|

|

Economic Development Committee

9 March 2020

|

Part

A Reports

Dunedin City - 2019 Annual Economic

Profile

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

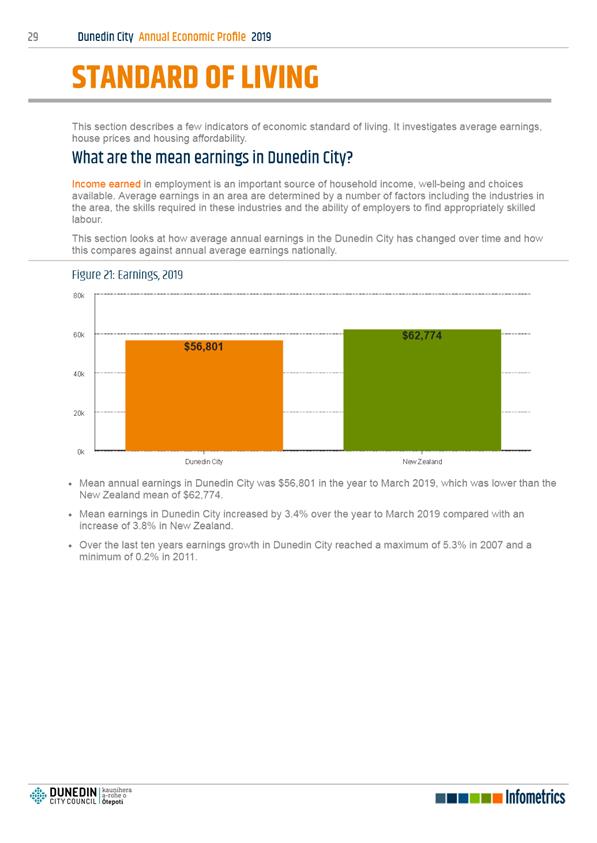

1 Economics

consulting firm Infometrics was commissioned to provide the Dunedin City Annual

Economic Profile report.

2 The

purpose of the report is to provide Enterprise Dunedin, the Economic

Development Committee and the Economic Development Strategy partners, with an

update of progress against the 2023-2023 Economic Development Strategy and

overview of the Dunedin economy.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Dunedin City – 2019 Annual Economic Profile report.

|

BACKGROUND

3 Enterprise

Dunedin activity is informed by the 2013-23 Economic Development Strategy. The

strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances

for innovation – to improve linkages between industry and research.

c) A

hub for skills and talent – to increase retention of graduates, build the

skills base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A

compelling destination – to increase the value of tourism and events and

improve the understanding of Dunedin’s advantages.

The Strategy sets out two economic goals:

· 10,000

extra jobs over 10 years.

· An

average $10,000 extra income for each person.

DISCUSSION

Overview

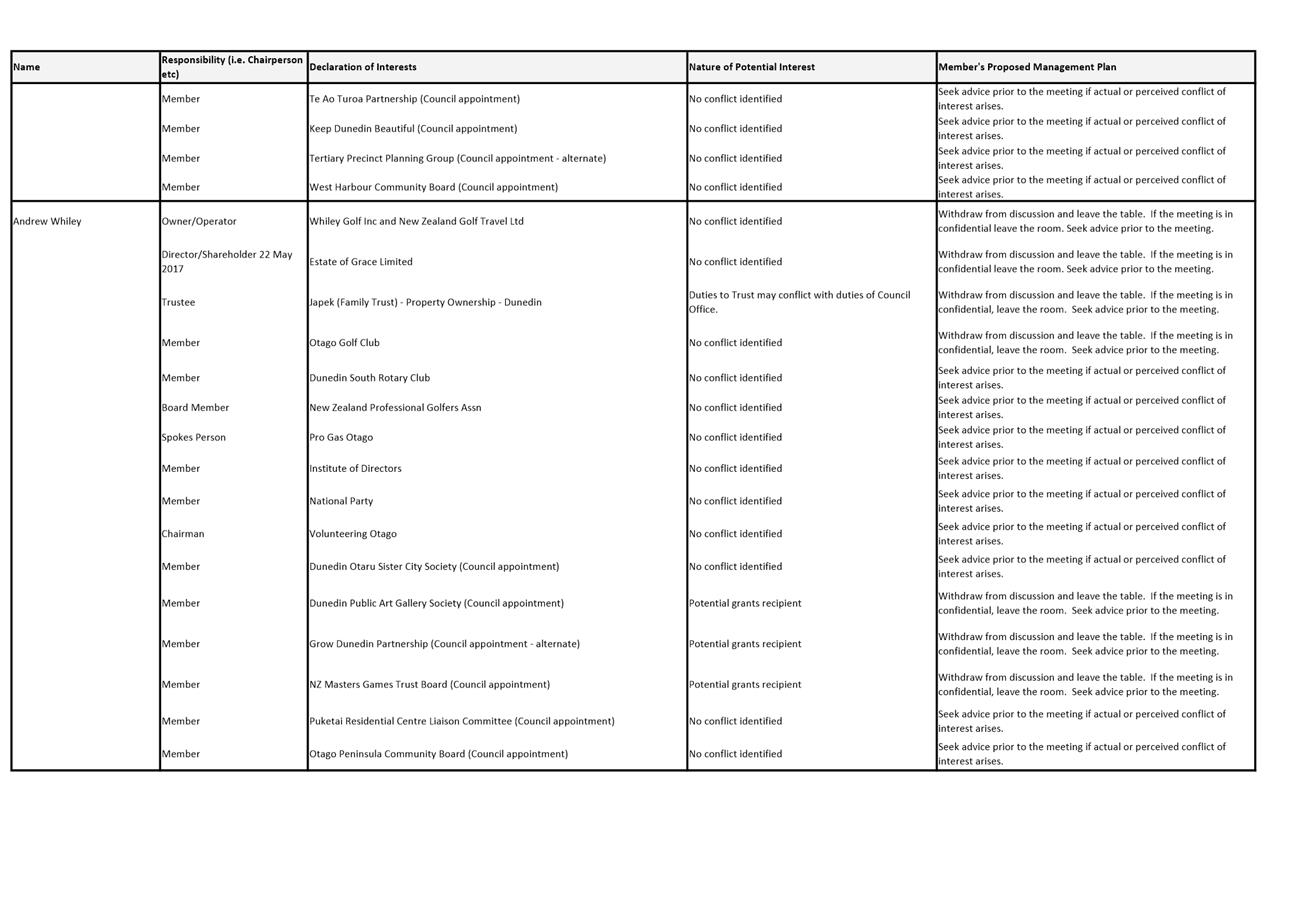

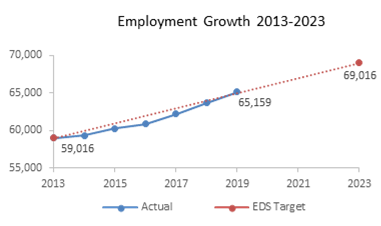

4 Job

growth in Dunedin exceeded New Zealand growth for the first time since 2006.

