Notice of Meeting:

I hereby give notice that an ordinary meeting of the

Economic Development Committee will be held on:

Date: Monday

21 June 2021

Time: 1.00

pm

Venue: Edinburgh

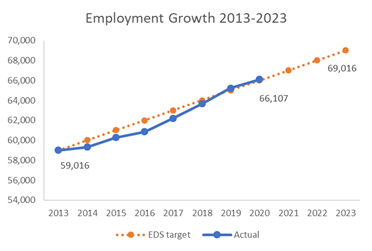

Room, Municipal Chambers, The Octagon, Dunedin

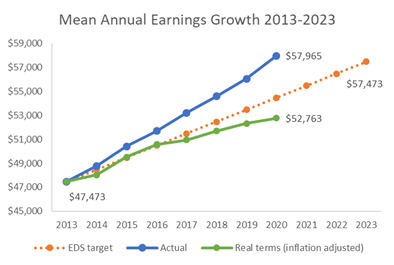

Sandy Graham

Economic Development Committee

PUBLIC AGENDA

|

Chairperson

|

Cr Chris Staynes

|

|

|

Deputy Chairperson

|

Cr Rachel Elder

|

Cr Andrew Whiley

|

|

Members

|

Cr Sophie Barker

|

Cr David Benson-Pope

|

|

|

Cr Christine Garey

|

Cr Doug Hall

|

|

|

Mayor Aaron Hawkins

|

Cr Carmen Houlahan

|

|

|

Cr Marie Laufiso

|

Cr Mike Lord

|

|

|

Cr Jim O'Malley

|

Cr Jules Radich

|

|

|

Cr Lee Vandervis

|

Cr Steve Walker

|

Senior Officer John

Christie, Manager Enterprise Dunedin

Governance Support Officer Wendy

Collard

Wendy Collard

Governance Support Officer

Telephone: 03 477 4000

Wendy.Collard@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as Council

policy until adopted.

|

|

Economic Development

Committee

21 June 2021

|

ITEM TABLE OF CONTENTS PAGE

1 Public

Forum 4

2 Apologies 4

3 Confirmation

of Agenda 4

4 Declaration

of Interest 5

5 Confirmation

of Minutes 17

5.1 Economic

Development Committee meeting - 9 February 2021 17

Part

A Reports (Committee has power to decide these matters)

6 Actions

from resolutions of Economic Development Committee meetings 22

7 Economic

Development Committee Forward Work Programme 25

8 Grow

Dunedin Partnership June 2021 Update 29

9 Dunedin

City - Annual Economic Profile Update 43

10 Enterprise

Dunedin Activity Report - June 2021 Update 95

11 Study

Dunedin Update 106

12 Strategic

Tourism Assets Protection Programme June 2021 Update 111

13 Plan

D Marketing Campaign June 2020 - April 2021 118

14 Items

for Consideration by the Chair 124

|

|

Economic Development

Committee

21 June 2021

|

1 Public

Forum

At the close of the agenda no

requests for public forum had been received.

2 Apologies

At the close of the agenda no

apologies had been received.

