|

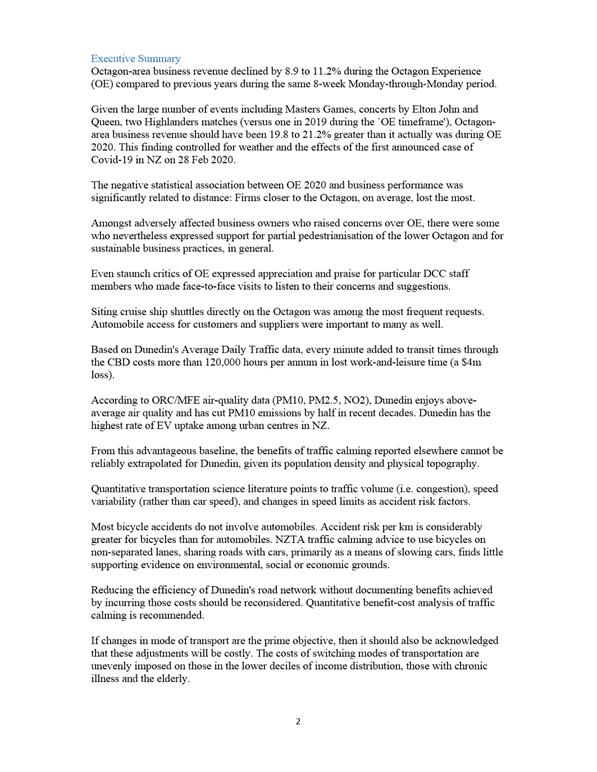

|

Council

30 June 2020

|

Octagon Experience Evaluation Report

Department: Community and Planning and Corporate

EXECUTIVE SUMMARY

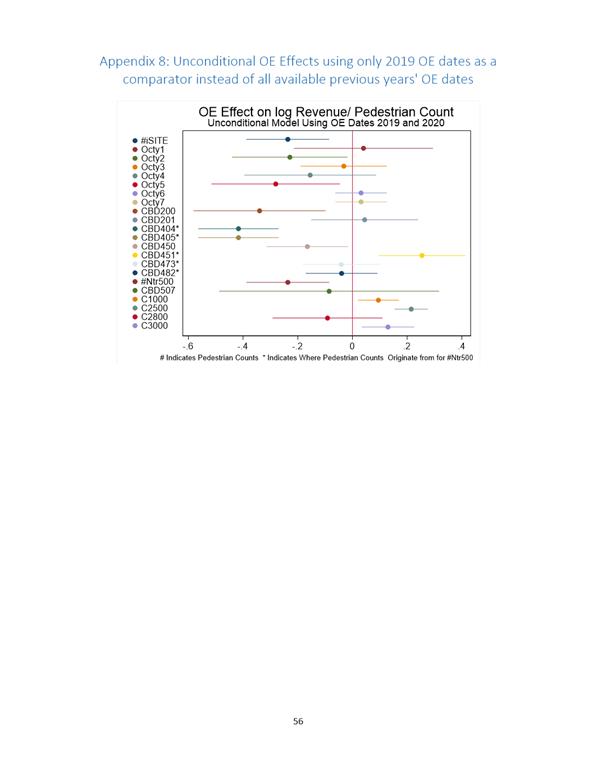

1 This

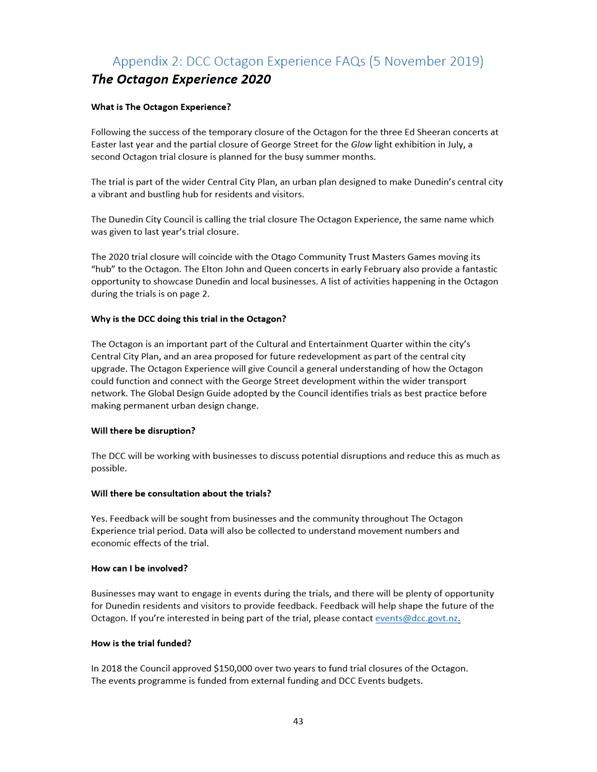

report provides feedback on the pedestrianisation trials for the Octagon

conducted in January – March this year. These trials were commissioned in

response to the Council decision to allocate funding in the 2018/ 19 and

2019/20 Annual Plans for further trials in the Octagon and lower Stuart Street.

This decision followed the successful pedestrianisation trial conducted at

Easter in 2018, timed around the Ed Sheeran concert.

2 The

pedestrianisation trials were scheduled to coincide with other planned events

in the city including the Masters Games 2020 and the city activations for the

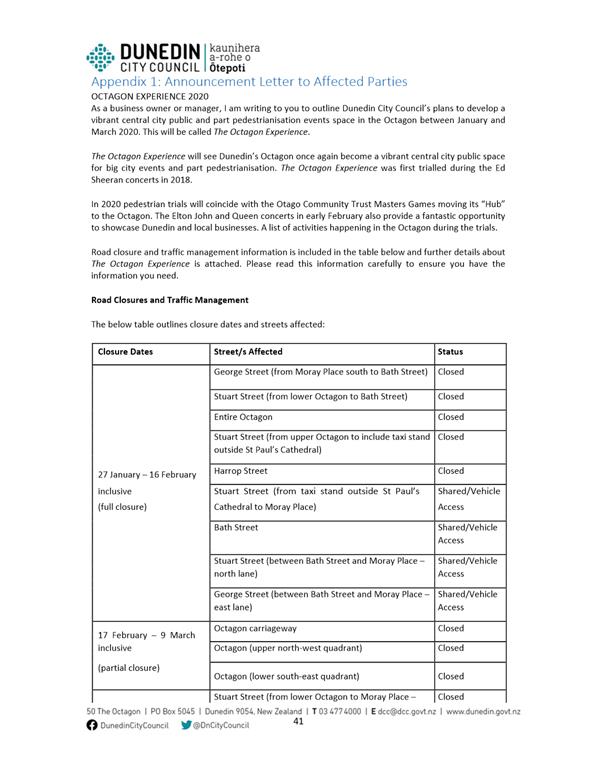

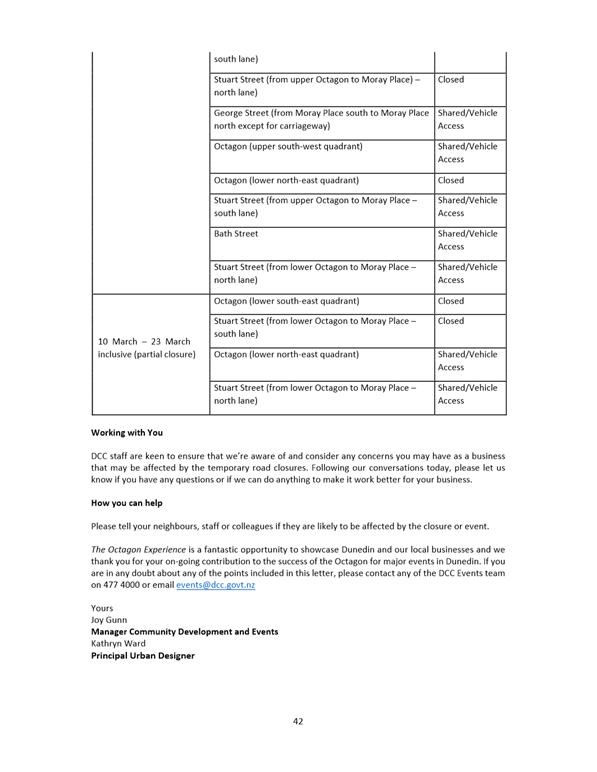

Queen and Elton John concerts in an attempt to enhance the vitality of the

Octagon and support commercial activity. (A separate evaluation report is

presented to this meeting on the Masters Games).

3 This

report presents the outcome of the trial and includes the analysis of the

specialist reports commissioned to evaluate the trials from economic and social

dimensions, along with community feedback. It also outlines the challenges

encountered due to unforeseen events including the impacts of the COVID-19

pandemic and the closure of the country’s borders to international

visitors.

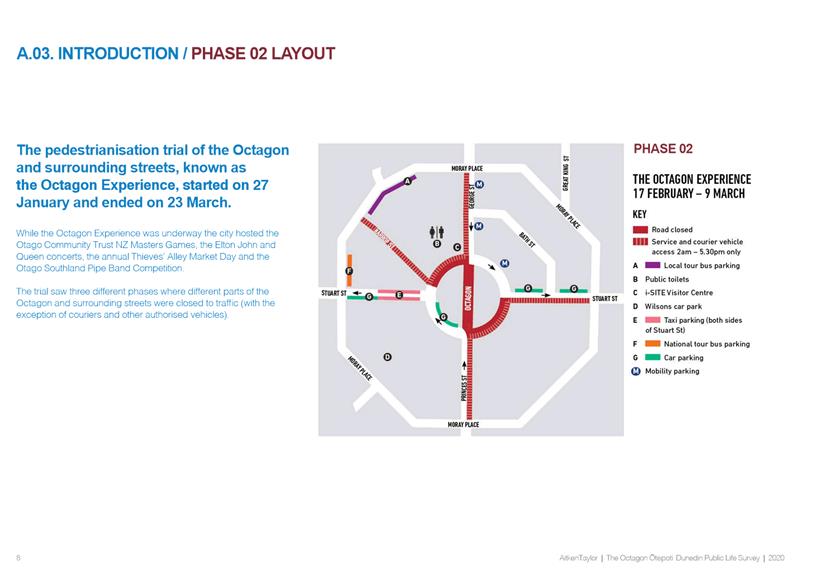

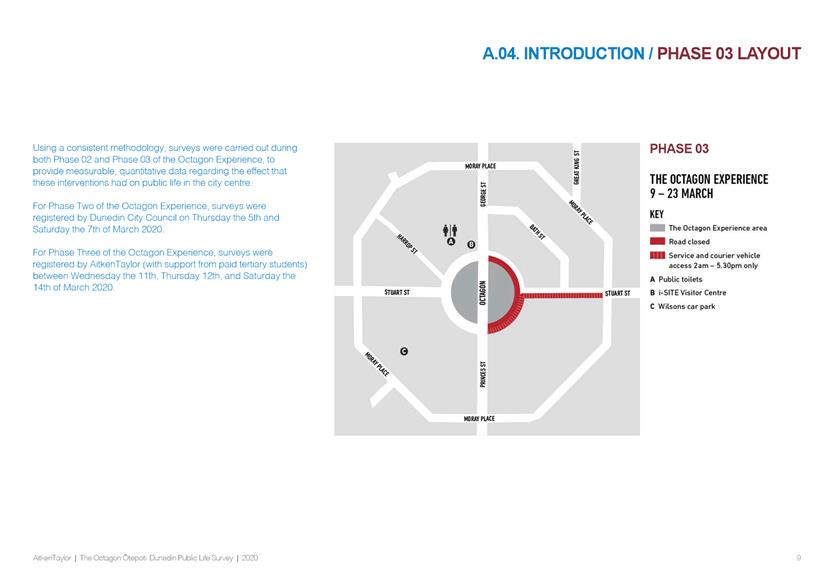

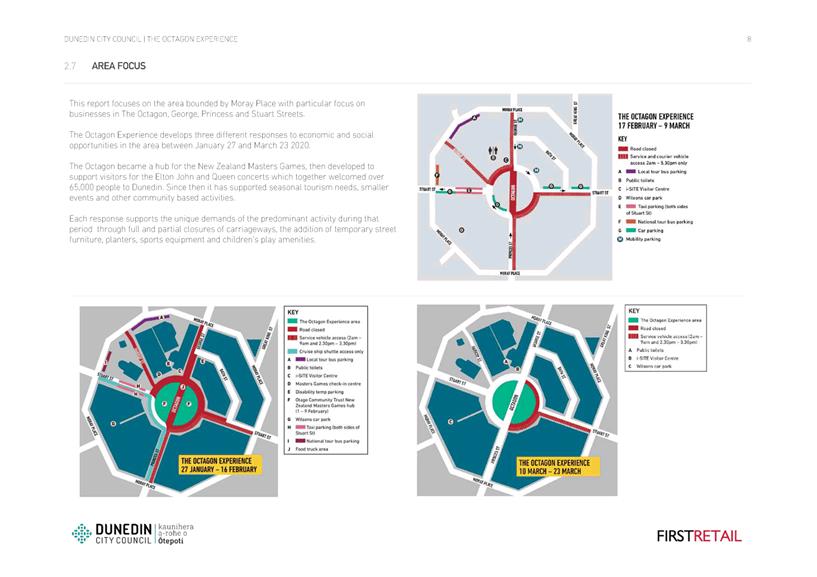

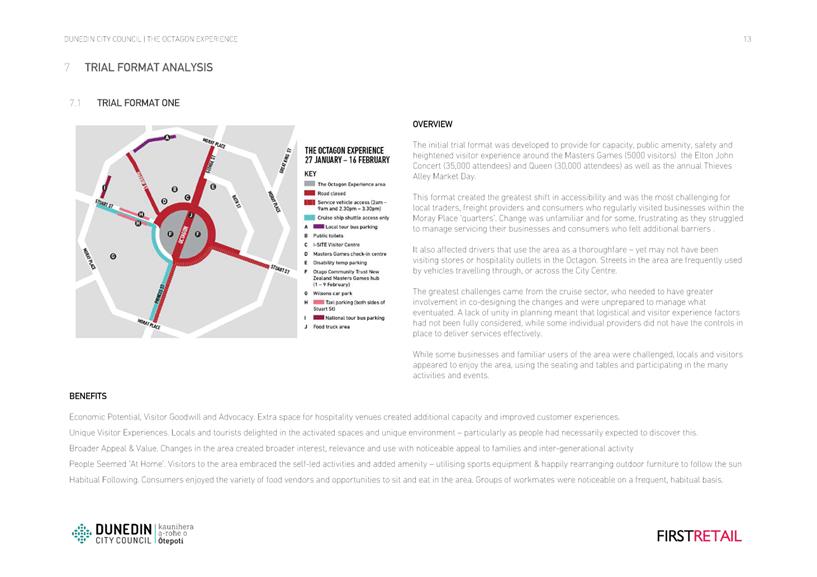

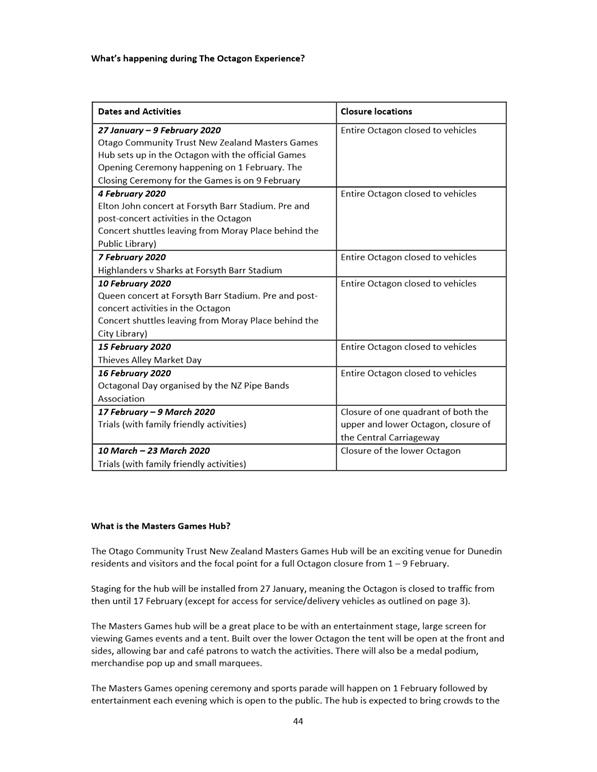

4 Some

conclusions regarding the trials and lessons to be applied in future planning

are presented for council consideration.

|

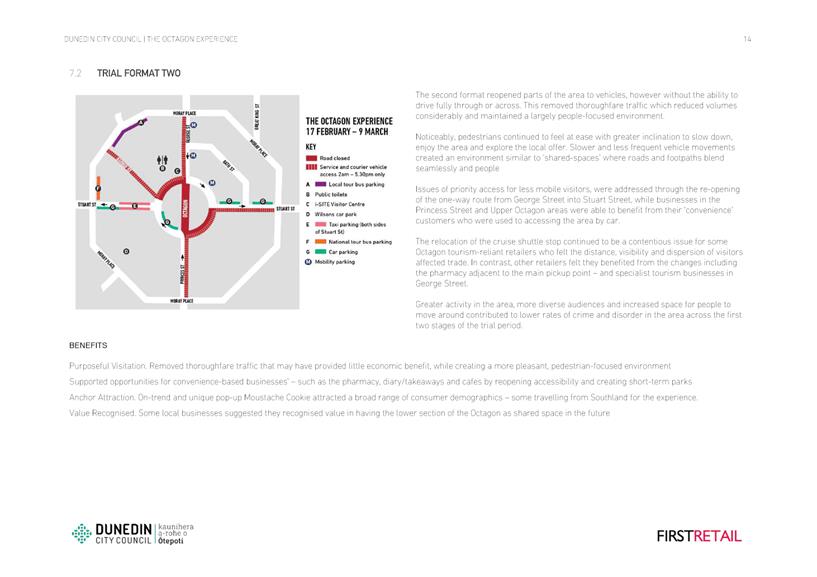

RECOMMENDATIONS

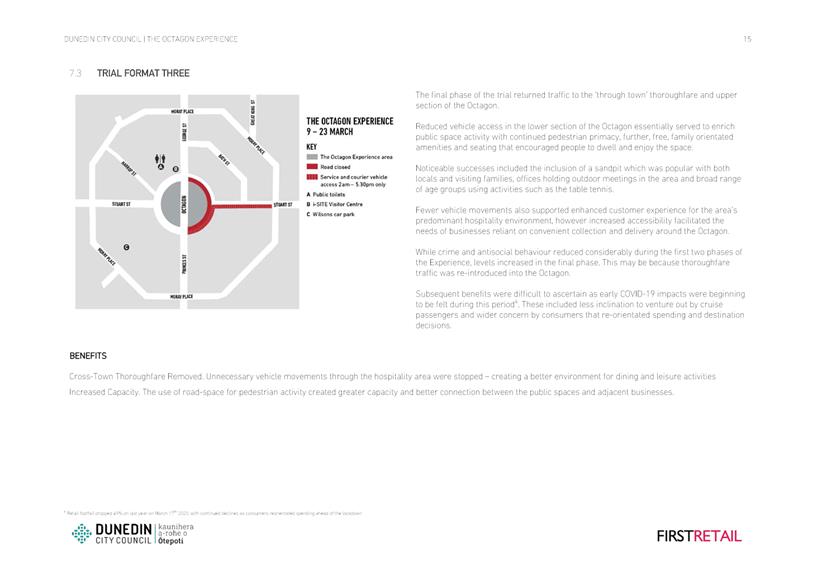

That the Council:

a) Notes the feedback (including feedback from the

community and affected parties) and quantitative data relating to the Octagon Experience 2020, and the

specialist reports

commissioned to evaluate the trials.

b) Notes that the findings of this

evaluation report will be used to inform planning on George Street and other

major projects.

|

BACKGROUND

5 In

April 2018 Planning and Environment Committee received a report outlining the

feedback received regarding the Octagon Experience, a five-day trial

pedestrianisation of the Octagon over the Easter / Ed Sheeran concert weekend.

6 The

Committee noted the feedback report. The committee also passed the following

resolutions:

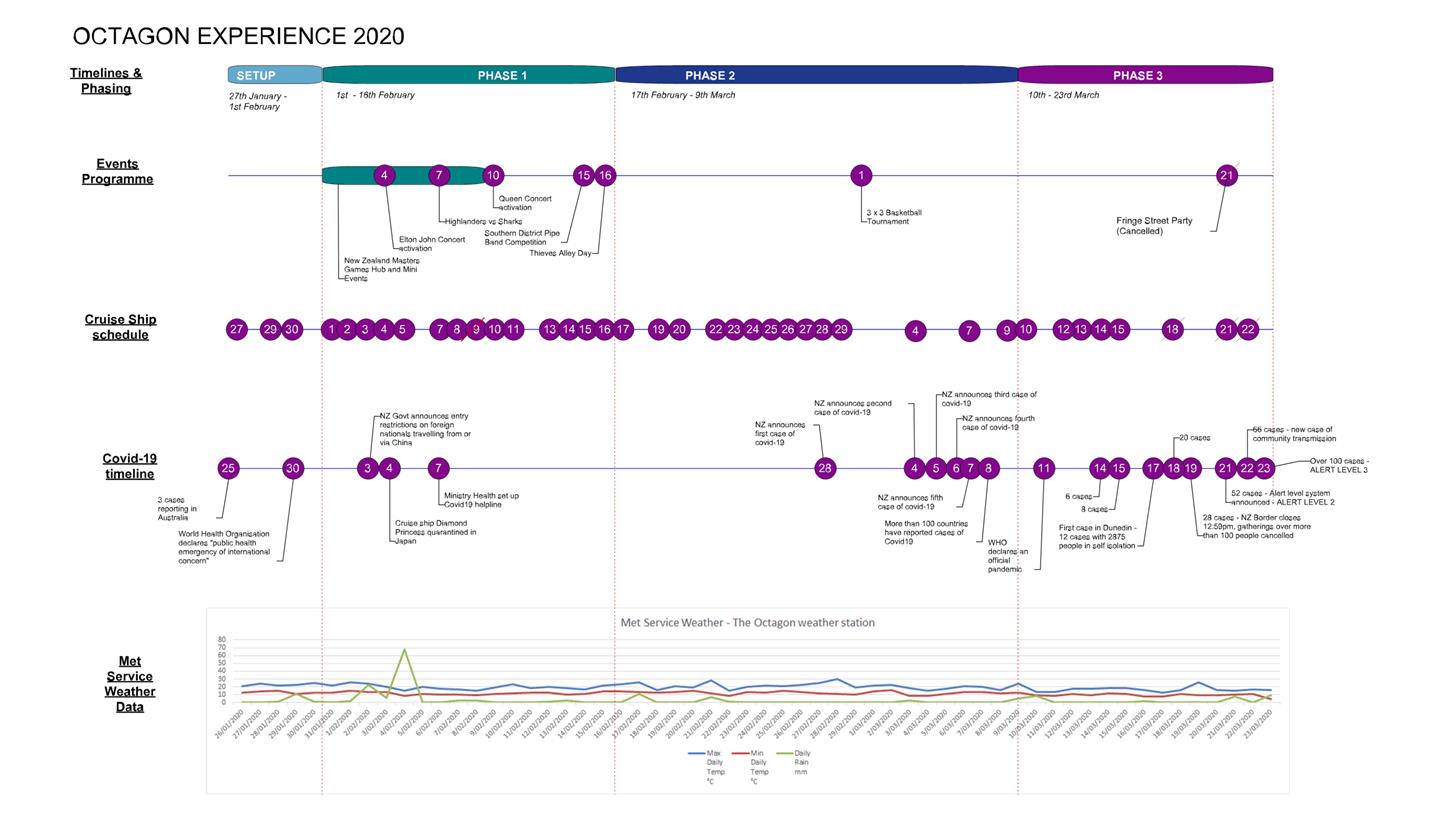

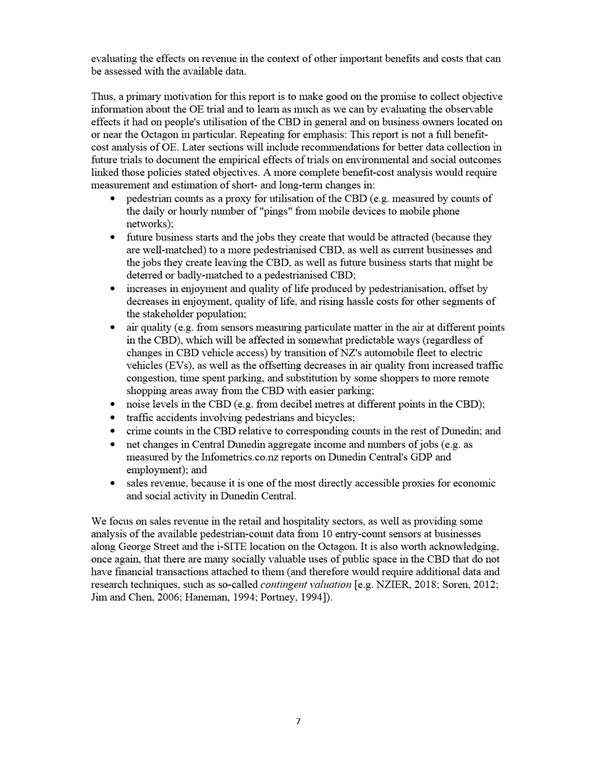

Moved (Cr Aaron Hawkins/Damian Newell):

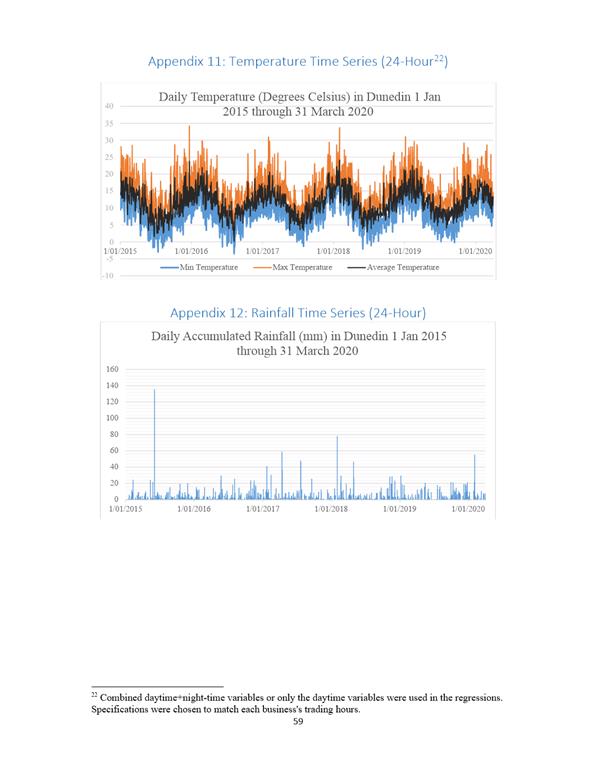

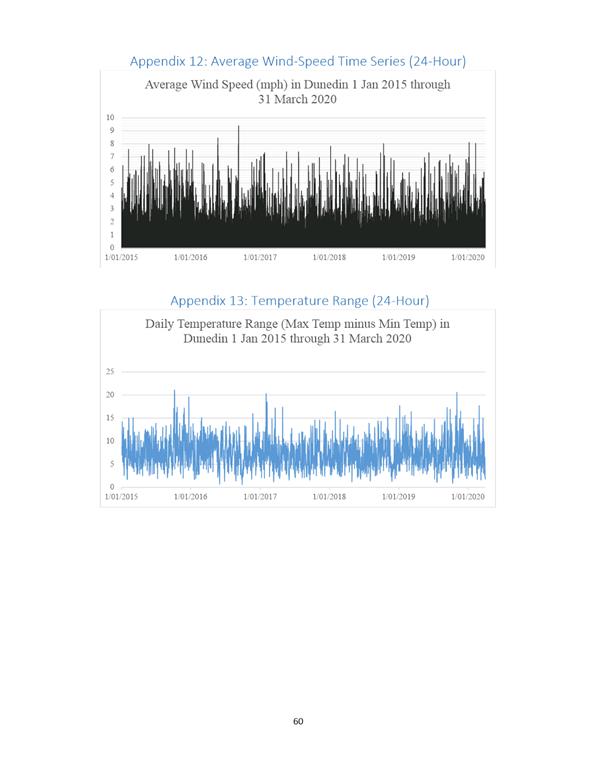

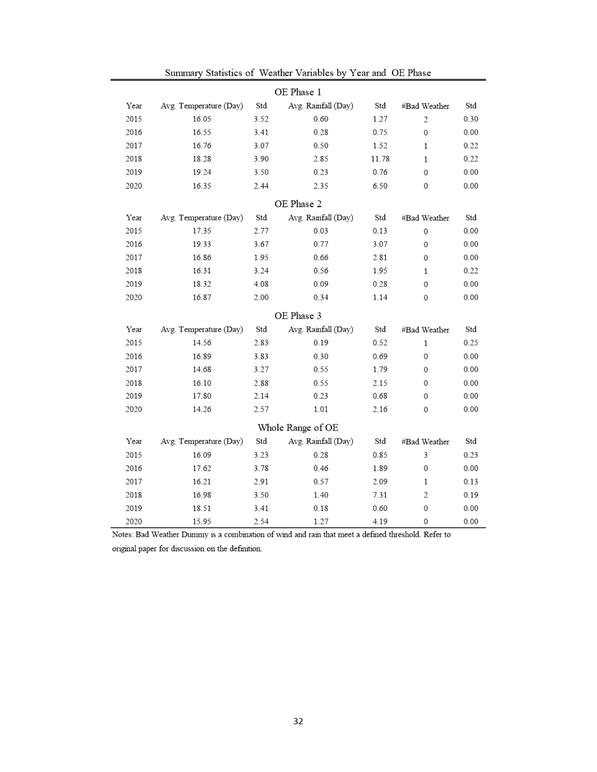

That the Committee:

a) Notes the report.

