|

|

Council

10 November 2020

|

Reports

COVID-19 Response Fund

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 On

28 May 2020, Council requested a report outlining options for allocating a

COVID-19 Support Fund of $950k. The COVID-19 Support Fund aims to strengthen

social wellbeing and economic development activities in response to the local

impact of the pandemic.

2 The

purpose of this report is to seek Council approval to allocate up to $160k from

the COVID-19 Support Fund for three proposals identified during the Great

Dunedin Brainstorm. This funding will be administered by Enterprise Dunedin and

be allocated subject to further development, project planning and contracting.

|

RECOMMENDATIONS

That the Council:

a) Approves the

proposed allocation of up to $160k of the COVID-19 Support Fund to be

administered by Enterprise Dunedin.

b) Notes that

an update on further proposals for the COVID-19 Support Fund will be

presented to Council in February 2021.

|

BACKGROUND

3 As

part of the Draft 2020/21 Annual Plan deliberations on 27 and 28 May 2020,

Council resolved the following:

Moved (Cr Chris Staynes/Cr Christine

Garey):

That the Council:

a) Approves

an overall rates increase of 4.1% for the Annual Plan 2020-21

b) Allocates

$950k to a COVID-19 Support Fund

c) Requests

staff provide a report to the 30 June 2020 meeting outlining options for allocating

the support fund towards COVID-19 recovering initiatives for social wellbeing

and economic development objectives; and

d) Acknowledges

combined borrowing for the Dunedin Railway Limited mothballing costs and the

2020-21 revenue shortfall currently budgeted at $7.538m.

Division

The Council voted by division:

