Notice of Meeting:

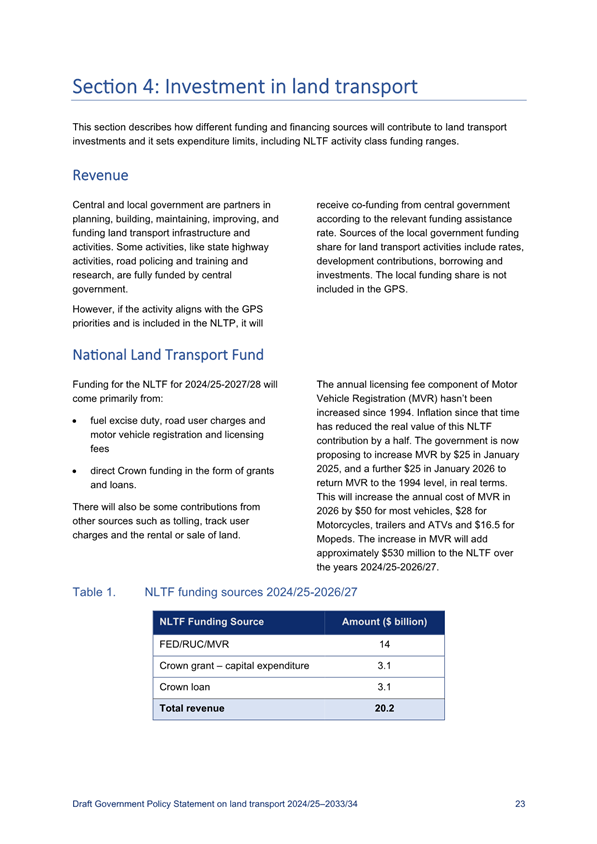

I hereby give notice that an ordinary meeting of the Dunedin

City Council will be held on:

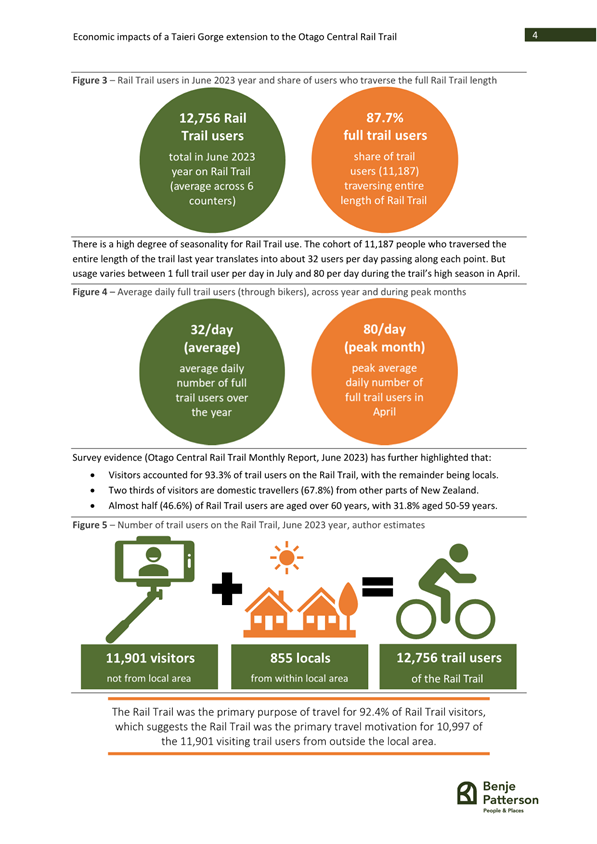

Date: Tuesday

12 March 2024

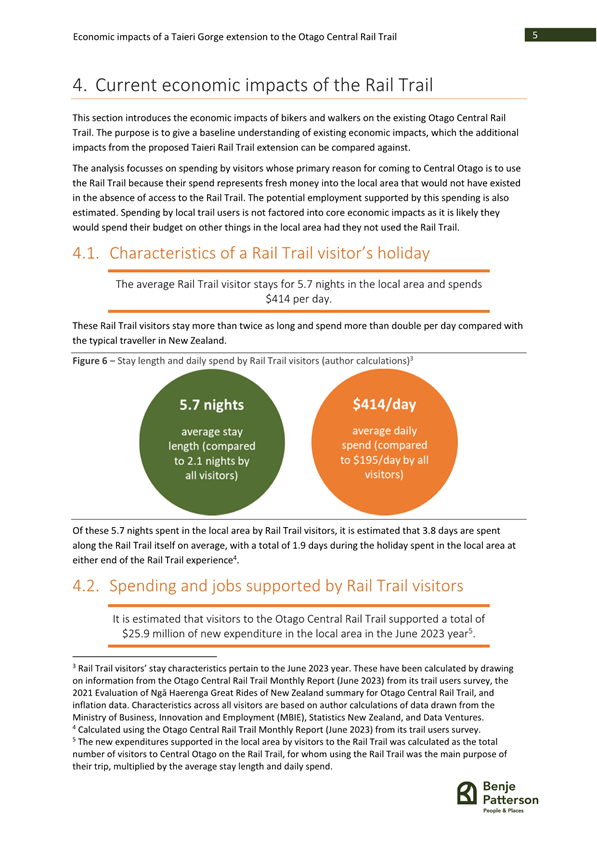

Time: 9:00

a.m.

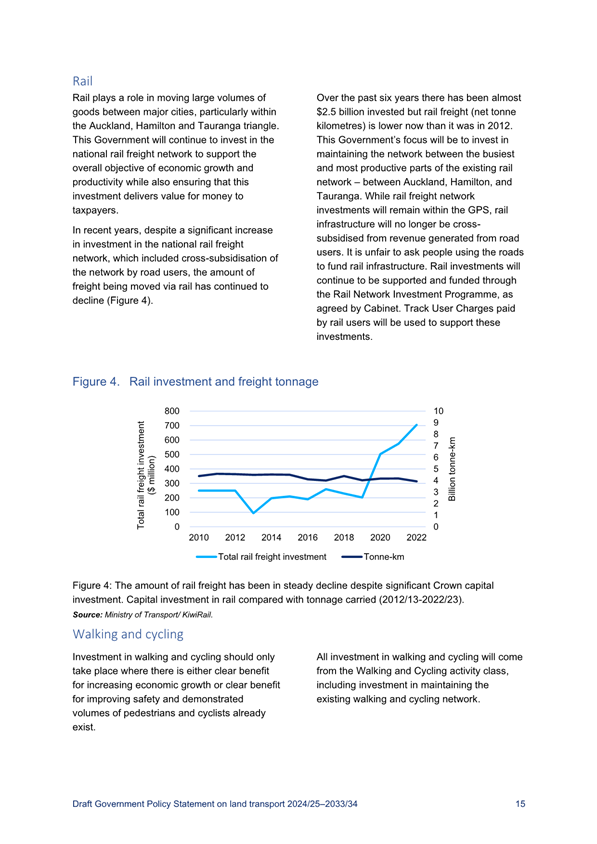

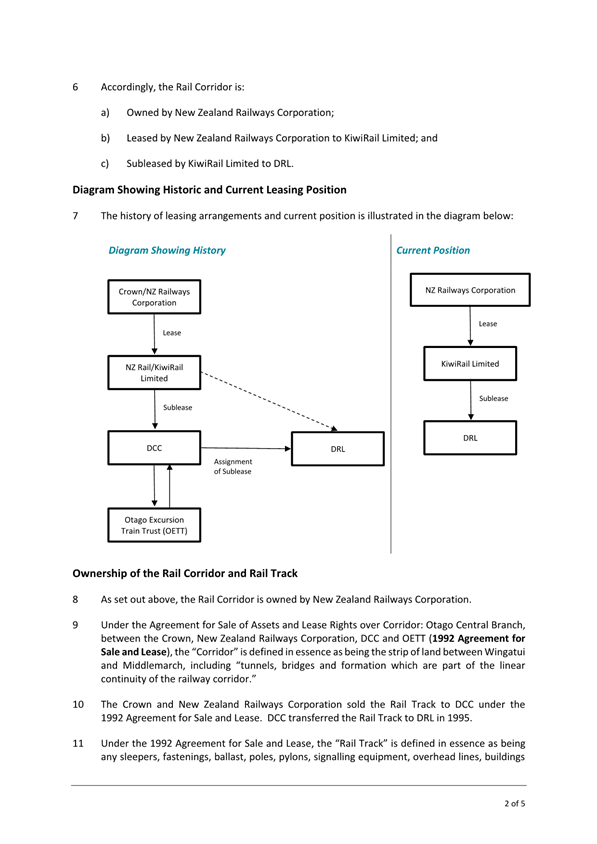

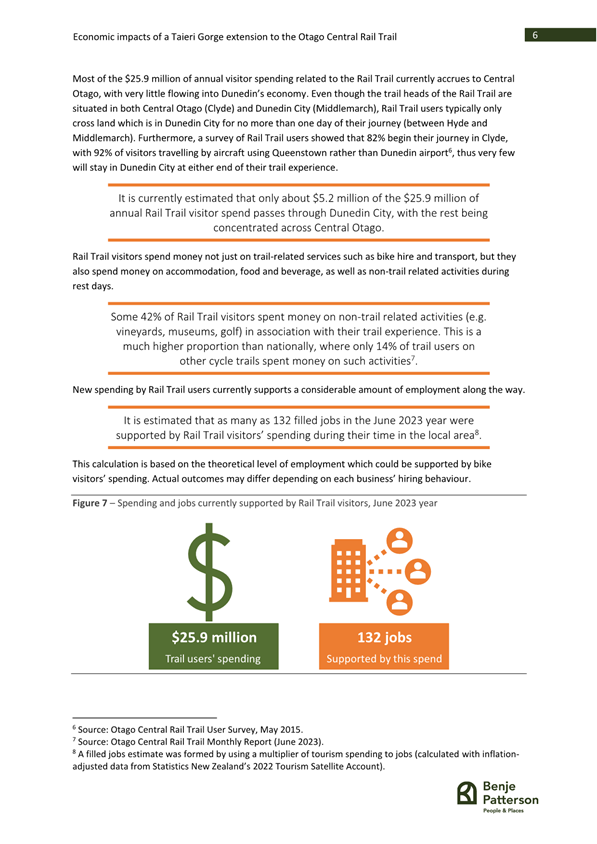

Venue: Council

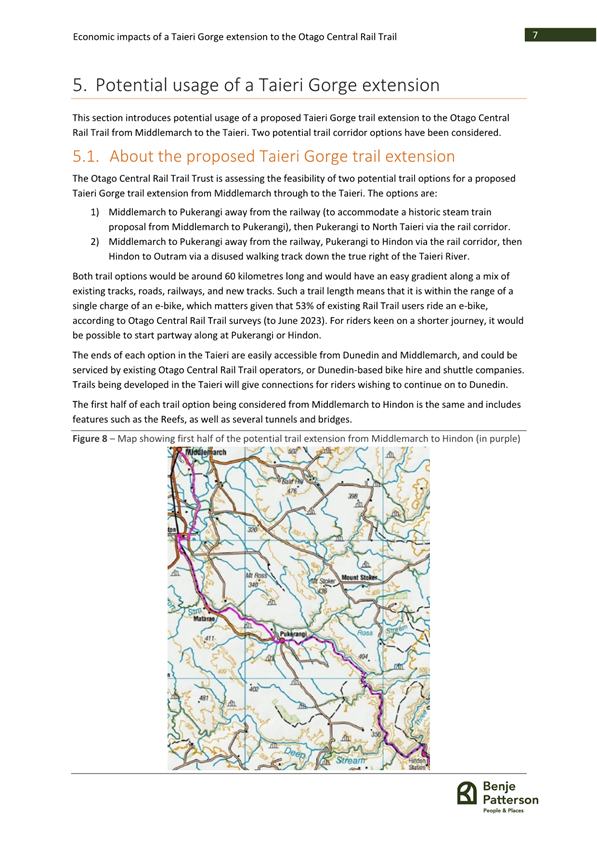

Chamber, Dunedin Public Art Gallery, The Octagon, Dunedin

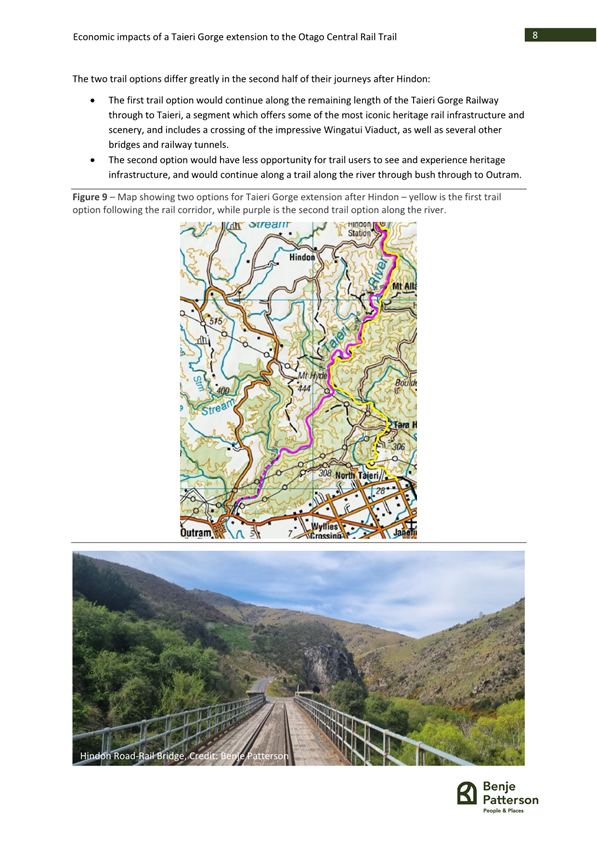

Sandy Graham

Council

PUBLIC AGENDA

|

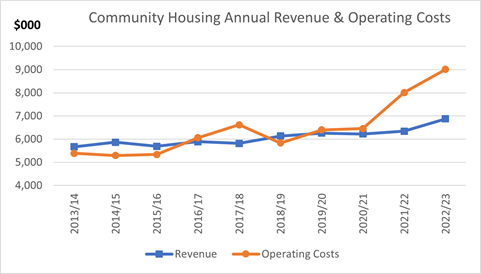

Mayor

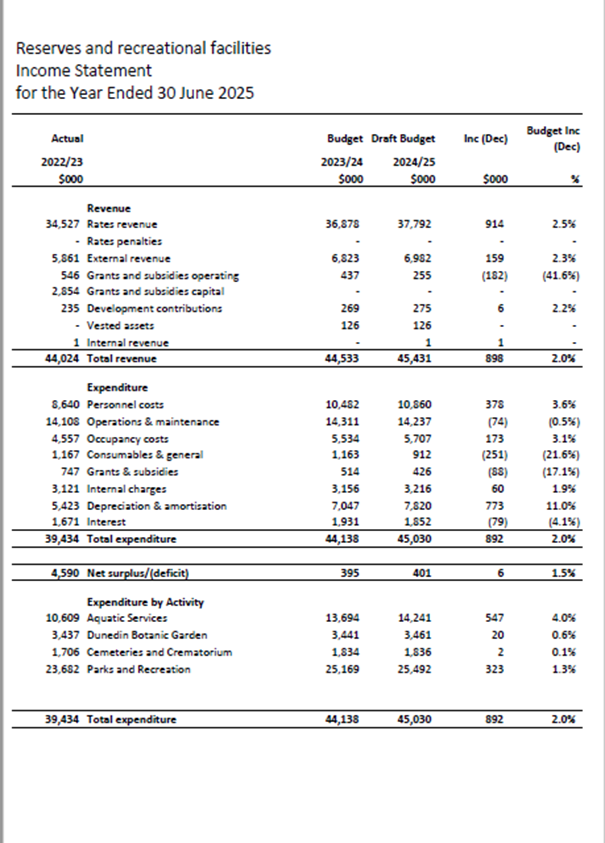

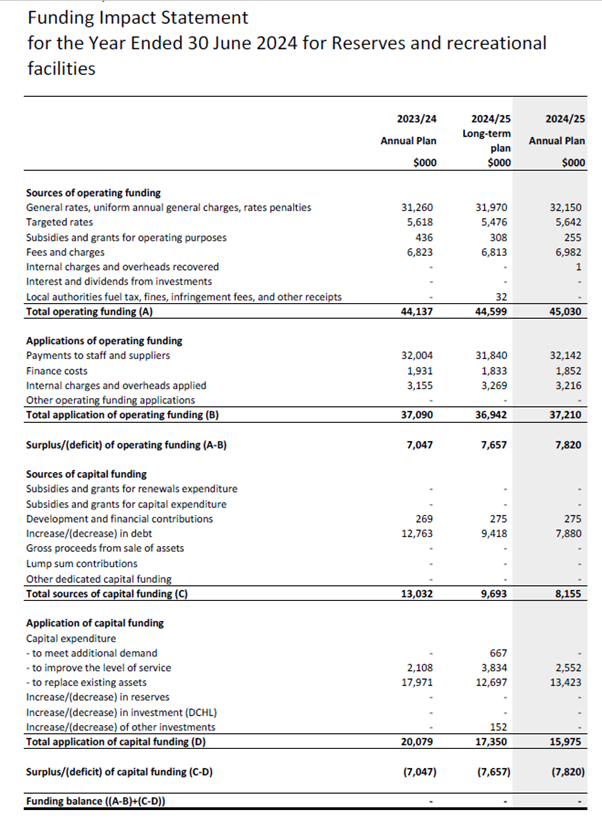

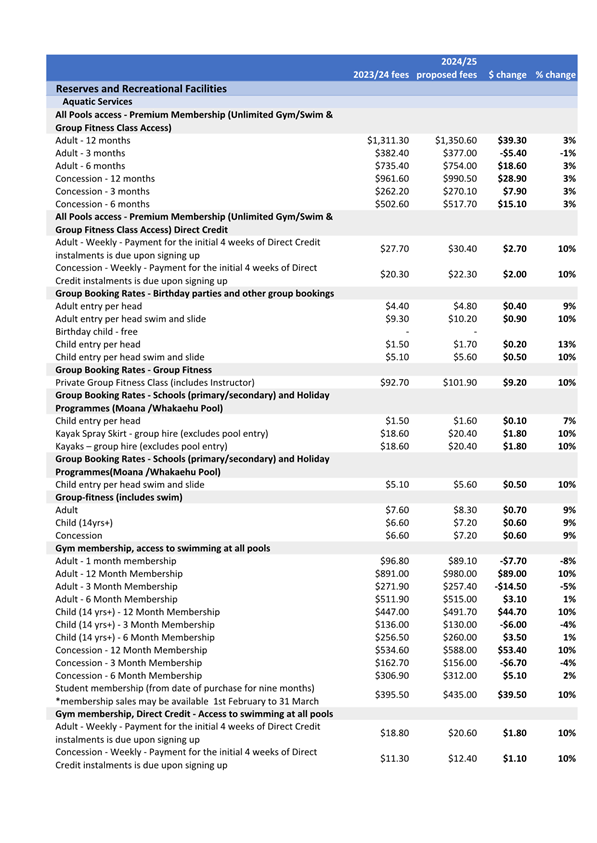

|

Mayor Jules Radich

|

|

|

Deputy Mayor

|

Cr Cherry Lucas

|

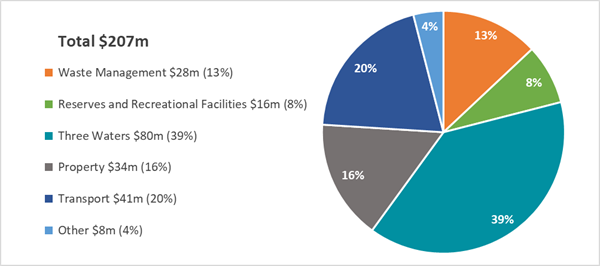

|

|

Members

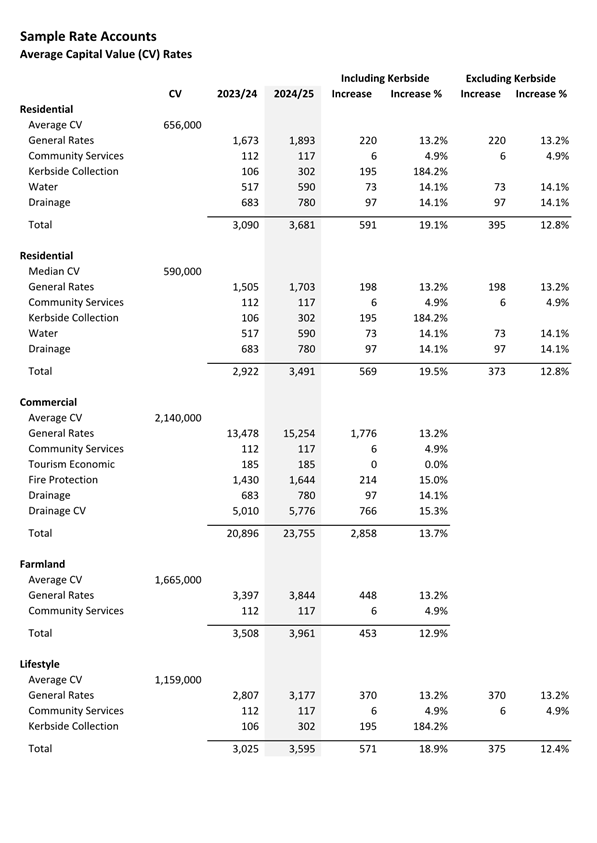

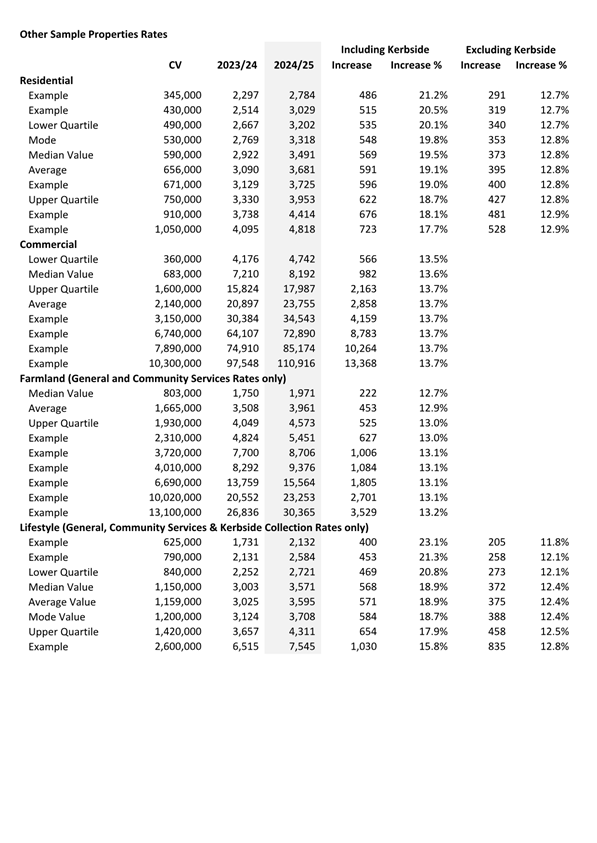

|

Cr Bill Acklin

|

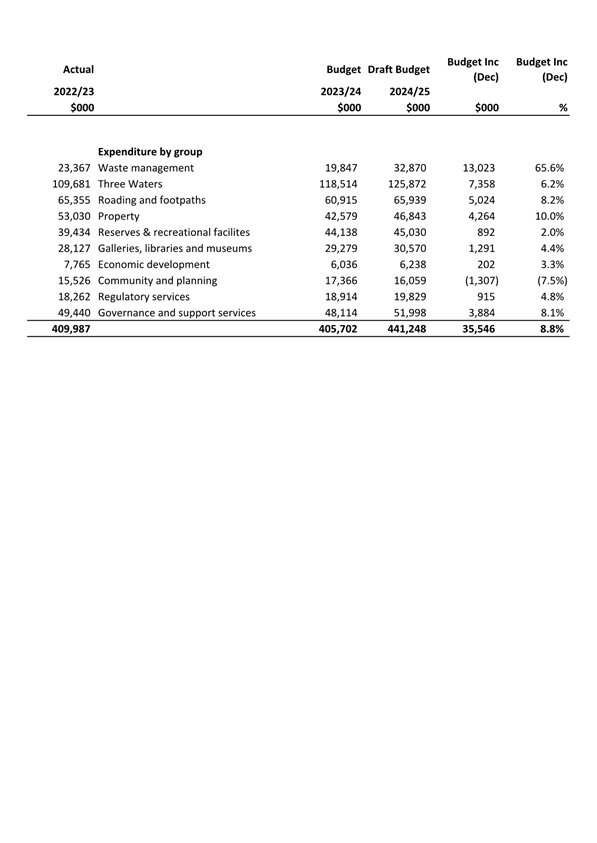

Cr Sophie Barker

|

|

|

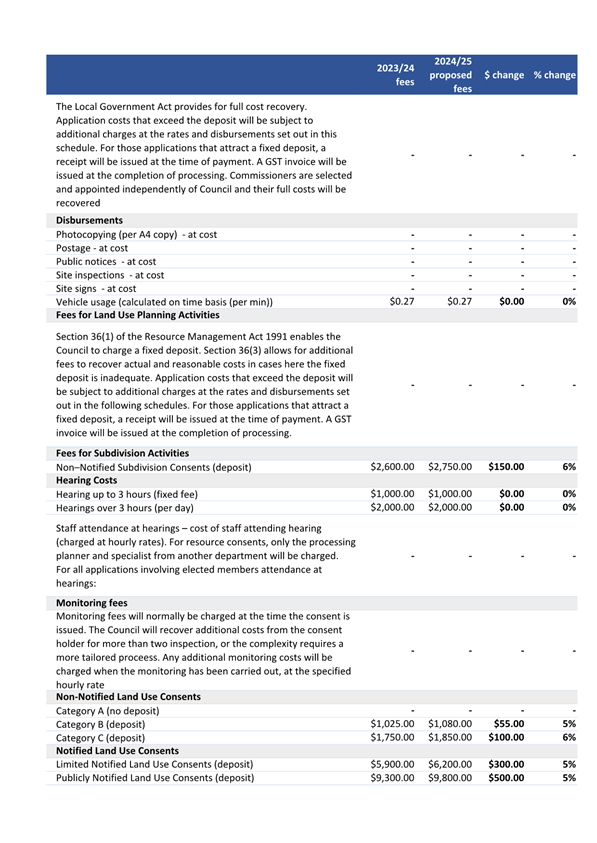

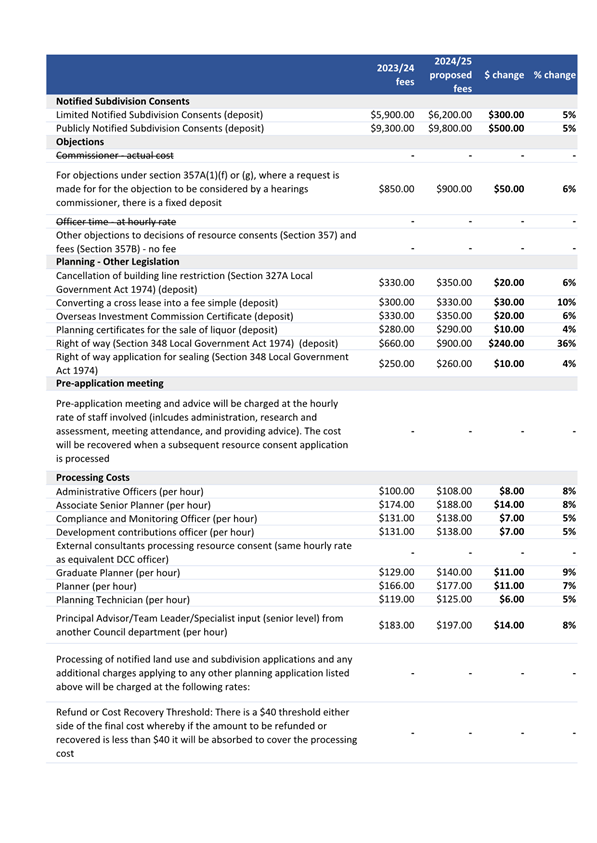

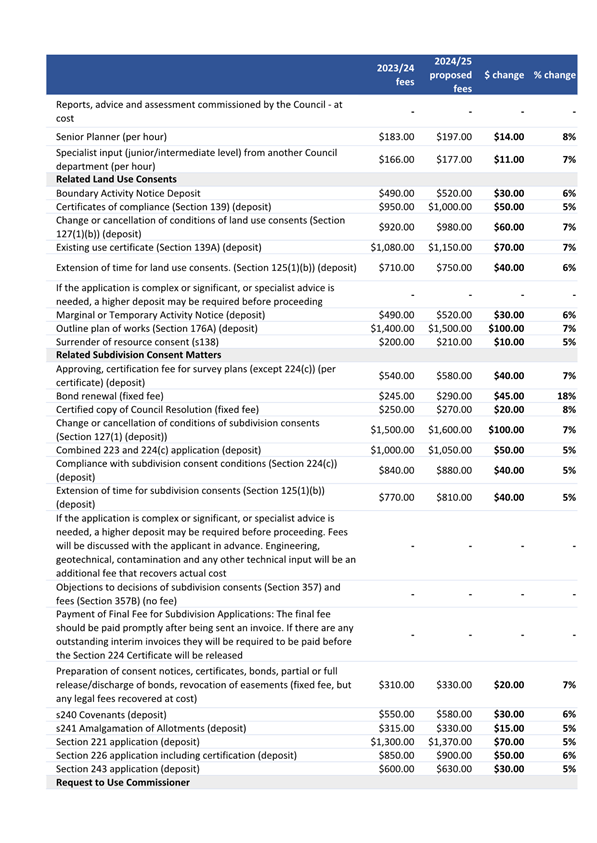

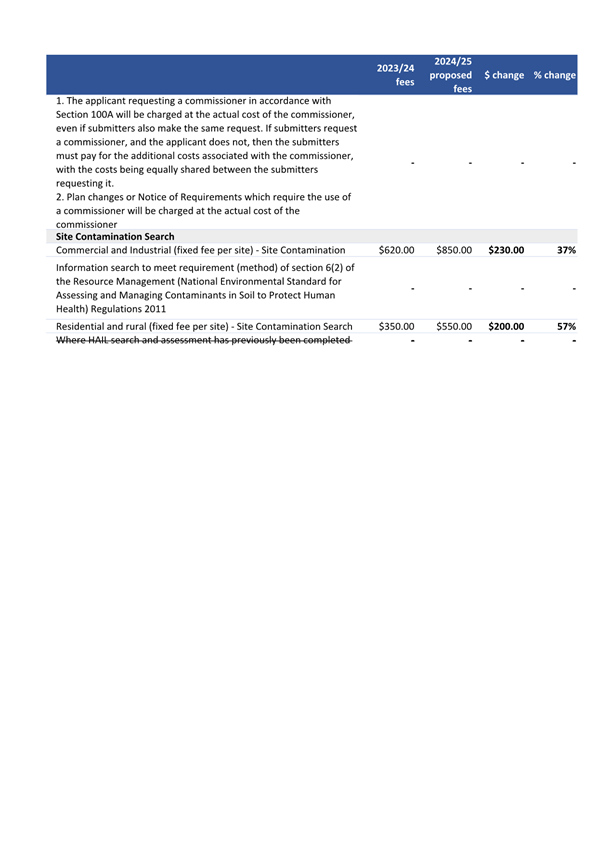

Cr David Benson-Pope

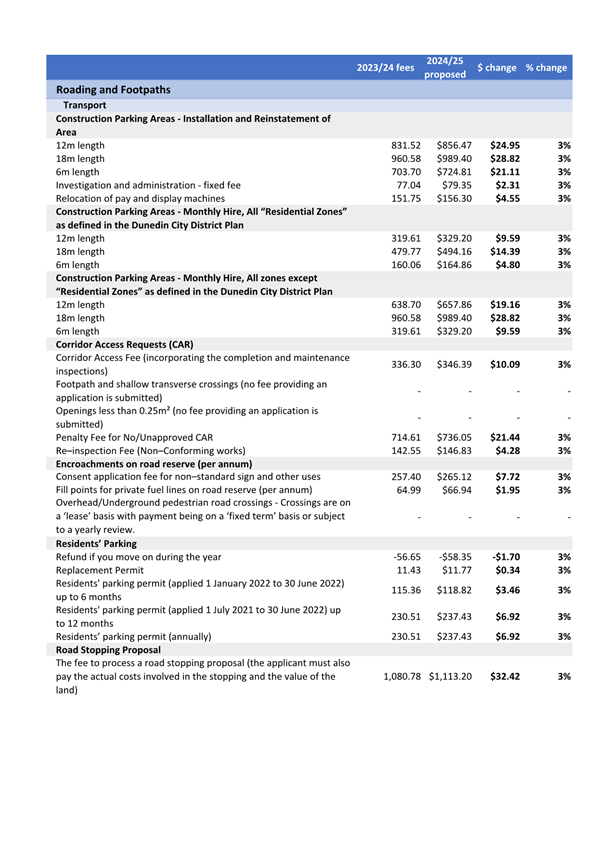

|

Cr Christine Garey

|

|

|

Cr Kevin Gilbert

|

Cr Carmen Houlahan

|

|

|

Cr Marie Laufiso

|

Cr Mandy Mayhem

|

|

|

Cr Jim O'Malley

|

Cr Lee Vandervis

|

|

|

Cr Steve Walker

|

Cr Brent Weatherall

|

|

|

Cr Andrew Whiley

|

|

Senior Officer Sandy

Graham, Chief Executive Officer

Governance Support Officer Lynne

Adamson

Lynne Adamson

Governance Support Officer

Telephone: 03 477 4000

governance.support@dcc.govt.nz

www.dunedin.govt.nz

Note: Reports

and recommendations contained in this agenda are not to be considered as

Council policy until adopted.