3 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

|

|

Economic Development Committee

21 June 2021

|

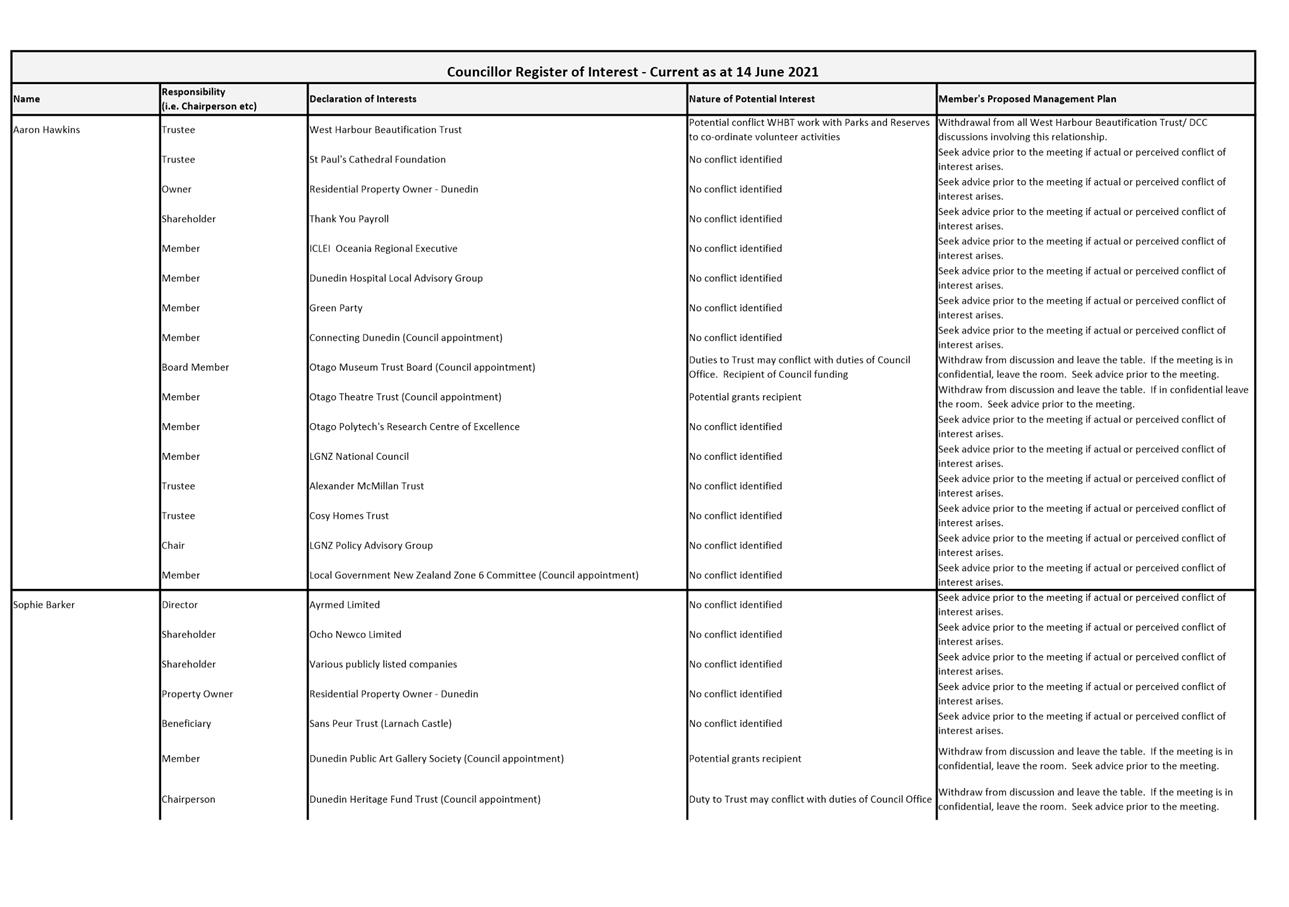

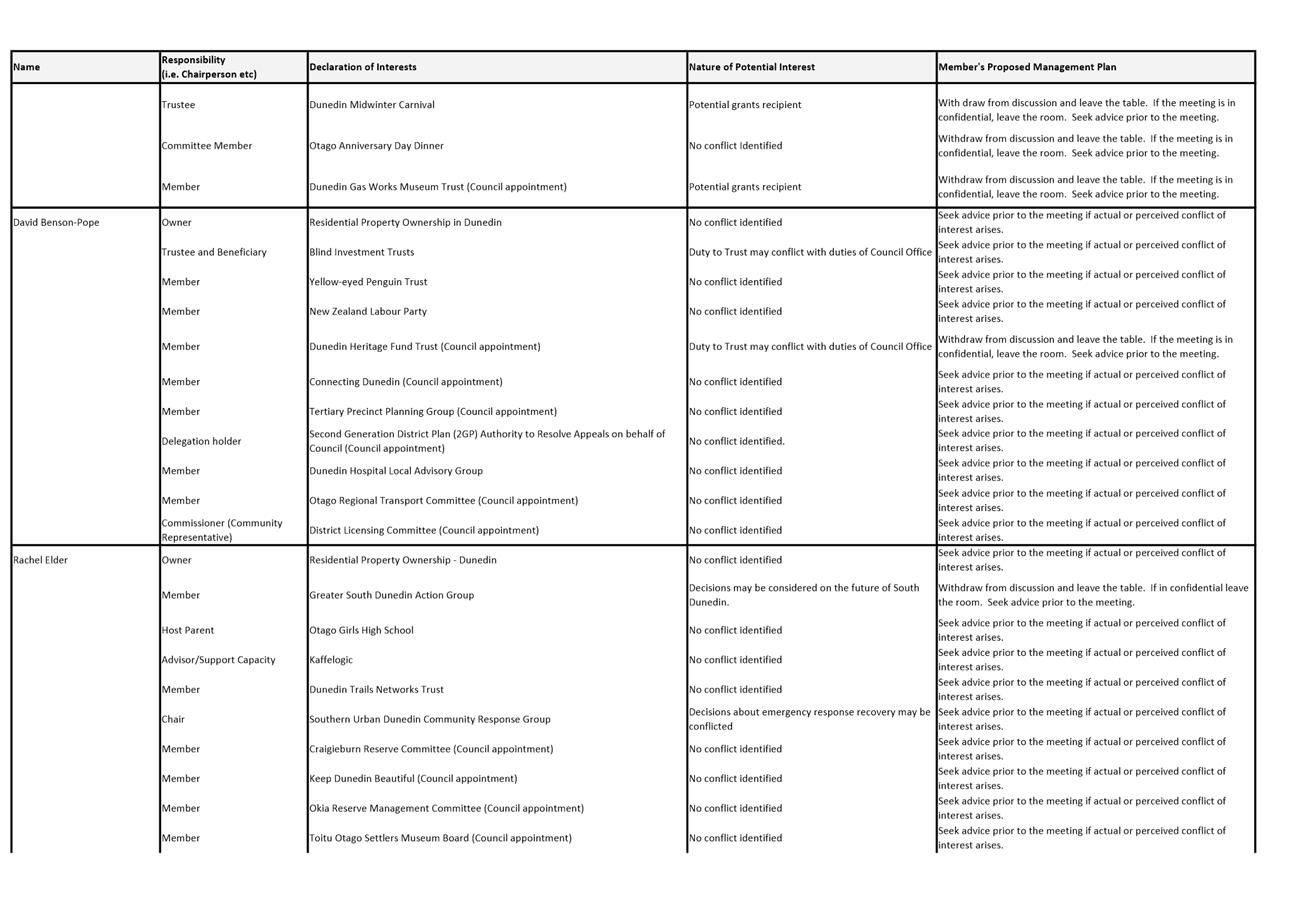

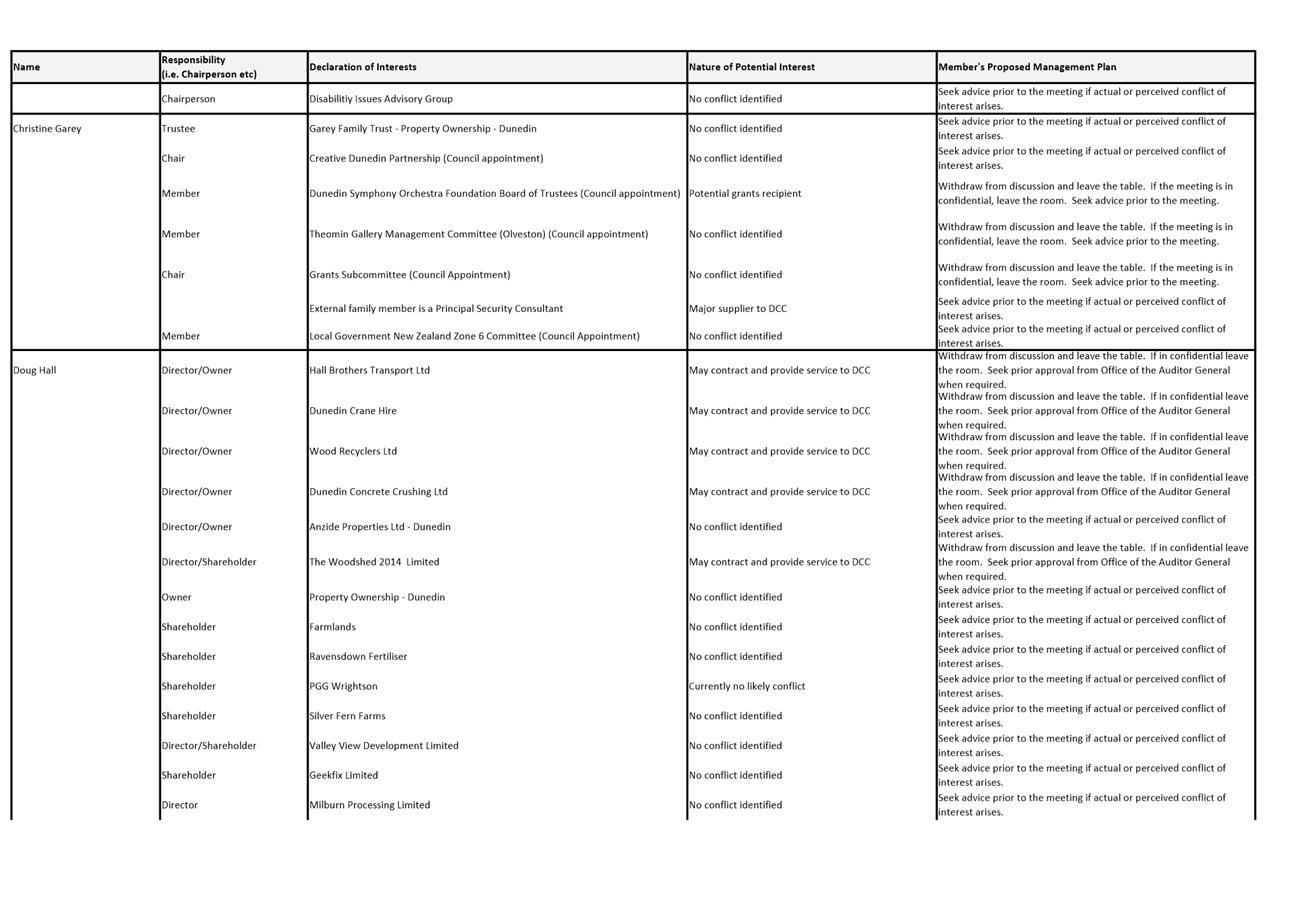

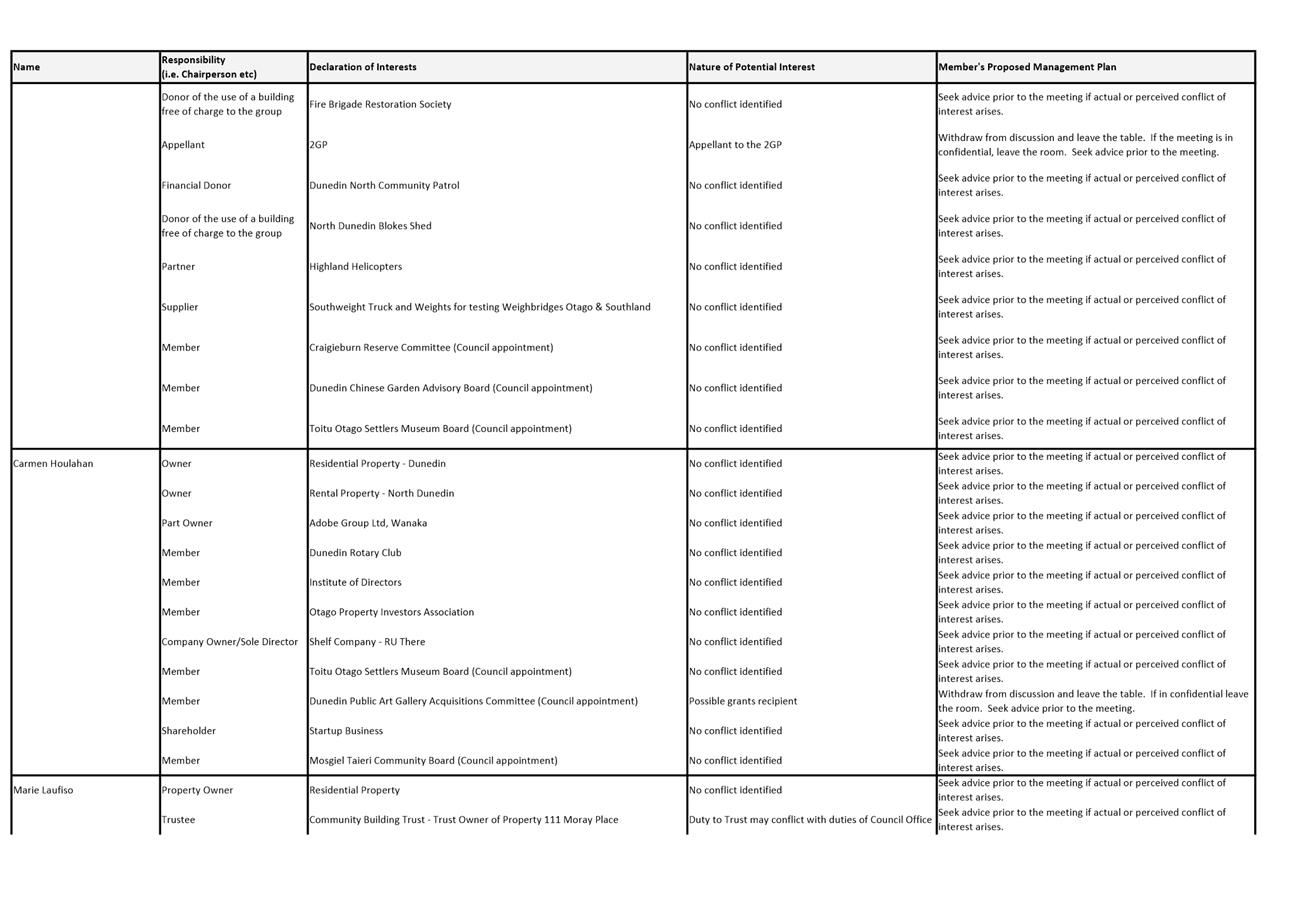

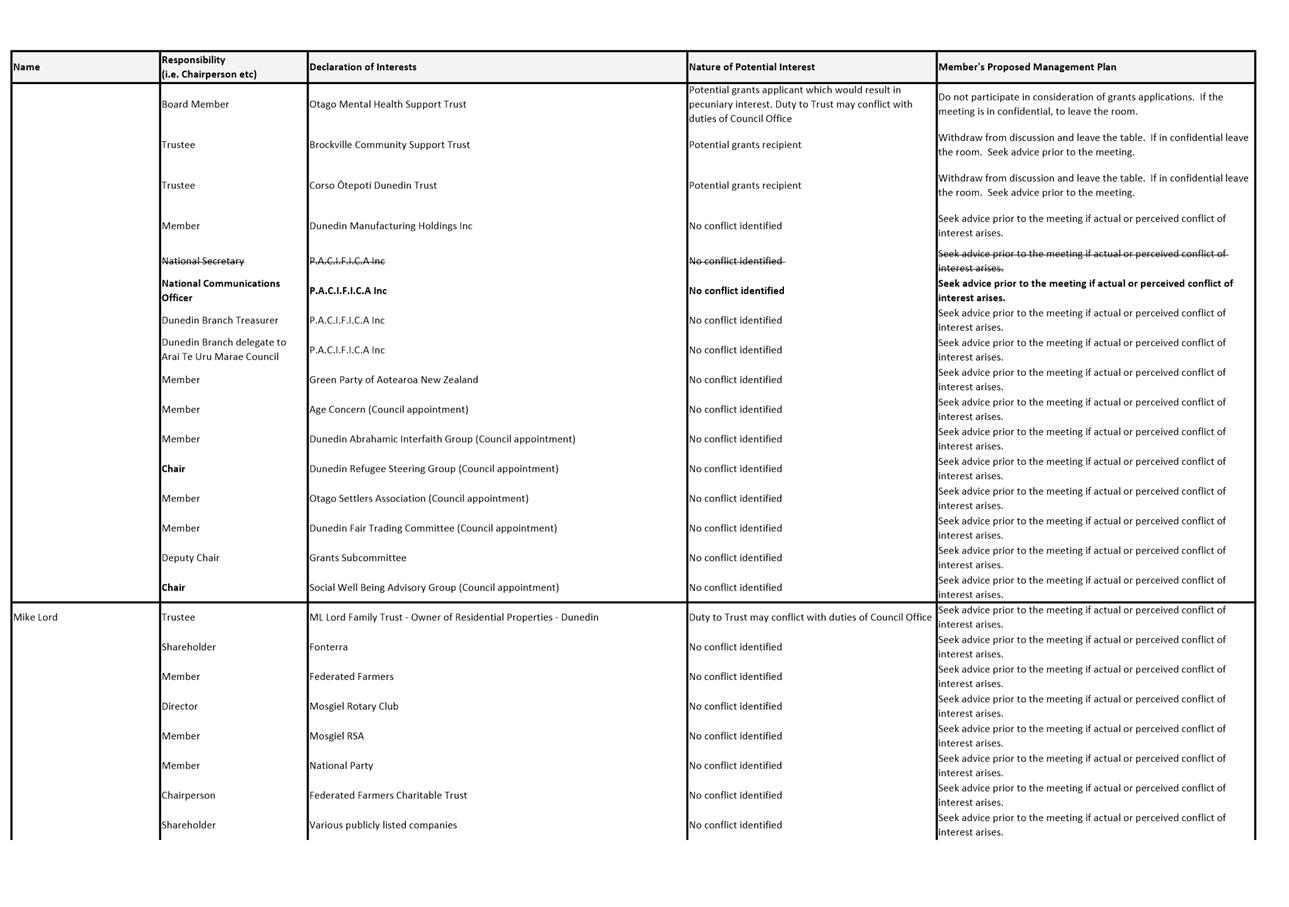

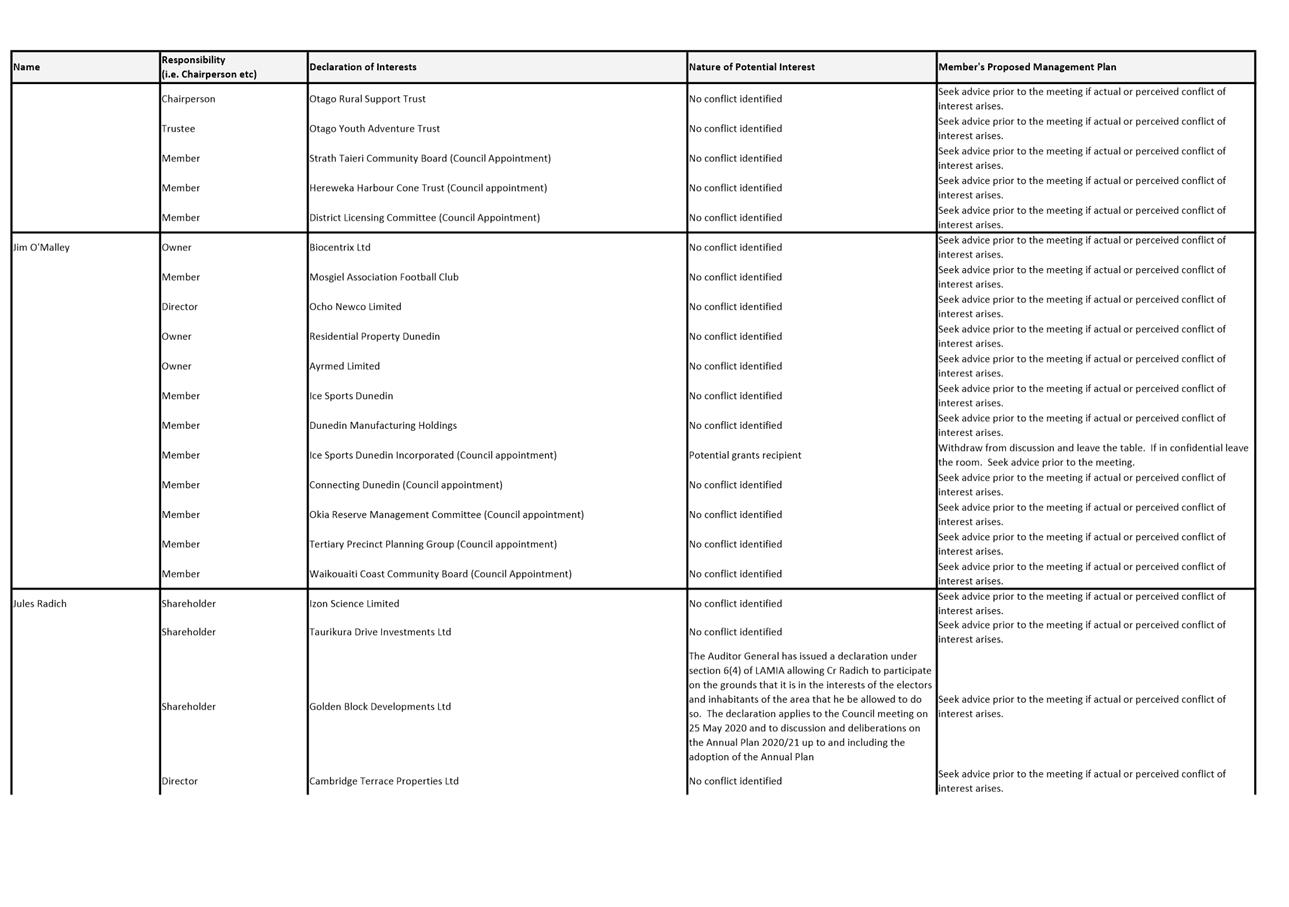

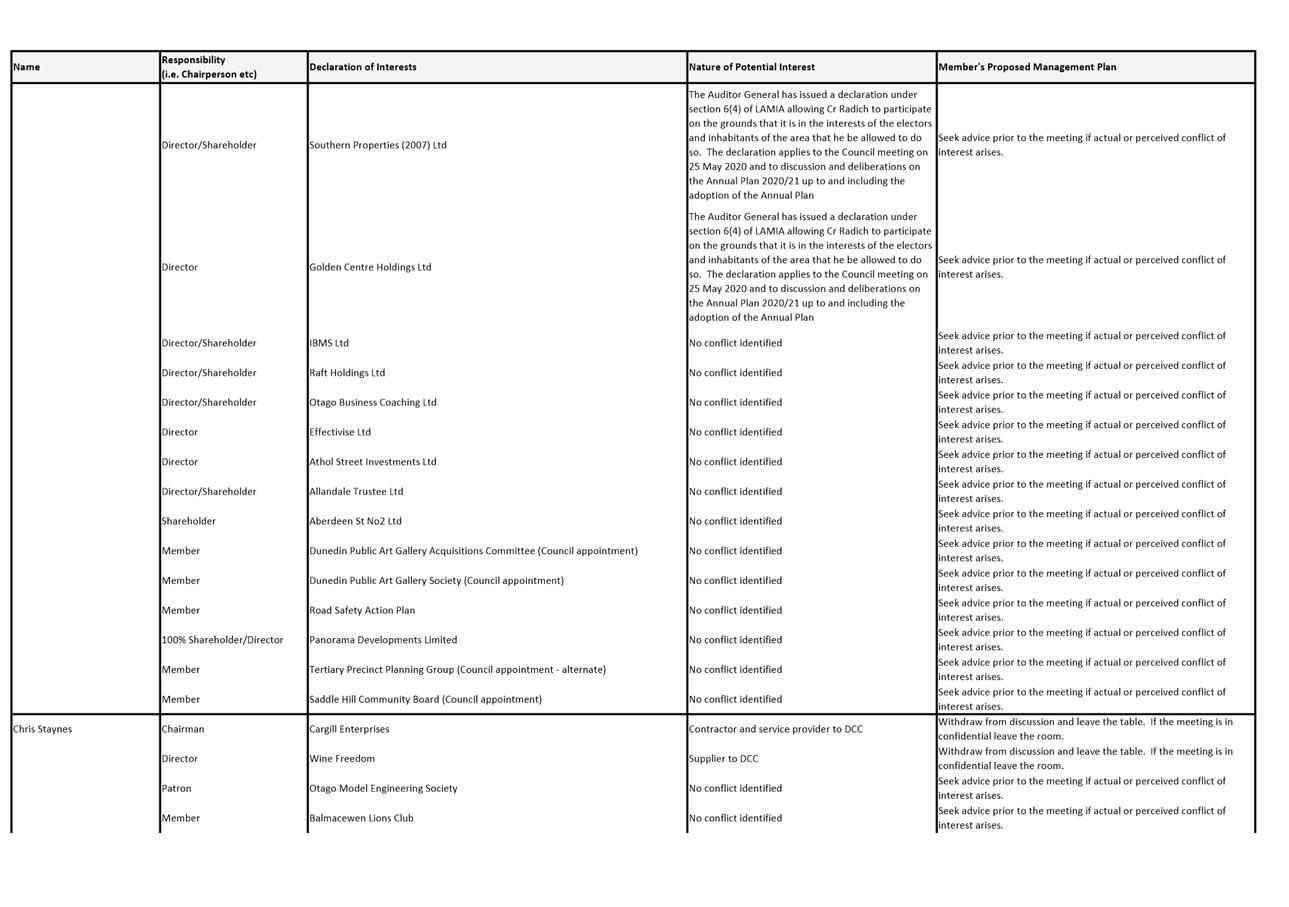

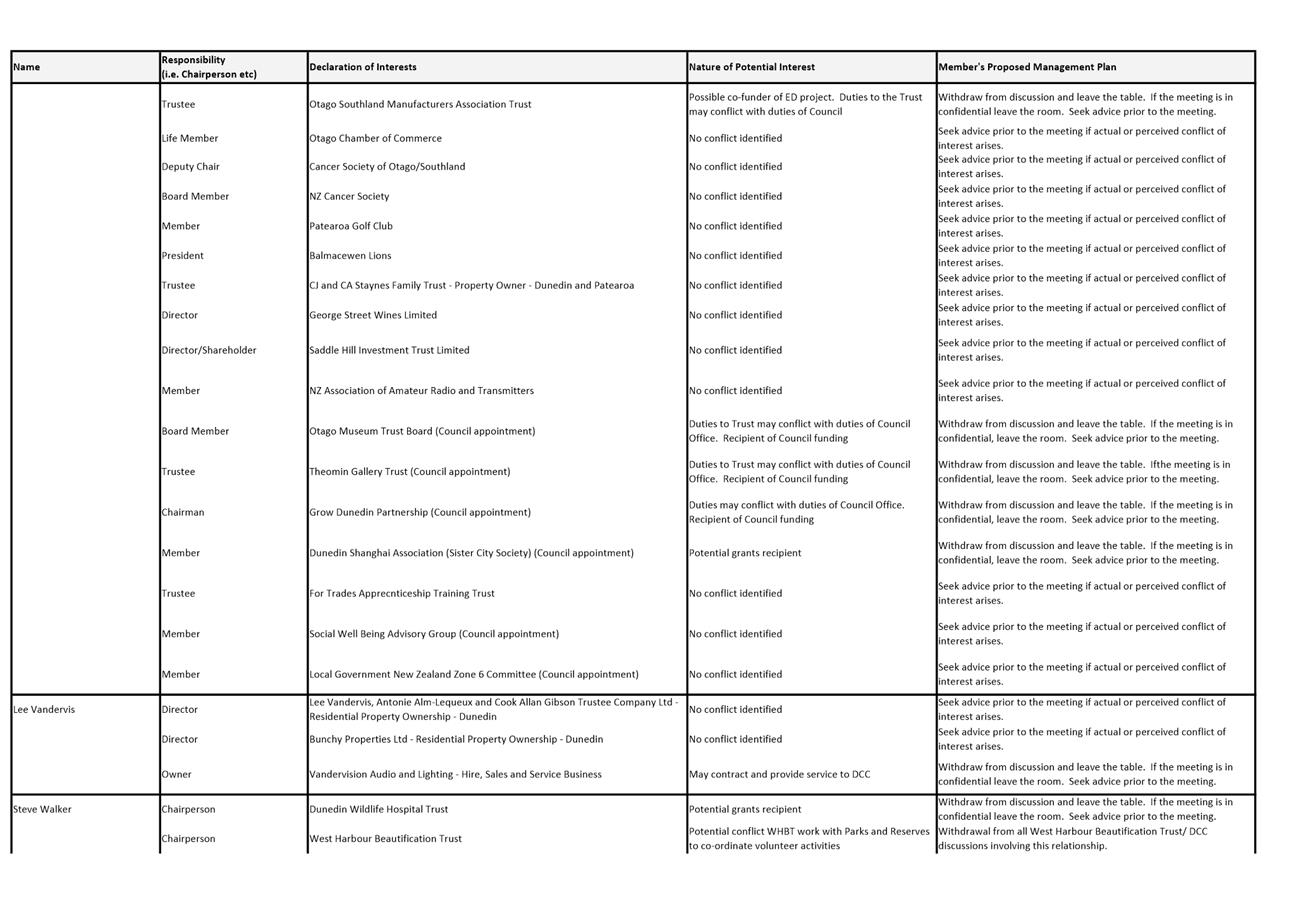

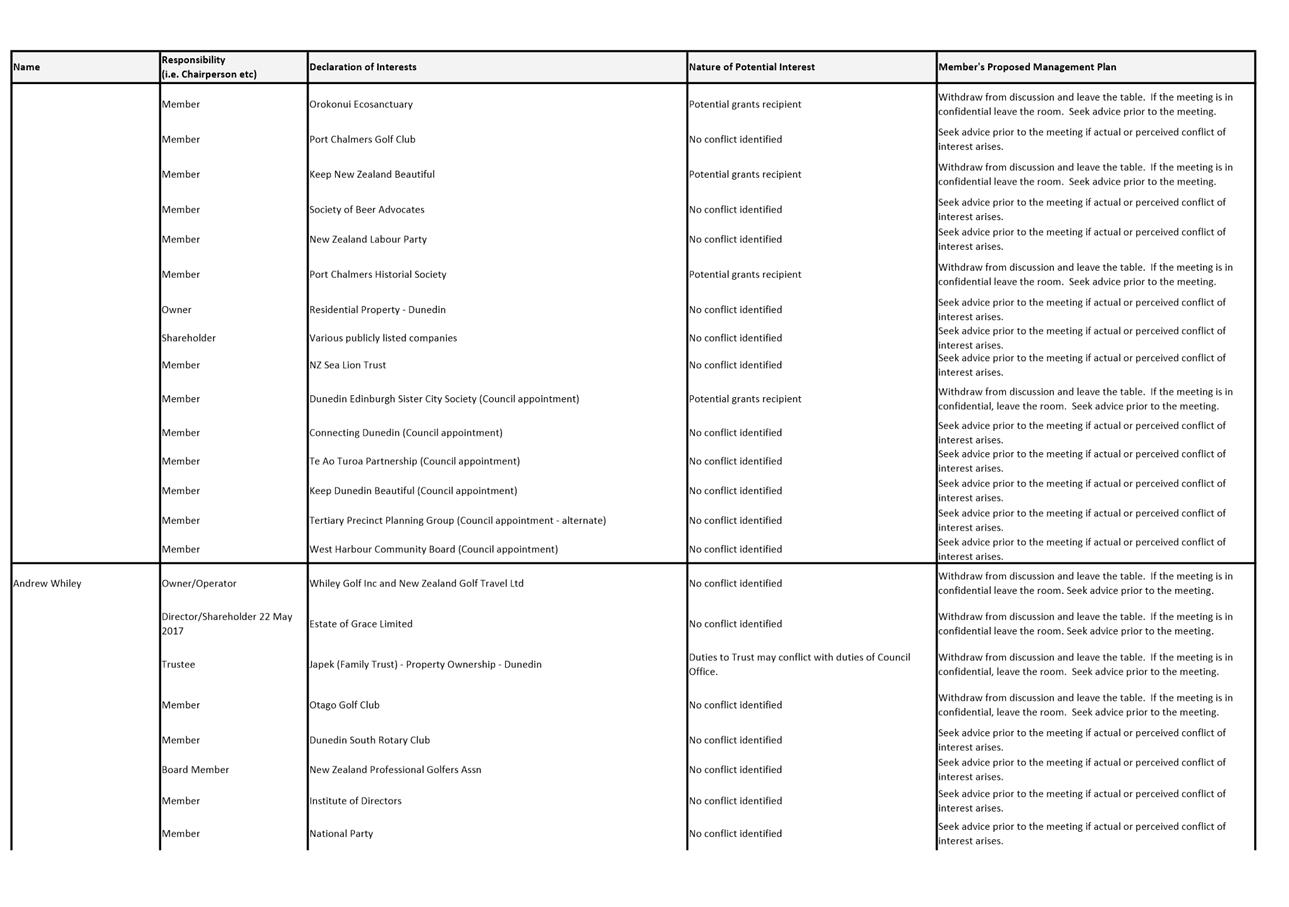

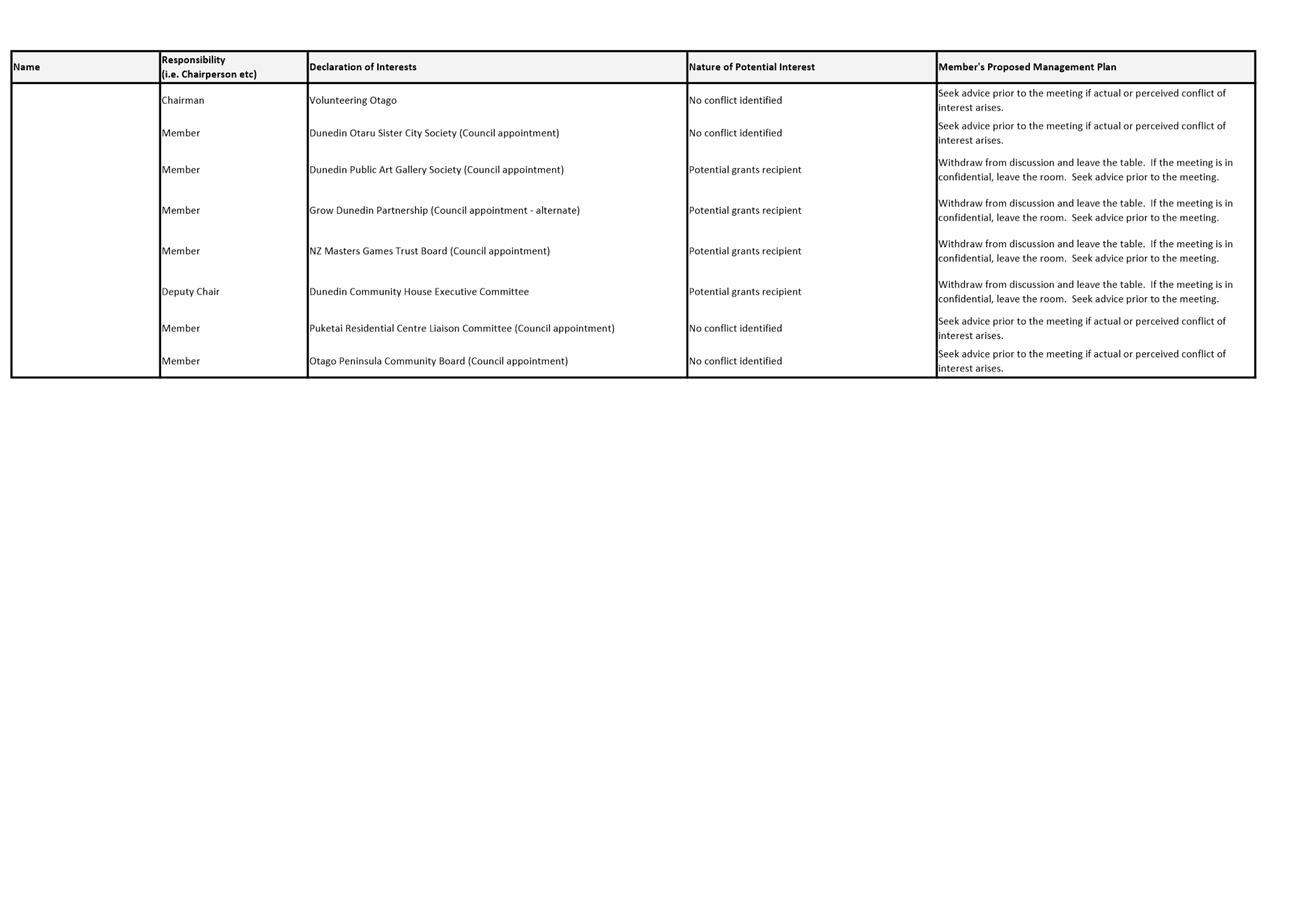

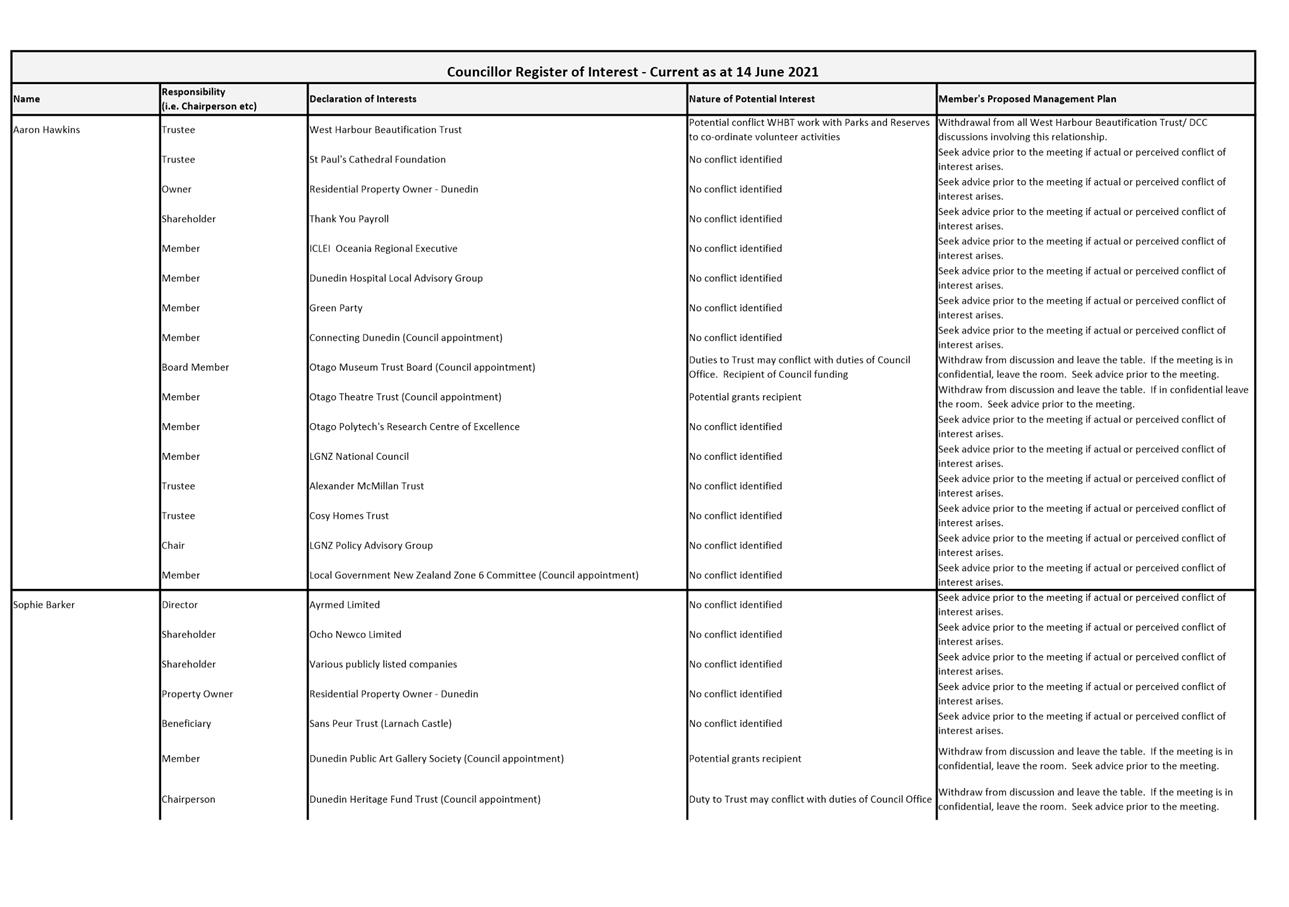

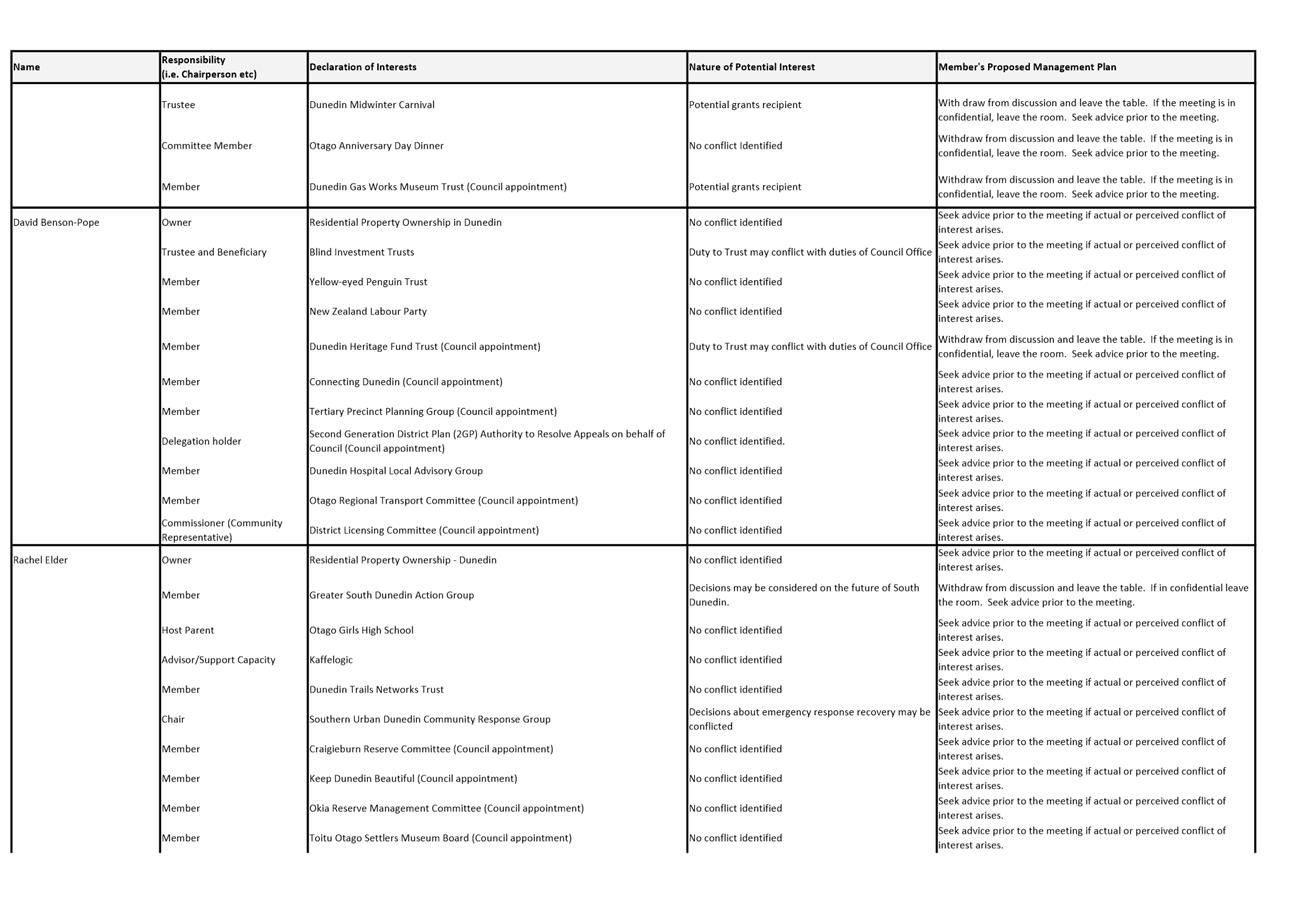

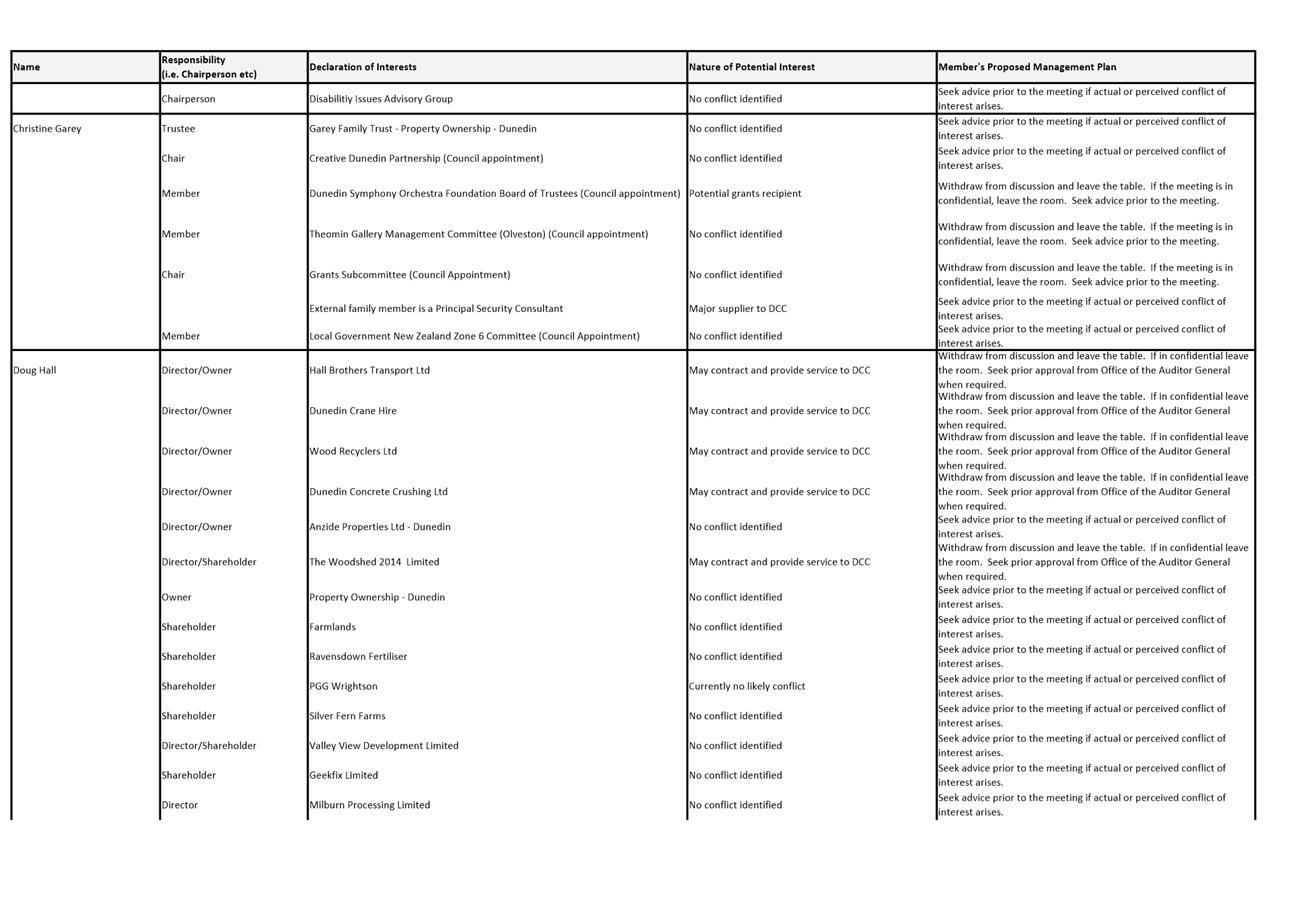

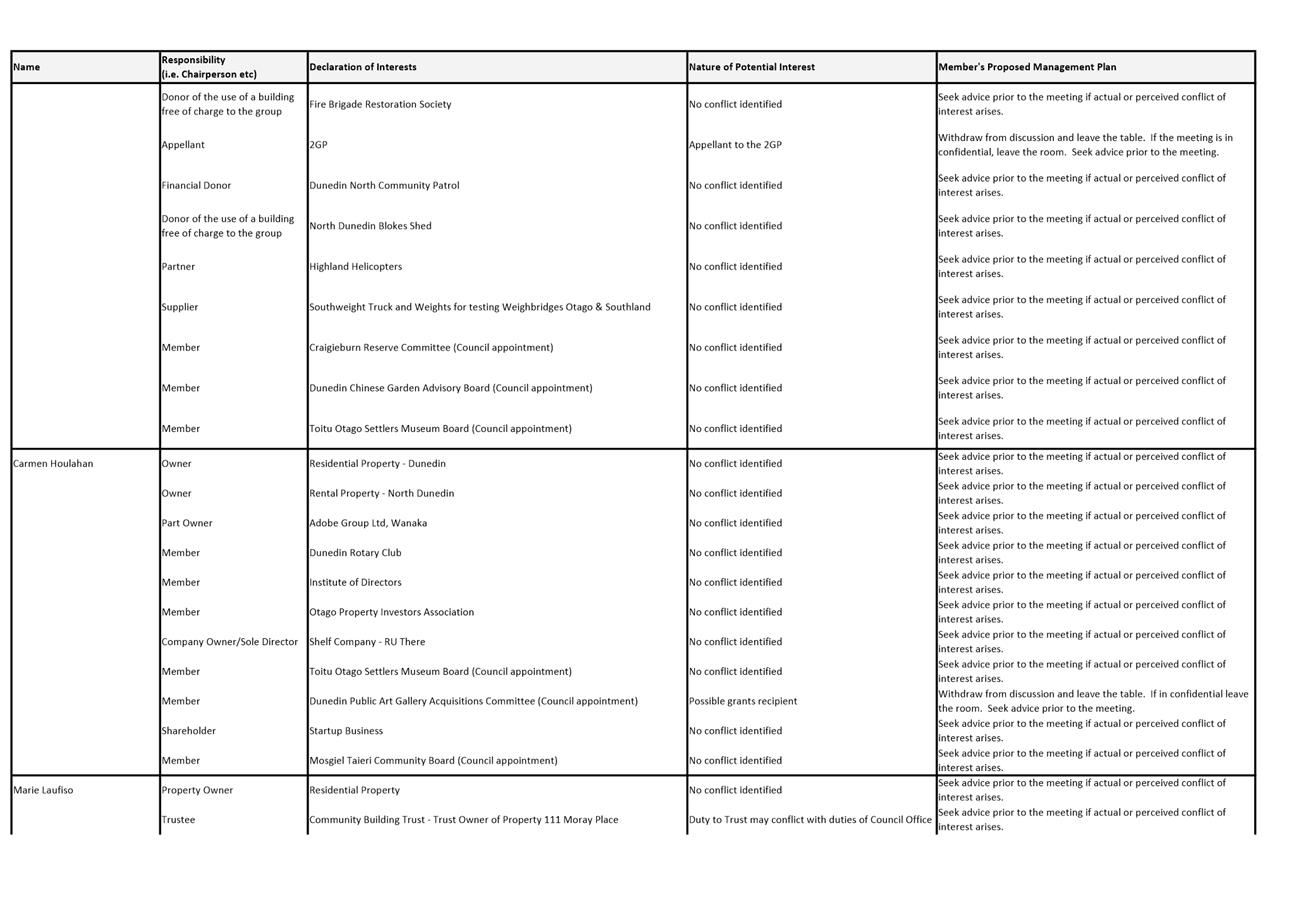

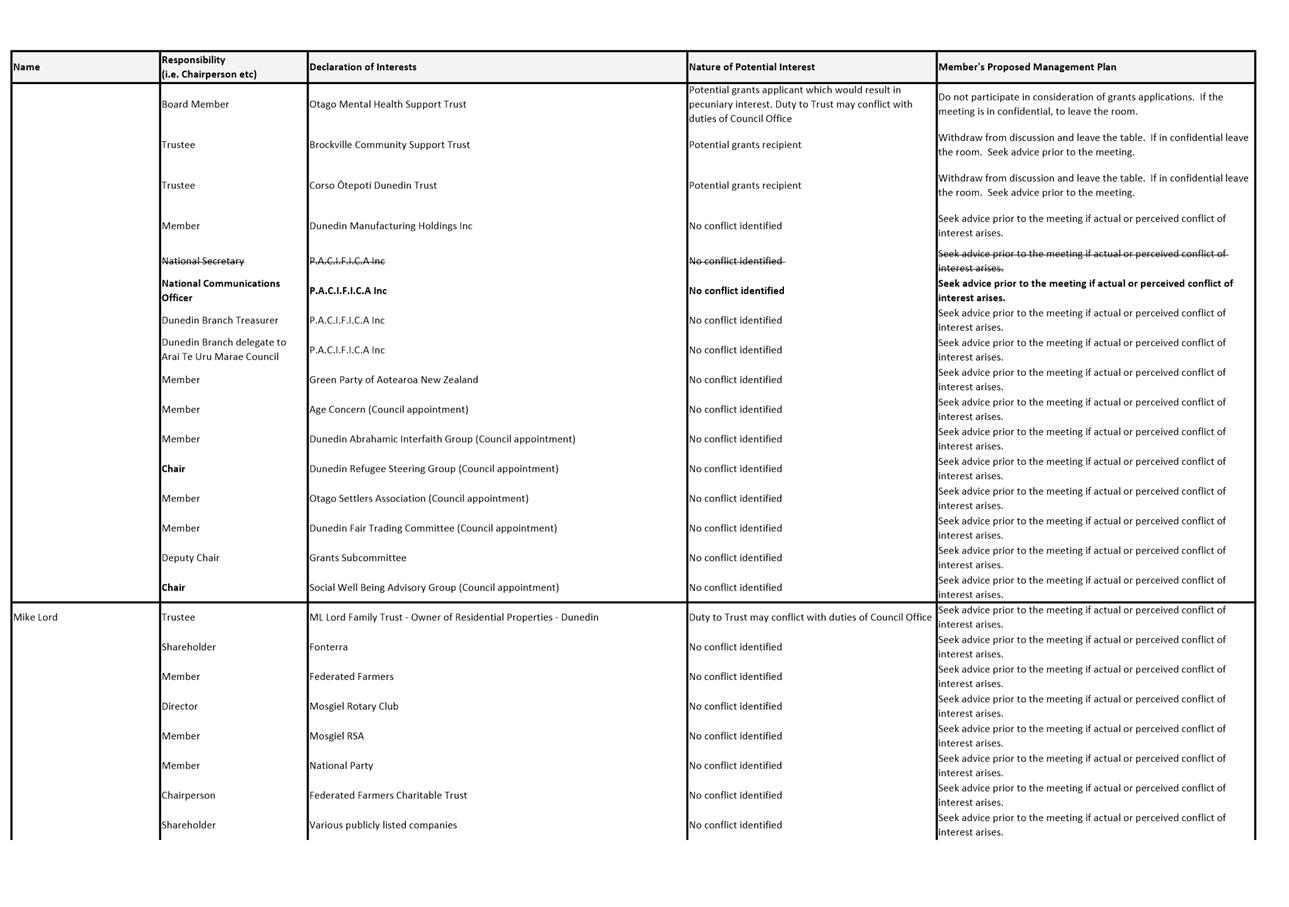

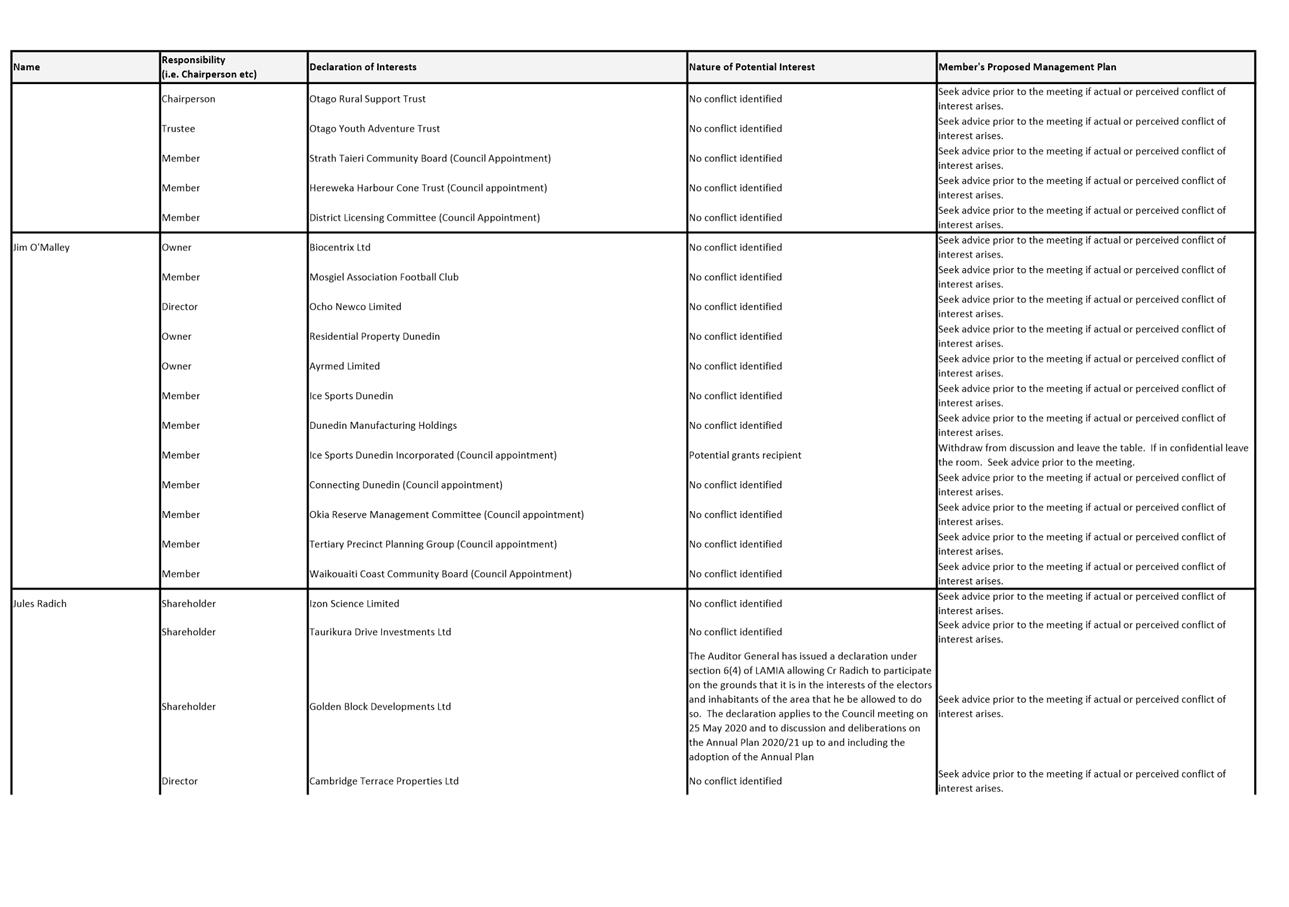

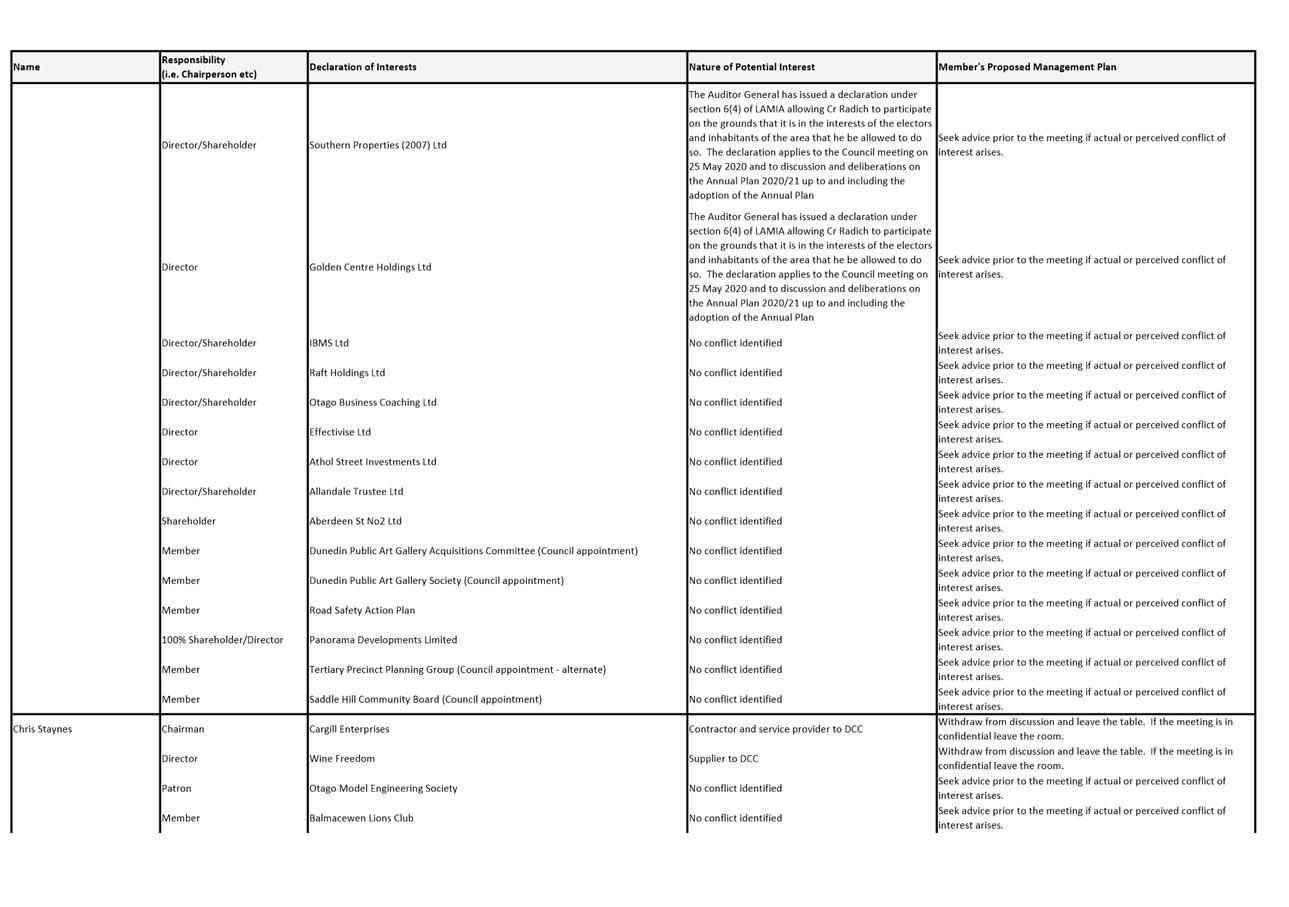

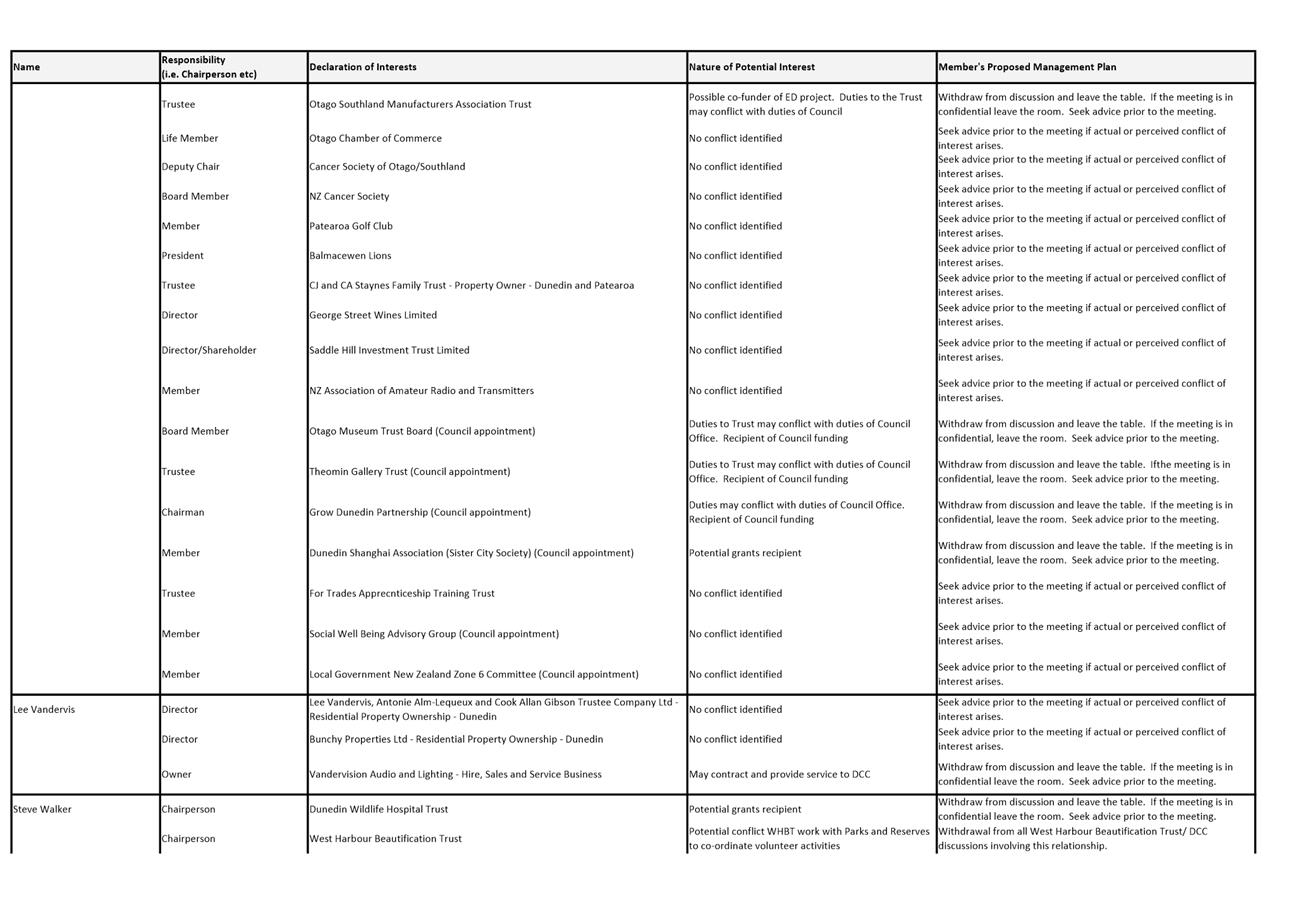

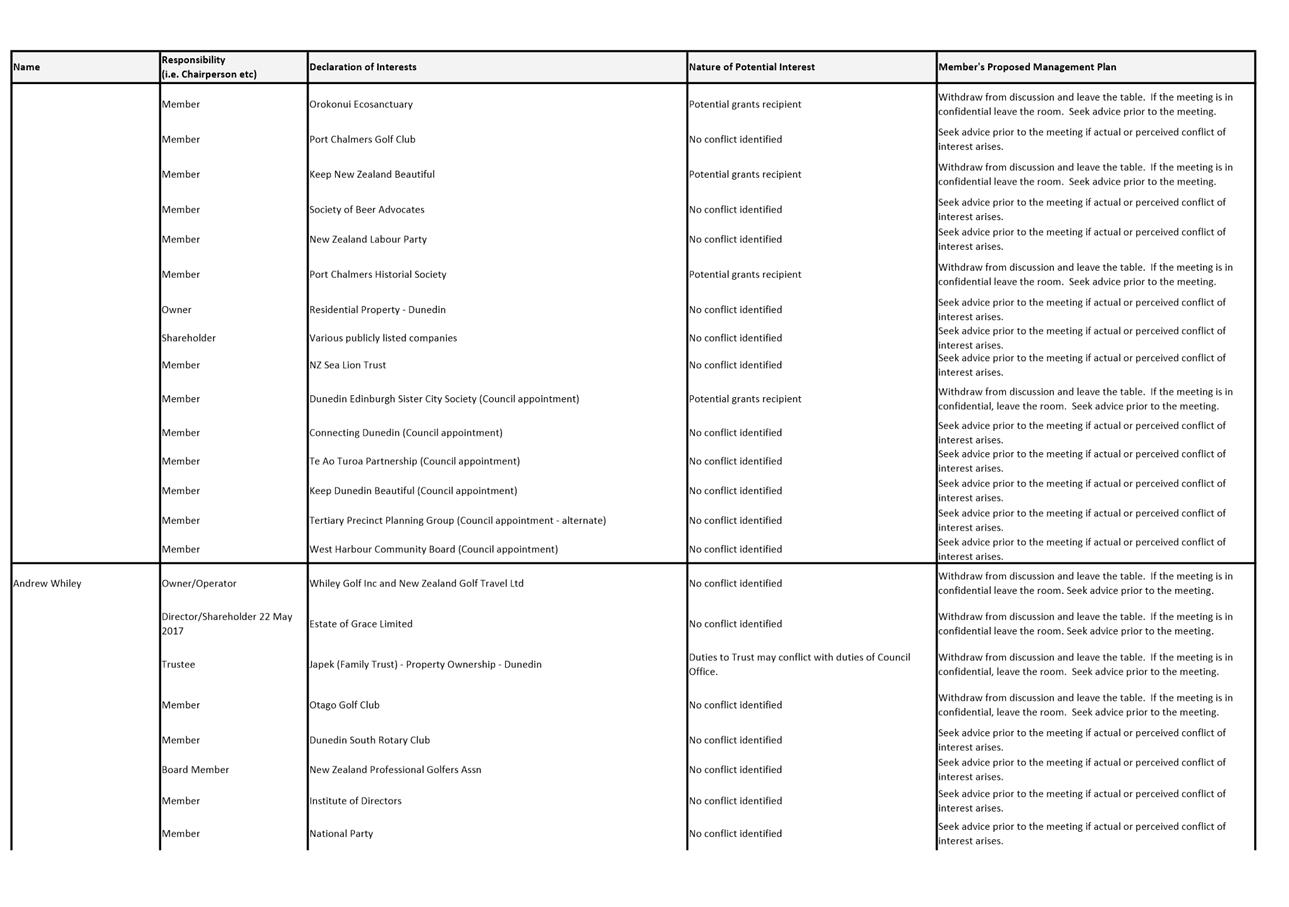

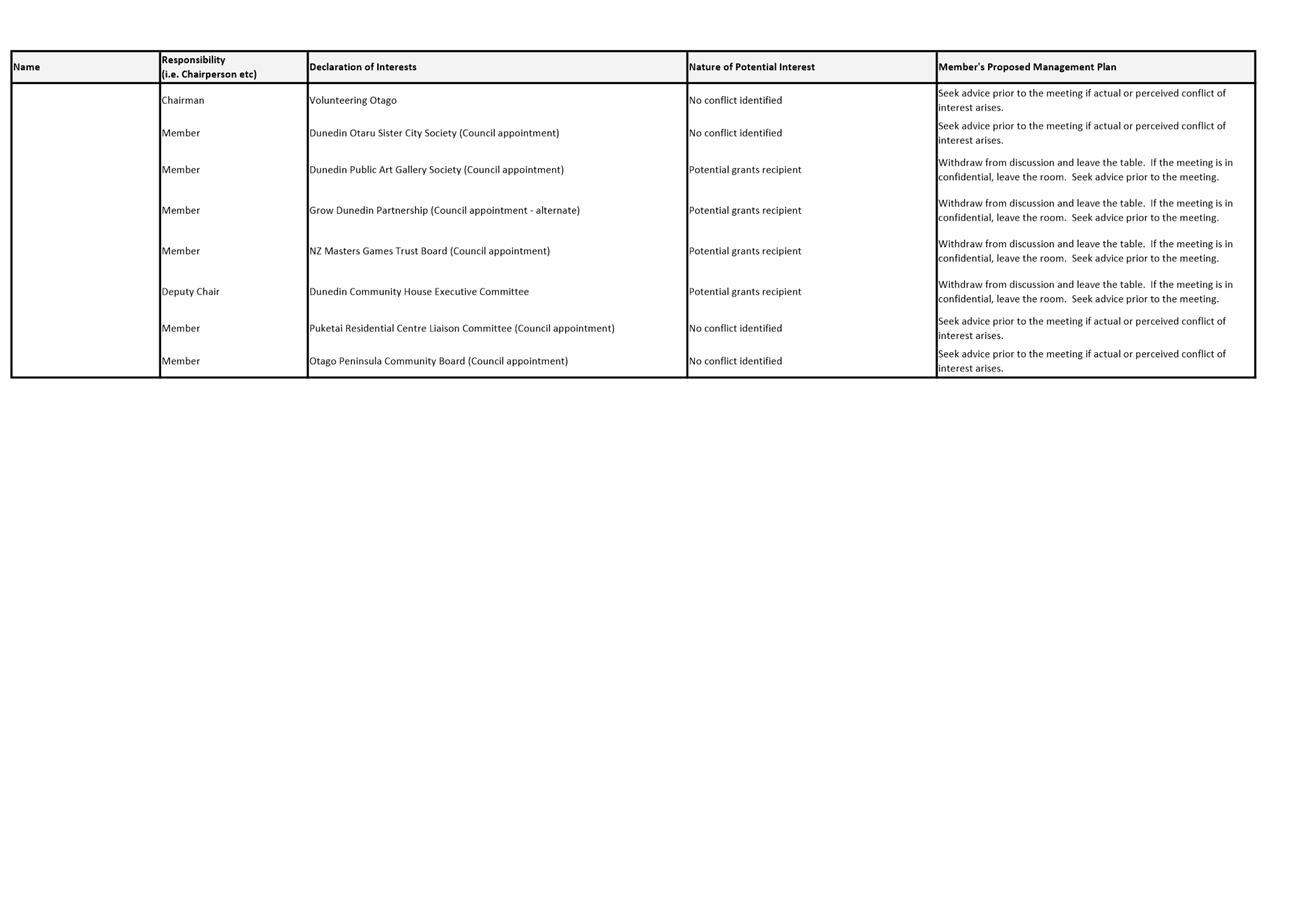

Declaration of Interest

EXECUTIVE SUMMARY

1. Members

are reminded of the need to stand aside from decision-making when a conflict

arises between their role as an elected representative and any private or other

external interest they might have.

2. Elected

members are reminded to update their register of interests as

soon as practicable, including amending the register at this meeting if

necessary.

|

RECOMMENDATIONS

That the Committee:

a) Notes/Amends if necessary the Elected Members'

Interest Register attached as Attachment A; and

b) Confirms/Amends the proposed management plan for

Elected Members' Interests.

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Elected Members'

Register of Interest

|

7

|

|

|

Economic Development Committee

21 June 2021

|

|

|

Economic Development Committee

21 June 2021

|

Confirmation

of Minutes

Economic Development Committee meeting - 9 February 2021

|

RECOMMENDATIONS

That the Committee:

a) Confirms the public part of the minutes of the

Economic Development Committee meeting held on 09 February 2021 as a correct

record.

|

Attachments

|

|

Title

|

Page

|

|

A⇩

|

Minutes of Economic

Development Committee meeting held on 9 February 2021

|

18

|

|

|

Economic

Development Committee

21 June 2021

|

Economic Development Committee

MINUTES

Minutes of an ordinary

meeting of the Economic Development Committee held in the Edinburgh Room,

Municipal Chambers, The Octagon, Dunedin on Tuesday 09 February 2021,

commencing at 1.37 pm

PRESENT

|

Chairperson

|

Cr Chris Staynes

|

|

|

Deputy Chairperson

|

Cr Rachel Elder

|

Cr Andrew Whiley

|

|