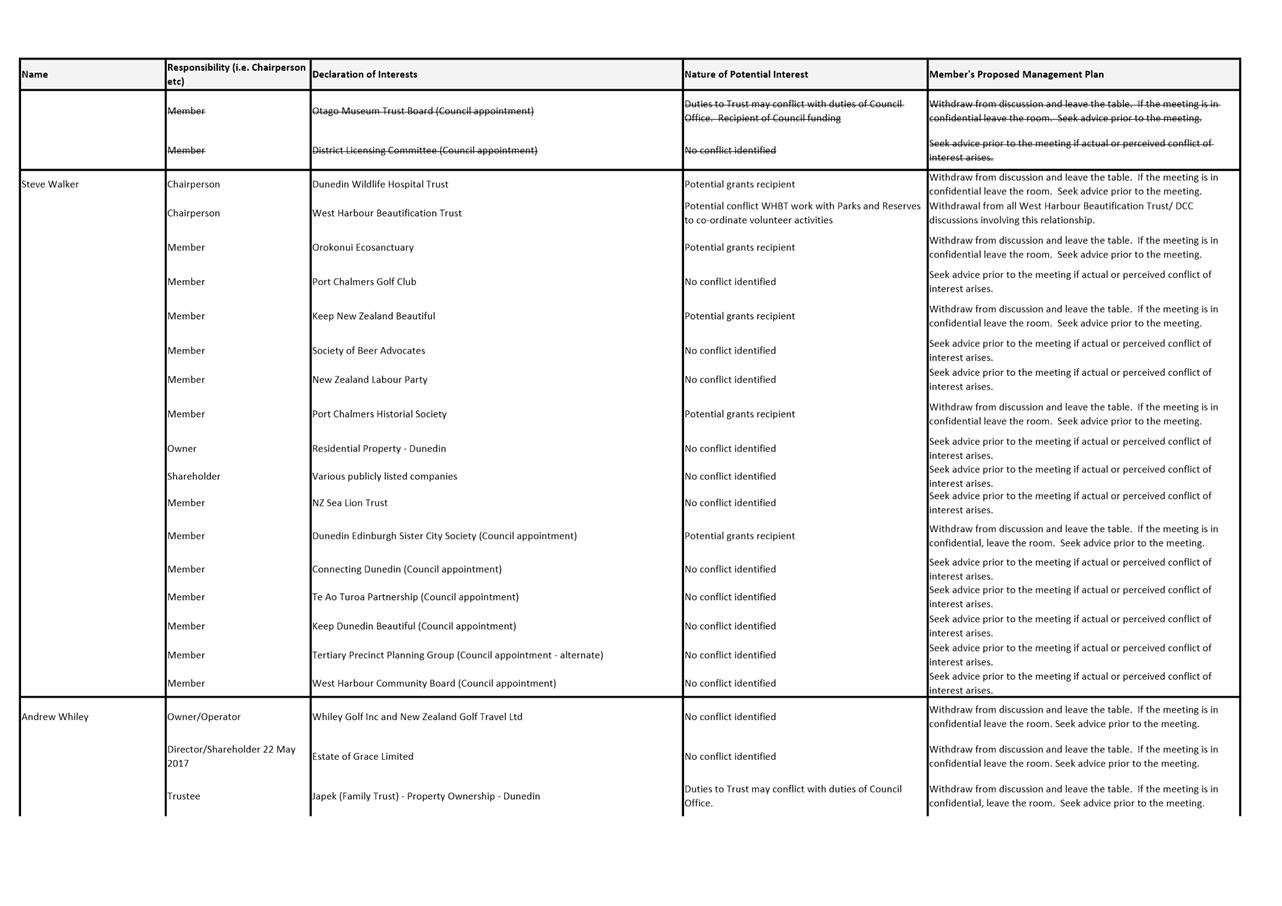

For: Crs

Sophie Barker, David Benson-Pope, Rachel Elder, Christine Garey, Doug Hall,

Carmen Houlahan, Marie Laufiso, Mike Lord, Jim O'Malley, Jules Radich, Chris

Staynes, Steve Walker, Andrew Whiley and Aaron Hawkins (14).

Against: Cr

Lee Vandervis (1).

Abstained:

Nil

The division was declared CARRIED

by 14 votes to 1

Motion carried (AP/2020/001)

4 At

the 30 June 2020 Council meeting, Community Development and Events presented a

report proposing the allocation of $435k of the COVID-19 Support Fund for

social wellbeing activities. The proposed allocation was approved, leaving a

balance of $515k.

5 The

Grants Subcommittee considered the allocation of the $435k for social wellbeing

activities at its meeting on 5 November 2020.

DISCUSSION

6 The

Grow Dunedin Partnership (GDP) which includes the University of Otago, Otago

Polytechnic, Ngāi Tahu, Otago Chamber of Commerce, Otago Southland

Employers Association and the Dunedin City Council undertook a series of

workshops to develop a coordinated response to the economic and social impacts

of COVID-19 between April and June 2020.

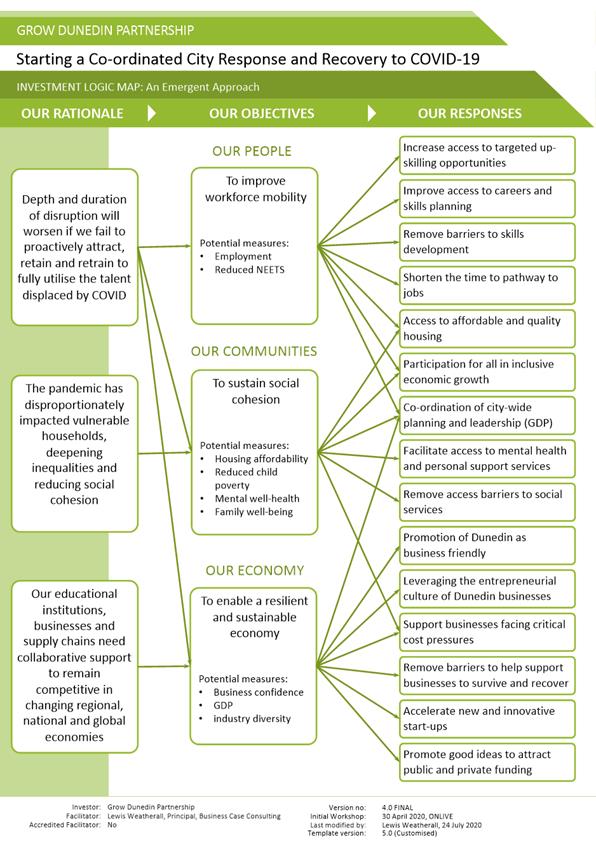

7 This

work, using Investment Logic Mapping (ILM) identified a number of initial

economic and social challenges, possible solutions and actions (see Attachment

A).