5 Dunedin’s

economy, measured by GDP, expanded faster than the New Zealand economy for the

first time since 2003.

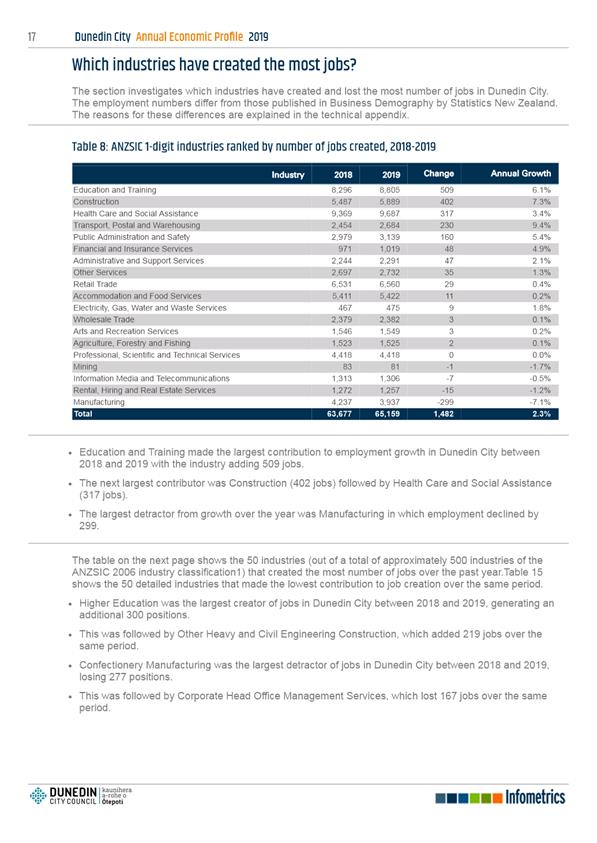

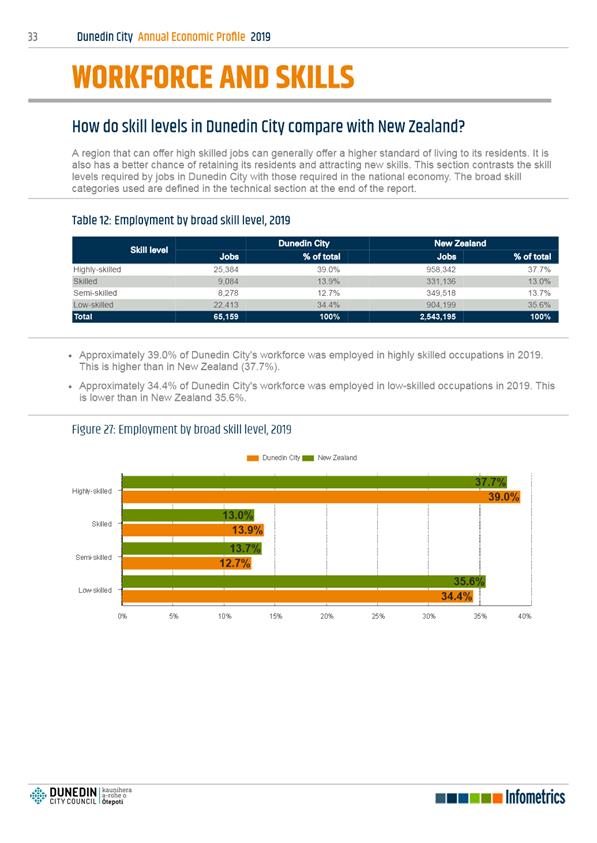

Jobs

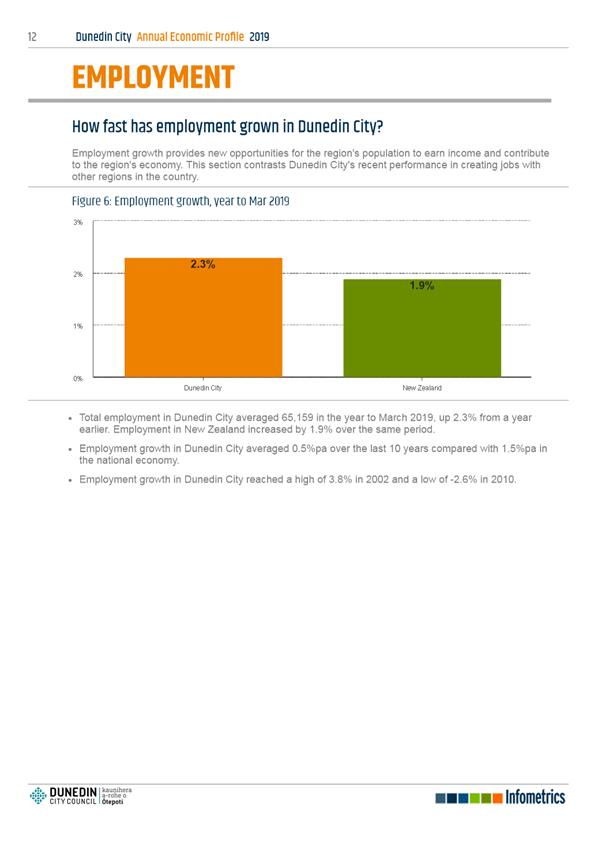

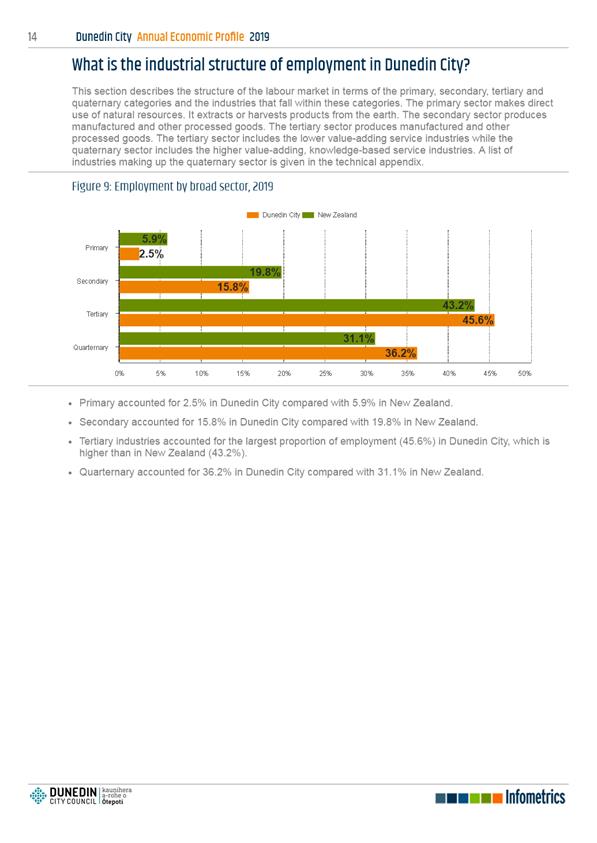

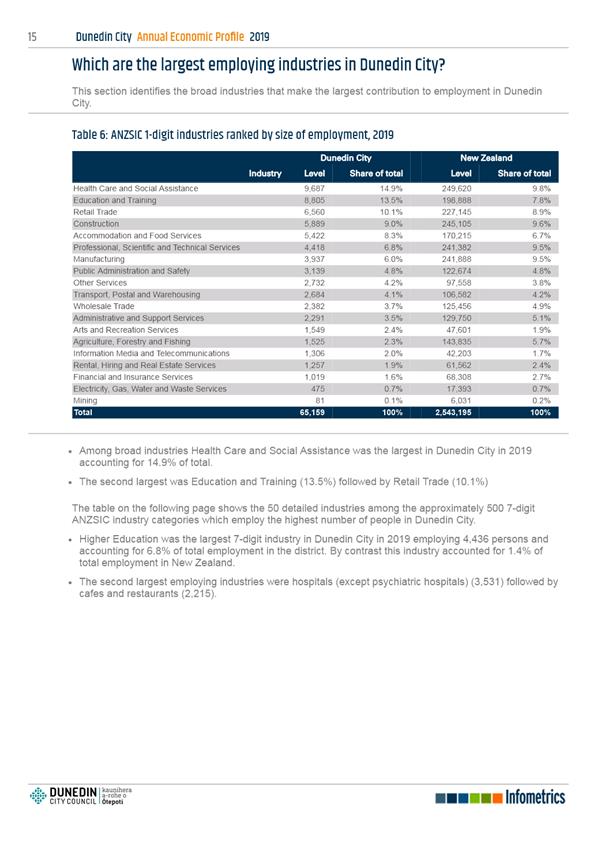

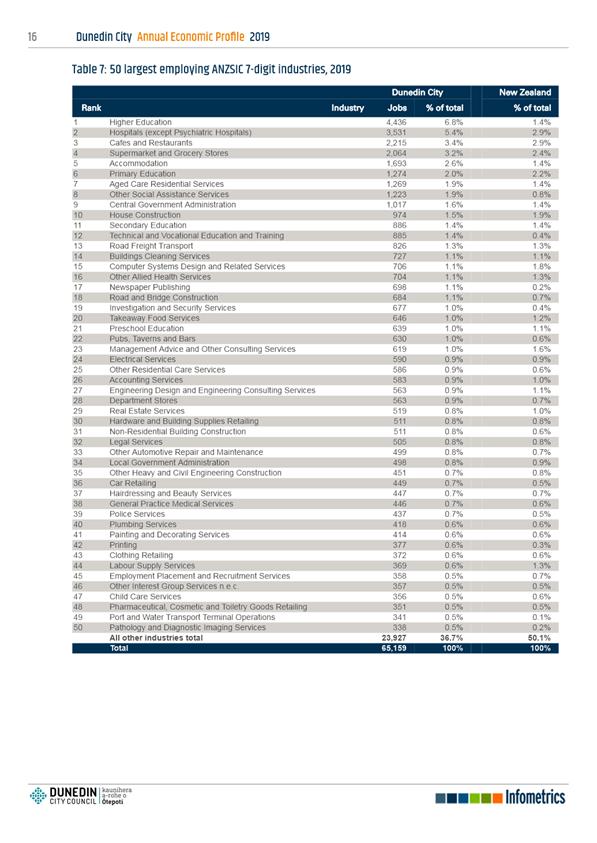

6 Job

numbers in Dunedin expanded by 1,482 in the March 2019 year to reach 65,159.

7 The

rate of job growth in Dunedin (2.3%pa) in the March 2019 year exceeded the

national average (1.9%pa) for the first time since 2006.

8 Job

numbers over the six years since 2013 have expanded by 6,143 – on track

