|

|

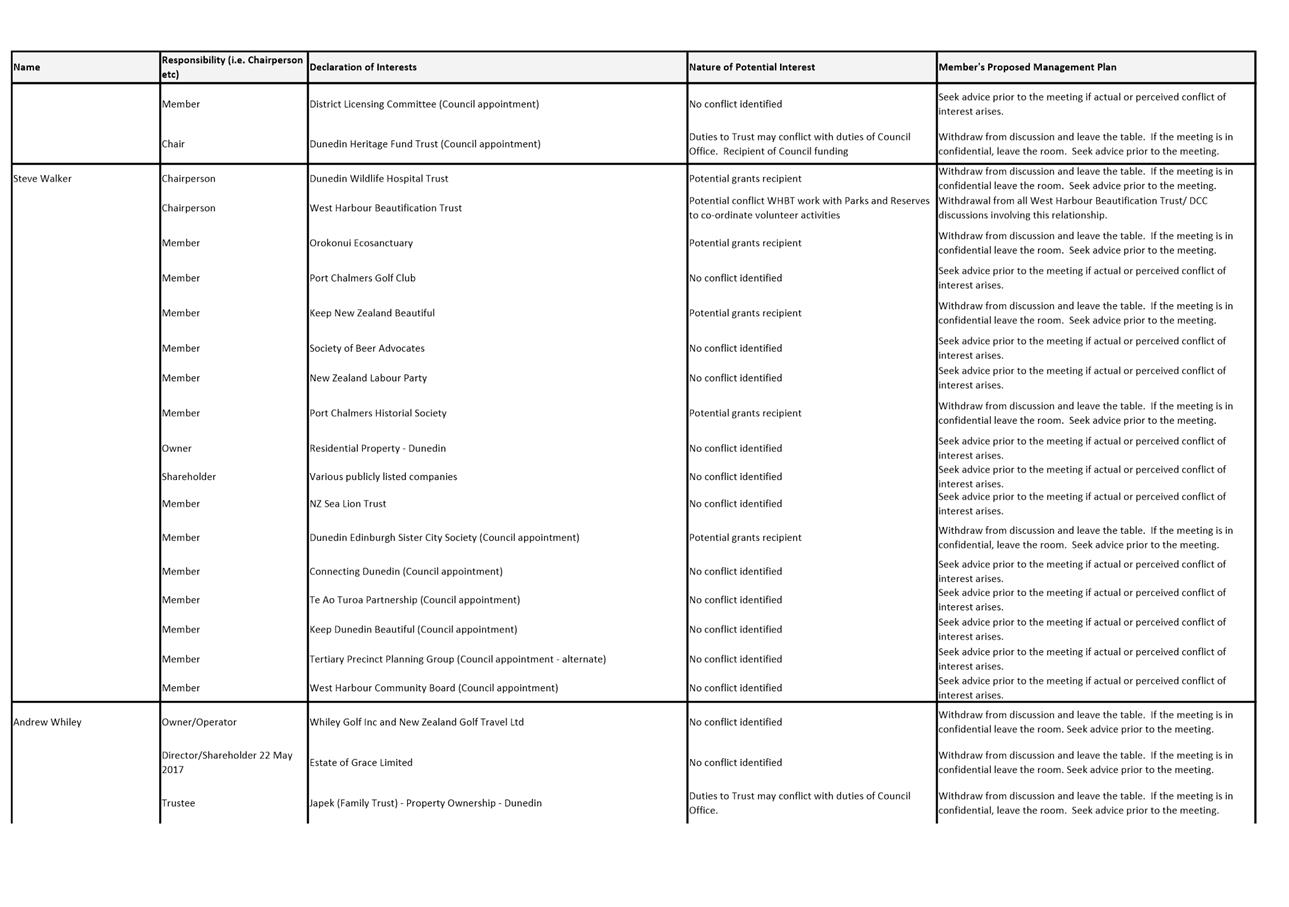

Finance and Council

Controlled Organisations Committee

31 August 2020

|

Financial Result - Year Ended 30 June 2020

Department: Finance

EXECUTIVE SUMMARY

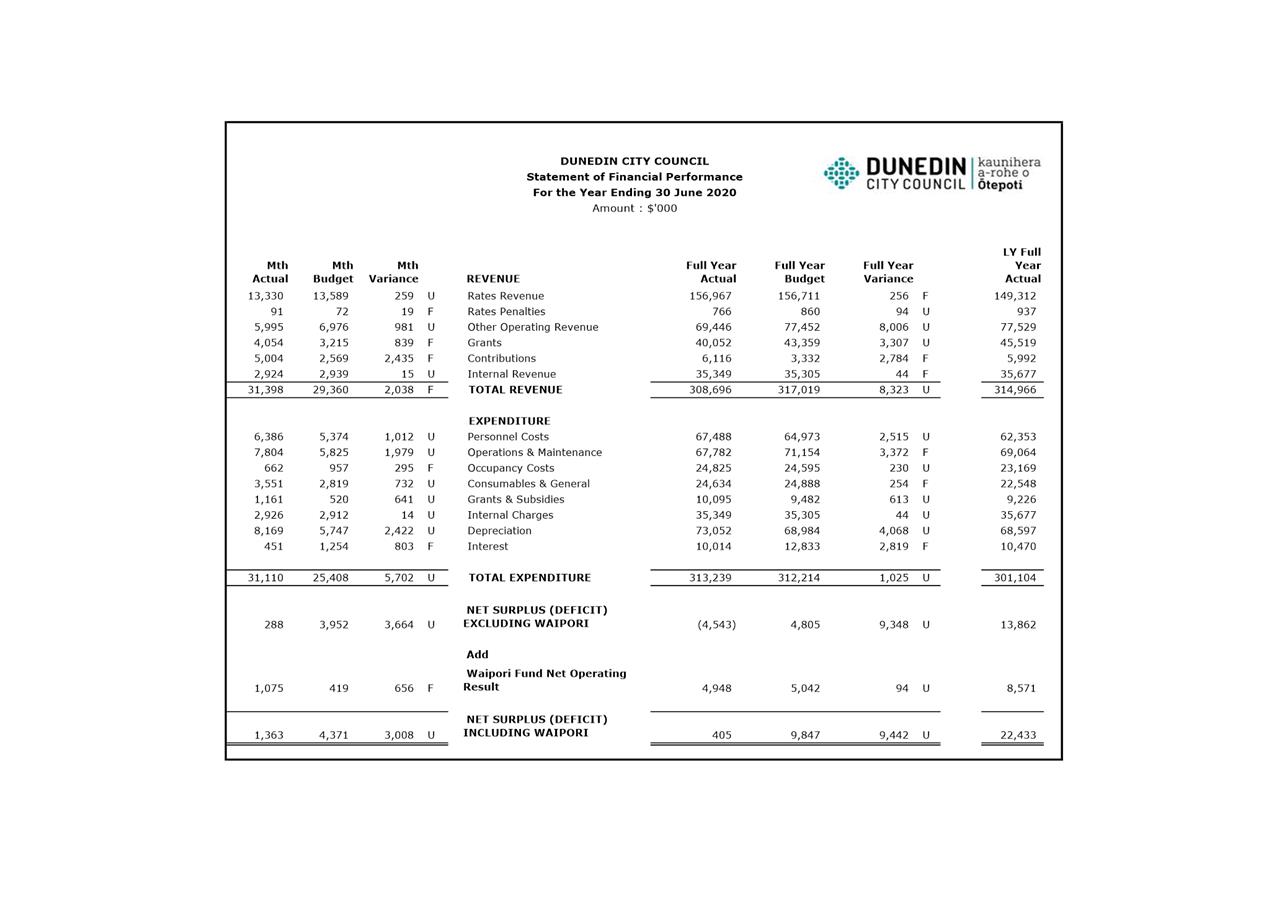

1 This

report provides the financial results for the year ended 30 June 2020 and the

financial position as at that date.

|

RECOMMENDATIONS

That the Council:

a) Notes the

Financial Performance for the year ended 30 June 2020 and the Financial

Position as at that date.

b) Notes that

the year end result is subject to final adjustments and external audit by

Audit New Zealand.

|

BACKGROUND

2 This

report provides the financial statements for the year ended 30 June 2020.

It includes reports on: financial performance, financial position, cashflows

and capital expenditure. The operating result is also shown by group,

including analysis by revenue and expenditure type.

DISCUSSION

3 The

full year unfavourable revenue variance included the impact of the nationwide

lockdown with a number of operating units recording little or no income in the

month of April, flowing into May. The variance also included the

previously reported reduced activity at the Green Island Landfill and lower

parking revenue.

Grants revenue was also less than budget due to the lower

than expected capital expenditure on roading projects.

These unfavourable variances were partially offset by an

unbudgeted dividend from Civic Assurance and unbudgeted revenue from the

Provincial Growth Fund for economic development initiatives.

