Notice of Meeting:

I hereby give notice that an ordinary meeting of the Dunedin

City Council will be held on:

Date: Tuesday

11 February 2020

Time: 2.30

pm or at the conclusion of the previous meeting whichever is later

Venue: Edinburgh

Room, Municipal Chambers, The Octagon, Dunedin

Sue Bidrose

Council

PUBLIC AGENDA

|

Mayor

|

Mayor Aaron Hawkins

|

|

|

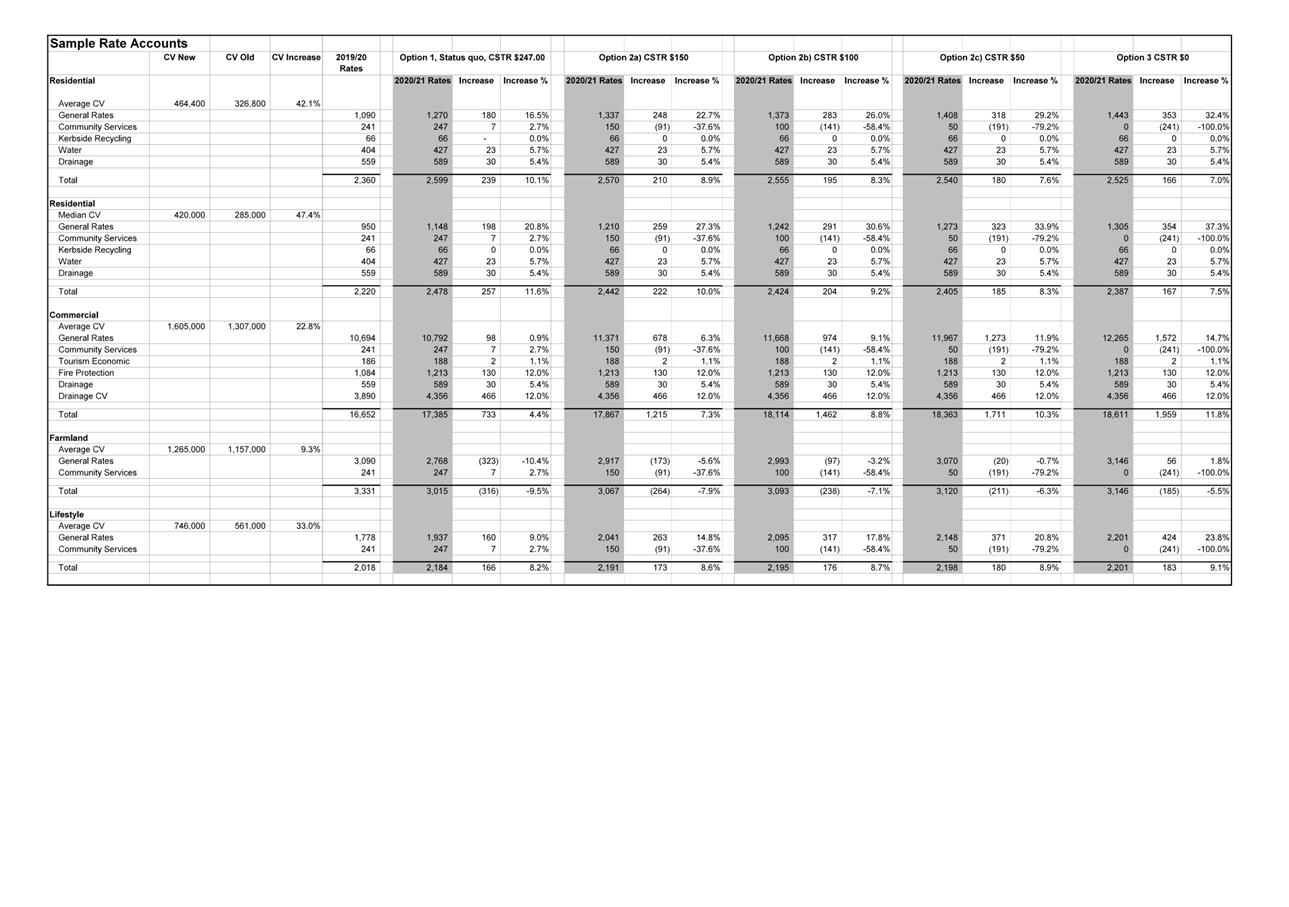

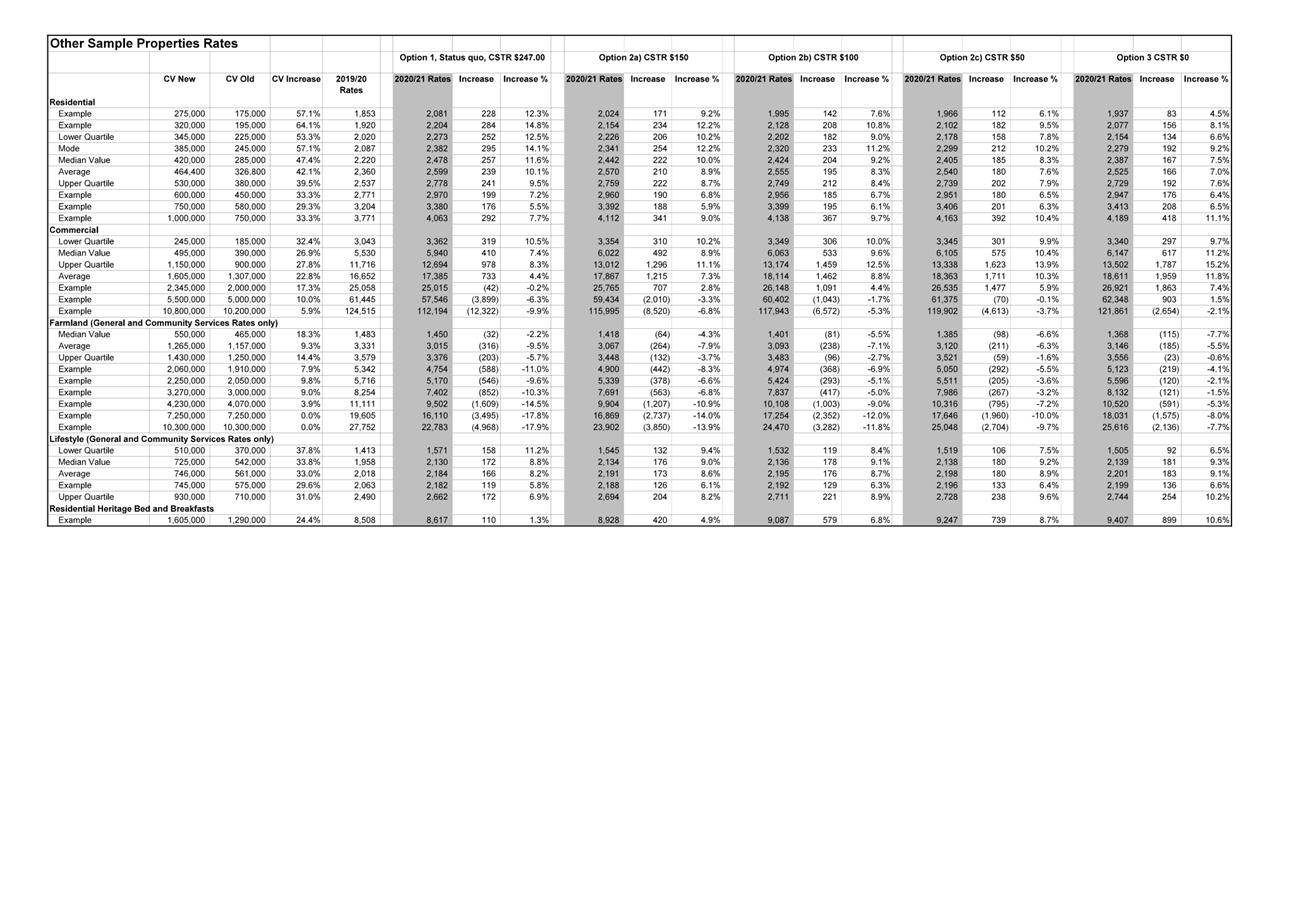

Deputy Mayor

|

Cr Christine Garey

|

|

|

Members

|

Cr Sophie Barker

|

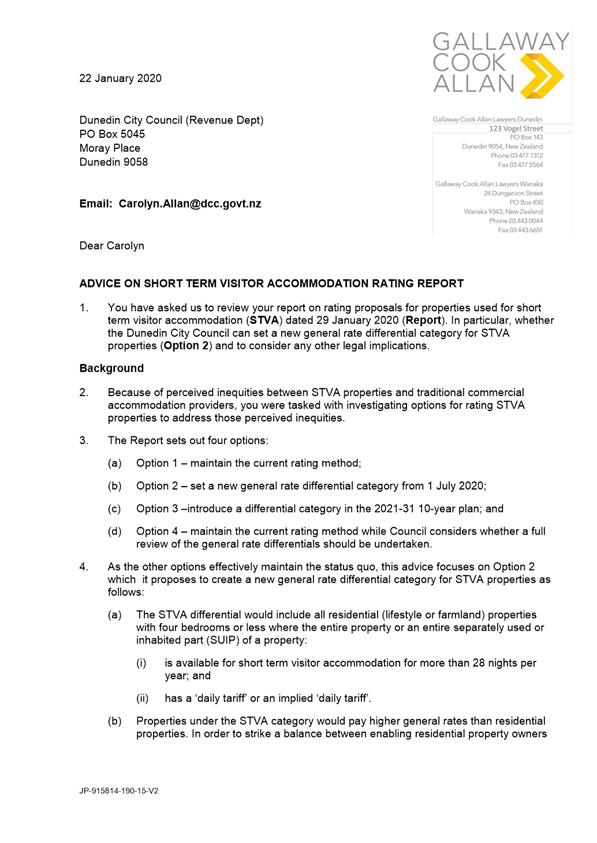

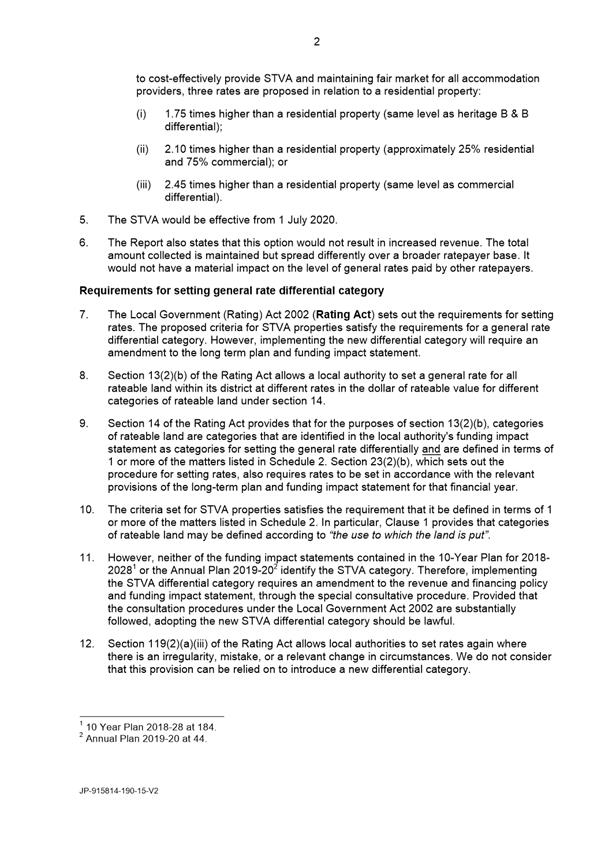

Cr David Benson-Pope

|

|

|

Cr Rachel Elder

|

Cr Doug Hall

|

|

|

Cr Carmen Houlahan

|

Cr Marie Laufiso

|

|

|

Cr Mike Lord

|

Cr Jim O'Malley

|

|

|

Cr Jules Radich

|

Cr Chris Staynes

|

|

|

Cr Lee Vandervis

|

Cr Steve Walker

|

|

|

Cr Andrew Whiley

|

|

Senior Officer Sue

Bidrose, Chief Executive Officer

Governance Support Officer Lynne

Adamson

Lynne Adamson

Governance Support Officer

Telephone: 03 477 4000

Lynne.Adamson@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

|

Council

11 February 2020

|

ITEM TABLE OF CONTENTS PAGE

1 Public

Forum 4

2 Apologies 4

3 Confirmation

of Agenda 4

4 Declaration

of Interest 5

Reports

5 2020-21

Rating Method 19

6 Short

Term Visitor Accommodation 31

7 Funding

Options: Subsidised Bus Fares in Dunedin 47

|

|

Council

11 February 2020

|

1 Public

Forum

At the close of the agenda no

requests for public forum had been received.