8 GDP

proposed the concept of the Great Dunedin Brainstorm to engage the community on

ideas to respond to the economic and social challenges arising from COVID-19.

This idea-generating workshop (an approach not previously used by GDP) was held

on 11 and 12 September 2020.

9 46

people participated in the Great Dunedin Brainstorm. The event was facilitated

by Steve Renata and participants were supported by experienced mentors. At the

conclusion of the event 11 potential projects were presented to GDP.

10 GDP

and Enterprise Dunedin have further reviewed and engaged with the teams on the

proposals. Three proposals totalling $160k have been identified for initial

support through the COVID-19 Support Fund:

|

Initiative

|

Project Details

|

Strategy Link

|

Allocation

|

|

Improving diversity in

the construction workforce

|

Based on a successful model from the

United States and sponsored by a team led by a lecturer from the

University of Otago. This proposal aims to increase diversity in the

construction workforce. Those disproportionately impacted by COVID-19 (Maori,

Pasifika and women) will be prioritised.

|

Economic Development

Social Wellbeing

|

$50k

|

|

Support

for the local film sector

|

This proposal was sponsored by members

of the Dunedin film industry and will provide seed funding for early

development of three projects that will create employment, training, and

investment in the city’s screen sector.

|

Economic Development

Arts and Culture

Social Wellbeing

|

$60k

|

|

A

place-based community model for intergenerational skill-sharing

|

This proposal was sponsored by Otago

Polytechnic staff and will target tertiary graduates whose immediate plans

have been disrupted by COVID-19. It will include the development of the

soft skills important for future

employment, and the creation of a sense of purpose

in uncertain times through engagement with the wider community.

|

Economic Development

Social Wellbeing

|

$50k

|

|

Total Proposed

|

|

|

$160k

|

11 Subject

to Council approval, this report proposes allocating up to $160k to the three

proposals which will be administered by Enterprise Dunedin. Staff will

undertake further work with the sponsors of each proposal, which subject to

further development and project planning will be contracted for delivery in

accordance with Council process.

12 Several

additional projects that could be developed further or enhanced by the COVID-19

Support Fund have been also been identified in addition to those generated at

the Great Dunedin Brainstorm. These initiatives align with the objectives of

the COVID-19 Support Fund and ILM developed by the GDP, however additional

scoping is required before further recommendations are made.

OPTIONS

13 Two

Options are presented below.

Option

One – Recommended Option

14 Council

approves the three initiatives developed and recommended from the Great Dunedin

Brainstorm.

Advantages

· Allows

the development and implementation of three initiatives to improve diversity in

the construction workforce, support for the local film sector and support for

tertiary graduates impacted by COVID-19;

· The

proposed initiatives are within the scope of the GDP ‘Coordinated City Response

and Recovery to COVID-19’ ILM; and

· The

proposed initiatives were developed with community input and are supported by

the GDP.

Disadvantages

· No

identified disadvantages.

Option

Two – Status Quo

15 Council

does not approve some or all three of the proposed initiatives.

Advantages

· $160k

retained for other initiatives under the COVID-19 Support Fund.

Disadvantages

· This

option does not follow the advice from GDP; and

· No

initiatives would be taken forward from the Great Dunedin Brainstorm.

NEXT STEPS

16 Enterprise

Dunedin will undertake further due diligence and work on the development of the

proposals with the project sponsors. This will include engagement with the

project teams that participated in the Great Dunedin Brainstorm, formulation of

more detailed project plans, contracting and procurement of services.

17 Updates

on the proposals will be provided through the Economic Development Committee

activity report. Additional proposals associated with the ILM and generated at

the Great Dunedin Brainstorm will be further developed and brought back to

Council for consideration in February 2021.