Contributions revenue was also greater than budget primarily

due to a higher than budgeted level of vested assets.

4 Overall

expenditure was an unfavourable spend of $1.025 million.

The unfavourable variances included:

· higher

depreciation following the revaluation of Transport and Three Waters assets,

· higher

personnel costs due to additional staffing required to support the delivery of

2GP. Personnel costs were also impacted by an increase in the liability

for annual leave due to the current restrictions on travel and staff electing

to defer their holiday plans,

· higher

grants & subsidies due to the payment of $500k in relation to the planned

hockey turf at Kings High School originally budgeted in the 2017/2018 financial

year,

· an

increase in the aftercare provision related to the Green Island Landfill.

The unfavourable variances were partially offset by:

· lower

than expected costs associated with Parks maintenance contracts (reserves,

buildings and other facilities) resulting from the nationwide lockdown and

improved management of scheduled and unscheduled spending,

· lower

variable costs resulting from the reduced landfill activity,

· favourable

interest costs due to a lower level of borrowing and favourable floating

interest rate.

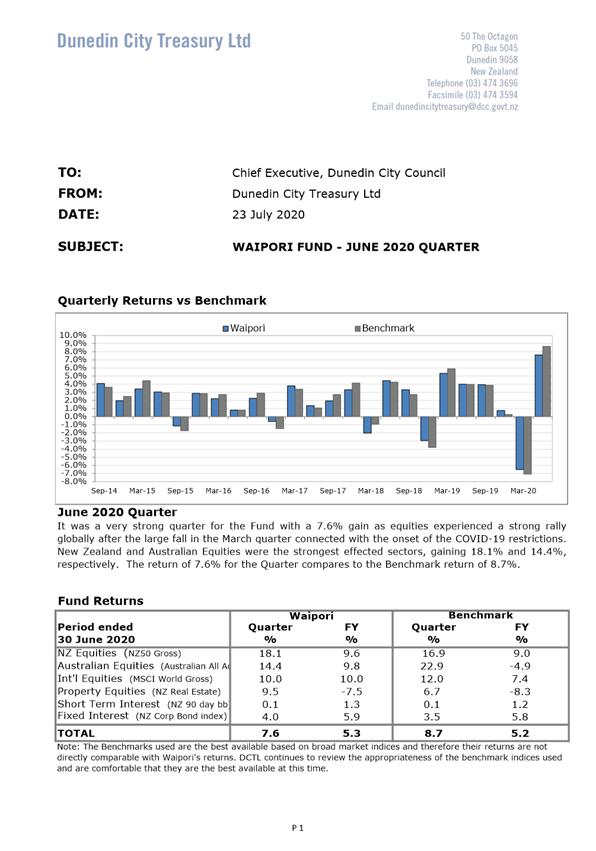

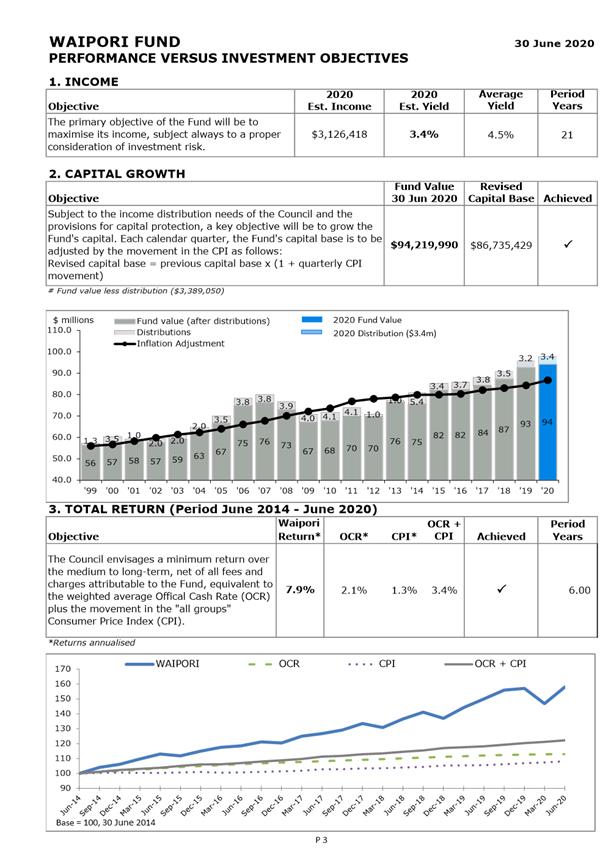

5 The

full year Waipori result was close to budget with a significant degree of

recovery in April/May following the initial market decline that occurred in

March.