2 Apologies

An apology has been received from

Cr Andrew Whiley.

That the Council:

Accepts the apology from Cr

Andrew Whiley.

3 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

|

|

Council

11 February 2020

|

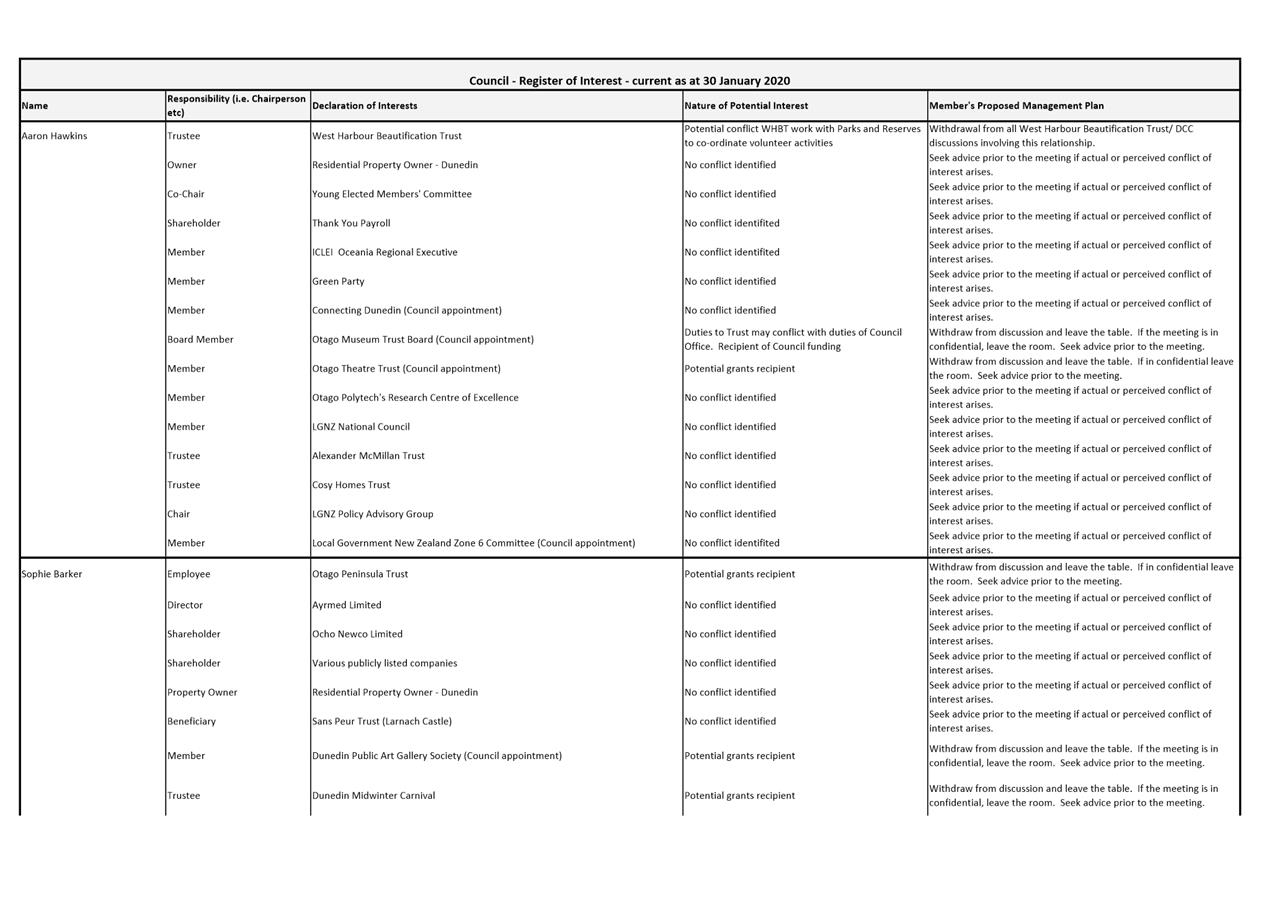

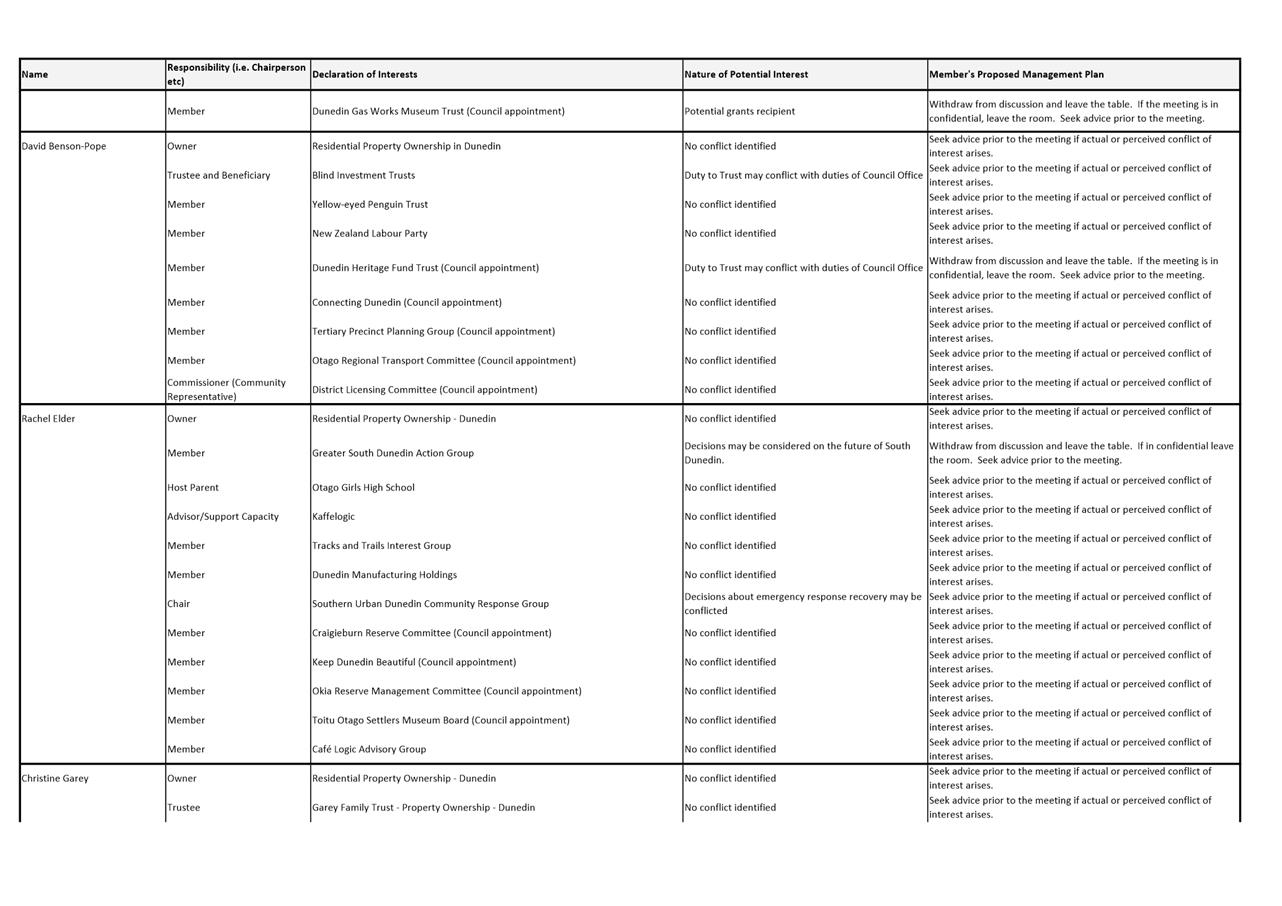

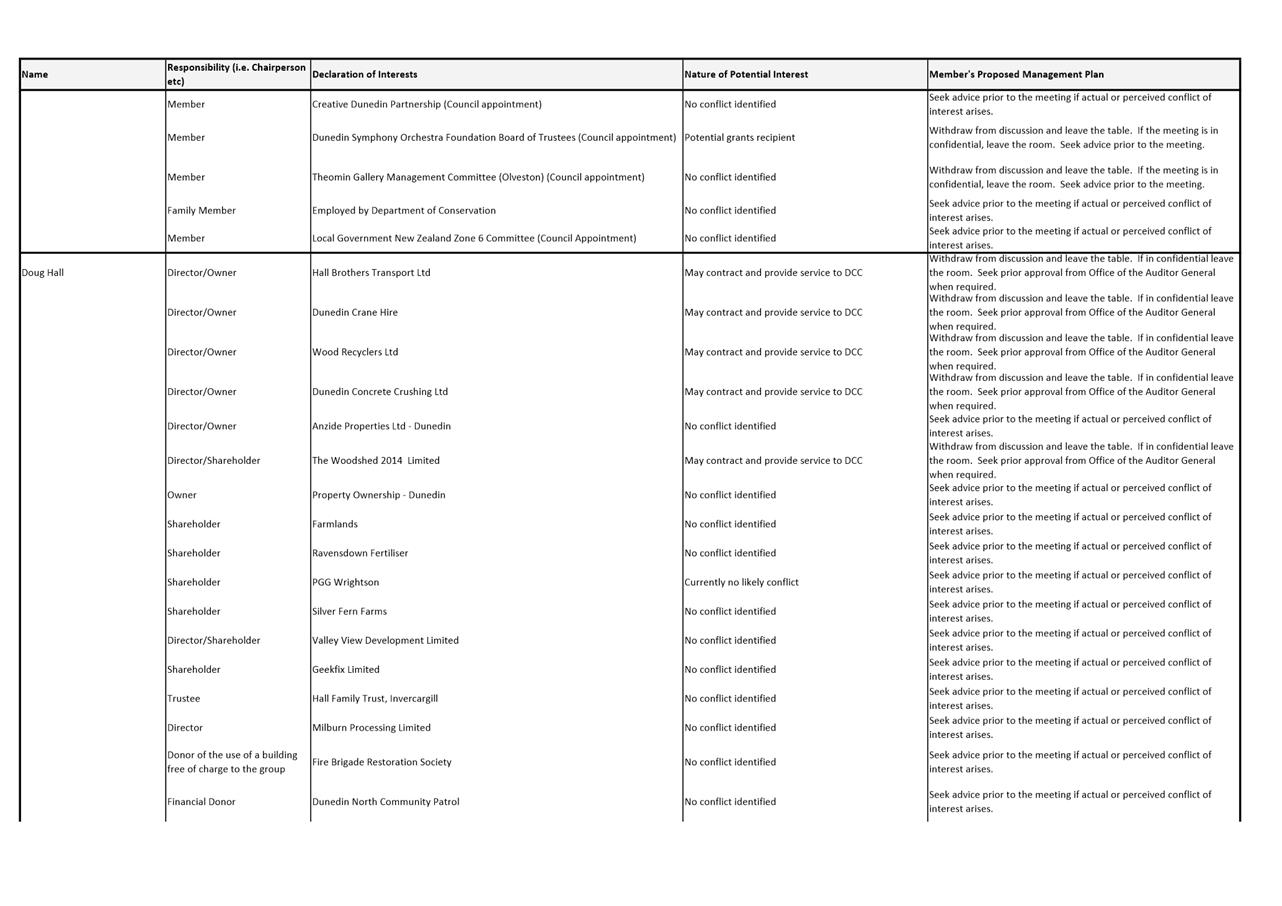

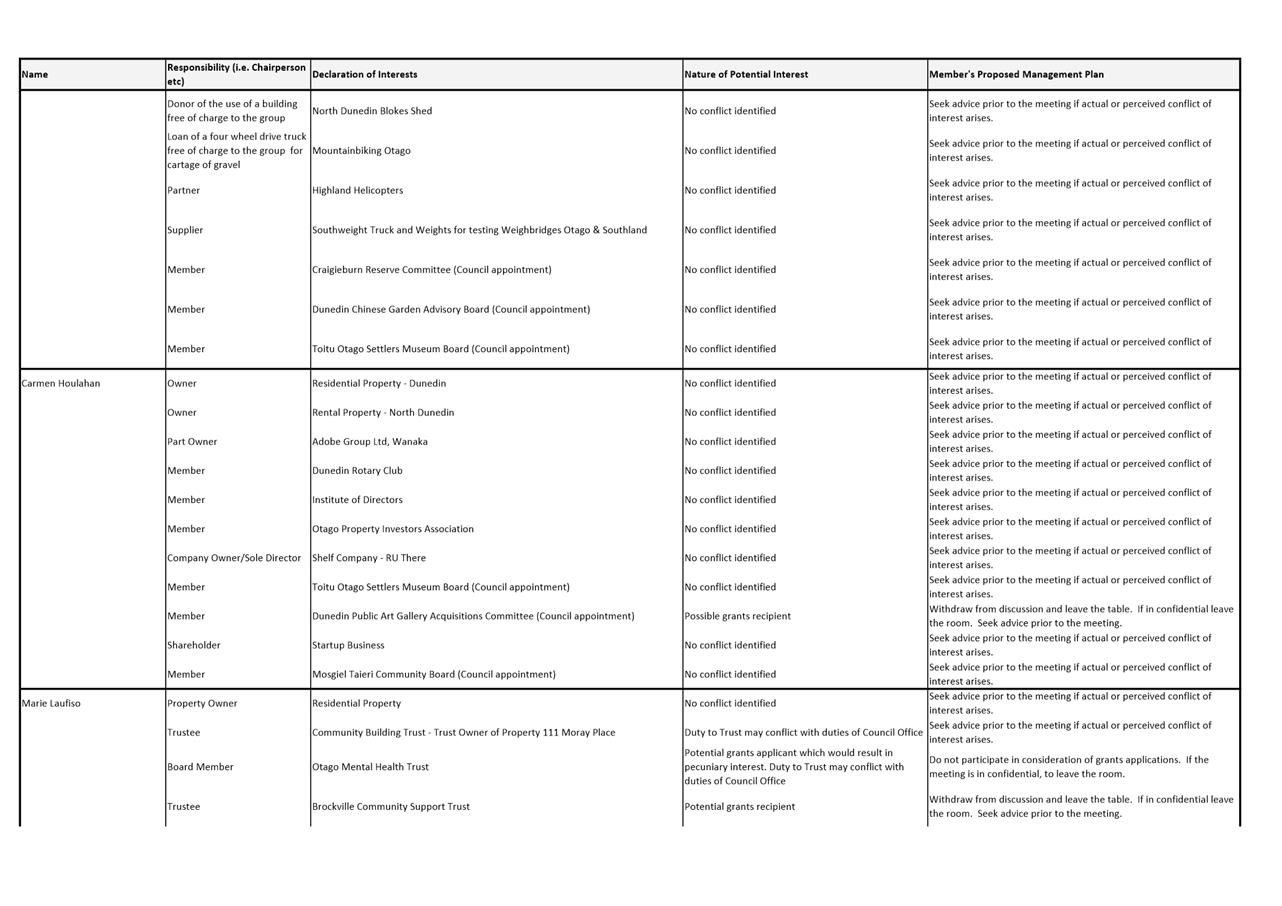

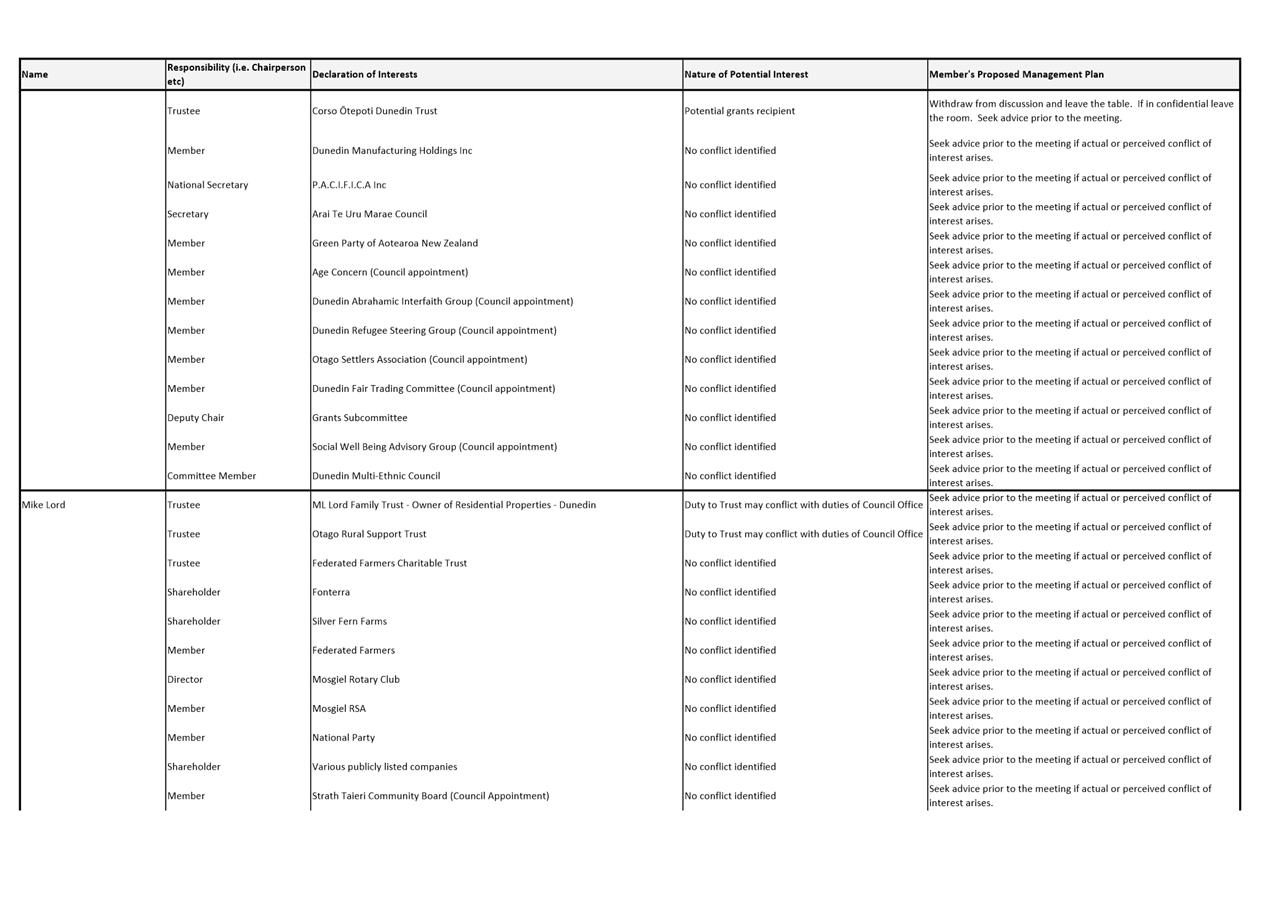