Members

|

Cr Sophie Barker

|

Cr David Benson-Pope

|

|

|

Cr Christine Garey

|

Cr Doug Hall

|

|

|

Mayor Aaron Hawkins

|

Cr Carmen Houlahan

|

|

|

Cr Marie Laufiso

|

Cr Mike Lord

|

|

|

Cr Jim O'Malley

|

Cr Jules Radich

|

|

|

Cr Lee Vandervis

|

Cr Steve Walker

|

|

IN ATTENDANCE

|

Sandy Graham (Chief Executive

Officer), John Christie (Director Enterprise Dunedin), Fraser Liggett

(Economic Development Programme Manager), Malcolm Anderson (City Marketing

Manager), Dougal McGowan (Economic Development Project Manager), Antony

Deaker (Film Dunedin Coordinator, Enterprise Dunedin), Louise van der

Vlierd (Manager Visitors Centre), Suz Jenkins (Finance and Operations

Manager), Benje Patterson (Business Analyst) and Margo Reid (Study Dunedin

Coordinator),

|

Governance Support Officer Wendy

Collard

1 Public

Forum

There was no Public

Forum.

|

2 Apologies

|

|

There were no apologies.

|

|

3 Confirmation

of agenda

|

|

|

Moved (Cr Chris Staynes/Cr Andrew Whiley):

That the Committee:

Confirms the agenda

without addition or alteration

Motion

carried (ED/2021/001)

|

4 Declarations

of interest

Members were

reminded of the need to stand aside from decision-making when a conflict arose

between their role as an elected representative and any private or other

external interest they might have.

|

|

Moved (Cr Chris Staynes/Cr Rachel Elder):

That the Committee:

a) Notes the Elected Members' Interest Register; and

b) Amends the proposed management plan for Elected Members'

Interests.

Motion

carried (ED/2021/002)

|

5 Confirmation

of Minutes

|

5.1 Economic

Development Committee meeting - 19 October 2020

|

|

|

Moved (Cr Chris Staynes/Cr Steve Walker):

That the Committee:

a) Confirms

the public and confidential minutes of the Economic Development Committee

meeting held on 19 October 2020 as a correct record.

b) Notes that

the confidential minutes were publicly released in November 2020.

Motion

carried (ED/2021/003)

|

Part

A Reports

|

6 Economic

Development Committee Forward Work Programme

|

|

|

A report from Civic provided

the forward work programme for the 2021 year

The Director, Enterprise

Dunedin (John Christie) spoke to the report and responded to questions.

|

|

|

Moved (Cr Andrew Whiley/Cr Rachel Elder):

That the Committee:

a) Notes the Economic Development Committee forward work

programme.

Motion

carried (ED/2021/004)

|

|

7 Actions

From Resolutions of Economic Development Committee Meetings

|

|

|

A report from Civic provided

the open and completed actions from resolutions of Economic Development

