Notice of Meeting:

I hereby give notice that an ordinary meeting of the

Economic Development Committee will be held on:

Date: Monday

19 October 2020

Time: 1.30

pm (or at the conclusion of the previous meeting, whichever is later)

Venue: Edinburgh

Room, Municipal Chambers, The Octagon, Dunedin

Sandy Graham

Economic Development Committee

PUBLIC AGENDA

|

Chairperson

|

Cr Chris Staynes

|

|

|

Deputy Chairperson

|

Cr Rachel Elder

|

Cr Andrew Whiley

|

|

Members

|

Cr Sophie Barker

|

Cr David Benson-Pope

|

|

|

Cr Christine Garey

|

Cr Doug Hall

|

|

|

Mayor Aaron Hawkins

|

Cr Carmen Houlahan

|

|

|

Cr Marie Laufiso

|

Cr Mike Lord

|

|

|

Cr Jim O'Malley

|

Cr Jules Radich

|

|

|

Cr Lee Vandervis

|

Cr Steve Walker

|

Senior Officer John

Christie, Director Enterprise Dunedin

Governance Support Officer Wendy

Collard

Wendy Collard

Governance Support Officer

Telephone: 03 477 4000

Wendy.Collard@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

|

Economic Development Committee

19 October 2020

|

ITEM TABLE OF CONTENTS PAGE

1 Public

Forum 4

1.1 Study Dunedin 4

2 Apologies 4

3 Confirmation

of Agenda 4

4 Declaration

of Interest 5

Part

A Reports (Committee has power to decide these matters)

5 Study

Dunedin Transitions Report 17

6 Enterprise

Dunedin Activity Report - October 2020 Update 23

7 Centre

of Digital Excellence (CODE) Update Report 34

8 Film

Dunedin 39

9 Economic

Development Committee Forward Work Programme 45

10 Actions

From Resolutions of Economic Development Committee Meetings 48

11 Items

for Consideration by the Chair 51

Resolution to Exclude the Public 52

|

|

Economic Development

Committee

19 October 2020

|

1 Public

Forum

1.1 Study

Dunedin

Linda Miller, Chairperson of Study

Dunedin, wishes to provide an update on Study Dunedin.

2 Apologies

An apology has been received from

Cr Rachel Elder.

That the Committee:

Accepts the apology from Cr

Rachel Elder.