6 Capital

expenditure ended the year below budget with delays for a number of projects

including limited expenditure during the nationwide lockdown.

OPTIONS

7 Not

applicable.

NEXT STEPS

8 Not

applicable.

Signatories

|

Author:

|

Lawrie Warwood - Financial Analyst

|

|

Authoriser:

|

Gavin Logie - Acting General Manager Finance

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Summary Financial

Information

|

29

|

|

⇩b

|

Statement of Financial

Performance

|

30

|

|

⇩c

|

Statement of Financial

Position

|

31

|

|

⇩d

|

Statement of Cashflows

|

32

|

|

⇩e

|

Capital Expenditure

Summary

|

33

|

|

⇩f

|

Summary of Operating

Variances

|

34

|

|

⇩g

|

Financial Review

|

35

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose of Local Government

The financial expenditure

reported in this report relates to

providing local infrastructure, public services and regulatory functions

which contribute to the well-being of the community.

|

|

Fit with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development

Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport

Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation

Strategy

|

☐

|

☐

|

☒

|

|

Other strategic

projects/policies/plans

|

☐

|

☐

|

☒

|

This report has no direct

contribution to the Strategic Framework, although the financial expenditure

reported in this report has contributed to all of the strategies.

|

|

Māori Impact Statement

There are no known impacts

for tangata whenua.

|

|

Sustainability

There are no known

implications for sustainability.

|

|

LTP/Annual Plan / Financial Strategy /Infrastructure

Strategy

This report fulfils the

internal financial reporting requirements for Council.

|

|

Financial considerations

Not applicable –

reporting only.

|

|

Significance

Not applicable –

reporting only.

|

|

Engagement – external

There has been no external

engagement.

|

|

Engagement - internal

The report is prepared as a

summary for the individual department financial reports.

|

|

Risks: Legal / Health and Safety etc.

There are no known risks.

|

|

Conflict of Interest

There are no known

conflicts of interest.

|

|

Community Boards

There are no known implications

for Community Boards.

