|

Economic

Development Committee

15 June 2020

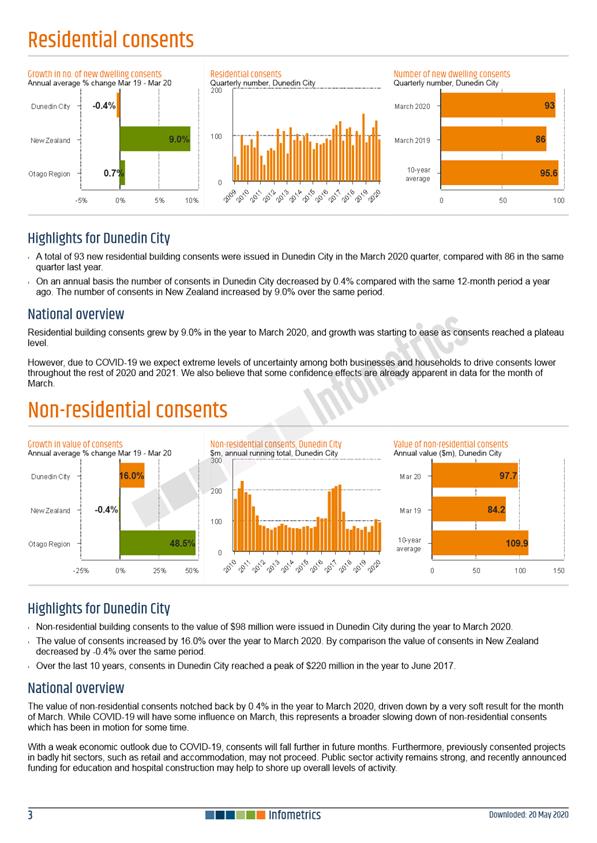

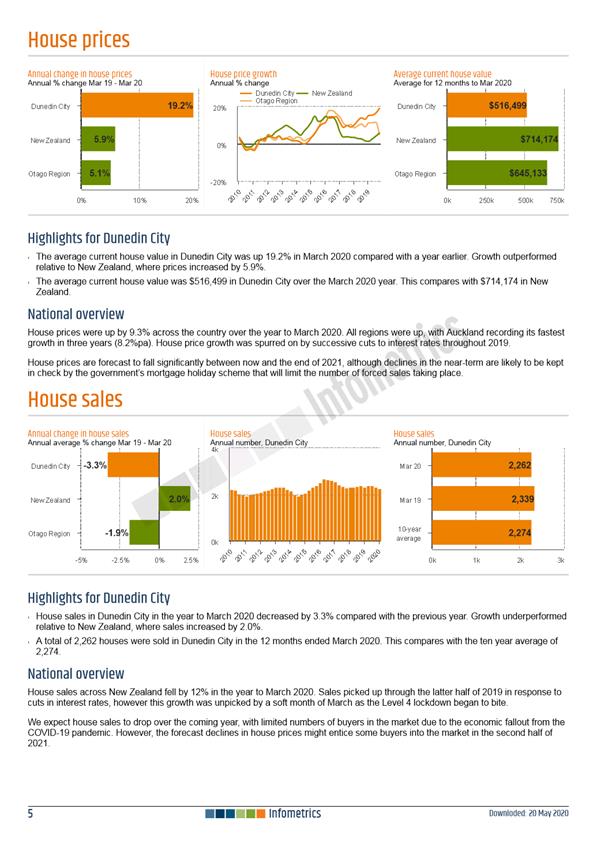

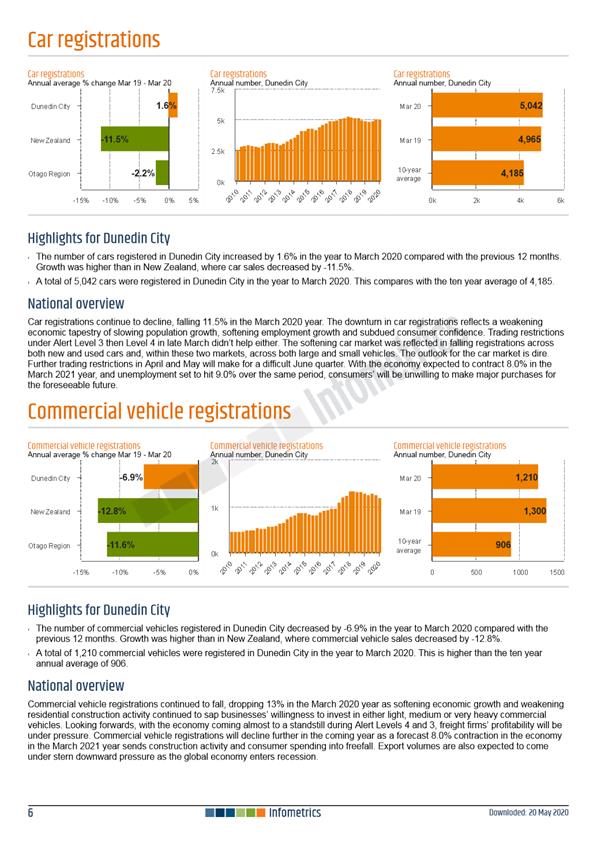

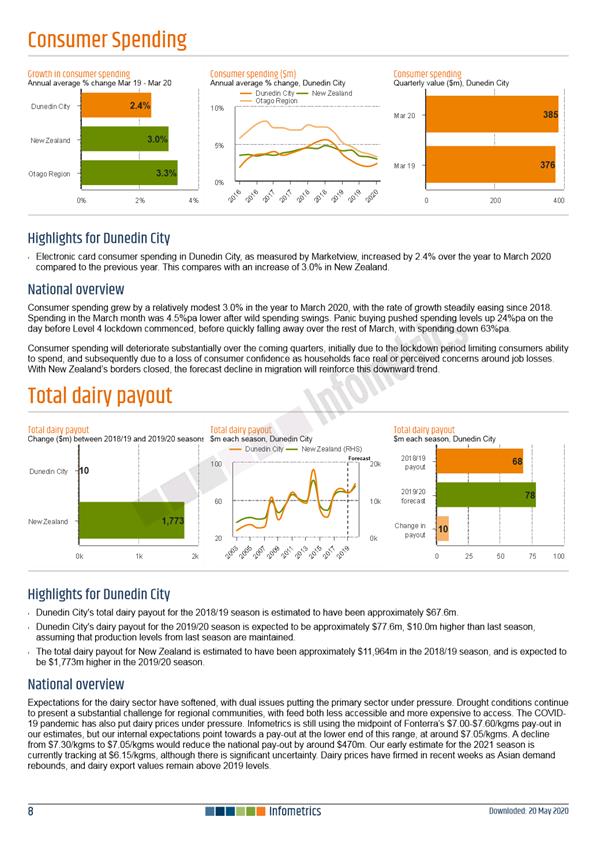

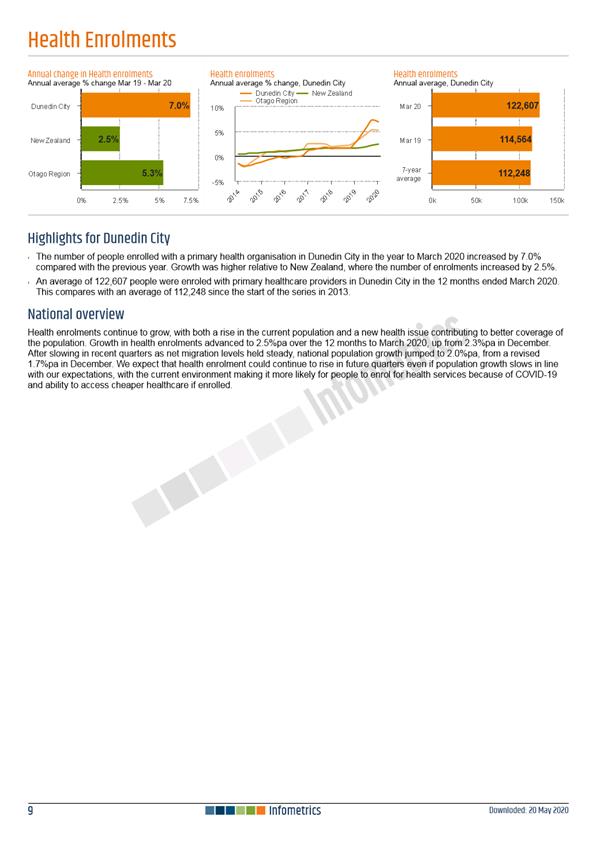

|

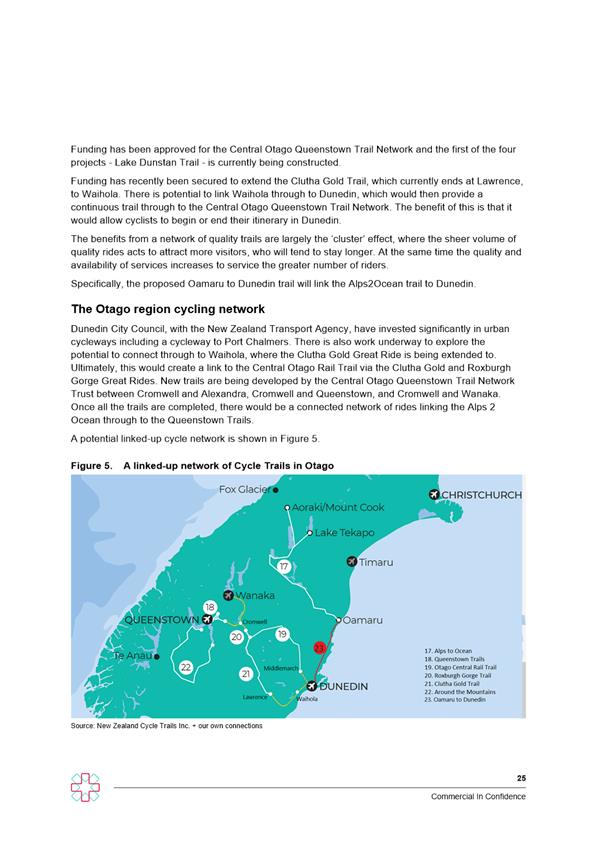

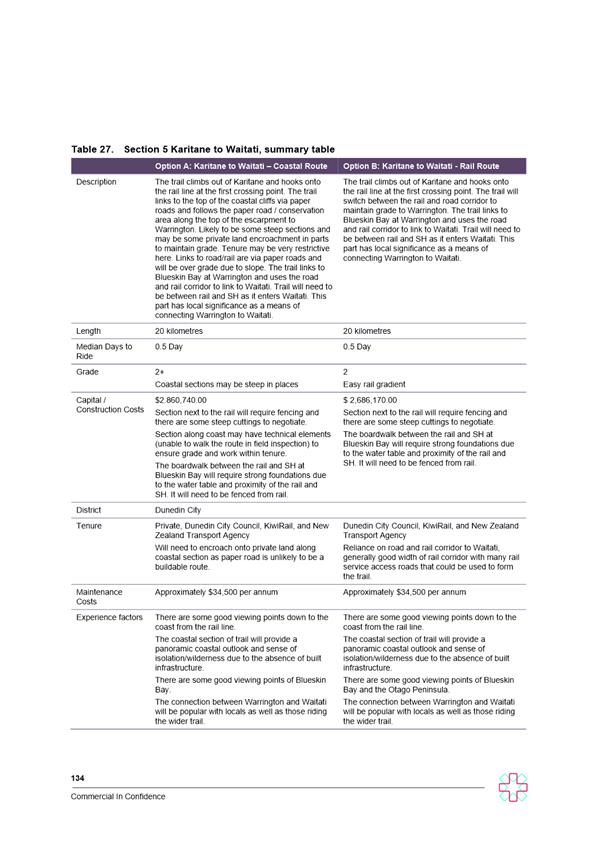

|

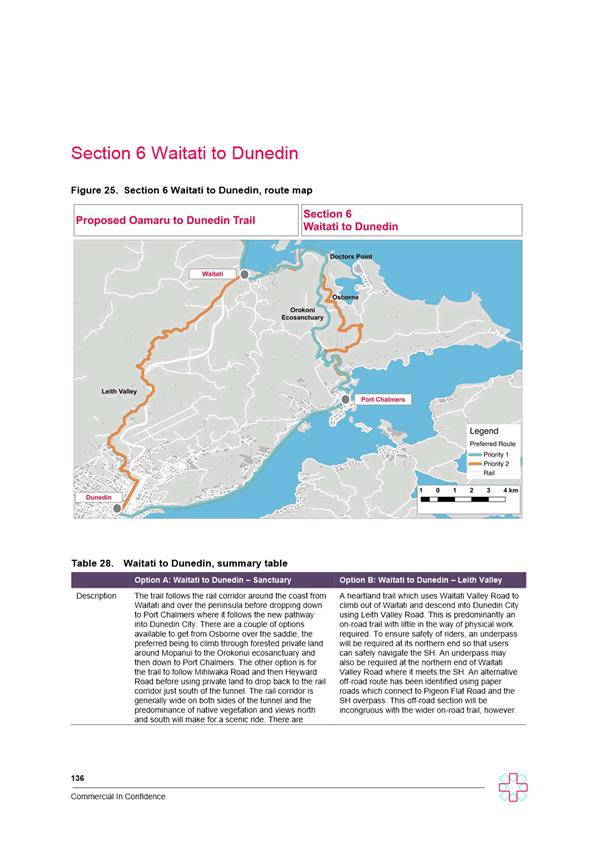

Part

A Reports

Startup

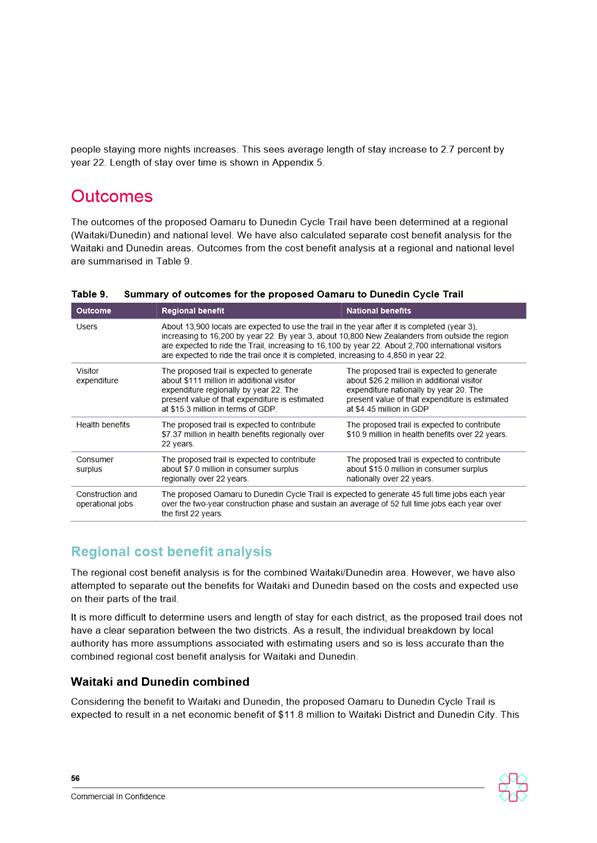

Ecosystem

Department:

Enterprise Dunedin

EXECUTIVE SUMMARY

1 This report seeks

Economic Development Committee (EDC) approval for a Grow Dunedin Partnership

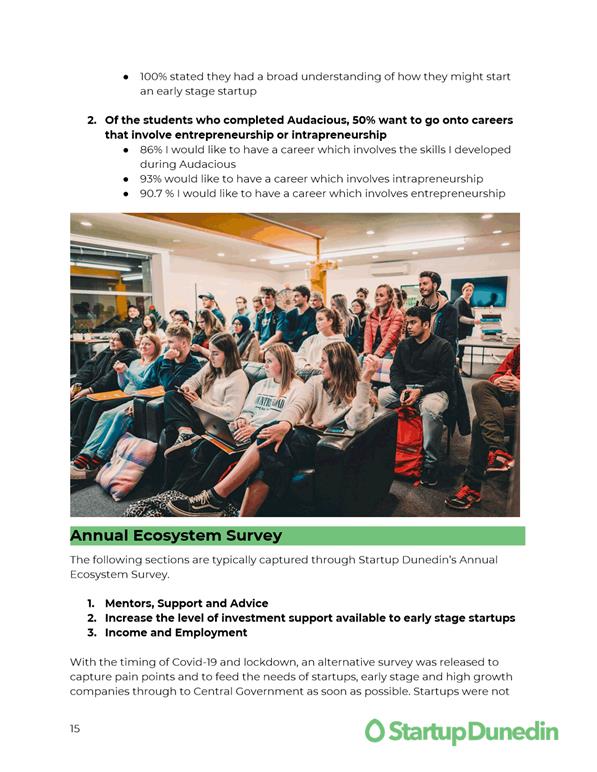

(GDP) funding decision in line with GDP’s approvals and delegation.

2 On 28 May 2020, GDP

resolved to allocate $150,000 to the Startup Dunedin Trust (SUDT) to support

the continued development of the start-up ecosystem for the 2020/21 financial

year. This funding is from a proposed $362,600 2020/21 operating budget

for GDP activities.

3 This investment will be

supported by an additional $44,000 from Enterprise Dunedin’s 2020/2021

Operational Budget for the delivery of Audacious.

4 This funding

builds on 2019/2020 activities

and will further support the Dunedin start-up

ecosystem as part of a post COVID-19

economic response

|

RECOMMENDATIONS

That

the Committee:

a) Approves $150,000

funding to the Startup Dunedin Trust (SUDT) for the 2020/21 financial year.

b) Notes this

investment will be supported:

i) $44,000 from Enterprise Dunedin for the 2020/21

delivery of Audacious;

ii) $40,000 from the University of Otago for the 2020/21

delivery of Audacious;

iii) $20,000 from the Otago Polytechnic for the 2020/21

delivery of Audacious.

c) Notes its

appreciation to Nigel Bamford, DCC representative on SUDT who stepped down in

March 2020.

d) Notes its

