|

RECOMMENDATIONS

That the Council:

a) Sets the following rates under the Local Government (Rating)

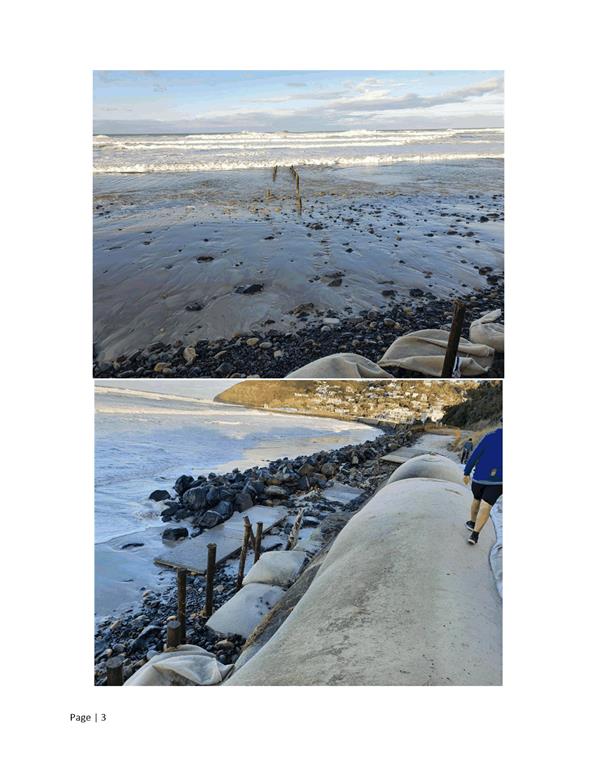

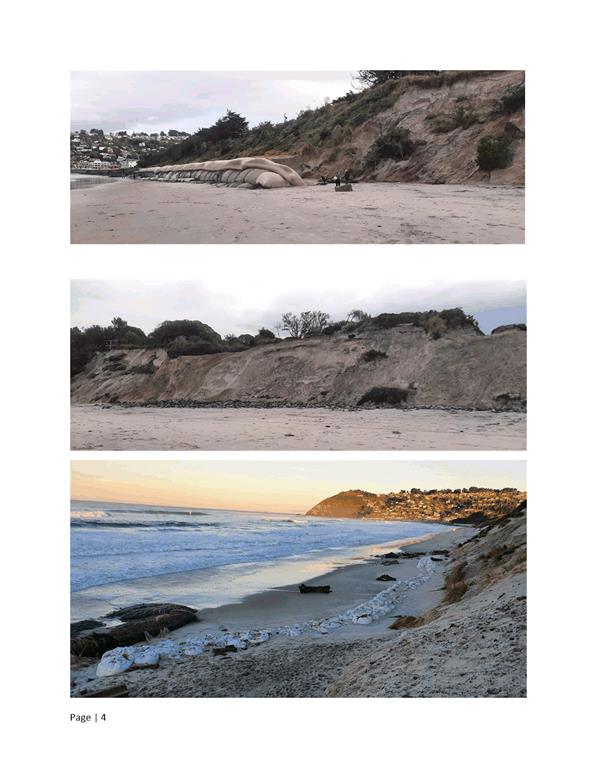

Act 2002 on rating units in the district for the financial year commencing 1

July 2022 and ending on 30 June 2023.

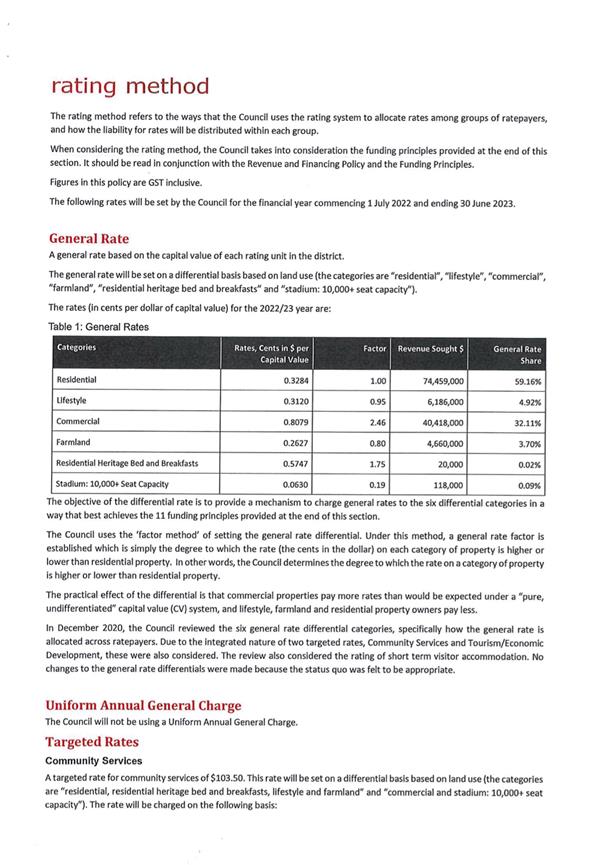

1 General

Rate

A general rate set under section 13 of the Local

Government (Rating) Act 2002 made on every rating unit, assessed on a

differential basis as described below:

· A

rate of 0.3284 cents in the dollar (including GST) of capital value on every

rating unit in the "residential" category.

· A

rate of 0.3120 cents in the dollar (including GST) of capital value on every

rating unit in the "lifestyle" category.

· A

rate of 0.8079 cents in the dollar (including GST) of capital value on every

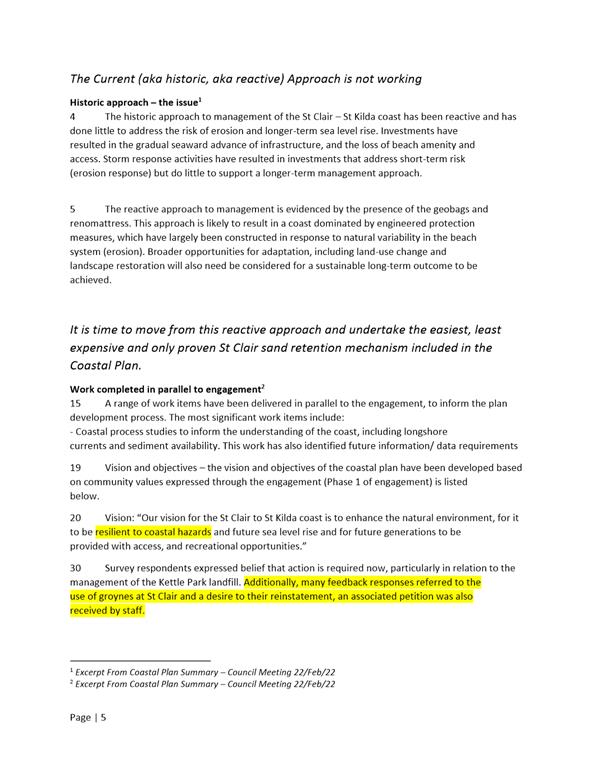

rating unit in the "commercial" category.

· A

rate of 0.5747 cents in the dollar (including GST) of capital value on every

rating unit in the "residential heritage bed and breakfasts"

category.

· A

rate of 0.2627 cents in the dollar (including GST) of capital value on every

rating unit in the "farmland" category.

· A

rate of 0.0630 cents in the dollar (including GST) of capital value on the

“stadium: 10,000+ seat capacity” category.

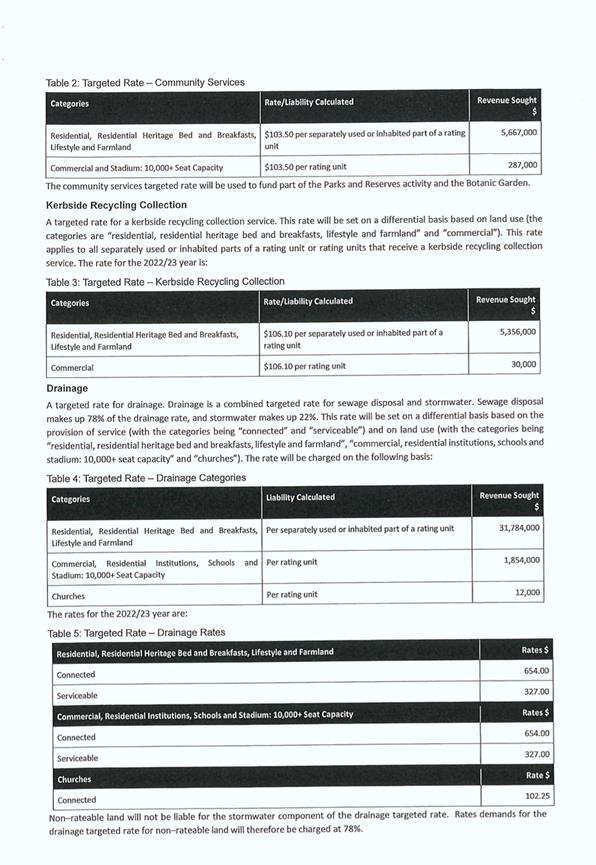

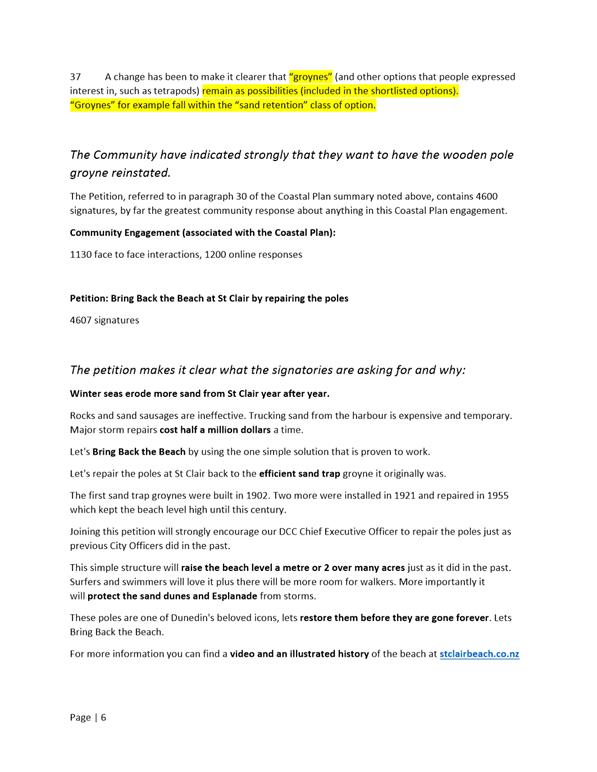

2 Community

Services Rate

A targeted rate for community services, set under section

16 of the Local Government (Rating) Act 2002, assessed on a differential

basis as follows:

· $103.50

(including GST) per separately used or inhabited part of a rating unit for

all rating units in the "residential, residential heritage bed and

breakfasts, lifestyle and farmland" categories.

· $103.50

(including GST) per rating unit for all rating units in the "commercial

and stadium: 10,000+ seat capacity" categories.

3 Kerbside

Recycling Rate

A targeted rate for kerbside recycling, set under section

16 of the Local Government (Rating) Act 2002, assessed on a differential

basis as follows:

· $106.10

(including GST) per separately used or inhabited part of a rating unit for

rating units in the "residential, residential heritage bed and

breakfasts, lifestyle and farmland" categories.

· $106.10

(including GST) per rating unit for rating units in the

"commercial" category.

4 Drainage

Rates

A targeted rate for drainage, set under section 16 of the

Local Government (Rating) Act 2002, assessed on a differential basis as

follows:

· $654.00

(including GST) per separately used or inhabited part of a rating unit for

all rating units in the "residential, residential heritage bed and

breakfasts, lifestyle and farmland" categories and which are

"connected" to the public sewerage system.

· $327.00

(including GST) per separately used or inhabited part of a rating unit for

all rating units in the "residential, residential heritage bed and

breakfasts, lifestyle and farmland" categories and which are

"serviceable" by the public sewerage system.

· $654.00

(including GST) per rating unit for all rating units in the "commercial,

residential institutions, schools and stadium: 10,000+ seat capacity"

categories and which are "connected" to the public sewerage system.

· $327.00

(including GST) per rating unit for all rating units in the "commercial,

residential institutions and schools" categories and which are

"serviceable" by the public sewerage system.

· $102.25

(including GST) per rating unit for all rating units in the

"church" category and which are "connected" to the public

sewerage system.

Rating units which are not "connected" to the

scheme and which are not "serviceable" will not be liable for this

rate. Drainage is a combined targeted rate for sewage disposal and

stormwater. Sewage disposal makes up 78% of the drainage rate, and

stormwater makes up 22%. Non-rateable land will not be liable for the

stormwater component of the drainage targeted rate. Rates demands for

the drainage targeted rate for non-rateable land will therefore be charged at

78%.

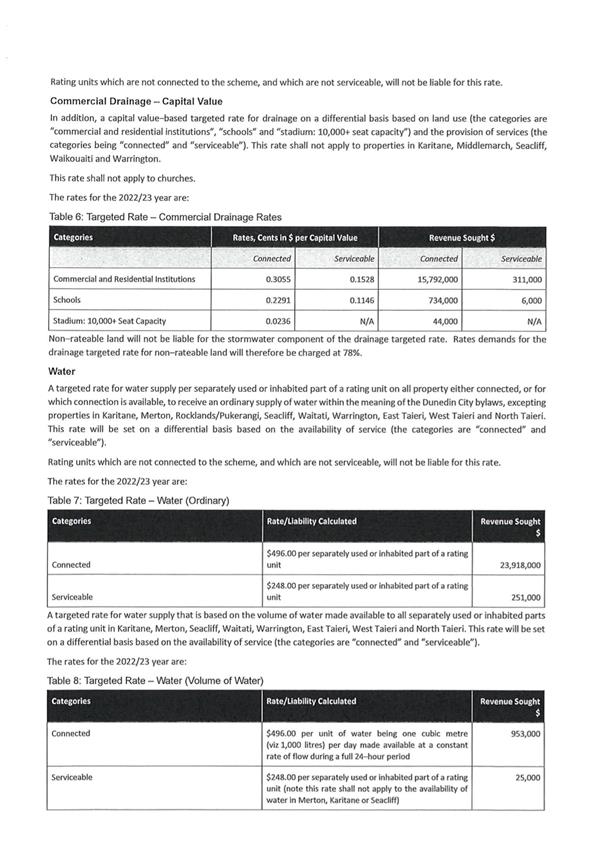

5 Commercial

Drainage Rates – Capital Value

A targeted rate for drainage, set under section 16 of the

Local Government (Rating) Act 2002, assessed on a differential basis as

follows:

· A

rate of 0.3055 cents in the dollar (including GST) of capital value on every

rating unit in the "commercial and residential institution"

category and which are "connected" to the public sewerage system.

· A

rate of 0.1528 cents in the dollar (including GST) of capital value on every

rating unit in the "commercial" category and which are

"serviceable" by the public sewerage system.

· A

rate of 0.2291 cents in the dollar (including GST) of capital value on every

rating unit in the "school" category and which are

"connected" to the public sewerage system.

· A

rate of 0.1146 cents in the dollar (including GST) of capital value on every

rating unit in the "school" category and which are

"serviceable" by the public sewerage system.

· A

rate of 0.0236 cents in the dollar (including GST) of capital value on the

“stadium: 10,000+ seat capacity” category.

This rate shall not apply to properties in Karitane,

Middlemarch, Seacliff, Waikouaiti and Warrington. This rate shall not

apply to churches. Drainage is a combined targeted rate for sewage

disposal and stormwater. Sewage disposal makes up 78% of the drainage

rate, and stormwater makes up 22%. Non-rateable land will not be liable

for the stormwater component of the drainage targeted rate. Rates

demands for the drainage targeted rate for non-rateable land will therefore

be charged at 78%.