|

|

Council

12 March 2024

|

ITEM TABLE OF CONTENTS PAGE

1 Opening 4

2 Public

Forum 4

3 Apologies 4

4 Confirmation

of Agenda 4

5 Declaration

of Interest 5

Reports

6 CEO

Overview Report - Annual Plan 2024/25 17

7 Rating

Method 2024/25 34

8 Draft

Capital Budget Including Zero Carbon Options 2024/25 45

9 Three

Waters - Operating Budget 2024/25 125

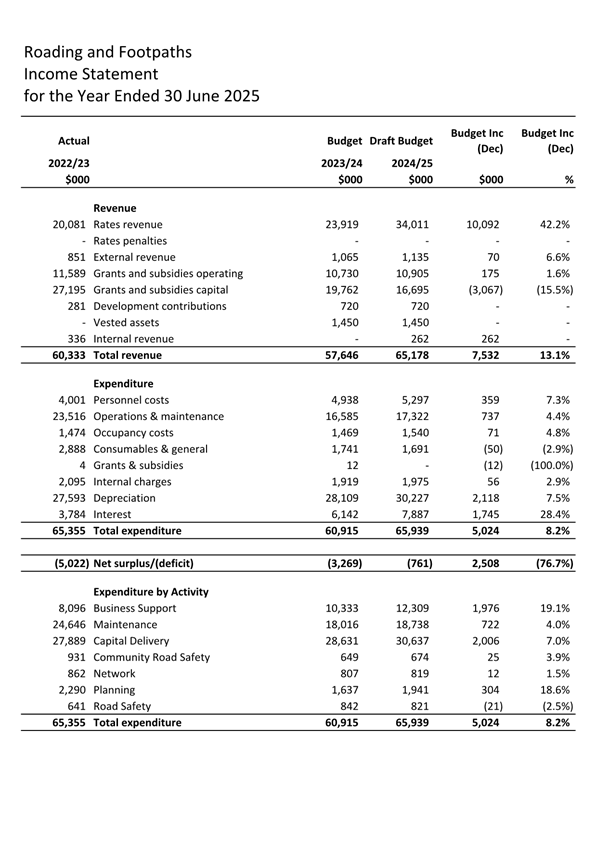

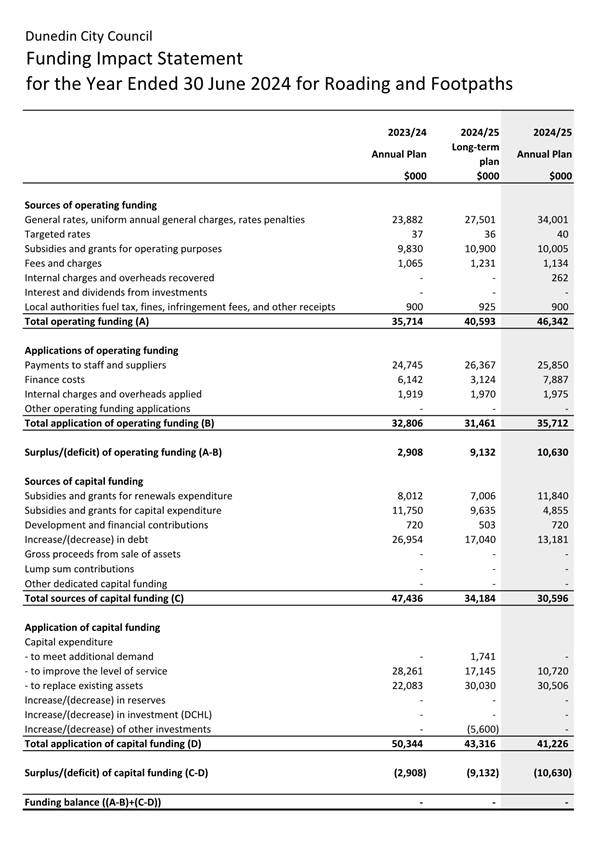

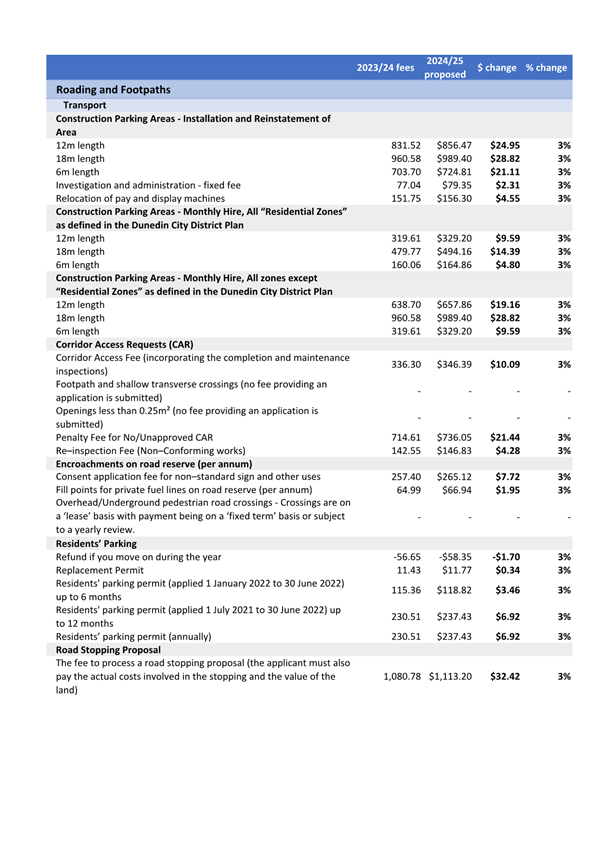

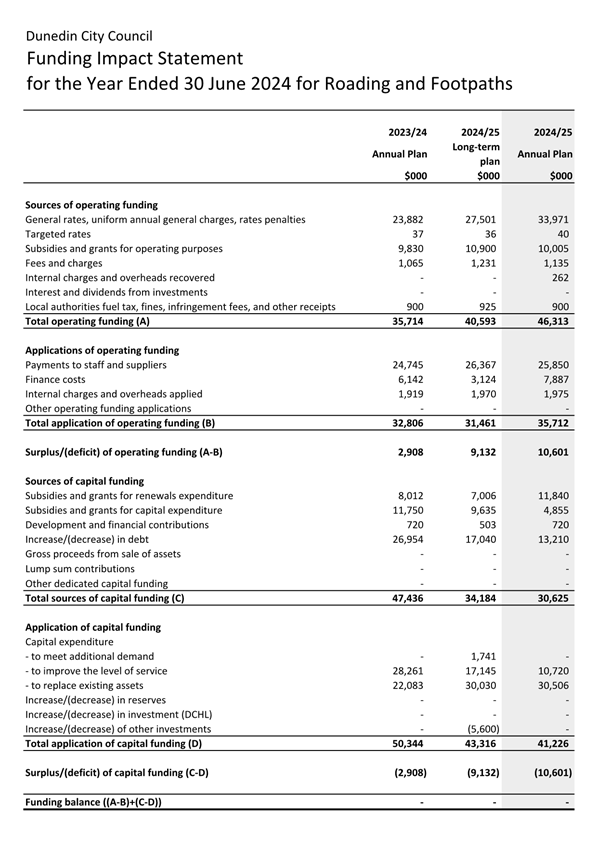

10 Roading

and Footpaths - Operating Budget 2024/25 138

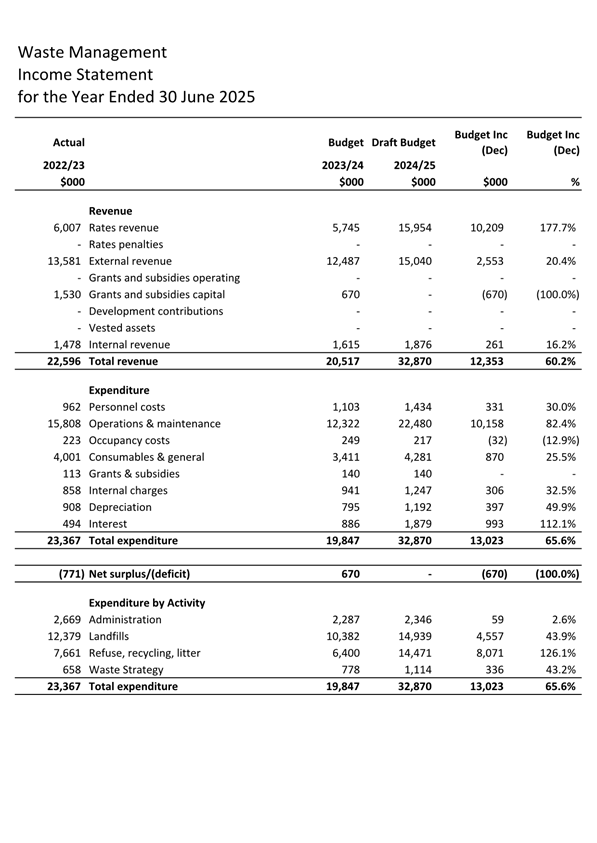

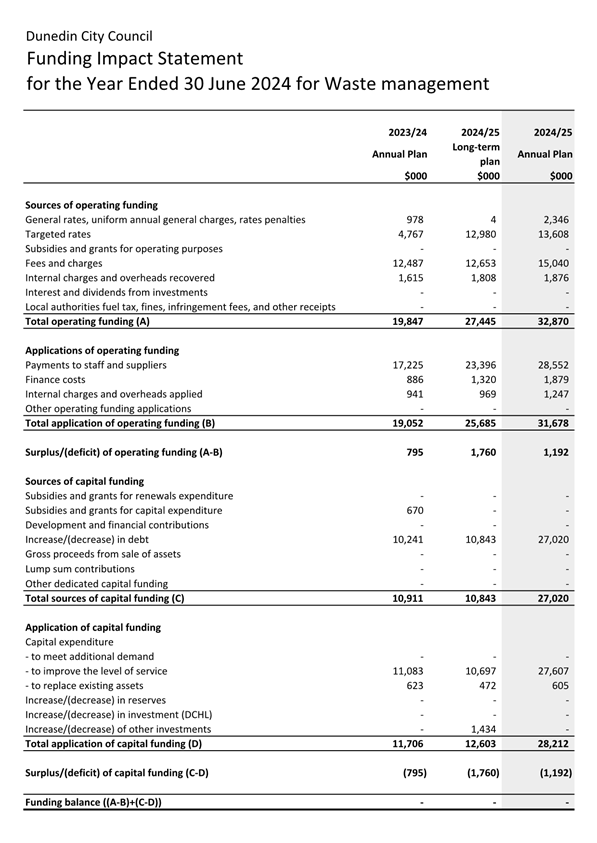

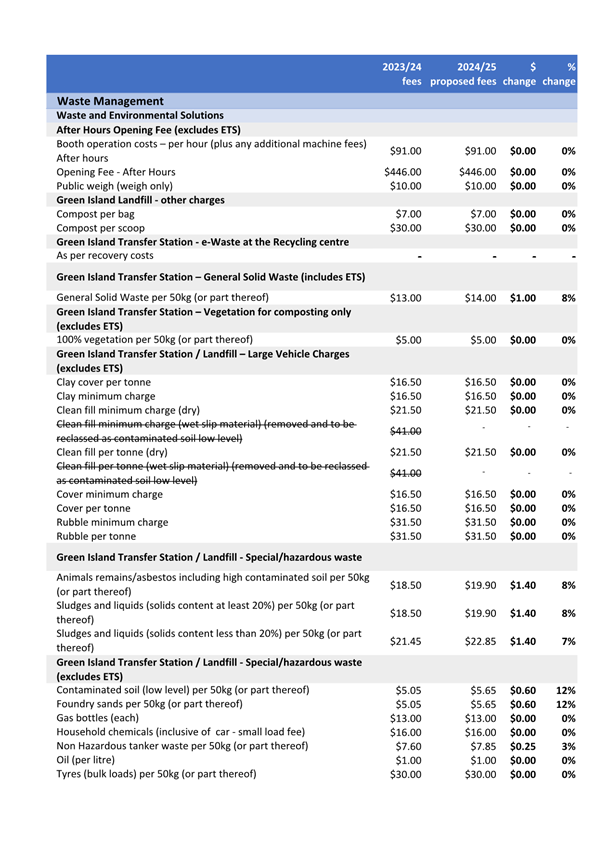

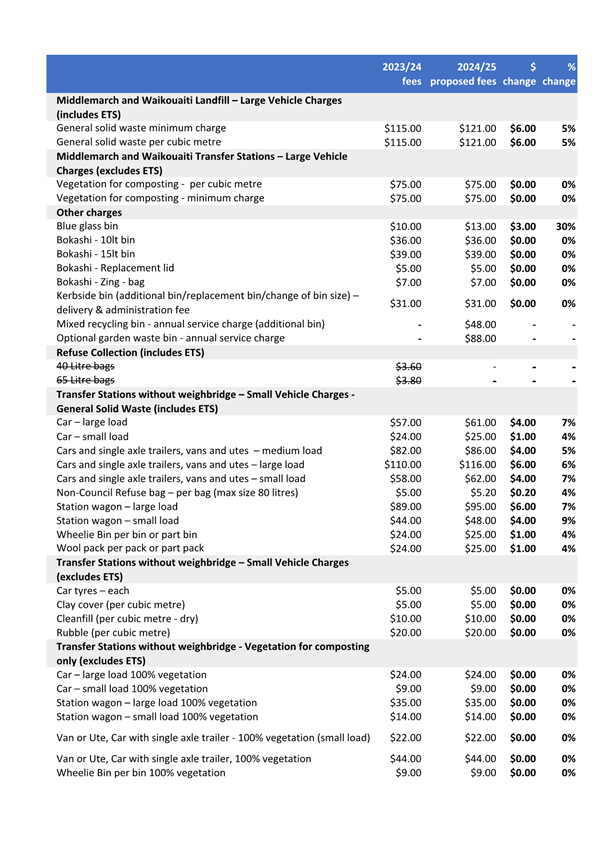

11 Waste

Management - Operating Budget 2024/25 146

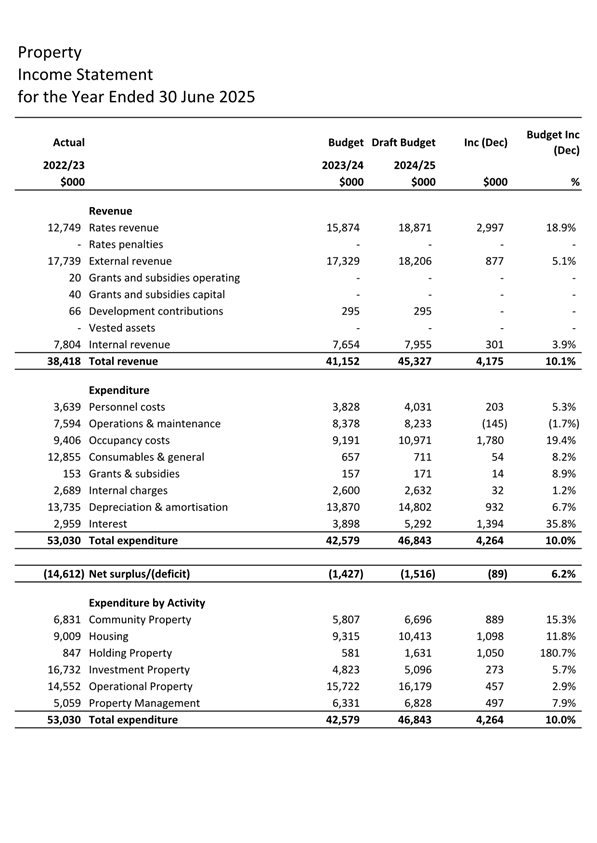

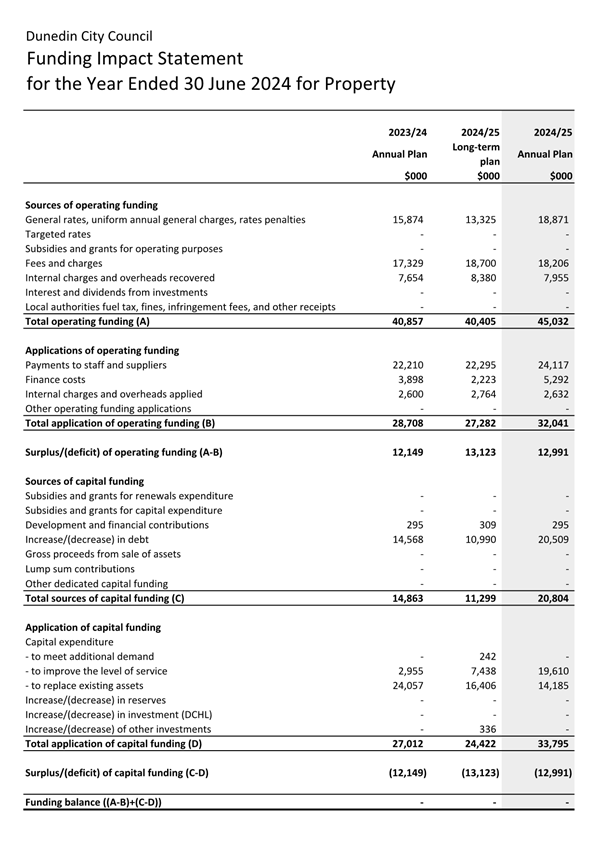

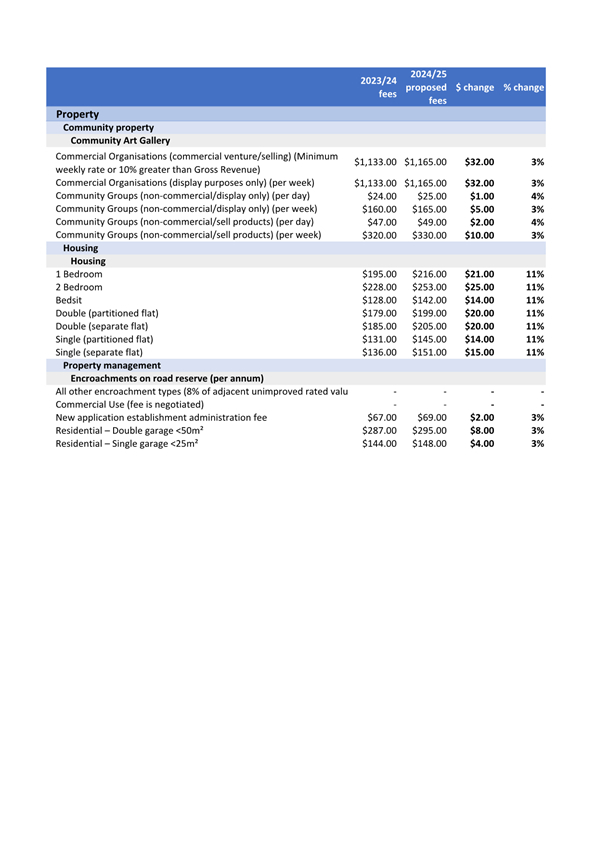

12 Property

- Operating Budget 2024/25 157

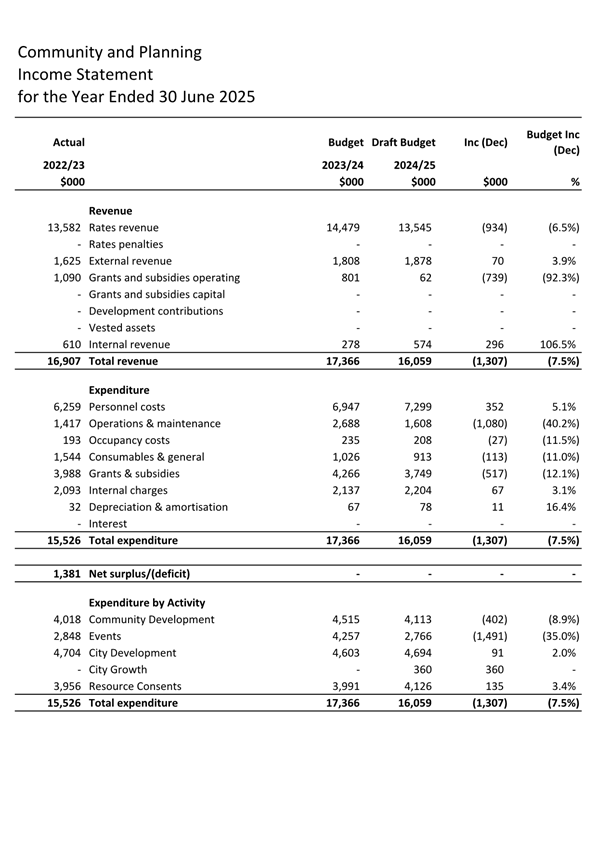

13 Community

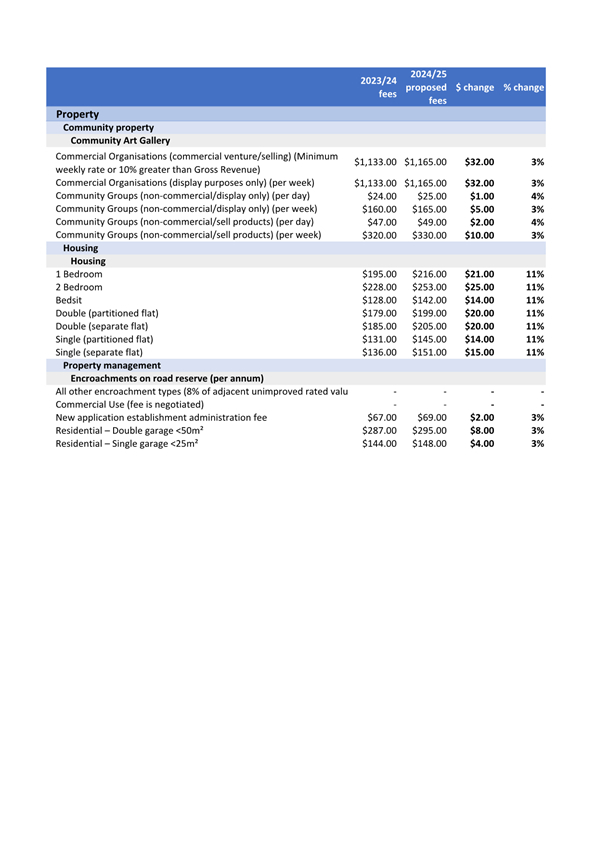

Housing Fees and Charges 165

14 Reserves

and Recreational Facilities - Operating Budget 2024/25 174

15 Options

for the replacement of the Hockey Turfs at Logan Park 189

16 Governance

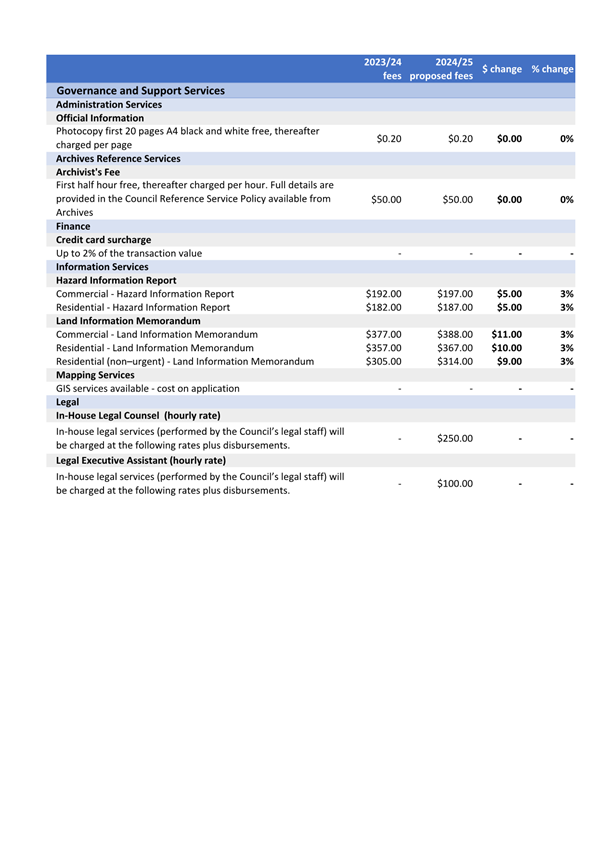

and Support Services - Operating Budget 2024/25 200

17 Dunedin

Railways 2024/25 209

18 DCC

Grants - Update Report 282

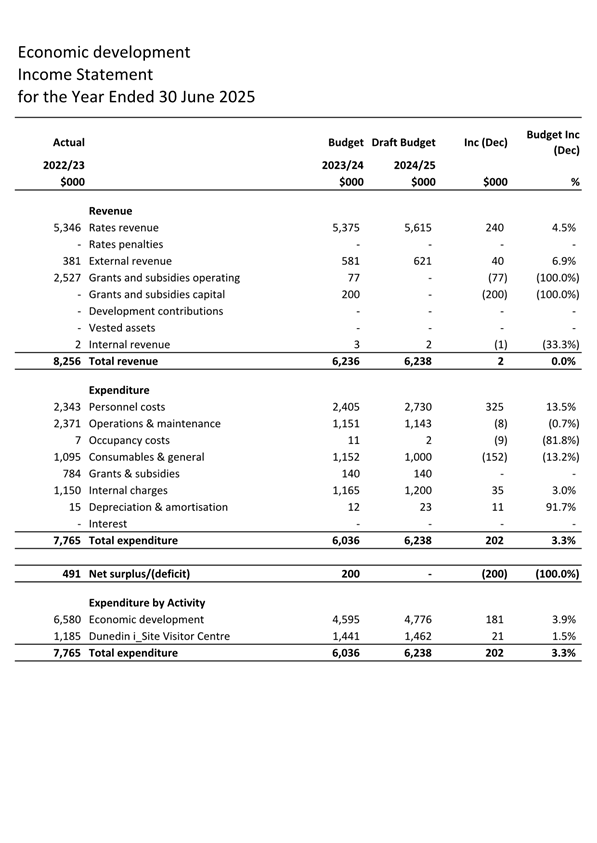

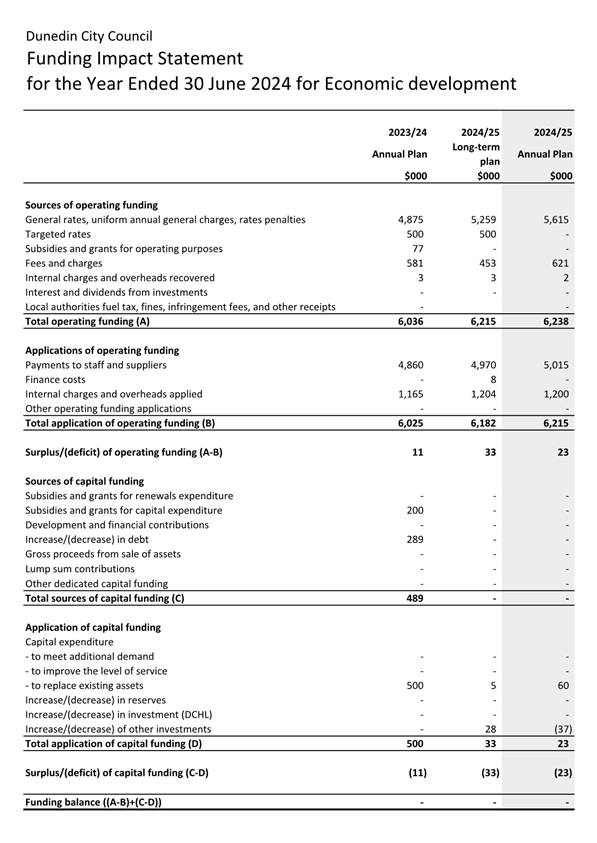

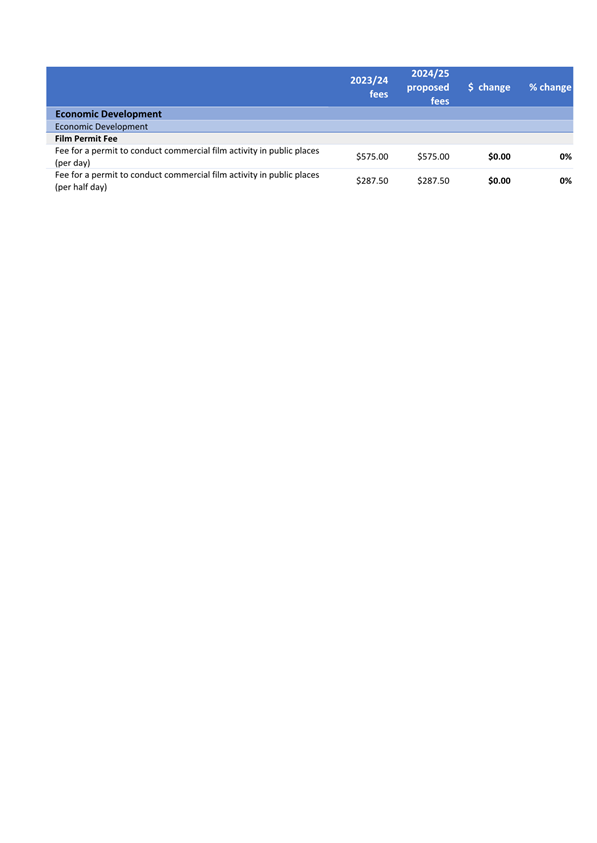

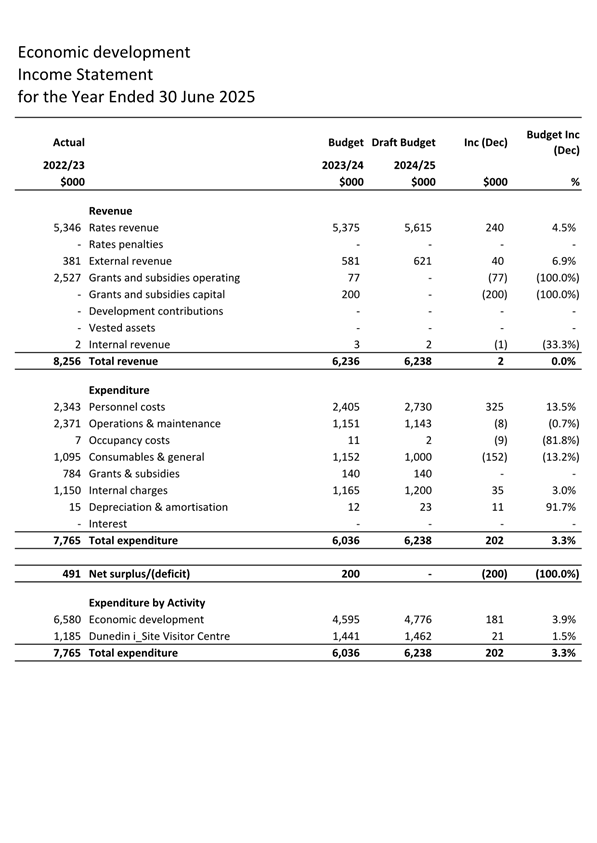

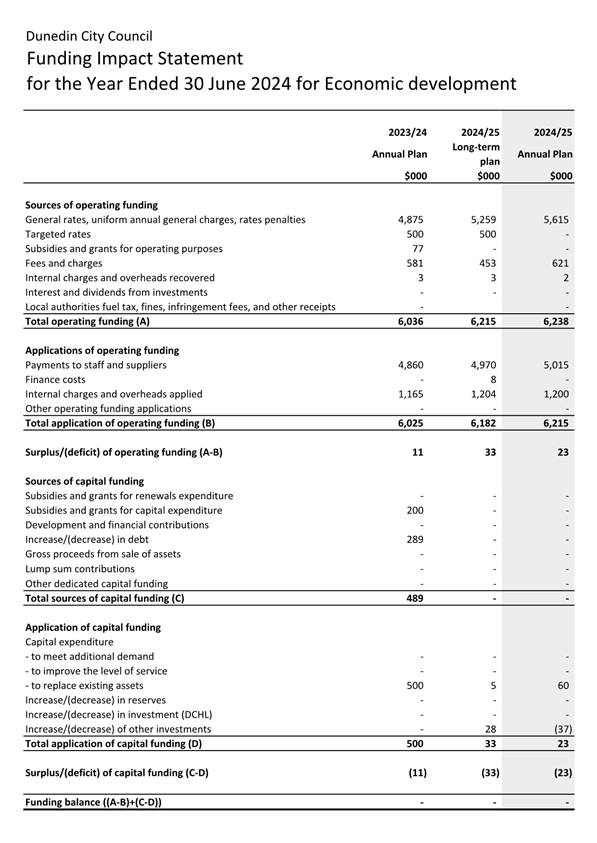

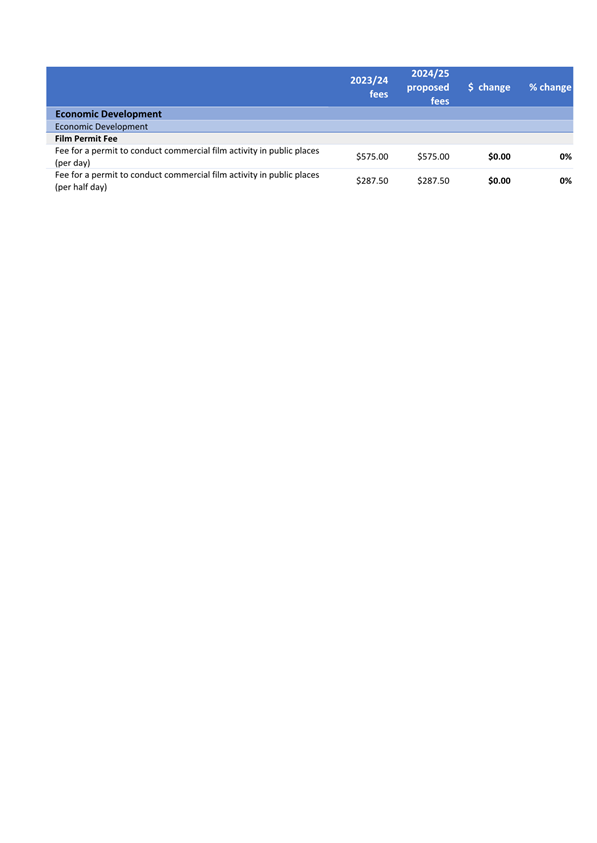

19 Economic

Development - Operating Budget 2024/25 287

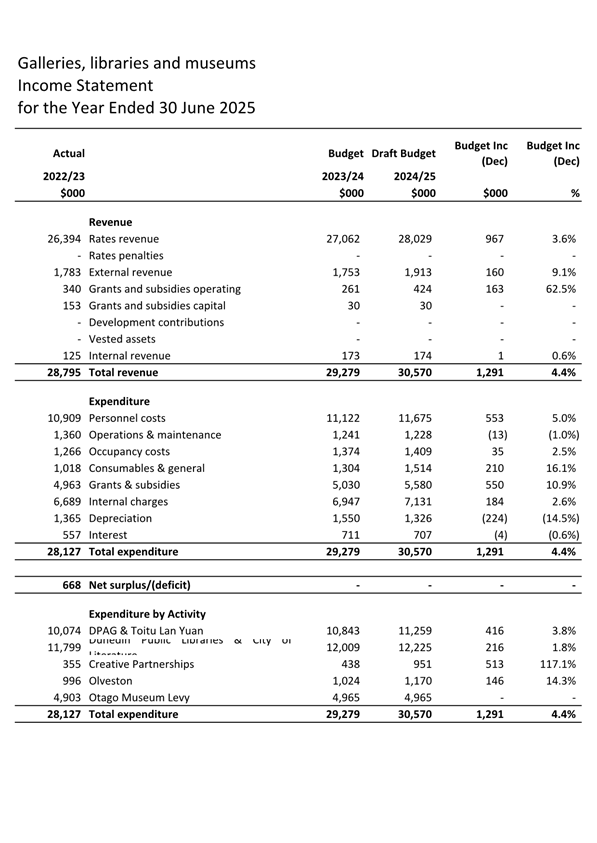

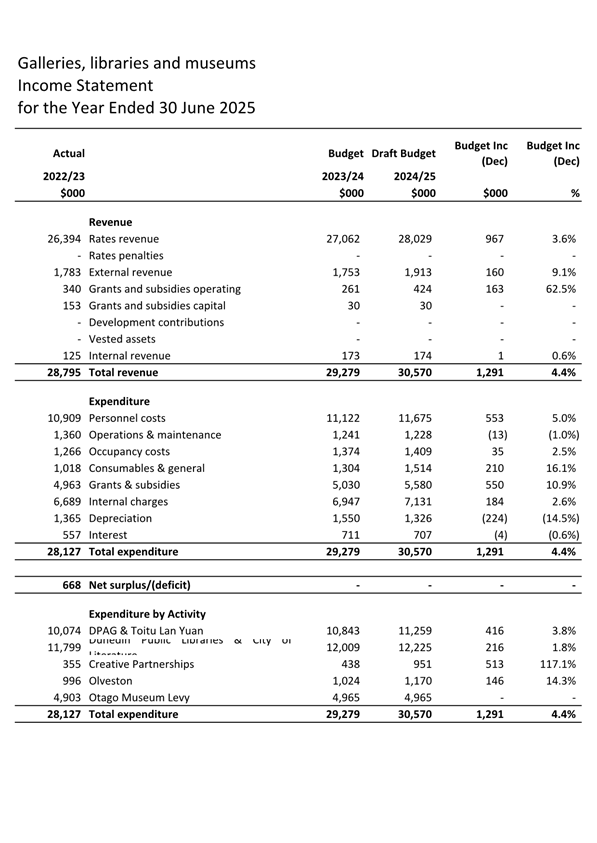

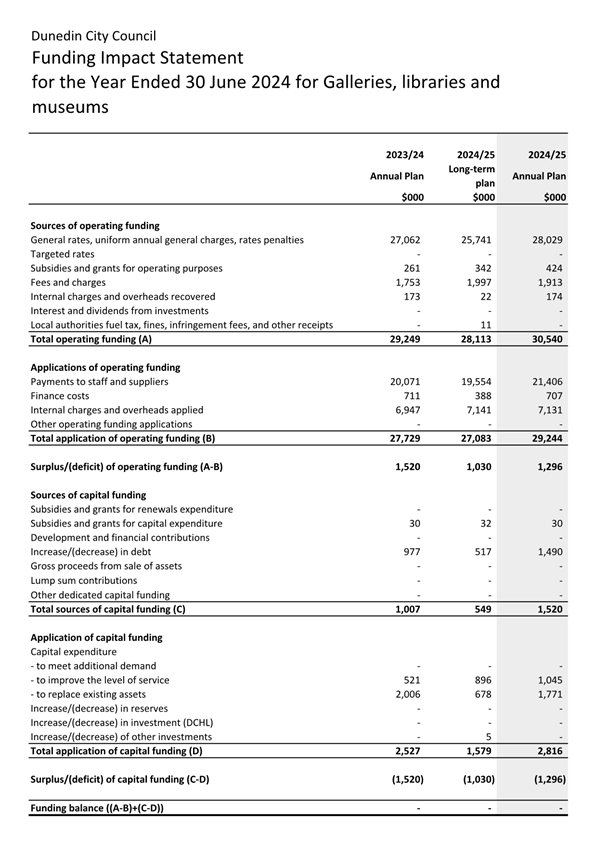

20 Galleries,

Libraries and Museums - Operating Budget 2024/25 294

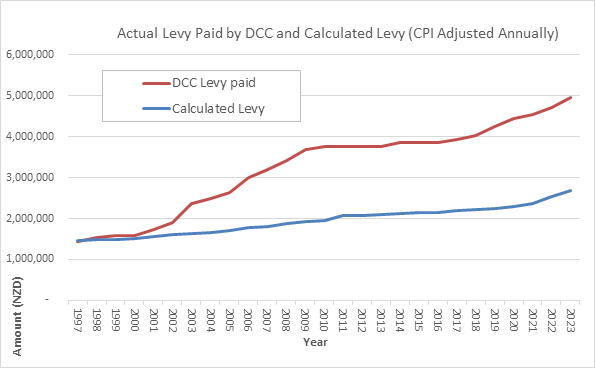

21 Tuhura

Otago Museum - DCC Funding Approach 304

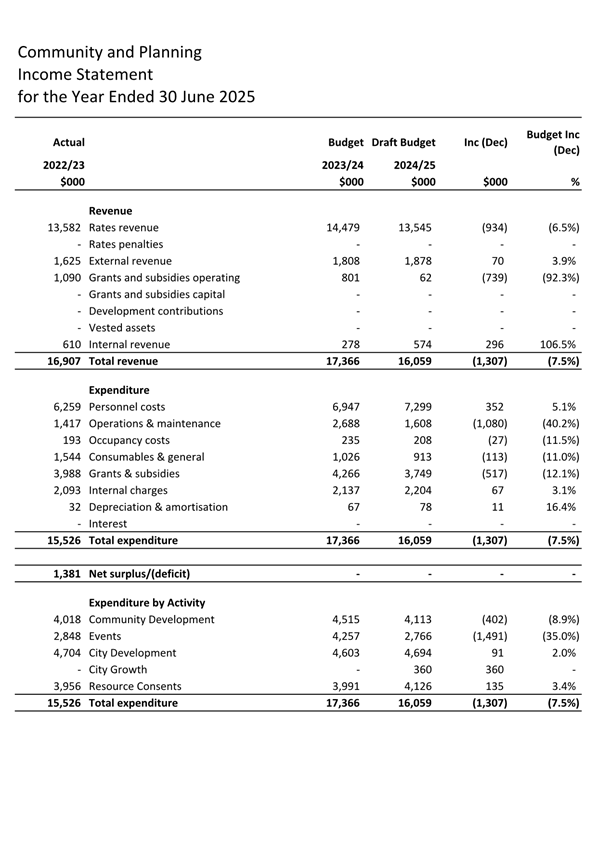

22 Community

and Planning - Operating Budget 2024/25 310

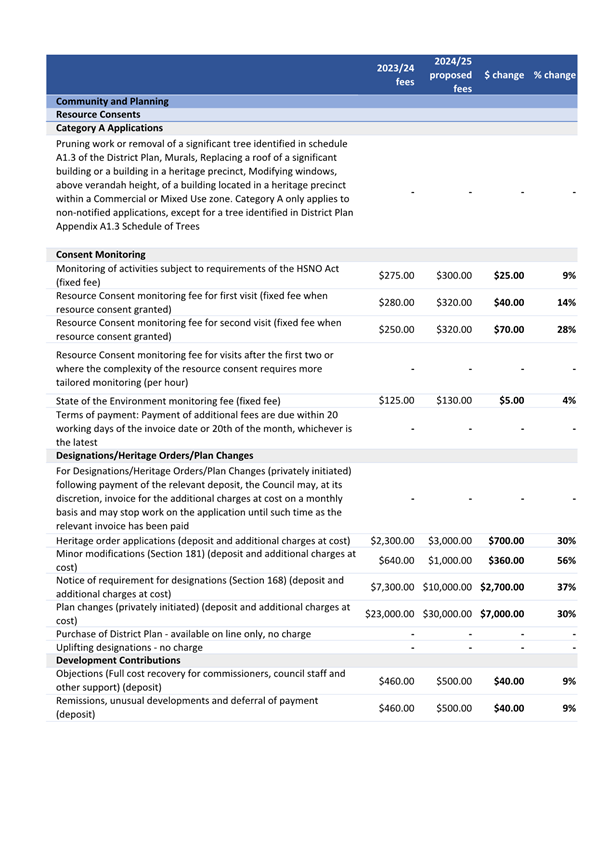

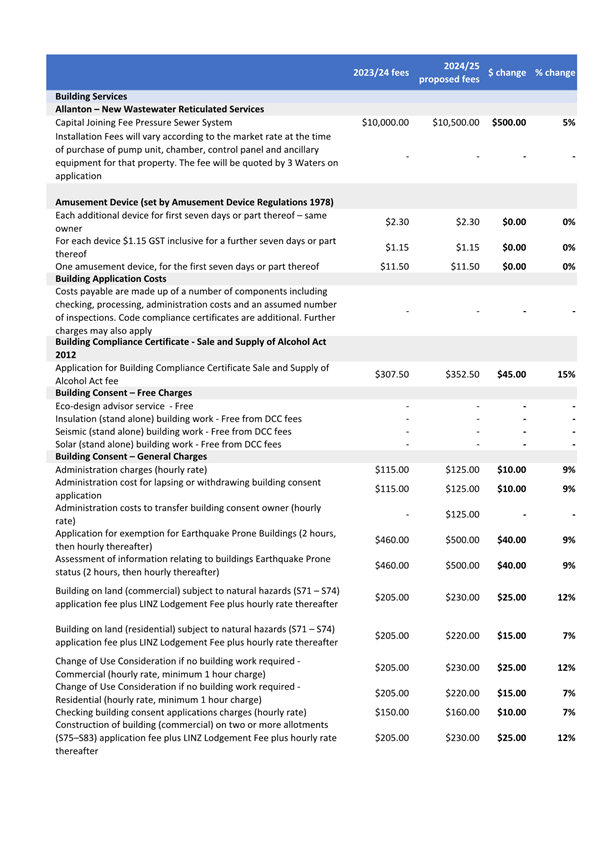

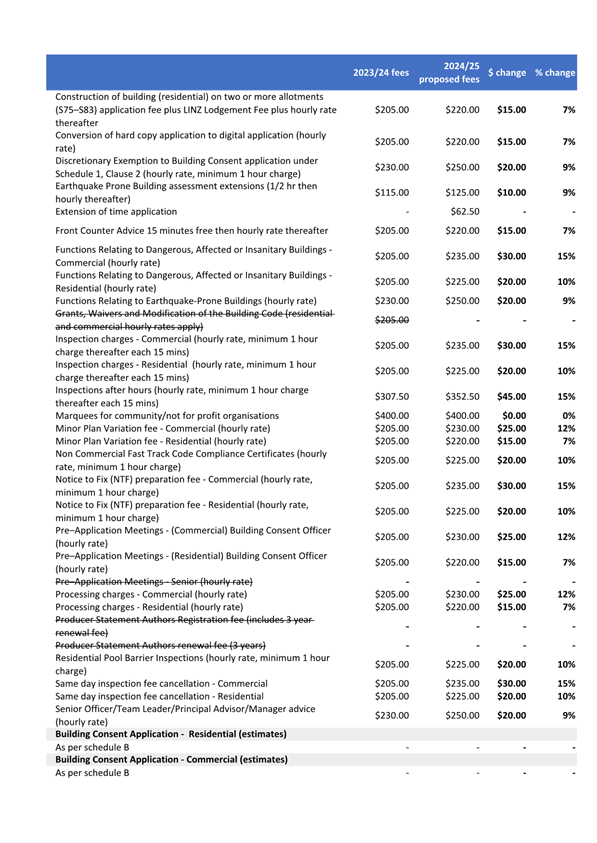

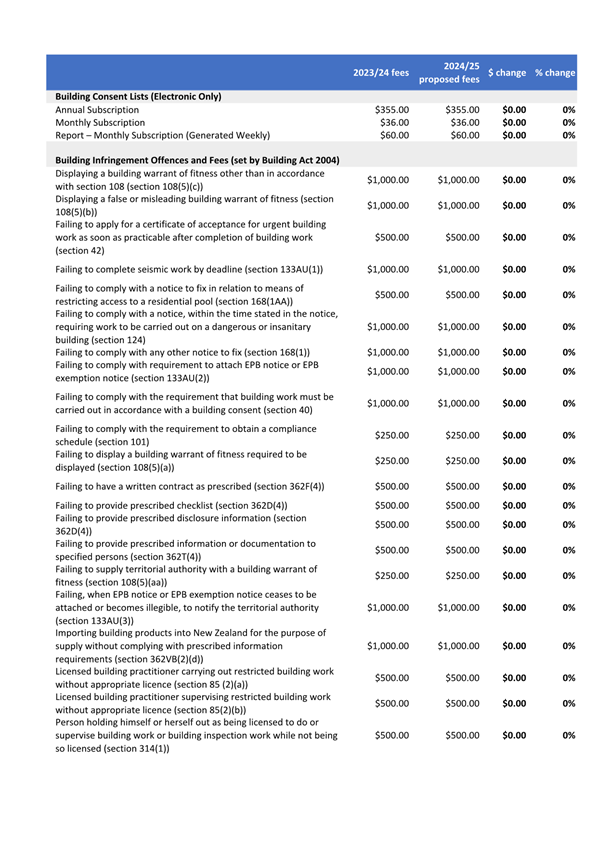

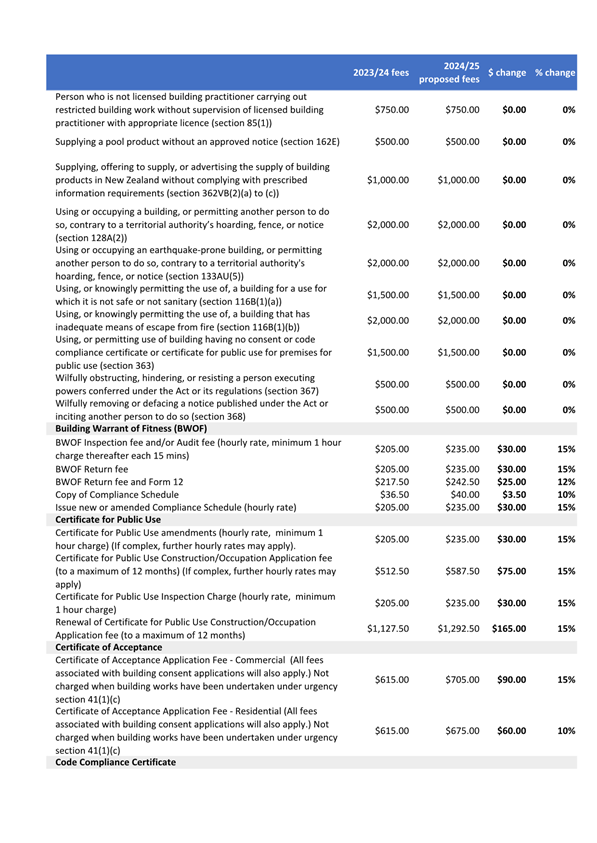

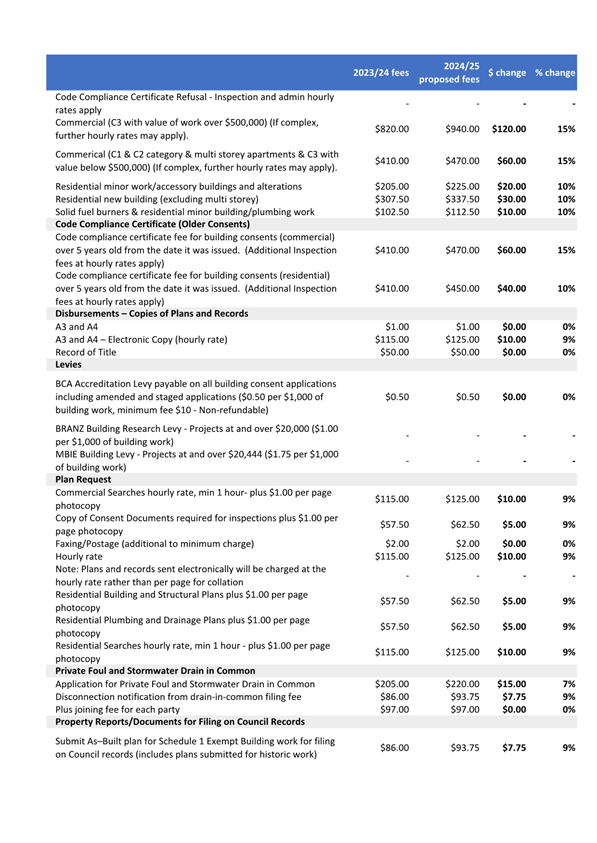

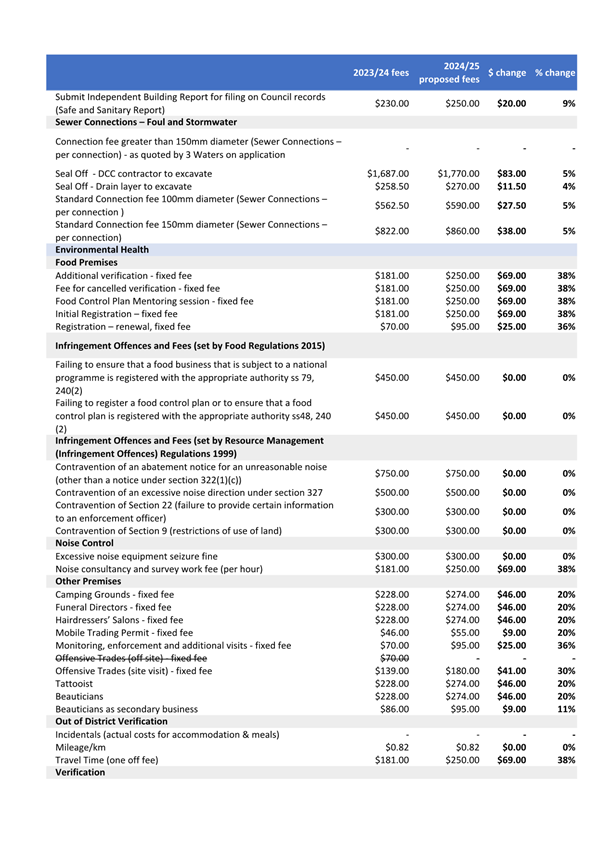

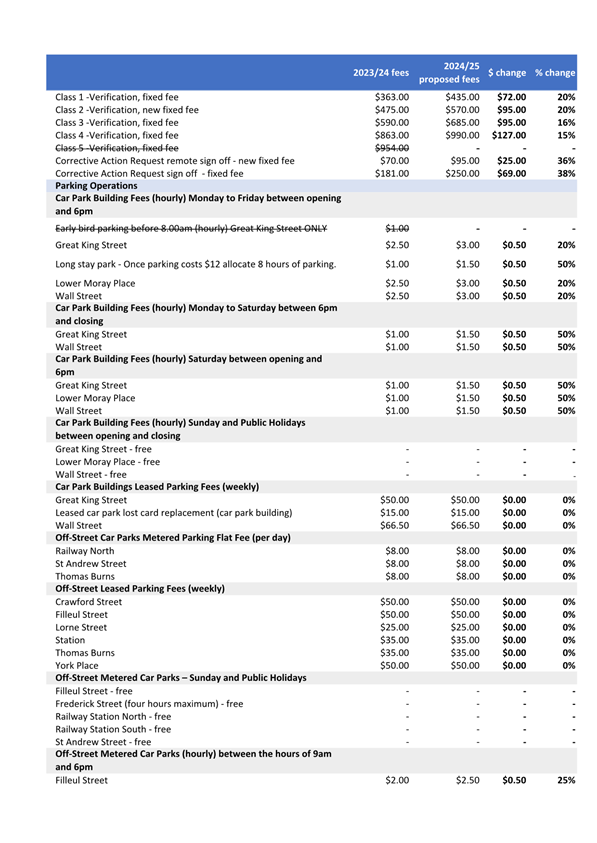

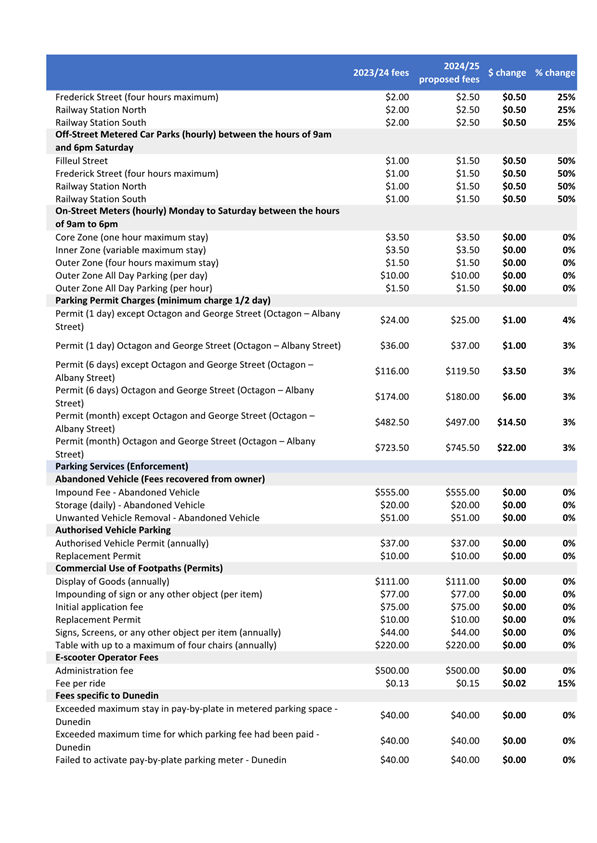

23 Regulatory

Services - Operating Budget 2024/25 322

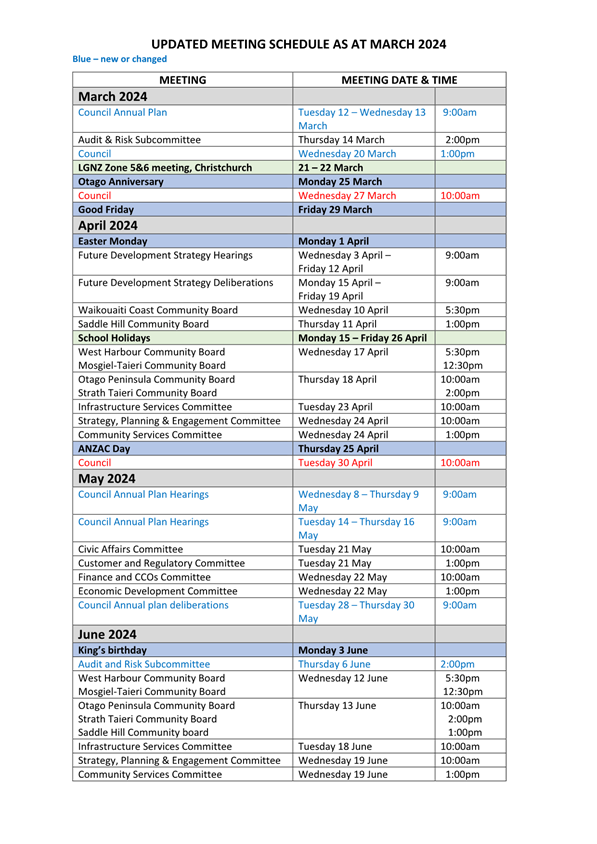

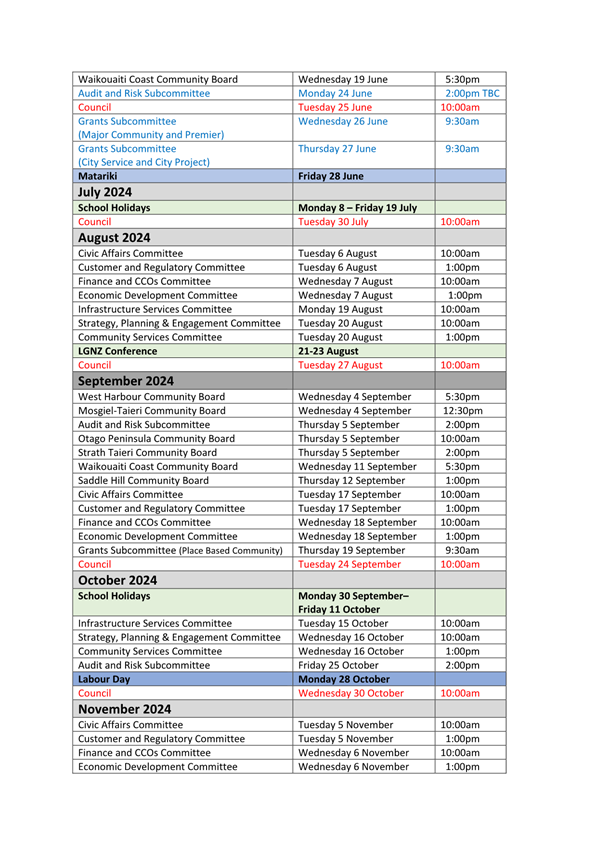

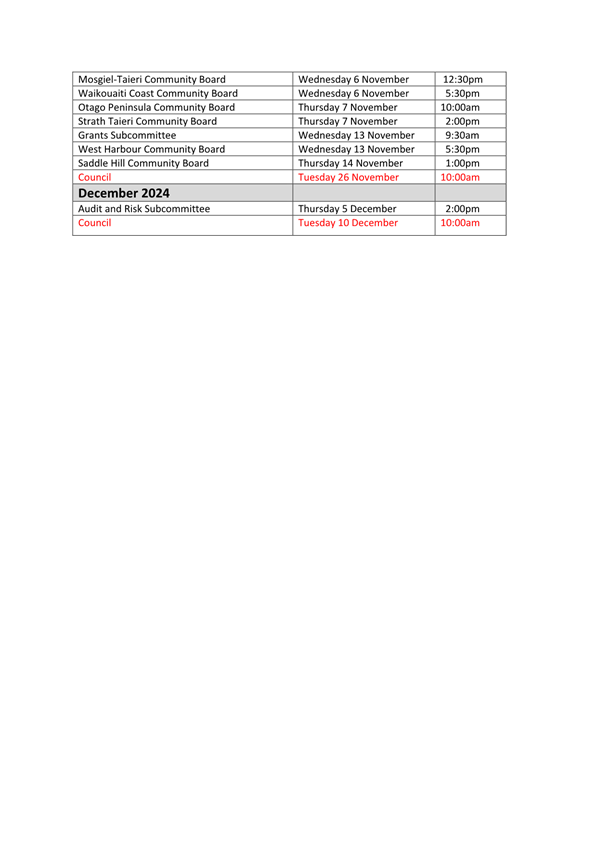

24 Revised

meeting schedule March - December 2024 344

Resolution to Exclude the Public 348

|

|

Council

12 March 2024

|

1 Opening

Rev Greg Hughson will

open the meeting with a prayer on behalf of the Dunedin Interfaith Society.

2 Public

Forum

There is no public forum.

3 Apologies

At the close of the agenda no

apologies had been received.

4 Confirmation

of agenda

Note:

Any additions must be approved by resolution with an explanation as to why they

cannot be delayed until a future meeting.

|

|

Council

12 March 2024

|

Declaration of Interest

EXECUTIVE SUMMARY

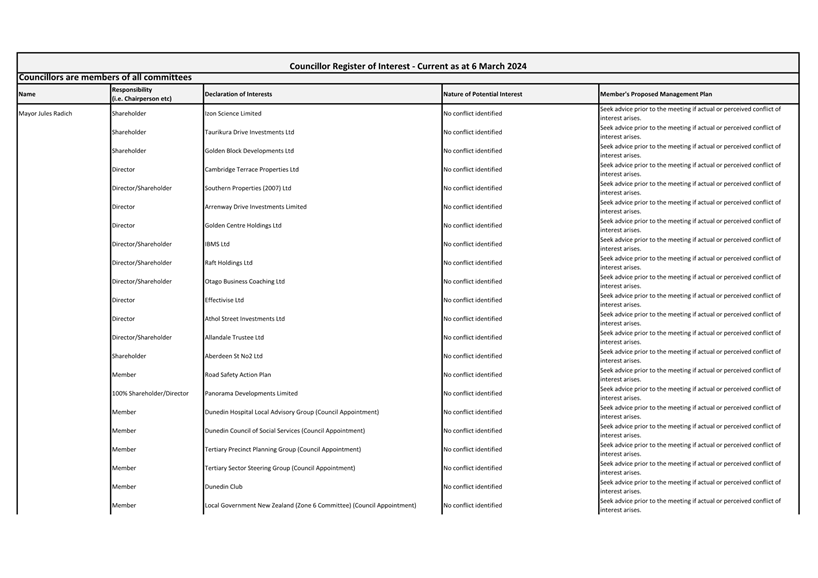

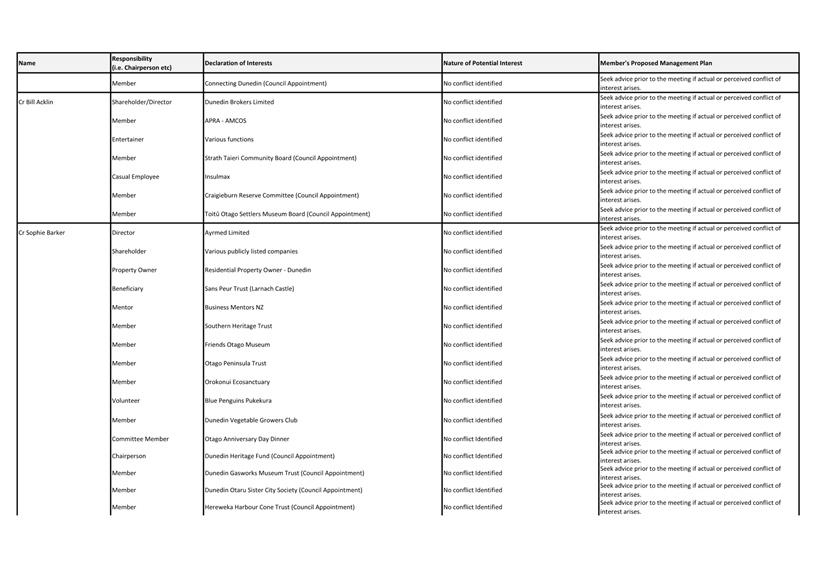

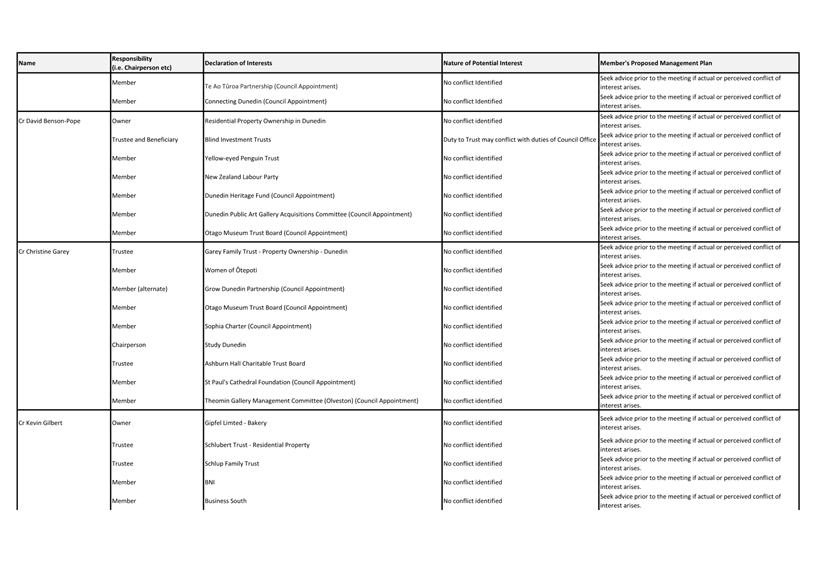