appreciation to Donna Hall for her contribution to the SUDT.

e) Notes further

advice will be brought back regarding the appointment of a new DCC

representative on SUDT

|

BACKGROUND

5 A start-up ecosystem is

formed in a physical location by people, businesses (in their various stages of

growth) and organisations who wish to support and scale new start-up companies.

6 The ecosystem is

typically led by entrepreneurs and often includes economic development

agencies, universities, polytechnics, co-working spaces, professional services

and existing and established businesses.

7 Development of the

start-up ecosystem has been identified as a key priority by GDP and Enterprise

Dunedin given the role it plays in supporting the goals of the 2013-23 Economic

Development Strategy (EDS):

a) 10,000 extra jobs over ten

years (requiring employment growth of approximately 2% per annum);

b) an average of $10,000 extra

income for each person (requiring gross domestic product per capita to rise by

about 2.5% per annum).

8 The development of the

start-up ecosystem contributes to all themes of the EDS:

a) Business Vitality;

b) Alliances for Innovation;

c) A Hub for Skills and Talent;

d) Linkages Beyond Our Borders;

e) Compelling Destination.

9 On 21 May 2019 the EDC:

Moved (Cr Andrew Whiley/Cr Christine Garey):

That

the Committee:

a) Approves $150,000

funding to the Start-up Dunedin Trust for the 2019/20 financial year from

proposed 2019/20 Grow Dunedin Partnership operating budgets.

b) Notes this investment will

attract $25,000 of funding from Callaghan Innovation for continuation of the

Challenger Series.

Motion carried (ED/2019/001)

2019/2020 SUDT activity

10 On 28 May 2020, GDP resolved to

allocate $150,000, from a proposed 2020/21 operating budget of $362,600 to the

SUDT to support the development of the start-up ecosystem.

