Notice of Meeting:

I hereby give notice that an ordinary meeting of the Dunedin

City Council will be held on:

Date: Wednesday

22 February 2023

Time: 10.00

am

Venue: Council

Chamber, Dunedin Public Art Gallery, The Octagon, Dunedin

Sandy Graham

Council

SUPPLEMENTARY AGENDA

|

Mayor

|

Mayor Jules Radich

|

|

|

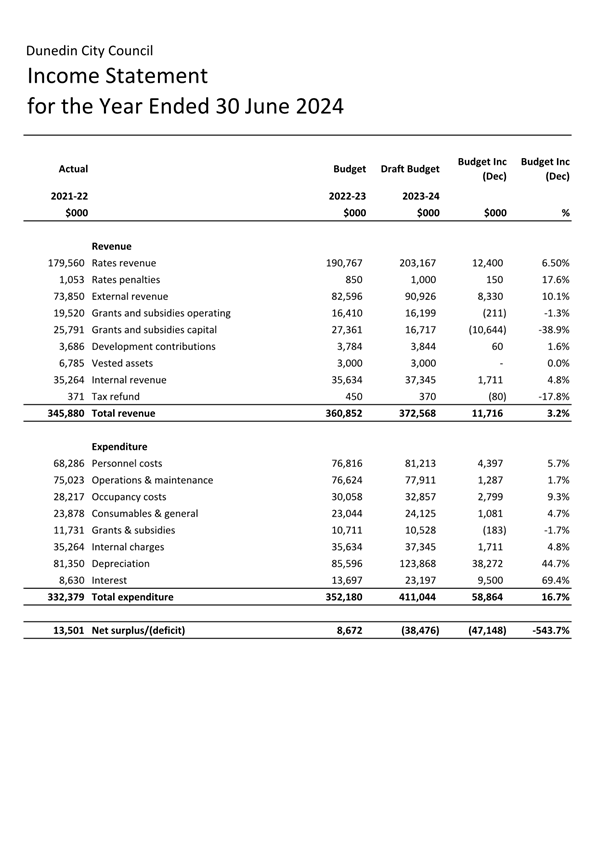

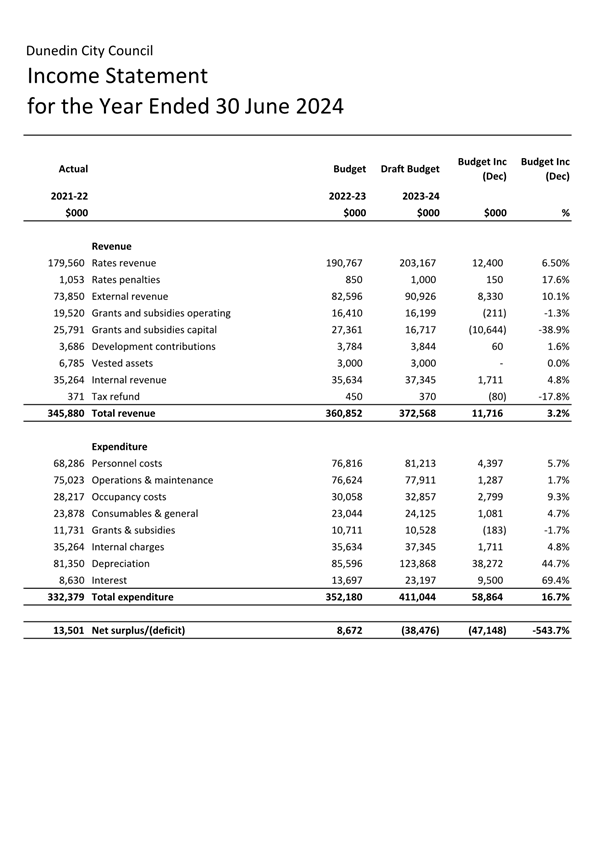

Deputy Mayor

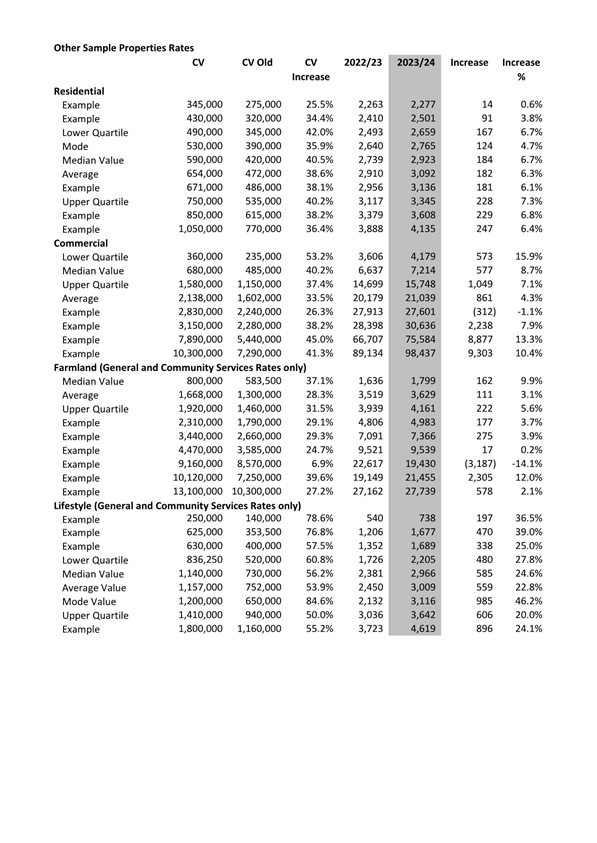

|

Cr Sophie Barker

|

|

|

Members

|

Cr Bill Acklin

|

Cr David Benson-Pope

|

|

|

Cr Christine Garey

|

Cr Kevin Gilbert

|

|

|

Cr Carmen Houlahan

|

Cr Marie Laufiso

|

|

|

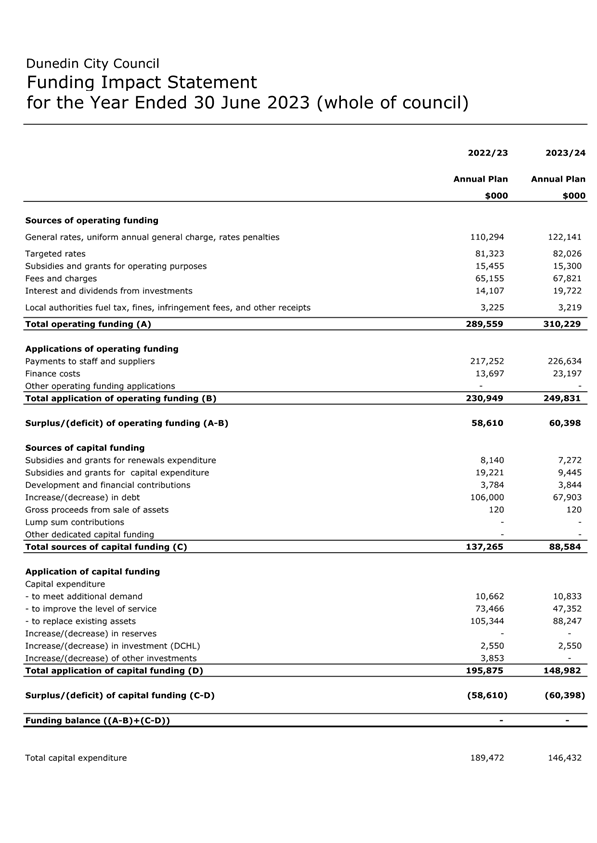

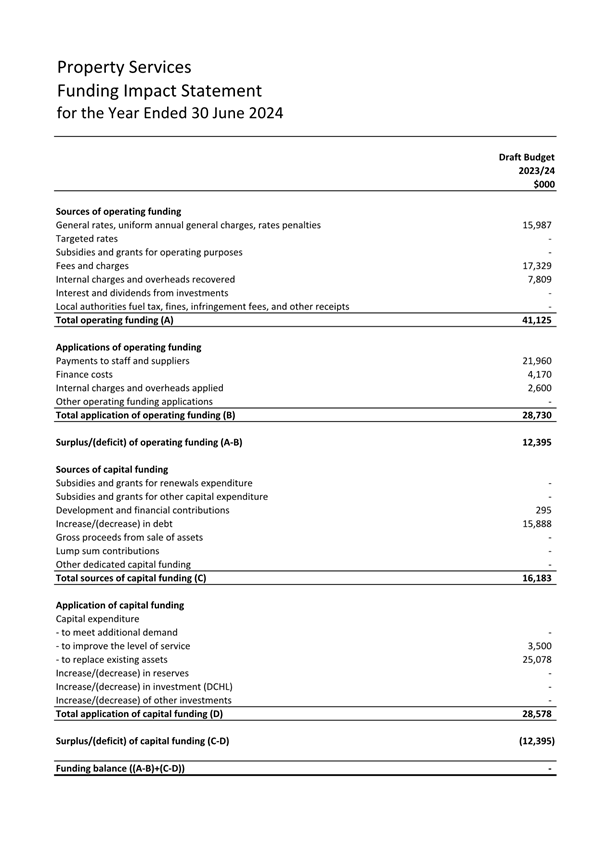

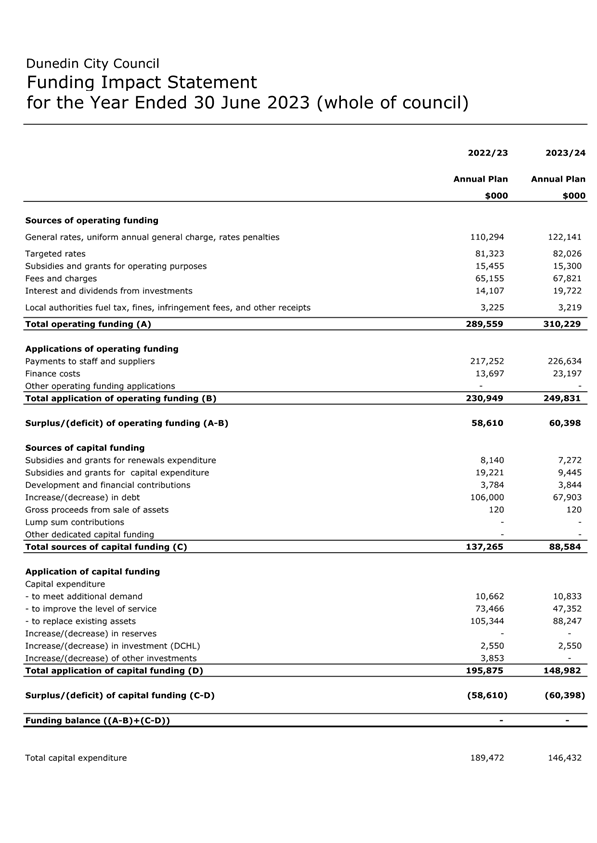

Cr Cherry Lucas

|

Cr Mandy Mayhem

|

|

|

Cr Jim O'Malley

|

Cr Lee Vandervis

|

|

|

Cr Steve Walker

|

Cr Brent Weatherall

|

|

|

Cr Andrew Whiley

|

|

Senior Officer Sandy

Graham, Chief Executive Officer

Governance Support Officer Lynne

Adamson

Lynne Adamson

Governance Support Officer

Telephone: 03 477 4000

Lynne.Adamson@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

|

Council

22 February 2023

|

ITEM TABLE OF CONTENTS PAGE 22

Reports

4 CEO

Overview Report- Annual Plan 2023/24 4

5 Annual

Plan Budget Update - Property Services 16

7 Annual

Plan Budget Update - Reserves and Recreational Facilities 24

11 Annual

Plan Budget Update - Roading and Footpaths 37

13 Annual

Plan Budget Update - Governance and Support Services 45

14 Annual

Plan Budget Update - Regulatory Services 53

15 Annual

Plan Budget Update - 3 Waters 69

16 Annual

Plan Budget Update - Galleries, Libraries and Museums 78

17 Annual

Plan Budget Update - Community and Planning 88

18 Annual

Plan Budget Update - Economic Development 97

19 Annual

Plan Budget Update - Waste Management 104

20 2023-24

Rating Method 114

21 Revenue

Policy Compliance 124

22 Engagement

on the 2023/24 Annual Plan 132

|

|

Council

22 February 2023

|

Reports

CEO Overview Report- Annual Plan 2023/24

Department: Finance and Executive Leadership Team

EXECUTIVE SUMMARY

1 This

report provides an overview of the budgets to be included in the draft 2023/24

Annual Plan (“the draft Plan”). The draft Plan for 2023/24 is

an update of year three of the 10 year plan 2021-31.

2 This

report highlights the budget challenges the DCC faces with the current economic

climate of high inflation and rising interest rates. While savings have been

found across the board, these are largely offset by the inflationary pressures

faced when procuring goods and services and operating the business. The budget

approach has also needed to balance the costs associated with the planned work

programme against the resources it takes to deliver this work.

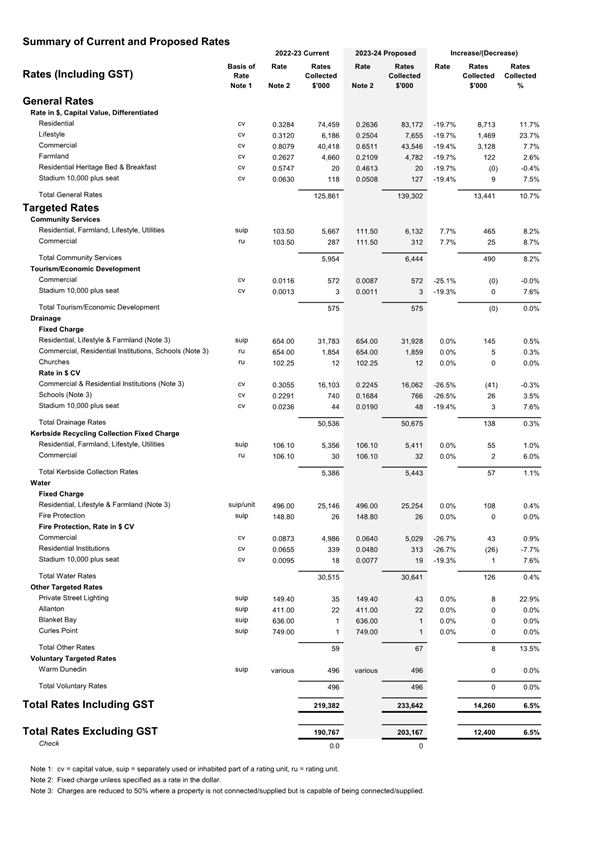

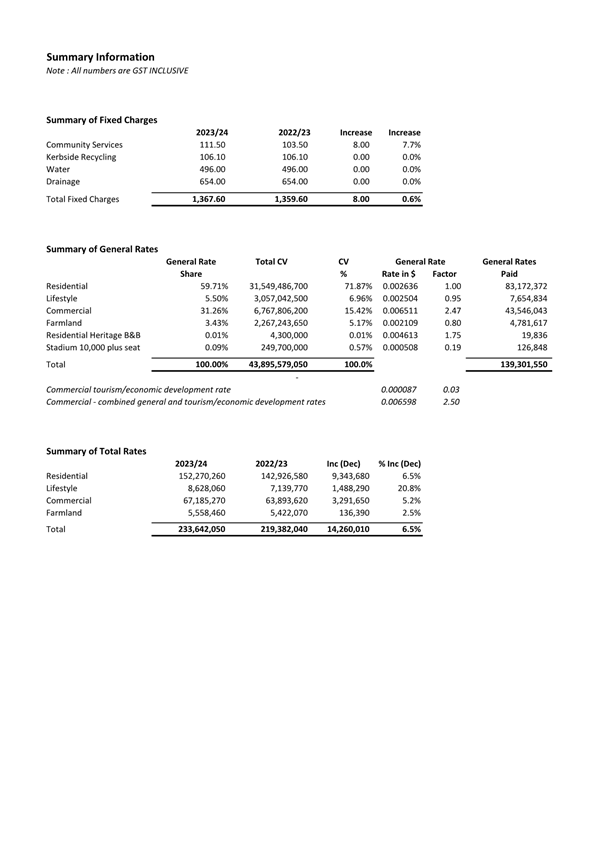

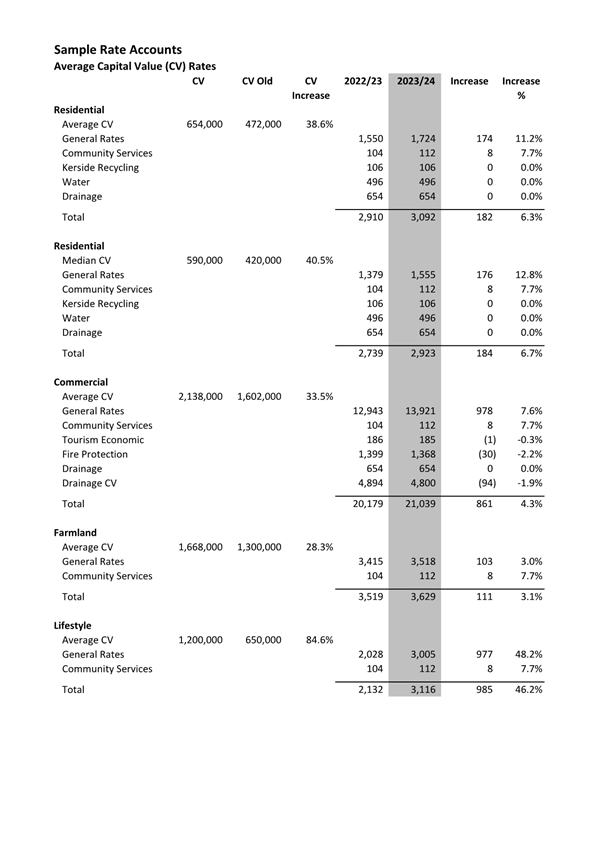

3 The

draft budgets propose a rate rise of 6.5% for 2023/24 which is lower than the

7.0% provided for in year three of the 10 year plan but in line with the

Financial Strategy.

|

RECOMMENDATIONS

That the Council:

a) Adopts the draft 2023/24 operating budgets for

the purpose of community engagement as shown/amended at Attachment A.

b) Notes that any resolution made during this meeting related

to the 2023/24 Annual plan reports may be subject to further discussions and

decision by the meeting.

|

BACKGROUND

4 The

Local Government Act 2002 (the Act) provides that Council must prepare and

adopt an annual plan for each financial year. Section 95 (5) sets out the

purpose of an annual plan as follows:

The purpose of an annual plan is to –

(a) Contain the proposed annual budget and

funding impact statement for the year to which the annual plan relates; and

(b) Identify any variation from the financial

statements and funding impact statement included in the local authority’s

long-term plan in respect of the year; and

(c) Provide integrated decision making and

co-ordination of the resources of the local authority; and

(d) Contribute to the accountability of the

local authority to the community.

5 The

draft Plan for 2023/24 is an update of year three of the 10 year plan.

Budgets for the 2023/24 year have been reviewed and budget update reports for each

activity of Council have been prepared for consideration at this meeting.

DISCUSSION

6 This

has been a challenging budget process with pressures from rising inflation, as

well as interest costs increasing by $9.500 million, and depreciation expense due

to the revaluation of assets, and an extensive capital work programme

increasing by $38.272 million. When those factors are accounted for the budget

shows savings have been made in other areas of the organisation where costs are

controllable.

7 This

includes continuing work to reduce the reliance on consultants while

recognising that there will always be a need for specialist services. The

reliance on consultants continues to be a challenge especially in a tight

employment market. Further work is being undertaken to review these costs.

8 When

the 10 year plan budgets were set, the financial climate and broader economy

were very different than they are now. Inflationary pressures have been felt in

all areas of the Council operations. Staff have worked hard to absorb cost

increases by finding efficiencies and different ways of doing things while

trying to maintain current levels of service. The impact of interest cost

increases and depreciation have made this especially challenging.

9 A

rate increase of 6.5% has been used to develop the draft budgets with no

obvious decreases to levels of service.

10 In

line with an early engagement approach, staff have worked with a range of

parties and organisations about various initiatives suggested by the community.

As a result of this engagement, some of these initiatives can be met from

existing budgets and is covered off in separate reports.

11 Council

have also asked staff to prepare a number of reports as part of the development

of the Annual Plan, and these are presented at this meeting alongside the

relevant activity report.

Workstreams for the next 10 year plan

12 This

budget signals some challenging conversations will be needed with the community

around the next 10 year plan. In the context of Central Government’s

reform programme and the broader economic outlook, the DCC will need to review

a range of services to ensure services can be delivered on a sustainable basis.

13 Work

on levels of service will begin shortly to feed into the 10 year plan.

Alongside that, work is progressing on an Investment Plan that will look at how

the DCC can ensure income generating assets are managed to ensure they are

delivering an adequate return to the ratepayer.

14 As

part of the development of the 10 year plan 2024-34, there are a number of

workstreams which will determine future budgets. These workstreams

include:

· Delivery

of services – a review to identify streamlining opportunities and build

in further efficiencies in service delivery

· Levels

of service – reviewing what levels of service we provide, how much we

provide and how they will be paid for

· Capital

programme - developing a sustainable capital work programme for the next 10

years

· Strategic

refresh – including the development of wellbeing statements

· Grants

– a cross council review of all grant funding pools and spend

· 3

Waters reform – the timing and impacts of reform

· Investment

Plan – implementing the provisions of the Investment Plan following its

adoption

· Revenue

and Financing Policy – a full review of the policy including charges for

community housing and aquatic services.

Significant forecasting

assumptions

15 The

10 year plan sets out a number of significant forecasting assumptions that have

been used in the development of the draft annual plan 2023/24. Some

relate to inflation and interest rates and these have been updated for the

draft budgets.

16 Key

assumptions included in the preparation of the draft budget will be further

updated in May 2023. This will include but not be limited to:

a) Interest

rate on borrowings – including allocation of interest cost to each

activity group

b) Forecast

debt as at 30 June 2024

c) Update

assumptions for the 3 Waters depreciation following finalisation and audit

clearance of year end valuation as at 30 June 2022

d) Updating

rates on DCC owned properties

e) The

impacts of inflation.

Capital expenditure

17 In

terms of the capital budgets, good progress has been made against the 10 year

plan capital programme, and this has been reported regularly to Council.

Capital expenditure was forecast to be $204.543 million for the 2023/24 year.

Cost escalations and increases in interest rates have prompted a need to reduce

this to a more sustainable level which is in line with year three of the 10 year

plan ($145.050 million).

18 Capital

budget updates for 2023/24 are underway and will be presented at the May 2023

deliberations meeting, when we have more clarity about the proposed levels of

spend.

Operating budgets

19 The

draft operating budget for 2023/24 provides for the day-to-day running of all

the activities and services the DCC provides such as core water and roading

infrastructure, waste management, parks, pools, libraries, galleries and

museums. The draft budget includes operating expenditure of $411.044 million

(refer to Attachment A).

20 The

rate increase of 6.5% included in the draft budget, while consistent with the

Financial Strategy, does not deliver a balanced budget. A balanced budget means

that we will have a positive operating surplus. The draft budget doesn’t

deliver this for the 2023/24 year due to the significant increases in interest

and depreciation. The draft budget provides a net deficit of $38.476 million.

21 Expenses

within our control continue to be reviewed in order to find further savings to

address the budget deficit. The draft operating budget shows savings have been

made in other areas of the organisation where costs are controllable.

22 The

draft Transport budget is the most challenging because of increased costs,

including traffic management and contract escalations. Work is being undertaken

to find alternatives for the provision of traffic management services, to

improve our understanding of Central Government funding and reviewing levels of

service.

23 For

the 2023/24 year, focus will be on how to deliver the work programme within the

Transport budget while determining the services we deliver for the 10 year plan

as part of the review of levels of service. An updated Transport budget will be

provided in May 2023 when more work has been done to understand the cost

pressures and impact on service delivery.