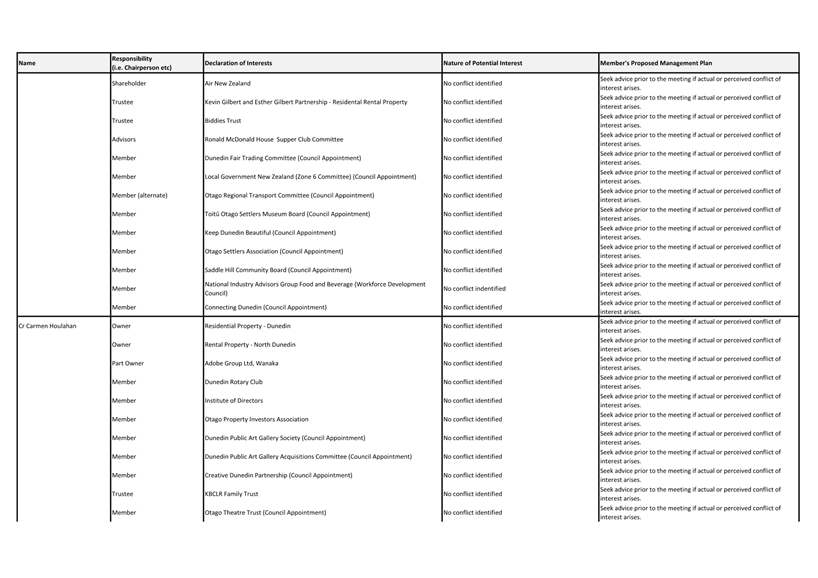

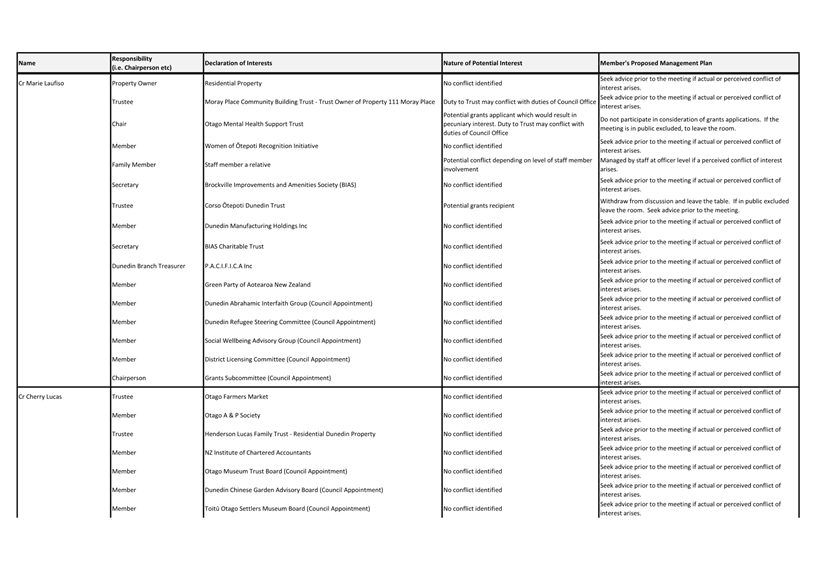

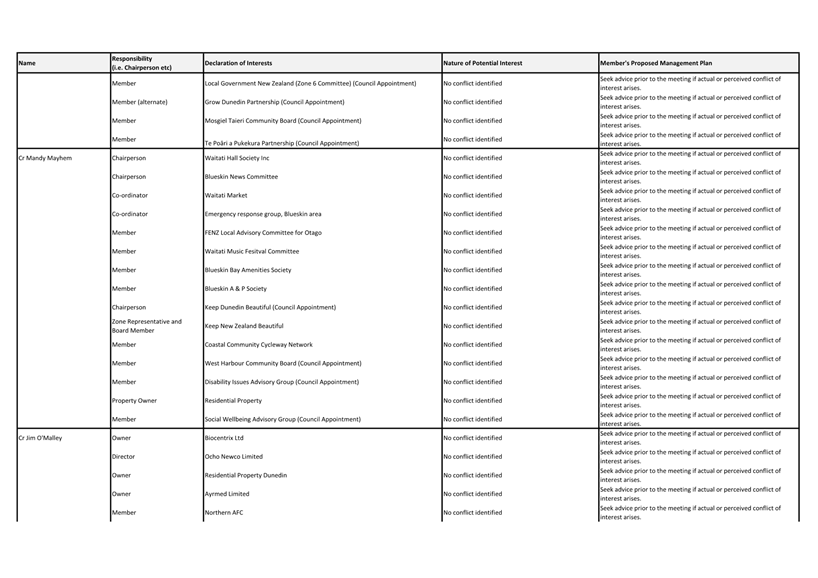

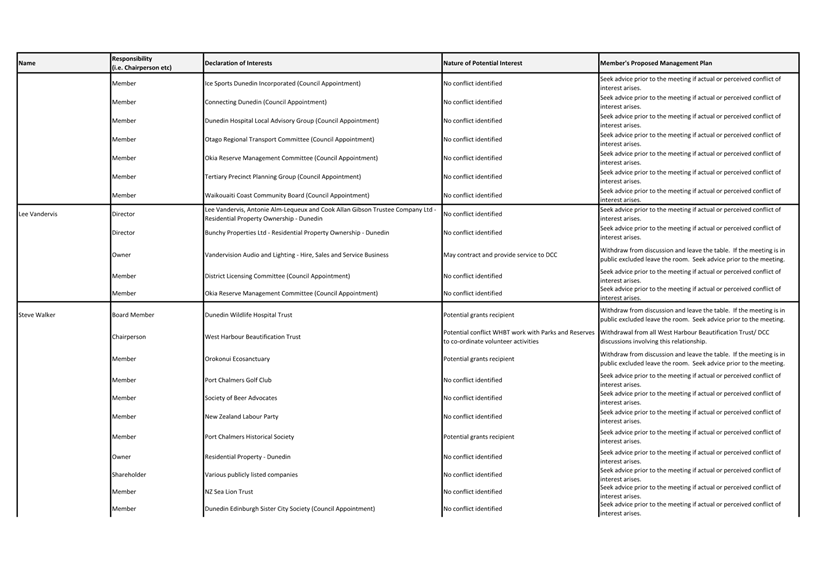

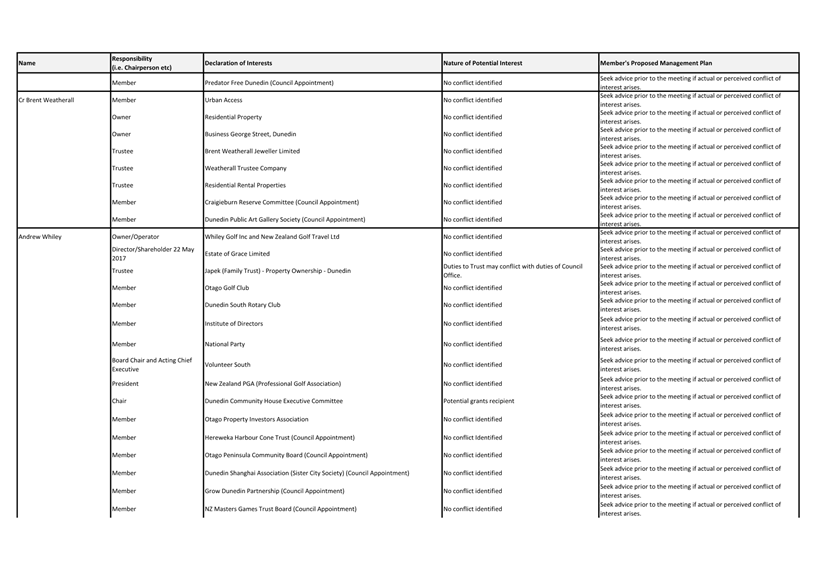

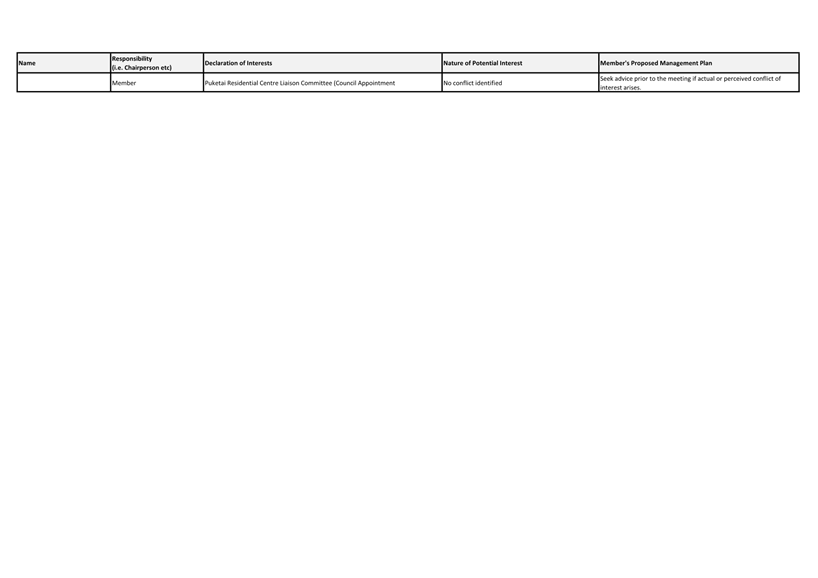

1. Members

are reminded of the need to stand aside from decision-making when a conflict

arises between their role as an elected representative and any private or other

external interest they might have.

2. Elected

members are reminded to update their register of interests as

soon as practicable, including amending the register at this meeting if

necessary.

3 Staff

are reminded to update their register of interests as soon as practicable.

RECOMMENDATIONS

That the Council:

a) Notes/Amends if

necessary the Elected Members' Interest Register attached as Attachment A; and

b) Confirms/Amends the

proposed management plan for Interests.

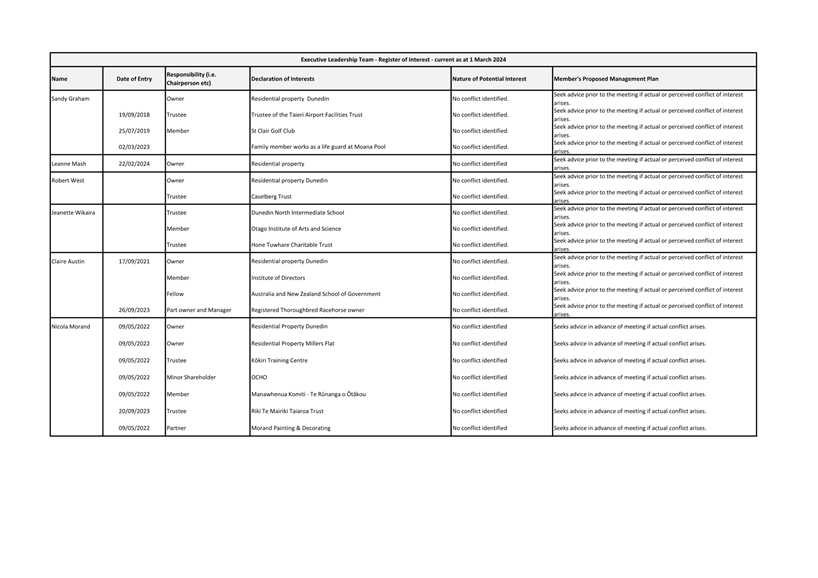

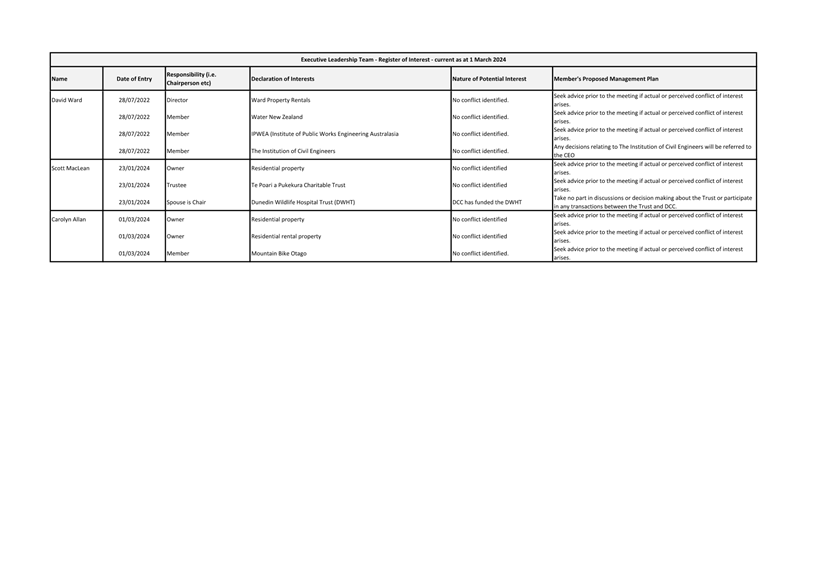

c) Notes the proposed

management plan for the Executive Leadership Team’s Interests.

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Elected Members'

Interest Register

|

6

|

|

⇩b

|

Executive Leadersship

Team Interest Register

|

15

|

|

|

Council

12 March 2024

|

Reports

CEO Overview Report - Annual Plan 2024/25

Department: Civic and Finance

EXECUTIVE SUMMARY

1 On

16 February 2024, the Water Services Act Repeal Act 2024 (the Repeal Act) was

enacted. Given the significant changes to 3 Water reform, the Repeal Act

provides the ability to prepare an enhanced Annual Plan for the 2024/25 year,

rather than completing a 10 year plan 2024-34.

2 At

its meeting on 27 February, Council approved the preparation of a 2024/25

Annual Plan for community consultation. The 2024/25 Annual Plan will be

followed by the completion of a 9 year plan for the period 2025-34.

3 This

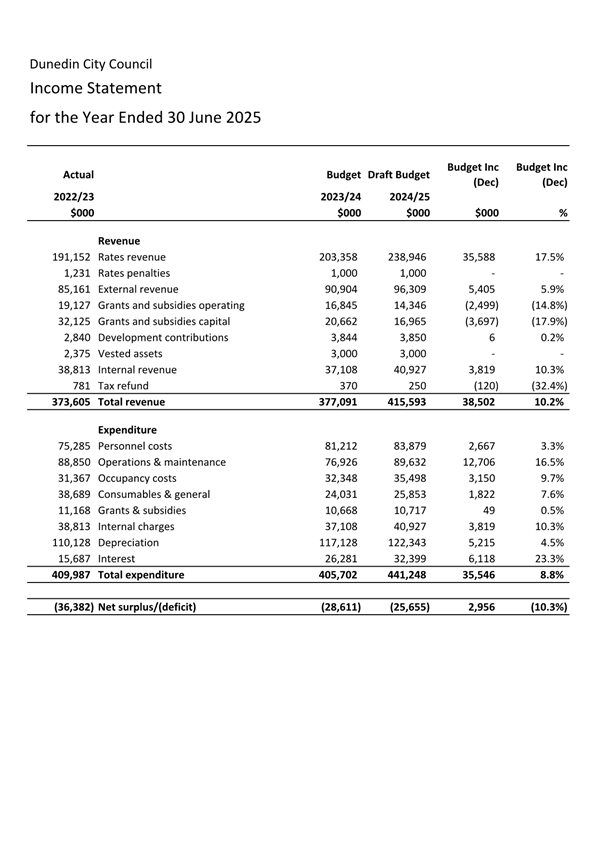

report provides an overview of the budgets to be included in the draft 2024/25

Annual Plan (the draft Annual Plan). The draft Annual Plan is an update

of year four of the 10 year plan 2021-31. Draft Income Statements are at

Attachment A, and draft Funding Impact Statements are at Attachment B.

4 This

report highlights the budget challenges the DCC faces with the current economic

climate of high inflation and interest rates. Savings have been found

across the organisation, but these have largely been offset by rising costs.

5 The

draft budgets propose a rate rise of 17.5% for 2024/25 which is higher than the

6.0% provided for in year four of the 10 year plan, and higher than the

Financial Strategy rate limit of 6.5%.

6 Budgeted

staffing numbers have reduced from 903 FTE to 852 FTE – a reduction in 51

FTE positions. All other controllable costs have been reviewed and

reduced where possible.

RECOMMENDATIONS

That the Council:

a) Adopts the draft

2024/25 operating budgets for the purpose of community engagement as shown /

amended at Attachment A.

b) Notes that any

resolution made during this meeting relating to the 2024/25 Annual Plan reports

may be subject to further discussions and decision by the meeting.

BACKGROUND

7 Following

the enactment of the Repeal Act on 16 February 2024, at its meeting on 27

February, Council approved taking up the option of preparing an enhanced

2024/25 Annual Plan for community consultation, rather than preparing a 10 year

plan 2024-34.