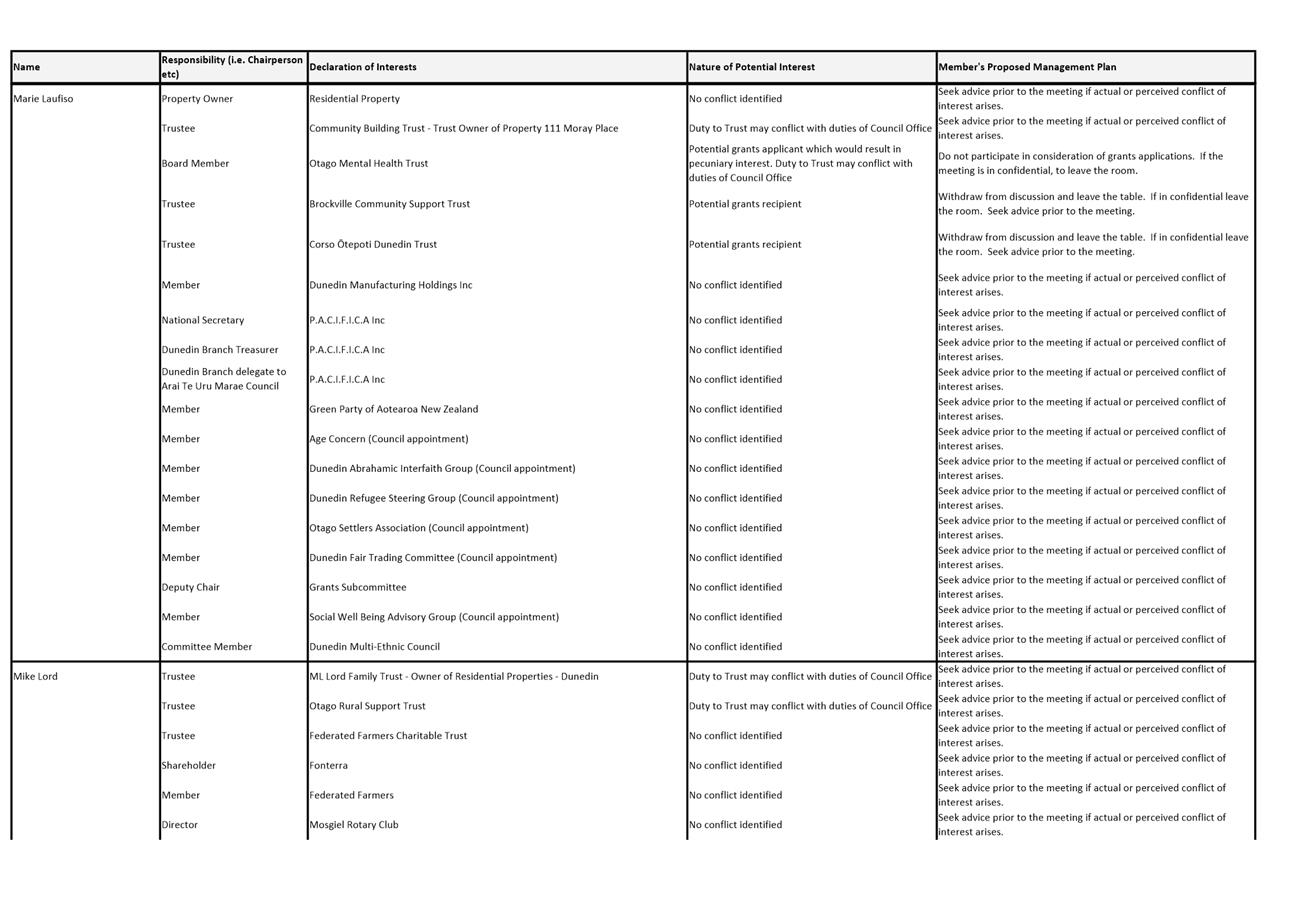

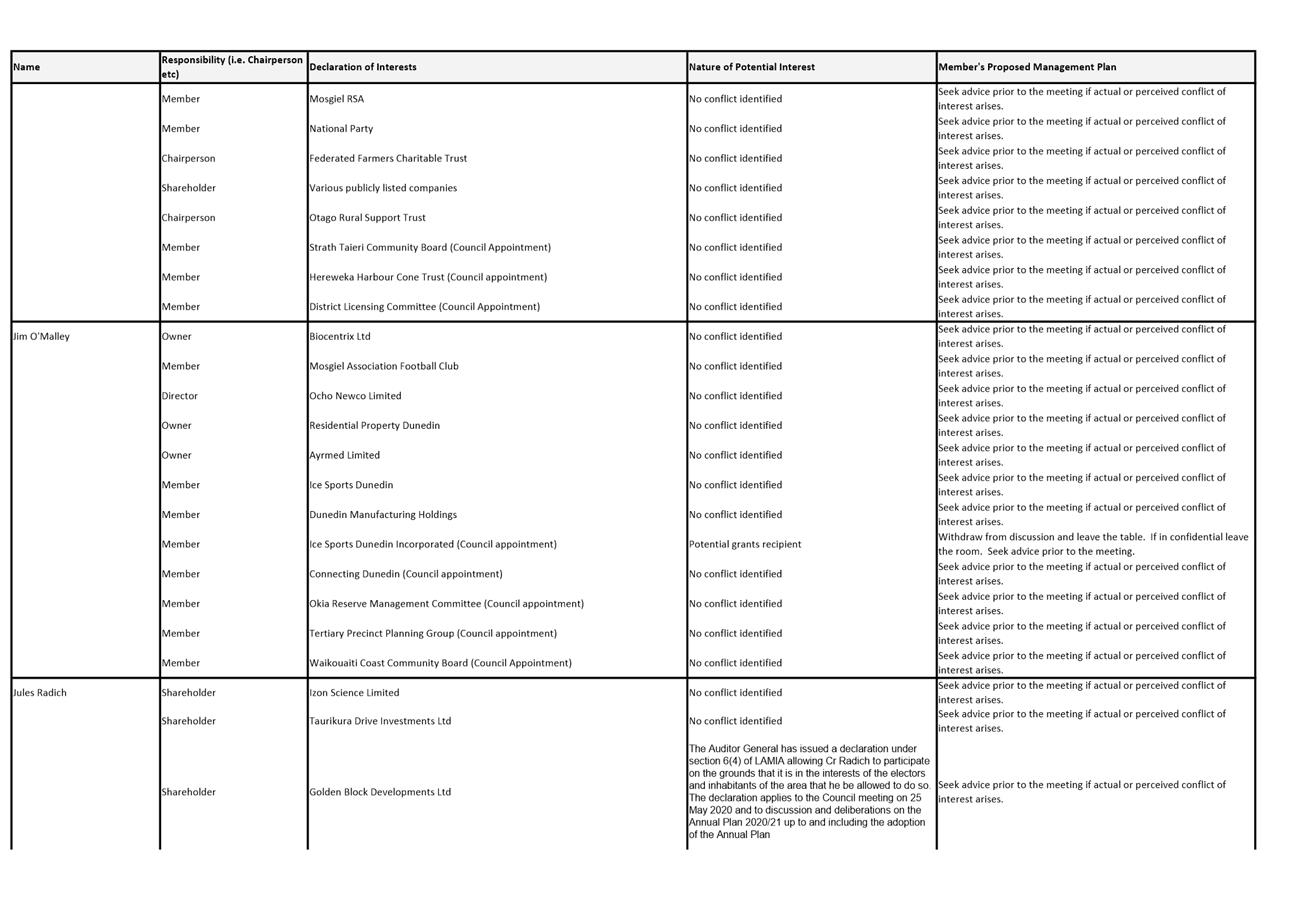

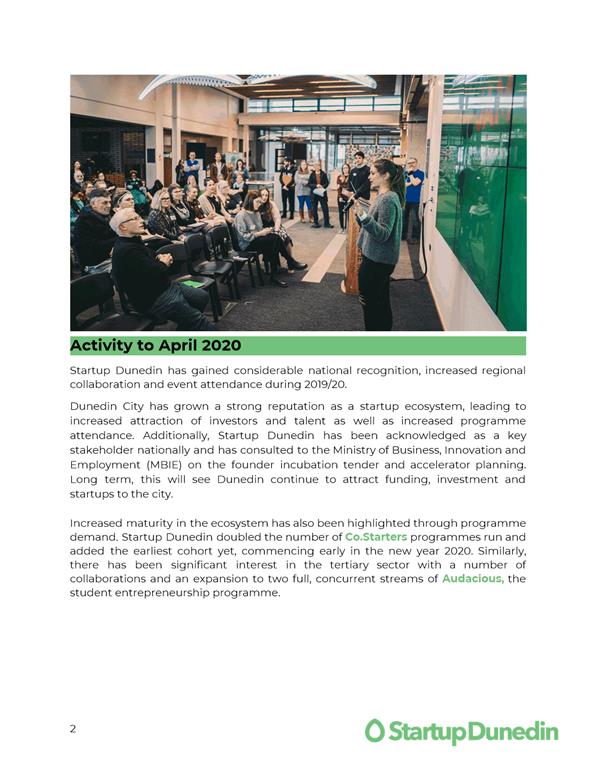

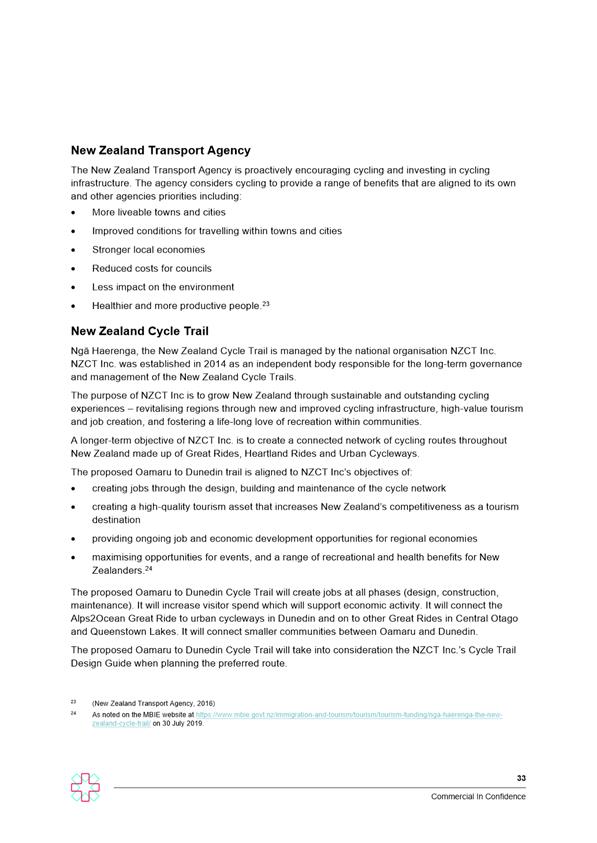

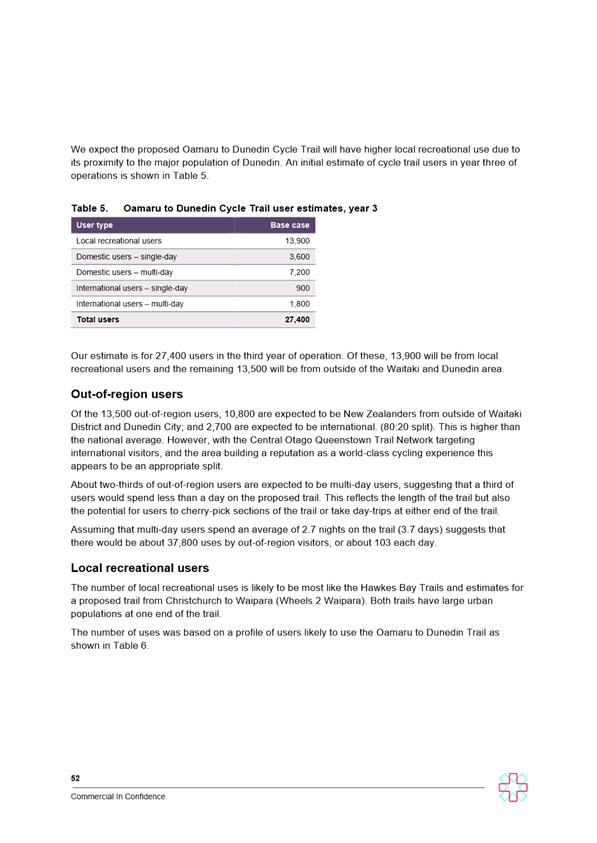

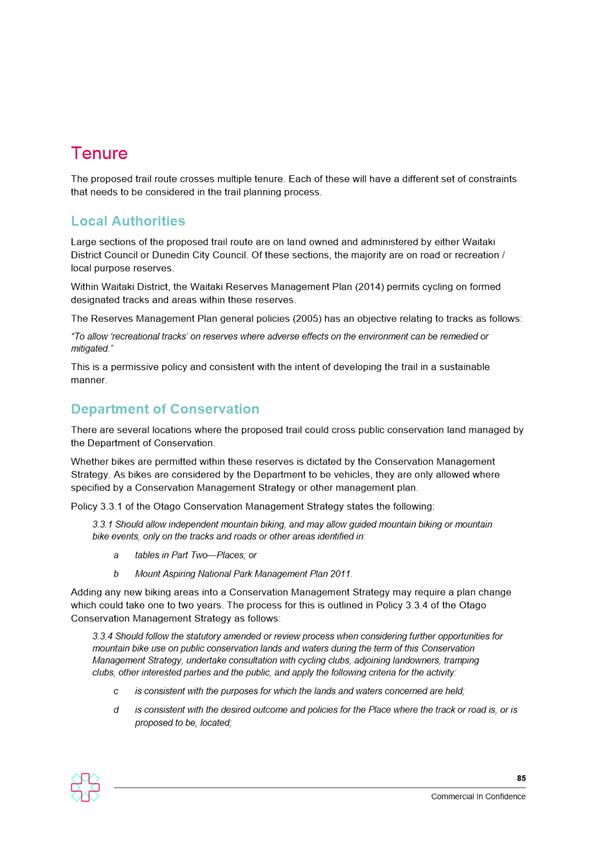

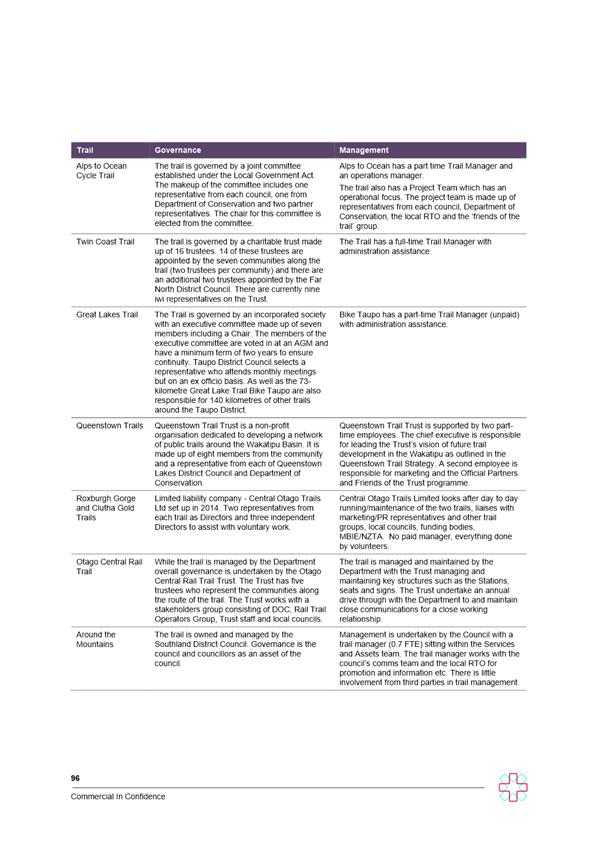

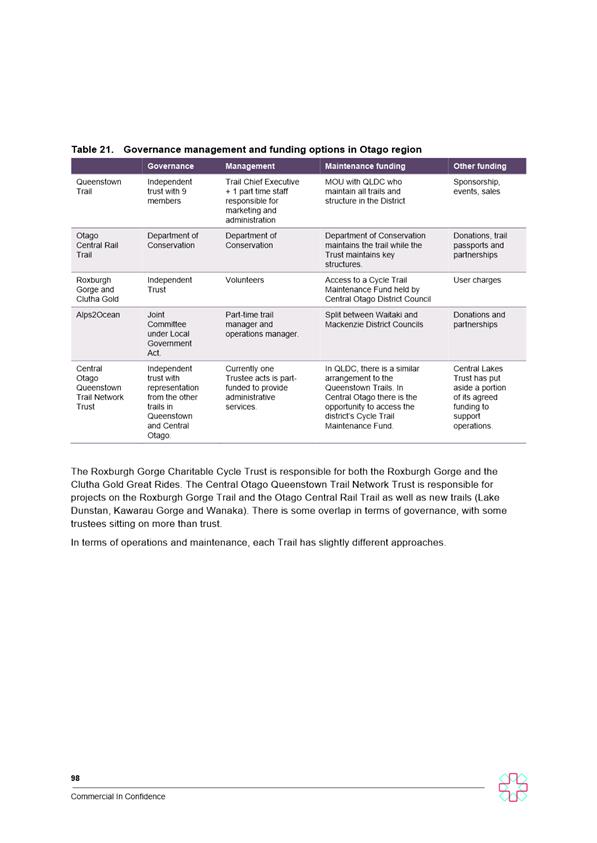

11 Table one summarises a selection of

activity undertaken, and outcomes achieved by the SUDT in the 2019/2020 year to

date.

12 Over the last 12 months the SUDT has

focused on three key areas:

a) Enable connections, better

collaboration and alignment of resource;

b) Improve visibility;

c) Improve performance measures.

Table One: Summary of SUDT activity 2019/2020

|

Objective

|

2019/2020 KPI

|

Outcome (based on participation

feedback)

|

|

Programme completion/Mentor support

and advice

|

|

Co.Starters

|

· Two cohorts

· Recommendation rate

80%

· Instrumental in validation

· Connection and

support by community

|

Five held

100% rated 7+ out of 10

100% rated 7+ out of 10

80% felt connected and supported

|

|

The Distiller Workspace

|

· Five incubates per

year

· Recommendation rate

100% Instrumental in validation

|

10 used the space

85% agreed, 15% neutral

|

|

The Challenger Series

|

· 40 applications from

businesses who believe they are ready for global growth

· Recommendation rate

100% instrumental in validation

|

42 applications received

100% rated 7+ out of 10

|

|

Audacious

|

· 100% understand how

to found/play a role in a start-up

· 50% want careers

that involve entrepreneurship

|

100% rated an improvement in understanding)

(86% want a career which develops the

skills gained via Audacious)

|

|

Events

|

|

|

· start-up events

· Host high level

investor pitch

|

Average 3-4 per month

100+ attended

|

13 During the period:

a) DCC’s representative

Nigel Bamford, appointed on the SUDT in 2015 resigned in March 2020;

b) Donna Hall who led and managed

the SUDT team returned to Polson Higgs in December 2020.

14 We wish to acknowledge Mr Bamford

and Ms Hall’s leadership, commitment and work in supporting the SUDT and

ecosystem.

15 During the initial COVID-19 lockdown

the SUDT undertook an assessment of the start-up ecosystem. SUDT received 123

responses in 48 hours which indicated that:

• 38%

had been operating for less than a year;

• 30.1%

were pre-revenue and 35% less than $100,000;

• 68.6%

did not qualify for the government relief package

16 The top three areas of concern

indicated by respondents at the beginning of lockdown were:

• Ongoing

financial viability - 25.8%

• Support

to manage cash flow challenges - 20.1%

• Regular

updates and advice on market changes – 9.4%

17 The Annual Ecosystem Survey will now

be sent in September (Q3). Enterprise Dunedin has requested supplementary

questions to understand the future challenges due to COVID-19 and related

factors facing start-ups in Dunedin.

OPTIONS

Option One–Approve $150,000 investment in the

Start-up Dunedin Trust (preferred option).

18 EDC approves $150,000 from proposed

2020/2021 operating budgets to support the startup ecosystem.

Advantages

· Option one is

supported by GDP and has been developed in conjunction with the SUDT, the wider

ecosystem, local businesses and partners;

· SUDT activities,

delivery and outcomes are resourced during the 2020/2021 financial year;

· Provides a platform to

support the development of talent and start-ups to grow Dunedin’s

technology and creative sectors.

Disadvantages

· $150,000 less for

other 2020/2021 GDP activities.

Option

Two–Approve a smaller investment or no investment in the Startup Dunedin

Trust

19 EDC approves a smaller or no

investment (i.e. less than $150,000) for 2020/2021 from proposed GDP budgets to