to meet the Economic Development Strategy target of 10,000 jobs over 10 years

to 2023.

9 The

key sectors contributing to job growth in 2019 were education, construction,

health, transport and logistics, and public administration.

10 Service

sector-orientated industries that cater for demand from an expanding population

and higher incomes also created jobs during 2019, such as finance, insurance,

administration support services, retail and hospitality.

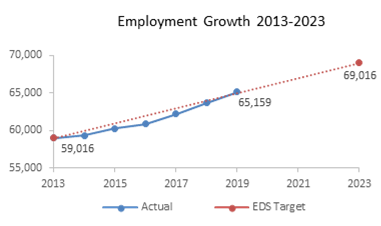

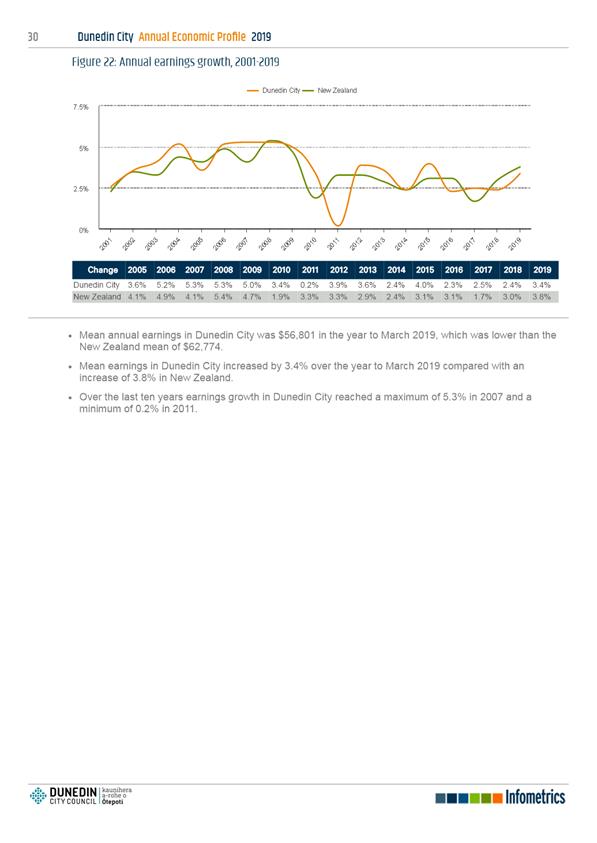

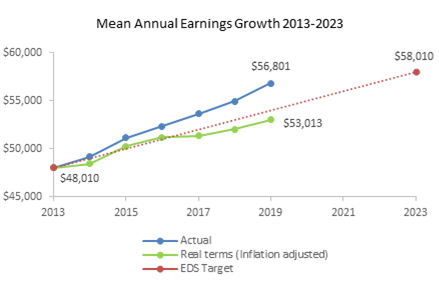

Incomes

11 Average

wages rose 3.4% to $56,801 in the March 2019, compared to the previous year.