6 Water

Rates

A targeted rate for water supply, set under section 16 of

the Local Government (Rating) Act 2002, assessed on a differential basis as

follows:

· $496.00

(including GST) per separately used or inhabited part of any

"connected" rating unit which receives an ordinary supply of water

within the meaning of the Dunedin City Bylaws excepting properties in

Karitane, Merton, Rocklands/Pukerangi, Seacliff, Waitati, Warrington, East

Taieri, West Taieri and North Taieri.

· $248.00

(including GST) per separately used or inhabited part of any

"serviceable" rating unit to which connection is available to

receive an ordinary supply of water within the meaning of the Dunedin City

Bylaws excepting properties in Karitane, Merton, Rocklands/Pukerangi,

Seacliff, Waitati, Warrington, East Taieri, West Taieri and North Taieri.

· $496.00

(including GST) per unit of water being one cubic metre (viz.

1,000 litres) per day supplied at a constant rate of flow during a full

24 hour period to any "connected" rating unit situated in

Karitane, Merton, Seacliff, Waitati, Warrington, West Taieri, East Taieri or

North Taieri.

· $248.00

(including GST) per separately used or inhabited part of any

"serviceable" rating unit situated in Waitati, Warrington, West

Taieri, East Taieri or North Taieri. This rate shall not apply to the

availability of water in Merton, Karitane or Seacliff.

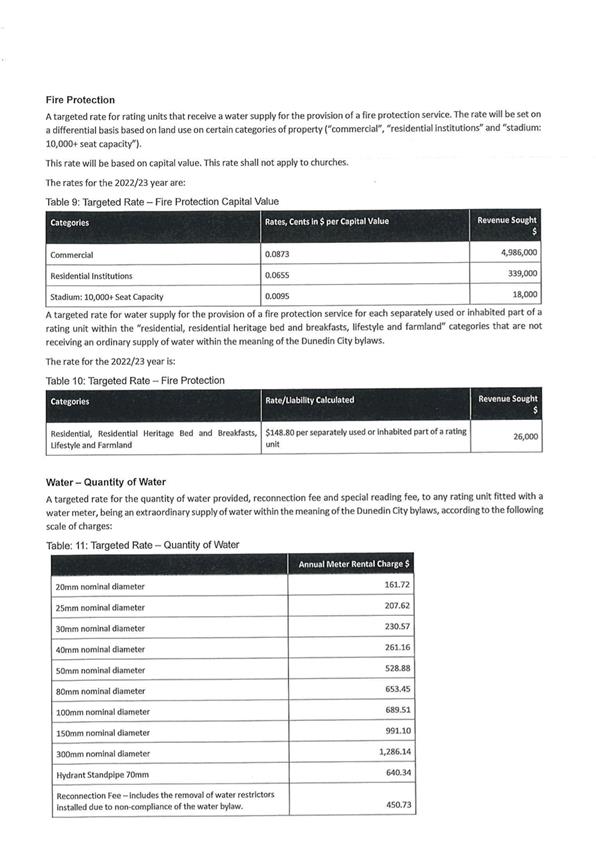

7 Fire

Protection Rates

A targeted rate for the provision of a fire protection

service, set under section 16 of the Local Government (Rating) Act 2002,

assessed on a differential basis as follows:

· A

rate of 0.0873 cents in the dollar (including GST) of capital value on all

rating units in the "commercial" category. This rate shall

not apply to churches.

· A

rate of 0.0655 cents in the dollar (including GST) of capital value on all

rating units in the "residential institutions" category.

· A

rate of 0.0095 cents in the dollar (including GST) of capital value on the

“stadium: 10,000+ seat capacity” category.

· $148.80

(including GST) for each separately used or inhabited part of a rating unit

within the "residential, residential heritage bed and breakfasts,

lifestyle and farmland" category that is not receiving an ordinary

supply of water within the meaning of the Dunedin City Bylaws.

8 Water

Rates – Quantity of Water

A targeted rate for the quantity of water provided to any

rating unit fitted with a water meter, being an extraordinary supply of water

within the meaning of the Dunedin City Bylaws, set under section 19 of the

Local Government (Rating) Act 2002, according to the following scale of

charges (GST inclusive):

|

|

Annual Meter Rental

Charge

|

|

20mm nominal diameter

|

$161.72

|

|

25mm nominal diameter

|

$207.62

|

|

30mm nominal diameter

|

$230.57

|

|

40mm nominal diameter

|

$261.16

|

|

50mm nominal diameter

|

$528.88

|

|

80mm nominal diameter

|

$653.45

|

|

100mm nominal diameter

|

$689.51

|

|

150mm nominal diameter

|

$991.10

|

|

300mm nominal diameter

|

$1,286.14

|

|

70mm Hydrant Standpipe

|

$640.34

|

|

Reconnection Fee – includes the removal of

water restrictors installed due to non-compliance of the water bylaw

|

$450.73

|

|

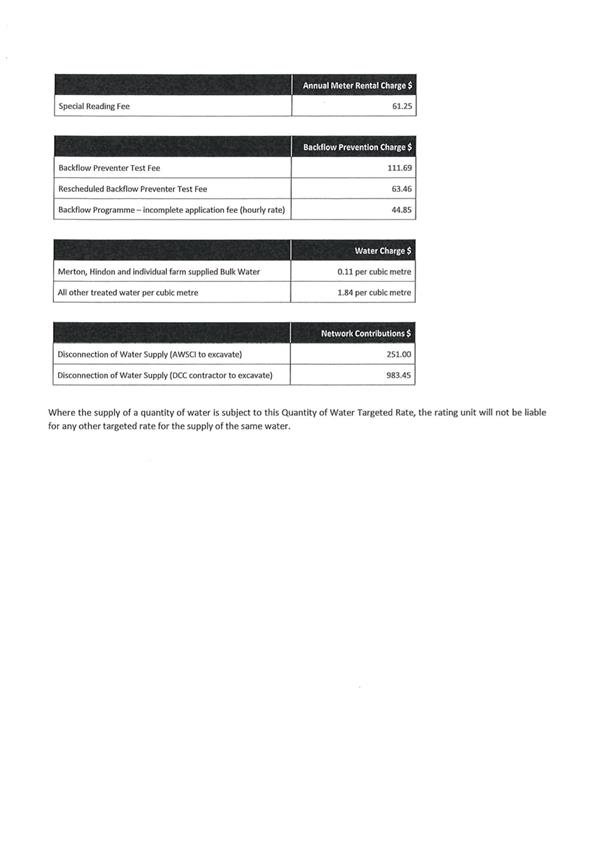

Special Reading Fee

|

$61.25

|

|

|

Backflow Prevention Charge

|

|

Backflow Preventer

Test Fee

|

$111.69

|

|

Rescheduled Backflow

Preventer Test Fee

|

$63.46

|

|

Backflow Programme - incomplete application fee

(hourly rate)

|

$44.85

|

|

|

Water Charge

|

|

Merton, Hindon and individual farm supplied Bulk

Raw Water Tariff

|

$0.11 per cubic metre

|

|

All other treated water per cubic metre

|

$1.84 per cubic metre

|

|

|

Network Contributions

|

|

Disconnection of Water Supply – AWSCI to

excavate

|

$251.00

|

|

Disconnection of Water Supply – DCC

contractor to excavate

|

$983.45

|

Where the supply of a quantity of water is subject

to this Quantity of Water Targeted Rate, the rating unit will not be liable

for any other targeted rate for the supply of the same water.

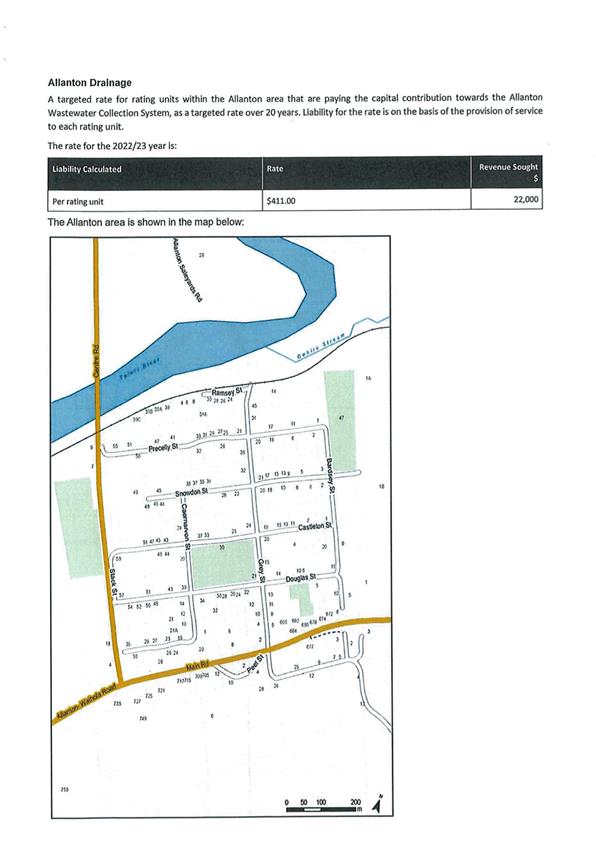

9 Allanton

Drainage Rate

A targeted rate for the capital contribution towards the

Allanton Wastewater Collection System, set under section 16 of the Local

Government (Rating) Act 2002, of $411.00 (including GST) per rating unit, to

every rating unit paying their contribution towards the scheme as a targeted

rate over 20 years. Liability for the rate is on the basis of the

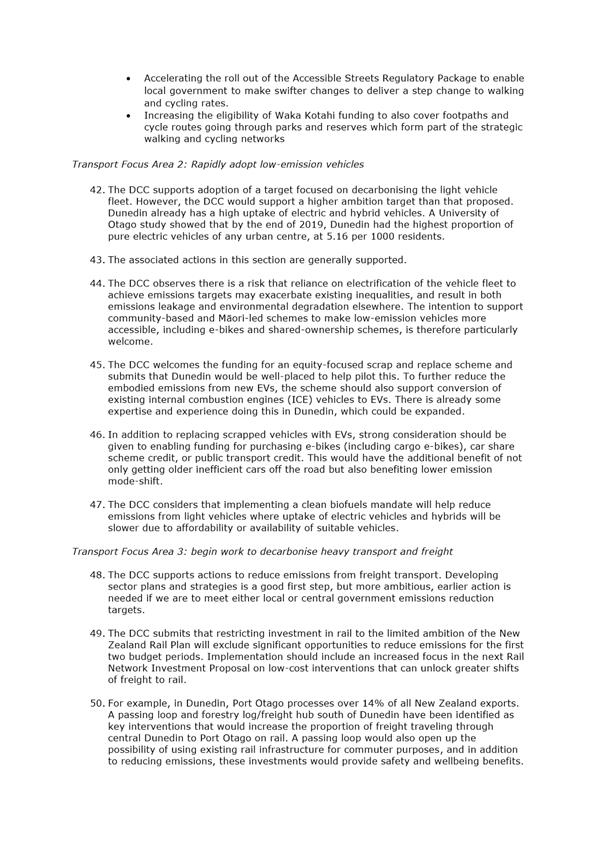

provision of the service to each rating unit. The Allanton area is

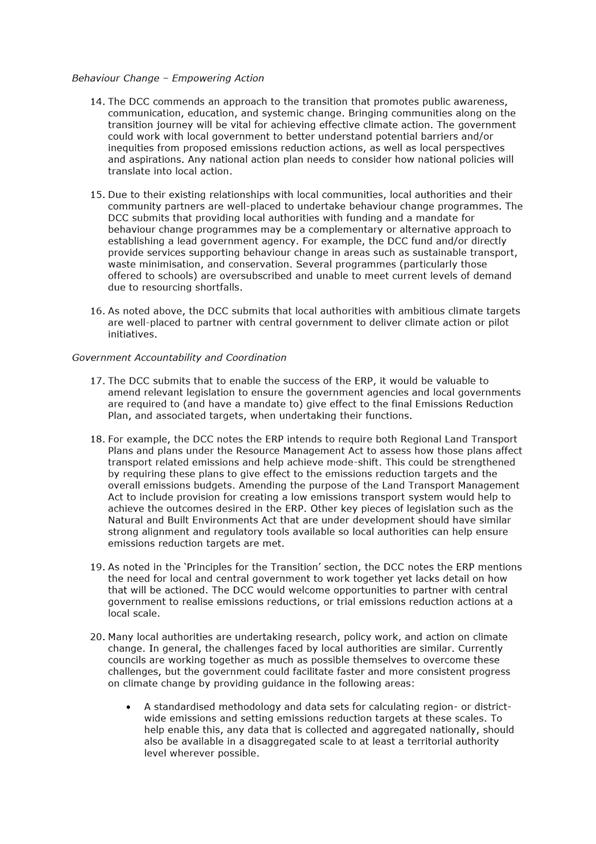

shown in the map below:

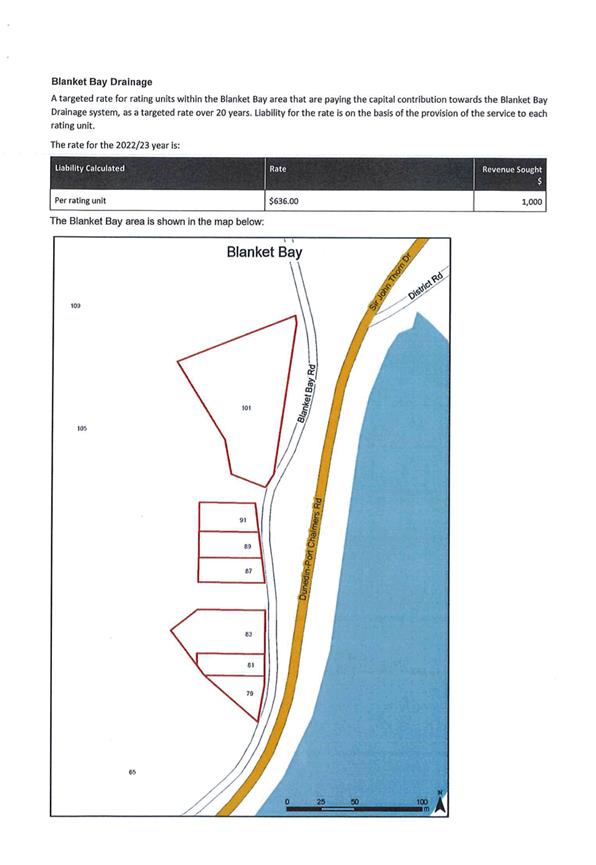

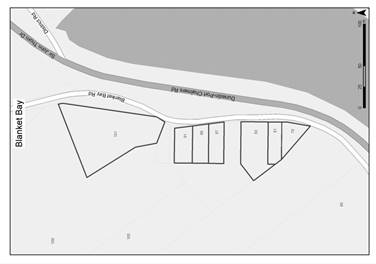

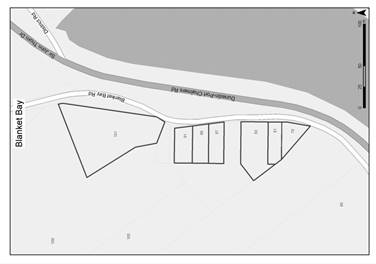

10 Blanket

Bay Drainage Rate

A targeted rate for the capital contribution towards the

Blanket Bay Drainage System, set under section 16 of the Local Government

(Rating) Act 2002, of $636.00 (including GST) per rating unit, to every

rating unit paying their contribution towards the scheme as a targeted rate

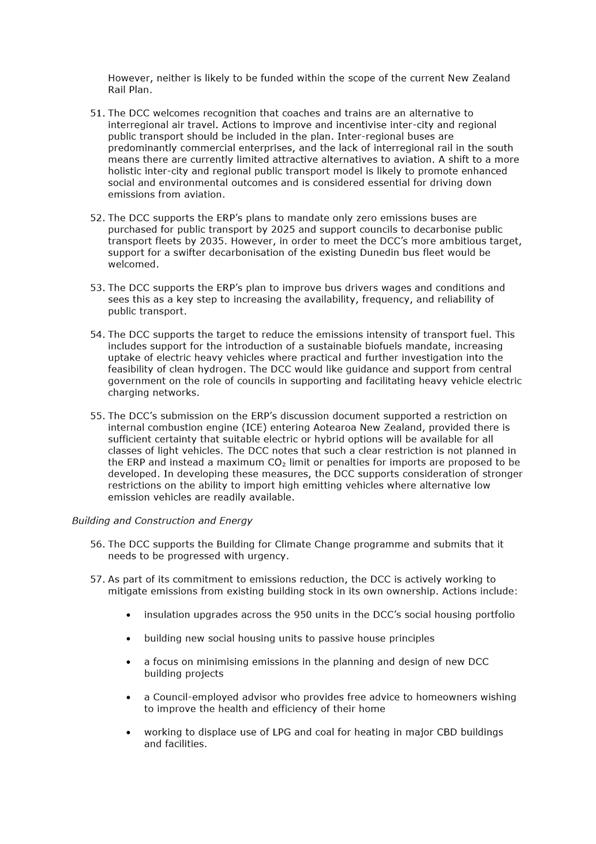

over 20 years. Liability for the rate is on the basis of the

provision of the service to each rating unit. The Blanket Bay area is

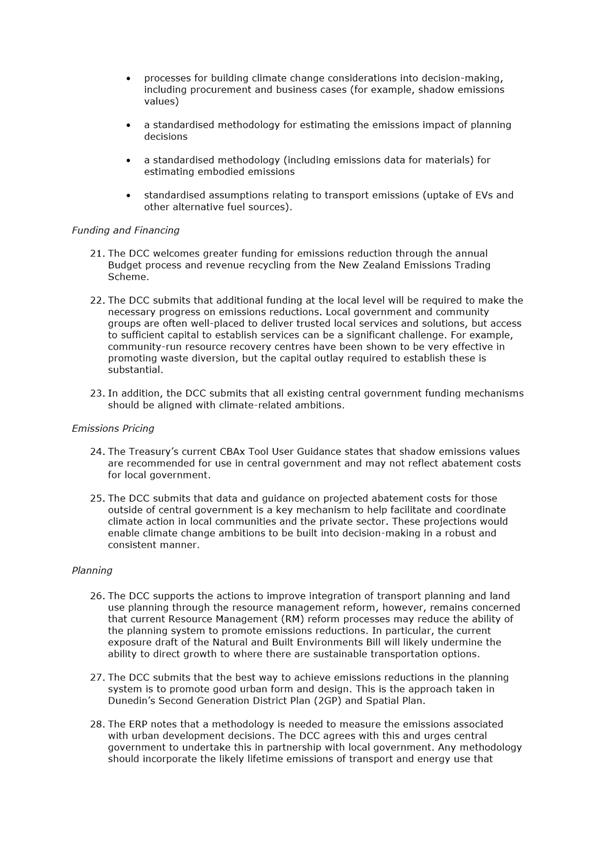

shown in the map below:

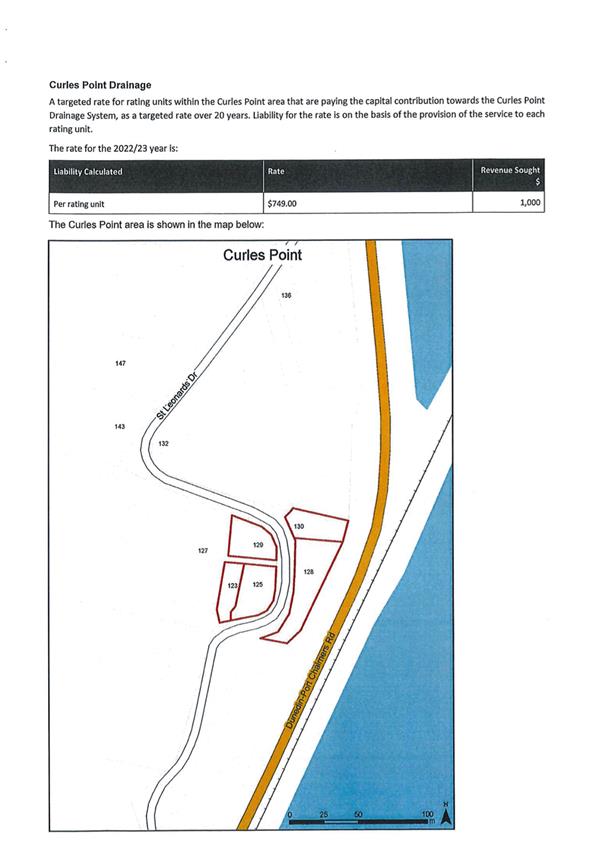

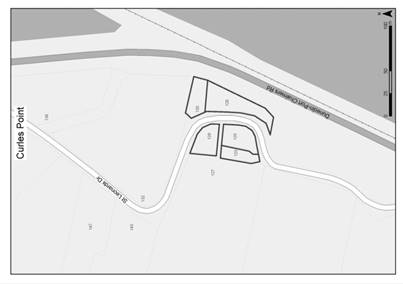

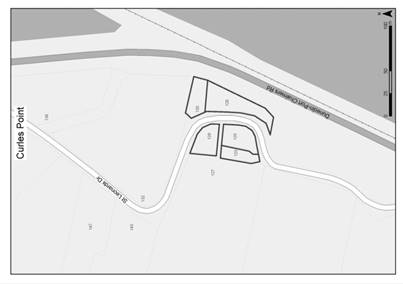

11 Curles

Point Drainage Rate

A targeted rate for the capital contribution towards the

Curles Point Drainage System, set under section 16 of the Local Government

(Rating) Act 2002, of $749.00 (including GST) per rating unit, to every

rating unit paying their contribution towards the scheme as a targeted rate

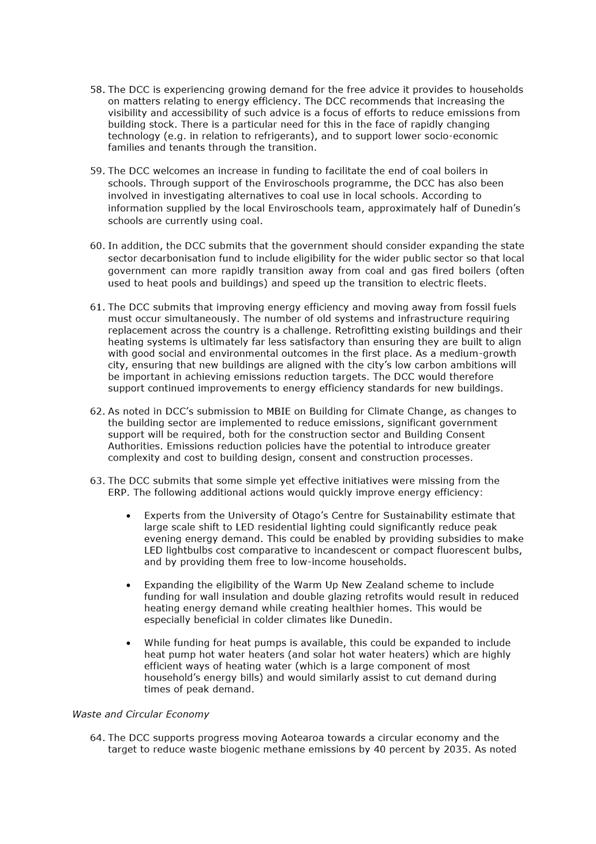

over 20 years. Liability for the rate is on the basis of the

provision of the service to each rating unit. The Curles Point area is

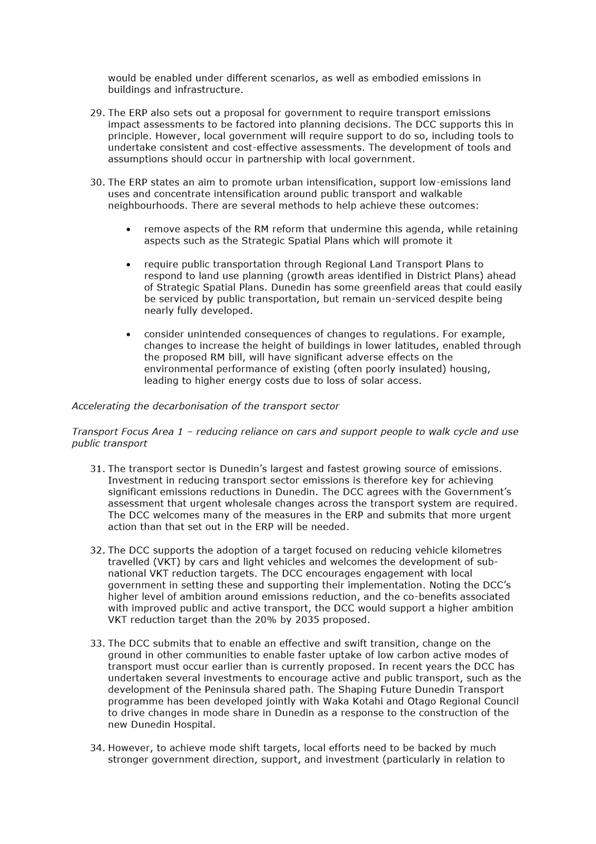

shown in the map below:

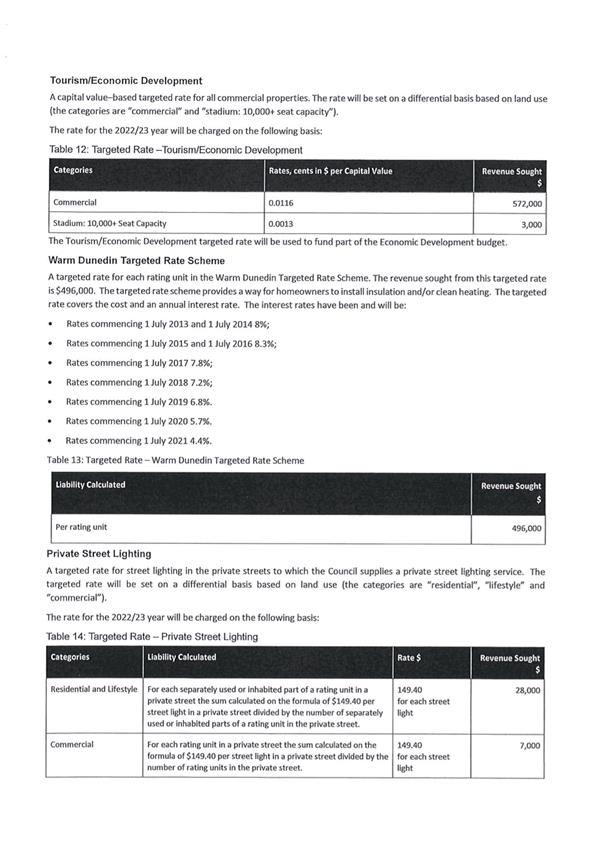

12 Tourism/Economic

Development Rate

A targeted rate for Tourism/Economic Development, set

under section 16 of the Local Government (Rating) Act 2002, assessed on

a differential basis as follows:

· 0.0116

cents in the dollar (including GST) of capital value on every rating unit in

the "commercial" category.

· 0.0013

cents in the dollar (including GST) of capital value on the “stadium:

10,000+ seat capacity” category.

13 Warm

Dunedin Targeted Rate Scheme

A targeted rate for the Warm Dunedin Targeted Rate

Scheme, set under section 16 of the Local Government (Rating) Act 2002, per

rating unit in the Warm Dunedin Targeted Rate Scheme.

The targeted rate scheme provides a way for homeowners to

install insulation and/or clean heating. The targeted rate covers the

cost and an annual interest rate. The interest rates have been and will

be:

Rates commencing 1 July 2013

and 1 July 2014 8%

Rates commencing 1 July 2015

and 1 July 2016 8.3%

Rates commencing 1 July 2017

7.8%

Rates commencing 1 July 2018

7.2%

Rates commencing 1 July 2019

6.8%

Rates commencing 1 July 2020

5.7%

Rates commencing 1 July 2021

4.4%

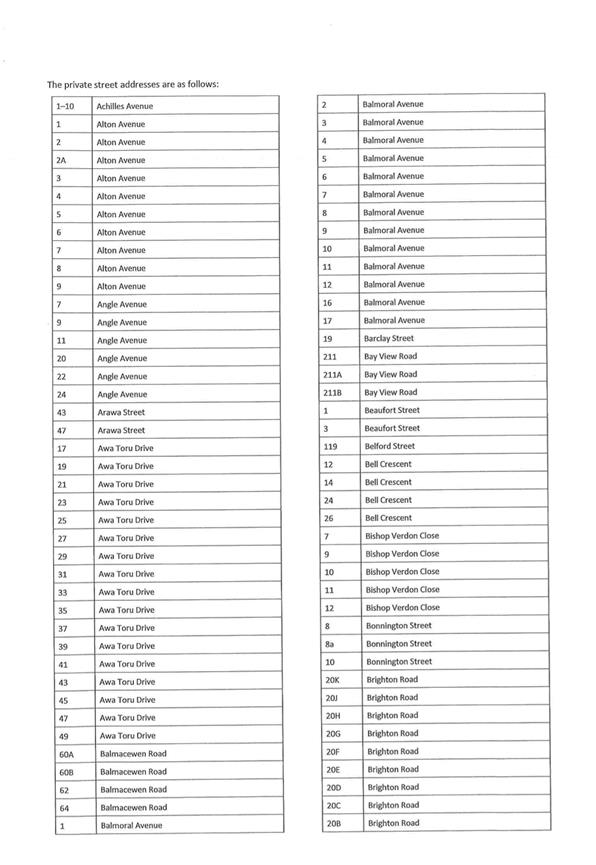

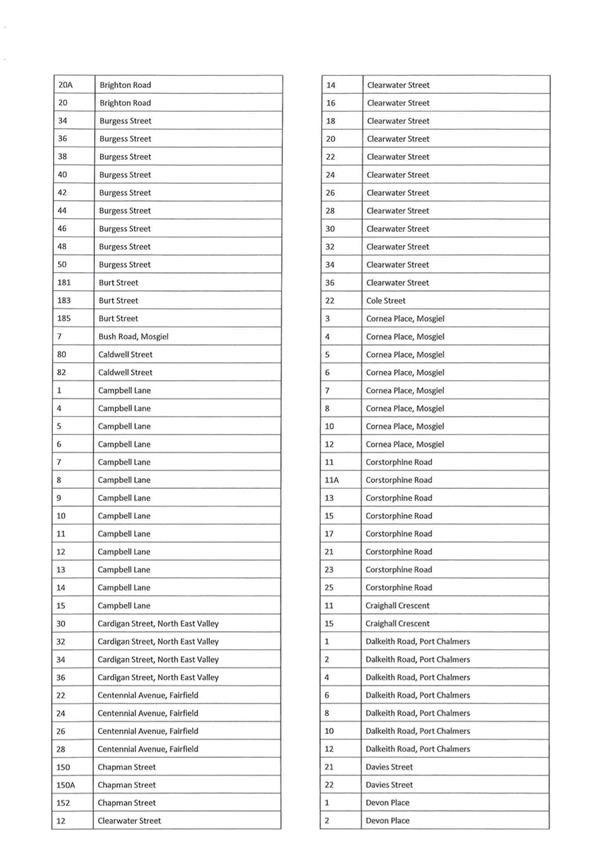

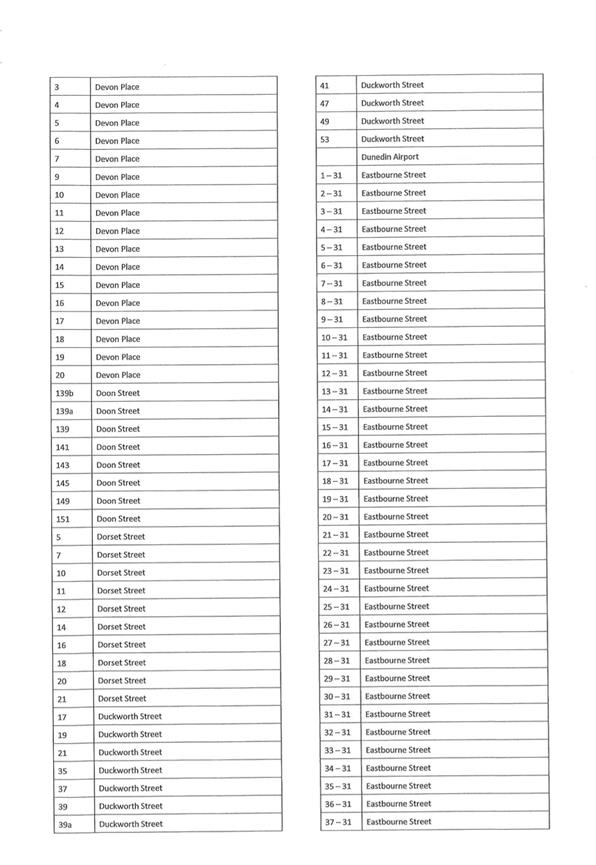

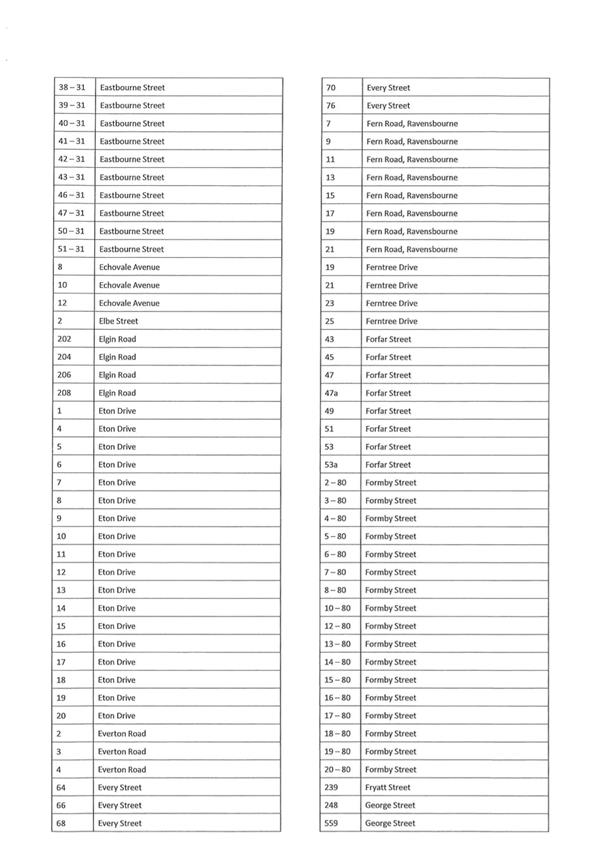

14 Private

Street Lighting Rate

A targeted rate for the purpose of

recovering the cost of private street lights, set under section 16 of the

Local Government (Rating) Act 2002, assessed on a differential basis as

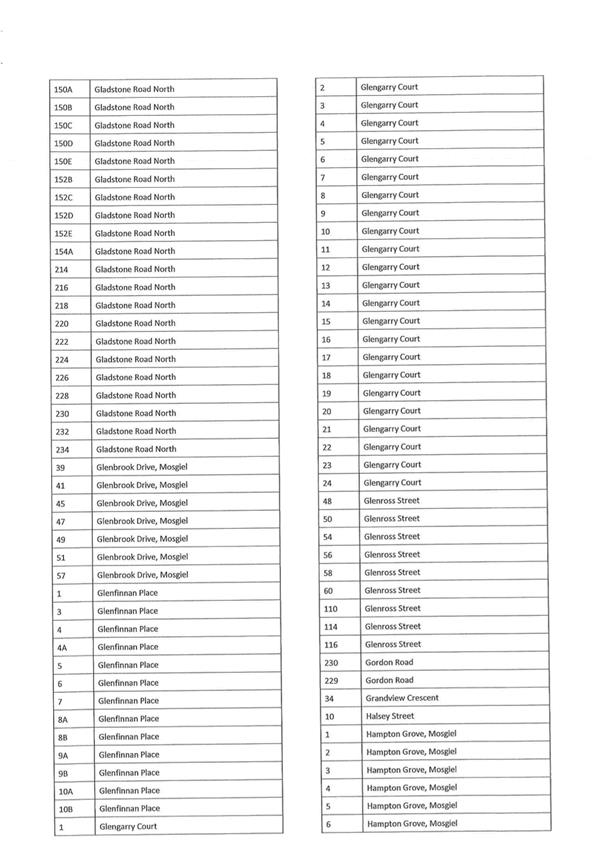

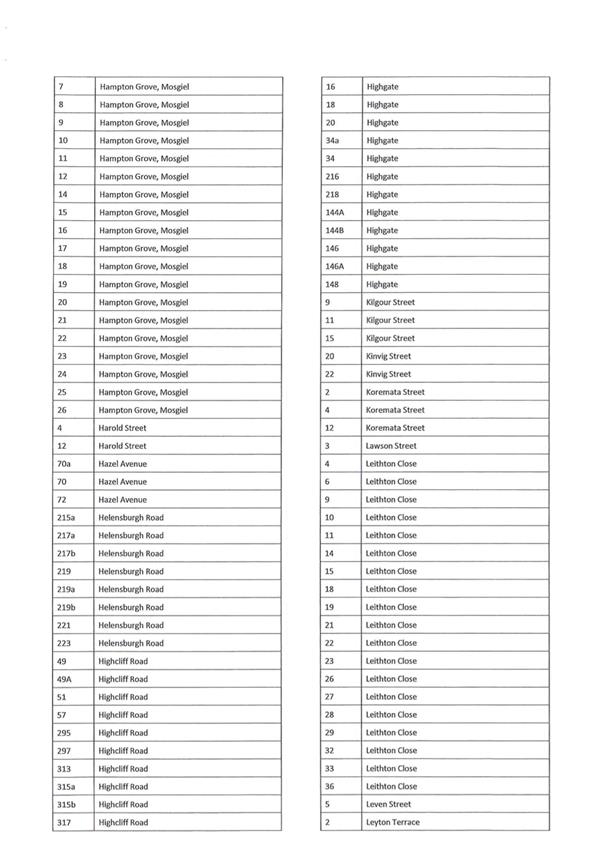

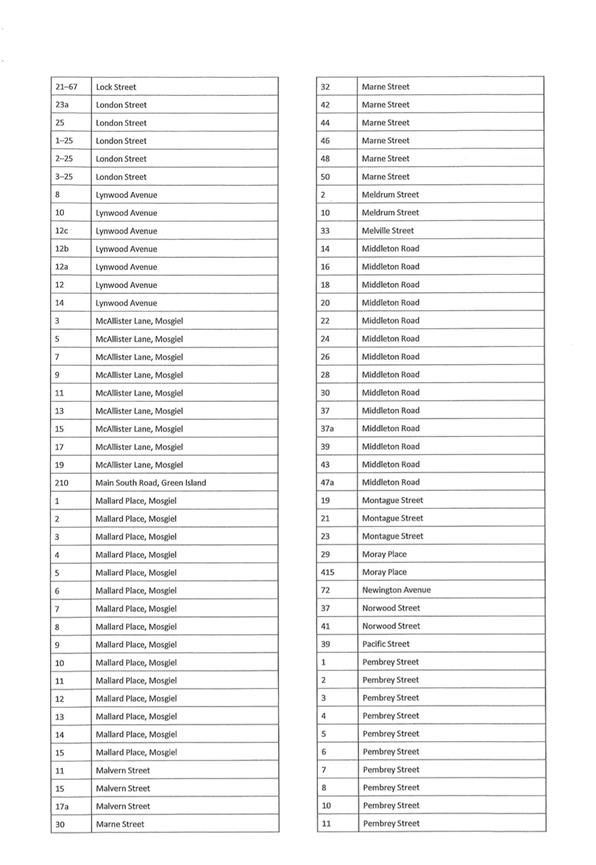

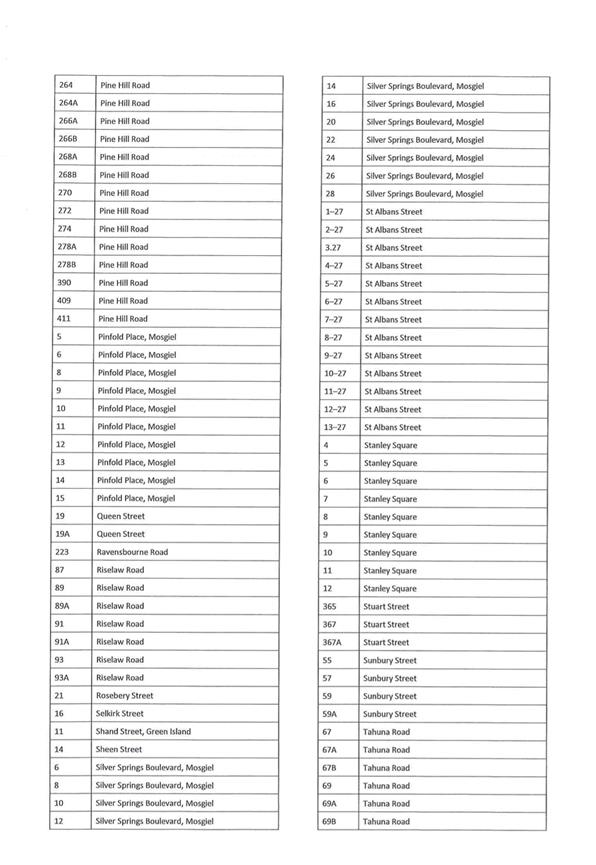

follows:

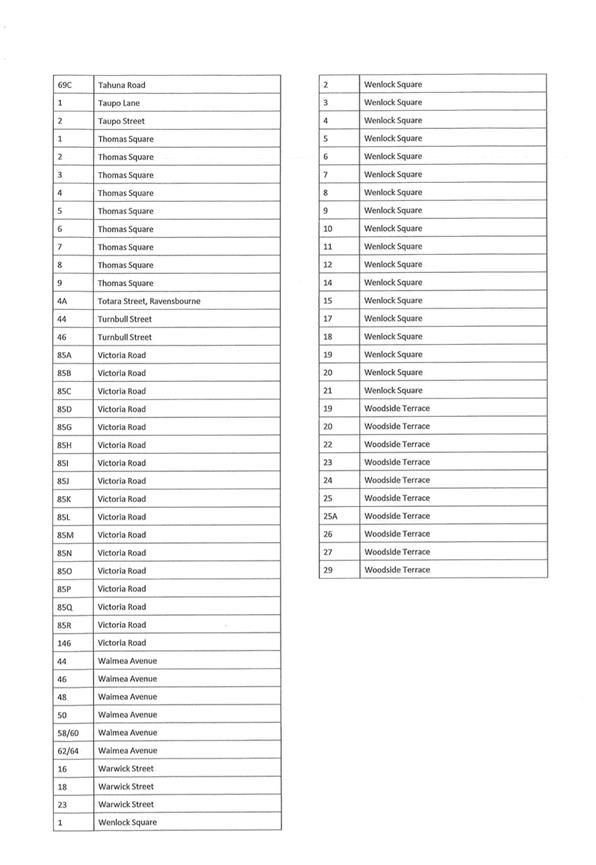

· $149.40

(including GST) per private street light divided by the number of separately

used or inhabited parts of a rating unit for all rating units in the

"residential and lifestyle" categories in the private streets as

identified in the schedule below.

· $149.40

(including GST) per private street light divided by the number of rating

units for all rating units in the "commercial" category in the

private streets as identified in the schedule below.