Committee meetings from the start of the triennium in October 2019.

The Director, Enterprise

Dunedin (John Christie) spoke to the report and responded to questions.

|

|

|

Moved (Cr Andrew Whiley/Cr Chris Staynes):

That the Committee:

a) Notes the Open and Completed Actions from resolutions of

Economic Development Committee meetings.

Motion

carried (ED/2021/005)

|

|

8 Enterprise

Dunedin Activity Report - February 2021 Update

|

|

|

A report from Enterprise

provided an update on Enterprise Dunedin activities.

The Economic Development Programme Manager (Fraser

Liggett), the City Marketing Manager (Malcolm Anderson), Study Dunedin

Coordinator (Margo Reid), the I-Site Manager (Louise Van der Vlierd) and the

Film Co-ordinator (Antony Deaker) spoke to the report and responded to

questions.

|

|

|

Moved (Cr Rachel Elder/Cr Andrew Whiley):

That the Committee:

a) Notes the Enterprise Dunedin Activity Report –

February 2021 Update.

Motion

carried (ED/2021/006)

|

|

9 Strategic

Tourism Assets Protection Programme Update

|

|

|

A report from Enterprise

Dunedin provided an update on the progress in implementation of the Strategic

Tourism Assets Protection Programme (STAPP). The STAPP programme had

been designed to support tourism businesses and Regional Tourism

Organisations. It noted that decisions on funding allocations were made

by the Tourism Recovery Ministers Group, supported by Ministry of Business,

Innovation and Employment (MBIE) advice.

The report also noted that

Enterprise Dunedin received $700k + GST for the implementation of 15

individual programmes between November 2020 and March 2022.

The City Marketing Manager

(Malcolm Anderson) spoke to the report and responded to questions.

|

|

|

Moved (Cr Andrew Whiley/Cr Rachel Elder):

That the Committee:

a) Notes the Strategic Tourism Assets Protection Programme

Update.

Motion

carried (ED/2021/007)

|

The meeting concluded at 2.42 pm.

..............................................

CHAIRPERSON

|

|

Economic Development Committee

21 June 2021

|

Part

A Reports

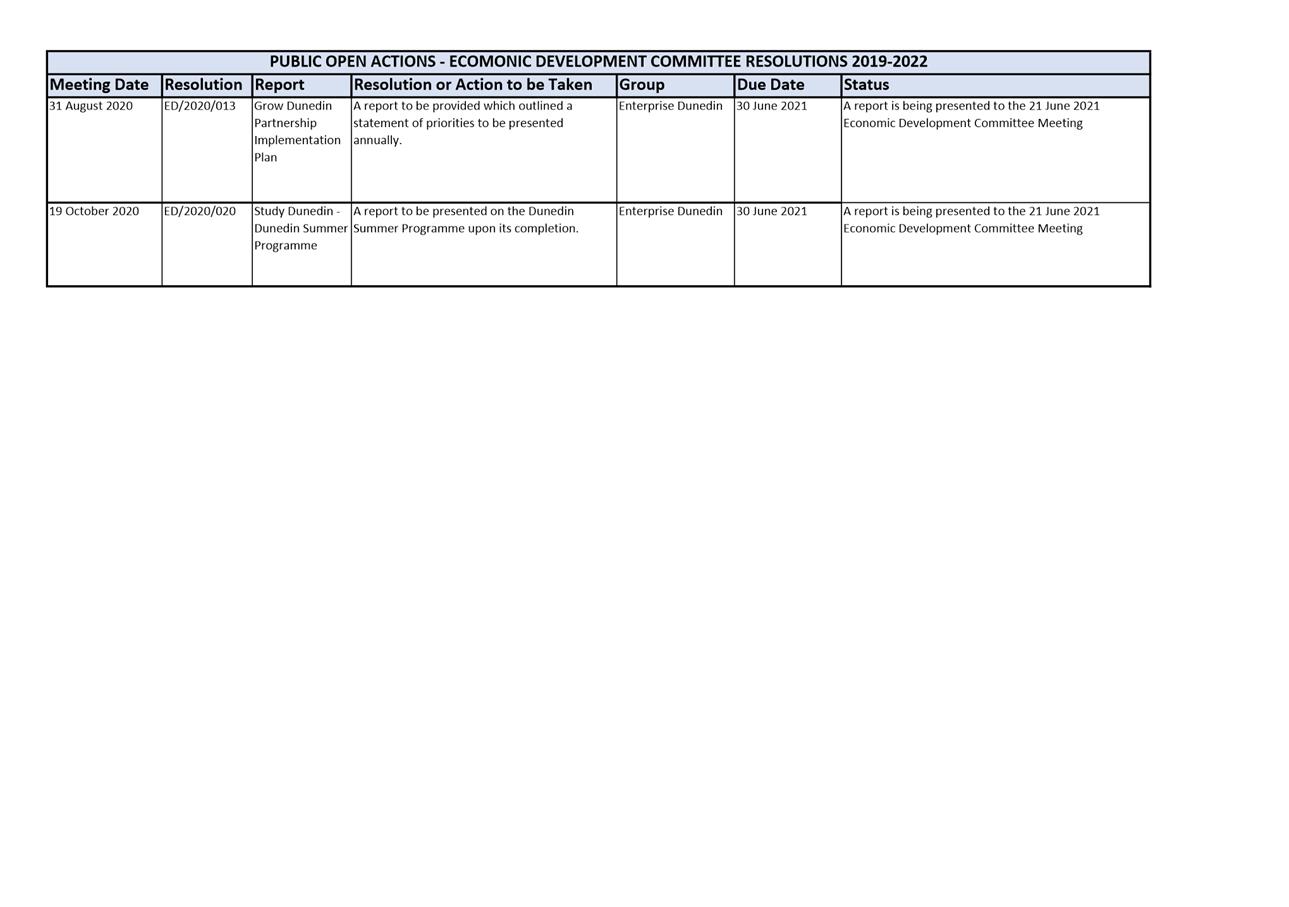

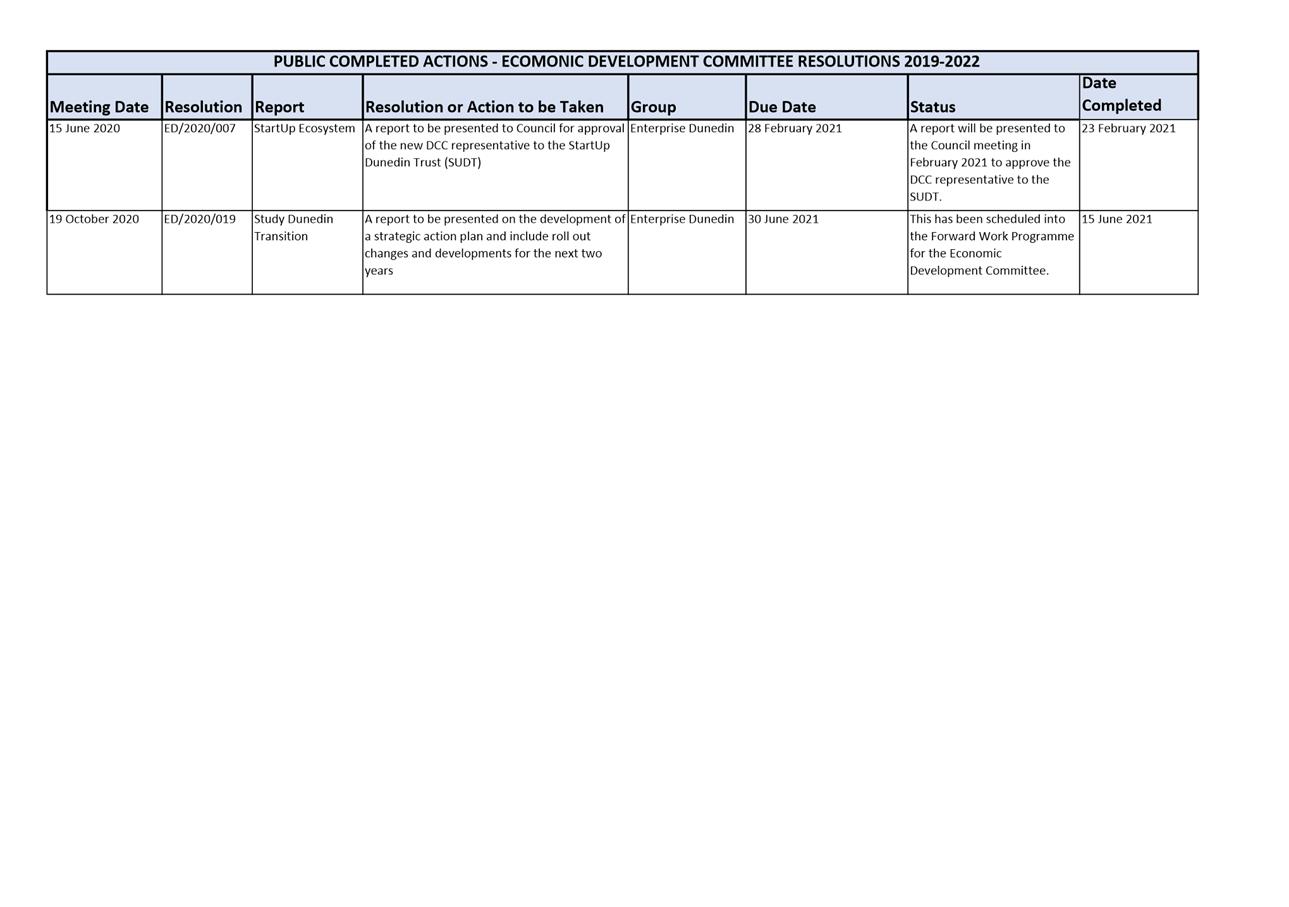

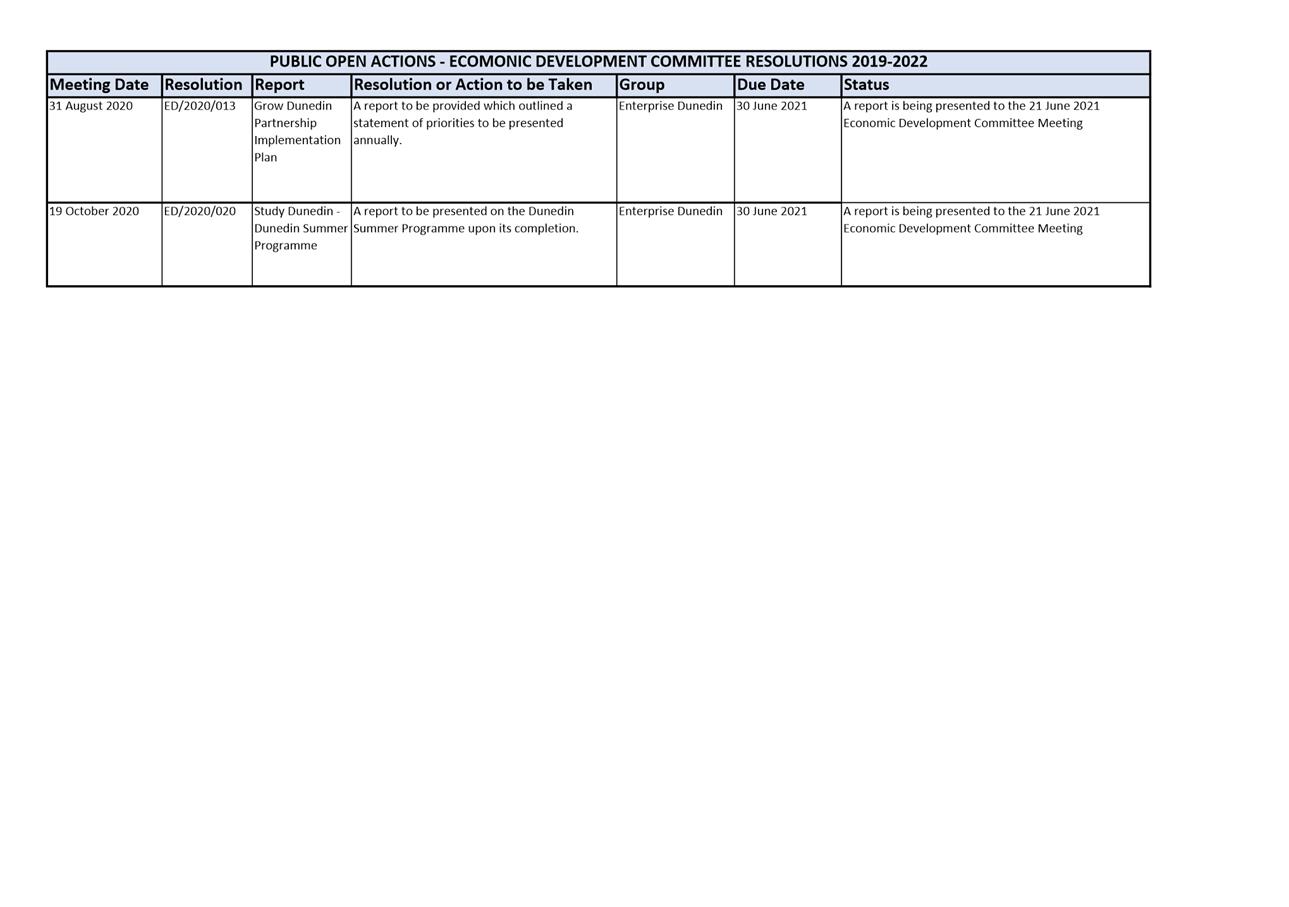

Actions from resolutions of Economic

Development Committee meetings

Department: Civic

EXECUTIVE SUMMARY

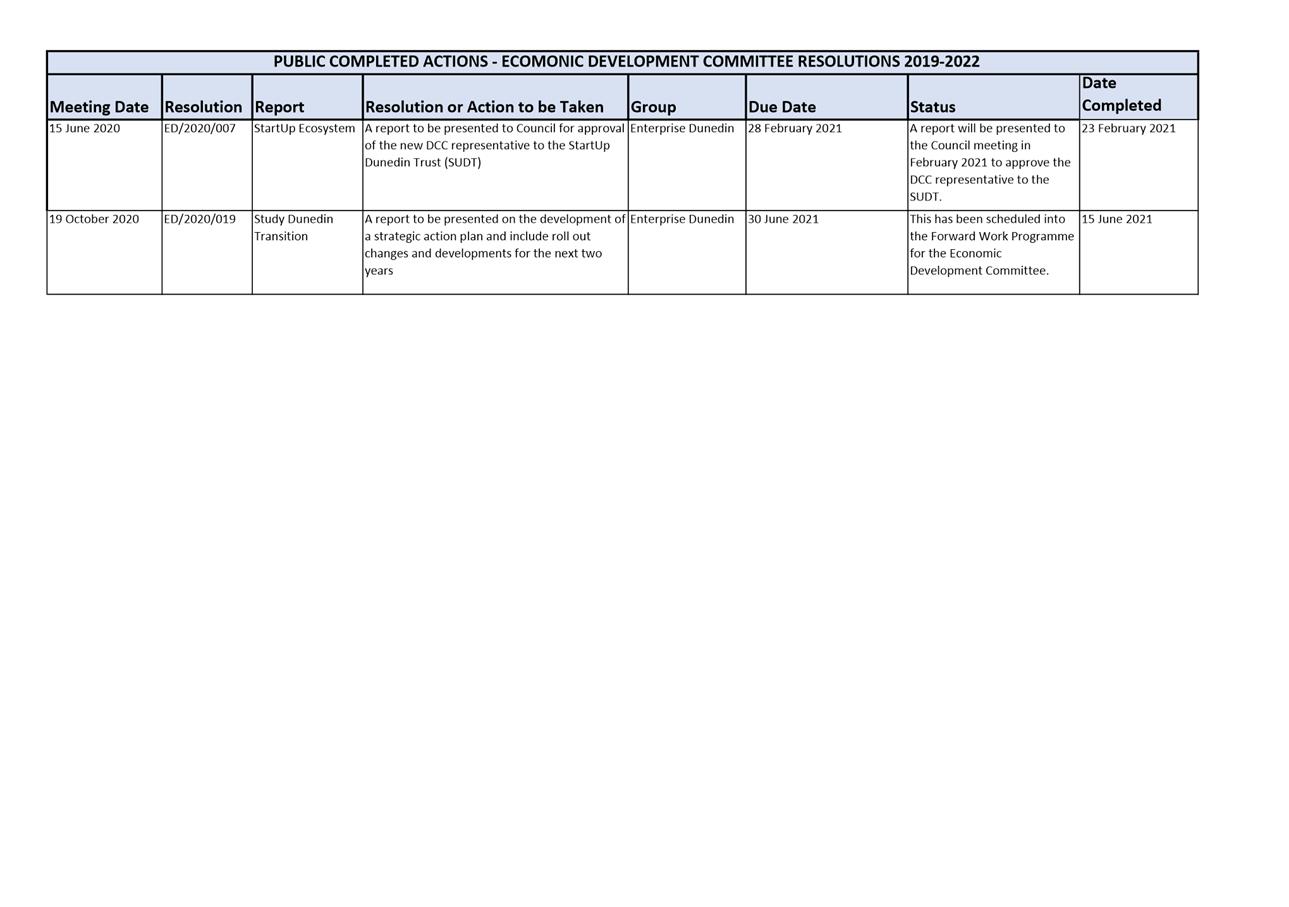

1 The

purpose of this report is to detail the open and completed actions from

resolutions of Economic Development Committee meetings from the start of the

triennium in October 2019 (Attachment A and B).