24 Each

of the DCC’s groups of activities have updated year three of their draft

operating budgets as provided for in the 10 year plan. The key changes in

funding sources and expected costs of delivery are explained in the group

operating budget reports.

Revenue

25 The

draft operating budget for 2023/24 shows overall rates revenue increasing by

$12.400 million, which is 6.5% higher than 2022/23, but is lower than the rate

increase of 7.0% provided for in the 10 year plan.

26 External

revenue has increased by $8.330 million, 10.1%. The main changes to external

revenue are:

· Governance

and Support Services – an increase of $5.673 million reflecting a $5.500

million increase in dividends from Dunedin City Holdings Limited.

· Parks

and Recreation – an increase of $1.613 million relating mainly to Te Puna

o Whakaehu.

· Waste

Management – an increase of $672k due to increases in the waste disposal

levy and Green Island Landfill revenue.

27 Fees

and charges are discussed separately in the group budget reports. There has

been a consolidation of Parking fees and charges to reduce the types of paid

parking zones. Details are outlined in the Regulatory Services Group report but

of note is that the paid main street 30-minute parking restriction will be

replaced by an unpaid 30-minute restriction.

28 There

are some variances with the Revenue and Financing Policy and these are

highlighted in a separate report – Revenue Policy Compliance. A full

review of the policy will occur as part of the development of the next 10 year

plan.

Expenditure

Staff costs

29 The

draft budget provides for an increase in personnel costs of $4.397 million,

5.7%, incorporating an increase of 41.9 full time equivalent (FTE) staff.

Further details are provided in each of the group budget reports.

30 Staffing

numbers have increased in the draft budgets. Around half the increase (17 FTE)

is required to staff Te Puna o Whakaehu.

31 The

other roles are spread across the organisation. These roles, many in

back-of-house support areas like IT, HR and quality

improvement, are necessary to support the changes that are being made

internally to increase efficiency and support service delivery.

32 The

increases should be seen in the context of the level of vacancies that are

being carried. Currently, there are 85 vacant positions. As work continues to

find efficiencies and right size various activities, how and if these roles are

filled will be considered.

33 The

vacancies mean there is an allowance in the budget that is available to fund a

salary increase for existing staff, as no increase has been factored into the

draft budget.

Operations and maintenance

costs

34 Operations

and maintenance costs have increased by $1.287 million, 1.7%. The main changes

are due to:

· Waste

Management – an increase of $1.062 million relates primarily to increases

at the Green Island Landfill and the kerbside collection contract.

· Community

and Planning – an increase of $783k for community events.

· Transport

- an increase of $532k mostly relating to coastal management costs, $426k of

this was transferred from Parks and Recreation.

· Parks

and Recreation – an increase of $224k due to Te Puna o Whakaehu and

maintenance cost increases.

· 3

Waters – a reduction of $743k primarily related to sludge from the Tahuna

wastewater treatment plant ($1.099 million) which can now be lime treated and

transferred to the Green Island Landfill, partially offset by an increase in

internal disposal costs of $794k. A reduction in contracted services offsets

internal resourcing changes. Other changes reflect increases in maintenance,

shipping charges for chemicals and additional regulations around laboratory

testing requirements.

· Governance

and Support Services– a reduction of $549k due mainly to the

election.

Occupancy costs

35 Occupancy

and property-related costs such as rates, insurance and fuel have increased by

$2.799 million, 9.3%. Note the rates expenditure budgets will be reviewed to

reflect the new rating valuations.

Consumables and general

costs

36 Consumables

and general costs have increased by $1.081 million, 4.7%. The main changes are

due to:

· Waste

Management – an increase of $628k relates primarily to increases at the

Green Island Landfill for the waste disposal levy.

· Galleries,

Libraries and Museums – an increase of $291k for stock purchases and

catering, which are both recovered, and increased costs.

· Governance

and Support Services – an increase of $260k due to costs associated with

the 10 year plan 2024-34 development including an audit fee of

$145k.

· Community

and Planning – an increase of $194k due to increased legal fees for

appeals to the 2nd Generation District Plan’s Variation 2

Greenfield rezoning.

· Parks

and Recreation – a decrease of $283k due to savings in consultancy and a

transfer of budget to Transport.

· Transport

- a decrease of $250k primarily driven by a reduction in consultants.

Depreciation

37 Depreciation

expense has increased by $38.272 million, 44.7%. The main increase in

depreciation for the draft budget 2023/24 relates to reticulation assets within

3 Waters. Previously the DCC valued its 3 Waters assets based on historical

replacement costs indexed annually to reflect the cost/valuation for accounting

purposes. Last financial year it was concluded that this methodology was

no longer appropriate, and a methodology based on current replacement costs has

been applied as at 30 June 2022.

38 This

change in methodology has seen an increase in cost/valuation for accounting

purposes of circa $1.3 billion and comes with an increased level of

depreciation which has been estimated for the draft budgets.

39 The

valuation uplift is subject to audit clearance and further work is still

required to ensure the depreciation correctly reflects the new values. It is

possible that the valuation will be reduced, which would see a reduction in

depreciation and therefore in the budget deficit.

Interest

40 Interest

expense has increased by $9.500 million, 69.4% reflecting the predicted

increase in debt funding required to support the planned capital expenditure

programme and an increase in interest rates.

41 The

long term plan 2021-2031 included an interest rate assumption of 2.85%.

At the time the corresponding OCR was 0.25%. This rate was increased for the

2022/23 annual plan to 3.6% (OCR 2.00%). The DCC current interest rate

applicable to its borrowing is 4.35% which was effective from 1 January 2023 –

up from the predicted 3.60%.

42 The

interest rate used in developing the 2023/24 draft budget has been set at

4.85%. Interest rates over the last 12 months have been impacted by various

world events. The New Zealand official cash rate has increased markedly in this

period and currently sits at 4.25%.

Funding Depreciation

43 There

is no ability for Council to fund the uplift in depreciation for 3 Waters.

Funding this alone would mean a rates increase of 17%. Given the reform

environment and likely decisions about 3 Waters, it is not prudent to rate fund

this increase at this time.

44 This

does not mean that renewal work is not happening because the draft budgets

focus on trying to fund capital renewals expenditure from operations rather

than trying to fund depreciation.

45 The

budget for each group (and all of Council) includes a Funding Impact Statement

(FIS) – see Attachment B. The FIS statements represent a

restatement of the income statements by:

· Removing

non-cash items including depreciation

· Separating

operating and capital funding

· Including

how the total funding will be used ie capital expenditure

· Identifying

how any shortfall in funding will be financed ie increase in debt.

46 Ideally

the available operating funding being “Surplus/(deficit) of operating

funding (A-B)” plus “Subsidies and grants for renewal

expenditure” will be sufficient to cover capital expenditure “to

replace existing assets”.

|

Funding Impact Summary

|

Budget

2022/23 $000

|

Draft

Budget 2023/24 $000

|

Increase

(Decrease) $000

|

|

Surplus/(deficit) of

operating funding (A-B)

|

58,610

|

60,398

|

1,788

|

|

Subsidies & grants for

renewals expenditure

|

8,140

|

7,272

|

(868)

|

|

Capex to replace existing

assets

|

(105,344)

|

(88,247)

|

17,097

|

|

Increase in investment

DCHL

|

(2,550)

|

(2,550)

|

-

|

|

Funding surplus/(deficit)

|

(41,144)

|

(23,127)

|

18,017

|

47 What the table shows is that

we are borrowing $23.127 million in the draft budgets to fund renewals. While

this is not sustainable long-term, it is necessary to ensure that we continue

with the renewal programme while we develop a sustainable capital expenditure

programme as part of the next 10 year plan.

OPTIONS

48 There

are no options.

Signatories

|

Author:

|

Carolyn Allan - Senior Management Accountant

Gavin Logie - Chief Financial Officer

|

|

Authoriser:

|

Sandy Graham - Chief Executive Officer

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Draft Operating Budget

2023/24

|

14

|

|

⇩b

|

Draft Funding Impact

Statement 2023/24

|

15

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision enables democratic local

decision making and action by, and on behalf of communities, and promotes the

social economic, environmental, and cultural well-being of communities in the

present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The Group Activities contribute to the objectives and

priorities of the above strategies.

|

|

Māori Impact Statement

Council budgets impact broadly across all Dunedin

communities including Māori. The Council is committed to developing

ongoing relationships with Māori communities, particularly with mana

whenua. Strategic projects that have significance to Māori have been

identified from across the organisation and these projects will work

collaboratively with the Maori Partnerships Manager to ensure beneficial

outcomes for Māori are achieved.

|

|

Sustainability

The draft budgets continue to support the principles of

sustainability and financial resilience, as outlined in the 10 year plan,

most notably in the Infrastructure Strategy and in the Financial Strategy.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report provides draft budget information for

inclusion in the draft 2023/24 Annual Plan.

|

|

Financial

considerations

Financial considerations are detailed in the report.

|

|

Significance

The 10 year plan 2021-31 budgets were considered

significant in terms of the Council’s Significance and Engagement

Policy, and were consulted on. Variations to those budgets as discussed

in this report are not considered significant in terms of the policy.

|

|

Engagement –

external

A report on engagement is on the agenda.

|

|

Engagement -

internal

Staff from across the Council have been involved in the

development of the draft budgets and reports.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

Projects identified in Community Board Plans were

considered in the development of the budgets for the 10 year plan, and

Community Boards were consulted at this time. Community Boards will

have an opportunity to present on the draft 2023/24 Annual Plan.

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

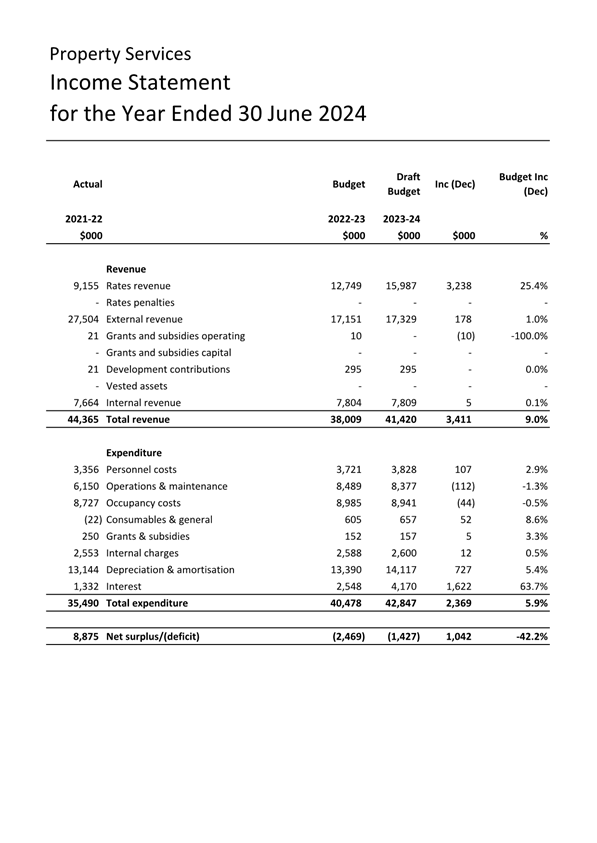

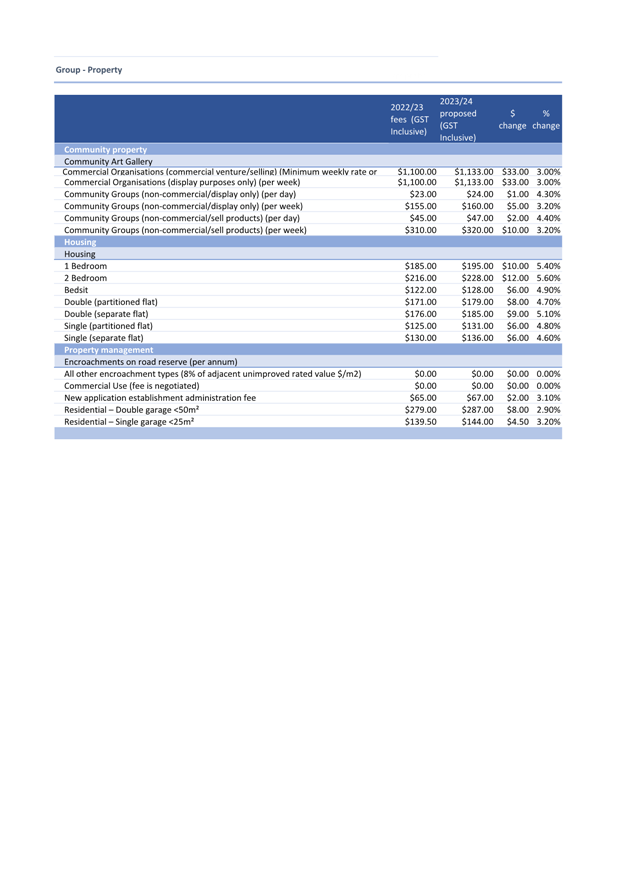

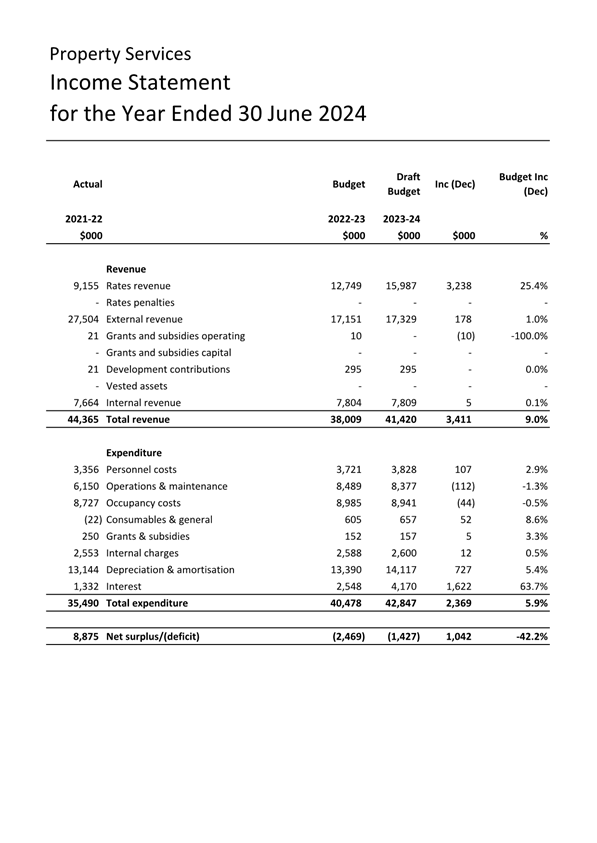

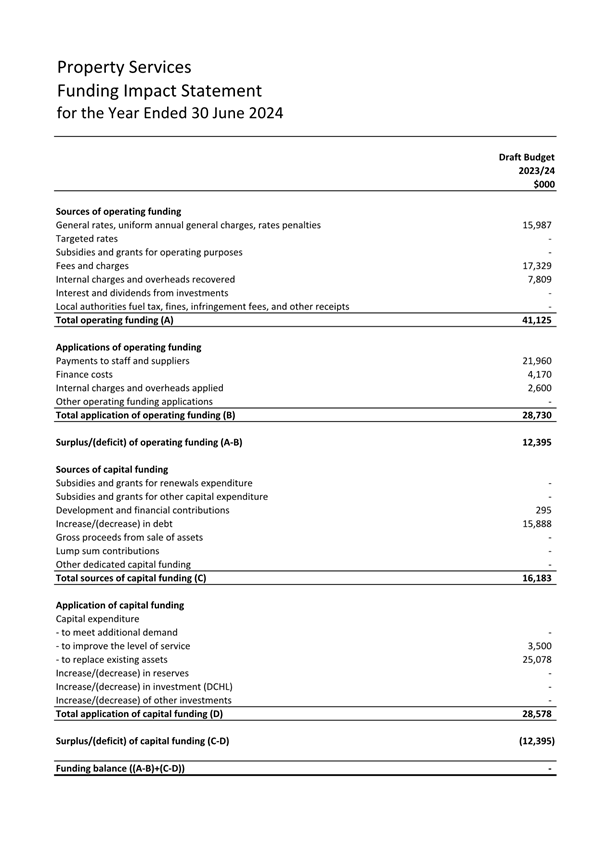

Annual Plan Budget Update - Property Services

Department: Property

EXECUTIVE SUMMARY

1. This

report provides an overview of the operating expenditure (opex) budgets for the

2023/24 Annual Plan year for the Property Group as shown at Attachment A. A

draft funding impact statement (FIS) is shown at Attachment B. The following

activities are provided for:

· Community

Housing

· Investment

Property

· Holding

Property

· Operational

Property

· Community

Property

· Property

management

2. A

schedule of proposed fees and charges for the 2023/24 year is also

presented at Attachment C.

|

RECOMMENDATIONS

That the Council:

a) Approves the draft 2023/24 operating budget for the Property Group as

shown/amended at Attachment A.

b) Approves the draft 2023/24 fees and charges

schedules for the Property Group as shown/amended at Attachment C.

|

operating budgets

Revenue

Rates

3. The

rates contribution for the Group has increased by $3.238 million, 25.4%.

External Revenue

4. External

revenue has increased by $178k. The main revenue changes incorporate the

following:

a) An

increase in Community Housing revenue of $314k, representing an overall

increase of 5%. Rental increases range from $6 - $12/week.

b) An

increase of $195k in the Community Property portfolio due to project delays for

the South Dunedin Community complex, resulting in existing tenancies continuing

in 2023/24.

c) A

decrease of $285k on the Holding portfolio due to the sale of a property and

the loss of the main tenant at 1 White St.

d) A

decrease of $105k in the Investment Property portfolio due to renegotiated Wall

St leases and continued vacancies at 54 Moray Place.

Expenditure

Personnel Costs

5. Personnel

costs have increased by $107k, 2.9% reflecting salary changes.

Operations and

Maintenance

6. Operations

and maintenance costs have decreased by $112k with the main changes being:

a) A

decrease of $453k in the Community Property portfolio due to the Railway

Station planned maintenance project being completed in 2022/23, and a

reduction in maintenance needed for community halls.

b) An

increase of $311k for contracted services costs in Property Management due to the

three-yearly revaluation of property assets.

Depreciation

7. Depreciation

has increased by $727k and reflects the capital expenditure programme.

Interest

8. Interest

expense has increased by $1.622 million as a result of the capital expenditure

programme and higher interest rate.

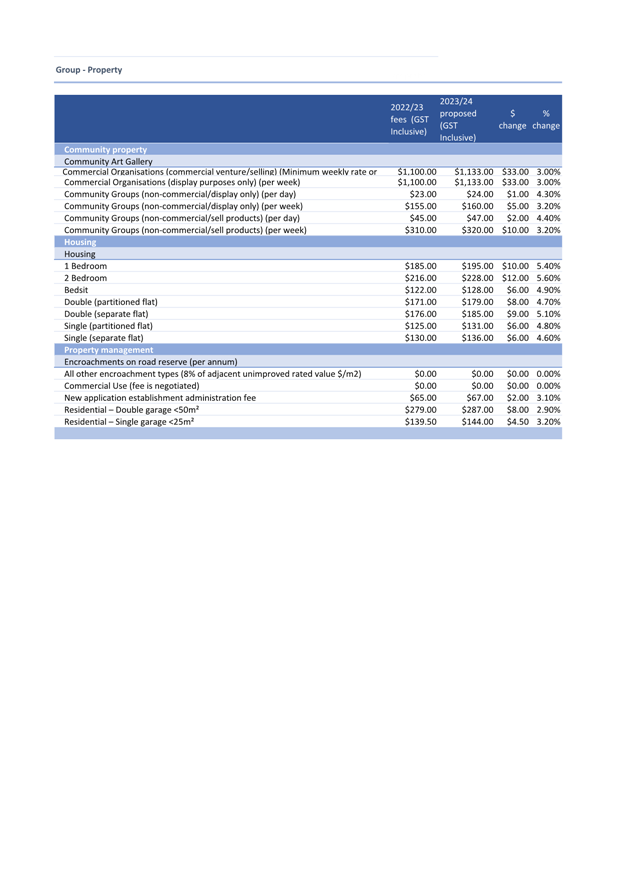

FEES and charges

9. Rental

fees for community housing are proposed to increase by between 4.6% - 5.6%,

being between $6 - $12 per week.

10. Community

Gallery hire fees are proposed to increase by between 3.0% – 4.4%.

11. Fees

for encroachments on road reserves are proposed to increase by around 3%.

Signatories

|

Author:

|

Anna Nilsen - Group Manager, Property Services

|

|

Authoriser:

|

Robert West - General Manager Corporate and Quality

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Income Statement

|

21

|

|

⇩b

|

FIS Statement

|

22

|

|

⇩c

|

Property Fees Schedule

|

23

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision enables democratic local

decision making and action by, and on behalf of communities, and promotes the

social economic, environmental, and cultural well-being of communities in the

present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☐

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☐

|

☐

|

☐

|

The Property Group activities primarily contribute to the

objectives and priorities of the above strategies.

|

|

Māori Impact

Statement

Council budgets impact broadly across all Dunedin

communities including Māori. The Council is committed to

developing ongoing relationships with Māori communities, particularly

with mana whenua. Strategic projects that have significance to Māori

have been identified from across the organisation and these projects will

work collaboratively with the Māori Partnerships Manager to ensure

beneficial outcomes for Māori are achieved.

|

|

Sustainability

The Annual Plan is not proposing any changes to that

provided for in the 10 year plan. Major issues and implications for

sustainability are discussed and considered in the 50 year Infrastructure

Strategy and financial resilience is discussed in the Financial Strategy of

the current 10 year plan 2021-31.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report provides a draft budget for the Property Group

for inclusion in the draft 2023/24 Annual Plan.

|

|

Financial

considerations

Financial considerations are detailed in the report.

|

|

Significance

The 10 year plan 2021-31 budgets were considered

significant in terms of the Council’s Significance and Engagement

Policy, and were consulted on. Variations to those budgets as discussed

in this report are not considered significant in terms of the

policy.

|

|

Engagement –

external

There has been no external engagement in updating the

draft budget for the Property Group.

|

|

Engagement -

internal

Staff and managers from across council have been involved

in the development of the draft budget.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

Projects identified in Community Board Plans were

considered in the development of the budgets for the 10 year plan, and

Community Boards were consulted at this time. Community Boards will

have an opportunity to present on the draft 2023/24 Annual Plan.