|

1-10

|

Achilles Avenue

|

6

|

Glengarry Court

|

|

1

|

Alton Avenue

|

7

|

Glengarry Court

|

|

2

|

Alton Avenue

|

8

|

Glengarry Court

|

|

2A

|

Alton Avenue

|

9

|

Glengarry Court

|

|

3

|

Alton Avenue

|

10

|

Glengarry Court

|

|

4

|

Alton Avenue

|

11

|

Glengarry Court

|

|

5

|

Alton Avenue

|

12

|

Glengarry Court

|

|

6

|

Alton Avenue

|

13

|

Glengarry Court

|

|

7

|

Alton Avenue

|

14

|

Glengarry Court

|

|

8

|

Alton Avenue

|

15

|

Glengarry Court

|

|

9

|

Alton Avenue

|

16

|

Glengarry Court

|

|

7

|

Angle Avenue

|

17

|

Glengarry Court

|

|

9

|

Angle Avenue

|

18

|

Glengarry Court

|

|

11

|

Angle Avenue

|

19

|

Glengarry Court

|

|

20

|

Angle Avenue

|

20

|

Glengarry Court

|

|

22

|

Angle Avenue

|

21

|

Glengarry Court

|

|

24

|

Angle Avenue

|

22

|

Glengarry Court

|

|

43

|

Arawa Street

|

23

|

Glengarry Court

|

|

47

|

Arawa Street

|

24

|

Glengarry Court

|

|

17

|

Awa Toru Drive

|

48

|

Glenross Street

|

|

19

|

Awa Toru Drive

|

50

|

Glenross Street

|

|

21

|

Awa Toru Drive

|

54

|

Glenross Street

|

|

23

|

Awa Toru Drive

|

56

|

Glenross Street

|

|

25

|

Awa Toru Drive

|

58

|

Glenross Street

|

|

27

|

Awa Toru Drive

|

60

|

Glenross Street

|

|

29

|

Awa Toru Drive

|

110

|

Glenross Street

|

|

31

|

Awa Toru Drive

|

114

|

Glenross Street

|

|

33

|

Awa Toru Drive

|

116

|

Glenross Street

|

|

35

|

Awa Toru Drive

|

230

|

Gordon Road

|

|

37

|

Awa Toru Drive

|

229

|

Gordon Road

|

|

39

|

Awa Toru Drive

|

34

|

Grandview Crescent

|

|

41

|

Awa Toru Drive

|

10

|

Halsey Street

|

|

43

|

Awa Toru Drive

|

1

|

Hampton Grove, Mosgiel

|

|

45

|

Awa Toru Drive

|

2

|

Hampton Grove, Mosgiel

|

|

47

|

Awa Toru Drive

|

3

|

Hampton Grove, Mosgiel

|

|

49

|

Awa Toru Drive

|

4

|

Hampton Grove, Mosgiel

|

|

60A

|

Balmacewen Road

|

5

|

Hampton Grove, Mosgiel

|

|

60B

|

Balmacewen Road

|

6

|

Hampton Grove, Mosgiel

|

|

62

|

Balmacewen Road

|

7

|

Hampton Grove, Mosgiel

|

|

64

|

Balmacewen Road

|

8

|

Hampton Grove, Mosgiel

|

|

1

|

Balmoral Avenue

|

9

|

Hampton Grove, Mosgiel

|

|

2

|

Balmoral Avenue

|

10

|

Hampton Grove, Mosgiel

|

|

3

|

Balmoral Avenue

|

11

|

Hampton Grove, Mosgiel

|

|

4

|

Balmoral Avenue

|

12

|

Hampton Grove, Mosgiel

|

|

5

|

Balmoral Avenue

|

14

|

Hampton Grove, Mosgiel

|

|

6

|

Balmoral Avenue

|

15

|

Hampton Grove, Mosgiel

|

|

7

|

Balmoral Avenue

|

16

|

Hampton Grove, Mosgiel

|

|

8

|

Balmoral Avenue

|

17

|

Hampton Grove, Mosgiel

|

|

9

|

Balmoral Avenue

|

18

|

Hampton Grove, Mosgiel

|

|

10

|

Balmoral Avenue

|

19

|

Hampton Grove, Mosgiel

|

|

11

|

Balmoral Avenue

|

20

|

Hampton Grove, Mosgiel

|

|

12

|

Balmoral Avenue

|

21

|

Hampton Grove, Mosgiel

|

|

16

|

Balmoral Avenue

|

22

|

Hampton Grove, Mosgiel

|

|

17

|

Balmoral Avenue

|

23

|

Hampton Grove, Mosgiel

|

|

19

|

Barclay Street

|

24

|

Hampton Grove, Mosgiel

|

|

211

|

Bay View Road

|

25

|

Hampton Grove, Mosgiel

|

|

211A

|

Bay View Road

|

26

|

Hampton Grove, Mosgiel

|

|

211B

|

Bay View Road

|

4

|

Harold Street

|

|

1

|

Beaufort Street

|

12

|

Harold Street

|

|

3

|

Beaufort Street

|

70a

|

Hazel Avenue

|

|

119

|

Belford Street

|

70

|

Hazel Avenue

|

|

12

|

Bell Crescent

|

72

|

Hazel Avenue

|

|

14

|

Bell Crescent

|

215a

|

Helensburgh Road

|

|

24

|

Bell Crescent

|

217a

|

Helensburgh Road

|

|

26

|

Bell Crescent

|

217b

|

Helensburgh Road

|

|

7

|

Bishop Verdon Close

|

219

|

Helensburgh Road

|

|

9

|

Bishop Verdon Close

|

219a

|

Helensburgh Road

|

|

10

|

Bishop Verdon Close

|

219b

|

Helensburgh Road

|

|

11

|

Bishop Verdon Close

|

221

|

Helensburgh Road

|

|

12

|

Bishop Verdon Close

|

223

|

Helensburgh Road

|

|

8

|

Bonnington Street

|

49

|

Highcliff Road

|

|

8a

|

Bonnington Street

|

49A

|

Highcliff Road

|

|

10

|

Bonnington Street

|

51

|

Highcliff Road

|

|

20K

|

Brighton Road

|

57

|

Highcliff Road

|

|

20J

|

Brighton Road

|

295

|

Highcliff Road

|

|

20H

|

Brighton Road

|

297

|

Highcliff Road

|

|

20G

|

Brighton Road

|

313

|

Highcliff Road

|

|

20F

|

Brighton Road

|

315a

|

Highcliff Road

|

|

20E

|

Brighton Road

|

315b

|

Highcliff Road

|

|

20D

|

Brighton Road

|

317

|

Highcliff Road

|

|

20C

|

Brighton Road

|

16

|

Highgate

|

|

20B

|

Brighton Road

|

18

|

Highgate

|

|

20A

|

Brighton Road

|

20

|

Highgate

|

|

20

|

Brighton Road

|

34a

|

Highgate

|

|

34

|

Burgess Street

|

34

|

Highgate

|

|

36

|

Burgess Street

|

216

|

Highgate

|

|

38

|

Burgess Street

|

218

|

Highgate

|

|

40

|

Burgess Street

|

144A

|

Highgate

|

|

42

|

Burgess Street

|

144B

|

Highgate

|

|

44

|

Burgess Street

|

146

|

Highgate

|

|

46

|

Burgess Street

|

146A

|

Highgate

|

|

48

|

Burgess Street

|

148

|

Highgate

|

|

50

|

Burgess Street

|

9

|

Kilgour Street

|

|

181

|

Burt Street

|

11

|

Kilgour Street

|

|

183

|

Burt Street

|

15

|

Kilgour Street

|

|

185

|

Burt Street

|

20

|

Kinvig Street

|

|

7

|

Bush Road, Mosgiel

|

22

|

Kinvig Street

|

|

80

|

Caldwell Street

|

2

|

Koremata Street

|

|

82

|

Caldwell Street

|

4

|

Koremata Street

|

|

1

|

Campbell Lane

|

12

|

Koremata Street

|

|

4

|

Campbell Lane

|

3

|

Lawson Street

|

|

5

|

Campbell Lane

|

4

|

Leithton Close

|

|

6

|

Campbell Lane

|

6

|

Leithton Close

|

|

7

|

Campbell Lane

|

9

|

Leithton Close

|

|

8

|

Campbell Lane

|

10

|

Leithton Close

|

|

9

|

Campbell Lane

|

11

|

Leithton Close

|

|

10

|

Campbell Lane

|

14

|

Leithton Close

|

|

11

|

Campbell Lane

|

15

|

Leithton Close

|

|

12

|

Campbell Lane

|

18

|

Leithton Close

|

|

13

|

Campbell Lane

|

19

|

Leithton Close

|

|

14

|

Campbell Lane

|

21

|

Leithton Close

|

|

15

|

Campbell Lane

|

22

|

Leithton Close

|

|

30

|

Cardigan Street, North East Valley

|

23

|

Leithton Close

|

|

32

|

Cardigan Street, North East Valley

|

26

|

Leithton Close

|

|

34

|

Cardigan Street, North East Valley

|

27

|

Leithton Close

|

|

36

|

Cardigan Street, North East Valley

|

28

|

Leithton Close

|

|

22

|

Centennial Avenue, Fairfield

|

29

|

Leithton Close

|

|

24

|

Centennial Avenue, Fairfield

|

32

|

Leithton Close

|

|

26

|

Centennial Avenue, Fairfield

|

33

|

Leithton Close

|

|

28

|

Centennial Avenue, Fairfield

|

36

|

Leithton Close

|

|

150

|

Chapman Street

|

5

|

Leven Street

|

|

150A

|

Chapman Street

|

2

|

Leyton Terrace

|

|

152

|

Chapman Street

|

21-67

|

Lock Street

|

|

12

|

Clearwater Street

|

23a

|

London Street

|

|

14

|

Clearwater Street

|

25

|

London Street

|

|

16

|

Clearwater Street

|

1-25

|

London Street

|

|

18

|

Clearwater Street

|

2-25

|

London Street

|

|

20

|

Clearwater Street

|

3-25

|

London Street

|

|

22

|

Clearwater Street

|

8

|

Lynwood Avenue

|

|

24

|

Clearwater Street

|

10

|

Lynwood Avenue

|

|

26

|

Clearwater Street

|

12c

|

Lynwood Avenue

|

|

28

|

Clearwater Street

|

12b

|

Lynwood Avenue

|

|

30

|

Clearwater Street

|

12a

|

Lynwood Avenue

|

|

32

|

Clearwater Street

|

12

|

Lynwood Avenue

|

|

34

|

Clearwater Street

|

14

|

Lynwood Avenue

|

|

36

|

Clearwater Street

|

3

|

McAllister Lane, Mosgiel

|

|

22

|

Cole Street

|

5

|

McAllister Lane, Mosgiel

|

|

3

|

Cornea Place, Mosgiel

|

7

|

McAllister Lane, Mosgiel

|

|

4

|

Cornea Place, Mosgiel

|

9

|

McAllister Lane, Mosgiel

|

|

5

|

Cornea Place, Mosgiel

|

11

|

McAllister Lane, Mosgiel

|

|

6

|

Cornea Place, Mosgiel

|

13

|

McAllister Lane, Mosgiel

|

|

7

|

Cornea Place, Mosgiel

|

15

|

McAllister Lane, Mosgiel

|

|

8

|

Cornea Place, Mosgiel

|

17

|

McAllister Lane, Mosgiel

|

|

10

|

Cornea Place, Mosgiel

|

19

|

McAllister Lane, Mosgiel