8 This

decision was made following consideration of factors such as the changing

legislative environment (both recent and signalled), and our need for more

information that will allow us to prepare a more robust and informed 9 year

plan.

9 The

Local Government Act 2002 provides that Council must prepare and adopt an

annual plan for each financial year. Section 95 (5) sets out the purpose

of an annual plan as follows:

The purpose of an annual plan

is to –

(a) Contain the proposed annual budget and funding impact

statement for the year to which the annual plan relates; and

(b) Identify any variation from the financial statements and

funding impact statement included in the local authority’s long-term plan

in respect of the year; and

(c) Provide integrated decision making and co-ordination of the

resources of the local authority; and

(d) Contribute to the accountability of the local authority to

the community.

10 The Repeal

Act provides that an enhanced Annual Plan is to include information additional

to the Local Government Act requirements. The additional information

includes financial statements and statement of service performance information

for each group activity. This information will be included in the 2024/25

Annual Plan document adopted in June 2024.

11 The draft

Annual Plan for 2024/25 is an update of year four of the 10 year plan.

Budgets for the 2024/25 year have been reviewed and budget update reports for

each activity of Council have been prepared for consideration at this

meeting.

DISCUSSION

12 When

the decision was made to prepare an enhanced Annual Plan, a significant amount

of work had already been undertaken to prepare both operating and capital

budgets for the 10 year period 2024 – 34. There was, however, a

high level of uncertainty of our information for years 2 – 10, as

legislative changes signalled by the new Government would likely take effect

from 2025/26 year onwards. Staff have confidence in the 2024/25

information, which is being used to produce the draft Annual Plan.

13 We continue

to have the pressures of high inflation rates, increased interest costs –

both rate increases combined with increasing debt levels, and the impact of

asset revaluation on our depreciation costs. Interest is estimated to be

up $6.1 million (23.3% on 2023/24), and depreciation by $5.2 million.

14 Many of the

cost increases we are experiencing are outside of the control of Council, e.g.,

increased energy costs to run our pools and other facilities, insurance costs,

and new costs such as compliance monitoring to meet water quality

standards.

15 A rate

increase of 17.5% is proposed in the draft budgets. This increase in

rates will maintain current service levels but also pay for an increased level

of service for a new kerbside collection service. This new service, commencing

in July 2024, replaces the black rubbish bag system. Of the 17.5% rate

increase, 4.4% will cover the cost of this new service.

Significant

forecasting assumptions

16 The 10 year

plan sets out a number of Significant Forecasting Assumptions.

Assumptions relating to inflation and interest rates have been updated for the

draft budgets.

17 Key

assumptions included in the preparation of the draft budgets will be further

updated in May 2024 if required. This will include but not be limited to:

· Interest rates on

borrowing – including the allocation of interest costs to each activity

group.

· Forecast debt as

at 30 June 2025.

· The impacts of

inflation.

· The level of grant

funding from NZTA Waka Kotahi (if available).

Rates breakdown at a high level

18 The summary

below provides a breakdown of the main factors making up the rate increase:

3 Waters 5.4%

Increase in depreciation (excl. 3

waters) 4.9%

New kerbside collection service 4.4%

Interest (excl. 3 waters) 1.8%

All other costs 1.0%

Total rate

increase 17.5%

19 The

breakdown is relatively simplistic and does not take into account the impact of

increases in other revenue but does highlight the three main drivers of the

rates increase. Broadly this shows that costs have been absorb where they

can be, and savings found in an attempt to control discretionary

expenditure. Fees and charges have been reviewed more critically, and

rather than apply a blanket increase across these, many have been modified to

reflect the actual cost of the services provided.

20 The

increase in 3 Waters includes increased regulation and compliance costs to meet

water quality standards, such as for chemicals and laboratory testing.

21 The

increase in depreciation reflects the revaluation of some assets and the

budgeted capital programme.

22 The

Kerbside collection rates are for the new service starting in July 2024,

replacing the current black bag system.

Capital expenditure

23 The draft

capital budget for the Annual Plan provides for replacing existing assets and

infrastructure. Across the Council’s activities, the proposed

budget is $207.357 million in the 2024/25 year, compared to $157.044 million

provided for in year four of the 10 year plan.

24 One area of

uncertainty is the amount of co-funding that may be received from NZTA Waka

Kotahi for budgeted transport activities. The draft Government Policy

Statement on land transport 2024-34 has now been released for consultation

purposes. It sets out the Government’s priorities for land

transport investment. Staff are reviewing the draft Statement to

understand the impacts it may have on our assumptions

around co-funding for transport initiatives. Our findings will be

reported to Council before finalising the Annual Plan.

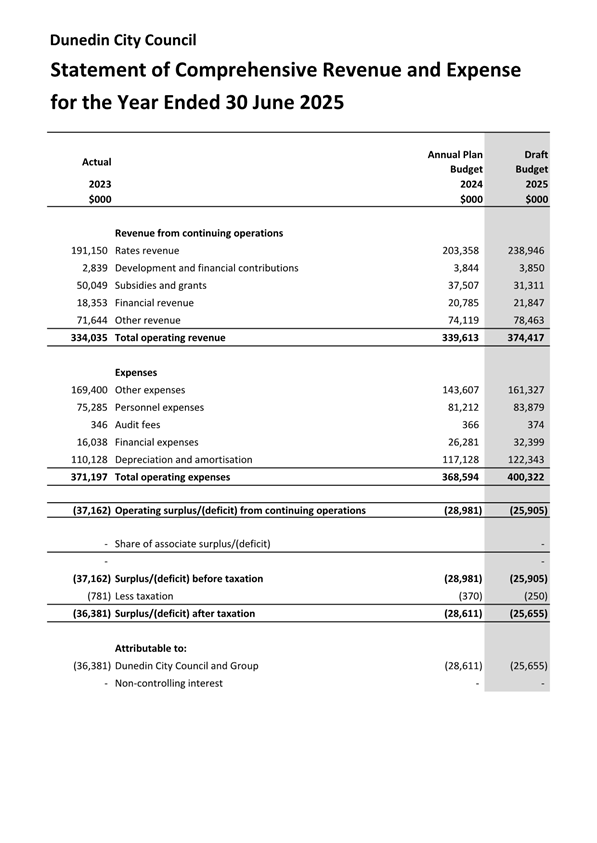

Operating

budgets

25 The draft

operating budgets provide for the day to day running of all the activities and

services the DCC provides to its community. These include 3 Waters

services, parks, galleries, libraries, pool, and roading.

26 The rate

increase of 17.5% included in the draft budget does not deliver a balanced

budget, but provides for a net deficit of $25.655 million.

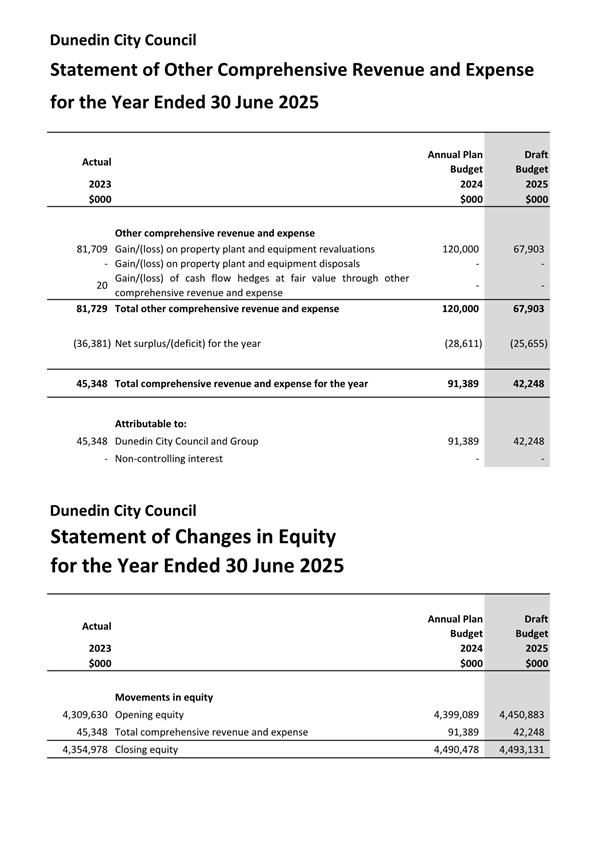

27 The revaluation

of three waters infrastructure assets in 2022/23 resulted in a significant

increase in depreciation. Since this time, the depreciation charge has

not been fully funded, and Council has been running an operating deficit

budget.

28 As part of

the development of the 9 year plan 2025-34, a financial strategy will be

prepared that addresses the issue of ongoing deficits, and provide for

balancing the budget before the end of the 9 year plan.

29 Expenses

within our control have been reviewed and the operating budgets show that

savings have been made in many of the group activities.

30 The biggest

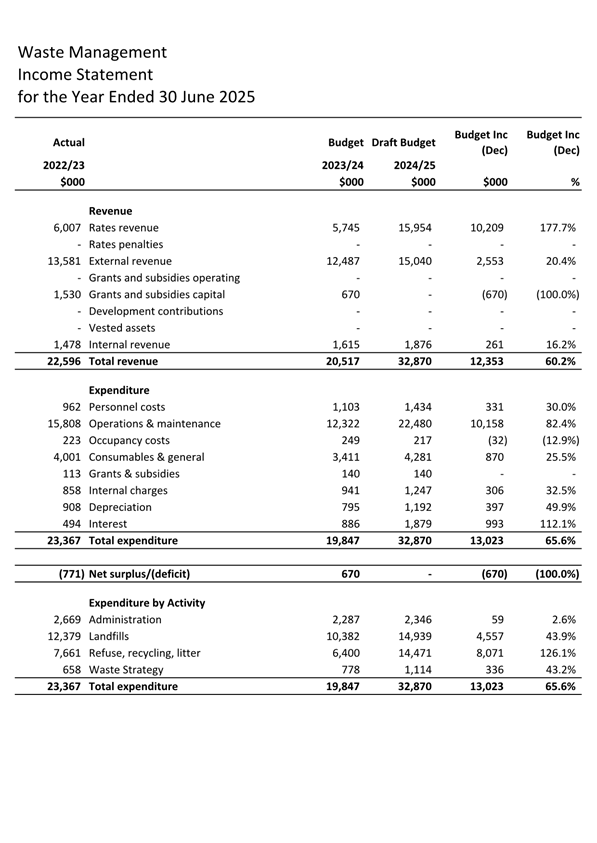

area of increase in operating budgets is in the Waste Management

activity. This significant increase in operating budget is primarily due

to new contracts for the new kerbside collection service and monitoring costs

required in the consent for the new Smooth Hill Landfill.

31 Each of the

groups of activities have updated year 4 of their draft operating budgets as

provided for in the 10 year plan. The key changes in funding sources and

expected costs of delivery are discussed in the group operating budget reports.

Revenue

Rates

32 The draft

operating budget for 2024/25 shows overall rates revenue increasing by $35.588

million, which is 17.5% higher than 2023/24. It is also higher than the

rate increase of 6.0% provided for in the 10 year plan.

External

revenue

33 External

revenue has increased by $5.405 million, 5.9%. The main changes to

external revenue are:

· Waste Management

– a net increase of $2.553 million reflecting an increase in landfill

revenue due to an expected increase in tonnage because of the closure of a

transfer station and an increase in landfill disposal charges to cover expected

increases in waste levy and ETS charges. Offsetting these increases,

revenue from the sale of black rubbish bags ceases.

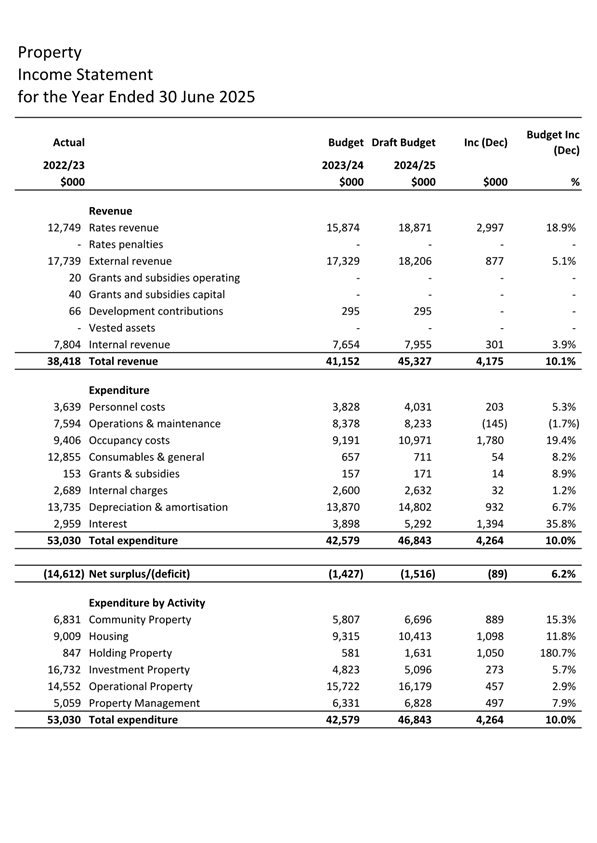

· Property –

an increase of $877k due primarily to an increase in community housing rental.

· 3 Waters –

an increase of $647k due to increases in fees and charges, including water

sales and trade waste.

· Regulatory –

an increase of $499k in fees to recover increased costs of processing consents

and licenses.

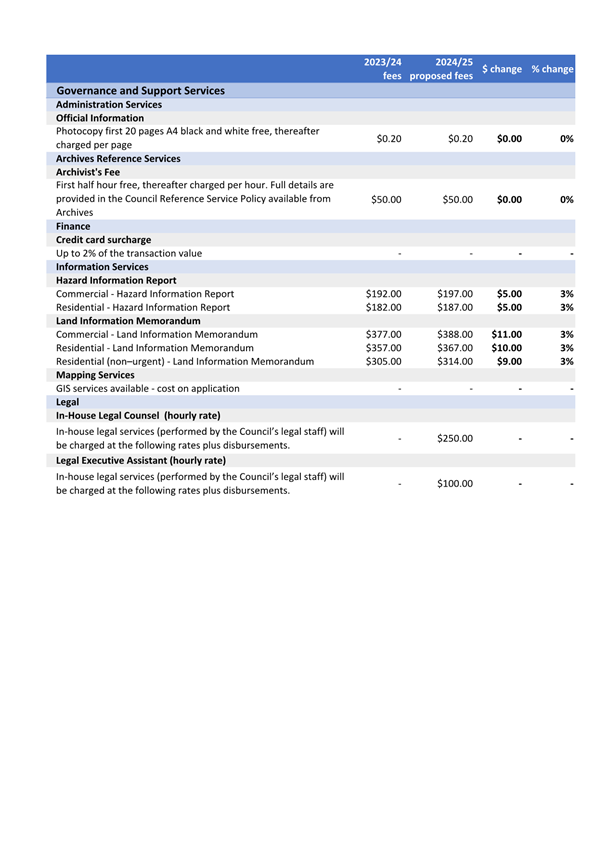

34 Fees and

charges are discussed separately in the group budget reports. Rather than

apply a fee increase of 3%, as has been done in past years, fee increases for

some areas are reflecting the increase in costs from the 2023/24 year.

Grants

35 Grant

funding received from NZTA Waka Kotahi for transport activities is based on the

nature of the planned capital works, and their eligibility for funding.

It is also dependent on how much funding assistance is available, noting that

there has been a shortfall in the Funding Assistant Rate in recent years.

36 The 2024/25

draft budget shows operating grants and subsidies revenue is down $2.499

million. The main changes are as follows:

· 3 Waters –

operating grant funding has decrease by $4.400 million. The Transition

Support Package funded by the former Government, set up to contribute towards

transitioning to the now repealed Water Services Entities has been

discontinued. In addition, Government funding for the 3 Waters Strategic

Work Programme has been replaced by Better off Funding.

· Governance –

operating grant funding has increased by $2.559 million, being the

Government’s Better Off Funding package. This funding is being used

for various projects across Council.

37 Capital

grants revenue is down $3.697 million. The main changes are as follows:

· Waste - capital

grant revenue has decreased by $670k. In 2023/24 grant funding was

provided from the Ministry for the Environment for the purchase of bins.

· Transport –

capital grant revenue has decreased by $3.067 million, based on the proposed

capital programme and estimated funding assistance from NZTA Waka Kotahi.

Expenditure

Staff costs

38 The draft

budget provides for an increase in personnel costs of $2.667 million,

3.3%. This provides for a union negotiated salary increase for

staff.

39 The 2023/24

budget did not provide for a salary increase, and the negotiated increase was

absorbed within existing budgets.

40 This saving

has been achieved by vacancy management and a slow-down in recruitment. Vacancy

management and a thorough review of budgets has resulted in the budgeted

headcount reducing from 903 FTE to 852 FTE – a reduction in 51 FTE

positions. Management of vacancies continues to be a priority, along with

careful recruitment and looking after existing staff.

Operations

and maintenance costs

41 Operations

and maintenance costs have increased by $12.706 million, 16.5%. The main

changes are due to the following:

· Waste management

– an increase of $10.158 million relates primarily to the new kerbside

collection service, increases in ETS costs and Green Island landfill costs, and

additional monitoring for Smooth Hill and the implementation of the Southern

Black Back Gull management plan, both required under the resource consent.

· 3 Waters –

an increase of $2.311 million relates to plant maintenance cost increases,

chemical and laboratory cost increases. There is a reduction in

contractor fees, as government funding for the 3 Waters Strategic Work

Programme ends.

· Transport –

an increase of $737k, with $486k relating to costal management work, and $234k

for an increase in bus shelters (fully recoverable from the Otago Regional

Council) and State Highway maintenance (fully recoverable from NZTA Waka

Kotahi).

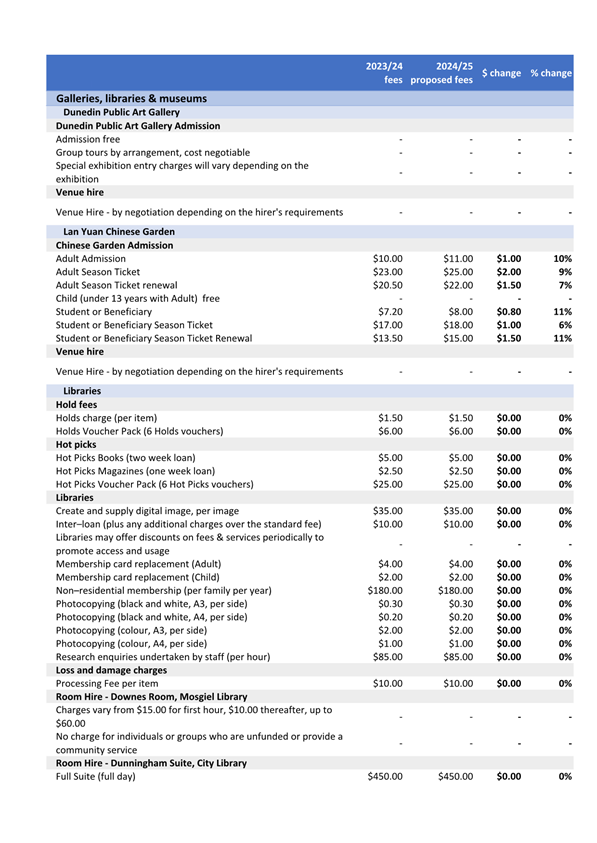

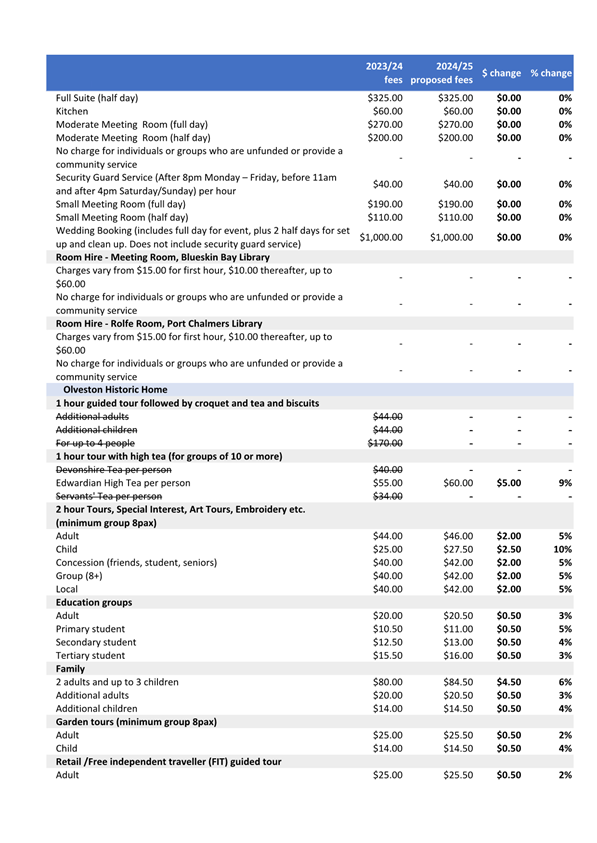

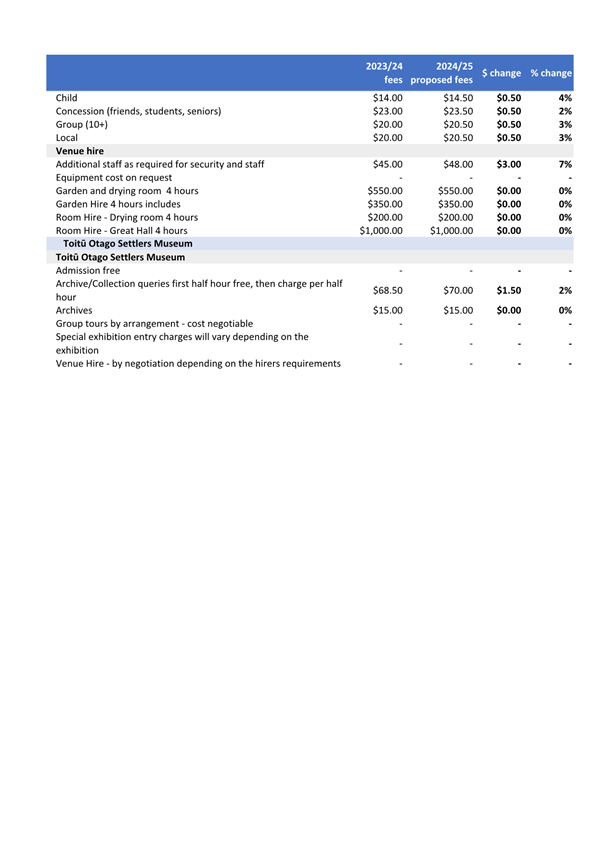

· Parks, Galleries

Libraries and Museums, Community and Planning, Property, and Economic

Development have all made savings in their operations and maintenance

costs. Further details are provided in each of the group budget reports.

Occupancy costs

42 Occupancy

and property related costs such as rates, insurance and fuel have increased by

$3.150 million, 9.7%. These increases have largely impacted the Property

activity with an increase of $1.780 million and 3 Waters with an increase of

$1.005 million.

Consumables

and general costs

43 Consumables

and general costs have increased by $1.822 million. The main changes are

due to the following:

· Waste Management

– an increase of $870k due to an increase in waste levy costs at the

Green Island landfill, reflecting an increased tonnage in materials entering

the landfill, offset by a reduction in costs relating to communications and

marketing of the new kerbside collection service.

· Governance –

an increase of $970k largely due to increases in software licencing fees of

$743k.

Depreciation

44 Depreciation

expense has increased by $5.215 million, 4.5%, reflecting the valuation of

assets at 30 June 2023 and the capital expenditure programme. The

increase is reflected mainly in the Transport, 3 Waters, Property, and Parks

and Recreation activities.

Interest

45 Interest

expense has increased by $6.118 million, 23.3%, reflecting the increase in debt

funding required to support the planned capital expenditure programme and an

increase in interest rates.

46 The 10 year

plan 2021-31 had an interest rate assumption of 2.85%. The DCC’s

current interest rate applicable to its borrowing is 4.66% as advised by

Dunedin City Treasury Limited. For the purposes of preparing the draft

Annual Plan, an assumption has been made that the borrowing rate for the

2024/25 year will be 5%.

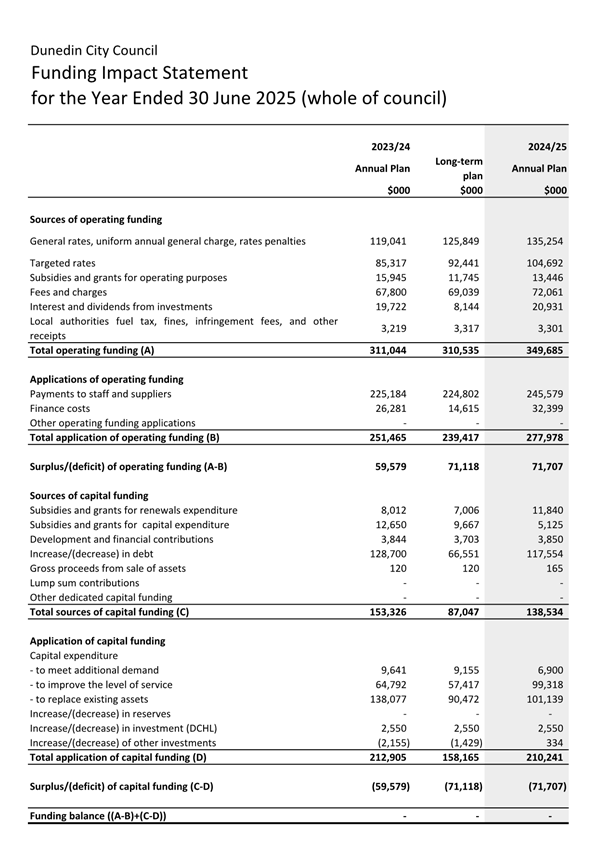

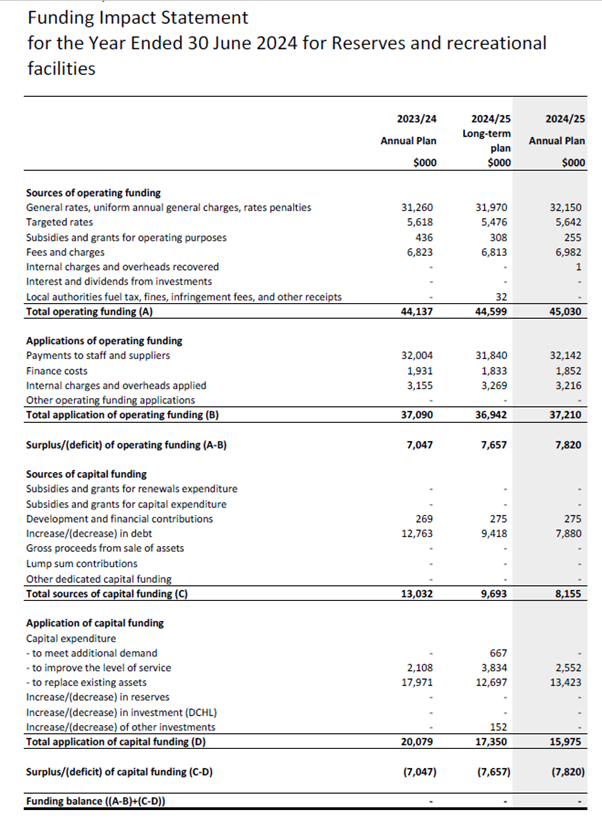

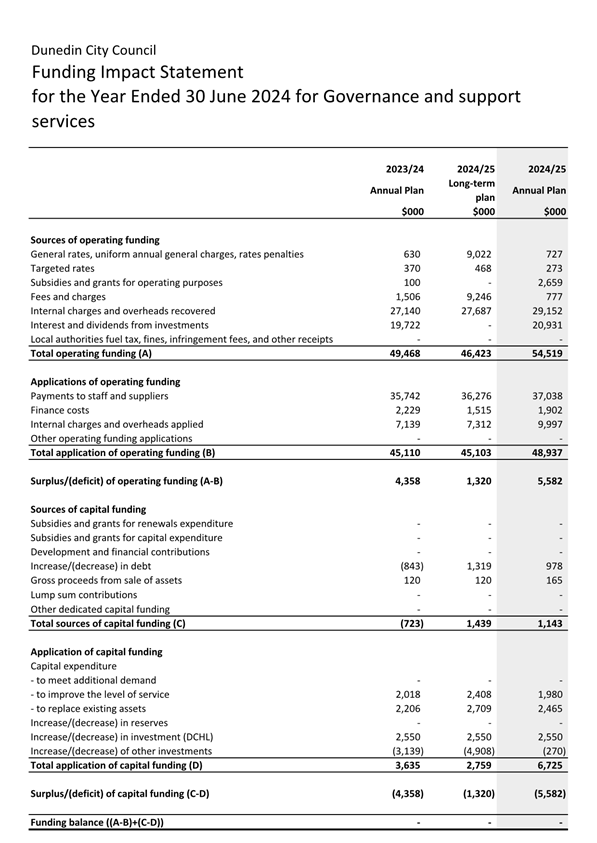

Funding

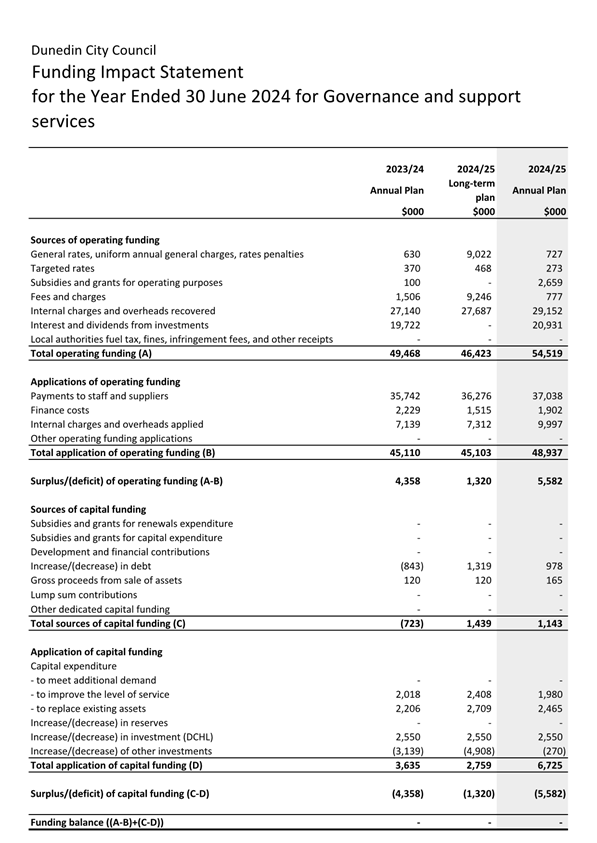

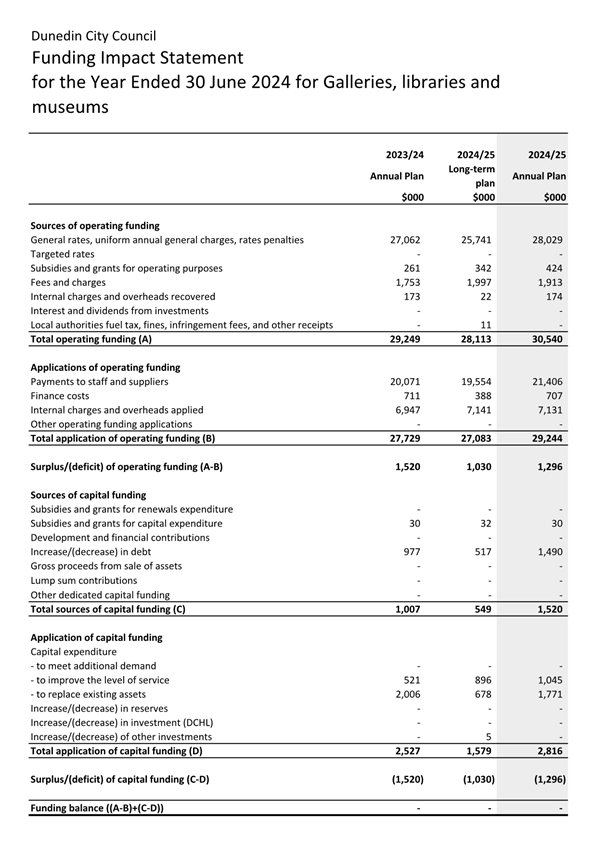

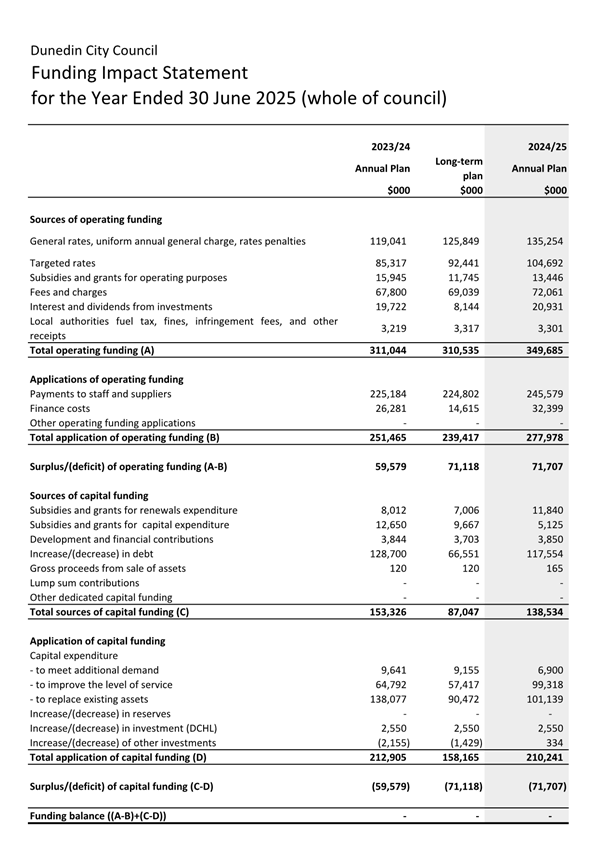

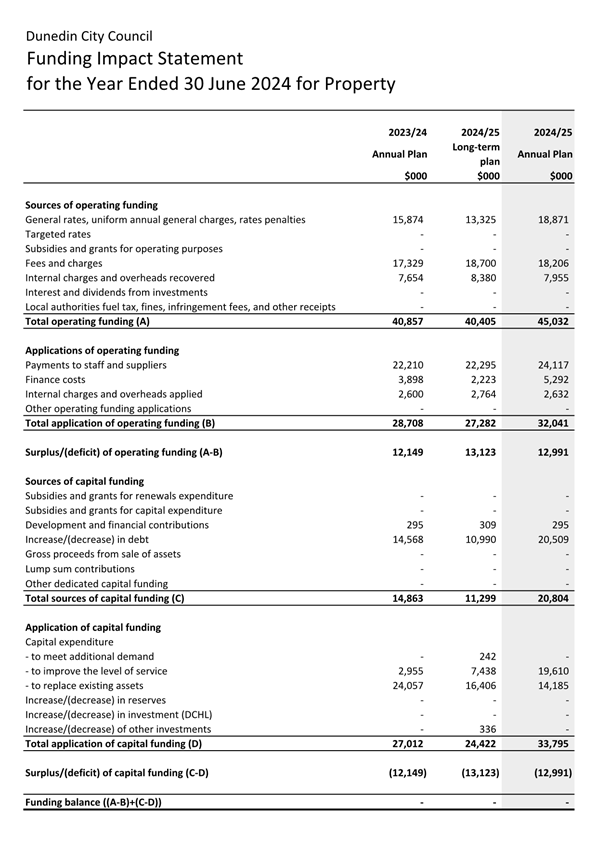

impact statement

47 The budget

for each group, and all of Council, includes a Funding Impact Statement, as

provided at Attachment B. Funding Impact Statements differ from Income

Statements because they:

· Remove non-cash

items such as depreciation,

· Separate operating

and capital funding

· Include how total

funding will be used, i.e., capital expenditure

· Identify how any

shortfall in funding will be financed, i.e., an increase in debt.

48 Ideally the

available operating funding being “Surplus/(deficit) of operating funding

(A-B)” plus “Subsidies and grants for renewal expenditure”

will be sufficient to cover capital expenditure “to replace existing

assets”.

|

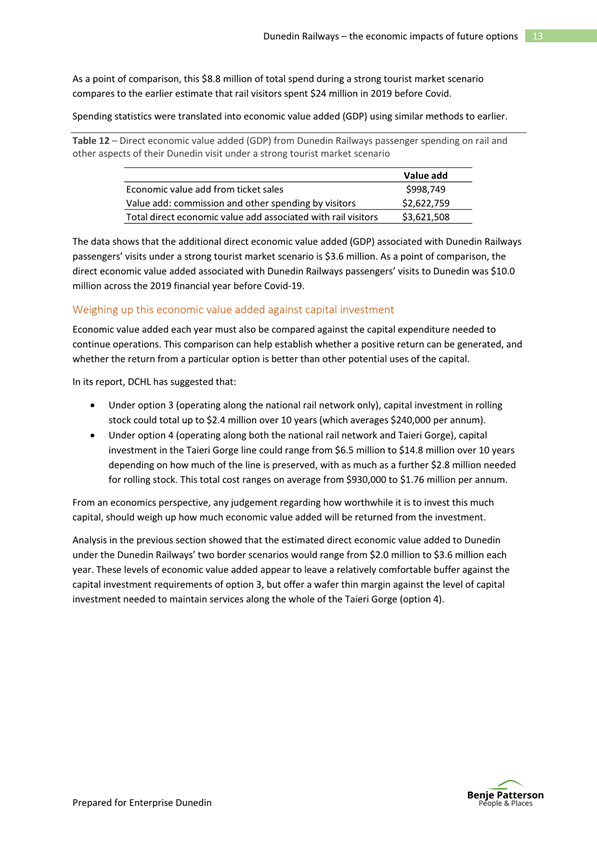

Funding Impact Summary

|

Budget 2023/24 $000

|

Draft Budget 2024/25 $000

|

|

Surplus/(deficit)

of operating funding (A-B)

|

59,579

|

71,707

|

|

Subsidies

& grants for renewals expenditure

|

8,012

|

11,840

|

|

Capex to

replace existing assets

|

(138,077)

|

(101,139)

|

|

Increase in

investment DCHL

|

(2,550)

|

(2,550)

|

|

Funding surplus/(deficit)

|

(73,036)

|

(20,142)

|

49 The table

above shows that we are borrowing $20.142 million in the draft budgets to fund

renewals. While this is not sustainable long-term, this will be addressed

in a review of the Financial Strategy that will be prepared for the 9 year plan

2025-34.