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

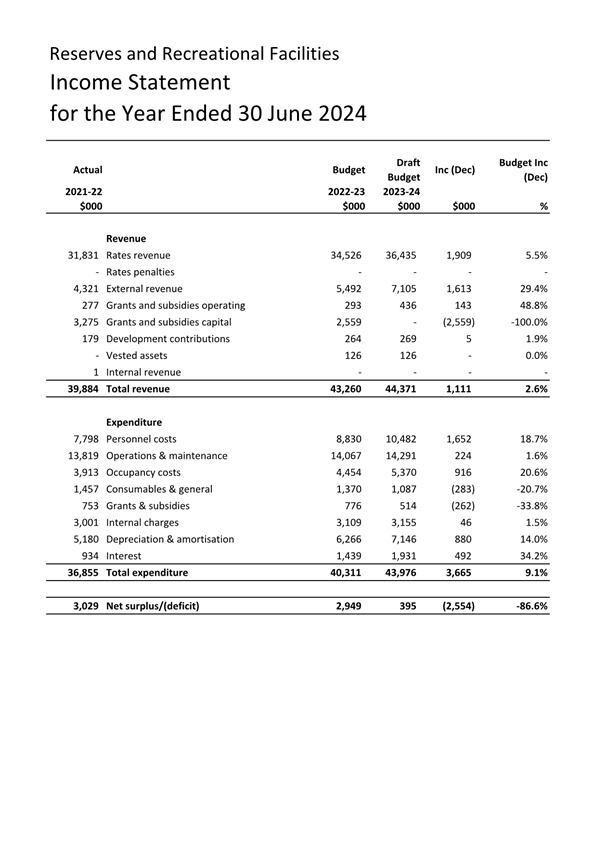

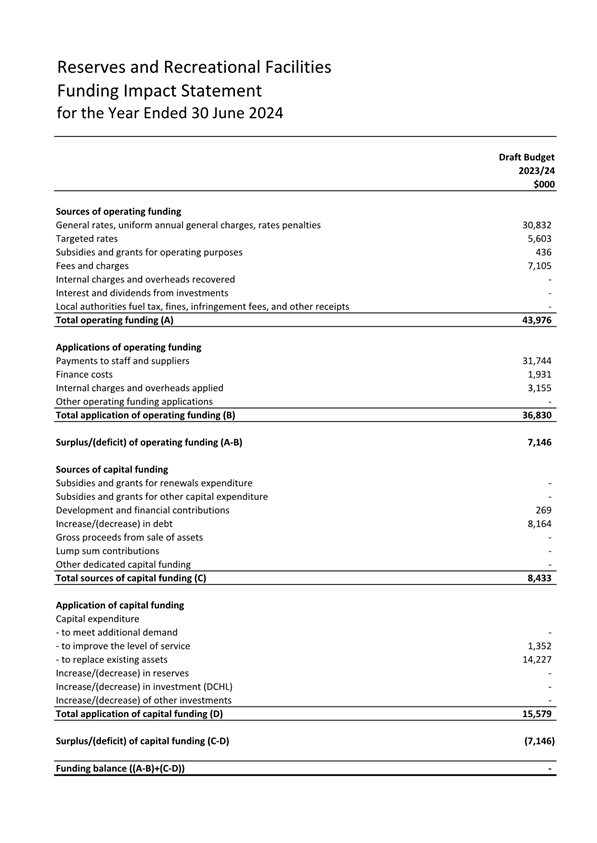

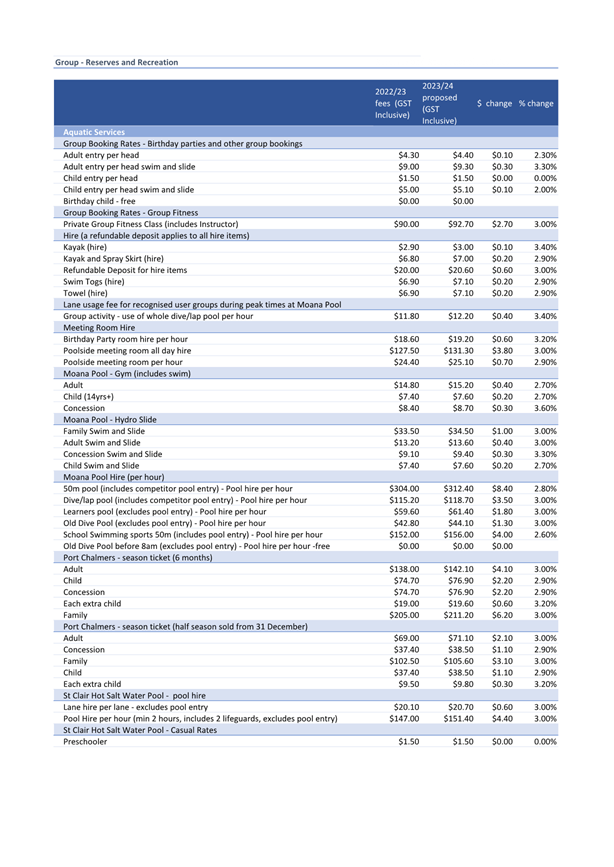

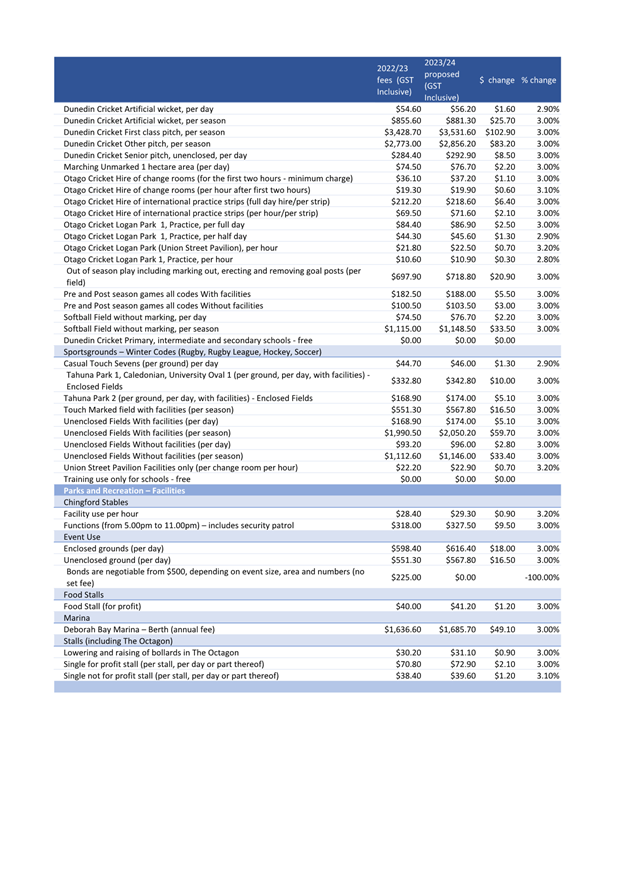

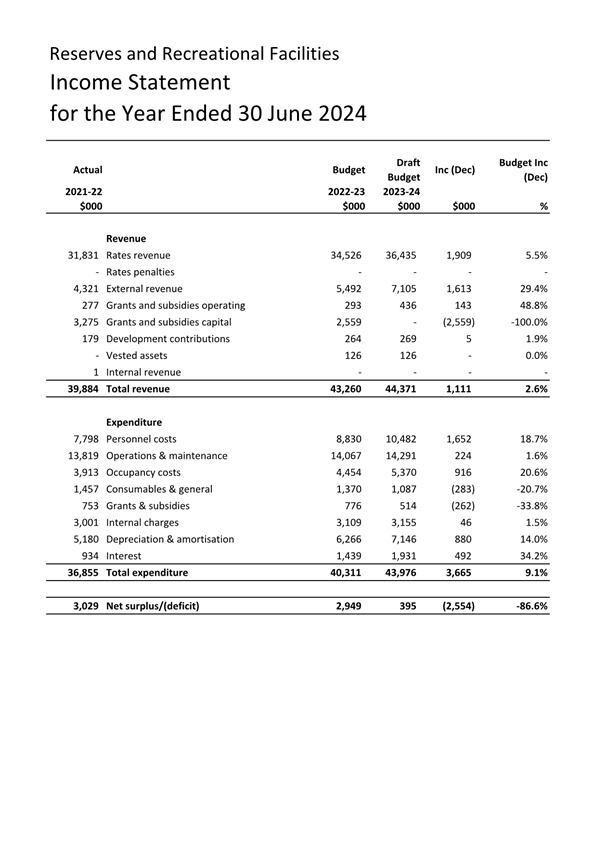

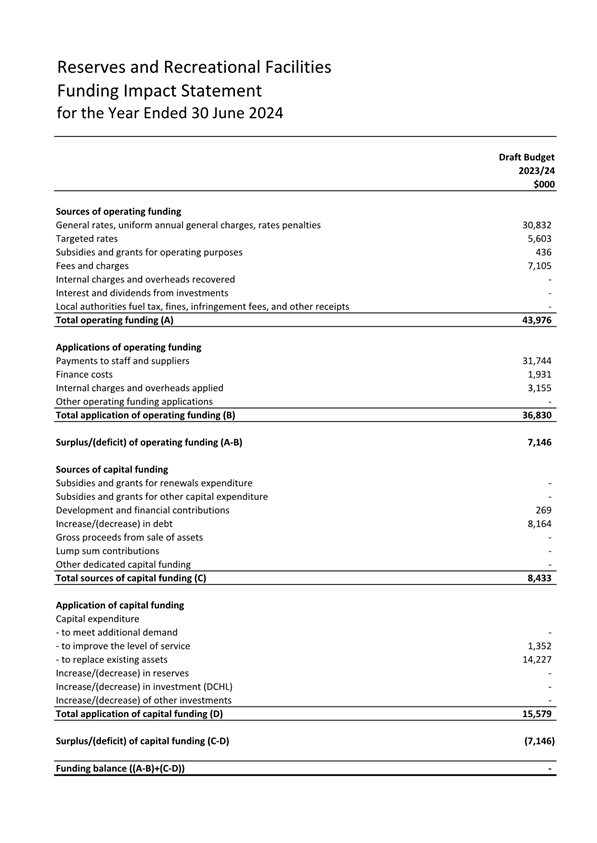

Annual Plan Budget Update - Reserves and Recreational

Facilities

Department: Parks and Recreation

EXECUTIVE SUMMARY

1 This

report provides an overview of the operating expenditure (opex) budgets for the

2023/24 Annual Plan year for the Reserves and Recreational Facilities

Group as shown at Attachment A. A draft funding impact statement (FIS) is

shown at Attachment B. The following activities are provided for:

· Aquatic

Services

· Botanic

Garden

· Cemeteries

and Crematorium

· Parks

and Recreation

2 A

schedule of proposed fees and charges for the 2023/24 year is also presented at

Attachment C.

|

RECOMMENDATIONS

That the Council:

a) Approves the draft 2023/24 operating budget for the Reserves and

Recreational Facilities Group as shown/amended at Attachment A.

b) Approves the draft 2023/24 fees and charges

schedules for Reserves and Recreational Facilities as shown/amended at

Attachment C.

|

operating budgets

Revenue

Rates

3 The

rates contribution for the Group increases by $1.909 million, 5.5%.

External

Revenue

4 External

revenue increases by $1.613 million, 29.4%. The main revenue changes

incorporate the following:

a) A

general 3% increase in fees and charges across most activities.

b) Mosgiel

Pool revenue increases by $1.041 million as this is the first full year of

operation.

c) Moana

Pool revenue increases by $42k. A $90k revenue increase generated by the 3%

increase in fees and charges is partially offset by $48k due to the closure of

the hydro slide from April 2024.

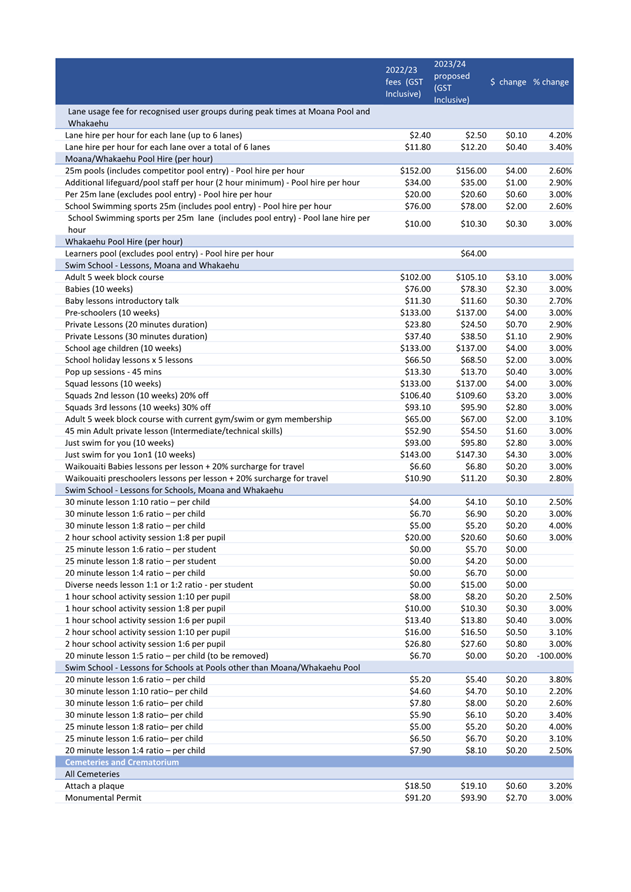

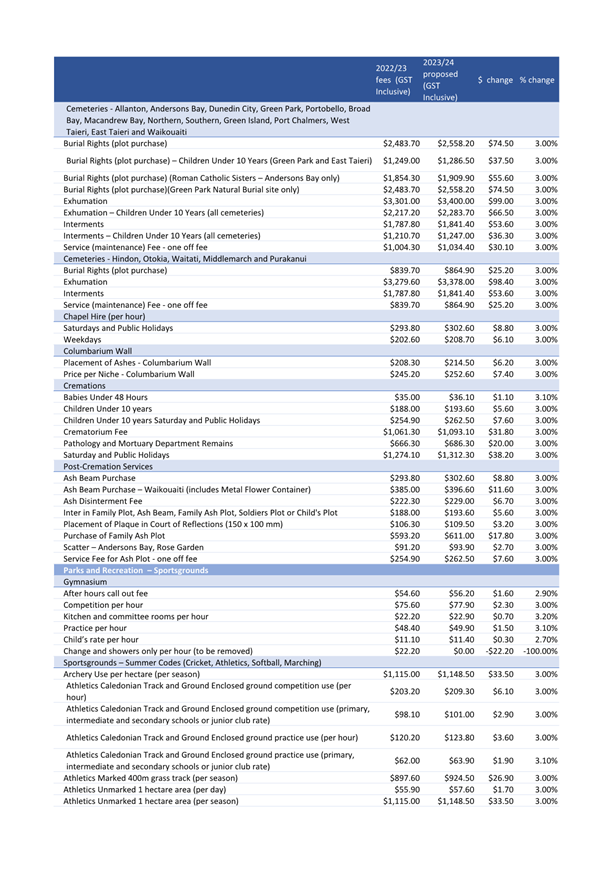

d) Cemeteries

and Crematorium revenue increases by $134k reflecting prior year actual revenue

and a 3% increase in fees and charges.

e) Sportsground

Revenue increases by $315k due mainly to funding being received from FIFA for

training site hire for the 2023 FIFA Women’s World Cup.

Grants

and Subsidies Capital and Operating

5 Grants

and subsidies capital revenue decreases by $2.559 million due to the

removal of the one-off capital grants received from MBIE (Tunnel Beach) &

FIFA (lighting/facilities) in 2022/23.

6 Grants

and subsidies operating revenue increases by $143k due to an increase in

funding from Predator Free Dunedin to fund the additional City Sanctuary

resourcing.

Expenditure

Personnel Costs

7 Personnel

costs increase by $1.652 million, 18.7% across the Group, mostly due to

increased staffing requirements for the new Mosgiel Pool facility. Two

additional fixed term positions in Parks and Recreation for the City Sanctuary

project are funded by Predator Free Dunedin.

Operations

and Maintenance

8 Operations

and maintenance costs increase by $224k, 1.6% due to additional operational

costs for the new Mosgiel pool ($119k) and an increase in the reserves and

trees maintenance contract ($146k).

Occupancy

Costs

9 Occupancy

costs increase by $916k, 20.6% including costs for the new Mosgiel Pool of

$664k (cleaning, energy, rates, and water charges). Security costs have

increased $96k to fund the shared DOC ranger programme (Freedom Camping,

Beaches Bylaw).

Consumables and general

costs

10 Consumables

and general costs have decreased by $283k, -20.7% due to savings in consultancy

and a transfer of budget to Transport.

Grants

and Subsidies

11 Grants

and Subsidies decrease by $262k mainly due to the removal of expiring grants:

a) The

Otago Artificial Turf Trust $30k,

b) Predator

Free NZ $150k,

c) Dunedin

Gymnastics Academy rental support $65k and

d) NZ

Salmon Anglers Association $11.9k.

Depreciation

12 Depreciation

has increased by $880k due to the capital expenditure programme.

Interest

13 Interest

expense has increased by $492k as a result of the capital expenditure programme

and higher interest rate.

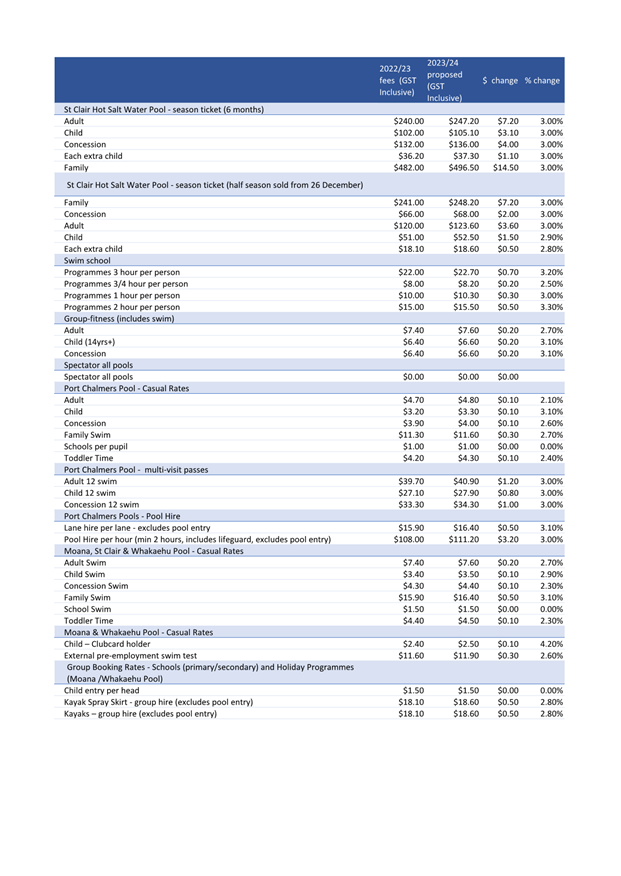

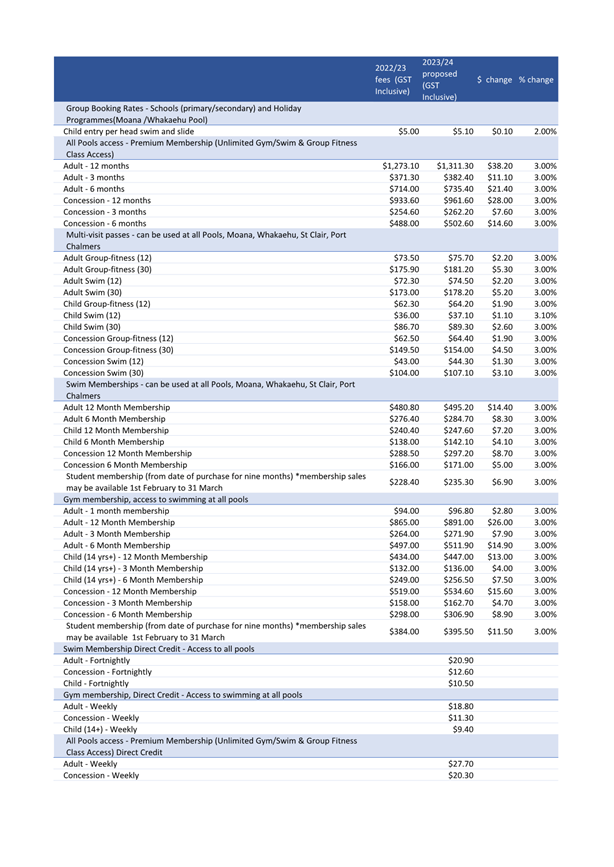

FEES and charges

14 Fees

and charges for Reserves and Recreational Facilities have generally been

increased by 3% (with some rounding).

15 The

new Mosgiel Pool fees & charges are in line with Moana and St Clair Pools.

Signatories

|

Author:

|

Scott MacLean - Group Manager Parks and Recreation

|

|

Authoriser:

|

Simon Pickford - General Manager Community Services

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Income Statement

|

29

|

|

⇩b

|

FIS Statement

|

30

|

|

⇩c

|

Reserves and

Recreational Fees Schedule

|

31

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision enables democratic local

decision making and action by, and on behalf of communities, and promotes the

social economic, environmental, and cultural well-being of communities in the

present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☐

|

☐

|

☐

|

|

Environment Strategy

|

☐

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☐

|

|

Spatial Plan

|

☐

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The activities of the Reserves and Recreational Facilities

Group primarily contribute to the objectives and priorities of the above

strategies.

|

|

Māori Impact

Statement

Council budgets impact broadly across all Dunedin communities

including Māori. The Council is committed to developing ongoing

relationships with Māori communities, particularly with mana whenua.

Strategic projects that have significance to Māori have been identified

from across the organisation and these projects will work collaboratively

with the Māori Partnerships Manager to ensure beneficial outcomes for

Māori are achieved.

|

|

Sustainability

The Annual Plan is not proposing any changes to that

provided for in the 10 year plan. Major issues and implications for

sustainability are discussed and considered in the 50 year Infrastructure

Strategy and financial resilience is discussed in the Financial Strategy of

the current 10 year plan 2021-31.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report provides a draft budget for the Reserves and

Recreational Facilities Group for inclusion in the draft 2023/24 Annual Plan.

|

|

Financial

considerations

Financial considerations are detailed in the report.

|

|

Significance

The 10 year plan 2021-31 budgets were considered

significant in terms of the Council’s Significance and Engagement

Policy, and were consulted on. Variations to those budgets as discussed

in this report are not considered significant in terms of the

policy.

|

|

Engagement –

external

There has been no external engagement in updating the

draft budget for the Reserves and Recreational Facilities Group.

|

|

Engagement -

internal

Staff and managers from across council have been involved

in the development of the draft budget.

|

|

Risks: Legal / Health

and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

Projects identified in Community Board Plans were

considered in the development of the budgets for the 10 year plan, and

Community Boards were consulted at this time. Community Boards will

have an opportunity to present on the draft 2023/24 Annual Plan.