Signatories

|

Author:

|

Fraser Liggett - Economic Development Programme Manager

|

|

Authoriser:

|

John Christie - Director Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

|

⇩a

|

Grow Dunedin

Partnership: Investment Logic Map

|

25

|

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision promotes the social

well-being and economic development of communities in the present and for the

future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

The proposed allocation has been developed to primarily

support economic development and social wellbeing objectives. The proposed

allocation also supports the implementation of the Otago Regional Economic

Development Strategic Framework, and the Ōtepoti Youth

Vision.

|

|

Māori Impact

Statement

Ngāi Tahu are a member of the Grow Dunedin

Partnership. Mana whenua, who have been disproportionately impacted by

COVID-19, will be prioritised in the implementation of the proposed projects.

|

|

Sustainability

The proposals are expected to positively contribute to

economic and social sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Provision for the fund has been included in the 2020-21

Annual Plan.

|

|

Financial

considerations

Provision of $950k has been made in accordance with the resolution

of Council on 27-28 May 2020.

|

|

Significance

This decision is considered of low significance in terms

of the Council’s Significance and Engagement Policy.

|

|

Engagement –

external

46 individuals and a number of external agencies,

including the Grow Dunedin Partners, the Ministry of Social Development, the

Otago Community Trust, Aukaha and Great Dunedin Brainstorm participants have

been engaged.

|

|

Engagement -

internal

Enterprise Dunedin, Ara Toi, Community Development and

Events, Parks and Recreation, Property and Policy were involved in

discussions on the proposed events.

|

|

Risks: Legal /

Health and Safety etc.

There are no known legal or health and safety risks associated

with the three proposals. Project risks will be managed through further

development of the proposals, contracting and Enterprise Dunedin support.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no implications for Community Boards.

|

|

|

Council

10 November 2020

|

Financial Strategy - Debt Limit

Department: Executive Leadership Team

EXECUTIVE SUMMARY

1 This

report presents options for setting a debt limit to be used in the preparation

of the 10 year plan 2021-31. The approved option would be included in the

Financial Strategy and would be used to inform a proposed level of capital

expenditure over the 10 year period.

|

RECOMMENDATIONS

That the Council:

a) Approves

setting a debt limit as a percentage of revenue;

b) Considers the

percentage of revenue to be used in the

preparation of the 10 year plan, and for inclusion in the draft Financial

Strategy.

|

BACKGROUND

2 The

Local Government Act 2002 (LGA) requires all councils to prepare and adopt a

Financial Strategy. The purpose of a Financial Strategy is:

· To

facilitate prudent financial management by providing a guide for considering

proposals for funding and expenditure; and

· Provide

a context for consultation, by making transparent the overall effects of

proposals on services, rates, debt and investments.

3 The

LGA sets out the information that must be contained in a Financial Strategy and

includes statements on:

· Factors

that will have a significant impact on the 10 year plan, e.g., change in

population, land use, and capital expenditure;

· Limits

on rate increases and debt;

· Ability

to provide and maintain levels of service, and meet additional demands within

the rate and debt limits;

· Policy

on giving securities for debt;

· Objectives

for holding investments; and

· Targets

for investment returns.

4 The

focus of this report is on debt limits for Council only, i.e., not the Group

being Council and its Council Controlled Organisations. A report on the

full Financial Strategy will be presented to Council at a future date, and this

will consider the broader issue for the Group.

DISCUSSION

Current position

5 Council

uses debt to fund the cost of new capital. The use of debt allows the

financial burden of new capital expenditure to be spread across a number of

financial years, recognising that the expenditure is on intergenerational

assets, i.e., the assets have a long life and generate benefits both now and to

future generations.

6 Debt

is also used to fund the portion of capital renewals that is not covered by

funded depreciation.

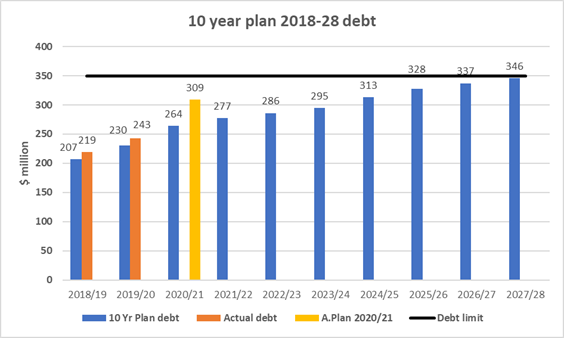

7 The

Financial Strategy in the current 10 year plan (2018-28) provides for a fixed

debt limit of $350 million. The graph below shows the level of actual

debt at 30 June 2020 as $243 million, and debt is forecast to reach $346

million by 2027/28.