|

|

|

Finance and Council

Controlled Organisations Committee

31 August 2020

|

Financial Review

For the year ended 30 June 2020

This report provides a detailed commentary

on the Council’s financial result for the year ended

30 June 2020 and the financial position at that date.

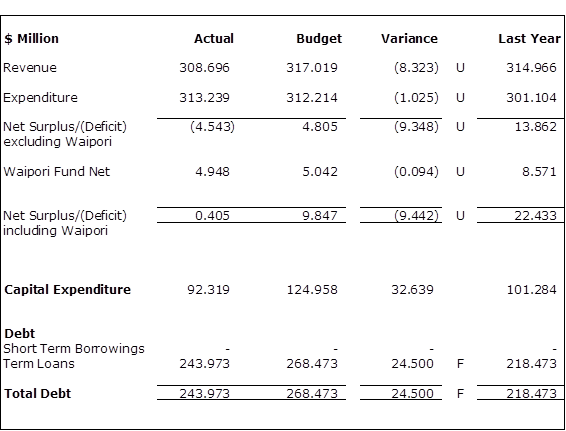

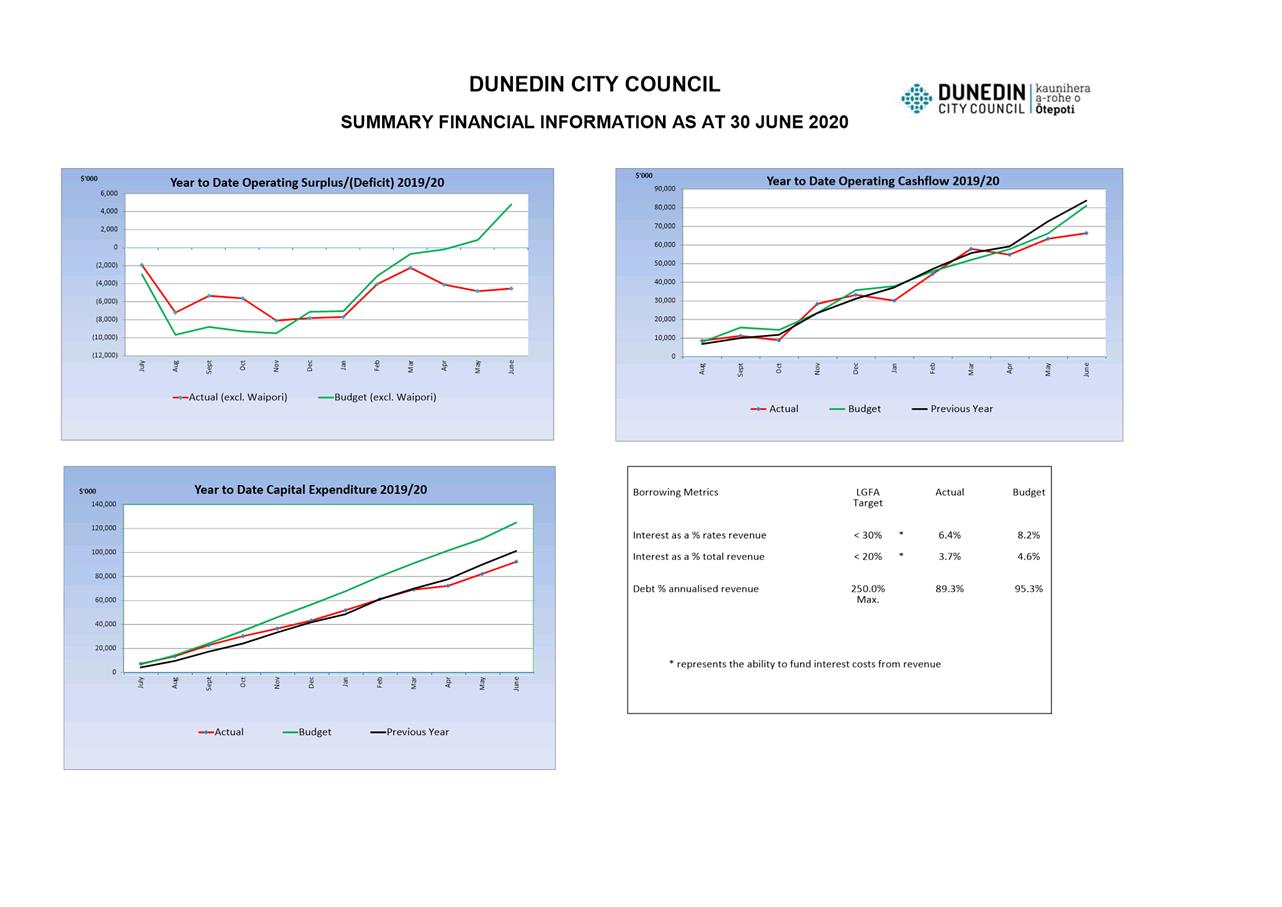

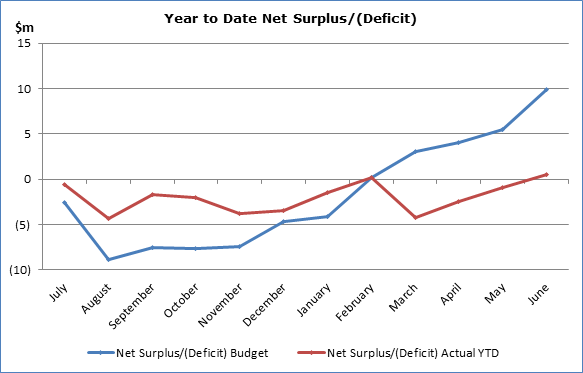

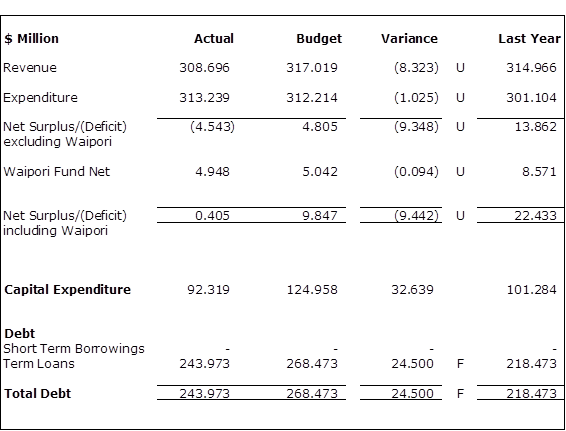

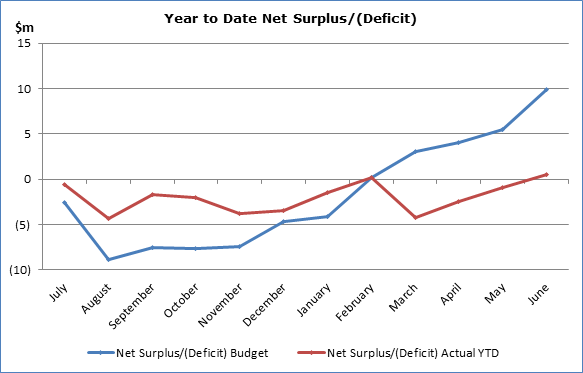

net surplus/(Deficit) (including

waipori)

The net surplus (including Waipori) for the

year ended 30 June 2020 was $405k or

$9.442 million lower than budget.

REVENUE

The total revenue for the year was

$308.696 million or $8.323 million less than budget.

The major variances were as follows:

Other Operating Revenue

Actual $69.446 million, Budget $77.452

million, Unfavourable variance $8.006 million

Waste and Environmental revenue was

unfavourable $3.402 million primarily due to lower than expected activity at

the Green Island landfill.

Parking Operations revenue was unfavourable

$2.750 million, resulting from delays in implementing the new pricing structure

at the start of the financial year, and the budget being over-optimistic with

regards to the additional income arising from this pricing structure. The

variance also included the impact of providing free parking during/after the

period of the nationwide lockdown.

A number of other operating units were

impacted by the lockdown and subsequent alert level changes. The main

areas included:

· Parking Services with lower level of infringement activity ($432k).

· Aquatic Services with reduced user fees ($915k).

· Ara Toi group with reduced visitor activity ($398k).

These unfavourable variances were partially

offset by:

Investment account revenue included an

unbudgeted dividend received from Civic Assurance ($355k).

Enterprise Dunedin revenue was favourable

$285k mainly due to revenue from the Provincial Growth Fund for several

initiatives, namely Otago Regional Economic Development, Construction Labour

Forecast and the Code of Digital Excellence.

Grants and Subsidies Revenue

Actual $40.052 million, Budget $43.359

million, Unfavourable variance $3.307 million

Transportation revenue was unfavourable

$3.527 million due to the lower than expected capital expenditure for the year

including the impact of limited activity in April.

Contributions Revenue

Actual $6.116 million, Budget $3.332

million, Favourable variance $2.784 million

The full year actual included $4.900

million of vested infrastructure assets versus a budget of

$2.500 million.

Expenditure

The total expenditure for the year was

$313.239 million or $1.025 million greater than budget.

The major variances were as follows:

Personnel Costs

Actual $67.488 million, Budget $64.973

million, Unfavourable variance $2.515 million

The full year variance reflected additional

staffing and staffing cost required to support the delivery of the 2GP and

process a higher than expected volume of building consents. The variance

also reflected ongoing recruitment of staff into the higher salary grades and a

reduction in annual leave taken across the organisation due to the nationwide

lockdown resulting in a higher than expected accrued leave as at 30 June 2020.

Operations and Maintenance Costs

Actual $67.782 million, Budget $71.154

million, Favourable variance $3.372 million

Parks costs were favourable $1.693 million partly due to tighter management of scheduled and

unscheduled work under the North and South Greenspace contracts. Some living

asset, building and paving maintenance costs were also deferred. Contract

costs savings attributed to the nationwide lockdown in April and May were

estimated to be approx. $520k across the Greenspace, Ecological and tree

maintenance contracts.