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

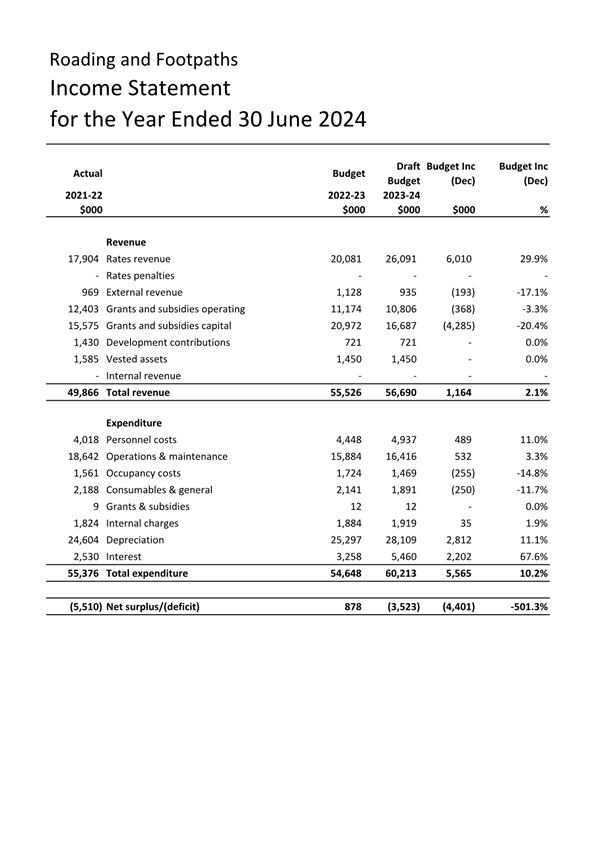

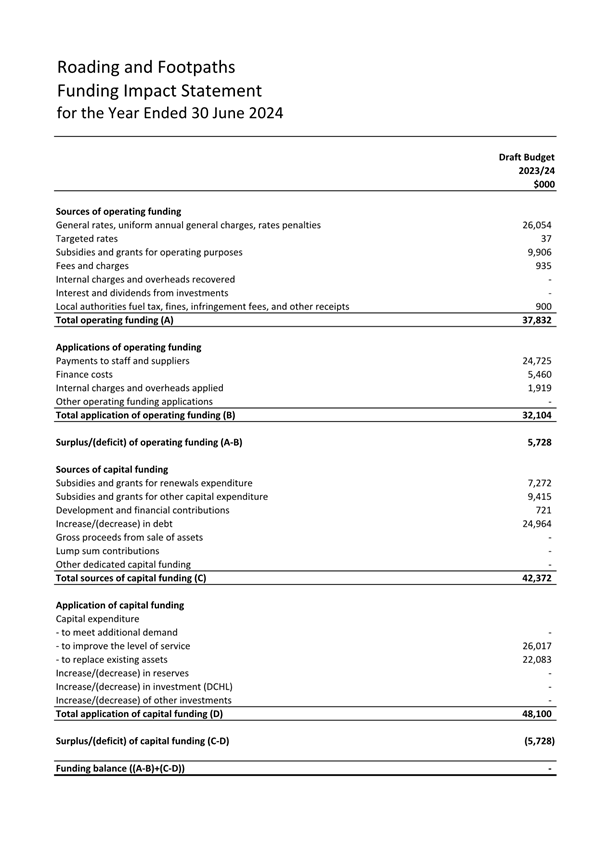

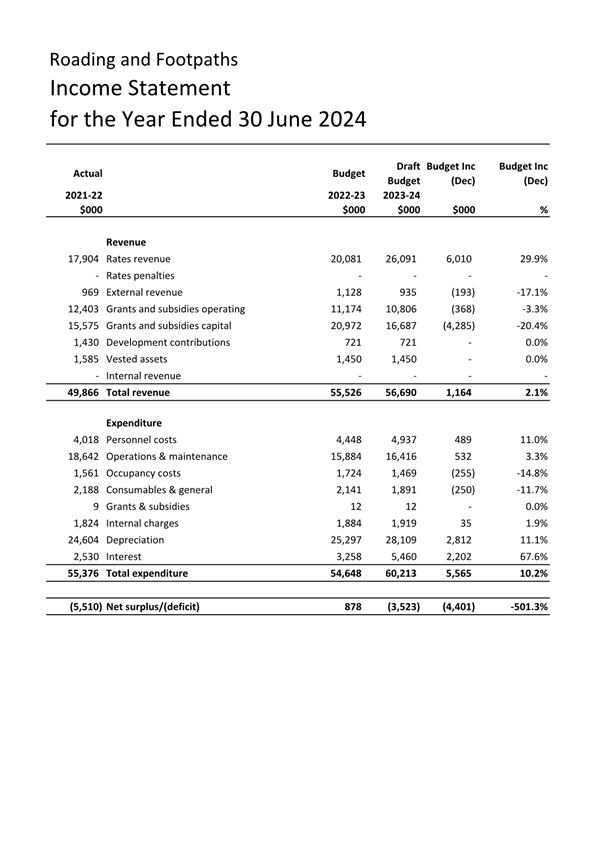

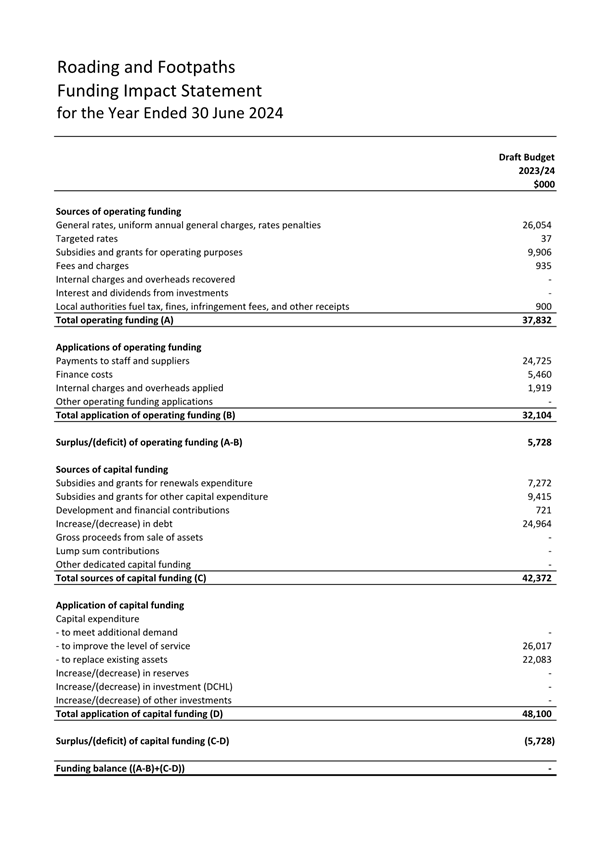

Annual Plan Budget Update - Roading and

Footpaths

Department: Transport

EXECUTIVE SUMMARY

1 This

report provides an overview of the operating expenditure (opex) budgets for the

2023/24 Annual Plan year for the Roading and Footpaths Group as shown at

Attachment A. A drafting funding impact statement (FIS) is shown at Attachment

B. The following activities are provided for:

· Asset

and Funding (Business Support)

· Capital

Delivery

· Maintenance

· Network

Development

· Community

Road Safety

· Planning

· Safety

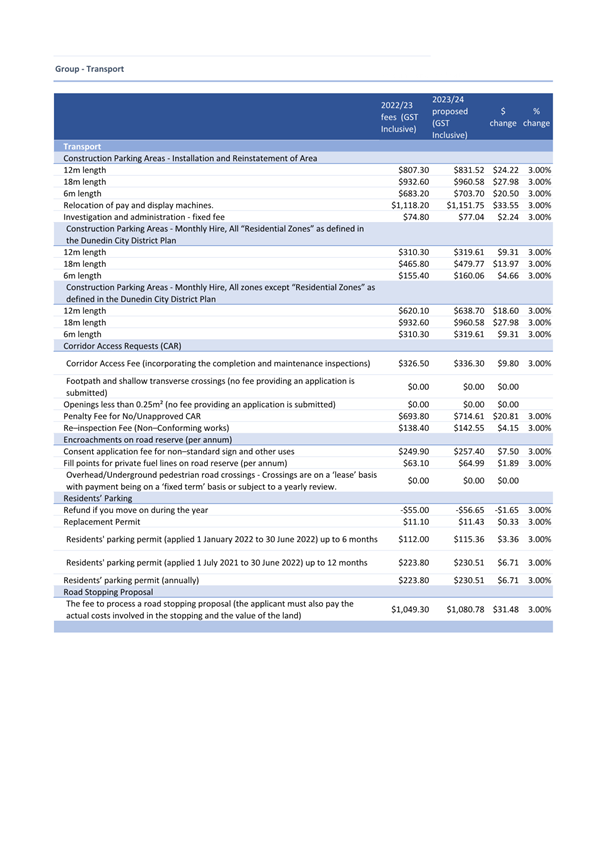

2 A

schedule of proposed fees and charges for the 2023/24 year is also presented at

Attachment C.

|

RECOMMENDATIONS

That the Council:

a) Approves the draft 2023/24 operating budget for

the Roading and Footpaths Group as shown/amended at Attachment A.

b) Approves the draft 2023/24 fees and charges

schedules for the Roading and Footpaths Group as shown/amended at Attachment

C.

|

operating budgets

Revenue

Rates

3 The

rates contribution for the Group has increased by $6.010 million, 29.9%.

External Revenue

4 External

revenue has decreased by $193k, -17.1% due to the transfer of the Road Stopping

activity to Property Services ($60k) and aligning Corridor Access revenue to

actual volumes ($131k). Corridor Access request volumes have decreased since

the city wide ultra-fast broadband rollout was completed.

Grants and Subsidies

5 The

Waka Kotahi Funding Assistance Rate (FAR) has been dropping by 1.0% per annum,

in 2023/24 it will reach 51.0% where it will remain. The volume of capital

expenditure for Waka Kotahi co-funded projects directly impacts on the revenue

received within a year. The exception is renewals funding which has a FAR rate

for the 2023/24 year of 33%.

6 Grants

and subsidies capital revenue has decreased $4.285 million, -20.0%. Waka

Kotahi funding for capital projects reflects the capital programme proposed for

the 2023/24 year.

7 Grants

and subsidies operating revenue has decreased $368k -3.3% being subsidies from

Waka Kotahi on maintenance, consultancy, and other eligible costs.

Expenditure

Personnel

8 Personnel

costs have increased by $489k, 11% reflecting salary changes and an increase in

full time equivalent staff (FTE) of 3.2. This increase is offset by a

reduction in consultant costs of $107k as work will be undertaken in-house and

a transfer of 1.0 FTE from 3 Waters.

Operations and

Maintenance

9 Operations

and maintenance costs have increased by $532k, 3.3% to address coastal

management costs including sea wall repairs and maintenance, surveying, and

modelling for future intervention. Of this, $426k was transferred from the

Reserves and Recreational Facilities Group.

Occupancy costs

10 Occupancy

costs have decreased by $255k, -14.8%, reflecting reductions in insurance and

electricity costs.

Consumables and General

11 Consumables

and general costs have decreased by $250k, -11.7% primarily driven by a

reduction in business case consulting.

Depreciation

12 Depreciation

has increased by $2.812 million, 11.1%, reflecting the 30 June 2022

revaluation. This valuation reflects assets condition and recent contract

rates.

Interest

13 Interest

expense has increased by $2.202 million as a result of the capital expenditure

programme and higher interest rate.

FEES and charges

14 Fees

and charges for activities in the Roading and Footpaths Group have increased by

3%.

Signatories

|

Author:

|

Jeanine Benson - Group Manager Transport

|

|

Authoriser:

|

Simon Drew - General Manager Infrastructure and

Development

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Income Statement

|

42

|

|

⇩b

|

Funding Impact

Statement

|

43

|

|

⇩c

|

Transport Fees Schedule

|

44

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision enables democratic local

decision making and action by, and on behalf of communities, and promotes the

social economic, environmental, and cultural well-being of communities in the

present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☐

|

|

3 Waters Strategy

|

☐

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The Roading and Footpaths Group activities primarily

contribute to the objectives and priorities of the above strategies.

|

|

Māori Impact

Statement

Council budgets impact broadly across all Dunedin

communities including Māori. The Council is committed to developing

ongoing relationships with Māori communities, particularly with mana

whenua. Strategic projects that have significance to Māori have been

identified from across the organisation and these projects will work

collaboratively with the Māori Partnerships Manager to ensure beneficial

outcomes for Māori are achieved.

|

|

Sustainability

The Annual Plan is not proposing any changes to that

provided for in the 10 year plan. Major issues and implications for

sustainability are discussed and considered in the 50 year Infrastructure

Strategy and financial resilience is discussed in the Financial Strategy of

the current 10 year plan 2021-31.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report provides a draft budget for the Roading and

Footpaths Group for inclusion in the draft 2022/23 Annual Plan.

|

|

Financial

considerations

Financial considerations are detailed in the report.

|

|

Significance

The 10 year plan 2021-31 budgets were considered significant

in terms of the Council’s Significance and Engagement Policy, and were

consulted on. Variations to those budgets as discussed in this report

are not considered significant in terms of the policy.

|

|

Engagement –

external

There has been no external engagement in updating the

draft budget for the Roading and Footpaths Group.

|

|

Engagement -

internal

Staff and managers from across council have been involved

in the development of the draft budget.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

Projects identified in Community Board Plans were

considered in the development of the budgets for the 10 year plan, and

Community Boards were consulted at this time. Community Boards will

have an opportunity to present on the draft 2022/23 Annual Plan.

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

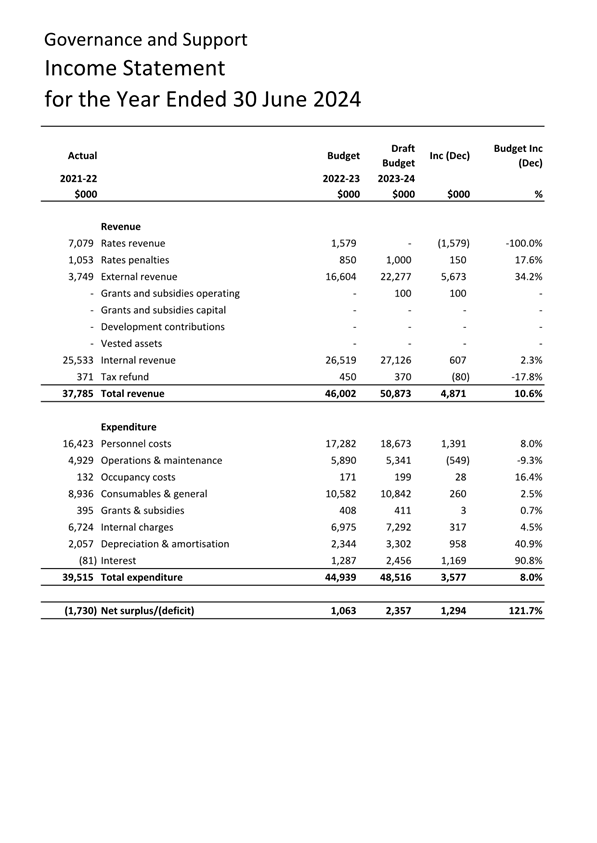

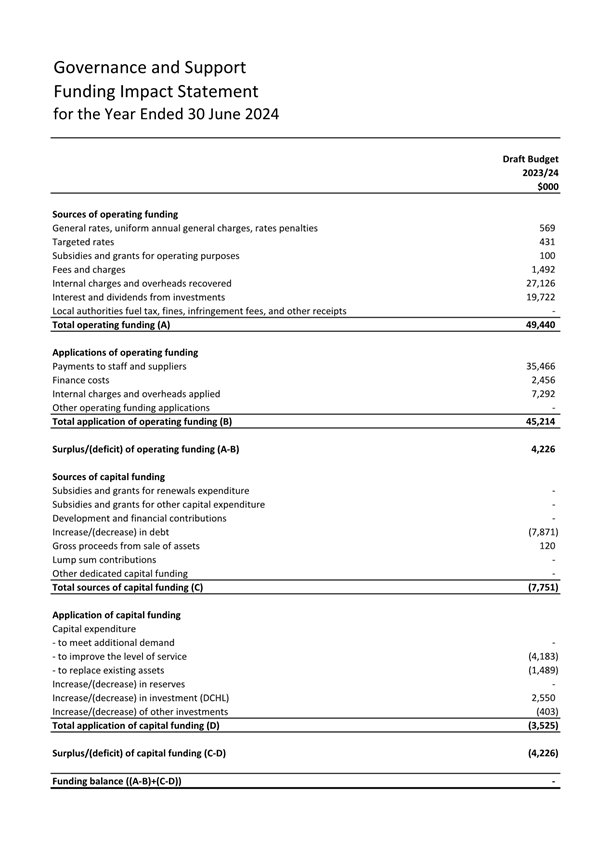

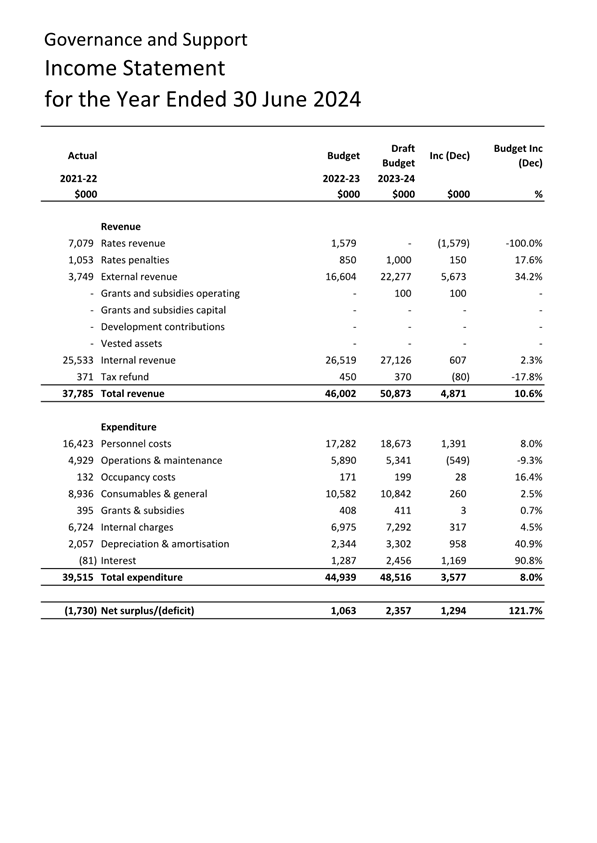

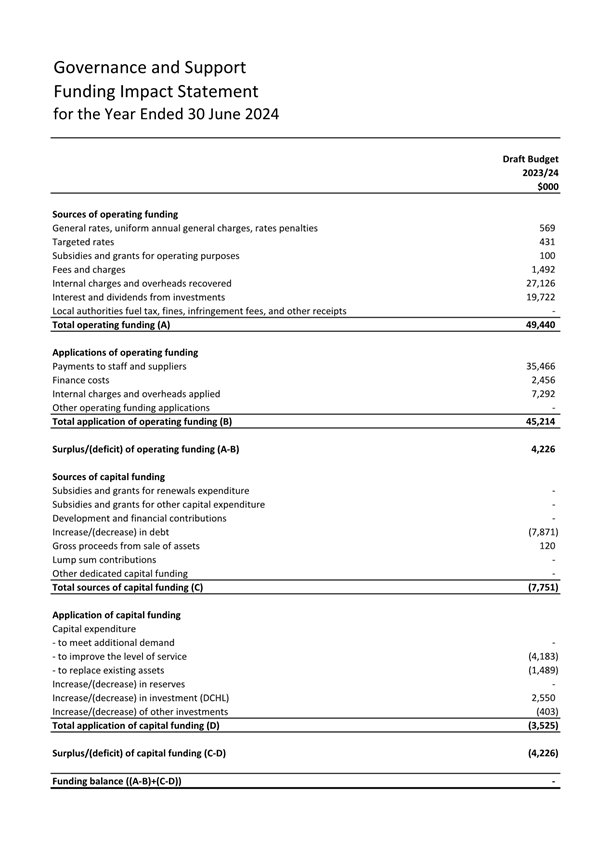

Annual Plan Budget Update - Governance and

Support Services

Department: Executive Leadership Team

EXECUTIVE SUMMARY

1 This

report provides an overview of the operating expenditure (opex) budgets for the

2023/24 Annual Plan year for the Governance and Support Services Group as shown

at Attachment A. A draft funding impact statement (FIS) is shown at Attachment

B. The activities include:

· Business information services (BIS)

· Civic and administration

· Civil defence

· Council communications and marketing (CCM)

· Corporate leadership

· Corporate policy

· Customer services agency (CSA)

· Finance

· Fleet operations

· Human resources

2 A

schedule of proposed fees and charges for the 2023/24 year is also presented at

Attachment C.

|

RECOMMENDATIONS

That the Council:

a) Approves the draft 2023/24 operating budget for

the Governance and Support Services Group as shown/amended at Attachment A.

b) Approves the draft 2023/24 fees and charges

schedules for the Regulatory Services Group as shown/amended at Attachment C.

|

operating budgets

Revenue

Rates

3 The

rates contribution for this Group has decreased by $1.579 million.

External Revenue

4 External

revenue has increased by $5.673 million. The draft budget includes an

increase of $5.500 million in dividends from Dunedin City Holdings

Limited.

5 Other

revenue increases are due to a new budget to recover costs from the Otago

Regional Council (ORC) relating to South Dunedin Future costs. The other change

is a reduction in recoveries for the election.

Expenditure

Personnel Costs

6 Personnel

costs have increased by $1.391 million 8.0%. This increase is made up of

the following key changes:

· Māori,

Partnerships and Policy – 1.5 FTE increase. This is made up of 1

FTE to assist with the development of the 10 year plan. The other 0.5 FTE

increase relates to sustainability and zero carbon, and South Dunedin future

initiatives. These are offset by savings in operating costs or are being

funded by external revenue recoveries.

· Corporate and Quality – 7.7 FTE increase. These

increases relate to the provision of back-end support for the programme of work

being undertaken by Council, and include increases in Human Resources, Health

and Safety, Quality improvement, BIS, web-team and the Project Management

Office. The Housing Advisor position is now also provided for in the

budget.

· City Development Engineer – 1 FTE. This position is to co-ordinate

the delivery of infrastructure to support growth.

· In-house legal - 1 FTE. This new position is being funded by 3

Waters reform.

Operations and

Maintenance

7 Operations

and maintenance costs have decreased by $549k, -9.3%.

8 This

decrease combines the following key changes:

a) $599k

decrease in election costs,

b) $196k

decrease in contract costs in BIS and a reduction in the use of contractors for

system development work,

These decreases have been partially offset

by:

c) $50k

increase in contracted services to assist the Project Management Office

transition to a new project management system.

d) $29k

increase in CSA due to an increase in the cost of the after-hours service.

e) $34k

increase in Corporate policy for Quality of Life project fieldwork and survey

development.

Consumables and general

costs

9 Consumables

and general costs have increased by $260k, 2.5%.

10 This

increase combines the following key changes:

a) An

increase in budget of $354k for the 10 year plan

2024-34 development including an audit fee of $145k.

b) An

increase in budget for South Dunedin Future projects $224k

(recovered from the ORC).

c) An

increase in elected member remuneration $132k.

d) A

decrease of $237k in BIS due to cost reductions for internet/fibre service,

software licence fees and aerial photography costs.

e) A

decrease of $145k in CCM due to reductions in software and media monitoring

costs.

Depreciation

11 Depreciation

has increased by $958k relating to capital expenditure in BIS and Fleet

Operations.

Interest

12 Interest

has increased by $1.169 million relating to the capital expenditure programme

and higher interest rates.

Signatories

|

Author:

|

Gavin Logie - Chief Financial Officer

|

|

Authoriser:

|

Sandy Graham - Chief Executive Officer

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Income Statement

|

50

|

|

⇩b

|

FIS Statement

|

51

|

|

⇩c

|

Governance Fees

Schedule

|

52

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision enables democratic local

decision making and action by, and on behalf of communities, and promotes the

social economic, environmental, and cultural well-being of communities in the

present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The Governance and Support Services Group contributes to

the delivery of all of the objectives and priorities of the strategic

framework.

|

|

Māori Impact

Statement

Council budgets impact broadly across all Dunedin

communities including Māori. The Council is committed to

developing ongoing relationships with Māori communities, particularly

with mana whenua. Strategic projects that have significance to Māori

have been identified from across the organisation and these projects will

work collaboratively with the Maori Partnerships Manager to ensure beneficial

outcomes for Māori are achieved.

|

|

Sustainability

The Annual Plan is not proposing any changes to that

provided for in the 10 year plan. Major issues and implications for

sustainability are discussed and considered in the 50 year Infrastructure

Strategy and financial resilience is discussed in the Financial Strategy of

the current 10 year plan 2021-31.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report provides a draft budget for the Governance and

Support Services Group for inclusion in the draft 2023/24 Annual Plan.

|

|

Financial

considerations

Financial considerations are detailed in the report.

|

|

Significance

The 10 year plan 2021-31 budgets were considered

significant in terms of the Council’s Significance and Engagement

Policy, and were consulted on. Variations to those budgets as discussed

in this report are not considered significant in terms of the

policy.

|

|

Engagement –

external

There has been no external engagement in updating the

draft budget for the Governance and Support Services Group.

|

|

Engagement -

internal

Staff and managers from across council have been involved

in the development of the draft budget.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

Projects identified in Community Board Plans were

considered in the development of the budgets for the 10 year plan, and

Community Boards were consulted at this time. Community Boards will

have an opportunity to present on the draft 202/24 Annual Plan.