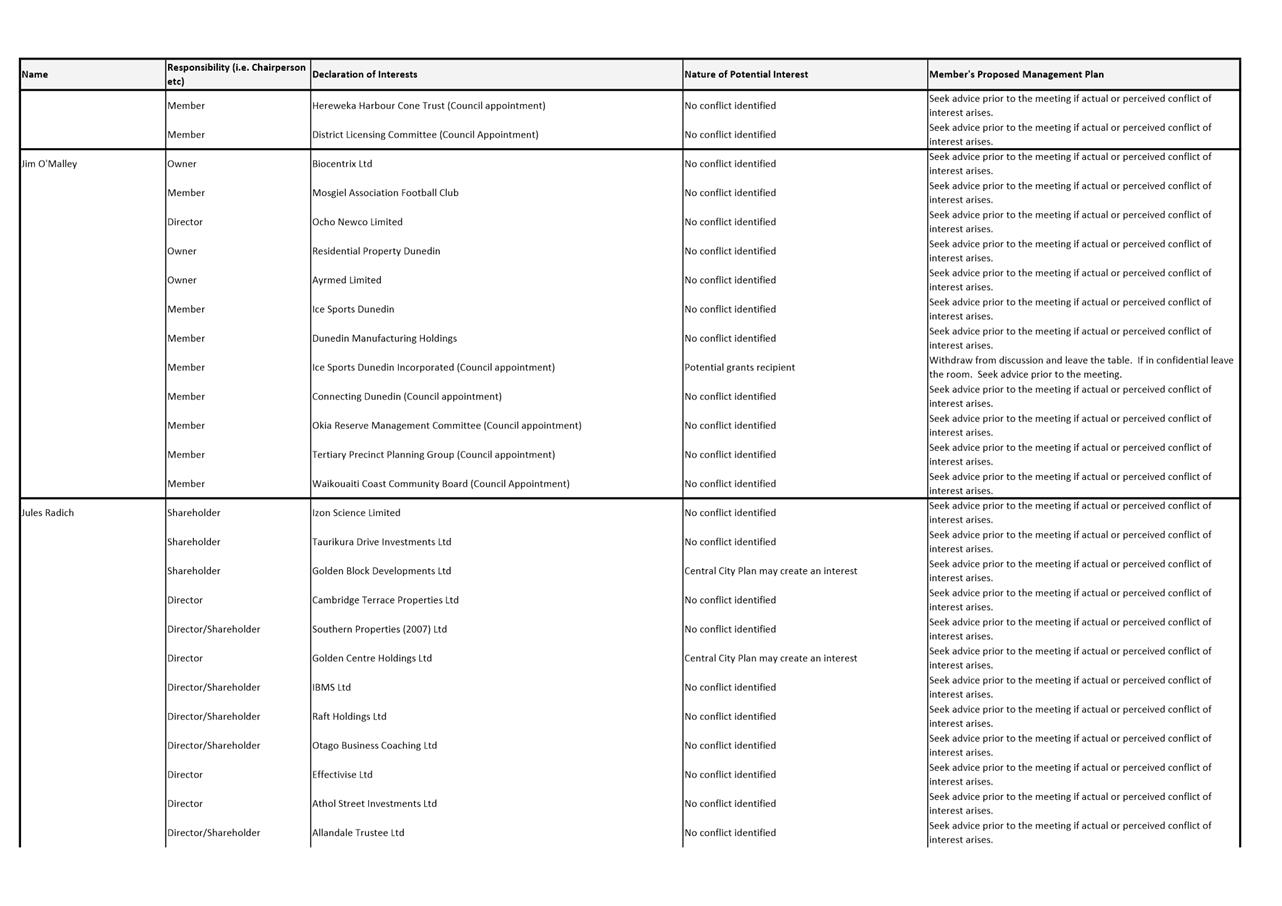

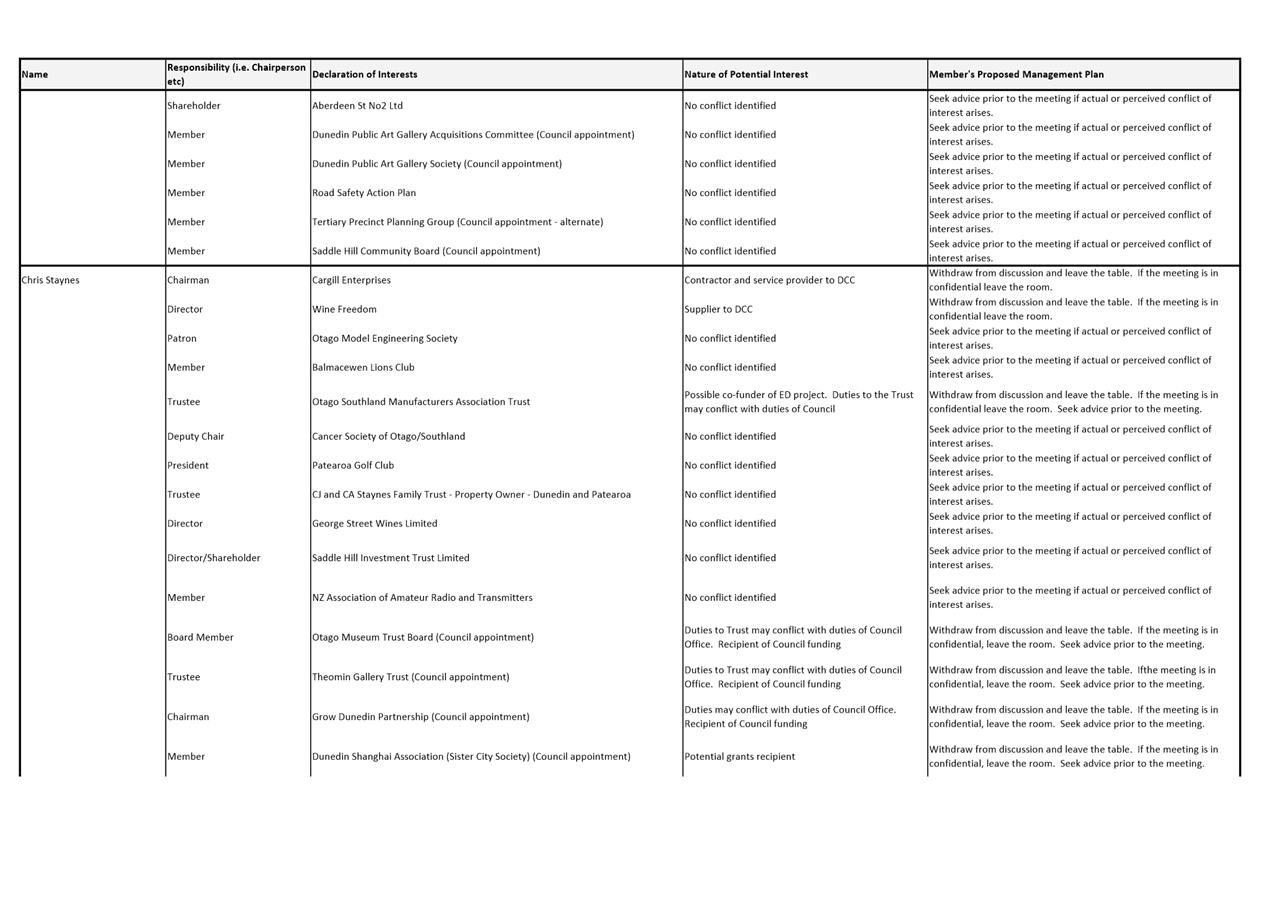

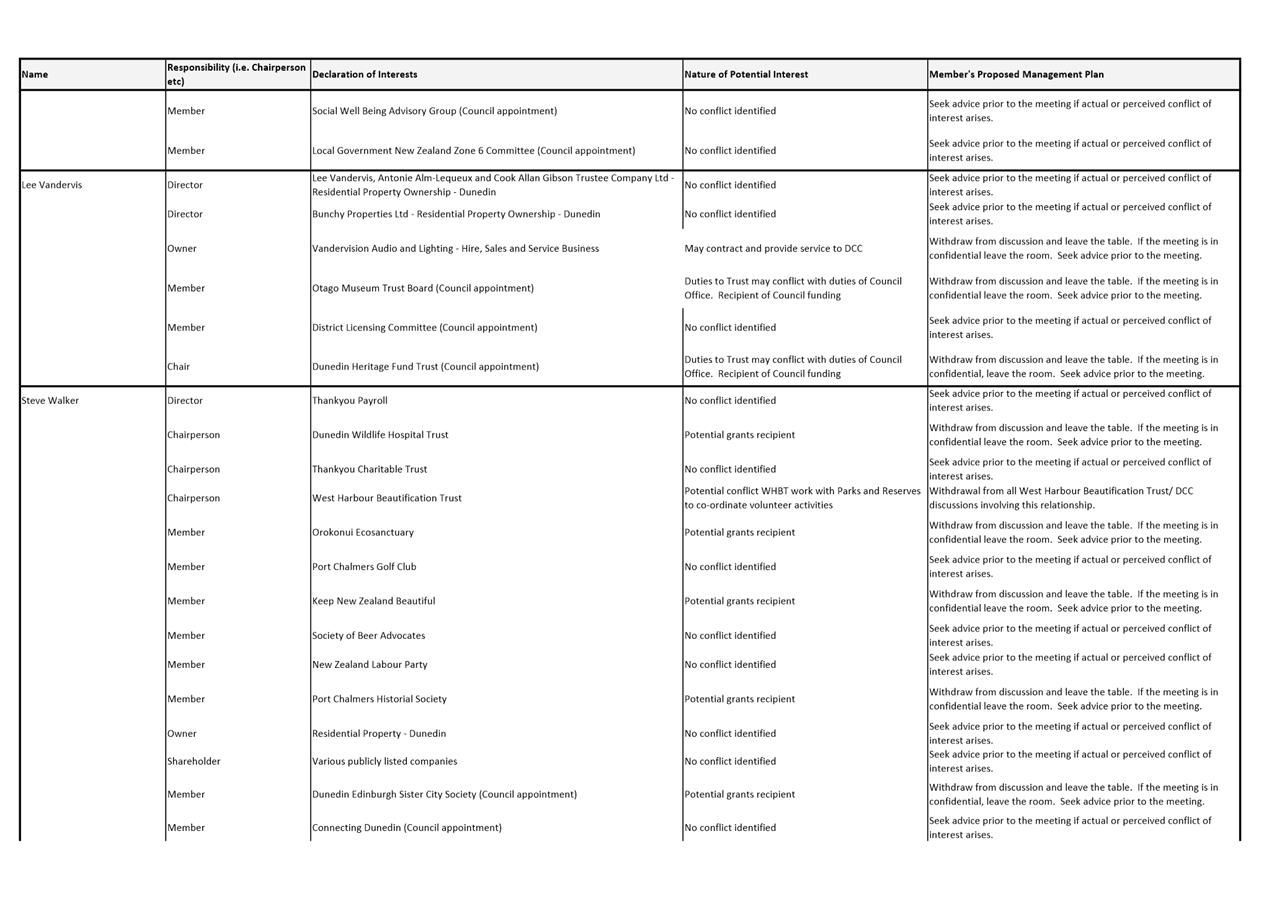

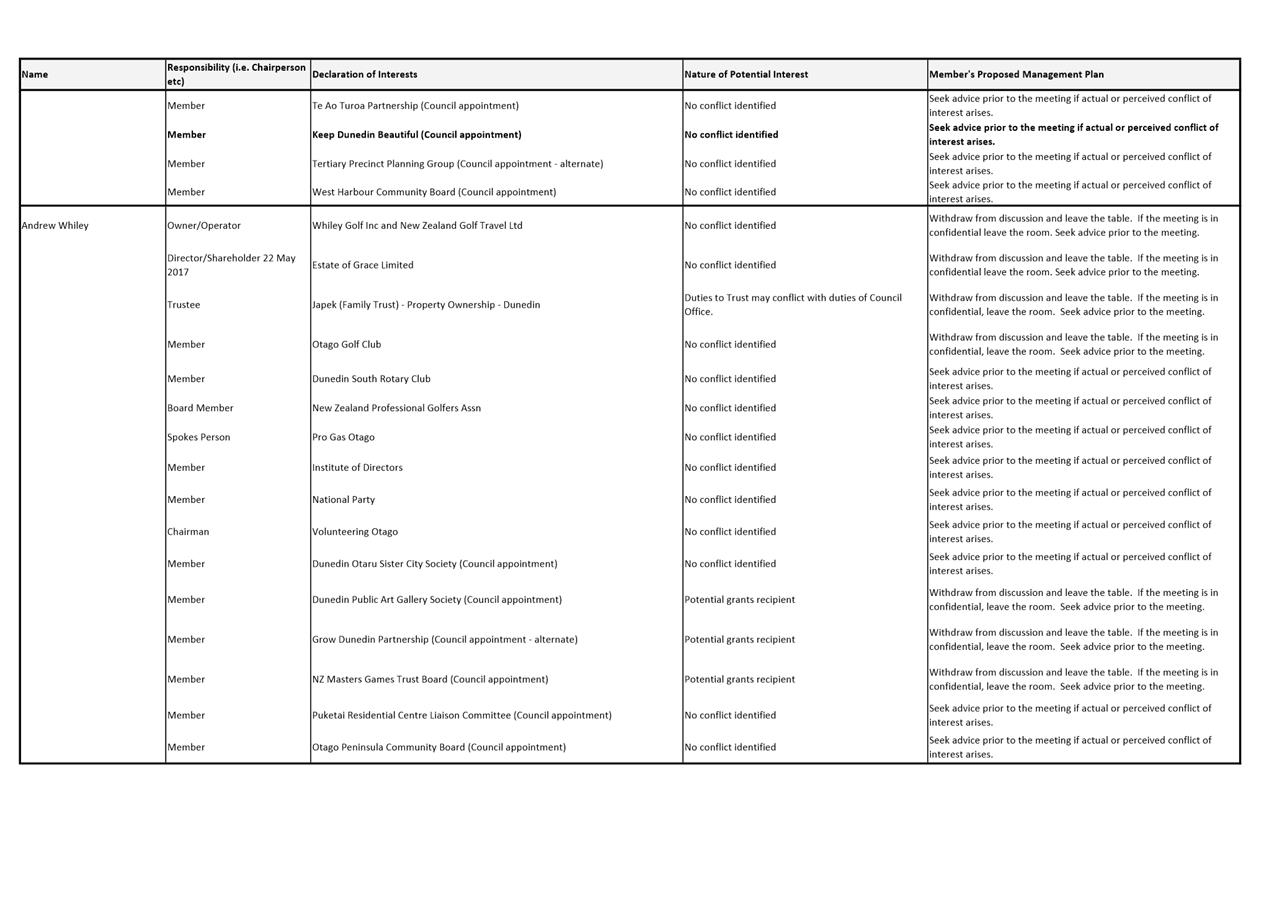

Declaration of Interest

EXECUTIVE SUMMARY

1. Members

are reminded of the need to stand aside from decision-making when a conflict

arises between their role as an elected representative and any private or other

external interest they might have.

2. Elected

members are reminded to update their register of interests as

soon as practicable, including amending the register at this meeting if

necessary.

3. Staff members are

reminded to update their register of interests as soon as practicable.

|

RECOMMENDATIONS

That the Council:

a) Notes/Amends

if necessary the Elected Members' Interest Register attached as Attachment A;

and

b) Confirms/Amends the proposed management plan for Elected Members' Interests.