Three Waters costs were favourable $1.078 million partly due to the

impact of the nationwide lockdown in April and May. A larger than

expected amount of work under the City Care contract was capital in nature,

resulting in savings in operational maintenance and contract overhead costs of

$630k. There were also significant treatment savings in testing and

chemicals.

Grants and Subsidies Costs

Actual $10.095 million, Budget $9.482

million, Unfavourable variance $613k

Parks costs were unfavourable $508k due to

a grant relating to the Kings hockey turf budgeted in 2017/18 being paid in the

2019/20 year.

Depreciation

Actual $73.052 million, Budget $68.984

million, Unfavourable variance $4.068 million

Depreciation was unfavourable mainly due to

revaluation of Transportation and Three Waters assets effective from 1 July

2019.

Interest

Actual $10.014 million, Budget $12.833

million, Favourable variance $2.819 million

Interest expenditure was less than budget

primarily due to a favourable floating interest rate applied to the non-fixed

interest borrowing, along with a lower loan balance.

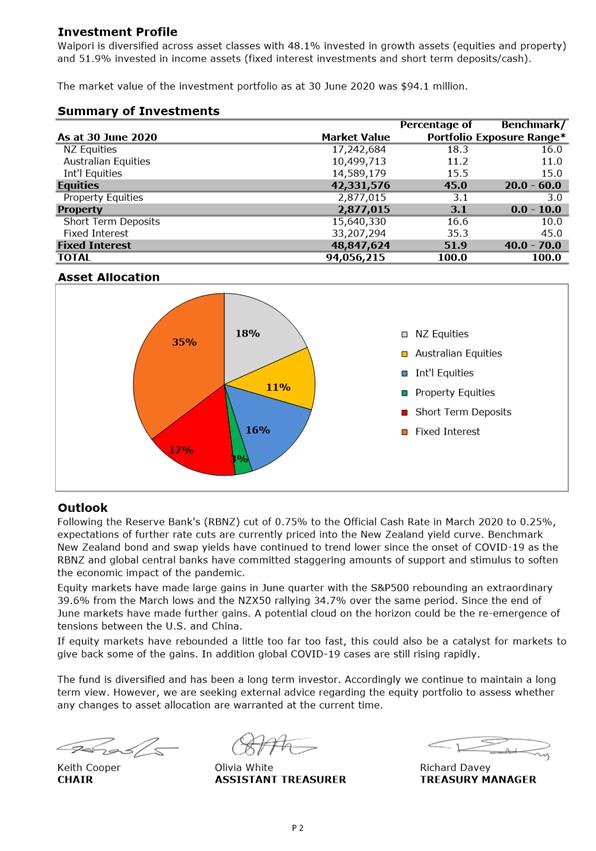

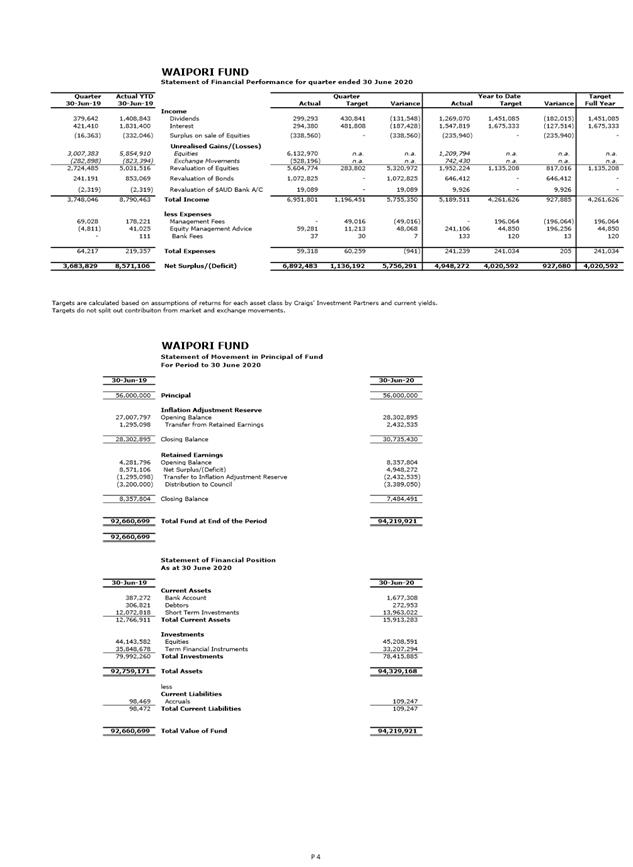

WAIPORI FUND NET OPERATING RESULT

Actual

$4.948 million, Budget $5.042 million, Unfavourable variance $94k

The Waipori Fund ended the year relatively

close to budget following the earlier market decline in March.