Average wages in

Dunedin have risen from $48,010 since the beginning of the Economic Development

Strategy (2013), to $56,801 in 2019.

GDP

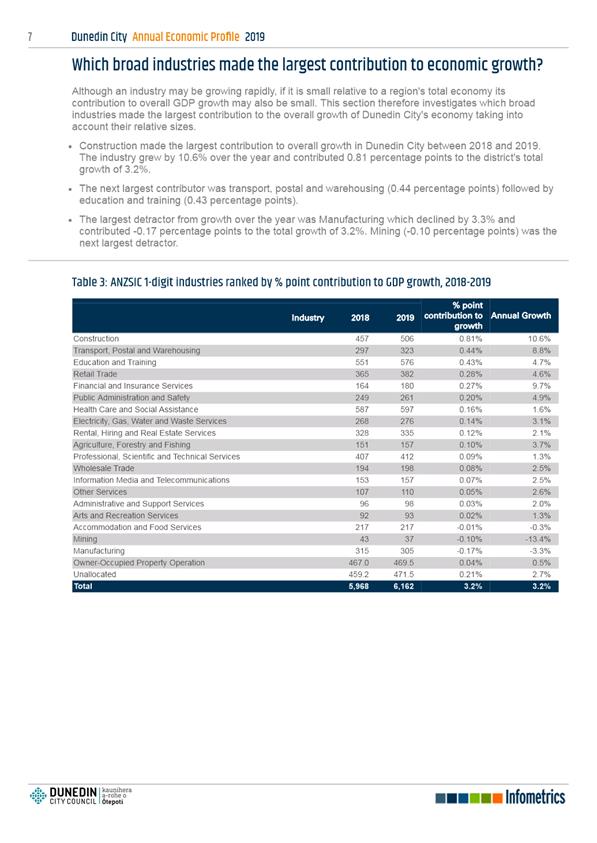

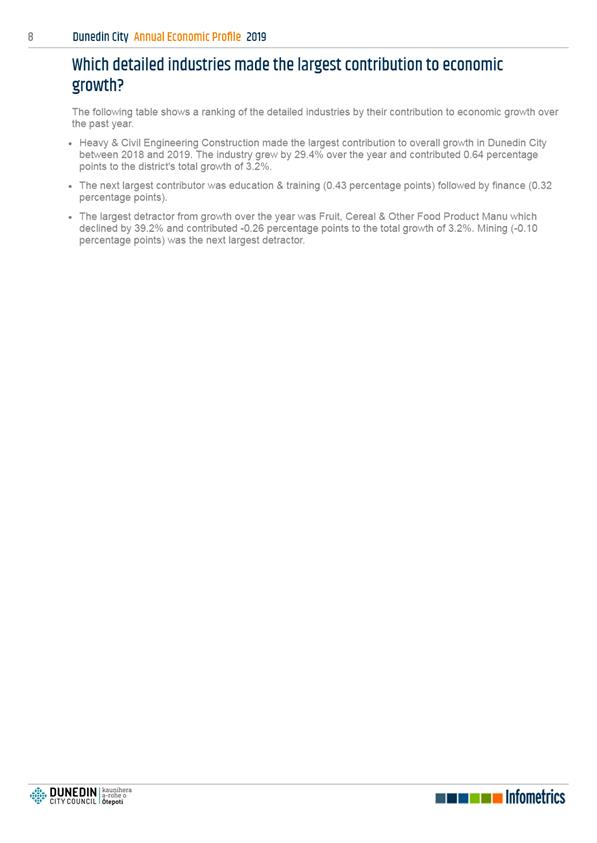

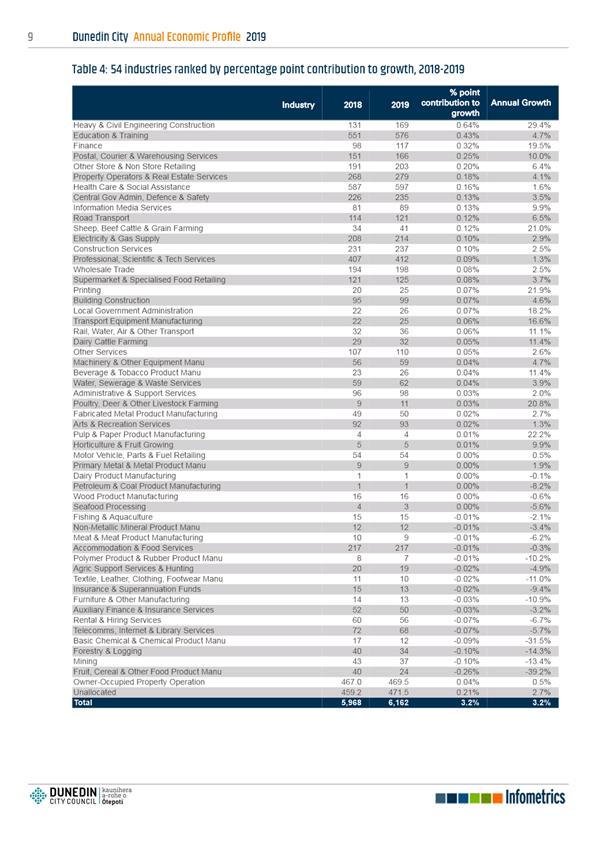

12 Dunedin’s

economy expanded 3.2% in the March 2019 year, compared to previous year.

13 Dunedin’s

economy, measured by GDP, grew faster than the national average (3.0%pa) for

the first time since 2003.

14 GDP

per capita increased by 2.3% in the March 2019 year in Dunedin, compared to

1.4%pa growth nationally.

Living standards

15 Better

job prospects improved Dunedin’s unemployment rate, from 6.5% in March

2018 to 5.1% by March 2019.

16 Beneficiary

numbers in Dunedin declined by 0.7% in the March 2019 year, compared to a 2.8%

lift nationally.