2 As

this report is an administrative report only, there are no options or Summary

of Considerations.

|

RECOMMENDATIONS

That the Committee:

a) Notes the Open and Completed Actions from resolutions of

Economic Development Committee meetings shown in Attachment A and B.

|

discussion

3 This

report provides an update on resolutions that have been actions and completed

since the last Economic Development Committee meeting.

NEXT STEPS

4 An

updated actions report will be provided at all Economic Development Committee

meetings.

Signatories

|

Author:

|

Wendy Collard - Governance Support Officer

|

|

Authoriser:

|

Clare Sullivan - Manager Governance

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Open Actions

|

23

|

|

⇩b

|

Completed Actions

|

24

|

|

|

Economic Development Committee

21 June 2021

|

|

|

Economic Development Committee

21 June 2021

|

|

|

Economic Development Committee

21 June 2021

|

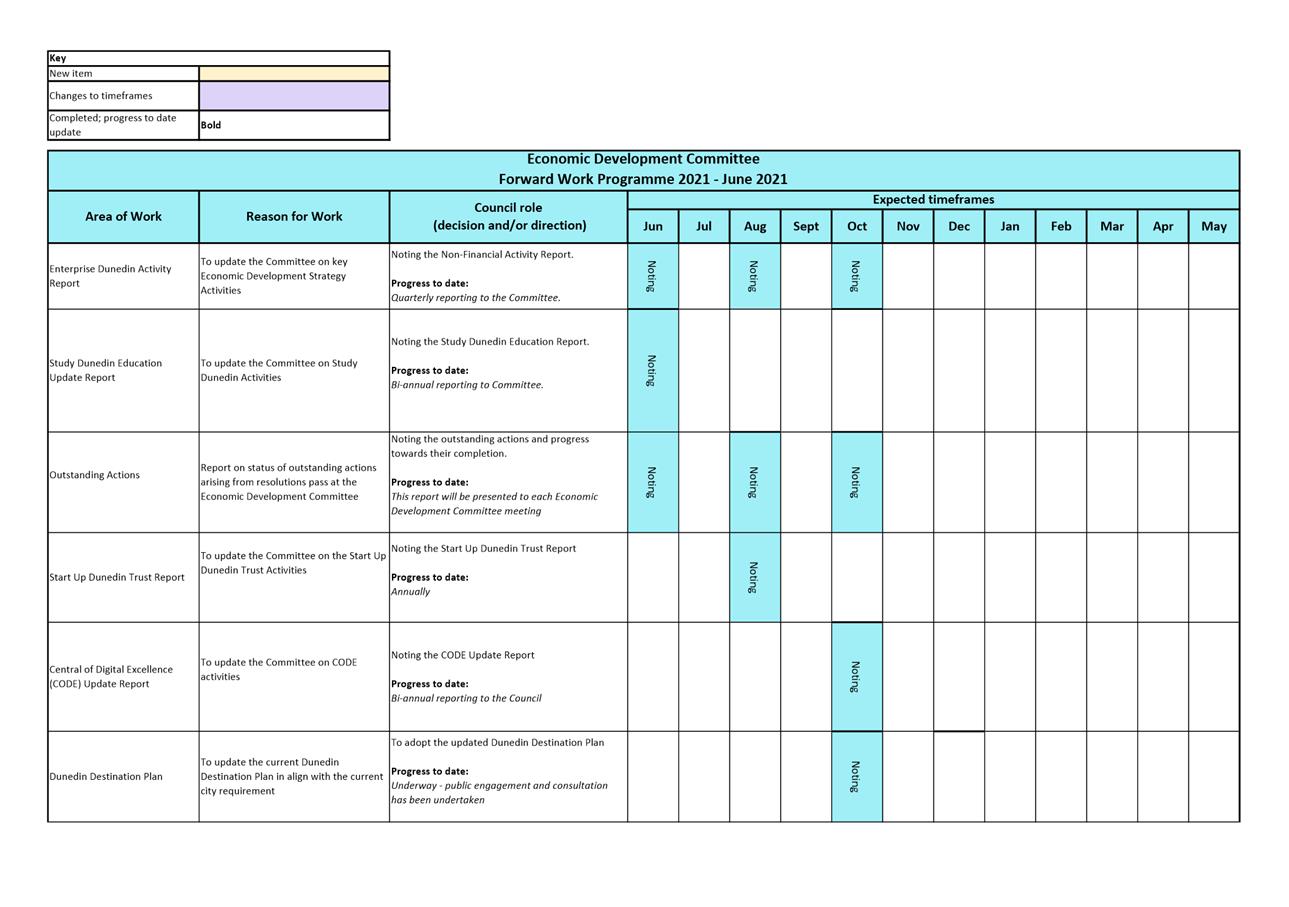

Economic Development Committee Forward Work

Programme

Department: Civic

EXECUTIVE SUMMARY

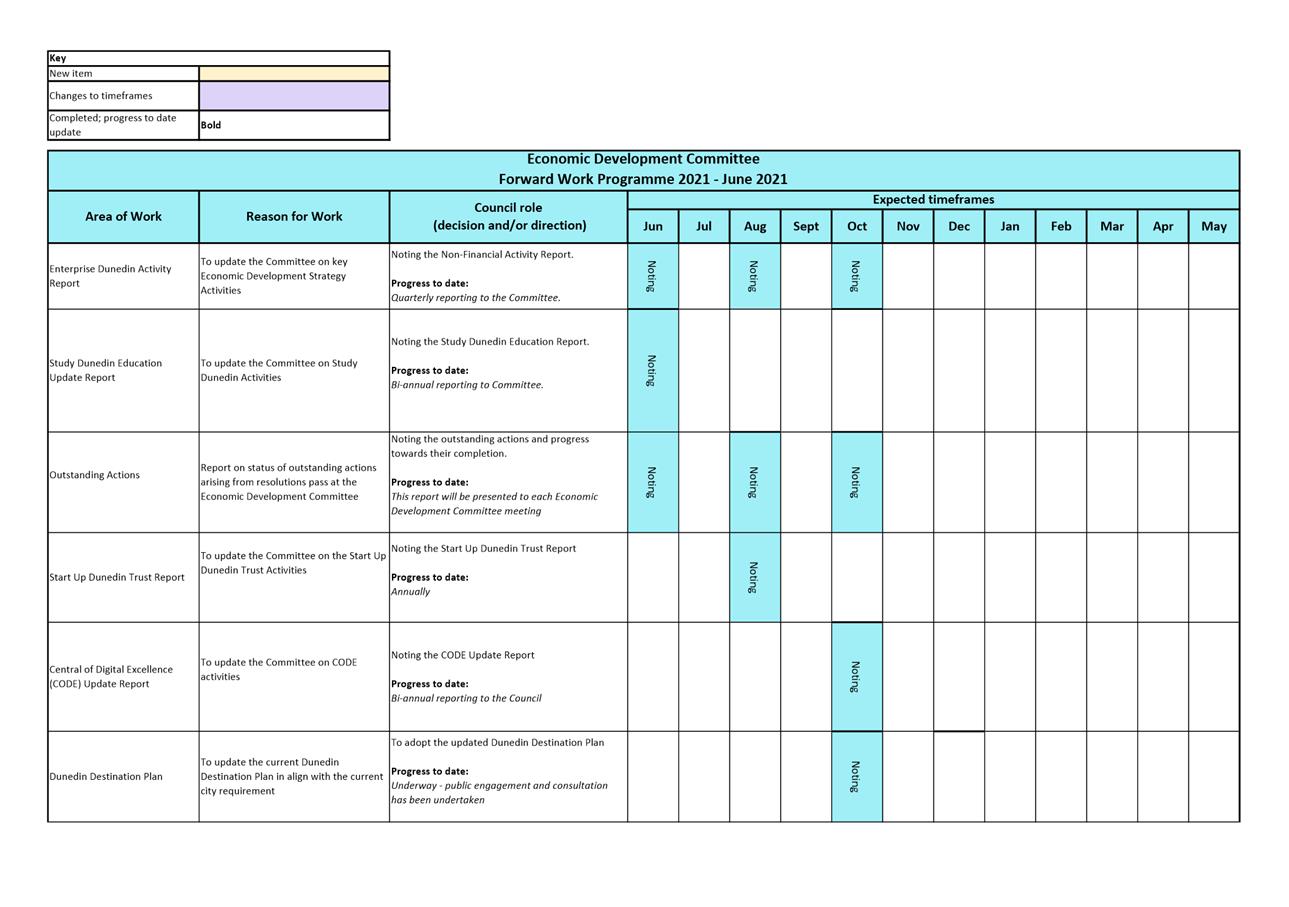

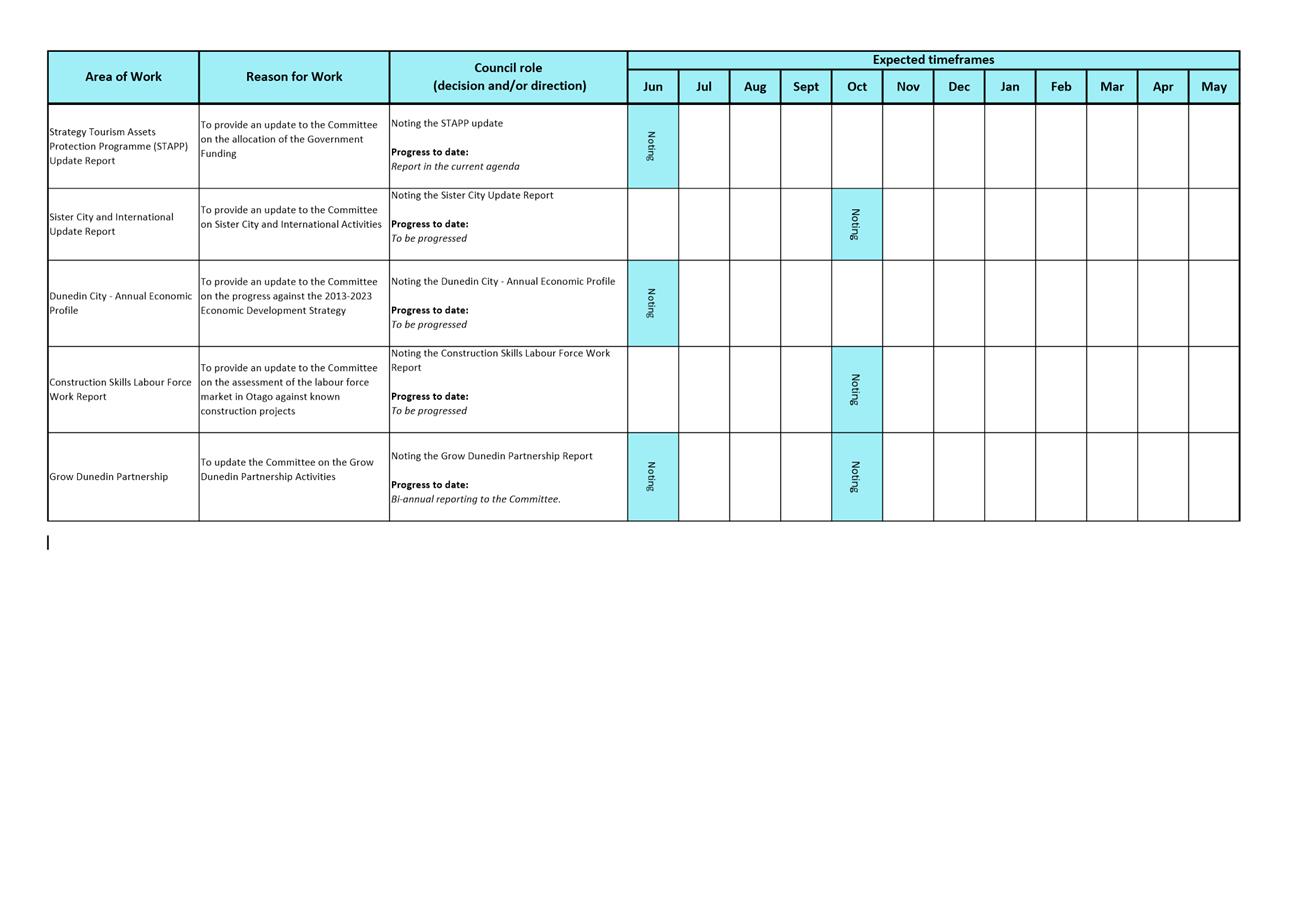

1 The

purpose of this report is to provide the forward work programme for the

2021-2022 year (Attachment A).

2 As

this is an administrative report only, there are no options or Summary of

Considerations.

|

RECOMMENDATIONS

That the Committee:

a) Notes the Economic Development Committee forward work

programme as shown in Attachment A.

|

NEXT STEPS

3 An

updated report will be provided to future meetings of the Economic Development

Committee.

Signatories

|

Author:

|

Wendy Collard - Governance Support Officer

|

|

Authoriser:

|

Clare Sullivan - Manager Governance

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Economic Development

Committee Forward Work Programme

|

27

|

|

|

Economic Development Committee

21 June 2021

|

|

|

Economic Development Committee

21 June 2021

|

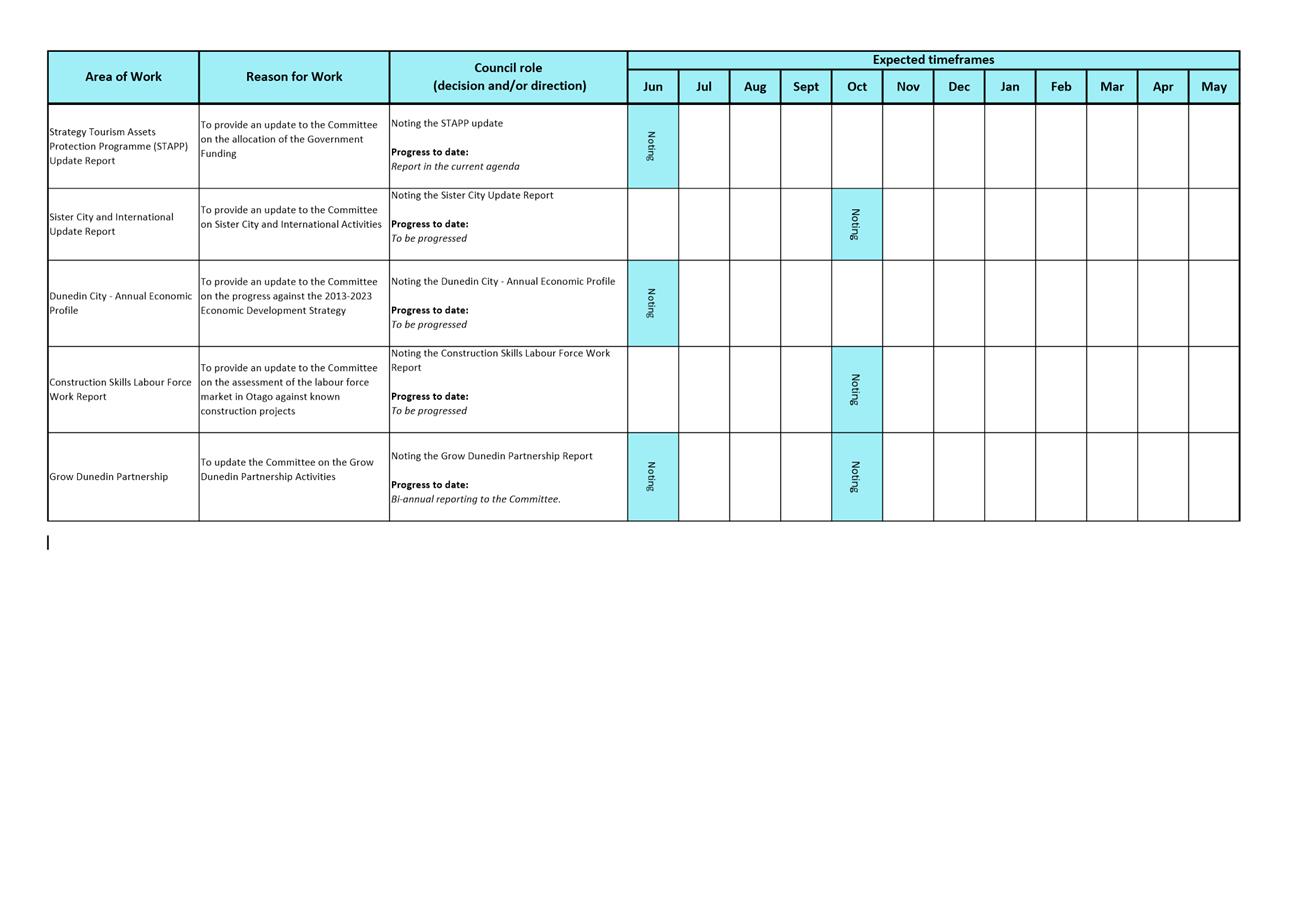

Grow Dunedin Partnership June

2021 Update

Department: Enterprise

Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee (EDC) on

Grow Dunedin Partnership (the Partnership) activity. The update, report and

attachments are being presented on behalf of the Partnership by Chair, John

Gallaher and Deputy Chair, David Thomson (University of Otago).

2 In

summary:

a) An

independent Chair, John Gallaher was appointed in October 2020;

b) Two

independent Board members were appointed to the Partnership in March 2021;

c) An

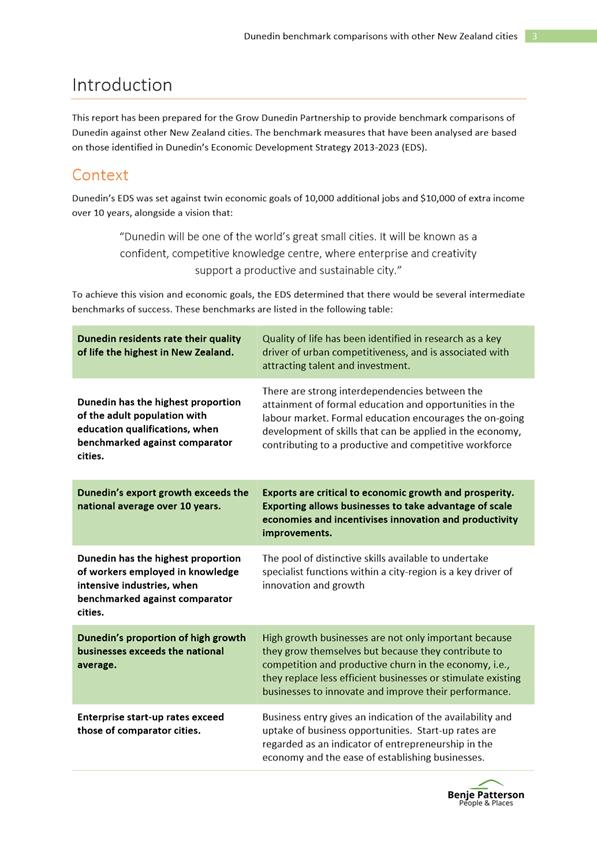

independent report has been commissioned to benchmark Dunedin with other New

Zealand cities, based on the Economic Development Strategy 2013-2023 (the

Strategy) measures;

d) The

Partnership has developed an Implementation Plan for 2021/22.

|

RECOMMENDATIONS

That the Committee:

a) Notes the June 2021 Grow Dunedin

Partnership Update Report

b) Notes the May 2021 Dunedin

Benchmarking Report

c) Notes the Grow Dunedin Partnership

Implementation Plan 2021/22.

|

BACKGROUND

3 The

Partnership was established in 2012 to lead the city’s delivery of the

Economic Development Strategy 2013-2023.

4 The

Strategy sets out two economic goals:

a) 10,000

extra jobs over 10 years (requiring approximately 2% per annum); and

b) An

average of 10,000 of extra income for each person (requiring GDP per capital to

raise 2.5% per annum).

DISCUSSION

5 The

Partnership has implemented the following actions over the last 12 months:

a) The

terms of reference have been reviewed and refreshed. These were approved by

Council in September 2020 and the individual Partners;

b) An

independent Chair, John Gallaher was appointed in October 2020;

c) A

recruitment process for independent representatives on the Partnership was

undertaken by John Gallaher, David Thomson and Councillor Chris Staynes which

resulted in the following appointments in March 2021:

· Barbara Bridger, Chief Executive, Otago Community Trust;

· Jason Tibble, Regional Commissioner & Chair of Regional Public

Service, Ministry of Social Development;

d) Benje

Patterson Ltd was engaged in April 2021 to benchmark Dunedin with other New

Zealand cities based on the measures in the Strategy (Attachment A);

e) A

2021/22 Implementation Plan has been developed (Attachment B).

OPTIONS

6 As

this is a report for noting, there are no options.

NEXT STEPS

7 The

Partnership will provide further updates on the Strategy and outcomes to EDC.

These reports will be noted in the EDC forward work programme.

Signatories

|

Author:

|

Fraser Liggett - Economic Development

Programme Manager

|

|

Authoriser:

|

John Christie - Manager Enterprise

Dunedin

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Dunedin

Benchmarking Report - May 2021

|

33

|

|

⇩b

|

Grow

Dunedin Partnership Implementation Plan 2021/22

|

41

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit

with purpose of Local Government

This decision promotes the economic

well-being of communities in the present and for the future.

|

|

Fit

with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

The Grow Dunedin Partnership

Implementation Plan aligns with the strategic delivery of the Economic

Development Strategy 2013-2023.

|

|

Māori

Impact Statement

Ngai Tahu is a partner of the Grown

Dunedin Partnership. Engagement with Rūnaka will be undertaken

throughout the development and delivery of the Grow Dunedin Partnership

Implementation Plan projects.

|

|

Sustainability

Sustainability will feature as a key

component for development of all projects identified in the Grow Dunedin

Partnership Implementation Plan.

|

|

LTP/Annual

Plan / Financial Strategy /Infrastructure Strategy

Council supports contribution for the

delivery of the Economic Development Strategy through Enterprise

Dunedin’s operational budgets. Other partners will contribute to the

delivery of the Implementation Plan via their own organisations.

|

|

Financial

considerations

There are no known financial implications

and delivery of the projects will be assessed by the Partnership.

|

|

Significance

This decision is considered low in terms

of the Council’s Significance and Engagement Policy.

|

|

Engagement

– external

External engagement has been undertaken

with the Grow Dunedin Partners and their representatives e.g. Otago Chamber

of Commerce, Otago Polytechnic, Otago Southland Employers Association,

University of Otago; and independent Board members from Forsyth Barr Ltd,

Otago Community Trust, Ministry of Social Development.

|

|

Engagement

- internal

There has been no internal engagement.

|

|

Risks:

Legal / Health and Safety etc.

There are no known risks; however, risk

assessments will be undertaken when planning the Grow Dunedin Partnership

Implementation projects.

|

|

Conflict

of Interest

There are no known conflicts of interest.

|

|

Community

Boards

Engagement with Community Boards will be

undertaken as relevant to the Grow Dunedin Partnerships Implementation Projects.

|

|

|

Economic Development Committee

21 June 2021

|

|

|

Economic Development Committee

21 June 2021

|

GDP Implementation Plan

– 2021/22

|

The Grow Dunedin

Partners (GDP) Implementation Plan has been designed

to prioritise action for the partners of the Economic Development Strategy

(EDS). The EDS was developed collaboratively by the Dunedin City

Council, Otago Chamber of Commerce, Ngai Tahu, Otago/ Southland Employers

Association, The University of Otago and Otago Polytechnic. Projects included

in the plan have been identified to have strong alignment with the themes

from the EDS and Enterprise Dunedin’s Business Plan.

|

|

Implementation Plan opportunities:

1. To engage and partner with Runaka to give effect to Te Tiriti

o Waitangi in GDP activities and outcomes;

2. To progress and communicate our strategic response to current

economic challenges;

3. To align and prioritise initiatives that deliver outcomes

beyond what we are already and/or planning on doing;

4. To seek investment which builds

on and scale up existing initiatives;

5. To align the proposed

implementation plan with our regional economic development strategy and

framework;

6. To champion, support and promote

the plan and activities within each partner organisation and wider Dunedin

community.

|

|

|

|

EDS themes: Priority areas for change that will help us meet our

objectives

|

|

Alliance for innovation Alliance for innovation

|

Business

Vitality Business

Vitality

|

A Hub for Skills and Talent A Hub for Skills and Talent

|

Linkages Beyond our Boarders Linkages Beyond our Boarders

|

A Compelling Destination A Compelling Destination

|

|

Improve linkages between industry and research.