3 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

|

|

Economic Development Committee

19 October 2020

|

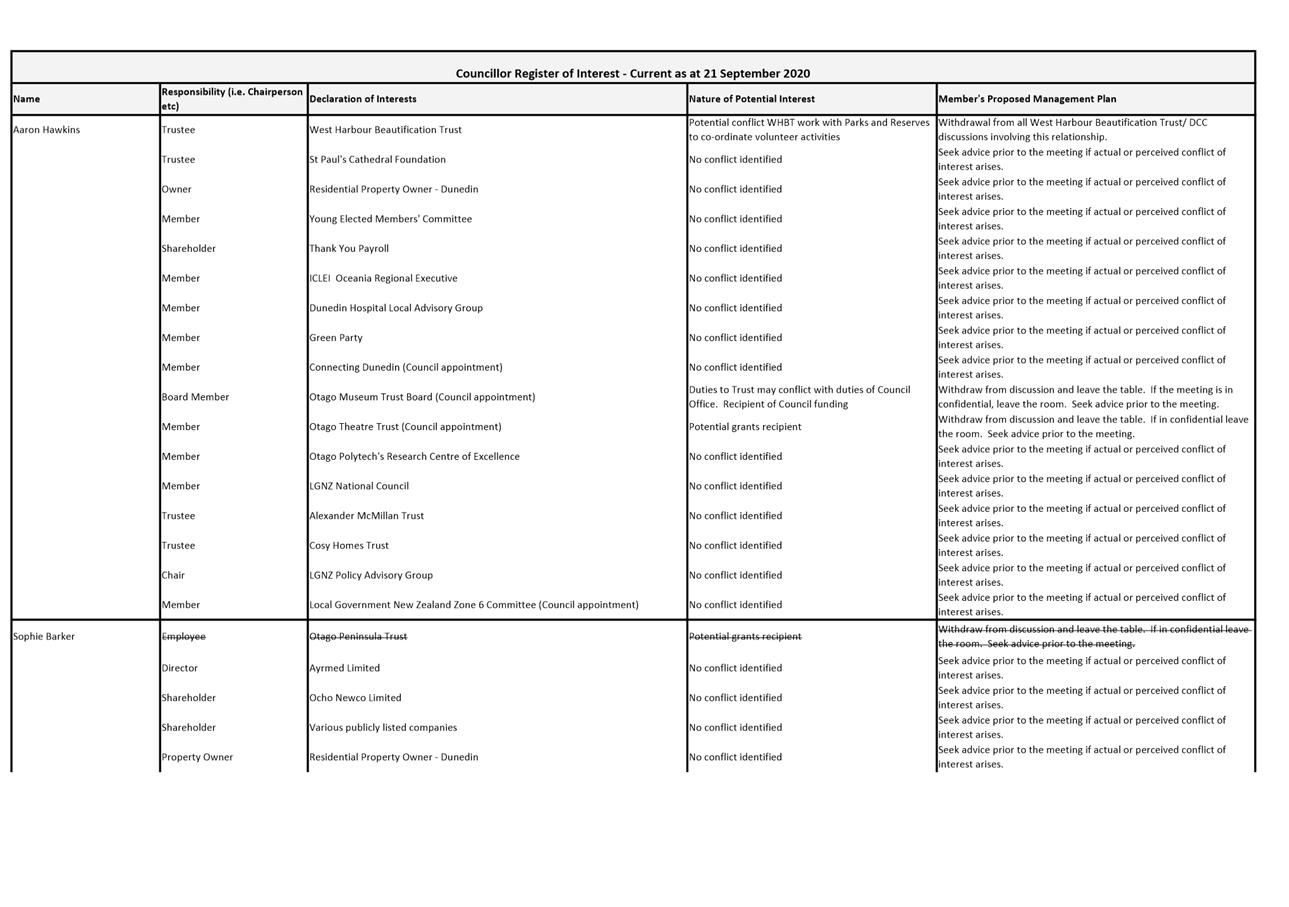

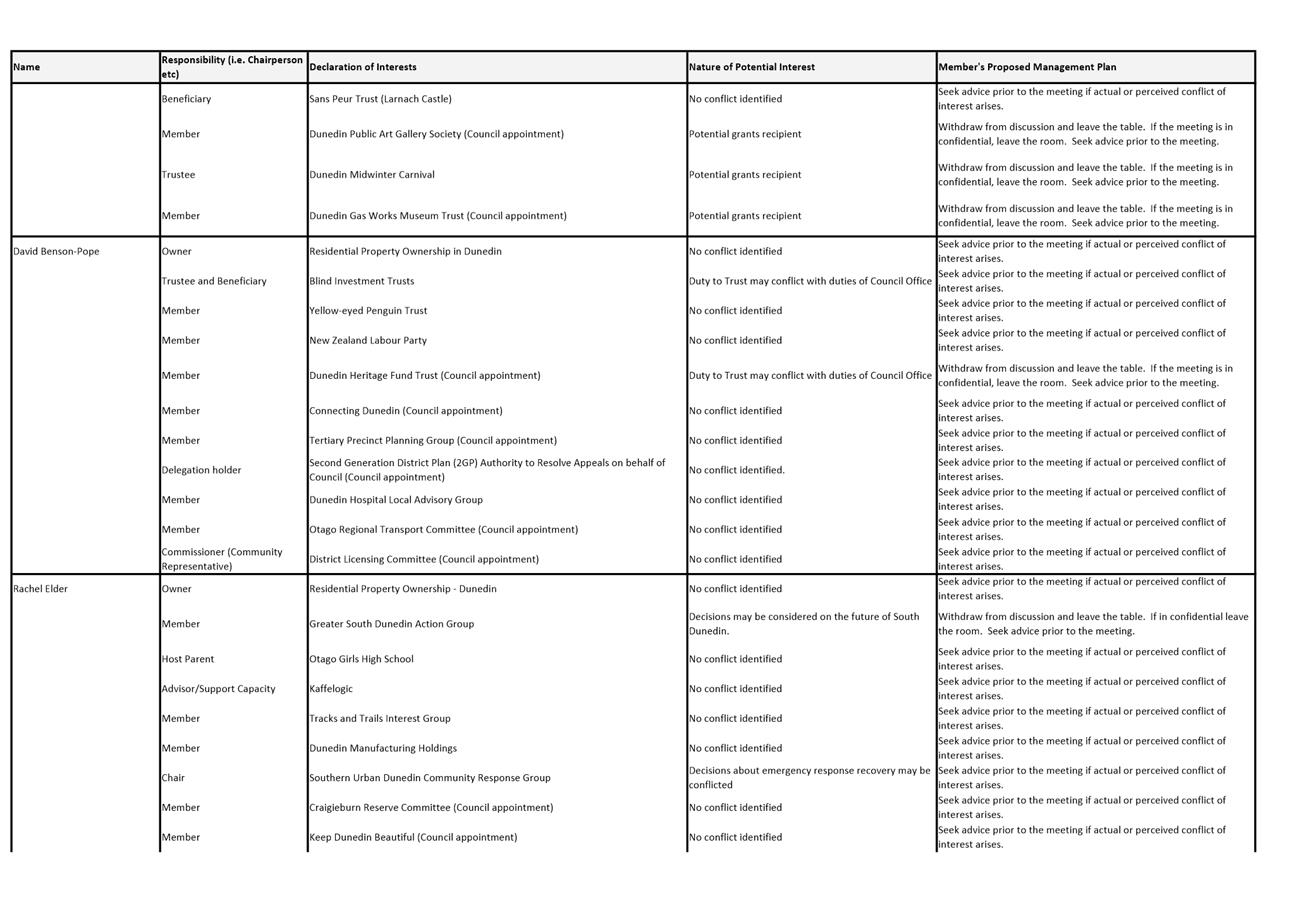

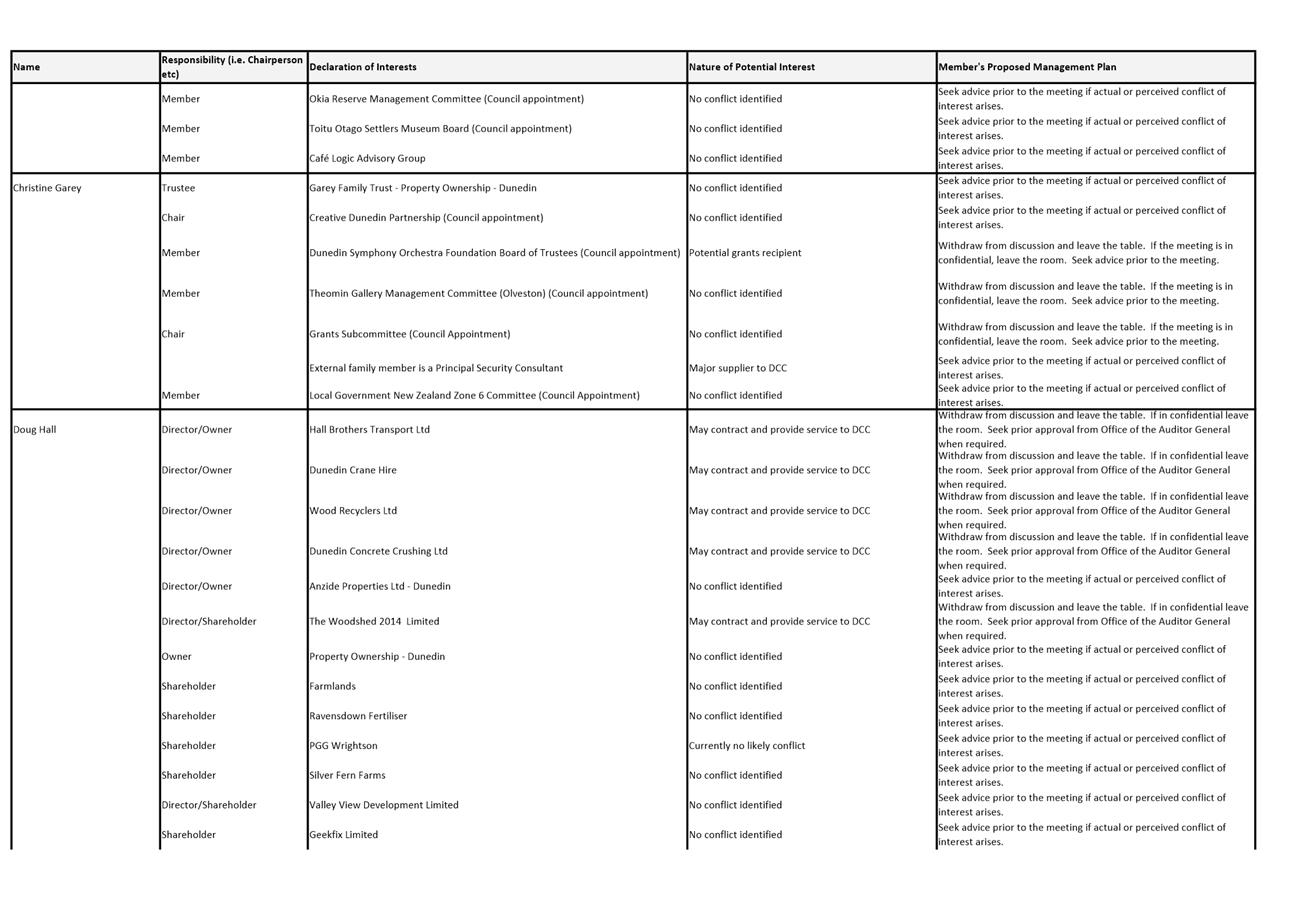

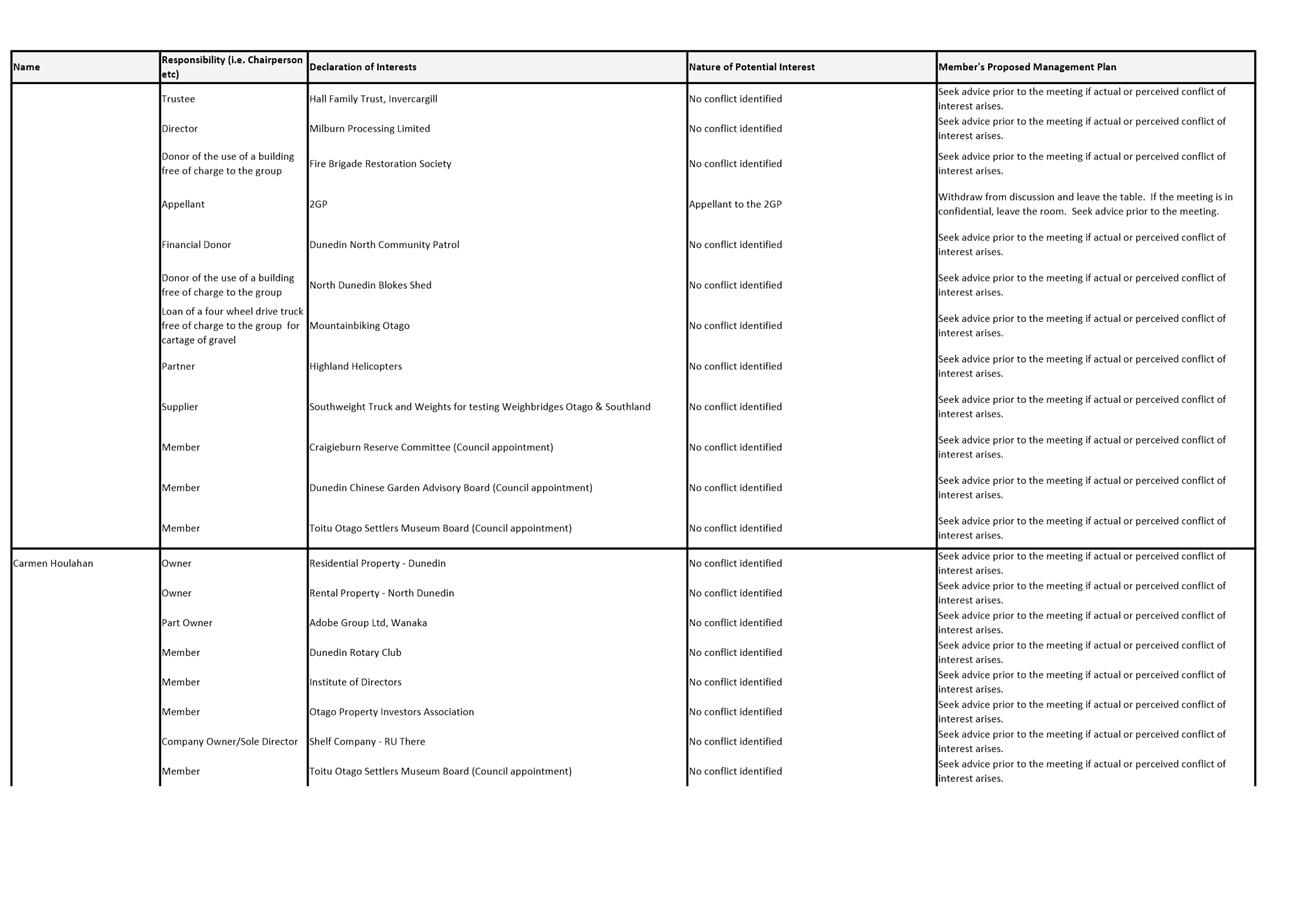

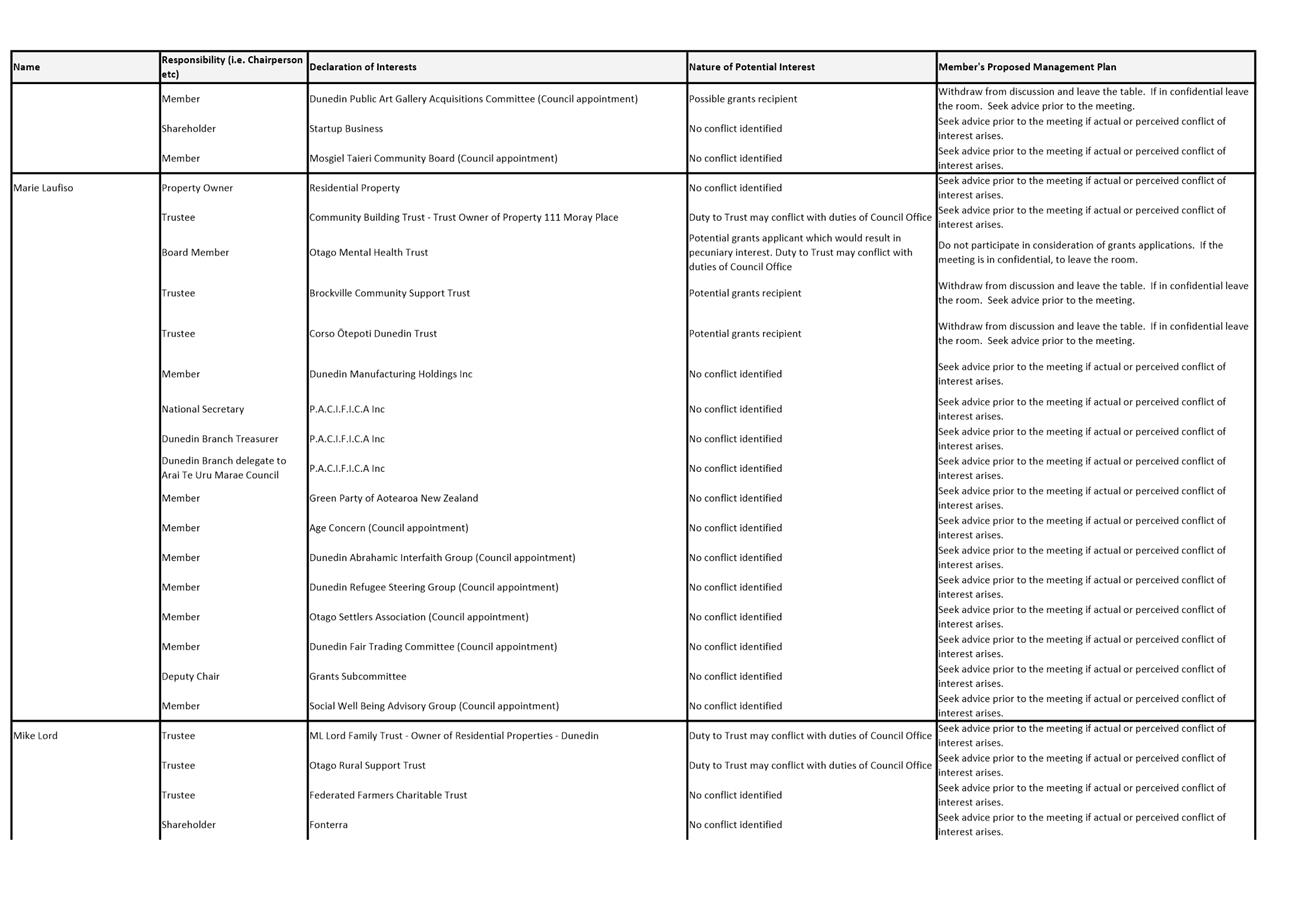

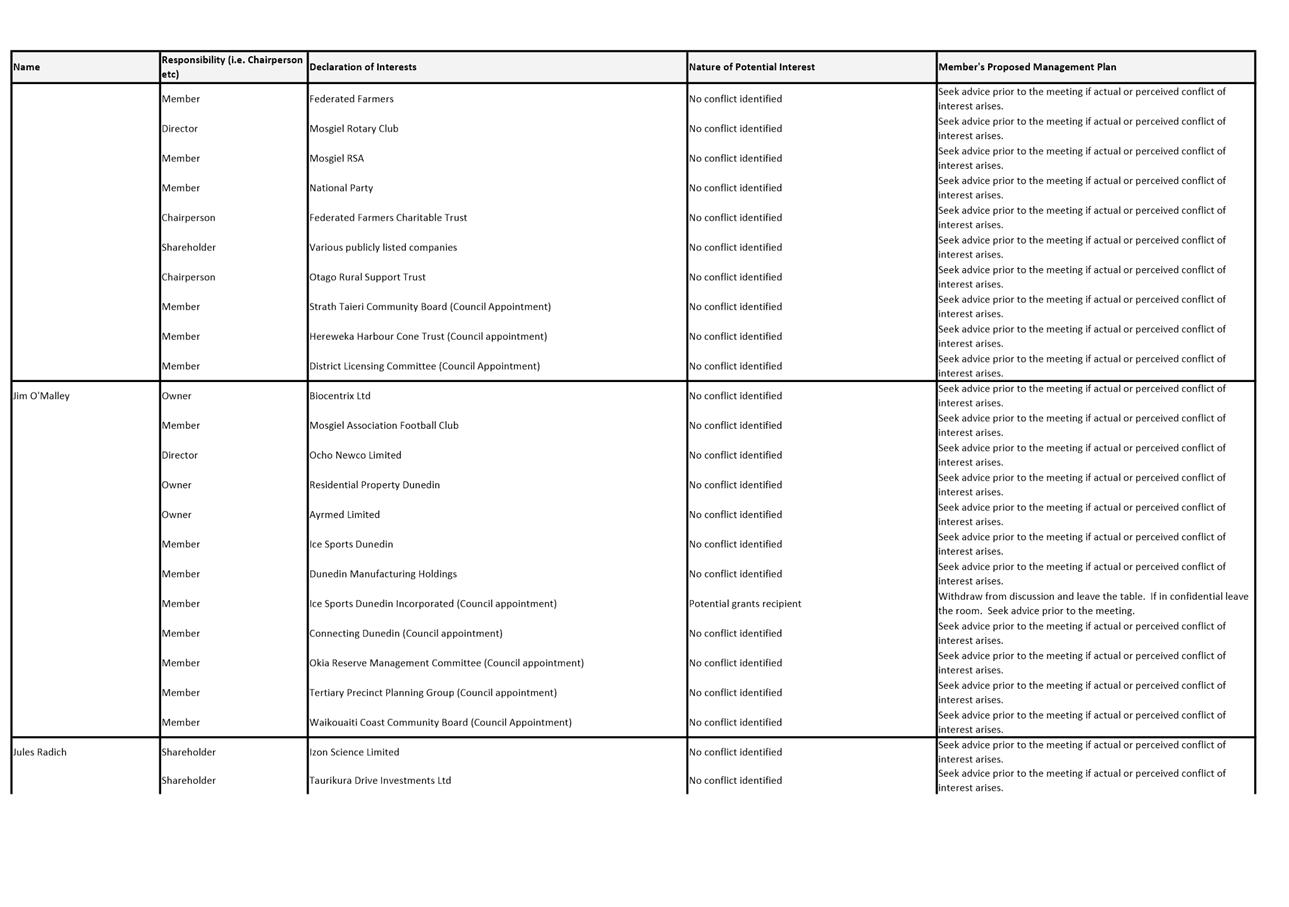

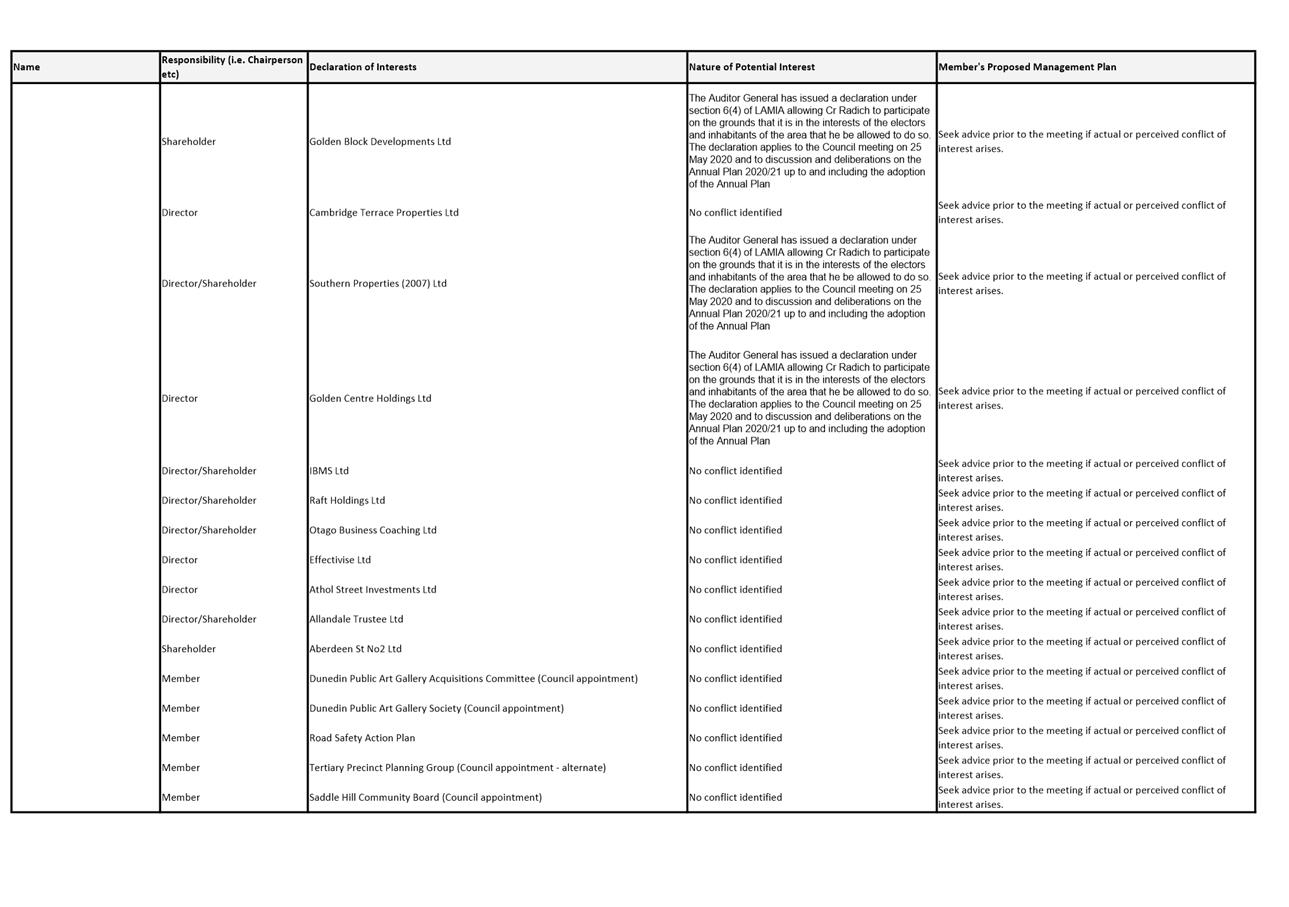

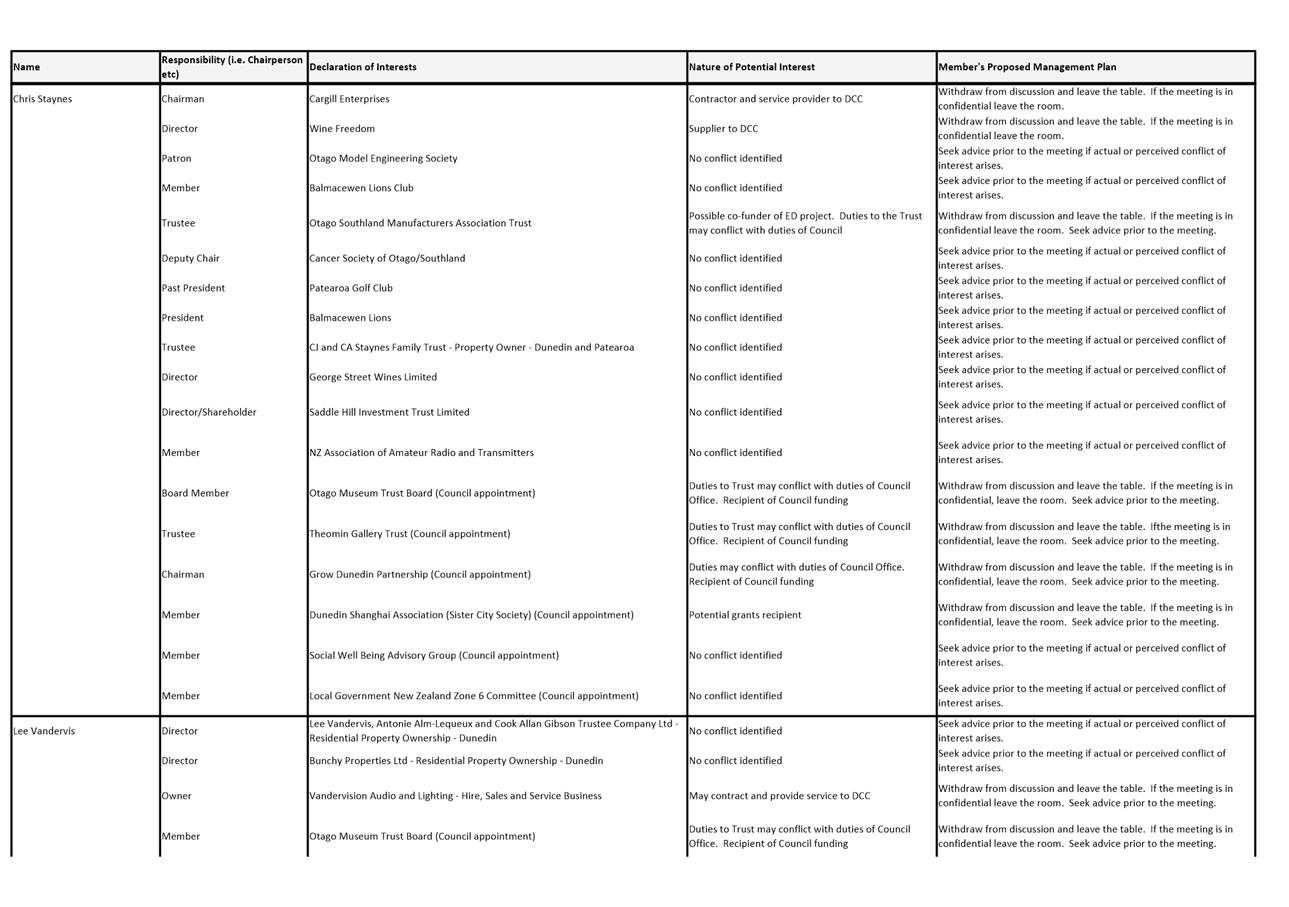

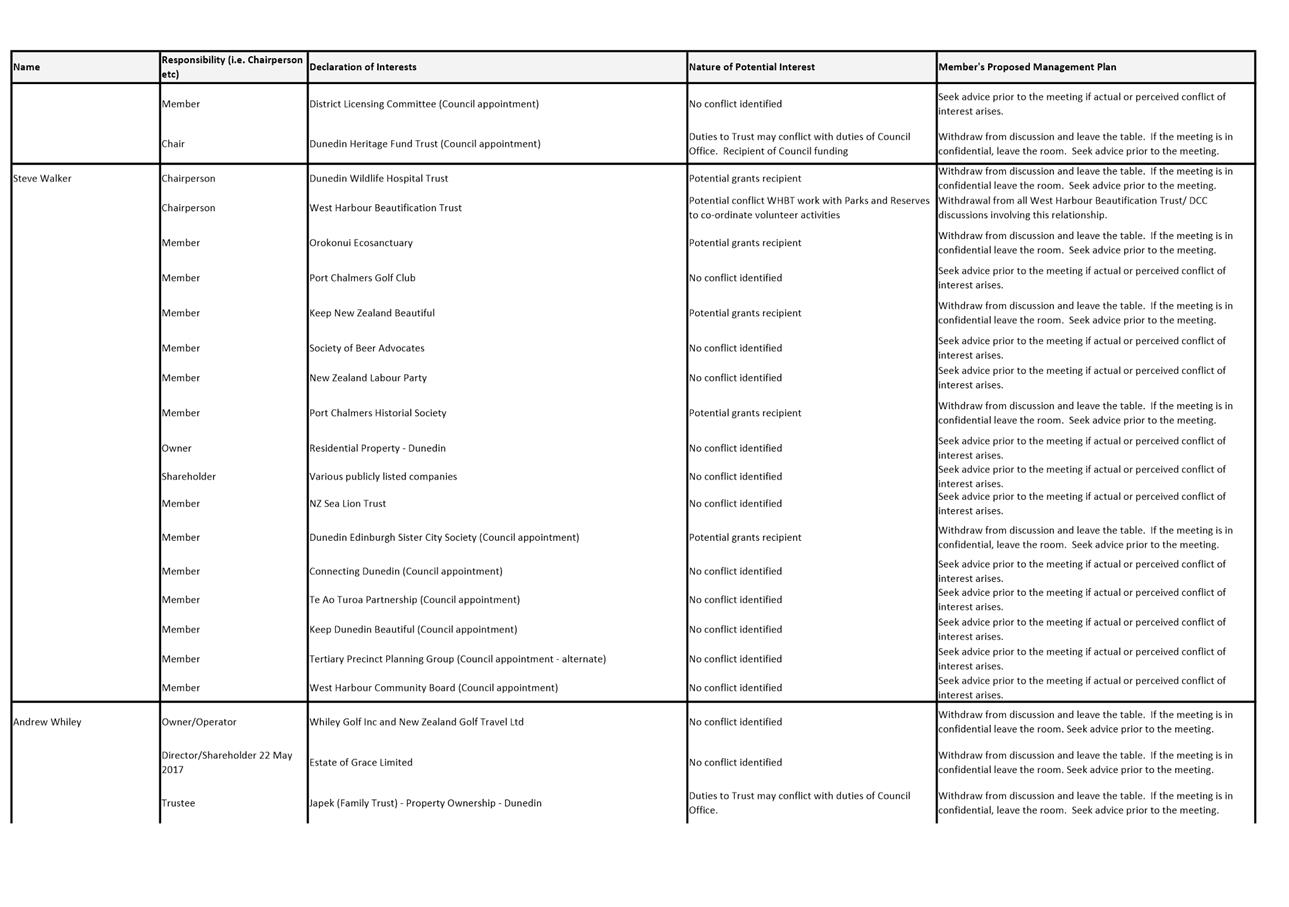

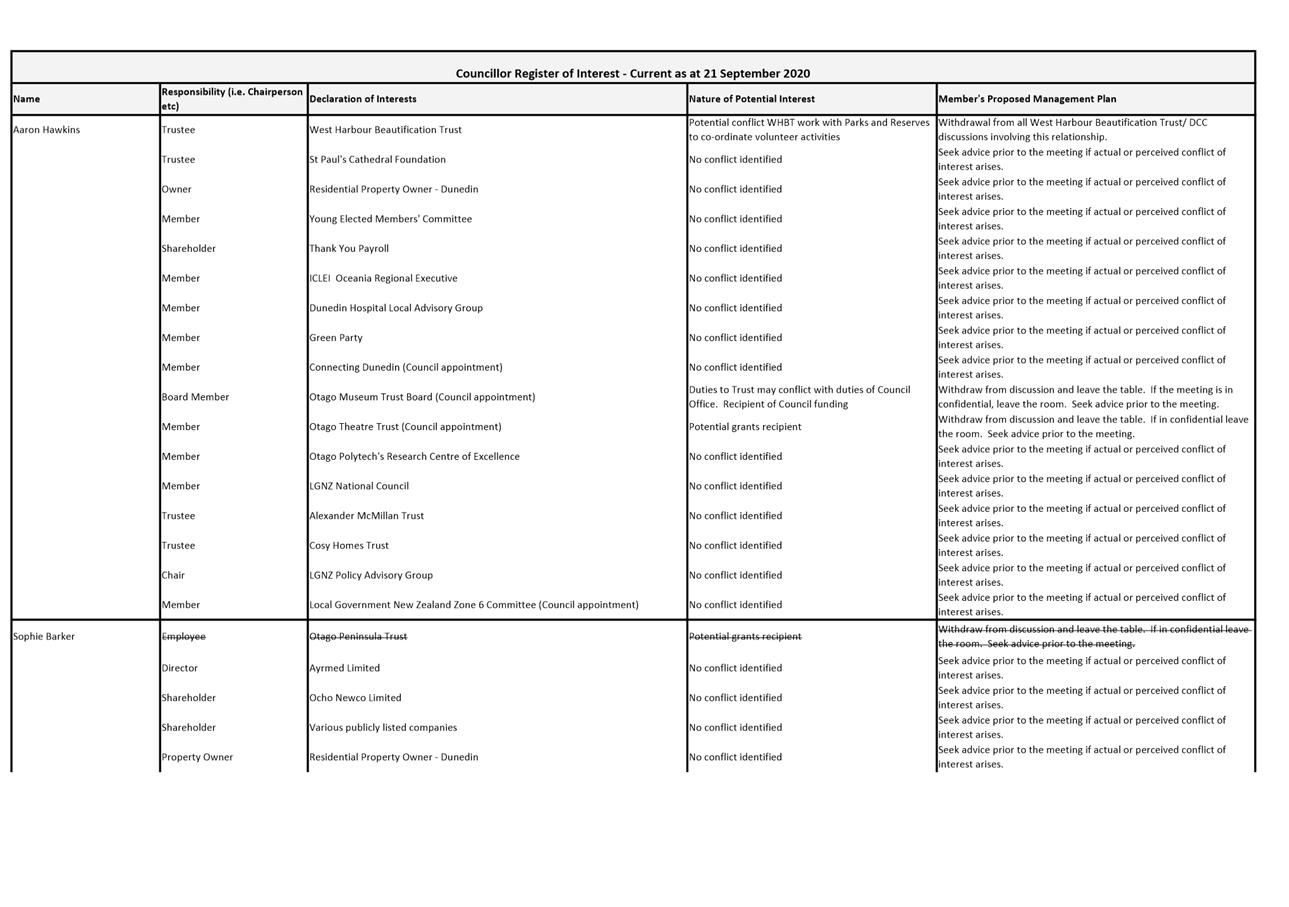

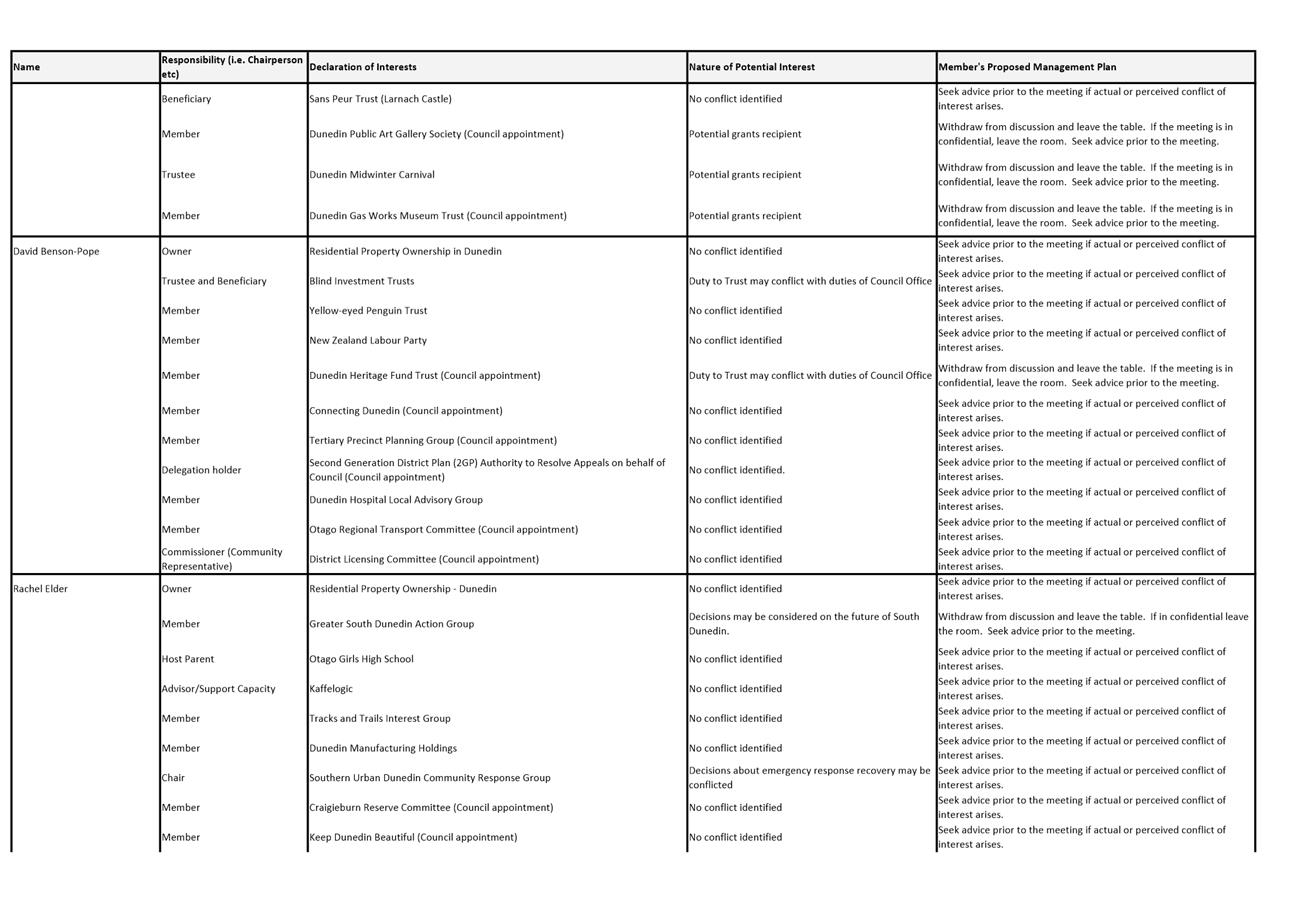

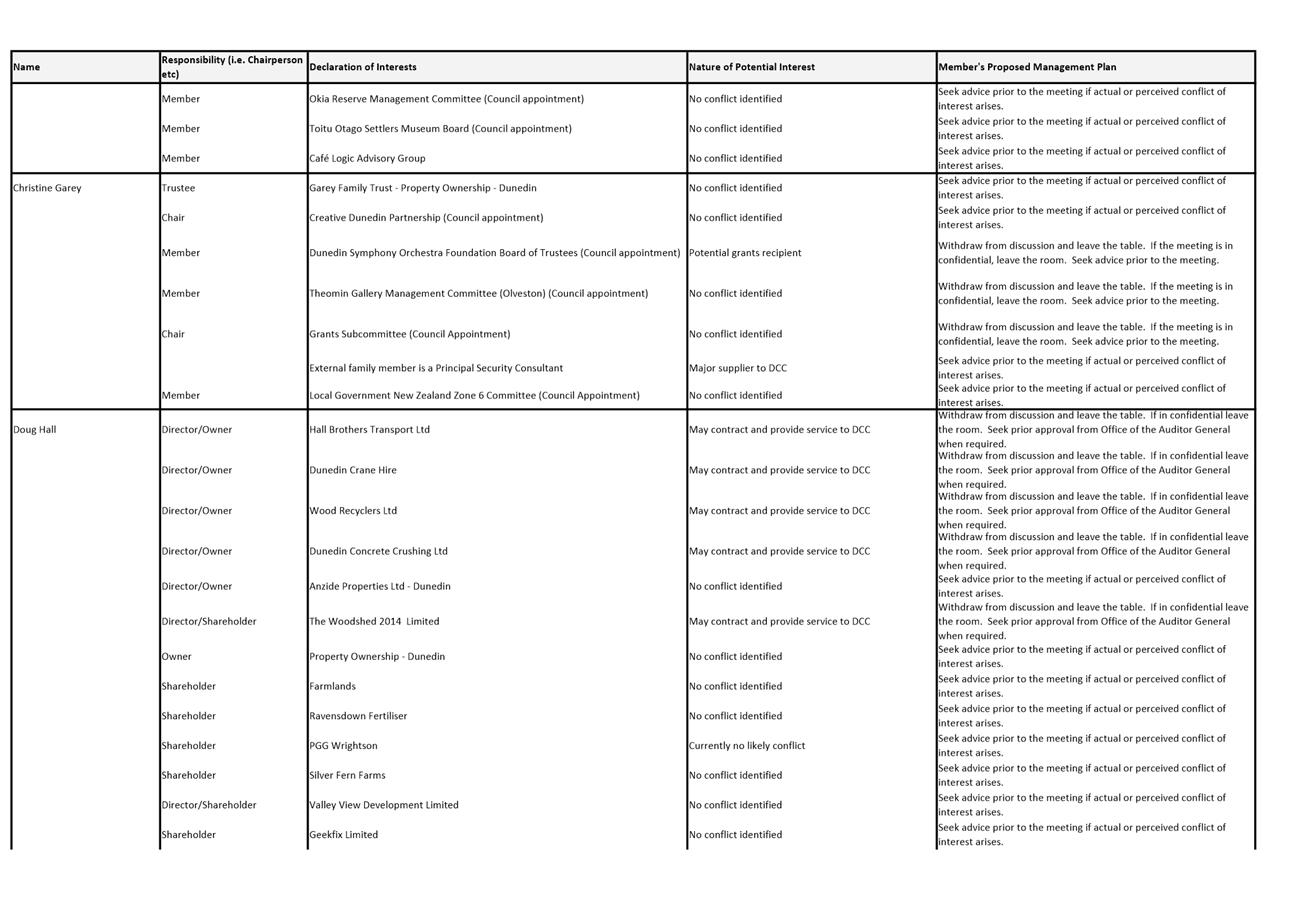

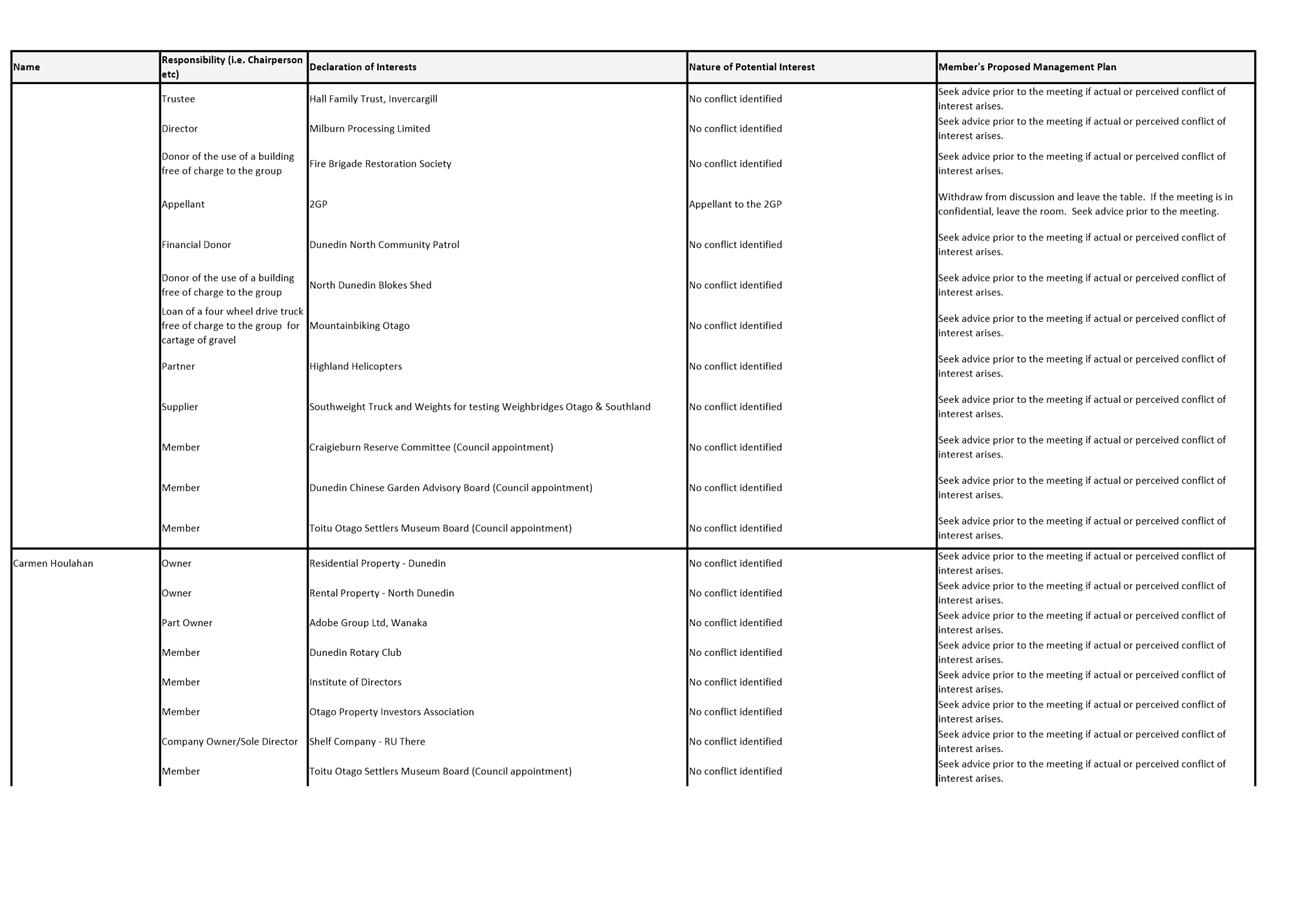

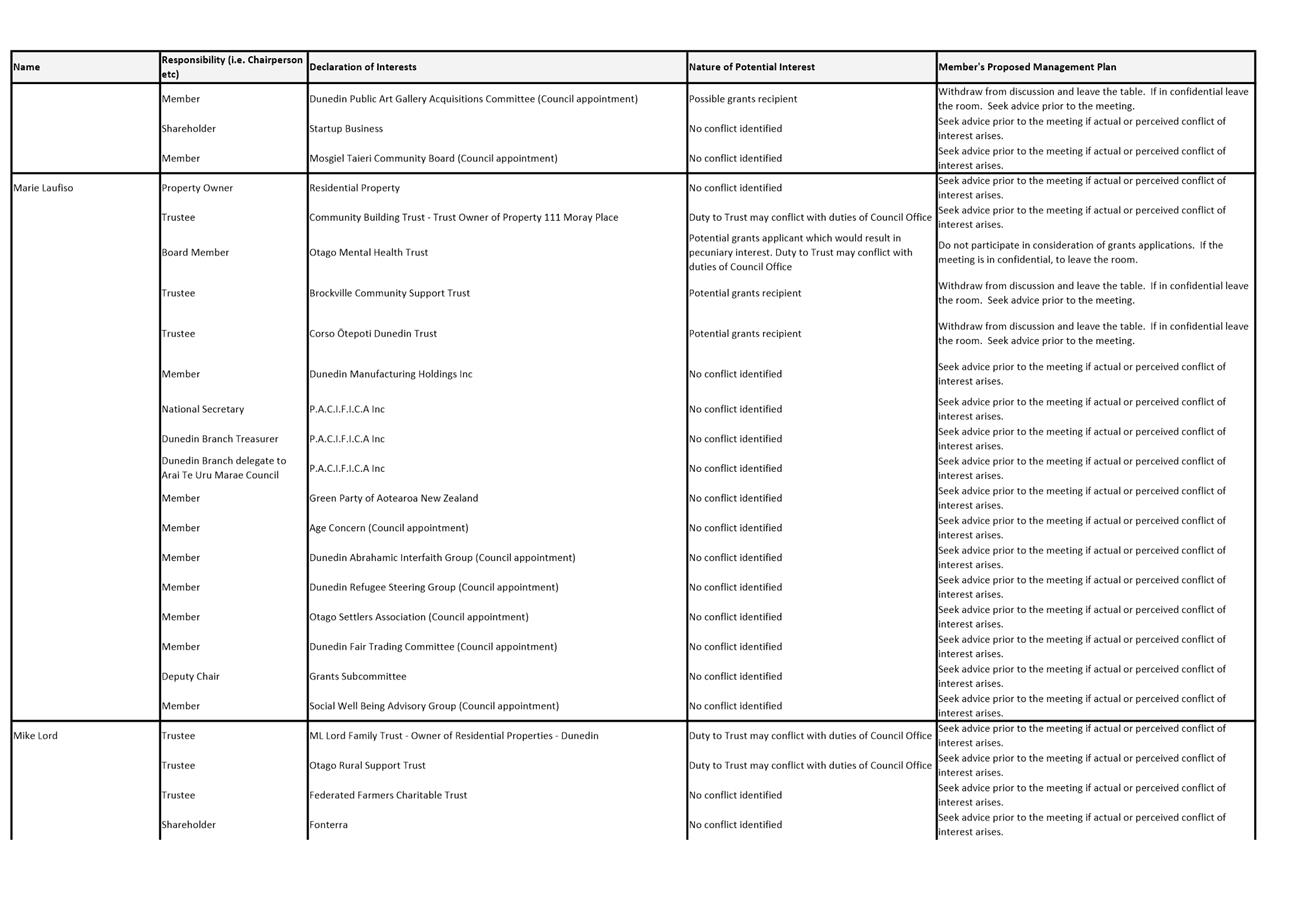

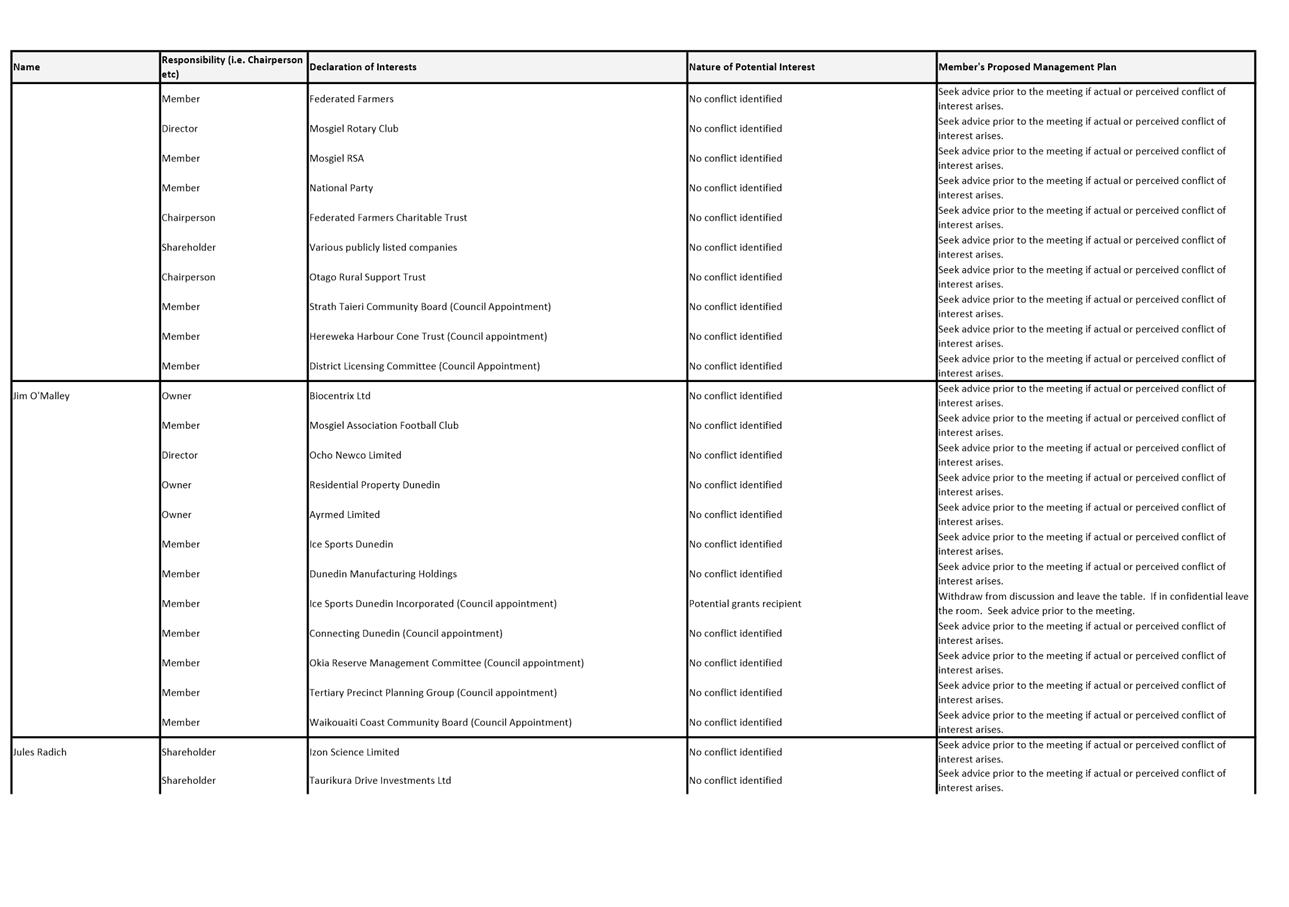

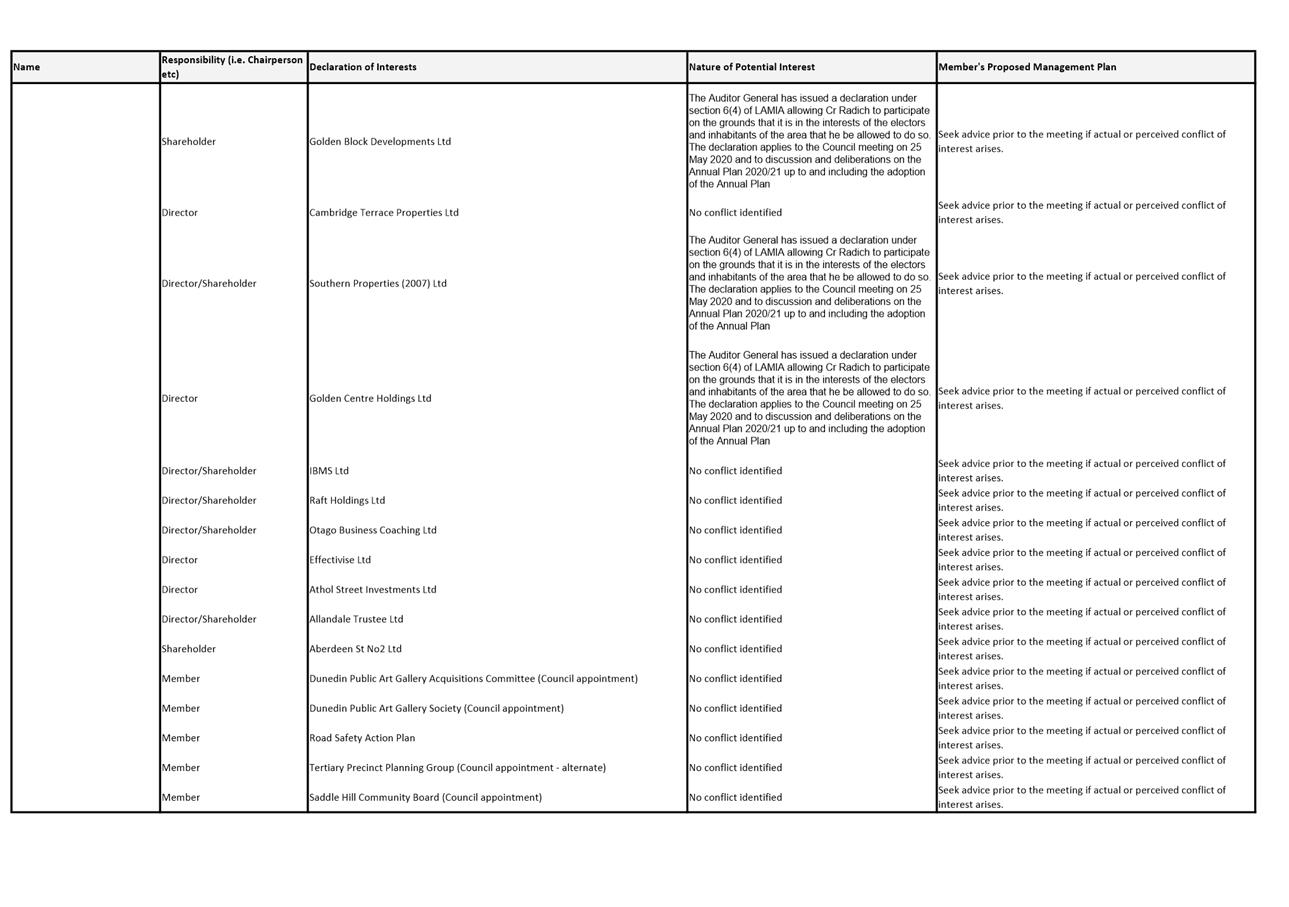

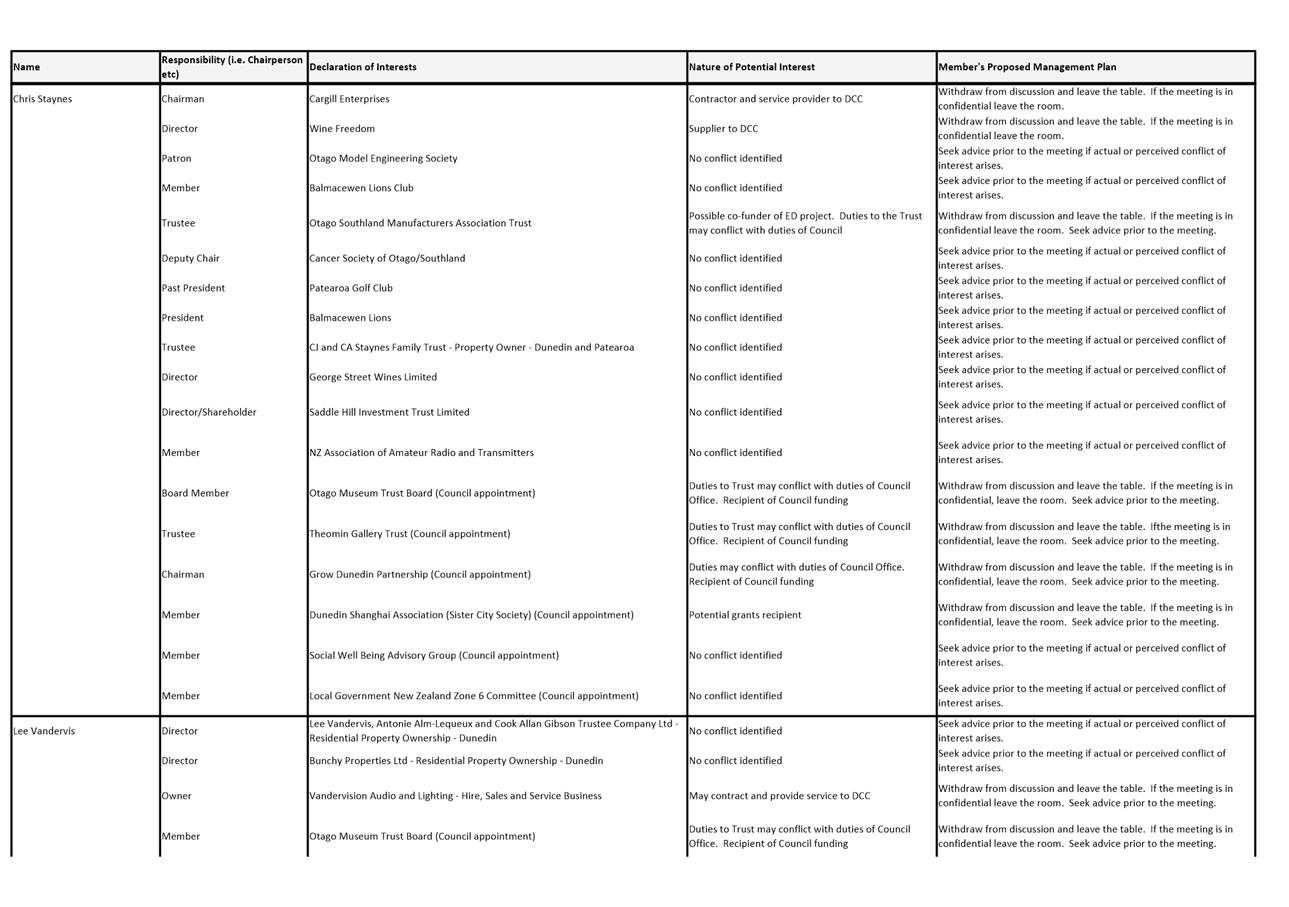

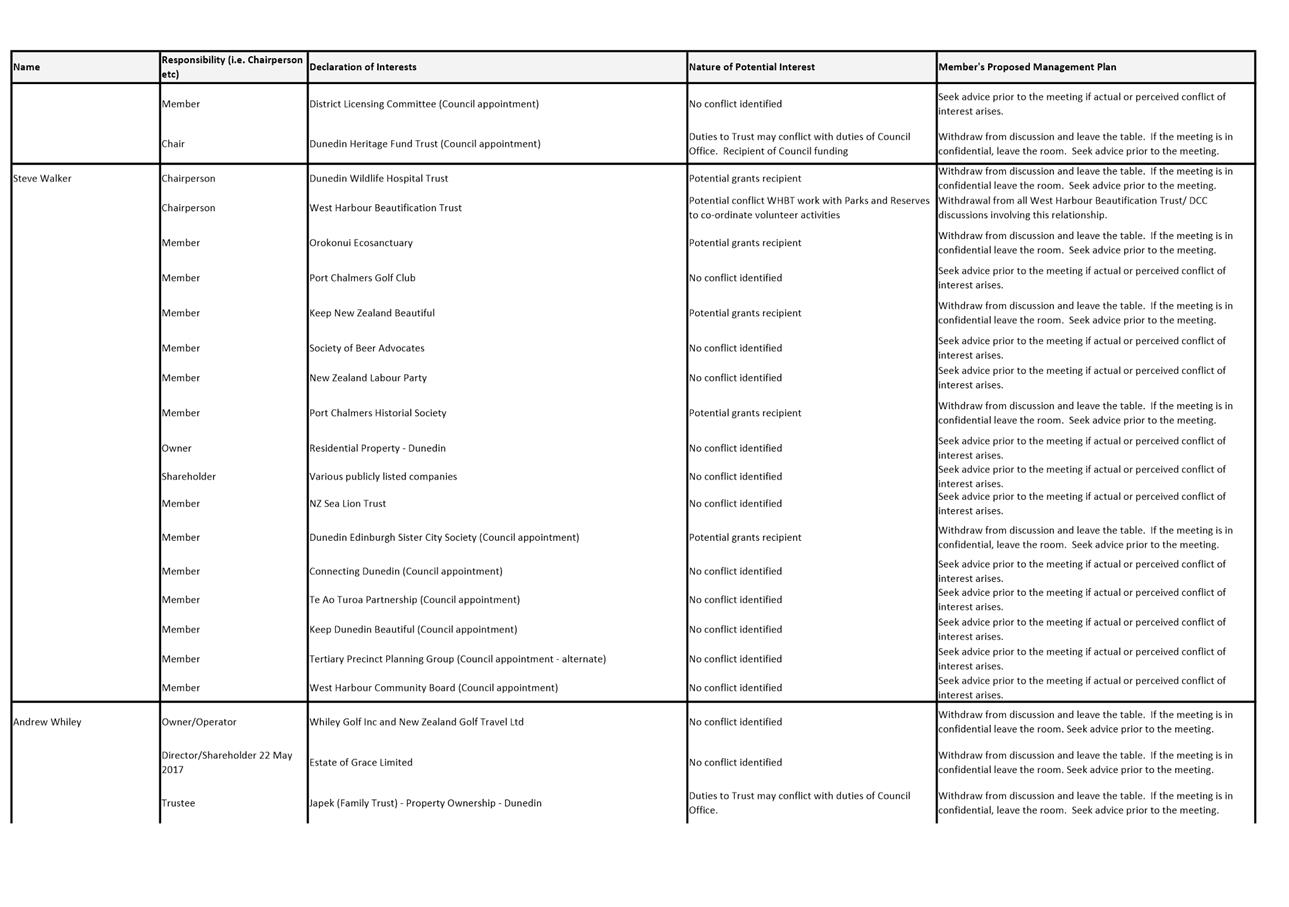

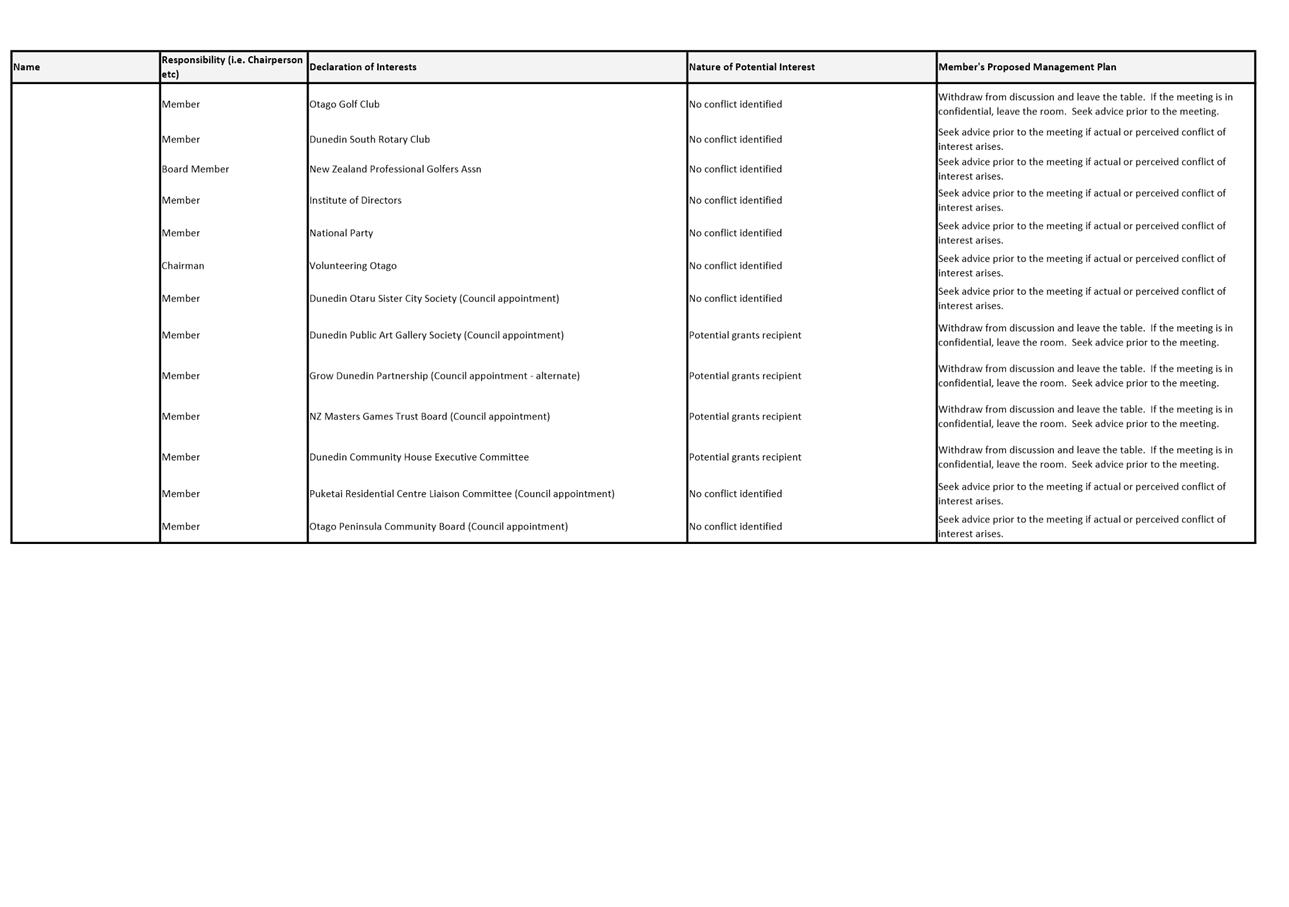

Declaration of Interest

EXECUTIVE SUMMARY

1. Members

are reminded of the need to stand aside from decision-making when a conflict

arises between their role as an elected representative and any private or other

external interest they might have.

2. Elected

members are reminded to update their register of interests as

soon as practicable, including amending the register at this meeting if

necessary.

|

RECOMMENDATIONS

That the Committee:

a) Notes/Amends

if necessary the Elected Members' Interest Register attached as Attachment A;

and

b) Confirms/Amends the proposed management plan for Elected Members' Interests.

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Elected Members'

Register of Interests

|

7

|

|

|

Economic Development Committee

19 October 2020

|

|

|

Economic Development Committee

19 October 2020

|

Part

A Reports

Study Dunedin Transitions Report

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee (EDC) on

a research project (funded by Education New Zealand (ENZ)) into transition

pathways between high schools and tertiary institutions for international

students in Dunedin and Otago.

2 Traditionally

the number of international students transitioning from high school to tertiary

study in New Zealand is low. The Transition Report provides insights into

current challenges and options to improve conversion rates.

3 Six

outputs and conclusions were identified in the report that could positively

change the rates of transition.

4 The

report indicated that a target of 25% more students transitioning from high

school to tertiary study in the 2022 year (from a baseline of 20%) would be

achievable.

5 The

Study Dunedin Advisory Group (SDAG) will collate and prioritise the results of

the report in a strategic action plan to support improved transition rates.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

results of the Study Dunedin Transitions Report.

|

BACKGROUND

6 Study

Dunedin was formed in 2013 as part of Dunedin’s Economic Development

Strategy (EDS) to attract and facilitate greater numbers and quality international

students to live and study in the city. Study Dunedin works with ENZ and

the SDAG who enable activities including:

a) Destination

marketing;

b) Student

experiences;

c) Capacity

and capability building; and

d) Facilitation

of education and education-to-workforce pathways.

7 New

Zealand has a low (anecdotally under 20%) transition rate for international

students from high school in to tertiary study. In other countries, such

as Australia, the rate is significantly higher with research suggesting their

rate is over 50%.

8 Increasing

the transition rate by just a small margin would add economic, social and

cultural value to both the Otago region and New Zealand.

9 Study

Dunedin successfully applied for $20,000 from ENZ to undertake research into

the barriers on the transition of international students from high school to

tertiary study in the Otago region. The research was undertaken from November

2019 to June 2020. Interviews were undertaken with:

a) High

school and tertiary students;

b) Sector

International Directors at high schools;

c) Agents

and parents; and

d) Staff

at Otago Polytechnic and the University of Otago.

10 While

COVID-19 made the methodology challenging, there was enough data and one-on-one

interviewing completed to build a compelling picture of expectations, gaps and

opportunities.

DISCUSSION

Current Situation

11 Generally,

international students enrol at Dunedin high schools for two reasons:

a) Experiential

learning and to increase English language acquisition. These students are

generally short-term enrolments; and

b) Long

term study to achieve National Certificate of Educational Achievement (NCEA)

qualifications to enable entry into the tertiary sector both in New Zealand and

overseas.

12 The

research focused on the second group to firstly increase enrolment in New

Zealand high schools and secondly, transition from these schools to tertiary

study.

13 The

Transitions Report and objective of improved retention aligns with ENZ

ambitions and recovery planning for the sector post COVID-19. The work

undertaken by Study Dunedin will support and align to central government plans.