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

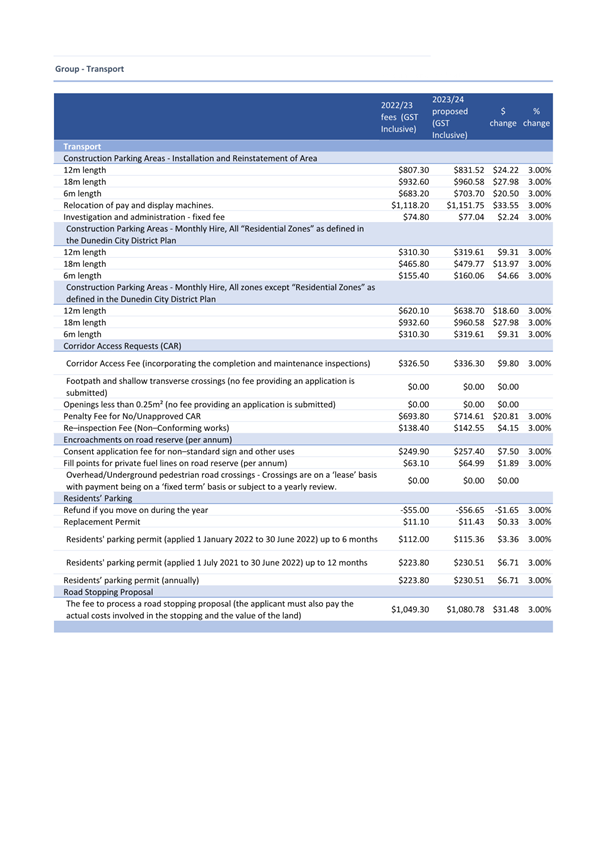

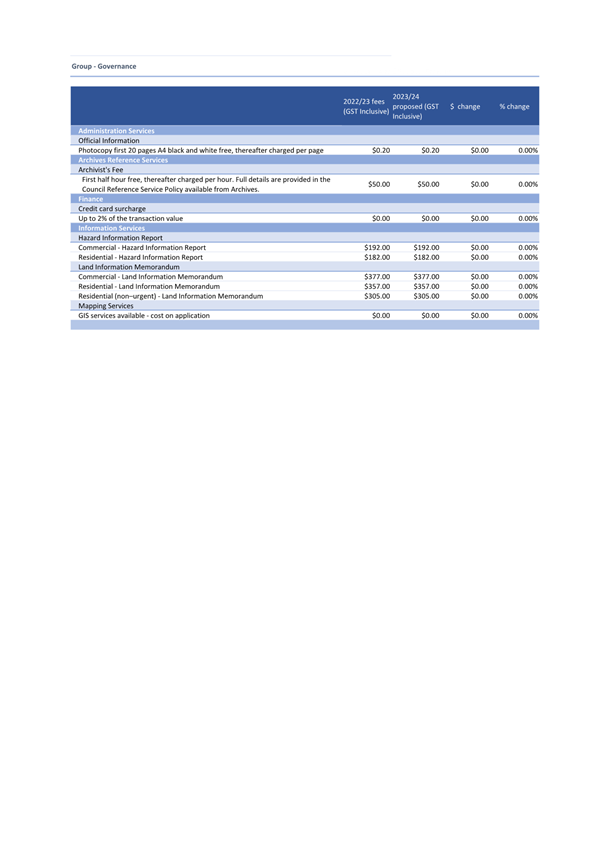

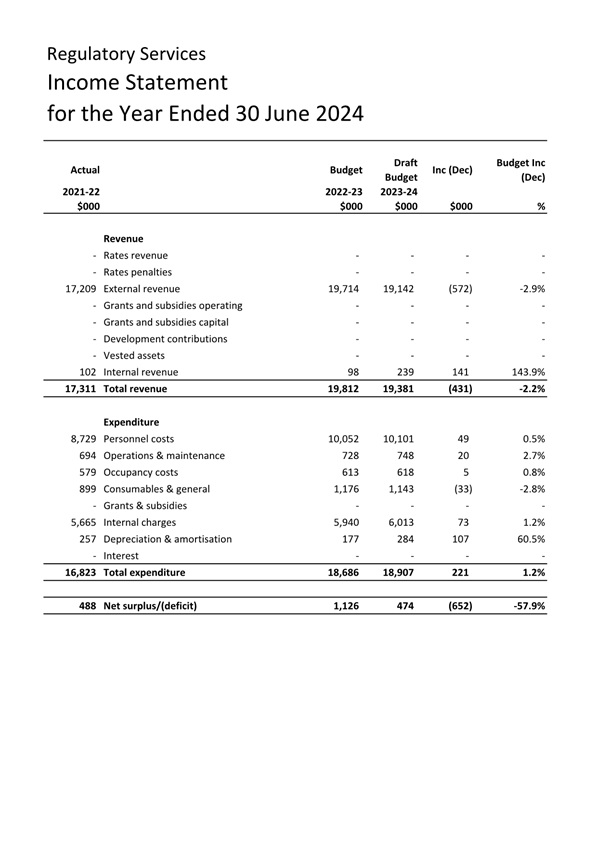

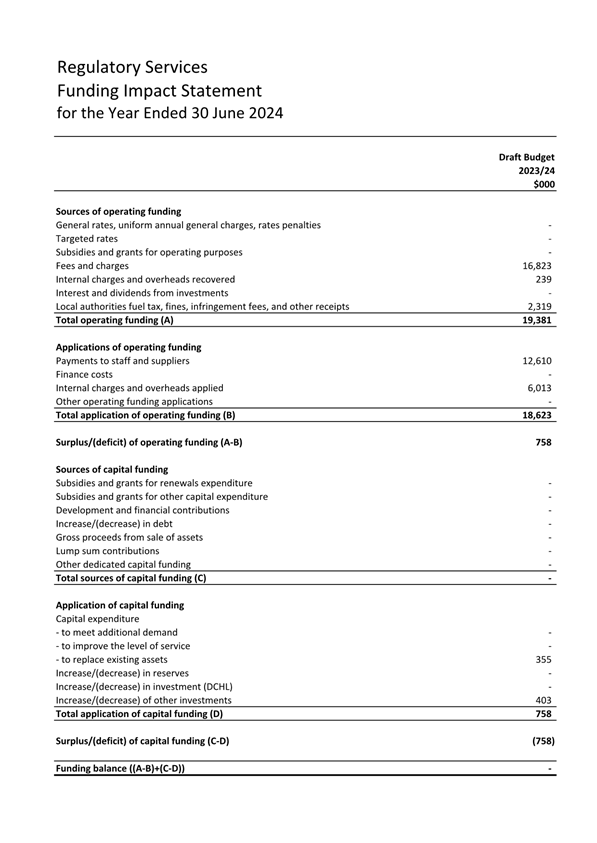

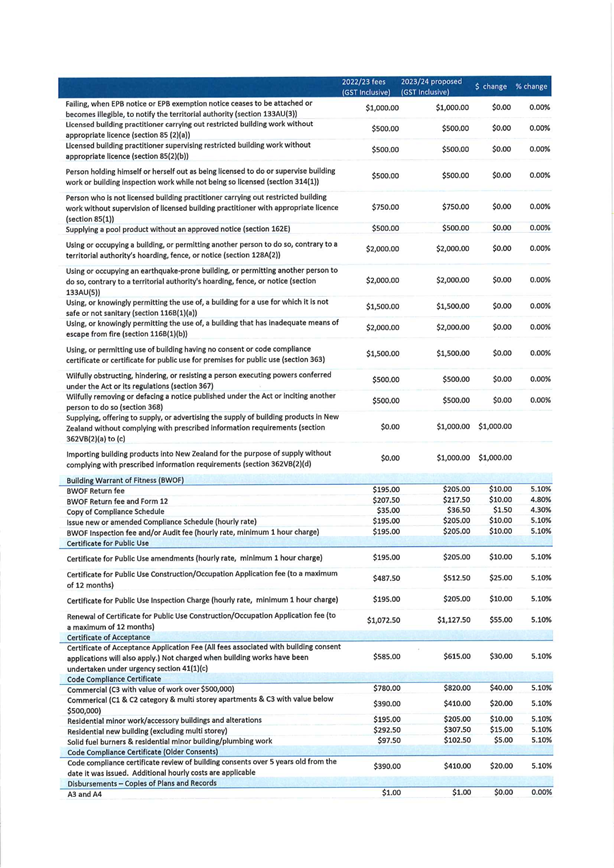

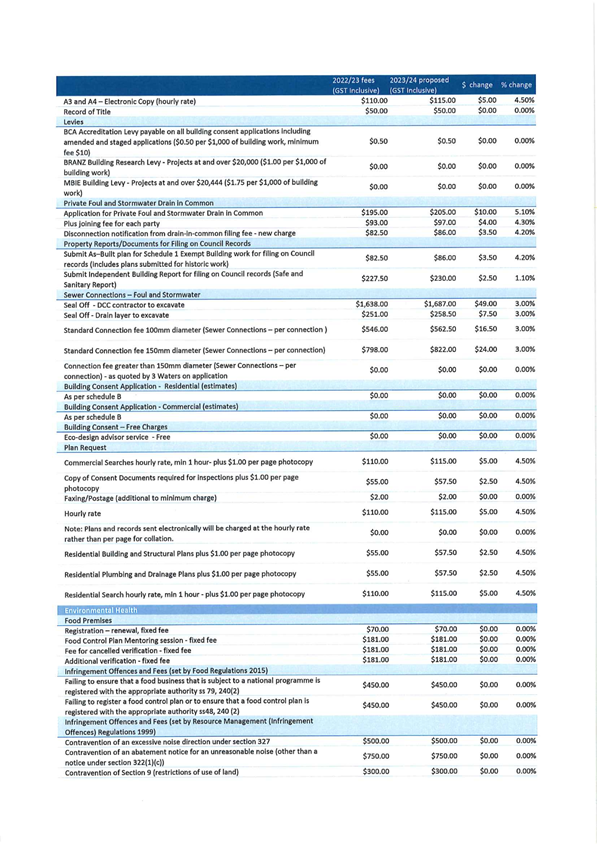

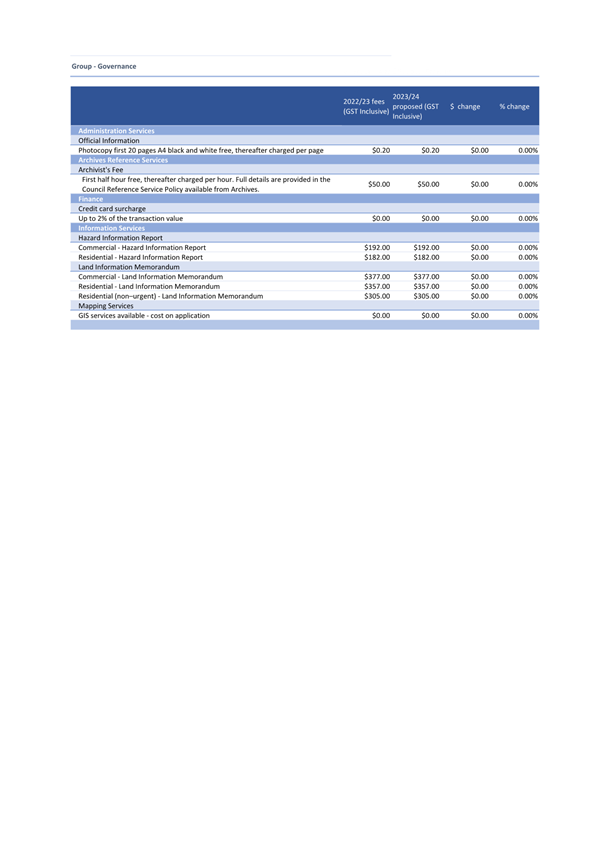

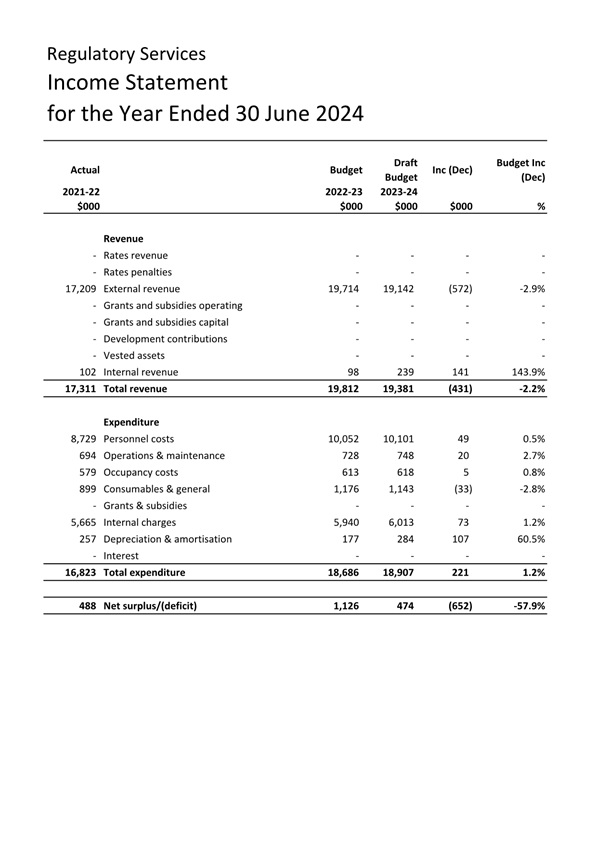

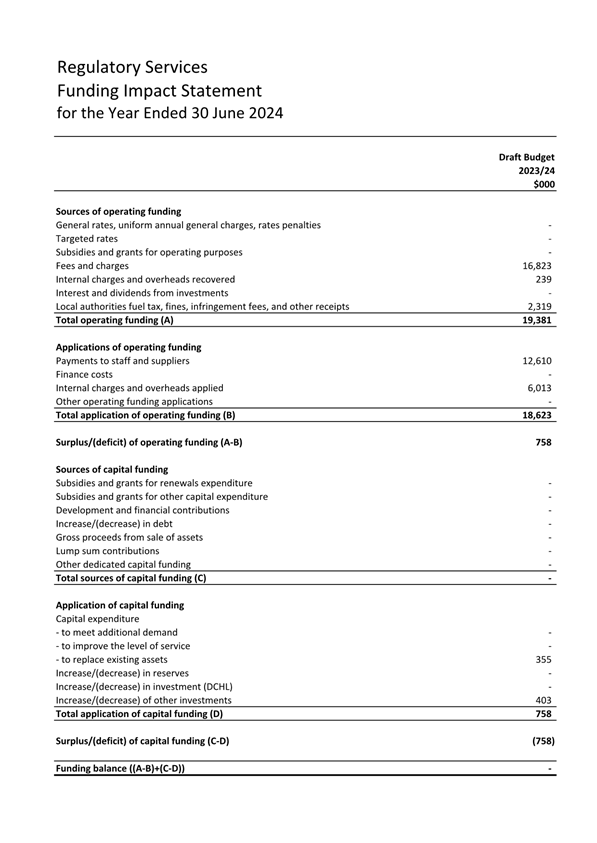

Annual Plan Budget Update - Regulatory

Services

Department: Executive Leadership Team

EXECUTIVE SUMMARY

1 This

report provides an overview of the operating expenditure (opex) budget for the

2023/24 Annual Plan year for the Regulatory Services Group as shown at

Attachment A. A draft funding impact statement (FIS) is shown at Attachment B.

The following activities are provided for:

· Alcohol Licensing

· Animal Services

· Building Services

· Environmental Health

· Parking Operations

· Parking Services (enforcement)

2 A

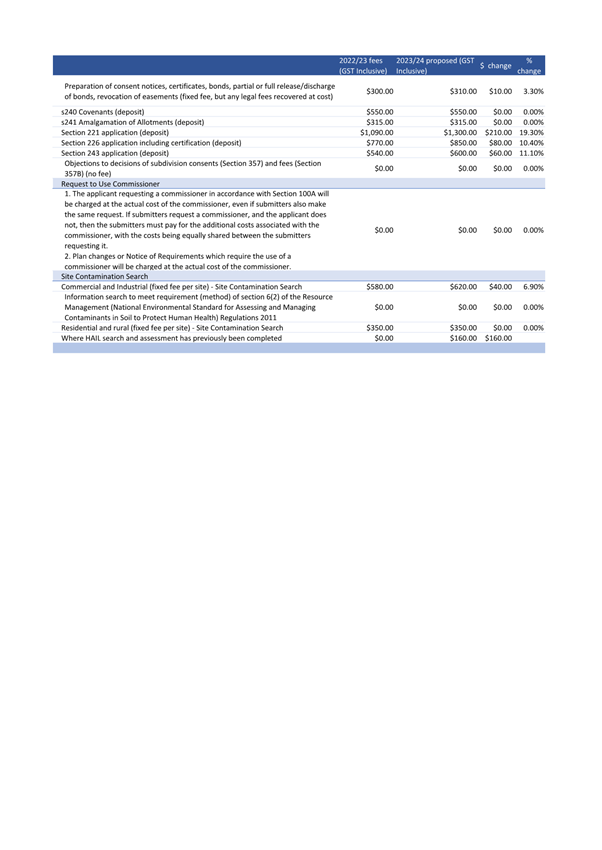

schedule of proposed fees and charges for the 2023/24 year is also presented at

Attachment C.

|

RECOMMENDATIONS

That the Council:

a) Approves the draft 2023/24 operating budget for

the Regulatory Services Group as shown/amended at Attachment A.

b) Approves the draft 2023/24 fees and charges

schedules for the Regulatory Services Group as shown/amended at Attachment C.

|

operating budgets

Revenue

External Revenue

3 External

revenue has decreased by $572k, -2.9%. The main revenue changes incorporate the

following:

a) $408k reduction

in Parking Operations due to the temporary closure of the Moray Place/Regent

carpark building and a reduction in on-street and carpark meter revenue,

b) $190k reduction

in Building Services reflects a reduction in chargeable hours due to mandatory

training for building inspectors.

Expenditure

Depreciation

4 Depreciation

has increased by $107k, 60.5% mainly due to the renewal of parking meters.