8 Setting

a debt limit is required to inform the level of capital expenditure that can be

provided for in the 10 year plan 2021-31. The capital budget in the

current 10 year plan (2018-28) totals $878 million.

Preliminary capital budgets

9 Preliminary

capital budgets developed for the draft 10 year plan 2021-31 show between $1.3

billion to $1.5 billion proposed total capital expenditure. Of this,

approximately $900 million is for renewals, with the remainder for new

capital. Options informing the preliminary capital budgets will be

considered as part of the 14-16 December 2020 Council meeting.

10 The

preliminary capital programme has been developed, taking into consideration the

need for greater investment in infrastructure renewals, and the impacts that

COVID-19 has had on the economy. This preliminary programme can not be

delivered within Council’s current debt limit of $350 million.

11 The

budgeted debt for 2020/21 (see graph above) is $309 million, so the forecast

debt based on the preliminary programme uplift would fall in the range $731

million to $931 million.

Options for setting debt

limits

12 The

LGA requires that debt limits are quantifiable, for example, set as a

percentage of revenue, or set as a fixed limit. If set as a percentage of

revenue, the debt limit will change as activity changes, and therefore would

provide some flexibility throughout the life of the 10 year plan. A fixed

limit does not recognise the impact of changing costs and / or activity.

13 The

Local Government Funding Authority (LGFA) quantifies lending to its members on

a percentage to revenue basis. It has a generic covenant that limits the

level of net debt to total revenue, with all its member local authorities that

have an external credit rating (such as from Standard & Poors) of

“A” or higher, and these are shown in the table below.

Council’s current rating is AA, so these ratios would apply.

Table 1

|

Year

|

Net debt to total revenue ratio

|

|

2019/20

|

< 250%

|

|

2020/21

|

< 300%

|

|

2021/22

|

< 300%

|

|

2022/23

|

< 295%

|

|

2023/24

|

< 290%

|

|

2024/25

|

< 285%

|

14 A

temporary uplift in the percentage ratio over the two year period from 2020/21

-2021/22 was in response to the impacts of COVID-19. This is being phased

down in later years.

15 The

LGFA defines net debt as total debt less liquid financial assets and

investments. The DCC’s Waipori Fund is an example of a liquid financial

asset. For the purposes of providing options for consideration, numbers

used are based on total debt, rather than net debt.

16 The

table below shows a sample of debt limit options for Council, based on setting

debt as a percentage of revenue.

Table 2

|

Financial Ratio

|

Debt limit %

|

Limit $

|

Revenue 2020/21

|

|

Debt/Total

Revenue

|

125%

|

$350m

|

$279m

|

|

175%

|

$488m

|

$279m

|

|

200%

|

$558m

|

$279m

|

|

250%

|

$698m

|

$279m

|

|

300%

|

$837m

|

$279m

|

17 The

current fixed debt limit of $350 million equates to 125% of the 2020/21

budgeted revenue.

18 For

comparative purposes, the table below shows the debt limits for the NZ metro

councils and Invercargill, from the 10 year plans 2018-28. All of these

councils except for Invercargill City and DCC, determine their debt limit as a

percentage of revenue. The equivalent calculation for these two councils

is shown.

Table 3

|

Council

|

10 YP limit

% to revenue

|

Interest exp % to revenue

|

Estimated

10 YP Debt

2028

|

Estimated Debt Limit

2028

|

% of debt taken up

|

|

Auckland

|

265%

|

N/A

|

$13.1 B

|

$14.3 B

|

91.6%

|

|

Porirua

|

250%

|

20%

|

$127.4 M

|

$310 M

|

41.1%

|

|

Queenstown Lakes

|

250%

|

20%

|

$323 M

|

$555 M

|

58.2%

|

|

Tauranga

|

250%

|

20%

|

$1.07 B

|

$1.18 B

|

90.7%

|

|

Hamilton

|

230%

|

N/A

|

$776 M

|

$906 M

|

85.6%

|

|

Christchurch

|

221%

|

20%

|

$2.73 B

|

$3.38 B

|

80.8%

|

|

Palmerton North

|

200%

|

15%

|

$367 M

|

$367 M

|

100.0%

|

|

Upper Hutt

|

175%

|

10%

|

$114 M

|

$130 M

|

87.7%

|

|

Wellington

|

175%

|

N/A

|

$1.16 B

|

$1.32 B

|

87.9%

|

|

Whangarei

|

175%

|

25%

|

$237.6 M

|

$378 M

|

62.8%

|

|

Hutt

|

170%

|

10%

|

$241 M

|

$495 M

|

48.7%

|

|

Dunedin

|

Fixed $350 M

(125%)