Benefits of Transition

14 Improved

transition pathways for international students between high schools and

tertiaries provides a range of benefits. While many of the benefits

reside with tertiary institutions there are quantifiable, additional benefits

for high schools, Boards of Trustees and Principals:

a) Higher

academic achievement of students;

b) Less

turn-over of students leading to less work in enrolment processes, visa

processing, homestay placement and student support services; and

c) Stronger

partnerships between the high school and tertiary providers.

15 Improved partnerships and collaboration with tertiary

institutions also allows high schools to:

a) Attract

students through the ‘bigger machine’ of the tertiary recruitment

team;

b) Provide

the compelling story of a guaranteed pathway to the students’ end

goal.

16 The

benefit for the tertiary institutions is a larger and more consistent pipeline

of New Zealand educated international students who are more ‘kiwi-fied’

by the time they reach the campus.

17 The Dunedin 2013-23 Economic Development Strategy

recognises the value of international students as a ‘source of talent,

investment and international connections’ and that often they can be

‘at the forefront of new knowledge, science and research’.

18 Research also shows international students can become

ambassadors and that they are positive storytellers, stay engaged with the city

and its progress.

Outputs of the Research

and Transitions Report

19 The

Transitions Report highlights six outputs for further development.

a) Output

One: Document existing transitions in the Otago region from high school

to tertiary institutions.

Targets are proposed for incremental improvement over the

next three years. It showed that transitions were inconsistent year on

year and accessing accurate data was difficult. A goal of 25% increase in

students transitioning in to tertiary study for 2022 is indicated as

reasonable. While the numbers are not large, based on an estimate of 8-10

students starting tertiary study it is estimated the flow-on economic impact

will be $200k for those (8-10 students) each year that they remain.

b) Output

Two: Determine barriers to transitions and recommended improvements to overcome

them.

Twenty high school and tertiary students were interviewed as

part of the process. A broad range of perspectives emerged. Students commented

on how supportive, relaxed and friendly life was here, how accessible teachers

and lecturers are and that living in Dunedin allowed them a study/life balance.

Several participants highlighted barriers including issues with accommodation

(specifically homestay), inadequate public transport and the city

‘closing early’. This feedback has resulted in several

recommendations around:

i) Accommodation;

and

ii) Targeted

information sharing through collateral development to mitigate some of the

negative impressions.

c) Output

Three: Review existing tertiary provider transition processes

On-campus experiences were viewed as very important and it

was suggested that the tertiary sector develop a two to three day immersive

(summer and school holiday) campus experience.

The report also recommended scheduling:

i) Regular

information sessions with international students separate to those sessions

already in place for domestic students; and

ii) Separate

information sessions with staff from both tertiary and high school institutions

who have contact with international students in the transition space.

d) Output

Four: Key market agent feedback regarding changes to process and

collateral to support the transition process.

The report recommended the need for regular communication

with agents both in Dunedin and Auckland and recognised agent’s requests

for:

i) More

material to be translated in to other languages;

ii) Experiential

on-campus programmes to be developed and for a video(s) showing the pathway

journey from high school to tertiary study in the city be made available; and

iii) Targeted

scholarships to raise the profile of Dunedin.

e) Output

Five: Development and documentation of processes/programmes to improve the

transition of students and meet the newly established transition target

numbers.

A key theme throughout the report is the value of

relationships between institutions and sectors, for students at all levels and

the need to facilitate relationships in an authentic and rewarding way. For

students, there was a perception that the greatest value was peer-to-peer

marketing and support for social and informal networks for information sharing

and gatherings.

Communication channels need to exist between all staff

interacting with students as they pathway through high school in to tertiary

study. Communication needs to be regular and consistent ensuring messaging is

accurate and cohesive. A yearly Hui bringing staff from all sectors together

was considered a valuable tool to achieve this.

f) Output

Six: Action changes from the interviews and research outcomes (including

school visits).

Given the timing of the report coincided with COVID-19

restrictions, school visits could not be made and therefore measured at the