|

|

12

|

Cornea Place, Mosgiel

|

210

|

Main South Road, Green Island

|

|

11

|

Corstorphine Road

|

1

|

Mallard Place, Mosgiel

|

|

11A

|

Corstorphine Road

|

2

|

Mallard Place, Mosgiel

|

|

13

|

Corstorphine Road

|

3

|

Mallard Place, Mosgiel

|

|

15

|

Corstorphine Road

|

4

|

Mallard Place, Mosgiel

|

|

17

|

Corstorphine Road

|

5

|

Mallard Place, Mosgiel

|

|

21

|

Corstorphine Road

|

6

|

Mallard Place, Mosgiel

|

|

23

|

Corstorphine Road

|

7

|

Mallard Place, Mosgiel

|

|

25

|

Corstorphine Road

|

8

|

Mallard Place, Mosgiel

|

|

11

|

Craighall Crescent

|

9

|

Mallard Place, Mosgiel

|

|

15

|

Craighall Crescent

|

10

|

Mallard Place, Mosgiel

|

|

1

|

Dalkeith Road, Port Chalmers

|

11

|

Mallard Place, Mosgiel

|

|

2

|

Dalkeith Road, Port Chalmers

|

12

|

Mallard Place, Mosgiel

|

|

4

|

Dalkeith Road, Port Chalmers

|

13

|

Mallard Place, Mosgiel

|

|

6

|

Dalkeith Road, Port Chalmers

|

14

|

Mallard Place, Mosgiel

|

|

8

|

Dalkeith Road, Port Chalmers

|

15

|

Mallard Place, Mosgiel

|

|

10

|

Dalkeith Road, Port Chalmers

|

11

|

Malvern Street

|

|

12

|

Dalkeith Road, Port Chalmers

|

15

|

Malvern Street

|

|

21

|

Davies Street

|

17a

|

Malvern Street

|

|

22

|

Davies Street

|

30

|

Marne Street

|

|

1

|

Devon Place

|

32

|

Marne Street

|

|

2

|

Devon Place

|

42

|

Marne Street

|

|

3

|

Devon Place

|

44

|

Marne Street

|

|

4

|

Devon Place

|

46

|

Marne Street

|

|

5

|

Devon Place

|

48

|

Marne Street

|

|

6

|

Devon Place

|

50

|

Marne Street

|

|

7

|

Devon Place

|

2

|

Meldrum Street

|

|

9

|

Devon Place

|

10

|

Meldrum Street

|

|

10

|

Devon Place

|

33

|

Melville Street

|

|

11

|

Devon Place

|

14

|

Middleton Road

|

|

12

|

Devon Place

|

16

|

Middleton Road

|

|

13

|

Devon Place

|

18

|

Middleton Road

|

|

14

|

Devon Place

|

20

|

Middleton Road

|

|

15

|

Devon Place

|

22

|

Middleton Road

|

|

16

|

Devon Place

|

24

|

Middleton Road

|

|

17

|

Devon Place

|

26

|

Middleton Road

|

|

18

|

Devon Place

|

28

|

Middleton Road

|

|

19

|

Devon Place

|

30

|

Middleton Road

|

|

20

|

Devon Place

|

37

|

Middleton Road

|

|

139b

|

Doon Street

|

37a

|

Middleton Road

|

|

139a

|

Doon Street

|

39

|

Middleton Road

|

|

139

|

Doon Street

|

43

|

Middleton Road

|

|

141

|

Doon Street

|

47a

|

Middleton Road

|

|

143

|

Doon Street

|

19

|

Montague Street

|

|

145

|

Doon Street

|

21

|

Montague Street

|

|

149

|

Doon Street

|

23

|

Montague Street

|

|

151

|

Doon Street

|

29

|

Moray Place

|

|

5

|

Dorset Street

|

415

|

Moray Place

|

|

7

|

Dorset Street

|

72

|

Newington Avenue

|

|

10

|

Dorset Street

|

37

|

Norwood Street

|

|

11

|

Dorset Street

|

41

|

Norwood Street

|

|

12

|

Dorset Street

|

39

|

Pacific Street

|

|

14

|

Dorset Street

|

1

|

Pembrey Street

|

|

16

|

Dorset Street

|

2

|

Pembrey Street

|

|

18

|

Dorset Street

|

3

|

Pembrey Street

|

|

20

|

Dorset Street

|

4

|

Pembrey Street

|

|

21

|

Dorset Street

|

5

|

Pembrey Street

|

|

17

|

Duckworth Street

|

6

|

Pembrey Street

|

|

19

|

Duckworth Street

|

7

|

Pembrey Street

|

|

21

|

Duckworth Street

|

8

|

Pembrey Street

|

|

35

|

Duckworth Street

|

10

|

Pembrey Street

|

|

37

|

Duckworth Street

|

11

|

Pembrey Street

|

|

39

|

Duckworth Street

|

264

|

Pine Hill Road

|

|

39a

|

Duckworth Street

|

264A

|

Pine Hill Road

|

|

41

|

Duckworth Street

|

266A

|

Pine Hill Road

|

|

47

|

Duckworth Street

|

266B

|

Pine Hill Road

|

|

49

|

Duckworth Street

|

268A

|

Pine Hill Road

|

|

53

|

Duckworth Street

|

268B

|

Pine Hill Road

|

|

|

Dunedin Airport

|

270

|

Pine Hill Road

|

|

1–31

|

Eastbourne Street

|

272

|

Pine Hill Road

|

|

2–31

|

Eastbourne Street

|

274

|

Pine Hill Road

|

|

3–31

|

Eastbourne Street

|

278A

|

Pine Hill Road

|

|

4–31

|

Eastbourne Street

|

278B

|

Pine Hill Road

|

|

5–31

|

Eastbourne Street

|

390

|

Pine Hill Road

|

|

6–31

|

Eastbourne Street

|

409

|

Pine Hill Road

|

|

7–31

|

Eastbourne Street

|

411

|

Pine Hill Road

|

|

8–31

|

Eastbourne Street

|

5

|

Pinfold Place, Mosgiel

|

|

9–31

|

Eastbourne Street

|

6

|

Pinfold Place, Mosgiel

|

|

10–31

|

Eastbourne Street

|

8

|

Pinfold Place, Mosgiel

|

|

11–31

|

Eastbourne Street

|

9

|

Pinfold Place, Mosgiel

|

|

12–31

|

Eastbourne Street

|

10

|

Pinfold Place, Mosgiel

|

|

13–31

|

Eastbourne Street

|

11

|

Pinfold Place, Mosgiel

|

|

14–31

|

Eastbourne Street

|

12

|

Pinfold Place, Mosgiel

|

|

15–31

|

Eastbourne Street

|

13

|

Pinfold Place, Mosgiel

|

|

16–31

|

Eastbourne Street

|

14

|

Pinfold Place, Mosgiel

|

|

17–31

|

Eastbourne Street

|

15

|

Pinfold Place, Mosgiel

|

|

18–31

|

Eastbourne Street

|

19

|

Queen Street

|

|

19–31

|

Eastbourne Street

|

19A

|

Queen Street

|

|

20–31

|

Eastbourne Street

|

223

|

Ravensbourne Road

|

|

21–31

|

Eastbourne Street

|

87

|

Riselaw Road

|

|

22–31

|

Eastbourne Street

|

89

|

Riselaw Road

|

|

23–31

|

Eastbourne Street

|

89A

|

Riselaw Road

|

|

24–31

|

Eastbourne Street

|

91

|

Riselaw Road

|

|

25–31

|

Eastbourne Street

|

91A

|

Riselaw Road

|

|

26–31

|

Eastbourne Street

|

93

|

Riselaw Road

|

|

27–31

|

Eastbourne Street

|

93A

|

Riselaw Road

|

|

28–31

|

Eastbourne Street

|

21

|

Rosebery Street

|

|

29–31

|

Eastbourne Street

|

16

|

Selkirk Street

|

|

30–31

|

Eastbourne Street

|

11

|

Shand Street, Green Island

|

|

31–31

|

Eastbourne Street

|

14

|

Sheen Street

|

|

32–31

|

Eastbourne Street

|

6

|

Silver Springs Boulevard, Mosgiel

|

|

33–31

|

Eastbourne Street

|

8

|

Silver Springs Boulevard, Mosgiel

|

|

34–31

|

Eastbourne Street

|

10

|

Silver Springs Boulevard, Mosgiel

|

|

35–31

|

Eastbourne Street

|

12

|

Silver Springs Boulevard, Mosgiel

|

|

36–31

|

Eastbourne Street

|

14

|

Silver Springs Boulevard, Mosgiel

|

|

37–31

|

Eastbourne Street

|

16

|

Silver Springs Boulevard, Mosgiel

|

|

38–31

|

Eastbourne Street

|

20

|

Silver Springs Boulevard, Mosgiel

|

|

39–31

|

Eastbourne Street

|

22

|

Silver Springs Boulevard, Mosgiel

|

|

40–31

|

Eastbourne Street

|

24

|

Silver Springs Boulevard, Mosgiel

|

|

41–31

|

Eastbourne Street

|

26

|

Silver Springs Boulevard, Mosgiel

|

|

42–31

|

Eastbourne Street

|

28

|

Silver Springs Boulevard, Mosgiel

|

|

43–31

|

Eastbourne Street

|

1-27

|

St Albans Street

|

|

46–31

|

Eastbourne Street

|

2-27

|

St Albans Street

|

|

47–31

|

Eastbourne Street

|

3-27

|

St Albans Street

|

|

50–31

|

Eastbourne Street

|

4-27

|

St Albans Street

|

|

51–31

|

Eastbourne Street

|

5-27

|

St Albans

Street

|

|

8

|

Echovale Avenue

|

6-27

|

St Albans Street

|

|

10

|

Echovale Avenue

|

7-27

|

St Albans Street

|

|

12

|

Echovale Avenue

|

8-27

|

St Albans Street

|

|

2

|

Elbe Street

|

9-27

|

St Albans Street

|

|

202

|

Elgin Road

|

10-27

|

St Albans Street

|

|

204

|

Elgin Road

|

11-27

|

St Albans Street

|

|

206

|

Elgin Road

|

12-27

|

St Albans Street

|

|

208

|

Elgin Road

|

13-27

|

St Albans Street

|

|

1

|

Eton Drive

|

4

|

Stanley Square

|

|

4

|

Eton Drive

|

5

|

Stanley Square

|

|

5

|

Eton Drive

|

6

|

Stanley Square

|

|

6

|

Eton Drive

|

7

|

Stanley Square

|

|

7

|

Eton Drive

|

8

|

Stanley Square

|

|

8

|

Eton Drive

|

9

|

Stanley Square

|

|

9

|

Eton Drive

|

10

|

Stanley Square

|

|

10

|

Eton Drive

|

11

|

Stanley Square

|

|

11

|

Eton Drive

|

12

|

Stanley Square

|

|

12

|

Eton Drive

|

365

|

Stuart Street

|

|

13

|

Eton Drive

|

367

|

Stuart Street

|

|

14

|

Eton Drive

|

367A

|

Stuart Street

|

|

15

|

Eton Drive

|

55

|

Sunbury Street

|

|

16

|

Eton Drive

|

57

|

Sunbury Street

|

|

17

|

Eton Drive

|

59

|

Sunbury Street