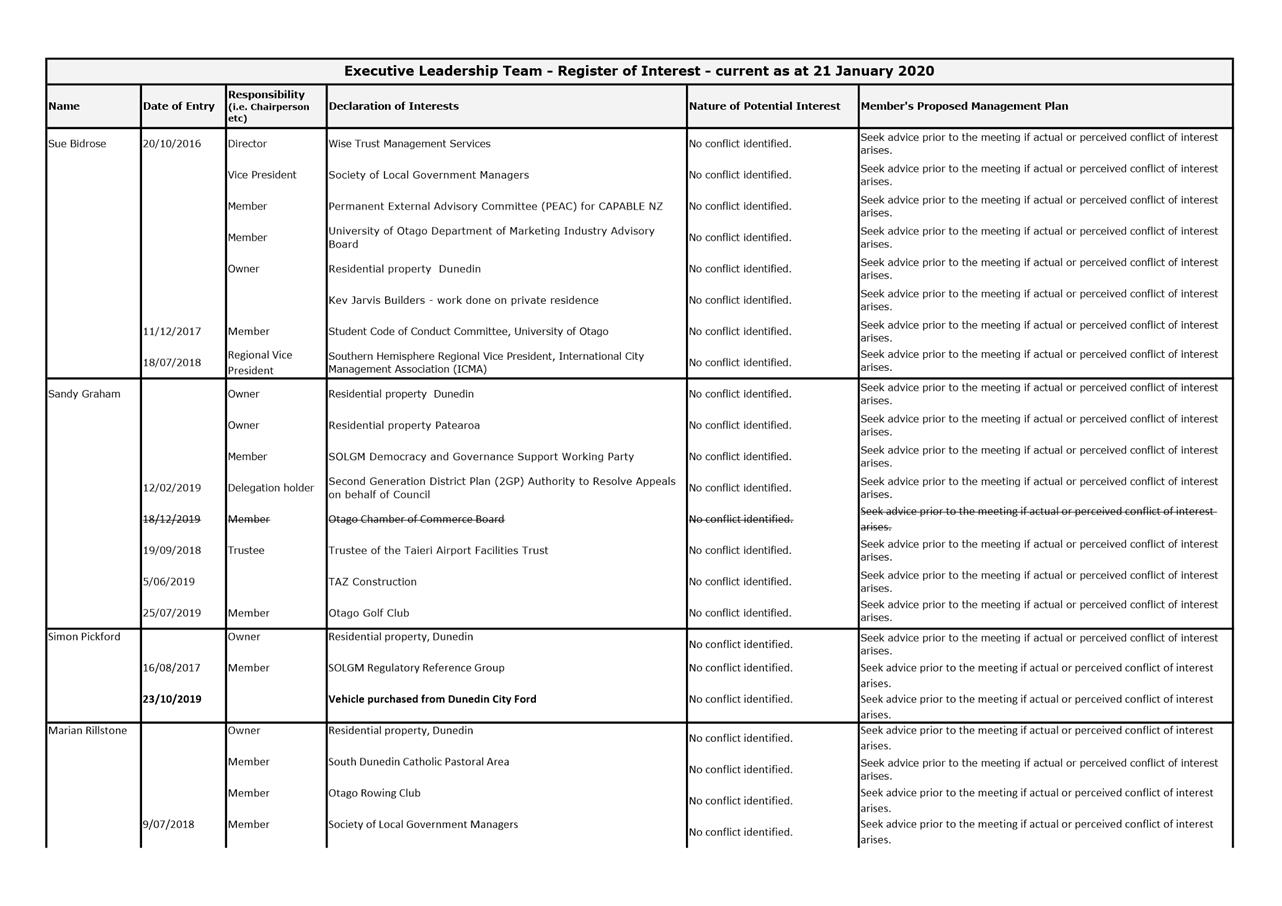

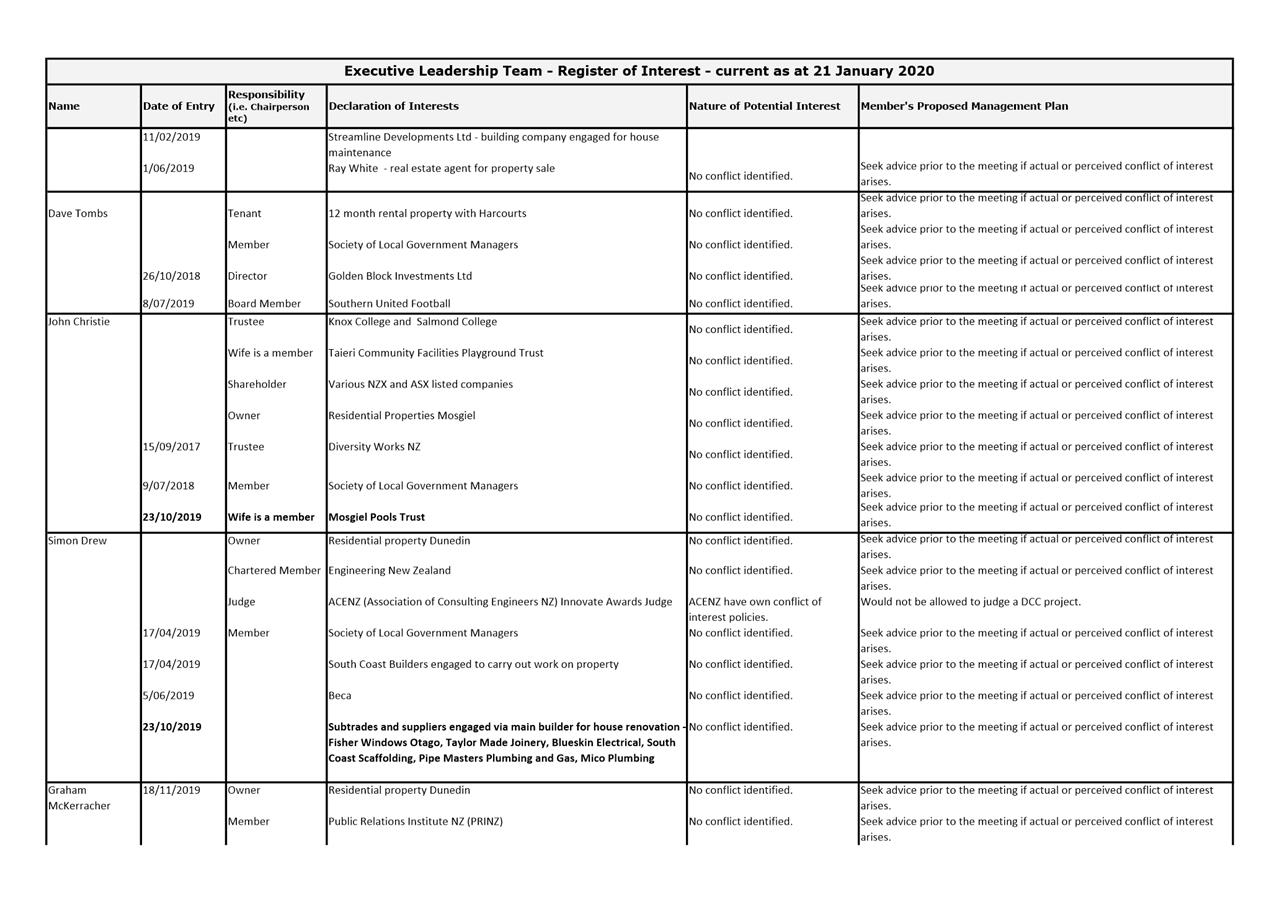

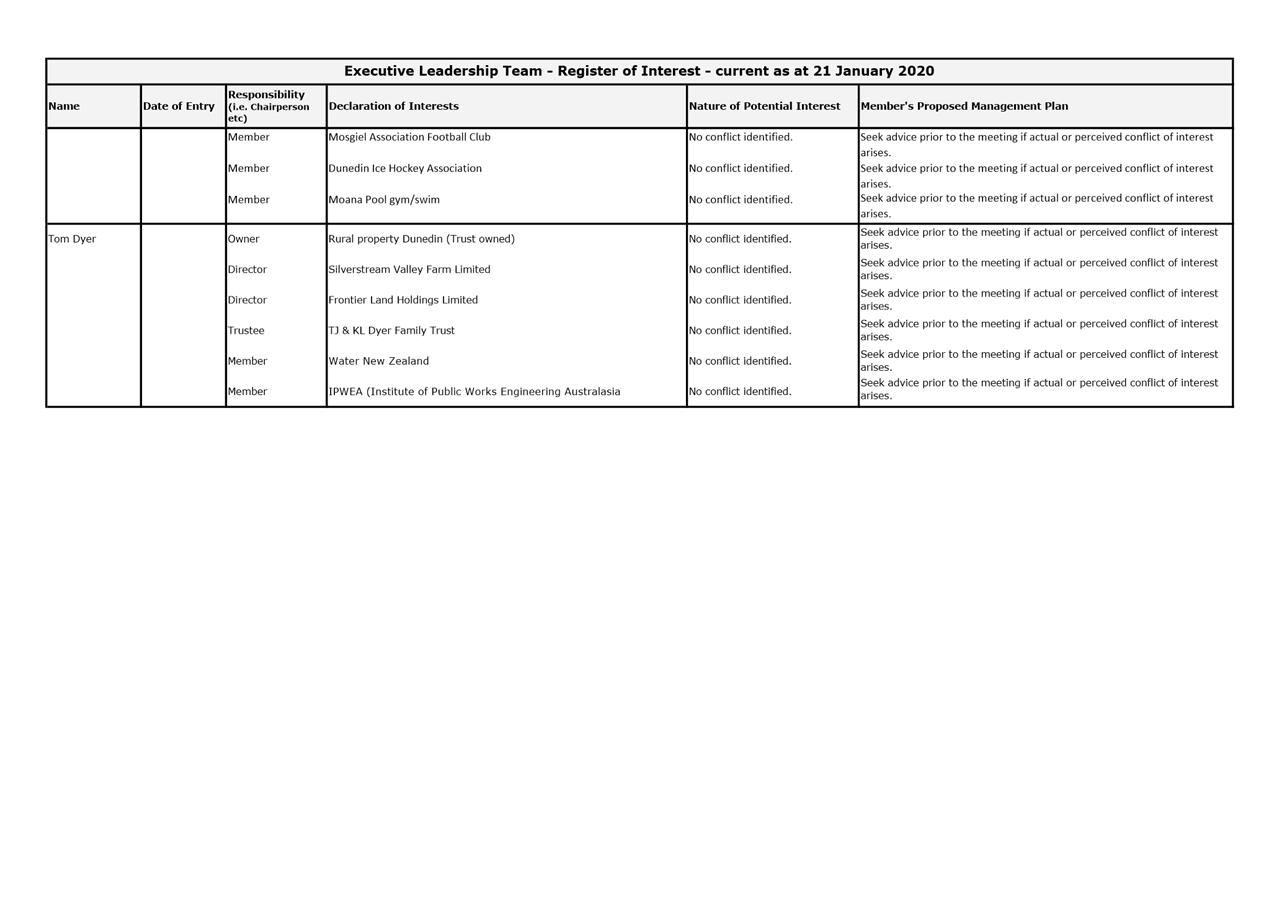

c) Notes the

staff members’ Interest Register.

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Elected Members'

Register of Interest

|

7

|

|

⇩b

|

Executive Leadership

Team Register of Interest

|

16

|

|

|

Council

11 February 2020

|

Reports

2020-21 Rating Method

Department: Finance

EXECUTIVE SUMMARY

1 This

report provides Council with options to increase the proportion of rates

revenue collected by way of the general rate following a request from Council.

2 The

options considered in this report propose variations to the level of the

community services targeted rate. They have the effect of redistributing the increase

in rates across properties and property categories.

|

RECOMMENDATIONS

That the Council, for the purposes of community engagement:

a) Considers

which of the options for the community services targeted rate be included in

the rating method for the 2020-21 year.

b) Approves the

current rating method for the setting of all other rates for the 2020-21

year.

|

BACKGROUND

3 During

the Annual Plan Council meeting on 29 January 2020, the Council approved the

following resolution:

Moved (Mayor Aaron Hawkins/Cr David Benson-Pope):

That the Council:

Request a report in time for the February 11th

meeting, presenting options to increase the proportion of rates revenue

collected by way of the general rate.

Motion carried (CNL/2020/006)

4 DCC

rates are made up of general rates (53%) and targeted rates (47%). General

rates are based on capital value. Targeted rates are made up of fixed charges

(78%) and rates based on capital value (22%). When property values change as a

result of a revaluation, the largest impact relates to the general rate.

5 Dunedin

properties were revalued in 2019 and these property values form the basis for

rating for the 2020-21 rating year. Overall, there has been a 33.5% increase in

capital value (CV) of Dunedin properties.

6 Historically,

property revaluations have not had a significant impact on how rates are

distributed between properties. This time, however, the increase in capital

values of certain properties in the city will have a notable impact on the

overall rate increase experienced by ratepayers.

7 This

is because the residential category of properties increased in CV by 39.9%,

compared to the overall increase of 33.5%. Within the residential category, the

CV of lower value properties (median CV of $420,000 and below) increased by

50%; while properties with a CV greater than the median CV increased by 34%.

The rating effect means lower value residential properties will pay a greater

share of the general rate and therefore have a higher rate increase.

8 Please

note that unless specified, all rating figures in this report are GST

inclusive.

DISCUSSION

9 There

are a variety of ways to increase the proportion of rates collected by way of

the general rate. These would be by reducing the amount of rates collected by

fixed charges.

10 Rates

collected as fixed charges include the community services rate, kerbside

recycling rate, water rate and drainage rate. The last three of these rates

directly relate to the delivery of specific services. Without a full review of

the service delivery and funding of these activities, changes to these rates

were not considered.

11 It

is worth noting that the potential changes to the refuse and kerbside

collection services from 1 July 2021 are likely to impact on the proportion of

rates charged as fixed charges.

Community

Services Targeted Rate (CSTR)

12 This

report considers increasing the proportion of rates collected using the general

rate and reducing the proportion of rates collected using the community

services targeted rate (CSTR). A reduction in rates collected by the CSTR would

be offset by an increase in rates collected by the general rate.

13 As

specified in the Revenue and Financing Policy, the CSTR funds the Botanic

Garden and part of the Parks and Reserves activity. In the 2019-20 year,

$13.557 million (including GST) is budgeted to be collected using the CSTR. The

following table shows the amount collected from each property category:

|

Property Category

|

$’000

|

|

Residential

|

11,998

|

|

Lifestyle

|

602

|

|

Commercial

|

671

|

|

Farmland

|

286

|

|

Total

|

13,557

|

14 The

CSTR is a fixed charge on all rateable properties and is forecast in the

2018-28 10 year plan to be increased annually by an indexed amount, last year

by 3% to $240.50.

OPTIONS

15 Options

for the level of the CSTR, for the 2020-21 year, are provided as follows:

a) Option

one – status quo, increases the CSTR by $6.50 to $247.00.

b) Option

two –provides three different levels of a reduced CSTR: $150.00, $100.00

and $50.00.

c) Option

three – removes the CSTR.

16 Each

option incorporates the forecast rate increase for the 2020-21 year of 6.5%.

17 The

following table shows the total rates income (including GST) by property

category for 2020-21 and 2019-20 for each option, along with the overall

increase or decrease by category. The last column in the table shows the

increase or decrease for each option compared to the status quo option.