Motion carried (PLA/2018/013)

Moved (Cr Aaron Hawkins/Cr Damian

Newell): That the Committee:

a) Reaffirms support for pedestrianisation trials to be undertaken in the Lower Octagon and Lower Stuart Street.

Division

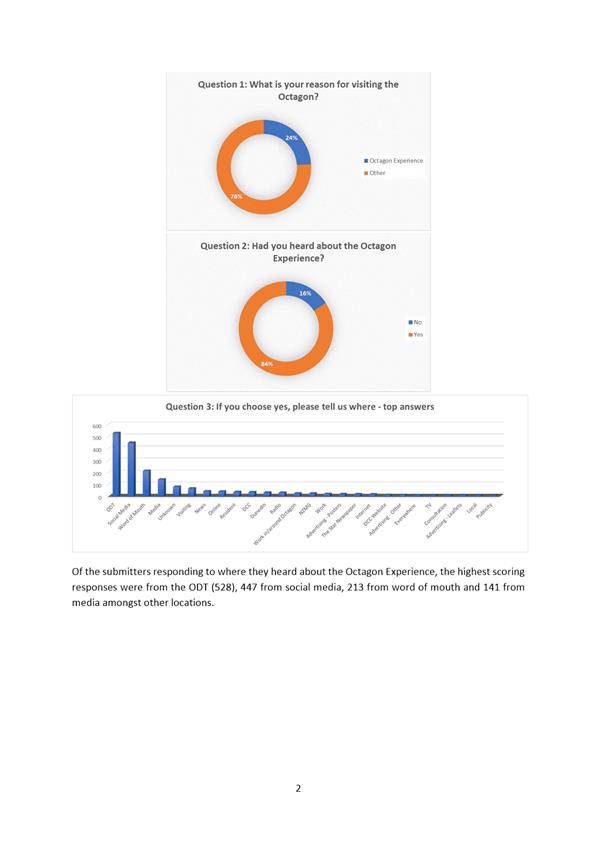

The

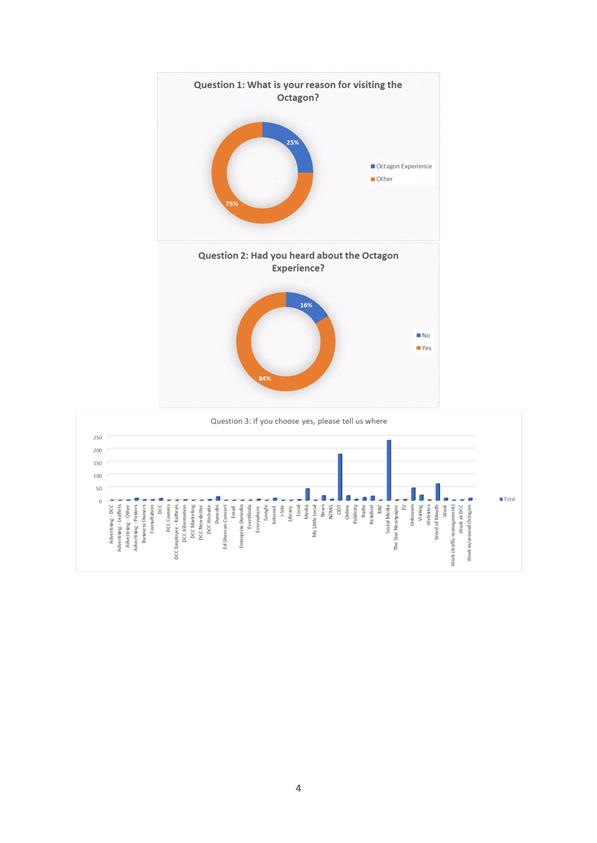

Committee voted

by division.

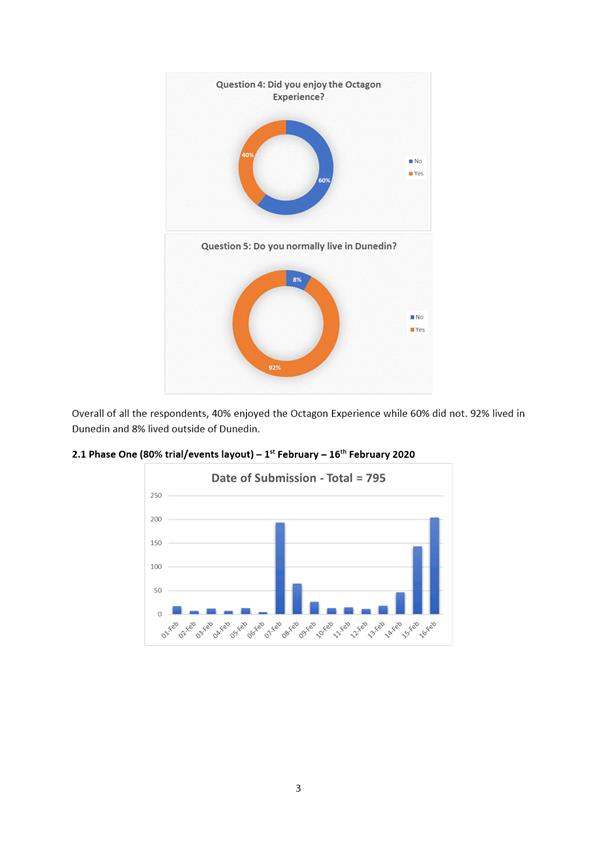

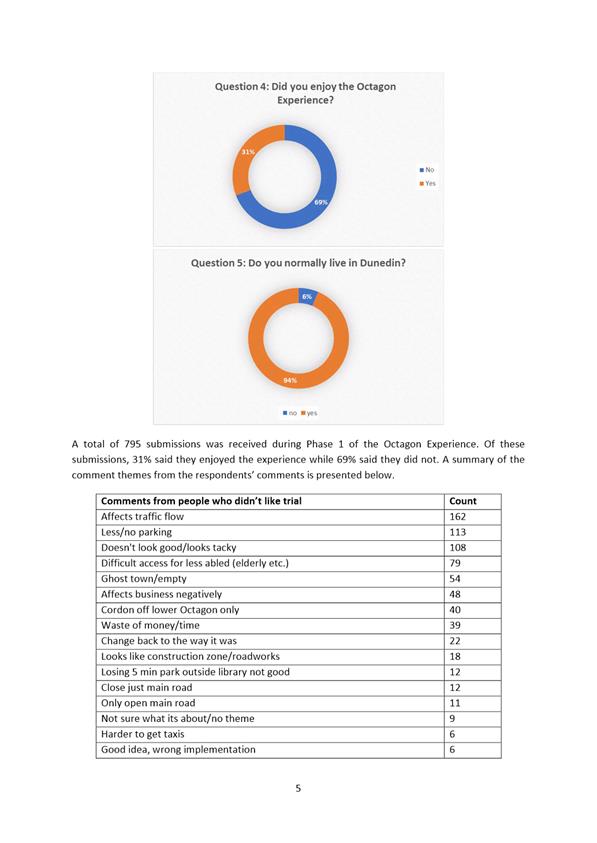

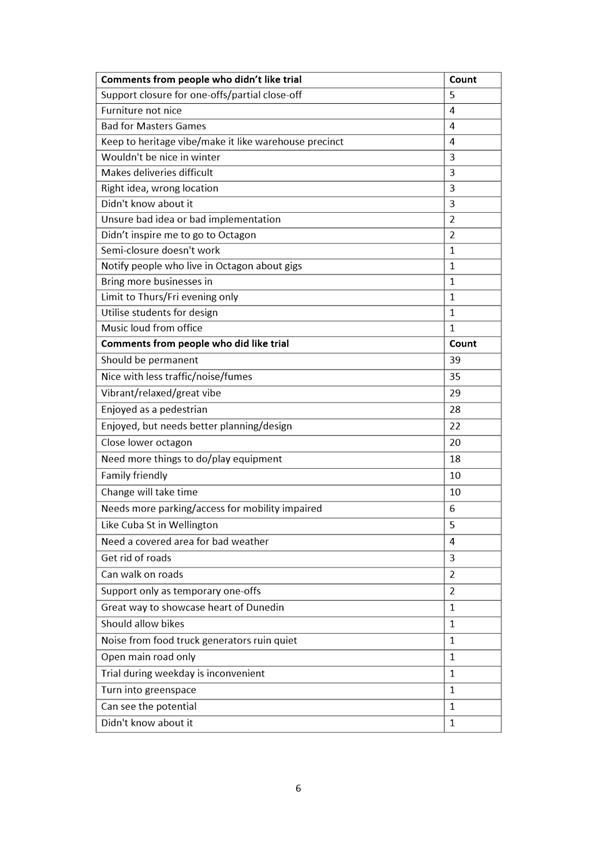

For: Mayor Dave Cull, Crs Rachel Elder, Christine Garey, Doug Hall, Aaron Hawkins,

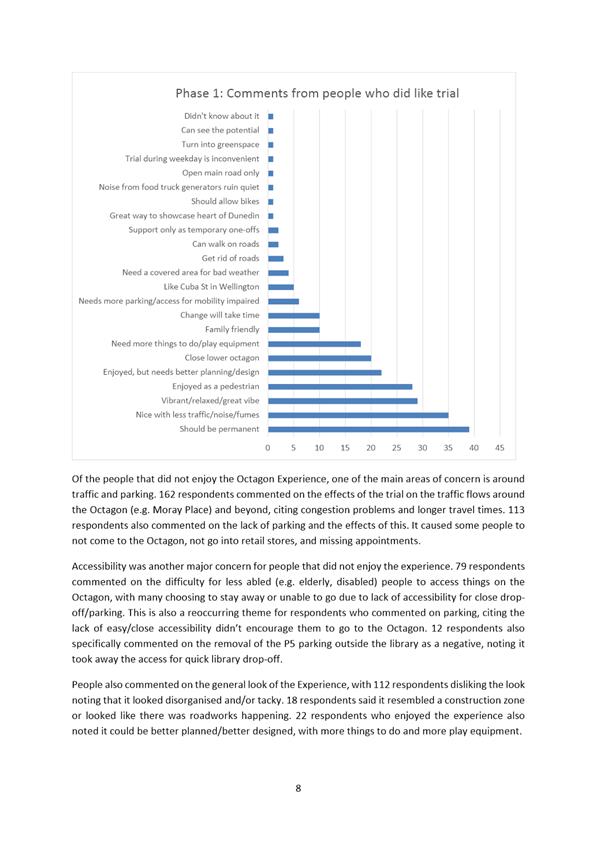

Marie Laufiso, Mike Lord, Jim O'Malley,

Damian Newell, Conrad

Stedman, Andrew Whiley, Kate Wilson and David Benson-

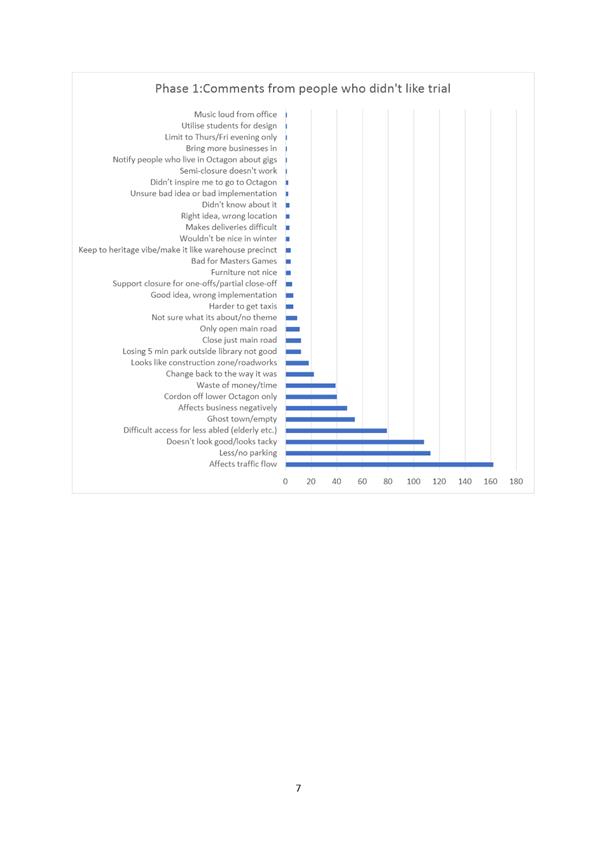

Pope (13).

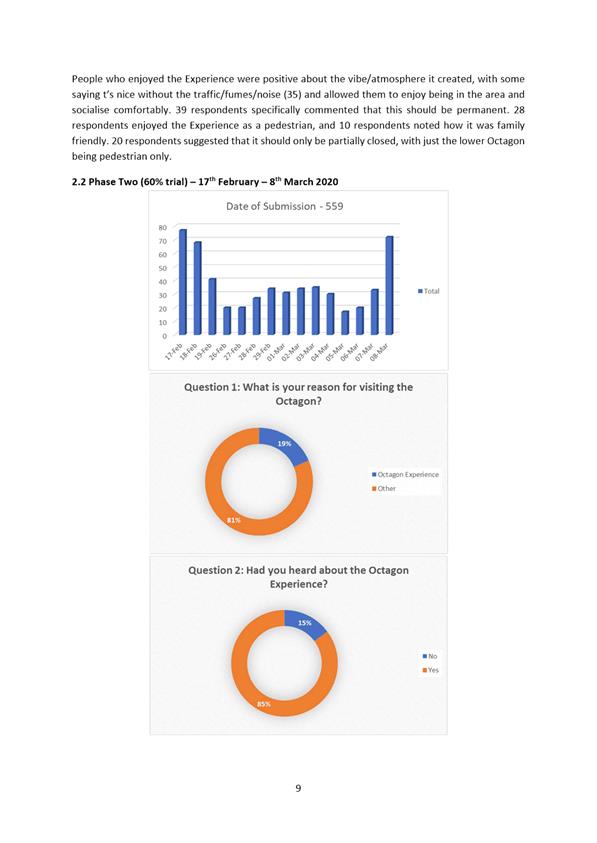

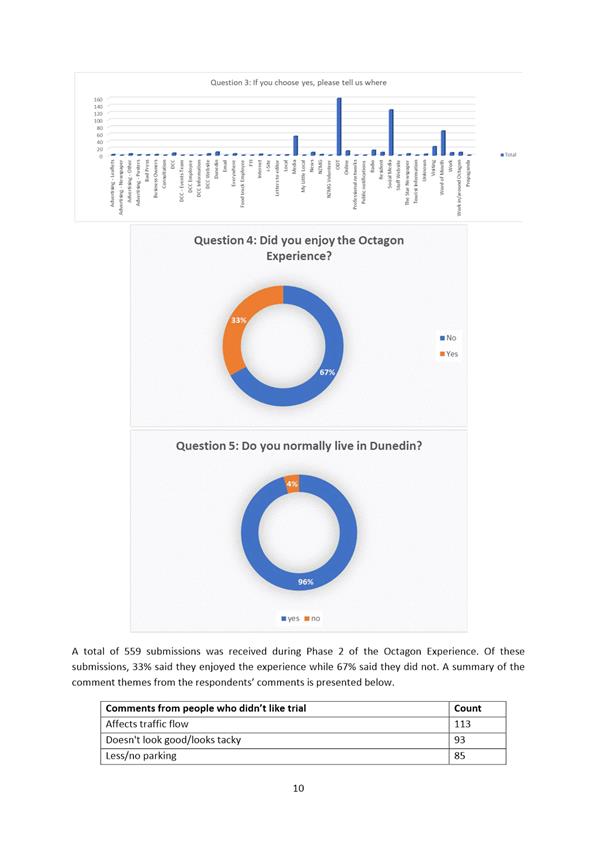

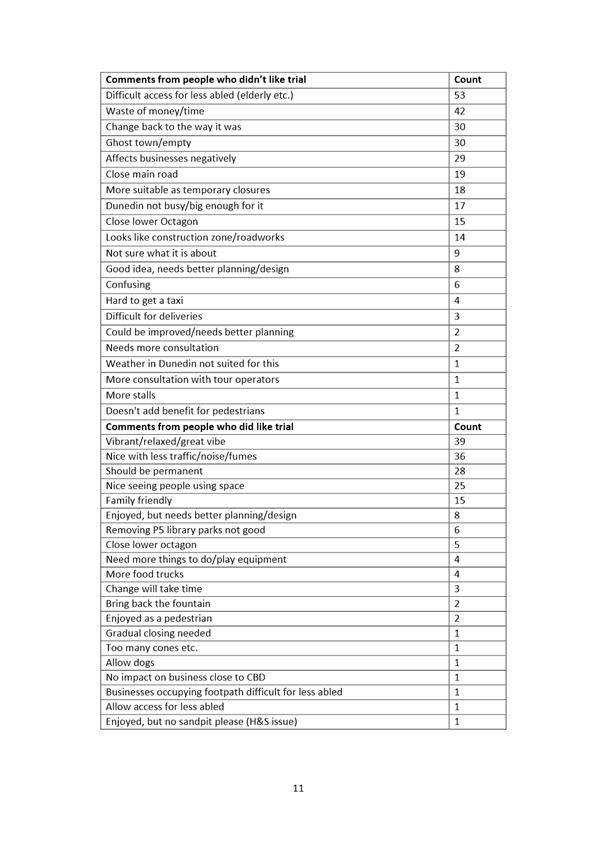

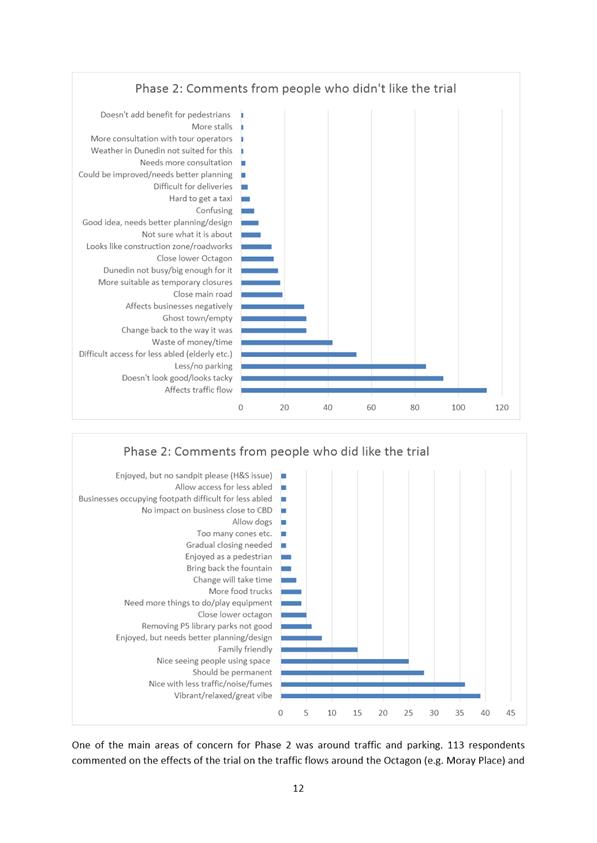

Against: Cr Lee Vandervis (1).

The division

was declared CARRIED

by 13 votes to 1

Motion carried (PLA/2018/014)

Moved (Cr Aaron Hawkins/Cr Damian Newell):

That the Committee:

b) Recommends Council give consideration to the allocation of $75,000 a year in 2018/19 and 2019/20 at the ten year plan hearings to support pedestrianisation trials in the lower Octagon

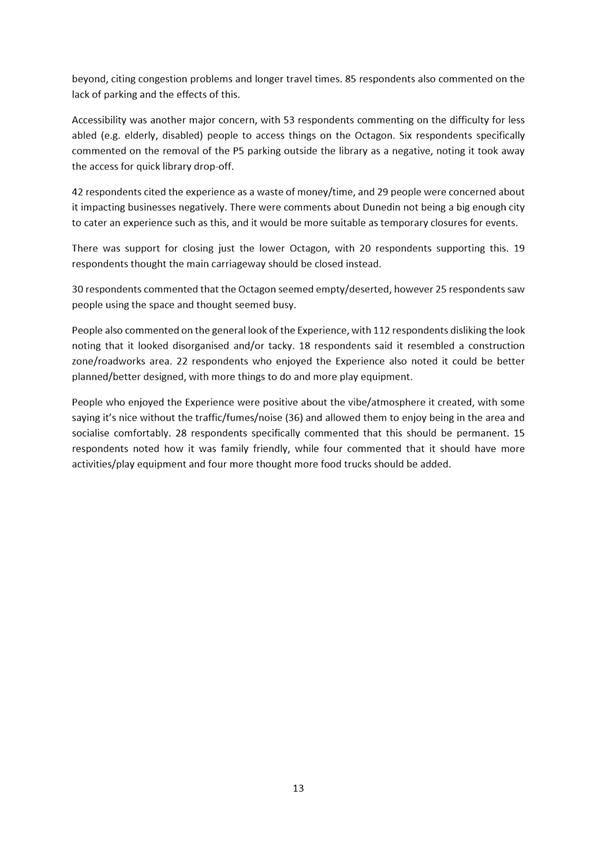

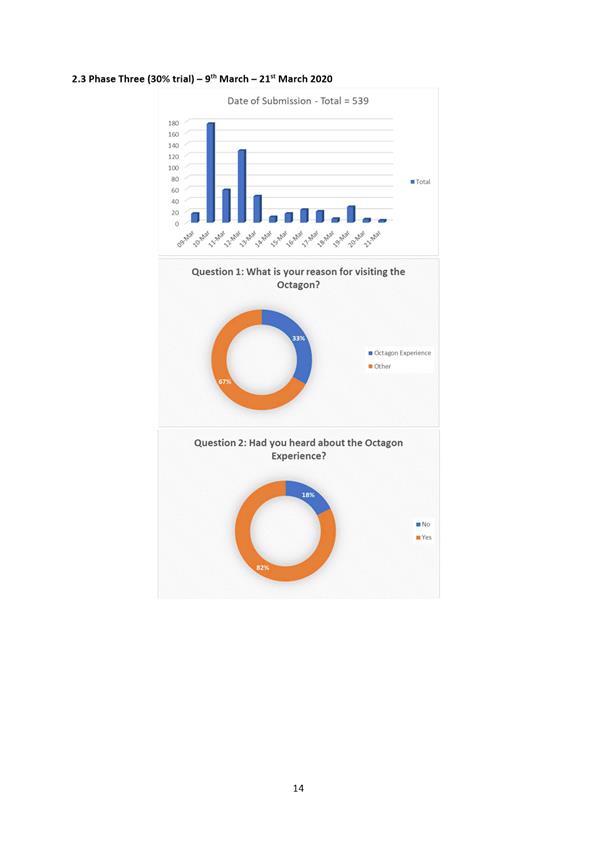

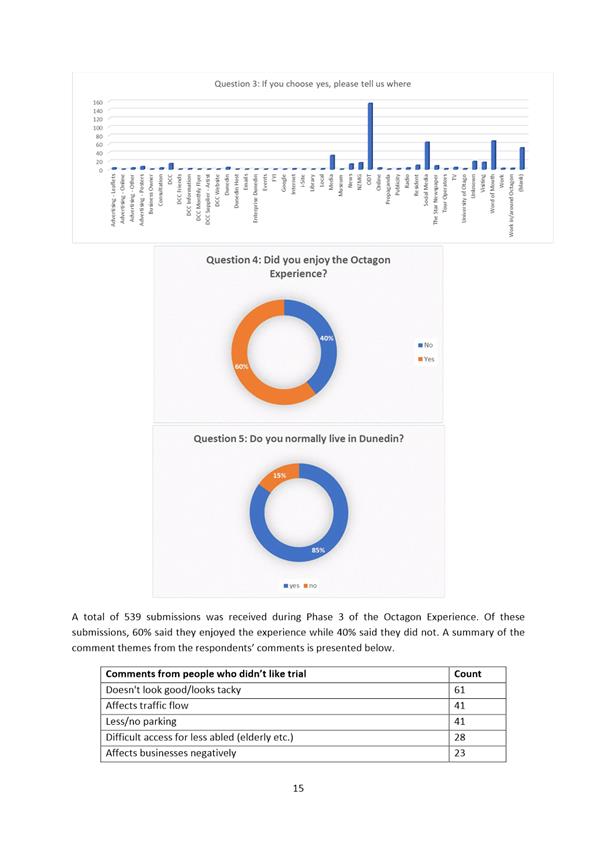

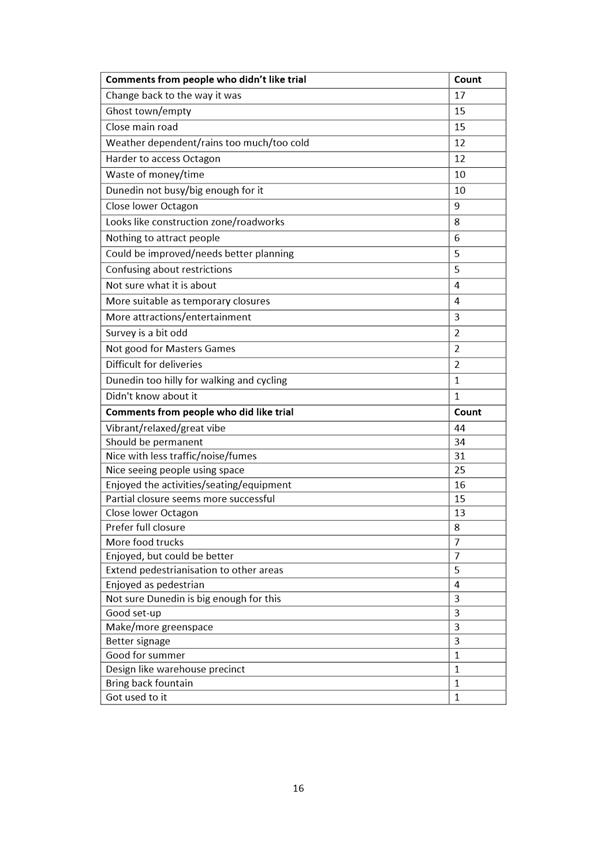

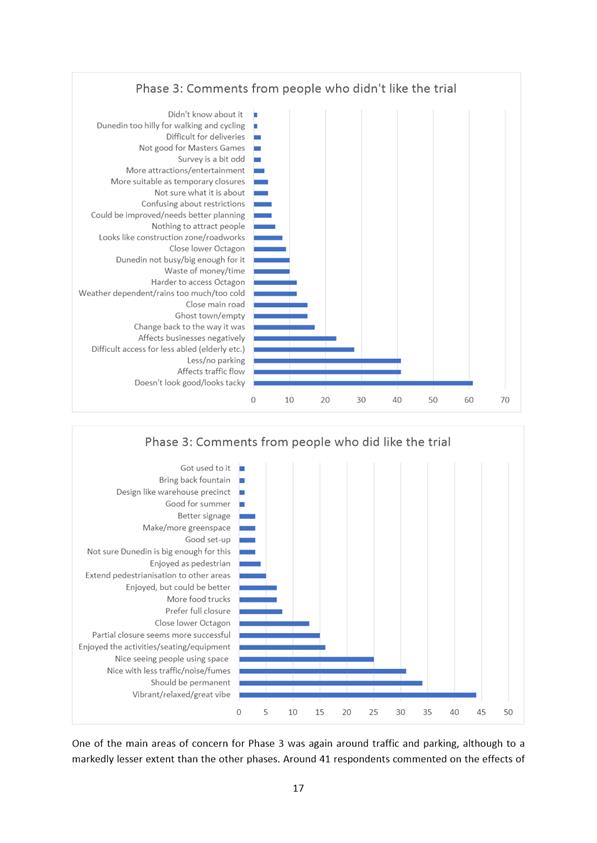

and lower Stuart

Street.