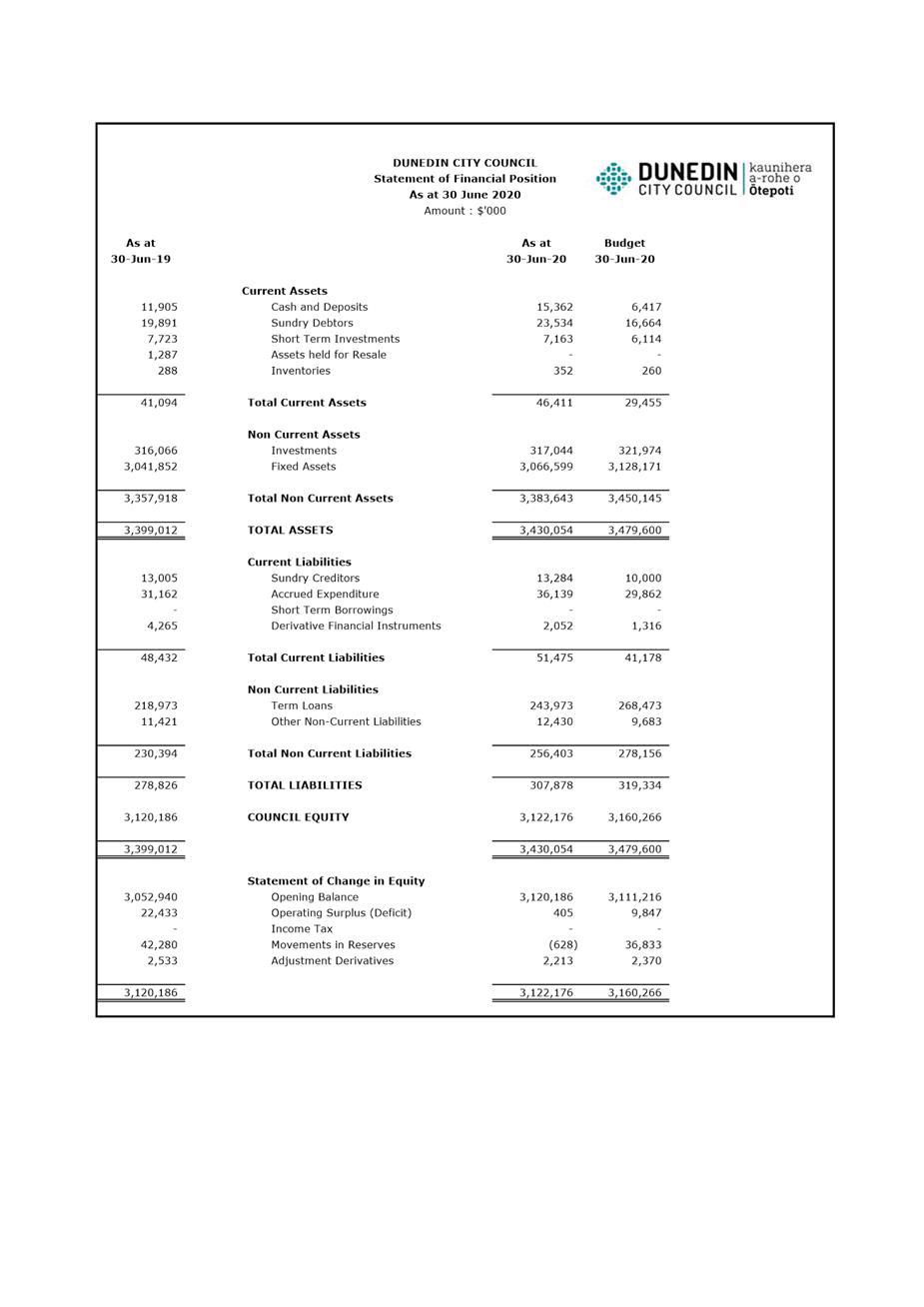

Statement of Financial Position

A Statement of Financial Position is

provided as Attachment C.

Short term investments of $7.163 million

relate to the Waipori Fund.

Total Debt ended the year below budget

following the lower level of capital expenditure, partially offset by the

revenue shortfalls discussed above.