Total rates income

by property category

|

|

2020/21

|

2019/20

|

Increase (Decrease)

|

% Increase (Decrease)

|

Inc/(Dec) on Option 1, SQ

|

|

Option 1 – status quo, increase CSTR to $247

|

|

Residential

|

126,471,300

|

115,646,300

|

10,825,000

|

9.4%

|

|

|

Lifestyle

|

6,110,400

|

5,688,300

|

422,100

|

7.4%

|

|

|

Commercial

|

54,673,800

|

53,642,200

|

1,031,600

|

1.9%

|

|

|

Farmland

|

4,739,300

|

5,241,100

|

(501,800)

|

-9.6%

|

|

|

Total

|

191,994,800

|

180,217,900

|

11,776,900

|

6.5%

|

|

|

Option 2 (a) – reduce CSTR to $150

|

|

Residential

|

124,831,700

|

115,646,300

|

9,185,400

|

7.9%

|

(1,639,600)

|

|

Lifestyle

|

6,130,100

|

5,688,300

|

441,800

|

7.8%

|

19,700

|

|

Commercial

|

56,198,100

|

53,642,200

|

2,555,900

|

4.8%

|

1,524,300

|

|

Farmland

|

4,834,900

|

5,241,100

|

(406,200)

|

-7.7%

|

95,600

|

|

Total

|

191,994,800

|

180,217,900

|

11,776,900

|

6.5%

|

0

|

|

Option 2 (b) – reduce CSTR to $100

|

|

Residential

|

123,992,800

|

115,646,300

|

8,346,500

|

7.2%

|

(2,478,500)

|

|

Lifestyle

|

6,140,900

|

5,688,300

|

452,600

|

8.0%

|

30,500

|

|

Commercial

|

56,978,400

|

53,642,200

|

3,336,200

|

6.2%

|

2,304,600

|

|

Farmland

|

4,882,700

|

5,241,100

|

(358,400)

|

-6.8%

|

143,400

|

|

Total

|

191,994,800

|

180,217,900

|

11,776,900

|

6.5%

|

0

|

|

Option 2 (c) – reduce CSTR to $50

|

|

Residential

|

123,146,900

|

115,646,300

|

7,500,600

|

6.5%

|

(3,324,400)

|

|

Lifestyle

|

6,151,700

|

5,688,300

|

463,400

|

8.1%

|

41,300

|

|

Commercial

|

57,763,800

|

53,642,200

|

4,121,600

|

7.7%

|

3,090,000

|

|

Farmland

|

4,932,400

|

5,241,100

|

(308,700)

|

-5.9%

|

193,100

|

|

Total

|

191,994,800

|

180,217,900

|

11,776,900

|

6.5%

|

0

|

|

Option 3 – reduce CSTR to $0

|

|

Residential

|

122,304,900

|

115,646,300

|

6,658,600

|

5.8%

|

(4,166,400)

|

|

Lifestyle

|

6,160,600

|

5,688,300

|

472,300

|

8.3%

|

50,200

|

|

Commercial

|

58,549,100

|

53,642,200

|

4,906,900

|

9.1%

|

3,875,300

|

|

Farmland

|

4,980,200

|

5,241,100

|

(260,900)

|

-5.0%

|

240,900

|

|

Total

|

191,994,800

|

180,217,900

|

11,776,900

|

6.5%

|

0

|

18 The

outcome of any change to the rating method is that some properties pay more and

some properties pay less. There are around 56,000 rate accounts. As a

result of any CSTR change, the impact on each account is the same (the only

variable being the number of CSTR charges), however the change in general rate

varies depending on the CV.

19 Some

specific property examples are provided in Attachment A but there is the

potential risk of unique issues and unintended consequences. Attachment A

provides sample property rate impacts for each category of property, for each

of the options. The table below provides a small sample list from Attachment A.

It shows the impact on the average value property for each category as well as the

median and mode values for residential property. Farmland and lifestyle

properties include general and community services rates only. Residential and

commercial properties are charged all rates.

Sample rates by property category

|

|

CV New

|

CV Old

|

CV % Increase

|

2019/20 Rates

|

2020/21 Rates

|

Rate Increase (Dec)

|

% Rate Increase (Dec)

|

|

Option 1 – status quo, increase CSTR to $247

|

|

Residential Mode

|

385,000

|

245,000

|

57.1%

|

2,087

|

2,382

|

295

|

14.1%

|

|

Residential Median

|

420,000

|

285,000

|

47.4%

|

2,220

|

2,478

|

257

|

11.6%

|

|

Residential Average

|

464,400

|

326,800

|

42.1%

|

2,360

|

2,599

|

239

|

10.1%

|

|

Commercial

|

1,605,000

|

1,307,000

|

22.8%

|

16,652

|

17,385

|

733

|

4.4%

|

|

Farmland

|

1,265,000

|

1,157,000

|

9.3%

|

3,331

|

3,015

|

(316)

|

-9.5%

|

|

Lifestyle

|

746,000

|

561,000

|

33.0%

|

2,018

|

2,184

|

166

|

8.2%

|

|

Option 2 (a) – reduce CSTR to $150

|

|

Residential Mode

|

385,000

|

245,000

|

57.1%

|

2,087

|

2,341

|

254

|

12.2%

|

|

Residential Median

|

420,000

|

285,000

|

47.4%

|

2,220

|

2,442

|

222

|

10.0%

|

|

Residential Average

|

464,400

|

326,800

|

42.1%

|

2,360

|

2,570

|

210

|

8.9%

|

|

Commercial

|

1,605,000

|

1,307,000

|

22.8%

|

16,652

|

17,867

|

1,215

|

7.3%

|

|

Farmland

|

1,265,000

|

1,157,000

|

9.3%

|

3,331

|

3,067

|

(264)

|

-7.9%

|

|

Lifestyle

|

746,000

|

561,000

|

33.0%

|

2,018

|

2,191

|

173

|

8.6%

|

|

Option 2 (b) – reduce CSTR to $100

|

|

Residential Mode

|

385,000

|

245,000

|

57.1%

|

2,087

|

2,320

|

233

|

11.2%

|

|

Residential Median

|

420,000

|

285,000

|

47.4%

|

2,220

|

2,424

|

204

|

9.2%

|

|

Residential Average

|

464,400

|

326,800

|

42.1%

|

2,360

|

2,555

|

195

|

8.3%

|

|

Commercial

|

1,605,000

|

1,307,000

|

22.8%

|

16,652

|

18,114

|

1,462

|

8.8%

|

|

Farmland

|

1,265,000

|

1,157,000

|

9.3%

|

3,331

|

3,093

|

(238)

|

-7.1%

|

|

Lifestyle

|

746,000

|

561,000

|

33.0%

|

2,018

|

2,195

|

176

|

8.7%

|

|

Option 2 (c) – reduce CSTR to $50

|

|

Residential Mode

|

385,000

|

245,000

|

57.1%

|

2,087

|

2,299

|

212

|

10.2%

|

|

Residential Median

|

420,000

|

285,000

|

47.4%

|

2,220

|

2,405

|

185

|

8.3%

|

|

Residential Average

|

464,400

|

326,800

|

42.1%

|

2,360

|

2,540

|

180

|

7.6%

|

|

Commercial

|

1,605,000

|

1,307,000

|

22.8%

|

16,652

|

18,363

|

1,711

|

10.3%

|

|

Farmland

|

1,265,000

|

1,157,000

|

9.3%

|

3,331

|

3,120

|

(211)

|

-6.3%

|

|

Lifestyle

|

746,000

|

561,000

|

33.0%

|

2,018

|

2,198

|

180

|

8.9%

|

|

Option 3 – reduce CSTR to $0

|

|

Residential Mode

|

385,000

|

245,000

|

57.1%

|

2,087

|

2,279

|

192

|

9.2%

|

|

Residential Median

|

420,000

|

285,000

|

47.4%

|

2,220

|

2,387

|

167

|

7.5%

|

|

Residential Average

|

464,400

|

326,800

|

42.1%

|

2,360

|

2,525

|

166

|

7.0%

|

|

Commercial

|

1,605,000

|

1,307,000

|

22.8%

|

16,652

|

18,611

|

1,959

|

11.8%

|

|

Farmland

|

1,265,000

|

1,157,000

|

9.3%

|

3,331

|

3,146

|

(185)

|

-5.5%

|

|

Lifestyle

|

746,000

|

561,000

|

33.0%

|

2,018

|

2,201

|

183

|

9.1%

|

20 Overall

impacts are provided for each option.

Option

One – Status Quo

21 Under

the status quo, allowing for both the June 2019 Local Government Cost Index of

2.8% and rounding to the nearest 50 cents would increase the CSTR from $240.50

to $247.00 for the 2020-21 year.

22 The

impacts are:

· The

total amount of rates collected from the CSTR increases from $13.557 million to

$14.000 million for the 2020-21 year, an increase of 3.3%.

· General

rates increase overall by 7.8%.

· The

overall rate increase for residential, lifestyle and commercial categories is

9.4%, 7.4% and 1.9% respectively. The overall rate reduction for farmland

properties is 9.6%.

· The

CSTR increase is consistent with the 2018-28 10 year plan.

Option

Two – Decrease the CSTR

23 Option

two reduces the CSTR. Three different levels are provided:

2a) CSTR of $150.00,

2b) CSTR of $100.00 and

2c) CSTR of $50.00.

24 The

impacts are:

· Option

2a (CSTR $150):

- The

total amount of rates that would have been collected from the CSTR, $14 million

under the status quo option, is reduced by $5.5 million. This is added to the

general rate which increases overall by 13.5%.

- The

rate increase is redistributed between categories. The residential category

overall rate increase reduces to 7.9% (9.4% in the status quo option). The

lifestyle and commercial categories overall increases become 7.8% and 4.8%

respectively (from 7.4% and 1.9% respectively). The farmland category

overall decrease is 7.7% (-9.6% in the status quo option).

· Option

2b (CSTR $100):

- The

total amount of rates that would have been collected from the CSTR, $14 million

under the status quo option, is reduced by $8.3 million. This is added to the

general rate which increases overall by 16.5%.

- The

rate increase is redistributed between categories. The residential category

overall rate increase reduces to 7.2% (9.4% in the status quo option). The

lifestyle and commercial categories overall increases become 8.0% and 6.2%

respectively (from 7.4% and 1.9% respectively). The farmland category

overall decrease is 6.8% (-9.6% in the status quo option).

· Option

2c (CSTR $50):

- The

total amount of rates that would have been collected from the CSTR, $14 million

under the status quo option, is reduced by $11.2 million. This is added to the

general rate which increases overall by 19.5%.

- The

rate increase is redistributed between categories. The residential category

overall rate increase reduces to 6.5% (9.4% in the status quo option). The

lifestyle and commercial categories overall increases become 8.1% and 7.7%

respectively (from 7.4% and 1.9% respectively). The farmland category

overall decrease is 5.9% (-9.6% in the status quo option).

· The

CSTR would be at a lower level than predicted in the 2018-28 10 year plan.

· Maintaining

the CSTR at any quantum provides a rating mechanism that can be utilised,

depending on other decisions involving the rating method.

Option

Three – Remove the CSTR

25 Option

three removes the CSTR.

26 The

impacts are:

· The

total amount of rates that would have been collected from the CSTR, $14 million

under the status quo option, is added to the general rate. General rates

increase overall by 22.5%.

· The

rate increase is redistributed between categories. The residential category

overall rate increase reduces to 5.8% (9.4% in the status quo option). The

lifestyle and commercial categories overall increase becomes 8.3% and 9.1%

respectively (from 7.4% and 1.9% respectively). The farmland category overall

decrease is 5.0% (-9.6% in the status quo option).

· The

CSTR would be at a lower level than predicted in the 2018-28 10 year plan.

2018-28

10 year plan

27 A

decision to reduce the CSTR by a material amount (option two) or remove it

altogether (option three), would be a change from the 2018-28 10 year plan,

requiring an amendment. The relevant sections that would need to be amended

include the Revenue and Financing Policy, the Funding Impact Statements and

other minor sections of supporting information.

28 The

Revenue and Financing Policy (the Policy) states the Council’s policies

on the funding of its operating and capital expenditure and the sources of

those funds. One of the factors the Council can take into account when

considering the Policy is the overall impact on the social, economic,

environmental and cultural well-being of the community. For example,

affordability issues (the impact on the elderly or low-income families) and the

size and materiality of any shift in funding.