Increase scale in innovation and tradeable sectors.

|

Improve ease of doing business.

Grow the value of exports.

|

Increase retention of graduates.

Build the skills base.

Grow Migrant numbers.

|

Increase international investment.

Establish strategic projects with other cities.

|

Enhance the city centre and environs.

Increase the value derived from tourism and events.

Improve an awareness and opportunities of Dunedin’s

advantages.

|

|

|

|

Our initiatives (projects/proposals that are strategically

aligned)

|

|

On-going

projects: Priority projects for 2021/22:

|

Success Measures

|

|

|

|

|

|

|

Economic Development Strategy – Support

the review of the Dunedin Economic Development Strategy.

|

In

collaboration with the Dunedin City Council, the EDS review is aligned to the

Thriving Cities Framework.

|

|

|

|

|

|

|

CODE (New

Zealand Centre of Digital Excellence) - A Dunedin-based initiative intended

to enable the development of a $1bn video game industry over ten years. CODE

has the potential to connect gaming professionals through the development of

Centre of Vocational Excellence (COVE) and apply games technology to serious

issues such as health.

|

Implementation

of CODE is completed, and new entity is established by 31 December 2021.

|

|

|

|

|

|

|

Otago

Regional Economic Development – Support focussed

and productive long-term collaboration between Otago Councils, including the

identification and progression of economic development activities and

projects which align with their individual strategic priorities and provide

regional benefits.

|

Initial partnership

programme phase is completed by June 2022.

|

|

|

|

|

|

|

Start-up

Ecosystem – Investment, support and continuing development of

Dunedin’s start-up, technology, innovation ecosystem through access to

talent, internships, business support and coordination.

|

Support

ongoing commitment and investment by shareholders (University of Otago, Otago

Polytechnic and Dunedin City Council) in Start-up Dunedin activities.

|

|

|

|

|

|

|

International

Relations – Leverage off Dunedin’s sister city relationships such as

Shanghai (plus other city agreements) to identify two-way trade and

investment opportunities (including for talent and education). Assess the

extent to which our connections with political (China) plus business

interests (for instance JPGames/Japan) can benefit Dunedin businesses.

|

Review

and implementation of the Memo Of Understanding schedule.

|

|

|

|

|

|

|

Export

Education – International education has the potential to provide significant

economic and social value to Dunedin and be incorporated into destination

marketing activities. Ability to create partnerships that are mutually

beneficial.

|

Achieve

contribution from Export Education of $20m to Dunedin’s economy.

(Based on approx. $200m value and of 10% of market).

|

|

Developmental

projects Priority projects for 2021/22:

|

Success

Measures

|

|

|

|

|

|

|

Games for

Health – The CODE business case identified opportunities to develop and

apply games technology to health issues. Southern District Health

Board’s $1.4b health transformation programme, along with the

University of Otago and Otago Polytechnic provides an opportunity to develop

a niche for games for health. This provides the ability to combine

health with the start up sector, then research the outcomes.

|

Development

of business case and advice for Games for Health by 30 June 2022.

|

|

|

|

|

|

|

Skills

/Labour force attraction – With $3.3 bn investment over

the next 10 years in capital investment, there is an opportunity to enable

economic benefits for Dunedin residents. There is a need to match training

and education with skills need for Dunedin (current and future).

|

Collaboration

between government agencies MBIE/MSD and GDP Partners to explore

opportunities.

|

|

|

|

|

|

|

Export

logistics - One major challenge for our primary sector, which can also be

viewed as an opportunity, is the speed/effectiveness to which our

high-quality perishable goods can get to market. A collaborative approach is

critical to create the scale required to change this.

|

Complete

research into primary sector volumes in Otago and Southland by 31 December

2021.

|

|

|

|

|

|

|

Dunedin

Destination Plan - Rewrite the 2017 Dunedin Destination Plan to implement a Dunedin

Inc approach to both Destination Marketing and Management of the City.

|

Complete

the review and development of the new Dunedin Destination Plan by 30 June

2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Economic Development Committee

21 June 2021

|

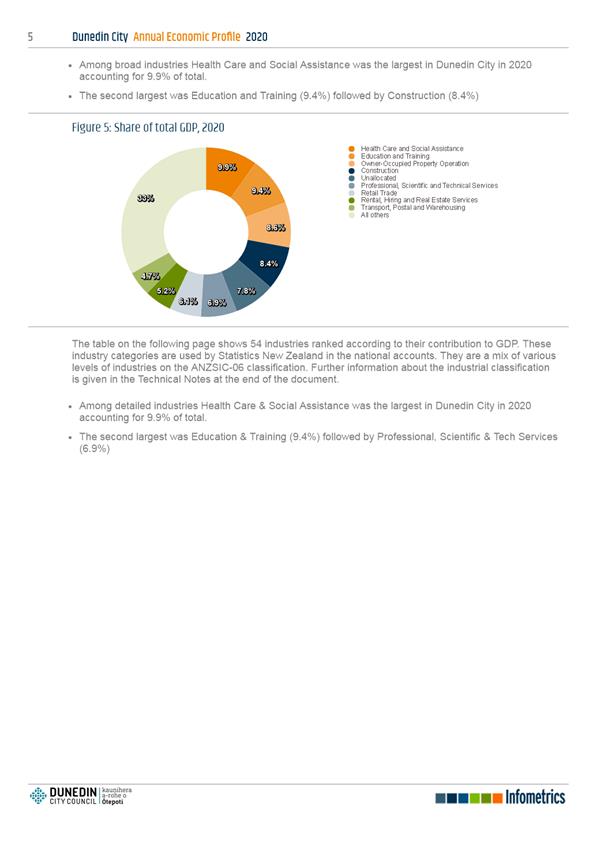

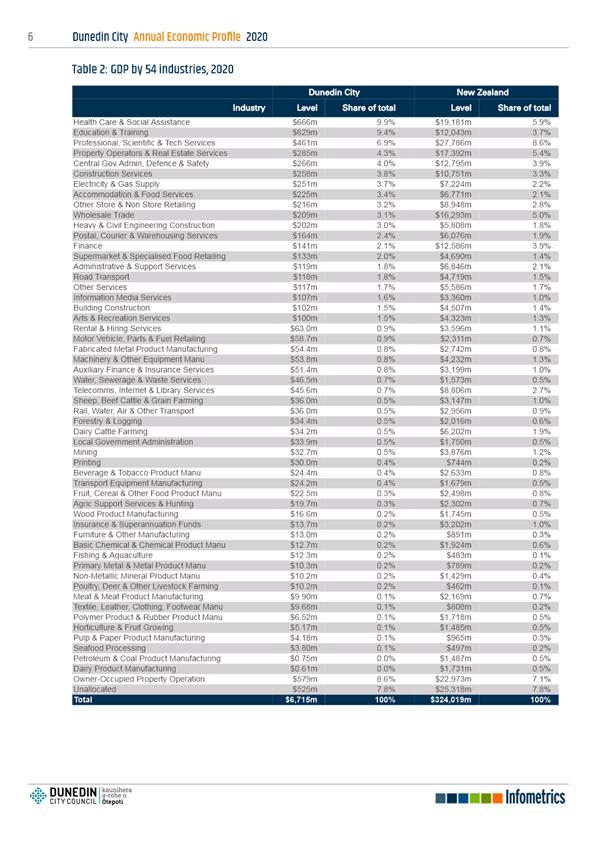

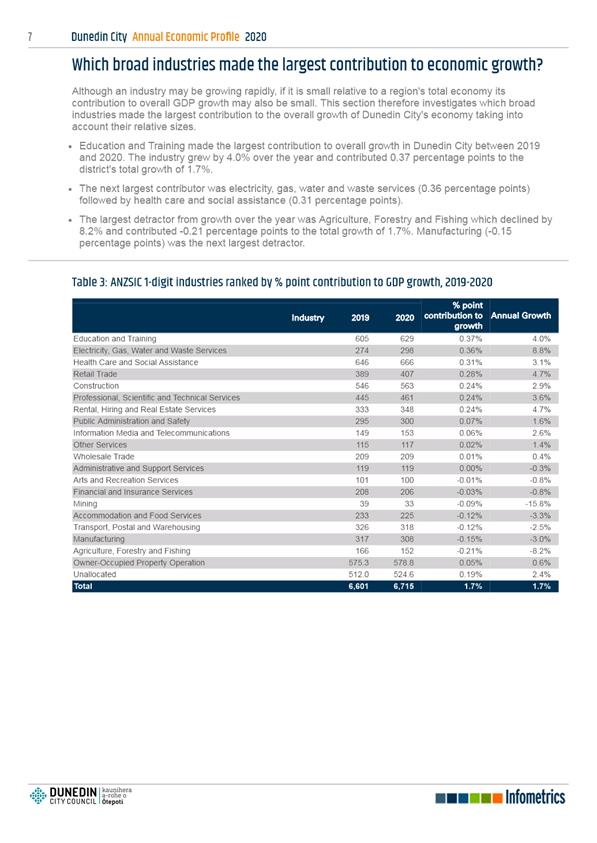

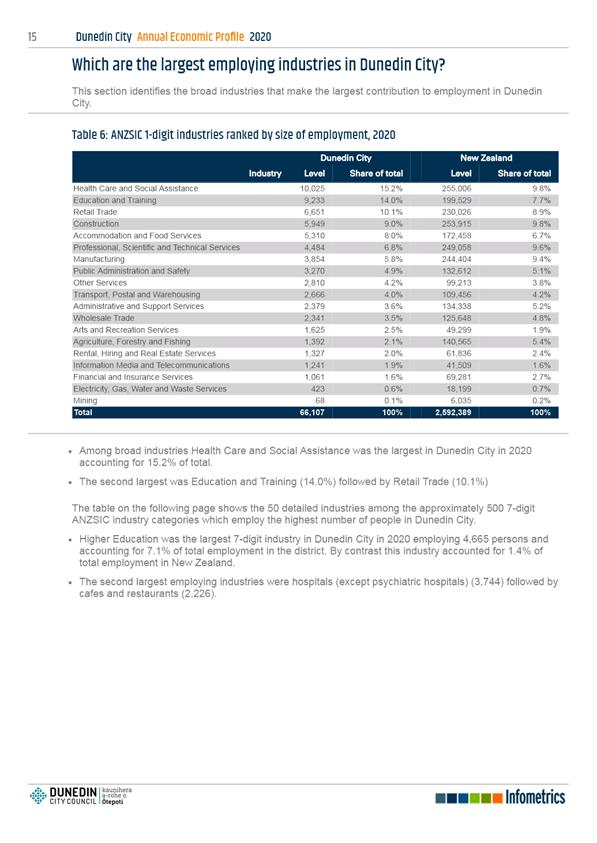

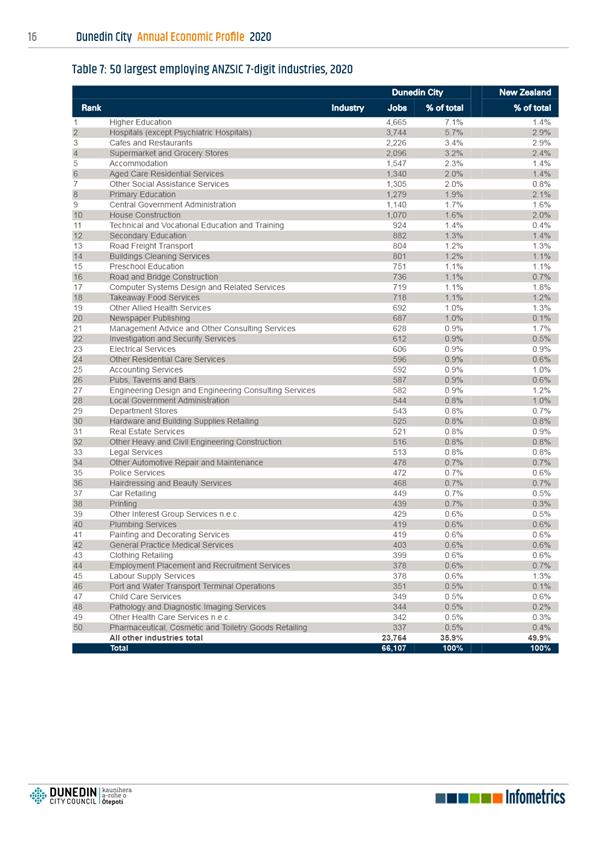

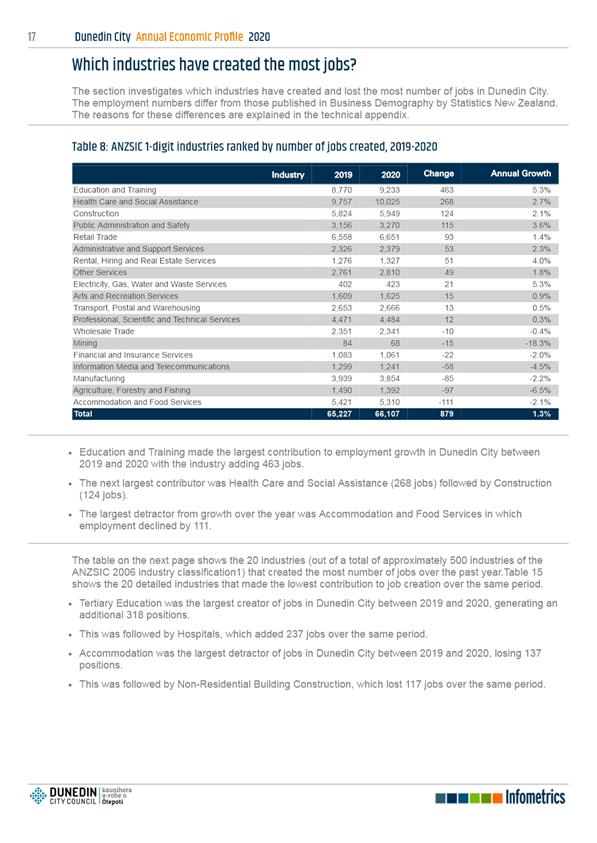

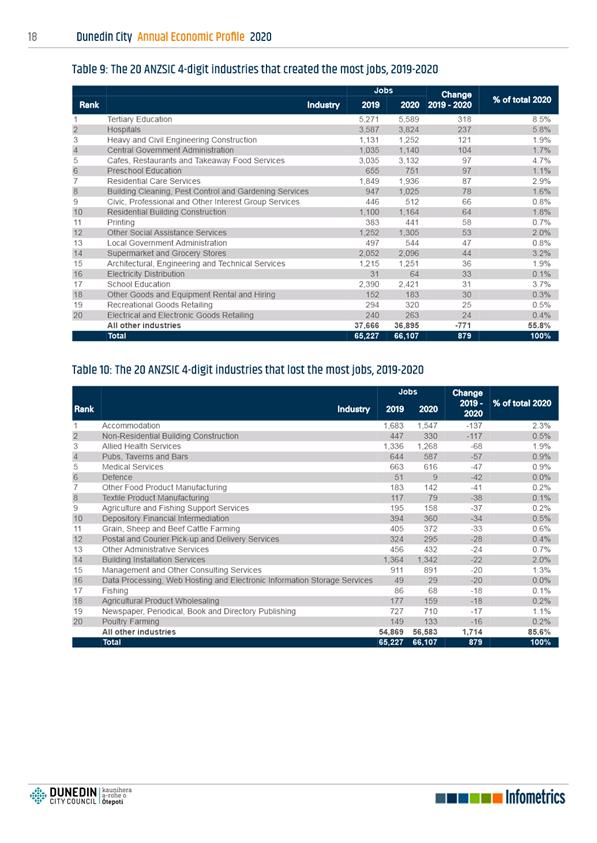

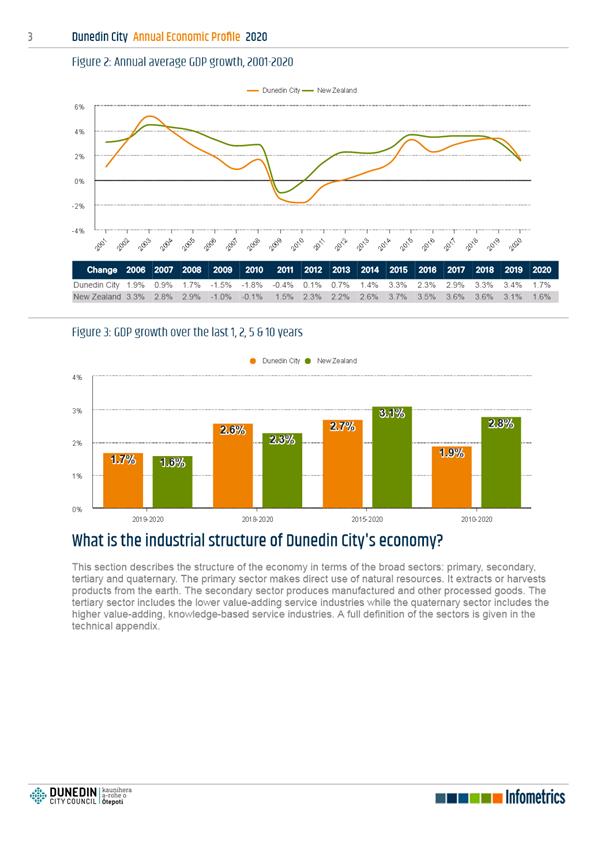

Dunedin City - Annual Economic Profile

Update

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to provide the Economic Development Committee with an

update of progress against the 2013-2023 Economic Development Strategy goals

and an overview of the Dunedin economy.

2 Calculations

in this report draw on detailed data in the Infometrics Annual Economic Profile

(to March 2020) and more recent Statistics New Zealand estimates (to March

2021) based on payroll tax filings.

|

RECOMMENDATIONS

That the Committee:

a) Notes the Dunedin City – Annual Economic Profile

Update report.

|

BACKGROUND

3 Enterprise

Dunedin activity is informed by the 2013-23 Economic Development Strategy

(EDS). The EDS is underpinned by five themes:

a) Business

vitality – to improve the ease of doing business.

b) Alliances

for innovation – to improve linkages between industry and research.

c) A

hub for skills and talent – to increase retention of graduates, build the

skills base and grow migrant numbers.

d) Linkages

beyond our borders – to increase international investment and establish

projects with other cities.

e) A

compelling destination – to increase the value of tourism and events and

improve the understanding of Dunedin’s advantages.

4 The

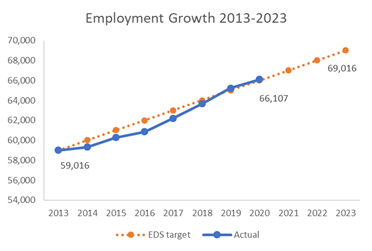

EDS sets out two overarching economic goals:

· 10,000

extra jobs over 10 years.

· An

average $10,000 extra income for each person.