support the SUDT and the continued development of the startup ecosystem.

Advantages

· $150,000 for other

2020/2021 GDP activities.

Disadvantages

· Fewer services and

support for the start-up ecosystem during a period of increased uncertainty,

after a period of continued momentum and growth;

· Fewer services and

support for groups that are already underrepresented in the start-up ecosystem,

which includes an increase in first-time beneficiaries/jobseekers as a result

of COVID-19;

· Uncertainly for SUDT,

staff and existing programmes.

NEXT STEPS

20 Enterprise Dunedin will update the

2020/2021 SLA with SUDT to continue to support the social, economic,

environmental and cultural wellbeing of Dunedin, by emphasising a focus on

groups that are already underrepresented in the start-up ecosystem, and an

increase in first-time beneficiaries/jobseekers as a result of COVID-19.

Outcomes will be reported back to EDC through quarterly reports.

21 Enterprise Dunedin will commence a

process to replace Nigel Bamford on the SUDT Board and will make a

recommendation to Council for approval.

Signatories

|

Author:

|

Chanel O'Brien - Business Development Advisor Skills and

Entrepreneurship

Fraser Liggett - Economic Development Programme Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Startup Dunedin Trust

(SUDT) Progress Report 2019/20

|

24

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose of

Local Government

This

decision promotes the economic well-being of communities in the present and

for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not

applicable

|

|

Social

Wellbeing Strategy

|

|

☐

|

☒

|

|

Economic

Development Strategy

|

☒

|

☐

|

☐

|

|

Environment

Strategy

|

☐

|

☐

|

☒

|

|

Arts

and Culture Strategy

|

☒

|

☐

|

☐

|

|

3

Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial

Plan

|

☐

|

☐

|

☒

|

|

Integrated

Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks

and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other

strategic projects/policies/plans

|

☐

|

☐

|

☒

|

The

preferred option in the report supports the goals of the Dunedin Economic

Development Strategy under the themes Alliances for Innovation and Hub for

Skills and Talent. Creative businesses are represented in the startup

ecosystem. The proposed option and measures also support the theme of

Creative Economy under the Arts and Culture Strategy.

|

|

Māori Impact

Statement

Ngai

Tahu are represented on GDP and have an opportunity to contribute to decision

making on the 2020/2021 activities of the SUDT and the startup ecosystem.

|

|

Sustainability

Ongoing

business development and support for the startup ecosystem has been identified

as one priority by GDP and Enterprise Dunedin to meet the economic goals in

the 2013-23 Economic Development Strategy.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There

are no implications for the LTP, Annual Plan, Financial Strategy and

Infrastructure Strategy.

|

|

Financial

considerations

The

total cost of the recommended option is $150,000 from proposed 2020/21 Annual

Plan budgets

|

|

Significance

This

decision is considered low in terms of the Council’s Significance and

Engagement Policy.

|

|

Engagement –

external

The

following organisations have been engaged regarding the recommendations in

this report, the Grow Dunedin Partnership (including: Dunedin City Council,

Otago Chamber of Commerce Incorporated, Otago Southland Employers Association,

University of Otago, Otago Polytechnic, Ngai Tahu, John Gallaher, Forsyth

Barr), the Otago Business School, Startup Dunedin Trust and wider startup

ecosystem.

|

|

Engagement -

internal

There

has been no internal engagement.

|

|

Risks: Legal /

Health and Safety etc.