time of writing the report.

Initial Changes and Solutions

20 The

research and report noted three initial changes to progress the outputs and

recommendations:

a) There

needs to be agreement that a value over volume approach to student

recruitment is taken which includes the creation of a strategy to attract the

right students to study here.

b) Systems

and processes need to be made easier for students transitioning. The

seamless approach needs to raise awareness of the opportunity, include the

Education Agents early in the process, promote the Immigration New Zealand

(INZ) Pathway Visa and package the study opportunity as an attractive story

about studying in Dunedin (New Zealand).

c) There

needs to be an ability for students to build meaningful and long-term

relationships with their future institutions and staff. One option is

summer and school holiday on-campus programmes which are considered a good way

of relationship building once students are studying in New Zealand.

OPTIONS

21 There

are no options.

NEXT STEPS

22 The

Study Dunedin Advisory Group will be reviewing the report recommendations and

collating these with the intention of using them to inform the development of a

strategic action plan, to roll out changes and developments over the next two

years. The recommendations will be prioritised by the Group and relevant

actions will be assigned to members. Several key areas for action are

likely to include:

a) Researching

local patterns and progression tracked (linked to national research

undertaken);

b) Development

of a specific regional marketing strategy promoting transitions;

c) Transition

pathway and product(s) development;

d) Schools

liaison processes (including summer/semester break programmes);

e) Agent

engagement; and

f) Student

experience(s).

23 Study

Dunedin will report back to the Economic Development Committee once this piece

of work is completed in early 2021.

Signatories

|

Author:

|

Fraser Liggett - Economic Development Programme Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY

OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report promotes the economic, social

and cultural well-being of communities in the present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the delivery of the

2013-2023 Economic Development Strategy.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

There are no known impacts for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Study Dunedin activities and the 2013-2023 Economic

Development Strategy framework are included in the 2018-28 Long Term Plan.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This decision is considered of low significance under the

Significance Engagement Policy.

|

|

Engagement –

external

As an update report, external engagement has been

undertaken with Study Dunedin Advisory Group.

|

|

Engagement -

internal

No internal engagement has been undertaken.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

|

Economic Development Committee

19 October 2020

|

Enterprise Dunedin Activity

Report - October 2020 Update

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee on

several Enterprise Dunedin activities.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Enterprise Dunedin Activity Report – October 2020 Update.

|

BACKGROUND

2 Enterprise

Dunedin activity is informed by the 2013-2023 Economic Development

Strategy. The strategy is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business;

b) Alliances

for innovation – to improve linkages between industry and research;

c) A

hub for skills and talent – to increase retention of graduates, build the

skills base and grow migrant numbers;

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities

e) A

compelling destination – to increase the value of tourism and events and

improve the understanding of Dunedin's advantages.

3 The

strategy sets out two economic goals:

a) 10,000

extra jobs over 10 years (requiring growth of approximately 2% per annum); and

b) An

average of 10,000 of extra income for each person (requiring GDP per capita to

rise 2.5% per annum).

Dunedin

City Economic Overview

4 Economic

indicators monitored by Enterprise Dunedin show economic activity in Dunedin

City has remained resilient despite a temporary re-escalation to Alert Level 2

between 12 August and 21 September 2020.

5 Even

with stringent public health restrictions retail spending in Dunedin over the

four-week period to 20 September 2020 was only 1.1% below its 2019 level,

compared to a 3.3% decline nationally.

6 Over

the four-week period to 9 August 2020 when New Zealand was at Alert Level 1,

retail spending in Dunedin was 4.7% (compared to 2.9% growth nationally) above

the 2019 level.

7 Provisional

data from Statistics NZ based on payday tax information shows that the number

of jobs in Dunedin in August was 1% higher than a year ago, while average wages

over the three months to August were 3.3% above their 2019 level.

8 There

has been a wide divergence in employment trends between industries. The largest

contributors to job increase by sector were public administration, health,