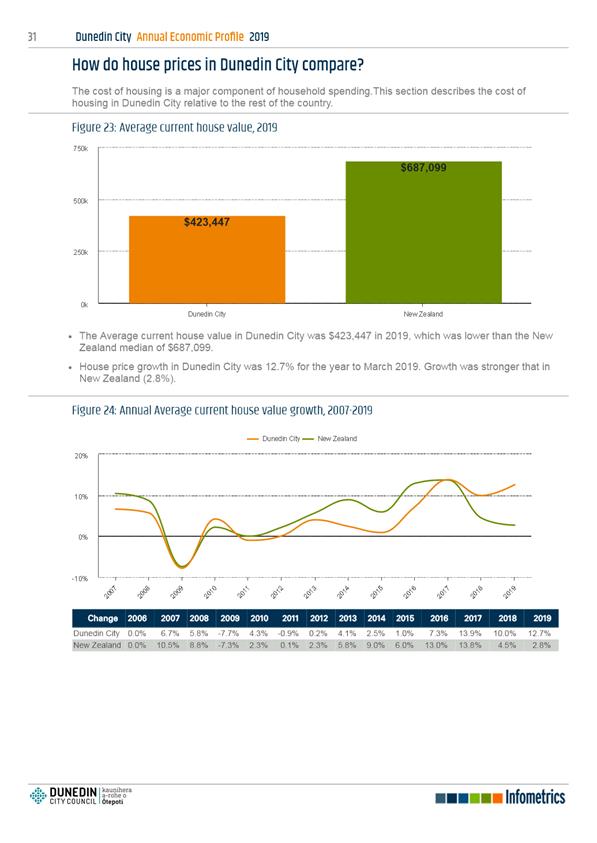

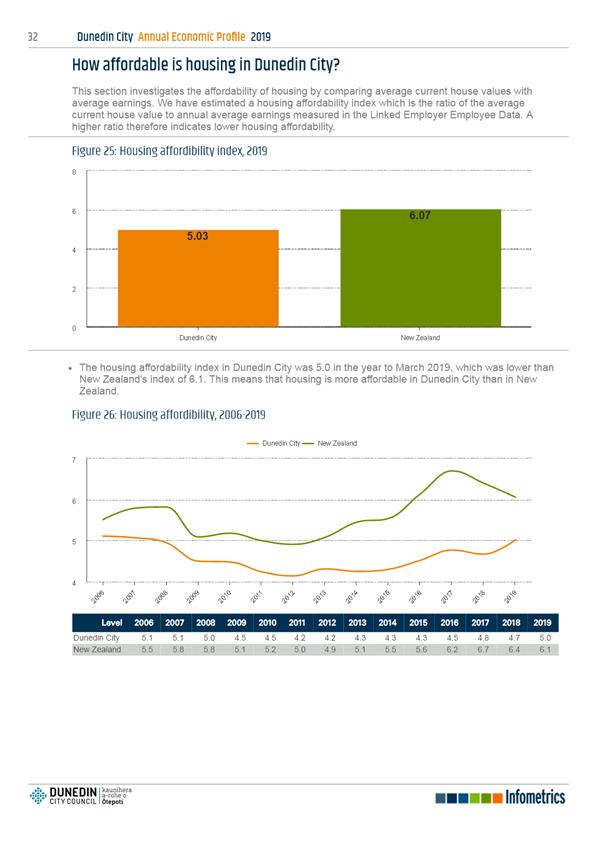

17 Housing

affordability, as measured by the ratio of house prices to household income,

has deteriorated as a result of higher house prices. Houses in Dunedin remained

more affordable than the national average at 5.0 times a household income,

compared to 6.1 times nationally.

OPTIONS

18 There

are no options.

NEXT STEPS

19 Further

reports will be commissioned to monitor Dunedin’s Economic Growth and

progress being made against the Economic Development Strategy goals.

Signatories

|

Author:

|

Fraser Liggett - Economic Development Programme Manager

Des Adamson - Business Relationship Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Dunedin City - 2019

Annual Economic Profile

|

23

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing a public

service and it is considered good-quality and cost-effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the delivery of the

2013-2023 Economic Development Strategy.

|

|

Māori Impact Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known impacts for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Enterprise Dunedin activities and delivery on the

2013-2023 Economic Development Strategy are included in the 2018-2018 Long

Term Plan.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This report is considered low significance under the

Significance Engagement Policy.

|

|

Engagement –

external

Infometrics Ltd were engaged to provide the report.

|

|

Engagement –

internal

No internal engagement has been undertaken.

|

|

Risks: Legal /

Health and Safety etc.

The are no identified risks.

|

|

Conflict of

Interest

There are no conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

|

Economic Development Committee

9 March 2020

|

Enterprise Dunedin Activity Report - March

2020

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee on

several Enterprise Dunedin activities.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Enterprise Dunedin Activity Report – March 2020.

|

BACKGROUND

2 Enterprise

Dunedin activity is informed by the 2013-2023 Economic Development

Strategy. The strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances

for innovation – to improve linkages between industry and research.

c) A

hub for skills and talent – to increase retention of graduates, build the

skills base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A

compelling destination – to increase the value of tourism and events and

improve the understanding of Dunedin's advantages.

3 The

strategy sets out two economic goals:

a) 10,000

extra jobs over 10 years (requiring growth of approximately 2% per annum).

b) An

average of 10,000 of extra income for each person (requiring GDP per capita to

rise 2.5% per annum).

DISCUSSION

Enterprise Dunedin Activity

Outcomes

4 Enterprise

Dunedin’s activities are focused around the Economic Development Strategy

themes. The following section provides highlights of some of the key activities

and outcomes that have occurred within each theme during the past few months.

Otago Regional Economic

Development Framework

5 Enterprise

Dunedin continues to work with the Otago economic development agencies on the

Otago Regional Economic Development (ORED) framework implementation. The

framework was endorsed by Otago Mayors and Chief Executives in June 2019. It

promotes effective collaboration between Otago Councils, Ngāi Tahu, local

runaka, and regional and national stakeholders, so that economic development

projects that provide multi-district benefits can be identified and progressed.

6 A

Regional Economic Development Advisor (Central Otago) commenced work in January

2020. Their role is to manage a portfolio of regionally relevant economic

development activities across Central Otago. A similar, complementary role for

Coastal Otago was appointed in February 2020. Two years funding for these

positions was provided by the Provincial Growth Fund to ensure successful

delivery of the outcomes sought from both the Provincial Growth Fund and the

ORED Framework.

Centre of Digital Excellence

7 In

October 2019, MBIE announced that Dunedin would receive $10million from the

Provincial Growth Fund for the Centre of Digital Excellence (CODE). The key aim

of CODE is to grow the New Zealand video gaming sector from its current value

of $203.4 million dollars to create a $1billion industry over six years.

8 CODE

is expected to grow the video game development industry in Dunedin through:

· supporting

local leadership, education, research and innovation and international

connections, while also fostering talent, diversity and inclusion;

· working

with the Dunedin start-up ecosystem to enable them to scale up and build

capability;

· focusing

on points of difference for Dunedin - particularly in relation to health,

education and research strengths;

· showcasing

game development and its application across multiple sectors.

9 CODE

is now in its establishment phase and is expected to become a new stand-alone

entity later in 2020. This is being led by the CODE Project team through

Enterprise Dunedin and supported by the CODE working group comprising Otago

Polytechnic, the University of Otago, Ngāi Tahu, SDHB, and industry.

Several work streams are being actioned with the CODE working group to ensure

that CODE is a fit for purpose entity with the mandate to deliver on its

objectives. These include determining a “fit for purpose” legal

entity and structure, curriculum development, and industry momentum building.

Business Vitality

10 Energy

Enterprise Dunedin has finalised the site license agreement

with ChargeNet and Aurora to progress installation of an electric vehicle (EV)

fast charger on Water Street, as approved by Council on 26 March 2019. This

work is expected to be completed by the end of February 2020.