|

N/A

|

$346 M

|

$350 M

|

98.9%

|

|

Invercargill

|

15% of total assets (103%)

|

N/A

|

$132 M

|

$186 M

|

70.9%

|

19 Tables

4 and 5 below show two methods for setting debt limits along with a variety of

options for each.

20 Based

on the remainder years of the current 10 year plan 2018-28, with 2021/22

modified to reflect the current Annual Plan, Table 4 shows what the debt limit

would be, calculated at various percentage of revenue.

Table 4

|

Year

|

Revenue

|

Debt limit

10 yr plan (2018-28)

|

Debt limit 175% of revenue

|

Debt limit 200% of revenue

|

Debt limit 225% of revenue

|

Debt limit 250% of revenue

|

|

2020/21

|

$279m

|

$350m

|

$488m

|

$558m

|

$628m

|

$697m

|

|

2021/22

|

$285m

|

$350m

|

$499m

|

$570m

|

$641m

|

$712m

|

|

2022/23

|

$287m

|

$350m

|

$502m

|

$574m

|

$646m

|

$717m

|

|

2023/24

|

$295m

|

$350m

|

$516m

|

$590m

|

$664m

|

$737m

|

|

2024/25

|

$305m

|

$350m

|

$534m

|

$610m

|

$686m

|

$762m

|

|

2025/26

|

$316m

|

$350m

|

$181m

|

$632m

|

$711m

|

$790m

|

|

2026/27

|

$325m

|

$350m

|

$569m

|

$650m

|

$731m

|

$812m

|

|

2027/28

|

$335m

|

$350m

|

$586m

|

$670m

|

$754m

|

$837m

|

21 If

Council’s preference is to have a fixed debt limit rather than a limit

based on a percentage of revenue, then two options are available. The

first option is to have a set limit for the 10 year period, and the second

option is to have a fixed limit with incremental increases over the period of

the 10 year plan. Table 5 below provides an example of incremental

increases, taking the current debt limit of $350m and applying a 5% and 10%

increase per annum.

Table 5

|

Year

|

Debt limit

5% increase

|

Debt limit

10% increase

|

|

2020/21

|

$367m

|

$385m

|

|

2021/22

|

$386m

|

$423m

|

|

2022/23

|

$405m

|

$466m

|

|

2023/24

|

$425m

|

$512m

|

|

2024/25

|

$447m

|

$564m

|

|

2025/26

|

$469m

|

$620m

|

|

2026/27

|

$492m

|

$682m

|

|

2027/28

|

$517m

|

$750m

|

OPTIONS

22 A

debt limit is required to be used in the preparation of the 10 year plan as

part of the Financial Strategy. Four options for setting the debt limit

are provided below, including the status quo. The advantages and

disadvantages presented for each option are dependent on the debt limit that is

agreed to.

Option

One – Debt limit calculated as a percentage of revenue (Recommended

Option)

23 This

involves Council approving that the debt limit is set as a percentage of

revenue. Council then needs to approve the percentage of revenue, which

will be used to develop the 10 year plan and will be included in the draft

Financial Strategy.

Advantages

· The

debt limit would increase or decrease year on year for the period of the plan,

in line with activity changes. This provides some flexibility throughout

the life of the 10 year plan.

· Is

the approach adopted by all NZ metro sector councils, except Dunedin.

· Would

provide sufficient funds to allow the Council to deliver its capital programme

for the 10 years 2021-2031.

· This

approach would be responsive to any sector reform.

Disadvantages

· Certainty

of absolute debt will be removed.

· Depending

on the percentage chosen, this will result in an increase in Council debt, and

the cost of borrowing.