Division

The Committee

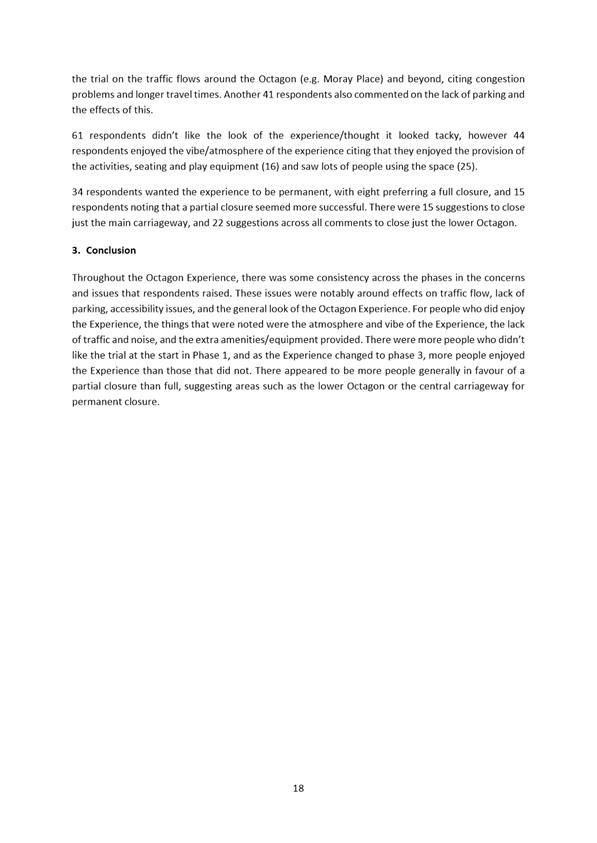

voted by division.

For: Mayor Dave Cull, Crs Rachel Elder, Christine Garey, Doug Hall, Aaron Hawkins,

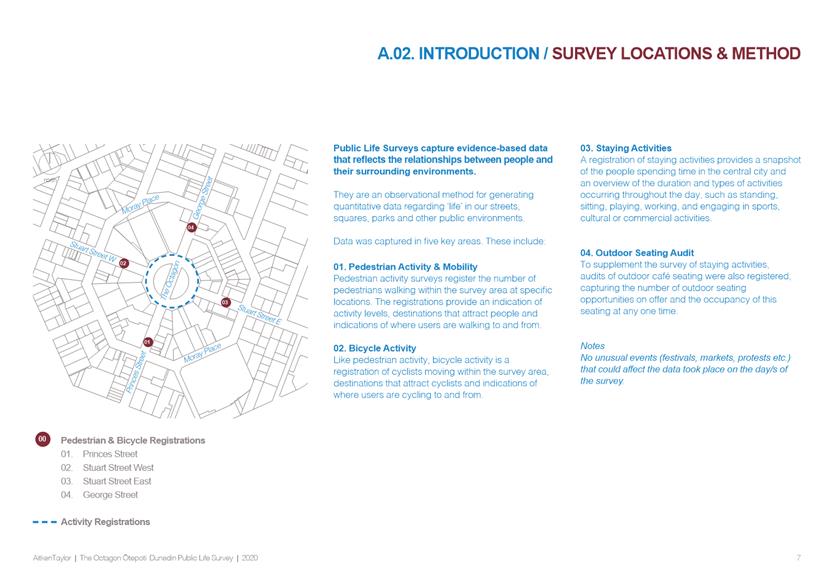

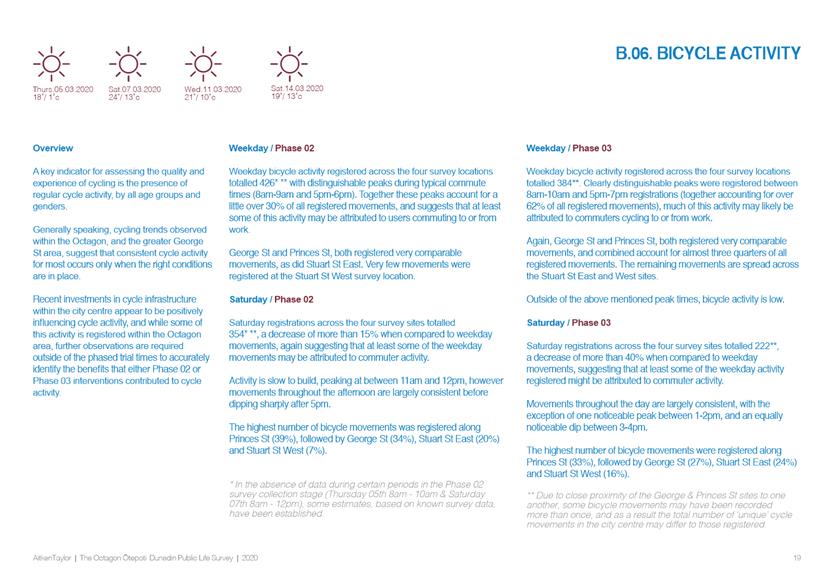

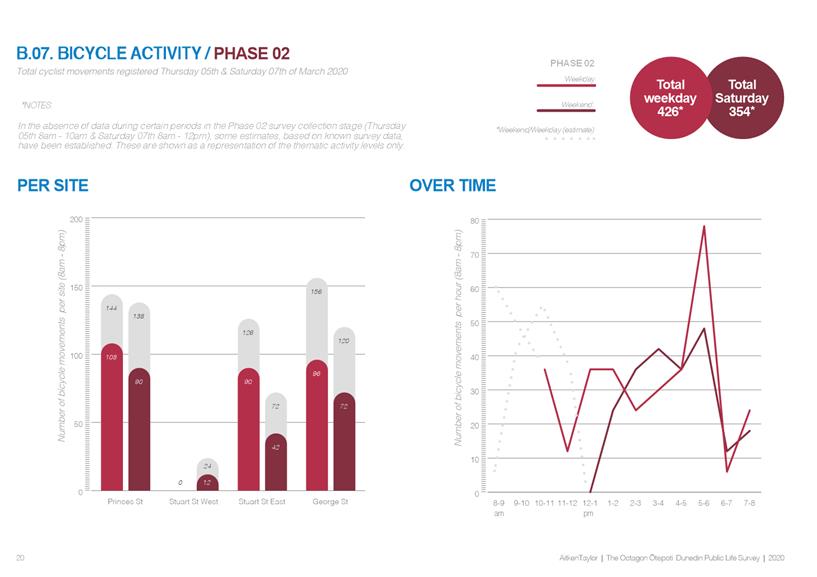

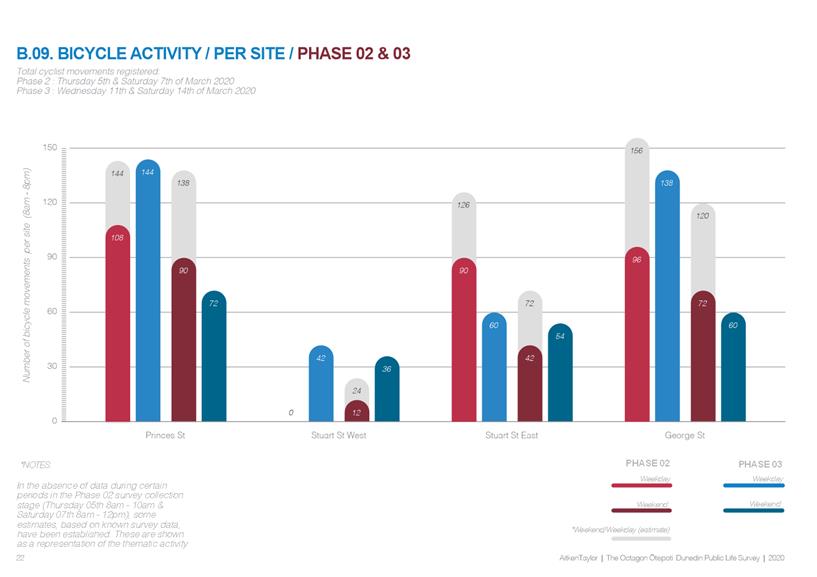

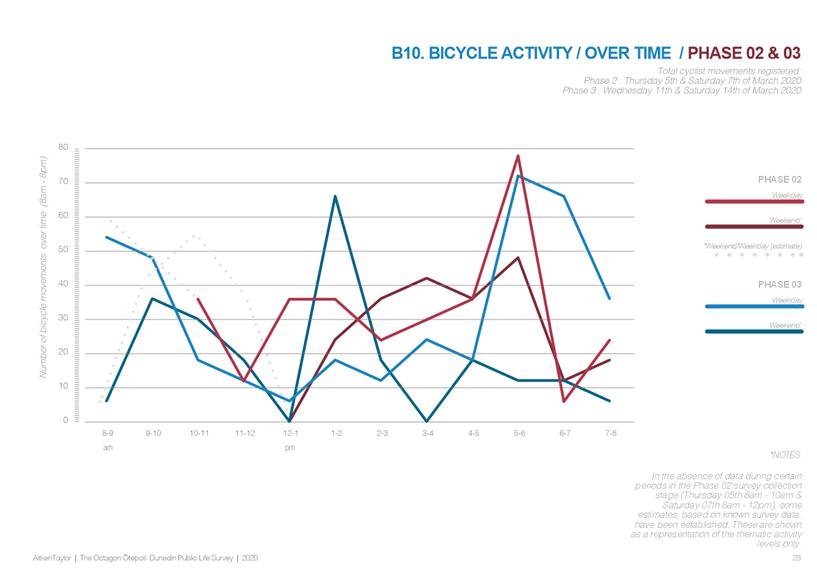

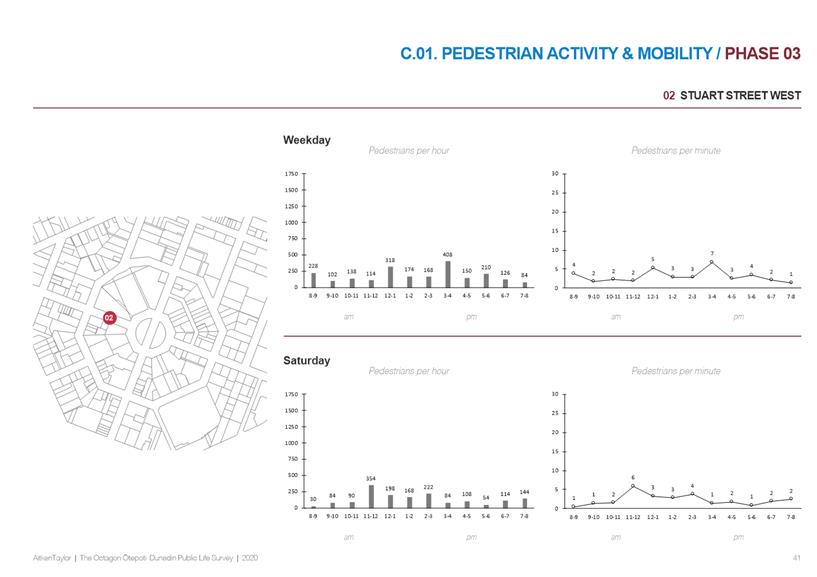

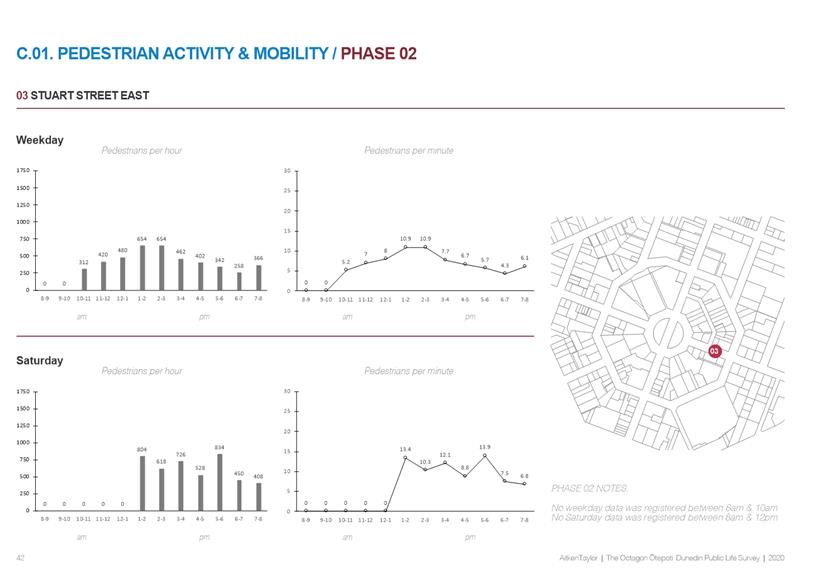

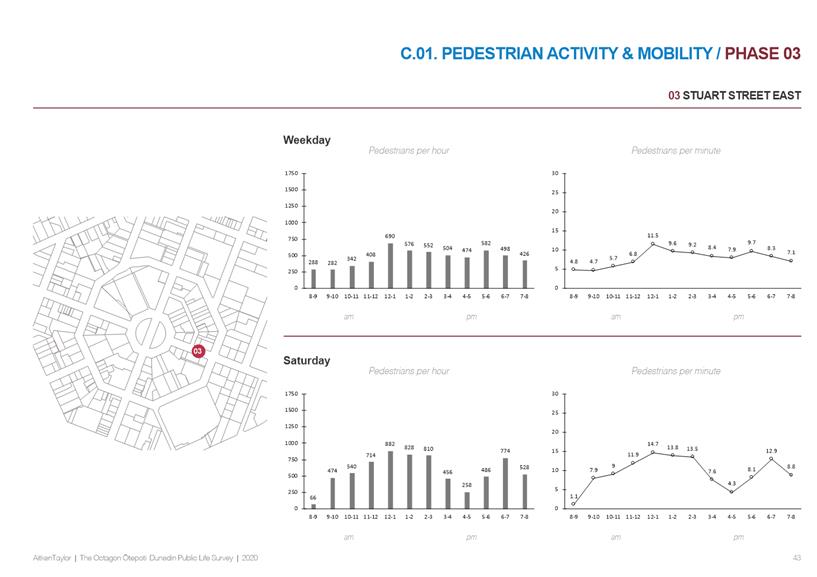

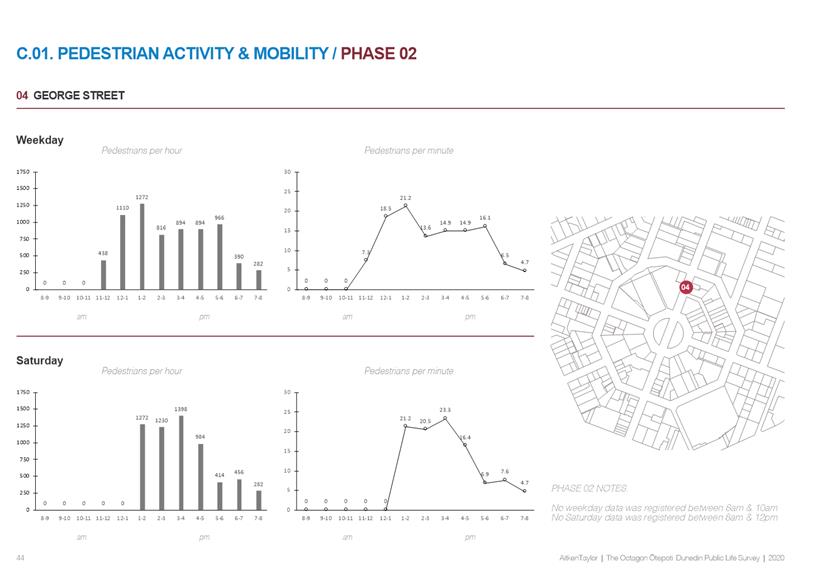

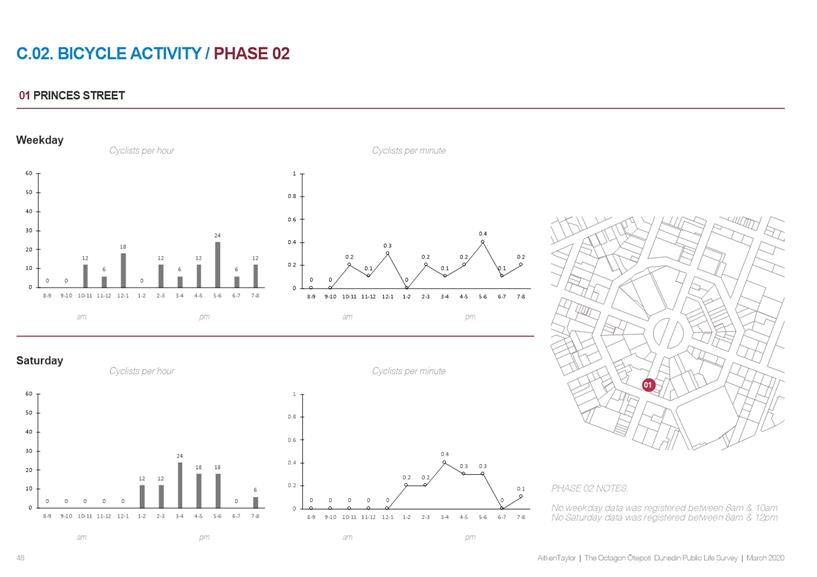

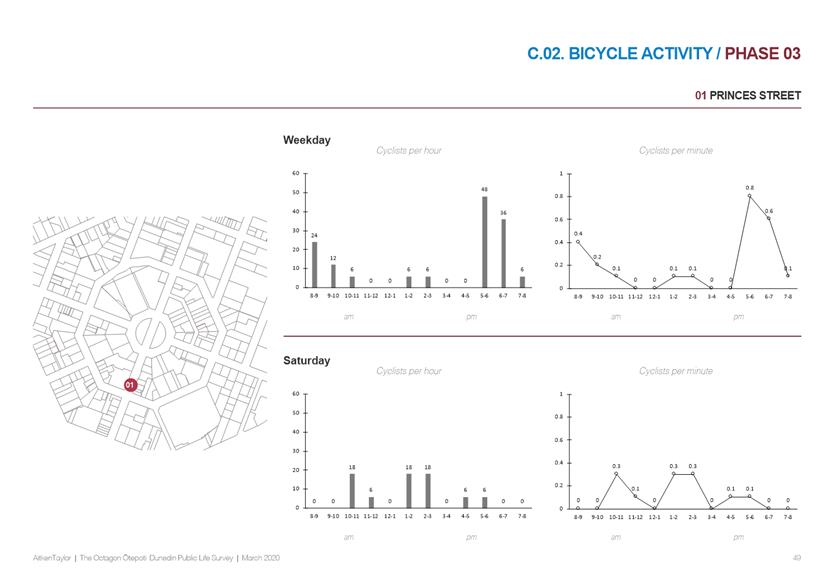

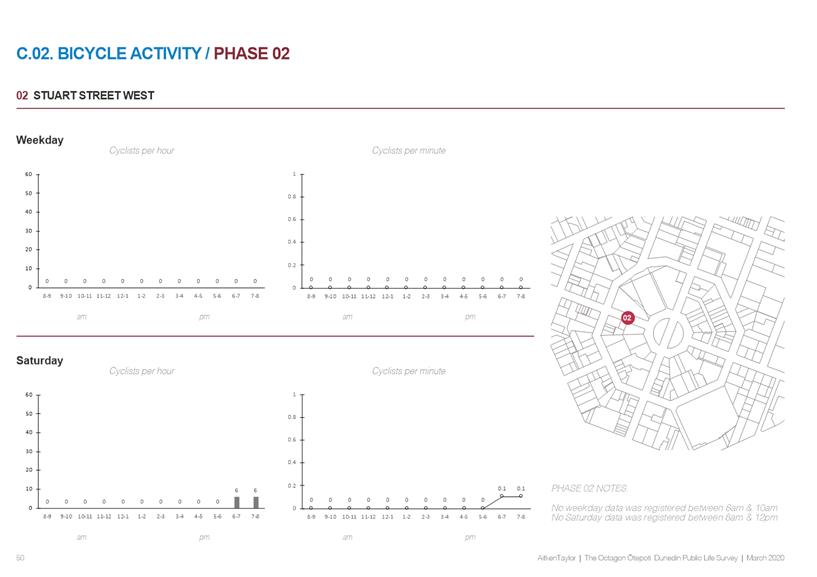

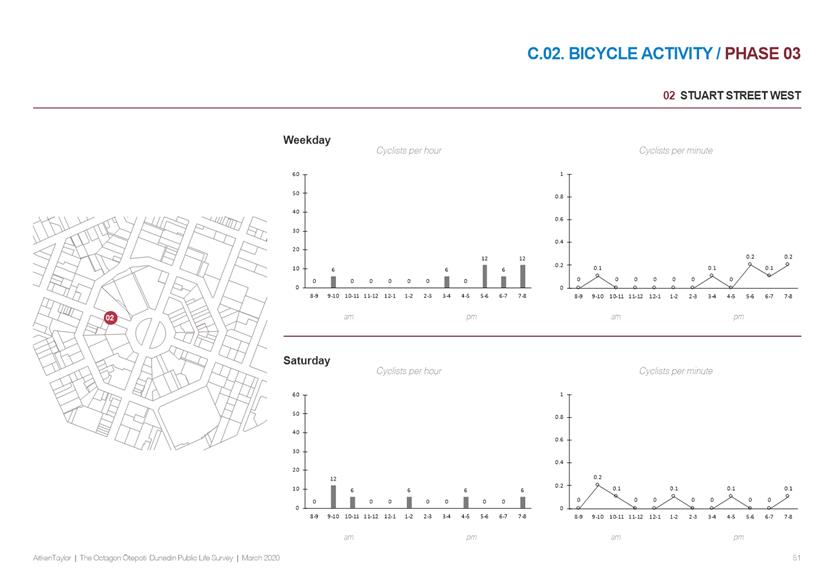

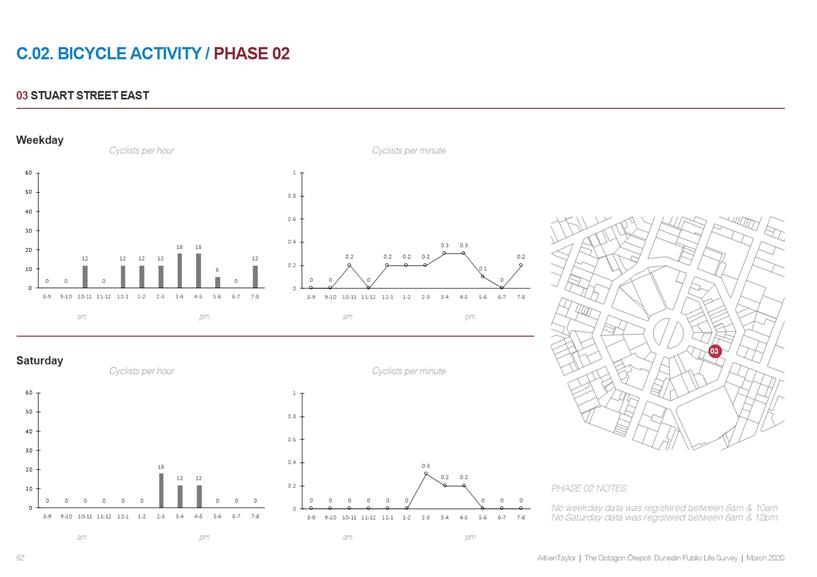

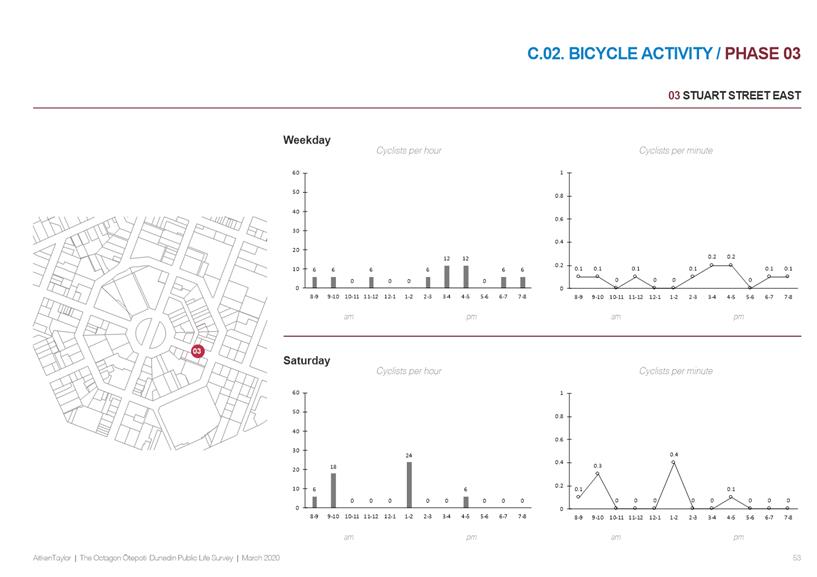

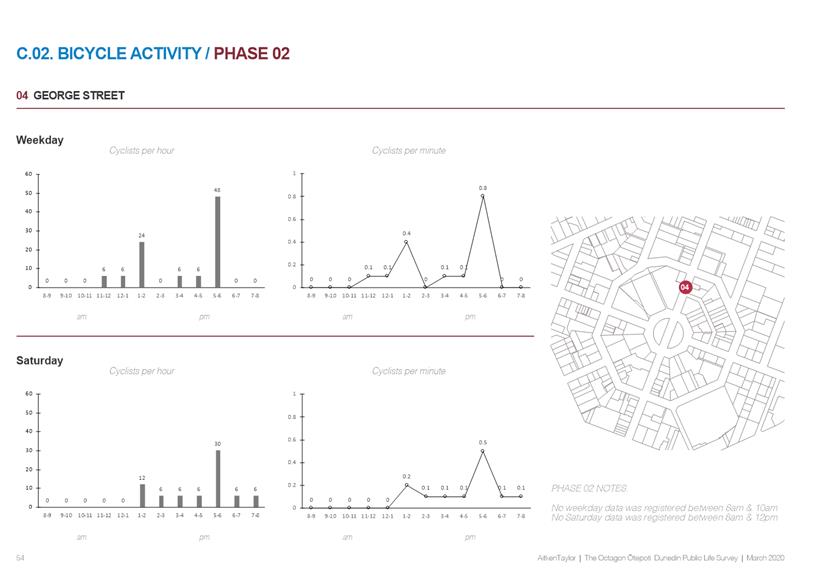

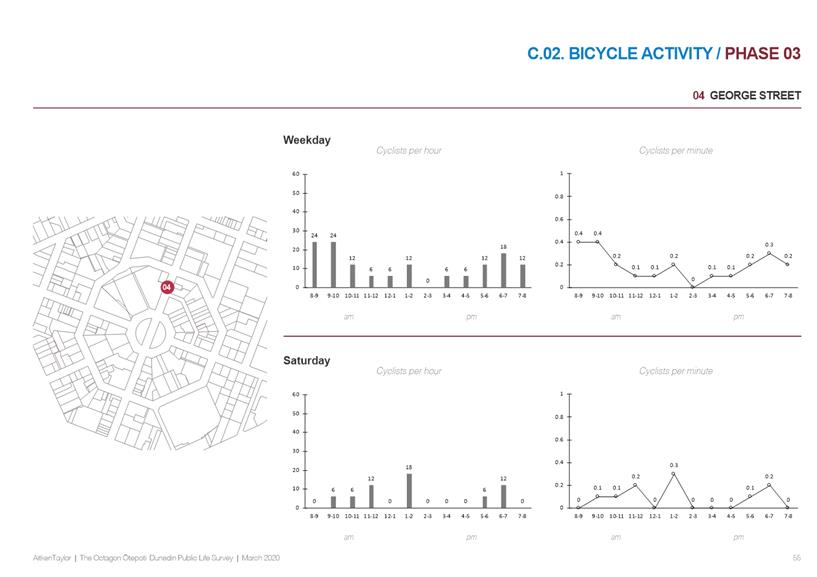

Marie Laufiso, Jim O'Malley, Damian

Newell, Conrad Stedman, Andrew Whiley, Kate Wilson and David Benson-Pope (12).