11 Good

Food Dunedin

a) Hand

Over A Hundy

In partnership with Supergrans, Taskforce Green and Bunnings

Warehouse, Good Food Dunedin launched ‘Hand Over A Hundy’ in

Dunedin in late 2019. Hand Over a Hundy is a one-year challenge to families to

learn to grow their own vegetable gardens. Eight families are participating in

the pilot season. Each family is sponsored a ‘hundy’ ($100) to buy

garden essentials and provided with a gardening mentor for the year. The

challenge to the family is to recoup the money through savings or selling extra

produce from their gardens so that they can then ‘Hand Over A

Hundy’ to a new family at the end of the year.

b) Foodprint

Auckland start-up Foodprint is

launching in Dunedin in late February. Foodprint is an app-based platform

for rescuing perishable edible food before it becomes waste. It fills a gap

between food rescue services such as KiwiHarvest, and composting initiatives. As well as being aligned with the Good Food Dunedin

charter, Foodprint provides eateries with potential new customers and marketing

opportunities, and the ability to reduce their food waste.

c) Schools

at the Heart

The DCC has pledged $2500 to partner organisation Our Food

Network to help establish a part-time school-based aide position to assist

schools with embedding edible gardening in to their practices.

Alliances for Innovation

12 Film

Dunedin

a) Film

Dunedin is a Regional Film Office (RFO). There are five other RFOs in New

Zealand, who work co-operatively where possible, and have collectively entered

an agreement with New Zealand Film Commission for jointly managing

international enquiries and marketing. Since its establishment in 2016, Film

Dunedin has earned a strong reputation for its ease of doing business.

b) Film

Dunedin works with Dunedin education providers, businesses and the creative

sector to support business development, capacity building and networking.

Within the city, the numbers and diversity of film and television content in

production is growing.

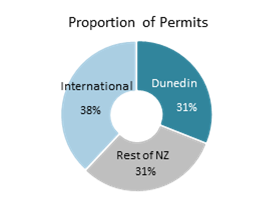

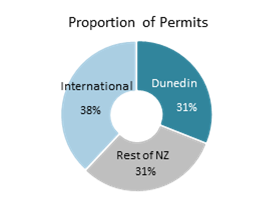

c) The

number of film enquiries serviced in Dunedin and permits issued has steadily

grown.

i) Film

Dunedin responded to 69 screen filming enquires in Dunedin for the six-months

ending December 2019. This compares to 23 enquiries in the corresponding period

in 2018.

ii) There

were 29 film permits issued over the six-months to December 2019, compared to

15 in the corresponding period in 2018.

iii) Permit

data indicates an additional 4,860 bed nights were generated by film in Dunedin

over the six-months to December 2019, compared with 2,352 in the corresponding

period in 2018. Permits are only issued for shoot days on public land. Total

bed nights are therefore more than the actual permitted activity.

iv) Total

crew numbers working on productions reached 188 in the six-months to the end of

December 2019, with 101 of these employed on international productions, 51 on

local Dunedin productions, and 36 on productions from elsewhere in New Zealand.

v) International

productions are typically larger scale than New Zealand productions. In the

six-months to 2019 year, there were 9.2 crew on average per international

permit. By comparison Dunedin productions had an average of 5.6 crew, while

other New Zealand productions had an average of four crew.

A Hub for Skills and Talent

13 JobDUN

- Business Internship programme 2019/2020

a) Enterprise

Dunedin facilitates the business internship programme – JobDUN

(previously known as Sexy Summer Jobs). The objective of the JobDUN programme

is to meet business needs, create high value jobs, retain skills and talent in

the city and contribute to the economic growth of Dunedin. The programme

allocates funding for 50 intern placements however due to the demand 53 interns

were placed this season.

b) The

2019/20 programme is still underway with businesses and interns reporting back

on the season. All reports are due by 30 June 2020.

c) Responses

so far show:

i) Seven

businesses (in the areas of ICT, Media and Sport/Recreation) have employed 10

interns in roles including Quality Assurance, Marketing, Media Analyst,

Software Engineer and Coaching. Eight of these are new roles to the

organisations.

ii) Four

interns were employed as part-time equivalents (PTE), four on contract and two

as full-time equivalents (FTE).

14 Techweek

2019/2020

Techweek helps raise the innovation profile of the city by

developing its reputation for being a launch-pad for businesses moving into

global markets. The Dunedin tech sector is increasingly important to the

city’s growth generating approximately $330 million to GDP and creating

approximately 2,000 jobs. In summary:

a) Techweek

in Dunedin has grown from one event in 2017 to 45 in 2018 which indicates there

is an appetite for the community, industry and city partners to grow and

increase activity in the future.

b) Dunedin's

Techweek19 offerings made it the largest calendar outside of Auckland,

Wellington and Christchurch, and has assisted in promoting Dunedin as an

innovative tech savvy hub.

c) Dunedin

Techweek delivered 42 unique events and 51 individual sessions across seven

days which highlighted opportunities for Non-Tech (new to tech) people and

youth to engage with the Tech sector, and start-up events focussing on

entrepreneurship.

d) In

seven days, Dunedin Techweek brought out over 2,000 people to events in 27

locations across the city.

e) Over

50 of Dunedin’s best tech professionals, researchers, products and

industries recognised and promoted Dunedin’s successful Startup

community.

f) Techweek

TV showcased 24 local tech specialists and their businesses via a live online

broadcast to over 13,000 viewers.

g) The

objective for Techweek20 is to have fewer, higher value events that will focus

on various aspects of video game development and community/business engagement

with the Tech sector and start up ecosystem.

h) A

Techweek Event Coordinator was contracted by Enterprise Dunedin in November

2019 to lead the development of the festival programme for Dunedin in May 2020.

A Compelling Destination

15 The

last six months has seen a focus on developing relationships, understanding

data needs and solutions, and redefining the marketing programme.

16 The

Dunedin Destination Plan continues to underpin marketing work, however over the

next 12 months, Enterprise Dunedin will be refreshing certain aspects of the

plan to align with recent MBIE guidelines.