Debt

50 The Draft

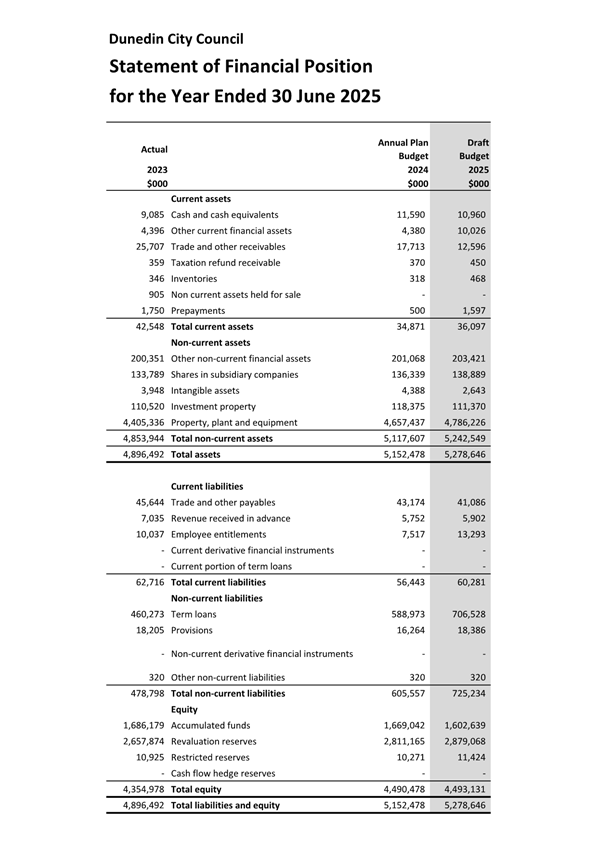

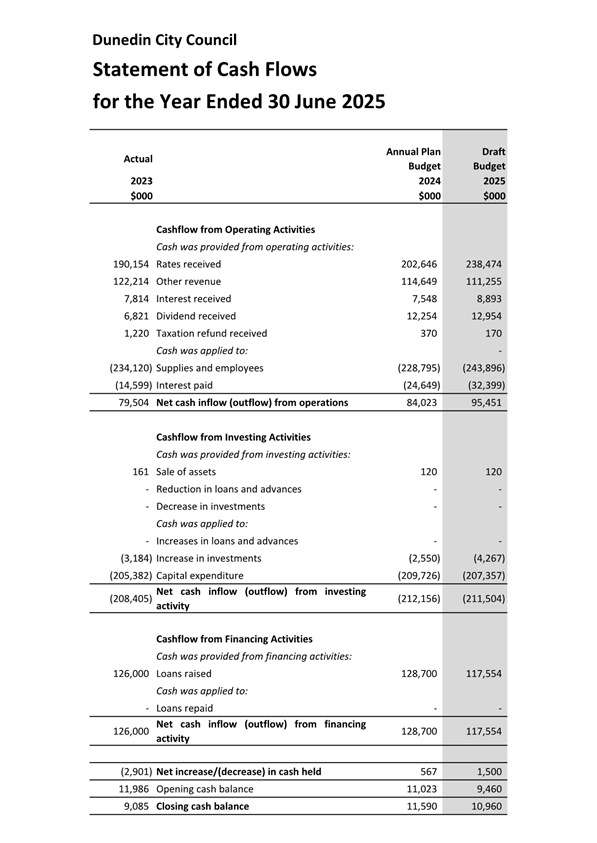

Forecast Financial Statements at Attachment C shows that by 30 June 2025, the

estimated debt level will be $706.528 million which is 188.6% of revenue.

The debt limit provided for in the current Financial Strategy is 250% of

revenue. This is an increase in debt of $117.554 million on the 2023/24

Annual Plan.

OPTIONS

51 There are

no options.

Signatories

|

Author:

|

Sharon Bodeker - Special Projects Manager

Carolyn Allan - Chief Financial Officer

|

|

Authoriser:

|

Sandy Graham - Chief Executive Officer

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Draft Operating Budget

2024/25

|

27

|

|

⇩b

|

Draft Funding Impact

Statement 2024/25

|

29

|

|

⇩c

|

Draft Forecast Financial

Statements 2024/25

|

30

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose of Local Government

This decision enables democratic local decision

making and action by, and on behalf of communities, and promotes the social,

economic, environmental, and cultural well-being of communities in the

present and for the future.

|

|

Fit with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

✔

|

☐

|

☐

|

|

Economic Development Strategy

|

✔

|

☐

|

☐

|

|

Environment Strategy

|

✔

|

☐

|

☐

|

|

Arts and Culture Strategy

|

✔

|

☐

|

☐

|

|

3 Waters Strategy

|

✔

|

☐

|

☐

|

|

Spatial Plan

|

✔

|

☐

|

☐

|

|

Integrated Transport Strategy

|

✔

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

✔

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

✔

|

☐

|

☐

|

The Group Activities contribute to the objectives and

priorities of the above strategies.

|

|

Māori Impact Statement

Council budgets impact broadly across all Dunedin

communities including Māori. The adoption of Te Taki Haruru – Māori

Strategic Framework signals Council’s commitment to mana whenua and to

its obligations under the Treaty of Waitangi. Mana whenua and Māori

will have an opportunity to engage on the Annual Plan 2024/25.

|

|

Sustainability

The Annual Plan 2024/25 is not proposing any changes to

that provided for in the 10 year plan. Major issues and implications

for sustainability are discussed in the Infrastructure Strategy and financial

resilience is discussed in the Financial Strategy of the current 10 year plan

2021-31.

|

|

LTP/Annual Plan / Financial Strategy /Infrastructure

Strategy

This report provides draft budget information for

inclusion in the draft 2024/25 Annual Plan.

|

|

Financial considerations

Financial considerations are detailed in the report.

|

|

Significance

The 10 year plan 2021-31 budgets were considered

significant in terms of the Council’s Significance and Engagement

Policy, and were consulted on. Variations to those budgets are

discussed in this report. The draft budgets will be included in the Annual

Plan 2024/25, and will be consulted on.

|

|

Engagement – external

External engagement will be undertaken.

|

|

Engagement - internal

Staff from across Council have been involved in the

development of the draft budgets and reports.

|

|

Risks: Legal / Health and Safety etc.

There are no identified risks.

|

|

Conflict of Interest

There are no known conflicts of interest.

|

|

Community Boards

Community Boards will have the opportunity to present on

the draft 2024/25 Annual Plan.

|

|

|

Council

12 March 2024

|

|

|

Council

12 March 2024

|

Rating Method 2024/25

Department: Finance

EXECUTIVE SUMMARY

1 The

draft budget as presented for 2024/25 includes an overall increase in rates of

17.5%. This increase in rates is collected using the rating method. The

proposed rates charged to individual rate accounts incorporate the budget

increase and changes in the rating database (new improvements and new

homes).

2 The

proposed changes to the rating method are discussed in this report. These

include increases to the Community Services targeted rate (increase of 4.9%)

and the Stadium differentiated rates (increase of 4.9%).

3 The

Kerbside Collection targeted rate continues as a flat targeted rate to fund the

new Kerbside Collection Service in keeping with the current rating method.

RECOMMENDATIONS

That the Council, for

the purposes of the community engagement:

a) Approves

an increase in the Community Services targeted rate for the

2024/25 year of $5.50 to $117.00 including GST.

b) Approves

an increase in the Stadium 10,000 plus seat differentiated

rates for the 2024/25 year based on the June 2023 Local

Government Cost Index of 4.9%.

c) Approves

the current rating method for the setting of all other rates for the

2024/25 year.

d) Revokes

the decision made at the meeting of 28 November 2023, to combine the

tourism/economic development targeted rate into the commercial general rate.

e) Notes

that a decision to combine the tourism/economic development targeted rate into

the commercial general rate will be requested as part of the development of the

9 year plan 2025-34.

BACKGROUND

4 The

purpose of this report is to demonstrate the impact of the proposed rate

increase by property and rating differential (how general rates are allocated

across all ratepayers) for the 2024/25 year and confirm the proposed changes to

the rating method.

5 At

its meeting on 27 February 2024, Council made a decision to prepare an Annual

Plan 2024/25, followed by a 9 year plan, rather than completing a 10 year plan

2021-31. Prior to making this decision, as part of the 10 year plan work

programme, the Rating Workstream group undertook a review of how general rates

are allocated by differential across all ratepayers. The review compared the

general rate differential with other metropolitan and provincial councils.

6 It

also considered the ongoing need for the Tourism/Economic Development targeted

rate (Economic rate) introduced in 2010 and concluded that there were no

identified benefits in keeping this rate.

7 On

28 November 2023, a report was presented to Council on the review of the

general rates differential. Council resolved as follows:

Moved (Cr David Benson-Pope/Cr Steve Walker):

That the Council:

a) Decides for

the purposes of preparing the 2024/25 Rating Method report for the Council

meeting in January 2024, to combine the tourism/economic development targeted

rate into the commercial general rate, and maintain all other current general

rate differentials.

Motion

carried (CNL/2023/283)

8 While

there is no change to the rates collected from commercial ratepayers as a

result of this resolution, it is recommended that this resolution be revoked

for the purposes of preparing an Annual Plan 2024/25 but be considered again

during the preparation of the 9 year plan 2025-34.

9 At

the same Council meeting, in response to a request from Council, staff also

provided a report outlining funding options for both flat and progressive

targeted rates to fund a new Kerbside Collection Service. Council resolved as

follows:

Moved (Cr Bill Acklin/Cr Kevin Gilbert):

That the Council:

a) Funds the new kerbside collection service from 1 July 2024

using a flat targeted rate (the current rating method).

Motion carried (CNL/2023/281)

10 Please note

that unless specified, all rating figures in this report are GST inclusive.

DISCUSSION

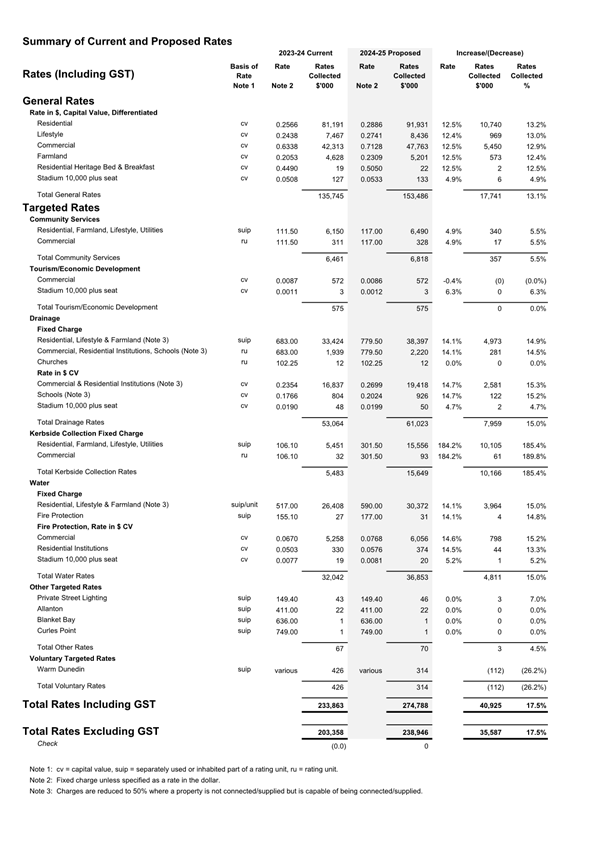

11 The overall

increase in rates to be collected is driven by the draft budget for 2024-25 which includes a 17.5% rate increase. This increase

in rates is collected using the rating method.

12 The rating

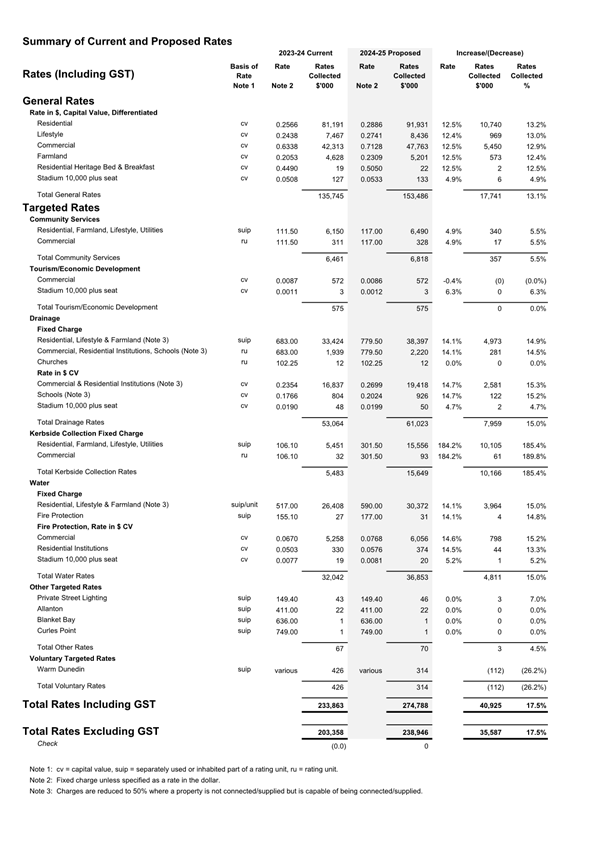

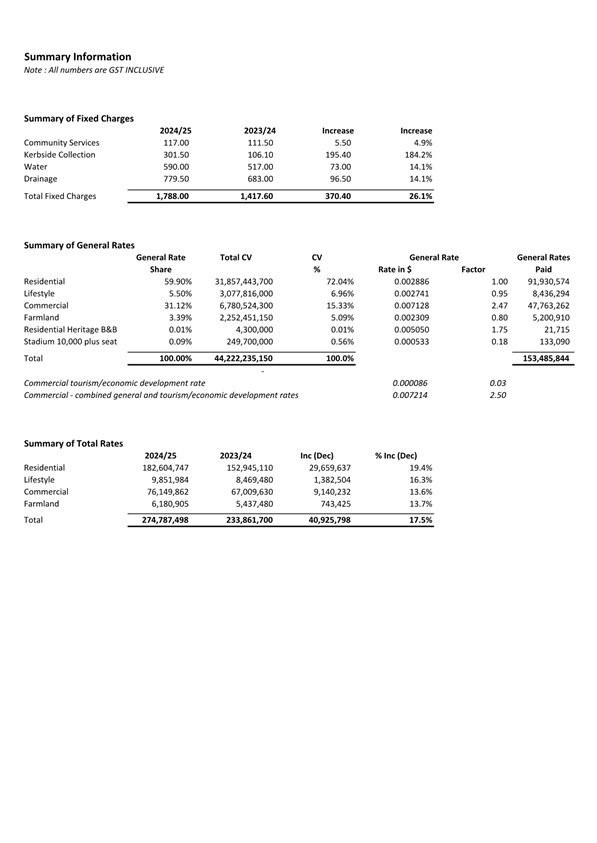

method comprises two main elements, general rates and targeted rates, as

demonstrated in Attachment A. Attachment A provides a summary of current and

proposed rates, provides details of the individual rates and the amount

collected from each rate. Attachment B, summary information, provides a summary

of fixed charges, general rates and total rates.

13 DCC rates

are made up of general rates (56%) and targeted rates (44%). General rates are based

on capital value. Targeted rates are made up of fixed charges (78%) and rates

based on capital value (22%). When property values change because of a

revaluation, the largest impact is on the general rate.

14 The general

rate is collected as a rate in the dollar on the capital value (CV) of each

property. The Council sets the general rate differentially for six property

categories: Residential, Lifestyle, Commercial, Farmland, Residential Heritage

Bed and Breakfast establishments, and the Stadium.

15 A

differential, described as a factor, is the degree to which the rate (the cents

in the dollar) on each category of property is higher or lower than residential

property. For example, the rate paid by commercial properties for the current

year is 2.5 times more than the rate paid by residential properties.

16 Targeted

rates fund particular activities and are either fixed charges, i.e., the same

amount per property, or collected as a rate in the dollar on the CV of each

property.

17 The impact of

a rates increase on individual properties is driven by the budget increase, the

rating method (how we rate) and changes in the property database (for example,

new improvements or new houses).

Kerbside

Collection Rate

18 As part of

the 10 year plan 2021-31, Council resolved to introduce a new Kerbside Collection

service consisting of four bins estimated to cost between $270 - $310 per year.

Council uses targeted rates to pay for its Kerbside Collection services.

Properties receiving the service are charged the flat rate for every separately

used or inhabited part (SUIP). Commercial properties are charged the flat

rate for each individual rating unit.

19 In November

2023, staff provided Council with the option to change the way the service was

funded from the current method of a flat targeted rate to a progressive

targeted rate or a combination of both. It was indicated at that time that the

estimated cost had increased to $320 - $340 per year.

20 As per the

Council resolution on 28 November 2023, the Kerbside Collection service will

continue to be funded by a flat targeted rate.

21 Based on

actual costs, the Kerbside Collection targeted rate will increase from $106.10

to $301.50 to fund the enhanced Kerbside Collection service which will commence

in July 2024.

Community

Services Rate

22 The Council

has a Community Services targeted rate (CSTR) which funds the Botanic Garden

and part of the Parks and Reserves activity. The CSTR is a fixed charge on all

rateable properties and is normally increased annually by an indexed

amount. An increase based on the June 2023 Local Government Cost Index

(LGCI) of 4.9% would increase this rate from $111.50 to $117.00, an increase of

$5.50 per property, for the 2024/25 year.

23 Council may

decide to keep this rate at $111.50. If so, the foregone increase in this

rate would need to be collected via the general rate, which is capital value

based. For a median valued property (being $590,000), the impact of not

increasing the community services rate would be a saving of $2.00, i.e., $5.50

would be saved on the fixed rate but the general rate would increase by $3.50.

Stadium

Rates

24 The Council

has a rating differential for the Forsyth Barr Stadium for the general rate,

the Economic Development/Tourism rate, the capital value-based Drainage rate

and the capital value-based Fire Protection rate. Since 2013/14, the

differentiated Stadium rates have been inflation adjusted annually. For the

2024/25 year, it is proposed to increase these rates by the June 2023 LGCI of 4.9%.

Overall

Impact

25 The

following table shows the overall rates income (including GST) by property

category for 2023/24 and 2024/25.

|

Category

|

2023/24

($’000)

|

2024/25

($’000)

|

$ change

($’000)

|

% change

|

|

Residential

|

152,945

|

182,605

|

29,660

|

19.4%

|

|

Lifestyle

|

8,469

|

9,851

|

1,382

|

16.3%

|

|

Commercial

|

67,010

|

76,150

|

9,140

|

13.6%

|

|

Farmland

|

5,437

|

6,181

|

744

|

13.7%

|

|

Total

|

233,861

|

274,787

|

40,926

|

17.5%

|

26 Attachment

C provides sample property rate changes for each category of property. The

increase for residential and lifestyle properties show the overall increase in

rates proposed and the increase excluding kerbside. The sample property rate changes

incorporate:

· The forecast rate

increase of 17.5%, including the increase for the kerbside collection service

· An increase of 4.9%,

$5.50 in the Community Services rate, and

· An increase of 4.9%

in the differentiated rates paid by the Stadium.

27 Prior

to engaging with the community, the sample property rate changes for each

category of property will be updated to reflect more up to date property data,

taking into account the growth in our city. Growth in the property

database will result in individual property rates reducing.

Rate

Maximum

27 Under the

Local Government (Rating) Act 2002, certain rates must not exceed 30% of total

rates revenue. This includes the use of a uniform annual general charge

and any targeted rates that are set on a uniform basis, excluding targeted

rates set solely for water supply or sewage disposal. Based on the draft

budgets, these rates represent 23% of total rates revenue.

OPTIONS

28 No options

are provided, as this report is giving effect to the current rating method and

previous decisions of the Council.

NEXT STEPS

29 While the

Council is engaging with the community on the draft 2024/25 Annual Plan, rate

account information will be available on the DCC website that shows the

proposed rating impact by individual rate account.

Signatories

|

Author:

|

Lara McBride - Assistant Accountant - Compliance

|

|

Authoriser:

|

Carolyn Allan - Chief Financial Officer

|

Attachments

|

|

Title

|

Page

|

|

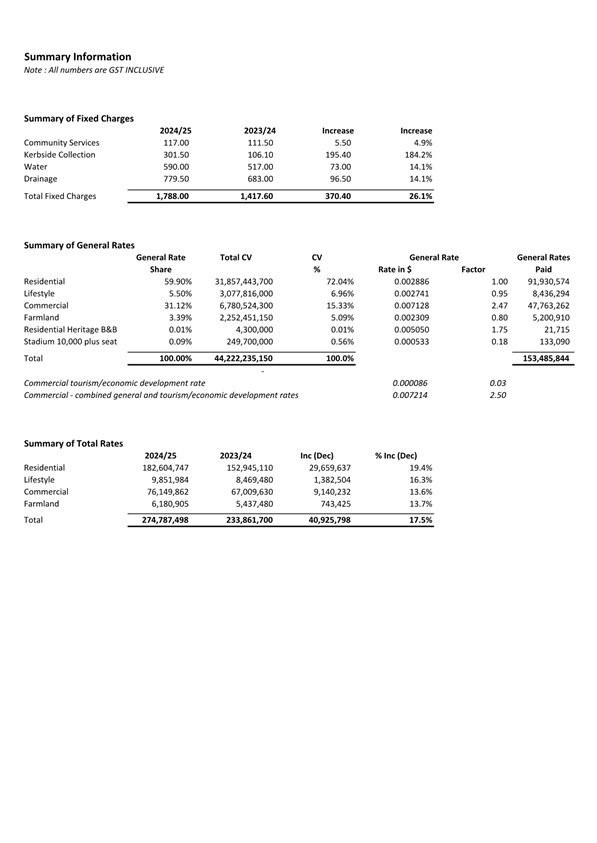

⇩a

|

Summary of Current and

Proposed Rates

|

41

|

|

⇩b

|

Summary Information

|

42

|

|

⇩c

|

Sample Rate Accounts

|

43

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose of Local Government

This decision enables democratic local

decision making and action by, and on behalf of communities,

and promotes the social, economic,

environmental and cultural wellbeing of communities in the

present and for the future.

|

|

Fit with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

✔

|

☐

|

☐

|

|

Economic Development Strategy

|

✔

|

☐

|

☐

|

|

Environment Strategy

|

✔

|

☐

|

☐

|

|

Arts and Culture Strategy

|

✔

|

☐

|

☐

|

|

3 Waters Strategy

|

✔

|

☐

|

☐

|

|

Spatial Plan

|

✔

|

☐

|

☐

|

|

Integrated Transport Strategy

|

✔

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

✔

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

✔

|

☐

|

☐

|

The Annual Plan contributes to objectives across the

strategic framework, as it describes the Council’s activities, which

are aligned to community outcomes.

|

|

Māori Impact Statement

Council budgets impact broadly across all Dunedin

communities including Māori. The adoption of Te Taki Haruru –

Māori Strategic Framework signals Council’s commitment to mana

whenua and to its obligations under the Treaty of Waitangi. Mana whenua and

Māori will have an opportunity to engage in the Annual Plan consultation

process through a series of planned hui.

|

|

Sustainability

Sustainability is an underlying principle of the

DCC’s strategic framework. The Annual

Plan 2024/25 is not proposing any changes to that provided for in the 10 year

plan. Major issues and implications for sustainability are discussed in

the Infrastructure Strategy and financial resilience is discussed in the

Financial Strategy of the current 10 year plan 2021-31.

|

|

LTP/Annual Plan / Financial Strategy /Infrastructure

Strategy

The proposed rating method will be included as supporting

documentation as part of the Annual Plan budget material during the community

engagement period.

|

|

Financial considerations

The rating method gives effect to the draft budget. The

financial implications of the draft budget are discussed Annual Plan 2024/25

overview report and the group budget reports.

|

|

Significance

The Annual Plan and rating are being consulted on.

|

|

Engagement – external

The content of the Annual Plan will be consulted on.

|

|

Engagement - internal

Staff and managers from across the Council have been

involved in the development of the draft budgets.

|

|

Risks: Legal / Health and Safety etc.

There are no identified risks.

|

|

Conflict of Interest

There are no known conflicts of interest.

|

|

Community Boards

The rating method will be of interest to Community Boards.

|

|

|

Council

12 March 2024

|

|

|

Council

12 March 2024

|

|

|

Council

12 March 2024

|

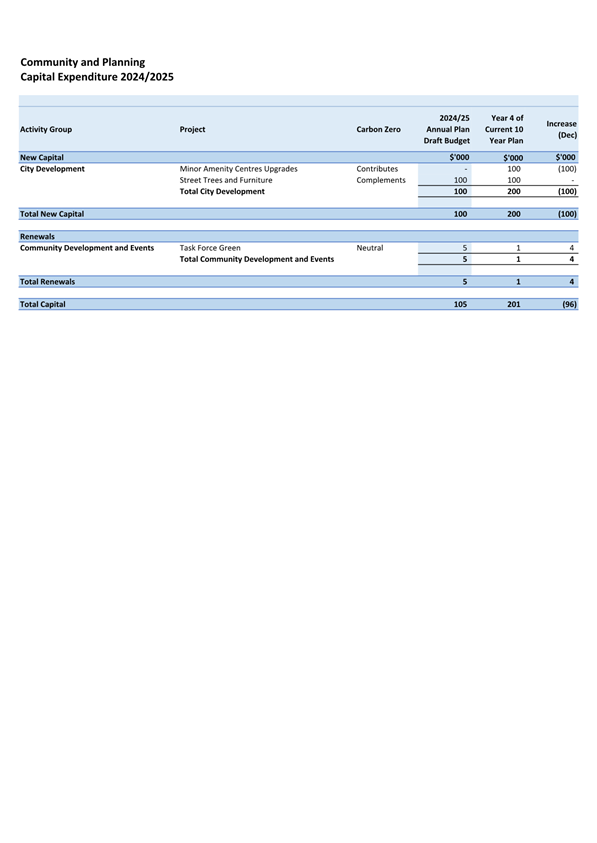

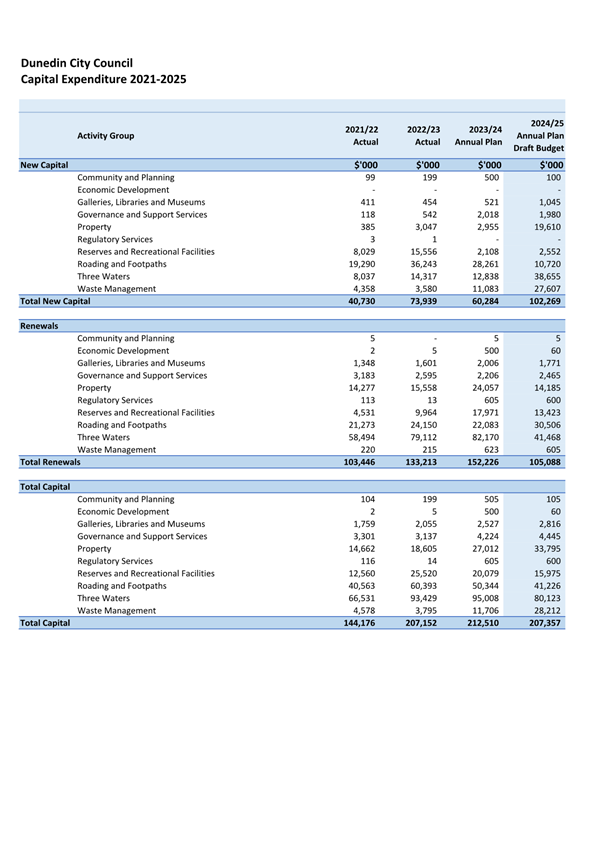

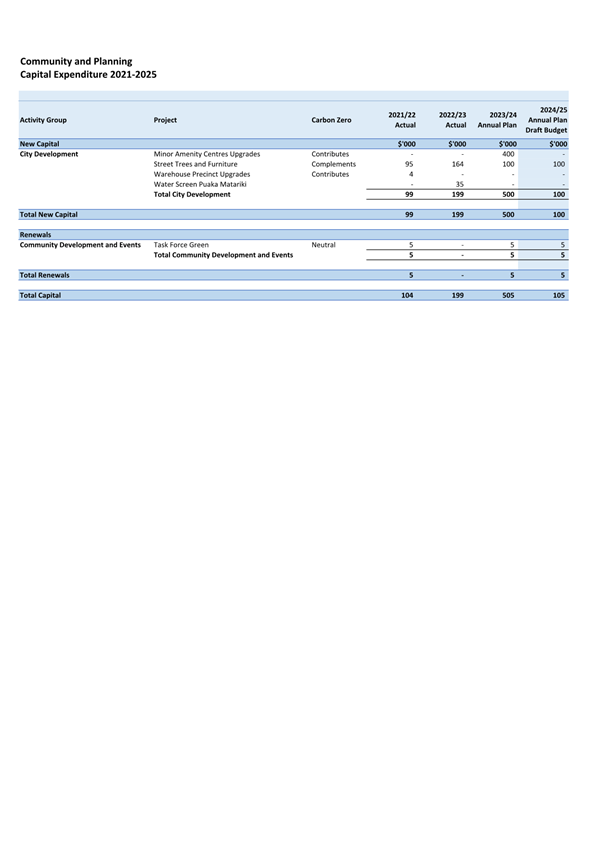

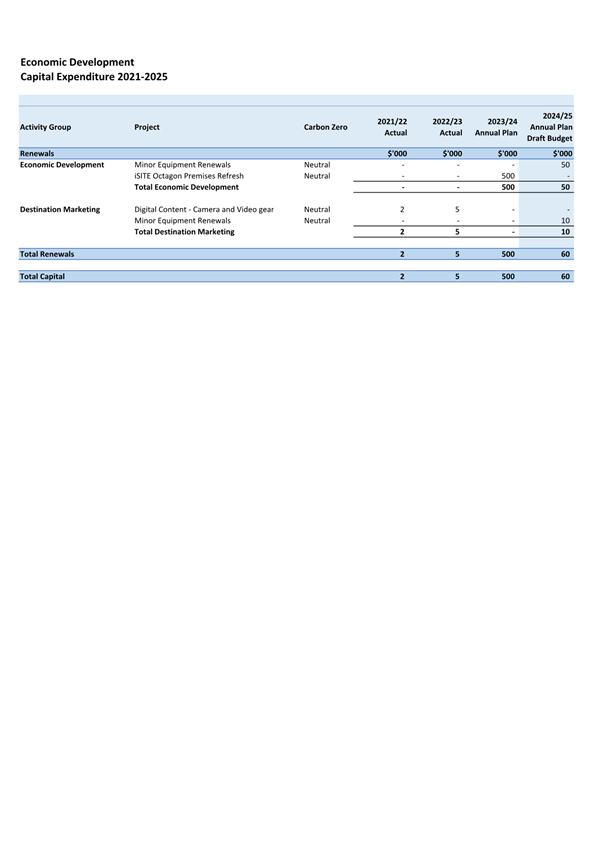

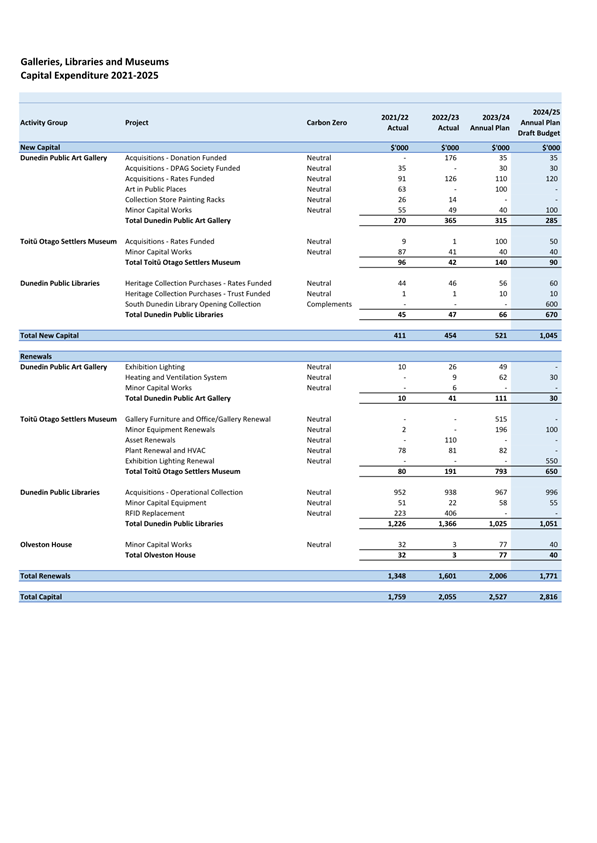

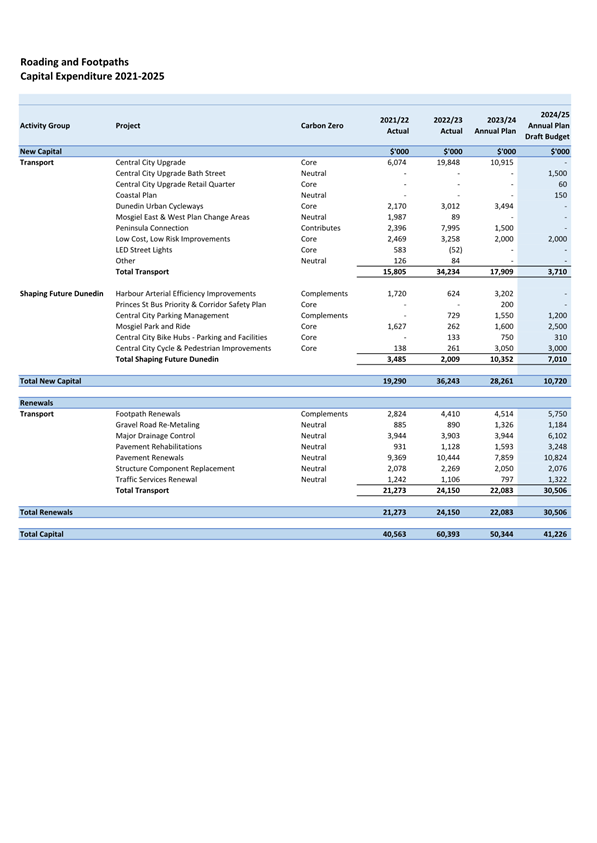

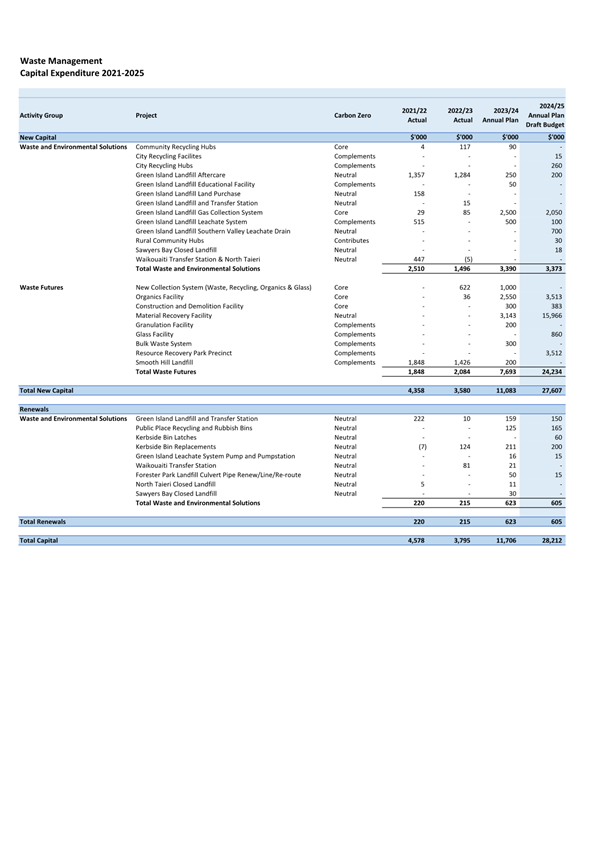

Draft Capital Budget Including Zero Carbon Options 2024/25

Department: Civic and Finance

EXECUTIVE SUMMARY

1 This

report seeks approval of the draft capital budget (draft budget) for inclusion

in the 2024/25 Annual Plan (“Annual Plan”).

2 At

its meeting on 27 February, Council approved the preparation of a 2024/25

Annual Plan for community consultation, rather than completing a 10 year plan

2024-34.

3 When

the decision was made to prepare an Annual Plan, a significant amount of work

had already been undertaken to develop capital budgets for the 10 year period

2024 – 34. There was, however, a high level of uncertainty of our

information for years 2 – 10, as legislative changes signalled by the new

Government would likely take effect from 2025/26 year onwards. The

2024/25 capital budget information that was prepared for the 10 year plan, is

now being used to produce the draft Annual Plan.

4 The

updated budget for 2024/25 is $207.357 million, compared to $157.044 million

provided for in year four of the 10 year plan 2021-31, an increase of $50.313

million.

RECOMMENDATIONS

That the Council:

a) Approves the proposed

capital expenditure budget for inclusion in the draft 2024/25 Annual Plan.

b) Decides what zero

carbon investment option, if any, it wishes to include in the capital

expenditure budget for the draft 2024/25 Annual Plan.

BACKGROUND

5 The

10 year plan 2021-31 provided a capital expenditure budget of $1.5 billion to

be spent over 10 years.

6 The

first three years spend is forecast to be $564 million compared to a budget of

$450 million. Projects such as the Central City Upgrade were brought forward,

and capital spend in Three Waters were accelerated.