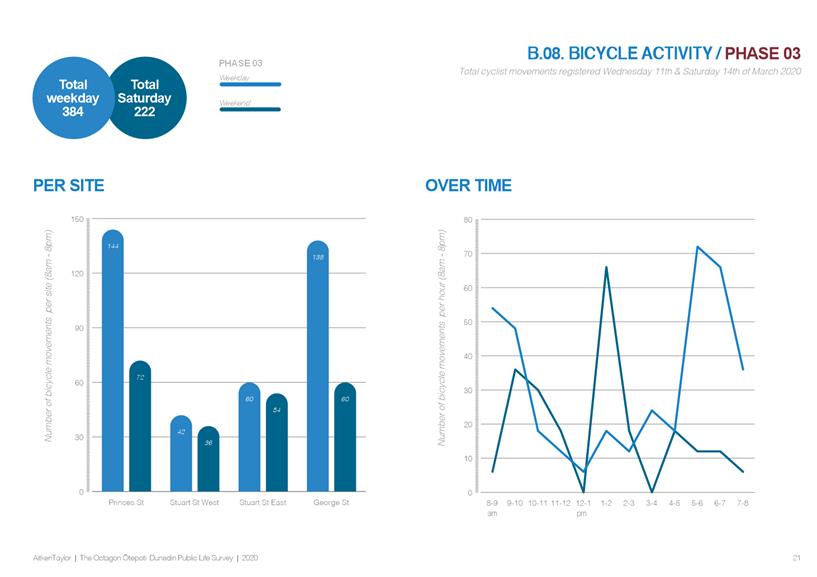

Against: Crs Mike Lord and Lee Vandervis

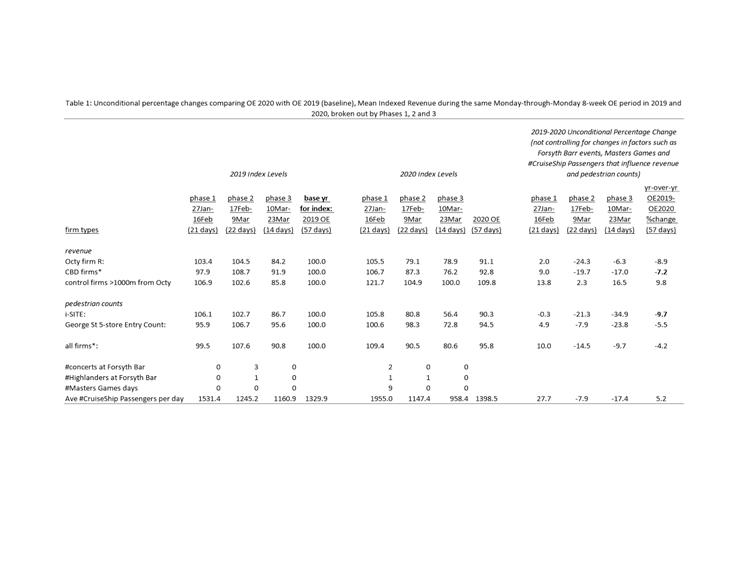

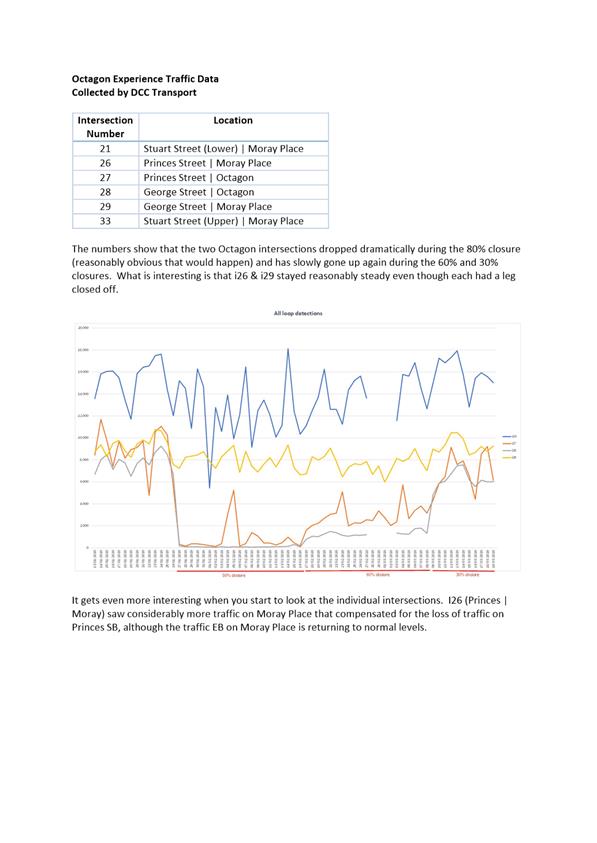

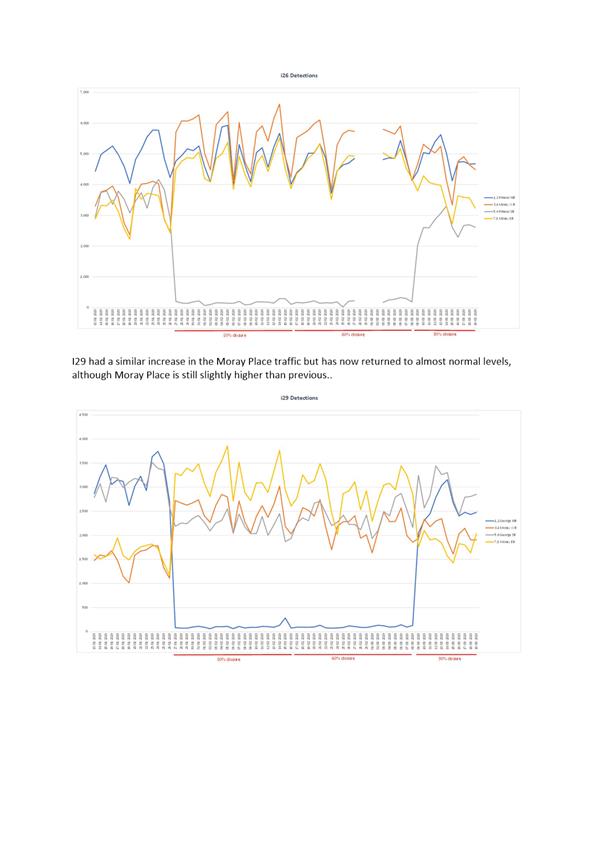

(2). The division was declared

CARRIED by

12 votes to 2.