There

are no identified risks.

|

|

Conflict of Interest

There

is no conflict of interests.

|

|

Community Boards

There

are no implications for Community Boards.

|

|

|

Economic Development Committee

15 June 2020

|

Enterprise Dunedin Activity Report - June 2020

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee on

several Enterprise Dunedin activities.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Enterprise Dunedin Activity Report – June 2020.

|

BACKGROUND

2 Enterprise

Dunedin activity is informed by the 2013-2023 Economic Development

Strategy. The strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances

for innovation – to improve linkages between industry and research.

c) A

hub for skills and talent – to increase retention of graduates, build the

skills base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A

compelling destination – to increase the value of tourism and events and

improve the understanding of Dunedin's advantages.

3 The

strategy sets out two economic goals:

a) 10,000

extra jobs over 10 years (requiring growth of approximately 2% per annum).

b) An

average of 10,000 of extra income for each person (requiring GDP per capita to

rise 2.5% per annum).

DISCUSSION

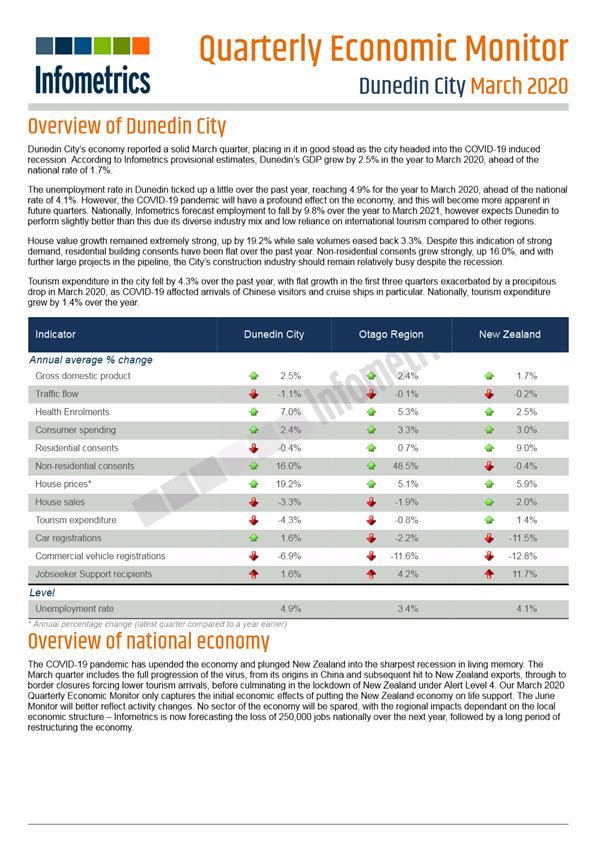

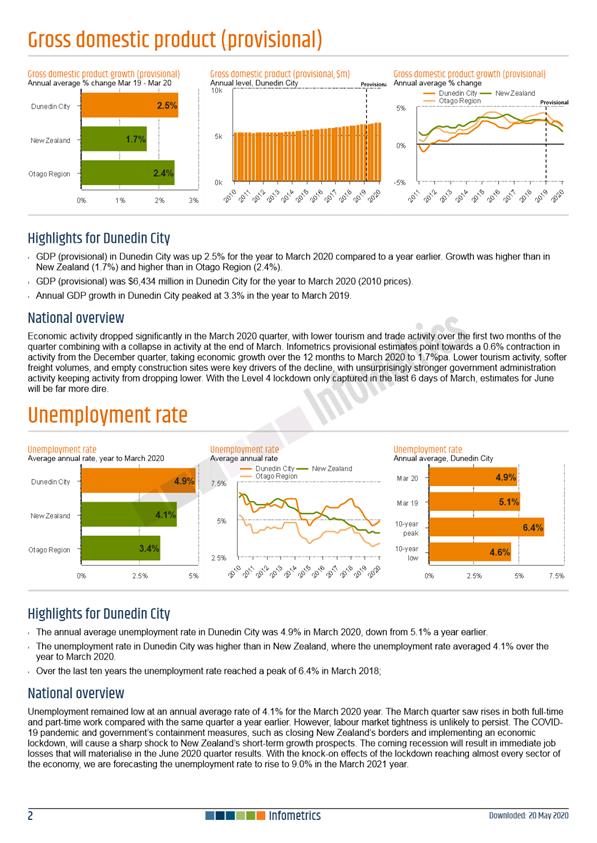

Enterprise Dunedin Activity

Outcomes and COVID19 response

March 2020 pre-COVID-19 lockdown

economic position

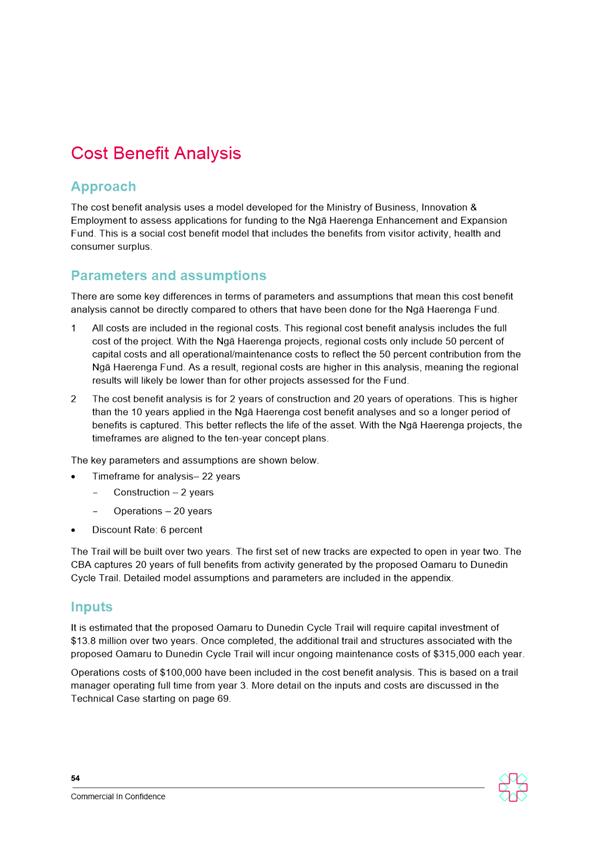

4 According

to the Infometrics Quarterly Economic Monitor the Dunedin economic entered the

COVID-19 pandemic from a solid starting position – see Attachment A.

5 March quarter data showed that Dunedin's economy was still

growing above the national average. Over the March 2020 year, Dunedin's economy

expanded by 2.4%, compared to 1.7% nationally.

6 Dunedin's unemployment rate in March was 4.9%, down

from 5.1% a year ago, but slightly above its December level.

7 Building activity, particularly in the commercial sector,

as well as a buoyant property market, kept activity levels high during the

March quarter.

8 Activity in the visitor space was already being held back

due to poor weather affecting cruise ship dockings and early

signs of fewer visitors due to COVID-19.

Subsequent insights during April

and May

9 The

pace and economic impacts of COVID -19 has limited the availability of

up-to-date and detailed indicators since March 2020. The following datasets

from a range of sources provide an overview, rather than an exhaustive list of

all aspects of the economy.

o Ministry

of Social Development (MSD) data shows the number of work ready recipients of

Jobseeker Support rose by 660 people to reach a total of 2,713 in April. In

percentage terms, this was a 32% increase (slightly below the 35% increase

experienced nationally).

o Weekly retail

spending in Dunedin during lockdown fell to 39% of its usually level, however

at the end of the first full week of Level 2 (24 May), spending had recovered

to 1.0% above its level from the same week last year. Some of the increase will

be due to pent-up demand, as spending concentrated on homeware and clothing,

rather than hospitality.

o Traffic

flows of light vehicles in Dunedin during the week ended 22 May were about 15%

below their level from the same week a year earlier, while heavy traffic flows

had recovered to their 2019 level.

Early

Assessments for Dunedin

10 It

is expected further job losses in Dunedin will emerge over the coming months.

This will continue to impact on specific parts of the economy and businesses.

However, given our economic position prior to COVID-19, we expect Dunedin's

economy to perform better than the rest of New Zealand, and some of the inland

parts of Otago (source Infometrics Quarterly Economic Monitor YE March 2020).

11 Planned

and publicly funded large-scale infrastructure and major construction work for

coastal Otago (worth approximately $3.3bn over the next 15 years in Dunedin)

will support significant activity for the construction sector and services

across the city.

12 As

with previous, historical economic shocks including the Global Financial

Crisis, we anticipate an increase in the city’s $576k tertiary education

sector, particularly in the areas of vocational education (source Infometrics

Dunedin City Economic Profile 2019).

13 Dunedin

has also seen significant development of the start-up and entrepreneurial

ecosystem over several years. This activity, in addition to the growth of more

high-tech and service businesses have, though the roll out of ultrafast

broadband, made it more practical for remote working during the lockdown

period.

14 The

local visitor economy relies more heavily on domestic tourism than other parts

of the country. 70% of visitor spending in Dunedin is by New Zealanders,

compared to 60% across the country. Although some New Zealanders will be

more hesitant to travel from a financial perspective, Dunedin is poised to

capture business from those that do choose to explore their own backyard.

Otago

Regional Economic Development Framework

15 Enterprise

Dunedin has engaged twice weekly with other economic development agencies and

Otago Regional Council (ORC) on data sharing and response and recovery planning

since the outbreak of COVID-19. This work which has been informed by the Otago

Regional Economic Development (ORED) framework has been supported through the

two Provincial Growth Fund (PGF) supported Regional Economic Development

Advisors based in Dunedin and Central Otago.

16 The

focus has been to realign strategic priorities from economic growth to economic

recovery. This has resulted in engagement with Ministry of Business Innovation

and Employment (MBIE) and other agencies including the Ministry of Social

Development (MSD) and University of Otago.

17 The

Economic Development Advisors in conjunction with an ORC and external

economists are currently developing COVID-19 economic scenarios. This work has

included engagement with impacted businesses sectors across the city and

region. This project and modelling which should be finalised by the end of the

month is intended to provide advice and data to inform post-COVID-19 for local

and regional economic opportunities.