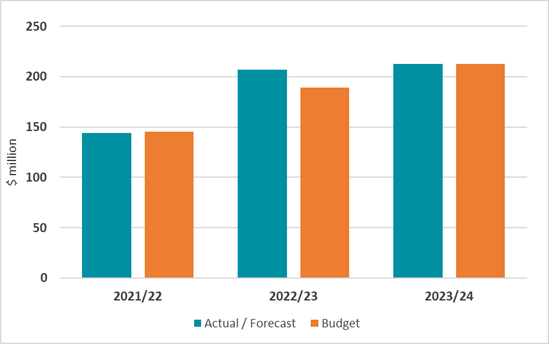

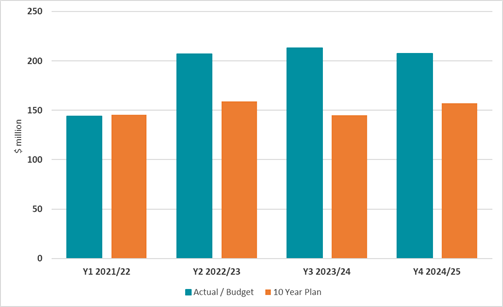

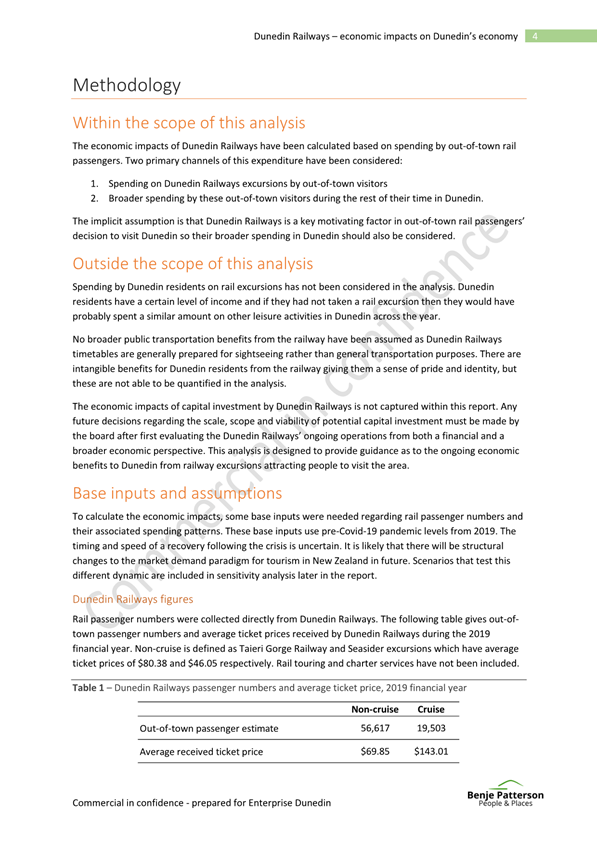

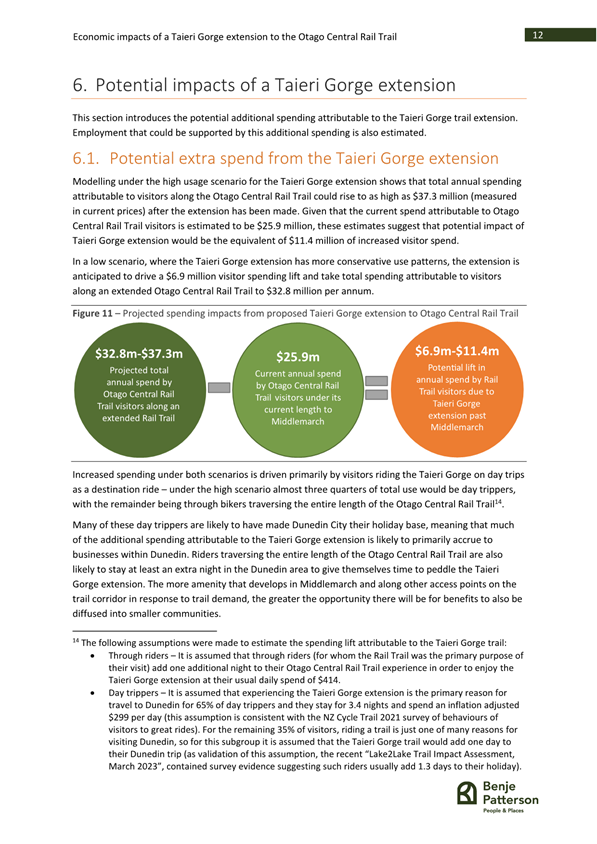

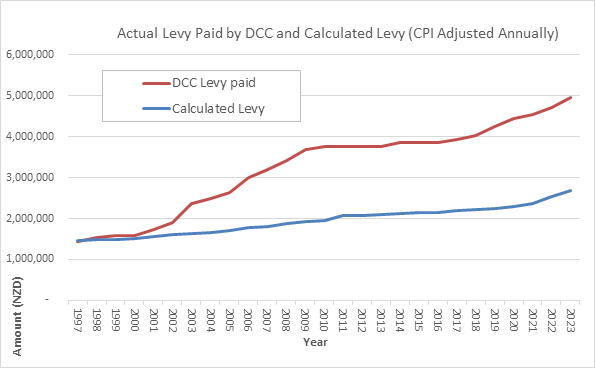

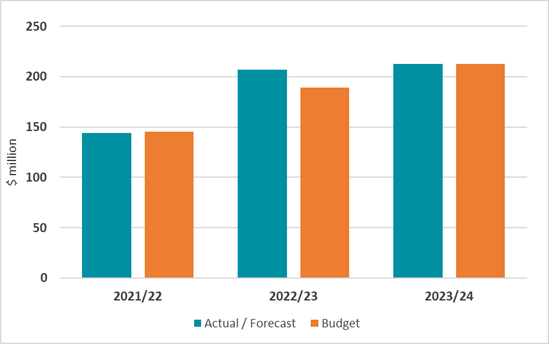

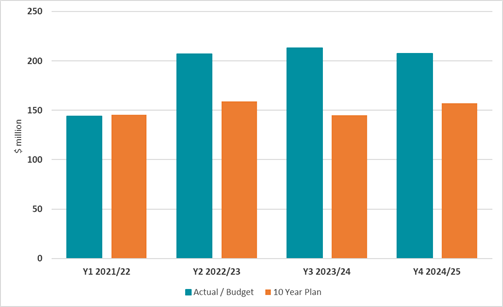

7 Chart

1 below shows progress against the 10 year plan 2021-31. It shows:

a) Actual

capital expenditure for the 2021/22 and 2022/23 years

b) Forecast

capital expenditure for the 2023/24 year

c) 10

year plan 2021-31 capital expenditure budget for the 2021/22 to 2023/24 years.

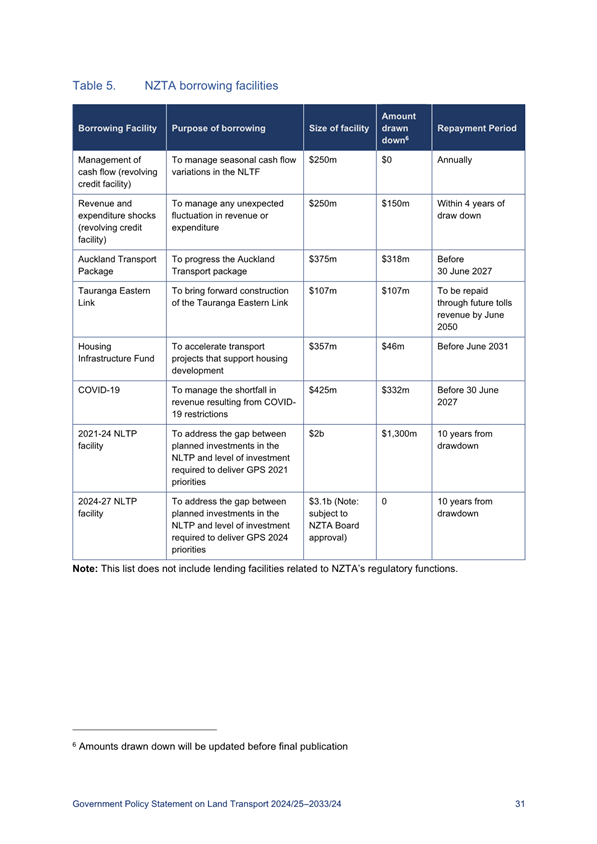

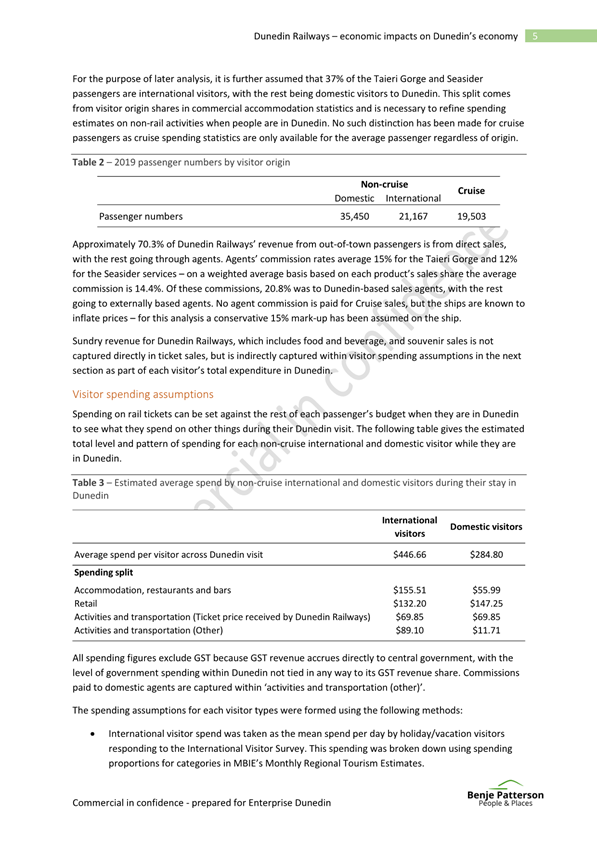

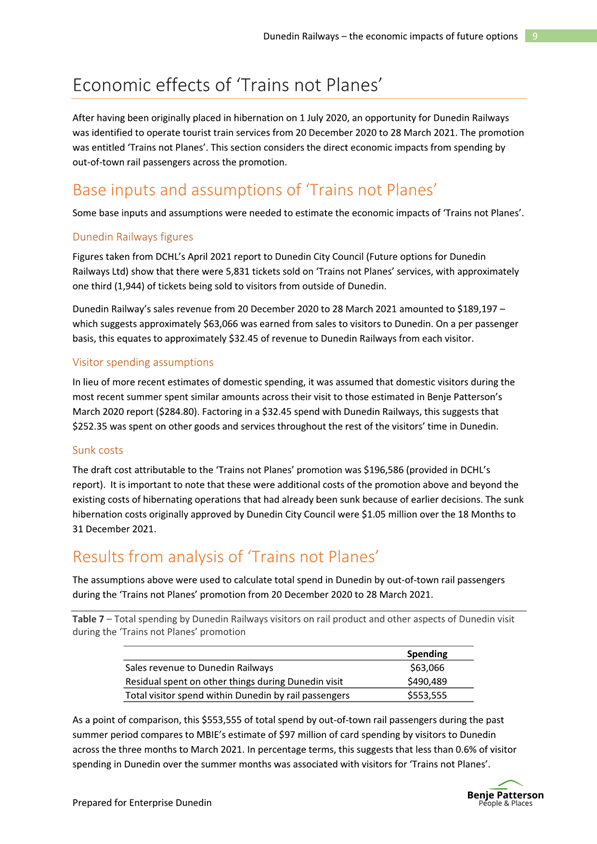

Chart 1 – Bar chart showing actual and

forecast capital expenditure vs budget

8 Capital

expenditure is funded as follows:

· Funded

depreciation – for renewals

· Debt – for

new capital, and any shortfall in funded depreciation for renewals

· NZTA Waka Kotahi

grant funding – renewals and new capital for transport projects

· Development

contributions – for growth capital

DISCUSSION

9 The

capital budgets proposed for the draft Annual Plan are year one of the budgets

that were being prepared for the new 10 year plan 2024-34. The budget

provides for a continuation of the capital programmes provided for in the

current 10 year plan. The level of spend of $207.357 million is higher

than that provided for in the current 10 year plan, but more accurately

reflects the cost and delivery phases of various projects.

10 The draft capital

budget for 2024/25 reflects the following:

· Asset

management plans, incorporating current condition assessments and risk

profiling to inform the timing of any renewal

· Update

of costs to complete projects underway

· Priority

of work – renewals over new capital

· Ability

to deliver – both internally and the available market capacity

· Timing

of work – forecasting progress against the current 2023/24 budget and

considering how timing differences may impact the 2024/25 year

· Climate

change and zero carbon targets – assessment of possible impacts from

capital projects

· Ability

to fund – debt limits and our ability to service debt

11 The draft

capital budget for the 2024/25 year provides for replacing existing assets and

infrastructure. Across the Council’s activities, the proposed

budget is $207.357 million in the 2024/25 year, compared to $157.044 million

provided for in year four of the 10 year plan. The draft capital budgets are at

Attachment A.

Zero

Carbon Plan approach

12 The Council’s

Zero Carbon Policy provides that all DCC activities, including renewals, should

seek to minimise emissions and contribute to achieving both city-wide and DCC

emissions reduction.

13 Staff have

assessed proposed capital projects to determine if they contribute to reducing

Dunedin’s city-wide emissions. The capital expenditure budget at

Attachment A indicate by project, what contribution they may make to

Council’s zero carbon goals. Projects have been assessed as

follows:

· A

core city-wide emissions reduction initiative (a

key focus of the project is to reduce city-wide emissions and/or it is a

priority area in the Zero Carbon Implementation Plan)

· Contributes

to reducing city-wide emissions (there is an emissions

reduction aspect to the project, but city-wide emissions reduction is not a

primary reason for investing in the project) or is an important aspect of the

DCC’s own decarbonisation

· Complements

emissions reduction efforts - the project is not

focussed on emissions reduction; however emissions reduction is a co-benefit of

this project

· Neutral

where the project is considered to neither increase nor decrease city-wide

emissions, nor significantly decrease DCC emissions.

14 Core

emissions reduction projects identified in the draft budgets include:

· Shaping

Future Dunedin Transport: improvements to public transport, including Mosgiel

Park and Ride, and some funding for Central City Cycle and Pedestrian

Improvements.

· Low

Cost, Low Risk Improvements: - small projects aimed to improve pedestrian

safety, particularly around schools.

· Waste

Futures and Green Island Landfill: measures to reduce waste emissions, such as

constructing facilities to store/process material diverted from landfill, and

improvements to landfill gas capture and destruction.

15 Projects

that contribute towards achieving city-wide emissions reduction include:

· South

Dunedin Library and Community Complex.

· Construction

of new infrastructure at wastewater treatment plants, including infrastructure

to better capture and destroy greenhouse gases generated in treatment

processes.

· EV

Charging Infrastructure: development of a network to service the city’s

fleet of electric vehicles.

16 There are a

wide range of projects within the draft capital budgets that complement

city-wide emissions reduction efforts. These projects will reduce emissions

from stationary energy, transport and waste systems.

17 Most

renewals are in the neutral category.

18 High/medium

zero carbon investment scenarios are considered later in this report.

Draft

2024/25 Capital Expenditure Programme

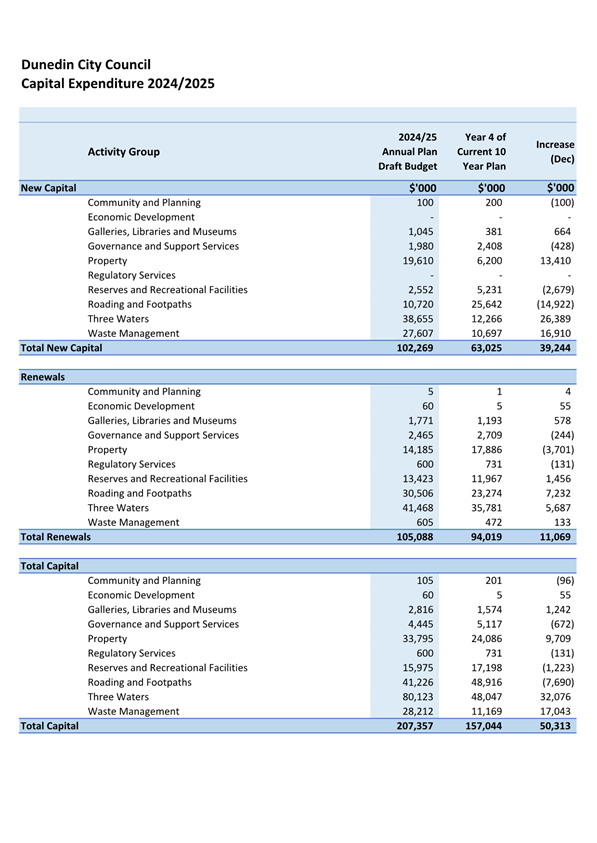

19 Table 1

provides a summary of the draft capital expenditure budget for 2024/25 year, by

group activity. It also shows the budget included in year 4 of the 10 year plan

2021-31.

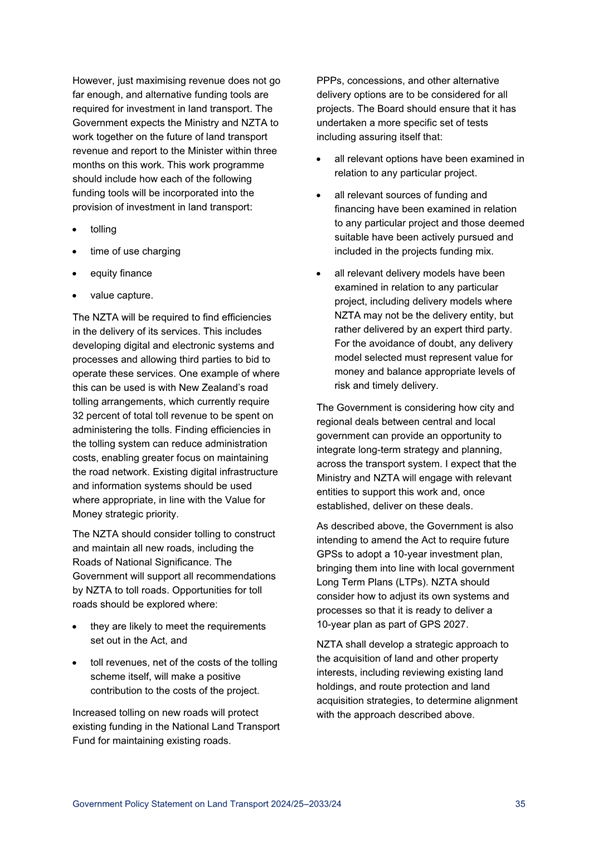

Table 1 – 2024/25 draft capital expenditure

budget vs year 4 of the 10 year plan 2021-2031

|

2024/2025

Capital Expenditure Budget

$000s

|

Draft Budget

|

Year 4 of 10 Year Plan 2021-31

|

Increase (Decrease)

|

|

Community and Planning

|

105

|

201

|

(96)

|

|

Economic Development

|

60

|

5

|

55

|

|

Galleries, Libraries and Museums

|

2,816

|

1,574

|

1,242

|

|

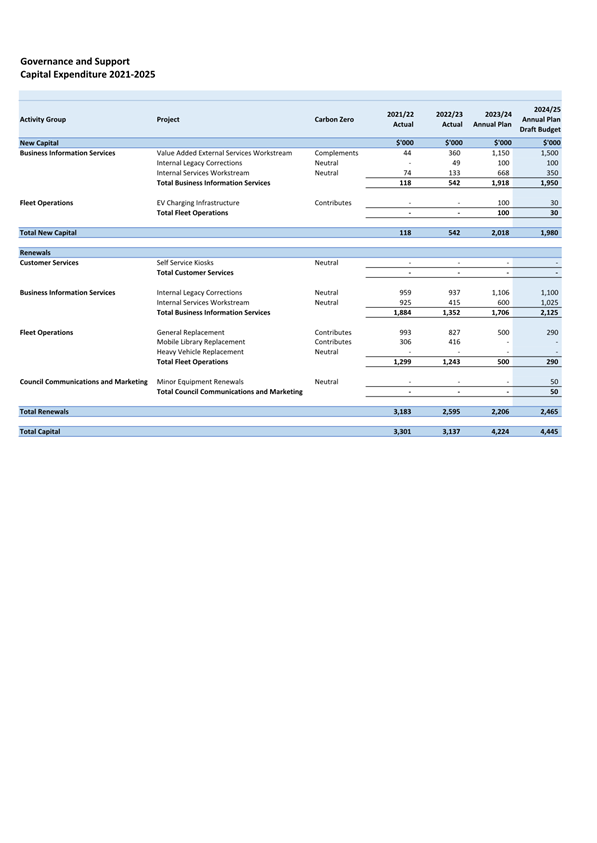

Governance and Support Services

|

4,445

|

5,117

|

(672)

|

|

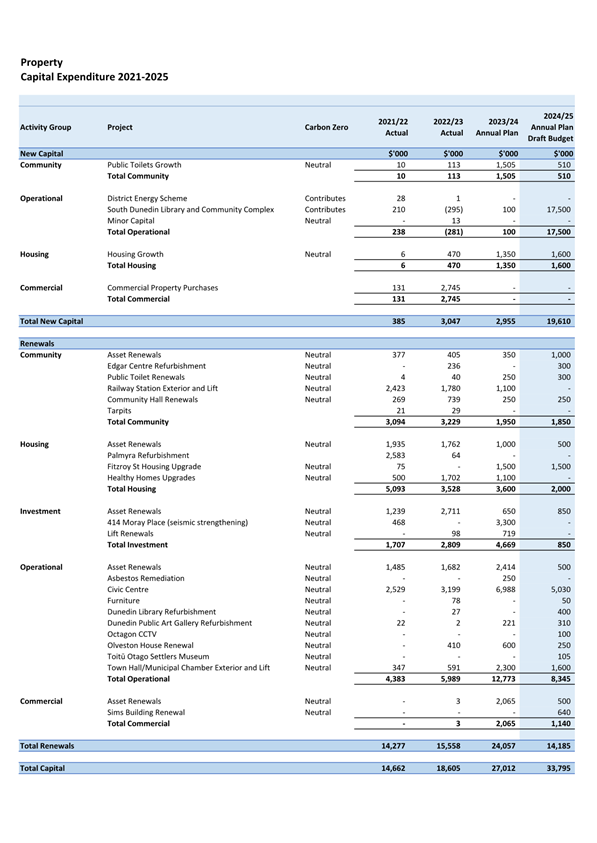

Property

|

33,795

|

24,086

|

9,709

|

|

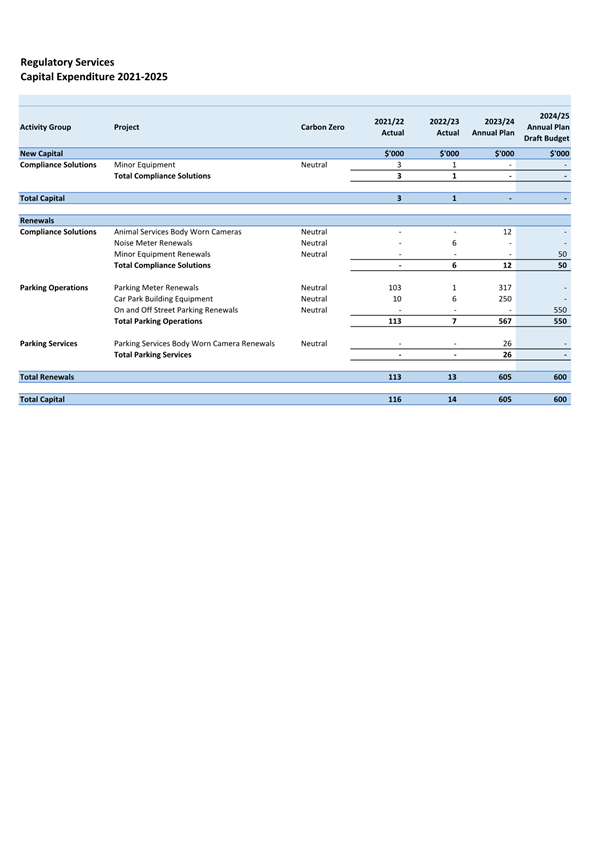

Regulatory Services

|

600

|

731

|

(131)

|

|

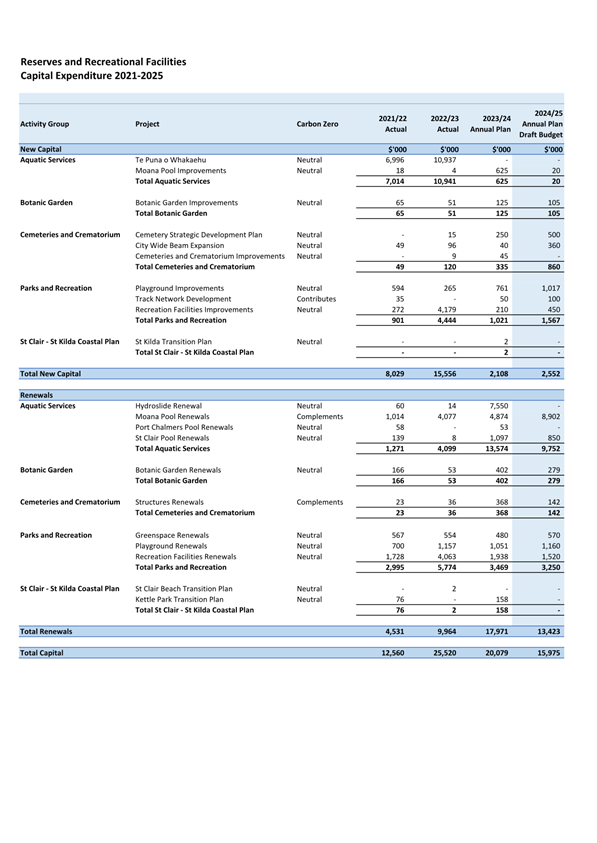

Reserves and Recreational Facilities

|

15,975

|

17,198

|

(1,223)

|

|

Roading and Footpaths

|

41,226

|

48,916

|

(7,690)

|

|

Three Waters

|

80,123

|

48,047

|

32,076

|

|

Waste Management

|

28,212

|

11,169

|

17,043

|

|

Total Expenditure

|

207,357

|

157,044

|

50,313

|

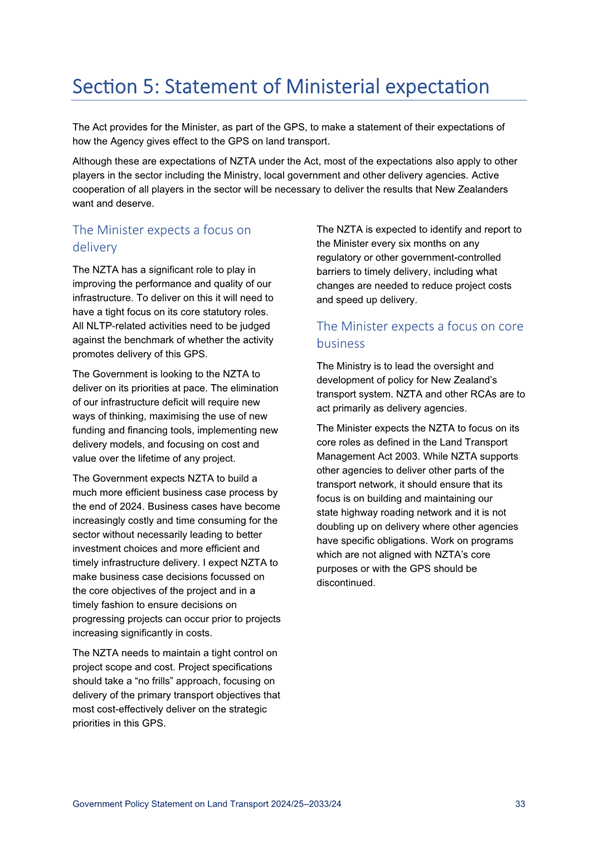

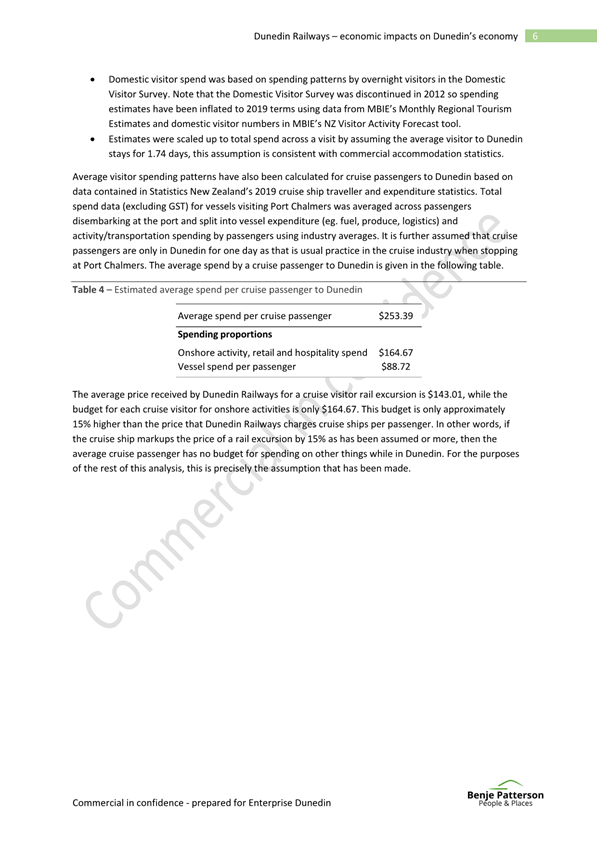

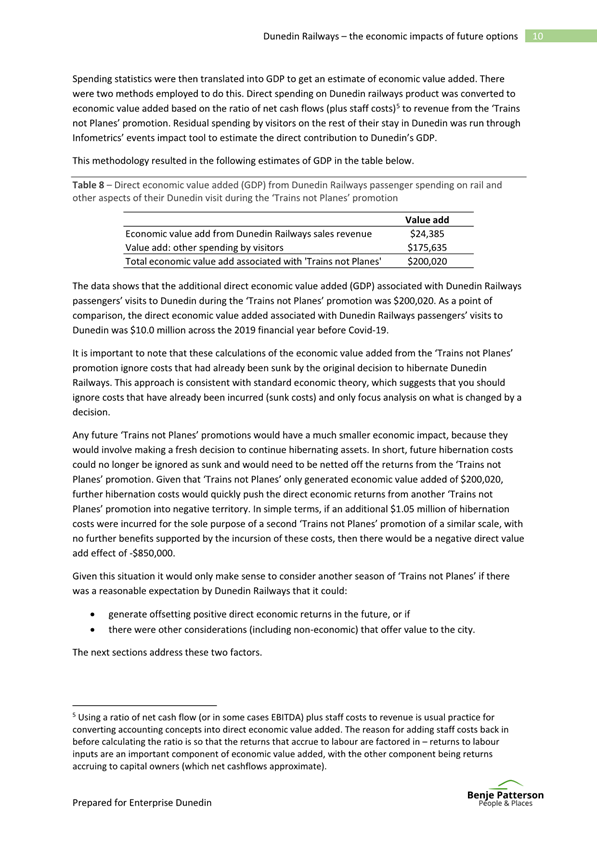

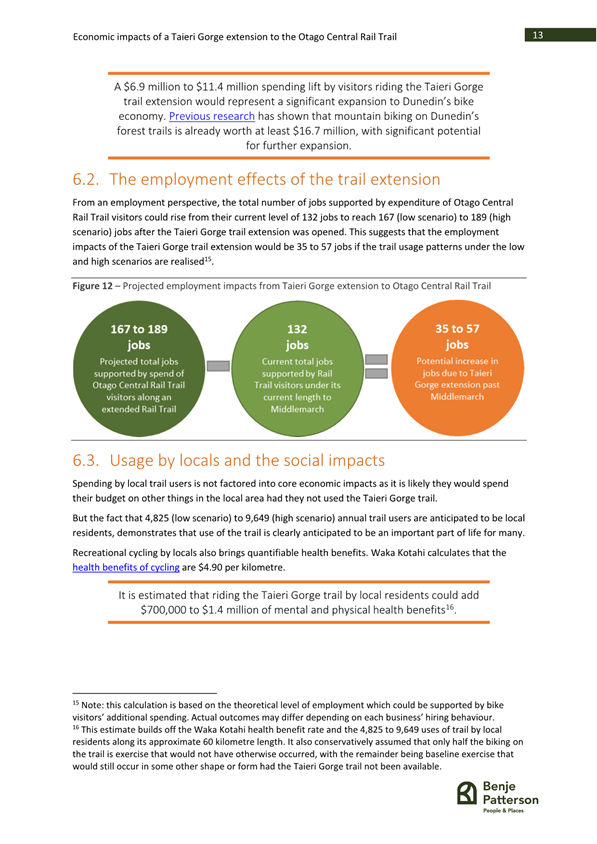

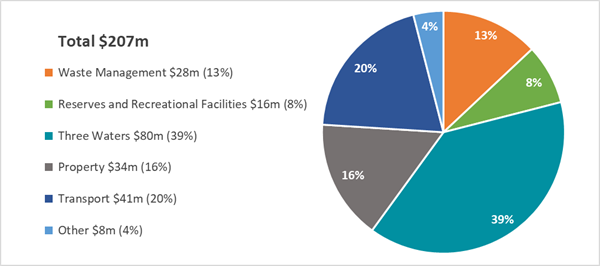

20 Chart 2

below shows, for the larger groups of activities, the proportion of the

$207.357 million budget is for each group.

Chart 2 – Draft 2024/25 capital expenditure budget

by group

21 The level

of spend at $207.357 million is higher than anticipated in the 10 year plan

2021-31 but more accurately reflects the delivery phases of various

projects. The accelerated capital expenditure programme in Three Waters

is continued.

22 Staff will

manage the capital programme closely and look for any savings during the

year. Regular reporting to either Council or the Finance & CCO

Committee on progress on the capital programme will continue, with close

attention to actual vs budget, to ensure that the capital budget is not

exceeded.

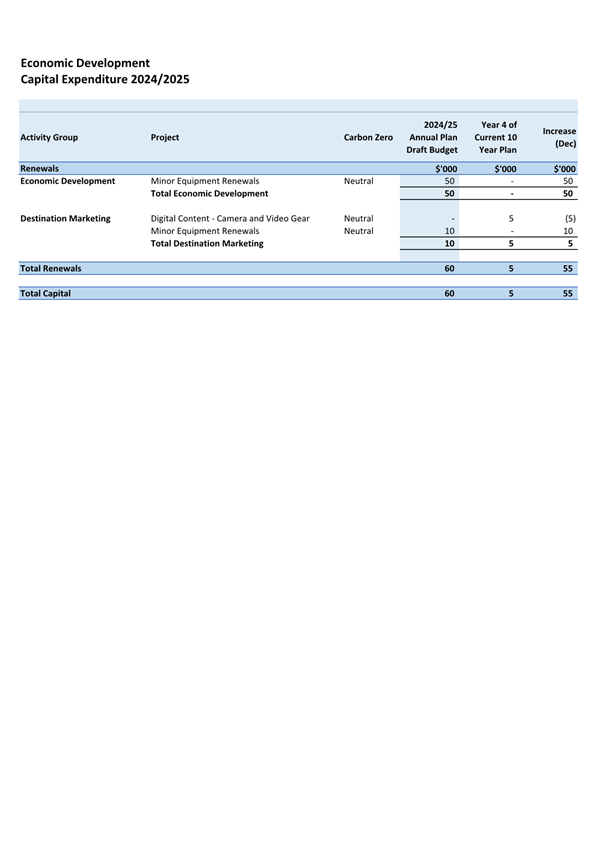

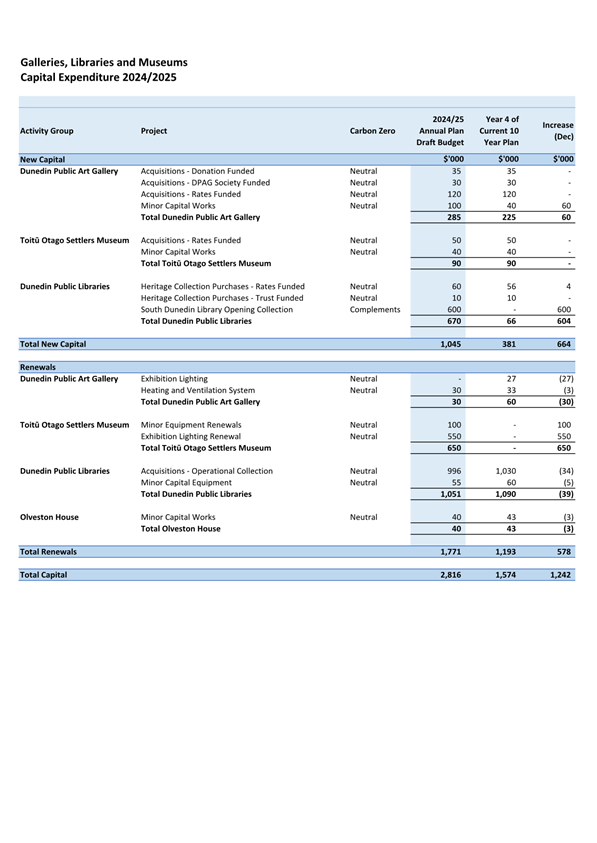

Galleries,

Libraries and Museums

23 The draft

budget provides $600k for the opening collection of the South Dunedin Library

and Community Complex. This expenditure was previously scheduled for 2023/24.

Additional budget of $550k has been provided to renew the exhibition lighting

at Toitū Otago Settlers Museum.

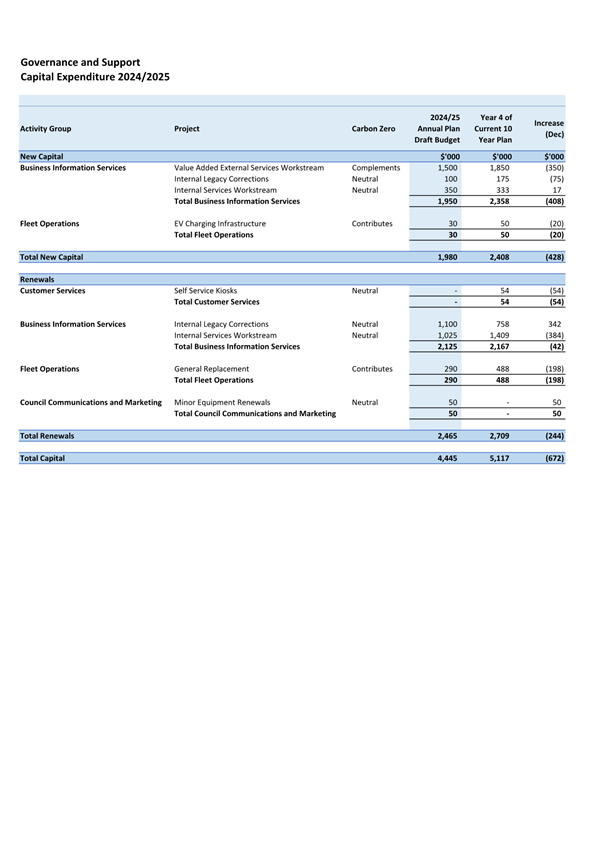

Governance

and Support Services

24 Fleet

Operations General Vehicle Replacement is lower than budgeted for in the 10

year plan due to the prior acceleration of spend to replace vehicles.

25 Business

Information Services has $1.500 million budgeted for the continuation of work

on the Customer Self Service Portal project. This project will enable

ratepayers to easily access DCC information, log a complaint, pay their rates,

complete online bookings, and any other online services the DCC can provide

though a DCC web interface/portal. The hardware replacement budget has

increased to $850k in response to the increasing cost of technology required.

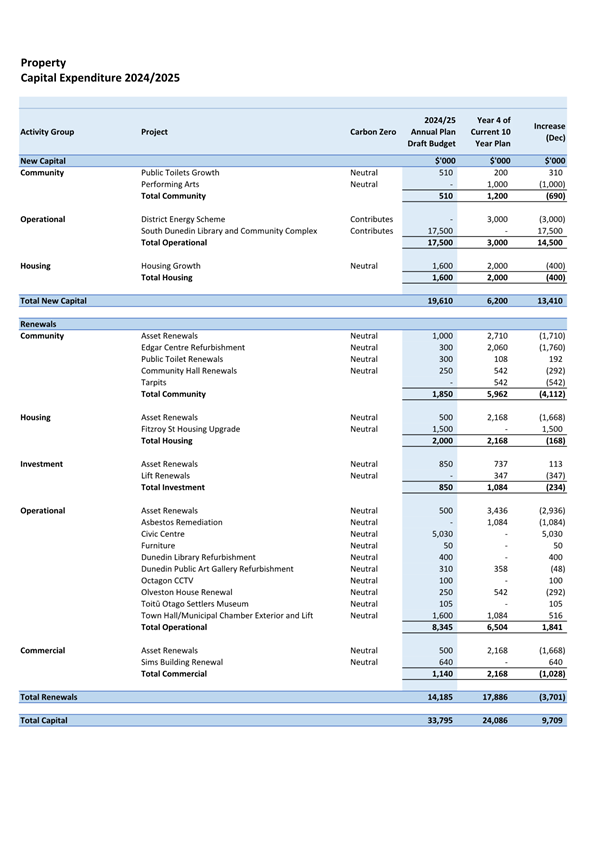

Property

26 The Property

budget provides $17.500 million for the South Dunedin Library and Community

Complex, previously scheduled to be undertaken during the first three years of

the 10 year plan. The budget provides $5.030 million for ongoing work on

the Civic Centre. There is also an increase in the budget for Public Toilets

(provision for two locations) due to escalating costs of construction.