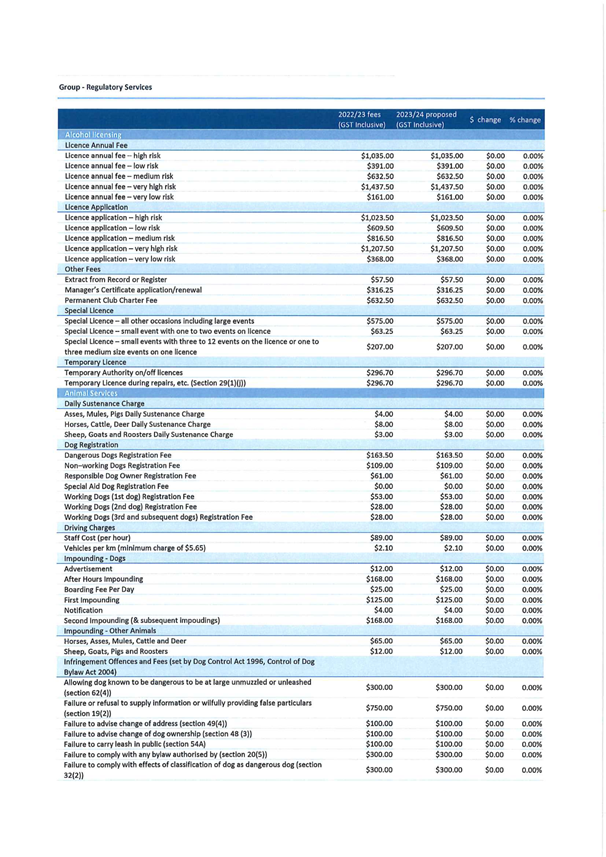

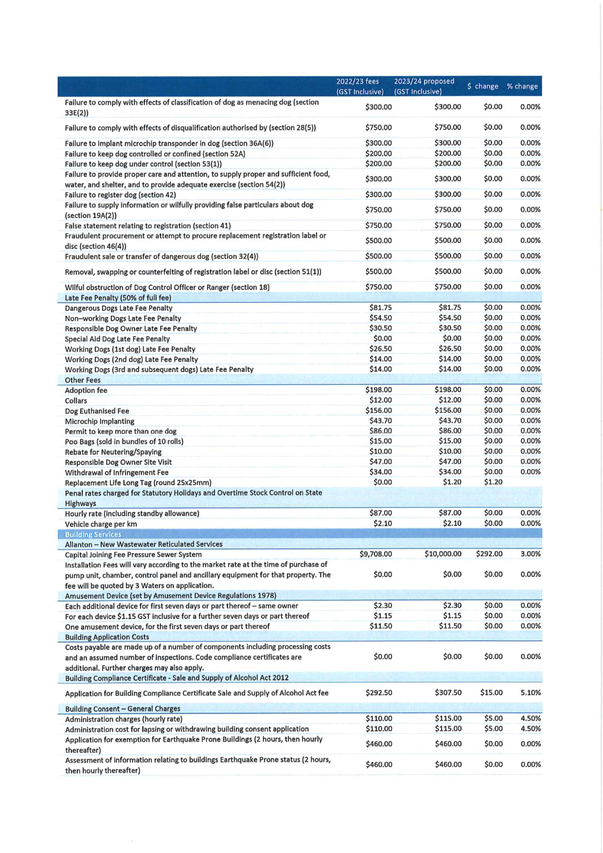

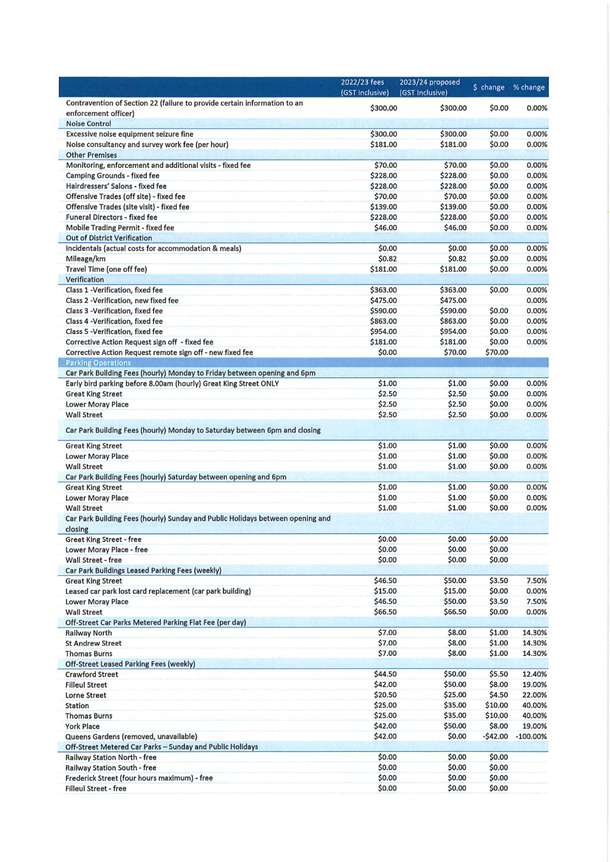

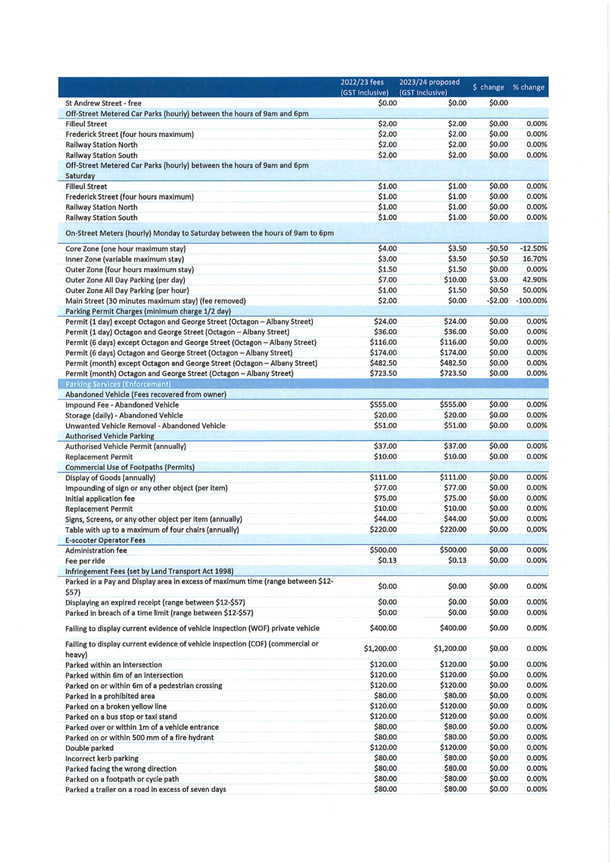

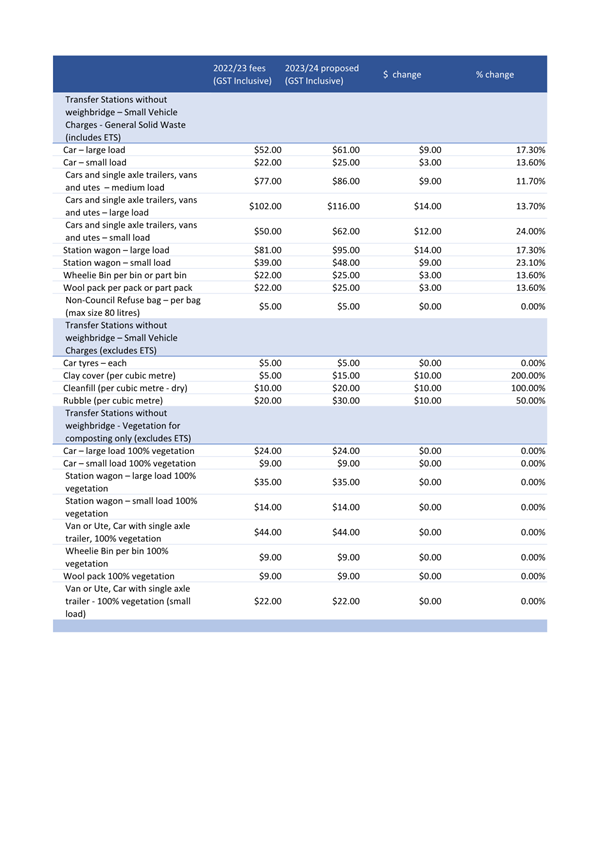

FEES and charges

5 Fees

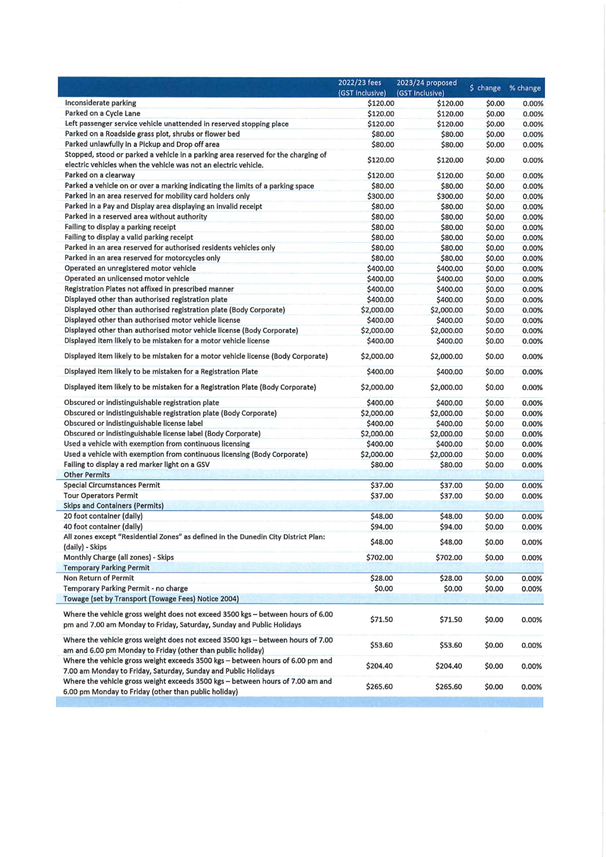

and charges for Animal Services, Alcohol Licensing, Building Infringement,

Environmental Health and Parking Services (enforcement) fees are unchanged.

Note some of these fees are set by legislation.

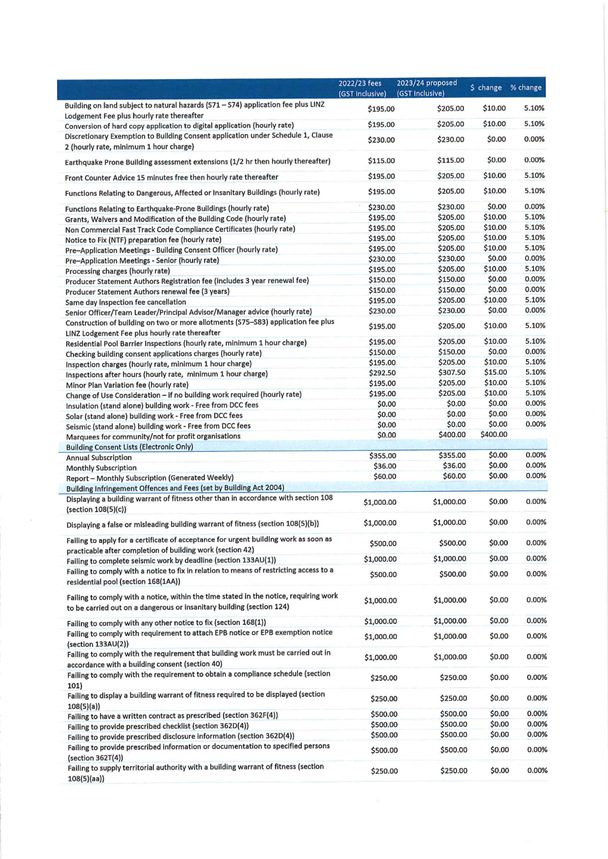

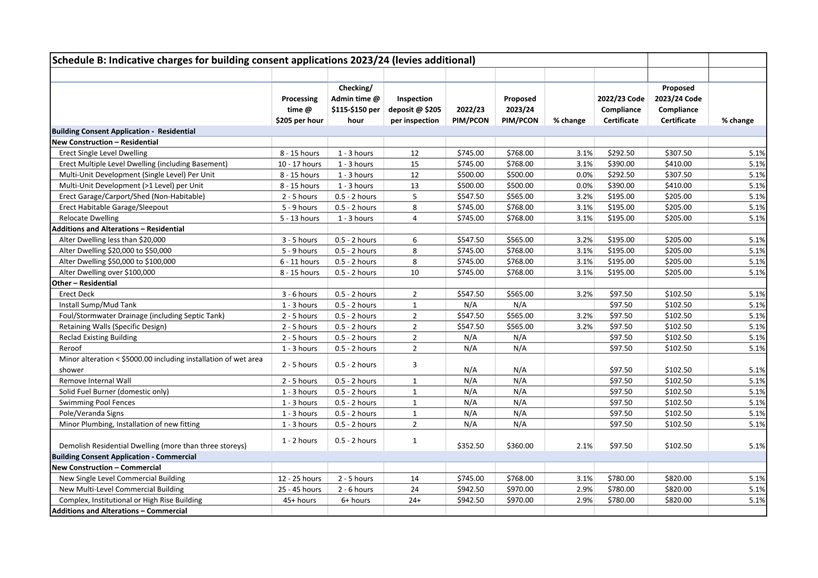

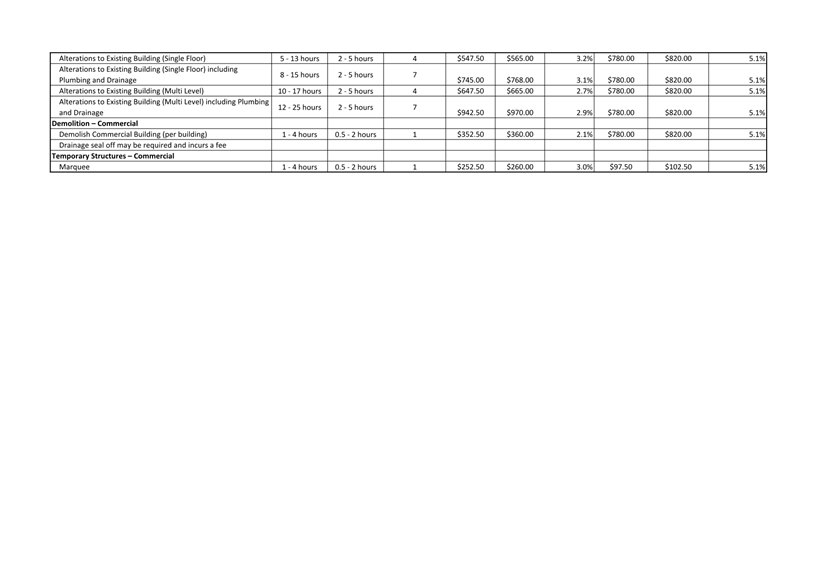

6 Building

Services fees incorporate an increase in hourly rate for processing and

inspections from $195 to $205.

7 Proposed

changes to Parking Operations fees and charges are as follows:

a) Fees

for hourly on-street parking have been changed as follows: The core ($4.00) and

inner ($3.00) zones will be amalgamated into a $3.50 inner city zone. The

variable $1/hr and $1.50 (max stay 4 hours) zones will be changed to $1.50 per

hour outer zone (the parking restrictions will not change, and all-day parking

will remain in some areas). These changes will result in two paid parking zones

(currently five) which will make pricing easier to understand and manage.

b) The paid

main street 30-minute parking restriction will be replaced by an unpaid

30-minute restriction.

c) Fees

for all day on-street parking have been increased $7 to $10 a day. Off street

daily rates have been increased from $7 to $8 a day. These changes are designed

to encourage the use of off-street parking to free up on-street parking for

shorter term stays.

d) Fees for

weekly leased parking have been increased ranging from $3.50 to

$10.00. The new weekly charge for Thomas Burns and Dunedin Train

Station carparks at $35.00 remains cheaper than the casual on-street daily

rate.

Signatories

|

Authoriser:

|

Claire Austin - General Manager Customer and Regulatory

Gavin Logie - Chief Financial Officer

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Income Statement

|

57

|

|

⇩b

|

FIS Statement

|

58

|

|

⇩c

|

Regulatory Fees

Schedule

|

59

|

|

⇩d

|

Building Fees Schedule

B

|

67

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision enables democratic local

decision making and action by, and on behalf of communities, and promotes the

social economic, environmental, and cultural well-being of communities in the

present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The Regulatory Services Group activities primarily

contribute to the objectives and priorities of the above strategies.

|

|

Māori Impact

Statement

Council budgets impact broadly across all Dunedin

communities including Māori. The Council is committed to

developing ongoing relationships with Māori communities, particularly

with mana whenua. Strategic projects that have significance to Māori

have been identified from across the organisation and these projects will

work collaboratively with the Māori Partnerships Manager to ensure

beneficial outcomes for Māori are achieved.

|

|

Sustainability

The Annual Plan is not proposing any changes to that

provided for in the 10 year plan. Major issues and implications for

sustainability are discussed and considered in the 50 year Infrastructure

Strategy and financial resilience is discussed in the Financial Strategy of

the current 10 year plan 2021-31.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report provides a draft budget for the Regulatory

Services Group for inclusion in the draft 2023/24 Annual Plan.

|

|

Financial

considerations

Financial considerations are detailed in the report.

|

|

Significance

The 10 year plan 2021-31 budgets were considered

significant in terms of the Council’s Significance and Engagement

Policy, and were consulted on. Variations to those budgets as discussed

in this report are not considered significant in terms of the

policy.

|

|

Engagement –

external

There has been no external engagement in updating the

draft budget for the Regulatory Services Group.

|

|

Engagement -

internal

Staff and managers from across council have been involved

in the development of the draft budget.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

Projects identified in Community Board Plans were

considered in the development of the budgets for the 10 year plan, and

Community Boards were consulted at this time. Community Boards will

have an opportunity to present on the draft 2023/24 Annual Plan.

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

|

|

Council

22 February 2023

|

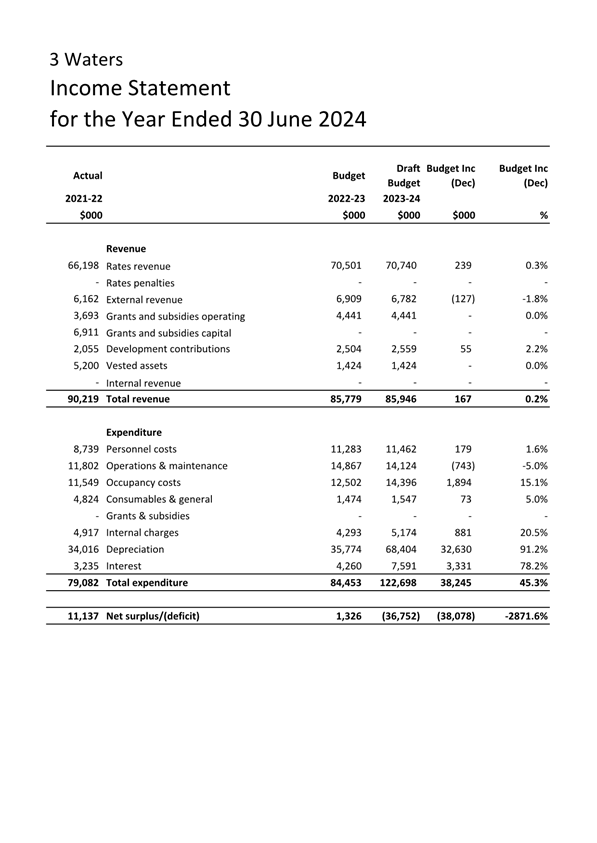

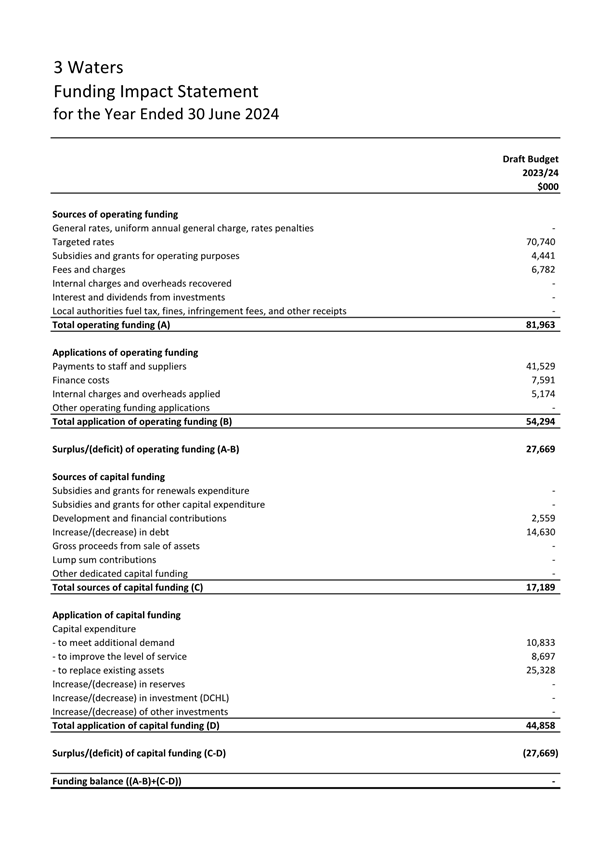

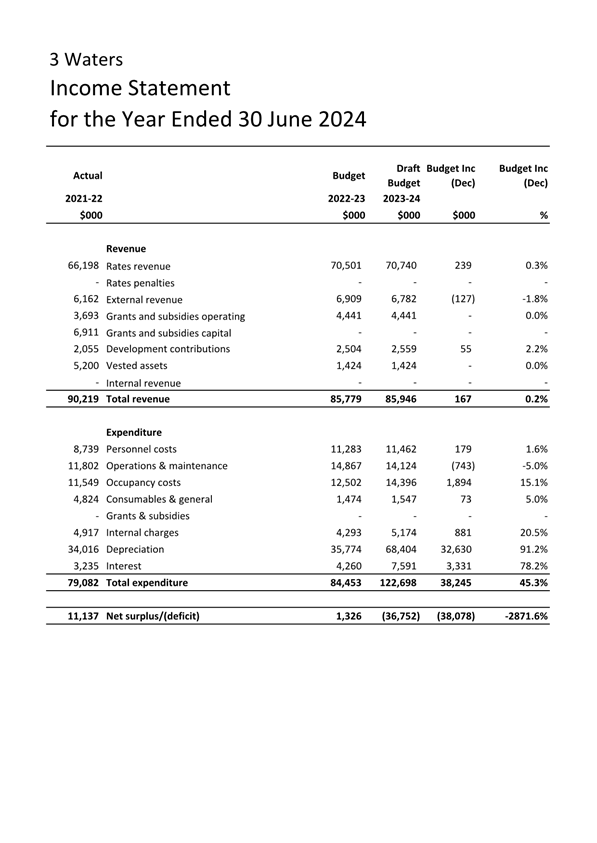

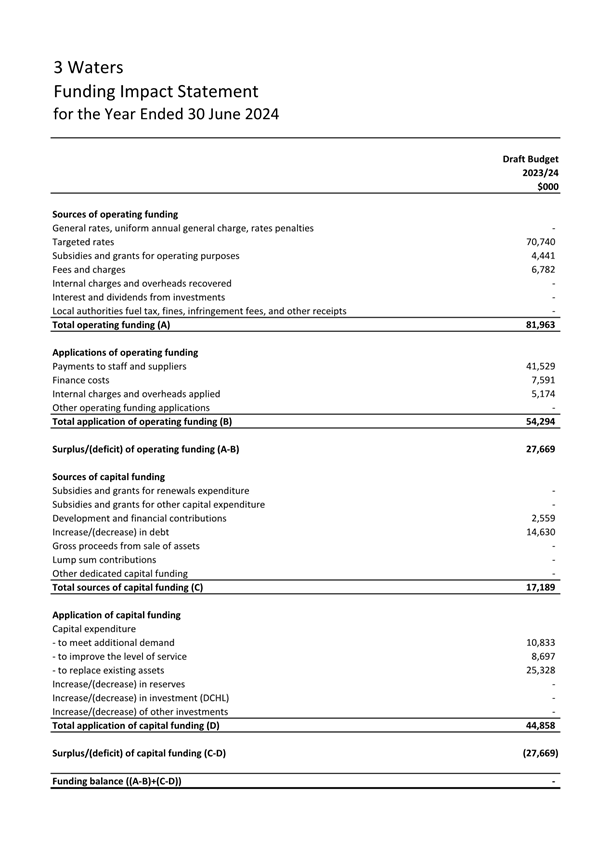

Annual Plan Budget Update - 3 Waters

Department: 3 Waters

EXECUTIVE SUMMARY

1 This

report provides an overview of the operating expenditure (opex) budgets for the

draft 2023/24 Annual Plan year for the 3 Waters Group as shown at Attachment A.

A draft funding impact statement (FIS) is shown at Attachment B. The

following activities are provided for:

· Water

supply

· Wastewater

· Stormwater

2 A

schedule of proposed fees and charges for the 2023/24 year is also presented at

Attachment C.

|

RECOMMENDATIONS

That the Council:

a) Approves the draft 2023/24 operating budget for the 3 Waters Group as

shown/amended at Attachment A.

b) Approves the draft 2023/24 fees and charges

schedules for the 3 Waters Group as shown/amended at Attachment C.

|

operating budgets

3 In

its May 2022 meeting, Council (CNL/2022/001) approved the 3 Waters Strategic

Work Programme funded through Government Funding. Implementation of the

programme resulted in an annual uplift in the operating budget of $4.400

million per year in 2022/23 and 2023/24. Apart from a transfer of budget between

personnel and contracted services, the draft budget for the implementation is

unchanged.

Revenue

Rates

4 The

rates contribution for the Group has increased by $239k, 0.3%.

External Revenue

5 External

revenue decreased by $127k, -1.8%. The draft budget aligns water sales to

historical levels which is somewhat offset by increases in backflow charges,

trade waste and tankered waste revenue. Fee changes are incorporated.

Expenditure

Personnel Costs

6 Personnel

costs have increased by $179k, 1.6% reflecting an increase in full time

equivalent (FTE) staff of 4.3, the transfer of one FTE to Transport, changes in

salaries and associated costs. The increase in FTE is offset by a reduction in

contracted services as noted below.

Operations and

Maintenance

7 Operations

and maintenance costs have decreased by $743k, -5.0%. This is primarily due to:

a) Sludge

from Tahuna Wastewater Treatment Plant can now be lime treated and transferred

to the Green Island Landfill, avoiding special waste capacity constraints. This

reduces external disposal fees and cartage costs by $1.099 million, partially

offset by an increase in internal disposal costs of $794k.

b) A

reduction in contracted services of $443k to reflect internal resourcing

changes.

c) Plant

maintenance costs across various sites increase by $392k to better reflect the

current and forecast work programme and contract increases.

d) Plant

operations costs increase by $373k due largely to extra shipping charges for

chemicals and additional regulations around laboratory testing requirements.

Occupancy

costs

8 Occupancy

costs have increased by $1.894 million, 15.1% mainly due to increase in rates,

insurance and fuel. Note the rates expense budgets will be reviewed to reflect

the new rating valuations.

Internal charges

9 Internal

charges have increased by $881k, 20.5% primarily due to a $794k increase in

sludge disposal fees being charged through the Green Island landfill.

Depreciation

10 Depreciation

has been increased by $32.630 million, 91.2% which is estimated based on the

latest asset revaluation – refer additional commentary in the CEO

Overview Report.

Interest

11 Interest

expense has increased by $3.331 million as a result of the capital expenditure

programme and higher interest rate.

Fees and charges

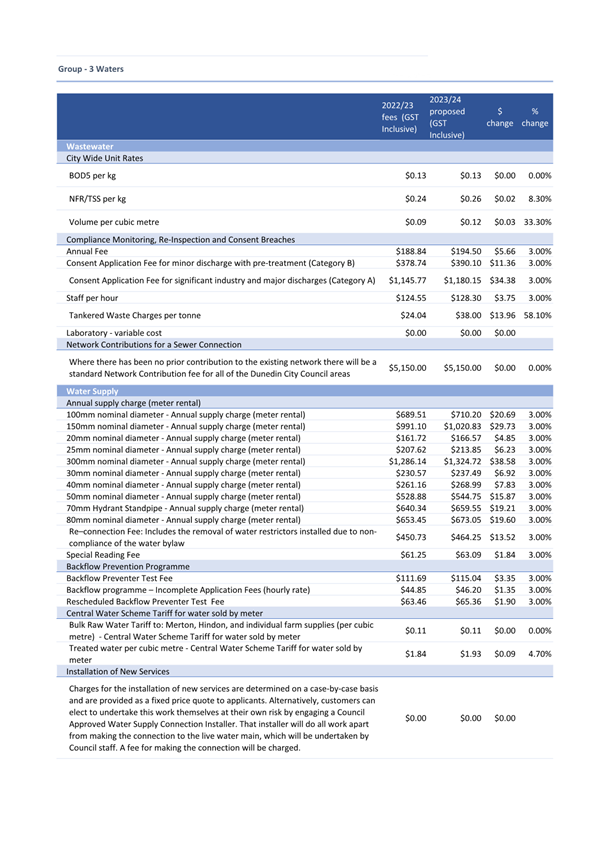

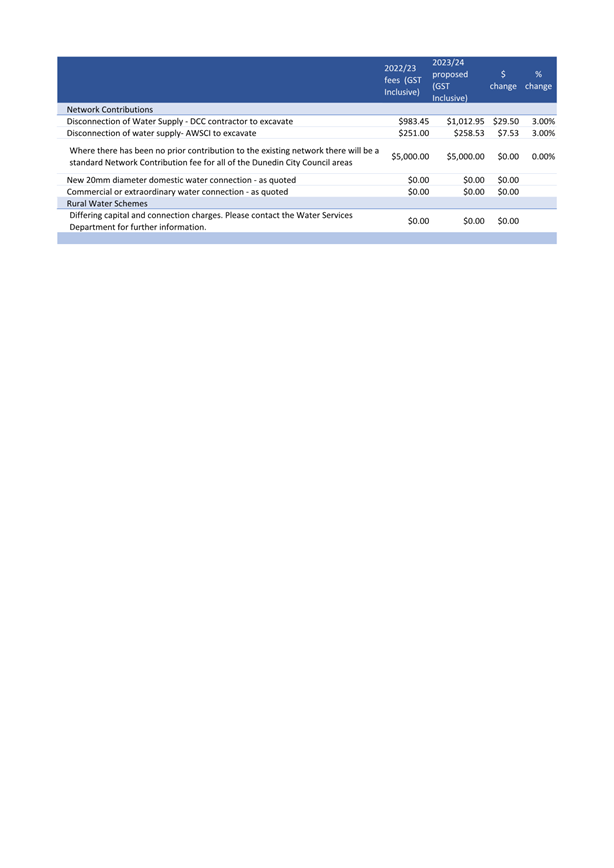

12 Fees

and charges for activities in the 3 Waters Group have either remained the same

or have generally been increased by 3%. There are some exceptions as follows:

e) City-wide

unit rates for wastewater are calculated on a formula for trade waste charges,

using budgeted volume and cost information. These unit rates are increased by

between 0% and 33.3%.

f) Tankered

waste charges have increased by 58.1% to reflect investment in waste reception

and handling facilities, health & safety requirements, consent and disposal

fees.

g) Treated

water per cubic meter - Central Water Scheme Tariff for water sold by meter has

increased by 4.69%.