18 Enterprise

Dunedin, the Ministry of Social Development, Aukaha and ORED Councils have

continued to progress the Construction Skills Labour Forecasting (CSLF)

project, funded through the Provincial Growth Fund (PGF). This project is

aligned to work undertaken by the Otago Chamber of Commerce on employment and

skills opportunities arising from the Dunedin Hospital rebuild.

19 A

draft model submitted in early April is currently being re-worked by the

Building Construction Industry Training Organisation (BCITO) to take account of

COVID-19 implications on investment decisions.

20 The

updated report and model are due by the end of next month and will identify

proposed projects, skills requirements and measures to support employment

opportunities on proposed infrastructure and shovel ready projects. A separate

report will be brought back to the Economic Development Committee.

Centre of Digital Excellence

21 In its 2017 election manifesto, the Government committed to

establishing a Centre of Digital Excellence (CODE) in Dunedin. The

Government’s vision for CODE is to contribute to a video game development

sector generating $1B of output over 10 years.

22 In October 2019 the PGF confirmed $10m, supported by approximately

$2.6m funding from Enterprise Dunedin, the University of Otago and Southern

District Health Board for CODE. Since then, the Working Group and project team

led by Enterprise Dunedin has progressed (and accelerated during the Alert

Level 4 lockdown) several workstreams in order to establish CODE

23 The key areas of focus have included:

Development

of a business grants programme (ongoing)

Ongoing

development of ‘Kaupapa CODE’;

Development

of the CODE operating principles, legal entity, shareholding structures;

Ongoing

development of vocational models (drawing on international good practice) and

tertiary curriculum with the Otago Polytechnic and University of Otago;

Contracting the

appointment of an Establishment Director and identification of a physical home

for CODE (currently in process);

Progressing

opportunities with Japanese gaming company, JPGames.

24 Announcement on a number of these workstreams are expected over the

next month and further updates will be provided to the Economic Development

Committee.

Business Vitality

25 Energy

a) Biomass

i. Investigations

into a wood-fuelled Dunedin District Energy System (DES) for the CBD continue,

following the jointly commissioned DCC/University of Otago/SDHB/MoH Indicative

Business Case.

ii. The DCC is

also doing due diligence into the non-DES options available to heat the

DCC-owned Octagon area buildings and Moana Pool, as a comparative measure to

the jointly commissioned Indicative Business Case that was delivered by Stantec

late last year. Stantec is undertaking this work for the DCC.

iii. The DCC is as we

move through this investigation phase, incorporating provision for pipework

into its design work on the George Street upgrade, to ensure the opportunity of

connecting to the DES is preserved.

iv. The DCC is a member of

a joint working group progressing discussions around the DES. Through this

working group, the DCC is seeking clarity about the possibility of obtaining

clean energy through the existing Pioneer-operated DES, as an interim measure while

other energy centre(s) are established. The DCC is also seeking clarity around

proposed commercial models for the DES generally, and energy centre(s)

specifically.

v. The DCC will

shortly commission an update to wood supply chain projections.

b) Baseline

Energy

The University of Otago’s Centre for Sustainability

is again completing the Dunedin Energy Study for the DCC, however due to

Covid-19 this has been delayed. The final report is anticipated within two

weeks.

c) Electric

Vehicles

i. The DCC supported

a CODC application to the Round 8 EECA Low Emissions Vehicle Fund, for a rapid

charger in Middlemarch.

ii. The new Water Street

rapid charger, supported by Council, is now operational.

iii. The DCC is scoping an EV

charging needs assessment and charging plan for Dunedin.

d) Energy

Leaders

i. The DCC has

commenced a refresh of its internal Emissions Reduction Plan, with the plan of

developing new targets and a comprehensive action plan.

ii. Discussions

have commenced with various stakeholders regarding a possible Zero Emissions

Business Support programme.

26 Good

Food Dunedin

a) COVID-19

support for the local food sector

The Good Food Dunedin Coordinator has continued to provide

one-to-one support, information sharing with industry bodies to the local food

sector. While many businesses have shown their ability to pivot quickly and

thereby provide some income security, the current environment has proved

challenging for others.

b) Foodprint

Foodprint, an app-based platform for rescuing perishable

edible food, launched in Dunedin in February. 28 eateries are now using the

platform to sell ready-to-eat food that would otherwise become waste. Foodprint

acts in a complimentary way to KiwiHarvest, who rescue non-perishable food

which is distributed to our vulnerable residents.

c) Aotearoa

Food Policy Network

As a member of the Aotearoa Food Policy Network the

Dunedin City Council continues to provide a leadership role in national

conversations around food policy. It is anticipated that food resilience will

high on the agenda in the wake of COVID-19 particularly considering the impacts

on small scale growers, farmers and producers who are not part of the

mainstream supply chain, and on rates of food insecurity in NZ homes.

Alliances for Innovation

27 Film

The Covid-19 pandemic

shut down all filming activity at Level 3 and Level 4. Film permitting in

Dunedin has resumed at Level 2 however all permit requests now require project

registration with ScreenSafe and Health and Safety plans that meet standards

endorsed by Worksafe.

a) Film

Dunedin has progressed two key related activities of COVID-19 related response

as part of the lock down:

i) A

funding request to develop Council owned property at Parry St for film studio

and workshops was submitted to the Crown Infrastructure Fund ‘shovel

ready’ projects in April. The proposal has progressed to the second

round of assessment.

ii) Work

has commenced on the development of an Investment Logic Mapping (ILM) and

business case to further coordinate, strengthen and develop the Dunedin and

regional film ecosystem. This work (“strengthening the screen

eco-system”) was planned pre COVID-19 to support the Parry Street shovel

ready proposal and has brought together screen business leaders, academics,

creatives and council staff from Dunedin and Queenstown. An initial report is

expected by end of June 2020.

b) The

Dunedin and the Queenstown Film Offices are continuing to collaborate

successfully through Film Otago Southland (FOS) to deliver regional marketing,

project facilitation and industry support. Most recently FOS has produced a

‘show reel’ https://www.youtube.com/watch?v=QXumlxNsFOc

which showcases film locations across Otago.

c) In

the nine-month period ending March 2020.

i) Film

Dunedin responded to 79 screen filming enquires in Dunedin compared to 43 in

the corresponding period in 2019.

ii) There

were 42 film permits issued over the nine months to March 2020, compared to 33

in the corresponding period in 2019.

b) Film

Dunedin is currently engaged with:

i) eight

domestic feature film and six domestic television and web series in varying

levels of production. These are projects developed by Dunedin writers or set in

Dunedin. This represents a growing focus to develop local content for national

and international audiences.

ii) Film

Dunedin is currently engaged with the Producers for five Short Films set in

Dunedin and planned for production in the next six months.

A Hub for Skills and Talent

28 JobDUN

- Business Internship programme 2019/2020

a) Enterprise

Dunedin facilitates the business internship programme – JobDUN. The

objective of the JobDUN programme is to meet business needs, create high value

jobs, retain skills and talent in the city and contribute to the economic

growth of Dunedin. The programme allocates funding for 50 intern placements.

b) The

2019/20 programme is still underway with businesses and interns currently

reporting back on the season by 30 June 2020.

Responses so far show:

i. 28

businesses have participated in the programme from nine sectors, mostly from

the ICT/Tech sector, followed by other, engineering/niche manufacturing,

marketing/media, sport/recreation.

ii. Businesses

have employed 31 interns in roles such as marketing, communications, design,

software developer and engineers.

iii. 24

of these are new roles to the participating organisations.

iv. 16

interns were employed in casual/contract roles, seven in part-time equivalents

(PTE), and eight as full-time equivalents (FTE).

