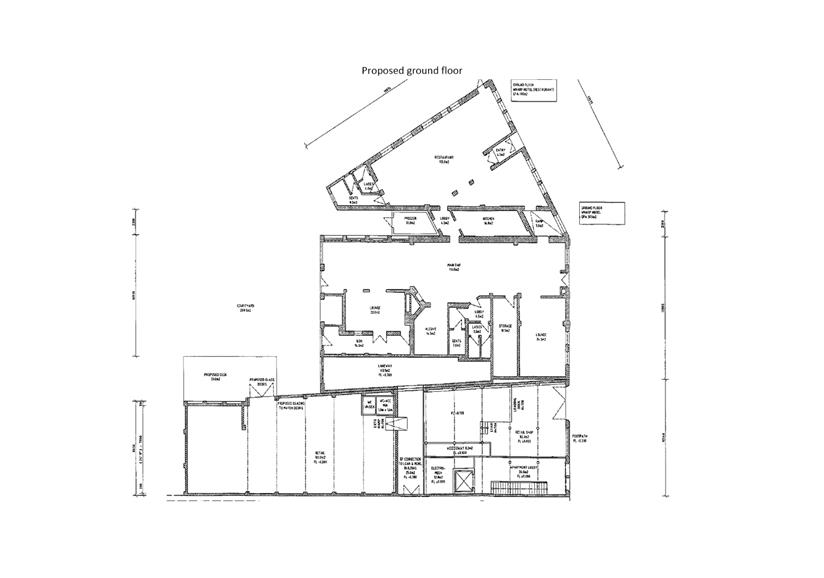

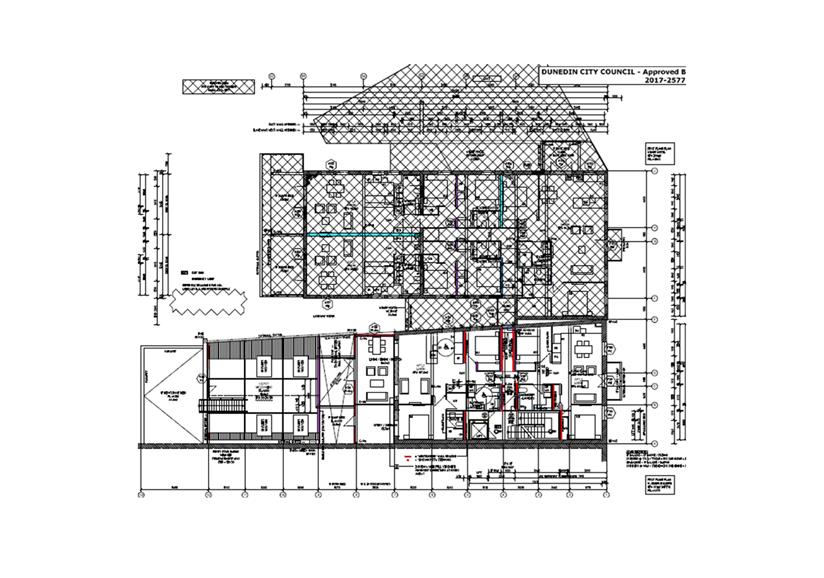

Attachments

|

|

Title

|

Page

|

|

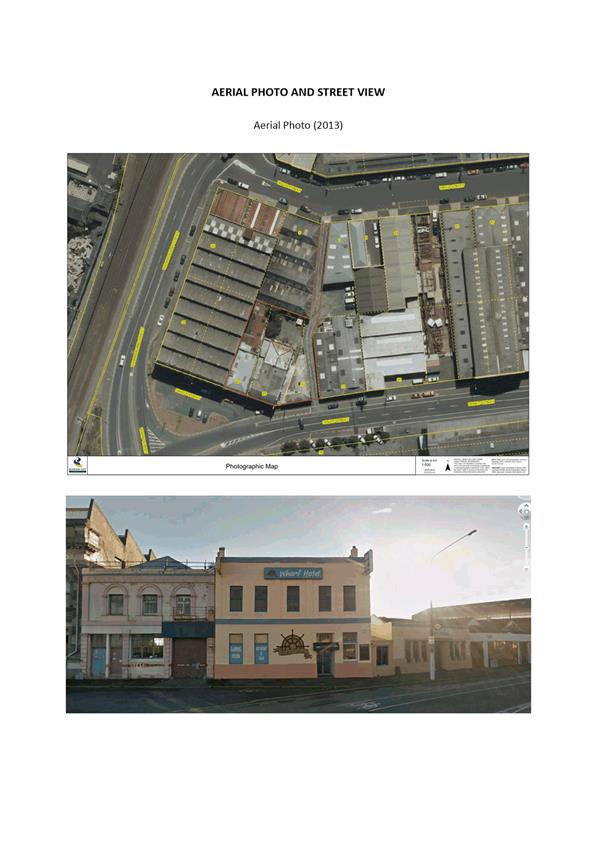

⇩a

|

Aerial Photo and Street

View

|

15

|

|

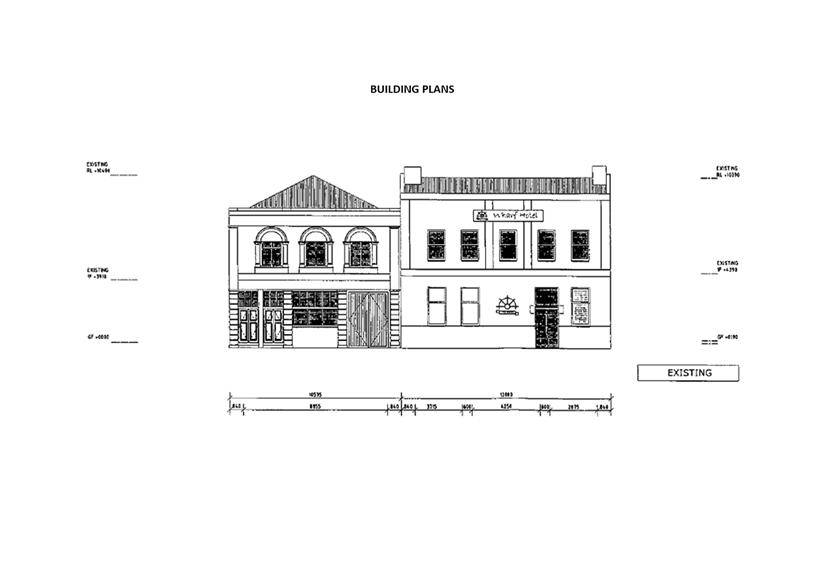

⇩b

|

Building Plans

|

16

|

|

⇩c

|

Remission Request

|

26

|

|

⇩d

|

Development

Contributions Assessment

|

33

|

|

⇩e

|

Development Contributions

Policy Detailed Supporing Document

|

34

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing local

services and infrastructure that it is considered good-quality and

cost-effective and contributes to community well-being in the present and for

the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Within the Council’s financial strategy, the role of

development contributions is to fund the growth portion of capital projects.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

Long term consequences of undermining the integrity of the

Development Contributions Policy from not recouping fully from developers the

cost of those developments.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

The collection of development contributions is included as

a revenue line item in the Long Term Plan and forms part of the overall

financial strategy.

|

|

Financial

considerations

The collection of development contributions is included as

a revenue line item in the Long Term Plan and forms part of the overall

financial strategy.

|

|

Significance

The decision is assessed as low under the Council’s

Significance and Engagement Policy.

|

|

Engagement –

external

There has been external engagement with Utility NZ (Walter

Clarke) in relation to application of the Policy.

|

|

Engagement -

internal

There has been no internal engagement.

|

|

Risks: Legal /

Health and Safety etc.

The decision could be challenged by judicial review.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|