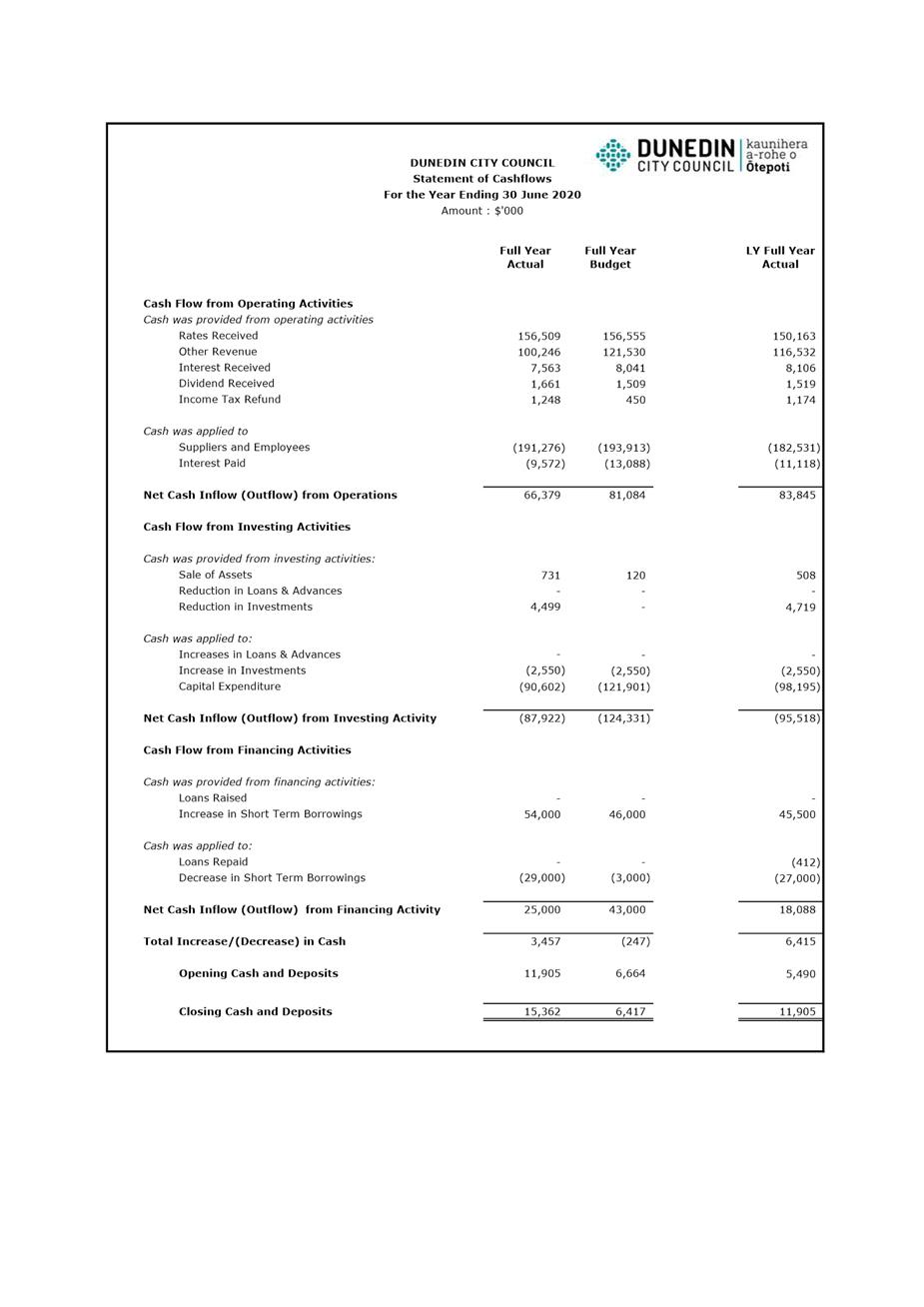

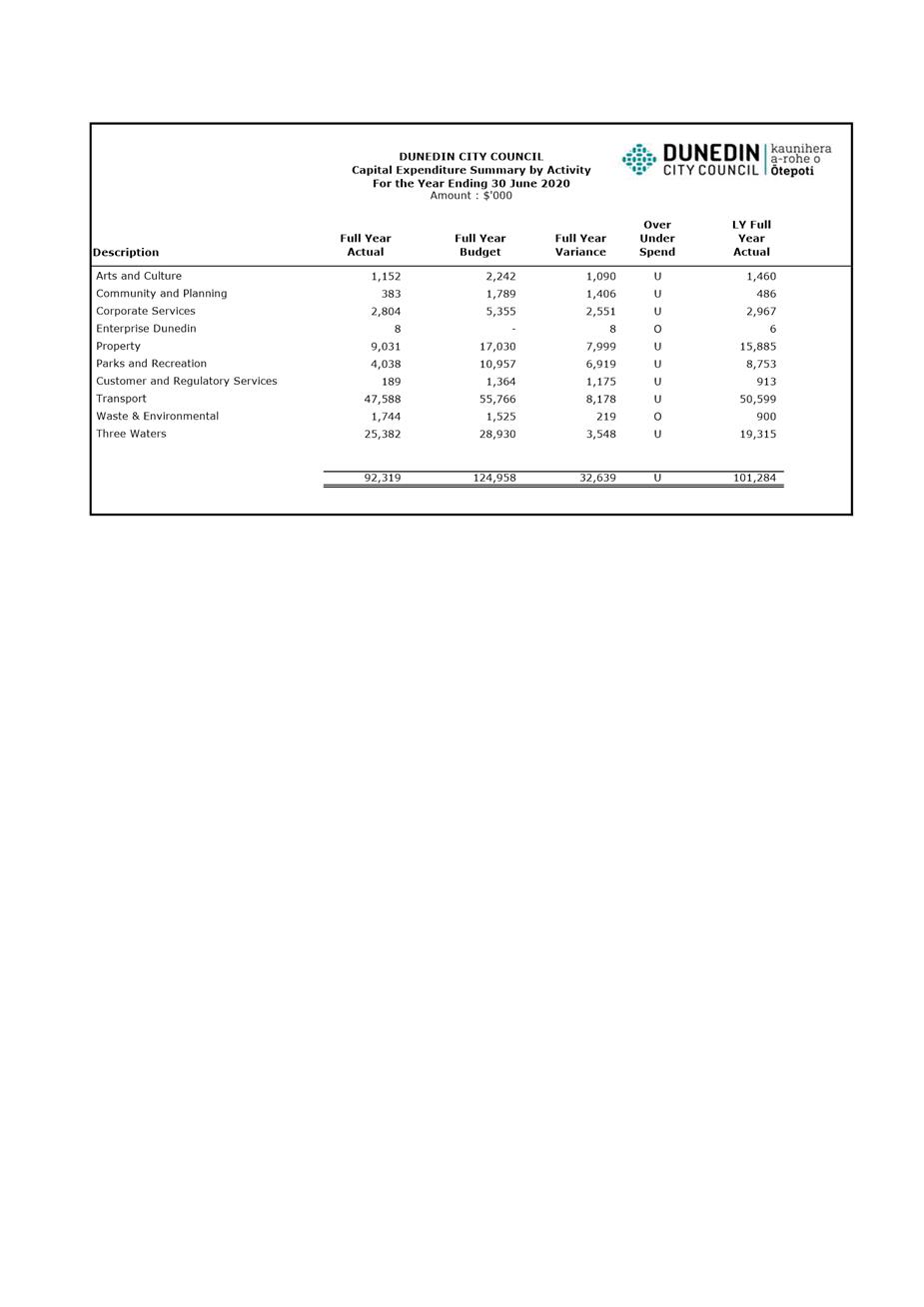

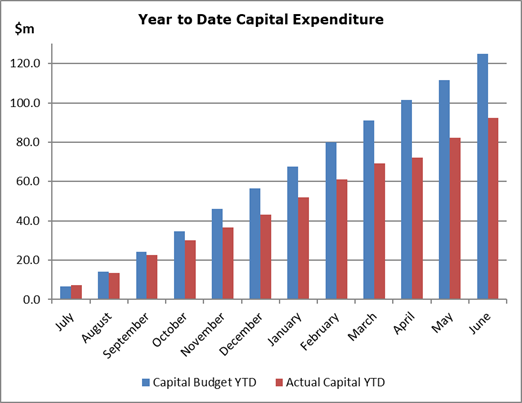

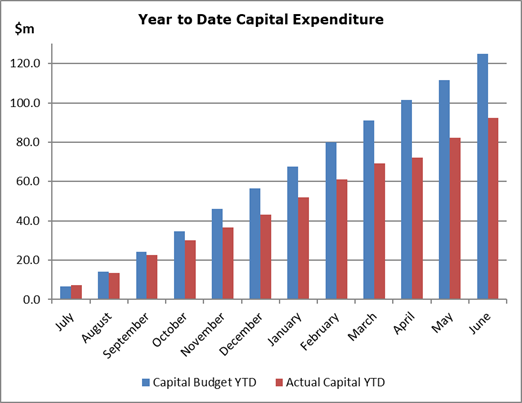

Capital Expenditure

A summary of the capital expenditure

programme by Activity is provided as Attachment E.

Total capital expenditure for the year was

$92.319 million or 73.9% of the full year budget of

$124.958 million.

Community

Planning capital expenditure was $1.406 million

underspent

There was limited expenditure for the year

on the Central City Plan and Citywide Amenity Upgrades.

Corporate

Services capital expenditure was $2.551 million

underspent

The underspend was primarily driven by

lower than expected expenditure on a number of key IT projects including the

Payroll System Replacement, Online Services, and Mobility Solutions,

Infrastructure Program and Performance Management System.

Property capital

expenditure was $7.999 million underspent

The underspend was due the delayed timing

of projects including the South Dunedin Community Complex, School St and

Palmyra Housing Upgrades, Tarpit Renewal, Ice Stadium Roof, Civic Centre Roof

Renewal, and the Central Library Refurbishment project.

Parks and Recreation capital expenditure was $6.919 million underspent

This variance primarily reflected delays in

key Aquatics projects (Moana upgrade and the Mosgiel Aquatic centre

development) pending finalising of project scope and design.

Transport capital

expenditure was $8.178 million underspent

A number of key projects were underspent

for the year, partially driven by the impact of the nationwide lockdown and

managed project recommencement in May and June.