construction and hospitality. Job losses occurred in media, warehousing,

wholesale trade, recreational services, including visitor activities and

education.

9 Despite

recent strength in the labour market there is a risk of some areas of future

impact on the market occurring over the next couple of months, as many

employers have come off wage subsidy support over recent weeks.

Centre

of Digital Excellence (CODE)

10 Enterprise

Dunedin has continued to work on the establishment of CODE in conjunction with

the CODE Working Group. Several workstreams have been progressed over the last

few months, which are summarised in a separate report to Economic Development

Committee.

Otago

Regional Economic Development (ORED)

11 The

ORED framework has continued to facilitate economic development collaboration

between the Otago councils throughout the period. A key focus has been

continued engagement with local industries regarding the economic impact of

COVID-19 across the city and region.

12 This

exercise has provided a current analysis of the challenges facing individual

industries or identifying opportunities that can be supported through recovery

initiatives. This activity has directly aligned with the Government’s

recently established interim Regional Skills Leadership Group (iRSLG) which

includes the Waitaki District Council Economic Development Manager as a

representative from the ORED, the Ministry of Social Development Regional

Commissioner and others.

13 Work

has also commenced on possible future regional economic development activities

based on the ORED framework. These options will be further progressed and

subject to decision making and will be ready for discussion with government on

any further extension of the Provincial Growth Fund.

The

Great Dunedin Brainstorm

14 Enterprise

Dunedin coordinated the Great Dunedin Brainstorm between 11 and 12 September

2020. The idea generating event which was sponsored and supported by Economic

Development Strategy Partners, sought to engage the community on three

challenges identified by the Grow Dunedin Partnership and arising from

COVID-19:

a) Jobs

in a post CODIV-19 world

b) Raising

hope and social connectiveness

c) Supporting

a resilient economy.

15 The

intention was to engage and seek ideas from the community which could be

supported through the Council COVID-19 recovery fund and other agencies. The

event was hosted at the Otago Polytechnic/New Zealand Institute of Skills and

Technology and Steve Renata, Innov8HQ and Kiwa Digital and resulted in 48

attendees and 11 proposals which are currently being developed further and will

be considered for investment.

Alliances for

Innovation

Film

16 Film

Dunedin together with local industry and Economic Development Strategy partners

have now completed the Investment Logic Mapping to further strengthen the

regional screen eco-system. The completed document is further explained in a

separate report to this meeting.

17 Notwithstanding

COVID-19, the number of Dunedin film inquiries and permits has increased when

compared with the corresponding 2019 quarter. Film permitting has continued in

line with nationally determined COVID-19 precautions. All permit requests

require project registration with ScreenSafe and health and safety plans that

meet standards endorsed by Worksafe.

18 Film

Dunedin has:

a) Responded

to 53 screen, filming and work inquiries in Dunedin during quarter one and

period ending 30 September 2020. This compares to 21 total inquiries in the

same corresponding period in 2019.

b) 14

file permits issued for the period 1 July to 30 September 2020. This compares

with 13 permits in the corresponding period in 2019.

19 Film

Dunedin is currently working with nine domestic feature films and four domestic

television and web series in varying levels of production. There are projects

developed by Dunedin writers or set in Dunedin. In addition, work is continuing

with producers for five short film set in Dunedin and planned for production in

the next six months.

20 The

Dunedin and the Queenstown Film Offices have continued to collaborate under the

umbrella of Film Otago Southland (FOS). Over the last three months work

has progressed on the development of a regional collection of location images,

an ‘endorsement campaign’ using visiting film makers experience

working in the region, and a training and internship programme to create

employment and capacity in the sector.

21 In

response to COVID-19, work has also commenced on the review of available crew

in the city. The intention is to identify skills gaps and opportunities to

train new crew from sectors affected by COVID-19 related redundancies and

support local Dunedin projects.

A Hub for Skills and

Talent

JobDUN - Business Internship programme 2020-2021

22 The

objective of the JobDUN programme is to meet business needs, create high value

jobs, retain skills and talent in the city and contribute to the economic

growth of Dunedin. The programme allocates funding for 50 intern placements.

23 COVID-19

has impacted on the number of placement opportunities offered by businesses for

the 2020-21 season.