27 This uplift

in spend has been partially offset by the rephasing and prioritisation of asset

renewals work across the portfolios. The Performing Arts budget has been

rephased while work continues on investigating possible options.

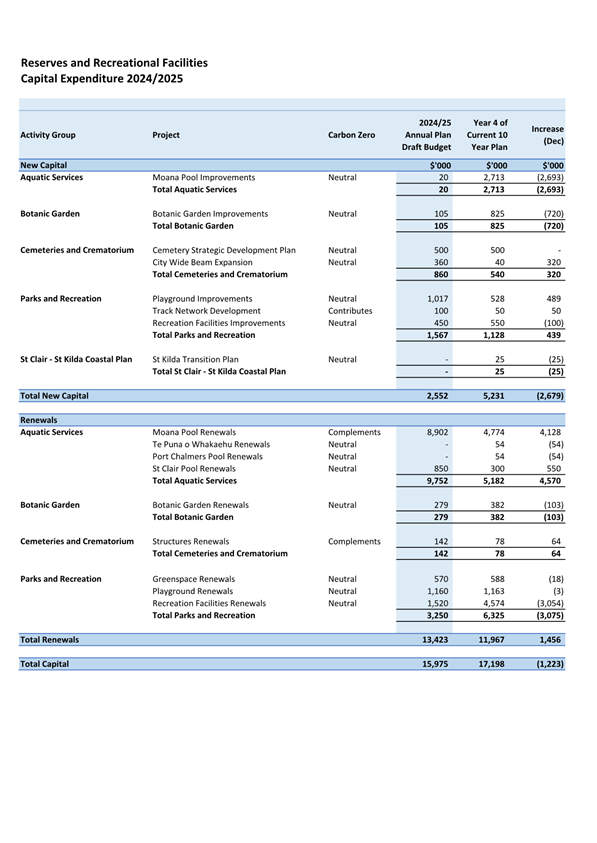

Reserves and Recreational Facilities

28 Renewals

expenditure includes an increase in budget of $4.128 million to $8.902 million,

to undertake work at Moana Pool. This increase is a result of the

redevelopment plan having been rescoped and timelines changing, with some works

deferred from 2023/24 to 2024/25 and later years.

29 Funding for

Playground Improvements has increased by $489k to $1.017 million ahead of work

for the Destination Playgrounds. There is also increased provision for creating

more burial capacity across the city and the associated infrastructure.

30 These

increases have been offset by a reduction in recreation facilities renewals and

a Botanic Garden improvement decrease of $720k. A Botanic Garden Strategic

Plan is being developed, and this will inform a capital programme for the

Garden.

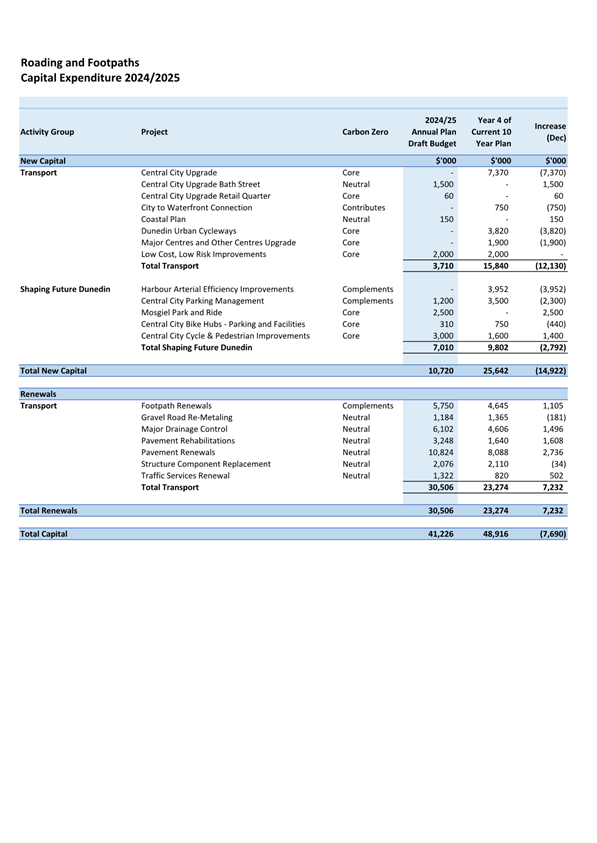

Roading and Footpaths

31 Review of

the transport capital budget has taken account of the uncertainty around the

amount of co-funding that may be received from NZTA Waka Kotahi for new capital

projects. Projects such as the Tunnels Trail and other cycleways will be

considered in the development of the 9 year plan 2025-34.

32 The budget

includes funding of $1.500 million for Bath Street works. It also

includes budget for Shaping Future Dunedin projects such as $3.000 million for

Central City Cycle and Pedestrian Improvements, $1.200 million for Central City

Parking Management and $2.500 million for the Mosgiel Park and Ride.

33 Low Cost,

Low Risk minor safety improvement projects such as intersection improvements

and school safety are ongoing with an unchanged budget of $2.000 million.

34 Over the

first three years of the plan, the Central City Upgrade was brought forward and

because of early completion, the budget of $7.370 million for the 2024/25 year

in the 10 year plan is not required.

35 An increase

in budget of $7.232 million to $30.506 million for transport renewals

highlights the work needed on the transport network. Of this, $10.824 million

is for Pavement Renewals and $3.248 million is for Pavement Rehabilitations

where roading surfaces require more intensive work than a standard

renewal. Major Drainage Control, with a budget of $6.102 million, allows

for kerb and channel renewals, along with renewals for the culvert and mud tank

network.

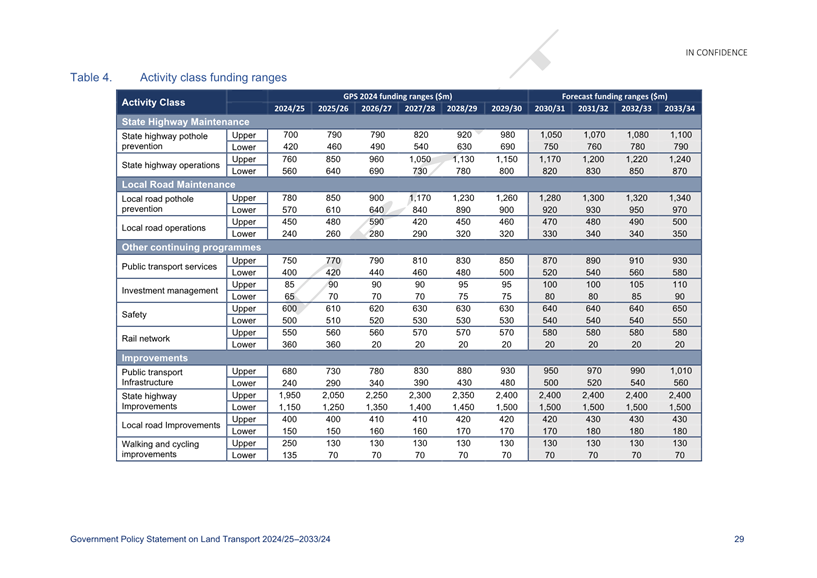

36 The draft

Government Policy Statement on land transport 2024 -34 has just been released

for consultation purposes. A copy of the draft Government Policy

Statement is at Attachment C. Staff are reviewing the draft Statement to

understand the impacts it may have on our assumptions around co-funding for the

transport initiatives included in our proposed capital expenditure

programme. Staff will report back to Council on its findings.

37 In the

interim, the budget assumes that NZTA Waka Kotahi will provide the full funding

assistance rate (grant funding) on the new capital expenditure, but the grant

funding on renewals will be capped. The shortfall in renewals grant funding is

estimated to be $3.605 million and will be debt funded.

Zero Carbon -

High and medium investment scenarios for roading and footpaths

38 At

its meeting on 25 September 2023, Council considered a draft Zero Carbon Plan

2030, and at that meeting asked staff to develop a high investment option for the Zero Carbon Implementation plan (as

the preferred option) with medium investment as the alternative option, to be

done for the draft 10 year plan 2024-34.

39 With the decision to prepare an Annual Plan, two

investment scenarios are presented below for the 2024/25 year only.

Further work will be undertaken on these scenarios, to look at future

investment for consideration as part of the 9 year plan 2025-34.

40 The high

investment scenario for the 2024/25 year will require an additional $3.9

million to be added to the capital budget.

41 The zero

carbon initiatives in the high investment scenario fall within the Transport

activity. These projects encompass cycle and pedestrian improvements,

intersection safety and accessibility upgrades, investment in the Princes

Street bus and corridor plan, and enhancements to the accessibility of

footpaths.

42 The medium

investment scenario would require an additional $2.65

million to be added to the capital budget. These zero carbon initiatives mirror

those in the high scenario, except for a reduction in the budget allocated for

intersection safety and accessibility upgrades.

43 Staff have

assumed that the items proposed will not attract co-funding from NZTA Waka

Kotahi.

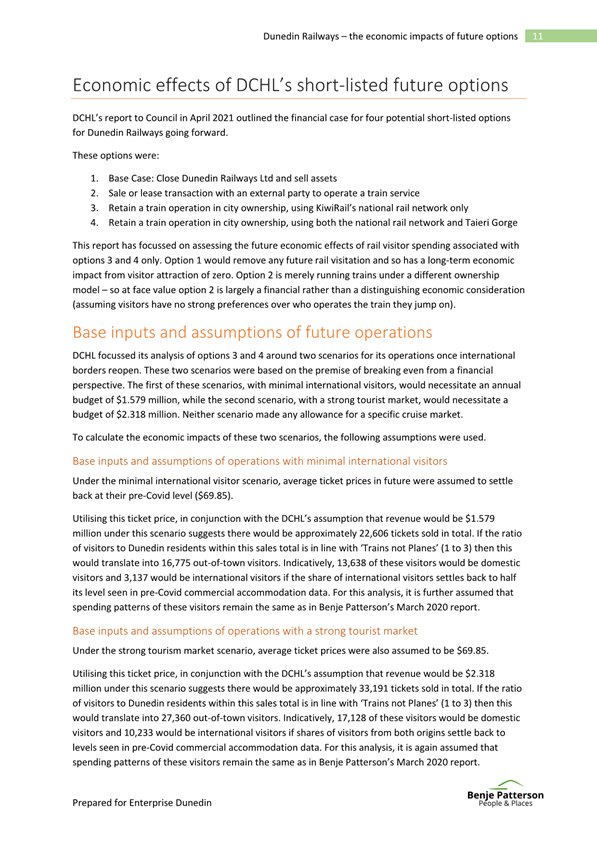

44 A summary table

of the high and medium investment scenarios is shown in Figure 1.

|

|

|

2024/25

|

|

Activity Name

|

Project Name

|

High Package $'000

|

Medium Package $'000

|

|

Shaping Future Dunedin

|

Central City Cycle and Pedestrian Improvements

|

500

|

500

|

|

Princes Street Bus Priority and Corridor Safety Plan

|

400

|

400

|

|

Transport

|

Accessibility-driven Footpath Renewals

|

500

|

500

|

|

Low Risk, Low Cost Improvements: Intersection Safety and

Accessibility Upgrades

|

2,500

|

1,250

|

|

Total Additional Investment

|

3,900

|

2,650

|

25 Council is

asked to consider what, if any investment option it may wish to include in the

capital programme for the 2024/25 year. Given the uncertainty around

co-funding from NZTA Waka Kotahi, and how this may impact on transport’s

capital programme, it is recommended that no additional investment be added

into the 2024/25 year.

45 This will

allow more time to interrogate the programme, understand the implications of

changes to co-funding priorities, refine the cost estimates and develop a more

robust zero carbon investment programme in time for the 9 year plan 2025-34.

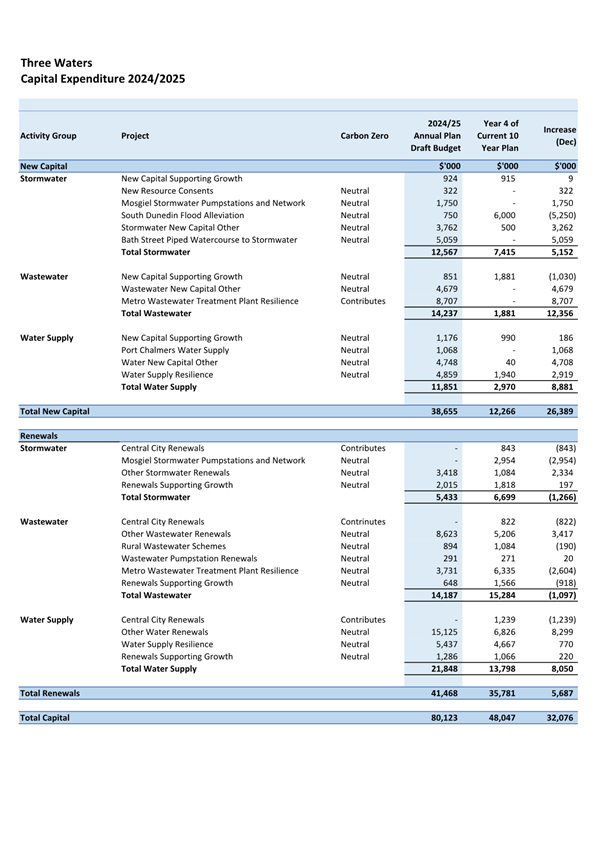

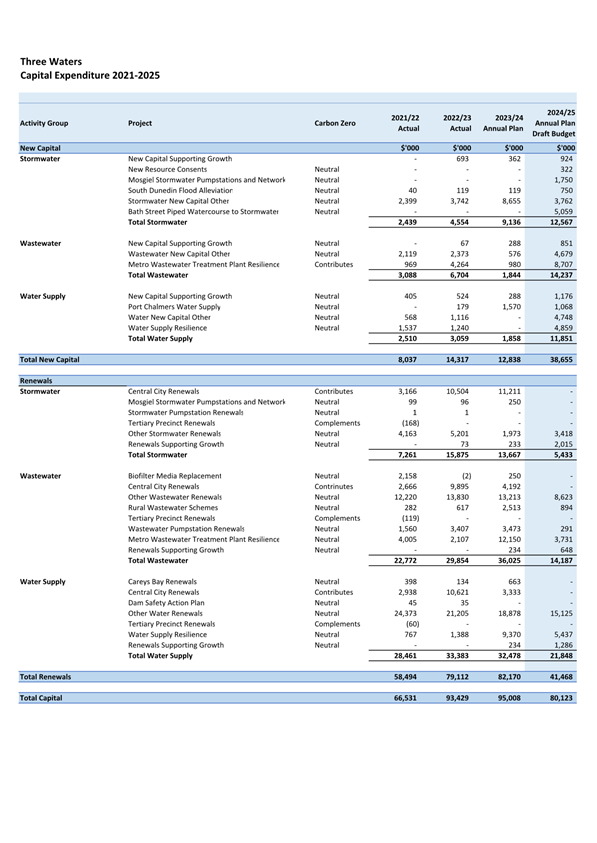

Three

Waters

46 Three

Waters capital expenditure budget of $80.123 million provides an increase of $32.076

million on year 4 of the 10 year plan. Tables 2 and 3 below provide a summary

of the draft Three Waters capital budget.

Table 2 – 2024/25 Three Waters draft

capital expenditure budget

|

Capital Expenditure $’000s

|

|

2024/25 Annual Plan Draft

Budget

|

Year 4 of Current 10 Year Plan

|

Increase (Decrease)

|

|

Stormwater

|

Renewals supporting Growth

|

2,015

|

1,818

|

197

|

|

|

Renewals

|

3,418

|

4,881

|

(1,463)

|

|

|

Total Renewals

|

5,433

|

6,699

|

(1,266)

|

|

|

New Capital for Growth

|

924

|

915

|

9

|

|

|

New Capital

|

11,643

|

6,500

|

5,143

|

|

|

Total New Capital

|

12,567

|

7,415

|

5,152

|

|

Total Stormwater

|

|

18,000

|

14,114

|

3,886

|

|

Wastewater

|

Renewals supporting Growth

|

648

|

1,566

|

(918)

|

|

|

Renewals

|

13,539

|

13,718

|

(179)

|

|

|

Total Renewals

|

14,187

|

15,284

|

(1,097)

|

|

|

New Capital for Growth

|

851

|

1,881

|

(1,030)

|

|

|

New Capital

|

13,386

|

0

|

13,386

|

|

|

Total New Capital

|

14,237

|

1,881

|

12,356

|

|

Total Wastewater

|

|

28,424

|

17,165

|

11,259

|

|

Water Supply

|

Renewals supporting Growth

|

1,286

|

1,066

|

220

|

|

|

Renewals

|

20,562

|

12,732

|

7,830

|

|

|

Total Renewals

|

21,848

|

13,798

|

8,050

|

|

|

New Capital for Growth

|

1,176

|

990

|

186

|

|

|

New Capital

|

10,675

|

1,980

|

8,695

|

|

|

Total New Capital

|

11,851

|

2,970

|

8,881

|

|

Total Water Supply

|

|

33,699

|

16,768

|

16,931

|

|

Total Three Waters Capital

Expenditure

|

80,123

|

48,047

|

32,076

|

Table 3 – 2024/25 Summary of Three Waters

draft capital expenditure

|

Capital Expenditure

$’000s

|

|

2024/25 Annual Plan Draft

Budget

|

Year 4 of Current 10 Year Plan

|

Increase (Decrease)

|

|

Three Waters

|

Renewals supporting Growth

|

3,949

|

4,450

|

(501)

|

|

|

Renewals

|

37,519

|

31,331

|

6,188

|

|

|

Total Renewals

|

41,468

|

35,781

|

5,687

|

|

|

New Capital for Growth

|

2,951

|

3,786

|

(835)

|

|

|

New Capital

|

35,704

|

8,480

|

27,224

|

|

|

Total New Capital

|

38,655

|

12,266

|

26,389

|

|

Total Three Waters Capital

Expenditure

|

80,123

|

48,047

|

32,076

|

Growth

47 3 Waters

infrastructure is required to service areas rezoned within the 2GP and

Dunedin’s anticipated growth as provided for in the draft Future

Development Strategy.

48 The capital

budget includes $6.900 million for growth across the stormwater, wastewater and

water supply activities, and of this, $2.951 million is for New Capital

Supporting Growth which enables the creation of new reticulation assets.

49 The balance

of $3.949 million is for “renewals supporting growth”

projects. These renewal projects involve upsizing existing networks to

cater for growth, e.g., upsizing pipes on renewal.

New capital

50 Stormwater

- The new capital budget includes $5.059 million for the Bath St watercourse

and $1.750 million for the Mosgiel Pumpstations and Network, both not provided

for in the 10 year plan. There is also an uplift in the budget of $3.262

million for resilience projects, increased monitoring requirements and hydraulic

model building.

51 Offsetting

these increases is a reduction in the budget for South Dunedin Flood

Alleviation of $5.250 million against the 10 year plan budget. This is due to

the rephasing of this work, which will be included in the 9 year plan 2025-34.

52 Wastewater

– the new capital budget provides $8.707 million for the construction of

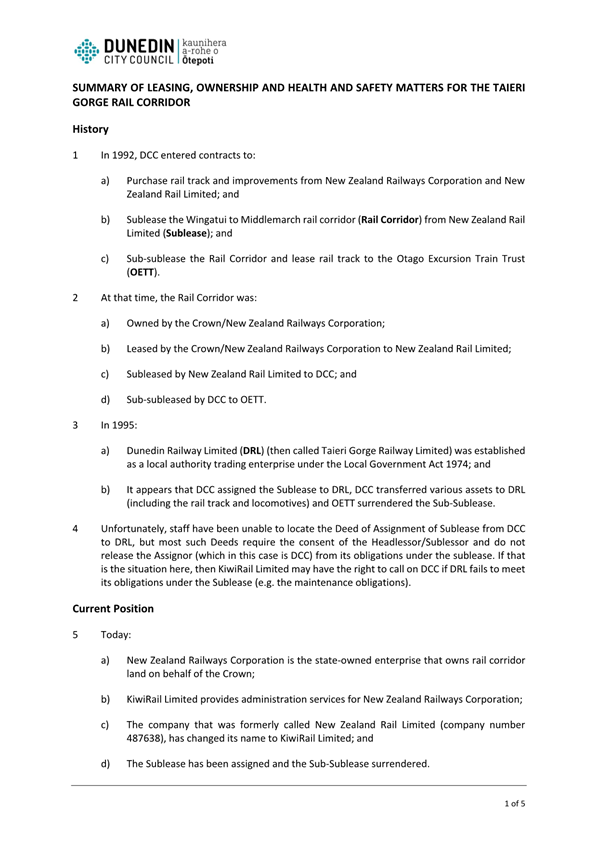

new infrastructure at the metro wastewater treatment plants, based on the

outcomes of plant condition and resilience assessments. A budget of $4.679

million has been provided for other projects such as wet weather discharges,

resilience work and system upgrades.

53 Water

Supply – the new capital budget has increased by $8.695 million to

$10.675 million. Of this, $4.859 million is for water supply resilience

projects including upgrades to water treatment plants based on the outcomes of

process capability assessments. A budget of $4.748 million has been provided for

other capital works such as water network upgrades to support compliance with

new regulations. A budget of $1.068 million has been provided for the design

and construction of a water supply main to Port Chalmers.

Renewals

54 The 3

waters renewals programme is informed by condition assessment programmes on

treatment plants and performance data.

55 The

proposed renewals programme only includes projects that are required to

maintain service levels or meet exiting service level shortfalls. Renewals will

proactively target significant risk areas such as highly critical areas to

prevent service level failure.

56 Where

possible, rather than replace assets, rehabilitation work will be undertaken to

repair assets and extend their useful lives. Rehabilitation is a cost-effective

method for maintaining the 3 waters network.

57 Stormwater

- a budget of $3.418 million provides for general network and pumpstation

renewals, being an uplift in budget of $2.334 million.

58 Wastewater

- $3.731 million has been provided for Metro Wastewater Treatment Plant

Resilience and $8.623 million for other renewals including systems upgrades and

consent renewals.

59 Water

supply – there has been an uplift in the budget of $8.299 million to

$15.125 million for the renewal of existing water supply treatment and network

assets renewals. A budget of $5.437 million has been provided for the

renewal of water treatment plants, and other critical water pump assets.

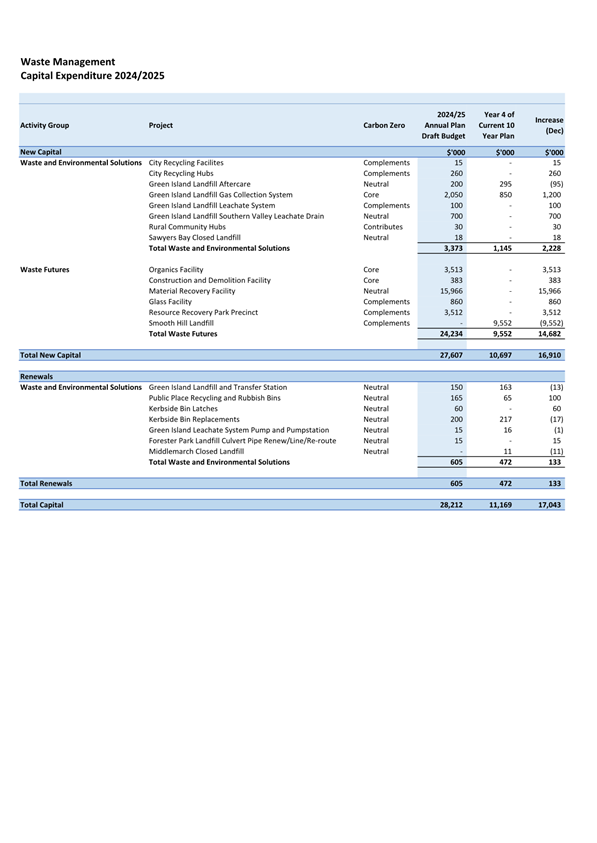

Waste

Management

60 The Waste Futures

budget is $14.682 million higher than the budget provided for in the 10 year

plan, due to timing changes. Projects now planned to be underway and continuing

in 2024/25, include $15.966 million for the construction of the Material

Recovery Facility, $3.512 million for the Resource Recovery Park and $3.513

million for the Organics Facility. These projects will support the enhanced

Kerbside Collection Services commencing on 1 July 2024.

61 Expenditure

for Smooth Hill Landfill of $9.552 million has been rephased to future

years. It is assumed that resource consent will be granted to extend the

life of the Green Island Landfill beyond what was expected in the 10 year plan.

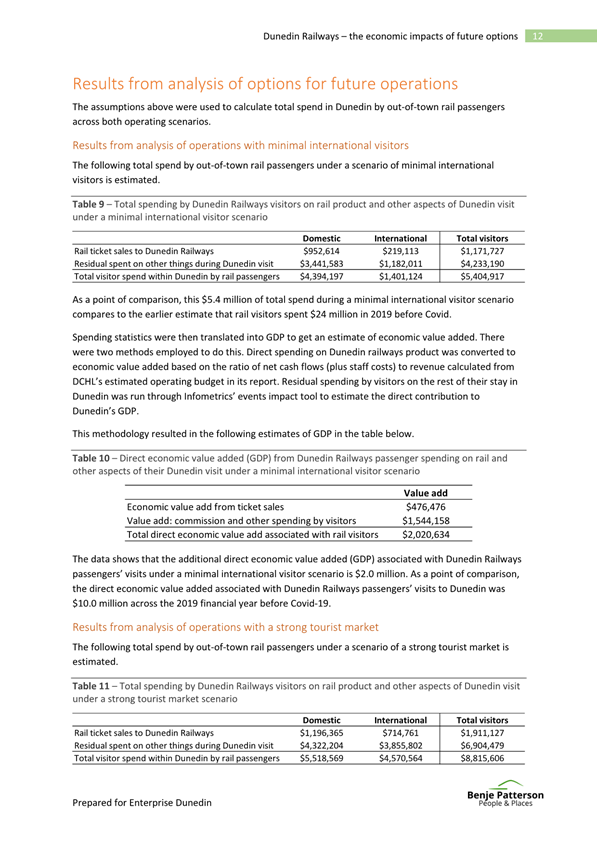

Comparison

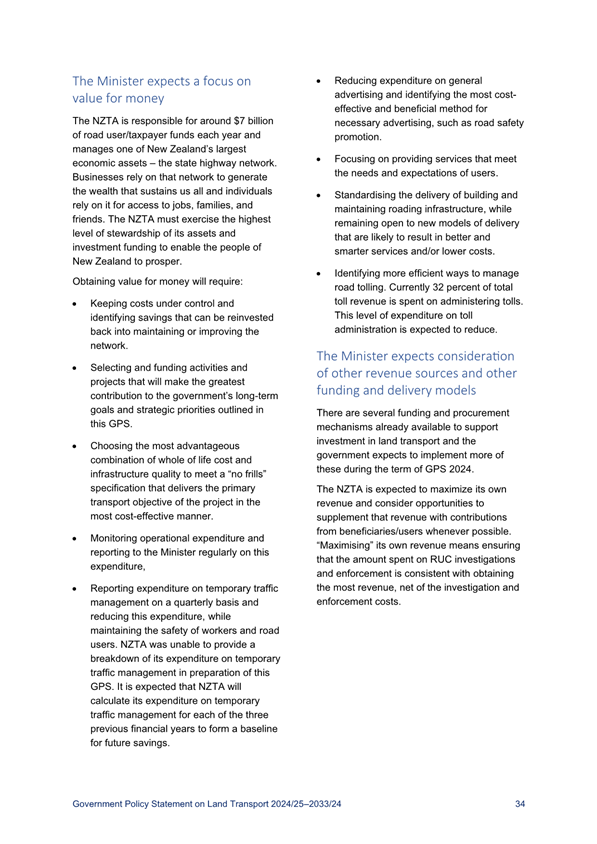

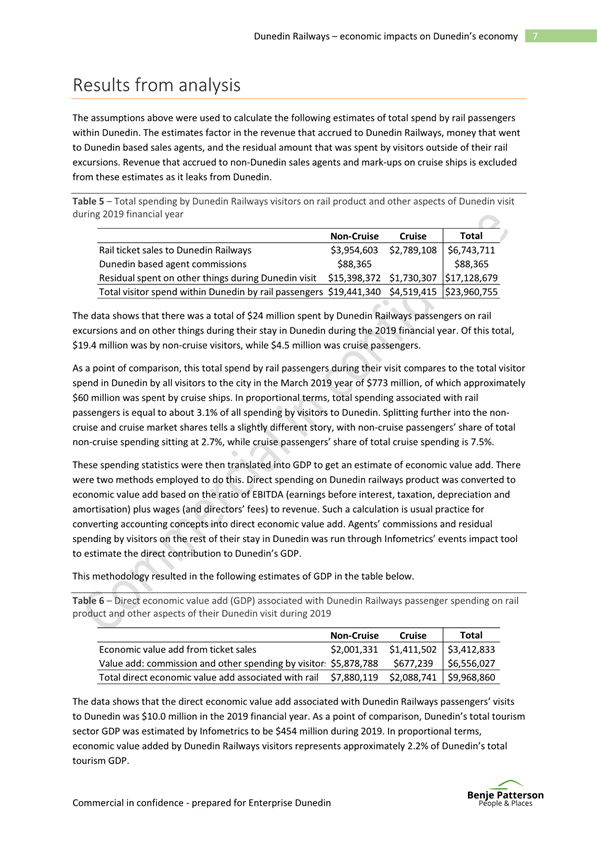

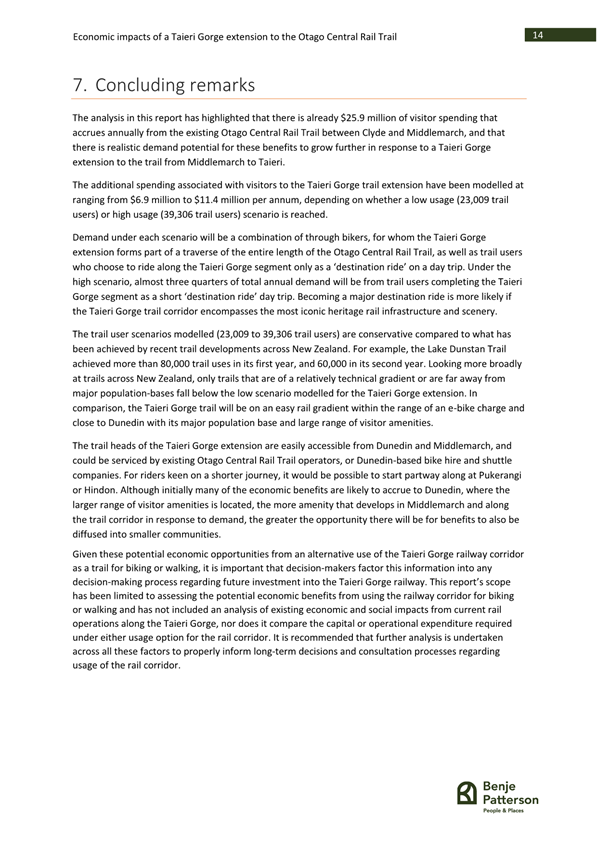

with 10 year plan 2021-31

62 Chart 3

compares actual and forecast capital expenditure with the 10 year plan for the

first 4 years from 2021/22 – 2024/25.

Chart 3 –

Capital Expenditure Years 1 – 4 of the 10 Year plan 2021-2031

63 Over the

four year period from 2021/22 – 2024/25, capital expenditure is forecast

to be $771.195 million, $164.684 million higher than the 10 year plan budget of

$606.5111 million. This is made up as follows:

· the actual 2021/22

year expenditure was $1.352 million less than year 1 of the 10 year

plan;

· the 2022/23 year expenditure

was $48.263 million ahead of that provided for in year 2 of the 10 year plan;

· the 2023/24 year is

forecast to be $67.460 million ahead of that provided for in year 3 of the 10

year plan; and

· in 2024/25 the draft

budget provides for an increase of $50.313 million compared to that provided

for in year 4 of the 10 year plan.

64 Table 4

provides a capital expenditure summary for the financial years ended 30 June

2022, 2023, 2024 and 2025 by activity group.

Table 4 – Capital Expenditure Years 1

– 4 of the 10 Year plan 2021-2031

|

Capital Expenditure $000s

Years 1 - 4 10 Year Plan

|

Actual + Draft Budget

|

10 Year Plan 2021-31

|

Increase (Decrease)

|

|

Community and Planning

|

913

|

1,932

|

(1,019)

|

|

Economic Development

|

567

|

291

|

276

|

|

Galleries, Libraries and Museums

|

9,157

|

8,264

|

893

|

|

Governance and Support Services

|

15,107

|

19,835

|

(4,728)

|

|

Property

|

94,074

|

96,290

|

(2,216)

|

|

Reserves and Recreational Facilities

|

1,335

|

1,740

|

(405)

|

|

Regulatory Services

|

74,134

|

73,872

|

262

|

|

Roading and Footpaths

|

192,526

|

181,714

|

10,812

|

|

Three Waters

|

335,091

|

176,327

|

158,764

|

|

Waste Management

|

48,291

|

46,246

|

2,045

|

|

Total Expenditure

|

771,195

|

606,511

|

164,684

|

Three

Waters

65 An increase

of $158.764 million reflects the acceleration of the 3 waters programme provided

for in the current 10 year plan. The accelerated programme has resulted

in an increased investment in 3 water asset renewal, sooner than planned, to

address areas of risk and increase resilience in these significant

infrastructure assets.

OPTIONS

66 There are

no options presented but Council may decide to modify the draft capital

budgets.

NEXT STEPS

67 The

decision of Council will be included in the draft Annual Plan 2024/25 for the

purposes of community engagement.

Signatories

|

Author:

|

Sharon Bodeker - Special Projects Manager

Carolyn Allan - Chief Financial Officer

|

|

Authoriser:

|

Sandy Graham - Chief Executive Officer

|

Attachments

|

|

Title

|

Page

|

|

⇩a

|

Capital Expenditure

Comparison Summary

|

60

|

|

⇩b

|

Capital Expenditure

Four Year Summary

|

71

|

|

⇩c

|

Draft Government Policy

Statement on land transport 2024-34

|

82

|

|

SUMMARY OF CONSIDERATIONS

|

|

Fit with purpose of Local Government

This decision enables democratic local

decision making and action by, and on behalf of communities and promotes the

social, economic, environmental and cultural wellbeing of the communities in

the present and for the future.

|

|

Fit with strategic framework

|

|

Contributes

|

Detracts

|

Not applicable

|

|

Social Wellbeing Strategy

|

☒

|

☐

|

☐

|

|

Economic Development Strategy

|

☒

|

☐

|

☐

|

|

Environment Strategy

|

☒

|

☐

|

☐

|

|

Arts and Culture Strategy

|

☒

|

☐

|

☐

|

|

3 Waters Strategy

|

☒

|

☐

|

☐

|

|

Spatial Plan

|

☒

|

☐

|

☐

|

|

Integrated Transport Strategy

|

☒

|

☐

|

☐

|

|

Parks and Recreation Strategy

|

☒

|

☐

|

☐

|

|

Other strategic projects/policies/plans

|

☒

|

☐

|

☐

|

The Activity Groups contribute to the delivery of all of

the objectives and priorities of the strategic framework.

|

|

Māori Impact Statement

The Annual Plan provides a mechanism for Māori to

contribute to local decision-making. The Council’s engagement with Mana

Whenua and Mātāwaka is an ongoing and continuous process.

|

|

Sustainability

The Annual Plan budget is based on the 10 year plan

2021-31. Major issues and implications for sustainability were

considered in the development of the 50 year Infrastructure Strategy and

financial resilience was discussed in the Financial Strategy, both strategies

being key to the development of the 10 year plan.

|

|

LTP/Annual Plan / Financial Strategy /Infrastructure

Strategy

This report provides draft budgets for each Activity Group

for inclusion in the Annual Plan.

|

|

Financial considerations

Financial considerations are detailed in the report.

|

|

Significance

The 10 year plan 2021-31 budgets were considered

significant in terms of the Council’s Significance and Engagement

Policy, and were consulted on. Variations to those budgets as discussed

in this report are not considered significant in terms of the policy.

|

|

Engagement – external

There has been no external engagement in developing the

draft budgets for the Activity Groups.

|

|

Engagement - internal

Staff and managers from across council have been involved

in the development of the draft budgets.

|

|

Risks: Legal / Health and Safety etc.