Signatories

|

Author:

|

David Ward - Group Manager 3 Waters

|

|

Authoriser:

|

Simon Drew - General Manager Infrastructure and

Development

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Income Statement

|

74

|

|

⇩b

|

FIS Statement

|

75

|

|

⇩c

|

3 Waters Fees Schedule

|

76

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose

of Local Government

This decision enables democratic local decision

making and action by, and on behalf of communities, and promotes the social

economic, environmental, and cultural well-being of communities in the

present and for the future.

|

|

Fit with strategic

framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☐

|

☐

|

☒

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☐

|

☐

|

☒

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☐

|

☐

|

☒

|

|

Integrated Transport Strategy

|

☐

|

☐

|

☒

|

|

Parks and Recreation Strategy

|

☐

|

☐

|

☒

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The Three Waters Group activities primarily contribute to

the objectives and priorities of the above strategies.

|

|

Māori Impact

Statement

Council budgets impact broadly across all Dunedin

communities including Māori. The Council is committed to

developing ongoing relationships with Māori communities, particularly

with mana whenua. Strategic projects that have significance to Māori

have been identified from across the organisation and these projects will

work collaboratively with the Maori Partnerships Manager to ensure beneficial

outcomes for Māori are achieved.

|

|

Sustainability

The Annual Plan is not proposing any changes to that

provided for in the 10 year plan. Major issues and implications for

sustainability are discussed and considered in the 50 year Infrastructure

Strategy and financial resilience is discussed in the Financial Strategy of

the current 10 year plan 2021-31.

|

|

LTP/Annual Plan /

Financial Strategy /Infrastructure Strategy

This report provides a draft budget for the 3 Waters Group

for inclusion in the draft 2023/24 Annual Plan.

|

|

Financial

considerations

Financial considerations are detailed in the report.

|

|

Significance

The 10 year plan 2021-31 budgets were considered

significant in terms of the Council’s Significance and Engagement

Policy, and were consulted on. Variations to those budgets as discussed

in this report are not considered significant in terms of the policy.

|

|

Engagement –

external

There has been no external engagement in updating the

draft budget for the 3 Waters Group.

|

|

Engagement -

internal

Staff and managers from across council have been involved

in the development of the draft budget.

|

|

Risks: Legal /

Health and Safety etc.

There are no identified risks.

|

|

Conflict of

Interest

There are no known conflicts of interest.