|

|

18

|

Eton Drive

|

59A

|

Sunbury Street

|

|

19

|

Eton Drive

|

67

|

Tahuna Road

|

|

20

|

Eton Drive

|

67A

|

Tahuna Road

|

|

2

|

Everton Road

|

67B

|

Tahuna Road

|

|

3

|

Everton Road

|

69

|

Tahuna Road

|

|

4

|

Everton Road

|

69A

|

Tahuna Road

|

|

64

|

Every Street

|

69B

|

Tahuna Road

|

|

66

|

Every Street

|

69C

|

Tahuna Road

|

|

68

|

Every Street

|

1

|

Taupo Lane

|

|

70

|

Every Street

|

2

|

Taupo Street

|

|

76

|

Every Street

|

1

|

Thomas Square

|

|

7

|

Fern Road, Ravensbourne

|

2

|

Thomas Square

|

|

9

|

Fern Road, Ravensbourne

|

3

|

Thomas Square

|

|

11

|

Fern Road, Ravensbourne

|

4

|

Thomas Square

|

|

13

|

Fern Road, Ravensbourne

|

5

|

Thomas Square

|

|

15

|

Fern Road, Ravensbourne

|

6

|

Thomas Square

|

|

17

|

Fern Road, Ravensbourne

|

7

|

Thomas Square

|

|

19

|

Fern Road, Ravensbourne

|

8

|

Thomas Square

|

|

21

|

Fern Road, Ravensbourne

|

9

|

Thomas Square

|

|

19

|

Ferntree Drive

|

4A

|

Totara Street, Ravensbourne

|

|

21

|

Ferntree Drive

|

44

|

Turnbull Street

|

|

23

|

Ferntree Drive

|

46

|

Turnbull Street

|

|

25

|

Ferntree Drive

|

85A

|

Victoria Road

|

|

43

|

Forfar Street

|

85B

|

Victoria Road

|

|

45

|

Forfar Street

|

85C

|

Victoria Road

|

|

47

|

Forfar Street

|

85D

|

Victoria Road

|

|

47a

|

Forfar Street

|

85G

|

Victoria Road

|

|

49

|

Forfar Street

|

85H

|

Victoria Road

|

|

51

|

Forfar Street

|

85I

|

Victoria Road

|

|

53

|

Forfar Street

|

85J

|

Victoria Road

|

|

53a

|

Forfar Street

|

85K

|

Victoria Road

|

|

2–80

|

Formby Street

|

85L

|

Victoria Road

|

|

3–80

|

Formby Street

|

85M

|

Victoria Road

|

|

4–80

|

Formby Street

|

85N

|

Victoria Road

|

|

5–80

|

Formby Street

|

85O

|

Victoria Road

|

|

6–80

|

Formby Street

|

85P

|

Victoria Road

|

|

7–80

|

Formby Street

|

85Q

|

Victoria Road

|

|

8–80

|

Formby Street

|

85R

|

Victoria Road

|

|

10–80

|

Formby Street

|

146

|

Victoria Road

|

|

12–80

|

Formby Street

|

44

|

Waimea Avenue

|

|

13–80

|

Formby Street

|

46

|

Waimea Avenue

|

|

14–80

|

Formby Street

|

48

|

Waimea Avenue

|

|

15–80

|

Formby Street

|

50

|

Waimea Avenue

|

|

16–80

|

Formby Street

|

58/60

|

Waimea Avenue

|

|

17–80

|

Formby Street

|

62/64

|

Waimea Avenue

|

|

18–80

|

Formby Street

|

16

|

Warwick Street

|

|

19–80

|

Formby Street

|

18

|

Warwick Street

|

|

20–80

|

Formby Street

|

23

|

Warwick Street

|

|

239

|

Fryatt Street

|

1

|

Wenlock Square

|

|

248

|

George Street

|

2

|

Wenlock Square

|

|

559

|

George Street

|

3

|

Wenlock Square

|

|

150A

|

Gladstone Road North

|

4

|

Wenlock Square

|

|

150B

|

Gladstone Road North

|

5

|

Wenlock Square

|

|

150C

|

Gladstone Road North

|

6

|

Wenlock Square

|

|

150D

|

Gladstone Road North

|

7

|

Wenlock Square

|

|

150E

|

Gladstone Road North

|

8

|

Wenlock Square

|

|

152B

|

Gladstone Road North

|

9

|

Wenlock Square

|

|

152C

|

Gladstone Road North

|

10

|

Wenlock Square

|

|

152D

|

Gladstone Road North

|

11

|

Wenlock Square

|

|

152E

|

Gladstone Road North

|

12

|

Wenlock Square

|

|

154A

|

Gladstone Road North

|

14

|

Wenlock Square

|

|

214

|

Gladstone Road North

|

15

|

Wenlock Square

|

|

216

|

Gladstone Road North

|

17

|

Wenlock Square

|

|

218

|

Gladstone Road North

|

18

|

Wenlock Square

|

|

220

|

Gladstone Road North

|

19

|

Wenlock Square

|

|

222

|

Gladstone Road North

|

20

|

Wenlock Square

|

|

224

|

Gladstone Road North

|

21

|

Wenlock Square

|

|

226

|

Gladstone Road North

|

19

|

Woodside Terrace

|

|

228

|

Gladstone Road North

|

20

|

Woodside Terrace

|

|

230

|

Gladstone Road North

|

22

|

Woodside Terrace

|

|

232

|

Gladstone Road North

|

23

|

Woodside Terrace

|

|

234

|

Gladstone Road North

|

24

|

Woodside Terrace

|

|

39

|

Glenbrook Drive, Mosgiel

|

25

|

Woodside Terrace

|

|

41

|

Glenbrook Drive, Mosgiel

|

25a

|

Woodside Terrace

|

|

45

|

Glenbrook Drive, Mosgiel

|

26

|

Woodside Terrace

|

|

47

|

Glenbrook Drive, Mosgiel

|

27

|

Woodside Terrace

|

|

49

|

Glenbrook Drive, Mosgiel

|

29

|

Woodside Terrace

|

|

51

|

Glenbrook Drive, Mosgiel

|

|

|

|

57

|

Glenbrook Drive, Mosgiel

|

|

|

|

1

|

Glenfinnan Place

|

|

|

|

3

|

Glenfinnan Place

|

|

|

|

4

|

Glenfinnan Place

|

|

|

|

4A

|

Glenfinnan Place

|

|

|

|

5

|

Glenfinnan Place

|

|

|

|

6

|

Glenfinnan Place

|

|

|

|

7

|

Glenfinnan Place

|

|

|

|

8A

|

Glenfinnan Place

|

|

|

|

8B

|

Glenfinnan Place

|

|

|

|

9A

|

Glenfinnan Place

|

|

|

|

9B

|

Glenfinnan Place

|

|

|

|

10A

|

Glenfinnan Place

|

|

|

|

10B

|

Glenfinnan Place

|

|

|

|

1

|

Glengarry Court

|

|

|

|

2

|

Glengarry Court

|

|

|

|

3

|

Glengarry Court

|

|

|

|

4

|

Glengarry Court

|

|

|

|

5

|

Glengarry Court

|

|

|

|

6

|

Glengarry Court

|

|

|

|

7

|

Glengarry Court

|

|

|

|

8

|

Glengarry Court

|

|

|

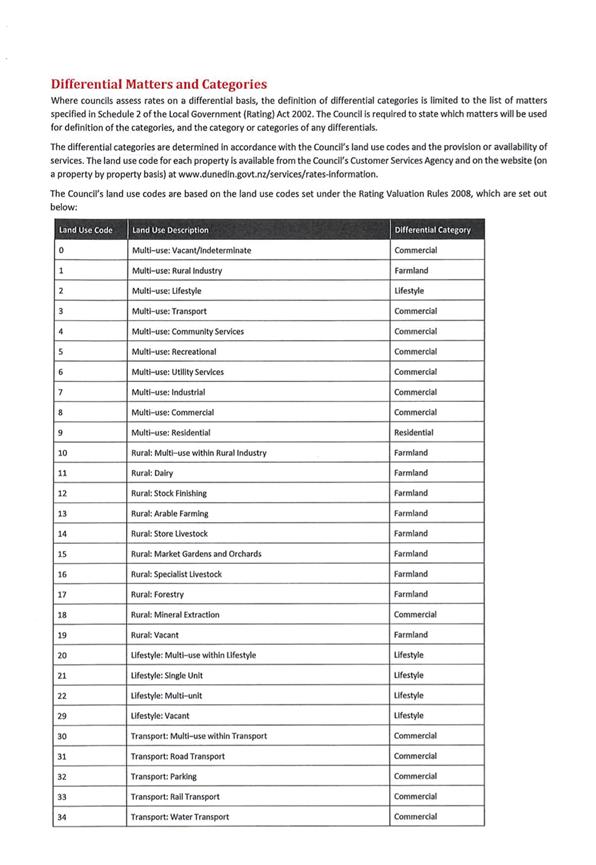

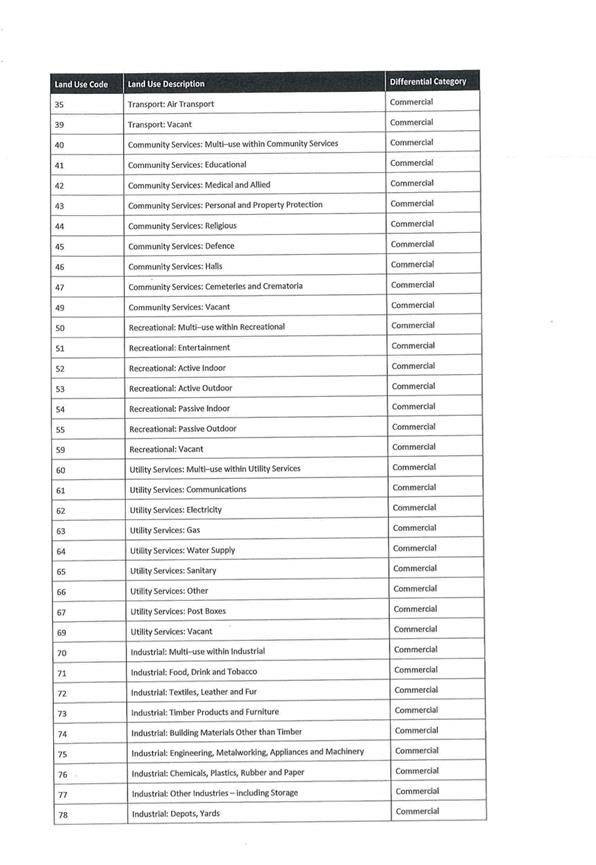

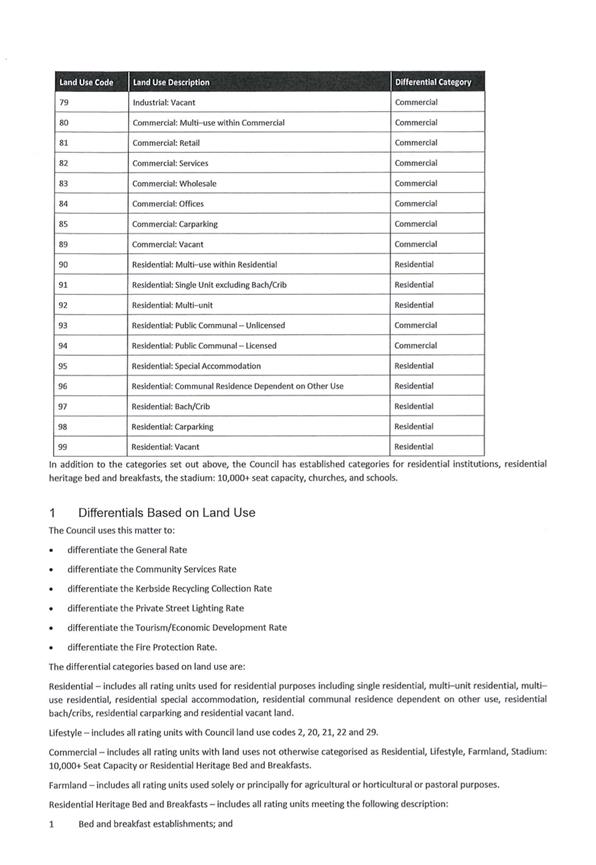

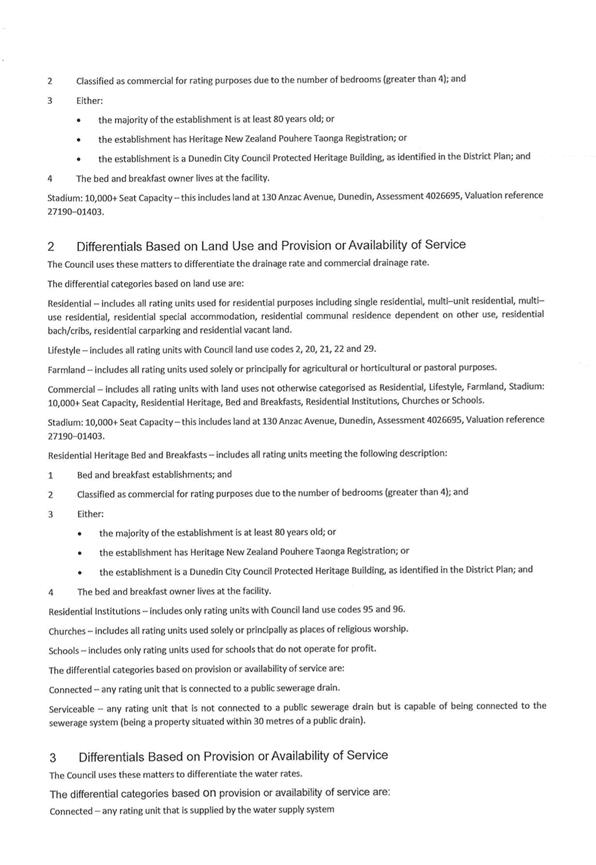

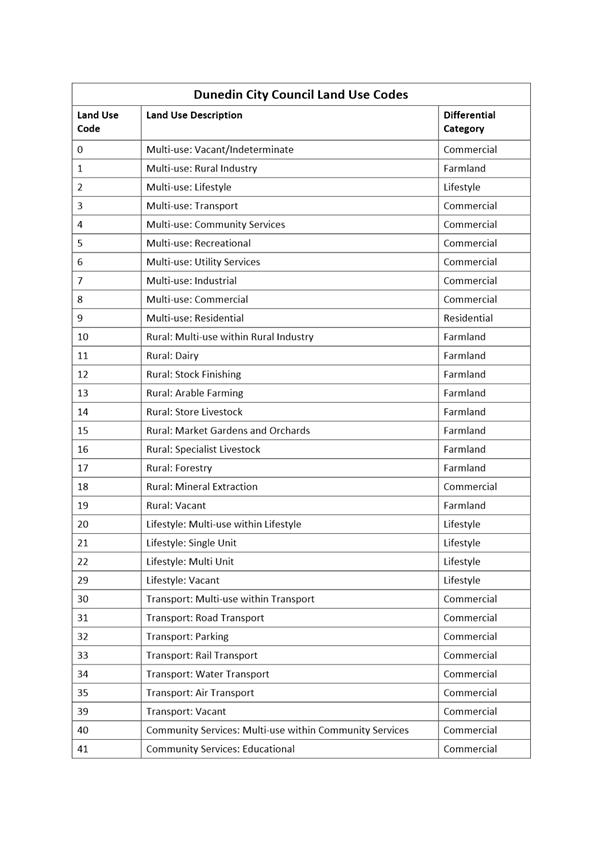

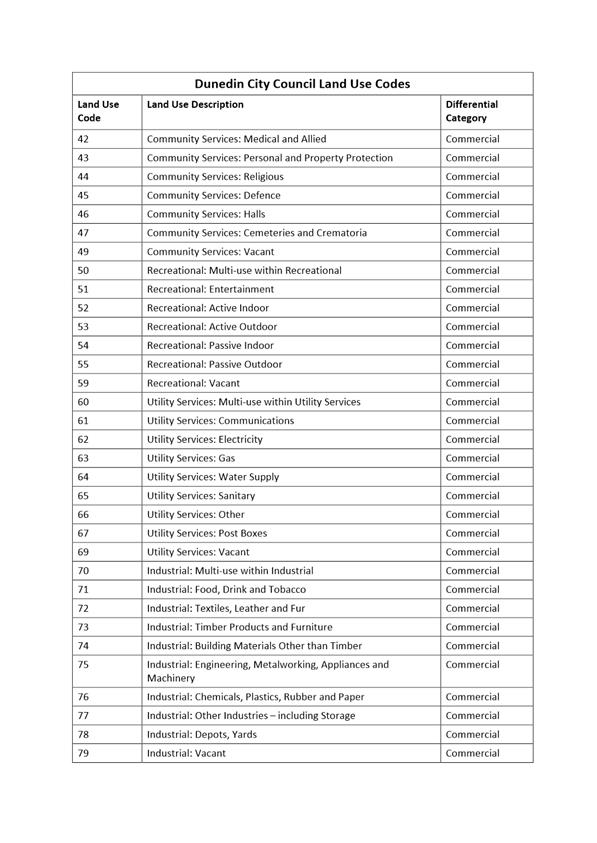

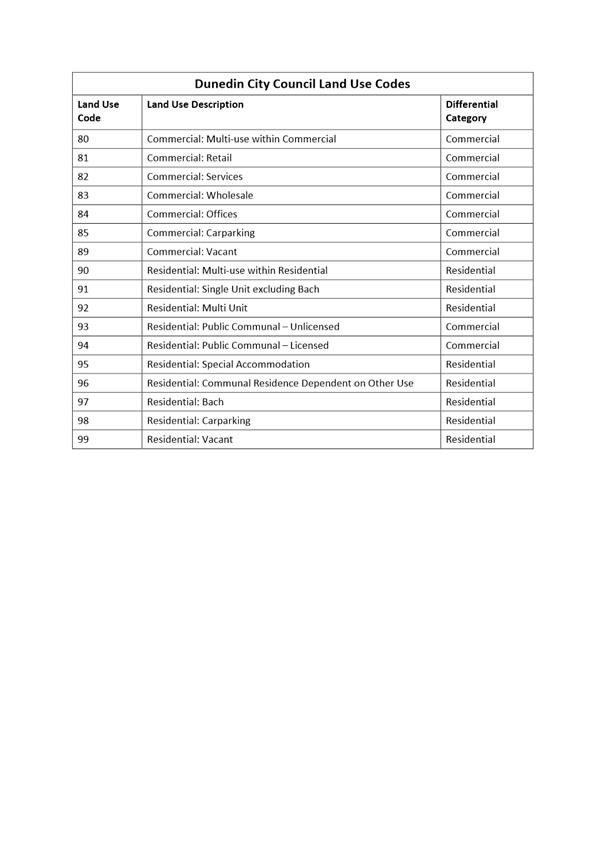

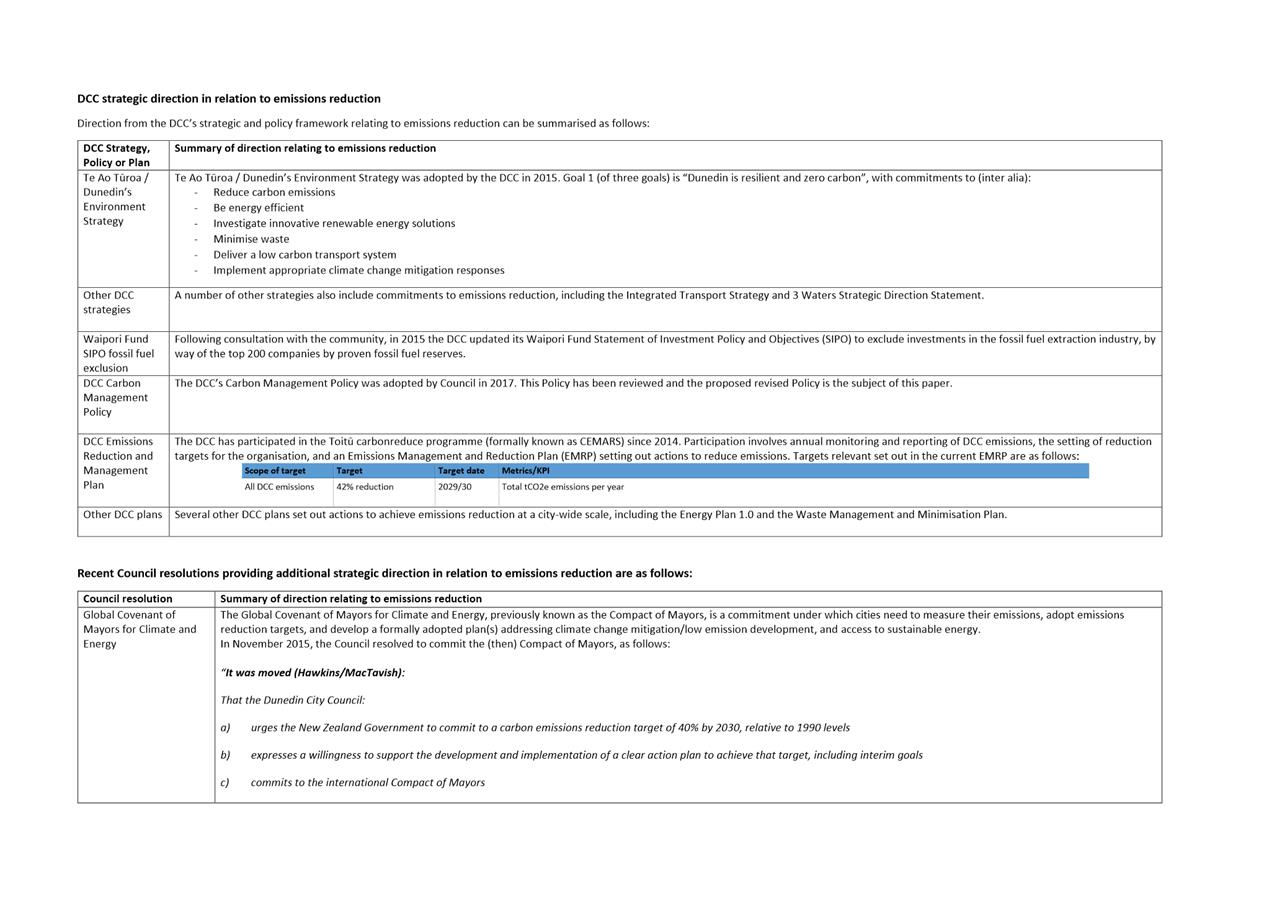

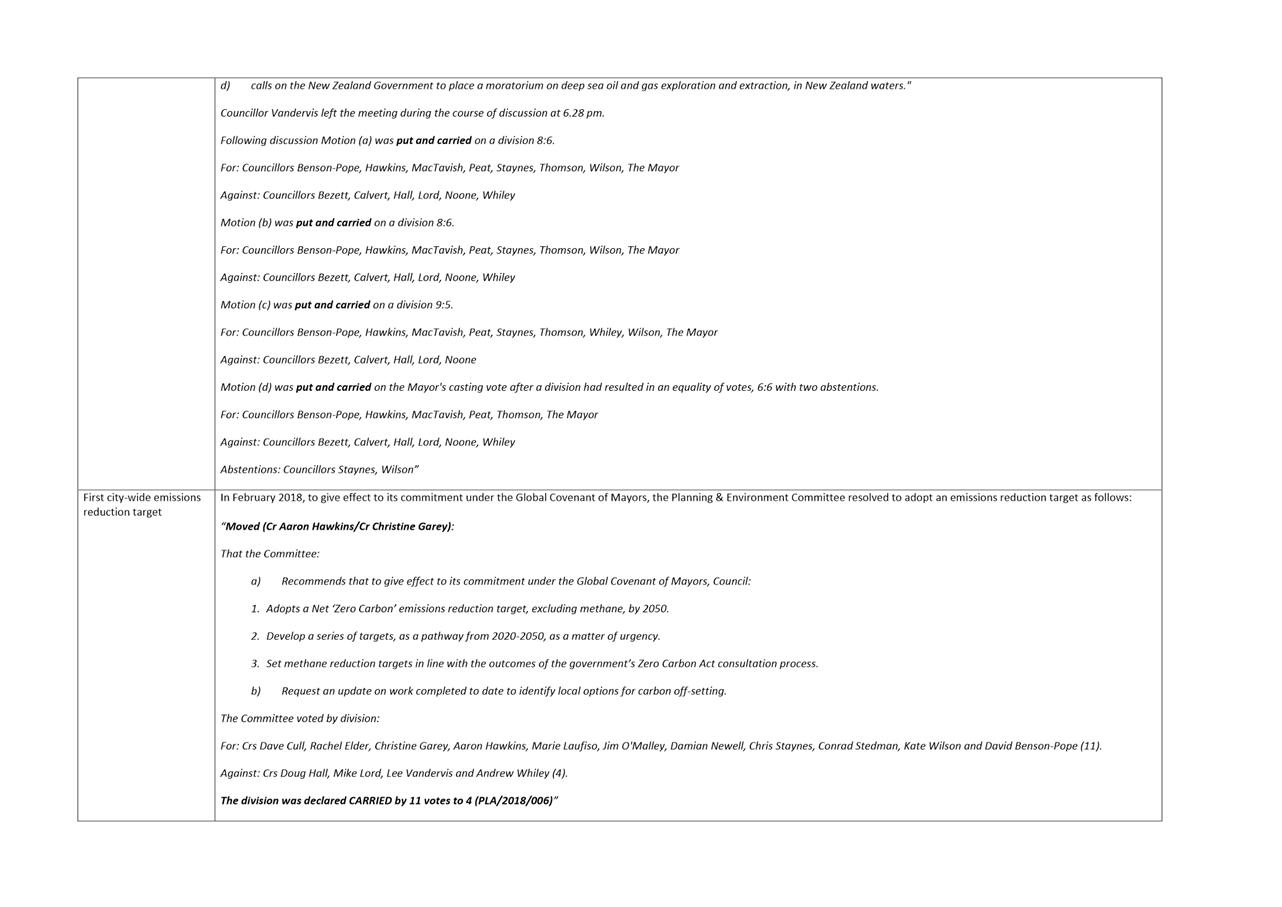

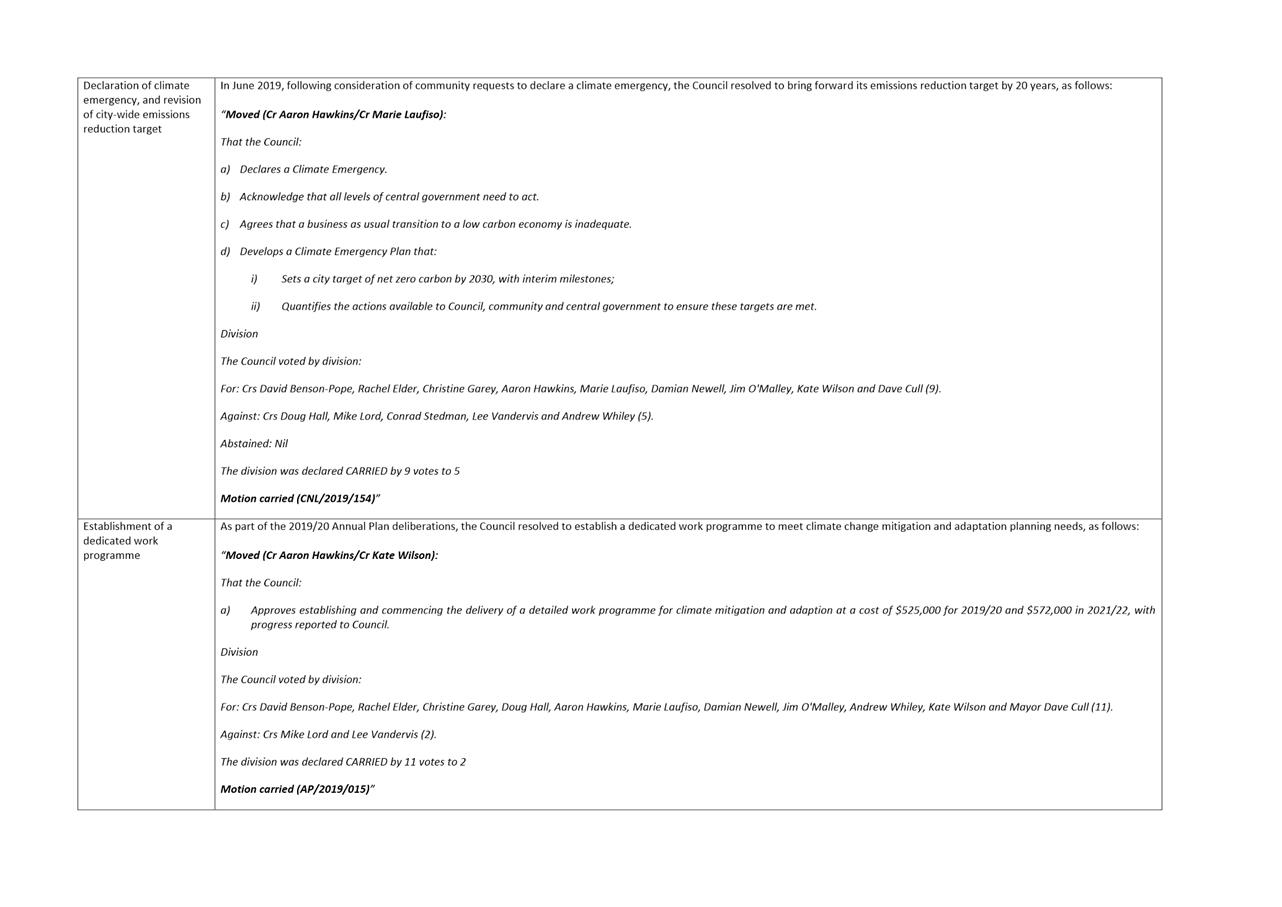

Differential Matters and Categories

b) Adopts the following differential categories for the

2022/23 financial year.

The differential categories are determined in

accordance with the Council's land use codes. The Council's land use

codes are based on the land use codes set under the Rating Valuation Rules

2008 and are set out in Attachment A. In addition, the Council has

established categories for residential institutions, residential heritage bed

and breakfasts, the stadium: 10,000+ seat capacity, churches, and schools.

1 Differentials

Based on Land Use

The Council uses this matter to:

· Differentiate

the General rate.

· Differentiate

the Community Services rate.

· Differentiate

the Kerbside Recycling rate.

· Differentiate

the Private Street Lighting rate.

· Differentiate

the Tourism/Economic Development rate.

· Differentiate

the Fire Protection rate.

The differential categories based on land use are:

· Residential

– includes all rating units used for residential purposes including

single residential, multi-unit residential, multi-use residential,

residential special accommodation, residential communal residence dependant

on other use, residential bach/cribs, residential carparking and residential

vacant land.

· Lifestyle

– includes all rating units with Council's land use codes 2, 20,

21, 22 and 29.

· Commercial

– includes all rating units with land uses not otherwise categorised as

Residential, Residential Heritage Bed and Breakfasts, Lifestyle, Farmland or

Stadium: 10,000+ seat capacity.

· Farmland

- includes all rating units used solely or principally for agricultural or

horticultural or pastoral purposes.

· Residential

Heritage Bed and Breakfasts – includes all rating units meeting the

following description:

· Bed

and breakfast establishments; and

· Classified

as commercial for rating purposes due to the number of bedrooms (greater than

four); and

· Either:

· the

majority of the establishment is at least 80 years old, or

· the

establishment has Heritage New Zealand Pouhere Taonga Registration, or

· the

establishment is a Dunedin City Council Protected Heritage Building as

identified in the District Plan; and

· The

bed and breakfast owner lives at the facility.

· Stadium:

10,000+ seat capacity – this includes land at 130 Anzac Avenue,

Dunedin, Assessment 4026695, Valuation reference 27190-01403.

2 Differentials

Based on Land Use and Provision or Availability of Service

The Council uses these matters to differentiate the

drainage rate and the commercial drainage rate.