29 The

funding impact statements (FIS) provide a schedule of funding sources, how

those sources are applied and describe what rates and charges the Council will

be setting. The FIS must be consistent with the revenue and financing policy.

NEXT STEPS

30 As

discussed above, Council approval of option two or three would require a formal

amendment to the 2018-28 10 year plan. This section details the consultation

requirements necessary should the Council wish to implement a change from 1

July 2020.

31 The

Council must use the special consultative procedure when making an amendment.

This could occur concurrently while Council engages with the community on the

2020-21 Annual Plan.

32 The

Council would need to prepare a consultation document which provides:

a) A

description of the proposed amendment

b) The

reasons for the proposed amendment

c) The

implications of the proposed amendment

d) Any

alternatives to the proposed amendment.

33 The

consultation document would need to be audited and the final document must

contain a report from the Auditor-General. This would be achievable within the

current timeframe.

34 The

consultation document, amended Revenue and Financing Policy, amended FIS and

any other consequential amendments to the 2018-28 10 year plan would be

provided to the Council for adoption on 24 February 2020.

35 The

proposed rating method would be included in the supporting documentation that

accompanies the draft 2020-21 budget.

36 While

the Council is engaging with the community on the draft 2020-21 budget, rate

account information will be available on the DCC website that shows the

proposed rating impact by individual rate account.

Signatories

|

Author:

|

Carolyn Allan - Senior Management Accountant

|

|

Authoriser:

|

Gavin Logie - Financial Controller

Sandy Graham - General Manager City Services

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Sample property rate

accounts

|

29

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

The development of the Annual Plan

2020-21 enables democratic local decision making and action by, and on behalf

of, communities; and promotes the social, economic, environmental, and

cultural well-being of Dunedin communities in the present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The Annual Plan 2020-21 contributes to

objectives across the strategic framework, as it describes the

Council’s activities, which are aligned to community outcomes. It also

provides a long term focus for decision making and coordination of the

Council’s resources, as well as a basis for community accountability.

|

|

Māori Impact

Statement

The DCC works in partnership with mana

whenua across a range of projects and activities outlined in the Annual Plan

2020-21, and provides opportunities for all Māori

to participate and contribute to decision-making processes.

|

|

Sustainability

Sustainability is an underlying principle

of the DCC’s strategic framework. Activity in the Annual Plan 2020-21

supports the DCC to embed the principles of sustainability across DCC work

outlined in the 10 Year Plan.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

The proposed rating method will be set out with the draft 2020-21

budget material during the community engagement period. Depending on the

option approved by Council, an amendment to the 2021-31 10 year plan may be

required.

|

|

Financial

considerations

The proposed rating method will be set out with the draft 2020-21

budget material during the community engagement period.

|

|

Significance

There will be full engagement on the

2020-21 draft budget as part of the Annual Plan process, which will cover any

issues of significance.

|

|

Engagement –

external

The proposed rating method for 2020-21 is

of interest to the community and there will be a full community engagement

process.

|

|

Engagement -

internal

Staff and managers from across the

Council have been involved in the development of the draft budgets.

|

|

Risks: Legal /

Health and Safety etc.

There were no risks identified.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

Community Boards had an opportunity to

present any issues for their community as part of the 2020-21 Annual Plan

development. Staff are working with community boards to develop new Community

Board Plans to inform the Annual Plan and next 10 year plan.

|

|

|

Council

11 February 2020

|

Short Term Visitor Accommodation

Department: Finance

EXECUTIVE SUMMARY

1 The

Council currently has two active resolutions related to rating differentials:

i. One

related to the rating of residential properties used for Short Term Visitor

Accommodation (STVA) and;

ii. The

other requesting a full review of all current rating differentials as part of

the next 10 year plan.

2 This

report recommends that Council considers dealing with both matters as part of a

single review to be carried out as part of the development of the 2021-31 10

year plan. This will avoid unnecessary, and costly, administrative

duplication and avoid adopting a piecemeal approach to changes to the current

rating method.

|

RECOMMENDATIONS

That the Council:

a) Considers a

new differential rating category for residential properties being used for

short term visitor accommodation as part of a wider review of all general

rate differentials during preparation of the 2021-31 10 year plan.

b) Notes that

there will be no change to rating differentials for the 2020/21 financial

year.

|

BACKGROUND

3 During

the last triennium, Council considered options for introducing higher rates for

residential properties that provide short term visitor accommodation (STVA).

4 The

Council approved the following resolutions on 29 January 2019:

Moved (Mayor

Dave Cull/Cr Mike Lord):

That the Council:

a) Supports

the implementation of a new rating method for non-owner-occupied residential

properties (or a separately used or inhabited part) being used for short term

visitor accommodation to apply from 1 July 2020, and

b) Requests

a full proposal be developed for inclusion in the 2020/21 Annual Plan, and as

part of the development of the proposal, that officers investigate targeted

rate options as an alternative approach to a differentiated general rate, and

c) Requests

staff commence engagement with the community, in advance of full

consultation with the 2020/21 Annual Plan, and

d) Notes

that further work be done on the definitions to refine relevant definitions

as part of this process.

Motion carried (CNL/2019/006)

5 A

report addressing these resolutions was scheduled to be presented to Council

for consideration on 11 February 2020. However during the Annual Plan

Council meeting on 29 January 2020, the following resolution was approved:

Moved (Cr David

Benson-Pope/Cr Jim O'Malley):

That the Council:

Requests that staff provide a background report, for

consideration at the time of the next Long Term Plan, on Property Category

Differentials.

Motion carried (CAPCC/2020/007)”

6 This

report looks at how the Council could progress both of these resolutions, in

time for the 2021-31 10 year plan.

General rates

7 General

rates are collected as a rate in the dollar on the capital value (CV) of each

property. The Council sets the general rate differentially for six property

categories, residential, lifestyle, commercial, farmland, residential Heritage

Bed and Breakfast establishments and the Stadium.

8 A

differential, described as a factor, is the degree to which the rate (the cents

in the dollar) on each category of property is higher or lower than residential

property. For example, the rate paid by commercial properties for the

current year is 2.45 times more than the rate paid by residential properties.

9 The

last time the general rate differentials were changed was in the 2017/18 year.

This was the last year in a series of changes which started in the 2009/10

year. The general rate differential for commercial and farmland was reduced and

increased for commercial properties in Strath Taieri.

10 Importantly

from a financial perspective the introduction of a new rating category or any

change in the current differentials will not result in additional rates revenue

for the Council. The total amount of rates would remain the same but

would be spread differently over the ratepayer base.

11 The

table below provides a summary of how the different types of short term visitor

accommodation providers are currently rated as compared to residential

properties having a factor of 1.00.

|

Type of short term visitor accommodation

|

General rate differential category

|

Factor

|

|

Hotels,

motels, backpackers and camping grounds - traditional commercial

accommodation

|

Commercial

|

2.45

|

|

Commercial

B & B* – B & B’s with greater than four bedrooms.

|

Commercial

|

2.45

|

|

Heritage

B & B* – B & B’s with greater than four bedrooms,

meets ‘heritage’ criteria and the owner lives at the facility.

The differential is set at a lower level to ease the rates burden on these

operators.

|

Residential

Heritage B & B

|

1.75

|

|

Residential

STVA – with four bedrooms or less.

|

Residential

|

1.00

|

* B

& B properties in this category are those the Council has knowledge of, or

has been advised of.

DISCUSSION

12 The

current rating method generally allows residential properties to be used for

STVA while paying normal residential rates. Traditional commercial

accommodation providers (hotels, motels, commercial B&B, etc) on the other

hand are required to pay commercial general rates (2.45 times the residential

rate).

13 Both

traditional accommodation providers and residential STVA providers benefit from

Council expenditure on marketing and economic development, such as event

attraction and major events funding.

14 In

most cases, using residential property for STVA will not place any greater

requirements on water supply and drainage services than other, similar sized

residential properties.

15 Residential

properties providing STVA can generally be divided into two types:

i. Residential

(residential with incidental STVA use) – the main use of the property

is a residential home (ie: generally owner-occupied), with the homeowner

supplementing their income by providing short term visitor accommodation. These

include home-owners letting out their houses to short-term paying visitors for

less than 28 nights per calendar year or by letting out a single room or a

number of rooms within the residence.

ii. Residential

STVA (residential with more significant STVA use) – a more significant

use of the property is to provide short term visitor accommodation. The entire

property, or separately used or inhabited part (SUIP) of a property, is used

more frequently for short term visitor accommodation. These properties are more

aligned with commercial accommodation providers and are typically non-owner

occupied.

Residential

STVA category

16 Staff

have identified an option which could provide a new general rate differential

category for STVA properties falling into the Residential STVA category

described in paragraph 15 (ii) above. Properties in the new category would pay

higher general rates than other residential properties.

17 All

properties meeting the following criteria would be included in the Residential

STVA category:

All residential (lifestyle or farmland) properties with

four bedrooms or less where the entire property or an entire separately

used or inhabited part (SUIP) of a property;

a) is available

for short term visitor accommodation for more than 28 nights per calendar year;

and

b) has a

‘daily tariff’ or an implied ‘daily tariff’.

Explanation of key terms in definition

of Residential STVA

Residential, lifestyle or farmland properties

18 The

properties will often be non-owner-occupied residential properties but also

includes SUIPs included in the lifestyle and farmland categories.

Four bedrooms or less

19 Residential

properties with greater than four bedrooms available for STVA are currently

included within the commercial or heritage bed and breakfast (B & B)

categories.

Entire property or SUIP

20 The

definition includes only those properties where the entire property or SUIP is

used for STVA. This helps to ensure that cases where some rooms in the property

are used for STVA while the owner remains in residence are not captured, as

this is considered a homestay arrangement.

21 In

situations where the owner of the property uses part of the house for storage,

for example the garage and/or a bedroom, while the rest of the property is used

for visitor accommodation, the Council would consider this as meeting the

definition of a Residential STVA.

Daily tariff

22 A

‘daily tariff’ or an implied ‘daily tariff’ is included

within the definition to ensure that properties used for standard rental

accommodation purposes are not captured by the higher rates charge.

Available for more than 28 nights

23 If

the property is only available for 28 nights or less per calendar year, there

would be no change in rates.

24 A

differential boundary of 28 nights per calendar year allows for property owners

to let out their property for up to four weeks, for example the family home

while on holiday, a rental property in between tenancies or offering the family

home at peak times such as a major event in the city. It also recognises the

limited revenue generated and the fairness compared to other businesses run

from the family home.

25 The

Council could vary the 28 night threshold and incorporate an alternative number

of nights into the options provided below.

Identification

of STVA properties

26 During

the last 12 months, staff have been identifying properties that potentially

meet this definition. The identification process has involved searching

websites, particularly online booking sites such as Airbnb, Bookabach and

Holiday Houses. Often the physical address of the property is not named in the

listing and will only be provided when the accommodation is booked.

27 Staff

have so far compiled a list of 261 residential STVA properties or SUIPs that

have had their address confirmed. There are around 100 properties that are

unconfirmed and require further investigation.

28 This

is an imperfect process and is time consuming.

29 However,

the Council has received legal advice (Attachment A) that states only official

information sources should be used when assessing the appropriate rating

valuation category for a property (or part of a property). A change to a

property’s status from Residential to Residential STVA, resulting in the

payment of additional rates, would therefore require some form of official

notification. In the absence of any official information source,

declaration by the property owner would be seen as the best mechanism to

trigger this change. The legal advice suggests confirmation by owners of these

properties by way of a statutory declaration.

30 If

the Council proceeds with the differential rating of Residential STVA, affected

property owners would be contacted in advance of the new rating year and

advised that their property appears to meet the above criteria and, if

confirmed, will be rated accordingly. Only those properties confirmed by

the owner as being used for STVA would then be rated as such.

31 Note

: Auckland Council charge STVA rates based on self-declaration by the STVA

providers.

32 Council

will need to ensure that Land Information Memorandum (LIM) information reflects

the STVA category and that the property is subject to higher general rates.

33 Consideration

was given to the possibility of incentivising as a way of attracting self-

declaration. In Queenstown for example, free advertising on accommodation

and tourism websites is offered for properties that register. This is

something that could be further investigated following initial implementation

of any change in rating.

Rating

and regulatory considerations

34 In

29 January 2019 Council requested a targeted rate option be considered for

STVAs. Targeted rates are generally used to pay for specific services or

projects and are generally set across all ratepayers or applied to a specific

group of ratepayers. The use of a targeted rate for STVA would need to be

applied wider than the Residential STVA providers being discussed in this

report and would therefore not address the current issue.