24 In

discussion with tertiary partners, Enterprise Dunedin cancelled the 2020 face

to face interview event at Otago Polytechnic on 23 September 2020. This was to

ensure the health and wellbeing of all concerned and to manage expectations for

students during an already difficult time. With fewer internships on offer, the

window of opportunity to promote to students was narrowing and businesses have

also had various priorities to manage.

25 The

programme will remain open until 2 April 2021 to support businesses if they

require an intern. Facilitation occurs online via the JobDUN website and

through email and/or virtual interactions between students and businesses.

Businesses have more time and flexibility to make decisions about taking on an

intern.

26 So

far 2020-21 has seen 18 businesses applying for 32 interns. Of those businesses

participating, over half have come from the ICT/Tech and Creative sectors.

Under the circumstances this compares favourably with 28 businesses in the

2019-2020 season from nine sectors, mostly from the ICT/Tech sector, followed

by other sectors such as engineering/niche manufacturing, marketing/media and

sport/recreation.

27 Enterprise

Dunedin will continue to liaise weekly with tertiary partners to monitor

student responses and to reiterate a selective approach to ensure businesses

are contacted by only the most relevant potential interns to mitigate supply

overload on businesses.

Start Up Dunedin

28 Work

continues with the appointment of a new Dunedin City Council representative on

the Start Up Dunedin Trust (SUDT). The new appointee will replace Nigel Bamford

and will ensure that the city’s interests are considered and aligned with

the 2013-2023 Dunedin Economic Development Strategy. The recruitment process is

being supported by Grow Dunedin Partners.

29 Enterprise

Dunedin will prepare a paper and a final recommendation for the Dunedin City

Council representative for approval by Council on 24 November 2020.

A Compelling

Destination

Destination Marketing

30 Dunedin’s

visitor sector continues to be widely affected by COVID-19. Figures for

domestic spend for the 12 months ending July 2020 was $480m, down -16.1%

compared to the same period in 2019; the total spend for New Zealand for

domestic visitors was down 9.3% for the year ending July 2020.

31 Independent

research on the impact of the change of COVID-19 alert level for Auckland in

August, suggests that Dunedin lost around $270k per day with no Aucklanders

visiting, and only half the normal volume of Waikato and Northland visitors in

the city.

32 International

visitor spend in Dunedin City for the 12 months ending July 2020 was $187m,

down 18.7% compared to the same period in 2019; whilst New Zealand

international visitors spend was down 18.35% for the 12 months ending 2020.

33 Enterprise

Dunedin’s campaign continues to adjust depending on COVID-19 alert

levels. Our playbook (scenario’s) have been extended and planning and

research is underway for campaigns in the third and fourth quarters of 2021.

Strategic Assets Protection Programme (STAPP)

34 Project

planning and procurement of $700k of investment from MBIE’s STAPP is

continuing across the funded areas for:

a) Destination

Management;

b) Product

Development and Capability; and

c) Destination

Marketing.

35 At

this stage six Dunedin businesses have been funded from MBIE’s STAPP,

with more announcements possible.

36 Enterprise

Dunedin has taken the coordinating role for MBIE’s Regional Events Fund.

This new funding ($1.5 m) will be shared across our International

Marketing Alliance (IMA), which consists of Enterprise Dunedin, Great South,

Tourism Waitaki and Destination Clutha. The fund is for new or growing existing

events or capability building and is expected to last two years. It is designed

to replace lost international visitor spend and boost regional domestic spend.

Visit Sector Initiatives and Engagement

37 The

Otago Central Rail Trail Trust has joined the Cycle Trails collective which

brings together all other cycle trails in the region for marketing purposes.

38 The

new Central Otago Touring Route from Dunedin to Queenstown is due to be

launched in late November 2020. This is a Central Otago Tourism project which

Enterprise Dunedin has contributed investment and staff time.

39 The

Southern Scenic Route is being targeted for a new marketing push by all Otago

and Southland Regional Tourism Organisations (RTO’s) involved. This

project is driven by Great South.

40 The

45 South Group has appointed a full-time project coordinator. This project is

being driven by Great South and funded by eight RTO’s. This project is

seeking to coordinate destination marketing and destination management

initiatives across Otago and Southland.

Research and Data

41 The

new Accommodation Data Programme commenced in July 2020. The occupancy rate for

August 2020 sits at 41.7% down from 49.3% in July 2020. Average nights stayed

per guest is 1.9, the same as July 2020.

Business Events (Conferences)

42 A

final Business Events Strategy will be completed in October 2020 with

implementation to follow.

43 As

a result of less sales events and change in COVID-19 alert levels across New

Zealand, enquiries for new business events has slowed down, with seven new

leads to date compared to 11 in the same quarter in 2019. From these seven

leads, Enterprise Dunedin has submitted three conference bids, one was

successful (with an estimate value of $257k), one lost to Queenstown, and

another yet to confirm.

44 Dunedin

has been successful in securing an international conference in partnership with

Tourism New Zealand and the University of Otago. The International Human

Resources Conference 2023 will have an expected attendance of 200 delegates,

the majority being international visitors. The original bid for this conference

was submitted in late May 2020.

45 Dunedin

Business Events has launched a new page on the web site. This serves as a value

add for conference organisers promoting to their delegates and is seeking to

entice them to book a few extra days when visiting Dunedin for their

conference.

Consumer Marketing – New Zealand and Australia

46 Despite

continued international border closures, DunedinNZ.com website has seen little

change in the quantity of its website traffic in comparison to 2019. User

engagement remains high across the breadth of website content including a 28%

increase in pageviews, 36% increase in pages per session, 17% increase in

average session duration, and a 50% decrease in the website’s bounce rate.

47 Referrals

from DunedinNZ.com to external websites (e.g. local businesses) has similarly

increased by 18% which indicates the quality of website traffic discovering and

engaging with the site.

48 In

collaboration with Dunedin Airport, Air New Zealand ran a competition to win a

weekend in Dunedin and then filmed the experience for their Grab a Seat social

media channels, which included a return flight deal for Dunedin. The results

for the weekend video were:

· Video

Views – 302,495

· Reach

– 980,127

· Engagement

– 1791 (measure of comments, likes and shares).

49 The

follow up Facebook post with the Dunedin deal gained 133,933 reach – with

click throughs of 6,087 to the deal page. This is the best performing campaign

this year for Grab a Seat.

50 To

encourage visitors to Dunedin for the school holidays and to promote activities

to locals, Enterprise Dunedin launched ‘Kids Insiders’ on 21

September 2020. This campaign puts kids at the front and centre, as they show

off their favourite spots, food, and things to do. The campaign activity

includes competitions run on MediaWorks morning radio in Queenstown, Timaru,

Southland and Dunedin, digital advertising on MediaWorks and NZME, print and

digital with Allied Press and advertising on the DunedinNZ social channels.

This activity ran until 11 September 2020 with initial engaged

users’ traffic from Dunedin (35%), Christchurch (21%), and Auckland

(17%).

51 Over

72% of users who visit the School Holidays Deals page, visit an operator

website as a result. The Kids Insiders webpages will be an ongoing marketing

activity for the family market.

52 Enterprise

Dunedin continues to promote Dunedin as a desirable visitor destination using

the ‘A pretty Good Plan D’ campaign activity with new creatives

being launched in early October 2020 for the summer dream and planning phases.

Billboards in Auckland, Wellington and Christchurch were timed to be in market

once Auckland came out of Alert Level 3.

53 Over

the time period 18 August to 30 September 2020, the DunedinNZ Facebook page had

a reach of 1.5 million and an increase in followers of 1,033. In the last

30 days the DunedinNZ Instagram account had a reach of 343k and an increase of

153 followers.

54 Enterprise

Dunedin continues to work closely with Tourism New Zealand on joint venture

campaign activity.

PR and Promotions

55 Since

August 2020, Enterprise Dunedin has secured 23 features or inclusions in

regional and national publications and hosted one media familiarisation.

Coverage published over this period included a variety of publications e.g.

features/articles in Stuff, Kia Ora magazine, New Zealand Herald New Zealand

Geographic and the Otago Daily Times.

56 Additional

coverage resulting from media visits and story pitching will be published over

the next quarter, including features on education and Dunedin’s start-up

ecosystem.

57 Tourism

New Zealand’s domestic marketing and PR campaign continues to present

additional opportunities to promote the city, and Enterprise Dunedin regularly

contributes.

58 Work

is currently underway to develop a new communications plan for all Enterprise

Dunedin activities. This will identify current and future opportunities to

communicate and promote each portfolio or special projects to stakeholders.

Trade Marketing

59 Enterprise

Dunedin recently supported the Tourism New Zealand global team with logistics

for the Dunedin features in the latest Tourism New Zealand Trade campaign,

“Messages from New Zealand” to be shared through all the individual

international trade offices.

60 Kim

McVicker (TNZ North American Marketing Executive) recently chose Dunedin as her

next “on the road” location. During Kim’s visit, Enterprise

Dunedin jointly hosted two on location webinars; Dunedin101 live from Olveston

House and Wildlife Experience from The Royal Albatross Centre. These webinars

were also paired with Facebook live experiences and further posts on the North

American travel agents private Facebook community. Success measures/key

highlights:

· Dunedin

101 webinar had 215 registrants and Dunedin Wildlife webinar had 113

registrants with a further 395 Facebook live viewers and 29

comments/engagements across the webinars;

· Over

1,100 views and 80 comments across six “on location” DunedinNZ

Facebook live posts; and

· An

expanded database of 315 North American travel sellers who have indicated they

are open to receiving further communication from DunedinNZ.

61 Dunedin

is now the featured destination case study on how other markets could be

working with RTOs to produce engaging content to further educate their agents.

62 In

support of future domestic consumer-facing campaigns with Flight Centre,

Enterprise Dunedin facilitated a day with local operators and experiences. A

video of their experience was shared with Flight Centre teams around the

country for education and inspiration.

63 This

activity has also resulted in developed relationships with other Dunedin based

travel agents working within several travel brands e.g. House of Travel and

Travel Associates. Future familiarisation activity and relationship

building support between these agents and our local operators is planned.

64 The

international trade market continues to recover with a growing number of

inquiries from companies in support of itinerary building and brochure development

for 2021 and 2022.

Study Dunedin

65 Dunedin

Summer Programme

a) Work

continues on building a Summer Programme for international students staying in

New Zealand over the holiday period. A programme of events has been agreed and

dates set.

i) Feedback

was sought via an Expressions of Interest (EOI) with intention to gather

specific data regarding student expectations of the programme activities they

would engage in. EOI responses have been received from students studying

in Dunedin and other parts of New Zealand;

ii) Education

New Zealand (ENZ) is supporting regional Summer Programme activities by running

a Virtual Fair on 31 October 2020, inviting students to go on-line and find out

what activity options are available to them from around New Zealand. Study

Dunedin will be participating in this; and

iii) A

full report on the complete programme will be provided to the Economic

Development Committee in early 2021.

66 Auckland

Agent Event

a) Study

Dunedin and Study Queenstown will jointly host an event to promote Dunedin to

international education agents based in Auckland on 22 October 2020. Currently

35 agents have confirmed attendance, which is comparable to the event in

previous years. Study Dunedin will provide details on the Summer Programme and

a competition to attract Education Agents to Dunedin for a familiarisation

programme in March 2021.

67 I-Hub

a) The

International Student Hub (I-Hub) was launched on 2 October 2020 with an event

at Unipol attended by over 50 students. The intention is to provide a safe

place for students to come together to network, complete workshops and skills

training and have fun. There will also be opportunities for them to interact

with the Dunedin community including other organisations such as the Dunedin

Multi Ethnic Council.

i-SITE Visitor Centre

68 From

1 July 2020 the i-SITE Visitor Centre has welcomed and made bookings for

visitors from throughout New Zealand and a wide range of international

countries.

69 The

main source of visitors by percentage are:

· Dunedin

residents 54% (19% making bookings for Dunedin attractions and activities, the

majority booking transport in and out of Dunedin as the Visitor Centre has a

complete overview of the options)

· Auckland

10%

· Canterbury

7%

· Wellington

4%

· Bay

of Plenty 3%

· Northland

3%

· Other

regions of North Island 4.5%

· Other

regions of the South Island 5.5%

· International

visitors 8%

70 International

visitors consisted of those here at the time of lockdown on a working holiday

visa (they decided to stay and are now continuing with their working holidays)

and retired visitors who were already in the country and able to stay and

holiday longer.

71 The

team have also handled several inquiries from international students planning

their summer holidays in New Zealand as they will not return home over the

tertiary holidays.

NEXT STEPS

72 Feedback

on Enterprise Dunedin activity will be incorporated into future reports.

Signatories

|

Author:

|

Malcolm Anderson - City Marketing Manager

Fraser Liggett - Economic Development Programme Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report promotes the economic

well-being of communities in the present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the delivery of the

2013-2023 Economic Development Strategy.

|

|

Māori Impact

Statement

The CODE Working Group is working with Te Runanga o Otakou

and Kati Huirapa Runaka ki Puketeraki regarding the development of Kaupapa

CODE.

|

|

Sustainability

There are no known impacts for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Enterprise Dunedin activities and the 2013-2023 Economic

Development Strategy are included in the 2018-28 Long Term Plan.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This decision is considered low significance under the

Significance Engagement Policy.

|

|

Engagement –

external

External engagement has been held with Te Runanga o Otakou

and Kati Huirapa Runaka ki Puketeraki and Dunedin’s Tech, Education,

Visit, Film, Food and general business sectors.

|

|

Engagement –

internal

As an update report, no internal engagement has been

undertaken.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

|

Economic Development Committee

19 October 2020

|

Centre of Digital Excellence (CODE) Update

Report

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee (EDC) on

workstreams and activities to establish the Centre of Digital Excellence

(CODE).

2 The

report highlights activities currently being undertaken by CODE including:

a) Development

of the CODE operating principles, legal entity, shareholding structures;

b) Development

of ‘Kaupapa CODE’ focused on Māori gaming companies,

entrepreneurs, pathways and talent;

c) Development

of an industry grants programme;

d) Ongoing

development of vocational models (drawing on the ‘Future Games’

model from Sweden) and tertiary curriculum with the Otago Polytechnic and

University of Otago;

e) Progressing

‘Games for Health’ in conjunction with the Southern District Health

Board (SDHB).

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Centre for Digital Excellence (CODE) report.

|

BACKGROUND

3 In

October 2019, Government announced $10m funding from the Provincial Growth Fund

(PGF) to establish CODE in Dunedin.

4 Over

ten years, the ambition of CODE is to grow a $1b video games industry and to

maximise economic and social outcomes through developing a niche ‘games

for health’ sector.

5 A

Working Group, chaired by independent Director Murray Strong and comprised of

the following representatives, has overseen the development of CODE:

a) Richard

Blaikie – Deputy Vice Chancellor Research and Enterprise, University of

Otago;

b) Oonagh

McGirr - Deputy Chief Executive Learning and Teaching Services, Otago

Polytechnic;

c) Katharina

Ruckstuhl – Ngāi Tahu Representative;

d) Mike

Collins - Executive Director People, Culture and Technology, Southern District Health

Board; and

e) John

Christie – Director, Enterprise Dunedin.

DISCUSSION

Legal Entity

6 Work

has continued on the development of a separate legal entity for CODE. As part

of this process, a limited liability company under the Companies Act 1993 has

been identified as a preferred option.

7 The

next stage of creating the CODE company requires:

a) Confirmation

of the procedure and appointment of Directors and independent Chair;

b) Agreement

of the shareholders agreement by all parties; and

c) Company

formation.

Kaupapa CODE

8 The development of an enduring and credible partnership with local

Runaka and Ngāi Tahu gaming companies is a

critical component of CODE. Engagement has commenced with Te Rūnaka

o Ōtākou and Kāti Huirapa Runaka ki Puketeraki ngā

Rūnaka regarding CODE and potential shareholding in the company as well as

ongoing support for activities such as grants, employment

pathways and curriculum development.

Grants Programme

9 The

development of a $700k business grants programme has been launched to support

and grow Dunedin’s game development ecosystem. The programme includes

three contestable CODE funds:

a) KickStart;

b) Start

Up; and

c) Scale

Up.

10 The

current round of KickStart and Start Up assessment is under way and involves 24

full applications. Final recommendations from the panel are expected by the end

of October 2020. The funding will contribute to Dunedin’s economic

development, and commercial outcomes that lead to the strengthening of the game

development ecosystem in the city.

11 The

next round for KickStart and Start Up funding will commence in December 2020.

Curriculum Development

Otago Polytechnic

12 CODE

has engaged Future Games (Sweden) to provide advice to the Otago Polytechnic on

the development of specialised courses aligned to international leading

practice. Otago Polytechnic is looking at creating a game strand within its

Bachelor of Design and Bachelor of IT degrees which CODE is also supporting.

University of Otago

13 The

University of Otago is proposing to pilot a pathway for developing games and

serious games. The University has early stage proposals on Bachelor’s

degrees in Serious Games Development and Games Engineering. Abertay University

has been engaged to help validate the University’s approach.

Visiting Chair

14 Work

is continuing on the process for a Visiting Chair. The concept was part of the

original CODE business case and application to the PGF. The proposal, currently

under consideration includes:

a) Otago

Polytechnic and the University of Otago hosting Visiting Chairs;

b) Each

Visiting Chair will spend between 30-90 days in Dunedin, however longer visits

are possible; and

c) CODE

supporting a per diem allowance meeting actual and reasonable costs.

Games for Health

15 The

CODE PGF application included the objective of “Games for Health

initiatives and support for CODE health initiatives”. An additional

business case is planned over the next few months in order to progress this

workstream. This will be brought to the CODE Working Group and updates provided

to EDC.

OPTIONS

16 There

are no options.

NEXT STEPS

17 The

CODE Project Team and Working Group will continue to progress the workstreams

summarised in the update report. Specific decisions and updates on workstreams

(for instance the legal entity) are expected to be brought back to Council

before the end of the calendar year.