17 Research

and Data

a) The

Destination Marketing team is focussing on gathering and using new and relevant

data. They have established a yearly benchmarking process that measures tourism

sentiment (sum of positive and negative comments) and ‘place

sentiment’ for Dunedin. They have also commenced monitoring peer-to-peer

accommodation trends.

b) We

are about to commence a visitor insights programme which correlates visitor

experiences, motivations and visitor flows.

c) The

national Commercial Accommodation Monitor (a gauge to visitor arrivals into

Dunedin) produced by Statistics NZ, was discontinued last year. This means the

team will rely on visitor spend, with a three-month lag, to gain relevant data

about visitor spend.

|

Dec 2019 ($M)

|

Change from Dec 2018

|

|

Domestic

|

|

Dunedin

|

52.36

|

-8.1%

|

|

NZ

|

1830.22

|

2.8%

|

|

International

|

|

Dunedin

|

29.66

|

9.5%

|

|

NZ

|

1500.85

|

8.2%

|

|

Total

|

|

Dunedin

|

82.02

|

-2.4%

|

|

NZ

|

3331.06

|

5.2%

|

|

Source: MBIE

|

d) December

2019 visitor spend update data:

|

Spend ($M) Dec 2019

|

Change from Nov 2019

|

Market Share

|

Market Share YoY % Change

|

|

Australia

|

7.96

|

18.7%

|

26.8%

|

▲ 0.1%

|

|

USA

|

4.61

|

23.0%

|

15.6%

|

▲ 6.0%

|

|

China

|

2.01

|

19.5%

|

6.8%

|

▼ -3.7%

|

|

UK

|

2.00

|

26.0%

|

6.7%

|

▼ -7.2%

|

|

Germany

|

1.80

|

22.3%

|

6.1%

|

▼ -5.3%

|

|

Japan

|

0.79

|

57.4%

|

2.7%

|

▲ 44.7%

|

|

Source: MBIE

|

Source: MBIE

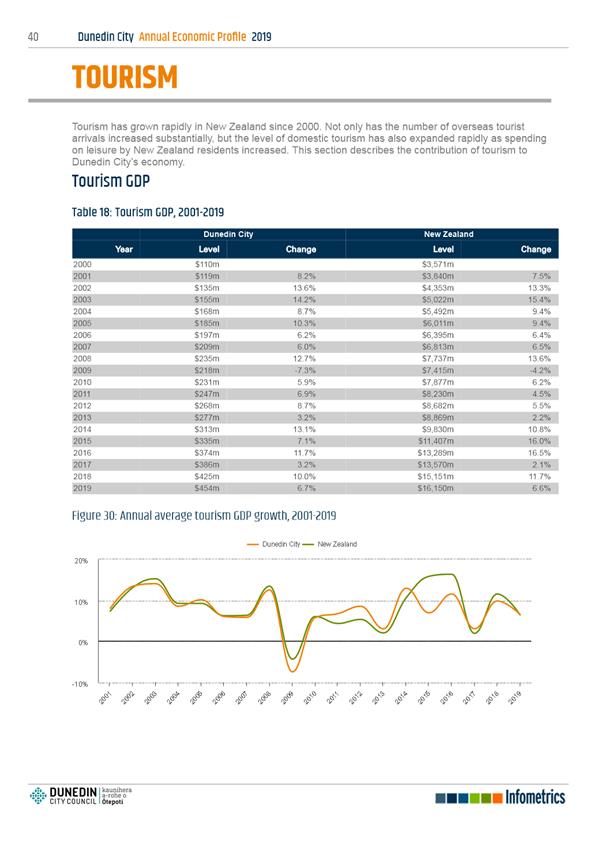

Dunedin

tourism contribution to GDP (YE Mar 2019)

Tourism contributed $454m

towards total GDP in Dunedin City, representing 7.4% of the city’s

economic output, which is the fourth largest contributor to GDP among 20

industries.

Sources: Infometrics

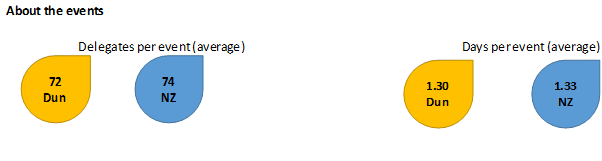

18 Business

Events (Conferences)

a) The

delivery of successful business events aligns to several of objectives sitting

under the Dunedin’s Economic Development Strategy (2013-2023). Dunedin

currently holds a 3% market share of business events tourism in New Zealand

with an approximate value of $16.4m. Since 2013, the number of business events

in Dunedin each year has risen by 26% to 1,388, while the number of days spent

by delegates in the city has climbed 58% to 130,500.

b) There

is typically a long lead time between when Enterprise Dunedin staff make an

initial engagement with a prospective business event lead to when a final

decision is made. Leads on twenty-one prospective business events (due to occur

as far out as 2022) were engaged with during the first half of the current

financial year. By comparison there were engagements with 23 prospective

business events in the 2018/19 year. Two bids to hold conference events in

Dunedin were successful; four were unsuccessful, and the remainder are still in

progress.

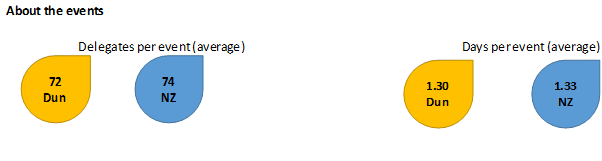

Sector overview

In 2019 (June year), Dunedin hosted:

|

1,388 Events

|

100,557 Delegates

|

130,500 Delegate

days

|

|

Origins of delegates

|

|

|

|

|

|

Local

|

Rest of NZ

|

Australian

|

Other International

|

|

Dunedin

|

81%

|

15%

|

2%

|

2%

|

|

New Zealand

|

78%

|

17%

|

2%

|

2%

|

|

Proportion of events by

event size

|

Proportion of events of

event type

|

|

|

Delegates

|

Dunedin

|

NZ

|

|

Event type

|

Dunedin

|

NZ

|

|

10-30

|

44%

|

50%

|

|

Conference/convention

|

64%

|

66%

|

|

31-60

|

23%

|

23%

|

|

Meetings/seminars

|

11%

|

11%

|

|

61-100

|

15%

|

12%

|

|

Special occasions

|

20%

|

17%

|

|

101-200

|

11%

|

10%

|

|

Trade shows/exhibitions

|

2%

|

2%

|

|

200+

|

7%

|

6%

|

|

Other

|

2%

|

4%

|

19 Consumer

Marketing – New Zealand and Australia

A campaign with on-line booking

agency, Expedia (investment of $20,000) from 11 November - 8 December, targeted

Australian consumers on the Eastern Seaboard searching for South Island

destinations. The focus of this campaign was to increase awareness of Dunedin

as a ‘must see’ destination in a South Island self-drive holiday,

and promotion of the Virgin Australia direct flights Brisbane to Dunedin.

This activity is complemented by a Tourism New Zealand

campaign in February 2020 on Expedia platforms.

The campaign generated:

• $43,000

USD in revenue, which included 314 room nights booked

• 1.2

million impressions of digital advertising

• 3.6

multiplier on original investment

a) Enterprise

Dunedin has invested $2,000 in Dunedin Airport’s Lower South NZ Autumn

campaign. The campaign promotes the regional tourism organisations of the lower

south to Australians on the south east coast, for a short break fly-drive

holiday during autumn and winter of 2020.