DISCUSSION

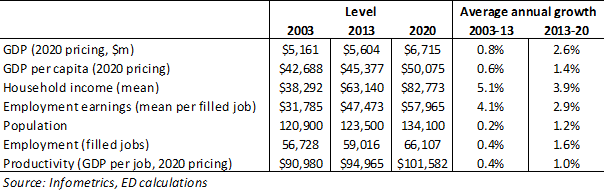

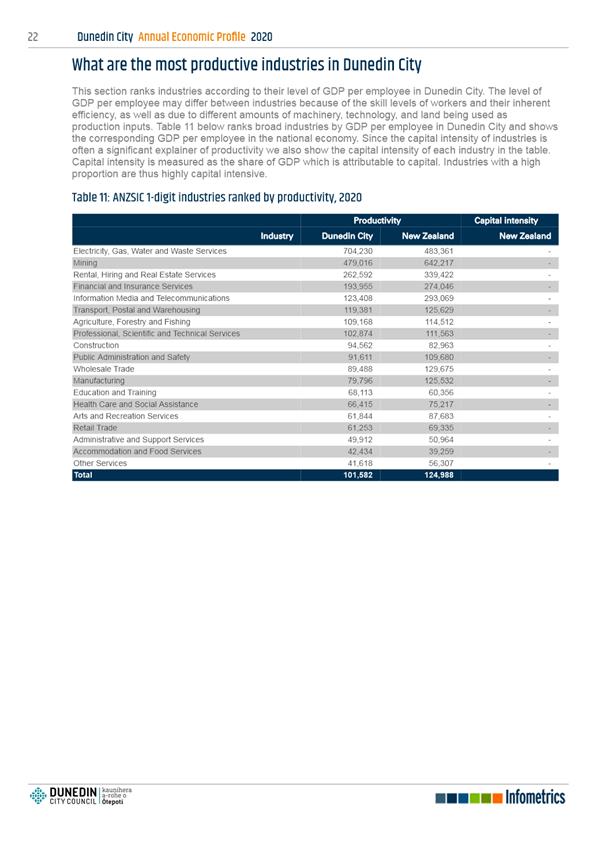

Progress of the

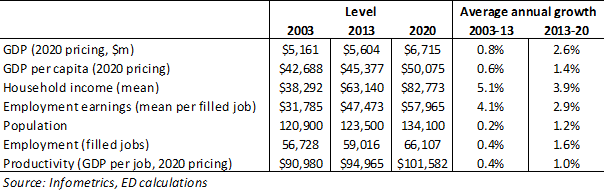

EDS goals to March 2020

5 The

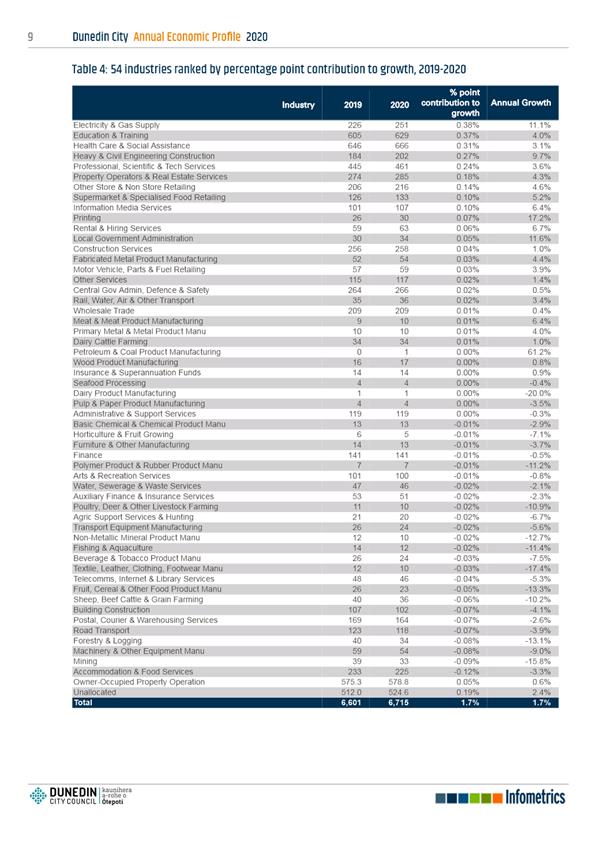

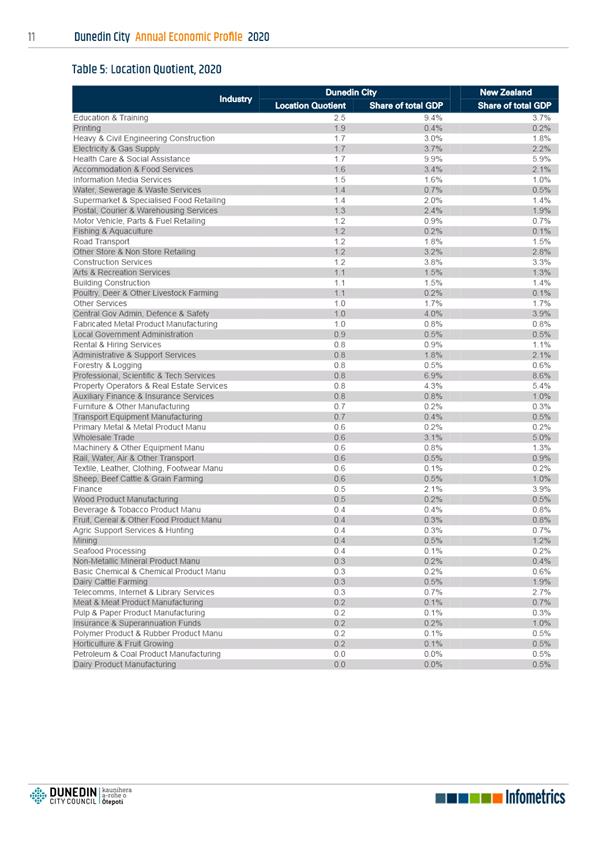

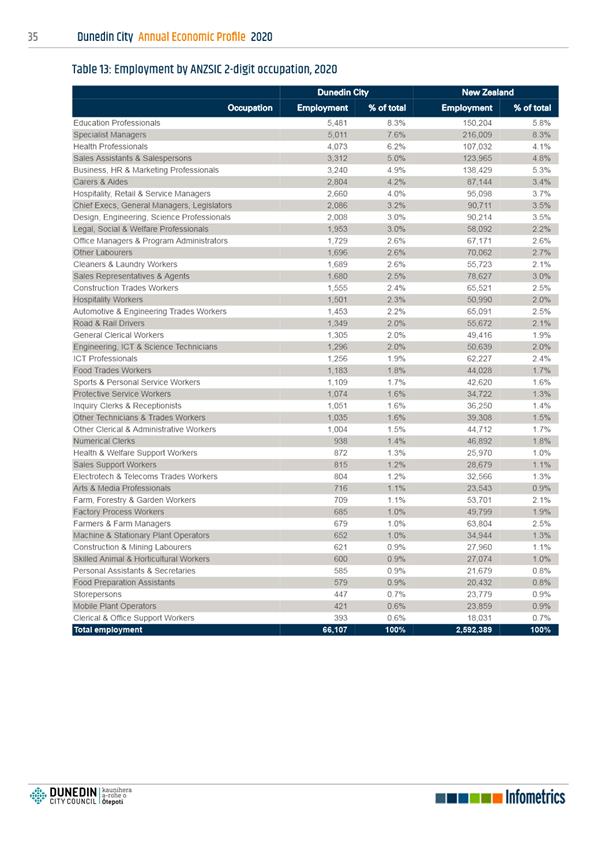

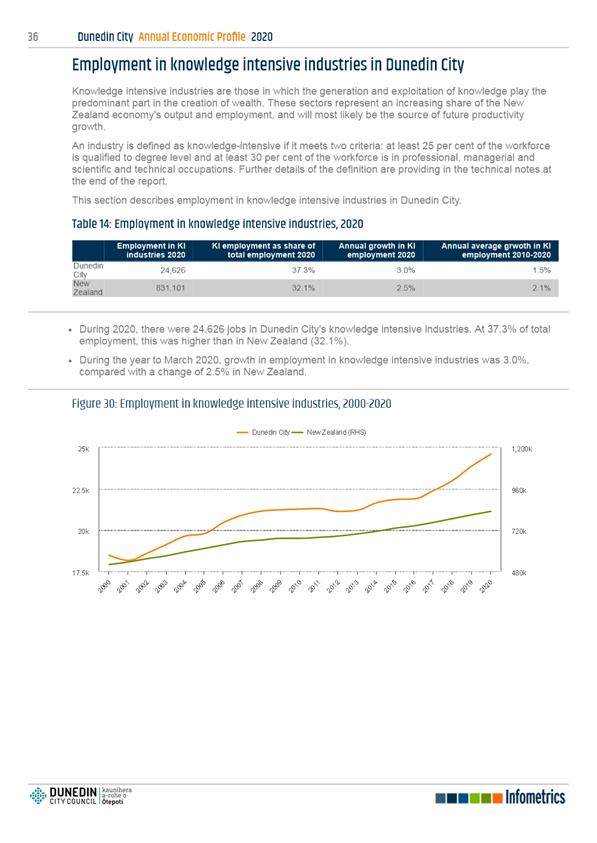

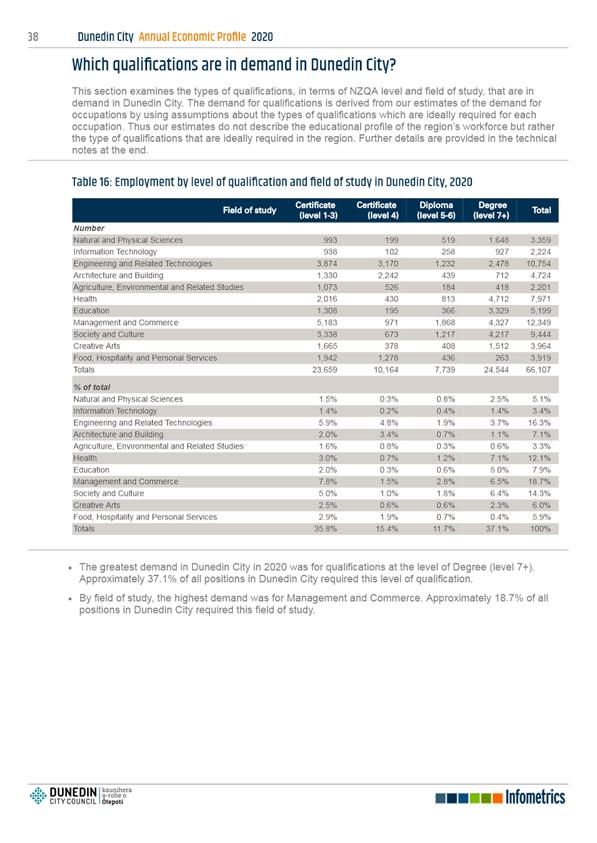

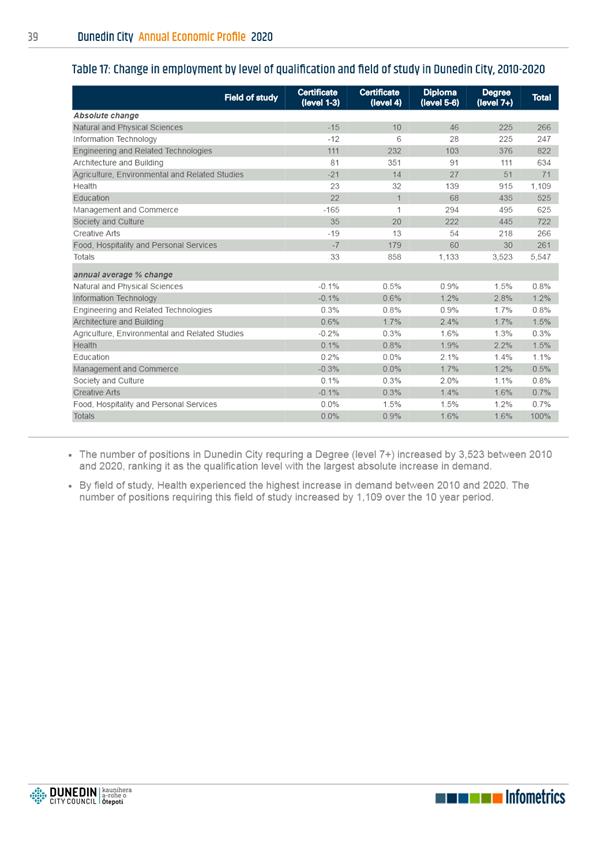

following table shows an update of key economic performance measures that cover

those summarised in the 2013-23 EDS.

6 Insights

presented in the table are based on calculations from data in the Infometrics

Annual Economic Profile.

7 The

data in the Annual Economic Profile is to March 2020. To supplement this

information with more recent information (to March 2021), payroll filings data

from Statistics New Zealand has also been analysed and presented later in this

report.

8 Jobs

in Dunedin increased by 7,091 over the seven years to March 2020, compared to

an employment expansion of just 2,288 jobs in the decade prior to the

implementation of the 2013-2023 EDS.

9 The

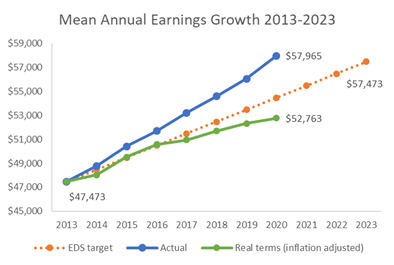

following chart highlights that in inflation adjusted terms, average wage

earnings growth is tracking just below what is needed to lift incomes by

$10,000 per person over the EDS 10-year period.

Employment and wage trends since

COVID-19

10 Dunedin’s

overall economy has remained resilient since the COVID-19 lockdown in March

2020.

11 Data

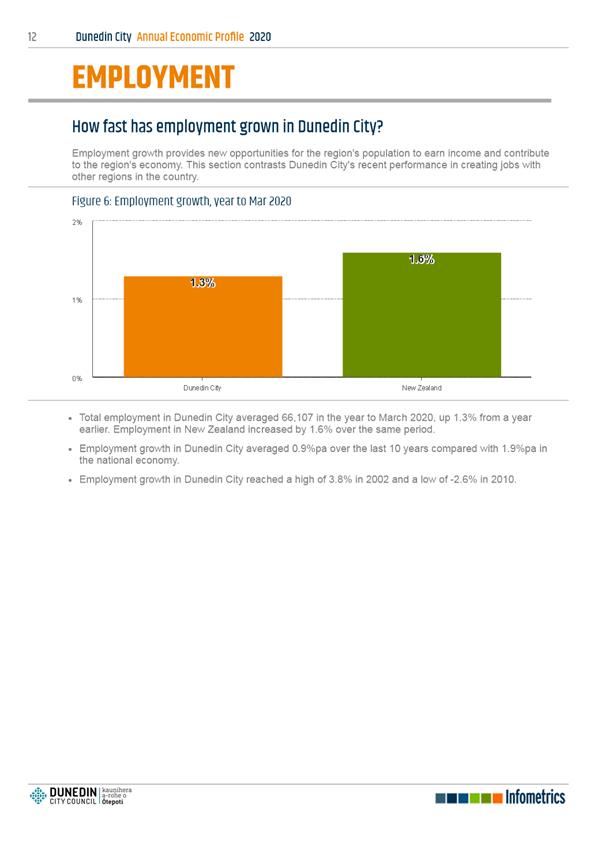

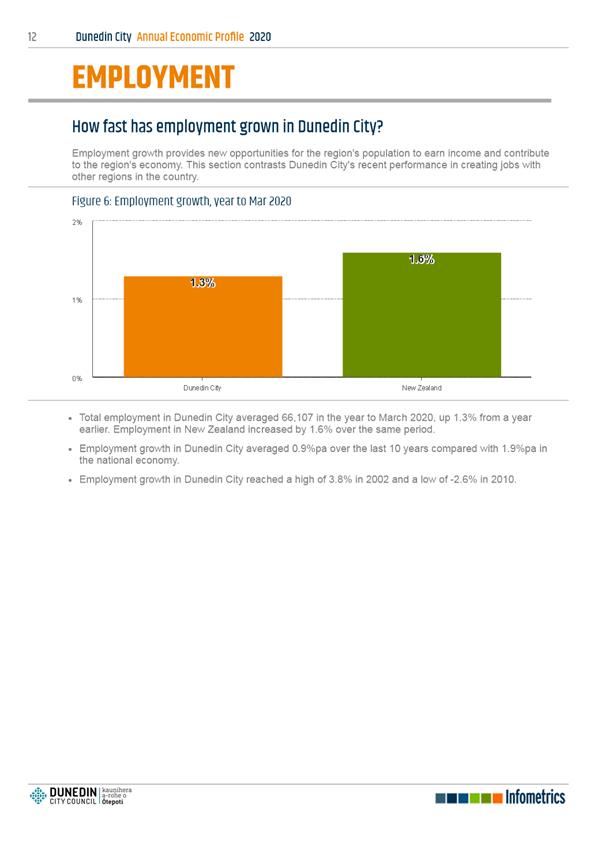

from Statistics New Zealand, based on payday payroll filings, shows that job

numbers in Dunedin during March 2021 were on par with a year ago (0.0% growth).

12 From

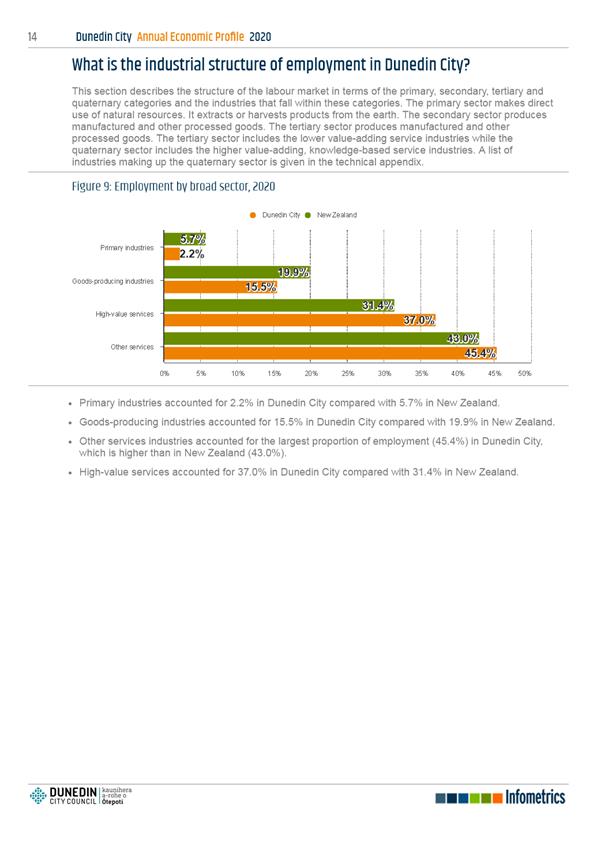

an industry perspective, job numbers are continuing to expand particularly

strongly within health, construction, and public administration, while there

have also been gains to finance and agriculture. These growth trends are

consistent with higher levels of public spending, population growth, and

increasing building consents data.

13 Growth

industries have offset declines within retail, transport and warehousing,

manufacturing, administrative support, rentals and hiring, media, hospitality,

and arts and recreational activities (which capture many visitor attractions).

14 The

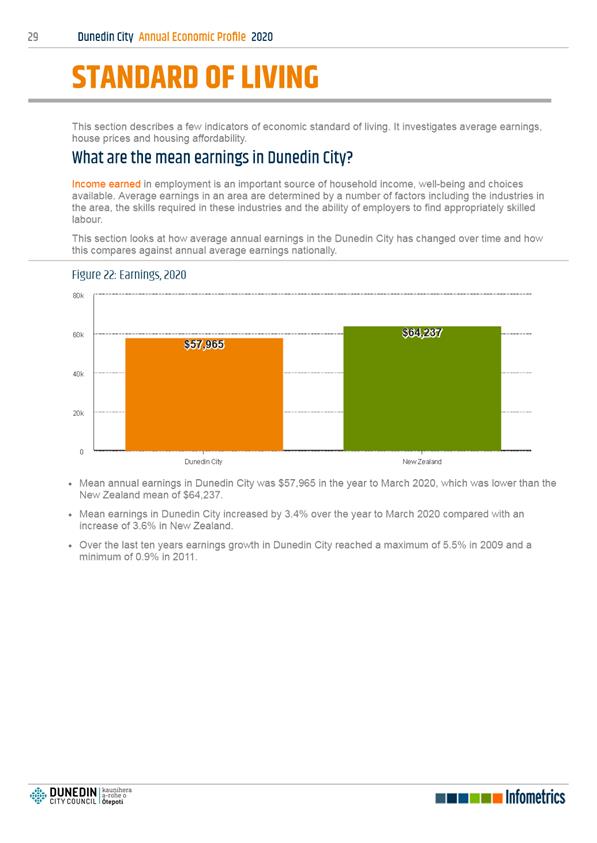

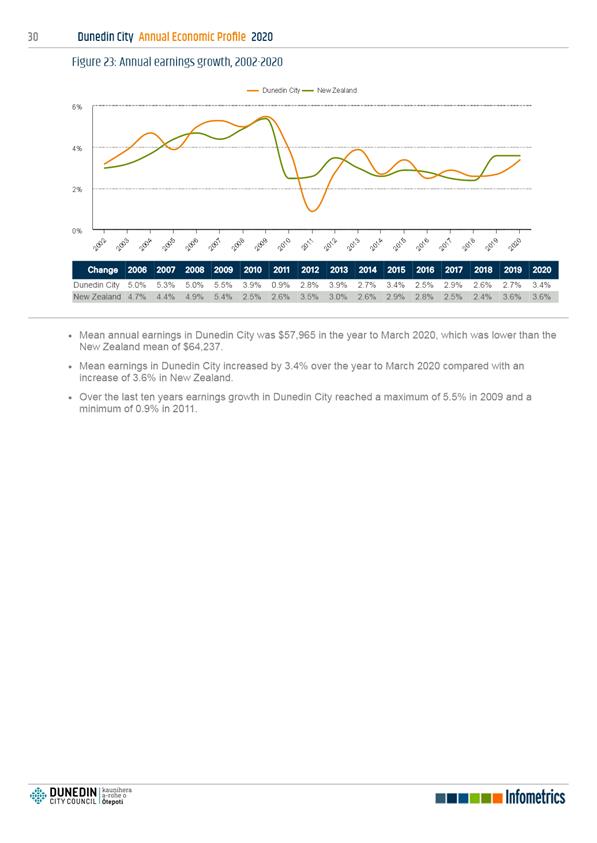

payroll data also gives insight as to what has happened to wages. The data

shows that wages across the March 2021 year averaged $59,239, compared to

average wages of $57,965 in the March 2020 year prior to the COVID-19 pandemic.

15 Despite

overall job numbers and earnings data holding, there were still vulnerable

groups who have missed out. Detailed demographic insight from MSD Jobseeker

Benefits data highlights that youth and Pasifika have been disproportionately

affected, as have women.

16 The

emergence of migration from New Zealand’s biggest cities into regional

centres including Dunedin, is also expected to continue.

OPTIONS

17 As

this is an update report, there are no options.

NEXT STEPS

18 Further

reports will be commissioned to monitor Dunedin’s Economic Growth and

progress against the EDS goals.

19 Enterprise

Dunedin has commissioned Infometrics to provide an early update of its economic

profile to March 2021 to take into consideration the impacts of COVID-19, and

this report will be received later in 2021.

Signatories

|

Author:

|

Benje Patterson - Business Analysis Contractor

Fraser Liggett - Economic Development Programme Manager

|

|

Authoriser:

|

John Christie - Manager Enterprise Dunedin

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Infometrics 2020 Annual

Economic Profile

|

48

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose of Local Government

This report shows the

economic well-being of communities in the present and for the future.

|

|

Fit with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development

Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport

Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation

Strategy

|

☐

|

☐

|

☒

|

|

Other strategic

projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is

responsible for the delivery of the 2013-2023 Economic Development Strategy.

|

|

Māori Impact Statement

There are no known impacts

for tangata whenua.

|

|

Sustainability

There are no known impacts

for sustainability.

|

|

LTP/Annual Plan / Financial Strategy /Infrastructure

Strategy

Enterprise Dunedin

activities and delivery on the 2013-2023 Economic Development Strategy are

included in the 2018-2018 Long Term Plan.

|

|

Financial considerations

There are no identified

financial considerations.

|

|

Significance

This report is considered

of low significance in terms of the Significance Engagement Policy.

|

|

Engagement – external

Infometrics Ltd were

engaged to provide the annual Regional Economic Profile Report.

|

|

Engagement – internal

No internal engagement has

been undertaken.

|

|

Risks: Legal / Health and Safety etc.

The are no known identified

risks.

|

|

Conflict of Interest

There are no known

conflicts of interest.

|

|

Community Boards

There are no known

implications for Community Boards.

|

|

|

Economic Development Committee

21 June 2021

|

|

|

Economic Development Committee

21 June 2021

|

Enterprise Dunedin Activity

Report - June 2021 Update

Department: Enterprise

Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee on

Enterprise Dunedin activities.

|

RECOMMENDATIONS

That the Committee:

a) Notes the Enterprise Dunedin

Activity Report – June 2021 Update.

|

DISCUSSION

2 Enterprise

Dunedin activity is informed by the 2013-2023 Economic Development

Strategy.

3 The

strategy sets out two economic goals:

a) 10,000

extra jobs over 10 years (requiring growth of approximately 2% per annum); and

b) An

average of 10,000 of extra income for each person (requiring GDP per capita to

rise 2.5% per annum).

Centre of Digital Excellence (CODE)

4 Work

has continued across several workstreams. The CODE Project Team and Working

Group has:

a) finalised

legal constitutional and shareholding arrangements with CODE partners;

b) progressed

negotiations with Kati Huirapa Rūnaka ki Puketeraki and negotiations with Te

Rūnanga o Ōtākou regarding shareholding;

c) commenced

the recruitment process for the DCC director and CODE Chair.

5 The

second round of CODE grants closed on 3 May 2021 with 28 expressions of

interest (EOI) for kickstart (development of prototypes), start-up (games and

smaller studios) and scale up (encouraging larger studios) funding. The

proposals are currently being developed into full request for proposals and

assessed.

6 This

builds on 56 EOIs received in the first round of funding, seven contracted

projects and creation of five new studios in Dunedin.

7 Dunedin

based Kiwi Paralympian Holly Robinson, was announced as a character in the

JPGAMES Pegasus Dream Tour on 17 May. This opportunity was the culmination of

work by Enterprise Dunedin, Ms Robinson and Mr Kawashima of JPGAMES as part of

a memorandum of understanding signed with CODE in late 2019.

8 The

Games for Health workstream continues to be developed. A workshop is planned

with the CODE Working Group at the end of June to determine the initial scope.

Considerations are likely to include the implications of the Health and

Disability Review, choices regarding primary, secondary and tertiary health and

alignment with the Ministry of Health’s Health Technology Framework.

Otago Regional Economic Development (ORED) and

Regional Strategic Partnership Fund

9 ORED

is a regional project partnership of economic development agencies across Otago

that has been endorse by the region’s Mayors.

10 The

ORED Working Group has engaged with the DCC’s Manahautū General

Manager Māori

Corporate Services Group, who has guided ORED in developing a pathway to

establish a partnership with Iwi.

11 A

key focus is the ongoing development of relationships and partnerships with

stakeholders and developing a set of draft priorities which can sit under the

ORED Framework. This will be an opportunity to develop a more widely shared

vision for the region’s economic development and to review and adapt the

Framework to reflect the current context.

12 This

work continues to align with the Provincial Development Unit (PDU) and recently

announced $200m Regional Strategic Partnership Fund announced by Stuart Nash,

Economic and Regional Development Minister on 27 May 2021.

Business Vitality

Business

Clinics

13 Enterprise

Dunedin supports people seeking information such as compliance, financial planning

and funding and refers people to relevant agencies and services.

14 32

people attended clinic sessions in the period between 1 July 2020 and 30 April

2021 on ideas including new food businesses, dog walking, tech services and

shared workshop spaces, with six requesting follow up sessions.

Alliances for Innovation

Film

15 Film

Dunedin provided support on a range of services including crew introductions,

business introductions, locations search, city services information, parking,

and access to land and buildings.

16 Support

was provided to the producers of ‘The Royal Treatment’ feature

film. The project contracted Dunedin crew, actors and service providers and

generated close to 4,500 bed nights in the period January to April 2021.

17 The

crews working on ‘The Royal Treatment’ film and the television

series ‘One Lane Bridge’ (Series 2) and ‘Under the

Vines’ filmed in Otago during the first quarter of 2021 were 50% local

hires. Film Dunedin is working with Film Otago Southland and Film Queenstown

Lakes to facilitate training for crew in areas where there are regional

shortages. This includes sound, grips, camera locations and production

accounting.

18 Film

Dunedin continues to receive inquiries for a range of feature films and

television projects considering Dunedin and Otago as their base. There are

currently nine major projects in the inquiries pipeline regionally through to

mid-2022.

19 In

the 11 months to May 2021, Film Dunedin:

a) responded

to 173 inquiries related to filming in the city, compared to 85 inquiries in

the same period in 2020; and

b) issued

44 film permits compared with 43 permits in the corresponding period in 2020.

A Hub for Skills and Talent

JobDUN - Business Internship programme

2020/2021

20 The objective of the JobDUN programme is to meet business needs,

create high value jobs, retain skills and talent and contribute to the economic

growth of Dunedin. The programme allocates funding for 50 intern placements on

an annual basis.

21 The 2020/2021 season attracted 24 businesses applying for 44

interns, with over half from the ICT/Tech and Creative sectors. Notwithstanding

the impact of COVID-19, this compares favourably with 28 businesses in the

2019/2020 season.