Signatories

|

Author:

|

Fraser Liggett - Economic Development Programme Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose of Local Government

This decision

promotes the economic well-being of communities in the present and for the

future.

|

|

Fit with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development

Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport

Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation

Strategy

|

☐

|

☐

|

☒

|

|

Other strategic

projects/policies/plans

|

☐

|

☐

|

☒

|

|

|

Māori Impact Statement

CODE is working with Te

Rūnanga o Ōtākou and Kāti Huirapa Rūnaka ki

Puketeraki regarding the development Kaupapa CODE.

|

|

Sustainability

The economic and social

impacts are addressed within the report. As a weightless export, the

development of gaming products has a lower carbon footprint than other

sectors.

|

|

LTP/Annual Plan / Financial Strategy /Infrastructure

Strategy

There are no implications.

|

|

Financial considerations

CODE received $10m funding

from the Provincial Growth Fund.

|

|

Significance

This decision is considered

low in terms of the Council’s Significance and Engagement Policy.

|

|

Engagement – external

The CODE Working Group has

been involved in all aspects of the CODE workstreams and activities.

|

|

Engagement - internal

There has been no internal

engagement.

|

|

Risks: Legal / Health and Safety etc.

There are no identified

risks.

|

|

Conflict of Interest

There are no known

conflicts of interest.

|

|

Community Boards

There are no implications

for Community Boards.

|

|

|

Economic Development Committee

19 October 2020

|

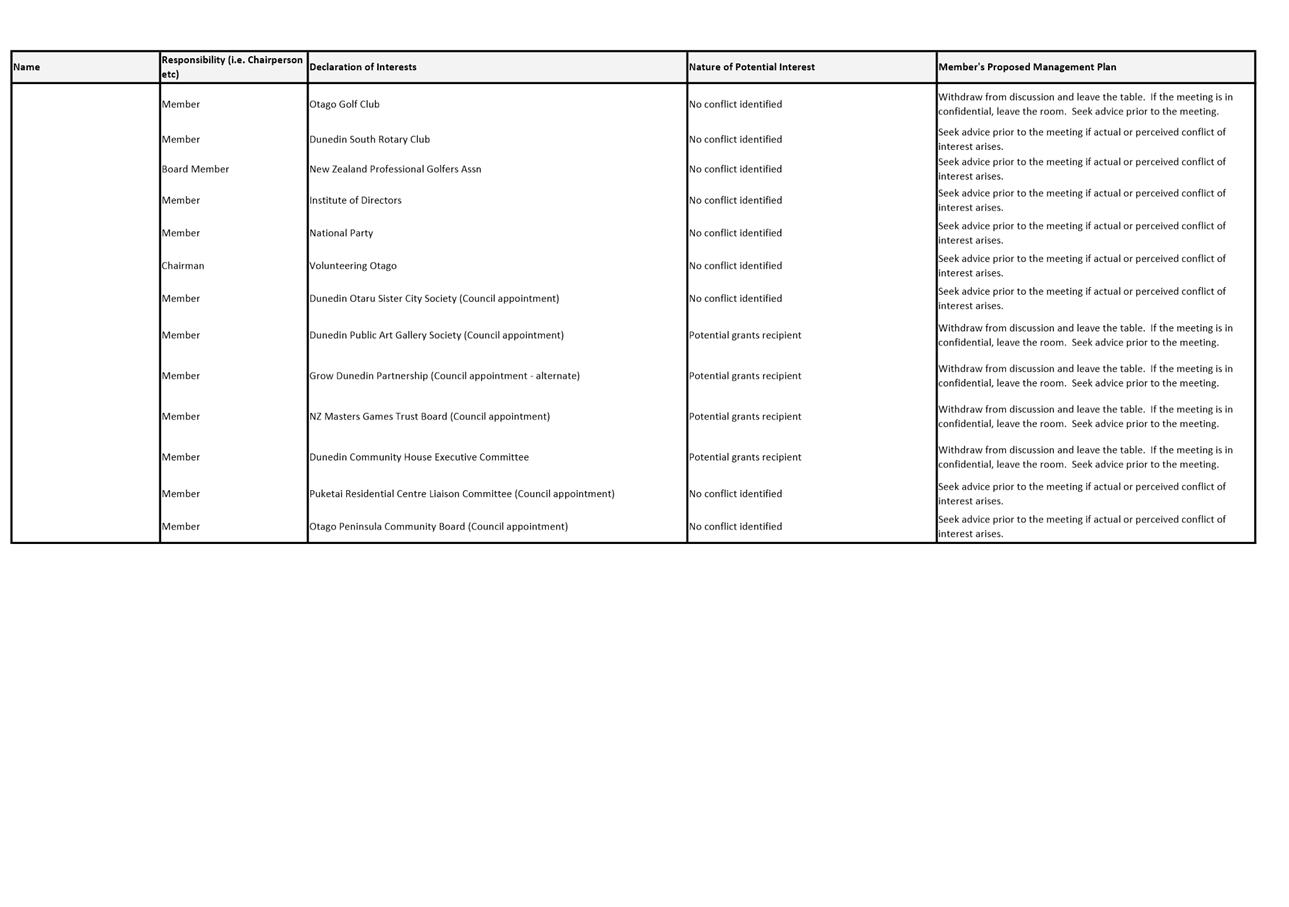

Film Dunedin

Department: Enterprise Dunedin

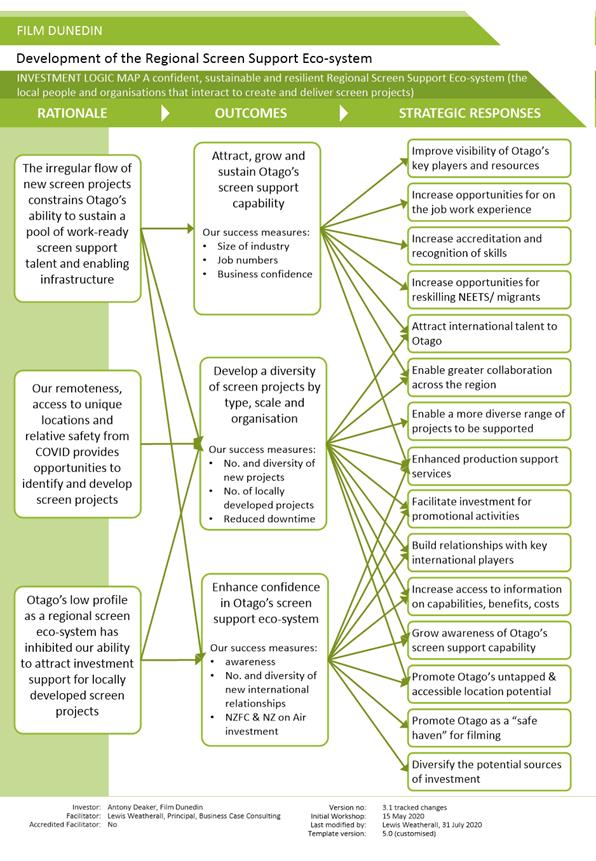

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee (EDC) on

engagement with the local and regional screen sector on the creation of an

Investment Logic Map (ILM) to support film activity. The ILM considered the

impacts of COVID-19 and highlighted:

a) Problems

or opportunities with the existing screen support eco-system;

b) Outcomes

which Otago should be working towards; and

c) Options

on how this can be achieved including consideration of existing screen support

services.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Film Dunedin report.

|

BACKGROUND

2 Over

the last three years the Dunedin City Council and Grow Dunedin Partners (GDP)

have invested in the film sector through establishment of Film Dunedin as a

Regional Film Office. This investment and the COVID-19 recovery have resulted

in increased interest in Dunedin as a film location, a growing reputation for

ease of business for visiting and homegrown projects, growth in film activity

and attraction of talent to base in the city.

3 Enterprise

Dunedin has identified development of the screen sector as a priority for the

city. The city has experienced growth in film activity over recent years,

while this has resulted in increased film activity, permits and projects,

further work has been undertaken on the drivers underpinning growth in the

sector and how best the city (and region via Film Otago Southland (FOS) and

Queenstown Film Office) can respond in the medium to long term.

DISCUSSION

4 In

order to understand the problems and opportunities further, a panel of public

and private sector stakeholders and mana whenua were invited to participate in

a series of ILM workshops between May and July 2020 (attachment A). The

stakeholders were approached based on their involvement in the regional screen

eco-system and their potential influence in the outcome of any proposal for

change.

5 In

summary, the panel of stakeholders concluded:

a) The

irregular flow of new screen projects constrained Otago’s ability to

sustain a pool of work ready screen support skills and enabling infrastructure;

b) The

remoteness of Dunedin and Otago, access to unique locations and relative safety

from COVID provides opportunities to identify and develop screen projects; and

c) Otago’s

low profile as a regional screen eco-system has inhibited our ability to

attract investment for locally developed screen projects.

6 The

ILM noted a series of economic and social outcomes which could shape activity

over the medium to long term including:

a) Attracting,

growing and sustaining Otago’s screen support capability;

b) Developing

a diversity of screen projects by type, scale and organisation; and

c) Enhancing

the confidence in Otago’s screen support ecosystem.

7 There

was a preference for longer-running TV series as anchor projects and for a mix

and diversity of projects by scale and type. The potential to connect local

talent and creativity, ideas, the market and investment opportunities was

recognised as an important ‘pipeline’ in supporting the sector.

8 The

pipeline model (from idea creation to release) was explored further to help

shape the group’s thinking about how to support an end-to-end approach to

the eco-system. The second part of the process was seen as promoting and

marketing these ideas to potential investors and distributors. Two key enablers

were identified:

a) Access

to seed or development investment; and

b) Championing

by known producers.

9 The

panel identified a range of strategic responses to achieve the

panel’s vision for ‘A Confident, Sustainable and Resilient Regional

Screen Support Eco-system’. These are reflected in the attached ILM. A

selection of the strategic responses includes:

a) Improved

visibility of Otago’s key players and resources, building on existing

collaboration between the Dunedin Film and Queenstown Film Offices and FOS;

b) Enhanced production support services such as studio and associated

workshops. The opportunity to establish production support

infrastructure continues to be investigated in the context of enquires and

projects considering Dunedin and New Zealand as a location;

c) Increased opportunities for reskilling, accreditation and

recognition of skills. Both the Dunedin and Queenstown Film Offices are

working with the Ministry of Social Development (MSD), New Zealand Film

Commission (NZFC), Private Training Providers, the Otago Polytechnic and

visiting productions to coordinate work force planning and support. A key focus

is accessing opportunities for young people not in employment education and

training, migrants and people who have lost work in sectors as a result of

COVID-19 with transferable skills for crew work such as hospitality and events.

d) On the job work experience and the need to improve visibility of the

region’s key players and resources.

e) Both

the Queenstown and Dunedin Film Offices and FOS will continue to support

writers in residence opportunities to encourage development of content filmed

in the region. The recent ‘Great Dunedin Brainstorm’ resulted in a

proposal to support and scale the development of Dunedin stories for film and

television production. Additionally, ‘essential services’

collateral is being developed to support producers working in the region

identify and source available resources, products and services from local

businesses.

OPTIONS

10 There

are no options.

NEXT STEPS

11 Further

engagement on the results of the ILM and the development of strategic responses

is planned with Grow Dunedin Partners, Otago Regional Economic Development, the

NZFC, New Zealand on Air and the Ministry of Business Innovation and Employment

(MBIE).

12 More

specifically:

a) Engagement

with communities and partners will be undertaken to identify participants for

training and internship opportunities;

b) The

opportunity to formalise accreditation of skills and provision of training will

be further explored with Otago Polytechnic; and

c) The

Film Offices will work with NZFC and other sector organisations to support the

professional development of emerging Producers in the region for scripted

content.

Signatories

|

Author:

|

Fraser Liggett - Economic Development Programme Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Screen Support

Investment Logic Map (ILM)

|

44

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision promotes the economic

well-being of communities in the present and for the future.

This decision promotes the cultural

well-being of communities in the present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

|

|

Māori Impact

Statement

Mana whenua were engaged in the development of ILM and

continue to be engaged in development of training and employment

opportunities and the development of potential stories for production.

|

|

Sustainability

Support for the film sector contributes to economic growth

and sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

There are no implications.

|

|

Financial

considerations

There are no financial implications.

|

|

Significance

This decision is considered low in terms of the

Council’s Significance and Engagement Policy.

|

|

Engagement –

external

External engagement includes: NZFC, NZ on Air, Ministry of

Social Development, Ministry of Business Innovation and Employment, Ministry

of Culture and Heritage, Ministry of Education, New Zealand Trade &

Enterprise, Natural History NZ, Otago Polytechnic, Otago University, R&R

Productions, Punakaiki Productions, Ruaimoko Trust, Aukaha, Legal Fiction

Productions, Rebecca Rowe Freelance, 5 to 9 Productions, Torchlight

Productions, Shotover Camera Systems.

|

|

Engagement -

internal

Internal engagement has occurred with Ara Toi and

Property.

|

|

Risks: Legal /

Health and Safety etc.

There are no known risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no implications for Community Boards.