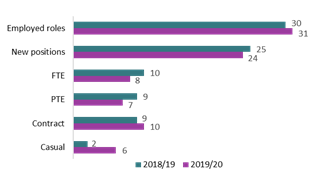

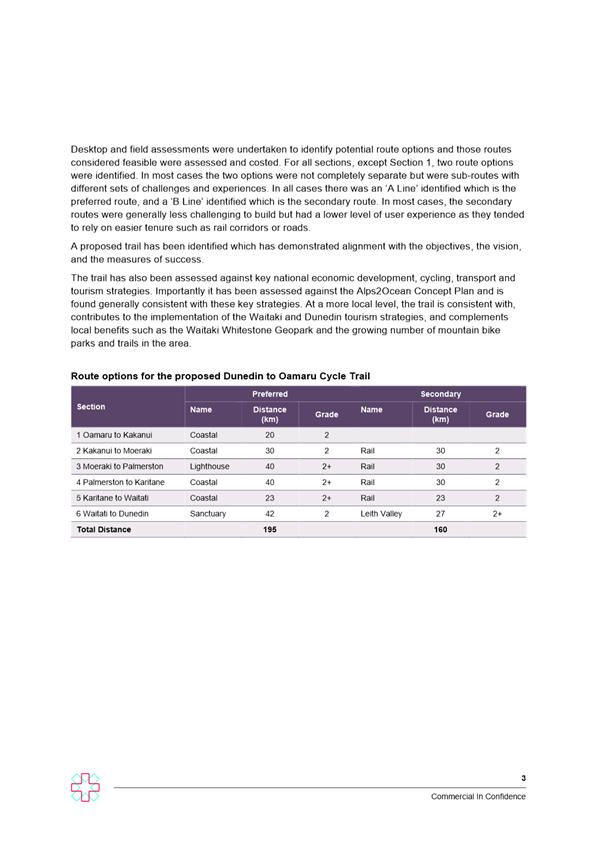

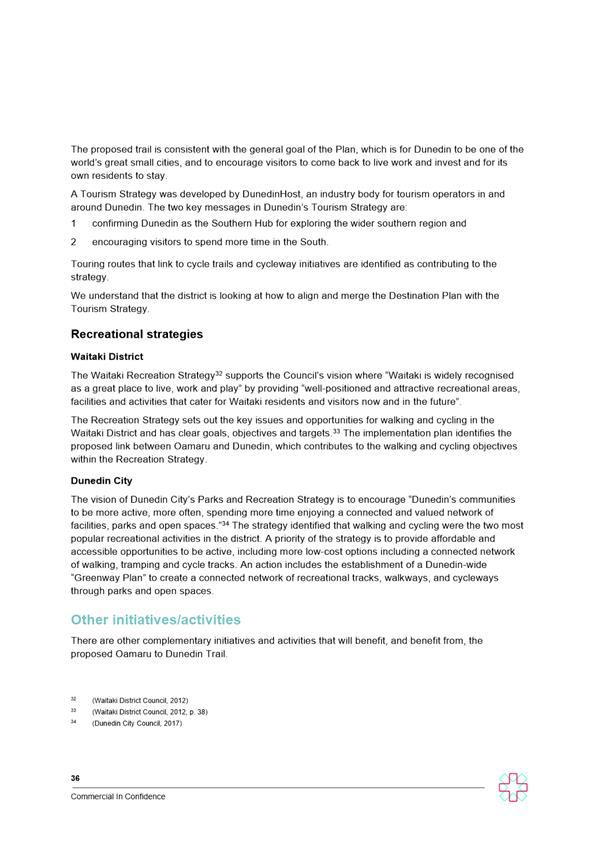

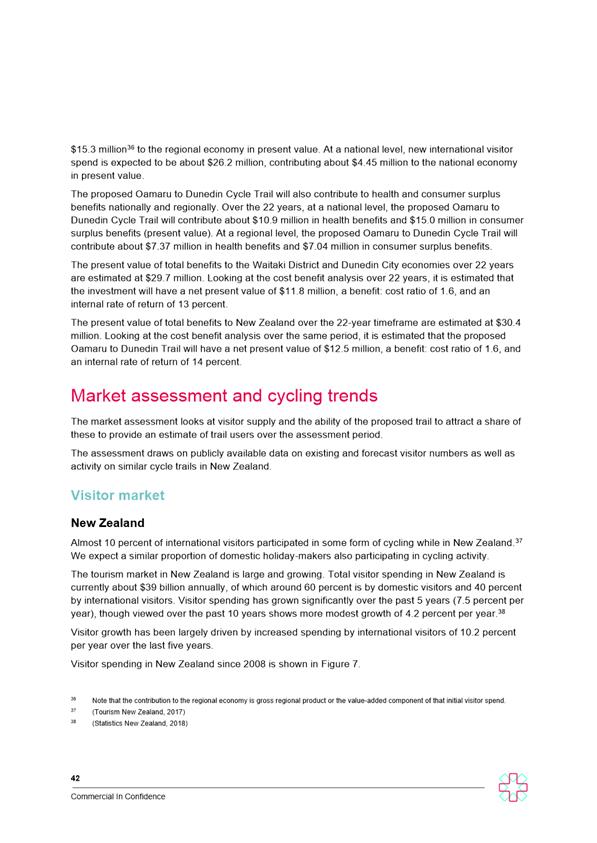

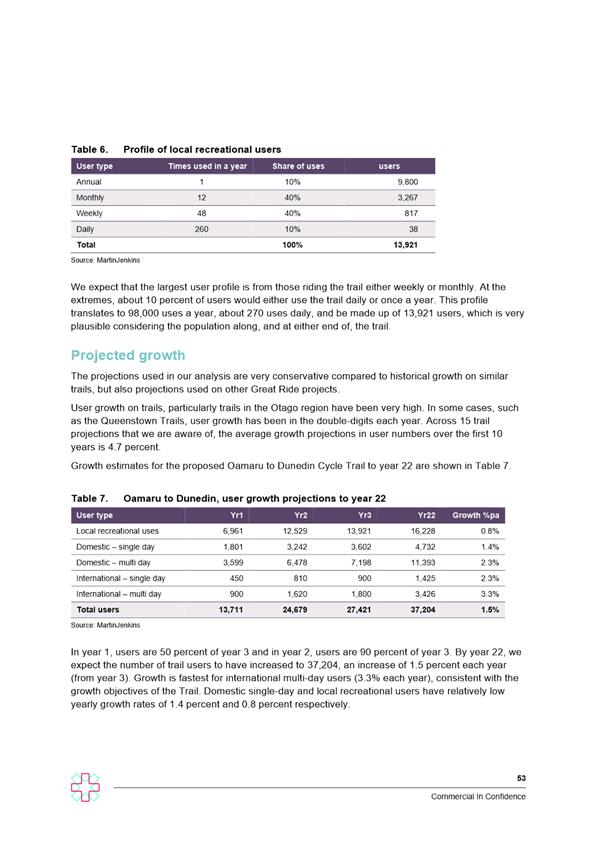

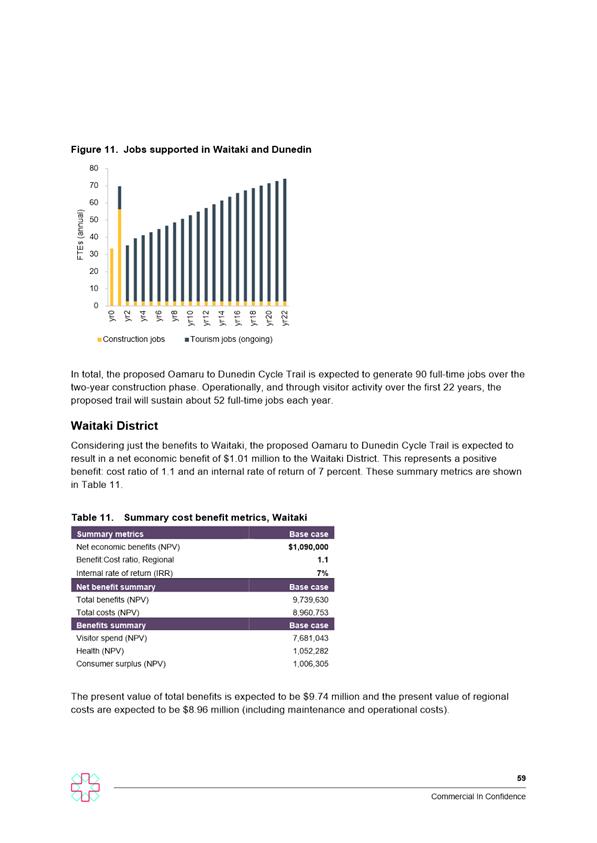

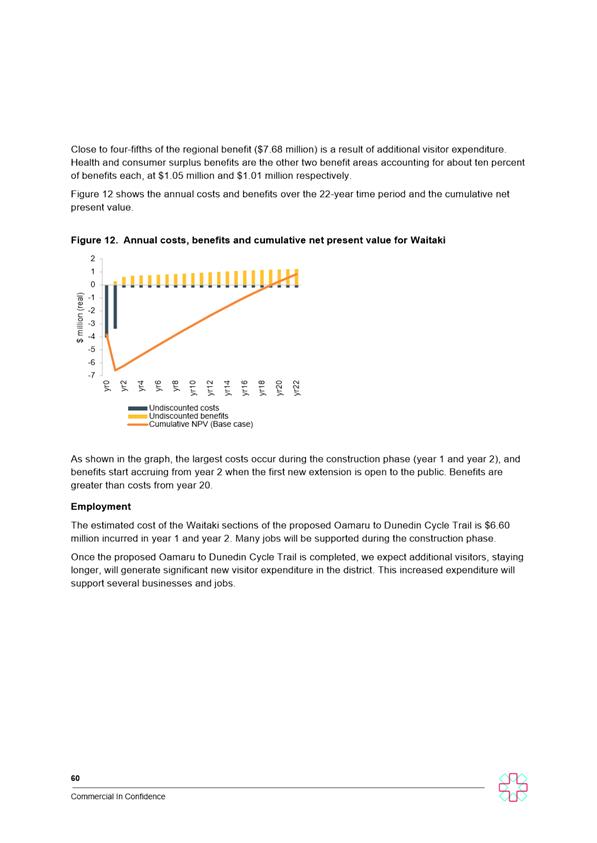

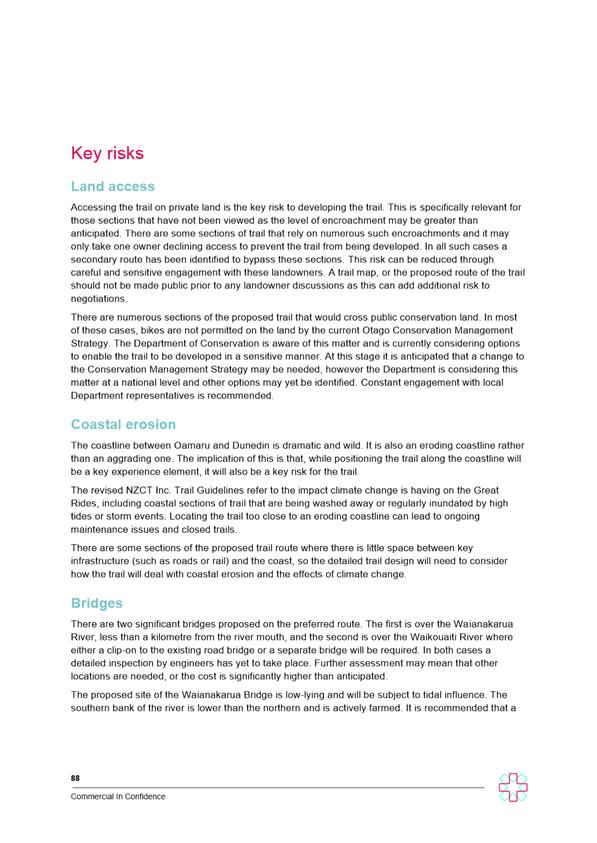

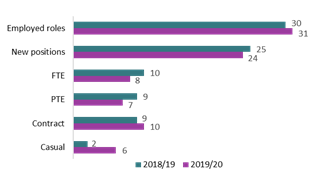

Graph 1. Employed roles and new positions 2018/19 and

2019/20

v. Business

satisfaction has remained high with 75% business very satisfied with the

programme and 23% satisfied.

Business satisfaction

with JobDUN 2019/20

|

|

2018/19

|

2019/20

|

|

Very satisfied

|

77%

|

75%

|

|

Satisfied

|

23%

|

23%

|

vi. JobDUN

COVID-19 response:

Enterprise Dunedin is currently undertaking a survey of the

companies who have used the JobDUN in the last two years to seek advice on

their business needs and internship opportunities in a post COVID-19

environment. Businesses may have a reduced appetite, or an increased one, for

taking on an intern, depending on their sector, situation and needs. Based on

this feedback JobDUN maybe reposition and change for the 2020/2021 year.

29 Techweek

2019/20

a) Techweek

helps raise the innovation profile of the city by developing its reputation for

being a launch-pad for businesses moving into global markets. The Dunedin tech

sector is increasingly important to the city’s growth generating

approximately $330 million to GDP and creating approximately 2,000 jobs.

Techweek’s response to COVID-19 means Techweek 2020 scheduled for

May has been rescheduled for July 2020 with a programme of national festival of

digital events from July to 2 August 2020.

b) Techweek’s

overall purpose is to help people ‘Connect to their future’ by

enabling digital events throughout the country. The objective of Dunedin

Techweek2020 is:

i. To

build on Dunedin Techweek 2019’s success and continue its objectives to

be a national festival showcasing and celebrating New Zealand innovation.

ii. To

work with event organisers locally to shape a festival programme that reflects

the strengths and uniqueness of Dunedin’s tech sector, and in alignment

with the Dunedin Economic Development strategy and Dunedin’s Centre

of Digital Excellence (CODE).

iii. Moving

Techweek 2020 to late July gives Dunedin Techweek the opportunity to be a

channel and platform for positive regrowth, economic stimulation and

connections during the COVID-19 recovery phase.

c) While

the new format means that only digital events will be part of the Techweek2020

festival, it also means that people will not be restricted by their

geographical locations. Dunedin Techweek will support Enterprise Dunedin to

highlight the region to NZ (and internationally) and assist in lifting industry

scale and perception. Dunedin events include a ‘GameJam’ and unique

one-off online workshops/Masterclasses, with support from CODE.