The results from the first two weeks of this campaign have

resulted in

· $30,000 of

packages booked

· 2.4 million

impressions of digital advertising.

b) In

addition to this, Enterprise Dunedin has supported this activity with a

Dunedin/Lower South booth at Flight Centre expos in Sydney and Brisbane in

February - $14,000 investment for both events. These expos provide the

opportunity for Enterprise Dunedin staff to promote Dunedin directly to

consumers and understand decision making from this target market with Flight

Centre providing flight and activity specials.

c) Wellington

remains a primary focus for domestic activity, supporting the flight route on

Air New Zealand, with two radio competition and digital campaigns during

October and November leveraging off past activity and promoting longer stays in

the city.

d) The

‘#dunnerstunner summer’ campaign promotes Dunedin on multiple

channels, targeting the drive market, including Christchurch. It has a focus on

February events and Dunedin activities and encourages longer stays in the city.

· Dunnerstunner

video has had 90,000 views on the DunedinNZ Facebook page https://www.youtube.com/watch?v=QGxHEh6Syws

· A Google Ad

campaign has resulted in 12,624-page views on DunedinNZ.com and a high

click-through rate of 19.2%.

· DunedinNZ social

media posts have appeared on Facebook, Instagram and Linked In.

· Full

page print advertising has appeared in Kia Ora, Style and Jetstar magazines. https://www.yumpu.com/en/document/read/63007246/style-january-08-2020

e) The

DunedinNZ Visual Library was launched in December 2019 to provide a curated

selection of royalty-free photography, video and digital assets for city

promotional purposes. To date, 196 registered users have downloaded 122GB

of assets from 1890 image and video options.

f) The

Māori Language week video showcasing place names in Māori during 9-15

September had 73,000 views with more Māori language integration planned

for 2020. https://www.youtube.com/watch?v=bKuMhrlW3SY

g) Various

discussions have occurred with Air New Zealand for future campaigns in 2019/20.

An ongoing partnership agreement is planned for 2020/21 to further encourage

increased domestic visitation.

h) Collaborative

marketing opportunities with Dunedin educational institutions have been

identified and are due to commence in February 2020.

i) As

discussed with the industry, a Marketing Calendar has been completed for the

period January to June 2020. A full one-year Marketing Plan (bring ED into line

with Tourism New Zealand) will be produced in June 2020, and thereafter a

rolling two-year Marketing Plan 2021-23 will be produced.

20 International

Trade

a) We

continue to work closely with Tourism New Zealand in offshore markets,

particularly in promoting Dunedin to Tourism Agents and Product Managers. Highlights

include:

· South East Asia

Kiwilink (Manila & Jakarta)

· China Kiwilink

(Chengdu/Guangzhou/Beijing & Shanghai)

· Australian Mega

Famil (Christchurch)

· South East Asian

Mega Famil (Auckland)

· Regional training

day (Christchurch).

b) Where

appropriate, agents and operators are hosted in both the domestic and

international tourism sector including:

· South East Asian

agents

· Wellington-based

inbound operators and Tourism Industry Aotearoa staff

· Australia-based

inbound operators, coach tour operators and wholesale agents

· Australian agents

· Auckland-based

inbound operators

· Chinese agents and

cruise line staff for new cruise ship.

21 PR

and Promotions

a) Enterprise

Dunedin hosted three television series - two of these as part of the Tourism

New Zealand International Media Programme. They include the Mr Player https://www.youtube.com/watch?v=iDPiOfaoRWY

game show anniversary episode which aired late last year (2.5 million viewers)

and Japanese travel show Tabi Salada https://spaces.hightail.com/receive/A3JylCYvO1/U2FyYWguQnJhbWhhbGxAZGNjLmdvdnQubno=

which aired during the 2019 Rugby World Cup (four million viewers).

b) With

financial support from Tourism New Zealand Australia, Dunedin hosted the crew

from Delish Destinations, a food travel show on Channel 9 that went to

air on 7 February. Six shows featuring food destination in Dunedin have been

aired http://www.delish-tv.com/episode.php?country=au&id=1180

c) In

addition to this, four media famils were hosted including;

· a

freelance writer for Jetstar’s magazine (277,000 monthly readers)

· the

lifestyle editor of the Chinese New Zealand Herald (readership of

120,000– 250,000 across several platforms)

· a

freelancer for Stuff (437,000 readership in travel)

· and

the editor of Good magazine (readership of 40,000).

d) Based

on a strengthening relationship with the New Zealand Herald, stories were

published about Dunedin businesses Ocho and Urbn Vino, as well as two travel

stories on Dunedin by New Zealand Herald freelance writer Alexia

Santamaria. A further piece was published in Newshub travel, along

with video content.

22 Study

Dunedin - COVID-19 Impact on International Education

a) The

impact of COVID-19 on the international education cohort began soon after the

outbreak was confirmed. Its ongoing impact has been felt to varying

degrees across the industry.

b) The

high school sector was the first to deal with the situation as school began at

the end of January and in to February. Some students who may have been in

contact with the virus, had already entered New Zealand and were in homestay

and starting school by the time the travel ban was announced by central

government. Schools reported that they followed the guidelines set out by

the Ministry of Health and the Ministry of Education and where it was deemed

necessary, students were self-isolated. Many staff dealing with the

situation commented that it had been a difficult time as often information from

different government departments was either contradictory or changed on a daily

basis, making it hard to control the situation with any certainty.

c) Of

the eleven high schools who have reported back six have confirmed that COVID-19

has had no effect on their student enrolments. Three schools report that

one of their students has not managed to make it so far however they are in

contact with them and where appropriate providing them with work to carry on

with while they wait for the travel ban to be lifted. Two schools have

three students unable to enrol. One school has had a short stay group postpone

until May 2020. One school has two students going via Thailand with their

parents, sitting out a quarantine period there.

d) The

University of Otago reported that as at 25 February just under 200 Chinese

students have been unable to begin classes due to the New Zealand Government

imposed travel ban. There have also been a small number of students who had

planned to travel to Dunedin through China from their home country, that have

had their travel disrupted. The University is developing a range of options to

support those students impacted by the travel ban. The temporary closure

of the Immigration New Zealand (INZ) Beijing Office has had an impact on visa

processing times, however it is understood INZ is working to address this.

There is also a potential issue regarding the status of private accommodation

arrangements for those students who are unable to return to Dunedin due to the

travel ban. The University is allowing students disrupted by the travel bans,

to withdraw from their accommodation obligations without penalty.

NEXT STEPS

23 Feedback

on Enterprise Dunedin activity will be incorporated into future updates.

Signatories

|

Author:

|

Fraser Liggett - Economic Development Programme Manager

Malcolm Anderson - City Marketing Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report promotes the economic

well-being of communities in the present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the delivery of the

2013-2023 Economic Development Strategy.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known impacts for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Enterprise Dunedin activities and the 2013-2023 Economic

Development Strategy are included in the 2018-28 Long Term Plan.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This decision is considered low significance under the

Significance Engagement Policy.

|

|

Engagement –

external

As an update report, no external engagement has been

undertaken.

|

|

Engagement -

internal

As an update report, no internal engagement has been

undertaken.

|

|

Risks: Legal / Health

and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|