7 In

May 2018 when Council considered the community feedback on the 10 Year Plan,

there was discussion on trialling of pedestrianisation treatments within the

Octagon and extents within Moray Place including the lower Octagon and Lower

Stuart Street over the next two years. The discussion included trialling

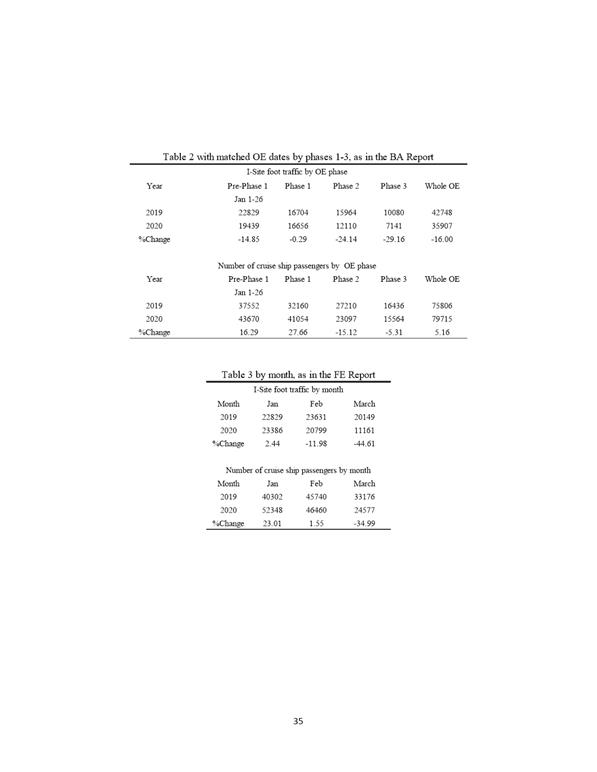

treatments that could inform permanent change identified within the Central

City Plan, informing the George Street project and conducting a trial of

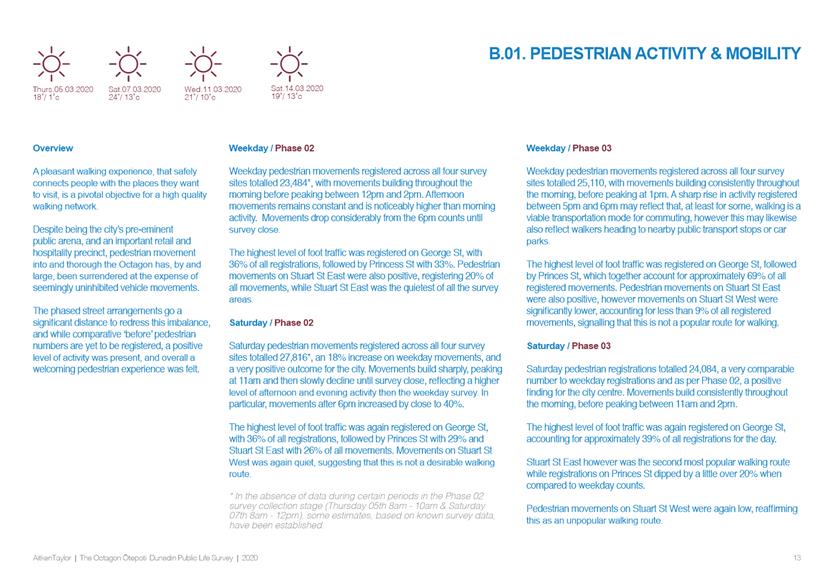

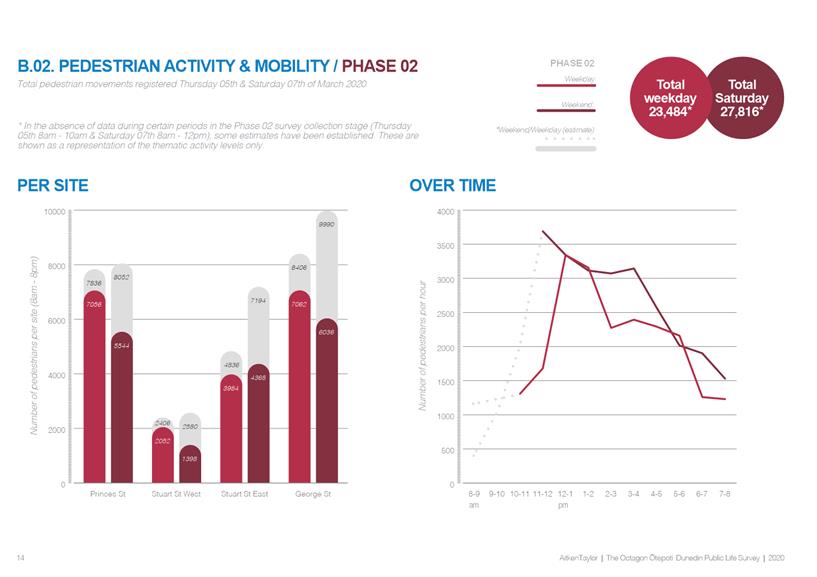

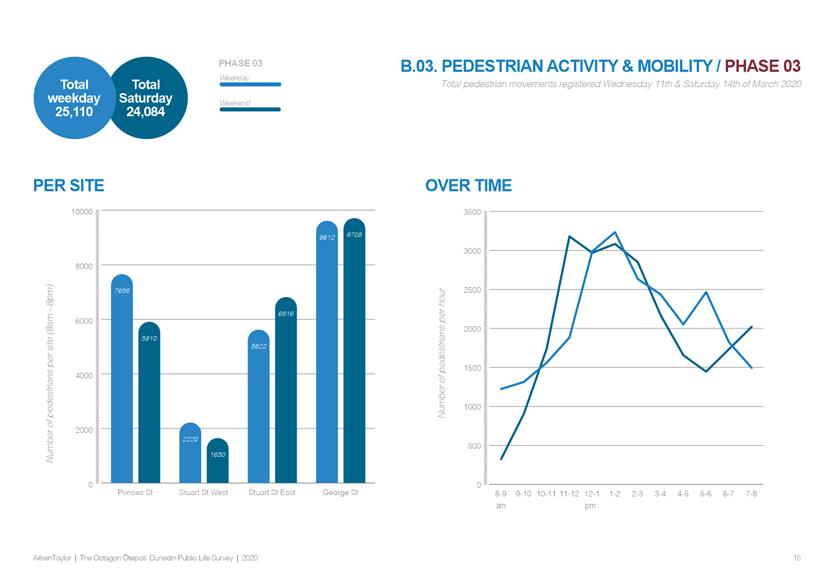

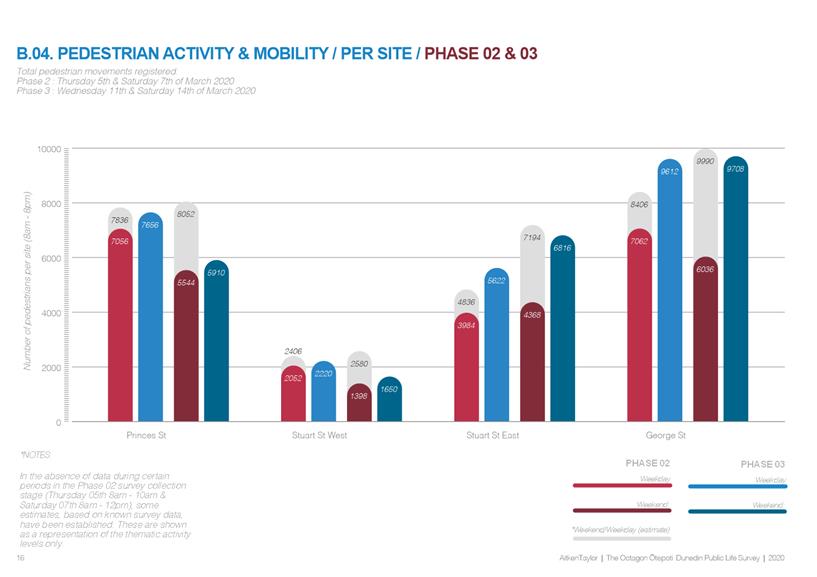

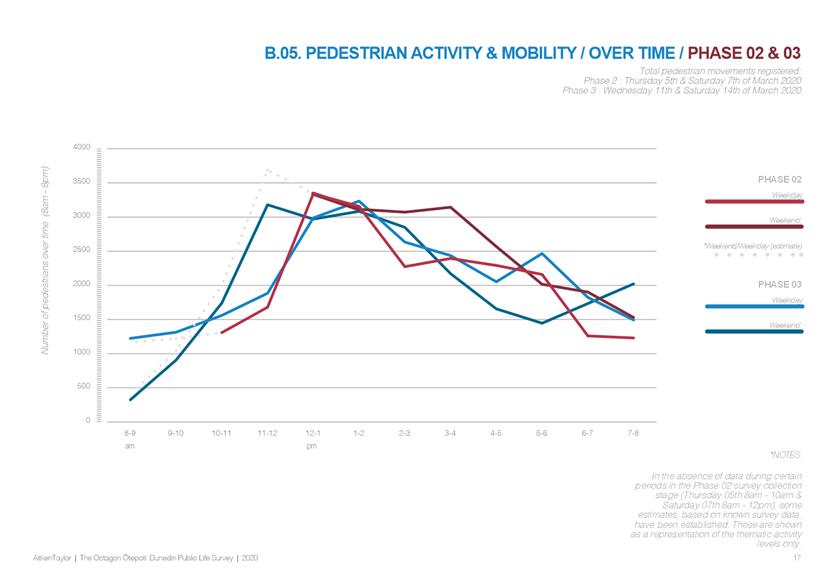

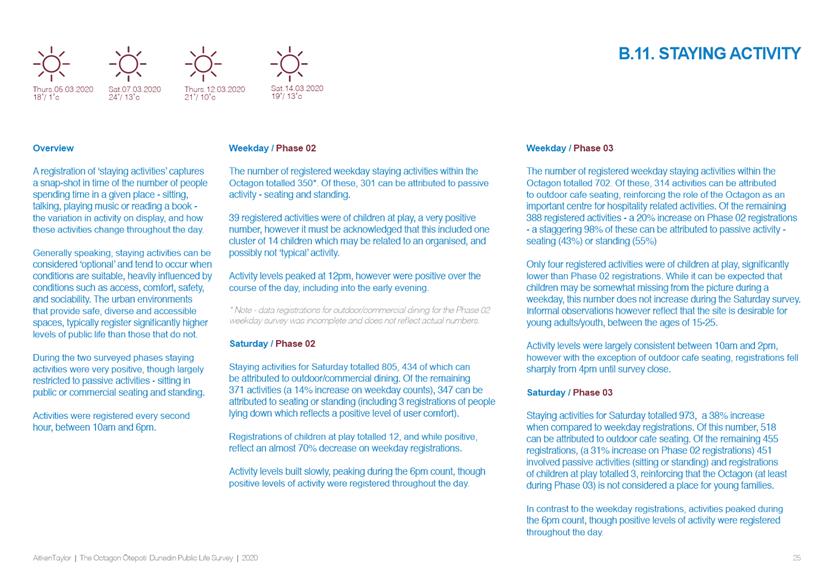

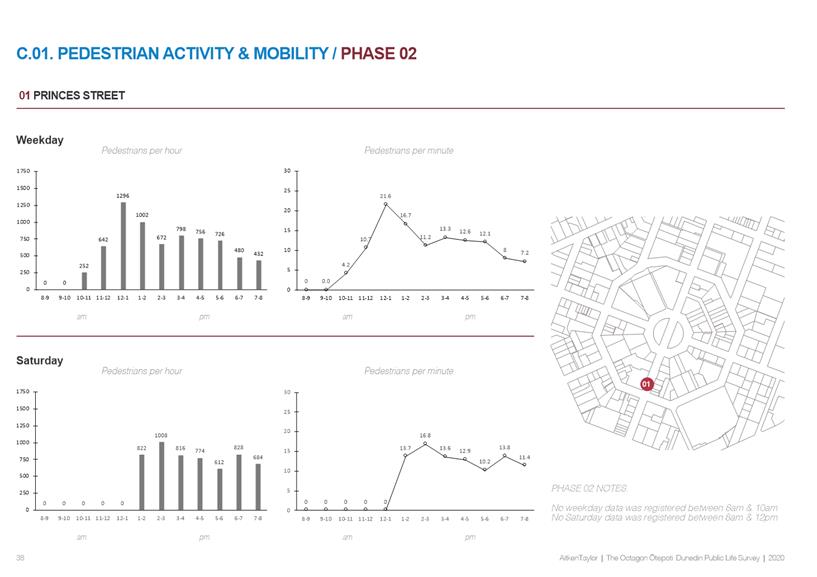

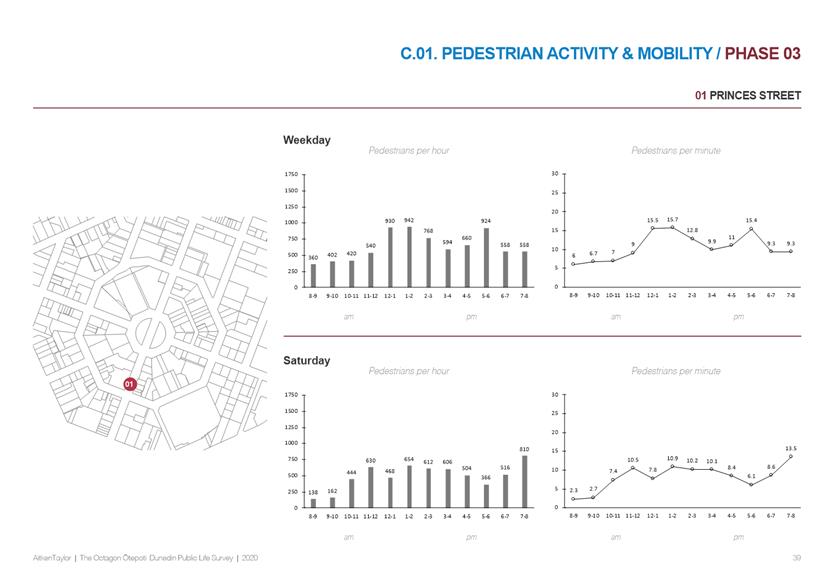

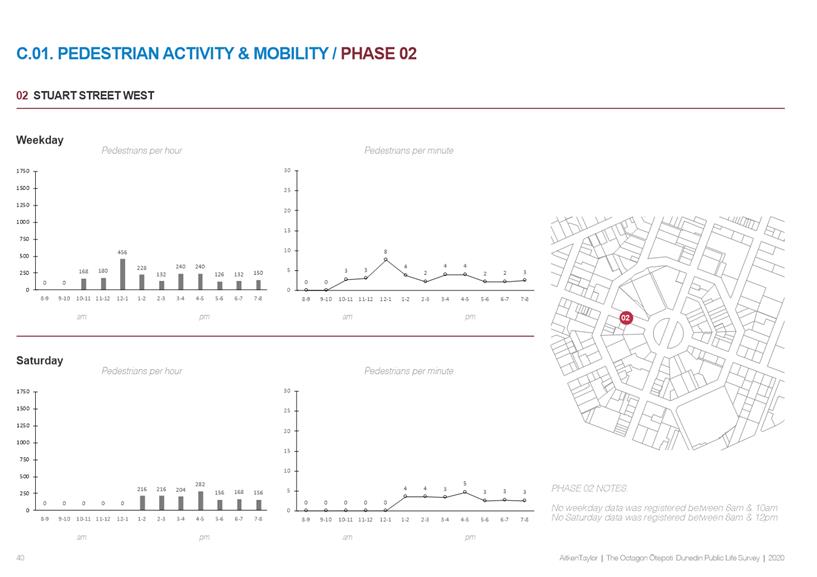

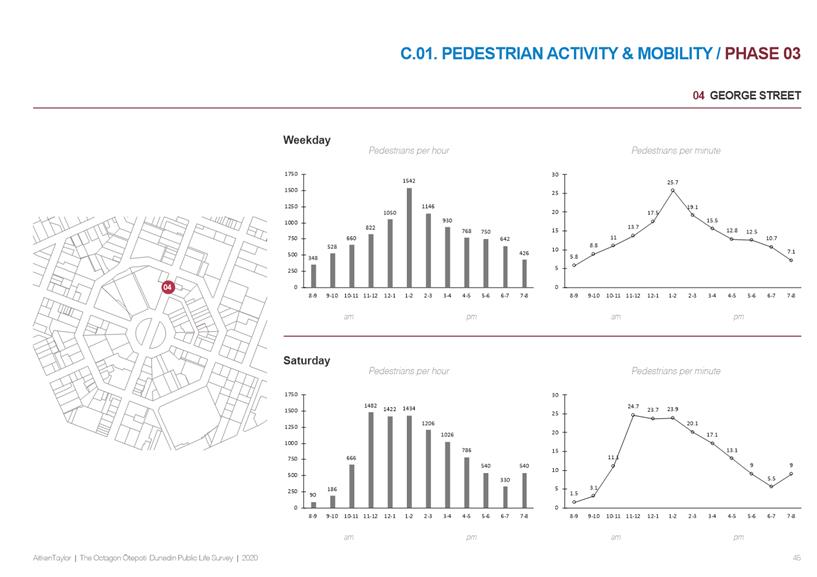

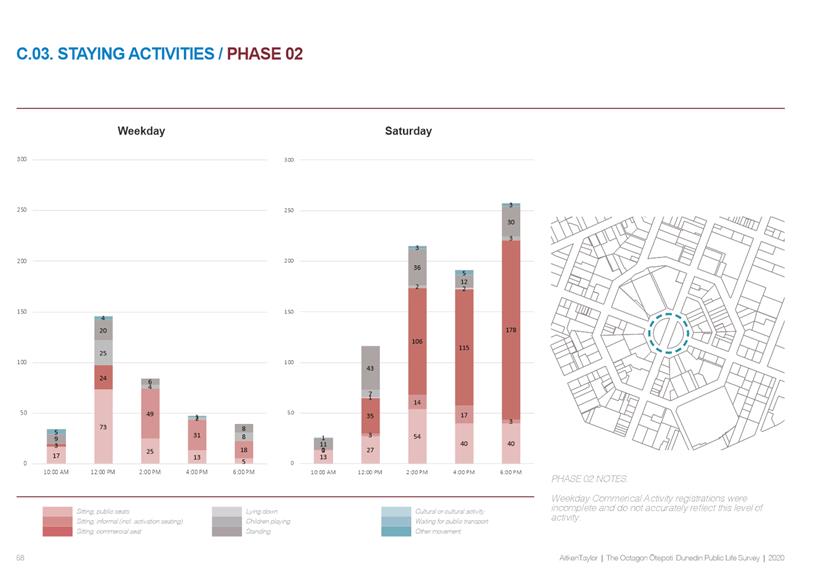

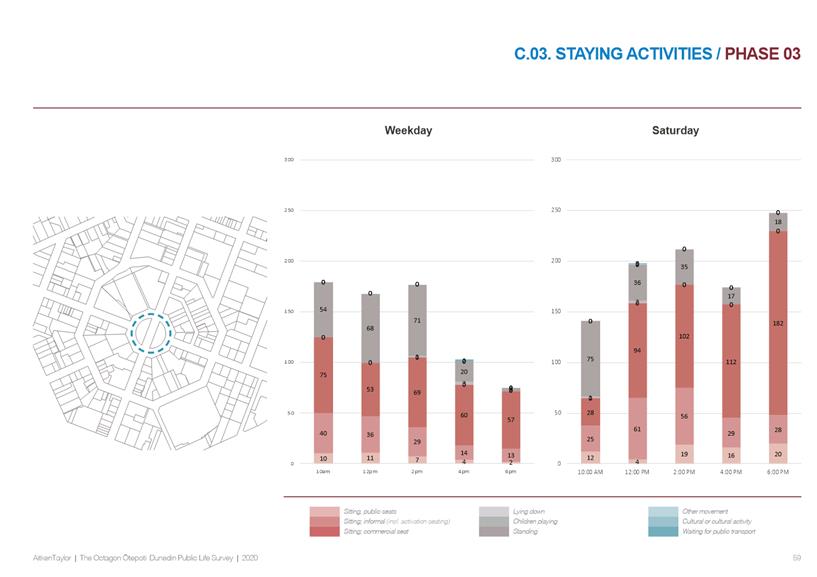

pedestrianisation and assess its impacts. The discussion resolved to trial a

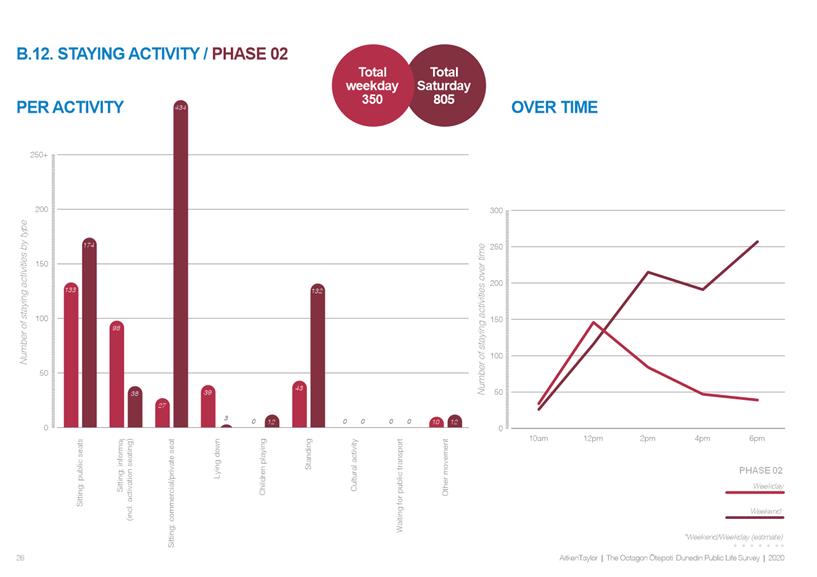

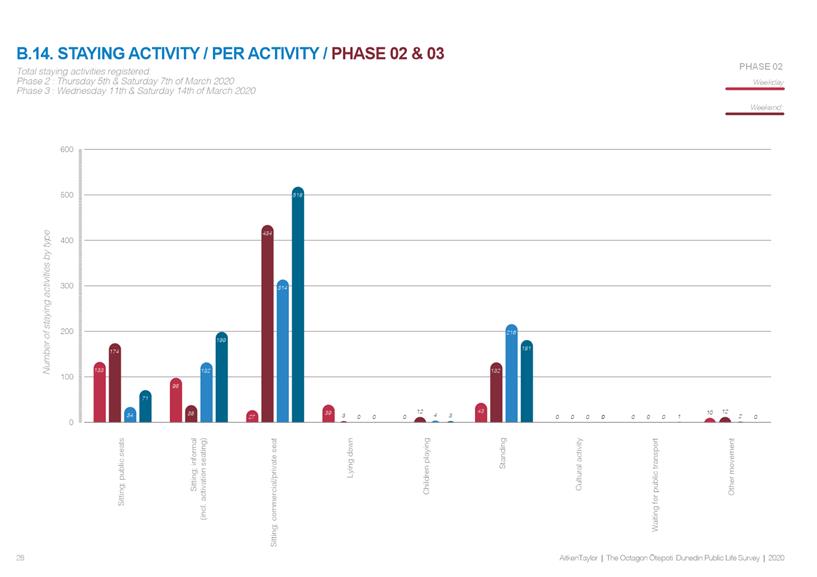

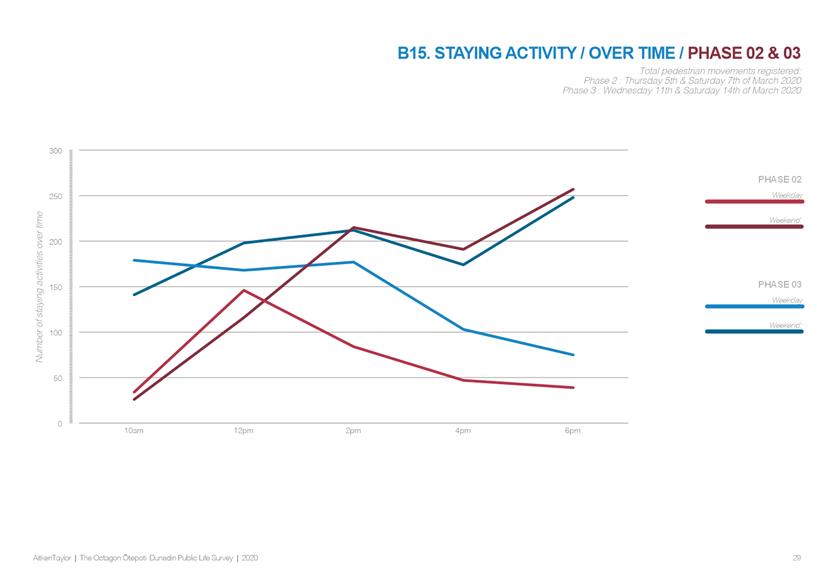

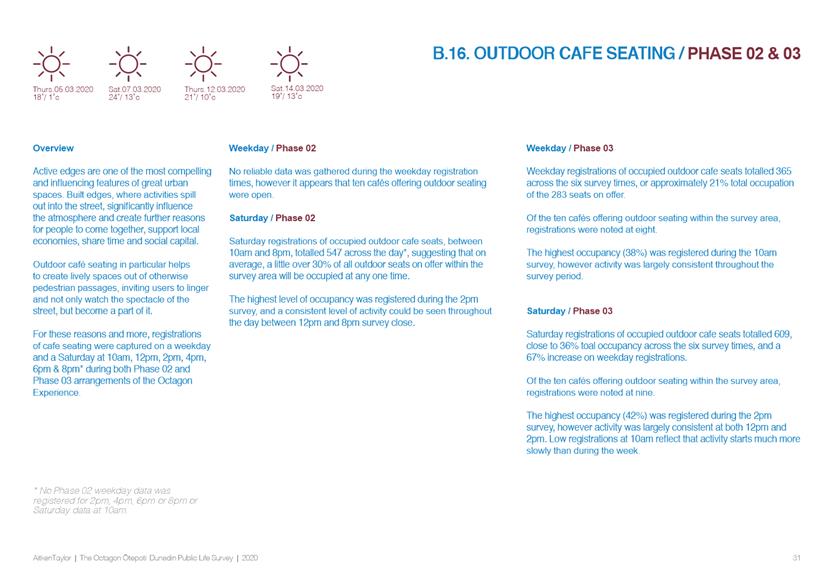

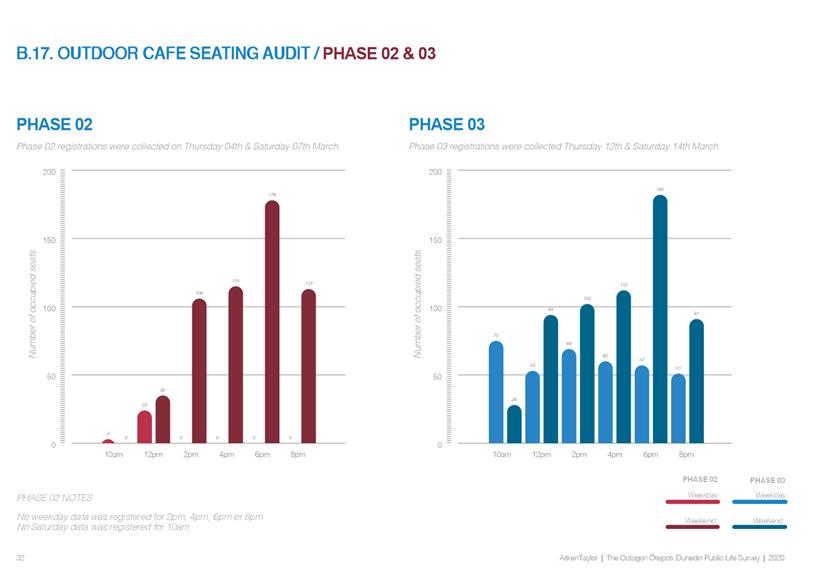

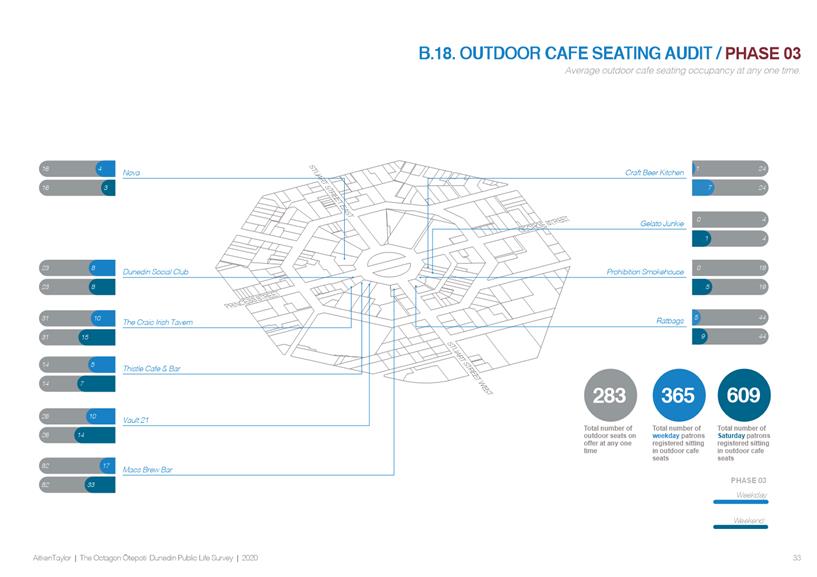

number of interventions’ in order to ascertain a future layout of the

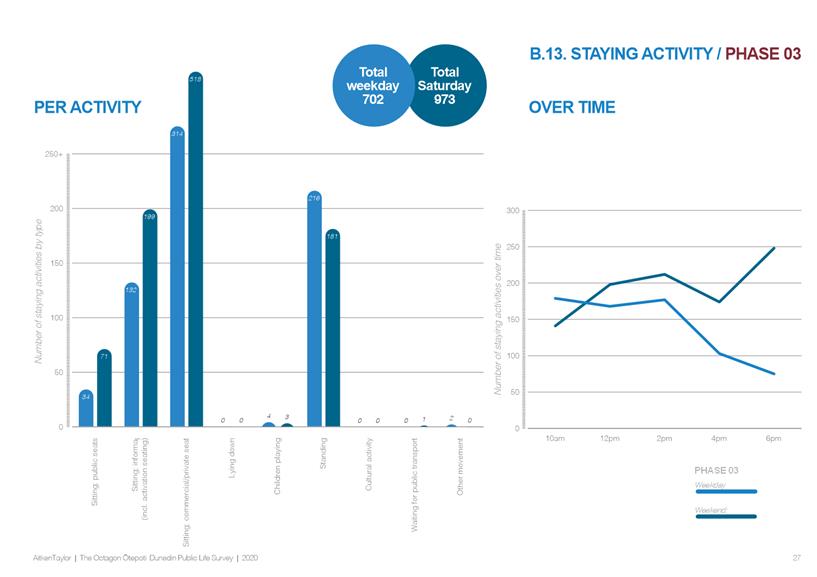

Octagon. The Council passed the following resolution:

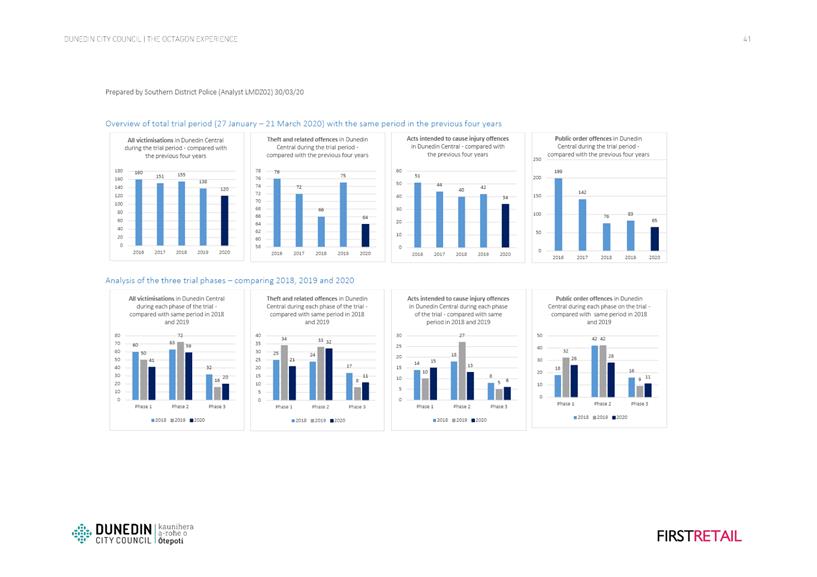

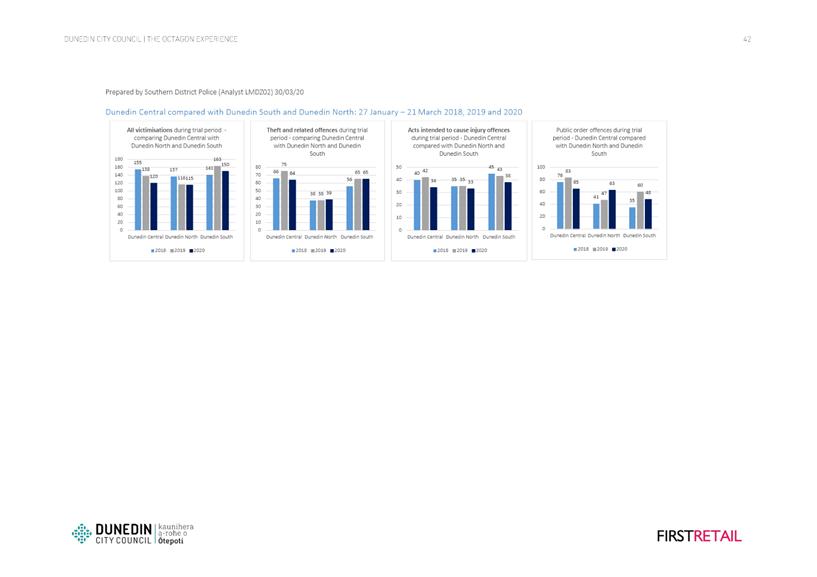

Moved (Cr Aaron Hawkins/Cr Damian Newell):

That the Council:

a) Allocates $75,000 a year to the operational Community and Planning budget in 2018/19 and 2019/20 to support pedestrianisation trials, and associated

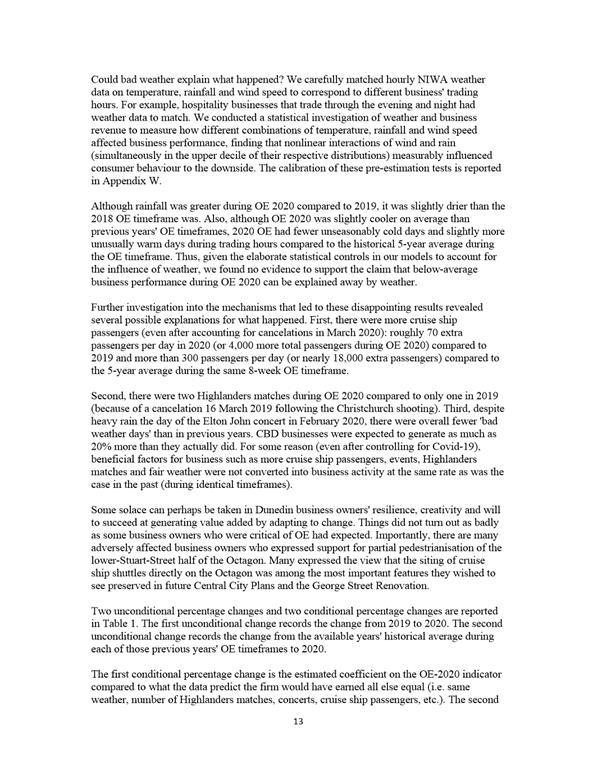

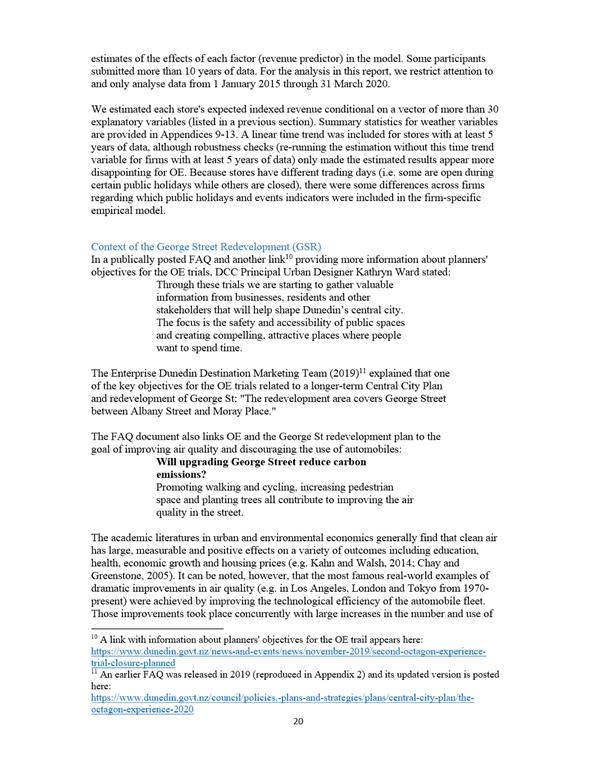

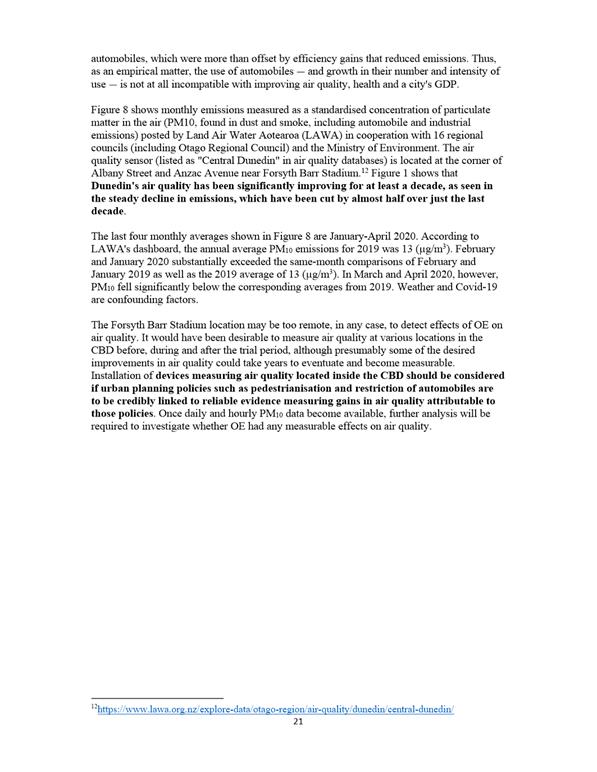

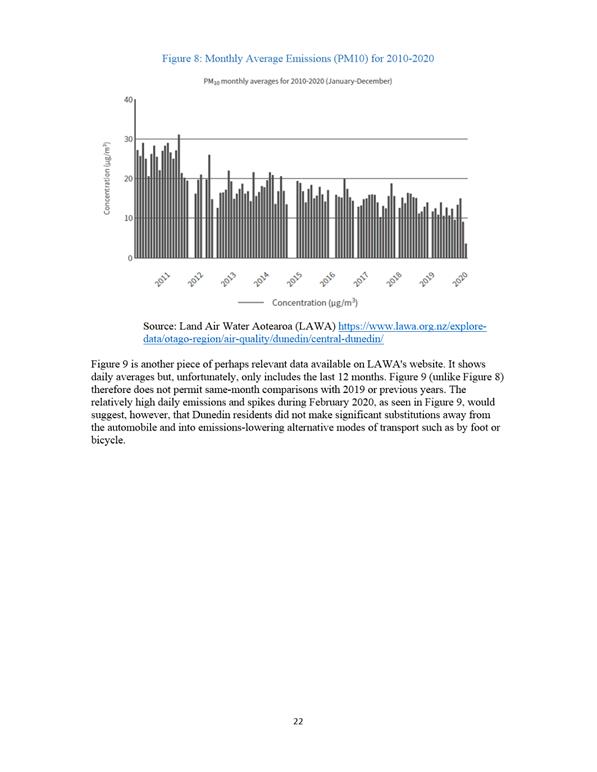

activities in the lower Octagon

and Stuart Street.

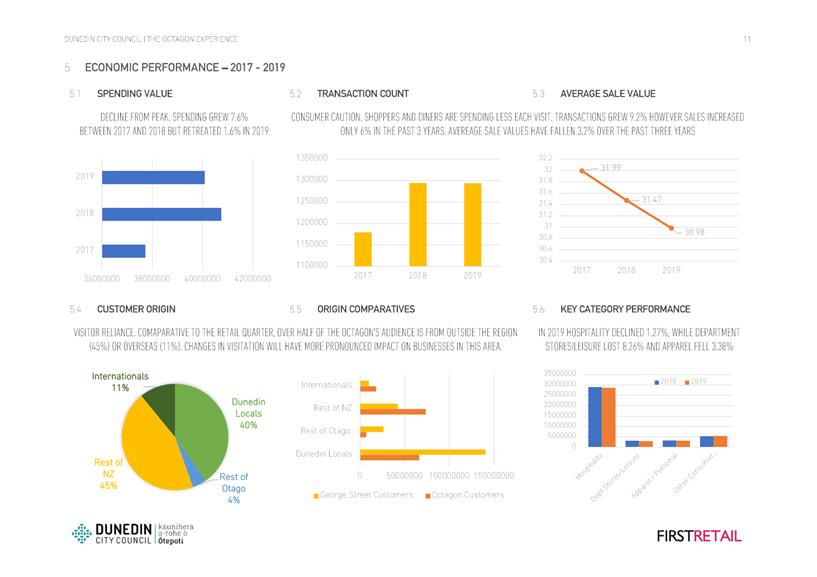

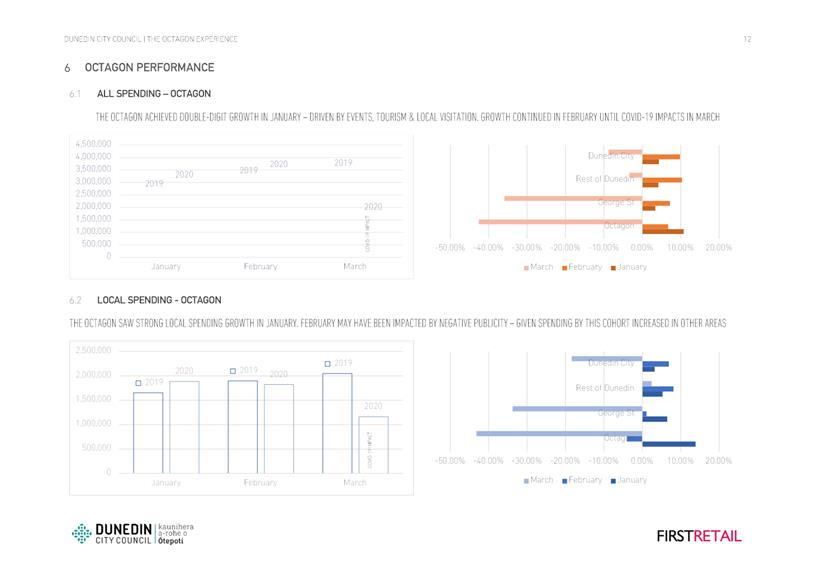

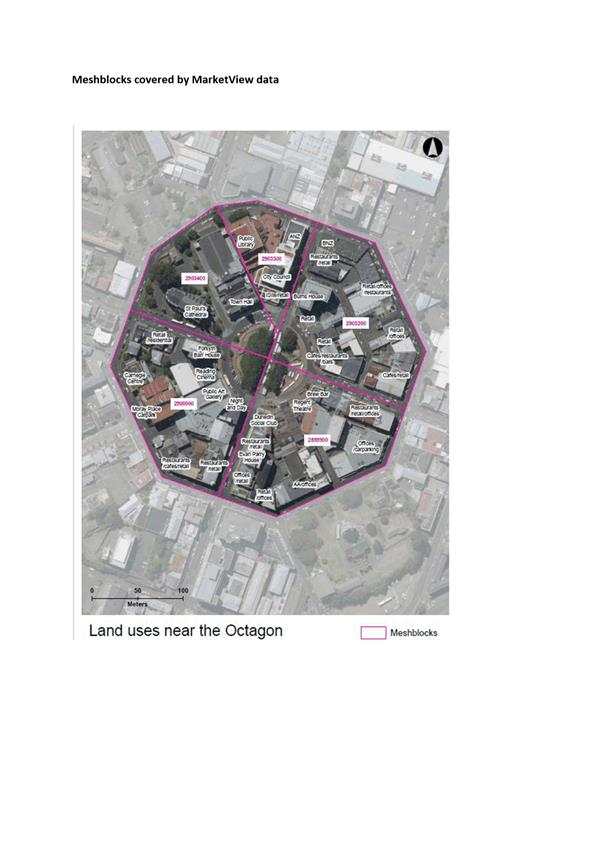

Division

The Council voted by division.