|

|

Community Boards

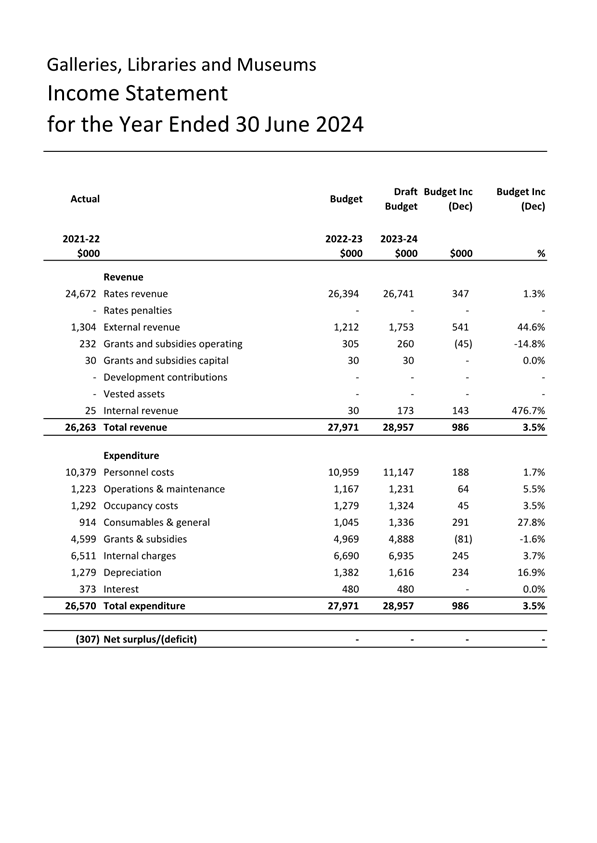

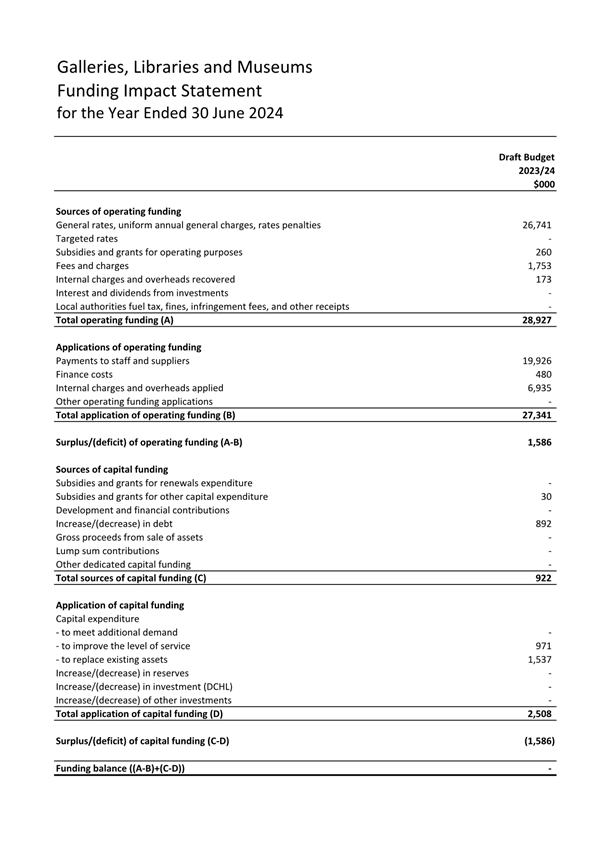

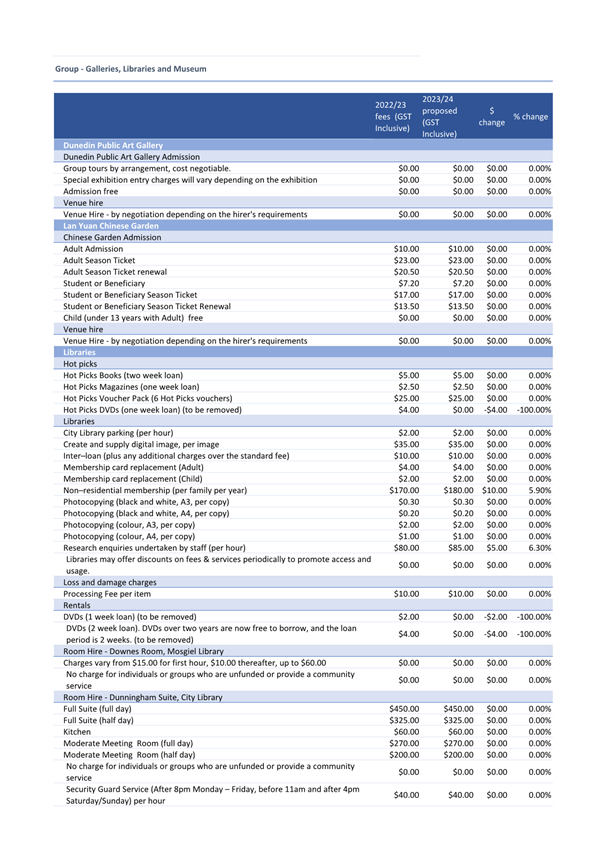

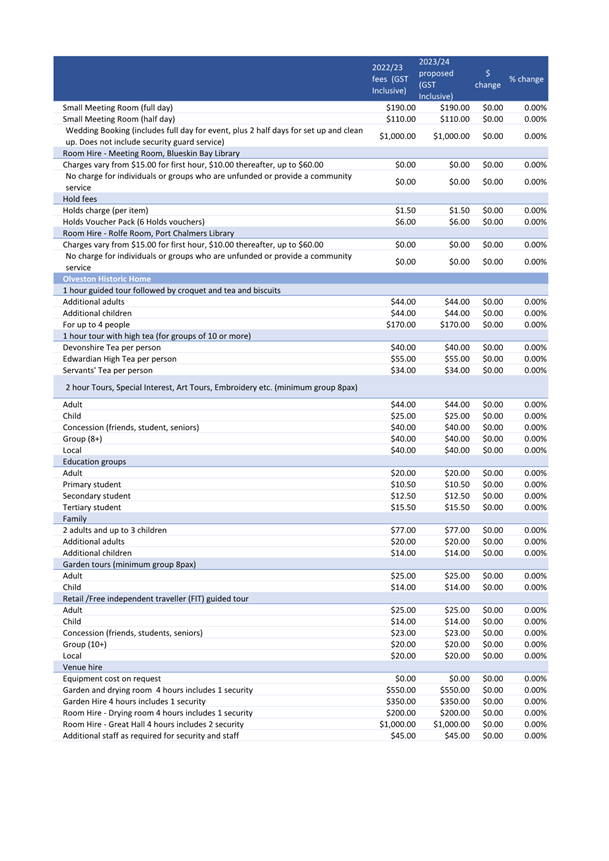

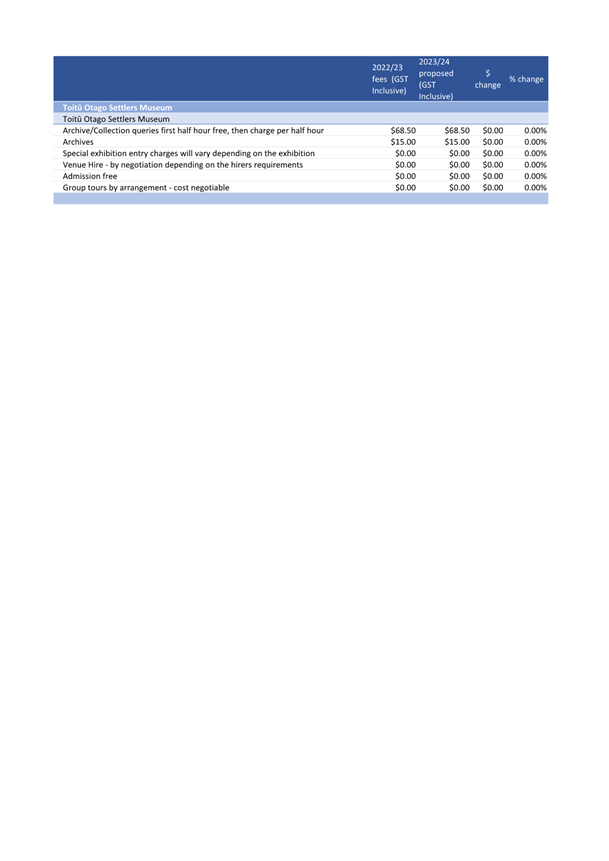

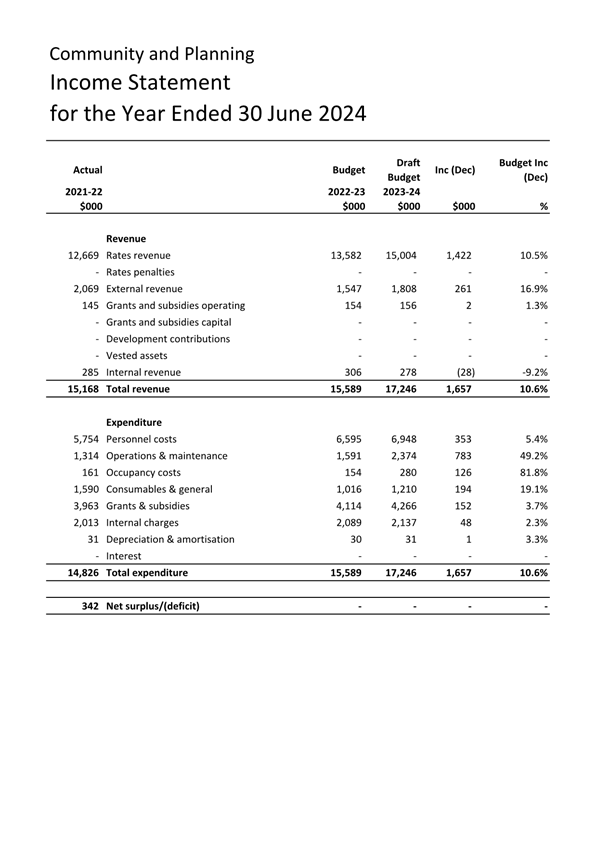

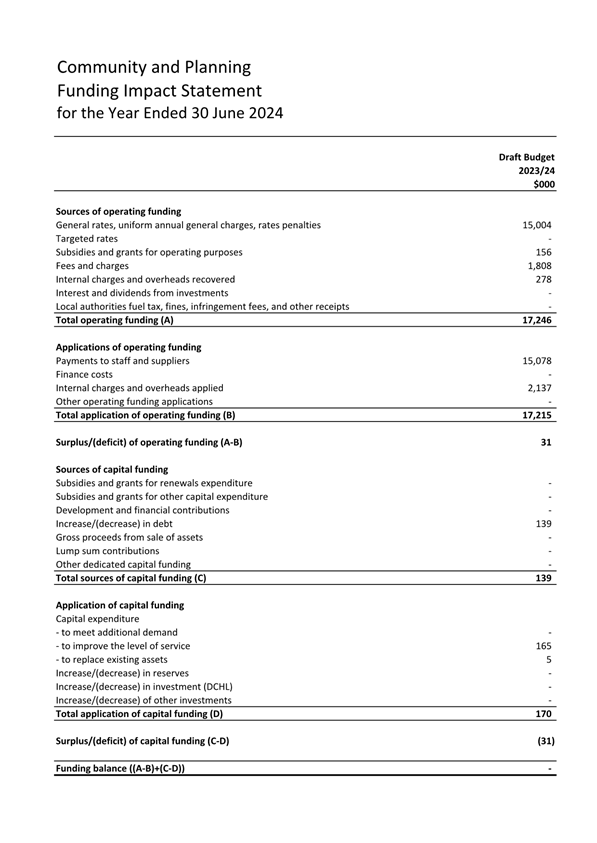

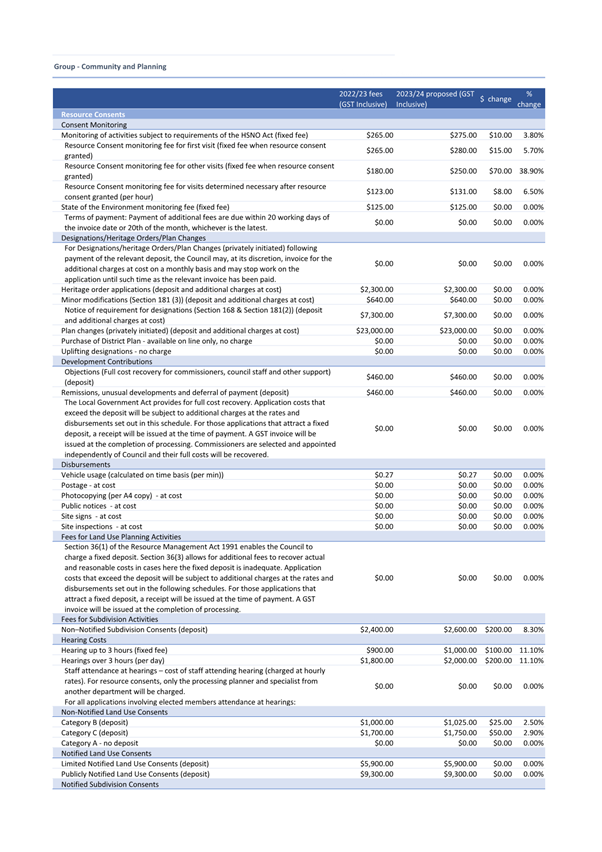

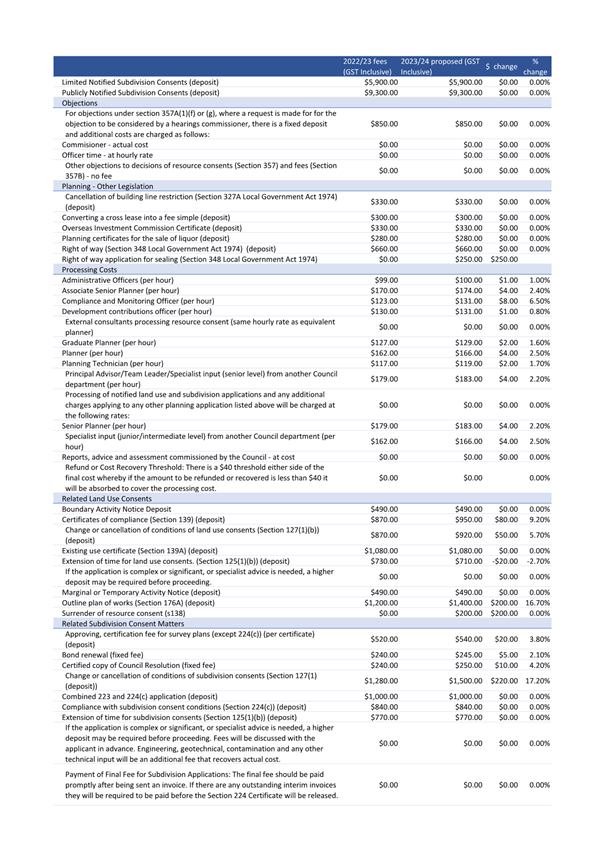

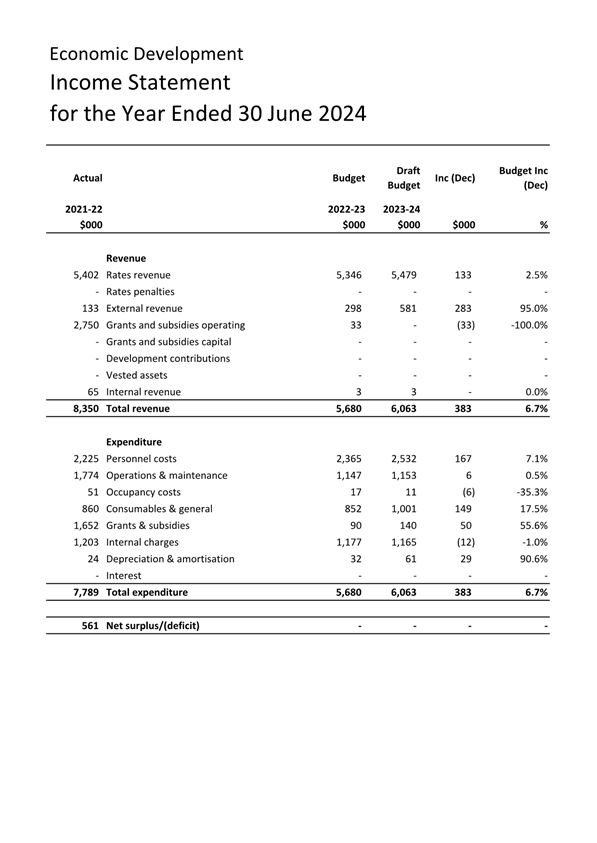

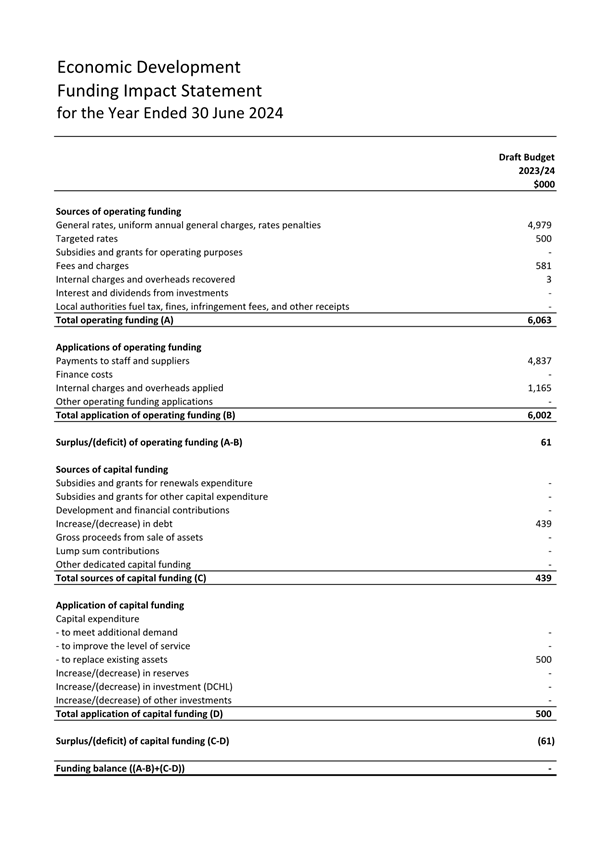

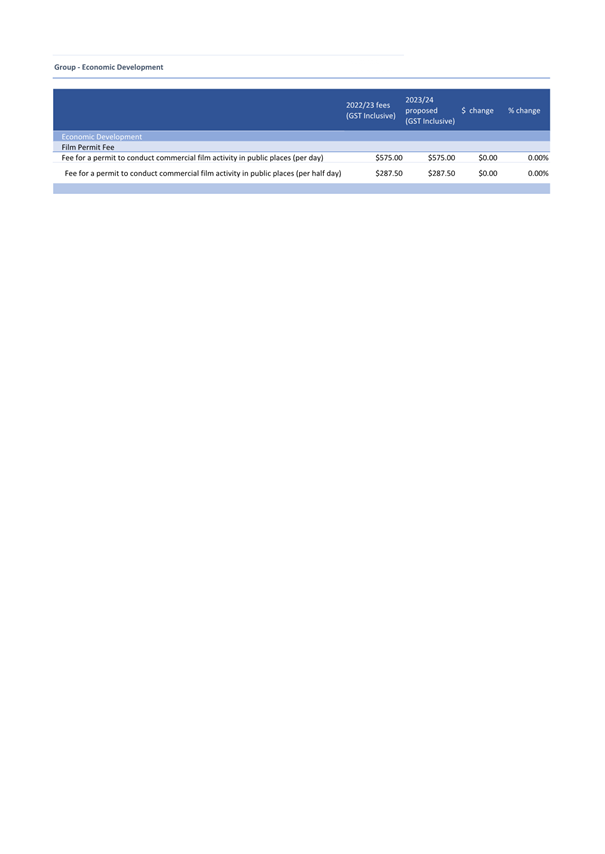

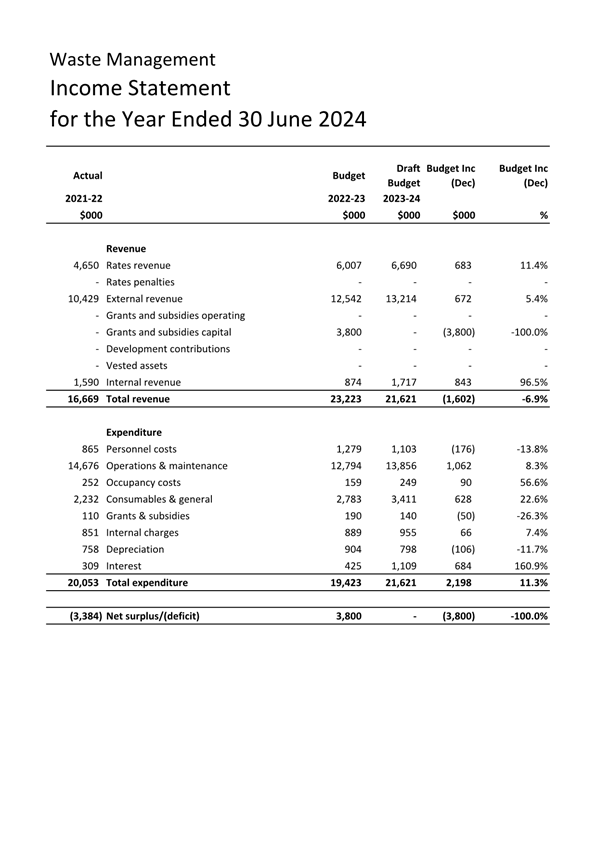

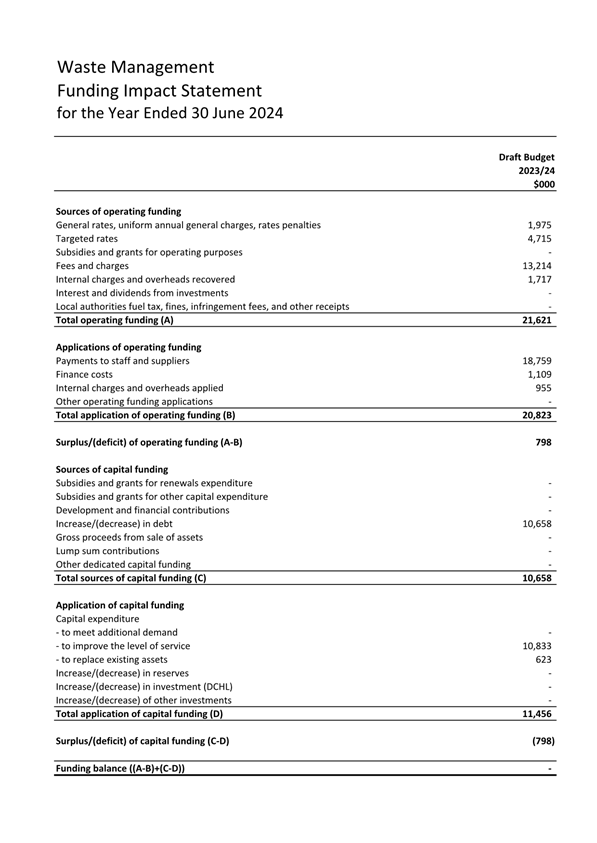

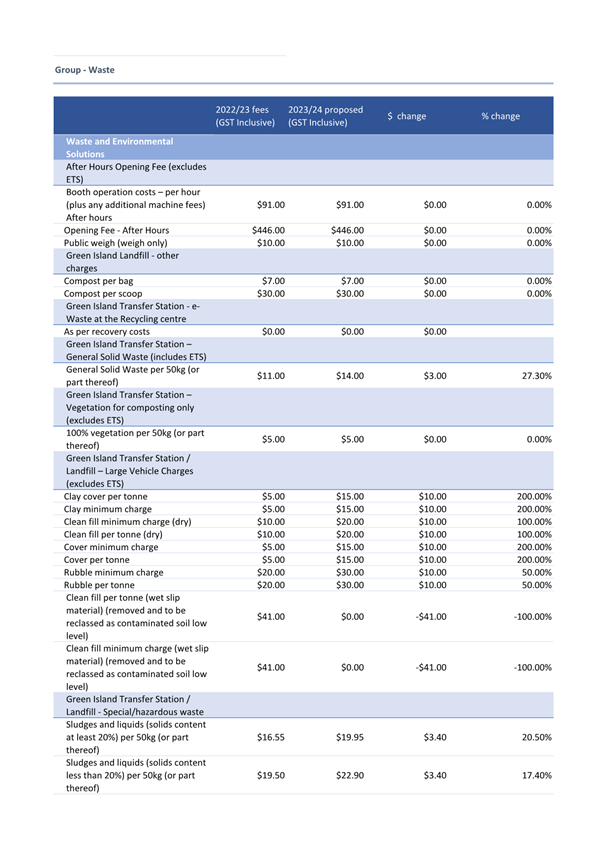

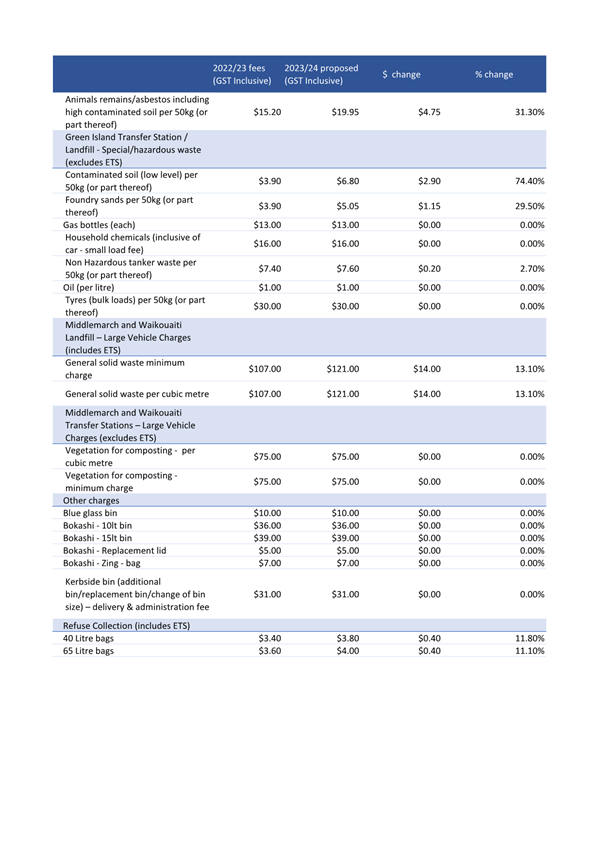

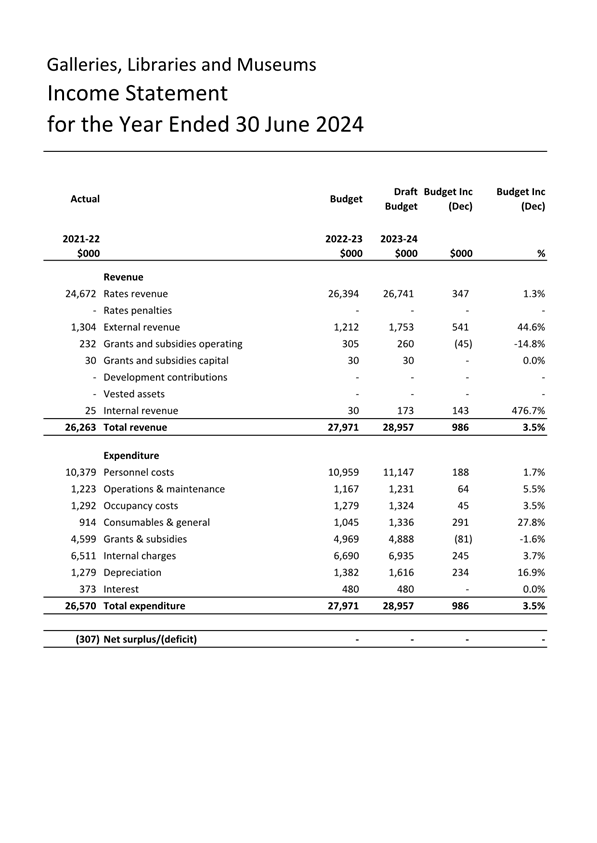

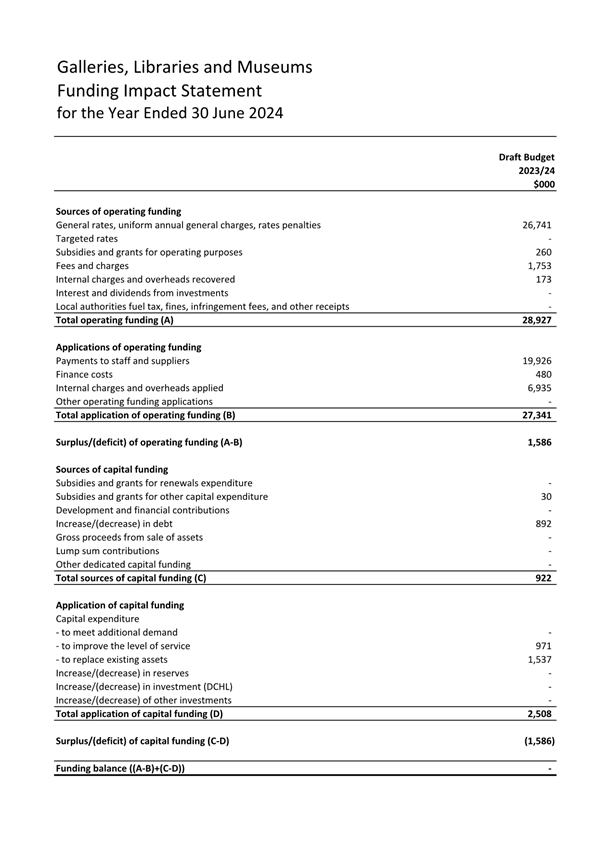

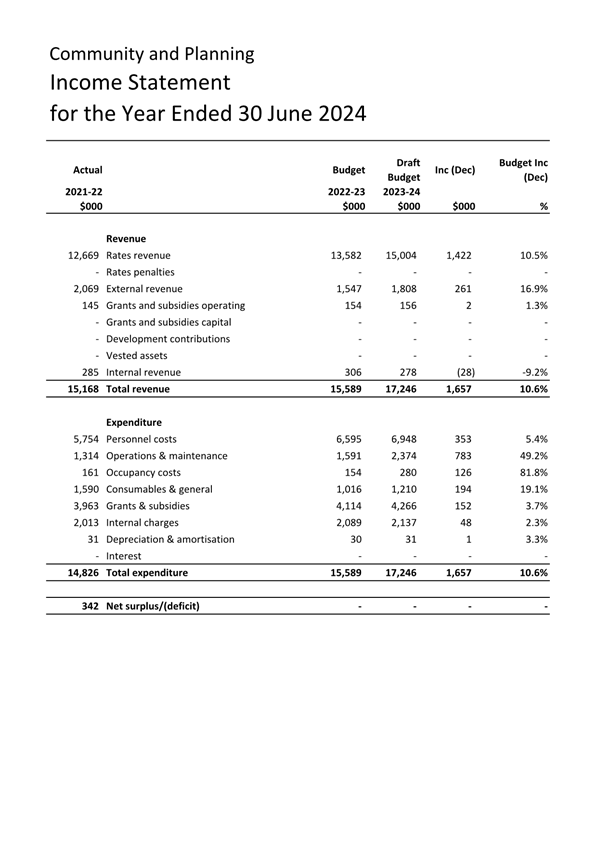

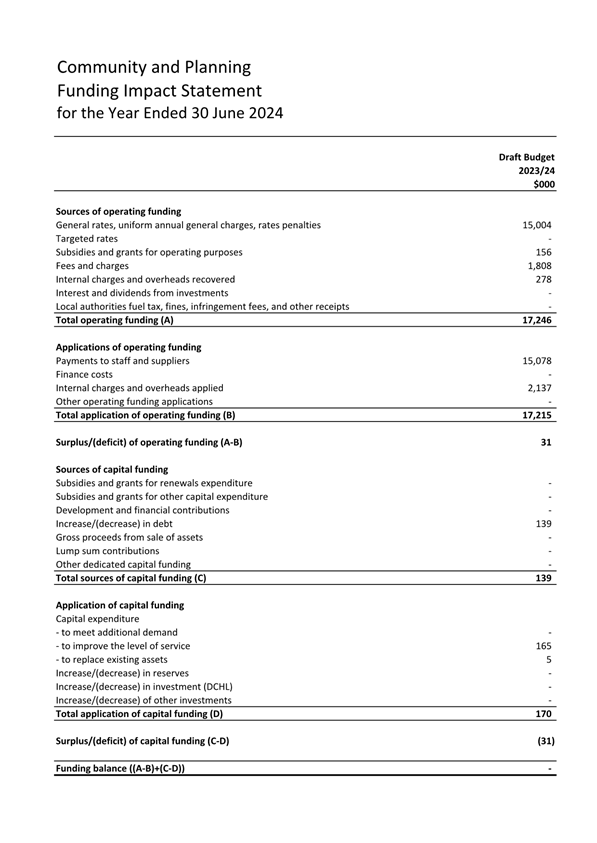

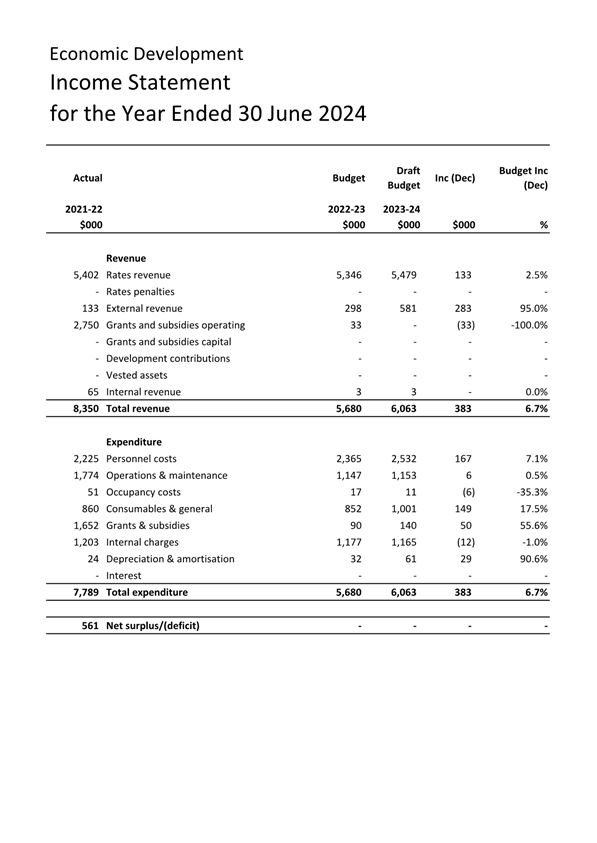

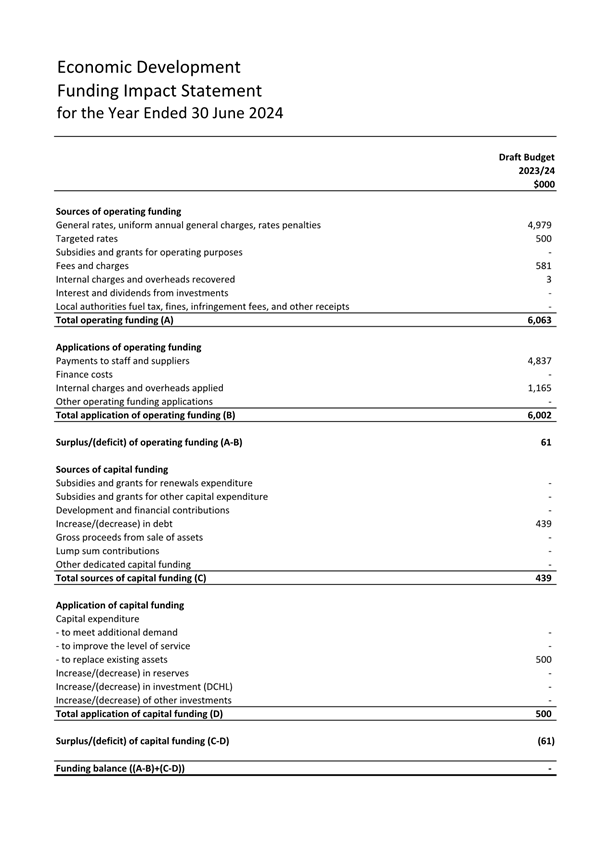

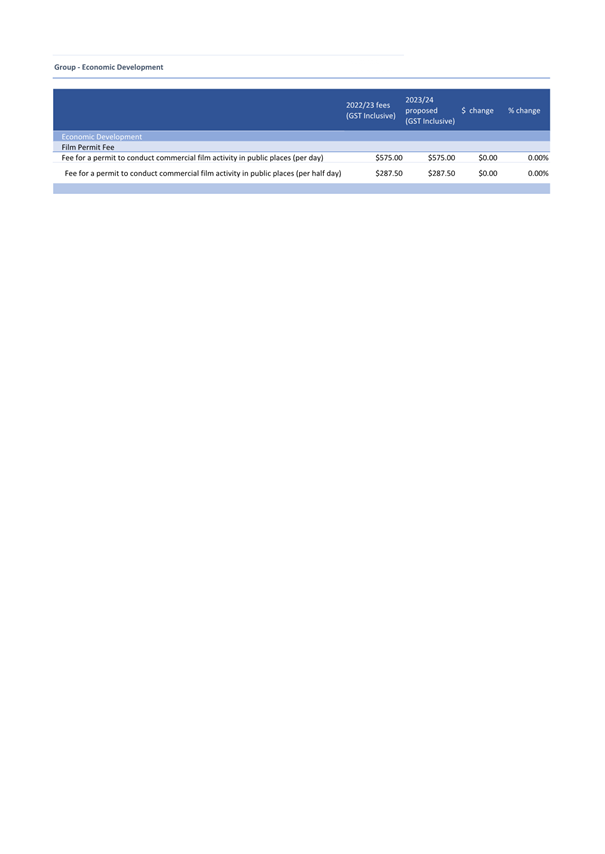

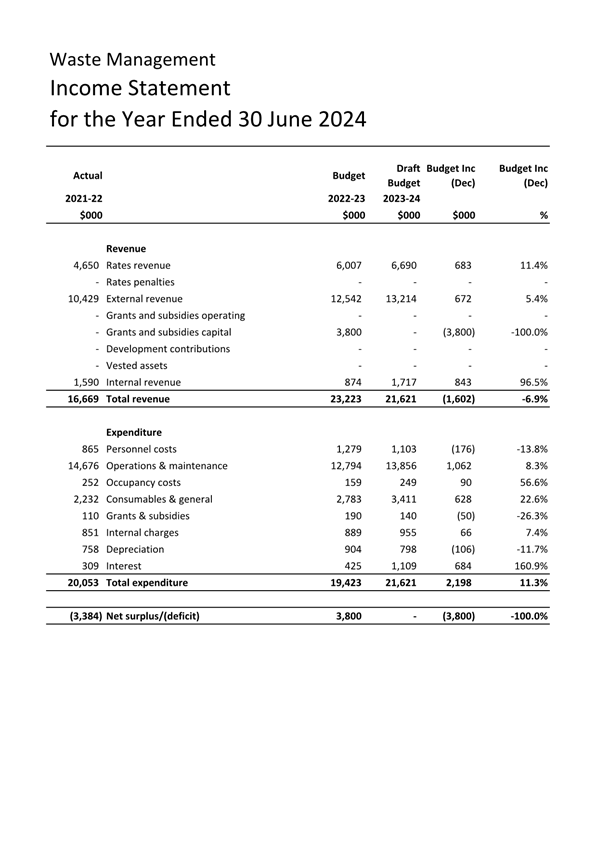

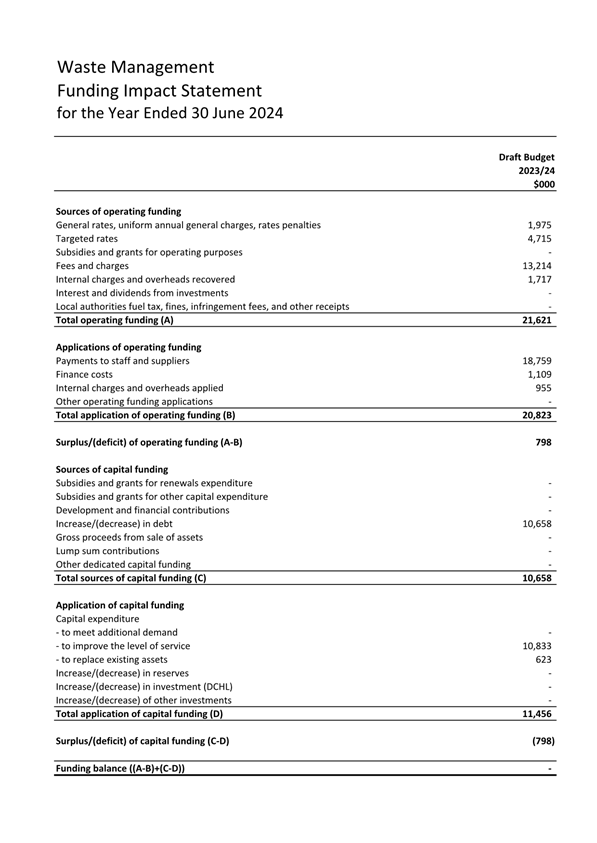

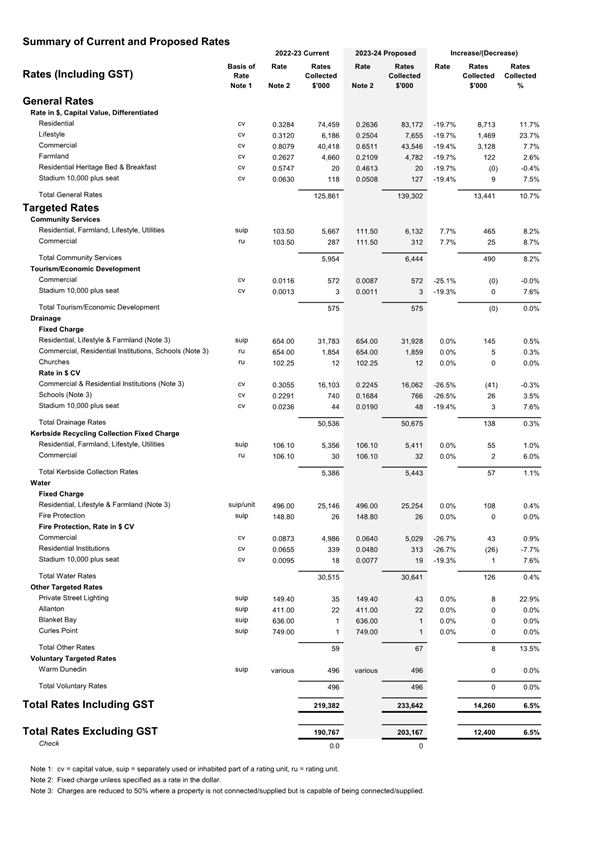

Projects identified in Community Board Plans were