22 Enterprise Dunedin will analyse results with businesses and interns

in June 2021 to report on satisfaction levels and job creation results. Early

indications are that JobDUN has produced 20 roles, 11 of which are new roles

(nine FTE, six PTE, five Contract) in 2020/2021. The 2021/2022 season

will be launched in July 2021.

Start Up Ecosystem

23 The

following highlights were achieved by Start Up Dunedin Trust (SUDT) during the

period between January – March 2021:

a) 22

enquires from new founders (including incubation screening and support)

bringing the year to date total to 184;

b) delivery

of three cohorts of “Audacious” during the period (two in person

and one online) with 85 new ventures accepted into the programme;

c) events

included sessions with Cognito, Young Enterprise, Pacific Students support and

inclusive entrepreneurial support organisation Hui;

d) Five

applications were received for Distiller incubation, bringing the year to date

total to 19;

e) work

has continued with investors including Icehouse and Blackbird Ventures.

24 The

local premier of Outside the Valley was held on 6 June 2021 at the

Rialto Cinema. The film which documented start up activity outside Silicon

Valley included communities in Mexico, Uruguay, Portugal and New Zealand with a

particular focus on Dunedin as an entrepreneurial destination. The session was

attended by nearly 200 people and showcased Pōtiki

Poi, Cloud Cannon and Heidi Renata from Innov8HQ.

Linkages Across Borders

Project China

25 Project

China received a runner up award in the Best Project (Corporate or Commercial

Focused) category at the Sister Cities New Zealand’s Annual Conference on

15 April.

26 The

following activities were undertaken during the period:

a) supporting

the coordination of the New Zealand-China Non-Communicable Diseases Research

Collaboration Centre (NCD CRCC) forum in March 2021.

b) Zoom

were held conferences with:

· the Qingyuan Foreign Affairs Office to discuss current economic and

social conditions and develop a work plan for future cooperation in education,

trade and high-tech areas in April 2021;

· the Shanghai Foreign Affairs Office on proposed activities over the

next 12 months in May 2021.

c) preparation

continues the planned renewal of memorandums of understanding with Shanghai Yu

Garden, Shanghai Public Library and the Shanghai Science & Technology

Commission in the area of non-communicable disease research.

d) planning

has commenced on the development of an International Strategic Framework

(commencing with Project China) to further enable

economic, social opportunities and city strengths with sister cities and other

cities.

Compelling Destination

Destination Marketing

27 Dunedin’s

visitor sector continues to be affected by COVID-19 travel restrictions. Across

New Zealand there has been a distinct shift by domestic travellers away from

urban centres. The opening of both Trans-Tasman and Cook Islands will have

further impact on domestic visitation.

28 Enterprise

Dunedin’s marketing activity continues to adjust depending on COVID-19

alert levels and border restrictions. Planning and subsequent implementation is

underway for a refreshed domestic campaign focusing on school holidays and

events.

29 Investment

in marketing opportunities in Australia are well advanced both directly and in

conjunction with Tourism New Zealand.

Strategic

Tourism Assets Protection Programme (STAPP v1)

30 Destination

Management (DM) brings together difference stakeholders to achieve the common

goal of developing a well-managed and sustainable visitor destination. A

Destination Management Plan (DMP) is the outcome of this initiative and is

being funded by STAPP.

31 In

February 2021, Enterprise Dunedin commissioned Stafford Strategy to write a new

Destination Plan, in accordance with the Ministry of Business, Innovation and

Employment’s (MBIE) guidelines.

32 Stafford

Strategy are currently developing the new Destination Plan. To date face to

face engagement has included mana whenua, key stakeholders, partners, tourism

operators and Community Boards, with 35 written submissions received. A review

of the feedback including the workshop findings is underway.

33 During

COVID-19 a Central Government Industry taskforce launched an initial draft of

the future of tourism in Aotearoa. This proposed an enhance role for entities

such as ED in Destination Management. The taskforce recommended DMPs be

integrated into local planning processes and aligned with national visitor

planning frameworks. The Tourism Minister is now seeking to develop new

outcomes through a government partnership with tourism businesses, members of

the taskforce, iwi, researchers and independent advisors.

34 The

new outcomes will be delivered through a Tourism Industry Transformation Plan

(ITP). The IPT will build on recent work by the Parliamentary Commissioner for

the Environment, Tourism Future Taskforce and the Climate Change Commission to

transform tourism to a more sustainable model.

35 It

is anticipated that Dunedin’s new Destination Plan will be completed by

November 2021. This date may change if work currently undertaken on the ITP

signals changes that may affect the management of Dunedin as a

destination.

Strategic

Tourism Assets Protection Programme (STAPP v2)

36 In

May 2021 the Tourism Minister announced a $200m fund investment entitled

Tourism Communities. The package focuses on Support, Recovery and Re-set and

seeks to provide immediate funding support. Applications are open to

Regional Tourism Offices (RTOs) and close on 20 June 2021.

37 $26m

has been allocated to RTOs to manage, plan, promote, and market tourism

activities in their regions. Enterprise Dunedin expects to receive $1.0m

subject to agreement on planned activity.

38 Overall,

this investment will support RTOs to implement destination management and planning

and be used to encourage more people to explore their regions. The funding aims

to support the broader tourism sector, stimulate regional demand, increase

industry capability, and progress the goals of the New Zealand-Aotearoa

Government Tourism Strategy.

39 The

investment plans that RTOs will be required to develop sit across three streams

as per STAPP; Product Development and Capability, Destination Management and

Destination Marketing.

Visit Sector Initiatives and Engagement

40 Enterprise

Dunedin continues to invest in marketing the Central Otago Touring Route from

Dunedin to Queenstown. Work with other RTO partners in marketing the Southern

Scenic Route (SSR), reviewing current branding and positioning of the SSR.

Investment in these opportunities is likely to increase in line with Touring

Route initiatives with Tourism New Zealand (TNZ), particularly in the

Australian market.

41 Enterprise

Dunedin is coordinating the region’s MBIE’s Regional Events Fund.

The fund is for new or existing events, or capability building and is available

to June 2023. It is designed to replace lost international visitor spend and

boost regional domestic spend. The latest round distributed $110,000 to two

events. Two more rounds occur in 2021 and 2022.

Research and Data

42 The

new Accommodation Data Programme commenced in July 2020. Dunedin’s

occupancy rate for March 2021 was 56.4% (New Zealand’s was 41.3%).

Average nights stayed per guest remains consistent with February at 1.9 nights.

43 The

Ministry of Business, Employment and Innovation (MBIE) has replaced the Monthly

Regional Tourism Estimates (MRTE) to measure tourism spend at an RTO level,

with Tourism Electronic Card Transactions (TECTs). The

TECTs aims to present the measured electronic card transactions (ECT) attributable

to tourism but without any attempt to represent the total spend. The TECTs are

based almost exclusively on physical electronic card transactions, and do not

include any other form of spending such as cash, pre-purchases or online spend.

This results in the figures in the TECTs being substantially smaller than those

in the MRTEs so the two series should not be directly compared and limitations

of the TECT figures needs to be acknowledged.

44 A comparison of the

last three months visitor spend for Dunedin is shown

below:

|

TECT Spend

Month end

|

Domestic

2020

|

Domestic

2021

|

International

2020

|

International

2021

|

|

January

|

$28m

|

$28m

|

$11m

|

$2m

|

|

February

|

$34m

|

$31m

|

$10m

|

$3m

|

|

March

|

$28m

|

$33m

|

$6m

|

$3m

|

45 For

the year ending March 2021 domestic visitor spend in Dunedin fell 15% compared

to March 2020; the national average was down 17% for the period.

46 Social

and website engagement results for January to May 2021 are:

a) DunedinNZ.com

remains high with 33% increase in the number of website visitors and a 24%

increase in the number of pages per session compared to the previous reporting

period;

b) the DunedinNZ Instagram account had 815,481 impressions with 41,994

interactions and 43,600 followers (a user who follows your account and can see,

like and comment on any photo you post). The DunedinNZ Instagram account has an

engagement rate of 5% (quantitative measure of how users interact with the

content), which compared to other Regional Tourism Organisations (RTOs) is the

highest in New Zealand;

c) the DunedinNZ Facebook page has had 2,483,883 impressions with

followers totalling 91,190. The engagement rate totals 5.8% with 7,981 clicks

on post links.

47 The Destination Marketing research portfolio is complete for the

year, with work including microsegments, residents’ sentiment around

tourism, visitor perceptions and visitor expectations (with University of

Otago). These sit alongside new data sources and will continue to inform

Enterprise Dunedin’s marketing direction.

Business Events (Conferences)

48 Dunedin

Business Events has extended the contract for Tourism Marketing Solutions to

generate new conference leads and this is funded by MBIEs STAPP fund. Four

leads have been generated with Enterprise Dunedin submitting one bid for March

2022, which was unsuccessful.

49 Enquiries

for new business events has increased with 14 new leads to date compared to

nine in the same quarter of 2020.

50 Enterprise

Dunedin is fielding enquiries for International Conferences and is currently

working on two International Bids; one with the University of Otago and one

with the Otago Polytechnic Design School.

Consumer Marketing – New Zealand and

Australia

51 The

“Event-full Autumn” domestic campaign was launched in March. Events

have been identified by Tourism New Zealand as a key driver of domestic tourism

outside of the traditional school holiday periods. Marketing collateral has

featured in NZME Digital, NZ Geographic, Stuff Digital, Viva Magazine, TVNZ

OnDemand, NZME Travel Inserts and North & South. The aim is to encourage

external visitation to attend events and to stay longer and enjoy extra

activities.

52 In

partnership with Dunedin Airport and OUSA, Enterprise Dunedin facilitated a

‘Dunedin Takeover’ at the Auckland Craft Beer & Food Festival

in March. The aim was to create awareness of Dunedin as a visit destination and

showcase a major Dunedin event (Dunedin Craft Beer & Food Festival).

Overall, the event achieved the key objectives of raising awareness of Dunedin,

enhancing travel opportunities to Dunedin and working with other Dunedin

business partners.

53 Enterprise

Dunedin currently supports the Otago Nuggets with the Dunedin brand on court

signage and the team warmup strip. This brand placement seeks to drive

awareness of Dunedin as a destination to national and international audiences

through widespread television coverage. As part of the agreement players are

contracted to promote Dunedin through their social channels.

54 The

“Anything But” domestic winter campaign was launched in May. This

campaign is pitching Dunedin as a place to visit in winter and challenge the

negative perceptions of Dunedin head-on. The initial launch in May features a

mix of events aligned with key marketing pillars and will be featured across

multiple channels e.g. NZME Digital, Stuff Winter Insert, Southland Times,

Herald Winter Insert, Viva Gloss, Kia Ora Magazine, Fashion Quarterly, North

& South.

55 In

collaboration with University of Otago, Enterprise Dunedin attended Tertiary

Open Day to market the city for future students and parents. Prior to the

event, digital channels were used to push extending stay and to facilitate

visiting attractions beyond the tertiary precinct. Data Ventures reported

10,260 domestic visitors in the city on Sunday 23 May, well above the ongoing

monthly average of 6,300.

56 Enterprise

Dunedin continues to use ‘Plan D’ as the creative direction to

market Dunedin and launched a continuation of that campaign in Australia. The

campaign reflects the domestic success with Tourism Sentiment Index (TSI)

reporting “On a global average of 20,000 destinations analysed in the TSI

database. Dunedin finished in the top 30% of global TSI scores around the

world.

57 Enterprise

Dunedin is working closely with Tourism New Zealand on joint venture domestic

campaign activity. Dunedin received the highest engagement on social platforms

during February’s Urban Leisure Travel campaign. In April, TNZ launched

the “Active Recharge” campaign featuring two Dunedin operators.

PR and Promotions

58 Enterprise

Dunedin has secured 36 dedicated features or inclusions in regional, national

and international publications. Featured stories were a mix of travel,

lifestyle, business and city sector profiles including education and the

start-up ecosystem.

59 Enterprise

Dunedin’s broader activities and commentary from June 2020 to April 2021

have included 215 news articles nationally.

60 Coverage

published over this period included a variety of media channels including

Guardian Australia, National Geographic UK, Spinoff, the Young Adventuress,

Cuisine and major New Zealand media outlets Stuff and NZME.

Trade Marketing

61 Enterprise

Dunedin initiated the inaugural national domestic campaign with Flight Centre,

Travel Associates and Travel Manager. The campaign featured three tourism

operators and accommodation providers in Dunedin packages.

62 With

commencement of trans-Tasman travel, Enterprise Dunedin has been working

closely with TNZ to support the promotion of Dunedin to Australian Travel

Trade. The Australian Travel Trade have specifically requested regional

content, with TNZ filming in Dunedin as part of a regional series.

63 Enterprise

Dunedin attended TRENZ in April in Christchurch with 15 Dunedin operators. This

event had over 700 tourism attendees. Enterprise Dunedin and local operators participated

in the workshops which will shape the future Tourism Strategy for New Zealand.

i-SITE Visitor Centre

64 As

a result of COVID-19, the mix of visitors to the i-SITE Visitor Centre has

changed significantly. International travellers who were in the country

pre COVID-19 have been continuing with their working holidays as planned.

65 The

table below demonstrates the sales by domestic, international and cruise

visitors at the Visitor Centre, from 1 July 2020 to 30 April 2021 compared to

same period last year.

|

|

1 July 2019 – 30 April 2020

|

1 July 2020 – 30 April 2021

|

|

Domestic Travellers

|

24%

|

92%

|

|

International Travellers

|

47%

|

8%

|

|

Cruise Ship Travellers

|

28%

|

0%

|

|

Total

|

100%

|

100%

|

66 This

table demonstrates the split of domestic visitors to the Dunedin visitor centre

by region for 1 July 2020 to 30 April 2021 compared to the same period last

year.

|

|

1 July 2019 – 30 April 2020

|

1 July 2020 – 30 April 2021

|

|

Northland

|

1.6%

|

2.6%

|

|

Auckland

|

9.9%

|

16.4%

|

|

Waikato

|

1.4%

|

2.9%

|

|

Bay of Plenty

|

3.5%

|

5.5%

|

|

Gisborne

|

0.1%

|

0.3%

|

|

Hawkes Bay

|

0.6%

|

1.5%

|

|

Taranaki

|

0.4%

|

0.8%

|

|

Manawatu-Wanganui

|

1.2%

|

1.0%

|

|

Wellington

|

4.2%

|

7.3%

|

|

Marlborough

|

1.1%

|

1.3%

|

|

Canterbury

|

6.8%

|

5.3%

|

|

Dunedin

|

62.8%

|

51.5%

|

|

Otago

|

4.2%

|

2.2%

|

|

Southland

|

2.2%

|

1.4%

|

|

Total

|

100%

|

100%

|

NEXT STEPS

67 Enterprise

Dunedin activity will be incorporated into future reports.

Signatories

|

Author:

|

Malcolm Anderson - City Marketing Manager

Fraser Liggett - Economic Development

Programme Manager

|

|

Authoriser:

|

John Christie - Manager Enterprise

Dunedin

|

Attachments

There are no

attachments for this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit

with purpose of Local Government

This report promotes the economic

well-being of communities in the present and for the future.

|

|

Fit

with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

Enterprise Dunedin is responsible for the

delivery of the 2013-2023 Economic Development Strategy.

|

|

Māori

Impact Statement

The CODE Working Group is working with Te

Rūnanga

o Ōtākou and Kati Huirapa Rūnaka ki

Puketeraki regarding the development of Kaupapa CODE. Further engagement with

Rūnaka

is planned during the development of the OREDP.

Enterprise Dunedin continues to work with

Aukaha around the rewrite of the Destination Plan and the cultural audit

component of our marketing activity.

|

|

Sustainability

There are no known impacts for

sustainability.

|

|

LTP/Annual

Plan / Financial Strategy /Infrastructure Strategy

Enterprise Dunedin activities and the

2013-2023 Economic Development Strategy are included in the 2018-28 10-year

plan.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This decision is considered low

significance in terms of the Significance Engagement Policy.

|

|

Engagement

– external

External engagement has been held as

relevant across Enterprise Dunedin’s portfolio, including Te Rūnanga o Ōtākou and Kāti Huirapa Rūnaka ki

Puketeraki, Dunedin’s Tech sector, Education, Tourism, Film, Food,

Cruise and general business sectors. The has included consultation,

online workshops, meetings and surveys, newsletters and general updates via

Enterprise Dunedin’s CRM and face to face to meetings.

|

|

Engagement

– internal

As an update report, no internal

engagement has been undertaken.

|

|

Risks:

Legal / Health and Safety etc.

There are no identified risks.

|

|

Conflict

of Interest

There are no known conflicts of interest.

|

|

Community

Boards

Community Boards will be involved with

ongoing discussions around the new Dunedin Destination Plan.

|

|

|

Economic Development Committee

21 June 2021

|

Study Dunedin Update

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee (EDC) on

recent activity undertaken by Study Dunedin, a key initiative in the 2013-2023

Economic Development Strategy (the Strategy). Study Dunedin supports international

education in partnership with tertiary institutions, high schools, English

language centres and the Otago Chamber of Commerce.

2 Education

remains one of Dunedin’s key industries and economic drivers. Study

Dunedin has continued to advocate and support the sector during a period of

significant uncertainty arising from border restrictions in the international

education market.

|

RECOMMENDATIONS

That the Committee:

a) Notes the Study Dunedin update report.

|

BACKGROUND

3 Education

is a significant industry in the city. The latest reports produced by the

University of Otago and Otago Polytechnic indicate the tertiary sector

contributed over $1.5b to the Dunedin economy. In addition to economic benefits

the tertiary sector also enables a range of other outcomes including:

a) Influence

through nationwide campuses;

b) Research

outputs;

c) Relationships

with business and institutions nationally and internationally.

4 Dunedin’s

12 high schools produce high quality National Certificate of Educational

Achievement (NCEA) results each year and provide a wide range of quality

subject options.

5 International

education is a valuable part of the wider education ecosystem. As well as

providing economic value, international students provide social and cultural

benefits to the city. Until the impact of COVID-19 and border restrictions

international education:

a) Resulted

in 5,000 international students studying in Dunedin each year;

b) Contributed

approximately $200m in economic value to Dunedin;

c) Supported

over 2,200 jobs.

6 Study

Dunedin was formed in 2013 to attract and facilitate greater numbers of

international students to live and study in the city. Study Dunedin works

with the Study Dunedin Advisory Group (SDAG). This partnership includes the

University of Otago, Otago Polytechnic, Otago Chamber of Commerce, and Dunedin

high schools who enable activities including:

a) Destination

marketing to promote Dunedin as a destination to study and live;

b) A

positive student experience ensuring students feel valued and that their time

in Dunedin is safe, inclusive and they are recognised as part of the community;

c) Capacity

and capability building including data gathering to ensure sound

decision-making and provision of training and development to the sector;

d) Education

and workforce pathway building. Activities are focussed on transitions

between education sectors and developing programmes to support students into

employment in Dunedin, and New Zealand, particularly in areas where skill

shortages exist.

DISCUSSION

Sector Update

7 New

Zealand’s borders continue to be closed to almost all international

students. Current predictions indicate that up to 90% of international

students will have departed New Zealand by the end of 2021, leaving

approximately 16,000 studying onshore.

8 Starting

this year, Government has allowed 1,250 tertiary undergraduate and

post-graduate students entry into New Zealand under strict exemption conditions

and through managed isolation. Currently under half of those places have

been activated, and so arrangements have been made for 400 places to be

available for Chinese undergraduate students to fly in June from Shanghai to

Auckland to begin second semester studies at all eight universities.

9 The

Ministry of Education has been working on a Strategic Recovery Plan for

International Education with peak bodies, industry groups and stakeholders.

Together the regions have been collaborating with the Ministry of

Education/Education New Zealand (ENZ) to ensure a regional perspective is

included in the process and the final plan.

Supporting the

Dunedin international education market

10 Study

Dunedin has continued to support tertiaries and high schools over the last 12

months. Key work streams have focussed on student well-being, advocacy and

supporting institutions as uncertainty remains. Activities to support student

well-being have included:

a) An

End of Year Celebration in December 2020 at Logan Park which was attended by

the Deputy Mayor. This was an opportunity for all international students across

the sector to come together over food and activities;

b) An

Amazing Race event run in partnership with Sport Otago for high school students

in March 2021. The objective was to welcome international students back

for the academic year;

c) An

I-Hub café run on a monthly basis where students can spend time

together, doing activities and events that they have chosen. The first

event was undertaken on Thursday 20 May 2021 at the Dunedin Public Library.

11 Study

Dunedin has continued to support institutions and partners (particularly

education agents) through:

a) Quarterly

gatherings where high schools, English language schools, the University and

Polytechnic can come together to share information and support;

b) Attending

monthly meetings with International Directors from Dunedin high schools to

share information and provide support;

c) Planning

and implementing an Auckland Education Agent Famil programme in March

2021. This was a follow-on from the Auckland Agent Event Study Dunedin in

November 2020. Nine international education agents spent three days

visiting high schools and tertiary institutions.

A survey was completed by 75% of participants with 100%

agreeing their experience was what they expected. Agents were also asked how they

would describe Dunedin to students and parents. A sample response noted:

“Otago is one of the top recommendations I

make to students and their parents for high school and tertiary study. I was

extremely impressed with the high schools and the academic results they get

from their students - they far exceed that of Auckland schools in particular.

The pastoral care they are giving their students also exceeds expectations.

This wrap around support is also evident in both Otago Poly and Uni and the

close proximity to the city and student accommodation is very appealing.”

d) Collaborating

with the University of Otago International Office to support their Tertiary

Open Day programme. Study Dunedin supplied a ‘Welcome to

Dunedin’ gift bag to 28 international students flown to the city for the

day by the International Office.

12 Study

Dunedin is working with Education NZ to secure funding for a future focussed

project aligned to work already underway in the city. The project (focussed on

transitions and social licence/student stories) would span the next three

financial years with the first year testing the hypothesis and a proof of

concept. Study Dunedin should learn the outcome of the application later

in June.

OPTIONS

As this is an update report, there are no options.

NEXT STEPS

13 Study

Dunedin will report on ongoing activities and the outcome of the ENZ funding

application as part of the EDC forward work programme.

Signatories

|

Author:

|

Margo Reid - Study Dunedin Co-ordinator

Dougal McGowan - Economic Development Project Manager

|

|

Authoriser:

|

Fraser Liggett - Economic Development Programme Manager

John Christie - Manager Enterprise Dunedin

|

Attachments

There are no attachments for

this report.

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This report promotes the economic

well-being of communities in the present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☐

|

☐

|

☒

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☒

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☐

|

☐

|

☒

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☒

|

|

|

Māori Impact

Statement

There are no known

impacts for tangata whenua.

|

|

Sustainability

There are no known impacts for sustainability.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

Study Dunedin activities and the 2013-2023 Economic

Development Strategy framework are included in the 2018-28 Long Term Plan.

|

|

Financial

considerations

There are no financial considerations.

|

|

Significance

This decision is considered low significance under the

Significance Engagement Policy.

|

|

Engagement –

external

As an update report, no external engagement has been

undertaken.

|

|

Engagement -

internal

As an update report, no internal engagement has been

undertaken.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

There are no known implications for Community Boards.

|

|

|

Economic Development Committee

21 June 2021

|

Strategic Tourism Assets Protection Programme

June 2021 Update

Department: Enterprise Dunedin

EXECUTIVE SUMMARY

1 The

purpose of this report is to update the Economic Development Committee on the

implementation of the Government funded Strategic Tourism Assets Protection

Programme (STAPP).

2 The

aim of STAPP is to support tourism businesses and Regional Tourism

Organisations dealing with the economic impact of COVID-19.

3 Enterprise

Dunedin received $700k to implement 15 STAPP projects between November 2020 and

March 2022.

|

RECOMMENDATIONS

That the Committee:

a) Notes the Strategic Tourism Assets Protection Programme

update report.

|

BACKGROUND

4 In

August 2020 Government allocated $20.2 million to the 31 Regional Tourism

Organisations (RTOs) across New Zealand.

5 The

investment supports RTOs to implement destination marketing initiatives that

encourage more people to explore their regions. The funding also allows

RTO’s to support the broader tourism industry, stimulate regional demand,

increase industry capability and progress the goals of the New Zealand-Aotearoa

Government Tourism Strategy.

6 Enterprise

Dunedin (ED) has received $700k to implement 15 individual projects between

November 2020 and March 2022.

DISCUSSION

7 A

brief overview of the status of the fifteen STAPP projects underway with

contractors and ED staff is summarised below.

Rewrite of the Dunedin

Destination Plan

8 The

first round of face to face consultation on the new Dunedin Destination Plan by

Stafford Strategy has been completed and online submissions are now closed.

9 The

next step is for the consultants to deliver a draft which will outline issues

and opportunities for managing and marketing Dunedin as a destination.