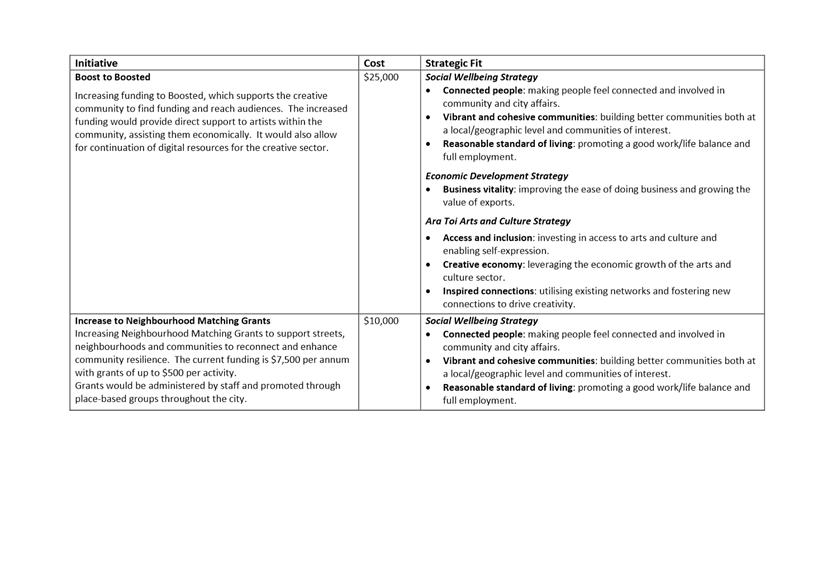

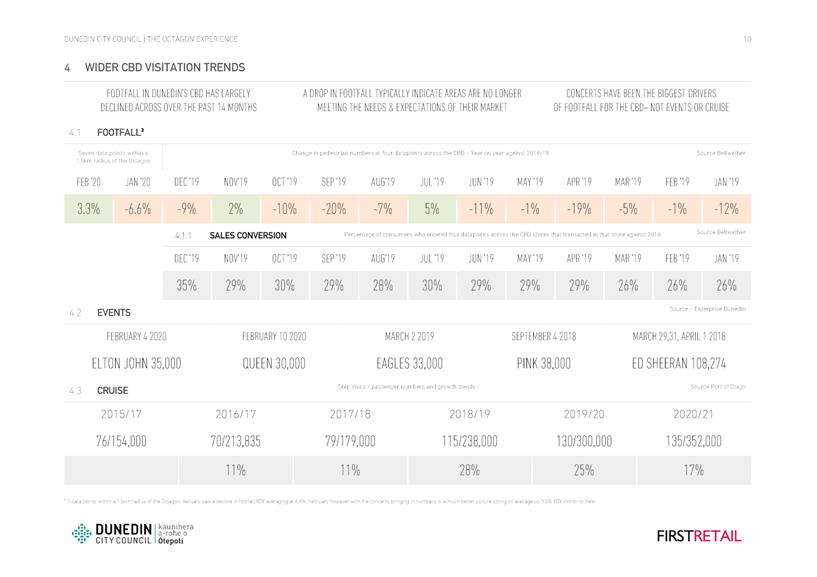

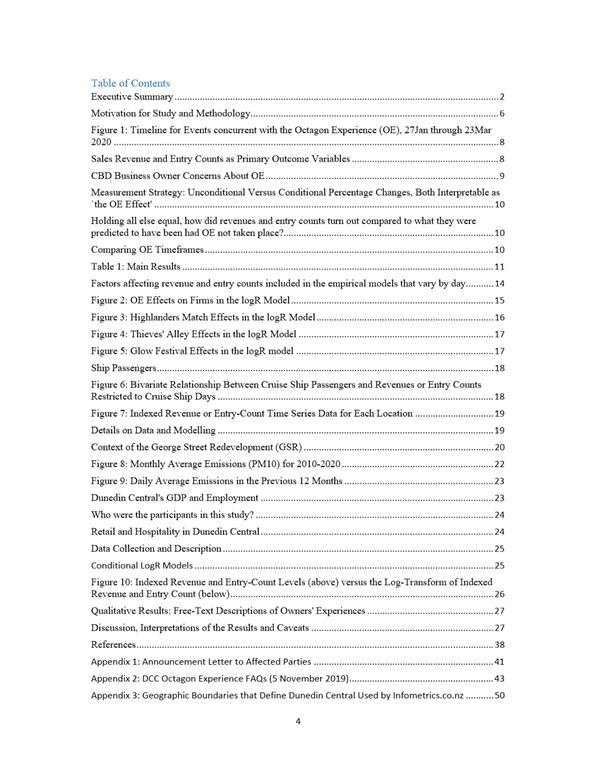

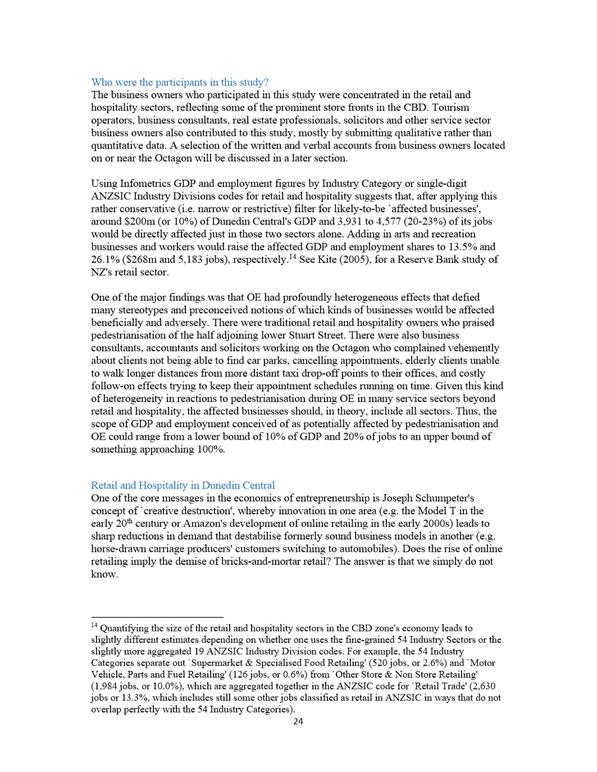

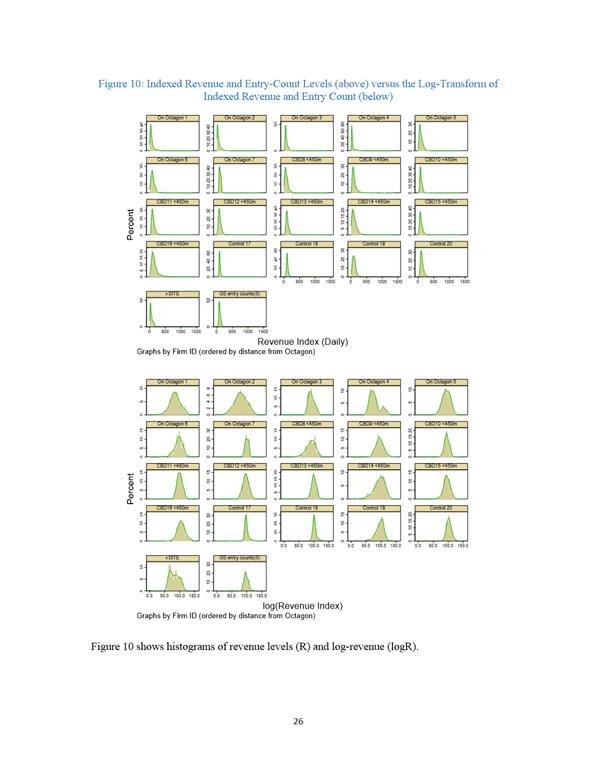

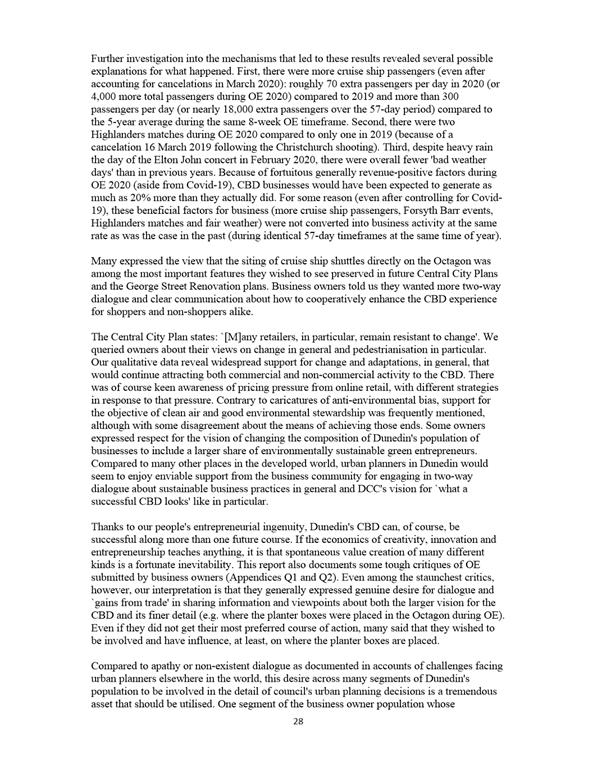

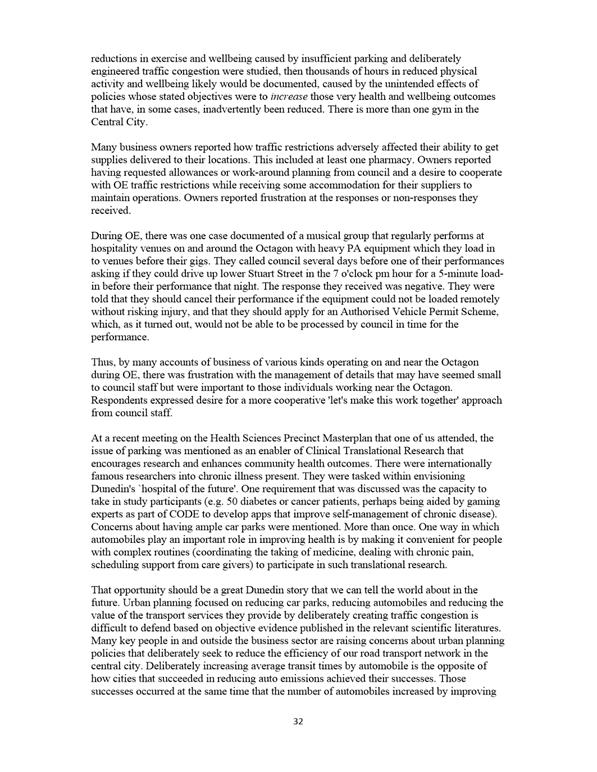

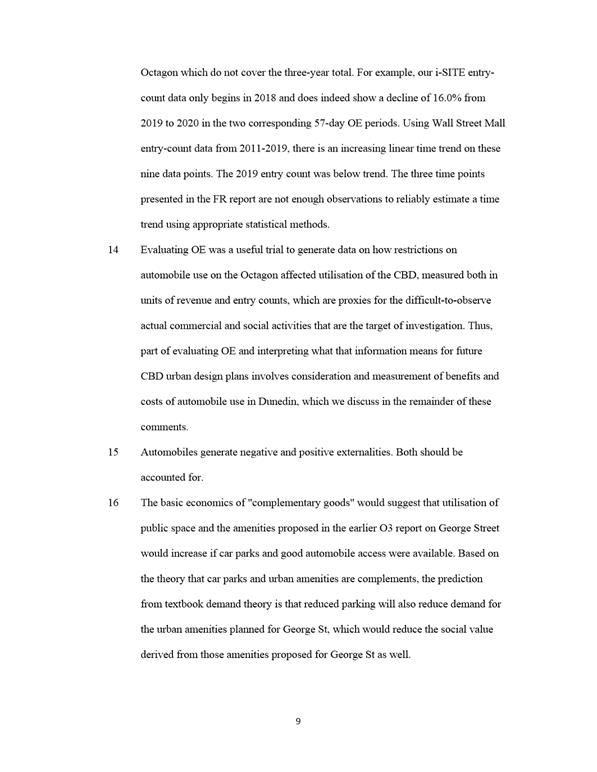

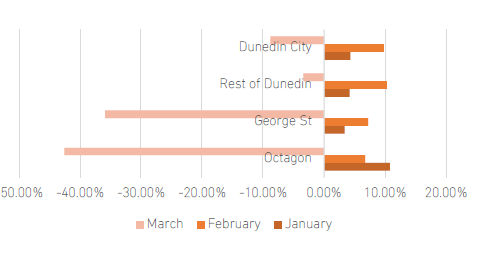

For: Crs David Benson-Pope, Rachel Elder, Christine

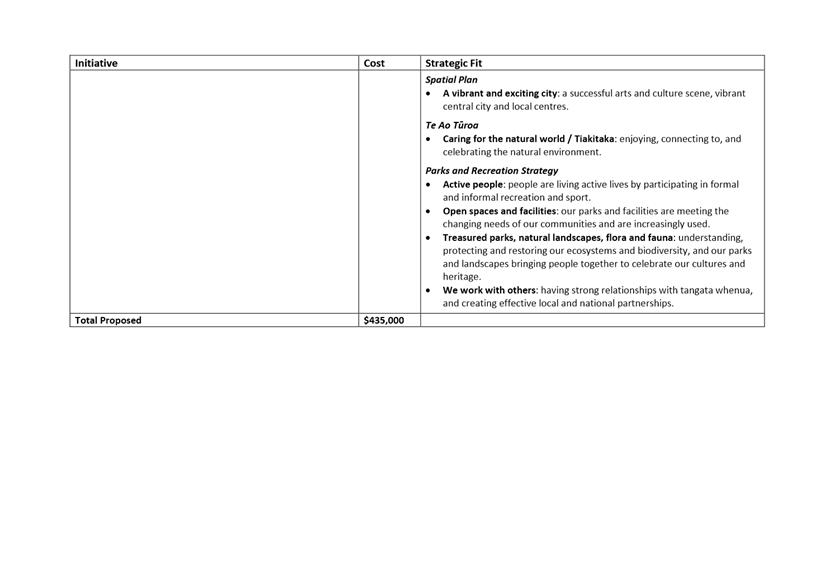

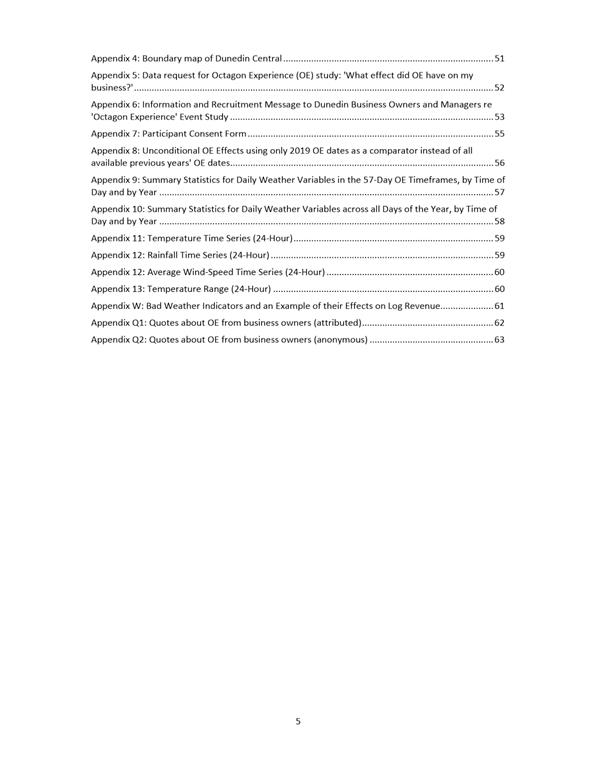

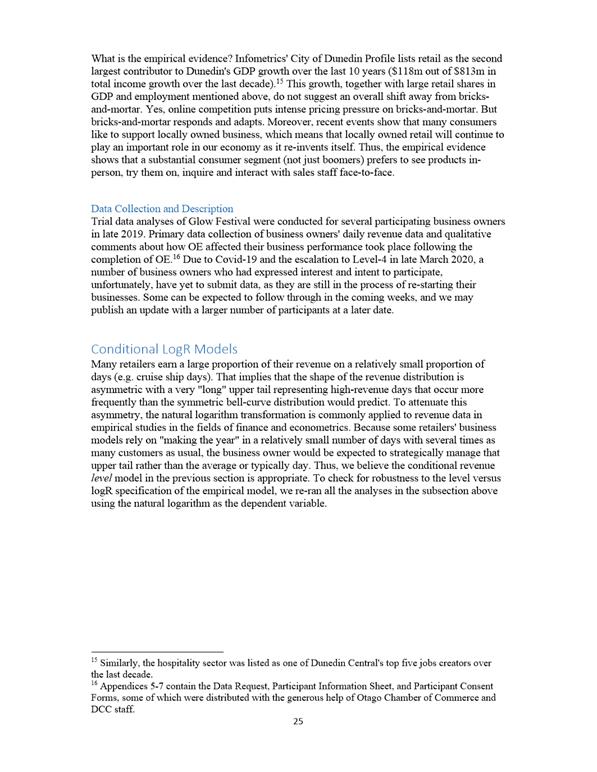

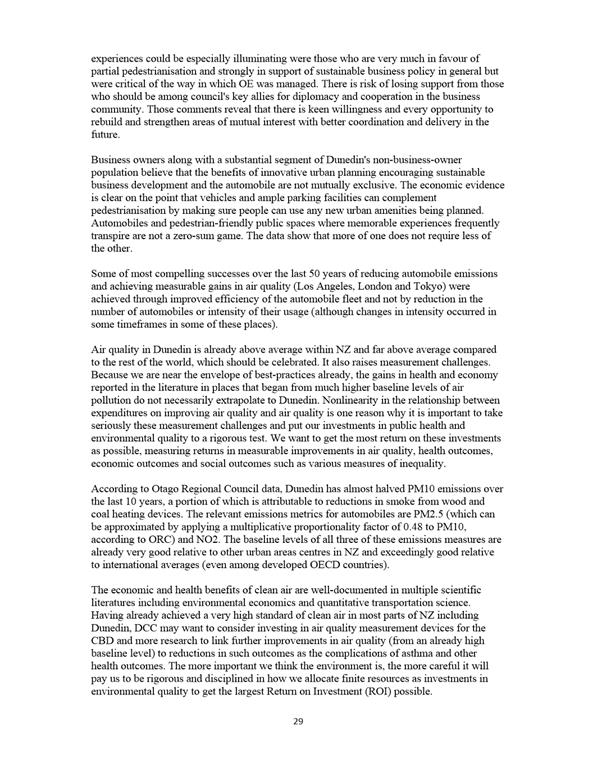

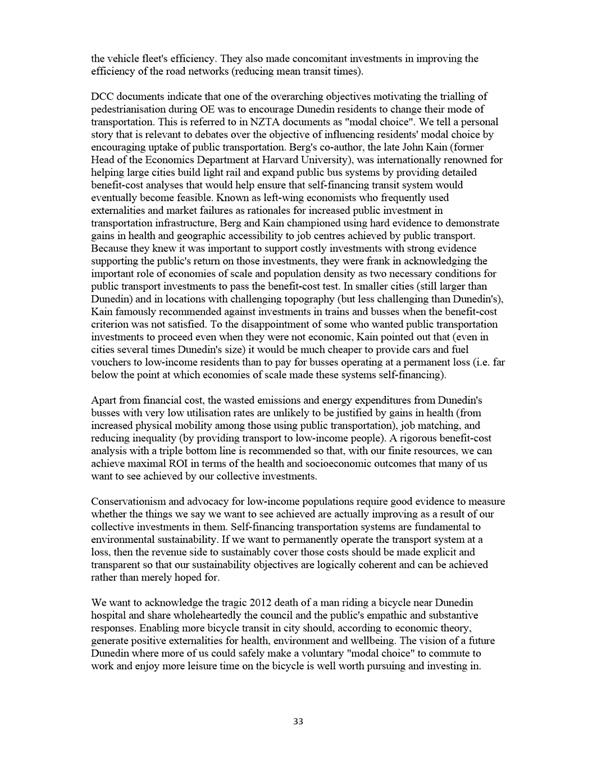

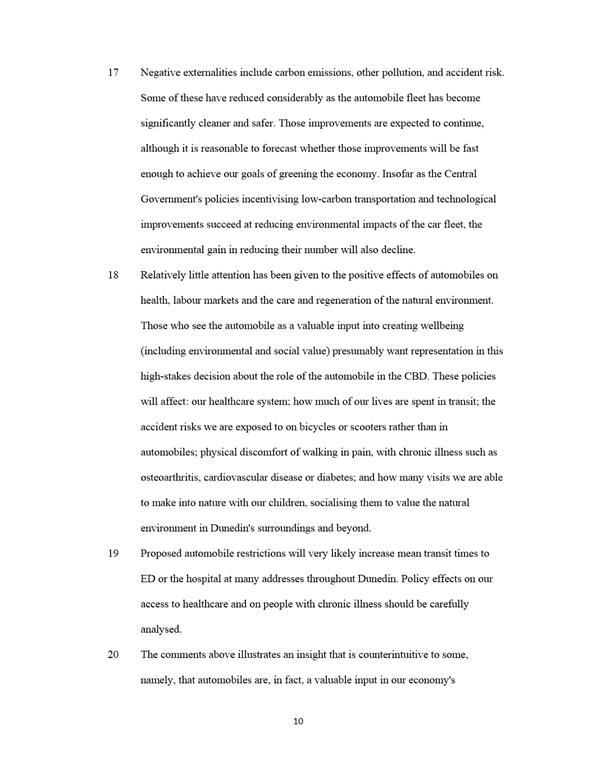

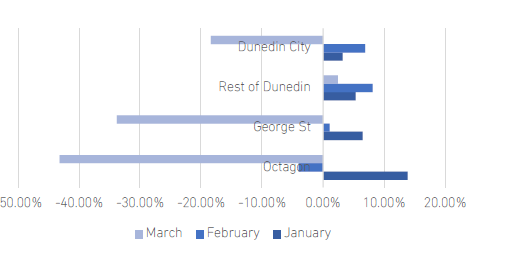

Garey, Doug Hall, Aaron Hawkins, Marie Laufiso, Mike Lord, Damian Newell, Jim O'Malley, Chris Staynes, Conrad Stedman, Andrew Whiley, Kate Wilson and Mayor Dave Cull (14).

Against: Cr Lee Vandervis

(1).

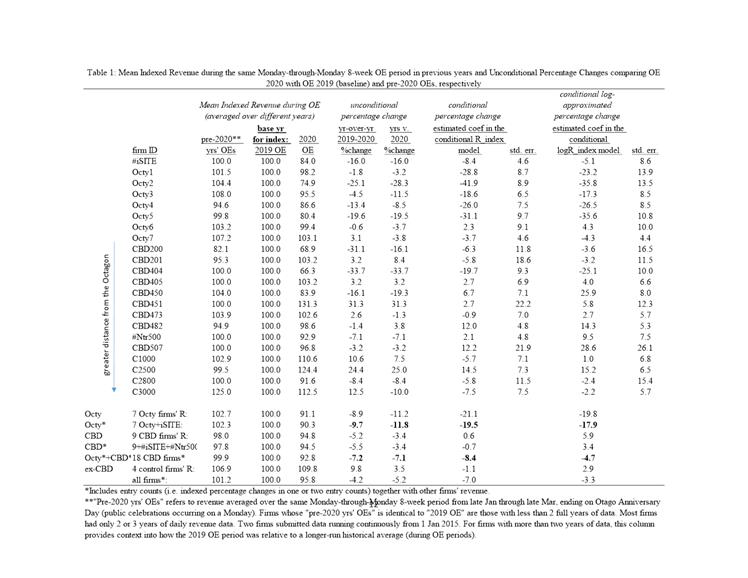

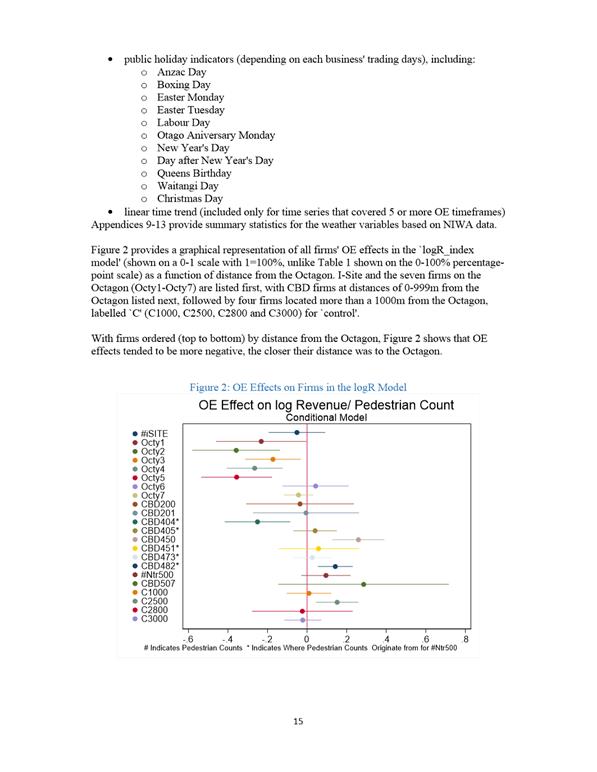

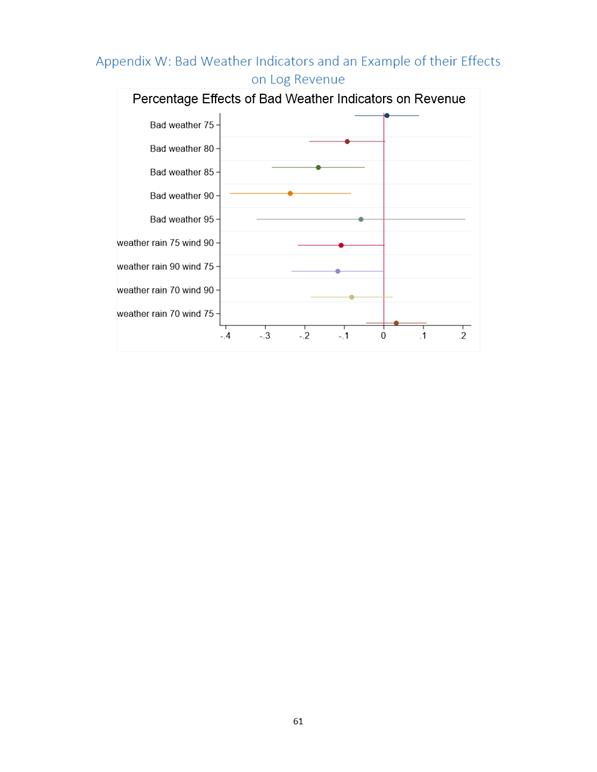

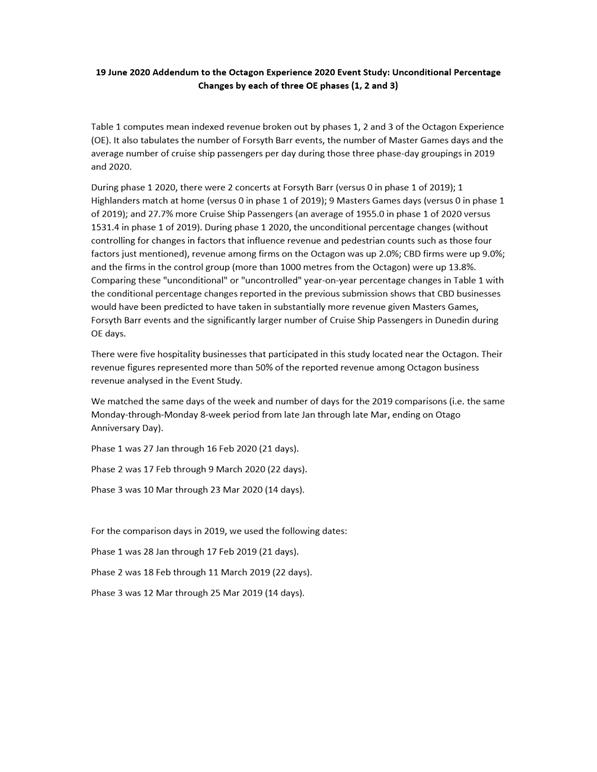

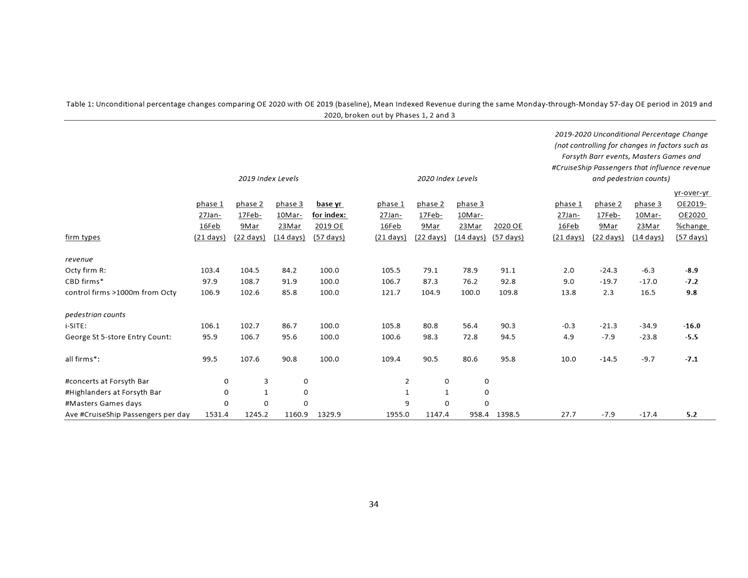

The division was declared CARRIED by 14 votes to 1

Motion carried (TEN/2018/041)

8 A

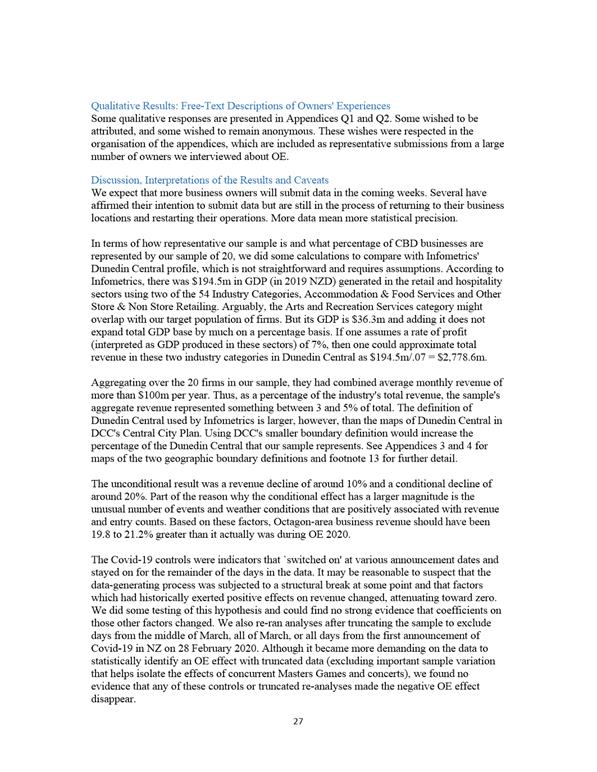

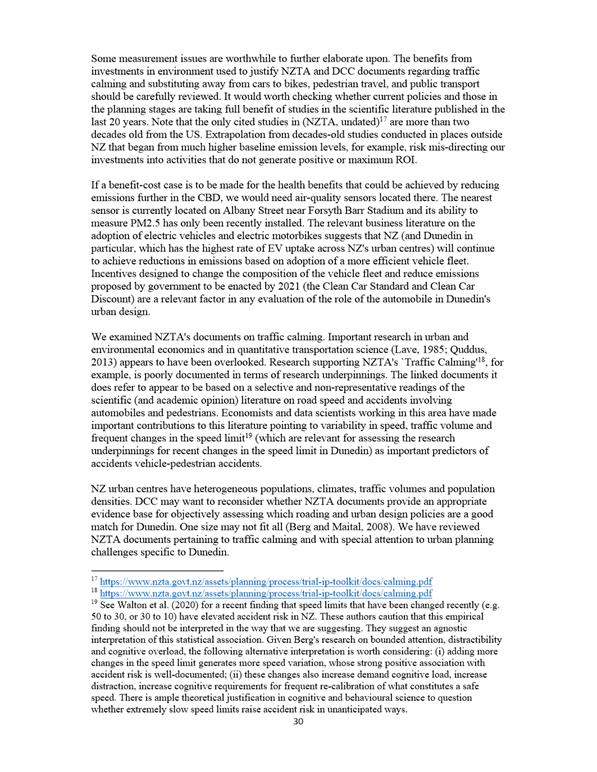

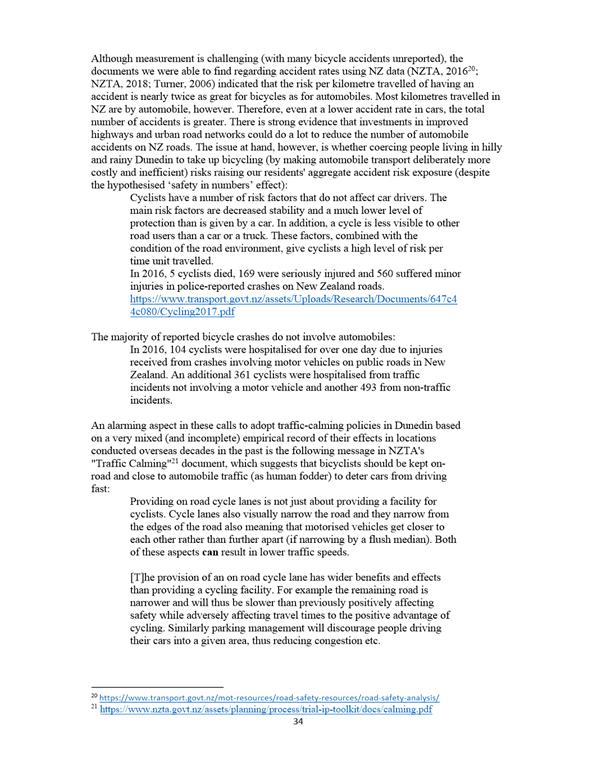

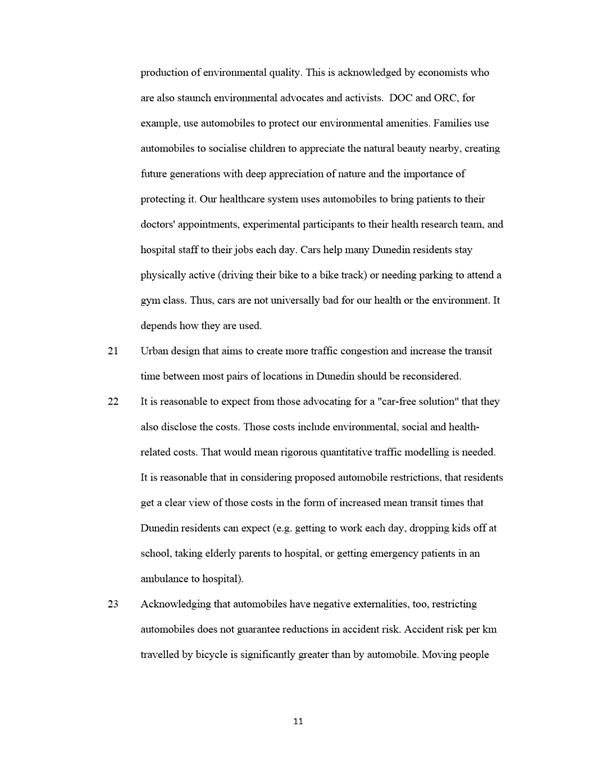

Notice of Motion considered by Council in December 2019 is discussed under

engagement (paragraph 24).