There are no identified risks.

|

|

Conflict of Interest

There are no known conflicts of interest.

|

|

Community Boards

Community Boards will have an opportunity to engage on the

Annual Plan.

|

|

|

Council

12 March 2024

|

Three Waters - Operating Budget 2024/25

Department: 3 Waters

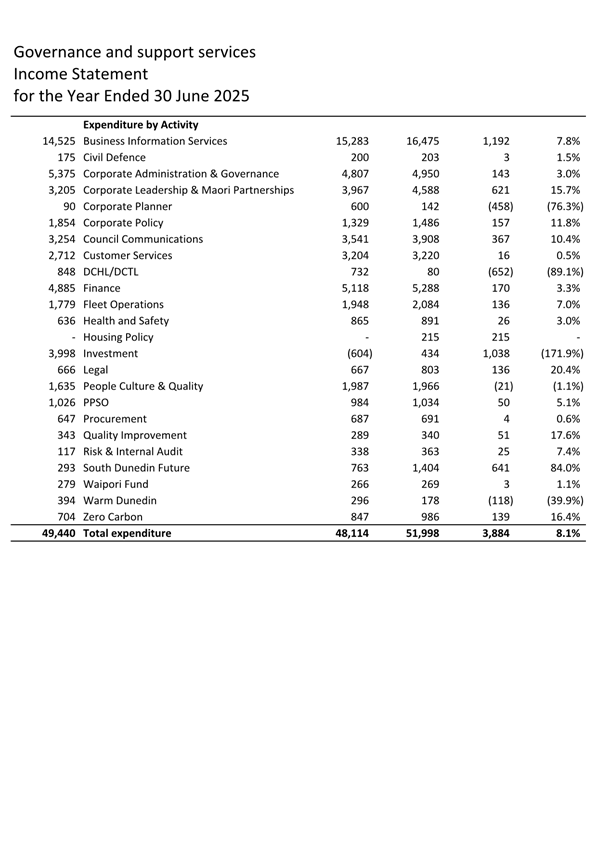

EXECUTIVE SUMMARY

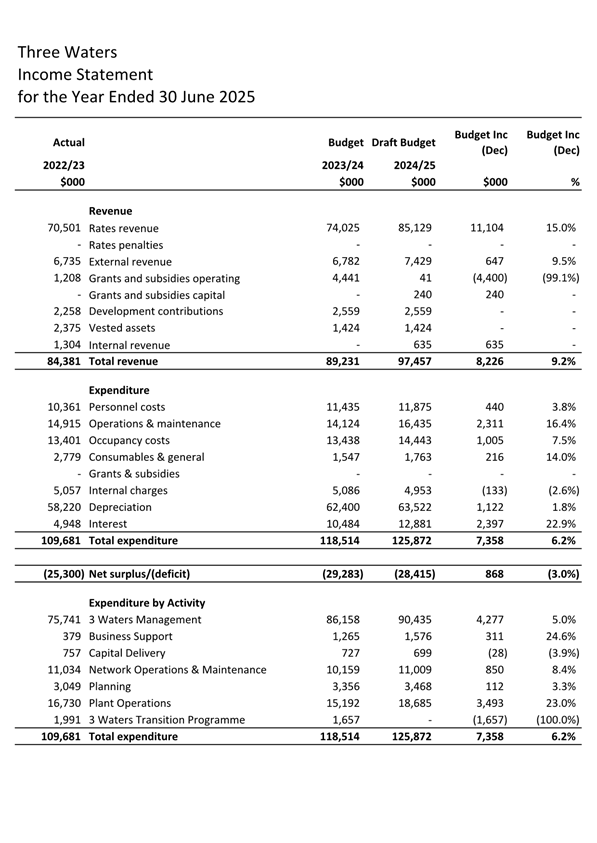

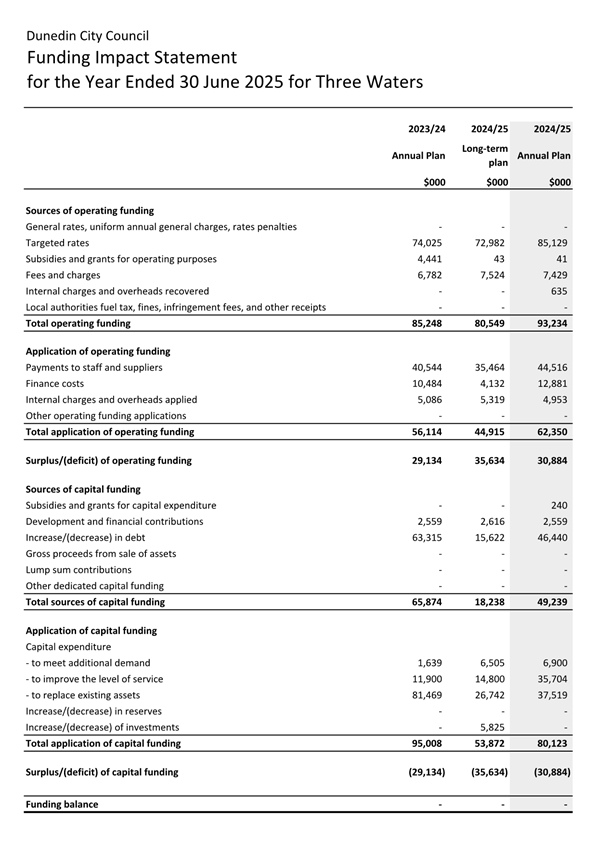

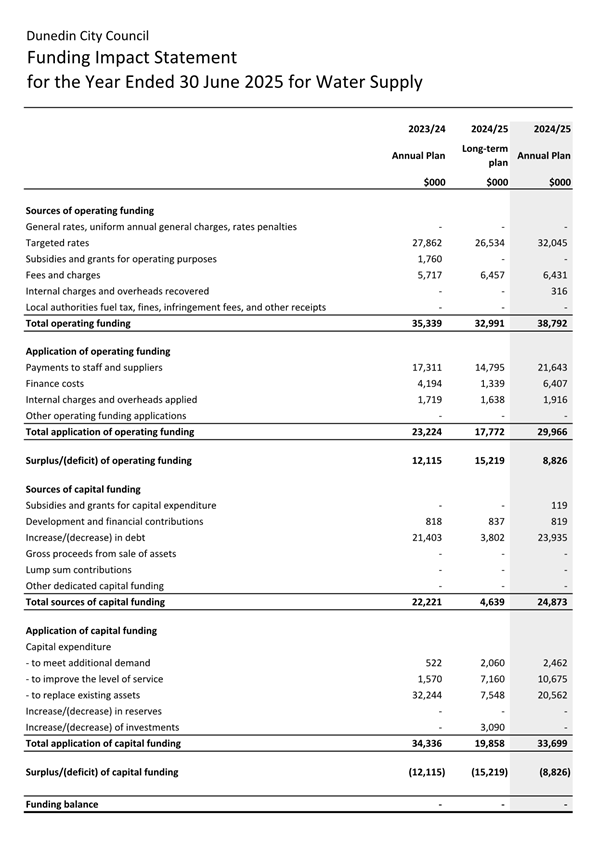

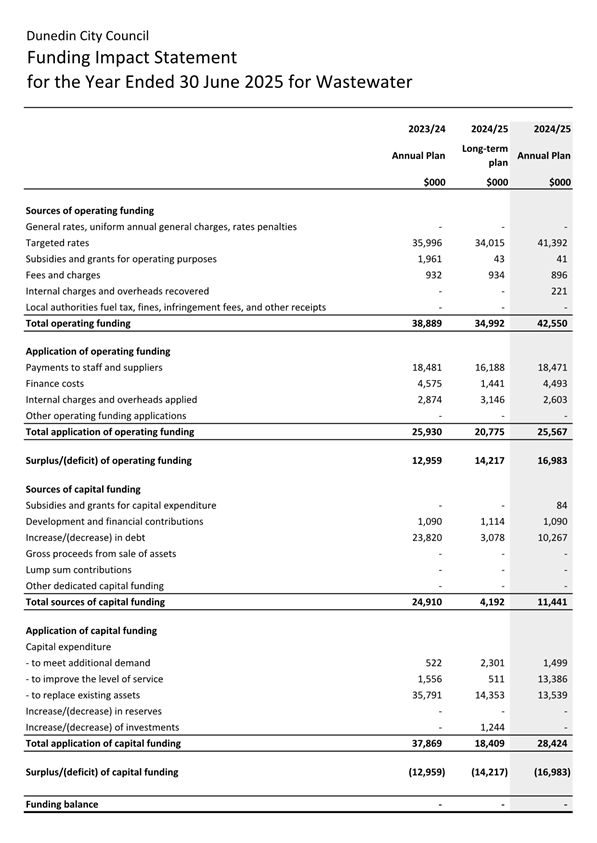

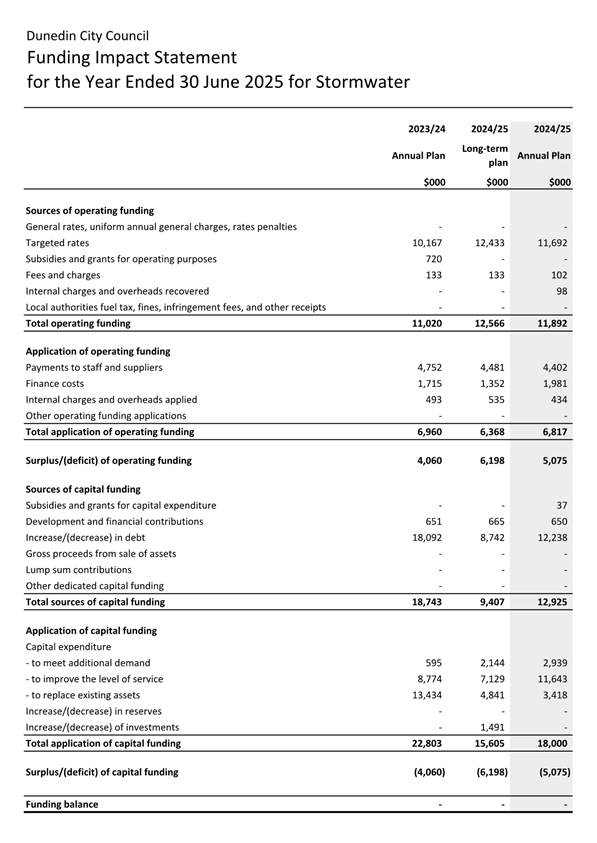

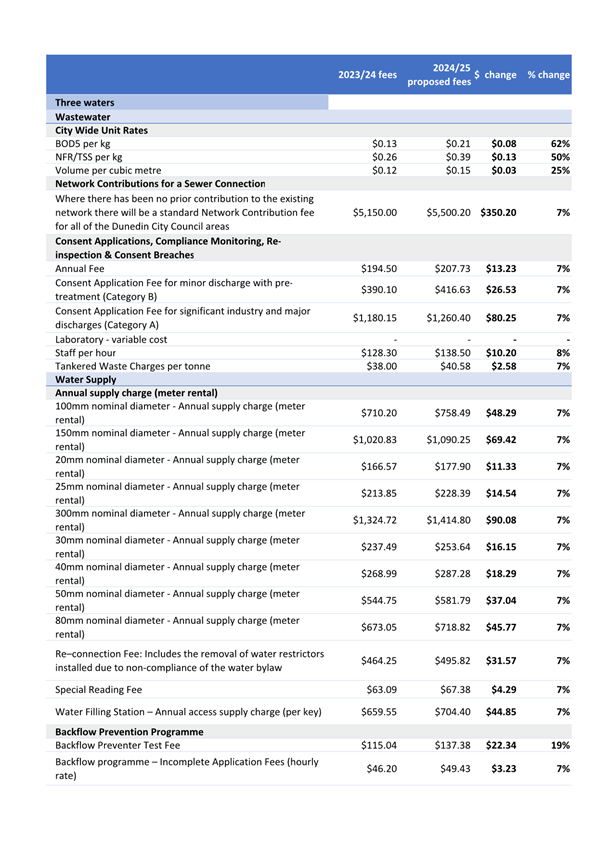

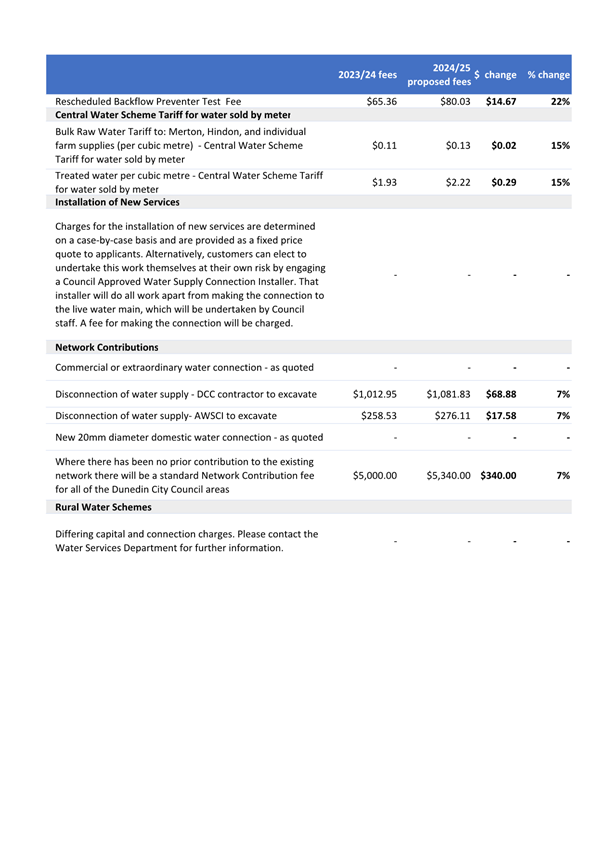

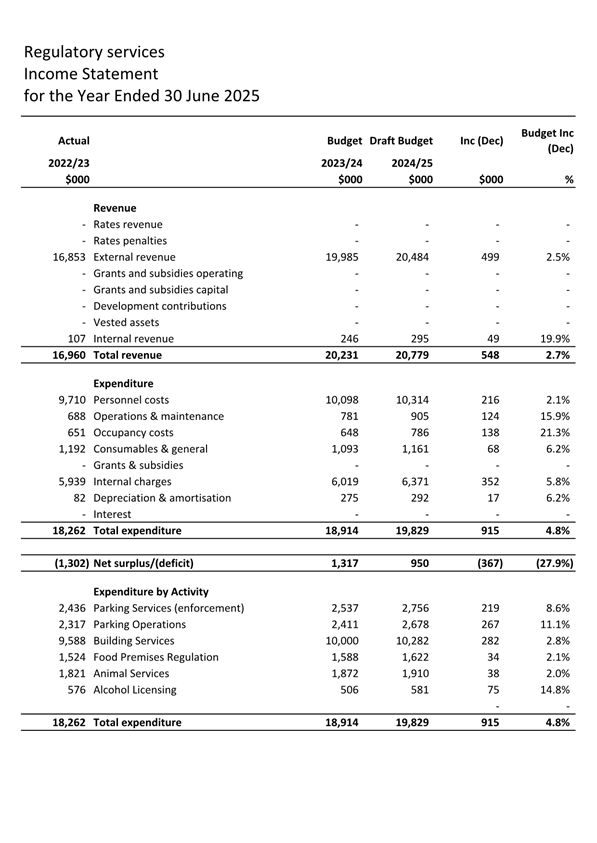

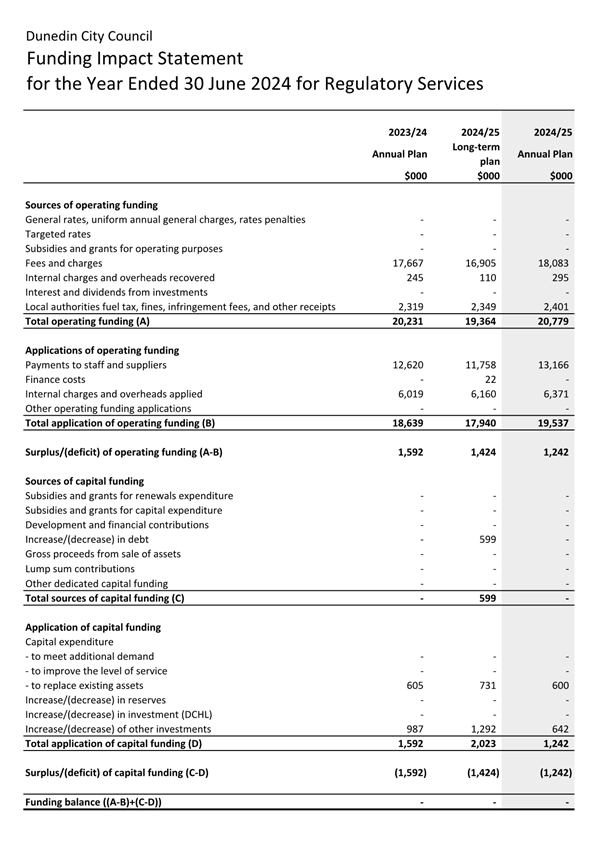

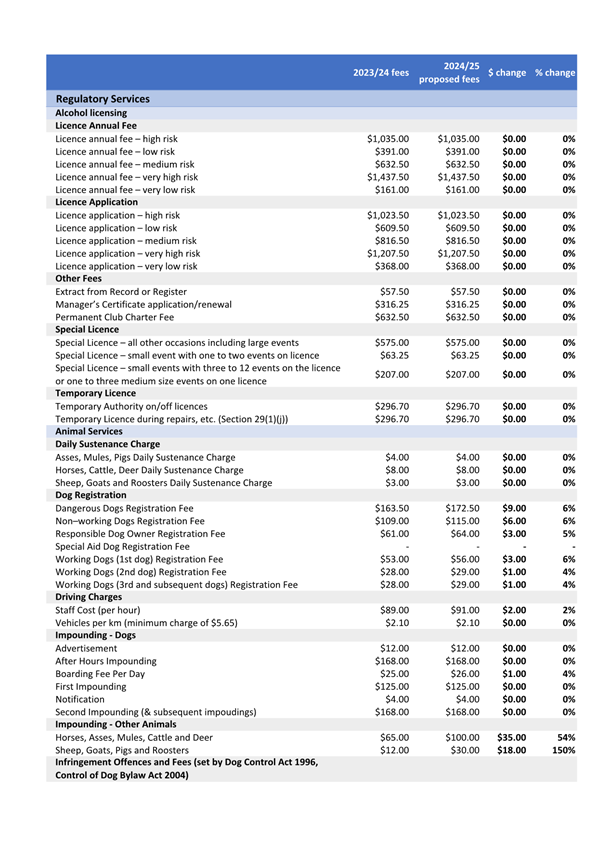

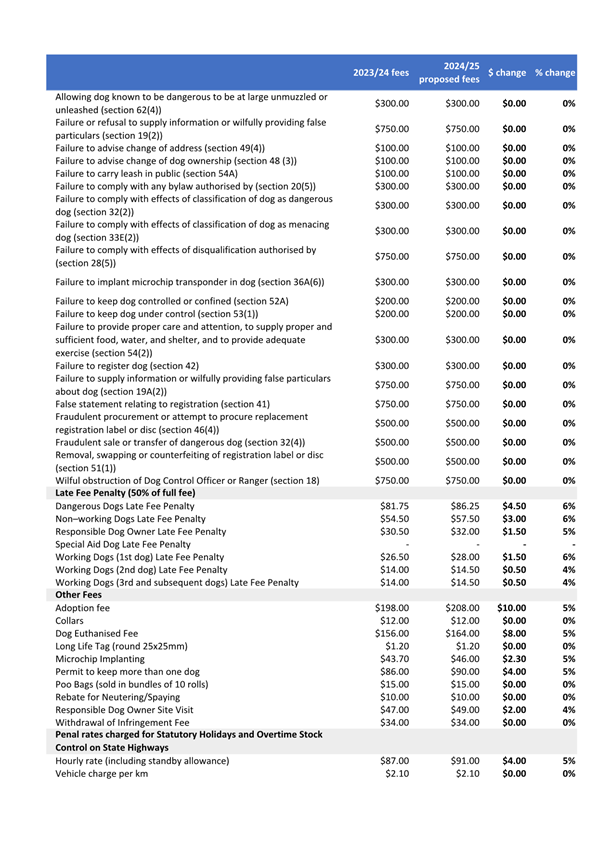

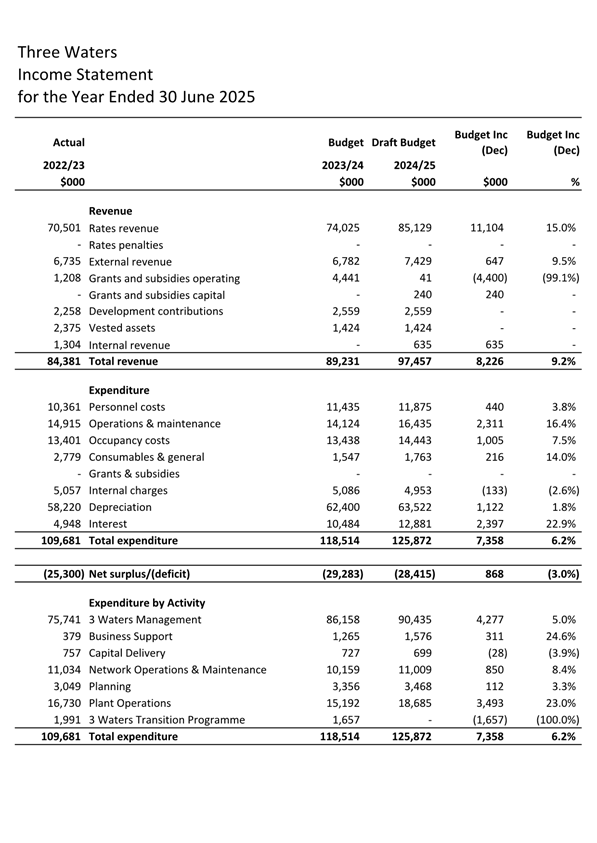

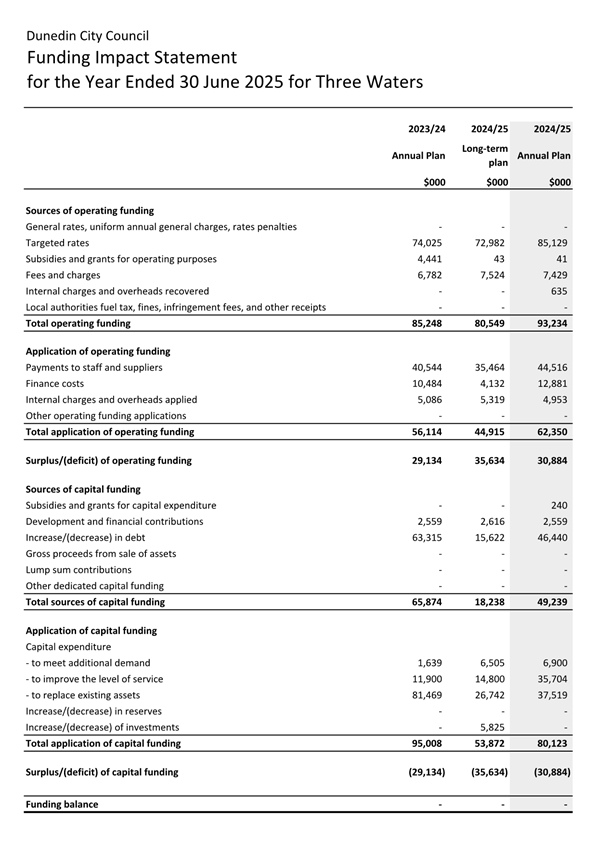

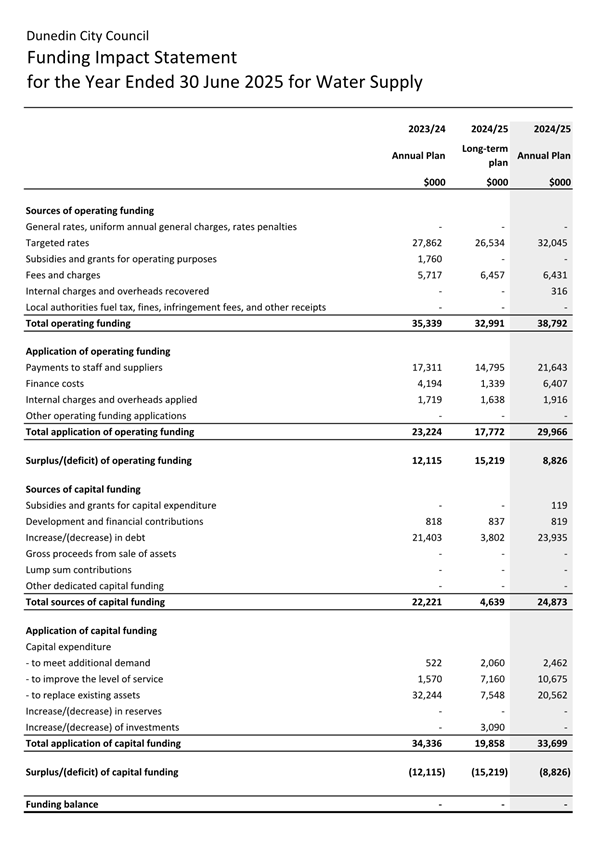

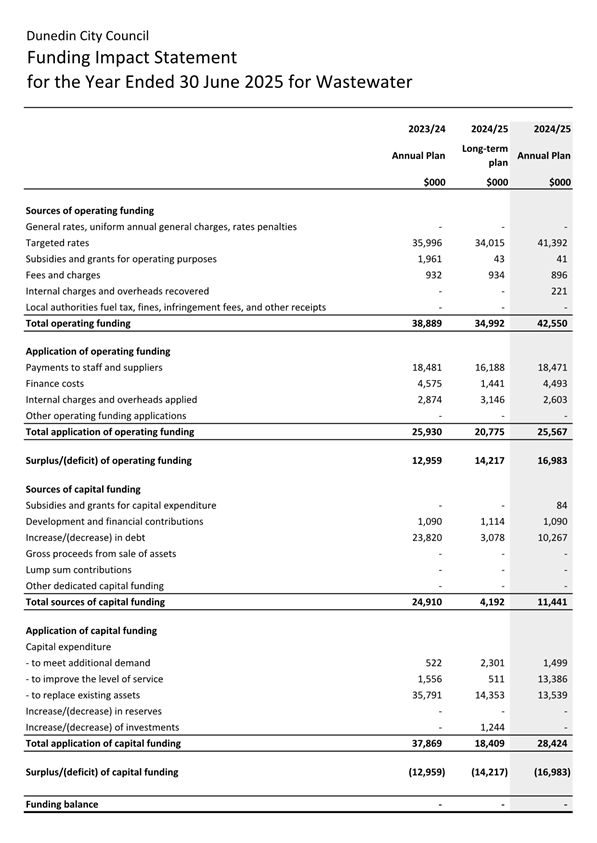

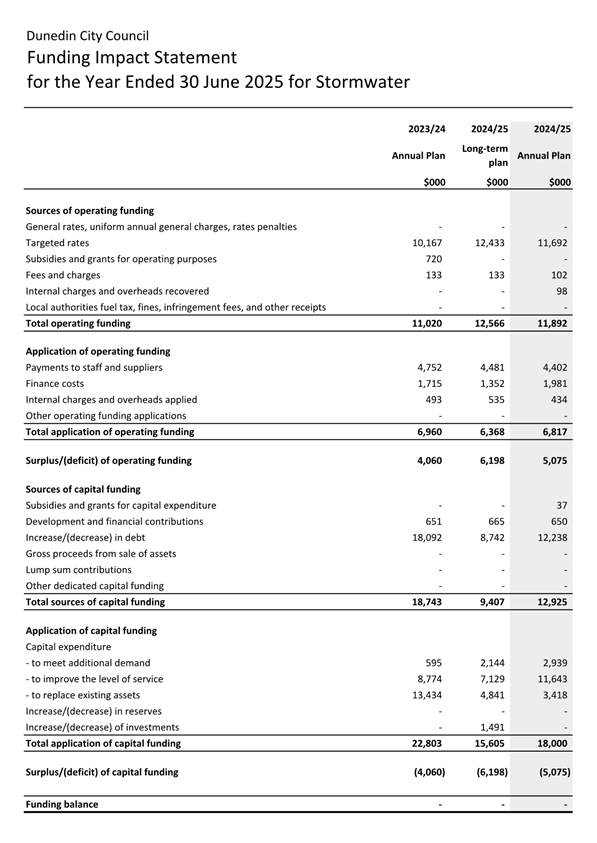

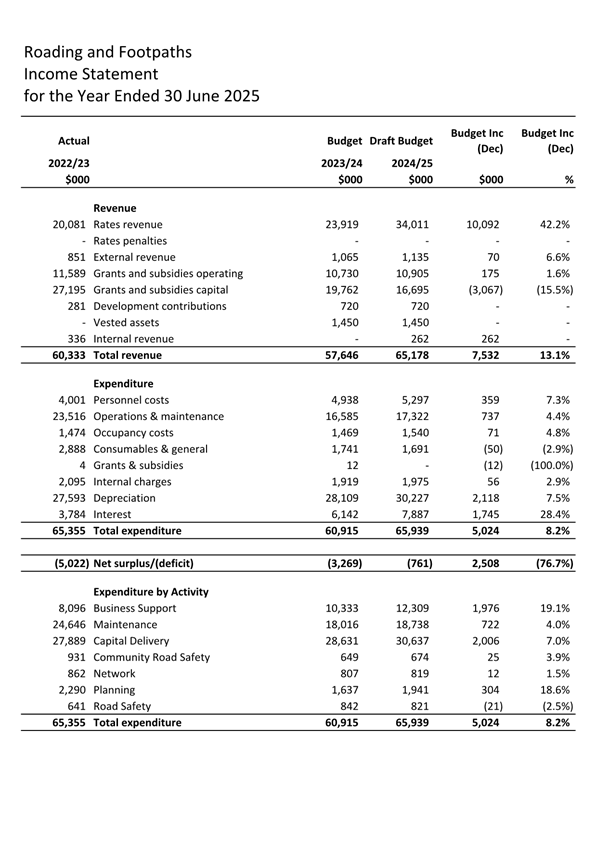

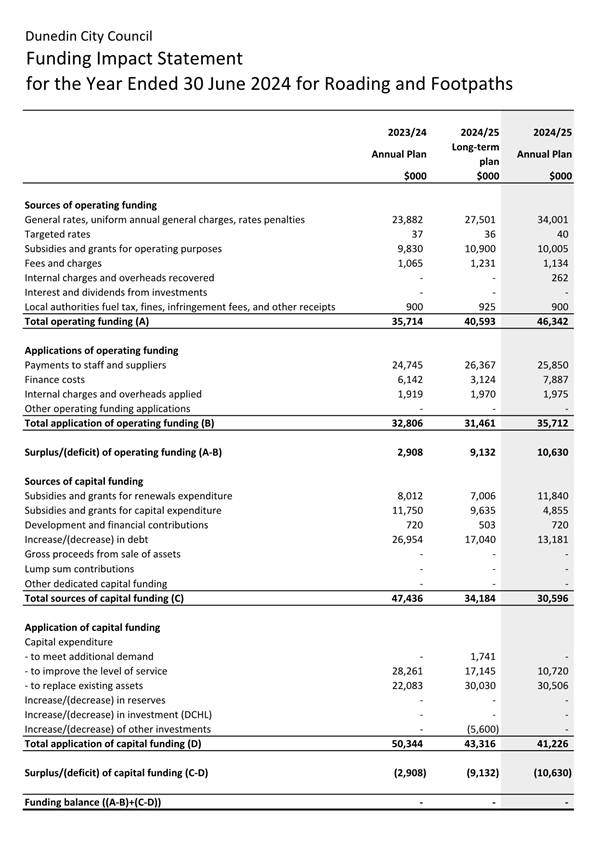

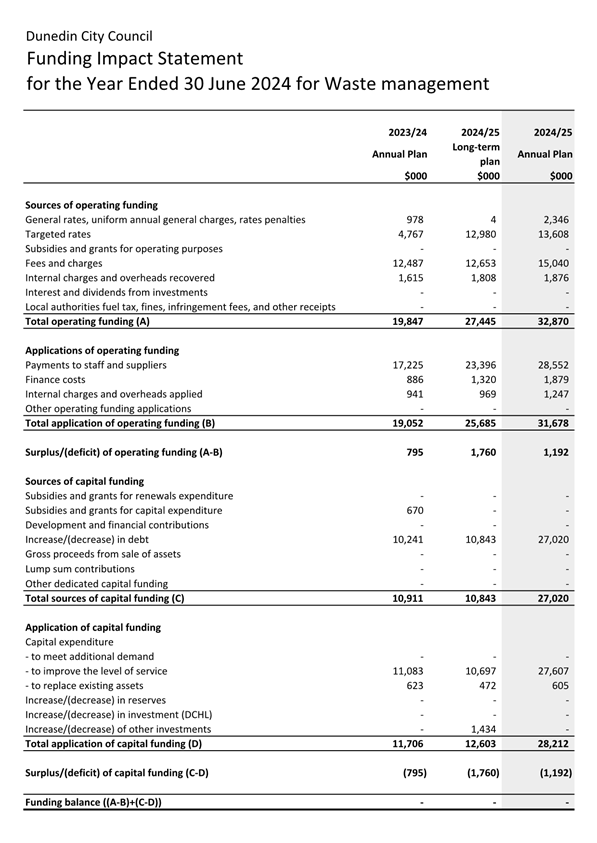

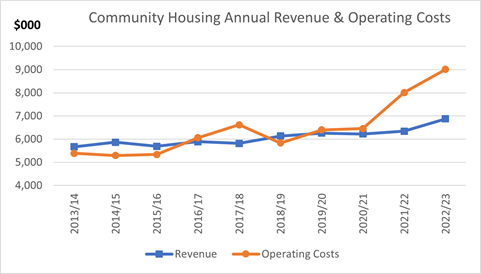

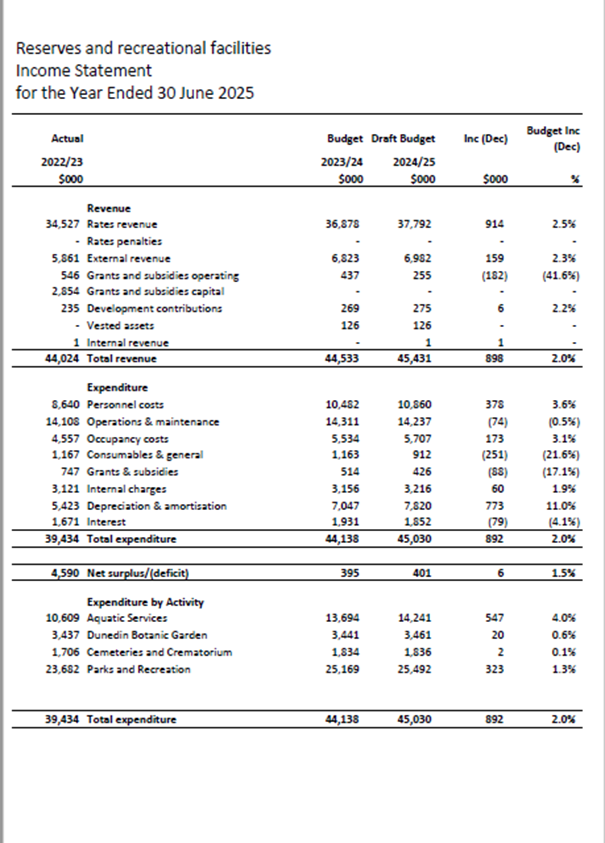

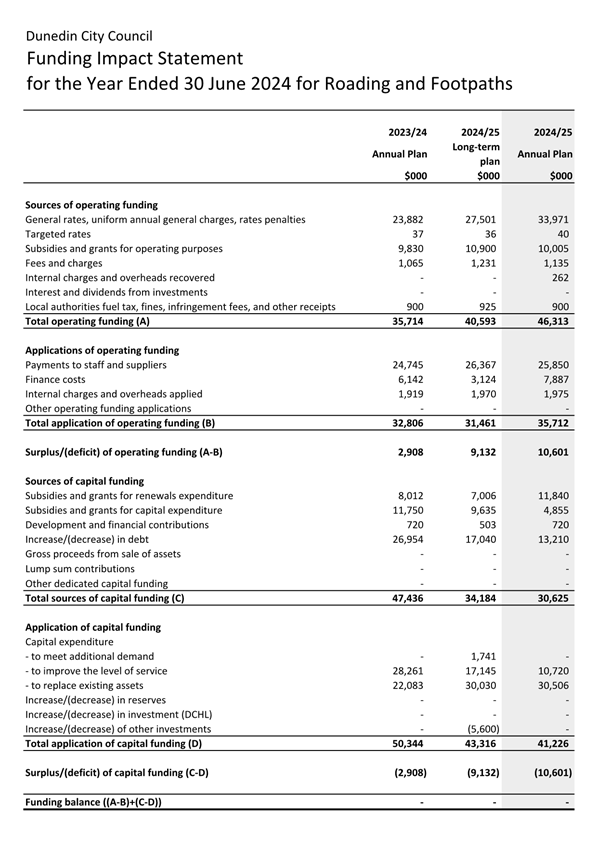

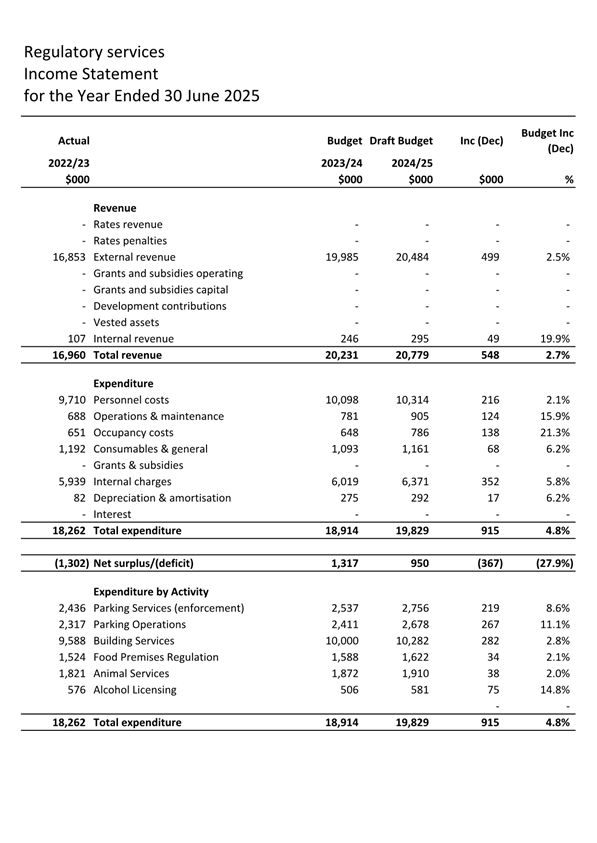

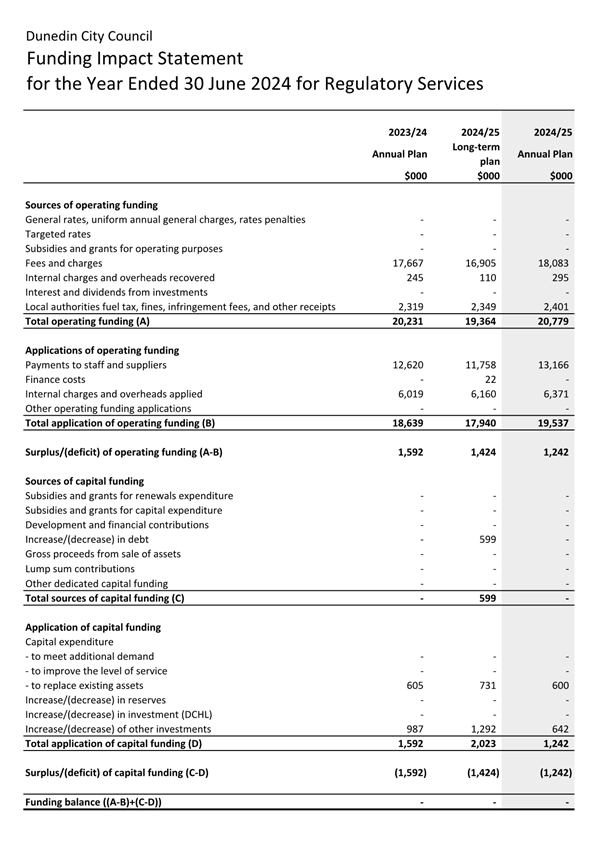

1 This

report provides an overview of the operating expenditure budget for the Annual

Plan 2024/25 for the Three Waters Group, as shown at Attachment A. A

draft funding impact statement is shown at Attachment B. The following

activities are provided for:

· Water

Supply

· Wastewater

· Stormwater

2 A