Dunedin Urban Cycleways expenditure was

underspent $1.969 million, with expenditure being deferred until 2021 to allow

negotiations with Kiwirail to be concluded.

Three Waters

capital expenditure was $3.548 million underspent

The underspend was primarily driven by

delays in Mosgiel stormwater renewals while further investigative work on flood

risks in Mosgiel is undertaken.

Comments from group activities

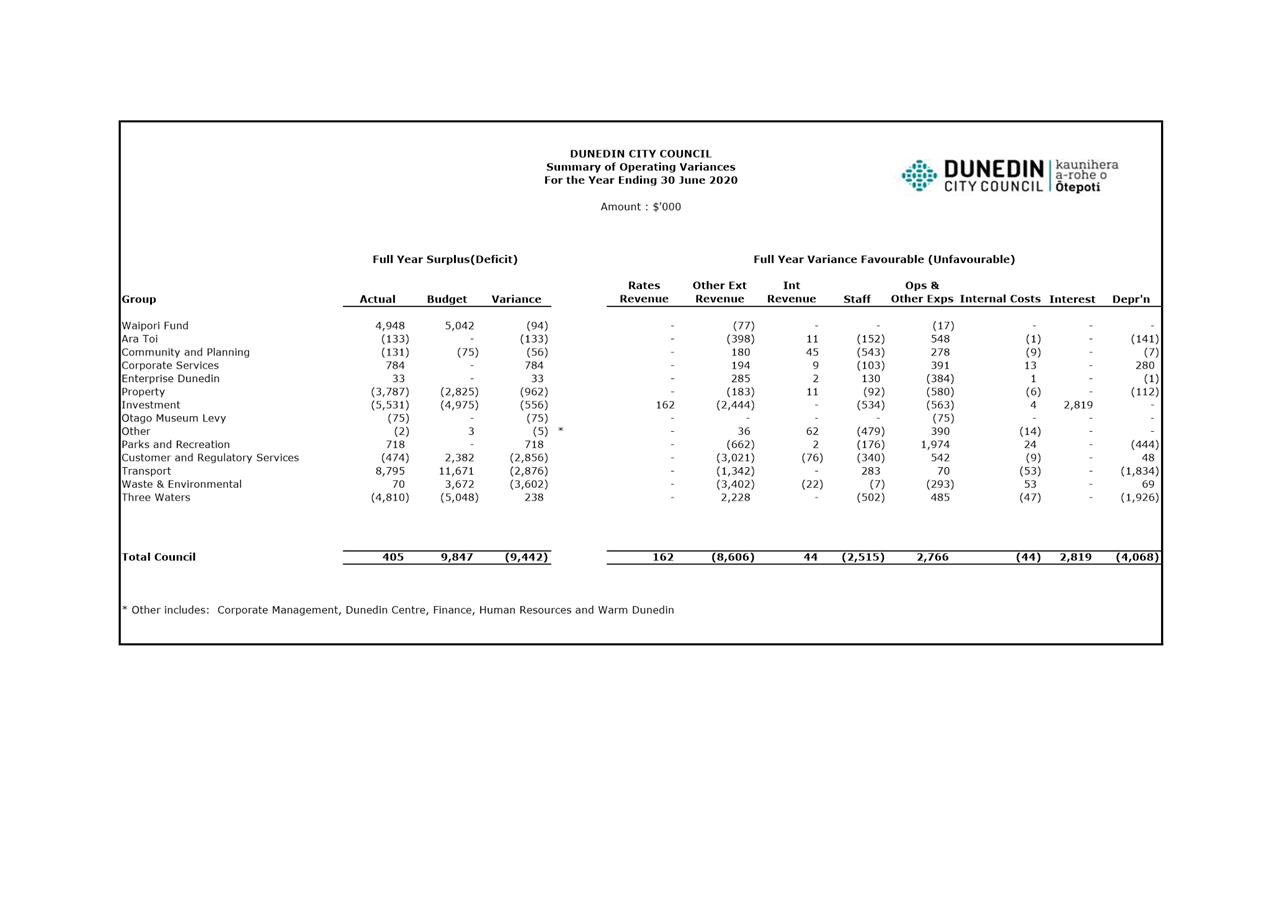

Attachment F, the Summary of Operating

Variances, shows by Group Activity the overall net surplus or deficit variance

for the year. It also shows the variances by revenue and expenditure

type.

Corporate Services - $784k Favourable

BIS operating costs were favourable

primarily due to project management costs being capitalised to the relevant

software projects (including payroll).

Group depreciation was also favourable due

to the delayed completion of some key IT projects.

Property - $962k Unfavourable

External revenue was impacted by reduced

rental income during the nationwide lockdown period, partially offset by an

unbudgeted net increase in the value of the investment property portfolio.

Operating costs were unfavourable due

largely to unbudgeted fire compliance costs for several properties, including

the Regent Theatre and Art Gallery, maintenance costs in the Civic Centre, Town

Hall air condition systems maintenance and asbestos assessment costs at Toitu

Settlers Museum.

Parks and Recreation - $718k Favourable

Parks costs were favourable due to tighter

management of scheduled and unscheduled work under the North and South

Greenspace contracts. Some living asset, building and paving maintenance costs

were also deferred. Contract costs savings attributed to the nationwide

lockdown in April and May were estimated to be approx. $520k across the

Greenspace, Ecological and tree maintenance contracts.

Group

revenue was unfavourable primarily due to the impact of the lockdown and subsequent alert level changes in Aquatic Services.

Customer and Regulatory Services - $2.856 million Unfavourable

Parking Operations and Parking Enforcement

revenue was unfavourable due to less than budgeted parking meter revenue

partially as a result of delays in implementing the new pricing structure, and

the budget being over-optimistic with regards the additional income arising

from this pricing structure. The variance also included the impact of

providing free parking during/after the period of the nationwide

lockdown.

Transport - $2.876 million Unfavourable

Depreciation was unfavourable as a result

of latest revaluation of Transportation assets.

NZTA grants revenue was unfavourable due to

lower operational expenditure on both maintenance and subsidised consultants

during the nationwide lockdown as well as the underspend on major capital

projects and subsidised renewals.

These unfavourable variances were partially

offset by unbudgeted vested asset income of

$3.200 million.

Waste and Environmental - $3.602 million Unfavourable

This variance reflected the net impact of a

reduction in commercial tonnage at Green Island Landfill, along with an

increase in the aftercare provision related to the landfill.