Purpose of the Trials

9 Following

the success of the Ed Sheeran weekend trial in autumn 2018, the purpose of the

Octagon Experience was to trial a range of layouts and pedestrianisation

treatments within the Octagon, together with activation by events and family

friendly activities, and assess their impacts. The trials were to explore how

pedestrian friendly layouts activated with placemaking features and artistic

interventions, could be used to enhance the vibrancy and vitality of the

Octagon, increase footfall and support commercial activity. The intention was

that the findings could inform a future layout of the Octagon and potentially

inform other changes proposed.

10 The

summer timing was chosen because it enabled the collection of peak season data

(previously all data has been collected in autumn). In addition, the number of

scheduled events provided the opportunity to create a summer programme, and

harness the visitor economy to improve the experience of the CBD for all.

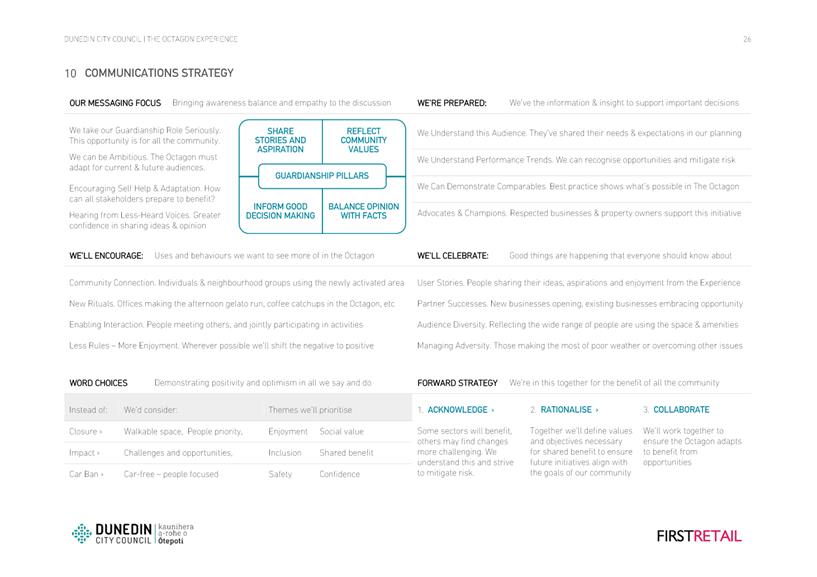

Planning for the trials

11 The

initial planning for the Octagon Experience was underway in May 2019 when the

potential to site the NZ Masters Games hub in the Octagon and coordinate the

Octagon Experience pedestrian trials with the city events programme was

identified. The Masters Games Trust was looking to reinvigorate the Games hub

and the Octagon Experience was seen as providing that opportunity.

12 As

outlined in the Masters Games report, when the Masters Games Village was

previously located at Logan Park many participants chose to head to the CBD in

the evenings. Siting the Masters Games within the CBD was seen by the Dunedin

Masters Games Trust as an opportunity to showcase the largest multi-sport event

in New Zealand.

13 Discussions

with the Masters Games and a cross-Council Working Group led to the Octagon

Experience being developed in September 2019. This proposal to trial partial

Octagon closures alongside the events programme was considered by ELT in

September 2019. This was the same decision making process followed with the

trials for Ed Sheeran weekend.

14 The

Masters Games Hub was designed to provide a nine-day “experience”

for entrants, residents and visitors. The hub consisted of an entertainment

stage, large screen for viewing Games events and a tent. Built over the lower

Octagon the tent was open at the front and sides, allowing bar and café

patrons to watch the activities. The Masters Games hub also included a medal

podium, merchandise pop up and small marquees.

15 The

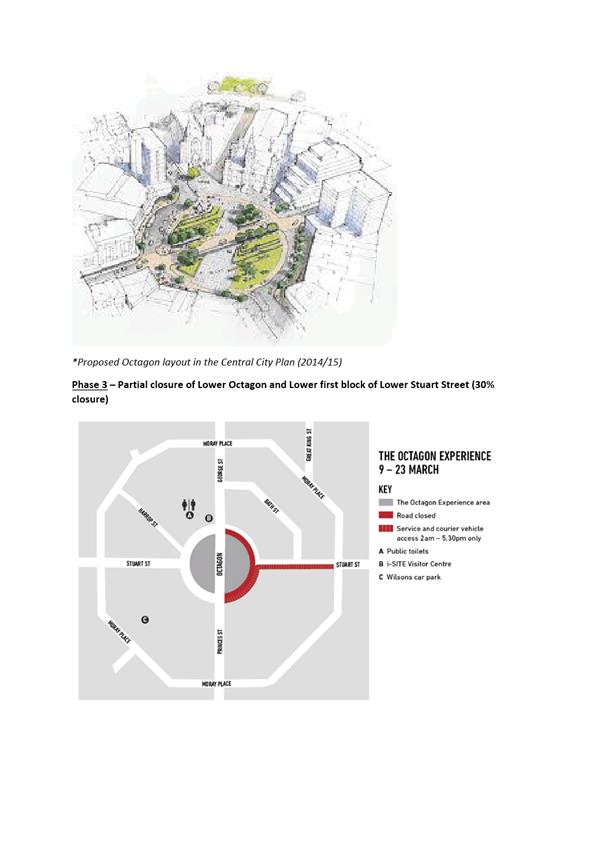

proposal included trialling three layouts of the Octagon, guided by the Global

Street Design Guide’s recommendations. The original plan was to increase

the degree of closure incrementally from 30% closure moving to 60% closure and

then 100% from December 2019 to February 2020, finishing the Octagon Experience

with the events programme. However, once the complexity of accommodating the

Master Games and cruise ship shuttles within the Octagon was factored into the

planning, this phasing was not possible.

16 The

revised plan was to trial three options: starting with 80% closure, 60% closure

and 30% closure around a revised timeframe (1 Feb 2020 – 23 March 2020).

The first phase was designed to accommodate large scale events (i.e.

Masters Games and activations for Elton John and Queen concerts) and increased

pedestrian space. The second phase layout was the design proposed in the

Central City Plan (2014). It involved creation of a “shared space”

treatment with space for all vehicles and some areas for pedestrians only. The

third phase was focused on the Lower Octagon and Lower Stuart Street.

17 The

layouts proposed increasing public space for recreation to varying degrees;

addressing transport objectives of slowing traffic and through movement of the

Octagon; and placemaking to provide family friendly activation. The aim of

proposing the layouts concurrently was so each layout could be compared by the

community and stakeholders, while measuring impacts of various scales across

the project objectives. The duration of each layout was as per the design guide

with two/three week duration per layout allowed in order to assess impacts of

change following adaptation to a new traffic management layout.

Consultation /

engagement

18 Consultation

on the proposal commenced in November 2019 and continued throughout the Octagon

Experience. The plan was set out in the communications and engagement strategy

for the Experience.

19 The Octagon

Experience trials were promoted through a range of means, including:

· Media release

· Advertising in the

ODT and on radio

· Social media,

including DCC Facebook page and My Little Local

· Posters within the

Octagon and flyers in businesses

· NZ Masters Games

information for participants.

20 Staff

visited businesses in the Octagon and surrounding streets to talk through the

proposals. Letters were sent to tourism companies. Meetings were held

with tourism providers, Chamber of Commerce, local business owners, access

forum representatives and property owners. Discussions were also held with the

two Octagon Market providers who utilise the Octagon on cruise ship visitor

days.

21 The

affected persons process, which is the Council’s standard method of

consulting stakeholders about events and road closures was used. More than 75

businesses were consulted as affected parties. However, the affected persons

process was late in starting due to the number of events involved and the range

of stakeholders involved.

22 As

is common practice for road closures, the decision was taken to limit the

affected parties consultation to properties bordering the closed roads. For

example, it did not extend to Moray Place. However the team responded to

requests across the CBD and across the city and made changes where appropriate such

as changing plans for Princes Street to accommodate cruise ship shuttles and

large scale deliveries for businesses.

24 With

the benefit of hindsight, the affected persons process for the trial closures

should have been better managed and more comprehensive. This process

should have commenced earlier. Future affected persons processes (for one-off

events coordinated by Council or other activities led by Council) will be

implemented differently as more notice and engagement with stakeholders would

have resolved some issues earlier.

25

The engagement generated much community interest and at the Council meeting on

10 December 2019 Council:

Moved (Cr Carmen Houlahan/Cr

Sophie Barker):

That the Council:

a) Urgently reviews the plans for

Octagon closures

Division

The Council voted

by

division

For: Crs Sophie Barker,

Rachel Elder, Doug Hall, Carmen Houlahan,

Jim

O'Malley, Jules Radich, Chris

Staynes and Lee Vandervis (8).

Against: Crs David Benson-Pope, Christine Garey, Marie Laufiso, Mike Lord, Steve Walker

and Aaron

Hawkins (6).

Abstained: Nil

The

division was declared CARRIED by

8 votes to 6

Motion carried (CNL/2019/072)

b) Discuss the plans thoroughly

with all affected parties weekly.

Division

The Council voted

by

division

For: Crs Doug Hall, Jules Radich

and Lee Vandervis (3).

Against: Crs Sophie Barker,

David Benson-Pope, Rachel

Elder, Christine Garey,

Carmen Houlahan,

Marie Laufiso, Mike Lord, Jim O'Malley, Chris

Staynes, Steve Walker and Aaron Hawkins (11).

Abstained: Nil

The division was declared

LOST by 11 votes

to 3

26 Following this resolution urgent meetings were

held with the Chamber

of Commerce, Dunedin

Host, tourism operators

and Ritchies bus company (cruise ship shuttle operators), and a

solution agreed that met the needs of most parties. The resultant changes are described later

in the report. The key change

was agreement that Princes

Street would be the drop-off

and pick up

point for all cruise passengers to allow easy access to retail,

hospitality and the CBD and that tour operators would use the

space in Moray Place in front of the Public Library.

Set up and transition

27 Setup

of the Octagon Experience commenced on 27 January 2020. Temporary traffic

management was put in place including orange road cones, to close the road to

traffic in order to allow setup of the stage and elements of the Masters Games.

This setup took 5 days to complete. Traffic cones were replaced with planter

boxes and placemaking items to make the public space more attractive. The

timeframe meant that the Octagon Experience looked messy and confusing for an

extended period of time. The setup was not well executed and this was remedied

with transitions into later phases undertaken at night to minimise disruption

to businesses and the public.

Phases and timing

28 The

layouts for the three phases are described below and are illustrated in

Attachment A. Photographs showing each of the phases in operation are included

in Attachment B.

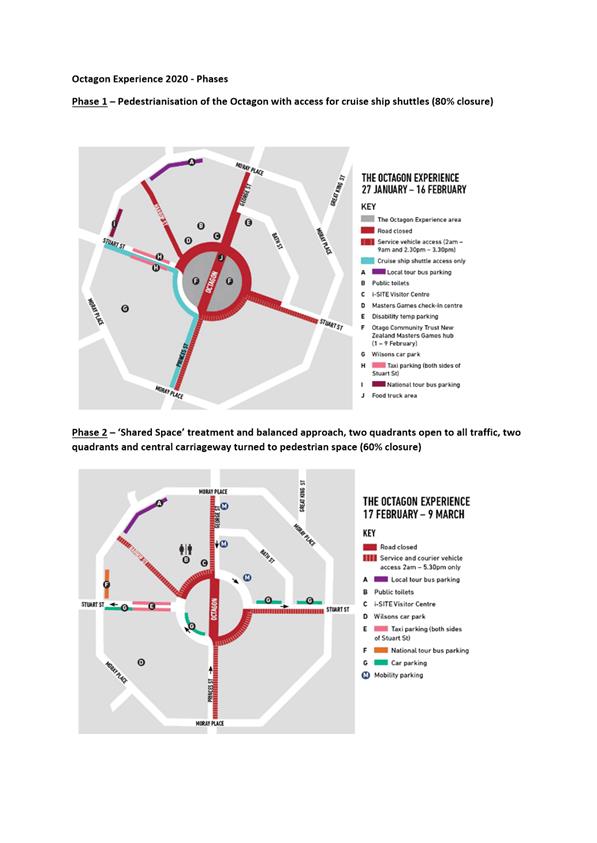

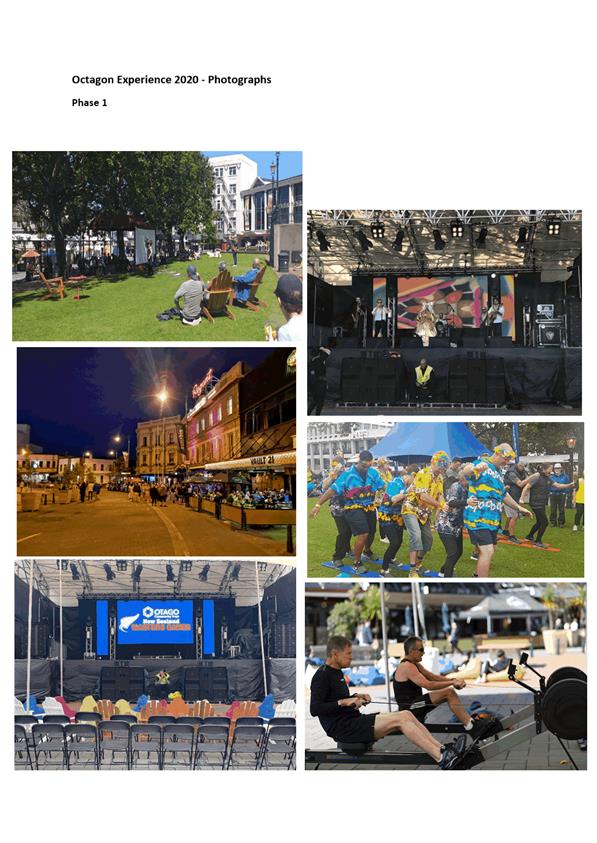

Phase

1 - Pedestrianisation of the Octagon with access for cruise ship shuttles

(80% closure)

29 The

first phase layout was trialled from 27 January to 16 February and

was developed to accommodate the city events proposed including the New Zealand

Masters Games hub. The Masters Games opened on 1 February and included

entertainment each evening which was open to the public. The tent area was an

alcohol-free zone, and the public were able to watch some Masters Games events

in the Octagon. City activations for the Elton John and Queen concerts were

also held. Two annual events (Thieves Alley Market and the Otago

Southland Pipe Band Contest) also occurred within the period and required full

closure. The need to activate these two events added cost count and complexity

to the Octagon Experience detailed more fully later in the report.

30 The

original plan for Phase 1 was intended to involve 100% closure to traffic with

the exception of route and delivery windows for businesses. Following the

Council resolution in December 2020, and consultation with businesses and

cruise ship shuttle operators, this was reduced to 80% closure (as shown in

Attachment A) to maintain shuttle drop-off locations near the Octagon in

Princes Street. (This is discussed in some detail below under Traffic

management.

31 This

layout included removing car parking, relocating one mobility space with an

additional two space located in the first block of George Street, and taxi rank

relocated to Upper Stuart Street entrance to the Octagon. Businesses utilised

delivery drop offs from 9pm – 5pm inclusive (20 hours) using the

identified delivery route. The speed limit for shuttles and operational

vehicles was restricted to 10km/h.

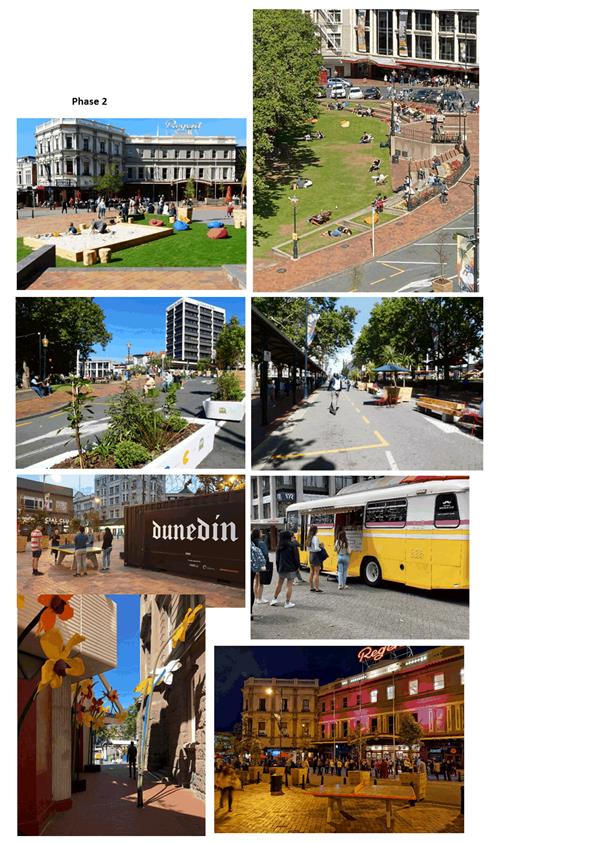

Phase

2

32 The

second phase layout commenced on 17 February to 9 March and trialled the design

of the Octagon identified within the Central City Plan. It balanced an increase

in public space with some general traffic. This layout included creating two

‘shared spaces’ open to all traffic in the lower and upper Octagon

for general traffic and using the remaining roads and central carriageway for

public space. The speed limit for this layout was 10-15km/h for all traffic.

Mobility spaces and taxi rank remained in the same locations as phase 1, and

car parking was reintroduced to the Octagon outside the Dunedin Public Art

Gallery. Cruise buses were accommodated in Princes Street and tour buses in

Moray Place.

Phase

3

33 The

third phase layout commenced on 9 March until 23 March. It included

partial closure of the lower Octagon and reopening of the central carriageway

and upper Octagon for general traffic, returning these parts of the space to

business as usual. The speed limit in the Lower Octagon and Lower Stuart Street

was 10-15km/h for all traffic, and the remaining Octagon speeds returned to

business as usual speeds of 30km/h. In this layout the Octagon Market returned

to the grassed area in the upper Octagon. The existing full car parking provision

returned to the Octagon and the taxi rank returned to its existing locations.

Mobility spaces returned to their existing locations. Cruise and tour buses

were accommodated back in the central carriageway and the Octagon.

Traffic management / Cruise ship and tour buses

34 Traffic management planning was underway in November,

with plans revised in response to feedback and the changes made after further

discussion with cruise and tour operators. The traffic management of the trials

was discussed at length with the traffic management supplier and New Zealand

Transport Agency (NZTA) to identify ways in which the trial might utilise more

attractive equipment, rather than traditional traffic cones and barriers, which

are in keeping with statutory regulations. It was agreed that the trials could

utilise planter boxes, troughs, and fencing to form the layout, however the

dimensions, robustness and particular items was dictated and restricted by the

regulations of current practice.

35 The

physical layout of each phase of the trial and its traffic management was test

driven by the emergency services and discussed with an accessibility

representative.

36 The

space needs of the Masters Games layout had implications for cruise ship buses

and other service traffic which have in recent years utilised the central

carriageway of the Octagon. Options were developed for the siting of drop offs

for cruise ship shuttles that allowed sufficient space, frequency of movements

(1 movement every two minutes) and the size and number of buses.

37 Staff considered six options for relocation of cruise ship

related transport operators during Phase 1 period. Outside Toitū Otago Settlers Museum was the recommended option for Phase 1 due

to the length of roadway; space for local tour providers; space for the Octagon

Markets; shelter from the weather within the museum and adjacent tourist

facilities for a high customer experience. This, and options were discussed

with stakeholders.

38 Following

stakeholder engagement, the walking distance to the Octagon was identified as

an issue for some cruise ship passengers, along with concern that shuttle drop

off being located away from Octagon businesses. However

following concerns raised by Ritchie’s buses and Octagon retailers, the

Cruise ship bus stops were temporarily relocated to State Highway 1 on

Cumberland Street. This was the preferred option of the provider.

39 Following

further feedback from tour providers and volunteers, concerns were raised that

the visitor experience was not good at this location and a new location sought.

Ongoing engagement with stakeholders, including the cruise ship shuttle

providers, meant that the final location of shuttles was in Princes Street on

single cruise ship days and the provider made their own decision to split to

Cumberland Street on double cruise ship days.

40 Other changes

made in response to feedback included:

· Providing public

maps and signage for visitors to navigate the CBD

· Activating the Municipal

Lane and the Civic Plaza to make them more attractive and encourage tourists to

access local tours on Moray Place.

41 Alternative locations were

also agreed with the two Octagon Market providers that utilise the space on

cruise ship visitor days. During PhaseS 1 and 2, the space occupied by the

markets was utilised for other activities, while in Phase 3 meant the Octagon

markets could utilise the grassed area within the Octagon.

42 Staff offered a number of

locations for consideration by the stall holders including the community

gallery, civic plaza, municipal chamber and other non-DCC owned locations.

During Phase 1, one market provider utilised the space within the community

gallery on cruise ship days. The second market provider did not accept alternative

locations. In Phase 3, the market providers returned to the grass area of the

Octagon.

COVID-19 Pandemic

43 While stakeholder

engagement was a known requirement, and could have been improved through better

planning and earlier engagement, there were other challenges which were

unforeseen, which had a material impact on the trials, namely the COVID-19

pandemic.

44 Central government

applied travel restrictions to Chinese visitors from 2 February. New Zealand

reported its first case of COVID-19 on 28 February, with further cases reported

in early March. New Zealand’s borders were closed at 12.59 pm on 19 March.

Cruise ship visits scheduled for 18, 21 and 22 March were cancelled, as was the

Fringe Street party scheduled for 21 March. New Zealand moved quickly through

the alert levels and the country went into lockdown at 11.59pm on 25

March.

45 StatsNZ

reported that industries related to international travel, such as accommodation

and transport, began to feel the effects of Covid-19 earlier in the quarter,

with activity dropping significantly once the borders closed on 19 March. The

economy fell 0.2% after growing at an annual pace of 1.8% in the December

quarter.

46 Service

industries, which make up two-thirds of the economy, fell 1.1% in the quarter.

Retail, accommodation and restaurants fell 2.2% while transport, postal and

warehousing experienced a 5.2% drop. Both were heavily affected by the fall in

international visitors.

47 StatsNZ

advise real gross national disposable income, which measures the real

purchasing power of the country’s disposable income, fell by 1.6% in the

quarter, “impacted by a fall in the terms of trade and an increase in the

net flow of income to overseas”.

48 Household

spending declined 0.3% in the March quarter. This was largely due to weaker

spending on services. Restaurant meals and ready-to-eat food, international

passenger services and accommodation services all contributed to the fall.

49 StatsNZ

predict that the “majority of the impact of COVID-19 response

restrictions will be shown in the June 2020 quarter GDP release.’’

The ANZ Chief Economist predicts a 19% decrease in GDP for the June quarter.

(Source: ODT 19 June 2020).

TIMELINE

50 A

timeline showing how these various events aligned with the timing of the

Octagon Experience phases is included in Attachment C. While most events were

scheduled during Phase 1, other events were planned in Phases 2 and 3,

including a 3x3 Basketball tournament (Phase 2) and the Fringe Street Party at

the end of Phase 3. This was ultimately cancelled due to COVID-19.

51 This attachment also

includes daily weather data for the trial period. There was a weather event on

4 February, with torrential rain forcing the cancellation of planned

activations for the Elton John concert. In contrast, fine

weather for the Queen concert resulted in audiences in the Octagon enjoying a

pre-concert performance on the Masters Games stage by Tahu and Takahes.

BUDGET

52 A

$150k budget was allocated in the Annual Plan for the trials. The budget was

overspent in part because of increased traffic management and the need for the

activation of Municipal Lane. The layout changes in Princes Street to

accommodate the changed cruise ship drop offs also required additional planter

boxes and increased costs. The total cost was $327,943. This includes elements

associated with Masters Games and other events. (e.g. Traffic

management). The costs of the trial were met from existing budgets.

53 Local

providers were used and many of the items can be reused. These are indicated by

an asterisk in the table below. Transport Group plan to reuse elements for

future trials; plants and furniture are being reused by Parks and Recreation;

and City Property have requested planters for community centres and schools.

All remaining furniture will be used by Events team for activations, in the

same way as furniture for Ed Sheeran was refurbished and reused for this event

54 The

high level breakdown of how the budget was applied is as follows:

Summary

of Expenditure on the Octagon Experience and Evaluation

|

|

Cost

|

|

Activation

|

|

|

Furniture including seats / tables and chairs / sandpit *

|

$44,937

|

|

Planter boxes *

|

$53,000

|

|

Family games (table tennis and games) *

|

$9,282

|

|

Plants and trees *

|

$14,699

|

|

Lighting

|

$15,451

|

|

Artist

|

$5,468

|

|

Advertising

|

$18,486

|

|

Municipal Lane activation

|

$34,000

|

|

Logistics - Container / Student Labour / Transporting

Furniture between phases

|

$10,487

|

|

Traffic Management for event

|

$35,272

|

|

Subtotal

|

$240,082

|

|

Events

|

|

|

Traffic management for Masters Games and events

|

$9,000

|

|

Subtotal

|

$9,000

|

|

Evaluation

|

|

|

Evaluation report (Aitken Taylor)

|

$27,500

|

|

Evaluation reports (First Retail)

|

$26,361

|

|

Evaluation report (Nathan Berg)

|

$25,000

|

|

Subtotal

|

$78,861

|

|

TOTAL

|

$327,943

excl GST

|

|

*being reused

|

COMMUNITY ENGAGEMENT AND FEEDBACK

55 One

of the tools for evaluating the trials was an Octagon Experience Feedback

Survey. The survey was available online via the Council website and in paper

form at two locations within the Octagon.

56 The

survey was a mechanism for residents, businesses and visitors to express their

views of the trial. The 7 questions which are set out in full in Attachment D,

along with the results, included:

· What is your reason for

visiting the Octagon today?

· Did you enjoy the

Octagon Experience? If not, why not?

· Do you have any other

comments about the Octagon Experience?

57 A

business and retailer specific survey was developed with the Chamber of

Commerce and Dunedin Host which was intended to be sent out to businesses

following the trial. However, due to COVID-19, it was agreed with the

stakeholders this survey should not be undertaken.

58 Of

the 1997 respondents to the Feedback survey, 14% (291) completed the paper form

within the Octagon and remaining 1706 via the online form. An overwhelming

majority of respondents (92%) lived in Dunedin and 8% lived outside of Dunedin.

59 Of

the submitters responding to where they heard about the Octagon Experience, the

highest scoring responses were from the ODT (528), 447 from social media, 213

from word of mouth and 141 from media amongst other locations.

Survey results

60 The survey

results are set out in Attachment D and summarised below.

Phase One

61 A

total of 795 submissions was received during Phase 1 of the Octagon Experience.

Of these submissions, 31% said they enjoyed the experience while 69% said they

did not.

62 Of

the people that did not enjoy the Octagon Experience, one of the main areas of

concern is around traffic and parking. 162 respondents commented on the effects

of the trial on the traffic flows around the Octagon (e.g. Moray Place) and

beyond, citing congestion problems and longer travel times. 113 respondents

also commented on the lack of parking and the effects of this. It caused some

people to not come to the Octagon, not go into retail stores, and missing

appointments.

63 Accessibility

was another major concern for people that did not enjoy the experience. 79

respondents commented on the difficulty for less abled (e.g. elderly, disabled)

people to access things on the Octagon, with many choosing to stay away or

unable to go due to lack of accessibility for close drop-off/parking. This is

also a reoccurring theme for respondents who commented on parking, citing the

lack of easy/close accessibility didn’t encourage them to go to the

Octagon. 12 respondents also specifically commented on the removal of the P5

parking outside the library as a negative, noting it took away the access for

quick library drop-off.

64 People

also commented on the general look of the Experience, with 112 respondents

disliking the look noting that it looked disorganised and/or tacky. 18

respondents said it resembled a construction zone or looked like there was

roadworks happening. 22 respondents who enjoyed the experience also noted it

could be better planned/better designed, with more things to do and more play

equipment.