35 If

the Residential STVA property is a separately used or inhabited part (SUIP) of

a larger property, the Council will need to be able to rate the STVA part

differently. The establishment of these ‘divisions’ may not be

possible in order to meet a timeframe of 1 July 2020.

36 Rating

changes on a property generally can’t be applied retrospectively.

For example, where a property included in the Residential STVA category is sold

part way through a rating year and the buyer wishes to change the

property’s use back to residential, this cannot be updated in the rating

method until the start of the next rating year (ie: the new home owner will

continue paying higher rates for the remainder of the rating year).

37 There

are potential regulatory issues relating to resource consents and building

consents. These issues are largely around the need to have consent in certain

situations eg a resource consent. The issues vary from case to case.

38 A

potential issue has recently been identified related to the Development

Contributions Policy application to residential properties converting to STVA.

The Development Contributions Policy will be reviewed as part of the 2021-31 10

year plan preparation allowing this issue to be addressed.

OPTIONS

39 The

options presented below consider how residential properties being used for STVA

may be rated in terms of the general rate and how this fits with the

preparation of a background report on all property category differentials.

Option

One – Review all general rate differentials in time for 2021-31 10 year

plan – recommended option

40 Council

has two active resolutions relating to rating differentials.

41 This

option maintains the status quo for the 2020-21 rating year while the Council

undertakes a full review of all general rate differentials as part of the

development of the 2021-31 10 year plan. This review would incorporate

the options for introduction of a new residential STVA category.

Advantages

· Consideration all

property categories at the same time avoids a potentially piecemeal approach.

· Allows the Council

time to consider all differentials following the impact of the latest

revaluation.

· Allows time for

regulatory issues to be considered and an incentivisation to be investigated.

· The Development

Contributions Policy will be reviewed as part of the 2021-31 10 year plan

preparation. This will ensure coordination between the 10 year plan and the

underlying documents.

· The outcome of the

Local Authority Funding and Financing report may be known including any

potential changes related to the general rate differential.

Disadvantages

· Addressing the

current perceived fairness in rates paid by traditional commercial

accommodation providers is delayed for a year.

Option

Two – Establish a new Residential STVA rating category from 1 July 2020

42 This

option creates a new general rate differential category for STVA properties.

Properties in the new category would pay higher general rates than residential

properties. This change would be effective from 1 July 2020.

General Rate differential factor options

43 Three

potential scenarios are provided below for the general rate differential factor

that could be applied to the new category. These scenarios give differing

levels of tolerance to strike a balance between enabling residential property

owners to cost-effectively provide STVA and maintaining a fair market for all

accommodation providers:

|

Scenario

|

Description

|

Factor

|

|

a

|

STVA category set at the same

level as heritage B & B differential

|

1.75

|

|

b

|

STVA category set at

approximately 25% residential and 75% commercial

|

2.10

|

|

c

|

STVA category set at the same

level as commercial differential

|

2.45

|

Advantages

This option, regardless of which scenario is preferred:

· Would make rates

fairer between Residential STVA properties and traditional accommodation

providers, such as hotels and motels.

· Would not impact

on properties where only one or two bedrooms in the house are available for

STVA and the owner lives in the residence.

· Would not deter

home owners from making their homes available for STVA at peak times, such as

major events in the city for less than the designated number of nights a year.

Disadvantages

· Given a full

review of the differentials will take place in time for the 2021-31 10 year

plan, a new STVA category may be in place for only one year.

· To a large extent,

the specific general rate differential factor that is chosen to apply to

Residential STVA would be selected in isolation from the other rating

categories.

· Additional staff

resource required to identify, monitor and administer STVA providers including

changes made between rating years.

· Likely to result

in complaints and, as a result, dissatisfied ratepayers and additional staff

resources to deal with these.

· There may be a

risk that by rating these STVA properties differently implies an acceptance of

other potential regulatory issues relating to planning or consents.

Option

Three – Establish a new Residential STVA rating category from 1 July 2021

44 This

option is identical to Option Two but introduced as part of the 2021-31 10 year

plan.

Option

Four – Maintain the current rating method

45 This

option involves maintaining the status quo. Residential properties with greater

than four bedrooms available for STVA would continue to be included within the

commercial or heritage bed and breakfast (B & B) categories. Properties

with four bedrooms or less would continue to be rated within the residential

category.

Advantages

· The issues

highlighted in this report which arise from a flawed rating system are avoided

under this option.

· No administrative

costs required to identify and monitor STVA properties.

Disadvantages

· Does not address

the current perceived inequity in rates paid by traditional commercial

accommodation providers.

NEXT STEPS

46 Depending

on which option Council chooses, there will be a range of next steps.

47 A

review of the general rate differentials will be undertaken in time for the

2021-31 10 year plan. If the Council approves Option One, this review would

include consideration of a new STVA differential category.

48 If

the Council approves Option Two, the change in rating method for 2020/21 will

require a formal amendment to the 2018-28 10 year plan. The Council must

use the special consultative procedure when making an amendment and this could

occur concurrently with consultation/engagement on the 2020-21 Annual Plan.

49 Staff

will continue to work through regulatory issues as they arise. A review of the

Development Contributions Policy will be progressed as part of the 2021-31 10

year plan preparation.

50 If

the Council introduces a new Residential STVA category from the 2021/22 year,

the change would be included in the 2021/31 10 year plan and would,

accordingly, avoid a special consultation.

Signatories

|

Author:

|

Gavin Logie - Financial Controller

|

|

Authoriser:

|

Dave Tombs - General Manager Finance and Commercial

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Legal Opinion

|

41

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision enables democratic local

decision making and action by, and on behalf of communities. This decision

promotes the social, economic, environmental and cultural well-being of

communities in the present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Aspects of rating policy changes may touch on the

strategies selected including the Revenue and Financing Policy.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known impacts for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Any decision to establish a new rating category prior to

the 2021/22 year will require an amendment to the 2018-28 10 year plan and be

consulted concurrently with the 2020/21 Annual Plan consultation.

|

|

Financial

considerations

There are no financial implications at this stage.

Different options do have different cost implications.

|

|

Significance

This decision is considered low in terms of the

Council’s significant and engagement policy but any proposal to

introduce a new rating category will be fully consulted on with the

community.

|

|

Engagement –

external

Communication has been held with representatives of the

Motel Industry, Queenstown Council and Auckland Council.

|

|

Engagement -

internal

Internal engagement has occurred with staff in the

relevant departments.

|

|

Risks: Legal /

Health and Safety etc.

Legal advice has been obtained that supports the validity

of the rating options provided but does highlight a number of issues to

consider.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

This is likely to be of interest to Community Boards as

there will be STVA properties in the Community Board areas. Community Boards

will be involved in any consultation that is undertaken on STVAs.

|

|

|

Council

11 February 2020

|

Funding Options: Subsidised Bus Fares in

Dunedin

Department: Finance

EXECUTIVE SUMMARY

1 This

report provides options for the funding of subsidised bus fares in Dunedin for

the 2020/21 financial year.

|

RECOMMENDATIONS

That the Council:

a) Considers the

options to provide subsidised Dunedin bus fares that may be required in

2020/21 as unbudgeted.

b) Notes that

once the required level of expenditure is ascertained, the cost can be

included in the development of the 2021-31 10 year plan.

|

BACKGROUND

2 As

part of the consultation for the annual plan 2019/20, residents were asked to

provide feedback on the following: “Would you support the idea of using

money from rates or parking charges to make city bus fares cheaper?”.

3 The

Council received 79 feedback forms where respondents indicated whether or not

they support offsetting bus fares in Dunedin.

|

Support

for offsetting bus fares in Dunedin

|

Number

of responses

|

Percentage

|

|

Supports

offsetting bus fares in Dunedin

|

62

|

78%

|

|

Does

not support offsetting bus fares in Dunedin

|

17

|

22%

|

4 Following

this feedback, the final annual plan for 2019/20 noted “A progress report

on the ORC Regional Public Transport Plan review, particularly as it relates to

using DCC revenue to offset bus fares on the wider public transport network

will be provided before the Annual Plan 2020/21”.

5 At

the annual plan meeting held on the 29 January 2020 the overview report on the

draft budget for 2020/21 presented by Chief Executive Dr S Bidrose noted the

following narrative in relation to bus fares in Dunedin:

Collaborative work is underway between the DCC and Otago

Regional Council (ORC) to investigate improvements to Dunedin’s public

transport system, encouraging behaviour shift away from single occupancy

vehicle usage and investigating changes to the fare structure. It is

anticipated a subsidised fare arrangement, similar to the Queenstown Lakes

District Council’s (QLDC) subsidy to ORC ($600k in the QLDC 2017/18

Annual Plan), has the potential to increase bus patronage and achieve similar

outcomes. At this stage, this item is unfunded in the draft 2020/21 budget,

pending further discussion. Options are being progressed to implement cheaper

fares in the coming year.

6 The

meeting discussed options for achieving the aim of providing cheaper bus fares

in Dunedin, with the resulting resolution being passed:

“That the

Council:

a) Allocate

up to $600k to provide for cheaper public bus fares from July 1 2020;

b) Request

a report in time for February 11th outlining options to resource this; and

c) Request

a report in time for Annual Plan deliberations providing options for delivering

a new fare structure.”

DISCUSSION

7 As

noted above, staff have already commenced engagement with the ORC on how the

outcome of cheaper fares could be achieved. These discussions are

ongoing.

8 A

similar initiative, in the Queenstown area, resulted in an overall increase in

passenger numbers such that the local authority was not required to make any

subsidy payment to ORC.

9 Depending

on the level of patronage and the fare structure agreed for Dunedin, the

outcome for Dunedin could be similar to that of Queenstown - the actual level

of subsidy could fall below the $600k allocation.

10 There

are a number of options that Council could consider to deliver the required

funding for the 2020/21 financial year. These options are detailed

below. Note that all options must be considered in light of the need to

maintain a balanced budget.

OPTIONS

11 The

options assume the scheme can be established in the required timeframes.

Option

One – Treat any required subsidy that may be required as unbudgeted

expenditure in the 2020/21 financial year

12 Any

subsidy that may be required from the DCC can be treated as an unbudgeted spend

in 2020/21.

Advantages

· This

would allow the scheme to commence, without reducing other budgets or rating

for a level of expenditure or that may or may not be incurred.

· Maintains

a balance budget.

Disadvantages

· The

DCC could incur an unbudgeted level of expenditure up to $600k.

Option

Two – Reduce other budgets or increase Rates Income to fund the subsidy

amount of $600k

13 Include

the $600k subsidy in the 2020/21 operating budget and increase rates by the

same figure. This would mean that the draft budget would have a 6.9% increase.

Advantages

· Any

expenditure up to the anticipated level of $600k is funded in the 2020/21

financial year.

Disadvantages

· The

level of additional income generated could exceed the actual level of subsidy

required to be paid.

NEXT STEPS

14 Staff

to continue working with the ORC to establish the mechanism for achieving the

goal of lower bus fares in Dunedin effective from 1 July 2020.

15 Monitor

the level of any subsidy required from the DCC, with the view of including a

more accurate level of expenditure in the 2021/31 ten year plan.

Signatories

|

Author:

|

Gavin Logie - Financial Controller

|

|

Authoriser:

|

Dave Tombs - General Manager Finance and Commercial

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report enables democratic local

decision making and action by, and on behalf of communities; and promotes the

social, cultural, environmental and economic well-being of communities in the

present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☐

|

Key contributions to the Council’s strategic

priorities and plans include: the provision of travel choice, resilient

network and connectivity of centres (Integrated Transport Strategy),

connected people (Social Wellbeing Strategy) and resilient and carbon zero

depending on outcome (Environment Strategy).

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

A reduction in carbon emissions may result if the

subsidised bus fares results in a mode shift from private vehicle use to

public transport.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This project has no current funding source and represents

an increase in the level of service offered to the community.

|

|

Financial

considerations

The cost estimate for subsidised bus fares is circa. $600k

per annum and is currently unbudgeted,

|

|

Significance

This decision is considered of low significance in terms

of the Council’s Significance and Engagement Policy.

|

|

Engagement –

external

Community feedback was sought during the 2019/20 annual

plan engagement. Some preliminary discussions have occurred with the

Otago Regional Council.

|

|

Engagement -

internal

A number of departments have been involved in the

preparation of this report including Civic, Finance and Corporate Management.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks, unless the actual cost of

any subsidised bus fare scheme exceeds the current anticipated level of

subsidy.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards,

although the topic may be of interest to Community Boards.

|