Linkages Beyond Our Borders

30 Project

China

a) Chinese,

New Zealand medical experts share 1st-hand experience on COVID-19

The Chinese Consulate-General in Christchurch and Enterprise

Dunedin supported a webinar between medical experts from China and Southern

District Health Board (SDHB) on the exchange of experiences and best practice

on combating COVID-19. During the two-hour session, The Deputy Director of

Shanghai Centre for Disease Control and Prevention and Shanghai Pulmonary

Hospital answered a broad range of questions raised by frontline medical

professionals from SDHB, including tracing suspected cases, testing

asymptomatic carriers, improving diagnostic accuracy, enhancing personal

protective equipment (PPE) and evaluating cytokine storm. The SDHB noted the

exchange was valuable and illustrated the benefits brought by sister-city

relationship between Shanghai and Dunedin.

b) Communication

and contact with Foreign Affairs Offices and Friendship Cities in China

A key milestone for 2020/21 will be the renewal of the

Shanghai – Dunedin Sister City Agreement. This will be progressed with

the Shanghai Foreign Affairs Office (FAO) over the coming months and is

expected to focus on measures which can support the economic stimulus post

COVID 19.

c) Work

with main education and tourism agents in Dunedin

The Project China Coordinator has continued to work closely

and engage with the Dunedin Chinese community members and businesses during the

Alert Level 4 lock down. Amongst other things this included supporting a local

company with an online seminar to promote Dunedin as a future destination for

international students, once travel restrictions are lifted.

A Compelling Destination

31 Dunedin’s

visitor sector has been widely affected by COVID-19. The effect has varied from

business to business, but has included: closures, hibernation, staff

redundancies, cashflow issues, uncertainty about the future and mental stress.

a) Engagement

with the Dunedin Visitor Sector

i. The

Destination Marketing team contacted over 75 operators during level 4 and level

3 restrictions. Generally, the mood within the industry was low, however the

majority remained positive about their situations and were eagerly awaiting

when they could return to work.

ii. A

new Facebook Group was established called ‘Tourism Korero’ was

established to increase communication and accessibility, with more than 90

members registered.

iii. Zoom

sessions with an average of 50 attendees have been hosted with the sector; to

discuss marketing themes, ideas and opportunities about the future for Dunedin

tourism.

iv. Working

with the wider Dunedin tourism community including Dunedin Airport Ltd, Otago

Polytechnic and Otago University to encourage a shift towards a Dunedin Inc

approach to Destination Marketing and Management.

v. Tourism

New Zealand (TNZ) has formed a reference group of RTOs with the purpose of

representing RTOs view to TNZ. Enterprise Dunedin is involved in

discussions with TNZ and Ministry of Business Innovation and Employment (MBIE)

including:

· the

re-imagining tourism project,

· potential

Dunedin involvement in the Strategic Tourism Assistance Protection Programme

(for strategic businesses) and

· the

Tourism Transition Programme (business advice and support).

vi. A

Project Manager has been appointed to coordinate a marketing and destination management

joint venture of the eight southern Regional Tourism Organisations under a

working alliance called 45°South.

vii. Collaboration

with Central Otago and Queenstown continues around the Central Otago Touring

Route which will eventually be absorbed into 45° South joint venture.

b) Research

and Data

A new Accommodation Data Programme (ADP) commences in June

with the first report due in July; the ADP replaces Statistics New

Zealand’s Commercial Accommodation Monitor (CAM) which monitored trends

in New Zealand’s commercial accommodation sector) which was discontinued

last year.

c) Business

Events (Conferences)

In partnership with Dunedin Venues Management Limited,

Dunedin Business Events has commenced a strategic review which will result in a

closer collaboration to help grow domestic business events.

d) Consumer

Marketing – New Zealand and Australia

i. In

early March in response to the international COVID 19 situation the domestic

campaign ‘Dunedin, was developed to encourage domestic visitors to

Dunedin. This was shared with operators in mid-March. However, due to lockdown

this was postponed and will now align with the Tourism New Zealand domestic

campaign launch in mid-June. The campaign will target the ‘drive’

market (residents in a 4.5-hour drive distance from Dunedin including

Christchurch) and the ‘fly’ market Wellington and Auckland using

digital and print channels. The campaign has been presented to Tourism New

Zealand, VISIT Dunedin, Air New Zealand, Dunedin Airport, Dunedin Tourism Korero

plus other visit stakeholders.

ii. Council

was approached by Firebrand to support an online platform to encourage buy

local during COVID19. Enterprise Dunedin provided marketing funding to market

and promote the site.

iii. Based

on feedback from the Dunedin visitor industry on how tourism operators can

attract Dunedin locals during the COVID-19 economic recovery phase. Enterprise

Dunedin have created a new digital campaign, with the aim of getting locals out

and enjoying the city’s unique attractions and tours. ‘Explore

Dunedin’ will be a bespoke “button” within the My Little

Local app, which already has an audience of 43,000, is easy to navigate and

will give Enterprise Dunedin some robust insights. There is no charge for operators

to take part with the initiative will be supported by a targeted marketing

campaign utilising local print and online media, push notifications, radio and

social media.

iv. In

collaboration with Dunedin Airport a welcome back to students’ message

was activated on the digital billboard above the baggage carousel on 18 March,

when the first direct scheduled service from Auckland resumed.

32 Study

Dunedin - COVID-19 Impact on International Education

International education has been significantly impacted on

and off shore by COVID-19 and New Zealand Government lockdown of borders.

Study Dunedin has worked during this period to support institutions, students

and agents in several ways.

a) Two

large repatriation missions were launched during lockdown by the German and

Thai governments. Study Dunedin chartered a bus for both repatriation

efforts so that 13 students could safely travel to Christchurch for

international flights or further domestic flights to Auckland to connect with

international flights. This was a complex operation involving up to six

high schools, the University of Otago Language Centre, Education New

Zealand and Embassy staff from both countries. Fit to Fly certificates for Thai

students were also required from GP’s and all students under 18 (a

majority) were legally required to have guardianship support when staying

overnight in airport hotels.

b) Four

Thai high school students who had been studying at Dunedin high schools as part

of an agreement with Study Dunedin were part of the group needing repatriation

as they had been unable to return home at the end of their study. Study

Dunedin supported this group with one-week Homestay payments.

c) The

Study Dunedin Advisory Group (SDAG) continued to meet during lockdown,

increasing their regularity to two-weekly to ensure a steady flow of

information and support. Communication continues to be the most important work

with a message of support sent to all our Auckland based education agents early

in the lockdown, followed by a Postcard to our international student cohort from

Mayor Hawkins acknowledging that they were far from family and friends at this

challenging time. A Study Dunedin Storyboard has also been developed to

keep Dunedin as a preferred destination at the top of student’s minds.

This was launched on several media platforms the week beginning 18 May.

d) Study

Dunedin is continuing to work with Education New Zealand (ENZ) regarding a post

COVID-19 international education future. ENZ believes the industry will

take some time to re-build with a three-phase focus on Stabilise –

Transform - Grow. Early indications were that 2021 would be a very

quiet year for international education however recent publicly reported

comments from both the Minister of Education and Minister of Finance regarding

international students being exempted to enter New Zealand under strict

quarantine rules before the border is open, have given the industry a sense of

purpose. Discussions will be progressed at the next SDAG meeting on how

we can develop a strong quarantine plan for the Dunedin and wider Otago region,

possibly in collaboration with Christchurch – with indications that it

will become an international entry point for the South Island.

e) Dunedin

City Council (DCC) partnered with Otago Polytechnic to bid for the New Zealand

Institute of Skills & Technology (NZIST) Headquarters in a two-stage

process which was completed just before Lockdown with a Panel visit to the

city. On 15 May 2020 it was announced that Hamilton had won the bid to

host the Headquarters. We will be seeking feedback from the Panel to

support future bids for other functions still to be rolled out as part of the

Reform of Vocational Education (RoVE).

f) COVID-19

has created the necessity for fast-tracking RoVE processes and various aspects

of the Reform will now be established as ‘interim’ functions,

including the Regional Skills Leadership Groups (iRSLG’s) and the

Workforce Development Councils (iWDCs). These are being worked on at a

regional level using the Otago Regional Economic Development (ORED) group as a cohesive

forum to contribute to this work and benefit the region in its re-set and

recovery.

33 Dunedin

i-SITE Visitor Centre

a) The

i-SITE Visitor Centre remained open remotely throughout Level 3 and 4 assisting

visitors and locals who were forced to cancel travel and holiday plans. Staff

were available to handle phone calls, answer emails and process bookings as

required. During Level 3 inquiries were about future visits and travel with

people using their time to plan.

b) Staff

not required to cover i-SITE inquiries were re-deployed assisting the Welfare

Call Back team and one of the team with foreign language skills was transferred

to the Queenstown team to assist with helping their large numbers of foreign

nationals.

c) On

Monday 25 May the i-SITE re-opened its doors, starting on shorter trading

hours, while still answering inquiries remotely from 8.30am to 5pm daily. During

Level 2 the i-SITE have been operating two teams as a safety measure should

there be the need to isolate.

d) Several

initiatives have been put in place or are being investigated to best support

our operators.

i. Providing

the operators’, a six-month brochure payment holiday, while enabling them

to keep their brochures on display. This maximises the chances of uncommitted

visitors to the i-SITE seeing operators’ product on offer and making a

booking or decision to visit.

ii. To

assist operators with cashflow, working with Finance to set up a process to pay

operator’s commission on sales, fortnightly instead than monthly.

e) In

response to closed borders and the impact of COVID-19 on travel within New

Zealand, the i-SITE have signalled significant cost savings, including staff

savings and not filling a vacancy to offset the reduction in income for the

2020/21 financial year.

f) The

current focus will be to ensure our domestic visitors continue to receive a

quality experience, as we answer inquires and book ahead for internationals

planning to travel when the boarders open and be ready to step up to look after

the cruise market when it does return whatever form that may take.

NEXT STEPS

34 Feedback

on Enterprise Dunedin activity will be incorporated into future updates.

Signatories

|

Author:

|

Fraser Liggett - Economic Development Programme Manager

Malcolm Anderson - City Marketing Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Infometrics Quarterly

Economic Monitor - Dunedin City March 2020 Report

|

59

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report promotes the economic

well-being of communities in the present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the delivery of the

2013-2023 Economic Development Strategy.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known impacts for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Enterprise Dunedin activities and the 2013-2023 Economic

Development Strategy are included in the 2018-28 Long Term Plan.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This decision is considered low significance under the

Significance Engagement Policy.

|

|

Engagement –

external

As an update report, no external engagement has been

undertaken.

|

|

Engagement -

internal

As an update report, no internal engagement has been

undertaken.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|