|

|

|

Economic Development Committee

19 October 2020

|

|

|

Economic Development Committee

19 October 2020

|

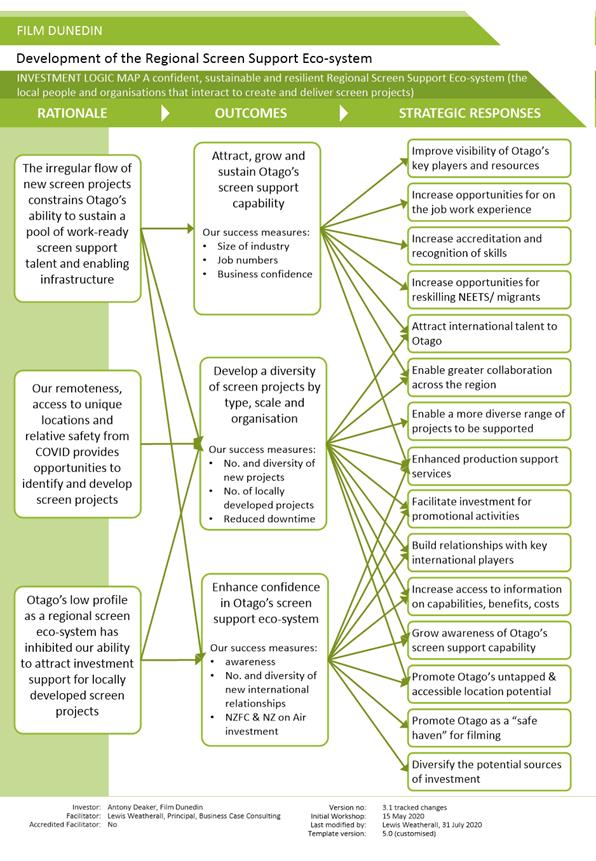

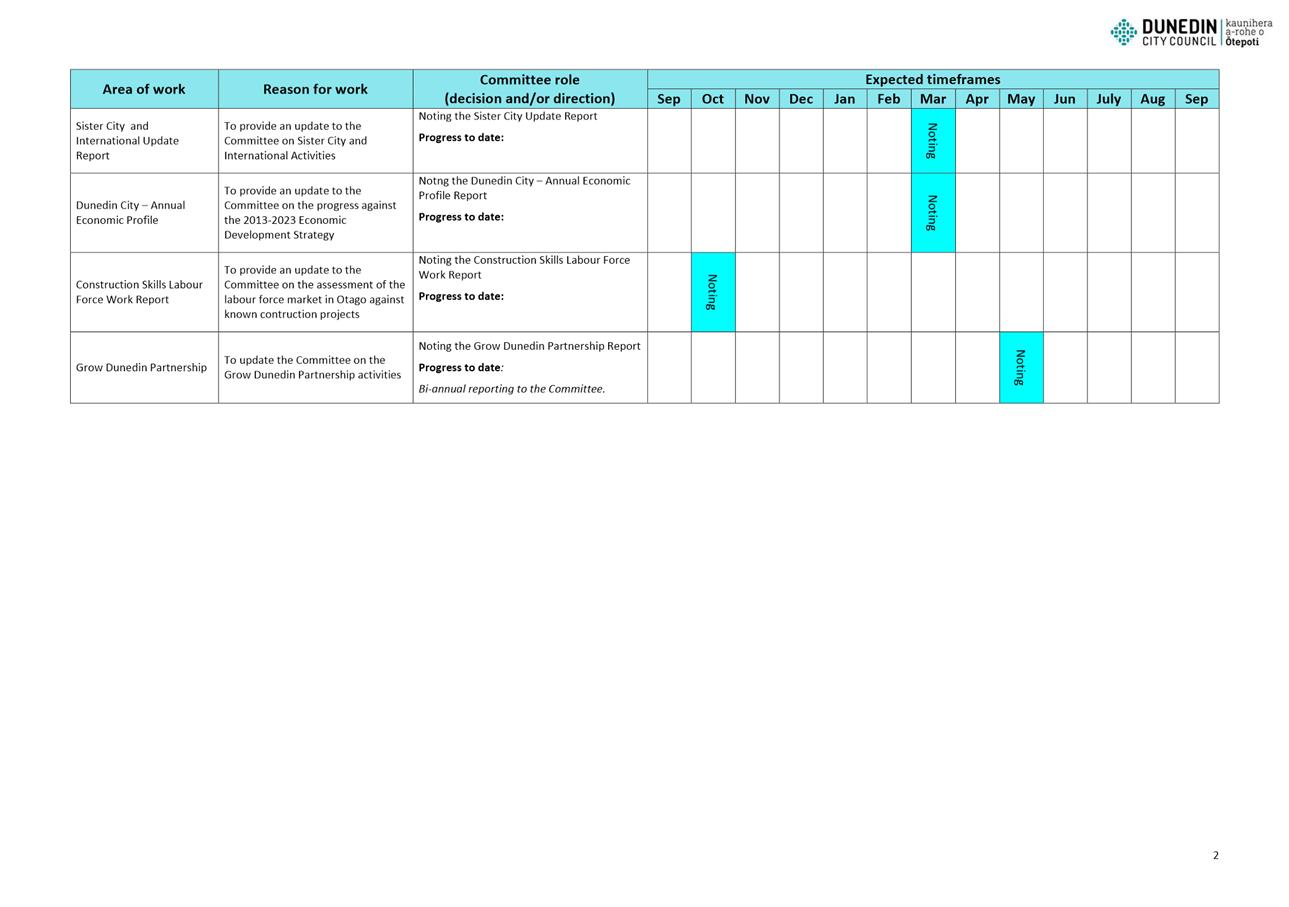

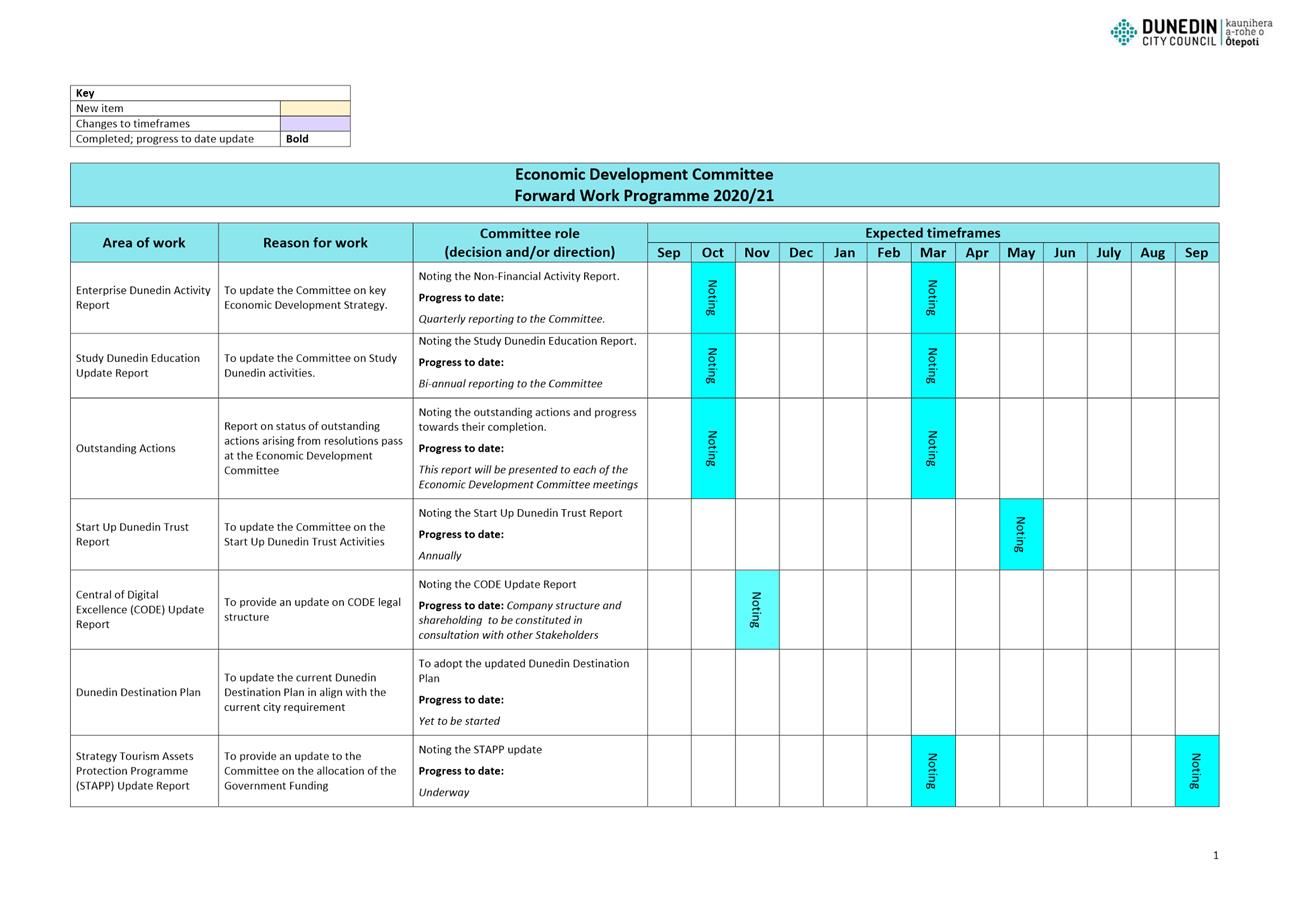

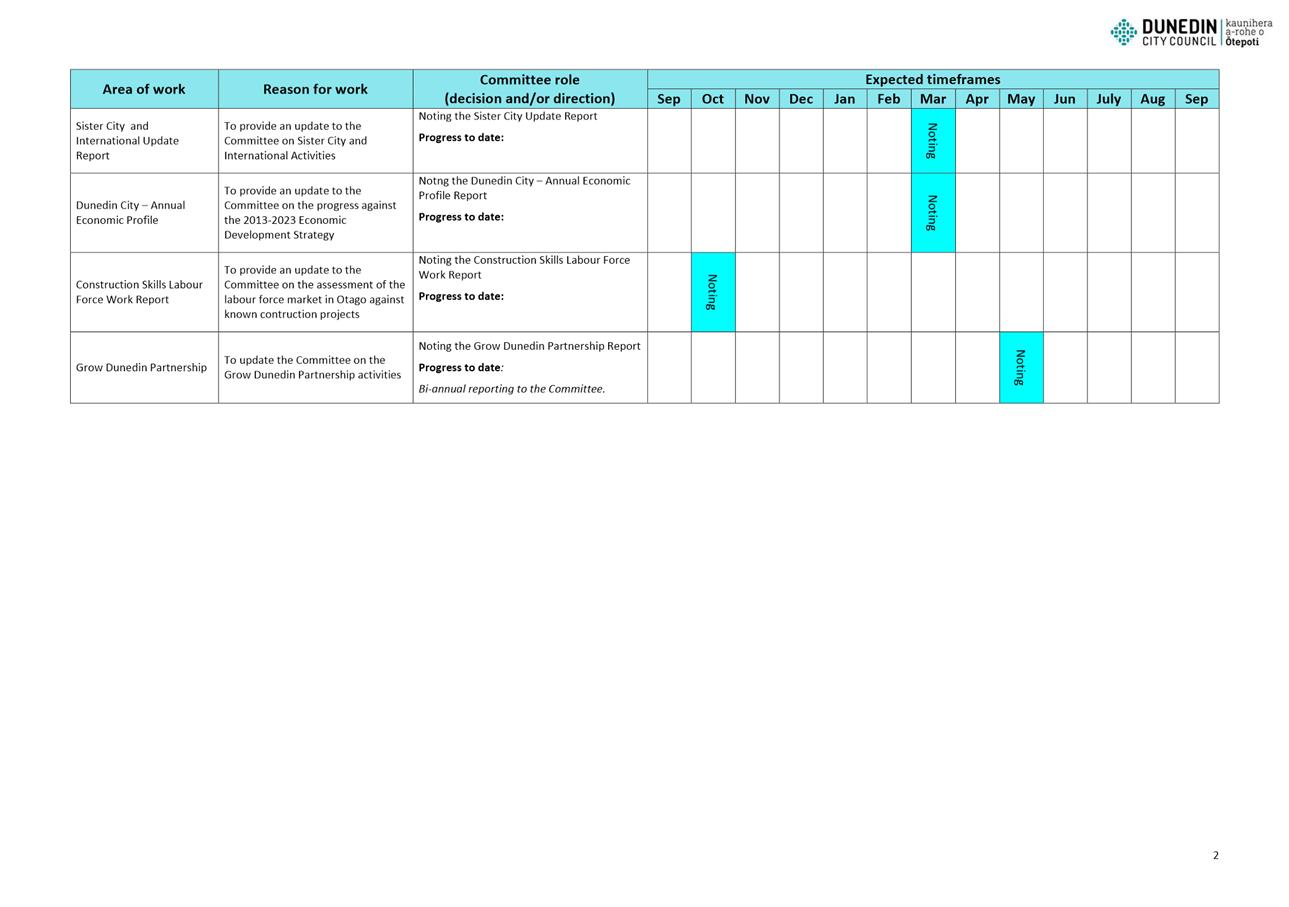

Economic Development

Committee Forward Work Programme

Department: Civic

EXECUTIVE SUMMARY

1 The

purpose of this report is to provide the forward work programme for the

2020-2021 year (Attachment A).

2 As

this is an administrative report only, there are no options or Summary of

Considerations.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Economic Development Committee forward work programme as shown in Attachment

A.

|

DISCUSSION

3 The

Council’s forward work programme was first presented to Council at the 28

July 2020 meeting. As advised forward work programmes would be created for

the Committees as well, they will be a regular agenda item for Council and

Committees to show areas of activity, progress and expected timeframes for

decision making across a range of areas of work.

4 This

document is the first report for the Economic Development Committee.

Future reports will show any changes to timeframe. New items will be

added to the schedule and highlighted in yellow. This report shows a

12-month rolling period from September 2020 to September 2021, to identify

items that have been completed.

NEXT STEPS

5 An

updated report will be provided for the first meeting of 2021 for the Economic

Development Committee.

Signatories

|

Author:

|

Wendy Collard - Governance Support Officer

|

|

Authoriser:

|

Clare Sullivan - Team Leader Civic

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Economic Development

Committee Forward Work Programme

|

46

|

|

|

Economic Development Committee

19 October 2020

|

|

|

Economic Development Committee

19 October 2020

|

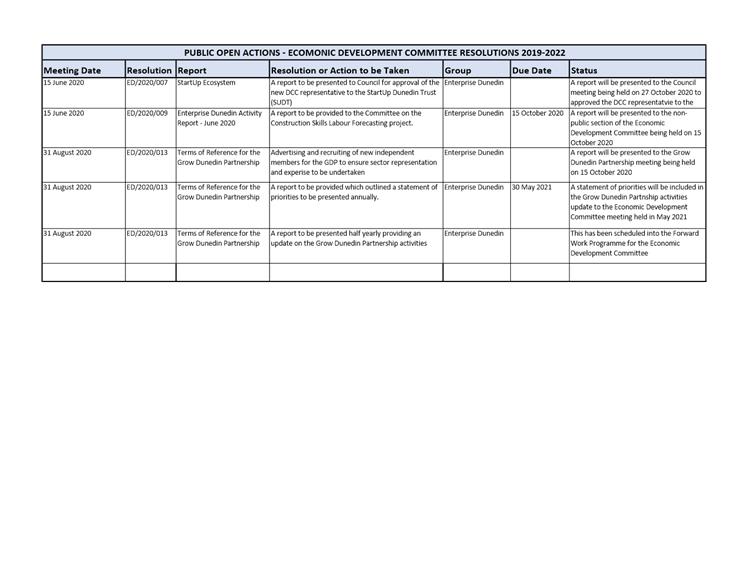

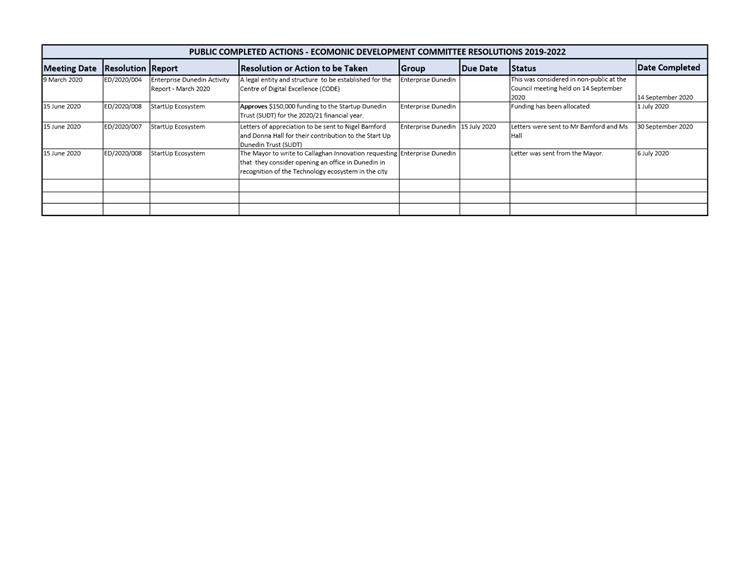

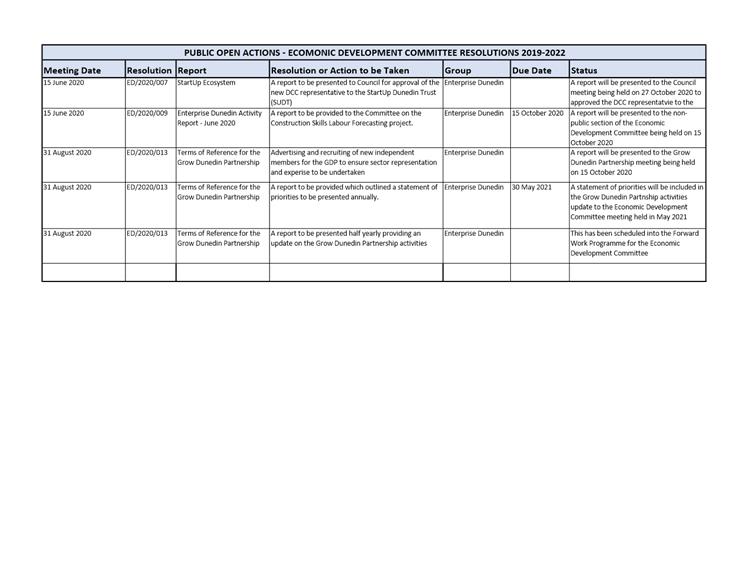

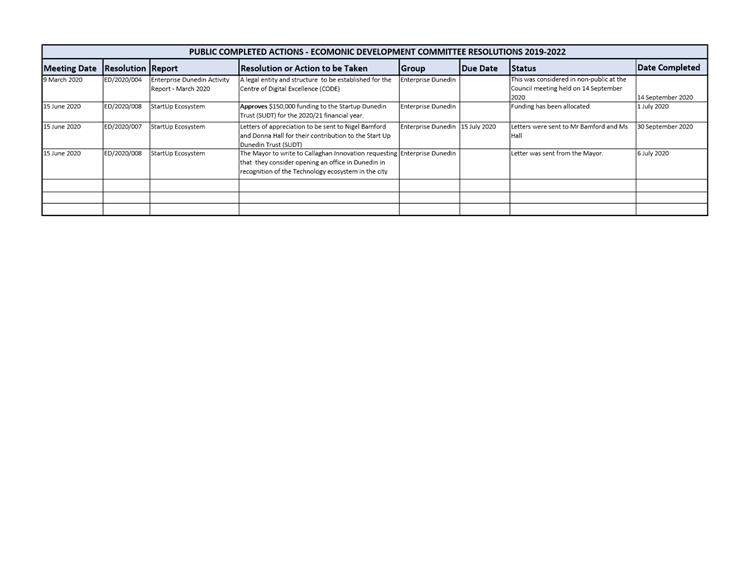

Actions From Resolutions of

Economic Development Committee Meetings

Department: Civic

EXECUTIVE SUMMARY

1 The

purpose of this report is to detail the open and completed actions from

resolutions of Economic Development Committee meetings from the start of the

triennium in October 2019 (Attachment A and B).

2 As

this report is an administrative report only, there are no options or Summary

of Considerations.

|

RECOMMENDATIONS

That the Committee:

a) Notes the

Open and Completed Actions from resolutions of Economic Development Committee

meetings shown in Attachment A and B.

|

discussion

3 The

actions report will be a regular report which will show progress on

implementing resolutions made at Committee meetings. Matters that have

been completed will be identified as such. The document contains actions

dating back to the start of the triennium.

4 The

outstanding actions report will become a standing item on future Committee

agendas.

NEXT STEPS

5 An

updated actions report will be provided for the first 2021 meeting for the

Economic Development Committee meeting.

Signatories

|

Author:

|

Wendy Collard - Governance Support Officer

|

|

Authoriser:

|

Clare Sullivan - Team Leader Civic

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Public Open Actions

|

49

|

|

⇩b

|

Public Completed

Actions

|

50

|

|

|

Economic Development Committee

19 October 2020

|

|

|

Economic Development Committee

19 October 2020

|

|

|

Economic Development Committee

19 October 2020

|

Items for Consideration by

the Chair

Any items for

consideration by the Chair

|

|

Economic Development

Committee

19 October 2020

|

Resolution to Exclude the

Public

That the Economic

Development Committee:

Pursuant to the provisions of the

Local Government Official Information and Meetings Act 1987, exclude the public

from the following part of the proceedings of this meeting namely:

|

General subject of the matter to be considered

|

Reasons

for passing this resolution in relation to each matter

|

Ground(s) under

section 48(1) for the passing of this resolution

|

Reason for

Confidentiality

|

|

C1

Otago Construction Labour Forecasting

|

S7(2)(b)(ii)

The

withholding of the information is necessary to protect information where the

making available of the information would be likely unreasonably to prejudice

the commercial position of the person who supplied or who is the subject of

the information.

S7(2)(i)

The

withholding of the information is necessary to enable the local authority to

carry on, without prejudice or disadvantage, negotiations (including

commercial and industrial negotiations).

|

S48(1)(a)

The public conduct of

the part of the meeting would be likely to result in the disclosure of

information for which good reason for withholding exists under section 7.

|

|

This resolution is made in

reliance on Section 48(1)(a) of the Local Government Official Information and

Meetings Act 1987, and the particular interest or interests protected by

Section 6 or Section 7 of that Act, or Section 6 or Section 7 or Section 9 of

the Official Information Act 1982, as the case may require, which would be

prejudiced by the holding of the whole or the relevant part of the proceedings

of the meeting in public are as shown above after each item.