65 People

who enjoyed the Experience were positive about the vibe/atmosphere it created,

with some saying its nice without the traffic/fumes/noise (35) and allowed them

to enjoy being in the area and socialise comfortably. 39 respondents

specifically commented that this should be permanent. 28 respondents enjoyed

the Experience as a pedestrian, and 10 respondents noted how it was family

friendly. 20 respondents suggested that it should only be partially closed with

just the lower Octagon being pedestrian only.

Phase Two

66 A

total of 559 submissions was received during Phase 2 of the Octagon Experience.

Of these submissions, 33% said they enjoyed the experience while 67% said they

did not. A summary of the comment themes is presented below.

67 One

of the main areas of concern for Phase 2 is again around traffic and parking.

113 respondents commented on the effects of the trial on the traffic flows

around the Octagon (e.g. Moray Place) and beyond, citing congestion problems

and longer travel times. 85 respondents also commented on the lack of parking

and the effects of this.

68 Accessibility

was another major concern, with 53 respondents commenting on the difficulty for

less abled (e.g. elderly, disabled) people to access things on the Octagon. Six

respondents specifically commented on the removal of the P5 parking outside the

library as a negative, noting it took away the access for quick library

drop-off.

69 Respondents

cited the experience as a waste of money/time, and 29 people were concerned

about it impacting businesses negatively. There were comments about Dunedin not

being a big enough city to cater an experience such as this, and it would be

more suitable as temporary closures for events.

70 There

was support for closing just the lower Octagon, with 20 respondents supporting

this. 19 respondents thought the main carriageway should be closed instead.

71 Respondents

commented that the Octagon seemed empty/deserted, however 25 respondents saw

people using the space and thought seemed busy.

72 People

also commented on the general look of the Experience, with 112 respondents

disliking the look noting that it looked disorganised and/or tacky. 18

respondents said it resembled a construction zone/roadworks area. 22

respondents who enjoyed the Experience also noted it could be better

planned/better designed, with more things to do and more play equipment.

73 People

who enjoyed the Experience were positive about the vibe/atmosphere it created,

with some saying it’s nice without the traffic/fumes/noise (36) and

allowed them to enjoy being in the area and socialise comfortably. 28

respondents specifically commented that this should be permanent. 15

respondents noted how it was family friendly, while four commented that it

should have more activities/play equipment and four more thought more food

trucks should be added.

Phase

Three

74 A

total of 539 submissions was received during Phase 3 of the Octagon Experience.

Of these submissions, 60% said they enjoyed the experience, while 40% said they

did not.

75 One

of the main areas of concern for Phase 3 is again around traffic and parking,

although to a much lesser extent than the other phases. Around 41 respondents

commented on the effects of the trial on the traffic flows around the Octagon

(e.g. Moray Place) and beyond, citing congestion problems and longer travel

times. Another 41 respondents also commented on the lack of parking and the

effects of this.

76 Respondents

didn’t like the look of the experience/thought it looked tacky, however

44 respondents enjoyed the vibe/atmosphere of the experience citing that they

enjoyed the provision of the activities, seating and play equipment (16) and

saw lots of people using the space (25).

77 Respondents

wanted the experience to be permanent, with eight preferring a full closure,

and 15 respondents citing a partial closure seemed more successful. There were

15 suggestions to close just the main carriageway, and 22 suggestions across

all comments to close just the lower Octagon.

Summary of Feedback survey results

78 The

feedback, concerns and issues raised by the respondents to the Octagon

Experience Feedback survey were relatively consistent across the phases. These

issues were notably around effects on traffic flow, lack of parking,

accessibility issues, and the general look of the Octagon Experience. For

people who did enjoy the Experience, the things that were noted were the

atmosphere and vibe of the Experience, the lack of traffic and noise, and the

extra amenities/equipment provided. There were more people who didn’t

like the trial at the start in Phase 1, and as the Experience changed to phase

3, more people enjoyed the Experience than those that did not. There appeared

to be more people generally in favour of a partial closure than full,

suggesting the lower Octagon and/ or the central carriageway for permanent

closure.

TRIAL EVALUATION

79 The

trial was assessed using the objectives for evaluating streets are

stated in the Global Streets Design Guide. Data relating to the following

dimensions was collected and assessed:

· User Counts

· Behaviour comfort

and safety

· Environment

· Commercial

Activity

User Counts

Number of people cycling

80 The

Aitken Taylor report captured bicycle activity data within the Octagon. Four

survey locations were used, with surveying taking place for Phases 2 and 3

only.

81 For

Phase 2, there were 426 total weekday bicycle movements, with peaks at commute

times at 8-9am and 5-6pm. On Saturday, there were 354 movements with the peak

time taking place between 11am-12pm.

82 For

Phase 3, there were 384 weekday bicycle movements, with peaks between 8-10am

and 5-7pm. On Saturdays, 222 movements were observed, with a noticeable peak

between 1-2pm and dip from 3-4pm.

Driving

83 For

vehicle movements, data was extracted from the traffic signal system (SCATS).

Analysis was conducted on the six intersections on or within Moray Place. The

intersections were:

· Stuart

Street (Lower) and Moray Place

· Princes

Street and Moray Place

· Princes

Street and Octagon

· George

Street and Octagon

· George

Street and Moray Place

· Stuart

Street (Upper) and Moray Place.

84 Vehicle

movements at the two Octagon intersections dropped dramatically during Phase 1

and then increased during Phase 2 and Phase 3, returning to normal levels. The

surrounding intersections stayed reasonably steady throughout, even though each

had one ‘leg’ closed completely or restricted.

85 The

other two legs showed a significant increase in volumes, as the vehicles had

been detoured around Moray Place rather than driving through the Octagon.

86 The most

congestion observed was at the corner of Princes Street and Moray Place.

Footfall figures in central city and local facilities

87 User

counts were taken at the City Library, the Dunedin Public Art Gallery (DPAG)

and at the i-SITE Dunedin Visitor Centre.

88 For

the City Library during Phases 1 and 2, loans and physical visits were used to determine

user counts. February 2020 usage was compared to February 2019. Overall, loans

(-2.4%) and physical visits (-0.7%) for 2020 are slightly down, however, there

is no large variance.

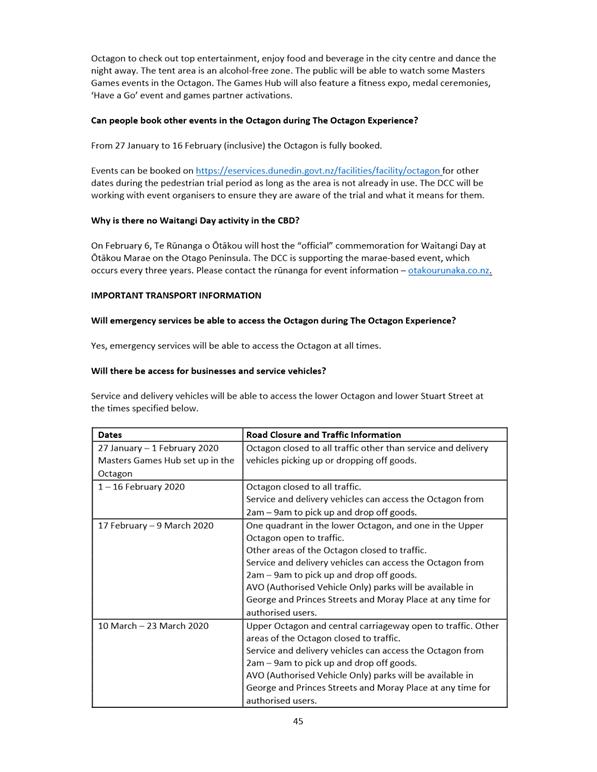

Table 1 – Comparison of loans and physical visits

to the City Library for February 2019 and 2020

|

|

Loans

|

Variance

|

% Change

|

Physical Visits

|

Variance

|

% Change

|

|

February 2019

|

55,085

|

|

|

55,707

|

|

|

|

February 2020

|

53,785

|

-1,300

|

-2.4%

|

55,321

|

-386

|

-0.7%

|

89 Phase

3 shows (below) a significant reduction in loans and physical visits to the

City Library. To note, however, the facility was closed for nine opening days

in March (29% of total opening days for the month). The cancellation of public

programmes in the two weeks prior to the COVID-19 lockdown would also have contributed

to the reduction in visitation.

Table 2 – Comparison of loans and physical visits

to the City Library March 2019 and March 2020

|

|

Loans

|

Variance

|

% Change

|

Physical Visits

|

Variance

|

% Change

|

|

March 2019

|

56,086

|

|

|

59,522

|

|

|

|

March 2020

|

47,333

|

-8,753

|

-15.6%

|

40,312

|

-19,210

|

-32.3%

|

90 For DPAG, visitor

statistics were recorded (below) from 27 January to 22 March 2020, and between

2017 to 2020. All show that 2020 visitor numbers had generally increased from

2019 visitations.

Table 3 – Yearly comparisons of visitations to

Dunedin Public Art Gallery

|

Phase 1

|

27 Jan – 2

Feb

|

3 Feb – 9

Feb

|

10 Feb – 16

Feb

|

|

2017

|

4,255

|

6,184

|

4,833

|

|

2018

|

3,944

|

3,843

|

4,229

|

|

2019

|

5,120

|

5,492

|

5,372

|

|

2020

|

5,347 (+227)

|

6,297 (+805)

|

5,899 (+527)

|

|

Phase 2

|

17 Feb – 23

Feb

|

24 Feb – 1

Mar

|

2 Mar – 8

Mar

|

|

2017

|

4,901

|

4,371

|

4,810

|

|

2018

|

4,371

|

4,103

|

3,642

|

|

2019

|

5,347

|

4,530

|

6,039

|

|

2020

|

5,362 (+15)

|

6,696 (+166)

|

5,160 (-879)

|

|

Phase 3

|

9 Mar – 15

Mar

|

16 Mar – 22

Mar

|

|

|

2017

|

5,137

|

4,868

|

|

|

2018

|

4,754

|

4,378

|

|

|

2019

|

5,031

|

5,782

|

|

|

2020

|

5,030 (-1)

|

No data

|

|

91 The i-SITE

Dunedin Visitor Centre recorded footfall data from 6 January to 31 March

2020.

Table 4 – Comparisons of Dunedin i-SITE visitations

for 2019 and 2020

|

Week ending

|

2019

|

2020

|

% Change

|

|

6 January

|

7518

|

5107

|

-32%

|

|

13 January

|

6555

|

6046

|

-8%

|

|

20 January

|

6993

|

4220

|

-40%

|

|

3 February

|

5706

|

4917

|

-14%

|

|

10 February

|

7405

|

5778

|

-21%

|

|

17 February

|

6566

|

4373

|

-27%

|

|

24 February

|

7345

|

4507

|

-33%

|

|

3 March

|

6008

|

4399

|

-39%

|

|

10 March

|

6974

|

4526

|

-27%

|

|

17 March

|

5000

|

1390

|

-72%

|

|

24 March

|

4752

|

0

|

N/A

|

|

31 March

|

5463

|

0

|

N/A

|

92 Visitor

numbers to the i-SITE were down on 2019 figures for January before the trials

began. There was a 23.5% decrease on 2019 figures for the first 4 weeks of

January compared with a 36.5% decrease over the weeks of the trial. (This

excludes the weeks when there no visitor figures collected due to the COVID-19

Lockdown).

Behaviour, Comfort and Safety

Number of pedestrians by type of activity and duration of stay

93 In

addition to bicycle activity, the Aitken Taylor report captured pedestrian,

staying (standing, sitting, playing) and sitting activity data. As noted above,

four survey locations were used, with surveying taking place for Phases 2 and 3

only.

94 For Phase 2:

· Weekday

pedestrian movements were recorded at a total of 23,484 peaking at 12 and 2pm,

with the highest foot traffic on George Street, Princes St, and Stuart St East

respectively.

· Saturday

pedestrian movements totalled 27,816 (18% increase compared to weekday), with

the highest foot traffic reflecting the above.

· 350

persons were observed as staying (with 301 seating and standing), and 39

children at play, with activity peaking at 12pm.

· 805

persons staying on Saturday (with 434 outdoor/commercial dining, 347 seating

and standing).

· 547

persons were observed at outdoor café seating on Saturday, with 30% of

outdoor seats on offer being occupied at any one time.

95 For Phase 3:

· Weekday

pedestrian movements were recorded at a total of 25,110, peaking at 1pm.

· Saturday

pedestrian movements totalled 24,084.

· 702

persons were observed as staying during the weekday (with 314 outdoor

commercial dining, 388 seating and standing – a 20% increase from Phase

2).

· A

total of 973 persons were observed as staying on a Saturday (with 518

attributed to outdoor café seating, and 451 seating and standing).

Crime rates

96 The

First Retail Report noted in the initial two Phases “a confident decline

in theft and related incidents, public order and acts to cause injury offences”. When thoroughfare traffic returned in Phase 3, levels of

crime and disorder escalated.

97 ‘All

victimisations’ NZ Police data was used to record these observations,

which includes ‘Acts intended to cause injury’; ‘Theft and

related offences.’; ‘Unlawful entry with intent/burglary’;

and ‘Sexual assault’. ‘Theft and related offences’ and

‘Acts intended to cause injury’ together made up 81% of ‘All

victimisations’ in Dunedin Central during the trial period.

98 The

Report noted that “increased activity, welcoming a more diverse and

family-orientated audience and greater space for movement around licenced

premises contributed to these positive outcomes”.

Environment

Levels of particulate matter

99 The Nathan Berg Report cited

the air quality sensor (listed as "Central Dunedin" in air quality

databases) located at the corner of Albany Street and Anzac Avenue near Forsyth

Barr Stadium. The report notes this shows Dunedin's air quality has been

significantly improving for at least a decade, as seen in the steady decline in

emissions, which have been cut by almost half over just the last decade.

100 The report however also notes that devices

measuring air quality located inside the CBD should be considered if urban

planning policies such as pedestrianisation and restriction of automobiles are

to be credibly linked to reliable evidence measuring gains in air quality

attributable to those policies. Once daily and hourly PM10 data become

available, further analysis will be required to investigate whether the Octagon

Experience had any measurable effects on air quality.

Commercial activity

Impacts on consumer spend

locally and across the city

101 The

retail spending data provided in the First Retail report was measured using the

MarketView[1]

(electronic transactions) data. This data was split by month, area, local and

total spend, and spending by industry. The MarketView data in the First Retail

report is based on 5 Octagon mesh blocks, see the shaded area in Attachment F.

102 The

retail spending for the Octagon area was variable over the months of the

Octagon Experience.

Total retail spending

103 The

report from First Retail shows total retail spending in the Octagon area was up

10.8% in January 2020, up 6.7% in February and down 42.6% in March (see Figure

1). Retail spending in March 2020 was down in the Octagon, George St and

the rest of Dunedin as the impacts of COVID-19 border restrictions, cruise ship

cancellations and lockdown became apparent.

Figure 1 –

Percentage change in total retail spending Jan 2020 to Mar 2020 (on same month

of the previous year) – sourced First Retail

Table 5 - Percentage change in total retail spending Jan

2020 to Mar 2020 (on same month of the previous year)

|

|

Percentage

change on same month of the previous year

|

|

|

Jan 2020

|

Feb 2020

|

Mar 2020

|

|

Octagon

|

10.8%

|

6.7%

|

-42.6%

|

|

George St

|

3.4%

|

7.2%

|

-35.9%

|

|

Rest of Dunedin

|

4.2%

|

10.3%

|

-3.4%

|

|

Dunedin city

|

4.3%

|

9.8%

|

-8.8%

|

Local retail spending

104 The

First Retail report shows local retail spending was up 13.9% in January 2020,

down 4.0% in February and down 43.2% in March. Retail spending in March 2020

was down in the Octagon, George St and the rest of Dunedin mostly likely due to

the impacts of COVID-19; border restrictions, cruise ship cancellations and

lockdown from 25 March.

Figure 2 –

Percentage change in local retail spending Jan 2020 to Mar 2020 (compared with

2019) – sourced First Retail

Table 6 - Percentage change in local retail spending Jan

2020 to Mar 2020 (on same month of the previous year) (First Retail)

|

|

Percentage

change on same month of the previous year

|

|

|

Jan 2020

|

Feb 2020

|

Mar 2020

|

|

Octagon

|

13.9%

|

-4.0%

|

-43.2%

|

|

George St

|

6.5%

|

1.1%

|

-33.8%

|

|

Rest of Dunedin

|

5.3%

|

8.1%

|

2.4%

|

105 Due

to the impacts of COVID-19, it is difficult to assess the outcome of the

Octagon Experience on retail spending, particularly during the March period.

The Octagon Experience started on 27 January and continued through February and

March. Due to the timing of the Octagon Experience and the impacts of COVID-19,

February data potentially provides the most useful indication of retail

spending during the trial.

Retail spending by key industry

106 The

key industries with the highest growth in the Octagon during February 2020 (on

the same month the previous year) was hospitality, up 19.8%, Apparel and

personal goods, up 17.9% and department stores and leisure down 14.5%.

Table 7 - Percentage change in retail spending by

industry for key Octagon industries – Feb 2020 (compared with the same

month in 2019) (First Retail)

|

|

Variable

|

Octagon

|

George St

|

Rest of Dunedin

|

Dunedin city

|

|

Apparel and personal

|

Percentage change

|

17.9%

|

4.7%

|

3.5%

|

4.8%

|

|

Hospitality

|

Percentage change

|

19.8%

|

17.7%

|

17.9%

|

18.1%

|

|

Department stores and leisure

|

Percentage change

|

-14.5%

|

10.0%

|

11.8%

|

10.8%

|

107 Professor

Nathan Berg (DCC Chair in Entrepreneurship, Otago Business School and the

Department of Economics and Tahu Andrell (a post-graduate student in the

Department of Economics at the University of Otago) undertook an analysis of a

sample of Octagon and CBD businesses during the Octagon Experience.

Professor Berg’s analysis was based on a sample of 7 Octagon businesses

and 8 CBD businesses. The analysis focuses on business revenue.

Analysis of the sample of Octagon businesses

108 Professor

Berg’s analysis of the sample of Octagon businesses found a 2.0% increase

in revenue during phase 1 (27 January – 16 February) on the same period

in 2019, a 24.3% drop during phase 2 (17 February – 9 March) when

compared to the same time the year before and a 6.3% drop during phase 3 (10

March to 23 March) on the comparable 2019 time period.

Table 8 - Percentage

change in business revenue for sample of Octagon businesses (compared with the

same time period in 2019) (Prof. Berg report)

|

|

Phase 1

|

Phase 2

|

Phase 3

|

|

Octagon sample

|

2.0%

|

-24.3%

|

-6.3%

|

109 There

are some differences in the MarketView and Professor Berg findings, with the

MarketView data providing more positive results for February but a more

significant drop in retail sales during March. The differences may be due

to the different sample of businesses (MarketView based on all businesses in

the five Octagon meshblocks as shown in Appendix 6) and Professor Berg’s

work focused on a sample of 7 Octagon businesses. Professor Berg suggests

that businesses located within the Octagon had a bigger fall in revenue during

the Octagon Experience than businesses located further from the Octagon,

although this may in part be due to the importance of international visitors to

this area, and the impacts of COVID-19 on international visitors as the trial progressed.

i-SITE

revenue

110 In

addition to the economic data in the First Retail and Nathan Berg reports,

revenue at the i-SITEs in the Octagon and at Port Chalmers is also presented.

Revenue collected at the Octagon i-SITE in January was higher than the same

period in 2019, while revenue was notably reduced in February and March. The

revenue at the Port Chalmers i-SITE showed a similar pattern, suggesting that

the reduced revenue at the i-SITE in February and March was not due to the

Octagon Experience.

Figure 3: Revenue at i-SITEs

January -March 2020 (compared with revenue for 2019)

|

|

City i-SITE

|

Port i-SITE

|

|

|

2019

|

2020

|

2019

|

2020

|

|

January

|

$266,655

|

$283,159

|

$214,155

|

$224,543

|

|

February

|

$309,296

|

$255,273

|

$213,905

|

$116,247

|

|

March

|

$250,824

|

$123,426

|

$137,446

|

$78,003

|

111 Professor

Nathan Berg and First Retail have been asked to comment on the differences in

the findings of their respective reports. Their further comments will be

reported at the meeting.

Commentary from Transport and NZTA

112 The

Berg report makes a number of statements about transport related issues and the

Octagon Experience. It includes commentary regarding New Zealand Transport

Agency (NZTA), transportation and urban planning. The report has been

referred to NZTA for feedback which will be reported at the meeting.

113 Transport

staff note that aspects of the report are not consistent with Council’s

Integrated Transport Strategy or the Government Policy Statement on transport

which are linked. Staff further note that the assertion that health will be

impacted by the congestion and traffic calming in the CBD (lack of carparks)

for gyms is not backed by any data.

114 Staff

will need to undertake further analysis of some of the other assertions in the

report, e.g. those relating to choice of modes; levels of service for transit

times by automobiles; and self-financing transit systems before they can

provide any further comment on the findings.

CONCLUSIONS

AND LESSONS LEARNED

Conclusions

115 The

Octagon comprises a complexity of interests and of functions. These

complexities were not well understood and as a consequence were not well

managed. Changes in one dimension have impacts on others. For example when

cruise ship drop-offs were relocated to Cumberland Street to accommodate

shuttle operators, Octagon retailers were unhappy with the changes. Some

businesses are vulnerable to small changes.

116 The

focus of the trials shifted because of the perceived opportunity presented by

linking with the Masters Games and other events. The inclusion of Masters Games

detracted from both the Octagon Experience and that of the Masters Games

participants. The focus on the Octagon Experience itself was lost. The layout

of Lower Stuart street was difficult to “read” for both pedestrians

and traffic.

117 Accommodating

the Masters Games and other events such as Thieves Alley and the Pipe Band

competition, with their own layouts, impacted the trial. The Masters Games

required a large stage and stretch tent which occupied most of the Lower

Octagon, and the health and safety requirements associated with the need to

accommodate up to 1500 people, necessitated the 80% closures.

118 The COVID-19 pandemic and the

restrictions on cruise ships and other international visitors impacted the

trial.

119 The

timing relative to the George Street project and the extent of community

comment on George Street may have negatively influenced community feedback.

Positives

120 There

were positives to emerge from the trials including reductions

in crime, as reflected in Police data. The Octagon Experience provided family

friendly activities and a ‘non-alcohol related’ culture to balance

out the night time economy in the Octagon.

121 Hospitality

and some retail businesses (i.e. personal and apparel sectors) benefitted with

total spending in Octagon businesses in these sectors in February higher (19.8%

and 17.9%) compared with the same month in 2019.

122 Community

feedback confirms there was a higher level of amenity and usage during the

period without traffic. Food trucks were popular and introduced an added aspect

of choice for Octagon users.

123 There

are changes Council could make now to enhance the user experience in the

Octagon, such as the provision of informal seating and an outdoor table tennis

table that do not require changes to traffic layouts.

124 Public

transport continued to function unimpeded. The ORC reported no delays to the

public transport network.

125 The

trial provided a chance to learn more about the Octagon, and pedestrianisation

in Dunedin, particularly during peak visitor season. Council now has the

benefit of significant data and improved understanding of how the Octagon

functions, which can inform future planning. It is now clear that the central

carriageway is a key element of the way the Octagon functions.

126 Council’s

Transport Group now have data from our ITS traffic detection system to describe

how traffic responded / diverted as a result of the closures and this

information will be used to inform future proposals.

Lessons Learned

127 The

lessons learned from the trials are set out in more detail below:

128 Engagement:

Communications and engagement with affected parties could have been better

timed and executed with the full range of stakeholders identified from the

beginning. Including stakeholders in more timely consultations about the

future of the Octagon and the Central City Plan will be vital, as will be

balancing the commercial and community interests. It should

have started sooner and provided stakeholders with a genuine opportunity to

provide input into what was being planned.

129 More thorough consultation with cruise ship providers and business

owners, but also individuals and other stakeholders, should be undertaken ahead

of any future trials. This engagement would cover strategies to keep the

proximity of Octagon retailers to cruise ship visitors or other tourist drop

off areas. It would also include outdoor dining coverage and other methods to

clarify business signage and boundaries for alfresco dining.

130 Decision

making process: The final design for the Octagon Experience was not signed

off by Council. Staff followed the same process as the Ed Sheeran trial. In

order to ensure certainty, in future, a clear decision process should be agreed

by Council.

131 Evaluation:

A clear evaluation framework, as requested by Council for the Octagon Experience,

should be in place before any trials commence. Baseline should be evaluated

before the trial beginning. Staff should also ensure more baseline data is

available with which to compare trial evaluation impacts to. Ideally staff

would model the impacts of road closures before trailing closures (i.e. refine

baselining of the impacts of certain traffic treatments or road closures).

132 Timings:

Multiple transitions (accommodating revised layouts for one-day events) in one

trial period are problematic. In future Council needs to ensure events and

layouts are compatible. Sequential trials of layouts were proposed in order to

enable comparisons, in the absence of baseline data. However, ideally no more

than one layout should be trialed at any one time. A shorter trial period than

eight weeks would also be more beneficial.

133 Communications:

There was heavy reliance on the Council’s website for communication.

Although control of positive media message is challenging, there needs to be

more focus on public communications for future projects to ensure that the

public are more aware of the purpose of trials, not just road closures.

134 Project

planning and resourcing: Significant lead in time is required for planning

trials. More senior personnel should be included in planning discussions,

which will refine trial parameters and treatments. Plans need to ensure

adequate staff resourcing to respond to issues in a timely way, e.g. getting

signage and wayfinding in place for relocated tourism operators.

135 Logistics:

The set-up phase was protracted over five days, and created confusion

and a negative impression of the trials at the outset. Further planning should

identify what transitions are required and ensure they are undertaken in a way

that minimises disruption and ensures adequate staff time and

rostering especially during weekend times is provided for in planning future

trials. This includes pack up/pack down times, as well as securing furniture

overnight.

136 Physical

activation: Activation of some areas (e.g. Upper Octagon and feeder starts

including Upper Stuart St) is challenging due to the sloping topography and

requires extra work. Activation of Municipal Lane worked well, but could

have occurred earlier. The permanency of some activation

furniture and street signage needs to be reconsidered to avoid the

‘tacky’ visage of some treatments.

137 Traffic: Pick-up and drop-off- locations

could be closer for taxis. Alternative locations for siting cruise ship

shuttles, buses and tourism operators should be negotiated and agreed with

transport and tourism operators now, rather than close to the period of any

proposed closures.

NEXT STEPS

138 The

information gathered will be used to inform future planning for the Octagon (as

part of the Central City Plan). The findings will also be used to inform the

“reset” of the consultation on the George Street (Central City

Plan) project.

Signatories

|

Author:

|

Nicola Pinfold - Group Manager Community and Planning

Sandy Graham - General Manager City Services

|

|

Authoriser:

|

Sue Bidrose - Chief Executive Officer

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Octagon Experience

phases - scope and timing

|

42

|

|

⇩b

|

Octagon Experience

phases - photographs

|

44

|

|

⇩c

|

Timeline and weather

data

|

47

|

|

⇩d

|

Community Feedback

|

49

|

|

⇩e

|

Aitken Taylor: The

Octagon Experience Public Life Survey (June 2020)

|

67

|

|

⇩f

|

First Retail: The

Octagon Experience (May 2020)

|

127

|

|

⇩g

|

Map of the mesh blocks

covered by the MarketView data

|

171

|

|

⇩h

|

Nathan Berg and Tahu

Andrell (June 2020): An Event Study measuring Change in Sales Revenue and

Entry Counts associated with the Octagon Experience 2020

|

172

|

|

⇩i

|

Addendum (June 2020) to

Nathan Berg and Tahu Andrell: An Event Study

|

236

|

|

⇩j

|

Traffic and pedestrian

footfall data

|

238

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report relates to providing local infrastructure and

it is considered good-quality and cost- effective.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

The Octagon Experience aligns with all key strategies.

|

|

Māori Impact

Statement

Mana whenua will be involved as a key partner in any

future project work.

|

|

Sustainability

Sustainability has been a key consideration during the

development of this project with the street furniture, plants and assets used

for the trial being reused across parks and reserves.

|

|

LAP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There was $150k allocated on the Annual Plan for

pedestrianisation trial. The costs are detailed in the report.

|

|

Financial

considerations

The budget and spend is outlined in the report.

|

|

Significance

This report is considered low – medium significance

in terms of the Council’s Significant and Engagement Policy. (Low in

terms of financial value but high degree of public interest).

|

|

Engagement –

external

As detailed in the report, external engagement has

occurred prior to and during the Octagon Experience.

|

|

Engagement -

internal

Internal engagement has occurred throughout this process

and the project development across many departments of Council.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks associated with this information

report.

|

|

Conflict of

Interest

No conflicts have been identified.

|

|

Community Boards

The Octagon is not located within a Community board area,

however, the report may be of interest to community boards.

|