The differential categories based on land use are:

· Residential

– includes all rating units used for residential purposes including

single residential, multi-unit residential, multi-use residential,

residential special accommodation, residential communal residence dependant

on other use, residential bach/cribs, residential carparking and residential

vacant land.

· Lifestyle

- includes all rating units with Council's land use codes 2, 20, 21, 22 and

29.

· Farmland

- includes all rating units used solely or principally for agricultural or

horticultural or pastoral purposes.

· Commercial

– includes all rating units with land uses not otherwise categorised as

Residential, Residential Heritage Bed and Breakfasts, Lifestyle, Farmland,

Residential Institutions, Stadium: 10,000+ seat capacity, Churches or

Schools.

· Stadium:

10,000+ seat capacity – this includes land at 130 Anzac Avenue,

Dunedin, Assessment 4026695, Valuation reference 27190-01403.

· Residential

Heritage Bed and Breakfasts – includes all rating units meeting the

following description:

· Bed

and breakfast establishments; and

· Classified

as commercial for rating purposes due to the number of bedrooms (greater than

four); and

· Either:

· the

majority of the establishment is at least 80 years old or

· the

establishment has Heritage New Zealand Pouhere Taonga Registration or

· the

establishment is a Dunedin City Council Protected Heritage Building as

identified in the District Plan; and

· The

bed and breakfast owner lives at the facility.

· Residential

Institutions - includes only rating units with the Council's land use codes

95 and 96.

· Churches

– includes all rating units used for places of religious worship.

· Schools

- includes only rating units used for schools that do not operate for profit.

The differential categories based on provision or

availability of service are:

· Connected

– any rating unit that is connected to a public sewerage drain.

· Serviceable

– any rating unit that is not connected to a public sewerage drain but

is capable of being connected to the sewerage system (being a property

situated within 30 metres of a public drain).

3 Differentials

Based on Provision or Availability of Service

The Council uses this matter to differentiate the

water rates.

The differential categories based on provision or

availability of service are:

· Connected

– any rating unit that is supplied by the water supply system.

· Serviceable

– any rating unit that is not supplied but is capable of being supplied

by the water supply system (being a rating unit situated within 100 metres of

the nearest water supply).

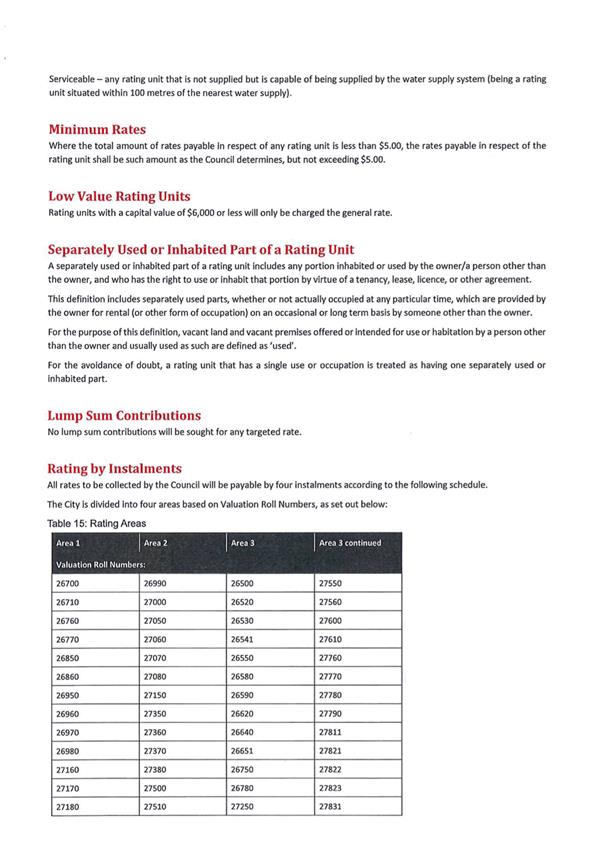

Minimum Rates

c) Approves that where the total amount of rates

payable in respect of any rating unit is less than $5.00 including GST, the

rates payable in respect of the rating unit shall be such amount as the

Council determines but not exceeding $5.00 including GST.

Low Value Rating

Units

d) Approves that rating units with a capital value

of $6,000 or less will only be charged the general rate.

Land Use Codes

e) Approves that the land use codes attached to

this report are adopted as the Council's land use codes for the purpose of

the rating method.

Separately Used or Inhabited Part of a Rating Unit

f) Adopts the following definition of a separately used or

inhabited part of a rating unit:

"A

separately used or inhabited part of a rating unit includes any portion

inhabited or used by the owner/a person other than the owner, and who has the

right to use or inhabit that portion by virtue of a tenancy, lease, licence,

or other agreement.

This

definition includes separately used parts, whether or not actually occupied

at any particular time, which are provided by the owner for rental (or other

form of occupation) on an occasional or long term basis by someone other than

the owner.

For the

purpose of this definition, vacant land and vacant premises offered or

intended for use or habitation by a person other than the owner and usually

used as such are defined as 'used'.

For the

avoidance of doubt, a rating unit that has a single use or occupation is

treated as having one separately used or inhabited part."

Lump Sum

Contributions

g) Approves that no lump sum contributions will be

sought for any targeted rate.

Rating by

Instalments

h) Approves the following schedule of rates to be

collected by the Council, payable by four instalments.

The City is divided into four areas based on

Valuation Roll Numbers, as set out below:

|

Area 1

|

Area 2

|

Area 3

|

Area 3 continued

|

|

Valuation Roll

Numbers:

|

|

26700

|

26990

|

26500

|

27550

|

|

26710

|

27000

|

26520

|

27560

|

|

26760

|

27050

|

26530

|

27600

|

|

26770

|

27060

|

26541

|

27610

|

|

26850

|

27070

|

26550

|

27760

|

|

26860

|

27080

|

26580

|

27770

|

|

26950

|

27150

|

26590

|

27780

|

|

26960

|

27350

|

26620

|

27790

|

|

26970

|

27360

|

26640

|

27811

|

|

26980

|

27370

|

26651

|

27821

|

|

27160

|

27380

|

26750

|

27822

|

|

27170

|

27500

|

26780

|

27823

|

|

27180

|

27510

|

27250

|

27831

|

|

27190

|

27520

|

27260

|

27841

|

|

27200

|

27851

|

27270

|

27871

|

|

|

27861

|

27280

|

27911

|

|

|

27880

|

27450

|

27921

|

|

|

27890

|

27460

|

27931

|

|

|

27901

|

27470

|

27941

|

|

|

28000

|

|

|

|

|

28010

|

|

|

|

|

28020

|

|

|

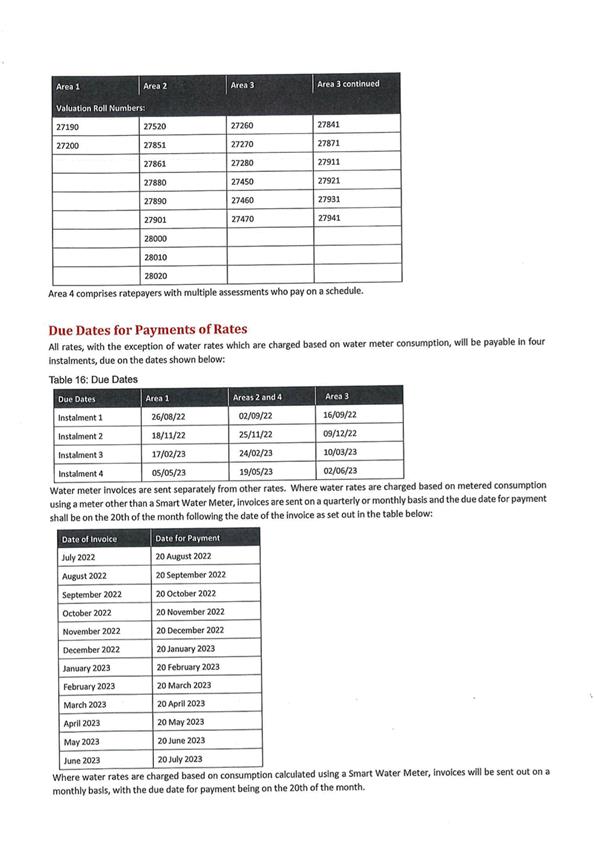

Area 4 comprises ratepayers with multiple

assessments who pay on a schedule.

Due Dates for Payment of Rates

i) Approves the due dates for all rates with the

exception of water rates, which are charged based on water meter consumption,

will be payable in four instalments due on the dates below:

|

|

Area 1

|

Area 2

|

Area 3

|

Area 4

|

|

Instalment 1

|

26/08/22

|

02/09/22

|

16/09/22

|

02/09/22

|

|

Instalment 2

|

18/11/22

|

25/11/22

|

09/12/22

|

25/11/22

|

|

Instalment 3

|

17/02/23

|

24/02/23

|

10/03/23

|

24/02/23

|

|

Instalment 4

|

05/05/23

|

19/05/23

|

02/06/23

|

19/05/23

|

Water meter invoices are sent separately from other

rates. Where water rates are charged based on metered consumption using

a meter other than a Smart Water Meter, invoices are sent on a quarterly or

monthly basis and the due date for payment shall be on the 20th of the month

following the date of the invoice as set out in the table below:

|

Date of

Invoice

|

Date

for Payment

|

|

July 2022

|

20 August 2022

|

|

August 2022

|

20 September 2022

|

|

September 2022

|

20 October 2022

|

|

October 2022

|

20 November 2022

|

|

November 2022

|

20 December 2022

|

|

December 2022

|

20 January 2023

|

|

January 2023

|

20 February 2023

|

|

February 2023

|

20 March 2023

|

|

March 2023

|

20 April 2023

|

|

April 2023

|

20 May 2023

|

|

May 2023

|

20 June 2023

|

|

June 2023

|

20 July 2023

|

Where water rates are charged

based on consumption calculated using a Smart Water Meter, invoices will be

sent out on a monthly basis, with the due date being on the 20th of the

month.

Penalties

j) Resolves to charge the following penalties on

unpaid rates:

1 A

charge of 10% of the unpaid rates instalment will be added to the amount of

any instalment remaining unpaid the day after the instalment due date set out

above.

2 Where

a ratepayer has not paid the first instalment by the due date of that

instalment, and has paid the total rates and charges in respect of the rating

unit for the 2022/23 rating year by the due date of the second instalment,

the 10% additional charge for the first instalment shall be remitted.

3 For

amounts levied in any previous financial year and which remain unpaid on

1 October 2022, 10% of that sum shall be charged, including

additional charges (if any).

4 For

amounts levied in any previous financial year and which remain unpaid on

1 April 2023, 10% of that sum shall be charged, including

additional charges (if any).

Assessing and Recovering Rates

k) Approves that the Chief Executive Officer, Chief

Financial Officer and Rates and Revenue Team Leader be authorised to take all

necessary steps to assess and recover the above rates.

|