Option

Two – Debt is set as a fixed limit for the period of the 10 year plan

24 This

option approves a fixed debt limit, to be used in the development of the 10

year plan, and to be included in the draft Financial Strategy.

Advantages

· Provides

certainty of an absolute set debt limit over the 10 year period.

· Could

provide sufficient funds to allow the Council to deliver its capital programme

for the 10 years 2021-2031, depending on the level of the set limit.

Disadvantages

· Does

not respond to changes in activity levels, and therefore lacks flexibility over

the 10 year period.

· Capital

programme may be impacted.

· This

approach would not be responsive to any sector reform.

· Depending

on the set limit chosen, this will result in an increase in Council debt, and

the cost of borrowing.

Option

Three – Debt is set as a fixed limit, but with incremental increases over

the period of the 10 year plan

25 This

option approves a fixed debt limit, that has staged increases over the period

of the 10 year plan, to be used in the development of the 10 year plan, and to

be included in the draft Financial Strategy.

Advantages

· Provides

certainty of a set debt limit that will increase over the 10 year period.

· May

respond to changes in activity levels.

· Could

provide sufficient funds to allow the Council to deliver its capital programme

for the 10 years 2021-2031 depending on the level of the set limit.

Disadvantages

· While

staged increases are provided for, does not directly respond to changes in

activity levels, and therefore lacks flexibility over the 10 year period.

· Capital

programme may be impacted.

· This

approach would not be responsive to any sector reform.

· Depending

on the set limits chosen, this will result in an increase in Council debt, and

the cost of borrowing.

Option

Four – Debt is set as a fixed limit of $350m over the period of the 10

year plan (Status Quo)

26 This

option approves a fixed debt limit of $350m for the period of the 10 year plan,

to be used in the development of the 10 year plan, and to be included in the

draft Financial Strategy.

Advantages

· Provides

certainty of a set debt limit.

· No

increase in Council debt, or cost of borrowing.

Disadvantages

· Neither

the current or preliminary capital programme of renewals and new capital can be

delivered.

· Does

not respond to changes in activity levels, and therefore lacks flexibility over

the 10 year period.

· This

approach would not be responsive to any sector reform.

NEXT STEPS

27 The

approved debt limit will be used in the development of the 10 year plan and be

included in the draft financial strategy.

28 The

debt limit set will inform the development of the 10 year capital programme.

29 Regular

reporting on capital expenditure and debt levels will be provided to Council.

Signatories

|

Author:

|

Gavin Logie - Acting General Manager Finance

|

|

Authoriser:

|

Sandy Graham - Chief Executive Officer

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision enables democratic local

decision making and action by, and on behalf of communities, and promotes the

social, economic, environmental and cultural well-being of communities in the

present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The 10 year plan contributes to all of the objectives and

priorities of the strategic framework as it describes the Council’s

activities, the community outcomes, and provides a long term focus for

decision making and coordination of the Council’s resources, as well as

a basis for community accountability. This decision impacts directly on

the development of the 10 year plan.

|

|

Māori Impact

Statement

There are no known impacts for tangata whenua.

|

|

Sustainability

The 10 year plan contains content regarding the

Council’s approach to sustainability. Major issues and implications for

sustainability are discussed in the 30 year Infrastructure Strategy and

financial resilience is discussed in the Financial Strategy.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

The debt limit will impact directly on the development of

the 10 year plan, the level of capital works that could be undertaken over

the 10 year period, and therefore levels of service provided.

|

|

Financial considerations

The debt limit will impact directly on the development of

the 10 year plan, and the level of capital works that could be undertaken

over the 10 year period.

|

|

Significance

This decision is significant in terms of the Significance

and Engagement Policy. The debt limit will be consulted on as part of

the 10 year plan process.

|

|

Engagement –

external

While there has been no external engagement with other

territorial authorities, researching current debt limits for the NZ metro

councils and Invercargill City Council has been undertaken. An initial

discussion has been held with DCHL about the recommended option.

|

|

Engagement -

internal

Various departments have been consulted, including

finance, corporate leadership, and those areas that have a proposed programme

of capital expenditure.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no implications for Community Boards.

|